principal amount of the 3.75% Senior Notes due 2024, $350,000,000 aggregate principal amount of the 3.40% Senior Notes due 2024, $300,000,000 aggregate principal amount of the 3.85% Senior Notes due 2023, $500,000,000 aggregate principal amount of the 4.25% Senior Notes due 2023 and $375,000,000 aggregate principal amount of the 3.25% Senior Notes due 2023.

We collateralized each series of Utility Reinstated Notes by delivering first mortgage bonds to the applicable unsecured trustee of such series. The Utility Reinstated Collateralized Senior Notes are the Company’s senior obligations and rank equally in right of payment with our other existing or future first mortgage bonds issued under the Mortgage Indenture, including the mortgage bonds offered hereby.

We may redeem each series of Utility Reinstated Collateralized Senior Notes at any time prior to maturity, in whole or in part, at a “make-whole” redemption price set forth in the applicable supplemental indenture, except that during a period prior to maturity specified in the applicable supplemental indenture, we may redeem each series of the Utility Reinstated Collateralized Senior Notes, in whole or in part, at a redemption price equal to 100% of the principal amount of the Utility Reinstated Collateralized Senior Notes being redeemed, plus accrued and unpaid interest to, but not including, the redemption date.

The indentures under which the Utility Reinstated Collateralized Senior Notes were issued include covenants limiting, with certain exceptions, sale and leaseback transactions and consolidation, merger, conveyance or other transfers.

Subsequent First Mortgage Bond Issuances

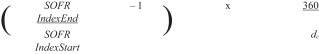

In connection with the Company’s emergence from bankruptcy, in June 2020, the Company completed the sale of (i) $500 million aggregate principal amount of floating rate first mortgage bonds due June 16, 2022, (ii) $2.5 billion aggregate principal amount of 1.75% first mortgage bonds due June 16, 2022, (iii) $1 billion aggregate principal amount of 2.10% first mortgage bonds due August 1, 2027, (iv) $2 billion aggregate principal amount of 2.50% first mortgage bonds due February 1, 2031, (v) $1 billion aggregate principal amount of 3.30% first mortgage bonds due August 1, 2040, and (vi) $1.925 billion aggregate principal amount of 3.50% first mortgage bonds due August 1, 2050.

In November 2020, the Company completed the sale of $1.45 billion aggregate principal amount of floating rate first mortgage bonds due November 15, 2021, which were repaid at maturity.

In March 2021, the Company completed the sale of (i) $1.5 billion aggregate principal amount of 1.367% first mortgage bonds due March 10, 2023, (ii) $450 million aggregate principal amount of 3.25% first mortgage bonds due June 1, 2031, and (iii) $450 million aggregate principal amount of 4.20% first mortgage bonds due June 1, 2041.

In June 2021, the Company completed the sale of $800 million aggregate principal amount of 3.000% first mortgage bonds due June 15, 2028.

In November 2021, the Company completed the sale of (i) $900 million aggregate principal amount of 1.70% first mortgage bonds due November 15, 2023 and (ii) an additional $550 million aggregate principal amount of 3.25% first mortgage bonds due June 1, 2031 (the “2031 Bonds”). The 2031 Bonds are part of the same series of debt securities issued by the Company in March 2021.

Each aforementioned series of first mortgage bonds has substantially similar covenants, events of default, security and other terms as the mortgage bonds offered hereby, with the exception of interest rates, payment dates, maturity dates and redemption provisions.

S-25