UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-04163

| T. Rowe Price Tax-Free High Yield Fund, Inc. |

|

| (Exact name of registrant as specified in charter) |

| |

| 100 East Pratt Street, Baltimore, MD 21202 |

|

| (Address of principal executive offices) |

| |

| David Oestreicher |

| 100 East Pratt Street, Baltimore, MD 21202 |

|

| (Name and address of agent for service) |

Registrant’s telephone number, including area code: (410) 345-2000

Date of fiscal year end: February 28

Date of reporting period: August 31, 2021

Item 1. Reports to Shareholders

(a) Report pursuant to Rule 30e-1.

| Tax-Free High Yield Fund | August 31, 2021 |

| PRFHX | Investor Class |

| PATFX | Advisor Class |

| PTYIX | I Class |

| T. ROWE PRICE TAX-FREE FUNDS |

|

HIGHLIGHTS

| ■ | Strong demand for tax-advantaged securities helped fuel positive returns for the broad municipal bond market over the six months ended August 31, 2021. In the tax-exempt money market, yields remained very low due to the Federal Reserve’s highly accommodative monetary policy and other technical factors. |

| | |

| ■ | T. Rowe Price’s Tax-Free Funds produced positive returns and generally delivered favorable results compared with their respective benchmarks and peer group averages. |

| | |

| ■ | Our near-term outlook on the general obligation (GO) sector, supported in large part by substantial federal aid to states and municipalities, became more constructive. However, we maintained underweight positions in the sector due to our concerns about longer-term pension-related risks. |

| | |

| ■ | With the coronavirus pandemic continuing, we are closely monitoring the delta variant’s impacts, which we believe are likely to skew the short-term economic trajectories of some sectors. Overall, however, we expect market fundamentals to remain solid. |

Log in to your account at troweprice.com for more information.

*Certain mutual fund accounts that are assessed an annual account service fee can also save money by switching to e-delivery.

CIO Market Commentary

Dear Shareholder

Most stock and bond indexes produced positive results during the first half of your fund’s fiscal year, the six-month period ended August 31, 2021. Despite concerns about elevated inflation and the spread of coronavirus variants, markets were supported by strong corporate earnings, additional fiscal stimulus, and the continuation of accommodative monetary policy.

Equity markets faced relatively few speed bumps during the period, and most major benchmarks continued the strong recovery they recorded in the second half of 2020. The large-cap S&P 500 Index returned nearly 20% (including dividends) and reached multiple record highs over the six months, with double-digit gains in all sectors except for energy, which was hampered by falling oil prices late in the period. Strong quarterly earnings reports appeared to factor prominently in the market’s advance. According to FactSet, overall profits for the S&P 500 rose nearly 90% in the second quarter versus the year before, the best showing in over a decade, with roughly 87% of firms topping analyst expectations.

Meanwhile, fixed income investors faced a more volatile landscape. A sell-off in Treasuries that had begun in January continued through March, sending longer-term yields to their highest levels since January 2020. However, investors began rotating back into Treasuries in April, and the yield of the benchmark 10-year Treasury note finished the period at 1.30%, down from 1.44% at the end of February.

In the falling yield environment, most bond sectors produced positive returns over the six-month period. Corporate debt performed well, supported by strong corporate earnings and demand for higher-yielding securities. Municipal bonds also delivered solid results during the period, as demand for tax-free income remained strong and state and local governments benefited from an influx of federal cash and stronger-than-expected tax revenues.

Besides strong corporate earnings, investor sentiment was also buoyed by plans for increased fiscal spending. President Joe Biden signed the $1.9 trillion American Rescue Plan Act into law in March, and in August the Senate passed a roughly $1 trillion bipartisan infrastructure package. Monetary policy remained very accommodative, but investors were increasingly focused on when the Federal Reserve would begin tapering the bond-buying program put in place at the outset of the pandemic.

Inflation readings were elevated, with the consumer price index increasing 5.4% for the 12 months through July. While the surge in prices pressured fixed income markets earlier in the year, most investors seemed to agree with Fed officials that higher inflation was a transitory issue that would ease as supply chains recovered from pandemic-related disruptions.

Other economic news was more ambiguous during the period, as some strong reports came in below expectations or showed declines from the beginning of the recovery. But these misses rarely dented investor sentiment. Coronavirus developments were also mixed. The rollout of vaccines and declining case numbers led many to believe that the pandemic was largely finished as the summer began. Unfortunately, the spread of the highly contagious delta variant soon led to an increase in hospitalizations and deaths, and some businesses were feeling the impact as office reopenings and an expected rebound in business travel were again pushed back.

As we look ahead, valuations are elevated in nearly all asset classes, and the path of the pandemic, questions about monetary policy, and the pace of the economic recovery create the possibility for volatility in financial markets. It is not an easy environment to invest in, but our investment teams remain rooted in company and bond issuer fundamentals and focused on the long term, and they will continue to apply strong fundamental analysis as they seek out the best investments for your portfolio.

Thank you for your continued confidence in T. Rowe Price.

Sincerely,

Robert Sharps

Group Chief Investment Officer

Management’s Discussion of Fund Performance

TAX-EXEMPT MONEY FUND

INVESTMENT OBJECTIVE

The fund seeks to provide preservation of capital, liquidity, and, consistent with these objectives, the highest current income exempt from federal income taxes.

FUND COMMENTARY

How did the fund perform in the past six months?

The Tax-Exempt Money Fund returned 0.01% for the six months ended August 31, 2021, and performed in line with the Lipper Tax-Exempt Money Market Funds Index. (I Class shares of the fund also returned 0.01%. Past performance cannot guarantee future results.)

What factors influenced the fund’s performance?

Highly accommodative monetary policy from the Federal Reserve (Fed) and other technical factors kept municipal money market yields at ultralow levels, thereby limiting the fund’s return potential. Tax-exempt money funds industrywide experienced net outflows during the period. However, municipal bond funds received a record-setting pace of inflows that boosted demand for municipal issues, including those with the shortest maturities. Alongside robust demand, direct federal aid to many issuers lessened their near-term borrowing needs and helped limit the available supply of short-term tax-exempt securities.

After ticking slightly higher early in the reporting period, yields on seven-day municipal securities traded around 0.02% by the end of August 2021, down from 0.03% six months earlier. One-year municipal rates declined to 0.08% from 0.12% since our last report.

How is the fund positioned?

Variable rate demand notes (VRDNs) with maturities of one to seven days remained the fund’s largest allocation. As of the period-end, VRDNs totaled 58% of the fund’s net assets, which represented a slight increase since the start of the period. We believe that our positioning in VRDNs provides us with the flexibility to respond to a potential shift in the Fed’s monetary policy outlook or changes in supply and demand dynamics, such as an uptick in tax-exempt issuance or a reversal of cash flows.

The fund’s weighted average maturity (WAM) lengthened modestly over the past six months as we sought to appropriately balance our variable rate holdings with investments in longer-dated fixed rate notes and bonds as well as commercial paper with maturities out to 90 days. The fund’s WAM, which increased from 36 days to 40 days over the period, concluded August 31, 2021, longer than that of the benchmark.

Consistent with the fund’s objective, we continued to rely on our fundamental credit research process when selecting individual securities. Within the revenue-backed health care space, which remained the fund’s largest sector allocation, we added holdings of California Health Facilities Financing Authority securities issued for Stanford Hospital. (Please refer to the portfolio of investments for a complete list of holdings and the amount each represents in the portfolio.)

The fund’s allocation to the revenue-backed housing sector increased modestly over the period. Notable purchases within this segment included variable rate securities issued by the New York City Housing Development Corporation and the Alaska Housing Finance Corporation.

Following approval by the shareholders of each fund, T. Rowe Price’s California and New York Tax-Free Money Funds were reorganized into the Tax-Exempt Money Fund. We believe that offering a single fund with the Tax-Exempt Money Fund investment program to a wide variety of investors will allow shareholders to take advantage of potential economies of scale and reduce inefficiencies.

What is portfolio management’s outlook?

With yields remaining suppressed by Fed policy, we continue to closely monitor the central bank’s messaging for signs of a potential acceleration in its path to policy tightening. We are also evaluating incoming inflation data as lingering price pressures could force the Fed to raise interest rates sooner than market participants currently anticipate.

As a result of these factors, we are pursuing a strategy that will allow the fund to quickly respond to a change in interest rate sentiment, an increase in issuance, or changing patterns of cash flows into or out of the municipal money market. We believe the fund’s positioning in VRDNs and commercial paper is appropriate in this environment.

As always, we remain committed to managing a high-quality, diversified portfolio focused on liquidity and stability of principal, which we deem of utmost importance to our shareholders.

TAX-FREE SHORT-INTERMEDIATE FUND

INVESTMENT OBJECTIVE

The fund seeks to provide, consistent with modest price fluctuation, a high level of income exempt from federal income taxes by investing primarily in short- and intermediate-term investment-grade municipal securities.

FUND COMMENTARY

How did the fund perform in the past six months?

The Tax-Free Short-Intermediate Fund returned 0.80% for the six months ended August 31, 2021. The fund underperformed its benchmark, the Bloomberg 1–5 Year Blend (1–6 Year Maturity) Index, and its Lipper peer group average. (Results for Advisor and I Class shares varied, reflecting their different fee structures. Past performance cannot guarantee future results.)

What factors influenced the fund’s performance?

U.S. fiscal policy loomed large over the municipal bond market, contributing to positive fundamental and technical dynamics during the period. Alongside economic growth, direct federal aid to many issuers limited their near-term borrowing needs and eased investors’ concerns about credit conditions. Additionally, proposals to raise taxes on corporations and some individuals underpinned surging demand for tax-free securities. However, with high-grade municipal bond yields at or near record lows, investor appetite for extra yield led to strong outperformance for lesser quality bonds.

In this environment, yield curve management weighed on the fund’s results versus the benchmark. Given low yields and elevated concerns among investors regarding inflation and Federal Reserve policy, we remained mindful of the potential for rates to climb. Accordingly, we kept the fund’s duration—a key measure of its interest rate sensitivity—modestly shorter than the benchmark’s duration. This positioning hindered relative performance, however, as municipal bond yields broadly declined—aided by a rally in Treasuries amid growing worries over the delta variant of the coronavirus.

Individual security selections in the revenue sector added value, partly reflecting renewed economic activity amid rising vaccination rates. Our selections of hospital revenue bonds contributed to relative returns, as did our investments in special tax revenue bonds—particularly those from COFINA, which are backed by Puerto Rico’s sales tax receipts, and convention centers. (Please refer to the portfolio of investments for a complete list of holdings and the amount each represents in the portfolio.)

Strategic sector allocations benefited performance. The fund’s underweight allocation to prerefunded issues and overweight to the typically higher-yielding revenue-backed sector contributed to relative returns. Positioning within the revenue sector further supported results, largely due to an underweight to the more defensively oriented water and sewer subsector.

How is the fund positioned?

The fund’s weighted average credit quality was unchanged over the period. Continuing to lean heavily on our bottom-up credit research, we modestly increased our exposure to BBB rated bonds based on relative value opportunities and our view that credit conditions would be supported by the economic recovery, fiscal stimulus, and accommodative monetary policy.

As the period progressed, intense demand for additional yield drove credit spreads—the yield differences between higher- and lower-quality bonds of similar maturities—to historically tight levels, leading us to grow more cautious on some lower-rated areas of the market. We paired our investments in lower-quality segments with selections of high-grade bonds, particularly those rated AA or A. These rating categories composed the fund’s two largest allocations as of August 31, as shown in the Credit Quality Diversification chart. We also maintained a small position in non-investment-grade debt (BB and below), intended to enhance the fund’s yield profile, as well as a modest allocation to unrated issues.

Effective July 1, 2021, the fund’s maximum limit on non-investment-grade holdings as a percentage of net assets increased to 10% from 5%. Through this adjustment, we now have greater flexibility to pursue higher yields if we believe that a larger allocation to below investment-grade debt is appropriate for the fund.

As always, we strove to maintain a disciplined approach toward yield curve management. Seeking to preserve the fund’s maturity diversification and mitigate its exposure to interest rate risk, we aimed to balance opportunities to earn higher yields in intermediate- to long-term bonds with investments in shorter-dated issues. Relatedly, we kept the fund’s duration, which decreased to 2.3 years from 2.4 years over the past six months, in a close range of the benchmark’s duration. At the end of the period, the fund’s duration position represented a modestly shorter, more defensive posture relative to the benchmark, reflecting our view that a possible acceleration in the Federal Reserve’s path to policy tightening could lead to upward pressure on short- and intermediate-term municipal yields.

There were no major adjustments in the fund’s sector allocations. We upheld structural overweight positions in the revenue-backed transportation and health care subsectors, which we continued to prefer over general obligation (GO) debt. At the same time, our near-term outlook on the GO sector grew somewhat more constructive during the period. This was partly due to the substantial funding that state and local governments received through the American Rescue Plan Act, which resulted in meaningful budget relief for fiscally challenged obligors. To that end, we increased our exposure to short-and intermediate-maturity GOs from the State of New Jersey and the State of Illinois, both of which were upgraded by credit rating agencies near the end of the period.

Over a longer investment horizon, however, we remain cautious on these issuers and many others in the GO sector due to their immense, unfunded pension and other post-employment benefit liabilities. Namely, we believe that these liabilities constitute a long-term budget risk that has yet to be fully priced in by market participants. As a result, we kept the fund’s GO holdings concentrated in states and locales with above-average economic growth and more manageable pension funding levels. Balancing our tactical investments in lower-grade GOs, we increased our holdings of higher-quality GOs from the State of California.

Within our preferred areas of the market, we were active buyers of transportation revenue bonds, especially those issued for major toll roads and large-hub airports. Our conviction in toll roads is rooted in the monopolistic nature of the industry, strong federal and state government support for managed lane projects, and the resiliency of toll usage through the pandemic compared with public transit alternatives. Favoring toll projects based in growing metropolitan areas, we increased our holdings of Central Texas Regional Mobility Authority and North Texas Tollway Authority revenue bonds.

We also felt that the rapid distribution of coronavirus vaccines would support fundamentals for airport issuers, which outperformed amid a meaningful rebound in domestic travel volume. Notable purchases within this segment included revenue bonds issued on behalf of Philadelphia International Airport. While concerns about coronavirus variants have raised uncertainty about travel volume in the coming years, we believe that the fiscal health of many large-hub airports is cushioned by their critical role in the national economy, as well as their solid cash levels, large debt service reserve funds, and federal stimulus.

What is portfolio management’s outlook?

The technical tailwind that has powered the tax-exempt market over the past year remains firmly intact, with steady cash flows into municipal bond portfolios boosting demand broadly. Market fundamentals are also constructive, strengthened in 2021 by substantial federal aid for states and localities, rapid vaccine distribution, and economic growth. This highly favorable backdrop has helped push yields and credit spreads toward record lows, leading to a shortage of attractively valued bonds, in our view.

While seasonal supply trends could be less beneficial for the market in the coming months, we see potential for municipal bond prices to stay elevated, supported by accommodative monetary policy as well as proposed tax increases that could prolong strong demand for tax-advantaged securities.

We believe the current market dynamics underscore the need for rigorous credit research. Despite stretched valuations in most segments, we see select pockets of relative value owing to idiosyncratic factors. At the same time, we are closely monitoring the delta variant’s impacts, which are likely to skew the short-term economic trajectories of some revenue-backed sectors. Additionally, we maintain longer-term concerns about pension-related risks connected with many GO debt issuers.

Overall, however, we expect the municipal asset class to remain high quality, with low defaults and high recovery rates relative to other areas of fixed income. Ultimately, we will remain disciplined in our fundamental, bottom-up approach, which we believe will continue to serve our shareholders well.

TAX-FREE INCOME FUND

INVESTMENT OBJECTIVE

The fund seeks to provide a high level of income exempt from federal income taxes by investing primarily in long-term investment-grade municipal securities.

FUND COMMENTARY

How did the fund perform in the past six months?

The Tax-Free Income Fund returned 3.60% for the six months ended August 31, 2021, and outperformed its benchmark, the Bloomberg Municipal Bond Index, which gained 2.51%. The fund also outpaced its Lipper peer group average, which advanced 3.06%. (Results for Advisor and I Class shares varied, reflecting their different fee structures. Past performance cannot guarantee future results.)

What factors influenced the fund’s performance?

U.S. fiscal policy loomed large over the municipal bond market, contributing to positive fundamental and technical dynamics during the period. Alongside economic growth, direct federal aid to many issuers limited their near-term borrowing needs and eased investors’ concerns about credit conditions. Additionally, proposals to raise taxes on corporations and some individuals underpinned surging demand for tax-free securities. However, with high-grade municipal bond yields at or near record lows, investor appetite for extra yield led to strong outperformance for lesser quality bonds.

In this environment, credit selection in the revenue sector buoyed the fund’s relative performance. Our selections of hospital and transportation revenue bonds contributed to excess returns, partly reflecting renewed economic activity amid rising vaccination rates. Credit selection in the special tax subsector also added value—especially our investments in COFINA, whose bonds are backed by Puerto Rico’s sales tax receipts, and convention centers. (Please refer to the portfolio of investments for a complete list of holdings and the amount each represents in the portfolio.)

Yield curve management advanced relative returns. The fund’s duration—a key measure of its interest rate sensitivity—was, on average, modestly longer than the benchmark’s duration. This positioning contributed to performance as municipal bond yields decreased. Overweight exposures to the 20- and 30-year portions of the yield curve, where rates declined most meaningfully, further supported returns.

Sector allocations also contributed to relative performance. The fund’s structural underweight to general obligation (GO) bonds and overweight to revenue-backed debt assisted results, as did positioning within the revenue sector. Namely, the fund’s overweight to hospital revenue bonds and underweight to the more defensively oriented water and sewer subsector aided performance. However, its overweight to the industrial revenue/pollution control revenue subsector and underweight to the special tax subsector slightly dulled relative returns.

How is the fund positioned?

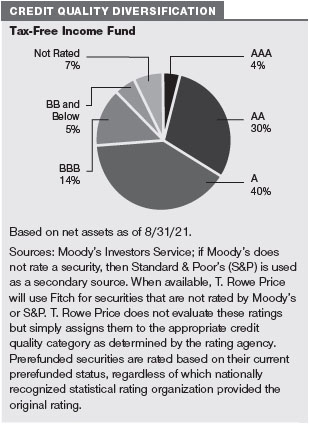

The fund’s weighted average credit quality was unchanged over the period. As of August 31, 2021, nearly three-fourths of the fund’s net assets were invested in bonds rated A or better, as shown in the Credit Quality Diversification chart.

We also preserved a meaningful allocation to BBB rated bonds and, for additional credit quality diversification and enhanced return potential, a small position in non-investment-grade debt (rated BB or lower). Particularly at the start of the period, we felt that these areas of the market offered attractive opportunities to earn incremental risk-adjusted yield, based on our view that the economic recovery, fiscal stimulus, and accommodative monetary policy would support credit conditions.

Over the ensuing months, intense demand for additional yield drove credit spreads—the yield differences between higher- and lower-quality bonds of similar maturities—to historically tight levels, leading us to grow more cautious on some lower-rated areas of the market.

However, issuer-specific credit factors—rather than wholesale views on rating categories—continued to drive our security selections. Relying heavily on our in-depth research process, we increased our exposure to low-grade Puerto Rico issuers. Specifically, we felt that continued progress in the commonwealth’s debt restructuring, strong external oversight, and federal funding to this U.S. territory would guide a positive credit trajectory for the Puerto Rico bond complex. In turn, we increased our positions in Commonwealth of Puerto Rico GO bonds as well as special tax revenue bonds from COFINA.

There were no major adjustments in the fund’s sector allocations. We upheld sizable positions in the revenue-backed health care and transportation subsectors, which we continued to prefer over GO debt. At the same time, our near-term outlook on the GO sector grew somewhat more constructive during the period. This was partly due to the substantial aid that state and local governments received through the American Rescue Plan Act, which resulted in meaningful budget relief for fiscally challenged obligors.

Over a longer investment horizon, however, we remain cautious on the GO sector due to the immense, unfunded pension and other post-employment benefit liabilities that many state and local governments face. Namely, we believe that these liabilities constitute a long-term budget risk that has yet to be fully priced in by market participants.

Within our preferred areas of the market, we were active buyers of transportation revenue bonds, especially those issued for essential-service projects. Notable purchases during the period included seaport revenue bonds from Miami-Dade County (Florida). We also maintained a favorable outlook on ground transportation issuers as we believed that fiscal relief and the rapid distribution of coronavirus vaccines would add fundamental support to this market segment.

The fund’s duration position was little changed over the past six months. At the end of the period, the fund’s duration was moderately longer than that of the benchmark as we continued to see attractive opportunities to earn incremental risk-adjusted yield in longer maturities. Seeking to preserve the fund’s maturity diversification and mitigate its exposure to interest rate risk, we strove to balance our longer maturity holdings with investments in shorter-dated issues, such as tax and revenue anticipation notes issued by the City of Los Angeles.

What is portfolio management’s outlook?

The technical tailwind that has powered the tax-exempt market over the past year remains firmly intact, with steady cash flows into municipal bond portfolios boosting demand broadly. Market fundamentals are also constructive, strengthened in 2021 by substantial federal aid for states and localities, rapid vaccine distribution, and economic growth. This highly favorable backdrop has helped push yields and credit spreads toward record lows, leading to a shortage of attractively valued bonds, in our view.

While seasonal supply trends could be less beneficial for the market in the coming months, we see potential for municipal bond prices to stay elevated, supported by accommodative monetary policy as well as proposed tax increases that could prolong strong demand for tax-advantaged securities.

We believe the current market dynamics underscore the need for rigorous credit research. Despite stretched valuations in most segments, we see select pockets of relative value owing to idiosyncratic factors. At the same time, we are closely monitoring the delta variant’s impacts, which are likely to skew the short-term economic trajectories of some revenue-backed sectors. Additionally, we maintain longer-term concerns about pension-related risks connected with many GO debt issuers.

Overall, however, we expect the municipal asset class to remain high quality, with low defaults and high recovery rates relative to other areas of fixed income. Ultimately, we will remain disciplined in our fundamental, bottom-up approach, which we believe will continue to serve our shareholders well.

TAX-FREE HIGH YIELD FUND

INVESTMENT OBJECTIVE

The fund seeks to provide a high level of income exempt from federal income taxes by investing primarily in long-term low- to upper-medium-grade municipal securities.

FUND COMMENTARY

How did the fund perform in the past six months?

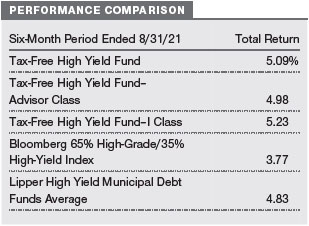

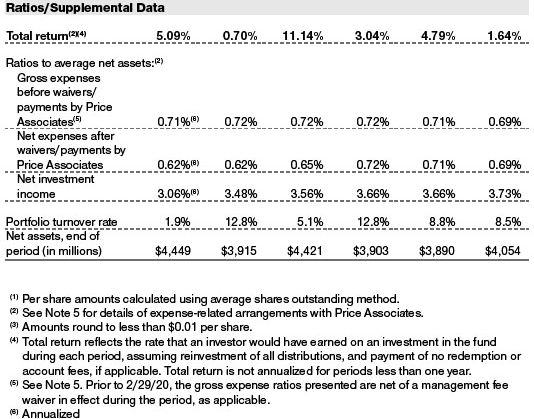

The Tax-Free High Yield Fund gained 5.09% over the six months ended August 31, 2021, outperforming its Bloomberg benchmark and its Lipper peer group average. (Results for Advisor and I Class shares varied, reflecting their different fee structures. Past performance cannot guarantee future results.)

What factors influenced the fund’s performance?

U.S. fiscal policy loomed large over the municipal bond market, contributing to positive fundamental and technical dynamics during the period. Alongside economic growth, direct federal aid to many issuers limited their near-term borrowing needs and eased investors’ concerns about credit conditions. Additionally, proposals to raise taxes on corporations and some individuals underpinned surging demand for tax-free securities. However, with high-grade municipal bond yields at or near record lows, investor appetite for extra yield led to strong outperformance for lesser quality bonds.

In this environment, credit selection in the revenue sector buoyed the fund’s relative outperformance. Our selections of health care revenue bonds meaningfully benefited results, followed by credit selection in the transportation, power, and water and sewer revenue subsectors. However, these contributions were partially offset by negative selections of industrial development revenue/pollution control revenue (IDR/PCR) bonds. In the general obligation (GO) sector, tactical investments in lower-rated bonds—especially those from state issuers—further supported relative returns.

Strategic allocations also contributed to excess returns. Within the revenue sector, overweight exposures to health care and IDR/PCR revenue bonds added value, as did an underweight to the more defensively oriented water and sewer subsector. At the broad sector level, the fund’s underweight to GO debt and overweight to revenue-backed securities aided relative results.

Yield curve management added slight support to relative performance. Overweight exposures to bonds with 20- and 30-year maturities helped results as yields declined most meaningfully in these portions of the curve.

How is the fund positioned?

As always, we strove to maintain a disciplined approach toward yield curve management. In an effort to avoid large bets on interest rate movements, we kept the fund’s duration—a key measure of its interest rate sensitivity—in a relatively close range of the benchmark’s duration position. Since our last report, the fund’s weighted average duration decreased from 4.7 years to 4.5 years, concluding the period with a moderately shorter posture compared with the benchmark.

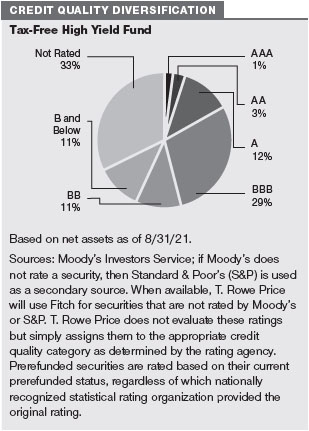

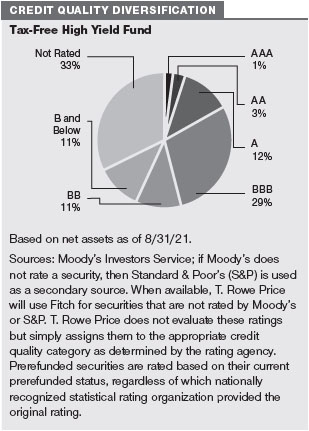

The fund’s weighted average credit quality was unchanged over the past six months. We maintained meaningful positions in the lower range of the investment-grade spectrum—namely, BBB rated bonds and, to a smaller degree, A rated bonds—and below investment-grade credits (BB and B and below).

As shown in the Credit Quality Diversification chart, nonrated bonds composed the fund’s largest allocation at the end of August. Our exposure to nonrated debt increased modestly over the past six months as we continued to lean on our in-depth research process in an attempt to source attractive relative value opportunities in smaller deals and bonds that may be overlooked by investors. Notable purchases within the nonrated segment included housing revenue bonds issued by the California Community Housing Agency for the Serenity at Larkspur and Creekwood multifamily communities. (Please refer to the portfolio of investments for a complete list of holdings and the amount each represents in the portfolio.)

In the context of the fund’s total return orientation, we emphasized a patient investment approach as bond valuations, in our view, stretched beyond what was justified by their underlying fundamentals throughout much of the asset class. As the period progressed, steady demand for higher-yielding bonds pushed credit spreads—the yield differences between higher- and lower-quality bonds of similar maturities—to historically tight levels, reinforcing our disciplined analysis of lower-quality debt.

Issuer-specific credit factors—rather than wholesale views on rating categories—continued to drive our security selections. To that end, we increased the fund’s allocations to several low-grade Puerto Rico issuers, based on our view that continued progress in the commonwealth’s debt restructuring, strong external oversight, and federal funding to the U.S. territory would guide a positive credit trajectory for the Puerto Rico bond complex. Specifically, we added to existing positions in Commonwealth of Puerto Rico GO bonds; Puerto Rico Aqueduct and Sewer Authority (PRASA) revenue bonds; and special tax revenue bonds from COFINA, whose debt is backed by Puerto Rico’s sales tax receipts.

We also felt that near-term technical factors remained positive for tobacco settlement bonds, leading us to increase the fund’s exposure to the Buckeye Tobacco Settlement Financing Authority (Ohio). Despite longer-term headwinds from regulatory pressures and declining cigarette consumption, ultralow interest rates over the past several years have been a boon to tobacco issuers, enabling many of them to effectively refinance their debt and extend bond maturities without impairment. We continue to exercise caution in this area of the market but remain comfortable investing in tobacco bonds that, in our view, derive from fundamentally sound deal structures.

There were no major adjustments in the fund’s sector allocations. We upheld strategic overweight exposures to health care revenue bonds and corporate-backed IDR/PCR revenue bonds. In addition to offering above-average yields, these revenue subsectors are largely insulated from the immense, unfunded pension and other post-employment benefit liabilities that saddle many issuers in the GO sector, where we preserved an underweight allocation.

At the same time, our near-term outlook on the GO sector grew somewhat more constructive during the period, evidenced by a modest increase in the fund’s state GO holdings. This was partly due to the substantial funding that state and local governments received through the American Rescue Plan Act, which resulted in meaningful budget relief for fiscally challenged issuers. Over a longer investment horizon, however, we remain cautious on the GO sector, as we believe that unfunded retirement liabilities constitute a long-term budget risk that has yet to be fully priced in by market participants.

In the health care space, which represented the fund’s largest sector allocation, we continued to like the underlying fundamental conditions of large hospital systems. In most instances, large hospitals have effectively balanced normal operations alongside dedicated care for COVID-19 patients. Together with operational efficiencies, we believe that many of these systems are supported by generally resilient profit margins through the pandemic and strong balance sheets, with ample liquidity to sustain their existing ratings. However, we continue to closely monitor these factors amid the continued spread of the delta variant, which could lead to postponements of elective surgeries and procedures.

We are also carefully evaluating the delta variant’s impacts on life care facilities, many of which have grappled with labor shortages and, relatedly, rising staffing expenses. Still, we continue to believe that demographic trends pose a long-term tailwind for this market segment. As always, bottom-up credit factors will continue to guide our investment decisions in this area of the market, as we see sharp distinctions in the business models, management capabilities, and financial conditions of life care operators.

What is portfolio management’s outlook?

The technical tailwind that has powered the tax-exempt market over the past year remains firmly intact, with steady cash flows into municipal bond portfolios boosting demand broadly. Market fundamentals are also constructive, strengthened in 2021 by substantial federal aid for states and localities, rapid vaccine distribution, and economic growth. This highly favorable backdrop has helped push yields and credit spreads toward record lows, leading to a shortage of attractively valued bonds, in our view.

While seasonal supply trends could be less beneficial for the market in the coming months, we see potential for municipal bond prices to stay elevated, supported by accommodative monetary policy as well as proposed tax increases that could prolong strong demand for tax-advantaged securities.

We believe the current market dynamics underscore the need for rigorous credit research. Despite stretched valuations in most segments, we see select pockets of relative value owing to idiosyncratic factors. At the same time, we are closely monitoring the delta variant’s impacts, which are likely to skew the short-term economic trajectories of some revenue-backed sectors. Additionally, we maintain longer-term concerns about pension-related risks connected with many GO debt issuers.

Overall, however, we expect the municipal asset class to remain high quality, with low defaults and high recovery rates relative to other areas of fixed income. Ultimately, we will remain disciplined in our fundamental, bottom-up approach, which we believe will continue to serve our shareholders well.

INTERMEDIATE TAX-FREE HIGH YIELD FUND

INVESTMENT OBJECTIVE

The fund seeks to provide a high level of income exempt from federal income taxes.

FUND COMMENTARY

How did the fund perform in the past six months?

The Intermediate Tax-Free High Yield Fund returned 4.05% for the six months ended August 31, 2021. The fund outperformed its benchmark, the Bloomberg 65% High-Grade/35% High-Yield Intermediate Competitive (1–17 Year Maturity) Index, but underperformed the Lipper High Yield Municipal Debt Funds Average, which encompasses funds of various maturity and duration constraints. (Results for Advisor and I Class shares varied, reflecting their different fee structures. Past performance cannot guarantee future results.)

What factors influenced the fund’s performance?

U.S. fiscal policy loomed large over the municipal bond market, contributing to positive fundamental and technical dynamics during the period. Alongside economic growth, direct federal aid to many issuers limited their near-term borrowing needs and eased investors’ concerns about credit conditions. Additionally, proposals to raise taxes on corporations and some individuals underpinned surging demand for tax-free securities. However, with high-grade municipal bond yields at or near record lows, investor appetite for extra yield led to strong outperformance for lesser quality bonds.

In this environment, credit selection in the revenue sector buoyed the fund’s performance versus the benchmark. Our selections of health care revenue bonds contributed to relative outperformance, followed by positive selections in the power and special tax revenue subsectors. In the general obligation (GO) sector, tactical investments in lower-rated bonds—especially those from state issuers—further supported relative results.

Strategic allocations also contributed to excess returns. Within the revenue sector, overweight exposures to the typically higher-yielding health care and industrial development revenue/pollution control revenue (IDR/PCR) subsectors benefited relative performance, as did an underweight to the more defensively oriented water and sewer subsector. At the broad sector level, the fund’s underweight to GO debt and overweight to revenue-backed securities added value.

However, yield curve management modestly dulled relative performance. The fund’s duration—a key measure of its interest rate sensitivity—was, on average, shorter than the benchmark’s duration. This positioning weighed on relative returns as municipal yields declined over the period.

How is the fund positioned?

As always, we strove to maintain a disciplined approach toward yield curve management. In an effort to avoid large bets on interest rate movements, we kept the fund’s duration in a close range of the benchmark’s duration. Since our last report, the fund’s weighted average duration decreased from 4.1 years to 3.9 years, concluding the period with a marginally shorter position compared with the benchmark.

The fund’s weighted average credit quality was unchanged over the past six months. As shown in the Credit Quality Diversification chart, BBB rated bonds and nonrated bonds composed the fund’s largest allocations by the period-end, each representing 25% of net assets. Our exposure to nonrated debt increased modestly over the period as we continued to lean on our in-depth research process in an attempt to source attractive opportunities in smaller deals and bonds that may be overlooked by investors.

We also maintained a meaningful allocation to A rated bonds, which decreased modestly since the start of the period. For enhanced return potential and additional credit quality diversification, we kept an allocation to non-investment-grade credits (BB and below), which totaled 27% of the fund’s net assets as of August 31, 2021.

In the context of the fund’s total return orientation, we emphasized a patient investment approach as bond valuations, in our assessment, stretched beyond what was justified by their underlying fundamentals throughout much of the asset class. As the period progressed, steady demand for higher-yielding bonds pushed credit spreads—the yield differences between higher- and lower-quality bonds of similar maturities—to historically tight levels, reinforcing our disciplined analysis of lower-quality debt.

Issuer-specific credit factors—rather than wholesale views on rating categories—continued to drive our security selections. To that end, we increased the fund’s allocations to select low-grade Puerto Rico issuers, based on our view that continued progress in the commonwealth’s debt restructuring, strong external oversight, and federal funding to the U.S. territory would guide a positive credit trajectory for the Puerto Rico bond complex. Namely, we added to existing positions in Commonwealth of Puerto Rico GO bonds and special tax revenue bonds from COFINA, whose debt is backed by Puerto Rico’s sales tax receipts. (Please refer to the portfolio of investments for a complete list of holdings and the amount each represents in the portfolio.)

We also felt that near-term technical factors remained positive for tobacco settlement bonds, leading us to increase the fund’s exposure to the Buckeye Tobacco Settlement Financing Authority (Ohio). Despite longer-term headwinds from regulatory pressures and declining cigarette consumption, ultralow interest rates over the past several years have been a boon to tobacco issuers, enabling many of them to effectively refinance their debt and extend bond maturities without impairment. We continue to exercise caution in this area of the market but remain comfortable investing in tobacco bonds that, in our view, derive from fundamentally sound deal structures.

There were no major adjustments in the fund’s sector allocations. We upheld strategic overweight exposures to health care revenue bonds—both from hospitals and life care communities—and corporate-backed IDR/PCR revenue bonds. In addition to offering above-average yields, these revenue subsectors are largely insulated from the immense, unfunded pension and other post-employment benefit liabilities that saddle many issuers in the GO sector, where we preserved an underweight allocation.

At the same time, our near-term outlook on the GO sector grew somewhat more constructive during the period, evidenced by a small increase in the fund’s state GO holdings. This was partly due to the substantial funding that state and local governments received through the American Rescue Plan Act, which resulted in meaningful budget relief for fiscally challenged issuers. Over a longer investment horizon, however, we remain cautious on the GO sector as we believe that unfunded retirement liabilities constitute a long-term budget risk that has yet to be fully priced in by market participants.

Within our preferred areas of the market, we were active buyers of IDR/PCR bonds, which we believe offer unique diversification benefits to a municipal bond portfolio. Since our previous report, we purchased Indiana State Finance Authority bonds backed by the United States Steel Corporation, as well as New York Transportation Development Corporation bonds guaranteed by American Airlines Group, Inc.

In the health care space, which represented the fund’s largest sector allocation, we continued to like the underlying fundamental conditions of large hospital systems. In most instances, large hospitals have effectively balanced normal operations alongside dedicated care for COVID-19 patients. Together with operational efficiencies, we believe that many of these systems are supported by their generally resilient profit margins through the pandemic and strong balance sheets, with ample liquidity to sustain their existing ratings. However, we continue to closely monitor these factors amid the continued spread of the delta variant, which could lead to postponements of elective surgeries and procedures.

We are also carefully evaluating the delta variant’s impacts on life care facilities, many of which have grappled with labor shortages and, relatedly, rising staffing expenses. Still, we continue to believe that demographic trends pose a long-term tailwind for this market segment. As always, bottom-up credit factors will continue to guide our investment decisions in this area of the market, as we see sharp distinctions in the business models, management capabilities, and financial conditions of life care operators.

What is portfolio management’s outlook?

The technical tailwind that has powered the tax-exempt market over the past year remains firmly intact, with steady cash flows into municipal bond portfolios boosting demand broadly. Market fundamentals are also constructive, strengthened in 2021 by substantial federal aid for states and localities, rapid vaccine distribution, and economic growth. This highly favorable backdrop has helped push yields and credit spreads toward record lows, leading to a shortage of attractively valued bonds, in our view.

While seasonal supply trends could be less beneficial for the market in the coming months, we see potential for municipal bond prices to stay elevated, supported by accommodative monetary policy as well as proposed tax increases that could prolong strong demand for tax-advantaged securities.

We believe the current market dynamics underscore the need for rigorous credit research. Despite stretched valuations in most segments, we see select pockets of relative value owing to idiosyncratic factors. At the same time, we are closely monitoring the delta variant’s impacts, which are likely to skew the short-term economic trajectories of some revenue-backed sectors. Additionally, we maintain longer-term concerns about pension-related risks connected with many GO debt issuers.

Overall, however, we expect the municipal asset class to remain high quality, with low defaults and high recovery rates relative to other areas of fixed income. Ultimately, we will remain disciplined in our fundamental, bottom-up approach, which we believe will continue to serve our shareholders well.

The views expressed reflect the opinions of T. Rowe Price as of the date of this report and are subject to change based on changes in market, economic, or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

RISKS OF INVESTING IN THE TAX-EXEMPT MONEY FUND

You could lose money by investing in the Fund. Although the Fund seeks to preserve the value of your investment at $1.00 per share, it cannot guarantee it will do so. The Fund may impose a fee upon the sale of your shares or may temporarily suspend your ability to sell shares if the Fund’s liquidity falls below required minimums because of market conditions or other factors. An investment in the Fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. The Fund’s sponsor has no legal obligation to provide financial support to the Fund, and you should not expect that the sponsor will provide financial support to the Fund at any time.

RISKS OF INVESTING IN FIXED INCOME SECURITIES

Bonds are subject to interest rate risk (the decline in bond prices that usually accompanies a rise in interest rates) and credit risk (the chance that any fund holding could have its credit rating downgraded or that a bond issuer will default by failing to make timely payments of interest or principal), potentially reducing the fund’s income level and share price. Investments in high yield bonds involve greater risk of price volatility, illiquidity, and default than higher-rated debt securities. Municipal bond funds may be highly impacted by events tied to the overall municipal securities markets, including unfavorable legislative or political developments and adverse changes in the financial conditions of municipal bond issuers and the economy. Some income may be subject to state and local taxes and the federal alternative minimum tax.

BENCHMARK INFORMATION

Note: Bloomberg® and Bloomberg 1–5 Year Blend (1–6 Year Maturity) Index, Bloomberg Municipal Bond Index, Bloomberg 65% High-Grade/35% High-Yield Index, and Bloomberg 65% High-Grade/35% High-Yield Intermediate Competitive (1–17 Year Maturity) Index are service marks of Bloomberg Finance L.P. and its affiliates, including Bloomberg Index Services Limited (“BISL”), the administrator of the index (collectively, “Bloomberg”) and have been licensed for use for certain purposes by T. Rowe Price. Bloomberg is not affiliated with T. Rowe Price, and Bloomberg does not approve, endorse, review, or recommend its products. Bloomberg does not guarantee the timeliness, accurateness, or completeness of any data or information relating to its products.

Note: Lipper, a Thomson Reuters Company, is the source for all Lipper content reflected in these materials. Copyright 2021 © Refinitiv. All rights reserved. Any copying, republication or redistribution of Lipper content is expressly prohibited without the prior written consent of Lipper. Lipper shall not be liable for any errors or delays in the content, or for any actions taken in reliance thereon.

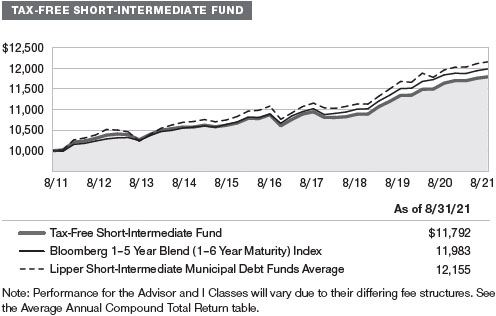

GROWTH OF $10,000

This chart shows the value of a hypothetical $10,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The result is compared with benchmarks, which include a broad-based market index and may also include a peer group average or index. Market indexes do not include expenses, which are deducted from fund returns as well as mutual fund averages and indexes.

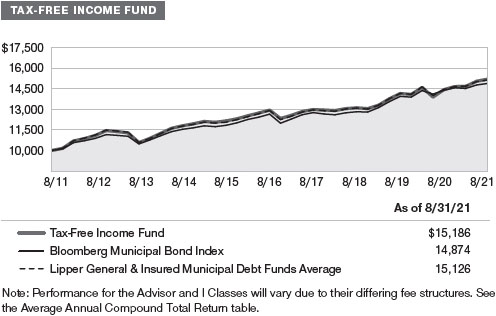

GROWTH OF $10,000

This chart shows the value of a hypothetical $10,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The result is compared with benchmarks, which include a broad-based market index and may also include a peer group average or index. Market indexes do not include expenses, which are deducted from fund returns as well as mutual fund averages and indexes.

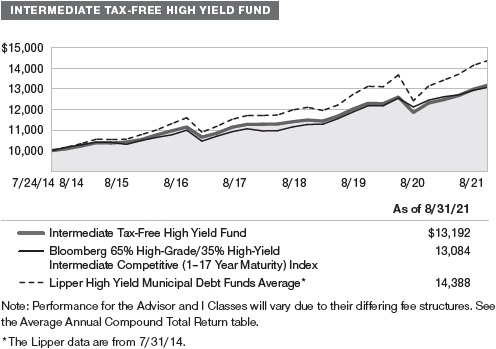

GROWTH OF $10,000

This chart shows the value of a hypothetical $10,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The result is compared with benchmarks, which include a broad-based market index and may also include a peer group average or index. Market indexes do not include expenses, which are deducted from fund returns as well as mutual fund averages and indexes.

GROWTH OF $10,000

This chart shows the value of a hypothetical $10,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The result is compared with benchmarks, which include a broad-based market index and may also include a peer group average or index. Market indexes do not include expenses, which are deducted from fund returns as well as mutual fund averages and indexes.

GROWTH OF $10,000

This chart shows the value of a hypothetical $10,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The result is compared with benchmarks, which include a broad-based market index and may also include a peer group average or index. Market indexes do not include expenses, which are deducted from fund returns as well as mutual fund averages and indexes.

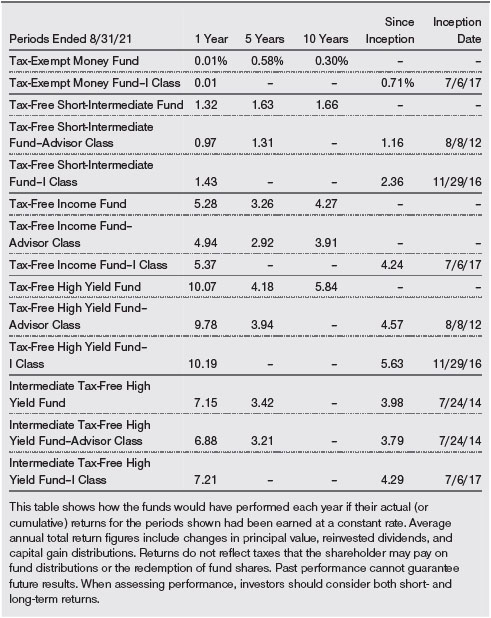

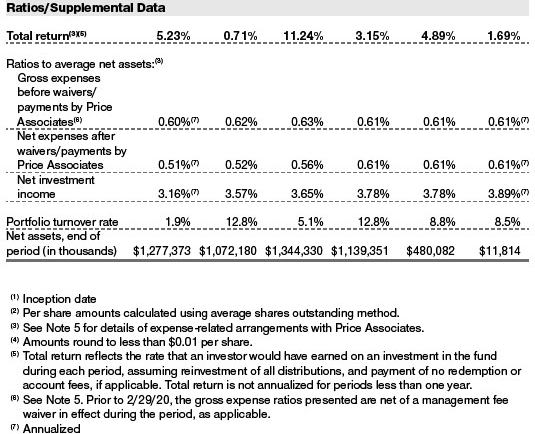

AVERAGE ANNUAL COMPOUND TOTAL RETURN

EXPENSE RATIOS

FUND EXPENSE EXAMPLE

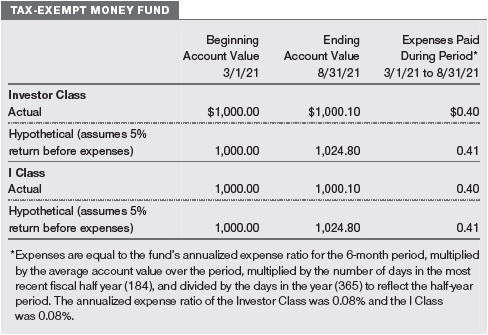

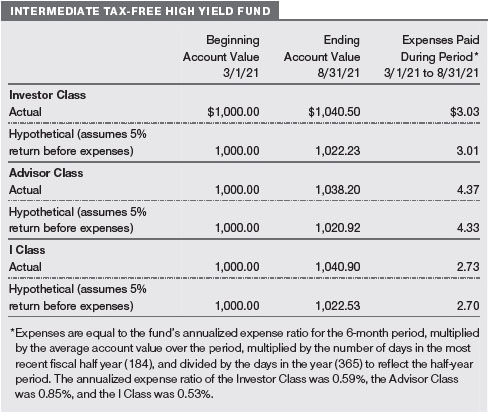

As a mutual fund shareholder, you may incur two types of costs: (1) transaction costs, such as redemption fees or sales loads, and (2) ongoing costs, including management fees, distribution and service (12b-1) fees, and other fund expenses. The following example is intended to help you understand your ongoing costs (in dollars) of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the most recent six-month period and held for the entire period.

Please note that the Intermediate Tax-Free High Yield Fund, Tax-Free High Yield Fund, Tax-Free Income Fund, and Tax-Free Short-Intermediate Fund have three share classes: The original share class (Investor Class) charges no distribution and service (12b-1) fee, the Advisor Class shares are offered only through unaffiliated brokers and other financial intermediaries and charge a 0.25% 12b-1 fee, and the I Class shares are available to institutionally oriented clients and impose no 12b-1 or administrative fee payment. The Tax-Exempt Money Fund has two share classes: The original share class (Investor Class) charges no distribution and service (12b-1) fee, and the I Class shares are also available to institutionally oriented clients and impose no 12b-1 or administrative fee payment. Each share class is presented separately in the table.

Actual Expenses

The first line of the following table (Actual) provides information about actual account values and actual expenses. You may use the information on this line, together with your account balance, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number on the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The information on the second line of the table (Hypothetical) is based on hypothetical account values and expenses derived from the fund’s actual expense ratio and an assumed 5% per year rate of return before expenses (not the fund’s actual return). You may compare the ongoing costs of investing in the fund with other funds by contrasting this 5% hypothetical example and the 5% hypothetical examples that appear in the shareholder reports of the other funds. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

Note: T. Rowe Price charges an annual account service fee of $20, generally for accounts with less than $10,000. The fee is waived for any investor whose T. Rowe Price mutual fund accounts total $50,000 or more; accounts electing to receive electronic delivery of account statements, transaction confirmations, prospectuses, and shareholder reports; or accounts of an investor who is a T. Rowe Price Personal Services or Enhanced Personal Services client (enrollment in these programs generally requires T. Rowe Price assets of at least $250,000). This fee is not included in the accompanying table. If you are subject to the fee, keep it in mind when you are estimating the ongoing expenses of investing in the fund and when comparing the expenses of this fund with other funds.

You should also be aware that the expenses shown in the table highlight only your ongoing costs and do not reflect any transaction costs, such as redemption fees or sales loads. Therefore, the second line of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. To the extent a fund charges transaction costs, however, the total cost of owning that fund is higher.

QUARTER-END RETURNS

Unaudited

The accompanying notes are an integral part of these financial statements.

Unaudited

The accompanying notes are an integral part of these financial statements.

Unaudited

The accompanying notes are an integral part of these financial statements.

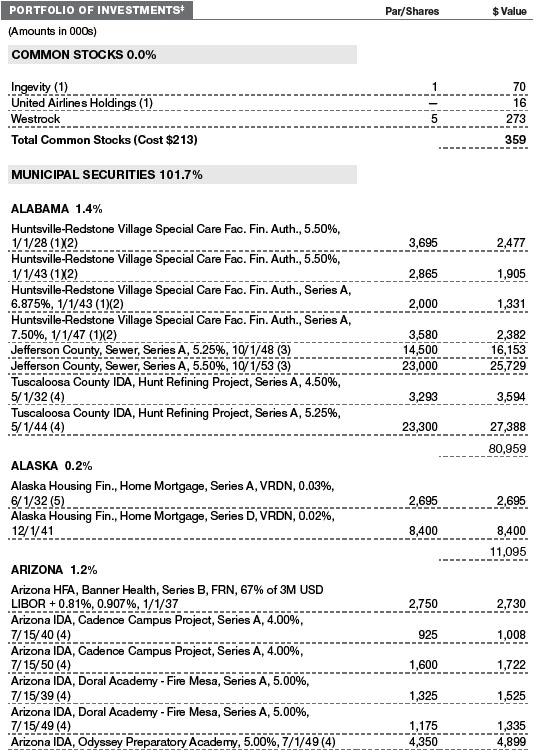

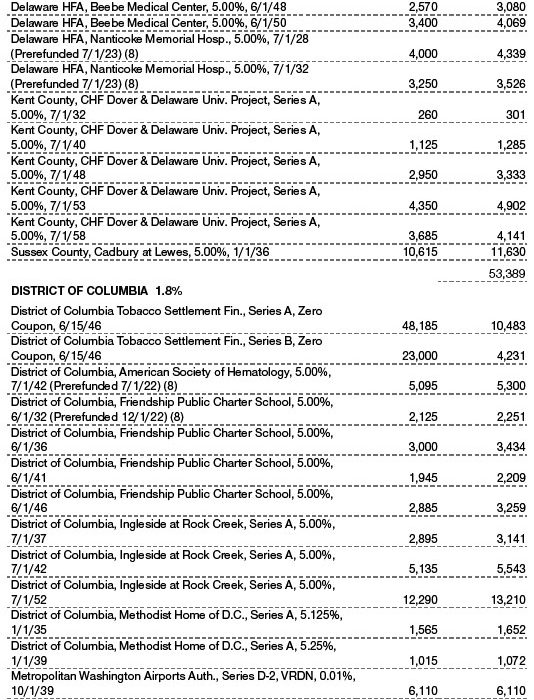

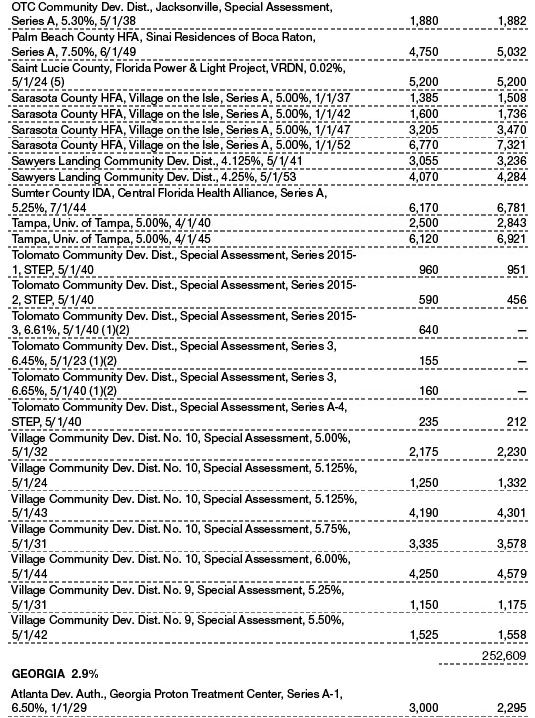

August 31, 2021 (Unaudited)

The accompanying notes are an integral part of these financial statements.

August 31, 2021 (Unaudited)

The accompanying notes are an integral part of these financial statements.

Unaudited

The accompanying notes are an integral part of these financial statements.

Unaudited

The accompanying notes are an integral part of these financial statements.

Unaudited

| NOTES TO FINANCIAL STATEMENTS |

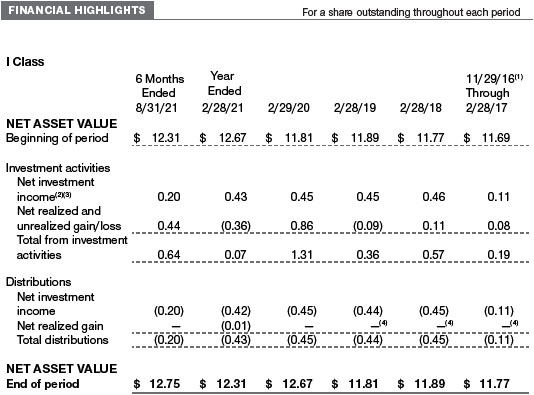

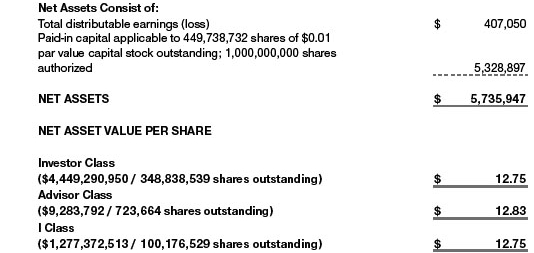

T. Rowe Price Tax-Free High Yield Fund, Inc. (the fund) is registered under the Investment Company Act of 1940 (the 1940 Act) as a diversified, open-end management investment company. The fund seeks to provide a high level of income exempt from federal income taxes by investing primarily in long-term low- to upper-medium-grade municipal securities. The fund has three classes of shares: the Tax-Free High Yield Fund (Investor Class), the Tax-Free High Yield Fund–Advisor Class (Advisor Class) and the Tax-Free High Yield Fund–I Class (I Class). Advisor Class shares are sold only through various brokers and other financial intermediaries. I Class shares require a $1 million initial investment minimum, although the minimum generally is waived for retirement plans, financial intermediaries, and certain other accounts. The Advisor Class operates under a Board-approved Rule 12b-1 plan pursuant to which the class compensates financial intermediaries for distribution, shareholder servicing, and/or certain administrative services; the Investor and I Classes do not pay Rule 12b-1 fees. Each class has exclusive voting rights on matters related solely to that class; separate voting rights on matters that relate to all classes; and, in all other respects, the same rights and obligations as the other classes.

NOTE 1 - SIGNIFICANT ACCOUNTING POLICIES

Basis of Preparation The fund is an investment company and follows accounting and reporting guidance in the Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946 (ASC 946). The accompanying financial statements were prepared in accordance with accounting principles generally accepted in the United States of America (GAAP), including, but not limited to, ASC 946. GAAP requires the use of estimates made by management. Management believes that estimates and valuations are appropriate; however, actual results may differ from those estimates, and the valuations reflected in the accompanying financial statements may differ from the value ultimately realized upon sale or maturity.

Investment Transactions, Investment Income, and Distributions Investment transactions are accounted for on the trade date basis. Income and expenses are recorded on the accrual basis. Realized gains and losses are reported on the identified cost basis. Premiums and discounts on debt securities are amortized for financial reporting purposes. Income tax-related interest and penalties, if incurred, are recorded as income tax expense. Dividend income is recorded on the ex-dividend date. Non-cash dividends, if any, are recorded at the fair market value of the asset received.

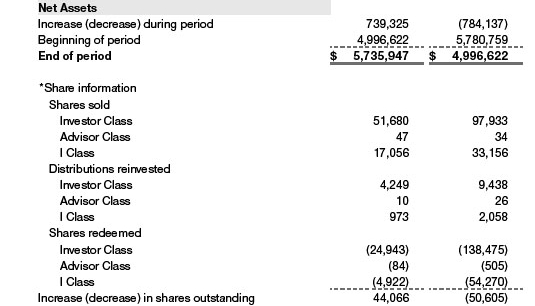

Distributions to shareholders are recorded on the ex-dividend date. Income distributions are declared by each class daily and paid monthly. A capital gain distribution may also be declared and paid by the fund annually.

Class Accounting Shareholder servicing, prospectus, and shareholder report expenses incurred by each class are charged directly to the class to which they relate. Expenses common to all classes and investment income are allocated to the classes based upon the relative daily net assets of each class’s settled shares; realized and unrealized gains and losses are allocated based upon the relative daily net assets of each class’s outstanding shares. The Advisor Class pays Rule 12b-1 fees, in an amount not exceeding 0.25% of the class’s average daily net assets.

Capital Transactions Each investor’s interest in the net assets of the fund is represented by fund shares. The fund’s net asset value (NAV) per share is computed at the close of the New York Stock Exchange (NYSE), normally 4 p.m. ET, each day the NYSE is open for business. However, the NAV per share may be calculated at a time other than the normal close of the NYSE if trading on the NYSE is restricted, if the NYSE closes earlier, or as may be permitted by the SEC. Purchases and redemptions of fund shares are transacted at the next-computed NAV per share, after receipt of the transaction order by T. Rowe Price Associates, Inc., or its agents.

New Accounting Guidance In March 2020, the FASB issued Accounting Standards Update (ASU), ASU 2020–04, Reference Rate Reform (Topic 848) – Facilitation of the Effects of Reference Rate Reform on Financial Reporting, which provides optional, temporary relief with respect to the financial reporting of contracts subject to certain types of modifications due to the planned discontinuation of the London Interbank Offered Rate (LIBOR) and other interbank-offered based reference rates as of the end of 2021. The guidance is effective for certain reference rate-related contract modifications that occur during the period March 12, 2020 through December 31, 2022. Management expects that the adoption of the guidance will not have a material impact on the fund's financial statements.

Indemnification In the normal course of business, the fund may provide indemnification in connection with its officers and directors, service providers, and/or private company investments. The fund’s maximum exposure under these arrangements is unknown; however, the risk of material loss is currently considered to be remote.

NOTE 2 - VALUATION

Fair Value The fund’s financial instruments are valued at the close of the NYSE and are reported at fair value, which GAAP defines as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. The T. Rowe Price Valuation Committee (the Valuation Committee) is an internal committee that has been delegated certain responsibilities by the fund’s Board of Directors (the Board) to ensure that financial instruments are appropriately priced at fair value in accordance with GAAP and the 1940 Act. Subject to oversight by the Board, the Valuation Committee develops and oversees pricing-related policies and procedures and approves all fair value determinations. Specifically, the Valuation Committee establishes policies and procedures used in valuing financial instruments, including those which cannot be valued in accordance with normal procedures or using pricing vendors; determines pricing techniques, sources, and persons eligible to effect fair value pricing actions; evaluates the services and performance of the pricing vendors; oversees the pricing process to ensure policies and procedures are being followed; and provides guidance on internal controls and valuation-related matters. The Valuation Committee provides periodic reporting to the Board on valuation matters.

Various valuation techniques and inputs are used to determine the fair value of financial instruments. GAAP establishes the following fair value hierarchy that categorizes the inputs used to measure fair value:

Level 1 – quoted prices (unadjusted) in active markets for identical financial instruments that the fund can access at the reporting date

Level 2 – inputs other than Level 1 quoted prices that are observable, either directly or indirectly (including, but not limited to, quoted prices for similar financial instruments in active markets, quoted prices for identical or similar financial instruments in inactive markets, interest rates and yield curves, implied volatilities, and credit spreads)

Level 3 – unobservable inputs (including the fund’s own assumptions in determining fair value)

Observable inputs are developed using market data, such as publicly available information about actual events or transactions, and reflect the assumptions that market participants would use to price the financial instrument. Unobservable inputs are those for which market data are not available and are developed using the best information available about the assumptions that market participants would use to price the financial instrument. GAAP requires valuation techniques to maximize the use of relevant observable inputs and minimize the use of unobservable inputs. When multiple inputs are used to derive fair value, the financial instrument is assigned to the level within the fair value hierarchy based on the lowest-level input that is significant to the fair value of the financial instrument. Input levels are not necessarily an indication of the risk or liquidity associated with financial instruments at that level but rather the degree of judgment used in determining those values.

Valuation Techniques Debt securities generally are traded in the over-the-counter (OTC) market and are valued at prices furnished by independent pricing services or by broker dealers who make markets in such securities. When valuing securities, the independent pricing services consider the yield or price of bonds of comparable quality, coupon, maturity, and type, as well as prices quoted by dealers who make markets in such securities.

Equity securities, including exchange-traded funds, listed or regularly traded on a securities exchange or in the over-the-counter (OTC) market are valued at the last quoted sale price or, for certain markets, the official closing price at the time the valuations are made. OTC Bulletin Board securities are valued at the mean of the closing bid and asked prices. A security that is listed or traded on more than one exchange is valued at the quotation on the exchange determined to be the primary market for such security. Listed securities not traded on a particular day are valued at the mean of the closing bid and asked prices for domestic securities.

Assets and liabilities other than financial instruments, including short-term receivables and payables, are carried at cost, or estimated realizable value, if less, which approximates fair value.

Investments for which market quotations or market-based valuations are not readily available or deemed unreliable are valued at fair value as determined in good faith by the Valuation Committee, in accordance with fair valuation policies and procedures. The objective of any fair value pricing determination is to arrive at a price that could reasonably be expected from a current sale. Financial instruments fair valued by the Valuation Committee are primarily private placements, restricted securities, warrants, rights, and other securities that are not publicly traded. Factors used in determining fair value vary by type of investment and may include market or investment specific considerations. The Valuation Committee typically will afford greatest weight to actual prices in arm’s length transactions, to the extent they represent orderly transactions between market participants, transaction information can be reliably obtained, and prices are deemed representative of fair value. However, the Valuation Committee may also consider other valuation methods such as market-based valuation multiples; a discount or premium from market value of a similar, freely traded security of the same issuer; discounted cash flows; yield to maturity; or some combination. Fair value determinations are reviewed on a regular basis and updated as information becomes available, including actual purchase and sale transactions of the investment. Because any fair value determination involves a significant amount of judgment, there is a degree of subjectivity inherent in such pricing decisions, and fair value prices determined by the Valuation Committee could differ from those of other market participants.

Valuation Inputs The following table summarizes the fund’s financial instruments, based on the inputs used to determine their fair values on August 31, 2021 (for further detail by category, please refer to the accompanying Portfolio of Investments):

NOTE 3 - OTHER INVESTMENT TRANSACTIONS

Consistent with its investment objective, the fund engages in the following practices to manage exposure to certain risks and/or to enhance performance. The investment objective, policies, program, and risk factors of the fund are described more fully in the fund’s prospectus and Statement of Additional Information.

Noninvestment-Grade Debt The fund invests, either directly or through its investment in other T. Rowe Price funds, in noninvestment-grade debt, including “high yield” or “junk” bonds or leveraged loans. Noninvestment-grade debt issuers are more likely to suffer an adverse change in financial condition that would result in the inability to meet a financial obligation. The noninvestment-grade debt market may experience sudden and sharp price swings due to a variety of factors that may decrease the ability of issuers to make principal and interest payments and adversely affect the liquidity or value, or both, of such securities. Accordingly, securities issued by such companies carry a higher risk of default and should be considered speculative.

Restricted Securities The fund invests in securities that are subject to legal or contractual restrictions on resale. Prompt sale of such securities at an acceptable price may be difficult and may involve substantial delays and additional costs.

When-Issued Securities The fund enters into when-issued purchase or sale commitments, pursuant to which it agrees to purchase or sell, respectively, an authorized but not yet issued security for a fixed unit price, with payment and delivery not due until issuance of the security on a scheduled future date. When-issued securities may be new securities or securities issued through a corporate action, such as a reorganization or restructuring. Until settlement, the fund maintains liquid assets sufficient to settle its commitment to purchase a when-issued security or, in the case of a sale commitment, the fund maintains an entitlement to the security to be sold. Amounts realized on when-issued transactions are included in realized gain/loss on securities in the accompanying financial statements.

LIBOR The fund may invest in instruments that are tied to reference rates, including LIBOR. On March 5, 2021, the ICE Benchmark Administration Limited, the administrator of LIBOR, announced its intention to cease publishing a majority of the USD LIBOR settings immediately after publication on June 30, 2023, with the remaining USD LIBOR settings to end immediately after publication on December 31, 2021. There remains uncertainty regarding the future utilization of LIBOR and the nature of any replacement rate. Any potential effects of the transition away from LIBOR on the fund, or on certain instruments in which the fund invests, are not known. The transition process may result in, among other things, an increase in volatility or illiquidity of markets for instruments that currently rely on LIBOR, a reduction in the value of certain instruments held by the fund, or a reduction in the effectiveness of related fund transactions such as hedges. Any such effects could have an adverse impact on the fund's performance.

Other Purchases and sales of portfolio securities other than short-term securities aggregated $710,718,000 and $98,308,000, respectively, for the six months ended August 31, 2021.

NOTE 4 - FEDERAL INCOME TAXES

No provision for federal income taxes is required since the fund intends to continue to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code and distribute to shareholders all of its income and gains. Distributions determined in accordance with federal income tax regulations may differ in amount or character from net investment income and realized gains for financial reporting purposes. Financial reporting records are adjusted for permanent book/tax differences to reflect tax character but are not adjusted for temporary differences. The amount and character of tax-basis distributions and composition of net assets are finalized at fiscal year-end; accordingly, tax-basis balances have not been determined as of the date of this report.

The fund intends to retain realized gains to the extent of available capital loss carryforwards. Net realized capital losses may be carried forward indefinitely to offset future realized capital gains. As of February 28, 2021, the fund had $26,073,000 of available capital loss carryforwards.

At August 31, 2021, the cost of investments for federal income tax purposes was $5,412,295,000. Net unrealized gain aggregated $421,277,000 at period-end, of which $482,608,000 related to appreciated investments and $61,331,000 related to depreciated investments.

NOTE 5 - RELATED PARTY TRANSACTIONS

The fund is managed by T. Rowe Price Associates, Inc. (Price Associates), a wholly owned subsidiary of T. Rowe Price Group, Inc. (Price Group). The investment management agreement between the fund and Price Associates provides for an annual investment management fee, which is computed daily and paid monthly. The fee consists of an individual fund fee, equal to 0.30% of the fund’s average daily net assets, and a group fee. The group fee rate is calculated based on the combined net assets of certain mutual funds sponsored by Price Associates (the group) applied to a graduated fee schedule, with rates ranging from 0.48% for the first $1 billion of assets to 0.260% for assets in excess of $845 billion. The fund’s group fee is determined by applying the group fee rate to the fund’s average daily net assets. The fee is computed daily and paid monthly. At August 31, 2021, the effective annual group fee rate was 0.28%. Effective July 1, 2019, Price Associates has contractually agreed, at least through June 30, 2022, to waive a portion of its management fee in order to limit the fund’s management fees to 0.49% of the fund’s average daily net assets. Thereafter, this agreement will automatically renew for one-year terms unless terminated or modified by the fund’s Board. Any fees waived under this agreement are not subject to reimbursement to Price Associates by the fund. The total management fees waived were $2,486,000 and allocated ratably in the amounts of $1,934,000 for the Investor Class, $4,000 for the Advisor Class, and $548,000 for the I Class, for the six months ended August 31, 2021.

The I Class is subject to an operating expense limitation (I Class Limit) pursuant to which Price Associates is contractually required to pay all operating expenses of the I Class, excluding management fees; interest; expenses related to borrowings, taxes, and brokerage; and other non-recurring expenses permitted by the investment management agreement, to the extent such operating expenses, on an annualized basis, exceed the I Class Limit. This agreement will continue through the expense limitation date indicated in the table below, and may be renewed, revised, or revoked only with approval of the fund’s Board. The I Class is required to repay Price Associates for expenses previously paid to the extent the class’s net assets grow or expenses decline sufficiently to allow repayment without causing the class’s operating expenses (after the repayment is taken into account) to exceed the lesser of: (1) the I Class Limit in place at the time such amounts were paid; or (2) the current I Class Limit. However, no repayment will be made more than three years after the date of a payment or waiver.

In addition, the fund has entered into service agreements with Price Associates and a wholly owned subsidiary of Price Associates, each an affiliate of the fund (collectively, Price). Price Associates provides certain accounting and administrative services to the fund. T. Rowe Price Services, Inc. provides shareholder and administrative services in its capacity as the fund’s transfer and dividend-disbursing agent. For the six months ended August 31, 2021, expenses incurred pursuant to these service agreements were $35,000 for Price Associates and $345,000 for T. Rowe Price Services, Inc. All amounts due to and due from Price, exclusive of investment management fees payable, are presented net on the accompanying Statement of Assets and Liabilities.

The fund may participate in securities purchase and sale transactions with other funds or accounts advised by Price Associates (cross trades), in accordance with procedures adopted by the fund’s Board and Securities and Exchange Commission rules, which require, among other things, that such purchase and sale cross trades be effected at the independent current market price of the security. During the six months ended August 31, 2021, the aggregate value of purchases and sales cross trades with other funds or accounts advised by Price Associates was less than 1% of the fund’s net assets as of August 31, 2021.

NOTE 6 - OTHER MATTERS