UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-04119

T. Rowe Price High Yield Fund, Inc.

(Exact name of registrant as specified in charter)

100 East Pratt Street, Baltimore, MD 21202

(Address of principal executive offices)

David Oestreicher

100 East Pratt Street, Baltimore, MD 21202

(Name and address of agent for service)

Registrant’s telephone number, including area code: (410) 345-2000

Date of fiscal year end: May 31

Date of reporting period: May 31, 2024

Item 1. Reports to Shareholders

(a) Report pursuant to Rule 30e-1

Annual Shareholder Report

May 31, 2024

This annual shareholder report contains important information about U.S. High Yield Fund (the "fund") for the period of June 1, 2023 to May 31, 2024. You can find the fund’s prospectus, financial information on Form N-CSR (which includes required tax information for dividends), holdings, proxy voting information, and other information atwww.troweprice.com/prospectus. You can also request this information without charge by contacting T. Rowe Price at 1-800-638-5660 or info@troweprice.com or contacting your intermediary.

What were the fund costs for the last year? (based on a hypothetical $10,000 investment)

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| U.S. High Yield Fund - Investor Class | $80 | 0.75% |

What drove fund performance during the past 12 months?

High yield bonds strongly advanced in the 12-month period ended May 31, 2024, as a pause in rate hikes, receding recession fears, healthy risk appetite, and favorable technical conditions—a pickup in primary issuance and improved market liquidity—supported performance.

Compared with the style-specific ICE BofA US High Yield Constrained Index, the fund’s strongest relative results were in the media, consumer goods, and services segments. By credit quality, our selection in the B and BB rating tiers provided meaningful relative contributions. Our underweight to BBs was also beneficial as lower qualities outperformed. The fund’s off-benchmark allocation to bank loans added relative value as they outperformed high yield bonds for the year.

Relative to the style-specific benchmark, the fund’s weakest results were in the capital goods, technology and electronic, and automotive industries. Our selection among CCC rated bonds also detracted. The fund’s cash position, necessary for liquidity purposes, held back relative gains in the strong performance environment.

The fund seeks total return and, secondarily, current income by investing primarily in U.S. below investment-grade corporate debt securities. We utilized the market’s rally to trim/exit names that we believed to be fully valued and redeployed proceeds into higher-conviction ideas, selectively taking advantage of stronger primary issuance. We expect more income-like returns from here given tight spread levels. We significantly increased the credit quality of the fund and sought to maintain a current yield advantage versus the index by exchanging lower-coupon COVID-era bonds for higher-coupon paper and increasing bank loan exposure.

How has the fund performed?

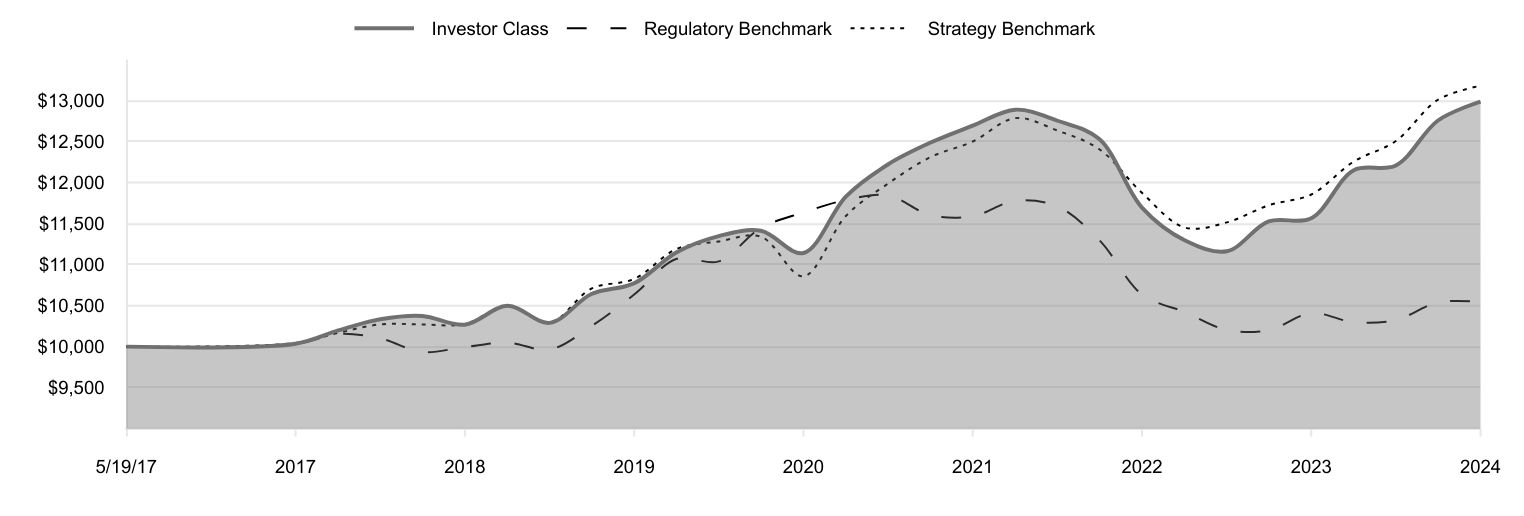

Cumulative Returns of a Hypothetical $10,000 Investment as of May 31, 2024

| Investor Class | Regulatory Benchmark | Strategy Benchmark |

|---|

| 5/19/17 | 10,000 | 10,000 | 10,000 |

| 5/31/17 | 10,036 | 10,032 | 10,044 |

| 8/31/17 | 10,198 | 10,156 | 10,168 |

| 11/30/17 | 10,334 | 10,100 | 10,272 |

| 2/28/18 | 10,374 | 9,935 | 10,271 |

| 5/31/18 | 10,268 | 9,995 | 10,274 |

| 8/31/18 | 10,498 | 10,049 | 10,500 |

| 11/30/18 | 10,290 | 9,965 | 10,294 |

| 2/28/19 | 10,641 | 10,250 | 10,708 |

| 5/31/19 | 10,772 | 10,635 | 10,825 |

| 8/31/19 | 11,151 | 11,071 | 11,191 |

| 11/30/19 | 11,348 | 11,040 | 11,283 |

| 2/29/20 | 11,412 | 11,447 | 11,341 |

| 5/31/20 | 11,141 | 11,636 | 10,858 |

| 8/31/20 | 11,833 | 11,788 | 11,596 |

| 11/30/20 | 12,224 | 11,844 | 11,990 |

| 2/28/21 | 12,485 | 11,605 | 12,308 |

| 5/31/21 | 12,694 | 11,589 | 12,501 |

| 8/31/21 | 12,889 | 11,778 | 12,786 |

| 11/30/21 | 12,754 | 11,708 | 12,634 |

| 2/28/22 | 12,530 | 11,299 | 12,407 |

| 5/31/22 | 11,695 | 10,636 | 11,875 |

| 8/31/22 | 11,298 | 10,422 | 11,452 |

| 11/30/22 | 11,163 | 10,204 | 11,515 |

| 2/28/23 | 11,526 | 10,200 | 11,723 |

| 5/31/23 | 11,565 | 10,408 | 11,855 |

| 8/31/23 | 12,151 | 10,298 | 12,257 |

| 11/30/23 | 12,209 | 10,325 | 12,507 |

| 2/29/24 | 12,757 | 10,540 | 13,010 |

| 5/31/24 | 12,988 | 10,544 | 13,181 |

202405-3565004, 202407-3567727

Average Annual Total Returns

| 1 Year | 5 Years | Since Inception 5/19/2017 |

|---|

| U.S. High Yield Fund (Investor Class) | 12.31% | 3.81% | 3.79% |

| Bloomberg U.S. Aggregate Bond Index (Regulatory Benchmark) | 1.31 | | 0.76 |

| ICE BofA US High Yield Constrained Index (Strategy Benchmark) | 11.18 | 4.02 | 4.01 |

The preceding line graph shows the value of a hypothetical $10,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The fund’s performance information included in the line graph and table above is compared with a regulatory required index that represents an overall securities market (Regulatory Benchmark). In addition, the line graph and table may also include one or more indexes that more closely aligns to the fund's investment strategy (Strategy Benchmark(s)). Due to new SEC Rules on shareholder reporting the fund adopted a new broad-based securities market index, referred to as the Regulatory Benchmark. Market index returns do not include expenses, which are deducted from fund returns. The fund's total return figures reflect the reinvestment of dividends and capital gains, if any. Neither the fund’s returns nor the index returns reflect the deduction of taxes that a shareholder would pay on fund distributions or redemptions of fund shares. The fund’s past performance is not a good predictor of the fund’s future performance. Updated performance information can be found at www.troweprice.com.

What are some fund statistics?

| Total Net Assets (000s) | $474,187 |

| Number of Portfolio Holdings | 104 |

| Investment Advisory Fees Paid (000s) | $2,174 |

| Portfolio Turnover Rate | 87.0% |

What did the fund invest in?

Credit Quality Allocation* (as a % of Net Assets)

| BB Rated | 22.8% |

| B Rated | 48.9 |

| CCC Rated | 9.9 |

| Bank Debt | 13.5 |

| D Rated | 0.2 |

| Reserves | 4.7 |

*Credit ratings for the securities held in the Fund are provided by Moody’s, Standard & Poor’s, and Fitch and are converted to the Standard & Poor’s nomenclature. A rating of AAA represents the highest-rated securities, and a rating of D represents the lowest rated securities. When a rating is available from all three agencies, the median rating is used. If there are two ratings, the lower rating is used, and if only one rating is available, that rating is used. If a rating is not available, the security is classified as Not Rated. The rating of the underlying investment vehicle is used to determine the creditworthiness of credit default swaps and sovereign securities. The Fund is not rated by any agency.

Top Ten Holdings (as a % of Net Assets)

| Energy Transfer | 2.3% |

| Osaic Holdings | 2.3 |

| Aretec Group | 2.0 |

| Vistra | 2.0 |

| Victra Holdings | 1.9 |

| Six Flags Entertainment | 1.9 |

| Enbridge | 1.7 |

| Heartland Dental | 1.7 |

| Sigma Holdco | 1.6 |

| Civitas Resources | 1.5 |

If you invest directly with T. Rowe Price, you can elect to receive future shareholder reports or other important documents through electronic delivery by enrolling at www.troweprice.com/paperless. If you invest through a financial intermediary such as an investment advisor, a bank, retirement plan sponsor or a brokerage firm, please contact that organization and ask if it can provide electronic delivery.

Bloomberg and ICE do not accept any liability for any errors or omissions in the indexes or data, and hereby expressly disclaim all warranties of originality, accuracy, completeness, timeliness, merchantability and fitness for a particular purpose. No party may rely on any indexes or data contained in this communication. Visit www.troweprice.com/en/us/market-data-disclosures for additional legal notices & disclaimers.

U.S. High Yield Fund

Investor Class (TUHYX)

T. Rowe Price Investment Services, Inc.

100 East Pratt Street

Baltimore, MD 21202

Annual Shareholder Report

May 31, 2024

This annual shareholder report contains important information about U.S. High Yield Fund (the "fund") for the period of June 1, 2023 to May 31, 2024. You can find the fund’s prospectus, financial information on Form N-CSR (which includes required tax information for dividends), holdings, proxy voting information, and other information atwww.troweprice.com/prospectus. You can also request this information without charge by contacting T. Rowe Price at 1-800-638-5660 or info@troweprice.com or contacting your intermediary.

What were the fund costs for the last year? (based on a hypothetical $10,000 investment)

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| U.S. High Yield Fund - Advisor Class | $95 | 0.90% |

What drove fund performance during the past 12 months?

High yield bonds strongly advanced in the 12-month period ended May 31, 2024, as a pause in rate hikes, receding recession fears, healthy risk appetite, and favorable technical conditions—a pickup in primary issuance and improved market liquidity—supported performance.

Compared with the style-specific ICE BofA US High Yield Constrained Index, the fund’s strongest relative results were in the media, consumer goods, and services segments. By credit quality, our selection in the B and BB rating tiers provided meaningful relative contributions. Our underweight to BBs was also beneficial as lower qualities outperformed. The fund’s off-benchmark allocation to bank loans added relative value as they outperformed high yield bonds for the year.

Relative to the style-specific benchmark, the fund’s weakest results were in the capital goods, technology and electronic, and automotive industries. Our selection among CCC rated bonds also detracted. The fund’s cash position, necessary for liquidity purposes, held back relative gains in the strong performance environment.

The fund seeks total return and, secondarily, current income by investing primarily in U.S. below investment-grade corporate debt securities. We utilized the market’s rally to trim/exit names that we believed to be fully valued and redeployed proceeds into higher-conviction ideas, selectively taking advantage of stronger primary issuance. We expect more income-like returns from here given tight spread levels. We significantly increased the credit quality of the fund and sought to maintain a current yield advantage versus the index by exchanging lower-coupon COVID-era bonds for higher-coupon paper and increasing bank loan exposure.

How has the fund performed?

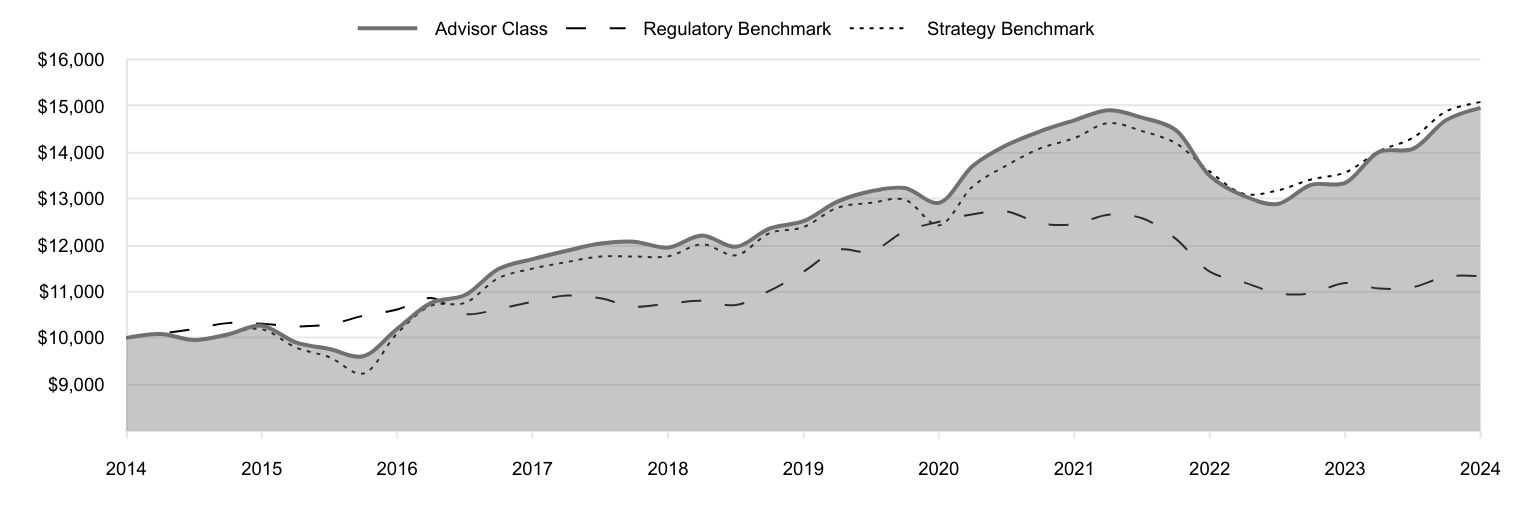

Cumulative Returns of a Hypothetical $10,000 Investment as of May 31, 2024

| Advisor Class | Regulatory Benchmark | Strategy Benchmark |

|---|

| 2014 | 10,000 | 10,000 | 10,000 |

| 2014 | 10,084 | 10,090 | 10,104 |

| 2014 | 9,955 | 10,192 | 9,933 |

| 2015 | 10,073 | 10,318 | 10,089 |

| 2015 | 10,263 | 10,303 | 10,186 |

| 2015 | 9,903 | 10,247 | 9,793 |

| 2015 | 9,760 | 10,291 | 9,582 |

| 2016 | 9,604 | 10,473 | 9,230 |

| 2016 | 10,195 | 10,612 | 10,096 |

| 2016 | 10,754 | 10,859 | 10,696 |

| 2016 | 10,924 | 10,514 | 10,756 |

| 2017 | 11,485 | 10,621 | 11,288 |

| 2017 | 11,697 | 10,780 | 11,493 |

| 2017 | 11,877 | 10,912 | 11,635 |

| 2017 | 12,033 | 10,852 | 11,754 |

| 2018 | 12,074 | 10,674 | 11,753 |

| 2018 | 11,946 | 10,739 | 11,757 |

| 2018 | 12,209 | 10,798 | 12,016 |

| 2018 | 11,963 | 10,707 | 11,780 |

| 2019 | 12,354 | 11,013 | 12,254 |

| 2019 | 12,515 | 11,426 | 12,388 |

| 2019 | 12,937 | 11,896 | 12,806 |

| 2019 | 13,161 | 11,862 | 12,912 |

| 2020 | 13,230 | 12,299 | 12,978 |

| 2020 | 12,911 | 12,502 | 12,425 |

| 2020 | 13,709 | 12,666 | 13,270 |

| 2020 | 14,156 | 12,726 | 13,720 |

| 2021 | 14,453 | 12,470 | 14,084 |

| 2021 | 14,690 | 12,452 | 14,305 |

| 2021 | 14,909 | 12,655 | 14,631 |

| 2021 | 14,748 | 12,579 | 14,458 |

| 2022 | 14,483 | 12,140 | 14,198 |

| 2022 | 13,496 | 11,428 | 13,589 |

| 2022 | 13,063 | 11,198 | 13,105 |

| 2022 | 12,886 | 10,964 | 13,177 |

| 2023 | 13,300 | 10,960 | 13,415 |

| 2023 | 13,340 | 11,183 | 13,566 |

| 2023 | 14,011 | 11,064 | 14,025 |

| 2023 | 14,073 | 11,094 | 14,312 |

| 2024 | 14,699 | 11,324 | 14,887 |

| 2024 | 14,960 | 11,329 | 15,083 |

202405-3565004, 202407-3567727

Average Annual Total Returns

| 1 Year | 5 Years | 10 Years |

|---|

| U.S. High Yield Fund (Advisor Class) | 12.14% | 3.63% | 4.11% |

| Bloomberg U.S. Aggregate Bond Index (Regulatory Benchmark) | 1.31 | | 1.26 |

| ICE BofA US High Yield Constrained Index (Strategy Benchmark) | 11.18 | 4.02 | 4.20 |

The preceding line graph shows the value of a hypothetical $10,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The fund’s performance information included in the line graph and table above is compared with a regulatory required index that represents an overall securities market (Regulatory Benchmark). In addition, the line graph and table may also include one or more indexes that more closely aligns to the fund's investment strategy (Strategy Benchmark(s)). Due to new SEC Rules on shareholder reporting the fund adopted a new broad-based securities market index, referred to as the Regulatory Benchmark. Market index returns do not include expenses, which are deducted from fund returns. The fund's total return figures reflect the reinvestment of dividends and capital gains, if any. Neither the fund’s returns nor the index returns reflect the deduction of taxes that a shareholder would pay on fund distributions or redemptions of fund shares. The fund’s past performance is not a good predictor of the fund’s future performance. Updated performance information can be found at www.troweprice.com.

What are some fund statistics?

| Total Net Assets (000s) | $474,187 |

| Number of Portfolio Holdings | 104 |

| Investment Advisory Fees Paid (000s) | $2,174 |

| Portfolio Turnover Rate | 87.0% |

What did the fund invest in?

Credit Quality Allocation* (as a % of Net Assets)

| BB Rated | 22.8% |

| B Rated | 48.9 |

| CCC Rated | 9.9 |

| Bank Debt | 13.5 |

| D Rated | 0.2 |

| Reserves | 4.7 |

*Credit ratings for the securities held in the Fund are provided by Moody’s, Standard & Poor’s, and Fitch and are converted to the Standard & Poor’s nomenclature. A rating of AAA represents the highest-rated securities, and a rating of D represents the lowest rated securities. When a rating is available from all three agencies, the median rating is used. If there are two ratings, the lower rating is used, and if only one rating is available, that rating is used. If a rating is not available, the security is classified as Not Rated. The rating of the underlying investment vehicle is used to determine the creditworthiness of credit default swaps and sovereign securities. The Fund is not rated by any agency.

Top Ten Holdings (as a % of Net Assets)

| Energy Transfer | 2.3% |

| Osaic Holdings | 2.3 |

| Aretec Group | 2.0 |

| Vistra | 2.0 |

| Victra Holdings | 1.9 |

| Six Flags Entertainment | 1.9 |

| Enbridge | 1.7 |

| Heartland Dental | 1.7 |

| Sigma Holdco | 1.6 |

| Civitas Resources | 1.5 |

If you invest directly with T. Rowe Price, you can elect to receive future shareholder reports or other important documents through electronic delivery by enrolling at www.troweprice.com/paperless. If you invest through a financial intermediary such as an investment advisor, a bank, retirement plan sponsor or a brokerage firm, please contact that organization and ask if it can provide electronic delivery.

Bloomberg and ICE do not accept any liability for any errors or omissions in the indexes or data, and hereby expressly disclaim all warranties of originality, accuracy, completeness, timeliness, merchantability and fitness for a particular purpose. No party may rely on any indexes or data contained in this communication. Visit www.troweprice.com/en/us/market-data-disclosures for additional legal notices & disclaimers.

U.S. High Yield Fund

Advisor Class (TUHAX)

T. Rowe Price Investment Services, Inc.

100 East Pratt Street

Baltimore, MD 21202

Annual Shareholder Report

May 31, 2024

This annual shareholder report contains important information about U.S. High Yield Fund (the "fund") for the period of June 1, 2023 to May 31, 2024. You can find the fund’s prospectus, financial information on Form N-CSR (which includes required tax information for dividends), holdings, proxy voting information, and other information atwww.troweprice.com/prospectus. You can also request this information without charge by contacting T. Rowe Price at 1-800-638-5660 or info@troweprice.com or contacting your intermediary.

What were the fund costs for the last year? (based on a hypothetical $10,000 investment)

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| U.S. High Yield Fund - I Class | $65 | 0.61% |

What drove fund performance during the past 12 months?

High yield bonds strongly advanced in the 12-month period ended May 31, 2024, as a pause in rate hikes, receding recession fears, healthy risk appetite, and favorable technical conditions—a pickup in primary issuance and improved market liquidity—supported performance.

Compared with the style-specific ICE BofA US High Yield Constrained Index, the fund’s strongest relative results were in the media, consumer goods, and services segments. By credit quality, our selection in the B and BB rating tiers provided meaningful relative contributions. Our underweight to BBs was also beneficial as lower qualities outperformed. The fund’s off-benchmark allocation to bank loans added relative value as they outperformed high yield bonds for the year.

Relative to the style-specific benchmark, the fund’s weakest results were in the capital goods, technology and electronic, and automotive industries. Our selection among CCC rated bonds also detracted. The fund’s cash position, necessary for liquidity purposes, held back relative gains in the strong performance environment.

The fund seeks total return and, secondarily, current income by investing primarily in U.S. below investment-grade corporate debt securities. We utilized the market’s rally to trim/exit names that we believed to be fully valued and redeployed proceeds into higher-conviction ideas, selectively taking advantage of stronger primary issuance. We expect more income-like returns from here given tight spread levels. We significantly increased the credit quality of the fund and sought to maintain a current yield advantage versus the index by exchanging lower-coupon COVID-era bonds for higher-coupon paper and increasing bank loan exposure.

How has the fund performed?

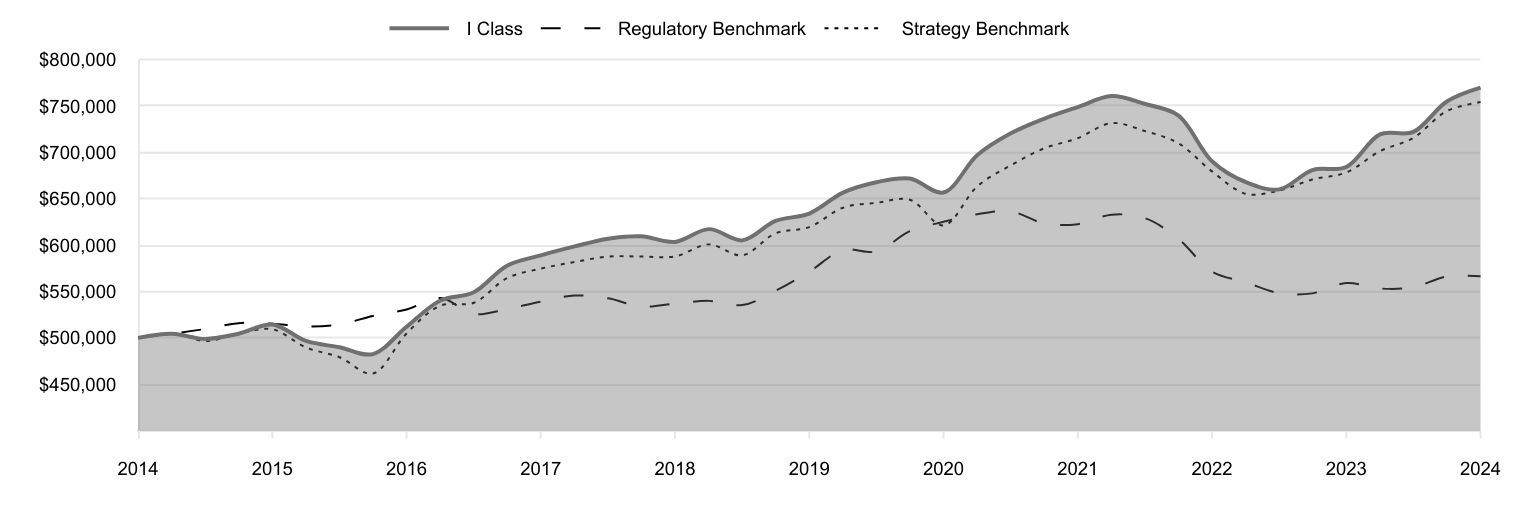

Cumulative Returns of a Hypothetical $500,000 Investment as of May 31, 2024

| I Class | Regulatory Benchmark | Strategy Benchmark |

|---|

| 2014 | 500,000 | 500,000 | 500,000 |

| 2014 | 504,483 | 504,512 | 505,175 |

| 2014 | 498,835 | 509,603 | 496,626 |

| 2015 | 504,448 | 515,879 | 504,434 |

| 2015 | 514,350 | 515,171 | 509,286 |

| 2015 | 496,715 | 512,359 | 489,630 |

| 2015 | 489,896 | 514,547 | 479,114 |

| 2016 | 482,542 | 523,631 | 461,513 |

| 2016 | 511,917 | 530,599 | 504,786 |

| 2016 | 540,269 | 542,926 | 534,798 |

| 2016 | 549,185 | 525,721 | 537,810 |

| 2017 | 577,867 | 531,041 | 564,408 |

| 2017 | 588,989 | 538,976 | 574,663 |

| 2017 | 598,563 | 545,600 | 581,766 |

| 2017 | 606,915 | 542,619 | 587,704 |

| 2018 | 609,489 | 533,724 | 587,666 |

| 2018 | 603,431 | 536,956 | 587,840 |

| 2018 | 617,210 | 539,875 | 600,781 |

| 2018 | 605,111 | 535,337 | 588,977 |

| 2019 | 626,055 | 550,642 | 612,690 |

| 2019 | 633,993 | 571,324 | 619,376 |

| 2019 | 656,606 | 594,794 | 640,301 |

| 2019 | 667,768 | 593,106 | 645,582 |

| 2020 | 671,801 | 614,971 | 648,889 |

| 2020 | 656,660 | 625,117 | 621,250 |

| 2020 | 697,127 | 633,297 | 663,480 |

| 2020 | 720,500 | 636,307 | 686,003 |

| 2021 | 736,167 | 623,480 | 704,219 |

| 2021 | 748,834 | 622,586 | 715,245 |

| 2021 | 760,649 | 632,763 | 731,542 |

| 2021 | 752,129 | 628,967 | 722,890 |

| 2022 | 739,817 | 606,994 | 709,880 |

| 2022 | 690,468 | 571,397 | 679,452 |

| 2022 | 667,883 | 559,895 | 655,227 |

| 2022 | 660,044 | 548,211 | 658,837 |

| 2023 | 680,912 | 547,983 | 670,764 |

| 2023 | 684,257 | 559,153 | 678,303 |

| 2023 | 719,315 | 553,214 | 701,268 |

| 2023 | 722,056 | 554,678 | 715,617 |

| 2024 | 754,829 | 566,215 | 744,365 |

| 2024 | 769,729 | 566,453 | 754,162 |

202405-3565004, 202407-3567727

Average Annual Total Returns

| 1 Year | 5 Years | 10 Years |

|---|

| U.S. High Yield Fund (I Class) | 12.49% | 3.96% | 4.41% |

| Bloomberg U.S. Aggregate Bond Index (Regulatory Benchmark) | 1.31 | | 1.26 |

| ICE BofA US High Yield Constrained Index (Strategy Benchmark) | 11.18 | 4.02 | 4.20 |

The preceding line graph shows the value of a hypothetical $500,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The fund’s performance information included in the line graph and table above is compared with a regulatory required index that represents an overall securities market (Regulatory Benchmark). In addition, the line graph and table may also include one or more indexes that more closely aligns to the fund's investment strategy (Strategy Benchmark(s)). Due to new SEC Rules on shareholder reporting the fund adopted a new broad-based securities market index, referred to as the Regulatory Benchmark. Market index returns do not include expenses, which are deducted from fund returns. The fund's total return figures reflect the reinvestment of dividends and capital gains, if any. Neither the fund’s returns nor the index returns reflect the deduction of taxes that a shareholder would pay on fund distributions or redemptions of fund shares. The fund’s past performance is not a good predictor of the fund’s future performance. Updated performance information can be found at www.troweprice.com.

What are some fund statistics?

| Total Net Assets (000s) | $474,187 |

| Number of Portfolio Holdings | 104 |

| Investment Advisory Fees Paid (000s) | $2,174 |

| Portfolio Turnover Rate | 87.0% |

What did the fund invest in?

Credit Quality Allocation* (as a % of Net Assets)

| BB Rated | 22.8% |

| B Rated | 48.9 |

| CCC Rated | 9.9 |

| Bank Debt | 13.5 |

| D Rated | 0.2 |

| Reserves | 4.7 |

*Credit ratings for the securities held in the Fund are provided by Moody’s, Standard & Poor’s, and Fitch and are converted to the Standard & Poor’s nomenclature. A rating of AAA represents the highest-rated securities, and a rating of D represents the lowest rated securities. When a rating is available from all three agencies, the median rating is used. If there are two ratings, the lower rating is used, and if only one rating is available, that rating is used. If a rating is not available, the security is classified as Not Rated. The rating of the underlying investment vehicle is used to determine the creditworthiness of credit default swaps and sovereign securities. The Fund is not rated by any agency.

Top Ten Holdings (as a % of Net Assets)

| Energy Transfer | 2.3% |

| Osaic Holdings | 2.3 |

| Aretec Group | 2.0 |

| Vistra | 2.0 |

| Victra Holdings | 1.9 |

| Six Flags Entertainment | 1.9 |

| Enbridge | 1.7 |

| Heartland Dental | 1.7 |

| Sigma Holdco | 1.6 |

| Civitas Resources | 1.5 |

If you invest directly with T. Rowe Price, you can elect to receive future shareholder reports or other important documents through electronic delivery by enrolling at www.troweprice.com/paperless. If you invest through a financial intermediary such as an investment advisor, a bank, retirement plan sponsor or a brokerage firm, please contact that organization and ask if it can provide electronic delivery.

Bloomberg and ICE do not accept any liability for any errors or omissions in the indexes or data, and hereby expressly disclaim all warranties of originality, accuracy, completeness, timeliness, merchantability and fitness for a particular purpose. No party may rely on any indexes or data contained in this communication. Visit www.troweprice.com/en/us/market-data-disclosures for additional legal notices & disclaimers.

U.S. High Yield Fund

I Class (TUHIX)

T. Rowe Price Investment Services, Inc.

100 East Pratt Street

Baltimore, MD 21202

Item 1. (b) Notice pursuant to Rule 30e-3.

Not applicable.

Item 2. Code of Ethics.

The registrant has adopted a code of ethics, as defined in Item 2 of Form N-CSR, applicable to its principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. A copy of this code of ethics is filed as an exhibit to this Form N-CSR. No substantive amendments were approved or waivers were granted to this code of ethics during the period covered by this report.

Item 3. Audit Committee Financial Expert.

The registrant’s Board of Directors has determined that Mr. Paul F. McBride qualifies as an audit committee financial expert, as defined in Item 3 of Form N-CSR. Mr. McBride is considered independent for purposes of Item 3 of Form N-CSR.

Item 4. Principal Accountant Fees and Services.

(a) – (d) Aggregate fees billed for the last two fiscal years for professional services rendered to, or on behalf of, the registrant by the registrant’s principal accountant were as follows:

| | | | | | | | | | |

| | | | 2024 | | | 2023 | |

| | Audit Fees | | $ | 33,841 | | | $ | 33,192 | |

| | Audit-Related Fees | | | - | | | | - | |

| | Tax Fees | | | - | | | | - | |

| | All Other Fees | | | - | | | | - | |

Audit fees include amounts related to the audit of the registrant’s annual financial statements and services normally provided by the accountant in connection with statutory and regulatory filings. Audit-related fees include amounts reasonably related to the performance of the audit of the registrant’s financial statements and specifically include the issuance of a report on internal controls and, if applicable, agreed-upon procedures related to fund acquisitions. Tax fees include amounts related to services for tax compliance, tax planning, and tax advice. The nature of these services specifically includes the review of distribution calculations and the preparation of Federal, state, and excise tax returns. All other fees include the registrant’s pro-rata share of amounts for agreed-upon procedures in conjunction with service contract approvals by the registrant’s Board of Directors/Trustees.

(e)(1) The registrant’s audit committee has adopted a policy whereby audit and non-audit services performed by the registrant’s principal accountant for the registrant, its investment adviser, and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant require pre-approval in advance at regularly scheduled audit committee meetings. If such a service is required between regularly scheduled audit committee meetings, pre-approval may be authorized by one audit committee member with ratification at the next scheduled audit committee meeting. Waiver of pre-approval for audit or non-audit services requiring fees of a de minimis amount is not permitted.

(2) No services included in (b) – (d) above were approved pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X.

(f) Less than 50 percent of the hours expended on the principal accountant’s engagement to audit the registrant’s financial statements for the most recent fiscal year were attributed to work performed by persons other than the principal accountant’s full-time, permanent employees.

(g) The aggregate fees billed for the most recent fiscal year and the preceding fiscal year by the registrant’s principal accountant for non-audit services rendered to the registrant, its investment adviser, and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant were $1,230,000 and $1,521,000, respectively.

(h) All non-audit services rendered in (g) above were pre-approved by the registrant’s audit committee. Accordingly, these services were considered by the registrant’s audit committee in maintaining the principal accountant’s independence.

(i) Not applicable.

(j) Not applicable.

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Investments.

(a) Not applicable. The complete schedule of investments is included in Item 7 of this Form N-CSR.

(b) Not applicable.

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies.

(a – b) Report pursuant to Regulation S-X.

Financial

Highlights

Portfolio

of

Investments

Financial

Statements

and

Notes

Additional

Fund

Information

Financial

Statements

and

Other

Information

For

more

insights

from

T.

Rowe

Price

investment

professionals,

go

to

troweprice.com

.

T.

ROWE

PRICE

TUHYX

U.S.

High

Yield

Fund

–

.

TUHAX

U.S.

High

Yield

Fund–

.

Advisor Class

TUHIX

U.S.

High

Yield

Fund–

.

I Class

T.

ROWE

PRICE

U.S.

High

Yield

Fund

Go

Paperless

Going

paperless

offers

a

host

of

benefits,

which

include:

Timely

delivery

of

important

documents

Convenient

access

to

your

documents

anytime,

anywhere

Strong

security

protocols

to

safeguard

sensitive

data

Waive

your

account

service

fee

by

going

paperless.*

To

Enroll:

˃

If

you

invest

directly

with

T.

Rowe

Price,

go

to

troweprice.com/paperless

.

If

you

invest

through

a

financial

intermediary

such

as

an

investment

advisor,

a

bank,

or

a

brokerage

firm,

please

contact

that

organization

and

ask

if

it

can

provide

electronic

documentation.

Log

in

to

your

account

at

troweprice.com

for

more

information.

*

An

account

service

fee

will

be

charged

annually

for

each

T.

Rowe

Price

mutual

fund

account

unless

you

meet

criteria

for

a

fee

waiver.

Go

to

troweprice.com/personal-investing/

help/fees-and-minimums.html

to

learn

more

about

this

account

service

fee,

including

other

ways

to

waive

it.

T.

ROWE

PRICE

U.S.

High

Yield

Fund

For

a

share

outstanding

throughout

each

period

Investor

Class

..

Year

..

..

Ended

.

5/31/24

5/31/23

5/31/22

5/31/21

5/31/20

NET

ASSET

VALUE

Beginning

of

period

$

8.02

$

8.73

$

10.11

$

9.39

$

9.61

Investment

activities

Net

investment

income

(1)(2)

0.62

0.60

0.55

0.56

0.55

Net

realized

and

unrealized

gain/loss

0.34

(0.71)

(1.30)

0.72

(0.22)

Total

from

investment

activities

0.96

(0.11)

(0.75)

1.28

0.33

Distributions

Net

investment

income

(0.63)

(0.60)

(0.55)

(0.56)

(0.55)

Net

realized

gain

—

—

(0.08)

—

—

Total

distributions

(0.63)

(0.60)

(0.63)

(0.56)

(0.55)

NET

ASSET

VALUE

End

of

period

$

8.35

$

8.02

$

8.73

$

10.11

$

9.39

T.

ROWE

PRICE

U.S.

High

Yield

Fund

For

a

share

outstanding

throughout

each

period

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

Investor

Class

..

Year

..

..

Ended

.

5/31/24

5/31/23

5/31/22

5/31/21

5/31/20

Ratios/Supplemental

Data

Total

return

(2)(3)

12.31%

(1.11)%

(7.87)%

13.94%

3.43%

Ratios

to

average

net

assets:

(2)

Gross

expenses

before

waivers/payments

by

Price

Associates

0.83%

0.87%

0.78%

0.79%

0.87%

Net

expenses

after

waivers/

payments

by

Price

Associates

0.75%

0.75%

0.77%

0.79%

0.79%

Net

investment

income

7.57%

7.34%

5.62%

5.60%

5.75%

Portfolio

turnover

rate

87.0%

31.6%

73.4%

135.3%

156.7%

Net

assets,

end

of

period

(in

thousands)

$254,953

$216,586

$266,157

$437,017

$276,480

0%

0%

0%

0%

0%

(1)

Per

share

amounts

calculated

using

average

shares

outstanding

method.

(2)

Includes

the

impact

of

expense-related

arrangements

with

Price

Associates.

(3)

Total

return

reflects

the

rate

that

an

investor

would

have

earned

on

an

investment

in

the

fund

during

each

period,

assuming

reinvestment

of

all

distributions,

and

payment

of

no

redemption

or

account

fees,

if

applicable.

T.

ROWE

PRICE

U.S.

High

Yield

Fund

For

a

share

outstanding

throughout

each

period

Advisor

Class

..

Year

..

..

Ended

.

5/31/24

5/31/23

5/31/22

5/31/21

5/31/20

NET

ASSET

VALUE

Beginning

of

period

$

8.01

$

8.71

$

10.10

$

9.38

$

9.61

Investment

activities

Net

investment

income

(1)(2)

0.61

0.58

0.54

0.55

0.54

Net

realized

and

unrealized

gain/loss

0.33

(0.70)

(1.31)

0.71

(0.24)

Total

from

investment

activities

0.94

(0.12)

(0.77)

1.26

0.30

Distributions

Net

investment

income

(0.61)

(0.58)

(0.54)

(0.54)

(0.53)

Net

realized

gain

—

—

(0.08)

—

—

Total

distributions

(0.61)

(0.58)

(0.62)

(0.54)

(0.53)

NET

ASSET

VALUE

End

of

period

$

8.34

$

8.01

$

8.71

$

10.10

$

9.38

T.

ROWE

PRICE

U.S.

High

Yield

Fund

For

a

share

outstanding

throughout

each

period

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

Advisor

Class

..

Year

..

..

Ended

.

5/31/24

5/31/23

5/31/22

5/31/21

5/31/20

Ratios/Supplemental

Data

Total

return

(2)(3)

12.14%

(1.16)%

(8.13)%

13.78%

3.17%

Ratios

to

average

net

assets:

(2)

Gross

expenses

before

waivers/payments

by

Price

Associates

1.13%

1.01%

0.99%

0.97%

0.98%

Net

expenses

after

waivers/

payments

by

Price

Associates

0.90%

0.90%

0.92%

0.94%

0.94%

Net

investment

income

7.43%

7.17%

5.49%

5.52%

5.60%

Portfolio

turnover

rate

87.0%

31.6%

73.4%

135.3%

156.7%

Net

assets,

end

of

period

(in

thousands)

$2,940

$4,178

$6,873

$13,815

$14,497

0%

0%

0%

0%

0%

(1)

Per

share

amounts

calculated

using

average

shares

outstanding

method.

(2)

Includes

the

impact

of

expense-related

arrangements

with

Price

Associates.

(3)

Total

return

reflects

the

rate

that

an

investor

would

have

earned

on

an

investment

in

the

fund

during

each

period,

assuming

reinvestment

of

all

distributions,

and

payment

of

no

redemption

or

account

fees,

if

applicable.

T.

ROWE

PRICE

U.S.

High

Yield

Fund

For

a

share

outstanding

throughout

each

period

I

Class

..

Year

..

..

Ended

.

5/31/24

5/31/23

5/31/22

5/31/21

5/31/20

NET

ASSET

VALUE

Beginning

of

period

$

7.98

$

8.68

$

10.06

$

9.35

$

9.57

Investment

activities

Net

investment

income

(1)(2)

0.63

0.61

0.57

0.57

0.56

Net

realized

and

unrealized

gain/loss

0.34

(0.70)

(1.31)

0.71

(0.22)

Total

from

investment

activities

0.97

(0.09)

(0.74)

1.28

0.34

Distributions

Net

investment

income

(0.64)

(0.61)

(0.56)

(0.57)

(0.56)

Net

realized

gain

—

—

(0.08)

—

—

Total

distributions

(0.64)

(0.61)

(0.64)

(0.57)

(0.56)

NET

ASSET

VALUE

End

of

period

$

8.31

$

7.98

$

8.68

$

10.06

$

9.35

T.

ROWE

PRICE

U.S.

High

Yield

Fund

For

a

share

outstanding

throughout

each

period

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

I

Class

..

Year

..

..

Ended

.

5/31/24

5/31/23

5/31/22

5/31/21

5/31/20

Ratios/Supplemental

Data

Total

return

(2)(3)

12.49%

(0.90)%

(7.79)%

14.04%

3.58%

Ratios

to

average

net

assets:

(2)

Gross

expenses

before

waivers/payments

by

Price

Associates

0.67%

0.69%

0.65%

0.68%

0.72%

Net

expenses

after

waivers/

payments

by

Price

Associates

0.61%

0.61%

0.61%

0.63%

0.64%

Net

investment

income

7.71%

7.49%

6.04%

5.78%

5.86%

Portfolio

turnover

rate

87.0%

31.6%

73.4%

135.3%

156.7%

Net

assets,

end

of

period

(in

thousands)

$216,294

$191,390

$228,946

$55,120

$44,469

0%

0%

0%

0%

0%

(1)

Per

share

amounts

calculated

using

average

shares

outstanding

method.

(2)

Includes

the

impact

of

expense-related

arrangements

with

Price

Associates.

(3)

Total

return

reflects

the

rate

that

an

investor

would

have

earned

on

an

investment

in

the

fund

during

each

period,

assuming

reinvestment

of

all

distributions,

and

payment

of

no

redemption

or

account

fees,

if

applicable.

T.

ROWE

PRICE

U.S.

High

Yield

Fund

May

31,

2024

Par/Shares

$

Value

(Amounts

in

000s)

‡

BANK

LOANS

13.5%

(1)

Consumer

Goods

2.0%

Journey

Personal

Care,

FRN,

3M

TSFR

+

4.25%,

9.694%,

3/1/28

4,874

4,853

Naked

Juice,

FRN,

3M

TSFR

+

6.00%,

11.402%,

1/24/30

5,596

4,678

9,531

Energy

0.8%

GIP

III

Stetson

I,

FRN,

1M

TSFR

+

3.50%,

8.829%,

10/31/28

3,931

3,947

3,947

Financial

Services

0.5%

Osaic

Holdings,

FRN,

1M

TSFR

+

4.00%,

9.329%,

8/17/28

2,291

2,308

2,308

Health

Care

1.5%

Endo

Finance

Holdings,

FRN,

1M

TSFR

+

4.50%,

9.826%,

4/23/31

2,340

2,337

Surgery

Center

Holdings,

FRN,

1M

TSFR

+

3.50%,

8.821%,

12/5/30

4,440

4,459

6,796

Leisure

1.5%

Caesars

Entertainment,

FRN,

1M

TSFR

+

2.75%,

8.097%,

2/6/31

5,880

5,889

Life

Time,

FRN,

1M

TSFR

+

4.00%,

9.591%,

1/15/26

1,095

1,099

6,988

Media

1.0%

Magnite,

FRN,

1M

TSFR

+

4.50%,

9.793%,

2/6/31

4,590

4,616

4,616

Retail

0.6%

Victra

Holdings,

FRN,

3M

TSFR

+

6.50%,

11.829%,

3/31/29 (2)

(3)

2,952

2,996

2,996

Services

1.7%

KNS

Midco,

FRN,

1M

TSFR

+

6.25%,

11.694%,

4/21/27

4,002

3,432

Vestis,

FRN,

1M

TSFR

+

2.25%,

7.577%,

2/22/31

4,750

4,729

8,161

Technology

&

Electronics

2.0%

Applied

Systems,

FRN,

1M

TSFR

+

3.50%,

8.809%,

2/24/31

4,755

4,793

UKG,

FRN,

1M

TSFR

+

3.50%,

8.82%,

2/10/31

4,745

4,779

9,572

Transportation

1.9%

Mileage

Plus

Holdings,

FRN,

3M

TSFR

+

5.25%,

10.733%,

6/21/27

3,567

3,646

T.

ROWE

PRICE

U.S.

High

Yield

Fund

Par/Shares

$

Value

(Amounts

in

000s)

‡

WestJet

Loyalty,

FRN,

1M

TSFR

+

3.75%,

9.052%,

2/14/31

5,390

5,416

9,062

Total

Bank

Loans

(Cost

$64,683)

63,977

CORPORATE

BONDS

81.2%

Automotive

2.8%

Adient

Global

Holdings,

4.875%,

8/15/26 (4)

1,512

1,465

Adient

Global

Holdings,

8.25%,

4/15/31 (4)

1,005

1,045

Aston

Martin

Capital

Holdings,

10.00%,

3/31/29 (4)

4,848

4,666

Clarios

Global,

8.50%,

5/15/27 (4)

4,835

4,853

Jaguar

Land

Rover

Automotive,

5.50%,

7/15/29 (4)

1,045

992

13,021

Basic

Industry

5.5%

Camelot

Return

Merger

Sub,

8.75%,

8/1/28 (4)

4,455

4,399

ERO

Copper,

6.50%,

2/15/30 (4)

5,075

4,917

First

Quantum

Minerals,

6.875%,

10/15/27 (4)

4,575

4,508

LGI

Homes,

8.75%,

12/15/28 (4)

4,425

4,569

Miter

Brands

Acquisition

Holdco,

6.75%,

4/1/32 (4)

2,015

1,992

White

Cap

Parent,

(8.250%

Cash

or

9.00%

PIK),

8.25%,

3/15/26 (4)(5)

5,760

5,688

26,073

Capital

Goods

4.6%

AAR

Escrow

Issuer,

6.75%,

3/15/29 (4)

4,815

4,869

Bombardier,

7.25%,

7/1/31 (4)

4,645

4,715

GrafTech

Finance,

4.625%,

12/15/28 (4)

2,220

1,438

GrafTech

Global

Enterprises,

9.875%,

12/15/28 (4)

2,177

1,638

TransDigm,

6.75%,

8/15/28 (4)

4,570

4,621

Trivium

Packaging

Finance,

8.50%,

8/15/27 (4)

4,670

4,664

21,945

Consumer

Goods

3.4%

Coty,

6.625%,

7/15/30 (4)

4,653

4,688

HLF

Financing,

12.25%,

4/15/29 (4)

3,774

3,708

Sigma

Holdco,

7.875%,

5/15/26 (4)

8,013

7,793

16,189

Energy

19.1%

Ascent

Resources

Utica

Holdings,

8.25%,

12/31/28 (4)

4,505

4,584

Civitas

Resources,

8.75%,

7/1/31 (4)

6,490

6,912

Comstock

Resources,

6.75%,

3/1/29 (4)

5,175

4,994

CVR

Energy,

8.50%,

1/15/29 (4)

5,005

5,024

Enbridge,

Series NC5,

VR,

8.25%,

1/15/84 (6)

7,920

8,196

Encino

Acquisition

Partners

Holdings,

8.75%,

5/1/31 (4)

4,805

4,943

Energy

Transfer,

VR,

8.00%,

5/15/54 (6)

5,075

5,286

T.

ROWE

PRICE

U.S.

High

Yield

Fund

Par/Shares

$

Value

(Amounts

in

000s)

‡

Energy

Transfer,

Series F,

VR,

6.75% (6)(7)

760

748

Energy

Transfer,

Series H,

VR,

6.50% (6)(7)

5,090

4,982

Harvest

Midstream

I,

7.50%,

9/1/28 (4)

2,540

2,569

Howard

Midstream

Energy

Partners,

6.75%,

1/15/27 (4)

4,655

4,649

Kinetik

Holdings,

6.625%,

12/15/28 (4)

4,620

4,655

Matador

Resources,

6.50%,

4/15/32 (4)

4,845

4,821

NGL

Energy

Operating,

8.125%,

2/15/29 (4)

4,825

4,909

PBF

Holding,

7.875%,

9/15/30 (4)

4,740

4,852

Permian

Resources

Operating,

7.00%,

1/15/32 (4)

4,650

4,737

Sunoco,

7.00%,

5/1/29 (4)

4,725

4,808

Tallgrass

Energy

Partners,

7.375%,

2/15/29 (4)

4,125

4,135

Weatherford

International,

8.625%,

4/30/30 (4)

4,503

4,655

90,459

Financial

Services

10.2%

Aretec

Group,

10.00%,

8/15/30 (4)

8,730

9,527

Credit

Acceptance,

9.25%,

12/15/28 (4)

5,010

5,273

Encore

Capital

Group,

9.25%,

4/1/29 (4)

4,835

5,028

FirstCash,

6.875%,

3/1/32 (4)

4,893

4,838

OneMain

Finance,

7.875%,

3/15/30

4,850

4,941

Osaic

Holdings,

10.75%,

8/1/27 (4)

8,275

8,513

PennyMac

Financial

Services,

7.875%,

12/15/29 (4)

5,047

5,167

PRA

Group,

8.375%,

2/1/28 (4)

4,855

4,812

48,099

Health

Care

5.3%

CHS,

8.00%,

3/15/26 (4)

2,496

2,502

CHS,

8.00%,

12/15/27 (4)

3,125

3,110

Endo

Finance

Holdings,

8.50%,

4/15/31 (4)

2,410

2,461

Heartland

Dental,

10.50%,

4/30/28 (4)

7,528

8,008

IQVIA,

6.50%,

5/15/30 (4)

4,810

4,846

Tenet

Healthcare,

6.25%,

2/1/27

4,366

4,355

25,282

Insurance

2.0%

Alliant

Holdings

Intermediate,

7.00%,

1/15/31 (4)

4,660

4,672

Panther

Escrow

Issuer,

7.125%,

6/1/31 (4)

4,800

4,830

9,502

Leisure

5.6%

Carnival,

6.00%,

5/1/29 (4)

4,690

4,567

Carnival

Holdings

Bermuda,

10.375%,

5/1/28 (4)

4,265

4,601

Life

Time,

5.75%,

1/15/26 (4)

3,674

3,651

NCL,

8.375%,

2/1/28 (4)

4,395

4,582

Six

Flags

Entertainment,

7.25%,

5/15/31 (4)

8,978

8,933

26,334

T.

ROWE

PRICE

U.S.

High

Yield

Fund

Par/Shares

$

Value

(Amounts

in

000s)

‡

Media

2.9%

CCO

Holdings,

4.50%,

5/1/32

5,950

4,700

DISH

Network,

11.75%,

11/15/27 (4)

4,406

4,406

Outfront

Media

Capital,

7.375%,

2/15/31 (4)

4,665

4,817

13,923

Real

Estate

1.0%

Brookfield

Property

REIT,

4.50%,

4/1/27 (4)

5,315

4,910

4,910

Retail

2.9%

Cougar

JV

Subsidiary,

8.00%,

5/15/32 (4)

2,760

2,843

eG

Global

Finance,

12.00%,

11/30/28 (4)

4,605

4,749

Victra

Holdings,

7.75%,

2/15/26 (4)

6,067

5,991

13,583

Services

4.0%

Avis

Budget

Car

Rental,

8.00%,

2/15/31 (4)

4,845

4,772

Ritchie

Bros

Holdings,

6.75%,

3/15/28 (4)

2,475

2,500

Ritchie

Bros

Holdings,

7.75%,

3/15/31 (4)

2,045

2,129

Sabre

GLBL,

11.25%,

12/15/27 (4)

5,060

4,921

Williams

Scotsman,

7.375%,

10/1/31 (4)

4,565

4,685

19,007

Technology

&

Electronics

3.9%

Cloud

Software

Group,

8.25%,

6/30/32 (4)

4,820

4,844

McAfee,

7.375%,

2/15/30 (4)

4,825

4,469

Open

Text,

6.90%,

12/1/27 (4)

4,571

4,674

Seagate

HDD

Cayman,

8.25%,

12/15/29 (4)

2,285

2,445

Seagate

HDD

Cayman,

8.50%,

7/15/31 (4)

1,970

2,093

18,525

Telecommunications

2.0%

Level

3

Financing,

10.50%,

4/15/29 (4)

4,645

4,633

Telesat

Canada,

6.50%,

10/15/27 (4)

4,080

1,183

Viasat,

6.50%,

7/15/28 (4)

5,050

3,712

9,528

Transportation

1.9%

American

Airlines,

5.75%,

4/20/29 (4)

4,855

4,685

VistaJet

Malta

Finance,

6.375%,

2/1/30 (4)

4,130

3,314

VistaJet

Malta

Finance,

9.50%,

6/1/28 (4)

1,055

960

8,959

Utility

4.1%

NRG

Energy,

VR,

10.25% (4)(6)(7)

4,730

5,144

Talen

Energy

Supply,

8.625%,

6/1/30 (4)

4,635

4,971

T.

ROWE

PRICE

U.S.

High

Yield

Fund

Par/Shares

$

Value

(Amounts

in

000s)

‡

Vistra,

VR,

8.00% (4)(6)(7)

9,286

9,379

19,494

Total

Corporate

Bonds

(Cost

$386,117)

384,833

PREFERRED

STOCKS

0.6%

Financial

Services

0.6%

Osaic

Financial

Services,

6.50%,

11/30/27

152

2,955

Total

Preferred

Stocks

(Cost

$2,727)

2,955

SHORT-TERM

INVESTMENTS

2.2%

Money

Market

Funds

2.2%

T.

Rowe

Price

Government

Reserve

Fund,

5.39% (8)(9)

10,444

10,444

Total

Short-Term

Investments

(Cost

$10,444)

10,444

Total

Investments

in

Securities

97.5%

of

Net

Assets

(Cost

$463,971)

$

462,209

T.

ROWE

PRICE

U.S.

High

Yield

Fund

‡

Par/Shares

are

denominated

in

U.S.

dollars

unless

otherwise

noted.

(1)

Bank

loan

positions

may

involve

multiple

underlying

tranches.

In

those

instances,

the

position

presented

reflects

the

aggregate

of

those

respective

underlying

tranches

and

the

rate

presented

reflects

the

weighted

average

rate

of

the

settled

positions.

(2)

All

or

a

portion

of

this

loan

is

unsettled

as

of

May

31,

2024.

The

interest

rate

for

unsettled

loans

will

be

determined

upon

settlement

after

period

end.

(3)

See

Note

2.

Level

3

in

fair

value

hierarchy.

(4)

Security

was

purchased

pursuant

to

Rule

144A

under

the

Securities

Act

of

1933

and

may

be

resold

in

transactions

exempt

from

registration

only

to

qualified

institutional

buyers.

Total

value

of

such

securities

at

period-end

amounts

to

$351,625

and

represents

74.2%

of

net

assets.

(5)

Security

has

the

ability

to

pay

in-kind

or

pay

in

cash.

When

applicable,

separate

rates

of

such

payments

are

disclosed.

(6)

Security

is

a

fix-to-float

security,

which

carries

a

fixed

coupon

until

a

certain

date,

upon

which

it

switches

to

a

floating

rate.

Reference

rate

and

spread

are

provided

if

the

rate

is

currently

floating.

(7)

Perpetual

security

with

no

stated

maturity

date.

(8)

Seven-day

yield

(9)

Affiliated

Companies

1M

TSFR

One

month

term

SOFR

(Secured

overnight

financing

rate)

3M

TSFR

Three

month

term

SOFR

(Secured

overnight

financing

rate)

FRN

Floating

Rate

Note

PIK

Payment-in-kind

VR

Variable

Rate;

rate

shown

is

effective

rate

at

period-end.

The

rates

for

certain

variable

rate

securities

are

not

based

on

a

published

reference

rate

and

spread

but

are

determined

by

the

issuer

or

agent

and

based

on

current

market

conditions.

T.

ROWE

PRICE

U.S.

High

Yield

Fund

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

AFFILIATED

COMPANIES

($000s)

The

fund

may

invest

in

certain

securities

that

are

considered

affiliated

companies.

As

defined

by

the

1940

Act,

an

affiliated

company

is

one

in

which

the

fund

owns

5%

or

more

of

the

outstanding

voting

securities,

or

a

company

that

is

under

common

ownership

or

control.

The

following

securities

were

considered

affiliated

companies

for

all

or

some

portion

of

the

year

ended

May

31,

2024.

Net

realized

gain

(loss),

investment

income,

change

in

net

unrealized

gain/loss,

and

purchase

and

sales

cost

reflect

all

activity

for

the

period

then

ended.

Affiliate

Net

Realized

Gain

(Loss)

Change

in

Net

Unrealized

Gain/Loss

Investment

Income

T.

Rowe

Price

Government

Reserve

Fund,

5.39%

$

—#

$

—

$

1,134+

Supplementary

Investment

Schedule

Affiliate

Value

05/31/23

Purchase

Cost

Sales

Cost

Value

05/31/24

T.

Rowe

Price

Government

Reserve

Fund,

5.39%

$

10,724

¤

¤

$

10,444^

#

Capital

gain

distributions

from

underlying

Price

funds

represented

$0

of

the

net

realized

gain

(loss).

+

Investment

income

comprised

$1,134

of

dividend

income

and

$0

of

interest

income.

¤

Purchase

and

sale

information

not

shown

for

cash

management

funds.

^

The

cost

basis

of

investments

in

affiliated

companies

was

$10,444.

T.

ROWE

PRICE

U.S.

High

Yield

Fund

May

31,

2024

Statement

of

Assets

and

Liabilities

($000s,

except

shares

and

per

share

amounts)

Assets

Investments

in

securities,

at

value

(cost

$463,971)

$

462,209

Interest

receivable

7,792

Receivable

for

investment

securities

sold

6,348

Receivable

for

shares

sold

184

Cash

115

Other

assets

50

Total

assets

476,698

Liabilities

Payable

for

investment

securities

purchased

1,230

Payable

for

shares

redeemed

801

Investment

management

fees

payable

221

Due

to

affiliates

16

Other

liabilities

243

Total

liabilities

2,511

Commitments

and

Contingent

Liabilities

(note

5

)

NET

ASSETS

$

474,187

T.

ROWE

PRICE

U.S.

High

Yield

Fund

May

31,

2024

Statement

of

Assets

and

Liabilities

($000s,

except

shares

and

per

share

amounts)

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

Net

Assets

Consist

of:

Total

distributable

earnings

(loss)

$

(93,877)

Paid-in

capital

applicable

to

56,920,371

shares

of

$0.01

par

value

capital

stock

outstanding;

3,000,000,000

shares

of

the

Corporation

authorized

568,064

NET

ASSETS

$

474,187

NET

ASSET

VALUE

PER

SHARE

Investor

Class

(Net

assets:

$254,953;

Shares

outstanding:

30,526,574)

$

8.35

Advisor

Class

(Net

assets:

$2,940;

Shares

outstanding:

352,428)

$

8.34

I

Class

(Net

assets:

$216,294;

Shares

outstanding:

26,041,369)

$

8.31

T.

ROWE

PRICE

U.S.

High

Yield

Fund

Year

Ended

5/31/24

Investment

Income

(Loss)

Income

Interest

$

36,128

Dividend

1,194

Other

1

Total

income

37,323

Expenses

Investment

management

2,492

Shareholder

servicing

Investor

Class

$

437

Advisor

Class

9

I

Class

76

522

Rule

12b-1

fees

Advisor

Class

10

Prospectus

and

shareholder

reports

Investor

Class

35

Advisor

Class

1

I

Class

10

46

Custody

and

accounting

179

Registration

80

Legal

and

audit

39

Proxy

and

annual

meeting

10

Directors

2

Miscellaneous

26

Waived

/

paid

by

Price

Associates

(318)

Total

expenses

3,088

Net

investment

income

34,235

T.

ROWE

PRICE

U.S.

High

Yield

Fund

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

Year

Ended

5/31/24

Realized

and

Unrealized

Gain

/

Loss

–

Net

realized

loss

on

securities

(49,215)

Change

in

net

unrealized

gain

/

loss

Securities

66,317

Other

assets

and

liabilities

denominated

in

foreign

currencies

5

Change

in

net

unrealized

gain

/

loss

66,322

Net

realized

and

unrealized

gain

/

loss

17,107

INCREASE

IN

NET

ASSETS

FROM

OPERATIONS

$

51,342

T.

ROWE

PRICE

U.S.

High

Yield

Fund

Statement

of

Changes

in

Net

Assets

.

Year

.

.

.

.

.

.

.

.

.

.

.

.

.

.

Ended

.

.

.

.

.

.

.

.

.

.

.

.

.

.

5/31/24

5/31/23

Increase

(Decrease)

in

Net

Assets

Operations

Net

investment

income

$

34,235

$

32,596

Net

realized

loss

(49,215)

(35,410)

Change

in

net

unrealized

gain

/

loss

66,322

(4,990)

Increase

(decrease)

in

net

assets

from

operations

51,342

(7,804)

Distributions

to

shareholders

Net

earnings

Investor

Class

(18,275)

(16,896)

Advisor

Class

(295)

(393)

I

Class

(15,665)

(15,194)

Decrease

in

net

assets

from

distributions

(34,235)

(32,483)

Capital

share

transactions

*

Shares

sold

Investor

Class

118,318

104,416

Advisor

Class

888

852

I

Class

64,814

58,729

Distributions

reinvested

Investor

Class

17,412

15,963

Advisor

Class

295

392

I

Class

13,121

12,773

Shares

redeemed

Investor

Class

(106,516)

(148,928)

Advisor

Class

(2,601)

(3,398)

I

Class

(60,805)

(90,334)

Increase

(decrease)

in

net

assets

from

capital

share

transactions

44,926

(49,535)

T.

ROWE

PRICE

U.S.

High

Yield

Fund

Statement

of

Changes

in

Net

Assets

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

Year

.

.

.

.

.

.

.

.

.

.

.

.

.

.

Ended

.

.

.

.

.

.

.

.

.

.

.

.

.

.

5/31/24

5/31/23

Net

Assets

Increase

(decrease)

during

period

62,033

(89,822)

Beginning

of

period

412,154

501,976

End

of

period

$

474,187

$

412,154

*Share

information

(000s)

Shares

sold

Investor

Class

14,322

12,826

Advisor

Class

109

104

I

Class

7,896

7,195

Distributions

reinvested

Investor

Class

2,110

1,973

Advisor

Class

36

48

I

Class

1,599

1,587

Shares

redeemed

Investor

Class

(12,904)

(18,305)

Advisor

Class

(314)

(420)

I

Class

(7,444)

(11,177)

Increase

(decrease)

in

shares

outstanding

5,410

(6,169)

T.

ROWE

PRICE

U.S.

High

Yield

Fund

NOTES

TO

FINANCIAL

STATEMENTS

T.

Rowe

Price

High

Yield

Fund,

Inc. (the

corporation) is

registered

under

the

Investment

Company

Act

of

1940

(the

1940

Act).

The

U.S.

High

Yield

Fund

(the

fund)

is a

diversified, open-end

management

investment

company

established

by

the

corporation.

The

fund

seeks

total

return,

and

secondarily,

current

income.

The

fund

has three classes

of

shares:

the

U.S.

High

Yield

Fund

(Investor

Class),

the

U.S.

High

Yield

Fund–Advisor

Class

(Advisor

Class)

and

the

U.S.

High

Yield

Fund–I

Class

(I

Class).

Advisor

Class

shares

are

sold

only

through

various

brokers

and

other

financial

intermediaries.

I

Class

shares

require

a

$500,000

initial

investment

minimum,

although

the

minimum

generally

is

waived

or

reduced

for

financial

intermediaries,

eligible

retirement

plans,

and

certain

other

accounts.

The

Advisor

Class

operates

under

a

Board-approved

Rule

12b-1

plan

pursuant

to

which

the

class

compensates

financial

intermediaries

for

distribution,

shareholder

servicing,

and/or

certain

administrative

services;

the

Investor

and

I

Classes

do

not

pay

Rule

12b-1

fees. Each

class

has

exclusive

voting

rights

on

matters

related

solely

to

that

class;

separate

voting

rights

on

matters

that

relate

to

all

classes;

and,

in

all

other

respects,

the

same

rights

and

obligations

as

the

other

classes.

NOTE

1

-

SIGNIFICANT

ACCOUNTING

POLICIES

Basis

of

Preparation

The fund

is

an

investment

company

and

follows

accounting

and

reporting

guidance

in

the

Financial

Accounting

Standards

Board

(FASB)

Accounting

Standards

Codification

Topic

946

(ASC

946).

The

accompanying

financial

statements

were

prepared

in

accordance

with

accounting

principles

generally

accepted

in

the

United

States

of

America

(GAAP),

including,

but

not

limited

to,

ASC

946.

GAAP

requires

the

use

of

estimates

made

by

management.

Management

believes

that

estimates

and

valuations

are

appropriate;

however,

actual

results

may

differ

from

those

estimates,

and

the

valuations

reflected

in

the

accompanying

financial

statements

may

differ

from

the

value

ultimately

realized

upon

sale

or

maturity.

Investment

Transactions,

Investment

Income,

and

Distributions

Investment

transactions

are

accounted

for

on

the

trade

date

basis.

Income

and

expenses

are

recorded

on

the

accrual

basis.

Realized

gains

and

losses

are

reported

on

the

identified

cost

basis. Premiums

and

discounts

on

debt

securities

are

amortized

for

financial

reporting

purposes. Income

tax-related

interest

and

penalties,

if

incurred,

are

recorded

as

income

tax

expense. Dividends

received

from other

investment

companies are

reflected

as

dividend income;

capital

gain

T.

ROWE

PRICE

U.S.

High

Yield

Fund

distributions

are

reflected

as

realized

gain/loss. Dividend

income and

capital

gain

distributions

are

recorded

on

the

ex-dividend

date. Non-cash

dividends,

if

any,

are

recorded

at

the

fair

market

value

of

the

asset

received. Proceeds

from

litigation

payments,

if

any,

are

included

in

either

net

realized

gain

(loss)

or

change

in

net

unrealized

gain/loss

from

securities. Distributions

to

shareholders

are

recorded

on

the

ex-dividend

date. Income

distributions,

if

any, are

declared

by

each

class daily

and

paid

monthly. A

capital

gain

distribution,

if

any, may

also

be

declared

and

paid

by

the

fund

annually.

Currency

Translation

Assets,

including

investments,

and

liabilities

denominated

in

foreign

currencies

are

translated

into

U.S.

dollar

values

each

day

at

the

prevailing

exchange

rate,

using

the

mean

of

the

bid

and

asked

prices

of

such