- GOLD Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

6-K Filing

Barrick Gold (GOLD) 6-KIncreased Dividend Reflects

Filed: 6 Nov 19, 3:01pm

Exhibit 99.2

MANAGEMENT’S DISCUSSION AND ANALYSIS (“MD&A”)

QUARTERLY REPORT ON THE THIRD QUARTER OF 2019

This portion of the Quarterly Report provides management’s discussion and analysis (“MD&A”) of the financial condition and results of operations, to enable a reader to assess material changes in financial condition and results of operations as at, and for the three and nine month periods ended September 30, 2019, in comparison to the corresponding prior-year periods. The MD&A is intended to help the reader understand Barrick Gold Corporation (“Barrick”, “we”, “our” or the “Company”), our operations, financial performance and present and future business environment. This MD&A, which has been prepared as of November 5, 2019, is intended to supplement and complement the condensed unaudited interim consolidated financial statements and notes thereto, prepared in accordance with International Accounting Standard 34 Interim Financial Reporting (“IAS 34”) as issued by the International Accounting Standards Board (“IASB”), for the three and nine month periods ended September 30, 2019 (collectively, the “Financial Statements”), which are included in this Quarterly Report on pages 102 to 123. You are encouraged to review the Financial Statements in conjunction with your review of this MD&A. This MD&A should be read in conjunction with both the annual audited consolidated financial statements for the two years ended December 31, 2018, the related annual MD&A included in the 2018 Annual Report, and the most

recent Form 40–F/Annual Information Form on file with the U.S. Securities and Exchange Commission (“SEC”) and Canadian provincial securities regulatory authorities. These documents and additional information relating to the Company are available on SEDAR at www.sedar.com and EDGAR at www.sec.gov. Certain notes to the Financial Statements are specifically referred to in this MD&A and such notes are incorporated by reference herein. All dollar amounts in this MD&A are in millions of United States dollars (“$” or “US$”), unless otherwise specified.

For the purposes of preparing our MD&A, we consider the materiality of information. Information is considered material if: (i) such information results in, or would reasonably be expected to result in, a significant change in the market price or value of our shares; or (ii) there is a substantial likelihood that a reasonable investor would consider it important in making an investment decision; or (iii) it would significantly alter the total mix of information available to investors. We evaluate materiality with reference to all relevant circumstances, including potential market sensitivity.

CAUTIONARY STATEMENT ON FORWARD-LOOKING INFORMATION

Certain information contained or incorporated by reference in this MD&A, including any information as to our strategy, projects, plans or future financial or operating performance, constitutes “forward-looking statements”. All statements, other than statements of historical fact, are forward-looking statements. The words “believe”, “expect”, “anticipate”, “target”, “plan”, “objective”, “assume”, “intend”, “project”, “pursue”, “goal”, “continue”, “budget”, “estimate”, “potential”, “may”, “will”, “can”, “could”, “would”, “should” and similar expressions identify forward-looking statements. In particular, this MD&A contains forward-looking statements including, without limitation, with respect to: (i) Barrick’s forward-looking production guidance; (ii) estimates of future cost of sales per ounce for gold and per pound for copper, total cash costs per ounce and C1 cash costs per pound, andall-in-sustaining costs per ounce/pound; (iii) cash flow forecasts; (iv) projected capital, operating and exploration expenditures; (v) mine life and production rates; (vi) estimated timing for construction of, and production from, new projects; (vii) anticipated gold production from the Deep South Project; (viii) timing of completion of a feasibility study for Goldrush and Fourmile and timing of approval of the plan of operations; (ix) the potential for plant expansion at Pueblo Viejo to increase throughput and convert resources into reserves; (x) the new partnership between Barrick and the Government of Tanzania (“GoT”) and the agreement to resolve all outstanding disputes between Acacia and the GoT; (xi) expected agreement with the government of Papua New Guinea regarding an extension of Porgera’s special mining lease; (xii) expected timing for completion of refurbishments at one of the smelters that processes Lumwana concentrate; (xiii) our pipeline of high confidence projects at or near existing operations; (xiv)

potential mineralization and metal or mineral recoveries; (xv) our ability to convert resources into reserves; (xvi) asset sales, joint ventures and partnerships, including with respect to Kalgoorlie; and (xvii) expectations regarding future price assumptions, financial performance and other outlook or guidance.

Forward-looking statements are necessarily based upon a number of estimates and assumptions including material estimates and assumptions related to the factors set forth below that, while considered reasonable by the Company as at the date of this MD&A in light of management’s experience and perception of current conditions and expected developments, are inherently subject to significant business, economic and competitive uncertainties and contingencies. Known and unknown factors could cause actual results to differ materially from those projected in the forward-looking statements and undue reliance should not be placed on such statements and information. Such factors include, but are not limited to: fluctuations in the spot and forward price of gold, copper or certain other commodities (such as silver, diesel fuel, natural gas and electricity); the speculative nature of mineral exploration and development; changes in mineral production performance, exploitation and exploration successes; risks associated with projects in the early stages of evaluation and for which additional engineering and other analysis is required; whether the agreement to settle all disputes between Acacia and the GoT will be legalized and executed by the GoT; the Company’s ability to successfullyre-integrate Acacia’s operations; the benefits expected from recent transactions being realized, including Nevada Gold Mines; diminishing quantities or grades of reserves; increased

| BARRICK THIRD QUARTER 2019 | 28 | MANAGEMENT’S DISCUSSION AND ANALYSIS |

costs, delays, suspensions and technical challenges associated with the construction of capital projects; operating or technical difficulties in connection with mining or development activities, including geotechnical challenges and disruptions in the maintenance or provision of required infrastructure and information technology systems; failure to comply with environmental and health and safety laws and regulations;non-renewal of key licenses by governmental authorities; timing of receipt of, or failure to comply with, necessary permits and approvals; uncertainty whether some or all of Barrick’s targeted investments and projects will meet the Company’s capital allocation objectives and internal hurdle rate; the impact of global liquidity and credit availability on the timing of cash flows and the values of assets and liabilities based on projected future cash flows; adverse changes in our credit ratings; the impact of inflation; fluctuations in the currency markets; changes in U.S. dollar interest rates; risks arising from holding derivative instruments; changes in national and local government legislation, taxation, controls or regulations and/or changes in the administration of laws, policies and practices, expropriation or nationalization of property and political or economic developments in Canada, the United States and other jurisdictions in which the Company or its affiliates do or may carry on business in the future; lack of certainty with respect to foreign legal systems, corruption and other factors that are inconsistent with the rule of law; risks associated with illegal and artisanal mining; the risks of operating in jurisdictions where infectious diseases present major health care issues; disruption of supply routes which may cause delays in construction and mining activities; damage to the Company’s reputation due to the actual or perceived occurrence of any number of events, including negative publicity with respect to the Company’s handling of environmental matters or dealings with community groups, whether true or not; the possibility that future exploration results will not be consistent with the Company’s expectations; risks that exploration data may be incomplete and considerable additional work may be required to complete further evaluation, including but not limited to drilling, engineering and socioeconomic studies and investment; risk

of loss due to acts of war, terrorism, sabotage and civil disturbances; litigation and legal and administrative proceedings; contests over title to properties, particularly title to undeveloped properties, or over access to water, power and other required infrastructure; business opportunities that may be presented to, or pursued by, the Company; our ability to successfully integrate acquisitions or complete divestitures; risks associated with working with partners in jointly controlled assets; employee relations including loss of key employees; increased costs and physical risks, including extreme weather events and resource shortages, related to climate change; and availability and increased costs associated with mining inputs and labor. In addition, there are risks and hazards associated with the business of mineral exploration, development and mining, including environmental hazards, industrial accidents, unusual or unexpected formations, pressures,cave-ins, flooding and gold bullion, copper cathode or gold or copper concentrate losses (and the risk of inadequate insurance, or inability to obtain insurance, to cover these risks).

Many of these uncertainties and contingencies can affect our actual results and could cause actual results to differ materially from those expressed or implied in any forward-looking statements made by, or on behalf of, us. Readers are cautioned that forward-looking statements are not guarantees of future performance. All of the forward-looking statements made in this MD&A are qualified by these cautionary statements. Specific reference is made to the most recent Form40-F/Annual Information Form on file with the SEC and Canadian provincial securities regulatory authorities for a more detailed discussion of some of the factors underlying forward-looking statements and the risks that may affect Barrick’s ability to achieve the expectations set forth in the forward-looking statements contained in this MD&A. We disclaim any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise, except as required by applicable law.

| BARRICK THIRD QUARTER 2019 | 29 | MANAGEMENT’S DISCUSSION AND ANALYSIS |

MERGER WITH RANDGOLD RESOURCES LIMITED

On January 1, 2019, Barrick acquired 100% of the issued and outstanding shares of Randgold Resources Limited (“Randgold”) for $7.9 billion based on the December 31, 2018 closing share price of Barrick’s common shares (the “Merger”). We began consolidating the operating results, cash flows and net assets of Randgold from January 1, 2019 and the results presented in this MD&A reflect that. Refer to note 4 of the Financial Statements for further details of this transaction.

USE OFNON-GAAP FINANCIAL PERFORMANCE MEASURES

We use the followingnon-GAAP financial performance measures in our MD&A:

| • | “adjusted net earnings” |

| • | “free cash flow” |

| • | “EBITDA” |

| • | “adjusted EBITDA” |

| • | “total cash costs per ounce” |

| • | “C1 cash costs per pound” |

| • | “all-in sustaining costs per ounce/pound” |

| • | “all-in costs per ounce” and |

| • | “realized price” |

For a detailed description of each of thenon-GAAP financial performance measures used in this MD&A and a detailed reconciliation to the most directly comparable measure under International Financial Reporting Standards (“IFRS”), please refer to theNon-GAAP Financial Performance Measures section of this MD&A on pages 77 to 98. Eachnon-GAAP financial performance measure has been annotated with a reference to an endnote on page 99. Thenon-GAAP financial performance measures set out in this MD&A are intended to provide additional information to investors and do not have any standardized meaning under IFRS, and therefore may not be comparable to other issuers, and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS.

Changes in Presentation ofNon-GAAP Financial Performance Measures

Total cash costs

Starting from the first quarter of 2019, we have renamed “cash costs” to “total cash costs” when referring to our gold operations. The calculation of total cash costs is identical to our previous calculation of cash costs with only a change in the naming convention of thisnon-GAAP measure.

All-in sustaining costs andall-in costs

Starting from the first quarter of 2019, we have included sustaining capital expenditures and project capital expenditures on a cash basis instead of an accrual basis. As a result of adopting IFRS 16Leases, the full lease amount is included in accrued capital expenditures on initial recognition. We believe that the change in capital expenditures from an accrual basis to a cash basis better reflects the timing of costs associated with our operations. The original World Gold Council (“WGC”) Guidance Note explicitly excluded certain financing activities fromall-in sustaining costs andall-in costs. As a result of the new lease accounting standard, the WGC Guidance Note was updated to include both the principal and interest portion of the cash lease payment in theall-in sustaining costs andall-in cost metrics. We have updated our calculation accordingly. Prior periods have not been restated but would not be materially different.

| INDEX | page | |||

| Overview | ||||

Financial and Operating Highlights | 31 | |||

Key Business Developments | 35 | |||

Full Year 2019 Outlook | 37 | |||

Production and Cost Summary | 39 | |||

| Operating Divisions Performance | 41 | |||

Nevada Gold Mines LLC | 42 | |||

Cortez | 43 | |||

Carlin | 45 | |||

Turquoise Ridge | 47 | |||

Other Mines | 49 | |||

Pueblo Viejo | 50 | |||

Loulo-Gounkoto | 52 | |||

Kibali | 53 | |||

Veladero | 55 | |||

Tanzania | 57 | |||

Other Mines | 60 | |||

Projects | 62 | |||

Exploration | 63 | |||

| Review of Financial Results | 65 | |||

Revenue | 65 | |||

Production Costs | 67 | |||

Capital Expenditures | 68 | |||

General and Administrative Expenses | 69 | |||

Exploration, Evaluation and Project Expenses | 70 | |||

Finance Costs, Net | 70 | |||

Additional Significant Statement of Income Items | 71 | |||

Income Tax Expense | 72 | |||

| Financial Condition Review | 73 | |||

Balance Sheet Review | 73 | |||

Shareholders’ Equity | 73 | |||

Financial Position and Liquidity | 73 | |||

Summary of Cash Inflow (Outflow) | 74 | |||

| Commitments and Contingencies | 75 | |||

| Review of Quarterly Results | 76 | |||

| Internal Control over Financial Reporting and Disclosure Controls and Procedures | 76 | |||

| IFRS Critical Accounting Policies and Accounting Estimates | 77 | |||

| Non-GAAP Financial Performance Measures | 77 | |||

| Technical Information | 99 | |||

| Endnotes | 99 | |||

| Financial Statements | 102 | |||

| Notes to Consolidated Financial Statements | 107 | |||

| BARRICK THIRD QUARTER 2019 | 30 | MANAGEMENT’S DISCUSSION AND ANALYSIS |

OVERVIEW

Financial and Operating Highlights

| For the three months ended | For the nine months ended | |||||||||||||||||||||||||||||||

| 9/30/19 | 6/30/19 | % Change | 9/30/18 | % Change | 9/30/19 | 9/30/18 | % Change | |||||||||||||||||||||||||

Financial Results($ millions) | ||||||||||||||||||||||||||||||||

Revenues | 2,678 | 2,063 | 30 | % | 1,837 | 46 | % | 6,834 | 5,339 | 28 | % | |||||||||||||||||||||

Cost of sales | 1,889 | 1,545 | 22 | % | 1,315 | 44 | % | 4,924 | 3,643 | 35 | % | |||||||||||||||||||||

Net earnings (loss)a | 2,277 | 194 | 1,074 | % | (412 | ) | 653 | % | 2,582 | (348 | ) | 842 | % | |||||||||||||||||||

Adjusted net earningsb | 264 | 154 | 71 | % | 89 | 197 | % | 602 | 340 | 77 | % | |||||||||||||||||||||

Adjusted EBITDAb | 1,297 | 972 | 33 | % | 776 | 67 | % | 3,271 | 2,274 | 44 | % | |||||||||||||||||||||

Adjusted EBITDA marginc | 48 | % | 47 | % | 2 | % | 42 | % | 14 | % | 48 | % | 43 | % | 12 | % | ||||||||||||||||

Total capital expenditures - sustainingd | 406 | 267 | 52 | % | 256 | 59 | % | 926 | 701 | 32 | % | |||||||||||||||||||||

Total project capital expendituresd | 96 | 108 | (11 | )% | 131 | (27 | )% | 324 | 325 | 0 | % | |||||||||||||||||||||

Total consolidated capital expendituresd,e | 502 | 379 | 32 | % | 387 | 30 | % | 1,255 | 1,026 | 22 | % | |||||||||||||||||||||

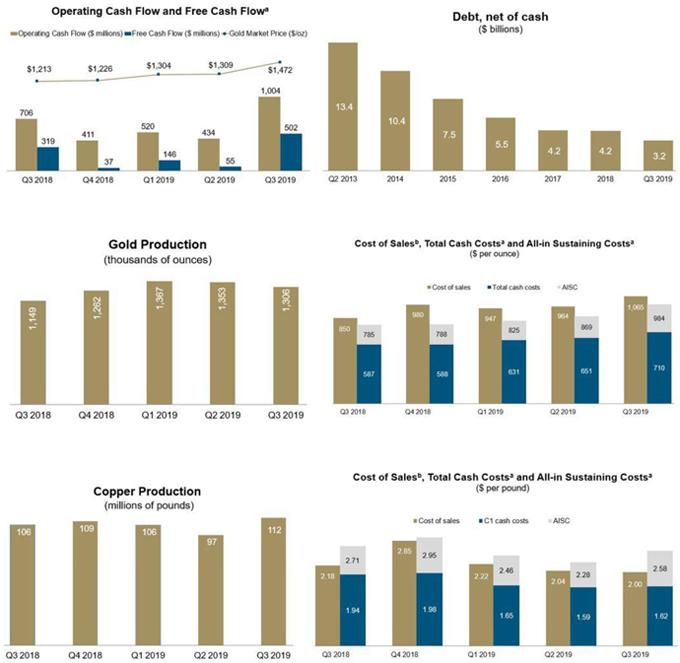

Net cash provided by operating activities | 1,004 | 434 | 131 | % | 706 | 42 | % | 1,958 | 1,354 | 45 | % | |||||||||||||||||||||

Net cash provided by operating activities marginf | 37 | % | 21 | % | 76 | % | 38 | % | (3 | )% | 29 | % | 25 | % | 16 | % | ||||||||||||||||

Free cash flowb | 502 | 55 | 813 | % | 319 | 57 | % | 703 | 328 | 114 | % | |||||||||||||||||||||

Net earnings (loss) per share (basic and diluted) | 1.30 | 0.11 | 1,082 | % | (0.35 | ) | 471 | % | 1.47 | (0.30 | ) | 590 | % | |||||||||||||||||||

Adjusted net earnings (basic)bper share | 0.15 | 0.09 | 67 | % | 0.08 | 88 | % | 0.34 | 0.29 | 17 | % | |||||||||||||||||||||

Weighted average diluted common shares (millions of shares) | 1,756 | 1,752 | 0 | % | 1,167 | 50 | % | 1,751 | 1,167 | 50 | % | |||||||||||||||||||||

Operating Results | ||||||||||||||||||||||||||||||||

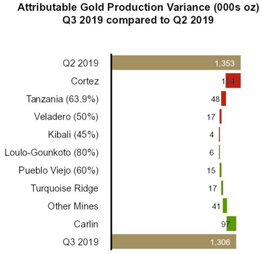

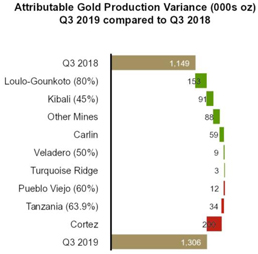

Gold production (thousands of ounces)g | 1,306 | 1,353 | (3 | )% | 1,149 | 14 | % | 4,026 | 3,265 | 23 | % | |||||||||||||||||||||

Gold sold (thousands of ounces)g | 1,318 | 1,372 | (4 | )% | 1,204 | 9 | % | 4,055 | 3,312 | 22 | % | |||||||||||||||||||||

Market gold price ($/oz) | 1,472 | 1,309 | 12 | % | 1,213 | 21 | % | 1,364 | 1,282 | 6 | % | |||||||||||||||||||||

Realized gold priceb,g($/oz) | 1,476 | 1,317 | 12 | % | 1,216 | 21 | % | 1,365 | 1,284 | 6 | % | |||||||||||||||||||||

Gold cost of sales (Barrick’s share)g,h($/oz) | 1,065 | 964 | 10 | % | 850 | 25 | % | 991 | 859 | 15 | % | |||||||||||||||||||||

Gold total cash costsb,g($/oz) | 710 | 651 | 9 | % | 587 | 21 | % | 663 | 588 | 13 | % | |||||||||||||||||||||

Goldall-in sustaining costsb,g($/oz) | 984 | 869 | 13 | % | 785 | 25 | % | 883 | 813 | 9 | % | |||||||||||||||||||||

Copper production (millions of pounds)i | 112 | 97 | 15 | % | 106 | 6 | % | 315 | 274 | 15 | % | |||||||||||||||||||||

Copper sold (millions of pounds)i | 65 | 96 | (32 | )% | 114 | (43 | )% | 264 | 273 | (3 | )% | |||||||||||||||||||||

Market copper price ($/lb) | 2.63 | 2.77 | (5 | )% | 2.77 | (5 | )% | 2.74 | 3.01 | (9 | )% | |||||||||||||||||||||

Realized copper priceb,i($/lb) | 2.55 | 2.62 | (3 | )% | 2.76 | (8 | )% | 2.78 | 2.92 | (5 | )% | |||||||||||||||||||||

Copper cost of sales (Barrick’s share)i,j($/lb) | 2.00 | 2.04 | (2 | )% | 2.18 | (8 | )% | 2.10 | 2.22 | (5 | )% | |||||||||||||||||||||

Copper C1 cash costsb,i($/lb) | 1.62 | 1.59 | �� | 2 | % | 1.94 | (16 | )% | 1.62 | 1.97 | (18 | )% | ||||||||||||||||||||

Copperall-in sustaining costsb,i($/lb) | 2.58 | 2.28 | 13 | % | 2.71 | (5 | )% | 2.42 | 2.76 | (12 | )% | |||||||||||||||||||||

| As at 9/30/19 | As at 6/30/19 | % Change | As at 9/30/18 | % Change | ||||||||||||||||||||||||||||

Financial Position($ millions) | ||||||||||||||||||||||||||||||||

Debt (current and long-term) | 5,560 | 5,807 | (4 | )% | 5,745 | (3 | )% | |||||||||||||||||||||||||

Cash and equivalents | 2,405 | 2,153 | 12 | % | 1,697 | 42 | % | |||||||||||||||||||||||||

Debt, net of cash | 3,155 | 3,654 | (14 | )% | 4,048 | (22 | )% | |||||||||||||||||||||||||

| a. | Net earnings (loss) represents net earnings (loss) attributable to the equity holders of the Company. |

| b. | Adjusted net earnings, adjusted EBITDA, free cash flow, adjusted net earnings per share, realized gold price,all-in sustaining costs, total cash costs, C1 cash costs and realized copper price arenon-GAAP financial performance measures with no standardized meaning under IFRS and therefore may not be comparable to similar measures presented by other issuers. For further information and a detailed reconciliation of eachnon-GAAP measure to the most directly comparable IFRS measure, please see pages 77 to 98 of this MD&A. |

| c. | Represents adjusted EBITDA divided by revenue. |

| d. | Amounts presented on a consolidated cash basis. Project capital expenditures are included in our calculation ofall-in costs, but not included in our calculation ofall-in sustaining costs. |

| e. | Total consolidated capital expenditures also includes capitalized interest. |

| f. | Represents net cash provided by operating activities divided by revenue. |

| g. | Includes Tanzania on a 63.9% basis (notwithstanding the completion of the Acacia transaction on September 17, 2019, we consolidated our interest in Acacia and recorded anon-controlling interest of 36.1% in the income statement for the entirety of the third quarter of 2019 as a matter of convenience), Pueblo Viejo on a 60% basis, South Arturo on a 60% basis (36.9% from July 1, 2019 onwards as a result of its contribution to Nevada Gold Mines), and Veladero on a 50% basis, which reflects our equity share of production and sales. Also includes Loulo-Gounkoto on an 80% basis, Kibali on a 45% basis, Tongon on an 89.7% basis and Morila on a 40% basis, which reflects our equity share of production and sales, commencing January 1, 2019, the effective date of the Merger. Also removes thenon-controlling interest of 38.5% Nevada Gold Mines from July 1, 2019 onwards. |

| h. | Gold cost of sales (Barrick’s share) is calculated as cost of sales - gold on an attributable basis (excluding sites in care and maintenance) divided by ounces sold. |

| i. | Amounts reflect production and sales from Jabal Sayid and Zaldívar on a 50% basis, which reflects our equity share of production, and Lumwana. |

| j. | Copper cost of sales (Barrick’s share) is calculated as cost of sales - copper plus our equity share of cost of sales attributable to Zaldívar and Jabal Sayid divided by pounds sold. |

| BARRICK THIRD QUARTER 2019 | 31 | MANAGEMENT’S DISCUSSION AND ANALYSIS |

| a. | These arenon-GAAP financial performance measures with no standardized meaning under IFRS and therefore may not be comparable to similar measures presented by other issuers. For further information and a detailed reconciliation of eachnon-GAAP measure to the most directly comparable IFRS measure, please see pages 77 to 98 of this MD&A. |

| b. | Cost of sales applicable to gold per ounce is calculated using cost of sales applicable to gold on an attributable basis (removing thenon-controlling interest of 40% Pueblo Viejo, 36.1% Tanzania (notwithstanding the completion of the Acacia transaction on September 17, 2019, we consolidated our interest in Acacia and recorded anon-controlling interest of 36.1% in the income statement for the entirety of the third quarter of 2019 as a matter of convenience) and 40% South Arturo from cost of sales (63.1% of South Arturo from July 1, 2019 onwards as a result of its contribution to Nevada Gold Mines)), divided by attributable gold ounces. Thenon-controlling interest of 20% Loulo-Gounkoto and 10.3% of Tongon is also removed from cost of sales and our proportionate share of cost of sales attributable to equity method investments (Kibali and Morila) is included commencing January 1, 2019, the effective date of the Merger. Also removes thenon-controlling interest of 38.5% Nevada Gold Mines from cost of sales from July 1, 2019 onwards. Cost of sales applicable to copper per pound is calculated using cost of sales applicable to copper including our proportionate share of cost of sales attributable to equity method investments (Zaldívar and Jabal Sayid), divided by consolidated copper pounds (including our proportionate share of copper pounds from our equity method investments). |

| BARRICK THIRD QUARTER 2019 | 32 | MANAGEMENT’S DISCUSSION AND ANALYSIS |

Factors affecting net earnings and adjusted net earnings1- three months ended September 30, 2019 versus June 30, 2019

Net earnings attributable to equity holders of Barrick (“net earnings”) for the three months ended September 30, 2019 were $2,277 million compared to $194 million in the prior quarter. The significant increase was primarily due to a gain of $1.9 billion ($1.5 billion net of taxes) relating to the remeasurement of Turquoise Ridge to fair value as a result of its contribution to Nevada Gold Mines LLC (“Nevada Gold Mines”) and an impairment reversal of $947 million ($663 million net of taxes) at Lumwana. After adjusting for items that are not indicative of future operating earnings, adjusted net earnings1 of $264 million for the three months ended September 30, 2019 were 71% higher than the prior quarter. The increase in adjusted net earnings was primarily due to higher realized gold prices1of $1,476 per ounce in the three months ended September 30, 2019 compared to $1,317 per ounce in the prior quarter. This was partially offset by lower gold sales volumes as a result of the Prohibition Notice, which resulted in the suspension of operations at North Mara in Tanzania.

Factors affecting net earnings and adjusted net earnings1- three months ended September 30, 2019 versus September 30, 2018

Net earnings for the third quarter of 2019 were $2,277 million compared to a loss of $412 million in the same prior year period. The significant increase was mainly due to a gain of $1.9 billion ($1.5 billion net of taxes) relating to the remeasurement of Turquoise Ridge to fair value as a result of its contribution to Nevada Gold Mines and an impairment reversal of $947 million ($663 million net of taxes) at Lumwana. In addition to these impacts, there was a $405 million impairment charge recorded in the third quarter of 2018 resulting from an asset impairment of Lagunas Norte. After adjusting for items that are not indicative of future operating earnings, adjusted net earnings1 of $264 million in the third quarter of 2019 were $175 million higher than the same prior year period. The increase in adjusted net earnings was primarily due to the Merger. Excluding the impact of the Merger, the increase in adjusted net earnings was primarily due to higher realized gold prices1of $1,476 per ounce in the three months ended September 30, 2019 compared to $1,216 per ounce in the same prior year period.

Significant adjusting items(pre-tax and excludingnon-controlling interest effects) in the three months ended September 30, 2019 include:

| • | $1,901 million in acquisition/disposition gains mainly relating to the remeasurement of Turquoise Ridge to fair value as a result of its contribution to Nevada Gold Mines; partially offset by |

| • | $872 million in net impairment reversals, relating to Lumwana, partially offset by impairments of land holdings and CHOP infrastructure assets at Cortez; and |

| • | $53 million in other expense adjustments, primarily related to severance costs as a result of the implementation of a number of organizational reductions, the impact of changes in the discount rate assumptions on our closed mine rehabilitation provision, and transaction costs related to Nevada Gold Mines and Acacia Mining plc. |

Refer to page 78 for a full list of reconciling items between net earnings and adjusted net earnings1 for the current and previous periods.

Factors affecting net earnings and adjusted net earnings1- nine months ended September 30, 2019 versus September 30, 2018

Net earnings for the nine months ended September 30, 2019 were $2,582 million compared to a loss of $348 million in the same prior year period. The significant increase was mainly due to a gain of $1.9 billion ($1.5 billion net of taxes) relating to the remeasurement of Turquoise Ridge to fair value as a result of its contribution to Nevada Gold Mines and an impairment reversal of $947 million ($663 million net of taxes) at Lumwana. In addition to these impacts, there was a $405 million impairment charge recorded in the third quarter of 2018 resulting from an asset impairment of Lagunas Norte. Net earnings were also positively impacted by relatively lower foreign currency translation losses relating to the Argentine peso. The peso has significantly depreciated in both periods and has revalued our peso denominated value-added tax receivable balances. After adjusting for items that are not indicative of future operating earnings, adjusted net earnings1 of $602 million for the nine months ended September 30, 2019 were $262 million higher than the same prior year period. The increase in adjusted net earnings was primarily due to the Merger. Excluding the impact of the Merger, the increase in adjusted net earnings was primarily due to an increase in realized gold prices1.

Significant adjusting items(pre-tax and excludingnon-controlling interest effects) in the nine months ended September 30, 2019 include:

| • | $1,913 million in acquisition/disposition gains mainly relating to the remeasurement of Turquoise Ridge to fair value as a result of its contribution to Nevada Gold Mines; partially offset by, |

| • | $158 million in other expense adjustments, primarily related to severance costs as a result of the implementation of a number of organizational reductions, the impact of changes in the discount rate assumptions on our closed mine rehabilitation provision, and transaction costs related to Nevada Gold Mines and Acacia Mining plc; and |

| • | $857 million in net impairment reversals, relating to Lumwana, partially offset by impairments of land holdings and CHOP infrastructure assets at Cortez. |

Refer to page 78 for a full list of reconciling items between net earnings and adjusted net earnings1 for the current and previous periods.

* Numerical annotations throughout the text of this document refer to the endnotes found on page 99.

| BARRICK THIRD QUARTER 2019 | 33 | MANAGEMENT’S DISCUSSION AND ANALYSIS |

Factors affecting Operating Cash Flow and Free Cash Flow1- three months ended September 30, 2019 versus June 30, 2019

In the three months ended September 30, 2019, we generated $1,004 million in operating cash flow, compared to $434 million in the prior quarter. The increase of $570 million was primarily due to the impact of the production from Nevada Gold Mines, which commenced on July 1, 2019 and is consolidated and included at 100%. This was combined with higher realized gold prices1 of $1,476 per ounce in the three months ended September 30, 2019 compared to $1,317 per ounce in the prior quarter and a favorable movement in working capital, mainly as a result of the timing of payments and receivables, partially offset by an unfavorable movement in other current assets. Operating cash flow was also positively impacted by lower income taxes paid and cash interest paid.

Free cash flow1 for the three months ended September 30, 2019 was $502 million, compared to $55 million in the prior quarter, reflecting higher operating cash flows, partially offset by higher capital expenditures. In the three months ended September 30, 2019, capital expenditures on a cash basis were $502 million compared to $379 million in the prior quarter primarily due to the consolidation impact of Nevada Gold Mines, as described above. This was combined with a strategic land acquisition at Cortez and increased capitalized stripping, underground development and minesite sustaining capital at Loulo-Gounkoto, while project capital expenditures were in line with the same prior year period.

Factors affecting Operating Cash Flow and Free Cash Flow1- three months ended September 30, 2019 versus September 30, 2018

In the third quarter of 2019, we generated $1,004 million in operating cash flow, compared to $706 million in the same prior year period. The increase of $298 million was primarily due to higher sales volume as a result of the Merger and the formation of Nevada Gold Mines as discussed above. This was combined with higher realized gold prices1 of $1,476 per ounce in the three months ended September 30, 2019 compared to $1,216 per ounce in the same prior year period, partially offset by higher direct mining costs as a result of the increased sales volume.

In the third quarter of 2019, we generated free cash flow1 of $502 million compared to $319 million in the same prior year period. The increase primarily reflects higher operating cash flows, partially offset by higher capital expenditures. In the third quarter of 2019, capital expenditures on a cash basis were $502 million compared to $387 million in the third quarter of 2018. The increase in capital expenditures of $115 million was primarily due to higher project minesite sustaining capital expenditures as a result of the Merger and the consolidation impact of Nevada Gold Mines, partially offset by decreases at Pueblo Viejo as a result of lower capitalized stripping costs and timing in project execution and at Tanzania due to lower capitalized stripping. This was further impacted by a decrease in project capital expenditures at Cortez due to the ramp down in the Rangefront Declines, Deep South, and Crossroads dewatering projects, partially offset by increased Crossroads stripping.

Factors affecting Operating Cash Flow and Free Cash Flow1- nine months ended September 30, 2019 versus September 30, 2018

For the nine months ended September 30, 2019, we generated $1,958 million in operating cash flow, compared to $1,354 million in the same prior year period. The increase of $604 million was primarily due to higher sales volume as a result of the Merger, the formation of Nevada Gold Mines. This was combined with higher realized gold prices1of $1,365 per ounce in the nine months ended September 30, 2019 compared to $1,284 per ounce in the same prior year period and higher direct mining costs as a result of the increased sales volume.

For the nine months ended September 30, 2019, we generated free cash flow1 of $703 million compared to $328 million in the same prior year period. The increase primarily reflects higher operating cash flows, partially offset by higher capital expenditures. In the nine months ended September 30, 2019, capital expenditures on a cash basis were $1,255 million compared to $1,026 million in the same prior year period. Higher capital expenditures of $229 million were primarily due to an increase in minesite sustaining capital expenditures as a result of the Merger and the consolidation impact of Nevada Gold Mines, while project capital expenditures remained in line with the same prior year period.

| BARRICK THIRD QUARTER 2019 | 34 | MANAGEMENT’S DISCUSSION AND ANALYSIS |

Key Business Developments

Acacia Mining plc

On September 17, 2019, Barrick acquired all of the Acacia Mining plc (“Acacia”) shares we did not already own through ashare-for-share exchange of 0.168 Barrick shares and any Acacia Exploration Special Dividends for each ordinary share of Acacia. The Acacia Exploration Special Dividends3 and any deferred cash consideration dividends (if applicable) will be paid as a consequence of a sales process to realize value from the sale of certain Acacia exploration properties to be undertaken during the two year period following closing. This transaction resulted in the issuance of 24,836,876 Barrick common shares or approximately 1% of Barrick’s share capital. As a result, Acacia ceased trading on the London Stock Exchange and became a wholly-owned subsidiary of Barrick called Barrick TZ Limited. Refer to note 4 to the Financial Statements for more information.

Notwithstanding the completion of the Acacia transaction on September 17, 2019, we consolidated our interest in Acacia and recorded anon-controlling interest of 36.1% in the income statement for the entirety of the third quarter of 2019 as a matter of convenience. As at September 30, 2019, we derecognized thenon-controlling interest on the balance sheet related to our former 63.9% ownership of Acacia to reflect our current 100% interest. The former Acacia mine sites (Bulyanhulu, North Mara and Buzwagi) will now be referred to as Tanzania in this report.

On October 20, 2019, we announced that we had reached an agreement with the Government of Tanzania (“GoT”) to settle all disputes between the GoT and the mining companies formerly operated by Acacia but now managed by Barrick. The final agreements have been submitted to the Tanzanian Attorney General for review and legalization.

The terms of the agreement include the payment of $300 million to settle all outstanding tax and other disputes; the lifting of the concentrate export ban; the sharing of future economic benefits from the mines on a 50/50 basis; and a dispute resolution mechanism that provides for binding international arbitration.

In conjunction with the finalization of the agreement, a new operating company called Twiga Minerals Corporation (“Twiga”) has been formed to manage the Bulyanhulu, Buzwagi and North Mara mines. The GoT will receive a free carried shareholding of 16% in each of the mines and will receive its half of the economic benefits from taxes, royalties, clearing fees and participation in all cash distributions made by the mines and Twiga. An annualtrue-up mechanism will be included to maintain the 50/50 split.

Operating results will be included at 100% from October 1, 2019 up until the GoT’s 16% free-carried interest is made effective, and on an 84% basis thereafter.

Nevada Gold Mines LLC

On March 10, 2019, we entered into an implementation agreement with Newmont Mining Corporation, now Newmont Goldcorp Corporation, (“Newmont Goldcorp”) to create a joint venture combining our respective mining operations, assets, reserves and talent in Nevada, USA. This includes Barrick’s Cortez, Goldstrike, Turquoise Ridge and Goldrush properties

and Newmont’s Carlin, Twin Creeks, Phoenix, Long Canyon and Lone Tree properties. On July 1, 2019, the transaction closed, establishing Nevada Gold Mines LLC (“Nevada Gold Mines”), and we began consolidating the operating results, cash flows and net assets of Nevada Gold Mines from that date forward. Barrick is the operator of the joint venture and owns 61.5%, with Newmont Goldcorp owning the remaining 38.5% of the joint venture.

As a result of this transaction, Barrick recognized a gain through earnings of $1.9 billion on the remeasurement of our previous 75% interest of Turquoise Ridge. Refer to note 4 to the Financial Statements for more information.

Debt Management

On July 15, 2019, Barrick completed a make-whole repurchase of the approximately $248 million of outstanding principal on our 4.95% Notes due 2020 and incurred a loss on debt extinguishment of $3 million in the third quarter of 2019. The debt repayment is expected to result in an annualized interest saving of approximately $12 million.

Reko Diq Arbitration

On July 12, 2019, the World Bank International Centre for Settlement of Investment Disputes (“ICSID”) awarded $5.84 billion in damages to Tethyan Copper Company Pty Limited, a joint venture held equally by Barrick and Antofagasta plc, in relation to the arbitration claims filed against the Islamic Republic of Pakistan following the unlawful denial of a mining lease for the Reko Diq project in Pakistan in 2011.

Damages include compensation of $4.087 billion in relation to the fair market value of the Reko Diq project at the time the mining lease was denied, and interest until the date of the award of $1.753 billion. Compound interest continues to apply at a rate of US Prime +1% per annum until the award is paid. The proceeds of this award will not be recognized in our financial statements until any such proceeds have been collected. Refer to note 17 to the Financial Statements for more information regarding these and related matters.

Randgold Resources Limited Merger

On January 1, 2019, we acquired 100% of the issued and outstanding shares of Randgold. Each Randgold shareholder received 6.1280 common shares of Barrick for each Randgold share, which resulted in the issuance of 583,669,178 Barrick common shares. After this share issuance, Barrick shareholders owned 66.7%, while former Randgold shareholders owned 33.3%, of the shares of the combined company. We have determined that this transaction represents a business combination with Barrick identified as the acquirer. Based on the December 31, 2018 closing share price of Barrick’s common shares, the total consideration of the acquisition is $7.9 billion.

Randgold was a publicly traded mining company with ownership interests in the following gold mines: Kibali in the Democratic Republic of Congo; Tongon in Côte d’Ivoire; Loulo-Gounkoto and Morila in Mali; and the Massawa project in Senegal and various exploration properties. We began consolidating the operating results, cash flows and net assets of Randgold from January 1, 2019.

| BARRICK THIRD QUARTER 2019 | 35 | MANAGEMENT’S DISCUSSION AND ANALYSIS |

In conjunction with the Merger, Barrick has a new management team, effective January 1, 2019. Mark Bristow is now President and Chief Executive Officer of Barrick. He was formerly the Chief Executive Officer of Randgold, a position he held since its incorporation in 1995. Graham Shuttleworth is now Senior Executive Vice-President and Chief Financial Officer of Barrick, having formerly served as Randgold‘s Chief Financial Officer since 2007. Kevin Thomson, Senior Executive Vice-President, Strategic Matters, continues in the role to which he was appointed at Barrick in October 2014.

In addition, Barrick is now managed by three regional Chief Operating Officers, each of whom report to the President and CEO. Mark Hill, formerly Barrick’s Chief Investment Officer, was appointed Chief Operating Officer, LATAM and Australia Pacific. Willem Jacobs, formerly Randgold’s General Manager East and Central Africa, was appointed Chief Operating Officer, Africa and Middle East. Catherine Raw, formerly Barrick’s Chief Financial Officer, was appointed Chief Operating Officer, North America.

Following the closing of the Merger, Barrick’s Board of Directors was reconstituted with the following nine Directors: John Thornton (Executive Chairman), Brett Harvey (Lead Independent Director) Mark Bristow, María Ignacia Benítez, Gustavo Cisneros, Christopher Coleman, Michael Evans, Brian Greenspun, and Andrew Quinn. Regrettably, on February 28, 2019, María Ignacia Benítez passed away. Barrick’s Corporate Governance & Nominating Committee initiated a search for an equally compelling and qualified female candidate to fill the vacant Board position and on August 9, 2019, we announced the appointment of Loreto Silva to the Board of Directors as an independent director.

| BARRICK THIRD QUARTER 2019 | 36 | MANAGEMENT’S DISCUSSION AND ANALYSIS |

Full Year 2019 Outlook

Based on the solid results of our first three quarters of 2019, we expect 2019 attributable gold production to be at the upper end of our existing guidance range of5.1-5.6 million ounces and both total cash costs per ounce1 andall-in sustaining costs per ounce1at the lower end of the ranges. As reported in our second quarter MD&A, our guidance range for cost of sales per ounce has now been revised for the impact of the formation of Nevada Gold Mines.

Commencing with this third quarter MD&A, we report on Nevada Gold Mines as five distinct operating divisions in which we own 61.5%: Cortez, Carlin (including Goldstrike), Turquoise Ridge (including Twin Creeks), Phoenix and Long Canyon. In relation to Cortez, Goldstrike and Turquoise Ridge, the full year guidance is inclusive of our interest in these operating divisions for the first six months of 2019 prior to the formation of Nevada Gold Mines. The guidance for cost of sales per ounce for Carlin, Turquoise Ridge, Phoenix and Long Canyon has been updated to include the additional depreciation resulting from the restatement of these assets to fair market value as a consequence of the formation of Nevada Gold Mines from July 1, 2019.

As reported in our second quarter MD&A, we will cease to include production ornon-GAAP cost metrics for Lagunas Norte going forward following the decision to place the mine on care and maintenance at the end of the third quarter.

All other guidance metrics are unchanged inclusive of the Company Outlook.

Five year outlook (2020-2024)

We continue to expect our five-year gold production outlook to be maintained within the5.1-5.6 million ounce range based on the existing portfolio. We also expect that our cost metrics will be maintained within the following ranges over this five-year time frame: cost of sales per ounce at$1,000-$1,060 per ounce, total cash costs per ounce1 at$650-$700 per ounce andall-in sustaining costs per ounce1 at$850-$950 per ounce, noting we expectall-in sustaining costs per ounce1 to decline over this period.

Company Outlook ($ millions, except per ounce/pound data) | 2019 Estimate | |||

Gold production (millions of ounces) | 5.10 - 5.60 | |||

Gold unit production costs | ||||

Cost of sales - gold ($/oz) | 940 - 990 | |||

Total cash costs ($/oz)a | 650 - 700 | |||

Depreciation ($/oz) | 320 - 350 | |||

All-in sustaining costs ($/oz)a | 870 - 920 | |||

Copper production (millions of pounds) | 375 - 430 | |||

Copper unit production costs | ||||

Cost of sales - copper ($/lb) | 2.30 - 2.70 | |||

C1 cash costs ($/lb)a | 1.70 - 2.00 | |||

Depreciation ($/lb) | 0.60 - 0.70 | |||

Copperall-in sustaining costs ($/lb)a | 2.40 - 2.90 | |||

Exploration and project expenses | 280 - 340 | |||

Exploration and evaluation | 170 - 180 | |||

Project expenses | 120 - 150 | |||

General and administrative expenses | ~200 | |||

Corporate administration | ~140 | |||

Share-based compensationb | ~40 | |||

Tanzaniac | ~20 | |||

Other expensed | 80 - 100 | |||

Finance costs | 500 - 550 | |||

Attributable capital expenditures: | ||||

Attributable minesite sustaining | 1,100 - 1,300 | |||

Attributable project | 300 - 400 | |||

Total attributable capital expenditurese | 1,400 - 1,700 | |||

Effective income tax ratef | 40% - 50% | |||

Key Assumptions | ||||

Gold Price ($/oz) | 1,250 | |||

Copper Price ($/lb) | 2.75 | |||

Oil Price (WTI) ($/barrel) | 65 | |||

AUD Exchange Rate (AUD:USD) | 0.75 | |||

ARS Exchange Rate (USD:ARS) | 60.00 | |||

CAD Exchange Rate (USD:CAD) | 1.30 | |||

CLP Exchange Rate (USD:CLP) | 680 | |||

EUR Exchange Rate (EUR:USD) | 1.20 | |||

| a. | Total cash costs, C1 cash costs andall-in sustaining costs arenon-GAAP financial performance measures with no standardized meaning under IFRS and therefore may not be comparable to similar measures of performance presented by other issuers. For further information and a detailed reconciliation of thenon-GAAP measures used in this section of the MD&A to the most directly comparable IFRS measure, please see pages 77 to 98 of this MD&A. |

| b. | Based on US$12.40 share price and excludes share-based compensation relating to Acacia Mining plc. |

| c. | Formerly known as Acacia Mining plc, this includes share-based compensation based on a share price of £1.50 or ~US$2.00. |

| d. | Other expense guidance excludes the remeasurement gain on Turquoise Ridge |

| e. | 2019 Guidance includes our 60% share of Pueblo Viejo, our 80% share of Loulo-Gounkoto, our 89.7% share of Tongon, our 63.9% share of Tanzania up until September 30, 2019 (notwithstanding the completion of the Acacia transaction on September 17, 2019, our guidance includes our 63.9% share up until the end of the third quarter of 2019 as a matter of convenience), our 50% share of Zaldívar and Jabal Sayid, our 45% of Kibali, and our share of joint operations. Furthermore, 2019 Guidance includes Cortez (100%), Goldstrike (100%) and Turquoise Ridge (75%), also known as Barrick Nevada, from January 1, 2019 to June 30, 2019, and Cortez, Carlin (including Goldstrike), Turquoise Ridge (including Twin Creeks), Phoenix and Long Canyon on a 61.5% basis from July 1, 2019 onwards as a result of the formation of Nevada Gold Mines with Newmont Goldcorp on July 1, 2019. South Arturo is included on a 60% basis from January 1, 2019 to June 30, 2019 and 36.9% from July 1, 2019 onwards. |

| f. | Based on key assumptions included in this table. |

| BARRICK THIRD QUARTER 2019 | 37 | MANAGEMENT’S DISCUSSION AND ANALYSIS |

Operating Division Guidance

Our 2019 forecast gold and copper production, cost of sales, total cash costs1, andall-in sustaining costs1 ranges by operating division are as follows:

| Operating Division | 2019 forecast attributable production (000s ozs) | 2019 forecast cost of salesa ($/oz) | 2019 forecast total cash costsb ($/oz) | 2019 forecast all-in sustaining costsb ($/oz) | ||||||||||||

| Gold | ||||||||||||||||

Carlinc,d | 960 - 1,020 | 1,020 - 1,080 | 740 - 790 | 955 - 995 | ||||||||||||

Cortezc | 760 - 810 | 810 - 850 | 530 - 580 | 670 - 710 | ||||||||||||

Turquoise Ridgec | 330 - 370 | 800 - 850 | 550 - 600 | 680 - 730 | ||||||||||||

Phoenixc | 50 - 70 | 2,250 - 2,300 | 940 - 990 | 1,120 - 1,150 | ||||||||||||

Long Canyonc | 40 - 50 | 1,100 - 1,150 | 300 - 350 | 920 - 950 | ||||||||||||

Pueblo Viejo (60%) | 550 - 600 | 780 - 830 | 465 - 510 | 610 - 650 | ||||||||||||

Loulo-Gounkoto (80%) | 520 - 570 | 880 - 930 | 575 - 625 | 810 - 850 | ||||||||||||

Kibali (45%) | 330 - 350 | 1,150 - 1,200 | 555 - 605 | 670 - 730 | ||||||||||||

Kalgoorlie (50%) | 260 - 280 | 920 - 970 | 740 - 790 | 1,010 - 1,050 | ||||||||||||

Tongon (89.7%) | 250 - 270 | 1,300 - 1,350 | 710 - 760 | 780 - 820 | ||||||||||||

Porgera (47.5%) | 240 - 260 | 980 - 1,030 | 800 - 850 | 985 - 1,025 | ||||||||||||

Veladero (50%) | 230 - 250 | 1,250 - 1,350 | 770 - 820 | 1,150 - 1,250 | ||||||||||||

Hemlo | 200 - 220 | 890 - 940 | 765 - 815 | 1,100 - 1,200 | ||||||||||||

Tanzania (63.9%)e | 320 - 350 | 920 - 970 | 665 - 710 | 860 - 920 | ||||||||||||

Other Sitesf | 120 - 160 | 1,155 - 1,240 | 895 - 945 | 1,055 - 1,115 | ||||||||||||

| Total Attributable to Barrickg,h,i | 5,100 - 5,600 | 940 - 990 | 650 - 700 | 870 - 920 | ||||||||||||

| 2019 forecast attributable production (millions lbs) | 2019 forecast cost of salesa($/lb) | 2019 forecast C1 cash costsb ($/lb) | 2019 forecastall-in sustaining costsb ($/lb) | |||||||||||||

| Copper | ||||||||||||||||

Lumwana | 210 - 240 | 2.25 - 2.50 | 1.80 - 2.10 | 2.75 - 3.15 | ||||||||||||

Zaldívar (50%) | 120 - 130 | 2.40 - 2.70 | 1.65 - 1.85 | 2.00 - 2.20 | ||||||||||||

Jabal Sayid (50%) | 45 - 60 | 2.00 - 2.30 | 1.60 - 1.90 | 1.60 - 1.90 | ||||||||||||

| Total Copperh | 375 - 430 | 2.30 - 2.70 | 1.70 - 2.00 | 2.40 - 2.90 | ||||||||||||

| a. | Cost of sales applicable to gold per ounce is calculated using cost of sales applicable to gold on an attributable basis (removing thenon-controlling interest of 40% Pueblo Viejo, 20% of Loulo-Gounkoto, 10.3% of Tongon, 36.1% Tanzania (notwithstanding the completion of the Acacia transaction on September 17, 2019, our guidance includes our 63.9% share up until the end of the third quarter of 2019 as a matter of convenience) and 40% South Arturo (63.1% of South Arturo from July 1, 2019 onwards as a result of its contribution to Nevada Gold Mines) from cost of sales and including our proportionate share of cost of sales attributable to our equity method investments in Kibali and Morila), divided by attributable gold ounces sold. Also removes thenon-controlling interest of 38.5% Nevada Gold Mines from cost of sales from July 1, 2019 onwards. Cost of sales applicable to copper per pound is calculated using cost of sales applicable to copper including our proportionate share of cost of sales attributable to our equity method investments in Zaldívar and Jabal Sayid, divided by consolidated copper pounds sold (including our proportionate share of copper pounds sold from our equity method investments). The guidance for cost of sales per ounce for Carlin, Turquoise Ridge, Phoenix and Long Canyon has been updated to include the additional depreciation resulting from the restatement of these assets to fair market value as a consequence of the formation of Nevada Gold Mines from July 1, 2019. |

| b. | Total cash costs,all-in sustaining costs and C1 cash costs arenon-GAAP financial performance measures with no standardized meaning under IFRS and therefore may not be comparable to similar measures of performance presented by other issuers. For further information and a detailed reconciliation of thenon-GAAP measures used in this section of the MD&A to the most directly comparable IFRS measures, please see pages 61 to 76 of this MD&A. |

| c. | These five operations are part of Nevada Gold Mines from July 1, 2019. Amounts include Cortez (100%), Goldstrike (100%) and Turquoise Ridge (75%), also known collectively as Barrick Nevada, from January 1, 2019 to June 30, 2019, and Cortez, Carlin (which includes Goldstrike), Turquoise Ridge (including Twin Creeks), Phoenix and Long Canyon on a 61.5% basis from July 1, 2019 onwards as a result of the formation of Nevada Gold Mines with Newmont Goldcorp on July 1, 2019. |

| d. | Includes our 60% share of South Arturo from January 1, 2019 to June 30, 2019 and 36.9% from July 1, 2019 onwards as a result of the formation of Nevada Gold Mines with Newmont Goldcorp on July 1, 2019. |

| e. | Formerly known as Acacia Mining plc. On September 17, 2019, Barrick acquired all of the shares of Acacia it did not own. Operating results will be included at 100% from October 1, 2019 (notwithstanding the completion of the Acacia transaction on September 17, 2019, we consolidated our interest in Acacia and recorded anon-controlling interest of 36.1% in the income statement for the entirety of the third quarter of 2019 as a matter of convenience) up until the GoT’s 16% free-carried interest is made effective, and on an 84% basis thereafter. |

| f. | Other sites include Lagunas Norte, Golden Sunlight, and Morila (40%) and excludes Pierina which is mining incidental ounces as it enters closure. Due to the planned ramp down of operations, we have ceased to include production ornon-GAAP cost metrics for Golden Sunlight or Morila after the second quarter and will cease to include Lagunas Norte after the end of the third quarter. |

| g. | Total cash costs andall-in sustaining costs per ounce include the impact of hedges and/or costs allocated tonon-operating sites. |

| h. | Operating unit guidance ranges reflect expectations at each individual operating unit, and may not add up to the company-wide guidance range total. Guidance ranges exclude Pierina which is mining incidental ounces as it enters closure. |

| i. | Includes corporate administration costs. |

| BARRICK THIRD QUARTER 2019 | 38 | MANAGEMENT’S DISCUSSION AND ANALYSIS |

Production and Cost Summary - Gold

| For the three months ended | ||||||||||||||||||||

| 9/30/19 | 6/30/19 | % Change | 9/30/18 | % Change | ||||||||||||||||

| Nevada Gold Mines LLC (61.5%)a | ||||||||||||||||||||

Gold produced (000s oz) | 535 | 526 | 2 | % | 624 | (14 | )% | |||||||||||||

Cost of sales ($/oz) | 1,027 | 842 | 22 | % | 800 | 28 | % | |||||||||||||

Total cash costs ($/oz)b | 693 | 594 | 17 | % | 526 | 32 | % | |||||||||||||

All-in sustaining costs ($/oz)b | 946 | 752 | 26 | % | 640 | 48 | % | |||||||||||||

Cortez (61.5%)c | ||||||||||||||||||||

Gold produced (000s oz) | 126 | 280 | (55 | )% | 326 | (61 | )% | |||||||||||||

Cost of sales ($/oz) | 829 | 719 | 15 | % | 630 | 32 | % | |||||||||||||

Total cash costs ($/oz)b | 570 | 489 | 17 | % | 342 | 67 | % | |||||||||||||

All-in sustaining costs ($/oz)b | 772 | 561 | 38 | % | 444 | 74 | % | |||||||||||||

Carlin (61.5%)d | ||||||||||||||||||||

Gold produced (000s oz) | 278 | 181 | 54 | % | 219 | 27 | % | |||||||||||||

Cost of sales ($/oz) | 1,007 | 1,116 | (10 | )% | 1,047 | (4 | )% | |||||||||||||

Total cash costs ($/oz)b | 775 | 769 | 1 | % | 738 | 5 | % | |||||||||||||

All-in sustaining costs ($/oz)b | 1,014 | 1,088 | (7 | )% | 892 | 14 | % | |||||||||||||

Turquoise Ridge (61.5%)e | ||||||||||||||||||||

Gold produced (000s oz) | 82 | 65 | 26 | % | 79 | 4 | % | |||||||||||||

Cost of sales ($/oz) | 1,077 | 665 | 62 | % | 805 | 34 | % | |||||||||||||

Total cash costs ($/oz)b | 622 | 569 | 9 | % | 711 | (13 | )% | |||||||||||||

All-in sustaining costs ($/oz)b | 840 | 667 | 26 | % | 757 | 11 | % | |||||||||||||

Phoenix (61.5%)f | ||||||||||||||||||||

Gold produced (000s oz) | 25 | |||||||||||||||||||

Cost of sales ($/oz) | 2,186 | |||||||||||||||||||

Total cash costs ($/oz)b | 1,010 | |||||||||||||||||||

All-in sustaining costs ($/oz)b | 1,622 | |||||||||||||||||||

Long Canyon (61.5%)f | ||||||||||||||||||||

Gold produced (000s oz) | 24 | |||||||||||||||||||

Cost of sales ($/oz) | 1,170 | |||||||||||||||||||

Total cash costs ($/oz)b | 353 | |||||||||||||||||||

All-in sustaining costs ($/oz)b | 714 | |||||||||||||||||||

| Pueblo Viejo (60%) | ||||||||||||||||||||

Gold produced (000s oz) | 139 | 124 | 12 | % | 151 | (8 | )% | |||||||||||||

Cost of sales ($/oz) | 807 | 852 | (5 | )% | 803 | 0 | % | |||||||||||||

Total cash costs ($/oz)b | 504 | 557 | (10 | )% | 517 | (3 | )% | |||||||||||||

All-in sustaining costs ($/oz)b | 631 | 702 | (10 | )% | 688 | (8 | )% | |||||||||||||

| Loulo-Gounkoto (80%)g | ||||||||||||||||||||

Gold produced (000s oz) | 153 | 147 | 4 | % | ||||||||||||||||

Cost of sales ($/oz) | 1,018 | 1,072 | (5 | )% | ||||||||||||||||

Total cash costs ($/oz)b | 630 | 598 | 5 | % | ||||||||||||||||

All-in sustaining costs ($/oz)b | 966 | 811 | 19 | % | ||||||||||||||||

| Kibali (45%)g | ||||||||||||||||||||

Gold produced (000s oz) | 91 | 95 | (4 | )% | ||||||||||||||||

Cost of sales ($/oz) | 1,187 | 868 | 37 | % | ||||||||||||||||

Total cash costs ($/oz)b | 554 | 540 | 3 | % | ||||||||||||||||

All-in sustaining costs ($/oz)b | 703 | 651 | 8 | % | ||||||||||||||||

| Kalgoorlie (50%) | ||||||||||||||||||||

Gold produced (000s oz) | 58 | 57 | 2 | % | 75 | (23 | )% | |||||||||||||

Cost of sales ($/oz) | 1,037 | 1,038 | 0 | % | 923 | 12 | % | |||||||||||||

Total cash costs ($/oz)b | 856 | 846 | 1 | % | 753 | 14 | % | |||||||||||||

All-in sustaining costs ($/oz)b | 1,170 | 1,204 | (3 | )% | 840 | 39 | % | |||||||||||||

| BARRICK THIRD QUARTER 2019 | 39 | MANAGEMENT’S DISCUSSION AND ANALYSIS |

Production and Cost Summary - Gold (continued)

| For the three months ended | ||||||||||||||||||||

| 9/30/19 | 6/30/19 | % Change | 9/30/18 | % Change | ||||||||||||||||

| Tongon (89.7%)g | ||||||||||||||||||||

Gold produced (000s oz) | 62 | 61 | 2 | % | ||||||||||||||||

Cost of sales ($/oz) | 1,396 | 1,562 | (11 | )% | ||||||||||||||||

Total cash costs ($/oz)b | 793 | 750 | 6 | % | ||||||||||||||||

All-in sustaining costs ($/oz)b | 869 | 802 | 8 | % | ||||||||||||||||

| Porgera (47.5%) | ||||||||||||||||||||

Gold produced (000s oz) | 75 | 61 | 23 | % | 53 | 42 | % | |||||||||||||

Cost of sales ($/oz) | 1,024 | 1,032 | (1 | )% | 1,067 | (4 | )% | |||||||||||||

Total cash costs ($/oz)b | 868 | 893 | (3 | )% | 775 | 12 | % | |||||||||||||

All-in sustaining costs ($/oz)b | 1,053 | 1,112 | (5 | )% | 1,084 | (3 | )% | |||||||||||||

| Veladero (50%) | ||||||||||||||||||||

Gold produced (000s oz) | 58 | 75 | (23 | )% | 49 | 18 | % | |||||||||||||

Cost of sales ($/oz) | 1,243 | 1,186 | 5 | % | 1,083 | 15 | % | |||||||||||||

Total cash costs ($/oz)b | 773 | 746 | 4 | % | 581 | 33 | % | |||||||||||||

All-in sustaining costs ($/oz)b | 1,142 | 1,046 | 9 | % | 995 | 15 | % | |||||||||||||

| Hemlo | ||||||||||||||||||||

Gold produced (000s oz) | 49 | 55 | (11 | )% | 41 | 20 | % | |||||||||||||

Cost of sales ($/oz) | 1,083 | 953 | 14 | % | 1,095 | (1 | )% | |||||||||||||

Total cash costs ($/oz)b | 953 | 822 | 16 | % | 996 | (4 | )% | |||||||||||||

All-in sustaining costs ($/oz)b | 1,280 | 1,015 | 26 | % | 1,247 | 3 | % | |||||||||||||

| Tanzania (63.9%)h | ||||||||||||||||||||

Gold produced (000s oz) | 53 | 101 | (48 | )% | 87 | (39 | )% | |||||||||||||

Cost of sales ($/oz) | 1,057 | 920 | 15 | % | 842 | 26 | % | |||||||||||||

Total cash costs ($/oz)b | 788 | 659 | 20 | % | 670 | 18 | % | |||||||||||||

All-in sustaining costs ($/oz)b | 947 | 792 | 20 | % | 880 | 8 | % | |||||||||||||

| Lagunas Norte | ||||||||||||||||||||

Gold produced (000s oz) | 33 | 39 | (15 | )% | 64 | (48 | )% | |||||||||||||

Cost of sales ($/oz) | 1,661 | 952 | 74 | % | 720 | 131 | % | |||||||||||||

Total cash costs ($/oz)b | 1,327 | 732 | 81 | % | 472 | 181 | % | |||||||||||||

All-in sustaining costs ($/oz)b | 1,422 | 998 | 42 | % | 631 | 125 | % | |||||||||||||

| Total Attributable to Barricki | ||||||||||||||||||||

Gold produced (000s oz) | 1,306 | 1,353 | (3 | )% | 1,149 | 14 | % | |||||||||||||

Cost of sales ($/oz)j | 1,065 | 964 | 10 | % | 850 | 25 | % | |||||||||||||

Total cash costs ($/oz)b | 710 | 651 | 9 | % | 587 | 21 | % | |||||||||||||

All-in sustaining costs ($/oz)b | 984 | 869 | 13 | % | 785 | 25 | % | |||||||||||||

| a. | Represents the combined results of Cortez, Goldstrike (including our 60% share of South Arturo) and our 75% interest in Turquoise Ridge until June 30, 2019. Commencing July 1, 2019, the date Nevada Gold Mines was established, the results represent our 61.5% interest in Cortez, Carlin (including Goldstrike and 60% of South Arturo), Turquoise Ridge (including Twin Creeks), Phoenix and Long Canyon. |

| b. | These arenon-GAAP financial performance measures with no standardized meaning under IFRS and therefore may not be comparable to similar measures presented by other issuers. For further information and a detailed reconciliation of eachnon-GAAP measure used in this section of the MD&A to the most directly comparable IFRS measure, please see pages 77 to 98 of this MD&A. |

| c. | On July 1, 2019, Cortez was contributed to Nevada Gold Mines, a joint venture with Newmont Goldcorp. As a result, the amounts presented are on an 100% basis up until June 30, 2019, and on a 61.5% basis thereafter. |

| d. | On July 1, 2019, Barrick’s Goldstrike and Newmont Goldcorp’s Carlin were contributed to Nevada Gold Mines and are now referred to as Carlin. As a result, the amounts presented represent Goldstrike on a 100% basis (including our 60% share of South Arturo) up until June 30, 2019, and the combined results of Carlin and Goldstrike (including our 60% share of South Arturo) on a 61.5% basis thereafter. |

| e. | Barrick owned 75% of Turquoise Ridge through the end of the second quarter of 2019, with our joint venture partner, Newmont Goldcorp, owning the remaining 25%. Turquoise Ridge was proportionately consolidated on the basis that the joint venture partners that have joint control have rights to the assets and obligations for the liabilities relating to the arrangement. The figures presented in this table are based on our 75% interest in Turquoise Ridge until June 30, 2019. On July 1, 2019, Barrick’s 75% interest in Turquoise Ridge and Newmont Goldcorp’s Twin Creeks and 25% interest in Turquoise Ridge were contributed to Nevada Gold Mines. Starting July 1, 2019, the results represent our 61.5% share of Turquoise Ridge and Twin Creeks, now referred to as Turquoise Ridge. |

| f. | These sites were acquired as a result of the formation of Nevada Gold Mines on July 1, 2019. |

| g. | These sites did not form a part of the Barrick consolidated results in the three months ended June 30, 2018 as these sites were acquired as a result of the Merger. |

| h. | Formerly known as Acacia Mining plc. On September 17, 2019, Barrick acquired all of the shares of Acacia it did not own. Operating results will be included at 100% from October 1, 2019 (notwithstanding the completion of the Acacia transaction on September 17, 2019, we consolidated our interest in Acacia and recorded anon-controlling interest of 36.1% in the income statement for the entirety of the third quarter of 2019 as a matter of convenience) up until the GoT’s 16% free-carried interest is made effective, and on an 84% basis thereafter. |

| i. | With the end of mining at Golden Sunlight and Morila in the second quarter as previously reported, we have ceased to include production ornon-GAAP cost metrics for these sites from July 1, 2019 onwards although these sites are included in the Total Attributable to Barrick in the prior period comparatives. |

| j. | Cost of sales per ounce (Barrick’s share) is calculated as cost of sales - gold on an attributable basis (excluding sites in care and maintenance) divided by gold equity ounces sold. |

| BARRICK THIRD QUARTER 2019 | 40 | MANAGEMENT’S DISCUSSION AND ANALYSIS |

Production and Cost Summary - Copper

| For the three months ended | ||||||||||||||||||||

| 9/30/19 | 6/30/19 | % Change | 9/30/18 | % Change | ||||||||||||||||

| Lumwana | ||||||||||||||||||||

Copper production (millions lbs) | 65 | 49 | 33 | % | 64 | 2 | % | |||||||||||||

Cost of sales ($/lb) | 2.04 | 2.07 | (1 | )% | 2.21 | (8 | )% | |||||||||||||

C1 cash costs ($/lb)a | 1.83 | 1.70 | 8 | % | 2.05 | (11 | )% | |||||||||||||

All-in sustaining costs ($/lb)a | 3.66 | 2.78 | 32 | % | 3.12 | 17 | % | |||||||||||||

| Zaldívar (50%) | ||||||||||||||||||||

Copper production (millions lbs) | 32 | 32 | 0 | % | 28 | 14 | % | |||||||||||||

Cost of sales ($/lb) | 2.18 | 2.32 | (6 | )% | 2.59 | (16 | )% | |||||||||||||

C1 cash costs ($/lb)a | 1.55 | 1.61 | (4 | )% | 1.98 | (22 | )% | |||||||||||||

All-in sustaining costs ($/lb)a | 1.91 | 1.85 | 3 | % | 2.29 | (17 | )% | |||||||||||||

| Jabal Sayid (50%) | ||||||||||||||||||||

Copper production (millions lbs) | 15 | 16 | (6 | )% | 14 | 7 | % | |||||||||||||

Cost of sales ($/lb) | 1.63 | 1.45 | 12 | % | 1.66 | (2 | )% | |||||||||||||

C1 cash costs ($/lb)a | 1.42 | 1.22 | 16 | % | 1.56 | (9 | )% | |||||||||||||

All-in sustaining costs ($/lb)a | 1.65 | 1.31 | 26 | % | 1.67 | (1 | )% | |||||||||||||

| Total Copper | ||||||||||||||||||||

Copper production (millions lbs) | 112 | 97 | 15 | % | 106 | 6 | % | |||||||||||||

Cost of sales ($/lb)b | 2.00 | 2.04 | (2 | )% | 2.18 | (8 | )% | |||||||||||||

C1 cash costs ($/lb)a | 1.62 | 1.59 | 2 | % | 1.94 | (16 | )% | |||||||||||||

All-in sustaining costs ($/lb)a | 2.58 | 2.28 | 13 | % | 2.71 | (5 | )% | |||||||||||||

| a. | These arenon-GAAP financial performance measures with no standardized meaning under IFRS and therefore may not be comparable to similar measures presented by other issuers. For further information and a detailed reconciliation of eachnon-GAAP measure used in this section of the MD&A to the most directly comparable IFRS measure, please see pages 77 to 98 of this MD&A. |

| b. | Cost of sales per pound (Barrick’s share) is calculated as cost of sales - copper plus our equity share of cost of sales attributable to Zaldívar and Jabal Sayid divided by copper pounds sold. |

OPERATING DIVISIONS PERFORMANCE

Following the Merger in Q1 2019 and the events surrounding Nevada Gold Mines and Acacia Mining plc in Q3 2019 (refer to page 35 for further details), our presentation of reportable operating segments consists of seven gold mines (Cortez, Carlin, Turquoise Ridge, Pueblo Viejo, Loulo-Gounkoto, Kibali and Veladero) and Tanzania, a grouping of three operating mines formerly held in Acacia Mining plc (now called Barrick TZ Limited). The remaining operating segments, including our

remaining gold mines, copper mines and projects, have been grouped into an “other” category and will not be reported on individually. Segment performance is evaluated based on a number of measures including operating income before tax, production levels and unit production costs. Certain costs are managed on a consolidated basis and are therefore not reflected in segment income.

| BARRICK THIRD QUARTER 2019 | 41 | MANAGEMENT’S DISCUSSION AND ANALYSIS |

Nevada Gold Mines (61.5% basis)a, Nevada USA

| Summary of Operating and Financial Data | For the three months ended | For the nine months ended | ||||||||||||||||||||||||||||||

| 9/30/19 | 6/30/19 | % Change | 9/30/18 | % Change | 9/30/19 | 9/30/18 | % Change | |||||||||||||||||||||||||

| Total tonnes mined (000s) | 52,528 | 43,916 | 20 | % | 43,039 | 22 | % | 136,189 | 142,375 | (4 | )% | |||||||||||||||||||||

Open pit ore | 7,706 | 4,339 | 78 | % | 6,636 | 16 | % | 17,626 | 14,691 | 20 | % | |||||||||||||||||||||

Open pit waste | 43,572 | 38,569 | 13 | % | 35,474 | 23 | % | 115,245 | 125,000 | (8 | )% | |||||||||||||||||||||

Underground | 1,250 | 1,008 | 24 | % | 929 | 35 | % | 3,318 | 2,684 | 24 | % | |||||||||||||||||||||

Average grade (grams/tonne) | ||||||||||||||||||||||||||||||||

Open pit mined | 0.77 | 0.72 | 7 | % | 2.87 | (73 | )% | 0.99 | 3.01 | (67 | )% | |||||||||||||||||||||

Underground mined | 9.97 | 10.86 | (8 | )% | 10.57 | (6 | )% | 10.45 | 10.76 | (3 | )% | |||||||||||||||||||||

Processed | 2.02 | 2.75 | (27 | )% | 3.32 | (39 | )% | 2.44 | 3.42 | (29 | )% | |||||||||||||||||||||

Ore tonnes processed (000s) | 10,211 | 7,137 | 43 | % | 6,972 | 46 | % | 25,138 | 17,844 | 41 | % | |||||||||||||||||||||

Oxide mill | 3,124 | 1,114 | 180 | % | 1,091 | 186 | % | 5,294 | 3,348 | 58 | % | |||||||||||||||||||||

Roaster | 1,309 | 1,364 | (4 | )% | 1,410 | (7 | )% | 4,033 | 3,638 | 11 | % | |||||||||||||||||||||

Autoclave | 1,316 | 1,351 | (3 | )% | 1,106 | 19 | % | 4,100 | 3,458 | 19 | % | |||||||||||||||||||||

Heap leach | 4,462 | 3,308 | 35 | % | 3,365 | 33 | % | 11,711 | 7,400 | 58 | % | |||||||||||||||||||||

Recovery rate | 79 | % | 79 | % | 0 | % | 82 | % | (4 | )% | 82 | % | 83 | % | (1 | )% | ||||||||||||||||

Oxide Mill | 60 | % | 78 | % | (23 | )% | 82 | % | (27 | )% | 72 | % | 83 | % | (13 | )% | ||||||||||||||||

Roaster | 87 | % | 87 | % | 0 | % | 91 | % | (4 | )% | 87 | % | 90 | % | (3 | )% | ||||||||||||||||

Autoclave | 79 | % | 67 | % | 18 | % | 66 | % | 20 | % | 74 | % | 69 | % | 7 | % | ||||||||||||||||

Gold produced (000s oz) | 535 | 526 | 2 | % | 624 | (14 | )% | 1,633 | 1,674 | (2 | )% | |||||||||||||||||||||

Oxide mill | 76 | 82 | (7 | )% | 108 | (30 | )% | 260 | 457 | (43 | )% | |||||||||||||||||||||

Roaster | 275 | 255 | 8 | % | 365 | (25 | )% | 784 | 745 | 5 | % | |||||||||||||||||||||

Autoclave | 112 | 122 | (8 | )% | 121 | (8 | )% | 392 | 358 | 9 | % | |||||||||||||||||||||

Heap leach | 72 | 67 | 8 | % | 30 | 141 | % | 197 | 114 | 73 | % | |||||||||||||||||||||

Gold sold (000s oz) | 537 | 547 | (2 | )% | 671 | (20 | )% | 1,658 | 1,698 | (2 | )% | |||||||||||||||||||||

Revenue ($ millions) | 804 | 713 | 13 | % | 816 | (1 | %) | 2,267 | 2,174 | 4 | % | |||||||||||||||||||||

Cost of sales ($ millions) | 552 | 462 | 19 | % | 534 | 3 | % | 1,462 | 1,394 | 5 | % | |||||||||||||||||||||

Income ($ millions) | 237 | 244 | (3 | )% | 271 | (13 | )% | 773 | 751 | 3 | % | |||||||||||||||||||||

EBITDA ($ millions)b | 403 | 371 | 9 | % | 454 | (11 | )% | 1,202 | 1,234 | (3 | )% | |||||||||||||||||||||

EBITDA marginc | 50 | % | 52 | % | (4 | )% | 56 | % | (10 | )% | 53 | % | 57 | % | (7 | )% | ||||||||||||||||

Capital expenditures ($ millions)d,e | 164 | 169 | (3 | )% | 154 | 6 | % | 482 | 476 | 1 | % | |||||||||||||||||||||

Minesite sustainingd | 110 | 76 | 45 | % | 57 | 93 | % | 256 | 211 | 21 | % | |||||||||||||||||||||

Projectd | 54 | 93 | (42 | )% | 97 | (44 | )% | 226 | 265 | (15 | )% | |||||||||||||||||||||

Cost of sales ($/oz) | 1,027 | 842 | 22 | % | 800 | 28 | % | 881 | 822 | 7 | % | |||||||||||||||||||||

Total cash costs ($/oz)b | 693 | 594 | 17 | % | 526 | 32 | % | 608 | 536 | 13 | % | |||||||||||||||||||||

All-in sustaining costs ($/oz)b | 946 | 752 | 26 | % | 640 | 48 | % | 789 | 682 | 16 | % | |||||||||||||||||||||

All-in costs ($/oz)b | 1,048 | 922 | 14 | % | 788 | 33 | % | 926 | 840 | 10 | % | |||||||||||||||||||||

| a. | Represents the combined results of Cortez, Goldstrike (including our 60% share of South Arturo) and our 75% interest in Turquoise Ridge until June 30, 2019. Commencing July 1, 2019, the date Nevada Gold Mines was established, the results represent our 61.5% interest in Cortez, Carlin (including Goldstrike and 60% of South Arturo), Turquoise Ridge (including Twin Creeks), Phoenix and Long Canyon. |

| b. | These arenon-GAAP financial performance measures with no standardized meaning under IFRS and therefore may not be comparable to similar measures presented by other issuers. For further information and a detailed reconciliation of eachnon-GAAP measure used in this section of the MD&A to the most directly comparable IFRS measure, please see pages 77 to 98 of this MD&A. |

| c. | Represents EBITDA divided by revenue. |

| d. | Presented on a cash basis as a result of adopting IFRS 16Leasesstarting in the first quarter of 2019. Capital expenditures for the three and nine months ended September 30, 2018 are presented on an accrued basis. Please refer to page 30 of this MD&A for more details. |

| e. | Amounts presented exclude capitalized interest. |

As discussed on page 35, on July 1, 2019, Nevada Gold Mines was established, which includes Barrick’s Cortez, Goldstrike, Turquoise Ridge and Goldrush properties and Newmont’s Carlin, Twin Creeks, Phoenix, Long Canyon and Lone Tree properties. Barrick is the operator of the joint venture and owns 61.5%, with Newmont Goldcorp owning the remaining 38.5% of the joint venture. Refer to the following pages for a detailed discussion of Cortez, Carlin (including Goldstrike) and Turquoise Ridge (including Twin Creeks) results.

| BARRICK THIRD QUARTER 2019 | 42 | MANAGEMENT’S DISCUSSION AND ANALYSIS |

Cortez (61.5% basis)a, Nevada USA

| Summary of Operating and Financial Data | For the three months ended | For the nine months ended | ||||||||||||||||||||||||||||||

| 9/30/19 | 6/30/19 | % Change | 9/30/18 | % Change | 9/30/19 | 9/30/18 | % Change | |||||||||||||||||||||||||

| Total tonnes mined (000s) | 23,357 | 31,598 | (26 | )% | 30,174 | (23 | )% | 82,527 | 93,843 | (12 | )% | |||||||||||||||||||||

Open pit ore | 2,158 | 3,945 | (45 | )% | 4,804 | (55 | )% | 10,764 | 11,909 | (10 | )% | |||||||||||||||||||||

Open pit waste | 20,948 | 27,283 | (23 | )% | 25,029 | (16 | )% | 70,754 | 80,909 | (13 | )% | |||||||||||||||||||||

Underground | 251 | 370 | (32 | )% | 341 | (26 | )% | 1,009 | 1,025 | (2 | )% | |||||||||||||||||||||

Average grade (grams/tonne) | ||||||||||||||||||||||||||||||||

Open pit mined | 0.42 | 0.65 | (35 | )% | 2.39 | (82 | )% | 1.00 | 2.87 | (65 | )% | |||||||||||||||||||||

Underground mined | 11.41 | 10.74 | 6 | % | 10.57 | 8 | % | 10.39 | 10.72 | (3 | )% | |||||||||||||||||||||

Processed | 1.54 | 1.82 | (15 | )% | 2.38 | (35 | )% | 1.68 | 2.68 | (37 | )% | |||||||||||||||||||||

Ore tonnes processed (000s) | 2,837 | 5,014 | (43 | )% | 4,997 | (43 | )% | 13,324 | 11,929 | 12 | % | |||||||||||||||||||||

Oxide mill | 654 | 1,114 | (41 | )% | 1,091 | (40 | )% | 2,824 | 3,348 | (16 | )% | |||||||||||||||||||||

Roaster | 329 | 592 | (44 | )% | 541 | (39 | )% | 1,397 | 1,181 | 18 | % | |||||||||||||||||||||

Heap leach | 1,854 | 3,308 | (44 | )% | 3,365 | (45 | )% | 9,103 | 7,400 | 23 | % | |||||||||||||||||||||

Recovery rate | 84 | % | 84 | % | 0 | % | 85 | % | (1 | )% | 89 | % | 88 | % | 1 | % | ||||||||||||||||

Oxide Mill | 79 | % | 78 | % | 2 | % | 82 | % | (3 | )% | 80 | % | 83 | % | (4 | )% | ||||||||||||||||

Roaster | 86 | % | 88 | % | (2 | )% | 92 | % | (6 | )% | 87 | % | 91 | % | (5 | )% | ||||||||||||||||

Gold produced (000s oz) | 126 | 280 | (55 | )% | 326 | (61 | )% | 668 | 906 | (26 | )% | |||||||||||||||||||||

Oxide mill | 34 | 82 | (59 | )% | 108 | (69 | )% | 218 | 457 | (52 | )% | |||||||||||||||||||||

Roaster | 62 | 131 | (53 | )% | 188 | (67 | )% | 295 | 335 | (12 | )% | |||||||||||||||||||||

Heap leach | 30 | 67 | (55 | )% | 30 | — | % | 155 | 114 | 36 | % | |||||||||||||||||||||

Gold sold (000s oz) | 126 | 281 | (55 | )% | 354 | (64 | )% | 666 | 911 | (27 | )% | |||||||||||||||||||||

Revenue ($ millions) | 185 | 368 | (50 | )% | 432 | (57 | %) | 892 | 1,166 | (24 | )% | |||||||||||||||||||||

Cost of sales ($ millions) | 105 | 202 | (48 | )% | 224 | (53 | )% | 484 | 595 | (19 | )% | |||||||||||||||||||||

Income ($ millions) | 77 | 158 | (51 | )% | 199 | (61 | )% | 390 | 550 | (29 | )% | |||||||||||||||||||||

EBITDA ($ millions)b | 109 | 223 | (51 | )% | 301 | (64 | )% | 551 | 824 | (33 | )% | |||||||||||||||||||||

EBITDA marginc | 59 | % | 61 | % | (2 | )% | 70 | % | (15 | )% | 62 | % | 71 | % | (12 | )% | ||||||||||||||||

Capital expenditures ($ millions)d,e | 53 | 83 | (36 | )% | 97 | (46 | )% | 212 | 255 | (17 | )% | |||||||||||||||||||||

Minesite sustainingd | 22 | 15 | 47 | % | 22 | 0 | % | 50 | 49 | 1 | % | |||||||||||||||||||||