Competition is intense in all of the Company’s markets and includes numerous large companies and many smaller regional competitors. In many cases, the Company’s primary competition comes from alternative, often older, technologies, such as chemical, sand filtration, and pasteurization as opposed to the finer level of membrane filtration that the Company provides. In many markets, there are significant barriers to entry limiting the number of qualified suppliers. These barriers result from stringent product performance standards, product qualification protocols and requirements for consistent levels of global service and support. The Company’s broad array of patented materials and product designs coupled with its engineering and manufacturing expertise and global reach enable it to provide customers with differentiated product performance and value and global customer support.

The Company’s Life Sciences technologies facilitate the process of drug discovery, development, regulatory validation and production. They are used extensively in the research laboratory, pharmaceutical and biotechnology industries, in blood centers and in hospitals at the point of patient care. The Company’s broad capability in the life sciences industry is a competitive strength and an important element of its strategy going forward. Sales in the Medical and BioPharmaceuticals markets are made through direct sales and distributors. The BioPharmaceuticals market includes the Laboratory market previously reported in the Medical market. Prior year amounts conform to current classification.

Safety, quality, efficacy, ease of use, technical support, product delivery and price are all important considerations among the Company’s Life Sciences customers. Pricing for blood filtration products has become more of a consideration as the Company’s customers have increasingly become large centralized procurers, such as blood centers in the Western Hemisphere and nationalized blood services in Europe and Asia. The backlog for the Life Sciences segment at July 31, 2009 was approximately $140,082,000 (all of which is expected to be shipped in fiscal year 2010) compared with $140,285,000 at July 31, 2008.

The Company’s medical products improve the safety of the use of blood products in patient care and help control the spread of infections in hospitals. The Company’s cell therapy product portfolio provides efficient enabling technologies for the emerging regenerative medicine market.

The backlog for the Medical market at July 31, 2009 was approximately $39,809,000 (all of which is expected to be shipped in fiscal year 2010) compared with $41,311,000 at July 31, 2008. The Company’s principal competitors in the Medical market include Fenwal, Inc., MacoPharma Group, Fresenius Medical Care AG & Co., Millipore Corporation, GE Healthcare (a unit of General Electric Company (“GE”)), Tyco International Ltd., Teleflex Incorporated, Terumo Medical Corporation, and Capital Health Inc.

The Company sells separation systems and disposable filtration and purification technologies primarily to pharmaceutical and biotechnology companies for use by them in the development and commercialization of chemically synthesized and biologically derived drugs and vaccines. The Company provides a broad range of advanced filtration solutions for each critical stage of drug development through drug production. Its filtration systems and validation services assist drug manufacturers through the regulatory process and on to the market. The Company’s broad laboratory product line is used in drug discovery, gene manipulation and proteomics applications.

Company management believes that the Company’s established record of product performance and innovation, as well as its ability to sell and globally support a complete range of products, including its engineered systems, give it a strong competitive advantage among BioPharmaceuticals customers because of the high costs and safety risks associated with drug development and production. The backlog for the BioPharmaceuticals market at July 31, 2009 was approximately $100,273,000 (all of which is expected to be shipped in fiscal year 2010) compared with $98,974,000 at July 31, 2008. Principal competitors in the BioPharmaceuticals market include Millipore Corporation, The Sartorius Group, CUNO (a 3M company) and GE Healthcare.

INDUSTRIAL SEGMENT:

The Company provides enabling and process enhancing technologies throughout the industrial marketplace. This includes the aerospace and transportation, microelectronics and consumer electronics, municipal and industrial water, fuels, chemicals, energy, and food and beverage markets. The Company has the capability to provide customers with integrated solutions for their process fluids. The backlog for the Industrial segment at July 31, 2009 was approximately $388,115,000 (of which approximately $286,800,000 is expected to be shipped in fiscal year 2010) compared with $476,153,000 at July 31, 2008.

ENERGY, WATER & PROCESS TECHNOLOGIES MARKET:

Included in this diverse market are sales of filters, coalescers and integrated separation systems for hydraulic, fuel and lubrication systems on mechanical equipment to many industries, as well as to producers of energy (i.e., oil, gas, renewable and alternative fuels, electricity and chemicals), food and beverages and municipal and industrial water. Virtually all of the raw materials, process fluids and waste streams that course through industry are candidates for multiple stages of filtration, separation and purification. The growing demand for “clean” and “green” technology and increasing demand for water and energy also create growth opportunities for the Company.

Technologies that purify water for use and reuse represent an important opportunity. Governments around the world are implementing stringent new regulations governing drinking water standards and Company management believes that the Company’s filters and systems provide a solution for these requirements. These standards apply to municipal water supplies throughout the U.S. and in a growing number of countries. Industry, which consumes enormous quantities of water, also increasingly needs to filter water before, during and after use both to conserve it and to ensure it meets discharge requirements.

Within the energy market, demand is driven by oil and gas producers, refineries and power generating stations work to increase production, produce cleaner burning fuels, conserve water, meet environmental regulations and develop alternative fuel sources. Each of these applications provides opportunities for the Company.

Within the Food & Beverage market, filtration solutions are provided to the wine, beer, soft drink, bottled water and food ingredient markets. A growing filtration opportunity in this market is the need of wine and beer manufacturers to eliminate the use of diatomaceous earth and pasteurization in their processes.

The backlog at July 31, 2009 was approximately $249,342,000 (of which approximately $215,000,000 is expected to be shipped in fiscal year 2010) compared with $290,931,000 at July 31, 2008. Sales to Energy, Water & Process Technologies customers are made through Company personnel, distributors and manufacturers’ representatives. The Company believes that its TFM strategy and ability to engineer fully integrated systems solutions, underscored by product performance and quality, customer service, and price, are the principal competitive factors in this market. The Company’s primary competitors in the Energy, Water & Process Technologies market include CUNO (a 3M company), GE Infrastructure (a unit of GE), U.S. Filter (a Siemens business), The Sartorius Group, Parker Hannifin Corporation and Rohm and Haas Company.

AEROSPACE & TRANSPORTATION MARKET:

The Company sells filtration and fluid monitoring equipment to the aerospace industry for use on commercial and military aircraft, ships and land-based military vehicles to help protect critical systems and components. Commercial, Military and Transportation sales represented 34%, 49% and 17%, respectively, of total Aerospace & Transportation sales in fiscal year 2009. Key drivers in this market include passenger air miles flown, military budgets, new military and commercial aircraft, and demand for new aircraft and mobile construction equipment in emerging geographic markets, particularly in Asia. Increasing environmental regulation faced by the Company’s customers, as well as customer requirements for improved equipment reliability and fuel efficiency impact demand.

6

The Company’s products are sold to customers through a combination of direct sales to airframe manufacturers and other customers, including the U.S. military, and through the Company’s distribution partner, Satair A/S, for the commercial aerospace “aftermarket,” such as sales to commercial airlines. The backlog at July 31, 2009 was approximately $119,695,000 (of which approximately $58,000,000 is expected to be shipped in fiscal year 2010) compared with $160,792,000 at July 31, 2008. Competition varies by product. The Company’s principal competitors in the Aerospace & Transportation markets include Donaldson Company, Inc., ESCO Technologies Inc. and CLARCOR Inc.

Company management believes that efficacy, performance and quality of product and service, as well as price, are determinative in most sales.

MICROELECTRONICS MARKET:

The Company sells highly sophisticated filtration and purification technologies for the semiconductor, data storage, fiber optic, advanced display and materials markets. The Company provides a comprehensive suite of contamination control solutions for chemical, gas, water, chemical mechanical polishing and photolithography processes to meet the needs of this demanding industry. Integrated circuits, which control almost every device or machine in use today, require exceedingly high levels of filtration technologies, which the Company provides. Diversification into the macroelectronics side of the market is enabling the Company to capitalize on demand for computer gaming consoles, MP3 players, flat screen TVs and monitors, multimedia cell phones and ink jet printers and cartridges. A newer application served by Microelectronics is the growing production of solar cells.

The Company’s products are sold to customers in this market through its own personnel, distributors and manufacturers’ representatives. The backlog at July 31, 2009 was approximately $19,078,000 (of which approximately $13,800,000 is expected to be shipped in fiscal year 2010) compared with $24,430,000 at July 31, 2008. Company management believes that performance, product quality, innovation and service are the most important factors in the majority of sales in this market. The Company’s principal competitors of the Company’s Microelectronics technologies market include Entegris, Inc. and Mott Corporation.

The following comments relate to the two operating segments discussed above:

RAW MATERIALS:

Most raw materials used by the Company are available from multiple sources. A limited number of materials are proprietary products of major chemical companies. Management believes that the Company could obtain satisfactory substitutes for these materials should they become unavailable.

INTELLECTUAL PROPERTY:

The Company owns numerous U.S. and foreign patents and has patent applications pending in the U.S. and abroad. The Company also licenses intellectual property rights from third parties, some of which bear royalties and are terminable in specified circumstances. In addition to the Company’s patent portfolio, the Company possesses a wide array of proprietary technology and know-how. The Company also owns numerous U.S. and foreign trademarks covering its diverse array of products, and has applications pending for the registration of trademarks. The Company believes that patents and other proprietary rights are important to the strength of the Company. The Company also relies upon trade secrets, know-how, continuing technological innovations and licensing opportunities to develop and maintain its competitive position. The Company does not believe that the expiration of any individual patent or any patents due to expire in the foreseeable future will have a material adverse impact on its business, financial condition or results of operations in any one year.

7

ITEM 1A. RISK FACTORS.

The risk factors described below are not inclusive of all risk factors but highlight those that the Company believes are the most significant and that could impact its performance and financial results. These risk factors should be considered together with all other information presented in this Form 10-K report.

Litigation and regulatory inquiries associated with the restatement of the Company’s prior period financial statements could result in substantial costs, penalties and other adverse effects.

Substantial costs may be incurred to defend and resolve regulatory proceedings and litigation arising out of or relating to matters underlying the Company’s restatement of prior period financial statements as described in its 2007 Form 10-K. These proceedings include the ongoing audits of the Company’s tax returns, as well as audits expected to commence of the Company’s tax returns for some of the periods affected by the restatement. In September 2007, the Company deposited $135 million with the U.S. Treasury, which reflected management’s preliminary assessment of additional taxes and interest that the Company might owe the Internal Revenue Service (“IRS”) for prior years as a result of tax compliance matters identified at the time and did not include any amount with respect to potential penalties. In completing the restatement, the Company examined the appropriateness of the Company’s accounting treatment of the tax consequences of each type of intercompany transaction in the various taxing jurisdictions in which the Company operates. As a result of this analysis, the Company determined that additional financial statement reserves were required with respect to certain other lesser tax compliance matters. The Company cannot predict when the ongoing IRS audit will be completed or the amount or timing of the final resolution with the IRS or other relevant taxing authorities of the matters that gave rise to the restatement, including the amount of any penalties that may be imposed, which could be substantial.

The Company is also subject to other regulatory and litigation proceedings relating to, or arising out of, the restatement, including pending investigations by the SEC and the Department of Justice, purported securities class action lawsuits and derivative lawsuits seeking relief against certain of the Company’s officers and directors. These proceedings could also result in civil or criminal fines and other non-monetary penalties. The Company has not reserved any amount in respect of these matters in its consolidated financial statements.

The Company cannot predict whether any monetary losses it experiences in the proceedings will be covered by insurance or whether insurance proceeds recovered will be sufficient to offset such losses. Pending civil, regulatory and criminal proceedings may also divert the efforts and attention of the Company’s management from business operations, particularly if adverse developments are experienced in any of them, such as an expansion of the investigations being conducted by the SEC and the Department of Justice. See Part I – Item 3 – Legal Proceedings, for further discussion of these pending matters.

If the Company experiences a disruption of its information technology systems, or if the Company fails to successfully implement, continue to manage and integrate its information technology systems, it could harm the Company’s business.

The Company’s information technology (“IT”) systems are an integral part of its business. A serious disruption of its IT systems, whether caused by fire, storm, flood, telecommunications failures, physical or software break-ins or viruses, or any other events, could have a material adverse effect on the Company’s business and results of operations. The Company depends on its IT systems to process transactions, prepare its financial reporting and effectively manage and monitor its business. The Company cannot provide assurance that its contingency plans will allow it to operate at its current level of efficiency in the event of a serious IT disruption.

Additionally, the Company’s ability to most effectively implement its business plans in a rapidly evolving market requires effective planning, reporting and analytical processes and systems. The Company is improving and expects that it will need to continue to improve and further integrate its IT systems, reporting systems and operating procedures on an ongoing basis. If the Company fails to incrementally improve, manage and integrate its IT systems, reporting systems and operating procedures, it could adversely affect the Company’s ability to achieve its objectives.

8

The Company may be adversely affected by global and regional economic conditions and legislative, regulatory and political developments.

The Company conducts operations around the globe. The Company expects to continue to derive a substantial portion of sales and earnings from outside the U.S. The recession in the U.S. and other countries around the globe in which the Company derives significant sales adversely affected the Company’s results for fiscal year 2009 and could continue to have a negative impact on demand for the Company’s products as the prospects, strength and timing of any recovery remain uncertain. Customers or suppliers may experience serious cash flow problems and as a result, may modify, delay or cancel plans to purchase the Company’s products and suppliers may significantly and quickly increase their prices or reduce their output. Additionally, if customers are not successful in generating sufficient revenue or are precluded from securing financing, they may not be able to pay, or may delay payment of, accounts receivable that are owed to the Company. Any inability of current and/or potential customers to purchase the Company’s products and/or to pay the Company for its products may adversely affect the Company’s earnings and cash flow. Sales and earnings could also be affected by the Company’s ability to manage the risks and uncertainties associated with the application of local legal requirements or the enforceability of laws and contractual obligations, trade protection measures, changes in tax laws, regional political instability, war, terrorist activities, severe or prolonged adverse weather conditions and natural disasters as well as health epidemics or pandemics.

Changes in demand for the Company’s products and business relationships with key customers and suppliers, including delays or cancellations in shipments, may affect operating results.

To achieve its objectives, the Company must develop and sell products that are subject to the demands of customers. This is dependent on many factors including, but not limited to, managing and maintaining relationships with key customers, responding to the rapid pace of technological change and obsolescence, which may require increased investment by or greater pressure to commercialize developments rapidly or at prices that may not fully recover the associated investment, and the effect on demand resulting from customers’ research and development, capital expenditure plans and capacity utilization.

The manufacturing of the Company’s products is dependent on an adequate supply of raw materials. The Company’s ability to maintain an adequate supply of raw materials could be impacted by the availability and price of those raw materials and maintaining relationships with key suppliers.

Fluctuations in foreign currency exchange rates and interest rates may materially affect operating results.

In fiscal year 2009, the Company derived 69% of sales from outside the U.S. Although sales and expenditures outside the U.S. are typically made in the local currencies of those countries providing a natural hedge against fluctuations in foreign currency rates, the company retains significant exposure to the value of foreign currencies relative to the U.S. dollar and operating results may be materially affected by changes in foreign currency rates. The primary foreign currency exposures relate to adverse changes in the relationships of the U.S. dollar to the Euro, the British Pound, the Japanese Yen, the Australian Dollar, the Canadian Dollar, the Swiss Franc and the Singapore Dollar, as well as adverse changes in the relationship of the Pound to the Euro.

Giving effect to the Company’s interest rate swap, the Company’s debt portfolio was approximately 45% variable rate at July 31, 2009. Fluctuations in interest rates may also materially affect operating results.

Changes in product mix and product pricing may affect the Company’s operating results particularly with the expansion of the systems business, in which the Company experiences significantly longer sales cycles with less predictable revenue and no certainty of future revenue streams from related consumable product offerings and services.

The Company’s TFM strategy is partially reliant on sales of integrated systems. Because systems are generally sold at lower gross margins than many other products, gross margins could decline if systems sales continue to grow as a percentage of total sales and the anticipated future revenue streams from related consumable product offerings and services are not realized.

9

The Company’s systems platform generally also experiences significantly longer sales cycles and involves less predictable revenue and uncertainty of future revenue streams from related consumable product offerings and services. In addition, the profitability of the Company’s systems sales depends substantially on the ability of management to estimate accurately the costs involved in manufacturing and implementing the relevant system according to the customer’s specifications. Company estimates can be adversely affected by disruptions in a customer’s plans or operations and unforeseen events, such as manufacturing defects. Failure to accurately estimate the Company’s cost of system sales can adversely affect the profitability of those sales, and the Company may not be able to recover lost profits through pricing or other actions.

Increases in costs of manufacturing and operating costs may affect operating results.

The Company’s costs are subject to fluctuations, particularly due to changes in commodity prices, raw materials, energy and related utilities and cost of labor. The achievement of the Company’s financial objectives is reliant on its ability to manage these fluctuations through cost savings or recovery actions and efficiency initiatives.

The Company may not be able to achieve the savings anticipated from its cost reduction and gross margin improvement initiatives.

Since fiscal year 2006, the Company has launched a number of cost reduction and gross margin improvement initiatives, including its facilities rationalization, AmeriPall cost reduction, and EuroPall cost reduction initiatives. Unexpected delays or other factors in these cost reduction and lean manufacturing initiatives could impact the Company’s ability to realize the anticipated savings and to improve or maintain gross margins.

The Company may not be able to obtain regulatory approval or market acceptance of new technologies.

Part of the Company’s planned growth is dependent on new products and technologies. Some of those new products may require regulatory approval. Growth from those new technologies may not be realized if regulatory approval is not granted or customer demand for those products or technologies does not materialize.

The Company may not successfully enforce patents and protect proprietary products and manufacturing techniques.

Some of the Company’s products, as well as some competitor’s products, are based on patented technology and other intellectual property rights. Some of these patented technologies and intellectual property require substantial resources to develop. Operating results may be affected by the costs associated with the Company’s defense of its intellectual property against unauthorized use by others, as well as third-party challenges to its intellectual property. The Company could also experience disruptions in its business, including loss of revenues and adverse effects on its prospects, if its patented or other proprietary technologies are successfully challenged.

Changes in the Company’s effective tax rate may affect operating results.

Fluctuations in the Company’s effective tax rate may affect operating results. The Company’s effective tax rate is subject to fluctuation based on a variety of factors, such as:

the geographical mix of income derived from the countries in which it operates;

currently applicable tax rates, particularly in the U.S.;

the nature, timing and impact of permanent or temporary changes in tax laws or regulations;

the timing and amount of the Company’s repatriation of foreign earnings;

the timing and nature of the Company’s resolution of uncertain income tax positions; and

the Company’s success in managing its effective tax rate through the implementation of global tax and cash management strategies.

The Company operates in numerous countries and is subject to taxation in all of the countries in which it operates. The tax rules and regulations in such countries can be complex and, in many cases, uncertain in their application. In addition to challenges to the Company’s tax positions arising during routine audits, disputes can arise with the taxing authorities over the interpretation or application of certain rules to the Company’s business conducted within the country involved and with respect to intercompany transactions when the parties are taxed in different jurisdictions. Pending proceedings to which the Company is subject include ongoing audits of the Company’s tax returns for some of the periods affected by the restatement, and the Company cannot predict the timing or outcome of the completion of those audits, which could result in the imposition of additional taxes and substantial penalties. See “Litigation and regulatory inquiries associated with the restatement of the Company’s prior period financial statements could result in substantial costs, penalties and other adverse effects” risk factor above.

10

The Company may not be able to successfully complete or integrate acquisitions.

In so far as acquisition opportunities are identified, there is no assurance of the Company’s ability to complete any such transactions and successfully integrate the acquired business as planned.

The Company is subject to domestic and international competition in all of its global markets.

The Company is subject to competition in all of the global markets in which it operates. The Company’s achievement of its objectives is reliant on its ability to successfully respond to many competitive factors including, but not limited to, pricing, technological innovations, product quality, customer service, manufacturing capabilities and hiring and retention of qualified personnel.

ITEM 1B. UNRESOLVED STAFF COMMENTS.

None.

11

ITEM 2. PROPERTIES.

The following are the Company’s principal facilities (i.e., facilities with square footage in excess of 25,000 square feet), which in the opinion of management are suitable and adequate to meet the Company’s requirements:

| | | | Principally Supports | | |

| | | | the Following | | Fiscal Year 2009 |

| Location | | Principal Activities (1) | | Business Groups (2) | | Square Footage |

| OWNED: | | | | | | |

| Western Hemisphere | | | | | | |

| Cortland, NY | | A | | PI | | 338,000 |

| DeLand, FL | | M | | PI | | 279,000 |

| Fajardo & Luquillo, Puerto Rico | | M,W | | PLS | | 261,000 |

| Pt. Washington, NY | | L,S | | A | | 280,000 |

| Ann Arbor, MI | | L,W,S | | PLS | | 186,000 |

| New Port Richey, FL | | A | | PI | | 179,000 |

| Timonium, MD | | M,W,S | | PI | | 160,000 |

| Ft. Myers, FL | | A | | PI | | 111,000 |

| Pensacola, FL | | A | | PLS | | 98,000 |

| Hauppauge, NY | | M | | PLS | | 75,000 |

| Covina, CA | | M,L | | PLS | | 71,000 |

| Putnam, CT | | M | | PI | | 63,000 |

| Europe | | | | | | |

| Bad Kreuznach, Germany | | A | | PI | | 390,000 |

| Portsmouth, U.K. | | A | | A | | 270,000 |

| Crailsheim, Germany | | A | | PI | | 215,000 |

| Ascoli, Buccinasco & Verona, Italy | | A | | A | | 189,000 |

| Tipperary, Ireland | | M | | PI | | 178,000 |

| Redruth, U.K. | | M | | PI | | 163,000 |

| Ilfracombe, U.K. | | M | | PLS | | 125,000 |

| Newquay, U.K. | | M | | PLS | | 110,000 |

| Bazet, France | | A | | PI | | 96,000 |

| Frankfurt, Germany | | W,S | | A | | 75,000 |

| Saint Germain, France | | L,W,S | | A | | 60,000 |

| Ternay, France | | A | | PI | | 33,000 |

| Asia | | | | | | |

| Tsukuba, Japan | | M,L,W | | PI | | 122,000 |

| |

| LEASED: | | | | | | |

| Western Hemisphere | | | | | | |

| Fajardo, Puerto Rico | | W | | PLS | | 114,000 |

| Cortland, NY | | M,W | | PI | | 111,000 |

| Timonium, MD | | M,W | | PI | | 71,000 |

| Tijuana, Mexico | | W | | PLS | | 63,000 |

| Baltimore, MD | | W | | PI | | 41,000 |

| Covina, CA | | W | | PLS | | 40,000 |

| Northborough, MA | | M,W | | A | | 38,000 |

| San Diego, CA | | A | | PI | | 26,000 |

| Europe | | | | | | |

| Johannesburg, South Africa | | W,S | | PI | | 99,000 |

| Madrid, Spain | | L,W,S | | A | | 44,000 |

| Cergy, France | | A | | PLS | | 43,000 |

| Ascoli, Italy | | W | | PLS | | 35,000 |

| Asia | | | | | | |

| Beijing, China | | A | | PI | | 318,000 |

| Melbourne & Somersby, Australia | | A | | A | | 102,000 |

| Mumbai, Banglore, Pune & Bhiwandi, India | | L,W,S | | A | | 73,000 |

| Tokyo, Osaka & Nagoya, Japan | | L,S | | A | | 47,000 |

12

| (1)Definition of Principal Activities | | (2)Definition of Business Groups |

| M: Manufacturing activities | | PLS: Pall Life Sciences |

| L: Laboratories for research & development and validation activities | | PI: Pall Industrial |

| W: Warehousing activities | | CS: Corporate and Shared Services |

| S: Sales, marketing and administrative activities | | A: All of the above |

| A: All of the above | | |

ITEM 3. LEGAL PROCEEDINGS.

Federal Securities Class Actions:

Four putative class action lawsuits were filed against the Company and certain members of its management team alleging violations of the federal securities laws relating to the Company’s understatement of certain of its U.S. income tax payments and of its provision for income taxes in certain prior periods as described in Note 2, Audit Committee Inquiry and Restatement to the consolidated financial statements included in the 2007 Form 10-K. These lawsuits were filed between August 14, 2007 and October 11, 2007 in the U.S. District Court for the Eastern District of New York. By Order dated May 28, 2008, the Court consolidated the cases under the caption “In re Pall Corp,” No. 07-CV-3359 (E.D.N.Y.) (JS) (ARL), appointed a lead plaintiff and ordered that the lead plaintiff file a consolidated amended complaint. The lead plaintiff filed its consolidated amended complaint on August 4, 2008. The lead plaintiff seeks to act as representative for a class consisting of purchasers of the Company’s stock between April 20, 2007, and August 2, 2007, inclusive. The consolidated amended complaint names the Company and its current chief executive officer and chief financial officer as defendants and alleges violations of Section 10(b) and 20(a) of the Exchange Act, as amended, and Rule 10b-5 promulgated by the Securities and Exchange Commission. It alleges that the defendants violated these provisions of the federal securities laws by issuing materially false and misleading public statements about the Company’s financial results and financial statements, including the Company’s income tax liability, effective tax rate, internal controls and accounting practices. The plaintiffs seek unspecified compensatory damages, costs and expenses. The Company moved to dismiss the consolidated amended complaint on September 19, 2008, and filed its reply brief to the lead plaintiff’s opposition to the Company’s motion to dismiss on December 2, 2008. By Memorandum and Order dated September 21, 2009, the Court denied the Company’s motion to dismiss the consolidated amended complaint and granted the lead plaintiff leave to amend the consolidated amended complaint by filing a second amended complaint.

Shareholder Derivative Lawsuits:

On October 5, 2007, two plaintiffs filed identical derivative lawsuits in New York Supreme Court, Nassau County relating to the tax matter described above. These actions purported to bring claims on behalf of the Company based on allegations that certain current and former directors and officers of the Company breached their fiduciary duties by failing to evaluate and otherwise inform themselves about the Company’s internal controls and financial reporting systems and procedures. In addition, plaintiffs allege that certain officers of the Company were unjustly enriched as a result of the Company’s inaccurate financial results over fiscal years 1999-2006 and the first three quarters of fiscal year 2007. The complaints sought unspecified compensatory damages on behalf of the Company, disgorgement of defendants’ salaries, bonuses, stock grants and stock options, equitable relief and costs and expenses. The Company, acting in its capacity as nominal defendant, moved to dismiss the complaints for failure to make a demand upon the Company’s board of directors, which motions were granted on April 30 and May 2, 2008. On September 19, 2008, the same two plaintiffs filed a derivative lawsuit in New York Supreme Court, Nassau County, which was served on the Company on September 26, 2008 (“September Derivative”). This action purports to bring claims on behalf of the Company based on allegations that certain current and former directors and officers of the Company breached their fiduciary duties and were unjustly enriched in connection with the tax matter. In addition, the plaintiffs allege that the Board’s refusal of their demand to commence an action against the defendants was not made in good faith. The plaintiffs and the Company agreed to stay these proceedings pending resolution of the Company’s motion to dismiss in the federal securities class action lawsuit discussed above, after which resolution the plaintiffs and the Company agreed to confer about a schedule for the defendants’ time to answer or otherwise respond to the complaint.

On November 13, 2008, another shareholder filed a derivative lawsuit in New York Supreme Court, Nassau County, against certain current and former directors and officers of the Company, and against the Company, as nominal defendant, which was served on the Company on December 4, 2008. This action purports to bring similar claims as the September Derivative. The plaintiffs and the Company have agreed to an identical stay as in the September Derivative.

Other Proceedings:

The SEC and U.S. Attorney’s Office for the Eastern District of New York are conducting investigations in connection with the tax matter described above. The Company is cooperating with these investigations.

13

Environmental Matters:

The Company has environmental matters, discussed below, at the following four U.S. sites: Ann Arbor, Michigan; Pinellas Park, Florida; Glen Cove, New York and Hauppauge, New York.

The Company’s balance sheet at July 31, 2009 contains environmental liabilities of $12,454,000, which relate to the items discussed below. In the opinion of Company management, the Company is in substantial compliance with applicable environmental laws and regulatory orders and its accruals for environmental remediation are adequate at this time.

Reference is also made to Note 15, Contingencies and Commitments, to the accompanying consolidated financial statements.

Ann Arbor, Michigan:

In February 1988, an action was filed in the Circuit Court for Washtenaw County, Michigan (the “Court”) by the State of Michigan (the “State”) against Gelman Sciences Inc. (“Gelman”), a subsidiary acquired by the Company in February 1997. The action sought to compel Gelman to investigate and remediate contamination near Gelman’s Ann Arbor facility and requested reimbursement of costs the State had expended in investigating the contamination, which the State alleged was caused by Gelman’s disposal of waste water from its manufacturing process. Pursuant to a consent judgment entered into by Gelman and the State in October 1992 (amended September 1996 and October 1999) (the “Consent Judgment”), which resolved that litigation, Gelman is remediating the contamination without admitting wrongdoing. In February 2000, the State Assistant Attorney General filed a Motion to Enforce Consent Judgment in the Court seeking approximately $4,900,000 in stipulated penalties for the alleged violations of the Consent Judgment and additional injunctive relief. Gelman disputed these assertions. Following an evidentiary hearing in July 2000, the Court took the matter of penalties “under advisement.” The Court issued a Remediation Enforcement Order requiring Gelman to submit and implement a detailed plan to reduce the contamination to acceptable levels within five years. Gelman’s plan has been approved by both the Court and the State. Although groundwater concentrations remain above acceptable levels in much of the affected area, the Court has expressed its satisfaction with Gelman’s progress during hearings both before and after the five-year period expired. Neither the State nor the Court has sought or suggested that Gelman should be penalized based on the continued presence of groundwater contamination at the site.

In February 2004, the Court instructed Gelman to submit its Final Feasibility Study describing how it intends to address an area of groundwater contamination not addressed by the previously approved plan. Gelman submitted its Feasibility Study as instructed. The State also submitted its plan for remediating this area of contamination to the Court. On December 17, 2004, the Court issued its Order and Opinion Regarding Remediation and Contamination of the Unit E Aquifer (the “Order”) to address an area of groundwater contamination not addressed in the previously approved plan. Gelman is now in the process of implementing the requirements of the Order.

In correspondence dated June 5, 2001, the State asserted that stipulated penalties in the amount of $142,000 were owed for a separate alleged violation of the Consent Judgment. The Court found that a “substantial basis” for Gelman’s position existed and again took the State’s request “under advisement,” pending the results of certain groundwater monitoring data. That data has been submitted to the Court, but no ruling has been issued.

On August 9, 2001, the State made a written demand for reimbursement of $227,000 it has allegedly incurred for groundwater monitoring. On October 23, 2006, the State made another written demand for reimbursement of these costs, which now total $494,000, with interest. In February 2007, the Company met with the State to discuss whether the State would be interested in a proposal for a “global settlement” to include, among other matters, the claim for past monitoring costs ($494,000). Gelman is engaged in discussion with the State with regard to this demand, however, Gelman considers this claim barred by the Consent Judgment.

14

By letter dated June 15, 2007, the Michigan Department of Environmental Quality (“DEQ”) claimed Gelman was in violation of the Consent Judgment and related work plans due to its failure to operate a groundwater extraction well in the Evergreen Subdivision at the approved minimum purge rate. The DEQ sought to assess stipulated penalties. Gelman filed a Petition for Dispute Resolution with the Court on July 6, 2007 contesting these penalties. Prior to the hearing on Gelman’s petition, the parties met and the DEQ agreed to waive these penalties in exchange for Gelman’s agreement to perform additional investigations in the area. The Court entered a Stipulated Order to this effect on August 7, 2007. Since then, Gelman has installed several monitoring wells requested by the State. Representatives of Gelman and the State met on December 10, 2007 to discuss the data obtained from these wells and to plan further investigative activities. These discussions are ongoing. On April 15, 2008, Gelman submitted two reports summarizing the results of the investigation to date. Gelman also submitted a “capture zone analysis” that confirmed that Gelman was achieving the cleanup objective for the Evergreen Subdivision system. On June 23, 2008, the State provided its response to these reports. The response also addressed outstanding issues regarding several other areas of the site. In its response, the State asked the Company to undertake additional investigation in the Evergreen Subdivision area and in other areas of the site to more fully delineate the extent of contamination. The State also asked the Company to capture additional contaminated groundwater in the Wagner Road area, near the Gelman property, unless the Company can show that it is not feasible to do so. Gelman proposed to the DEQ several modifications to the Consent Judgment on August 1, 2008 and met with the DEQ to discuss these modifications (and other outstanding issues) on September 15, 2008. The parties agreed that Gelman would prepare and submit to the DEQ an outline for modifications to the existing Consent Judgment (and Administrative Orders) by October 15, 2008 and that the parties would meet thereafter to discuss. On April 29, 2009, the Court issued an order that sets forth a schedule for the various steps that must be taken to implement agreed upon modifications to the cleanup program. Pursuant to that schedule, the Company submitted its Comprehensive Proposal to Modify Cleanup Program (the “Proposal”) to the State on May 4, 2009. On June 15, 2009, the State refused to approve the Company’s Proposal. Pursuant to the Court-imposed schedule, the Company filed pleadings identifying areas of dispute and motions seeking approval of its Proposal on August 18, 2009. The DEQ did not file any pleadings regarding the Company’s Proposal, but did file a motion to enforce the existing Consent Judgment that asks the Court to order the Company to undertake additional response activities with regard to certain portions of the site. The DEQ’s motion does not seek monetary damages. The Court has not indicated the exact process by which it will resolve these disputes.

Pinellas Park, Florida:

In 1995, as part of a facility closure, an environmental site assessment was conducted to evaluate potential soil and groundwater impacts from chemicals that may have been used at the Company’s Pinellas Park facility during the previous 24-year period of manufacturing and testing operations. Methyl Isobutyl Ketone (“MIBK”) concentrations in groundwater were found to be higher than regulatory levels. Soil excavation was conducted in 1998 and subsequent groundwater sampling showed MIBK concentrations below the regulatory limits.

In October 2000, environmental consultants for a prospective buyer of the property found groundwater contamination at the Company’s property. In October 2001, a Site Assessment Report conducted by the Company’s consultants, which detailed contamination concentrations and distributions, was submitted to the Florida Department of Environmental Protection (“FDEP”).

In July 2002, a Supplemental Contamination Assessment Plan and an Interim Remedial Action Plan (“IRAP”) were prepared by the Company’s consultants and submitted to the FDEP. A revised IRAP was submitted by the Company in December 2003, and it was accepted by the FDEP in January 2004. A Remedial Action Plan (“RAP”) was submitted by the Company to the FDEP in June 2004. Final approval by the FDEP of the Company’s RAP was received by the Company on August 26, 2006. Pursuant to the approved RAP, the Company began active remediation on the property.

On March 31, 2006, the FDEP requested that the Company investigate potential off-site migration of contaminants. Off-site contamination was identified and the FDEP was notified. On April 13, 2007, the FDEP reclassified the previously approved RAP as an Interim Source Removal Plan (“ISRP”) because a RAP can only be submitted after all contamination is defined.

Pursuant to FDEP requirements, the Company installed additional on-site and off-site monitoring wells during 2006, 2007, 2008 and 2009. Additional monitoring wells will be installed in fiscal year 2010. After they have been installed and sampled, the results will be provided to FDEP. Once the delineation has been declared complete by FDEP, the Company will complete and submit a Site Assessment Report Addendum, summarizing the soil and groundwater contamination, delineation and remediation.

15

Active remediation through the fourth quarter of fiscal year 2009 was performed in accordance with work defined in the ISRP and addenda approved by FDEP. Additional remediation is scheduled to satisfy site closure requirements, which include (1) no free product contaminants, (2) shrinking or stable plumes, and (3) prevention of future exposure of the public or environment through recordation of restrictive covenants prohibiting groundwater use. The first two requirements will be demonstrated through groundwater monitoring; a local law firm is assisting Company management during negotiations with the owners of adjacent properties regarding the third requirement.

Once the contamination has been delineated and active remediation has stopped, groundwater sampling and analysis must continue for at least the legislative minimum of one year. After groundwater sampling is complete, a closure application will be submitted to FDEP.

Glen Cove, New York:

A March 1994 report indicated groundwater contamination consisting of chlorinated solvents at a neighboring site to the Company’s Glen Cove facility, and later reports found groundwater contamination in both the shallow and intermediate zones at the facility. In 1999, the Company entered into an Order on Consent with the New York State Department of Environmental Conservation (“NYSDEC”), and completed a Phase II Remedial Investigation at the Glen Cove facility.

The NYSDEC has designated two operable units (“OUs”) associated with the Glen Cove facility. In March 2004, the NYSDEC finalized the Record of Decision (“ROD”) for the shallow and intermediate groundwater zones, termed OU-1. The Company signed an Order on Consent for OU-1 effective July 5, 2004, which requires the Company to prepare a Remedial Design/Remedial Action (“RD/RA”) Work Plan to address groundwater conditions at the Glen Cove facility.

The Company completed a pilot test involving the injection of a chemical oxidant into on-site groundwaterand, on May 31, 2006, submitted a report to NYSDEC entitled “In-Situ Chemical Oxidation Phase II Pilot Test and Source Evaluation Report” (the “Report”). The Report contained data which demonstrated that (1) in general, the pilot test successfully reduced contaminant levels and (2) the hydraulic controls installed on the upgradient Photocircuits Corporation (“Photocircuits”) site are not effective and contaminated groundwater continues to migrate from that site. On July 31, 2006, the Company received comments from NYSDEC on the Report. On September 27, 2006, the Company submitted responses to the NYSDEC comments. On November 16, 2006, the Company met with the NYSDEC representatives to discuss the Report and the impact of the continued migration of contaminated groundwater from the upgradient Photocircuits site onto the Glen Cove facility. On January 26, 2007, the Company submitted a draft conceptual remedial design document for the Glen Cove facility to NYSDEC for its technical review.

The Company met with NYSDEC representatives on April 12, 2007 to discuss a possible settlement of liability for OU-1 and for the contamination in the deep groundwater zone, termed OU-2. NYSDEC would not agree to settle OU-2 because a remedial investigation has not been completed. On October 23, 2007, NYSDEC requested submittal of a RD/RA Work Plan, which the Company submitted on December 20, 2007. The Company has pursued possible settlement of liability for OU-1 and met with NYSDEC again on November 30, 2007 to present a settlement framework. On December 20, 2007, the Company submitted a description of the settlement framework for NYSDEC’s further review. On April 15, 2008, the Company met with NYSDEC staff to discuss settlement terms and reached conceptual agreement on settlement for liability for OU-1. In an April 18, 2008 letter, NYSDEC confirmed its acceptance of the conceptual settlement. On August 13, 2008, the Company received for review and comment a proposed Consent Decree to settle this matter. Since August 13, 2008, the Company and NYSDEC have been discussing the terms of the Consent Decree for the settlement of liability for OU-1 and are in the process of finalizing a Consent Decree that would provide for a $2 million payment by the Company (which amount does not exceed the Company’s reserve for this matter) in exchange for a broad release of OU-1 claims and liability (claims and losses arising out of or in connection with OU-2 or any damages to the State’s natural resources would be excluded from the settlement). The Company expects to execute a Consent Decree by October 31, 2009, the end of its first quarter.

The ROD for OU-2 has been deferred by NYSDEC until additional data is available to delineate contamination and select an appropriate remedy. NYSDEC requested that the Company and Photocircuits enter into a joint Order on Consent for the remedial investigation. Photocircuits was not willing to enter into an Order and the Company was informed by NYSDEC that it would undertake the OU-2 investigation at the Photocircuits property. Photocircuits is now in Chapter 11 bankruptcy and, in or about March 2006, the assets of Photocircuits’ Glen Cove facility were sold to American Pacific Financial Corporation (“AMPAC”). AMPAC operated the facility under the Photocircuits name, but closed it on or about April 15, 2007.

16

In July 2007, NYSDEC commenced the OU-2 investigation at both the Photocircuits and Pall sites. The Company has retained an engineering consultant to oversee NYSDEC’s OU-2 work. NYSDEC's OU-2 investigation continues to be ongoing.

Hauppauge, New York:

On December 3, 2004, a third-party action was commenced against the Company in the U.S. District Court for the Eastern District of New York in connection with groundwater contamination. In the primary action, plaintiff Anwar Chitayat (“Chitayat” or the “plaintiff”) seeks recovery against defendants Vanderbilt Associates and Walter Gross for environmental costs allegedly incurred, and to be incurred, in connection with the disposal of hazardous substances from a property located in Hauppauge, New York (the “Site”). The Site is a property located in the same industrial park as a Company facility. Vanderbilt Associates is the prior owner of the site and Walter Gross was a partner in Vanderbilt Associates. Following Mr. Gross’ death in 2005, Barbara Gross was substituted as a third-party plaintiff. Ms. Gross claims that the Company is responsible for releasing hazardous substances into the soil and groundwater at its property, which then migrated to the Site, and seeks indemnification and contribution under Section 113 of CERCLA from third-party defendants, including the Company, in the event she is liable to Chitayat.

Chitayat alleges that prior to 1985, Vanderbilt Associates leased the Site to Sands Textiles Finishers, Inc. for textile manufacturing and dry cleaning. Chitayat alleges that hazardous substances were disposed at the Site during the time period that Mr. Gross and Vanderbilt Associates owned and/or operated the Site, which migrated from the Site to surrounding areas. Chitayat alleges that in August 1998, he entered into a Consent Order with the NYSDEC which resulted in NYSDEC investigating the Site and developing a remediation plan, and required Chitayat to reimburse the State via a periodic payment plan. Chitayat alleges that the total response costs will exceed $3,000,000, and that he has incurred more than $500,000 in costs to date.

In 2005, the plaintiff moved to amend his complaint to add a claim for contribution under Section 113 of CERCLA against the Company, and the Company opposed the proposed amendment. In March 2006, the Court terminated the plaintiff’s motion to amend, and plaintiff has not renewed his motion. As a result, the only claim asserted against the Company is by Barbara Gross.

The NYSDEC has designated two operable units (“OU”) associated with the Site. OU-1 relates to the “on-site” contamination at 90, 100 and 110 Oser Avenue, and represents the geographic area which Chitayat alleges will result in response costs in excess of $3,000,000. OU-2 relates to off-site groundwater contamination migrating away from the Site. In January 2006, the NYSDEC issued a ROD selecting a remedial program for OU-2 which is projected to cost approximately $4,500,000 to implement.

Fact discovery in the case was completed in January 2006. Experts for plaintiff, Barbara Gross, Vanderbilt Associates and the Company served expert reports in March and April 2006, and expert discovery was concluded in May 2006. There is a dispute among the experts as to whether contaminants from the Company’s facility have contributed to cleanup costs at the Site and, if so, to what extent. In September 2006, the Court established a briefing schedule for all parties to submit summary judgment motions, and for Barbara Gross and the Company to make motions to strike certain expert testimony. Third-party defendants, including the Company, filed motions for summary judgment on October 6, 2006. The Company also filed motions to strike certain expert testimony. Plaintiff filed opposition papers with the Court on November 6, 2006, and the moving third-party defendants, including the Company, filed reply papers on November 20, 2006.

While the motions were pending, the parties enlisted the aid of a mediator to negotiate a settlement of the case. The parties met with the mediator on July 30 through August 1, 2007, which resulted in a tentative settlement agreement, subject to drafting of definitive settlement documents. During the process of negotiating the settlement documents, a disagreement developed between the plaintiff and the primary defendants as to the terms of establishment of the settlement fund that had been agreed upon at the mediation. Although the plaintiff and the primary defendants continued in discussions for several months, this dispute was not resolved. The discussions have ceased and the proposed settlement has not yet been achieved.

The summary judgment motions remains pending without a decision. On September 27, 2007, the Court issued a decision on the Company’s motionsin limine to preclude testimony by the experts for plaintiff and third-party plaintiff Barbara Gross, granting the motions in part and denying them in part.

If the settlement were completed as contemplated, the Company’s responsibility would be fixed and it would be released from further liability to the plaintiff or third-party plaintiffs. Because it is not completed, if the Company’s motion for summary judgment is denied, the case will continue. If that happens, the Company will remain subject to potential liability and an allocation of some portion of the response costs paid by plaintiff to the State of New York.

17

ITEM 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS.

There were no matters submitted to a vote of the Company’s shareholders during the fourth quarter of fiscal year 2009.

EXECUTIVE OFFICERS OF THE REGISTRANT

| | | | | | | First Appointed an |

| Name | | Age(1) | | Current Positions Held | | Executive Officer |

| Eric Krasnoff | | 57 | | Chairman and Chief Executive Officer | | 1986 |

| Lisa McDermott | | 44 | | Chief Financial Officer and Treasurer | | 2006 |

| Donald B. Stevens | | 64 | | President, Chief Operating Officer and President, Industrial | | 1994 |

| Roberto Perez | | 60 | | Group Vice President and President, Life Sciences | | 2003 |

| Sandra Marino | | 39 | | Senior Vice President, General Counsel and Corporate Secretary | | 2008 |

| | (1) | | Age as of September 18, 2009. |

None of the persons listed above is related.

Eric Krasnoff has served as Chairman and Chief Executive Officer since July 1994. Since joining the Company in 1975, Mr. Krasnoff served in several corporate management positions, including Group Vice President and Executive Vice President. He was elected President and Chief Operating Officer of the Company in 1993. Mr. Krasnoff is a director of the Company and member of the board’s executive committee.

Lisa McDermott has served as Chief Financial Officer and Treasurer since January 2006. Ms. McDermott began her employment with the Company in 1999 as Corporate Controller and was promoted to Vice President - Finance in July 2004.

Donald B. Stevens has served as President of the Company since April 2008 and also serves as Chief Operating Officer and President, Industrial. Mr. Stevens has held many key management positions since joining the Company in 1968, including that of Executive Vice President responsible for the Company’s Industrial business.

Roberto Perez has served as Group Vice President and President, Life Sciences, since November 2004. Mr. Perez joined the Company in January 2000 as President of the Medical Products Manufacturing Group. In March 2001, Mr. Perez was promoted to Vice President of the Company’s blood filtration business.

Sandra Marino has served as Senior Vice President and General Counsel since September 2008 and as Corporate Secretary since March 2008. Ms. Marino joined the Company in January 2005 as Corporate Counsel and Assistant Corporate Secretary. Prior to that, Ms. Marino was employed as a corporate attorney at Carter Ledyard & Milburn LLP.

None of the above persons has been involved in those legal proceedings required to be disclosed by Item 401(f) of Regulation S-K during the past five years.

18

PART II

ITEM 5. MARKET FOR THE REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDERMATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES.

The Company’s common stock is listed on the New York Stock Exchange under the symbol PLL. The table below sets forth quarterly data relating to the Company’s common stock prices and cash dividends declared per share for the past two fiscal years.

| | | | | | | | | | | | | Cash Dividends |

| 2009 | | 2008 | | Declared Per Share |

| Price per share | High | | Low | | High | | Low | | 2009 | | 2008 |

| Quarter: | First | $ | 42.72 | | $ | 21.79 | | $ | 44.55 | | $ | 33.46 | | $ | 0.130 | | $ | 0.24 |

| | Second | | 29.59 | | | 21.61 | | | 42.26 | | | 33.37 | | | 0.145 | | | 0.12 |

| Third | | 28.68 | | | 18.20 | | | 41.48 | | | 34.01 | | | 0.145 | | | 0.13 |

| Fourth | | 30.63 | | | 24.00 | | | 43.19 | | | 34.33 | | | 0.145 | | | 0.13 |

As of September 18, 2009 there were approximately 3,326 holders of record of the Company’s common stock. Dividends are paid when, as and if declared by the board of directors of the Company.

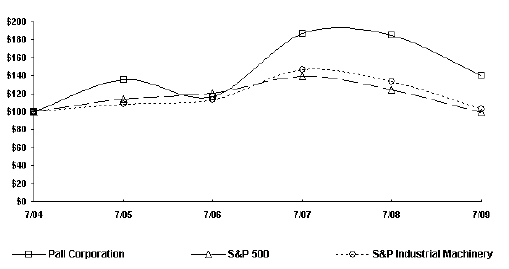

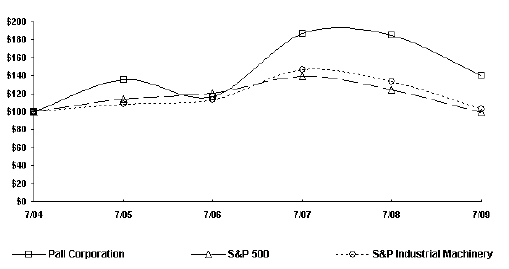

PERFORMANCE GRAPH

The following graph compares the annual change in the cumulative total return on the Company’s common stock during the Company’s last five fiscal years with the annual change in the cumulative total return of the Standard & Poor’s Composite-500 Index and the Standard & Poor’s Industrial Machinery Index (which includes the Company). The graph assumes an investment of $100 on July 30, 2004 (the last trading day of the Company’s fiscal year 2004) and the reinvestment of all dividends paid during the last five fiscal years.

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN

Among Pall Corporation, The S&P 500 Index

And The S&P Industrial Machinery Index

Copyright© 2009 S&P, a division of The McGraw-Hill Companies Inc. All rights reserved.

| | 30-Jul-04 | 29-Jul-05 | 31-Jul-06 | 31-Jul-07 | 31-Jul-08 | 31-Jul-09 |

| Pall Corporation | $ | 100 | $ | 136 | $ | 116 | $ | 187 | $ | 185 | $ | 140 |

| S&P 500 | $ | 100 | $ | 114 | $ | 120 | $ | 140 | $ | 124 | $ | 99 |

| S&P Industrial Machinery | $ | 100 | $ | 108 | $ | 113 | $ | 147 | $ | 134 | $ | 103 |

19

The following table provides information with respect to purchases made by or on behalf of the Company or any “affiliated purchaser” of the Company’s common stock during the quarter ended July 31, 2009.

| | | (In thousands, except per share data) |

| | | | | | | Total Number of | | Approximate |

| | | | | | | Shares Purchased as | | Dollar Value of Shares |

| | | Total Number | | | | Part of Publicly | | that May Yet Be |

| | | of Shares | | Average Price | | Announced Plans or | | Purchased Under the |

| Period | | Purchased | | Paid Per Share | | Programs (1) | | Plans or Programs (1) |

| May 1, 2009 to May 31, 2009 | | — | | $ | — | | — | | $ | 484,498 |

| June 1, 2009 toJune 30, 2009 | | — | | $ | — | | — | | | 484,498 |

| July 1, 2009 toJuly 31, 2009 | | 1,208 | | $ | 26.12 | | 1,208 | | | 452,943 |

| |

| Total | | 1,208 | | $ | 26.12 | | 1,208 | | | |

| | (1) | | On November 15, 2006, the board authorized an expenditure of $250,000 to repurchase shares. On October 16, 2008, the board authorized an additional expenditure of $350,000 to repurchase shares. The Company’s shares may be purchased over time, as market and business conditions warrant. There is no time restriction on this authorization. During the fourth quarter of fiscal year 2009, the Company purchased 1,208 shares in open-market transactions at an aggregate cost of $31,555, with an average price per share of $26.12. Total repurchases in fiscal year 2009 were 3,347 shares at an aggregate cost of $96,439, with an average price per share of $28.81. The aggregate cost of repurchases in fiscal years 2008 and 2007 was $148,850 (4,056 shares at an average price per share of $36.70) and $61,795 (1,586 shares at an average price per share of $38.98), respectively. As of July 31, 2009, $452,943 remains to be expended under the current board repurchase authorizations. Repurchased shares are held in treasury for use in connection with the Company’s stock plans and for general corporate purposes. |

| |

| | | During the fiscal year 2009, 1 share was traded in by an employee in payment of a stock option exercise at a price of $39.84 per share and an aggregate cost of $13. |

20

ITEM 6. SELECTED FINANCIAL DATA.

The following table sets forth selected financial data for the last five fiscal years. This selected financial data is not necessarily indicative of results of future operations and should be read in conjunction with “Item 7–Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the accompanying consolidated financial statements and related notes included elsewhere in this Form 10-K.

| (In millions, except per share data) | | 2009 | | 2008 | | 2007 | | 2006 | | 2005 |

| RESULTS FOR THE YEAR: | | | | | | | | | | | | | | | | | | | | |

| |

| Net sales | | $ | 2,329.2 | | | $ | 2,571.6 | | | $ | 2,249.9 | | | $ | 2,016.8 | | | $ | 1,902.3 | |

| Cost of sales | | | 1,228.5 | | | | 1,360.8 | | | | 1,190.5 | (a) | | | 1,072.8 | (a) | | | 978.9 | (a) |

| Gross profit | | | 1,100.7 | | | | 1,210.8 | | | | 1,059.4 | | | | 944.0 | | | | 923.4 | |

| Selling, general and administrative expenses | | | 699.9 | | | | 749.5 | | | | 675.0 | | | | 641.0 | | | | 621.4 | |

| Research and development | | | 71.2 | | | | 71.6 | | | | 62.4 | | | | 57.3 | | | | 56.2 | |

| Restructuring and other charges, net | | | 30.7 | | | | 31.5 | | | | 22.4 | | | | 12.3 | | | | 38.8 | |

| Interest expense, net | | | 28.1 | | | | 32.6 | | | | 39.1 | | | | 30.2 | | | | 30.0 | |

| Earnings before income taxes | | | 270.8 | | | | 325.6 | | | | 260.5 | | | | 203.2 | | | | 177.0 | |

| Provision for income taxes | | | 75.2 | | | | 108.3 | | | | 133.0 | | | | 151.1 | | | | 63.3 | |

| Net earnings | | $ | 195.6 | (b) | | $ | 217.3 | (b) | | $ | 127.5 | (b) | | $ | 52.1 | (b) | | $ | 113.7 | |

| Earnings per share: | | | | | | | | | | | | | | | | | | | | |

| Basic | | $ | 1.65 | | | $ | 1.77 | | | $ | 1.04 | | | $ | 0.42 | | | $ | 0.91 | |

| Diluted | | $ | 1.64 | | | $ | 1.76 | | | $ | 1.02 | | | $ | 0.41 | | | $ | 0.91 | |

| Dividends declared per share | | $ | 0.565 | | | $ | 0.62 | | | $ | 0.35 | | | $ | 0.43 | | | $ | 0.39 | |

| |

| Capital expenditures | | $ | 133.0 | | | $ | 123.9 | | | $ | 97.8 | | | $ | 96.0 | | | $ | 86.2 | |

| Depreciation and amortization of long-lived assets | | $ | 89.4 | | | $ | 93.2 | | | $ | 94.0 | | | $ | 95.7 | | | $ | 90.9 | |

| |

| YEAR-END POSITION: | | | | | | | | | | | | | | | | | | | | |

| Working capital | | $ | 853.1 | | | $ | 1,085.7 | (c) | | $ | 774.2 | | | $ | 653.3 | | | $ | 598.1 | |

| Property, plant and equipment | | | 681.7 | | | | 663.0 | | | | 607.9 | | | | 621.0 | | | | 608.8 | |

| Total assets | | | 2,840.8 | | | | 2,956.7 | | | | 2,708.8 | | | | 2,461.3 | | | | 2,185.3 | |

| Long-term debt, net of current portion | | | 577.7 | | | | 747.1 | | | | 591.6 | | | | 640.0 | | | | 510.2 | |

| Total liabilities | | | 1,726.2 | | | | 1,817.5 | | | | 1,648.2 | | | | 1,524.2 | | | | 1,193.2 | |

| Stockholders’ equity | | | 1,114.6 | | | | 1,139.2 | | | | 1,060.6 | | | | 937.1 | | | | 992.1 | |

| | a) | | Includes $2.8, $1.7 and $0.8 of adjustments recorded in cost of sales in fiscal years 2007, 2006 and 2005, respectively. The adjustments include a one-time purchase accounting adjustment to record, at market value, inventory acquired from the BioSepra® Process Division (“BioSepra”) of Ciphergen Biosystems, Inc. This resulted in a $2.4 increase in acquired inventories in fiscal year 2005, in accordance with SFAS No. 141, Business Combinations (“SFAS No. 141”), in the opening balance sheet and an increase in cost of sales of $0.6, $0.9 and $0.8 in fiscal years 2007, 2006 and 2005, respectively, concurrent with the sale of a portion of the underlying inventory. The adjustment is considered non-recurring in nature because, although the Company acquired the manufacturing operations of BioSepra, this adjustment was required by SFAS No. 141 as an elimination of the manufacturing profit in inventory acquired from BioSepra and subsequently sold in the period. The adjustments recorded in cost of sales also reflect $2.2 and $0.8 in fiscal years 2007 and 2006, respectively, primarily comprised of incremental depreciation from the planned early retirement of certain fixed assets recorded in conjunction with the Company’s facilities rationalization initiatives in accordance with SFAS No. 144, Accounting for the Impairment or Disposal of Long-Lived Assets. |

| |

| b) | | Effective August 1, 2005, the Company adopted SFAS 123(R), Share Based Payment. The years ended July 31, 2009, July 31, 2008, July 31, 2007 and July 31, 2006 include stock-based compensation expense related to stock options and the employee stock purchase plan of $7.6, $5.2, $4.7 and $7.2, respectively, after pro forma tax effect (6, 4, 4 and 6 cents per share, respectively). |

| |

| c) | | Non-cash working capital at July 31, 2008 has been impacted by the adoption of a new accounting standard, FIN No. 48, Accounting for Uncertainty in Income Taxes (“FIN No. 48”). Consistent with the provisions of FIN No. 48, the Company has reclassified certain tax related assets and liabilities from current to non-current. Such reclassifications had the effect of increasing non-cash working capital at July 31, 2008 by approximately $137.0. |

21

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION ANDRESULTS OF OPERATIONS.

Forward-Looking Statements and Risk Factors

You should read the following discussion together with the accompanying consolidated financial statements and notes thereto and other financial information in this Form 10-K. The discussions under the subheadings “Review of Operating Segments” below are in local currency unless indicated otherwise. Company management considers local currency growth an important measure because by excluding the volatility of exchange rates, underlying volume change is clearer. Dollar amounts discussed below are in thousands, unless otherwise indicated, except per share dollar amounts. In addition, per share dollar amounts are discussed on a diluted basis.

The matters discussed in this Annual Report on Form 10-K contain “forward-looking statements” as defined in the Private Securities Litigation Reform Act of 1995. Forward-looking statements contained in this and other written and oral reports are based on current Company expectations and are subject to risks and uncertainties, which could cause actual results to differ materially. All statements regarding future performance, earnings projections, earnings guidance, management’s expectations about its future cash needs and effective tax rate, and other future events or developments are forward-looking statements. Such risks and uncertainties include, but are not limited to, those discussed in “Part I–Item 1A–Risk Factors” in this Form 10-K. The Company makes these statements as of the date of this disclosure and undertakes no obligation to update them.

Critical Accounting Policies and Estimates

The Company’s accompanying consolidated financial statements are prepared in accordance with U.S. generally accepted accounting principles (“GAAP”). These accounting principles require the Company to make certain estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the accompanying consolidated financial statements, as well as the reported amounts of revenues and expenses during the periods presented. Although these estimates are based on Company management’s knowledge of current events and actions it may undertake in the future, actual results may differ from estimates. The following discussion addresses the Company’s critical accounting policies, which are those that are most important to the portrayal of the Company’s financial condition and results, and that require judgment. See also the notes to the accompanying consolidated financial statements, which contain additional information regarding the Company’s accounting policies.

Income Taxes

Significant judgment is required in determining the worldwide provision for income taxes. In the ordinary course of a global business, there are many transactions and calculations where the ultimate tax outcome is uncertain. Some of these uncertainties arise as a consequence of revenue sharing and cost reimbursement arrangements among related entities, the process of identifying items of revenue and expense that qualify for preferential tax treatment and appropriate segregation of foreign and domestic income and expense to avoid double taxation. No assurance can be given that the final tax outcome of these matters will not be different than that which is reflected in the Company’s historical income tax provisions and accruals. Such differences could have a material effect on the Company’s income tax provision and net earnings in the period in which a final determination is made.

The Company records a valuation allowance to reduce deferred tax assets to the amount of the future tax benefit that is more likely than not to be realized. While Company management has considered future taxable income and ongoing prudent and feasible tax planning strategies in assessing the need for the valuation allowance, there is no assurance that the valuation allowance would not need to be increased to cover additional deferred tax assets that may not be realizable. Any increase in the valuation allowance could have a material adverse impact on the Company’s income tax provision and net earnings in the period in which such determination is made.

Purchase Accounting and Goodwill

Determining the fair value of certain assets and liabilities acquired in a business combination in accordance with SFAS No. 141 is judgmental in nature and often involves the use of significant estimates and assumptions. There are various methods used to estimate the value of tangible and intangible assets acquired, such as discounted cash flow and market multiple approaches. Some of the more significant estimates and assumptions inherent in the two approaches include: projected future cash flows (including timing); discount rates reflecting the risk inherent in the future cash flows; perpetual growth rate; determination of appropriate market comparables; and the determination of whether a premium or a discount should be applied to comparables. There are also judgments made to determine the expected useful lives assigned to each class of assets and liabilities acquired.

22

The Company accounts for its goodwill and intangible assets in accordance with SFAS No. 142, Goodwill and Other Intangible Assets (“SFAS No. 142”). As such, goodwill is assessed for impairment at least annually during the Company’s fiscal third quarter, or more frequently if certain events or circumstances indicate impairment might have occurred. The Company evaluates the recoverability of goodwill using a two-step impairment test approach at the reporting unit level. In the first step, the overall fair value for the reporting unit is compared to its book value including goodwill. In the event that the overall fair value of the reporting unit was determined to be less than the book value, a second step is performed which compares the implied fair value of the reporting unit’s goodwill to the book value of the goodwill. The implied fair value for the goodwill is determined based on the difference between the overall fair value of the reporting unit and the fair value of the net identifiable assets. If the implied fair value of the goodwill is less than its book value, the difference is recognized as an impairment. In fiscal years 2009 and 2008, the fair value of the Company’s reporting units exceeded the book value of the reporting units and as such, step two was not performed.

When testing for impairment, the Company uses significant estimates and assumptions to estimate the fair values of its reporting units. Fair value of the Company’s reporting units is determined using market multiples (derived from trailing-twelve-month revenue, earnings before interest and taxes (“EBIT”) and earnings before interest, taxes depreciation and amortization (“EBITDA”)), of publicly traded companies with similar operating and investment characteristics as the Company’s reporting units. These various market multiples are applied to the operating performance of the reporting unit being tested to determine a range of fair values for the reporting unit. The fair value of the reporting units is then determined using the average of the fair values derived from the minimum and median market multiples. The minimum and median market multiples used in the fiscal year 2009 impairment testing ranged from 0.2 to 2.4 times revenue, 5.4 to 14.5 times EBIT and 2.1 to 10.7 times EBITDA. The median and minimum market multiples used in the fiscal year 2008 impairment testing ranged from 1.1 to 3.6 times revenue, 8.3 to 22.4 times EBIT and 6.5 to 15.0 times EBITDA. To further substantiate the reasonableness of the fair value of its reporting units, the Company compares enterprise value (outstanding shares multiplied by the closing market price per share, plus debt, less cash and cash equivalents) to the aggregate fair value of its reporting units.

Revenue Recognition

Revenue is recognized when title and risk of loss have transferred to the customer and when contractual terms have been fulfilled, except for certain long-term contracts, whereby revenue is recognized under the percentage of completion method (see below). Transfer of title and risk of loss occurs when the product is delivered in accordance with the contractual shipping terms. In instances where contractual terms include a provision for customer acceptance, revenue is recognized when either (i) the Company has previously demonstrated that the product meets the specified criteria based on either seller or customer-specified objective criteria or (ii) upon formal acceptance received from the customer where the product has not been previously demonstrated to meet customer-specified objective criteria.

For contracts accounted for under the percentage of completion method, revenue is based upon the ratio of costs incurred to date compared with estimated total costs to complete. The cumulative impact of revisions to total estimated costs is reflected in the period of the change, including anticipated losses.

Allowance for Doubtful Accounts

Company management evaluates its ability to collect outstanding receivables and provide allowances when collection becomes doubtful. In performing this evaluation, significant estimates are involved, including an analysis of specific risks on a customer-by-customer basis. Based upon this information, Company management records in earnings an amount believed to be uncollectible. If the factors used to estimate the allowance provided for doubtful accounts do not reflect the future ability to collect outstanding receivables, additional provisions for doubtful accounts may be needed and the future results of operations could be materially affected.

Inventories

Inventories are valued at the lower of cost (principally on the first-in, first-out method) or market. The Company records adjustments to the carrying value of inventory based upon assumptions about historic usage, future demand and market conditions. These adjustments are estimates which could vary significantly, either favorably or unfavorably, from actual requirements if future conditions, customer inventory levels or competitive conditions differ from the Company’s expectations.

23