- GOLD Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

6-K Filing

Barrick Gold (GOLD) 6-KStrong Q4 Caps Great Year

Filed: 13 Feb 20, 11:23am

Exhibit 99.1

STRONG Q4 CAPS GREAT YEAR FOR BARRICK

All amounts expressed in U.S. dollars unless otherwise indicated (Unaudited)

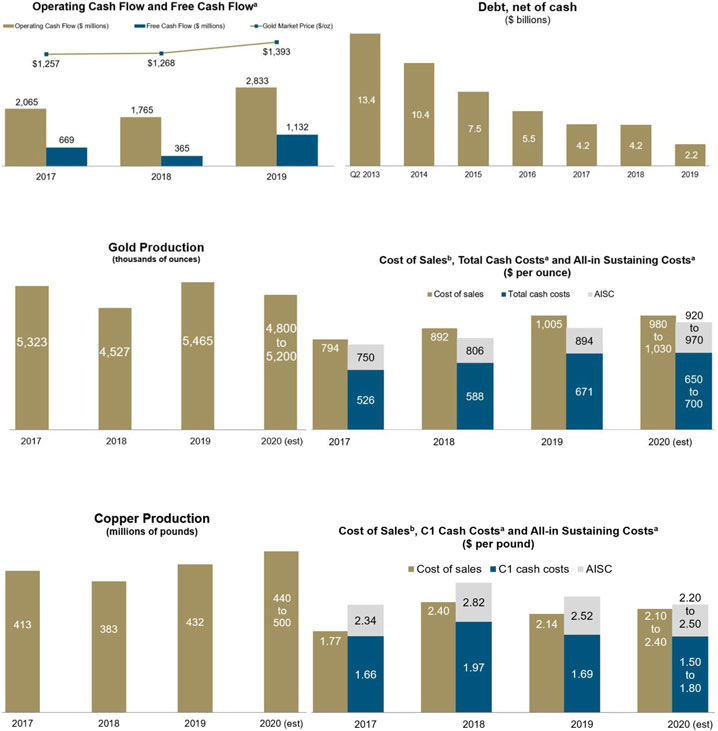

Toronto, February 12, 2020 — Barrick Gold Corporation’s gold production for 2019 of 5,465,000 ounces was at the top end of its guidance range while copper production of 432 million pounds was above the guidance range, the company reported today.

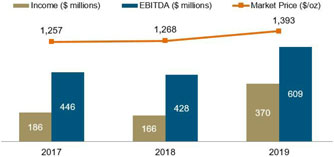

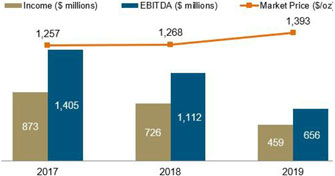

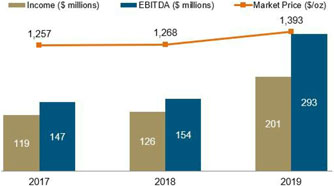

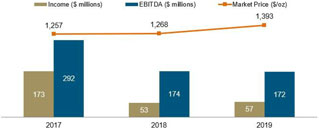

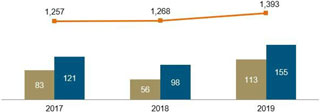

Announcing its results for the fourth quarter and the year, the company reported net earnings per share of $2.26 for the year and noted that its adjusted net earnings per share1 were up 46% year-on-year while debt net of cash was halved from 2018 to $2.2 billion. The quarterly dividend was increased by 40% from Q3, to $0.07 cents per share, which was itself a 25% increase from Q2.

In a presentation here, president and chief executive Mark Bristow said the successful formation of the Nevada Gold Mines joint venture during the year had resulted in the North American operations delivering at the midpoint of its production and cost guidance ranges. There were also strong performances from Barrick’s Latin American, Asia Pacific and Africa Middle East operations.

“In the year since the completion of Barrick’s merger with Randgold Resources, we have transformed the new company while creating the world’s largest gold mining complex in Nevada in a transaction that had been unsuccessfully pursued for two decades. The Acacia minorities’ buy-out enabled us to settle that company’s long-running dispute with the Tanzanian government and to integrate its assets into our operations. We’ve also started selling off non-core assets with the disposal of our stakes in the Kalgoorlie gold mine in Australia and the agreed sale of the Massawa project in Senegal,” Bristow said.

Continued on page 2 |

|

Financial and Operating

Highlights

(Unaudited)

| Financial Results | Q4 2019 | Q3 2019 | 2019 | 2018 | ||||||||||||

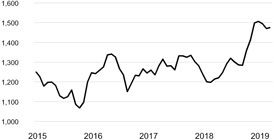

Realized gold price3,4 | 1,483 | 1,476 | 1,396 | 1,270 | ||||||||||||

($ per ounce) | ||||||||||||||||

Net earnings (loss) | 1,387 | 2,277 | 3,969 | (1,545) | ||||||||||||

($ millions) | ||||||||||||||||

Adjusted net earnings1 | 300 | 264 | 902 | 409 | ||||||||||||

($ millions) | ||||||||||||||||

Net cash provided by operating activities | 875 | 1,004 | 2,833 | 1,765 | ||||||||||||

($ millions) | ||||||||||||||||

Free cash flow5 | 429 | 502 | 1,132 | 365 | ||||||||||||

($ millions) | ||||||||||||||||

Net earnings (loss) per share($) | 0.78 | 1.30 | 2.26 | (1.32) | ||||||||||||

Adjusted net earnings per share1($) | 0.17 | 0.15 | 0.51 | 0.35 | ||||||||||||

Total attributable capital expenditures6($ millions) | 393 | 397 | 1,512 | 1,363 | ||||||||||||

Operating Results

Gold | Q4 2019 | Q3 2019 | 2019 | 2018 | ||||||||||||

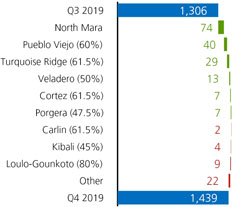

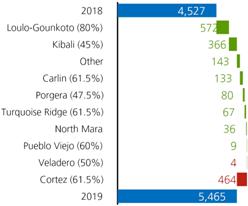

Production | 1,439 | 1,306 | 5,465 | 4,527 | ||||||||||||

(000s of ounces) | ||||||||||||||||

Cost of sales7(Barrick’s share) | 1,046 | 1,065 | 1,005 | 892 | ||||||||||||

($ per ounce) | ||||||||||||||||

Total cash costs8 | 692 | 710 | 671 | 588 | ||||||||||||

($ per ounce) | ||||||||||||||||

All-in sustaining costs8 | 923 | 984 | 894 | 806 | ||||||||||||

($ per ounce) | ||||||||||||||||

Copper | ||||||||||||||||

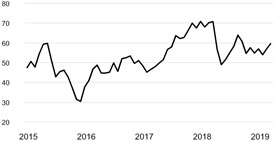

Production | 117 | 112 | 432 | 383 | ||||||||||||

(millions of pounds) | ||||||||||||||||

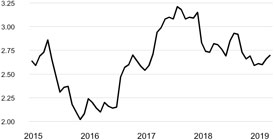

Cost of sales7(Barrick’s share) | 2.26 | 2.00 | 2.14 | 2.40 | ||||||||||||

($ per pound) | ||||||||||||||||

C1 cash costs9 | 1.90 | 1.62 | 1.69 | 1.97 | ||||||||||||

($ per pound) | ||||||||||||||||

All-in sustaining costs9 | 2.82 | 2.58 | 2.52 | 2.82 | ||||||||||||

($ per pound) | ||||||||||||||||

Key Performance

Indicators

| ◾ | Full year gold production at upper end and copper production above guidance ranges |

| ◾ | Gold costs per ounce down quarter on quarter |

| ◾ | Debt net of cash at $2.2 billion, down 47% from 2018 |

| ◾ | Adjusted net earnings per share1up 46% year on year |

| ◾ | Increased efficiency drives significant year-over-year improvement in copper production and costs |

| ◾ | Successful formation and integration of Nevada Gold Mines JV results in North American operations delivering at midpoint of its production and cost guidance ranges |

| ◾ | Pueblo Viejo expansion evaluation and revised flowsheet enhances project |

| ◾ | Strong performances across the board at Latin American, Asia Pacific and Africa Middle East operations |

| ◾ | Proven and probable reserves increase net of depletionyear-on-year at higher grade |

| ◾ | Tanzanian disputes resolved with signing of framework agreement |

| ◾ | Significant progress made in resolving tax related issues in Mali to pave the way for further investment in the country |

| ◾ | Non-core asset disposals reinforce strategy of concentrated Tier One2asset portfolio |

| ◾ | Exceeded water recycling target of 70%; recycled >70% of water used at our sites |

| ◾ | Another quarterly dividend increase, up 40% from Q3 to $0.07 per share |

Continued from page 1

“We started the year with five Tier One2 gold mines and ended it with six, thanks to the Nevada deal. We’ve also succeeded in replenishing our reserves and resources, net of depletion, at a higher grade.”

Bristow said the pace of these achievements was attributable to a flattened management structure and the transfer of responsibilities from the corporate office to the operations.

“We now have agile multi-disciplinary teams capable not only of executing complex, industry-leading corporate transactions but also of running our operations efficiently while pursuing new growth opportunities,” he said.

“The significant reduction in Barrick’s debt and the growth in its liquidity means that the company is now capable of managing its business and taking advantage of new opportunities independent of the vagaries of the capital

markets. Our organic growth potential alone will support the10-year production plan we’ll be sharing with the market in March and our exploration teams are stocking our future pipeline.”

Bristow noted that there was a strong focus on automation and clean energy across the group, while retaining and building on the operations’ social license remained a priority. Barrick’s commitment to sustainability is evidenced by the fact that more than 80% of the water used by our operations was recycled or reused.

“We believe that our ability to operate successfully depends on our ability to deliver long-term value to shareholders and other stakeholders, including the host countries, and on scrupulously managing our impact on the environment,” he said.

Conference Call and Webcast

Please join us for a conference call and webcast today at 11:00 ET/16:00 GMT to discuss the results.

US and Canada,1-800-319-4610

UK, 0808 101 2791

International, +1 416915-3239

Webcast

The webcast will remain on the website for later viewing, and the conference call will be available for replay by telephone at 1 855 669 9658 (US and Canada) and +1 604 674 8052 (international), access code 3969.

BARRICK INCREASES DIVIDEND 40% FOR Q4 2019

Barrick Gold Corporation today announced that its Board of Directors has declared a dividend for the fourth quarter of 2019 of $0.07 per share, a 40% increase on the previous quarter’s dividend, payable on March 16, 2020 to shareholders of record at the close of business on February 28, 2020.10

Senior executive vice-president and chief financial officer Graham Shuttleworth said this was the third dividend increase this year and reflected the excellent performance for the year and Barrick’s profitability and financial strength.

“The board believes the dividend increase is justified by the significant reduction in net debt and strong balance sheet,

together with the growth in free cash flow supported by a robust5-year plan which we have shared with the market,” said Shuttleworth.

“At the time the Barrick-Randgold merger was announced, the Q3 2018 dividend was 3 cents per share, which was subsequently increased to 4 cents for Q1 2019 after the merger, then increased to 5 cents for Q3 2019 on the back of our strong operating performance, and now to 7 cents for Q4. This is consistent with the company’s stated financial and operating objectives and in line with the commitment to shareholder returns made when the merger with Randgold was announced on September 24, 2018.”

SUSTAINABILITY: AT THE HEART

OF BARRICK’S BUSINESS STRATEGY

Long before the current rise of investor interest in ESG (environmental, sustainability and governance) issues, Barrick and Randgold recognized that their ability to operate successfully was dependent on delivering long-term value to all stakeholders and to minimize their impact on the environment.

“At Barrick, ESG is not somebox-ticking compliance function but a core strategy,” says president and chief executive Mark Bristow. “It starts at the top and permeates through the entire organization, and we believe that if it is managed well, it will drive our ability to deliver long-term profitability. It’s not only a social imperative - it’s a commercial one.”

Grant Beringer, Barrick’s group sustainability executive, says every site is expected to minimize water and energy use, manage waste and land responsibly, and put employee safety first. The operations promote the social and economic development of their communities, and work constantly to form and maintain mutually beneficial partnerships with their stakeholders. Putting ESG into practice requires

accountability to these stakeholders, which is why Barrick reports comprehensively and transparently on its sustainability performance and impacts.

“In 2019, there were no fatalities or high-impact environmental incidents at any of our sites. We recycled more than 70% of the water we used and we made significant progress in curbing our carbon emissions, phasing in solar power at Loulo-Gounkoto, converting the power plant at Pueblo Viejo to natural gas and linking Veladero with grid power. We also developed and implemented biodiversity action plans at our priority sites and we’re on track to roll these out across the group by 2021. Our investment in community development projects exceeded $23 million for the year,” he said.

COMMITMENT TO EXCELLENCE IN GEOLOGY

SECURES SUSTAINABILITY

Barrick’s intensified focus on geocentric principles enables its geologists to increase existing reserves as well as to find their next major discovery, says Rob Krcmarov, executive vice-president, exploration and growth.

“Understanding the orebodies is the key to defining the revenue value of an asset as well as high-quality mine planning. It ensures that every bit of that value can be extracted safely and that the process maximizes the recovery rate,” he says.

“Loulo-Gounkoto and Cortez-Goldrush are prime examples of how orebody knowledge and quality geological work have delivered world-class discoveries, and there is an abundance of similar opportunities across our portfolio.”

Nevada Gold Mines’ holdings encompass more than one million hectares across some of the best-endowed gold trends in North America, and early versions of unified and more sophisticated geological models have already identified new areas of interest there. At Fourmile, the inferred resource was increased by more than 170%11 in 2019 thanks to an improved understanding of the mineralization controls, which also delivered a new high-grade discovery more than a kilometer from the main orebody.

In Latin America, the number of drill targets in the resource triangle had increased threefold by the end of the year. In the highly prospective and under-explored

El Indio belt, advances in exploration technology and improved ore deposit models are being employed to probe for concealed gold deposits.

At Porgera in Papua New Guinea, a new drill hole, hundreds of meters beyond the pit, has validated the exploration team’s prediction that the mineralized system is far larger than currently defined.

Africa remains a target-rich environment, with the Faraba complex in Mali and Bambadji in Senegal looking particularly promising. Both Loulo-Gounkoto in Mali and Kibali in the Democratic Republic of Congo continue to replace their reserves and develop their resource growth opportunities, while at the recently consolidated North Mara mine in Tanzania, a new orebody model has identified an abundant upside.

“All our Tier One2 mines have in excess of 10 years’ worth of reserves at a $1,200/oz gold price. We expect that many of these will yield extensions and additional discoveries and will be producing for years to come. It is significant in this regard to note that Barrick replaced its reserves net of depletion and at a higher grade in 2019,” says Krcmarov.

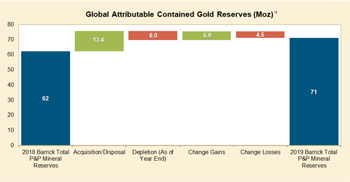

BARRICK GROWS AND IMPROVES RESERVE AND RESOURCE BASE

IN A YEAR OF CHANGE

Barrick’s annual resource and reserve declaration, published today as part of its fourth quarter results, shows an attributable gold mineral reserve increase of 14.5% in ounces at 7.7% higher grade after depletion from mining, reflecting a busy year which included the incorporation of Randgold Resources, the formation of the Nevada Gold Mines joint venture with Newmont and the disposal of KCGM. Attributable reserves now stand at 1,300 million tonnes at 1.68 g/t for 71 million ounces of gold.12 This has been achieved through reserve additions greater than mining depletion at a number of our principal assets including Kibali, Loulo-Gounkoto, Veladero, Porgera, Goldstrike underground mine, Leeville/Portal underground mines, Mega Pit, Turquoise Ridge underground mine, and Phoenix. This was achieved through the refocus on geology as a core discipline within the business and cost improvements at the Nevada joint venture, which allowed for the lowering ofcut-off grades and the increase in reserves.

Global attributable mineral resources also increased, net of depletion with significant inferred mineral resource additions at Robertson and Fourmile in the Cortez district of Nevada, moving these new projects up the resource triangle. Goldrush, Robertson, and Pueblo Viejo contain significant indicated and inferred mineral resources not currently in reserves and are three growth projects from which further reserve growth can be expected in the near future upon completion of feasibility studies. Total attributable measured and indicated mineral resources, now reported inclusive of reserves and at a $1,500/oz gold price stand at 3,400 million tonnes at 1.55 g/t for 170 million ounces, with a further 940 million tonnes at 1.30 g/t for 39 million ounces in the inferred category, highlight the potential for growth in a higher gold price environment.12 All underground mineral resources are now reported within $1,500/oz stope optimizer shells and as such have shown significant growth in ounces albeit at lower grade, but which better reflects the opportunity at higher gold prices.

The Group gold mineral reserve reconciliation is supplied below and explains the changes that occurred during the year. Acquisition and disposal includes the net change to Barrick’s reserves from the Randgold merger, the formation of the

Nevada joint venture, the Acacia minorities’ acquisition, and the disposition of KCGM. Total depletion includes depletion from mining which was offset by gains due to extensions to mineral reserves through drilling andcut-off grade changes. Losses incurred were comprised primarily of the reclassification of Lagunas Norte to mineral resources, plus the removal of the Phase Six pit pushback at Hemlo.

All assets are optimized on the full value of the deposit and as such copper and silver are reported as dedicated mineral resources and reserves for all assets where copper or silver is produced and sold as a primary product orby-product. Total attributable copper mineral reserves now stand at 1,600 million tonnes at 0.38% for 13 billion pounds of contained copper.12The growth of copper mineral reserves was primarily driven by Lumwana due to the reclassification and remodeling of the Chimiwungo pit and cost improvements, with a small contribution from Zaldivar.

Total attributable silver mineral reserves are 900 million tonnes at 5.03 g/t for 150 million ounces of contained silver.12

TAKING TECH TO THE NEXT LEVEL

Trials and projects designed to make Barrick’s operations more efficient as well as safer are driving the increased use of technology and automation across the group.

Centres of excellence have been established to advance autonomous applications for both surface and underground operations. This means that rather than having a range of operations trialing different systems, these will be proven on both technological and operating cost grounds at the centres. Should they pass these filters, they will be rolled out across the group.

In Nevada, which is the centre of surface automation and technology development for Barrick, the first stage of a project designed to enable the retrofitting of an autonomous system for Carlin’s haulage fleet has been completed successfully. A number of trucks have already been retrofitted and work is now under way on increasing their speed from 15km/h to 35km/h, and installing portable locators that will allow manned and unmanned operations in the same zone. Following the creation of the Nevada Gold Mines JV, the autonomous drilling trials Barrick and Newmont had been running with different systems have been consolidated and will be tested at Phoenix and Lone Tree this year.

Kibali remains at the leading edge of underground automation in the global gold mining industry. After the implementation of the Sandvik Automine Multifleet system, which allows

multiple autonomous machines to operate on the same haulage level; a trial to utilize this technology on the production levels has been completed successfully. Using the same operations centre as the haulage system, one operator can now control up to three machines acting semi-autonomously in three different zones.

Also at Kibali, the installation of the Newtrax system, which provides real-time visibility of the underground operations, including personnel and equipment tracking and proximity warning, machine health and productivity as well as automated control of ventilation fans, was completed and will be fully commissioned in Q1 of 2020.

With the rapid development of electric vehicles, Barrick has introduced a battery-powered development drill at Hemlo in a first step towards establishing the potential of this new technology. Further trials of battery equipment are planned, predominantly at Turquoise Ridge’s underground operation, where it offers the potential of increasing production without having to make significant changes to the ventilation system.

PEOPLE MAKE A BUSINESS

To build a modern mining business at the top of its field, you needbest-in-class people to run its portfolio ofbest-in-class assets, says president and chief executive Mark Bristow.

“That is why we are promoting a culture of inclusion across the organization and at every level. We’ve flattened the corporate structure to create a larger ownership base, we’re sharing our strategic vision with all employees and theroll-out of team effectiveness programs is reinforcing their understanding of and commitment to our high-performance ethos. I want everyone to come to work in the morning inspired by the desire to help make Barrick the world’s safest, most efficient, and most highly valued company,” he says.

Attracting, training and retaining the right people is obviously the basis of this employee-oriented philosophy. Barrick offers

Pictured: Poupak Bahamin, Barrick’s deputy general counsel

executive and management development programs at leading universities to foster its next generation of world-class leaders. It also invests in and mentors young professionals through rotational training and internship programs for college graduates.

“Our successful recruitment drive is filling our pipeline of future talent with people who come from a broad range of backgrounds but who all have the desire and the ability to buy into the Barrick DNA,” Bristow says.

KEEPING OUR COUNSEL

Rich Haddock has decided to defer his retirement and returns as Barrick’s general counsel in order, he says, to participate in the exciting new developments at the company. He joined Barrick in 1997 and has been involved in some of the most important steps in its growth.

Poupak Bahamin has joined Barrick as deputy general counsel from Norton Rose Fulbright, where she was a partner andco-led its US mining practice. She is the current chair of the World Association of Mining Lawyers.

EXPANSION PROJECT WILL UNLOCK VALUE, EXTEND

LIFE AT PUEBLO VIEJO

Studies continue to support a plant expansion project which will confirm Pueblo Viejo’s status as one of the world’s greatest gold mines by extending its life beyond 2040 at a production rate of some 800,000 ounces per year.13

Barrick president and chief executive Mark Bristow says a substantial portion of the mine’s mineral resources would have been sterilized by the limitation of its tailings storage facility. Alongside the plant expansion project, which will significantly boost throughput, the planned increase in the mine’s tailings management capacity has the potential to convert roughly 11 million ounces of indicated resources to reserves on a 100% basis.

“A study completed last quarter indicated that the throughput increase can be achieved without additional autoclaves. An oxidation upgrade will provide the required capacity at a lower capital and operating cost than the options previously considered,” explained John Steele, Barrick’s Metallurgy, Engineering and Capital Projects Executive.

Pueblo Viejo currently has 9.5 million ounces of gold in reserves. Total measured and indicated mineral resources contain 25 million ounces and thus offer a significant opportunity to expand reserves.14

The mine is an important component of the Dominican Republic’s economy, contributing more than 20% of the country’s annual corporate tax revenue. It operates in close partnership with the government and the community, and recently committed its support for the development of a local cacao-based agribusiness.

BARRICK BACK IN BUSINESS IN TANZANIA

Barrick says it has made significant progress in reshaping the Tanzanian operations it consolidated through the take-over of Acacia Mining in September last year in order to create a sustainable business capable of long-term value creation for its stakeholders.

At a signing ceremony with the President of the United Republic of Tanzania, Dr John Pombe Magufuli, to formalize the establishment of a joint venture between Barrick and the government, Bristow said the joint venture, which will give the government full visibility of and participation in operating decisions made for and by the North Mara, Bulyanhulu and Buzwagi mines, was a pioneering move which would take Barrick’s policy of partnership with its host countries to a new level.

The agreement also ratifies the creation of Twiga Minerals Corporation, the management company jointly owned by the government and Barrick, that will oversee the management of Barrick’s local operations, which are now owned 84% by Barrick and 16% by the government. The deal provides for a 50/50 sharing in the economic benefits generated by the mining operations after the recoupment of capital investments.

Following the ceremony, there are a number of matters which Barrick and the government will work together to implement. In particular, Barrick will partner with the University of Dar es Salaam and commit up to $10 million in funding over a10-year period for training and skills development in the mining industry, and will also commit up to $40 million to upgrade the road between Bulyanhulu and Mwanza as well as constructing a housing compound and related infrastructure.

“Since taking over the operatorship, we have been engaging with local communities to restore the mines’ social license to

operate and we are cooperating closely with the authorities to address the environmental issues at North Mara. In addition, we are working on a local supplier strategy as well as a community development plan to create sustainable economic opportunities for the people around our mines”, Bristow said.

Bristow said there was a strong focus on rationalizing and optimizing mine plans. Following the successful transition to owner mining at North Mara, this has already delivered a reduction in costs and an increase in free cash flow. A similar result is expected at Bulyanhulu, where an integrated study aimed at optimizing the complete orebody should kick-start the resumption of operations there later this year.

“Reflecting our confidence in the potential of this highly prospective gold region, we have budgeted $50 million for brown and greenfields exploration here in 2020 alone and are looking at various opportunities to sustain and expand our operations,” Bristow said.

In line with Barrick’s commitment to employing and advancing locals at its mines, Tanzanian nationals are being recruited and trained to replace expatriate employees as has been done successfully at Barrick’s other African operations. In addition, Acacia’s offices outside Tanzania have been closed, and company records andday-to-day decision-making and accountability have been moved back to the operations in Tanzania.

PIONEERING PARTNERSHIP WITH TANZANIA OFF TO

A STRONG START

Twiga Minerals Corporation, the recently formed joint venture between the Tanzanian government and Barrick, has had its first two board meetings, and Willem Jacobs, Barrick’s chief operating officer for Africa and the Middle East, says the positive energy in the room was palpable.

“Twiga has made a strong start, we’re getting the Tanzanian operations back on track and we’re building a strong foundation for sustainable profitability,” says Jacobs. “We recognize that there’s still a long way to go, considering that we also have to repair the damage these assets suffered during the previous operator’s longstand-off with the government,” he said.

“There are many examples of exploitation by the extractive industries, as well as their hosts. With their short-term focus, these enterprises are incapable of delivering sustainable profitability. Similarly, those governments which flirt with resource nationalization fail to see that the engine of profitability drives their economies. With its ‘Win Together, Lose Together’ creed, Twiga is a true partnership which will create long-term benefits and share them equally.”

KIBALI SOARS PAST GUIDANCE

TO POST ANOTHER RECORD YEAR

Barrick Gold Corporation’s Kibali mine beat its 2019 production guidance of 750,000 ounces of gold by a substantial margin, delivering 814,027 ounces in another record year.15

Barrick president and chief executive Mark Bristow told a media briefing here that Kibali’s continuing stellar performance was a demonstration of how a modern, Tier One2 gold mine could be developed and operated successfully in what is one of the world’s most remote and infrastructurally under-endowed regions. He also noted that in line with Barrick’s policy of employing, training and advancing locals, the mine was managed by a majority Congolese team, supported by a corps of majority Congolese supervisors and personnel.

Already one of the world’s most highly automated underground gold mines, Kibali continues its technological advance with the introduction of truck and drill training simulators and the integration of systems for personnel safety tracking and ventilation demand control. The simulators will also be used to train operators from Barrick’s Tanzanian mines.

“The completion of the Kalimva-Ikamva prefeasibility study has delivered another viable opencast project which will help balance Kibali’s opencast/underground ore ratio and enhance

the flexibility of the mine plan. Down-plunge extension drilling at Gorumbwa has highlighted future underground potential and ongoing conversion drilling at KCD is delivering reserve replenishment. All in all, Kibali is well on track not only to meet its10-year production targets but to extend them beyond this horizon,” Bristow said.

“We’re maintaining a strong focus on energy efficiency through the development of our grid stabilizer project, scheduled for commissioning in the second quarter of 2020. This uses new battery technology to offset the need for running diesel generators as a spinning reserve and ensures we maximize the use of renewable hydro power. The installation of three new elution diesel heaters will also help improve efficiencies and control power costs. It’s worth noting that our clean energy strategy not only achieves cost and efficiency benefits but also once again reduces Kibali’s environmental footprint.”

Bristow said despite the pace of production and the size and complexity of the mine, Kibali was maintaining its solid safety and environmental records, certified by ISO 45001 and ISO 14001 accreditations. It also remained committed to community upliftment and local economic development. In 2019, it spent $158 million with Congolese contractors and suppliers and in December, it started work on a trial section for a new concrete road between Durba and the Watsa bridge.

LOULO-GOUNKOTO COMMITS TO NEW DECADE OF

DELIVERY AND INVESTMENT

Barrick Gold Corporation’s Loulo-Gounkoto complex has again demonstrated its mettle, exceeding its 2019 guidance with production of 714,802 ounces of gold.16

Barrick’s president and chief executive Mark Bristow told a briefing for local media that the complex continued to perform consistently to plan and was still managing to replace depleted reserves through successful brownfields exploration and resource conversion.

“With the development of the complex’s third underground mine scheduled to start in the fourth quarter of this year, and an intensive exploration program in the Kenieba region, Loulo-Gounkoto has significant growth potential and is well-placed to meet all the targets of its10-year plan,” he said.

In line with Barrick’s clean energy strategy, Loulo-Gounkoto is pioneering the group’s first solar power project. This is being developed in four phases, with the first scheduled for commissioning at the end of the first quarter and the last in the fourth quarter of this year. It will add 20MW to the complex’s grid, reduce the unit cost of its power and cut carbon emissions by some 40,000 tonnes per year. Bristow said it would serve as a model for the introduction of solar power elsewhere across Barrick, particularly at its North American operations.

Also being implemented at present is the Ramjack Newtrax project, which is setting the foundation for the automation and monitoring of the complex’s underground mines through a fiber network.

Despite the high activity level, the complex maintained its solid safety record with Lost Time Injuries (LTIs) at Loulo decreasing from four to twoyear-on-year, and Gounkoto recording its second successiveLTI-free year.

Bristow said Loulo-Gounkoto continued to invest in community health, education, and economic development programs. One of these is the agricultural complex established and funded to the tune of $2.2 million.

This has produced its first crop of 48 young farmers who have been installed on 30 new farms and provided not only with the necessary technical and entrepreneurial skills, but with the credit to apply these effectively.

During 2019, Loulo-Gounkoto spent $313 million with local contractors and suppliers and continued developing local businesses by creating a $500,000 provision for an incubation project designed to incorporate local contractors into the mining industry.

“Over the past 23 years, Barrick and its legacy company Randgold Resources have contributed $7.2 billion to the Malian economy in the form of taxes, royalties, salaries and payments to local suppliers. Over the same period, our mines in Mali paid $2.7 billion in dividends, taxes and royalties to the state - almost three times the $1 billion dividend received by Barrick,” Bristow said.

“It is a cardinal principle of Barrick that our host countries and communities should share equitably in the benefits created by our operations. Some, such as skills development and employment creation, cannot be measured, but as these figures demonstrate, the quantifiable value we deliver to Mali is very substantial,” Bristow said.

“This is also the product of a long and constructive partnership between the government of Mali and ourselves, and in this regard it is gratifying to report that we have made significant progress towards settling the dispute between us over tax and related issues which allows us to look forward to continuing to grow our partnership with the Mali government and its people.”

Appendix 1

2020 Operating and Capital Expenditure Guidance

GOLD PRODUCTION AND COSTS |

| |||||||||||||||

| 2020 forecast attributable | 2020 forecast cost of | 2020 forecast total cash | 2020 forecastall-in | |||||||||||||

| production (000s ozs) | sales7($/oz) | costs8($/oz) | sustaining costs8 ($/oz) | |||||||||||||

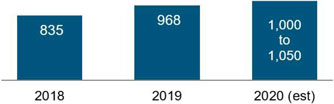

Carlin (61.5%)17,18 | 1,000 - 1,050 | 920 -970 | 760 - 810 | 1,000 - 1,050 | ||||||||||||

Cortez (61.5%)17 | 450 - 480 | 980 - 1,030 | 640 - 690 | 910 - 960 | ||||||||||||

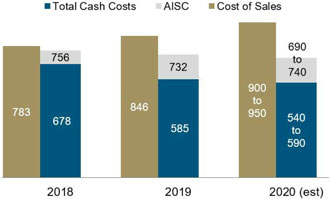

Turquoise Ridge(61.5%)17 | 430 - 460 | 900 - 950 | 540 - 590 | 690 - 740 | ||||||||||||

Phoenix (61.5%)17 | 100 - 120 | 1,850 - 1,900 | 700 - 750 | 920 - 970 | ||||||||||||

Long Canyon (61.5%)17 | 130 - 150 | 910 - 960 | 240 - 290 | 450 - 500 | ||||||||||||

Nevada Gold Mines(61.5%) | 2,100 - 2,250 | 970 - 1,020 | 660 - 710 | 880 - 930 | ||||||||||||

Hemlo | 200 - 220 | 960 - 1,010 | 800 - 850 | 1,200 - 1,250 | ||||||||||||

North America | 2,300 - 2,450 | 970 - 1,020 | 660 - 710 | 900 - 950 | ||||||||||||

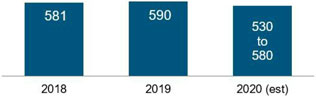

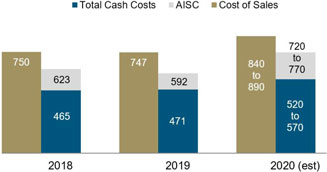

Pueblo Viejo (60%) | 530 - 580 | 840 - 890 | 520 - 570 | 720 - 770 | ||||||||||||

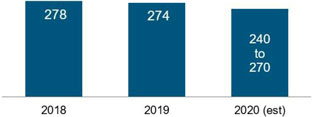

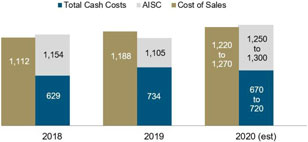

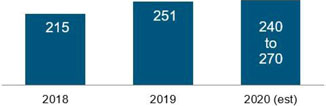

Veladero (50%) | 240 - 270 | 1,220 - 1,270 | 670 - 720 | 1,250 - 1,300 | ||||||||||||

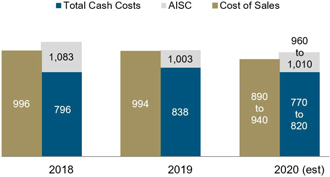

Porgera (47.5%) | 240 - 270 | 890 - 940 | 770 - 820 | 960 - 1,010 | ||||||||||||

Latin America & Asia Pacific | 1,000 - 1,100 | 930 - 980 | 610 - 660 | 890 - 940 | ||||||||||||

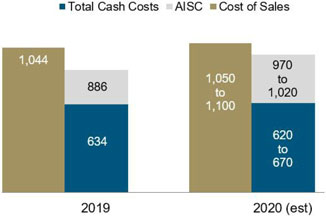

Loulo-Gounkoto (80%) | 500 - 540 | 1,050 - 1,100 | 620 - 670 | 970 - 1,020 | ||||||||||||

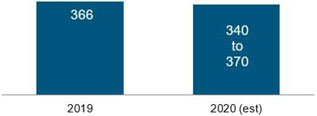

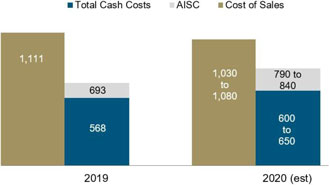

Kibali (45%) | 340 - 370 | 1,030 - 1,080 | 600 - 650 | 790 - 840 | ||||||||||||

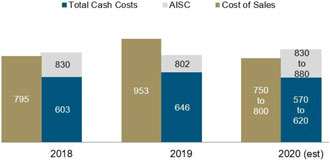

North Mara19 | 240 - 270 | 750 - 800 | 570 - 620 | 830 - 880 | ||||||||||||

Tongon (89.7%) | 240 - 260 | 1,390 - 1,440 | 680 - 730 | 740 - 790 | ||||||||||||

Bulyanhulu19 | 30 - 50 | 1,210 - 1,260 | 790 - 840 | 1,110 - 1,160 | ||||||||||||

Buzwagi19 | 80 - 100 | 850 - 900 | 820 - 870 | 850 - 900 | ||||||||||||

Africa & Middle East | 1,450 - 1,600 | 1,040 - 1,090 | 640 - 690 | 870 - 920 | ||||||||||||

Total Attributable to Barrick20,21,22,23 | 4,800 - 5,200 | 980 - 1,030 | 650 - 700 | 920 - 970 | ||||||||||||

COPPER PRODUCTION AND COSTS |

| |||||||||||||||

| 2020 forecast attributable production (M lbs) | 2020 forecast cost of sales7($/lb) | 2020 forecast C1 cash costs9($/lb) | 2020 forecast all-in sustaining costs9 ($/lb) | |||||||||||||

Lumwana | 250 - 280 | 2.20 - 2.40 | 1.50 - 1.70 | 2.30 - 2.60 | ||||||||||||

Zaldívar (50%) | 120 - 135 | 2.40 - 2.70 | 1.65 - 1.85 | 2.30 - 2.60 | ||||||||||||

Jabal Sayid (50%) | 60 - 70 | 1.75 - 2.00 | 1.40 - 1.60 | 1.50 - 1.70 | ||||||||||||

Total Copper22 | 440 - 500 | 2.10 - 2.40 | 1.50 - 1.80 | 2.20 - 2.50 | ||||||||||||

CAPITAL EXPENDITURES |

| |||||||||||||||

| ($ millions) | ||||||||||||||||

Attributable minesite sustaining |

| 1,300 - 1,500 | ||||||||||||||

Attributable project | 300 - 400 | |||||||||||||||

Total attributable capital expenditures24 |

| 1,600 - 1,900 | ||||||||||||||

| BARRICK YEAR-END 2019 | 14 | PRESS RELEASE |

Appendix 2

Production and Cost Summary

Production and Cost Summary - Gold

| (Unaudited) | For the three months ended | For the years ended | ||||||||||||||||||||||

| 12/31/2019 | 9/30/2019 | % Change | 12/31/2019 | 12/31/2018 | % Change | |||||||||||||||||||

Nevada Gold Mines LLC (61.5%)a | ||||||||||||||||||||||||

Gold produced (000s oz attributable basis) | 585 | 535 | 9 % | 2,218 | 2,368 | (6)% | ||||||||||||||||||

Gold produced (000s oz 100% basis) | 951 | 870 | 9 % | 2,967 | 2,457 | 21 % | ||||||||||||||||||

Cost of sales ($/oz) | 1,038 | 1,027 | 1 % | 924 | 814 | 13 % | ||||||||||||||||||

Total cash costs ($/oz)b | 711 | 693 | 3 % | 634 | 526 | 20 % | ||||||||||||||||||

All-in sustaining costs ($/oz)b | 944 | 946 | 0 % | 828 | 664 | 25 % | ||||||||||||||||||

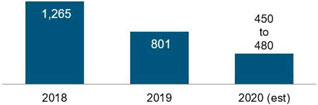

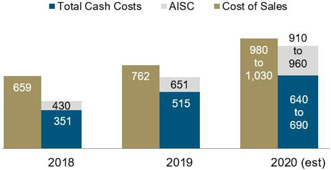

Cortez (61.5%)c | ||||||||||||||||||||||||

Gold produced (000s oz attributable basis) | 133 | 126 | 6 % | 801 | 1,265 | (37)% | ||||||||||||||||||

Gold produced (000s oz 100% basis) | 216 | 205 | 6 % | 963 | 1,265 | (24)% | ||||||||||||||||||

Cost of sales ($/oz) | 945 | 829 | 14 % | 762 | 659 | 16 % | ||||||||||||||||||

Total cash costs ($/oz)b | 681 | 570 | 19 % | 515 | 351 | 47 % | ||||||||||||||||||

All-in sustaining costs ($/oz)b | 1,012 | 772 | 31 % | 651 | 430 | 51 % | ||||||||||||||||||

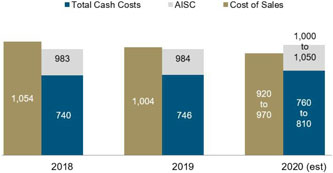

Carlin (61.5%)d | ||||||||||||||||||||||||

Gold produced (000s oz attributable basis) | 276 | 278 | (1)% | 968 | 835 | 16 % | ||||||||||||||||||

Gold produced (000s oz 100% basis) | 449 | 452 | (1)% | 1,315 | 835 | 57 % | ||||||||||||||||||

Cost of sales ($/oz) | 975 | 1,007 | (3)% | 1,004 | 1,054 | (5)% | ||||||||||||||||||

Total cash costs ($/oz)b | 766 | 775 | (1)% | 746 | 740 | 1 % | ||||||||||||||||||

All-in sustaining costs ($/oz)b | 965 | 1,014 | (5)% | 984 | 983 | 0 % | ||||||||||||||||||

Turquoise Ridge (61.5%)e | ||||||||||||||||||||||||

Gold produced (000s oz attributable basis) | 111 | 82 | 35 % | 335 | 268 | 25 % | ||||||||||||||||||

Gold produced (000s oz 100% basis) | 181 | 133 | 35 % | 504 | 357 | 41 % | ||||||||||||||||||

Cost of sales ($/oz) | 971 | 1,077 | (10)% | 846 | 783 | 8 % | ||||||||||||||||||

Total cash costs ($/oz)b | 625 | 622 | 0 % | 585 | 678 | (14)% | ||||||||||||||||||

All-in sustaining costs ($/oz)b | 800 | 840 | (5)% | 732 | 756 | (3)% | ||||||||||||||||||

Phoenix (61.5%)f | ||||||||||||||||||||||||

Gold produced (000s oz attributable basis) | 31 | 25 | 24 % | 56 | ||||||||||||||||||||

Gold produced (000s oz 100% basis) | 50 | 41 | 24 % | 91 | ||||||||||||||||||||

Cost of sales ($/oz) | 2,025 | 2,186 | (7)% | 2,093 | ||||||||||||||||||||

Total cash costs ($/oz)b | 902 | 1,010 | (11)% | 947 | ||||||||||||||||||||

All-in sustaining costs ($/oz)b | 1,034 | 1,622 | (36)% | 1,282 | ||||||||||||||||||||

Long Canyon (61.5%)f | ||||||||||||||||||||||||

Gold produced (000s oz attributable basis) | 34 | 24 | 42 % | 58 | ||||||||||||||||||||

Gold produced (000s oz 100% basis) | 55 | 39 | 42 % | 94 | ||||||||||||||||||||

Cost of sales ($/oz) | 1,026 | 1,170 | (12)% | 1,088 | ||||||||||||||||||||

Total cash costs ($/oz)b | 317 | 353 | (10)% | 333 | ||||||||||||||||||||

All-in sustaining costs ($/oz)b | 657 | 714 | (8)% | 681 | ||||||||||||||||||||

Pueblo Viejo (60%) | ||||||||||||||||||||||||

Gold produced (000s oz attributable basis) | 179 | 139 | 29 % | 590 | 581 | 2 % | ||||||||||||||||||

Gold produced (000s oz 100% basis) | 298 | 232 | 29 % | 983 | 968 | 2 % | ||||||||||||||||||

Cost of sales ($/oz) | 660 | 807 | (18)% | 747 | 750 | 0 % | ||||||||||||||||||

Total cash costs ($/oz)b | 422 | 504 | (16)% | 471 | 465 | 1 % | ||||||||||||||||||

All-in sustaining costs ($/oz)b | 517 | 631 | (18)% | 592 | 623 | (5)% | ||||||||||||||||||

| BARRICK YEAR-END 2019 | 15 | PRESS RELEASE |

Production and Cost Summary - Gold (continued)

| (Unaudited) | For the three months ended | For the years ended | ||||||||||||||||||||||

| 12/31/2019 | 9/30/2019 | % Change | 12/31/19 | 12/31/18 | % Change | |||||||||||||||||||

Loulo-Gounkoto (80%)g | ||||||||||||||||||||||||

Gold produced (000s oz attributable basis) | 144 | 153 | (6)% | 572 | ||||||||||||||||||||

Gold produced (000s oz 100% basis) | 180 | 191 | (6)% | 715 | ||||||||||||||||||||

Cost of sales ($/oz) | 1,037 | 1,018 | 2 % | 1,044 | ||||||||||||||||||||

Total cash costs ($/oz)b | 631 | 630 | 0 % | 634 | ||||||||||||||||||||

All-in sustaining costs ($/oz)b | 917 | 966 | (5)% | 886 | ||||||||||||||||||||

Kibali (45%)g | ||||||||||||||||||||||||

Gold produced (000s oz attributable basis) | 87 | 91 | (4)% | 366 | ||||||||||||||||||||

Gold produced (000s oz 100% basis) | 193 | 202 | (4)% | 813 | ||||||||||||||||||||

Cost of sales ($/oz) | 1,205 | 1,187 | 2 % | 1,111 | ||||||||||||||||||||

Total cash costs ($/oz)b | 608 | 554 | 10 % | 568 | ||||||||||||||||||||

All-in sustaining costs ($/oz)b | 740 | 703 | 5 % | 693 | ||||||||||||||||||||

Kalgoorlie (50%)h | ||||||||||||||||||||||||

Gold produced (000s oz attributable basis) | 36 | 58 | (38)% | 206 | 314 | (34)% | ||||||||||||||||||

Gold produced (000s oz 100% basis) | 72 | 116 | (38)% | 413 | 628 | (34)% | ||||||||||||||||||

Cost of sales ($/oz) | 1,127 | 1,037 | 9 % | 1,062 | 899 | 18 % | ||||||||||||||||||

Total cash costs ($/oz)b | 940 | 856 | 10 % | 873 | 732 | 19 % | ||||||||||||||||||

All-in sustaining costs ($/oz)b | 1,172 | 1,170 | 0 % | 1,183 | 857 | 38 % | ||||||||||||||||||

Tongon (89.7%)g | ||||||||||||||||||||||||

Gold produced (000s oz attributable basis) | 61 | 62 | (2)% | 245 | ||||||||||||||||||||

Gold produced (000s oz 100% basis) | 68 | 69 | (2)% | 273 | ||||||||||||||||||||

Cost of sales ($/oz) | 1,476 | 1,396 | 6 % | 1,469 | ||||||||||||||||||||

Total cash costs ($/oz)b | 803 | 793 | 1 % | 787 | ||||||||||||||||||||

All-in sustaining costs ($/oz)b | 867 | 869 | 0 % | 844 | ||||||||||||||||||||

Porgera (47.5%) | ||||||||||||||||||||||||

Gold produced (000s oz attributable basis) | 82 | 75 | 9 % | 284 | 204 | 39 % | ||||||||||||||||||

Gold produced (000s oz 100% basis) | 172 | 158 | 9 % | 597 | 429 | 39 % | ||||||||||||||||||

Cost of sales ($/oz) | 909 | 1,024 | (11)% | 994 | 996 | 0 % | ||||||||||||||||||

Total cash costs ($/oz)b | 757 | 868 | (13)% | 838 | 796 | 5 % | ||||||||||||||||||

All-in sustaining costs ($/oz)b | 894 | 1,053 | (15)% | 1,003 | 1,083 | (7)% | ||||||||||||||||||

Veladero (50%)i | ||||||||||||||||||||||||

Gold produced (000s oz attributable basis) | 71 | 58 | 22 % | 274 | 278 | (1)% | ||||||||||||||||||

Gold produced (000s oz 100% basis) | 142 | 116 | 22 % | 548 | 556 | (1)% | ||||||||||||||||||

Cost of sales ($/oz) | 1,138 | 1,243 | (8)% | 1,188 | 1,112 | 7 % | ||||||||||||||||||

Total cash costs ($/oz)b | 710 | 773 | (8)% | 734 | 629 | 17 % | ||||||||||||||||||

All-in sustaining costs ($/oz)b | 1,142 | 1,142 | 0 % | 1,105 | 1,154 | (4)% | ||||||||||||||||||

Hemlo | ||||||||||||||||||||||||

Gold produced (000s oz) | 54 | 49 | 10 % | 213 | 171 | 25 % | ||||||||||||||||||

Cost of sales ($/oz) | 1,632 | 1,083 | 51 % | 1,137 | 1,157 | (2)% | ||||||||||||||||||

Total cash costs ($/oz)b | 1,091 | 953 | 14 % | 904 | 1,046 | (14)% | ||||||||||||||||||

All-in sustaining costs ($/oz)b | 1,380 | 1,280 | 8 % | 1,140 | 1,318 | (14)% | ||||||||||||||||||

North Maraj | ||||||||||||||||||||||||

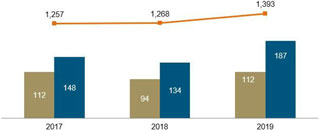

Gold produced (000s oz attributable basis) | 103 | 29 | 255 % | 251 | 215 | 17 % | ||||||||||||||||||

Gold produced (000s oz 100% basis) | 103 | 45 | 129 % | 334 | 336 | (1)% | ||||||||||||||||||

Cost of sales ($/oz) | 1,021 | 907 | 13 % | 953 | 795 | 20 % | ||||||||||||||||||

Total cash costs ($/oz)b | 675 | 603 | 12 % | 646 | 603 | 7 % | ||||||||||||||||||

All-in sustaining costs ($/oz)b | 830 | 850 | (2)% | 802 | 830 | (3)% | ||||||||||||||||||

| BARRICK YEAR-END 2019 | 16 | PRESS RELEASE |

| (Unaudited) | For the three months ended | For the years ended | ||||||||||||||||||||||

| 12/31/2019 | 9/30/2019 | % Change | 12/31/19 | 12/31/18 | % Change | |||||||||||||||||||

Buzwagij | ||||||||||||||||||||||||

Gold produced (000s oz attributable basis) | 28 | 18 | 56 % | 83 | 93 | (11)% | ||||||||||||||||||

Gold produced (000s oz 100% basis) | 28 | 28 | — % | 115 | 146 | (21)% | ||||||||||||||||||

Cost of sales ($/oz) | 1,235 | 1,292 | (4)% | 1,240 | 939 | 32 % | ||||||||||||||||||

Total cash costs ($/oz)b | 1,144 | 1,202 | (5)% | 1,156 | 916 | 26 % | ||||||||||||||||||

All-in sustaining costs ($/oz)b | 1,169 | 1,220 | (4)% | 1,178 | 947 | 24 % | ||||||||||||||||||

Bulyanhuluj | ||||||||||||||||||||||||

Gold produced (000s oz attributable basis) | 9 | 6 | 50 % | 27 | 26 | 4 % | ||||||||||||||||||

Gold produced (000s oz 100% basis) | 9 | 9 | — % | 37 | 41 | (10)% | ||||||||||||||||||

Cost of sales ($/oz) | 1,293 | 1,288 | 0 % | 1,207 | 1,231 | (2)% | ||||||||||||||||||

Total cash costs ($/oz)b | 752 | 729 | 3 % | 676 | 650 | 4 % | ||||||||||||||||||

All-in sustaining costs ($/oz)b | 909 | 769 | 18 % | 773 | 754 | 3 % | ||||||||||||||||||

Total Attributable to Barrickk | ||||||||||||||||||||||||

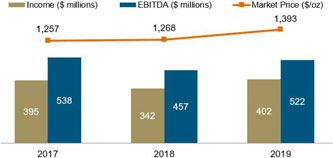

Gold produced (000s oz attributable basis) | 1,439 | 1,306 | 10 % | 5,465 | 4,527 | 21 % | ||||||||||||||||||

Cost of sales ($/oz)l | 1,046 | 1,065 | (2)% | 1,005 | 892 | 13 % | ||||||||||||||||||

Total cash costs ($/oz)b | 692 | 710 | (3)% | 671 | 588 | 14 % | ||||||||||||||||||

All-in sustaining costs ($/oz)b | 923 | 984 | (6)% | 894 | 806 | 11 % | ||||||||||||||||||

| a. | Represents the combined results of Cortez, Goldstrike (including our 60% share of South Arturo) and our 75% interest in Turquoise Ridge until June 30, 2019. Commencing July 1, 2019, the date Nevada Gold Mines was established, the results represent our 61.5% interest in Cortez, Carlin (including Goldstrike and 60% of South Arturo), Turquoise Ridge (including Twin Creeks), Phoenix and Long Canyon. |

| b. | These arenon-GAAP financial performance measures with no standardized meaning under IFRS and therefore may not be comparable to similar measures presented by other issuers. For further information and a detailed reconciliation of eachnon-GAAP measure used in this section of the press release to the most directly comparable IFRS measure, please see pages 91 to 112 of our fourth quarter 2019 MD&A. |

| c. | On July 1, 2019, Cortez was contributed to Nevada Gold Mines, a joint venture with Newmont. As a result, the amounts presented are on an 100% basis up until June 30, 2019, and on a 61.5% basis thereafter. |

| d. | On July 1, 2019, Barrick’s Goldstrike and Newmont’s Carlin were contributed to Nevada Gold Mines and are now referred to as Carlin. As a result, the amounts presented represent Goldstrike on a 100% basis (including our 60% share of South Arturo) up until June 30, 2019, and the combined results of Carlin and Goldstrike (including our 60% share of South Arturo) on a 61.5% basis thereafter. |

| e. | Barrick owned 75% of Turquoise Ridge through to the end of the second quarter of 2019, with our joint venture partner, Newmont, owning the remaining 25%. Turquoise Ridge was proportionately consolidated on the basis that the joint venture partners that have joint control have rights to the assets and obligations for the liabilities relating to the arrangement. The figures presented in this table are based on our 75% interest in Turquoise Ridge until June 30, 2019. On July 1, 2019, Barrick’s 75% interest in Turquoise Ridge and Newmont’s Twin Creeks and 25% interest in Turquoise Ridge were contributed to Nevada Gold Mines. Starting July 1, 2019, the results represent our 61.5% share of Turquoise Ridge and Twin Creeks, now referred to as Turquoise Ridge. |

| f. | These sites were acquired as a result of the formation of Nevada Gold Mines on July 1, 2019. |

| g. | These sites did not form a part of the Barrick consolidated results in 2018 and 2017 as these sites were acquired as a result of the Merger. |

| h. | On November 28, 2019, we completed the sale of our 50% interest in Kalgoorlie in Western Australia to Saracen Mineral Holdings Limited for total cash consideration of $750 million. Accordingly, these represent our 50% interest until November 28, 2019. |

| i. | On June 30, 2017, we sold 50% of Veladero; therefore, these represent results on a 100% basis from January 1 to June 30, 2017 and on a 50% basis from July 1, 2017 onwards |

| j. | Formerly known as Acacia Mining plc. On September 17, 2019, Barrick acquired all of the shares of Acacia it did not own. Operating results are included at 100% from October 1, 2019 (notwithstanding the completion of the Acacia transaction on September 17, 2019, we consolidated our interest in Acacia and recorded anon-controlling interest of 36.1% in the income statement for the entirety of the third quarter of 2019 as a matter of convenience) up until the GoT’s 16% free-carried interest is made effective, which is expected to be January 1, 2020, and on an 84% basis thereafter. |

| k. | With the end of mining at Golden Sunlight and Morila in the second quarter and Lagunas Norte in the third quarter as previously reported, we have ceased to include production ornon-GAAP cost metrics for these sites from July 1, 2019 and October 1, 2019, respectively, onwards although these sites are included in the Total Attributable to Barrick in the prior period comparatives. |

| l. | Cost of sales per ounce (Barrick’s share) is calculated as cost of sales - gold on an attributable basis (excluding sites in care and maintenance) divided by gold equity ounces sold. |

| BARRICK YEAR-END 2019 | 17 | PRESS RELEASE |

Production and Cost Summary - Copper

| (Unaudited) | For the three months ended | For the years ended | ||||||||||||||||||||||

| 12/31/2019 | 9/30/2019 | % Change | 12/31/19 | 12/31/18 | % Change | |||||||||||||||||||

Lumwana | ||||||||||||||||||||||||

Copper production (millions lbs) | 63 | 65 | (3)% | 238 | 224 | 6 % | ||||||||||||||||||

Cost of sales ($/lb) | 2.22 | 2.04 | 9 % | 2.13 | 2.51 | (15)% | ||||||||||||||||||

C1 cash costs ($/lb)a | 2.10 | 1.83 | 15 % | 1.79 | 2.08 | (14)% | ||||||||||||||||||

All-in sustaining costs ($/lb)a | 3.41 | 3.66 | (7)% | 3.04 | 3.08 | (1)% | ||||||||||||||||||

Zaldívar (50%) | ||||||||||||||||||||||||

Copper production (millions lbs attributable basis) | 36 | 32 | 13 % | 128 | 104 | 23 % | ||||||||||||||||||

Copper produced (millions lbs 100% basis) | 72 | 64 | 13 % | 256 | 208 | 23 % | ||||||||||||||||||

Cost of sales ($/lb) | 2.59 | 2.18 | 19 % | 2.46 | 2.55 | (4)% | ||||||||||||||||||

C1 cash costs ($/lb)a | 1.95 | 1.55 | 26 % | 1.77 | 1.97 | (10)% | ||||||||||||||||||

All-in sustaining costs ($/lb)a | 2.56 | 1.91 | 34 % | 2.15 | 2.47 | (13)% | ||||||||||||||||||

Jabal Sayid (50%) | ||||||||||||||||||||||||

Copper production (millions lbs attributable basis) | 18 | 15 | 20 % | 66 | 55 | 20 % | ||||||||||||||||||

Copper produced (millions lbs 100% basis) | 36 | 30 | 20 % | 132 | 110 | 20 % | ||||||||||||||||||

Cost of sales ($/lb) | 1.47 | 1.63 | (10)% | 1.53 | 1.73 | (12)% | ||||||||||||||||||

C1 cash costs ($/lb)a | 1.29 | 1.42 | (9)% | 1.26 | 1.53 | (18)% | ||||||||||||||||||

All-in sustaining costs ($/lb)a | 1.78 | 1.65 | 8 % | 1.51 | 1.92 | (21)% | ||||||||||||||||||

Total Copper | ||||||||||||||||||||||||

Copper production (millions lbs attributable basis) | 117 | 112 | 4 % | 432 | 383 | 13 % | ||||||||||||||||||

Cost of sales ($/lb)b | 2.26 | 2.00 | 13 % | 2.14 | 2.40 | (11)% | ||||||||||||||||||

C1 cash costs ($/lb)a | 1.90 | 1.62 | 17 % | 1.69 | 1.97 | (14)% | ||||||||||||||||||

All-in sustaining costs ($/lb)a | 2.82 | 2.58 | 9 % | 2.52 | 2.82 | (11)% | ||||||||||||||||||

| a. | These arenon-GAAP financial performance measures with no standardized meaning under IFRS and therefore may not be comparable to similar measures presented by other issuers. For further information and a detailed reconciliation of eachnon-GAAP measure used in this section of the MD&A to the most directly comparable IFRS measure, please see pages 91 to 112 of our fourth quarter 2019 MD&A. |

| b. | Cost of sales per pound (Barrick’s share) is calculated as cost of sales - copper plus our equity share of cost of sales attributable to Zaldívar and Jabal Sayid divided by copper pounds sold. |

| BARRICK YEAR-END 2019 | 18 | PRESS RELEASE |

Appendix 3

2020 Outlook Assumptions and Economic Sensitivity Analysis

Outlook Assumptions and Economic Sensitivity Analysis

| 2020 Guidance Assumption | Hypothetical Change | Impact on EBITDA (millions)25 | Impact onAll-in Sustaining Costs8,9 | |||||

Gold revenue, net of royalties | $1,350/oz | +/- $100/oz | +/- $472 | +/- $4/oz | ||||

Copper revenue, net of royalties | $2.75/lb | +/- $0.50/lb | +/- $224 | +/- $0.02/lb | ||||

TECHNICAL INFORMATION

The scientific and technical information contained in this press release has been reviewed and approved by Steven Yopps, MMSA, Director - Metallurgy, North America; Craig Fiddes, North America Resource Modeling Manager; Chad Yuhasz, P.Geo, Mineral Resource Manager, Latin America and Australia Pacific; Simon Bottoms, CGeol, MGeol, FGS, MAusIMM, Mineral Resources Manager: Africa and Middle East; Rodney Quick, MSc, Pr. Sci.Nat, Mineral Resource Management and Evaluation Executive; John Steele, CIM, Metallurgy, Engineering and Capital Projects Executive; and Rob Krcmarov, FAusIMM, Executive Vice President, Exploration and Growth – each a “Qualified Person” as defined in National Instrument43-101 –Standards of Disclosure for Mineral Projects.

All mineral reserve and mineral resource estimates are estimated in accordance with National Instrument43-101 –Standards of Disclosure for Mineral Projects. Unless otherwise noted, such mineral reserve and mineral resource estimates are as of December 31, 2019.

Endnotes

Endnote 1

In this press release of unaudited financial results, “adjusted net earnings” and “adjusted net earnings per share” arenon-GAAP financial performance measures. Adjusted net earnings excludes the following from net earnings: certain impairment charges (reversals) related to intangibles, goodwill, property, plant and equipment, and investments; gains (losses) and otherone-time costs relating to acquisitions or dispositions; foreign currency translation gains (losses); significant tax adjustments not related to current period earnings; unrealized gains (losses) onnon-hedge derivative instruments; and the tax effect andnon-controlling interest of these items. The Company uses this measure internally to evaluate our underlying operating performance for the reporting periods presented and to assist with the planning and forecasting of future operating results. Barrick believes that adjusted net earnings is a useful measure of our performance because these adjusting items do not reflect the underlying operating performance of our core mining business and are not necessarily indicative of future operating results. Adjusted net earnings and adjusted net earnings per share are intended to provide additional information only and do not have any standardized meaning under IFRS and may not be comparable to similar measures of performance presented by other companies. They should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. Further details on thesenon-GAAP measures are provided in the MD&A accompanying Barrick’s financial statements filed from time to time on SEDAR at www.sedar.com and on EDGAR at www.sec.gov.

| BARRICK YEAR-END 2019 | 19 | PRESS RELEASE |

Reconciliation of Net Earnings to Net Earnings per Share, Adjusted Net Earnings and Adjusted Net Earnings per Share

(Unaudited)

| ($ millions, except per share amounts in dollars) | For the three months ended | For the years ended | ||||||||||||||||||

| 12/31/19 | 9/30/19 | 12/31/19 | 12/31/18 | 12/31/17 | ||||||||||||||||

Net earnings (loss) attributable to equity holders of the Company | 1,387 | 2,277 | 3,969 | (1,545 | ) | 1,438 | ||||||||||||||

Impairment charges (reversals) related to long-lived assetsa | (566 | ) | (872 | ) | (1,423 | ) | 900 | (212 | ) | |||||||||||

Acquisition/disposition (gains) lossesb | (414 | ) | (1,901 | ) | (2,327 | ) | (68 | ) | (911 | ) | ||||||||||

(Gain) loss on currency translation | 53 | 40 | 109 | 136 | 72 | |||||||||||||||

Significant tax adjustmentsc | 74 | 35 | 34 | 742 | 244 | |||||||||||||||

Other (income) expense adjustmentsd | (845 | ) | 53 | (687 | ) | 366 | 178 | |||||||||||||

Unrealized gains (losses) onnon-hedge derivative instruments | 0 | 1 | 0 | 1 | (1 | ) | ||||||||||||||

Tax effect andnon-controlling intereste | 611 | 631 | 1,227 | (123 | ) | 68 | ||||||||||||||

Adjusted net earnings | 300 | 264 | 902 | 409 | 876 | |||||||||||||||

Net earnings (loss) per sharef | 0.78 | 1.30 | 2.26 | (1.32 | ) | 1.23 | ||||||||||||||

Adjusted net earnings per sharef | 0.17 | 0.15 | 0.51 | 0.35 | 0.75 | |||||||||||||||

| a. | Net impairment reversals for the current year primarily relate tonon-current asset reversals at Pueblo Viejo, partially offset by impairment charges at Pascua-Lama in the fourth quarter of 2019. This was further impacted bynon-current asset reversals at Lumwana in the third quarter of 2019. Net impairment charges for 2018 primarily relate tonon-current asset impairments at Lagunas Norte andnon-current asset and goodwill impairments at Veladero. |

| b. | Acquisition/disposition gains for the current year primarily relate to the gain on the sale of our 50% interest in Kalgoorlie in the fourth quarter of 2019 and the gain on the remeasurement of Turquoise Ridge to fair value as a result of its contribution to Nevada Gold Mines in the third quarter of 2019. |

| c. | Significant tax adjustments in 2018 primarily relate to thede-recognition of our Canadian and Peruvian deferred tax assets. |

| d. | Other expense adjustments for the current year primarily relate to the gain on thede-recognition of the deferred revenue liability relating to our silver sale agreement with Wheaton Precious Metals Corp. and the gain on a tax settlement at Lumwana, both occurring in the fourth quarter of 2019. |

| e. | Tax effect andnon-controlling interest for the current year primarily relates to the impairment charges related to long-lived assets. |

| f. | Calculated using weighted average number of shares outstanding under the basic method of earnings per share. |

Endnote 2

A Tier One Gold Asset is a mine with a stated life in excess of 10 years, annual production of at least 500,000 ounces of gold and total cash costs per ounce over the mine life that are in the lower half of the industry cost curve.

Endnote 3

Includes Tanzania on a 63.9% basis (notwithstanding the completion of the Acacia transaction on September 17, 2019, we consolidated our interest in Acacia and recorded anon-controlling interest of 36.1% in the income statement for the entirety of the third quarter of 2019 as a matter of convenience), Pueblo Viejo on a 60% basis, South Arturo on a 60% basis (36.9% from July 1, 2019 onwards as a result of its contribution to Nevada Gold Mines), and Veladero on a 50% basis, which reflects our equity share of production and sales. Also includes Loulo-Gounkoto on an 80% basis, Kibali on a 45% basis, Tongon on an 89.7% basis and Morila on a 40% basis, which reflects our equity share of production and sales, commencing January 1, 2019, the effective date of the Merger. Also removes thenon-controlling interest of 38.5% Nevada Gold Mines from July 1, 2019 onwards.

Endnote 4

“Realized price” is anon-GAAP financial measure which excludes from sales: unrealized gains and losses onnon-hedge derivative contracts; unrealizedmark-to-market gains and losses on provisional pricing from copper and gold sales contracts; sales attributable to ore purchase arrangements; treatment and refining charges; export duties; and cumulativecatch-up adjustments to revenue relating to our streaming arrangements. This measure is intended to enable Management to better understand the price realized in each reporting period for gold and copper sales because unrealizedmark-to-market values ofnon-hedge gold and copper derivatives are subject to change each period due to changes in market factors such as market and forward gold and copper prices, so that prices ultimately realized may differ from those recorded. The exclusion of such unrealizedmark-to-market gains and losses from the presentation of this performance measure enables investors to understand performance based on the realized proceeds of selling gold and copper production. The realized price measure is intended to provide additional information and does not have any standardized definition under IFRS and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. Further details on thesenon-GAAP measures are provided in the MD&A accompanying Barrick’s financial statements filed from time to time on SEDAR at www.sedar.com and on EDGAR at www.sec.gov.

| BARRICK YEAR-END 2019 | 20 | PRESS RELEASE |

Reconciliation of Sales to Realized Price per ounce/pound

(Unaudited)

($ millions, except per ounce/ pound information in dollars) | Gold | Copper | Gold | Copper | ||||||||||||||||||||||||||||||||||||

| For the three months ended | For the years ended | |||||||||||||||||||||||||||||||||||||||

| 12/31/19 | 9/30/19 | 12/31/19 | 9/30/19 | 12/31/19 | 12/31/18 | 12/31/17 | 12/31/19 | 12/31/18 | 12/31/17 | |||||||||||||||||||||||||||||||

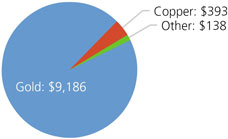

Sales | 2,758 | 2,585 | 82 | 45 | 9,186 | 6,600 | 7,631 | 393 | 512 | 608 | ||||||||||||||||||||||||||||||

Sales applicable to non-controlling interests | (769 | ) | (748 | ) | 0 | 0 | (1,981 | ) | (734 | ) | (810 | ) | 0 | 0 | 0 | |||||||||||||||||||||||||

Sales applicable to equity method investmentsa,b | 139 | 140 | 147 | 100 | 543 | 0 | 0 | 492 | 442 | 427 | ||||||||||||||||||||||||||||||

Realizednon-hedge gold/copper derivative (losses) gains | 0 | 0 | 0 | 0 | 1 | 2 | 3 | 0 | 0 | 0 | ||||||||||||||||||||||||||||||

Sales applicable to sites in care and maintenancec | (56 | ) | (32 | ) | 0 | 0 | (140 | ) | (111 | ) | (153 | ) | 0 | 0 | 0 | |||||||||||||||||||||||||

Treatment and refinement charges | 0 | 0 | 25 | 18 | 0 | 1 | 1 | 99 | 144 | 157 | ||||||||||||||||||||||||||||||

Export duties | 0 | 0 | 0 | 0 | 0 | (1 | ) | 0 | 0 | 0 | 0 | |||||||||||||||||||||||||||||

Otherd | 22 | 0 | 0 | 0 | 22 | 12 | 0 | 0 | 0 | 0 | ||||||||||||||||||||||||||||||

Revenues – as adjusted | 2,094 | 1,945 | 254 | 163 | 7,631 | 5,769 | 6,672 | 984 | 1,098 | 1,192 | ||||||||||||||||||||||||||||||

Ounces/pounds sold (000s ounces/ millions pounds)c | 1,413 | 1,318 | 91 | 65 | 5,467 | 4,544 | 5,302 | 355 | 382 | 405 | ||||||||||||||||||||||||||||||

Realized gold/copper price per ounce/ pounde | 1,483 | 1,476 | 2.76 | 2.55 | 1,396 | 1,270 | 1,258 | 2.77 | 2.88 | 2.95 | ||||||||||||||||||||||||||||||

| a. | Represents sales of $130 million and $505 million, respectively, for the three months and year ended December 31, 2019 (September 30, 2019: $133 million; 2018: $nil; 2017: $nil) applicable to our 45% equity method investment in Kibali and $9 million and $39 million, respectively (September 30, 2019: $8 million; 2018: $nil; 2017: $nil) applicable to our 40% equity method investment in Morila for gold. Represents sales of $110 million and $343 million for the three months and year ended December 31, 2019 (September 30, 2019: $66 million; 2018: $300 million; 2017: $325 million) applicable to our 50% equity method investment in Zaldívar and $43 million and $168 million, respectively (September 30, 2019: $37 million; 2018: $161 million; 2017: $116 million) applicable to our 50% equity method investment in Jabal Sayid. |

| b. | Sales applicable to equity method investments are net of treatment and refinement charges. |

| c. | Figures exclude Pierina, Golden Sunlight and Morila starting in the third quarter of 2019, and Lagunas Norte starting in the fourth quarter of 2019 from the calculation of realized price per ounce, which are mining incidental ounces as they enter closure. |

| d. | Represents cumulativecatch-up adjustment to revenue relating to our streaming arrangements. |

| e. | Realized price per ounce/pound may not calculate based on amounts presented in this table due to rounding. |

Endnote 5

“Free cash flow” is anon-GAAP financial performance measure which deducts capital expenditures from net cash provided by operating activities. Barrick believes this to be a useful indicator of our ability to operate without reliance on additional borrowing or usage of existing cash. Free cash flow is intended to provide additional information only and does not have any standardized meaning under IFRS and may not be comparable to similar measures of performance presented by other companies. Free cash flow should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. Further details on thisnon-GAAP measure are provided in the MD&A accompanying Barrick’s financial statements filed from time to time on SEDAR at www.sedar.com and on EDGAR at www.sec.gov.

Reconciliation of Net Cash Provided by Operating Activities to Free Cash Flow

(Unaudited)

| ($ millions) | For the three months ended | For the years ended | ||||||||||||||||||

| 12/31/19 | 9/30/19 | 12/31/19 | 12/31/18 | 12/31/17 | ||||||||||||||||

Net cash provided by operating activities | 875 | 1,004 | 2,833 | 1,765 | 2,065 | |||||||||||||||

Capital expenditures | (446 | ) | (502 | ) | (1,701 | ) | (1,400 | ) | (1,396 | ) | ||||||||||

Free cash flow | 429 | 502 | 1,132 | 365 | 669 | |||||||||||||||

Endnote 6

These amounts are presented on the same basis as our guidance and include our 60% share of Pueblo Viejo and South Arturo (36.9% of South Arturo from July 1, 2019 onwards as a result of its contribution to Nevada Gold Mines), our 63.9% share of Tanzania until September 30, 2019 (notwithstanding the completion of the Acacia transaction on September 17, 2019, we consolidated our interest in Acacia and recorded anon-controlling interest of 36.1% in the income statement for the entirety of the third quarter of 2019 as a matter of convenience) and our 50% share of Zaldívar and Jabal Sayid. Also includes our 80% share of Loulo-Gounkoto, 89.7% share of Tongon, 45% share of Kibali and 40% share of Morila commencing January 1, 2019, the effective date of the Merger. Starting July 1, 2019, it also includes our 61.5% share of Nevada Gold Mines.

| BARRICK YEAR-END 2019 | 21 | PRESS RELEASE |

Endnote 7

Cost of sales applicable to gold per ounce is calculated using cost of sales applicable to gold on an attributable basis (removing thenon-controlling interest of 40% Pueblo Viejo, 36.1% Tanzania until September 30, 2019 (notwithstanding the completion of the Acacia transaction on September 17, 2019, we consolidated our interest in Acacia and recorded anon-controlling interest of 36.1% in the income statement for the entirety of the third quarter of 2019 as a matter of convenience) and 40% South Arturo from cost of sales (63.1% of South Arturo from July 1, 2019 onwards as a result of its contribution to Nevada Gold Mines)), divided by attributable gold ounces. Thenon-controlling interest of 20% Loulo-Gounkoto and 10.3% of Tongon is also removed from cost of sales and our proportionate share of cost of sales attributable to equity method investments (Kibali and Morila) is included commencing January 1, 2019, the effective date of the Merger. Also removes thenon-controlling interest of 38.5% Nevada Gold Mines from cost of sales from July 1, 2019 onwards. Cost of sales applicable to copper per pound is calculated using cost of sales applicable to copper including our proportionate share of cost of sales attributable to equity method investments (Zaldívar and Jabal Sayid), divided by consolidated copper pounds (including our proportionate share of copper pounds from our equity method investments).

Endnote 8

“Total cash costs” per ounce,“All-in sustaining costs” per ounce and“All-in costs” per ounce arenon-GAAP financial performance measures. “Total cash costs” per ounce starts with cost of sales related to gold production but removes depreciation, thenon-controlling interest of cost of sales, and includesby-product credits.“All-in sustaining costs” per ounce begin with “Total cash costs” per ounce and add further costs which reflect the expenditures made to maintain current production levels, primarily sustaining capital expenditures, sustaining leases, general & administrative costs, minesite exploration and evaluation costs, and reclamation cost accretion and amortization.“All-in costs” per ounce starts with“All-in sustaining costs” per ounce and adds additional costs that reflect the varying costs of producing gold over the life-cycle of a mine, including: project capital expenditures and othernon-sustaining costs. Barrick believes that the use of “total cash costs” per ounce,“all-in sustaining costs” per ounce and“All-in costs” per ounce will assist investors, analysts and other stakeholders in understanding the costs associated with producing gold, understanding the economics of gold mining, assessing our operating performance and also our ability to generate free cash flow from current operations and to generate free cash flow on an overall Company basis. “Total cash costs” per ounce,“All-in sustaining costs” per ounce and“All-in costs” per ounce are intended to provide additional information only and do not have any standardized meaning under IFRS. Although a standardized definition ofall-in sustaining costs was published in 2013 by the World Gold Council (a market development organization for the gold industry comprised of and funded by 25 gold mining companies from around the world, including Barrick), it is not a regulatory organization, and other companies may calculate this measure differently. Starting from the first quarter of 2019, we have renamed “cash costs” to “total cash costs” when referring to our gold operations. The calculation of total cash costs is identical to our previous calculation of cash costs with only a change in the naming convention of thisnon-GAAP measure. These measures should not be considered in isolation or as a substitute for measures prepared in accordance with IFRS. Further details on thesenon-GAAP measures are provided in the MD&A accompanying Barrick’s financial statements filed from time to time on SEDAR at www.sedar.com and on EDGAR at www.sec.gov.

| BARRICK YEAR-END 2019 | 22 | PRESS RELEASE |

Reconciliation of Gold Cost of Sales to Total cash costs,All-in sustaining costs andAll-in costs, including on a per ounce basis

(Unaudited)

| ($ millions, except per ounce information in dollars) | For the three months ended | For the years ended | ||||||||||||||||||||

| Footnote | 12/31/19 | 9/30/19 | 12/31/19 | 12/31/18 | 12/31/17 | |||||||||||||||||

Cost of sales applicable to gold production | 1,896 | 1,831 | 6,514 | 4,621 | 4,836 | |||||||||||||||||

Depreciation | (549 | ) | (538 | ) | (1,902 | ) | (1,253 | ) | (1,529 | ) | ||||||||||||

Cash cost of sales applicable to equity method investments | 57 | 45 | 226 | 0 | 0 | |||||||||||||||||

By-product credits | (43 | ) | (48 | ) | (138 | ) | (131 | ) | (135 | ) | ||||||||||||

Realized (gains) losses on hedge andnon-hedge derivatives | a | 1 | 1 | 1 | 3 | 23 | ||||||||||||||||

Non-recurring items | b | (22 | ) | (4 | ) | (55 | ) | (172 | ) | 0 | ||||||||||||

Other | c | (37 | ) | (19 | ) | (102 | ) | (87 | ) | (106 | ) | |||||||||||

Non-controlling interests | d | (326 | ) | (339 | ) | (878 | ) | (313 | ) | (299 | ) | |||||||||||

Total cash costs | 977 | 929 | 3,666 | 2,668 | 2,790 | |||||||||||||||||

General & administrative costs | 31 | 68 | 212 | 265 | 248 | |||||||||||||||||

Minesite exploration and evaluation costs | e | 24 | 22 | 69 | 45 | 47 | ||||||||||||||||

Minesite sustaining capital expenditures | f | 394 | 406 | 1,320 | 975 | 1,109 | ||||||||||||||||

Sustaining leases | 4 | 5 | 27 | 0 | 0 | |||||||||||||||||

Rehabilitation - accretion and amortization (operating sites) | g | 7 | 28 | 65 | 81 | 64 | ||||||||||||||||

Non-controlling interest, copper operations and other | h | (135 | ) | (184 | ) | (470 | ) | (374 | ) | (273 | ) | |||||||||||

All-in sustaining costs | 1,302 | 1,274 | 4,889 | 3,660 | 3,985 | |||||||||||||||||

Project exploration and evaluation and project costs | e | 60 | 64 | 273 | 338 | 307 | ||||||||||||||||

Community relations costs not related to current operations | 0 | 1 | 2 | 4 | 4 | |||||||||||||||||

Project capital expenditures | f | 46 | 96 | 370 | 459 | 273 | ||||||||||||||||

Rehabilitation - accretion and amortization (non-operating sites) | g | 3 | 5 | 22 | 33 | 20 | ||||||||||||||||

Non-controlling interest and copper operations and other | h | (28 | ) | (46 | ) | (105 | ) | (21 | ) | (21 | ) | |||||||||||

All-in costs | 1,383 | 1,394 | 5,451 | 4,473 | 4,568 | |||||||||||||||||

Ounces sold - equity basis (000s ounces) | i | 1,413 | 1,318 | 5,467 | 4,544 | 5,302 | ||||||||||||||||

Cost of sales per ounce | j,k | 1,046 | 1,065 | 1,005 | 892 | 794 | ||||||||||||||||

Total cash costs per ounce | k | 692 | 710 | 671 | 588 | 526 | ||||||||||||||||

Total cash costs per ounce (on aco-product basis) | k,l | 712 | 735 | 689 | 607 | 544 | ||||||||||||||||

All-in sustaining costs per ounce | k | 923 | 984 | 894 | 806 | 750 | ||||||||||||||||

All-in sustaining costs per ounce (on aco-product basis) | k,l | 943 | 1,009 | 912 | 825 | 768 | ||||||||||||||||

All-in costs per ounce | k | 976 | 1,074 | 996 | 985 | 860 | ||||||||||||||||

All-in costs per ounce (on aco-product basis) | k,l | 996 | 1,099 | 1,014 | 1,004 | 878 | ||||||||||||||||

| a. | Realized (gains) losses on hedge andnon-hedge derivatives |

Includes realized hedge losses of $nil and $nil for the three months and year ended December 31, 2019, respectively (September 30, 2019: $nil; 2018: $4 million; 2017: $27 million), and realizednon-hedge losses of $1 million and $1 million for the three months and year ended December 31, 2019, respectively (September 30, 2019: $1 million; 2018: gains of $1 million; 2017: gains of $4 million).

| b. | Non-recurring items |

Non-recurring items in 2019 relate to organizational restructuring. These costs are not indicative of our cost of production and have been excluded from the calculation of total cash costs.

| c. | Other |

Other adjustments for the three months and year ended December 31, 2019 include the removal of total cash costs andby-product credits associated with our Pierina mine, Golden Sunlight and Morila starting in the third quarter of 2019, and Lagunas Norte starting in the fourth quarter of 2019, which all are mining incidental ounces as they enter closure, of $35 million and $92 million, respectively (September 30, 2019: $19 million; 2018: $87 million; 2017: $108 million).

| BARRICK YEAR-END 2019 | 23 | PRESS RELEASE |

| d. | Non-controlling interests |

Non-controlling interests includenon-controlling interests related to gold production of $477 million and $1,306 million, respectively, for the three months and year ended December 31, 2019 (September 30, 2019: $506 million; 2018: $453 million; 2017: $454 million).Non-controlling interests include Pueblo Viejo and Tanzania until September 30, 2019 (notwithstanding the completion of the Acacia transaction on September 17, 2019, we consolidated our interest in Acacia and recorded anon-controlling interest of 36.1% in the income statement for the entirety of the third quarter of 2019 as a matter of convenience). Starting January 1, 2019, the effective date of the Merger,non-controlling interests also include Loulo-Gounkoto and Tongon and starting July 1, 2019, it also includes Nevada Gold Mines.

| e. | Exploration and evaluation costs |

Exploration, evaluation and project expenses are presented as minesite if it supports current mine operations and project if it relates to future projects. Refer to page 84 of the Fourth Quarter 2019 MD&A.

| f. | Capital expenditures |

Capital expenditures are related to our gold sites only and are presented on a 100% cash basis starting from January 1, 2019 and on a 100% accrued basis for 2018 and 2017. They are split between minesite sustaining and project capital expenditures. Project capital expenditures are distinct projects designed to increase the net present value of the mine and are not related to current production. Significant projects in the current year are stripping at Rangefront declines, Cortez Crossroads, the Goldrush exploration declines, the Deep South Expansion, and construction of the third shaft at Turquoise Ridge. Refer to page 83 of the Fourth Quarter 2019 MD&A.

| g. | Rehabilitation - accretion and amortization |

Includes depreciation on the assets related to rehabilitation provisions of our gold operations and accretion on the rehabilitation provisions of our gold operations, split between operating andnon-operating sites.

| h. | Non-controlling interest and copper operations |