SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant [X]

Filed by a party other than the Registrant [ ]

Check the appropriate box:

// Preliminary Proxy Statement

/X/ Definitive Proxy Statement

// Definitive Additional Materials

// Soliciting Material pursuant to Rule 14a-11(c) or Section Rule 14a-12

// Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e) (2))

T. Rowe Price All-Cap Opportunities Fund, Inc. 002-99122/811-4358

T. Rowe Price Balanced Fund, Inc. 033-38791/811-6275

T. Rowe Price Blue Chip Growth Fund, Inc. 033-49581/811-7059

T. Rowe Price Capital Appreciation Fund, Inc. 033-05646/811-4519

T. Rowe Price Communications & Technology Fund, Inc. 333-27963/811-07075

T. Rowe Price Corporate Income Fund, Inc. 033-62275/811-07353

T. Rowe Price Credit Opportunities Fund, Inc. 333-194114/811-22939

T. Rowe Price Diversified Mid-Cap Growth Fund, Inc. 333-109958/811-21454

T. Rowe Price Dividend Growth Fund, Inc. 033-49187/811-7055

T. Rowe Price Equity Funds, Inc. 333-04753/811-07639

T. Rowe Price Equity Income Fund, Inc. 033-00070/811-4400

T. Rowe Price Equity Series, Inc. 033-52161/811-07143

T. Rowe Price Exchange-Traded Funds, Inc. 333-235450/811-23494

T. Rowe Price Financial Services Fund, Inc. 333-09551/811-07749

T. Rowe Price Fixed Income Series, Inc. 033-52749/811-07153

T. Rowe Price Floating Rate Fund, Inc. 333-174605/811-22557

T. Rowe Price Global Allocation Fund, Inc. 333-187446/811-22810

T. Rowe Price Global Funds, Inc. 033-29697/811-5833

T. Rowe Price Global Multi-Sector Bond Fund, Inc. 333-154155/811-22243

T. Rowe Price Global Real Estate Fund, Inc. 333-153130/811-22218

T. Rowe Price Global Technology Fund, Inc. 333-40086/811-09995

T. Rowe Price GNMA Fund, Inc. 033-01041/811-4441

T. Rowe Price Government Money Fund, Inc. 002-54926/811-2603

T. Rowe Price Growth Stock Fund, Inc. 002-10780/811-579

T. Rowe Price Health Sciences Fund, Inc. 033-63759/811-07381

T. Rowe Price High Yield Fund, Inc. 002-93707/811-4119

T. Rowe Price Index Trust, Inc. 033-32859/811-5986

T. Rowe Price Inflation Protected Bond Fund, Inc. 333-99241/811-21185

T. Rowe Price Institutional Income Funds, Inc. 333-84634/811-21055

T. Rowe Price Integrated Equity Funds, Inc. 333-26323/811-08203

T. Rowe Price Intermediate Tax-Free High Yield Fund, Inc. 333-196145/811-22968

T. Rowe Price International Funds, Inc. 002-65539/811-2958

T. Rowe Price International Index Fund, Inc. 333-44964/811-10063

T. Rowe Price International Series, Inc. 033-52171/811-07145

T. Rowe Price Limited Duration Inflation Focused Bond Fund, Inc. 333-136805/811-21919

T. Rowe Price Mid-Cap Growth Fund, Inc. 033-47806/811-6665

T. Rowe Price Mid-Cap Value Fund, Inc. 333-02993/811-07605

T. Rowe Price Multi-Sector Account Portfolios, Inc. 333-178660/811-22620

T. Rowe Price Multi-Strategy Total Return Fund, Inc. 333-218649/811-23261

T. Rowe Price New Era Fund, Inc. 002-29866/811-1710

T. Rowe Price New Horizons Fund, Inc. 002-18099/811-958

T. Rowe Price New Income Fund, Inc. 002-48848/811-2396

T. Rowe Price QM U.S. Bond Index Fund, Inc. 333-45018/811-10093

T. Rowe Price Real Assets Fund, Inc. 333-166395/811-22410

T. Rowe Price Real Estate Fund, Inc. 333-36137/811-08371

T. Rowe Price Reserve Investment Funds, Inc. 811-08279

T. Rowe Price Retirement Funds, Inc. 333-92380/811-21149

T. Rowe Price Science & Technology Fund, Inc. 033-16567/811-5299

T. Rowe Price Short-Term Bond Fund, Inc. 002-87568/811-3894

T. Rowe Price Small-Cap Stock Fund, Inc. 002-12171/811-696

T. Rowe Price Small-Cap Value Fund, Inc. 002-43237/811-2215-99

T. Rowe Price Spectrum Fund, Inc. 033-10992/811-4998

T. Rowe Price Spectrum Funds II, Inc. 033-53675/811-07173

T. Rowe Price State Tax-Free Funds, Inc. 033-06533/811-4521

T. Rowe Price Summit Funds, Inc. 033-50319/811-7093

T. Rowe Price Summit Municipal Funds, Inc. 033-50321/811-7095

T. Rowe Price Tax-Efficient Funds, Inc. 333-26441/811-08207

T. Rowe Price Tax-Exempt Money Fund, Inc. 002-67029/811-3055

T. Rowe Price Tax-Free High Yield Fund, Inc. 002-94641/811-4163

T. Rowe Price Tax-Free Income Fund, Inc. 002-57265/811-2684

T. Rowe Price Tax-Free Short-Intermediate Fund, Inc. 002-87059/811-3872

T. Rowe Price Total Return Fund, Inc. 333-213574/811-23180

T. Rowe Price U.S. Equity Research Fund, Inc. 033-56015/811-07225

T. Rowe Price U.S. Large-Cap Core Fund, Inc. 333-158764/811-22293

T. Rowe Price U.S. Treasury Funds, Inc. 033-30531/811-5860

T. Rowe Price Value Fund, Inc. 033-54963/811-07209

________________________________________________________________

(Name of Registrant as Specified in its Charter)

________________________________________________________________

(Name of Person(s) Filing Proxy Statement)

Payment of Filing Fee (Check the appropriate box):

[X] No fee required.

[ ] Fee computed on table below per Exchange Act Rules 14a-6(i) and 0-11.

1) Title of each class of securities to which transaction applies:

____________________________________________________

2) Aggregate number of securities to which transaction applies:

____________________________________________________

3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined:

____________________________________________________

4) Proposed maximum aggregate value of transaction:

____________________________________________________

5) Total fee paid:

____________________________________________________

[ ] Fee paid previously with preliminary materials.

____________________________________________________

[ ] Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and

identify the filing for which the offsetting fee was paid previously. Identify the previous

filing by registration statement number, or the form or schedule and the date of its filing.

1) Amount previously paid:

____________________________________________________

2) Form, schedule, or Registration Statement no.:

____________________________________________________

3) Filing party:

____________________________________________________

4) Date filed:

____________________________________________________

|

| |||

Proxy Information May 10, 2023 | ||||

This proxy material concerns: All mutual funds and exchange-traded funds sponsored and managed by T. Rowe Price Associates, Inc. (each a “Fund” and together the “T. Rowe Price Funds”) | We cordially invite you to attend a joint special meeting of shareholders (the “Shareholder Meeting”) of T. Rowe Price Funds on Monday, July 24, 2023, at 12:15 p.m. eastern time. The Shareholder Meeting will be conducted as a virtual meeting hosted by means of a live webcast. A complete list of the T. Rowe Price Funds is included in Exhibit 1. The T. Rowe Price Funds’ Boards of Directors (each, a “Board”) has implemented a virtual meeting format to provide our shareholders with a convenient forum for the Shareholder Meeting. Shareholders will be able to listen, vote, and submit questions from their home or any location with internet connectivity. The following matters will be considered and acted upon at that time: | |||

1. Elect four (4) director-nominees for each Fund; and

2. To transact such other business as may properly come before the Shareholder Meeting and any adjournments or postponements thereof.

You or your proxy holder will be able to attend the meeting online, vote your shares electronically, and submit questions by visiting the portable document format (“PDF”) available at the following url: https://vote.proxyonline.com/trowe/docs/2023virtualmeetinginformation.pdf. The PDF will provide a url to attend the Shareholder Meeting. You must register prior to attending the Shareholder Meeting. You must have PDF viewing software, such as Adobe Reader, installed on your computer to view the document and attend the Shareholder Meeting. More detailed instructions are provided in the proxy materials that follow.

You are receiving these combined proxy materials for any Fund(s) you own. We hope that you will be able to attend the Shareholder Meeting and we encourage you to vote by telephone or online using the control number that appears on the enclosed proxy card prior to the Shareholder Meeting. Voting prior to the Shareholder Meeting will

reduce the time and costs associated with this proxy solicitation. Whichever method you choose, please read the enclosed proxy statement carefully before you vote.

Since the T. Rowe Price Funds’ last joint shareholder meeting in 2018, certain directors have retired or resigned and new directors have been added to replace them. In conjunction with these changes and more long-term succession planning, it has become necessary to seek shareholder approval to elect four directors for each Fund. If all proposed nominees are elected, each Fund’s Board will be composed of at least 75% independent directors and the same independent directors would serve on each Fund’s Board.

If you have questions, please call one of our service representatives at 1-800-541-5910.

Your participation in this vote is extremely important. By voting promptly, you can help the Funds that you own avoid the expense of additional mailings.

As always, thank you for investing with T. Rowe Price.

Sincerely,

Robert W. Sharps

Chief Executive Officer, T. Rowe Price Group, Inc.

Notice of Joint Special Meeting of Shareholders

All mutual funds and exchange-traded funds sponsored and managed by T. Rowe Price Associates, Inc. (each a “Fund” and together the “T. Rowe Price Funds”) | T. Rowe Price Funds Fran M. Pollack-Matz |

May 10, 2023 | |

A joint special meeting of shareholders (the “Shareholder Meeting”) of the T. Rowe Price Funds will be held virtually on Monday, July 24, 2023, at 12:15 p.m. eastern time, by means of a live webcast. A complete list of the T. Rowe Price Funds is included in Exhibit 1. The following matters will be acted upon at that time: | |

1. Elect four (4) director-nominees for each Fund; and 2. To transact such other business as may properly come before the Shareholder Meeting and any adjournments or postponements thereof. | |

You or your proxy holder will be able to attend the meeting online, vote your shares electronically, and submit questions by visiting the portable document format (“PDF”) available at the following url: https://vote.proxyonline.com/trowe/docs/2023virtualmeetinginformation.pdf. The PDF will provide a url to attend the Shareholder Meeting. You must register prior to attending the Shareholder Meeting and vote your shares. You must have PDF viewing software, such as Adobe Reader, installed on your computer to view the document and attend the Shareholder Meeting. More detailed instructions are provided in the proxy materials that follow. If your shares are held through an intermediary (such as a brokerage account or by a bank or other holder of record), you will need to request a legal proxy to vote during the virtual Shareholder Meeting. To do so, you must submit proof of your proxy power (legal proxy) reflecting your holdings along with your name and email address to AST |

2

Financial (“AST”), the proxy tabulator for the Shareholder Meeting. Requests for registration must be labeled as “Legal Proxy” and be received no later than 5:00 p.m. eastern time, on July 19, 2023. You will receive a confirmation of your registration by email that includes the control number necessary to vote during the Shareholder Meeting. Requests for registration should be directed to AST at attendameeting@equiniti.com. The Shareholder Meeting webcast will begin promptly at 12:15 p.m. eastern time. We encourage you to access the Shareholder Meeting prior to the start time in order to register to attend. For additional information on how you can vote your shares and participate in the virtual Shareholder Meeting, please see the instructions under the heading SUMMARY beginning on page 1 of the enclosed proxy materials that follow. Because the Shareholder Meeting will be a completely virtual meeting, there will be no physical location for shareholders to attend. Only shareholders of record at the close of business on Thursday, April 27, 2023, are entitled to notice of, and to vote at, this Shareholder Meeting or any adjournment or postponement thereof. The Boards of Directors recommend that you vote in favor of each director nominated for election. FRAN M. POLLACK-MATZ |

3

YOUR VOTE IS IMPORTANT |

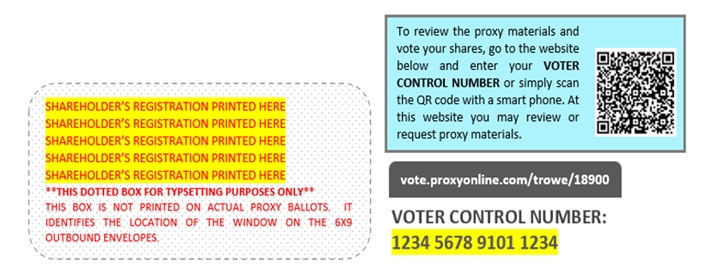

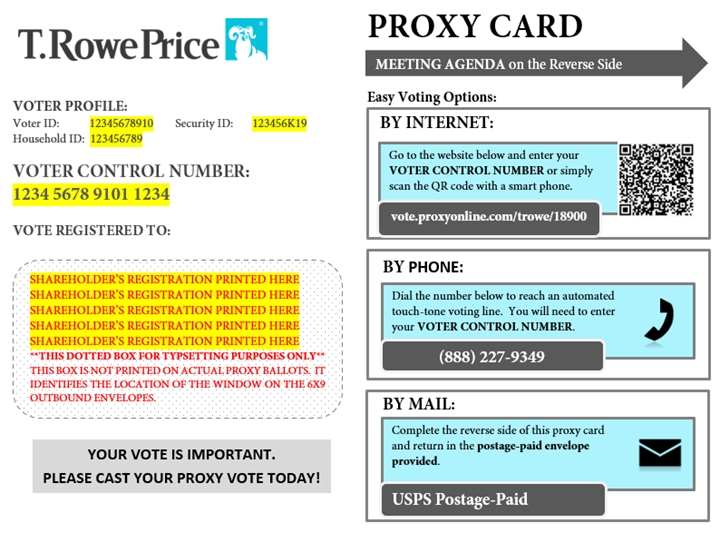

Shareholders are urged to designate their choice on the matters to be acted upon by using one of the following four methods: 1. Vote online. · Read the enclosed proxy materials. · Go to the Internet voting site found on your proxy card. · Enter the control number found on your proxy card. · Follow the instructions using your proxy card as a guide. 2. Vote by telephone. · Read the enclosed proxy materials. · Call the toll-free number found on your proxy card. · Enter the control number found on your proxy card. · Follow the recorded instructions using your proxy card as a guide. 3. Vote by mail. · Read the enclosed proxy materials. · Date, sign, and return the enclosed proxy card in the envelope provided, which requires no postage if mailed in the United States. Your proxy card must be received prior to the Shareholder Meeting. 4. Attend the virtual Shareholder Meeting. · Read the enclosed proxy materials. · Vote your shares electronically during the live Shareholder Meeting webcast by going to the Internet voting site found on your proxy card. · Enter the control number found on your proxy card. · Follow the instructions using your proxy card as a guide. Your prompt response will help to achieve a quorum at the Shareholder Meeting and avoid the potential for additional expenses to each Fund and its shareholders of further solicitation. Your vote must be received prior to the conclusion of the Shareholder Meeting. |

4

T. Rowe Price Funds

100 East Pratt Street

Baltimore, Maryland 21202

Joint Special Meeting of Shareholders

Monday, July 24, 2023

JOINT PROXY STATEMENT

This proxy material relates to all mutual funds and exchange-traded funds (“ETFs”) sponsored and managed by T. Rowe Price Associates, Inc. (“T. Rowe Price”). A complete list of the T. Rowe Price Funds is included in Exhibit 1 (each a “Fund,” and together, the “T. Rowe Price Funds,” the “Price Funds,” or the “Funds”). This document provides you with the information you need to vote on the matters coming before the upcoming joint special meeting (the “Shareholder Meeting”) and is furnished in connection with the solicitation of proxies by the T. Rowe Price Funds. If you have any questions, please feel free to call us toll free at 1-800-541-5910. The Notice of Joint Special Meeting of Shareholders, the proxy card, and this joint proxy statement (the “Proxy Statement”) began mailing to shareholders of record on or about May 10, 2023.

How can shareholders access the virtual Shareholder Meeting?

The Shareholder Meeting will be a virtual meeting conducted exclusively via live webcast starting at 12:15 p.m. eastern time on Monday, July 24, 2023. You or your proxy holder will be able to attend the meeting online, vote your shares electronically, and submit questions by visiting the portable document format (“PDF”) available at the following url: https://vote.proxyonline.com/trowe/docs/2023virtualmeetinginformation.pdf. The PDF will provide a url to attend the Shareholder Meeting. You must register by providing your name and email address prior to attending the Shareholder Meeting. You must have PDF viewing software, such as Adobe Reader, installed on your computer to view the document and attend the Shareholder Meeting.

Because the Shareholder Meeting is completely virtual and will be conducted via live webcast, shareholders will not be able to attend the Shareholder Meeting in person. If your shares are held through a brokerage account or by a bank or other holder of record you will need to request a legal proxy to vote your shares during the virtual meeting. To do so, you must submit proof of your proxy power (“legal proxy”) reflecting your holdings as of April 27, 2023, along with your name and email address to AST. Requests for registration must be labeled as “Legal Proxy” and be received no later than 5:00 p.m. eastern time, on July 19, 2023. You will receive a confirmation of your registration by email that includes the control number necessary to vote during the Shareholder Meeting. Requests for registration should be directed to AST at attendameeting@equiniti.com.

We are pleased to offer our shareholders a completely virtual Shareholder Meeting, which provides worldwide access and communication. We are committed to ensuring that shareholders will be afforded the same rights and opportunities to participate as they would at an in-person meeting. We will reserve time at the end of the Shareholder Meeting (prior to the final vote tabulation) to answer as many shareholder-submitted

5

questions as time permits; however, we reserve the right to exclude questions that are not pertinent to Shareholder Meeting matters or that are otherwise inappropriate. If substantially similar questions are received, we will group such questions together and provide a single response to avoid repetition.

Who is asking for my vote?

The Boards of Directors (each, a “Board” and together, the “Boards”) of the T. Rowe Price Funds request that you vote on each director nominated for election. The votes will be formally counted at the Shareholder Meeting on Monday, July 24, 2023, and if the Shareholder Meeting is adjourned or postponed, on the date of the adjourned or postponed meeting. Fund shareholders may vote electronically at the Shareholder Meeting, and they may also vote prior to the Shareholder Meeting online, by telephone, or by returning a completed proxy card in the postage-paid envelope provided. Details can be found on the enclosed proxy card. Do not mail the proxy card if you are voting online or by telephone.

The Boards, including the Funds’ independent directors, recommend that shareholders vote FOR all the proposed nominees.

Who is eligible to vote?

Shareholders of record at the close of business on Thursday, April 27, 2023, (the “record date”) of each Fund are hereby notified of the Shareholder Meeting and are entitled to one vote for each full share and a proportionate vote for each fractional share of each Fund they held as of the record date. Shareholders of a Fund are entitled to vote with respect to that Fund and not with respect to any Fund of which they do not own any shares as of the record date.

Under Maryland law, shares owned by two or more persons (whether as joint tenants, co-fiduciaries, or otherwise) will be voted as follows, unless a written instrument or court order providing to the contrary has been filed with a Fund: (1) if only one votes, that vote will bind all; (2) if more than one votes, the vote of the majority will bind all; and (3) if more than one votes and the vote is evenly divided, the vote will be cast proportionately.

What are shareholders being asked to vote on?

At a meeting held on Monday, March 6, 2023, the Boards, including the independent directors, unanimously approved submitting the following proposals to the shareholders of the Funds to be considered and acted upon:

Proposal | Funds Affected |

1. Elect four (4) director-nominees; | All Funds |

2. To transact such other business as may properly come before the Shareholder Meeting and any adjournments or postponements thereof. | All Funds |

6

How can I get more information about the Funds?

A copy of each Fund’s most recent prospectus, annual and semiannual shareholder reports, and statement of additional information are available at no cost by visiting our website at troweprice.com/prospectus; by calling 1-800-541-5910; or by writing to T. Rowe Price, 4515 Painters Mill Road, Owings Mills, Maryland 21117.

PROPOSAL – ELECTION OF DIRECTORS

Under the Investment Company Act of 1940, as amended (the “1940 Act”), a certain percentage of each Fund’s Board must be elected by shareholders. Due to the retirement or resignation of certain directors over the past few years, it is now necessary for the Funds to hold a shareholder meeting to elect directors. Two of the proposed nominees, Kellye L. Walker and Eric L. Veiel, presently serve as directors on the current Boards. Melody Bianchetto and Mark J. Parrell do not currently serve as directors although each has served on each Board’s Advisory Board since February 24, 2023 and January 1, 2023, respectively. As discussed in further detail below, Advisory Board members serve in a consultative capacity to the Board and, in doing so, participate in Board discussions and review Board materials. None of these proposed nominees have yet been elected by shareholders.

The current directors who have not been nominated for shareholder approval at the upcoming Shareholder Meeting were previously elected by each Fund’s shareholders. Each of the current directors who are not nominated for election at this time will continue to serve on the Boards following the Shareholder Meeting. Each Board will be composed of at least 75% independent directors if the proposed nominees are elected. Robert J. Gerrard, Jr., an independent director, currently serves as the chair of the Board. Mr. Gerrard is expected to continue serving as the chair following the Shareholder Meeting.

If all proposed nominees are elected, there will be seven independent directors and two interested directors on each Fund’s Board. Once elected, each nominee will become a director immediately.

What are the primary responsibilities of the Boards and their committees, and how often do they meet?

The same directors serve on each Board. This shared structure provides effective governance by exposing the directors to a wide range of business issues and market trends, and permits the Boards to operate more efficiently, particularly with respect to matters common to all Funds. The Boards are responsible for the general oversight of each Fund’s business and for assuring that each Fund is managed in the best interests of its shareholders.

The directors meet regularly to review a wide variety of matters affecting or potentially affecting the Funds, including performance, investment programs, compliance matters, advisory fees and expenses, service providers, and business and regulatory affairs.

The Boards of the T. Rowe Price Funds held five regularly scheduled formal meetings during calendar year 2022. The Funds are not required to hold annual shareholder meetings. Accordingly, unless the Boards determine otherwise, the Funds do not hold

7

an annual meeting of shareholders. If a shareholder meeting to elect directors is held, all nominee directors are encouraged to attend, subject to availability.

Although the Boards have direct responsibility over various matters (such as approval of advisory contracts and review of Fund performance), each Board also exercises certain oversight responsibilities through several Board established committees. Each committee reports back to the full Boards. The Boards believe that a committee structure is an effective means to permit directors to focus on particular operations or issues affecting the Funds, including risk oversight. The Boards currently have three standing committees, a Joint Nominating and Governance Committee, a Joint Audit Committee, and a Joint Executive Committee, which are described in greater detail in the following paragraphs.

The Joint Nominating and Governance Committee consists of all the independent directors of the Funds. Pursuant to the Joint Nominating and Governance Committee’s charter (which is filed as an Appendix to this Proxy Statement), it is responsible for, among other things, seeking, reviewing, and selecting candidates to fill independent director vacancies on each Fund’s Board; periodically evaluating the compensation payable to the independent directors; and performing certain functions with respect to the governance of the Funds. The chair of the Boards of the T. Rowe Price Funds serves as chair of the committee. The committee will consider written recommendations from shareholders for possible nominees for independent directors. Nominees will be considered based on their ability to review critically, evaluate, question, and discuss information provided to them; to interact effectively with the Funds’ management and counsel and the various service providers to the Funds; and to exercise reasonable business judgment in the performance of their duties as directors. The Joint Nominating and Governance Committee seeks to ensure that the Boards are composed of independent directors who bring diverse perspectives, including diverse experiences, backgrounds, race, ethnicity, gender, qualifications, skills, thoughts, viewpoints, and other qualities. Nominees will also be considered based on their independence from T. Rowe Price and other principal service providers. Other than executive sessions in connection with Board meetings, the Joint Nominating and Governance Committee formally met one time in 2022.

The Joint Audit Committee consists of only independent directors. The current members of the committee are Teresa Bryce Bazemore, Robert J. Gerrard, Jr., Paul F. McBride, and Kellye L. Walker. Ms. Bazemore currently serves as chair of the committee and is considered an “audit committee financial expert,” as defined by the Securities and Exchange Commission (“SEC”). The Joint Audit Committee oversees the pricing processes for the T. Rowe Price Funds and holds at least three regular meetings during each fiscal year for the specific purpose of meeting with management of the Price Funds and the Price Funds’ independent registered public accounting firm. The Joint Audit Committee reviews: (1) the services provided; (2) the findings of the most recent audits; (3) management’s response to the findings of the most recent audits; (4) the scope of the audits to be performed; (5) the accountants’ fees; (6) the qualifications, independence, and performance of the independent registered public accounting firm; and (7) any accounting questions relating to particular areas of the T. Rowe Price Funds’ operations, accounting service provider performance, or the operations of parties dealing with the T. Rowe Price Funds, as circumstances indicate.

8

The Joint Audit Committee also reviews the risk management program of the Funds’ investment adviser and valuation-related materials and reports provided by the Funds’ valuation designee. The Joint Audit Committee met four times in 2022.

The Joint Executive Committee, which consists of each Fund’s interested directors, has been authorized by the Boards to exercise all powers of the Boards of the Funds in the intervals between regular meetings of the Boards, except for those powers prohibited by statute from being delegated. All actions of the Joint Executive Committee must be approved in advance by the independent chair of the Board (and if the independent chair is unavailable, consult an independent director of the Board) and reviewed after the fact by the full Board. The Joint Executive Committee for each Fund does not hold regularly scheduled meetings. The Joint Executive Committee was called upon one time to take action on behalf of the Funds during 2022.

From time to time, the independent directors may create a special committee (“Special Committee”) or an ad hoc working group composed of independent directors, whose purpose is to review certain limited topics that require in-depth consideration outside of the Boards’ regular review.

In addition to the Boards and the various committees, the directors have established an Advisory Board which consists of Melody Bianchetto and Mark J. Parrell. Advisory Board members serve in a consultative capacity to the Boards. As such, Ms. Bianchetto and Mr. Parrell participate in Board discussions and review Board materials relating to the T. Rowe Price Funds. However, Advisory Board members are not eligible to vote on any matter presented to the Boards and have no power to act on behalf of or bind the directors or any committee of the Boards.

Like other investment companies, the T. Rowe Price Funds are subject to various risks, including, among others, investment, compliance, operational, and valuation risks. The Boards oversee risk as part of their oversight of the Funds. Risk oversight is addressed as part of various Board and committee activities. Each Board, directly or through its committees, interacts with and reviews reports from, among others, the investment adviser or its affiliates, the Funds’ chief compliance officer, the adviser’s liquidity committee, the derivatives risk manager, the Funds’ independent registered public accounting firm, legal counsel, and internal auditors for T. Rowe Price or its affiliates, as appropriate, regarding risks the Funds face and the risk management programs of the investment adviser and certain other service providers. Also, the Joint Audit Committee receives periodic reports from the valuation designee, chief risk officer and members of T. Rowe Price’s Risk and Operational Steering Committee on the significant risks inherent to the adviser’s business, including aggregate investment risks, reputational risk, business continuity risk, technology and cybersecurity risk, and operational risk. The actual day-to-day risk management functions with respect to the Funds are subsumed within the responsibilities of the investment adviser, its affiliates that serve as investment subadvisers to the Funds, and other service providers (depending on the nature of the risk) that carry out the Funds’ investment management and business affairs. Although the risk management policies of T. Rowe Price and its affiliates, and the Funds’ other service providers, are reasonably designed to be effective, those policies and their implementation vary among service providers over time, and there is no guarantee that they will always be effective.

9

As of each Fund’s last fiscal year end, each director attended at least 75% of the aggregate meetings of the Board and any committees on which he or she served.

If a shareholder wishes to send a communication to any of the Boards, or to a particular director, the communication should be submitted in writing to Fran M. Pollack-Matz, Secretary of the T. Rowe Price Funds, 100 East Pratt Street, Baltimore, MD 21202, who will forward such communication to the directors.

Who are the directors and director nominees?

The Boards have proposed the persons listed below for election as director, each to hold office until the next annual meeting (if any), retirement, or resignation, or until his or her successor is duly elected and qualified. Each of the nominees has agreed to serve as a director if elected; however, should any nominee become unable or unwilling to accept nomination or election, the persons named in the proxy will exercise their voting power in favor of such other person or persons as the Boards may recommend.

Independent Directors and Nominees. Teresa Bryce Bazemore, Bruce W. Duncan, Robert J. Gerrard, Jr., Paul F. McBride, and Kellye L. Walker currently serve on the Board of each T. Rowe Price Fund and are not considered “interested persons” of the T. Rowe Price Funds, as defined in the 1940 Act. Such persons are commonly referred to as “independent directors.” Shareholders are being asked to consider electing Ms. Walker to continue serving on the Boards of all the T. Rowe Price Funds. Ms. Walker has served on the Boards since November 8, 2021, following her nomination to the Boards by the Joint Nominating and Governance Committee and her appointment by the Boards.

Shareholders are also being asked to consider electing Melody Bianchetto and Mark J. Parrell as independent directors. Ms. Bianchetto and Mr. Parrell do not currently serve as independent directors, although they have served on the Advisory Board since February 24, 2023 and January 1, 2023, respectively. Both Ms. Bianchetto and Mr. Parrell are not considered “interested persons” of the T. Rowe Price Funds, as defined in the 1940 Act. The Joint Nominating and Governance Committee of each Board has selected Ms. Bianchetto and Mr. Parrell to be nominated for election by shareholders and the Boards have nominated them for election. If Ms. Bianchetto and Mr. Parrell are elected by shareholders, they will no longer serve on the Advisory Board and the Advisory Board is expected to terminate.

Ms. Bazemore and Messrs. Duncan, Gerrard, and McBride were previously elected by the shareholders of all Funds and are therefore not standing for election at this time.

Interested Directors Eric Veiel and David Oestreicher currently serve as interested directors of all T. Rowe Price Funds. They are considered interested because they are employed by, and serve as officers of, T. Rowe Price and/or its affiliates. They are also shareholders of T. Rowe Price Group, Inc., the parent company of T. Rowe Price. Shareholders are being asked to elect Mr. Veiel to continue serving on the Boards of all T. Rowe Price Funds. Mr. Veiel was appointed to the Boards in February, 2022. Mr. Oestreicher was elected by shareholders of all Funds in 2018 and is therefore not standing for election at this time.

10

The Boards have determined that each director, regardless of whether they are standing for election, should continue to serve on each Fund’s Board. In making this determination, the Boards considered the overall composition of the combined Board in conjunction with each individual director’s experience, qualifications, attributes, or skills. Attributes common to all directors include the ability to review critically, evaluate, question, and discuss information provided to them, to interact effectively with the Funds’ management and counsel and the various service providers to the Funds, and to exercise reasonable business judgment in the performance of their duties as a director. In addition, the actual service and commitment of the directors during their tenure on the Funds’ Boards were taken into consideration. A director’s ability to perform his or her duties effectively may have been attained through his or her educational background or professional training; business, consulting, public service, or academic positions; experience from service as a director of the T. Rowe Price Funds, public companies, non-profit entities, or other organizations; or other experiences. Each director brings a diverse perspective to the Boards.

Each director’s mailing address is 100 E. Pratt Street, Baltimore, MD 21202.

Set forth below is a brief discussion of the specific experience, qualifications, attributes, or skills of each director or director-nominee that led to the conclusion that he or she should serve (or continue to serve) as a director.

Teresa Bryce Bazemore (independent director; not standing for election) has more than 25 years of experience as a senior executive in the mortgage banking field, including building both mortgage insurance and services businesses. Ms. Bazemore currently serves as president and chief executive officer (“CEO”)of the Federal Home Loan Bank of San Francisco (March 2021 to present); a director of First Industrial Realty Trust, an owner and operator of industrial properties (May 2020 to present); a director of Public Media Company (2008 to present); and a trustee of the Southern California chapter of the International Women’s Forum (January 2021 to present). She previously served as chief executive officer of Bazemore Consulting LLC (2018 to 2021); a director of Chimera Investment Corporation, a publicly traded mortgage REIT (November 2017 to February 2021); a director of the University of Virginia Foundation (July 2014 to June 2022); a member of the University of Virginia’s Center for Politics Advisory Board (October 2019 to July 2022); a president of Radian Guaranty, a national private mortgage insurer (2008 to 2017); and a director of the Federal Home Loan Bank of Pittsburgh (August 2017 to February 2019). She has been an independent director of the Price Funds since January 2018 and became the chair of the Joint Audit Committee in August 2019. Ms. Bazemore has a J.D. from Columbia University and a B.A. from the University of Virginia (“UVA”).

Melody Bianchetto (independent director-nominee; standing for election) is an accomplished finance professional with over 30 years of experience. She served as vice president for finance at UVA from 2015 until her retirement in February 2023, with oversight of key financial activities, including tax, accounting, financial reporting, debt and cash management, procurement, payroll, financial planning, and enterprise risk management. Prior to that, she led UVA’s financial planning and analysis function from 1998 to 2015. Ms. Bianchetto earned a B.S. in commerce with a concentration in accounting from UVA and an M.B.A. from James Madison University. She is also a

11

licensed Certified Public Accountant. Ms. Bianchetto has served as a member of the Board’s Advisory Committee since February 24, 2023.

Bruce W. Duncan (independent director; not standing for election) has substantial experience in the field of commercial real estate. Mr. Duncan served as president, CEO, and a director of CyrusOne, Inc., a real estate investment trust specializing in engineering, building, and managing data centers, from July 2020 to July 2021. He served as chair of the board of First Industrial Realty Trust from January 2016 until July 2020, president and CEO from January 2009 until September 2016, and CEO until December 2016. Mr. Duncan served as a senior advisor to KKR from November 2018 to December 2022. In May 2016, Mr. Duncan became a member of the board of Boston Properties, and he is currently a member of the nominating and governance committee and is a member of the audit committee of Boston Properties. From September 2016 until July 2020, Mr. Duncan served as a member of the board of Marriott International, Inc. He has been an independent director of the Price Funds since October 2013; in September 2014, he became a member of the Joint Audit Committee until August 2019 and served as chair of the Joint Audit Committee from July 2017 to August 2019. Mr. Duncan holds an M.B.A. in finance from the University of Chicago and a B.A. in economics from Kenyon College.

Robert J. Gerrard, Jr. (independent director; not standing for election) has served as chair of the Boards of all Price Funds since July 2018. He has been an independent director of certain Price Funds since 2012 (and all Price Funds since October 2013), served as the chair of the Joint Audit Committee from September 2014 to July 2017, and became a member of the Joint Audit Committee in August 2019. He has substantial legal and business experience in the industries relating to communications and interactive data services. He has served on the board and compensation committee for Syniverse Holdings and served as general counsel to Scripps Networks. Mr. Gerrard earned a J.D. from Harvard Law School and an A.B. from Harvard College.

Paul F. McBride (independent director; not standing for election) has served in various management and senior leadership roles with the Black & Decker Corporation and General Electric Company. He led businesses in the materials, industrial, and consumer durable segments, and has significant global experience. He serves on the advisory board of Vizzia Technologies as well as Gilman School and Bridges Baltimore. He has been an independent director of the Price Funds since October 2013; served as a member of the Joint Audit Committee from September 2014 to August 2019; and became a member of the Joint Audit Committee in February 2022. Mr. McBride received a B.A. in economics from Trinity College.

Mark J. Parrell (independent director-nominee; standing for election) has been CEO and a member of the Board of Trustees of Equity Residential (“EQR”) since January 2019 and president of EQR since September 2018. Mr. Parrell served as executive vice president and chief financial officer of EQR from October 2007 to September 2018. Mr. Parrell was senior vice president and treasurer of EQR from August 2005 to October 2007 and has held various positions within the EQR finance group since September 1999. He served as director of Brookdale Senior Living Inc., a leading operator of senior living communities throughout the United States, from April 2015 to July 2017, and served as a director of Aviv REIT, Inc., a real estate investment trust, from March 2013 until April 2015 when it merged with Omega

12

Healthcare. Mr. Parrell serves on the Board of Directors of the Real Estate Roundtable and the 2022 Executive Board of the National Association of Real Estate Investment Trusts (“Nareit”). He is a member of the Nareit Dividends Through Diversity, Equity & Inclusion CEO Council and was chair of the Nareit 2021 Audit and Investment Committee. He is a member of the Advisory Board for the Ross Business School at University of Michigan, and is a member of the National Multifamily Housing Council and served as the chair of the Finance Committee in 2015 to 2016. Mr. Parrell also serves on the Board of Directors and is chair of the Finance Committee of the Greater Chicago Food Depository and is a member of the Economic Club of Chicago. Mr. Parrell received a B.B.A. from the University of Michigan and a J.D. from the Georgetown University Law Center. Mr. Parrell has served as a member of the Board’s Advisory Committee since January 1, 2023.

David Oestreicher (interested director; not standing for election) has served as an interested director of all Price Funds since July 2018. He is the general counsel for T. Rowe Price Group, Inc. and a member of the firm’s management committee. Mr. Oestreicher serves as a member of the Board of Governors for the Investment Company Institute (“ICI”), and previously served as the chair of the ICI’s international committee. He is on the Mutual Insurance Company Board of Governors, where he serves as a member of its executive committee and chair of its risk management committee. He also served on the board of the Investment Adviser Association and was a past chair of its legal and regulatory committee. Before joining T. Rowe Price in 1997, Mr. Oestreicher was special counsel in the Division of Market Regulation with the SEC. Mr. Oestreicher earned a B.S. in business administration from Bucknell University and a J.D. from Villanova University School of Law.

Eric L. Veiel (interested director; standing for election) has served as an interested director of all Price Funds since February 2022. He is the head of Global Equity and chief investment officer, chair of the Investment Management Steering Committee, and a member of the Management, Equity Steering, International Steering, Multi-Asset Steering, Product Steering, and Management Compensation and Development Committees. Mr. Veiel’s investment experience began in 1999. Prior to joining T. Rowe Price, he spent six years as a sell-side equity analyst, covering health insurers and pharmacy benefit managers at Wachovia Securities, Deutsche Bank Securities, and A.G. Edwards & Sons. He has been with T. Rowe Price since 2005, beginning in the Equity Division as an investment analyst covering life insurance companies, asset managers, money-centered banks, and investment banks. From 2010 to 2014, he was the portfolio manager of the Financial Services Equity Strategy and the financial services sector team leader. He served as a co-director of Equity Research for North America from 2014 to 2015 and co-portfolio manager of the US Equity Structured Research Strategy from 2015 to 2017. Most recently, from 2016 to 2021, he was co-head of Global Equity and head of U.S. Equity. Mr. Veiel earned a B.B.A., magna cum laude, in finance from James Madison University and an M.B.A., with concentrations in finance and accounting, from Washington University in St. Louis, John M. Olin School of Business, where he was a Charles F. Knight Scholar. He also has earned the Chartered Financial Analyst® designation.

Kellye L. Walker (independent director; standing for election) is executive vice president, chief legal officer, and corporate secretary of Eastman Chemical Company.

13

She is a seasoned senior executive with over 25 years of experience helping publicly traded companies increase value through forward thinking, strategic discipline, and a focus on continuous improvement. Her experience includes leading law departments, as well as other functions including compliance; government affairs; human resources; health, safety, environment and security; and information technology. Ms. Walker received a B.S. from Louisiana Tech University and a J.D. from Emory University School of Law. Ms. Walker has served as an independent director of the Price Funds since November 2021.

The following table entitled “Independent Directors/Nominees” provides biographical information for the independent directors, including those who have been nominated for election as an independent director, along with their principal occupation(s) during the past five years and any directorships of public companies and other investment companies. The table also shows their ownership in the Funds on which they currently serve or to which they are being nominated to serve as director, as well as their total ownership in all T. Rowe Price Funds. The table entitled “Interested Directors/Nominees” provides similar information, except the information pertains to the interested directors, including those who have been nominated for election as an interested director.

Independent Directors/Nominees | |||

Name, Year of Birth, Position on Fund Board, and Principal Occupations and Other Directorships of Public Companies | Dollar Range of Fund Shares Beneficially Owned, Directly or Indirectly, as of 12/31/2022 | Total Dollar Range of Shares Owned, Directly or Indirectly, in All Funds as of 12/31/2022 | |

Melody Bianchetto, 1966 Advisory Board member / nominated for election as director, Vice President for Finance, University of Virginia (2015 to 2023) | None | None | None |

Teresa Bryce Bazemore, 1959 Director of all T. Rowe Price Funds President and Chief Executive Officer, Federal Home Loan Bank of San Francisco (2021 to present); Chief Executive Officer, Bazemore Consulting LLC (2018 to 2021) Chimera Investment Corporation (2017 to 2021); First Industrial Realty Trust (2020 to present); Federal Home Loan Bank of Pittsburgh (2017 to 2019) | Blue Chip Growth Emerging Markets Local Currency Bond | Over $100,000 Over $100,000 | Over $100,000 |

14

Independent Directors/Nominees | |||

Name, Year of Birth, Position on Fund Board, and Principal Occupations and Other Directorships of Public Companies | Dollar Range of Fund Shares Beneficially Owned, Directly or Indirectly, as of 12/31/2022 | Total Dollar Range of Shares Owned, Directly or Indirectly, in All Funds as of 12/31/2022 | |

Bruce W. Duncan, 1951 Director of all T. Rowe Price Funds President, Chief Executive Officer, and Director, CyrusOne, Inc. (2020 to 2021); Chair of the Board (2016 to 2020), and President (2009 to 2016), First Industrial Realty Trust, owner and operator of industrial properties; Member, Investment Company Institute Board of Governors (2017 to 2019); Member, Independent Directors Council Governing Board (2017 to 2019); Senior Advisor, KKR (2018 to 2022) CyrusOne, Inc. (2020 to 2021); First Industrial Realty Trust (2016 to 2020); Boston Properties (2016 to present); Marriott International, Inc. (2016 to 2020) | Emerging Markets Stock | Over $100,000 | Over $100,000 |

Robert J. Gerrard, Jr., 1952 Director of all T. Rowe Price Funds None | All-Cap Opportunities Blue Chip Growth Capital Appreciation China Evolution Equity Communications & Technology Diversified Mid-Cap Growth Dividend Growth Emerging Markets Corporate Bond Emerging Markets Discovery Stock Emerging Markets Stock Equity Income Extended Equity Market Index Financial Services Global Consumer Global Industrials Global Stock Global Technology GNMA Growth Stock Health Sciences Integrated U.S. Small-Mid Cap Core Equity Integrated U.S. Small-Cap Growth Equity | $50,001--$100,000 $50,001--$100,000 Over $100,000 $10,001--$50,000 Over $100,000 $10,001--$50,000 $10,001--$50,000 $1--$10,000 $10,001--$50,000 $10,001--$50,000 $10,001--$50,000 $10,001--$50,000 Over $100,000 $10,001--$50,000 $10,001--$50,000 $50,001--$100,000 Over $100,000 $1--$10,000 Over $100,000 Over $100,000 $1--$10,000 $1--$10,000 | Over $100,000 |

15

Independent Directors/Nominees | |||

Name, Year of Birth, Position on Fund Board, and Principal Occupations and Other Directorships of Public Companies | Dollar Range of Fund Shares Beneficially Owned, Directly or Indirectly, as of 12/31/2022 | Total Dollar Range of Shares Owned, Directly or Indirectly, in All Funds as of 12/31/2022 | |

International Discovery International Stock Japan Large-Cap Growth Large-Cap Value Mid-Cap Growth Mid-Cap Value New Era New Horizons Overseas Stock Real Assets Retirement 2020 Retirement 2025 Retirement 2030 Retirement 2035 Retirement 2040 Retirement 2055 Retirement 2060 Science & Technology Small-Cap Stock Small-Cap Value Spectrum Moderate Allocation Spectrum Moderate Growth Allocation Target 2060 Target 2065 U.S. Equity Research U.S. Large-Cap Core Ultra Short-Term Bond Value | $1--$10,000 $1--$10,000 $1--$10,000 $10,001--$50,000 $10,001--$50,000 $10,001--$50,000 $50,001--$100,000 $1--$10,000 Over $100,000 $50,001--$100,000 $10,001--$50,000 $10,001--$50,000 $10,001--$50,000 $10,001--$50,000 $10,001--$50,000 $10,001--$50,000 $1--$10,000 $1--$10,000 $50,001--$100,000 $50,001--$100,000 $10,001--$50,000 $50,001-$100,00 $50,001--$100,000 $1--$10,000 $10,001--$50,000 $50,001--$100,000 $50,001--$100,000 $1--$10,000 Over $100,000 | ||

Paul F. McBride, 1956 Director of all T. Rowe Price Funds Advisory Board Member, Vizzia Technologies (2015 to present); Board Member, Dunbar Armored (2012 to 2018) None | All-Cap Opportunities Capital Appreciation Health Sciences Tax-Free High Yield | Over $100,000 Over $100,000 Over $100,000 Over $100,000 | Over $100,000 |

16

Independent Directors/Nominees | |||

Name, Year of Birth, Position on Fund Board, and Principal Occupations and Other Directorships of Public Companies | Dollar Range of Fund Shares Beneficially Owned, Directly or Indirectly, as of 12/31/2022 | Total Dollar Range of Shares Owned, Directly or Indirectly, in All Funds as of 12/31/2022 | |

Mark J. Parrell, 1966 Advisory Board Member / nominated for election as director, Chief Executive Officer (2019 to present) and President, EQR (2018 to present); Executive Vice President and Chief Financial Officer, EQR (2007 to 2018); Senior Vice President and Treasurer, EQR (2005 to 2007); Member, Nareit Dividends Through Diversity, Equity & Inclusion CEO Council and Chair, Nareit 2021 Audit and Investment Committee (2021); Advisory Board, Ross Business School at University of Michigan (2015 to 2016); Member, National Multifamily Housing Council and served as the Chair of the Finance Committee, (2015 to 2016), Member of the Economic Club of Chicago EQR (2019 to present); Brookdale Senior Living Inc. (2015 to 2017); Aviv REIT, Inc. (2013 to 2015); Real Estate Roundtable and the 2022 Executive Board Nareit; Board of Directors and is Chair of the Finance Committee of the Greater Chicago Food Depository | International Value Equity Value | $50,001--$100,000(a) $10,001--$50,000(a) | Over $100,000(a) |

Kellye L. Walker, 1966 Director/Nominee of all T. Rowe Price Funds (210 portfolios) Executive Vice President, Chief Legal Officer, and Corporate Secretary, Eastman Chemical Company (April 2020 to present); Executive Vice President and Chief Legal Officer, Huntington Ingalls Industries, Inc. (January 2015 to March 2020) Lincoln Electric Company (October 2020 to present) | Dividend Growth Emerging Markets Bond Equity Index 500 Floating Rate Global Stock Inflation Protected Bond Mid-Cap Growth Overseas Stock Small-Cap Value Total Return | Over $100,000 $10,001--$50,000 $50,001--$100,000 $10,001--$50,000 $50,001--$100,000 $10,001--$50,000 $10,001--$50,000 $50,001--$100,000 $10,001--$50,000 $10,001--$50,000 | Over $100,000 |

(a) Holdings information for Mr. Parrell is as of February 28, 2023.

17

Interested Directors/Nominees | |||

Name, Year of Birth, Position on Fund Board, and Principal Occupations and Other Directorships of Public Companies | Dollar Range of Fund Shares Beneficially Owned, Directly or Indirectly, as of 12/31/2022 | Total Dollar Range of Shares Owned, Directly or Indirectly, in All Funds as of 12/31/2022 | |

David Oestreicher, 1967 Director of all T. Rowe Price Funds (210 portfolios) Principal Executive Officer and Executive Vice President, all T. Rowe Price Funds Director, Vice President, and Secretary, T. Rowe Price, T. Rowe Price Investment Services, Inc., T. Rowe Price Retirement Plan Services, Inc., and T. Rowe Price Services, Inc.; Director and Secretary, Price Investment Management; Vice President and Secretary, Price International; Vice President, Price Hong Kong, Price Japan, and Price Singapore; General Counsel, Vice President, and Secretary, T. Rowe Price Group, Inc.; Chair of the Board, Chief Executive Officer, President, and Secretary, T. Rowe Price Trust Company None | Blue Chip Growth Equity Income Government Money High Yield Mid-Cap Growth Mid-Cap Value New Income Retirement 2020 Retirement 2025 Small-Cap Stock Spectrum Income U.S. Treasury Money | $50,001--$100,000 $50,001--$100,000 $50,001--$100,000 $10,001--$50,000 $10,001-$50,000 $10,001--$50,000 $50,001--$100,000 Over $100,000 $10,001--$50,000 $10,001--$50,000 $1--$10,000 Over $100,000 | Over $100,000 |

Eric L. Veiel, 1972 Director/Nominee of all T. Rowe Price Funds (210 portfolios) Director and Vice President, T. Rowe Price; Vice President, T. Rowe Price Group, Inc. and T. Rowe Price Trust Company Vice President, Global Funds None | All-Cap Opportunities Dividend Growth Floating Rate Fund Inflation Protected Bond Mid-Cap Growth U.S. Treasury Money | Over $100,000 Over $100,000 Over $100,000 Over $100,000 $50,001--$100,000 Over $100,000 | Over $100,000 |

18

The following table entitled “Term of T. Rowe Price Funds Directorship” shows the year from which each current director has served on each Fund’s Board (or that of the corporation of which the Fund is a part).

Term of T. Rowe Price Funds Directorship

Corporation | Bazemore | Duncan | Gerrard | McBride | Oestreicher | Veiel | Walker |

All-Cap Opportunities Fund | 2018 | 2013 | 2012 | 2013 | 2018 | 2022 | 2021 |

Balanced Fund | 2018 | 2013 | 2012 | 2013 | 2018 | 2022 | 2021 |

Blue Chip Growth Fund | 2018 | 2013 | 2012 | 2013 | 2018 | 2022 | 2021 |

Capital Appreciation Fund | 2018 | 2013 | 2012 | 2013 | 2018 | 2022 | 2021 |

Communications & Technology Fund | 2018 | 2013 | 2012 | 2013 | 2018 | 2022 | 2021 |

Corporate Income Fund | 2018 | 2013 | 2013 | 2013 | 2018 | 2022 | 2021 |

Credit Opportunities Fund | 2018 | 2014 | 2014 | 2014 | 2018 | 2022 | 2021 |

Diversified Mid-Cap Growth Fund | 2018 | 2013 | 2012 | 2013 | 2018 | 2022 | 2021 |

Dividend Growth Fund | 2018 | 2013 | 2012 | 2013 | 2018 | 2022 | 2021 |

Equity Funds | 2018 | 2013 | 2012 | 2013 | 2018 | 2022 | 2021 |

Equity Income Fund | 2018 | 2013 | 2012 | 2013 | 2018 | 2022 | 2021 |

Equity Series | 2018 | 2013 | 2012 | 2013 | 2018 | 2022 | 2021 |

Exchange-Traded Funds | 2019 | 2019 | 2019 | 2019 | 2019 | 2022 | 2021 |

Financial Services Fund | 2018 | 2013 | 2012 | 2013 | 2018 | 2022 | 2021 |

Fixed Income Series | 2018 | 2013 | 2013 | 2013 | 2018 | 2022 | 2021 |

Floating Rate Fund | 2018 | 2013 | 2013 | 2013 | 2018 | 2022 | 2021 |

Global Allocation Fund | 2018 | 2013 | 2013 | 2013 | 2018 | 2022 | 2021 |

Global Funds | 2018 | 2013 | 2012 | 2013 | 2018 | 2022 | 2021 |

Global Multi-Sector Bond Fund | 2018 | 2013 | 2013 | 2013 | 2018 | 2022 | 2021 |

Global Real Estate Fund | 2018 | 2013 | 2012 | 2013 | 2018 | 2022 | 2021 |

Global Technology Fund | 2018 | 2013 | 2012 | 2013 | 2018 | 2022 | 2021 |

GNMA Fund | 2018 | 2013 | 2013 | 2013 | 2018 | 2022 | 2021 |

Government Money Fund | 2018 | 2013 | 2013 | 2013 | 2018 | 2022 | 2021 |

19

Corporation | Bazemore | Duncan | Gerrard | McBride | Oestreicher | Veiel | Walker |

Growth Stock Fund | 2018 | 2013 | 2012 | 2013 | 2018 | 2022 | 2021 |

Health Sciences Fund | 2018 | 2013 | 2012 | 2013 | 2018 | 2022 | 2021 |

High Yield Fund | 2018 | 2013 | 2013 | 2013 | 2018 | 2022 | 2021 |

Index Trust | 2018 | 2013 | 2012 | 2013 | 2018 | 2022 | 2021 |

Inflation Protected Bond Fund | 2018 | 2013 | 2013 | 2013 | 2018 | 2022 | 2021 |

Institutional Income Funds | 2018 | 2013 | 2013 | 2013 | 2018 | 2022 | 2021 |

Integrated Equity Funds | 2018 | 2013 | 2012 | 2013 | 2018 | 2022 | 2021 |

Intermediate Tax-Free High Yield Fund | 2018 | 2014 | 2014 | 2014 | 2018 | 2022 | 2021 |

International Funds | 2018 | 2013 | 2012 | 2013 | 2018 | 2022 | 2021 |

International Index Fund | 2018 | 2013 | 2012 | 2013 | 2018 | 2022 | 2021 |

International Series | 2018 | 2013 | 2012 | 2013 | 2018 | 2022 | 2021 |

Limited Duration Inflation Focused Bond Fund | 2018 | 2013 | 2013 | 2013 | 2018 | 2022 | 2021 |

Mid-Cap Growth Fund | 2018 | 2013 | 2012 | 2013 | 2018 | 2022 | 2021 |

Mid-Cap Value Fund | 2018 | 2013 | 2012 | 2013 | 2018 | 2022 | 2021 |

Multi-Sector Account Portfolios | 2018 | 2013 | 2013 | 2013 | 2018 | 2022 | 2021 |

Multi-Strategy Total Return Fund | 2018 | 2017 | 2017 | 2017 | 2018 | 2022 | 2021 |

New Era Fund | 2018 | 2013 | 2012 | 2013 | 2018 | 2022 | 2021 |

New Horizons Fund | 2018 | 2013 | 2012 | 2013 | 2018 | 2022 | 2021 |

New Income Fund | 2018 | 2013 | 2013 | 2013 | 2018 | 2022 | 2021 |

QM U.S. Bond Index Fund | 2018 | 2013 | 2013 | 2013 | 2018 | 2022 | 2021 |

Real Assets Fund | 2018 | 2013 | 2012 | 2013 | 2018 | 2022 | 2021 |

Real Estate Fund | 2018 | 2013 | 2012 | 2013 | 2018 | 2022 | 2021 |

Reserve Investment Funds | 2018 | 2013 | 2013 | 2013 | 2018 | 2022 | 2021 |

Retirement Funds | 2018 | 2013 | 2012 | 2013 | 2018 | 2022 | 2021 |

Science & Technology Fund | 2018 | 2013 | 2012 | 2013 | 2018 | 2022 | 2021 |

Short-Term Bond Fund | 2018 | 2013 | 2013 | 2013 | 2018 | 2022 | 2021 |

Small-Cap Stock Fund | 2018 | 2013 | 2012 | 2013 | 2018 | 2022 | 2021 |

20

Corporation | Bazemore | Duncan | Gerrard | McBride | Oestreicher | Veiel | Walker |

Small-Cap Value Fund | 2018 | 2013 | 2012 | 2013 | 2018 | 2022 | 2021 |

Spectrum Funds | 2018 | 2013 | 2012 | 2013 | 2018 | 2022 | 2021 |

Spectrum Funds II | 2018 | 2013 | 2012 | 2013 | 2018 | 2022 | 2021 |

State Tax-Free Funds | 2018 | 2013 | 2013 | 2013 | 2018 | 2022 | 2021 |

Summit Income Funds | 2018 | 2013 | 2013 | 2013 | 2018 | 2022 | 2021 |

Summit Municipal Funds | 2018 | 2013 | 2013 | 2013 | 2018 | 2022 | 2021 |

Tax-Efficient Funds | 2018 | 2013 | 2012 | 2013 | 2018 | 2022 | 2021 |

Tax-Exempt Money Fund | 2018 | 2013 | 2013 | 2013 | 2018 | 2022 | 2021 |

Tax-Free High Yield Fund | 2018 | 2013 | 2013 | 2013 | 2018 | 2022 | 2021 |

Tax-Free Income Fund | 2018 | 2013 | 2013 | 2013 | 2018 | 2022 | 2021 |

Tax-Free Short-Intermediate Fund | 2018 | 2013 | 2013 | 2013 | 2018 | 2022 | 2021 |

Total Return Fund | 2018 | 2016 | 2016 | 2016 | 2018 | 2022 | 2021 |

U.S. Equity Research Fund | 2018 | 2013 | 2012 | 2013 | 2018 | 2022 | 2021 |

U.S. Large-Cap Core Fund | 2018 | 2013 | 2012 | 2013 | 2018 | 2022 | 2021 |

U.S. Treasury Funds | 2018 | 2013 | 2013 | 2013 | 2018 | 2022 | 2021 |

Value Fund | 2018 | 2013 | 2012 | 2013 | 2018 | 2022 | 2021 |

21

What are the directors paid for their services to the Funds?

Messrs. Oestreicher and Veiel are considered “interested persons” of the Funds because they are employed by, and serve as officers of, T. Rowe Price and/or its affiliates. The officers of the Funds and interested directors do not receive any compensation or benefits from the Funds for their service.

Each independent director and Advisory Board member is paid $375,000 annually for his or her service on the Boards or Advisory Board, as applicable. The chair of the Boards, an independent director, receives an additional $165,000 annually for serving in this capacity. An independent director serving on the Joint Audit Committee receives an additional $30,000 annually for his or her service and the chair of the Joint Audit Committee receives an additional $35,000 for his or her service. An independent director serving as a member of a Special Committee of the Independent Directors receives an additional $1,500 per meeting of the Special Committee (currently, no Special Committees have been assigned by the Boards). All of these fees are allocated to each Fund on a pro-rata basis based on each Fund’s net assets relative to the other Funds.

The following table entitled “Compensation” shows the accrued amounts paid by each Fund, and the total compensation that was paid from all Funds to all the independent directors for the 2022 calendar year. The fees are allocated to each Fund on a pro rata basis based on each Fund’s net assets relative to the other Funds. The independent directors of the Funds do not receive any pension or retirement benefits from the Funds or T. Rowe Price.

Compensation

Fund | Aggregate Compensation From Fund | ||||

Bazemore | Duncan | Gerrard | McBride | Walker | |

Africa & Middle East Fund | $74 | $63 | $96 | $68 | $63 |

All-Cap Opportunities Fund | 3,745 | 3,191 | 4,851 | 3,427 | 3,191 |

All-Cap Opportunities Portfolio | 184 | 157 | 238 | 168 | 157 |

Asia Opportunities Fund | 82 | 70 | 106 | 75 | 70 |

Balanced Fund | 2,176 | 1,855 | 2,819 | 1,991 | 1,855 |

Blue Chip Growth ETF (a) | — | — | — | — | — |

Blue Chip Growth Fund | 34,533 | 29,435 | 44,760 | 31,555 | 29,435 |

Blue Chip Growth Portfolio | 913 | 778 | 1,184 | 835 | 778 |

California Tax-Free Bond Fund | 309 | 263 | 400 | 282 | 263 |

Capital Appreciation Fund | 23,332 | 19,885 | 30,221 | 21,355 | 19,885 |

Cash Reserves Fund | 1,930 | 1,644 | 2,499 | 1,768 | 1,644 |

China Evolution Equity Fund | 31 | 27 | 40 | 29 | 27 |

Communications & Technology Fund | 3,862 | 3,292 | 5,006 | 3,529 | 3,292 |

Corporate Income Fund | 295 | 251 | 382 | 270 | 251 |

Credit Opportunities Fund | 44 | 37 | 57 | 40 | 37 |

Diversified Mid-Cap Growth Fund | 926 | 790 | 1,200 | 847 | 790 |

Dividend Growth ETF (a) | — | — | — | — | — |

Dividend Growth Fund | 9,706 | 8,272 | 12,573 | 8,884 | 8,272 |

Dynamic Credit Fund | 18 | 15 | 23 | 16 | 15 |

Dynamic Global Bond Fund | 2,229 | 1,900 | 2,887 | 2,042 | 1,900 |

Emerging Europe Fund | 26 | 22 | 34 | 24 | 22 |

Emerging Markets Bond Fund | 1,943 | 1,656 | 2,517 | 1,777 | 1,656 |

Emerging Markets Corporate Bond Fund | 316 | 269 | 409 | 289 | 269 |

22

Fund | Aggregate Compensation From Fund | ||||

Bazemore | Duncan | Gerrard | McBride | Walker | |

Emerging Markets Corporate Multi-Sector Account Portfolio (a) | — | — | — | — | — |

Emerging Markets Discovery Stock Fund | 1,945 | 1,657 | 2,517 | 1,781 | 1,657 |

Emerging Markets Local Currency Bond Fund | 182 | 155 | 236 | 167 | 155 |

Emerging Markets Local Multi-Sector Account Portfolio (a) | — | — | — | — | — |

Emerging Markets Stock Fund | 4,027 | 3,432 | 5,216 | 3,682 | 3,432 |

Equity Income ETF (a) | — | — | — | — | — |

Equity Income Fund | 8,663 | 7,383 | 11,218 | 7,930 | 7,383 |

Equity Income Portfolio | 354 | 302 | 459 | 324 | 302 |

Equity Index 500 Fund | 12,741 | 10,859 | 16,508 | 11,651 | 10,859 |

Equity Index 500 Portfolio | 12 | 10 | 16 | 11 | 10 |

European Stock Fund | 483 | 412 | 626 | 441 | 412 |

Extended Equity Market Index Fund | 469 | 400 | 608 | 429 | 400 |

Financial Services Fund | 856 | 730 | 1,108 | 784 | 730 |

Floating Rate ETF (a) | — | — | — | — | — |

Floating Rate Fund | 2,274 | 1,938 | 2,942 | 2,084 | 1,938 |

Floating Rate Multi-Sector Account Portfolio (a) | — | — | — | — | — |

Georgia Tax-Free Bond Fund | 212 | 180 | 274 | 194 | 180 |

Global Allocation Fund | 508 | 433 | 658 | 465 | 433 |

Global Consumer Fund | 34 | 29 | 43 | 31 | 29 |

Global Growth Stock Fund | 563 | 480 | 730 | 515 | 480 |

Global High Income Bond Fund | 135 | 115 | 175 | 124 | 115 |

Global Impact Equity Fund | 8 | 7 | 11 | 8 | 7 |

Global Industrials Fund | 87 | 74 | 113 | 80 | 74 |

Global Multi-Sector Bond Fund | 751 | 640 | 972 | 687 | 640 |

Global Real Estate Fund | 49 | 42 | 63 | 45 | 42 |

Global Stock Fund | 2,774 | 2,365 | 3,595 | 2,536 | 2,365 |

Global Technology Fund | 2,359 | 2,011 | 3,059 | 2,152 | 2,011 |

Global Value Equity Fund | 18 | 15 | 23 | 16 | 15 |

GNMA Fund | 479 | 408 | 620 | 438 | 408 |

Government Money Fund | 4,819 | 4,108 | 6,246 | 4,410 | 4,108 |

Government Money Portfolio | 9,181 | 7,823 | 11,882 | 8,402 | 7,823 |

Government Reserve Fund | 508 | 433 | 658 | 465 | 433 |

Growth Stock ETF (a) | — | — | — | — | — |

Growth Stock Fund | 25,701 | 21,907 | 36,293 | 23,065 | 21,907 |

Health Sciences Fund | 7,864 | 6,703 | 10,190 | 7,196 | 6,703 |

Health Sciences Portfolio | 355 | 302 | 459 | 324 | 302 |

High Yield Fund | 3,530 | 3,009 | 4,573 | 3,230 | 3,009 |

High Yield Multi-Sector Account Portfolio (a) | — | — | — | — | — |

Inflation Protected Bond Fund | 353 | 301 | 457 | 323 | 301 |

Institutional Emerging Markets Bond Fund | 192 | 164 | 228 | 145 | 164 |

Institutional Emerging Markets Equity Fund | 615 | 524 | 796 | 561 | 524 |

Institutional Floating Rate Fund | 3,012 | 2,566 | 3,898 | 2,758 | 2,566 |

Institutional High Yield Fund | 834 | 711 | 1,080 | 763 | 711 |

Institutional International Disciplined Equity Fund | 148 | 126 | 191 | 135 | 126 |

23

Fund | Aggregate Compensation From Fund | ||||

Bazemore | Duncan | Gerrard | McBride | Walker | |

Institutional Large-Cap Core Growth Fund | 2,171 | 1,850 | 2,813 | 1,984 | 1,850 |

Institutional Long Duration Credit Fund | 13 | 11 | 17 | 12 | 11 |

Institutional Mid-Cap Equity Growth Fund | 2,622 | 2,235 | 3,399 | 2,397 | 2,235 |

Institutional Small-Cap Stock Fund | 2,395 | 2,042 | 3,103 | 2,192 | 2,042 |

Integrated Global Equity Fund | 11 | 10 | 15 | 10 | 10 |

Integrated U.S. Large-Cap Value Equity Fund | 19 | 17 | 25 | 18 | 17 |

Integrated U.S. Small-Cap Growth Equity Fund | 3,602 | 3,070 | 4,667 | 3,294 | 3,070 |

Integrated U.S. Small-Mid Cap Core Equity Fund | 138 | 117 | 178 | 126 | 117 |

Intermediate Tax-Free High Yield Fund | 31 | 27 | 41 | 29 | 27 |

International Bond Fund | 493 | 420 | 639 | 451 | 420 |

International Bond Fund (USD Hedged) | 2,690 | 2,293 | 3,484 | 2,462 | 2,293 |

International Disciplined Equity Fund | 149 | 127 | 193 | 136 | 127 |

International Discovery Fund | 3,605 | 3,072 | 4,671 | 3,294 | 3,072 |

International Equity Index Fund | 313 | 267 | 405 | 286 | 267 |

International Stock Fund | 6,171 | 5,259 | 7,993 | 5,646 | 5,259 |

International Stock Portfolio | 115 | 98 | 149 | 105 | 98 |

International Value Equity Fund | 5,361 | 4,568 | 6,942 | 4,904 | 4,568 |

Investment-Grade Corporate Multi-Sector Account Portfolio (a) | — | — | — | — | — |

Japan Fund | 280 | 239 | 363 | 256 | 239 |

Latin America Fund | 191 | 163 | 248 | 175 | 163 |

Large-Cap Growth Fund | 8,671 | 7,391 | 11,238 | 7,925 | 7,391 |

Large-Cap Value Fund | 1,670 | 1,423 | 2,164 | 1,528 | 1,423 |

Limited Duration Inflation Focused Bond Fund | 4,101 | 3,495 | 5,310 | 3,752 | 3,495 |

Limited-Term Bond Portfolio | 86 | 74 | 112 | 79 | 74 |

Maryland Short-Term Tax-Free Bond Fund | 79 | 67 | 102 | 72 | 67 |

Maryland Tax-Free Bond Fund | 1,174 | 1,001 | 1,521 | 1,074 | 1,001 |

Maryland Tax-Free Money Fund | 48 | 41 | 62 | 44 | 41 |

Mid-Cap Growth Fund | 14,417 | 12,287 | 18,680 | 13,186 | 12,287 |

Mid-Cap Growth Portfolio | 247 | 210 | 320 | 226 | 210 |

Mid-Cap Index Fund | 44 | 37 | 57 | 40 | 37 |

Mid-Cap Value Fund | 6,653 | 5,670 | 8,616 | 6,090 | 5,670 |

Moderate Allocation Portfolio | 85 | 72 | 110 | 77 | 72 |

Mortgage-Backed Securities Multi-Sector Account Portfolio (a) | — | — | — | — | — |

Multi-Strategy Total Return Fund | 178 | 151 | 230 | 163 | 151 |

New Asia Fund | 1,461 | 1,246 | 1,893 | 1,336 | 1,246 |

New Era Fund | 1,520 | 1,295 | 1,967 | 1,392 | 1,295 |

New Horizons Fund | 12,994 | 11,076 | 16,840 | 11,877 | 11,076 |

New Income Fund | 8,360 | 7,125 | 10,829 | 7,647 | 7,125 |

New Jersey Tax-Free Bond Fund | 197 | 168 | 256 | 181 | 168 |

New York Tax-Free Bond Fund | 222 | 189 | 288 | 203 | 189 |

Overseas Stock Fund | 9,586 | 8,169 | 12,415 | 8,771 | 8,169 |

QM U.S. Bond Index ETF (a) | — | — | — | — | — |

24

Fund | Aggregate Compensation From Fund | ||||

Bazemore | Duncan | Gerrard | McBride | Walker | |

QM U.S. Bond Index Fund | 619 | 527 | 801 | 566 | 527 |

Real Assets Fund | 2,764 | 2,355 | 3,579 | 2,533 | 2,355 |

Real Estate Fund | 704 | 600 | 912 | 644 | 600 |

Retirement 2005 Fund | 524 | 447 | 679 | 479 | 447 |

Retirement 2010 Fund | 1,451 | 1,237 | 1,880 | 1,327 | 1,237 |

Retirement 2015 Fund | 2,213 | 1,886 | 2,867 | 2,024 | 1,886 |

Retirement 2020 Fund | 5,838 | 4,976 | 7,865 | 5,340 | 4,976 |

Retirement 2025 Fund | 6,444 | 5,492 | 8,347 | 5,894 | 5,492 |

Retirement 2030 Fund | 8,598 | 7,327 | 11,138 | 7,865 | 7,327 |

Retirement 2035 Fund | 5,521 | 4,705 | 7,152 | 5,051 | 4,705 |

Retirement 2040 Fund | 6,202 | 5,286 | 8,035 | 5,674 | 5,286 |

Retirement 2045 Fund | 3,685 | 3,140 | 4,773 | 3,371 | 3,140 |

Retirement 2050 Fund | 3,231 | 2,754 | 4,185 | 2,956 | 2,754 |

Retirement 2055 Fund | 1,881 | 1,603 | 2,436 | 1,721 | 1,603 |

Retirement 2060 Fund | 673 | 573 | 871 | 616 | 573 |

Retirement 2065 Fund | 42 | 36 | 54 | 39 | 36 |

Retirement Balanced Fund | 910 | 775 | 1,178 | 832 | 775 |

Retirement Blend 2005 Fund | 2 | 2 | 2 | 2 | 2 |

Retirement Blend 2010 Fund | 2 | 2 | 3 | 2 | 2 |

Retirement Blend 2015 Fund | 4 | 3 | 5 | 4 | 3 |

Retirement Blend 2020 Fund | 13 | 11 | 17 | 12 | 11 |

Retirement Blend 2025 Fund | 21 | 18 | 28 | 20 | 18 |

Retirement Blend 2030 Fund | 18 | 16 | 24 | 17 | 16 |

Retirement Blend 2035 Fund | 20 | 17 | 26 | 18 | 17 |

Retirement Blend 2040 Fund | 17 | 15 | 22 | 16 | 15 |

Retirement Blend 2045 Fund | 13 | 11 | 17 | 12 | 11 |

Retirement Blend 2050 Fund | 9 | 7 | 11 | 8 | 7 |

Retirement Blend 2055 Fund | 5 | 4 | 6 | 4 | 4 |

Retirement Blend 2060 Fund | 2 | 1 | 2 | 2 | 1 |

Retirement Blend 2065 Fund | 1 | 1 | 1 | 1 | 1 |

Retirement I 2005 Fund—I Class | 148 | 126 | 192 | 136 | 126 |

Retirement I 2010 Fund—I Class | 444 | 379 | 575 | 407 | 379 |

Retirement I 2015 Fund—I Class | 785 | 669 | 1,016 | 718 | 669 |

Retirement I 2020 Fund—I Class | 2,627 | 2,239 | 3,402 | 2,404 | 2,239 |

Retirement I 2025 Fund—I Class | 3,667 | 3,125 | 4,749 | 3,356 | 3,125 |

Retirement I 2030 Fund—I Class | 4,910 | 4,184 | 6,359 | 4,494 | 4,184 |

Retirement I 2035 Fund—I Class | 3,595 | 3,064 | 4,657 | 3,291 | 3,064 |

Retirement I 2040 Fund—I Class | 3,934 | 3,352 | 5,095 | 3,600 | 3,352 |

Retirement I 2045 Fund—I Class | 2,783 | 2,372 | 3,605 | 2,548 | 2,372 |

Retirement I 2050 Fund—I Class | 2,645 | 2,255 | 3,427 | 2,422 | 2,255 |

Retirement I 2055 Fund—I Class | 1,510 | 1,287 | 1,956 | 1,382 | 1,287 |

Retirement I 2060 Fund—I Class | 673 | 574 | 872 | 617 | 574 |

Retirement I 2065 Fund—I Class | 36 | 31 | 47 | 33 | 31 |

Retirement Balanced I Fund—I Class | 248 | 211 | 321 | 227 | 211 |

Retirement Income 2020 Fund | 62 | 53 | 81 | 57 | 53 |

Science & Technology Fund | 3,068 | 2,615 | 3,975 | 2,803 | 2,615 |

Short Duration Income Fund | 23 | 20 | 30 | 21 | 20 |

Short-Term Fund | 0 | 0 | 0 | 0 | 0 |

Short-Term Bond Fund | 2,465 | 2,100 | 3,192 | 2,256 | 2,100 |

Short-Term Government Fund | — | — | — | — | — |

Small-Cap Index Fund | 45 | 38 | 58 | 41 | 38 |

Small-Cap Stock Fund | 4,521 | 3,853 | 5,857 | 4,136 | 3,853 |

Small-Cap Value Fund | 5,657 | 4,821 | 7,328 | 5176, | 4,821 |

25

Fund | Aggregate Compensation From Fund | ||||

Bazemore | Duncan | Gerrard | McBride | Walker | |

Spectrum Conservative Allocation Fund | 1,103 | 940 | 1,429 | 1,009 | 940 |

Spectrum Diversified Equity Fund | 1,817 | 1,548 | 2,354 | 1,662 | 1,548 |

Spectrum Income Fund | 3,058 | 2,607 | 3,961 | 2,799 | 2,607 |

Spectrum International Equity Fund | 801 | 683 | 1,037 | 732 | 683 |

Spectrum Moderate Allocation Fund | 1,133 | 966 | 1,468 | 1,037 | 966 |

Spectrum Moderate Growth Allocation Fund | 1,601 | 1,364 | 2,074 | 1,464 | 1,364 |

Summit Municipal Income Fund | 1,148 | 978 | 1,487 | 1,050 | 978 |

Summit Municipal Intermediate Fund | 2,896 | 2,468 | 3,751 | 2,649 | 2,468 |

Target 2005 Fund | 27 | 23 | 35 | 25 | 23 |

Target 2010 Fund | 36 | 31 | 47 | 33 | 31 |

Target 2015 Fund | 89 | 76 | 115 | 81 | 76 |

Target 2020 Fund | 164 | 140 | 212 | 150 | 140 |

Target 2025 Fund | 239 | 204 | 310 | 219 | 204 |

Target 2030 Fund | 261 | 222 | 338 | 239 | 222 |

Target 2035 Fund | 204 | 174 | 264 | 186 | 174 |

Target 2040 Fund | 176 | 150 | 228 | 161 | 150 |

Target 2045 Fund | 156 | 133 | 202 | 143 | 133 |

Target 2050 Fund | 119 | 102 | 154 | 109 | 102 |

Target 2055 Fund | 83 | 71 | 108 | 76 | 71 |

Target 2060 Fund | 40 | 34 | 52 | 37 | 34 |

Target 2065 Fund | 4 | 4 | 6 | 4 | 4 |

Tax-Efficient Equity Fund | 367 | 312 | 475 | 335 | 312 |

Tax-Exempt Money Fund | 300 | 256 | 389 | 275 | 256 |

Tax-Free High Yield Fund | 2,242 | 1,911 | 2,905 | 2,051 | 1,911 |

Tax-Free Income Fund | 1,145 | 976 | 1,483 | 1,047 | 976 |

Tax-Free Short-Intermediate Fund | 949 | 809 | 1,229 | 868 | 809 |

Total Equity Market Index Fund | 1,001 | 853 | 1,298 | 915 | 853 |

Total Return ETF (a) | — | — | — | — | — |

Total Return Fund | 304 | 259 | 393 | 278 | 259 |

Transition Fund | — | — | — | — | — |

Treasury Reserve Fund | 1,502 | 1,280 | 1,945 | 1,376 | 1,280 |

U.S. Equity Research ETF (a) | — | — | — | — | — |

U.S. Equity Research Fund | 5,382 | 4,586 | 6,967 | 4,934 | 4,586 |

U.S. High Yield ETF (a) | — | — | — | — | — |

U.S. High Yield Fund | 240 | 204 | 311 | 219 | 204 |

U.S. Large-Cap Core Fund | 3,240 | 2,762 | 4,198 | 2,968 | 2,762 |

U.S. Limited Duration TIPS Index Fund | 754 | 643 | 976 | 690 | 643 |

U.S. Treasury Intermediate Index Fund | 394 | 335 | 510 | 360 | 335 |

U.S. Treasury Long-Term Index Fund | 1,975 | 1,683 | 2,558 | 1,810 | 1,683 |

U.S. Treasury Money Fund | 5,916 | 5,042 | 7,661 | 5,421 | 5,042 |

Ultra Short-Term Bond ETF (a) | — | — | — | — | — |

Ultra Short-Term Bond Fund | 1,722 | 1,467 | 2,230 | 1,574 | 1,467 |

Value Fund | 15,445 | 13,163 | 20,007 | 14,130 | 13,163 |

Virginia Tax-Free Bond Fund | 701 | 598 | 909 | 642 | 598 |

(a) Directors’ fees were paid by T. Rowe Price on behalf of the fund.

26

FURTHER INFORMATION ABOUT VOTING AND THE SHAREHOLDER MEETING

Who is eligible to vote?

Shareholders of record of each Fund at the close of business on Thursday, April 27, 2023, (the “record date”) are entitled to one vote for each full share and a proportionate vote for each fractional share of the Fund they held on April 27, 2023.

The Notice of Joint Meeting of Shareholders, the proxy card, and this Proxy Statement were first mailed to shareholders of record on or about Wednesday, May 10, 2023.

Under Maryland law, shares owned by two or more persons (whether as joint tenants, co-fiduciaries, or otherwise) will be voted as follows, unless a written instrument or court order providing to the contrary has been filed with the Fund: (1) if only one votes, that vote will bind all; (2) if more than one votes, the vote of the majority will bind all; and (3) if more than one votes and the vote is evenly divided, the vote will be cast proportionately.

What is the required quorum?

To hold a shareholder meeting for a T. Rowe Price Fund, one-third of a Fund’s shares entitled to be voted must have been received by proxy or be present at the virtual meeting. In the event that a quorum is present but sufficient votes in favor of a proposal are not received by the Shareholder Meeting date, the persons named as proxies may propose one or more adjournments to permit further solicitation of proxies. Any such adjournment will require the affirmative vote of a majority of the shares present in person or by proxy at the Shareholder Meeting to be adjourned. Shares withheld will be voted against the proposed adjournment. The persons named as proxies will vote in favor of such adjournment if they determine that additional solicitation is reasonable and in the interests of a Fund’s shareholders.

What vote is required to elect the directors?