| | |

SECOND QUARTER REPORT 2011 July 28, 2011 Based on and expressed in US dollars | | For a full explanation of results, the Financial Statements and Management Discussion & Analysis, please see the Company’s website,www.barrick.com. |

Barrick Reports Q2 2011 Financial and Operating Results

Financial and Operating Results

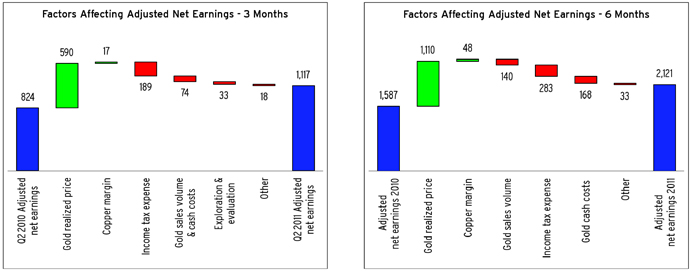

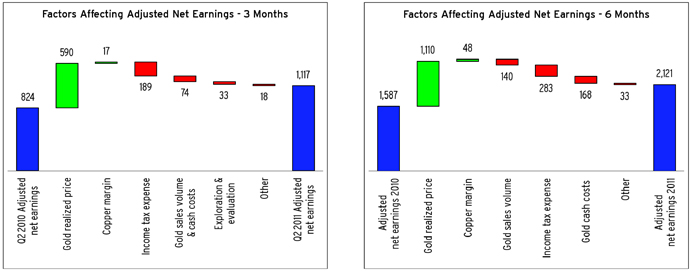

| | • | | Reported net earnings for Q2 rose 35% to $1.2 billion ($1.16 per share) from $859 million in the prior year period. Q2 adjusted net earnings increased 36% to a record $1.1 billion ($1.12 per share)1 from $824 million ($0.84 per share) in Q2 2010, reflecting higher realized gold and copper prices and higher gold sales volumes, resulting in an annualized return on equity of about 21%1. | |

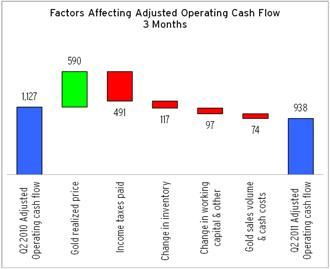

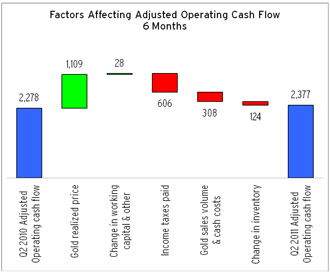

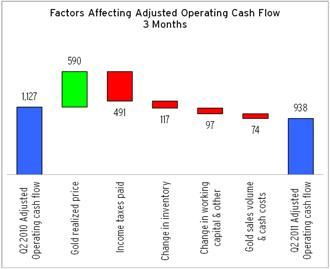

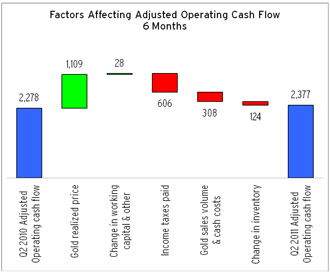

| | • | | Q2 EBITDA increased 40% to $2.1 billion1 from $1.5 billion in the same prior year period. Q2 operating cash flow of $690 million and adjusted operating cash flow of $938 million1, respectively, were lower than the prior year operating cash flow of $1,108 million and adjusted operating cash flow of $1,127 million, respectively. This reduction was primarily as a result of higher income tax payments of $736 million, of which about $420 million was due to final 2010 income tax payments in a number of jurisdictions. Income tax payments are expected to be about $400 million per quarter in the subsequent quarters of 2011. | |

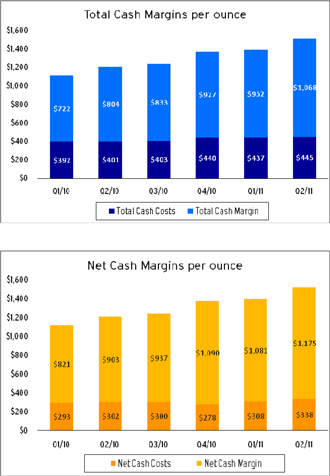

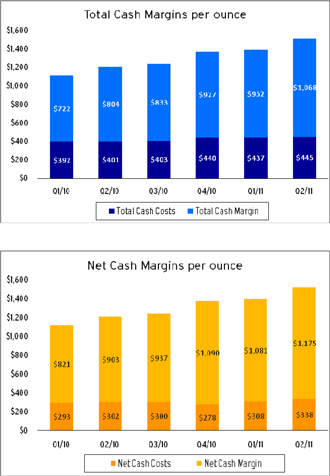

| | • | | Q2 gold production was 1.98 million ounces at total cash costs of $445 per ounce and net cash costs of $338 per ounce1. The Company is on track to meet its 2011 operating guidance of 7.6-8.0 million ounces at total cash costs of $450-$480 per ounce and lower expected net cash costs of $290-$320 per ounce2 compared to previous guidance of $340 -$380 per ounce. Including Lumwana, Barrick expects to produce 455-475 million pounds of copper in 2011 at total cash costs of $1.55 -$1. 70 per pound. | |

| | • | | Gold and copper cash margins expanded significantly in the second quarter, highlighting Barrick’s leverage to higher metal prices. Gold cash margins increased 33% to $1,068 per ounce1 from $804 per ounce in Q2 2010 and net cash margins rose 30 % to $1,175 per ounce1 from $903 per ounce in the prior year period. Copper cash margins rose 39% to $2.51 per pound1 from $1.80 per pound in the prior year period. | |

Increasing Gold and Copper Reserves through Exploration and Selective Acquisitions

| | • | | Major exploration programs are advancing at Cortez, Turquoise Ridge, Ruby Hill, and Spring Valley in North America, on early stage targets in the El Indio belt in South America, and at Porgera and on regional targets in the Australia Pacific region. | |

| | • | | Barrick completed the acquisition of Equinox Minerals in July, adding two quality copper mines and increasing our leverage to strong copper prices while maintaining our gold exposure. Low cost financing has been secured and will enhance the returns from the acquisition. The Company is focused on three areas to realize the full potential of the Lumwana mine, which is located in one of the world’s most prolific copper regions in Zambia: operational improvements and efficiencies, a focus on exploration to expand the resource, and an ongoing evaluation to determine the optimal scope of an expansion. | |

Investing in and Developing High Return Projects

| | • | | The mining industry is facing global cost trends which reflect a substantially higher commodity price environment, stronger local currencies, tighter labor markets and higher inflation in some regions compared to several years ago when many projects were at the feasibility stage. For Barrick, stronger metal prices have significantly improved project economics and overall rates of return despite higher estimated capital costs. | |

| | • | | At Pueblo Viejo, a major rainfall event that occurred in May requires remediation of the starter tailings dam and new permits for this facility. Primarily as a result of the unanticipated remediation work and impact to the schedule, mine construction capital for the project has increased to $3.6-$3.8 billion (100% basis) or $2.2-$2.3 billion (Barrick’s 60% share) and first production is now expected to occur in mid -2012 subject to the receipt of these permits. As part of a longer-term, optimized power solution for Pueblo Viejo, the Company is advancing a plan to build a dual-fueled power plant at an estimated incremental capital cost of about $0.3 billion (100% basis). The new plant is expected to provide lower cost, long term power to the project. | |

| | • | | Capital costs for Pascua-Lama have been impacted by continued inflationary effects on costs for key consumable inputs and labor, re-estimations of materials such as steel, cement, fuel and equipment and increased expenditures to essentially maintain the schedule to deliver first production in mid-2013. As a result, pre-production capital is now estimated at $4.7-$ 5.0 billion. | |

| | • | | Pueblo Viejo and Pascua-Lama are anticipated to contribute 1.4-1.5 million ounces of average annual production over the first full five years of operation and to lower Barrick’s overall total cash costs by about 20%3. At current metal prices, these two projects are expected to generate combined average annual EBITDA of about $2.8 billion4 to Barrick over the same period, with an average investment to EBITDA ratio of about 2.5 times. | |

1 Adjusted net earnings, adjusted operating cash flow, EBITDA, return on equity, total cash costs, net cash costs, cash margins and net cash margins per ounce/pound are non-GAAP financial measures. See pages 54-60 of Barrick’s Second Quarter 2011 Report.

2 Based on an expected realized copper price of $4.00/lb for the balance of 2011 compared to the prior expected realized copper price of $3.75/lb and reflecting expected 2011 production of 455-475 million pounds compared to previous guidance of about 300 million pounds.

3 Based on the estimated combined average annual production in the first full five years of operation and on gold, silver and oil price assumptions of $1,300/oz, $25/oz and $100/bbl, respectively.

4 EBITDA is based on the midpoint of average annual production and average total cash costs in the first full five years of operation assuming a $1,600/oz gold price, a $40/oz silver price and a $100/bbl oil price.

| | | | |

| BARRICK SECOND QUARTER 2011 | | | | PRESS RELEASE |

FINANCIAL AND OPERATING RESULTS

Q2 production was 1.98 million ounces of gold at total cash costs of $445 per ounce and net cash costs of $338 per ounce. The Company is on track to achieve its full year operating guidance of 7.6-8.0 million ounces at total cash costs of $450-$480 per ounce and significantly lower expected net cash costs of $290-$320 per ounce compared to previous guidance of $340-$380 per ounce, positioning Barrick as one of the lowest cost senior gold producers. Q2 gold cash margins increased 33% to $1,068 per ounce from $804 per ounce in Q2 2010 and net cash margins increased 30% to $1,175 per ounce from $903 per ounce in the same prior year period. Second quarter copper cash margins increased 39% to $2.51 per pound from $1.80 per pound in the prior year period on higher copper prices. This margin expansion demonstrates the Company’s exceptional leverage to higher metal prices.

Q2 adjusted net earnings rose 36% to a record $1.1 billion ($1.12 per share) compared to adjusted net earnings of $824 million ($0.84 per share) in the prior year period, reflecting higher realized prices for both gold and copper and higher gold sales volumes. Q2 adjusted net earnings translate to an annualized return on equity of about 21%. Q2 reported net earnings were $1.2 billion ($1.16 per share) before net adjustments of $42 million. Q2 EBITDA increased 40% to $2.1 billion from $1.5 billion in the same prior year period. Q2 operating cash flow of $690 million and adjusted operating cash flow of $938 million (which adjusts for the one-time operating cash flow impacts related to the Equinox acquisition) compares to operating cash flow of $1,108 million and adjusted operating cash flow of $1,127 million in the same prior year period, respectively. Operating cash flow and adjusted operating cash flow were negatively impacted by an increase in income tax payments, primarily due to final 2010 income tax payments in Argentina, Australia and Chile. Income tax payments totaled $736 million in the second quarter of 2011, of which about $420 million related to 2010 tax payments in the above jurisdictions compared to $245 million in the same prior year period. Based on current gold

and copper prices, we expect income tax payments to be about $400 million per quarter for the remainder of 2011. In addition, we expect to make an intercompany dividend withholding tax payment of about $85 million in the third quarter.

“Operationally and financially, Barrick had a solid quarter, meeting our operating and cash cost targets which resulted in significant margin expansion and record financial results,” said Aaron Regent, Barrick’s President and CEO. “We also completed the acquisition and long term financing of Equinox which adds two attractive assets to our portfolio and another source of long term cash flow. Our project pipeline continues to progress with the ongoing construction of Pueblo Viejo and Pascua-Lama and while we are disappointed with the increased capital costs of these projects, their overall economics have improved significantly as a result of much higher gold and silver prices than originally forecasted.”

The North America region continued to perform ahead of expectations in Q2, producing 0.92 million ounces at total cash costs of $404 per ounce, primarily due to strong performances from Cortez and Goldstrike. Cortez production of 0.42 million ounces at total cash costs of $220 per ounce in Q2 reflects the ramp up of leach pad production, increased mill throughput from de-bottlenecking and the processing of refractory ore at Goldstrike’s facilities.

The Goldstrike operation exceeded plan in Q2, producing 0.30 million ounces at total cash costs of $511 per ounce on better than expected grades and more ore than anticipated from the open pit, which is anticipated to transition to a higher stripping phase in the second half of the year. Full year 2011 production for the North America region is expected to be 3.30-3.46 million ounces at total cash costs of $425-$450 per ounce.

The South American business unit produced 0.45 million ounces at total cash costs of $373 per ounce in Q2. The Lagunas Norte mine outperformed expectations, producing 0.18 million ounces at total cash costs of $267 per ounce on positive grade reconciliations. Veladero contributed 0.24 million ounces at total cash costs of $364 per

| | | | |

BARRICK SECOND QUARTER 2011 | | 2 | | PRESS RELEASE |

ounce in Q2 and is on track to produce nearly 1.0 million ounces this year. In 2011, South America is expected to contribute 1.80-1.935 million ounces at total cash costs of $350-$380 per ounce.

The Australia Pacific business unit produced 0.46 million ounces at total cash costs of $611 per ounce in Q2. The Porgera mine, which produced 0.12 million ounces at total cash costs of $569 per ounce, was impacted by lower underground and open pit production as well as power outages and unplanned maintenance which affected mill throughput. Australia Pacific is expected to produce 1.85-2.00 million ounces at total cash costs of $610-$635 per ounce in 2011.

Attributable production from African Barrick Gold plc in Q2 was 0.13 million ounces at total cash costs of $652 per ounce. Barrick’s share of 2011 production is expected to be 0.515-0.560 million ounces at total cash costs of $590-$650 per ounce.

Q2 copper production of 93 million pounds at total cash costs of $1.56 per pound included one month of production from the Lumwana mine in June. Utilizing option collar strategies, the Company has put in place floor protection on approximately 45% of its expected remaining copper production for 2011 at an average floor price of $3.27 per pound and can participate in upside up to an average ceiling price of about $4.85 per pound on approximately 55% of expected remaining 2011 production5. Barrick also has floor protection in place on approximately 45% of expected copper production for 2012 at an average floor price of about $3.75 per pound and can participate in upside up to an average ceiling price of about $5.50 per pound6 on approximately 40% of expected 2012 production. The Company’s remaining copper production is subject to market prices. Following Barrick’s acquisition of Equinox Minerals, the Company expects to produce 455-475 million pounds of copper in 2011 at total cash costs of $1.55-$1.70 per pound.

About 60% of Barrick’s consolidated production costs are denominated in US dollars. The Company’s largest single currency exposure is

5 The realized price for remaining 2011 production is expected to be reduced by $0.06 per pound as a result of the net premium paid on hedging strategies.

6 The realized price on 2012 production is expected to be reduced by $0.12 per pound as a result of the net premium paid on hedging strategies.

the Australian dollar/US dollar exchange rate. Barrick is 92% hedged on its expected remaining Australian operating and capital expenditures in 2011 at an effective average rate of $0.76 and has substantial coverage for the following three years at rates at or below $0.75.

The Company has also mitigated the impact of higher oil prices through the use of financial contracts and production from Barrick Energy such that a $10 change in WTI crude oil prices is only expected to impact 2011 total cash costs by about $1 per ounce. The Barrick Energy contribution, along with the financial contracts, provides hedge protection for approximately 85% of expected remaining 2011 fuel consumption. Beyond 2011, financial contracts provide substantial hedge coverage in 2012 and 2013 and production from Barrick Energy is expected to continue to provide long term natural offsets to expected energy costs.

INCREASING GOLD AND COPPER RESERVES THROUGH EXPLORATION AND SELECTIVE ACQUISITIONS

Barrick completed the acquisition of Equinox Minerals in July and is in the process of integrating the Lumwana mine and Jabal Sayid project into the Australia Pacific regional business unit. This transaction has added two quality copper mines to our portfolio and improves our copper leverage while maintaining our exposure to gold. Low cost financing has been secured and will enhance returns from the acquisition. The Equinox transaction was a unique opportunity to acquire a large, producing asset in an environment of strong copper fundamentals. The Lumwana mine is a high quality, long-life mine with significant expansion and resource growth potential and provides us with a major presence in Zambia, one of the most prospective copper regions in the world.

The Company is focused on three areas to realize the full potential of Lumwana and maximize long term cash flows: operational improvements and efficiencies, a focus on exploration to materially expand the resource and an ongoing evaluation to determine the optimal size of the expansion.

| | | | |

| BARRICK SECOND QUARTER 2011 | | 3 | | PRESS RELEASE |

Lumwana is expected to produce 155-175 million pounds at total cash costs of $1.75-$1.95 per pound from June 1 to the end of 2011. On a full year annualized basis, production is expected to be about 300 million pounds beyond 2011 prior to a potential expansion. Cash costs for 2011 have been impacted by plant availability and lower grades related to dilution, as well as higher costs related to currency, labor and power. Areas of expected operating improvements include mill de-bottlenecking, pit re-optimization, changes to mine sequencing, dilution control, and benefits from higher equipment availability and leveraging Barrick’s supply chain agreements. An infill drill program at the producing Malundwe deposit is underway to improve dilution control and more accurately model orebody characteristics.

Lumwana has excellent potential for both brownfield and greenfield resource growth. Barrick expects to spend over $50 million in 2011 as part of an 18 month exploration program to increase the measured and indicated resource as part of the expansion study which is expected to be completed in the second half of 2012. As a result, the Company’s total exploration budget for 2011 will increase to $370-$390 million7, of which approximately 40% will be capitalized. A minimum of 16 drill rigs are planned to be added in Zambia, primarily at the development stage Chimiwungo deposit, to convert mineralized inventory and inferred resources to the measured and indicated category, conduct extensional drilling, infill drill two potential starter pits and evaluate the potential for a third starter pit. Malundwe is open to the north and south and Chimiwungo remains open in multiple directions. Recent condemnation drilling west of the current optimized Chimiwungo pit shell is intersecting typical “Chimi-style” mineralization. Wide spaced drilling is planned for the recent Mutoma discovery as well as drilling to test advanced sediment-hosted copper-gold targets elsewhere on the Lumwana Mining Lease and on other exploration properties in Zambia including

7 Barrick’s exploration programs are designed and conducted under the supervision of Robert Krcmarov, Senior Vice President, Global Exploration of Barrick. For information on the geology, exploration activities generally, and drilling and analysis procedures on Barrick’s material properties, see Barrick’s most recent Annual Information Form/Form 40-F on file with Canadian provincial securities regulatory authorities and the U.S. Securities and Exchange Commission.

the copper belt. In addition, Barrick is advancing an expansion study that could potentially double processing rates in conjunction with the exploration program to better determine the optimal scope of the operation.

The Jabal Sayid copper project in Saudi Arabia is expected to enter production in the second half of 2012 at a total capital cost of approximately $400 million, of which $275 million remains to be spent. The mine is expected to produce 100-130 million pounds annually over its first full five years. Good potential exists for material extensions to known deposits and new discoveries from an ongoing evaluation of the entire Jabal Sayid site. Current exploration is focused on testing Lode 4 at depth, where mineralization has been intersected in several previous drill holes, including an intercept of 111 meters at 2.67% copper. Several geophysical surveys are also in progress.

INVESTING IN AND DEVELOPING HIGH RETURN PROJECTS IN CONSTRUCTION

Barrick has targeted growth in production to 9 million ounces of gold8 within the next five years. Total cash costs are expected to benefit from its large, low cost projects, primarily Pueblo Viejo and Pascua-Lama, as these mines come on stream. Once at full capacity, these two mines are expected to contribute about 1.4-1.5 million ounces of average annual production over the first full five years of operation and are expected to lower Barrick’s overall total cash costs by about 20%. At current metal prices, these two projects are anticipated to generate combined average annual EBITDA of about $2.8 billion to Barrick over the same period.

“The mining industry has been impacted by global cost trends which are a product of a higher commodity price environment, stronger local currencies, tighter labor markets and higher inflation,” said Peter Kinver, Executive Vice-President and Chief Operating Officer. “While Barrick has not been immune to these trends, the

8 The target of 9 Moz of annual production within five years reflects a current assessment of the expected production and timeline to complete and commission Barrick’s projects currently in construction (Pueblo Viejo and Pascua-Lama) and the Company’s current assessment of existing mine site opportunities, some of which are sensitive to metal price and various capital and input cost assumptions.

| | | | |

| BARRICK SECOND QUARTER 2011 | | 4 | | PRESS RELEASE |

higher metal prices have significantly improved the economics and overall rates of return for these projects despite the higher than previously estimated capital costs.”

At the Pueblo Viejo project in the Dominican Republic, overall construction is now more than 70% complete. A major rainfall event that occurred in May requires remediation of damage to the partially constructed starter tailings dam facility and as a result, first production is now anticipated in mid-2012, subject to the receipt of new tailings permit approvals. The unanticipated remediation work and impact on the schedule has resulted in mine construction capital increasing to $3.6-$3.8 billion (100%)9, or $2.2-$2.3 billion (Barrick’s 60% share) of which about 75% had been committed at the end of the second quarter. Barrick’s share of annual gold production in the first full five years of operation is expected to average 625,000-675,000 ounces at total cash costs of $275-$300 per ounce9. At the current gold price of about $1,600 per ounce, Pueblo Viejo is expected to contribute approximately $900 million of average annual EBITDA to Barrick over this period, representing an investment to EBITDA ratio of about 2.5 times.

At the end of the second quarter, three of the four autoclaves had been brick-lined and the remaining autoclave is more than 70% complete. About 90% of the planned concrete has been poured, approximately 90% of the steel has been erected and more than 4.8 million tonnes of ore have been stockpiled. Work continues toward achieving key milestones including the connection of power to the site. As part of a longer-term, optimized power solution for Pueblo Viejo, the Company is advancing a plan to build a dual-fueled power plant at an estimated incremental capital cost of about $300 million (100% basis) or $180 million (Barrick’s share) that would commence operations utilizing heavy fuel oil (HFO) power but have the ability to subsequently convert to cheaper liquid natural gas (LNG). The new plant is expected to provide lower cost, long term power to the project.

9Based on gold and oil price assumptions of $1,300/oz and $100/bbl, respectively.

Since February 2011, Barrick has reorganized its Capital Projects group, increasing the involvement and co-ordination of its Regional Business Units in the construction of major projects to assist in operational readiness and to capture regional synergies. As a result, personnel changes were made at the Pascua-Lama project. In connection with these changes, a detailed review of the underlying assumptions and trending analysis for Pascua-Lama was completed in the second quarter. This review coincided with the review of the capital costs of Cerro Casale, where additional data and information applicable to Pascua-Lama was identified. The Company has concluded that, based on current trends, certain earlier estimates and assumptions are not achievable, including those for productivity rates and inflationary effects on costs, as well as for required quantities of certain construction materials such as steel and cement. In addition, the Company has increased its projected expenditures to essentially maintain the schedule for bringing the project into production in mid-2013. As a result, pre-production capital is now estimated at $4.7-$5.0 billion10. Included in this estimate is a contingency of $350-$650 million which is about 15%-25% of the remaining uncommitted expenditure of about $2.5 billion. Barrick has engaged an independent, globally recognized engineering consultant who has reviewed the robustness of our processes and methodology in deriving this updated capital estimate. Approximately 40% of the capital had been committed at the end of the second quarter for items including structural steel, the mining fleet, autogenous and ball mills, the overland conveyor and the primary and pebble crushers.

Since the 2009 feasibility study (which estimated pre-production capital at $2.8-$3.0 billion), costs for key consumables have increased materially. Since the beginning of 2009, steel prices are up about 100%, oil prices have increased about 120% and copper prices are up more than 200%. Projects in Chile and Argentina are also being adversely affected by the continued increase in demand for project resources due to the large number of projects that are in construction or at

| | | | |

| BARRICK SECOND QUARTER 2011 | | 5 | | PRESS RELEASE |

the feasibility stage. High inflation rates of over 25% in Argentina, as well as the earthquake in Chile, have resulted in significantly higher labor costs and a tight labor market, and a stronger Chilean peso has negatively impacted cost estimates. These inflationary pressures represent approximately 50% of the increased estimated capital expenditures over the 2009 study.

Based on construction experience to date, we have re-estimated quantities of material required for such items as steel, cement, fuel and equipment, which represents approximately 35% of the increased estimated capital expenditures over the 2009 study.

Given lower than expected productivity levels, the Company has increased expenditures to essentially maintain the schedule for the project in order to deliver first production in mid-2013, including expanded camp facilities and the higher costs associated with winter construction. These increased expenditures represent approximately 15% of the increased estimated capital expenditures over the 2009 study.

Pascua-Lama is a high quality, world class resource. Expected average annual gold production for Pascua-Lama has increased to 800,000–850,000 ounces in the first full five years of operation at negative total cash costs of $225-$275 per ounce10 assuming a silver price of $25 per ounce. Average annual silver production for the first full five years is expected to be about 35 million ounces. For every $1 per ounce increase in the silver price, total cash costs are expected to decrease by about $35 per ounce over this period. At current commodity prices of $1,600 per ounce gold and $40 per ounce silver, Pascua-Lama is expected to generate approximately $1.9 billion of average annual EBITDA in its first full five years of operation. At today’s prices, this represents an investment to EBITDA ratio of about 2.6 times.

At the end of the second quarter, engineering design was about 90% complete. In Chile, earthworks were more than 80% complete, the truck shop platform was completed and work advanced on road construction to the Pascua pit. In

10 Based on gold, silver and oil price assumptions of $1,300/oz, $25/oz, and $100/bbl respectively and assuming a Chilean peso f/x rate of 475:1.

Argentina, platforms for the conveyor portal, coarse ore stockpile, pebble crusher and Merrill Crowe facility were completed. Occupancy and expansion of the construction camps in Chile and Argentina continues to ramp up with more than 2,300 housed on site and a further 2,800 expected by the end of the year. Preparations are underway to commence pre-strip mining in Q4 2011 and development of the tunnel connecting the mine in Chile and the processing plant in Argentina is progressing on both sides.

PROJECTS IN FEASIBILITY

A capital review has been completed for the Cerro Casale project in Chile that incorporates design changes resulting from advanced engineering and a review of recent industry projects, and which has resulted in a more robust and lower risk technical design. Estimated pre-production capital of about $6.0 billion (100% basis)11, which includes a higher contingency of about $0.9 billion, has been impacted by inflationary effects on costs for key consumable inputs and labor, re-estimations of required quantities of construction materials, increased costs related to productivity, and higher expenditures for expanded temporary camps and other facilities. The revised estimate is based on updated commodity price assumptions and also reflects the impact of a stronger Chilean peso and tight labor markets in Chile. The feasibility study was based on 2009 prices, exchange rates and labor conditions.

Inflationary and other impacts on labor and consumables such as steel and cement, which have increased costs for structural work, represent approximately 25% of the increased estimated capital expenditures over the 2009 study. Based on a review of recent industry projects, we have re-estimated costs for items such as mechanical and electrical work and quantities of other materials, which accounts for approximately 20% of the increased estimated capital expenditures. We have also increased projected expenditures related to lower than anticipated productivity based on

11 Based on gold, copper and oil price assumptions of $1,300/oz, $3.00/lb and $100/bbl respectively and assuming a Chilean peso f/x rate of 475:1.

| | | | |

| BARRICK SECOND QUARTER 2011 | | 6 | | PRESS RELEASE |

construction experience to date at Pascua-Lama and these higher expenditures represent approximately 20% of the increased estimated capital expenditures. In connection with the current labor environment, we have expanded the temporary camps and facilities, which accounts for approximately 10% of the increased estimated capital expenditures. A provision for a higher contingency represents approximately 25% of the increase.

Barrick is evaluating several options to further optimize the project and the potential for higher grade satellite starter pits. Exploration programs will continue in parallel with advancing detailed engineering and permitting. The Environmental Impact Assessment is expected to be submitted shortly and the permitting process is anticipated to be about 18 months, at which time Barrick would consider a construction decision. Discussions with the government and meetings with local communities and indigenous groups are continuing in parallel with these activities. Barrick’s 75% share of average annual production is anticipated to be about 750,000-825,000 ounces of gold and 190-210 million pounds of copper in the first full five years of operation at lower total cash costs than previously estimated of about $125-$175 per ounce11.

At the 50%-owned Donlin Gold project in Alaska, feasibility study revisions that include updated costs and the utilization of natural gas are expected to be completed and submitted to the Board of Donlin Gold LLC in the second half of 2011.

At the Reko Diq copper-gold project in which Barrick holds a 37.5% interest, the Supreme Court of Pakistan has ruled that the provincial government of Balochistan has the authority to decide to grant a mining license to the project company, Tethyan Copper. Efforts to secure the mining license and associated Project and Mineral Agreements are expected to continue in the second half of 2011.

A peer review of the draft Social, Environmental Impact Assessment (SEIA) report for the 50%-owned Kabanga project in Tanzania was completed during the quarter and is expected to be

finalized along with the feasibility study in the second half of 2011. Focus will shift in the approval phase to gaining the required Tanzanian regulatory approvals and negotiating an acceptable Mineral Development Agreement with the Tanzanian government.

* * * *

Barrick’s vision is to be the world’s best gold company by finding, acquiring, developing and producing quality reserves in a safe, profitable and socially responsible manner. Barrick’s shares are traded on the Toronto and New York stock exchanges.

| | | | |

| BARRICK SECOND QUARTER 2011 | | 7 | | PRESS RELEASE |

Key Statistics

| | | | | | | | | | | | | | | | |

Barrick Gold Corporation (in United States dollars) | | Three months ended

June 30, | | | Six months ended June 30, | |

| | | | |

| (Unaudited) | | 2011 | | | 2010 | | | 2011 | | | 2010 | |

| | |

Operating Results | | | | | | | | | | | | | | | | |

Gold production (thousands of ounces)1 | | | 1,977 | | | | 1,944 | | | | 3,934 | | | | 4,005 | |

Gold sold (thousands of ounces) | | | 1,915 | | | | 1,903 | | | | 3,778 | | | | 3,962 | |

Per ounce data | | | | | | | | | | | | | | | | |

Average spot gold price | | $ | 1,506 | | | $ | 1,197 | | | $ | 1,445 | | | $ | 1,152 | |

Average realized gold price2 | | | 1,513 | | | | 1,205 | | | | 1,452 | | | | 1,158 | |

Net cash costs2 | | | 338 | | | | 302 | | | | 323 | | | | 297 | |

Total cash costs2 | | | 445 | | | | 401 | | | | 441 | | | | 397 | |

Depreciation3 | | | 152 | | | | 142 | | | | 147 | | | | 137 | |

Other4 | | | 17 | | | | 6 | | | | 16 | | | | 5 | |

Total production costs | | | 614 | | | | 549 | | | | 604 | | | | 539 | |

Copper credits | | | 107 | | | | 99 | | | | 118 | | | | 100 | |

Copper production (millions of pounds)5 | | | 93 | | | | 102 | | | | 168 | | | | 202 | |

Copper sold (millions of pounds) | | | 82 | | | | 105 | | | | 162 | | | | 198 | |

Per pound data | | | | | | | | | | | | | | | | |

Average spot copper price | | $ | 4.14 | | | $ | 3.18 | | | $ | 4.26 | | | $ | 3.23 | |

Average realized copper price2 | | | 4.07 | | | | 2.93 | | | | 4.16 | | | | 3.10 | |

Total cash costs2 | | | 1.56 | | | | 1.13 | | | | 1.41 | | | | 1.09 | |

Depreciation3 | | | 0.26 | | | | 0.21 | | | | 0.25 | | | | 0.21 | |

Total production costs | | | 1.82 | | | | 1.34 | | | | 1.66 | | | | 1.30 | |

| | |

Financial Results(millions) | | | | | | | | | | | | | | | | |

Revenues | | $ | 3,426 | | | $ | 2,621 | | | $ | 6,516 | | | $ | 5,202 | |

Net earnings6 | | | 1,159 | | | | 859 | | | | 2,160 | | | | 1,679 | |

Adjusted net earnings2 | | | 1,117 | | | | 824 | | | | 2,121 | | | | 1,587 | |

EBITDA2 | | | 2,090 | | | | 1,489 | | | | 3,918 | | | | 3,082 | |

Operating cash flow | | | 690 | | | | 1,108 | | | | 2,125 | | | | 2,238 | |

Adjusted operating cash flow2 | | | 938 | | | | 1,127 | | | | 2,377 | | | | 2,278 | |

Per Share Data (dollars) | | | | | | | | | | | | | | | | |

Net earnings (basic) | | | 1.16 | | | | 0.87 | | | | 2.16 | | | | 1.70 | |

Adjusted net earnings (basic)2 | | | 1.12 | | | | 0.84 | | | | 2.12 | | | | 1.61 | |

Net earnings (diluted) | | | 1.16 | | | | 0.86 | | | | 2.16 | | | | 1.69 | |

Weighted average basic common shares (millions) | | | 999 | | | | 985 | | | | 999 | | | | 985 | |

Weighted average diluted common shares (millions)7 | | | 1,001 | | | | 997 | | | | 1,001 | | | | 997 | |

| | |

| | | | | | | | | As at June 30, | | | As at

December 31, | |

| | | | | | | | | 2011 | | | 2010 | |

| | |

Financial Position(millions) | | | | | | | | | | | | | | | | |

Cash and equivalents | | | | | | | | | | $ | 2,863 | | | $ | 3,968 | |

Non-cash working capital | | | | | | | | | | | 1,924 | | | | 1,696 | |

Adjusted debt2 | | | | | | | | | | | 13,018 | | | | 6,392 | |

Net debt2 | | | | | | | | | | | 10,161 | | | | 2,427 | |

Average shareholders’ equity | | | | | | | | | | | 20,525 | | | | 17,352 | |

Return on equity2 | | | | | | | | | | | 21% | | | | 20% | |

| | |

1 Production includes our equity share of gold production at Highland Gold. 2 Realized price, net cash costs, total cash costs, adjusted net earnings, EBITDA, adjusted operating cash flow, adjusted debt, net debt and return on equity are non-GAAP financial performance measures with no standard definition under IFRS. See pages 54 - 60 of the Company’s MD&A. 3 Represents equity amortization expense divided by equity ounces of gold sold or pounds of copper sold. 4 Represents the impact of Barrick Energy and realized gains and losses on non-hedge commodity contracts at the Company’s producing mines divided by equity ounces of gold sold or pounds of copper sold. 5 Production includes one month’s production from the newly acquired Lumwana mine. 6 Net earnings represents net income attributable to the equity holders of the Company. 7 Fully diluted includes dilutive effect of stock options and convertible debt. | |

| | | | |

| BARRICK SECOND QUARTER 2011 | | 8 | | SUMMARY INFORMATION |

Production and Cost Summary

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Gold Production (attributable ounces) (000’s) | | | Total Cash Costs ($/oz) | |

| | | | | | | | |

| | | Three months ended June 30, | | | Six months ended June 30, | | | Three months ended June 30, | | | Six months ended June 30, | |

| | | | | | | | | | | | | | | | |

| (Unaudited) | | 2011 | | | 2010 | | | 2011 | | | 2010 | | | 2011 | | | 2010 | | | 2011 | | | 2010 | |

| | | | | | | | | | | | | |

North America | | | 923 | | | | 755 | | | | 1,785 | | | | 1,484 | | | $ | 404 | | | $ | 438 | | | $ | 400 | | | $ | 447 | |

South America | | | 453 | | | | 566 | | | | 951 | | | | 1,225 | | | | 373 | | | | 204 | | | | 358 | | | | 190 | |

Australia Pacific | | | 463 | | | | 482 | | | | 922 | | | | 971 | | | | 611 | | | | 560 | | | | 597 | | | | 557 | |

African Barrick Gold3 | | | 127 | | | | 132 | | | | 256 | | | | 309 | | | | 652 | | | | 543 | | | | 655 | | | | 528 | |

Other | | | 11 | | | | 9 | | | | 20 | | | | 16 | | | | 475 | | | | 494 | | | | 475 | | | | 494 | |

| |

Total | | | 1,977 | | | | 1,944 | | | | 3,934 | | | | 4,005 | | | $ | 445 | | | $ | 401 | | | $ | 441 | | | $ | 397 | |

| |

| | |

| | | Copper Production (attributable pounds) (Millions) | | | Total Cash Costs ($/lb) | |

| | | | | | | | |

| | | Three months ended June 30, | | | Six months ended June 30, | | | Three months ended June 30, | | | Six months ended

June 30, | |

| | | | | | | | | | | | | | | | |

| (Unaudited) | | 2011 | | | 2010 | | | 2011 | | | 2010 | | | 2011 | | | 2010 | | | 2011 | | | 2010 | |

| | | | | | | | | | | | | |

South America | | | 69 | | | | 78 | | | | 144 | | | | 158 | | | | 1.45 | | | $ | 1.07 | | | $ | 1.33 | | | $ | 1.06 | |

Australia Pacific/Zambia4 | | | 24 | | | | 24 | | | | 24 | | | | 44 | | | | 1.97 | | | | 1.31 | | | | 1.90 | | | | 1.20 | |

| |

Total | | | 93 | | | | 102 | | | | 168 | | | | 202 | | | $ | 1.56 | | | $ | 1.13 | | | $ | 1.41 | | | $ | 1.09 | |

| |

| | | | | |

| | | | | | | | | | | | | | | Total Gold Production Costs ($/oz) | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | Three months ended June 30, | | | Six months ended

June 30, | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| (Unaudited) | | | 2011 | | | 2010 | | | 2011 | | | 2010 | |

| | | | | |

Direct mining costs at market foreign exchange rates | | | $ | 501 | | | $ | 396 | | | $ | 489 | | | $ | 395 | |

Gains realized on currency hedge and commodity hedge/economic hedge contracts | | | | (57 | ) | | | (8 | ) | | | (51 | ) | | | (10) | |

Adjustments to direct mining costs2 | | | | (17 | ) | | | (6 | ) | | | (16 | ) | | | (5) | |

By-product credits | | | | (19 | ) | | | (14 | ) | | | (18 | ) | | | (16) | |

Copper credits | | | | (107 | ) | | | (99 | ) | | | (118 | ) | | | (100) | |

| |

Cash operating costs, net basis | | | | 301 | | | | 269 | | | | 286 | | | | 264 | |

Royalties | | | | 37 | | | | 33 | | | | 37 | | | | 33 | |

| |

Net cash costs1 | | | | 338 | | | | 302 | | | | 323 | | | | 297 | |

Copper credits | | | | 107 | | | | 99 | | | | 118 | | | | 100 | |

| |

Total cash costs1 | | | | 445 | | | | 401 | | | | 441 | | | | 397 | |

Depreciation | | | | 152 | | | | 142 | | | | 147 | | | | 137 | |

Adjustments to direct mining costs2 | | | | 17 | | | | 6 | | | | 16 | | | | 5 | |

| |

Total production costs | | | $ | 614 | | | $ | 549 | | | $ | 604 | | | $ | 539 | |

| |

| |

| | | | Total Copper Production Costs($/lb) | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Three months ended June 30, | | | Six months ended

June 30, | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| (Unaudited) | | | 2011 | | | 2010 | | | 2011 | | | 2010 | |

| | | | | |

Cash operating costs | | | $ | 1.53 | | | $ | 1.11 | | | $ | 1.39 | | | $ | 1.07 | |

Royalties | | | | 0.03 | | | | 0.02 | | | | 0.02 | | | | 0.02 | |

| |

Total cash costs1 | | | | 1.56 | | | | 1.13 | | | | 1.41 | | | | 1,09 | |

Depreciation | | | | 0.26 | | | | 0.21 | | | | 0.25 | | | | 0,21 | |

| |

Total production costs | | | $ | 1.82 | | | $ | 1.34 | | | $ | 1.66 | | | $ | 1,30 | |

| |

| 1 | Total cash costs and net cash costs are non-GAAP financial performance measures with no standard meaning under IFRS. See page 56 of the Company’s MD&A. |

| 2 | Represents realized gains and losses on non-hedge currency and commodity contracts and the impact of Barrick Energy’s net contribution |

| 3 | Figures relating to African Barrick Gold are presented on a 100% basis up to March 31, 2010 and a 73.9% basis thereafter, which reflects our equity share of production, |

| 4 | Production includes one month’s production from the newly acquired Lumwana mine |

| | | | |

| BARRICK SECOND QUARTER 2011 | | 9 | | SUMMARY INFORMATION |

MANAGEMENT’S DISCUSSION AND ANALYSIS (“MD&A”)

This portion of the Quarterly Report provides management’s discussion and analysis (“MD&A”) of the financial condition and results of operations to enable a reader to assess material changes in financial condition and results of operations as at and for the three and six month periods ended June 30, 2011, in comparison to the corresponding prior-year periods. The MD&A is intended to help the reader understand Barrick Gold Corporation (“Barrick”, “we”, “our” or the “Company”), our operations, financial performance and present and future business environment. This MD&A, which has been prepared as of July 27, 2011, is intended to supplement and complement the unaudited interim consolidated financial statements and notes thereto, prepared in accordance with International Financial Reporting Standards (“IFRS”), for the three and six month periods ended June 30, 2011 (collectively, the “Financial Statements”), which are included in this Quarterly Report on pages 61 to 107. You are encouraged to review the Financial Statements in conjunction with your review of this MD&A. This MD&A should be read in conjunction with both the annual audited consolidated financial statements for the three years ended December 31, 2010, prepared in accordance

with United States Generally Accepted Accounting Principles (“US GAAP”), the related annual MD&A included in the 2010 Annual Report, and the most recent Form 40-F/Annual Information Form on file with the US Securities and Exchange Commission (“SEC”) and Canadian provincial securities regulatory authorities. Certain notes to the Financial Statements are specifically referred to in this MD&A and such notes are incorporated by reference herein. All dollar amounts in this MD&A are in millions of US dollars, unless otherwise specified.

For the purposes of preparing our MD&A, we consider the materiality of information. Information is considered material if: (i) such information results in, or would reasonably be expected to result in, a significant change in the market price or value of our shares; or (ii) there is a substantial likelihood that a reasonable investor would consider it important in making an investment decision; or (iii) it would significantly alter the total mix of information available to investors. We evaluate materiality with reference to all relevant circumstances, including potential market sensitivity.

CAUTIONARY STATEMENT ON FORWARD-LOOKING INFORMATION

Certain information contained or incorporated by reference in this MD&A, including any information as to our strategy, plans or future financial or operating performance, constitutes “forward-looking statements”. All statements, other than statements of historical fact, are forward-looking statements. The words “believe”, “expect”, “anticipate”, “contemplate”, “target”, “plan”, “intend”, “continue”, “budget”, “estimate”, “may”, “will”, “schedule” and similar expressions identify forward-looking statements. Forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable by the Company, are inherently subject to significant business, economic and competitive uncertainties and contingencies. Known and unknown factors could cause actual results to differ materially from those projected in the forward-looking statements. Such factors include, but are not limited to: fluctuations in the market and forward price of gold and copper or certain other commodities (such as silver, diesel fuel and electricity); the impact of global liquidity and credit availability on the timing of cash flows and the values of assets and liabilities based on projected future cash flows; fluctuations in the currency markets (such as Canadian and Australian dollars, Chilean and Argentinean peso, British pound, Peruvian sol and Papua New Guinean kina versus US dollar); changes in US dollar interest rates that

could impact the mark-to-market value of outstanding derivative instruments and ongoing payments/receipts under interest rate swaps and variable rate debt obligations; risks arising from holding derivative instruments (such as credit risk, market liquidity risk and mark-to-market risk); changes in national and local government legislation, taxation, controls, regulations and political or economic developments in Canada, the United States, Dominican Republic, Australia, Papua New Guinea, Chile, Peru, Argentina, Tanzania, Zambia, Saudi Arabia, United Kingdom, Pakistan or Barbados or other countries in which we do or may carry on business in the future; business opportunities that may be presented to, or pursued by, the Company; our ability to successfully integrate acquisitions; operating or technical difficulties in connection with mining or development activities; employee relations; availability and increased costs associated with mining inputs and the construction of capital projects; litigation; the speculative nature of exploration and development, including the risks of obtaining necessary licenses and permits; diminishing quantities or reserve grades; adverse changes in our credit rating; contests over title to properties, particularly title to undeveloped properties; and the organization of our previously held African gold operations and properties under a separate listed company. In addition, there are risks and hazards

| | | | |

| BARRICK SECOND QUARTER 2011 | | 10 | | MANAGEMENT’S DISCUSSION AND ANALYSIS |

associated with the business of exploration, development and mining, including environmental hazards, industrial accidents, unusual or unexpected formations, pressures, cave-ins, flooding and gold bullion or copper cathode losses (and the risk of inadequate insurance, or inability to obtain insurance, to cover these risks). Many of these uncertainties and contingencies can affect our actual results and could cause actual results to differ materially from those expressed or implied in any forward-looking statements made by, or on behalf of, us. Readers are cautioned that forward-looking statements are not

guarantees of future performance. All of the forward-looking statements made in this MD&A are qualified by these cautionary statements. Specific reference is made to the most recent Form 40-F/Annual Information Form on file with the SEC and Canadian provincial securities regulatory authorities for a discussion of some of the factors underlying forward-looking statements. We disclaim any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise, except to the extent required by applicable law.

| | | | |

| INDEX | | | | |

| |

| | | page | |

Financial and Operating Highlights | | | | |

2011 Second Quarter Results | | | 12 | |

Business Developments, Outlook and Market Review | | | 14 | |

| |

Financial and Operating Results | | | | |

Summary of Operating Results | | | 20 | |

Key Operating Performance Metrics | | | 21 | |

Summary Cash Flow Performance | | | 24 | |

Review of Operating Segment Results | | | 26 | |

| |

Financial Condition Review | | | | |

Balance Sheet Review | | | 34 | |

Liquidity and Cash Flow | | | 36 | |

Financial Instruments | | | 38 | |

Contractual Obligations and Commitments | | | 40 | |

| |

Review of Quarterly Results | | | 41 | |

| |

International Financial Reporting Standards (IFRS) | | | 42 | |

| |

IFRS Critical Accounting Policies and Accounting Estimates | | | 51 | |

| |

Non-GAAP Financial Performance Measures | | | 54 | |

| | | | |

| BARRICK SECOND QUARTER 2011 | | 11 | | MANAGEMENT’S DISCUSSION AND ANALYSIS |

FINANCIAL AND OPERATING HIGHLIGHTS

| | | | | | | | | | | | | | | | |

Summary of Financial and Operating Data | | For the three months ended

June 30 | | | For the six months ended

June 30 | |

| ($ millions, except where indicated) | | 2011 | | | 2010 | | | 2011 | | | 2010 | |

Financial Data | | | | | | | | | | | | | | | | |

Revenue | | | $ 3,426 | | | | $ 2,621 | | | | $ 6,516 | | | | $ 5,202 | |

Net earnings1 | | | 1,159 | | | | 859 | | | | 2,160 | | | | 1,679 | |

Per share (“EPS”)2 | | | 1.16 | | | | 0.87 | | | | 2.16 | | | | 1.70 | |

Adjusted net earnings3 | | | 1,117 | | | | 824 | | | | 2,121 | | | | 1,587 | |

Per share (“adjusted EPS”)2,3 | | | 1.12 | | | | 0.84 | | | | 2.12 | | | | 1.61 | |

EBITDA3 | | | 2,090 | | | | 1,489 | | | | 3,918 | | | | 3,082 | |

Capital expenditures | | | 1,068 | | | | 851 | | | | 2,139 | | | | 1,560 | |

Operating cash flow | | | 690 | | | | 1,108 | | | | 2,125 | | | | 2,238 | |

Adjusted operating cash flow | | | 938 | | | | 1,127 | | | | 2,377 | | | | 2,278 | |

Cash and equivalents | | | | | | | | | | | 2,863 | | | | 3,851 | |

Adjusted debt3 | | | | | | | | | | | 13,018 | | | | 7,337 | |

Net debt3 | | | | | | | | | | | $ 10,161 | | | | $ 3,696 | |

Return on equity3 | | | 21% | | | | 20% | | | | 21% | | | | 20% | |

| | | | | | | | | | | | | | | | | |

Operating Data | | | | | | | | | | | | | | | | |

| | | | |

Gold | | | | | | | | | | | | | | | | |

Gold produced (000s ounces)4 | | | 1,977 | | | | 1,944 | | | | 3,934 | | | | 4,005 | |

Gold sold (000s ounces) | | | 1,915 | | | | 1,903 | | | | 3,778 | | | | 3,962 | |

Realized price ($ per ounce)3 | | | $ 1,513 | | | | $ 1,205 | | | | $ 1,452 | | | | $ 1,158 | |

Net cash costs ($ per ounce)3 | | | $ 338 | | | | $ 302 | | | | $ 323 | | | | $ 297 | |

Total cash costs ($ per ounce)3 | | | $ 445 | | | | $ 401 | | | | $ 441 | | | | $ 397 | |

| | | | |

Copper | | | | | | | | | | | | | | | | |

Copper produced (millions of pounds) | | | 93 | | | | 102 | | | | 168 | | | | 202 | |

Copper sold (millions of pounds) | | | 82 | | | | 105 | | | | 162 | | | | 198 | |

Realized price ($ per pound)3 | | | $ 4.07 | | | | $ 2.93 | | | | $ 4.16 | | | | $ 3.10 | |

Total cash costs ($ per pound)3 | | | $ 1.56 | | | | $ 1.13 | | | | $ 1.41 | | | | $ 1.09 | |

| 1 | Net earnings represent net income attributable to the equity holders of the Company. |

| 2 | Calculated using weighted average number of shares outstanding under the basic method. |

| 3 | Adjusted net earnings, adjusted EPS, EBITDA, adjusted debt, net debt, return on equity, realized price, net cash costs and total cash costs are non-GAAP financial performance measures with no standardized definition under IFRS. For further information and a detailed reconciliation, please see pages 54 - 60 of this MD&A. |

| 4 | Production includes our equity share of gold production at Highland Gold. |

SECOND QUARTER FINANCIAL AND OPERATING HIGHLIGHTS

| | • | | Net earnings and adjusted net earnings for the quarter were $1,159 million and $1,117 million, respectively, which represent significant increases from the net earnings of $859 million and adjusted net earnings of $824 million recorded in the same prior year period. The increases in net earnings and adjusted net earnings were largely driven by higher market gold and copper prices along with higher gold sales volumes, which were partially offset by lower copper sales volumes, higher cost of sales applicable to gold and copper and higher income tax expense. |

| | • | | EPS and adjusted EPS for the second quarter 2011 were $1.16 and $1.12, respectively, up significantly compared to EPS of $0.87 and adjusted EPS of $0.84 for the second quarter 2010. The increases were due to the increase in both net earnings and adjusted net earnings. |

| | • | | EBITDA for the second quarter 2011 was $2,090 million up significantly compared to EBITDA of $1,489 million for the second quarter 2010. The increase in EBITDA reflects the same factors affecting net earnings, except for income tax expense. |

| | | | |

| BARRICK SECOND QUARTER 2011 | | 12 | | MANAGEMENT’S DISCUSSION AND ANALYSIS |

| | • | | Operating cash flow was $690 million, compared to operating cash flow of $1,108 million for the second quarter 2010. Adjusted operating cash flow, which primarily adjusts for the one-time operating cash flow impacts related to the Equinox acquisition and impact of VAT recoverable relating to capital expenditures at our projects, was $938 million compared to $1,127 million for the second quarter 2010. The decreases in cash flow and adjusted operating cash flow primarily relates to final 2010 income tax payments in a number of jurisdictions totaling $420 million, partially offset by higher net earnings levels. |

| | • | | Significant adjusting items in the second quarter include: $66 million in gains from sale of assets and a $49 million in unrealized gains on our derivative hedge; partially offset by $83 million in acquisition related costs attributable to the Equinox acquisition. |

| | • | | Gold production and sales volumes for second quarter 2011 were 1.98 million ounces and 1.92 million ounces, respectively. In second quarter 2010, gold production and sales volumes were 1.94 million and 1.90 million ounces, respectively. The increase in production volume compared to the prior year period is primarily due to higher production in North America, partially offset by lower production in South America, Australia Pacific and ABG. |

| | • | | Total cash costs for gold were $445 per ounce, up $44 per ounce or 11% compared to the second quarter 2010. The increase reflects higher total cash costs in South America, Australia Pacific and ABG; partially offset by lower total cash costs in North America. Net cash costs were $338 per ounce in second quarter 2011, an increase of $36 per ounce or 12% compared to the same prior year period. The increase in total cash costs were partially mitigated by higher copper credits. |

| | • | | Copper production and total cash costs for the second quarter 2011 were 93 million pounds and $1.56 per pound respectively, compared to production of 102 million pounds and total cash costs of $1.13 per pound for second quarter 2010. Copper production decreased for the second quarter 2011 primarily due to decreased production at Zaldívar and the impact of the Osborne divestiture in third quarter 2010. These decreases were partially offset by production from Lumwana, acquired as part of the Equinox transaction, starting June 1, 2011. Total cash costs per pound increased in 2011 mainly due to the inclusion of Lumwana production in the sales mix. |

FIRST SIX MONTHS 2011 vs. FIRST SIX MONTHS 2010

| | • | | Net earnings and adjusted net earnings for the first half of 2011 were $2,160 million and $2,121 million, respectively, which represent significant increases from the net earnings of $1,679 million and adjusted net earnings of $1,587 million recorded in the first half of 2010. The increase in net earnings and adjusted net earnings was largely driven by higher market gold and copper prices, which were partially offset by lower gold and copper sales volumes, higher cost of sales applicable to gold and copper and higher income tax expense. |

| | • | | EPS and adjusted EPS for the first half of 2011 were $2.16 and $2.12, respectively, up significantly compared to EPS of $1.70 and adjusted EPS of $1.61 for the first half of 2010. The increases were due to the increase in both net earnings and adjusted net earnings. |

| | • | | EBITDA for the first half of 2011 was $3,918 million, compared to EBITDA of $3,082 million for the first half of 2010. The increase in EBITDA reflects the same factors affecting net earnings, except for income tax expense. |

| | • | | Operating cash flow was $2,125 million, compared to operating cash flow of $2,238 million for the first half of 2010. Adjusted operating cash flow was $2,377 million compared to $2,278 million for the first half of 2010. The decreases in cash flow and adjusted operating cash flow primarily relate to final 2010 income tax payments in a number of jurisdictions totaling $470 million, partially offset by higher net earnings levels. |

| | • | | Significant adjusting items in the first half include: $133 million in gains from sale of assets; partially offset by $83 million in acquisition related costs attributable to the Equinox acquisition and a $23 million post-tax charge for the recognition of a liability for contingent consideration related to the acquisition of an additional 40% of the Cortez property in 2008. |

| | • | | Gold production and sales volumes for first half of 2011 were 3.93 million ounces and 3.78 million ounces, respectively. In first half of 2010, gold production and sales volumes were 4.0 million and 3.96 million ounces, respectively. The slight decrease in production volume compared to the prior year period is primarily due to lower production in South America, which was partially offset by higher production in North America. |

| | • | | Total cash costs for gold were $441 per ounce, up $44 per ounce or 11% compared to the first half of 2010. The increase reflects higher total cash costs in South America, Australia Pacific and ABG; partially offset by lower total cash costs in North America. Net cash costs were $323 per ounce in first half of 2010, an increase of $26 per ounce or 9% compared to the same prior year period. The increase in total cash costs was partially mitigated by higher copper credits. |

| | | | |

| BARRICK SECOND QUARTER 2011 | | 13 | | MANAGEMENT’S DISCUSSION AND ANALYSIS |

| | • | | Copper production and total cash costs for the first half of 2011 were 168 million pounds and $1.41 per pound respectively, compared to production of 202 million pounds and total cash costs of $1.09 per pound for first half of 2010. Copper production decreased for the first half of 2011 primarily due to decreased production at Zaldívar and the impact of the Osborne divestiture in third quarter 2010. The decrease was partially offset by production from Lumwana, acquired as part of the Equinox transaction, starting in June 1, 2011. Total cash costs per pound increased in 2011 due to the inclusion of Lumwana production in the sales mix as well as lower production from Zaldívar mine at higher cash costs. |

Business Developments

Adoption of IFRS

We adopted IFRS effective January 1, 2011. The financial results discussed in this MD&A were prepared in accordance with IFRS, including the relevant prior year comparative amounts. Under IFRS, certain costs such as production phase waste stripping costs and exploration and evaluation costs can be capitalized where there is probable future economic benefit. As a result, the conversion to IFRS resulted in a decrease in operating costs, an increase in net assets and an increase in operating cash flow and capital expenditures compared to equivalent results if presented in accordance with US GAAP. For a discussion of our significant accounting policies, refer to note 2 of the Financial Statements.

Economic, Fiscal and Legislative and Regulatory Developments

The current global economic situation has impacted Barrick in a number of ways. The response from many governments to the ongoing economic crisis has led to continuing low interest rates and a reflationary environment that has supported higher commodity prices. The increase in gold, copper and silver market prices in particular (refer to Market Review section of this MD&A for more details) have been key drivers of higher income and operating cash flows for Barrick. The fiscal pressures currently experienced by many governments have resulted in a search for new sources of revenues, and the mining industry, which is generating significant profits and cash flow in this high metal price environment, is facing the possibility of higher income taxes and royalties. The proposed Australian Mineral Resources Rent Tax (“MRRT”) is one example. While the MRRT has been greatly revised to its current form, and is no longer expected to apply to our gold operations, we continue to monitor developments related to this proposal. In addition, in order to finance reconstruction stemming from the devastating 2010 earthquake, the Chilean government enacted a temporary first tier income tax increase from 17% to 20% in 2011 and 18.5% in 2012 as well as a new elective mining royalty. In January 2011, we adopted the new royalty. The impact on the Company of the temporary income tax rate increase and the elective mining royalty on 2011 income tax expense are expected to be about $20 million and $15 million, respectively.

On the legislative front, Argentina recently passed a federal glacier protection law that restricts mining in areas on or near the nation’s glaciers. Our activities do not take place on glaciers, and are undertaken pursuant to existing environmental approvals issued on the basis of comprehensive environmental impact studies that fully considered potential impacts on water resources, glaciers and other sensitive environmental areas around Veladero and Pascua-Lama. We have a comprehensive range of measures in place to protect such areas and resources. Further, we believe that the new federal law is unconstitutional, as it seeks to legislate matters that are within the constitutional domain of the provinces. The Province of San Juan, where our operations are located, previously enacted glacier protection legislation with which we comply. We believe we are legally entitled to continue our current activities on the basis of existing approvals. In this regard, the Federal Court in San Juan has granted injunctions, based on the unconstitutionality of the federal law, suspending its application in the Province and in particular to Veladero and Pascua-Lama pending consideration of the constitutionality of the law by the Supreme Court of Argentina. It is possible that others may attempt to bring legal challenges seeking to restrict our activities based on the new federal law. We will vigorously oppose any such challenges.

The Australian government recently announced details of its proposed carbon tax scheme, which will commence on July 1, 2012. We have completed a preliminary assessment and expect the impact of complying with the legislation, to be an increase in our total cash costs of about $4 per ounce on a consolidated basis and about $20 per ounce for the regional business unit on an annualized basis.

Acquisitions and Divestitures

Acquisition of Equinox Minerals Limited

In April 2011, we announced an offer to acquire all of the issued and outstanding common shares of Equinox Minerals Limited (“Equinox”) for an all-cash offer of C$8.15 per share. This strategic, all-cash transaction, was accomplished without issuing equity or diluting our shareholders exposure to gold and has added two attractive assets to our portfolio which improve our

| | | | |

| BARRICK SECOND QUARTER 2011 | | 14 | | MANAGEMENT’S DISCUSSION AND ANALYSIS |

leverage to copper. By June 1, 2011, we had acquired 83% of the shares, thus obtaining control. We began consolidating operating results, including cash flows from this date onwards. By July 19, 2011, we had acquired 100% of the issued and outstanding common shares for total cash consideration of $7.482 billion. Equinox’s primary asset is the Lumwana copper mine, a high-quality, long-life property in the highly prospective Zambian Copperbelt region. Equinox’s other significant asset is the Jabal Sayid copper project in Saudi Arabia, which is currently in development and is expected to enter production in 2012. This acquisition was funded through our existing cash balances and $6.5 billion in new debt, as described below. Following the Equinox acquisition, operating guidance has been updated to include production from Lumwana, as well as capital expenditures expected at both Lumwana and Jabal Sayid in 2011. The contribution of Equinox operations has been consolidated into Barrick’s results effective June 1, 2011, onwards.

In April 2011, we secured a new $2 billion revolving credit facility with an interest rate of LIBOR plus 1.25%. In June 2011, we drew $1 billion on this credit facility. In May 2011, we drew $1.5 billion on our previously existing revolving credit facility, which has an interest rate of LIBOR plus 0.30%. In June 2011, we issued an aggregate of $4.0 billion in debt securities comprised of: $700 million of 1.75% notes due 2014; $1.1 billion of 2.90% notes due 2016; $1.35 billion of 4.40% notes due 2021; and $850 million of 5.70% notes due 2041. Guidance for interest expense in 2011 has been updated for these debt issuances.

The acquisition of Equinox for cash consideration of $7.482 billion has substantially changed the liquidity position of Barrick, with an increase in net debt from $2.1 billion to $10.2 billion, and a net debt to equity ratio of 0.47:1 at June 30, 2011.

Barrick Energy Acquisition

In June 2011, our oil and gas subsidiary, Barrick Energy, acquired all of the outstanding shares of Venturion Natural Resources Limited (“Venturion”), for approximately $185 million. The acquisition was made to acquire additional producing assets, proven and probable reserves as well as facilities to allow us to grow and expand our energy business. Barrick Energy provides a natural economic hedge against our fuel price exposure.

Full year 2011 Outlook1

| | | | | | | | |

| | | 2011 E | | | 2011 Original

Guidance | |

| Gold production and costs | | | | | | | | |

Production (millions of ounces) | | | 7.6 - 8.0 | | | | 7.6 - 8.0 | |

Cost of sales | | | 5,100 - 5,300 | | | | 5,100 - 5,300 | |

| Gold unit production costs | | | | | | | | |

Total cash costs ($ per ounce) | | | 450 - 480 | | | | 450 - 480 | |

Net cash costs ($ per ounce)2,3 | | | 290 - 320 | | | | 340 - 380 | |

Depreciation ($ per ounce) | | | 150 - 160 | | | | 150 - 160 | |

| Copper production and costs | | | | | | | | |

Production (millions of pounds)3 | | | 455 - 475 | | | | ~300 | |

Cost of sales3 | | | 940 - 1,040 | | | | 500 - 520 | |

| Copper unit production costs | | | | | | | | |

Total cash costs ($ per pound)3 | | | 1.55 - 1.70 | | | | 1.35 - 1.45 | |

Depreciation ($ per pound)3 | | | 0.35 - 0.50 | | | | 0.25 - 0.30 | |

| Other depreciation | | | 35 - 45 | | | | 35 - 45 | |

| Exploration and evaluation expense4 | | | 350 - 370 | | | | 330 - 350 | |

Exploration4 | | | 230 - 240 | | | | 210 - 220 | |

Evaluation | | | 120 - 130 | | | | 120 - 130 | |

| Corporate administration | | | 160 - 170 | | | | 160 - 170 | |

| Other expense5 | | | 340 - 360 | | | | 325 - 350 | |

| Other income5 | | | 25 - 30 | | | | 25 - 30 | |

| Finance income6 | | | 15 - 20 | | | | 20 - 25 | |

| Finance costs6 | | | 200 - 220 | | | | 60 - 80 | |

| Capital expenditures7 | | | | | | | | |

Minesite sustaining | | | 1,000 -1,100 | | | | 900 - 1,000 | |

Open pit and underground mine development | | | 900 - 1,000 | | | | 750 - 850 | |

Minesite expansion | | | 600 - 650 | | | | 450 - 500 | |

Capital projects | | | 2,300 - 2,450 | | | | 2,100 - 2,300 | |

| Effective income tax rate | | | ~33% | | | | 33% | |

| 1 | Our latest 2011 E has been adjusted in the second quarter, and primarily reflects changes as a result of the Equinox acquisition. |

| 2 | Assumes a realized copper price of $4.00 per pound for the balance of 2011. |

| 3 | Guidance for net cash costs, copper production, copper cost of sales, total cash costs per pound and depreciation per pound have been updated in the second quarter, reflecting additional copper production expected from Lumwana as a result of the Equinox acquisition. |

| 4 | Guidance for exploration and evaluation has been updated in the second quarter, reflecting increased exploration and drilling activities that will be incurred during the year to support the expansion of the Lumwana operation. Total exploration expenditures in 2011 are expected to be about $370 - $390 million including $230 -$240 million in exploration expense and $140 - $150 million in capitalized exploration costs. Capitalized exploration costs are included in the guidance for open pit and underground mine development and minesite expansion. |

| 5 | Guidance for other expense has been updated in the second quarter, reflecting additional expenses expected from the Equinox acquisition. These figures do not include special items of $150 million in gains related to sale of assets, $82 million transaction of costs related to the Equinox acquisition and a $39 million charge for the recognition of a liability for contingent consideration related to the acquisition of the additional 40% of the Cortez property in 2008. |

| 6 | Finance income guidance has been updated in the second quarter, reflecting a lower cash and equivalents balance as a result of the Equinox acquisition. Finance costs guidance has also been updated reflecting increased costs as a result of new debt issued in connection with the Equinox acquisition. |

| 7 | Capital expenditures guidance, which represents our equity share, has been adjusted to reflect additional expenditures as a result of the acquisition of Equinox. Incremental expenditures relate to minesite sustaining, development and expansion activities at the Lumwana mine and construction costs at the Jabal Sayid project. We now expect our full year capital expenditures to be in the range of $4.8 billion to $5.2 billion. |

| | | | |

| BARRICK SECOND QUARTER 2011 | | 15 | | MANAGEMENT’S DISCUSSION AND ANALYSIS |

We continue to expect full year gold production to be in the range of 7.6 to 8.0 million ounces and full year gold total cash costs to be $450 to $480 per ounce. Our gold total cash costs are projected to increase in the second half as a result of changes in our production mix, with higher cost mine sites contributing a greater share of total company production. We also expect our gold cost of sales to be within the range of $5.1 billion to $5.3 billion for the year, in line with our original guidance.

We expect full year copper production to be in the range of 455 to 475 million pounds, reflecting increased production from Lumwana as a result of our acquisition of Equinox. Consequently, we expect full year total copper cash costs to be $1.55 to $1.70 per pound, reflecting the inclusion of higher cost production from the Lumwana copper mine in the sales mix. Similarly, we expect our copper cost of sales to be within the range of $940 to $1,040 million.

We continue to target increasing our gold production to 9 million ounces1 within the next five years. Total cash costs are expected to benefit from its large, low cost projects, primarily Pueblo Viejo and Pascua-Lama, as these mines come on stream. Once at full capacity, these two mines are expected to contribute about 1.4-1.5 million ounces of average annual production over the first full five years of operation and are expected to lower Barrick’s overall total cash costs by about 20%. At current metal prices, these two projects are anticipated to generate combined average annual EBITDA of about $2.8 billion to Barrick over the same period.

Market Review

Gold and Copper Prices

The market prices of gold and copper are the primary drivers of our profitability and our ability to generate free cash flow for our shareholders. The gold price remained historically strong in the second quarter, with the price ranging from $1,413 to an all-time high of $1,578 per ounce (subsequent to quarter end, gold set a new high of $1,628 per share on July 27) due to continuing economic and political uncertainties and continued weakness in the US dollar. The price of gold closed at $1,506 per ounce, while the average quarterly market price of $1,506 was a new quarterly record and represented a $309 or 26% per ounce increase from the

| 1 | The target of 9 Moz of annual production within five years reflects a current assessment of the expected production and timeline to complete and commission Barrick’s projects currently in construction (Pueblo Viejo and Pascua-Lama) and the Company’s current assessment of existing mine site opportunities, some of which are sensitive to metal price and various capital and input cost assumptions. |

$1,197 per ounce average market price in the same prior year period.

Due to the slower pace of economic recovery, historically accommodative monetary policies put in place by the world’s most prominent central banks, geopolitical issues, and European sovereign debt concerns, gold has continued to attract investor interest through its role as a safe haven investment, store of value and alternative to fiat currency. In addition, the weakness of the US dollar and strength of physical demand remain significant drivers of the overall gold market. We expect that a continuation of these trends should be supportive of higher gold prices.

Gold prices also continue to be influenced by negative long-term trends in global gold mine production and the impact of central bank gold activities. We believe that the outlook for global gold mine production will be one of declining supply in the years to come, which is supported by a lack of significant growth over the past 10 years despite increases in the gold price. While modest increases in production have occurred in recent years, we continue to expect a decline over the long term. When the International Monetary Fund (“IMF”) completed its previously announced and approved sale of gold in late 2010, no other significant seller of gold emerged from the official sector. In the second year of the current Central Bank Gold Agreement, which began in September 2010, the signatory members have sold only 1 ton of gold, or less than 1% percent of the maximum agreed amount, while the central banks of Mexico, Russia and Thailand, among others, have been adding to gold reserves.

Copper prices also remained strong in the second quarter of 2011, trading in a range of $3.86 per pound to $4.51 per pound. The average price for the second quarter was $4.14 per pound and the closing price was $4.22 per pound. Copper’s strength lies mainly in strong physical demand from emerging markets, especially China, and increasing investor interest in base metals with strong forward-looking supply/demand fundamentals. Copper prices should continue to be positively influenced by demand from Asia, global economic growth, the limited availability of scrap and production levels of mines and smelters in the future. In the near term, expectations of a physical deficit of refined copper in 2011 should keep prices at historically strong levels.

Utilizing option collar strategies, we have put in place floor protection on approximately 45% of our remaining expected copper production for 2011 at an average floor price of $3.27 per pound. In addition, we have sold call

| | | | |

| BARRICK SECOND QUARTER 2011 | | 16 | | MANAGEMENT’S DISCUSSION AND ANALYSIS |

options on approximately 55% of our remaining expected 2011 production at an average price of approximately $4.85 per pound. Our realized price on remaining 2011 production is expected to be reduced by $0.06 per pound as a result of the net premium paid on hedging strategies, which was $20 million. We have similarly put in place floor protection on approximately 45% of our expected copper production for 2012 at an average floor price of $3.75 per pound and have sold call options on approximately 40% of our expected 2012 production at an average price of approximately $5.50 per pound. Our realized price on all 2012 production is expected to be reduced by $0.12 per pound as a result of the net premium of $71 million paid on hedging strategies. Our remaining copper production is subject to market prices.

Silver

Silver prices do not significantly impact our current operating earnings, cash flows or gold total cash costs. Silver prices, however, will have a significant impact on the overall economics for our Pascua-Lama project, which is currently in the construction phase. In the first five full years of production, Pascua-Lama is expected to produce an average of 35 million of ounces of silver annually. Each $10 increase in silver price is expected to contribute approximately $260 million to $300 million2in revenue and pre-tax earnings in each of the first full five years of operation.

In the second quarter, silver prices traded in a wide range of $32.31 per ounce to a 31-year high of $49.79 per ounce, averaged an all-time quarterly high of $37.96 per ounce and closed the quarter at $35.02 per ounce. Silver has managed to reach long-term highs due mainly to very strong investment demand, which is driven by factors similar to those influencing investment demand for gold. The physical silver market is currently in surplus and, while continuing global economic growth is expected to improve currently weak industrial demand, investment demand is expected to continue to be the primary driver of prices in the near term.

During the quarter, utilizing option collar strategies, we continued to take advantage of high silver market prices by adding hedge protection against expected future silver production. We purchased 15 million ounces of silver collar contracts to designate as hedges against silver bullion sales from our silver producing mines in the