| | Mercer International Inc. |

Safe Harbor Statement

The Private Securities Litigation Reform Act of 1995 provides a "safe harbor" for forward-looking statements. Certain information included in this presentation contains statements that are forward-looking, such as statements relating to results of operations and financial condition and business development activities, as well as capital spending and financing sources. Such forward-looking information involves important risks and uncertainties that could significantly affect anticipated results in the future and, accordingly, such results may differ materially from those expressed in any forward-looking statements made by or on behalf of Mercer. For more information regarding these risks and uncertainties, review Mercer's filings with the Securities and Exchange Commission.

July 8, 2003

2

The Issues

- •

- What is the Motive Behind the Dissident Proxy?

- •

- Independent Directors Should Not Receive Third Party Remuneration

- •

- Mercer is at a Critical Stage of Corporate Development

- •

- Mercer has High Quality Assets

- •

- Extensive Misleading Statements by Greenlight

- •

- Corporate Governance Initiatives

- •

- Mercer Nominees

3

What Is The Motive?

- •

- Greenlight Have Refused Two New Independent Directors Unless They Have SOLE Veto Powers

- •

- Greenlight's Nominees Have No:

- •

- Corporate experience

- •

- Pulp & paper experience

- •

- International or European experience

- •

- Board-level experience at a company as complex as Mercer

- •

- Greenlight's Nominees are Well Compensated in Cash and Stock Options by Greenlight

4

What Is The Motive? (Continued)

- •

- One of the Greenlight Nominees Violated U.S. Federal Securities Laws Relating to Proxy Solicitation

- •

- Greenlight Has Not Presented an Alternative Refinancing Plan

- •

- Is there a plan to impose onerous financing by Greenlight?

5

Third Party Remuneration of Independent Directors

- •

- Raises the Question of Ultimate Loyalty

- •

- Mercer or Greenlight

- •

- Amount of Remuneration is Substantial

- •

- Guy Adams — $75,000 cash, 325,000 options

- •

- Saul Diamond — $100,000 cash, 50,000 options

- •

- Both Receive 100% Indemnification from Greenlight

6

Mercer: A Critical Time in Development

- •

- Refinancing of Bridge Loans

- •

- €53 million maturing in October 2003

- •

- Refinancing put on hold due to Greenlight actions

- •

- Stendal Pulp Mill Project is in Mid-Construction

- •

- Any default on Bridge loans will trigger cross-defaults on Stendal and other debt

7

Quality of Mercer Assets

- •

- The High Quality of Mercer's Assets are Obvious and Acknowledged by Greenlight

- •

- Quality will be further enhanced at completion of Stendal Project

- •

- To be Discussed in "Mercer's Current Status and Corporate Achievements"

8

Extensive Misleading Statements By Greenlight

- •

- Greenlight: Mercer reshuffled Board terms.

- •

- Fact: Only Class III Trustees being elected.

- •

- Greenlight: Babington Ltd. solely controlled by Mr. Lee.

- •

- Fact: Babington Ltd. is a wholly owned subsidiary of Mercer.

- •

- Greenlight: Mr. Lee is conflicted through his MFC Merchant Bank Directorship.

- •

- Fact: Mr. Lee is a non-executive director with no participation in operations.

- •

- Greenlight: Management is responsible for poor financial results and stock performance.

- •

- Fact: The Company has had solid financial results and stock performance relative to its peers.

9

Corporate Governance Initiatives

- •

- Appointment of Deloitte & Touche, LLP

- •

- Voluntary Adoption of Code of Business Conduct & Ethics Prior to SEC mandate

- •

- Adoption of New Audit Committee Charter

- •

- Listing on Toronto Stock Exchange

- •

- Engagement of Leading North American Investment Bank for Refinancing

- •

- Expansion of Board of Trustees by Two Independent Qualified Trustees

10

Mercer's Slate: Provides Added Value

- •

- Per Gundersby

- •

- 30+ Years' Experience in European Pulp and Paper

- •

- Extensive Career at Jaako Poyry

- •

- Stendal project director

- •

- Michel Arnulphy

- •

- Trustee since 1995

- •

- Extensive knowledge of Mercer International

- •

- Proven experience with Rosenthal conversion

— Our nominees contribute relevant experience

that will benefit all shareholders. —

11

Where We Are

Mercer's Current Status and Corporate Achievements

12

Commitment To Building Shareholder Value

- •

- Key features of our corporate strategy include:

| |

| | Overview

| |

| | Example

|

|---|

Creating Value |

|

X |

|

Focus operations in grades of products

where we can effectively compete |

|

- -->

- --> |

|

NBSK Pulp

Specialty Papers |

Stakeholder Approach |

|

X |

|

Leverage synergistic relationships with:

management & employees; customers &

suppliers; communities & the

environment; and government bodies |

|

- -->

- --> |

|

Government

guarantees and

grants

Environmental

compliance |

Pursuing Growth |

|

X |

|

Acquire under-performing assets and

implement turn-arounds / restructurings

to create shareholder value |

|

- -->

- --> |

|

Dresden Papier

23% CAGR in

production capacity

post Stendal |

13

Rosenthal: An Unparalleled Success

In 1999, conversion of Rosenthal Mill to kraft pulp

production created unique asset

approximately €361 million invested (€101 million from grants)

fastest ever start-up of an NBSK facility

capacity increased from 160,000 tonnes to 300,000 tonnes

Strong cost position (€312/tonne*)

lowest quartile from a global delivered cost perspective | |  |

| | | Rosenthal Mill |

*2002 cash production costs

14

Commitment to Building Shareholder Value

- •

- Greenlight Does Not Challenge Our Strategic Plan

- •

- They Note That We Have Valuable Assets

- •

- These Assets Exist Because of Current Management and The Board of Trustees

15

The Stendal Project

- •

- €1 billion "greenfield" project is the largest industrial project investment in Eastern Germany

- •

- capacity of 552,000 t/a

- •

- production of saleable pulp scheduled for Q3, 2004

- •

- Makes Mercer one of the world's leading NBSK pulp producers

- •

- Strong cost position (approx. €293/tonne*)

- •

- Proximity to Rosenthal allows for operating synergies

- •

- Triple total current NBSK pulp production

*Forecast 2005 cash production cost

Stendal Mill

Sources of Funding:

| | (MM)

|

|---|

| Equity | | €100 |

| Grants | | €274 |

| Project debt | | €637 |

| Other | | €26 |

| | |

|

| Total | | €1,037 |

| | |

|

16

Stendal Project: A Critical Time

- •

- Stendal Project — Key to continued strategic development

- •

- Massive, complex and time consuming project that requires in-depth experience and cohesive teamwork

- •

- Rosenthal Conversion — Proves expertise of Management and current Board of Trustees

- •

- Refinancing — Key to Stendal Project

- •

- Completion is critical

- •

- Potential default on Bridge Loans if not completed

- •

- Other refinancing alternatives less attractive

17

Stendal Project: A Critical Time

- •

- Now Is Not The Time To Experiment

- •

- Election of Two Unqualified Nominees Could Negatively Impact Stendal Project and Refinancing

- •

- Lack of valid experience

- •

- No knowledge of pulp and paper industry

- •

- No experience in European marketplace

- •

- Potential dissention within the Board of Trustees

18

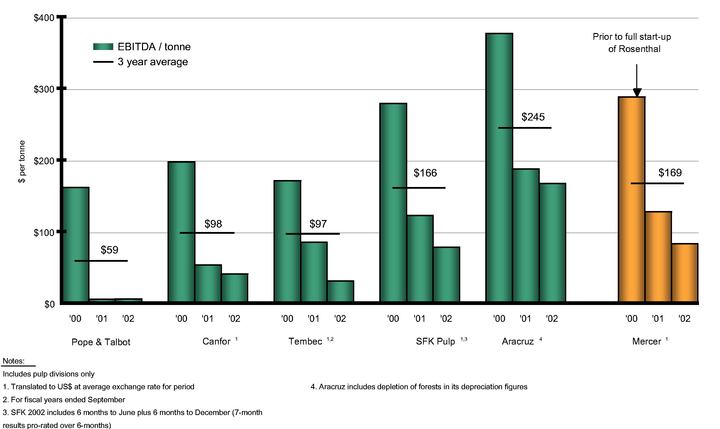

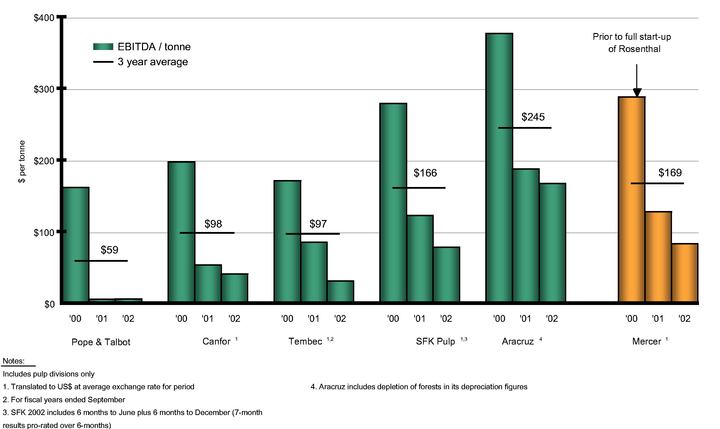

Proven Performance vs. Peers

EBITDA per Tonne

19

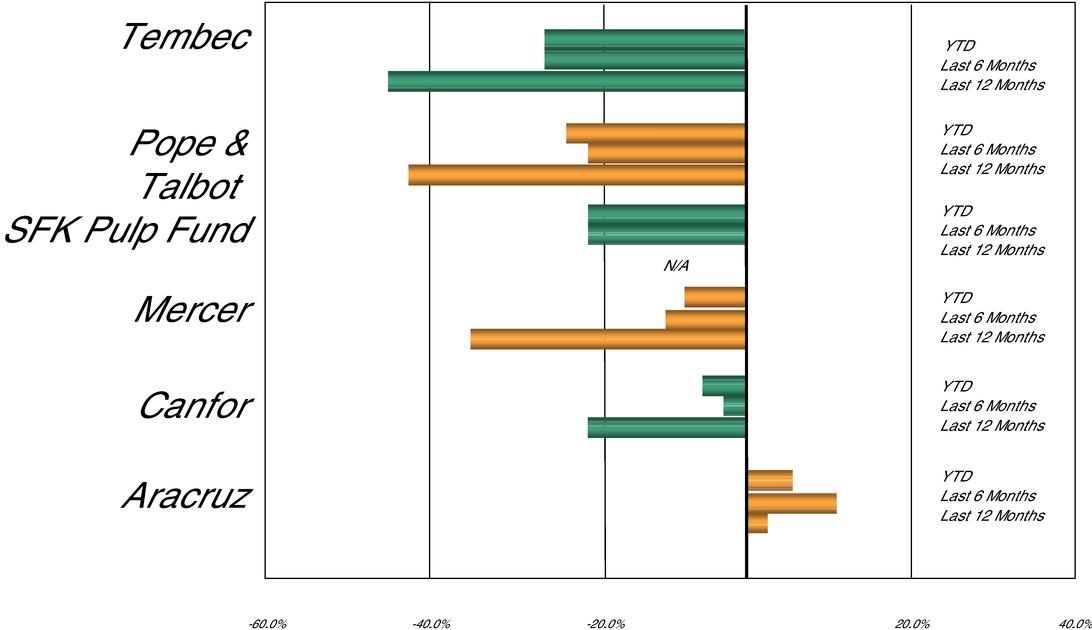

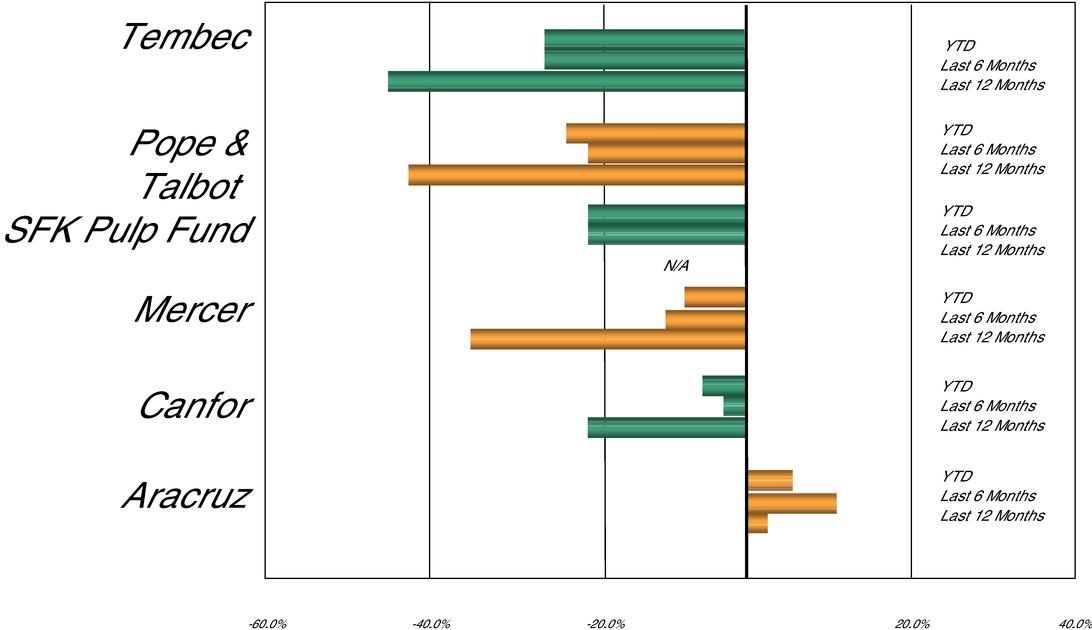

Share Price Performance of Comparable Pulp Companies

20

Our Position

A Vote For Mercer's Slate of Trustees is a Vote For:

- •

- Qualified, Seasoned Industry Veterans That Will Provide Value

- •

- An Efficient, Cohesive Board

- •

- The Continued Evolution of Our Company

- •

- Corporate Governance

- •

- Enhanced Value For ALL Shareholders

VOTE THE WHITE CARD

21

| | Mercer International Inc. |