MANAGEMENT’S DISCUSSION AND ANALYSIS (“MD&A”)

Management’s Discussion and Analysis (“MD&A”) is intended to help the reader understand Barrick Gold Corporation (“Barrick”, “we”, “our” or the “Company”), our operations, financial performance and the present and future business environment. This MD&A, which has been prepared as of February 14, 2018, should be read in conjunction with our audited consolidated financial statements (“Financial Statements”) for the year ended December 31, 2017. Unless otherwise indicated, all amounts are presented in U.S. dollars.

For the purposes of preparing our MD&A, we consider the materiality of information. Information is considered material if: (i) such information results in, or would reasonably be expected to result in, a significant change in the market price or value of our shares; (ii) there is a

substantial likelihood that a reasonable investor would consider it important in making an investment decision; or (iii) it would significantly alter the total mix of information available to investors. We evaluate materiality with reference to all relevant circumstances, including potential market sensitivity.

Continuous disclosure materials, including our most recentForm 40-F/Annual Information Form, annual MD&A, audited consolidated financial statements, and Notice of Annual Meeting of Shareholders and Proxy Circular will be available on our website at www.barrick.com, on SEDAR at www.sedar.com and on EDGAR at www.sec.gov. For an explanation of terminology unique to the mining industry, readers should refer to the glossary on page 86.

CAUTIONARY STATEMENT ON FORWARD-LOOKING INFORMATION

Certain information contained or incorporated by reference in this MD&A, including any information as to our strategy, projects, plans or future financial or operating performance, constitutes “forward-looking statements”. All statements, other than statements of historical fact, are forward-looking statements. The words “believe”, “expect”, “anticipate”, “target”, “plan”, “objective”, “assume”, “intend”, “intention”, “project”, “goal”, “continue”, “budget”, “estimate”, “potential”, “may”, “will”, “can”, “could”, “would” and similar expressions identify forward-looking statements. In particular, this MD&A contains forward-looking statements including, without limitation, with respect to: (i) Barrick’s forward-looking production guidance; (ii) estimates of future cost of sales per ounce for gold and per pound for copper, cash costs per ounce and C1 cash costs per pound, andall-in-sustaining costs per ounce/pound; (iii) cash flow forecasts; (iv) projected capital, operating and exploration expenditures; (v) Barrick’s expectations regarding the potential benefits resulting from a new partnership between Acacia Mining plc (“Acacia”) and the Government of Tanzania; (vi) targeted debt and cost reductions; (vii) mine life and production rates; (viii) potential mineralization and metal or mineral recoveries; (ix) savings from our improved capital management program; (x) Barrick’sBest-in-Class program (including potential improvements to financial and operating performance that may result from certainBest-in-Class initiatives); (xi) the timing and results of the prefeasibility study at Pascua-Lama; (xii) our pipeline of high confidence projects at or near existing operations; (xiii) the benefits of unifying the Cortez and Goldstrike operations; (xiv) the potential impact and benefits of Barrick’s ongoing digital transformation; (xv) our ability to convert resources into reserves; (xvi) asset sales, joint

ventures and partnerships; and (xvii) expectations regarding future price assumptions, financial performance and other outlook or guidance.

Forward-looking statements are necessarily based upon a number of estimates and assumptions including material estimates and assumptions related to the factors set forth below that, while considered reasonable by the Company as at the date of this MD&A in light of management’s experience and perception of current conditions and expected developments, are inherently subject to significant business, economic and competitive uncertainties and contingencies. Known and unknown factors could cause actual results to differ materially from those projected in the forward-looking statements and undue reliance should not be placed on such statements and information. Such factors include, but are not limited to: fluctuations in the spot and forward price of gold, copper or certain other commodities (such as silver, diesel fuel, natural gas and electricity); the speculative nature of mineral exploration and development; changes in mineral production performance, exploitation and exploration successes; risks associated with the fact that certainBest-in-Class initiatives are still in the early stages of evaluation and additional engineering and other analysis is required to fully assess their impact; the duration of the Tanzanian ban on mineral concentrate exports; the ultimate terms of any definitive agreement between Acacia and the Government of Tanzania to resolve a dispute relating to the imposition of the concentrate export ban and allegations by the Government of Tanzania that Acacia under-declared the metal content of concentrate exports from Tanzania; the status of certain tax reassessments by the Tanzanian government; the manner in which amendments to the

| | | | |

BARRICK YEAR-END 2017 | | 22 | | MANAGEMENT’S DISCUSSION AND ANALYSIS |

2010 Mining Act (Tanzania) increasing the royalty rate applicable to metallic minerals such as gold, copper and silver to 6% (from 4%), the new Finance Act (Tanzania) imposing a 1% clearing fee on the value of all minerals exported from Tanzania from July 1, 2017 and the new Mining Regulations announced by the Government of Tanzania in January 2018 will be implemented and the impact of these and other legislative changes on Acacia; whether Acacia will approve the terms of any final agreement reached between Barrick and the Government of Tanzania with respect to the dispute between Acacia and the Government of Tanzania; the benefits expected from recent transactions being realized; diminishing quantities or grades of reserves; increased costs, delays, suspensions and technical challenges associated with the construction of capital projects; operating or technical difficulties in connection with mining or development activities, including geotechnical challenges and disruptions in the maintenance or provision of required infrastructure and information technology systems; failure to comply with environmental and health and safety laws and regulations; timing of receipt of, or failure to comply with, necessary permits and approvals; uncertainty whether some or all of theBest-in-Class initiatives, targeted investments and projects will meet the Company’s capital allocation objectives and internal hurdle rate; the impact of global liquidity and credit availability on the timing of cash flows and the values of assets and liabilities based on projected future cash flows; adverse changes in our credit ratings; the impact of inflation; fluctuations in the currency markets; changes in U.S. dollar interest rates; risks arising from holding derivative instruments; changes in national and local government legislation, taxation, controls or regulations and/or changes in the administration of laws, policies and practices; expropriation or nationalization of property and political or economic developments in Canada, the United States and other jurisdictions in which the Company or its affiliates do or may carry on business in the future; lack of certainty with respect to foreign legal systems, corruption and other factors that are inconsistent with the rule of law; the outcome of the appeal of the decision of Chile’s Superintendencia del Medio Ambiente; damage to the Company’s reputation due to the actual or perceived occurrence of any number of events, including negative publicity with respect to the Company’s handling of environmental matters or dealings with community groups, whether true or not; the possibility that future exploration results will not be consistent with the Company’s expectations; risks that exploration data may be incomplete and considerable additional work may be required to complete further evaluation, including but not limited to drilling, engineering and socioeconomic studies and investment; risk of loss due to acts of war, terrorism, sabotage and civil disturbances; litigation; contests over title to properties, particularly title to undeveloped properties, or over access to water, power and other required infrastructure; business opportunities that may be presented to, or pursued by, the Company; risks

associated with the fact that certain of the initiatives described in this MD&A are still in the early stages and may not materialize; our ability to successfully integrate acquisitions or complete divestitures; risks associated with working with partners in jointly controlled assets; employee relations including loss of key employees; increased costs and physical risks, including extreme weather events and resource shortages, related to climate change; availability and increased costs associated with mining inputs and labor; and the organization of our previously held African gold operations and properties under a separate listed Company. In addition, there are risks and hazards associated with the business of mineral exploration, development and mining, including environmental hazards, industrial accidents, unusual or unexpected formations, pressures,cave-ins, flooding and gold bullion, copper cathode or gold or copper concentrate losses (and the risk of inadequate insurance, or inability to obtain insurance, to cover these risks).

Many of these uncertainties and contingencies can affect our actual results and could cause actual results to differ materially from those expressed or implied in any forward-looking statements made by, or on behalf of, us. Readers are cautioned that forward-looking statements are not guarantees of future performance. All of the forward-looking statements made in this MD&A are qualified by these cautionary statements. Specific reference is made to the most recent Form40-F/Annual Information Form on file with the SEC and Canadian provincial securities regulatory authorities for a more detailed discussion of some of the factors underlying forward-looking statements and the risks that may affect Barrick’s ability to achieve the expectations set forth in the forward-looking statements contained in this MD&A. We disclaim any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise, except as required by applicable law.

| | | | |

BARRICK YEAR-END 2017 | | 23 | | MANAGEMENT’S DISCUSSION AND ANALYSIS |

USE OFNON-GAAP FINANCIAL PERFORMANCE MEASURES

We use the followingnon-GAAP financial performance measures in our MD&A:

| | ● | “C1 cash costs per pound” |

| | ● | “all-in sustaining costs per ounce/pound” |

| | ● | “all-in costs per ounce” and |

For a detailed description of each of thenon-GAAP measures used in this MD&A and a detailed reconciliation to the most directly comparable measure under International Financial Reporting Standards (“IFRS”), please refer to theNon-GAAP Financial Performance Measures section of this MD&A on pages 69 to 84. Eachnon-GAAP financial performance measure has been annotated with a reference to an endnote on page 85. Thenon-GAAP financial performance measures set out in this MD&A are intended to provide additional information to investors and do not have any standardized meaning under IFRS, and therefore may not be comparable to other issuers, and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS.

Changes in presentation ofnon-GAAP financial performance measures

Adjusted EBITDA

Starting in the second quarter 2017 MD&A, we began including additional adjusting items in the Adjusted EBITDA reconciliation to provide a greater level of consistency with the adjusting items included in our Adjusted Net Earnings reconciliation. These new items include: acquisition/disposition gains/losses; foreign currency translation gains/losses; other expense adjustments; and unrealized gains onnon-hedge derivative instruments. These amounts are adjusted to remove any impact on finance costs/income, income tax expense and/or depreciation as they do not affect EBITDA. The prior periods have been restated to reflect the change in presentation. We believe this additional information will assist analysts, investors and other stakeholders of Barrick in better understanding our ability to generate liquidity from operating cash flow, by excluding these amounts from the calculation as they are not indicative of the performance of our core mining business and not necessarily reflective of the underlying operating results for the periods presented.

| | | | | | | | |

| INDEX | | page | | | | |

| | | |

Overview | | | | | | | | |

| | | |

Our Vision | | | 25 | | | | | |

Our Business | | | 25 | | | | | |

Our Strategy | | | 25 | | | | | |

Full Year Financial and Operating Highlights | | | 26 | | | | | |

Outlook for 2018 | | | 33 | | | | | |

Risks and Risk Management | | | 37 | | | | | |

Market Overview | | | 39 | | | | | |

| | | |

Review of Annual Financial Results | | | 42 | | | | | |

| | | |

Revenue | | | 42 | | | | | |

Production Costs | | | 42 | | | | | |

Capital Expenditures | | | 43 | | | | | |

General and Administrative Expenses | | | 44 | | | | | |

Exploration, Evaluation and Project Costs | | | 44 | | | | | |

Finance Costs, Net | | | 44 | | | | | |

Additional Significant Statement of Income Items | | | 45 | | | | | |

Income Tax Expense | | | 45 | | | | | |

| | | |

Financial Condition Review | | | 47 | | | | | |

| | | |

Balance Sheet Review | | | 47 | | | | | |

Shareholders’ Equity | | | 47 | | | | | |

Financial Position and Liquidity | | | 47 | | | | | |

Summary of Cash Inflow (Outflow) | | | 48 | | | | | |

Summary of Financial Instruments | | | 49 | | | | | |

| | | |

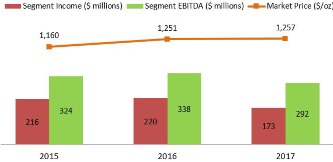

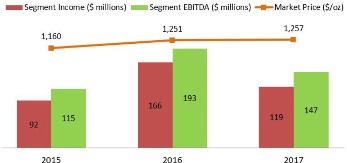

Operating Segments Performance | | | 49 | | | | | |

| | | |

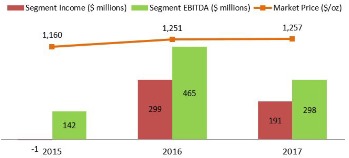

Barrick Nevada | | | 50 | | | | | |

Pueblo Viejo | | | 52 | | | | | |

Lagunas Norte | | | 54 | | | | | |

Veladero | | | 56 | | | | | |

Turquoise Ridge | | | 60 | | | | | |

Acacia Mining plc | | | 62 | | | | | |

Pascua-Lama | | | 65 | | | | | |

| | | |

| Commitments and Contingencies | | | 66 | | | | | |

| | | |

| Review of Quarterly Results | | | 67 | | | | | |

| | | |

| Internal Control over Financial Reporting and Disclosure Controls and Procedures | | | 68 | | | | | |

| | | |

| IFRS Critical Accounting Policies and Accounting Estimates | | | 69 | | | | | |

| | | |

| Non-GAAP Financial Performance Measures | | | 69 | | | | | |

| | | |

| Technical Information | | | 85 | | | | | |

| | | |

| Endnotes | | | 85 | | | | | |

| | | |

| Glossary of Technical Terms | | | 86 | | | | | |

| | | | |

BARRICK YEAR-END 2017 | | 24 | | MANAGEMENT’S DISCUSSION AND ANALYSIS |

OVERVIEW

Our Vision

Our Vision is the generation of wealth through responsible mining - wealth for our owners, our people, and the countries and communities with which we partner.

We aim to be the leading mining company focused on gold, growing our cash flow per share by developing and operating high-quality assets through disciplined allocation of human and financial capital and operational excellence.

Our Business

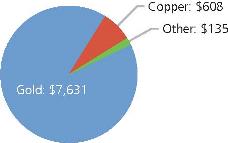

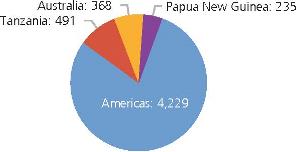

Barrick is one of the world’s leading gold mining companies with annual gold production and gold reserves that are among the largest in the industry. We are principally engaged in the production and sale of gold and copper, as well as related activities such as exploration and mine development. We hold interests in nine producing gold mines, which are located in Argentina, Australia, Canada, the Dominican Republic, Papua New Guinea, Peru and the United States. We also hold a 63.9% equity interest in Acacia Mining plc (“Acacia”), a company listed on the London Stock Exchange (“LSE”) that owns gold mines and exploration properties in Africa. More than 75% of our gold production comes from the Americas region. Our copper business contains a wholly-owned copper mine in Zambia and 50% interests in copper mines in Chile and Saudi Arabia. We also have projects located throughout the Americas. We sell our production in the world market through the following distribution channels: gold bullion is sold in the gold spot market; and gold and copper concentrate is sold to independent smelting companies. Barrick’s shares trade on the New York Stock Exchange (“NYSE”) and the Toronto Stock Exchange under the symbol ABX.

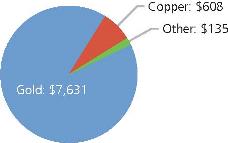

2017 Revenue ($ millions)

2017 Gold Production (thousands of ounces)

Our Strategy

Our strategy remains consistent. We are focused on growing free cash flow per share over the long term by: maintaining and growing industry-leading margins, driven by operational excellence, investments in digital technology and innovation; managing our portfolio and allocating capital with discipline and rigor; and leveraging our talent and distinctive partnership culture as a competitive advantage.

Operational Excellence and Innovation

We seek to maximize revenue and expand margins by continuously optimizing existing operations, pushing technical limits to achievebest-in-class performance, improving the returns of existing assets and strengthening the feasibility and economics of undeveloped assets. We will make targeted investments in innovation and accelerate our digital transformation in an effort to drive step changes in current performance and redefine what is possible over the long term. We will continue to refine our decentralized operating model, in which our head office is focused on doing a small number of tasks exceptionally well: setting strategy, allocating capital and managing talent. Our leaders in the field will operate as business owners, focused on optimizing free cash flow, alongside managing risk and creating long-term value.

Exploration and Project Development

Growing free cash flow per share means continually replenishing and improving the quality of our reserves and resources. The quality of our asset base means we have significant opportunities to replace and grow reserves throughlow-risk brownfield and minex drilling, balanced with greenfield exploration, and emerging discoveries that have the potential to become profitable mines. In addition to organic projects, we are continuously evaluating external opportunities. We take a highly disciplined approach to all investments, including acquisitions, and will only pursue those that have the

| | | | |

BARRICK YEAR-END 2017 | | 25 | | MANAGEMENT’S DISCUSSION AND ANALYSIS |

potential to generate clear value for our shareholders, while aligning with our strategic focus.

Partnerships

We believe a core part of our business is that of partnering with host governments and communities to transform their natural resources into sustainable benefits and mutual prosperity. These partnerships must be built on a foundation of transparency and mutual respect that

moves beyond an emphasis on maximizing short-term financial returns and transactional relationships. By doing so, our intent is to strengthen our social license to operate, reduce operational disruptions and develop stronger and more durable partnerships with our host governments and communities.

FULL YEAR FINANCIAL AND OPERATING HIGHLIGHTS

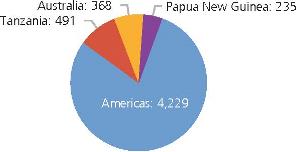

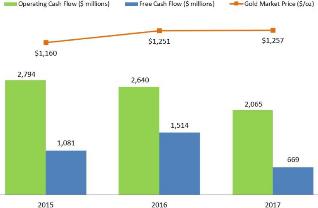

Operating Cash Flow and Free Cash Flow1

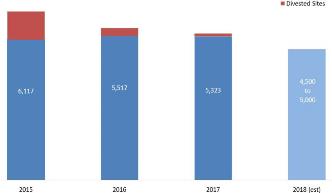

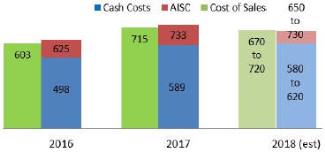

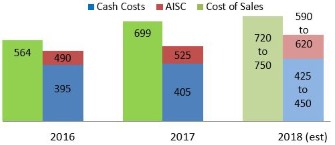

Cost of Sales, Cash Costs1 and

Al-in Sustaining Costs1

($ per ounce)

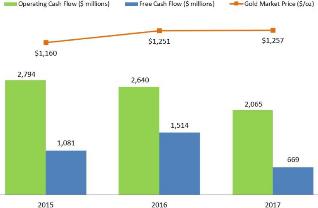

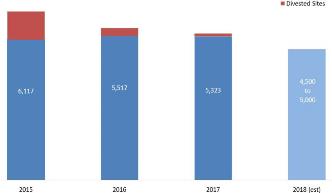

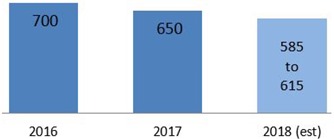

Gold Production

(000s ounces)

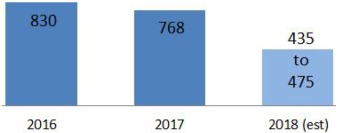

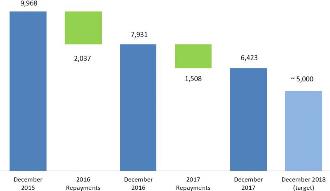

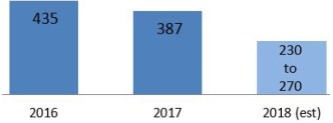

Debt

($ millions)

| | | | |

BARRICK YEAR-END 2017 | | 26 | | MANAGEMENT’S DISCUSSION AND ANALYSIS |

| | | | | | | | | | | | | | | | | | | | |

| ($ millions, except per share amounts in dollars) | | | | | For the years ended December 31 | | | For the three months ended December 31 | |

| | | 2017 | | | 2016 | | | 2015 | | | 2017 | | | 2016 | |

Net earnings (loss) attributable to equity holders of the Company | | | $1,438 | | | | $655 | | | | ($2,838 | ) | | | ($314 | ) | | | $425 | |

Per share (dollars)1 | | | 1.23 | | | | 0.56 | | | | (2.44 | ) | | | (0.27 | ) | | | 0.36 | |

Adjusted net earnings2 | | | 876 | | | | 818 | | | | 344 | | | | 253 | | | | 255 | |

Per share (dollars)1,2 | | | 0.75 | | | | 0.70 | | | | 0.30 | | | | 0.22 | | | | 0.22 | |

Operating cash flow | | | 2,065 | | | | 2,640 | | | | 2,794 | | | | 590 | | | | 711 | |

Free cash flow2 | | | $669 | | | | $1,514 | | | | $1,081 | | | | $240 | | | | $385 | |

| | 1 | Calculated using weighted average number of shares outstanding under the basic method of earnings per share of 1,166 million shares in 2017 (2016: 1,165 million shares; 2015: 1,165 million shares). |

| | 2 | Adjusted net earnings and free cash flow arenon-GAAP financial performance measures with no standardized meaning under IFRS and therefore may not be comparable to similar measures of performance presented by other issuers. For further information and a detailed reconciliation of thenon-GAAP measures used in this section of the MD&A to the most directly comparable IFRS measure, please see pages 69 to 84 of this MD&A. |

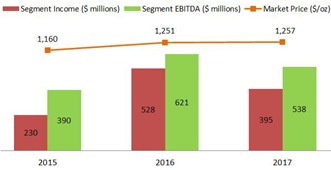

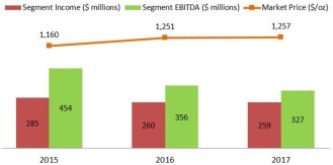

In 2017, we generated net cash flow provided by operating activities (“operating cash flow”) of $2.1 billion and free cash flow1 of $669 million for the year. We reduced our cost of sales applicable to gold by $4 per ounce to $794 per ounce, while ourall-in sustaining costs1(“AISC”) increased by 3% to $750 per ounce, reflecting higher capital expenditures as we increased investments in the future of our business. At the same time, we continued to strengthen our balance sheet by exceeding our debt reduction target.

In 2017, we divested 50% and 25% interests in our Veladero mine and Cerro Casale project, respectively. The successful formation of these new partnerships helped us strengthen our balance sheet,de-risk our portfolio and provide a renewed impetus to how we approach these assets. These two transactions resulted in proceeds of $990 million and combined impairment reversals and gains on disposition of $2,031 million. In addition, we recognized $259 million of impairment reversals at Lumwana due to an increase in reserves. This was offset by an impairment of $740 million(pre-tax, 100%) taken at Acacia’s Bulyanhulu mine related to the continued challenges experienced in the operating environment in Tanzania; and an impairment of $429 million at Pascua-Lama, mainly attributable to the reclassification ofopen-pit reserves to resources after receiving a closure order from the Chilean regulators.

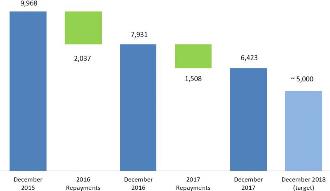

Balance Sheet and Liquidity

In 2017, we reduced our total debt by $1.51 billion, or 19%, from $7.93 billion to $6.42 billion, exceeding our original target of $1.45 billion. Since the beginning of

2015, we have reduced our debt by a total of $6.66 billion, which will reducepre-tax interest payments by approximately $300 million on an annualized basis. Approximately $5 billion of our $6.4 billion in outstanding debt matures after 2032. Since the beginning of December 2015, the average tenor on our outstanding public debt has increased from approximately 14 years to approximately 17 years. Our liquidity position is strong and continues to improve, with robust cash flow generation, modest near-term debt repayment obligations, a $4 billion undrawn credit facility and a consolidated cash balance of approximately $2.2 billion3. Our goal remains to reduce our total debt to around $5 billion by the end of 2018. We plan to achieve this primarily by using cash flow from operations and cash on hand, and potentially through further portfolio optimization. Barrick will continue to pursue debt reduction with discipline, taking only those actions that make sense for the business, on terms we consider favorable to our shareholders.

Cost Performance

In 2017, we continued our focus on drivingBest-in-Class productivity and efficiency improvements across our portfolio. Cost of sales per ounce4 in 2017 decreased by $4 per ounce to $794 per ounce, reflecting a decrease in direct mining costs combined with a positive sales mix, partially offset by higher depreciation expense. Ourall-in sustaining costs1 for 2017 increased by 3% to $750 per ounce, compared to the prior year primarily reflecting the 17% increase in minesite sustaining capital expenditures attributed to the future investment in our business.

| | | | |

BARRICK YEAR-END 2017 | | 27 | | MANAGEMENT’S DISCUSSION AND ANALYSIS |

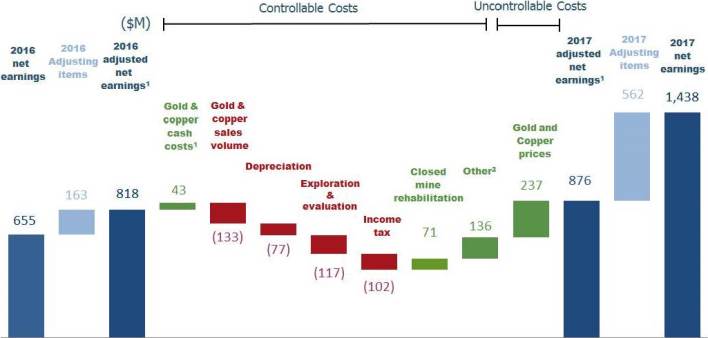

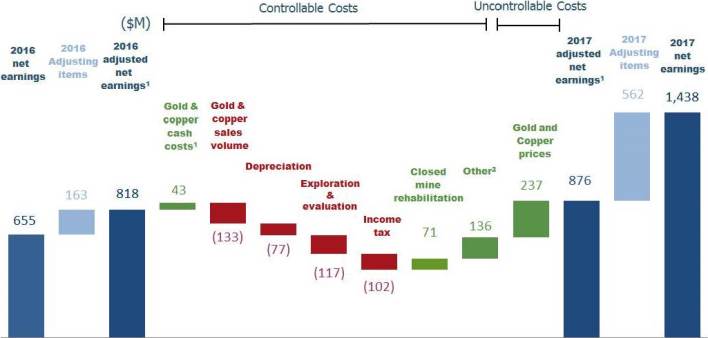

Net Earnings (Loss), Adjusted Net Earnings1, Operating Cash Flow and Free Cash Flow1

Factors affecting Net Earnings and Adjusted Net Earnings1

| 1 | These arenon-GAAP financial performance measures with no standardized meaning under IFRS and therefore may not be comparable to similar measures of performance presented by other issuers. For further information and a detailed reconciliation of thenon-GAAP measures used in this section of the MD&A to the most directly comparable IFRS measure, please see pages 69 to 84 of this MD&A. |

| 2 | Primarily consists of higher earnings from equity investees (~$56 million) and a reduction in finance costs (~$34 million). |

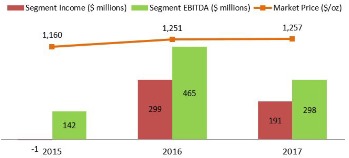

Net earnings attributable to equity holders of Barrick (“net earnings”) for 2017 was $1,438 million compared with $655 million in the prior year. This significant improvement in net earnings was primarily due to $2,031 million ($1,425 million net of tax andnon-controlling interest) in impairment reversals and gains on sale in 2017 related to our successful formation of joint operations at the Veladero mine and Cerro Casale project. This was partially offset by net impairment charges of $908 million ($511 million net of tax andnon-controlling interest) mainly relating to impairment charges at Acacia’s Bulyanhulu mine and the Pascua-Lama project, coupled with an impairment reversal at Lumwana. After adjusting for items that are not indicative of future operating earnings, adjusted net earnings1 of $876 million in 2017 were 7% higher than the prior year primarily as a result of an increase in gold and copper prices, as well as lower direct mining costs driven by higher capitalized waste stripping costs at Barrick Nevada and Veladero, a positive change in our sales mix with lower relative sales volume from our higher cost Acacia mines and lower inventory write-downs than the prior year. This was offset by an increase in exploration and evaluation costs primarily due to an increased investment in the Pascua-Lama project, global exploration and innovation initiatives combined with lower sales volume. The increase in adjusted net earnings1 was further offset by higher income tax expense associated with our higher net earnings and higher depreciation expense as a result of a depreciation adjustment at Pueblo Viejo, partially offset by lower depreciation at Barrick Nevada associated with the South Arturo pit.

Significant adjusting items to net earnings(pre-tax andnon-controlling interest effects) in 2017 include:

| • | | $718 million ($714 million net of tax) gain relating to the sale of a 50% interest in the Veladero mine (for further details, refer to note 4 to the Financial Statements); |

| • | | $193 million ($192 million net of tax) gain related to the sale of a 25% interest in the Cerro Casale project (for further details, refer to note 4 to the Financial Statements); |

| • | | $212 million ($7 million net of tax andnon-controlling interest) net impairment charges, primarily on Acacia’s Bulyanhulu mine of $740 million ($350 million net of tax andnon-controlling interest) and on the Pascua-Lama project of $407 million ($407 million net of tax), partially offset by impairment reversals as a result of the indicative fair value of the Cerro Casale project related to our divestment of 25% of $1,120 million ($518 million net of tax andnon-controlling interest) and on Lumwana of $259 million ($259 million net of tax); partially offset by |

| • | | $244 million significant tax adjustments primarily relating to dividend withholding tax expense and a tax provision relating to the impact of the proposed framework for Acacia operations in Tanzania, partially offset by the anticipated impact of the U.S tax reform; |

| • | | $178 million other expense adjustments, mainly relating to losses on debt extinguishment and reduced operations program costs at Acacia’s Bulyanhulu mine; and |

| • | | $72 million foreign currency translation losses, primarily related to the devaluation of the Argentinean peso on VAT receivables. |

Refer to page 70 for a full list of reconciling items between net earnings and adjusted net earnings for the current and prior year.

| | | | |

BARRICK YEAR-END 2017 | | 28 | | MANAGEMENT’S DISCUSSION AND ANALYSIS |

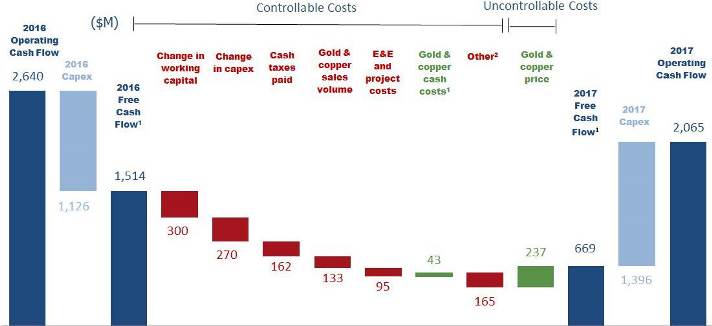

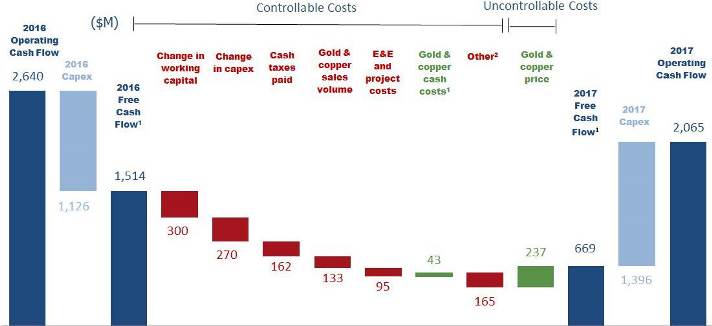

Factors affecting Operating Cash Flow and Free Cash Flow1

| 1 | These arenon-GAAP financial performance measures with no standardized meaning under IFRS and therefore may not be comparable to similar measures of performance presented by other issuers. For further information and a detailed reconciliation of thenon-GAAP measures used in this section of the MD&A to the most directly comparable IFRS measure, please see pages 69 to 84 of this MD&A. |

| 2 | Other primarily includes the negative impact on free cash flow attributable tonon-controlling interests (~$100 million) combined with an increase in legal costs (~$20 million) and in reclamation payments (~$10 million). |

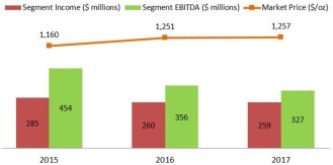

In 2017, we generated $2,065 million in operating cash flow, compared to $2,640 million of operating cash flow in the prior year. The decrease of $575 million was due to lower gold sales as a result of the divestment of 50% of the Veladero mine on June 30, 2017, lower gold sales volume at Pueblo Viejo, Hemlo, Turquoise Ridge, Lagunas Norte and Acacia, partially offset by higher sales at Barrick Nevada attributed to higher grades andBest-in-Class initiatives positively impacting throughput. This was further impacted by working capital outflows reflecting the buildup of metals inventory at Pueblo Viejo, Lagunas Norte and Acacia combined with an increase in exploration, evaluation and project expenses. Operating cash flow was also affected by lower cash flows attributed tonon-controlling interest, combined with higher cash taxes paid. These outflows were partially offset by higher gold and copper prices as well as lower direct mining costs.

Free cash flow1 for 2017 was $669 million, compared to $1,514 million in the prior year, reflecting lower operating cash flows combined with higher capital expenditures. In 2017, capital expenditures on a cash basis were $1,396 million compared to $1,126 million in 2016 as we reinvested more into our business. The increase of $270 million is due to a $109 million increase in project capital expenditures, primarily at Barrick Nevada relating to the development of Crossroads and Cortez Hills Lower Zone, and Goldrush project drilling, partially offset by a decrease inpre-production stripping at the South Arturo pit, which entered commercial production in August 2016. In addition, minesite sustaining capital expenditures increased by $161 million primarily reflecting an increase in sustaining capital at Barrick Nevada relating to higher capitalized stripping costs at Goldstrike and the timing of a greater number of minesite sustaining projects in the current year, combined with increased spending relating to phases 4B and 5B of the leach pad expansion and additional equipment purchases at Veladero. These increases were partially offset by a decrease in sustaining capital at Acacia as a result of reduced operations at Bulyanhulu combined with lower capitalized stripping at North Mara relating to Nyabirama Stage 3 and 4.

The free cash flow1 generated in 2017 was combined with the $990 million in proceeds from the sale of a 50% interest in Veladero in the second quarter of 2017 and existing cash balances to repay $1.51 billion in debt in the current year, which allowed us to exceed our 2017 debt reduction target of $1.45 billion.

| | | | |

BARRICK YEAR-END 2017 | | 29 | | MANAGEMENT’S DISCUSSION AND ANALYSIS |

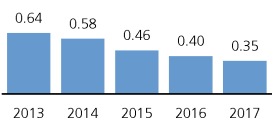

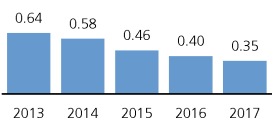

Safety

Nothing is more important to Barrick than the safety, health and well-being of our workers and their families. Our safety vision is “Every person going home safe and healthy every day.” In 2017, we continued our trend of improving our total reportable injury frequency rate5(“TRIFR”) and since 2009, there has been a 71% improvement in the TRIFR from 1.20 to 0.35.

The foundation underpinning Barrick’s safety improvement continues to be our Courage to Care program, designed to help Barrick make the next step in safety performance through building a strong team-based culture. In addition, we continue to focus on compliance with Barrick’s “Safety and Health Management System”.

On a weekly basis, the global leadership team, including the Executive Committee and representatives from each of Barrick’s country offices, mine sites and corporate functions, participate in a Business Plan Review (“BPR”) meeting. This forum provides us with the opportunity to stress the importance of safety, recall the lessons learned from past fatal incidents, review our current safety performance against targets and share best practices across our business.

Although we are pleased with these trends, this performance was overshadowed by two fatalities in 2017. As previously reported, in February of 2017 a contract worker at Pascua-Lama was involved in a fatal incident while performing scheduled maintenance work. In November of 2017 a surveyor at Hemlo was fatally struck underground by a piece of heavy machinery. Barrick is fully committed to zero fatalities and is implementing Critical Control Management across all sites and exploration activities. Critical Control Management is specifically focused on fatality prevention and is based upon guidance published by the International Council on Mining and Metals (“ICMM”) in 2015. Significant progress has been made in the development of digital technologies that significantly reduce risks of fatalities at our mines, including the development of autonomous vehicles.

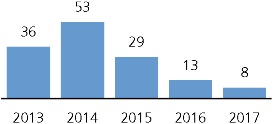

Total Reportable Injury Frequency

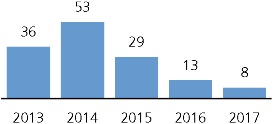

Environment

Barrick is focused on rebuilding our reputation for environmental excellence and being the preferred partner of host governments and communities. In 2017, our operations worked on adapting the ICMM Critical Control Management guidance to our environmental operations. In addition, each site developed anin-depth improvement plan with a focus on water management. The results of this are demonstrated in a 72% reduction in reportable environmental incidents between 2015 and 2017.

Despite these achievements, in March 2017 the monitoring system at the Veladero mine detected a rupture of a pipe carrying gold-bearing process solution on the leach pad. Although the solution was contained within the operating site and no solution reached any diversion channels or watercourses, it was the third cyanide-related incident in the past three years at this site. Barrick along with Shandong Gold, our new joint venture partner at Veladero, made modifications to the leach pad as agreed with San Juan provincial authorities to reduce the risk of this happening again.

Reportable Environmental Incidents

Climate Change

Climate change, including shifts in temperature and precipitation and more frequent severe weather events, will affect the mining industry in a range of possible ways. Volatile climatic conditions can affect the stability and effectiveness of infrastructure and equipment; potentially impact environmental protection and site closure practices; lead to changes in the regulatory environment, including increased carbon tax regimes; and potentially impact the stability and cost of water and energy supplies. We therefore view climate change as a company, community, and global concern. In 2017, we developed a climate change strategy aligned with our overall business strategy to grow free cash flow per share through safe and responsible mining.

Barrick’s climate change strategy has three pillars: understand and mitigate the risks associated with climate change; reduce our impacts on climate change; and improve our disclosure on climate change. Action taken on each pillar in 2017 is described below.

Understand and mitigate the risks associated with climate change: In 2017, we performed a climate change risk

| | | | |

BARRICK YEAR-END 2017 | | 30 | | MANAGEMENT’S DISCUSSION AND ANALYSIS |

assessment, using our standard risk management framework. We assessed risks and opportunities across both potential transition (e.g., regulatory, policy, reputational) and physical (e.g., extreme climate events) aspects of climate change. We have identified the top three climate-related risks and opportunities for our business: an increase in extended duration extreme precipitation events; an increase in climate change regulations to limit greenhouse gas (“GHG”) emissions; and increased global investment in innovation and low carbon technologies. The assessment also included a review of the current mitigation and controls associated with each risk and identified areas which may need further strengthening to reduce risk.

Reduce the Company’s impact on climate change: Over the course of 2017, we analyzed our current and forecasted GHG emissions to develop an ambitious but realistic goal to reduce Barrick’s GHG emissions. Mining is an energy-intensive business, and we understand the important link between energy use and GHG emissions. By effectively managing our energy use, we can reduce our draw from local energy grids, reduce our GHG emissions, achieve more efficient production, and save direct mining costs. Barrick has set a goal to keep its current GHG emissions flat in the short term and is targeting a 30 percent reduction in GHG emissions by 2030, from a 2016 baseline of 3.5 MT CO2e emitted. This target is also closely aligned with the national targets set by many of our host governments.

Improve our disclosure on climate change: In 2017, we committed to supporting the voluntary recommendations of theindustry-led Financial Stability Board Task Force on Climate-related Financial Disclosures (“TCFD”). The TCFD recommendations are considered the new benchmark for disclosure of climate-related risks and opportunities, and Barrick was the only Canadian mining company to make this public commitment. We will implement the full recommendations over the next two years.

Governance over climate-related risks and opportunities is provided at both the Board and management level. The Board’s Corporate Responsibility Committee meets at least quarterly and is responsible for overseeing Barrick’s policies, programs, and performance relating to the environment, including climate change. The Risk Committee assists the Board in overseeing the Company’s management of enterprise risks as well as the implementation of policies and standards for monitoring and mitigating such risks. Climate change is built into our formal risk management process, outputs of which are reviewed by the Risk Committee. The Audit Committee reviews the Company’s approach to climate change in the context of Barrick’s disclosures.

At the management level, our Climate Change Committee, comprised of senior members of our

management team, provides strategic oversight and governance over key decisions related to Barrick’s Climate Change Strategy, such as overseeing climate change risk and opportunity assessments, monitoring progress against GHG emissions targets, and providing guidance on external disclosures.

Further to the specific focus of the Climate Change Committee, the weekly BPR allows for the discussion of opportunities and risks that may help or hinder the Company from achieving its objectives, including climate-related risks (e.g., spring snow melts, hurricanes, flooding, and mud slides).

Climate change activities initiated in 2017 will continue into 2018 and beyond. Site-level climate-related risks and mitigation plans will be reviewed in the context of the company-wide risk assessment, and site-level plans to reduce energy and GHG emissions will be strengthened. We will continue to enhance our climate-related disclosure according to the TCFD recommendations. Overall, based on the groundwork completed in 2017, Barrick is building resilience to withstand the potential impacts of climate change and leverage potential opportunities as the global economy transitions to alow-carbon future.

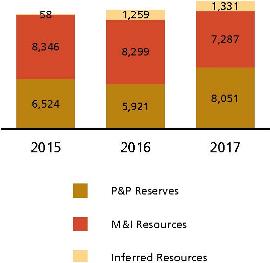

Reserves and Resources

Our 2017 reserves were calculated using a gold price assumption of $1,200 per ounce. As of December 31, 2017, Barrick’s proven and probable gold reserves were 64.4 million ounces6, compared to 86.0 million ounces at the end of 2016. This decline primarily reflects the divestment of approximately 9.2 million ounces associated with Veladero and Cerro Casale, and the reclassification of approximately 14.0 million ounces of Pascua-Lama proven and probable gold reserves as measured and indicated resources.

Barrick added 8.0 million ounces of proven and probable gold reserves at existing operations (as well as the Goldrush project) through drilling, more than replacing the 6.2 million ounces depleted through processing last year. This success reflects increased investment in mine exploration drilling in 2017. Significant additions included 2.1 million ounces at Turquoise Ridge, 1.4 million ounces at Cortez, 1.3 million ounces at Goldstrike, 397,000 ounces at Hemlo, and 392,000 ounces at Lagunas Norte. We also declared an initial reserve of 1.5 million ounces at the Goldrush project. In addition, Barrick’s 63.9 percent share of reserves at Acacia’s North Mara mine increased by 504,000 ounces. The average grade of Barrick’s reserves also increased by 17 percent, from 1.33 grams per tonne, to 1.55 grams per tonne.

In 2017, measured, indicated, and inferred gold resources were calculated using a gold price assumption of $1,500 per ounce, consistent with 2016. Measured and indicated

| | | | |

BARRICK YEAR-END 2017 | | 31 | | MANAGEMENT’S DISCUSSION AND ANALYSIS |

gold resources increased to 88.6 million ounces6 at the end of 2017, compared to 75.2 million ounces at the end of 2016. Roughly 9.1 million ounces of measured and indicated gold resources were added as a result of the formation of the Norte Abierto joint venture (which includes the Cerro Casale and Caspiche deposits), net of resources divested at Cerro Casale and Veladero. Roughly 14.0 million ounces of measured and indicated resources were added as a result of the reclassification of Pascua-Lama reserves to resources, and 5.8 million ounces were added through drilling, including 1.5 million ounces at Goldstrike, 1.2 million ounces at Cortez, and 535,000 ounces at Hemlo.

Inferred gold resources decreased to 30.8 million ounces6at the end of 2017, compared to 30.7 million ounces at the end of 2016.

Gold Reserves and Resources

(millions of ounces)

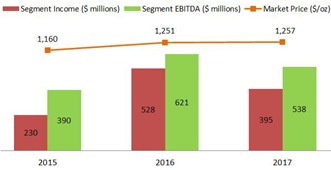

Proven and probable copper reserves were calculated using a copper price of $2.75 per pound, consistent with the long-price assumption we used in 2016. Copper reserves, including copper within gold reserves, increased to 11.2 billion pounds6 at the end of 2017, compared to 11.1 billion pounds at the end of 2016. The Lumwana mine added approximately 2.6 billion pounds to its reserves as a result of successful cost reduction efforts. Approximately 1.4 billion pounds of copper reserves were divested with the sale of 25% of Cerro Casale, 554 million pounds were processed, and 505 million pounds of copper contained within gold reserves were reclassified as copper contained within gold resources.

In 2017, measured, indicated, and inferred copper resources were calculated using a copper price assumption of $3.50 per pound, consistent with 2016. Measured and indicated copper resources, including copper within measured and indicated gold resources, increased to 11.7 billion pounds6, compared to 9.7 billion pounds at the end of 2016. Approximately 2.6 billion pounds of measured and indicated copper resources were upgraded to copper reserves, 2.6 billion pounds were added through the inclusion of the Caspiche deposit, and 1.6 billion pounds were added through drilling. Inferred copper resources were 3.0 billion pounds5, compared to 3.1 billion pounds at the end of 2016.

Copper Reserves and Resources

(millions of pounds)

| | | | |

BARRICK YEAR-END 2017 | | 32 | | MANAGEMENT’S DISCUSSION AND ANALYSIS |

Outlook for 2018

Operating Unit Guidance

Our 2017 gold and copper production, cost of sales, cash costs1,all-in sustaining costs1 and 2018 forecast gold and copper production, cost of sales, cash costs1 andall-in sustaining costs1 ranges by operating unit are as follows:

| | | | | | | | | | | | | | | | |

Operating Unit | | 2017 production (000s ozs) | | 2017 cost of sales ($/oz) | | 2017 cash costs1 ($/oz) | | 2017all-in sustaining costs1 ($/oz) | | 2018 forecast production (000s ozs) | | 2018 forecast cost of sales ($/oz) | | 2018 forecast

cash costs1 ($/oz) | | 2018 forecast all-in sustaining costs1 ($/oz) |

Gold | | | | | | | | | | | | | | | | |

| | | | | | | | |

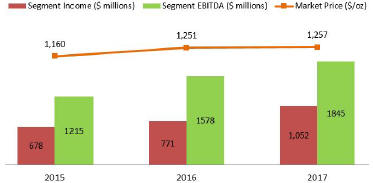

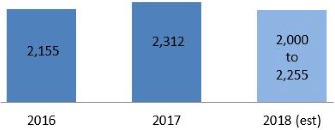

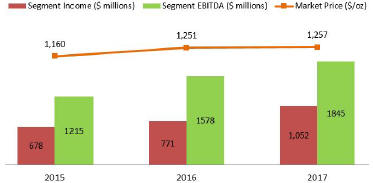

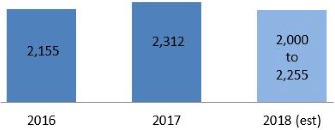

Barrick Nevada | | 2,312 | | $792 | | $455 | | $624 | | 2,000 -2,255 | | 760 -810 | | 470 -530 | | 610 - 660 |

| | | | | | | | |

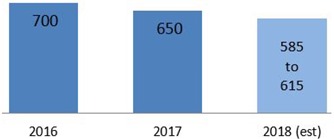

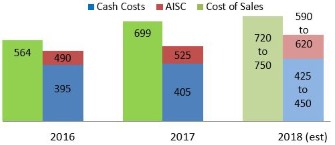

Pueblo Viejo (60%) | | 650 | | 699 | | 405 | | 525 | | 585 - 615 | | 720 - 750 | | 425 - 450 | | 590 - 620 |

| | | | | | | | |

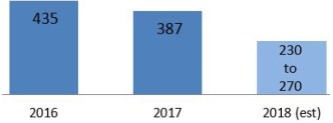

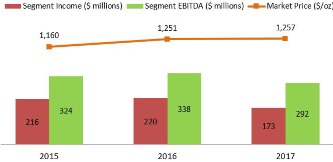

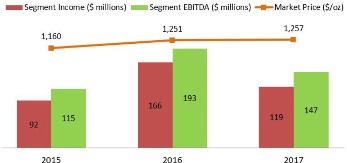

Lagunas Norte | | 387 | | 617 | | 405 | | 483 | | 230 - 270 | | 780 - 910 | | 420 - 490 | | 670 - 780 |

| | | | | | | | |

Veladero (50%)2 | | 432 | | 897 | | 598 | | 987 | | 275 - 330 | | 970 - 1,110 | | 560 - 620 | | 960 - 1,100 |

| | | | | | | | |

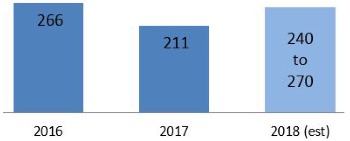

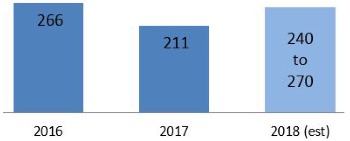

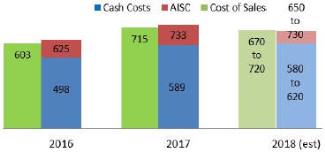

Turquoise Ridge (75%) | | 211 | | 715 | | 589 | | 733 | | 240 - 270 | | 670 - 720 | | 580 - 620 | | 650 - 730 |

| | | | | | | | |

Porgera (47.5%) | | 235 | | 944 | | 781 | | 993 | | 230 - 255 | | 950 - 1,000 | | 780 - 830 | | 950 - 1,000 |

| | | | | | | | |

Kalgoorlie (50%) | | 368 | | 806 | | 642 | | 729 | | 390 - 440 | | 720 - 820 | | 580 - 630 | | 695 - 745 |

| | | | | | | | |

Acacia (63.9%) | | 491 | | 791 | | 587 | | 875 | | 275 - 305 | | 970 - 1,020 | | 690 - 720 | | 935 - 985 |

| | | | | | | | |

Hemlo | | 196 | | 986 | | 841 | | 1,092 | | 200 - 220 | | 860 - 920 | | 740 - 790 | | 975 - 1,075 |

| | | | | | | | |

Golden Sunlight | | 41 | | 1,334 | | 1,265 | | 1,329 | | 35 - 50 | | 1,100 -1,200 | | 1,130 -1,230 | | 1,290 -1,460 |

Total Continuing Operations | | 5,323 | | $793 | | $522 | | $703 | | 4,500 -5,000 | | 810 - 850 | | 540 - 575 | | 765 - 815 |

Total Consolidated Barrick3,4,5 | | 5,323 | | $794 | | $526 | | $750 | | 4,500 -5,000 | | 810 - 850 | | 540 - 575 | | 765 - 815 |

| | | | | | | | | | | | | | | | | |

| | | 2017 production (millions lbs) | | 2017 cost of sales ($/lb) | | 2017 cash costs1

($/lb) | | 2017all-in sustaining costs1 ($/lb) | | 2018 forecast

production (millions lbs) | | 2018 forecast cost of sales ($/lb) | | 2018 forecast C1 cash costs1 ($/lb) | | 2018

forecast all-in sustaining costs1 ($/lb) |

Copper | | | | | | | | | | | | | | | | |

| | | | | | | | |

Zaldívar (50%) | | 114 | | $2.15 | | $1.66 | | $2.21 | | 115 - 130 | | 2.30 - 2.50 | | ~ 1.70 | | 2.05 - 2.25 |

| | | | | | | | |

Lumwana | | 256 | | 1.57 | | 1.66 | | 2.35 | | 230 - 265 | | 1.65 - 1.90 | | 1.65 - 1.90 | | 2.50 - 2.80 |

| | | | | | | | |

Jabal Sayid (50%) | | 43 | | 1.90 | | 1.70 | | 2.30 | | 40 - 55 | | 1.85 - 2.50 | | 1.40 - 1.80 | | 1.70 - 2.30 |

Total Copper | | 413 | | $1.77 | | $1.66 | | $2.34 | | 385 - 450 | | 1.80 - 2.10 | | 1.55 - 1.75 | | 2.30 - 2.60 |

| | 1 | Cash costs,all-in sustaining costs and C1 cash costs arenon-GAAP financial performance measures with no standardized meaning under IFRS and therefore may not be comparable to similar measures of performance presented by other issuers. For further information and a detailed reconciliation of thenon-GAAP measures used in this section of the MD&A to the most directly comparable IFRS measure, please see pages 69 to 84 of this MD&A. |

| | 2 | We sold 50% of Veladero on June 30, 2017; therefore these measures represent results on a 100% basis from January 1 to June 30, 2017 and on a 50% basis from July 1, 2017 onwards. |

| | 3 | Total gold cash costs andall-in sustaining costs per ounce include the impact of hedges and/or costs allocated tonon-operating sites. |

| | 4 | Operating unit guidance ranges reflect expectations at each individual operating unit, and may not add up to the company-wide guidance range total. The company-wide 2017 results and guidance ranges exclude Pierina which is mining incidental ounces as it enters closure. |

| | 5 | Total Consolidated Barrickall-in sustaining costs include corporate administration costs. |

| | | | |

BARRICK YEAR-END 2017 | | 33 | | MANAGEMENT’S DISCUSSION AND ANALYSIS |

Operating Unit, Consolidated Expense and Capital Guidance

Our 2017 gold and copper production, cost of sales, cash costs1,all-in sustaining costs1, consolidated expenses and capital expenditures and forecast gold and copper production, cost of sales, cash costs1,all-in sustaining costs1, consolidated expenses and capital expenditures for 2018 are as follows:

| | | | | | | | | | | | | | | | |

($ millions, except per ounce/pound data) | | 2017 Original Guidance | | | Q3 2017 Guidance | | | 2017 Actual | | | 2018 Guidance | |

Gold production and costs | | | | | | | | | | | | | | | | |

| | | | |

Production (millions of ounces) | | | 5.60 - 5.90 | | | | 5.30 - 5.50 | | | | 5.32 | | | | 4.50 - 5.00 | |

| | | | |

Gold unit production costs | | | | | | | | | | | | | | | | |

| | | | |

Cost of sales - gold ($ per oz) | | | 780 - 820 | | | | 790 - 810 | | | | 794 | | | | 810 - 850 | |

| | | | |

Cash costs ($ per oz)1 | | | 510 - 535 | | | | 520 - 535 | | | | 526 | | | | 540 - 575 | |

| | | | |

Depreciation ($ per oz) | | | 245 - 265 | | | | 245 - 265 | | | | 254 | | | | 240 - 260 | |

| | | | |

All-in sustaining costs ($ per oz)1 | | | 720 -770 | | | | 740 - 770 | | | | 750 | | | | 765 - 815 | |

Copper production and costs | | | | | | | | | | | | | | | | |

| | | | |

Production (millions of pounds) | | | 400 - 450 | | | | 420 - 440 | | | | 413 | | | | 385 - 450 | |

| | | | |

Copper unit production costs | | | | | | | | | | | | | | | | |

| | | | |

Cost of sales - copper ($ per lb) | | | 1.50 - 1.70 | | | | 1.70 - 1.85 | | | | 1.77 | | | | 1.80 - 2.10 | |

| | | | |

C1 cash costs ($ per lb)1 | | | 1.40 - 1.60 | | | | 1.60 - 1.75 | | | | 1.66 | | | | 1.55 - 1.75 | |

| | | | |

Depreciation ($ per lb) | | | 0.30 - 0.40 | | | | 0.30 - 0.40 | | | | 0.38 | | | | 0.40 - 0.50 | |

| | | | |

Copperall-in sustaining costs ($ per lb)1 | | | 2.10 - 2.40 | | | | 2.20 - 2.40 | | | | 2.34 | | | | 2.30 - 2.60 | |

Exploration and project expenses | | | 415 - 495 | | | | 415 - 495 | | | | 354 | | | | 325 - 405 | |

| | | | |

Exploration and evaluation | | | 185 - 225 | | | | 185 - 225 | | | | 173 | | | | 185 - 225 | |

| | | | |

Project expenses | | | 230 - 270 | | | | 230 - 270 | | | | 181 | | | | 140 -180 | |

| | | | |

General and administrative expenses | | | ~ 285 | | | | ~ 260 | | | | 248 | | | | ~ 340 | |

| | | | |

Corporate administration | | | ~ 200 | | | | ~ 200 | | | | 201 | | | | ~ 275 | |

| | | | |

Stock-based compensation2 | | | ~ 40 | | | | ~ 40 | | | | 26 | | | | ~ 30 | |

| | | | |

Acacia3 | | | ~ 45 | | | | ~ 20 | | | | 21 | | | | ~ 35 | |

| | | | |

Other expense (income)4 | | | 25 - 45 | | | | 25 - 45 | | | | (799 | ) | | | 80 - 100 | |

| | | | |

Finance costs5 | | | 600 - 650 | | | | 600 - 650 | | | | 705 | | | | 500 - 550 | |

| | | | |

Attributable capital expenditures: | | | | | | | | | | | | | | | | |

| | | | |

Attributable minesite sustaining | | | 1,050 - 1,200 | | | | 1,100 - 1,200 | | | | 1,095 | | | | 950 - 1,100 | |

| | | | |

Attributable project | | | 250 - 300 | | | | 250 - 300 | | | | 269 | | | | 450 - 550 | |

| | | | |

Total attributable capital expenditures6 | | | 1,300 - 1,500 | | | | 1,350 - 1,500 | | | | 1,364 | | | | 1,400 - 1,600 | |

| | 1 | Cash costs,all-in sustaining costs and C1 cash costs arenon-GAAP financial performance measures with no standardized meaning under IFRS and therefore may not be comparable to similar measures of performance presented by other issuers. For further information and a detailed reconciliation of thenon-GAAP measures used in this section of the MD&A to the most directly comparable IFRS measure, please see pages 69 to 84 of this MD&A. |

| | 2 | 2017 actual based on US$14.47 and 2018 guidance based on a three month trailing average ending December 31, 2017 of US$14.50 per share and excludes Acacia. |

| | 3 | 2017 actual includes $8 million in stock-based compensation recovery. 2018 guidance is substantially comprised of stock-based compensation. |

| | 4 | 2017 actual includes gain on sale ofnon-current assets of $911 million. |

| | 5 | 2017 actual includes a net loss on debt extinguishment of $127 million. |

| | 6 | Attributable capital expenditures are presented on the same basis as guidance, which includes our 60% share of Pueblo Viejo and South Arturo, our 63.9% share of Acacia and our 50% share of Zaldívar and Jabal Sayid. |

2018 Guidance Analysis

Estimates of future production, cost of sales, and cash costs1 presented in this MD&A are based on mine plans that reflect the expected method by which we will mine reserves at each site. Actual gold and copper production and associated costs may vary from these estimates due to a number of operational andnon-operational risk factors (see the “Cautionary Statement on Forward-Looking Information” on page 22 of this MD&A for a description of certain risk factors that could cause actual results to differ materially from these estimates).

Production

We expect 2018 gold production to be in the range of 4.5 to 5.0 million ounces. 2018 gold production is expected to be lower than 2017, primarily as a result of decreases at Barrick Nevada, Pueblo Viejo and Veladero. We expect first quarter production of around one million ounces at costs that will be proportionately higher than those anticipated for the remainder of the year, largely due to lower grades at Barrick Nevada, and the timing of planned maintenance at Pueblo Viejo.

Lower production is expected at Barrick Nevada as its Cortez Hills open pit and Cortez Hills underground moves from purely oxide ore to a mix of oxide, refractory, and

| | | | |

BARRICK YEAR-END 2017 | | 34 | | MANAGEMENT’S DISCUSSION AND ANALYSIS |

transitional ores. Grade is expected to be lower as production progresses deeper in the mine. This is partially offset by increased throughput at the oxide mill, increased grades at Goldstrike open pit from processing the third northwest layback, and higher grades at Goldstrike underground. Throughput initiatives at the autoclave are expected to more than offset lower autoclave recovery as we transition from an all acid blend to an alkaline/acid blend.

Production at Pueblo Viejo in 2018 is expected to be lower than 2017 production levels, driven by reduced gold grade, partially offset by increased autoclave throughput resulting from improved maintenance strategies.

Lower production for Veladero is expected as a result of the divestment of 50% of the Veladero mine as at June 30, 2017. This, combined with an increased proportion of ore tonnage mined at lower grade, will be offset by a higher inventory drawdown due to improved management of the leach pad.

Cost of Sales

On a per ounce basis, cost of sales attributable to gold4, after removing the portion related tonon-controlling interests, is expected to be in the range of $810 to $850 per ounce, higher than the prior year. The projected increase is mainly due to higher assumed energy and consumables costs. We are planning to offset those rising costs with a continued focus on lowering our other direct mining costs throughBest-in-Class initiatives, which should improve operating efficiencies and lower labor and contractor costs.

Cash Costs per ounce

Cash costs1 are expected to be in the range of $540 to $575 per ounce, slightly higher than the prior year due to increases at Barrick Nevada, Pueblo Viejo and Lagunas Norte, partially offset by a decrease at Veladero.

We expect Barrick Nevada to have higher cash costs1 than 2017 due to lower sold ounces. At Pueblo Viejo and Lagunas Norte we expect higher cash costs1 than 2017 primarily due to a reduction in total ounces produced and sold and higher fuel prices.

We expect lower cash costs1 at Veladero in 2018 compared to the prior year due to lower direct operating costs partly offset by the impact of higher charges from the production inventory movements.

All-In Sustaining Costs per ounce

All-in sustaining costs1 are expected to be in the range of $765 to $815 per ounce for gold, higher than the $750 per ounce in 2017 driven primarily by the higher expected cash costs as well as an increase in minesite sustaining capital expenditures on a per ounce basis. In 2018, we expect to incur increased corporate administration

expense. We will also continue to focus onBest-in-Class initiatives to reduce mining costs.

Exploration and Project Expenses

We expect to incur approximately $185 to $225 million of exploration and evaluation (“E&E”) expenditures in 2018 with approximately 80 percent allocated to the Americas. Our exploration programs balance high-quality brownfield projects, greenfield exploration, and emerging discoveries that we believe have the potential to become profitable mines. We continue to take advantage of existing infrastructure and advance key growth projects in Barrick Nevada. At our Hemlo mine we are building on the expansion potential of our underground, and at the Lagunas Norte mine in Peru we continue to advance a project to extend the life of the mine by potentially exploiting existing oxide stockpiles and then transitioning to mining the refractory material below the oxide ore body in the current open pit.

Highlights of our greenfield exploration program for 2018 include the Fourmile target, adjacent to our Goldrush discovery in Nevada, and the Frontera District on the border of Argentina and Chile.

We expect to incur approximately $140 to $180 million of project expenses in 2018, compared to $181 million in 2017. In 2018, project expenses include the Pascua-Lama study and ongoing site costs, there-scoping study of our Donlin Gold Project, costs associated with regional digital projects and Norte Abierto (our joint venture with Goldcorp containing Cerro Casale and Caspiche) projects. The Pascua-Lama study spend relates to the cost of ongoing work to evaluate and permit the development of an underground mine at Pascua-Lama, accessed from the Argentinean side of the project. Pascua-Lama’s ongoing site expenses include the cost of care and maintenance and does not anticipate the impact of the Superintendencia del Medio Ambiente (“SMA”) sanction received on January 17, 2018. The Company has appealed the SMA sanction on Pascua in Chile and the full impacts are still being evaluated.

General and Administrative Expenses

In 2018, we expect corporate administration costs to be approximately $275 million, an increase of $74 million compared to 2017. This reflects additional investments including improving our enterprise-wide processes and systems - the Barrick Data Fabric; accelerating the implementation of digital technology; and driving step-change innovations.

Finance Costs

Finance costs of $500 to $550 million primarily represent interest expense on long-term debt,non-cash interest expense relating to gold and silver streaming agreements, and accretion, net of finance income. We expect finance costs in 2018 to be lower than 2017 finance costs of $705 million primarily due to lower interest expense in 2017

| | | | |

BARRICK YEAR-END 2017 | | 35 | | MANAGEMENT’S DISCUSSION AND ANALYSIS |

following $1.5 billion of debt repayments in 2017. The impact of any further debt reductions accomplished in 2018 has not been reflected in our guidance on interest expense or extinguishment losses. 2017 finance costs included a $127 million net loss on the extinguishment of debt, and further debt repurchases could lead to additional losses on extinguishment that could cause an increase to forecasted finance costs.

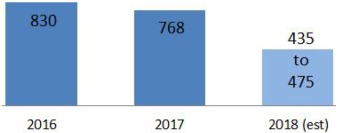

Capital Expenditures

Total attributable capital expenditures for 2018 are expected to be in the range of $1.40 to $1.60 billion. Investing in project capital is a priority in 2018 for Barrick, and we expect attributable project capital expenditures to increase to a range of $450 to $550 million, an increase over our 2017 project capital expenditure of $269 million. In contrast, attributable minesite sustaining capital expenditures are expected to be in the range of $950 to $1,100 million, compared to our 2017 minesite sustaining capital expenditure of $1,095 million.

Project capital expenditures reflect capital expenditures at new projects and existing operations that are related to discrete expansion projects intended to increase production and will not benefit production for at least 12 months. Project capital expenditures also include capital expenditures related to the initial construction of a project and include all of the expenditures required to bring the project into operation and achieve commercial production levels.

The budgeted increase in project capital expenditures in 2018 is primarily due to increased spending on the Lower Zone underground expansion and Crossroads project at Cortez, associated with the underground declines at Cortez Hills underground and Goldrush, an increase at Zaldívar associated with a planned plant expansion, and increases at Norte Abierto and Pascua-Lama.

Minesite sustaining capital expenditures reflect the capital spending required to support current planned production levels and those which do not meet our definition of project capital. This includes capitalized production phase stripping costs at our open pit mines, underground mine development, minesite E&E expenditures, and routine plant, equipment and maintenance spend that meet our criteria for capitalization.

Attributable minesite sustaining capital expenditures are expected to be in the range of $950 to $1,100 million compared to $1,095 in 2017. We expect reduced capitalized stripping at Barrick Nevada, Porgera and

Acacia, in addition to a reduction in processing and minesite sustaining capital at Barrick Nevada and Veladero. These are partially offset by an increase in capitalized stripping and equipment rebuilds at Lumwana, an increase in tailings and process facility upgrades at Pueblo Viejo and an increase in capital associated with environmental obligations at Lagunas Norte. These decreases in sustaining capital are the result of our continued focus on our asset optimization and capital discipline processes.

At Barrick Nevada in 2018, sustaining capital expenditures are expected to decrease primarily due to a reduction in capitalized stripping as the Goldstrike open pit transitions from stripping both the 3rd and 4th northwest laybacks to only stripping the 4th northwest layback until the fourth quarter of 2018. In addition, Goldstrike’s cooling and ventilation and dewatering projects to allow mining below a3,600-foot elevation will near completionmid-2018. The autoclave thiosulfate water treatment plant conversion was completed in 2017, which significantly improved water balances and the consumption of fresh reagent.

At Porgera, sustaining capital expenditures are expected to decrease in 2018 primarily due to a planned reduction in capitalized stripping as the site focuses on an underground expansion plan.

At Veladero, a reduction in sustaining capital is expected in 2018, mainly associated with the completion of the Phase 6 VFLF leach pad expansion and process facility upgrades along with a reduction in overall attributable capital spend due to 2018 being our first full year at our 50/50 equity ownership with our joint venture partner, Shandong Gold.

At Lumwana, the 2018 increase in sustaining capital is related to increased stripping of the Chimi deposit and purchase of major maintenance components and the electric conversion of the PC8000 shovel.

At Pueblo Viejo, the increase in sustaining capital in 2018 is related to initiatives to improve the plant’s operational efficiency, process facility upgrades and continued tailings expansion capital.

Effective Income Tax Rate

At current spot gold prices, our expected effective tax rate range for 2018 is 41% to 43%.

| | | | |

BARRICK YEAR-END 2017 | | 36 | | MANAGEMENT’S DISCUSSION AND ANALYSIS |

Outlook Assumptions and Economic Sensitivity Analysis

| | | | | | | | | | |

| | | 2018 Guidance Assumption | | Hypothetical Change | | Impact on Revenue (millions) | | Impact on Cost of Sales (millions) | | Impact on All-in Sustaining Costs1 |

Gold revenue, net of royalties2 | | $1,200/oz | | +/- $100/oz | | +/- $468 | | +/- $14 | | +/- $3/oz |

| | | | | |

Copper revenue, net of royalties3 | | $2.75/lb | | + $0.50/lb | | + $205 | | + $13 | | + $0.03/lb |

Copper revenue, net of royalties3 | | $2.75/lb | | - $0.50/lb | | - $180 | | - $12 | | - $0.03/lb |

Goldall-in sustaining costs | | | | | | | | | | |

| | | | | |

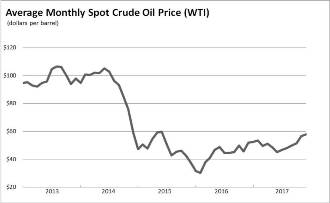

WTI crude oil price2 | | $55/bbl | | +/- $10/bbl | | n/a | | +/-

$26 | | +/- $5 /oz |

| | | | | |

Australian dollar exchange rate | | 0.75 : 1 | | +/- 10% | | n/a | | +/-

$31 | | +/- $7 /oz |

| | | | | |

Argentinean peso exchange rate | | 18.35 : 1 | | +/- 10% | | n/a | | +/- $7 | | +/- $2 /oz |

| | | | | |

Canadian dollar exchange rate | | 1.25 : 1 | | +/- 10% | | n/a | | +/-

$35 | | +/- $7 /oz |

| Copperall-in sustaining costs | | | | | | | | | | |

| | | | | |

WTI crude oil price2 | | $55/bbl | | +/- $10/bbl | | n/a | | +/- $5 | | +/- $0.06/lb |

| | | | | |

Chilean peso exchange rate | | 650 : 1 | | +/- 10% | | n/a | | +/-$10 | | +/- $0.02/lb |

| | 1 | All-in sustaining costs is anon-GAAP financial performance measure with no standardized definition under IFRS. For further information and a detailed reconciliation, please see pages 69 to 84 of this MD&A. |

| | 2 | Due to our hedging activities, which are reflected in these sensitivities, we are partially protected against changes in these factors. |

| | 3 | Utilizing option collar strategies, the Company has protected the downside of a portion of its expected 2018 copper production at an average floor price of $2.83 per pound and can participate on the same amount up to an average price of $3.25 per pound. Our remaining copper production is subject to market prices. |

Risks and Risk Management

Overview

The ability to deliver on our vision, strategic objectives and operating guidance depends on our ability to understand and appropriately respond to the uncertainties or “risks” we face that may prevent us from achieving our objectives. In order to achieve this we:

| | • | | Maintain a framework that ensures we manage risk effectively and in a manner that creates the greatest value; |

| | • | | Integrate a process for managing risk into all our important decision-making processes so that we reduce the effect of uncertainty on achieving our objectives; |

| | • | | Ensure that the key controls we rely on to achieve the Company’s objectives are actively monitored so that they remain in place and are effective at all times; and |

| | • | | Provide assurance to the executives and relevant Committees of the Board of Directors on the effectiveness of key control activities. |

Board and Committee Oversight

We maintain strong risk oversight practices, with responsibilities outlined in the Board’s and related committees’ mandates. The Board’s mandate makes clear its responsibility for reviewing and discussing with management the processes used to assess and manage risk, including the identification by management of the principal risks of the business, and the implementation of appropriate systems to deal with such risks.

The Risk Committee of the Board of Directors assists the Board in overseeing the Company’s management of principal risks as well as the implementation of policies and standards for monitoring and modifying such risks, and monitoring and reviewing the Company’s financial position and financial risk management programs generally. The Audit Committee and Corporate Responsibility Committee also provide oversight focusing on financial and operational (e.g., environmental, health and safety, corporate social responsibility, security and human rights) risk exposures, respectively.

Management Oversight

On a weekly basis, the global leadership team, including the Executive Committee and representatives from each of Barrick’s country offices, mine sites and corporate functions, participate in the BPR meeting. This forum allows for the timely identification of key risks that may prevent the Company from achieving its objectives. It also fosters a culture of transparent, real-time risk management as a collective and enables a learning organization. At regularly scheduled meetings, the Board and the Risk Committee are provided with updates on issues identified by management at these weekly sessions.

Principal Risks

The following subsections describe some of our key sources of uncertainty and most important risk modification activities. The risks described below are not the only ones facing Barrick. Our business is subject to inherent risks in financial, regulatory, strategic and operational areas. For a more comprehensive discussion of those inherent risks, see “Risk Factors” in our most recent Form40-F/Annual Information Form on file with

| | | | |

BARRICK YEAR-END 2017 | | 37 | | MANAGEMENT’S DISCUSSION AND ANALYSIS |

the SEC and Canadian provincial securities regulatory authorities. Also see the “Cautionary Statement on Forward-Looking Information” on page 22 of this MD&A.

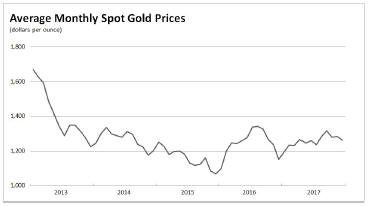

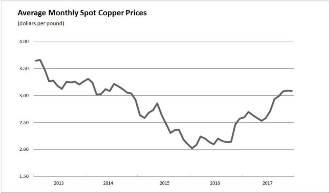

Financial position and liquidity

Our liquidity profile, level of indebtedness and credit ratings are all factors in our ability to meet short- and long-term financial demands. Barrick’s outstanding debt balances impact liquidity through scheduled interest and principal repayments and the results of leverage ratio calculations, which could influence our investment grade credit ratings and ability to access capital markets. In addition, the Company’s ability to draw on our credit facility is subject to meeting its covenants. Our primary source of liquidity is our operating cash flow, which is dependent on the ability of our operations to deliver projected future cash flows. The ability of our operations to deliver projected future cash flows, as well as future changes in gold and copper market prices, either favorable or unfavorable, will continue to have a material impact on our cash flow and liquidity.

Key risk modification activities:

| | • | | Reduced notional and lengthened average tenor of our outstanding debt through liability management activities; |

| | • | | Continued focus on generating positive free cash flow by improving the underlying cost structures of our operations in a sustainable manner; |

| | • | | Disciplined capital allocation criteria for all investments, and regular Investment Committee meetings to ensure a high degree of consistency and rigor is applied to all capital allocation decisions based on a comprehensive understanding of risk and reward; |

| | • | | Preparation of budgets and forecasts to understand the impact of different price scenarios on liquidity, and formulate appropriate strategies; and |

| | • | | Other options available to the Company to enhance liquidity include drawing on our $4.0 billion undrawn credit facility, asset sales, joint ventures, or issuance of debt or equity securities. |

Improving free cash flow1 and costs

Our ability to improve productivity, drive down operating costs and reduce working capital remains a focus in 2018 and is subject to several sources of uncertainty. This includes our ability to achieve and maintain industry-leading margins by improving the productivity and efficiency of our operations through ourBest-in-Class, Asset Integrity and digital transformation programs.

Key risk modification activities:

| | • | | Formal project management protocols are established around these business transformation programs. The status of these projects is reviewed on a weekly basis during the |

| | | BPR meetings to ensure the timely identification of key risk exposures that may affect their successful delivery; |

| | • | | Ongoing implementation of a digitization program including a Cisco partnership to unlock the potential of digital mining; and |

| | • | | Ongoing implementation of aBest-in-Class program to unleash the full potential of our mines and encompassing: |

| | ° | A standardized, performance-oriented measurement scorecard linking top operational and economic measures; |

| | ° | Monthly optimization forums as a way to communicate and review theBest-in-Class projects and performance to targets; |

| | ° | Innovation and digitization program focused on driving value across the business; and |

| | ° | Asset Integrity program to improve availability of critical infrastructure. |

Social license to operate

At Barrick, we are committed to building, operating, and closing our mines in a safe and responsible manner. To do this, we seek to develop long-term and mutually-beneficial relationships with host governments and communities while working to minimize the social and environmental impacts of our activities. Geopolitical risks such as resource nationalism and incidents of corruption are inherent for a company operating globally. Past environmental incidents in the extractive industry highlight the hazards (e.g., water management, tailings storage facilities, etc.) and the potential consequences to both the environment and community health and safety. Barrick also recognizes climate change as an area of risk requiring specific focus. Our ability to maintain compliance with regulatory and community obligations in order to protect the environment and our host communities alike remains one of our top priorities.

Key risk modification activities:

| | • | | Our external Corporate Social Responsibility Advisory Board was formed in 2012 and provides expert advice to the Company on a range of corporate social responsibility matters, including community relations, sustainable development, water, energy, climate change, security and human rights; |

| | • | | Our obligations, expectations and intentions are codified in our Vision and Values and the Code of Business Conduct and Ethics, and they are reinforced regularly at all levels of the Company; |

| | • | | Barrick’s community relations, environment, safety and health, security and compliance management systems set expectations, define performance standards and provide the necessary tools to modify the related risks; |

| | • | | We take a partnership approach with our home and host governments. This means we work to |

| | | | |

BARRICK YEAR-END 2017 | | 38 | | MANAGEMENT’S DISCUSSION AND ANALYSIS |

| | balance our own interests and priorities with those of our government partners, working to ensure that everyone derives real value from our operations; |

| | • | | We open our social and environmental performance to third-party scrutiny, including through the ISO 14001re-certification process, International Cyanide Management Code audits, annual human rights impact assessments, and an annual assurance against the International Council on Mining and Metal’s Sustainable Development Framework; |

| | • | | We participate in the annual CDP Climate Change and Water Disclosure process, providing investors and other interested partners with detailed information on our water and energy use and emissions data; |

| | • | | Under the direction of the Climate Change committee, we performed a climate change risk assessment. Refer to page 30 for details; and |

| | • | | We continually review and update our closure plans and cost estimates to plan for environmentally responsible closure and monitoring of operations. |

Resources and reserves and production outlook

Like any mining company, we face the risk that we are unable to discover or acquire new resources or that we do not convert resources into production. As we move into 2018 and beyond, our overriding objective of growing free cash flow per share is underpinned by a strong pipeline of organic projects and minesite expansion opportunities in our core regions. Uncertainty related to these and other opportunities exists (potentially both favorable and unfavorable) due to the speculative nature of mineral exploration and development as well as the potential for increased costs, delays, suspensions and technical challenges associated with the construction of capital projects.

Key risk modification activities:

| | • | | Focus on responsible Mineral Resource Management and continuously improved orebody knowledge, adding to and upgrading reserves and resources (organically and inorganically); |

| | • | | Develop and advance a balanced pipeline of high-return projects and seek to exit those that do not meet expectations; |

| | • | | Pursue high-return growth options with a mindset of innovation, cost control, and risk mitigation; |

| | • | | Enhance project design to stagger capital outlay and optimize timing of cash flows; and |

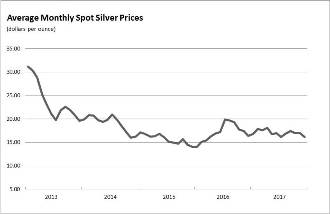

| | • | | Exploration activities including minesite exploration and global programs. |