UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K

(Mark One)

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2008

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission File Number 0-16761

HIGHLANDS BANKSHARES, INC.

(Exact name of registrant as specified in its charter)

| West Virginia | 55-0650743 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| P.O. Box 929 Petersburg, WV | 26847 |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: 304-257-4111

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: Common Stock, $5 par value

Indicate by check mark if the registrant is a well-know seasoned issuer, as defined in Rule 405 or the Securities Act [ ] Yes [X] No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act [ ] Yes [X] No

Indicate by check mark whether the registrant has (1) filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark if disclosure of delinquent filers in response to Item 405 of Regulation S-K is not contained in this form, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [X]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer.[ ] Large Accelerated Filer[ ] Accelerated Filer [X] Non-accelerated filer [ ] Smaller Reporting Company

Indicate by check mark whether the registrant is a shell company (as defined in rule 126-2 of the Act) Yes [ ] No [ X ]

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter:

The aggregate market value of the 1,241,108 shares of common stock of the registrant, issued and outstanding, held by non- affiliates on June 30, 2008, was approximately $41,701,232 based on the closing sale price of $33.60 per share on June 30, 2008. For the purposes of this calculation, the term “affiliate” refers to all directors and executive officers of the registrant.

Indicate the number of shares outstanding of each of the registrant’s classes of common stock as of the last practicable date: As of March 15, 2009: 1,336,873 shares of common stock.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Proxy Statement for the 2009 Annual Shareholders’ Meeting, to be held May 12, 2009, are incorporated by reference into Part III, Items 10,11,12,13 and 14.

|

| |

| Part I | | Page |

| | 1 |

| | 7 |

| | 9 |

| | 9 |

| | 9 |

| | 9 |

| | | |

| Part II | | |

| | 9 |

| | 11 |

| | 12 |

| | 32 |

| | 34 |

| | 65 |

| | 65 |

| | 65 |

| | | |

| Part III | | |

| | 65 |

| | 66 |

| | 66 |

| | 66 |

| | 66 |

| | | |

| Part IV | | |

| | 67 |

| | | |

| 68 |

General

Highlands Bankshares, Inc. (hereinafter referred to as “Highlands,” or the “Company”), incorporated under the laws of the state of West Virginia in 1985, is a multi bank holding company subject to the provisions of the Bank Holding Company Act of 1956, as amended. Highlands owns 100% of the outstanding stock of its subsidiary banks, The Grant County Bank and Capon Valley Bank (hereinafter referred to as the “Banks” or “Capon” and/or “Grant”), and its life insurance subsidiary, HBI Life Insurance Company (hereinafter referred to as “HBI Life”).

The Grant County Bank was chartered on August 6, 1902, and Capon Valley Bank was chartered on July 1, 1918. Both are state banks chartered under the laws of the State of West Virginia. HBI Life was chartered in April 1988 under the laws of the State of Arizona.

Services Offered by the Banks

The Banks offer all services normally offered by a full service commercial bank, including commercial and individual demand and time deposit accounts, commercial and individual loans, drive in banking services and automated teller machines. No material portion of the Banks' deposits have been obtained from a single or small group of customers and the loss of the deposits of any one customer or of a small group of customers would not have a material adverse effect on the business of the Banks. Credit life and accident and health insurance are sold to customers of the subsidiary Banks through HBI Life.

Employees

As of December 31, 2008, The Grant County Bank had 72 full time equivalent employees, Capon Valley Bank had 52 full time equivalent employees and Highlands had 3 full time equivalent employees. No person is employed by HBI Life on a full time basis.

Competition

The Banks' primary trade area is generally defined as Grant, Hardy, Mineral, Randolph, Pendleton and Tucker Counties in West Virginia, the western portion of Frederick County in Virginia and portions of Western Maryland. This area includes the towns of Petersburg, Wardensville, Moorefield and Keyser and several rural towns. The Banks' secondary trade area includes portions of Hampshire County in West Virginia. The Banks primarily compete with four state chartered banks, three national banks and three credit unions. In addition, the Banks compete with money market mutual funds and investment brokerage firms for deposits in their service area. No financial institution has been chartered in the area within the last five years although other state and nationally chartered banks have opened branches in this area within this time period. Competition for new loans and deposits in the Banks' service area is quite intense.

Regulation and Supervision

The Company, as a registered bank holding company, and its subsidiary Banks, as insured depository institutions, operate in a highly regulated environment and are regularly examined by federal and state regulators. The following description briefly discusses certain provisions of federal and state laws and regulations and the potential impact of such provisions to which the Company and subsidiary are subject. These federal and state laws and regulations are designed to reduce potential loss exposure to the depositors of such depository institutions and to the Federal Deposit Insurance Corporation’s insurance fund and are not intended to protect the Company’s security holders. Proposals to change the laws and regulations governing the banking industry are frequently raised in Congress, in state legislatures, and before the various bank regulatory agencies. The likelihood and timing of any changes and the impact such changes might have on the Company are impossible to determine with any certainty. A change in applicable laws or regulations, or a change in the way such laws or regulations are interpreted by regulatory agencies or courts, may have a material impact on the business, operations and earnings of the Company. To the extent that the following information describes statutory or regulatory provisions, it is qualified entirely by reference to the particular statutory or regulatory provision.

As a bank holding company registered under the Bank Holding Company Act of 1956, as amended (the “BHCA”), the Company is subject to regulation by the Federal Reserve Board. Federal banking laws require a bank holding company to serve as a source of financial strength to its subsidiary depository institutions and to commit resources to support such institutions in circumstances where it might not do so otherwise. Additionally, the Federal Reserve Board has jurisdiction under the BHCA to approve any bank or non-bank acquisition, merger or consolidation proposed by a bank holding company. The BHCA generally limits the activities of a bank holding company and its subsidiaries to that of banking, with the managing or controlling of banks as to be a proper incident thereto. The BHCA also prohibits a bank holding company, with certain exceptions, from acquiring more than 5% of the voting shares of any company and from engaging in any business other than banking or managing or controlling banks. The Federal Reserve Board has determined by regulation that certain activities are closely related to banking within the meaning of the BHCA. These activities include: operating a mortgage company, finance company, credit card company or factoring company; performing certain data processing operations; providing investment and financial advice; and acting as an insurance agent for certain types of credit-related insurance.

The Gramm-Leach-Bliley Act (“Gramm-Leach”) became law in November 1999. Gramm-Leach established a comprehensive framework to permit affiliations among commercial banks, investment banks, insurance companies, securities firms, and other financial service providers. Gramm-Leach permits qualifying bank holding companies to register with the Federal Reserve Board as “financial holding companies” and allows such companies to engage in a significantly broader range of financial activities than were historically permissible for bank holding companies. Although the Federal Reserve Board provides the principal regulatory supervision of financial services permitted under Gramm-Leach, the Securities and Exchange Commission and state regulators also provide substantial supervisory oversight. In addition to broadening the range of financial services a bank holding company may provide, Gramm-Leach also addressed customer privacy and information sharing issues and set forth certain customer disclosure requirements. The Company has no current plans to petition the Federal Reserve Board for consideration as a financial holding company.

The Riegle-Neal Interstate Banking and Branching Efficiency Act of 1994 (“Riegle-Neal”) permits bank holding companies to acquire banks located in any state. Riegle-Neal also allows national banks and state banks with different home states to merge across state lines and allows branch banking across state lines, unless specifically prohibited by state laws.

The International Money Laundering Abatement and Anti-Terrorist Financing Act of 2001 (“Patriot Act”) was adopted in response to the September 11, 2001 terrorist attacks. The Patriot Act provides law enforcement with greater powers to investigate terrorism and prevent future terrorist acts. Among the broad-reaching provisions contained in the Patriot Act are several designed to deter terrorists’ ability to launder money in the United States and provide law enforcement with additional powers to investigate how terrorists and terrorist organizations are financed. The Patriot Act creates additional requirements for banks, which were already subject to similar regulations. The Patriot Act authorizes the Secretary of Treasury to require financial institutions to take certain “special measures” when the Secretary suspects that certain transactions or accounts are related to money laundering. These special measures may be ordered when the Secretary suspects that a jurisdiction outside of the United States, a financial institution operating outside of the United States, a class of transactions involving a jurisdiction outside of the United States or certain types of accounts are of “primary money laundering concern.” The special measures include the following: (a) require financial institutions to keep records and report on transactions or accounts at issue; (b) require financial institutions to obtain and retain information related to the beneficial ownership of any account opened or maintained by foreign persons; (c) require financial institutions to identify each customer who is permitted to use the account; and (d) prohibit or impose conditions on the opening or maintaining of correspondence or payable-through accounts. Failure of a financial institution to maintain and implement adequate programs to combat money laundering and terrorist financing or to comply with all of the relevant laws or regulations could have serious legal and reputational consequences for an institution.

The operations of the insurance subsidiary are subject to the oversight and review by the State of Arizona Department of Insurance.

On July 30, 2002, the United States Congress enacted the Sarbanes-Oxley Act of 2002, a law that addresses corporate governance, auditing and accounting, executive compensation and enhanced timely disclosure of corporate information. As Sarbanes-Oxley directs, the Company’s Chief Executive Officer and Chief Financial Officer are each required to certify that the Company’s quarterly and annual reports do not contain any untrue statement of a material fact. Additionally, these individuals must certify the following: they are responsible for establishing, maintaining and regularly evaluating the effectiveness of the Company’s internal controls; they have made certain disclosures to the Company’s auditors and the Audit Committee of the Board of Directors about the Company’s internal controls; and they have included information in the Company’s quarterly and annual reports about their evaluation and whether there have been significant changes in the Company’s internal controls or in other factors that could significantly affect internal controls subsequent to the evaluations.

Capital Adequacy

Federal banking regulations set forth capital adequacy guidelines, which are used by regulatory authorities to assess the adequacy of capital in examining and supervising a bank holding company and its insured depository institutions. The capital adequacy guidelines generally require bank holding companies to maintain total capital equal to at least 8% of total risk-adjusted assets, with at least one-half of total capital consisting of core capital (i.e., Tier I capital) and the remaining amount consisting of “other” capital-eligible items (i.e., Tier II capital), such as perpetual preferred stock, certain subordinated debt, and, subject to limitations, the allowance for loan losses. Tier I capital generally includes common stockholders’ equity plus, within certain limitations, perpetual preferred stock and trust preferred securities. For purposes of computing risk-based capital ratios, bank holding companies must meet specific capital guidelines that involve quantitative measures of assets, liabilities and certain off-balance sheet items, calculated under regulatory accounting practices. The Company’s and its subsidiaries’ capital accounts and classifications are also subject to qualitative judgments by the regulators about components, risk weightings, and other factors.

In addition to total and Tier I capital requirements, regulatory authorities also require bank holding companies and insured depository institutions to maintain a minimum leverage capital ratio of 3%. The leverage ratio is determined as the ratio of Tier I capital to total average assets, where average assets exclude goodwill, other intangibles, and other specifically excluded assets. Regulatory authorities have stated that minimum capital ratios are adequate for those institutions that are operationally and financially sound, experiencing solid earnings, have high levels of asset quality and are not experiencing significant growth. The guidelines also provide that banking organizations experiencing internal growth or making acquisitions will be expected to maintain strong capital positions substantially above the minimum supervisory levels. In those instances where these criteria are not evident, regulatory authorities expect, and may require, bank holding companies and insured depository institutions to maintain higher than minimum capital levels.

Additionally, federal banking laws require regulatory authorities to take “prompt corrective action” with respect to depository institutions that do not satisfy minimum capital requirements. The extent of these powers depends upon whether the institutions in question are “well capitalized,” “adequately capitalized,” “undercapitalized,” “significantly undercapitalized,” or “critically undercapitalized,” as such terms are defined under uniform regulations defining such capital levels issued by each of the federal banking agencies. As an example, a depository institution that is not well capitalized is generally prohibited from accepting brokered deposits and offering interest rates on deposits higher than the prevailing rate in its market. Additionally, a depository institution is generally prohibited from making any capital distribution (including payment of a dividend) or paying any management fee to its holding company, may be subject to asset growth limitations and may be required to submit capital restoration plans if the depository institution is considered undercapitalized.

The Company’s and its subsidiaries’ regulatory capital ratios are presented in the table below:

| | | Actual Ratio | | Actual Ratio | | Regulatory |

| | | December 31, 2008 | | December 31, 2007 | | Minimum |

| Total Risk Based Capital | | | | | | | | | |

| Highlands Bankshares | | | 14.20 | % | | | 14.53 | % | | | |

| The Grant County Bank | | | 13.99 | % | | | 13.23 | % | | | 8.00 | % |

| Capon Valley Bank | | | 12.77 | % | | | 14.78 | % | | | 8.00 | % |

| | | | | | | | | | | | | |

| Tier 1 Leverage Ratio | | | | | | | | | | | | |

| Highlands Bankshares | | | 10.18 | % | | | 9.95 | % | | | | |

| The Grant County Bank | | | 10.00 | % | | | 9.09 | % | | | 4.00 | % |

| Capon Valley Bank | | | 9.11 | % | | | 10.00 | % | | | 4.00 | % |

| | | | | | | | | | | | | |

| Tier 1 Risk Based Capital Ratio | | | | | | | | | | | | |

| Highlands Bankshares | | | 12.98 | % | | | 13.28 | % | | | | |

| The Grant County Bank | | | 12.79 | % | | | 12.09 | % | | | 4.00 | % |

| Capon Valley Bank | | | 11.52 | % | | | 13.53 | % | | | 4.00 | % |

Dividends and Other Payments

The Company is a legal entity separate and distinct from its subsidiaries. Dividends and management fees from Grant County Bank and Capon Valley Bank are essentially the sole source of cash for the Company, although HBI Life will periodically pay dividends to the Company. The right of the Company, and shareholders of the Company, to participate in any distribution of the assets or earnings of Grant County Bank and Capon Valley Bank through the payment of such dividends or otherwise is necessarily subject to the prior claims of creditors of Grant County Bank and Capon Valley Bank, except to the extent that claims of the Company in its capacity as a creditor may be recognized. Moreover, there are various legal limitations applicable to the payment of dividends to the Company as well as the payment of dividends by the Company to its shareholders. Under federal law, Grant County Bank and Capon Valley Bank may not, subject to certain limited exceptions, make loans or extensions of credit to, or invest in the securities of, or take securities of the Company as collateral for loans to any borrower. Grant County Bank and Capon Valley Bank are also subject to collateral security requirements for any loans or extensions of credit permitted by such exceptions.

Grant County Bank and Capon Valley Bank are subject to various statutory restrictions on their ability to pay dividends to the Company. Specifically, the approval of the appropriate regulatory authorities is required prior to the payment of dividends by Grant County Bank and Capon Valley Bank in excess of earnings retained in the current year plus retained net profits for the preceding two years. The payment of dividends by the Company, Grant County Bank and Capon Valley Bank may also be limited by other factors, such as requirements to maintain adequate capital above regulatory guidelines. The Federal Reserve Board and the Federal Deposit Insurance Corporation have the authority to prohibit any bank under their jurisdiction from engaging in an unsafe and unsound practice in conducting its business. Depending upon the financial condition of Grant County Bank and Capon Valley Bank, the payment of dividends could be deemed to constitute such an unsafe or unsound practice. The Federal Reserve Board and the FDIC have indicated their view that it’s generally unsafe and unsound practice to pay dividends except out of current operating earnings. The Federal Reserve Board has stated that, as a matter of prudent banking, a bank or bank holding company should not maintain its existing rate of cash dividends on common stock unless (1) the organization’s net income available to common shareholders over the past year has been sufficient to fund fully the dividends and (2) the prospective rate or earnings retention appears consistent with the organization’s capital needs, asset quality, and overall financial condition. Moreover, the Federal Reserve Board has indicated that bank holding companies should serve as a source of managerial and financial strength to their subsidiary banks. Accordingly, the Federal Reserve Board has stated that a bank holding company should not maintain a level of cash dividends to its shareholders that places undue pressure on the capital of bank subsidiaries, or that can be funded only through additional borrowings or other arrangements that may undermine the bank holding company’s ability to serve as a source of strength.

Governmental Policies

The Federal Reserve Board regulates money and credit and interest rates in order to influence general economic conditions. These policies have a significant influence on overall growth and distribution of bank loans, investments and deposits and affect interest rates charged on loans or paid for time and savings deposits. Federal Reserve monetary policies have had a significant effect on the operating results of commercial banks in the past and are expected to continue to do so in the future.

Various other legislation, including proposals to overhaul the banking regulatory system and to limit the investments that a depository institution may make with insured funds, are from time to time introduced in Congress. The Company cannot determine the ultimate effect that such potential legislation, if enacted, would have upon its financial condition or operations.

Financial Market and Economic Conditions May Adversely Affect Our Business.

The United States is considered to be in a recession, and many businesses are having difficulty due to reduced consumer spending and the lack of liquidity in the credit markets. Unemployment has increased significantly.

Because of declines in home prices and the values of subprime mortgages across the country, financial institutions and the securities markets have been adversely affected by significant declines in the values of most asset classes and by a serious lack of liquidity. These conditions have led to the failure or merger of a number of prominent financial institutions. In 2008, the U.S. government, the Federal Reserve and other regulators have taken numerous steps to increase liquidity and to restore investor confidence, but asset values have continued to decline and access to liquidity continues to be very limited.

Highlands’ financial performance and the ability of borrowers to pay interest on and repay principal of outstanding loans and the value of collateral securing those loans depends on the business environment in the markets where Highlands operates.

An Increase in FDIC Assessments Could Impact Our Financial Performance.

The FDIC imposes an assessment against all depository institutions for deposit insurance. See “Supervision and Regulation – FDIC Assessments.” In the current economic environment, it is likely that this assessment will increase in general for financial institutions across the country, including the Bank, thereby increasing operating costs.

The FDIC imposes an assessment against all depository institutions for deposit insurance. This assessment is based on the risk category of the institution and, prior to 2009, ranged from five to 43 basis points of an institution’s deposits. On October 7, 2008, as a result of decreases in the reserve ratio of the DIF, the FDIC issued a proposed rule establishing a Restoration Plan for the DIF. The rulemaking proposed that, effective January 1, 2009, assessment rates would increase uniformly by seven basis points for the first quarter 2009 assessment period. The rulemaking proposed to alter the way in which the FDIC’s risk-based assessment system differentiates for risk and set new deposit insurance assessment rates, effective April 1, 2009. Under the proposed rule, the FDIC would first establish an institution’s initial base assessment rate. This initial base assessment rate would range, depending on the risk category of the institution, from 10 to 45 basis points. The FDIC would then adjust the initial base assessment (higher or lower) to obtain the total base assessment rate. The adjustment to the initial base assessment rate would be based upon an institution’s levels of unsecured debt, secured liabilities, and brokered deposits. The total base assessment rate would range from eight to 77.5 basis points of the institution’s deposits. On December 22, 2008, the FDIC published a final rule raising the current deposit insurance assessment rates uniformly for all institutions by seven basis points (to a range from 12 to 50 basis points) for the first quarter of 2009. However, the FDIC approved an extension of the comment period on the parts of the proposed rulemaking that would become effective on April 1, 2009. The FDIC expects to issue a second final rule early in 2009, to be effective April 1, 2009, to change the way that the FDIC’s assessment differentiates for risk and to set new assessment rates beginning with the second quarter of 2009. On February 27, 2009, the FDIC proposed an emergency assessment charged to all financial institutions of 0.20% of insured deposits as of June 30, 2009, payable on September 30, 2009. In March of 2009, the FDIC reduced the amount of the proposed assessment to 0.10% of insured deposits as of June 30, 2009.

Troubled Asset Relief Program – Capital Purchase Program

On October 3, 2008, the Federal government enacted the Emergency Economic Stabilization Act of 2008 (“EESA”). EESA was enacted to provide liquidity to the U.S. financial system and lessen the impact of looming economic problems. The EESA included broad authority. The centerpiece of the EESA is the Troubled Asset Relief Program (“TARP”). EESA’s broad authority was interpreted to allow the U.S. Treasury to purchase equity interests in both healthy and troubled financial institutions. The equity purchase program is commonly referred to as the Capital Purchase Program (“CPP”). The company elected not to participate in the CPP.

America Recovery and Reinvestment Act of 2009

On February 17, 2009, President Obama signed into law the American Recovery and Reinvestment Act of 2009 (“ARRA”), more commonly known as the economic stimulus or economic recovery package. ARRA includes a wide variety of programs intended to stimulate the economy and provide for extensive infrastructure, energy, health, and education needs.

Future Legislation

Various other legislative and regulatory initiatives, including proposals to overhaul the banking regulatory system and to limit the investments that a depository institution may make with insured funds, are from time to time introduced in Congress and state legislatures, as well as regulatory agencies. Such legislation may change banking statutes and the operating environment of Highlands and its subsidiary banks in substantial and unpredictable ways, and could increase or decrease the cost of doing business, limit or expand permissible activities or affect the competitive balance depending upon whether any of this potential legislation will be enacted, and if enacted, the effect that it or any implementing regulations, would have on the financial condition or results of operations of Highlands or any of its subsidiaries. With the recent enactments of EESA and ARRA, the nature and extent of future legislative and regulatory changes affecting financial institutions is very unpredictable at this time. The Company cannot determine the ultimate effect that such potential legislation, if enacted, would have upon its financial condition or operations.

Available Information

The Company files annual, quarterly and current reports, proxy statements and other information with the SEC. The Company’s SEC filings are filed electronically and are available to the public via the Internet at the SEC’s website, www.sec.gov. In addition, any document filed by the Company with the SEC can be read and copies obtained at the SEC’s public reference facilities at 100 F Street, NE, Washington, DC 20549. Copies of documents can be obtained at prescribed rates by writing to the Public Reference Section of the SEC at 100 F Street NE, Washington, DC 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. Copies of documents can also be obtained free of charge by writing to Highlands Bankshares, Inc., P.O. Box 929, Petersburg, WV 26847.

Executive Officers

| | Age | Position with the Company | Principal Occupation (Past Five Years) |

| C.E. Porter | 60 | Chief Executive Officer | CEO of Highlands since 2004, President of The Grant County Bank since 1991 |

| R. Alan Miller | 39 | Principal Financial Officer | PFO of Highlands since 2002 |

| Alan L. Brill | 54 | Secretary; President of Capon Valley Bank | President of Capon Valley Bank since 2001 |

Due to Increased Competition, the Company May Not Be Able to Attract and Retain Banking Customers At Current Levels.

If, due to competition from competitors in the Company’s market area, the Company is unable to attract new and retain current customers, loan and deposit growth could decrease causing the Company’s results of operations and financial condition to be negatively impacted. The Company faces competition from the following:

| | · | Local, regional and national banks; |

| | · | Brokerage firms serving the Company’s market areas. |

The Company’s Lending Limit May Prevent It from Making Large Loans.

In the future, the Company may not be able to attract larger volume customers because the size of loans that the company can offer to potential customers is less than the size of the loans that many of the Company’s larger competitors can offer. We anticipate that our lending limit will continue to increase proportionately with the Company’s growth in earnings; however, the Company may not be able to successfully attract or maintain larger customers.

Certain Loans That the Banks Make Are Riskier than Loans for Real Estate Lending.

The Banks make loans that involve a greater degree of risk than loans involving residential real estate lending. Commercial business loans may involve greater risks than other types of lending because they are often made based on varying forms of collateral, and repayment of these loans often depends on the success of the commercial venture. Consumer loans may involve greater risk because adverse changes in borrowers’ incomes and employment after funding of the loans may impact their abilities to repay the loans.

The Company Is Subject to Interest Rate Risk.

Aside from credit risk, the most significant risk resulting from the Company’s normal course of business, extending loans and accepting deposits, is interest rate risk. If market interest rate fluctuations cause the Company’s cost of funds to increase faster than the yield of its interest-earning assets, then its net interest income will be reduced. The Company’s results of operations depend to a large extent on the level of net interest income, which is the difference between income from interest-earning assets, such as loans and investment securities, and interest expense on interest-bearing liabilities, such as deposits and borrowings. Interest rates are highly sensitive to many factors that are beyond the Company’s control, including general economic conditions and the policies of various governmental and regulatory authorities.

The Company May Not Be Able to Retain Key Members of Management.

The departure of one or more of the Company’s officers or other key personnel could adversely affect the Company’s operations and financial position. The Company’s management makes most decisions that involve the Company’s operations.

Customers May Default on the Repayment of Loans.

The Bank’s customers may default on the repayment of loans, which may negatively impact the Company’s earnings due to loss of principal and interest income. Increased operating expenses may result from the allocation of management time and resources to the collection and workout of the loan. Collection efforts may or may not be successful causing the Company to write off the loan or repossess the collateral securing the loan, which may or may not exceed the balance of the loan.

An Economic Slowdown in the Company’s Market Area Could Hurt Our Business.

An economic slowdown in our market area could hurt our business. An economic slowdown could have the following consequences:

| | · | Loan delinquencies may increase; |

| | · | Problem assets and foreclosures may increase; |

| | · | Demand for the products and services of the Company may decline; |

| | · | Collateral (including real estate) for loans made by the company may decline in value, in turn reducing customers’ borrowing power and making existing loans less secure; |

| | · | Certain industries which are integral to the economy within the Company’s primary market area, may experience a downturn; and, |

| | · | The current economic environment poses significant challenges for the Company as well as other financial institutions across the country. These challenges could adversely affect our financial condition and results of operations. |

The Company and the Bank are Extensively Regulated.

The operations of the Company are subject to extensive regulation by federal, state and local governmental authorities and are subject to various laws and judicial and administrative decisions imposing requirements and restrictions on them. Policies adopted or required by these governmental authorities can affect the Company’s business operations and the availability, growth and distribution of the Company’s investments, borrowings and deposits. Proposals to change the laws governing financial institutions are frequently raised in Congress and before bank regulatory authorities. Changes in applicable laws or policies could materially affect the Company’s business, and the likelihood of any major changes in the future and their effects are impossible to determine.

The Company’s Allowance for Loan Losses May Not Be Sufficient.

In the future, the Company could experience negative credit quality trends that could lead to a deterioration of asset quality. Such deterioration could require the company to incur loan charge-offs in the future and incur additional loan loss provision, both of which would have the effect of decreasing earnings. The Company maintains an allowance for possible loan losses which is a reserve established through a provision for possible loan losses charged to expense that represents management’s best estimate of probable losses that have been incurred within the existing portfolio of loans. Any increases in the allowance for possible loan losses will result in a decrease in net income and, possibly, capital, and may not have a material adverse effect on the Company’s financial condition and results of operation.

A Shareholder May Have Difficulty Selling Shares.

Because a very limited public market exists for the Company’s common stock, a shareholder may have difficulty selling his or her shares in the secondary market. We cannot predict when, if ever, we could meet the listing qualifications of the NASDAQ Stock Market’s National Market Tier or any exchange. We cannot assure investors that there will be a more active public market for the shares in the near future.

Shares of the Company’s Common Stock Are Not FDIC Insured.

Neither the Federal Deposit Insurance Corporation nor any other governmental agency insures the shares of the Company’s common stock. Therefore, the value of investors’ shares in the Company will be based on their market value and may decline.

The Company’s Controls and Procedures May Fail or Be Circumvented.

Management regularly reviews and updates the Company’s internal controls, disclosure controls and procedures, and corporate governance policies and procedures. Any system of controls, no matter how well designed and operated, is based in part on certain assumptions and can provide only reasonable, not absolute, assurances that the objectives of the system are met. Any failure or circumvention of the Company’s controls and procedures or failure to comply with regulations related to controls and procedures could have a material adverse effect on the Company’s business, results of operations and financial conditions

| Unresolved Staff Comments |

None.

The table below lists the primary properties utilized in operations by the Company. All listed properties are owned by the Company.

| Location | Description |

| 3 N. Main Street, Petersburg, WV 26847 | Primary Office, The Grant County Bank |

| Route 33, Riverton, WV 26814 | Branch Office, The Grant County Bank |

| 500 S. Main Street, Moorefield, WV 26836 | Branch Office, The Grant County Bank |

| Route 220 & Josie Dr., Keyser, WV 26726 | Branch Office, The Grant County Bank |

| Main Street, Harman, WV 26270 | Branch Office, The Grant County Bank |

| William Avenue, Davis, WV 26260 | Branch Office, The Grant County Bank |

| Route 32 & Cortland Rd., Davis, WV 26260 | Branch Office, The Grant County Bank |

| 2 W. Main Street, Wardensville, WV 26851 | Primary Office, Capon Valley Bank |

| 717 N. Main Street, Moorefield, WV 26836 | Branch Office, Capon Valley Bank |

| Route 55, Baker, WV 26801 | Branch Office, Capon Valley Bank |

| 6701 Northwestern Pike, Gore, VA 22637 | Branch Office, Capon Valley Bank |

Management is not aware of any material pending or threatened litigation in which Highlands or its subsidiaries may be involved as a defendant. In the normal course of business, the Banks periodically must initiate suits against borrowers as a final course of action in collecting past due indebtedness.

| Submission of Matters to a Vote of Security Holders |

Highlands Bankshares, Inc. did not submit any matters to a vote of security holders during the fourth quarter of 2008.

| Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

The Company had approximately 1,100 shareholders as of December 31, 2008. This amount includes all shareholders, whether titled individually or held by a brokerage firm or custodian in street name. The Company's stock is not traded on any national or regional stock exchange although brokers may occasionally initiate or be a participant in a trade. The Company’s stock is listed on the Over The Counter Bulletin Board under the symbol HBSI.OB. The Company may not know terms of an exchange between individual parties.

The table on the following page outlines the dividends paid and market prices of the Company's stock based on prices disclosed to management. Prices have been provided using a nationally recognized online stock quote system. Such prices may not include retail mark-ups, mark-downs or commissions. Dividends are subject to the restrictions described in Note Nine to the Financial Statements.

| Highlands Bankshares, Inc. Common Stock | |

| | |

| | | | | | Estimated Market Range | |

| | | Dividends

Per Share | | | High | | | Low | |

| 2008 | | | | | | | | | |

| First Quarter | | $ | .27 | | | $ | 30.00 | | | $ | 27.00 | |

| Second Quarter | | $ | .27 | | | $ | 38.00 | | | $ | 27.75 | |

| Third Quarter | | $ | .27 | | | $ | 38.00 | | | $ | 31.00 | |

| Fourth Quarter | | $ | .27 | | | $ | 35.00 | | | $ | 29.00 | |

| | | | | | | | | | | | | |

| 2007 | | | | | | | | | | | | |

| First Quarter | | $ | .25 | | | $ | 34.50 | | | $ | 32.50 | |

| Second Quarter | | $ | .25 | | | $ | 34.75 | | | $ | 33.55 | |

| Third Quarter | | $ | .25 | | | $ | 34.85 | | | $ | 33.35 | |

| Fourth Quarter | | $ | .25 | | | $ | 34.85 | | | $ | 29.40 | |

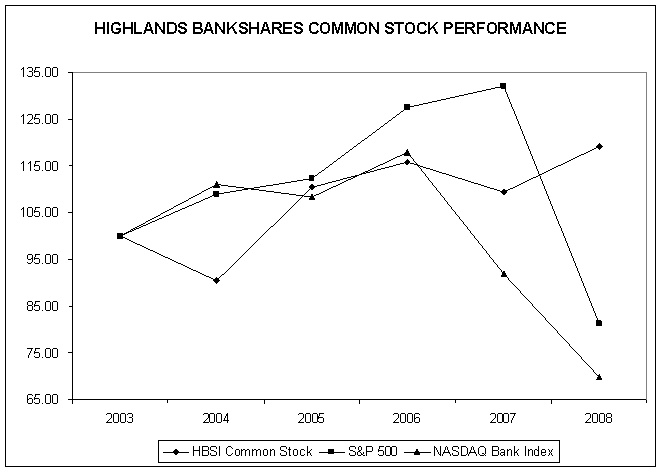

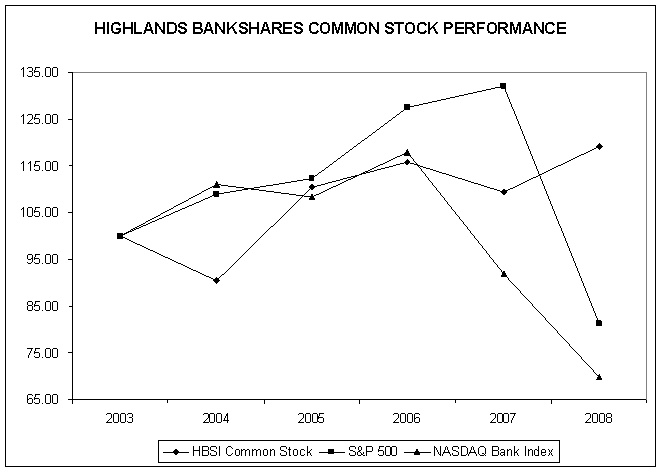

Set forth below is a line graph comparing the cumulative total return of Highlands Bankshares’ common stock from December 31, 2003, assuming reinvestment of dividends, with that of the Standard & Poor's 500 Index ("S&P 500") and the NASDAQ Bank Index.

| | | Years Ending December 31, | |

| | | (In thousands of dollars, except for per share amounts) | |

| | | 2008 | | | 2007 | | | 2006 | | | 2005 | | | 2004 | |

| Total Interest Income | | $ | 26,203 | | | $ | 27,664 | | | $ | 23,894 | | | $ | 19,813 | | | $ | 17,729 | |

| Total Interest Expense | | | 8,866 | | | | 10,703 | | | | 7,909 | | | | 5,761 | | | | 4,711 | |

| Net Interest Income | | | 17,337 | | | | 16,961 | | | | 15,985 | | | | 14,052 | | | | 13,018 | |

| | | | | | | | | | | | | | | | | | | | | |

| Provision for Loan Losses | | | 909 | | | | 837 | | | | 682 | | | | 875 | | | | 920 | |

| | | | | | | | | | | | | | | | | | | | | |

| Net Interest Income After Provision for Loan Losses | | | 16,428 | | | | 16,124 | | | | 15,303 | | | | 13,177 | | | | 12,098 | |

| | | | | | | | | | | | | | | | | | | | | |

| Other Income | | | 2,699 | | | | 2,080 | | | | 1,997 | | | | 1,669 | | | | 1,597 | |

| Other Expenses | | | 11,419 | | | | 10,952 | | | | 10,394 | | | | 9,128 | | | | 8,938 | |

| | | | | | | | | | | | | | | | | | | | | |

| Income Before Income Taxes | | | 7,708 | | | | 7,252 | | | | 6,906 | | | | 5,718 | | | | 4,757 | |

| | | | | | | | | | | | | | | | | | | | | |

| Income Tax Expense | | | 2,738 | | | | 2,599 | | | | 2,391 | | | | 1,916 | | | | 1,551 | |

| | | | | | | | | | | | | | | | | | | | | |

| Net Income | | $ | 4,970 | | | $ | 4,653 | | | $ | 4,515 | | | $ | 3,802 | | | $ | 3,206 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total Assets at Year End | | $ | 378,295 | | | $ | 380,936 | | | $ | 357,316 | | | $ | 337,573 | | | $ | 299,992 | |

| Long Term Debt at Year End | | $ | 11,317 | | | $ | 11,819 | | | $ | 14,992 | | | $ | 15,063 | | | $ | 8,377 | |

| | | | | | | | | | | | | | | | | | | | | |

| Net Income Per Share of Common Stock | | $ | 3.59 | | | $ | 3.24 | | | $ | 3.14 | | | $ | 2.65 | | | $ | 2.23 | |

| Dividends Per Share of Common Stock | | $ | 1.08 | | | $ | 1.00 | | | $ | .94 | | | $ | .82 | | | $ | .63 | |

| | | | | | | | | | | | | | | | | | | | | |

| Return on Average Assets | | | 1.32 | % | | | 1.24 | % | | | 1.29 | % | | | 1.21 | % | | | 1.07 | % |

| Return on Average Equity | | | 12.38 | % | | | 12.03 | % | | | 12.67 | % | | | 11.53 | % | | | 10.36 | % |

| Dividend Payout Ratio | | | 30.12 | % | | | 30.88 | % | | | 29.91 | % | | | 30.99 | % | | | 28.23 | % |

| Year End Equity to Assets Ratio | | | 10.41 | % | | | 10.66 | % | | | 10.38 | % | | | 10.07 | % | | | 10.55 | % |

| Management’s Discussion and Analysis of Financial Condition and Results or Operations |

Forward Looking Statements

Certain statements in this report may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are statements that include projections, predictions, expectations or beliefs about future events or results or otherwise are not statements of historical fact. Such statements are often characterized by the use of qualified words (and their derivatives) such as “expect,” “believe,” “estimate,” “plan,” “project,” “anticipate” or other similar words. Although the Company believes that its expectations with respect to certain forward-looking statements are based upon reasonable assumptions within the bounds of its existing knowledge of its business and operations, there can be no assurance that actual results, performance or achievements of the Company will not differ materially from any future results, performance or achievements expressed or implied by such forward-looking statements. Actual future results and trends may differ materially from historical results or those anticipated depending on a variety of factors, including, but not limited to, those factors set forth in “Risk Factors” and the effects of and changes in: general economic conditions, the interest rate environment, legislative and regulatory requirements, competitive pressures, new products and delivery systems, inflation, changes in the stock and bond markets, technology, downturns in the trucking and timber industries, effects of mergers and/or downsizing in the poultry industry in Hardy County, and consumer spending and savings habits. Additionally, actual future results and trends may differ from historical or anticipated results to the extent: (1) any significant downturn in certain industries, particularly the trucking and timber and coal extraction industries are experienced; (2) loan demand decreases from prior periods; (3) the Company may make additional loan loss provisions due to negative credit quality trends in the future that may lead to a deterioration of asset quality; (4) the Company may not continue to experience significant recoveries of previously charged-off loans or loans resulting in foreclosure; (5) increased liquidity needs may cause an increase in funding costs; (6) the quality of the Company’s securities portfolio may deteriorate and, (7) the Company is unable to control costs and expenses as anticipated. The Company does not update any forward-looking statements that may be made from time to time by or on behalf of the Company.

The following discussion focuses on significant results of the Company’s operations and significant changes in our financial condition or results of operations for the periods indicated in the discussion. This discussion should be read in conjunction with the preceding financial statements and related notes. Current performance does not guarantee, and may not be indicative of, similar performance in the future.

Critical Accounting Policies

The Company’s financial statements are prepared in accordance with accounting principles generally accepted in the United States (“GAAP”). The financial statements contained within these statements are, to a significant extent, financial information that is based on measures of the financial effects of transactions and events that have already occurred. A variety of factors could affect the ultimate value that is obtained either when earning income, recognizing an expense, recovering an asset or relieving a liability. In addition, GAAP itself may change from one previously acceptable method to another method. Although the economics of these transactions would be the same, the timing of events that would impact these transactions could change.

Allowance for Loan Losses

The allowance for loan losses is an estimate of the losses that may be sustained in the loan portfolio. The allowance is based on two basic principles of accounting: (i) Statement of Financial Accounting Standards No. 5, Accounting for Contingencies (SFAS 5), which requires that losses be accrued when they are probable of occurring and estimable and (ii) Statement of Financial Accounting Standards No. 114, Accounting by Creditors for Impairment of a Loan (SFAS 114), which requires that losses be accrued based on the differences between the value of collateral, present value of future cash flows or values that are observable in the secondary market and the loan balance.

The allowance for loan losses includes two basic components: estimated credit losses on individually evaluated loans that are determined to be impaired, and estimated credit losses inherent in the remainder of the loan portfolio. Under SFAS 114, an individual loan is impaired when, based on current information and events, it is probable that a creditor will be unable to collect all amounts due according to the contractual terms of the loan agreement. An individually evaluated loan that is determined not to be impaired under SFAS 114 is evaluated under SFAS 5 when specific characteristics of the loan indicate that it is probable there would be estimated credit losses in a group of loans with those characteristics.

SFAS 114 does not specify how an institution should identify loans that are to be evaluated for collectibility, nor does it specify how an institution should determine that a loan is impaired. Each subsidiary of Highlands uses its standard loan review procedures in making those judgments so that allowance estimates are based on a comprehensive analysis of the loan portfolio. For loans within the scope of SFAS 114 that are individually evaluated and found to be impaired, the associated allowance is based upon the estimated fair value, less costs to sell, of any collateral securing the loan as compared to the existing balance of the loan as of the date of analysis.

All other loans, including individually evaluated loans determined not to be impaired under SFAS 114, are included in a group of loans that are measured under SFAS 5 to provide for estimated credit losses that have been incurred on groups of loans with similar risk characteristics. The methodology for measuring estimated credit losses on groups of loans with similar risk characteristics in accordance with SFAS 5 is based on each group’s historical net charge-off rate, adjusted for the effects of the qualitative or environmental factors that are likely to cause estimated credit losses as of the evaluation date to differ from the group’s historical loss experience.

Post Retirement Benefits and Life Insurance Investments

The Company has invested in and owns life insurance policies on key officers. The policies are designed so that the company recovers the interest expenses associated with carrying the policies and the officer will, at the time of retirement, receive any earnings in excess of the amounts earned by the Company. The Company recognizes as an asset the net amount that could be realized under the insurance contract as of the balance sheet date. This amount represents the cash surrender value of the policies less applicable surrender charges. The portion of the benefits, which will be received by the executives at the time of their retirement, is considered, when taken collectively, to constitute a retirement plan. Therefore the Company accounts for these policies using guidance found in Statement of Financial Accounting Standards No. 106, "Employers' Accounting for Post Retirement Benefits Other Than Pensions.” SFAS No. 106 requires that an employer’s obligation under a deferred compensation agreement be accrued over the expected service life of the employee through their normal retirement date.

Assumptions are used in estimating the present value of amounts due officers after their normal retirement date. These assumptions include the estimated income to be derived from the investments and an estimate of the Company’s cost of funds in these future periods. In addition, the discount rate used in the present value calculation will change in future years based on market conditions.

Intangible Assets

The Company carries intangible assets related to the purchase of two banks. Amounts paid to purchase these banks were allocated as intangible assets. Generally accepted accounting principles were applied to allocate the intangible components of the purchases. The excess was allocated between identifiable intangibles (core deposit intangibles) and unidentified intangibles (goodwill). Goodwill is required to be evaluated for impairment on an annual basis, and the value of the goodwill adjusted accordingly, should impairment be found. As of December 31, 2008, the Company did not identify an impairment of this intangible.

In addition to the intangible assets associated with the purchases of banks, the company also carries intangible assets relating to the purchase of naming rights to certain features of a performing arts center in Petersburg, WV.

A summary of the change in balances of intangible assets can be found in Note Twenty Two to the Financial Statements.

Recent Accounting Pronouncements

In September 2006, the Financial Accounting Standards Board (FASB) reached a consensus on Emerging Issues Task Force (“EITF”) Issue 06-4, “Accounting for Deferred Compensation and Postretirement Benefit Aspects of Endorsement Split-Dollar Life Insurance Arrangements,” (“EITF Issue 06-4”). In March 2007, the FASB reached a consensus on EITF Issue 06-10, “Accounting for Collateral Assignment Split-Dollar Life Insurance Arrangements,” (“EITF Issue 06-10”). Both of these standards require a company to recognize an obligation over an employee’s service period based upon the substantive agreement with the employee such as the promise to maintain a life insurance policy or provide a death benefit postretirement. These EITF pronouncements became effective for Highlands Bankshares on January 1, 2008. These EITF pronouncements provided an option for affected companies to record the resulting liability as a cumulative effect adjustment to retained earnings at the beginning of the period in which recorded or to record through retrospective application to prior periods. Highlands Bankshares opted to record the liability as a cumulative effect adjustment to retained earnings and as such recorded a liability and corresponding reduction of retained earnings of $348,000. There is no corresponding deferred tax consequence relating to this liability.

In September 2006, the FASB issued Statement of Financial Accounting Standards No. 157, “Fair Value Measurements” (SFAS 157). SFAS 157 defines fair value, establishes a framework for measuring fair value in generally accepted accounting principles, and expands disclosures about fair value measurements. SFAS 157 does not require any new fair value measurements, but rather, provides enhanced guidance to other pronouncements that require or permit assets or liabilities to be measured at fair value. This Statement is effective for financial statements issued for fiscal years beginning after November 15, 2007 and interim periods within those years. The FASB has approved a one-year deferral for the implementation of the Statement for nonfinancial assets and nonfinancial liabilities that are recognized or disclosed at fair value in the financial statements on a nonrecurring basis. SFAS 157 had no material impact on the Company’s December 31, 2008 financial statements. Additional disclosure information required by this pronouncement is included as a footnote to the financial statements.

In February 2007, the FASB issued Statement of Financial Accounting Standards No. 159, “The Fair Value Option for Financial Assets and Financial Liabilities” (SFAS 159). This Statement permits entities to choose to measure many financial instruments and certain other items at fair value. The objective of this Statement is to improve financial reporting by providing entities with the opportunity to mitigate volatility in reported earnings caused by measuring related assets and liabilities differently without having to apply complex hedge accounting provisions. The fair value option established by this Statement permits all entities to choose to measure eligible items at fair value at specified election dates. A business entity shall report unrealized gains and losses on items for which the fair value option has been elected in earnings at each subsequent reporting date. The fair value option may be applied instrument by instrument and is irrevocable. SFAS 159 is effective as of the beginning of an entity’s first fiscal year that begins after November 15, 2007, with early adoption available in certain circumstances. The Company adopted SFAS 159 effective January 1, 2008. The Company decided not to report any existing financial assets or liabilities at fair value that are not already reported, thus the adoption of this statement did not have a material impact on the consolidated financial statements.

In November 2007, the Securities and Exchange Commission (SEC) issued Staff Accounting Bulletin No. 109, “Written Loan Commitments Recorded at Fair Value Through Earnings” (SAB 109). SAB 109 expresses the current view of the staff that the expected net future cash flows related to the associated servicing of the loan should be included in the measurement of all written loan commitments that are accounted for at fair value through earnings. SEC registrants are expected to apply the views in Question 1 of SAB 109 on a prospective basis to derivative loan commitments issued or modified in fiscal quarters beginning after December 15, 2007. SAB 109 did not have a material impact on the Company’s consolidated financial statements.

In April 2008, the FASB issued FASB Staff Position (FSP) No. 142-3, “Determination of the Useful Life of Intangible Assets” (“FSP No. 142-3”). FSP No. 142-3 amends the factors an entity should consider in developing renewal or extension assumptions used in determining the useful life of recognized intangible assets under FASB SFAS No. 142, “Goodwill and Other Intangible Assets” (“SFAS No. 142”). The intent of FSP No. 142-3 is to improve the consistency between the useful life of a recognized intangible asset under SFAS No. 142 and the period of expected cash flows used to measure the fair value of the assets under SFAS No. 141(R). FSP No. 142-3 is effective for the Company on January 1, 2009, and applies prospectively to intangible assets that are acquired individually or with a group of other assets in business combinations and asset acquisitions. The adoption of FSP No. 142-3 is not expected to have a material impact on the Company’s consolidated financial statements.

In May 2008, the FASB issued SFAS No. 162, “The Hierarchy of Generally Accepted Accounting Principles,” (“SFAS No. 162”). SFAS No. 162 identifies the sources of accounting principles and the framework for selecting the principles to be used in the preparation of financial statements of nongovernmental entities that are presented in conformity with generally accepted accounting principles. SFAS No. 162 is effective 60 days following the SEC’s approval of the Public Company Accounting Oversight Board amendments to AU Section 411, “The Meaning of Present Fairly in Conformity With Generally Accepted Accounting Principles.” Management does not expect the adoption of the provision of SFAS No. 162 to have any impact on the consolidated financial statements.

In October 2008, the FASB issued FSP FAS 157-3, “Determining the Fair Value of a Financial Asset When the Market for That Asset Is Not Active,” (“FSP 157-3”). FSP 157-3 clarifies the application of SFAS No. 157 in determining the fair value of a financial asset during periods of inactive markets. FSP 157-3 was effective as of September 30, 2008 and did not have material impact on the Company’s consolidated financial statements.

No other recent accounting pronouncements had a material impact on the Company’s consolidated financial statements, and it is believed that none will have a material impact on the Company’s operations in future years.

Overview of 2008 Results

Net income for 2008 increased by 6.81% as compared to 2007. The Company experienced a 2.22% increase in net interest income, which was partially offset by a $72,000 increase in the provision for loan losses. Non interest income increased 29.76% mostly as a result of increases in charges relating to non-sufficient funds fees charged to checking accounts and increases in insurance earnings. Non interest expense increased 4.26% due largely to an increase in salary and benefits expense and to increases in other operational expense as the result of expanding operational growth and usual inflationary pressures.

The table below compares selected commonly used measures of bank performance for the twelve month periods ended December 31, 2008, 2007 and 2006:

| | | 2008 | | | 2007 | | | 2006 | |

| Annualized return on average assets | | | 1.32 | % | | | 1.24 | % | | | 1.29 | % |

| Annualized return on average equity | | | 12.38 | % | | | 12.03 | % | | | 12.67 | % |

| Net interest margin (1) | | | 4.97 | % | | | 4.89 | % | | | 5.05 | % |

| Efficiency Ratio (2) | | | 56.99 | % | | | 57.52 | % | | | 57.80 | % |

| Earnings per share (3) | | $ | 3.59 | | | $ | 3.24 | | | $ | 3.14 | |

| | | | | | | | | | | | | |

| (1) On a fully taxable equivalent basis and including loan origination fees | |

| (2) Non-interest expenses for the period indicated divided by the sum of net interest income and non-interest income for the period indicated. | |

| (3) Per weighted average shares of common stock outstanding for the period indicated. Earnings per share for 2008 reflect share repurchase of 100,001 shares during the second and third quarters of 2008. | |

The change in net income from 2007 to 2008 was impacted significantly by non-recurring items. The table below summarizes the impact of non-recurring items on both 2008 and 2007 income.

| | | Impact of non

recurring item,

year ended

December 31, | | | | |

| | | 2008 | | | 2007 | | | Increase (Decrease) | |

| Description of non recurring item | | | | | | | | | |

| Gains (losses) recorded on calls of securities available for sale | | $ | 110 | | | $ | 1 | | | $ | 109 | |

| Gains (losses) recorded on sale of other real estate owned | | | 4 | | | | 0 | | | | 4 | |

| Gain on life insurance settlement | | | 30 | | | | 0 | | | | 30 | |

| Net gains (losses) recorded on sale of fixed assets | | | 32 | | | | (38 | ) | | | 70 | |

| Total impact of non recurring items on before tax income | | | 176 | | | | (37 | ) | | | 213 | |

| Income tax effect | | | (55 | ) | | | 13 | | | | (68 | ) |

| Total impact of non recurring items on net income | | $ | 121 | | | $ | (24 | ) | | $ | 145 | |

Quarterly Financial Results

| Quarterly Financial Results For the Year Ended December 31, 2008 | |

| (in thousands, except per share amounts) | |

| | |

| | | Fourth

Quarter | | | Third

Quarter | | | Second

Quarter | | | First

Quarter | |

| Total Interest Income | | $ | 6,325 | | | $ | 6,471 | | | $ | 6,570 | | | $ | 6,837 | |

| Total Interest Expense | | | 2,026 | | | | 2,054 | | | | 2,204 | | | | 2,582 | |

| Net Interest Income | | | 4,299 | | | | 4,417 | | | | 4,366 | | | | 4,255 | |

| | | | | | | | | | | | | | | | | |

| Provision for Loan Losses | | | 273 | | | | 238 | | | | 219 | | | | 179 | |

| | | | | | | | | | | | | | | | | |

| Net Interest Income After Provision for Loan Losses | | | 4,026 | | | | 4,179 | | | | 4,147 | | | | 4,076 | |

| | | | | | | | | | | | | | | | | |

| Other Income | | | 675 | | | | 687 | | | | 680 | | | | 657 | |

| Other Expenses | | | 2,848 | | | | 2,910 | | | | 2,875 | | | | 2,786 | |

| | | | | | | | | | | | | | | | | |

| Income Before Income Taxes | | | 1,853 | | | | 1,956 | | | | 1,952 | | | | 1,947 | |

| | | | | | | | | | | | | | | | | |

| Income Tax Expense | | | 642 | | | | 656 | | | | 731 | | | | 709 | |

| | | | | | | | | | | | | | | | | |

| Net Income | | $ | 1,211 | | | $ | 1,300 | | | $ | 1,221 | | | $ | 1,238 | |

| | | | | | | | | | | | | | | | | |

| Net Income Per Share of Common Stock outstanding | | $ | .90 | | | $ | .97 | | | $ | .86 | | | $ | .86 | |

| Dividends Per Share of Common Stock | | $ | .27 | | | $ | .27 | | | $ | .27 | | | $ | .27 | |

| Quarterly Financial Results For the Year Ended December 31, 2007 | |

| (in thousands, except per share amounts) | |

| | |

| | | Fourth Quarter | | | Third Quarter | | | Second Quarter | | | First Quarter | |

| Total Interest Income | | $ | 7,102 | | | $ | 7,079 | | | $ | 6,917 | | | $ | 6,566 | |

| Total Interest Expense | | | 2,799 | | | | 2,796 | | | | 2,660 | | | | 2,448 | |

| Net Interest Income | | | 4,303 | | | | 4,283 | | | | 4,257 | | | | 4,118 | |

| | | | | | | | | | | | | | | | | |

| Provision for Loan Losses | | | 351 | | | | 145 | | | | 168 | | | | 173 | |

| | | | | | | | | | | | | | | | | |

| Net Interest Income After Provision for Loan Losses | | | 3,952 | | | | 4,138 | | | | 4,089 | | | | 3,945 | |

| | | | | | | | | | | | | | | | | |

| Other Income | | | 572 | | | | 542 | | | | 495 | | | | 471 | |

| Other Expenses | | | 2,634 | | | | 2,857 | | | | 2,803 | | | | 2,658 | |

| | | | | | | | | | | | | | | | | |

| Income Before Income Taxes | | | 1,890 | | | | 1,823 | | | | 1,781 | | | | 1,758 | |

| | | | | | | | | | | | | | | | | |

| Income Tax Expense | | | 614 | | | | 690 | | | | 658 | | | | 637 | |

| | | | | | | | | | | | | | | | | |

| Net Income | | $ | 1,276 | | | $ | 1,133 | | | $ | 1,123 | | | $ | 1,121 | |

| | | | | | | | | | | | | | | | | |

| Net Income Per Share of Common Stock outstanding | | $ | .89 | | | $ | .79 | | | $ | .78 | | | $ | .78 | |

| Dividends Per Share of Common Stock | | $ | .25 | | | $ | .25 | | | $ | .25 | | | $ | .25 | |

Net Interest Income

2008 Compared to 2007

Net interest income, on a fully taxable equivalent basis, increased 2.27% from 2007 to 2008. As average balances of both earning assets and interest bearing liabilities remained relatively flat from year to year, this increase in net interest income was most impacted by changes in average rates earned on assets and paid on interest bearing liabilities and by changes in the relative mix of earning assets and interest bearing liabilities.

For the year ended December 31, 2008, the Company’s average balances of both earning assets and interest bearing liabilities remained relatively unchanged as compared to 2007. However, changes in the relative mix of earning assets and interest bearing liabilities for 2008 as compared to 2007 impacted the Company’s net interest earnings. The percent of average loan balances, the highest earning of the Company’s earning assets, to total average earning assets increased from 86.90% in 2007 to 90.04% in 2008, and the percent of average balances of time deposits and long term debt, both comparatively more expensive interest bearing liabilities, decreased slightly from 2007 to 2008. These changes in the relative mix of earning assets and interest bearing liabilities positively impacted the Company’s net interest income, contributing to the decline in average rates paid on interest bearing liabilities being greater than the decline seen on average rates on earning assets.

Recent rate cuts by the Federal Reserve (“the Fed”) for the target rate for federal funds sold continues to impact yields on earning assets and average rates paid on interest bearing liabilities. The Company experienced declining rates for 2008 as compared to 2007 on all components of earning assets and on all components of interest bearing liabilities.

During the fourth quarter of 2008, loan demand increased as compared to the first nine months of the year. The Company has substantially funded this loan growth through reductions in balances of federal funds sold, which stood at $21,714,000 at March 31, 2008, but decreased to nearly zero by the end of the year. In addition, competition for deposits appears to have increased, and, rather than increase deposit rates above that of the local competition, the Company allowed deposit balances to shrink. The result was that this fourth quarter loan growth required overnight and short term borrowings. The impact of these borrowings has been positive in the short term as a result of the low rate of interest paid on these borrowings versus those paid on time deposits or other long term debt instruments.

In the coming periods, should loan demand remain strong, the Company may be required to increase deposit rates to attract increased deposit balances to fund this potential loan growth, or may be required to further utilize its long term debt potential. This may have the effect of causing net interest margin to shrink, however, management anticipates, were this need to occur, that total net interest income should not be adversely affected.

Further discussion relating to potential risks relating to interest rates which might impact the Company’s net interest income in future periods occurs in Item 7A. Quantitative and Qualitative Disclosures About Market Risk.

Also, balances of non performing loans have increased from December 31, 2007 to December 31, 2008 and balances of other real estate acquired through foreclosures have increased over the same time period. Increases in balances of non-accrual loans and other real estate acquired through foreclosure often have adverse effects on net interest income. Should balances of non accrual loans and other real estate acquired through foreclosure continue to increase, net interest margin may decrease accordingly. Further discussion relating to the Company’s loan portfolio and credit quality can be found as part of this Management’s Discussion and Analysis under the headings of “Loan Portfolio” and “Credit Quality.”

The table below illustrates the effects on net interest income of changes in average volumes of interest bearing liabilities and earning assets from 2007 to 2008 and changes in average rates on interest bearing liabilities and earning assets from 2007 to 2008 (in thousands of dollars):

| EFFECT OF RATE-VOLUME CHANGES ON NET INTEREST | |

| (On a fully taxable equivalent basis) | |

| Increase (Decrease) 2008 Compared to 2007 | |

| | |

| | | Due to change in: | | | | |

| | | Average Volume | | | Average Rate | | | Total Change | |

| Interest Income | | | | | | | | | |

| Loans | | $ | 988 | | | $ | (1,474 | ) | | $ | (486 | ) |

| Taxable investment securities | | | (160 | ) | | | (167 | ) | | | (327 | ) |

| Nontaxable investment securities | | | 28 | | | | (1 | ) | | | 27 | |

| Interest bearing deposits | | | (37 | ) | | | (61 | ) | | | (98 | ) |

| Federal funds sold | | | (166 | ) | | | (401 | ) | | | (567 | ) |

| Total Interest Income | | | 653 | | | | (2,104 | ) | | | (1,451 | ) |

| | | | | | | | | | | | | |

| Interest Expense | | | | | | | | | | | | |

| Demand deposits | | | (7 | ) | | | (133 | ) | | | (140 | ) |

| Savings deposits | | | 9 | | | | (311 | ) | | | (302 | ) |

| Time deposits | | | (28 | ) | | | (1,280 | ) | | | (1,308 | ) |

| Overnight and other short term debt | | | 19 | | | | 0 | | | | 19 | |

| Long term debt | | | (54 | ) | | | (52 | ) | | | (106 | ) |

| Total Interest Expense | | | (61 | ) | | | (1,776 | ) | | | (1,837 | ) |

| | | | | | | | | | | | | |

| Net Interest Income | | $ | 714 | | | $ | (328 | ) | | $ | 386 | |

The table below sets forth an analysis of net interest income for the years ended December 31, 2008 and 2007 (average balances and interest income/expense shown in thousands of dollars):

| | | 2008 | | | 2007 | |

| | | Average Balance | | | Income /Expense | | | Yield /Rate | | | Average Balance | | | Income /Expense | | | Yield /Rate | |

| | | | | | | | | | | | | | | | | | | |

| Earning Assets | | | | | | | | | | | | | | | | | | |

| Loans | | $ | 315,473 | | | $ | 24,809 | | | | 7.86 | % | | $ | 302,906 | | | $ | 25,295 | | | | 8.35 | % |

| Taxable investment securities | | | 20,745 | | | | 987 | | | | 4.76 | % | | | 24,104 | | | | 1,314 | | | | 5.45 | % |

| Nontaxable investment securities | | | 3,392 | | | | 205 | | | | 6.04 | % | | | 2,929 | | | | 178 | | | | 6.06 | % |

| Interest bearing deposits | | | 1,419 | | | | 44 | | | | 3.10 | % | | | 2,610 | | | | 142 | | | | 5.44 | % |

| Federal funds sold | | | 9,354 | | | | 234 | | | | 2.50 | % | | | 16,006 | | | | 801 | | | | 5.00 | % |

| Total Earning Assets | | | 350,383 | | | | 26,279 | | | | 7.50 | % | | | 348,555 | | | | 27,730 | | | | 7.96 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Allowance for loan losses | | | (3,637 | ) | | | | | | | | | | | (3,589 | ) | | | | | | | | |

| Other non-earning assets | | | 30,276 | | | | | | | | | | | | 29,504 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Total Assets | | $ | 377,022 | | | | | | | | | | | $ | 374,470 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Interest Bearing Liabilities | | | | | | | | | | | | | | | | | | | | | | | | |

| Demand deposits | | $ | 23,258 | | | $ | 77 | | | | .33 | % | | $ | 25,363 | | | $ | 217 | | | | .86 | % |

| Savings deposits | | | 49,363 | | | | 383 | | | | .78 | % | | | 48,181 | | | | 685 | | | | 1.42 | % |

| Time deposits | | | 195,963 | | | | 7,897 | | | | 4.03 | % | | | 196,648 | | | | 9,205 | | | | 4.68 | % |

| Overnight and other short term debt | | | 1,412 | | | | 19 | | | | 1.35 | % | | | | | | | | | | | | |

| Long term debt | | | 11,357 | | | | 490 | | | | 4.31 | % | | | 12,613 | | | | 596 | | | | 4.73 | % |

| Total Interest Bearing Liabilities | | | 281,353 | | | | 8,866 | | | | 3.15 | % | | | 282,805 | | | | 10,703 | | | | 3.78 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Demand deposits | | | 49,827 | | | | | | | | | | | | 48,101 | | | | | | | | | |

| Other liabilities | | | 5,711 | | | | | | | | | | | | 4,886 | | | | | | | | | |

| Stockholders’ equity | | | 40,131 | | | | | | | | | | | | 38,678 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Total Liabilities and Stockholders’ Equity | | $ | 377,022 | | | | | | | | | | | $ | 374,470 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Net Interest Income | | | | | | $ | 17,413 | | | | | | | | | | | $ | 17,027 | | | | | |

| Net Yield on Earning Assets | | | | | | | | | | | 4.97 | % | | | | | | | | | | | 4.89 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Notes: | | | | | | | | | | | | | | | | | | | | | | | | |

| (1) Yields are computed on a taxable equivalent basis using a 37% tax rate | |

| (2) Average balances are based upon daily balances | |

| (3) Includes loans in non-accrual status | |

| (4) Income on loans includes fees | |

2007 Compared to 2006

Net interest income, on a fully taxable equivalent basis, increased 6.09% from 2006 to 2007.

Although the Company experienced an increase in income, margins shrank from 2006 to 2007. This shrinking of the Company’s net interest margin occurred for multiple reasons, included in which are the effect of the Fed’s decrease in the target rate for fed funds sold during the later months of 2007, the relative repricing of deposits as compared to earning assets and both the ratio of earning assets to interest bearing deposits and the ratio of loans, a comparatively higher earning asset, to other types of earning assets.

Although the Company experienced an increase in loan balances from December 31, 2006 to December 31, 2007 and a 9.01% increase in the average balances of loans for 2007 as compared to 2006, balances of deposits increased at a greater rate. Loan balances increased $17,383,000 from December 31, 2006 to December 31, 2007 while deposit balances increased $23,254,000 over the same time period, resulting in an increase in federal funds sold during the last half of 2007. The relative difference in these balances caused the Company’s average balances of federal funds sold to be greater during 2007 than in 2006 and the decreases by the Fed for the target rate for federal funds sold late in the year caused a significant impact on the Company’s interest earnings.

Although earning assets continued to reprice upward in 2007 as a result of the increases in rates during 2006, the relative increase in rates paid on deposits, particularly time deposits, was greater than the increase in average rates earned on earning assets. Average rates earned on loans during 2007 were 39 basis points higher than in 2006 while the average rates paid on time deposits were 76 basis points higher in 2007 than in 2006.

The table below sets forth an analysis of net interest income for the years ended December 31, 2007 and 2006 (average balances and interest income/expense shown in thousands of dollars):

| | | 2007 | | | 2006 | |

| | | Average Balance | | | Income /Expense | | | Yield /Rate | | | Average Balance | | | Income /Expense | | | Yield /Rate | |

| | | | | | | | | | | | | | | | | | | |

| Earning Assets | | | | | | | | | | | | | | | | | | |

| Loans | | $ | 302,906 | | | $ | 25,295 | | | | 8.35 | % | | $ | 277,871 | | | $ | 22,118 | | | | 7.96 | % |

| Taxable investment securities | | | 24,104 | | | | 1,314 | | | | 5.45 | % | | | 24,970 | | | | 1,095 | | | | 4.39 | % |

| Nontaxable investment securities | | | 2,929 | | | | 178 | | | | 6.06 | % | | | 2,987 | | | | 173 | | | | 5.79 | % |

| Interest bearing deposits | | | 2,610 | | | | 142 | | | | 5.44 | % | | | 1,576 | | | | 72 | | | | 4.57 | % |

| Federal funds sold | | | 16,006 | | | | 801 | | | | 5.00 | % | | | 10,287 | | | | 500 | | | | 4.87 | % |

| Total Earning Assets | | | 348,555 | | | | 27,730 | | | | 7.96 | % | | | 317,691 | | | | 23,958 | | | | 7.54 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Allowance for loan losses | | | (3,589 | ) | | | | | | | | | | | (3,283 | ) | | | | | | | | |

| Other non-earning assets | | | 29,504 | | | | | | | | | | | | 28,648 | | | | | | | | | |