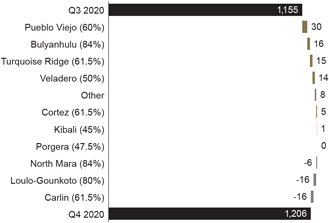

Factors affecting net earnings and adjusted net earnings4 – three months ended December 31, 2020 versus September 30, 2020

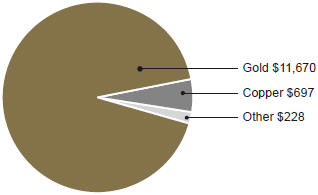

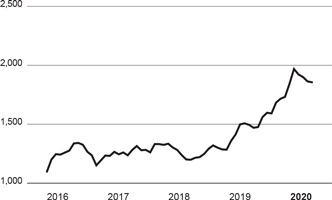

Net earnings attributable to equity holders of Barrick (“net earnings”) for the three months ended December 31, 2020 were $685 million compared to $882 million in the prior quarter. The decrease was primarily due to a lower realized gold price4 of $1,871 per ounce for the three months ended December 31, 2020, compared to $1,926 per ounce in the prior quarter.

After adjusting for items that are not indicative of future operating earnings, adjusted net earnings4 of $616 million for the three months ended December 31, 2020 were $110 million lower than the prior quarter. The decrease in adjusted net earnings4 was mainly due to a lower realized gold price4, as discussed above, and a decrease in gold and copper sales volumes.

The significant adjusting item in the three months ended December 31, 2020 was $118 million ($126 million before tax and non-controlling interest) in acquisition/disposition gains, primarily resulting from the sale of Eskay Creek, Morila and Bullfrog.

Refer to page 116 for a full list of reconciling items between net earnings and adjusted net earnings4 for the current and previous periods.

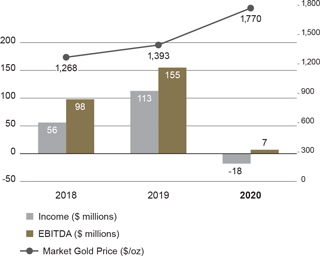

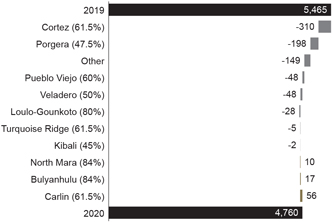

Factors affecting net earnings and adjusted net earnings4 – year ended December 31, 2020 versus December 31, 2019

Net earnings for the year ended December 31, 2020 were $2,324 million compared to $3,969 million in the prior year. The significant decrease was primarily due to items occurring in the prior year, including:

| 🌑 | | a gain of $1.9 billion ($1.5 billion net of taxes) relating to the remeasurement of Turquoise Ridge to fair value as a result of its contribution to Nevada Gold Mines; |

| 🌑 | | a gain of $408 million (no tax impact) resulting from the sale of our 50% interest in Kalgoorlie; |

| 🌑 | | an impairment reversal at Lumwana of $947 million ($663 million net of taxes) and at Pueblo Viejo of $865 million ($277 million net of taxes and non-controlling interest), partially offset by an impairment charge at Pascua-Lama of $296 million (no tax impact); |

| 🌑 | | a gain of $628 million (no tax impact) on the de-recognition of the deferred revenue liability relating to our silver sale agreement with Wheaton Precious Metals Corp. (“Wheaton”); and |

| 🌑 | | a gain of $216 million on a settlement of customs duty and indirect taxes at Lumwana. |

The decrease was partially offset by current year positive items consisting of:

| 🌑 | | a net impairment reversal of $91 million ($304 million before tax) resulting from the framework agreement with the Government of Tanzania being signed and made effective in the first quarter of 2020; |

| 🌑 | | a gain of $172 million ($180 million before tax and non-controlling interest) in acquisitions/dispositions, primarily resulting from the sales of Eskay Creek, Massawa, Morila and Bullfrog; and |

| 🌑 | | a gain of $104 million (no tax impact) on the remeasurement of the residual cash liability relating to our silver sale agreement with Wheaton. |

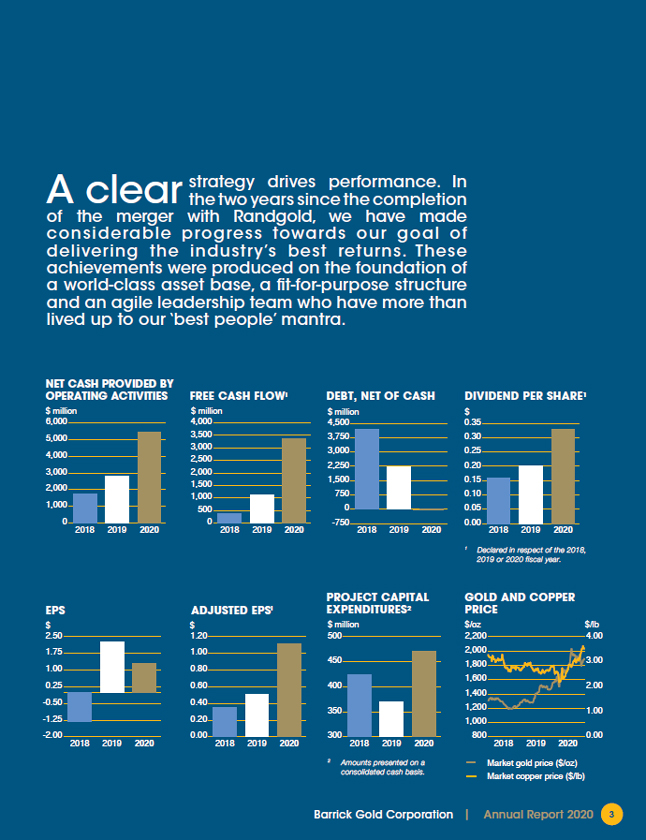

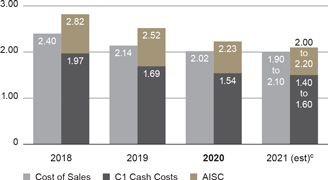

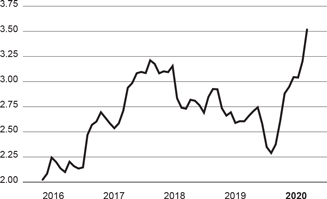

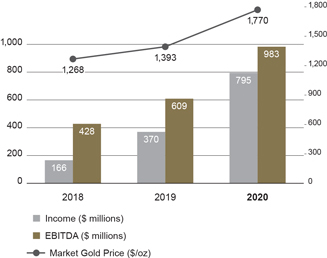

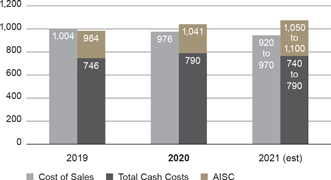

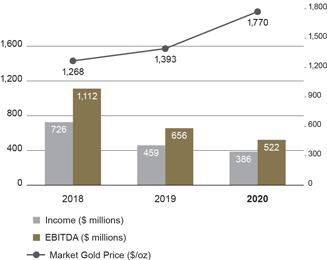

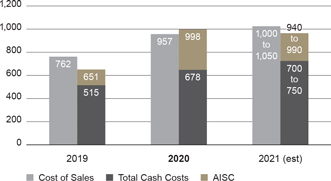

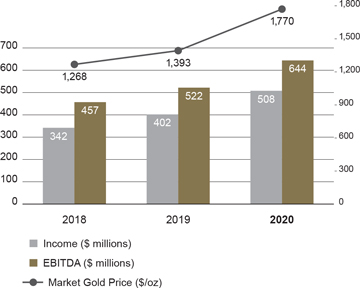

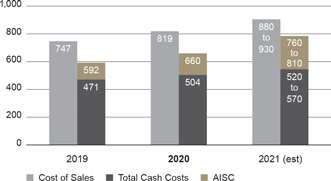

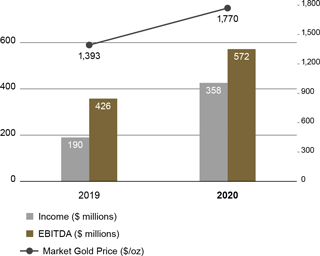

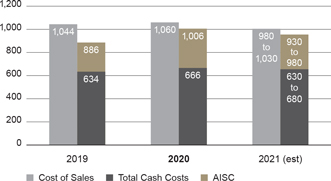

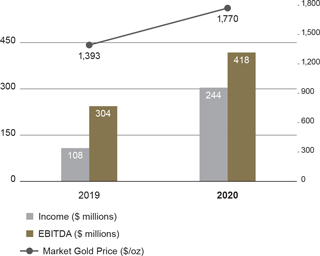

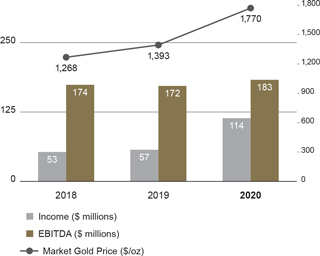

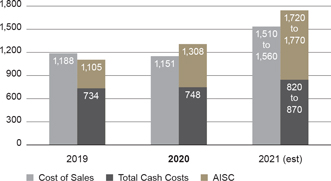

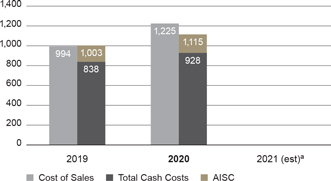

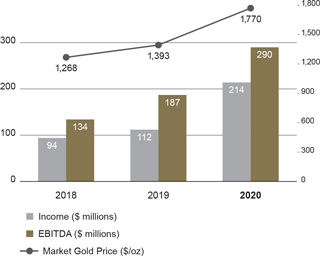

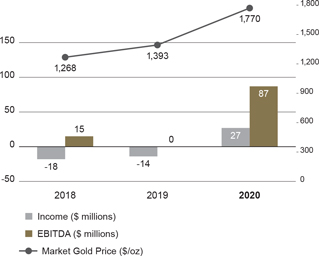

After adjusting for items that are not indicative of future operating earnings, adjusted net earnings4 of $2,042 million for the year ended December 31, 2020 were $1,140 million higher than the prior year. The increase in adjusted net earnings4 was primarily due to a higher realized gold price4 of $1,778 per ounce in 2020 compared to $1,396 per ounce in the prior year, partially offset by higher gold cost of sales per ounce5.

Refer to page 116 for a full list of reconciling items between net earnings and adjusted net earnings4 for the current and previous periods.

Factors affecting Operating Cash Flow and Free Cash Flow4 – three months ended December 31, 2020 versus September 30, 2020

In the three months ended December 31, 2020, we generated $1,638 million in operating cash flow, compared to $1,859 million in the prior quarter. The decrease of $221 million was primarily due to an increase in interest paid as a result of the timing of interest payments on our public market debt. This was combined with a lower realized gold price4 of $1,871 per ounce for the three months ended December 31, 2020, compared to $1,926 per ounce in the prior quarter.

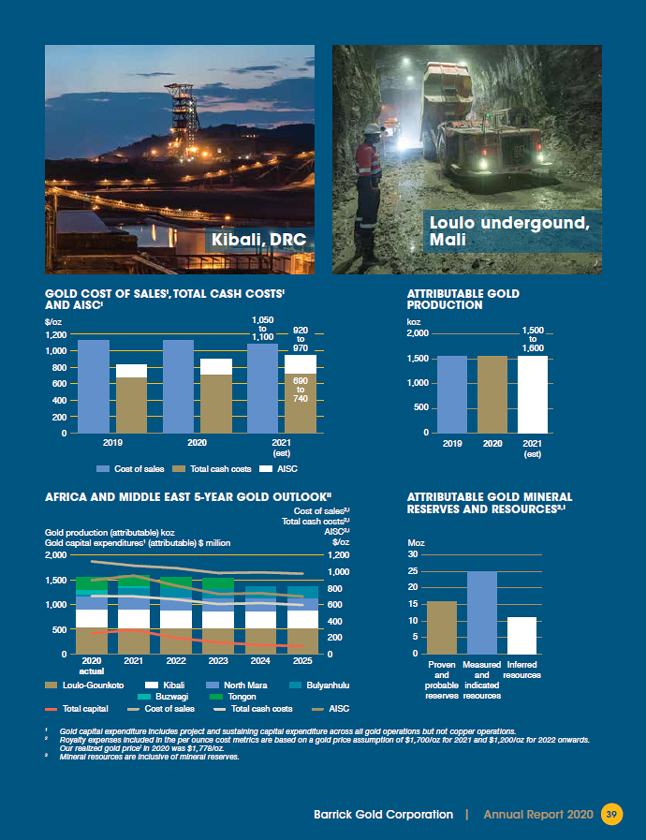

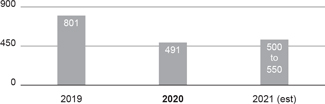

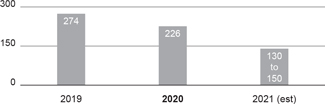

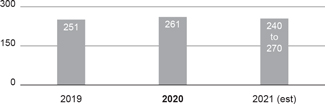

Free cash flow4 for the three months ended December 31, 2020 was $1,092 million, compared to $1,311 million in the prior quarter, reflecting lower operating cash flows, while capital expenditures remained consistent with the prior quarter. In the three months ended December 31, 2020, capital expenditures on a cash basis were $546 million compared to $548 million in the prior quarter as a decrease in minesite sustaining capital expenditures was offset by higher project capital expenditures. The decrease in minesite sustaining capital expenditures is primarily due to Loulo-Gounkoto and was driven by lower capitalized stripping at the Gounkoto open pit and a decrease in capital development at Loulo. This was combined with a decrease at Cortez as a result of fewer haul truck component replacements, the ramp-down of the Crossroads dewatering project until the next stages are reviewed and approved, and a reduction in capitalized stripping as the mine transitions out from a mostly stripping phase at Crossroads Phase 4. The increase in project capital expenditures was primarily due to the plant and tailings expansion project at Pueblo Viejo and the restart of underground mining and processing operations at Bulyanhulu.

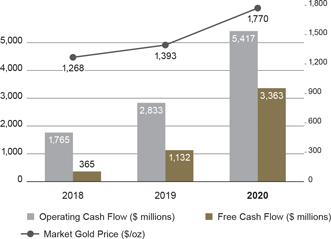

Factors affecting Operating Cash Flow and Free Cash Flow4 – year ended December 31, 2020 versus December 31, 2019

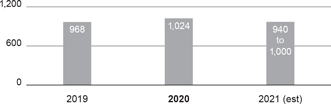

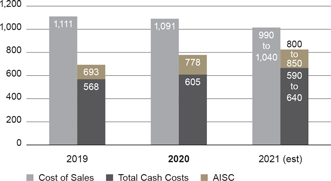

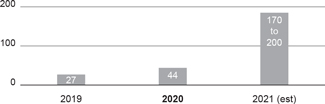

For the year ended December 31, 2020, we generated $5,417 million in operating cash flow, compared to $2,833 million in the prior year. The increase of $2,584 million was primarily due to a higher realized gold price4 of $1,778 per ounce in 2020, compared to $1,396 per ounce in the prior year, partially offset by higher gold cost of sales per ounce5. The current year also included a full year contribution from Nevada Gold Mines, whereas the prior year included a contribution for only the six month period from July 1, 2019.

For 2020, we generated free cash flow4 of $3,363 million compared to $1,132 million in the prior year. The increase primarily reflects higher operating cash flows, partially offset by higher capital expenditures. In 2020, capital expenditures on a cash basis were $2,054 million compared to $1,701 million in the prior year, mainly as a result of the formation of Nevada Gold Mines. This was combined with higher minesite sustaining capital expenditures as a result of increased capitalized stripping at Loulo-Gounkoto and our investment in the tailings storage facility and other water management initiatives at North Mara. This was further impacted by higher project capital expenditures related to the plant and tailings expansion project at Pueblo Viejo and the restart of underground mining and processing operations at Bulyanhulu.

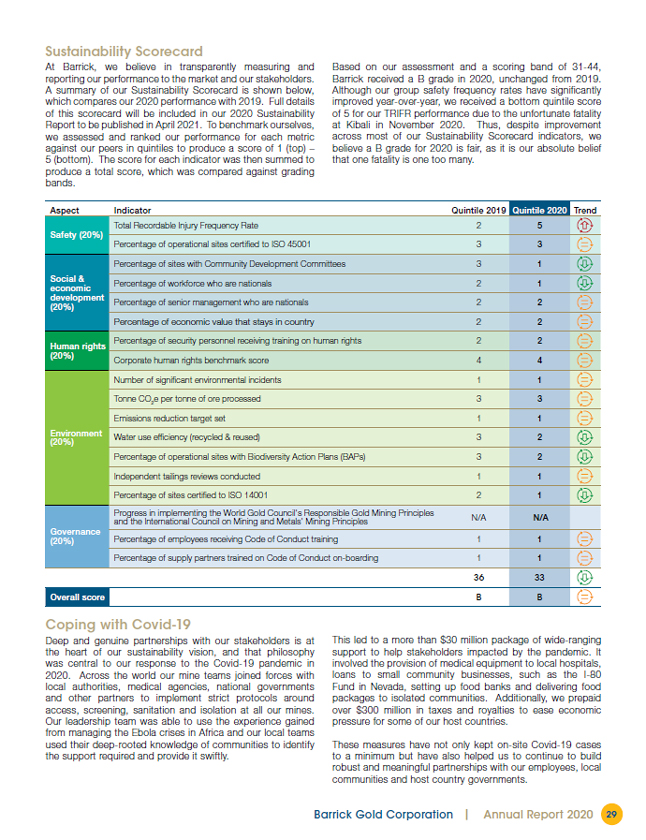

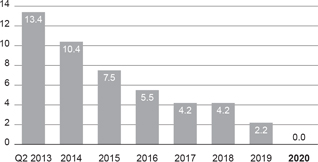

Environmental, Social and Governance (“ESG”)

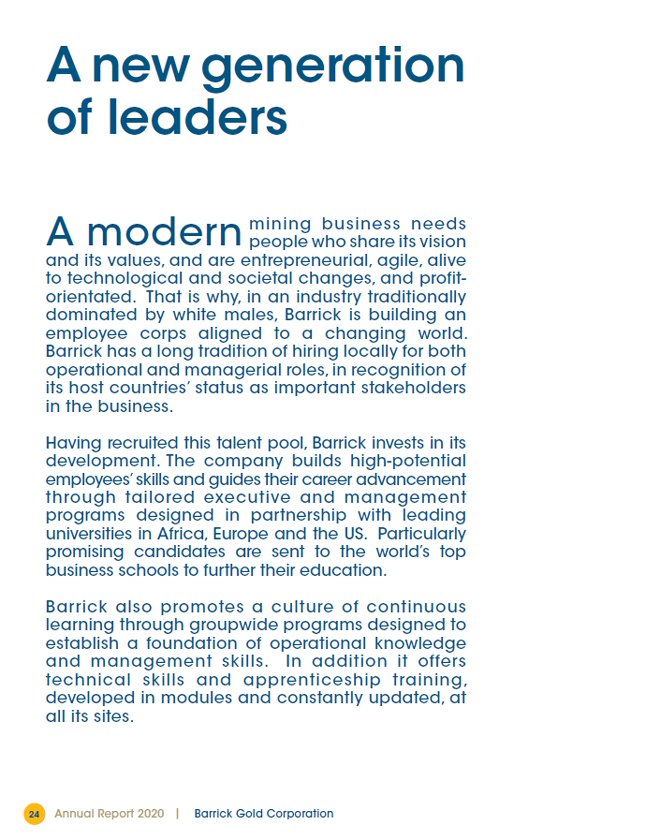

Sustainability is integral to Barrick and is entrenched in our DNA. This means that the day-to-day ownership of sustainability-related risks and opportunities is in the hands of individual sites. As each site manages its geological, operational and technical capabilities to meet our business objectives, the site must also manage its own sustainability performance.

Our commitment and responsibility for sustainability is driven at an operational level, not set in a corporate office as part of a compliance exercise. Each site plays a role in identifying programs, metrics, and targets that measure real progress and deliver real impacts for the business and our stakeholders, including our host countries and local communities. The Group Sustainability Executive, as a member of the Group’s Executive Committee, provides oversight and direction on this site-level ownership, ensuring alignment towards the strategic priorities of the overall business.