| | |

| | Exhibit 99.1 www.rpacan.com |

BARRICK GOLD CORPORATION

TECHNICAL REPORT ON THE

VELADERO MINE,

SAN JUAN PROVINCE,

ARGENTINA

PREPARED FOR BARRICK GOLD

CORPORATION

Report for NI 43-101

Rev. 0

Qualified Persons:

Luke Evans, P.Eng.

Glen Ehasoo, P.Eng.

Kathleen Ann Altman, Ph.D., P.E.

March 16, 2012

ROSCOE POSTLE ASSOCIATES INC.

Report Control Form

| | | | | | | | | | | | | | |

| Document Title | | Technical Report on the Veladero Gold Mine, San Juan Province, Argentina | |

| |

| Client Name & Address | | Barrick Gold Corporation Brookfield Place, TD Canada Trust Tower Suite 3700, 161 Bay Street, P.O. Box 212 Toronto, Ontario M5J 2S1 | |

| | | | |

| Document Reference | | Project #1682 | |

| Status &

Issue No. |

| |

| FINAL

Version |

| | | Rev 0 | |

| |

| Issue Date | | March 16, 2012 | |

| | | | |

| Lead Author | | Luke Evans Glen Ehasoo Kathleen Ann Altman | |

| (Signed)

(Signed) (Signed) |

| | | | | | | | |

| | | | |

| Peer Reviewer | | Graham Clow | | | (Signed) | | | | | | | | | |

| | | | |

| Project Manager Approval | | Luke Evans | | | (Signed) | | | | | | | | | |

| | | | |

| Project Director Approval | | Graham Clow | | | (Signed) | | | | | | | | | |

| | | |

| Report Distribution | | Name | | | No. of Copies | | | | | |

| | | | |

| | Client | | | | | | | | | | | | |

| | | |

| | RPA Filing | | | 1 (project box) | | | | | |

Roscoe Postle Associates Inc.

55 University Avenue, Suite 501

Toronto, Ontario M5J 2H7

Canada

Tel: +1 416 947 0907

Fax: +1 416 947 0395

mining@rpacan.com

| | |

| | www.rpacan.com |

TABLE OF CONTENTS

| | | | |

| | | PAGE | |

| |

1 SUMMARY | | | 1-1 | |

Executive Summary | | | 1-1 | |

Technical Summary | | | 1-6 | |

| |

2 INTRODUCTION | | | 2-1 | |

| |

3 RELIANCE ON OTHER EXPERTS | | | 3-1 | |

| |

4 PROPERTY DESCRIPTION AND LOCATION | | | 4-1 | |

| |

5 ACCESSIBILITY, CLIMATE, LOCAL RESOURCES, INFRASTRUCTURE AND PHYSIOGRAPHY | | | 5-1 | |

| |

6 HISTORY | | | 6-1 | |

| |

7 GEOLOGICAL SETTING AND MINERALIZATION | | | 7-1 | |

Regional Geology | | | 7-1 | |

Local and Property Geology | | | 7-3 | |

Alteration | | | 7-5 | |

Mineralization | | | 7-7 | |

| |

8 DEPOSIT TYPES | | | 8-1 | |

| |

9 EXPLORATION | | | 9-1 | |

| |

10 DRILLING | | | 10-1 | |

Core and RC Recovery | | | 10-4 | |

Possible Drill Hole Sampling Biases | | | 10-4 | |

| |

11 SAMPLE PREPARATION, ANALYSES AND SECURITY | | | 11-1 | |

Sampling Method and Approach | | | 11-1 | |

Sample Preparation, Analyses and Security | | | 11-2 | |

Quality Assurance and Quality Control | | | 11-3 | |

| |

12 DATA VERIFICATION | | | 12-1 | |

| |

13 MINERAL PROCESSING AND METALLURGICAL TESTING | | | 13-1 | |

Metallurgical Testwork | | | 13-1 | |

| |

14 MINERAL RESOURCE ESTIMATE | | | 14-1 | |

Summary | | | 14-1 | |

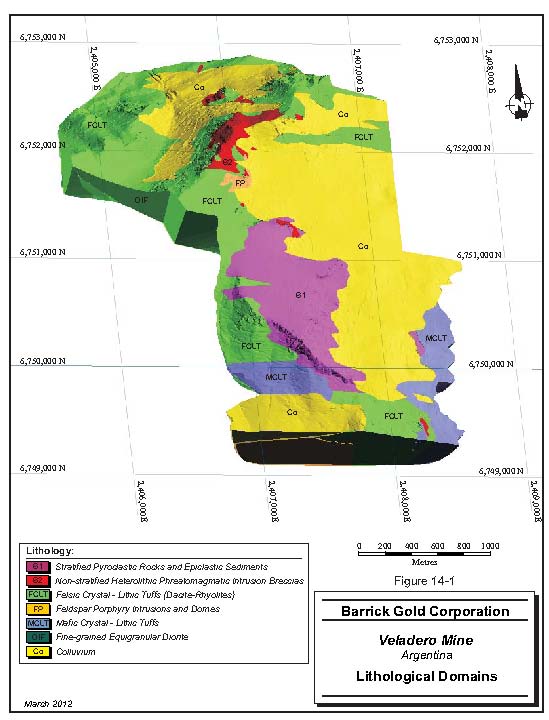

Geological Models | | | 14-2 | |

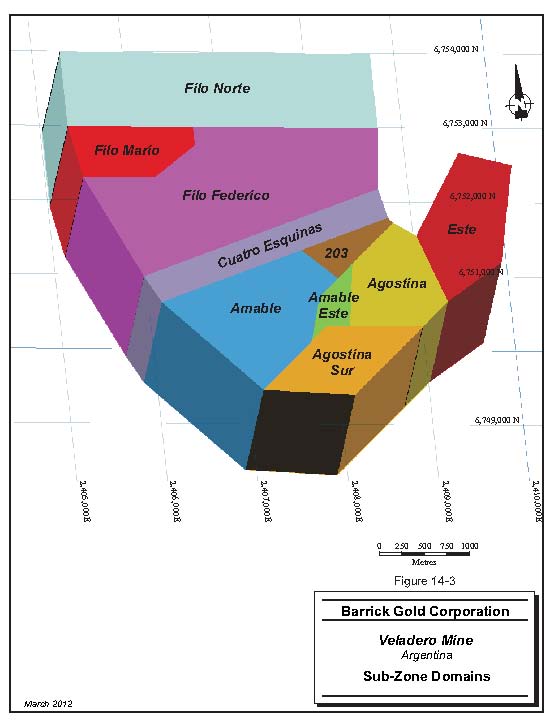

Geological Domains | | | 14-7 | |

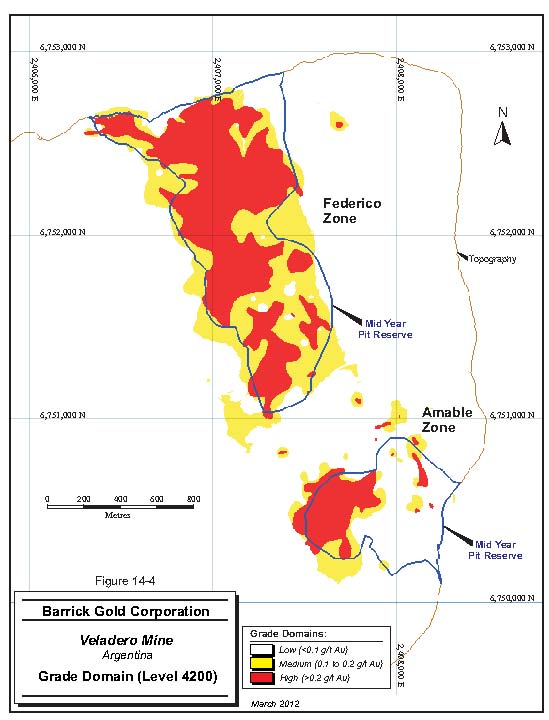

Grade Domains | | | 14-7 | |

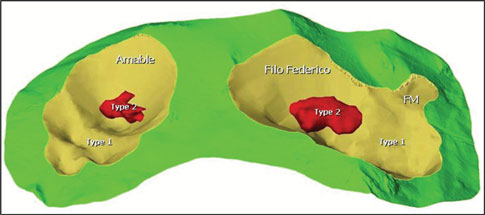

Metallurgical Domains | | | 14-10 | |

Density Data | | | 14-10 | |

Cut-Off Grades | | | 14-11 | |

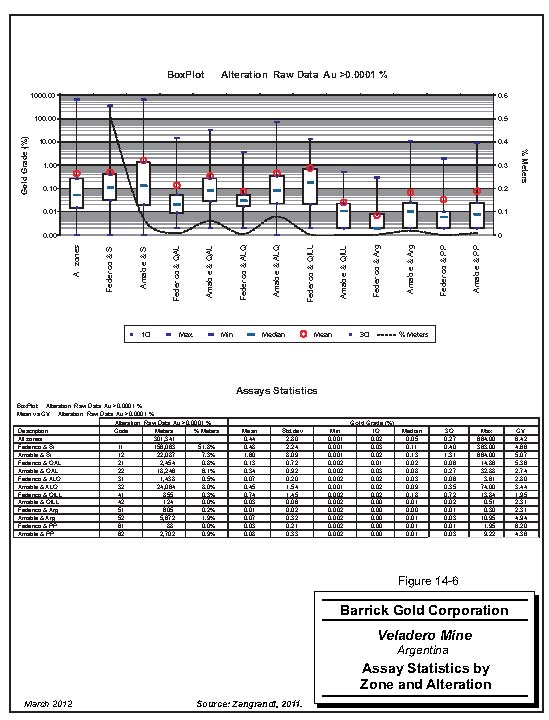

Assay Statistics | | | 14-11 | |

Capping of High Grade Values | | | 14-13 | |

Composites | | | 14-14 | |

| | |

| Barrick Gold Corporation — Veladero Mine, Project #1682 | | Rev. 0Page i |

| Technical Report NI 43-101 – March 16, 2012 | |

| | |

| | www.rpacan.com |

| | | | |

Contact Plot Analysis | | | 14-16 | |

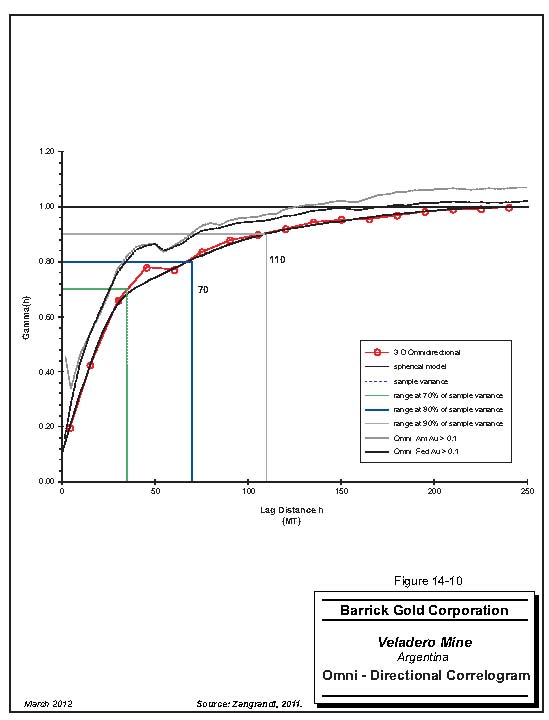

Variography | | | 14-17 | |

Resource Estimation Methodology | | | 14-19 | |

Resource Estimate Validation | | | 14-22 | |

Resource Classification | | | 14-26 | |

| |

15 MINERAL RESERVE ESTIMATE | | | 15-1 | |

| |

16 MINING METHODS | | | 16-1 | |

Production Schedule | | | 16-13 | |

Waste Rock | | | 16-15 | |

Valley Leach Facility | | | 16-18 | |

Mine Equipment | | | 16-20 | |

Manpower | | | 16-22 | |

Mine Infrastucture | | | 16-22 | |

| |

17 RECOVERY METHODS | | | 17-1 | |

| |

18 PROJECT INFRASTRUCTURE | | | 18-1 | |

| |

19 MARKET STUDIES AND CONTRACTS | | | 19-1 | |

Markets | | | 19-1 | |

Contracts | | | 19-1 | |

| |

20 ENVIRONMENTAL STUDIES, PERMITTING, AND SOCIAL OR COMMUNITY IMPACT | | | 20-1 | |

Environmental Studies | | | 20-1 | |

Project Permitting | | | 20-1 | |

Social or Community Requirements | | | 20-2 | |

Mine Closure Requirements | | | 20-2 | |

| |

21 CAPITAL AND OPERATING COSTS | | | 21-1 | |

Capital Costs | | | 21-1 | |

Operating Costs | | | 21-1 | |

Manpower | | | 21-4 | |

| |

22 ECONOMIC ANALYSIS | | | 22-1 | |

| |

23 ADJACENT PROPERTIES | | | 23-1 | |

| |

24 OTHER RELEVANT DATA AND INFORMATION | | | 24-1 | |

| |

25 INTERPRETATION AND CONCLUSIONS | | | 25-1 | |

| |

26 RECOMMENDATIONS | | | 26-1 | |

| |

27 REFERENCES | | | 27-1 | |

| |

28 DATE AND SIGNATURE PAGE | | | 28-1 | |

| |

29 CERTIFICATE OF QUALIFIED PERSON | | | 29-1 | |

| | |

| Barrick Gold Corporation — Veladero Mine, Project #1682 | | Rev. 0Page ii |

| Technical Report NI 43-101 – March 16, 2012 | |

| | |

| | www.rpacan.com |

LIST OF TABLES

| | | | |

| | | PAGE | |

Table 1-1 Mineral Resources—December 31, 2011 | | | 1-2 | |

Table 1-2 Mineral Reserves—December 31, 2011 | | | 1-2 | |

Table 1-3 Capital Costs Summary | | | 1-14 | |

Table 1-4 Total Operating Cost | | | 1-15 | |

Table 4-1 Mining Concessions | | | 4-2 | |

Table 4-2 Easements | | | 4-2 | |

Table 7-1 Orebody Dimensions | | | 7-9 | |

Table 7-2 Trace Element Geochemistry Results | | | 7-11 | |

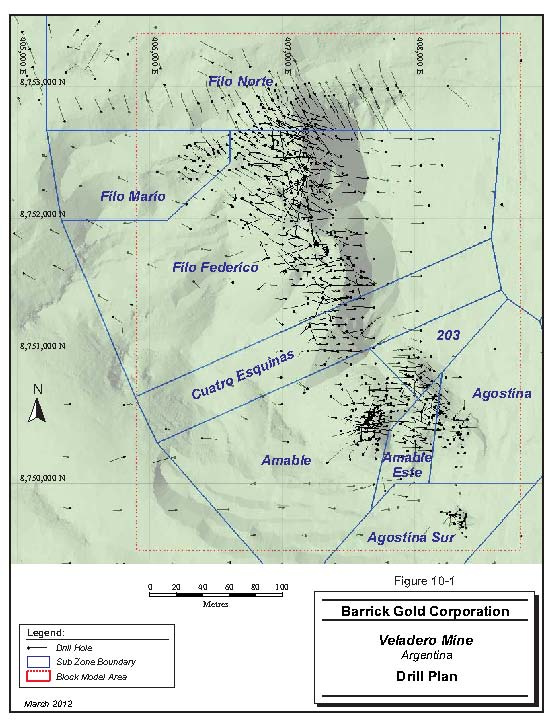

Table 10-1 Historical Drilling Summary | | | 10-2 | |

Table 13-1 Average Gold Recovery Formulae | | | 13-2 | |

Table 13-2 Evaluation of Estimated Recovery | | | 13-3 | |

Table 14-1 Mineral Resources—December 31, 2011 | | | 14-1 | |

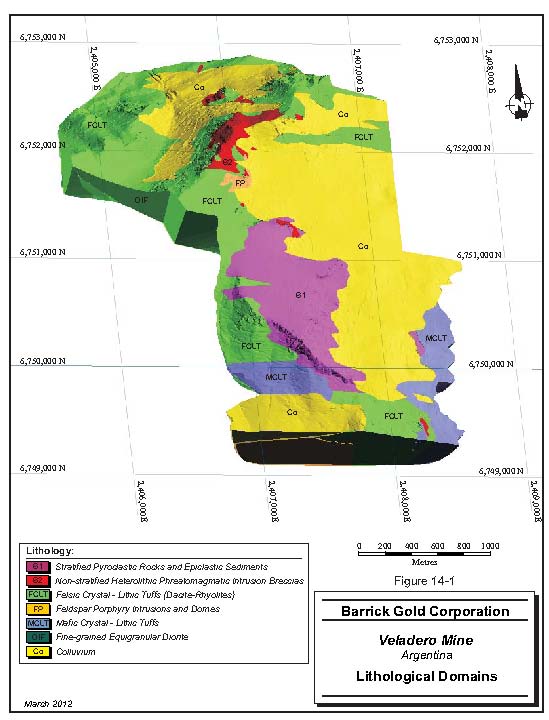

Table 14-2 Lithology Codes | | | 14-3 | |

Table 14-3 Alteration Codes | | | 14-3 | |

Table 14-4 Sub-zone Codes | | | 14-3 | |

Table 14-5 Grade Domain Codes | | | 14-8 | |

Table 14-6 Tonnage Factors | | | 14-11 | |

Table 14-7 Gold Capping Levels | | | 14-13 | |

Table 14-8 Gold Estimation Parameters | | | 14-21 | |

Table 14-9 2011 Reconciliation Results | | | 14-25 | |

Table 15-1 Mineral Reserves—December 31, 2011 | | | 15-1 | |

Table 16-1 Veladero Production History | | | 16-1 | |

Table 16-2 Mine Optimization Parameters | | | 16-6 | |

Table 16-3 Internal Cut-off Grades, Mine Reserves | | | 16-9 | |

Table 16-4 Mine Design Parameters | | | 16-10 | |

Table 16-5 Summary of Golder Slope Design Recommendations | | | 16-11 | |

Table 16-6 Mine Production Schedule | | | 16-14 | |

Table 16-7 Heap Leach Placement Schedule | | | 16-15 | |

Table 16-8 Mine Equipment Fleet | | | 16-21 | |

Table 21-1 Capital Costs Summary | | | 21-1 | |

Table 21-2 Mine Operating Costs | | | 21-2 | |

Table 21-3 Process Operating Costs | | | 21-3 | |

Table 21-4 G&A Costs | | | 21-3 | |

Table 21-5 Total Operating Cost | | | 21-4 | |

Table 21-6 Mine Site Manpower | | | 21-4 | |

LIST OF FIGURES

| | | | |

| | | PAGE | |

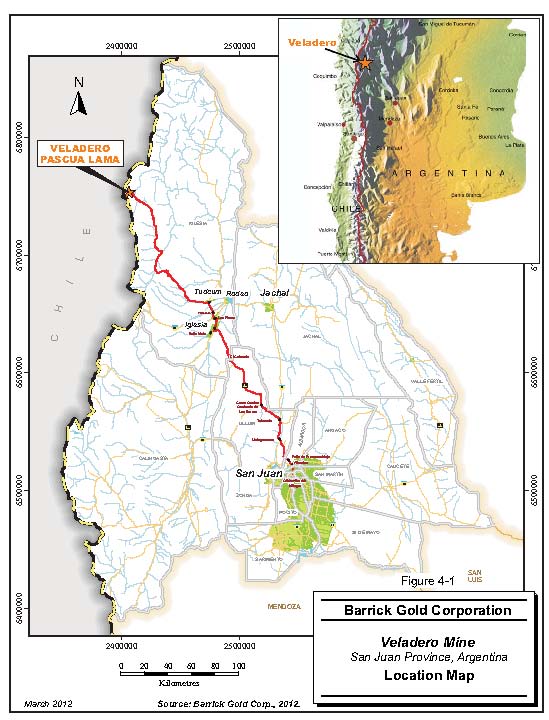

Figure 4-1 Location Map | | | 4-3 | |

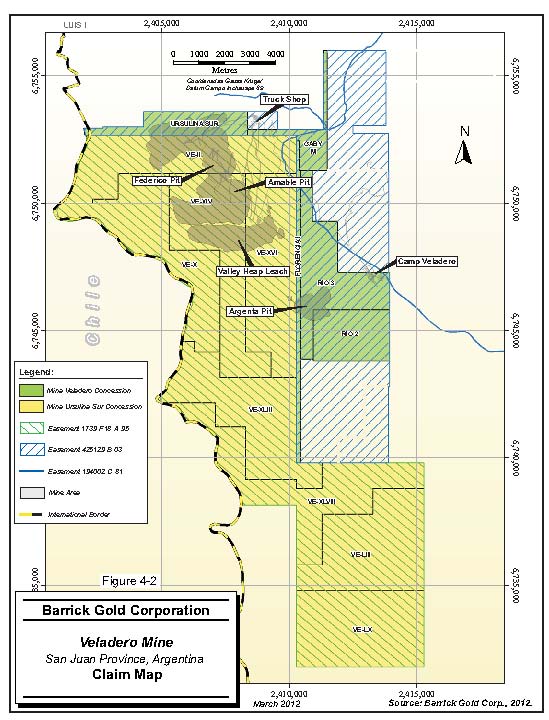

Figure 4-2 Claim Map | | | 4-4 | |

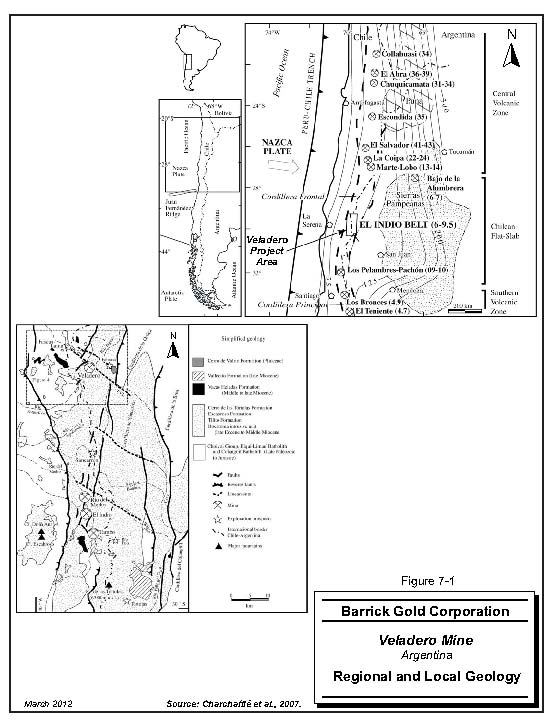

Figure 7-1 Regional and Local Geology | | | 7-2 | |

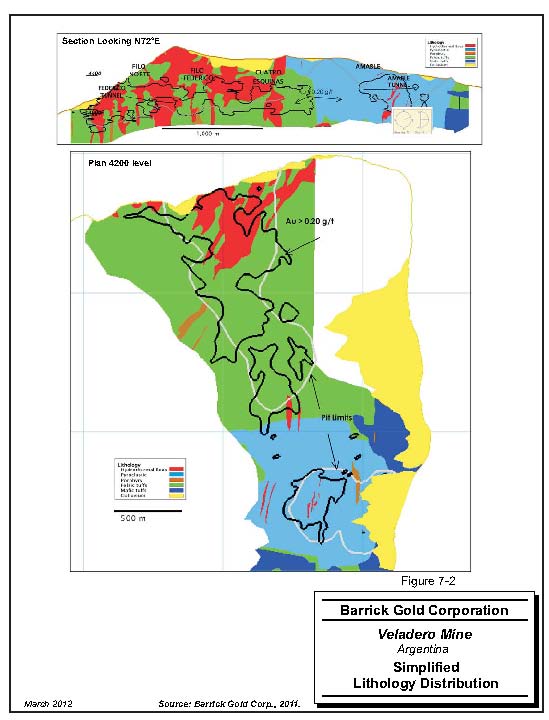

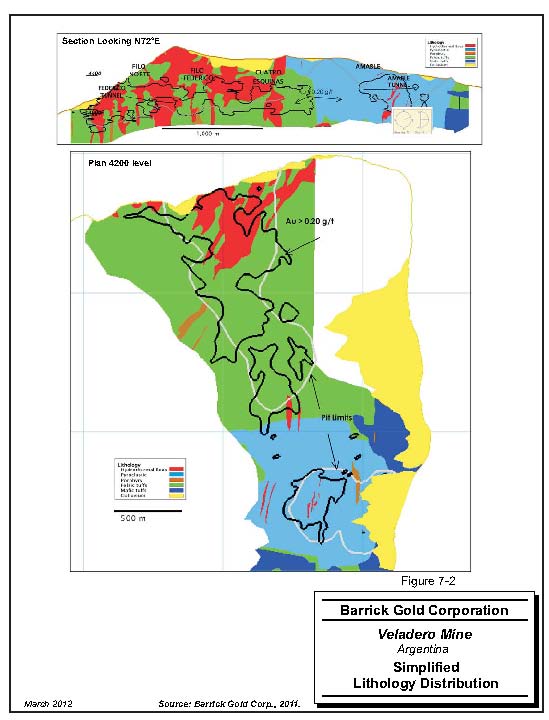

Figure 7-2 Simplified Lithology Distribution | | | 7-4 | |

Figure 7-3 Simplified Alteration Distribution | | | 7-6 | |

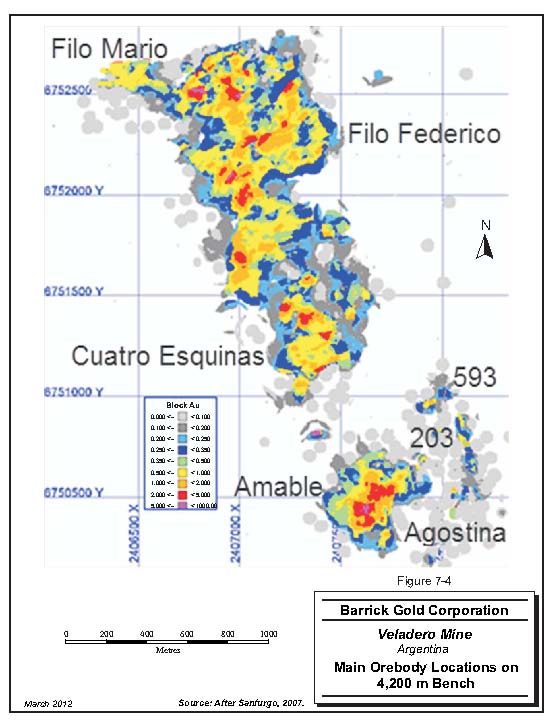

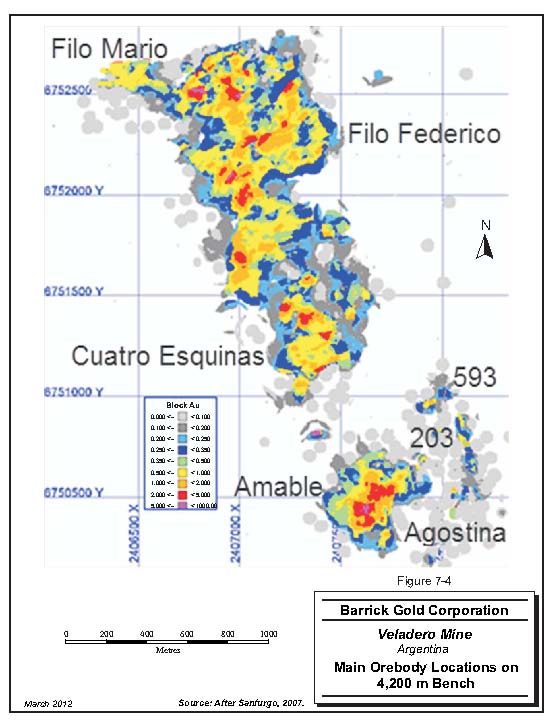

Figure 7-4 Main Orebody Locations on 4,200 m Bench | | | 7-8 | |

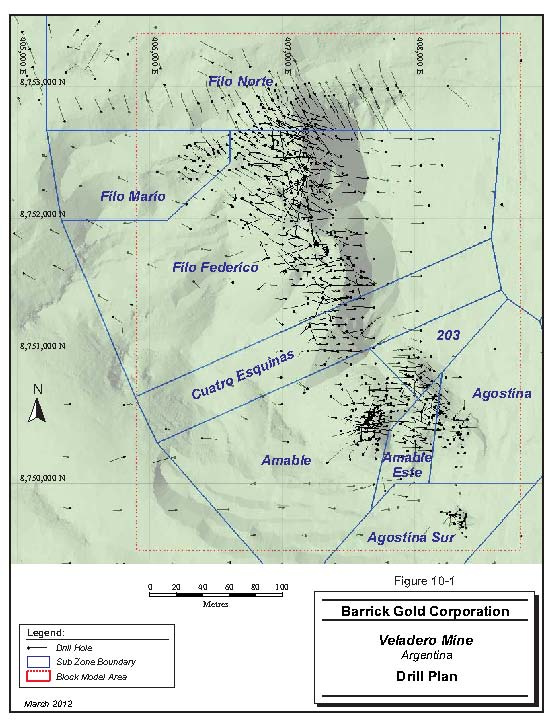

Figure 10-1 Drill Plan | | | 10-3 | |

Figure 14-1 Lithological Domains | | | 14-4 | |

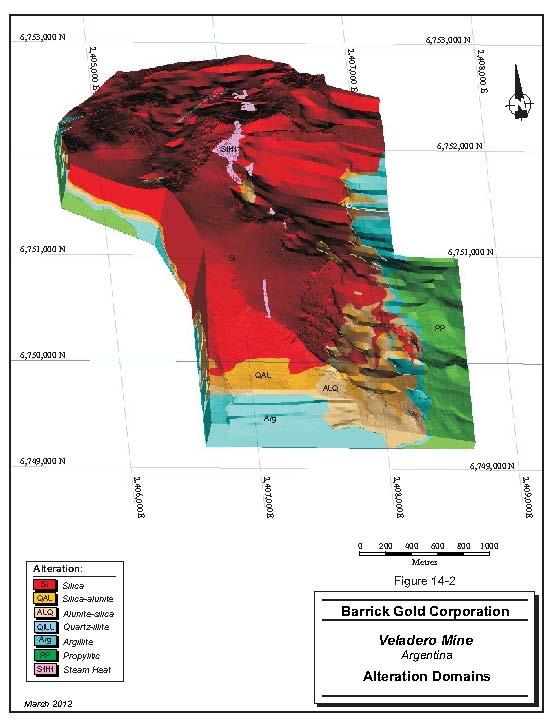

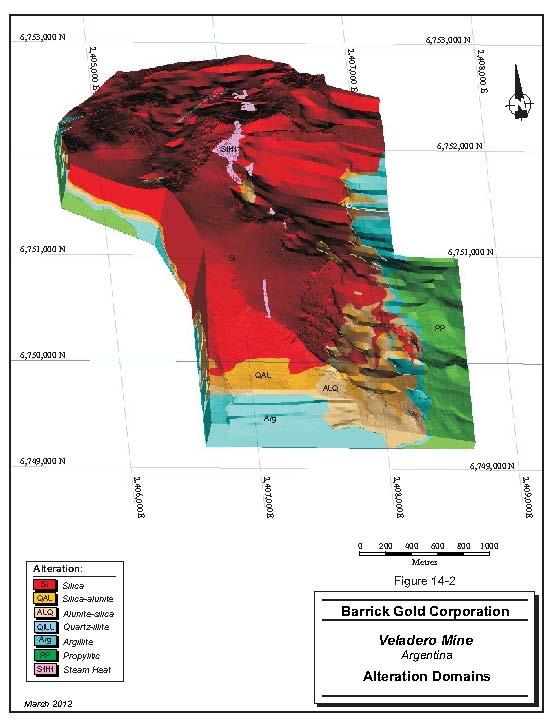

Figure 14-2 Alteration Domains | | | 14-5 | |

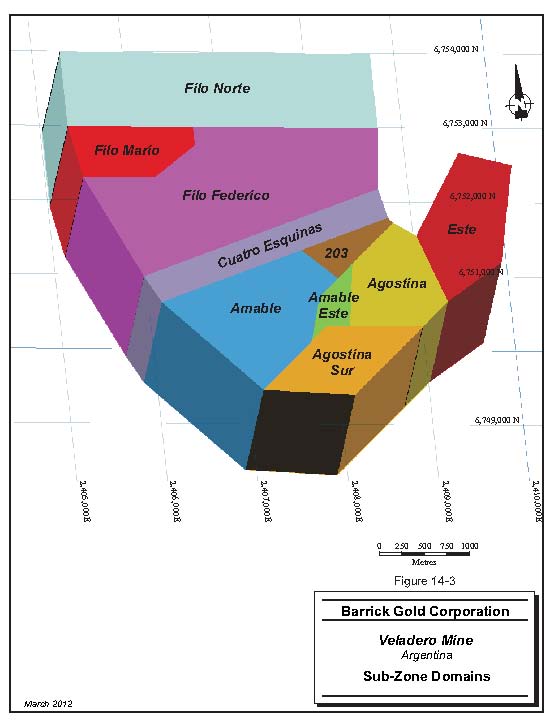

Figure 14-3 Sub-Zone Domains | | | 14-6 | |

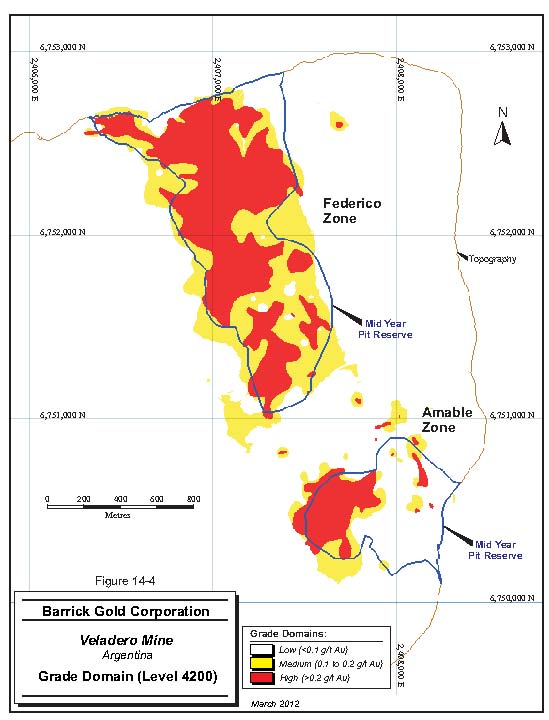

Figure 14-4 Grade Domains | | | 14-9 | |

| | |

| Barrick Gold Corporation — Veladero Mine, Project #1682 | | Rev. 0Page iii |

| Technical Report NI 43-101 – March 16, 2012 | |

| | |

| | www.rpacan.com |

| | | | |

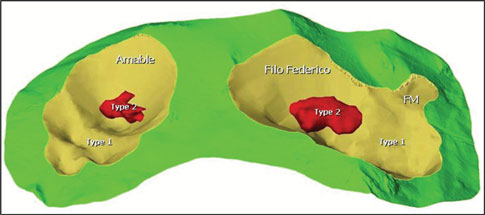

Figure 14-5 Metallurgical Domains | | | 14-10 | |

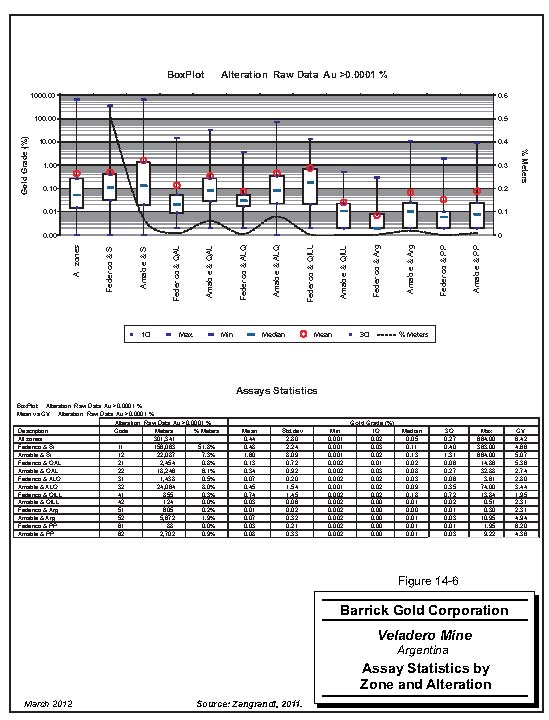

Figure 14-6 Assay Statistics by Zones and Alteration | | | 14-12 | |

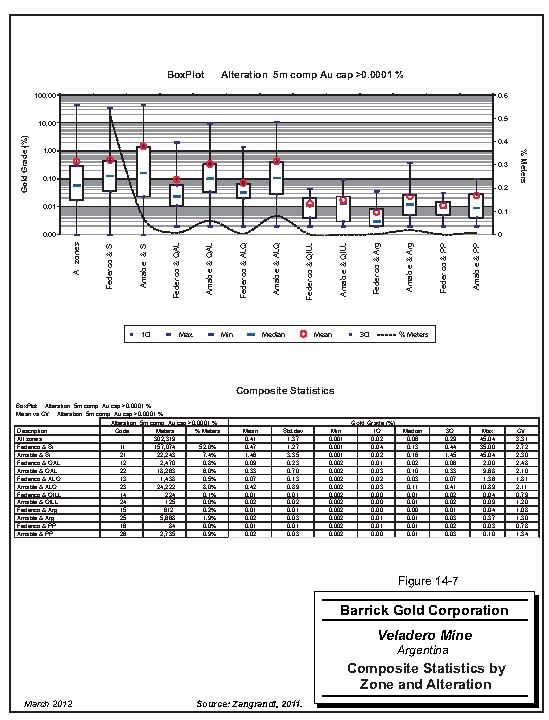

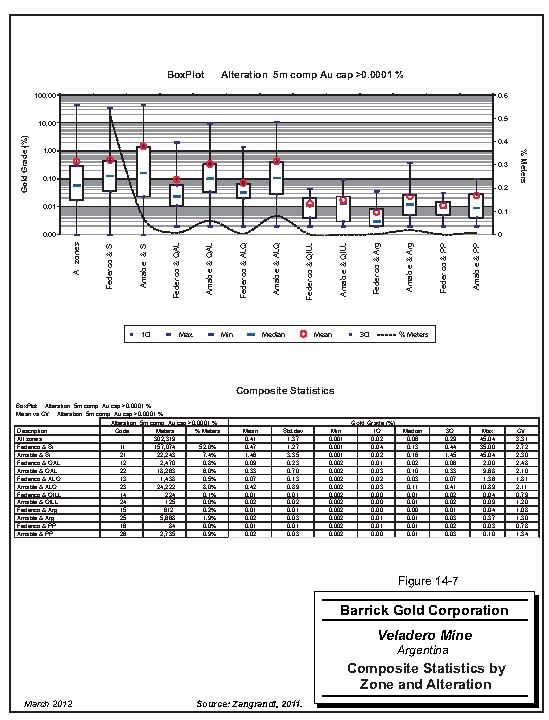

Figure 14-7 Composite Statistics by Zone and Alteration | | | 14-15 | |

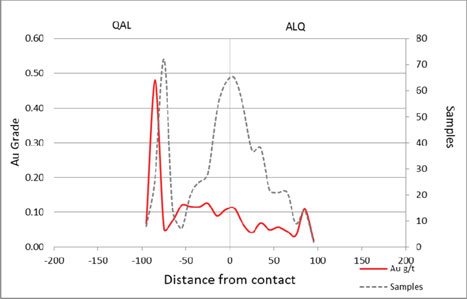

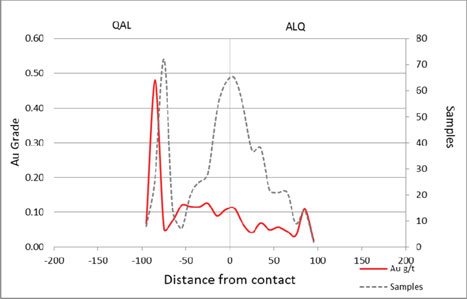

Figure 14-8 Gold Contact Plot for QAL and ALQ Alteration Domains at Filo Federico | | | 14-16 | |

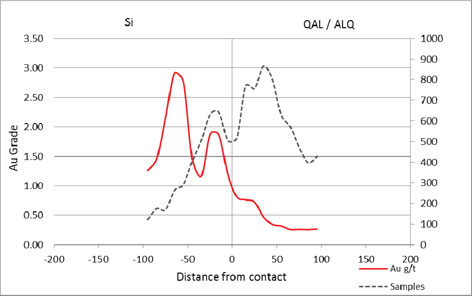

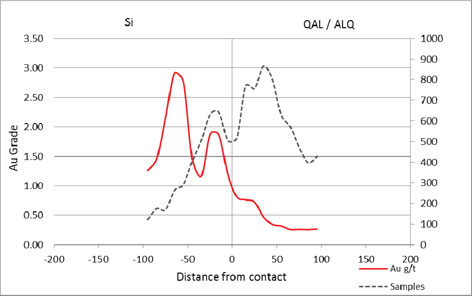

Figure 14-9 Gold Contact Plot for Si and QAL/ALQ Alteration Domains at Amable | | | 14-17 | |

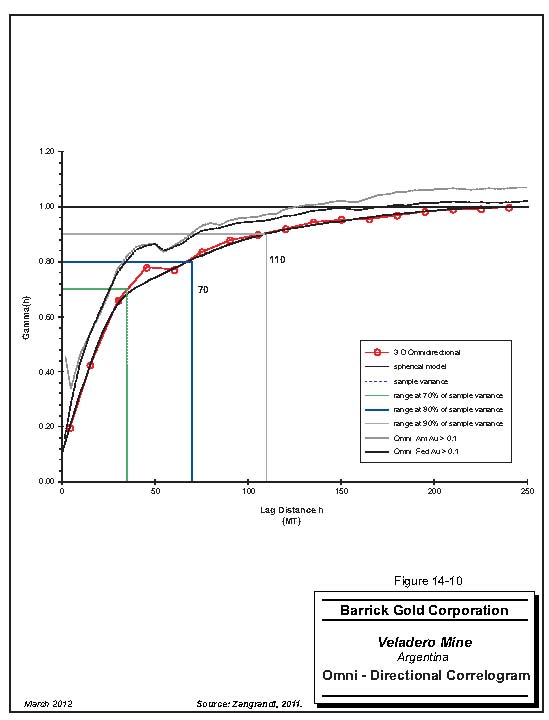

Figure 14-10 Veladero Omni-Directional Correlogram | | | 14-18 | |

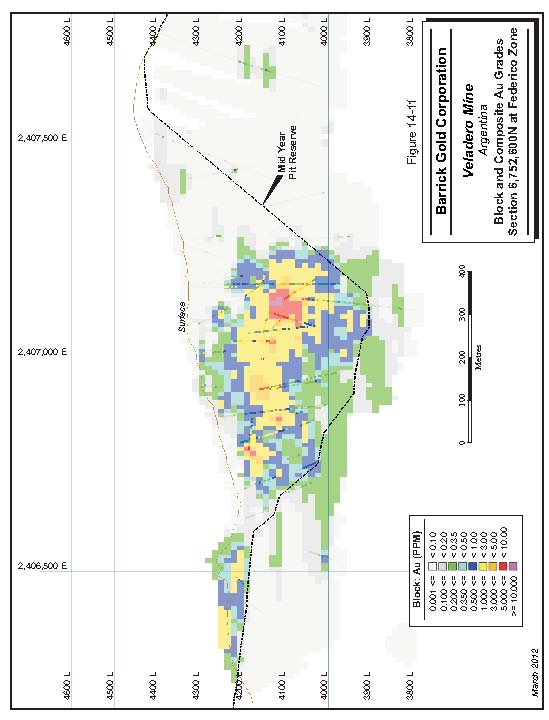

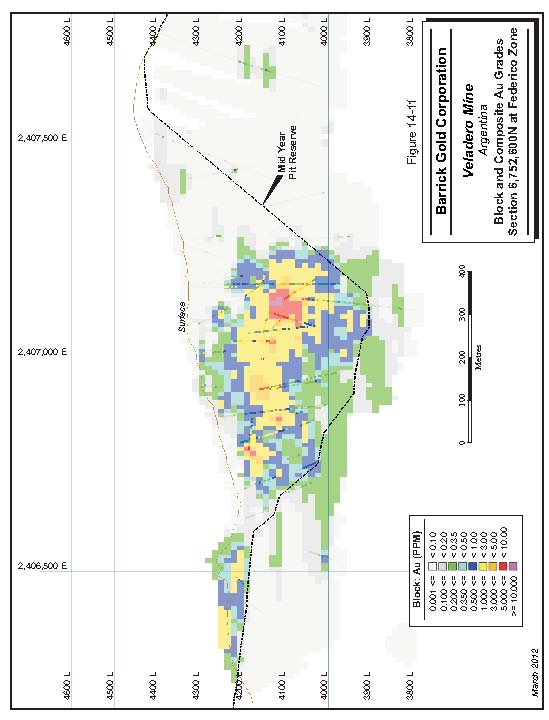

Figure 14-11 Block and Composite Au Grades—Section 6,752,600N at Filo Federico Pit | | | 14-23 | |

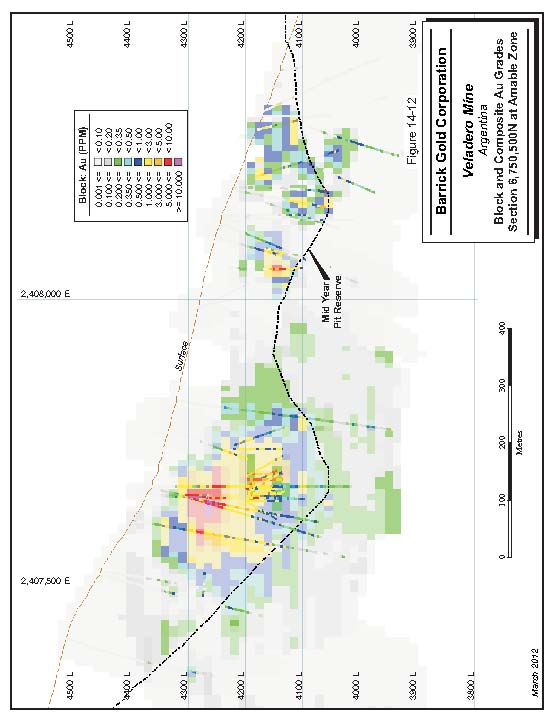

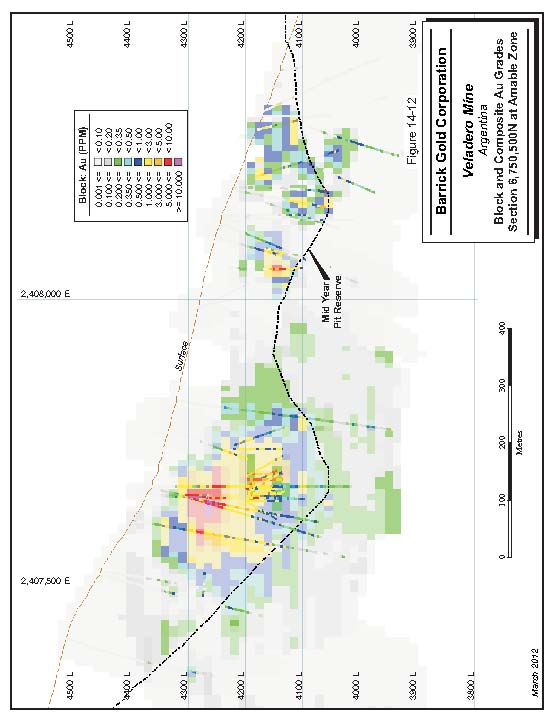

Figure 14-12 Block and Composite Au Grades—Section 6,750,500N at Amable Pit | | | 14-24 | |

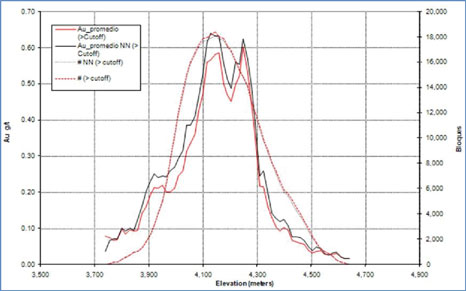

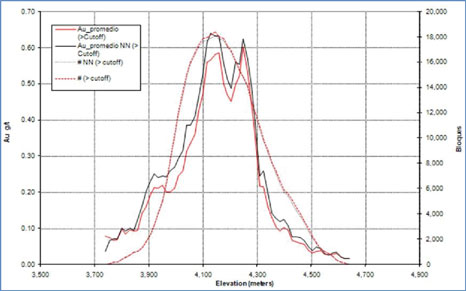

Figure 14-13 Elevation Swath Plot | | | 14-26 | |

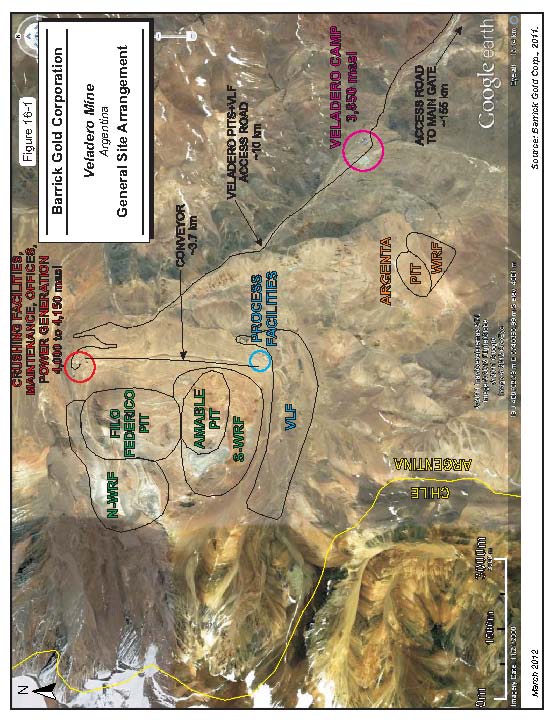

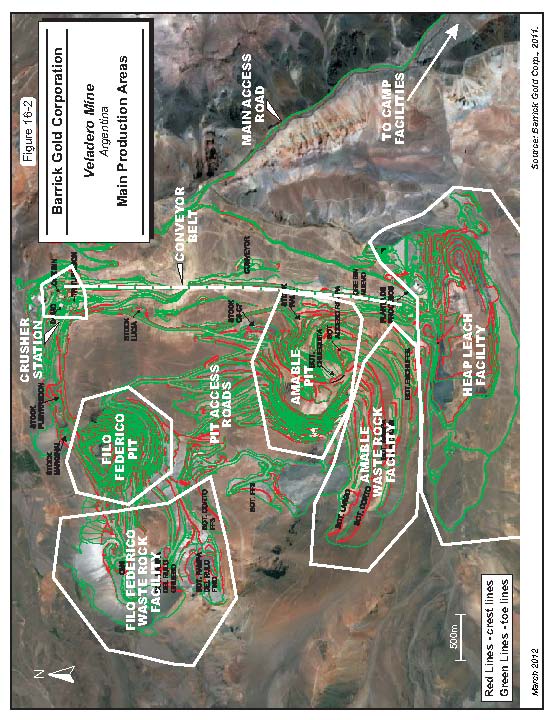

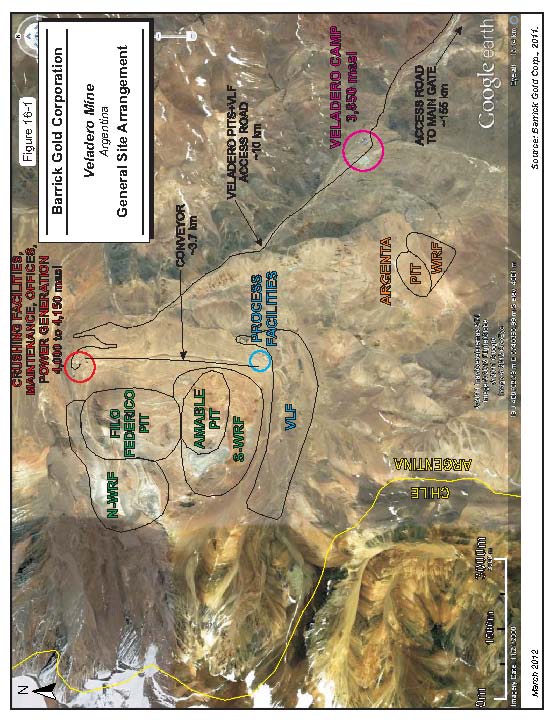

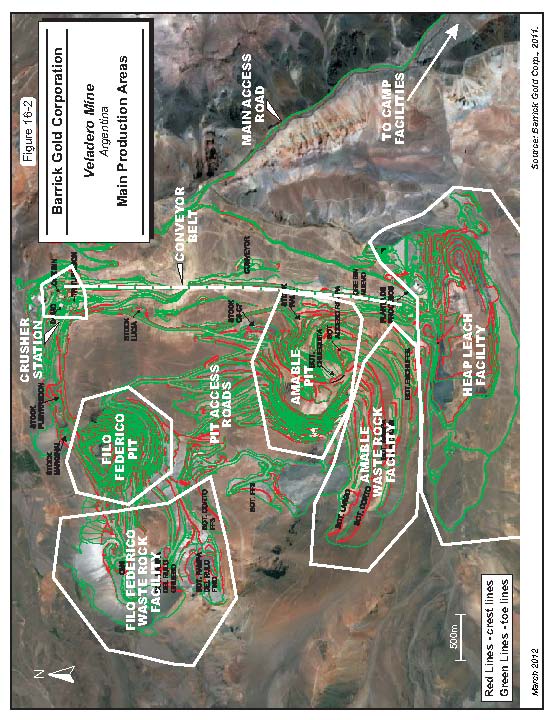

Figure 16-1 Veladero General Site Arrangement | | | 16-3 | |

Figure 16-2 Veladero Main Production Area | | | 16-4 | |

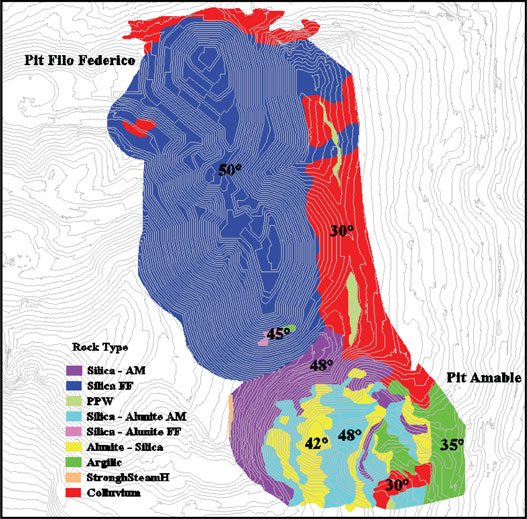

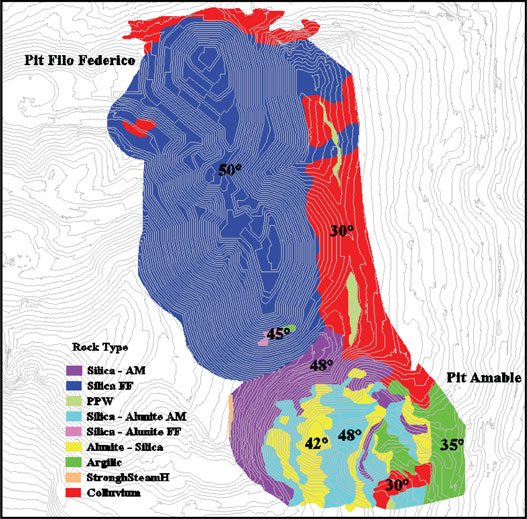

Figure 16-3 Veladero Pit Slope Design Sectors in Plan | | | 16-12 | |

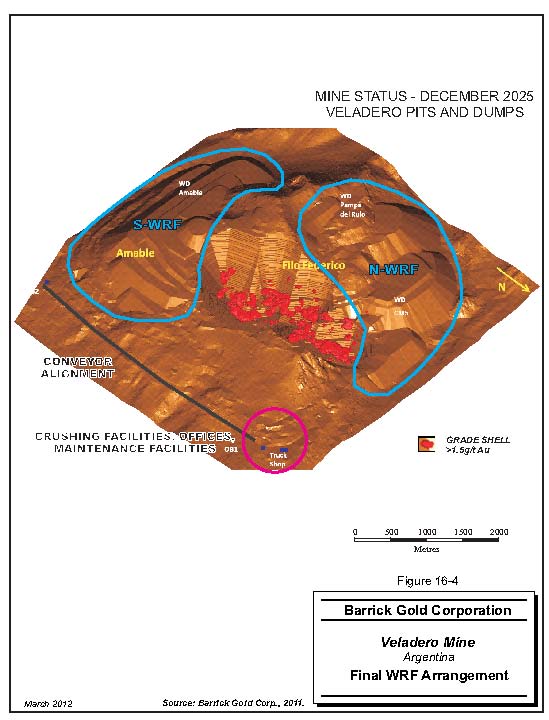

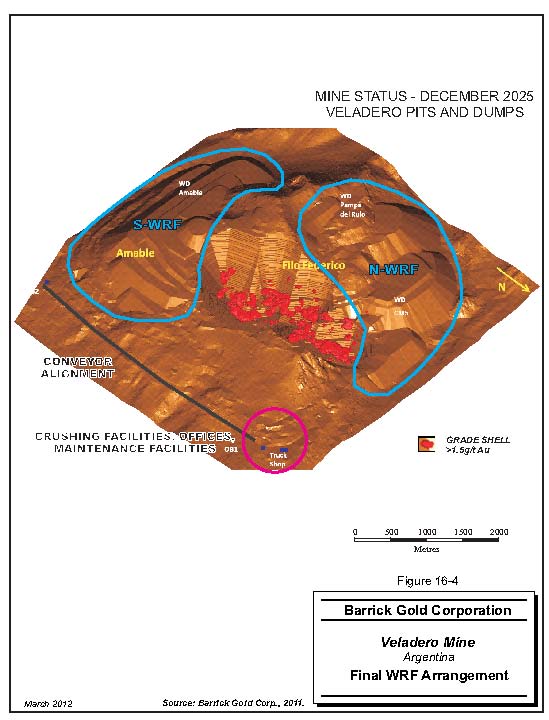

Figure 16-4 Final Veladero WRF Arrangement | | | 16-17 | |

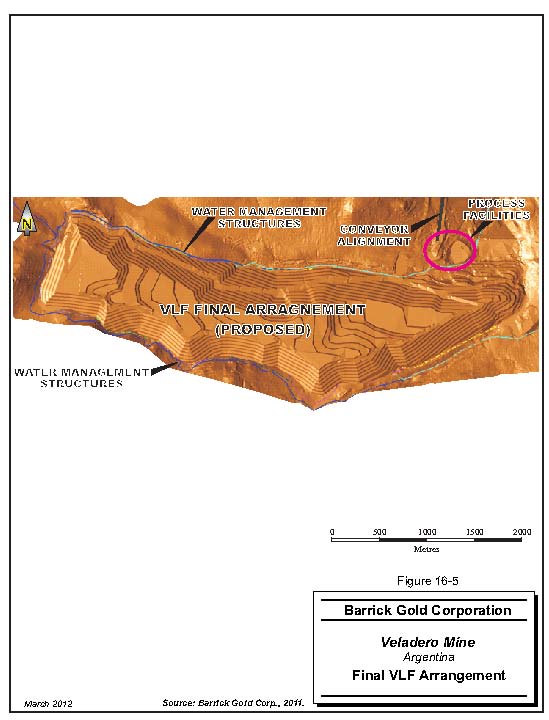

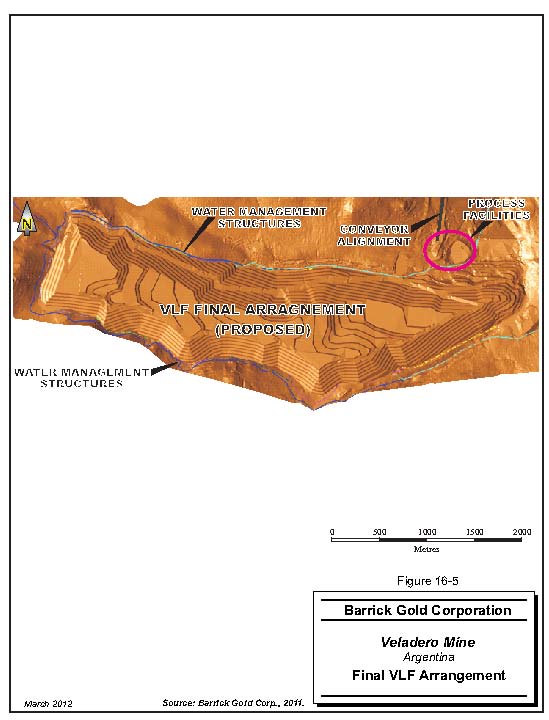

Figure 16-5 Final VLF Arrangement | | | 16-19 | |

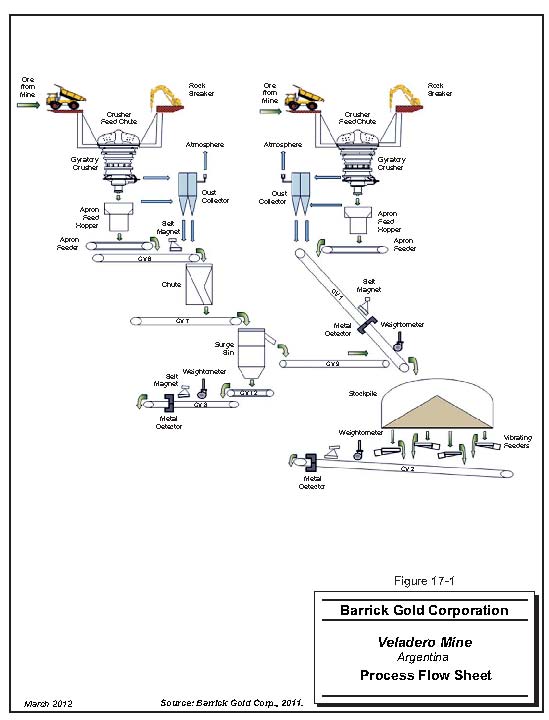

Figure 17-1 Process Flow Sheet | | | 17-3 | |

| | |

| Barrick Gold Corporation — Veladero Mine, Project #1682 | | Rev. 0Page iv |

| Technical Report NI 43-101 – March 16, 2012 | |

| | |

| | www.rpacan.com |

1 SUMMARY

EXECUTIVE SUMMARY

Roscoe Postle Associates Inc. (RPA) was retained by Barrick Gold Corporation (Barrick) to prepare an independent Technical Report on the Veladero Gold Mine (the Project) in Argentina. The purpose of this report is to support public disclosure of Mineral Resource and Mineral Reserve estimates at the Project as of December 31, 2011. This Technical Report conforms to NI 43-101 Standards of Disclosure for Mineral Projects. RPA visited the property from November 7 to November 9, 2011.

Barrick is a Canadian publicly traded mining company with a large portfolio of operating mines and projects across five continents. Veladero is a large open pit, heap leach gold and silver mine in the high Andes Cordillera of central western Argentina. Operations include open pit mining of gold-silver ore from two mining areas, two-stage crushing, and extraction of precious metals using valley-fill heap leaching and Merrill-Crowe recovery. Since Veladero started production in 2005, the mine has recovered over four million ounces of gold and over six million ounces of silver from approximately 142 million tonnes of ore averaging 1.25 g/t Au and 14.7 g/t Ag.

Mining an average of approximately 30 million tonnes per year ore is scheduled for Veladero over the next 14 years, with mine operations concluding in 2025.

Table 1-1 summarizes the Mineral Resources at Veladero as of December 31, 2011.

| | |

| Barrick Gold Corporation – Veladero Mine, Project #1682 | | Rev. 0Page 1-1 |

| Technical Report NI 43-101 – March 16, 2012 | |

| | |

| | www.rpacan.com |

|

| TABLE 1-1 MINERAL RESOURCES – DECEMBER 31, 2011 |

| Barrick Gold Corporation – Veladero Mine |

|

| | | | | | | | | | | | | | | | | | | | |

Category | | Tonnes

(Mt) | | | Gold

Grade

(g/t Au) | | | Silver

Grade

(g/t Ag) | | | Contained

Gold

(Moz Au) | | | Contained

Silver

(Moz Ag) | |

Measured | | | 3.4 | | | | 0.32 | | | | 5.5 | | | | 0.036 | | | | 0.6 | |

Indicated | | | 36.5 | | | | 0.36 | | | | 12.0 | | | | 0.426 | | | | 14.0 | |

| | | | | | | | | | | | | | | | | | | | |

Total Measured & Indicated | | | 39.9 | | | | 0.36 | | | | 11.4 | | | | 0.462 | | | | 14.7 | |

| | | | | |

Inferred | | | 67.7 | | | | 0.26 | | | | 11.3 | | | | 0.572 | | | | 24.5 | |

Notes:

| | 1. | CIM definitions were followed for Mineral Resources. |

| | 2. | Mineral Resources are estimated using an average gold price of US$1,400 per ounce and an US$/ARG exchange rate of 4.0. |

| | 3. | Mineral Resources are estimated at gold cut-off grades that vary by material type from approximately 0.109 g/t Au to 0.364 g/t Au. |

| | 4. | Mineral Resources are exclusive of Mineral Reserves. |

| | 5. | Numbers may not add due to rounding. |

Table 1-2 summarizes the Mineral Reserves at Veladero as of December 31, 2011.

TABLE 1-2 MINERAL RESERVES – DECEMBER 31, 2011

|

| Barrick Gold Corporation – Veladero Mine |

| | | | | | | | | | | | | | | | | | | | |

Category | | Tonnes

(Mt) | | | Gold

Grade

(g/t Au) | | | Silver

Grade

(g/t Ag) | | | Contained

Gold

(Moz Au) | | | Contained

Silver

(Moz Ag) | |

Proven | | | 17.0 | | | | 0.89 | | | | 16.2 | | | | 0.49 | | | | 8.9 | |

Probable | | | 403.0 | | | | 0.75 | | | | 14.5 | | | | 9.73 | | | | 187.4 | |

Stockpiles | | | 7.3 | | | | 0.51 | | | | 6.0 | | | | 0.12 | | | | 1.4 | |

Inventory | | | 9.3 | | | | 0.75 | | | | — | | | | 0.22 | | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Proven & Probable | | | 436.5 | | | | 0.75 | | | | 14.1 | | | | 10.56 | | | | 197.7 | |

Notes:

| | 1. | CIM definitions were followed for Mineral Reserves. |

| | 2. | Mineral Reserves are estimated at a variable cut-off grade based on process cost, recovery and profit. The cut-off grades vary from approximately 0.13 g/t Au to 0.42 g/t Au. |

| | 3. | Mineral Reserves are estimated using an average gold price of US$1,200 per ounce and an US$/ARG exchange rate of 4.0. |

| | 4. | Numbers may not add due to rounding. |

CONCLUSIONS

Based on the site visit and subsequent review, RPA offers the following conclusions:

MINERAL RESOURCE ESTIMATION

| | • | | The 2011 year-end Measured and Indicated Mineral Resources, exclusive of Mineral Reserves, total 39.9 million tonnes averaging 0.36 g/t Au and 11.4 g/t Ag and contain 462,000 ounces of gold and 14.7 million ounces of silver. |

| | |

| Barrick Gold Corporation – Veladero Mine, Project #1682 | | Rev. 0Page 1-2 |

| Technical Report NI 43-101 – March 16, 2012 | |

| | |

| | www.rpacan.com |

| | • | | The 2011 year-end Inferred Mineral Resources total 67.7 million tonnes averaging 0.26 g/t Au and 11.3 g/t Ag and contain 572,000 ounces of gold and 24.5 million ounces of silver. |

| | • | | The resource estimate gold cut-off grades continue to decrease with rising gold prices and this has necessitated adding a 0.1 g/t Au indicator grade envelope to the manually interpreted 0.2 g/t Au grade envelope. RPA’s preference would be to define the Medium Grade Domain manually in the future. |

| | • | | The resource estimate gold cut-off grades range from 0.109 g/t for run-of-mine (ROM) material from the Argenta pit to 0.364 g/t for Type 2 ROM material from the Filo Federico and Amable pits. |

| | • | | Mineral Resource estimates have been prepared utilizing acceptable estimation methodologies. The classification of Measured, Indicated, and Inferred Resources conform to CIM (2010) definitions. |

| | • | | The current drill hole database is reasonable for supporting a resource model for use in Mineral Resource and Mineral Reserve estimation. |

| | • | | The methods and procedures utilized to gather geological, geotechnical, assaying, density, and other information are reasonable and meet generally accepted industry standards. Standard operating protocols are well documented and updated on a regular basis for most of the common tasks. The mine carries out regular comparisons with blast hole data, previous models, and production reconciliation results to calibrate and improve the resource modelling procedures. |

| | • | | Exploration and development sampling and analysis programs use standard practices, providing generally reasonable results. The resulting data can effectively be used for the estimation of Mineral Resources and Mineral Reserves. |

| | • | | Overall, RPA is of the opinion that Mineral Resources are estimate with high quality work that exceeds industry practice. |

MINING AND MINERAL RESERVES

| | • | | The open pit Proven and Probable Reserves, including existing stockpiles scheduled for processing and inventory, are estimated to be 437 million tonnes at 0.75 g/t Au and 14.1 g/t Ag, containing 10.6 million ounces of gold and 198 million ounces of silver |

| | • | | The Mineral Reserve estimates have been prepared utilizing acceptable estimation methodologies and the classification of Proven and Probable Reserves conform to CIM (2010) definitions. |

| | • | | The operating data and the supporting documents were prepared using standard industry practices and provide reasonable results and conclusions. |

| | • | | The production reconciliation results for the first nine months of 2011 are very good. They indicate that the resource model overestimates the tonnage by approximately 3%, overestimates the gold grade by approximately 1% and overestimates the contained gold by approximately 4%. In RPA’s opinion, these are very good reconciliation numbers. |

| | |

| Barrick Gold Corporation – Veladero Mine, Project #1682 | | Rev. 0Page 1-3 |

| Technical Report NI 43-101 – March 16, 2012 | |

| | |

| | www.rpacan.com |

| | • | | Recovery and cost estimates are based upon actual operating data and engineering to support a Mineral Reserve statement. Economic analysis using these estimates generates a positive cash flow, which supports a statement of Mineral Reserves. |

| | • | | The current Veladero Life of Mine (LOM) plan provides reasonable results and, in RPA’s opinion, meets the requirements for statement of Mineral Reserves. In addition to the Mineral Reserves in the LOM plan, there are Mineral Resources that represent opportunities for the future. |

ENVIRONMENTAL CONSIDERATIONS

| | • | | Veladero has an Environmental Management Plan that is certified under the ISO 14001 standards. It is audited annually and it must be recertified every three years. |

| | • | | Veladero is certified by the International Cyanide Management Code. Veladero was last certified in August 2011 and is required to recertify every three years. |

| | • | | The Glacier Protection Act, which prohibits certain activities including mining, is temporarily suspended in San Juan province so it is not currently affecting mining at Veladero. Extensive information is continually being supplied to the regulators in order to support continued operation of Veladero. |

| | • | | Mine closure plans are reviewed and analyzed annually. Current cost estimates for closure at Veladero are approximately $40 million, of which approximately $30 million has been accredited to date. |

PROCESS

| | • | | During the site visit, RPA noted that the process operations are clean, organized and appear to be efficient and well run. Upon an evaluation of the recovery calculations and estimated recovery versus actual recovery, it was confirmed that the estimates for gold recovery are accurate, which indicates that the recovery equations are valid, however, the actual silver recovery varies significantly from the estimated silver recovery. Over the three years that were evaluated, estimates became more accurate, but the variance between the actual silver recovery and the estimated silver recovery is over 20%. |

| | • | | Recirculation of the pregnant leach solution (PLS) is planned in order to increase the stacking rate on the heap leach pad to 85,000 tpd. PLS recirculation ensures that: |

| | • | | Gold and silver recovery is accelerated and minimizes the potential for long-term recovery losses. |

| | • | | Gold production is increased in the short term. |

| | • | | Leaching cycles are more effective. |

| | • | | The gold inventory in the leach pad is reduced. |

| | • | | Control of the pregnant solution storage area (PSSA) is improved which, in turn, stabilizes the solution inventory and |

allows Veladero to maintain target solution levels while avoiding the need to build a new PLS pond.

| | • | | There are plans to conduct a formal risk/benefit analysis to confirm and quantify the benefits and project costs. |

| | |

| Barrick Gold Corporation – Veladero Mine, Project #1682 | | Rev. 0Page 1-4 |

| Technical Report NI 43-101 – March 16, 2012 | |

| | |

| | www.rpacan.com |

RECOMMENDATIONS

RPA makes the following recommendations:

GEOLOGY AND MINERAL RESOURCES

In RPA’s opinion, the resource modelling work is very good and no significant procedural changes are warranted. The resource model is performing very well, so it is best not to make any significant procedural changes. Some minor modelling refinements include:

| | • | | Define the grade envelopes manually using all of the drill and blast hole data available and do interpretation on both plans and sections to remove ragged edges. |

| | • | | Do more trend analysis work (3D Leapfrog, 2D bench contours) and more variography work in smaller structural domains to support implementing stronger anisotropies and more search domains in the future. |

| | • | | Run classification clean up script more than once and investigate changing the number of block face criteria to eliminate even more isolated blocks. |

| | • | | Automatically assign Inferred to blocks centred on isolated drill holes. |

| | • | | Automatically assign Inferred to blocks outside 0.1 g/t Au envelope. |

MINING AND MINERAL RESERVES

| | • | | The LOM plan is robust and Barrick should proceed to implement the plan as presented. |

| | • | | Continue with the proposed valley fill heap leach facility (VLF) expansion project permitting to allow for increased placement of material to the VLF if the opportunity becomes available through future positive exploration efforts or decreases in operating cut-off grades. |

| | • | | Review blasting practices with a view of improving blast fragmentation and or reducing powder factors to achieve same or better results. |

| | • | | Review application of gold price to cut-off grade calculation for short term mine planning to maximize ore tonnes placed without impacting project Net Present Value (NPV). |

| | • | | Consider creating grade groups for mineralized material dispatched to the waste rock facilities to increase future economic potential of this material. |

| | • | | Review conveyor belt extension to the heap leach pad for LOM operations to reduce the haulage cycle and corresponding demand on haul trucks. |

| | |

| Barrick Gold Corporation – Veladero Mine, Project #1682 | | Rev. 0Page 1-5 |

| Technical Report NI 43-101 – March 16, 2012 | |

| | |

| | www.rpacan.com |

PROCESS

| | • | | Barrick should continue to conduct metallurgical tests on samples of ore that are placed on the leach pad and adjust the recovery calculations in efforts to improve the estimated recovery, particularly for silver. |

ECONOMIC ANALYSIS

Under NI 43-101 rules, producing issuers may exclude the information required in Section 22—Economic Analysis on properties currently in production, unless the Technical Report includes a material expansion of current production. RPA notes that Barrick is a producing issuer, the Veladero Mine is currently in production, and a material expansion is not being planned. RPA has performed an economic analysis of the Veladero Mine using the estimates presented in this report and confirms that the outcome is a positive cash flow that supports the statement of Mineral Reserves.

TECHNICAL SUMMARY

PROPERTY DESCRIPTION AND LOCATION

The Veladero Mine is located on the east flank of the Andes Cordillera, six kilometres east of the Chile/Argentina border. The mine site is at approximately 29°20’ South latitude and 70°00’ West longitude in the Department of Iglesia, San Juan Province, northwest Argentina. The closest major population and commercial center is the provincial capital of San Juan, which is approximately 360 km by road. Elevations at the mine range from 3,900 m to 4,800 m.

LAND TENURE

Since 1989, Instituto Provincial de Exploraciones y Explotaciones Mineras de la Provincia de San Juan (IPEEM) has been the provincial mining entity responsible for holding title to certain of the San Juan Province’s mineral rights, and for soliciting and administering bids for exploration and mining licences in the province. Therefore, some of the mining licences are held by IPEEM. The remainder of the mining licences are held by Minera Argentina Gold S.A. (MAGSA), which is a wholly-owned subsidiary of Barrick. RPA notes that Barrick Exploraciones Argentina S.A. (BEASA) controls an extensive land package in the district that is contiguous with the mine concessions. This report summarizes only the mining and surface rights that are directly related to the Veladero Mine.

| | |

| Barrick Gold Corporation – Veladero Mine, Project #1682 | | Rev. 0Page 1-6 |

| Technical Report NI 43-101 – March 16, 2012 | |

| | |

| | www.rpacan.com |

Veladero comprises two distinct mining concessions, Mina Ursulina Sur (2,515.7 ha) and Mina Veladero (11,927 ha). Areas needed to provide access to the mine and additional areas for supporting facilities are subject to a different type of ownership claim, which are called easements. Through its exploitation contract and record of agreement with IPEEM, MAGSA’s rights to exploit Mina Veladero, in conjunction with development of Mina Ursulina Sur, are secured for 25 years. This term is renewable at MAGSA’s sole discretion for another 25 years.

Royalties to be paid by MAGSA total 3.75% of the value at the pit crest of ore mined at Veladero; 0.75% payable to IPEEM, and 3.0% payable to San Juan Province. The Argentine government collects an export duty royalty of 4.76%.

EXISTING INFRASTRUCTURE

Veladero is isolated from major cities and towns and operates on a self-sufficient basis with material and goods trucked in. Due to the remote location, the property is self-sufficient with regard to the infrastructure needed to support the operation. Electric power is generated on site using diesel generators and a wind turbine. The total electric supply is 22 MW. The water supply for industrial usage, i.e., process and dust control is secured from the Las Guas River. The domestic water supply is secured from two water wells. Potable water is treated using reverse osmosis. The Veladero site has four aerobic sewage treatment plants and one prototype sewage treatment plant that utilizes worms instead of bacteria to break down the domestic waste.

Accommodations on site are in a camp that includes emergency medical facilities, cafeteria, gymnasium, offices, and rooms for the Veladero workers.

Other infrastructure includes warehouse, truck shop, maintenance facilities, and analytical laboratory.

HISTORY

The Veladero area was first explored in the late 1980s by Argentine government geologists, who identified scattered gold anomalies in the Veladero Sur area and surrounding region during field examinations of hydrothermal alteration centers identified through satellite imagery. In 1988, administration of mineral rights in the region was transferred from the Federal to the Provincial government, and in 1989 San Juan

| | |

| Barrick Gold Corporation – Veladero Mine, Project #1682 | | Rev. 0Page 1-7 |

| Technical Report NI 43-101 – March 16, 2012 | |

| | |

| | www.rpacan.com |

Province established the IPEEM as the provincial mining entity responsible for holding title to certain of the province’s mineral rights, and for soliciting and administering bids for exploration and mining licences in the province.

Following a competitive bidding process completed by IPEEM in 1994, AGC, a Canadian junior exploration company, was awarded exploration rights to Veladero. AGC then entered into a 60:40 joint venture agreement with Lac Minerals (40%), which was acquired by Barrick a short time later.

In 1995 AGC assigned its interest to its subsidiary, MAGSA, and from 1996 through 1998 the MAGSA/Barrick joint venture successfully explored Veladero. Concurrently, Barrick, through its subsidiary BEASA, explored BEASA’s adjoining 100%-owned Ursulina Sur property as part of the Lama project. In early 1999, Homestake Mining acquired AGC. The December 2001 merger of Homestake and Barrick resulted in Barrick gaining 100% indirect control of Veladero through MAGSA and BEASA.

GEOLOGY AND MINERALIZATION

The Veladero deposit is situated at the north end of the El Indio Gold Belt, a 120 km by 25 km north-trending corridor of Permian to late Miocene volcanic and intrusive rocks, which host a number of hydrothermal alteration zones and epithermal mineral deposits. The belt consists of a Tertiary volcanic rift basin in which volcanic flows and tuffs were deposited and subsequently cut by associated intrusions. Basement rocks in the belt consist of andesitic to rhyolitic tuffs, lava flows, and volcaniclastic rocks of the Permo-Triassic Choiyoi Formation, which are overlain unconformably by Tertiary igneous and volcanic rocks ranging in age from older 40 Ma stocks to more recent 4 Ma tuffs, lava flows and volcaniclastic rocks.

The El Indio Gold Belt hosts both high and low sulphidation style mineralization over a 55 km strike length, from the Tambo-El Indio mines in the south to the Pascua-Lama project in the north. Epithermal mineralization within this belt is associated with Tertiary structural trends.

The Veladero deposit is a hypogene-oxidized, high sulphidation gold-silver deposit hosted by volcaniclastic sediments, tuffs, and volcanic breccias related to a Miocene diatreme-dome complex. Hydrothermal alteration is typical of high sulphidation gold deposits, with a silicified core grading outward into advanced argillic alteration, then into

| | |

| Barrick Gold Corporation – Veladero Mine, Project #1682 | | Rev. 0Page 1-8 |

| Technical Report NI 43-101 – March 16, 2012 | |

| | |

| | www.rpacan.com |

peripheral argillic and propylitic alteration haloes. Gold occurs as fine native grains, and is dominantly associated with silicification and with iron oxide or iron sulfate fracture coatings. Silver mineralization is distinct from gold, and occurs as a broader, more diffuse envelope, probably representing a separate mineralizing event.

The Veladero deposit forms a broad, disseminated, 400 m to 700 m wide by three kilometre long blanket of mineralization along a N15ºW-striking structural trend. The diatreme-dome complex includes a massive, central, brecciated core of heterolithic, matrix-supported tuffisite that transitions outward through clast-supported breccias into the volcanic country rocks. A bedded tuff unit that represents fragments ejected from the central vent forms a ring that overlies portions of the tuffisite and breccias at the southern end of the deposit. The Veladero deposit comprises three main orebodies: Amable in the south, Cuatro Esquinas in the centre, and Filo Federico in the north. The Argenta orebody is a small satellite deposit located approximately five kilometres to the southeast of the Veladero deposit.

The mineralized envelope encompassing greater than 0.2 g/t Au is oriented along a 345°-trending regional structural corridor. The mineralization is dominantly hosted in the diatreme breccias along the fault-bounded northwest trend. Within this trend, higher grade mineralized shoots, averaging approximately 4 g/t Au but with one metre values up to 100 g/t Au, with lengths of 300 m to 500 m, form along northeast striking structural trends and are surrounded by a halo of lower grade mineralization ranging between 0.1 g/t Au and 1.0 g/t Au.

A variety of volcanic explosion breccias and tuffs are the principal host rocks at Cuatro Esquinas and Filo Federico, where alteration consists of intense silicification. The Amable ore body is hosted within bedded pyroclastic breccias and tuffs which are affected by silicification and advanced argillic alteration. Much of the Veladero deposit is covered by approximately 40 m of overburden and the overburden in some areas is up to 170 m thick. The colluvium is generally uncemented.

Precious metal mineralization at Veladero is controlled by stratigraphy, structural trends, and elevation. Gold mineralization can be hosted by any kind of rock at Veladero, including overburden and steam-heat altered lithologies. Principal host rocks are hydrothermal breccias and felsic tuffs at Filo Federico and Cuatro Esquinas, and pyroclastic breccias and felsic to intermediate tuffs at Amable.

| | |

| Barrick Gold Corporation – Veladero Mine, Project #1682 | | Rev. 0Page 1-9 |

| Technical Report NI 43-101 – March 16, 2012 | |

| | |

| | www.rpacan.com |

EXPLORATION STATUS

The major exploration programs took place prior to the completion of the Feasibility Study in 2002. The original drilling program targeted structural intersections with surface geochemical anomalies (involving rock chip, soil, and screened talus sampling) that were coincident with Controlled-Source-Audio-Frequency-Magneto-Telluric (CSAMT) resistivity highs and magnetic lows. Since 2002, additional exploration and infill drilling has been completed. More drilling is planned to explore some gaps that still remain on the mining concessions.

MINERAL RESOURCES AND MINERAL RESERVES

The 2011 year-end Mineral Resources are summarized in Table 1-1. The Measured and Indicated Mineral Resources total 39.9 million tonnes averaging 0.36 g/t Au and 11.4 g/t Ag and contain 462,000 ounces of gold and 14.7 million ounces of silver. In addition, the Inferred Mineral Resources total 67.7 million tonnes averaging 0.26 g/t Au and 11.3 g/t Ag and contain 572,000 ounces of gold and 24.5 million ounces of silver. The resources are estimated using a gold price of $1,400/oz Au. RPA is of the opinion that the Mineral Resources are acceptable, reasonable, and compliant with NI 43-101.

Silver recoveries are very low at Veladero, so silver is not considered for the resource and reserve cut-off grades. The resource estimate gold cut-off grades are 0.155 g/t for Type 1 ROM material from the Filo Federico pit, 0.251 g/t for Type 1 ROM material from the Amable pit, 0.364 g/t for Type 2 ROM material from the Filo Federico and Amable pits, and 0.109 g/t for ROM material from the Argenta pit. The resource model was prepared using all of the drill holes available up to April 14, 2011.

RPA reviewed the resource assumptions, input parameters, geological interpretation, and block modelling procedures and is of the opinion that the Mineral Resource estimate is appropriate for the style of mineralization and that the resource model is reasonable and acceptable to support the 2011 year-end Mineral Resource and Mineral Reserve estimates.

The Veladero geology department has developed a very good understanding of the Veladero geology. Geological models were constructed to provide geologic control for grade estimation and to provide parameters for mine planning. Geology models for

| | |

| Barrick Gold Corporation – Veladero Mine, Project #1682 | | Rev. 0Page 1-10 |

| Technical Report NI 43-101 – March 16, 2012 | |

| | |

| | www.rpacan.com |

lithology, alteration and structural sub-zones were built using Vulcan software. The main faults have also been modelled. Lines and control points based on the exploration drill holes, blast holes, and pit mapping were used in Vulcan to create 3D geological wireframes.

The year-end 2011 Mineral Reserve estimate is summarized in Table 1-2. The open pit Mineral Reserves are estimated to be 427 million tonnes at 0.75 g/t Au and 14.4 g/t Ag, containing 10.3 million ounces of gold and 197 million ounces of silver and are classified as Proven and Probable Reserves. Over 90% of the open pit reserves are located within the Filo Federico pit of Veladero, with the remainder coming from Amable, Argenta, and Agostina Sur pits. Based on this review, it is RPA’s opinion that the reported material is appropriately classified as Proven and Probable Mineral Reserves and is compliant with NI 43-101.

MINING METHOD

The Veladero Mine is a traditional open pit truck/shovel heap leach operation that has been in continuous operation since 2005. Veladero has mined approximately 545.5 million tonnes and produced 4.26 million ounces of gold plus 6.6 million ounces of silver up to the end of 2011.

Mining is planned at an average of approximately 30 million tonnes per year ore is over the next 14 years, with mine operations concluding in 2025. Waste rock mining varies by year from a high of 75 million tonnes in 2017 to a low of four million tonnes in the final year of operations, averaging 52 million tonnes per year. Peak ROM material movement is scheduled at approximately 103 million tonnes per year (280,000 tpd) through 2017, tapering off to 34 million tonnes per year (93,000 tpd) in the final year of operations.

Open pit mining operations are located on mountain side slopes in rugged terrain with the majority of mining operations occurring between elevations of 3,800 MASL and 4,700 MASL. A total of 1.2 billion tonnes of material is scheduled to be moved over the next 14 years from two open pit mining areas referred to as Veladero and Argenta. Over 90% of remaining reserves are located within the Filo Federico pit of the Veladero area, with open pit mining operations scheduled to be complete in 2025. Additional Reserves within the Veladero area come from the Amable pit, with production scheduled to be completed in 2012, plus less than one year’s production is scheduled from the Agostina Sur pit. At Argenta, a single pit is currently being mined with production scheduled to be complete at the end of 2013.

| | |

| Barrick Gold Corporation – Veladero Mine, Project #1682 | | Rev. 0Page 1-11 |

| Technical Report NI 43-101 – March 16, 2012 | |

| | |

| | www.rpacan.com |

The Filo Federico ultimate pit will measure approximately 2.3 km along strike, typically 1.0 km across, and have a maximum depth of approximately 650 m. The Amable ultimate pit will measure approximately 1.0 km in diameter with a maximum depth of approximately 530 m. The southern ultimate pit wall of Filo Federico is designed to intersect the upper most benches of the northwest Amable ultimate pit wall for approximately 150 m of vertical. The Agostina Sur ultimate pit will measure under 0.3 km in diameter with a maximum depth of approximately 100 m. The Argenta ultimate pit will measure approximately 1.0 km along strike, typically 0.5 km across, and have a maximum depth of approximately 300 m.

Processing is based on a single valley fill heap leach facility (VLF) that receives crushed and ROM ore with final delivery to the pad by haul truck. Solution from the VLF is pumped to the Merrill-Crowe process facilities. The VLF is located less than 1.0 km to the south of the Amable ultimate pit, and it is almost 4.0 km south of the Filo Federico ultimate pit haul ramp exit where the majority of the remaining reserves are located. The extents of the current Phase 3 VLF are approximately 2.0 km east to west, and approximately 0.7 km north to south.

MINERAL PROCESSING

Gold is recovered from ore at Veladero using ROM and crushed ore cyanide heap leaching in a valley fill leach pad using a Merrill-Crowe zinc cementation gold recovery plant.

The lower gold grade ore, i.e., above the cut-off grade for ROM ore and below the cut-off grade for crushed ore, is mined and trucked to the leach pad in a separate area as ROM ore. Trucks dump over the side of the pad and the ore is pushed off using a track-mounted dozer.

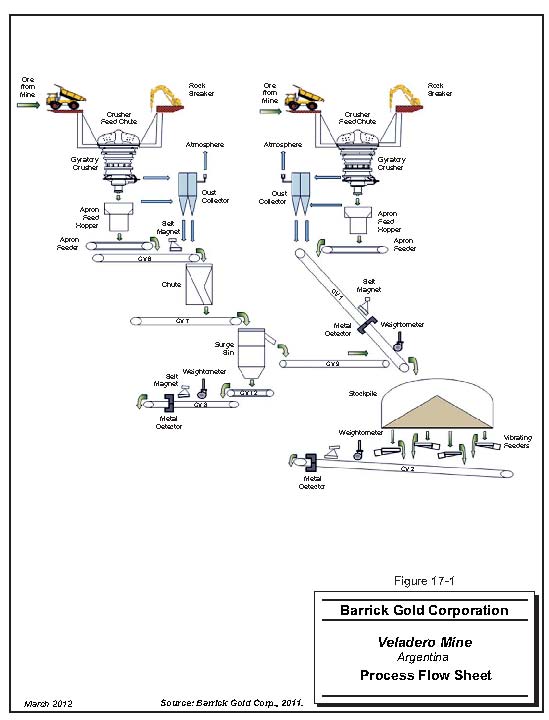

Ore that has a gold grade above the cut-off grade for crushed ore is trucked from the mine or stockpiles and crushed in one of two two-stage crushing circuits to a nominal size of 80% passing (P80) 40 mm. The crushing plant has a capacity of approximately 90,000 tpd, i.e., 60,000 tpd through line one and 30,000 tpd through line two. Rear dump haul trucks dump directly into the primary gyratory crushers. After crushing the ore is transferred to a covered stockpile.

| | |

| Barrick Gold Corporation – Veladero Mine, Project #1682 | | Rev. 0Page 1-12 |

| Technical Report NI 43-101 – March 16, 2012 | |

| | |

| | www.rpacan.com |

After a secondary round of crushing ore is conveyed to a 3.7 km long overland conveyor belt for transport to a truck loadout bin that is located adjacent to the processing plant near the heap leach pad. Lime is added to the ore as it is transported on the overland conveyor belt. The ore from the loadout bin is loaded into mine haul trucks for transport to the valley fill heap leach facility where it is stacked in 30 m lifts.

Approximately 250,000 m3 of ore is actively under leach at any given time with dilute cyanide leach solution applied using drip emitters. The nominal capacity of the solution pumping system is 2,066 m3/h. Pregnant solution is collected by the dam at the toe of the leach pad and pumped to the Merrill Crowe recovery plant.

Gold doré that is produced by the refining process is shipped off site for further refining to produce fine gold and silver.

ENVIRONMENTAL, PERMITTING AND SOCIAL CONSIDERATIONS

On September 30, 2010, the national government of Argentina adopted the Glacier Protection Act. The act requires an inventory of Argentina’s glaciers and environmental impact studies be conducted to evaluate the impact of human activity occurring near glaciers, as well as the prohibition of certain activities where there are glaciers including mining. The law is temporarily suspended in San Juan Province, so it is not currently affecting mining at Veladero, however, extensive information is continually being supplied to the regulators in order to support continued operation of Veladero.

Veladero has an Environmental Management Plan that is certified under the ISO 14001 standards. The plan is audited annually and must be recertified every three years. It is also certified by the International Cyanide Management Code. Veladero was last certified in August 2011.

Reports of the monitoring results are submitted to the authorities every six months.

The authorities conduct site inspections at Veladero on a regular basis. Written reports of comments are distributed and Veladero responds to the comments, as required.

Currently, RPA believes that there are no environmental issues which directly affect reserves or resources. The environmental requirements are managed by an on-site staff of professionals and technicians and the legal department in the San Juan office.

| | |

| Barrick Gold Corporation – Veladero Mine, Project #1682 | | Rev. 0Page 1-13 |

| Technical Report NI 43-101 – March 16, 2012 | |

| | |

| | www.rpacan.com |

The mine closure plan was developed to allow, when practical, closure and rehabilitation activities to be carried out simultaneously with mining activities. This rehabilitation in parallel with mining will allow the performance of certain tasks during the operation of the mine, reducing closure costs and the schedule for completing the tasks at the end of the mine life. Mine closure plans are reviewed and analyzed annually. Current cost estimates for closure at Veladero are approximately $40 million, of which approximately $30 million has been accredited to date.

CAPITAL AND OPERATING COST ESTIMATES

Remaining capital costs at Veladero are primarily sustaining capital, which includes mine equipment replacement and leach pad expansion. Total remaining capital costs are a nominal $871 million. Mine pre-stripping capital of $500 million has been treated as an operating cost for the purposes of this Technical Report. Table 1-3

TABLE 1-3 CAPITAL COSTS SUMMARY

Barrick Gold Corporation – Veladero Mine

| | |

Department | | Sustaining Capital

(US$ million) |

Engineered Facilities | | 513 |

Continuous Improvement | | 41 |

Safety, Health and Environment | | 10 |

Equipment Replacement & Other | | 256 |

| | |

Subtotal | | 820 |

Contingency | | 41 |

Closure | | 10 |

| | |

Total Capital Expenditures | | 871 |

Notes:

| | 1. | Numbers may not add due to rounding. |

All-in unit operating costs for Veladero are US$13.89 per tonne processed (Table 1-4).

| | |

| Barrick Gold Corporation – Veladero Mine, Project #1682 | | Rev. 0Page 1-14 |

| Technical Report NI 43-101 – March 16, 2012 | |

| | |

| | www.rpacan.com |

TABLE 1-4 TOTAL OPERATING COST

Barrick Gold Corporation – Veladero Mine

| | |

Cost | | US$/t processed |

Mining | | 8.78 |

Processing | | 2.97 |

G&A | | 2.15 |

| | |

Total | | 13.89 |

Notes:

| | 1. | Numbers may not add due to rounding. |

| | |

| Barrick Gold Corporation – Veladero Mine, Project #1682 | | Rev. 0Page 1-15 |

| Technical Report NI 43-101 – March 16, 2012 | |

| | |

| | www.rpacan.com |

2 INTRODUCTION

Roscoe Postle Associates Inc. (RPA) was retained by Barrick Gold Corporation (Barrick) to prepare an independent Technical Report on the Veladero Gold Mine (the Project) in Argentina. The purpose of this report is to support public disclosure of Mineral Resource and Mineral Reserve estimates at the Project as of December 31, 2011. This Technical Report conforms to NI 43-101 Standards of Disclosure for Mineral Projects. RPA visited the property from November 7 to November 9, 2011.

Barrick is a Canadian publicly traded mining company with a large portfolio of operating mines and projects across five continents.

Veladero is a large open pit, heap leach gold and silver mine in the high Andes Cordillera of central western Argentina. Operations include open pit mining of gold-silver ore from two mining areas, two-stage crushing, and extraction of precious metals using valley-fill heap leaching and Merrill-Crowe recovery. Since Veladero started production in 2005, the mine has recovered over four million ounces of gold and over six million ounces of silver from approximately 142 million tonnes of ore averaging 1.25 g/t Au and 14.7 g/t Ag.

Mining an average of approximately 30 million tonnes per year ore is scheduled for Veladero over the next 14 years, with mine operations concluding in 2025. Waste rock mining varies by year from a high of 75 million tonnes in 2017 to a low of 4 million tonnes in the final year of operations, averaging 52 million tonnes per year.

There are currently two main open pit mining areas referred to as Veladero and Argenta. Over 90% of remaining reserves are located within the Filo Federico pit of the Veladero area. Additional reserves within the Veladero area come from the Amable pit and the Agostina Sur pit. At Argenta, a single pit is mining a small satellite deposit.

Since 1989, the Instituto Provincial de Exploraciones y Explotaciones Mineras de la Provincia de San Juan (IPEEM) has been the provincial mining entity responsible for holding title to certain of the San Juan Province’s mineral rights, and for soliciting and administering bids for exploration and mining licences in the province. Following a competitive bidding process completed by IPEEM in 1994, Argentina Gold Corp. (AGC), a Canadian junior exploration company, was awarded exploration rights to Veladero.

| | |

| Barrick Gold Corporation – Veladero Mine, Project #1682 | | Rev. 0Page 2-1 |

| Technical Report NI 43-101 – March 16, 2012 | |

| | |

| | www.rpacan.com |

AGC then entered into a 60:40 joint venture agreement with Lac Minerals (40%), which shortly was to become a subsidiary of Barrick. In 1995, AGC assigned its interest to its subsidiary, Minera Argentina Gold S.A. (MAGSA), and from 1996 through 1998 the MAGSA/Barrick joint venture successfully explored the Veladero property. Concurrently, Barrick subsidiary Barrick Exploraciones Argentina S.A. (BEASA) explored the adjoining Ursulina Sur property as part of the Lama project. In early 1999, Homestake Mining (Homestake) acquired AGC. The December 2001 merger of Homestake and Barrick resulted in Barrick’s gaining 100% indirect control of Veladero through MAGSA and BEASA.

Veladero comprises two distinct mining concessions, Mina Ursulina Sur and Mina Veladero. Through its exploitation contract and record of agreement with IPEEM, MAGSA’s rights to exploit Mina Veladero, in conjunction with the development of Mina Ursulina Sur, are secured for 25 years. This term is renewable at MAGSA’s sole discretion for another 25 years. BEASA controls essentially all the surface of Mina Ursulina Sur and Mina Veladero, in addition to other large contiguous surface parcels in the region.

Royalties to be paid by MAGSA total 3.75% of the value at the pit crest of ore mined at Veladero. This includes separate pit crest royalties of 0.75% payable to IPEEM, and 3.0% payable to San Juan Province. In addition, MAGSA pays the Argentine government a 4.76% royalty.

SOURCES OF INFORMATION

RPA Principal Geological Engineer Luke Evans, M.Sc., P.Eng., RPA Senior Mining Engineer Glen Ehasoo, P.Eng., and RPA Principal Metallurgist, Kathleen Ann Altman, Ph.D., P.E., visited the mine from November 7 to 9, 2011 and held meetings at the Barrick office in San Juan on November 10 and 11, 2011.

Discussions were held with the following Barrick and MAGSA personnel:

| | • | | Zetti Gavelan – General Manager |

| | • | | Inivaldo Diaz – Regional Superintendent of Mine Planning |

| | • | | Raul Correa – Chief Engineer |

| | • | | Fernando Barrigón – Superintendent of Technical Services |

| | • | | Andres Lasry – Chief Geologist |

| | • | | Marcello Zangrandi – Senior Resource Geologist |

| | • | | Benjamin Sanfurgo - Superintendent of Resource and Reserve Modelling |

| | |

| Barrick Gold Corporation – Veladero Mine, Project #1682 | | Rev. 0Page 2-2 |

| Technical Report NI 43-101 – March 16, 2012 | |

| | |

| | www.rpacan.com |

| | • | | Juan Chuquimango – Ore Control Geologist |

| | • | | Osvaldo Brocca – Mine Geologist |

| | • | | Lucas Berbe – Modelling Geologist |

| | • | | Elio Terranova – AcQuire Database Manager |

| | • | | Boris Zavala – Process Manager |

| | • | | Jorge Coria – Mine Cost Controller |

| | • | | Martin Andino – Senior Fixed Assets Analyst |

| | • | | Daniela Esper – Senior Cost Analyst |

| | • | | Oscar Sagardia – Environmental Superintendent |

| | • | | Garbriel Barrionuevo – Chief Metallurgist |

| | • | | Federico Ojedo – Administrative Assistant, Process Department |

The Veladero operation has been the subject of resource/reserve technical audits as follows:

| | • | | May 2008, Mineral Reserve and Resource Audit, Scott Wilson Roscoe Postle Associates Inc. (Scott Wilson RPA, a predecessor company to RPA). |

| | • | | May 2007, Veladero Model Review, Resource Modelling Inc. (RMI) |

| | • | | March, 2005, NI 43-101 Technical Report, Barrick Gold Corporation. |

| | • | | February 2005, Reserve Procedure Audit, RPA. |

Mr. Evans is responsible for the overall preparation of this report. Mr. Evans reviewed the geology, sampling, assaying, and resource estimate work and is responsible for Sections 1 to 12 and 14. Mr. Ehasoo reviewed the mining, reserve estimate, and economics and is responsible for Sections 15, 16, 19, 21, and 22. Dr. Altman reviewed the metallurgical, environmental, and permitting aspects and is responsible for Sections 13, 17, 18, and 20. RPA would like to acknowledge the excellent cooperation in the transmittal of data by Barrick and MAGSA personnel.

The documentation reviewed, and other sources of information, are listed at the end of this report in Section 27 References.

| | |

| Barrick Gold Corporation – Veladero Mine, Project #1682 | | Rev. 0Page 2-3 |

| Technical Report NI 43-101 – March 16, 2012 | |

| | |

| | www.rpacan.com |

LIST OF ABBREVIATIONS

Units of measurement used in this report conform to the metric system. All currency in this report is US dollars (US$) unless otherwise noted.

| | | | | | |

| µm | | micron | | km2 | | square kilometre |

| | | |

| °C | | degree Celsius | | kPa | | kilopascal |

| | | |

| °F | | degree Fahrenheit | | kVA | | kilovolt-amperes |

| | | |

| µg | | microgram | | kW | | kilowatt |

| | | |

| A | | ampere | | kWh | | kilowatt-hour |

| | | |

| a | | annum | | L | | litre |

| | | |

| bbl | | barrels | | L/s | | litres per second |

| | | |

| Btu | | British thermal units | | m | | metre |

| | | |

| C$ | | Canadian dollars | | M | | mega (million) |

| | | |

| cal | | calorie | | m2 | | square metre |

| | | |

| cfm | | cubic feet per minute | | m3 | | cubic metre |

| | | |

| cm | | centimetre | | min | | minute |

| | | |

| cm2 | | square centimetre | | MASL | | metres above sea level |

| | | |

| d | | day | | mm | | millimetre |

| | | |

| dia. | | diameter | | mph | | miles per hour |

| | | |

| dmt | | dry metric tonne | | MVA | | megavolt-amperes |

| | | |

| dwt | | dead-weight ton | | MW | | megawatt |

| | | |

| ft | | foot | | MWh | | megawatt-hour |

| | | |

| ft/s | | foot per second | | m3/h | | cubic metres per hour |

| | | |

| ft2 | | square foot | | opt, oz/st | | ounce per short ton |

| | | |

| ft3 | | cubic foot | | oz | | Troy ounce (31.1035g) |

| | | |

| g | | gram | | ppm | | part per million |

| | | |

| G | | giga (billion) | | psia | | pound per square inch absolute |

| | | |

| Gal | | Imperial gallon | | psig | | pound per square inch gauge |

| | | |

| g/L | | gram per litre | | RL | | relative elevation |

| | | |

| g/t | | gram per tonne | | s | | second |

| | | |

| gpm | | Imperial gallons per minute | | st | | short ton |

| | | |

| gr/ft3 | | grain per cubic foot | | stpa | | short ton per year |

| | | |

| gr/m3 | | grain per cubic metre | | stpd | | short ton per day |

| | | |

| hr | | hour | | t | | metric tonne |

| | | |

| ha | | hectare | | tpa | | metric tonne per year |

| | | |

| hp | | horsepower | | tpd | | metric tonne per day |

| | | |

| in | | inch | | US$ | | United States dollar |

| | | |

| in2 | | square inch | | USg | | United States gallon |

| | | |

| J | | joule | | USgpm | | US gallon per minute |

| | | |

| k | | kilo (thousand) | | V | | volt |

| | | |

| kcal | | kilocalorie | | W | | watt |

| | | |

| kg | | kilogram | | wmt | | wet metric tonne |

| | | |

| km | | kilometre | | yd3 | | cubic yard |

| | | |

| km/h | | kilometre per hour | | yr | | year |

| | |

| Barrick Gold Corporation – Veladero Mine, Project #1682 | | Rev. 0Page 2-4 |

| Technical Report NI 43-101 – March 16, 2012 | |

| | |

| | www.rpacan.com |

3 RELIANCE ON OTHER EXPERTS

This report has been prepared by Roscoe Postle Associates Inc. (RPA) for Barrick Gold Corporation (Barrick). The information, conclusions, opinions, and estimates contained herein are based on:

| | • | | Information available to RPA at the time of preparation of this report; |

| | • | | Assumptions, conditions, and qualifications as set forth in this report; and |

| | • | | Data, reports, and other information supplied by Barrick and other third party sources. |

For the purpose of this report, RPA has relied on ownership information provided by Barrick. RPA has not researched property title or mineral rights for the Veladero property and expresses no opinion as to the ownership status of the property.

RPA has relied on Barrick for guidance on applicable taxes, royalties, and other government levies or interests, applicable to revenue or income from Veladero.

Except for the purposes legislated under provincial securities laws, any use of this report by any third party is at that party’s sole risk.

| | |

| Barrick Gold Corporation – Veladero Mine, Project #1682 | | Rev. 0Page 3-1 |

| Technical Report NI 43-101 – March 16, 2012 | |

| | |

| | www.rpacan.com |

4 PROPERTYDESCRIPTION AND LOCATION

LOCATION

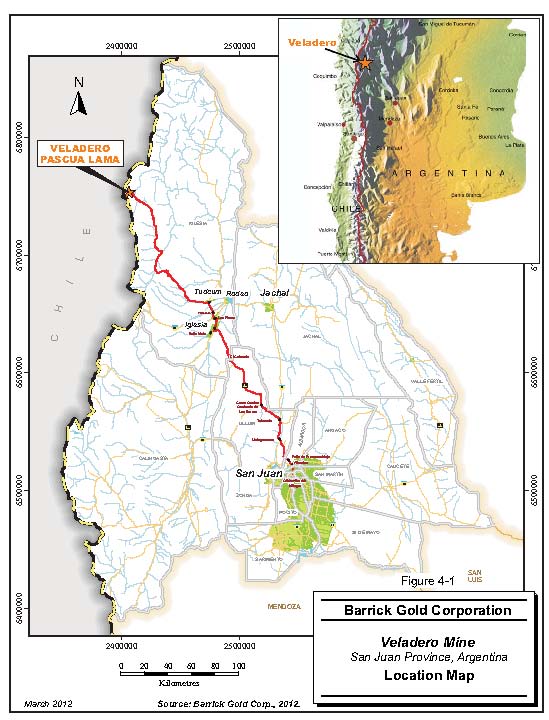

The Veladero Mine is located on the east flank of the Andes Cordillera, six kilometres east of the Chile/Argentina border. The mine site is at approximately 29°20’ South latitude and 70°00’ West longitude in the Department of Iglesia, San Juan Province, northwest Argentina. The closest major population and commercial center is the provincial capital of San Juan, which is approximately 280 km southeast of Veladero. By road the distance is approximately 360 km via paved National Highway No. 40 north from San Juan to Provincial Road No. 436 (paved) and the village of Pismanta, and by public gravel road to Tudcum. Barrick’s 156 km all-weather gravel road continues from Tudcum over Conconta Pass, through the Valle del Cura, and over Despoblados Pass to Veladero. Elevations at the mine range from 3,900 m to 4,800 m. The mine location is shown in Figure 4-1.

LAND TENURE

Since 1989, IPEEM has been the provincial mining entity responsible for holding title to certain of the San Juan Province’s mineral rights, and for soliciting and administering bids for exploration and mining licences in the province. Therefore, some of the mining licences are held by IPEEM. The remainder of the mining licences are held by MAGSA, which is a wholly-owned subsidiary of Barrick. RPA notes that BEASA controls an extensive land package in the district that is contiguous with the mine concessions. This report summarizes only the mining and surface rights that are directly related to the Veladero Mine.

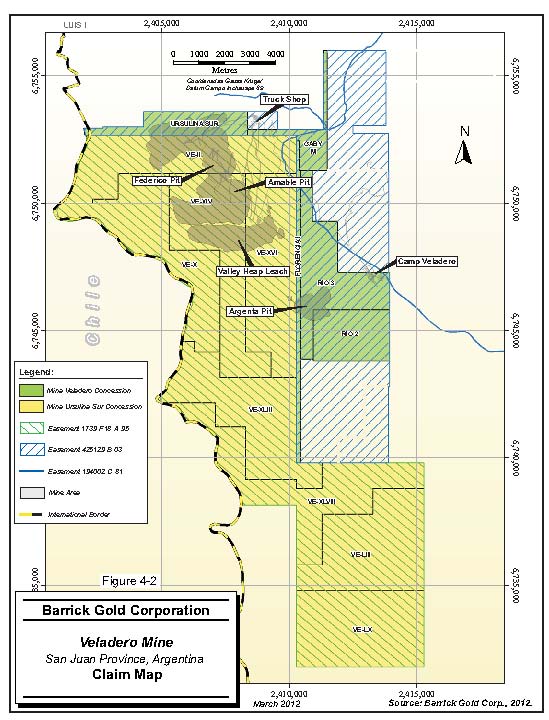

Veladero comprises two distinct mining concessions, Mina Ursulina Sur (2,515.7 ha) and Mina Veladero (11,927 ha). The ownership details of the mining properties are shown in Table 4-1. Areas needed to provide access to the mine and additional areas for supporting facilities are subject to a different type of ownership claim, which are called easements. Details of these land holdings are provided in Table 4-2. The land holdings are shown in Figure 4-2.

| | |

| Barrick Gold Corporation – Veladero Mine, Project #1682 | | Rev. 0Page 4-1 |

| Technical Report NI 43-101 – March 16, 2012 | |

| | |

| | www.rpacan.com |

|

| TABLE 4-1 MINING CONCESSIONS |

| Barrick Gold Corporation – Veladero Mine |

|

| | | | | | |

Concession & Licence Numbers | | Concession & Licence Names | | Owner | | Area (ha) |

520-0314-M-99 | | Mina Veladero | | IPEEM | | 11,927 |

338837-I-92 | | VE II | | IPEEM | | 1,459.1 |

338888-I-92 | | VE LIII | | IPEEM | | 1,500 |

338895-I-92 | | VE LX | | IPEEM | | 1,500 |

338845-I-92 | | VE X | | IPEEM | | 1,397.9 |

338849-I-92 | | VE XIV | | IPEEM | | 1,500 |

338878-I-92 | | VE XLIII | | IPEEM | | 1,520.7 |

338883-I-92 | | VE XLVIII | | IPEEM | | 1,470.9 |

338851-I-92 | | VE XVI | | IPEEM | | 1,500 |

1124-M-525-2009 | | Mina Ursulina Sur | | MAGSA | | 2,515.7 |

425380-B-03 | | Ursulina Sur | | MAGSA | | 469.1 |

0676-F18-M-95 | | Rio 2 | | MAGSA | | 600 |

0675-F18-M-95 | | Rio 3 | | MAGSA | | 998.4 |

0764-F28-M-96 | | Gaby M | | MAGSA | | 269.5 |

296942-F-89 | | Florencia I | | MAGSA | | 192.7 |

|

| TABLE 4-2 EASEMENTS |

| Barrick Gold Corporation – Veladero Mine |

|

| | | | | | |

Number | | Description | | Owner | | Area (ha) |

1739-F18-A-95 | | Camp and mine facilities | | IPEEM | | 1,1927.1 |

425129-B-03 | | Camp and mine facilities | | MAGSA | | 6,037 |

425255-B-03 | | Roads and antennas | | MAGSA | | 399.5 |

295,232-M-89 | | Roads | | MAGSA | | Approx. 60 km |

1124-418-M-2008 | | Airstrip | | MAGSA | | 1,100 |

MAGSA holds 100% direct ownership of the Mina Ursulina Sur mining concession, which is contiguous with and immediately north and east of the Mina Veladero mining concession (Figure 4-2). IPEEM owns the Mina Veladero mining concession. Through its exploitation contract and record of agreement with IPEEM, MAGSA’s rights to exploit Mina Veladero, in conjunction with development of Mina Ursulina Sur, are secured for 25 years. This term is renewable at MAGSA’s sole discretion for another 25 years.

BEASA controls essentially all the surface of Mina Ursulina Sur and Mina Veladero, in addition to other large contiguous surface parcels in the region. The main surface right easements in the mine area are shown in Figure 4-2. Easements that are not shown in Figure 4-2 are mostly related to communication antennas and access roads.

| | |

| Barrick Gold Corporation – Veladero Mine, Project #1682 | | Rev. 0Page 4-2 |

| Technical Report NI 43-101 – March 16, 2012 | |

| | |

| | www.rpacan.com |

FIGURE 4-1 LOCATION MAP

| | |

| Barrick Gold Corporation – Veladero Mine, Project #1682 | | Rev. 0Page 4-3 |

| Technical Report NI 43-101 – March 16, 2012 | |

| | |

| | www.rpacan.com |

FIGURE 4-2 CLAIM MAP

| | |

| Barrick Gold Corporation – Veladero Mine, Project #1682 | | Rev. 0Page 4-4 |

| Technical Report NI 43-101 – March 16, 2012 | |

| | |

| | www.rpacan.com |

Royalties to be paid by MAGSA total 3.75% of the value at the pit crest of ore mined at Veladero. This includes separate pit crest royalties of 0.75% payable to IPEEM, and 3.0% payable to San Juan Province.

Federal income taxes in Argentina are levied at the rate of 35%, but a number of provisions exist for reducing taxable income, and the Mining Investment Law provides for various foreign investment protections in the form of stabilization of key elements of fiscal, foreign exchange, and customs regimes. Argentina charges an additional tax of 5% of the gross revenue received from sale of minerals exported from the country. A number of other relatively minor taxes and fees are levied at the federal, provincial, and municipal levels.

The Argentine government initially stated that the export duty of 5% on gross sales was imposed as a temporary measure in 2002 was reduced in 2005; it was intended to be eliminated altogether by 2007, however, the current royalty is 4.76%.

| | |

| Barrick Gold Corporation — Veladero Mine, Project #1682 | | Rev. 0Page 4-5 |

| Technical Report NI 43-101 – March 16, 2012 | |

| | |

| | www.rpacan.com |

5 ACCESSIBILITY, CLIMATE, LOCAL

RESOURCES, INFRASTRUCTURE AND

PHYSIOGRAPHY

ACCESSIBILITY

The closest major population and commercial center is the provincial capital of San Juan, approximately 280 km southeast of Veladero. By road, the distance is approximately 360 km, via paved National Highway No.40 north from San Juan to Provincial Road No.436 (paved) and the village of Pismanta, and by public gravel road to Tudcum. Barrick’s 156 km all-weather gravel road continues from Tudcum over Conconta Pass, through the Valle del Cura, and over Despoblados Pass to Veladero.

It takes approximately six hours to drive to Veladero from San Juan, which in turn is approximately a two hour drive to the International airport at Mendoza. There are regular flights to Mendoza from Santiago, Chile and there are also direct flights to San Juan from Buenos Aires, Argentina.

LOCAL RESOURCES

Veladero is isolated from major cities and towns and operates on a self-sufficient basis with material and goods trucked in. Mine personnel work on a residential rotation. Operations personnel work a 14 day on – 14 day off rotation on 12-hour shifts. Administrative personnel work on either a four day on—three day off schedule or on an eight day on—six day off schedule if they have a cross shift who has the same duty functions such as a general supervisor.

INFRASTRUCTURE

Due to the remote location, the property is self-sufficient with regard to the infrastructure needed to support the operation. Electric power is generated on site using diesel generators and a wind turbine. The water supply for industrial usage, i.e. process and dust control is secured from the Las Guas River. The domestic water supply is secured from two water wells. The potable water is treated using reverse osmosis. The Veladero site has four aerobic sewage treatment plants and one prototype sewage treatment plant that utilizes worms instead of bacteria to break down the domestic waste.

| | |

| Barrick Gold Corporation — Veladero Mine, Project #1682 | | Rev. 0Page 5-1 |

| Technical Report NI 43-101 – March 16, 2012 | |

| | |

| | www.rpacan.com |

Accommodations on site are in a camp that includes emergency medical facilities, cafeteria, gymnasium, offices, and rooms for the Veladero workers.

Other infrastructure includes warehouse, truck shop, maintenance facilities, and analytical laboratory.

PHYSIOGRAPHY

The Veladero Mine area is characterized by rugged mountains with deeply incised steep-sided valleys. Elevations at the mine range from 3,900 MASL to 4,800 MASL, and the alpine climate is cold, dry, and windy. Vegetation is sparse, and is concentrated in wetlands areas. Rock outcrops and colluvial soils predominate on slopes, and overburden thicknesses of up to 170 m occur in the mine area.

Highest annual temperatures occur from December through February, when maximum daytime temperatures generally range from 10ºC to 22ºC, with lows between -5ºC and 5ºC. Winter months from June through August have daytime highs generally between -10ºC and 10ºC, and night time lows of -10ºC to -30ºC. Mean annual precipitation is estimated to be approximately 200 mm at 4,400 m elevation, with most of the precipitation arriving as snow. Winter conditions can be severe, with intense winds, blowing snow, and extreme cold, and can adversely affect mine access and operations. Rocks and gravel airborne by strong gusty winds are a common hazard in mine operations and on access roads. Local weather conditions are monitored by five meteorological stations across the site.

The mine is in the Rio de las Taguas watershed, with Despoblados, Potrerillos, Guanaco Zonzo, and Canito creeks comprising the other major perennial streams in the mine area. Water supplies for Veladero are extracted from surface and groundwater sources in the Rio de las Taguas valley.

There is no permanent habitation in the area. Tudcum is the nearest village.

| | |

| Barrick Gold Corporation — Veladero Mine, Project #1682 | | Rev. 0Page 5-2 |

| Technical Report NI 43-101 – March 16, 2012 | |

| | |

| | www.rpacan.com |

6 HISTORY

The Veladero area was first explored in the late 1980’s by Argentine government geologists, who identified scattered gold anomalies in the Veladero Sur area and surrounding region during field examinations of hydrothermal alteration centers identified through satellite imagery. In 1988, administration of mineral rights in the region was transferred from the Federal to the Provincial government, and in 1989 San Juan Province established the IPEEM as the provincial mining entity responsible for holding title to certain of the Province’s mineral rights, and for soliciting and administering bids for exploration and mining licences in the Province.

Following a competitive bidding process completed by IPEEM in 1994, AGC, a Canadian junior exploration company, was awarded exploration rights to Veladero. AGC then entered into a 60:40 joint venture agreement with Lac Minerals (40%), which was acquired by Barrick a short time later.

In 1995, AGC assigned its interest to its subsidiary, MAGSA, and from 1996 through 1998 the MAGSA/Barrick joint venture successfully explored Veladero. Concurrently, Barrick, through its subsidiary BEASA, explored BEASA’s adjoining 100%-owned Ursulina Sur property as part of the Lama project. In early 1999, Homestake Mining acquired AGC, and intensified Veladero exploration, while Barrick advanced definition of the Filo Norte or Federico deposit on the Ursulina Sur property. The December 2001 merger of Homestake and Barrick resulted in Barrick gaining 100% indirect control of Veladero through MAGSA and BEASA.

Exploration by the Veladero joint venture initially focused on the Veladero Sur gold anomalies, but eventually moved north and encountered strongly anomalous gold mineralization associated with outcropping breccia bodies in the area of what is now the Amable deposit. Initial RC drilling in late 1995 defined a small resource in this zone (Brecha Agostina), and focused the joint venture’s exploration efforts on other breccia exposures on the property.

Since Veladero started production in 2005, the mine has produced over four million ounces of gold and over six million ounces of silver from approximately 142 million tonnes of ore averaging 1.25 grams per tonne gold and 14.7 grams per tonne silver. The production history details are described in Section 16.

| | |

| Barrick Gold Corporation — Veladero Mine, Project #1682 | | Rev. 0Page 6-1 |

| Technical Report NI 43-101 – March 16, 2012 | |

| | |

| | www.rpacan.com |

7 GEOLOGICAL SETTING AND

MINERALIZATION

REGIONAL GEOLOGY

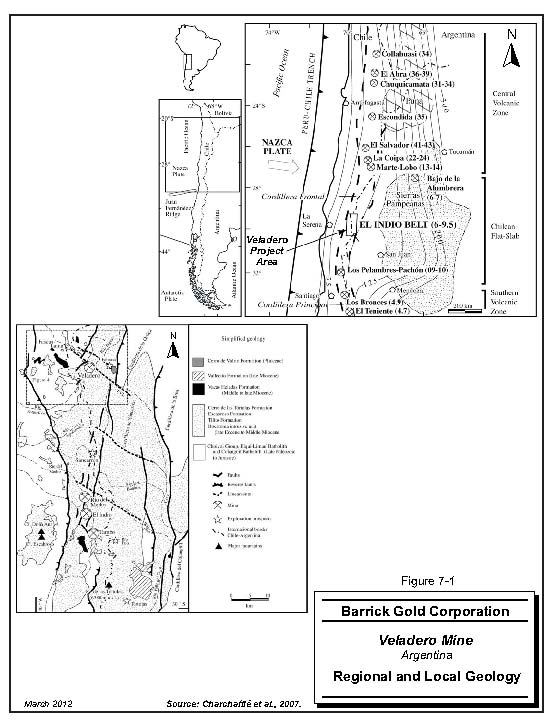

The Veladero deposit is situated at the north end of the El Indio Gold Belt, a 120 km by 25 km north-trending corridor of Permian to late Miocene volcanic and intrusive rocks, which host a number of hydrothermal alteration zones and epithermal mineral deposits (Figure 7-1). The belt consists of a Tertiary volcanic rift basin in which volcanic flows and tuffs were deposited and subsequently cut by associated intrusions. Basement rocks in the belt consist of andesitic to rhyolitic tuffs, lava flows, and volcaniclastic rocks of the Permo-Triassic Choiyoi Formation, which are overlain unconformably by Tertiary igneous and volcanic rocks ranging in age from older 40 Ma stocks to more recent 4 Ma tuffs, lava flows and volcaniclastic rocks. These volcanic rocks within the basin are grouped into five units, which from youngest to oldest are the Vallecito (5 Ma to 7 Ma), Vacas Heladas (9 Ma to 13 Ma), Cerro de las Tortolas (12 Ma to 19 Ma), Escabrosa (17 Ma to 21 Ma), and Tilito (21 Ma to 27 Ma). All of these units consist of felsic and intermediate-to-mafic volcanic rocks derived from volcanic centers located both within and outside of the mineralized belt.

The regional structural setting of the El Indio Gold Belt is dominated by fault and fracture sets associated with Tertiary east-west regional compression. The main fault set is a series of north-south striking reverse faults with associated east-west extensional fracture sets and 030º to 060º and 320º to 300º conjugate shear sets. Intrusive and volcanic centers are concentrated at structural intersections. The north-south reverse faults border the volcanic rift basin. These structural trends are important to the localization of mineralization at Veladero and at other deposits associated with the belt, including the El Indio, Pascua-Lama and Zancarron deposits.

The El Indio Gold Belt hosts both high and low sulphidation style mineralization over a 55 km strike length, from the Tambo-El Indio mines in the south to the Pascua-Lama project in the north. Epithermal mineralization within this belt is associated with Tertiary structural trends.

| | |

| Barrick Gold Corporation — Veladero Mine, Project #1682 | | Rev. 0Page 7-1 |

| Technical Report NI 43-101 – March 16, 2012 | |

| | |

| | www.rpacan.com |

FIGURE 7-1 REGIONAL AND LOCAL GEOLOGY

| | |

| Barrick Gold Corporation — Veladero Mine, Project #1682 | | Rev. 0Page 7-2 |

| Technical Report NI 43-101 – March 16, 2012 | |

| | |

| | www.rpacan.com |

LOCAL AND PROPERTY GEOLOGY

The Veladero deposit is a hypogene-oxidized, high sulphidation gold-silver deposit hosted by volcaniclastic sediments, tuffs, and volcanic breccias related to a Miocene diatreme-dome complex. Hydrothermal alteration is typical of high sulphidation gold deposits, with a silicified core grading outward into advanced argillic alteration, then into peripheral argillic and propylitic alteration haloes. Gold occurs as fine native grains, and is dominantly associated with silicification and with iron oxide or iron sulfate fracture coatings. Silver mineralization is distinct from gold, and occurs as a broader, more diffuse envelope, probably representing a separate mineralizing event. Copper and other base metals are insignificant, and sulfide mineralization is negligible. Principal controls on gold mineralization are structures, brecciation, alteration, host rocks, and elevation.

The Veladero deposit forms a broad, disseminated, three kilometre long blanket of mineralization along a N15ºW-striking structural trend. The diatreme-dome complex includes a massive, central, brecciated core of heterolithic, matrix-supported tuffisite that transitions outward through clast-supported breccias into the volcanic country rocks. A bedded tuff unit that represents fragments ejected from the central vent forms a ring that overlies portions of the tuffisite and breccias at the southern end of the deposit. The Veladero deposit comprises three main ore bodies: Amable in the south; Cuatro Esquinas in the center; and Filo Federico in the north. The Argenta ore body is a small satellite deposit located approximately five kilometres to the southeast of the Veladero deposit.

A variety of volcanic explosion breccias and tuffs are the principal host rocks at Cuatro Esquinas and Filo Federico, where alteration consists of intense silicification. The Amable ore body is hosted within bedded pyroclastic breccias and tuffs which are affected by silicification and advanced argillic alteration. Much of the Veladero deposit is covered by approximately 40 m of overburden and the overburden in some areas is up to 170 m thick. The colluvium is generally uncemented.

The water table at Veladero is deep, and is below the projected pit bottom elevation. There is also no known significant groundwater within the colluvial cover. The simplified lithology in the deposit area is shown in Figure 7-2.

| | |

| Barrick Gold Corporation — Veladero Mine, Project #1682 | | Rev. 0Page 7-3 |

| Technical Report NI 43-101 – March 16, 2012 | |

| | |

| | www.rpacan.com |

FIGURE 7-2 SIMPLIFIED LITHOLOGY DISTRIBUTION

| | |

| Barrick Gold Corporation — Veladero Mine, Project #1682 | | Rev. 0Page 7-4 |

| Technical Report NI 43-101 – March 16, 2012 | |

| | |

| | www.rpacan.com |

ALTERATION

The alteration assemblage is typical of high sulphidation deposits with a silica core grading outward into silica/alunite and then argillic alteration. The gold mineralization is dominantly associated with the silicified core, which is composed of silica, hematite, goethite and jarosite. Minor sulphide mineralization is present at less than one percent concentrations.

There are three main sectors, Amable in the south, Cuatro Esquinas in the centre, and Filo Federico to the north. The more recently discovered Argenta ore body represents a separate satellite sector located approximately five kilometres to the southeast of Amable. A variety of volcanic explosion breccias and tuffs are the principal host rocks at Federico and Cuatro Esquinas where alteration consists of intense silicification. Amable is hosted within bedded pyroclastic breccias and tuffs which are affected by both silicification and advanced argillic alteration. The intense silicification may be vuggy to massive. The surrounding country rocks are normally composed of argillically or propylitically altered intermediate volcanic flows, domes and volcaniclastic sediments.

A late-stage, silica-destructive event produced an intensely steam heated unit, concentrated around the main northwest-striking faults. This unit is highly altered and has very low rock strength.

The simplified alteration distribution in the deposit area is shown in Figure 7-3.

| | |

| Barrick Gold Corporation — Veladero Mine, Project #1682 | | Rev. 0Page 7-5 |

| Technical Report NI 43-101 – March 16, 2012 | |

| | |

| | www.rpacan.com |

FIGURE 7-3 SIMPLIFIED ALTERATION DISTRIBUTION

| | |

| Barrick Gold Corporation — Veladero Mine, Project #1682 | | Rev. 0Page 7-6 |

| Technical Report NI 43-101 – March 16, 2012 | |

| | |

| | www.rpacan.com |

MINERALIZATION

Precious metals mineralization at Veladero is controlled by stratigraphy, structural trends and elevation. Disseminated gold mineralization forms a 400 m to 700 m wide by three kilometre long tabular blanket localized between the 3,950 m and 4,400 m elevations. Veladero has been separated into three main sectors, Amable in the south, Cuatro Esquinas in the centre and Filo Federico to the north (Figure 7-4). All sectors of the deposit are characterized by the same high sulphidation style of mineralization.

The mineralized envelope encompassing greater than 0.2 g/t Au is oriented along a 345°-trending regional structural corridor. The mineralization is dominantly hosted in the diatreme breccias along the fault-bounded northwest trend. Within this trend, higher grade mineralized shoots, averaging approximately 4 g/t Au but with one metre values up to 100 g/t, with lengths of 300 m to 500 m, form along northeast striking structural trends and are surrounded by a halo of lower grade mineralization ranging between 0.1 g/t Au and 1.0 g/t Au.