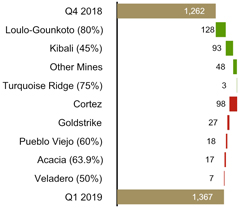

Factors affecting net earnings and adjusted net earnings1 - three months ended March 31, 2019 versus December 31, 2018

Net earnings attributable to equity holders of Barrick (“net earnings”) for the three months ended March 31, 2019 were $111 million compared with a net loss of $1,197 million in the prior quarter. The significant increase was primarily due to thede-recognition of deferred tax assets of $814 million in the prior quarter. This was combined with impairments of $246 million ($160 million net of tax) ofnon-current assets and $154 million (no tax impact) of goodwill at the Veladero mine, and inventory impairment at Lagunas Norte of $166 million in the prior quarter. After adjusting for items that are not indicative of future operating earnings, adjusted net earnings1 of $184 million for the three months ended March 31, 2019 were 167% higher than the prior quarter. The increase in adjusted net earnings was primarily due to the Merger and the commencement of the contribution of Randgold’s operations to Barrick’s net earnings. Excluding the impact of the merger, gold revenues decreased by 7%, primarily due to lower gold sales of 154 thousand ounces compared to the prior quarter, mainly due to lower grades at Cortez, Goldstrike, and Pueblo Viejo. Net earnings were also positively impacted by higher realized gold prices1 of $1,307 per ounce in the three months ended March 31, 2019 compared to $1,223 per ounce in the prior quarter. Excluding the impact of the Merger, direct mining costs decreased by 20%, primarily due to the lower sales volume and the impact of business improvement initiatives at Pueblo Viejo and Veladero.

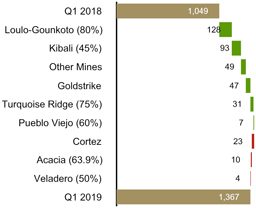

Factors affecting net earnings and adjusted net earnings1 - three months ended March 31, 2019 versus March 31, 2018

Net earnings for the first quarter of 2019 were $111 million compared with $158 million in the same prior year period. The decrease was mainly due to $32 million relating to organizational restructuring, primarily related to our assets in Peru, and higher foreign currency translation losses primarily relating to the significant weakening of the Argentine peso on the value-added taxes receivable balances. After adjusting for items that are not indicative of future operating earnings, adjusted net earnings1 of $184 million in the first quarter of 2019 were $14 million higher than the same prior year period. The increase in adjusted net earnings was primarily due to the Merger and the commencement of the contribution of Randgold’s operations to Barrick’s net earnings. Excluding the impact of the Merger, gold revenues and cost of sales applicable to gold remained relatively in line with the same prior year period, with no significant movements in realized gold prices1 or sales. Net earnings were also positively impacted by higher copper sales volume primarily due to higher throughput, grade, and recovery at Lumwana and Jabal Sayid following operational improvements at those sites. This was further impacted by higher realized copper price1 of $3.07 per pound in the first quarter of 2019 compared to $2.98 per pound in the same prior year period. This was partially offset by higher copper cost of sales as a result of higher sales volumes.

Significant adjusting items(pre-tax and excludingnon-controlling interest effects) in the three months ended March 31, 2019 include:

| | • | | $47 million in other expense adjustments, including $32 million relating to organizational restructuring, primarily related to our assets in Peru and $15 million relating to the impact of changes in the discount rate assumptions on our closed mine rehabilitation provision; and |

| | • | | $22 million in foreign currency translation losses primarily related to the significant weakening of the Argentine peso on the value-added taxes receivable balances. |

Refer to page 58 for a full list of reconciling items between net earnings and adjusted net earnings1 for the current and previous periods.

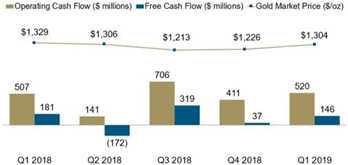

Factors affecting Operating Cash Flow and Free Cash Flow1 - three months ended March 31, 2019 versus December 31, 2018

In the three months ended March 31, 2019, we generated $520 million in operating cash flow, compared to $411 million in the prior quarter. The increase of $109 million is primarily due to less cash interest paid during the quarter mainly due to timing, combined with an increase in sales volume as a result of the Merger and the commencement of the contribution of Randgold’s operations to Barrick’s cash flows. Operating cash flow was also positively impacted by higher realized gold and copper prices1 of $1,307 per ounce and $3.07 per pound, respectively, in the three months ended March 31, 2019 compared to $1,223 per ounce and $2.76 per pound, respectively, in the prior quarter.

Free cash flow1 for the three months ended March 31, 2019 was $146 million, compared to $37 million in the prior quarter, reflecting higher operating cash flows, while capital expenditures remained in line with the prior quarter. In the three months ended March 31, 2019, capital expenditures on a cash basis were $374 million, consistent with the prior quarter, as an increase in project capital expenditures was offset by a decrease in minesite sustaining capital expenditures. The increase in project capital expenditures primarily relates to the funding of a power transmission line in Argentina as a result of an agreement made with the Provincial Power Regulatory Body of San Juan (“EPRE”). Minesite sustaining capital expenditures decreased in the first quarter of 2019 mainly due to the deferral of spending at Pueblo Viejo relating to tailing pumps and the Bonao Substation III project. This was combined with lower expenditures at Cortez associated with the Area 34 leach pad expansion and the purchase of underground mobile equipment occurring in the prior quarter.

1 Numerical annotations throughout the text of this document refer to the endnotes found on page 73.

| | | | |

BARRICK FIRST QUARTER 2019 | | 22 | | MANAGEMENT’S DISCUSSION AND ANALYSIS |