Exhibit 99.1

| | |

| | Rock solid resources. Proven advice.TM |

BARRICK GOLD CORPORATION

TECHNICAL REPORT ON THE

LAGUNAS NORTE MINE,

LA LIBERTAD REGION, PERU

NI 43-101 Report

Qualified Persons:

Luke Evans, P.Eng.

Hugo Miranda, MBA, P.C.

Brenna Scholey, P.Eng.

|

August 31, 2015

RPA Inc.55 University Ave. Suite 501 I Toronto, ON, Canada M5J 2H7 I T+ 1 (416) 947 0907 www.rpacan.com |

Report Control Form

| | | | |

| |

| Document Title | | Technical Report on the Lagunas Norte Mine, La Libertad Region, Peru |

| |

| | |

| |

| Client Name & Address | | Barrick Gold Corporation Brookfield Place, TD Canada Trust Tower Suite 3700, 161 Bay Street, P.O. Box 212 Toronto, Ontario M5J 2S1 |

| |

| | |

| | | | | | | | |

| | | | |

| Document Reference | | Project #2473 | | Status & Issue No. | | FINAL | | |

| | | | | | |

| | | |

| | | | | | |

| | | |

| Issue Date | | August 31, 2015 | | | | |

| | | | | | |

| | | |

| | | | | | |

| | | |

| Lead Author | | Luke Evans Hugo Miranda Brenna Scholey | | | | (Signed) (Signed) (Signed) |

| | | |

| | | | | | |

| | | |

| Peer Reviewer | | Graham G. Clow | | | | (Signed) |

| | | |

| | | | | | |

| | | |

| Project Manager Approval | | Deborah A. McCombe | | | | (Signed) |

| | | |

| | | | | | |

| | | |

| Project Director Approval | | Graham G. Clow | | | | (Signed) |

| | | |

| | | | | | |

| | | |

| Report Distribution | | Name | | | | No. of Copies |

| | | |

| | | | | | |

| | | |

| | Client | | | | |

| | | |

| | RPA Filing | | | | 1 (project box) |

Roscoe Postle Associates Inc.

55 University Avenue, Suite 501

Toronto, ON M5J 2H7

Canada

Tel: +1 416 947 0907

Fax: +1 416 947 0395

mining@rpacan.com

| | |

| | www.rpacan.com |

FORWARD-LOOKING INFORMATION

This report contains forward-looking statements. All statements, other than statements of historical fact regarding Barrick or Lagunas Norte, are forward-looking statements. The words “believe”, “expect”, “anticipate”, “contemplate”, “target”, “plan”, “intend”, “project”, “continue”, “budget”, “estimate”, “potential”, “may”, “will”, “can”, “could” and similar expressions identify forward-looking statements. In particular, this report contains forward-looking statements with respect to cash flow forecasts, projected capital, operating and exploration expenditure, targeted cost reductions, mine life and production rates, potential mineralization and metal or mineral recoveries, and information pertaining to potential improvements to financial and operating performance and mine life at the Lagunas Norte mine that may result from certain Value Realization Initiatives. All forward-looking statements in this report are necessarily based on opinions and estimates made as of the date such statements are made and are subject to important risk factors and uncertainties, many of which cannot be controlled or predicted. Material assumptions regarding forward-looking statements are discussed in this report, where applicable. In addition to such assumptions, the forward-looking statements are inherently subject to significant business, economic and competitive uncertainties and contingencies. Known and unknown factors could cause actual results to differ materially from those projected in the forward-looking statements. Such factors include, but are not limited to: fluctuations in the spot and forward price of commodities (including gold, copper, silver, diesel fuel, natural gas and electricity); the speculative nature of mineral exploration and development; changes in mineral production performance, exploitation and exploration successes; risks associated with the fact that certain Value Realization Initiatives are still in the early stages of evaluation and additional engineering and other analysis is required to fully assess their impact; diminishing quantities or grades of reserves; increased costs, delays, suspensions, and technical challenges associated with the construction of capital projects; operating or technical difficulties in connection with mining or development activities, including disruptions in the maintenance or provision of required infrastructure and information technology systems; damage to Barrick’s or Lagunas Norte’s reputation due to the actual or perceived occurrence of any number of events, including negative publicity with respect to the handling of environmental matters or dealings with community groups, whether true or not; risk of loss due to acts of war, terrorism, sabotage and civil disturbances; uncertainty whether some or all of the Value Realization Initiatives will meet Barrick’s capital allocation objectives; the impact of global liquidity and credit availability on the timing of cash flows and the values of assets and liabilities based on projected future cash flows; the impact of inflation; fluctuations in the currency markets; changes in interest rates; changes in national and local government legislation, taxation, controls or regulations and/or changes in the administration of laws, policies and practices, expropriation or nationalization of property and political or economic developments in Peru; failure to comply with environmental and health and safety laws and regulations; timing of receipt of, or failure to comply with, necessary permits and approvals; litigation; contests over title to properties or over access to water, power and other required infrastructure; increased costs and risks related to the potential impact of climate change; and availability and increased costs associated with mining inputs and labor. In addition, there are risks and hazards associated with the business of mineral exploration, development and mining, including environmental hazards, industrial accidents, unusual or unexpected formations, pressures, cave-ins, flooding and gold bullion, copper cathode or gold or copper concentrate losses (and the risk of inadequate insurance, or inability to obtain insurance, to cover these risks).

Many of these uncertainties and contingencies can affect Barrick’s actual results and could cause actual results to differ materially from those expressed or implied in any forward-looking statements made by, or on behalf of, Barrick. All of the forward-looking statements made in this report are qualified by these cautionary statements. Barrick and RPA and the Qualified Persons who authored this report undertake no obligation to update publicly or otherwise revise anyforward-looking statements whether as a result of new information or future events or otherwise, except as may be required by law.

| | |

Barrick Gold Corporation – Lagunas Norte Mine, Project #2473 Technical Report NI 43-101 – August 31, 2015 | | Page i |

| | |

| | www.rpacan.com |

TABLE OF CONTENTS

| | | | | | |

| | | | | PAGE | |

| |

1 SUMMARY | | | 1-1 | |

Executive Summary | | | 1-1 | |

Technical Summary | | | 1-8 | |

Refractory Project | | | 1-17 | |

Value Realization Initiatives | | | 1-19 | |

2 INTRODUCTION | | | 2-1 | |

3 RELIANCE ON OTHER EXPERTS | | | 3-1 | |

4 PROPERTY DESCRIPTION AND LOCATION | | | 4-1 | |

Location | | | 4-1 | |

Land Tenure | | | 4-1 | |

5 ACCESSIBILITY, CLIMATE, LOCAL RESOURCES, INFRASTRUCTURE AND PHYSIOGRAPHY | | | 5-1 | |

Accessibility | | | 5-1 | |

Climate | | | 5-1 | |

Local Resources | | | 5-2 | |

Infrastructure | | | 5-2 | |

Physiography | | | 5-3 | |

6 HISTORY | | | 6-1 | |

7 GEOLOGICAL SETTING AND MINERALIZATION | | | 7-1 | |

Regional Geology | | | 7-1 | |

Local Geology | | | 7-3 | |

Property Geology | | | 7-5 | |

Mineralization | | | 7-11 | |

Material Classification | | | 7-15 | |

8 DEPOSIT TYPES | | | 8-1 | |

9 EXPLORATION | | | 9-1 | |

10 DRILLING | | | 10-1 | |

11 SAMPLE PREPARATION, ANALYSES AND SECURITY | | | 11-1 | |

Sampling Method and Approach | | | 11-1 | |

Sample Preparation, Analyses and Security | | | 11-2 | |

12 DATA VERIFICATION | | | 12-1 | |

13 MINERAL PROCESSING AND METALLURGICAL TESTING | | | 13-1 | |

Value Realization Initiatives | | | 13-4 | |

14 MINERAL RESOURCE ESTIMATE | | | 14-1 | |

Summary | | | 14-1 | |

Geological Models | | | 14-3 | |

| | |

Barrick Gold Corporation – Lagunas Norte Mine, Project #2473 Technical Report NI 43-101 – August 31, 2015 | | Page i |

| | |

| | www.rpacan.com |

| | | | | | |

Geological Domains | | | 14-7 | |

Grade Domains | | | 14-7 | |

Density Data | | | 14-9 | |

Cut-Off Grades | | | 14-9 | |

Assay Statistics and Capping of High Grades | | | 14-10 | |

Composites | | | 14-14 | |

Contact Plot Analysis | | | 14-15 | |

Variography | | | 14-16 | |

Resource Estimation Methodology | | | 14-17 | |

Resource Estimate Validation | | | 14-26 | |

Resource Classification | | | 14-31 | |

Value Realization Initiatives | | | 14-31 | |

15 MINERAL RESERVE ESTIMATE | | | 15-1 | |

16 MINING METHODS | | | 16-1 | |

Summary of Mining Operations | | | 16-1 | |

Mine Design | | | 16-4 | |

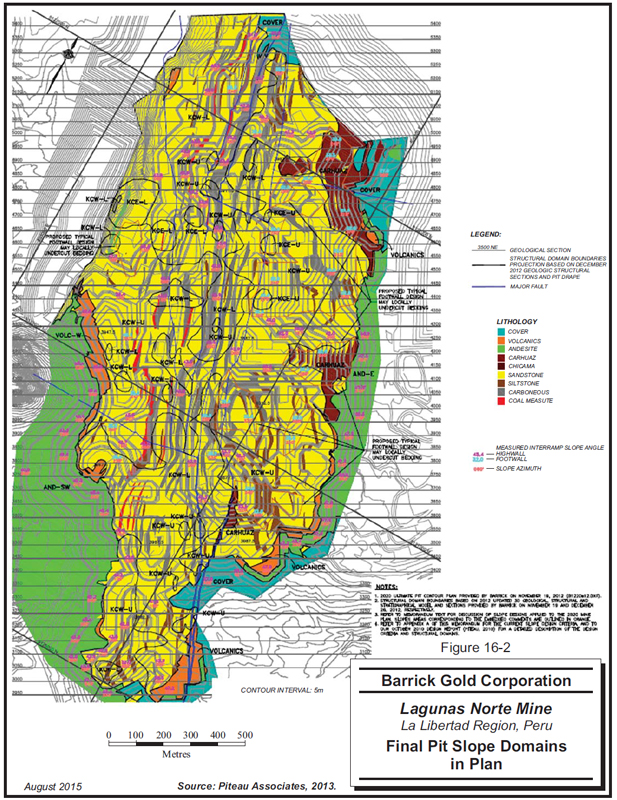

Ground Conditions/Slope Stability | | | 16-10 | |

Production Schedule | | | 16-13 | |

Waste Rock | | | 16-14 | |

Heap Leach Facility | | | 16-15 | |

Mine Equipment | | | 16-16 | |

Manpower | | | 16-17 | |

Mine Infrastructure | | | 16-17 | |

Value Realization Initiatives | | | 16-17 | |

17 RECOVERY METHODS | | | 17-1 | |

Process Description | | | 17-1 | |

Energy and Water Requirements | | | 17-4 | |

18 PROJECT INFRASTRUCTURE | | | 18-1 | |

19 MARKET STUDIES AND CONTRACTS | | | 19-1 | |

Markets | | | 19-1 | |

Contracts | | | 19-1 | |

20 ENVIRONMENTAL STUDIES, PERMITTING, AND SOCIAL OR COMMUNITY IMPACT | | | 20-1 | |

Environmental Studies | | | 20-1 | |

Project Permitting | | | 20-1 | |

Reclamation | | | 20-5 | |

Social or Community Requirements | | | 20-5 | |

21 CAPITAL AND OPERATING COSTS | | | 21-1 | |

Capital Costs | | | 21-1 | |

Operating Costs | | | 21-1 | |

Manpower | | | 21-3 | |

Value Realization Initiatives | | | 21-4 | |

22 ECONOMIC ANALYSIS | | | 22-1 | |

| | |

Barrick Gold Corporation – Lagunas Norte Mine, Project #2473 Technical Report NI 43-101 – August 31, 2015 | | Page ii |

| | |

| | www.rpacan.com |

| | | | | | |

| 23 ADJACENT PROPERTIES | | | 23-1 | |

| 24 OTHER RELEVANT DATA AND INFORMATION | | | 24-1 | |

Refractory Project Preliminary Economic Assessment | | | 24-1 | |

| 25 INTERPRETATION AND CONCLUSIONS | | | 25-1 | |

| 26 RECOMMENDATIONS | | | 26-1 | |

| 27 REFERENCES | | | 27-1 | |

| 28 DATE AND SIGNATURE PAGE | | | 28-1 | |

| 29 CERTIFICATE OF QUALIFIED PERSON | | | 29-1 | |

LIST OF TABLES

| | | | | | |

| | | | | PAGE | |

| | |

Table 1-1 | | Oxide Mineral Resources – December 31, 2014 | | | 1-2 | |

Table 1-2 | | Refractory Project Mineral Resources – December 31, 2014 | | | 1-3 | |

Table 1-3 | | Mineral Reserves – December 31, 2014 | | | 1-4 | |

Table 1-4 | | Capital Costs Summary | | | 1-17 | |

Table 4-1 | | Mining Concessions | | | 4-2 | |

Table 4-2 | | Surface Rights | | | 4-3 | |

Table 7-1 | | Material Classification | | | 7-18 | |

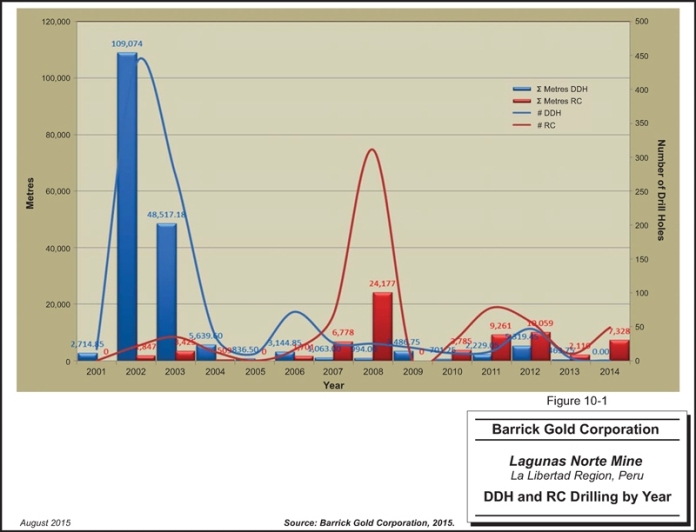

Table 10-1 | | DDH and RC Drilling Details | | | 10-1 | |

Table 10-2 | | Drilling Summary | | | 10-1 | |

Table 11-1 | | QC Insertion Rates | | | 11-4 | |

Table 12-1 | | 2008 to 2014 Data Verification | | | 12-2 | |

Table 13-1 | | Ore Types | | | 13-2 | |

Table 13-2 | | Metallurgical Model Recoverable Recovery Algorithms | | | 13-3 | |

Table 13-3 | | Evaluation of Recovery | | | 13-4 | |

Table 14-1 | | Oxide Mineral Resources – December 31, 2014 | | | 14-1 | |

Table 14-2 | | Refractory Project Mineral Resources – December 31, 2014 | | | 14-2 | |

Table 14-3 | | Lithology Codes | | | 14-3 | |

Table 14-4 | | Geostructural Codes | | | 14-4 | |

Table 14-5 | | Grade Domain Codes | | | 14-7 | |

Table 14-6 | | Resource Internal Cut-off Grades | | | 14-10 | |

Table 14-7 | | Au Capping Levels | | | 14-12 | |

Table 14-8 | | Gold Composite Statistics By lithology | | | 14-14 | |

Table 14-9 | | Gold Estimation Parameters | | | 14-20 | |

Table 14-10 | | Tonnage Factors | | | 14-26 | |

Table 15-1 | | Mineral Reserves – December 31, 2014 | | | 15-1 | |

Table 16-1 | | Lagunas Norte Production History | | | 16-1 | |

Table 16-2 | | Ore Type Classification | | | 16-5 | |

Table 16-3 | | Mine Optimization Parameters | | | 16-6 | |

Table 16-4 | | Internal Cut-off Grades, Mine Reserves | | | 16-8 | |

Table 16-5 | | Mine Design Parameters | | | 16-9 | |

Table 16-6 | | Summary of Piteau Inter-ramp Slope Design Recommendations | | | 16-10 | |

Table 16-7 | | Summary of Footwall Slope Design Recommendations | | | 16-11 | |

Table 16-8 | | Mine Production Schedule | | | 16-13 | |

Table 16-9 | | Heap Leach Placement Schedule | | | 16-14 | |

| | |

Barrick Gold Corporation – Lagunas Norte Mine, Project #2473 Technical Report NI 43-101 – August 31, 2015 | | Page iii |

| | |

| | www.rpacan.com |

| | | | | | |

Table 16-10 | | Mine Equipment Fleet | | | 16-16 | |

Table 20-1 | | Summary of Major Environmental and Main Operational Permits | | | 20-2 | |

Table 20-2 | | Summary of Water Permits | | | 20-3 | |

Table 21-1 | | Capital Costs Summary | | | 21-1 | |

Table 21-2 | | Mine Operating Costs | | | 21-2 | |

Table 21-3 | | Process Operating Costs | | | 21-2 | |

Table 21-4 | | G&A Costs | | | 21-3 | |

Table 21-5 | | Mine Site Manpower | | | 21-3 | |

Table 24-1 | | Refractory Project Mineral Resources as of December 31, 2014 | | | 24-3 | |

Table 24-2 | | Refractory Project Mine Optimization Parameters | | | 24-7 | |

Table 24-3 | | Summary of Leach and Refractory material in Refractory Project Plan | | | 24-8 | |

Table 24-4 | | Ore Types to Refractory Process | | | 24-10 | |

Table 24-5 | | Analytical Data on Lagunas Norte M3A Material | | | 24-11 | |

Table 24-6 | | Average Comminution Test Results | | | 24-11 | |

Table 24-7 | | Refractory Project Recovery Formulas | | | 24-13 | |

Table 24-8 | | Refractory Project Capital Costs Summary | | | 24-20 | |

Table 24-9 | | Refractory Project LOM Operating Costs | | | 24-21 | |

Table 24-10 | | Refractory Project Unit Operating Costs | | | 24-21 | |

Table 24-11 | | Refractory Project Production Schedule | | | 24-26 | |

Table 24-12 | | Refractory Project Production Schedule – Material Source | | | 24-27 | |

Table 24-13 | | Cash Flow Summary | | | 24-28 | |

Table 24-14 | | Sensitivity Analysis Table | | | 24-29 | |

LIST OF FIGURES

| | | | | | |

| | | | | PAGE | |

| | |

Figure 4-1 | | Location Map | | | 4-4 | |

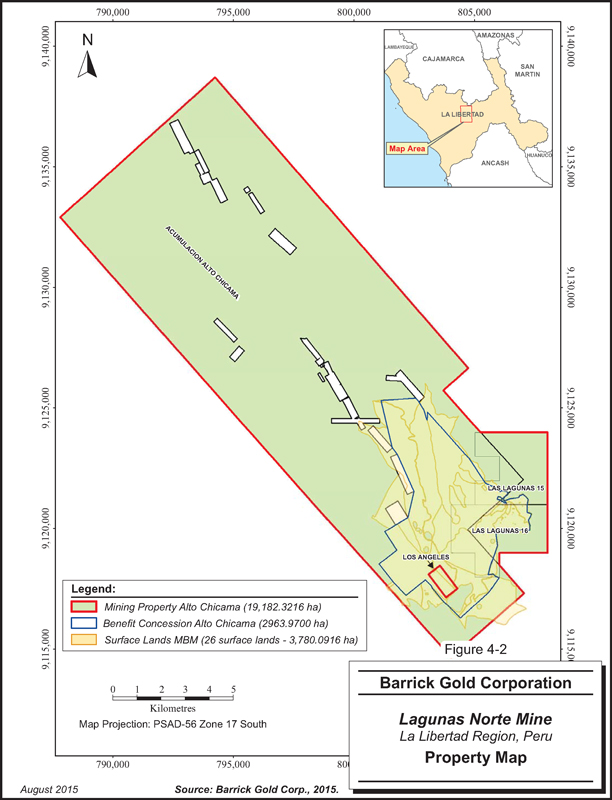

Figure 4-2 | | Property Map | | | 4-5 | |

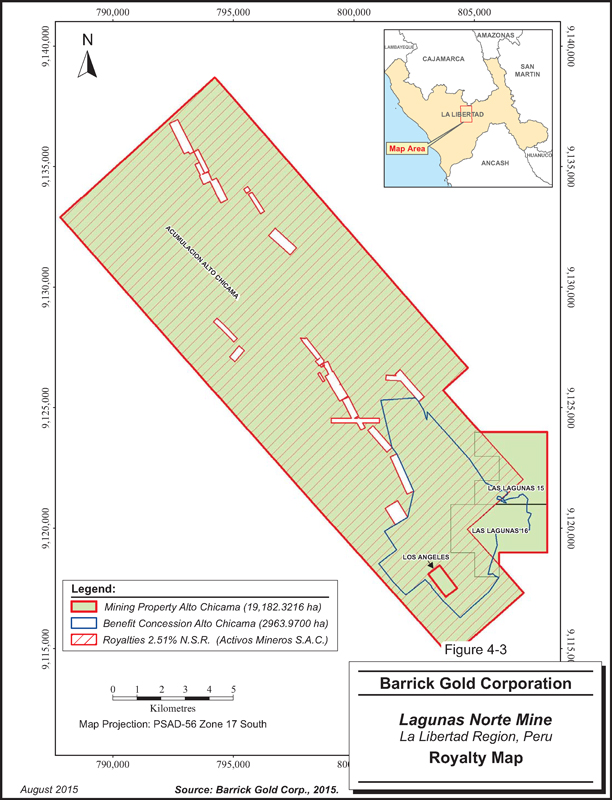

Figure 4-3 | | Royalty Map | | | 4-6 | |

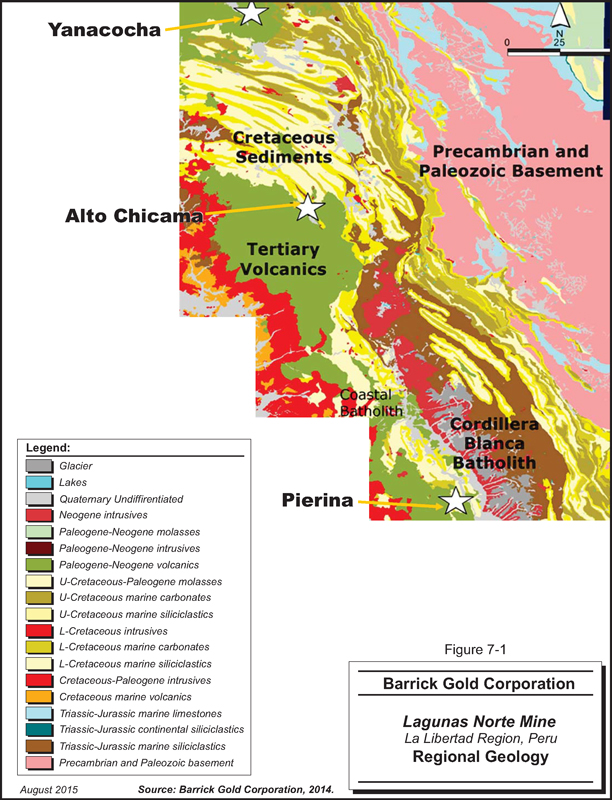

Figure 7-1 | | Regional Geology | | | 7-2 | |

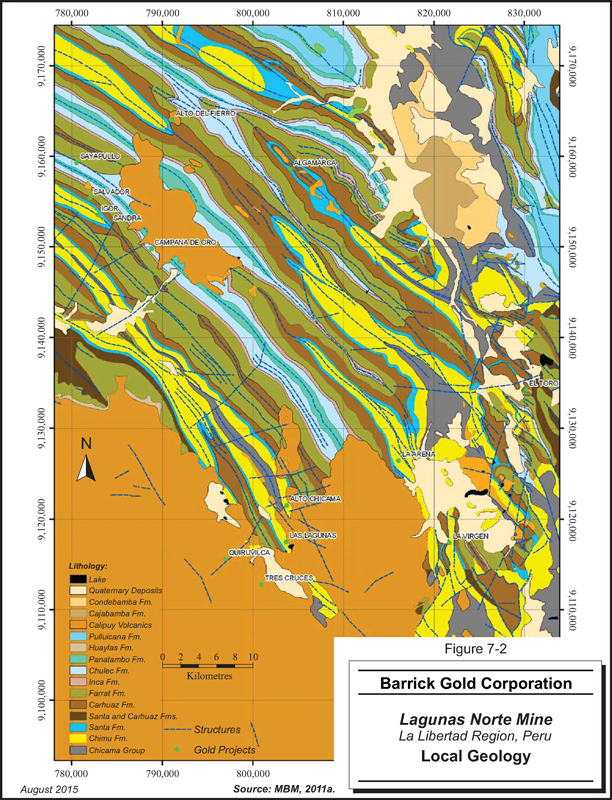

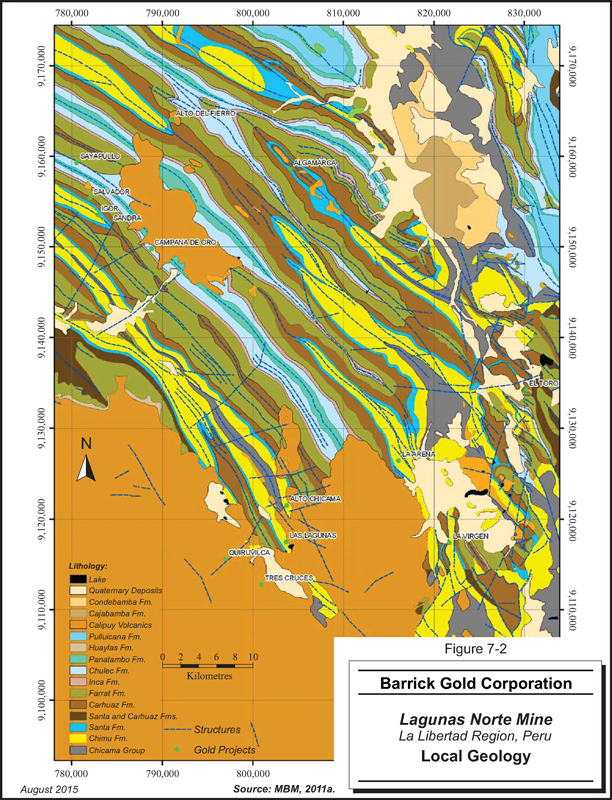

Figure 7-2 | | Local Geology | | | 7-6 | |

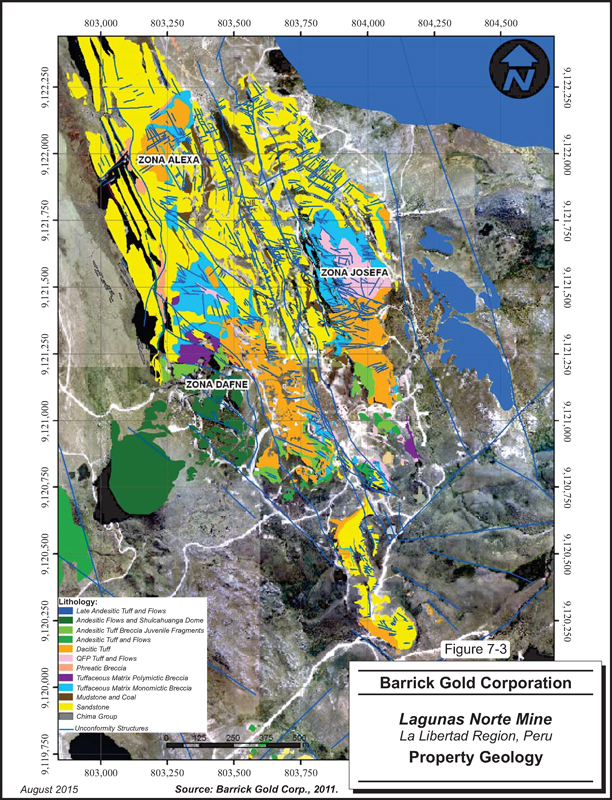

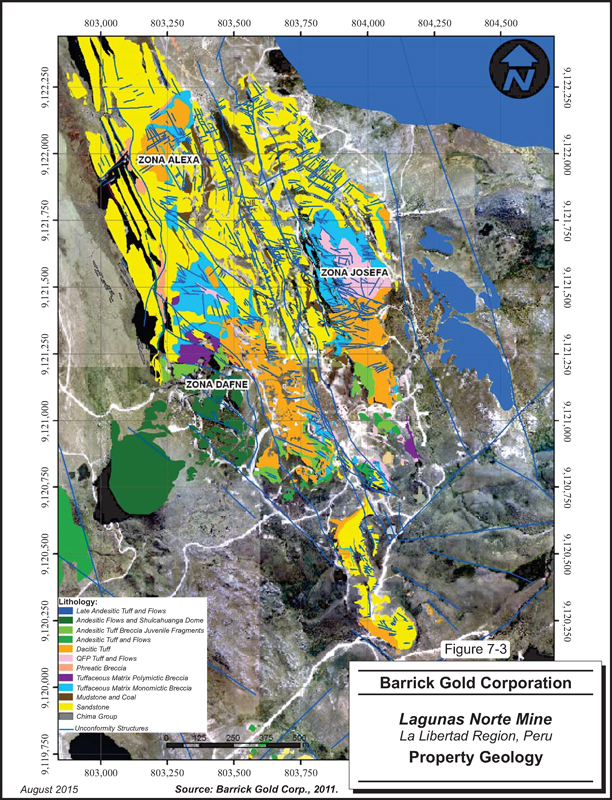

Figure 7-3 | | Property Geology | | | 7-7 | |

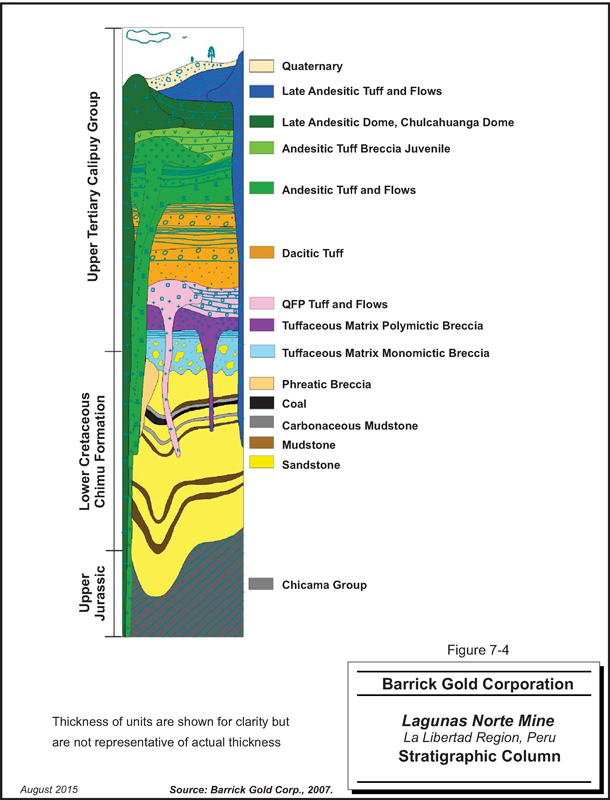

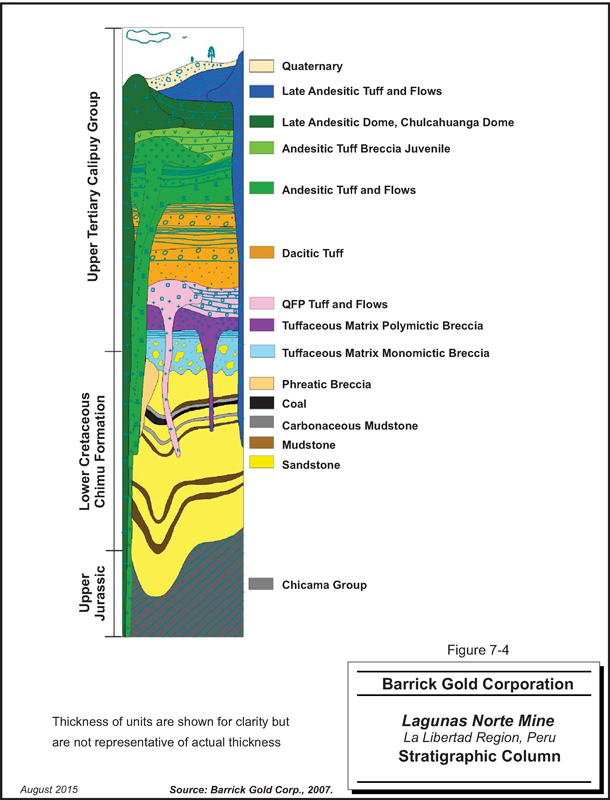

Figure 7-4 | | Stratigraphic Column | | | 7-8 | |

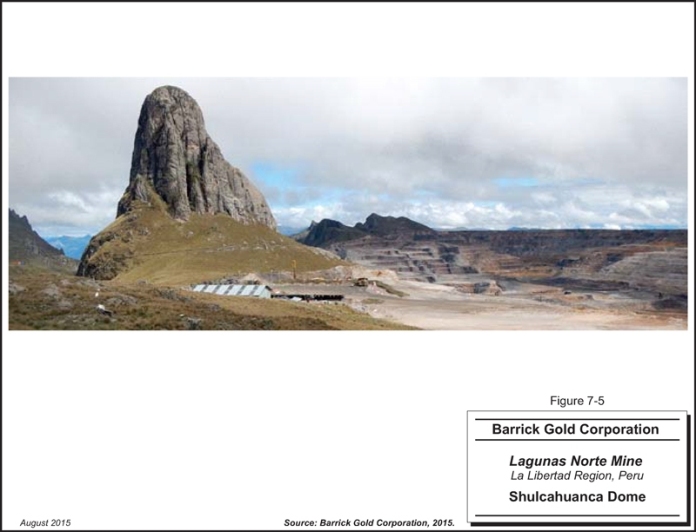

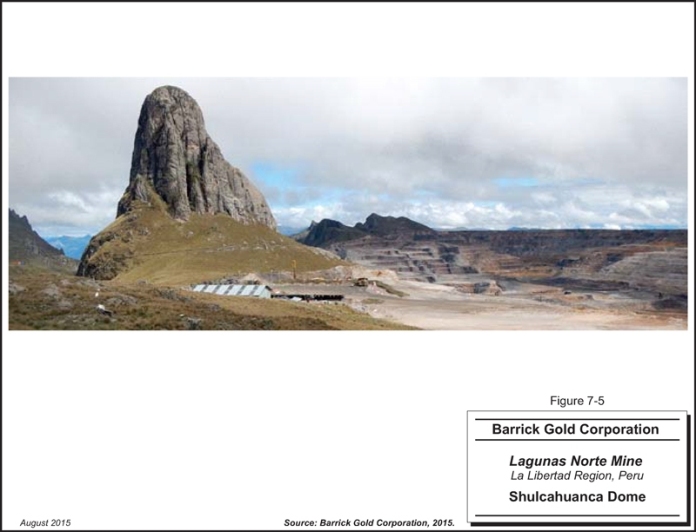

Figure 7-5 | | Shulcahuanca Dome | | | 7-9 | |

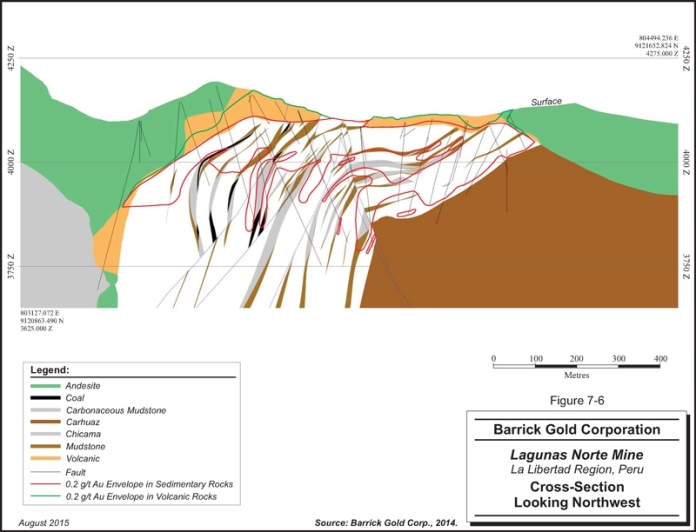

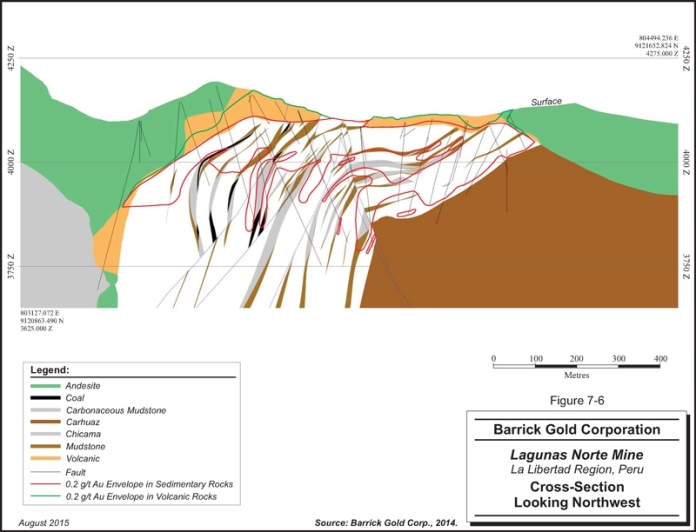

Figure 7-6 | | Cross-Section Looking Northwest | | | 7-10 | |

Figure 7-7 | | Gold Grade Thickness Contours | | | 7-13 | |

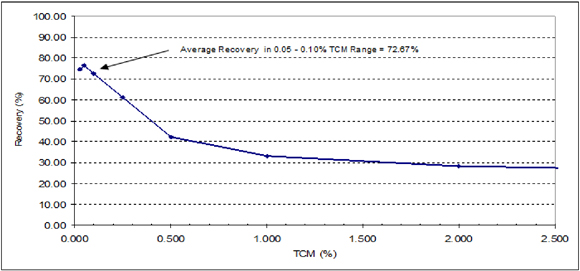

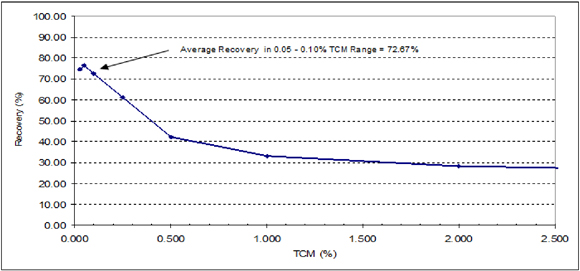

Figure 7-8 | | TCM Versus Gold Recovery | | | 7-16 | |

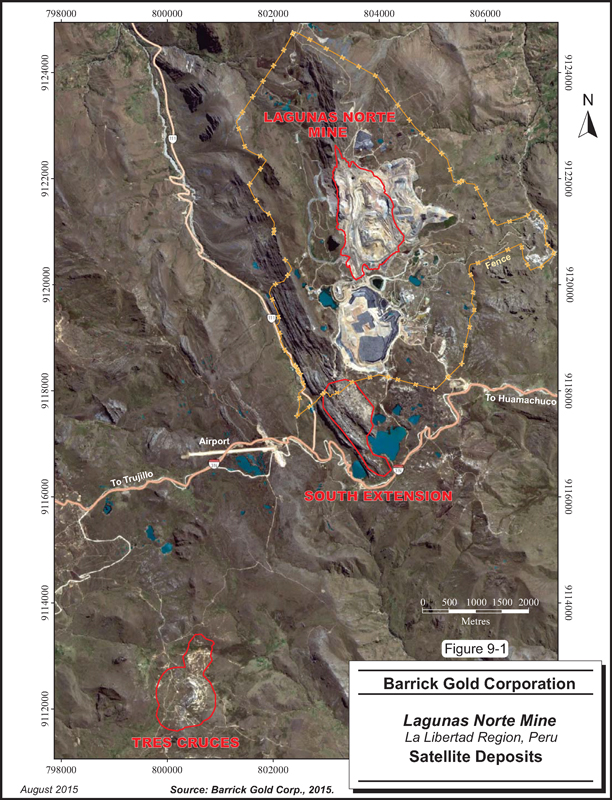

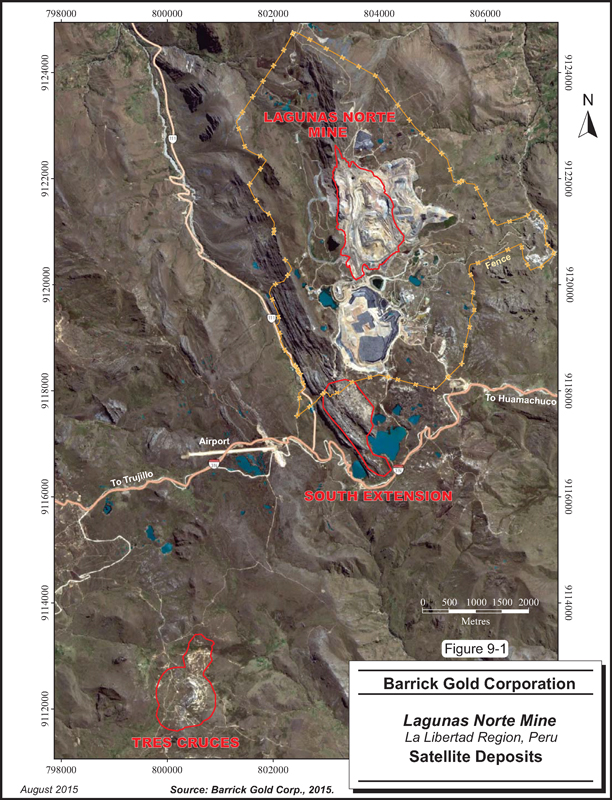

Figure 9-1 | | Satellite Deposits | | | 9-2 | |

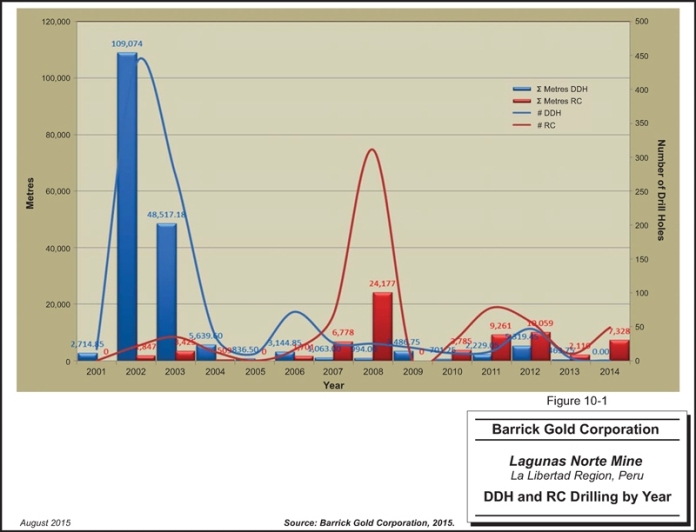

Figure 10-1 | | DDH and RC Drilling by Year | | | 10-3 | |

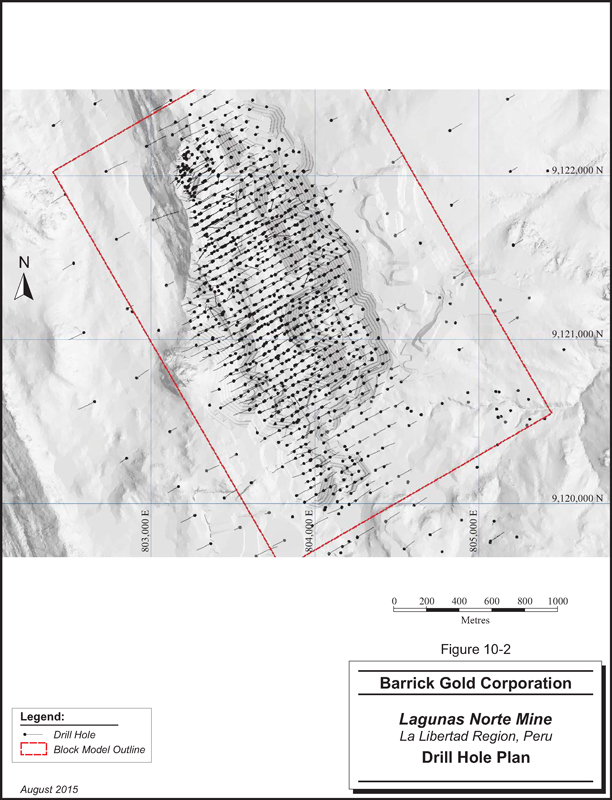

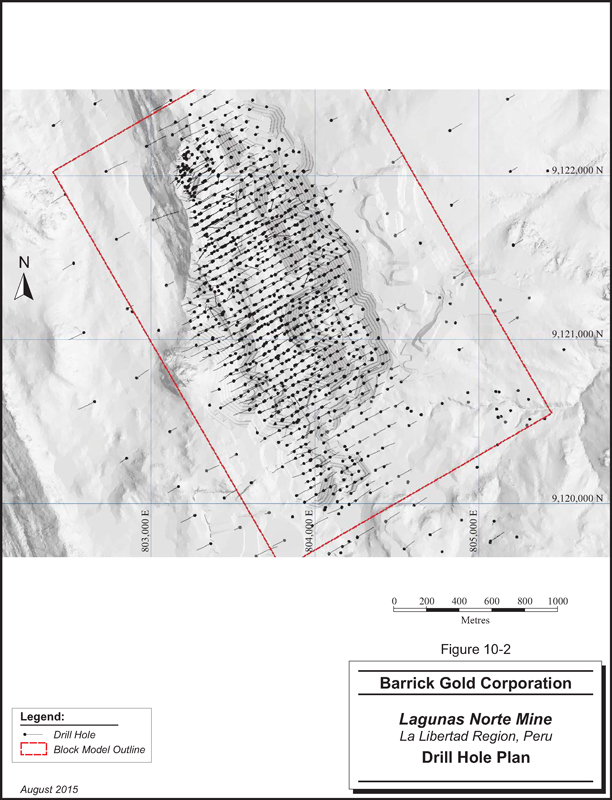

Figure 10-2 | | Drill Hole Plan | | | 10-4 | |

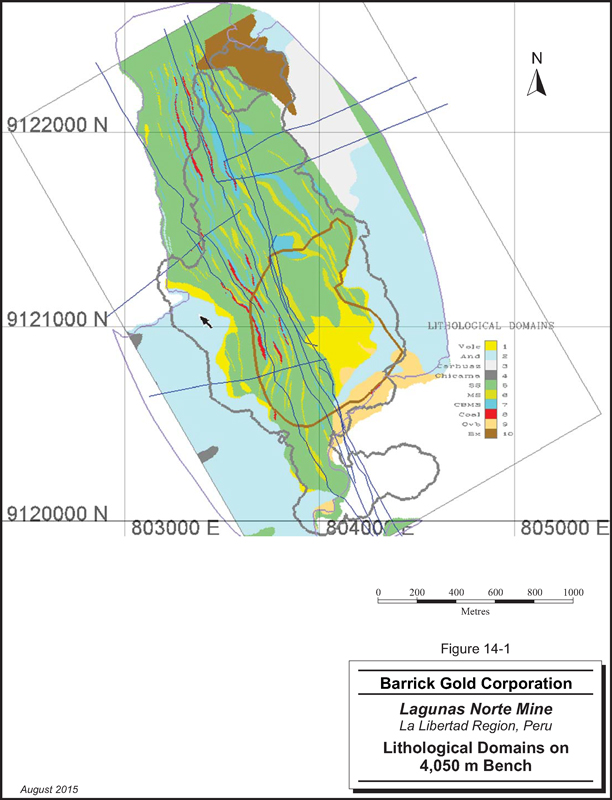

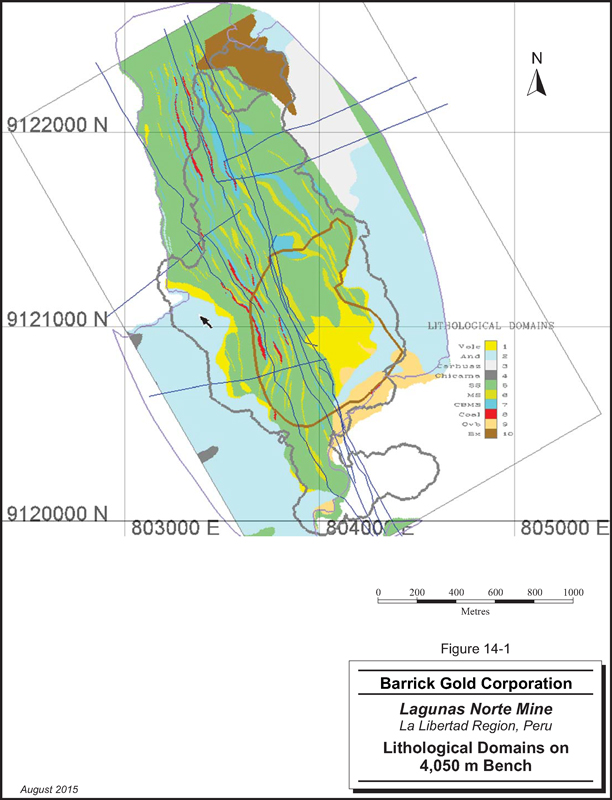

Figure 14-1 | | Lithological Domains on 4,050 m Bench | | | 14-5 | |

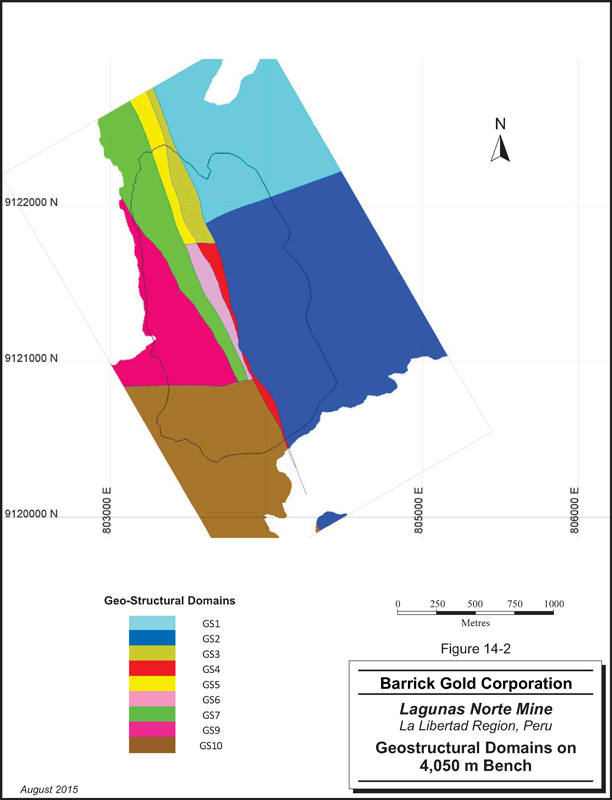

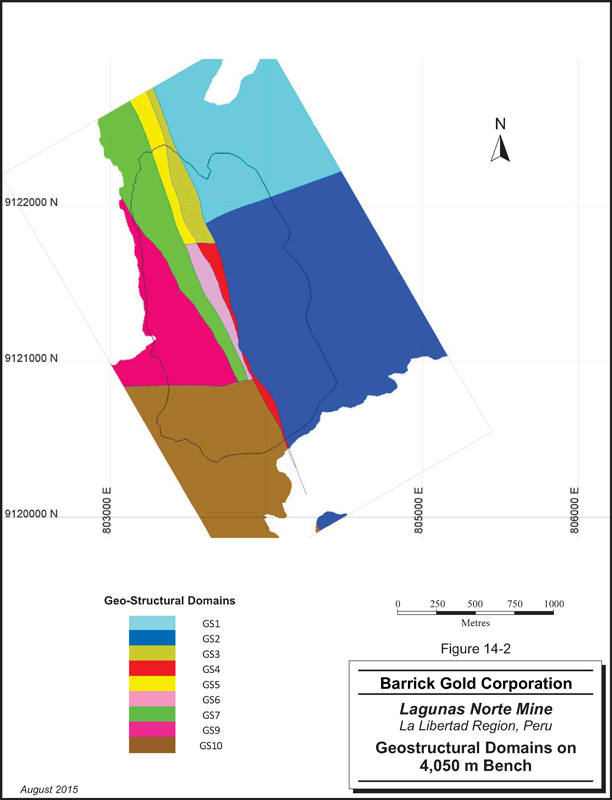

Figure 14-2 | | Geostructural Domains on 4,050 m Bench | | | 14-6 | |

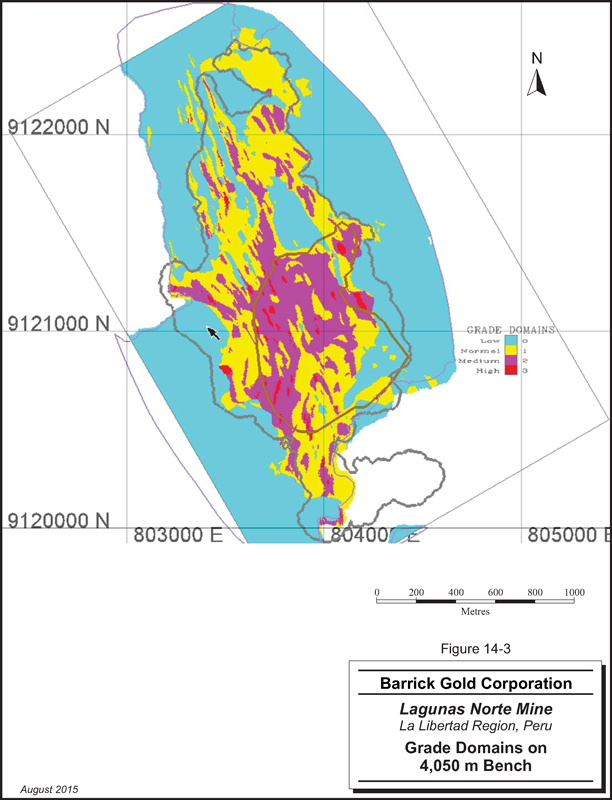

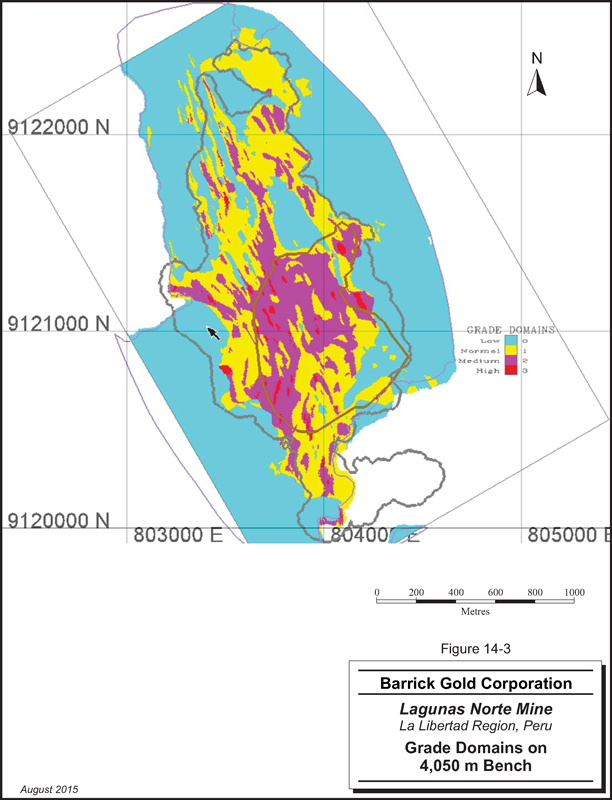

Figure 14-3 | | Grade Domains on 4,050 m Bench | | | 14-8 | |

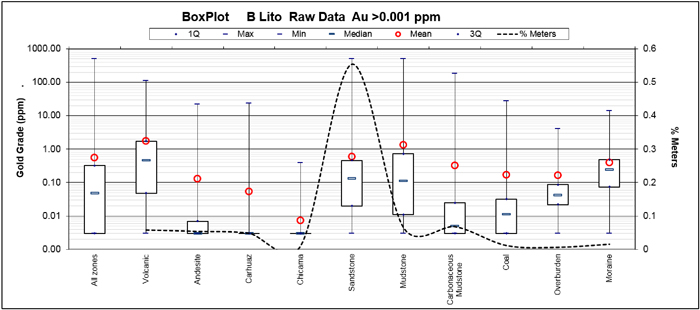

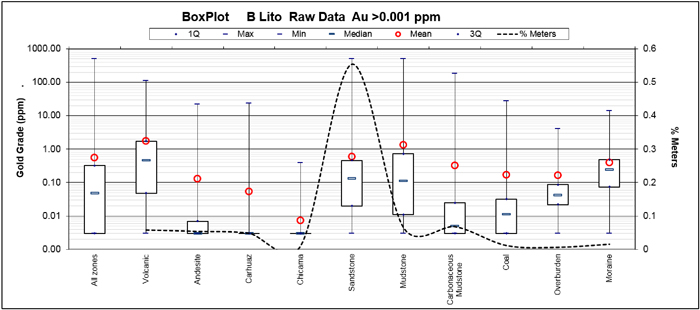

Figure 14-4 | | Gold Assays Box Plot | | | 14-11 | |

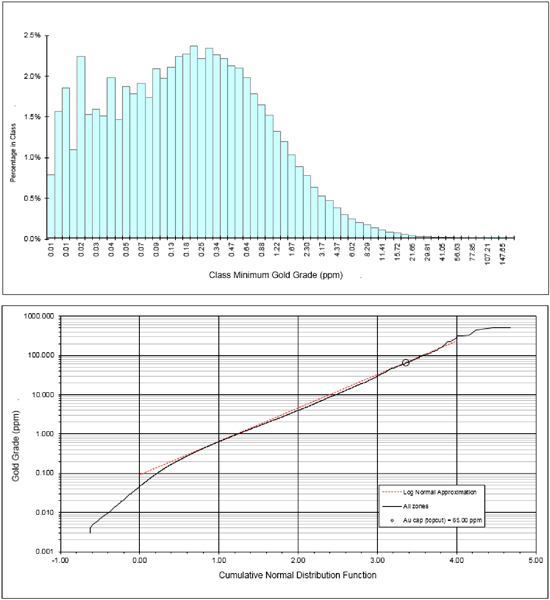

Figure 14-5 | | Assay Cumulative Frequency Distribution – Gold | | | 14-13 | |

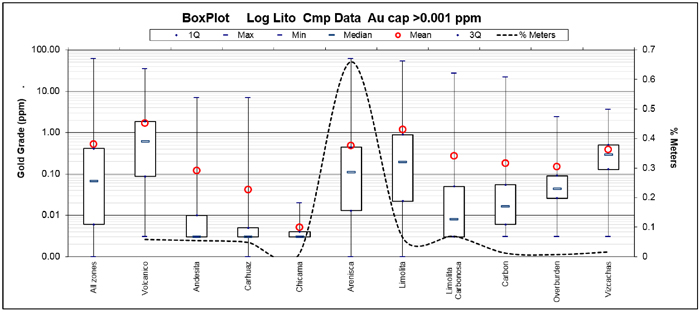

Figure 14-6 | | Gold Composites Box Plot | | | 14-15 | |

Figure 14-7 | | Gold Contact Plot for Volcanic and Sandstone Rocks | | | 14-16 | |

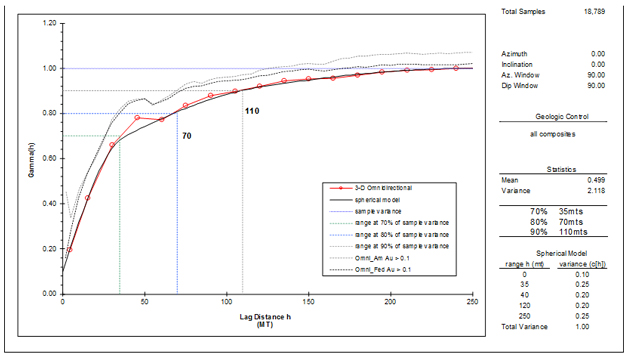

Figure 14-8 | | Lagunas Norte Gold Indicator Variogram | | | 14-17 | |

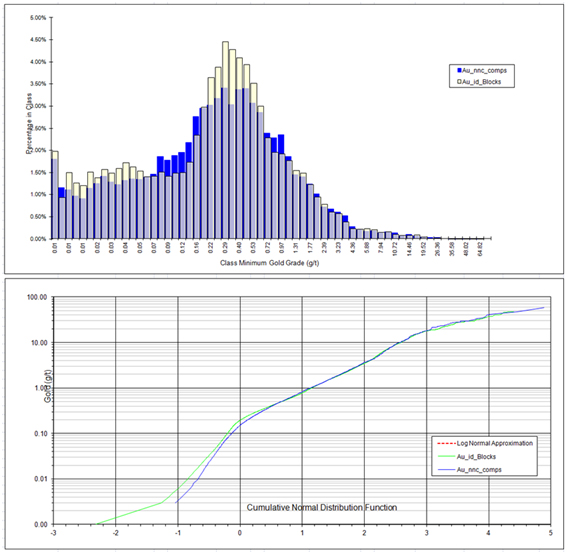

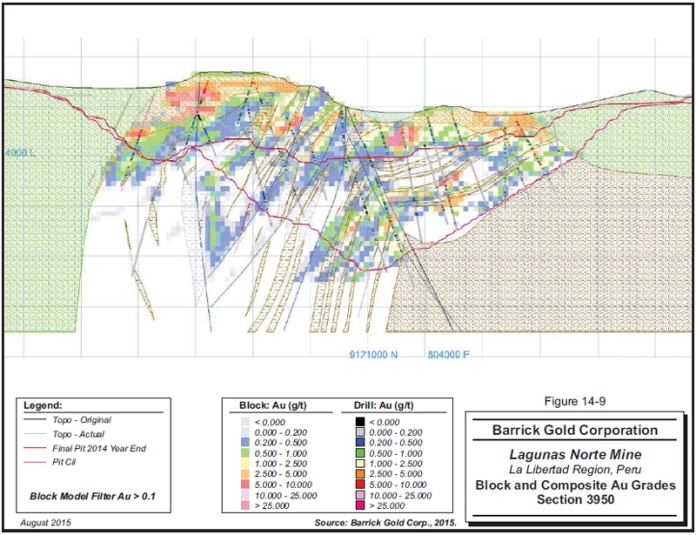

Figure 14-9 | | Block and Composite Au Grades | | | 14-28 | |

| | |

Barrick Gold Corporation – Lagunas Norte Mine, Project #2473 Technical Report NI 43-101 – August 31, 2015 | | Page iv |

| | |

| | www.rpacan.com |

| | | | | | |

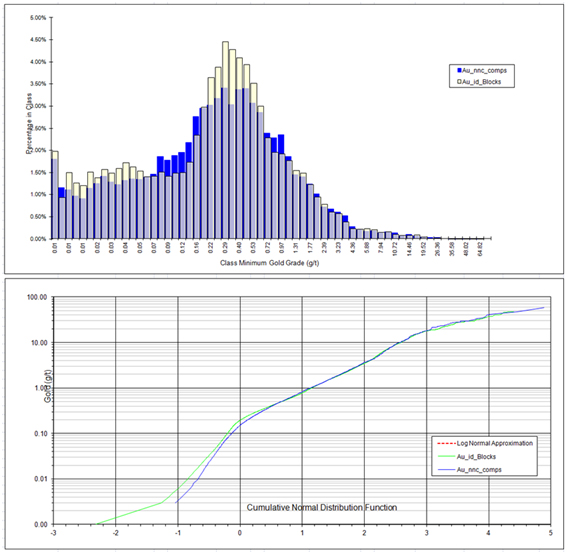

Figure 14-10 | | Gold Block Versus Composite Graphs | | | 14-29 | |

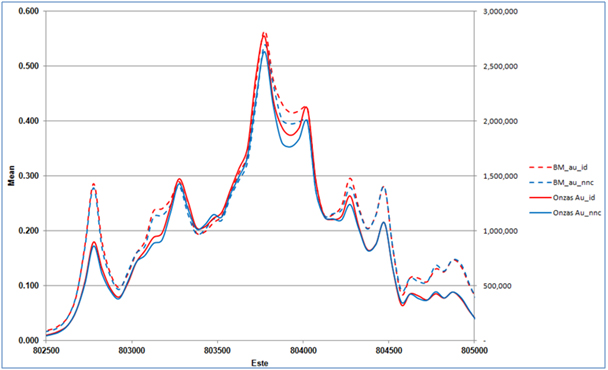

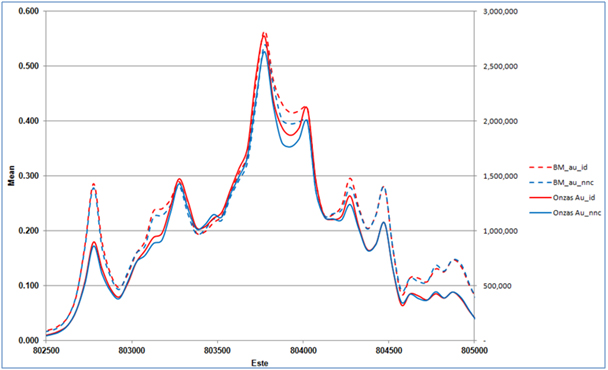

Figure 14-11 | | Gold Swath Plot by Eastings | | | 14-30 | |

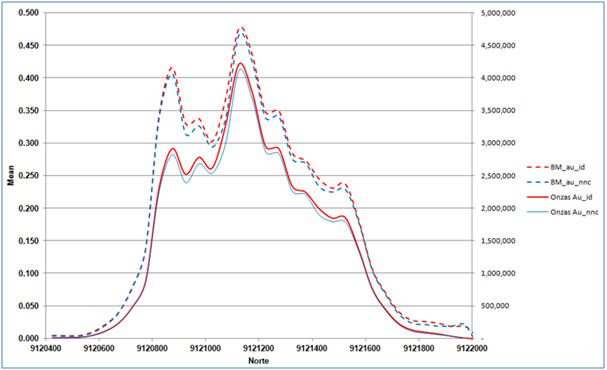

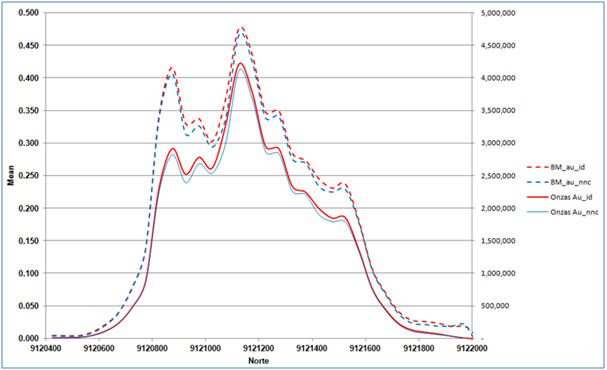

Figure 14-12 | | Gold Swath Plot by Northings | | | 14-30 | |

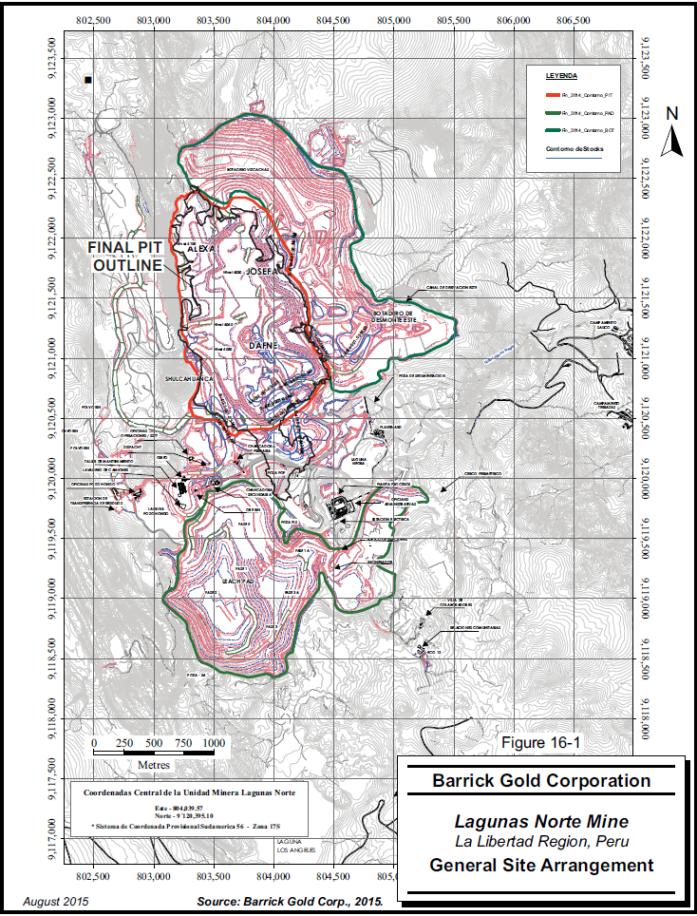

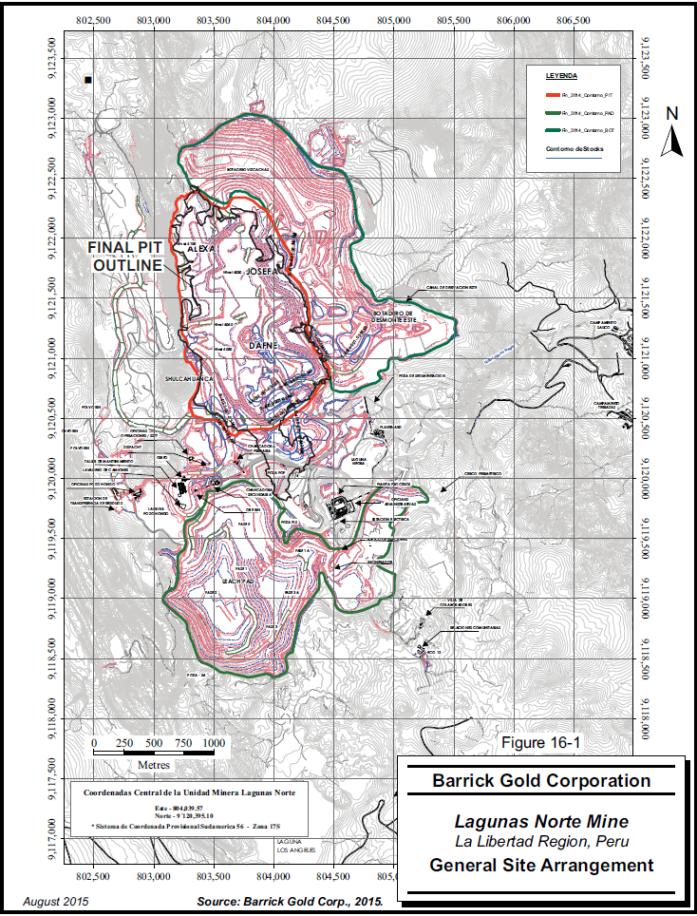

Figure 16-1 | | Lagunas Norte General Site Arrangement | | | 16-2 | |

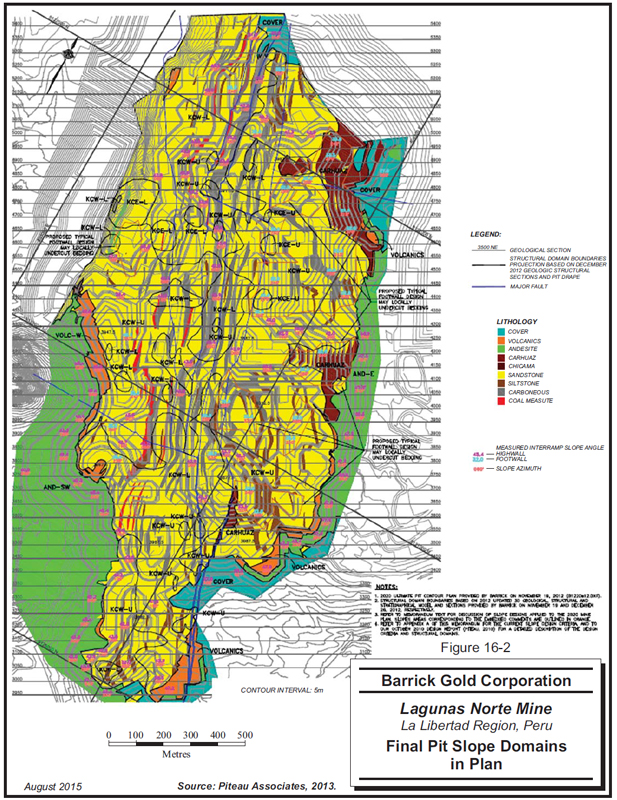

Figure 16-2 | | Lagunas Norte Final Pit Slope Domains in Plan | | | 16-12 | |

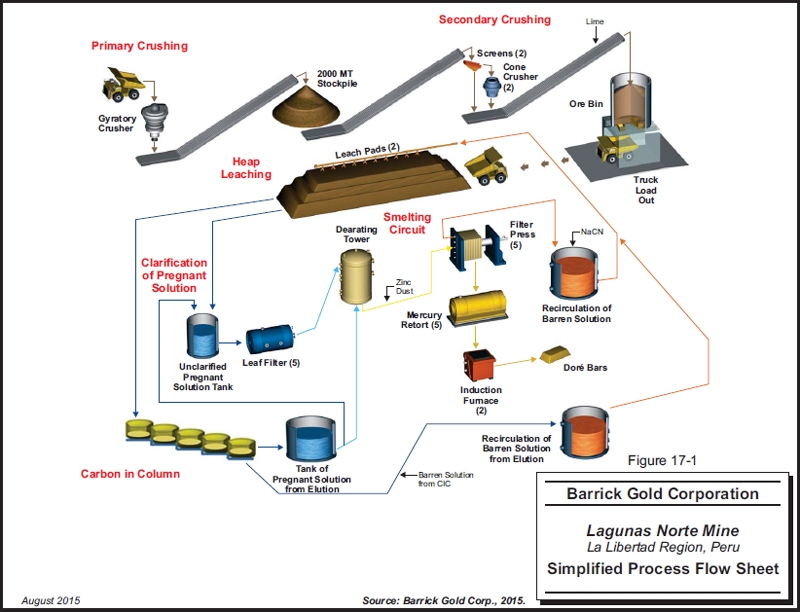

Figure 17-1 | | Simplified Process Flow Sheet | | | 17-6 | |

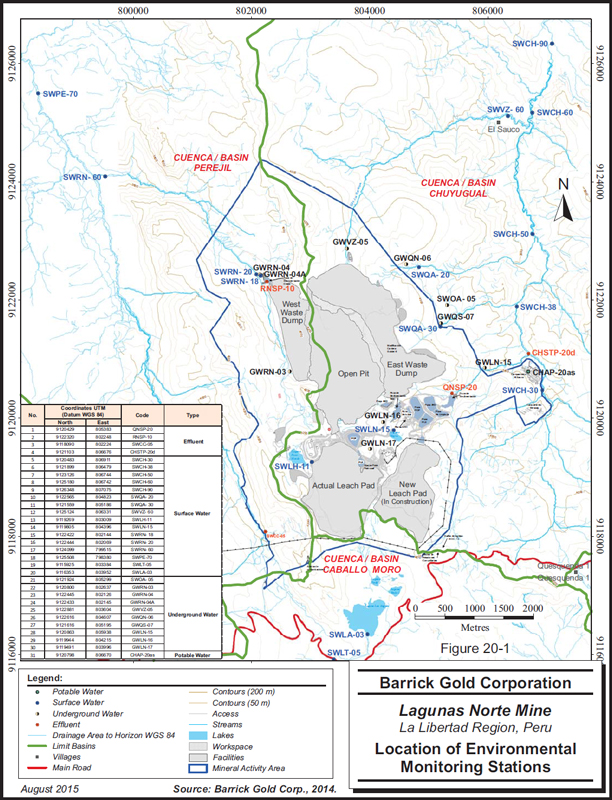

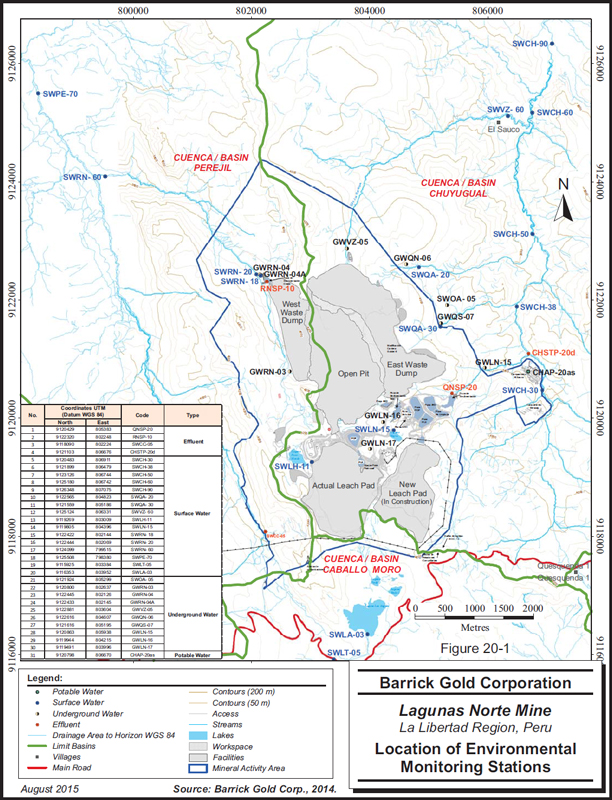

Figure 20-1 | | Location of Environmental Monitoring Stations | | | 20-4 | |

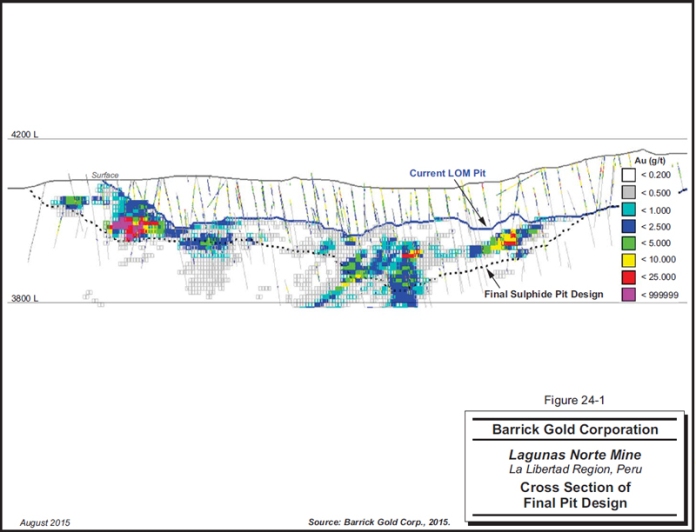

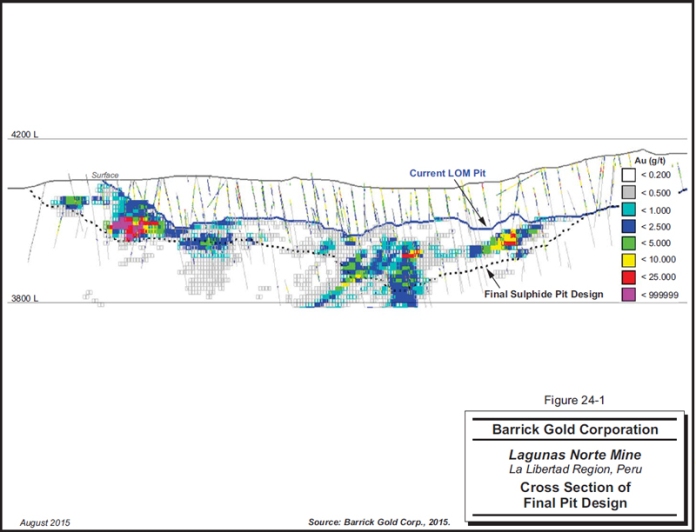

Figure 24-1 | | Cross Section of Final Pit Design | | | 24-5 | |

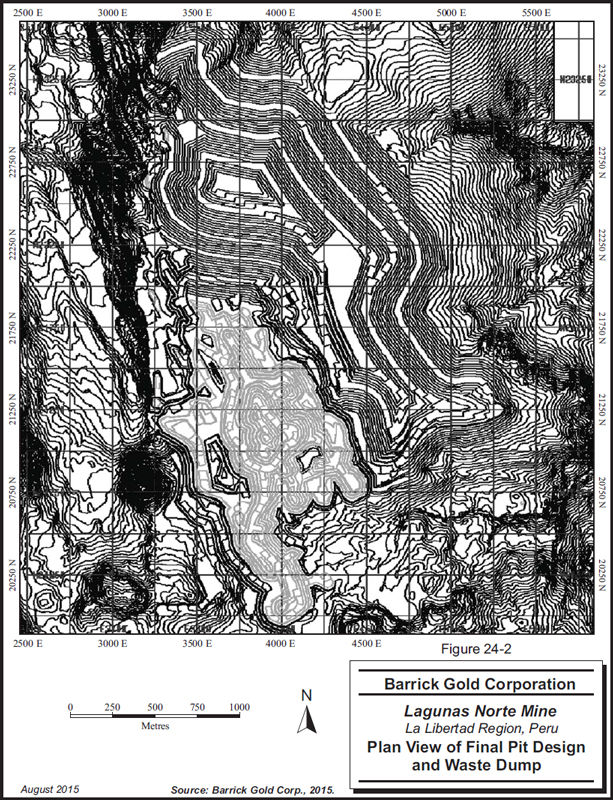

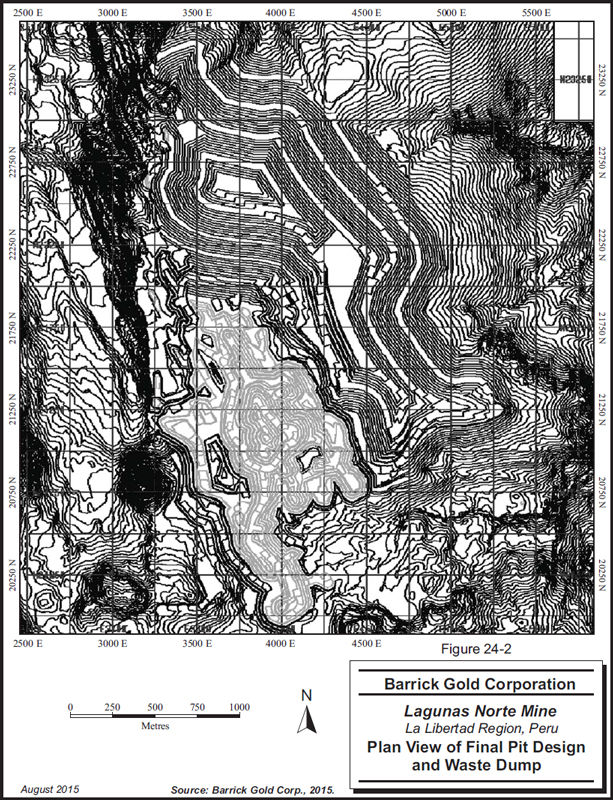

Figure 24-2 | | Plan View of Final Pit Design and Waste Dump | | | 24-6 | |

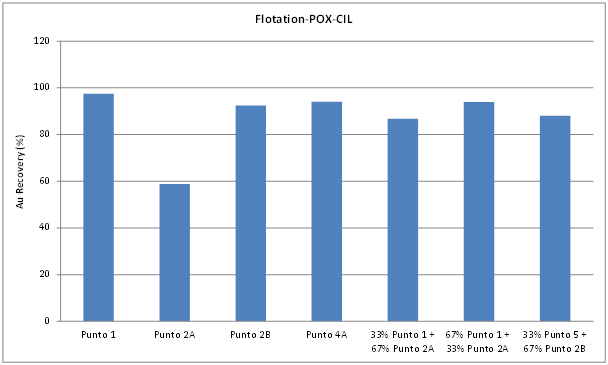

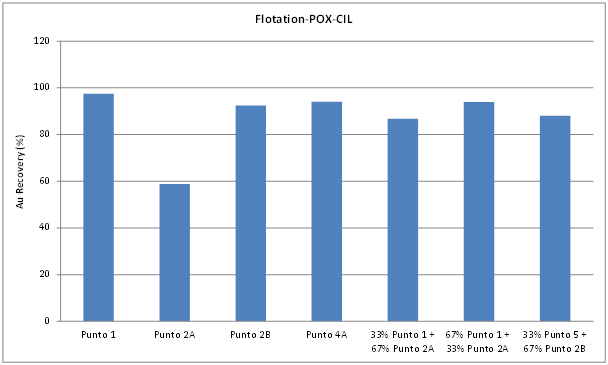

Figure 24-3 | | Final Gold Recovery for Individual Mineralized Material and Blended Mineralized Material | | | 24-13 | |

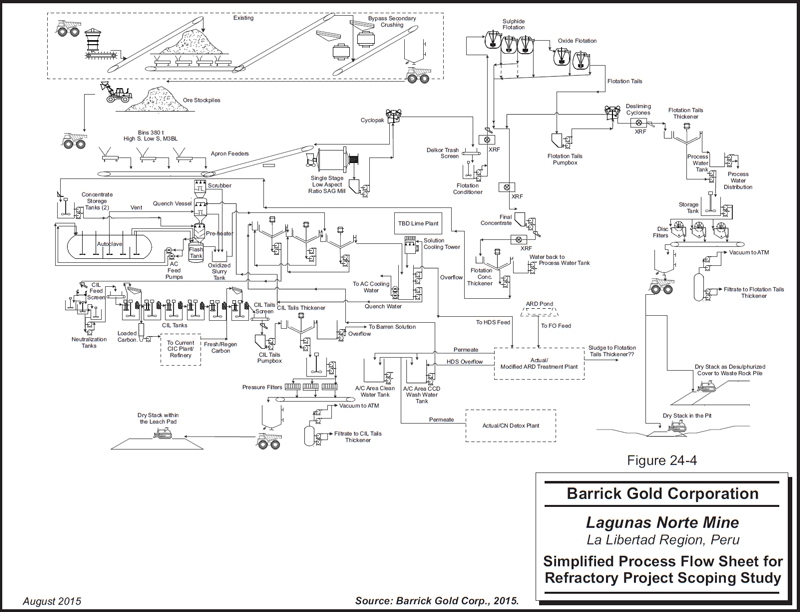

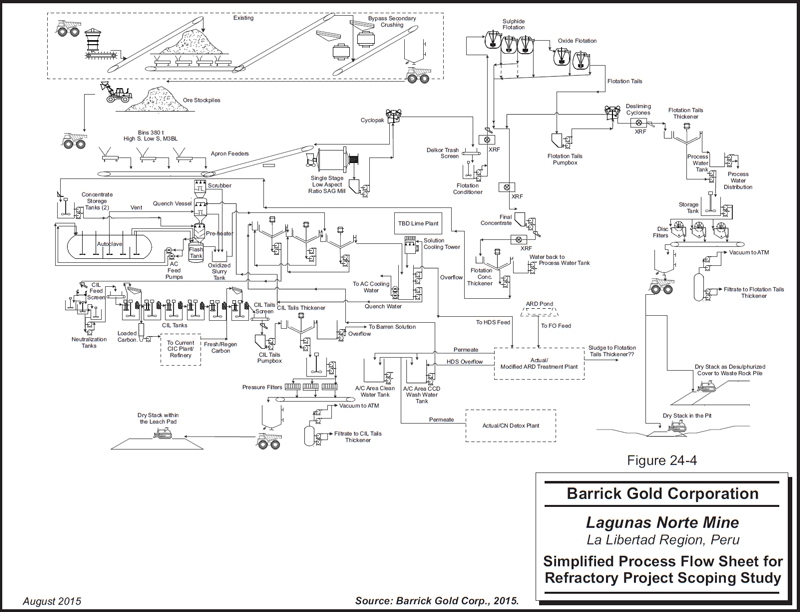

Figure 24-4 | | Simplified Process Flow Sheet for Refractory Project Scoping Study | | | 24-15 | |

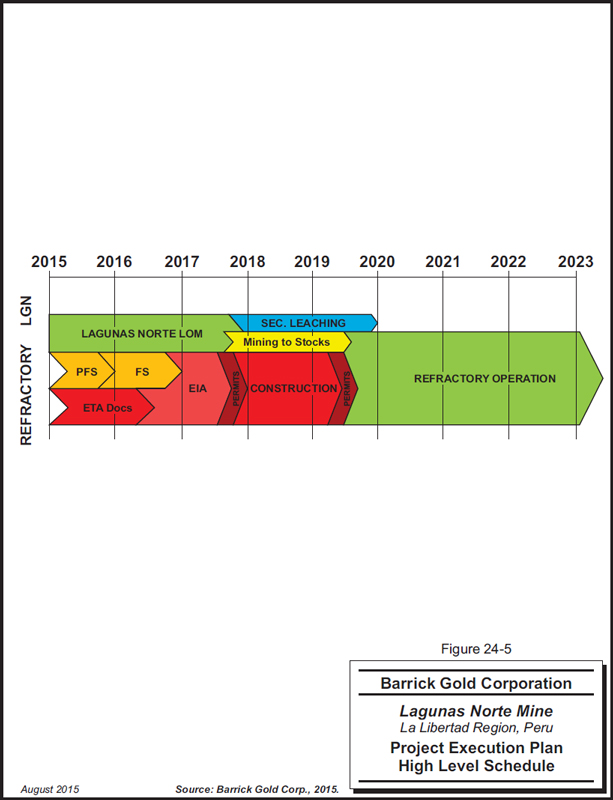

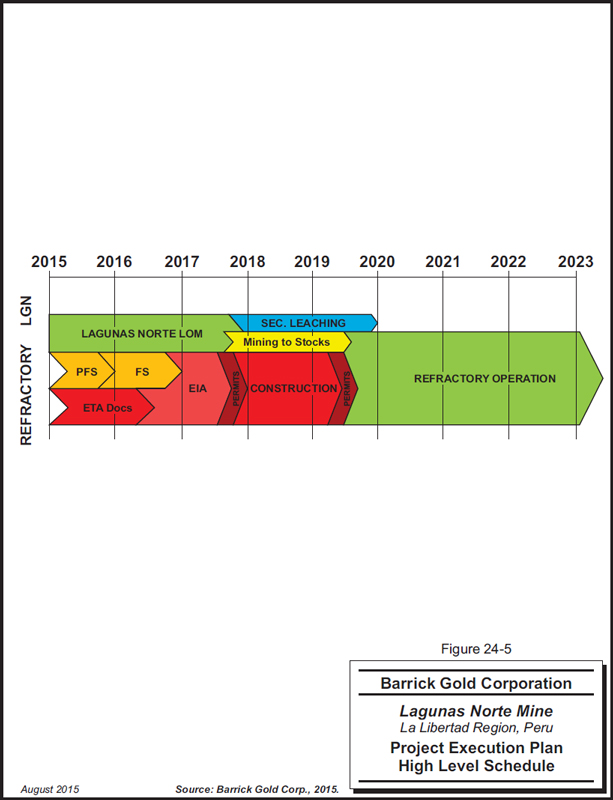

Figure 24-5 | | Project Execution Plan High Level Schedule | | | 24-23 | |

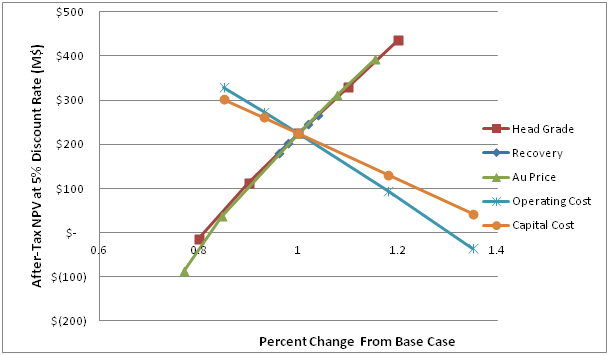

Figure 24-6 | | Sensitivity Analysis Chart | | | 24-30 | |

| | |

Barrick Gold Corporation – Lagunas Norte Mine, Project #2473 Technical Report NI 43-101 – August 31, 2015 | | Page v |

| | |

| | www.rpacan.com |

1 SUMMARY

EXECUTIVE SUMMARY

Roscoe Postle Associates Inc. (RPA) was retained by Barrick Gold Corporation (Barrick) to prepare an independent Technical Report on the Lagunas Norte Gold Mine (the Mine or Lagunas Norte) in Peru. The purpose of this report is to support the public disclosure of Mineral Resource and Mineral Reserve estimates at the Mine as of December 31, 2014. This Technical Report conforms to National Instrument 43-101 Standards of Disclosure for Mineral Projects. RPA visited the property from January 6 to 7, 2015 and held meetings at the Barrick offices in Trujillo and Lima on January 8 and 9, 2015, respectively.

Barrick is a Canadian publicly traded mining company with a large portfolio of operating mines and projects across five continents. The Lagunas Norte Mine is located in the District of Quiruvilca in the Province of Santiago de Chuco and the Department of La Libertad, in north-central Peru. The mine site is approximately 90 km east of the coastal city of Trujillo.

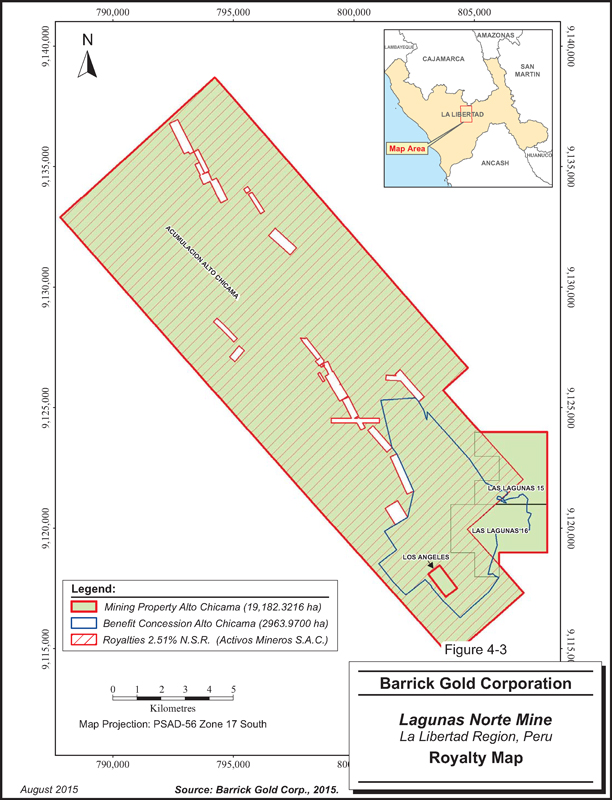

The Mine is owned and operated by Minera Barrick Misquichilca S.A. (MBM), a wholly-owned Peruvian subsidiary of Barrick. The Mine is part of the Alto Chicama property. A 2.51% Net Smelter Return (NSR) royalty is paid to a Peruvian state company, Activos Mineros S.A.C., formerly Centromin Peru S.A. (Centromin). In December 2006, Centromin transferred all of its rights and obligations with respect to the mine to Activos Mineros S.A.C. (Activos Mineros), a state mining company.

Lagunas Norte is a large open-pit, heap leach gold and silver mine in the high Andean Cordillera. Operations include open pit mining of gold-silver ore, crushing, and extraction of precious metals using heap leaching and Merrill Crowe recovery. Since Lagunas Norte started production in March 2005 through December 31, 2014, the mine has recovered 8.4 million ounces (Moz) of gold and 7.8 Moz of silver from approximately 201 million tonnes (Mt) of ore averaging 1.59 g/t Au and 3.6 g/t Ag.

Mining will continue through 2017, including approximately 25 Mt of ore in 2015 and 23 Mt in 2016 and an average of approximately 25 Mt of waste per year. Heap leach placement from

| | |

Barrick Gold Corporation – Lagunas Norte Mine, Project #2473 Technical Report NI 43-101 – August 31, 2015 | | Page 1-1 |

| | |

| | www.rpacan.com |

stockpile will continue for one year after mining ceases, with mine operations concluding in 2018. Most of the ore is crushed prior to placement on the heap leach facility (HLF).

In June 2015, Barrick completed a scoping study, or Preliminary Economic Assessment (PEA), of the potential to mine and process the Lagunas Norte sulphide resources and to extend the life of the operation beyond 2018 (the Lagunas Norte Refractory Material Mine Life Extension Project, or the Refractory Project). Based on a review of the Refractory Project PEA, RPA concurs with Barrick that some of the refractory sulphide mineralization at Lagunas Norte has reasonable prospects for eventual economic extraction if a new grinding-flotation-autoclave processing facility is installed. Work was initiated on a Prefeasibility Study (PFS) in June 2015 to further assess the technical and financial viability and risks associated with the Refractory Project, with completion expected by the end of 2015.

Table 1-1 summarizes the 2014 year-end open pit Mineral Resources exclusive of Mineral Reserves based on a $1,400/oz gold price. The resources in Table 1-1 are mostly oxide mineralization that could be processed using the current heap leaching facility.

TABLE 1-1 OXIDE MINERAL RESOURCES – DECEMBER 31, 2014

Barrick Gold Corporation – Lagunas Norte Mine

| | | | | | | | | | |

| | | Tonnage | | Grade | | Contained Metal |

Category | | (Mt) | | (g/t Au) | | (g/t Ag) | | (Moz Au) | | (Moz Ag) |

Measured | | 1.3 | | 0.75 | | 2.26 | | 0.03 | | 0.10 |

Indicated | | 18.1 | | 0.68 | | 2.10 | | 0.40 | | 1.22 |

| | | | | | | | | | |

Total Measured and Indicated | | 19.4 | | 0.69 | | 2.11 | | 0.43 | | 1.32 |

| | | | | |

Inferred | | 1.6 | | 0.73 | | 2.48 | | 0.04 | | 0.12 |

Notes:

| | 1. | CIM definitions were followed for Mineral Resources. |

| | 2. | Mineral Resources are estimated as of December 31, 2014 using a gold price of US$1,400 per ounce and a silver price of US$19 per ounce. |

| | 3. | Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. |

| | 4. | Mineral Resources are estimated at gold cut-off grades that vary by material type from 0.184 g/t to 0.858 g/t. |

| | 5. | Mineral Resources are exclusive of Mineral Reserves. |

| | 6. | Numbers may not add due to rounding. |

Table 1-2 summarizes the Refractory Project Mineral Resources that have been incorporated into the PEA. The effective date for the Refractory Project resource estimate is December 31, 2014. These resources are mostly sulphide mineralization. RPA notes that there is a minor overlap between the oxide and sulphide resource estimates that totals approximately 74,000

| | |

Barrick Gold Corporation – Lagunas Norte Mine, Project #2473 Technical Report NI 43-101 – August 31, 2015 | | Page 1-2 |

| | |

| | www.rpacan.com |

ounces of gold, which, in RPA’s view, is insignificant as it represents approximately 3% of the total combined oxide and sulphide resource.

TABLE 1-2 REFRACTORY PROJECT MINERAL RESOURCES – DECEMBER 31, 2014

Barrick Gold Corporation – Lagunas Norte Mine

| | | | | | | | | | | | | | | | | | | | |

| | | Tonnage | | | Grade | | | Contained Metal | |

Category | | (Mt) | | | (g/t Au) | | | (g/t Ag) | | | (Moz Au) | | | (Moz Ag) | |

Within Pit Design | | | | | | | | | | | | | | | | | | | | |

Measured | | | 1.2 | | | | 2.60 | | | | 6.51 | | | | 0.10 | | | | 0.25 | |

Indicated | | | 21.2 | | | | 2.54 | | | | 5.90 | | | | 1.73 | | | | 4.02 | |

Measured and Indicated | | | 22.4 | | | | 2.55 | | | | 5.93 | | | | 1.83 | | | | 4.27 | |

Inferred | | | 0.3 | | | | 1.92 | | | | 7.35 | | | | 0.02 | | | | 0.07 | |

| | | | | |

Heap Leach Stockpile | | | | | | | | | | | | | | | | | | | | |

Indicated | | | 5.3 | | | | 2.29 | | | | 8.59 | | | | 0.39 | | | | 1.46 | |

Notes:

| | 1. | CIM definitions were followed for Mineral Resources. |

| | 2. | Mineral Resources are estimated as at December 31, 2014 based on a gold price of US$1,400 per ounce and a silver price of US$24 per ounce. |

| | 3. | Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. |

| | 4. | Mineral Resources are estimated at gold cut-off grades that vary by material type from approximately 0.48 g/t to 1.00 g/t. |

| | 5. | Gold recovery as a result of the PEA is expected to reach an average of 90%. |

| | 6. | The “Within Pit Design” material includes 2.013 Mt of Measured and Indicated Resources grading 1.15 g/t Au and containing 74,000 ounces of gold that are already reported in Table 1-1. |

| | 7. | The “Heap Leach Stockpile” material is expected to be reclaimed from the existing leach facility and re-processed through the new Refractory Project processing facility. |

| | 8. | Numbers may not add due to rounding. |

Table 1-3 summarizes the open pit Mineral Reserves, including existing stockpiles scheduled for processing and inventory, as of December 31, 2014.

| | |

Barrick Gold Corporation – Lagunas Norte Mine, Project #2473 Technical Report NI 43-101 – August 31, 2015 | | Page 1-3 |

| | |

| | www.rpacan.com |

TABLE 1-3 MINERAL RESERVES – DECEMBER 31, 2014

Barrick Gold Corporation – Lagunas Norte Mine

| | | | | | | | | | | | | | | | | | | | |

Category | | Tonnage

(Mt) | | | Au (g/t) | | | Ag (g/t) | | | Contained

Metal

(Moz Au) | | | Contained

Metal

(Moz Ag) | |

Proven | | | 3.0 | | | | 1.30 | | | | 5.05 | | | | 0.1 | | | | 0.5 | |

Probable | | | 52.6 | | | | 1.21 | | | | 4.75 | | | | 2.1 | | | | 8.0 | |

Stockpiles | | | 12.1 | | | | 1.47 | | | | 3.56 | | | | 0.6 | | | | 1.4 | |

Inventory | | | 2.0 | | | | 1.27 | | | | 0.00 | | | | 0.1 | | | | 0.0 | |

| | | | | | | | | | | | | | | | | | | | |

Proven & Probable | | | 69.7 | | | | 1.27 | | | | 4.42 | | | | 2.8 | | | | 9.9 | |

Notes:

| | 1. | CIM definitions were followed for Mineral Reserves. |

| | 2. | Mineral Reserves are estimated at a variable cut-off grade based on process cost, recovery, and profit. The cut-off grades vary from approximately 0.235 g/t Au to 1.093 g/t Au. |

| | 3. | Mineral Reserves as at December 31, 2014 are estimated using an average long-term gold price of US$1,100 per ounce, US$17 per ounce silver, and an US$/PEN exchange rate of 2.8. |

| | 4. | The Mineral Reserve estimate includes inventory. |

| | 5. | Numbers may not add due to rounding. |

CONCLUSIONS

Based on the site visit and subsequent review, RPA offers the following conclusions:

MINERAL RESOURCE ESTIMATION

| | • | | The 2014 year-end Measured and Indicated Mineral Resources, exclusive of Mineral Reserves, total 19.4 Mt averaging 0.69 g/t Au and 2.11 g/t Ag and contain 430,000 oz of gold and 1,320,000 oz of silver. In addition, the 2014 year-end Inferred Mineral Resources total 1.6 Mt averaging 0.73 g/t Au and 2.48 g/t Ag and contain 40,000 oz of gold and 120,000 oz of silver. These resources are mostly oxide mineralization that can be processed using the current heap leaching facility. |

| | • | | The Refractory Project Measured and Indicated Mineral Resources total 27.7 Mt averaging 2.50 g/t Au and 6.44 g/t Ag and contain 2.2 Moz of gold and 5.7 Moz of silver. In addition, the sulphide Inferred Mineral Resources total 0.3 Mt averaging 1.92 g/t Au and 7.35 g/t Ag and contain 19,000 oz of gold and 74,000 oz of silver. These resources are mostly sulphide mineralization. |

| | • | | Mineral Resource estimates have been prepared utilizing acceptable estimation methodologies. The classification of Measured, Indicated, and Inferred Resources, conforms to Canadian Institute of Mining, Metallurgy and Petroleum (CIM) Definition Standards for Mineral Resources and Mineral Reserves dated May 10, 2014 (CIM definitions). |

| | • | | The current drill hole database is reasonable for supporting a resource model for use in Mineral Resource and Mineral Reserve estimation. |

| | • | | The methods and procedures utilized by MBM at the Lagunas Norte Mine to gather geological, geotechnical, assaying, density, and other information are reasonable and meet generally accepted industry standards. Standard operating protocols are well |

| | |

Barrick Gold Corporation – Lagunas Norte Mine, Project #2473 Technical Report NI 43-101 – August 31, 2015 | | Page 1-4 |

| | |

| | www.rpacan.com |

| | documented and updated on a regular basis for most of the common tasks. MBM developed and implemented its own laboratory information management system (LIMS) for the mine laboratory. The mine carries out regular comparisons with blast hole data, previous models, and production reconciliation results to calibrate and improve the resource modelling procedures. |

| | • | | Exploration and development sampling and analysis programs use standard practices, providing generally reasonable results. The resulting data can effectively be used for the estimation of Mineral Resources and Mineral Reserves. |

| | • | | The modelling procedures include hundreds of interpolation runs, the use of length weighted composites to simulate semi-soft boundaries, multiple interim block sizes, and other advanced features that collectively result in a very complex process that is well documented in a step-by-step manner. |

| | • | | The positive gold reconciliation variance of approximately 20% in the past has been eliminated due mostly to infill reverse circulation (RC) drilling and to procedural improvements to the resource model. RC drilling on the Refractory Project sulphide resource could lead to higher grades than currently estimated based on diamond drilling. |

| | • | | Overall, RPA is of the opinion that MBM has conducted very high quality work that exceeds industry practice. |

MINING AND MINERAL RESERVES

| | • | | The 2014 year-end Proven and Probable Reserves, including existing stockpiles scheduled for processing and inventory, total 69.7 Mt grading 1.27 g/t Au and 4.42 g/t Ag, containing 2.8 Moz of gold and 9.9 Moz of silver. |

| | • | | The Mineral Reserve estimates have been prepared utilizing acceptable estimation methodologies and the classification of Proven and Probable Reserves conforms to CIM definitions. |

| | • | | The operating data and the supporting documents were prepared using standard industry practices and provide reasonable results and conclusions. |

| | • | | Recovery and cost estimates are based upon actual operating data and engineering to support a Mineral Reserve statement. Economic analysis using these estimates generates a positive cash flow, which supports a statement of Mineral Reserves. |

| | • | | The current Lagunas Norte production schedule provides reasonable results and, in RPA’s opinion, meets the requirements for statement of Mineral Reserves. In addition to the Mineral Reserves within the ultimate pit, there are Mineral Resources and potential sulphide resources (as described in the PEA) that represent opportunities for the future. |

PROCESS

| | • | | RPA confirmed that the procedures used to estimate gold and silver recovery meet industry standards. |

| | |

Barrick Gold Corporation – Lagunas Norte Mine, Project #2473 Technical Report NI 43-101 – August 31, 2015 | | Page 1-5 |

| | |

| | www.rpacan.com |

| | • | | Solution management practices at Lagunas Norte exceed industry standards. Solution recirculation at the leach pad contributes to a positive water balance and higher concentrations of gold in solution to feed the Merrill Crowe cementation process. The water treatment system is effective in handling acid rock drainage (ARD) and in maintaining water quality at discharge. |

| | • | | In RPA’s opinion, the carbon-in-column (CIC) circuit increases solution flow and will be very beneficial in the long term for solution management. |

ENVIRONMENTAL CONSIDERATIONS

| | • | | The environmental and social practices at Lagunas Norte are very effective and enable Barrick to have a strong “social licence to operate”. |

| | • | | A program of System of Social Management has been instituted and provides employment and training. |

| | • | | Changes in water discharge criteria may require additional capital expenditures and higher operating costs for long term water treatment. |

REFRACTORY PROJECT

| | • | | The PEA confirms that the refractory sulphide mineralization has reasonable prospects for eventual economic extraction. |

| | • | | Operating and capital costs were estimated based on a combination of evaluating processes at similar Barrick operations and obtaining cost quotes for certain capital items. RPA is of the opinion that the estimates are adequate for the PEA study. |

| | • | | There is insufficient variability testing to assess the flotation performance of the various types of ores and the impact of highly carbonaceous material on CIL. Additional testing is currently in progress and while the testwork is not finalized, no material changes have been identified to date that would invalidate the results of the PEA. |

| | • | | The economic analysis of the Refractory Project shows an attractive after-tax Net Present Value (NPV) of $224 million at a discount rate of 5% and an internal rate of return (IRR) of 19% under the assumptions set forth in Section 24 including an assumed gold price of $1,300 per ounce. In RPA’s opinion, the cash flow model meets industry standards for a PEA study. |

RISKS

RPA has not identified any significant risks and uncertainties that could be reasonably expected to affect the reliability or confidence in the exploration information, oxide Mineral Resource, or Mineral Reserve estimates, or associated projected economic outcomes.

Risks associated with the Refractory Project include:

| | • | | Metal price fluctuations. |

| | • | | Preliminary nature of the initial capital cost estimates. |

| | |

Barrick Gold Corporation – Lagunas Norte Mine, Project #2473 Technical Report NI 43-101 – August 31, 2015 | | Page 1-6 |

| | |

| | www.rpacan.com |

| | • | | Sensitivity of economics to possible delays in the project schedule. |

| | • | | Additional metallurgical variability testing is required. |

| | • | | Permitting and approvals for the Refractory Project are at an early stage. |

Metal price, initial capital cost estimate variance, and project delays are the most significant risks to the economics of the Refractory Project. Barrick has developed a strategy to mitigate these risks as outlined in Section 24.

The primary opportunity that is most likely to increase the economic value of the Refractory Project would be an increase in the estimated Mineral Resource grade. Current diamond drilling of the sulphide orebody could understate the grade by as much as 10% to 20%.

RECOMMENDATIONS

RPA makes the following recommendations:

MINERAL RESOURCE ESTIMATION

| | • | | The resource modelling work is very good and no significant procedural changes are warranted. |

| | • | | The minor overlap between the oxide and sulphide resource estimates is due to the fact that the Refractory Project PEA was finalized after disclosure of the year-end 2014 resources. The overlap will be eliminated for the 2015 year-end estimates. |

MINING

| | • | | The Life of Mine (LOM) plan is reasonable and Barrick should proceed to implement the plan as presented. |

PROCESS

| | • | | Continue to conduct routine metallurgical tests to try to improve the accuracy of the calculations used to estimate the recovery of gold and silver. |

CAPITAL AND OPERATING COSTS

| | • | | The current operating costs are well managed and understood. RPA recommends that Lagunas Norte personnel continue exploring cost reduction alternatives. |

| | • | | Continue investigating capital cost reduction as the current mining operation will end in 2018. |

REFRACTORY PROJECT

| | • | | Complete a PFS on the Refractory Project. |

| | |

Barrick Gold Corporation – Lagunas Norte Mine, Project #2473 Technical Report NI 43-101 – August 31, 2015 | | Page 1-7 |

| | |

| | www.rpacan.com |

| | • | | Consider additional RC drilling. |

| | • | | Additional sampling and metallurgical testing should be undertaken during the next stage of study, including testing of M3BL ores. |

| | • | | Minimize potential risks associated with the design and operation of dry stack tailings residue disposal with advanced engineering study. |

| | • | | As part of a future EIA, update the Environmental Management Plan for Lagunas Norte to reflect the new facilities proposed under the Refractory Project. |

ECONOMIC ANALYSIS

Under NI 43-101 rules, producing issuers may exclude the information required in this section on properties currently in production, unless the Technical Report includes a material expansion of current production. RPA notes that Barrick is a producing issuer, the Lagunas Norte Mine is currently in production, and a material expansion is not being planned. RPA has performed an economic analysis of the Lagunas Norte Mine using the estimates presented in this report and confirms that the outcome is a positive cash flow that supports the statement of Mineral Reserves.

TECHNICAL SUMMARY

PROPERTY DESCRIPTION AND LOCATION

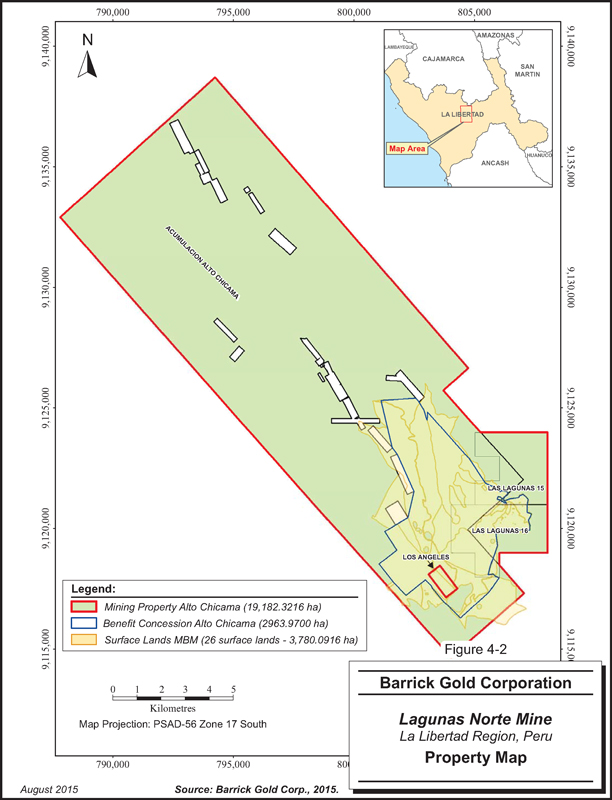

The Mine is located on the 185 km2 Alto Chicama property in the La Libertad Region, north-central Peru, approximately 90 km east of the coastal city of Trujillo and 175 km north of Barrick’s Pierina Mine. The mine is located at 7º57’ S latitude and 78º15’ W longitude and lies on the western flank of the Peruvian Andes at an elevation of 4,000 MASL to 4,260 MASL. Access is by public roads from Trujillo for a total driving distance of approximately 150 km.

LAND TENURE

The Alto Chicama property includes four mining concessions (Acumulación Alto Chicama, Los Angeles, Las Lagunas 15, and Las Lagunas 16) totalling 19,182.2760 ha. The Lagunas Norte Mine is located on the Acumulación Alto Chicama mining concession. MBM acquired this concession in December 2002 from Centromin, the Peruvian state mining company, pursuant to an international bid process. Production at Lagunas Norte is subject to 2.51% NSR royalty, payable semi-annually to Activos Mineros on the extraction of gold and all other minerals.

| | |

Barrick Gold Corporation – Lagunas Norte Mine, Project #2473 Technical Report NI 43-101 – August 31, 2015 | | Page 1-8 |

| | |

| | www.rpacan.com |

The Acumulación Alto Chicama has no expiry date since it is in exploitation phase. In order to maintain its validity, however, a Validity Fee, of US$3.00/ha, must be paid no later than June 30 each year. Non-fulfillment for two consecutive years results in expiration of a mining concession. The Validity Fee payments for the Alto Chicama property were up to date as of December 2014.

On December 29, 2004, Barrick entered into a Legal Stability Agreement with the Peruvian government, which provides increased certainty with respect to tax, administrative, and exchange stability to MBM for 15 years until December 31, 2020. In January 2015, Barrick made a limited election out of the tax stability provisions included in the Legal Stability Agreement to apply the reduced income tax rates.

MBM controls surface rights totalling 3,778.0798 ha in the mine area, which are sufficient to mine the current reserves.

EXISTING INFRASTRUCTURE

Lagunas Norte infrastructure and services have been designed to support an operation of 63,000 tonnes per day (tpd) of ore to an HLF and a nominal 140,000 tpd of total material mined. Due to the remote location, the property is self-sufficient with regard to the infrastructure needed to support the operation.

Site infrastructure includes the open pit, heap leach pads, crushing facilities, CIC Plant, Merrill Crowe recovery plant, on-site facilities (safety/security/first aid/emergency response building, assay laboratory, plant guard house, dining facilities, and offices), related mine services (truckshop, truck wash facility, warehouse, fuel storage and distribution facilities, reagent storage and distribution facilities), and other facilities to support operations. Permanent accommodations are available for certain Lagunas Norte employees and visitors and are located approximately three kilometres east and downslope of the Lagunas Norte open pit operations at approximately 3,800 MASL.

The water for process and mining consumptive needs is delivered rain captured on two small lakes. There is plenty of water available for consumptive use now and for the future. At Lagunas Norte, a water management group is in place to carry out all dewatering including pumping, distribution, delivery, and disposal. Lagunas Norte has a positive water balance.

| | |

Barrick Gold Corporation – Lagunas Norte Mine, Project #2473 Technical Report NI 43-101 – August 31, 2015 | | Page 1-9 |

| | |

| | www.rpacan.com |

Electricity is provided by a private-owned generation company and delivered to Lagunas Norte through a high voltage power line connected to the National Grid in Trujillo.

HISTORY

MBM commenced a field program at Alto Chicama in March 2001, which included geologic mapping, geochemical sampling, and ground geophysics. This work resulted in the identification of targets for drill testing. Drilling commenced in mid-2001 and the initial program identified the Las Lagunas Norte area as justifying detailed follow-up. Subsequent drilling was concentrated in the Las Lagunas Norte area.

On April 2, 2004, the Alto Chicama environmental impact assessment (EIA) received regulatory approval and on April 12, 2004, the Plant Construction Authorization was granted which authorized MBM to construct and install the Alto Chicama process plant and related facilities.

Construction started in 2004 and the first ore was placed on the leach pad in March 2005. First pour was realized in June 2005. In August 2010, the Project received regulatory approval for an EIA amendment, including the expansion of the leach pad facility, expansion of the Waste Rock Facility, construction of a new CIC process plant, construction of a new water treatment system, as well as other ancillary facilities.

As of the end of 2014, the mine has recovered 8.4 Moz of gold and 7.8 Moz of silver from approximately 201 Mt of ore averaging 1.59 g/t Au and 3.6 g/t Ag.

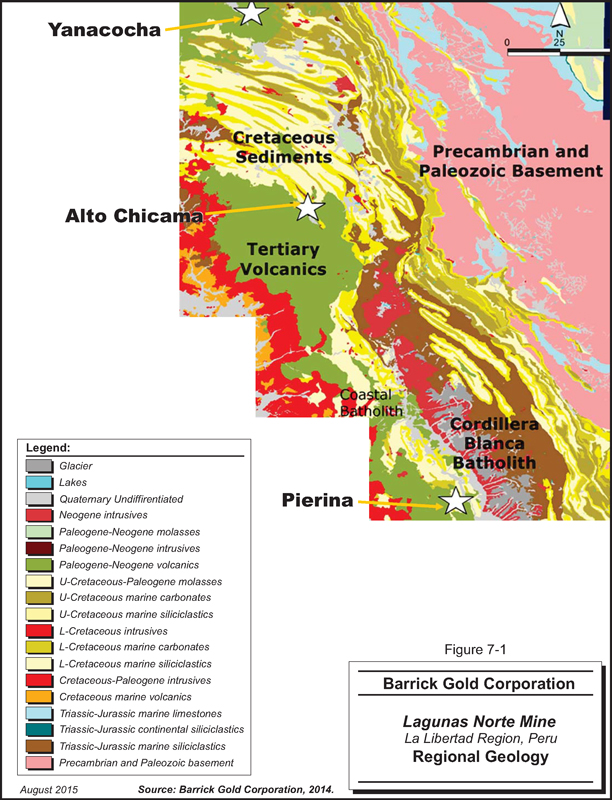

GEOLOGY AND MINERALIZATION

The regional geology is dominated by a thick sequence of Mesozoic marine clastic and carbonate sedimentary rocks, which are bounded to the west by the Mesozoic to Early Tertiary Coastal Batholith and to the east by the Precambrian metamorphic rocks of the Marañón Complex. The Mesozoic sequence has been affected by at least one and possibly two stages of deformation during the Andean Orogeny. The volcanic rocks of the Tertiary Calipuy Group unconformably overlie the Mesozoic rocks.

Mineralization is the result of multiple volcanic and hydrothermal events. It occurs in the southeast portion of the Alto Chicama property and is hosted in both the Tertiary volcanics of

| | |

Barrick Gold Corporation – Lagunas Norte Mine, Project #2473 Technical Report NI 43-101 – August 31, 2015 | | Page 1-10 |

| | |

| | www.rpacan.com |

the Calipuy Group and the underlying Cretaceous sedimentary rocks of the Chimú Formation. The deposit is locally faulted by relatively steeply dipping structures and is primarily controlled by stratigraphy and lithologic contacts.

The mineralization within the present pit extends for approximately two kilometres in the north-northwest direction by approximately two kilometres in the east-northeast direction and for more than 200 m vertically. Most of the mineralization (75%) occurs as oxide material, with approximately 25% occurring as sulphide material.

A significant characteristic of the Lagunas Norte deposit is the variable carbonaceous content found within the siliclastic sedimentary strata.

EXPLORATION

Field exploration on the Alto Chicama property by MBM commenced in March 2001. Following detailed mapping, geophysical and geochemical surveys, PIMA analysis, and channel sampling, drilling commenced in June 2001. In 2002, environmental, metallurgical, and engineering studies, together with cost estimation and economic analysis, were started, and by January 31, 2003, the first reserve estimate for Lagunas Norte was completed.

Approximately half of the metreage drilled up to 2011 was done in 2002 and included almost entirely diamond drill holes. Since 2007, there has been much more RC drilling after the discovery that the gold grades from core samples were biased low relative to production and to RC samples.

In 2006, resource definition drilling commenced at the satellite deposits of South Extension and Tres Cruces.

MINERAL RESOURCES

The 2014 year-end Measured and Indicated Mineral Resources, exclusive of Mineral Reserves, total 19.4 Mt averaging 0.69 g/t Au and 2.11 g/t Ag and contain 430,000 oz of gold and 1,320,000 oz of silver. In addition, the 2014 year-end Inferred Mineral Resources total 1.6 Mt averaging 0.73 g/t Au and 2.48 g/t Ag and contain 40,000 oz of gold and 120,000 oz of silver. These resources are mostly oxide mineralization that can be processed using the current heap leaching facility.

| | |

Barrick Gold Corporation – Lagunas Norte Mine, Project #2473 Technical Report NI 43-101 – August 31, 2015 | | Page 1-11 |

| | |

| | www.rpacan.com |

The June 2015 PEA confirms that the refractory sulphide mineralization has reasonable prospects for eventual economic extraction. The sulphide Measured and Indicated Mineral Resources total 27.7 Mt averaging 2.50 g/t Au and 6.44 g/t Ag and contain 2.2 Moz of gold and 5.7 Moz of silver. In addition, the sulphide Inferred Mineral Resources total 0.3 Mt averaging 1.92 g/t Au and 7.4 g/t Ag and contain 19,000 oz of gold and 74,000 oz of silver.

Most of the modelling work was completed in May 2014 by MBM Senior Resource Geologist Melissa Vasquez, MBM Superintendent of Geology Luis Sanchez, and Senior Geologist Cristobal Valenzuela under the supervision of Barrick Senior Manager, Resource and Reserve Benjamin Sanfurgo. The model was updated with 39 RC drill holes in November 2014.

RPA reviewed the resource assumptions, input parameters, geological interpretation, and block modelling procedures and is of the opinion that the resource modelling work is very good. A significant number of block model iterations were run to fine tune the resource block model estimation parameters. Reconciliation data for 2014 indicate that the resource model overestimates the tonnage by approximately 5%, and underestimates the gold grade by approximately 4% and contained gold ounces by approximately 0% compared to the grade control blast hole model

RPA notes that the modelling procedures include hundreds of interpolation runs, the use of length weighted composites to simulate semi-soft boundaries, multiple interim block sizes, and other advanced and innovative features that collectively result in a very complex, but effective process that is well documented in a step-by-step manner.

RPA is not aware of any environmental, permitting, legal, title, taxation, socio-economic, marketing, political, or other issues that could materially affect the Mineral Resource and Mineral Reserve estimates.

MINERAL RESERVES

RPA reviewed the reported resources, production schedules, and cash flow analysis to determine if the resources meet the CIM definitions. Based on this review, it is RPA’s assessment that the Measured and Indicated Mineral Resource within the final pit design at Lagunas Norte can be classified as Proven and Probable Mineral Reserves.

| | |

Barrick Gold Corporation – Lagunas Norte Mine, Project #2473 Technical Report NI 43-101 – August 31, 2015 | | Page 1-12 |

| | |

| | www.rpacan.com |

The open pit Proven and Probable Reserves, including existing stockpiles scheduled for processing, total 69.7 Mt at 1.27 g/t Au and 4.4 g/t Ag, containing 2.8 Moz of gold and 9.9 Moz of silver as presented in Table 1-3.

MINING METHOD

The Lagunas Norte Mine is a traditional open pit truck/shovel heap leach operation that has been in continuous production since 2005. To date, Lagunas Norte has produced 8.4 Moz of gold and 7.8 Moz of silver.

Open pit mining operations are located on a mountain top with gentle to extreme terrain between elevations of 3,800 MASL and 4,200 MASL. Mining is from a single open pit at a rate of 25 Mt of ore in 2015 and 23 Mt of ore in 2016 and is scheduled to continue through 2017, the final year of open pit operations. Heap leach placement from stockpile will continue for one year after mining ceases, with mine operations concluding in 2018. Most of the ore is crushed prior to placement on the HLF.

The Lagunas Norte ultimate pit measures approximately 2.5 km along strike, typically 0.8 km to 1.2 km across with a surface footprint of approximately 240 ha, and has a maximum depth of approximately 250 m. There are four main areas of development identified within the ultimate pit: Dafne, Josefa, Alexa, and the moraines furthest to the north. The open pit is overlooked by the Shulcahuanca Dome, a sacred feature, and there is an approximate 50 m standoff from the base of the Shulcahuanca Dome for mine planning and operations.

Final arrangement of the Lagunas Norte waste rock facilities is for the continued development of surface dumps surrounding the Lagunas Norte ultimate pit other than to the south-southeast where the HLF is located, resulting in a relatively compact overall footprint.

MINERAL PROCESSING

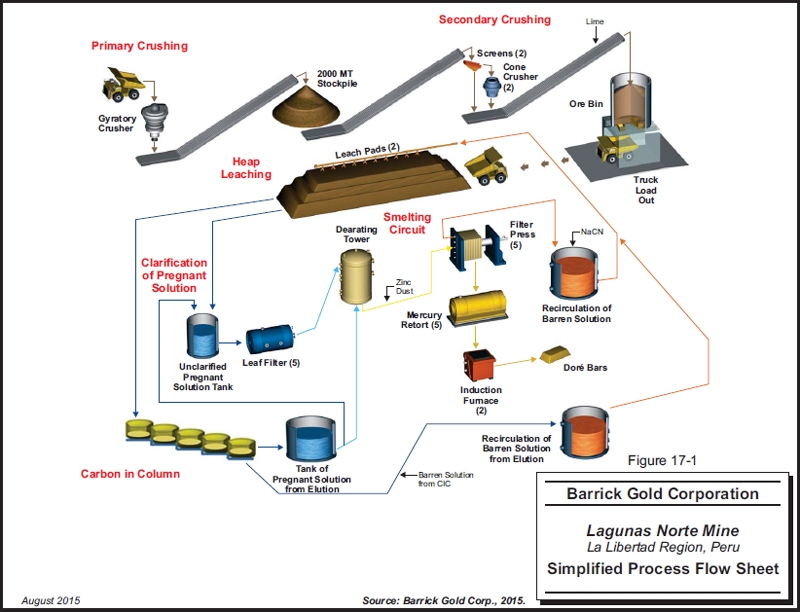

The recovery process used at Lagunas Norte is a two-stage conventional crushing circuit, followed by heap leaching, and a Merrill Crowe zinc cementation plant and CIC for recovery of the precious metals. The major components of the process are primary crushing, secondary crushing, heap leaching, recovery plant, refinery, and water discharge treatment plant.

| | |

Barrick Gold Corporation – Lagunas Norte Mine, Project #2473 Technical Report NI 43-101 – August 31, 2015 | | Page 1-13 |

| | |

| | www.rpacan.com |

The crushing circuit was originally designed to crush 42,000 tpd, but the capacity is permitted to 63,000 tpd. Historically, it was determined that the gold recovery from heap leaching at Lagunas Norte is not overly dependent on crush size, so the size has been increased over time to allow more material to be processed through the crushing circuit. The crushed ore is conveyed to a 2,000 tonne live capacity stockpile, from which it is fed to the secondary crushers. From the secondary crusher, the ore is loaded into haul trucks that transport it to the leach pad. Lime is added to the trucks to raise the pH of the leach solution.

At the leach pad, stacking of the crushed ore is done in 10 m high lifts with assistance from a high precision GPS dozer. Ore classified as contaminated based on the concentration of total carbonaceous material is stacked on a separate area of the leach pad. Some of the contaminated ore is crushed and some is not, depending on the type of ore. Once the cell has been prepared, a drip irrigation system is laid on top of the ore. Cyanide solution is trickled through the pad at the rate of 20 L/m2/h. After passing through the pad, pregnant solutions are temporarily stored in the pregnant leach solution pond, then pumped to the process plant using vertical turbine pumps at the rate of 2,700 m3/h. The plant and pumping systems have been modified to increase the flow rate to 3,000 m3/h, which is adequate to maintain the optimum solution to ore ratio.

The pregnant solution is pumped to the Merrill Crowe zinc cementation recovery plant. The suspended solids are removed in the clarifier and the dissolved oxygen concentration is reduced to less than one part per million by the de-aerator. From the de-aerator the solution passes through a cone where powdered zinc is added and the gold and silver precipitate out of the solution. The precipitate is recovered from the solution using filter presses and put into trays that are placed in mercury retorts. In the retorts, the precipitate is gradually heated so that it dries and the mercury is evaporated, condensed, and recovered under a vacuum system. After retorting, the precipitate is mixed with flux and placed in a smelting furnace. The impurities are removed from the precious metals in the slag and the mixture of gold and silver is recovered as doré. The doré is sent to a refinery outside of the operation for further processing.

Lagunas Norte’s water treatment facilities include cyanide destruction plant and acid rock drainage pond and treatment plant. At the time of the site visit, the secondary water treatment plant was being used to further improve the treatment facilities and the quality of the water that is discharged from the property.

| | |

Barrick Gold Corporation – Lagunas Norte Mine, Project #2473 Technical Report NI 43-101 – August 31, 2015 | | Page 1-14 |

| | |

| | www.rpacan.com |

At the time of the site visit, the CIC circuit was operating. It processes an average 1,800 m3/h of solution and accommodates a flow rate of 2,140 m3/h (design flow). The purpose of the installation is to further increase the solution flow to the leach pad to 4,300 m3/h. The excess available flow, i.e., 2,000 m3/h, from the CIC circuit will be used to wash the areas of the leach pad where leaching is completed.

ENVIRONMENTAL, PERMITTING, AND SOCIAL CONSIDERATIONS

Environmental studies at Lagunas Norte are ongoing and conducted as required to support the operation and any projects.

The EIA for the Project was approved in 2004. In August 2010, an amendment to the former EIA was approved which allowed:

| | • | | Expansion of the east waste dump |

| | • | | New ponds (doubling of size for process leach solution (PLS), process overflow, ARD, and sediment ponds) |

A second amendment to the EIA was submitted to authorities in November 2014, which includes the following changes:

| | • | | East Waste Dump Expansion |

| | • | | New areas for Topsoil Stock |

| | • | | West Waste Dump Optimization |

| | • | | Leach Pad Expansion (Phase 9) |

| | • | | Other modifications (auxiliary components) |

Permits to discharge from the sedimentation ponds (East and West) and the rotating bio-contactor (RBC) sewage treatment plant at El Sauco expire every two years. Permits for pit dewatering and the trout farm have been approved.

Water monitoring is completed at 31 points in three basins. Groundwater is monitored at ten points and surface water is monitored at 16 points. Mine effluent is monitored at three points and potable water and wastewater are monitored at two points. The data is reported every three months to the mining authority. Air monitoring is required at six points primarily for

| | |

Barrick Gold Corporation – Lagunas Norte Mine, Project #2473 Technical Report NI 43-101 – August 31, 2015 | | Page 1-15 |

| | |

| | www.rpacan.com |

particulate matter, gases, and noise. Reports are due quarterly. Additional permits are required for hazardous waste disposal, e.g., fire assay cupels, which is done off site by authorized companies. Wildlife is monitored every two years and aquatic life is monitored bi-annually during the operating phase of the mine for internal purposes.

Lagunas Norte is in compliance with the International Organization for Standardization (ISO) 14001 Environmental Management System and the International Cyanide Code. ISO certification is renewed every three years. Cyanide Code audits and renewals are completed every three years.

For year-end 2014, the total closure cost for the Mine was estimated to be a total of US$199.5 million (US$111.0 million for concurrent reclamation, US$56.4 million for final closure, and US$32.1 million for post closure costs) in accordance with the Closure Plan Update approved by regulators in 2011. According to the latest Closure Plan Update approved by regulators in 2015, the total closure cost for the Lagunas Norte Project is now estimated to be US$243.4 million (US$46.9 million for concurrent closure, US$56.1 million for final closure and US$140.4 for post closure costs).

In order to meet new Peruvian environmental water quality standards expected to enter into force in December 2015, various water treatment proposals have been identified and are currently under review. The capital costs for the water treatment will be defined once the technical studies are concluded.

The key social program at Lagunas Norte is an employment initiative designed to train unemployed workers. The focus is on local communities and suppliers and business generation. The Lagunas Norte social and community programs are participative. They encourage representatives from the local communities to take water samples in conjunction with the company employees and to submit them to laboratories of their own choice.

CAPITAL AND OPERATING COST ESTIMATES

Remaining capital costs at Lagunas Norte through 2018 are primarily sustaining capital, which includes mine equipment replacement and leach pad expansion. Total remaining capital costs are US$372 million (Table 1-4). Mine pre-stripping costs were considered an operating cost.

| | |

Barrick Gold Corporation – Lagunas Norte Mine, Project #2473 Technical Report NI 43-101 – August 31, 2015 | | Page 1-16 |

| | |

| | www.rpacan.com |

TABLE 1-4 CAPITAL COSTS SUMMARY

Barrick Gold Corporation – Lagunas Norte Mine

| | | | |

Department | | Sustaining Capital

US$ Millions | |

Engineered Facilities | | | 160 | |

Sustaining Capital | | | 6 | |

Other | | | 206 | |

| | | | |

Total Capital Expenditures | | | 372 | |

Notes:

| | 1. | Numbers may not add due to rounding. |

Mine operating costs are US$2.20 per tonne of material mined or US$4.58 per tonne of ore mined. Process operating costs are dependent on ore type and processing method and include the heap leach, crushing and conveying, stacking, Merrill Crowe process plant, power, and consumables. Process operating costs for the LOM are US$3.44 per tonne ore processed. General and administrative (G&A) costs average US$1.44 per tonne ore processed over the LOM. The total Mine operating cost is US$9.46 per tonne processed. The adjusted operating cost per ounce of gold production over the LOM is US$497/oz. Total all in sustaining cost (AISC) per ounce, including sustaining capital, over the LOM is US$809/oz.

REFRACTORY PROJECT

The Lagunas Norte Mine currently processes oxide ore through the use of conventional heap leach technologies. The presence of copper-, sulphur-, and/or carbon-rich mineralization limits the effectiveness of the heap leach process in the recovery of contained metals from this type of material. The Refractory Project comprises construction of a 6,000 tpd pressure oxidation (POX) processing facility and associated infrastructure to process material that cannot be treated economically by heap leach. Key components of the new facility include crushing, grinding, flotation, POX, carbon-in-leach (CIL), and dry stack residues handling and disposal. Feed for the facility will come from deepening and extending the existing open pit. The expansion of the open pit will be at a significantly higher stripping ratio than that of the current open pit, requiring an expansion of the current waste rock storage facilities.

The majority of the material to be processed in the Refractory Project will consist of two sulphide ore types, with copper (M3A) and with carbonaceous material (M3BL).

| | |

Barrick Gold Corporation – Lagunas Norte Mine, Project #2473 Technical Report NI 43-101 – August 31, 2015 | | Page 1-17 |

| | |

| | www.rpacan.com |

The Refractory Project cash flow model reflects the processing of 27.5 Mt of mineralized material containing 2.2 Moz of gold and 5.7 Moz of silver over a project life of 12 years (2018-2030). After processing, the estimated recoverable metal is 1.9 Moz of gold and 2.2 Moz of silver.

The PEA for the Refractory Project is preliminary in nature and is based in part on Inferred Resources which are considered too speculative geologically to have mining and economic considerations applied to them that would enable them to be categorized as Mineral Reserves. There is no certainty that economic forecasts on which this PEA is based will be realized.

MINERAL RESOURCES

The sulphide Measured and Indicated Mineral Resources total 27.7 Mt averaging 2.50 g/t Au and 6.44 g/t Ag and contain 2.2 Moz of gold and 5.7 Moz of silver. In addition, the sulphide Inferred Mineral Resources total 0.3 Mt averaging 1.92 g/t Au and 7.35 g/t Ag and contain 19,000 oz of gold and 74,000 oz of silver.

MINERAL RESERVES

There are presently no Mineral Reserves incorporating refractory material.

MINING

Mining will principally include the deepening of the central and southern portions of the current open pit. Mining is planned to be carried out using the existing mine fleet at a rate of approximately 25 Mt of total material moved per year at a stripping ratio of 4.4:1 (waste: mineralization). As a result of a higher stripping ratio, an expansion of the current waste rock storage facilities will be required.

MINERAL PROCESSING

Some new processing facilities will be constructed and some of the existing plant facilities at Lagunas Norte will be utilized or upgraded for the Refractory Project. The key steps in the Refractory Project process flow sheet include crushing and grinding, flotation, tailings handling and disposal, POX, and CIL. The Merrill Crowe plant will continue to treat the oxide heap leach solution and the pregnant solution, with some modifications related to ARD treatment and cyanide destruction.

| | |

Barrick Gold Corporation – Lagunas Norte Mine, Project #2473 Technical Report NI 43-101 – August 31, 2015 | | Page 1-18 |

| | |

| | www.rpacan.com |

ENVIRONMENTAL CONSIDERATIONS

An Environmental Management Plan currently exists for Lagunas Norte, however, the management programs will need to be updated to reflect the new facilities proposed under the Refractory Project. Key environmental aspects of the Refractory Project include: preparation of the Environmental Permit document for early submission, community and government relations, and on-going communications.

CAPITAL AND OPERATING COSTS

The capital cost estimate includes US$496 million for initial capital and US$157 million for sustaining capital, with a total Refractory Project LOM capital cost of US$653 million.

The operating cost estimate comprises US$302 million for mining, US$785 million for processing, and US$281 million for G&A over the Refractory Project LOM.

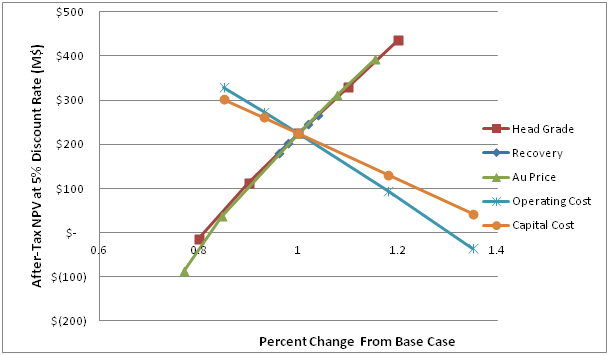

ECONOMIC ANALYSIS

Considering the Refractory Project on a stand-alone basis, the undiscounted after-tax cash flow totals US$339 million over the mine life. The after-tax Net Present Value (NPV) at a 5% discount rate is US$224 million and the after-tax Internal Rate of Return (IRR) is 19% under the assumptions set forth in Section 24, including a gold price assumption of $1,300 per ounce. Payback occurs after three years in the project life. The project is most sensitive to changes in the gold price, head grade, and recovery.

The PEA for the Refractory Project is preliminary in nature and is based in part on Inferred Resources which are considered too speculative geologically to have mining and economic considerations applied to them that would enable them to be categorized as Mineral Reserves. There is no certainty that economic forecasts on which this PEA is based will be realized.

VALUE REALIZATION INITIATIVES

In addition to the Refractory Project, Barrick has recently conducted a technical review of the Lagunas Norte operation with the objective of identifying potential opportunities for cost reductions and revenue enhancement. The opportunities that have been identified so far include:

| | 1. | Upgrade sulphide Mineral Resource grade |

| | |

Barrick Gold Corporation – Lagunas Norte Mine, Project #2473 Technical Report NI 43-101 – August 31, 2015 | | Page 1-19 |

| | |

| | www.rpacan.com |

The Lagunas Norte orebody was drilled using a large percentage of diamond core drill holes. During 2008, it was observed that gold grades from the diamond core holes were biased low relative to production and to RC drill holes. A number of core holes were subsequently twinned with RC holes and confirmed that gold assays from the core holes were significantly understated relative to the RC drill holes and the production blast holes. The reason for the bias is that diamond drilling was washing away the gold bearing fines during the drilling process, while the RC drilling and blast holes were able to collect the fines and properly represent the true grade of the ore. The oxide orebody was re-drilled using RC drill holes and re-modelled. The sulphide portion of the orebody was not drilled with RC drill holes to reduce costs as there was not a plan to mine this material in the LOM plan.

There is an opportunity to drill the sulphide deposit with RC drill holes and potentially upgrade the sulphide grade by as much as 10% to 20%. Additional RC drilling will be needed to twin the existing core holes and ascertain the grade of the sulphide deposit.

| | 2. | Revise final pit design to recover deeper resource blocks. |

A review of the reserve pit design was performed in order to evaluate the potential for an optimization to recover ore blocks near the final pit. Final ramp configurations and last bench geometries were adjusted to add extra “ore” blocks. A review for optimization showed an improvement of 0.5 Mt grading 0.567 g/t Au. This change added approximately 10,000 mined ounces. Some Indicated Resource blocks were included in these additional blocks.

An area for an in-pit waste dump was identified within the ultimate pit near the Vizcachas area and to the north of the pit. This reduces the capital expenditure for the expansion of the East Waste Dump (Phase 1) located beyond the current dump limits and permits. The design criteria consider a slope of 3:1 with berms of 10 m wide, each 45 m in height, to have an effective slope of 18.5º. This waste dump design follows closure design parameters.

| | |

Barrick Gold Corporation – Lagunas Norte Mine, Project #2473 Technical Report NI 43-101 – August 31, 2015 | | Page 1-20 |

| | |

| | www.rpacan.com |

The in-pit waste dump is being implemented and is expected to result in a reduction of capital costs by US$67 million as the new waste dump area would not need preparation (stripping, ditch construction, etc.). Other benefits include the reduction in environmental impact for acid water generation (no new area required).

Some risks include the loss of marginal ore under this new in-pit waste zone. This amounts to approximately 7,500 contained ounces, which are not economic at present metal prices.

| | 4. | Implement measures to improve post-operation leach recoveries. |

Incremental gold recovery from residual leach material is being considered post-operation. Irrigation and flushing the leach pad surface and contoured side slopes is assumed to yield in the order of 100,000 oz to 350,000 oz of additional gold production. Gold recovery will be dependent on material permeability and the amount of residual soluble gold.

| | 5. | Review sustaining capital requirements |

A review of sustaining capital requirements has shown the potential to reduce these expenditures over the existing mine life by approximately US$7.0 million.

| | |

Barrick Gold Corporation – Lagunas Norte Mine, Project #2473 Technical Report NI 43-101 – August 31, 2015 | | Page 1-21 |

| | |

| | www.rpacan.com |

2 INTRODUCTION

Roscoe Postle Associates Inc. (RPA) was retained by Barrick Gold Corporation (Barrick) to prepare an independent Technical Report on the Lagunas Norte Gold Mine (the Mine) in Peru. The purpose of this report is to support the public disclosure of Mineral Resource and Mineral Reserve estimates at the Mine as of December 31, 2014. This Technical Report conforms to National Instrument 43-101 Standards of Disclosure for Mineral Projects.

Barrick is a Canadian publicly traded mining company with a large portfolio of operating mines and projects across five continents. The Lagunas Norte Mine is located in the District of Quiruvilca in the Province of Santiago de Chuco and the Department of La Libertad, in north-central Peru. The mine site is approximately 90 km east of the coastal city of Trujillo.

The Mine is owned and operated by Minera Barrick Misquichilca S.A. (MBM), a wholly-owned Peruvian subsidiary of Barrick. The mine is part of the Alto Chicama property. A 2.51% Net Smelter Return (NSR) royalty is paid to a Peruvian state company, Activos Mineros S.A.C. (Activos Mineros), formerly Centromin Peru S.A. (Centromin). In December 2006, Centromin transferred all of its rights and obligations with respect to the mine to Activos Mineros.

Lagunas Norte is a large open pit, heap leach gold and silver mine in the high Andes Cordillera. Operations include open pit mining of gold-silver ore, crushing, and extraction of precious metals using heap leaching and Merrill Crowe recovery. Since Lagunas Norte started production in March 2005, the mine has recovered 8.4 million ounces (Moz) of gold and 7.8 Moz of silver from approximately 201 million tonnes (Mt) of ore averaging 1.59 g/t Au and 3.6 g/t Ag.

Mining will continue through 2017, including approximately 25 Mt of ore in 2015 and 23 Mt in 2016 and an average of approximately 25 Mt of waste per year. Heap leach placement from stockpile will continue for one year after mining ceases, with mine operations concluding in 2018. Most of the ore is crushed prior to placement on the heap leach facility (HLF).

Barrick has recently completed a study of the potential to mine and process the Lagunas Norte sulphide resources and to extend the life of the operation beyond 2018. The results of a scoping study, or Preliminary Economic Assessment (PEA), of processing the refractory

| | |

Barrick Gold Corporation – Lagunas Norte Mine, Project #2473 Technical Report NI 43-101 – August 31, 2015 | | Page 2-1 |

| | |

| | www.rpacan.com |

material (Barrick, 2015c) are summarized in Section 24. The PEA study is referred to in this Technical Report as the “Lagunas Norte Refractory Material Mine Life Extension Project” or the “Refractory Project”. Work was initiated on a Prefeasibility Study (PFS) in June 2015 to further assess the technical and financial viability and risks associated with the Refractory Project, with completion expected by the end of 2015.

In addition to the Refractory Project, Barrick has recently conducted a technical review of the Lagunas Norte operation with the objective of identifying potential opportunities for cost reductions and revenue enhancement. These opportunities are referred to in this Technical Report as the “Value Realization Initiatives”.

SOURCES OF INFORMATION

RPA Principal Geological Engineer Luke Evans, M.Sc., P.Eng., RPA Principal Mining Engineer Hugo Miranda, MBA, P.C., and RPA Principal Metallurgist, Brenna Scholey, P.Eng., visited the mine from January 6 to 7, 2015 and held meetings at the Barrick offices in Trujillo and Lima on January 8 and 9, 2015, respectively. Discussions were held with the following Barrick and MBM personnel:

| | • | | Hugo Roman, General Manager of Operations Lagunas Norte |

| | • | | Angel Vera, Manager of Operations Mine |

| | • | | Roberto Chumpitazi, Manager of Human Resources |

| | • | | Aldo Leon, Manager of Environment - EIA |

| | • | | Joe Pezo, Manager of Process |

| | • | | Isaias Kleinerman, Manager of Health and Safety |

| | • | | Manuela Hillenbrand, Manager of Community Relations |

| | • | | Jesus Yalan, Chief Hydrologist |

| | • | | Jose Nizama, Manager of Technical Services |

| | • | | Michael Sanchez, Superintendent of Geology |

| | • | | Fernando Porras, Superintendent of Engineering |

| | • | | Percy Maguiña, Superintendent of Metallurgy |

| | • | | Cesar Espejo, Superintendent of Leaching |

| | • | | Pedro Bobadilla, Process Plant Superintendent |

| | • | | Raul Orellana, Manager of Environment |

| | • | | Kelly Diaz, Senior Supervisor of Environment |

| | • | | Carlos Diaz, Senior Supervisor of Mining Properties |

| | • | | Carlos Salguero, Superintendent of Purchasing |

| | • | | Martin Castro, Senior Cost Supervisor |

| | • | | Melissa Vasquez, Senior Modelling Geologist |

| | • | | Augusto Mariscal, Supervisor Ore Control Geologist |

| | • | | Angela Zapana, Supervisor Modelling Geologist |

| | • | | Cristhel Becerra, AcQuire Database Administrator |

| | • | | Mario Poma, Senior Geotechnical Supervisor |

| | • | | Frank McCann, Barrick Regional Manager, Engineering and Planning |

| | |

Barrick Gold Corporation – Lagunas Norte Mine, Project #2473 Technical Report NI 43-101 – August 31, 2015 | | Page 2-2 |

| | |

| | www.rpacan.com |

| | • | | Benjamin Sanfurgo, Senior Manager of Resource and Reserve Modelling |

| | • | | Cristian Monroy, Manager of Reserves and Resources |

| | • | | Cristobal Valenzuela, Senior Modelling Geologist |

The Lagunas Norte Mine has been the subject of Technical Reports and resource/reserve technical audits as follows:

| | • | | March 2012, NI 43-101 Technical Report, RPA |

| | • | | March 2009, NI 43-101 Technical Report, Barrick |

| | • | | May 2008, Reserve Audit, Scott Wilson Roscoe Postle Associates Inc. (Scott Wilson RPA, a predecessor company to RPA) |

| | • | | April 2006, Reserve Procedure Audit, RPA |

| | • | | February 2005, Reserve Procedure Audit, RPA |

| | • | | March, 2003, NI 43-101 Technical Report, Barrick |

Mr. Evans reviewed the geology, sampling, assaying, and resource estimate work and is responsible for Sections 2 to 5, 7 to 12, 14, and 23. Mr. Miranda reviewed the mining, reserve estimate, and economics and is responsible for Sections 15, 16, 18, 19, 21, and 22. Ms. Scholey reviewed the metallurgical, environmental, and permitting aspects and is responsible for Sections 13, 17, and 20. The authors share responsibility for Sections 1, 6, 24, 25, 26, and 27 of this Technical Report. RPA would like to acknowledge the excellent cooperation in the transmittal of data by Barrick and MBM personnel.

The documentation reviewed, and other sources of information, are listed at the end of this report in Section 27 References.

| | |

Barrick Gold Corporation – Lagunas Norte Mine, Project #2473 Technical Report NI 43-101 – August 31, 2015 | | Page 2-3 |

| | |

| | www.rpacan.com |

LIST OF ABBREVIATIONS

Units of measurement used in this report conform to the Imperial system. All currency in this report is US dollars (US$ or $) unless otherwise noted.

| | | | | | |

| a | | annum | | kWh | | kilowatt-hour |

| A | | ampere | | L | | litre |

| bbl | | barrels | | lb | | pound |

| btu | | British thermal units | | L/s | | litres per second |

| °C | | degree Celsius | | m | | metre |

| C$ | | Canadian dollars | | M | | mega (million); molar |

| cal | | calorie | | m2 | | square metre |

| cfm | | cubic feet per minute | | m3 | | cubic metre |

| cm | | centimetre | | µ | | micron |

| cm2 | | square centimetre | | MASL | | metres above sea level |

| d | | day | | µg | | microgram |

| dia | | diameter | | m3/h | | cubic metres per hour |

| dmt | | dry metric tonne | | mi | | mile |

| dwt | | dead-weight ton | | min | | minute |

| °F | | degree Fahrenheit | | µm | | micrometre |

| ft | | foot | | mm | | millimetre |

| ft2 | | square foot | | mph | | miles per hour |

| ft3 | | cubic foot | | MVA | | megavolt-amperes |

| ft/s | | foot per second | | MW | | megawatt |

| g | | gram | | MWh | | megawatt-hour |

| G | | giga (billion) | | oz | | Troy ounce (31.1035g) |

| Gal | | Imperial gallon | | oz/st, opt | | ounce per short ton |

| g/L | | gram per litre | | PEN | | Nuevo Sol |

| Gpm | | Imperial gallons per minute | | ppb | | part per billion |

| g/t | | gram per tonne | | ppm | | part per million |

| gr/ft3 | | grain per cubic foot | | psia | | pound per square inch absolute |

| gr/m3 | | grain per cubic metre | | psig | | pound per square inch gauge |

| ha | | hectare | | RL | | relative elevation |

| hp | | horsepower | | s | | second |

| hr | | hour | | st | | short ton |

| Hz | | hertz | | stpa | | short ton per year |

| in. | | inch | | stpd | | short ton per day |

| in2 | | square inch | | t | | metric tonne |

| J | | joule | | tpa | | metric tonne per year |

| k | | kilo (thousand) | | tpd | | metric tonne per day |

| kcal | | kilocalorie | | US$ or $ | | United States dollar |

| kg | | kilogram | | USg | | United States gallon |

| km | | kilometre | | USgpm | | US gallon per minute |

| km2 | | square kilometre | | V | | volt |

| km/h | | kilometre per hour | | W | | watt |

| kPa | | kilopascal | | wmt | | wet metric tonne |

| kVA | | kilovolt-amperes | | wt% | | weight percent |

| kW | | kilowatt | | yd3 | | cubic yard |

| | | | yr | | year |

| | |

Barrick Gold Corporation – Lagunas Norte Mine, Project #2473 Technical Report NI 43-101 – August 31, 2015 | | Page 2-4 |

| | |

| | www.rpacan.com |

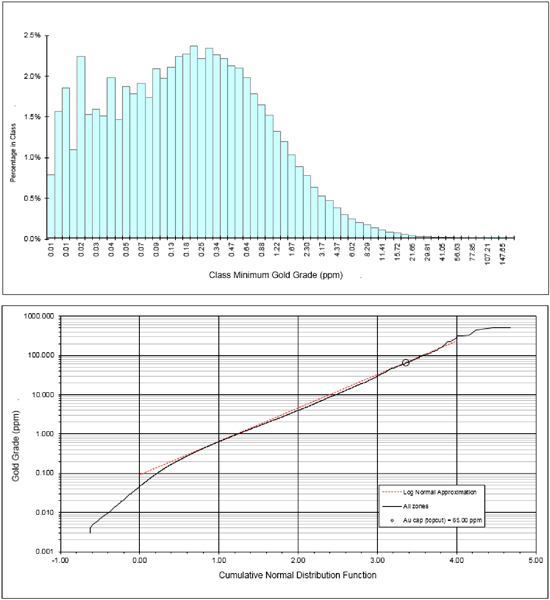

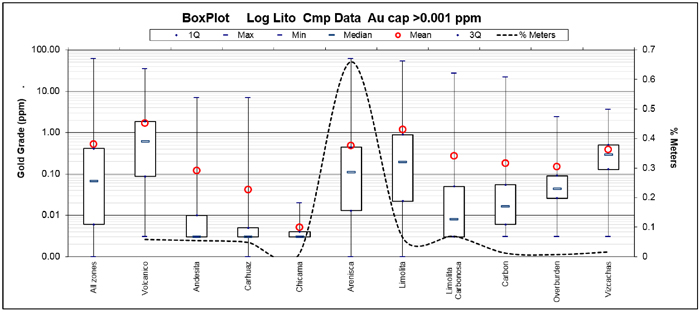

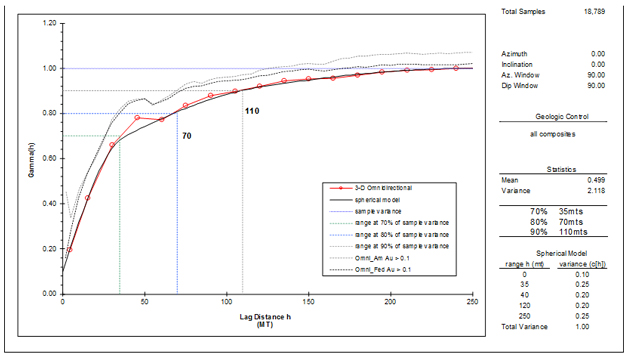

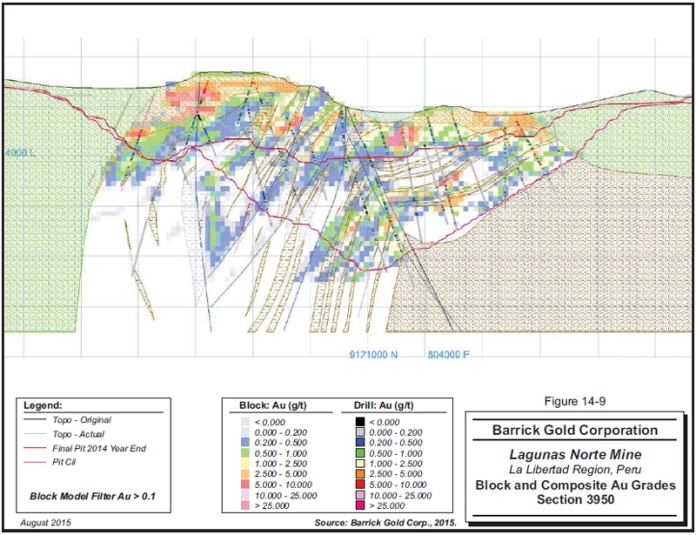

3 RELIANCE ON OTHER EXPERTS