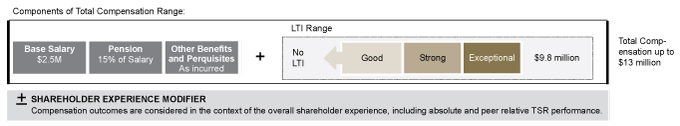

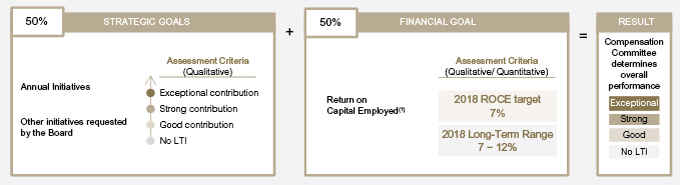

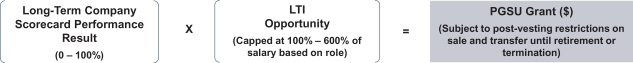

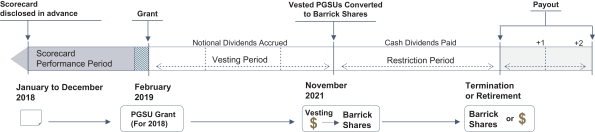

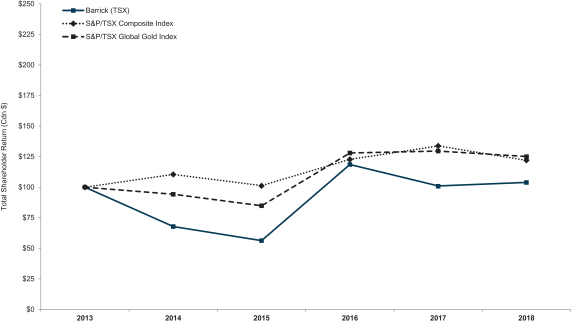

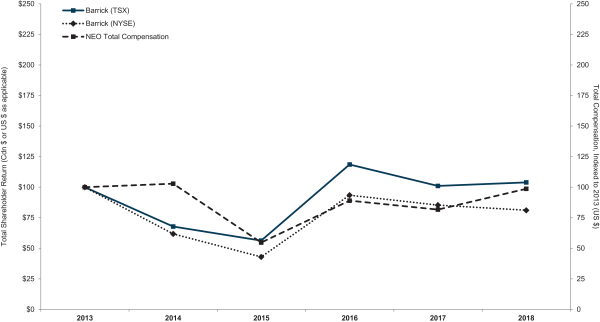

| | The Compensation Committee applied the Performance and Compensation Framework and considered the overall shareholder experience to determine the Executive Chairman’s 2018 incentive compensation award. The Executive Chairman’s performance was evaluated prior to the closing of the Merger by the Corporate Governance & Nominating Committee in consultation with the Lead Director and Compensation Committee based on this framework. In 2018, the Executive Chairman delivered against the annual initiatives we set out for him in our 2018 Circular. In addition, in 2018, Barrick achieved a ROCE of 6.8%, which is marginally below the target rate of 7%, but contributes to a three-year average ROCE of 8.3%, which is well within the long-term performance range of 7% to 12% and is a strong reflection of our commitment to deliver sustainable shareholder returns. Achievement of the Executive Chairman’s annual initiatives was, however, only one aspect of his accomplishments in 2018. In addition to delivering against the annual initiatives and financial performance initiatives set for the Executive Chairman in our 2018 Circular, the Executive Chairman led and completed Barrick’s transformational, nil-premium merger with Randgold, which meaningfully advances many of Barrick’s strategic goals and enhances Barrick’s prospects of becoming the world’s most valuable gold mining business. The transformational Randgold merger was the culmination of a number of key initiatives effectively executed by the Executive Chairman following his appointment in 2014. When first appointed, the Executive Chairman’s principal role was to restructure Barrick’s balance sheet and return the Company to financial stability. Under the Executive Chairman’s leadership, Barrick successfully completed a series of non-core asset sales between 2015 and 2018, allowing the Company to repay approximately $10 billion of debt over the past five-and-a-half years. In addition to restructuring Barrick’s balance sheet, the Executive Chairman successfully implemented a decentralized management model and made significant investments in acquiring top talent while significantly reducing Barrick’s overhead. During this same period, the Executive Chairman also engaged extensively with shareholders and established critical strategic partnerships with leading Chinese gold companies and host governments, playing a key role in the path to resolving Barrick’s majority-owned subsidiary’s dispute in Tanzania. Having restored Barrick’s balance sheet to one of the strongest in the industry and with a lean decentralized management team and strong partnerships in place, the Executive Chairman determined that Barrick’s portfolio of world class gold assets demanded a best-in-class leader to take Barrick’s operational business to the next level. The Executive Chairman canvassed a number of highly respected industry leaders to source a highly respected Chief Executive Officer with attributes needed to drive the Company’s business to the next level. After this extensive consultation, it became apparent that Mark Bristow, who was widely regarded as a talented and respected Chief Executive Officer keenly focused on the relentless pursuit of excellence, cost savings, operational excellence, and talent, was the Chief Executive Officer Barrick needed to achieve its goals. In February 2018, the Executive Chairman engaged in discussions with Mr. Bristow regarding a variety of strategic opportunities involving Barrick and Randgold, including the possibility of a merger transaction. In the months that followed, the Executive Chairman travelled extensively to meet with Mr. Bristow at various places around the world to ensure a common understanding of the merits and goals of a potential merged company. With a common understanding established, the Executive Chairman personally assembled and led a deal team to undertake the significant technical, financial, and legal diligence and structuring work required to complete a transaction of this nature. Importantly, the Executive Chairman pioneered the novel nil-premium structure that allowed the transaction to proceed. The Executive Chairman was also instrumental in convincing an overwhelming majority of shareholders of both Barrick and Randgold of the significant merits of the Merger. The Executive Chairman’s vision, determination and drive resulted in the industry-changing announcement of the Merger on September 24, 2018. The positive results of the Merger were discernible immediately. Following the announcement of Barrick’s nil-premium merger with Randgold on September 24, 2018, our share price on the NYSE increased 29% up until completion of the transaction on January 1, 2019. This equated to an increase in our market capitalization of $3.6 billion. By comparison over the same period, the share price on the NYSE and the Australian Securities Exchange (ASX) of the Senior Gold Peers increased by an average of 7%, while the average market gold price also only increased by 7%. Given the significant ordinary course and extraordinary achievements of the Executive Chairman in 2018, and the assumption by the Executive Chairman of additional responsibilities following the resignation of the former President in July, on the recommendation of the Compensation Committee, the independent directors approved an LTI award of $9.735 million for the Executive Chairman. To further underscore our ownership culture, a majority of the after-tax proceeds of the 2018 LTI award was used to purchase 215,000 Barrick Shares for the Executive Chairman which cannot be sold until the later of (a) three years from the date of purchase and (b) the date the Executive Chairman retires or leaves the Company. The Executive Chairman’s LTI award was not accrued to the Executive Retirement Plan. In 2018, the total compensation for the Executive Chairman was $12,859,994. The Board once again acknowledges the Executive Chairman’s continued commitment to deep, long-term ownership in the Company. The Executive Chairman continues to lead by example ensuring that Barrick is a company of owners having invested significantly more in Barrick shares than he has received in after-tax compensation from Barrick. Demonstrating his commitment to ownership as a core element of Barrick’s partnership culture, following announcement of the Merger, the Executive Chairman purchased more than 2.2 million Barrick Shares, nearly doubling his total shareholding in Barrick to five million shares. Including the shares purchased with a majority of the after-tax proceeds of the 2018 LTI award, he now holds 5,215,000 Barrick Shares, worth nearly 29 times his base salary as at March 28, 2019. The Compensation Committee’s considerations, including the specific assessment of the Executive Chairman’s performance highlights against his annual initiatives and financial initiatives disclosed in our 2018 Circular, are summarized below. |