Attachment 3

Form of Routine True-Up Mechanism Advice Letter

[date]

Application -E

(Pacific Gas and Electric Company ID [ ])

Public Utilities Commission of the State of California

Subject: Routine [Annual (and at least quarterly beginning 12 months prior to the last scheduled final payment date of the last maturing tranche of a series of Recovery Bonds)] [Semi- Annual] [Interim] Advice Letter for Fixed Recovery Charges True-up Mechanism

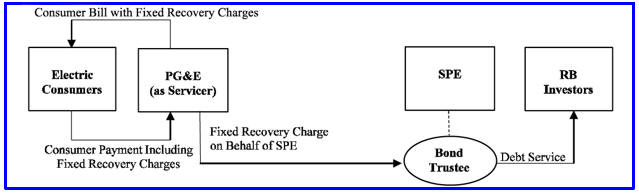

Pursuant to California Public Utilities Commission (CPUC) Decision (D.) [ ] (Decision), Pacific Gas and Electric Company (PG&E), as servicer of the Recovery Bonds (Recovery Bonds) and on behalf of the Special Purpose Entity, hereby applies for adjustment to the Fixed Recovery Charge for series , Tranche(s) of the Recovery Bonds.

Purpose:

This submission establishes revised Fixed Recovery Charges for rate schedules for Consumers, as set forth in D. [ ].

Background:

In D. [ ], the Commission granted PG&E authority to issue Recovery Bonds to finance certain costs and expenses related to catastrophic wildfires, including fire risk mitigation capital expenditures identified in subdivision (e) of Section 8386.3 of the Public Utilities Code, and associated financing costs.

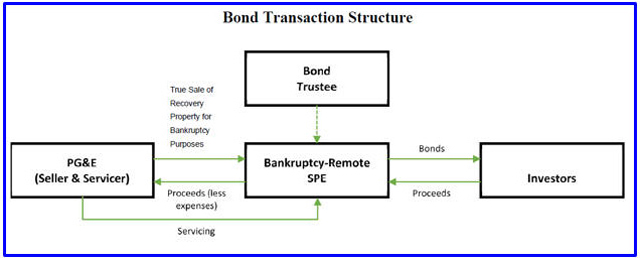

Recovery Bonds are securities that are backed by the cash flows generated by a specific asset that has been be sold by PG&E to a Special Purpose Entity that issued the Recovery Bonds secured by this asset. The asset sold is Recovery Property, a current property right that was created by Article 5.8 as the right, title and interest in and to all (i) Fixed Recovery Charges established pursuant to the Financing Order, including all rights to obtain adjustments, and (ii) revenues, collections, claims, payments, monies, or proceeds of or arising from the Fixed Recovery Charges that will cover debt service and all Ongoing Financing Cost, including any draws on the capital subaccount, as authorized in D. [ ]

In D. [ ], the Commission authorized PG&E to submit Routine True-up Mechanism Advice Letters at least annually, before each [insert FRC Annual Adjustment Date], semi-annually if required by the servicer before the Semi-Annual Adjustment Date, and more frequently as required by the servicer as permitted in the Financing Order. These submissions are intended to ensure that the actual revenues collected under the Fixed Recovery Charges will be sufficient to make all scheduled payments of Bond principal, interest, and other Ongoing Financing Costs on a timely basis during each of the two payment periods following the date of adjustment, including the replenishment of any draws upon the capital subaccount. The first payment period

3-1