SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ Preliminary Proxy Statement | ¨ Confidential, for Use of the Commission Only |

(as permitted by Rule 14a-6(a)(b))

x Definitive Proxy Statement

¨ Definitive Additional Materials

¨ Soliciting Material Pursuant to Section 240.14a-11(c) or Section 240.14a-12

TRANSMONTAIGNE INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

¨ | | Fee paid previously with preliminary materials. |

¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

TRANSMONTAIGNE INC.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

The Annual Meeting of Stockholders of TRANSMONTAIGNE INC., a Delaware corporation (“TransMontaigne” or the “Company”), will be held in the Central City Room of the Brown Palace Hotel, 321 Seventeenth Street, Denver, Colorado, on Thursday, November 21, 2002, at 9:00 a.m., Denver Time, for the following purposes:

| | 1. | | To elect nine Directors to serve until the next Annual Meeting of Stockholders and until their successors have been elected and qualified. The Board of Directors is nominating the following individuals for election as Directors: Cortlandt S. Dietler, Donald H. Anderson, Peter B. Griffin, Ben A. Guill, John A. Hill, Bryan H. Lawrence, Harold R. Logan, Jr., Edwin H. Morgens, and Walter P. Schuetze; |

| | 2. | | To approve the amendment of the TransMontaigne Inc. 1997 Equity Incentive Plan, as amended (the “1997 Incentive Plan”), to provide for the grant of equity-based awards to non-employee Directors of TransMontaigne from time to time; and |

| | 3. | | To consider and act upon such other matters and to transact such other business as may properly come before the meeting and any adjournment or postponement thereof. |

These matters are fully discussed in the Proxy Statement. The Company’s 2002 Annual Report accompanies the Proxy Statement.

The Board of Directors has fixed the close of business on September 23, 2002, as the record date for the meeting. Only holders of Common Stock, Series A Convertible Preferred Stock and/or Series B Convertible Preferred Stock of record at such time are entitled to receive notice of and to vote at the meeting and any adjournment or postponement thereof.

Whether or not you plan to attend the meeting in person, please indicate your voting instructions on the enclosed proxy, date and sign it, and return it promptly in the stamped return envelope which is included with these materials. In the event you do attend the meeting in person, you may withdraw your proxy and vote in person.

By Order of the Board of Directors

ERIK B. CARLSON,Secretary

Denver, Colorado

October 18, 2002

PLACE AND TIME OF ANNUAL MEETING

CENTRAL CITY ROOM

BROWN PALACE HOTEL

321 SEVENTEENTH STREET

DENVER, COLORADO

Thursday, November 21, 2002, 9:00 a.m. Denver Time

TRANSMONTAIGNE INC.

2750 REPUBLIC PLAZA

370 SEVENTEENTH STREET

DENVER, COLORADO 80202

PROXY STATEMENT

GENERAL

This Proxy Statement and the enclosed proxy are being mailed on or about October 18, 2002 to stockholders of record on September 23, 2002 of the common stock, $0.01 par value (the “Common Stock”), the holders of Series A Convertible Preferred Stock (the “Series A Preferred”) and the holders of Series B Convertible Preferred Stock (the “Series B Preferred”) of TransMontaigne Inc. (“TransMontaigne” or the “Company”) in connection with the solicitation of proxies for use at the 2002 Annual Meeting of Stockholders of the Company (the “Annual Meeting”), notice of which appears on the preceding page, and at any postponement or adjournment thereof. The Annual Meeting will be held on Thursday, November 21, 2002, at 9:00 a.m., Denver Time, in the Central City Room at the Brown Palace Hotel, 321 Seventeenth Street, Denver, Colorado.

The solicitation of proxies is being made, and the cost of soliciting proxies is being paid, by the Company. In addition to the mailings, the Company’s officers, Directors and other regular employees, without additional compensation, may solicit proxies personally or by other appropriate means.

The Company will request brokerage firms, bank nominees and other institutions that act as nominees or fiduciaries for owners of Common Stock, the Series A Preferred and the Series B Preferred, to forward this Proxy Statement to persons for whom they hold shares and to obtain authorization for the execution of proxies. If your shares of Common Stock, Series A Preferred and/or Series B Preferred are held in the name of a brokerage firm, bank nominee or other institution, only it can sign a proxy with respect to your shares. Accordingly, please contact the person responsible for your account and give instructions for a proxy to be signed representing your shares of Common Stock, Series A Preferred and/or Series B Preferred.

A stockholder or holder of the Series A Preferred and/or Series B Preferred giving a proxy has the power to revoke the proxy at any time before it is exercised. A proxy may be revoked by delivering to the Company an instrument revoking the proxy or a duly executed proxy bearing a later date. The powers of the proxy holders will be suspended if the person executing the proxy is present at the meeting and indicates to the inspector of elections that such person elects to vote in person. If the proxy is neither revoked nor suspended, it will be voted by one or more of the proxy holders therein named.

QUORUM AND VOTING

Only stockholders of record as of the record date, including holders of the Series A Preferred and Series B Preferred, are entitled to notice of and to vote at the Annual Meeting. The holders of the Series A Preferred and Series B Preferred shall vote together with holders of Common Stock as a single class on all actions to be voted on by the stockholders of the Company other than the election of Directors. Each holder of shares of Common Stock is entitled to one vote per share of Common Stock at the Annual Meeting. Each holder of Series A Preferred and Series B Preferred is entitled to a number of votes per share on each action equal to the number of shares of Common Stock (excluding fractions of a share) into which each share of Series A Preferred and Series B Preferred is convertible as of the record date. On September 23, 2002, the record date for the determination of stockholders and holders of the Series A Preferred and Series B Preferred entitled to receive notice of and to vote at the Annual Meeting, the Company had outstanding 39,934,967 shares of Common Stock, 24,421 shares of Series A Preferred convertible into 1,628,082 shares of Common Stock and 72,890 shares of Series B Preferred convertible into 11,043,928 shares of Common Stock.

1

The holders of a majority of the shares entitled to vote at the Annual Meeting, whether present in person or represented by proxy, will constitute a quorum for the transaction of business at the Annual Meeting. Directors shall be elected by a plurality of the votes of the shares of Common Stock present in person or by proxy at the Annual Meeting and entitled to vote. Approval of all other matters shall be determined by the affirmative vote of the majority of the votes cast with respect to the shares of Common Stock, Series A Preferred and Series B Preferred, voting together as a single class, present in person or represented by proxy at the meeting and entitled to vote. If no voting direction is indicated on an otherwise properly completed and signed proxy card, the shares will be considered votes FOR the election of the nominees for Director and FOR the approval of the amendment to the TransMontaigne Inc. Equity Incentive Plan (“1997 Incentive Plan”). Proxy cards that are not signed or that are not returned are treated as not voted for any purposes. If a broker indicates on a proxy card that it does not have discretionary authority as to certain shares to vote on a particular matter (a “broker non-vote”), those shares will be considered as present for the purpose of establishing a quorum, but will not be considered as present and entitled to vote with respect to that matter. Abstentions with respect to any matter will be treated as shares present and entitled to vote. Consequently, abstentions and broker non-votes will have no effect with respect to the election of Directors. Broker non-votes will also have no effect with respect to the approval of the amendment to the 1997 Incentive Plan, while abstentions will have the same effect as a vote against the approval of the amendment to the 1997 Incentive Plan. The Company knows of no proposals to be considered at the Annual Meeting other than those set forth in the Notice of Annual Meeting.

ELECTION OF DIRECTORS

Nominees

The Company’s By-laws provide that the number of Directors shall be no fewer than seven and no more than eleven, as fixed from time to time by the Board of Directors. The number of Directors is presently fixed at nine. The Company has agreed to take all action necessary to cause two Directors designated by affiliates of First Reserve Corporation from time to time to be elected to the Company’s Board of Directors so long as their collective ownership in the Company is at least 10%. The affiliates of First Reserve Corporation have designated Mr. Guill and Mr. Hill as their nominees for Directors.

Further, the Company has agreed to take all action necessary to cause one Director designated by Louis Dreyfus Corporation (“Dreyfus”) from time to time to be elected to the Company’s Board of Directors so long as its ownership in the Company is at least 10%. Dreyfus has designated Mr. Griffin as its nominee for Director.

Management has been informed that all nominees are willing to serve as Directors if elected, but if any of them should decline or be unable to act as a Director, the proxy holders will vote for the election of another person or persons as they, in their discretion, may choose. The Board of Directors has no reason to believe that any nominee will be unable or unwilling to serve.

The following sets forth, as to each of the nominees, such person’s age, principal occupations during recent years, and the period during which such person has served as a Director of the Company. Nominees elected at the Annual Meeting to serve as Directors will serve for a term of one year, until the next annual meeting of the Company’s stockholders and until their successors have been elected and qualified.

THE BOARD RECOMMENDS A VOTE FOR THE ELECTION OF EACH OF THE NOMINEES NAMED BELOW.

Cortlandt S. Dietler, age 81, has been the Chairman of TransMontaigne since April 1995. Mr. Dietler was Chief Executive Officer from April 1995 through September 1999. He was the founder, Chairman and Chief Executive Officer of Associated Natural Gas Corporation, a natural gas gathering, processing and marketing company, prior to its 1994 merger with PanEnergy Corporation, on whose Board he served as an Advisory

2

Director, prior to its merger with Duke Energy Corporation. Mr. Dietler also serves as a Director of Hallador Petroleum Company, Cimarex Energy Co., Forest Oil Corporation and Carbon Energy Corporation. Industry affiliations include: Member, National Petroleum Council; Director, American Petroleum Institute; and past Director, Independent Petroleum Association of America.

Donald H. Anderson, age 54, has been a Director of TransMontaigne, as well as Vice Chairman and Chief Executive Officer since September 1999. On January 4, 2000, Mr. Anderson was appointed President of TransMontaigne. Mr. Anderson was the Executive Director and a Principal of Western Growth Capital LLC (“WGC”), a Colorado-based private equity investment and consulting firm. He joined WGC in March 1997 and assumed responsibility for the firm’s private equity and consulting services activities. Prior to joining WGC, Mr. Anderson was Chairman, President and Chief Executive Officer of PanEnergy Services, PanEnergy’s non-jurisdictional operating subsidiary, from December 1994 until PanEnergy’s announced merger with Duke Energy Corporation in March 1997. During that time period, Mr. Anderson also served as a Director of TEPPCO Partners, LLP. Mr. Anderson was previously President, Chief Operating Officer and Director of Associated Natural Gas Corporation until its merger with PanEnergy Corporation in 1994.

Peter B. Griffin, age 57, was elected to the Board of Directors of TransMontaigne effective July 1, 2000. Mr. Griffin is President of Louis Dreyfus Corporation (“Dreyfus”), having been appointed to that position in 1998. Mr. Griffin served as Executive Vice President of Dreyfus from 1995 to 1998. Mr. Griffin joined Dreyfus in 1976 as Corporate Controller and subsequently held various administrative and financial positions in both the energy and agricultural business segments. Prior to joining Dreyfus, Mr. Griffin was an accountant with Arthur Young & Company.

Ben A. Guill, age 51, was elected to the Board of Directors of TransMontaigne effective March 21, 2001. Mr. Guill is President of First Reserve Corporation (“First Reserve”) and joined that firm in 1998. First Reserve is a private equity fund sponsor specializing in management buyouts and acquisitions in the energy and energy-related industries based in Greenwich, Connecticut. Prior to joining First Reserve, Mr. Guill spent 18 years with Simmons & Company International, an investment banking firm, where he served as Managing Director and Co-Head of Investment Banking. Prior to that time he was with Blyth Eastman Dillon & Company. Mr. Guill is a Director of National Oilwell, Inc., Superior Energy Services, Inc., Chicago Bridge & Iron Company, N.V., T3 Energy Services, Destiny Resource Services Corp. and Dresser, Inc.

John A. Hill, age 60, has been a Director of TransMontaigne since April 1995. Mr. Hill is Vice Chairman of the Board, Managing Director and founder of First Reserve Corporation (“First Reserve”). Mr. Hill is Chairman of the Board of Trustees of the Putnam Mutual Funds in Boston and serves as a Director of Devon Energy Corporation, various private companies owned by First Reserve and Continuum Health Partners in New York.

Bryan H. Lawrence, age 60, has been a Director of TransMontaigne since April 1995. Mr. Lawrence joined Dillon, Read & Co. Inc., an investment banking firm, in 1966 and served as a Managing Director until 1997 when Mr. Lawrence established Yorktown Partners LLC to manage Yorktown Energy Partners III, L.P. and predecessor partnerships previously managed by Dillon, Read & Co. Inc. Mr. Lawrence also serves as a Director of Vintage Petroleum, Inc., D&K Healthcare Services, Inc., Hallador Petroleum Company and Carbon Energy Corporation (each a United States public company), and Cavell Energy Corporation (a Canadian public company), and certain privately-owned companies in which affiliates of Yorktown Partners LLC hold equity interests including PetroSantander Inc., Savoy Energy, L.P., Athanor Resources Inc., Camden Resources, Inc., Crosstex Energy Holdings Inc, ESI Energy Services Inc., Ellora Energy Inc. and Dernick Resources Inc.

Harold R. Logan, Jr., age 57, has been Executive Vice President, Treasurer and a Director of TransMontaigne since April 1995. He has been Chief Financial Officer since March 1, 2000. From 1985 to 1994, Mr. Logan was Senior Vice President/Finance and a Director of Associated Natural Gas Corporation. Prior to joining Associated Natural Gas Corporation, Mr. Logan was with Dillon, Read & Co. Inc. and Rothschild, Inc. In

3

addition, Mr. Logan is a Director of Suburban Propane Partners, L.P., Graphic Packaging Corporation, Union Bankshares, Ltd., and Rivington Capital Advisors LLC.

Edwin H. Morgens, age 61, was appointed a Director of TransMontaigne in June 1996. Mr. Morgens has been Chairman of Morgens, Waterfall, Vintiadis & Company, Inc., an investment management firm, since 1970. In addition, Mr. Morgens serves as a Director of Programmer’s Paradise, Inc.

Walter P. Schuetze, age 70, was appointed a Director of TransMontaigne and Chairman of the Company’s Audit Committee, effective October 1, 2002. Mr. Schuetze currently is an Executive in Residence in the College of Business at the University of Texas—San Antonio, Texas. Mr. Schuetze was the Chief Accountant to the Securities and Exchange Commission of the United States of America from January 1992 through March 1995. He was appointed Chief Accountant of the Commission’s Division of Enforcement in November 1997 and served through mid-February 2000, and served as a consultant to the Commission’s Division of Enforcement from March 2000 through March 2002 on matters involving accounting and auditing. Mr. Schuetze began his accounting career in 1957 with the public accounting firm of Eaton & Huddle in San Antonio, Texas, which merged with Peat, Marwick, Mitchell & Co. (now KPMG LLP) in 1958. He was a partner in KPMG from 1965 to 1973 when he was appointed to the Financial Accounting Standards Board and from 1976 to 1992. Since April 1, 2002, he has been a member of the Board of Directors of Computer Associates International, Inc., a New York Stock Exchange listed company, and currently is chairman of that company’s audit committee.

Meetings and Certain Committees of the Board

During the fiscal year ended June 30, 2002, the Board of Directors met on six occasions. No Director attended fewer than 75% percent of the aggregate of the total number of meetings of the Board of Directors and the total number of meetings held by all committees of the Board on which he served. The Board has Audit and Compensation Committees. In accordance with the By-laws of the Company, the Board of Directors elects from its members the members of each committee, who serve at the pleasure of the Board. The Board of Directors, as a whole, is responsible for nominating Directors and has not formed a committee for such purpose.

The Audit Committee is composed of three independent Directors, each of whom is able to understand fundamental financial statements and at least one of whom has past experience in accounting or related financial management experience. The Audit Committee’s duties and responsibilities are fully discussed in the Report of the Audit Committee set forth in this Proxy Statement. The Audit Committee met three times during the Company’s fiscal year ended June 30, 2002. The members of the Audit Committee during the Company’s fiscal year ended June 30, 2002 were Bryan H. Lawrence, Chairman, Peter B. Griffin and John A. Hill. Each of the members of the Audit Committee is “independent” within the meaning of Section 121(A) of the American Stock Exchange listing standards.

The Compensation Committee is composed entirely of independent Directors and approves the salaries of the executive officers of the Company and administers the Company’s equity incentive plans, including the selection of the individuals to be granted awards from among those eligible to participate. The Company has one equity incentive plan: the TransMontaigne Inc. Equity Incentive Plan (the “1997 Incentive Plan”). The Amended and Restated Employee Nonqualified Stock Option Plan (the “1991 Option Plan”) was terminated September 30, 2002. The TransMontaigne Oil Company Employees’ Stock Option Plan (the “1995 Option Plan”) terminated on December 31, 2001. There are no options outstanding under the 1991 Option Plan. Options outstanding at the time of the 1995 Option Plan termination continue to be exercisable in accordance with their terms. During the Company’s fiscal year ended June 30, 2002, stock options and grants of restricted stock were awarded. During the Company’s fiscal year ended June 30, 2002, the Compensation Committee held one formal meeting and acted three times by unanimous written consent. The members of the Compensation Committee during the Company’s fiscal year were Bryan H. Lawrence, Chairman, and Edwin H. Morgens. A report of the Compensation Committee on Executive Compensation is set forth in this Proxy Statement.

4

Compensation Of Directors

Employee Directors receive no additional compensation for services on the Board of Directors or committees of the Board. Directors who are not employees were paid an annual fee of $18,000 through June 30, 2002, payable quarterly. All Directors are reimbursed for reasonable out-of-pocket expenses incurred in attending meetings of the Board or any committee or otherwise by reason of their being a Director. Due in part to the renewed focus on corporate governance issues and the passage of the Sarbanes-Oxley Act of 2002, which will require greater oversight by Board members and Board committees, the Company anticipates that the workload and number of meetings of the Board will increase substantially. In order to retain, as well as to attract, qualified persons to serve on the Board, as well as to chair its various committees, the Company has determined that a substantial increase in base annual compensation for non-employee Directors is warranted, as well as additional compensation for those non-employee Directors who chair those committees. Therefore, effective October 1, 2002, the base annual compensation for non-employee Directors was increased from $18,000 per year to $30,000 per year, payable quarterly. Also effective October 1, 2002, an additional sum of $30,000 per year will be paid to the non-employee Director serving as Chairman of the Audit Committee due to the increased responsibilities associated with that position under the Sarbanes-Oxley Act of 2002, while additional sums of $20,000 per year and $10,000 per year will be paid to the non-employee Directors serving as Chairman of the Finance Committee and the Compensation Committee, respectively. In addition, if the Company’s stockholders approve the proposed amendment to the 1997 Incentive Plan, discretionary grants of restricted stock, stock options or other stock–based awards may also be made to non-employee Directors.

5

MANAGEMENT

The following table sets forth the names, ages and positions of the executive officers of TransMontaigne:

Name

| | Age

| | Position

|

| Cortlandt S. Dietler | | 81 | | Chairman and Director |

| Donald H. Anderson | | 54 | | Vice Chairman, Chief Executive Officer, President and Director |

| Harold R. Logan, Jr. | | 57 | | Executive Vice President, Chief Financial Officer, Treasurer and Director |

| William S. Dickey | | 44 | | Executive Vice President |

| Randall J. Larson | | 45 | | Executive Vice President, Chief Accounting Officer and Controller |

| Erik B. Carlson | | 55 | | Senior Vice President, Corporate Secretary and General Counsel |

See “Election of Directors” for additional information with respect to Messrs. Dietler, Anderson and Logan.

William S. Dickey has been an Executive Vice President of TransMontaigne since May 2000. Prior to his employment with TransMontaigne, Mr. Dickey was a Vice President of TEPPCO from January 1999 until May 2000. Prior to joining TEPPCO, Mr. Dickey was a Vice President and Chief Financial Officer of Duke Energy Field Services from 1994 to 1998.

Randall J. Larsonjoined TransMontaigne as Executive Vice President, Chief Accounting Officer and Controller effective May 1, 2002. Prior to his employment with TransMontaigne, Mr. Larson was a partner in KPMG LLP, most recently in KPMG’s San Jose, California office. Prior to joining the San Jose office in 1996, Randy was a partner in KPMG’s Department of Professional Practice in the national office in New York City. From July 1992 to June 1994, Mr. Larson served as a Professional Accounting Fellow in the Office of Chief Accountant of the Securities and Exchange Commission. Mr. Larson began his accounting career with KPMG in 1981 in the Denver, Colorado office.

Erik B. Carlson has been a Senior Vice President, Corporate Secretary and General Counsel of TransMontaigne since January 1998. Prior to his employment with TransMontaigne, Mr. Carlson served as Senior Vice President, General Counsel and Corporate Secretary of Duke Energy Field Services, a wholly-owned subsidiary of Duke Energy Corporation, since February 1983.

6

OWNERSHIP OF COMMON STOCK

The following table sets forth certain information regarding the beneficial ownership of Common Stock and Common Stock equivalents as of August 31, 2002 by each Director, by each individual serving as an executive officer as of August 31, 2002 and who is named in the Summary Compensation table set forth under “Executive Compensation” below, by each person known by TransMontaigne to own more than 5% of the outstanding shares of Common Stock and by all Directors and those serving as executive officers as of August 31, 2002 as a group. The information set forth below is based solely upon information furnished by such individuals or contained in filings made by such beneficial owners with the Securities and Exchange Commission (the “SEC”).

Beneficial Owner

| | Number of Shares (1)(2)

| | Percent of Class

| |

Cortlandt S. Dietler(3) | | 2,304,950 | | 5.7 | % |

| PO Box 5660 | | | | | |

| Denver, CO 80217 | | | | | |

Donald H. Anderson(4) | | 201,750 | | (5 | ) |

Harold R. Logan, Jr.(6) | | 428,321 | | 1.1 | % |

William S. Dickey(7) | | 163,008 | | (5 | ) |

Randall J. Larson(8) | | 75,000 | | (5 | ) |

Erik B. Carlson(9) | | 123,853 | | (5 | ) |

First Reserve Corporation(10) | | | | | |

| First Reserve Fund VII, Limited Partnership | | 3,894,481 | | 9.3 | % |

| First Reserve Fund VIII, LP | | 6,225,953 | | 14.5 | % |

| | |

| | | |

| (Group Total) | | 10,112,244 | | 22.6 | % |

| Louis Dreyfus Corporation | | 4,351,080 | | 10.9 | % |

| Ten Westport Road | | | | | |

| P.O. Box 810 | | | | | |

| Wilton, CT 06897 | | | | | |

Merrill Lynch Investment Managers, L.P.(11) | | 3,901,480 | | 9.8 | % |

Vencap Holdings (1987) Pte Ltd(12) | | 3,347,584 | | 7.9 | % |

| c/o Government of Singapore Investment Corporation | | | | | |

| 255 Shoreline Drive, Suite 600 | | | | | |

| Redwood City, CA 94065 | | | | | |

Yorktown Partners LLC(13) | | | | | |

| Yorktown Energy Partners III, L.P | | 3,109,032 | | 7.5 | % |

| Yorktown Partners LLC | | 95,650 | | (5 | ) |

| | |

| | | |

| (Group Total) | | 3,204,682 | | 7.6 | % |

Vestar Capital Partners III, L.P.(14) | | 2,678,128 | | 6.4 | % |

| c/o Vestar Capital Partners | | | | | |

| 1225 Seventeenth Street, Suite 1660 | | | | | |

| Denver, CO 80202 | | | | | |

J.P. Morgan Chase & Co. (15) | | | | | |

| Fleming US Discovery Fund III, L.P | | 2,679,424 | | 6.5 | % |

| Fleming US Discovery Offshore Fund III, L.P | | 429,456 | | 1.1 | % |

| | |

| | | |

| (Group Total) | | 3,108,880 | | 7.6 | % |

| J.P. Morgan Chase & Co. | | | | | |

| 1211 Avenue of the Americas, 38th Floor | | | | | |

| New York, New York 10036 | | | | | |

Peter B. Griffin(16) | | 4,351,080 | | 10.9 | % |

| Louis Dreyfus Corporation | | | | | |

7

Beneficial Owner

| | Number of Shares (1)(2)

| | Percent of Class

| |

Ben A. Guill(17) | | 10,112,244 | | 22.6 | % |

| First Reserve Corporation | | | | | |

| 600 Travis, Suite 6000 | | | | | |

| Houston, TX 77002 | | | | | |

John A. Hill(17) | | 10,112,244 | | 22.6 | % |

| First Reserve Corporation | | | | | |

| 411 West Putnam Avenue, #109 | | | | | |

| Greenwich, CT 06830 | | | | | |

Bryan H. Lawrence(13) | | 77,246 | | (5 | ) |

| Yorktown Partners LLC | | | | | |

| 410 Park Avenue | | | | | |

| New York, NY 10022 | | | | | |

Edwin H. Morgens(18) | | 253,030 | | (5 | ) |

| Morgens, Waterfall, Vintiadis & Company, Inc. | | | | | |

| 600 Fifth Avenue, 27th Floor | | | | | |

| New York, NY 10022 | | | | | |

All Directors and Executive Officers as a Group (11 Persons)(19) | | 18,090,482 | | 40.1 | % |

| (1) | | All shares are owned both of record and beneficially unless otherwise specified by footnote to this table. Based solely upon information furnished by such individuals or contained in filings made by such beneficial owners with the SEC. |

| (2) | | Calculated pursuant to Rule 13d-3(d) of the Securities Exchange Act of 1934, as amended. Under Rule 13d-3(d), shares not outstanding that are subject to options, warrants, rights, or conversion privileges exercisable within sixty days of the date of this table (August 31, 2002) are deemed outstanding for the purpose of calculating the number and percentage owned by such person. |

| (3) | | Includes 2,000 shares, as to which Mr. Dietler disclaims beneficial ownership, held by Mr. Dietler’s spouse, 100,000 shares issuable upon the exercise of outstanding options, 149,696 shares issuable upon the conversion of Series B Preferred and 23,500 shares of restricted stock subject to vesting. |

| (4) | | Includes 29,000 shares issuable upon the exercise of outstanding options and 121,000 shares of restricted stock subject to vesting. |

| (5) | | Less than one percent. |

| (6) | | Includes 68,000 shares issuable upon the exercise of outstanding options and 39,500 shares of restricted stock subject to vesting. |

| (7) | | Includes 60,000 shares as to which Mr. Dickey disclaims beneficial ownership, owned by DQ Investment Group, a family general partnership, of which Mr. Dickey is a general partner. Includes 20,000 shares issuable upon exercise of outstanding options and 69,000 shares of restricted stock subject to vesting. |

| (8) | | Includes 75,000 shares of restricted stock subject to vesting. |

| (9) | | Includes 550 shares held in an IRA for Mr. Carlson’s spouse, and 840 shares and 725 shares held in trust for Mr. Carlson’s son and daughter, respectively, all of which Mr. Carlson disclaims beneficial ownership, 3,000 shares issuable upon the exercise of outstanding options and 45,790 shares of restricted stock subject to vesting. |

| (10) | | The number of shares shown as beneficially owned by First Reserve Corporation (“First Reserve”) consist of all the shares owned by First Reserve Fund VII, Limited Partnership and First Reserve Fund VIII, LP (collectively the “First Reserve Funds”). Includes 4,862,878 shares of Common Stock issuable upon conversion of Series B Preferred. Each of the First Reserve Funds is deemed to beneficially own the 8,190 shares held by Mr. Hill, but the shares held by Mr. Hill are included in the group total once. First Reserve may be deemed to have beneficial ownership of the shares of Common Stock held by the First Reserve Funds because it is the general partner of each of the First Reserve Funds and has voting and dispositive power over those shares. The First Reserve Funds may be deemed to have beneficial ownership of the shares held by Mr. Hill because of his ownership of common stock of First Reserve and his positions as Vice Chairman and Managing Director of First Reserve. First Reserve disclaims beneficial ownership of the shares held by Mr. Hill. The address of First Reserve and the First Reserve Funds is 411 West Putnam Avenue, Suite 109, Greenwich, CT 06830. |

| (11) | | TransMontaigne has granted to Merrill Lynch Investment Managers, L.P. the right to maintain its 15% ownership of Common Stock if TransMontaigne issues stock in the future. Merrill Lynch & Co., Inc., is a parent holding company. Merrill Lynch Investment Managers, an operating division of Merrill Lynch & Co., Inc., a widely-held public company, has sole voting and dispositive control over these shares. The address for Merrill Lynch & Co., Inc. (on behalf of Merrill Lynch Investment Managers, L.P.) is World Financial Center, North Tower, 250 Vesey Street, New York, New York 10381. The address for ML Fundamental Growth Fund Inc. is 800 Scudders Mill Road, Plainsboro, NJ 08536. |

| (12) | | Includes 904,490 and 935,151 shares of Common Stock issuable upon conversion of Series A Preferred and Series B Preferred, respectively, and 500,025 shares issuable upon exercise of warrants. |

| (13) | | Yorktown Partners LLC, as investment manager to Yorktown Energy Partners III, L.P. and as agent through an irrevocable power of attorney, is deemed to beneficially own an aggregate of 3,204,682 shares of Common Stock comprised of 1,542,423 shares issuable upon conversion of Series B Preferred. Yorktown Partners LLC is an affiliate of Bryan H. Lawrence. Mr. Lawrence owns 77,246 shares individually and disclaims beneficial ownership of the shares owned by Yorktown Partners LLC. The address for Yorktown Partners LLC and Yorktown Energy Partners III, L.P. is 410 Park Avenue, New York, NY 10022. |

| (14) | | Includes 723,592 and 748,181 shares of Common Stock issuable upon conversion of Series A Preferred and Series B Preferred, respectively, and 400,020 shares issuable on exercise of warrants. |

| (15) | | The shares of Common Stock held by J.P. Morgan Chase & Co. are held by the Fleming US Discovery Fund III, L.P. and Fleming US Discovery Offshore Fund III, L.P. (collectively the “Fleming Funds”) and are comprised of 1,496,211 shares of Common Stock issuable upon conversion of the Series B Preferred. J.P. Morgan Chase & Co., investment advisor to the Fleming Funds, may be deemed to have beneficial ownership of the shares of Common Stock held by the Fleming Funds. |

| (16) | | Peter B. Griffin does not directly own any Common Stock. Mr. Griffin may be deemed to have beneficial ownership of the shares of Common Stock held by Louis Dreyfus Corporation because Mr. Griffin is President of Louis Dreyfus Corporation, which owns |

8

| | 4,351,080 shares of Common Stock. Mr. Griffin expressly disclaims beneficial ownership of the shares owned by Louis Dreyfus Corporation. |

| (17) | | The number of shares shown as beneficially owned by Mr. Guill includes 10,112,244 shares owned by the First Reserve Funds. Mr. Guill may be deemed to have beneficial ownership of the shares held by the First Reserve Funds because of his ownership of common stock of First Reserve and his position as President of First Reserve. Mr. Guill expressly disclaims beneficial ownership of the shares owned by the First Reserve Funds. The number of shares shown as beneficially owned by Mr. Hill includes 8,190 shares directly owned and 10,112,244 shares owned by the First Reserve Funds. Since the shares owned by Mr. Hill are included in the shares held by the First Reserve Funds, they are included in the total beneficially owned by Mr. Hill once. Mr. Hill may be deemed to have beneficial ownership over the shares held by the First Reserve Funds because of his ownership of common stock of First Reserve and his positions as Vice Chairman and Managing Director of First Reserve. Mr. Hill expressly disclaims beneficial ownership of these shares. |

| (18) | | Includes 199,806 shares, as to which Mr. Morgens disclaims beneficial ownership, held by the Edwin Morgens and Linda Morgens 1993 Trust and 7,080 shares, as to which Mr. Morgens disclaims beneficial ownership, held by the Lauren W. Morgens 1999 Trust. |

| (19) | | Of such 18,090,482 shares, (a) 220,000 represent shares issuable upon the exercise of outstanding options, (b) 373,790 shares of restricted stock are subject to vesting, (c) 5,012,145 shares of Common Stock are issuable upon conversion of Series B Preferred, (d) 10,112,244 shares indicated as being owned by the First Reserve Funds, which includes the 8,190 shares directly owned by Mr. Hill and deemed beneficially owned by Mr. Guill and Mr. Hill, are included only once in the aggregate number of shares held by all Directors and executive officers as a group, (e) 4,351,080 shares indicated as being owned by Louis Dreyfus Corporation, and deemed beneficially owned by Mr. Griffin, are included only once in the aggregate number of shares held by all Directors and executive officers as a group, and (f) Directors and executive officers disclaim beneficial ownership with respect to 14,726,135 shares. |

9

EXECUTIVE COMPENSATION

Summary Compensation Table

The following table sets forth certain information regarding compensation earned during each of the Company’s last three fiscal years by all individuals serving as the Company’s Chief Executive Officer and each of the Company’s four other most highly compensated executive officers based on salary and bonus earned in the fiscal year ended June 30, 2002 (collectively, the “Named Executive Officers”).

| | | Annual Compensation

| | Long Term Compensation Awards

| | | |

Name and Principal Position

| | Year

| | Salary(1)

| | Bonus

| | Other Annual Compensation

| | Securities Underlying Options(#)

| | | Restricted Stock Awards($)

| | | All Other Compensation(2)

|

Donald H. Anderson(3) | | 2002 | | $ | 312,961 | | $ | 100,000 | | $ | — | | — | | | $ | 49,500 | (4) | | $ | 5,325 |

| Vice Chairman of the Board, | | 2001 | | | 301,538 | | | — | | | — | | 50,000 | | | | 142,500 | (5) | | | 4,500 |

| Chief Executive Officer and President | | 2000 | | | 254,615 | | | — | | | — | | 330,000 | (5) | | | 1,202,500 | (6) | | | 1,177 |

| Harold R. Logan, Jr. | | 2002 | | | 210,962 | | | 50,000 | | | — | | — | | | | 37,125 | (7) | | | 5,325 |

| Executive Vice President, | | 2001 | | | 200,000 | | | — | | | — | | 30,000 | | | | 95,000 | (8) | | | 5,250 |

| Chief Financial Officer and Treasurer | | 2000 | | | 200,000 | | | — | | | — | | — | | | | 102,500 | (9) | | | 4,800 |

William S. Dickey(10) | | 2002 | | | 235,962 | | | 100,000 | | | — | | — | | | | 123,750 | (10) | | | 5,325 |

| Executive Vice President | | 2001 | | | 225,000 | | | — | | | — | | 50,000 | | | | 47,500 | (10) | | | 3,375 |

| | | 2000 | | | 18,173 | | | — | | | — | | 50,000 | | | | 362,500 | (10) | | | — |

| Erik B. Carlson | | 2002 | | | 210,962 | | | 65,000 | | | — | | — | | | | 49,500 | (4) | | | 5,325 |

| Senior Vice President, | | 2001 | | | 200,000 | | | — | | | — | | 30,000 | | | | 133,475 | (11) | | | 4,519 |

| General Counsel and Secretary | | 2000 | | | 200,000 | | | — | | | — | | — | | | | 76,875 | (12) | | | 4,800 |

Randall J. Larson(13) | | 2002 | | | 36,538 | | | — | | | 10,000 | | 75,000 | | | | 378,750 | (13) | | | — |

| Executive Vice President, | | 2001 | | | — | | | — | | | — | | — | | | | — | | | | — |

| Chief Accounting Officer | | 2000 | | | — | | | — | | | — | | — | | | | — | | | | — |

Larry F. Clynch(14) | | 2002 | | | 161,731 | | | 30,000 | | | 415,648 | | — | | | | 24,750 | (15) | | | 2,683 |

| Former Senior Vice President | | 2001 | | | 238,846 | | | — | | | 14,922 | | 25,000 | | | | 95,000 | (15) | | | 5,400 |

| | | 2000 | | | 230,231 | | | — | | | 31,866 | | 30,000 | | | | — | | | | 4,800 |

| (1) | | Amounts shown set forth all cash compensation earned by each of the Named Executive Officers in the years shown, including salaries deferred under the TransMontaigne Inc. Savings and Profit Sharing Plan (the “401(k) Plan”) pursuant to Section 401(k) of the Internal Revenue Code. |

| (2) | | Amounts shown set forth the Company’s matching contributions to the Company’s 401(k) Plan. |

| (3) | | Mr. Anderson became an employee of the Company September 28, 1999, became the Chief Executive Officer on October 1, 1999 and President on January 4, 2000. |

| (4) | | Represents 10,000 shares of restricted stock granted on October 1, 2001 when the market price was $4.95. The restricted stock award vests 10% after the first year, 20% after the second year, 30% after the third year and 40% after the fourth year of continuous employment since the grant date. |

| (5) | | Represents 30,000 shares of restricted stock on granted October 15, 2000 when the market price was $4.75. The grant of 30,000 shares was made in connection with the underwater stock option/restricted stock exchange program (the “Exchange Program”). 250,000 of the 330,000 options granted during fiscal year 2000 were cancelled on October 15, 2000 in exchange for the 30,000 shares of restricted stock. The restricted stock award vests 10% after the first year, 20% after the second year, 30% after the third year and 40% after the fourth year of continuous employment since the grant date. |

| (6) | | Represents two grants of restricted stock at the market price of the stock on the date of each grant: 100,000 shares granted on September 28, 1999 when the market price was $11.00, and 20,000 shares granted on February 16, 2000 when the market price was $5.125. Each restricted stock award vests 10% after the first year, 20% after the second year, 30% after the third year and 40% after the fourth year of continuous employment since each grant date. |

10

| (7) | | Represents 7,500 shares of restricted stock granted on October 1, 2001 when the market price was $4.95. The restricted stock award vests 10% after the first year, 20% after the second year, 30% after the third year and 40% after the fourth year of continuous employment since the grant date. |

| (8) | | Represents 20,000 shares of restricted stock granted on October 15, 2000 when the market price was $4.75. 18,400 of the 20,000 shares were granted in connection with the Exchange Program to cancel 101,200 underwater options. The restricted stock award vests 10% after the first year, 20% after the second year, 30% after the third year and 40% after the fourth year of continuous employment since the grant date. |

| (9) | | Represents 20,000 shares of restricted stock granted on February 16, 2000 when the market price was $5.125 on the date of the grant. The restricted stock award vests 10% after the first year, 20% after the second year, 30% after the third year and 40% after the fourth year of continuous employment since the grant date. |

| (10) | | Mr. Dickey became an employee of the Company on May 26, 2000. The restricted stock award in fiscal year 2002 represents 25,000 shares of restricted stock granted on October 1, 2001 when the market price was $4.95. The restricted stock award in fiscal year 2001 represents 10,000 shares of restricted stock granted on October 15, 2000 when the market price was $4.75. The restricted stock award in fiscal year 2000 represents a grant of 50,000 shares of restricted stock when the market price was $7.25 on the date of the grant. The restricted stock awards vest 10% after the first year, 20% after the second year, 30% after the third year and 40% after the fourth year of continuous employment since each grant date. |

| (11) | | The restricted stock award in fiscal year 2001 represents a grant of 28,100 shares of restricted stock on October 15, 2000 when the market price was $4.75. The 28,100 shares were granted in connection with the Exchange Program to cancel 166,900 underwater options. The restricted stock awards vest 10% after the first year, 20% after the second year, 30% after the third year and 40% after the fourth year of continuous employment since the grant date. |

| (12) | | The restricted stock awards in fiscal year 2000 represent a grant of 15,000 shares of restricted stock on February 16, 2000 when the market price was $5.125 on the date of the grant. The restricted stock grants vest 10% after the first year, 20% after the second year, 30% after the third year and 40% after the fourth year of continuous employment since the grant date. |

| (13) | | Mr. Larson became an employee of the Company May 1, 2002 as Executive Vice President. Other 2002 annual compensation for Mr. Larson consists of a $10,000 relocation bonus. The restricted stock award in fiscal year 2002 represents a grant of 75,000 shares of restricted stock on May 1, 2002 when the market price was $5.05. The restricted stock award vests 10% after the first year, 20% after the second year, 30% after the third year and 40% after the fourth year of continuous employment since the grant date. |

| (14) | | Pursuant to the Separation and Release Agreement, Mr. Clynch’s employment with the Company terminated effective February 18, 2002. The other 2002 annual compensation for Mr. Clynch consists of costs incurred pursuant to his Separation and Release Agreement, $400,000 severance payment and $14,423 accrued vacation. In addition, other 2002, 2001 and 2000 annual compensation for Mr. Clynch consists of reimbursement for certain relocation expenses of $1,225, $14,922 and $31,866, respectively. |

| (15) | | The restricted stock award in fiscal year 2002 represents 5,000 shares of restricted stock granted on October 1, 2001 when the market price was $4.95. The restricted stock award in fiscal year 2001 represents 20,000 shares of restricted stock granted on October 15, 2000 when the market price was $4.75. 10,000 of the 20,000 shares were granted in connection with the Exchange Program to cancel 61,200 underwater options. The restricted stock awards vest 10% after the first year, 20% after the second year, 30% after the third year and 40% after the fourth year of continuous employment since the grant date. All unvested shares of restricted stock were forfeit effective February 18, 2002 when Mr. Clynch’s employment with the Company terminated. |

Option Grants In Last Fiscal Year

The following table contains information about stock options granted to the Named Executive Officers under the 1997 Incentive Plan during the fiscal year ended June 30, 2002.

| | | Individual Grants

| | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term (10 Years)(1)

|

Name

| | Number of Securities Underlying Options Granted

| | | % of Total Options Granted to Employees in Fiscal Year

| | | Exercise or Base Price ($/Share)

| | Expiration Date

| | 5% Aggregate Value(3)

| | 10% Aggregate Value(3)

|

| Donald H. Anderson | | — | | | — | | | | — | | — | | | — | | | — |

| Harold R. Logan, Jr. | | — | | | — | | | | — | | — | | | — | | | — |

| William S. Dickey | | — | | | — | | | | — | | — | | | — | | | — |

| Randall J. Larson | | 75,000 | (2) | | 100 | % | | $ | 5.05 | | 05/01/2012 | | $ | 238,194 | | $ | 603,630 |

| Erik B. Carlson | | — | | | — | | | | — | | — | | | — | | | — |

| Larry F. Clynch | | — | | | — | | | | — | | — | | | — | | | — |

| (1) | | The dollar gains under these columns result from calculations assuming 5% and 10% growth rates as set by the SEC and are not intended to forecast future price appreciation of the Company’s Common Stock. The gains reflect a future value based upon growth at these prescribed rates. The Company did not use an alternative formula for a grant date valuation, an approach which would state gains at present, and therefore lower, value. The Company is not aware of any formula that will determine with reasonable accuracy a present value based on future unknown or volatile factors. It is important to note that options have value to recipients, including the Named Executive Officers and to other option recipients, only if the stock price advances beyond the grant date price shown in the table during the effective option period. |

| (2) | | This award was made pursuant to the 1997 Incentive Plan. Under the 1997 Incentive Plan, the option price must be not less than 100% of the fair market value of Company’s Common Stock on the date the option is granted. The fair market value of a share of Company’s Common Stock is the officially listed closing price of the Company Common Stock on the American Stock Exchange on the date of grant. All unexercisable stock options granted under the 1997 Incentive Plan become exercisable upon a change in control. The stock options granted on May 1, 2002 have an exercise price equal to $5.05 per share and vest 10% on May 1, 2003; 20% on May 1, 2004; |

11

| | 30% on May 1, 2005, and 40% on May 1, 2006. The 1997 Incentive Plan allows shares of the Company’s Common Stock to be used to satisfy any resulting Federal, state and local tax liabilities, but does not provide for a cash payment by the Company for income taxes payable as a result of the exercise of a stock option award. |

| (3) | | Not discounted to present value. |

Aggregated Option Exercises In Last Fiscal Year And Fiscal Year End Option Values

The following table provides information with respect to the options that were exercised during fiscal year ended June 30, 2002 and the value as of June 30, 2002 of unexercised options held by the Named Executive Officers. The value of unexercised options at the fiscal year end is calculated using the difference between the option exercise price and the fair market value of the Company’s Common Stock at June 30, 2002, $6.05.

Name

| | Shares Acquired on Exercise (#)

| | Value Realized ($)

| | Number of Securities Underlying Unexercised Options at Fiscal Year-End (#)

| | Value of Unexercised Options At Fiscal Year-End ($)

|

| | | | | | | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

| Donald H. Anderson | | — | | | — | | 29,000 | | 101,000 | | $ | 33,700 | | $ | 155,300 |

| Harold R. Logan, Jr. | | — | | | — | | 68,000 | | 27,000 | | | 42,650 | | | 62,100 |

| William S. Dickey | | — | | | — | | 20,000 | | 80,000 | | | 11,500 | | | 103,500 |

| Randall J. Larson | | — | | | — | | — | | 75,000 | | | — | | | 75,000 |

| Erik B. Carlson | | — | | | — | | 3,000 | | 27,000 | | | 6,900 | | | 62,100 |

| | | — | | | — | | — | | — | | | — | | | — |

| Larry F. Clynch(1) | | 27,000 | | $ | 36,985 | | — | | — | | | — | | | — |

| (1) | | Mr. Clynch exercised options after his employment with the Company terminated. |

Equity Compensation Plan Information

The following table sets forth certain information regarding the Company’s Common Stock that may be issued upon the exercise of options, warrants and rights under all of the Company’s equity compensation plans as of June 30, 2002.

Plan Category

| | Number of Securities to be issued upon exercise of outstanding options, warrants and rights(1)

| | Weighted-average exercise prince of outstanding options, warrants and rights(1)

| | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a))(1)

|

| | | (a)

| | (b)

| | (c)

|

Equity compensation plans approved by security holders(2) | | 1,062,780 | | $ | 4.52 | | 2,283,945 |

Equity compensation plans not approved by security holders(3) | | 230,450 | | $ | 5.50 | | 3,000 |

| | |

| |

|

| |

|

| Total | | 1,293,230 | | $ | 4.69 | | 2,286,945 |

| | |

| |

|

| |

|

| (1) | | This table only includes the stock options outstanding under all of the Company’s equity compensation plans as of June 30, 2002. There were no warrants and rights outstanding at June 30, 2002 under the Company’s equity compensation plans. |

| (2) | | Includes only the TransMontaigne Inc. Equity Incentive Plan (the “1997 Incentive Plan”), as amended. The stockholders approved the 1997 Incentive Plan in 1997, and approved the amendment to the 1997 Incentive Plan in 1999. The amendment to the 1997 Incentive Plan increased the number of authorized shares from 1,800,000 to 3,500,000 and adding an “evergreen” provision to automatically increase the number of shares available for issuance under the 1997 Incentive Plan beginning on June 30, 2000, and on each June 30 thereafter during the term of the 1997 Incentive Plan, a number of shares of the Company’s Common Stock equal to one percent (1%) of the total number of issued and outstanding shares of the Company’s Common Stock on the last day of the immediately preceding fiscal year. The 1997 Incentive Plan terminates on August 27, 2007. |

| (3) | | Includes the Amended and Restated Employee Nonqualified Stock Option Plan (the “1991 Option Plan”) and the TransMontaigne Oil Company Employees’ Stock Option Plan (the “1995 Option Plan”). The 1991 Option Plan has no options outstanding and 3,000 shares remained available for future issuance at June 30, 2002. The 1991 Option Plan was terminated September 30, 2002. The 1995 Option Plan terminated on December 31, 2001. The 1995 Option Plan has 230,450 options outstanding that expire in March 2003. |

12

Employment Contracts And Termination Of Employment And Change In Control Agreements

With the authorization and approval of the Board of Directors, the Company has entered into Change in Control Agreements with certain executive officers and key employees of the Company and its subsidiaries, including the named executive officers listed in the Summary Compensation Table (the “Named Executive Officer”). The agreements are for an initial term of three years, from April 12, 2001 to April 11, 2004 with respect to all Named Executive Officers with the exception of Mr. Larson, whose Change in Control Agreement has an initial term of three years, from May 1, 2002 to April 30, 2005, after which they automatically renew on the anniversary date for consecutive one year periods, unless terminated by either party upon ninety days prior notice, provided, that notwithstanding any such notice, the agreement will continue in effect for twenty-four months in the event an actual or threatened change in control (as defined in the agreement) occurs during the initial term or any extension thereof. The agreements provide that if the Named Executive Officer is terminated other than for cause during the term of the agreement, or within two years after a change in control of the Company, or if the Named Executive Officer terminates his employment for good reason within such time period, the Named Executive Officer is entitled to receive a lump-sum severance payment equal to a multiple varying from one times, in the case of Mr. Clynch, to two times, in the case of all other Named Executive Officers, the sum of such Named Executive Officer’s annual salary and target bonus, as then in effect, together with certain other payments and benefits, including continuation of employee welfare benefits. In addition, should the Named Executive Officer be subject to the excise tax on excess parachute payments as a result of such payment and payments under other plans due to a change in control, an additional payment will be made to restore the after-tax severance payment due the Named Executive Officer to the same amount which the Named Executive Officer would have retained had the excise tax not been imposed.

Report of the Compensation Committee

The Compensation Committee is responsible for the Company’s executive compensation program, the purpose of which is to enable the Company to attract, retain and motivate the executive personnel deemed necessary to maximize return to stockholders. The fundamental concept of the program is to align the amount of an executive’s total compensation with his contribution to the success of the Company in creating stockholder value. The Compensation Committee’s duties include the annual review and approval of the compensation of the Chief Executive Officer, review and determination of individual elements of compensation for the Company’s other executive officers, administration of long-term incentive plans for management, including the selection of the individuals to be granted awards from among those eligible to participate. At present, the executive compensation program is comprised of salary, long-term incentive opportunities in the form of stock options and restricted stock awards, cash bonuses based upon the financial performance of the Company and employee welfare benefits typically offered.

Base Salaries. The factors considered in determining base compensation levels for the Chief Executive Officer and the Company’s other executive officers included the goals outlined above and were evaluated by the Compensation Committee to be consistent with competitive practices (including companies with comparable market valuations, lines of business and/or revenues) and level of responsibility. Based upon the Company’s overall substantially improved financial performance during the previous fiscal year, as well as the market performance of the Company’s Common Stock, the Compensation Committee, in discussions with Mr. Anderson, President and Chief Executive Officer of the Company, determined that Mr. Anderson’s annual base salary should be increased from $300,000 to $315,000.

Cash Bonuses. Given the continued improvement in financial performance of the Company during the previous fiscal year, cash bonuses were awarded to the Company’s executive officers, including Mr. Anderson.

Long-Term Incentives. The Compensation Committee believes that long-term compensation should comprise a substantial portion of each executive officer’s total compensation. Long-term compensation provides incentives that encourage the executive officers to own and hold the Company’s stock and tie their long-term economic interests directly to those of the Company’s stockholders and rewards executives for improved

13

performance by the Company. To date, the only long-term compensation available for use by the Compensation Committee has been the grant of awards of stock options and shares of restricted stock.

The Compensation Committee also approved certain grants of restricted stock to certain executive officers and key employees of the Company and its subsidiaries in order to align the equity incentive awards of such executive officers and key employees with other members of their peer group within the Company and its subsidiaries. The grant of restricted stock to certain executive officers and key employees of the Company and its subsidiaries was effective as of October 1, 2001, with a vesting schedule over a period of four years from the grant date.

During the fiscal year ended June 30, 2002, the Compensation Committee awarded 420,500 shares of restricted stock. Of that amount, 180,000 shares were issued to executive officers and key employees of the Company.

Other. In addition, the executive officers participate in the Company’s 401(k) Plan, which consists of elective employee salary reduction contributions and a Company match equal to 50% of employee contributions on the first 6% of employee compensation contributed.

The Compensation Committee has reviewed the limitation on the deductibility of compensation for federal income tax purposes pursuant to Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”). Section 162(m) of the Code generally disallows a tax deduction to public corporations for compensation over $1,000,000 paid for any fiscal year to the corporation’s chief executive officer and the four other most highly compensated executive officers as of the end of any fiscal year. However, the statute exempts qualifying performance-based compensation from the deduction limit if specified requirements are met. The Compensation Committee currently intends to structure performance-based compensation, including restricted stock and stock option grants, if any, and annual bonuses, to executive officers who may be subject to Section 162(m) of the Code in a manner that satisfies those requirements. For the year ended June 30, 2002, none of our executive officers’ compensation subject to the deductibility limits exceeded $1,000,000.

The Compensation Committee does not anticipate awarding levels of compensation that result in such a disallowance under Section 162(m) of the Code. The Compensation Committee may authorize compensation in the future that results in amounts above the limit if it determines that such compensation is in the best interests of the Company. In addition, the limitation may affect the future grant of restricted stock, stock options or other stock awards. Further, because of ambiguities and uncertainties as to the application and interpretation of Section 162(m) of the Code and the regulations issued thereunder, no assurance can be given, notwithstanding our efforts, that compensation intended by the Company to satisfy the requirements for deductibility under Section 162(m) of the Code does in fact do so.

Compensation Committee

Bryan H. Lawrence, Chairman

Edwin H. Morgens

Compensation Committee Interlocks and Insider Participation

At June 30, 2002, the Compensation Committee of the Board of Directors consisted of Bryan H. Lawrence and Edwin H. Morgens. Mr. Lawrence is a member of Yorktown Partners LLC, which participated in the recapitalization of the Company’s Series A Preferred in June 2002. During the fiscal year ended June 30, 2002, there were no other Compensation Committee interlocks between the Company and any other entity.

On June 28, 2002, the Company entered into an agreement with the holders of the Company’s Series A Preferred (the “Preferred Stock Recapitalization Agreement”) to redeem a portion of the outstanding Series A

14

Preferred and warrants in exchange for cash, shares of common stock and shares of a newly created and designated preferred stock, the Series B Preferred.

The Preferred Stock Recapitalization Agreement resulted in the redemption of 157,715 shares of Series A Preferred and warrants to purchase 9,841,493 shares of common stock in exchange for the (i) issue of 72,890 shares of Series B Preferred with a fair value of approximately $80.9 million, (ii) the issuance of 11,902,705 shares of common stock with a fair value of approximately $59.5 million, and (iii) a cash payment of approximately $21.3 million. In connection with the Preferred Stock Recapitalization Agreement, the Company also purchased approximately 4.1 million shares of its common stock from a fund managed by First Reserve Corporation for cash consideration of approximately $20.4 million.

Cortlandt S. Dietler, Chairman of the Board of the Company; First Reserve Corporation, of which John A. Hill, a Director of the Company, is Vice Chairman of the Board and Managing Director and Ben A. Guill, also a Director of the Company, is President; and Yorktown Partners LLC, of which Bryan Lawrence, a Director of the Company, is a member, participated in the recapitalization above described upon the same terms as all other holders of Series A Preferred. As a result of the recapitalization, Mr. Dietler exchanged all of his holdings of Series A Preferred (2,141.3335 shares, $1,000 liquidation value per share) and 133,340 warrants for 161,267 shares of common stock, a cash payment of $289,000 and 988 shares of Series B Preferred, $1,000 liquidation value per share. The First Reserve Funds exchanged all of their holdings of Series A Preferred (69,593.3417 shares, $1,000 liquidation value per share) and 4,333,550 warrants for 5,241,176 shares of common stock, a cash payment of $9,381,000 and 32,095 shares of Series B Preferred, $1,000 liquidation value per share. Yorktown Partners LLC exchanged all of its holdings of Series A Preferred (22,071.7957 shares, $1,000 liquidation value per share) and 1,374,402 warrants for 1,662,259 shares of common stock, a cash payment of $2,975,000 and 10,180 shares of Series B Preferred, $1,000 liquidation value per share. The exchange values included accrued and unpaid dividends at June 30, 2002.

15

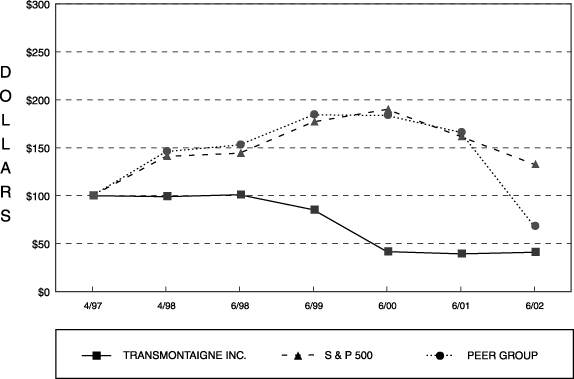

Performance Graph

The graph set forth below provides an indicator of cumulative total stockholder returns on an investment of $100 in shares of Common Stock as compared to an investment of $100 in the S&P 500 Stock Index and a “peer group” index over the period beginning April 30, 1997 and ending June 30, 2002.

| | | 4/30/97 | | 4/30/98 | | 6/30/98 | | 6/30/99 | | 6/30/00 | | 6/30/01 | | 6/30/02 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| TransMontaigne | | $ | 100.00 | | $ | 99.15 | | $ | 100.85 | | $ | 85.17 | | $ | 41.53 | | $ | 39.32 | | $ | 41.02 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| S & P 500 | | $ | 100.00 | | $ | 141.07 | | $ | 144.27 | | $ | 177.10 | | $ | 189.94 | | $ | 161.77 | | $ | 132.67 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Peer Group(1) | | $ | 100.00 | | $ | 146.14 | | $ | 152.92 | | $ | 184.47 | | $ | 183.79 | | $ | 165.90 | | $ | 68.10 |

| (1) | | The peer group consists of the following issuers, each of which has been weighted according the respective issuer’s stock market capitalization at the beginning of each period for which a return is indicated according to SEC requirements: Buckeye Partners, L.P., TEPPCO Partners, L.P., Kaneb Pipe Line Partners, L.P., The Williams Companies, Inc., Western Gas Resources, Inc. and GATX Corporation. |

Certain Relationships and Related Transactions

Harold R. Logan, Jr., the Executive Vice President, Chief Financial Officer, Treasurer and a Director of the Company, is also a Director of Lion Oil Company, in which the Company owns an 18.04% ownership interest. The Company purchased $2,983,091 of refined petroleum products from and sold $122,205 of refined petroleum products to Lion Oil Company in the year ended June 30, 2002, all of which product purchases were made at market prices negotiated between the Company and Lion Oil Company or through independent brokers. The Company believes the prices paid by and to Lion Oil Company were comparable to prices that would have been paid by and to independent third parties. The Company received no throughput revenue or additive revenue from Lion Oil Company in the year ended June 30, 2002. Previous years’ throughput and additive revenues were earned by the Company’s petroleum distribution facilities in Little Rock, Arkansas. These facilities were sold effective June 30, 2001.

16

During the 2002 fiscal year, the Company paid $82,427 to Arapahoe Development, Inc. (“Arapahoe”), owned by Cortlandt S. Dietler, Chairman of the Board of Directors and Chairman of the Company, for flights aboard an aircraft owned by Arapahoe. The Company believes that the prices paid for those flights were competitive with rates charged by other aircraft leasing companies for similar services.

Pursuant to a private placement agreement (i) partnerships managed by First Reserve Corporation, Yorktown Energy Partners, L.P. and other venture capital funds managed by, and shares owned by, officers of Dillon, Read & Co. Inc., and Waterwagon & Co., nominee for Merrill Lynch Growth Fund for Investment and Retirement, have the right to require the Company to register their shares under the Securities Act of 1933; and (ii) the Company agreed to take all action necessary to cause two Directors designated by affiliates of First Reserve Corporation from time to time to be elected to the Company’s Board of Directors so long as their collective ownership in the Company is at least 10%. The affiliates of First Reserve Corporation have designated Ben A. Guill and John A. Hill as their nominees for Directors.

Pursuant to a stock purchase agreement between the Company and Louis Dreyfus Corporation (“Dreyfus”), the Company agreed to take all action necessary to cause one Director designated by Dreyfus from time to time to be elected to the Company’s Board of Directors as long as its ownership in the Company is at least 10%. Dreyfus has designated Peter B. Griffin as its nominee for Director. Pursuant to a registration rights agreement entered into between the Company and Dreyfus contemporaneously with the stock purchase agreement, Dreyfus and each entity at least eighty percent owned, directly or indirectly by S.A. Louis Dreyfus et Cie., has the right to require the Company to register their shares under the Securities Act of 1933.

See “Compensation Committee Interlocks and Insider Participation” for a description of additional related party transactions.

Report of the Audit Committee

The Audit Committee operates under a written charter adopted by the Board of Directors. The responsibilities of the Audit Committee, as reflected in its charter, are intended to be in accordance with applicable requirements for corporate audit committees. The Audit Committee reviews and assesses the adequacy of its charter on an annual basis.

As described more fully in its charter, the purpose of the Audit Committee is to assist the Board of Directors in its general oversight of the Company’s financial reporting, internal control and compliance processes. Management is responsible for the preparation, presentation and integrity of the Company’s financial statements, accounting and financial reporting principles, internal controls and procedures designed to ensure compliance with accounting standards, applicable laws and regulations. KPMG LLP, the Company’s independent auditing firm, is responsible for performing an independent audit of the consolidated financial statements in accordance with generally accepted auditing standards.

At three meetings during the fiscal year ended June 30, 2002, the Audit Committee met with the independent auditors, as well as with Company officers and employees who are responsible for financial reporting, accounting, internal controls, and legal matters. In addition to its other responsibilities, the Audit Committee recommends the appointment of the independent auditors to the Board of Directors, and reviews the scope of and fees related to the audit. The Audit Committee monitors the activities and performance of the Company’s external auditors, auditor independence matters and the extent to which the independent auditor may be retained to perform non-audit services. The Audit Committee and the Board have ultimate authority and responsibility to select, evaluate and, when appropriate, replace the Company’s independent auditor. The Audit Committee has considered whether the provision of services other than audit services is compatible with maintaining the Company’s auditors’ independence and determined that it is compatible.

17

The Audit Committee also reviews the results of the external audit work with regard to the adequacy and appropriateness of the Company’s financial, accounting and internal controls. Management and independent auditor presentations to and discussions with the Audit Committee also cover various topics and events that may have significant financial impact or are the subject of discussions between management and the independent auditor.

Management has represented to the Audit Committee that the Company’s consolidated financial statements were prepared in accordance with generally accepted accounting principles, and the Audit Committee has reviewed and discussed the audited consolidated financial statements with management and the independent auditors. The Audit Committee discussed with the independent auditors matters required to be discussed by Statement on Auditing Standards No. 61 (Communication with Audit Committees). The Company’s independent auditors have provided to the Audit Committee written disclosures required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees), and the Audit Committee has discussed with the independent auditors that firm’s independence.

Based upon the Audit Committee’s discussion with management and the independent auditors and the Audit Committee’s review of the representation of management and the report of the independent auditors to the Audit Committee, the Audit Committee recommended that the Board of Directors include the audited consolidated financial statements in the Company’s Annual Report on Form 10-K for the year ended June 30, 2002 filed with the Securities and Exchange Commission.

In accordance with the rules of the Securities and Exchange Commission, the foregoing information, which is required by paragraphs (a) and (b) of Regulation S-K Item 306, shall not be deemed to be “soliciting material,” or to be “filed” with the Commission or subject to the Commission’s Regulation 14A, other than as provided in that Item, or to the liabilities of section 18 of the Securities Exchange Act of 1934, as amended, except to the extent that the Company specifically requests that the information be treated as soliciting material or specifically incorporates it by reference into a document filed under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended.

Audit Committee:

Bryan H. Lawrence (Chairman)

Peter B. Griffin

John A. Hill

Audit Fees:

During fiscal year 2002, the Company retained its principal auditor, KPMG LLP, to provide services in the following categories and amounts:

| Principal Auditor Fees: | | $ | 0.5 million |

All Other Fees:(1) | | $ | 0.1 million |

| (1) | | Other fees primarily related to work performed in connection with review of other SEC filings and various statutory or non-statutory audits. |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires the Company’s executive officers and Directors, and persons who own more than ten percent of a registered class of the Company’s equity securities (collectively, “Reporting Persons”) to file with the SEC and the American Stock Exchange initial reports of ownership and reports of changes in ownership of the Common Stock and other equity securities of the Company. Reporting Persons are also required by SEC regulations to furnish the Company with copies of all Section 16(a) reports they file.

18

To the Company’s knowledge, based solely on a review of the copies of such reports furnished to the Company and written representations that no other reports were required during the fiscal year ended June 30, 2002, all Section 16(a) filing requirements applicable to such Reporting Persons were complied with.

APPROVAL OF TRANSMONTAIGNE INC.

EQUITY INCENTIVE PLAN, AS AMENDED

The TransMontaigne Inc. Equity Incentive Plan, as amended (the “1997 Incentive Plan”), was originally approved by TransMontaigne’s stockholders in 1997 and certain amendments to the plan were approved by the stockholders in 1999. On September 27, 2002, the Board approved a further amendment to the 1997 Incentive Plan (the “Amendment”) to provide, commencing December 1, 2002, that the class of eligible participants under the 1997 Incentive Plan would be expanded to include non-employee Directors (“Eligible Outside Directors”). This Amendment was approved by the Board subject to the approval of the 1997 Incentive Plan, as amended by the Amendment, by TransMontaigne’s stockholders at this meeting. The Board believes that the 1997 Incentive Plan has promoted TransMontaigne’s interests and those of stockholders by providing opportunities to attract, retain and motivate eligible employees and consultants through the grant of equity-based awards. The Board believes that the addition of Eligible Outside Directors as eligible participants under the 1997 Incentive Plan will serve to assist the Company in attracting and retaining qualified non-employee Directors.

The 1997 Incentive Plan is administered by the Compensation Committee of the Board (the “Compensation Committee”) which is comprised of Directors who are not employees of the Company. Subject to the terms of the 1997 Incentive Plan, the Compensation Committee determines the persons to whom awards are granted, the type of awards granted, the number of shares granted, the vesting schedule, the type of consideration to be paid to the Company upon exercise of options and the terms of any options. The types of awards that may be granted under the 1997 Incentive Plan are options, restricted stock, stock appreciation rights, stock units, stock bonuses and other stock awards.

As of September 30, 2002, there were 2,315,850 shares available for grant under the 1997 Incentive Plan. Shares of Common Stock issued under the 1997 Incentive Plan may be authorized but unissued shares, or shares of Common Stock previously issued that are acquired by the Company.

A description of the 1997 Incentive Plan, as amended by the Amendment, is set forth below. The text of the Amendment to the 1997 Incentive Plan is set forth in Exhibit A. If the 1997 Incentive Plan, as amended by the Amendment, is not approved by the stockholders, non-employee Directors will not be eligible to receive grants of equity-based awards under the 1997 Incentive Plan.

Shares Available Under The 1997 Incentive Plan

Subject to adjustment as provided in the 1997 Incentive Plan in the case of stock splits, stock dividends and similar corporate events, 3,364,340 shares are reserved for issuance under the 1997 Incentive Plan at September 30, 2002. The number of reserved shares is increased annually by operation of the 1997 Incentive Plan’s “evergreen” provision. This provision provides that the number of shares reserved for issuance under the 1997 Incentive Plan is increased on each June 30 beginning June 30, 2000 by an amount equal to one percent (1%) of the total number of issued and outstanding shares of Company Common Stock on the last day of the immediately preceding fiscal year. The number of shares issued as incentive stock options may not in the aggregate exceed 5,940,000 shares. No single individual may be granted awards in the aggregate for more than 1,800,000 shares in any calendar year.