UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

| |

☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2021

| |

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE TRANSITION PERIOD FROM TO |

Commission file number 1-15399

(Exact Name of Registrant as Specified in its Charter)

| | |

Delaware | | 36-4277050 |

(State or Other Jurisdiction of

Incorporation or Organization) | | (I.R.S. Employer

Identification No.) |

| | |

1 North Field Court, Lake Forest, Illinois | | 60045 |

(Address of Principal Executive Offices) | | (Zip Code) |

Registrant's telephone number, including area code: (847) 482-3000

Securities registered pursuant to Section 12(b) of the Act:

| | |

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Common Stock, par value $0.01 per share | PKG | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | |

Large accelerated filer | | ☒ | | Accelerated filer | | ☐ |

| | | |

Non-accelerated filer | | ☐ | | Smaller reporting company | | ☐ |

| | | | | | |

Emerging growth company | | ☐ | | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

At June 30, 2021, the last day of the Registrant's most recently completed second fiscal quarter, the aggregate market value of Registrant's common equity held by non-affiliates was approximately $12,670,117,556 based upon the closing sale price as reported on the New York Stock Exchange. This calculation of market value has been made for the purposes of this report only and should not be considered as an admission or conclusion by the Registrant that any person is in fact an affiliate of the Registrant.

On February 18, 2022, there were 93,533,810 shares of Common Stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Specified portions of the Proxy Statement for the Registrant's 2022 Annual Meeting of Stockholders are incorporated by reference to the extent indicated in Part III of this Form 10-K.

Table of Contents

2

PART I

Item 1. BUSINESS

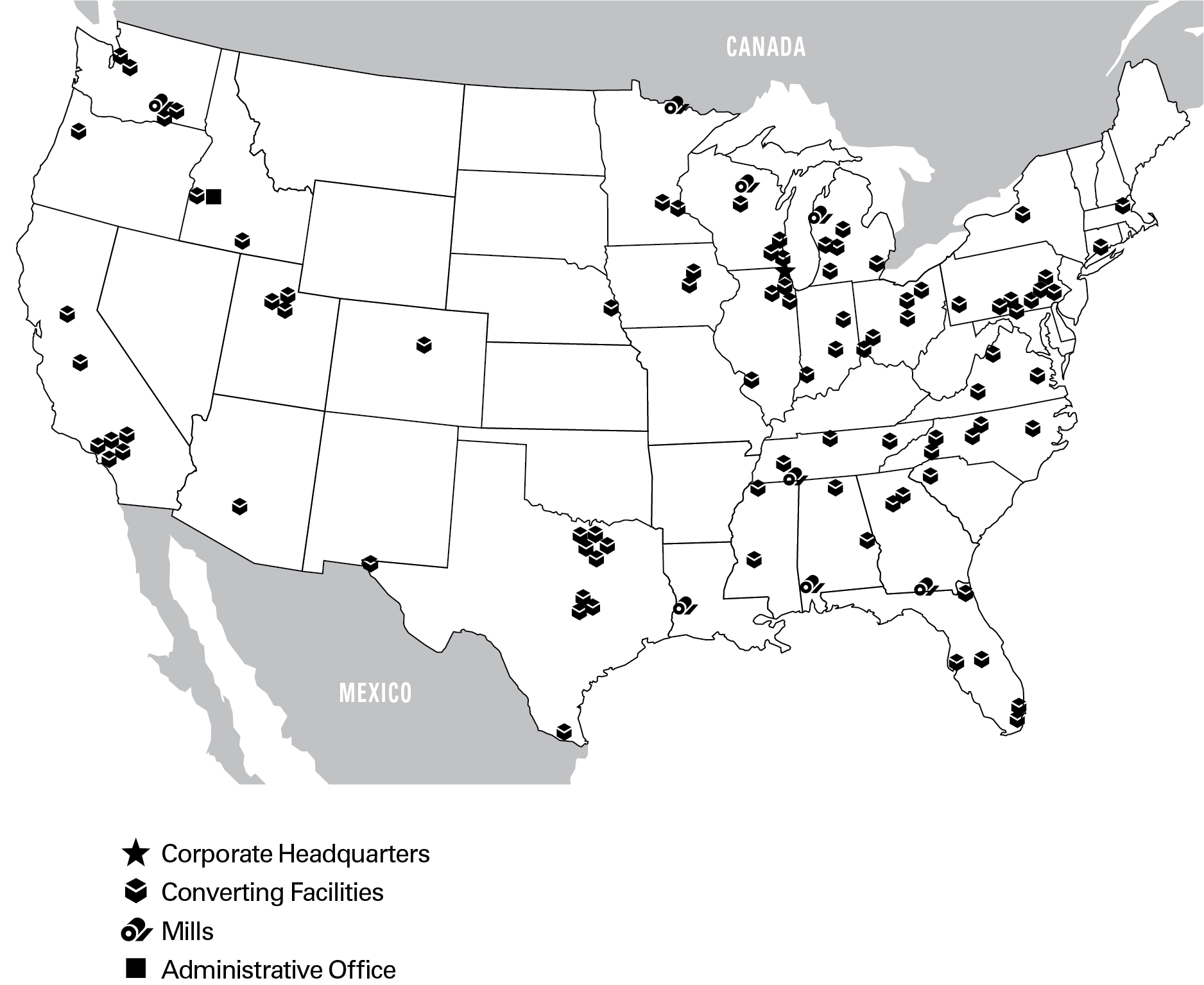

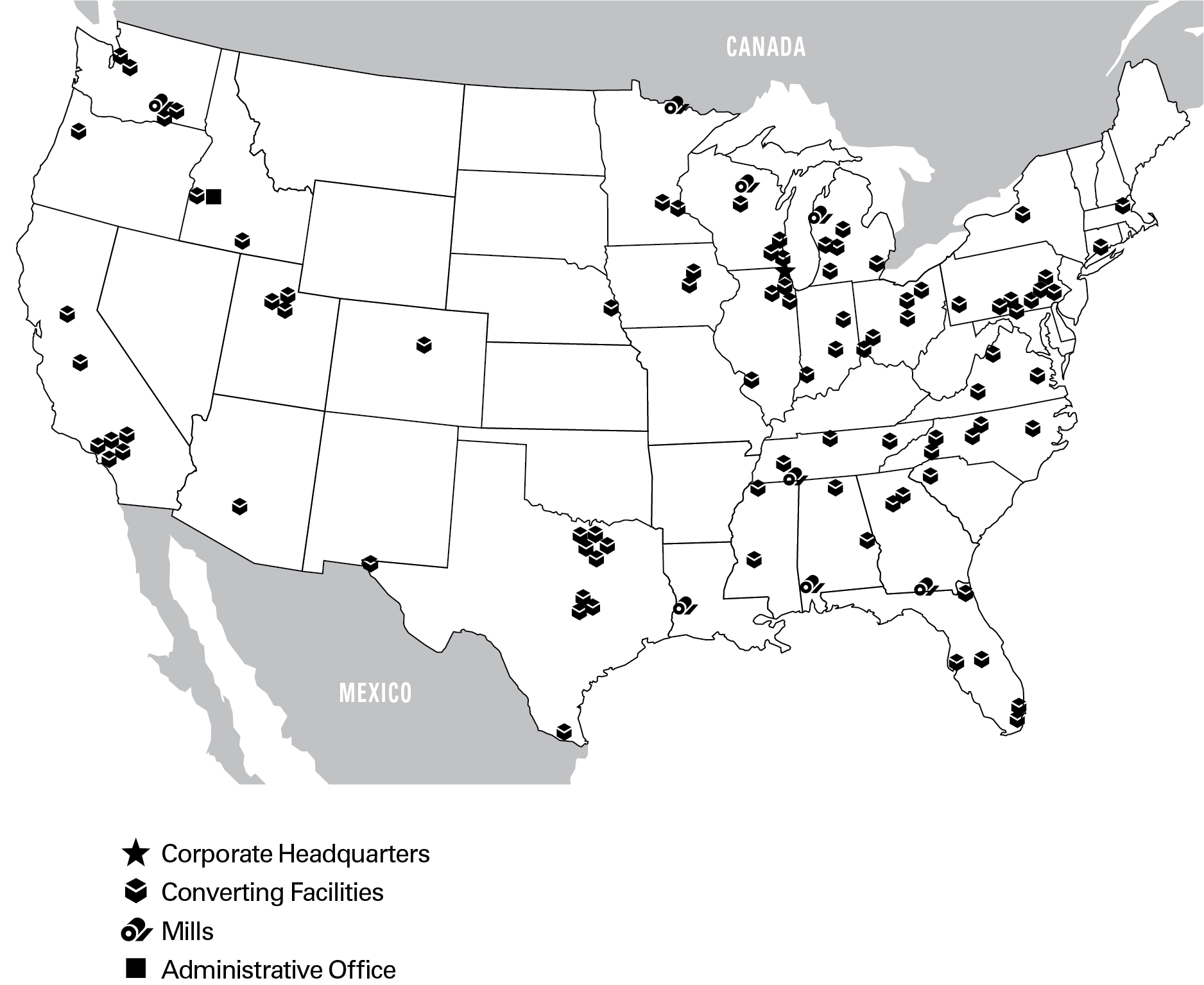

Packaging Corporation of America (“we,” “us,” “our,” “PCA,” or the “Company”) is the third largest producer of containerboard products and a leading producer of uncoated freesheet (UFS) paper in North America. We operate eight mills and 90 corrugated products plants and related facilities. We are headquartered in Lake Forest, Illinois and operate primarily in the United States.

We report in three reportable segments: Packaging, Paper and Corporate and Other. For segment financial information see Note 20, Segment Information, of the Notes to Consolidated Financial Statements in “Part II, Item 8, Financial Statements and Supplementary Data” of this Form 10-K.

Production and Shipments

The following table summarizes the Packaging segment's containerboard production and corrugated products shipments and the Paper segment's UFS production.

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | First

Quarter | | | Second

Quarter | | | Third

Quarter | | | Fourth

Quarter | | | Full Year | |

Containerboard Production | | | 2021 | | | | 1,195 | | | | 1,193 | | | | 1,256 | | | | 1,243 | | | | 4,887 | |

(thousand tons) | | | 2020 | | | | 1,047 | | | | 1,072 | | | | 1,048 | | | | 1,174 | | | | 4,341 | |

| | | 2019 | | | | 1,037 | | | | 1,063 | | | | 1,070 | | | | 1,079 | | | | 4,249 | |

Corrugated Products Shipments (billion square feet) | | | 2021 | | | | 16.4 | | | | 16.5 | | | | 16.4 | | | | 16.4 | | | | 65.7 | |

| | | 2020 | | | | 15.3 | | | | 15.1 | | | | 16.0 | | | | 16.4 | | | | 62.8 | |

| | | 2019 | | | | 14.5 | | | | 14.9 | | | | 15.1 | | | | 14.9 | | | | 59.4 | |

UFS Production | | | 2021 | | | | 145 | | | | 149 | | | | 148 | | | | 130 | | | | 572 | |

(thousand tons) | | | 2020 | | | | 224 | | | | 148 | | | | 129 | | | | 147 | | | | 648 | |

| | | 2019 | | | | 239 | | | | 236 | | | | 236 | | | | 236 | | | | 947 | |

3

Below is a map of our locations:

Packaging

Packaging Products

Our containerboard mills produce linerboard and corrugating medium, which are papers primarily used in the production of corrugated products. Our corrugated products manufacturing plants produce a wide variety of corrugated packaging products, including conventional shipping containers used to protect and transport manufactured goods, multi-color boxes and displays with strong visual appeal that help to merchandise the packaged product in retail locations, and honeycomb protective packaging. In addition, we are a large producer of packaging for meat, fresh fruit and vegetables, processed food, beverages, and other industrial and consumer products. Our products are sustainable and are produced from renewable raw materials, predominately using energy derived from biogenic fuels in our production processes and are recyclable at end-of-life.

During the year ended December 31, 2021, our Packaging segment produced 4.9 million tons of containerboard at our mills. Our corrugated products manufacturing plants sold 65.7 billion square feet (BSF) of corrugated products. The Packaging segment’s net sales to third parties totaled $7.1 billion in 2021.

4

Facilities

We manufacture containerboard, which includes a variety of performance and specialty grades, at our containerboard mills. Total annual containerboard capacity was approximately 5.0 million tons as of December 31, 2021. We also produce corrugated and protective packaging products at 90 manufacturing locations. The following provides more details of our primary operating facilities:

Counce. Our Counce, Tennessee mill produces kraft linerboard on two machines. The mill can produce basis weights from 26 lb. to 90 lb.

DeRidder. Our DeRidder, Louisiana mill produces kraft linerboard on its No. 1 machine and kraft linerboard and corrugating medium on its No. 3 machine. The mill can produce linerboard in basis weights of 26 lb. to 69 lb. and medium in basis weights of 23 lb. to 33 lb.

Valdosta. Our Valdosta, Georgia mill produces kraft linerboard on one machine. The mill can produce basis weights from 35 lb. to 96 lb.

Tomahawk. Our Tomahawk, Wisconsin mill produces corrugating medium on two machines. The mill can produce basis weights from 23 lb. to 47 lb.

Filer City. Our Filer City, Michigan mill produces corrugating medium on three machines. The mill can produce basis weights from 20 lb. to 47 lb.

Wallula. Our Wallula, Washington mill produces corrugating medium on its No. 2 machine and kraft linerboard on its No. 3 machine. The mill can produce medium in basis weights from 23 lb. to 33 lb. and linerboard in basis weights from 31 lb. to 52 lb.

Jackson. Our Jackson, Alabama mill produces kraft linerboard on its No. 3 machine and, beginning in the third quarter of 2021, we began producing corrugating medium on its No. 1 machine. Jackson had historically operated as a UFS paper mill, with its results of operations reported in our Paper segment. During the fourth quarter of 2020, in order to meet strong packaging demand and maintain appropriate inventory levels, we temporarily began producing linerboard on the No. 3 machine and, in the first quarter of 2021, we announced the discontinuation of producing uncoated freesheet paper grades on the machine and the permanent conversion of the machine to produce linerboard. Before October 2020, operating results for the Jackson mill were included in the Paper segment. Beginning in October 2020, operating results for the Jackson mill are included in both the Packaging and Paper segments. Jackson remains capable of producing white paper grades on the No. 1 and No. 3 machines.

We operate 90 corrugated manufacturing and protective packaging operations, a technical and development center, 10 regional design centers, a rotogravure printing operation, and a complement of packaging supplies and distribution centers. Of the 90 manufacturing facilities, 59 operate as combining operations, commonly called corrugated plants, which manufacture corrugated sheets and finished corrugated packaging products, 30 are sheet plants, which procure combined sheets and manufacture finished corrugated packaging products, and one is a corrugated sheet-only manufacturer.

Corrugated products plants tend to be located in close proximity to customers to minimize freight costs. Each of our plants serves a market radius of approximately 150 miles. Our sheet plants are generally located in close proximity to our larger corrugated plants, which enables us to offer additional services and converting capabilities such as small volume and quick turnaround items.

Major Raw Materials Used

Fiber supply. Fiber is the largest raw material cost to manufacture containerboard. We consume both virgin wood fiber and recycled fiber in our containerboard mills, and all of our fiber comes from renewable resources. Our mill system has the capability to shift a portion of its fiber consumption between softwood, hardwood, and recycled sources. All of our mills can utilize virgin wood fiber and all of our mills, other than the Valdosta mill, can utilize some recycled fiber in their containerboard production. Our corrugated manufacturing operations generate recycled fiber as a by-product from the manufacturing process, which is consumed by our mills. In 2021, our usage of recycled fiber, net of internal generation, represents 18% of our containerboard production. In order to improve our fiber flexibility and production capabilities, we have invested in additional capacity to process recycled fiber at our DeRidder, Wallula, and Jackson mills.

We procure wood fiber through leases of cutting rights, long-term supply agreements, and market purchases and believe we have adequate sources of fiber supply for the foreseeable future.

5

As part of our renewable virgin fiber sourcing efforts, we participate in the Sustainable Forestry Initiative® (SFI), the Programme for the Endorsement of Forest Certification (PEFC), as well as the Forest Stewardship Council® (FSC®), and we are certified under their sourcing and chain of custody standards. These standards are aimed at ensuring the long-term health and conservation of forestry resources. We are committed to sourcing wood fiber through environmentally, socially, and economically sustainable practices and promoting resource and conservation stewardship ethics.

Energy supply. Energy at our packaging mills is obtained through self-generated or purchased fuels and electricity. Fuel sources include by-products of the containerboard manufacturing and pulping process (including black liquor and wood waste), natural gas, purchased wood waste, and other purchased fuels. Each of our mills self-generates process steam requirements from by-products (black liquor and wood waste), as well as from the various purchased fuels. The process steam is used throughout the production process and also to generate electricity.

In 2021, our packaging mills consumed about 81 million MMBTUs of fuel to produce both steam and electricity. Of the 81 million MMBTUs consumed, about 61% was from mill-generated biogenic fuels that are by-products of our containerboard manufacturing and pulping process and 39% was from purchased fuels. Of the purchased fuels, 81% was from natural gas, 18% was from purchased wood waste and 1% was from other purchased fuels.

Chemical supply. We consume various chemicals in the production of containerboard, including caustic soda, sulfuric acid, soda ash, and lime. Most of our chemicals are purchased under contracts, which are bid or negotiated periodically.

Sales, Marketing, and Distribution

Our corrugated products are sold through our direct sales and marketing organization, independent brokers, and distribution partners. We have sales representatives and a sales manager at most of our corrugated manufacturing operations and also have corporate account managers who serve customer accounts with a national presence. Additionally, our design centers maintain an on-site dedicated graphics sales force. In addition to direct sales and marketing personnel, we utilize new product development engineers and product graphics and design specialists. These individuals are located at both the corrugated plants and the design centers. General marketing support is located at our corporate headquarters.

Our containerboard sales group is responsible for linerboard and corrugating medium order processing and sales to our corrugated plants, to outside domestic customers, and to export customers. These personnel also coordinate and execute all containerboard trade agreements with other containerboard manufacturers.

Containerboard produced in our mills is shipped by rail or truck. Our corrugated products are delivered by truck due to our large number of customers and their demand for timely service. Our corrugated manufacturing operations typically serve customers within a 150-mile radius. We sometimes use third-party warehouses for short-term storage of corrugated products. We have experienced higher freight costs in 2021 due to truck and driver shortages and limited boxcar availability, as well as fuel surcharges.

Customers

We sell containerboard and corrugated products to approximately 15,000 customers in approximately 33,000 locations. About 70% of our corrugated products sales are to regional and local accounts, which are broadly diversified across industries and geographic locations. The remaining 30% of our customer base consists primarily of national accounts that have multiple locations and are served by a number of PCA plants. No single customer exceeds 10% of segment sales.

The primary end-use markets in the United States for corrugated products are shown below as reported in the 2020 Fibre Box Association annual report:

| | | | |

Food, beverages, and agricultural products | | | 44 | % |

Retail and wholesale trade | | | 25 | % |

Paper and other products | | | 12 | % |

Chemical, plastic, and rubber products | | | 10 | % |

Miscellaneous manufacturing | | | 9 | % |

6

Competition

As of December 31, 2021, we were the third largest producer of containerboard products in North America, according to industry sources and our own estimates. According to industry sources, corrugated products are produced by about 445 U.S. companies operating approximately 1,150 plants. The primary basis for competition for most of our packaging products includes quality, service, price, product design, and innovation. Most corrugated products are manufactured to the customer’s specifications. Corrugated producers generally sell within a 150-mile radius of their plants and compete with other corrugated producers in their local region. Competition in our corrugated products operations tends to be regional, although we also face competition from competitors with significant national account presence.

On a national level, our primary competitors are International Paper, WestRock Company, Georgia-Pacific LLC, and Pratt Industries. However, with our strategic focus on regional and local accounts, we also compete with the smaller, independent producers.

Paper

We are a leading producer of UFS in North America, according to industry sources and our own estimates. We manufacture and sell papers, including both commodity and specialty papers, which may have custom or specialized features such as colors, coatings, high brightness, and recycled content. Our papers consist of communication papers, including cut-size office papers, and printing and converting papers. Our products are sustainable and are produced from renewable raw materials, predominately using energy derived from biogenic fuels in our production processes and are recyclable at end-of-life.

Facilities

We currently have two paper mills located in the United States with the capacity to produce 602,000 tons annually. Our operations include the following:

International Falls. Our International Falls, Minnesota mill produces both commodity and specialty papers on two paper machines.

Jackson. Our Jackson, Alabama mill has historically produced UFS and has the capability to produce both commodity and specialty papers on its No. 1 and No. 3 machines. Since October 2020, the mill has also produced containerboard. See "Packaging — Facilities — Jackson" for further information.

Major Raw Materials Used

Fiber supply. Fiber is the largest raw material cost in this segment. We consume wood fiber, recycled fiber, and purchased pulp. We purchase wood fiber through contracts and open-market purchase, and we purchase recycled fiber and pulp from third parties pursuant to contractual agreements.

As part of our renewable virgin fiber sourcing efforts, we participate in the Sustainable Forestry Initiative® (SFI), the Programme for the Endorsement of Forest Certification (PEFC), as well as the Forest Stewardship Council® (FSC®), and we are certified under their sourcing and chain of custody standards. These standards are aimed at ensuring the long-term health and conservation of forestry resources. We are committed to sourcing wood fiber through environmentally, socially, and economically sustainable practices and promoting resource and conservation stewardship ethics.

Energy supply. We obtain energy through self-generated or purchased fuels and electricity. Fuel sources include by-products of the manufacturing and pulping process (including black liquor and wood waste), natural gas, electricity, and purchased wood waste. Each of the paper mills self-generates process steam requirements from by-products (black liquor and wood waste), as well as from the various purchased fuels. The process steam is used throughout the production process and to generate electricity.

In 2021, our paper mills consumed about 12 million MMBTUs of fuel to produce both steam and electricity. Of the 12 million MMBTUs consumed, about 75% was from mill-generated biogenic fuels that are by-products of the manufacturing and pulping process and 25% was from purchased fuels. Of the purchased fuels, 95% was from natural gas and 5% from purchased wood waste.

Chemical supply. We consume various chemicals in the production of white papers, including starch, precipitated calcium carbonate, caustic soda, and sodium chlorate. Most of our chemicals are purchased under contracts, which are bid or negotiated periodically.

7

Sales, Marketing, and Distribution

Our papers are sold primarily through our sales and marketing organization. We ship to customers both directly from our mills and through distribution centers and a network of outside warehouses by rail or truck. This allows us to respond quickly to customer requirements.

Customers

We have about 100 customers in approximately 350 locations. These customers include office products distributors and retailers, paper merchants, and envelope and other converters. We have established long-term relationships with many of our customers. Office Depot, Inc. is our largest customer in the Paper segment. Effective January 1, 2020, we have a revised agreement with Office Depot in which we will continue to supply commodity and non-commodity office papers to Office Depot through December 31, 2022. Office Depot is not subject to a minimum volume commitment and is entitled to receive rebates for achieving certain volume thresholds. If the agreement is not renewed by the parties, Office Depot’s obligation to purchase paper would phase down over a two-year period beginning on January 1, 2023. In 2021, our sales revenue to Office Depot represented 51% of our Paper segment sales revenue and 4% of our consolidated sales revenue.

Competition

The markets in which our Paper segment competes are large and highly competitive. Commodity grades of UFS paper are globally traded, with numerous worldwide manufacturers, and as a result, these products compete primarily on the basis of price. All of our paper manufacturing facilities are located in the United States, and although we compete primarily in the domestic market, we do face competition from foreign producers. In 2016, as a result of a case brought by us and other domestic producers before United States international trade authorities, antidumping and countervailing duties at various levels were imposed on producers of uncoated freesheet papers produced in Australia, Brazil, China, Indonesia, and Portugal. These duties remain in effect after sunset review of duty orders by the U.S. International Trade Commission in January 2022. Other factors influencing competition from overseas producers include domestic and foreign demand and foreign currency exchange rates.

Our largest competitors include Domtar Corporation and Sylvamo Corporation. We also face competition from foreign producers. Although price is the primary basis for competition in most of our paper grades, quality and service are also important competitive determinants. Our papers compete with electronic data transmission, e-readers, electronic document storage alternatives, and paper grades we do not produce. Increasing shifts to these alternatives have had, and are likely to continue to have, an adverse effect on traditional print media and paper usage and lower demand for communication papers.

Corporate and Other

Our Corporate and Other segment includes corporate support staff services and related assets and liabilities. This segment also includes transportation assets, such as rail cars and trucks, which we use to transport some of our products to and from our manufacturing sites, and assets related to a 50% owned variable interest entity, Louisiana Timber Procurement Company, L.L.C. (LTP).

Human Capital

PCA’s success depends on a highly engaged, results-oriented workforce operating in an entrepreneurial culture. Our primary objective is to place the right people in the right roles, and empower them to succeed.

Safety is a core value at PCA and we believe that all accidents are preventable and an injury-free environment is achievable. We have implemented a robust occupational health and safety management system to assure accountability throughout the organization for safe work practices. Key components to our system include commitment from management, extensive training of employees, hazard identification and communication and regular safety audits.

During 2021, we were committed to conducting safe operations through the COVID-19 pandemic in accordance with the guidelines of the Center for Disease Control and applicable health and safety regulations. PCA has experienced some labor shortage issues due to labor market conditions in general which has been exacerbated by the pandemic, particularly the recent spread of the Omicron variant. However, PCA has not experienced significant disruptions in its operations and has managed through the issue to maintain adequate availability of its workforce and supply of raw materials and services to continue to serve its customers.

8

We have extensive recruiting, training and development programs designed to attract and retain a highly talented workforce aligned with our objectives to relentlessly serve our customers and achieve operational excellence throughout our organization. As demand for qualified personnel is increasing, we are expanding our efforts in these critical areas along with efforts to continue to develop, promote and maintain a diverse workforce with a culture and an environment of respect and inclusion. We believe it is essential to hire and promote diverse candidates and employees in order to bring the best ideas to serve our customers. We have established a Diversity, Equity, and Inclusion Council consisting of leaders throughout our organization to hone our strategy and to create a roadmap for inclusive leadership. In 2021, we began to publicly disclose in our annual responsibility report our employee demographics in the form of our annual EEO-1 report. Our responsibility report is available on our website and is not intended to be incorporated by reference herein.

To promote strong and increasing engagement of all PCA employees, we regularly conduct employee engagement surveys and are next scheduled to do so in 2022. We have generally experienced a high survey response rate, assuring us that the survey results strongly represent the feelings and opinions of our employees. Our most recent 2018 employee engagement index trended upward and remained notably above the Global Manufacturing Benchmark index. In their survey responses, our employees reaffirmed our strong safety culture and also overwhelmingly agreed that they enjoy the work they do and that it gives them a sense of personal accomplishment. Our next survey will include diversity, equity and inclusion topics.

As of December 31, 2021, we had approximately 15,200 employees, including 4,400 salaried and 10,800 hourly employees. Approximately 63% of our hourly employees worked pursuant to collective bargaining agreements. The majority of our unionized employees are represented by the United Steel Workers (USW), the International Brotherhood of Teamsters (IBT), the International Association of Machinists (IAM), and the Association of Western Pulp and Paper Workers (AWPPW). We are currently in negotiations to renew or extend union contracts that have recently expired or are expiring in the near future. During 2021, we experienced no work stoppages, and we believe we have satisfactory labor relations with our employees.

Regulatory and Environmental Matters

A discussion of the financial impact of our compliance with environmental laws is presented under the caption “Regulatory and Environmental Matters” in “Part II, Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations” of this Form 10-K.

Executive Officers of the Registrant

Brief statements setting forth the age at February 24, 2022, the principal occupation, employment during the past five years, the year in which such person first became an officer of PCA, and other information concerning each of our executive officers appears below.

Mark W. Kowlzan, 66, Chairman and Chief Executive Officer - Mr. Kowlzan has served as PCA's Chairman since January 2016 and as Chief Executive Officer and a director since July 2010. From 1998 through June 2010, Mr. Kowlzan led the company’s containerboard mill system, first as Vice President and General Manager and then as Senior Vice President - Containerboard. From 1996 through 1998, Mr. Kowlzan served in various senior mill-related operating positions with PCA and Tenneco Packaging, including as manager of the Counce linerboard mill. Prior to joining Tenneco Packaging, Mr. Kowlzan spent 15 years at International Paper, a global paper and packaging company, where he held a series of operational and managerial positions within its mill organization. Mr. Kowlzan is a member of the board of American Forest and Paper Association.

Charles J. Carter, 62, Executive Vice President - Mill Operations - Mr. Carter has led our mill operations since January 2011. Prior to this, he served as Vice President – Containerboard Mill Operations since January 2011. From March 2010 to January 2011, Mr. Carter served as PCA’s Director of Papermaking Technology. Prior to joining PCA in 2010, Mr. Carter spent 28 years with various pulp and paper companies in managerial and technical positions of increasing responsibility, most recently as Vice President and General Manager of the Calhoun, Tennessee mill of Abitibi Bowater from 2007 to 2010 and as manager of SP Newsprint’s Dublin, Georgia mill from 1999 to 2007.

Thomas A. Hassfurther, 66, Executive Vice President - Corrugated Products - Mr. Hassfurther has served as Executive Vice President - Corrugated Products of PCA since September 2009. From February 2005 to September 2009, Mr. Hassfurther served as Senior Vice President - Sales and Marketing, Corrugated Products. Prior to this he held various senior-level management and sales positions at PCA and Tenneco Packaging. Mr. Hassfurther joined the company in 1977.

9

Robert P. Mundy, 60, Executive Vice President and Chief Financial Officer - Mr. Mundy has served as our Chief Financial Officer since 2015. He previously served as Senior Vice President and Chief Financial Officer of Verso Corporation, a leading North American supplier of coated papers to catalog and magazine publishers, from 2006 to June 2015. Verso Corporation filed for Chapter 11 bankruptcy in January 2016. Prior to that, he worked at International Paper from 1983 to 2006, where he was Director of Finance of the Coated and Supercalendered Papers division from 2002 to 2006, Director of Finance Projects from 2001 to 2002, Controller of Masonite Corporation from 1999 to 2001, and Controller of the Petroleum and Minerals business from 1996 to 1999. He served in various business positions at International Paper from 1983 to 1996.

Pamela A. Barnes, 57, Senior Vice President – Finance and Controller - Ms. Barnes has served as Senior Vice President – Finance and Controller since May 2019. Ms. Barnes previously served as a Vice President in PCA’s finance organization from 2012 to 2019. After joining the company in 1992, she has held various positions of increasing responsibility, including serving as PCA’s Treasurer since 1999. Before joining PCA, Ms. Barnes worked for Deloitte & Touche.

Jeff S. Kaser, 56, Senior Vice President – Corrugated Products - Mr. Kaser has served as Senior Vice President — Corrugated Products since May 2020. Prior to this, he served as Vice President and Area General Manager of PCA’s Midwest Area, Mid-Atlantic Area and Pennsylvania Region. Mr. Kaser joined PCA in 1987 and has also held plant positions in sales, sales management and general management.

Darla J. Olivier, 52, Senior Vice President – Tax, ESG and Government Affairs - Ms. Olivier has led our tax department since 1994 and served as Vice President—Tax from October 2010 to January 2022. In January 2022, she was promoted to Senior Vice President—Tax, ESG and Government Affairs, and leads our sustainability reporting and government affairs functions. Before joining PCA, Ms. Olivier worked for Coopers & Lybrand LLP, Alberto-Culver Company and SPX Corporation.

Kent A. Pflederer, 51, Senior Vice President, General Counsel and Secretary - Mr. Pflederer has served as Senior Vice President, General Counsel and Corporate Secretary since January 2013 and has led our legal department since June 2007. Prior to joining PCA, Mr. Pflederer served as Senior Counsel, Corporate and Securities, at Hospira, Inc. from 2004 to 2007 and served in the corporate and securities practice at Mayer Brown, LLP from 1996 to 2004.

Bruce A. Ridley, 66, Senior Vice President – Environmental Health and Safety and Operational Services - Mr. Ridley has served as Senior Vice President – Environmental Health and Safety and Operational Services since May 2019. Mr. Ridley previously served as Vice President of Operations from 2012 to 2019 and at PCA’s Tomahawk, Wisconsin containerboard mill as the Operations Manager and Mill Manager from 1999 to 2011. Before joining PCA, he held several positions of increasing responsibility at multiple locations during his 19 years with International Paper and two years with Champion International.

Robert A. Schneider, 56, Senior Vice President and Chief Information Officer - Mr. Schneider has served as our Chief Information Officer since 2000 and was promoted to Senior Vice President in 2019. Mr. Schneider joined the company in 1989 and has held various management and other positions of increasing responsibility in information systems for PCA.

D. Ray Shirley, 50, Senior Vice President – Corporate Engineering and Process Technology - Mr. Shirley has served as PCA’s Senior Vice President – Corporate Engineering and Process Technology since May 2019. Mr. Shirley previously served as PCA’s Vice President – Containerboard Mills Engineering and Process Technology from 2012 to 2019 and as Mill Manager at PCA’s Counce, Tennessee containerboard mill from 2010 to 2012. He has served in various management roles within the company, including the Operations Manager at the Filer City, Michigan containerboard mill. Before joining PCA in 1996, Mr. Shirley worked for Georgia-Pacific Corporation.

Available Information

PCA’s internet website address is www.packagingcorp.com. Our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 are available free of charge through our website as soon as reasonably practicable after they are electronically filed with, or furnished to, the Securities and Exchange Commission. In addition, our Code of Ethics may be accessed in the Investor Relations section of PCA’s website. PCA’s website and the information contained or incorporated therein are not intended to be incorporated into this report.

10

Item 1A. RISK FACTORS

Some of the statements in this report and, in particular, statements found in Management’s Discussion and Analysis of Financial Condition and Results of Operations, that are not historical in nature are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include statements about our expectations regarding our future liquidity, earnings, expenditures, and financial condition. These statements are often identified by the words “will,” “should,” “anticipate,” “believe,” “expect,” “intend,” “estimate,” “hope,” or similar expressions. These statements reflect management’s current views with respect to future events and are subject to risks and uncertainties. There are important factors that could cause actual results to differ materially from those in forward-looking statements, many of which are beyond our control. These factors, risks and uncertainties include, but are not limited to, the factors described below.

Our actual results, performance, or achievement could differ materially from those expressed in, or implied by, these forward-looking statements, and accordingly, we can give no assurances that any of the events anticipated by the forward-looking statements will transpire or occur, or if any of them do so, what impact they will have on our results of operations or financial condition. In view of these uncertainties, investors are cautioned not to place undue reliance on these forward-looking statements. We expressly disclaim any obligation to publicly revise or otherwise update any forward-looking statements that have been made to reflect the occurrence of events after the date hereof.

In addition to the risks and uncertainties we discuss elsewhere in this Form 10-K (particularly in “Part II, Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations”) or in our other filings with the Securities and Exchange Commission (SEC), the following are important factors that could cause our actual results to differ materially from those we project in any forward-looking statement.

Risks Related to the COVID-19 Pandemic

The future effect of the COVID-19 pandemic on our operations is uncertain. Since the onset of the COVID-19 pandemic in 2020, federal, state and local authorities have taken measures to control the outbreak of COVID-19 in the United States, where we primarily operate. These measures have included travel bans and restrictions, quarantines and shelter in place orders, and standards affecting employers such as mask mandates, vaccine mandates and testing protocols. Due to the importance of our products to the continued distribution of food, beverage and other necessities, our operating facilities have remained in operation throughout the pandemic, and we have not experienced material disruptions in operations to date. PCA has experienced some labor shortage issues due to labor market conditions in general, which has been exacerbated by the pandemic, particularly the recent spread of the Omicron variant in late 2021 and early 2022. We have also experienced and may experience in the future higher supply chain and transportation costs, in part, due to the impacts of COVID-19. The impact of future variants of the virus and governmental measures to control the spread of the virus, including vaccine mandates or mandatory testing protocols, are uncertain and may materially restrict or hinder our ability to operate our facilities due to measures we may need to take to assure the health and safety of our employees, lack of available workforce, disruptions in the supply of key materials and services or restrictions due to governmental actions. If our operations are hindered or restricted, we may not be able to serve our customers, which could have a material adverse effect on our business, financial condition and results of operations.

The pandemic resulting from the COVID-19 outbreak, and measures to control the outbreak, have had a negative impact on certain businesses, which could adversely affect demand for our products and our business, financial condition and results of operations. Many businesses in the United States have been required to cease or curtail operations and workers have been laid off or furloughed, and have slowed down economic activity. The severity and duration of the impact on the economy will depend on the future spread of the outbreak, future measures by governmental authorities to control the outbreak, the timing and effectiveness of vaccination efforts, the timing and manner in which normal social and business activities are permitted to resume and the willingness of businesses and citizens to resume those activities and the effectiveness of governmental efforts to mitigate the economic effect of the outbreak, all of which are highly uncertain.

We have experienced significantly lower demand for our uncoated freesheet paper products, due to economic conditions, office closings and school shutdowns associated with the COVID-19 pandemic, which harmed the performance of our Paper segment and was a factor in our decision to permanently convert the No. 3 machine at our Jackson mill to permanently produce containerboard. While we have not experienced lower demand for our containerboard and corrugated packaging products to date, the effect of the pandemic on economic conditions affecting our business and future demand is uncertain. It is uncertain whether, to what extent and for what period of time current favorable demand conditions in the Packaging segment will continue. With the uncertainty of economic conditions, we are unable to determine the impact on our future operating and financial performance. A prolonged period of lower earnings and reduced cash flow could adversely affect our ability to fund operations, capital requirements, and common stock dividend payments and access capital markets.

11

Risks Related to our Operations, Business and Industry

Industry Cyclicality - Changes in the prices of our products could materially affect our financial condition, results of operations, and liquidity. Macroeconomic conditions and fluctuations in industry capacity can create changes in prices, sales volumes, and margins for most of our products, particularly commodity grades of packaging and paper products. Prices for all of our products are driven by many factors, including demand for our products, industry capacity and decisions made by other producers with respect to capacity and production, and other competitive conditions in our industry. These factors are affected by general global and domestic economic conditions. We have little influence over the timing and extent of price changes of our products, which may be unpredictable and volatile. In addition, as many of our customer contracts include price adjustment provisions based upon published index prices for containerboard or certain grades of UFS papers, our selling prices are influenced by index levels published by trade publications. Changes in how these index levels are determined or maintained may affect our sales prices. If supply exceeds demand, industry operating conditions deteriorate or other factors result in lower prices for our products, our earnings and operating cash flows would be harmed.

Competition - The intensity of competition in the industries in which we operate could result in downward pressure on pricing and volume, which could lower earnings and operating cash flows. Our industries are highly competitive, with no single containerboard, corrugated packaging, or UFS paper producer having a dominant position. Certain containerboard grades and commodity UFS paper products cannot generally be differentiated by producer, which tends to intensify price competition. The corrugated packaging industry is also sensitive to changes in economic conditions, as well as other factors including innovation, design, quality, and service. To the extent that one or more competitors are more successful than we are with respect to any key competitive factor, our business could be adversely affected. Our packaging products also compete, to some extent, with various other packaging materials, including products made of paper, plastics, wood, and various types of metal. If we are unable to successfully compete, we may lose market share or may be required to charge lower sales prices for our products, both of which would reduce our earnings and operating cash flows.

UFS paper products compete with electronic data transmission and document storage alternatives. Increasing shifts to electronic alternatives have had and will continue to have an adverse effect on usage of these products. As a result of such competition, the industry is experiencing decreasing demand for existing UFS paper products. As the use of these alternatives grows, demand for UFS paper products is likely to further decline. Declines in demand for our paper products may adversely affect our earnings and operating cash flows.

Some of our competitors are larger than we are and may have greater financial and other resources, greater manufacturing economies of scale, greater energy self-sufficiency, or lower operating costs, compared to our company. We may be unable to compete effectively with these companies particularly during economic downturns. Some of the factors that may adversely affect our ability to compete in the markets in which we participate include the entry of new competitors into the markets we serve, increased competition from overseas producers, our competitors' pricing strategies, changes in customer preferences, and the cost-efficiency of our facilities.

Cost of Fiber - An increase in the cost of fiber could increase our manufacturing costs and lower our earnings. The market price of wood fiber varies based upon availability, source, and the costs of fuels used in the harvesting and transportation of wood fiber. The cost and availability of wood fiber can also be impacted by weather, general logging conditions, geography, and regulatory activity.

The availability and cost of recycled fiber depends heavily on recycling rates and the domestic and global demand for recycled products. We purchase recycled fiber for use at six of our mills. In 2021, we purchased approximately 860,000 tons of recycled fiber, net of the recycled fiber generated by our corrugated box plants. The amount of recycled fiber purchased each year varies based upon production and the prices of both recycled fiber and wood fiber.

Periods of supply and demand imbalance have created significant price volatility. Periods of higher recycled fiber costs and unusual price volatility have occurred in the past, including during 2021, as demand for domestic recycled fiber remained high. Prices for recycled fiber may continue to fluctuate significantly in the future, which could result in higher costs and lower earnings. A $10 per ton price increase in recycled fiber for our containerboard mills would result in approximately $8.6 million of additional expense based on 2021 consumption.

12

Cost of Purchased Fuels and Chemicals - An increase in the cost of purchased fuels and chemicals could lead to higher manufacturing costs, resulting in reduced earnings. We are experiencing significant cost inflation for key inputs such as fuels and chemicals. We have the ability to use various types of purchased fuels in our manufacturing operations, including natural gas, bark, and other purchased fuels. Fuel prices, in particular prices for oil and natural gas, have fluctuated in the past. New and more stringent environmental regulations may discourage, reduce the availability of, or make more expensive, the use of certain fuels, such as natural gas, which represents the majority of our purchased fuels. In addition, costs for key chemicals used in our manufacturing operations also fluctuate. These fluctuations impact our manufacturing costs and result in earnings volatility. If fuel and chemical prices rise, our production costs and transportation costs will increase and cause higher manufacturing costs and reduced earnings if we are unable to recover such increases through higher prices of our products. A $0.10 per million MMBTU increase in natural gas prices would result in approximately $3 million of additional expense, based on 2021 usage.

Customer Concentration - We rely on certain large customers. Our packaging and paper segments each have large customers, the loss of which could adversely affect the segment’s sales and profitability. In particular, because our businesses operate in highly competitive industry segments, we regularly bid for new business or for renewal of existing business. The loss of business from our larger customers, or the renewal of business on less favorable terms, may adversely impact our financial results.

Office Depot, Inc. is our largest customer in the Paper segment. Effective January 1, 2020, we have a revised agreement with Office Depot in which we will continue to supply commodity and non-commodity office papers to Office Depot through December 31, 2022. Office Depot is not subject to a minimum volume commitment and is entitled to receive rebates for achieving certain volume thresholds. If the agreement is not renewed by the parties, Office Depot’s obligation to purchase paper would phase down over a two-year period beginning on January 1, 2023.

In 2021, sales to Office Depot represented 51% of our Paper segment sales and 4% of our consolidated sales. If these sales are reduced, including if we are unable to renew the agreement at historical volume levels, we would need to find new customers. We may not be able to fully replace any lost sales, and any new sales may be at lower prices or higher costs. Any significant deterioration in the financial condition of Office Depot affecting its ability to pay or any other change that makes Office Depot less willing to purchase our products will harm our business and results of operations.

Transportation Costs - Reduced truck and rail availability could lead to higher costs or poorer service, resulting in lower earnings, and harm our ability to distribute our products. We ship our products primarily by truck and rail. We have experienced lower availability of third-party trucking services, including truck and driver shortages, and service issues, interruptions, and delays in rail services. These issues became more pronounced later in 2021 and continue to persist. While we have generally been able to manage through these issues and have not experienced material disruptions in our ability to serve our customers, these issues have resulted in significantly higher costs for transportation services. If these factors persist, we could experience even higher transportation costs in the future and difficulties shipping our products in a timely manner. We may not be able to recover higher transportation costs through higher prices or otherwise, which would result in lower earnings.

Material Disruption of Manufacturing - A material disruption at one of our manufacturing facilities could prevent us from meeting customer demand, reduce our sales, and/or negatively affect our results of operations and financial condition. Our business depends on continuous operation of our facilities, particularly at our mills. Any of our manufacturing facilities, or any of our machines within such facilities, could cease operations unexpectedly for a significant period of time due to a number of events, including:

•Unscheduled maintenance outages.

•Prolonged power failures.

•Equipment or information system breakdowns or failures.

•Explosion of a boiler or other major facilities.

•Disruption in the supply of raw materials, such as wood fiber, energy, or chemicals.

•A spill or release of pollutants or hazardous substances.

•Closure or curtailment related to environmental concerns.

•Disruptions in the transportation infrastructure, including roads, bridges, railroad tracks, and tunnels.

•Terrorism or threats of terrorism.

•Other operational problems.

13

These events could harm our ability to produce our products and serve our customers and may lead to higher costs and reduced earnings.

Extreme Weather Events - Our facilities are susceptible to extreme weather events, which could disrupt our business. Extreme weather events like hurricanes, tornadoes, floods and winter storms have caused disruptions to our business both directly and indirectly in recent history. Climate change may increase the frequency and intensity of these extreme weather events. Certain weather events may cause damage to our facilities and require us to temporarily halt operations. In 2020, Hurricane Laura resulted in widespread damage and power interruption at our DeRidder, Louisiana containerboard mill resulting in a multiple day outage and significant lost production and incremental costs. These types of events may also disrupt our suppliers’ operations and their ability to transport materials to our facilities. Disruptions to the supply chain may cause the cost of goods to temporarily increase. Damage to our facilities may cause insurance premiums to increase and also require us to incur additional costs to mitigate future risks.

Reliance on Personnel - We may fail to attract and retain qualified personnel, including key management personnel. Our ability to operate and grow our business depends on our ability to attract and retain employees with the skills necessary to operate and maintain our facilities, produce our products and serve our customers. The increasing demand for qualified personnel may make it more difficult for us to attract and retain qualified employees. Changing demographics and labor work force trends may make it difficult for us to replace retiring employees at our manufacturing and other facilities. U.S. labor market conditions are tight and labor shortages have been exacerbated by the COVID-19 pandemic. We have experienced higher than historical employee turnover in certain of our facilities. These conditions are expected to persist into 2022 and may lead to higher labor costs. If we fail to attract and retain qualified personnel, or if we experience labor shortages, we may experience higher costs and other difficulties, and our business may be adversely impacted.

In addition, we rely on key executive and management personnel to manage our business efficiently and effectively. As our business has grown in size and geographic scope, we have relied on these individuals to manage increasingly complex operations. The loss of any of our key personnel could adversely affect our business.

Cyber Security - Risks related to security breaches of company, customer, employee, and vendor information, as well as the technology that manages our operations and other business processes, could adversely affect our business. We rely on various information technology systems to capture, process, store, and report data and interact with customers, vendors, and employees. Despite careful security and controls design, implementation, updating, and internal and independent third-party assessments, our information technology systems, and those of our third-party providers, could become subject to cyber-attacks or security breaches. Network, system, and data breaches could result in misappropriation of sensitive data or operational disruptions including interruption to systems availability and denial of access to and misuse of applications required by our customers to conduct business with us. Misuse of internal applications; theft of intellectual property, trade secrets, or other corporate assets; and inappropriate disclosure of confidential information could stem from such incidents. Delayed sales, slowed production, or other issues resulting from these disruptions could result in lost sales, business delays, and negative publicity and could have a material adverse effect on our operations, financial condition, or operating cash flows.

Environmental Matters - PCA may incur significant environmental liabilities with respect to both past and future operations. We are subject to, and must comply with, a variety of federal, state and local environmental laws, particularly those relating to air and water quality, waste disposal and the cleanup of contaminated soil and groundwater. Failure to comply with these regulations could result in fines, which may be significant, or other adverse regulatory action. Because environmental regulations are constantly evolving, we have incurred, and will continue to incur, costs to maintain compliance with those laws. See Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations - Environmental Matters” for estimates of expenditures we expect to make for environmental compliance in the next few years. New and more stringent environmental regulations may be adopted and may require us to incur additional operating expenses and/or significant additional capital expenditures to modify or replace certain of our boilers and other equipment. In addition, environmental regulations may increase the cost of our raw materials and purchased energy. Although we have established reserves to provide for known environmental liabilities, these reserves may change over time due to the enactment of new environmental laws or regulations or changes in existing laws or regulations, which might require additional significant environmental expenditures.

Labor Relations- If we experience strikes or other work stoppages, our business will be harmed. Our workforce is highly unionized and operates under various collective bargaining agreements. We must negotiate to renew or extend any union contracts that have recently expired or are expiring in the near future. While we believe that we have satisfactory labor relations, we may not be able to successfully negotiate new agreements without work stoppages or labor difficulties in the future or renegotiate them on favorable terms. If we are unable to successfully renegotiate the terms of any of these agreements, or if we experience any extended interruption of operations at any of our facilities as a result of strikes or other work stoppages, our business, results of operations and financial condition may be harmed.

14

Financial Risks

General Economic Conditions - If business, political, and economic conditions change in an adverse manner, our business, results of operations, liquidity, and financial position may be harmed. General global and domestic economic conditions directly affect the levels of demand and production of consumer goods, levels of employment, the availability and cost of credit, and ultimately, the profitability of our business. If economic conditions deteriorate and result in higher unemployment rates, lower disposable income, persistent inflation, unfavorable currency exchange rates, lower corporate earnings, lower business investment, and lower consumer spending, we may experience lower demand for our products, which is largely driven by demand for products of our customers which utilize our products. The U.S. economy is experiencing the highest levels of inflation in decades, and we are experiencing cost inflation across our business. Persistent inflation will result in continued higher production and transportation costs, which we may not be able to recover through higher prices charged to our customers or otherwise. In addition, changes in trade policy, including renegotiating or potentially terminating existing bilateral or multilateral agreements as well as the imposition of tariffs, could impact global markets and demand for our and our customers’ products and the costs associated with certain of our capital investments. Further changes in tax laws or tax rates may have a material impact on our future cash taxes, effective tax rate or deferred tax assets and liabilities. These conditions are beyond our control and may have a material impact on our business, results of operations, liquidity, and financial position.

Inflation and Other General Cost Increases - We may not be able to offset higher costs. We are subject to both contractual, inflationary, and other general cost increases, including with regard to our labor costs and purchases of raw materials and transportation services. General economic conditions have resulted in higher inflation, which has led to higher costs across our business. If we are unable to offset these cost increases by price increases, growth, and/or cost reductions in our operations, these inflationary and other general cost increases could have a material adverse effect on our operating cash flows, profitability, and liquidity.

In 2021, our total company costs including cost of sales (COS) and selling, general, and administrative expenses (SG&A) was $6.4 billion, and excluding non-cash costs (depreciation, depletion and amortization, pension and postretirement expense, and share-based compensation expense) was $6.0 billion. A 1% increase in COS and SG&A costs would increase costs by $64 million and cash costs by $60 million.

Debt obligations - Our debt service obligations may reduce our operating flexibility. At December 31, 2021, we had $2.5 billion of debt outstanding and a $323.2 million undrawn revolving credit facility, after deducting letters of credit. All debt is comprised of fixed-rate senior notes. We and our subsidiaries are not restricted from incurring, and may incur, additional indebtedness in the future.

Our current borrowings, plus any future borrowings, may affect our ability to operate our business, including, without limitation:

•Result in significant cash requirements to make interest and maturity payments on our outstanding indebtedness;

•Increase our vulnerability to adverse changes in our business or industry conditions;

•Increase our vulnerability to increases in interest rates;

•Limit our ability to obtain additional financing for working capital, capital expenditures, general corporate, and other purposes;

•Limit our flexibility in planning for, or reacting to, changes in our business and our industry; and

•Limit our flexibility to make acquisitions.

Further, if we cannot service our indebtedness, we may have to take actions to secure additional cash by selling assets, seeking additional equity or reducing investments, which may not be achievable on acceptable terms or at all.

Pension Plans – Our pension plans may require additional funding. We record a liability associated with our pensions equal to the excess of the benefit obligations over the fair value of the assets funding the plans. The actual required amounts and timing of future cash contributions will be sensitive to changes in the applicable discount rates and returns on plan assets, and could also be impacted by future changes in the laws and regulations applicable to plan funding. Fluctuations in the market performance of our plan assets will affect our pension plan costs in future periods. Changes in assumptions regarding expected long-term rate of return on plan assets, our discount rate, expected compensation levels, or mortality will also increase or decrease pension costs.

15

Market Price of our Common Stock - The market price of our common stock may be volatile, which could cause the value of the stock to decline. Securities markets worldwide periodically experience significant price declines and volume fluctuations due to macroeconomic factors and other factors beyond our control. This market volatility, as well as general economic, market, or political conditions, could reduce the market price of our common stock with little regard to our operating performance. In addition, our operating results could be below the expectations of public market analysts and investors, and in response, the market price of our common stock could decrease significantly.

None.

Item 2. PROPERTIES

We own and lease properties in our business. Primarily all of our leases are non-cancelable and are accounted for as operating leases. These leases are not subject to early termination except for standard nonperformance clauses.

Information regarding our principal operating facilities, the segments that use those facilities, and a map of geographical locations is presented in “Part I, Item 1. Business” of this Form 10-K. We assess the condition and capacity of our manufacturing, distribution, and other facilities needed to meet our operating requirements. Our properties have been generally well maintained and are in good operating condition. In general, our facilities have sufficient capacity and are adequate for our production and distribution requirements.

We currently own buildings and land for our eight mills. Additionally, we have 90 corrugated manufacturing operations, of which the buildings and land for 53 are owned, including 45 combining operations, or corrugated plants, one corrugated sheet-only manufacturer, and seven sheet plants. We lease the buildings for 14 corrugated plants and 23 sheet plants. We own warehouses and miscellaneous other properties, including sales offices and woodlands management offices. We lease space for regional design centers and numerous other distribution centers, warehouses, and facilities. The equipment in these leased facilities is, in virtually all cases, owned by us, except for forklifts and other rolling stock, which are generally leased.

We own our corporate headquarters building, which is located in Lake Forest, Illinois.

Item 3. LEGAL PROCEEDINGS

Information concerning legal proceedings can be found in Note 21, Commitments, Guarantees, Indemnifications, and Legal Proceedings, of the Notes to Consolidated Financial Statements in “Part II, Item 8. Financial Statements and Supplementary Data” of this Form 10-K.

Item 4. MINE SAFETY DISCLOSURE

Not applicable.

16

PART II

Item 5. MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS, AND ISSUER PURCHASES OF EQUITY SECURITIES

Market Information

PCA’s common stock is listed on the New York Stock Exchange (NYSE) under the symbol “PKG”.

Stockholders

On February 18, 2022, there were 137 holders of record of our common stock.

Purchases of Equity Securities

Stock Repurchase Program

On January 26, 2022, PCA announced that its Board of Directors authorized the repurchase of $1 billion of the Company's outstanding common stock from time to time in open market or privately negotiated transactions in accordance with applicable securities laws. At the time of the announcement, there was no remaining authority under previously announced programs. Repurchases may be made from time to time in open market or privately negotiated transactions in accordance with applicable securities regulations. The timing and amount of repurchases will be determined by the Company in its discretion based on factors such as PCA’s stock price and market and business conditions.

During the fourth quarter of 2021, we paid $193.0 million to repurchase 1.4 million shares of common stock, which was the entire remaining amount of repurchase authority we had under previously announced share repurchase programs. All shares repurchased have been retired. The Company did not repurchase any shares of its common stock during the years ended December 31, 2020 and 2019.

Pursuant to its equity incentive plan, the Company withholds shares from vesting employee equity awards to cover employee tax liabilities. Total shares withheld in 2021 were 95,437 to cover $12.9 million in employee tax liabilities. Total shares withheld in 2020 were 107,627 to cover $10.5 million in employee tax liabilities. Total shares withheld in 2019 were 87,668 to cover $8.2 million of employee tax liabilities.

The following table presents information related to our repurchases of common stock made under repurchase plans authorized by PCA's Board of Directors, and shares withheld to cover taxes on vesting of equity awards, during the three months ended December 31, 2021:

| | | | | | | | | | | | | | | | | |

Issuer Purchases of Equity Securities | |

Period | | Total Number

of Shares

Purchased | | | | Average

Price Paid

Per Share (b) | | | Total Number of

Shares Purchased

as Part of Publicly

Announced

Plans or Programs | | | Approximate

Dollar Value

of Shares That

May Yet Be

Purchased Under

the Plans or

Programs

(in millions) | |

October 1-31, 2021 | | | — | | | | $ | — | | | | — | | | $ | 193.0 | |

November 1-30, 2021 | | | 1,209,317 | | (a) | | | 133.91 | | | | 1,206,612 | | | | 31.4 | |

December 1-31, 2021 | | | 240,765 | | (a) | | | 133.17 | | | | 235,999 | | | | — | |

Total | | | 1,450,082 | | | | $ | 133.78 | | | | 1,442,611 | | | $ | — | |

(a)7,471 shares were withheld from employees to cover income and payroll taxes on equity awards that vested during the period.

17

Performance Graph

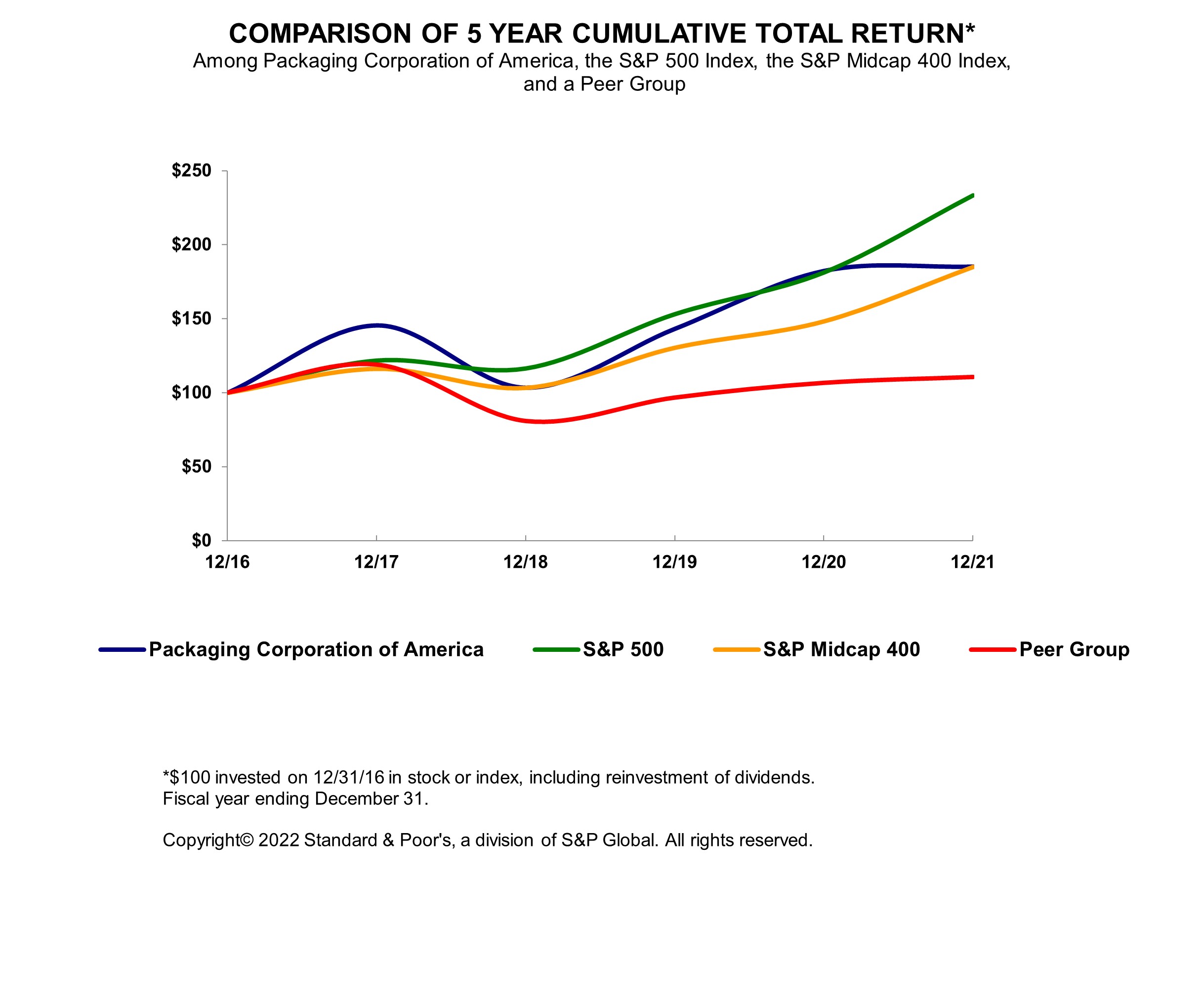

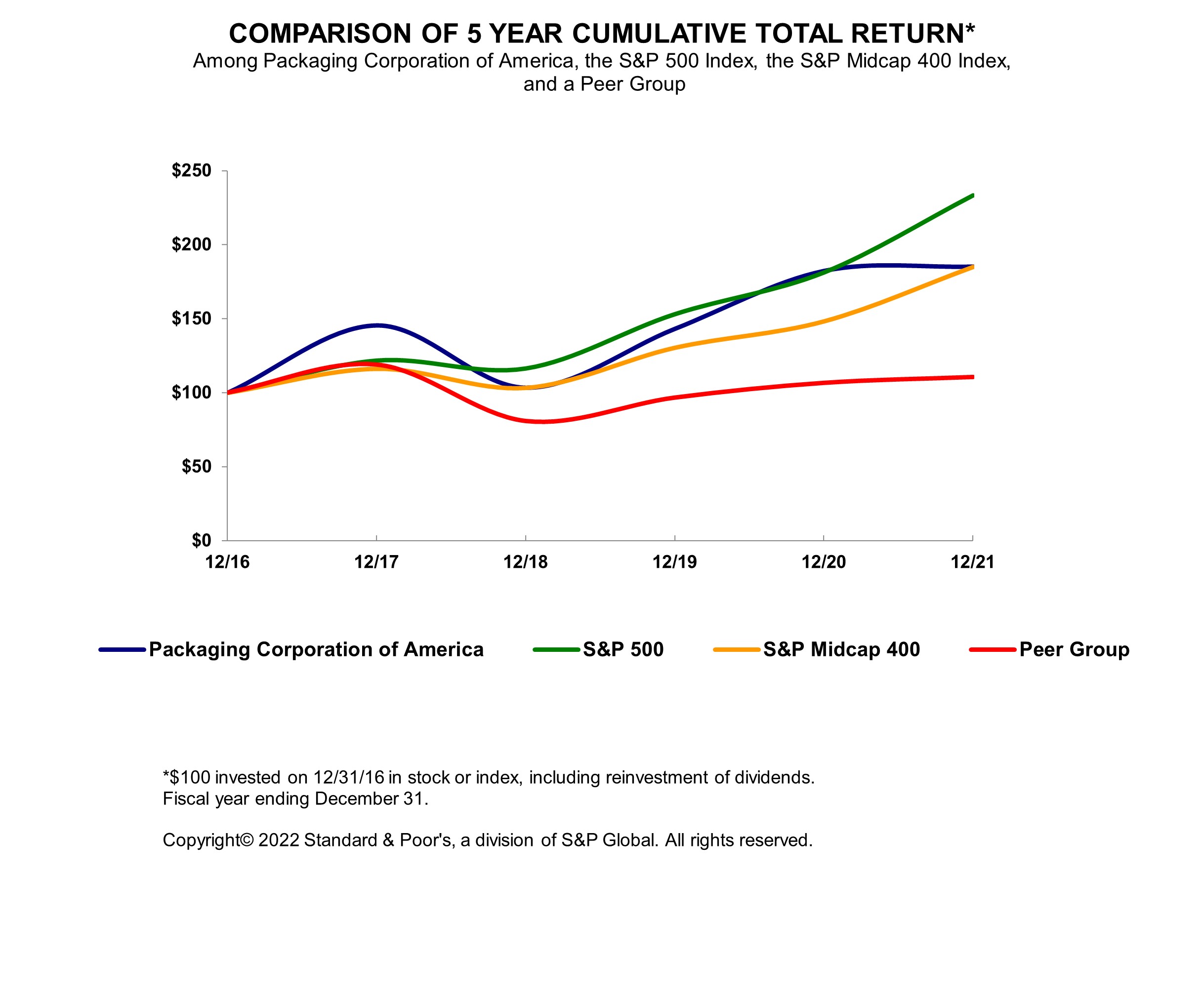

The graph below compares PCA’s cumulative 5-year total shareholder return on common stock with the cumulative total returns of the S&P 500 index; the S&P Midcap 400 index; and a customized peer group of two companies that includes: International Paper and WestRock Company. Domtar Corporation, which was included in the peer group in prior years, is no longer actively traded due to a recent acquisition. As a result, Domtar Corporation was subsequently removed from the peer group for the 2021 analysis. The graph tracks the performance of a $100 investment (including the reinvestment of all dividends) in our common stock, in each index, and in each peer group's common stock from December 31, 2016 through December 31, 2021. The stock price performance included in this graph is not necessarily indicative of future stock price performance.

| | | | | | | | | | | | | | | | | | | | | | | | |

| | Cumulative Total Return | |

| | December 31, | |

| | 2016 | | | 2017 | | | 2018 | | | 2019 | | | 2020 | | | 2021 | |

Packaging Corporation of America | | $ | 100.00 | | | $ | 145.49 | | | $ | 103.50 | | | $ | 143.19 | | | $ | 182.23 | | | $ | 185.17 | |

S&P 500 | | | 100.00 | | | | 121.83 | | | | 116.49 | | | | 153.17 | | | | 181.35 | | | | 233.41 | |

S&P Midcap 400 | | | 100.00 | | | | 116.24 | | | | 103.36 | | | | 130.44 | | | | 148.26 | | | | 184.96 | |

Peer Group | | | 100.00 | | | | 118.91 | | | | 80.79 | | | | 96.62 | | | | 106.57 | | | | 110.53 | |

The information in the graph and table above is not deemed “filed” with the Securities and Exchange Commission and is not to be incorporated by reference in any of PCA’s filings under the Securities Act of 1933 or the Securities Exchange Act of 1934, whether made before or after the date of this Annual Report on Form 10-K, except to the extent that PCA specifically incorporates such information by reference.

Item 6. [RESERVED]

18

Item 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion and analysis of historical results of operations and financial condition should be read in conjunction with the audited financial statements and the notes thereto which appear elsewhere in this Form 10-K. This discussion includes forward-looking statements regarding our expectations with respect to our future performance, liquidity, and capital resources. Such statements, along with any other non-historical statements in the discussion, are forward-looking. See our discussion regarding forward-looking statements included under “Part I, Item 1A. Risk Factors” of this Form 10-K. For our discussion and analysis of our results of operations, financial condition and cash flows for the year ended December 31, 2019, the earliest of the years presented in the accompanying audited financial statements included in Item 8 herein, please refer to our Annual Report on Form 10-K for the year ended December 31, 2020, filed with the Securities and Exchange Commission on February 24, 2021. Such information is presented in Item 7 of such report under the subcaptions “Results of Operations —Year Ended December 31, 2020, Compared with Year Ended December 31, 2019” and “Liquidity and Capital Resources” and is incorporated by reference herein.

Overview

PCA is the third largest producer of containerboard products and a leading producer of uncoated freesheet paper in North America. We operate eight mills and 90 corrugated products manufacturing plants. Our containerboard mills produce linerboard and corrugating medium, which are papers primarily used in the production of corrugated products. Our corrugated products manufacturing plants produce a wide variety of corrugated packaging products, including conventional shipping containers used to protect and transport manufactured goods, multi-color boxes and displays with strong visual appeal that help to merchandise the packaged product in retail locations, and honeycomb protective packaging. In addition, we are a large producer of packaging for meat, fresh fruit and vegetables, processed food, beverages, and other industrial and consumer products. We also manufacture and sell UFS papers, including both commodity and specialty papers, which may have custom or specialized features such as colors, coatings, high brightness, and recycled content. We are headquartered in Lake Forest, Illinois and operate primarily in the United States.

Executive Summary

Net sales were $7.73 billion for the year ended December 31, 2021 and $6.66 billion in 2020. We reported $841 million of net income, or $8.83 per diluted share, in 2021, compared to $461 million, or $4.84 per diluted share, in 2020. Net income included $53 million of expense for special items in 2021, compared to $89 million of expense for special items in 2020. Special items in both periods are described later in this section. Excluding special items, we recorded $894 million of net income, or $9.39 per diluted share, in 2021, compared to $550 million, or $5.78 per diluted share, in 2020. The increase was driven primarily by higher prices and mix in our Packaging and Paper segments and higher volumes in our Packaging segment, partially offset by higher operating and converting costs, higher annual outage expense, lower volumes in our Paper segment, and higher freight and logistic expense. For additional detail on special items included in reported GAAP results, as well as segment income (loss) excluding special items, earnings before non-operating pension expense, interest, income taxes, and depreciation, amortization, and depletion (EBITDA), and EBITDA excluding special items, see “Item 7. Reconciliations of Non-GAAP Financial Measures to Reported Amounts.” PCA ended the year with $765 million of cash and marketable debt securities and, including borrowing availability under its revolving credit facility, $1.1 billion in liquidity.

Packaging segment income from operations was $1,306 million in 2021, compared to $830 million in 2020. Packaging segment EBITDA excluding special items was $1,688 million in 2021, compared to $1,229 million in 2020. The increase was driven primarily by higher containerboard and corrugated products prices and mix and higher sales and production volumes, partially offset by higher operating and converting costs, higher annual outage expense, and higher freight and logistic expenses. Demand for Packaging segment products remained strong throughout the year, with record-setting shipments from our corrugated products and record containerboard production. We also continued to experience cost inflation across our business, including in the areas of labor and benefits, recycled fiber, energy, repairs, materials, and supplies, as well as higher transportation costs, driven by higher fuel costs, tight rail supply, driver and truck shortages, and higher spot prices. We have experienced some workforce availability issues late in the year and early in 2022 due to the spread of the Omicron variant, as well as effects from supply chain and transportation service disruptions, but we have generally been able to manage through these issues such that our operations have not been materially disrupted. We continue to deploy capital to improve productivity and efficiencies at our facilities and believe that our success in doing so is helping us to manage cost inflation and better serve our customers.

Paper segment income from operations was $39 million in 2021, compared to a loss of $20 million in 2020. Paper segment EBITDA excluding special items was $72 million in 2021, compared to $73 million in 2020. The decrease was due primarily to lower sales and production volumes and higher freight and logistic expenses, partially offset by lower operating costs, lower annual outage expense, and higher paper prices and mix. As described in Note 9, Goodwill and Intangible Assets included in Item 8 of this Annual Report on Form 10-K, we incurred a charge of $55.2 million during 2020 associated with the full impairment of goodwill within the Paper segment.

19

Sales and production volumes in the Paper segment significantly declined after the first quarter of 2020 as the COVID-19 pandemic caused lower demand for our paper products. During the second and third quarters of 2020, in response to such lower demand, we temporary idled both machines at our Jackson, Alabama mill. During the fourth quarter of 2020, in order to meet strong packaging demand and maintain appropriate inventory levels in the Packaging segment, we temporarily began producing linerboard on the No. 3 machine at the mill, and we have produced linerboard on the machine since that time. In the first quarter of 2021, we announced the discontinuation of production of uncoated freesheet paper grades on the machine and the permanent conversion of the machine to produce linerboard and other paper-to-containerboard conversion related activities. Demand for paper products has improved since the beginning of the pandemic, but our sales and production in the Paper segment will remain below pre-pandemic levels as we will no longer be producing paper products on the machine. Later in 2021, we began to produce corrugating medium on the No. 1 machine at the Jackson mill (which had produced uncoated freesheet paper in the past) to help satisfy our demand for containerboard, build necessary inventories, and evaluate the capability of the machine to produce containerboard on a cost-effective basis. We expect to continue to produce corrugating medium on the machine for the foreseeable future. Before October 2020, operating results for the Jackson mill were included in the Paper segment. Beginning in October 2020, operating results for the Jackson mill are included in both the Packaging and Paper segments.