Capital purchases of mobile mining equipment continued in the fourth quarter of 2021. Assembly has begun on a modular dry facility just outside of the existing office/shop facility near the Cortez Hills Open Pit. Engineering work is progressing on Ventilation Raise #1 (“VR1”), the materials handling system, and the underground backfill system. The drilling of test wells for the first three dewatering wells is currently expected to begin in the third quarter of 2022.

The headcount ramp-up at Goldrush also continues, with 127 NGM employees on-site at year-end. Headcount is planned to increase to 233 over the course of 2022.

As at December 31, 2021, we have spent $290 million on a 100% basis (including $26 million in the fourth quarter of 2021) on the Goldrush project, inclusive of the exploration declines. This capital spent to date, together with the remaining expected pre-production capital (until commercial production begins in 2025), is anticipated to be slightly less than the $1 billion initial capital estimate previously disclosed for the Goldrush project (on a 100% basis).

Turquoise Ridge Third Shaft, Nevada, USA14

Construction of the Third Shaft at Turquoise Ridge, which has a hoisting capacity of 5,500 tonnes per day, continues to advance according to schedule and within budget. We continue to expect commissioning in late 2022. Together with increased hoisting capacity, the Third Shaft is expected to provide additional ventilation for underground mining operations as well as shorter haulage distances.

Construction activities continued in the fourth quarter of 2021, focusing on shaft steel installation. At the end of the quarter, shaft steel equipping reached 28% completion as measured by steel weight. Furthermore, commissioning of the concrete/shotcrete slick line was successfully completed, construction on the 2280 level materials handling system restarted and surface construction of the additional main exhaust fan at the No. 1 Shaft began. Permanent conveyance deliveries have started and a contract is now in place for the construction of the change house facility, which will commence in 2022. The focus of the project will remain on shaft equipping for the first quarter of 2022, followed by final headframe refit.

As at December 31, 2021, we have spent $222 million (including $7 million in the fourth quarter of 2021) out of an estimated capital cost of approximately $300–$330 million (100% basis).

Pueblo Viejo Expansion, Dominican Republic15

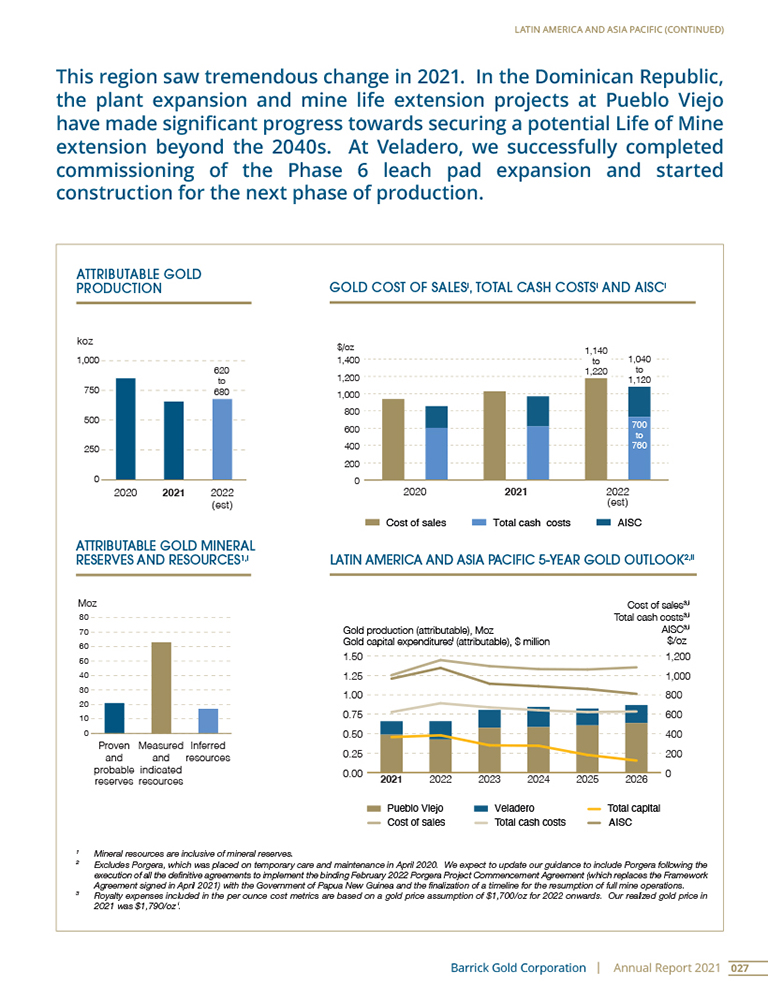

The Pueblo Viejo plant expansion and mine life extension project is designed to increase throughput to 14 million tonnes per annum, allowing the operation to maintain minimum average annual gold production of approximately 800,000 ounces after 2022 (100% basis).

Engineering design of the plant expansion continued to progress during the fourth quarter of 2021 and is now essentially complete (from 97% as of the third quarter of 2021). 94% of the contracts and purchase orders have been placed. Steel fabrication is now complete and 91% of the manufactured steel required had been shipped at the end of the fourth quarter of 2021.

Construction for the plant expansion is now 26% complete (from 16% as of the third quarter of 2021). Earthworks were 75% and civil concrete works were 60% complete at the end of the fourth quarter of 2021. Steel and mechanical installation has started, and will ramp up through the first quarter of 2022 upon the arrival of materials. We expect completion of the plant expansion by the end of 2022.

The social, environmental, and technical studies for additional tailings and mine waste rock capacity continued to advance, including the review of alternative sites, in consultation with the government. Detailed design and engineering of these alternative sites is ongoing. We are continuing to engage with local stakeholders to review concerns and feedback.

As of December 31, 2021, we have incurred $450 million (including $112 million in the fourth quarter of 2021) on the project. As previously disclosed, the project has experienced logistical

challenges and related delays primarily due to the impact of the Covid-19 pandemic on the global supply chain, and consequently the capital cost of the project is now estimated at approximately $1.4 billion (100% basis).

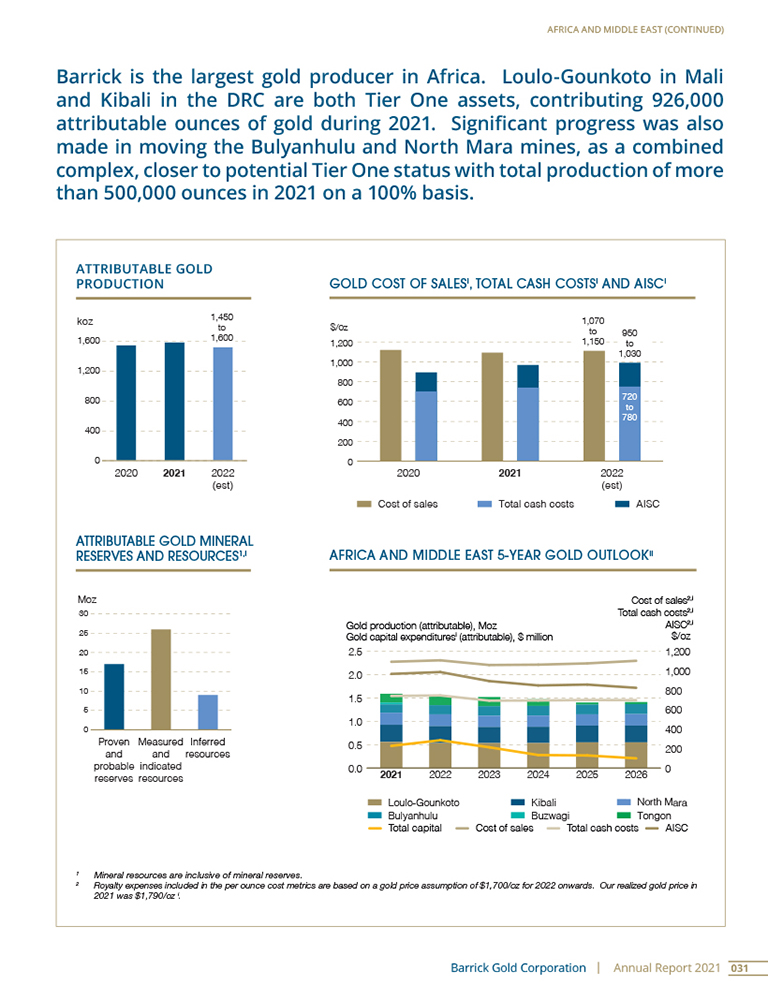

Bulyanhulu Re-Start and Optimization

During the fourth quarter of 2021, Bulyanhulu achieved record gold production of 68 thousand ounces (100% basis) since resuming mining operations, which is higher than the 2022 planned quarterly run-rate of 55 to 60 thousand ounces (100% basis). In addition, full commissioning of the grinding and gravity circuits has now been completed, enabling the plant to achieve steady throughput rates of 2,500 tonnes per day. As the construction phase of this project has been completed, it will no longer be separately reported in this section of the MD&A.

The internal feasibility study for Bulyanhulu delivered mineral reserve growth of 670 thousand ounces year on year (100% basis), net of 2021 depletion, as a direct result of the underground resource conversion drill program at Deep West. Accordingly, the updated mine plan is now expected to deliver an average of 240 thousand ounces (100% basis) per annum for the majority of the life of mine, in excess of 10 years. Furthermore, mineral reserve conversion drilling is planned to convert the lower half of the Deep West panel during 2022.

Zaldívar Chloride Leach Project, Chile

Zaldívar is jointly owned by Antofagasta and Barrick, and is operated by Antofagasta. In December 2019, the Board of Compañía Minera Zaldívar approved the Chloride Leach Project. The project contemplates the construction of a chloride dosing system, an upgrade of the solvent extraction plant and the construction of additional washing ponds.

During the fourth quarter of 2021, the fourth solvent extraction processing stream (Train D) was modified and recommissioned. Capital is trending in line with the approved budget. Construction of the project was substantially complete at the end of the fourth quarter of 2021 and subsequently completed in January 2022. Commissioning is expected in the first quarter of 2022.

Upon commissioning, the project is expected to increase copper recoveries by more than 10% through the addition of chlorides to the leach solution and with further potential upside in recoveries possible depending on the type of ore being processed. This process is based on a proprietary technology called CuproChlor® that was developed by Antofagasta at its Michilla operation, which had ore types similar to those that are processed at Zaldívar. Once in full operation, the project is expected to increase production at Zaldívar by approximately 10 to 15 thousand tonnes per annum at lower operating costs over the remaining life of mine.

As at December 31, 2021, we have spent $180 million (including $15 million in the fourth quarter of 2021) out of an estimated capital cost of approximately $189 million (100% basis).

Veladero Phase 7 Leach Pad, Argentina

In November 2021, the board of Minera Andina del Sol approved the Phase 7A leach pad construction project. Construction of Phase 7B will commence following the completion of Phase 7A subject to approval by the Board. Construction on both phases will include sub-drainage and monitoring, leak collection and recirculation, impermeabilization, and pregnant leaching solution collection. Additionally, the north channel (non-contacted water management) will be extended along the leach pad facility.

Construction of Phase 7A commenced in November 2021. Overall project progress was at 20% completion at the end of the fourth quarter of 2021, slightly ahead of schedule. Completion is expected in mid-2022, in line with the mine plan.

As at December 31, 2021, we have spent $10 million out of an estimated capital cost of $75 million (100% basis). Subject to approval by the board of Minera Andina del Sol, construction of Phase 7B is expected to commence in the fourth quarter of 2022.