Exhibit 99.1

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Searchable text section of graphics shown above

[LOGO]

Mercer International Inc.

(NASDAQ: MERCS)

(TSE: MRI.U)

M E R C E R

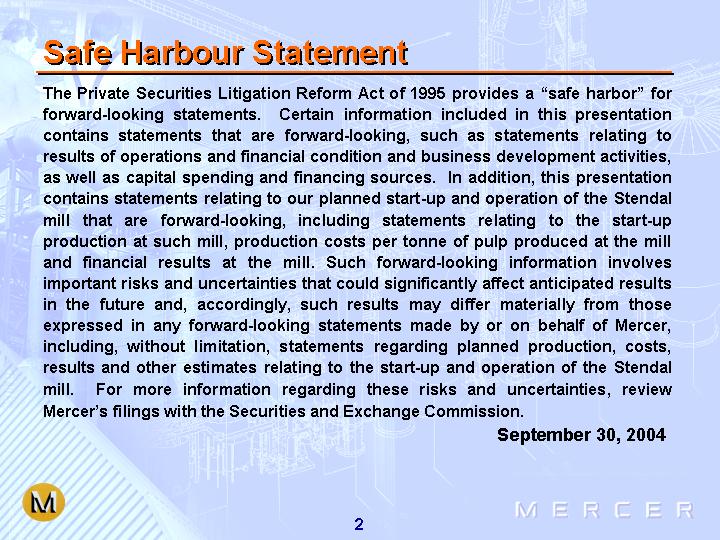

Safe Harbour Statement

The Private Securities Litigation Reform Act of 1995 provides a “safe harbor” for forward-looking statements. Certain information included in this presentation contains statements that are forward-looking, such as statements relating to results of operations and financial condition and business development activities, as well as capital spending and financing sources. In addition, this presentation contains statements relating to our planned start-up and operation of the Stendal mill that are forward-looking, including statements relating to the start-up production at such mill, production costs per tonne of pulp produced at the mill and financial results at the mill. Such forward-looking information involves important risks and uncertainties that could significantly affect anticipated results in the future and, accordingly, such results may differ materially from those expressed in any forward-looking statements made by or on behalf of Mercer, including, without limitation, statements regarding planned production, costs, results and other estimates relating to the start-up and operation of the Stendal mill. For more information regarding these risks and uncertainties, review Mercer’s filings with the Securities and Exchange Commission.

September 30, 2004

2

Mercer International Overview

• US Reporting Public Company (NASDAQ: MERCS TSE: MRI.U)

• Strategic Focus on High Quality Northern Bleached Softwood Kraft Pulp (NBSK)

• 862,000 Tonnes of Capacity Annually*

• Two Mills Ideally Located in Fiber Rich Germany

• Germany: the Largest Import Country in Europe

• Growth Exceeds Fiber Demand

• World Class State of the Art Machinery

• One of the Lowest Cost NBSK Producers in the Industry

* Including 552,000 tonnes per annum at the recently completed Stendal mill.

3

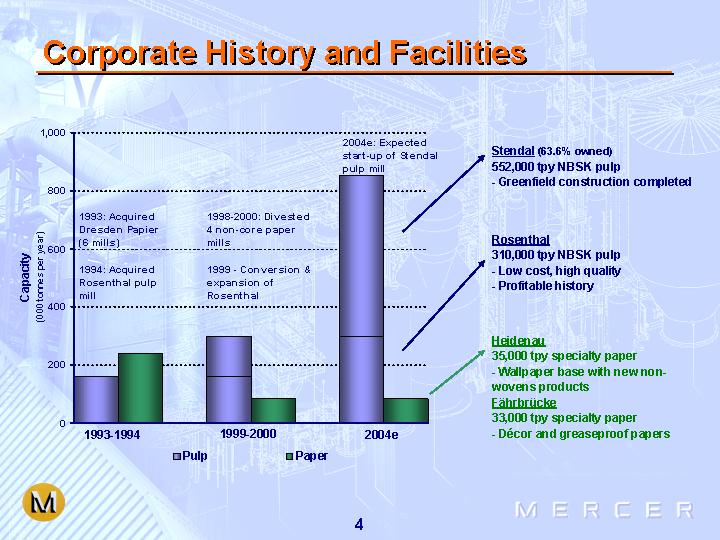

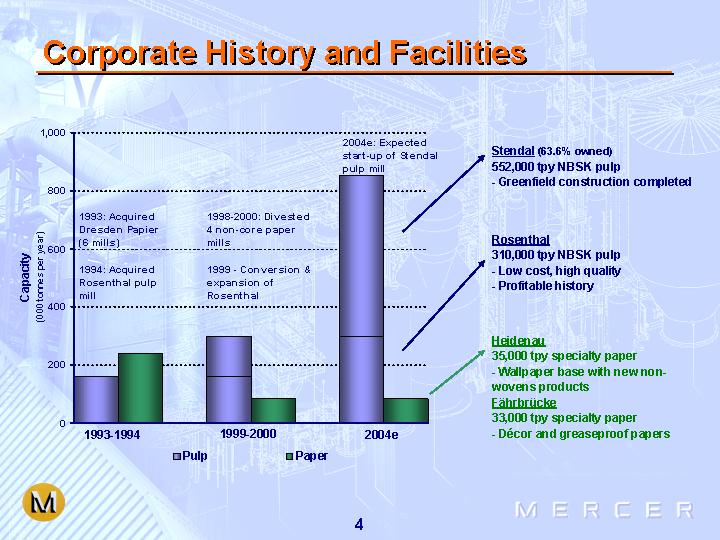

Corporate History and Facilities

[CHART]

4

Rosenthal Mill – An Unparalleled Success

• In 1999, Conversion of Rosenthal Mill to Kraft Pulp Production Created Unique Asset

• First Kraft Pulp Facility in Germany in Modern Times

• Strong Cost Position

• Lowest Quartile From a Global Delivered Cost Perspective to Europe

• 310,000 tpy NBSK pulp

• Low Cost – High Quality

• Profitable History

[GRAPHIC]

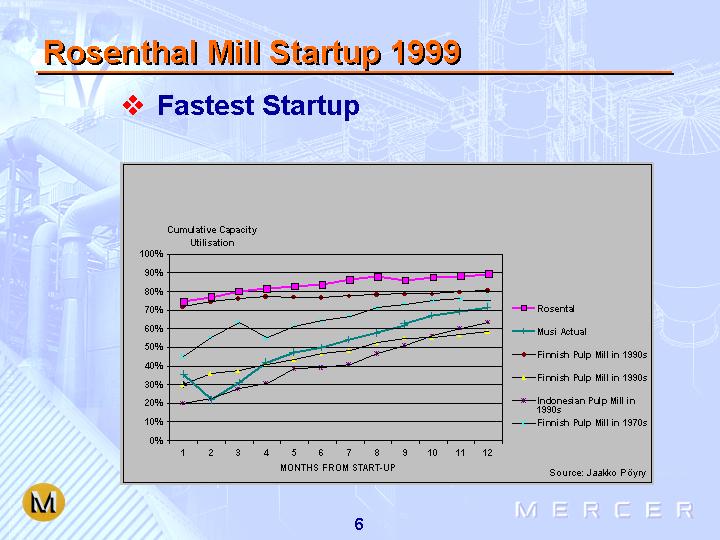

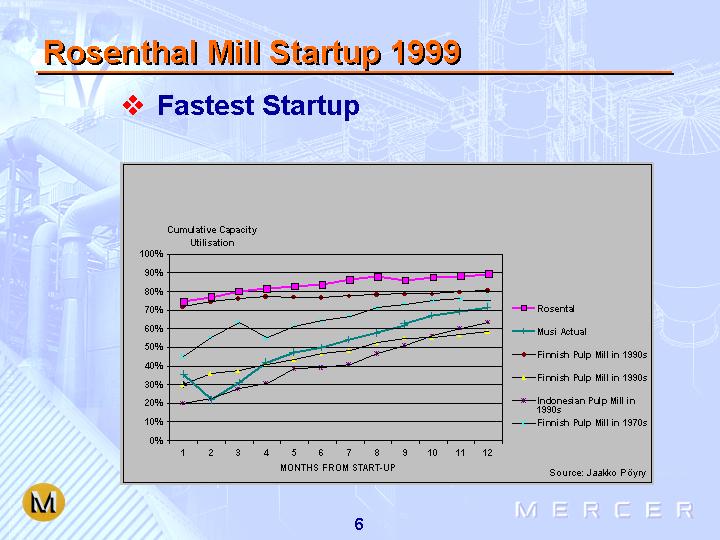

Rosenthal Mill Startup 1999

• Fastest Startup

[CHART]

6

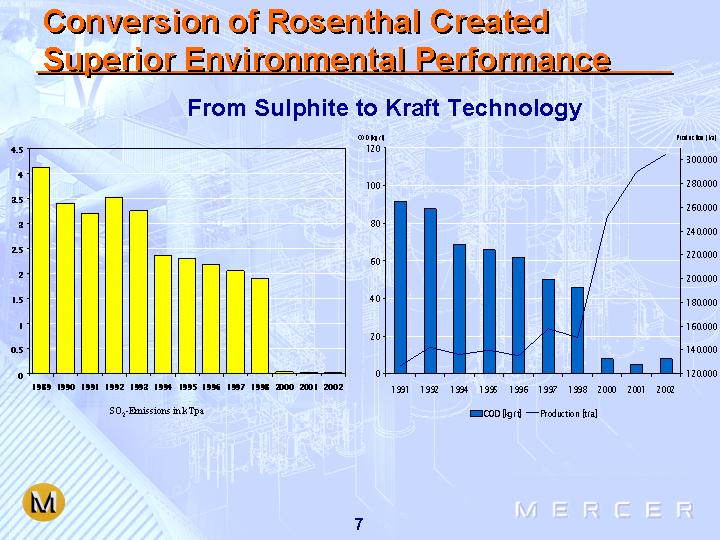

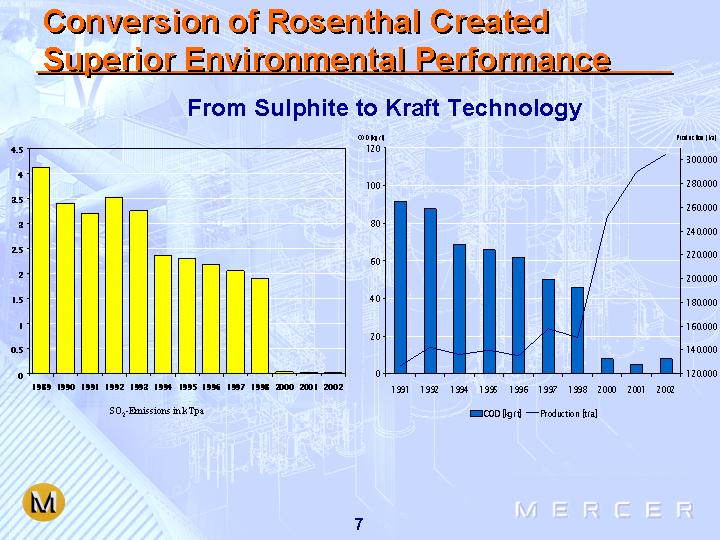

Conversion of Rosenthal Created Superior Environmental Performance

From Sulphite to Kraft Technology

[CHART]

[CHART]

7

Stendal Mill – Successful Startup

• €1 billion “Greenfield” Project Completed in July 2004

• Startup with Targeted Production of 80% by the end of 2004

• Projected to be Lowest Quartile From a Global Delivered Cost Perspective (est. €293/tonne*)

• Projected Cost Lower than Rosenthal Based on Economies of Scale

• Proximity to Rosenthal Allows for Operating Synergies

• 552,000 tpy NBSK Pulp Capacity

• 63.6% Owned

[GRAPHIC]

* Engineering cost estimate

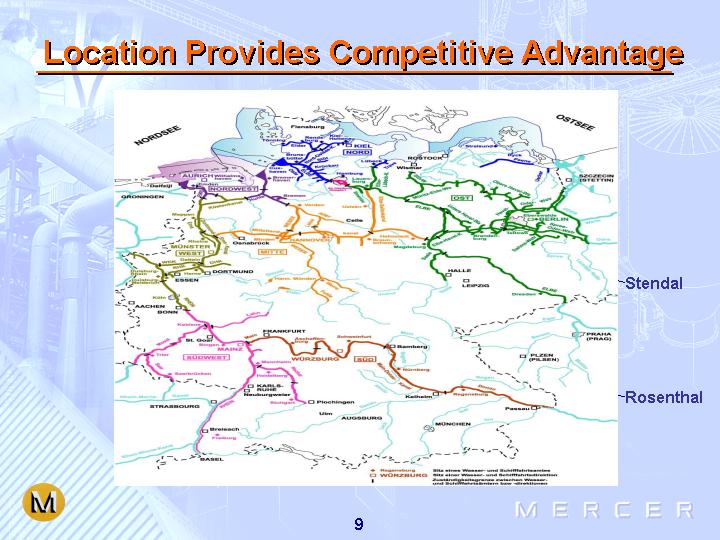

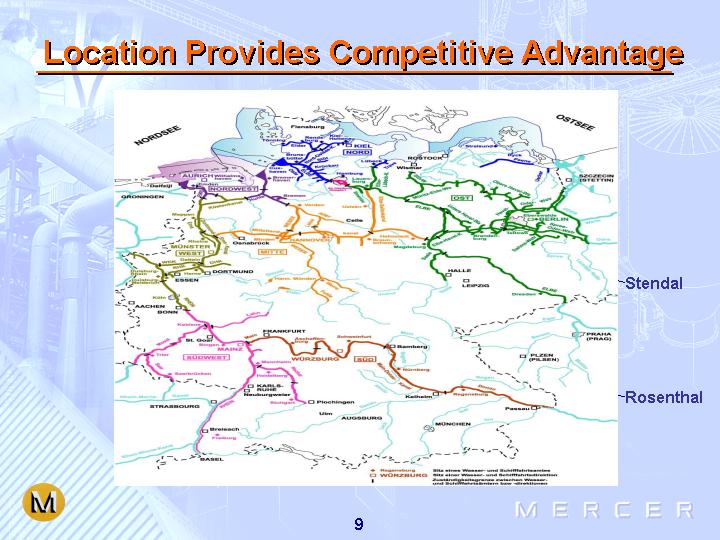

Location Provides Competitive Advantage

[GRAPHIC]

9

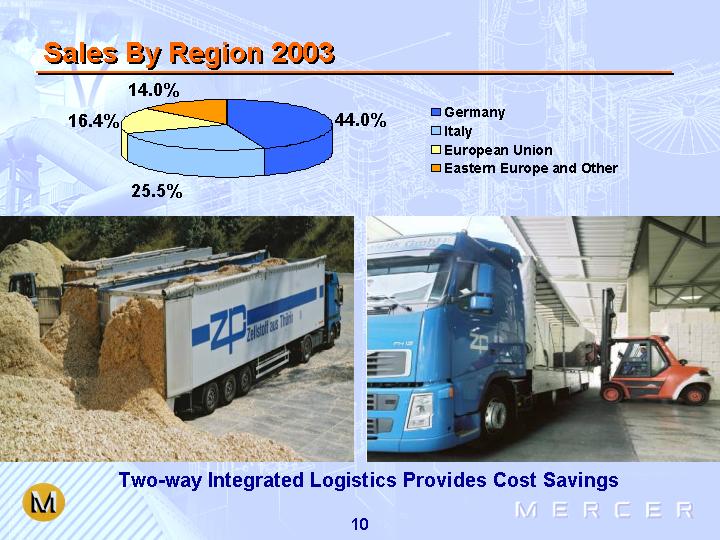

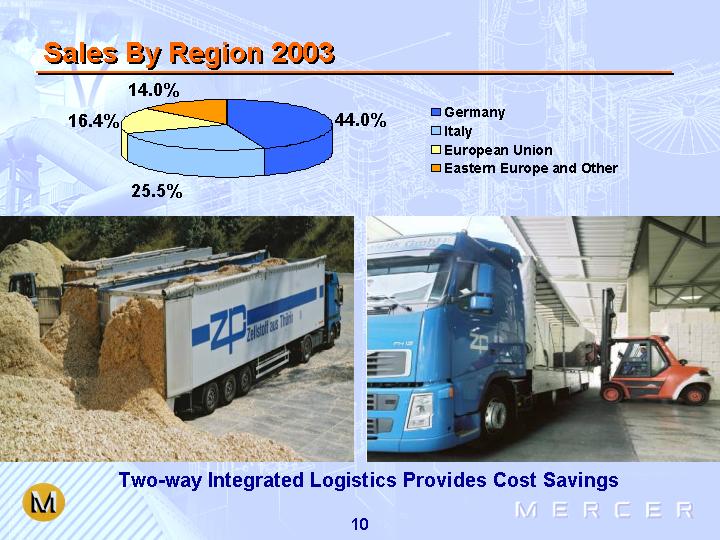

Sales By Region 2003

[CHART]

[GRAPHIC]

[GRAPHIC]

Two-way Integrated Logistics Provides Cost Savings

10

Strong Fiber Supply

• High Quality Fiber Supply

• Rosenthal – Spruce

• Stendal – Pine

• Largest Consumer of Wood Chips in Germany

• Typically 1 Year Contracts

• Numerous Suppliers

• Low Historical Volatility in Wood Chip Pricing

• Contracts Not Tied to Pulp Prices

[GRAPHIC]

[GRAPHIC]

11

Low Cost NBSK Pulp Producer €1.00=$1.23

[CHART]

Source: Jaakko Pöyry

Total volume 13.0 MM mt/a, Includes all dried pulp NBSK excluding domestic captive

* Engineering cost estimate per source

12

EU Accession Countries

• Consumption Growth within these Countries should be Significant

• According to Jaakko Pöyry:

• 2000-2015 Demand Growth in Eastern Europe Almost Twice Global Average

• Consumption Exceeds Production in Eastern European Accession Countries

• Per Capita Consumption is Currently Lower than Western European Countries – but Growth Rate is Expected to be Faster

[GRAPHIC]

Source: Paper Market and Paper Industry in Eastern Europe, Jaakko Pöyry, May 2003

13

World Class Assets €1.00=$1.23

[CHART]

[CHART]

Source: Jaakko Pöyry

NBSK excl. Coarse NBSK

* Engineering cost estimate per source

14

Mercer International – Investment Merits

• Low Cost NBSK Producer with World Class Assets

• Ideal Geographic Location Creates Unique Market Dynamics

• Strategically Positioned Relative to Emerging Markets

• Access to Stable, Low-Cost Fiber Sources

• Significant Leverage to Pulp Cycle

• Rapid Organic Growth

• Long-Term, Low-Cost Debt Financing in Place

15