2021 SECOND QUARTER EARNINGS July 29, 2021

® 2 This presentation contains statements regarding management’s expectations and objectives for future periods (including key factors affecting 2021 non-GAAP core earnings) as well as forecasts and estimates regarding PG&E Corporation’s and Pacific Gas and Electric Company’s (the “Utility”) 2021 Wildfire Mitigation Plan (WMP), rate base projections, capital expenditure forecasts and regulatory developments. These statements and other statements that are not purely historical constitute forward-looking statements that are necessarily subject to various risks and uncertainties. Actual results may differ materially from those described in forward-looking statements. PG&E Corporation and the Utility are not able to predict all the factors that may affect future results. Factors that could cause actual results to differ materially include, but are not limited to risks and uncertainties associated with: • unresolved claims from the Chapter 11 proceedings, including securities class action claims; • PG&E Corporation and the Utility’s substantial indebtedness; • any wildfires that have occurred in the Utility’s territory, including the extent of the Utility’s liability in connection with the 2019 Kincade fire (including the outcome of the criminal complaint filed by the Sonoma County District Attorney), the 2020 Zogg fire, and the 2021 Dixie fire; the Utility’s ability to recover related costs, and the timing of insurance recoveries; • the Utility’s ability to help reduce wildfire threats and improve safety as a result of climate driven wildfires and extreme weather, including the ability comply with its WMP; its ability to retain or contract for the workforce to execute its WMP; and the cost of the program and the timing of any proceeding to recover such costs through rates; • the ability to securitize $7.5 billion of costs related to the 2017 Northern California wildfires; • the Utility’s implementation of its Public Safety Power Shutoff (PSPS) program; • whether the Utility may be liable for future wildfires, and the impact of AB 1054 on potential losses in connection with such wildfires, including the CPUC’s procedures for recovering such losses; • the requirement that the Utility maintain a valid safety certification and the potential effects of the CPUC’s enhanced enforcement and oversight authority; • the Utility’s ability to access the Wildfire Fund, including that the Wildfire Fund has sufficient remaining funds; • the global COVID-19 pandemic and its impact on PG&E Corporation’s and the Utility’s financial condition, results of operations, liquidity and cash flows, as well as on energy demand, the ability to collect on customer invoices, the ability to mitigate these effects and to recover any related, and the impact of workforce disruptions; • the Utility’s ability to obtain wildfire insurance at a reasonable cost in the future, or at all; the adequacy of insurance coverage and scope of limitations; and the ability to obtain recovery of insurance premiums; • the timing and outcome of FERC rate cases and the Utility’s applications for cost recovery of recorded amounts, future cost of capital proceedings, and other ratemaking and regulatory proceedings, including the EOEP; • the Utility’s ability to control operating costs, timely recover costs through rates and achieve projected savings, and the extent to which it incurs unrecoverable costs that are higher than forecasted; • the outcome of the probation and the monitorship, and related compliance costs, including the costs of complying with any additional conditions of probation, including expenses associated with any material expansion of the Utility’s vegetation management program; • tax treatment of certain assets and liabilities, including whether PG&E Corporation or the Utility undergoes an “ownership change” that limits certain tax attributes; and • the other factors disclosed in PG&E Corporation and the Utility’s joint annual report on Form 10-K for the year ended December 31, 2020, as updated by their joint quarterly report on Form 10-Q for the quarter ended June 30, 2021 (the “Form 10-Q”) and other reports filed with the SEC, which are available on PG&E Corporation’s website at www.pgecorp.com and on the SEC website at www.sec.gov. Undefined, capitalized terms have the meanings set forth in the Form 10-Q. Unless otherwise indicated, the statements in this presentation are made as of July 29, 2021. PG&E Corporation and the Utility undertake no obligation to update information contained herein. This presentation was attached to PG&E Corporation and the Utility’s joint current report on Form 8-K that was furnished to the SEC on July 29, 2021 and is also available on PG&E Corporation’s website at www.pgecorp.com. Forward-Looking Statements

® 3 2021: A Focus on People, the Planet, and Prosperity Underpinned by Performance Execution On-Target for Wildfire Mitigation Plan Q2 Non-GAAP Core EPS of $0.27 Improved PSPS Protocols Filed 2023 General Rate Case People Planet Prosperity Non-GAAP core earnings is not calculated in accordance with GAAP and excludes non-core items. See Appendix 10, Exhibit A for a reconciliation of earnings per share ("EPS") on a GAAP basis to non-GAAP core earnings per share and Exhibit H for the use of non-GAAP financial measures. See the Forward-Looking Statements for factors that could cause actual results to differ materially from the guidance presented.

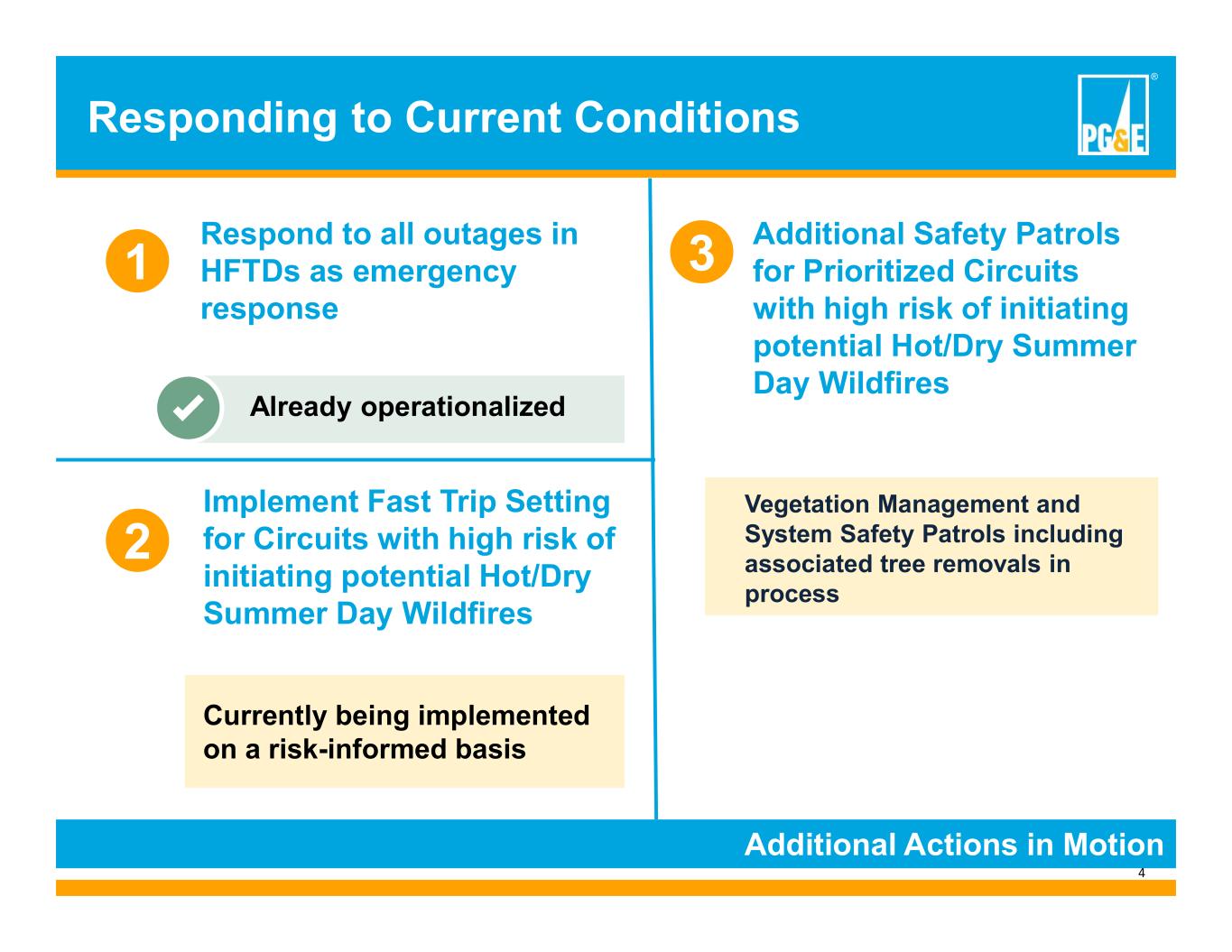

® 4 Responding to Current Conditions Additional Actions in Motion 1 Respond to all outages in HFTDs as emergency response 2 Implement Fast Trip Setting for Circuits with high risk of initiating potential Hot/Dry Summer Day Wildfires Already operationalized 3 Additional Safety Patrols for Prioritized Circuits with high risk of initiating potential Hot/Dry Summer Day Wildfires Vegetation Management and System Safety Patrols including associated tree removals in process Currently being implemented on a risk-informed basis

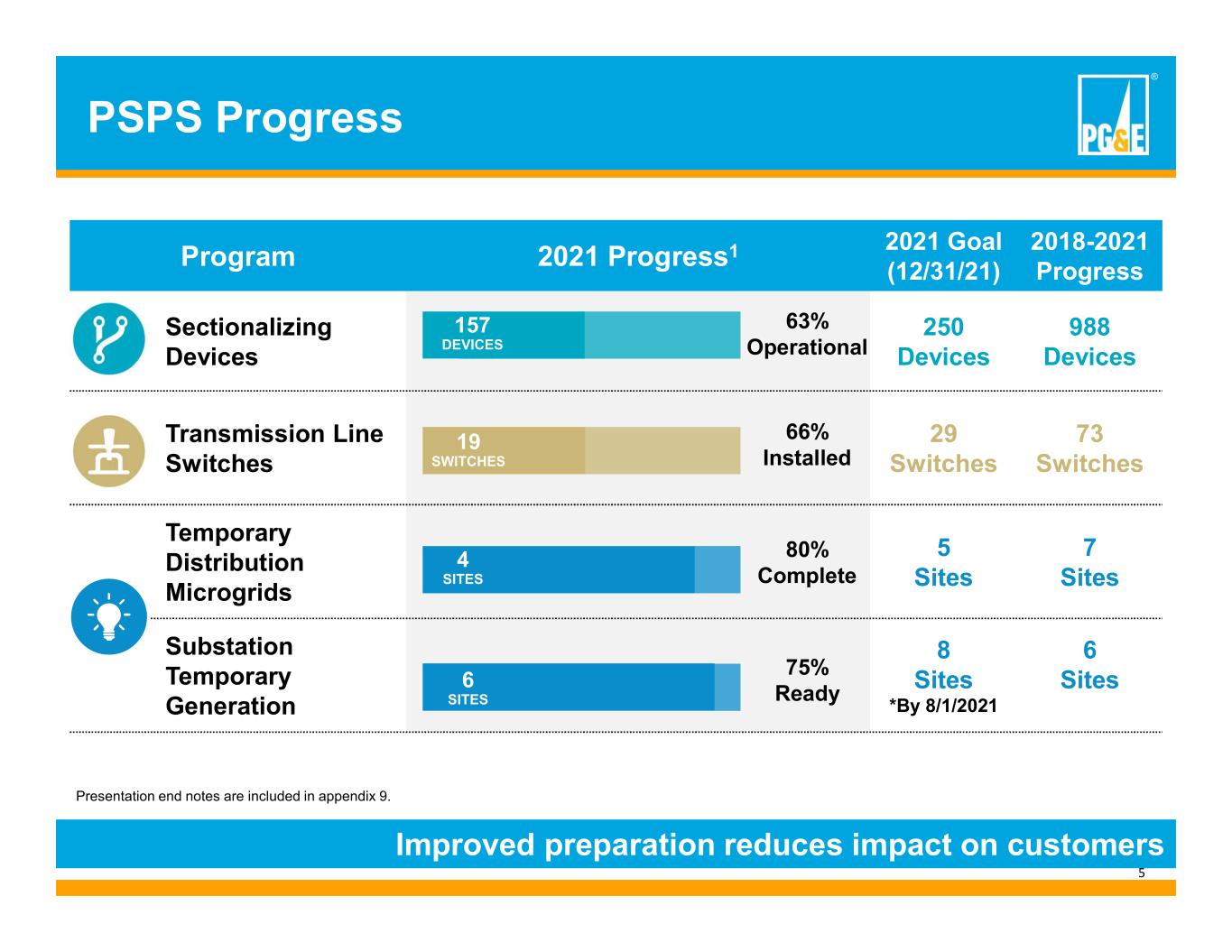

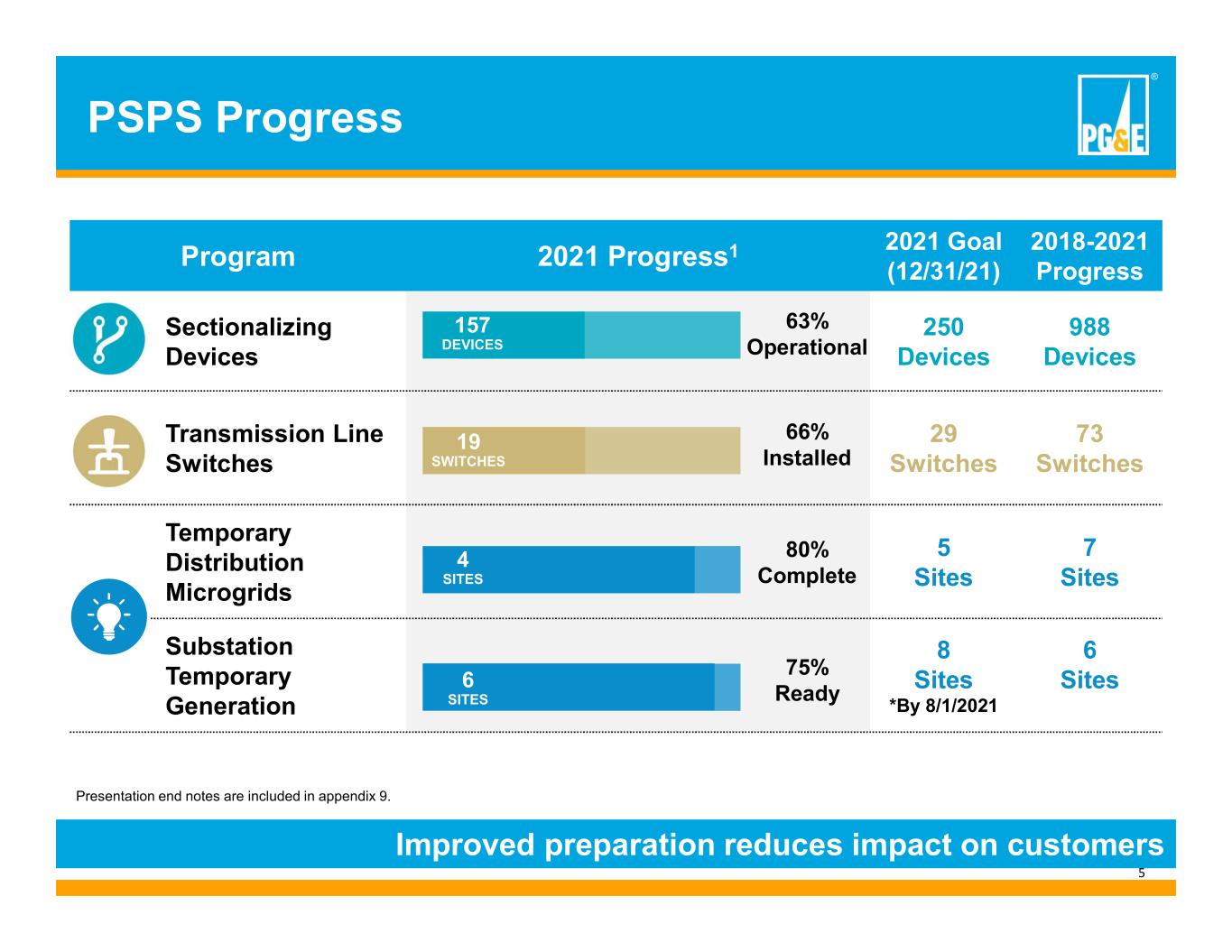

® 5 PSPS Progress Improved preparation reduces impact on customers Program 2021 Progress1 2021 Goal (12/31/21) 2018-2021 Progress Sectionalizing Devices 250 Devices 988 Devices Transmission Line Switches 29 Switches 73 Switches Temporary Distribution Microgrids 5 Sites 7 Sites Substation Temporary Generation 8 Sites *By 8/1/2021 6 Sites 63% Operational 66% Installed 80% Complete 75% Ready 157 DEVICES 19 SWITCHES 4 SITES 6 SITES Presentation end notes are included in appendix 9.

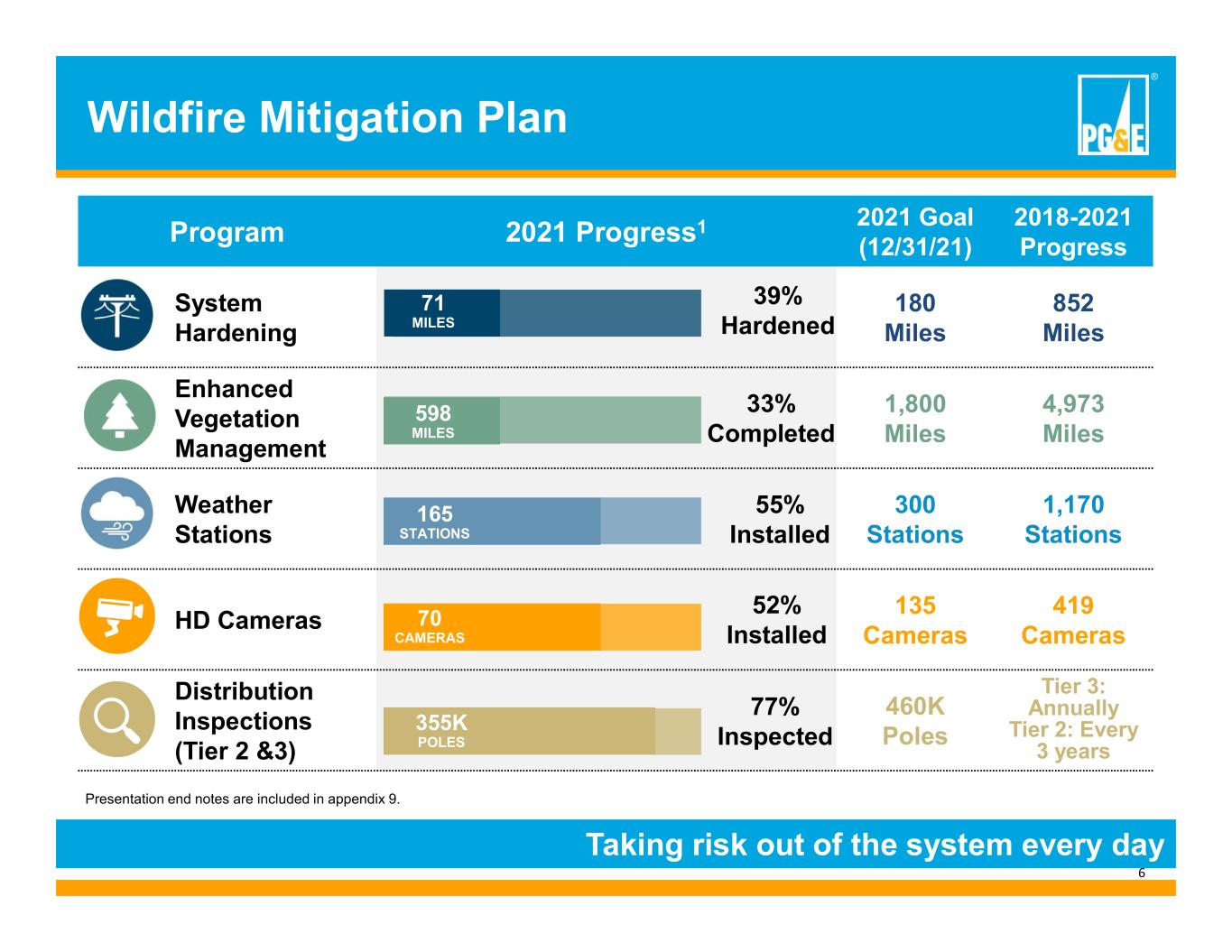

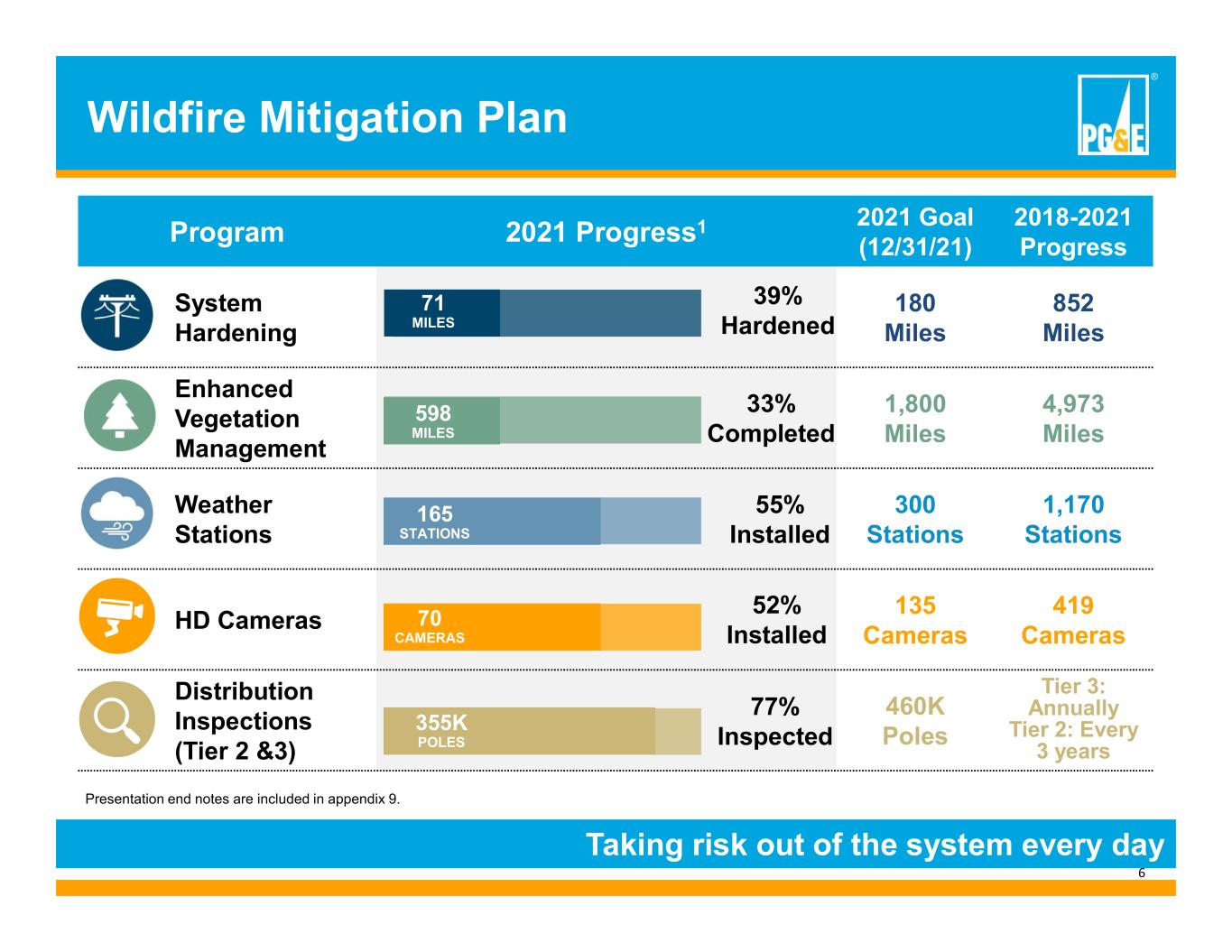

® 6 Wildfire Mitigation Plan Taking risk out of the system every day Program 2021 Progress1 2021 Goal (12/31/21) 2018-2021 Progress System Hardening 180 Miles 852 Miles Enhanced Vegetation Management 1,800 Miles 4,973 Miles Weather Stations 300 Stations 1,170 Stations HD Cameras 135 Cameras 419 Cameras Distribution Inspections (Tier 2 &3) 460K Poles Tier 3: Annually Tier 2: Every 3 years 71 MILES 39% Hardened 598 MILES 33% Completed 165 STATIONS 70 CAMERAS 55% Installed 52% Installed Presentation end notes are included in appendix 9. 355K POLES 77% Inspected

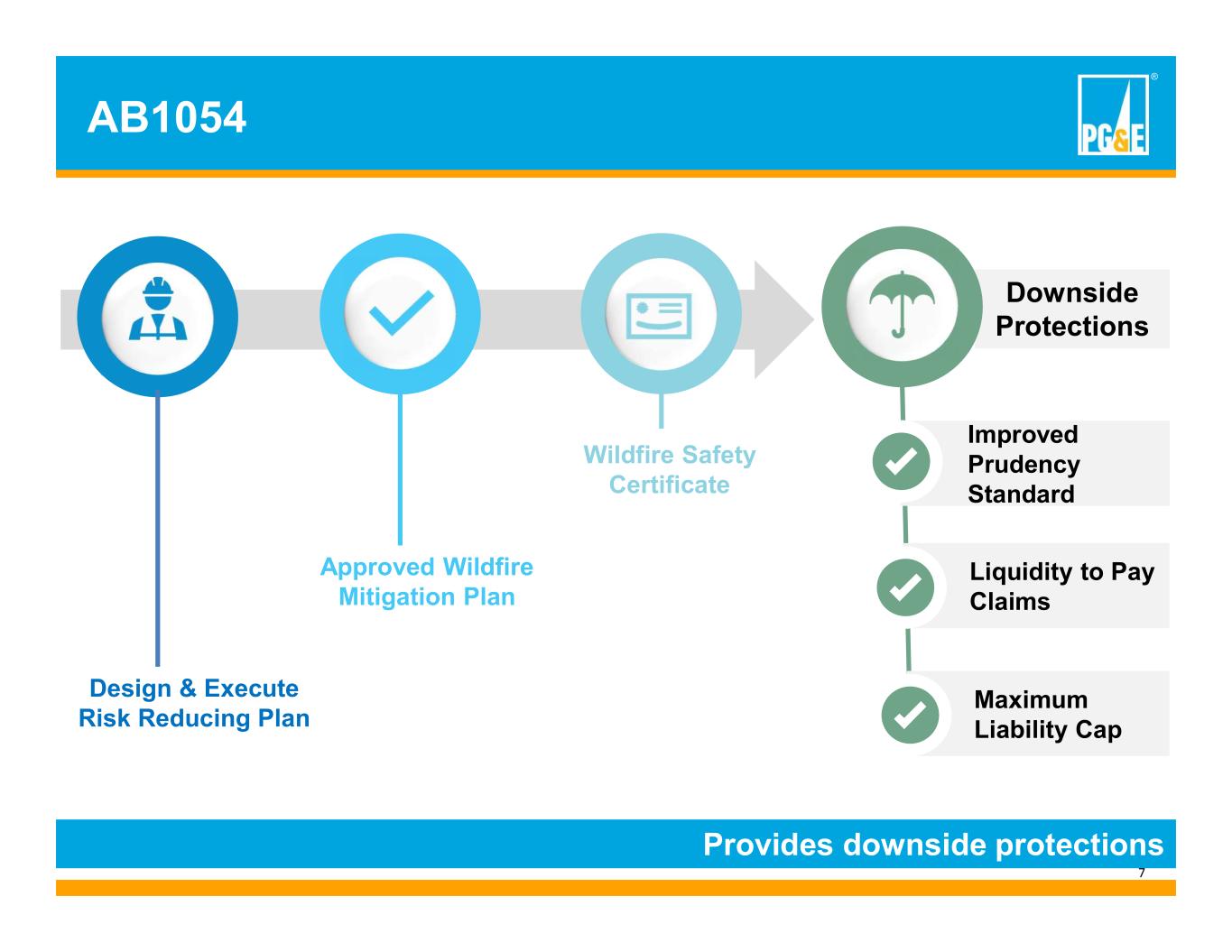

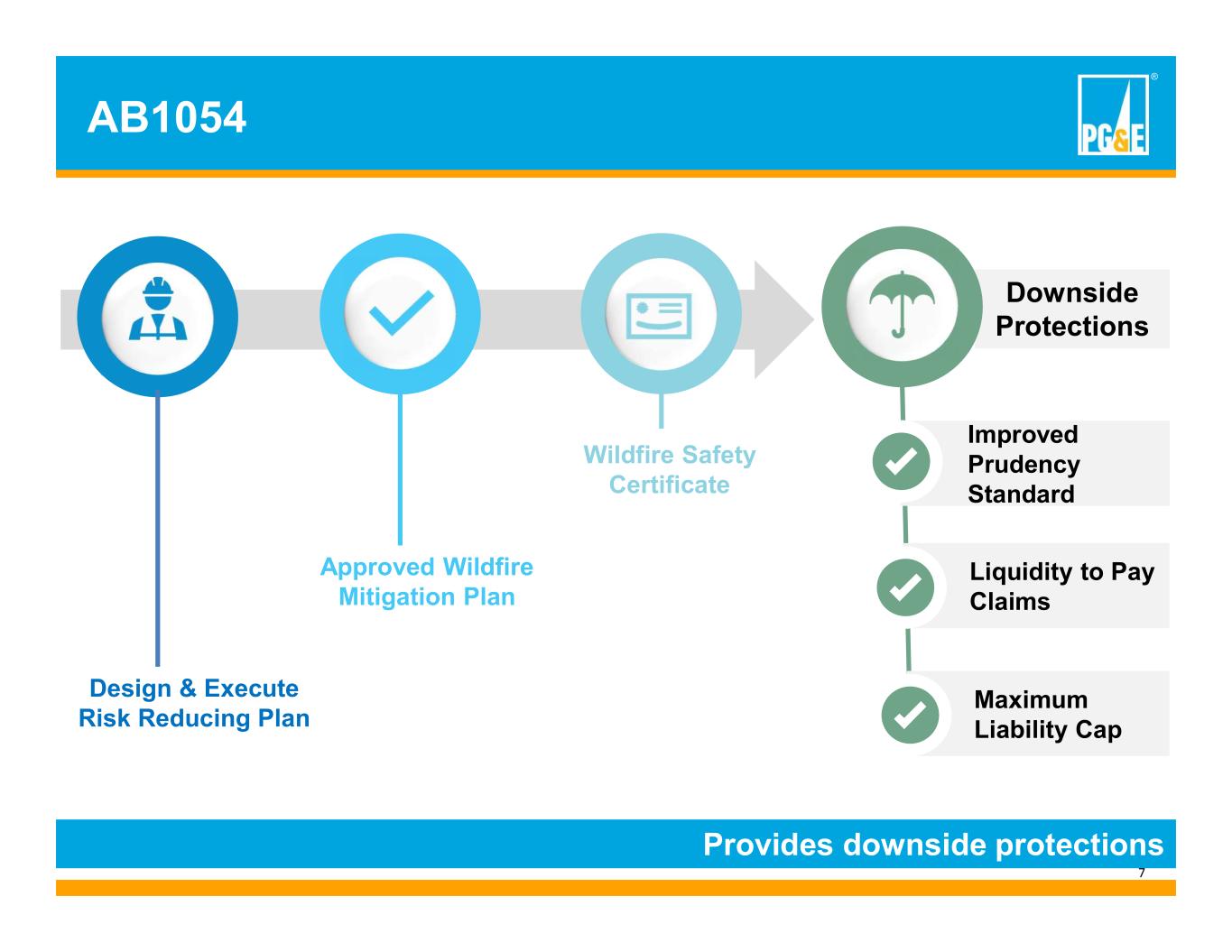

® 7 AB1054 Provides downside protections Downside Protections Design & Execute Risk Reducing Plan Approved Wildfire Mitigation Plan Wildfire Safety Certificate Improved Prudency Standard Liquidity to Pay Claims Maximum Liability Cap

Non-GAAP core earnings is not calculated in accordance with GAAP and excludes non-core items. See Appendix 10, Exhibit A for a reconciliation of EPS on a GAAP basis to non-GAAP core earnings per share and Exhibit H for the use of non-GAAP financial measures. See the Forward-Looking Statements for factors that could cause actual results to differ materially from the guidance presented. ® 8 Q2 2021 Earnings Results Three Months Ended June 30, 2021 Six Months Ended June 30, 2021 (in millions, except per share amounts) Earnings EPS Earnings EPS PG&E Corporation’s Earnings on a GAAP basis $ 397 $ 0.18 $ 517 $ 0.24 Non-core items: Amortization of Wildfire Fund contribution 85 0.04 171 0.08 Investigation remedies 50 0.02 78 0.04 Bankruptcy and legal costs 40 0.02 72 0.03 2019-2020 wildfire-related costs, net of insurance 3 — 136 0.06 Prior period net regulatory recoveries — — 88 0.04 PG&E Corporation’s Non-GAAP Core Earnings $ 575 $ 0.27 $ 1,062 $ 0.50 Non-Core Items (in millions, pre-tax) Three Months Ended June 30, 2021 Six Months Ended June 30, 2021 Amortization of Wildfire Fund contribution $ 118 $ 237 Investigation remedies 60 97 Bankruptcy and legal costs 54 98 2019-2020 wildfire-related costs, net of insurance 4 189 Prior period net regulatory recoveries — 122 Note: Amounts may not sum due to rounding.

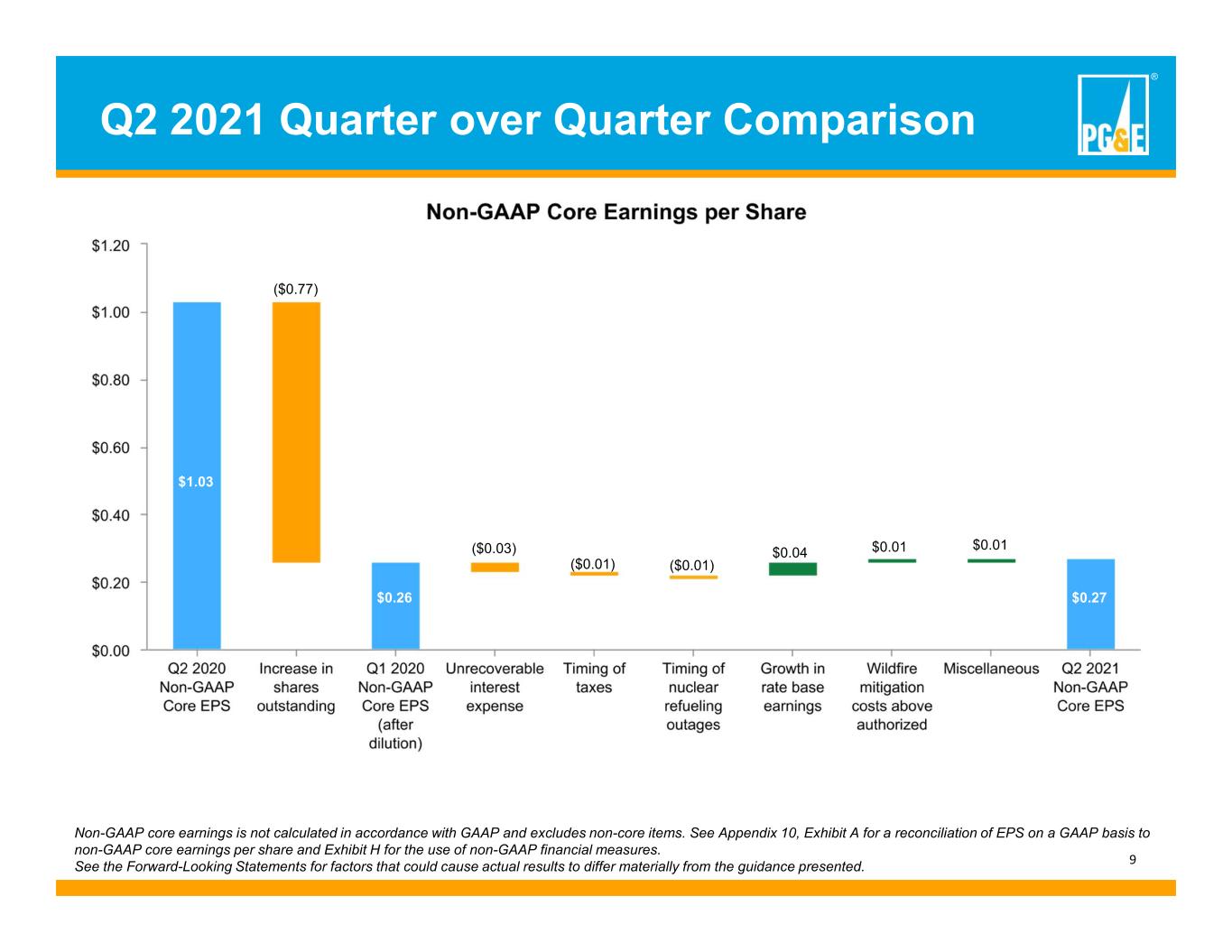

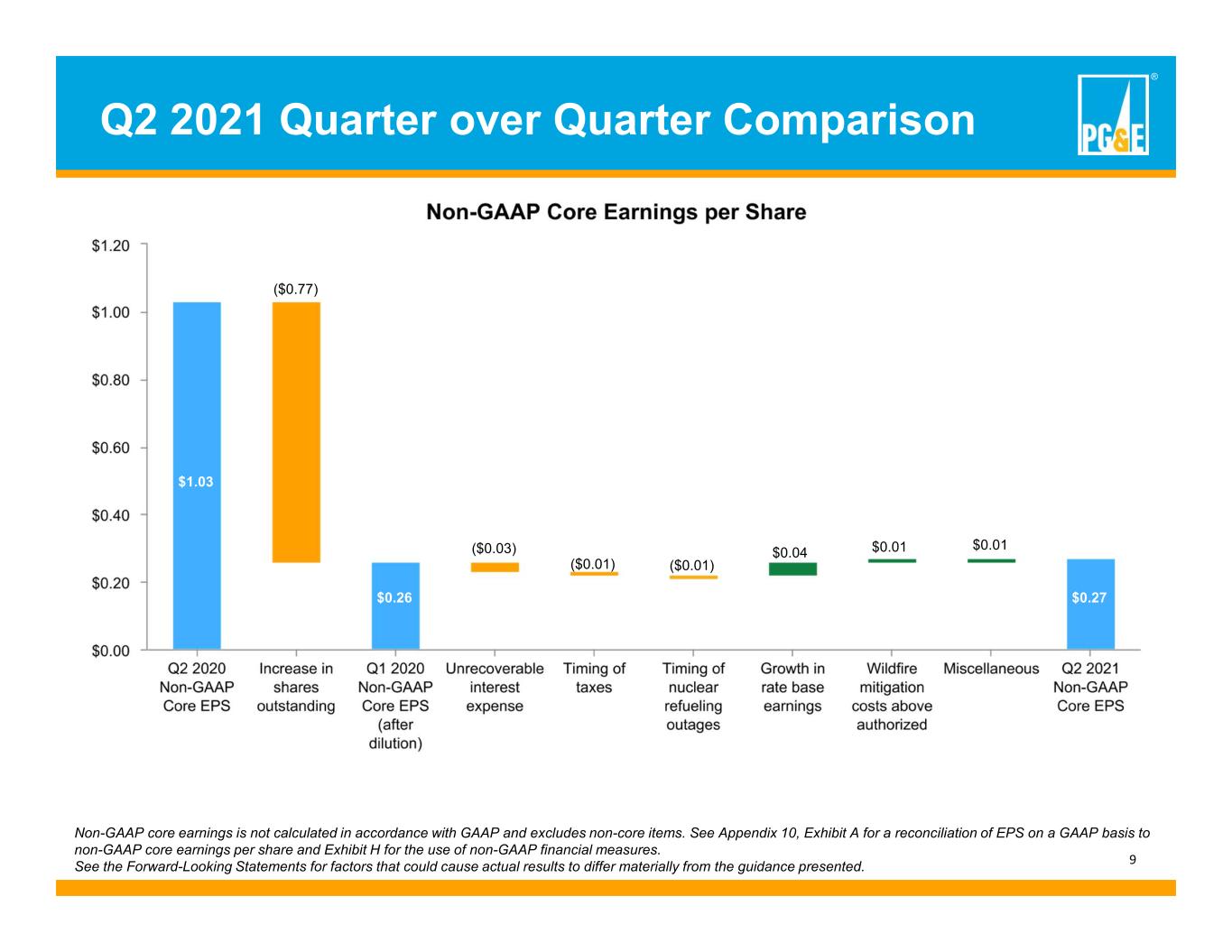

Non-GAAP core earnings is not calculated in accordance with GAAP and excludes non-core items. See Appendix 10, Exhibit A for a reconciliation of EPS on a GAAP basis to non-GAAP core earnings per share and Exhibit H for the use of non-GAAP financial measures. See the Forward-Looking Statements for factors that could cause actual results to differ materially from the guidance presented. ® 9 Q2 2021 Quarter over Quarter Comparison $1.03 $0.27 ($0.77) ($0.03) $0.01 $0.26 $0.04 $0.01 ($0.01)($0.01) $0.26 $0.27

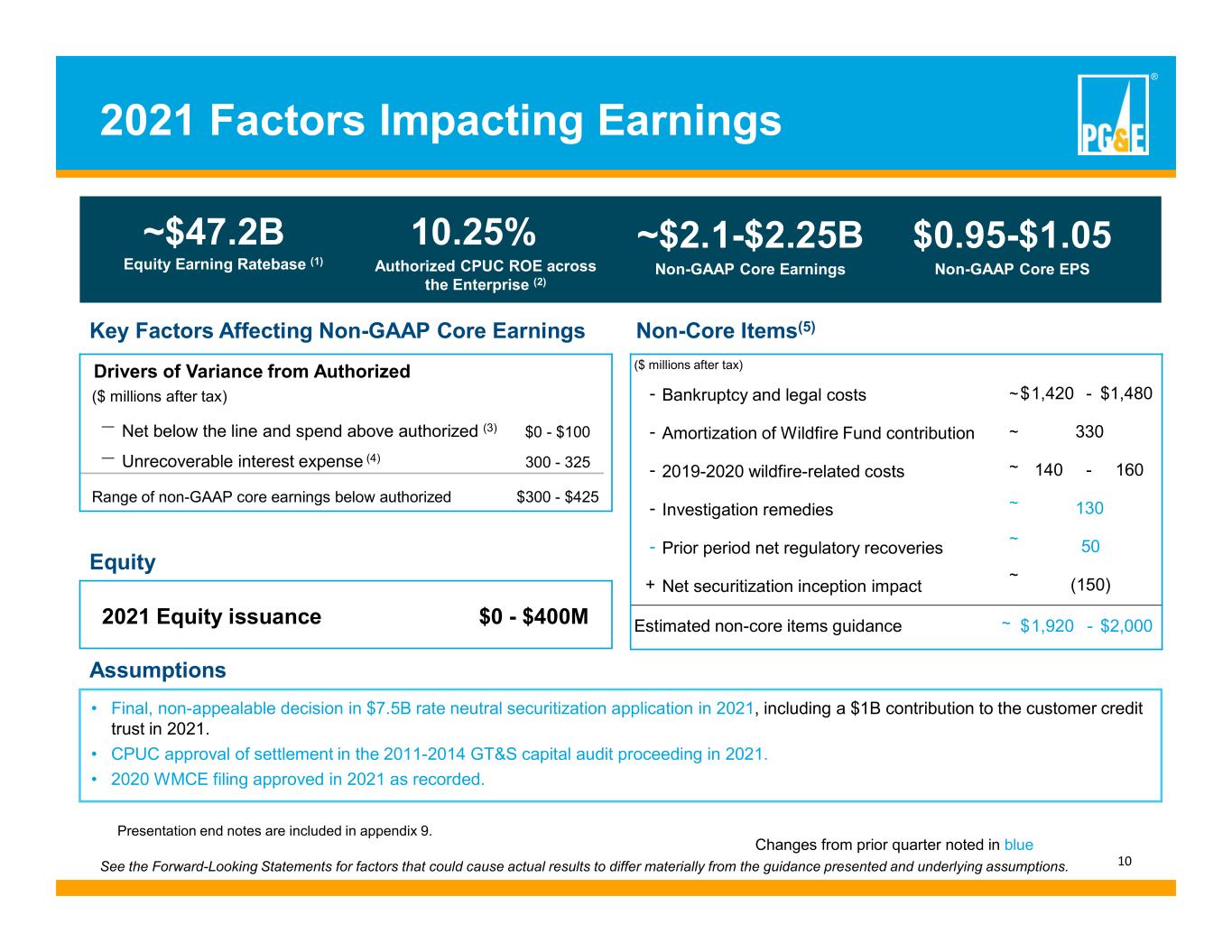

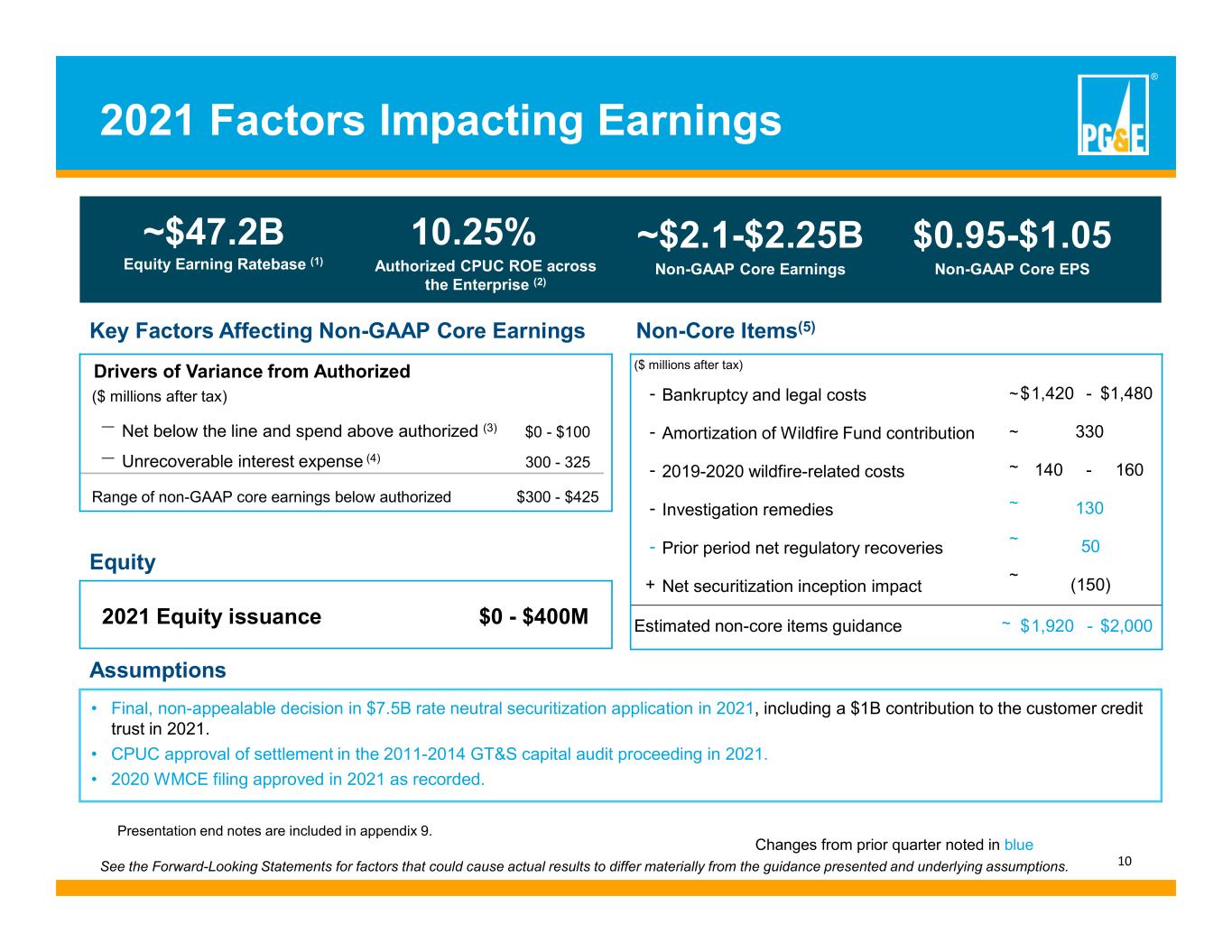

See the Forward-Looking Statements for factors that could cause actual results to differ materially from the guidance presented and underlying assumptions. ® 10 2021 Factors Impacting Earnings Key Factors Affecting Non-GAAP Core Earnings ($ millions after tax) - Bankruptcy and legal costs $1,420 - $1,480 - Amortization of Wildfire Fund contribution 330 - 2019-2020 wildfire-related costs 140 - 160 - Investigation remedies 130 - Prior period net regulatory recoveries 50 + Net securitization inception impact (150) Estimated non-core items guidance $1,920 - $2,000 Non-Core Items(5) Assumptions • Final, non-appealable decision in $7.5B rate neutral securitization application in 2021, including a $1B contribution to the customer credit trust in 2021. • CPUC approval of settlement in the 2011-2014 GT&S capital audit proceeding in 2021. • 2020 WMCE filing approved in 2021 as recorded. Equity Earning Ratebase (1) ~$44.5B Equity Earning Ratebase (1) ~$47.2B Authorized CPUC ROE across the Enterprise (2) 10.25% Non-GAAP Core Earnings ~$2.1-$2.25B Non-GAAP Core EPS $0.95-$1.05 Drivers of Variance from Authorized ($ millions after tax) — Net below the line and spend above authorized (3) $0 - $100 — Unrecoverable interest expense (4) 300 - 325 Range of non-GAAP core earnings below authorized $300 - $425 ~ ~ ~ ~ ~ Changes from prior quarter noted in blue ~ ~ Presentation end notes are included in appendix 9. Equity 2021 Equity issuance $0 - $400M

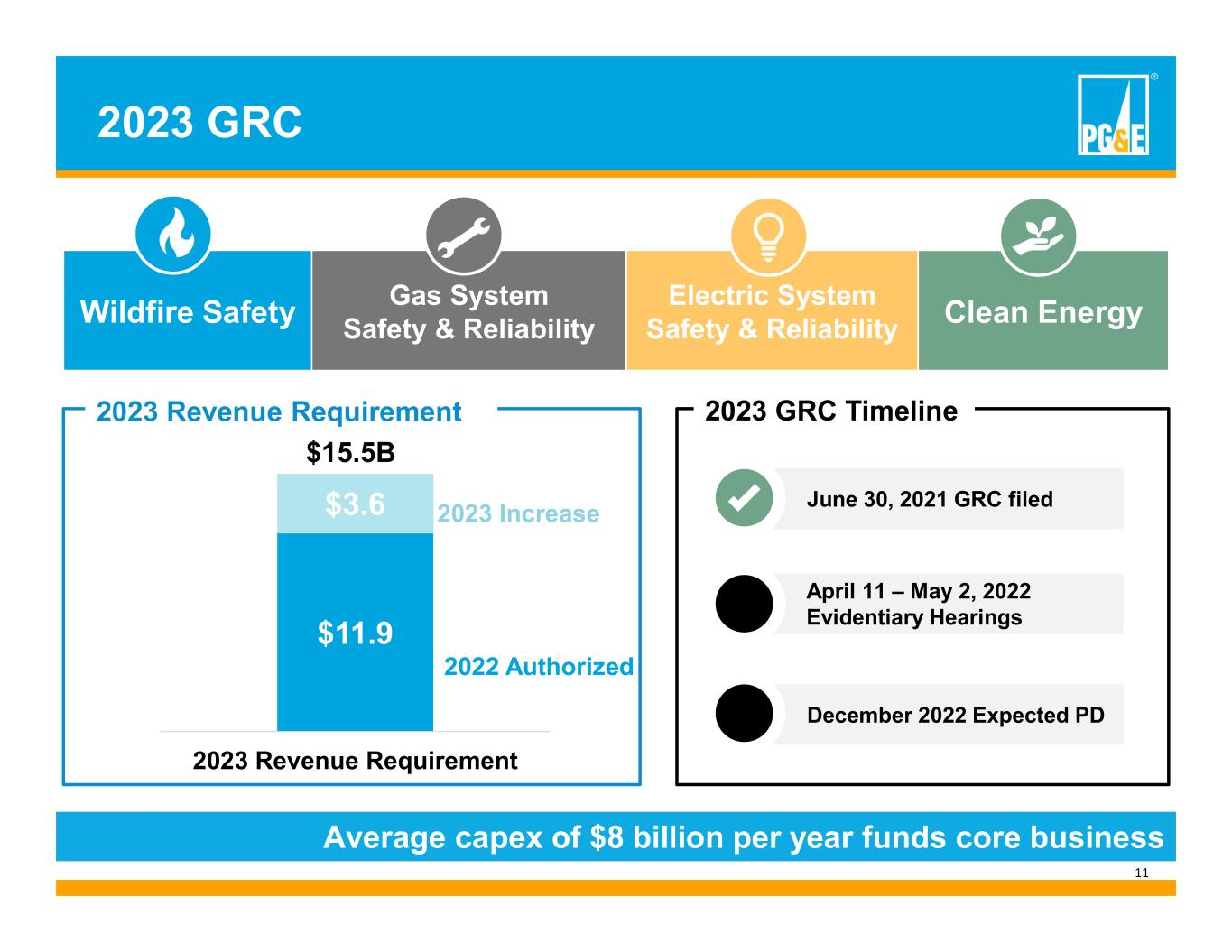

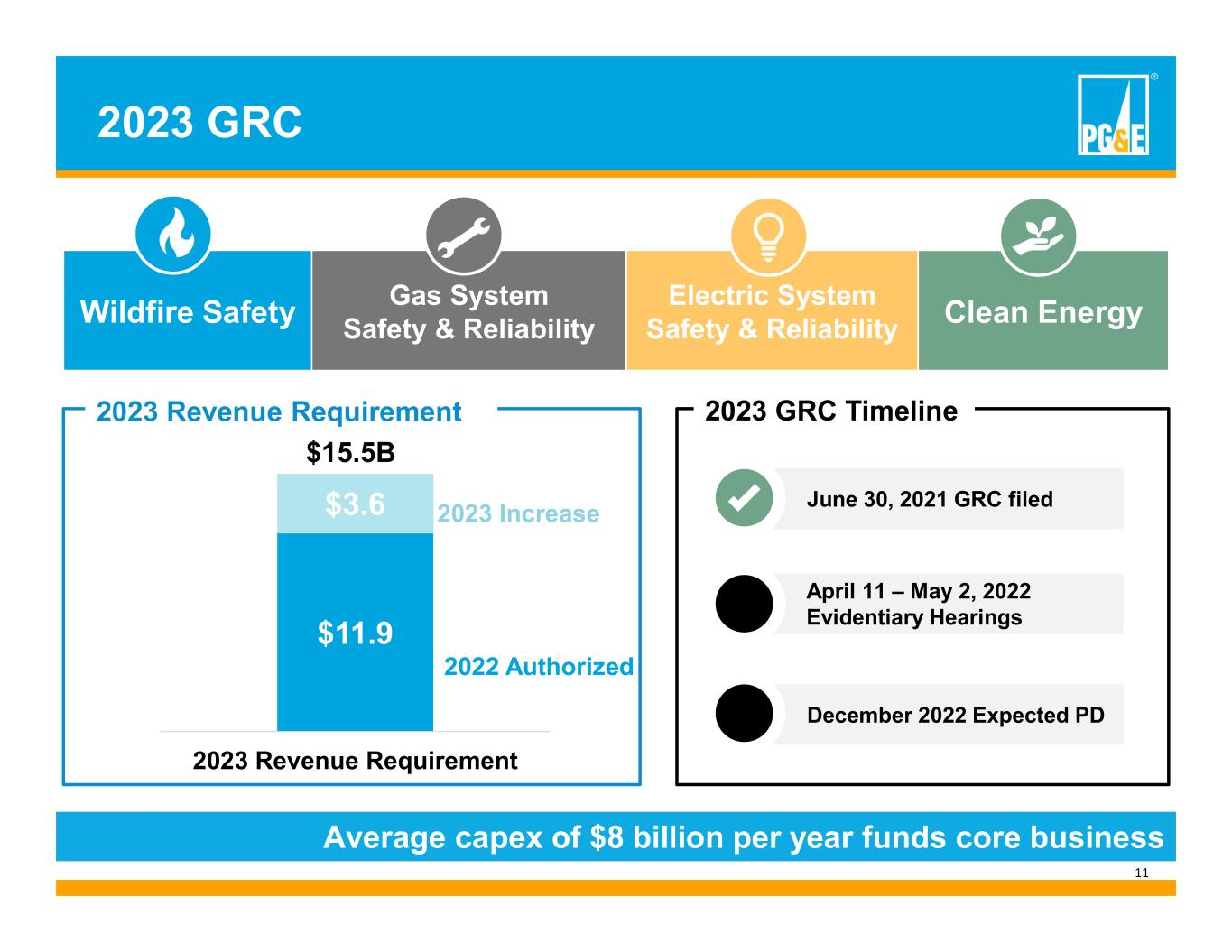

® 11 2023 GRC $11.9 $3.6 2023 Revenue Requirement Average capex of $8 billion per year funds core business Wildfire Safety Gas System Safety & Reliability Electric System Safety & Reliability Clean Energy 2023 Revenue Requirement $15.5B 2022 Authorized 2023 Increase June 30, 2021 GRC filed April 11 – May 2, 2022 Evidentiary Hearings December 2022 Expected PD 2023 GRC Timeline

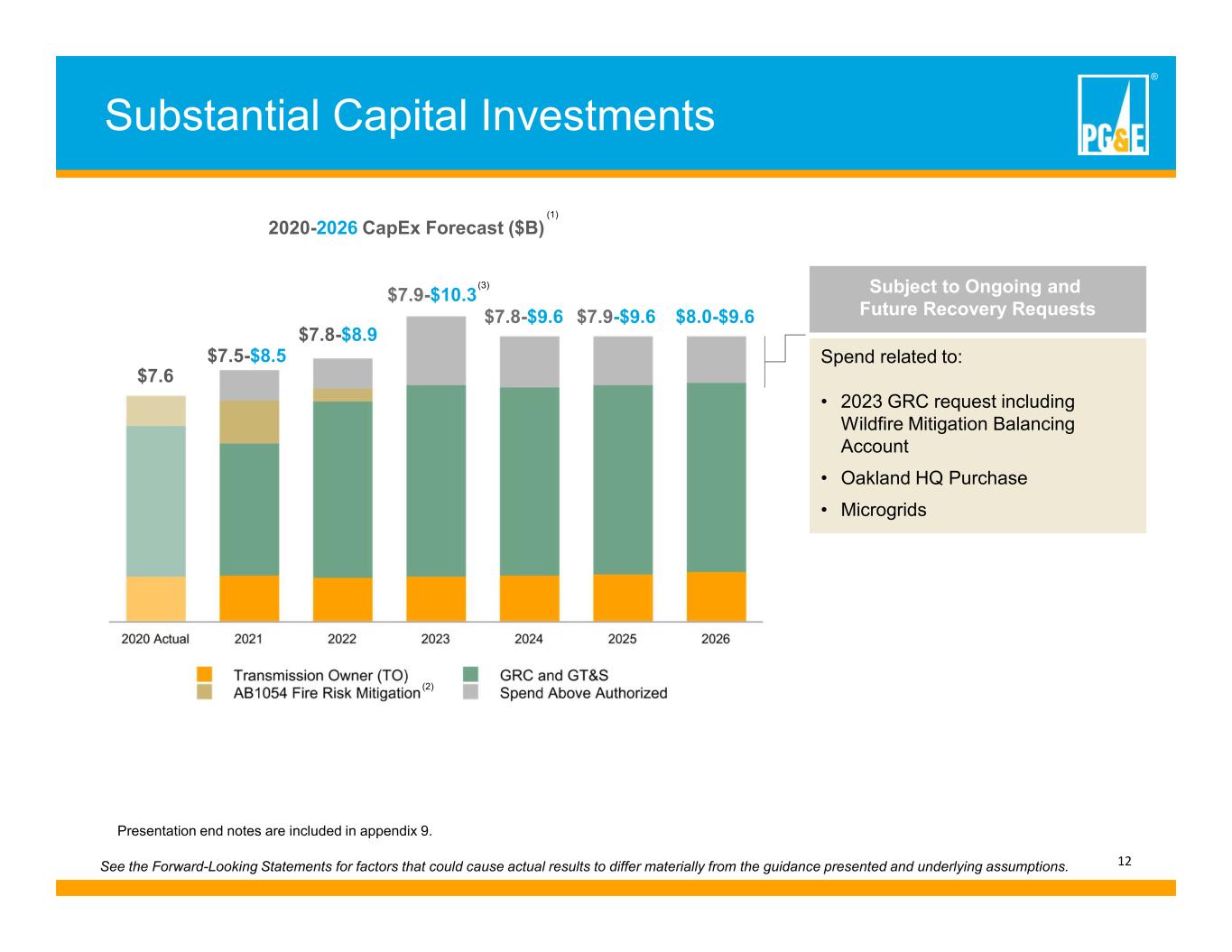

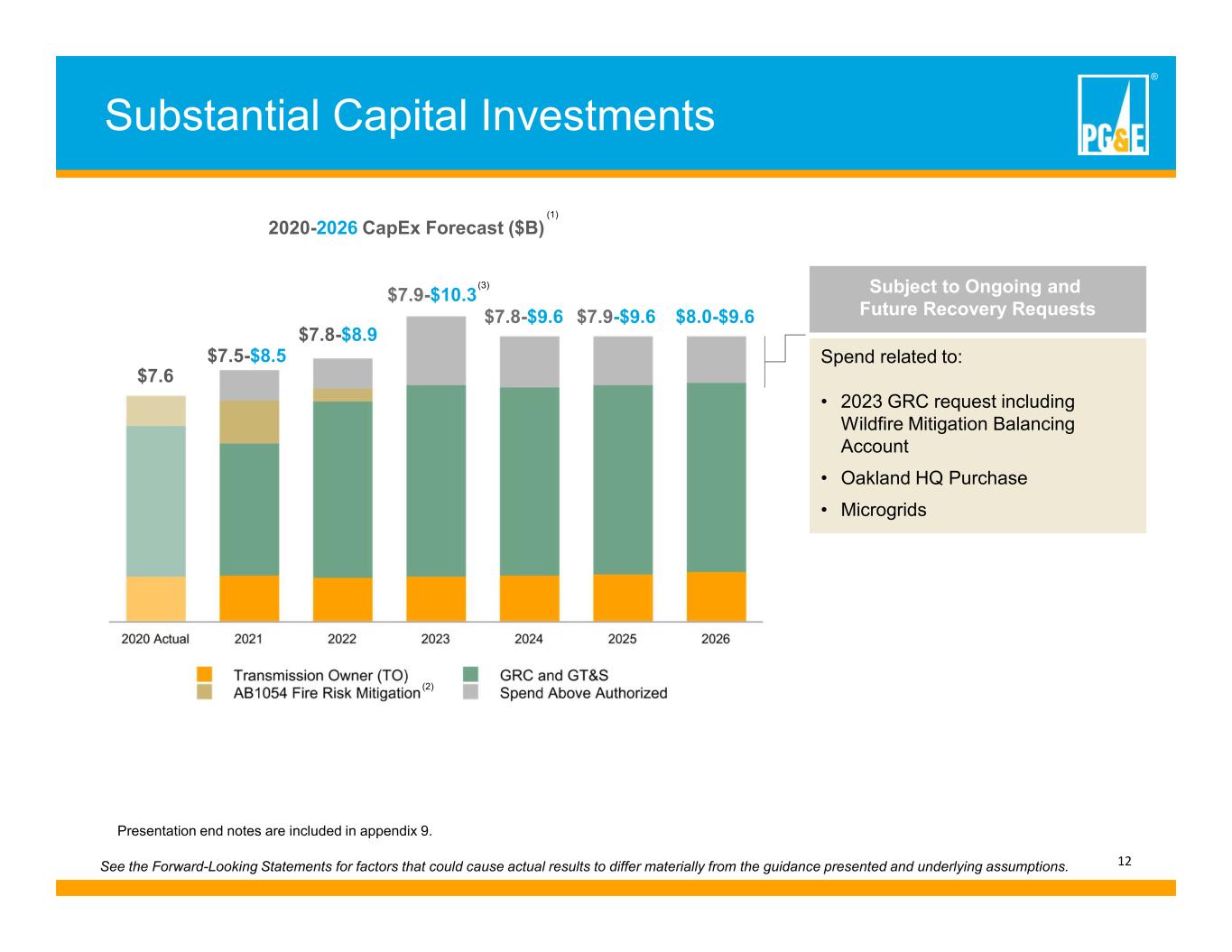

See the Forward-Looking Statements for factors that could cause actual results to differ materially from the guidance presented and underlying assumptions. ® 12 Substantial Capital Investments $7.6 $7.5-$8.5 $7.8-$8.9 $7.9-$10.3 $7.8-$9.6 $7.9-$9.6 Subject to Ongoing and Future Recovery Requests Spend related to: • 2023 GRC request including Wildfire Mitigation Balancing Account • Oakland HQ Purchase • Microgrids (1) (2) 2020-2026 CapEx Forecast ($B) $8.0-$9.6 Presentation end notes are included in appendix 9. (3)

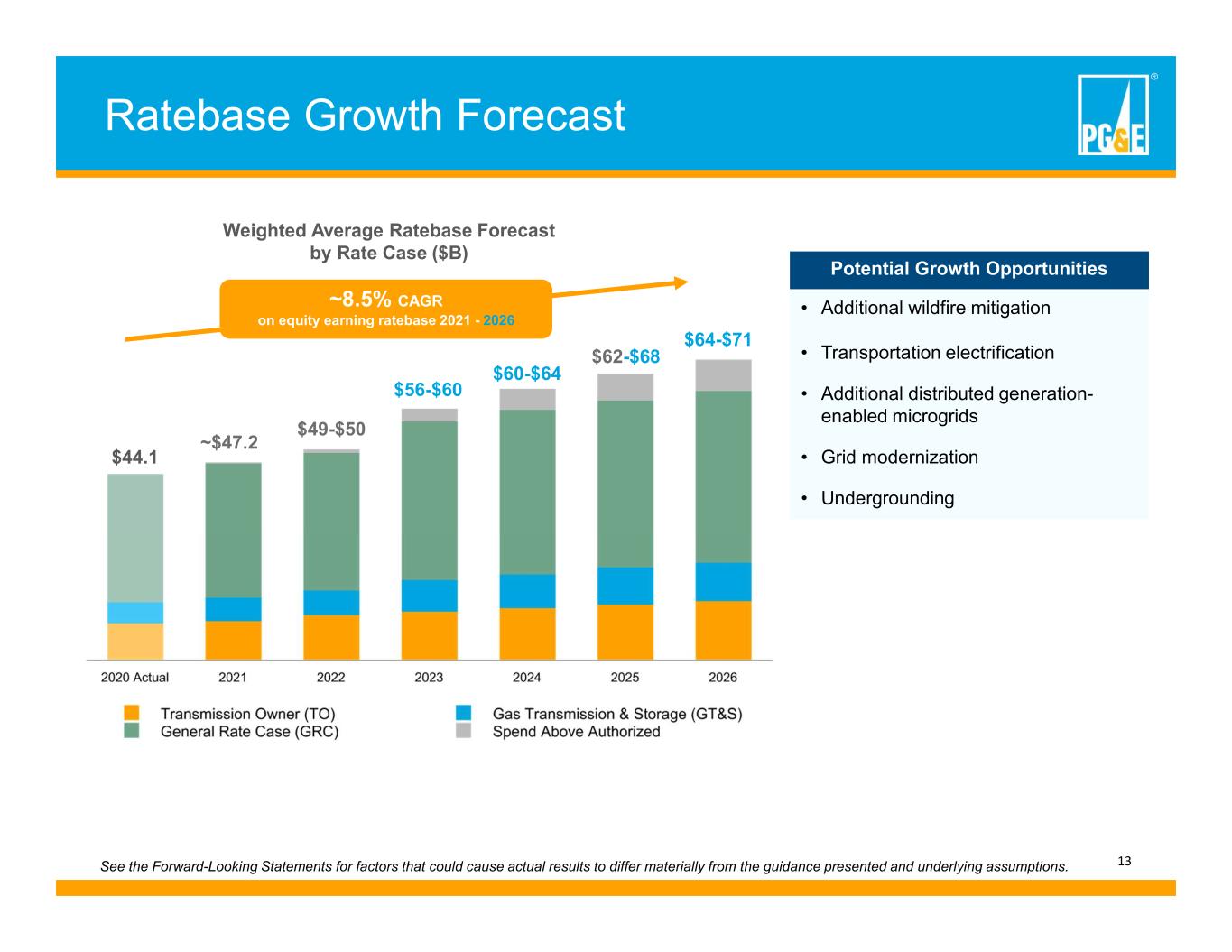

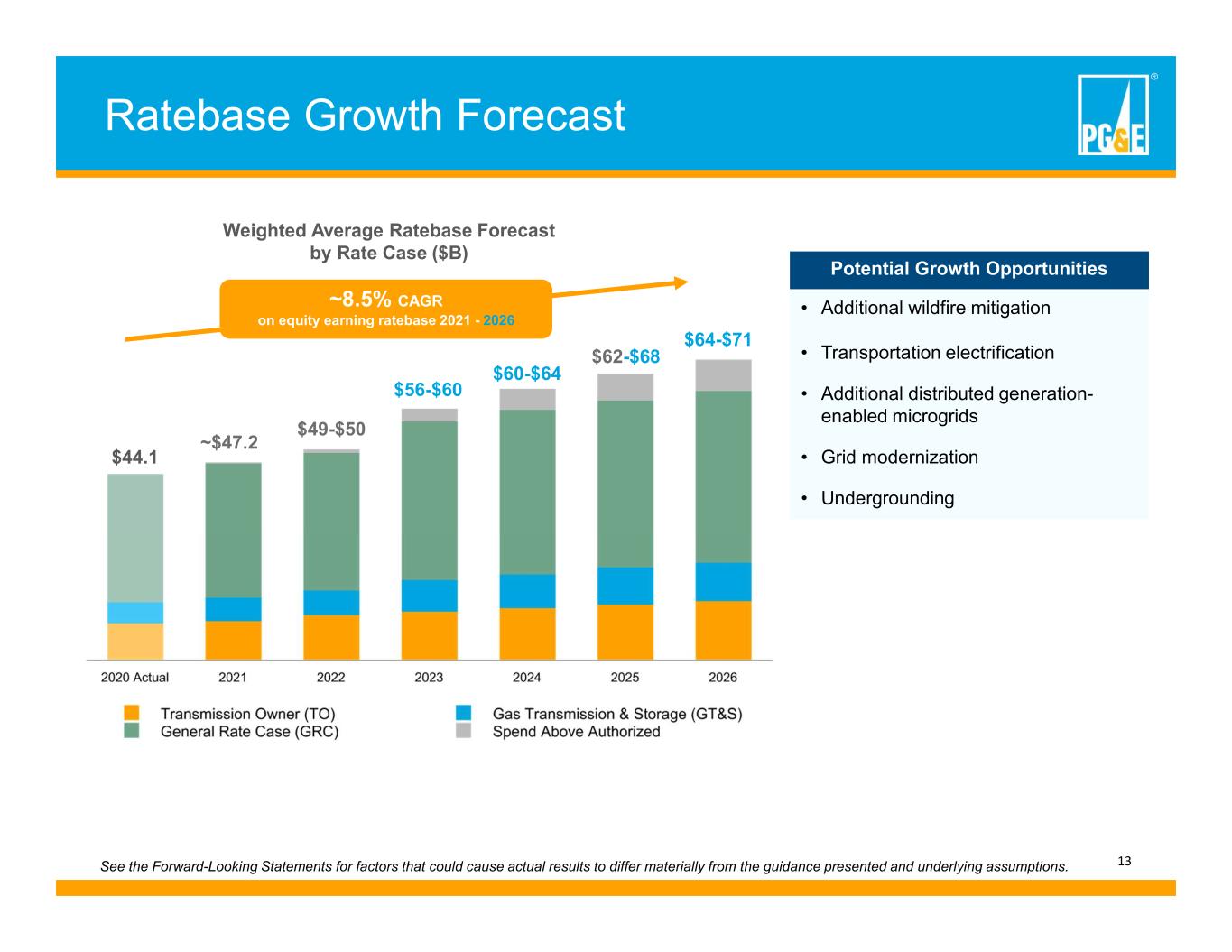

See the Forward-Looking Statements for factors that could cause actual results to differ materially from the guidance presented and underlying assumptions. ® 13 Ratebase Growth Forecast $44.1 $56-$60 $60-$64 $62-$68 ~8.5% CAGR on equity earning ratebase 2021 - 2026 Weighted Average Ratebase Forecast by Rate Case ($B) Potential Growth Opportunities • Additional wildfire mitigation • Transportation electrification • Additional distributed generation- enabled microgrids • Grid modernization • Undergrounding $49-$50 ~$47.2 $64-$71

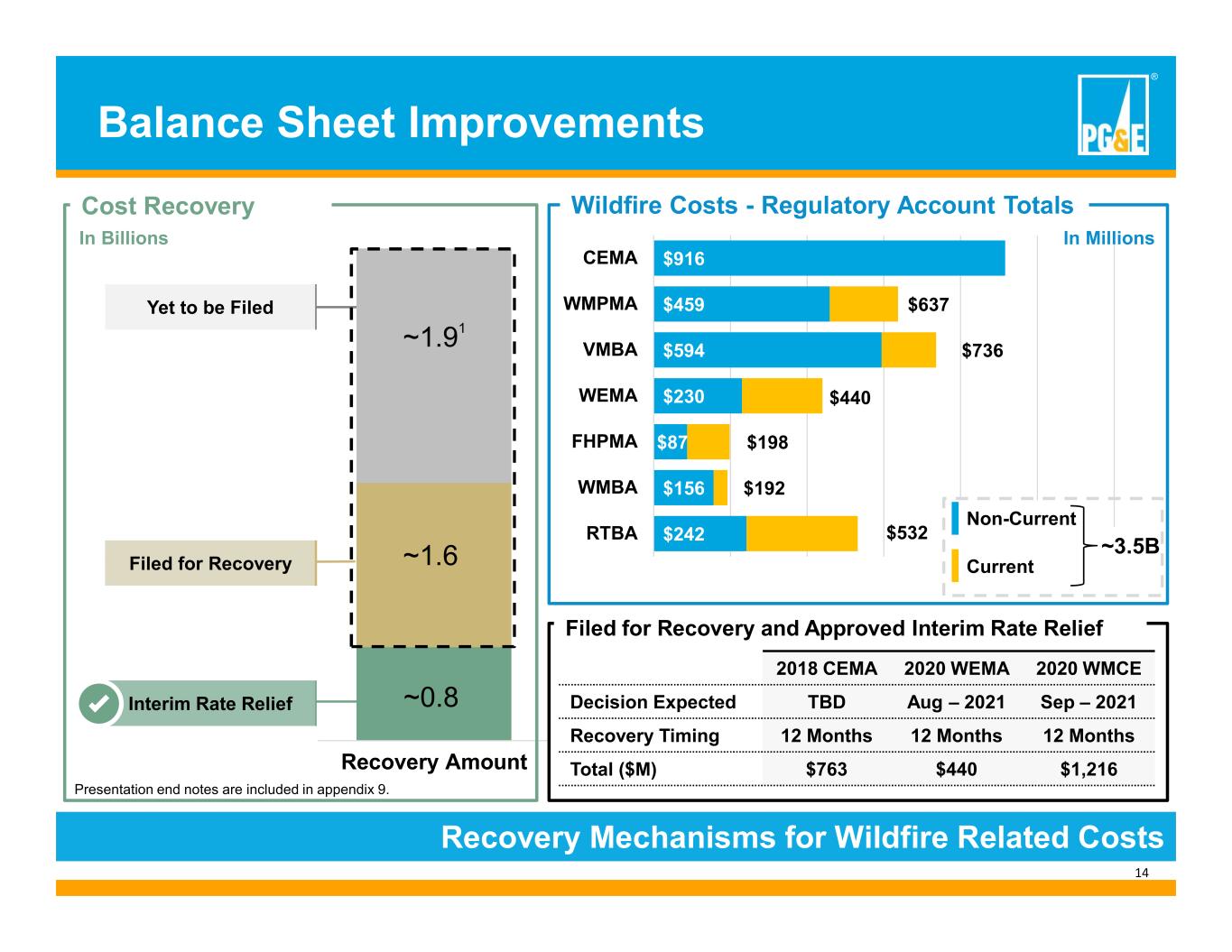

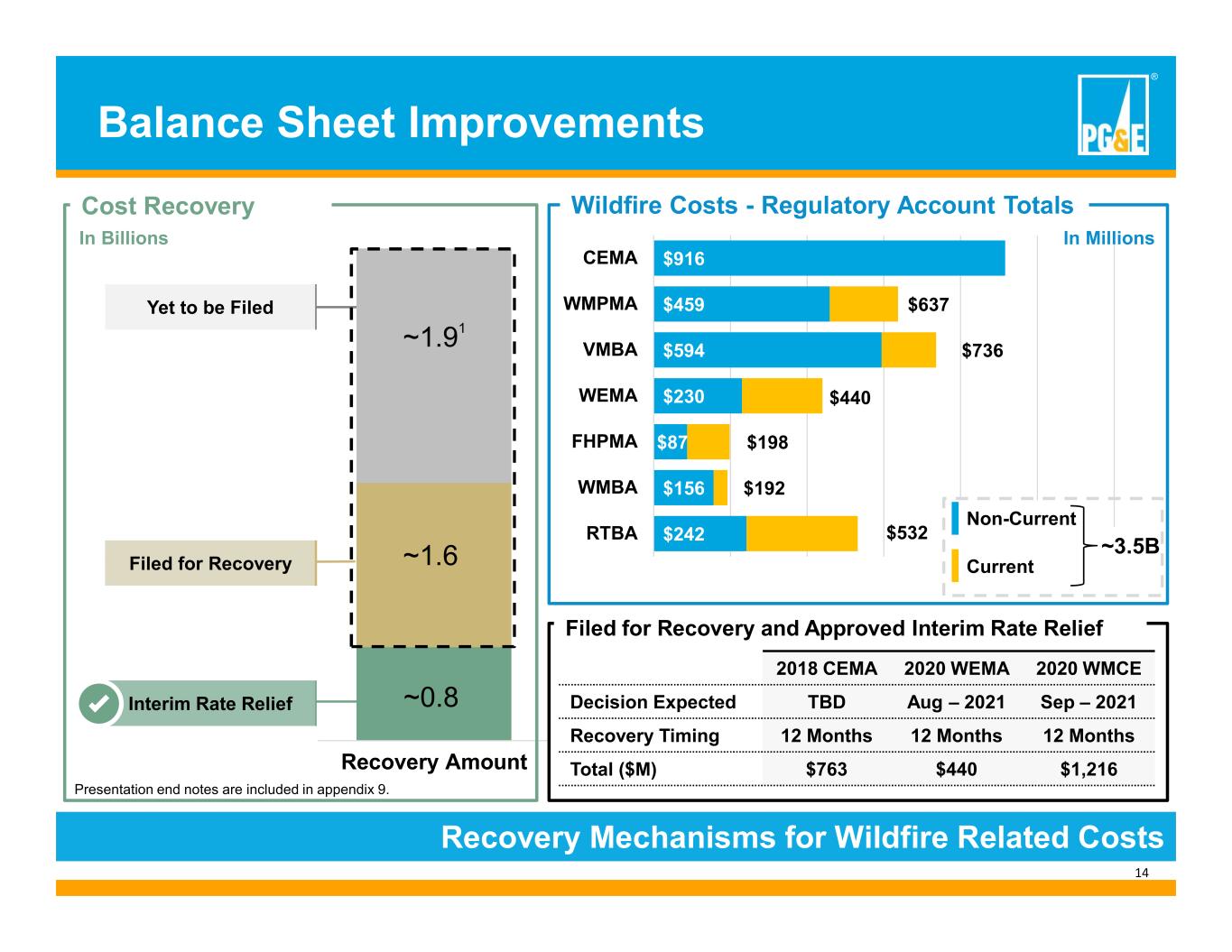

® 14 Recovery Amount Balance Sheet Improvements Recovery Mechanisms for Wildfire Related Costs Filed for Recovery and Approved Interim Rate Relief $242 $156 $87 $230 $594 $459 $916 $532 $192 $198 $736 $637 RTBA WMBA FHPMA WEMA VMBA WMPMA CEMA In Millions Yet to be Filed Filed for Recovery Cost Recovery In Billions ~0.8 ~1.6 ~1.9 Non-Current Current ~3.5B Wildfire Costs - Regulatory Account Totals 2018 CEMA 2020 WEMA 2020 WMCE Decision Expected TBD Aug – 2021 Sep – 2021 Recovery Timing 12 Months 12 Months 12 Months Total ($M) $763 $440 $1,216 Interim Rate Relief $440 1 Presentation end notes are included in appendix 9.

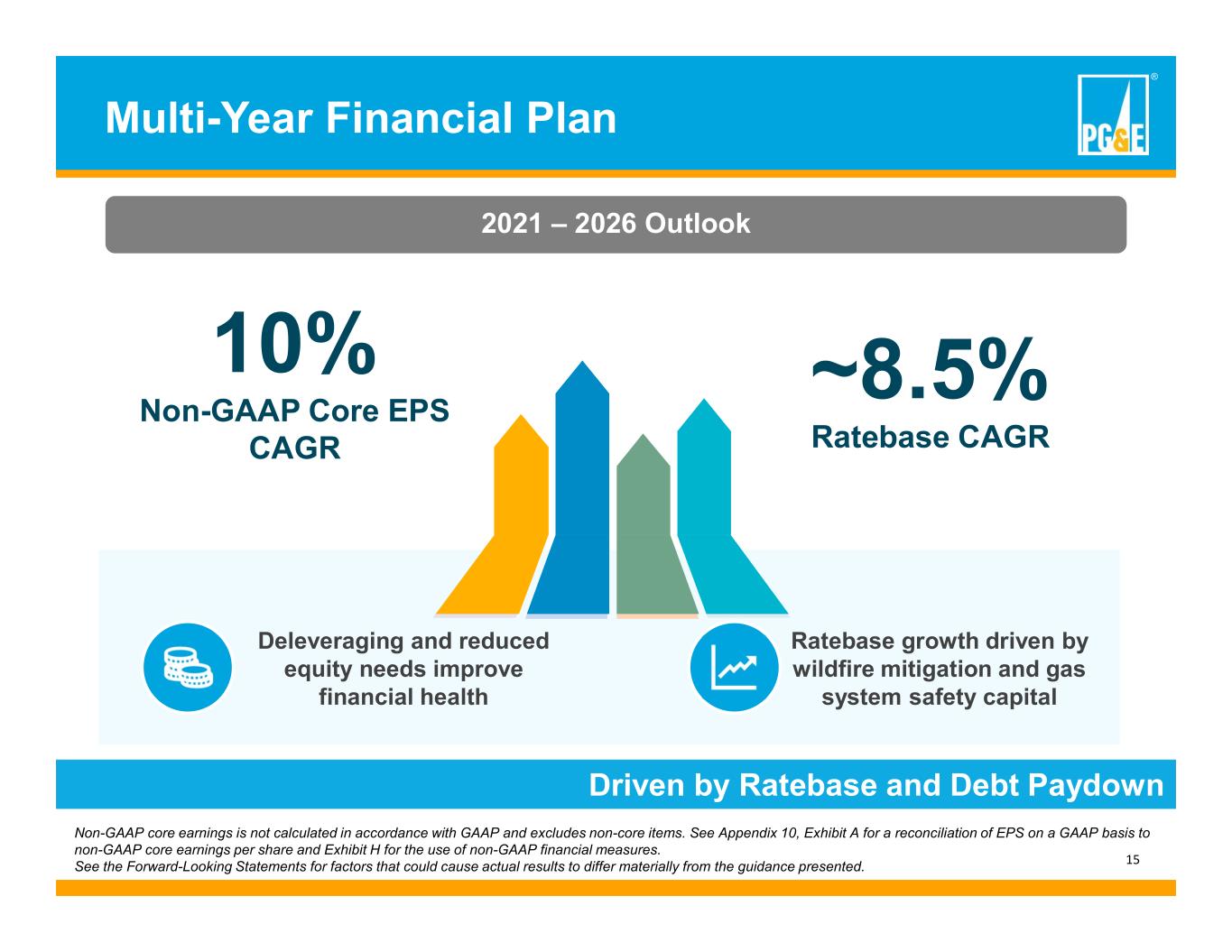

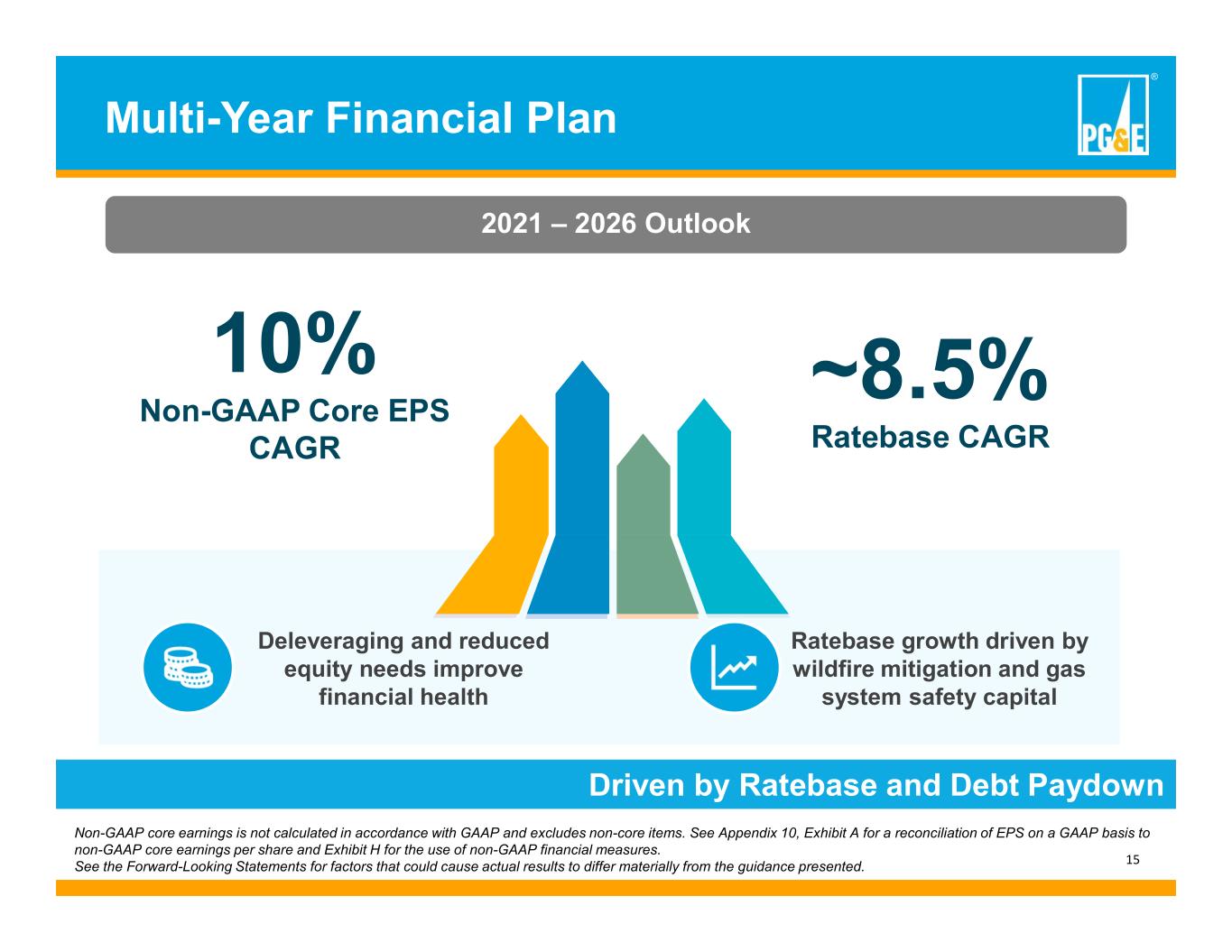

Non-GAAP core earnings is not calculated in accordance with GAAP and excludes non-core items. See Appendix 10, Exhibit A for a reconciliation of EPS on a GAAP basis to non-GAAP core earnings per share and Exhibit H for the use of non-GAAP financial measures. See the Forward-Looking Statements for factors that could cause actual results to differ materially from the guidance presented. ® 15 Multi-Year Financial Plan 10% Non-GAAP Core EPS CAGR 2021 – 2026 Outlook ~8.5% Ratebase CAGR Ratebase growth driven by wildfire mitigation and gas system safety capital Deleveraging and reduced equity needs improve financial health Driven by Ratebase and Debt Paydown

® 16 People, Planet, Prosperity Underpinned by Performance People ProsperityPlanet See you soon! Investor Day – August 9, 2021

Appendix

® 18 Table of Contents Appendix 1 - Wildfire Risk Reduction Programs Slide 19 Appendix 2 - AB 1054 Wildfire Fund Slide 20 Appendix 3 - Illustrative Wildfire Fund Scenarios Slide 21 Appendix 4 - Regulatory Progress Slide 22 Appendix 5 - PG&E Catastrophic Wildfire Cost Securitization Slide 23 Appendix 6 - PG&E Wildfire Mitigation Capex Securitization Slide 24 Appendix 7 - COVID-19 Impacts Slide 25 Appendix 8 - Expected Timelines of Selected Regulatory Cases Slide 26-29 Appendix 9 - Presentation Footnotes Slide 30-31 Appendix 10 - Supplemental Earnings Exhibits Slide 32-47

® 19 Appendix 1: Wildfire Risk Reduction Programs PROGRAM 2021 GOAL/TARGET 2018-2021 PROGRESS As of June 30, 2021 Enhanced and Targeted Inspections Inspecting distribution, transmission and substation equipment to address potential risks • Complete annual cycles for Tier 3 and every 3 years for Tier 2 Implementing annual cycles for Tier 3 and every 3 years for Tier 2 Enhanced Vegetation Management Meeting and exceeding state vegetation and safety standards • Complete 1,800 miles 4,973 miles System Hardening Installing stronger poles, covered lines and/or targeted undergrounding • Harden 180 miles 852 miles Targeted Equipment Upgrades (e.g. Expulsion Fuses, Surge Arrestors) Replacing existing expulsion fuses and surge arrestors with new, safer, CAL FIRE exempt equipment • Replace approximately 1,200 fuses and other non-exempt equipment identified on poles in Tier 2 and Tier 3 HFTD areas. • Replace at least 15,000 Tier 2 and Tier 3 non-exempt surge arresters. 1,447 fuses 21,631 arrestors Transmission and Distribution Sectionalizing Devices Separating the distribution grid into smaller sections for more targeted PSPS events • Install 29 transmission line switches • Install at least 250 sectionalizing devices 73 transmission line switches 988 sectionalizing devices HD Cameras & Weather Stations Installing HD cameras and weather stations for real time monitoring of high-risk areas to enable earlier warning and detection of wildfires • Install 300 weather stations • Install 135 HD cameras 1,170 weather stations 419 HD cameras Microgrids Readying substations and the distribution system to receive temporary generation during severe weather • Develop at least 5 temporary generation distribution microgrids sites • Prepare at least 8 substation temporary generation sites 7 temporary generation distribution microgrids sites 6 substation temporary generation sites

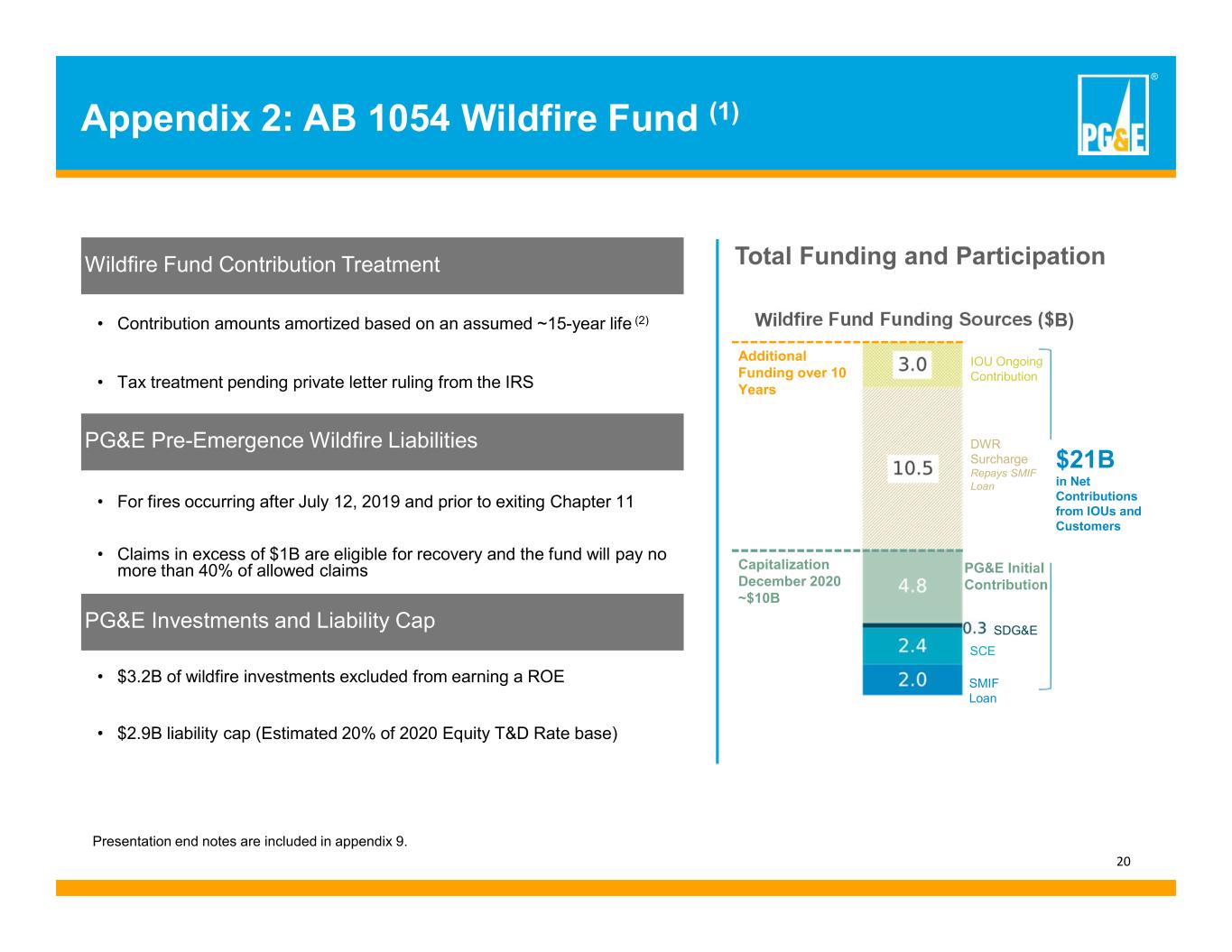

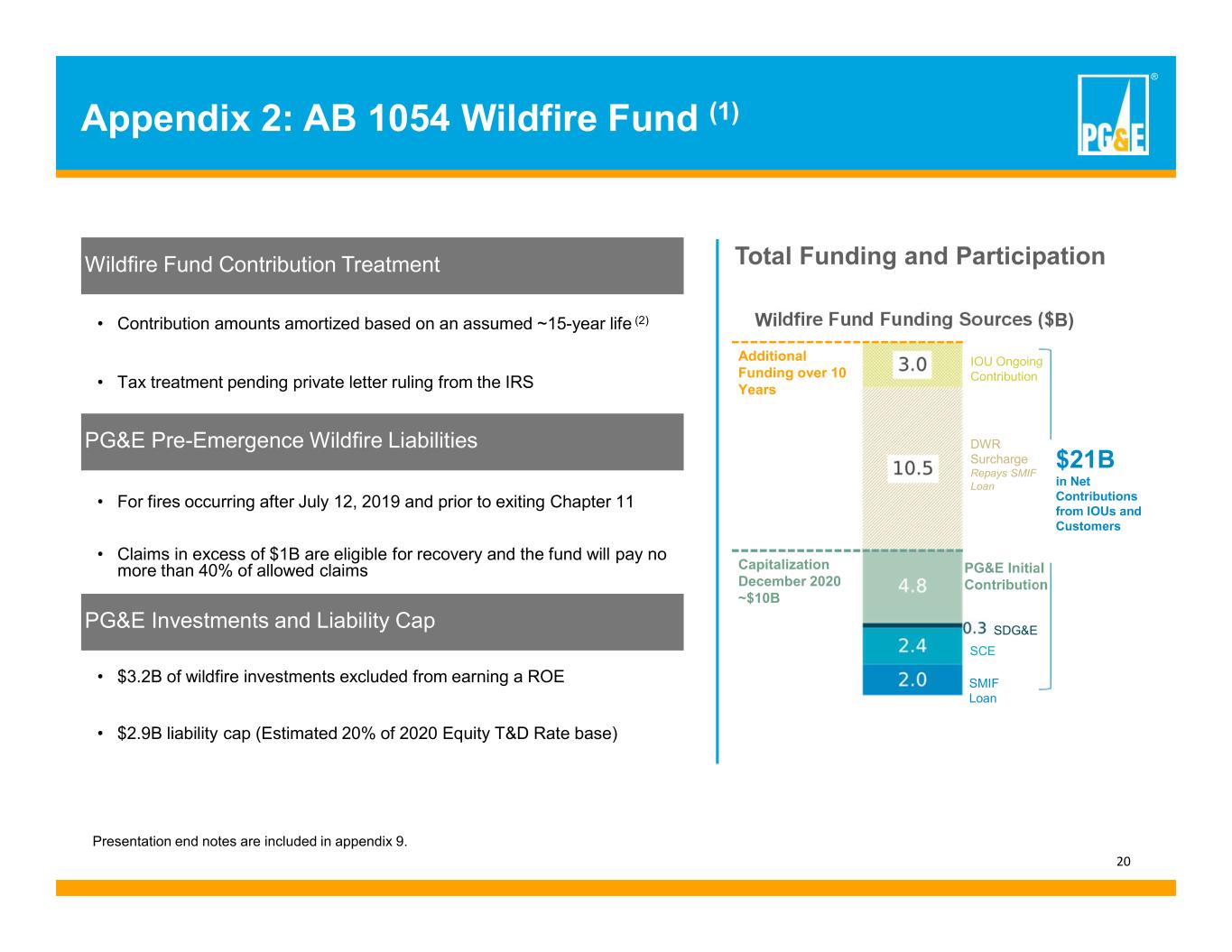

® 20 Wildfire Fund Contribution Treatment • Contribution amounts amortized based on an assumed ~15-year life (2) • Tax treatment pending private letter ruling from the IRS PG&E Pre-Emergence Wildfire Liabilities • For fires occurring after July 12, 2019 and prior to exiting Chapter 11 • Claims in excess of $1B are eligible for recovery and the fund will pay no more than 40% of allowed claims PG&E Investments and Liability Cap • $3.2B of wildfire investments excluded from earning a ROE • $2.9B liability cap (Estimated 20% of 2020 Equity T&D Rate base) Appendix 2: AB 1054 Wildfire Fund (1) Wildfire Fund Funding Sources ($B) SDG&E SCE SMIF Loan PG&E Initial Contribution Capitalization December 2020 ~$10B Additional Funding over 10 Years IOU Ongoing Contribution DWR Surcharge Repays SMIF Loan $21B in Net Contributions from IOUs and Customers Total Funding and Participation Presentation end notes are included in appendix 9.

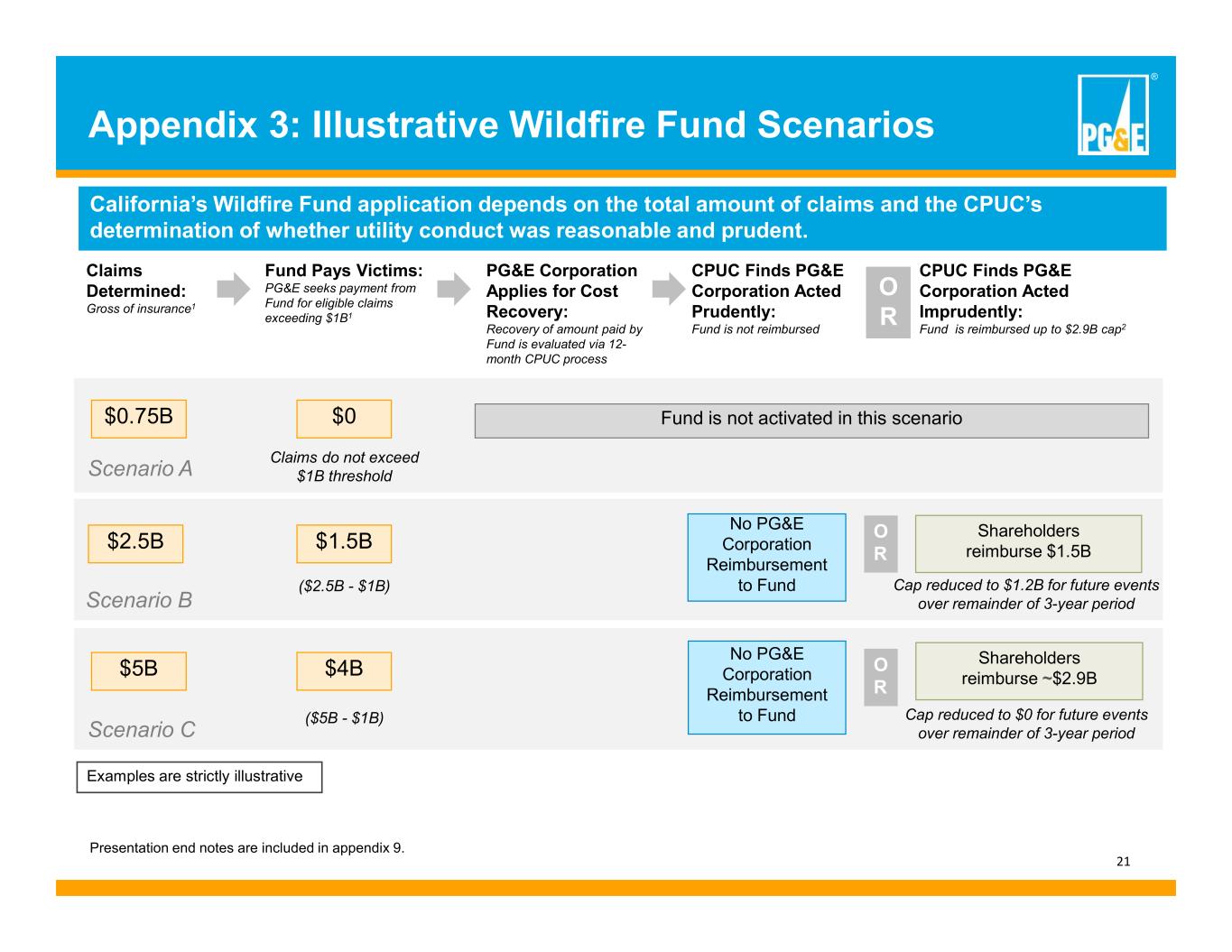

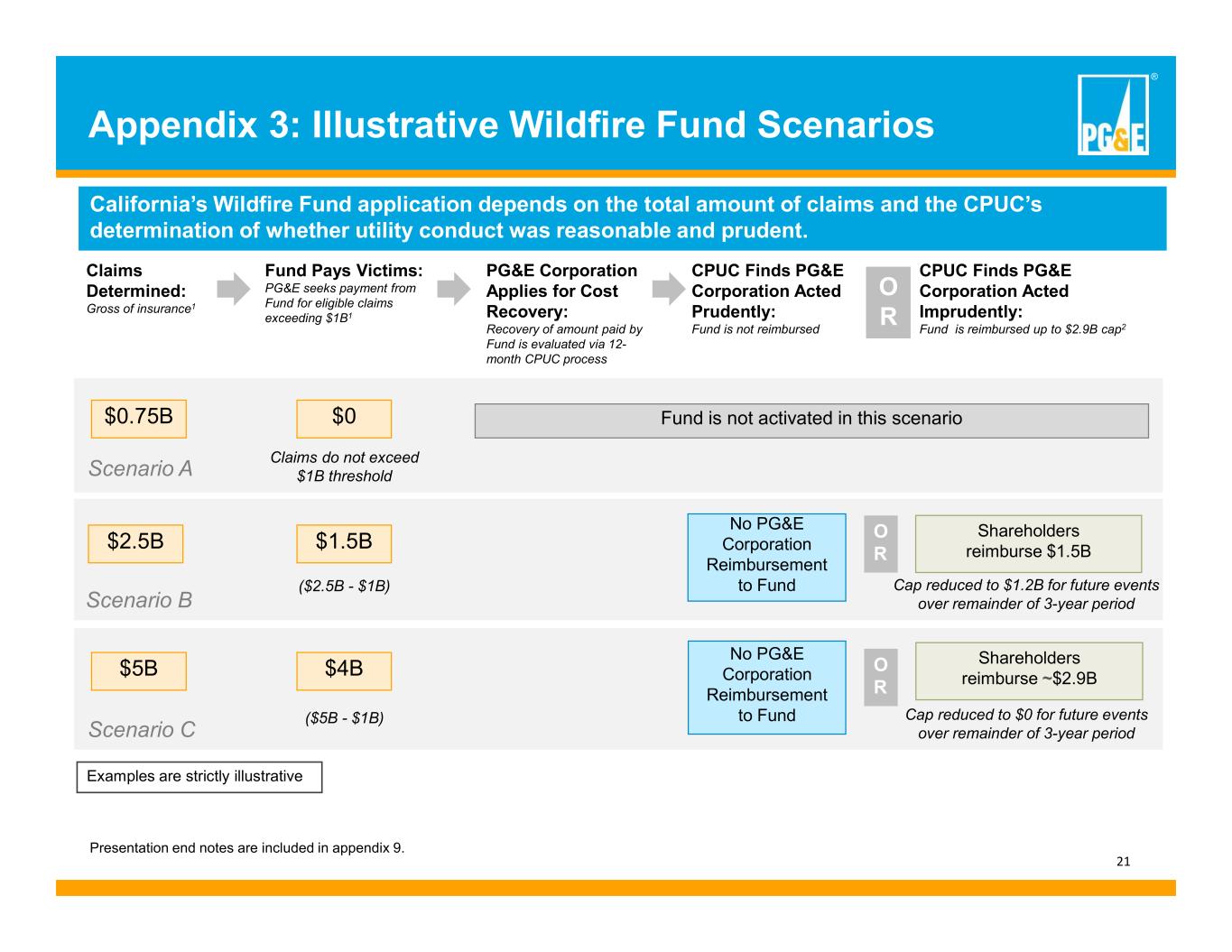

® 21 Appendix 3: Illustrative Wildfire Fund Scenarios California’s Wildfire Fund application depends on the total amount of claims and the CPUC’s determination of whether utility conduct was reasonable and prudent. Claims Determined: Gross of insurance1 Fund Pays Victims: PG&E seeks payment from Fund for eligible claims exceeding $1B1 PG&E Corporation Applies for Cost Recovery: Recovery of amount paid by Fund is evaluated via 12- month CPUC process CPUC Finds PG&E Corporation Acted Prudently: Fund is not reimbursed CPUC Finds PG&E Corporation Acted Imprudently: Fund is reimbursed up to $2.9B cap2 $0.75B Fund is not activated in this scenario No PG&E Corporation Reimbursement to Fund Shareholders reimburse $1.5B Shareholders reimburse ~$2.9B $2.5B $5B $0 Claims do not exceed $1B threshold $1.5B ($2.5B - $1B) $4B ($5B - $1B) No PG&E Corporation Reimbursement to Fund Cap reduced to $1.2B for future events over remainder of 3-year period Cap reduced to $0 for future events over remainder of 3-year period O R Scenario A Scenario B Scenario C O R O R Examples are strictly illustrative Presentation end notes are included in appendix 9.

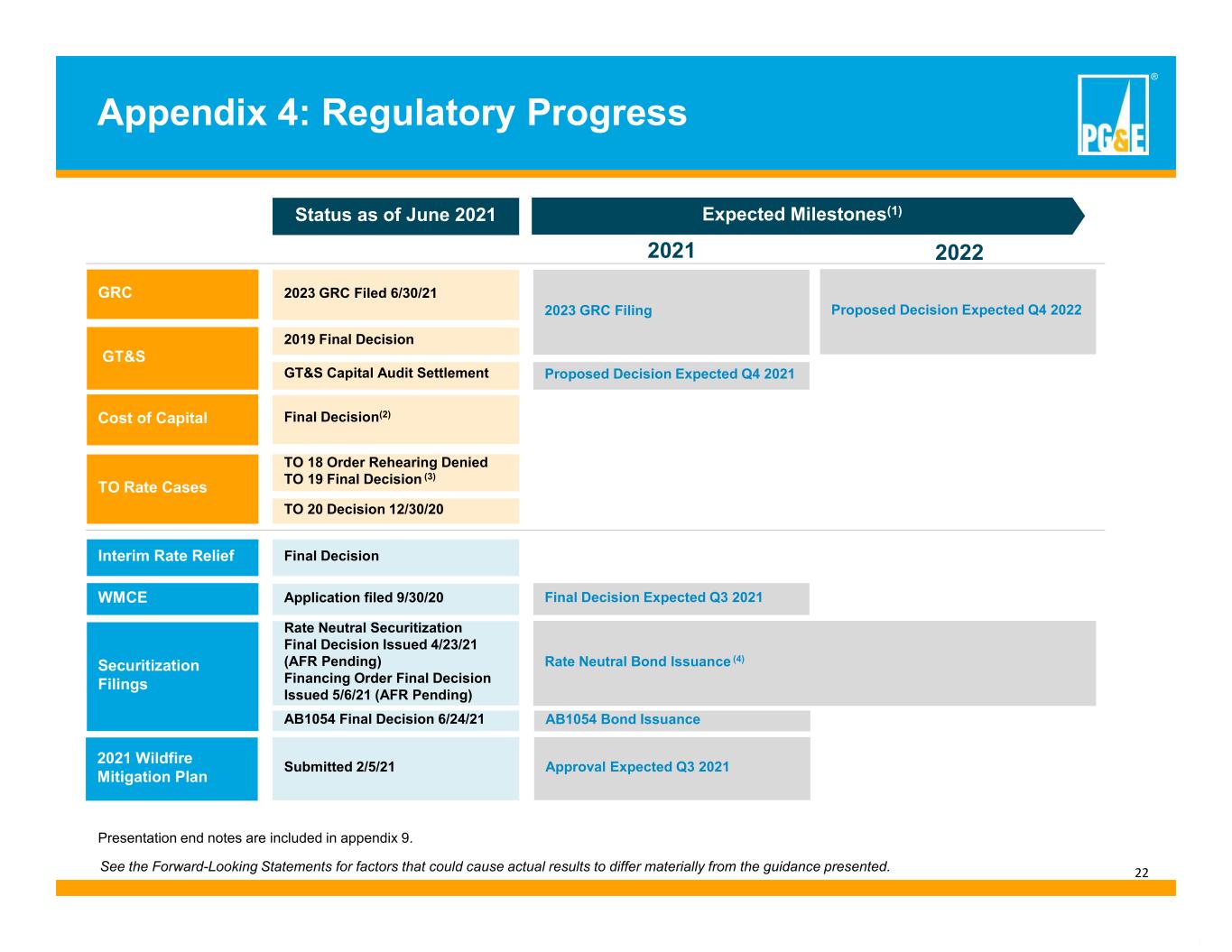

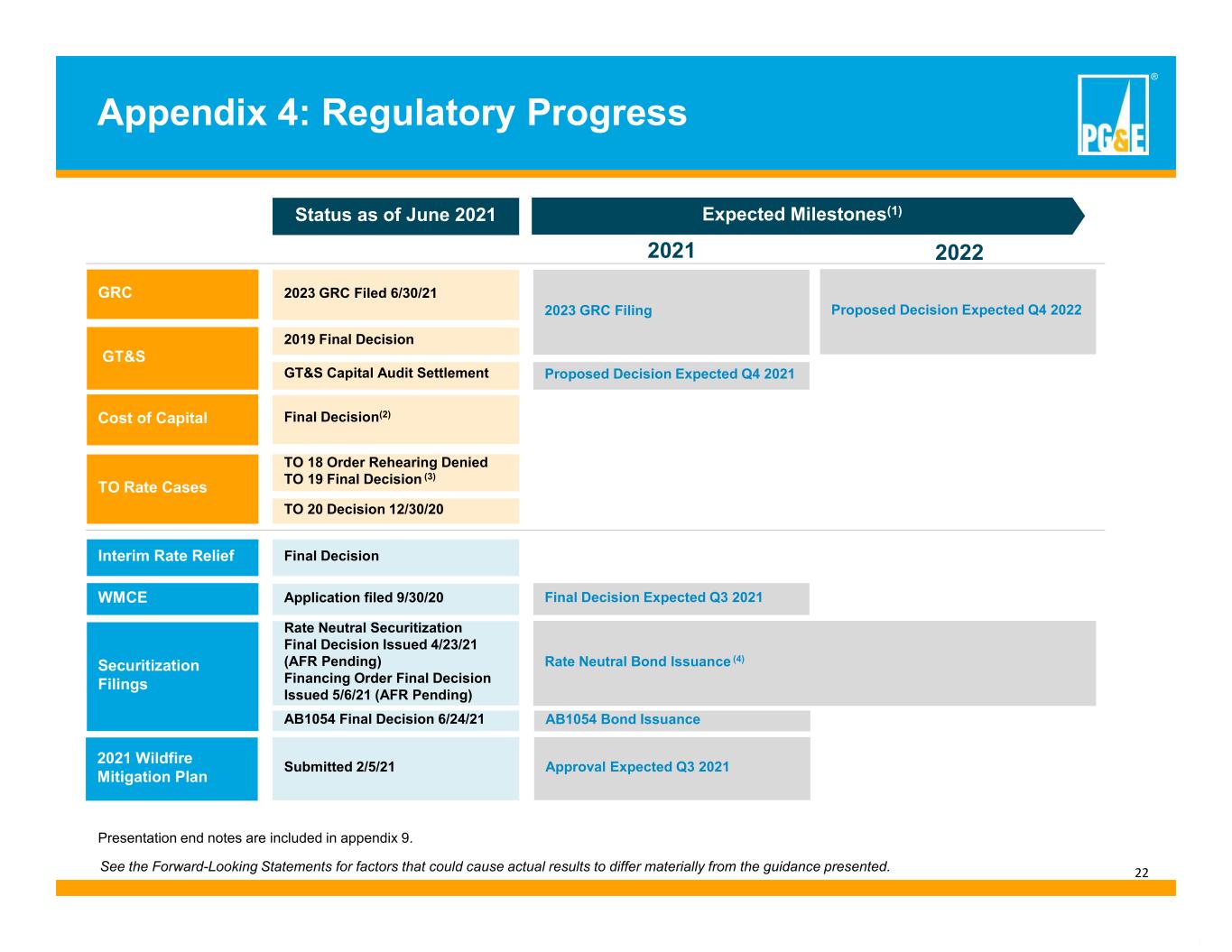

See the Forward-Looking Statements for factors that could cause actual results to differ materially from the guidance presented. ® 22 Appendix 4: Regulatory Progress Expected Milestones(1) 2021 Cost of Capital Status as of June 2021 Final Decision(2) 2023 GRC Filed 6/30/21GRC GT&S GT&S Capital Audit Settlement TO Rate Cases Final Decision Interim Rate Relief WMCE 2019 Final Decision Securitization Filings TO 20 Decision 12/30/20 Application filed 9/30/20 Rate Neutral Securitization Final Decision Issued 4/23/21 (AFR Pending) Financing Order Final Decision Issued 5/6/21 (AFR Pending) Proposed Decision Expected Q4 2021 TO 18 Order Rehearing Denied TO 19 Final Decision (3) Final Decision Expected Q3 2021 Rate Neutral Bond Issuance (4) 2023 GRC Filing AB1054 Final Decision 6/24/21 AB1054 Bond Issuance 2022 Proposed Decision Expected Q4 2022 2021 Wildfire Mitigation Plan Submitted 2/5/21 Approval Expected Q3 2021 Presentation end notes are included in appendix 9.

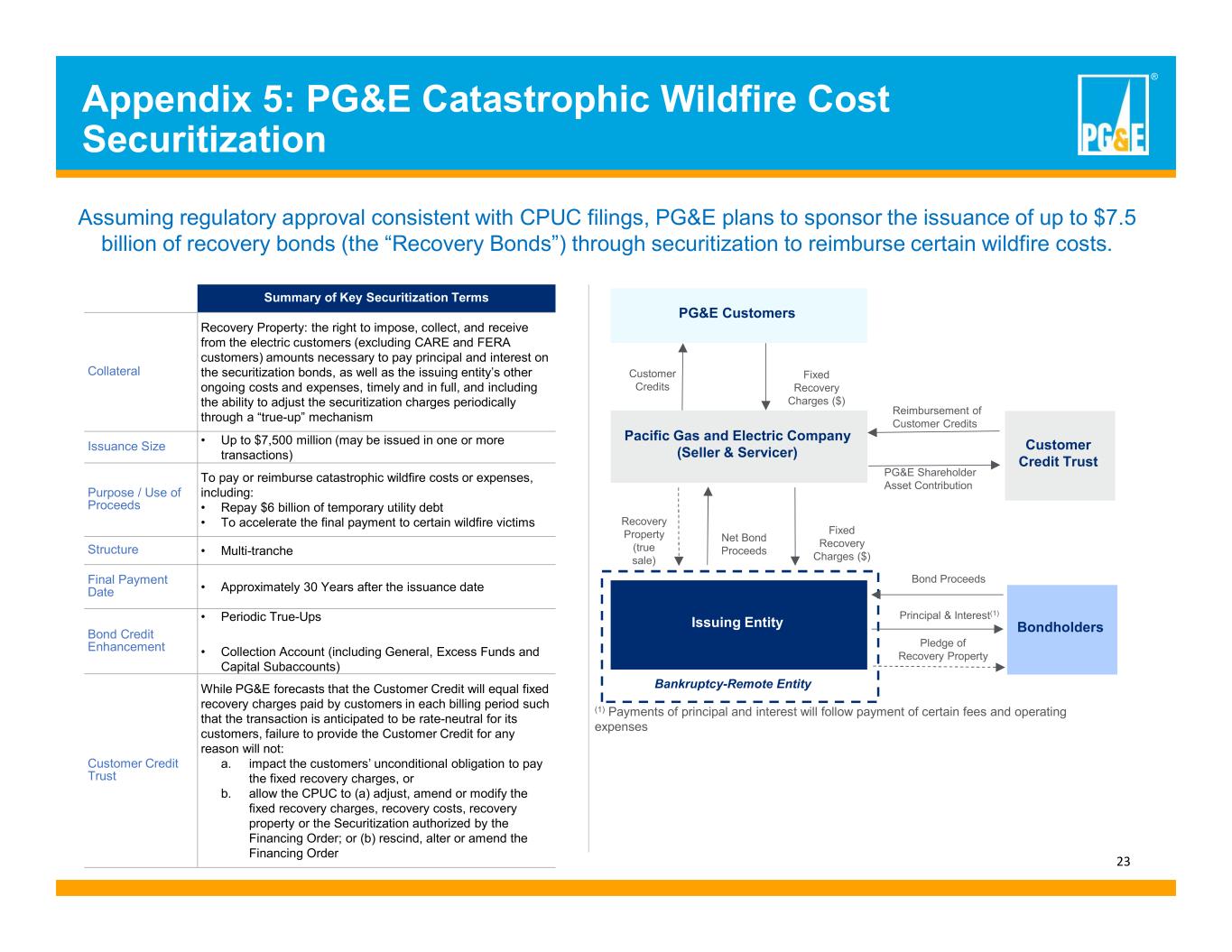

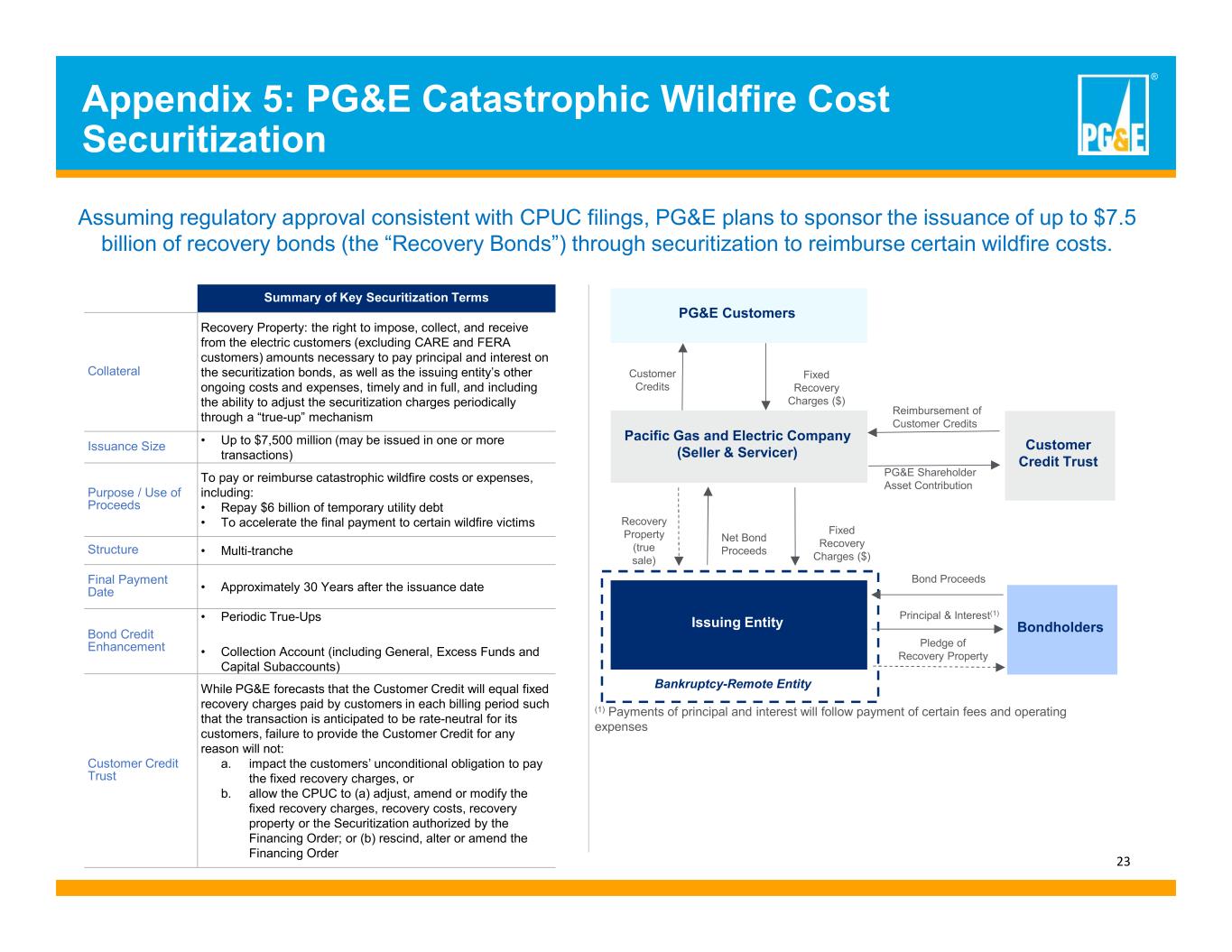

® 23 Pledge of Recovery Property PG&E Customers Fixed Recovery Charges ($) Pacific Gas and Electric Company (Seller & Servicer) BondholdersIssuing Entity Principal & Interest(1) (1) Payments of principal and interest will follow payment of certain fees and operating expenses Bankruptcy-Remote Entity Recovery Property (true sale) Fixed Recovery Charges ($) Net Bond Proceeds Bond Proceeds Customer Credits Reimbursement of Customer Credits PG&E Shareholder Asset Contribution Customer Credit Trust Summary of Key Securitization Terms Collateral Recovery Property: the right to impose, collect, and receive from the electric customers (excluding CARE and FERA customers) amounts necessary to pay principal and interest on the securitization bonds, as well as the issuing entity’s other ongoing costs and expenses, timely and in full, and including the ability to adjust the securitization charges periodically through a “true-up” mechanism Issuance Size • Up to $7,500 million (may be issued in one or more transactions) Purpose / Use of Proceeds To pay or reimburse catastrophic wildfire costs or expenses, including: • Repay $6 billion of temporary utility debt • To accelerate the final payment to certain wildfire victims Structure • Multi-tranche Final Payment Date • Approximately 30 Years after the issuance date Bond Credit Enhancement • Periodic True-Ups • Collection Account (including General, Excess Funds and Capital Subaccounts) Customer Credit Trust While PG&E forecasts that the Customer Credit will equal fixed recovery charges paid by customers in each billing period such that the transaction is anticipated to be rate-neutral for its customers, failure to provide the Customer Credit for any reason will not: a. impact the customers’ unconditional obligation to pay the fixed recovery charges, or b. allow the CPUC to (a) adjust, amend or modify the fixed recovery charges, recovery costs, recovery property or the Securitization authorized by the Financing Order; or (b) rescind, alter or amend the Financing Order Appendix 5: PG&E Catastrophic Wildfire Cost Securitization Assuming regulatory approval consistent with CPUC filings, PG&E plans to sponsor the issuance of up to $7.5 billion of recovery bonds (the “Recovery Bonds”) through securitization to reimburse certain wildfire costs.

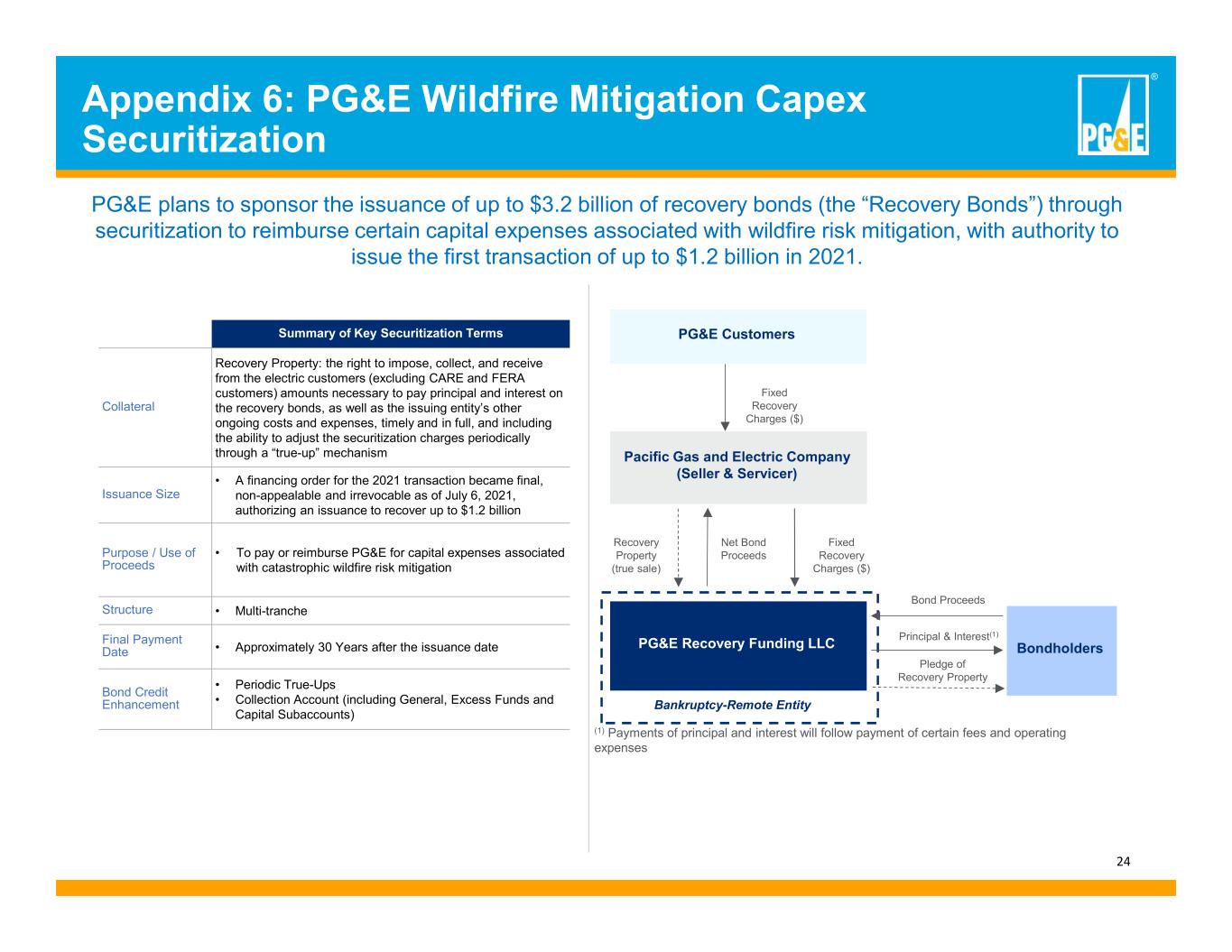

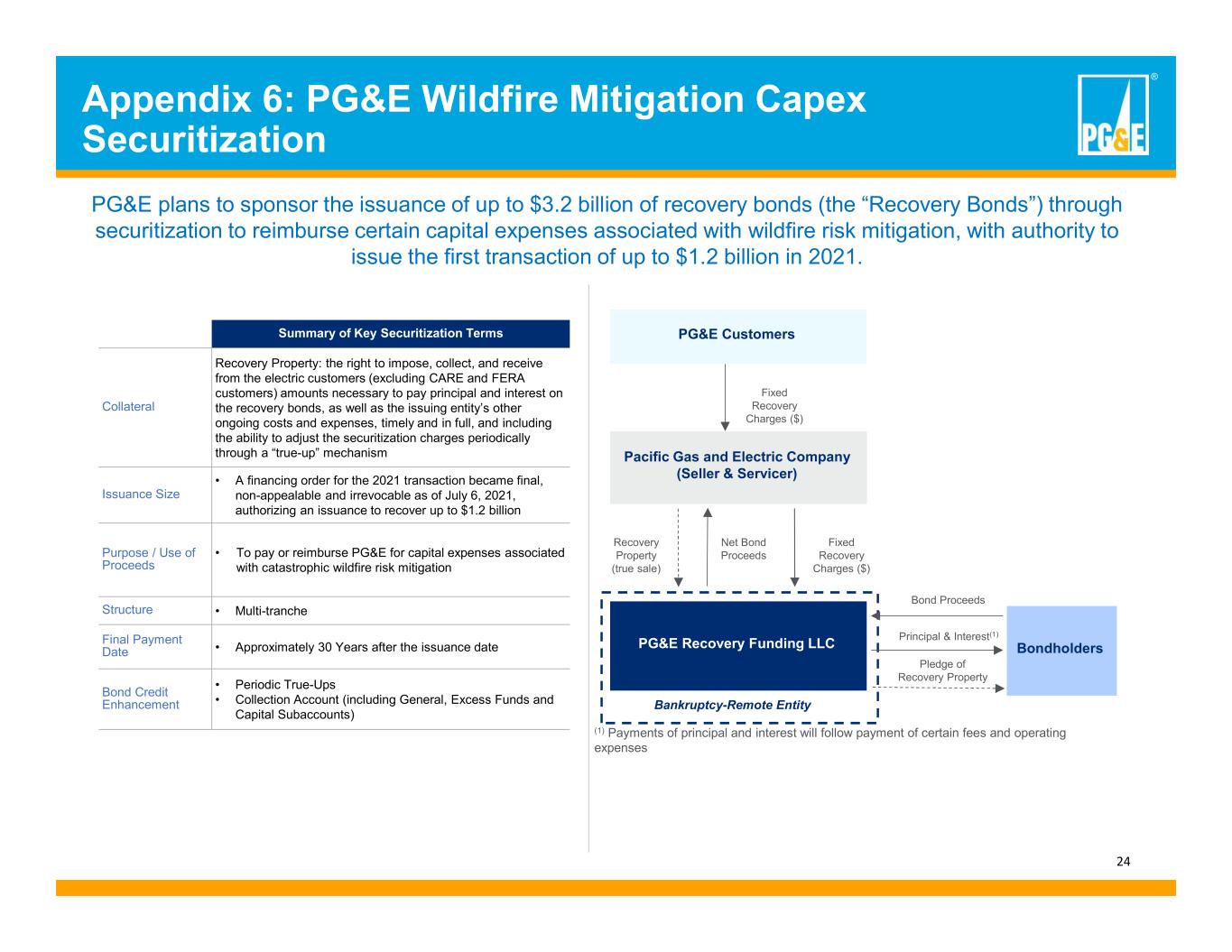

® 24 Pledge of Recovery Property PG&E Customers Fixed Recovery Charges ($) Pacific Gas and Electric Company (Seller & Servicer) BondholdersPG&E Recovery Funding LLC Principal & Interest(1) (1) Payments of principal and interest will follow payment of certain fees and operating expenses Bankruptcy-Remote Entity Recovery Property (true sale) Fixed Recovery Charges ($) Net Bond Proceeds Bond Proceeds Summary of Key Securitization Terms Collateral Recovery Property: the right to impose, collect, and receive from the electric customers (excluding CARE and FERA customers) amounts necessary to pay principal and interest on the recovery bonds, as well as the issuing entity’s other ongoing costs and expenses, timely and in full, and including the ability to adjust the securitization charges periodically through a “true-up” mechanism Issuance Size • A financing order for the 2021 transaction became final, non-appealable and irrevocable as of July 6, 2021, authorizing an issuance to recover up to $1.2 billion Purpose / Use of Proceeds • To pay or reimburse PG&E for capital expenses associated with catastrophic wildfire risk mitigation Structure • Multi-tranche Final Payment Date • Approximately 30 Years after the issuance date Bond Credit Enhancement • Periodic True-Ups • Collection Account (including General, Excess Funds and Capital Subaccounts) Appendix 6: PG&E Wildfire Mitigation Capex Securitization PG&E plans to sponsor the issuance of up to $3.2 billion of recovery bonds (the “Recovery Bonds”) through securitization to reimburse certain capital expenses associated with wildfire risk mitigation, with authority to issue the first transaction of up to $1.2 billion in 2021.

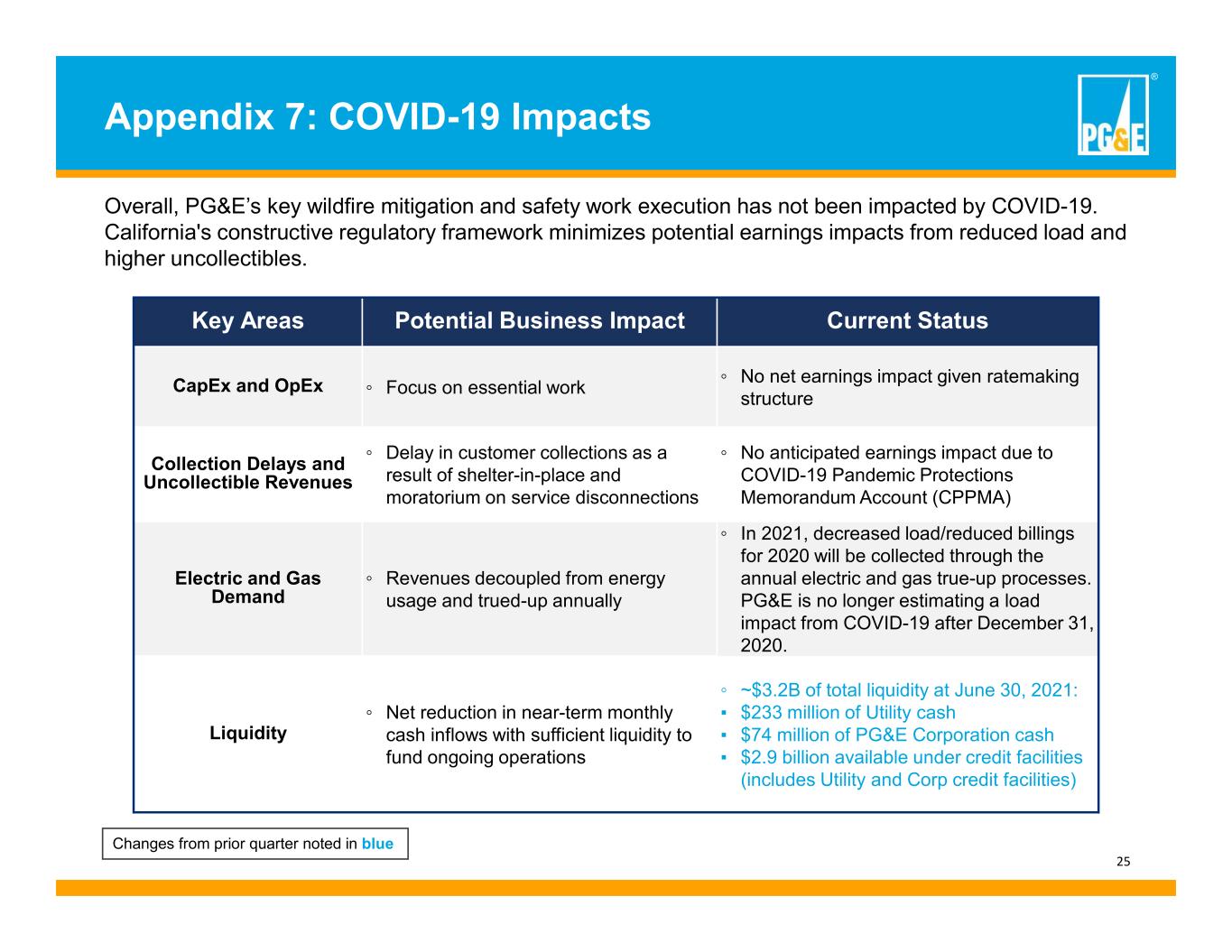

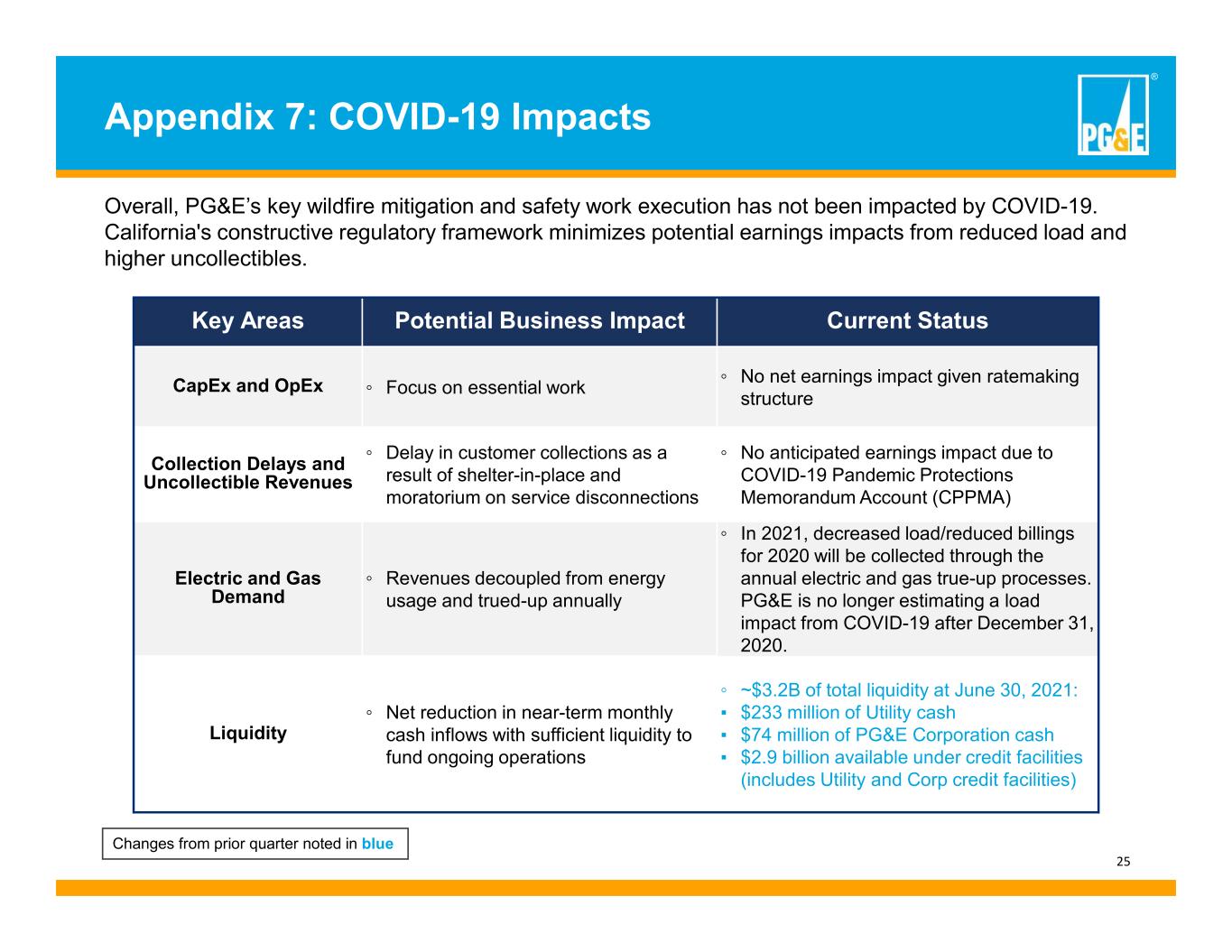

® 25 Key Areas Potential Business Impact Current Status CapEx and OpEx ◦ Focus on essential work ◦ No net earnings impact given ratemaking structure Collection Delays and Uncollectible Revenues ◦ Delay in customer collections as a result of shelter-in-place and moratorium on service disconnections ◦ No anticipated earnings impact due to COVID-19 Pandemic Protections Memorandum Account (CPPMA) Electric and Gas Demand ◦ Revenues decoupled from energy usage and trued-up annually ◦ In 2021, decreased load/reduced billings for 2020 will be collected through the annual electric and gas true-up processes. PG&E is no longer estimating a load impact from COVID-19 after December 31, 2020. Liquidity ◦ Net reduction in near-term monthly cash inflows with sufficient liquidity to fund ongoing operations ◦ ~$3.2B of total liquidity at June 30, 2021: ▪ $233 million of Utility cash ▪ $74 million of PG&E Corporation cash ▪ $2.9 billion available under credit facilities (includes Utility and Corp credit facilities) Appendix 7: COVID-19 Impacts Overall, PG&E’s key wildfire mitigation and safety work execution has not been impacted by COVID-19. California's constructive regulatory framework minimizes potential earnings impacts from reduced load and higher uncollectibles. Changes from prior quarter noted in blue

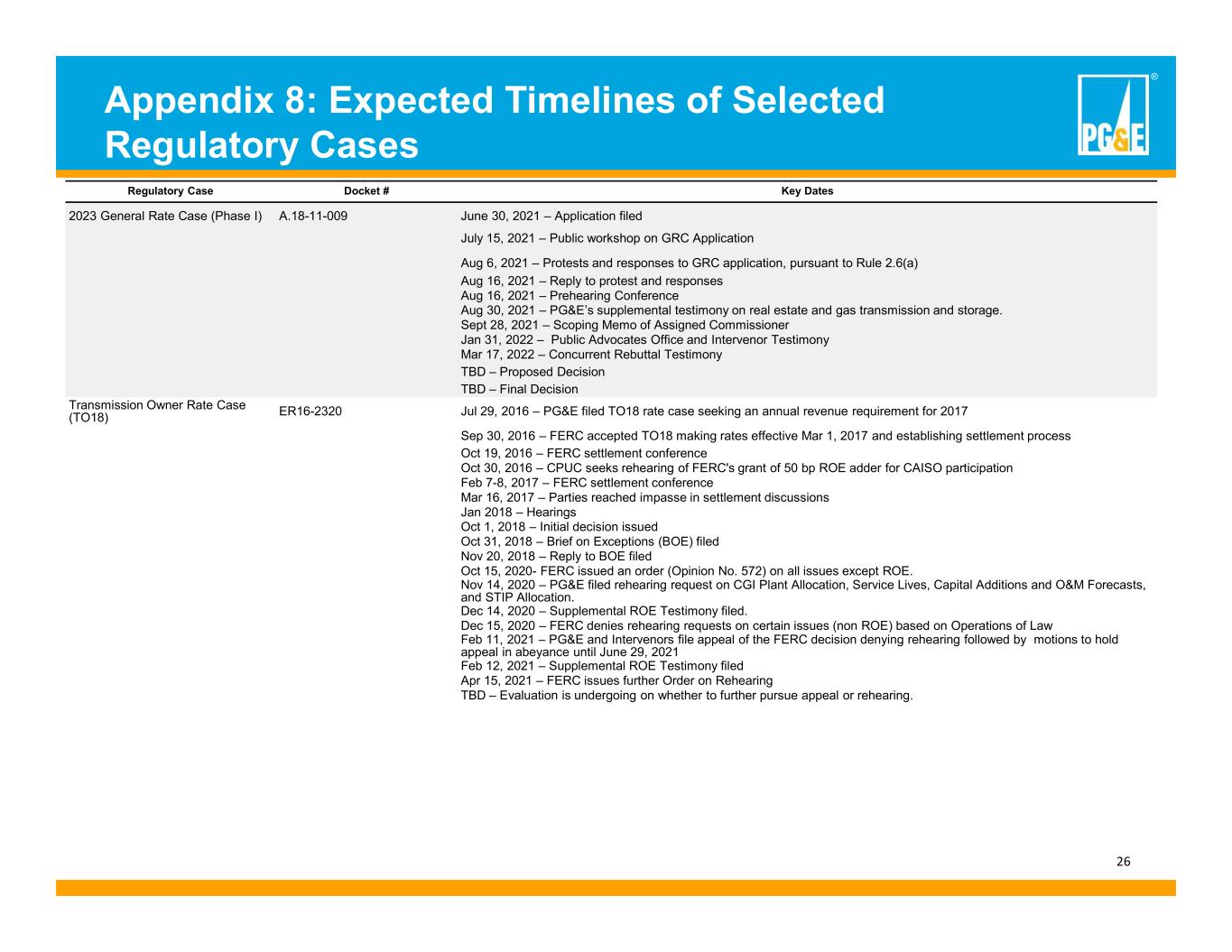

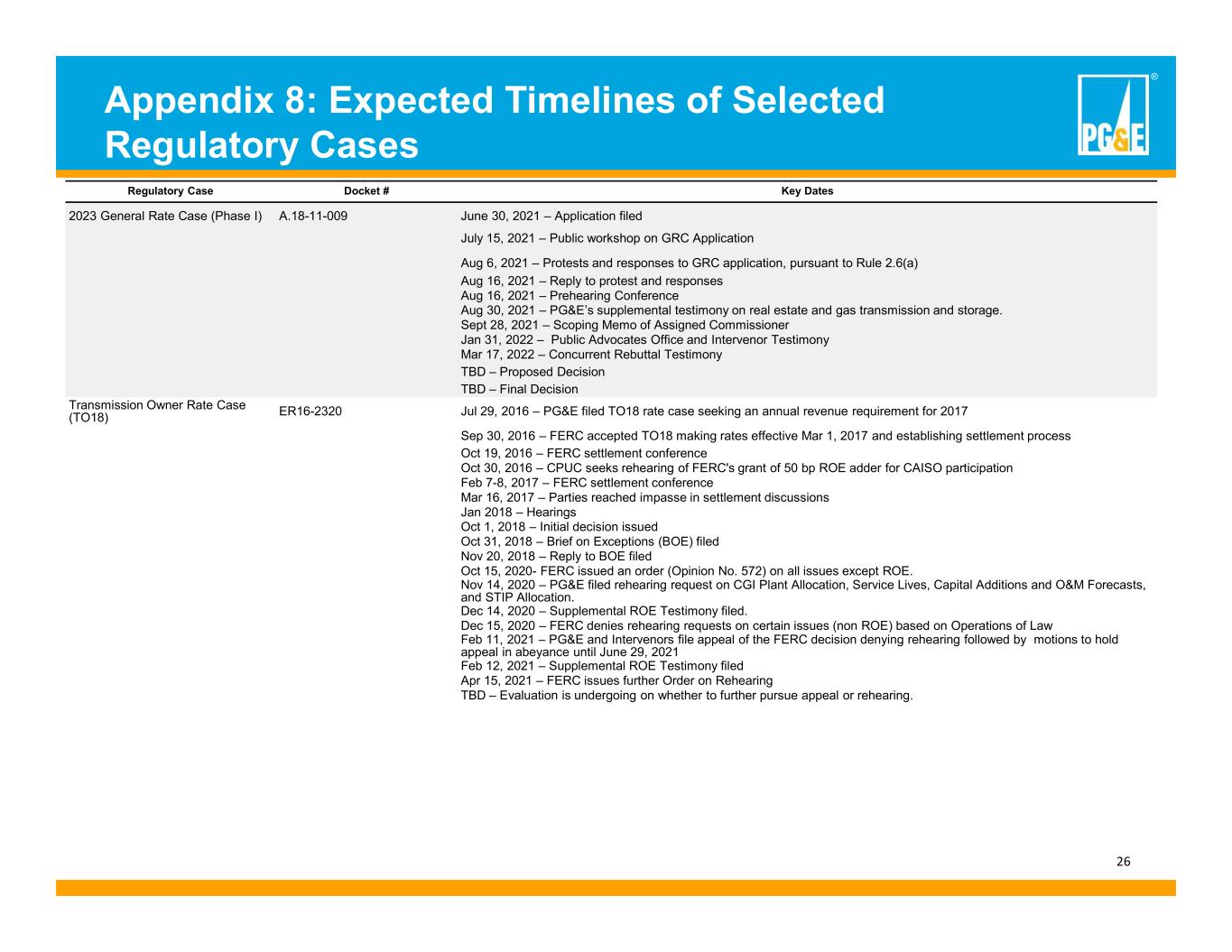

® 26 Regulatory Case Docket # Key Dates 2023 General Rate Case (Phase I) A.18-11-009 June 30, 2021 – Application filed July 15, 2021 – Public workshop on GRC Application Aug 6, 2021 – Protests and responses to GRC application, pursuant to Rule 2.6(a) Aug 16, 2021 – Reply to protest and responses Aug 16, 2021 – Prehearing Conference Aug 30, 2021 – PG&E’s supplemental testimony on real estate and gas transmission and storage. Sept 28, 2021 – Scoping Memo of Assigned Commissioner Jan 31, 2022 – Public Advocates Office and Intervenor Testimony Mar 17, 2022 – Concurrent Rebuttal Testimony TBD – Proposed Decision TBD – Final Decision Transmission Owner Rate Case (TO18) ER16-2320 Jul 29, 2016 – PG&E filed TO18 rate case seeking an annual revenue requirement for 2017 Sep 30, 2016 – FERC accepted TO18 making rates effective Mar 1, 2017 and establishing settlement process Oct 19, 2016 – FERC settlement conference Oct 30, 2016 – CPUC seeks rehearing of FERC's grant of 50 bp ROE adder for CAISO participation Feb 7-8, 2017 – FERC settlement conference Mar 16, 2017 – Parties reached impasse in settlement discussions Jan 2018 – Hearings Oct 1, 2018 – Initial decision issued Oct 31, 2018 – Brief on Exceptions (BOE) filed Nov 20, 2018 – Reply to BOE filed Oct 15, 2020- FERC issued an order (Opinion No. 572) on all issues except ROE. Nov 14, 2020 – PG&E filed rehearing request on CGI Plant Allocation, Service Lives, Capital Additions and O&M Forecasts, and STIP Allocation. Dec 14, 2020 – Supplemental ROE Testimony filed. Dec 15, 2020 – FERC denies rehearing requests on certain issues (non ROE) based on Operations of Law Feb 11, 2021 – PG&E and Intervenors file appeal of the FERC decision denying rehearing followed by motions to hold appeal in abeyance until June 29, 2021 Feb 12, 2021 – Supplemental ROE Testimony filed Apr 15, 2021 – FERC issues further Order on Rehearing TBD – Evaluation is undergoing on whether to further pursue appeal or rehearing. Appendix 8: Expected Timelines of Selected Regulatory Cases

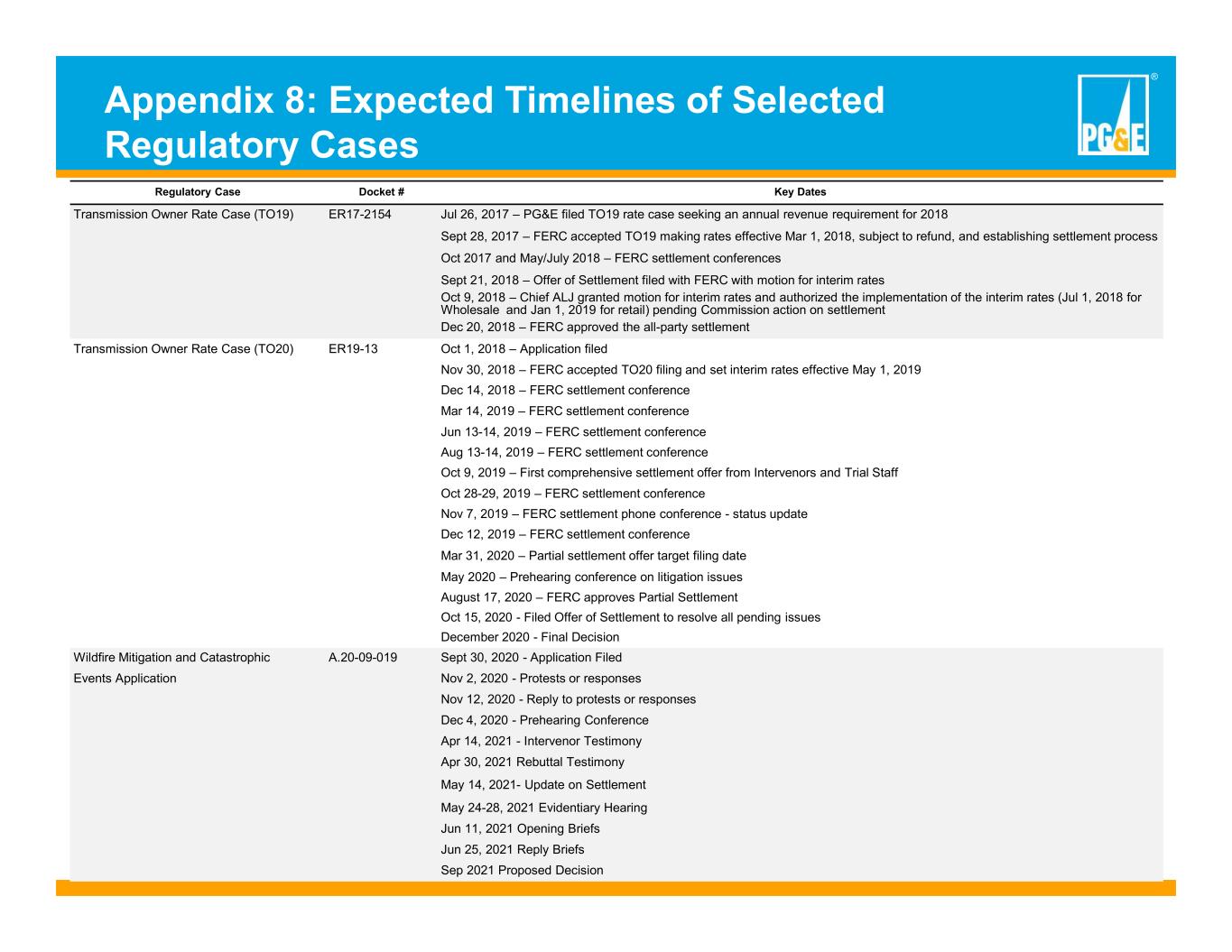

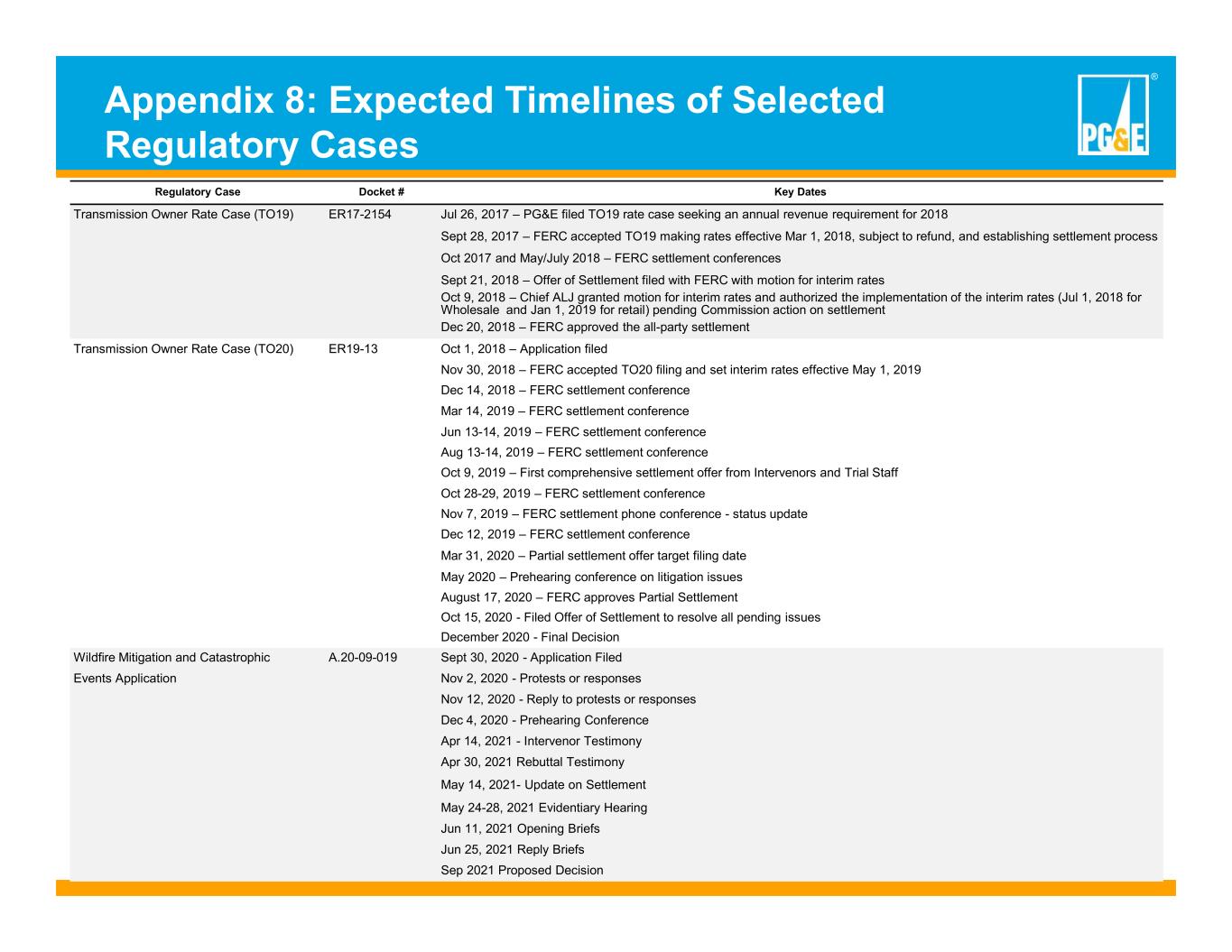

® 27 Appendix 8: Expected Timelines of Selected Regulatory Cases Regulatory Case Docket # Key Dates Transmission Owner Rate Case (TO19) ER17-2154 Jul 26, 2017 – PG&E filed TO19 rate case seeking an annual revenue requirement for 2018 Sept 28, 2017 – FERC accepted TO19 making rates effective Mar 1, 2018, subject to refund, and establishing settlement process Oct 2017 and May/July 2018 – FERC settlement conferences Sept 21, 2018 – Offer of Settlement filed with FERC with motion for interim rates Oct 9, 2018 – Chief ALJ granted motion for interim rates and authorized the implementation of the interim rates (Jul 1, 2018 for Wholesale and Jan 1, 2019 for retail) pending Commission action on settlement Dec 20, 2018 – FERC approved the all-party settlement Transmission Owner Rate Case (TO20) ER19-13 Oct 1, 2018 – Application filed Nov 30, 2018 – FERC accepted TO20 filing and set interim rates effective May 1, 2019 Dec 14, 2018 – FERC settlement conference Mar 14, 2019 – FERC settlement conference Jun 13-14, 2019 – FERC settlement conference Aug 13-14, 2019 – FERC settlement conference Oct 9, 2019 – First comprehensive settlement offer from Intervenors and Trial Staff Oct 28-29, 2019 – FERC settlement conference Nov 7, 2019 – FERC settlement phone conference - status update Dec 12, 2019 – FERC settlement conference Mar 31, 2020 – Partial settlement offer target filing date May 2020 – Prehearing conference on litigation issues August 17, 2020 – FERC approves Partial Settlement Oct 15, 2020 - Filed Offer of Settlement to resolve all pending issues December 2020 - Final Decision Wildfire Mitigation and Catastrophic A.20-09-019 Sept 30, 2020 - Application Filed Events Application Nov 2, 2020 - Protests or responses Nov 12, 2020 - Reply to protests or responses Dec 4, 2020 - Prehearing Conference Apr 14, 2021 - Intervenor Testimony Apr 30, 2021 Rebuttal Testimony May 14, 2021- Update on Settlement May 24-28, 2021 Evidentiary Hearing Jun 11, 2021 Opening Briefs Jun 25, 2021 Reply Briefs Sep 2021 Proposed Decision

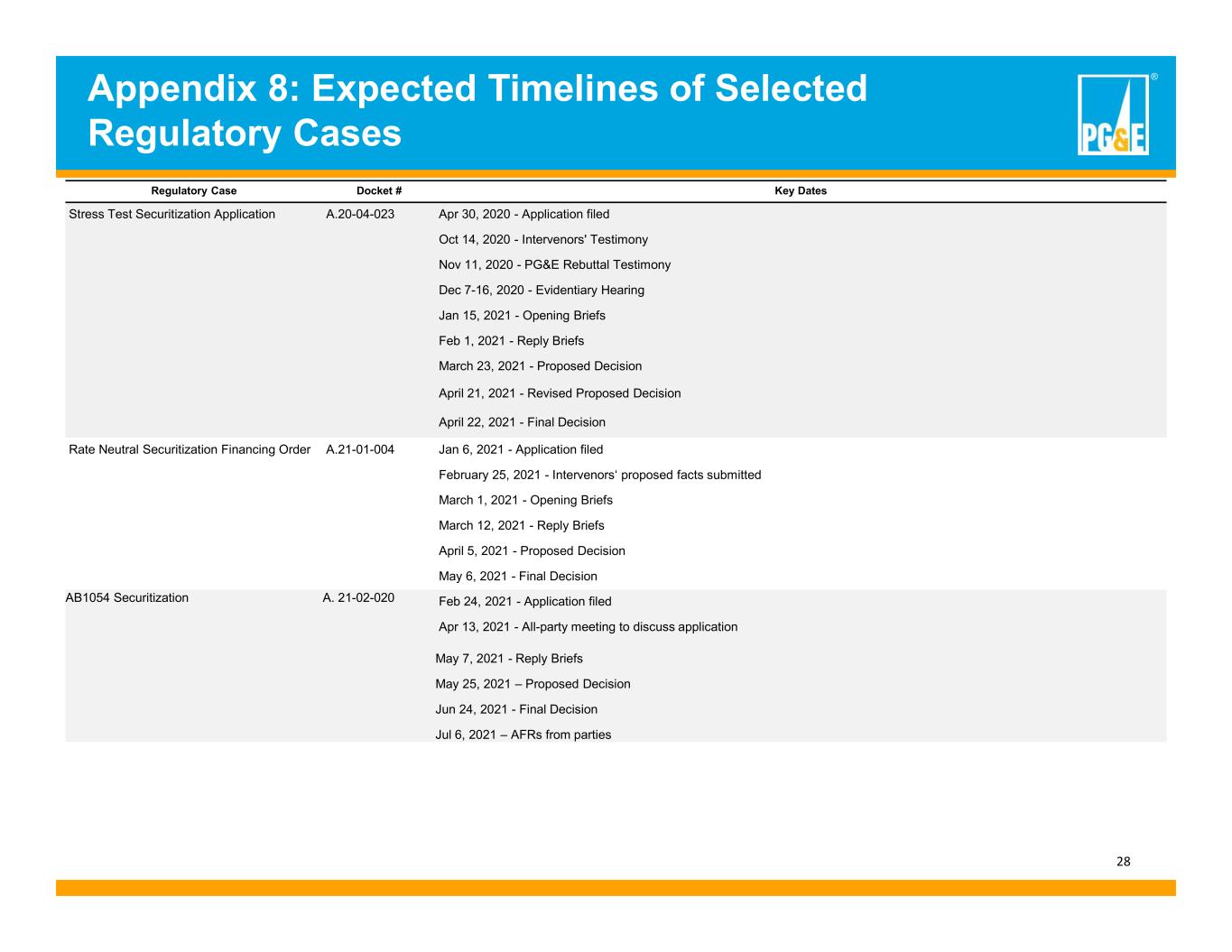

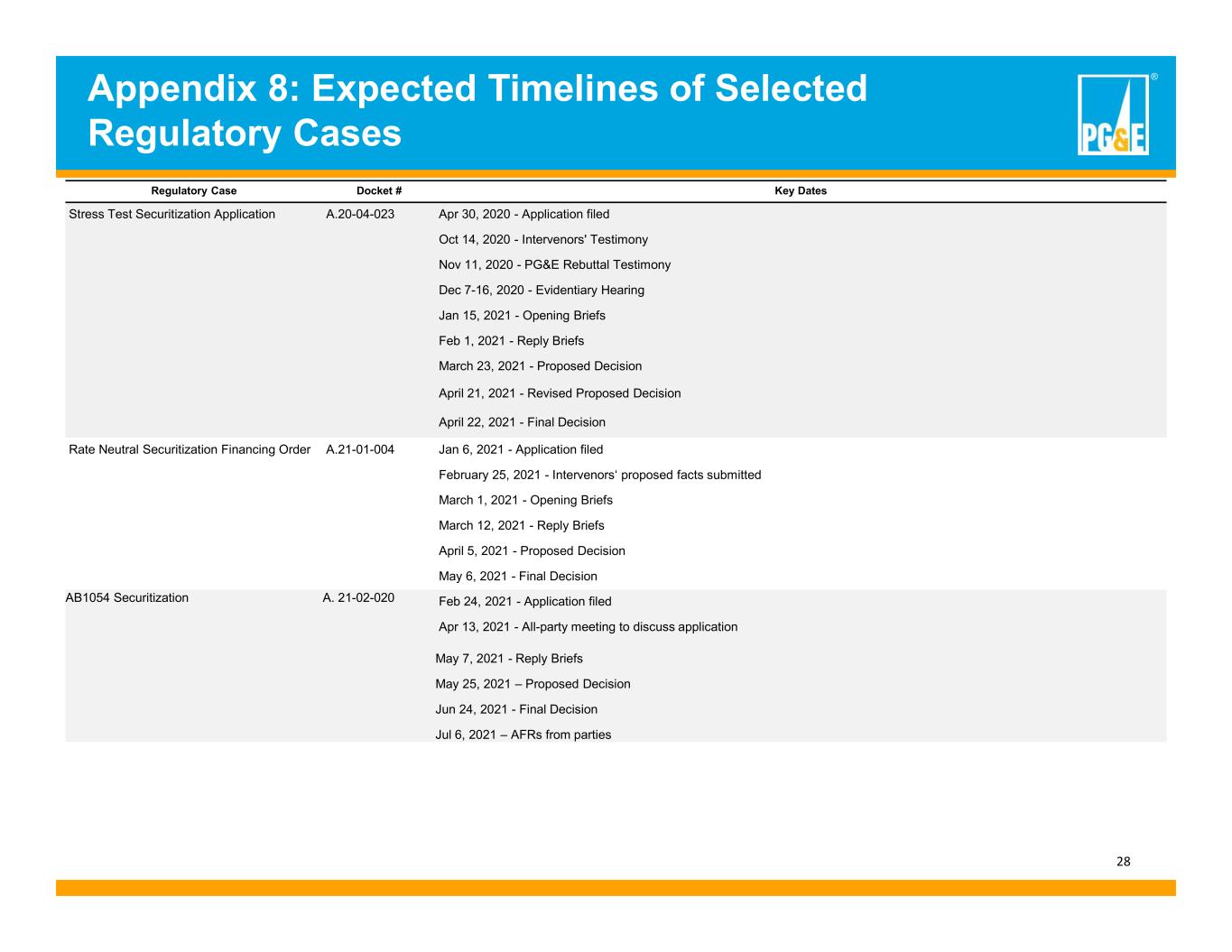

® 28 Appendix 8: Expected Timelines of Selected Regulatory Cases Regulatory Case Docket # Key Dates Stress Test Securitization Application A.20-04-023 Apr 30, 2020 - Application filed Oct 14, 2020 - Intervenors' Testimony Nov 11, 2020 - PG&E Rebuttal Testimony Dec 7-16, 2020 - Evidentiary Hearing Jan 15, 2021 - Opening Briefs Feb 1, 2021 - Reply Briefs March 23, 2021 - Proposed Decision April 21, 2021 - Revised Proposed Decision April 22, 2021 - Final Decision Rate Neutral Securitization Financing Order A.21-01-004 Jan 6, 2021 - Application filed February 25, 2021 - Intervenors‘ proposed facts submitted March 1, 2021 - Opening Briefs March 12, 2021 - Reply Briefs April 5, 2021 - Proposed Decision May 6, 2021 - Final Decision AB1054 Securitization A. 21-02-020 Feb 24, 2021 - Application filed Apr 13, 2021 - All-party meeting to discuss application May 7, 2021 - Reply Briefs May 25, 2021 – Proposed Decision Jun 24, 2021 - Final Decision Jul 6, 2021 – AFRs from parties

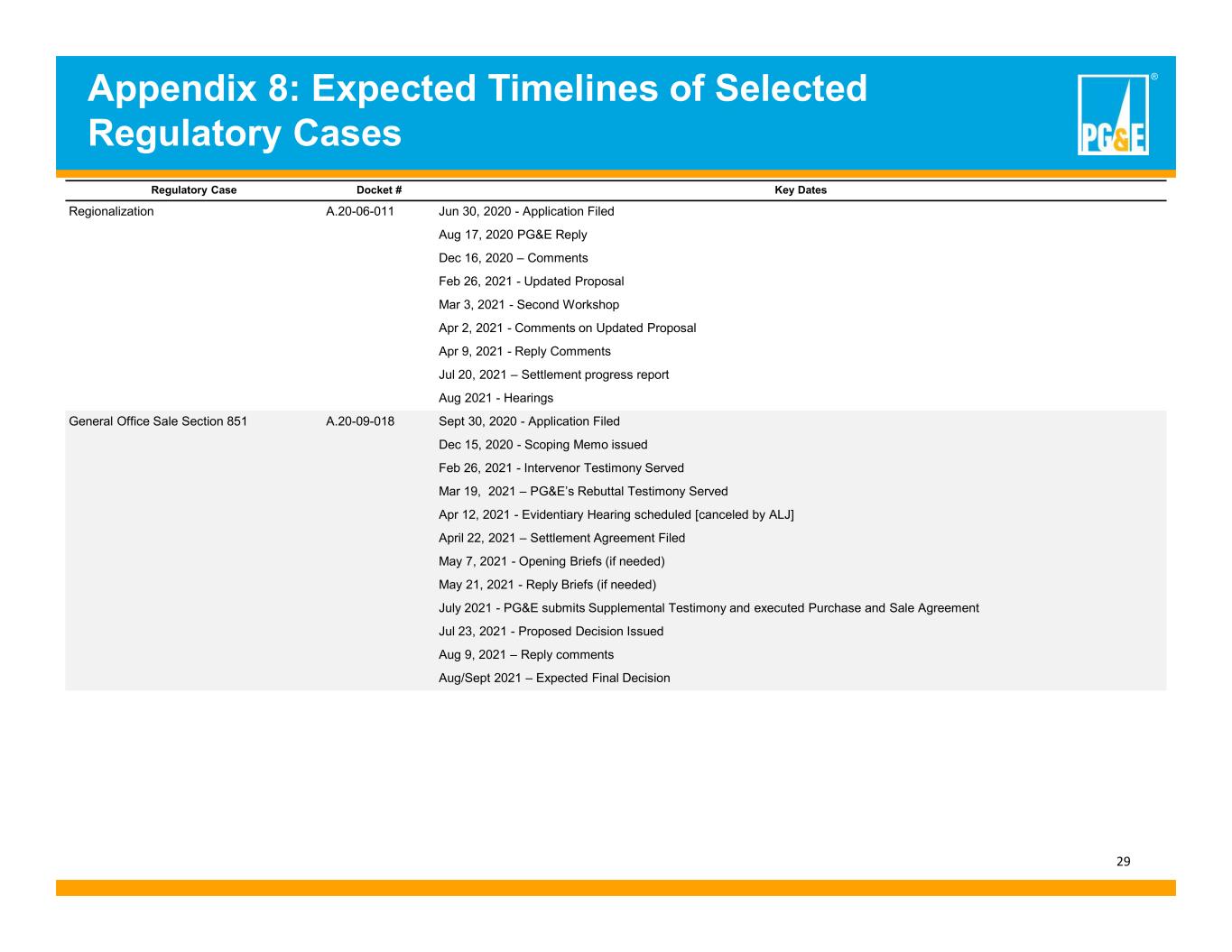

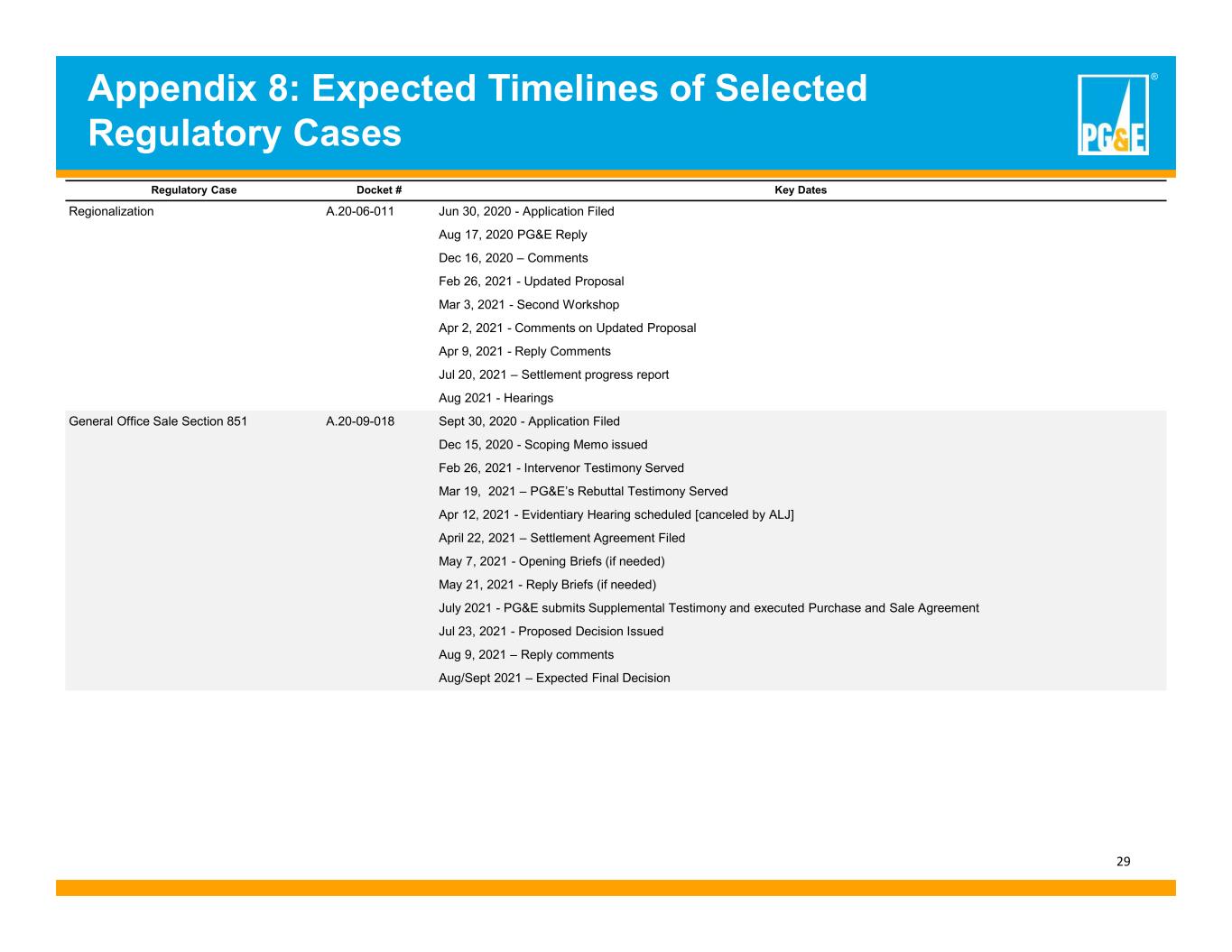

® 29 Appendix 8: Expected Timelines of Selected Regulatory Cases Regulatory Case Docket # Key Dates Regionalization A.20-06-011 Jun 30, 2020 - Application Filed Aug 17, 2020 PG&E Reply Dec 16, 2020 – Comments Feb 26, 2021 - Updated Proposal Mar 3, 2021 - Second Workshop Apr 2, 2021 - Comments on Updated Proposal Apr 9, 2021 - Reply Comments Jul 20, 2021 – Settlement progress report Aug 2021 - Hearings General Office Sale Section 851 A.20-09-018 Sept 30, 2020 - Application Filed Dec 15, 2020 - Scoping Memo issued Feb 26, 2021 - Intervenor Testimony Served Mar 19, 2021 – PG&E’s Rebuttal Testimony Served Apr 12, 2021 - Evidentiary Hearing scheduled [canceled by ALJ] April 22, 2021 – Settlement Agreement Filed May 7, 2021 - Opening Briefs (if needed) May 21, 2021 - Reply Briefs (if needed) July 2021 - PG&E submits Supplemental Testimony and executed Purchase and Sale Agreement Jul 23, 2021 - Proposed Decision Issued Aug 9, 2021 – Reply comments Aug/Sept 2021 – Expected Final Decision

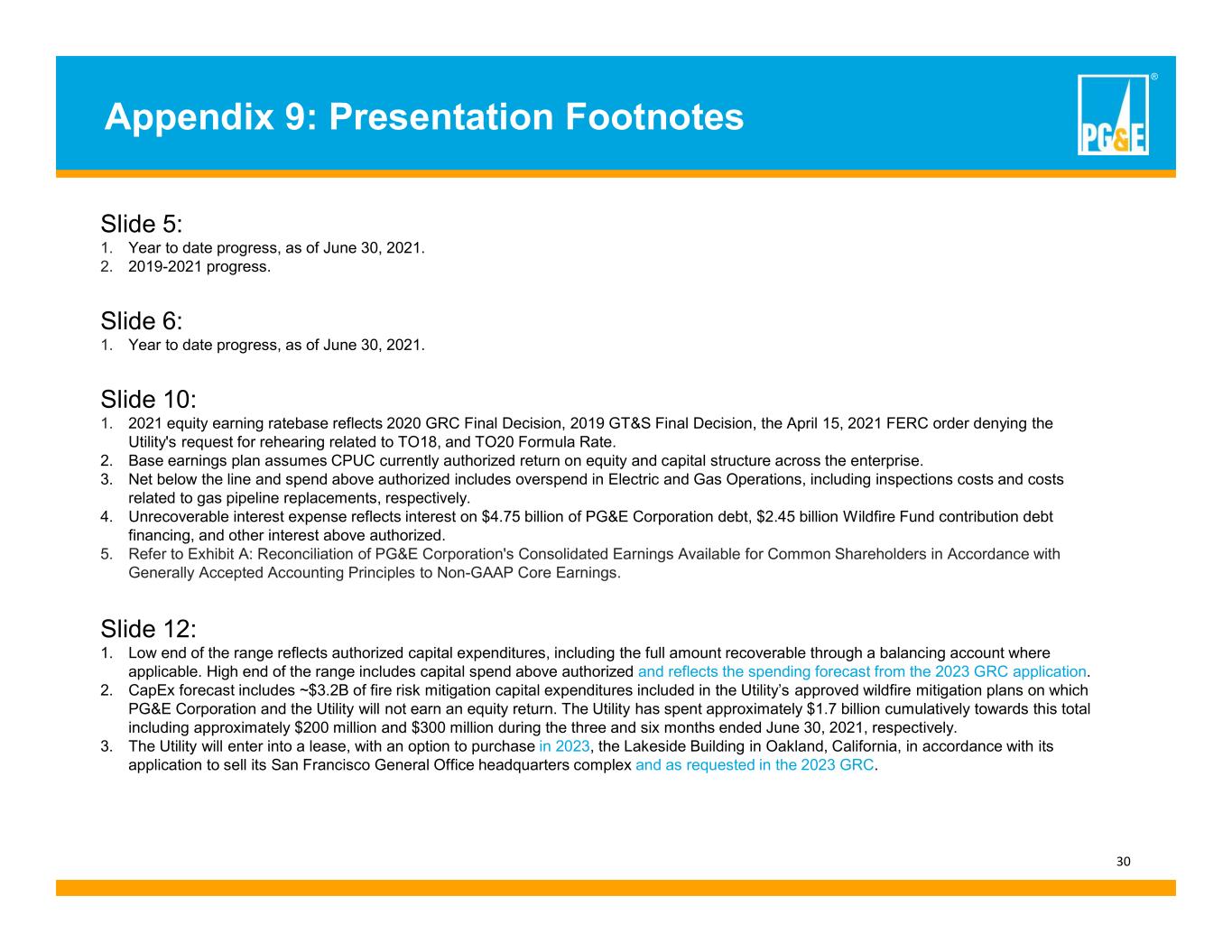

® 30 Appendix 9: Presentation Footnotes Slide 5: 1. Year to date progress, as of June 30, 2021. 2. 2019-2021 progress. Slide 6: 1. Year to date progress, as of June 30, 2021. Slide 10: 1. 2021 equity earning ratebase reflects 2020 GRC Final Decision, 2019 GT&S Final Decision, the April 15, 2021 FERC order denying the Utility's request for rehearing related to TO18, and TO20 Formula Rate. 2. Base earnings plan assumes CPUC currently authorized return on equity and capital structure across the enterprise. 3. Net below the line and spend above authorized includes overspend in Electric and Gas Operations, including inspections costs and costs related to gas pipeline replacements, respectively. 4. Unrecoverable interest expense reflects interest on $4.75 billion of PG&E Corporation debt, $2.45 billion Wildfire Fund contribution debt financing, and other interest above authorized. 5. Refer to Exhibit A: Reconciliation of PG&E Corporation's Consolidated Earnings Available for Common Shareholders in Accordance with Generally Accepted Accounting Principles to Non-GAAP Core Earnings. Slide 12: 1. Low end of the range reflects authorized capital expenditures, including the full amount recoverable through a balancing account where applicable. High end of the range includes capital spend above authorized and reflects the spending forecast from the 2023 GRC application. 2. CapEx forecast includes ~$3.2B of fire risk mitigation capital expenditures included in the Utility’s approved wildfire mitigation plans on which PG&E Corporation and the Utility will not earn an equity return. The Utility has spent approximately $1.7 billion cumulatively towards this total including approximately $200 million and $300 million during the three and six months ended June 30, 2021, respectively. 3. The Utility will enter into a lease, with an option to purchase in 2023, the Lakeside Building in Oakland, California, in accordance with its application to sell its San Francisco General Office headquarters complex and as requested in the 2023 GRC.

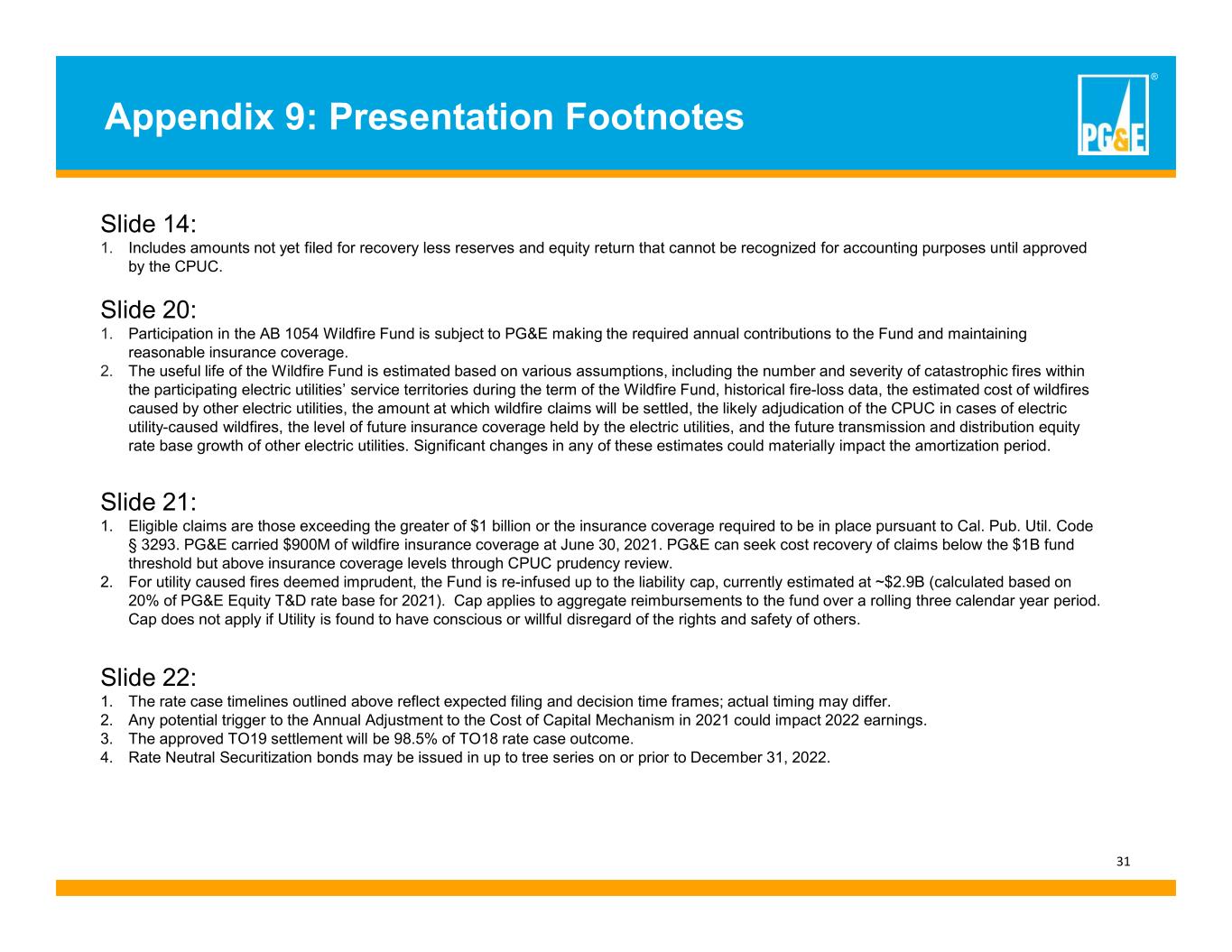

® 31 Appendix 9: Presentation Footnotes Slide 14: 1. Includes amounts not yet filed for recovery less reserves and equity return that cannot be recognized for accounting purposes until approved by the CPUC. Slide 20: 1. Participation in the AB 1054 Wildfire Fund is subject to PG&E making the required annual contributions to the Fund and maintaining reasonable insurance coverage. 2. The useful life of the Wildfire Fund is estimated based on various assumptions, including the number and severity of catastrophic fires within the participating electric utilities’ service territories during the term of the Wildfire Fund, historical fire-loss data, the estimated cost of wildfires caused by other electric utilities, the amount at which wildfire claims will be settled, the likely adjudication of the CPUC in cases of electric utility-caused wildfires, the level of future insurance coverage held by the electric utilities, and the future transmission and distribution equity rate base growth of other electric utilities. Significant changes in any of these estimates could materially impact the amortization period. Slide 21: 1. Eligible claims are those exceeding the greater of $1 billion or the insurance coverage required to be in place pursuant to Cal. Pub. Util. Code § 3293. PG&E carried $900M of wildfire insurance coverage at June 30, 2021. PG&E can seek cost recovery of claims below the $1B fund threshold but above insurance coverage levels through CPUC prudency review. 2. For utility caused fires deemed imprudent, the Fund is re-infused up to the liability cap, currently estimated at ~$2.9B (calculated based on 20% of PG&E Equity T&D rate base for 2021). Cap applies to aggregate reimbursements to the fund over a rolling three calendar year period. Cap does not apply if Utility is found to have conscious or willful disregard of the rights and safety of others. Slide 22: 1. The rate case timelines outlined above reflect expected filing and decision time frames; actual timing may differ. 2. Any potential trigger to the Annual Adjustment to the Cost of Capital Mechanism in 2021 could impact 2022 earnings. 3. The approved TO19 settlement will be 98.5% of TO18 rate case outcome. 4. Rate Neutral Securitization bonds may be issued in up to tree series on or prior to December 31, 2022.

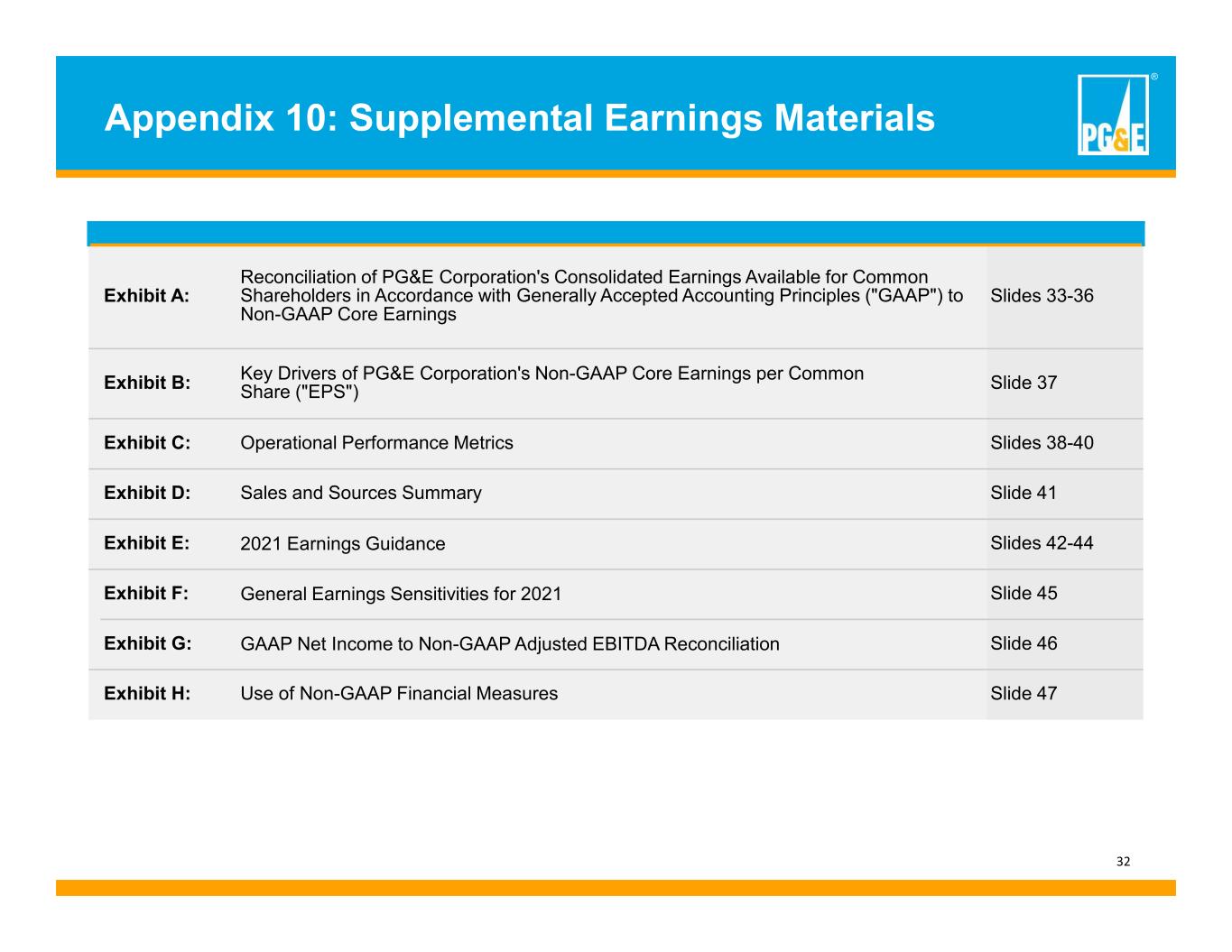

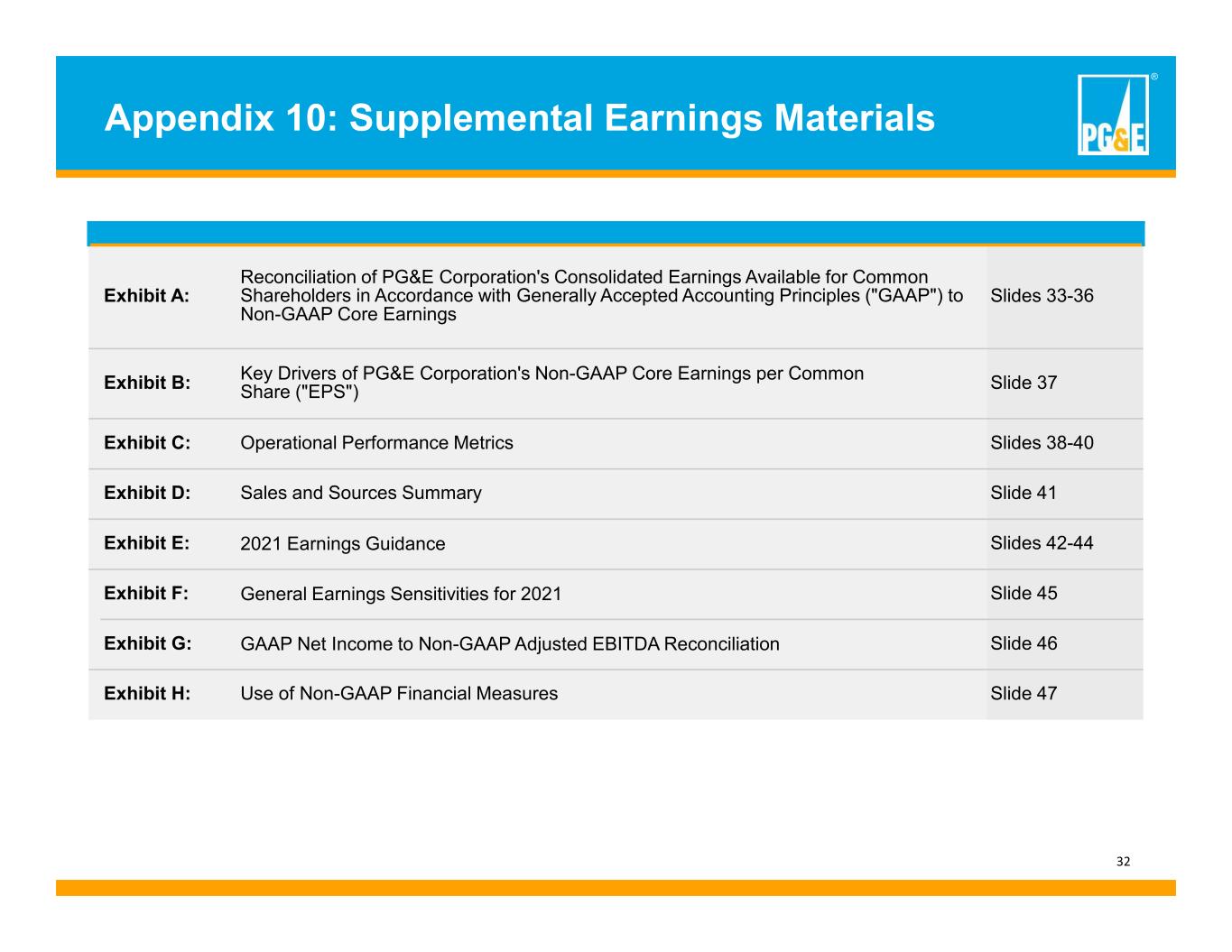

® 32 Appendix 10: Supplemental Earnings Materials Exhibit A: Reconciliation of PG&E Corporation's Consolidated Earnings Available for Common Shareholders in Accordance with Generally Accepted Accounting Principles ("GAAP") to Non-GAAP Core Earnings Slides 33-36 Exhibit B: Key Drivers of PG&E Corporation's Non-GAAP Core Earnings per Common Share ("EPS") Slide 37 Exhibit C: Operational Performance Metrics Slides 38-40 Exhibit D: Sales and Sources Summary Slide 41 Exhibit E: 2021 Earnings Guidance Slides 42-44 Exhibit F: General Earnings Sensitivities for 2021 Slide 45 Exhibit G: GAAP Net Income to Non-GAAP Adjusted EBITDA Reconciliation Slide 46 Exhibit H: Use of Non-GAAP Financial Measures Slide 47

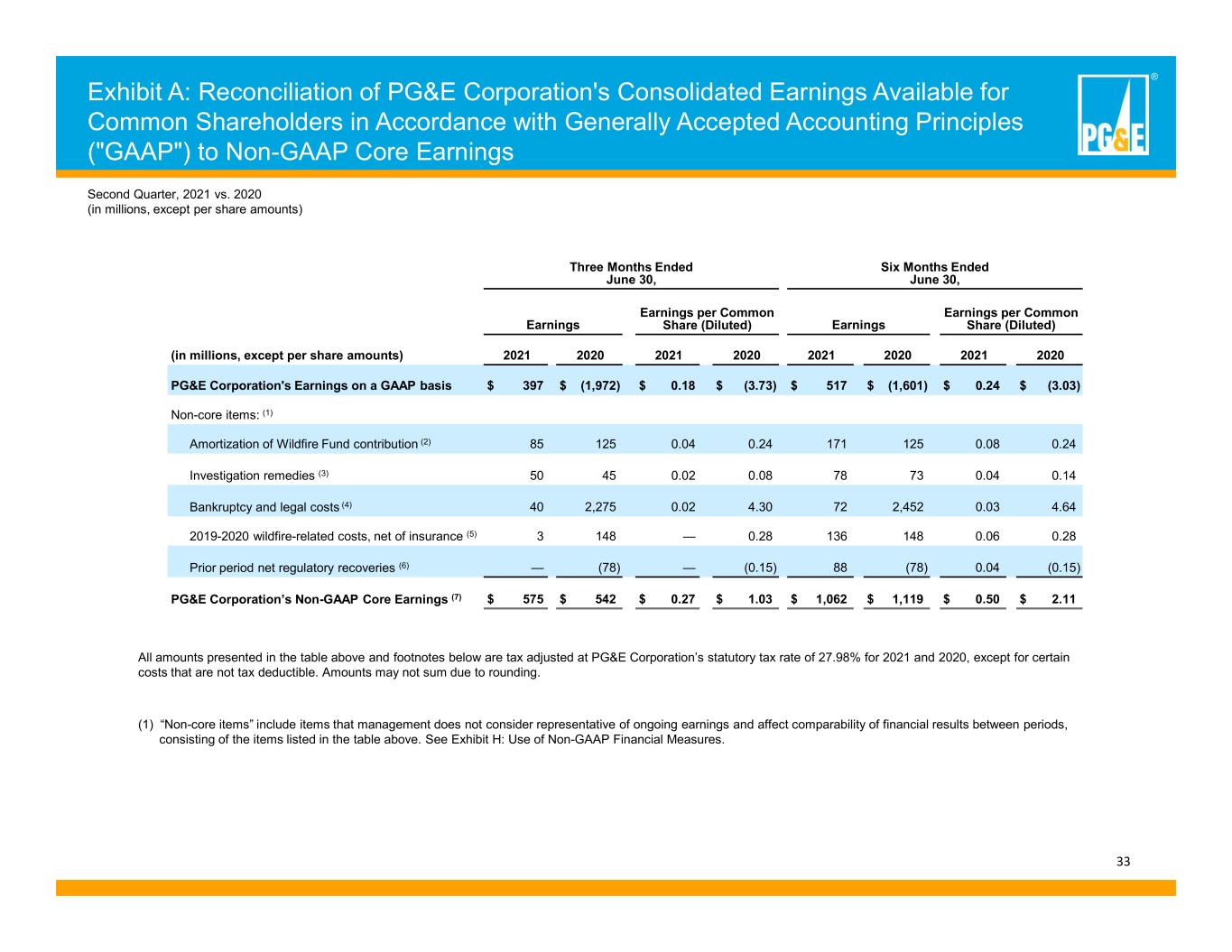

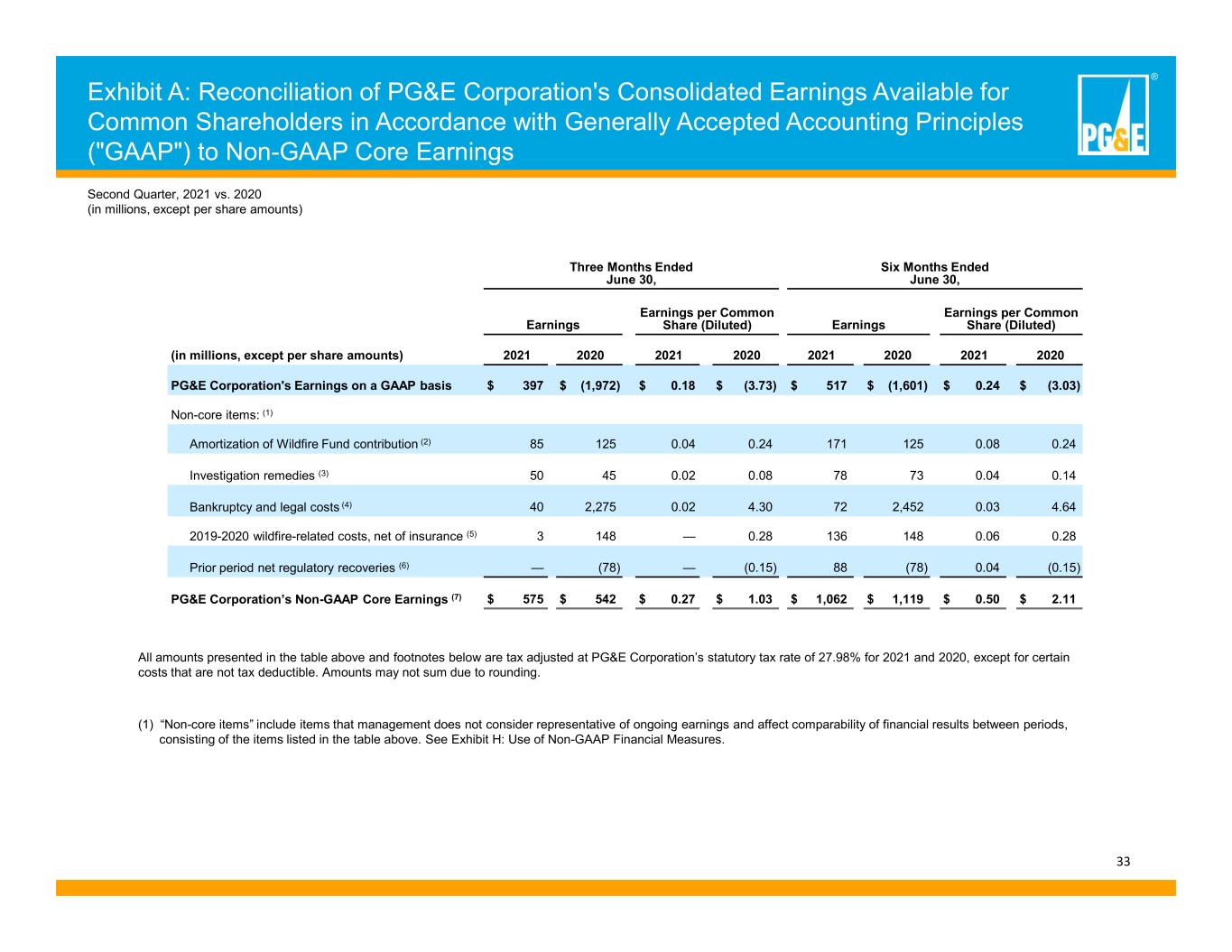

® 33 Exhibit A: Reconciliation of PG&E Corporation's Consolidated Earnings Available for Common Shareholders in Accordance with Generally Accepted Accounting Principles ("GAAP") to Non-GAAP Core Earnings Three Months Ended June 30, Six Months Ended June 30, Earnings Earnings per Common Share (Diluted) Earnings Earnings per Common Share (Diluted) (in millions, except per share amounts) 2021 2020 2021 2020 2021 2020 2021 2020 PG&E Corporation's Earnings on a GAAP basis $ 397 $ (1,972) $ 0.18 $ (3.73) $ 517 $ (1,601) $ 0.24 $ (3.03) Non-core items: (1) Amortization of Wildfire Fund contribution (2) 85 125 0.04 0.24 171 125 0.08 0.24 Investigation remedies (3) 50 45 0.02 0.08 78 73 0.04 0.14 Bankruptcy and legal costs (4) 40 2,275 0.02 4.30 72 2,452 0.03 4.64 2019-2020 wildfire-related costs, net of insurance (5) 3 148 — 0.28 136 148 0.06 0.28 Prior period net regulatory recoveries (6) — (78) — (0.15) 88 (78) 0.04 (0.15) PG&E Corporation’s Non-GAAP Core Earnings (7) $ 575 $ 542 $ 0.27 $ 1.03 $ 1,062 $ 1,119 $ 0.50 $ 2.11 All amounts presented in the table above and footnotes below are tax adjusted at PG&E Corporation’s statutory tax rate of 27.98% for 2021 and 2020, except for certain costs that are not tax deductible. Amounts may not sum due to rounding. Second Quarter, 2021 vs. 2020 (in millions, except per share amounts) (1) “Non-core items” include items that management does not consider representative of ongoing earnings and affect comparability of financial results between periods, consisting of the items listed in the table above. See Exhibit H: Use of Non-GAAP Financial Measures.

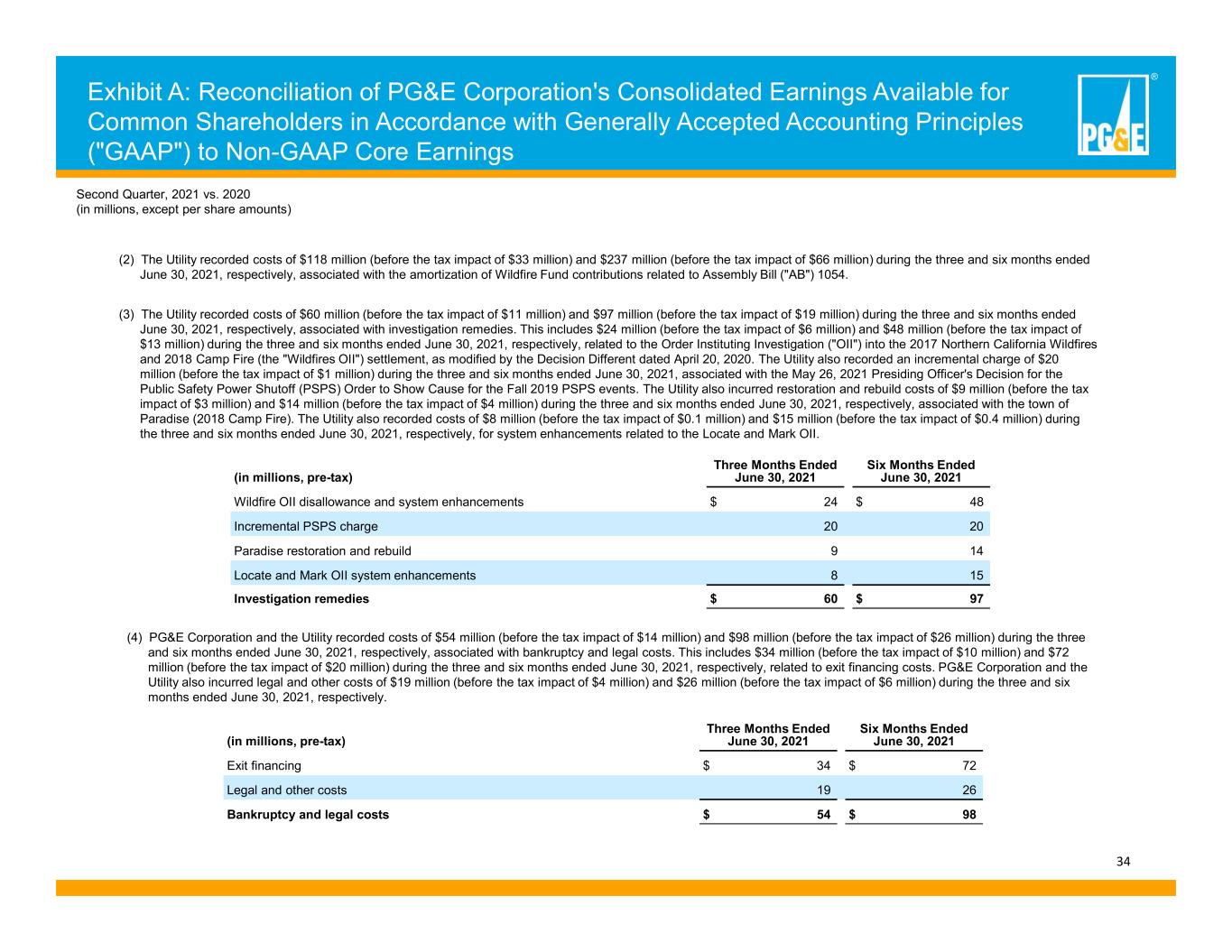

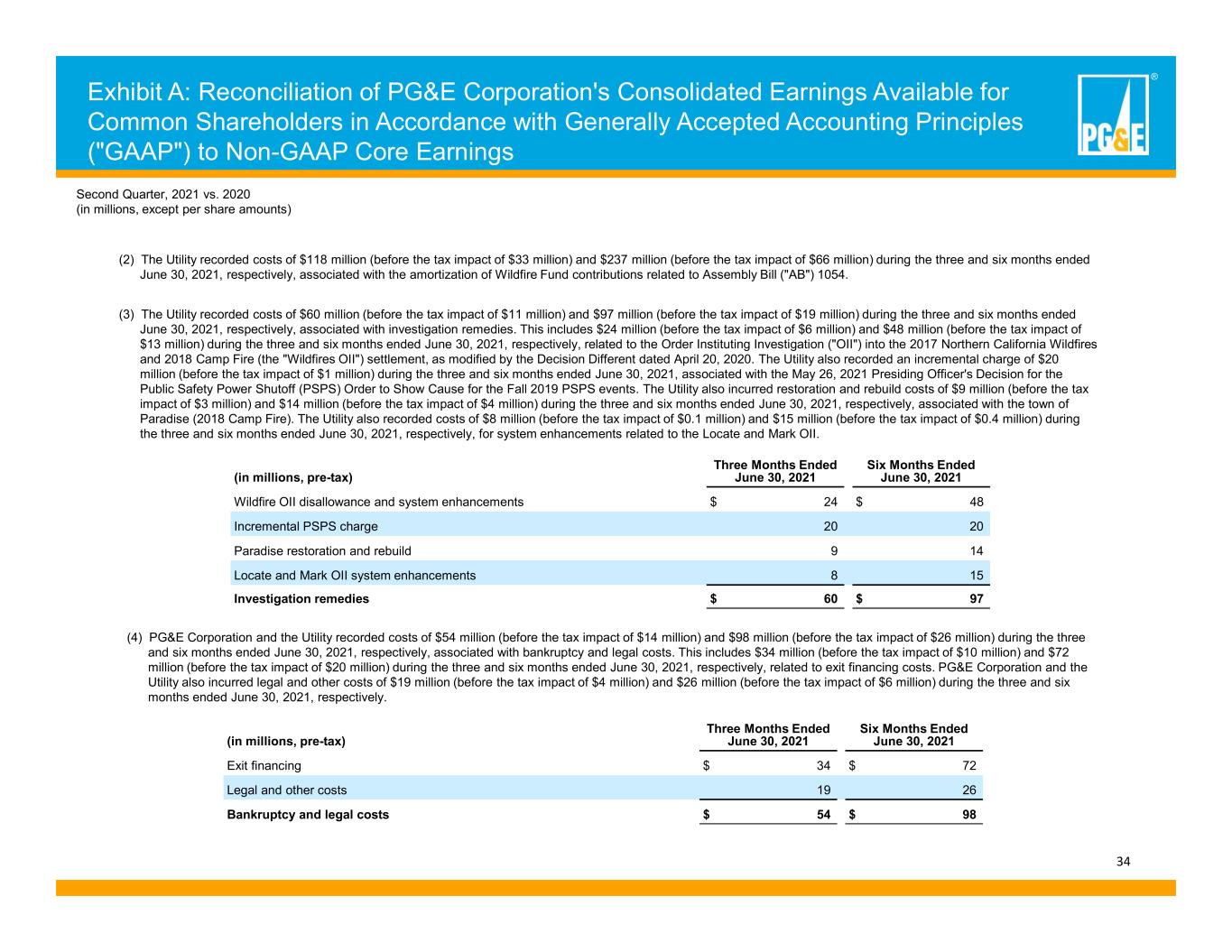

® 34 Exhibit A: Reconciliation of PG&E Corporation's Consolidated Earnings Available for Common Shareholders in Accordance with Generally Accepted Accounting Principles ("GAAP") to Non-GAAP Core Earnings (in millions, pre-tax) Three Months Ended June 30, 2021 Six Months Ended June 30, 2021 Exit financing $ 34 $ 72 Legal and other costs 19 26 Bankruptcy and legal costs $ 54 $ 98 (in millions, pre-tax) Three Months Ended June 30, 2021 Six Months Ended June 30, 2021 Wildfire OII disallowance and system enhancements $ 24 $ 48 Incremental PSPS charge 20 20 Paradise restoration and rebuild 9 14 Locate and Mark OII system enhancements 8 15 Investigation remedies $ 60 $ 97 Second Quarter, 2021 vs. 2020 (in millions, except per share amounts) (2) The Utility recorded costs of $118 million (before the tax impact of $33 million) and $237 million (before the tax impact of $66 million) during the three and six months ended June 30, 2021, respectively, associated with the amortization of Wildfire Fund contributions related to Assembly Bill ("AB") 1054. (4) PG&E Corporation and the Utility recorded costs of $54 million (before the tax impact of $14 million) and $98 million (before the tax impact of $26 million) during the three and six months ended June 30, 2021, respectively, associated with bankruptcy and legal costs. This includes $34 million (before the tax impact of $10 million) and $72 million (before the tax impact of $20 million) during the three and six months ended June 30, 2021, respectively, related to exit financing costs. PG&E Corporation and the Utility also incurred legal and other costs of $19 million (before the tax impact of $4 million) and $26 million (before the tax impact of $6 million) during the three and six months ended June 30, 2021, respectively. (3) The Utility recorded costs of $60 million (before the tax impact of $11 million) and $97 million (before the tax impact of $19 million) during the three and six months ended June 30, 2021, respectively, associated with investigation remedies. This includes $24 million (before the tax impact of $6 million) and $48 million (before the tax impact of $13 million) during the three and six months ended June 30, 2021, respectively, related to the Order Instituting Investigation ("OII") into the 2017 Northern California Wildfires and 2018 Camp Fire (the "Wildfires OII") settlement, as modified by the Decision Different dated April 20, 2020. The Utility also recorded an incremental charge of $20 million (before the tax impact of $1 million) during the three and six months ended June 30, 2021, associated with the May 26, 2021 Presiding Officer's Decision for the Public Safety Power Shutoff (PSPS) Order to Show Cause for the Fall 2019 PSPS events. The Utility also incurred restoration and rebuild costs of $9 million (before the tax impact of $3 million) and $14 million (before the tax impact of $4 million) during the three and six months ended June 30, 2021, respectively, associated with the town of Paradise (2018 Camp Fire). The Utility also recorded costs of $8 million (before the tax impact of $0.1 million) and $15 million (before the tax impact of $0.4 million) during the three and six months ended June 30, 2021, respectively, for system enhancements related to the Locate and Mark OII.

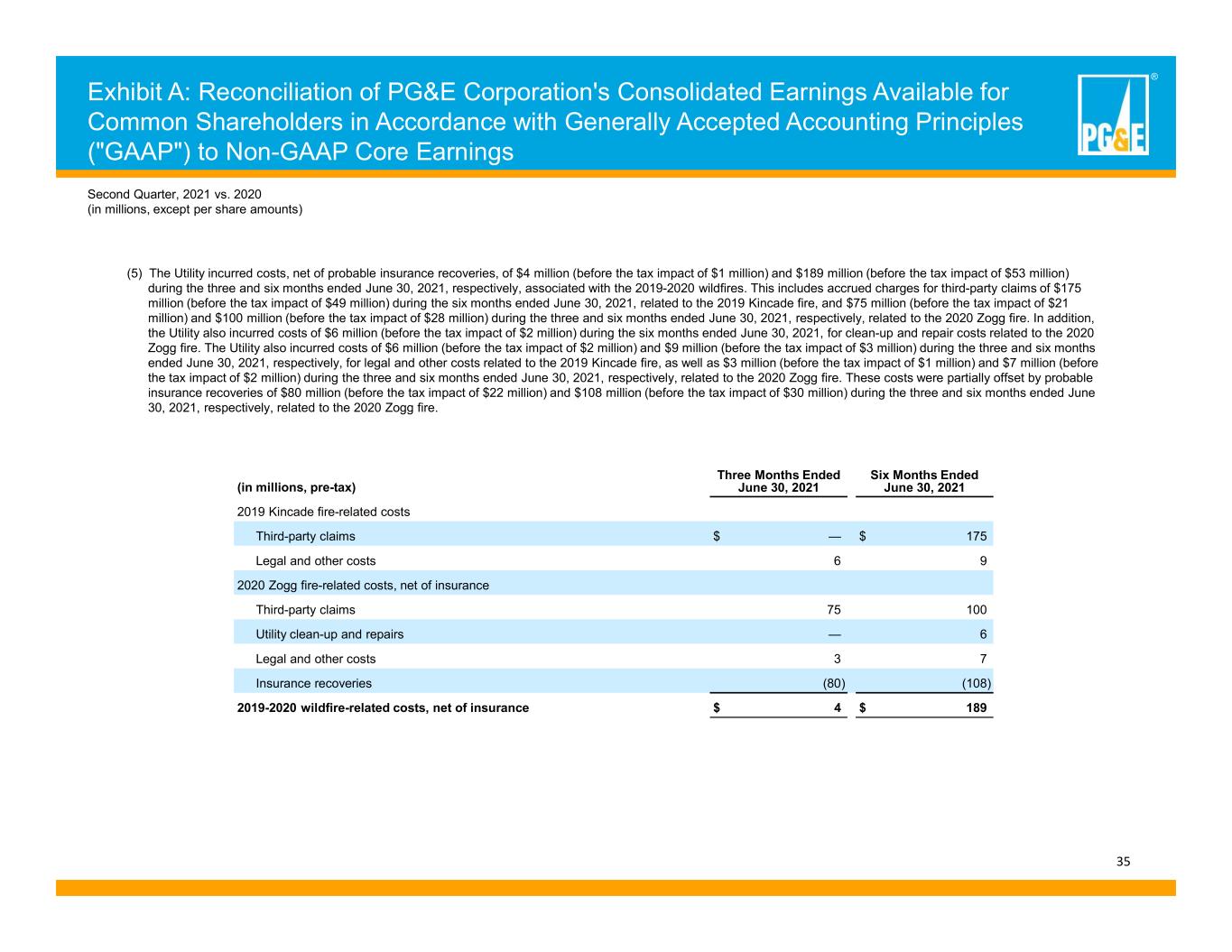

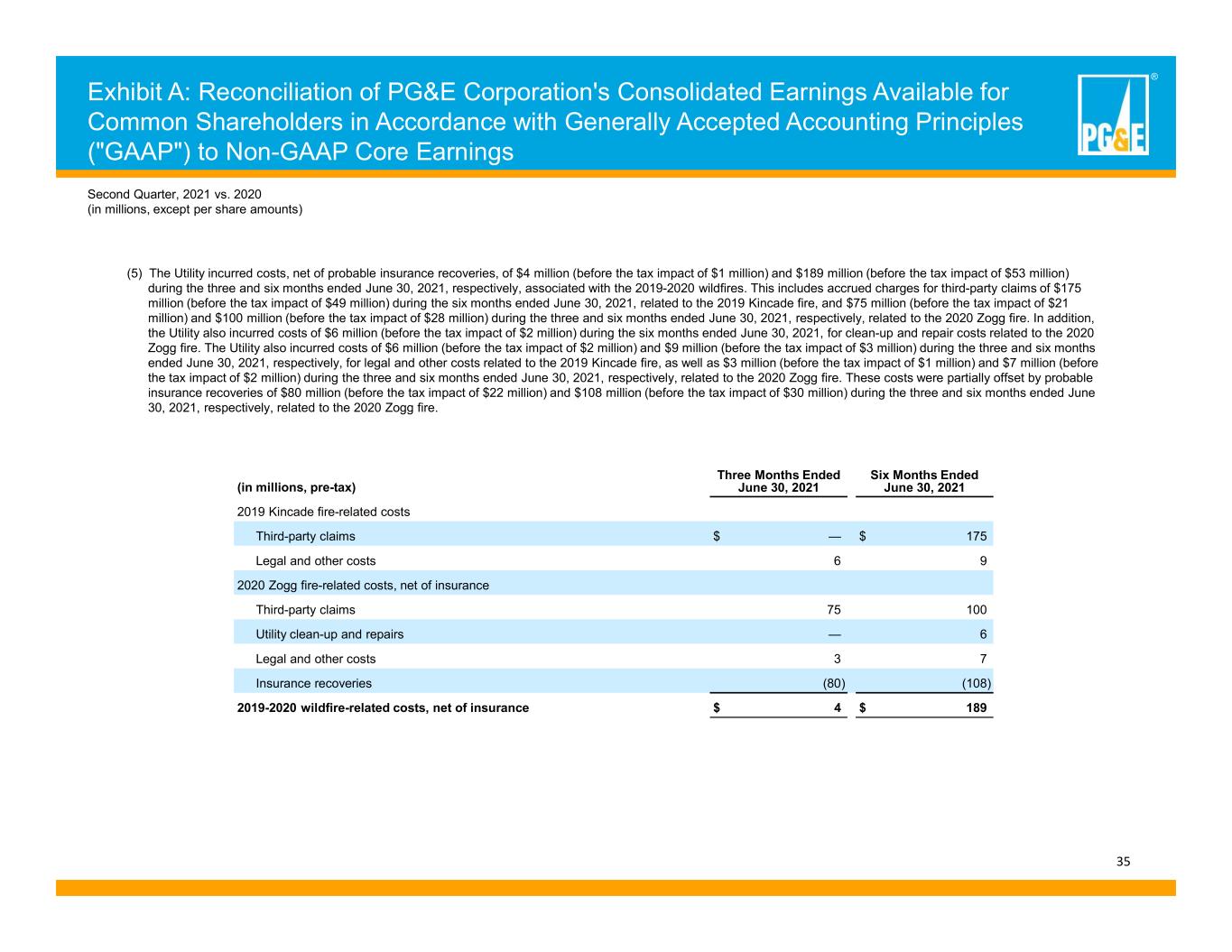

® 35 Exhibit A: Reconciliation of PG&E Corporation's Consolidated Earnings Available for Common Shareholders in Accordance with Generally Accepted Accounting Principles ("GAAP") to Non-GAAP Core Earnings (5) The Utility incurred costs, net of probable insurance recoveries, of $4 million (before the tax impact of $1 million) and $189 million (before the tax impact of $53 million) during the three and six months ended June 30, 2021, respectively, associated with the 2019-2020 wildfires. This includes accrued charges for third-party claims of $175 million (before the tax impact of $49 million) during the six months ended June 30, 2021, related to the 2019 Kincade fire, and $75 million (before the tax impact of $21 million) and $100 million (before the tax impact of $28 million) during the three and six months ended June 30, 2021, respectively, related to the 2020 Zogg fire. In addition, the Utility also incurred costs of $6 million (before the tax impact of $2 million) during the six months ended June 30, 2021, for clean-up and repair costs related to the 2020 Zogg fire. The Utility also incurred costs of $6 million (before the tax impact of $2 million) and $9 million (before the tax impact of $3 million) during the three and six months ended June 30, 2021, respectively, for legal and other costs related to the 2019 Kincade fire, as well as $3 million (before the tax impact of $1 million) and $7 million (before the tax impact of $2 million) during the three and six months ended June 30, 2021, respectively, related to the 2020 Zogg fire. These costs were partially offset by probable insurance recoveries of $80 million (before the tax impact of $22 million) and $108 million (before the tax impact of $30 million) during the three and six months ended June 30, 2021, respectively, related to the 2020 Zogg fire. (in millions, pre-tax) Three Months Ended June 30, 2021 Six Months Ended June 30, 2021 2019 Kincade fire-related costs Third-party claims $ — $ 175 Legal and other costs 6 9 2020 Zogg fire-related costs, net of insurance Third-party claims 75 100 Utility clean-up and repairs — 6 Legal and other costs 3 7 Insurance recoveries (80) (108) 2019-2020 wildfire-related costs, net of insurance $ 4 $ 189 Second Quarter, 2021 vs. 2020 (in millions, except per share amounts)

® 36 Exhibit A: Reconciliation of PG&E Corporation's Consolidated Earnings Available for Common Shareholders in Accordance with Generally Accepted Accounting Principles ("GAAP") to Non-GAAP Core Earnings Second Quarter, 2021 vs. 2020 (in millions, except per share amounts) (6) The Utility incurred $122 million (before the tax impact of $34 million) during the six months ended June 30, 2021, associated with prior period net regulatory recoveries, reflecting the impact of the April 15, 2021 FERC order denying the Utility's request for rehearing on the Transmission Owner ("TO") 18, which rejected the Utility's direct assignment of common plant to FERC, and impacted TO revenues recorded through December 31, 2020. (7) "Non-GAAP core earnings" is a non-GAAP financial measure. See Exhibit H: Use of Non-GAAP Financial Measures.

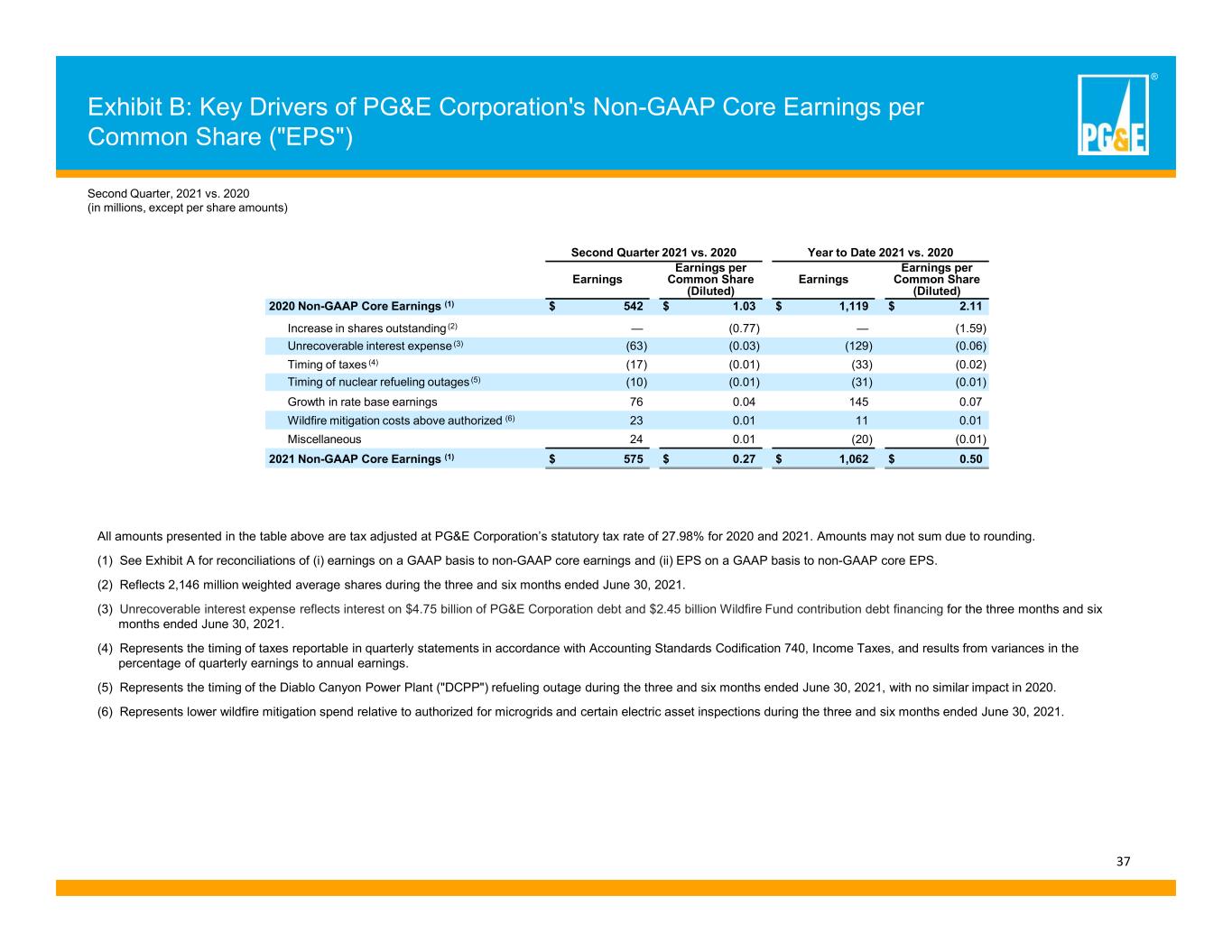

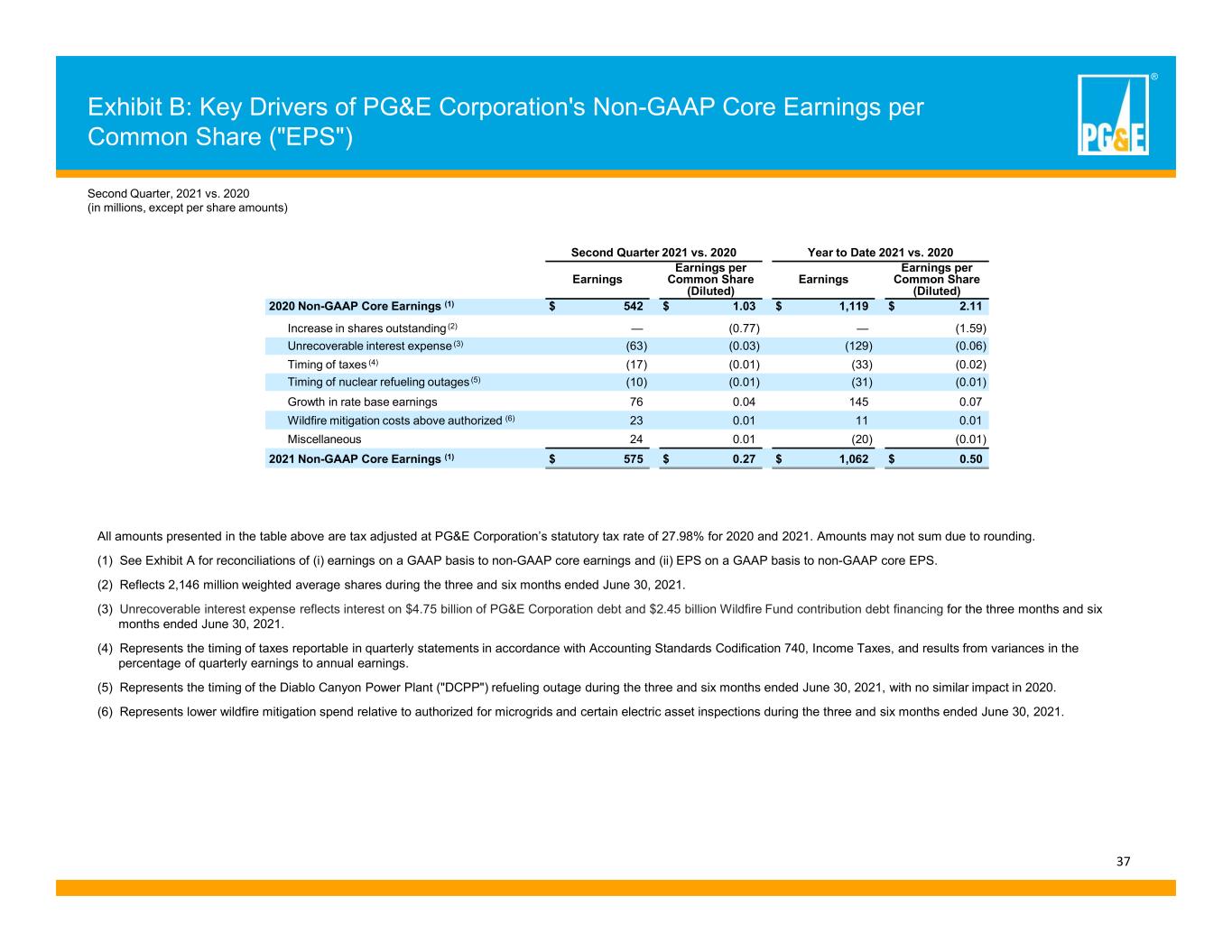

® 37 All amounts presented in the table above are tax adjusted at PG&E Corporation’s statutory tax rate of 27.98% for 2020 and 2021. Amounts may not sum due to rounding. (1) See Exhibit A for reconciliations of (i) earnings on a GAAP basis to non-GAAP core earnings and (ii) EPS on a GAAP basis to non-GAAP core EPS. (2) Reflects 2,146 million weighted average shares during the three and six months ended June 30, 2021. (3) Unrecoverable interest expense reflects interest on $4.75 billion of PG&E Corporation debt and $2.45 billion Wildfire Fund contribution debt financing for the three months and six months ended June 30, 2021. (4) Represents the timing of taxes reportable in quarterly statements in accordance with Accounting Standards Codification 740, Income Taxes, and results from variances in the percentage of quarterly earnings to annual earnings. (5) Represents the timing of the Diablo Canyon Power Plant ("DCPP") refueling outage during the three and six months ended June 30, 2021, with no similar impact in 2020. (6) Represents lower wildfire mitigation spend relative to authorized for microgrids and certain electric asset inspections during the three and six months ended June 30, 2021. Exhibit B: Key Drivers of PG&E Corporation's Non-GAAP Core Earnings per Common Share ("EPS") Second Quarter 2021 vs. 2020 Year to Date 2021 vs. 2020 Earnings Earnings per Common Share (Diluted) Earnings Earnings per Common Share (Diluted) 2020 Non-GAAP Core Earnings (1) $ 542 $ 1.03 $ 1,119 $ 2.11 Increase in shares outstanding (2) — (0.77) — (1.59) Unrecoverable interest expense (3) (63) (0.03) (129) (0.06) Timing of taxes (4) (17) (0.01) (33) (0.02) Timing of nuclear refueling outages (5) (10) (0.01) (31) (0.01) Growth in rate base earnings 76 0.04 145 0.07 Wildfire mitigation costs above authorized (6) 23 0.01 11 0.01 Miscellaneous 24 0.01 (20) (0.01) 2021 Non-GAAP Core Earnings (1) $ 575 $ 0.27 $ 1,062 $ 0.50 Second Quarter, 2021 vs. 2020 (in millions, except per share amounts)

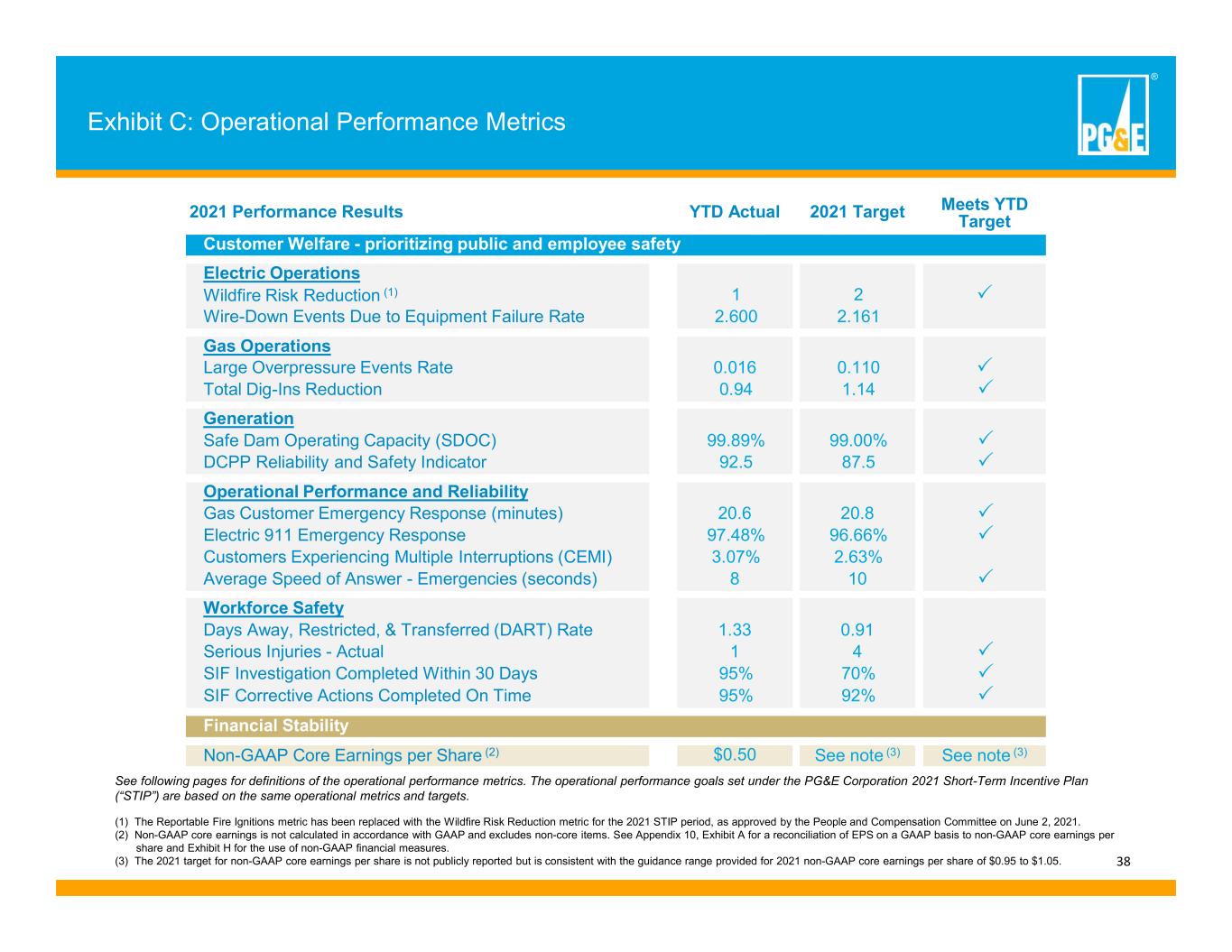

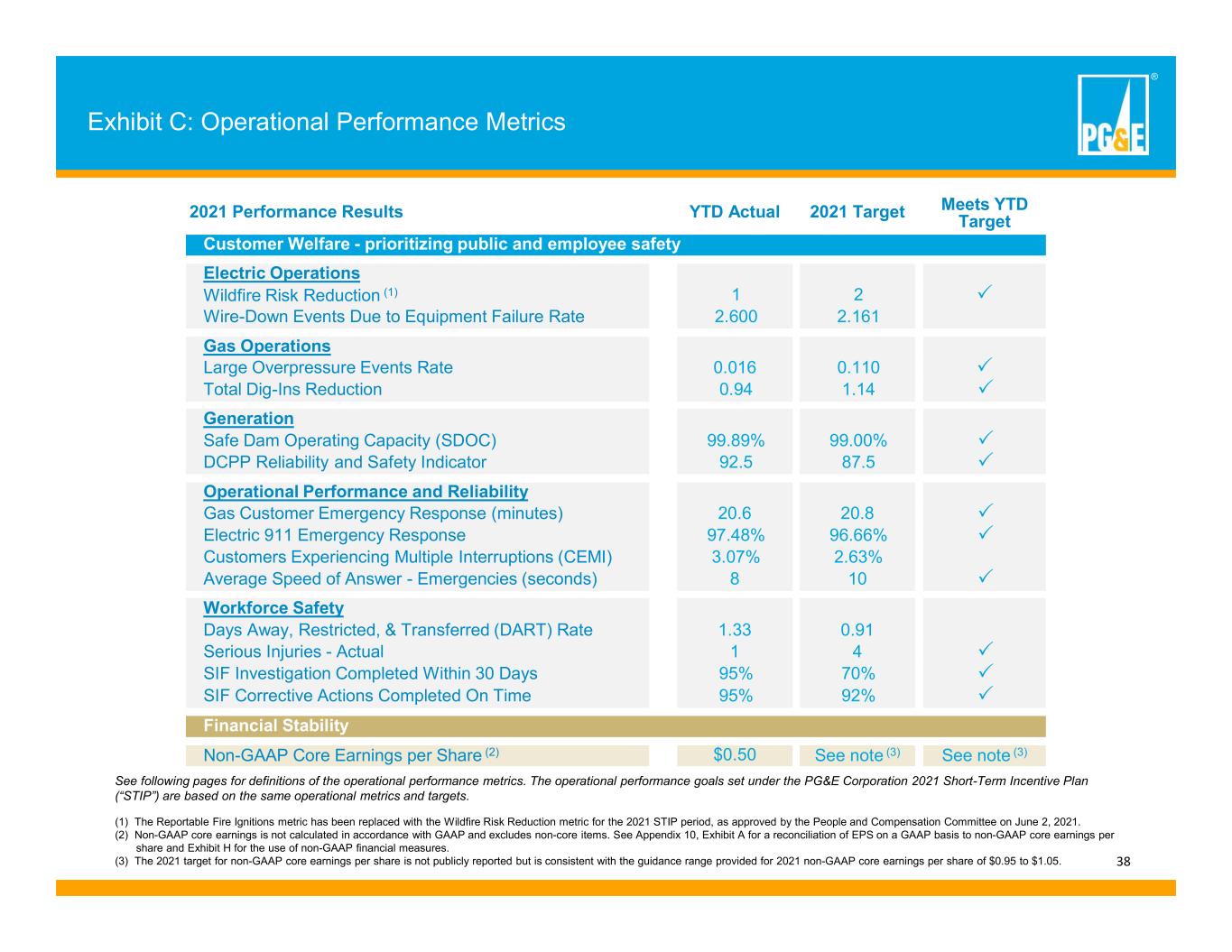

® 38 Exhibit C: Operational Performance Metrics 2021 Performance Results YTD Actual 2021 Target Meets YTD Target Customer Welfare - prioritizing public and employee safety Electric Operations Wildfire Risk Reduction (1) 1 2 P Wire-Down Events Due to Equipment Failure Rate 2.600 2.161 Gas Operations Large Overpressure Events Rate 0.016 0.110 P Total Dig-Ins Reduction 0.94 1.14 P Generation Safe Dam Operating Capacity (SDOC) 99.89% 99.00% P DCPP Reliability and Safety Indicator 92.5 87.5 P Operational Performance and Reliability Gas Customer Emergency Response (minutes) 20.6 20.8 P Electric 911 Emergency Response 97.48% 96.66% P Customers Experiencing Multiple Interruptions (CEMI) 3.07% 2.63% Average Speed of Answer - Emergencies (seconds) 8 10 P Workforce Safety Days Away, Restricted, & Transferred (DART) Rate 1.33 0.91 Serious Injuries - Actual 1 4 P SIF Investigation Completed Within 30 Days 95% 70% P SIF Corrective Actions Completed On Time 95% 92% P Financial Stability Non-GAAP Core Earnings per Share (2) $0.50 See note (3) See note (3) See following pages for definitions of the operational performance metrics. The operational performance goals set under the PG&E Corporation 2021 Short-Term Incentive Plan (“STIP”) are based on the same operational metrics and targets. (1) The Reportable Fire Ignitions metric has been replaced with the Wildfire Risk Reduction metric for the 2021 STIP period, as approved by the People and Compensation Committee on June 2, 2021. (2) Non-GAAP core earnings is not calculated in accordance with GAAP and excludes non-core items. See Appendix 10, Exhibit A for a reconciliation of EPS on a GAAP basis to non-GAAP core earnings per share and Exhibit H for the use of non-GAAP financial measures. (3) The 2021 target for non-GAAP core earnings per share is not publicly reported but is consistent with the guidance range provided for 2021 non-GAAP core earnings per share of $0.95 to $1.05.

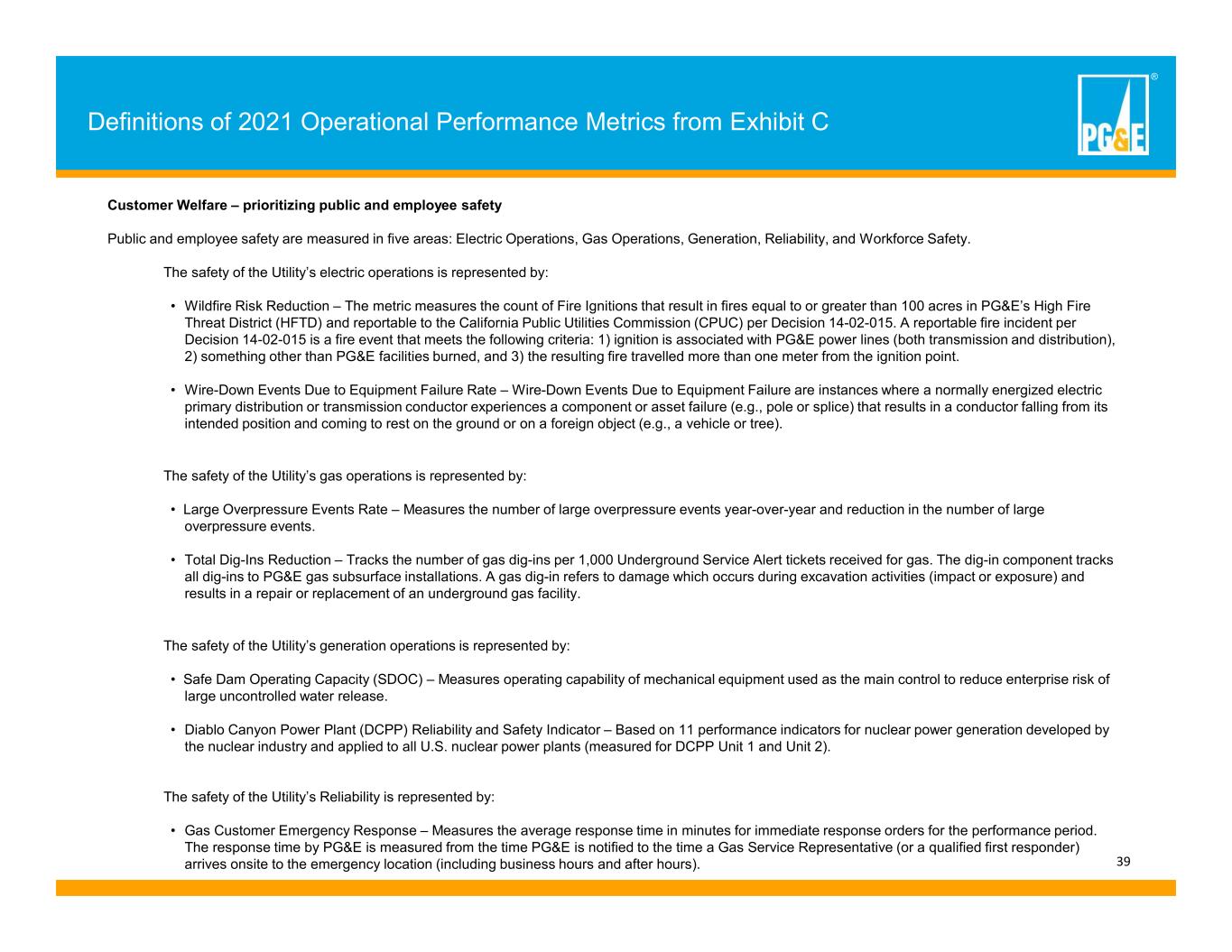

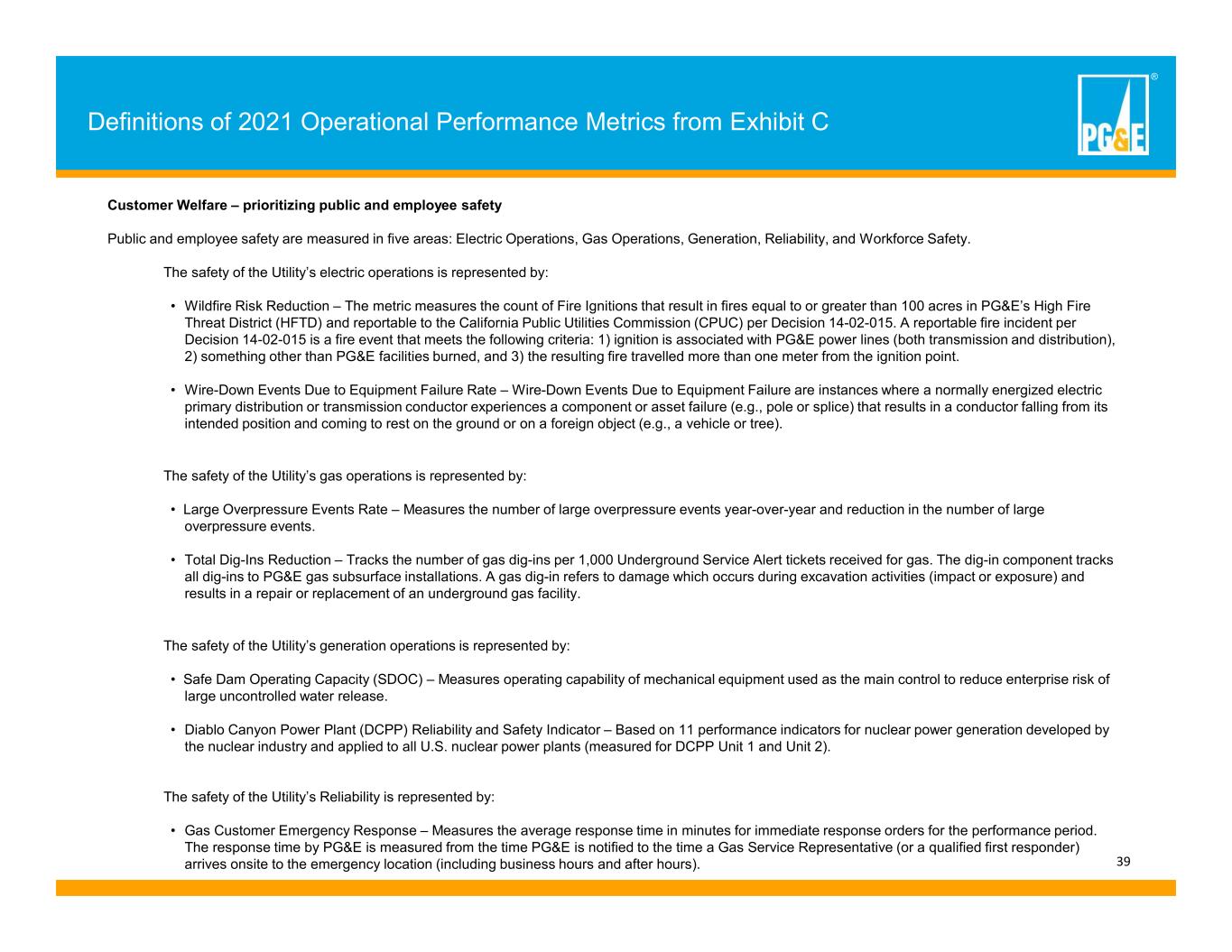

® 39 Definitions of 2021 Operational Performance Metrics from Exhibit C Customer Welfare – prioritizing public and employee safety Public and employee safety are measured in five areas: Electric Operations, Gas Operations, Generation, Reliability, and Workforce Safety. The safety of the Utility’s electric operations is represented by: • Wildfire Risk Reduction – The metric measures the count of Fire Ignitions that result in fires equal to or greater than 100 acres in PG&E’s High Fire Threat District (HFTD) and reportable to the California Public Utilities Commission (CPUC) per Decision 14-02-015. A reportable fire incident per Decision 14-02-015 is a fire event that meets the following criteria: 1) ignition is associated with PG&E power lines (both transmission and distribution), 2) something other than PG&E facilities burned, and 3) the resulting fire travelled more than one meter from the ignition point. • Wire-Down Events Due to Equipment Failure Rate – Wire-Down Events Due to Equipment Failure are instances where a normally energized electric primary distribution or transmission conductor experiences a component or asset failure (e.g., pole or splice) that results in a conductor falling from its intended position and coming to rest on the ground or on a foreign object (e.g., a vehicle or tree). The safety of the Utility’s gas operations is represented by: • Large Overpressure Events Rate – Measures the number of large overpressure events year-over-year and reduction in the number of large overpressure events. • Total Dig-Ins Reduction – Tracks the number of gas dig-ins per 1,000 Underground Service Alert tickets received for gas. The dig-in component tracks all dig-ins to PG&E gas subsurface installations. A gas dig-in refers to damage which occurs during excavation activities (impact or exposure) and results in a repair or replacement of an underground gas facility. The safety of the Utility’s generation operations is represented by: • Safe Dam Operating Capacity (SDOC) – Measures operating capability of mechanical equipment used as the main control to reduce enterprise risk of large uncontrolled water release. • Diablo Canyon Power Plant (DCPP) Reliability and Safety Indicator – Based on 11 performance indicators for nuclear power generation developed by the nuclear industry and applied to all U.S. nuclear power plants (measured for DCPP Unit 1 and Unit 2). The safety of the Utility’s Reliability is represented by: • Gas Customer Emergency Response – Measures the average response time in minutes for immediate response orders for the performance period. The response time by PG&E is measured from the time PG&E is notified to the time a Gas Service Representative (or a qualified first responder) arrives onsite to the emergency location (including business hours and after hours).

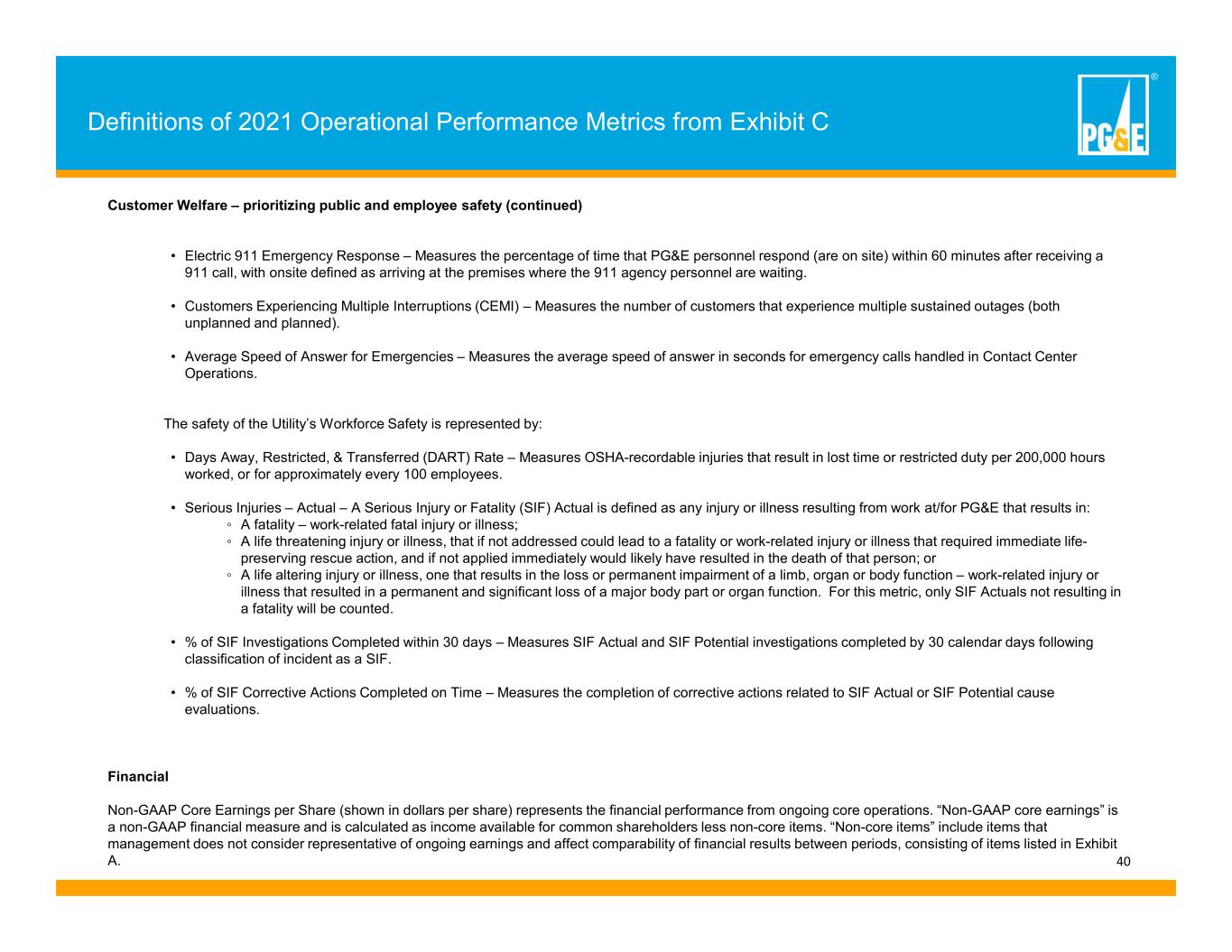

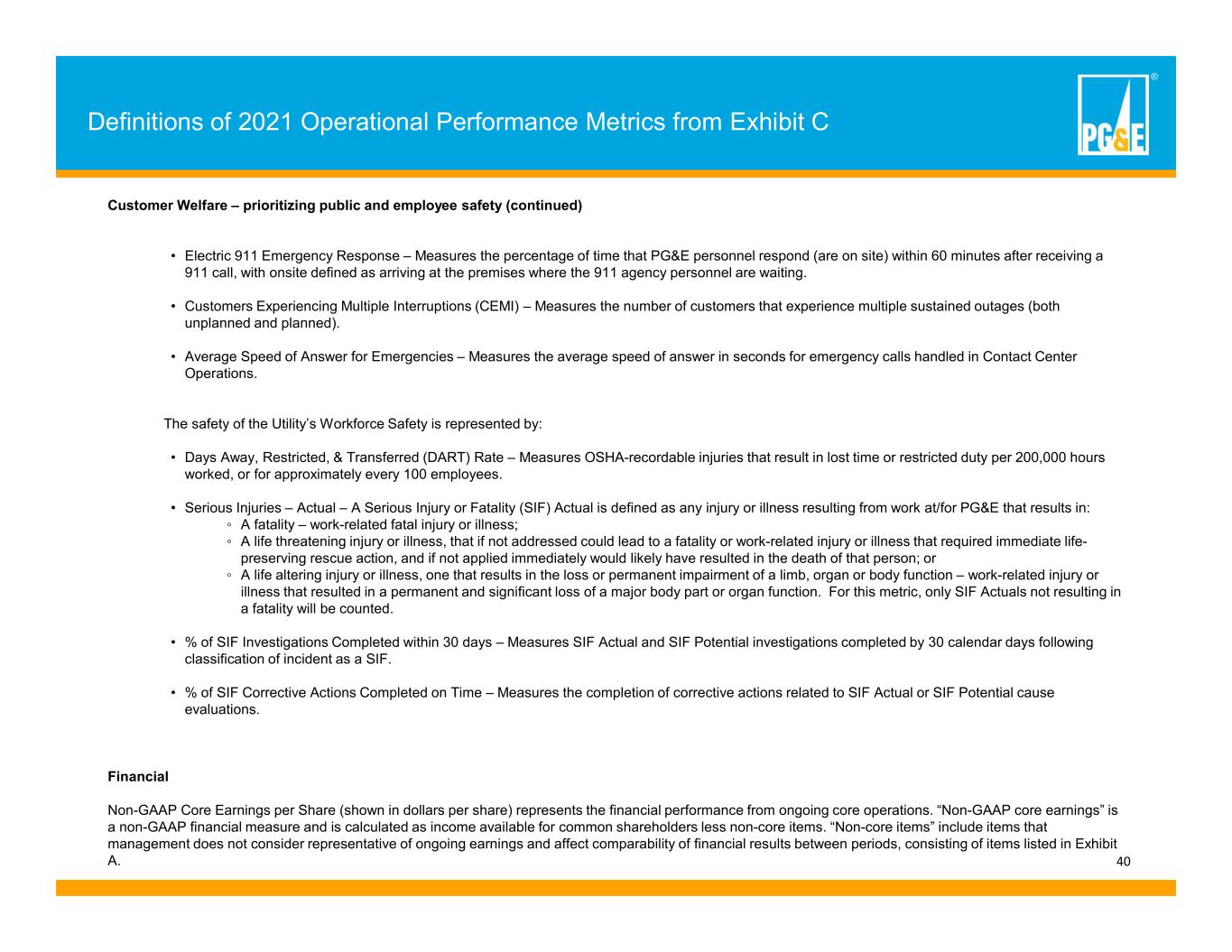

® 40 Definitions of 2021 Operational Performance Metrics from Exhibit C Customer Welfare – prioritizing public and employee safety (continued) • Electric 911 Emergency Response – Measures the percentage of time that PG&E personnel respond (are on site) within 60 minutes after receiving a 911 call, with onsite defined as arriving at the premises where the 911 agency personnel are waiting. • Customers Experiencing Multiple Interruptions (CEMI) – Measures the number of customers that experience multiple sustained outages (both unplanned and planned). • Average Speed of Answer for Emergencies – Measures the average speed of answer in seconds for emergency calls handled in Contact Center Operations. The safety of the Utility’s Workforce Safety is represented by: • Days Away, Restricted, & Transferred (DART) Rate – Measures OSHA-recordable injuries that result in lost time or restricted duty per 200,000 hours worked, or for approximately every 100 employees. • Serious Injuries – Actual – A Serious Injury or Fatality (SIF) Actual is defined as any injury or illness resulting from work at/for PG&E that results in: ◦ A fatality – work-related fatal injury or illness; ◦ A life threatening injury or illness, that if not addressed could lead to a fatality or work-related injury or illness that required immediate life- preserving rescue action, and if not applied immediately would likely have resulted in the death of that person; or ◦ A life altering injury or illness, one that results in the loss or permanent impairment of a limb, organ or body function – work-related injury or illness that resulted in a permanent and significant loss of a major body part or organ function. For this metric, only SIF Actuals not resulting in a fatality will be counted. • % of SIF Investigations Completed within 30 days – Measures SIF Actual and SIF Potential investigations completed by 30 calendar days following classification of incident as a SIF. • % of SIF Corrective Actions Completed on Time – Measures the completion of corrective actions related to SIF Actual or SIF Potential cause evaluations. Financial Non-GAAP Core Earnings per Share (shown in dollars per share) represents the financial performance from ongoing core operations. “Non-GAAP core earnings” is a non-GAAP financial measure and is calculated as income available for common shareholders less non-core items. “Non-core items” include items that management does not consider representative of ongoing earnings and affect comparability of financial results between periods, consisting of items listed in Exhibit A.

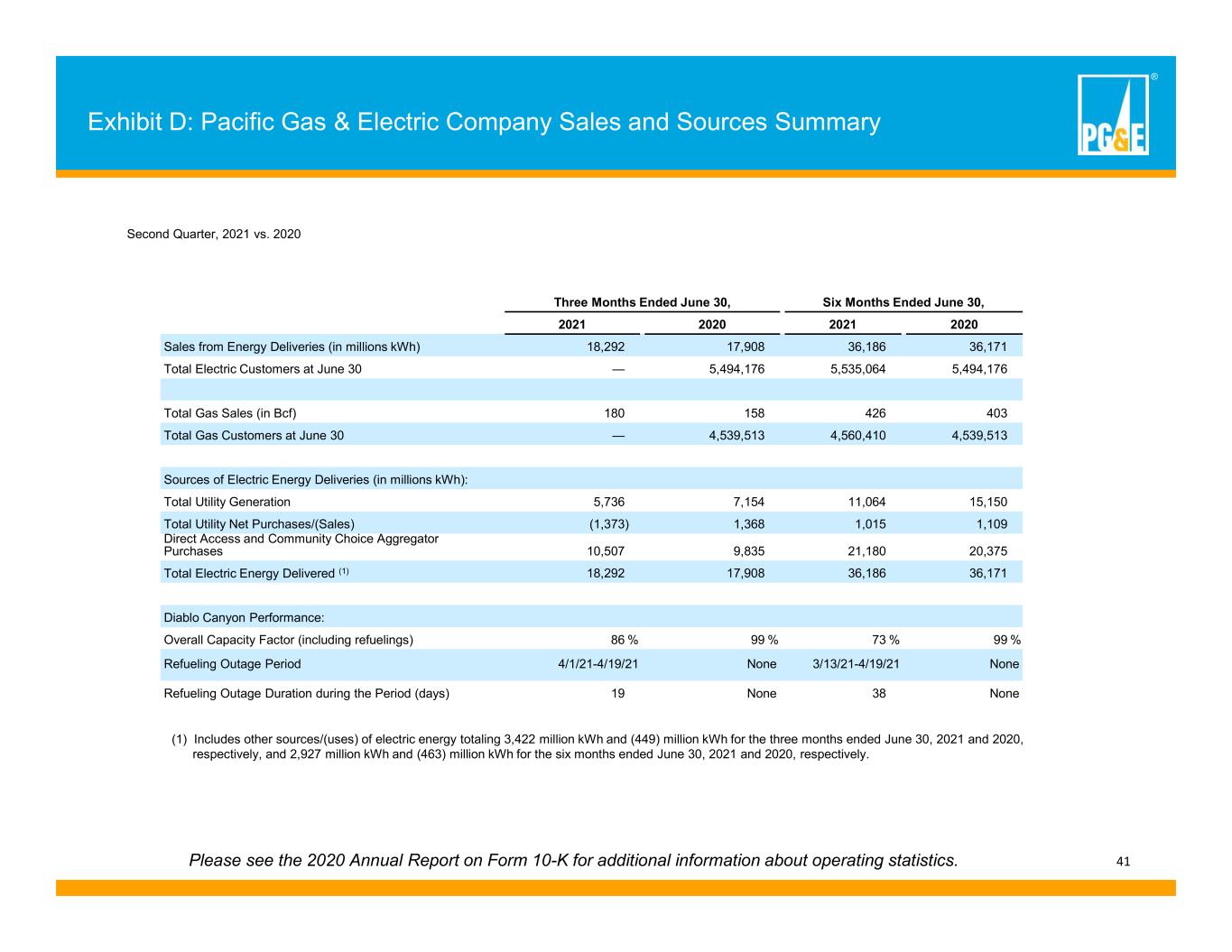

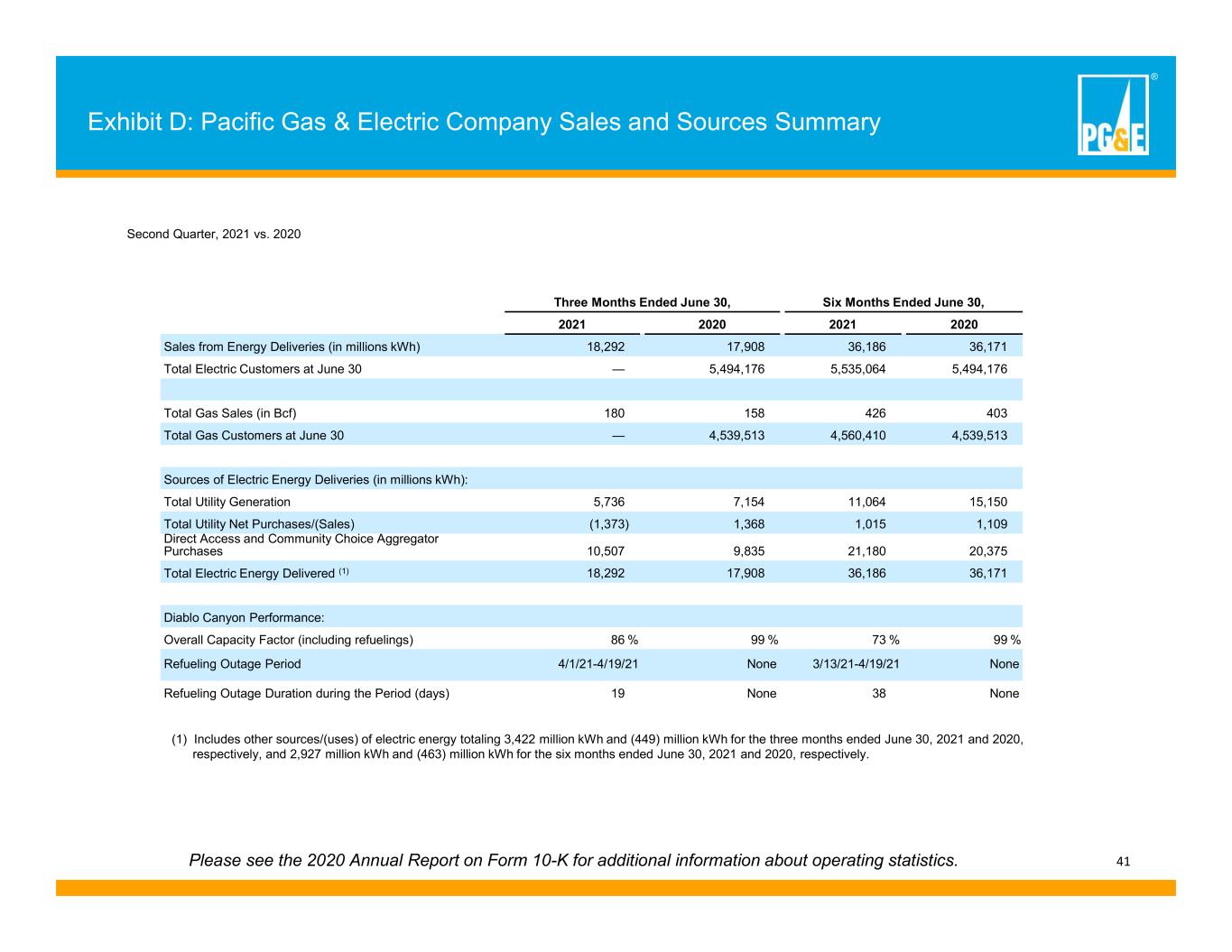

® 41 Exhibit D: Pacific Gas & Electric Company Sales and Sources Summary Three Months Ended June 30, Six Months Ended June 30, 2021 2020 2021 2020 Sales from Energy Deliveries (in millions kWh) 18,292 17,908 36,186 36,171 Total Electric Customers at June 30 — 5,494,176 5,535,064 5,494,176 Total Gas Sales (in Bcf) 180 158 426 403 Total Gas Customers at June 30 — 4,539,513 4,560,410 4,539,513 Sources of Electric Energy Deliveries (in millions kWh): Total Utility Generation 5,736 7,154 11,064 15,150 Total Utility Net Purchases/(Sales) (1,373) 1,368 1,015 1,109 Direct Access and Community Choice Aggregator Purchases 10,507 9,835 21,180 20,375 Total Electric Energy Delivered (1) 18,292 17,908 36,186 36,171 Diablo Canyon Performance: Overall Capacity Factor (including refuelings) 86 % 99 % 73 % 99 % Refueling Outage Period 4/1/21-4/19/21 None 3/13/21-4/19/21 None Refueling Outage Duration during the Period (days) 19 None 38 None Please see the 2020 Annual Report on Form 10-K for additional information about operating statistics. (1) Includes other sources/(uses) of electric energy totaling 3,422 million kWh and (449) million kWh for the three months ended June 30, 2021 and 2020, respectively, and 2,927 million kWh and (463) million kWh for the six months ended June 30, 2021 and 2020, respectively. Second Quarter, 2021 vs. 2020

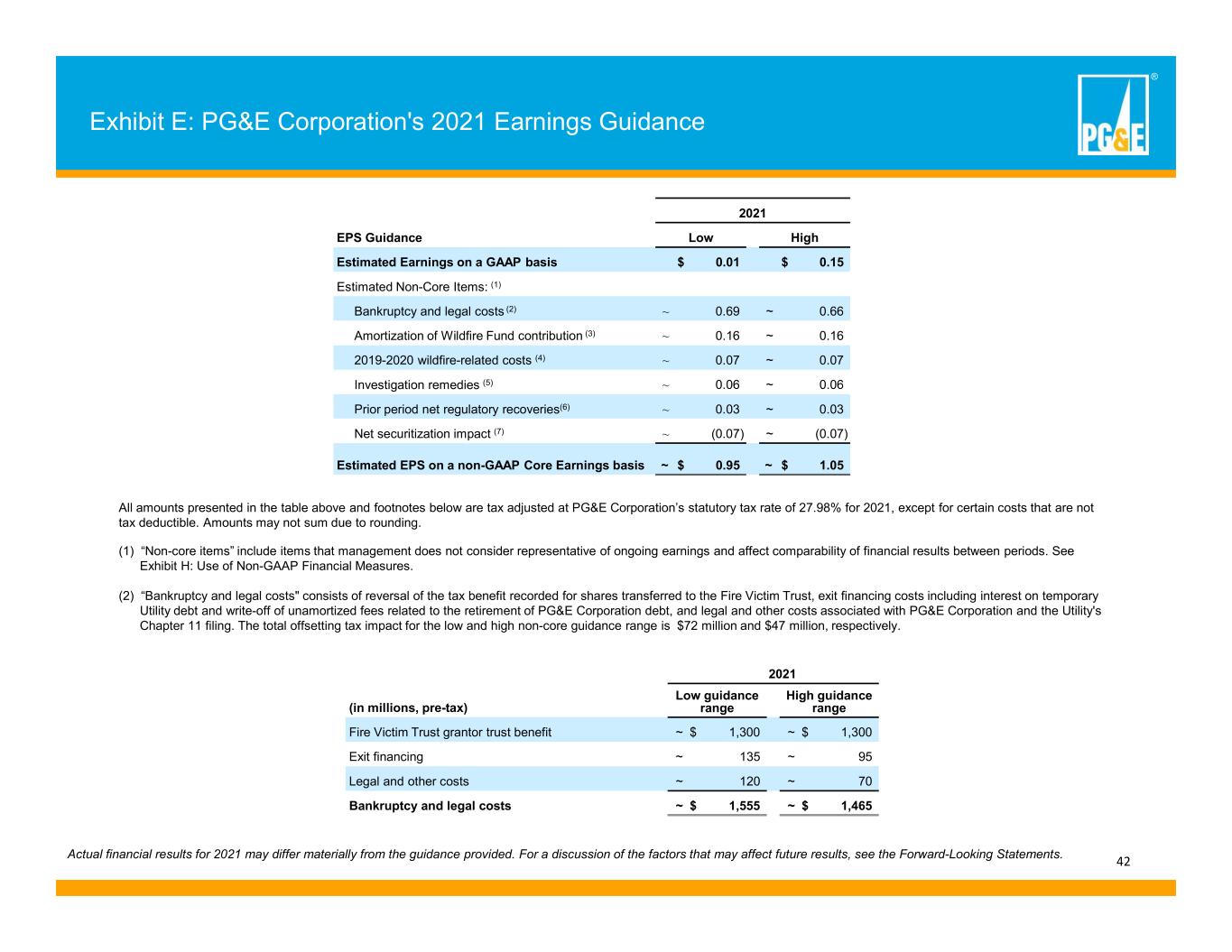

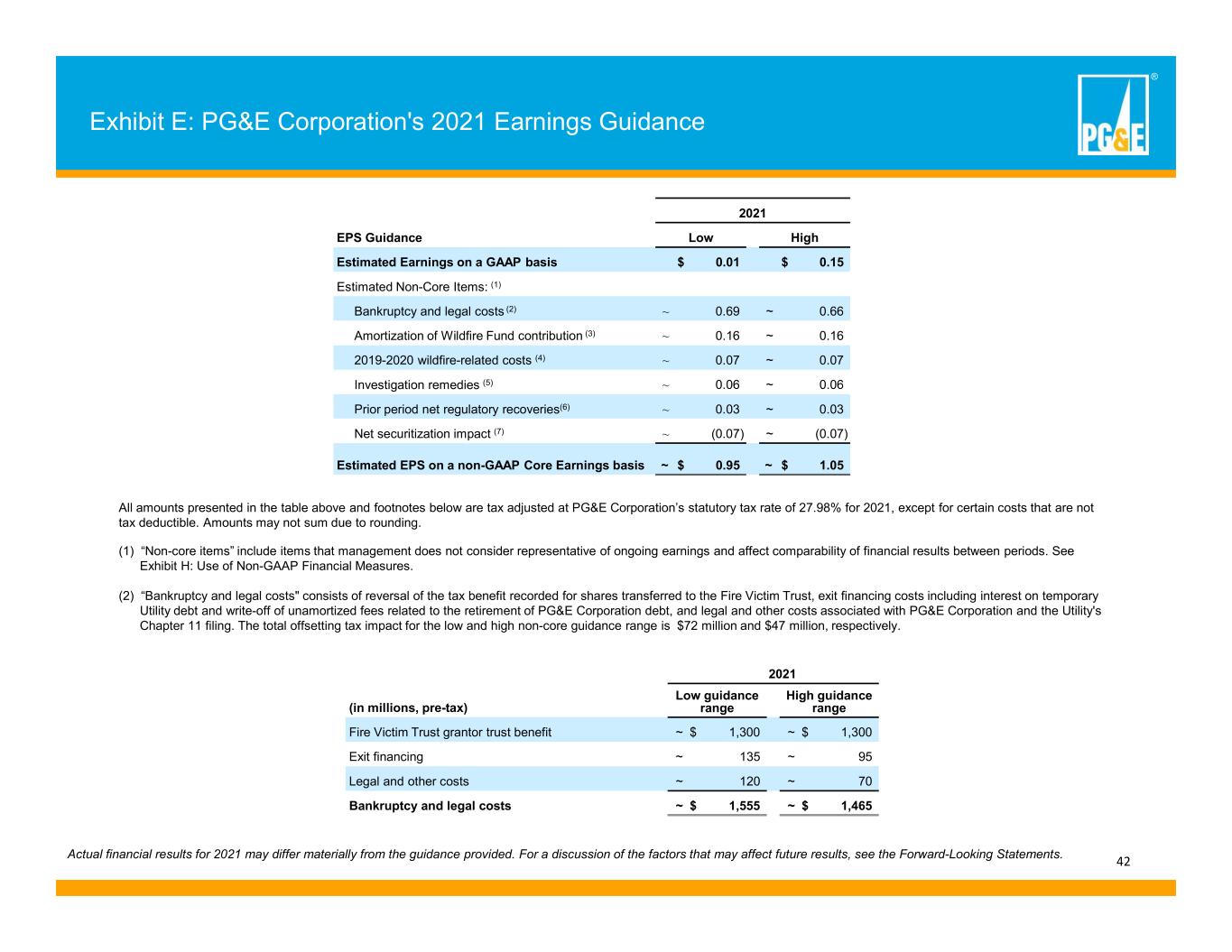

® 42 Exhibit E: PG&E Corporation's 2021 Earnings Guidance 2021 EPS Guidance Low High Estimated Earnings on a GAAP basis $ 0.01 $ 0.15 Estimated Non-Core Items: (1) Bankruptcy and legal costs (2) ~ 0.69 ~ 0.66 Amortization of Wildfire Fund contribution (3) ~ 0.16 ~ 0.16 2019-2020 wildfire-related costs (4) ~ 0.07 ~ 0.07 Investigation remedies (5) ~ 0.06 ~ 0.06 Prior period net regulatory recoveries(6) ~ 0.03 ~ 0.03 Net securitization impact (7) ~ (0.07) ~ (0.07) Estimated EPS on a non-GAAP Core Earnings basis ~ $ 0.95 ~ $ 1.05 All amounts presented in the table above and footnotes below are tax adjusted at PG&E Corporation’s statutory tax rate of 27.98% for 2021, except for certain costs that are not tax deductible. Amounts may not sum due to rounding. Actual financial results for 2021 may differ materially from the guidance provided. For a discussion of the factors that may affect future results, see the Forward-Looking Statements. (1) “Non-core items” include items that management does not consider representative of ongoing earnings and affect comparability of financial results between periods. See Exhibit H: Use of Non-GAAP Financial Measures. (2) “Bankruptcy and legal costs" consists of reversal of the tax benefit recorded for shares transferred to the Fire Victim Trust, exit financing costs including interest on temporary Utility debt and write-off of unamortized fees related to the retirement of PG&E Corporation debt, and legal and other costs associated with PG&E Corporation and the Utility's Chapter 11 filing. The total offsetting tax impact for the low and high non-core guidance range is $72 million and $47 million, respectively. 2021 (in millions, pre-tax) Low guidance range High guidance range Fire Victim Trust grantor trust benefit ~ $ 1,300 ~ $ 1,300 Exit financing ~ 135 ~ 95 Legal and other costs ~ 120 ~ 70 Bankruptcy and legal costs ~ $ 1,555 ~ $ 1,465

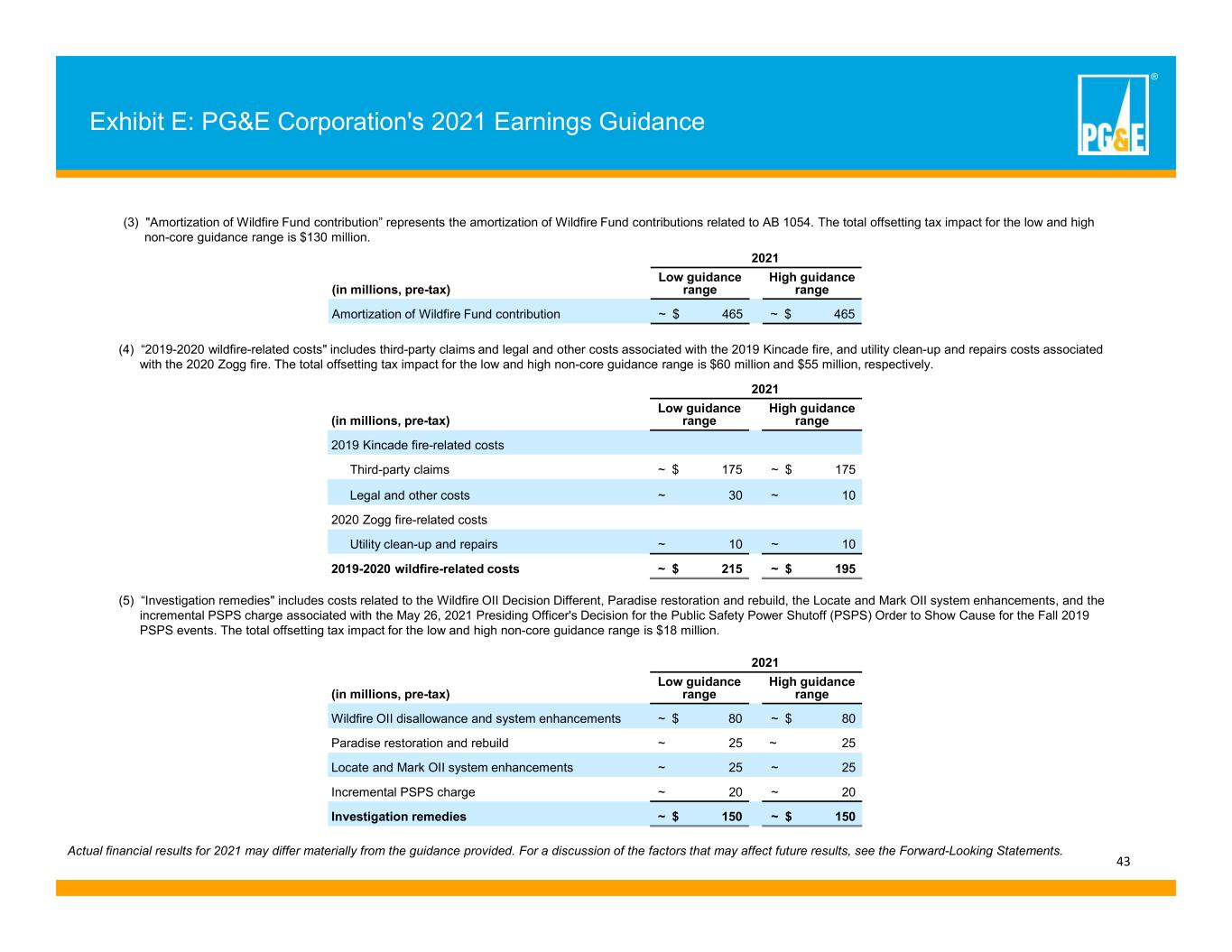

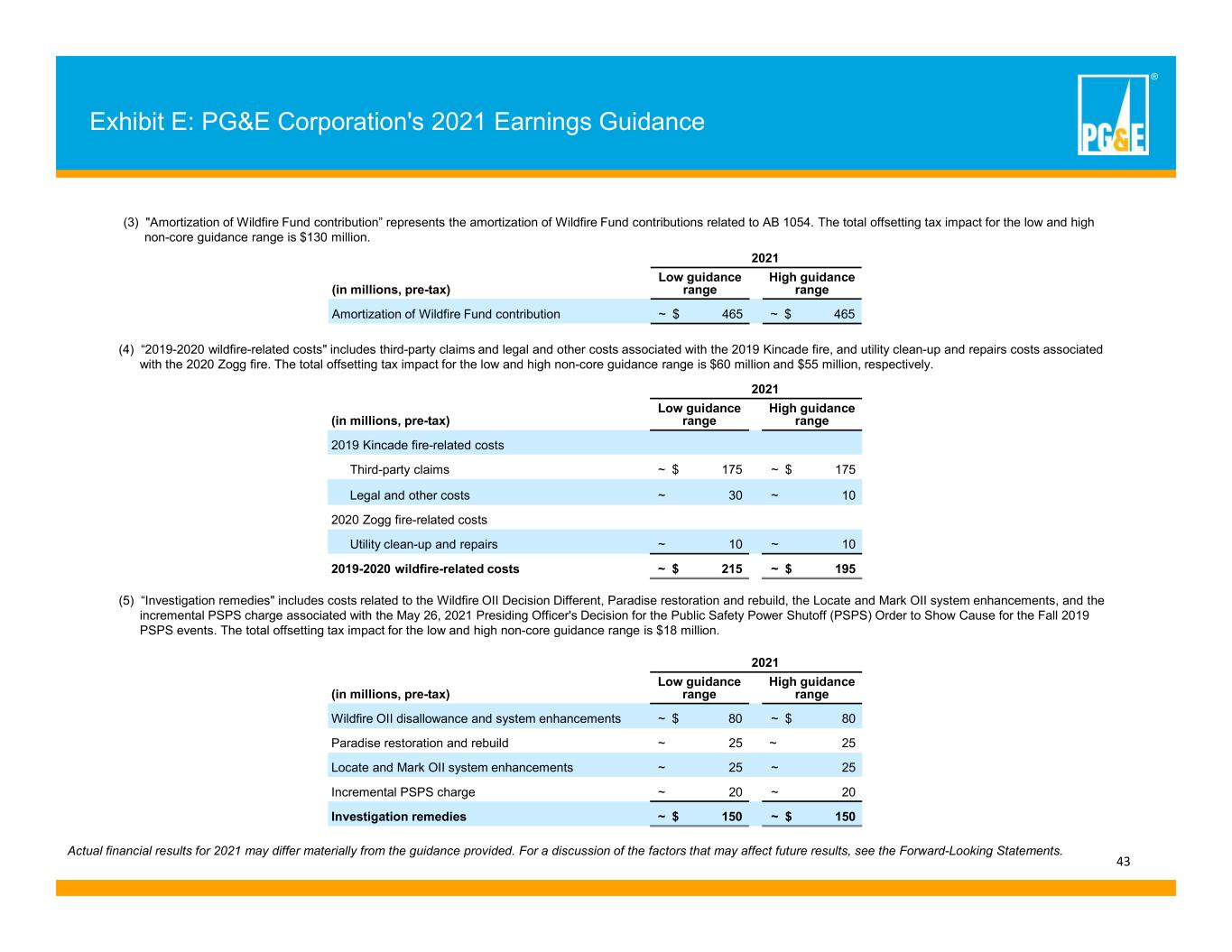

® 43 Exhibit E: PG&E Corporation's 2020 and 2021 Earnings Guidance Actual financial results for 2021 may differ materially from the guidance provided. For a discussion of the factors that may affect future results, see the Forward-Looking Statements. (3) "Amortization of Wildfire Fund contribution” represents the amortization of Wildfire Fund contributions related to AB 1054. The total offsetting tax impact for the low and high non-core guidance range is $130 million. 2021 (in millions, pre-tax) Low guidance range High guidance range Amortization of Wildfire Fund contribution ~ $ 465 ~ $ 465 (5) “Investigation remedies" includes costs related to the Wildfire OII Decision Different, Paradise restoration and rebuild, the Locate and Mark OII system enhancements, and the incremental PSPS charge associated with the May 26, 2021 Presiding Officer's Decision for the Public Safety Power Shutoff (PSPS) Order to Show Cause for the Fall 2019 PSPS events. The total offsetting tax impact for the low and high non-core guidance range is $18 million. 2021 (in millions, pre-tax) Low guidance range High guidance range Wildfire OII disallowance and system enhancements ~ $ 80 ~ $ 80 Paradise restoration and rebuild ~ 25 ~ 25 Locate and Mark OII system enhancements ~ 25 ~ 25 Incremental PSPS charge ~ 20 ~ 20 Investigation remedies ~ $ 150 ~ $ 150 Exhibit E: PG&E Corporation's 2021 Earnings Guidance 2021 (in millions, pre-tax) Low guidance range High guidance range 2019 Kincade fire-related costs Third-party claims ~ $ 175 ~ $ 175 Legal and other costs ~ 30 ~ 10 2020 Zogg fire-related costs Utility clean-up and repairs ~ 10 ~ 10 2019-2020 wildfire-related costs ~ $ 215 ~ $ 195 (4) “2019-2020 wildfire-related costs" includes third-party claims and legal and other costs associated with the 2019 Kincade fire, and utility clean-up and repairs costs associated with the 2020 Zogg fire. The total offsetting tax impact for the low and high non-core guidance range is $60 million and $55 million, respectively.

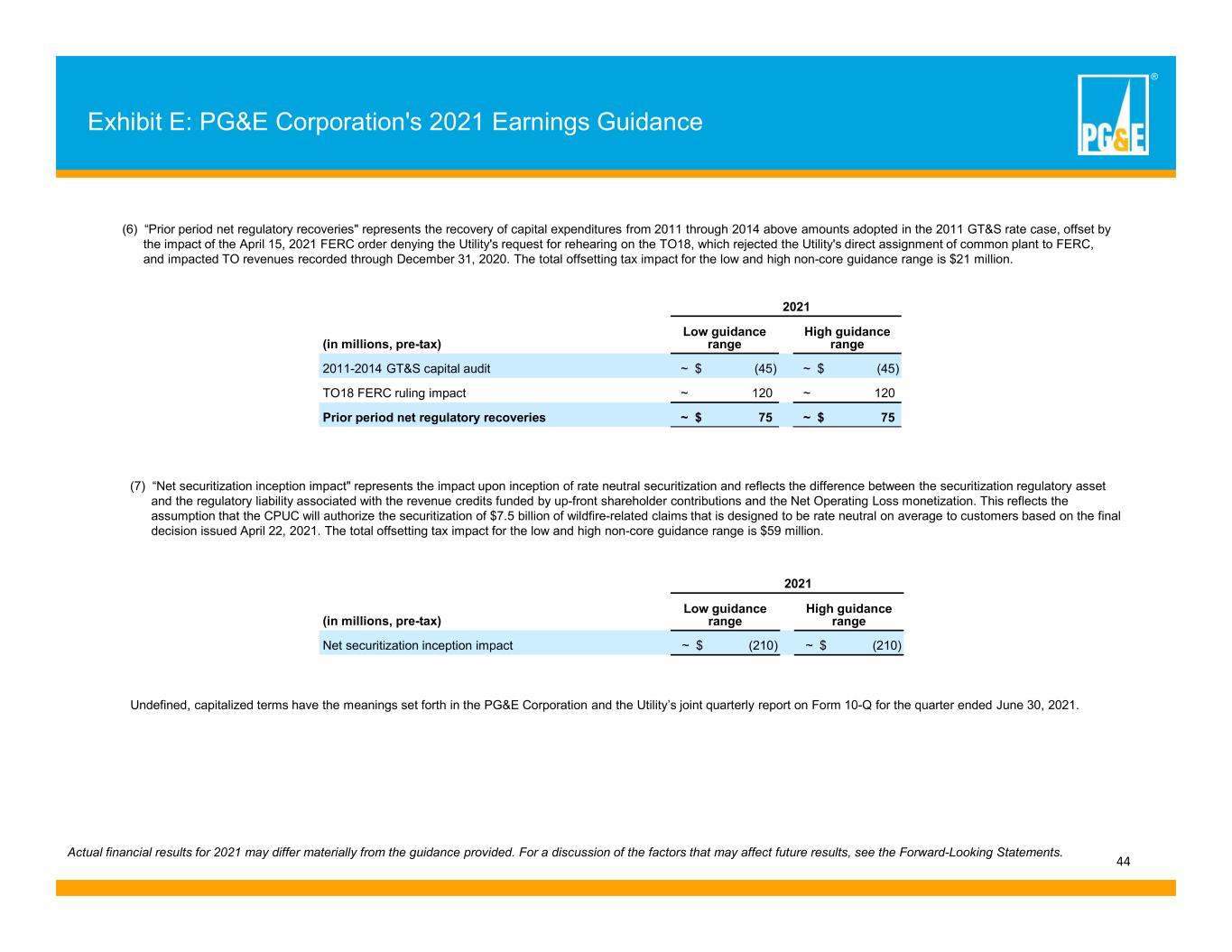

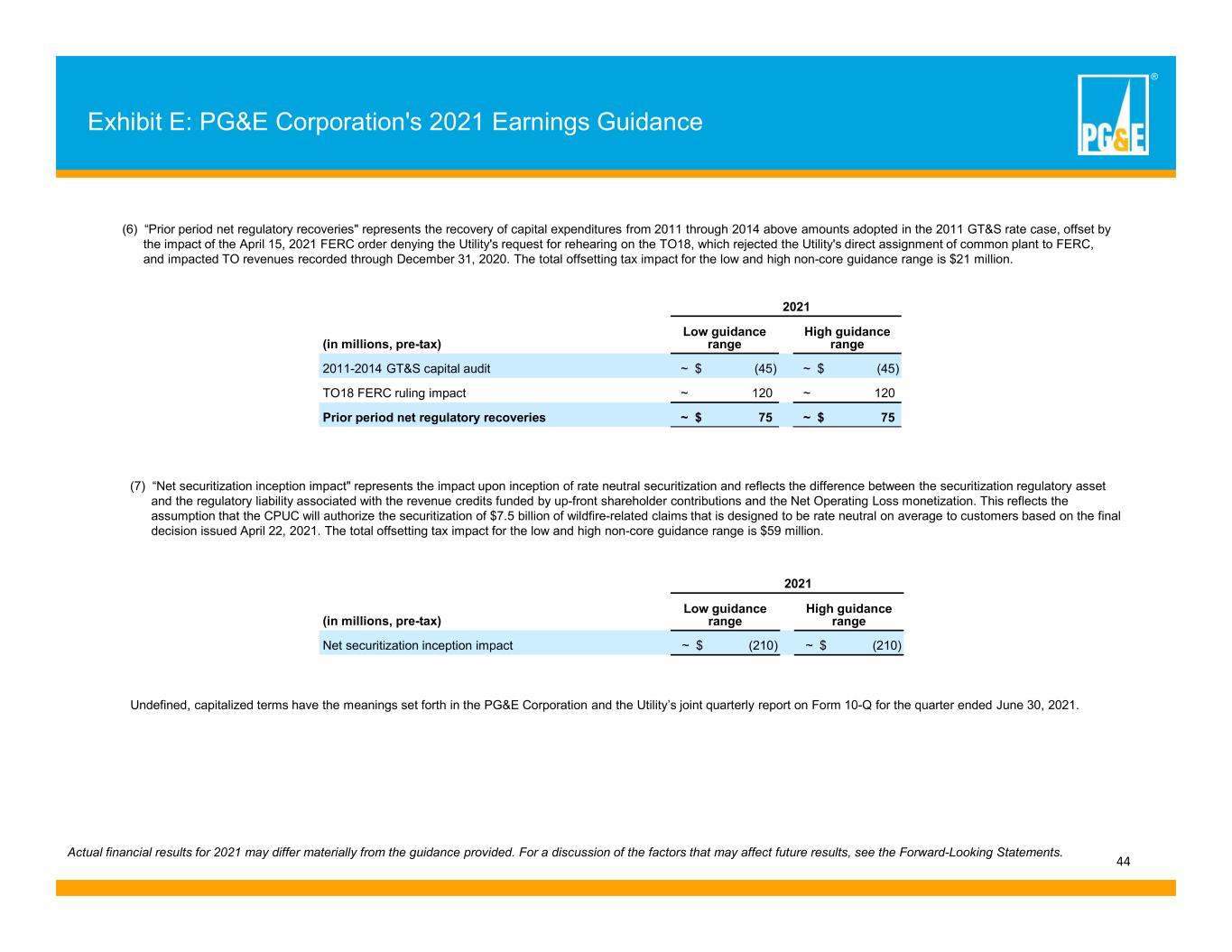

® 44 Exhibit E: PG&E Corporation's 2021 Earnings Guidance Actual financial results for 2021 may differ materially from the guidance provided. For a discussion of the factors that may affect future results, see the Forward-Looking Statements. (6) “Prior period net regulatory recoveries" represents the recovery of capital expenditures from 2011 through 2014 above amounts adopted in the 2011 GT&S rate case, offset by the impact of the April 15, 2021 FERC order denying the Utility's request for rehearing on the TO18, which rejected the Utility's direct assignment of common plant to FERC, and impacted TO revenues recorded through December 31, 2020. The total offsetting tax impact for the low and high non-core guidance range is $21 million. 2021 (in millions, pre-tax) Low guidance range High guidance range 2011-2014 GT&S capital audit ~ $ (45) ~ $ (45) TO18 FERC ruling impact ~ 120 ~ 120 Prior period net regulatory recoveries ~ $ 75 ~ $ 75 (7) “Net securitization inception impact" represents the impact upon inception of rate neutral securitization and reflects the difference between the securitization regulatory asset and the regulatory liability associated with the revenue credits funded by up-front shareholder contributions and the Net Operating Loss monetization. This reflects the assumption that the CPUC will authorize the securitization of $7.5 billion of wildfire-related claims that is designed to be rate neutral on average to customers based on the final decision issued April 22, 2021. The total offsetting tax impact for the low and high non-core guidance range is $59 million. 2021 (in millions, pre-tax) Low guidance range High guidance range Net securitization inception impact ~ $ (210) ~ $ (210) Undefined, capitalized terms have the meanings set forth in the PG&E Corporation and the Utility’s joint quarterly report on Form 10-Q for the quarter ended June 30, 2021.

® 45 Exhibit F: General Earnings Sensitivities for 2021 Pacific Gas & Electric Company These general earnings sensitivities with respect to factors that may affect 2021 earnings are forward looking statements that are based on various assumptions. Actual results may differ materially. For a discussion of the factors that may affect future results, see the Forward-Looking Statements. Variable Description of Change Estimated 2021 Non-GAAP Core Earnings Impact Rate base +/- $100 million change in allowed rate base +/- $5 million Return on Equity (ROE) +/- 0.1% change in allowed ROE +/- $25 million Share count +/- 1% change in average shares +/- $0.01 per share Revenue or expense +/- $30 million pre-tax change in at-risk revenue or expense +/- $0.01 per share

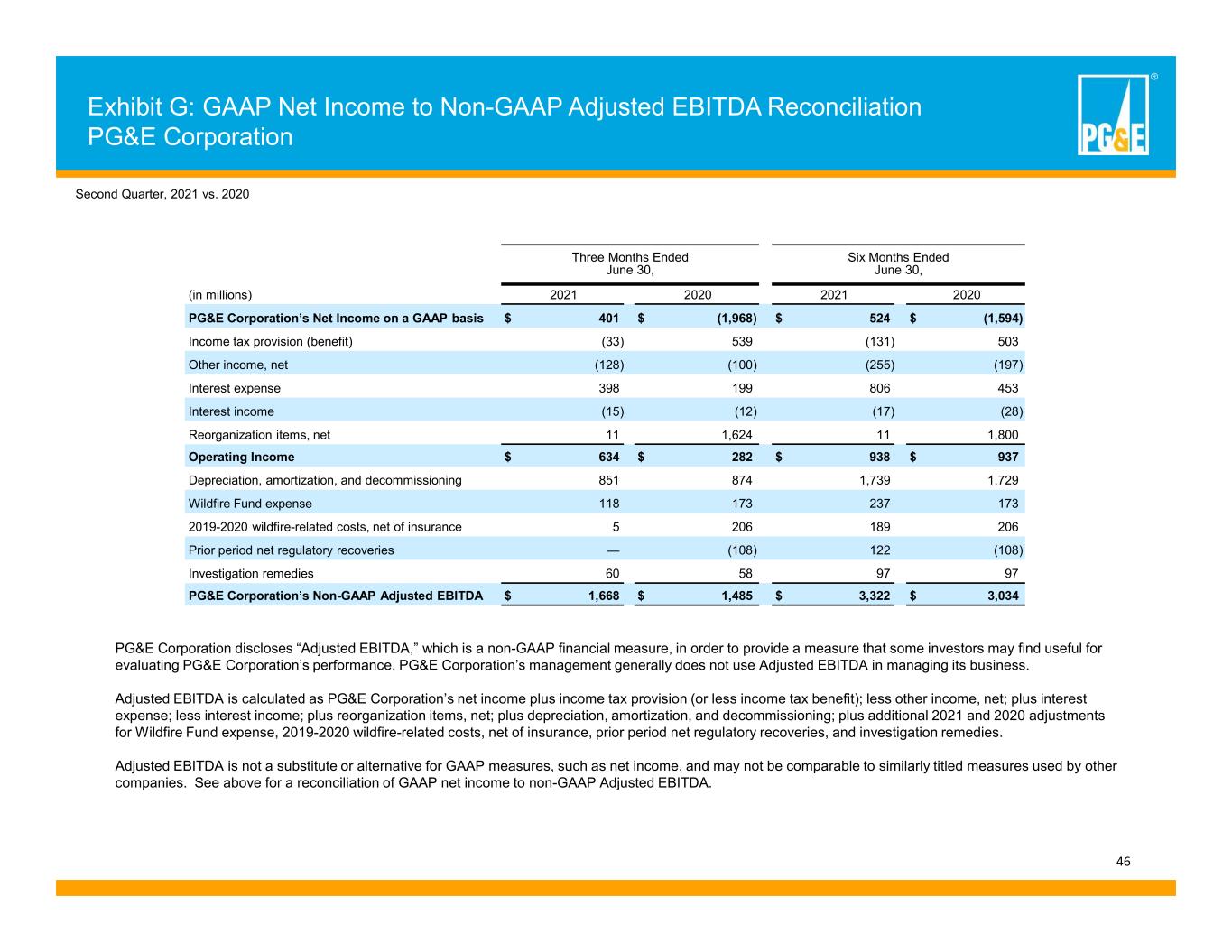

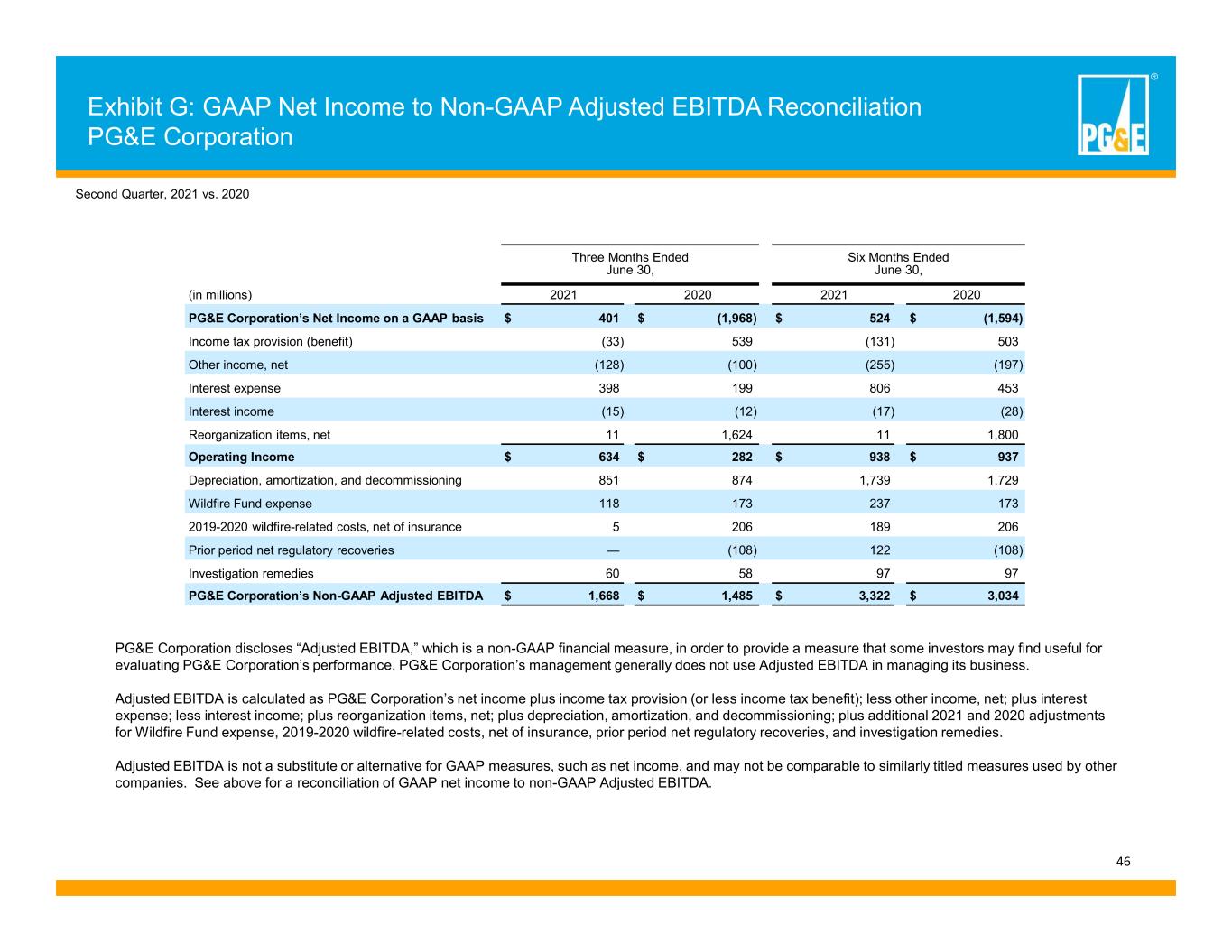

® 46 Three Months Ended June 30, Six Months Ended June 30, (in millions) 2021 2020 2021 2020 PG&E Corporation’s Net Income on a GAAP basis $ 401 $ (1,968) $ 524 $ (1,594) Income tax provision (benefit) (33) 539 (131) 503 Other income, net (128) (100) (255) (197) Interest expense 398 199 806 453 Interest income (15) (12) (17) (28) Reorganization items, net 11 1,624 11 1,800 Operating Income $ 634 $ 282 $ 938 $ 937 Depreciation, amortization, and decommissioning 851 874 1,739 1,729 Wildfire Fund expense 118 173 237 173 2019-2020 wildfire-related costs, net of insurance 5 206 189 206 Prior period net regulatory recoveries — (108) 122 (108) Investigation remedies 60 58 97 97 PG&E Corporation’s Non-GAAP Adjusted EBITDA $ 1,668 $ 1,485 $ 3,322 $ 3,034 PG&E Corporation discloses “Adjusted EBITDA,” which is a non-GAAP financial measure, in order to provide a measure that some investors may find useful for evaluating PG&E Corporation’s performance. PG&E Corporation’s management generally does not use Adjusted EBITDA in managing its business. Adjusted EBITDA is calculated as PG&E Corporation’s net income plus income tax provision (or less income tax benefit); less other income, net; plus interest expense; less interest income; plus reorganization items, net; plus depreciation, amortization, and decommissioning; plus additional 2021 and 2020 adjustments for Wildfire Fund expense, 2019-2020 wildfire-related costs, net of insurance, prior period net regulatory recoveries, and investigation remedies. Adjusted EBITDA is not a substitute or alternative for GAAP measures, such as net income, and may not be comparable to similarly titled measures used by other companies. See above for a reconciliation of GAAP net income to non-GAAP Adjusted EBITDA. Second Quarter, 2021 vs. 2020 Exhibit G: GAAP Net Income to Non-GAAP Adjusted EBITDA Reconciliation PG&E Corporation

® 47 Exhibit H: Use of Non-GAAP Financial Measures PG&E Corporation and Pacific Gas and Electric Company: Use of Non-GAAP Financial Measures PG&E Corporation discloses historical financial results and provides guidance based on “non-GAAP core earnings” and “non-GAAP core EPS” in order to provide a measure that allows investors to compare the underlying financial performance of the business from one period to another, exclusive of non-core items. “Non-GAAP core earnings” is a non-GAAP financial measure and is calculated as income available for common shareholders less non-core items. “Non-core items” include items that management does not consider representative of ongoing earnings and affect comparability of financial results between periods, consisting of the items listed in Exhibit A. “Non-GAAP core EPS,” also referred to as “non-GAAP core earnings per share,” is a non-GAAP financial measure and is calculated as non-GAAP core earnings divided by common shares outstanding (diluted). PG&E Corporation and the Utility use non-GAAP core earnings and non-GAAP core EPS to understand and compare operating results across reporting periods for various purposes including internal budgeting and forecasting, short- and long-term operating planning, and employee incentive compensation. PG&E Corporation and the Utility believe that non-GAAP core earnings and non-GAAP core EPS provide additional insight into the underlying trends of the business, allowing for a better comparison against historical results and expectations for future performance. With respect to our projection of Non-GAAP Core EPS for the years 2022-2025, we are not providing a reconciliation to the corresponding GAAP measures because we are unable to predict with reasonable certainty the reconciling items that may affect GAAP net income without unreasonable effort. The reconciling items are primarily due to the future impact of wildfire-related costs, timing of regulatory recoveries, special tax items, and investigation remedies. These reconciling items are uncertain, depend on various factors and could significantly impact, either individually or in the aggregate, the GAAP measures. Non-GAAP core earnings and non-GAAP core EPS are not substitutes or alternatives for GAAP measures such as consolidated income available for common shareholders and may not be comparable to similarly titled measures used by other companies.