FIRST QUARTER REPORT 2015

Barrick Reports First Quarter 2015 Results

| | • | | Production and costs in the first quarter were in line with operating plans. The company produced 1.39 million ounces of gold at all-in sustaining costs (AISC)1 of $927 per ounce and generated $316 million in operating cash flow. |

| | • | | Full-year gold operating guidance remains on track for 6.2-6.6 million ounces at all-in sustaining costs of $860-$895 per ounce, with higher production and lower costs expected in the second half of the year. All-in sustaining costs and cash costs are expected to be highest in the second quarter of the year. |

| | • | | The company remains committed to debt reduction of at least $3 billion by the end of 2015, with asset sales and other initiatives well advanced. |

| | • | | Detailed evaluation of all capital spending plans using a 15 percent hurdle rate is now underway. To date, we have identified $200 million in capital expenditure reductions for 2015, with further reductions expected as the evaluation proceeds. |

| | • | | Barrick is announcing a significant new gold discovery, known as Alturas, on Chile’s prolific El Indio belt. Drilling to date suggests Alturas is geologically similar to Veladero, with the potential to be significantly higher grade. |

| | • | | Barrick has formed a new partnership with Quantum Pacific Exploration, a company using innovative strategies and tools to increase the probability of discovery, faster than conventional approaches and at lower costs. |

| | • | | The Lumwana mine will continue operating following announcement of new tax system by the government of Zambia. Copper production guidance for 2015 has been increased to 480-520 million pounds, with C1 cash costs unchanged at $1.75-$2.00 per pound. |

| | • | | Value Realization Reviews underway to identify opportunities to maximize free cash flow, grow production and lower costs across the portfolio. |

TORONTO, April 27, 2015 – Barrick Gold Corporation (NYSE:ABX) (TSX:ABX) (Barrick or the company) met cost and production targets for the first quarter, reporting net earnings of $57 million ($0.05 per share). Adjusted net earnings were $62 million ($0.05 per share)1. Operating cash flow was $316 million. Gold production guidance for 2015 remains at 6.2-6.6 million ounces, with production 55 percent weighted to the second half of the year, in line with plan. Costs are also expected to be 20 percent lower in the second half of the year, with full-year all-in sustaining costs in line with guidance of $860-$895 per ounce.

1 All-in sustaining costs per ounce, adjusted net earnings and adjusted net earnings per share are non-GAAP financial performance measures with no standardized definition under IFRS. For further information and detailed reconciliations, please see pages 49-54 of Barrick’s First Quarter 2015 Report.

| | | | |

| BARRICK FIRST QUARTER 2015 | | 1 | | PRESS RELEASE |

TAKING BARRICK ‘BACK TO THE FUTURE’

We have revitalized the Board of Directors and the management team; implemented a lean, decentralized operating model to drive greater free cash flow per share; adopted a rigorous capital allocation framework with a minimum hurdle rate of 15 percent; implemented a concrete strategy to reduce debt by at least $3 billion this year; and restored the company’s original partnership culture with the appointment of 35 new partners and the creation of the most owner-centric, long-term compensation system of any company in Canada and within our industry.

We now have superb people, in the right roles, focused on the right things. In our new decentralized model, our miners are free from bureaucracy and are focused on maximizing free cash flow. A small head office is focused on allocating that cash flow to maximize shareholder returns. Our leaders are owners, with deep financial and emotional ownership in the long-term success of the business.

We are determined to once again be the world’s leading gold company, a company that consistently grows free cash flow per share from a portfolio of the best gold assets in the best regions, delivering industry-leading returns to our owners.

BECOMING A TALENT-OBSESSED COMPANY

Barrick is obsessed with talent. People issues are the first topic at every weekly meeting of Barrick’s most senior leaders and the Board of Directors now regularly engages in in-depth talent diagnosis. Darian Rich, elevated to the role of Executive Vice President, Talent Management, reports on people issues at every Board meeting. The company has attracted 13 new senior leaders in the last nine months, individuals who personify the company’s original values and bring vital skills and experience that support the company’s business objectives, such as strengthening the balance sheet, fixing Pascua-Lama, improving efficiency and productivity, and building partnerships in China and beyond. Our newest addition is Dana Easthope. He will join the company in May as Vice President and Corporate Secretary. His first responsibility will be to bring greater depth, continuity, and strength to the relationship between our owners and the Board of Directors. Under his tenure as Corporate Secretary at Sun Life Financial, the company consistently appeared at the top of the Globe and Mail’s annual ranking of companies with the best corporate governance practices, placing first out of 250 companies in Canada in 2012 and 2013 and second in 2014.

RESTORING A STRONG BALANCE SHEET

As we take Barrick ‘back to the future’, no priority is more important than restoring a strong balance sheet. Prudent financial management is a bedrock principle of the company.

Our lean, decentralized operating model will maximize free cash flow per share—with more efficient and rigorous capital spending, reduced general and administrative costs, and profitable growth. These changes will contribute to the strength of our balance sheet over the long-term.

We remain committed to our debt reduction target of at least $3 billion by the end of 2015, and have moved quickly to advance a number of asset sales and joint venture opportunities:

| | | | |

| BARRICK FIRST QUARTER 2015 | | 2 | | PRESS RELEASE |

| | • | | Numerous companies have participated in the sales processes for the Cowal mine and the Porgera Joint Venture. Detailed due diligence on both assets is now underway, including site visits with prospective buyers. |

| | • | | We have begun a process for the sale of a stake in the Zaldívar copper mine in Chile. Zaldívar is a consistently strong performer in the world’s best jurisdiction for copper mining. Potential buyers have expressed a strong interest in acquiring an interest in the mine. |

| | • | | We are actively exploring a number of other joint venture and sales opportunities. |

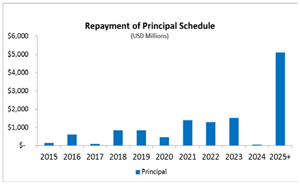

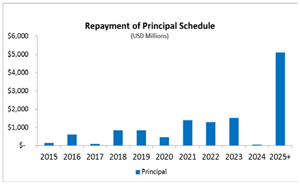

We will take only those actions that make sense for the business, on terms we consider most favorable to our owners. Our strong liquidity means we can proceed with patience and discipline. We have less than $900 million in debt due over the next three years, a $4 billion undrawn credit facility, and $2.3 billion2 in cash at the end of the first quarter.

CAPITAL ALLOCATION

Barrick has returned to a lean, decentralized operating model with minimal bureaucracy. Our operational leaders are focused on maximizing free cash flow, and the head office, now about half the size it was a year ago, is focused on allocating that cash flow to maximize long-term value for our owners.

At the end of 2014, we implemented a rigorous new capital allocation framework that goes beyond anything Barrick has undertaken in the past. We expect our portfolio to deliver a 10-15 percent return on invested capital through metal price cycles and, as such, individual projects are assessed against a hurdle rate of 15 percent. We will defer, cancel or sell projects that cannot achieve this target.

The capital we invest to sustain or increase production at our existing operations is not spread evenly across the portfolio. Our operations must compete for it. Capital will flow to mines that meet our overall expectations for returns on invested capital. Assets that are unable to meet our capital allocation objectives will be sold.

We are bringing this level of rigor to every part of the business. We have launched a detailed evaluation of all capital expenditures for 2015 and 2016. All spending plans will be re-assessed against our capital allocation objectives, including a minimum hurdle rate of 15 percent return on invested capital. Expenditures that do not meet our capital allocation objectives will be cancelled or deferred.

We have already identified $200 million in capital expenditure reductions for 2015, with further reductions expected as we continue to implement our new capital allocation framework. We will report further progress with our second quarter results.

The reductions identified thus far have been partially offset by an increase in copper sustaining capital following our decision to continue operations at Lumwana. As a result, our total capital expenditure guidance for 2015 has been reduced by $100 million to $1.8-$2.1 billion.

2 Includes $417 million cash held at Acacia and Pueblo Viejo, which may not be readily deployed outside of Acacia and/or Pueblo Viejo.

| | | | |

| BARRICK FIRST QUARTER 2015 | | 3 | | PRESS RELEASE |

OPERATIONAL EXCELLENCE

We remain on track to achieve our overall target of $30 million in savings from reduced general and administrative expenditures and overhead costs in 2015, reaching $70 million in annualized savings by 2016. We expect more to follow, as our operational leaders focus on maximizing free cash flow without the constraints of bureaucracy and unnecessary management layers.

A multidisciplinary team of Barrick’s leading mining experts and independent technical specialists is also in the process of reassessing the economic potential of every Barrick mine, identifying specific projects to maximize free cash flow, increase production and lower costs. Known as the Value Realization Project, these reviews also support our non-core asset sale process by ensuring we understand the full value of every mine before we proceed with any divestiture.

Value Realization reviews are well underway for 10 operations, including our five core mines. Upside opportunities identified as part of the process will be incorporated into current mine plans where the initiatives meet our 15 percent hurdle rate or, where more engineering work and evaluations are required, may be added to mine plans for 2016 and beyond, strengthening our long term business plans. See the Cautionary Statement on Forward-Looking Information on page 25 of this press release.

As one example, the Valuation Realization process completed at Barrick’s Pueblo Viejo mine has identified a number of initiatives designed to increase efficiencies and create substantial value (100 percent basis) to the already successful operation. Key initiatives include:

| | • | | Increasing processing plant throughput by 2019: By making a series of on-going upgrades to the processing plant requiring capital expenditures of approximately $20 million, Barrick anticipates that it could increase plant throughput capacity by up to an additional 10 percent. |

| | • | | Converting the fuel supply at the Quisqueya I power plant from heavy fuel oil to liquefied natural gas (LNG): By converting the fuel supply at the Quisqueya I power plant, which provides electricity to the Pueblo Viejo mine, from heavy fuel oil to LNG, Barrick anticipates that it could significantly reduce power plant operating costs. This initiative is expected to require minimal capital from Barrick, as the power plant is designed to operate on both fuels and could be completed as early as the end of 2017. |

| | • | | Mine plan enhancements: Approximately 7-8 million ounces of mineral resources may potentially be converted into mineral reserves, extending the mine life, as a result of continued optimization efforts and by removing tailings capacity and other constraints and bottlenecks in mining and processing, using Barrick’s current price guidance for reserves. This initiative is expected to require incremental capital expenditures over the life of mine of between $120-$150 million. |

| | • | | Lime Kilns Fuel Conversion by 2017: By converting the fuel supply for the lime kilns at Pueblo Viejo from diesel fuel to LNG, Barrick anticipates that it can reduce energy consumption, costs and greenhouse gas emissions. This initiative will require capital expenditures of approximately $25 million over 18 months, with a payback period of approximately three years. |

| | | | |

| BARRICK FIRST QUARTER 2015 | | 4 | | PRESS RELEASE |

Barrick will complete the technical analysis of these initiatives while its Value Realization team continues its site-by-site review. An updated Technical Report for Pueblo Viejo will be filed by the applicable filing deadline. We expect to provide more details about our Value Realization Project on a quarterly basis.

GROWTH IN THE AMERICAS

Barrick’s five core mines in the Americas are expected to account for 60 percent of our production in 2015 at average all-in sustaining costs of $725-$775 per ounce. At two grams per tonne, these mines have an average reserve grade more than double that of our peer group average. They generate strong free cash flow in today’s gold price environment and offer exceptional leverage to higher gold prices.

We maintain a strong competitive advantage in Nevada and the Andes, with a growing pipeline of projects that have the potential to grow free cash flow per share:

| | • | | Four prefeasibility studies on growth projects in Nevada will be completed by the end of this year; |

| | • | | We have formed an innovative new partnership for exploration in Chile; |

| | • | | We intend to initiate a prefeasibility study to extend the life of the Lagunas Norte mine in Peru; and |

| | • | | We are also announcing a significant new gold discovery on the El Indio belt in Chile. |

Alturas – A significant new gold discovery

Approximately 85 percent of our 2015 exploration budget of $220-$260 million is allocated to the Americas, where our teams have uncovered some of the largest gold discoveries in recent decades, including the Lagunas Norte and Goldrush deposits.

Today we are announcing another significant new gold discovery known as Alturas, located in the Andean region of Chile approximately 30 kilometers south of the former El Indio mine.

Alturas is part of a large mineralized system which extends well beyond the limits of the current drilling area. To date, 35 core holes have been completed in a one-square-kilometer area. Mineralization appears to be oxide in nature and geologically similar to Veladero, with the potential to be significantly higher grade. Intercepts have been thick (typically ranging from 50-150 meters) and continuous.

Assay results for the significant intercepts are provided in Appendix 3 and include the following highlights:

| | • | | ALT-011: 97 meters grading 4.4 grams per tonne |

| | • | | ALT-017: 103.5 meters grading 1.64 grams per tonne |

| | • | | ALT-033: 170 meters grading 2.76 grams per tonne |

| | | | |

| BARRICK FIRST QUARTER 2015 | | 5 | | PRESS RELEASE |

This region of the Andes is home to some of the world’s largest gold deposits, including Veladero, Pascua-Lama, El Indio and Tambo. Barrick controls almost all of the prospective ground on the 140 kilometer long El Indio belt. The new discovery at Alturas is the result of a methodical re-evaluation of the El Indio belt led by our exploration team, including members of the teams behind the Goldrush and Lagunas Norte discoveries. Drilling at Alturas will continue until the end of the summer season in May. With mineralization open in multiple directions, the focus going forward will be on defining the full extent of the deposit, as well as exploring for additional targets nearby. While we expect to report an initial resource at the end of the year, the potential quantities and grades in these preliminary results are conceptual in nature and there has been insufficient exploration to define a mineral resource at this time and it is uncertain that further exploration will result in the target being delineated as a mineral resource.

Lagunas Norte Mine Life Extension

Since it began operations in 2005, Lagunas Norte has outperformed production expectations. In 2014, the mine produced 582,000 ounces of gold at all-in sustaining costs of $543 per ounce. In its early years, production peaked at more than one million ounces per year. To date, Lagunas Norte has operated as an oxide heap leach mine. Barrick is currently evaluating a plan to significantly extend the life of Lagunas Norte by mining the refractory ore below the oxide ore body in the current pit. We intend to initiate a prefeasibility study to evaluate this opportunity. As part of the study, we intend to evaluate the installation of a new grinding-flotation-autoclave processing circuit to treat the refractory ore, including the potential relocation of one autoclave from the Goldstrike mine to Lagunas Norte.

Innovative exploration partnership with QPX

Barrick’s focus is gold. As we have said, we have no plans to expand our existing copper position. Yet we do seek to maximize the value of those assets we already own, including large land positions in Chile in some of the world’s most prolific districts for copper. Thus we have formed a strategic partnership with Quantum Pacific Exploration (QPX) to explore for copper deposits in a number of highly prospective areas of northern Chile.

QPX is a company that focuses on exploring for one mineral commodity—copper—in one country—Chile. It is a part of the Quantum Pacific Group, an international business that includes some of the most innovative companies in natural resources, energy and commodities. Consistent with that theme, QPX is pioneering a new, multidisciplinary approach to exploration. The company has built a world-class team of experts who have a proven track record of copper discoveries and expertise in machine learning and big data analysis, among other disciplines. Their internal R&D lab uses proprietary technology to develop new strategies and tools designed to increase the probability of discovery, faster than conventional approaches and at lower costs. They combine world-class technical expertise with cutting-edge computer science, and they bring in learning from other industries to develop non-traditional approaches.

| | | | |

| BARRICK FIRST QUARTER 2015 | | 6 | | PRESS RELEASE |

QPX also shares Barrick’s spirit of collaboration and regularly seeks out joint ventures with companies that are complementary in assets and expertise. Under the terms of our agreement, QPX will manage the exploration program. Any gold deposits located on Barrick land will remain 100 percent Barrick-owned. If a copper project is identified on either Barrick or QPX land, it will be 50 percent owned by each company. Certain properties where Barrick is already actively exploring, including zones around Zaldívar, Pascua-Lama, Cerro Casale and El Indio, are excluded from the agreement.

The agreement is for five years, with an option to extend for another three years. The partners will contribute up to $30 million per year for exploration, with each bearing 50 percent of the total costs.

Four Nevada Prefeasibility Studies on Track for Delivery in 2015

The Goldrush project, located six kilometers from the Cortez mine, is one of the largest and highest grade gold discoveries of the last decade. The prefeasibility study is now expected to be complete by the end of 2015. Permitting is progressing for twin exploration declines that will allow the company to better explore the northern limits of the known deposit.

At the Turquoise Ridge mine (75 percent owned by Barrick), we are advancing a project to develop an additional shaft, which could bring forward more than one million ounces of production, roughly doubling output to an average of 500,000 ounces per year (100 percent basis) at all-in sustaining costs of about $625-$675 per ounce. The joint venture partners have approved a feasibility study and detailed engineering for the project. Pending receipt of permits and joint venture approval, initial production could commence in 2019. Preliminary estimates indicate capital expenditures of approximately $300-$325 million (100 percent basis) for additional underground development and shaft construction, and an attractive payback period of about two and a half years at a gold price assumption of $1,300 per ounce. Drilling will continue in 2015 at the northern extension of the deposit where the ore body is still open to the north and east with higher grades than the average reserve grade.

A prefeasibility study for expanded underground mining at Cortez below currently permitted levels will be completed in late 2015. Mineralization in this zone is primarily oxide and higher grade compared to the current underground mine, which is refractory in nature. The limits of the Lower Zone have not yet been defined, and drilling has indicated the potential for new targets at depth.

The Spring Valley project (75 percent owned by Barrick) is located approximately 75 miles west of Cortez, is a low capital cost, oxide heap leach project with potential to become another standalone mine in Nevada. In addition, there is good potential to expand the current resource at higher gold prices. The company is on track to complete a prefeasibility study in late 2015.

FINANCIAL DISCUSSION

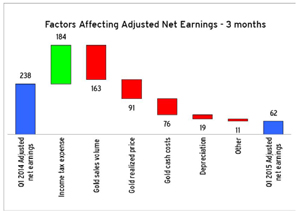

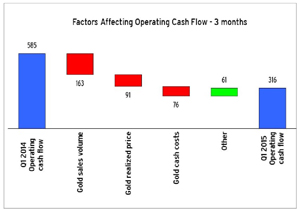

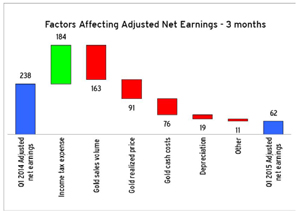

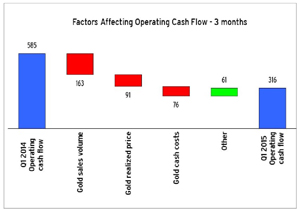

First quarter 2015 net earnings were $57 million ($0.05 per share) compared to $88 million ($0.08 per share) in the prior year period. Operating cash flow in the first quarter was $316 million compared to $585 million in the first quarter of 2014. Lower net earnings and operating cash flow reflect lower realized gold and copper prices, and lower gold sales compared to the prior year period. Adjusted net

| | | | |

| BARRICK FIRST QUARTER 2015 | | 7 | | PRESS RELEASE |

earnings for the first quarter were $62 million ($0.05 per share) compared to $238 million ($0.20 per share) in the first quarter of 2014. Significant adjusting items (net of tax and non-controlling interest effects) in the quarter include:

| | • | | $22 million in gains from asset dispositions; |

| | • | | $13 million adjustment reflecting the use of a lower discount rate to calculate the provision for environmental remediation at our closed mines; and |

| | • | | $6 million in unrealized foreign currency translation losses. |

Barrick expects to be free cash flow positive in 2015 at current gold prices.

OPERATING HIGHLIGHTS AND GUIDANCE

Gold production guidance for 2015 is 6.2-6.6 million ounces at AISC of $860-$895 per ounce. Production will be approximately 55 percent weighted to the second half of the year and costs are expected to be 20 percent lower in that period. Additionally, all-in sustaining costs and cash costs are expected to be highest in the second quarter of the year.

Following the decision to continue operations at Lumwana, total copper guidance for 2015 is now expected to be 480-520 million pounds at C1 cash costs of $1.75-$2.00 per pound.

| | | | | | | | | | | | |

| Gold | | First Quarter 2015 | | | Revised 2015 Guidance | | | Previous 2015 Guidance | |

Production (000s of ounces)3 | | | 1,390 | | | | | | | | 6,200-6,600 | |

All-in sustaining costs ($ per ounce) | | | 927 | | | | | | | | 860-895 | |

Cash costs ($ per ounce)4 | | | 642 | | | | | | | | 600-640 | |

| | | |

Copper | | | | | | | | | | | | |

Production (millions of pounds) | | | 118 | | | | 480-520 | | | | 310-340 | |

C1 cash costs ($ per pound)4 | | | 1.84 | | | | | | | | 1.75-2.00 | |

Total Capital Expenditures ($ millions)5 | | | 456 | | | | 1,800-2,100 | | | | 1,900-2,200 | |

Cortez

The Cortez mine produced 133,000 ounces at AISC of $962 per ounce in the first quarter. Production was higher than expected due to higher grades in both the open pit and underground as well as improved productivity. Costs benefited from higher production as well as lower capitalized stripping. Production at Cortez in 2015 is expected to be 825,000-900,000 ounces at AISC of $760-$835 per ounce. Production is expected to be higher in the second half of 2015 as the open pit mine transitions

3 Barrick’s share.

4 Cash costs per ounce and C1 cash costs per pound are non-GAAP financial performance measures. See pages 49-54 of Barrick’s First Quarter 2015 Report.

5 Barrick’s share on a 100% accrued basis.

| | | | |

| BARRICK FIRST QUARTER 2015 | | 8 | | PRESS RELEASE |

into higher grade material and with the ramp-up of the thiosulfate circuit (TCM) at the Goldstrike mine, which allows for processing of refractory ore from Cortez.

As part of our drive for operational excellence, the mine has identified opportunities to reduce costs by targeting energy costs, contractor services and labor and other process changes.

Goldstrike

The Goldstrike mine contributed 207,000 ounces in the first quarter at AISC of $876 per ounce, largely in line with expectations. The TCM process is an innovative and proprietary technology developed by Barrick which does not use cyanide. Several adjustments are being implemented to improve the throughput of the TCM circuit during the commissioning stage in order to meet the original ramp-up schedule. Production guidance for Goldstrike in 2015 remains unchanged at 1.00-1.15 million ounces and will be largely weighted to the second half of the year as a result of the ramp-up of the TCM circuit. AISC guidance for 2015 is unchanged at $700-$800 per ounce.

Goldstrike is anticipated to continue producing at the one million ounce level for the next three years (2015-2017) at AISC below $900 per ounce. The mine has targeted improved operating performance and reduced costs through better integration of maintenance and supply chain, which is resulting in inventory reductions and improvements in underground contractor costs.

Pueblo Viejo

Barrick’s 60 percent share of production from Pueblo Viejo for the first quarter was 135,000 ounces at AISC of $675 per ounce. Production in the quarter was weaker than planned due to lower grades and recoveries. Costs were impacted primarily by lower gold ounces sold, as well as weaker silver recoveries. Attributable production in 2015 is forecast to be 625,000-675,000 ounces at AISC of $540-$590 per ounce. Production is expected to be stronger in the second half of the year on higher grades and improved autoclave availability, with maintenance shutdowns weighted to the first half of 2015. Operating costs in the second half are also expected to benefit from higher by-product credits. The mine’s first copper concentrate sales are expected to begin in the second quarter.

Annual production of more than one million ounces (100 percent basis) at AISC below $700 per ounce is expected for the next three years (2015-2017). Several improvement initiatives are underway including improving ore blending and autoclave availability, and optimizing maintenance strategies. Longer-term, Pueblo Viejo has significant resources that are not currently in the mine plan but have the potential to extend the life of the mine.

Lagunas Norte

Lagunas Norte contributed 178,000 ounces at AISC of $461 per ounce in the first quarter. Production was stronger than expected due to higher recoveries. Costs benefited from higher ounces sold, lower operating costs and lower sustaining capital. Production in 2015 is anticipated to be 600,000-650,000 ounces at AISC of $675-$725 per ounce in 2015, with lower recoveries expected in the second half.

| | | | |

| BARRICK FIRST QUARTER 2015 | | 9 | | PRESS RELEASE |

The mine continues to explore opportunities to improve efficiencies and reduce costs through several initiatives including reducing leach pad inventory, improving the maintenance strategy for mine fleet engines, reducing cyanide consumption and reducing G&A costs.

Veladero

The Veladero mine produced 149,000 ounces of gold in the first quarter at AISC of $991 per ounce. Positive grade reconciliations continued, resulting in higher than expected production. Costs benefited from lower sustaining capital. Production guidance for 2015 is 575,000-625,000 ounces at AISC of $990-$1,075 per ounce.

The mine is targeting cost savings through improved operating performance and more efficient maintenance and blasting activities, reduced contractor costs and recovery of inventory ounces through better management of the leach pad.

Turquoise Ridge

The Turquoise Ridge mine had a strong first quarter, contributing 49,000 ounces (75 percent basis) at AISC of $709 per ounce, driven by increased tonnage and higher grades as well as improved productivity. Costs were lower than planned primarily due to lower sustaining capital expenditures. The mine is forecast to produce 175,000-200,000 ounces (75 percent basis) in 2015 at AISC of $875-$925 per ounce.

Initiatives are underway to improve operating performance and reduce costs through increased productivity, including enhancing tonnage per foot mined by increasing mining dimensions.

Porgera

The Porgera mine produced 118,000 ounces (95 percent basis) in the first quarter at AISC of $1,064 per ounce. Production was impacted by lower throughput and mill availability. Costs were lower than expected primarily as a result of reduced power and diesel usage and lower sustaining capital. In 2015, production is expected to be 500,000-550,000 ounces at AISC of $1,025-$1,125 per ounce.

The company is evaluating a number of initiatives with the potential to further reduce costs at Porgera. These include lowering energy costs through an alternative electricity supply project and reducing the number of expatriate staff and other external spending.

Other Mines

Barrick’s other mines—consisting of Bald Mountain, Round Mountain, Ruby Hill, Golden Sunlight, Hemlo, Cowal and KCGM—contributed 303,000 ounces at AISC of $987 per ounce in the first quarter.

Acacia Mining

Barrick’s share of first quarter production was 116,000 ounces at AISC of $1,117 per ounce. 2015 production from Acacia is anticipated to be 480,000-510,000 ounces at AISC of $1,050-$1,100 per

| | | | |

| BARRICK FIRST QUARTER 2015 | | 10 | | PRESS RELEASE |

ounce. Production will be weighted to the second half of 2015, driven by operational improvements and a planned ramp-up at Bulyanhulu.

Global Copper

Copper production in the first quarter was 118 million pounds at C1 cash costs of $1.84 per pound. For 2015, copper production is anticipated to be 480-520 million pounds at C1 cash costs of $1.75-$2.00 per pound.

Lumwana contributed 66 million pounds at C1 cash costs of $1.89 per pound in the first quarter. On April 20, 2015, the Zambian government announced amendments to the country’s mining tax regime that would replace the recently adopted 20 percent gross royalty on open pit mines with a nine percent royalty, along with the reintroduction of a 30 percent corporate income tax and a 15 percent variable profits tax. Based on our initial analysis, this system would enable Lumwana to remain free cash flow positive at current copper prices. As a result, we will continue operations at Lumwana. Production is anticipated to be 250-270 million pounds at C1 cash costs of $1.90-$2.15 per pound in 2015.

The Zaldívar mine produced 52 million pounds in the first quarter at C1 cash costs of $1.77 per pound. Production was impacted by an extreme rainfall event that affected mines across Chile’s Atacama region. The mine continues to be a steady generator of free cash flow and production is anticipated to be 230-250 million pounds at C1 cash costs of $1.65-$1.95 per pound in 2015.

Construction to complete safety and security infrastructure has begun at Jabal Sayid, and first shipments of low-cost copper-in-concentrate are anticipated in early 2016. Once the mine reaches full production, the average annual output is expected to be 100 million pounds per year with the potential to increase to 130 million pounds.

Qualified Person

Scientific and technical information relating to exploration at the company’s Alturas property contained in this press release has been reviewed and approved by Robert Krcmarov, Senior Vice President, Global Exploration of Barrick. Scientific and technical information relating to the Value Realization Project at the company’s 60 percent owned Pueblo Viejo mine contained in this press release has been reviewed and approved by Rick Sims, Senior Director, Resources and Reserves of Barrick, Steven Haggarty, Senior Director, Metallurgy of Barrick and Patrick Garretson, Director, Life of Mine Planning of Barrick. Each of Messrs. Krcmarov, Sims, Haggarty and Garretson is a “Qualified Person” as defined in National Instrument 43-101 - Standards of Disclosure for Mineral Projects.

Quality Assurance and Quality Control

The drilling results for the Alturas property contained in this press release have been prepared in accordance with National Instrument 43-101 - Standards of Disclosure for Mineral Projects. All drill hole assay information has been manually reviewed and approved by staff geologists and re-checked by the project manager. Sample preparation and analyses are conducted by an independent laboratory. Procedures are employed to ensure security of samples during their delivery from the

| | | | |

| BARRICK FIRST QUARTER 2015 | | 11 | | PRESS RELEASE |

drill rig to the laboratory. The quality assurance procedures, data verification and assay protocols used in connection with drilling and sampling on the Alturas property conform to industry accepted quality control methods.

| | | | |

| BARRICK FIRST QUARTER 2015 | | 12 | | PRESS RELEASE |

APPENDIX 1 —Detailed 2015 Operating and Capital Expenditure Guidance

| | | | | | |

| GOLD PRODUCTION AND COSTS | | |

| | | Production

(millions of ounces) | | AISC6 ($ per ounce) | | Cash Costs7 ($ per ounce) |

Cortez | | 0.825-0.900 | | 760-835 | | 560-610 |

Goldstrike | | 1.000-1.150 | | 700-800 | | 540-590 |

Pueblo Viejo (60%) | | 0.625-0.675 | | 540-590 | | 390-425 |

Lagunas Norte | | 0.600-0.650 | | 675-725 | | 375-425 |

Veladero | | 0.575-0.625 | | 990-1,075 | | 600-650 |

Sub-total | | 3.800-4.000 | | 725-775 | | 500-540 |

Porgera (95%) | | 0.500-0.550 | | 1,025-1,125 | | 775-825 |

Acacia (63.9%) | | 0.480-0.510 | | 1,050-1,100 | | 695-725 |

KCGM (50%) | | 0.315-0.330 | | 915-940 | | 775-800 |

Cowal | | 0.250-0.280 | | 740-775 | | 630-655 |

Hemlo | | 0.200-0.225 | | 940-980 | | 675-715 |

Turquoise Ridge (75%) | | 0.175-0.200 | | 875-925 | | 570-600 |

Round Mountain (50%) | | 0.170-0.190 | | 1,180-1,205 | | 875-900 |

Bald Mountain | | 0.170-0.195 | | 1,060-1,100 | | 560-600 |

Golden Sunlight | | 0.090-0.105 | | 1,000-1,025 | | 740-765 |

Total Gold | | 6.200-6.6008 | | 860-895 | | 600-640 |

| | | | | | | |

| COPPER PRODUCTION AND COSTS | | | | |

| | | Production (millions of pounds) | | C1 cash costs

($ per pound) | | C3 fully allocated costs9,10

($ per pound) |

Zaldívar | | 230-250 | | 1.65-1.95 | | 2.00-2.30 |

Lumwana | | 250-270 | | 1.90-2.15 | | 2.65-2.95 |

Total Copper | | 480-520 | | 1.75-2.00 | | 2.35-2.65 |

| | | |

| | | | | | | |

| CAPITAL EXPENDITURES | | | | |

| | | ($ millions) | | | | |

Mine site sustaining | | 1,500-1,70011 | | | | |

Mine site expansion | | 150-200 | | | | |

Projects | | 150-200 | | | | |

Total | | 1,800-2,10011 | | | | |

6 All-in sustaining costs are calculated in accordance with the standard published by the World Gold Council (“WGC”). See page 50 of Barrick’s First Quarter 2015 Report for further details.

7 Cash costs reflect our equity share of unit production costs, including the impact of by-product credits, which is calculated in accordance with the standard published by the WGC. See page 50 of Barrick’s First Quarter 2015 Report for further details.

8 Operating unit guidance ranges reflect expectations at each individual operating unit, but do not add up to corporate-wide guidance range total.

9 C3 fully allocated costs per pound is a non-GAAP financial performance measure. See pages 49-54 of Barrick’s First Quarter 2015 Report.

10 As a result of the decision to continue operations at Lumwana, we now expect copper production to be in the range of 480-520 million lbs and C3 fully allocated costs to be in the range of $2.35-$2.65 per pound compared to our previous guidance ranges of 310-340 million lbs and $2.30-$2.60 per pound, respectively.

11 We now expect minesite sustaining capital expenditures to be in the range of $1,500-$1,700 million and total capital expenditures to be in the range of $1,800-$2,100 million compared to our previous guidance ranges of $1,600-$1,800 million and $1,900-$2,200 million, respectively.

| | | | |

| BARRICK FIRST QUARTER 2015 | | 13 | | PRESS RELEASE |

APPENDIX 2 —Outlook Assumptions and Economic Sensitivity Analysis

| | | | | | | | | | |

| | | 2015 Guidance

Assumption | | Hypothetical

Change | | Impact on

AISC12 | | EBITDA12

(millions) | | |

Gold revenue, net of royalties | | $1,200/oz13 | | +/- $100/oz | | n/a | | $495 | | |

Copper revenue, net of royalties | | $2.60/lb | | +/- $0.50/lb | | n/a | | $119 | | |

Gold all-in sustaining costs | | | | | | | | | | |

Gold royalties & production taxes | | $1,200/oz | | $100/oz | | $3/oz | | $15 | | |

WTI crude oil price14, 15 | | $50/bbl | | $10/bbl | | $3/oz | | $13 | | |

Australian dollar exchange rate14 | | 0.80 : 1 | | +10% | | ($4)/oz | | ($19) | | |

Australian dollar exchange rate14 | | 0.80 : 1 | | -10% | | $4/oz | | $19 | | |

Canadian dollar exchange rate14 | | 1.25 : 1 | | +10% | | $2/oz | | $9 | | |

Canadian dollar exchange rate14 | | 1.25 : 1 | | -10% | | ($3)/oz | | ($15) | | |

Copper C1 cash costs | | | | | | Impact on C1 | | | | |

WTI crude oil price14,15 | | $50/bbl | | $10/bbl | | $0.00/lb | | $1 | | |

Chilean peso exchange rate14 | | 610 : 1 | | +10% | | $0.03/lb | | $7 | | |

Chilean peso exchange rate14 | | 610 : 1 | | -10% | | ($0.07)/lb | | ($17) | | |

12 All-in sustaining costs (AISC) and EBITDA are non-GAAP financial performance measures with no standard definition under IFRS. For further information and a detailed reconciliation, please see pages 49-54 of Barrick’s First Quarter 2015 Report.

13 Our outlook assumes an average gold price of $1,200 per ounce for the remainder of 2015, compared to our original assumption of $1,250 per ounce.

14 Due to our hedging activities, which are reflected in these sensitivities, we are partially protected against changes in these factors.

15 Impact on EBITDA only reflects contracts that mature in 2015.

| | | | |

| BARRICK FIRST QUARTER 2015 | | 14 | | PRESS RELEASE |

APPENDIX 3 —Alturas - Significant Intercepts16 through ALT-033

| | | | | | | | | | |

| Core Drill Hole | | Azimuth | | Dip | | Interval (m) | | Width (m)17 | | Au (g/t) |

CAR-01B | | 270 | | -70 | | 120.95 - 132 | | 11.05 | | 1.044 |

CAR-02 | | 90 | | -65 | | 113.3 - 142.9 | | 29.6 | | 1.110 |

| | | | | | 185 - 230 | | 45 | | 1.060 |

| | | | | | 251 - 264.5 | | 13.5 | | 0.742 |

| | | | | | 327.7 - 341 | | 13.3 | | 0.723 |

| | | | | | | 366 - 422.4 | | 56.4 | | 0.666 |

CAR-03 | | 90 | | -70 | | 267 - 287.5 | | 20.6 | | 1.042 |

CAR-04 | | 90 | | -70 | | 221 - 264.4 | | 43.4 | | 1.067 |

| | | | | | | 304 - 314.6 | | 10.6 | | 2.331 |

CAR-05 | | 270 | | -70 | | 312.4 - 338.4 | | 26 | | 0.825 |

CAR-06A | | 90 | | -70 | | 191.6 - 275.118 | | 81.518 | | 2.597 |

ALT-007/007W | | 90 | | -65 | | 343.5 - 403.3 | | 59.8 | | 2.198 |

| | | | | | | 438.5 - 501 | | 62.5 | | 2.312 |

ALT-008A | | 90 | | -65 | | 185 - 196.4 | | 11.5 | | 1.111 |

| | | | | | | 236 - 28718 | | 50.518 | | 1.614 |

ALT-009 | | 90 | | -70 | | 257.2 - 333.3 | | 76.2 | | 2.747 |

| | | | | | | 353.6 - 365 | | 11.4 | | 0.944 |

ALT-010/010W | | 90 | | -70 | | 178.6 - 34918 | | 168.318 | | 1.661 |

| | | | | | | 381.8 - 393.3 | | 11.5 | | 0.574 |

ALT-011 | | 90 | | -70 | | 194 - 291 | | 97 | | 4.400 |

| | | | | | | 323 - 351 | | 28 | | 1.330 |

ALT-015 | | 135 | | -80 | | 188 - 214.818 | | 23.818 | | 6.074 |

| | | | | | | 303 - 443 | | 140 | | 1.003 |

ALT-016 | | 85 | | -73 | | 224 - 233 | | 9 | | 1.121 |

ALT-017 | | 93 | | -69 | | 106.8 - 210.3 | | 103.5 | | 1.641 |

ALT-018 | | 90 | | -75 | | 202.2 - 214.2 | | 12 | | 3.902 |

| | | | | | | 238.2 - 404 | | 165.8 | | 2.129 |

ALT-019A | | 90 | | -69 | | 124 - 238 | | 114 | | 2.044 |

| | | | | | 268 - 316 | | 48 | | 0.945 |

| | | | | | | 328 - 340 | | 12 | | 0.580 |

ALT-020 | | 88 | | -69 | | 132.6 - 198 | | 65.4 | | 1.207 |

| | | | | | 273 - 288 | | 15 | | 0.845 |

16 All significant intercepts calculated using a 0.5 gpt Au cutoff and are uncapped; internal dilution included using reasonable professional discretion (generally less than 10% of total width).

17 General geometry of mineralized body is sub-horizontal; true width of intercepts are uncertain at this stage.

18 Interval and width differ due to exclusion of no core recovery zone from calculation of the weighted average gold grade.

| | | | |

| BARRICK FIRST QUARTER 2015 | | 15 | | PRESS RELEASE |

| | | | | | | | | | |

| Core Drill Hole | | Azimuth | | Dip | | Interval (m) | | Width (m)17 | | Au (g/t) |

| | | | | | | 355 - 366.8 | | 11.8 | | 2.459 |

ALT-021A | | 91 | | -71 | | 162 - 286 | | 124 | | 1.841 |

| | | | | | 310 - 328 | | 18 | | 0.869 |

| | | | | | 338 - 358 | | 20 | | 2.792 |

| | | | | | | 394 - 415 | | 21 | | 13.100 |

ALT-022 | | 90 | | -75 | | 154 - 204 | | 50 | | 0.809 |

ALT-024 | | 90 | | -69 | | 229 - 249 | | 20 | | 1.566 |

ALT-026 | | 93 | | -58 | | 256 - 305.5 | | 44.5 | | 1.319 |

| | | | | | | 337 - 361 | | 24 | | 1.197 |

ALT-027 | | 88 | | -69 | | 203 - 24718 | | 41.118 | | 3.065 |

ALT-029 | | 267 | | -59 | | 188 - 198 | | 10 | | 4.933 |

ALT-030 | | 270 | | -64 | | 189 - 235 | | 46 | | 0.905 |

ALT-031 | | 268 | | -60 | | 150 - 191 | | 41 | | 1.185 |

| | | | | | | 203 - 212.5 | | 9.5 | | 2.559 |

ALT-032 | | 92 | | -68 | | 144 - 154 | | 10 | | 0.798 |

| | | | | | | 214 - 280 | | 66 | | 0.744 |

ALT-033 | | 63 | | -88 | | 149 - 319 | | 170 | | 2.761 |

| | | | |

| BARRICK FIRST QUARTER 2015 | | 16 | | PRESS RELEASE |

Key Statistics

| | | | | | | | |

| Barrick Gold Corporation | | | | | | |

| (in United States dollars) | | Three months ended March 31, | |

| | | | |

| | | 2015 | | | 2014 | |

| |

Operating Results | | | | | | | | |

Gold production (thousands of ounces)1 | | | 1,390 | | | | 1,588 | |

Gold sold (thousands of ounces)1 | | | 1,385 | | | | 1,618 | |

Per ounce data | | | | | | | | |

Average spot gold price | | $ | 1,218 | | | $ | 1,293 | |

Average realized gold price2 | | | 1,219 | | | | 1,285 | |

Cash costs2 | | | 642 | | | | 587 | |

All-in sustaining costs2 | | | 927 | | | | 838 | |

All-in costs2 | | | 1,024 | | | | 938 | |

Cash costs (on a co-product basis)2 | | | 671 | | | | 610 | |

All-in sustaining costs (on a co-product basis)2 | | | 956 | | | | 861 | |

All-in costs (on a co-product basis)2 | | | 1,053 | | | | 961 | |

Copper production (millions of pounds) | | | 118 | | | | 104 | |

Copper sold (millions of pounds) | | | 121 | | | | 111 | |

Per pound data | | | | | | | | |

Average spot copper price | | $ | 2.64 | | | $ | 3.19 | |

Average realized copper price2 | | | 2.55 | | | | 3.03 | |

C1 cash costs2 | | | 1.84 | | | | 2.11 | |

Depreciation3 | | | 0.30 | | | | 0.37 | |

Other4 | | | 0.21 | | | | 0.16 | |

C3 fully allocated costs2 | | | 2.35 | | | | 2.64 | |

| |

Financial Results (millions) | | | | | | | | |

Revenues | | $ | 2,245 | | | $ | 2,647 | |

Net income5 | | | 57 | | | | 88 | |

Adjusted net earnings2 | | | 62 | | | | 238 | |

Operating cash flow | | | 316 | | | | 585 | |

Per Share Data (dollars) | | | | | | | | |

Net earnings (basic) | | | 0.05 | | | | 0.08 | |

Adjusted net earnings (basic)2 | | | 0.05 | | | | 0.20 | |

Net earnings (diluted) | | | 0.05 | | | | 0.08 | |

Weighted average basic and diluted common shares (millions) | | | 1,165 | | | | 1,165 | |

| |

| |

| As at

March 31, |

| |

| As at

December 31, |

|

| | | | |

| | | 2015 | | | | 2014 | |

| |

Financial Position (millions) | | | | | | | | |

Cash and equivalents | | $ | 2,258 | | | $ | 2,699 | |

Non-cash working capital | | | 3,596 | | | | 3,377 | |

| |

| | 1 | Production includes Acacia on a 73.9% basis until February 28, 2014 and a 63.9% basis thereafter and Pueblo Viejo on a 60% basis, both of which reflect our equity share of production. Also includes production from Plutonic up to January 31, 2014, Kanowna up to March 1, 2014 and Marigold up to April 4, 2014, the effective dates of sale of these assets. Sales include our equity share of gold sales from Acacia and Pueblo Viejo. | |

| | 2 | Realized price, cash costs, all-in sustaining costs, all-in costs, cash costs (on a co-product basis), all-in sustaining costs (on a co-product basis), all-in costs (on a co-product basis), C1 cash costs, C3 fully allocated costs and adjusted net earnings are non-GAAP financial performance measures with no standard definition under IFRS. Refer to the Non-GAAP Financial Performance Measures section of the Company’s MD&A. | |

| | 3 | Represents equity depreciation expense divided by equity pounds of copper sold. | |

| | 4 | For a breakdown, see reconciliation of cost of sales to C1 cash costs and C3 fully allocated costs per pound in the Non-GAAP Financial Performance Measures section of the Company’s MD&A. | |

| | 5 | Net income represents net income attributable to the equity holders of the Company. | |

| | | | |

| BARRICK FIRST QUARTER 2015 | | 17 | | SUMMARY INFORMATION |

Production and Cost Summary

| | | | | | | | | | | | | | | | | | |

| | | Gold Production (attributable ounces) (000’s) | | | All-in sustaining costs5 ($/oz) | |

| | | Three months ended March 31, | | | Three months ended

March 31, | |

| | | | | 2015 | | | 2014 | | | 2015 | | | 2014 | |

| | | | | |

Gold | | | | | | | | | | | | | | | | | | |

Goldstrike | | | | | 207 | | | | 262 | | | | $876 | | | | $759 | |

Cortez | | | | | 133 | | | | 227 | | | | 962 | | | | 654 | |

Pueblo Viejo3 | | | | | 135 | | | | 159 | | | | 675 | | | | 600 | |

Lagunas Norte | | | | | 178 | | | | 134 | | | | 461 | | | | 522 | |

Veladero | | | | | 149 | | | | 158 | | | | 991 | | | | 814 | |

Turquoise Ridge | | | | | 49 | | | | 54 | | | | 709 | | | | 526 | |

Porgera | | | | | 118 | | | | 110 | | | | 1,064 | | | | 1,039 | |

Kalgoorlie | | | | | 59 | | | | 78 | | | | 1,271 | | | | 1,014 | |

Acacia2 | | | | | 116 | | | | 118 | | | | 1,117 | | | | 1,131 | |

Other Mines - Gold1 | | | | | 244 | | | | 286 | | | | 916 | | | | 972 | |

Other4 | | | | | 2 | | | | 2 | | | | - | | | | - | |

| |

Total | | | | | 1,390 | | | | 1,588 | | | $ | 927 | | | $ | 838 | |

| |

| | | Copper Production (attributable pounds) (millions) | | | C1 Cash Costs5 ($/lb) | |

| | | Three months ended March 31, | | | Three months ended

March 31, | |

| | | | | 2015 | | | 2014 | | | 2015 | | | 2014 | |

| | | | | |

Lumwana | | | | | 66 | | | | 50 | | | $ | 1.89 | | | $ | 2.58 | |

Zaldívar | | | | | 52 | | | | 54 | | | | 1.77 | | | | 1.68 | |

| |

Total | | | | | 118 | | | | 104 | | | $ | 1.84 | | | $ | 2.11 | |

| |

| | | | | | | | | | | Total Gold Production Costs($/oz) | |

| | | | | | | | | | | Three months ended

March 31, | |

| | | | | | | | | | | 2015 | | | 2014 | |

| |

Direct mining costs before impact of hedges at market foreign exchange rates | | | | | | | | | | $ | 623 | | | $ | 595 | |

Losses (gains) realized on currency hedge and commodity hedge/economic hedge contracts | | | | | | | | | | | 13 | | | | (20) | |

By-product credits | | | | | | | | | | | (29 | ) | | | (23) | |

Royalties | | | | | | | | | | | 35 | | | | 35 | |

| |

Cash costs5 | | | | | | | | | | | | | 642 | | | | 587 | |

Depreciation | | | | | | | | | | | | | 237 | | | | 195 | |

| |

Total production costs | | | | | | | | | | | | $ | 879 | | | $ | 782 | |

| |

Cash costs5 | | | | | | | | | | | | $ | 642 | | | $ | 587 | |

General & administrative costs | | | | | | | | | | | 40 | | | | 54 | |

Rehabilitation - accretion and amortization (operating sites) | | | | | | | | | | | 25 | | | | 21 | |

Mine on-site exploration and evaluation costs | | | | | | | | | | | 4 | | | | 1 | |

Mine development expenditures | | | | | | | | | | | 120 | | | | 117 | |

Sustaining capital expenditures | | | | | | | | | | | 96 | | | | 58 | |

| |

All-in sustaining costs5 | | | | | | | | | | $ | 927 | | | $ | 838 | |

| |

All-in costs5 | | | | | | | | | | $ | 1,024 | | | $ | 938 | |

| |

| | | | | | | | | | | Total Copper Production Costs($/lb) | |

| | | | | | | | | | | Three months ended

March 31, | |

| | | | | | | | | | | 2015 | | | 2014 | |

| |

C1 cash costs5 | | | | | | | | | | | | $ | 1.84 | | | $ | 2.11 | |

Depreciation6 | | | | | | | | | | | | | 0.30 | | | | 0.37 | |

Other7 | | | | | | | | | | | | | 0.21 | | | | 0.16 | |

| |

C3 fully allocated costs4 | | | | | | | | | | | | $ | 2.35 | | | $ | 2.64 | |

| |

| | | | |

1 Includes production from Plutonic up to January 31, 2014, Kanowna up to March 1, 2014 and Marigold up to April 4, 2014, the effective dates of sale of these assets. 2 Figures relating to Acacia are presented on a 73.9% basis until February 28, 2014 and a 63.9% basis thereafter, which reflects our equity share of production. 3 Reflects production from Pueblo Viejo on a 60% basis, which reflects our equity share of production. | | | | |

4 Production and all-in sustaining costs include Pierina. 5 Cash costs, all-in sustaining costs, all-in costs, C1 cash costs and C3 fully allocated costs are non-GAAP financial performance measures with no standard meaning under IFRS. Refer to the Non-GAAP Financial Performance Measures section of the Company’s MD&A. 6 Represents equity depreciation expense divided by equity pounds of copper sold. 7 For a breakdown, see reconciliation of cost of sales to C1 cash costs and C3 fully allocated costs per pound in the Non-GAAP Financial Performance Measures section of the Company’s MD&A. | | |

| | | | |

| BARRICK FIRST QUARTER 2015 | | 18 | | SUMMARY INFORMATION |

MANAGEMENT’S DISCUSSION AND ANALYSIS (“MD&A”)

This portion of the Quarterly Report provides management’s discussion and analysis (“MD&A”) of the financial condition and results of operations to enable a reader to assess material changes in financial condition and results of operations as at and for the three month periods ended March 31, 2015, in comparison to the corresponding prior-year period. The MD&A is intended to help the reader understand Barrick Gold Corporation (“Barrick”, “we”, “our” or the “Company”), our operations, financial performance and present and future business environment. This MD&A, which has been prepared as of April 27, 2015, is intended to supplement and complement the condensed unaudited interim consolidated financial statements and notes thereto, prepared in accordance with International Accounting Standard 34 Interim Financial Reporting (“IAS 34”) as issued by the International Accounting Standards Board (“IASB”), for the three month period ended March 31, 2015 (collectively, the “Financial Statements”), which are included in this Quarterly Report on pages 55 to 74. You are encouraged to review the Financial Statements in conjunction with your review of this MD&A. This MD&A should be read in conjunction with both the annual audited

consolidated financial statements for the two years ended December 31, 2014, the related annual MD&A included in the 2014 Annual Report, and the most recent Form 40-F/Annual Information Form on file with the US Securities and Exchange Commission (“SEC”) and Canadian provincial securities regulatory authorities. Certain notes to the Financial Statements are specifically referred to in this MD&A and such notes are incorporated by reference herein. All dollar amounts in this MD&A are in millions of US dollars, unless otherwise specified.

For the purposes of preparing our MD&A, we consider the materiality of information. Information is considered material if: (i) such information results in, or would reasonably be expected to result in, a significant change in the market price or value of our shares; or (ii) there is a substantial likelihood that a reasonable investor would consider it important in making an investment decision; or (iii) it would significantly alter the total mix of information available to investors. We evaluate materiality with reference to all relevant circumstances, including potential market sensitivity.

CAUTIONARY STATEMENT ON FORWARD-LOOKING INFORMATION

Certain information contained or incorporated by reference in this MD&A, including any information as to our strategy, projects, plans or future financial or operating performance constitutes “forward-looking statements”. All statements, other than statements of historical fact, are forward-looking statements. The words “believe”, “expect”, “anticipate”, “contemplate”, “target”, “plan”, “intend”, “project”, “continue”, “budget”, “estimate”, “potential”, “may”, “will”, “can”, “could” and similar expressions identify forward-looking statements. Forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable by the Company in light of management’s experience and perception of current conditions and expected developments, are inherently subject to significant business, economic and competitive uncertainties and contingencies. Known and unknown factors could cause actual results to differ materially from those projected in the forward-looking statements. Such factors include, but are not limited to: fluctuations in the spot and forward price of gold, copper or certain other commodities (such as silver, diesel fuel and electricity); changes in national and

local government legislation, taxation, controls or regulations and/or changes in the administration of laws, policies and practices, expropriation or nationalization of property and political or economic developments in Canada, the United States, Zambia and other jurisdictions in which the Company does or may carry on business in the future; failure to comply with environmental and health and safety laws and regulations; timing of receipt of, or failure to comply with, necessary permits and approvals; diminishing quantities or grades of reserves; increased costs and risks related to the potential impact of climate change; increased costs, delays, suspensions and technical challenges associated with the construction of capital projects; the impact of global liquidity and credit availability on the timing of cash flows and the values of assets and liabilities based on projected future cash flows; adverse changes in our credit rating; the impact of inflation; operating or technical difficulties in connection with mining or development activities, including disruptions in the maintenance or provision of required infrastructure and information technology systems; damage to the Company’s reputation due to the actual or perceived occurrence

| | | | |

| BARRICK FIRST QUARTER 2015 | | 19 | | MANAGEMENT’S DISCUSSION AND ANALYSIS |

of any number of events, including negative publicity with respect to the Company’s handling of environmental matters or dealings with community groups, whether true or not; the speculative nature of mineral exploration and development; the possibility that future exploration results will not be consistent with the Company’s expectations; changes in mineral production performance, exploitation and exploration successes; risks that exploration data may be incomplete and considerable additional work may be required to complete further evaluation, including but not limited to drilling, engineering and socio-economic studies and investment; risk of loss due to acts of war, terrorism, sabotage and civil disturbances; fluctuations in the currency markets; changes in U.S. dollar interest rates; risks arising from holding derivative instruments; litigation; contests over title to properties, particularly title to undeveloped properties, or over access to water, power and other required infrastructure; business opportunities that may be presented to, or pursued by, the Company; our ability to successfully integrate acquisitions or complete divestitures; employee relations; availability and increased costs associated with mining inputs and labor; and the organization of our previously held African gold operations and properties under a separate listed company. In addition, there are risks

and hazards associated with the business of mineral exploration, development and mining, including environmental hazards, industrial accidents, unusual or unexpected formations, pressures, cave-ins, flooding and gold bullion, copper cathode or gold or copper concentrate losses (and the risk of inadequate insurance, or inability to obtain insurance, to cover these risks). Many of these uncertainties and contingencies can affect our actual results and could cause actual results to differ materially from those expressed or implied in any forward-looking statements made by, or on behalf of, us. Readers are cautioned that forward-looking statements are not guarantees of future performance. All of the forward-looking statements made in this MD&A are qualified by these cautionary statements. Specific reference is made to the most recent Form 40-F/Annual Information Form on file with the SEC and Canadian provincial securities regulatory authorities for a discussion of some of the factors underlying forward-looking statements. We disclaim any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise, except as required by applicable law.

| | | | |

| BARRICK FIRST QUARTER 2015 | | 20 | | MANAGEMENT’S DISCUSSION AND ANALYSIS |

INDEX

| | | | |

| | | page | |

Results Overview | | | | |

| |

Review of 2015 First Quarter Results and Full Year Outlook | | | 22 | |

| |

Key Business Developments | | | 25 | |

| |

Market Overview | | | 26 | |

| |

Review of Financial Results | | | | |

| |

Revenue | | | 28 | |

| |

Production Costs | | | 28 | |

| |

Capital Expenditures | | | 29 | |

| |

Additional Significant Statement of Income Items | | | 29 | |

| |

Income Tax Expense | | | 30 | |

| |

Operating Segments Performance | | | 30 | |

| |

Financial Condition Review | | | | |

| |

Balance Sheet Review | | | 42 | |

| |

Shareholders’ Equity | | | 42 | |

| |

Comprehensive Income | | | 42 | |

| |

Financial Position and Liquidity | | | 43 | |

| |

Financial Instruments | | | 45 | |

| |

Commitments and Contingencies | | | 45 | |

| |

Internal Control over Financial Reporting and Disclosure Controls and Procedures | | | 46 | |

| |

Review of Quarterly Results | | | 47 | |

| |

IFRS Critical Accounting Policies and Accounting Estimates | | | 48 | |

| |

Non-GAAP Financial Performance Measures | | | 49 | |

| | | | |

| BARRICK FIRST QUARTER 2015 | | 21 | | MANAGEMENT’S DISCUSSION AND ANALYSIS |

RESULTS OVERVIEW

Review of 2015 First Quarter Results and Full Year Outlook

| | | | | | |

| ($ millions, except where indicated) | | | | | For the three months ended March 31 |

| | | 2015 | | | 2014 |

Financial Data | | | | | | |

Revenue | | | $ 2,245 | | | $ 2,647 |

Net earnings (loss)1 | | | 57 | | | 88 |

Per share (“EPS”)2 | | | 0.05 | | | 0.08 |

Adjusted net earnings3 | | | 62 | | | 238 |

Per share (“adjusted EPS”)2,3 | | | 0.05 | | | 0.20 |

Total project capital expenditures4 | | | 15 | | | 51 |

Total capital expenditures - expansion4 | | | 88 | | | 89 |

Total capital expenditures - sustaining4 | | | 353 | | | 369 |

Operating cash flow | | | 316 | | | 585 |

Adjusted operating cash flow3 | | | 316 | | | 585 |

Free cash flow3 | | | $ (198) | | | $ (31) |

| | | | | | | |

Operating Data | | | | | | |

Gold | | | | | | |

Gold produced (000s ounces)5 | | | 1,390 | | | 1,588 |

Gold sold (000s ounces)5 | | | 1,385 | | | 1,618 |

Realized price ($ per ounce)3 | | | $ 1,219 | | | $ 1,285 |

Cash costs ($ per ounce)3 | | | 642 | | | 587 |

Cash costs on a co-product basis ($ per ounce)3 | | | 671 | | | 610 |

All-in sustaining costs ($ per ounce)3 | | | 927 | | | 838 |

All-in sustaining costs on a co-product basis ($ per ounce)3 | | | 956 | | | 861 |

All-in costs ($ per ounce)3 | | | 1,024 | | | 938 |

All-in costs on a co-product basis ($ per ounce)3 | | | $ 1,053 | | | $ 961 |

Copper | | | | | | |

Copper produced (millions of pounds) | | | 118 | | | 104 |

Copper sold (millions of pounds) | | | 121 | | | 111 |

Realized price ($ per pound)3 | | | $ 2.55 | | | $ 3.03 |

C1 cash costs ($ per pound)3 | | | $ 1.84 | | | $ 2.11 |

| | 1 | Net loss represents net loss attributable to the equity holders of the Company. |

| | 2 | Calculated using weighted average number of shares outstanding under the basic method. |

| | 3 | These are non-GAAP financial performance measures with no standardized definition under IFRS. For further information and detailed reconciliations, please see pages 49 - 54 of this MD&A. |

| | 4 | These amounts are presented on a 100% accrued basis. Project and expansion capital expenditures are included in our calculation of all-in costs, but not included in our calculation of all-in sustaining costs. |

| | 5 | Gold production and sales include our pro rata share of Acacia and Pueblo Viejo at our equity share. |

| | | | |

| BARRICK FIRST QUARTER 2015 | | 22 | | MANAGEMENT’S DISCUSSION AND ANALYSIS |

FIRST QUARTER FINANCIAL AND OPERATING HIGHLIGHTS

Net Income, Adjusted Net Income, Operating Cash Flow and Free Cash Flow

| | • | | Net earnings and adjusted net earnings were 35% and 74% lower, respectively, in first quarter 2015 than in the same prior year period primarily due to a 14% decrease in gold sales volume combined with a 5% and 16% decrease in gold and copper realized prices, respectively, partially offset by a 9% increase in copper sales volume and lower income tax expense. |

| | • | | Significant adjusting items (net of tax and non-controlling interest effects) in first quarter 2015 include: |

| | ¡ | | $22 million in gains from asset dispositions; partially offset by |

| | ¡ | | $13 million adjustment reflecting the impact of the decrease in the discount rate used to calculate the provision for environmental remediation at our closed mines; and |

| | ¡ | | $6 million in unrealized foreign currency translation losses. |

| | • | | Operating cash flow of $316 million was 46% lower than the same prior year period primarily reflecting lower net earnings combined with an increase in inventory due to increased leach pad inventory levels at Zaldívar as a result of the |

| | | severe rain event that occurred at the end of first quarter 2015. |

| | • | | Free cash flow in first quarter 2015 was an outflow of $198 million, compared to an outflow of $31 million in the same prior year period. The larger outflow primarily reflects the lower operating cash flows, which more than offset lower capital expenditures. We continue to expect to be free cash flow positive in 2015 at current market gold prices. |

Gold production, cash costs and all-in sustaining costs

| | • | | In first quarter 2015, gold production was 12% lower compared to the same prior year period largely due to the decrease in production at Cortez and Goldstrike, as well as the impact of 2014 asset sales. The lower production was in line with operating plan and consistent with our guidance that 55% of our production will come in the second half of the year. Higher second half production is primarily due to higher production at Goldstrike as the thiosulfate circuit ramps up to commercial production levels; higher production at Cortez as the open pit transitions into higher grade material and the thiosulfate circuit at Goldstrike allows for the processing of existing Cortez stockpiles; and |

| | | | |

| BARRICK FIRST QUARTER 2015 | | 23 | | MANAGEMENT’S DISCUSSION AND ANALYSIS |

| | higher production at Pueblo Viejo due to the availability of higher grade ore and increased throughput due to higher autoclave availability. Production remains in line with our plan and our expected production guidance for 2015 continues to be in the range of 6.2 to 6.6 million ounces. |

| | • | | In first quarter 2015, cash costs increased 9% compared to the same prior year period, primarily due to the impact of lower sales volume on unit costs. All-in sustaining costs for first quarter 2015 increased 11% compared to the same prior year period, as the higher cash costs were partially offset by lower sustaining capital expenditures, primarily due to a reduction in capitalized stripping costs. Second quarter 2015 is expected to be our highest cost quarter for both cash costs and all-in sustaining costs, largely due to the impact of higher costs at Goldstrike due to the impact of lower sales volume as a significant portion of thiosulfate circuit production from the second quarter will not be sold until the third quarter and higher sustaining capital expenditures. We continue to expect 2015 cash costs and all-in sustaining costs to be within our guidance ranges of $600 to $640 and $860 to $895 per ounce, respectively. Costs are expected to be about 20% lower in second half 2015 due to the impact of higher production levels on unit costs as well as lower sustaining capital expenditures. |

| | • | | All-in costs for first quarter 2015 were 9% higher than the same prior year period due to the same factors affecting all-in sustaining costs, partially offset by a reduction in project capital expenditures. |

Copper production and C1 costs

| | • | | In first quarter 2015, copper production increased 13% compared to the same prior year period, due to higher production at Lumwana, partially offset by lower production at Zaldívar due to the impact of a severe rain event at the end of the quarter. |

| | • | | Copper C1 cash costs were 13% lower than the same prior year period due to continued improvements in mine and processing efficiencies at Lumwana. |

Capital Expenditures

| | • | | In first quarter 2015, capital expenditures were down 10% from the same prior year period primarily due to lower project and minesite sustaining capital expenditures. We have incurred $456 million in capital expenditures as at the end of the first quarter. |

| | • | | As a result of a robust review of our sustaining capital expenditure budget in 2015, we now expect our sustaining capital expenditures to be in the range of $1.5 to $1.7 billion and total capital expenditures to be in the range of $1.8 to $2.1 billion, compared to our original guidance ranges of $1.6 to $1.8 billion and $1.9 to $2.2 billion, respectively. We have implemented a new capital allocation process, and, as a result, all significant new and ongoing projects will be reviewed by our investment committee against our target 15% hurdle rate. |

Strengthening the Balance Sheet

| | • | | We remain committed to debt reduction of at least $3 billion by the end of 2015 and are moving quickly to advance a number of asset sales and joint venture opportunities. |

| | • | | Numerous companies have participated in the sales processes for the Cowal mine and the Porgera Joint Venture. Detailed due diligence on both assets is now underway, including site visits with prospective buyers. |

| | • | | We have begun a process for the sale of a stake in the Zaldívar copper mine in Chile. Zaldívar is a consistently strong performer in the world’s best jurisdiction for copper mining. Potential buyers have expressed a strong interest in acquiring an interest in the mine. |

| | • | | We are actively exploring a number of other joint venture and sales opportunities. |

| | | | |

| BARRICK FIRST QUARTER 2015 | | 24 | | MANAGEMENT’S DISCUSSION AND ANALYSIS |

Full Year 2015 Outlook

| | | | |

| ($ millions, except per ounce/pound data) | | 2015E | |

Gold production and costs | | | | |

Production (millions of ounces) | | | 6.2 - 6.6 | |

Gold unit production costs | | | | |

All-in sustaining costs ($ per ounce)1 | | | 860 - 895 | |

Cash costs ($ per ounce)2 | | | 600 - 640 | |

Depreciation ($ per ounce) | | | 240 - 260 | |

Copper production and costs | | | | |

Production (millions of pounds)3 | | | 480 - 520 | |

Copper unit production costs | | | | |

C1 cash costs ($ per pound) | | | 1.75 - 2.00 | |

Depreciation ($ per pound) | | | 0.35 - 0.45 | |

C3 fully allocated costs ($ per pound)3 | | | 2.35 - 2.65 | |

Exploration and project expenses | | | 370 - 460 | |

Exploration and evaluation | | | 220 - 270 | |

Project expenses | | | 150 - 190 | |

General and administrative expenses | | | ~225 | |

Corporate administration | | | ~145 | |

Stock-based compensation | | | ~50 | |

Acacia | | | ~30 | |

Other expense | | | 40 - 60 | |

Finance costs | | | 800 - 825 | |

Capital expenditures: | | | | |

Minesite sustaining4 | | | 1,500 - 1,700 | |

Minesite expansion | | | 150 - 200 | |

Projects | | | 150 - 200 | |

Total capital expenditures4 | | | 1,800 - 2,100 | |

Effective income tax rate | | | ~53% | |

Key Assumptions | | | | |

Gold Price ($/ounce)5 | | | $1,200 | |

Copper Price ($/pound) | | | $2.60 | |

Oil Price ($/barrel) | | | $50 | |

AUD Exchange Rate | | | $0.80 | |

ARS Exchange Rate | | | 9.88 | |

CAD Exchange Rate | | | $1.25 | |

CLP Exchange Rate | | | 610 | |

| 1 | All-in sustaining costs are calculated in accordance with the standard published by the World Gold Council (‘WGC’). See page 50 of this MD&A for further details. |

| 2 | Cash costs reflect our equity share of unit production costs, including the impact of by-product credits, which is calculated in accordance with the standard published by the WGC. See pages 50 of this MD&A for further details. |

| 3 | As a result of the decision to continue operations at Lumwana, we now expect copper production to be in the range of 480 to 520 million lbs and C3 fully allocated costs to be in the range of $2.35 to $2.65 per pound compared to our previous guidance ranges of 310 to 340 million lbs and $2.30 to $2.60 per pound, respectively. |

| 4 | We now expect minesite sustaining capital expenditures to be in the range of $1,500 to $1,700 million and total capital expenditures to be in the range of $1,800 to $2,100 million compared to our previous guidance ranges of $1,600 to $1,800 million and $1,900 to $2,200 million, respectively. |

| 5 | Our outlook assumes an average gold price of $1,200 per ounce for the remainder of 2015, compared to our original assumption of $1,250 per ounce. |

Key Business Developments

Jabal Sayid Financing Facility

On April 2, 2015, Ma’aden Barrick Copper Company (our 50% Barrick owned equity method investment) signed a financing agreement with the Saudi British Bank to finance the Jabal Sayid copper project for SAR 750 million ($200 million USD). The proceeds will be used to fund the expenditures remaining to bring the mine into commercial production.

Royalty Changes in Zambia

On April 20, 2015, the Zambian government announced amendments to the country’s mining tax regime that would replace the recently adopted 20 percent gross royalty on open pit mines with a nine percent royalty, along with the reintroduction of a 30 percent corporate income tax and a 15 percent variable profits tax. Based on our initial analysis, this system would enable Lumwana to remain free cash flow positive at current copper prices. As a result, we will continue operations at Lumwana and have amended our operating guidance to reflect this change. In second quarter 2015 we will complete our analysis and evaluate the potential for a reversal of previous impairments recorded in fourth quarter 2014.

Pascua-Lama Chilean Environmental Court Ruling

On March 23, 2015, Chile’s Environmental Court ruled that the Pascua-Lama project has not damaged glaciers in the project area. Refer to note 21 to the consolidated financial statements for more information about this matter.

Pascua-Lama SMA Regulatory Sanctions

On April 22, 2015, Compañía Minera Nevada, Barrick’s Chilean subsidiary that holds the Chilean portion of the Pascua-Lama project, was notified that Chile’s environmental regulator has initiated a new administrative proceeding for alleged deviations from certain requirements of the Project’s environmental approval, including with respect to the Project’s environmental impact and a series of monitoring requirements. CMN is evaluating the allegations and preparing its response.

Hemlo Land Acquisition

In March 2015, Barrick acquired certain surface and mineral lands adjacent to the Hemlo property in Ontario from subsidiaries of Newmont Mining Corporation for $37.5 million. The acquisition will enable Hemlo to realize additional value through near-term, lower-cost ounces, optimize its current operation with the potential for mine life extensions, and increase exploration potential.

| | | | |

| BARRICK FIRST QUARTER 2015 | | 25 | | MANAGEMENT’S DISCUSSION AND ANALYSIS |

Alturas Gold Discovery

We have made a new gold discovery located in the Andean region of Chile. The new discovery is the result of a methodical re-evaluation of the El Indio belt led by our exploration team. Drilling will continue until the end of the summer season in May and we expect to report an initial resource at the end of the year.

Exploration Partnership with QPX

Our focus is gold and we have no plans to expand our existing copper position. However, we seek to maximize the value of our highly prospective land holdings where there is currently little to no exploration taking place, so we have formed a strategic partnership with Quantum Pacific Exploration (“QPX”) to explore for copper deposits on our land in northern Chile. Any gold deposits located on Barrick land will remain 100 percent Barrick-owned. If a copper deposit project is identified on either Barrick or QPX land, it will be 50 percent owned by each company.

Market Overview

Gold and Copper

The market prices of gold and, to a lesser extent, copper are the primary drivers of our profitability and our ability to generate free cash flow for our shareholders.

The price of gold is subject to volatile price movements over short periods of time and is impacted by numerous industry and macroeconomic factors. During the first quarter, the price of gold ranged from $1,143 to $1,308 per ounce. The price of gold closed at $1,187 per ounce on March 31, 2015, while the average quarterly market price of $1,218 per ounce represented a $75 per ounce or 6% decrease from the $1,293 per ounce average market price in the same prior year period.

Copper prices in first quarter traded in a range of $2.42 per pound to $2.86 per pound. The average price for first quarter was $2.64 per pound and the closing price was $2.74 per pound on March 31, 2015. Copper prices should continue to be influenced by demand from emerging markets, specifically China, the availability of scrap and production levels of mines and smelters in the future.

We have provisionally priced copper sales for which final price determination versus the relevant copper index is outstanding at the balance sheet date. As at March 31, 2015, we have recorded 60 million pounds of copper sales subject to final settlement at an average provisional price of $2.75 per pound. The impact to net income before taxation of a 10% movement in the market price of copper would be approximately $16 million, holding all other variables constant.

Silver

Silver prices do not significantly impact our current operating earnings, cash flows or gold cash costs. Silver prices, however, will have a significant impact on the overall economics for our Pascua-Lama project.

In first quarter, silver prices traded in a range of $15.30 per ounce to $18.49 per ounce, averaged $16.71 per ounce and closed the quarter at $16.60 per ounce. The silver price is driven by factors similar to those influencing investment demand for gold.

Currency Exchange Rates