EXHIBIT 99.1

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Searchable text section of graphics shown above

EXHIBIT 99.1

[LOGO]

Mercer International Inc.

MERCER

Safe Harbour Statement

The Private Securities Litigation Reform Act of 1995 provides a “safe harbor” for forward-looking statements. Certain information included in this presentation contains statements that are forward-looking, such as statements relating to results of operations and financial condition and business development activities, as well as capital spending and financing sources. Such forward-looking information involves important risks and uncertainties that could significantly affect anticipated results in the future and, accordingly, such results may differ materially from those expressed in any forward-looking statements made by or on behalf of Mercer. For more information regarding these risks and uncertainties, review Mercer’s filings with the Securities and Exchange Commission.

March 1, 2004

[LOGO]

2

Mercer International – Investment Merits

• Low Cost NBSK Producer with World Class Assets

• Ideal Geographic Location Creates Unique Market Dynamics

• Positioned Strategically Relative to Emerging Markets

• Access to Stable, Low-Cost Fiber Sources

• Significant Leverage to Pulp Cycle

• Rapid Organic Growth

• Long-Term, Low-Cost Debt Financing in Place

• Undervalued Relative to Peer Group

3

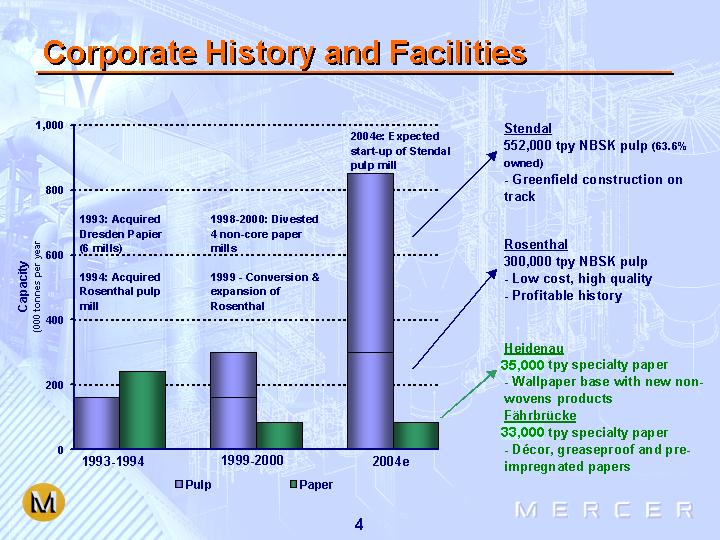

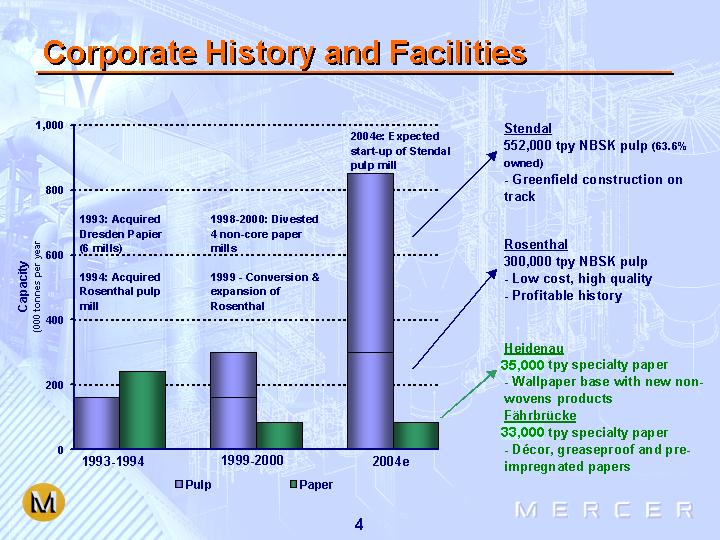

Corporate History and Facilities Corporate History and Facilities

[CHART]

Stendal

552,000 tpy NBSK pulp (63.6% owned)

• Greenfield construction on track

Rosenthal

300,000 tpy NBSK pulp

• Low cost, high quality

• Profitable history

Heidenau

35,000 tpy specialty paper

• Wallpaper base with new non-wovens products

Fährbrücke

33,000 tpy specialty paper

• Décor, greaseproof and pre-impregnated papers

4

INDUSTRY OVERVIEW

Global Market Pulp

Global Pulp Demand by Grade

[CHART]

Global NBSK Pulp Demand

[CHART]

• Pulp Market at Approximately 44 Million Tonnes

• Total Pulp Demand Growth Averaging Approximately 3% Per Year

• 28% is NBSK (Northern Bleached Softwood Kraft)

6

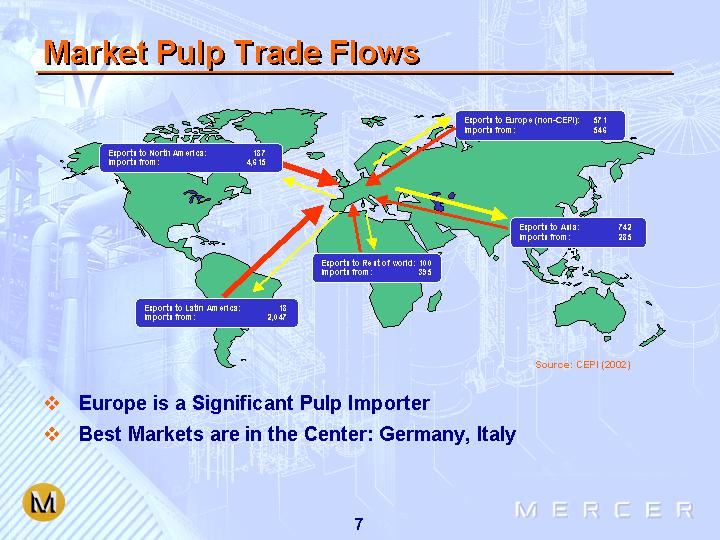

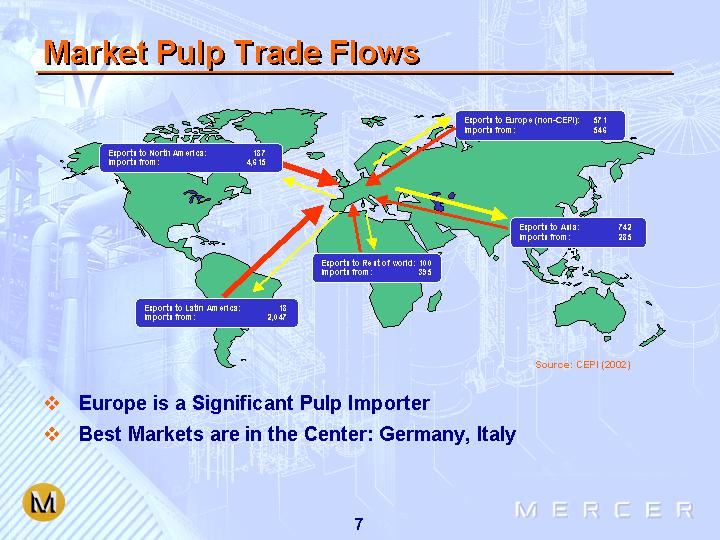

Market Pulp Trade Flows

[GRAPHIC]

• Europe is a Significant Pulp Importer

• Best Markets are in the Center: Germany, Italy

7

EU Accession Countries

• Consumption Growth within these Countries should be Significant

• According to Jaakko Pöyry:

• 2000-2015 Demand Growth in Eastern Europe Almost Twice Global Average

• Consumption Exceeds Production in Eastern European Accession Countries

• Per Capita Consumption is Currently Lower than Western European Countries – but Growth Rate is Expected to be Faster

[GRAPHIC]

Source: Paper Market and Paper Industry in Eastern Europe, Jaakko Pöyry, May 2003

8

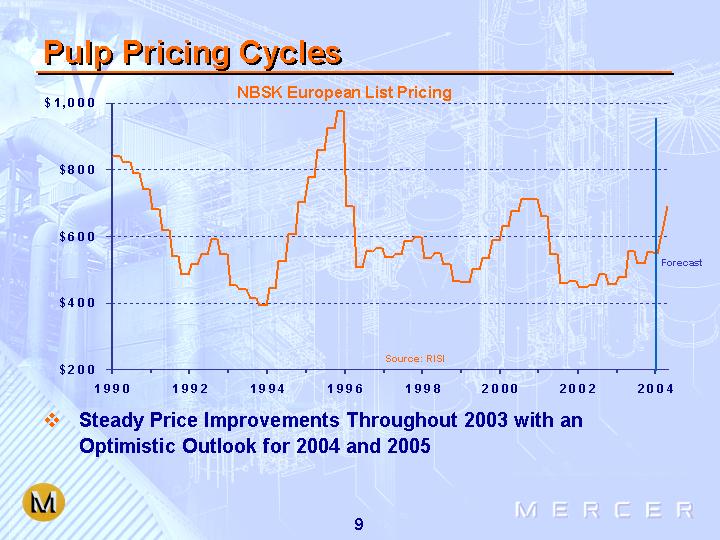

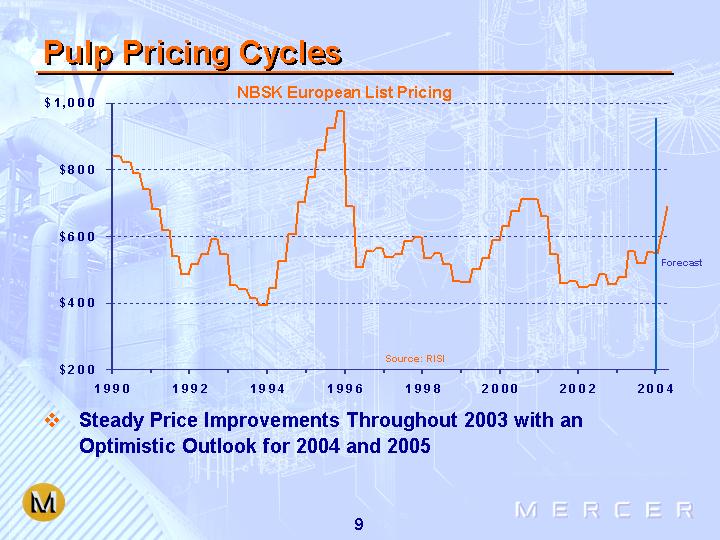

Pulp Pricing Cycles

NBSK European List Pricing

[CHART]

• Steady Price Improvements Throughout 2003 with an Optimistic Outlook for 2004 and 2005

9

BUSINESS DETAILS

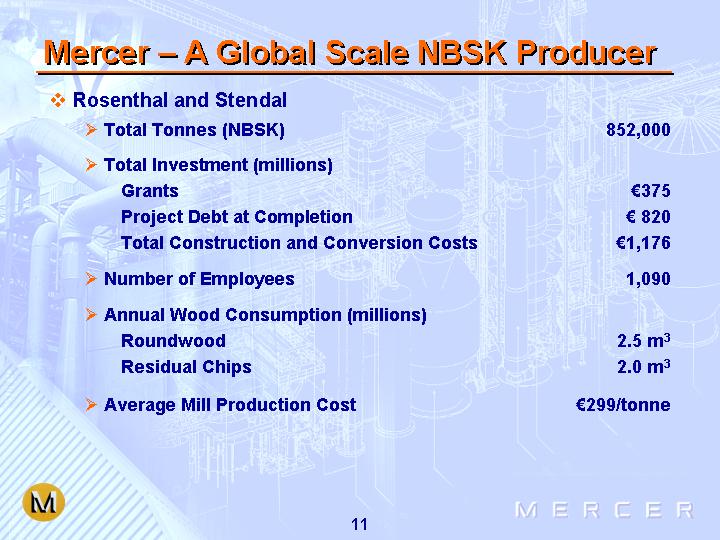

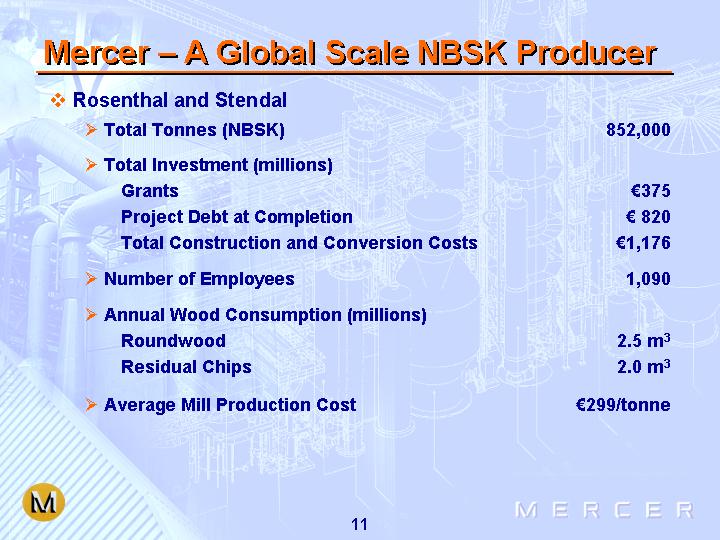

Mercer – A Global Scale NBSK Producer

• Rosenthal and Stendal | | | |

| | | |

• Total Tonnes (NBSK) | | 852,000 | |

| | | |

• Total Investment (millions) | | | |

Grants | | € | 375 | |

Project Debt at Completion | | € | 820 | |

Total Construction and Conversion Costs | | € | 1,176 | |

| | | |

• Number of Employees | | 1,090 | |

| | | |

• Annual Wood Consumption (millions) | | | |

Roundwood | | 2.5 m3 | |

Residual Chips | | 2.0 m3 | |

| | | |

• Average Mill Production Cost | | € | 299/tonne | |

11

Rosenthal – An Unparalleled Success

• In 1999, Conversion of Rosenthal Mill to Kraft Pulp Production Created Unique Asset

• Approximately €361 Million Invested (€101 million from grants)

• Fastest Ever Start-up of an NBSK Facility

• Capacity Increased From 160,000 Tonnes to 300,000 Tonnes

• Strong Cost Position (€310/tonne*)

• Lowest Quartile From a Global Delivered Cost Perspective

[GRAPHIC]

* 2003 cash production costs

12

Stendal Project – Near Term Growth Driver

• €1 billion “Greenfield” Project is the Largest Industrial Project Investment in Eastern Germany

• Qualifies for €274 Million of Grants

• Capacity of 552,000 t/a

• Production of Saleable Pulp Scheduled for Q3, 2004

• Strong Cost Position (approx. €293/tonne*)

• Proximity to Rosenthal Allows for Operating Synergies

• Turnkey, Fixed-price EPC Contract (RWE)

[GRAPHIC]

Sources of Funding: | | (MM) | |

Equity | | € | 100 | |

Grants | | € | 274 | |

Project debt | | € | 637 | |

Other | | € | 26 | |

Total | | € | 1,037 | |

* engineering cost estimate

13

Stendal Project – On Budget and On Time

[GRAPHIC]

Percent Complete at December 31/03

Average Stage of Completion | | 92 | % |

Engineering | | 99.2 | % |

Procurement & Equipment | | 99.4 | % |

Delivery | | | |

Civil Works | | 92.8 | % |

Mechanical Erection | | 70 | % |

Start-up | | Q3 2004 | |

[GRAPHIC]

COMPETITIVE STRENGTHS

Competitive Strengths

• One of Lowest Cost NBSK Producers in Industry

• World Class Assets

• Ideal Geographic Location

• Unique End Market Dynamics

• Shipping Cost and Customer Service Advantage

• Strong Fibre Supply

• Significant Leverage to Pulp Cycle

• Hedging Activities Protect Against Interest Rate and Currency Fluctuations

16

Low Cost NBSK Pulp Producer

DELIVERED CASH COST OF BSKP TO WESTERN EUROPE

ROSENTHAL vs. ALL MARKET PULP PRODUCERS

[CHART]

17

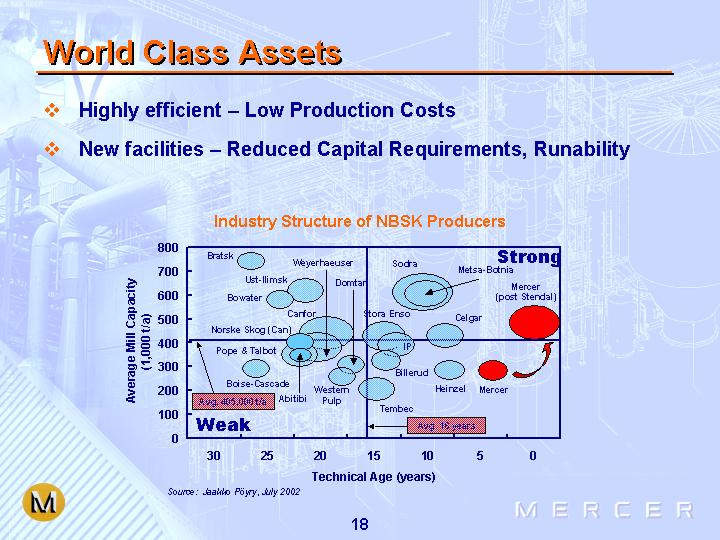

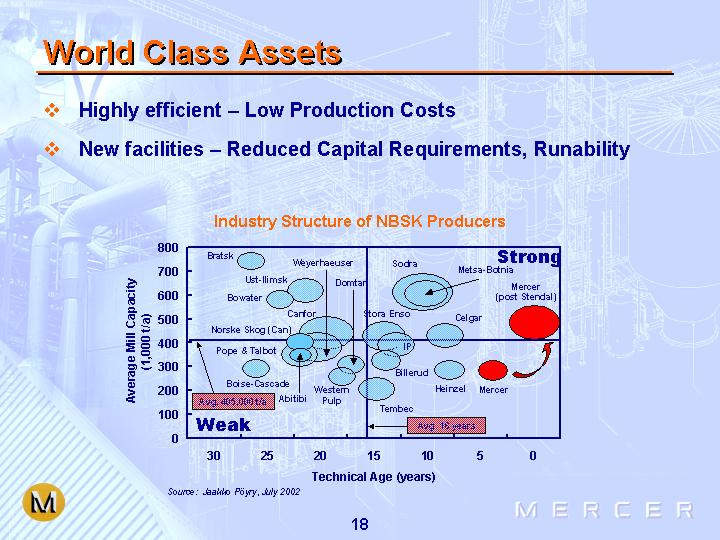

World Class Assets

• Highly efficient – Low Production Costs

• New facilities – Reduced Capital Requirements, Runability

Industry Structure of NBSK Producers

[CHART]

Source: Jakko Poyry, July 2002

18

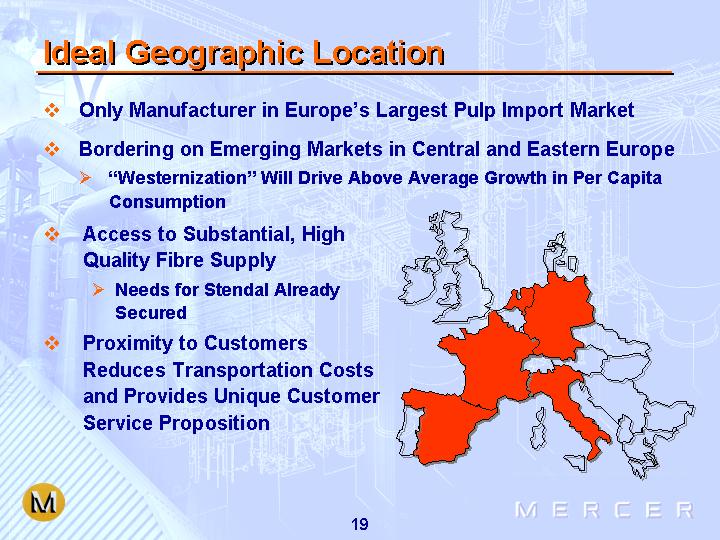

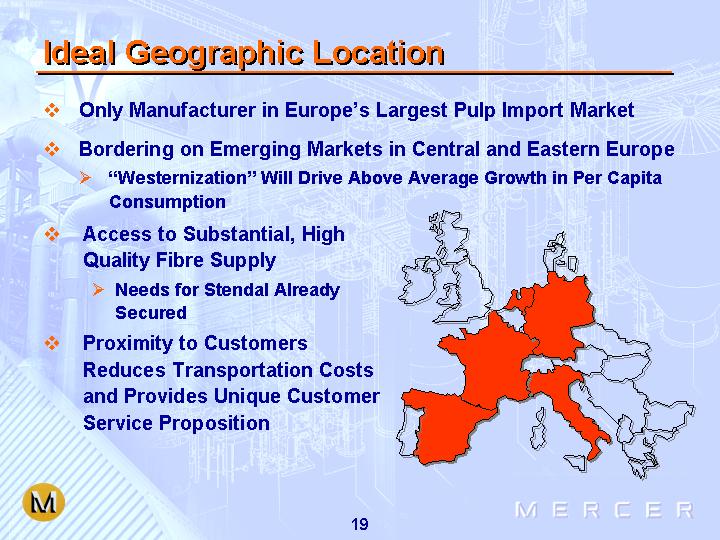

Ideal Geographic Location

• Only Manufacturer in Europe’s Largest Pulp Import Market

• Bordering on Emerging Markets in Central and Eastern Europe

• “Westernization” Will Drive Above Average Growth in Per Capita Consumption

• Access to Substantial, High Quality Fibre Supply

• Needs for Stendal Already Secured

• Proximity to Customers Reduces Transportation Costs and Provides Unique Customer Service Proposition

[GRAPHIC]

19

Strong Fibre

• High Quality Fibre Supply

• Rosenthal – Spruce

• Stendal – Pine

• Largest Consumer of Wood Chips in Germany

• Typically 1 Year Contracts

• Numerous Suppliers

• Low Historical Volatility in Wood Chip Pricing

• No Contracts Tied to Pulp Prices

[GRAPHIC]

| | Fibre Costs (per tonne) | |

| | 1998 | | 1999 | | 2000 | | 2001 | | 2002 | | 2003 | |

| | | | | | | | | | | | | |

SFK | | $ | 222 | | $ | 226 | | $ | 277 | | $ | 251 | | | | | |

| | 24% | | | | | | | |

| | | | | | | | | | | | | |

Mercer | | | | | | € | 180 | | € | 184 | | € | 178 | | € | 178 | |

| | | | | | no volatility | |

| | | | | | | | | | | | | | | | | | | |

Notes:

SFK shown as per reported “adjusted fibre cost” representing current contract Dollar amounts shown are in Canadian dollars

20

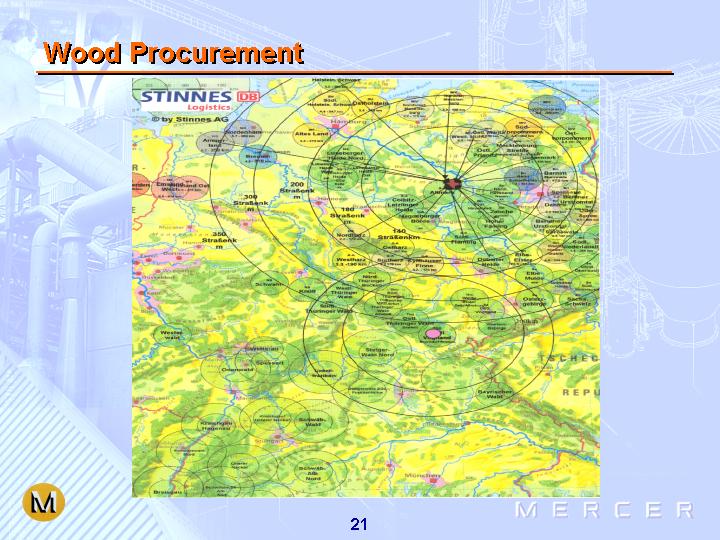

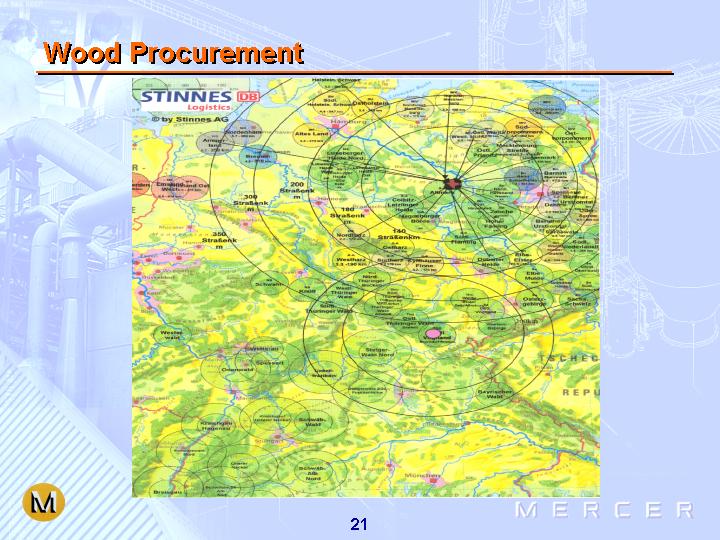

Wood Procurement

[GRAPHIC]

21

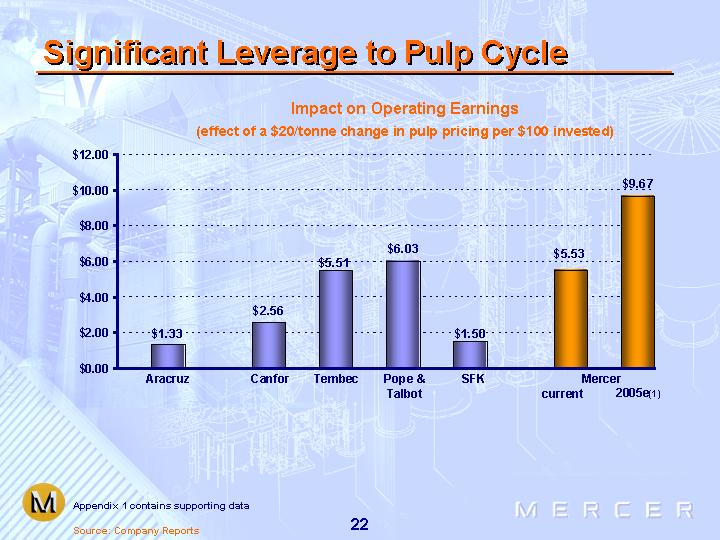

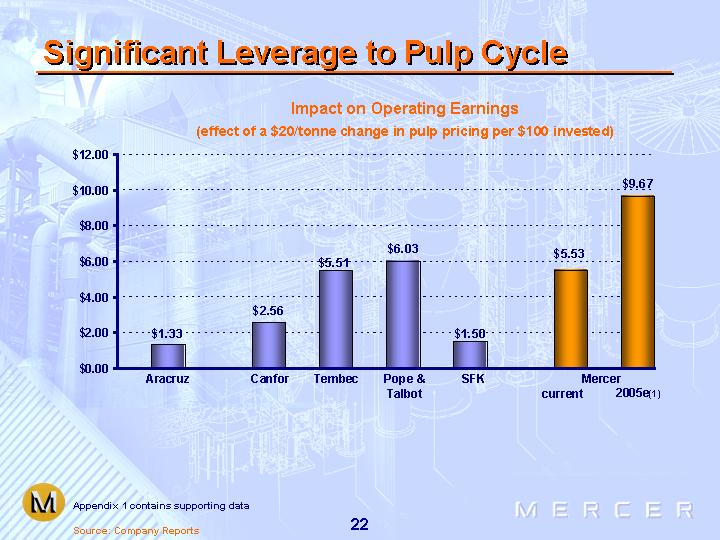

Significant Leverage to Pulp Cycle

Impact on Operating Earnings

(effect of a $20/tonne change in pulp pricing per $100 invested)

[CHART]

Appendix 1 contains supporting data

Source: Company Reports

22

Long Term, Low Cost Debt Financing

• Project Financings Benefit Our Equity Holders

• Reduced Dilution

• No Cash Sweep

• Ring Fenced Structure

• Government Guarantees, of 80% of Debt, is Maximized

• Resulting in Low Cost Financing Structure

| | Rosenthal | | Stendal | |

Size | | € | 191.7 | m(1) | € | 668 | m(2) |

| | | | | | | |

Term | | 15 years

amortizing | |

Financing Cost | | 6.8% | | 5.6% | |

| | (cap to ‘07) | | (est. fixed) | |

EBITDA(3) / Interest | | | | | |

| 2003 | | 1.7 | x | | |

| 2002 | | 1.9 | x | | |

| 2001 | | 2.2 | x | | |

Notes:

1. Amount outstanding as at December 31, 2003; Rosenthal had €25.1 million of restricted cash at such date

2. Initial permanent amounts available under the project facility

3. For discussion of EBITDA and limitations see page

23

Hedging Benefits

• Protect Against Currency Movements

• Monetized Currency Hedges in 2003 Fourth Quarter

• Have Opportunity to Enter into New Contracts

• Fix Interest Costs

• Interest Rates Fixed at Favorable Levels

24

FINANCIAL HIGHLIGHTS &

VALUATION

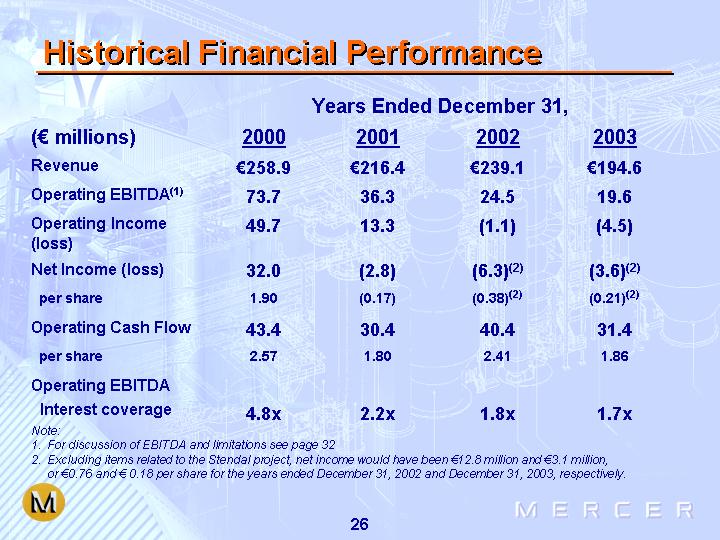

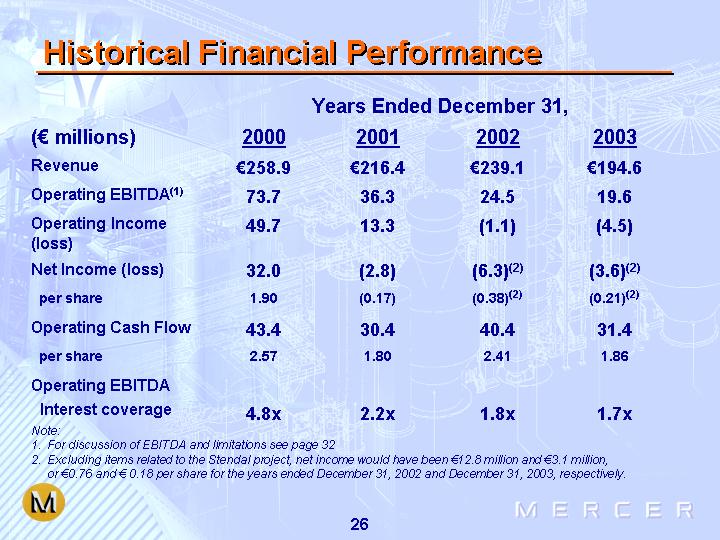

Historical Financial Performance

| | Years Ended December 31, | |

(€ millions) | | 2000 | | 2001 | | 2002 | | 2003 | |

| | | | | | | | | |

Revenue | | € | 258.9 | | € | 216.4 | | € | 239.1 | | € | 194.6 | |

Operating EBITDA(1) | | 73.7 | | 36.3 | | 24.5 | | 19.6 | |

Operating Income (loss) | | 49.7 | | 13.3 | | (1.1 | ) | (4.5 | ) |

Net Income (loss) | | 32.0 | | (2.8 | ) | (6.3 | )(2) | (3.6 | )(2) |

per share | | 1.90 | | (0.17 | ) | (0.38 | )(2) | (0.21 | )(2) |

Operating Cash Flow | | 43.4 | | 30.4 | | 40.4 | | 31.4 | |

per share | | 2.57 | | 1.80 | | 2.41 | | 1.86 | |

Operating EBITDA | | | | | | | | | |

Interest coverage | | 4.8 | x | 2.2 | x | 1.8x | | 1.7x | |

| | | | | | | | | | | | | |

Note:

1. For discussion of EBITDA and limitations see page 32

2. Excluding items related to the Stendal project, net income would have been €12.8 million and €3.1 million, or €0.76 and € 0.18 per share for the years ended December 31, 2002 and December 31, 2003, respectively.

26

Valuation

• Price to book multiples

[CHART]

Adjusted - adds back the €43.2 million of Stendal non-cash mark-to-market unrealized derivative holding losses

Appendix 2 contains supporting data

Source: Company Reports

27

[LOGO]

Mercer International Inc.

[CHART]

[CHART]

28

Mercer International – Investment Merits

• Low Cost NBSK Producer with World Class Assets

• Ideal Geographic Location Creates Unique Market Dynamics

• Positioned Strategically Relative to Emerging Markets

• Access to Stable, Low-Cost Fiber Sources

• Significant Leverage to Pulp Cycle

• Rapid Organic Growth

• Long-Term, Low-Cost Debt Financing in Place

• Management Believes Undervalued Relative to Peer Group

29

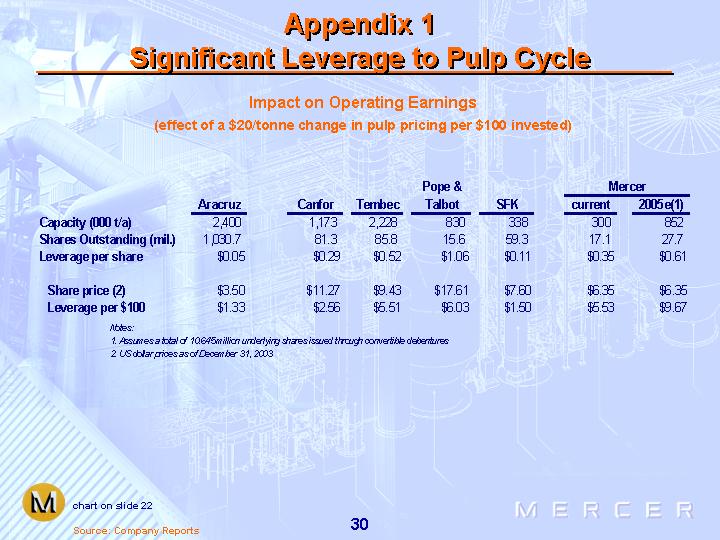

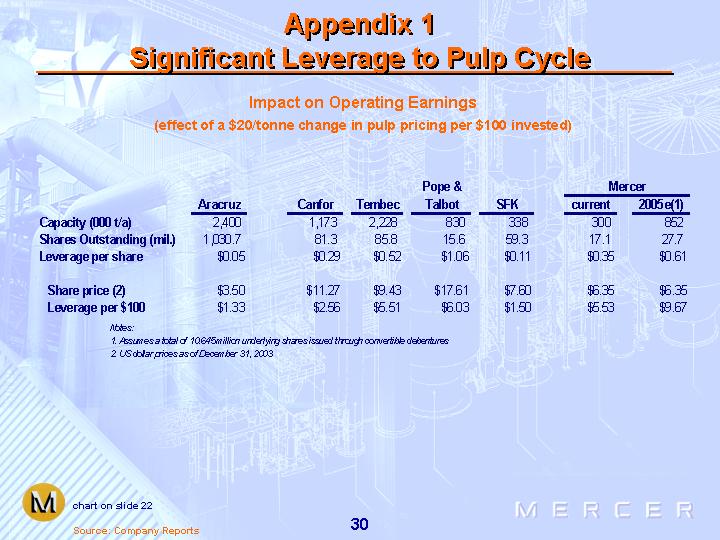

Appendix 1

Significant Leverage to Pulp Cycle

Impact on Operating Earnings

(effect of a $20/tonne change in pulp pricing per $100 invested)

| | | | | | | | Pope &

Talbot | | | | Mercer | |

| | Aracruz | | Canfor | | Tembec | | | SFK | | current | | 2005e(1) | |

Capacity (000 t/a) | | 2,400 | | 1,173 | | 2,228 | | 830 | | 338 | | 300 | | 852 | |

Shares Outstanding (mil.) | | 1,030.7 | | 81.3 | | 85.8 | | 15.6 | | 59.3 | | 17.1 | | 27.7 | |

Leverage per share | | $ | 0.05 | | $ | 0.29 | | $ | 0.52 | | $ | 1.06 | | $ | 0.11 | | $ | 0.35 | | $ | 0.61 | |

| | | | | | | | | | | | | | | |

Share price (2) | | $ | 3.50 | | $ | 11.27 | | $ | 9.43 | | $ | 17.61 | | $ | 7.60 | | $ | 6.35 | | $ | 6.35 | |

Leverage per $100 | | $ | 1.33 | | $ | 2.56 | | $ | 5.51 | | $ | 6.03 | | $ | 1.50 | | $ | 5.53 | | $ | 9.67 | |

Notes:

1. Assumes a total of 10.645 million underlying shares issued through convertible debentures

2. US dollar prices as of December 31, 2003

chart on slide 22

Source: Company Reports

30

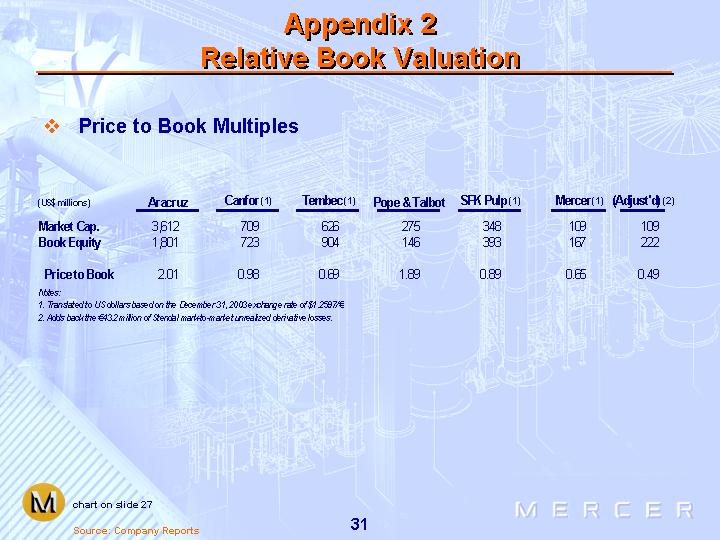

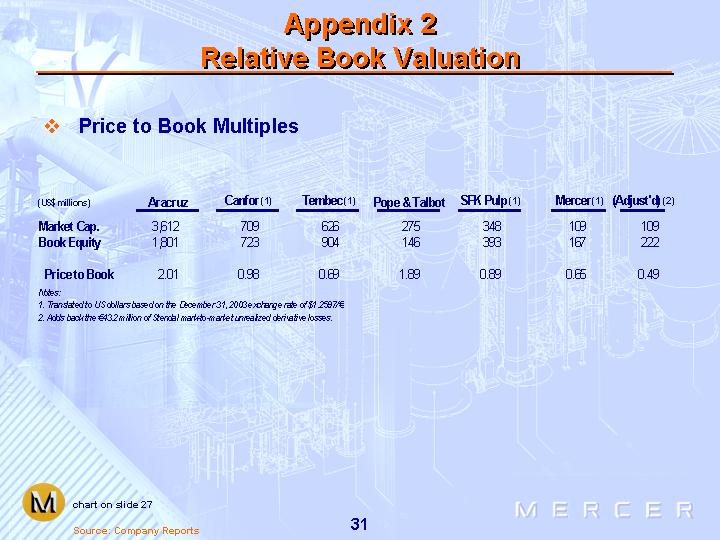

Appendix 2

Relative Book Valuation

• Price to Book Multiples

(US$millions) | | Aracruz | | Canfor (1) | | Tembec (1) | | Pope & Talbot | | SFK Pulp (1) | | Mercer (1) | | (Adjust’d) (2) | |

Market Cap. | | 3,612 | | 709 | | 626 | | 275 | | 348 | | 109 | | 109 | |

Book Equity | | 1,801 | | 723 | | 904 | | 146 | | 393 | | 167 | | 222 | |

| | | | | | | | | | | | | | | |

Price to Book | | 2.01 | | 0.98 | | 0.69 | | 1.89 | | 0.89 | | 0.65 | | 0.49 | |

Notes:

1. Translated to US dollars based on the December 31, 2003 exchange rate of $1.2597/€

2. Adds back the €43.2 million of Stendal mark-to-market unrealized derivative losses.

chart on slide 27

Source: Company Reports

31

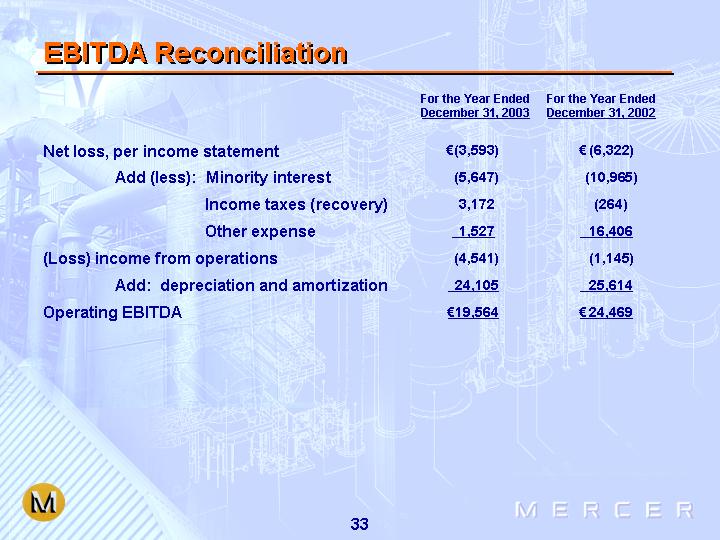

EBITDA

EBITDA as presented herein refers to Operating EBITDA, defined as income from operations plus depreciation and amortization. Management uses Operating EBITDA as a benchmark measurement of its own operating results, and as a benchmark relative to its competitors. Operating EBITDA is not a measure of financial performance under accounting principles generally accepted in the United States, and should not be considered as an alternative to net income (loss) or income (loss) from operations as a measure of performance, nor as an alternative to net cash from operating activities as a measure of liquidity. Operating EBITDA has significant limitations as an analytical tool, and should not be considered in isolation, or as a substitute for analysis of our results as reported under GAAP. Operating EBITDA as calculated by us may differ from Operating EBITDA as calculated by other companies.

32

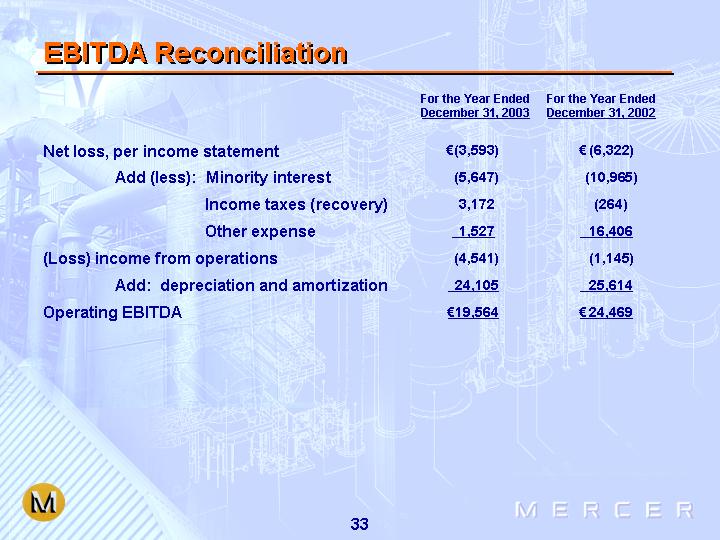

EBITDA Reconciliation

| | For the Year Ended

December 31, 2003 | | For the Year Ended

December 31, 2002 | |

| | | | | |

Net loss, per income statement | | € | (3,593 | ) | € | (6,322 | ) |

Add (less): Minority interest | | (5,647 | ) | (10,965 | ) |

Income taxes (recovery) | | 3,172 | | (264 | ) |

Other expense | | 1,527 | | 16,406 | |

(Loss) income from operations | | (4,541 | ) | (1,145 | ) |

Add: depreciation and amortization | | 24,105 | | 25,614 | |

Operating EBITDA | | € | 19,564 | | € | 24,469 | |

33