UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number_811-04149

_Franklin Tax-Free Trust

(Exact name of registrant as specified in charter)

_One Franklin Parkway, San Mateo, CA 94403-1906

(Address of principal executive offices) (Zip code)

_Craig S. Tyle, One Franklin Parkway, San Mateo, CA 94403-1906

(Name and address of agent for service)

Registrant's telephone number, including area code:_(650) 312-2000

Date of fiscal year end:_2/28

Date of reporting period: _02/29/16

Item 1. Reports to Stockholders.

| |

| Contents | |

| |

| Annual Report | |

| Municipal Bond Market Overview | 3 |

| Investment Strategy and Manager’s Discussion | 5 |

| Franklin Alabama Tax-Free Income Fund | 6 |

| Franklin Florida Tax-Free Income Fund | 13 |

| Franklin Georgia Tax-Free Income Fund | 20 |

| Franklin Kentucky Tax-Free Income Fund | 27 |

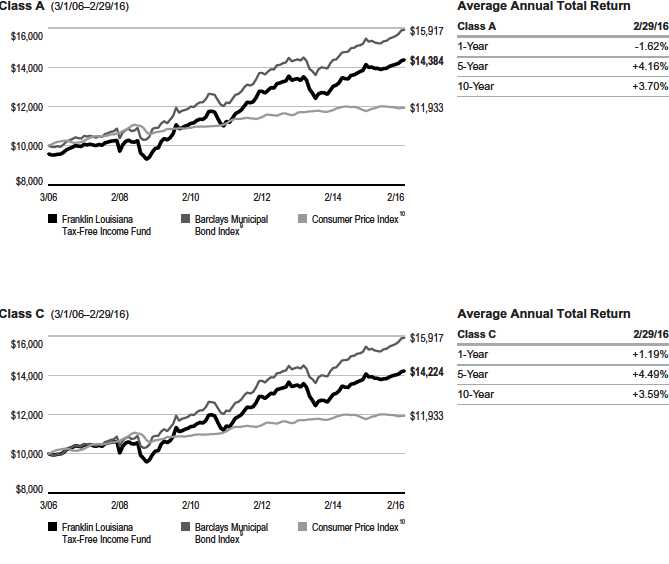

| Franklin Louisiana Tax-Free Income Fund | 33 |

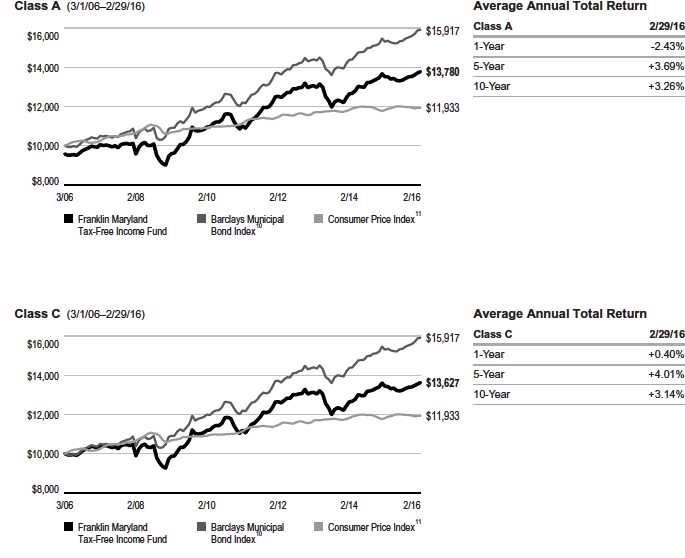

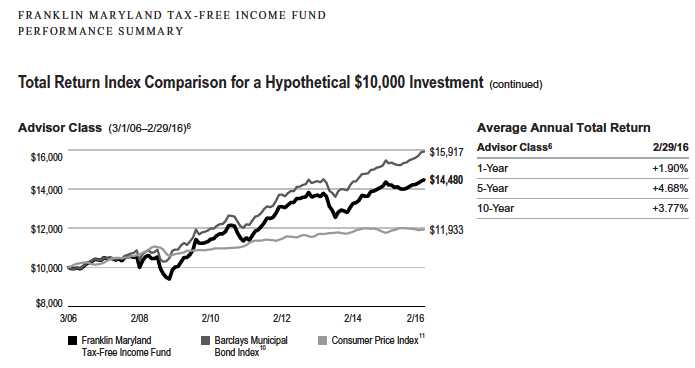

| Franklin Maryland Tax-Free Income Fund | 40 |

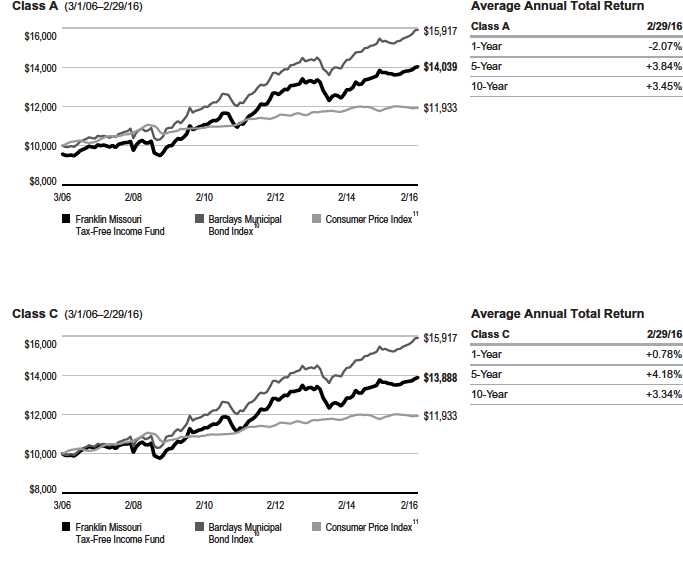

| Franklin Missouri Tax-Free Income Fund | 48 |

| Franklin North Carolina Tax-Free Income Fund | 56 |

| Franklin Virginia Tax-Free Income Fund | 64 |

| Financial Highlights and Statements of Investments | 72 |

| Financial Statements | 124 |

| Notes to Financial Statements | 135 |

| Report of Independent Registered | |

| Public Accounting Firm | 150 |

| Tax Information | 151 |

| Board Members and Officers | 152 |

| Shareholder Information | 157 |

Visit franklintempleton.com for fund updates, to access your account, or to find helpful financial planning tools.

franklintempleton.com

Annual Report

Municipal Bond Market Overview

The municipal bond market outperformed the U.S. Treasury and the U.S. stock markets during the 12-month period ended February 29, 2016. Investment-grade municipal bonds, as measured by the Barclays Municipal Bond Index, generated a +3.95% total return for the period, while U.S. Treasuries, as measured by the Barclays U.S. Treasury Index, posted a +2.88% total return.1 U.S. equities, as represented by the Standard & Poor’s 500 Index, underperformed with a -6.19% total return for the reporting period.1 The decline in U.S. equities was partly fueled by concerns about global economic growth, particularly a continuing slowdown in China and sluggish economic activity in Europe and Japan. Sustained price declines in the commodities markets also put downward pressure on U.S. equities. These factors led to a perceived flight to quality, which seemed to benefit municipal bondholders. In addition, in our opinion, municipal bonds continued to offer significant value relative to Treasuries because of their tax-exempt status and relatively low risk.

The Federal Reserve (Fed) raised its target interest-rate range to 0.25%–0.50% in December, citing labor market improvement and continued U.S. economic growth. This action ended a seven-year period of near-zero short-term interest rates. At the time, the Fed indicated the move would be followed by a “gradual” tightening of monetary policy, and the median estimate among Fed governors for the 2016 year-end federal funds rate was 1.375%. Despite the prospect of higher short-term interest rates in 2016, the municipal bond market rallied after the announcement. Benchmark 10-year and 30-year tax-exempt interest rates ended the period lower than where they began.

Municipal bond funds finished the period with four consecutive months of inflows, reflecting robust demand for tax-exempt debt. Bonds with longer maturities generally performed better than bonds with shorter maturities. In addition, investment-grade municipal bonds fared better than high yield municipal bonds. High yield tax-exempt bonds, as measured by the Barclays Municipal High Yield Index, generated a +2.11% total return for the period.1 Approximately $341 billion in bonds were issued over the past 12 months; this issuance was offset, however, by the nearly $342 billion in bonds that either matured or were called out of the market, making net supply flat for the period.2

Several developments affected Puerto Rico bonds over the reporting period. Puerto Rico and its municipal issuers continued to experience significant financial difficulties, which created additional strain on a commonwealth already facing economic stagnation and fiscal imbalances. These challenges also led to liquidity issues including reduced access to the financial markets. On February 6, 2015, a federal judge ruled that Puerto Rico’s Public Corporation Debt Enforcement and Recovery Act (the Act), signed into law on June 28, 2014, was unconstitutional. Following the ruling, which was affirmed by the U.S. Court of Appeals on July 6, 2015, independent credit rating agencies Moody’s Investors Service and Standard & Poor’s repeatedly downgraded Puerto Rico’s general obligation debt, as well as the ratings of certain related Puerto Rico issuers. On August 21, 2015, Puerto Rico petitioned the U.S. Supreme Court to review the ruling invalidating the Act. In early December, the U.S. Supreme Court granted Puerto Rico’s request, and the case was scheduled for oral argument in March 2016. In addition, the commonwealth continued to seek the expansion of Chapter 9 bankruptcy eligibility through the U.S. Congress.

Near the end of June 2015, in conjunction with announcing that Puerto Rico’s debt was “not payable,” Governor Alejandro Garcia Padilla publicly called for a restructuring of Puerto Rico debt obligations, while certain other Puerto Rico issuers continued to negotiate with creditors for a financial restructuring. During the reporting period, Puerto Rico’s financial issues led to partial defaults by Puerto Rico’s Public Finance Corporation on its debt service payments beginning on August 3, 2015. In September, Governor Garcia Padilla’s working group issued a preliminary report regarding the island’s financial situation and potential restructuring recommendations. On February 1, 2016, the governor officially released the commonwealth’s restructuring proposal. The plan seeks to reduce the burden of $49 billion in tax-supported debt by asking creditors to exchange current securities for a combination of “Base Bonds” and “Growth Bonds.” The uncertainty arising from these recent actions led to price volatility among several Puerto Rico municipal bond issues.

Franklin Templeton has been a member of a creditors’ committee (Ad Hoc Group) made up of bondholders of the Puerto Rico Electric Power Authority (PREPA) with the goal

1. Source: Morningstar. Treasuries, if held to maturity, offer a fixed rate of return and a fixed principal value; their interest payments and principal are guaranteed.

2. Source: Goldman Sachs Securities Division, Bloomberg.

See www.franklintempletondatasources.com for additional data provider information.

franklintempleton.com

Annual Report

3

MUNICIPAL BOND MARKET OVERVIEW

of achieving a negotiated, market-based, long-term solution to PREPA’s liquidity and structural issues. On December 23, 2015, a Restructuring Support Agreement was signed. The agreement, which has attained legislative approval, provides for the Ad Hoc Group to exchange its bonds at 85 cents on the dollar into a new “securitization” bond. There are still many details that need to be resolved, and the formulation of the exchange offer and necessary legislation may take several months. However, we believe that implementation of this agreement would allow PREPA to provide reliable and lower cost service, fund its capital needs for the medium term, ensure environmental compliance, diversify power generation resources to include more natural gas and provide jobs.

We believe the PREPA agreement demonstrates how the combination of pursuing our legal rights and engaging in negotiations can achieve positive results, avoiding costly lawsuits or bankruptcy proceedings. The market viewed this agreement as positive, and at period-end, PREPA bonds were priced at about 65 cents on the dollar.

At period-end, we maintained our positive view of the municipal bond market. We believe municipal bonds continue to be an attractive asset class among fixed income securities, and we intend to follow our solid discipline of investing to maximize income while seeking value in the municipal bond market.

The foregoing information reflects our analysis, opinions and portfolio holdings as of February 29, 2016, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, state, industry, security or fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

4 Annual Report

franklintempleton.com

Investment Strategy and Manager’s Discussion

Investment Strategy

We use a consistent, disciplined strategy in an effort to maximize tax-exempt income for our shareholders by seeking to maintain exposure to higher coupon securities while balancing risk and return within each Fund’s range of allowable investments. We generally employ a buy-and-hold approach and invest in securities we believe should provide the most relative value in the market. We do not use leverage or derivatives, nor do we use hedging techniques that could add volatility and contribute to underperformance in adverse markets.

Manager’s Discussion

Based on the combination of our value-oriented philosophy of investing primarily for income and a positive-sloping municipal yield curve, in which yields for longer term bonds are higher than those for shorter term bonds, we favored the use of longer term bonds. Consistent with our strategy, we sought to purchase bonds from 15 to 30 years in maturity with good call features. We believe our conservative, buy-and-hold investment strategy can help us achieve high, current, tax-free income for shareholders.

We invite you to read your Fund report for more detailed performance and portfolio information. Thank you for your participation in Franklin Tax-Free Trust. We look forward to serving your future investment needs.

The foregoing information reflects our analysis, opinions and portfolio holdings as of February 29, 2016, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, state, industry, security or fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

franklintempleton.com

Annual Report

5

Franklin Alabama Tax-Free Income Fund

This annual report for Franklin Alabama Tax-Free Income Fund covers the fiscal year ended February 29, 2016.

Your Fund’s Goal and Main Investments

The Fund seeks to provide as high a level of income exempt from federal and Alabama personal income taxes as is consistent with prudent investment management and preservation of capital by investing at least 80% of its total assets in securities that pay interest free from such taxes.1

| | |

| Credit Quality Breakdown* | | |

| 2/29/16 | | |

| | % of Total | |

| Ratings | Investments | |

| AAA | 3.49 | % |

| AA | 59.74 | % |

| A | 12.78 | % |

| BBB | 2.92 | % |

| Below Investment Grade | 2.29 | % |

| Refunded | 15.82 | % |

| Not Rated | 2.96 | % |

*Securities, except for those labeled Not Rated, are assigned ratings by one or more Nationally Recognized Statistical Credit Rating Organizations (NRSROs), such as Standard & Poor’s, Moody’s and Fitch, that can be considered by the investment manager as part of its independent securities analysis. When ratings from multiple agencies are available, the highest is used, consistent with the portfolio investment process. Ratings reflect an NRSRO’s opinion of an issuer’s creditworthiness and typically range from AAA (highest) to D (lowest). The Below Investment Grade category consists of bonds rated below BBB-. The Refunded category generally consists of refunded bonds secured by U.S. government or other high-quality securities and not rerated by an NRSRO. The Not Rated category consists of ratable securities that have not been rated by an NRSRO. Cash and equivalents are excluded from this breakdown.

Performance Overview

The Fund’s Class A share price, as measured by net asset value, decreased from $11.55 on February 28, 2015, to $11.35 on February 29, 2016. The Fund’s Class A shares paid dividends totaling 42.15 cents per share for the same period.2 The Performance Summary beginning on page 9 shows that at the end of this reporting period the Fund’s Class A shares’ distribution rate was 3.28% based on an annualization of February’s 3.24 cent per share monthly dividend and the maximum offering price of $11.85 on February 29, 2016. An investor in the 2016 maximum combined effective federal and Alabama personal income tax bracket of 46.42% (including 3.8% Medicare tax) would need to earn a distribution rate of 6.12% from a taxable investment to match the Fund’s Class A tax-free distribution rate. For the Fund’s Class C shares’ performance, please see the Performance Summary. Dividend distributions were affected by continued low interest rates during the period. This and other factors resulted in reduced income for the portfolio and caused dividends to be lower at the end of the period.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

State Update

Alabama’s economy grew moderately during the 12 months under review. Amid a global trade slowdown, the state’s calendar year 2015 exports declined slightly from 2014 but remained near record levels, driven by growing overseas shipments of transportation equipment, primary metals and machinery. Business sentiment in the state remained generally better than in the nation as a whole, with firms in many industries expecting improved capital expenditures, hiring and profits. The state’s housing market improved as home prices and new-home permit activity increased. Although most sectors added jobs, Alabama’s unemployment rate rose from 6.0% in February 2015 to 6.2% at period-end, which was higher than the 4.9% national average.3

The state has two major operating funds—the Education Trust Fund (ETF), the main funding source for education programs, and the general fund, the primary funding source for Medicaid and other non-education government programs. The enacted budget for fiscal year 2016, which ends on September 30, was balanced through a combination of revenue enhancements and spending cuts. It reduced the state’s reliance on nonrecurring general fund revenues, permanently transferred state use taxes from the ETF to the general fund, and raised the cigarette tax

1. For investors subject to alternative minimum tax, a small portion of Fund dividends may be taxable. Distributions of capital gains are generally taxable. To avoid imposition of

28% backup withholding on all Fund distributions and redemption proceeds, U.S. investors must be properly certified on Form W-9 and non-U.S. investors on Form W-8BEN.

2. The distribution amount is the sum of the dividend payments to shareholders for the period shown and includes only estimated tax-basis net investment income. All Fund

distributions will vary depending upon current market conditions, and past distributions are not indicative of future trends.

3. Source: Bureau of Labor Statistics.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI).

The SOI begins on page 74.

6 Annual Report

franklintempleton.com

FRANKLIN ALABAMA TAX-FREE INCOME FUND

| | |

| Dividend Distributions* | | |

| 3/1/15–2/29/16 | | |

| | Dividend per Share (cents) |

| Month | Class A | Class C |

| March | 3.59 | 3.03 |

| April | 3.59 | 3.03 |

| May | 3.59 | 3.03 |

| June | 3.55 | 3.03 |

| July | 3.55 | 3.03 |

| August | 3.55 | 3.03 |

| September | 3.55 | 3.04 |

| October | 3.55 | 3.04 |

| November | 3.55 | 3.04 |

| December | 3.55 | 3.05 |

| January | 3.29 | 2.79 |

| February | 3.24 | 2.74 |

| Total | 42.15 | 35.88 |

*The distribution amount is the sum of the dividend payments to shareholders for the period shown and includes only estimated tax-basis net investment income. Assumes shares were purchased and held for the entire accrual period. Since dividends accrue daily, your actual distributions will vary depending on the date you purchased your shares and any account activity. All Fund distributions will vary depending upon current market conditions, and past distributions are not indicative of future trends.

rate. The state also expected to receive a sizable settlement from BP resulting from the Deepwater Horizon oil spill, payable in annual installments over 18 years. As of February, revenues for 2016 fiscal year-to-date rose compared with the same period a year ago, driven partly by solid growth in property, sales and individual income tax collections, as well as a significant increase in cigarette tax collections.

Alabama’s net tax-supported debt was 2.3% of personal income and $824 per capita, compared with the 2.5% and $1,012 national medians.4 Independent credit rating agency Moody’s Investors Service rated Alabama’s general obligation debt Aa1 with a stable outlook.5 The rating reflected Moody’s view of the state’s constitutional and statutory provisions that encourage conservative management practices, history of rebuilding fund balances following economic downturns, and successful efforts to bring manufacturing companies to the state. According to Moody’s, the state’s challenges included depletion of rainy day funds in recent years, lack of certain best financial management practices such as multi-year financial planning, and high poverty and low labor force participation.

The stable outlook reflected Moody’s expectations that the state will manage its finances conservatively, as mandated by its statutory and constitutional provisions.

Portfolio Breakdown

2/29/16

| | |

| | % of Total | |

| | Investments* | |

| Utilities | 23.4 | % |

| Refunded** | 15.8 | % |

| Hospital & Health Care | 11.1 | % |

| General Obligation | 10.7 | % |

| Higher Education | 10.3 | % |

| Tax-Supported | 9.9 | % |

| Other Revenue | 8.8 | % |

| Subject to Government Appropriations | 3.7 | % |

| Corporate-Backed | 2.9 | % |

| Housing | 2.1 | % |

| Transportation | 1.3 | % |

*Does not include cash and cash equivalents.

**Includes all refunded bonds; the percentage may differ from that in the Credit Quality Breakdown.

Manager’s Discussion

We used various investment strategies during the 12 months under review as we sought to maximize tax-free income for shareholders. Please read the Investment Strategy and Manager’s Discussion on page 5 for more information.

The Fund holds a small portion of its assets in Puerto Rico bonds, which experienced price declines over the period. Puerto Rico and its municipal issuers continued to experience significant financial difficulties, which we discussed in the Municipal Bond Market Overview beginning on page 3. The Fund is not required to sell securities that have been downgraded to below investment grade, but it is prohibited from making further purchases of such securities as long as the securities are not rated investment grade by at least one U.S. nationally recognized rating service. Rating actions combined with news related to the commonwealth’s financial position and future financing endeavors caused the Puerto Rico bond market to experience volatility during the reporting period. We continue to closely monitor developments in Puerto Rico;

4. Source: Moody’s Investors Service, State Debt Medians 2015: Total Debt Falls for First Time in Almost 30 Years, 6/24/15.

5. This does not indicate Moody’’s rating of the Fund.

See www.franklintempletondatasources.com for additional data provider information.

franklintempleton.com

Annual Report

7

FRANKLIN ALABAMA TAX-FREE INCOME FUND

however, the municipal bond market’s overall fundamentals, such as general creditworthiness and low default rates, remained stable.

Thank you for your continued participation in Franklin Alabama Tax-Free Income Fund. We believe our conservative, buy-and-hold investment strategy can help us achieve high, current, tax-free income for shareholders.

The foregoing information reflects our analysis, opinions and portfolio holdings as of February 29, 2016, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, state, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

8 Annual Report

franklintempleton.com

FRANKLIN ALABAMA TAX-FREE INCOME FUND

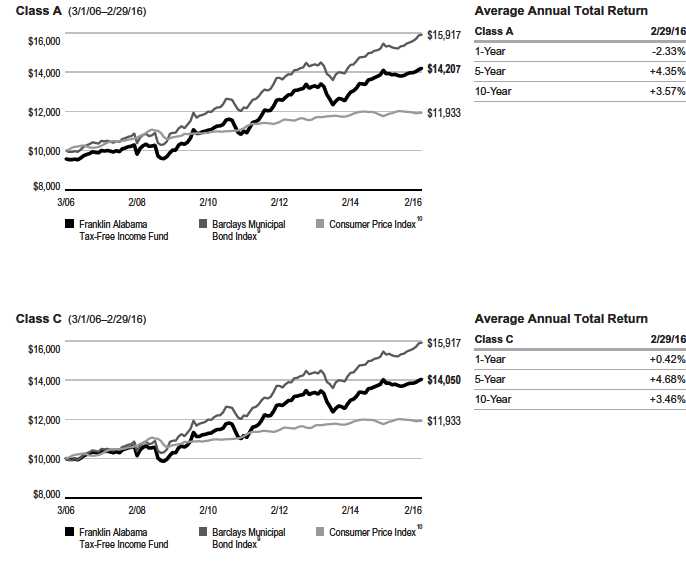

Performance Summary as of February 29, 2016

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities. The performance tables and graphs do not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses.

| | | | | | |

| Net Asset Value | | | | | | |

| Share Class (Symbol) | | 2/29/16 | | 2/28/15 | | Change |

| A (FRALX) | $ | 11.35 | $ | 11.55 | -$ | 0.20 |

| C (FALEX) | $ | 11.49 | $ | 11.69 | -$ | 0.20 |

| |

| Distributions1 (3/1/15–2/29/16) | | | | | | |

| | | Dividend | | | | |

| Share Class | | Income | | | | |

| A | $ | 0.4215 | | | | |

| C | $ | 0.3588 | | | | |

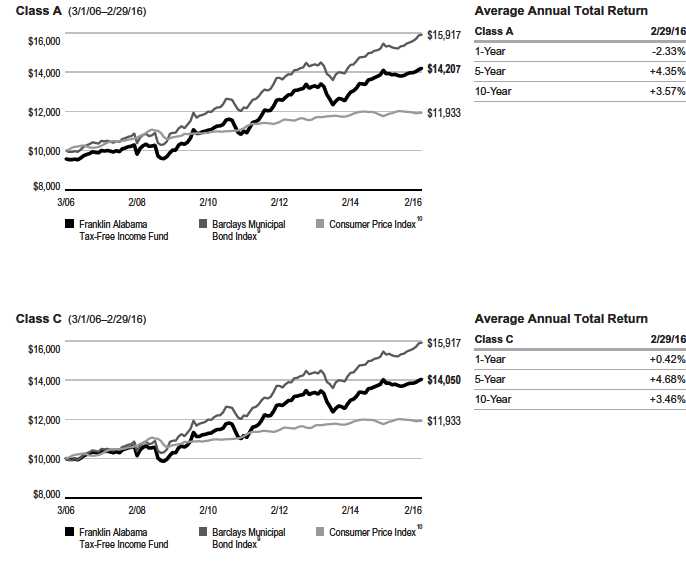

Performance

Cumulative total return excludes sales charges. Average annual total returns include maximum sales charges. Class A: 4.25% maximum initial sales charge; Class C: 1% contingent deferred sales charge in first year only.

| | | | | | | | |

| | Cumulative | | Average Annual | | Average Annual | | Total Annual | |

| Share Class | Total Return2 | | Total Return3 | | Total Return (3/31/16)4 | | Operating Expenses5 | |

| A | | | | | | | 0.72 | % |

| 1-Year | +1.99 | % | -2.33 | % | -2.11 | % | | |

| 5-Year | +29.17 | % | +4.35 | % | +4.57 | % | | |

| 10-Year | +48.38 | % | +3.57 | % | +3.64 | % | | |

| C | | | | | | | 1.27 | % |

| 1-Year | +1.41 | % | +0.42 | % | +0.66 | % | | |

| 5-Year | +25.68 | % | +4.68 | % | +4.91 | % | | |

| 10-Year | +40.50 | % | +3.46 | % | +3.53 | % | | |

| |

| |

| | Distribution | | Taxable Equivalent | | 30 | -Day | Taxable Equivalent 30-Day | |

| Share Class | Rate6 | | Distribution Rate7 | | Standardized Yield8 | | Standardized Yield7 | |

| A | 3.28 | % | 6.12 | % | 1.63 | % | 3.04 | % |

| C | 2.86 | % | 5.34 | % | 1.19 | % | 2.22 | % |

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

See page 11 for Performance Summary footnotes.

franklintempleton.com

Annual Report

9

FRANKLIN ALABAMA TAX-FREE INCOME FUND

PERFORMANCE SUMMARY

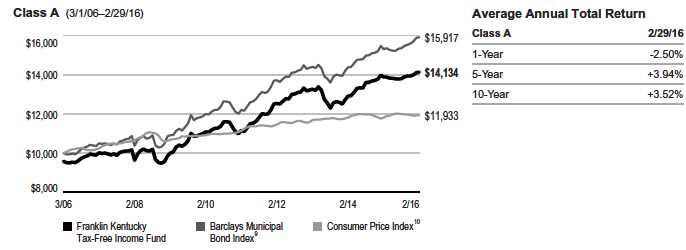

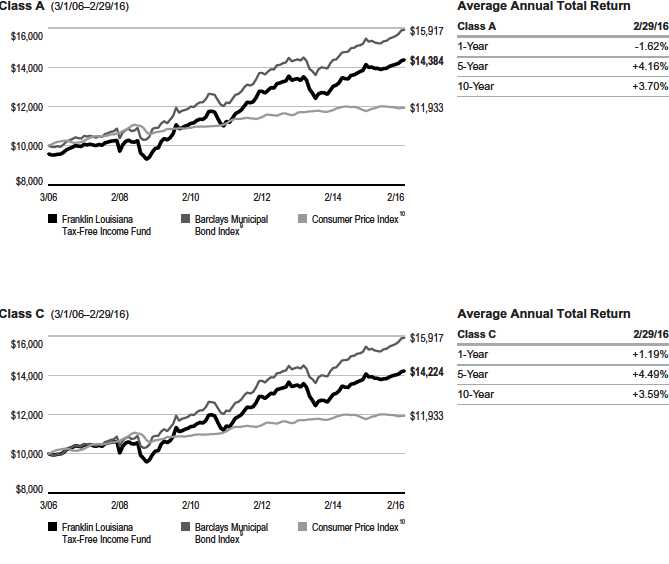

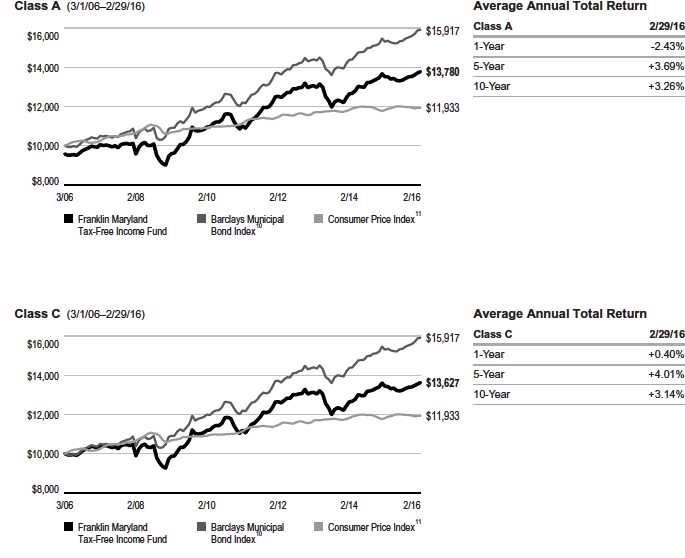

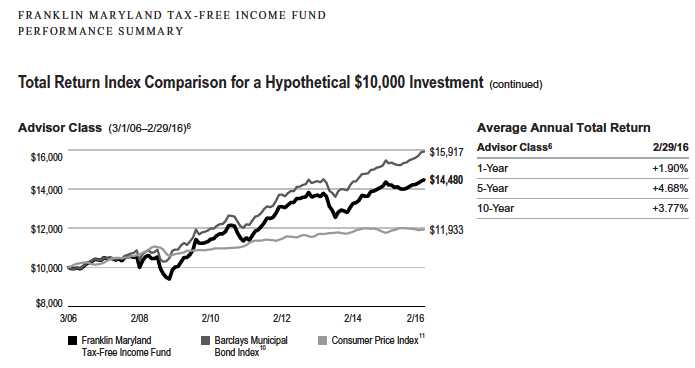

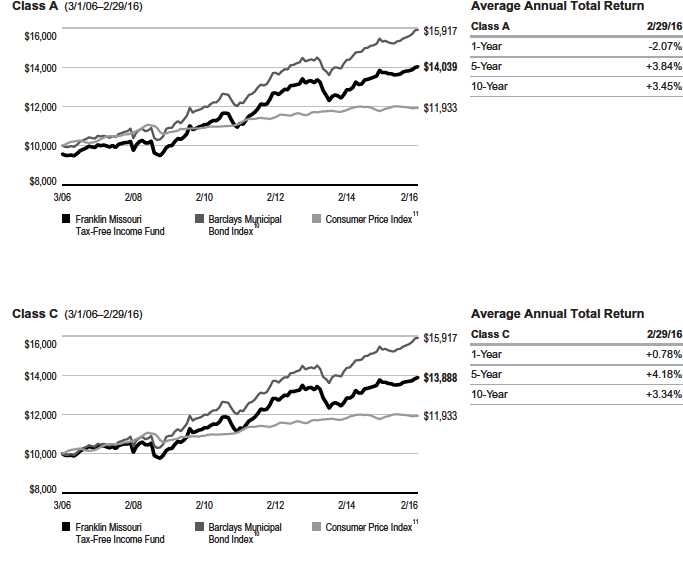

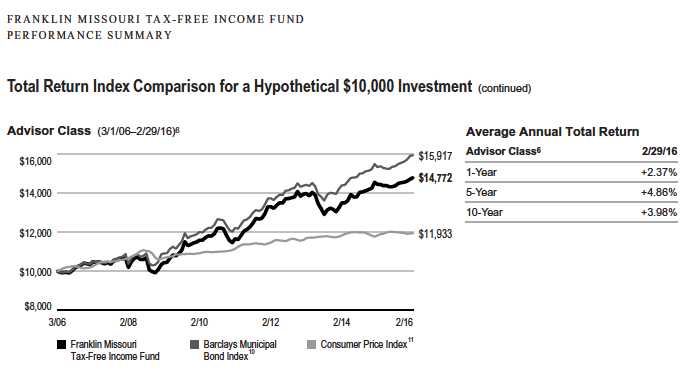

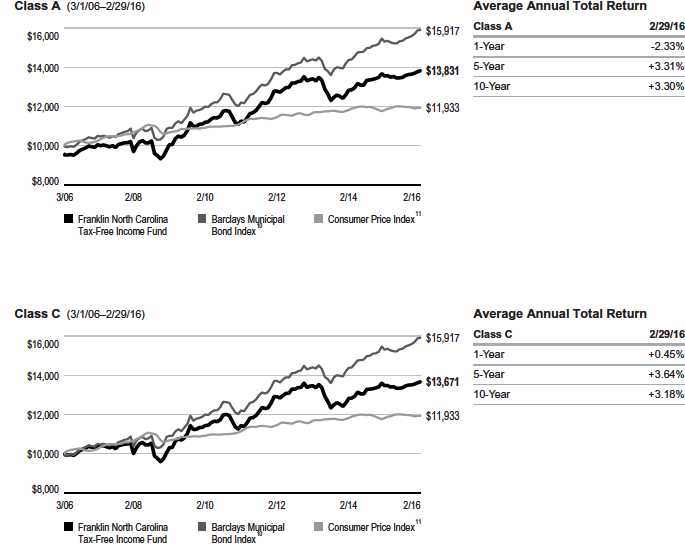

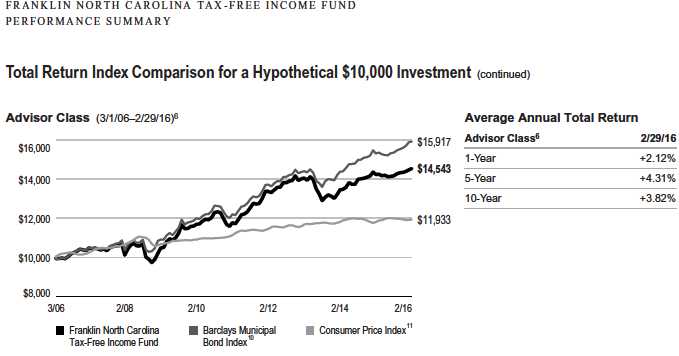

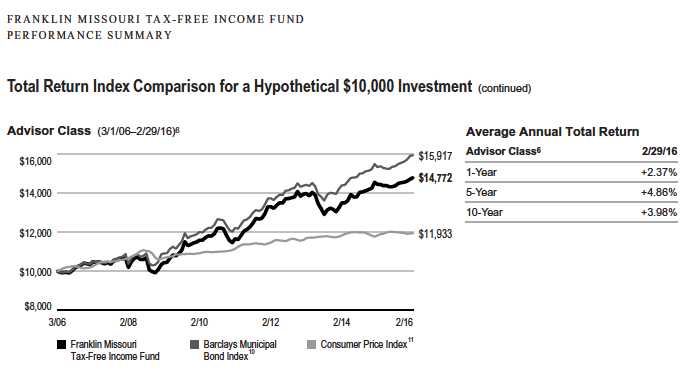

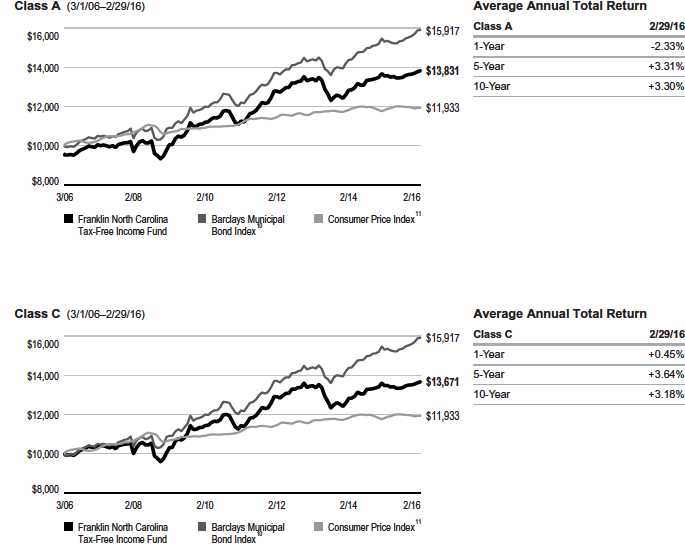

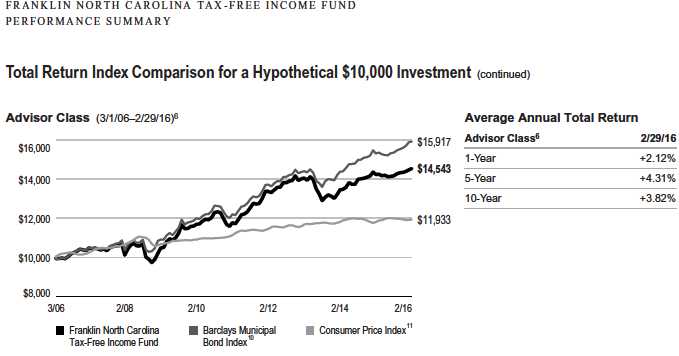

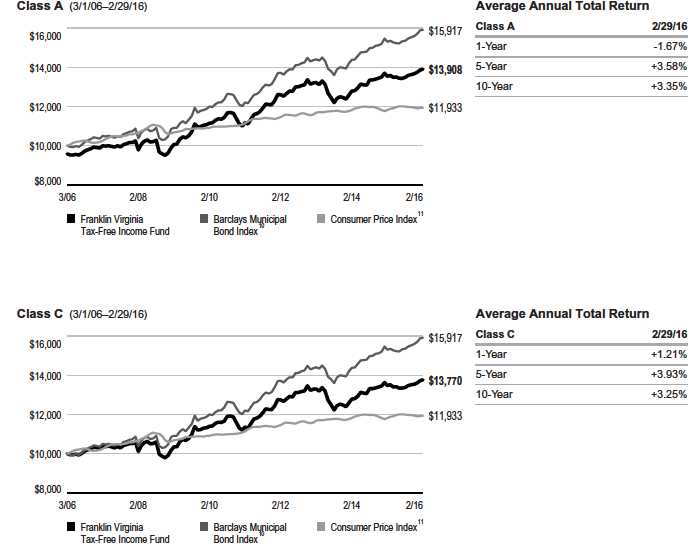

Total Return Index Comparison for a Hypothetical $10,000 Investment

Total return represents the change in value of an investment over the periods shown. It includes any applicable maximum sales charge, Fund expenses, account fees and reinvested distributions. The unmanaged index includes reinvestment of any income or distributions. It differs from the Fund in composition and does not pay management fees or expenses. One cannot invest directly in an index.

See page 11 for Performance Summary footnotes.

10 Annual Report

franklintempleton.com

FRANKLIN ALABAMA TAX-FREE INCOME FUND

PERFORMANCE SUMMARY

All investments involve risks, including possible loss of principal. Because municipal bonds are sensitive to interest rate movements, the Fund’s yield and share price will fluctuate with market conditions. Bond prices generally move in the opposite direction of interest rates. Thus, as prices of bonds in the Fund adjust to a rise in interest rates, the Fund’s share price may decline. Because the Fund invests principally in a single state, it is subject to greater risk of adverse economic and regulatory changes in that state than a geographically diversified fund. The Fund holds a small portion of its assets in Puerto Rico municipal bonds that have been impacted by recent adverse economic and market changes, which may cause the Fund’s share price to decline. Changes in the credit rating of a bond, or in the credit rating or financial strength of a bond’s issuer, insurer or guarantor, may affect the bond’s value. The Fund may invest a significant part of its assets in municipal securities that finance similar types of projects, such as utilities, hospitals, higher education and transportation. A change that affects one project would likely affect all similar projects, thereby increasing market risk. The Fund is actively managed but there is no guarantee that the manager’s investment decisions will produce the desired results. The Fund’s prospectus also includes a description of the main investment risks.

Class C: These shares have higher annual fees and expenses than Class A shares.

1. The distribution amount is the sum of the dividend payments to shareholders for the period shown and includes only estimated tax-basis net investment income.

2. Cumulative total return represents the change in value of an investment over the periods indicated.

3. Average annual total return represents the average annual change in value of an investment over the periods indicated. Return for less than one year, if any, has not been

annualized.

4. In accordance with SEC rules, we provide standardized average annual total return information through the latest calendar quarter.

5. Figures are as stated in the Fund’s current prospectus. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to

become higher than the figures shown.

6. Distribution rate is based on an annualization of the respective class’s February dividend and the maximum offering price (NAV for Class C) per share on 2/29/16.

7. Taxable equivalent distribution rate and yield assume the published rates as of 12/21/15 for the maximum combined effective federal and Alabama personal income tax rate

of 46.42%, based on the federal income tax rate of 39.60% plus 3.8% Medicare tax.

8. The 30-day standardized yield for the month ended 2/29/16 reflects an estimated yield to maturity (assuming all portfolio securities are held to maturity). It should be regarded

as an estimate of the Fund’s rate of investment income, and it may not equal the Fund’s actual income distribution rate (which reflects the Fund’s past dividends paid to

shareholders) or the income reported in the Fund’s financial statements.

9. Source: Morningstar. The Barclays Municipal Bond Index is a market value-weighted index engineered for the long-term tax-exempt bond market. To be included in the index,

bonds must be fixed rate, have at least one year to final maturity and be rated investment grade (Baa3/BBB- or higher) by at least two of the following agencies: Moody’s, S&P

and Fitch.

10. Source: Bureau of Labor Statistics, bls.gov/cpi. The Consumer Price Index is a commonly used measure of the inflation rate.

See www.franklintempletondatasources.com for additional data provider information.

franklintempleton.com

Annual Report

11

FRANKLIN ALABAMA TAX-FREE INCOME FUND

Your Fund’s Expenses

As a Fund shareholder, you can incur two types of costs:

- Transaction costs, including sales charges (loads) on Fund purchases; and

- Ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses.

The following table shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The first line (Actual) for each share class listed in the table provides actual account values and expenses. The “Ending Account Value” is derived from the Fund’s actual return, which includes the effect of Fund expenses.

You can estimate the expenses you paid during the period by following these steps. Of course, your account value and expenses will differ from those in this illustration:

| 1. | Divide your account value by $1,000. |

| | If an account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6. |

| 2. | Multiply the result by the number under the heading “Expenses Paid During Period.” |

| | If Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50. |

In this illustration, the estimated expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Information in the second line (Hypothetical) for each class in the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the actual expense ratio for each class and an assumed 5% annual rate of return before expenses, which does not represent the Fund’s actual return. The figure under the heading “Expenses Paid During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds.

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transaction costs, such as sales charges. Therefore, the second line for each class is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transaction costs were included, your total costs would have been higher. Please refer to the Fund prospectus for additional information on operating expenses.

| | | | | | |

| | | Beginning Account | | Ending Account | | Expenses Paid During |

| Share Class | | Value 9/1/15 | | Value 2/29/16 | | Period* 9/1/15–2/29/16 |

| A | | | | | | |

| Actual | $ | 1,000 | $ | 1,026.60 | $ | 3.63 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,021.28 | $ | 3.62 |

| C | | | | | | |

| Actual | $ | 1,000 | $ | 1,023.60 | $ | 6.39 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,018.55 | $ | 6.37 |

*Expenses are calculated using the most recent six-month expense ratio, annualized for each class (A: 0.72%; C: 1.27%), multiplied by the average account value over the period, multiplied by 182/366 to reflect the one-half year period.

12 Annual Report

franklintempleton.com

Franklin Florida Tax-Free Income Fund

This annual report for Franklin Florida Tax-Free Income Fund covers the fiscal year ended February 29, 2016.

Your Fund’s Goal and Main Investments

The Fund seeks to provide as high a level of income exempt from federal income taxes and any Florida personal income taxes as is consistent with prudent investment management and preservation of capital by investing at least 80% of its total assets in securities that pay interest free from such taxes.1

Credit Quality Breakdown*

2/29/16

| | |

| | % of Total | |

| Ratings | Investments | |

| AAA | 8.09 | % |

| AA | 40.28 | % |

| A | 37.62 | % |

| BBB | 2.20 | % |

| Below Investment Grade | 4.10 | % |

*Securities, except for those labeled Not Rated, are assigned ratings by one or more Nationally Recognized Statistical Credit Rating Organizations (NRSROs), such as Standard & Poor’s, Moody’s and Fitch, that can be considered by the investment manager as part of its independent securities analysis. When ratings from multiple agencies are available, the highest is used, consistent with the portfolio investment process. Ratings reflect an NRSRO’s opinion of an issuer’s creditworthiness and typically range from AAA (highest) to D (lowest). The Below Investment Grade category consists of bonds rated below BBB-. The Refunded category generally consists of refunded bonds secured by U.S. government or other high-quality securities and not rerated by an NRSRO. The Not Rated category consists of ratable securities that have not been rated by an NRSRO. Cash and equivalents are excluded from this breakdown.

Performance Overview

The Fund’s Class A share price, as measured by net asset value, decreased from $11.38 on February 28, 2015, to $11.19 on February 29, 2016. The Fund’s Class A shares paid dividends totaling 44.37 cents per share for the same period.2 The Performance Summary beginning on page 16 shows that at the end of this reporting period the Fund’s Class A shares’ distribution rate was 3.70% based on an annualization of February’s 3.60 cent per share monthly dividend and the maximum offering price of $11.69 on February 29, 2016. An investor in the 2016 maximum federal income tax bracket of 43.40% (including 3.8% Medicare tax) would need to earn a distribution rate of 6.54% from a taxable investment to match the Fund’s Class A tax-free distribution rate. For the Fund’s Class C shares’ performance, please see the Performance Summary. Dividend distributions were affected by continued low interest rates during the period. This and other factors resulted in reduced income for the portfolio and caused dividends to be lower at the end of the period.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

State Update

During the 12 months under review, Florida’s economy continued to grow as state employment, gross state product and population growth exceeded national averages. The state’s employment recovery was broad-based, with nearly all sectors experiencing yearly growth at period-end, notably professional and business services, leisure and hospitality, and education and health services. Additionally, the state’s unemployment rate declined from 5.6% in February 2015 to 4.9% at period-end, which matched the 4.9% national average.3 High population growth also helped strengthen Florida’s economy as the state continued to attract retirees drawn by its favorable climate, relatively affordable housing and lack of a personal income tax. Florida’s housing market also generally improved but foreclosures remained high. The state’s wealth and income levels also lagged those of the nation.

Florida’s net general revenue collections in the first half of fiscal year 2016, which began on July 1, 2015, increased compared with the same period in fiscal year 2015, primarily reflecting higher sales tax collections, which remained the state’s largest revenue source. However, corporate income tax collections came in lower than expected. Due to positive general revenue trends, Florida ended fiscal year 2015 with solid general fund and budget stabilization fund balances. The

1. For investors subject to alternative minimum tax, a small portion of Fund dividends may be taxable. Distributions of capital gains are generally taxable. To avoid imposition of

28% backup withholding on all Fund distributions and redemption proceeds, U.S. investors must be properly certified on Form W-9 and non-U.S. investors on Form W-8BEN.

2. The distribution amount is the sum of the dividend payments to shareholders for the period shown and includes only estimated tax-basis net investment income. All Fund

distributions will vary depending upon current market conditions, and past distributions are not indicative of future trends.

3. Source: Bureau of Labor Statistics.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI).

The SOI begins on page 78.

franklintempleton.com

Annual Report

13

FRANKLIN FLORIDA TAX-FREE INCOME FUND

| | |

| Dividend Distributions* | | |

| 3/1/15–2/29/16 | | |

| | Dividend per Share (cents) |

| Month | Class A | Class C |

| March | 3.86 | 3.34 |

| April | 3.86 | 3.34 |

| May | 3.86 | 3.34 |

| June | 3.86 | 3.36 |

| July | 3.73 | 3.23 |

| August | 3.60 | 3.10 |

| September | 3.60 | 3.09 |

| October | 3.60 | 3.09 |

| November | 3.60 | 3.09 |

| December | 3.60 | 3.07 |

| January | 3.60 | 3.07 |

| February | 3.60 | 3.07 |

| Total | 44.37 | 38.19 |

*The distribution amount is the sum of the dividend payments to shareholders for the period shown and includes only estimated tax-basis net investment income. Assumes shares were purchased and held for the entire accrual period. Since dividends accrue daily, your actual distributions will vary depending on the date you purchased your shares and any account activity. All Fund distributions will vary depending upon current market conditions, and past distributions are not indicative of future trends.

state’s forecasts for fiscal year 2016 and 2017 reflected continued net general revenue growth driven by healthy sales tax collections from motor vehicle purchases, tourism and business investment. The governor’s proposed budget for fiscal year 2017 maintained an even higher level of reserves than in fiscal year 2015.

The state has been focusing on reducing its debt and paying down more debt than it issues. Thus, Florida’s net tax-supported debt was 2.4% of personal income and $973 per capita, slightly lower than the national medians of 2.5% and $1,012.4 Standard & Poor’s (S&P) rated Florida’s general obligation debt AAA with a stable outlook, reflecting the independent credit rating agency’s assessment of the state’s improved economic climate, positive revenue growth, structurally balanced budget, solid reserve levels, moderate debt burden and strong financial management practices.5 Some challenges that Florida faces include a heavy dependence on economically sensitive sales taxes and a vulnerability to downturns from tourism and in-migration trends that are strongly tied to the national economy.

| | |

| Portfolio Breakdown | | |

| 2/29/16 | | |

| | % of Total | |

| | Investments* | |

| Utilities | 21.7 | % |

| Transportation | 18.9 | % |

| Refunded** | 16.9 | % |

| Hospital & Health Care | 15.7 | % |

| Tax-Supported | 8.1 | % |

| General Obligation | 7.8 | % |

| Subject to Government Appropriations | 4.7 | % |

| Higher Education | 3.9 | % |

| Other Revenue | 2.2 | % |

| Housing | 0.1 | % |

*Does not include cash and cash equivalents.

**Includes all refunded bonds; the percentage may differ from that in the Credit Quality Breakdown.

Manager’s Discussion

We used various investment strategies during the 12 months under review as we sought to maximize tax-free income for shareholders. Please read the Investment Strategy and Manager’s Discussion on page 5 for more information.

The Fund holds a small portion of its assets in Puerto Rico bonds, which experienced price declines over the period. Puerto Rico and its municipal issuers continued to experience significant financial difficulties, which we discussed in the Municipal Bond Market Overview beginning on page 3. The Fund is not required to sell securities that have been downgraded to below investment grade, but it is prohibited from making further purchases of such securities as long as the securities are not rated investment grade by at least one U.S. nationally recognized rating service. Rating actions combined with news related to the commonwealth’s financial position and future financing endeavors caused the Puerto Rico bond market to experience volatility during the reporting period. We continue to closely monitor developments in Puerto Rico; however, the municipal bond market’s overall fundamentals, such as general creditworthiness and low default rates, remained stable.

4. Source: Moody’s Investors Service, State Debt Medians 2015: Total Debt Falls for First Time in Almost 30 Years, 6/24/15.

5. This does not indicate S&P’s rating of the Fund.

See www.franklintempletondatasources.com for additional data provider information.

14 Annual Report

franklintempleton.com

FRANKLIN FLORIDA TAX-FREE INCOME FUND

Thank you for your continued participation in Franklin Florida Tax-Free Income Fund. We believe our conservative, buy-and-hold investment strategy can help us achieve high, current, tax-free income for shareholders.

The foregoing information reflects our analysis, opinions and portfolio holdings as of February 29, 2016, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, state, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

franklintempleton.com

Annual Report

15

FRANKLIN FLORIDA TAX-FREE INCOME FUND

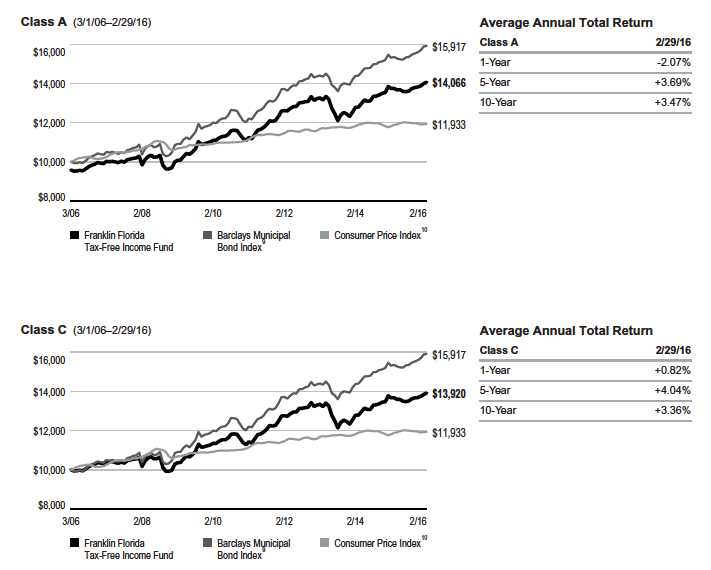

Performance Summary as of February 29, 2016

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities. The performance tables and graphs do not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses.

| | | | | | |

| Net Asset Value | | | | | | |

| Share Class (Symbol) | | 2/29/16 | | 2/28/15 | | Change |

| A (FRFLX) | $ | 11.19 | $ | 11.38 | -$ | 0.19 |

| C (FRFIX) | $ | 11.41 | $ | 11.59 | -$ | 0.18 |

| |

| Distributions1 (3/1/15–2/29/16) | | | | | | |

| | | Dividend | | | | |

| Share Class | | Income | | | | |

| A | $ | 0.4437 | | | | |

| C | $ | 0.3819 | | | | |

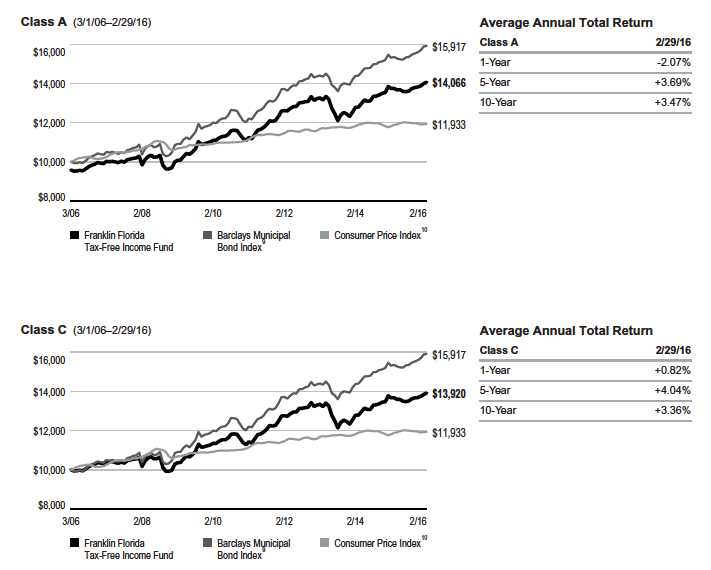

Performance

Cumulative total return excludes sales charges. Average annual total returns include maximum sales charges. Class A: 4.25% maximum initial sales charge; Class C: 1% contingent deferred sales charge in first year only.

| | | | | | | | |

| | Cumulative | | Average Annual | | Average Annual | | Total Annual | |

| Share Class | Total Return2 | | Total Return3 | | Total Return (3/31/16)4 | | Operating Expenses5 | |

| A | | | | | | | 0.64 | % |

| 1-Year | +2.32 | % | -2.07 | % | -1.76 | % | | |

| 5-Year | +25.17 | % | +3.69 | % | +3.85 | % | | |

| 10-Year | +46.91 | % | +3.47 | % | +3.56 | % | | |

| C | | | | | | | 1.19 | % |

| 1-Year | +1.81 | % | +0.82 | % | +0.98 | % | | |

| 5-Year | +21.87 | % | +4.04 | % | +4.18 | % | | |

| 10-Year | +39.20 | % | +3.36 | % | +3.45 | % | | |

| |

| |

| | Distribution | | Taxable Equivalent | | 30 | -Day | Taxable Equivalent 30-Day | |

| Share Class | Rate6 | | Distribution Rate7 | | Standardized Yield8 | | Standardized Yield7 | |

| A | 3.70 | % | 6.54 | % | 1.63 | % | 2.88 | % |

| C | 3.23 | % | 5.71 | % | 1.19 | % | 2.10 | % |

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

See page 18 for Performance Summary footnotes.

16 Annual Report

franklintempleton.com

FRANKLIN FLORIDA TAX-FREE INCOME FUND

PERFORMANCE SUMMARY

Total Return Index Comparison for a Hypothetical $10,000 Investment

Total return represents the change in value of an investment over the periods shown. It includes any applicable maximum sales charge, Fund expenses, account fees and reinvested distributions. The unmanaged index includes reinvestment of any income or distributions. It differs from the Fund in composition and does not pay management fees or expenses. One cannot invest directly in an index.

See page 18 for Performance Summary footnotes.

franklintempleton.com

Annual Report

17

FRANKLIN FLORIDA TAX-FREE INCOME FUND

PERFORMANCE SUMMARY

All investments involve risks, including possible loss of principal. Because municipal bonds are sensitive to interest rate movements, the Fund’s yield and share price will fluctuate with market conditions. Bond prices generally move in the opposite direction of interest rates. Thus, as prices of bonds in the Fund adjust to a rise in interest rates, the Fund’s share price may decline. Because the Fund invests principally in a single state, it is subject to greater risk of adverse economic and regulatory changes in that state than a geographically diversified fund. The Fund holds a small portion of its assets in Puerto Rico municipal bonds that have been impacted by recent adverse economic and market changes, which may cause the Fund’s share price to decline. Changes in the credit rating of a bond, or in the credit rating or financial strength of a bond’s issuer, insurer or guarantor, may affect the bond’s value. The Fund may invest a significant part of its assets in municipal securities that finance similar types of projects, such as utilities, hospitals, higher education and transportation. A change that affects one project would likely affect all similar projects, thereby increasing market risk. The Fund is actively managed but there is no guarantee that the manager’s investment decisions will produce the desired results. The Fund’s prospectus also includes a description of the main investment risks.

Class C: These shares have higher annual fees and expenses than Class A shares.

1. The distribution amount is the sum of the dividend payments to shareholders for the period shown and includes only estimated tax-basis net investment income.

2. Cumulative total return represents the change in value of an investment over the periods indicated.

3. Average annual total return represents the average annual change in value of an investment over the periods indicated. Return for less than one year, if any, has not been

annualized.

4. In accordance with SEC rules, we provide standardized average annual total return information through the latest calendar quarter.

5. Figures are as stated in the Fund’s current prospectus. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to

become higher than the figures shown.

6. Distribution rate is based on an annualization of the respective class’s February dividend and the maximum offering price (NAV for Class C) per share on 2/29/16.

7. Taxable equivalent distribution rate and yield assume the 2016 maximum federal income tax rate of 39.60% plus 3.8% Medicare tax.

8. The 30-day standardized yield for the month ended 2/29/16 reflects an estimated yield to maturity (assuming all portfolio securities are held to maturity). It should be regarded

as an estimate of the Fund’s rate of investment income, and it may not equal the Fund’s actual income distribution rate (which reflects the Fund’s past dividends paid to

shareholders) or the income reported in the Fund’s financial statements.

9. Source: Morningstar. The Barclays Municipal Bond Index is a market value-weighted index engineered for the long-term tax-exempt bond market. To be included in the index,

bonds must be fixed rate, have at least one year to final maturity and be rated investment grade (Baa3/BBB- or higher) by at least two of the following agencies: Moody’s, S&P

and Fitch.

10. Source: Bureau of Labor Statistics, bls.gov/cpi. The Consumer Price Index is a commonly used measure of the inflation rate.

See www.franklintempletondatasources.com for additional data provider information.

18 Annual Report

franklintempleton.com

FRANKLIN FLORIDA TAX-FREE INCOME FUND

Your Fund’s Expenses

As a Fund shareholder, you can incur two types of costs:

- Transaction costs, including sales charges (loads) on Fund purchases; and

- Ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses.

The following table shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The first line (Actual) for each share class listed in the table provides actual account values and expenses. The “Ending Account Value” is derived from the Fund’s actual return, which includes the effect of Fund expenses.

You can estimate the expenses you paid during the period by following these steps. Of course, your account value and expenses will differ from those in this illustration:

| 1. | Divide your account value by $1,000. |

| | If an account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6. |

| 2. | Multiply the result by the number under the heading “Expenses Paid During Period.” |

| | If Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50. |

In this illustration, the estimated expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Information in the second line (Hypothetical) for each class in the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the actual expense ratio for each class and an assumed 5% annual rate of return before expenses, which does not represent the Fund’s actual return. The figure under the heading “Expenses Paid During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds.

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transaction costs, such as sales charges. Therefore, the second line for each class is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transaction costs were included, your total costs would have been higher. Please refer to the Fund prospectus for additional information on operating expenses.

| | | | | | |

| | | Beginning Account | | Ending Account | | Expenses Paid During |

| Share Class | | Value 9/1/15 | | Value 2/29/16 | | Period* 9/1/15–2/29/16 |

| A | | | | | | |

| Actual | $ | 1,000 | $ | 1,033.40 | $ | 3.34 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,021.58 | $ | 3.32 |

| C | | | | | | |

| Actual | $ | 1,000 | $ | 1,029.90 | $ | 6.11 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,018.85 | $ | 6.07 |

*Expenses are calculated using the most recent six-month expense ratio, annualized for each class (A: 0.66%; C: 1.21%), multiplied by the average account value over the period, multiplied by 182/366 to reflect the one-half year period.

franklintempleton.com

Annual Report

19

Franklin Georgia Tax-Free Income Fund

This annual report for Franklin Georgia Tax-Free Income Fund covers the fiscal year ended February 29, 2016.

Your Fund’s Goal and Main Investments

The Fund seeks to provide as high a level of income exempt from federal and Georgia personal income taxes as is consistent with prudent investment management and preservation of capital by investing at least 80% of its total assets in securities that pay interest free from such taxes.1

Credit Quality Breakdown*

2/29/16

| | |

| | % of Total | |

| Ratings | Investments | |

| AAA | 6.19 | % |

| AA | 58.43 | % |

| A | 16.74 | % |

| Below Investment Grade | 3.14 | % |

| Refunded | 14.57 | % |

| Not Rated | 0.93 | % |

*Securities, except for those labeled Not Rated, are assigned ratings by one or more Nationally Recognized Statistical Credit Rating Organizations (NRSROs), such as Standard & Poor’s, Moody’s and Fitch, that can be considered by the investment manager as part of its independent securities analysis. When ratings from multiple agencies are available, the highest is used, consistent with the portfolio investment process. Ratings reflect an NRSRO’s opinion of an issuer’s creditworthiness and typically range from AAA (highest) to D (lowest). The Below Investment Grade category consists of bonds rated below BBB-. The Refunded category generally consists of refunded bonds secured by U.S. government or other high-quality securities and not rerated by an NRSRO. The Not Rated category consists of ratable securities that have not been rated by an NRSRO. Cash and equivalents are excluded from this breakdown.

Performance Overview

The Fund’s Class A share price, as measured by net asset value, decreased from $12.46 on February 28, 2015, to $12.32 on February 29, 2016. The Fund’s Class A shares paid dividends totaling 45.04 cents per share for the same period.2 The Performance Summary beginning on page 23 shows that at the end of this reporting period the Fund’s Class A shares’ distribution rate was 3.47% based on an annualization of February’s 3.72 cent per share monthly dividend and the

maximum offering price of $12.87 on February 29, 2016. An investor in the 2016 maximum combined effective federal and Georgia personal income tax bracket of 47.02% (including 3.8% Medicare tax) would need to earn a distribution rate of 6.55% from a taxable investment to match the Fund’s Class A tax-free distribution rate. For the Fund’s Class C shares’ performance, please see the Performance Summary.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

State Update

Georgia’s economy continued to grow during the 12 months under review, aided by strong employment growth that outpaced the national average. Despite a contraction in the country’s manufacturing sector, the state’s manufacturing sector continued to expand, resulting largely from growth in production and new orders, and contributing to employment growth. Most of the state’s other sectors added jobs, notably the professional and business services sector and the leisure and hospitality sector. The state’s unemployment rate fell from 6.2% in February 2015 to 5.4% at period-end, which was higher than the 4.9% national average.3 Georgia’s housing market continued to recover as home prices rose and foreclosure rates trended lower to prerecession levels.

The state’s enacted budget for fiscal year 2016, which started in July 2015, was based on projections of continued revenue growth, particularly in income and sales taxes. Although the fiscal year 2016 budget was larger than the amended 2015 budget, excluding a midyear adjustment, the overall spending increase was lower than the projected revenue growth. K-12 education accounted for the bulk of the spending increase. The budget also included greater spending for human services and transportation, as well as full funding of pension system contributions. In January, the governor released proposals for the amended fiscal year 2016 budget and the fiscal year 2017 budget. The budget proposals focused on providing resources for education, transportation, public safety, health care,

1. For investors subject to alternative minimum tax, a small portion of Fund dividends may be taxable. Distributions of capital gains are generally taxable. To avoid imposition of

28% backup withholding on all Fund distributions and redemption proceeds, U.S. investors must be properly certified on Form W-9 and non-U.S. investors on Form W-8BEN.

2. The distribution amount is the sum of the dividend payments to shareholders for the period shown and includes only estimated tax-basis net investment income. All Fund

distributions will vary depending upon current market conditions, and past distributions are not indicative of future trends.

3. Source: Bureau of Labor Statistics.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI).

The SOI begins on page 84.

20 Annual Report

franklintempleton.com

FRANKLIN GEORGIA TAX-FREE INCOME FUND

| | |

| Dividend Distributions* | | |

| 3/1/15–2/29/16 | | |

| | Dividend per Share (cents) |

| Month | Class A | Class C |

| March | 3.72 | 3.12 |

| April | 3.72 | 3.12 |

| May | 3.72 | 3.12 |

| June | 3.77 | 3.20 |

| July | 3.77 | 3.20 |

| August | 3.77 | 3.20 |

| September | 3.77 | 3.22 |

| October | 3.77 | 3.22 |

| November | 3.77 | 3.22 |

| December | 3.77 | 3.21 |

| January | 3.77 | 3.21 |

| February | 3.72 | 3.16 |

| Total | 45.04 | 38.20 |

*The distribution amount is the sum of the dividend payments to shareholders for the period shown and includes only estimated tax-basis net investment income. Assumes shares were purchased and held for the entire accrual period. Since dividends accrue daily, your actual distributions will vary depending on the date you purchased your shares and any account activity. All Fund distributions will vary depending upon current market conditions, and past distributions are not indicative of future trends.

economic development and government efficiency. Key highlights for fiscal year 2017 included salary increases for teachers and state employees as well as new state general and motor fuel funds for transportation.

Georgia’s net tax-supported debt was 2.8% of personal income and $1,043 per capita, compared with the 2.5% and $1,012 national medians.4 Standard & Poor’s (S&P) rated Georgia’s general obligation debt AAA with a stable outlook, reflecting the independent credit rating agency’s view of the state’s recovering and well-diversified economy, strong financial monitoring and oversight, a history of maintaining fiscal balance through spending cuts, a depleted but gradually growing revenue shortfall reserve, and moderate debt with rapid amortization.5 The stable outlook reflected S&P’s view of Georgia’s budget management and adjustments to an uncertain economic environment. Furthermore, S&P expected Georgia’s economy to continue to strengthen and experience above-average employment growth relative to the nation.

| | |

| Portfolio Breakdown | | |

| 2/29/16 | | |

| | % of Total | |

| | Investments* | |

| Refunded** | 22.0 | % |

| Utilities | 20.4 | % |

| Hospital & Health Care | 16.1 | % |

| Subject to Government Appropriations | 14.4 | % |

| Higher Education | 8.7 | % |

| Tax-Supported | 6.3 | % |

| Transportation | 5.3 | % |

| General Obligation | 4.9 | % |

| Housing | 1.4 | % |

| Other Revenue | 0.5 | % |

*Does not include cash and cash equivalents.

**Includes all refunded bonds; the percentage may differ from that in the Credit Quality Breakdown.

Manager’s Discussion

We used various investment strategies during the 12 months under review as we sought to maximize tax-free income for shareholders. Please read the Investment Strategy and Manager’s Discussion on page 5 for more information.

The Fund holds a small portion of its assets in Puerto Rico bonds, which experienced price declines over the period. Puerto Rico and its municipal issuers continued to experience significant financial difficulties, which we discussed in the Municipal Bond Market Overview beginning on page 3. The Fund is not required to sell securities that have been downgraded to below investment grade, but it is prohibited from making further purchases of such securities as long as the securities are not rated investment grade by at least one U.S. nationally recognized rating service. Rating actions combined with news related to the commonwealth’s financial position and future financing endeavors caused the Puerto Rico bond market to experience volatility during the reporting period. We continue to closely monitor developments in Puerto Rico; however, the municipal bond market’s overall fundamentals, such as general creditworthiness and low default rates, remained stable.

4. Source: Moody’s Investors Service, State Debt Medians 2015: Total Debt Falls for First Time in Almost 30 Years, 6/24/15.

5. This does not indicate S&P’s rating of the Fund.

See www.franklintempletondatasources.com for additional data provider information.

franklintempleton.com

Annual Report

21

FRANKLIN GEORGIA TAX-FREE INCOME FUND

Thank you for your continued participation in Franklin Georgia Tax-Free Income Fund. We believe our conservative, buy-and-hold investment strategy can help us achieve high, current, tax-free income for shareholders.

The foregoing information reflects our analysis, opinions and portfolio holdings as of February 29, 2016, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, state, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

22 Annual Report

franklintempleton.com

FRANKLIN GEORGIA TAX-FREE INCOME FUND

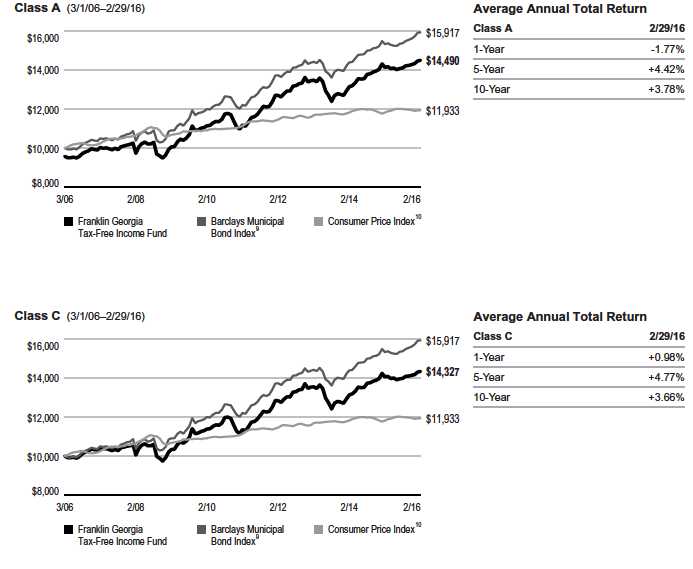

Performance Summary as of February 29, 2016

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities. The performance tables and graphs do not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses.

| | | | | | |

| Net Asset Value | | | | | | |

| Share Class (Symbol) | | 2/29/16 | | 2/28/15 | | Change |

| A (FTGAX) | $ | 12.32 | $ | 12.46 | -$ | 0.14 |

| C (FGAIX) | $ | 12.49 | $ | 12.63 | -$ | 0.14 |

| |

| Distributions1 (3/1/15–2/29/16) | | | | | | |

| | | Dividend | | | | |

| Share Class | | Income | | | | |

| A | $ | 0.4504 | | | | |

| C | $ | 0.3820 | | | | |

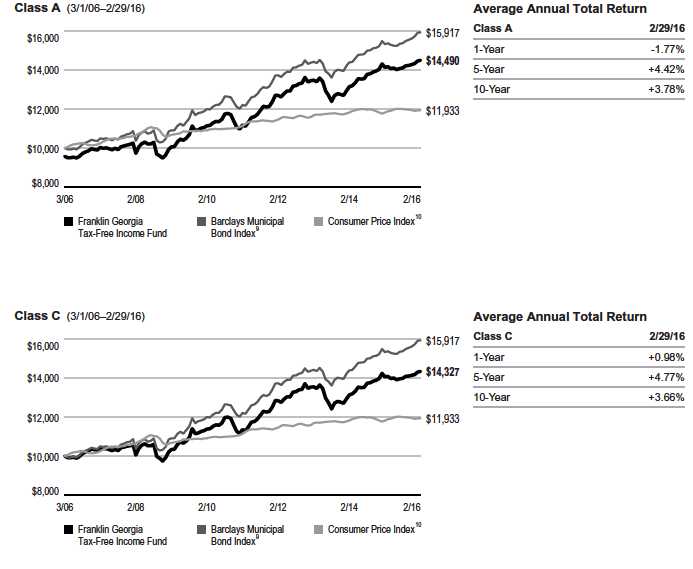

Performance

Cumulative total return excludes sales charges. Average annual total returns include maximum sales charges. Class A: 4.25% maximum initial sales charge; Class C: 1% contingent deferred sales charge in first year only.

| | | | | | | | |

| | Cumulative | | Average Annual | | Average Annual | | Total Annual | |

| Share Class | Total Return2 | | Total Return3 | | Total Return (3/31/16)4 | | Operating Expenses5 | |

| A | | | | | | | 0.67 | % |

| 1-Year | +2.56 | % | -1.77 | % | -1.69 | % | | |

| 5-Year | +29.69 | % | +4.42 | % | +4.60 | % | | |

| 10-Year | +51.35 | % | +3.78 | % | +3.89 | % | | |

| C | | | | | | | 1.22 | % |

| 1-Year | +1.97 | % | +0.98 | % | +1.07 | % | | |

| 5-Year | +26.21 | % | +4.77 | % | +4.93 | % | | |

| 10-Year | +43.27 | % | +3.66 | % | +3.77 | % | | |

| |

| |

| | Distribution | | Taxable Equivalent | | 30 | -Day | Taxable Equivalent 30-Day | |

| Share Class | Rate6 | | Distribution Rate7 | | Standardized Yield8 | | Standardized Yield7 | |

| A | 3.47 | % | 6.55 | % | 1.48 | % | 2.79 | % |

| C | 3.04 | % | 5.74 | % | 1.02 | % | 1.93 | % |

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

See page 25 for Performance Summary footnotes.

franklintempleton.com

Annual Report

23

FRANKLIN GEORGIA TAX-FREE INCOME FUND

PERFORMANCE SUMMARY

Total Return Index Comparison for a Hypothetical $10,000 Investment

Total return represents the change in value of an investment over the periods shown. It includes any applicable maximum sales charge, Fund expenses, account fees and reinvested distributions. The unmanaged index includes reinvestment of any income or distributions. It differs from the Fund in composition and does not pay management fees or expenses. One cannot invest directly in an index.

See page 25 for Performance Summary footnotes.

24 Annual Report

franklintempleton.com

FRANKLIN GEORGIA TAX-FREE INCOME FUND

PERFORMANCE SUMMARY

All investments involve risks, including possible loss of principal. Because municipal bonds are sensitive to interest rate movements, the Fund’s yield and share price will fluctuate with market conditions. Bond prices generally move in the opposite direction of interest rates. Thus, as prices of bonds in the Fund adjust to a rise in interest rates, the Fund’s share price may decline. Because the Fund invests principally in a single state, it is subject to greater risk of adverse economic and regulatory changes in that state than a geographically diversified fund. The Fund holds a small portion of its assets in Puerto Rico municipal bonds that have been impacted by recent adverse economic and market changes, which may cause the Fund’s share price to decline. Changes in the credit rating of a bond, or in the credit rating or financial strength of a bond’s issuer, insurer or guarantor, may affect the bond’s value. The Fund may invest a significant part of its assets in municipal securities that finance similar types of projects, such as utilities, hospitals, higher education and transportation. A change that affects one project would likely affect all similar projects, thereby increasing market risk. The Fund is actively managed but there is no guarantee that the manager’s investment decisions will produce the desired results. The Fund’s prospectus also includes a description of the main investment risks.

Class C: These shares have higher annual fees and expenses than Class A shares.

1. The distribution amount is the sum of the dividend payments to shareholders for the period shown and includes only estimated tax-basis net investment income.

2. Cumulative total return represents the change in value of an investment over the periods indicated.

3. Average annual total return represents the average annual change in value of an investment over the periods indicated. Return for less than one year, if any, has not been

annualized.

4. In accordance with SEC rules, we provide standardized average annual total return information through the latest calendar quarter.

5. Figures are as stated in the Fund’s current prospectus. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to

become higher than the figures shown.

6. Distribution rate is based on an annualization of the respective class’s February dividend and the maximum offering price (NAV for Class C) per share on 2/29/16.

7. Taxable equivalent distribution rate and yield assume the published rates as of 12/21/15 for the maximum combined effective federal and Georgia personal income tax rate of

47.02%, based on the federal income tax rate of 39.60% plus 3.8% Medicare tax.

8. The 30-day standardized yield for the month ended 2/29/16 reflects an estimated yield to maturity (assuming all portfolio securities are held to maturity). It should be regarded

as an estimate of the Fund’s rate of investment income, and it may not equal the Fund’s actual income distribution rate (which reflects the Fund’s past dividends paid to

shareholders) or the income reported in the Fund’s financial statements.

9. Source: Morningstar. The Barclays Municipal Bond Index is a market value-weighted index engineered for the long-term tax-exempt bond market. To be included in the index,

bonds must be fixed rate, have at least one year to final maturity and be rated investment grade (Baa3/BBB- or higher) by at least two of the following agencies: Moody’s, S&P

and Fitch.

10. Source: Bureau of Labor Statistics, bls.gov/cpi. The Consumer Price Index is a commonly used measure of the inflation rate.

See www.franklintempletondatasources.com for additional data provider information.

franklintempleton.com

Annual Report

25

FRANKLIN GEORGIA TAX-FREE INCOME FUND

Your Fund’s Expenses

As a Fund shareholder, you can incur two types of costs:

- Transaction costs, including sales charges (loads) on Fund purchases; and

- Ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses.

The following table shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The first line (Actual) for each share class listed in the table provides actual account values and expenses. The “Ending Account Value” is derived from the Fund’s actual return, which includes the effect of Fund expenses.

You can estimate the expenses you paid during the period by following these steps. Of course, your account value and expenses will differ from those in this illustration:

| 1. | Divide your account value by $1,000. |

| | If an account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6. |

| 2. | Multiply the result by the number under the heading “Expenses Paid During Period.” |

| | If Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50. |

In this illustration, the estimated expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Information in the second line (Hypothetical) for each class in the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the actual expense ratio for each class and an assumed 5% annual rate of return before expenses, which does not represent the Fund’s actual return. The figure under the heading “Expenses Paid During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds.

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transaction costs, such as sales charges. Therefore, the second line for each class is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transaction costs were included, your total costs would have been higher. Please refer to the Fund prospectus for additional information on operating expenses.

| | | | | | |

| | | Beginning Account | | Ending Account | | Expenses Paid During |

| Share Class | | Value 9/1/15 | | Value 2/29/16 | | Period* 9/1/15–2/29/16 |

| A | | | | | | |

| Actual | $ | 1,000 | $ | 1,027.70 | $ | 3.38 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,021.53 | $ | 3.37 |

| C | | | | | | |

| Actual | $ | 1,000 | $ | 1,025.40 | $ | 6.14 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,018.80 | $ | 6.12 |

*Expenses are calculated using the most recent six-month expense ratio, annualized for each class (A: 0.67%; C: 1.22%), multiplied by the average account value over the period, multiplied by 182/366 to reflect the one-half year period.

26 Annual Report

franklintempleton.com

Franklin Kentucky Tax-Free Income Fund

This annual report for Franklin Kentucky Tax-Free Income Fund covers the fiscal year ended February 29, 2016.

Your Fund’s Goal and Main Investments

The Fund seeks to provide as high a level of income exempt from federal and Kentucky personal income taxes as is consistent with prudent investment management and preservation of capital by investing at least 80% of its total assets in securities that pay interest free from such taxes.1

Credit Quality Breakdown*

2/29/16

| | |

| | % of Total | |

| Ratings | Investments | |

| AAA | 6.81 | % |

| AA | 42.77 | % |

| A | 31.90 | % |

| BBB | 5.79 | % |

| Below Investment Grade | 1.21 | % |

| Refunded | 11.52 | % |

*Securities, except for those labeled Not Rated, are assigned ratings by one or more Nationally Recognized Statistical Credit Rating Organizations (NRSROs), such as Standard & Poor’s, Moody’s and Fitch, that can be considered by the investment manager as part of its independent securities analysis. When ratings from multiple agencies are available, the highest is used, consistent with the portfolio investment process. Ratings reflect an NRSRO’s opinion of an issuer’s creditworthiness and typically range from AAA (highest) to D (lowest). The Below Investment Grade category consists of bonds rated below BBB-. The Refunded category generally consists of refunded bonds secured by U.S. government or other high-quality securities and not rerated by an NRSRO. The Not Rated category consists of ratable securities that have not been rated by an NRSRO. Cash and equivalents are excluded from this breakdown.

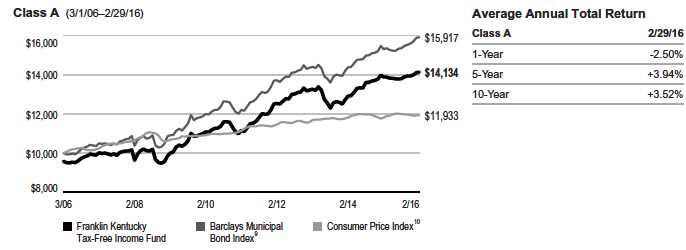

Performance Overview