Q3 FY 2012 Financial Results June 7, 2012 Better Lives. Better Planet.SM Exhibit 99.2

2 The matters discussed in this presentation contain “forward-looking statements” as defined in the Private Securities Litigation Reform Act of 1995. Results for the third quarter are preliminary until the Company’s form 10-Q is filed with the Securities and Exchange Commission on or before June 11, 2012. Forward-looking statements are those that address activities, events or developments that the Company or management intends, expects, projects, believes or anticipates will or may occur in the future. All statements regarding future performance, earnings projections, earnings guidance, management’s expectations about its future cash needs, dilution from the disposition or future allocation of capital and effective tax rate, and other future events or developments are forward-looking statements. Forward-looking statements are those that use terms such as “may,” “will,” “expect,” “believe,” “intend,” “should,” “could,” “anticipate,” “estimate,” “forecast,” “project,” “plan,” “predict,” “potential,” and similar expressions. Forward-looking statements contained in this and other written and oral reports are based on management’s assumptions and assessments in light of past experience and trends, current conditions, expected future developments and other relevant factors. The Company’s forward-looking statements are subject to risks and uncertainties and are not guarantees of future performance, and actual results, developments and business decisions may differ materially from those envisaged by the Company’s forward-looking statements. Such risks and uncertainties include, but are not limited to, those discussed in Part I–Item 1A.–Risk Factors in the 2011 Form 10-K, and other reports the Company files with the Securities and Exchange Commission, including: the impact of legislative, regulatory and political developments globally; the impact of the uncertain global economic environment; the extent to which adverse economic conditions may affect the Company's sales volume and results; changes in product mix, market mix and product pricing, particularly relating to the expansion of the systems business; the Company's ability to develop and commercialize new technologies, enforce patents and protect proprietary products and manufacturing techniques; demand for our products and business relationships with key customers and suppliers, which may be impacted by their cash flow and payment practices; delays or cancellations in shipments; the Company's ability to obtain regulatory approval or market acceptance of new technologies; the Company's ability to successfully complete the Company's business improvement initiatives, which include supply chain enhancements and integrating and upgrading the Company's information systems; the effect of a serious disruption in the Company's information systems; fluctuations in the Company's effective tax rate; volatility in foreign currency exchange rates, interest rates and energy costs and other macroeconomic challenges currently affecting the Company; increase in costs of manufacturing and operating costs; the Company's ability to achieve and sustain the savings anticipated from cost reduction and gross margin improvement initiatives; the Company's ability to attract and retain management talent; the impact of pricing and other actions by competitors; the effect of litigation and regulatory inquiries associated with the restatement of the Company's prior period financial statements; the effect of the restrictive covenants in the Company's debt facilities; and the Company's ability to successfully complete or integrate any acquisitions. Factors or events that could cause the Company's actual results to differ may emerge from time to time, and it is not possible for the Company to predict all of them. The Company makes these statements as of the date of this disclosure and undertakes no obligation to update them, whether as a result of new information, future developments or otherwise. Management uses certain non-GAAP measurements to assess the Company’s current and future financial performance. The non-GAAP measurements do not replace the presentation of the Company’s GAAP financial results. These measurements provide supplemental information to assist management in analyzing the Company’s financial position and results of operations. The Company has chosen to provide this information to facilitate meaningful comparisons of past, present and future operating results and as a means to emphasize the results of ongoing operations. Reconciliations of the non-GAAP financial measures used throughout this presentation to the most directly comparable GAAP measures appear at the end of this presentation in the Appendix and are also available on Pall’s website at www.pall.com/investor. Forward-Looking Statements

3 • Toll-Free: 855-859-2056 • International: 404-537-3406 • Conference ID: 82873458 • Internet: www.pall.com/investor Conference Call Replay Info

4 • Q3 Financial Performance • Impact of Blood Business Divestiture • Restructuring Update • Review of FY 2012 Outlook • Preview of FY 2013 Agenda All remarks in this presentation are on a “Continuing Operations” basis, which excludes the results of the Blood product line divestiture, unless indicated otherwise.

5 • Enterprise system conversion drove sales shortfall in consumables in the Americas • Conversion also created orders fluctuation over the past 3-4 months as customers buffered stock • Softness in short-term book-to-ship activity due to 3rd quarter slowing of Laboratory demand • European economic impact reflected in orders result Overview of the Quarter We are recovering from the enterprise system implementation; focus on cost to mitigate macro environment

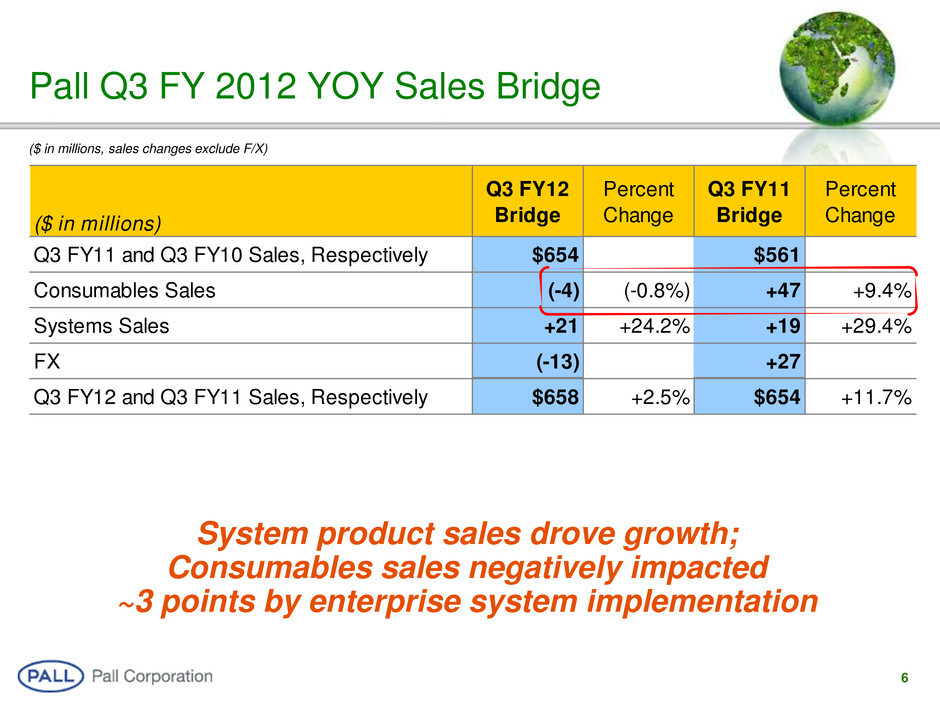

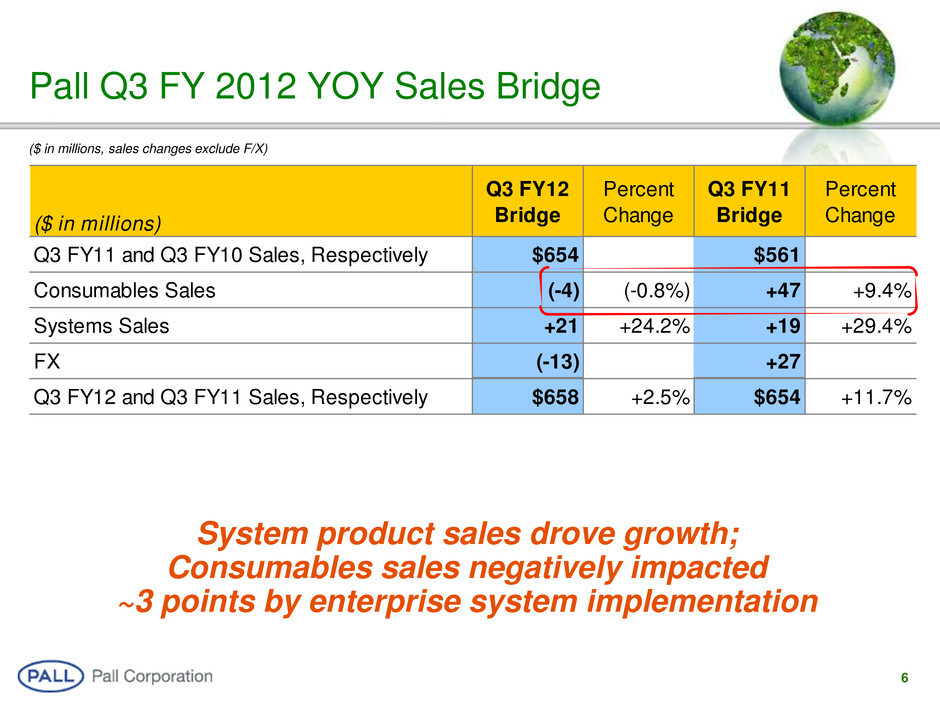

6 Pall Q3 FY 2012 YOY Sales Bridge ($ in millions, sales changes exclude F/X) System product sales drove growth; Consumables sales negatively impacted ~3 points by enterprise system implementation ($ in millions) Q3 FY12 Bridge Percent Change Q3 FY11 Bridge Percent Change Q3 FY11 and Q3 FY10 Sales, Respectively $654 $561 Consumables Sales (-4) (-0.8%) +47 +9.4% Systems Sales +21 +24.2% +19 +29.4% FX (-13) +27 Q3 FY12 and Q3 FY11 Sales, Respectively $658 +2.5% $654 +11.7%

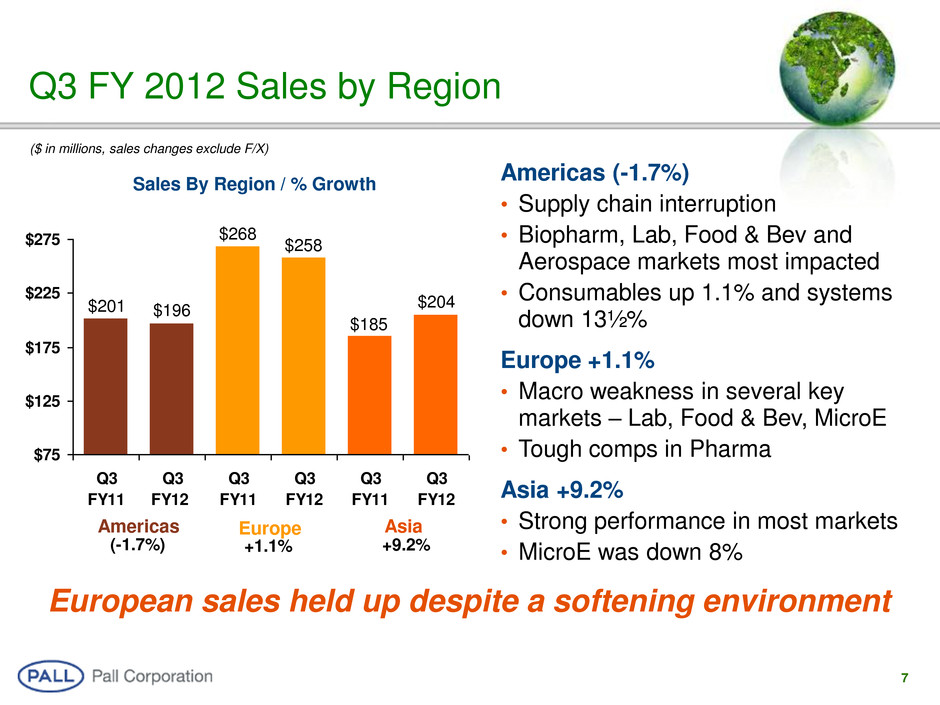

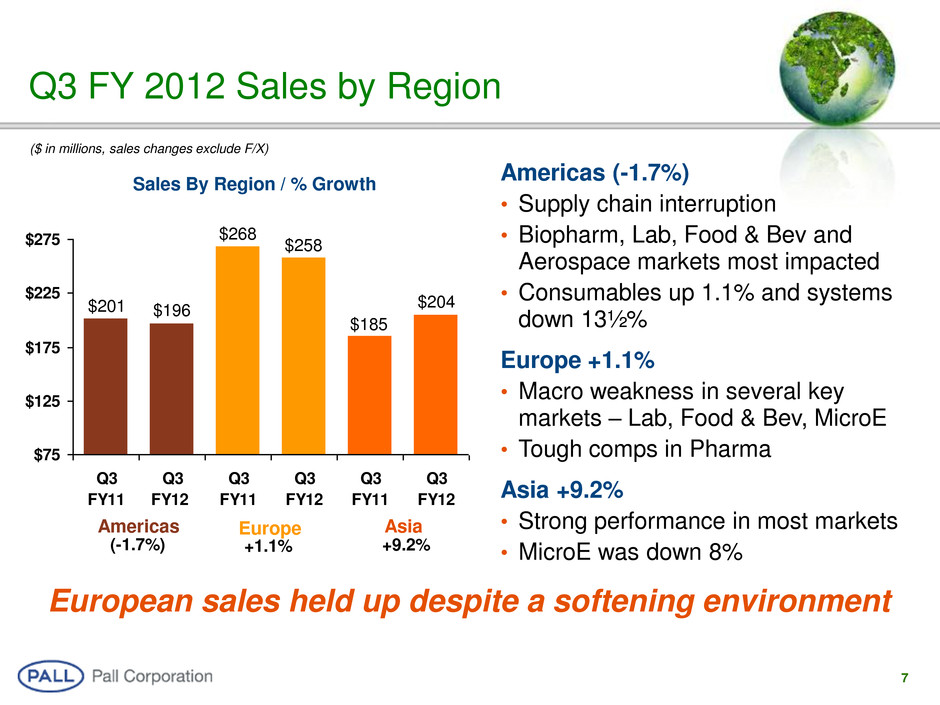

7 $75 $125 $175 $225 $275 Q3 FY11 Q3 FY12 Q3 FY11 Q3 FY12 Q3 FY11 Q3 FY12 Americas $196 $185 $201 $204 Europe Asia $268 $258 Q3 FY 2012 Sales by Region ($ in millions, sales changes exclude F/X) Americas (-1.7%) • Supply chain interruption • Biopharm, Lab, Food & Bev and Aerospace markets most impacted • Consumables up 1.1% and systems down 13½% Europe +1.1% • Macro weakness in several key markets – Lab, Food & Bev, MicroE • Tough comps in Pharma Asia +9.2% • Strong performance in most markets • MicroE was down 8% Sales By Region / % Growth (-1.7%) +9.2% +1.1% European sales held up despite a softening environment

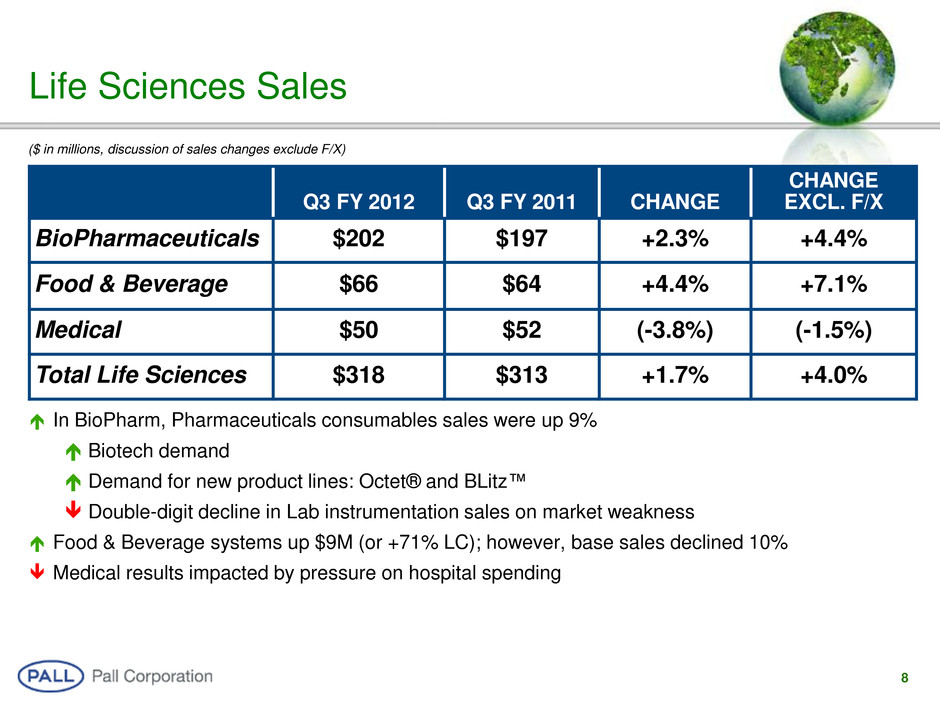

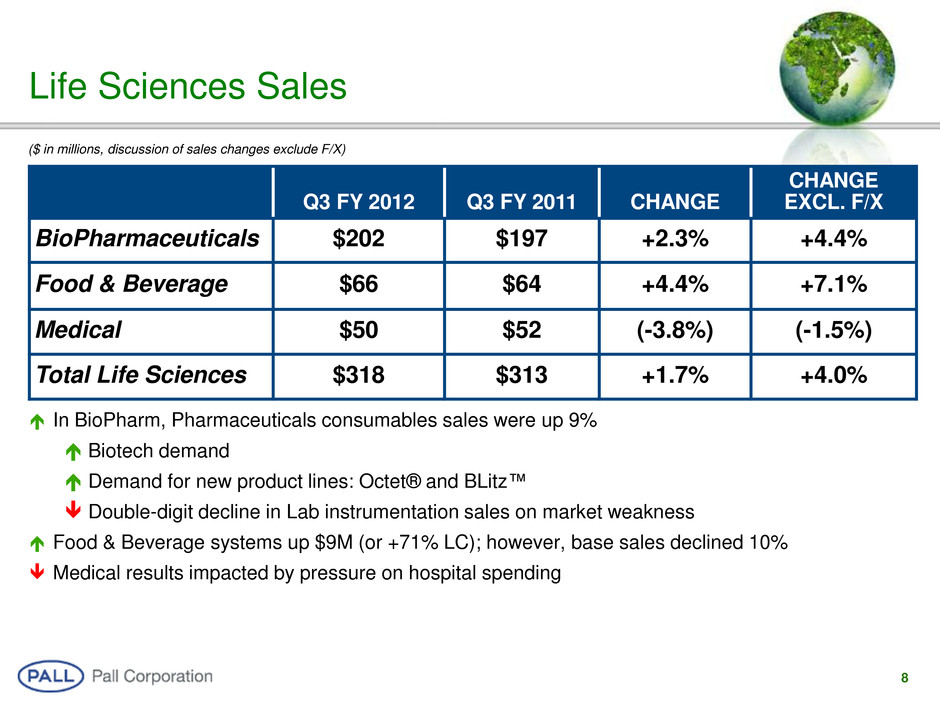

8 Life Sciences Sales In BioPharm, Pharmaceuticals consumables sales were up 9% Biotech demand Demand for new product lines: Octet® and BLitz™ Double-digit decline in Lab instrumentation sales on market weakness Food & Beverage systems up $9M (or +71% LC); however, base sales declined 10% Medical results impacted by pressure on hospital spending Q3 FY 2012 Q3 FY 2011 CHANGE CHANGE EXCL. F/X BioPharmaceuticals $202 $197 +2.3% +4.4% Food & Beverage $66 $64 +4.4% +7.1% Medical $50 $52 (-3.8%) (-1.5%) Total Life Sciences $318 $313 +1.7% +4.0% ($ in millions, discussion of sales changes exclude F/X)

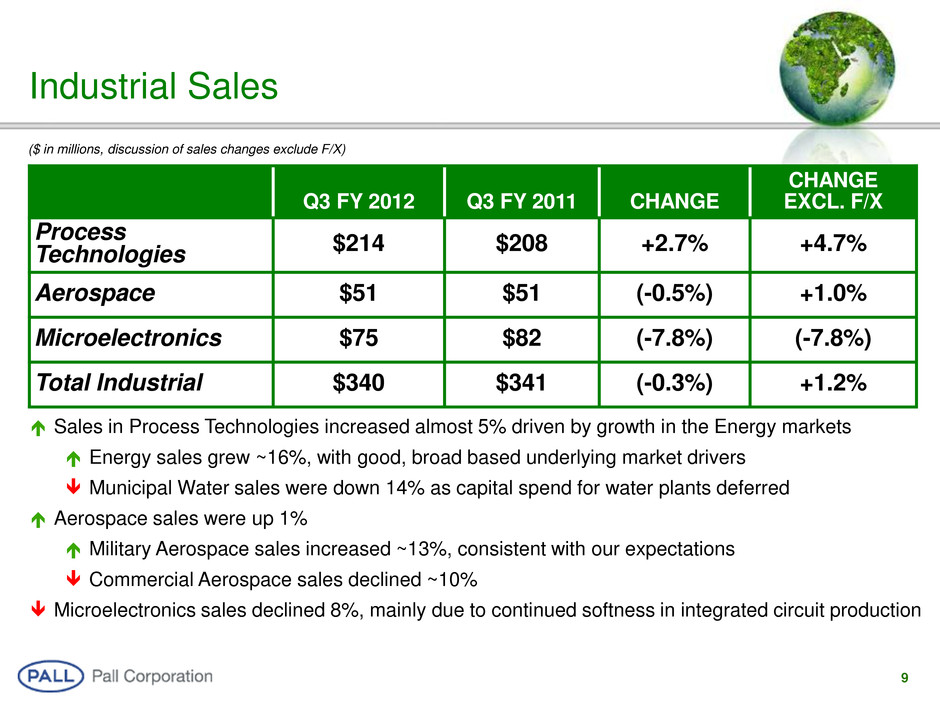

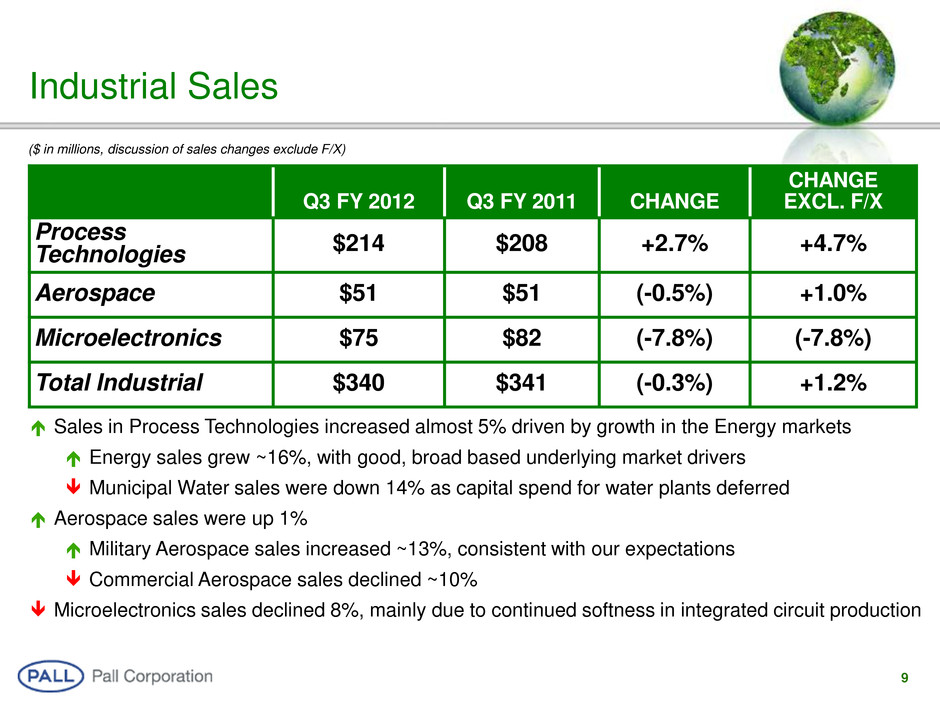

9 Industrial Sales ($ in millions, discussion of sales changes exclude F/X) Q3 FY 2012 Q3 FY 2011 CHANGE CHANGE EXCL. F/X Process Technologies $214 $208 +2.7% +4.7% Aerospace $51 $51 (-0.5%) +1.0% Microelectronics $75 $82 (-7.8%) (-7.8%) Total Industrial $340 $341 (-0.3%) +1.2% Sales in Process Technologies increased almost 5% driven by growth in the Energy markets Energy sales grew ~16%, with good, broad based underlying market drivers Municipal Water sales were down 14% as capital spend for water plants deferred Aerospace sales were up 1% Military Aerospace sales increased ~13%, consistent with our expectations Commercial Aerospace sales declined ~10% Microelectronics sales declined 8%, mainly due to continued softness in integrated circuit production

10 Pall Q3 FY 2012 Orders ($ in millions, orders changes exclude F/X) Underperformance in systems and a very strong Q3 FY11 comparable primarily drove the decline in orders ($ in millions) Q3 FY12 Bridge Percent Change Q3 FY11 Bridge Percent Change Q3 FY11 and Q3 FY10 Orders, Respectively $705 $610 Consumables Orders (-14) (-2.4%) +32 +6.1% Systems Orders (-48) (-41.9%) +33 +43.0% FX (-10) +30 Q3 FY12 and Q3 FY11 Orders, Respectively $633 (-8.8%) $705 +10.7%

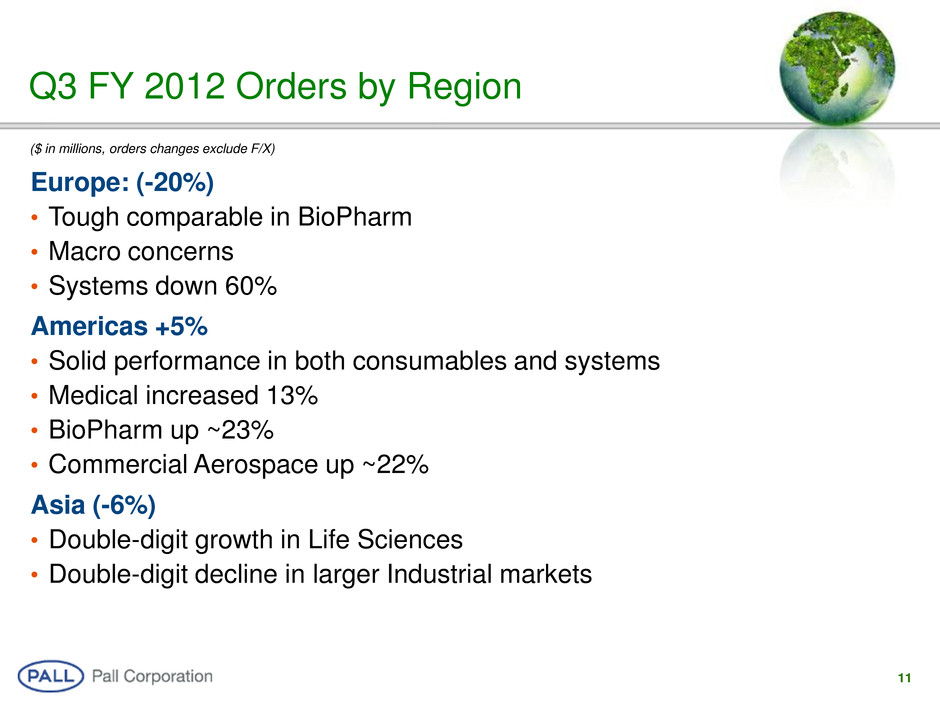

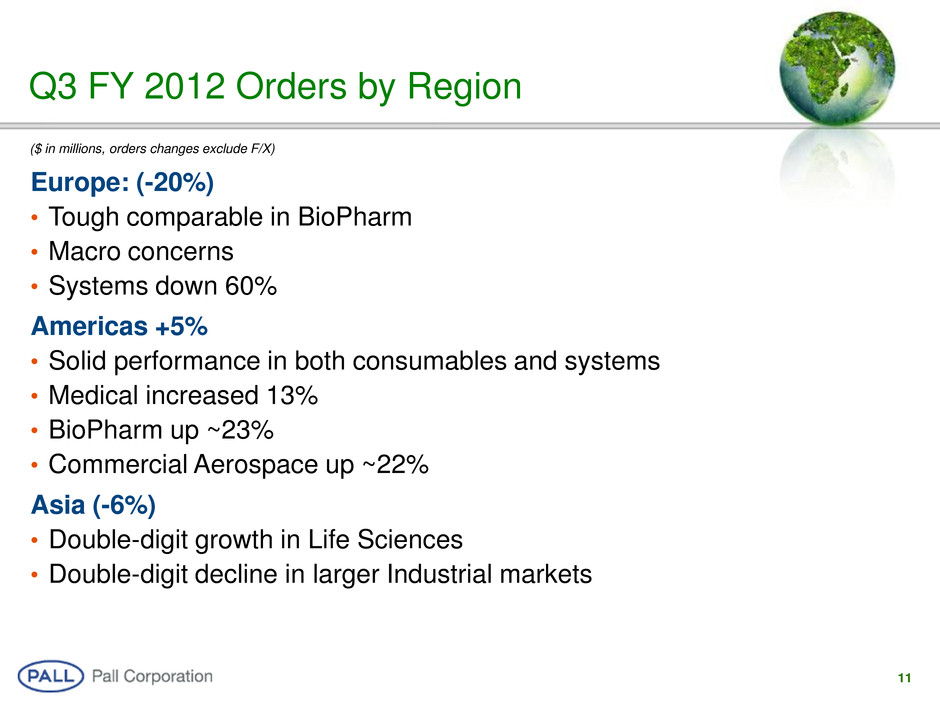

11 Q3 FY 2012 Orders by Region ($ in millions, orders changes exclude F/X) Europe: (-20%) • Tough comparable in BioPharm • Macro concerns • Systems down 60% Americas +5% • Solid performance in both consumables and systems • Medical increased 13% • BioPharm up ~23% • Commercial Aerospace up ~22% Asia (-6%) • Double-digit growth in Life Sciences • Double-digit decline in larger Industrial markets

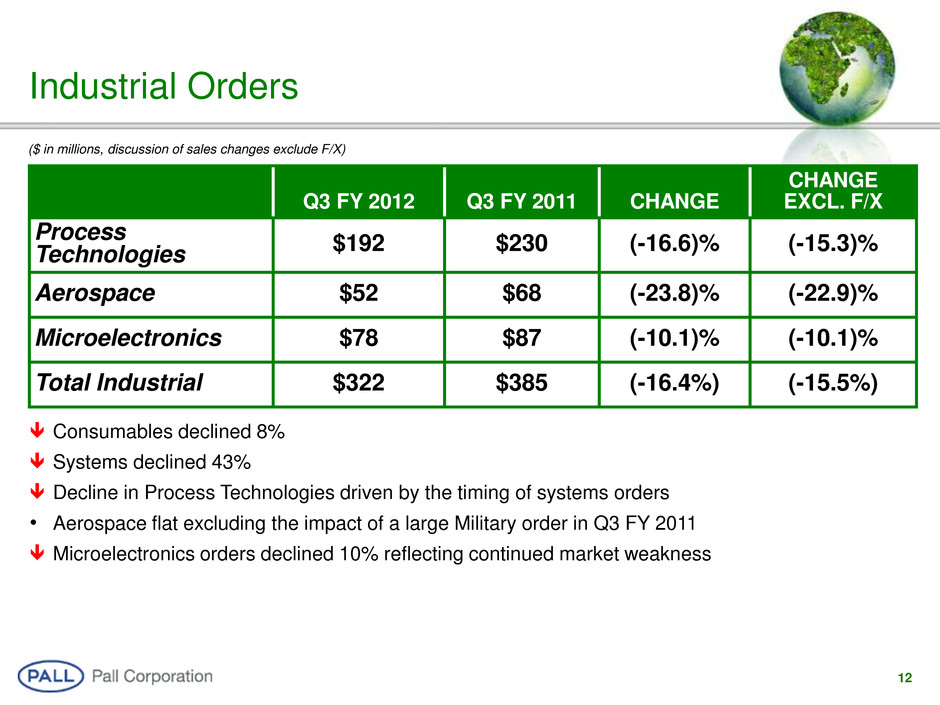

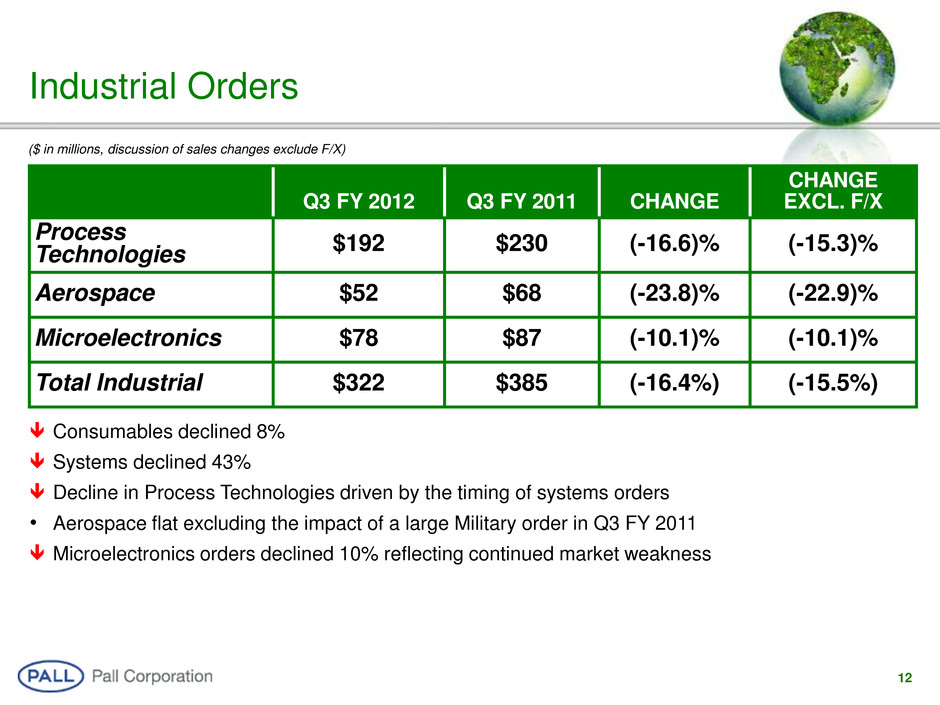

12 Industrial Orders ($ in millions, discussion of sales changes exclude F/X) Q3 FY 2012 Q3 FY 2011 CHANGE CHANGE EXCL. F/X Process Technologies $192 $230 (-16.6)% (-15.3)% Aerospace $52 $68 (-23.8)% (-22.9)% Microelectronics $78 $87 (-10.1)% (-10.1)% Total Industrial $322 $385 (-16.4%) (-15.5%) Consumables declined 8% Systems declined 43% Decline in Process Technologies driven by the timing of systems orders • Aerospace flat excluding the impact of a large Military order in Q3 FY 2011 Microelectronics orders declined 10% reflecting continued market weakness

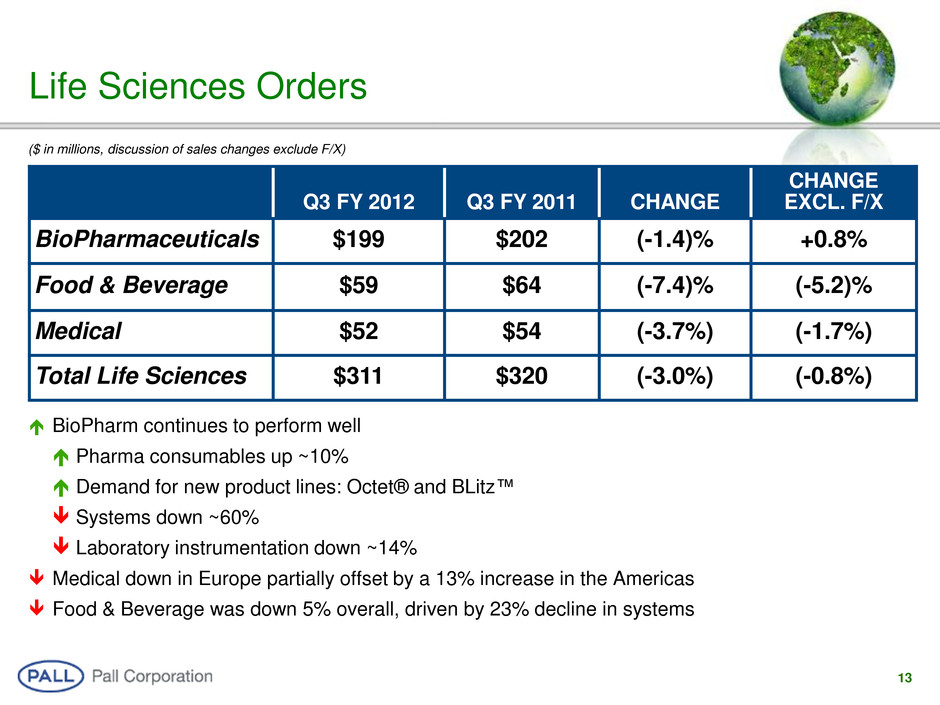

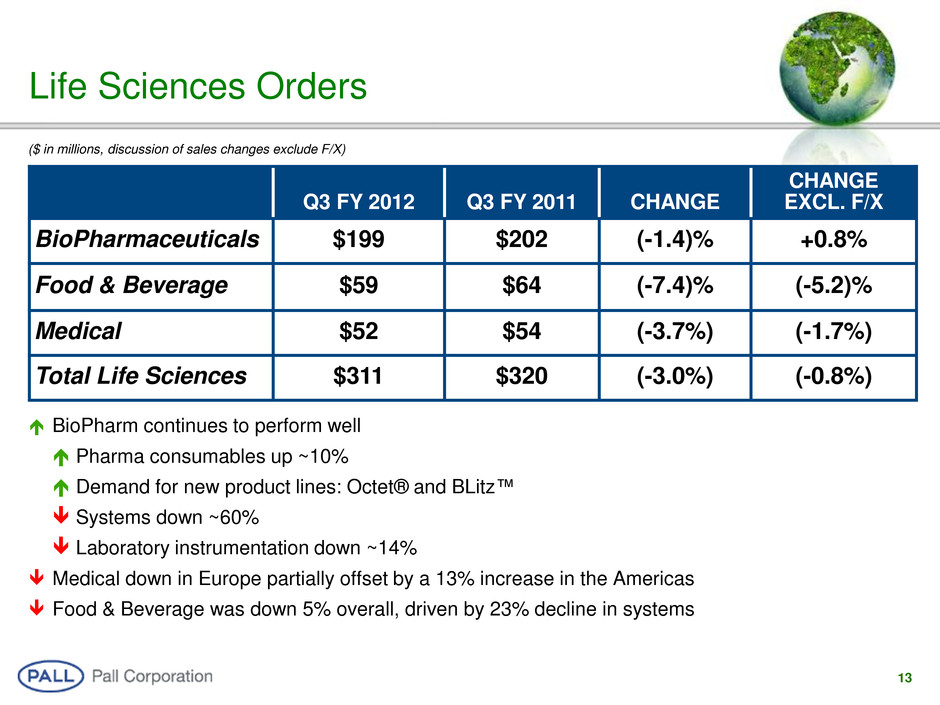

13 Life Sciences Orders BioPharm continues to perform well Pharma consumables up ~10% Demand for new product lines: Octet® and BLitz™ Systems down ~60% Laboratory instrumentation down ~14% Medical down in Europe partially offset by a 13% increase in the Americas Food & Beverage was down 5% overall, driven by 23% decline in systems Q3 FY 2012 Q3 FY 2011 CHANGE CHANGE EXCL. F/X BioPharmaceuticals $199 $202 (-1.4)% +0.8% Food & Beverage $59 $64 (-7.4)% (-5.2)% Medical $52 $54 (-3.7%) (-1.7%) Total Life Sciences $311 $320 (-3.0%) (-0.8%) ($ in millions, discussion of sales changes exclude F/X)

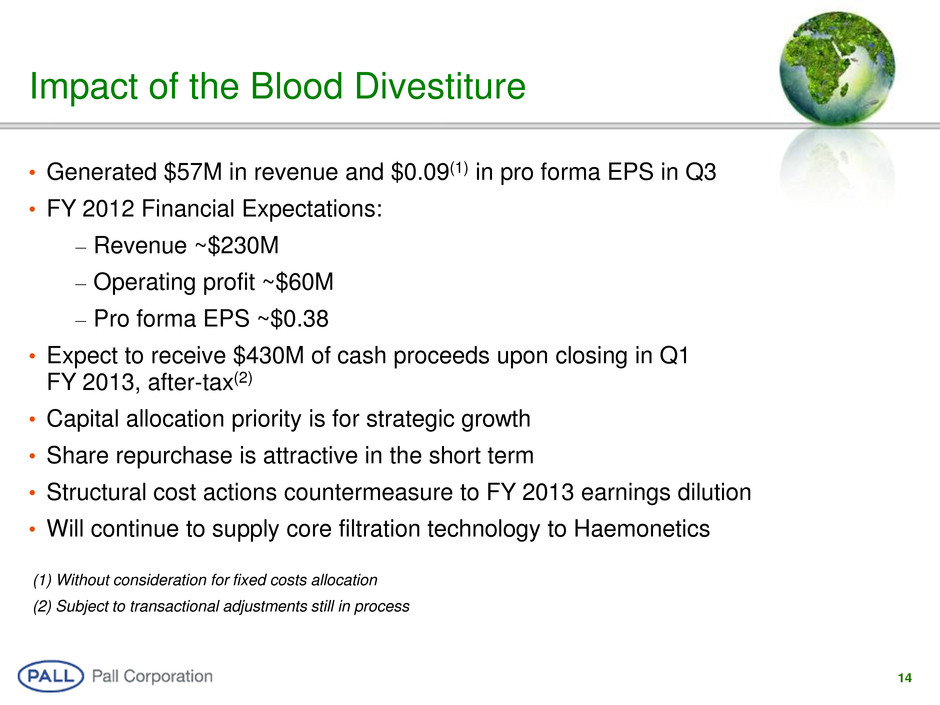

14 Impact of the Blood Divestiture • Generated $57M in revenue and $0.09(1) in pro forma EPS in Q3 • FY 2012 Financial Expectations: – Revenue ~$230M – Operating profit ~$60M – Pro forma EPS ~$0.38 • Expect to receive $430M of cash proceeds upon closing in Q1 FY 2013, after-tax(2) • Capital allocation priority is for strategic growth • Share repurchase is attractive in the short term • Structural cost actions countermeasure to FY 2013 earnings dilution • Will continue to supply core filtration technology to Haemonetics (1) Without consideration for fixed costs allocation (2) Subject to transactional adjustments still in process

15 $ in millions FY12 Actual FY11 Actual(a) Change Sales 340.0$ 341.1$ +1.2% LC Gross Profit 154.2$ 157.2$ Gross Margin 45.4% 46.1% (-70 bps) SG&A 107.5$ 102.9$ +4.5% % of Sales 31.6% 30.2% +140 bps R&D 7.3$ 7.1$ +1.7% % of Sales 2.1% 2.1% – Segment Profit 39.4$ 47.2$ (-16.5%) % of Sales 11.6% 13.8% (-220 bps) Segment Performance: Industrial Q3 FY 2012 vs. 2011 Comparison • Selling exp nses down ~3.0%; 17.5% of sales down 50 bps YOY –Benefit of restructuring activities • G&A up ~15%; 14.1% of sales, up 190 bps YOY –Emerging region investment, including Brazilian acquisition – IT investments and implementation costs Unfavorable mix with higher systems sales and MicroE decline Unfavorable absorption due to MicroE decline Price and CIP outpace inflation (a) FY11 restated to reflect a change in the allocation of certain shared costs on a continuing operations basis. • Emerging markets growth of ~15% • Mature markets decline of ~2%

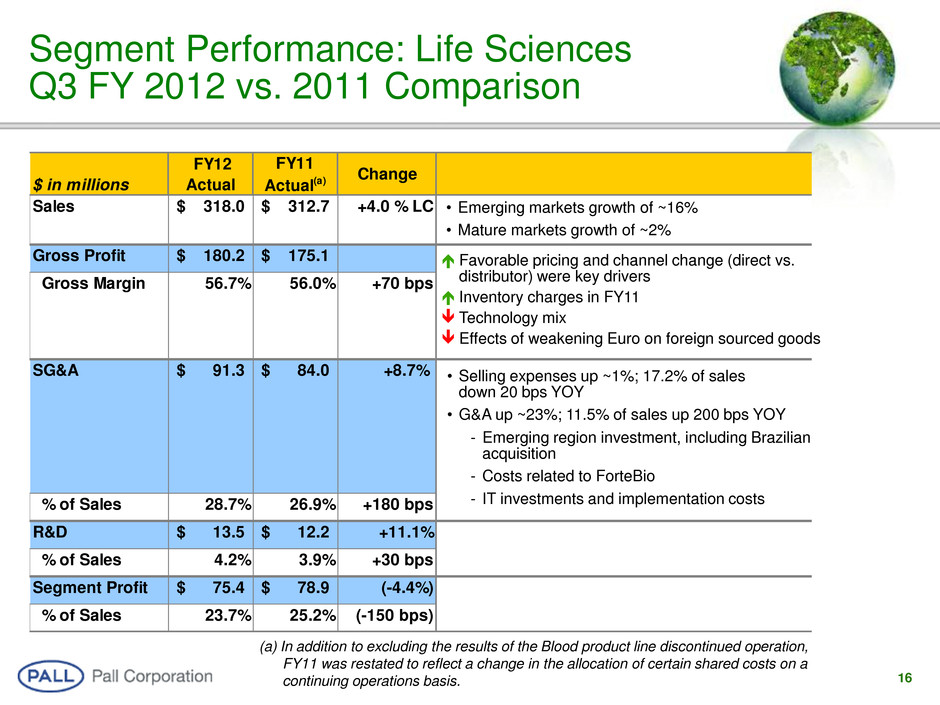

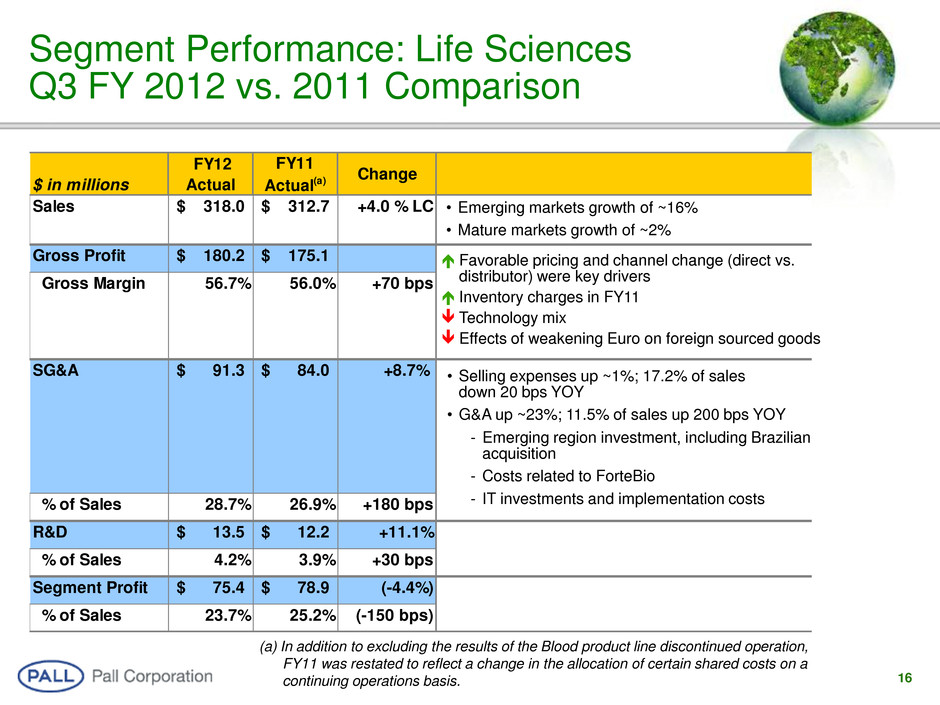

16 $ in millions FY12 Actual FY11 Actual(a) Change Sales 318.0$ 312.7$ +4.0 % LC Gross Profit 180.2$ 175.1$ Gross Margin 56.7% 56.0% +70 bps SG&A 91.3$ 84.0$ +8.7% % of Sales 28.7% 26.9% +180 bps R&D 13.5$ 12.2$ +11.1% % of Sales 4.2% 3.9% +30 bps Segment Profit 75.4$ 78.9$ (-4.4%) % of Sales 23.7% 25.2% (-150 bps) Segment Performance: Life Sciences Q3 FY 2012 vs. 2011 Comparison • Selling expenses up ~1%; 17.2% of sales down 20 bps YOY • G&A up ~23%; 11.5% of sales up 200 bps YOY - Emerging region investment, including Brazilian acquisition - Costs related to ForteBio - IT investments and implementation costs Favorable pricing and channel change (direct vs. distributor) were key drivers Inventory charges in FY11 Technology mix Effects of weakening Euro on foreign sourced goods (a) In addition to excluding the results of the Blood product line discontinued operation, FY11 was restated to reflect a change in the allocation of certain shared costs on a continuing operations basis. • Emerging markets growth of ~16% • Mature markets growth of ~2%

17 Analysis of Euro (€) Risk • ~25% of Pall sales are denominated in Euro.~70 - 80% of the cost associated with these sales are GBP (60%) and USD (20%) denominated. • Impact to Gross Profit: • Q3 FY 2012 • Vs. BOY outlook ~(-$3.0) • Vs. Q3 FY 2011 ~(-$2.5) • Q4E FY 2012 • Vs. BOY outlook ~(-$3.5) • Vs. Q4 FY 2011 ~(-$7.5) • Fiscal Year FY 2012E • Vs. BOY outlook ~(-$5.5) • Vs. 2011 ~(-$6.0) BOY = Beginning of Year Dollars in millions Implementing Euro risk mitigating cash flow hedges 0.8119 1.3843 1.3579 1.3252 1.3424 1.3636 1.3959 1.4480 1.4405 1.4387 1.4303 1.2842 1.3106 1.3931 1.3876 1.3700 1.3086 1.2947 1.3245 1.3281 1.4406 1.3211 1.2814 1.2582 0.88330.8824 0.8763 0.8853 0.8656 0.85260.85400.8539 0.8546 0.8426 0.8254 0.8703 0.87500.8762 0.8808 0.8628 0.8447 0.8360 0.8400 0.8376 0.8245 0.8036 0.7000 1.1000 1.5000 Aug Sep Oct Nov Dec Jan Feb Mar Apr May Jun Jul € to USD FY11 € to USD FY12 € to GBP FY11 € to GBP FY12 (a) (a) U SD a nd £ E qu iv al en t o f E ur o (a) Source: WSJ, Euro and GBP value as of 6/6/12

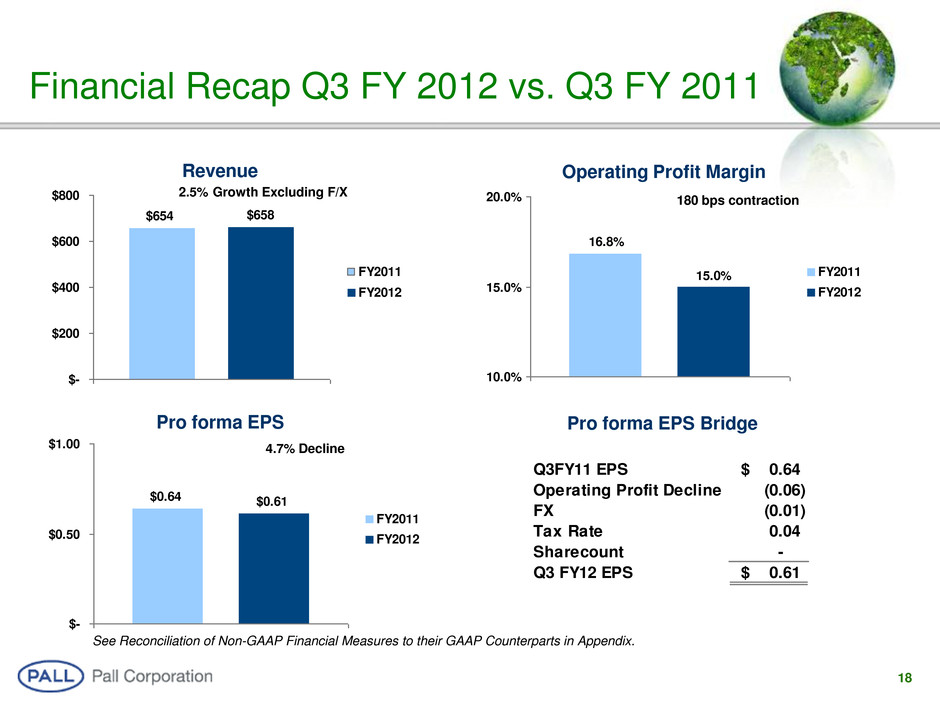

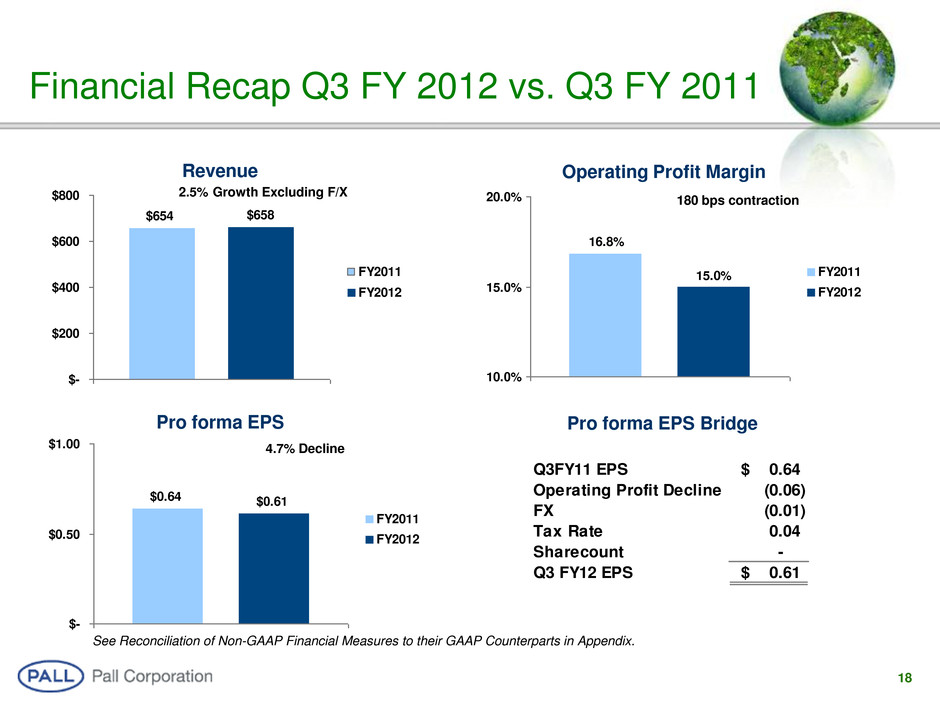

18 Financial Recap Q3 FY 2012 vs. Q3 FY 2011 $654 $658 $- $200 $400 $600 $800 FY2011 FY2012 Revenue 16.8% 15.0% 10.0% 15.0% 20.0% FY2011 FY2012 Operating Profit Margin $0.64 $0.61 $- $0.50 $1.00 FY2011 FY2012 Pro forma EPS 2.5% Growth Excluding F/X 180 bps contraction 4.7% Decline Pro forma EPS Bridge Q3FY11 EPS 0.64$ Operating Profit Decline (0.06) FX (0.01) Tax Rate 0.04 Sharecount - Q3 FY12 EPS 0.61$ See Reconciliation of Non-GAAP Financial Measures to their GAAP Counterparts in Appendix.

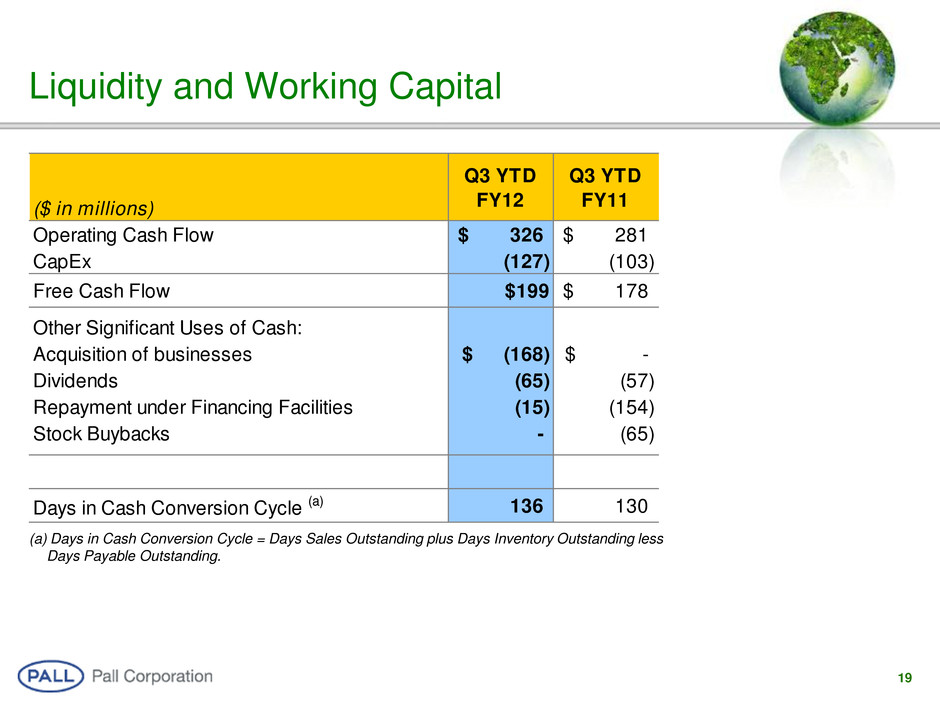

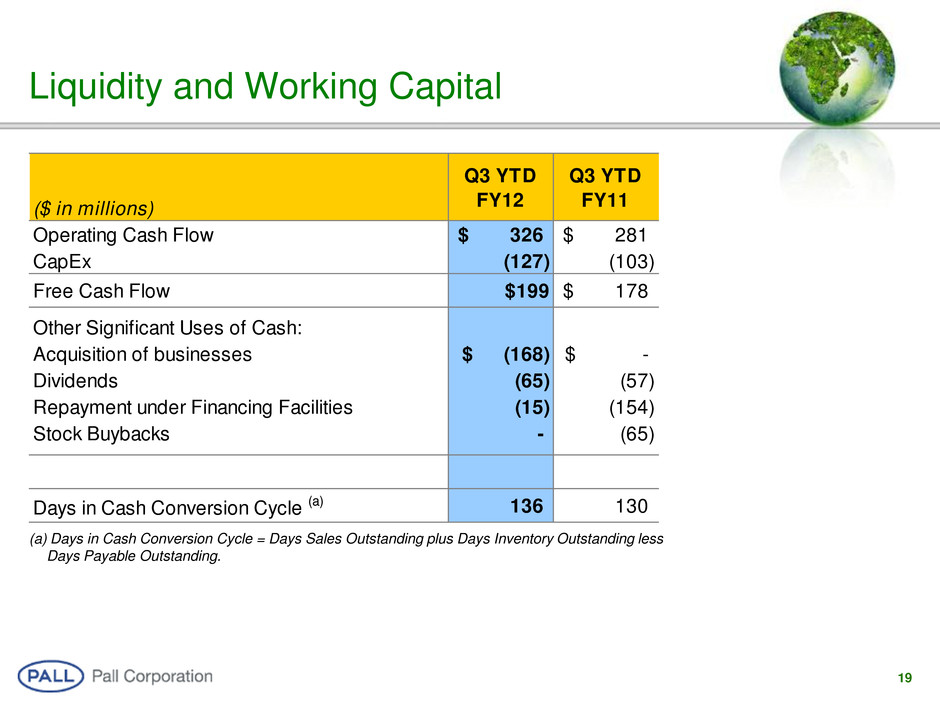

19 Liquidity and Working Capital (a) Days in Cash Conversion Cycle = Days Sales Outstanding plus Days Inventory Outstanding less Days Payable Outstanding. ($ in millions) Q3 YTD FY12 Q3 YTD FY11 Operating Cash Flow 326$ 281$ CapEx (127) (103) Free Cash Flow $199 178$ Other Significant Uses of Cash: Acquisition of businesses (168)$ -$ Dividends (65) (57) Repayment under Financing Facilities (15) (154) Stock Buybacks - (65) Days in Cash Conversion Cycle (a) 136 130

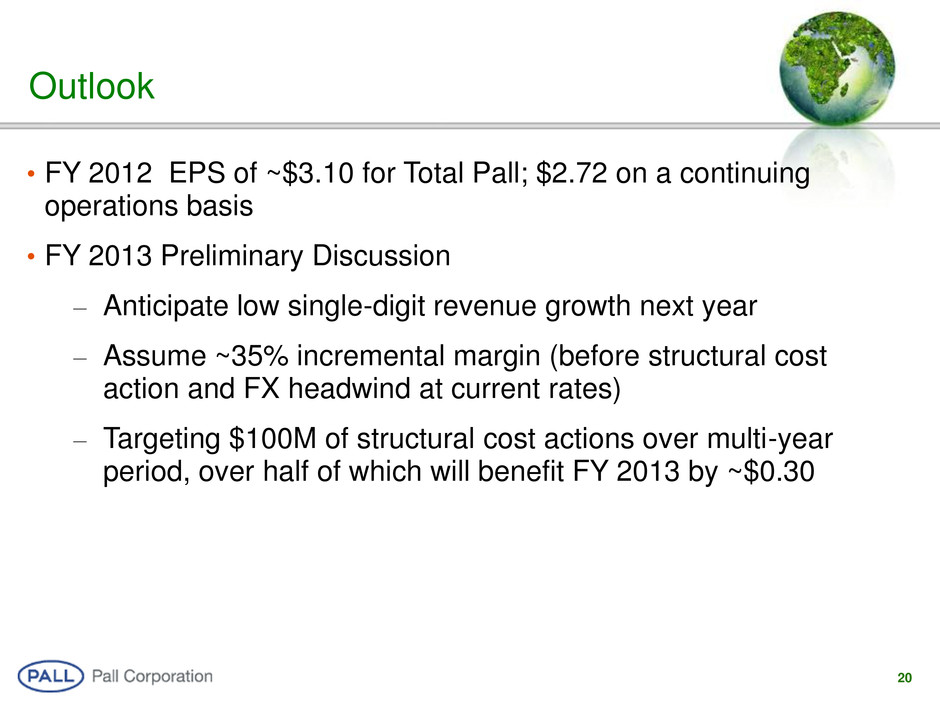

20 Outlook • FY 2012 EPS of ~$3.10 for Total Pall; $2.72 on a continuing operations basis • FY 2013 Preliminary Discussion – Anticipate low single-digit revenue growth next year – Assume ~35% incremental margin (before structural cost action and FX headwind at current rates) – Targeting $100M of structural cost actions over multi-year period, over half of which will benefit FY 2013 by ~$0.30

Appendix

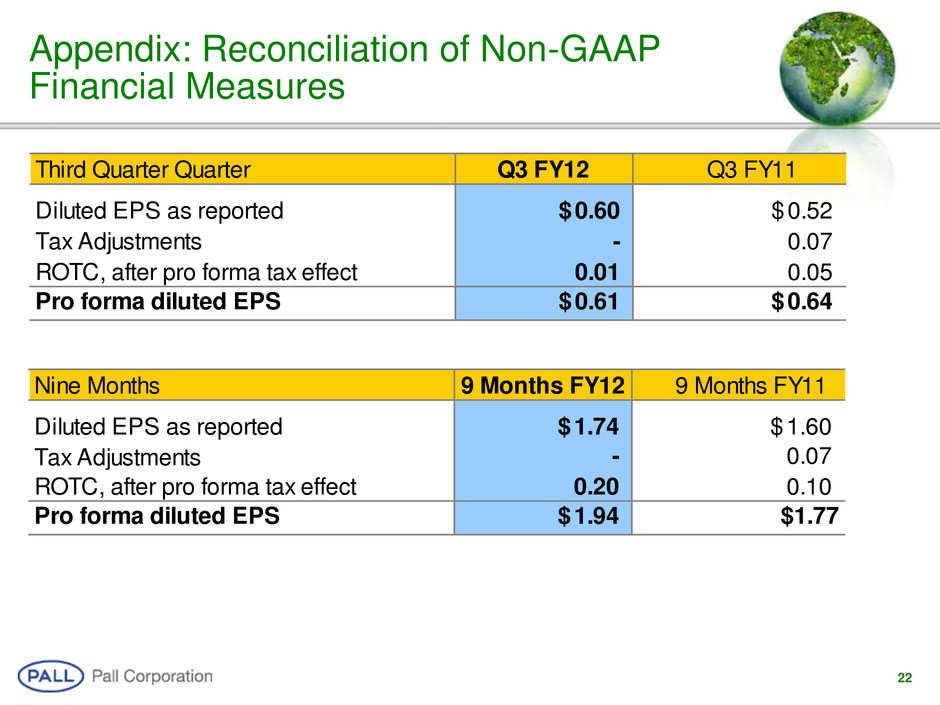

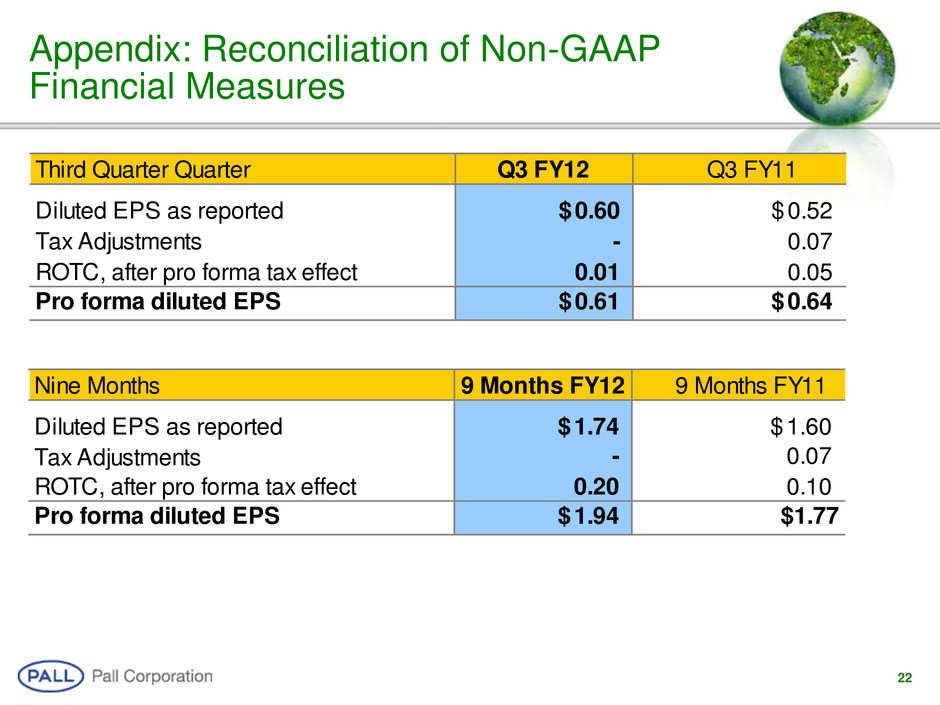

22 Appendix: Reconciliation of Non-GAAP Financial Measures Third Quarter Quarter Diluted EPS as reported 0.60$ 0.52$ Tax Adjustments - 0.07 ROTC, after pro forma tax effect 0.01 0.05 Pro forma diluted EPS 0.61$ 0.64$ Q3 FY12 Q3 FY11 Nine Months Diluted EPS as reported 1.74$ 1.60$ Tax Adjustments - 0.07 ROTC, after pro forma tax effect 0.20 0.10 Pro forma diluted EPS 1.94$ $1.77 9 Months FY12 9 Months FY11

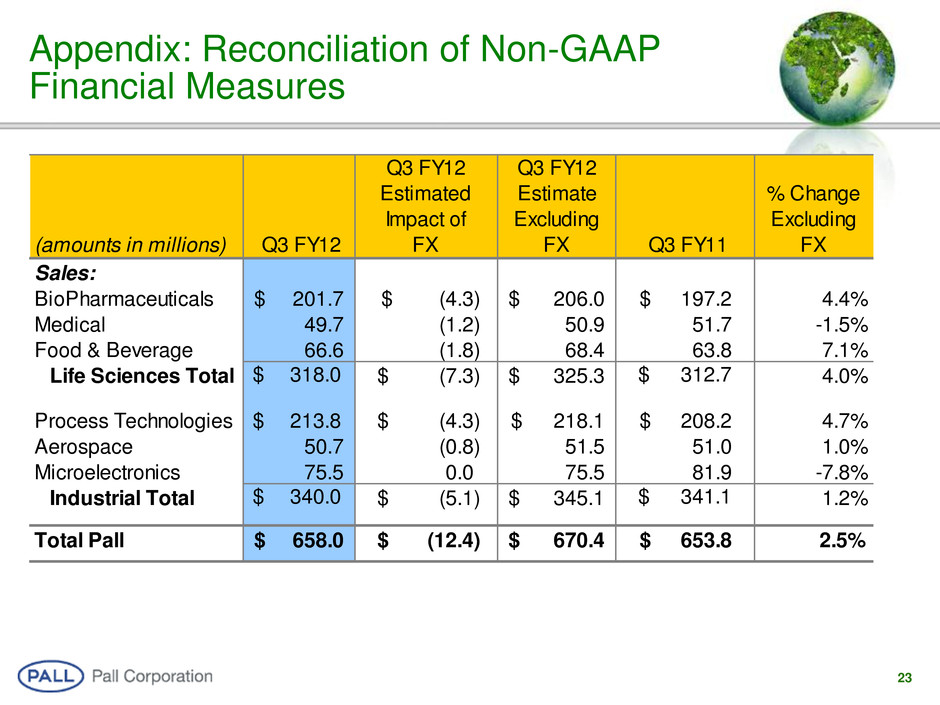

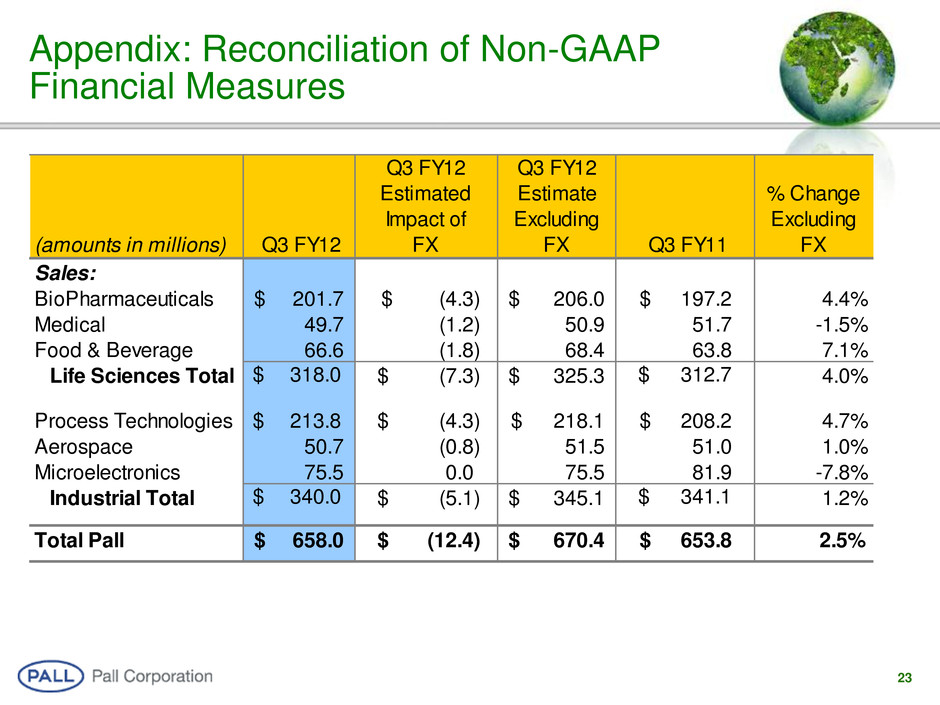

23 Appendix: Reconciliation of Non-GAAP Financial Measures (amounts in millions) Q3 FY12 Q3 FY12 Estimated Impact of FX Q3 FY12 Estimate Excluding FX Q3 FY11 % Change Excluding FX Sales: BioPharmaceuticals 201.7$ (4.3)$ 206.0$ 197.2$ 4.4% Medical 49.7 (1.2) 50.9 51.7 -1.5% Food & Beverage 66.6 (1.8) 68.4 63.8 7.1% Life Sciences Total $ 318.0 (7.3)$ 325.3$ $ 312.7 4.0% Process Technologies $ 213.8 (4.3)$ 218.1$ 208.2$ 4.7% Aerospace 50.7 (0.8) 51.5 51.0 1.0% Microelectronics 75.5 0.0 75.5 81.9 -7.8% Industrial Total $ 340.0 (5.1)$ 345.1$ $ 341.1 1.2% Total Pall 658.0$ (12.4)$ 670.4$ 653.8$ 2.5%

24 Appendix: Reconciliation of Non-GAAP Financial Measures (amounts in millions) Q3 FY12 Q3 FY12 Estimated Impact of FX Q3 FY12 Estimate Excluding FX Q3 FY11 % Change Excluding FX Sales: Americas 95.5$ (0.7)$ 96.2$ 88.2$ 9.1% Europe 154.5 (7.1) 161.6 164.7 -1.9% Asia 68.0 0.6 67.4 59.8 12.6% Life Sciences Total $ 318.0 (7.3)$ 325.3$ $ 312.7 4.0% Americas 100.2$ (0.7)$ 100.9$ 112.4$ -10.2% Europe 103.6 (5.4) 109.0 103.1 5.8% Asia 136.2 1.1 135.1 125.6 7.5% Industrial Total $ 340.0 (5.1)$ 345.1$ $ 341.1 1.2% Total Pall 658.0$ (12.3)$ 670.3$ 653.8$ 2.5%

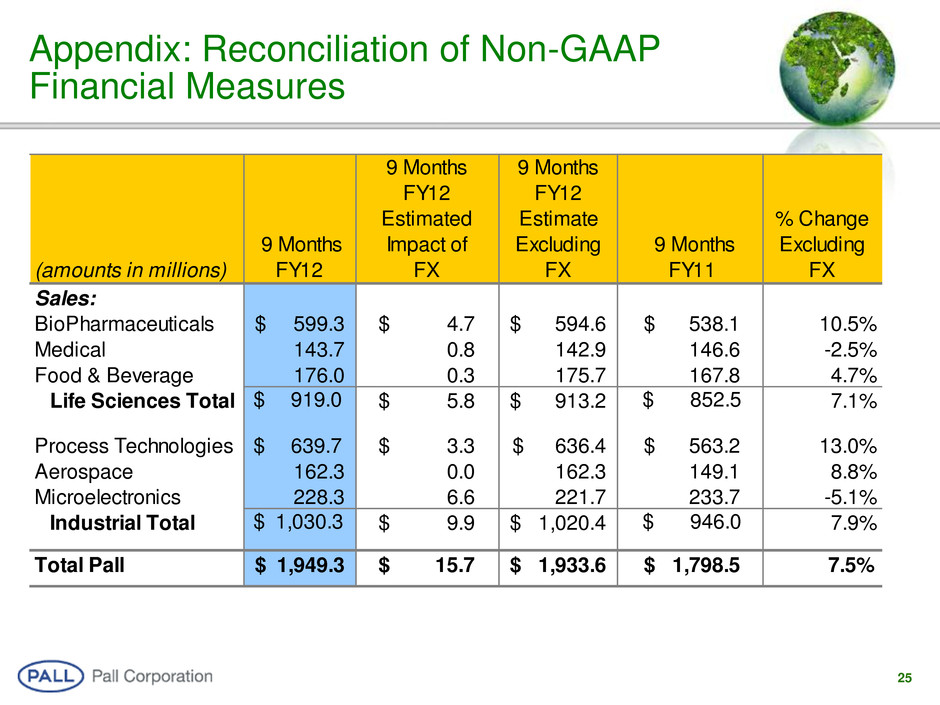

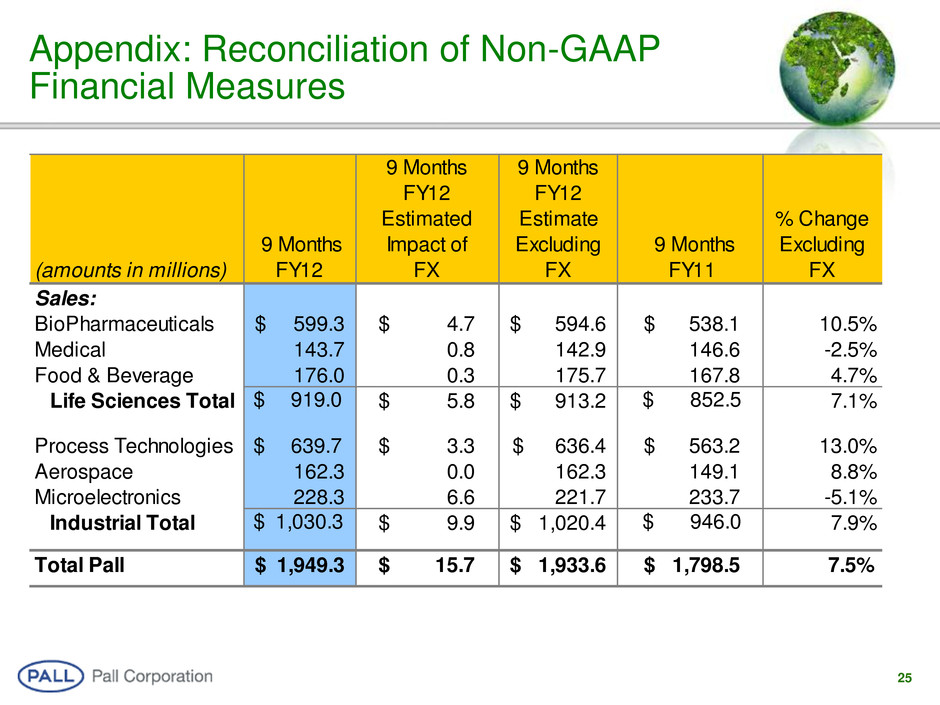

25 Appendix: Reconciliation of Non-GAAP Financial Measures (amounts in millions) 9 Months FY12 9 Months FY12 Estimated Impact of FX 9 Months FY12 Estimate Excluding FX 9 Months FY11 % Change Excluding FX Sales: BioPharmaceuticals 599.3$ 4.7$ 594.6$ 538.1$ 10.5% Medical 143.7 0.8 142.9 146.6 -2.5% Food & Beverage 176.0 0.3 175.7 167.8 4.7% Life Sciences Total $ 919.0 5.8$ 913.2$ $ 852.5 7.1% Process Technologies $ 639.7 3.3$ 636.4$ 563.2$ 13.0% Aerospace 162.3 0.0 162.3 149.1 8.8% Microelectronics 228.3 6.6 221.7 233.7 -5.1% Industrial Total $ 1,030.3 9.9$ 1,020.4$ $ 946.0 7.9% Total Pall 1,949.3$ 15.7$ 1,933.6$ 1,798.5$ 7.5%

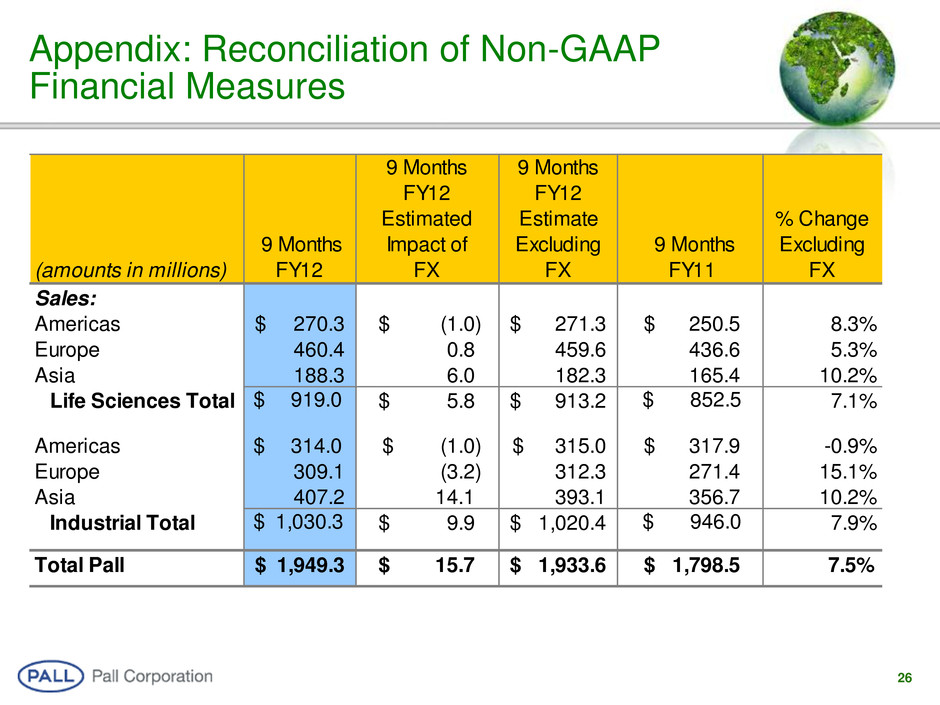

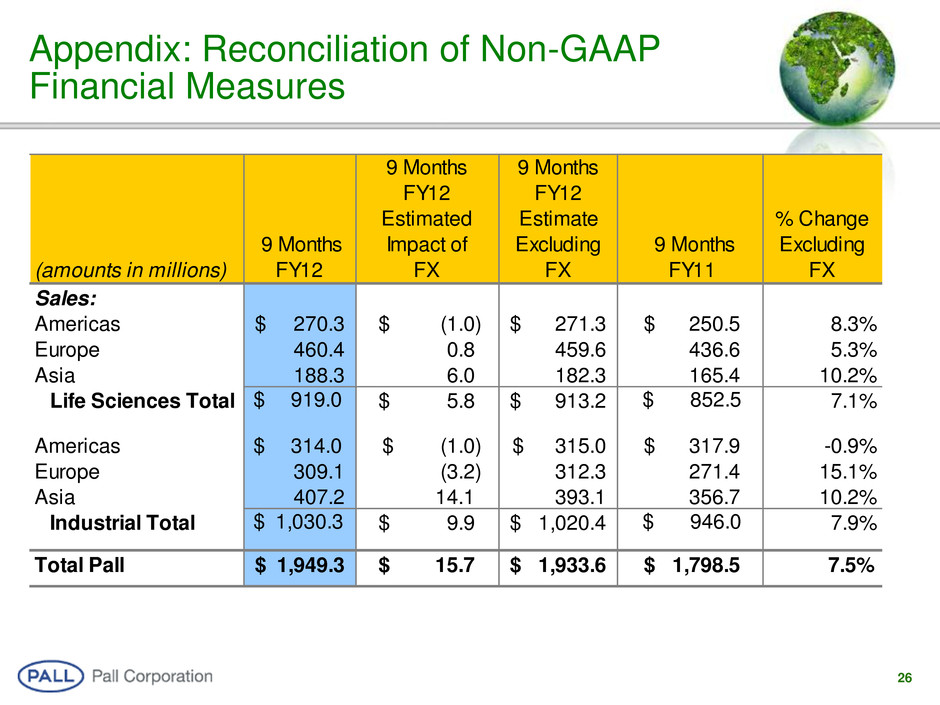

26 Appendix: Reconciliation of Non-GAAP Financial Measures (amounts in millions) 9 Months FY12 9 Months FY12 Estimated Impact of FX 9 Months FY12 Estimate Excluding FX 9 Months FY11 % Change Excluding FX Sales: Americas 270.3$ (1.0)$ 271.3$ 250.5$ 8.3% Europe 460.4 0.8 459.6 436.6 5.3% Asia 188.3 6.0 182.3 165.4 10.2% Life Sciences Total $ 919.0 5.8$ 913.2$ $ 852.5 7.1% Americas $ 314.0 (1.0)$ 315.0$ 317.9$ -0.9% Europe 309.1 (3.2) 312.3 271.4 15.1% Asia 407.2 14.1 393.1 356.7 10.2% Industrial Total $ 1,030.3 9.9$ 1,020.4$ $ 946.0 7.9% Total Pall 1,949.3$ 15.7$ 1,933.6$ 1,798.5$ 7.5%

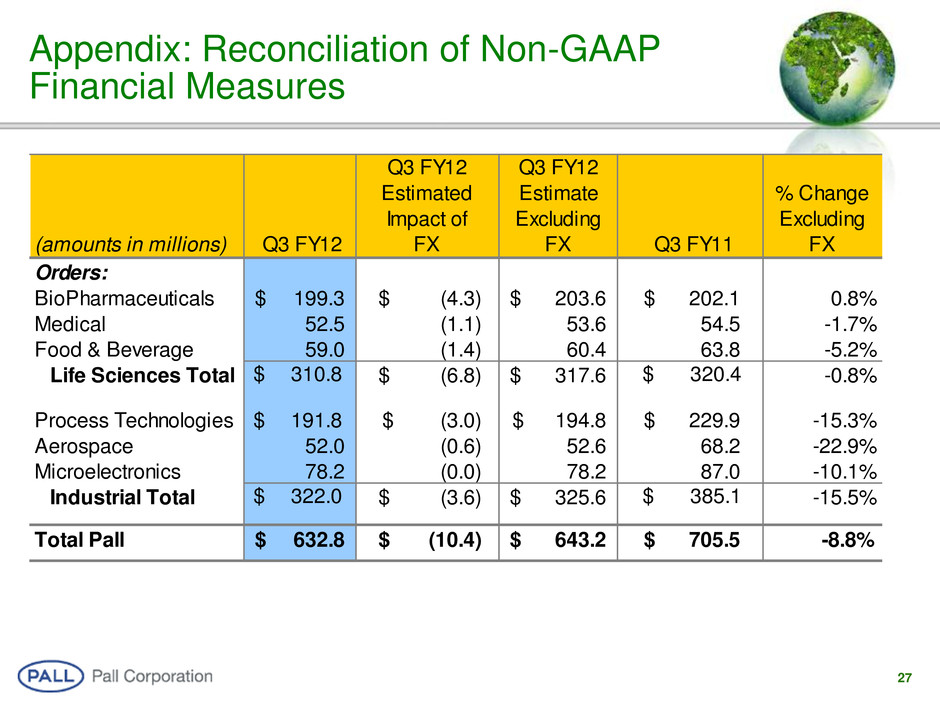

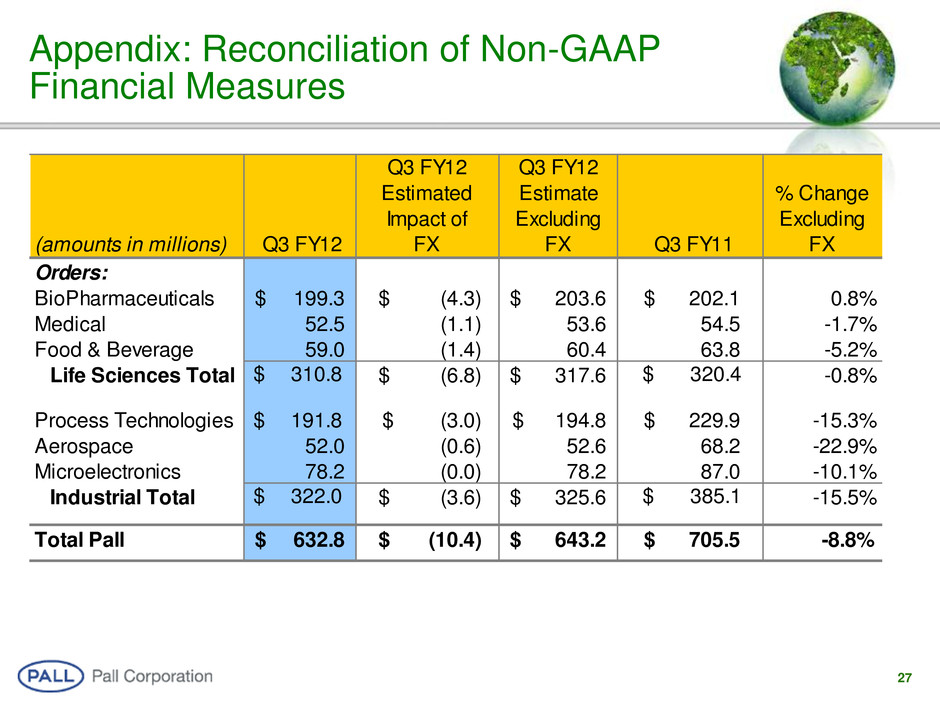

27 Appendix: Reconciliation of Non-GAAP Financial Measures (amounts in millions) Q3 FY12 Q3 FY12 Estimated Impact of FX Q3 FY12 Estimate Excluding FX Q3 FY11 % Change Excluding FX Orders: BioPharmaceuticals 199.3$ (4.3)$ 203.6$ 202.1$ 0.8% Medical 52.5 (1.1) 53.6 54.5 -1.7% Food & Beverage 59.0 (1.4) 60.4 63.8 -5.2% Life Sciences Total $ 310.8 (6.8)$ 317.6$ $ 320.4 -0.8% Process Technologies $ 191.8 (3.0)$ 194.8$ 229.9$ -15.3% Aerospace 52.0 (0.6) 52.6 68.2 -22.9% Microelectronics 78.2 (0.0) 78.2 87.0 -10.1% Industrial Total $ 322.0 (3.6)$ 325.6$ $ 385.1 -15.5% Total Pall 632.8$ (10.4)$ 643.2$ 705.5$ -8.8%

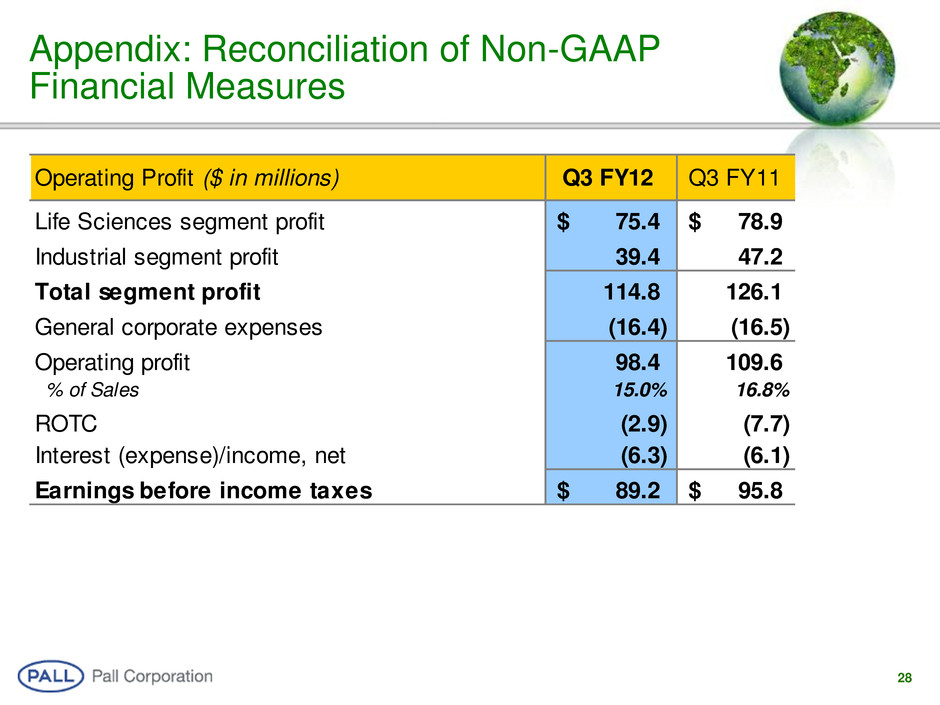

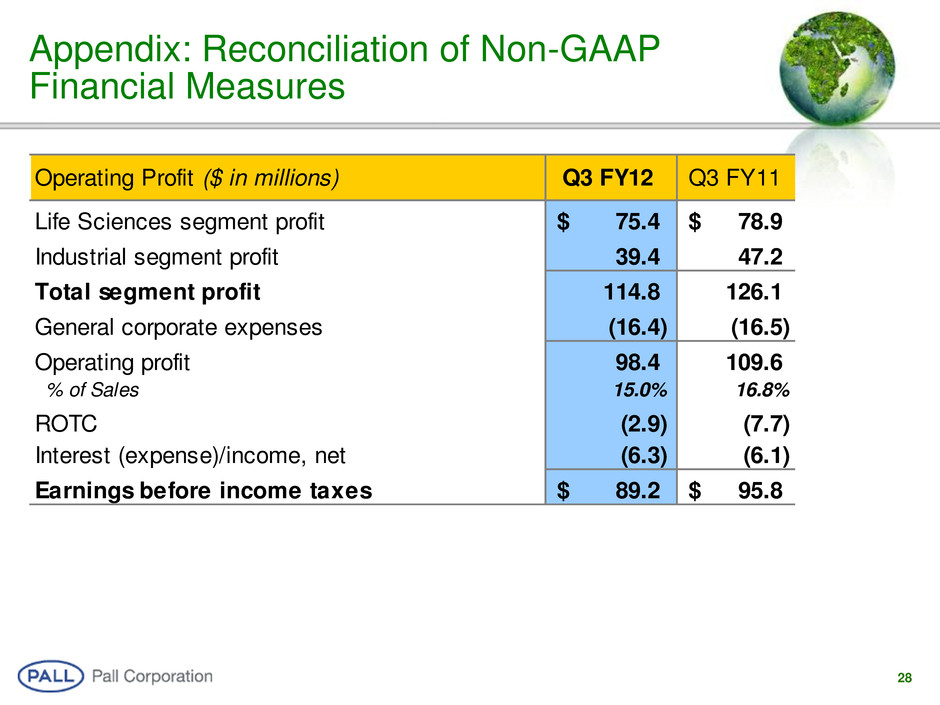

28 Appendix: Reconciliation of Non-GAAP Financial Measures Operating Profit ($ in millions) Q3 FY12 Q3 FY11 Life Sciences segment profit 75.4$ 78.9$ Industrial segment profit 39.4 47.2 Total segment profit 114.8 126.1 General corporate expenses (16.4) (16.5) Operating profit 98.4 109.6 % of Sales 15.0% 16.8% ROTC (2.9) (7.7) Interest (expense)/income, net (6.3) (6.1) Earnings before income taxes 89.2$ 95.8$

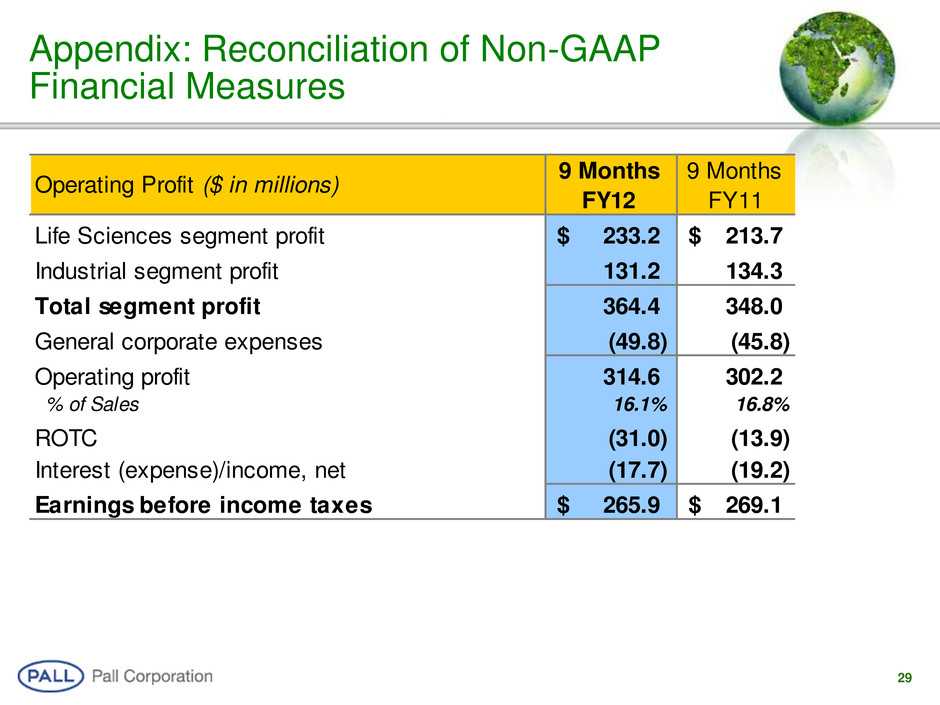

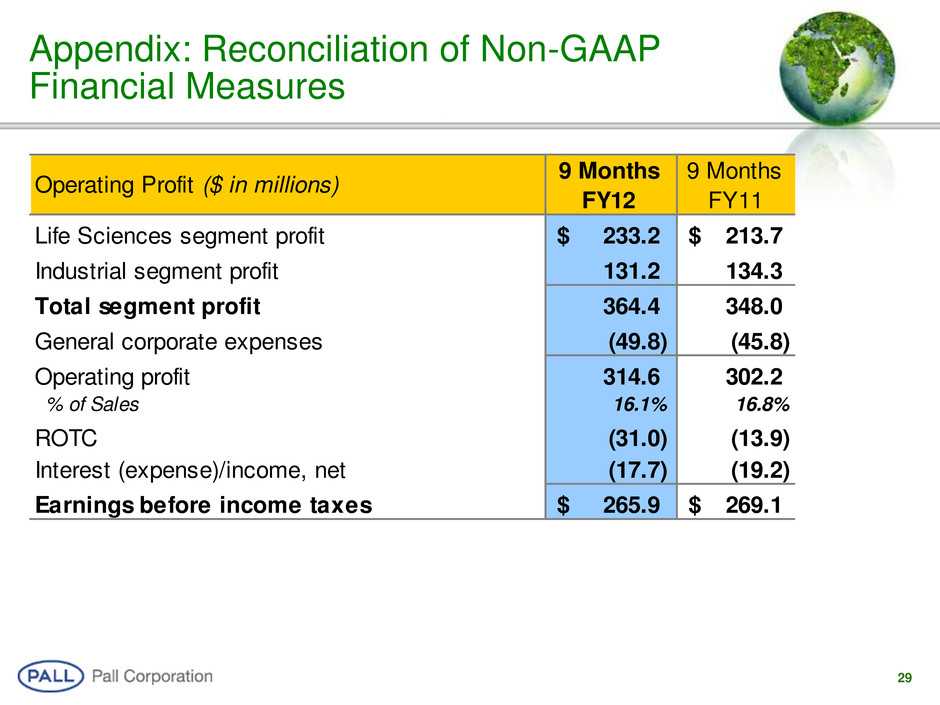

29 Appendix: Reconciliation of Non-GAAP Financial Measures Operating Profit ($ in millions) 9 Months FY12 9 Months FY11 Life Sciences segment profit 233.2$ 213.7$ Industrial segment profit 131.2 134.3 Total segment profit 364.4 348.0 General corporate expenses (49.8) (45.8) Operating profit 314.6 302.2 % of Sales 16.1% 16.8% ROTC (31.0) (13.9) Interest (expense)/income, net (17.7) (19.2) Earnings before income taxes 265.9$ 269.1$

www.pall.com/green