EXHIBIT 99.2

SECOND QUARTER EARNINGS CALL July 29, 2015

Safe Harbor Statements Management's statements providing guidance for PG&E Corporation’s 2015 financial results and the underlying assumptions and forecasts (including those relating to unrecovered costs, capital expenditures, rate base, equity issuances, authorized revenues, and general earnings sensitivities), the forecasts of capital expenditures and rate base through 2016, and the anticipated financial impact of the Penalty Decision issued on April 9, 2015, constitute forward-looking statements that reflect management’s judgment and opinions. These statements and assumptions are necessarily subject to various risks and uncertainties, the realization or resolution of which may be outside management’s control. Actual results may differ materially. Factors that could cause actual results to differ materially include:the outcome and timing of the 2015 Gas Transmission & Storage (GT&S) rate case, including the amount of revenue disallowance imposed as a penalty for improper ex parte communications and how the authorized revenue requirements are reduced to reflect the disallowance of costs associated with designated safety-related projects and programs as required by the Penalty Decision;the timing and amount of fines, penalties, and remedial costs that the Utility may incur in connection with the federal criminal prosecution of the Utility, the CPUC’s investigation of the Utility’s natural gas distribution operations, , and the other investigations that have been or may be commenced relating to the Utility’s compliance with natural gas-related laws and regulations, the Utility’s safety culture, or other matters, and whether the CPUC’s Safety and Enforcement Division imposes fines on the Utility with respect to self-reported or alleged non-compliance with safety regulations;the timing and outcome of the CPUC’s investigation and the pending criminal investigations relating to communications between the Utility and the CPUC that may have violated the CPUC’s rules regarding ex parte communications or are otherwise alleged to be improper, and whether such matters negatively affect the final decisions to be issued in the 2015 GT&S rate case or other ratemaking proceedings;the Utility’s ability to control its costs within the adopted levels of spending and the extent to which actual costs that are not recovered through rates exceed the forecast of unrecovered costs due to changes in cost forecasts or the scope and timing of planned work;the impact that reductions in customer demand for electricity and natural gas have on the Utility’s ability to make and recover its investments through rates and earn its authorized return on equity, and whether the Utility’s business strategy to address the impact of growing distributed and renewable generation resources and changing customer demands is successful;changes in estimated environmental remediation costs, including costs associated with the Utility’s natural gas compressor sites; the amount and timing of additional equity and debt issuances and whether PG&E Corporation and the Utility can continue to access capital markets and other sources of debt and equity financing in a timely manner on acceptable termsthe outcome of federal or state tax audits and the impact of any changes in federal or state tax laws, policies, regulations, or their interpretation; andthe other factors disclosed in PG&E Corporation’s and the Utility’s joint Annual Report on Form 10-K for the year ended December 31, 2014 and Quarterly Reports on Form 10-Q for the quarters ended March 31 and June 30, 2015.This presentation is not complete without the accompanying statements made by management during the webcast conference call held on July 29, 2015.This presentation, including Appendices, and the accompanying press release were attached to PG&E Corporation’s Current Report on Form 8-K that was furnished to the Securities and Exchange Commission on July 29, 2015 and, along with the replay of the conference call, is also available on PG&E Corporation’s website at www.pge-corp.com.

Key Focus Areas Grid of Things™Greenhouse gas reduction policyUpdated rate structures Unwavering safety focusCommunity and stakeholder engagementAffordable and reliable service Resolve outstanding regulatory and legal proceedingsBuild strong compliance programs Continue to execute gas safety work Positioning PG&E for a Clean Energy Economy Address Outstanding Issues Deliver on Customer Expectations

Electric Distribution Resource Plan – Filed with CPUC in JulyResidential Rate OIR – Final decision issued in JulyNet Energy Metering – Filing in AugustGas Transmission and Storage rate case – Two separate decisions Regulatory Update Regulatory and Operational Update Executing on Operations Public Safety Performance – Reduced wires down, gas dig-ins and emergency response timeEmergency Preparedness – Successfully conducted a large-scale earthquake drill Drought Response – Enhanced wildfire protections and hydro system flexibility

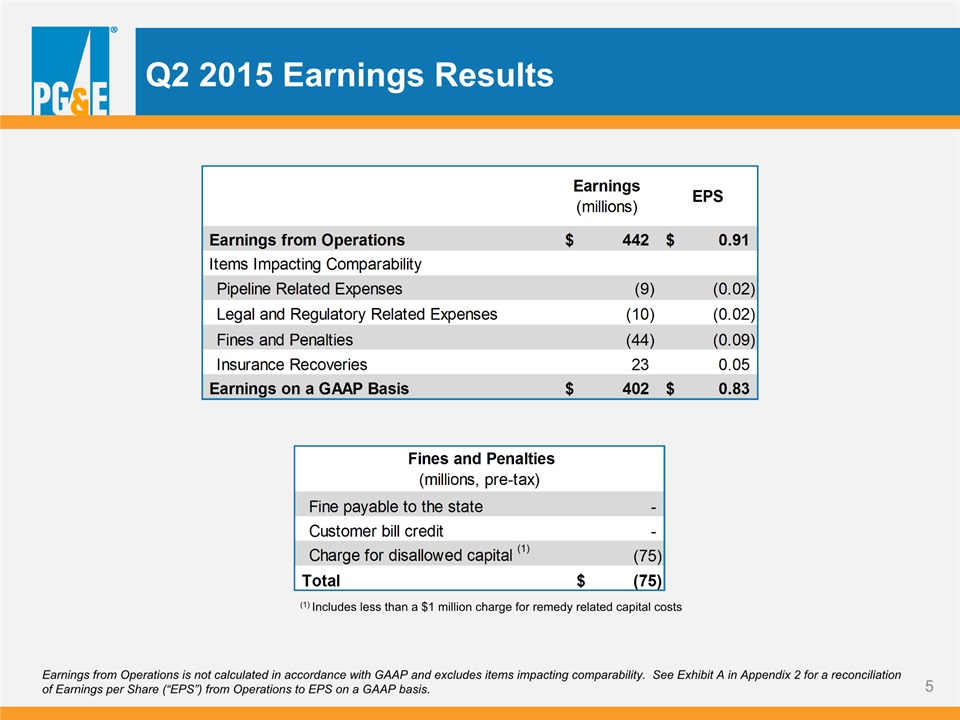

Q2 2015 Earnings Results Earnings from Operations is not calculated in accordance with GAAP and excludes items impacting comparability. See Exhibit A in Appendix 2 for a reconciliation of Earnings per Share (“EPS”) from Operations to EPS on a GAAP basis. (1) Includes less than a $1 million charge for remedy related capital costs

Q2 2015: Quarter over Quarter Comparison EPS from Operations Earnings per Share from Operations is not calculated in accordance with GAAP and excludes items impacting comparability. See Exhibit A in Appendix 2 for a reconciliation of EPS from Operations to EPS on a GAAP basis.

2015 Earnings Per Share Guidance See the Safe Harbor Statements for factors that could cause actual results to differ materially from the guidance presented and underlying assumptions. See Exhibit E in Appendix 2 for detailed 2015 earnings guidance. Guidance ranges exclude any potential future fines or penalties and any future insurance recoveries (1) Guidance is consistent with the April 9 final penalty decision, and the estimated safety-related costs that will be trued up with a final GT&S rate case decision.

Assumptions for 2015 Return on Equity: 10.4% Equity Ratio: 52% Authorized Cost of Capital* Authorized Rate Base (weighted average) ($ billions) Other Factors Affecting Earnings from Operations - Gas Transmission & Storage rate caseOutcome expected in 2016Amounts not requested+ Tax benefits+ Incentive revenues+ Monetizing shares in SolarCity CWIP earnings: offset by below-the-line costs Capital Expenditures($ millions) (1) Includes ~$400M of estimated capital disallowance from April 9 final penalty decision and updates expenditures due to likelihood of GT&S rate case resolution in 2016(2) Amounts previously reserved for limits on PSEP authorized spend *CPUC authorized See the Safe Harbor Statements for factors that could cause actual results to differ materially from the guidance presented and underlying assumptions. (3) Reduced to 2015 authorized rate base due to likelihood of GT&S rate case resolution in 2016 Changes from prior quarter are noted in blue.

2015 Items Impacting Comparability Guidance ranges exclude any potential future fines or penalties and any future insurance recoveries (1) Guidance is consistent with the April 9 final penalty decision, and the estimated safety-related costs that will be trued up with a final GT&S rate case decision.(2) Guidance assumes ~$400 million of the disallowed capital is written off in 2015 and the remaining ~$300 million in 2016; it also includes less than a $1 million charge for remedy related capital costs See the Safe Harbor Statements for factors that could cause actual results to differ materially from the guidance presented and underlying assumptions. See Exhibit E in Appendix 2 for detailed 2015 earnings guidance.

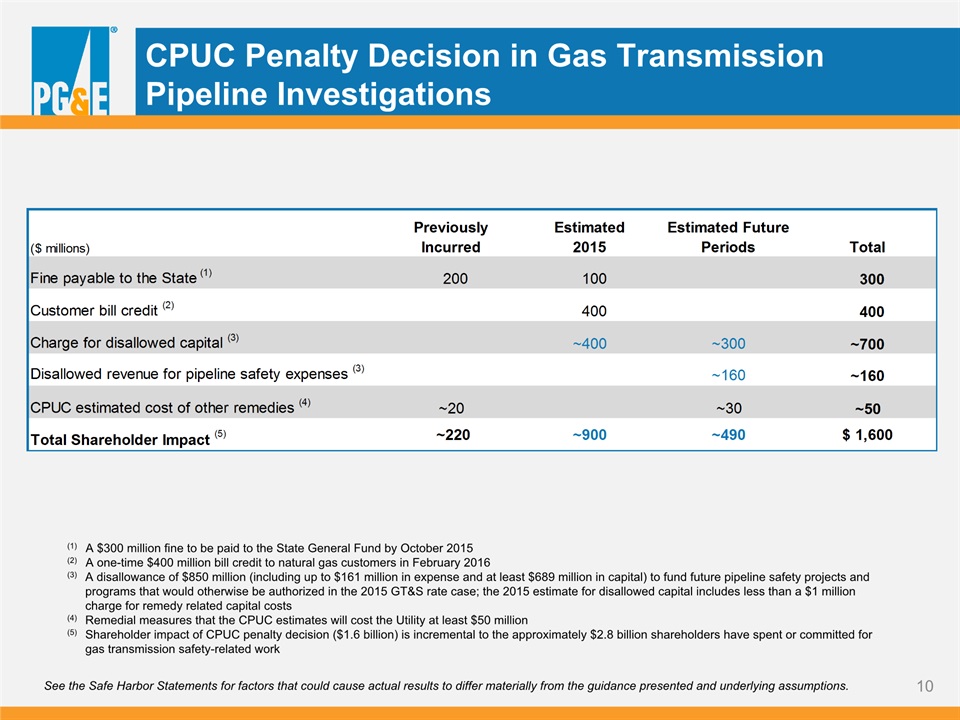

CPUC Penalty Decision in Gas Transmission Pipeline Investigations (1) A $300 million fine to be paid to the State General Fund by October 2015(2) A one-time $400 million bill credit to natural gas customers in February 2016(3) A disallowance of $850 million (including up to $161 million in expense and at least $689 million in capital) to fund future pipeline safety projects and programs that would otherwise be authorized in the 2015 GT&S rate case; the 2015 estimate for disallowed capital includes less than a $1 million charge for remedy related capital costs (4) Remedial measures that the CPUC estimates will cost the Utility at least $50 million(5) Shareholder impact of CPUC penalty decision ($1.6 billion) is incremental to the approximately $2.8 billion shareholders have spent or committed for gas transmission safety-related work See the Safe Harbor Statements for factors that could cause actual results to differ materially from the guidance presented and underlying assumptions.

2015 Equity Issuance $700M - 800M 2014 EOY shares outstanding: 476M 2015 See the Safe Harbor Statements for factors that could cause actual results to differ materially from the guidance presented and underlying assumptions. Changes from prior quarter are noted in blue. June 30, 2015 shares outstanding: 481M

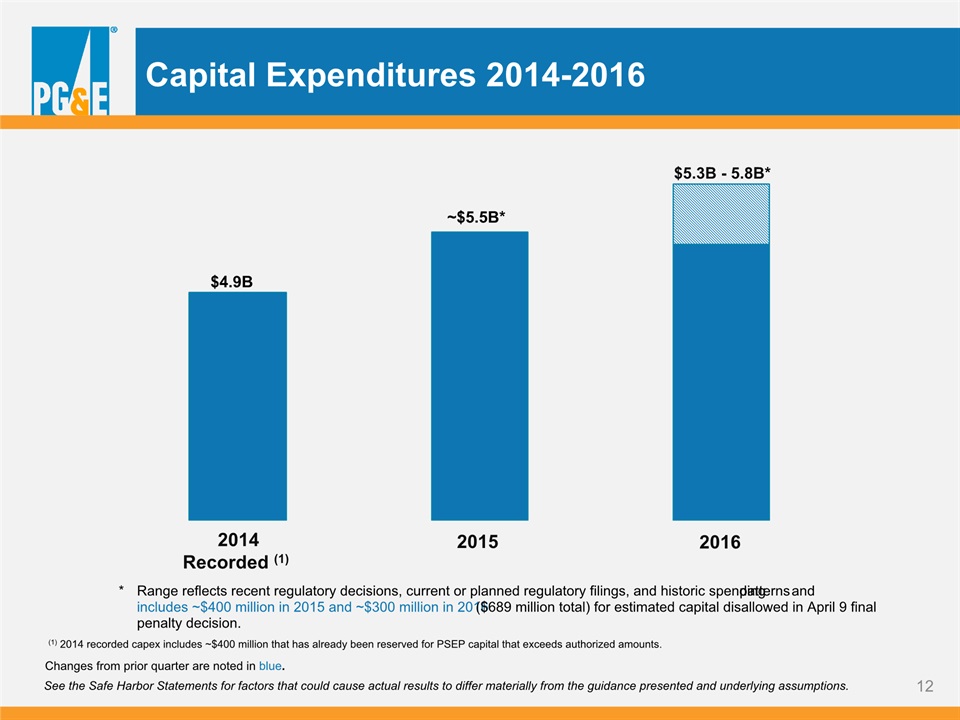

Capital Expenditures 2014-2016 $4.9B ~$5.5B* $5.3B - 5.8B* 2014 Recorded (1) (1) 2014 recorded capex includes ~$400 million that has already been reserved for PSEP capital that exceeds authorized amounts. * Range reflects recent regulatory decisions, current or planned regulatory filings, and historic spending patterns and includes ~$400 million in 2015 and ~$300 million in 2016 ($689 million total) for estimated capital disallowed in April 9 final penalty decision. See the Safe Harbor Statements for factors that could cause actual results to differ materially from the guidance presented and underlying assumptions. 2016 2015 Changes from prior quarter are noted in blue.

Rate Base Growth 2014-2016 $32.9 - 33.3B* ~$28.2B 2014 2016 2015 ~$29.5B* 2014-2016 Weighted Average Authorized Rate Base CAGR: ~8% * Range reflects recent regulatory decisions, current or planned regulatory filings, and historic spending patterns. See the Safe Harbor Statements for factors that could cause actual results to differ materially from the guidance presented and underlying assumptions. Changes from prior quarter are noted in blue.

Appendix 1 – Regulatory and Guidance Matters Updates to Appendix 1 Since the Previous Quarter slide 15Regulatory 2015 CPUC Gas Transmission and Storage Rate Case slide 16CPUC General Rate Cases slide 17FERC Transmission Owner Rate Cases slide 18Gas Regulatory Proceedings Schedule slide 19GuidanceIncremental Equity Factors slide 20

��Updates to Appendix 1 Since the Previous Quarter Slide 16 2015 CPUC Gas Transmission and Storage Rate CaseSlide 18 FERC Transmission Owner Rate Cases Slide 19 Gas Regulatory Proceedings Schedule

2015 CPUC Gas Transmission and StorageRate Case Application filed with the CPUC on December 19, 2013Request for authorized revenue requirement for 2015-2017Includes operating costs and capital for CPUC jurisdictional gas transmission and storage2015 requested revenue requirement of $1.3 billion includes increase of $555 millionRequest reflects significant expense and capital to comply with new gas regulationsRequested attrition increases of $61 million and $168 million in 2016 and 2017, respectively Errata and joint stipulation adjustmentsRevised revenue requirement to $532 millionRevised attrition to $83 million and $142 million in 2016 and 2017, respectivelyALJ approved revenue requirement retroactivity to January 1, 2015Decision on Order to Show Cause, November 20, 2014, includes potential disallowance of up to five months of the increase in the authorized revenue requirement.April 9, 2015 final penalty decision in gas transmission pipeline investigations included an $850 million disallowance of costs for future pipeline safety projects and programs that would otherwise be authorized. Qualifying safety work to be determined in Phase II of GT&S rate case decision. Assigned Commissioner: Peterman (Commissioner Florio recused from proceeding) Administrative Law Judge: Yip-Kikugawa (case reassigned from Wong) Q4 Q2 Q1 Q3 2015 Potential Phase I Proposed Decision Workshop on Remedies Evidentiary hearings 2016 Phase I Final DecisionPhase II Proposed DecisionPhase II Final Decision TestimonyEvidentiary Hearings (if necessary)Briefs

CPUC General Rate Cases General Rate Case set base revenue requirement for 2014-2016Includes operating costs and capital for generation and electric and gas distributionExcludes cost of capital determination, electric transmission, gas transmission, and cost of fuel and purchased power Final decision adopted an increase of $460 million compared to the requested increase of $1.16 billionDecision in August 2014; revenues retroactive to January 1, 2014Decision adopted attrition increases for 2015 and 2016 of $324 million and $371 million, compared to the requested increases of $436 million and $486 million, respectivelyThe CPUC approved balancing account treatment for recovery of costs associated with gas leak survey and repair (up to a cap), major emergencies, and certain new regulatory requirements related to nuclear operations and hydroelectric relicensing Request to be filed September 1, 2015 2017 GRC 2014 GRC Excerpt from Q4 2014 Earnings Presentation

FERC Transmission Owner Rate Case July 2, 2015 – PG&E filed a proposed settlementSettlement includes revenue requirement of $1.2 billion, a $161 million increase over TO15FERC approval expected in late 2015 or early 2016 TO16 July 29, 2015 – TO17 filed with FERC Requested revenue requirement of $1.5 billion, a $314 million increase over the TO16 settled amount, pending FERC approval TO17

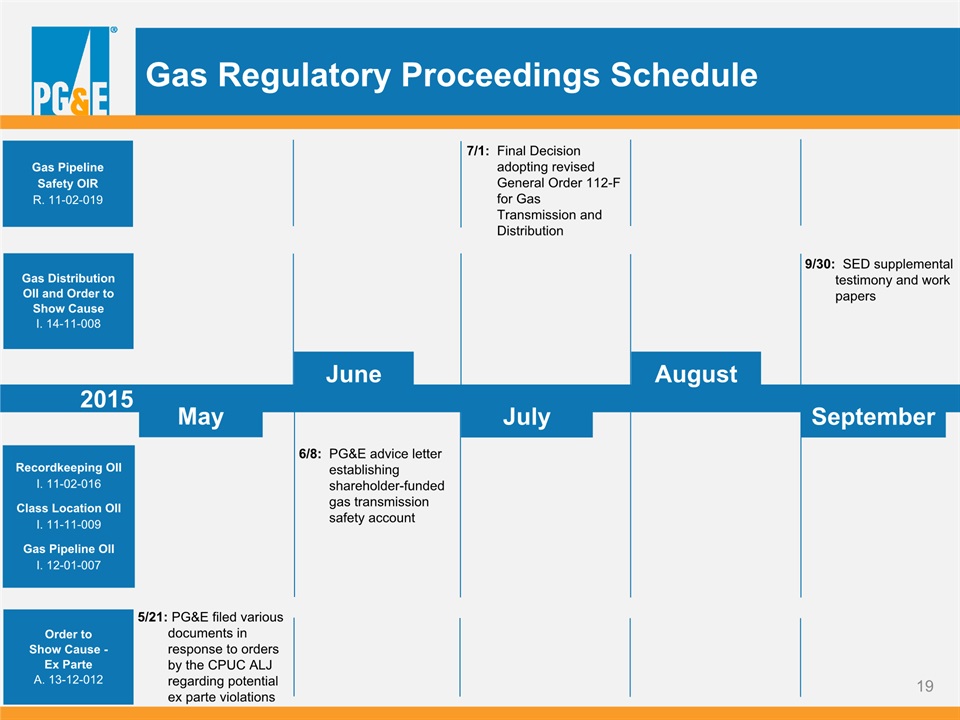

Gas Regulatory Proceedings Schedule Recordkeeping OIII. 11-02-016Class Location OIII. 11-11-009Gas Pipeline OIII. 12-01-007 August June July September Gas Pipeline Safety OIRR. 11-02-019 2015 Order toShow Cause -Ex ParteA. 13-12-012 Gas DistributionOII and Order toShow Cause I. 14-11-008 6/8: PG&E advice letter establishing shareholder-funded gas transmission safety account May 5/21: PG&E filed various documents in response to orders by the CPUC ALJ regarding potential ex parte violations 9/30: SED supplemental testimony and work papers 7/1: Final Decision adopting revised General Order 112-F for Gas Transmission and Distribution

Incremental Equity Factors Equity Impacting Event MultiplierFine payable to State (1) 100%Customer bill credit (2) (4) 60%Charge for disallowed capital (3) (4) 30%Disallowed revenue for pipeline safety expenses (2) (4) 60%CPUC estimated costs of other remedies (4) 60% Applies to newly issued fines. Fines already accrued: 50% multiplier at the time of paymentHalf of multiplier applies at the time of the non-cash impact; remaining half applies at the time the incremental cash is neededApplies to charges in the year in which they are incurredAssumes costs tax deductible Incremental Equity Factors for CPUC Final Penalty Decision

Appendix 2 – Supplemental Earnings Materials Exhibit A: Reconciliation of PG&E Corporation Earnings from Operations to Consolidated slide 22 Income Available for Common Shareholders in Accordance with GAAP Exhibit B: Key Drivers of PG&E Corporation Earnings per Common Share from Operations slide 23Exhibit C: Operational Performance Metrics slide 24-25 Exhibit D: Sales and Sources Summary slide 26Exhibit E: PG&E Corporation Earnings Per Share Guidance slide 27 Exhibit F: General Earnings Sensitivities slide 28Exhibit G: Summary of Selected Regulatory Cases slide 29-34

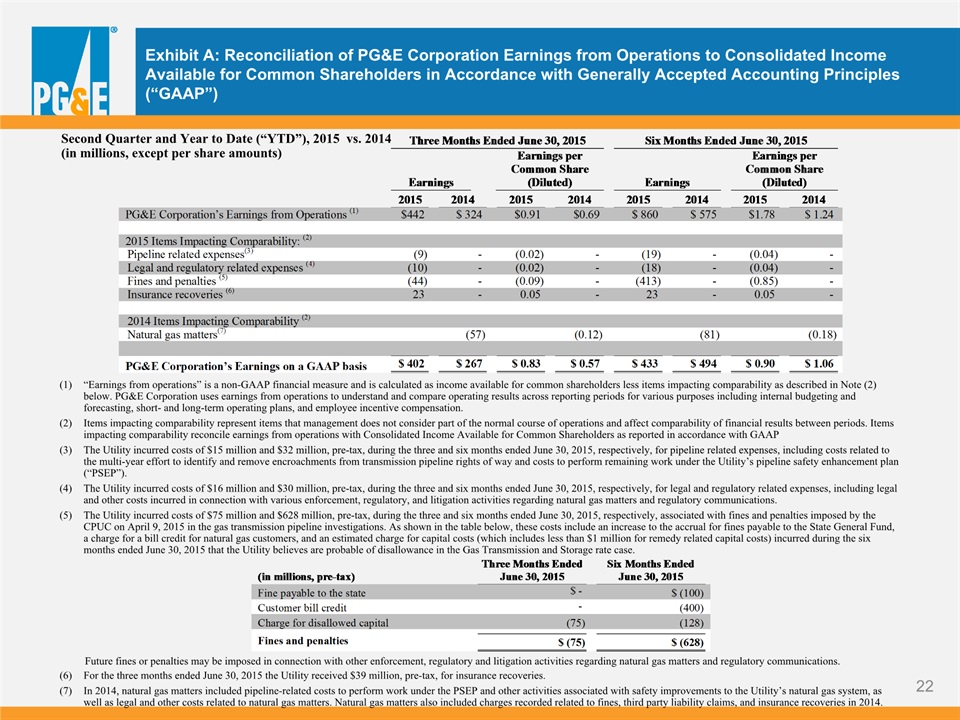

Exhibit A: Reconciliation of PG&E Corporation Earnings from Operations to Consolidated Income Available for Common Shareholders in Accordance with Generally Accepted Accounting Principles (“GAAP”) Second Quarter and Year to Date (“YTD”), 2015 vs. 2014(in millions, except per share amounts) For the three months ended June 30, 2015 the Utility received $39 million, pre-tax, for insurance recoveries.In 2014, natural gas matters included pipeline-related costs to perform work under the PSEP and other activities associated with safety improvements to the Utility’s natural gas system, as well as legal and other costs related to natural gas matters. Natural gas matters also included charges recorded related to fines, third party liability claims, and insurance recoveries in 2014. “Earnings from operations” is a non-GAAP financial measure and is calculated as income available for common shareholders less items impacting comparability as described in Note (2) below. PG&E Corporation uses earnings from operations to understand and compare operating results across reporting periods for various purposes including internal budgeting and forecasting, short- and long-term operating plans, and employee incentive compensation.Items impacting comparability represent items that management does not consider part of the normal course of operations and affect comparability of financial results between periods. Items impacting comparability reconcile earnings from operations with Consolidated Income Available for Common Shareholders as reported in accordance with GAAPThe Utility incurred costs of $15 million and $32 million, pre-tax, during the three and six months ended June 30, 2015, respectively, for pipeline related expenses, including costs related to the multi-year effort to identify and remove encroachments from transmission pipeline rights of way and costs to perform remaining work under the Utility’s pipeline safety enhancement plan (“PSEP”).The Utility incurred costs of $16 million and $30 million, pre-tax, during the three and six months ended June 30, 2015, respectively, for legal and regulatory related expenses, including legal and other costs incurred in connection with various enforcement, regulatory, and litigation activities regarding natural gas matters and regulatory communications.The Utility incurred costs of $75 million and $628 million, pre-tax, during the three and six months ended June 30, 2015, respectively, associated with fines and penalties imposed by the CPUC on April 9, 2015 in the gas transmission pipeline investigations. As shown in the table below, these costs include an increase to the accrual for fines payable to the State General Fund, a charge for a bill credit for natural gas customers, and an estimated charge for capital costs (which includes less than $1 million for remedy related capital costs) incurred during the six months ended June 30, 2015 that the Utility believes are probable of disallowance in the Gas Transmission and Storage rate case. Future fines or penalties may be imposed in connection with other enforcement, regulatory and litigation activities regarding natural gas matters and regulatory communications.

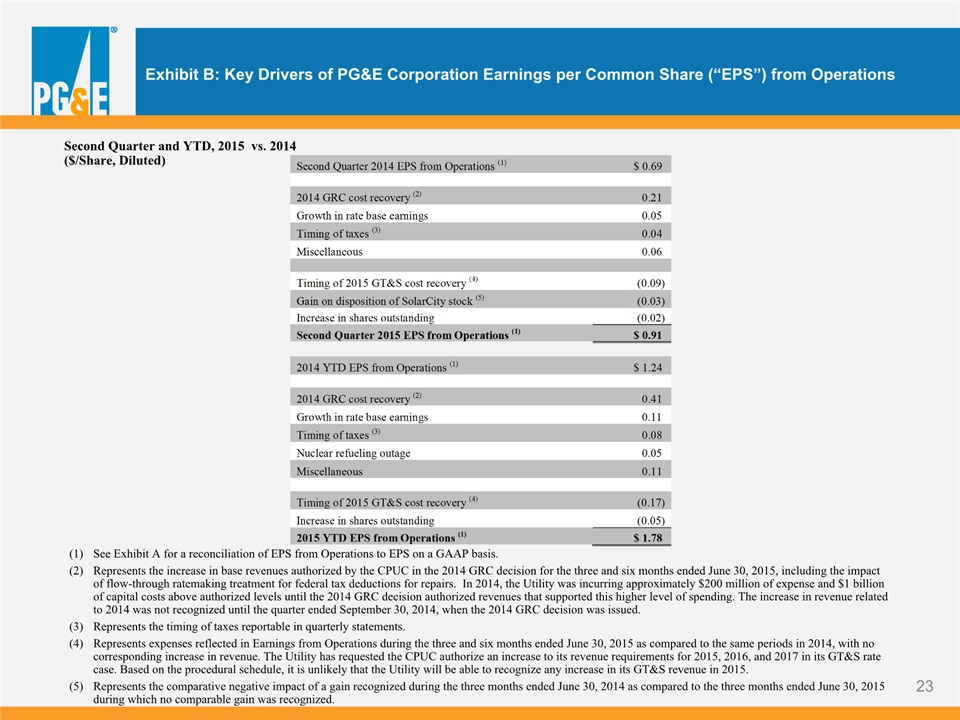

Exhibit B: Key Drivers of PG&E Corporation Earnings per Common Share (“EPS”) from Operations Second Quarter and YTD, 2015 vs. 2014($/Share, Diluted) See Exhibit A for a reconciliation of EPS from Operations to EPS on a GAAP basis.Represents the increase in base revenues authorized by the CPUC in the 2014 GRC decision for the three and six months ended June 30, 2015, including the impact of flow-through ratemaking treatment for federal tax deductions for repairs. In 2014, the Utility was incurring approximately $200 million of expense and $1 billion of capital costs above authorized levels until the 2014 GRC decision authorized revenues that supported this higher level of spending. The increase in revenue related to 2014 was not recognized until the quarter ended September 30, 2014, when the 2014 GRC decision was issued.Represents the timing of taxes reportable in quarterly statements. Represents expenses reflected in Earnings from Operations during the three and six months ended June 30, 2015 as compared to the same periods in 2014, with no corresponding increase in revenue. The Utility has requested the CPUC authorize an increase to its revenue requirements for 2015, 2016, and 2017 in its GT&S rate case. Based on the procedural schedule, it is unlikely that the Utility will be able to recognize any increase in its GT&S revenue in 2015.Represents the comparative negative impact of a gain recognized during the three months ended June 30, 2014 as compared to the three months ended June 30, 2015 during which no comparable gain was recognized.

Exhibit C: Operational Performance Metrics The 2015 target for earnings from operations is not publicly reported but is consistent with the guidance range provided for 2015 EPS from operations of $2.90 to $3.10. See following page for definitions of the operational performance metrics. The operational performance goals set under the PG&E Corporation 2015 Short Term Incentive Plan (“STIP”) are based on the same operational metrics and targets.

Definitions of 2015 Operational Performance Metrics from Exhibit C SafetyPublic and employee safety are measured in four areas: (1) Nuclear Operations Safety, (2) Gas Operations Safety, (3) Electric Operations Safety, and (4) Employee Safety.1. The safety of the Utility’s nuclear power operations, Unit 1 and Unit 2, is an index comprised of 12 performance indicators for nuclear power generation that are regularly benchmarked against other nuclear power generators. 2. The safety of the Utility’s natural gas operations is represented by (a) ability to complete planned in-line inspections and pipeline retrofit projects, measured by two equally weighted components of In-Line Inspections and In-Line Upgrades; (b) the timeliness (measured in minutes) of on-site response to gas emergency service calls; and (c) the number of third party “dig-ins” (i.e., damage resulting in repair or replacement of underground facility) to Utility gas assets per 1,000 Underground Service Alert tickets.3. The safety of the Utility’s electric operations is represented by (a) the percentage improvement in the number of wire down events with resulting sustained unplanned outages compared to the same report period of the previous year, and (b) the percentage of time that Utility personnel are on site within 60 minutes after receiving a 911 call of a potential PG&E electric hazard.4. The safety of the Utility’s employees is represented by (a) the number of lost workday cases incurred per 200,000 hours worked (or for approximately every 100 employees), and (b) the number of serious preventable motor vehicle incidents that the driver could have reasonably avoided, per one million miles driven.CustomerCustomer satisfaction and service reliability are measured by:1. The overall satisfaction (measured as a score of zero to 100) of customers with the products and services offered by the Utility, as measured through a quarterly survey performed by an independent third-party research firm.2. The total time (measured in minutes) the average customer is without electric power during a given time period.FinancialEarnings from Operations (shown in millions of dollars) measures PG&E Corporation’s earnings power from ongoing core operations. It allows investors to compare the underlying financial performance of the business from one period to another, exclusive of items that management believes do not reflect the normal course of operations (items impacting comparability). EFO is not calculated in accordance with GAAP. For a reconciliation of EFO to Consolidated Income Available for Common Shareholders as reported in accordance with GAAP, see Exhibit A.

(1) Includes other sources of electric energy totaling 1,366 kWh and 569 kWh for the three months ended June 30, 2015 and 2014, respectively, and 3,632 kWh and 1,273 kWh for the six months ended June 30, 2015 and 2014, respectively. Exhibit D: Pacific Gas and Electric Company Sales and Sources Summary Second Quarter and YTD, 2015 vs. 2014 Please see the 2014 Annual Report on Form 10-K for additional information about operating statistics.

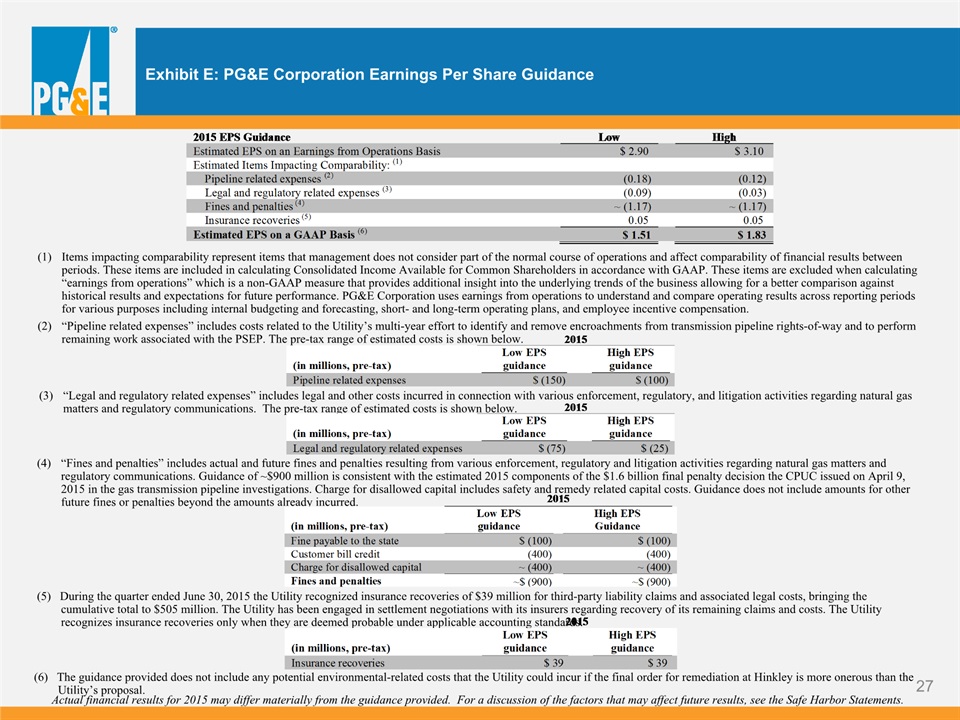

Exhibit E: PG&E Corporation Earnings Per Share Guidance Items impacting comparability represent items that management does not consider part of the normal course of operations and affect comparability of financial results between periods. These items are included in calculating Consolidated Income Available for Common Shareholders in accordance with GAAP. These items are excluded when calculating “earnings from operations” which is a non-GAAP measure that provides additional insight into the underlying trends of the business allowing for a better comparison against historical results and expectations for future performance. PG&E Corporation uses earnings from operations to understand and compare operating results across reporting periods for various purposes including internal budgeting and forecasting, short- and long-term operating plans, and employee incentive compensation.“Pipeline related expenses” includes costs related to the Utility’s multi-year effort to identify and remove encroachments from transmission pipeline rights-of-way and to perform remaining work associated with the PSEP. The pre-tax range of estimated costs is shown below. (3) “Legal and regulatory related expenses” includes legal and other costs incurred in connection with various enforcement, regulatory, and litigation activities regarding natural gas matters and regulatory communications. The pre-tax range of estimated costs is shown below. Actual financial results for 2015 may differ materially from the guidance provided. For a discussion of the factors that may affect future results, see the Safe Harbor Statements. (5) During the quarter ended June 30, 2015 the Utility recognized insurance recoveries of $39 million for third-party liability claims and associated legal costs, bringing the cumulative total to $505 million. The Utility has been engaged in settlement negotiations with its insurers regarding recovery of its remaining claims and costs. The Utility recognizes insurance recoveries only when they are deemed probable under applicable accounting standards. (4) “Fines and penalties” includes actual and future fines and penalties resulting from various enforcement, regulatory and litigation activities regarding natural gas matters and regulatory communications. Guidance of ~$900 million is consistent with the estimated 2015 components of the $1.6 billion final penalty decision the CPUC issued on April 9, 2015 in the gas transmission pipeline investigations. Charge for disallowed capital includes safety and remedy related capital costs. Guidance does not include amounts for other future fines or penalties beyond the amounts already incurred. (6) The guidance provided does not include any potential environmental-related costs that the Utility could incur if the final order for remediation at Hinkley is more onerous than the Utility’s proposal.

Exhibit F: General Earnings SensitivitiesPG&E Corporation and Pacific Gas and Electric Company These general earnings sensitivities on factors that may affect 2015 earnings are forward-looking statements that are based on various assumptions. Actual results may differ materially. For a discussion of the factors that may affect future results, see the Safe Harbor Statements.

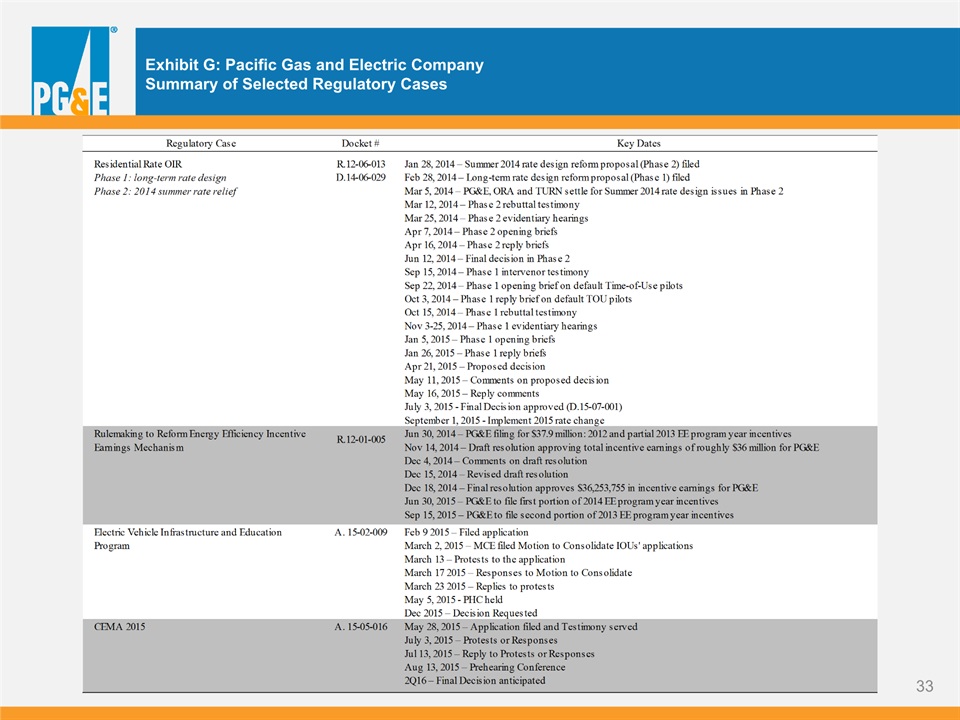

Exhibit G: Pacific Gas and Electric CompanySummary of Selected Regulatory Cases

Exhibit G: Pacific Gas and Electric CompanySummary of Selected Regulatory Cases

Exhibit G: Pacific Gas and Electric CompanySummary of Selected Regulatory Cases

Exhibit G: Pacific Gas and Electric CompanySummary of Selected Regulatory Cases

Exhibit G: Pacific Gas and Electric CompanySummary of Selected Regulatory Cases

Exhibit G: Pacific Gas and Electric CompanySummary of Selected Regulatory Cases