| | | |

| | |

| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

|

| FORM N-CSR |

|

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED |

| MANAGEMENT INVESTMENT COMPANIES |

|

| Investment Company Act file number: (811-04178) | |

| |

| Exact name of registrant as specified in charter: | Putnam American Government Income Fund |

| |

| Address of principal executive offices: One Post Office Square, Boston, Massachusetts 02109 |

|

| Name and address of agent for service: | Beth S. Mazor, Vice President |

| | One Post Office Square |

| | Boston, Massachusetts 02109 |

| |

| Copy to: | | John W. Gerstmayr, Esq. |

| | Ropes & Gray LLP |

| | 800 Boylston Street |

| | Boston, Massachusetts 02199-3600 |

| |

| Registrant’s telephone number, including area code: | (617) 292-1000 |

| |

| Date of fiscal year end: September 30, 2011 | | |

| | |

| Date of reporting period: October 1, 2010 — March 31, 2011 |

Item 1. Report to Stockholders:

The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940:

Putnam

American Government

Income Fund

Semiannual report

3 | 31 | 11

| | |

| Message from the Trustees | 1 | |

| |

| About the fund | 2 | |

| |

| Performance snapshot | 4 | |

| |

| Interview with your fund’s portfolio managers | 5 | |

| |

| Your fund’s performance | 11 | |

| |

| Your fund’s expenses | 13 | |

| |

| Terms and definitions | 15 | |

| |

| Other information for shareholders | 16 | |

| |

| Financial statements | 17 | |

| |

Message from the Trustees

Dear Fellow Shareholder:

The U.S. economy and markets continue to improve, despite the many headwinds that they face. The stock market has shown resilience, recently hitting multiple-year highs. The number of U.S. companies paying dividends is significantly higher than a year ago, and corporate profits remain strong.

Even with this positive news, Putnam believes that volatility will continue to roil the markets in the months ahead. Federal budget issues, inflationary pressures, stubbornly high unemployment, and global developments from Japan to Libya have created a cloud of uncertainty. In addition, the U.S. fixed-income market faces the end of the Federal Reserve’s quantitative easing program and the prospects of a tighter monetary policy in the future. We believe, however, that Putnam’s active, research-intensive approach is well suited to uncovering opportunities in this environment.

In news about your fund, Portfolio Manager Rob Bloemker has left Putnam Investments. We are grateful to Rob for his many contributions, including his leadership since 2007 of Putnam’s fixed-income team. Michael Salm, already part of your fund’s management team, has become Co-Head of Fixed Income, and will continue to manage the fund along with Daniel Choquette.

In addition, Putnam would like to thank Richard B. Worley and Myra R. Drucker, who have retired from the Board of Trustees, for their many years of dedicated and thoughtful leadership.

Lastly, we would like to take this opportunity to welcome new shareholders to the fund and to thank all of our investors for your continued confidence in Putnam.

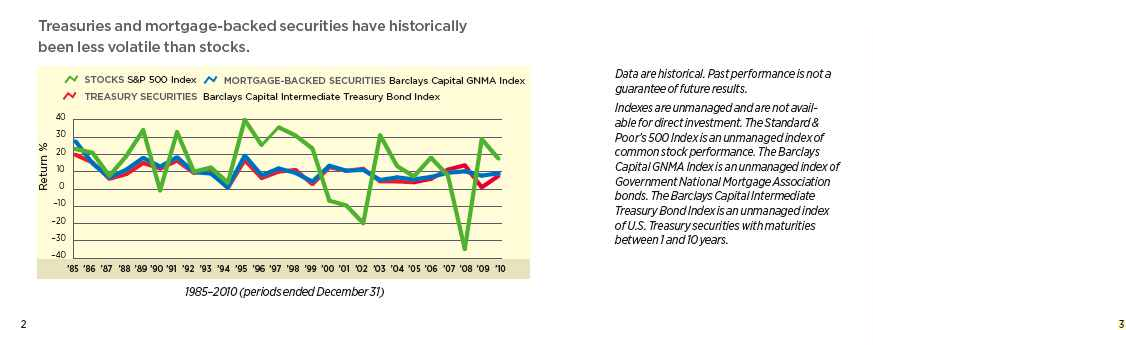

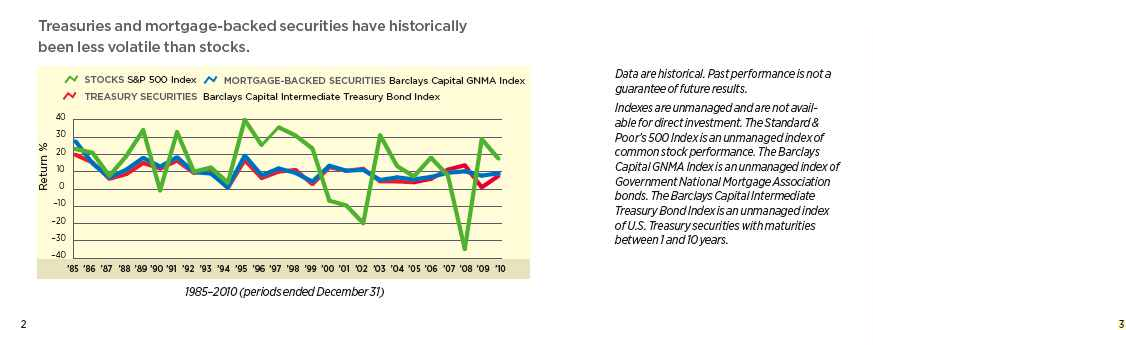

About the fund

Investing in government securities

When the U.S. government needs to finance a project, one way it raises capital is through the Bureau of the Public Debt. Every year, the Bureau holds more than 100 auctions for various government bonds (called Treasuries). U.S. Treasuries have traditionally been considered a safe investment because they are backed by the full faith and credit of the United States. In other words, the U.S. government’s ability to generate tax revenue guarantees payment on any outstanding Treasury debt. Treasuries, however, tend to generate relatively low returns.

In addition to U.S. Treasuries, Putnam American Government Income Fund invests in instruments such as mortgage-backed securities (MBSs). MBSs are essentially securities that represent a stake in the principal from, and interest paid on, a collection of mortgages. Most MBSs are created when government-sponsored entities, including Fannie Mae, Ginnie Mae, and Freddie Mac, buy mortgages from financial institutions, such as banks or credit unions, and package them together by the thousands. These pools of mortgages act as collateral for the MBSs that government-sponsored entities sell to different financial entities, such as Putnam American Government Income Fund.

As a consequence of the credit crisis that gripped financial markets in 2007 and 2008, Fannie Mae and Freddie Mac were placed under conservatorship by their regulator, the Federal Housing Finance Agency, and were given a line of credit with the U.S. Treasury. By investing in both Treasuries and MBSs, the fund’s managers seek to maintain a relatively low risk profile for the portfolio, while supplementing returns for long-term investors.

Consider these risks before investing: Funds that invest in government securities are not guaranteed. Mortgage-backed securities are subject to prepayment risk. The use of derivatives involves special risks and may result in losses. Funds that invest in bonds are subject to certain risks including interest-rate risk, credit risk, and inflation risk. As interest rates rise, the prices of bonds fall. Long-term bonds are more exposed to interest-rate risk than short-term bonds. Unlike bonds, bond funds have ongoing fees and expenses.

Understanding mortgage-related securities

MBSs (Mortgage-backed securities): MBSs are pools of mortgages used as collateral for issuing a security. These securities represent claims on the principal and interest payments made by the borrowers whose loans are in the pool.

Fannie Mae (Federal National Mortgage Association) and Freddie Mac (Federal Home Loan Mortgage Corporation): Formerly public companies, Fannie Mae and Freddie Mac were placed under conservatorship by the U.S. government in September 2008 and are now controlled by the Federal Housing Finance Agency. Both companies buy mortgages from primary lenders (savings and loans, commercial banks, credit unions, and housing finance agencies) and develop MBSs that may carry an explicit government guarantee on the payment of principal and interest.

Ginnie Mae (Government National Mortgage Association): Ginnie Mae is a government-owned corporation established in 1968 whose MBSs are backed by the full faith and credit of the U.S. government.

CMOs (Collateralized mortgage obligations): CMOs are structured mortgage-backed securities that use pools of MBSs, or mortgage loans themselves, as collateral and carve the cash flows into different classes to meet the needs of various investors.

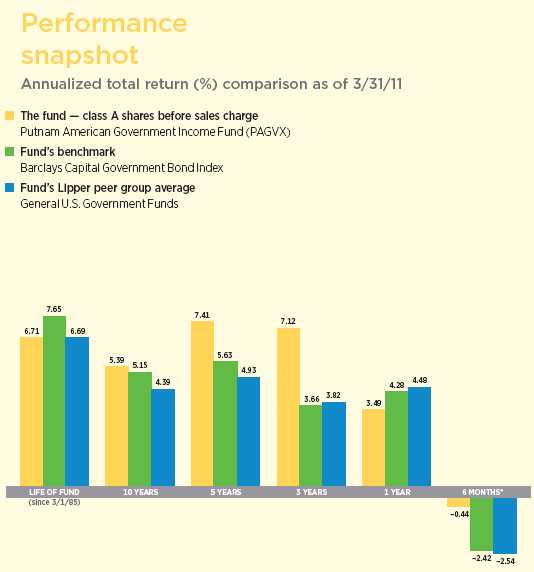

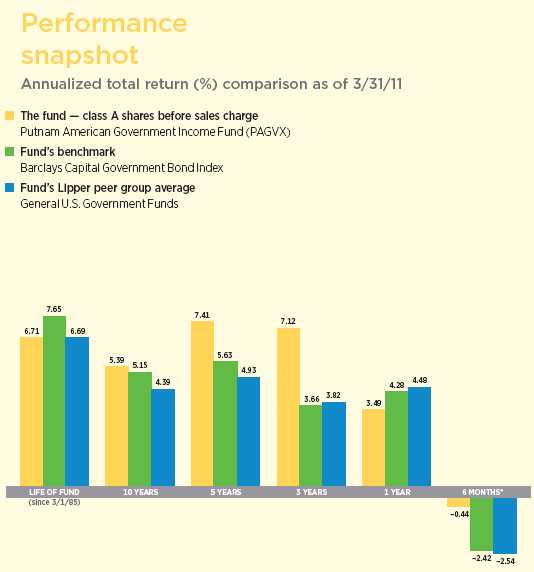

Current performance may be lower or higher than the quoted past performance, which cannot guarantee future results. Share price, principal value, and return will fluctuate, and you may have a gain or a loss when you sell your shares. Performance of class A shares assumes reinvestment of distributions and does not account for taxes. Fund returns in the bar chart do not reflect a sales charge of 4.00%; had they, returns would have been lower. See pages 5 and 11–12 for additional performance information. For a portion of the periods, the fund had expense limitations, without which returns would have been lower. To obtain the most recent month-end performance, visit putnam.com.

* Returns for the six-month period are not annualized, but cumulative.

4

Interview with your fund’s portfolio managers

Michael V. Salm and Daniel S. Choquette, CFA

During what was a volatile six months for the fixed-income markets, the fund posted solid returns versus both its benchmark and its Lipper peer group. What was driving that outperformance?

Daniel: One of Putnam American Government Income Fund’s key strategies within the mortgage space — our holdings of interest-only and inverse interest-only collateralized mortgage obligations [CMO IOs, CMO IIOs] — posted very strong returns during the past six months, which accounted for the bulk of the fund’s outperformance. To give some background, CMOs are securities backed by pools of mortgages; IO securities are derived from the interest payments on those mortgages. Essentially, the longer it takes for homeowners to pay down the principal on their mortgages, the more money a bondholder will make from interest payments on that loan. In an environment with low interest rates, declining home prices, and tighter bank lending standards, refinancing activity has been relatively light, and CMO IOs and IIOs benefited.

It wasn’t all smooth sailing in the CMO market, however. In the weeks leading up to the November midterm elections, there was increased chatter about the possibility of some new government programs that would lower the mortgage rates for a large group of homeowners — essentially, a government-sponsored wave of refinancing. If such a policy were enacted, it would have been quite detrimental to the CMO IO/IIO market. We believed that was unlikely and stuck to our investment thesis despite the volatility at the end of 2010. And, ultimately, we were rewarded for our patience.

It’s important to note that CMO IO/IIOs are not held by the benchmark index. This segment of the mortgage market was an opportunity that our fixed-income research team identified in mid 2007, and we have

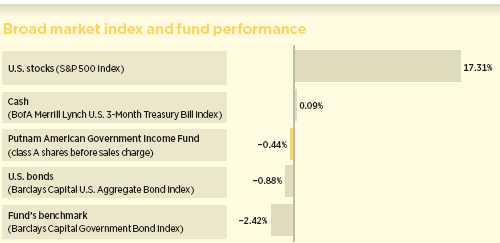

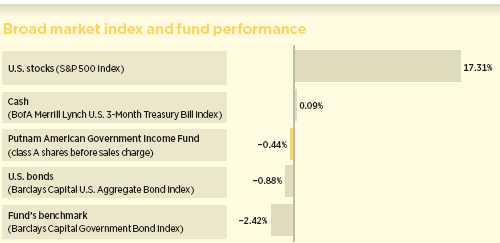

This comparison shows your fund’s performance in the context of broad market indexes for the six months ended 3/31/11. See pages 4 and 11–12 for additional fund performance information. Index descriptions can be found on page 15.

5

been making tactical allocations to the sector since then. We believe this type of allocation is a compelling example of the benefits of active fund management. I should also mention that we have recently begun to trim the fund’s exposure to CMO IO/IIO securities. We still find the securities attractive from a strategy point of view, but their strong recent performance has made their valuations less attractive, and as a result we have been selling off some of our holdings to lock in profits.

How would you characterize the performance of other sectors of the bond market during the period?

Michael: Other sectors of the bond market, particularly U.S. Treasuries, were quite volatile during the past six months. As we discussed in our last report to shareholders, at the end of last summer, the Federal Reserve [Fed] was sending signals that it was likely to introduce a second quantitative easing program, and in November, the Fed officially announced its intention to purchase up to $600 billion worth of U.S. Treasuries. This move was widely anticipated in the market, and many fixed-income investors seemed to try to get out ahead of the Fed by buying Treasuries in advance of the announcement. “Own what the Fed is buying” was the market mantra at the time. Meanwhile, economic data in the United States turned increasingly positive, suggesting that the recovery had taken root and that the possibility of a double-dip recession was fairly remote. Given this combination, by the time the Fed actually began purchasing Treasuries, demand had softened, and yields jumped higher. In this environment, mortgage-backed securities [MBSs] outperformed Treasuries, and the fund’s overweight position relative to its benchmark helped boost returns.

How have you been positioning the fund’s portfolio recently?

Daniel: In addition to reducing the fund’s CMO IO/IIO holdings, we have been taking positions

Allocations are represented as a percentage of net assets. Summary information may differ from the portfolio schedule included in the financial statements due to the inclusion of derivative securities and the exclusion of as-of trades, if any, and the use of different classifications of securities for presentation purposes. Holdings and allocations may vary over time.

6

designed to benefit from a flattening yield curve. As a reminder, the yield curve is a graphical representation of how the yields of bonds of various maturities compare. Usually, bonds with longer maturities offer higher yields than short-term bonds. This is true today, but the difference between the short and the long end of the curve is much greater than is typical. For more than two years, the Fed has kept the short end of the curve anchored around zero after it cut the benchmark for short-term interest rates, the federal funds rate, to a target of less than 0.25%. For comparison, as of March 31, 2011, the yield on the 30-year U.S. Treasury bond was more than 4.5%.

For several reasons, we believe this large discrepancy is unlikely to persist, and we have positioned the fund to benefit in one of two ways. If economic growth fails to materialize, perhaps due to a prolonged disruption in energy production and prolonged elevated oil prices, the yields on long-term bonds should decline as investors are willing to accept less income for the relative safety of Treasuries. If, on the other hand, the pro-stimulus policy the government has put in place has worked and more robust growth returns to the economy, we would expect the Fed would eventually raise short-term interest rates, which ultimately need to keep pace with economic growth. Under either scenario, the yield curve would flatten and the positioning of the fund with respect to interest rates would be beneficial.

Credit qualities are shown as a percentage of net assets as of 3/31/11. A bond rated Baa or higher (Prime-3 or higher, for short-term debt) is considered investment grade. The chart reflects Moody’s ratings; percentages may include bonds or derivatives not rated by Moody’s but rated by Standard & Poor’s or, if unrated by S&P, by Fitch, and then included in the closest equivalent Moody’s rating. Ratings will vary over time.

Credit quality includes bonds and represents only the fixed-income portion of the portfolio. Derivative instruments, including currency forwards, are only included to the extent of any unrealized gain or loss on such instruments and are shown in the not-rated category. The fund itself has not been rated by an independent rating agency.

7

As a part of those stimulative policies, the Fed purchased more than $1 trillion worth of agency mortgage-backed securities. If the Fed begins selling those securities, what effect would that likely have on the market?

Michael: That’s currently the subject of some debate. Today’s market valuations suggest that if the Fed begins selling the mortgage securities on its balance sheet, the increased supply would outpace demand, and prices in the agency MBS sector would decline considerably. We find that scenario unlikely. Given its history of implementing policy, we believe the Fed’s sale of MBS holdings is more likely to be orderly and transparent, and the pace of the sale should be contingent on market and economic conditions. In other words, we feel that the Fed will only begin to sell securities if the economy is showing signs of stable growth, in which case the yield premium — or spread — agency MBSs offer over Treasuries is likely to be narrowing. Should that occur, demand for these types of bonds is likely to be healthy enough to keep pace with the increased supply. As far as the fund is concerned, we have increased our exposure over the past six months to attractively valued agency mortgage-backed securities, given our view on the potential returns in the sector.

How does the fund use derivative securities?

Daniel: The fund will use derivatives in a number of ways. For example, the fund will often use derivatives, specifically “swaps,” to manage interest-rate exposure. If we identify a security that we believe offers an attractive spread over Treasuries, we may purchase that bond and hedge the associated interest-rate risk by entering into a swap contract with another party. Also, the fund may use futures to establish a strategy with respect to the shape of the yield curve, and hold so-called “swaptions” — which grant us

This chart illustrates the fund’s composition by maturity, showing the percentage of holdings in different maturity ranges and how the composition has changed over the past six months. Holdings and maturity ranges will vary over time.

8

the option to enter into a swap — in order to hedge the duration risk associated with our CMO IO/IIO positions.

What is your outlook for the bond markets and the fund?

Michael: While we believe the economy is improving, significant challenges remain, including persistently high unemployment, a weak housing market, geopolitical tensions in the Middle East, and rising fuel prices. In addition, the level of government debt is unsustainable, as is reflected by Standard & Poor’s recent downgrade in the United States’ long-term debt outlook from “stable” to “negative.” It’s unclear where the common ground exists between the Obama administration and the Republican-controlled House of Representatives in significantly reducing the deficit, so it would not be surprising to see elevated debt-to-GDP ratios for the foreseeable future.

On another note, we believe government agencies Fannie Mae and Freddie Mac will see their portfolios reduced significantly as policymakers decide the future role, if any, for the two institutions. The agencies, which at one point owned or guaranteed half of all mortgages in the United States, were placed under conservatorship in 2008. Today, it’s clear that the majority of these mortgages will need to find their way back into the private sector, but, given the lack of clarity in the regulatory environment, it’s uncertain how or when that transfer will begin in earnest. We believe this will be a slow process.

With this backdrop of heightened uncertainty, the bond markets will likely remain somewhat turbulent over the near term. Nevertheless, we believe our focus on using fundamental research to uncover overlooked opportunities should continue to serve our shareholders well.

Thank you, gentlemen, for your time and insights today.

The views expressed in this report are exclusively those of Putnam Management. They are not meant as investment advice.

Please note that the holdings discussed in this report may not have been held by the fund for the entire period. Portfolio composition is subject to review in accordance with the fund’s investment strategy and may vary in the future. Current and future portfolio holdings are subject to risk.

Of special interest

Effective April 2011, your fund’s monthly dividend has decreased from $0.046 per share to $0.036 per share. This is due to a decrease in interest income in the current low-interest-rate environment.

Michael V. Salm is Co-Head of Fixed Income at Putnam and Team Leader of Liquid Markets. He has a B.S. from Cornell University. He joined Putnam in 1997 and has been in the investment industry since 1992.

Portfolio Manager Daniel S. Choquette is an Investment Strategist at Putnam. He has a B.A. from Yale University and a B.A. from the Royal Conservatory of Music. A CFA charterholder, he joined Putnam in 2002 and has been in the investment industry since 1997.

9

IN THE NEWS

The Federal Reserve continues to back its stimulus efforts already underway. Besides maintaining its near-zero interest-rate policy, the Federal Open Market Committee at its April 15 meeting remained committed to completing its second round of quantitative easing, dubbed “QE2.” Last fall, the central bank launched QE2, which involves the purchase of $600 billion in U.S. Treasury securities, with the primary aim of preventing deflation in the U.S. economy. Last summer, the United States teetered perilously on the brink of a deflationary cliff, as inflation rates fell to 50-year lows. Deflation, which occurs when prices fall in an economy, can cause long-term significant damage to growth. QE2 may have worked, as inflation has returned. In March, the most recent data available, prices measured by the Consumer Price Index (CPI) edged up 0.5% after increasing by the same margin in February. Core inflation, which excludes volatile food and energy prices, rose by 0.1% in March, following a 0.2% uptick in February.

10

Your fund’s performance

This section shows your fund’s performance, price, and distribution information for periods ended March 31, 2011, the end of the first half of its current fiscal year. In accordance with regulatory requirements for mutual funds, we also include expense information taken from the fund’s current prospectus. Performance should always be considered in light of a fund’s investment strategy. Data represent past performance. Past performance does not guarantee future results. More recent returns may be less or more than those shown. Investment return and principal value will fluctuate, and you may have a gain or a loss when you sell your shares. Performance information does not reflect any deduction for taxes a shareholder may owe on fund distributions or on the redemption of fund shares. For the most recent month-end performance, please visit the Individual Investors section at putnam.com or call Putnam at 1-800-225-1581. Class R and class Y shares are not available to all investors. See the Terms and Definitions section in this report for definitions of the share classes offered by your fund.

Fund performance Total return for periods ended 3/31/11

| | | | | | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class Y |

| (inception dates) | (3/1/85) | (5/20/94) | (7/26/99) | (2/14/95) | (4/1/03) | (7/2/01) |

|

| | NAV | POP | NAV | CDSC | NAV | CDSC | NAV | POP | NAV | NAV |

|

| Annual average | | | | | | | | | | |

| (life of fund) | 6.71% | 6.55% | 5.85% | 5.85% | 5.92% | 5.92% | 6.41% | 6.28% | 6.45% | 6.82% |

|

| 10 years | 68.99 | 62.30 | 56.81 | 56.81 | 56.89 | 56.89 | 65.09 | 59.80 | 65.00 | 73.22 |

| Annual average | 5.39 | 4.96 | 4.60 | 4.60 | 4.61 | 4.61 | 5.14 | 4.80 | 5.14 | 5.65 |

|

| 5 years | 42.93 | 37.15 | 37.59 | 35.59 | 37.75 | 37.75 | 41.28 | 36.63 | 41.21 | 44.86 |

| Annual average | 7.41 | 6.52 | 6.59 | 6.28 | 6.62 | 6.62 | 7.16 | 6.44 | 7.15 | 7.69 |

|

| 3 years | 22.91 | 17.99 | 20.16 | 17.15 | 20.31 | 20.31 | 22.10 | 18.08 | 22.07 | 23.88 |

| Annual average | 7.12 | 5.67 | 6.31 | 5.42 | 6.36 | 6.36 | 6.88 | 5.70 | 6.87 | 7.40 |

|

| 1 year | 3.49 | –0.62 | 2.73 | –1.94 | 2.73 | 1.80 | 3.33 | 0.00 | 3.23 | 3.74 |

|

| 6 months | –0.44 | –4.43 | –0.82 | –5.44 | –0.81 | –1.73 | –0.45 | –3.71 | –0.57 | –0.31 |

|

Current performance may be lower or higher than the quoted past performance, which cannot guarantee future results. After-sales-charge returns (public offering price, or POP) for class A and M shares reflect a maximum 4.00% and 3.25% load, respectively. Class B share returns reflect the applicable contingent deferred sales charge (CDSC), which is 5% in the first year, declining over time to 1% in the sixth year, and is eliminated thereafter. Class C shares reflect a 1% CDSC for the first year that is eliminated thereafter. Class R and Y shares have no initial sales charge or CDSC. Performance for class B, C, M, R, and Y shares before their inception is derived from the historical performance of class A shares, adjusted for the applicable sales charge (or CDSC) and the higher operating expenses for such shares, except for class Y shares, for which 12b-1 fees are not applicable.

For a portion of the periods, the fund had expense limitations, without which returns would have been lower.

Class B share performance does not reflect conversion to class A shares.

11

Comparative index returns For periods ended 3/31/11

| | |

| | Barclays Capital Government | Lipper General U.S. Government Funds |

| | Bond Index | category average* |

|

| Annual average (life of fund) | 7.65% | 6.69% |

|

| 10 years | 65.22 | 54.26 |

| Annual average | 5.15 | 4.39 |

|

| 5 years | 31.50 | 27.40 |

| Annual average | 5.63 | 4.93 |

|

| 3 years | 11.38 | 11.98 |

| Annual average | 3.66 | 3.82 |

|

| 1 year | 4.28 | 4.48 |

|

| 6 months | –2.42 | –2.54 |

|

Index and Lipper results should be compared to fund performance at net asset value.

* Over the 6-month, 1-year, 3-year, 5-year, 10-year, and life-of-fund periods ended 3/31/11, there were 145, 142, 130, 118, 81, and 8 funds, respectively, in this Lipper category.

Fund price and distribution information For the six-month period ended 3/31/11

| | | | | | | | |

| Distributions | Class A | Class B | Class C | Class M | Class R | Class Y |

|

| Number | 6 | 6 | 6 | 6 | 6 | 6 |

|

| Income | $0.203 | $0.165 | $0.166 | $0.191 | $0.190 | $0.215 |

|

| Capital gains — Long-term | 0.525 | 0.525 | 0.525 | 0.525 | 0.525 | 0.525 |

|

| Capital gains — Short-term | — | — | — | — | — | — |

|

| Total | $0.728 | $0.690 | $0.691 | $0.716 | $0.715 | $0.740 |

|

| Share value | NAV | POP | NAV | NAV | NAV | POP | NAV | NAV |

|

| 9/30/10 | $10.28 | $10.71 | $10.21 | $10.25 | $10.34 | $10.69 | $10.29 | $10.27 |

|

| 3/31/11 | 9.50 | 9.90 | 9.43 | 9.47 | 9.57 | 9.89 | 9.51 | 9.49 |

|

| Current yield (end of period) | NAV | POP | NAV | NAV | NAV | POP | NAV | NAV |

|

| Current dividend rate 1 | 5.81% | 5.58% | 5.09% | 5.20% | 5.52% | 5.34% | 5.55% | 6.07% |

|

| Current 30-day SEC yield 2 | N/A | 2.23 | 1.58 | 1.58 | N/A | 2.01 | 2.08 | 2.58 |

|

The classification of distributions, if any, is an estimate. Final distribution information will appear on your year-end tax forms.

1 Most recent distribution, excluding capital gains, annualized and divided by NAV or POP at end of period.

2 Based only on investment income and calculated using the maximum offering price for each share class, in accordance with SEC guidelines.

12

Your fund’s expenses

As a mutual fund investor, you pay ongoing expenses, such as management fees, distribution fees (12b-1 fees), and other expenses. Using the following information, you can estimate how these expenses affect your investment and compare them with the expenses of other funds. You may also pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial representative.

| | | | | | |

| Expense ratios | | | | | | |

| |

| | Class A | Class B | Class C | Class M | Class R | Class Y |

|

| Total annual operating expenses for the fiscal year | | | | | | |

| ended 9/30/10* | 0.86% | 1.61% | 1.61% | 1.11% | 1.11% | 0.61% |

|

| Annualized expense ratio for the six-month period | | | | | | |

| ended 3/31/11 | 0.84% | 1.59% | 1.59% | 1.09% | 1.09% | 0.59% |

|

Fiscal-year expense information in this table is taken from the most recent prospectus, is subject to change, and may differ from that shown for the annualized expense ratio and in the financial highlights of this report. Expenses are shown as a percentage of average net assets.

* Restated to reflect projected expenses under a management contract effective 1/1/10.

Expenses per $1,000

The following table shows the expenses you would have paid on a $1,000 investment in the fund from October 1, 2010, to March 31, 2011. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

| | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class Y |

|

| Expenses paid per $1,000*† | $4.18 | $7.90 | $7.90 | $5.42 | $5.42 | $2.94 |

|

| Ending value (after expenses) | $995.60 | $991.80 | $991.90 | $995.50 | $994.30 | $996.90 |

|

* Expenses for each share class are calculated using the fund’s annualized expense ratio for each class, which represents the ongoing expenses as a percentage of average net assets for the six months ended 3/31/11. The expense ratio may differ for each share class.

† Expenses are calculated by multiplying the expense ratio by the average account value for the period; then multiplying the result by the number of days in the period; and then dividing that result by the number of days in the year.

13

Estimate the expenses you paid

To estimate the ongoing expenses you paid for the six months ended March 31, 2011, use the following calculation method. To find the value of your investment on October 1, 2010, call Putnam at 1-800-225-1581.

Compare expenses using the SEC’s method

The Securities and Exchange Commission (SEC) has established guidelines to help investors assess fund expenses. Per these guidelines, the following table shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total costs) of investing in the fund with those of other funds. All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

| | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class Y |

|

| Expenses paid per $1,000*† | $4.23 | $8.00 | $8.00 | $5.49 | $5.49 | $2.97 |

|

| Ending value (after expenses) | $1,020.74 | $1,017.00 | $1,017.00 | $1,019.50 | $1,019.50 | $1,021.99 |

|

* Expenses for each share class are calculated using the fund’s annualized expense ratio for each class, which represents the ongoing expenses as a percentage of average net assets for the six months ended 3/31/11. The expense ratio may differ for each share class.

† Expenses are calculated by multiplying the expense ratio by the average account value for the period; then multiplying the result by the number of days in the period; and then dividing that result by the number of days in the year.

14

Terms and definitions

Important terms

Total return shows how the value of the fund’s shares changed over time, assuming you held the shares through the entire period and reinvested all distributions in the fund.

Net asset value (NAV) is the price, or value, of one share of a mutual fund, without a sales charge. NAVs fluctuate with market conditions. NAV is calculated by dividing the net assets of each class of shares by the number of outstanding shares in the class.

Public offering price (POP) is the price of a mutual fund share plus the maximum sales charge levied at the time of purchase. POP performance figures shown here assume the 4.00% maximum sales charge for class A shares and 3.25% for class M shares.

Contingent deferred sales charge (CDSC) is generally a charge applied at the time of the redemption of class B or C shares and assumes redemption at the end of the period. Your fund’s class B CDSC declines over time from a 5% maximum during the first year to 1% during the sixth year. After the sixth year, the CDSC no longer applies. The CDSC for class C shares is 1% for one year after purchase.

Current yield is the annual rate of return earned from dividends or interest of an investment. Current yield is expressed as a percentage of the price of a security, fund share, or principal investment.

Share classes

Class A shares are generally subject to an initial sales charge and no CDSC (except on certain redemptions of shares bought without an initial sales charge).

Class B shares are not subject to an initial sales charge. They may be subject to a CDSC.

Class C shares are not subject to an initial sales charge and are subject to a CDSC only if the shares are redeemed during the first year.

Class M shares have a lower initial sales charge and a higher 12b-1 fee than class A shares and no CDSC (except on certain redemptions of shares bought without an initial sales charge).

Class R shares are not subject to an initial sales charge or CDSC and are available only to certain defined contribution plans.

Class Y shares are not subject to an initial sales charge or CDSC, and carry no 12b-1 fee. They are generally only available to corporate and institutional clients and clients in other approved programs.

Comparative indexes

Barclays Capital U.S. Aggregate Bond Index is an unmanaged index of U.S. investment-grade fixed-income securities.

Barclays Capital Government Bond Index is an unmanaged index of U.S. Treasury and agency securities.

BofA (Bank of America) Merrill Lynch U.S. 3-Month Treasury Bill Index is an unmanaged index that seeks to measure the performance of U.S. Treasury bills available in the marketplace.

S&P 500 Index is an unmanaged index of common stock performance.

Indexes assume reinvestment of all distributions and do not account for fees. Securities and performance of a fund and an index will differ. You cannot invest directly in an index.

Lipper is a third-party industry-ranking entity that ranks mutual funds. Its rankings do not reflect sales charges. Lipper rankings are based on total return at net asset value relative to other funds that have similar current investment styles or objectives as determined by Lipper. Lipper may change a fund’s category assignment at its discretion. Lipper category averages reflect performance trends for funds within a category.

15

Other information for shareholders

Important notice regarding delivery of shareholder documents

In accordance with SEC regulations, Putnam sends a single copy of annual and semiannual shareholder reports, prospectuses, and proxy statements to Putnam shareholders who share the same address, unless a shareholder requests otherwise. If you prefer to receive your own copy of these documents, please call Putnam at 1-800-225-1581, and Putnam will begin sending individual copies within 30 days.

Proxy voting

Putnam is committed to managing our mutual funds in the best interests of our shareholders. The Putnam funds’ proxy voting guidelines and procedures, as well as information regarding how your fund voted proxies relating to portfolio securities during the 12-month period ended June 30, 2010, are available in the Individual Investors section of putnam.com, and on the SEC’s website, www.sec.gov. If you have questions about finding forms on the SEC’s website, you may call the SEC at 1-800-SEC-0330. You may also obtain the Putnam funds’ proxy voting guidelines and procedures at no charge by calling Putnam’s Shareholder Services at 1-800-225-1581.

Fund portfolio holdings

The fund will file a complete schedule of its portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Shareholders may obtain the fund’s Forms N-Q on the SEC’s website at www.sec.gov. In addition, the fund’s Forms N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. You may call the SEC at 1-800-SEC-0330 for information about the SEC’s website or the operation of the Public Reference Room.

Trustee and employee fund ownership

Putnam employees and members of the Board of Trustees place their faith, confidence, and, most importantly, investment dollars in Putnam mutual funds. As of March 31, 2011, Putnam employees had approximately $376,000,000 and the Trustees had approximately $69,000,000 invested in Putnam mutual funds. These amounts include investments by the Trustees’ and employees’ immediate family members as well as investments through retirement and deferred compensation plans.

16

Financial statements

A guide to financial statements

These sections of the report, as well as the accompanying Notes, constitute the fund’s financial statements.

The fund’s portfolio lists all the fund’s investments and their values as of the last day of the reporting period. Holdings are organized by asset type and industry sector, country, or state to show areas of concentration and diversification.

Statement of assets and liabilities shows how the fund’s net assets and share price are determined. All investment and non-investment assets are added together. Any unpaid expenses and other liabilities are subtracted from this total. The result is divided by the number of shares to determine the net asset value per share, which is calculated separately for each class of shares. (For funds with preferred shares, the amount subtracted from total assets includes the liquidation preference of preferred shares.)

Statement of operations shows the fund’s net investment gain or loss. This is done by first adding up all the fund’s earnings — from dividends and interest income — and subtracting its operating expenses to determine net investment income (or loss). Then, any net gain or loss the fund realized on the sales of its holdings — as well as any unrealized gains or losses over the period — is added to or subtracted from the net investment result to determine the fund’s net gain or loss for the fiscal period.

Statement of changes in net assets shows how the fund’s net assets were affected by the fund’s net investment gain or loss, by distributions to shareholders, and by changes in the number of the fund’s shares. It lists distributions and their sources (net investment income or realized capital gains) over the current reporting period and the most recent fiscal year-end. The distributions listed here may not match the sources listed in the Statement of operations because the distributions are determined on a tax basis and may be paid in a different period from the one in which they were earned. Dividend sources are estimated at the time of declaration. Actual results may vary. Any non-taxable return of capital cannot be determined until final tax calculations are completed after the end of the fund’s fiscal year.

Financial highlights provide an overview of the fund’s investment results, per-share distributions, expense ratios, net investment income ratios, and portfolio turnover in one summary table, reflecting the five most recent reporting periods. In a semiannual report, the highlights table also includes the current reporting period.

17

The fund’s portfolio 3/31/11 (Unaudited)

| | |

| U.S. GOVERNMENT AND AGENCY | | |

| MORTGAGE OBLIGATIONS (40.9%)* | Principal amount | Value |

|

| U.S. Government Guaranteed Mortgage Obligations (20.7%) | | |

| Government National Mortgage Association | | |

| Pass-Through Certificates | | |

| 6s, January 15, 2029 | $8 | $9 |

| 5s, TBA, April 1, 2041 | 99,000,000 | 105,048,286 |

| 4 1/2s, with due dates from July 20, 2033 to February 20, 2041 | 30,880,157 | 31,867,717 |

| 4s, February 20, 2041 | 5,980,612 | 5,989,489 |

| 3 1/2s, with due dates from December 20, 2040 to March 20, 2041 | 2,999,802 | 2,861,305 |

| 3 1/2s, TBA, April 1, 2041 | 1,000,000 | 952,031 |

| 3 1/2s, TBA, April 1, 2041 | 1,000,000 | 952,656 |

|

| | | 147,671,493 |

| U.S. Government Agency Mortgage Obligations (20.2%) | | |

| Federal Home Loan Mortgage Corporation | | |

| Pass-Through Certificates | | |

| 7 1/2s, October 1, 2029 | 1,072,262 | 1,212,794 |

| 6s, September 1, 2021 | 22,400 | 24,402 |

| 5 1/2s, with due dates from July 1, 2019 to August 1, 2019 | 392,345 | 424,347 |

| Federal Home Loan Mortgage Corporation | | |

| Pass-Through Certificates | | |

| 4 1/2s, with due dates from January 1, 2037 to June 1, 2037 | 1,768,807 | 1,808,734 |

| 4s, TBA, April 1, 2041 | 35,000,000 | 34,368,359 |

| 3 1/2s, with due dates from December 1, 2040 to January 1, 2041 | 32,831,714 | 30,893,875 |

|

| Federal National Mortgage Association | | |

| Pass-Through Certificates | | |

| 6 1/2s, with due dates from July 1, 2016 to February 1, 2017 | 96,365 | 104,473 |

| 6s, with due dates from July 1, 2011 to August 1, 2022 | 3,673,420 | 4,007,933 |

| 6s, TBA, April 1, 2041 | 20,000,000 | 21,751,562 |

| 5 1/2s, with due dates from December 1, 2011 to February 1, 2021 | 861,113 | 933,386 |

| 5s, with due dates from January 1, 2038 to February 1, 2038 | 200,736 | 210,146 |

| 5s, March 1, 2021 | 46,657 | 49,903 |

| 4 1/2s, March 1, 2039 | 330,086 | 336,339 |

| 4s, with due dates from May 1, 2019 to September 1, 2020 | 394,448 | 412,470 |

| 4s, TBA, April 1, 2041 | 48,000,000 | 47,220,000 |

|

| | | 143,758,723 |

| | | |

| Total U.S. government and agency mortgage obligations (cost $290,844,902) | $291,430,216 |

| |

| U.S. TREASURY OBLIGATIONS (28.9%)* | Principal amount | Value |

|

| U.S. Treasury Bonds | | |

| 8s, November 15, 2021 | $16,475,000 | $23,014,802 |

| 7 1/2s, November 15, 2016 | 10,948,000 | 13,875,735 |

| 7 1/8s, February 15, 2023 | 14,634,000 | 19,415,203 |

| 6 1/4s, May 15, 2030 ## | 10,723,000 | 13,518,519 |

| 6 1/4s, August 15, 2023 | 17,491,000 | 21,728,468 |

| 6s, February 15, 2026 | 15,756,000 | 19,187,854 |

| 5 1/2s, August 15, 2028 | 14,632,000 | 16,945,685 |

| 5 1/4s, February 15, 2029 | 14,641,000 | 16,494,002 |

| 5 1/4s, November 15, 2028 | 14,988,000 | 16,877,894 |

| 4 1/2s, August 15, 2039 ## | 12,231,000 | 12,231,955 |

| 4 1/2s, February 15, 2036 | 14,640,000 | 14,788,687 |

| 4 3/8s, February 15, 2038 | 14,685,000 | 14,450,958 |

|

18

| | |

| U.S. TREASURY OBLIGATIONS (28.9%)* cont. | Principal amount | Value |

|

| U.S. Treasury Notes 2 5/8s, November 15, 2020 | $158,000 | $147,458 |

|

| U.S. Treasury Inflation Index Notes 1 1/4s, July 15, 2020 i | 3,049,669 | 3,159,320 |

|

| Total U.S. treasury obligations (cost $199,642,446) | | $205,836,540 |

|

| |

| MORTGAGE-BACKED SECURITIES (11.0%)* | Principal amount | Value |

|

| Countrywide Home Loans 144A | | |

| Ser. 05-R3, Class AS, IO, 5.532s, 2035 | $381,673 | $46,914 |

| FRB Ser. 05-R3, Class AF, 0.65s, 2035 | 375,189 | 322,662 |

|

| Federal Home Loan Mortgage Corp. | | |

| IFB Ser. 3408, Class EK, 24.767s, 2037 | 455,239 | 643,851 |

| IFB Ser. 2976, Class LC, 23.485s, 2035 | 224,304 | 305,936 |

| IFB Ser. 2979, Class AS, 23.338s, 2034 | 327,838 | 429,403 |

| IFB Ser. 3072, Class SM, 22.862s, 2035 | 791,554 | 1,059,394 |

| IFB Ser. 3072, Class SB, 22.715s, 2035 | 644,750 | 858,607 |

| IFB Ser. 3249, Class PS, 21.434s, 2036 | 477,924 | 635,144 |

| IFB Ser. 3065, Class DC, 19.095s, 2035 | 2,976,354 | 3,781,011 |

| IFB Ser. 3105, Class SI, IO, 18.961s, 2036 | 388,889 | 186,192 |

| IFB Ser. 3031, Class BS, 16.087s, 2035 | 812,036 | 987,893 |

| IFB Ser. 3184, Class SP, IO, 7.095s, 2033 | 869,943 | 99,092 |

| IFB Ser. 2752, Class XS, IO, 6.895s, 2030 | 7,386,677 | 573,280 |

| IFB Ser. 3287, Class SE, IO, 6.445s, 2037 | 1,562,810 | 243,830 |

| IFB Ser. 3398, Class SI, IO, 6.395s, 2036 | 2,054,526 | 256,220 |

| IFB Ser. 3762, Class SA, IO, 6.345s, 2040 | 5,457,275 | 884,889 |

| IFB Ser. 3677, Class KS, IO, 6.295s, 2040 | 7,298,451 | 1,036,739 |

| IFB Ser. 3485, Class SI, IO, 6.295s, 2036 | 1,804,085 | 268,267 |

| IFB Ser. 3225, Class EY, IO, 6.035s, 2036 | 3,506,996 | 458,189 |

| Ser. 3747, Class HI, IO, 4 1/2s, 2037 | 592,528 | 94,351 |

| Ser. 3768, Class MI, IO, 4s, 2035 | 13,246,113 | 1,837,414 |

| Ser. 3738, Class MI, IO, 4s, 2034 | 20,812,544 | 2,763,108 |

| Ser. 3707, Class HI, IO, 4s, 2023 | 1,225,690 | 137,682 |

| FRB Ser. T-57, Class 2A1, 3.966s, 2043 | 1,782 | 1,753 |

| Ser. 3327, Class IF, IO, zero %, 2037 | 41,424 | 311 |

| Ser. 3439, Class AO, PO, zero %, 2037 | 71,923 | 56,279 |

| Ser. 3391, PO, zero %, 2037 | 104,708 | 82,474 |

| Ser. 3300, PO, zero %, 2037 | 263,026 | 226,333 |

| Ser. 3046, PO, zero %, 2035 | 40,021 | 34,641 |

| Ser. 2947, Class AO, PO, zero %, 2035 | 7,976 | 6,408 |

| Ser. 2692, Class TO, PO, zero %, 2033 | 11,223 | 9,049 |

| Ser. 2684, PO, zero %, 2033 | 748,000 | 627,243 |

| FRB Ser. 3274, Class TX, zero %, 2037 | 68,008 | 64,979 |

| FRB Ser. 3326, Class YF, zero %, 2037 | 44,418 | 40,282 |

| FRB Ser. 3263, Class TA, zero %, 2037 | 6,549 | 6,547 |

| FRB Ser. 3238, Class LK, zero %, 2036 | 595,211 | 605,788 |

| FRB Ser. 3117, Class AF, zero %, 2036 | 33,699 | 31,472 |

| FRB Ser. 3326, Class WF, zero %, 2035 | 151,546 | 141,767 |

| FRB Ser. 3033, Class YF, zero %, 2035 | 10,362 | 10,288 |

| FRB Ser. 3036, Class AS, zero %, 2035 | 46,530 | 35,361 |

|

| Federal National Mortgage Association | | |

| IFB Ser. 07-75, Class JS, 50.364s, 2037 | 191,792 | 367,188 |

| IFB Ser. 06-62, Class PS, 38.403s, 2036 | 908,246 | 1,487,352 |

| IFB Ser. 05-74, Class NK, 26.253s, 2035 | 136,313 | 194,328 |

19

| | |

| MORTGAGE-BACKED SECURITIES (11.0%)* cont. | Principal amount | Value |

|

| Federal National Mortgage Association | | |

| IFB Ser. 06-8, Class HP, 23.652s, 2036 | $629,268 | $869,585 |

| IFB Ser. 05-45, Class DA, 23.505s, 2035 | 1,135,729 | 1,627,602 |

| IFB Ser. 07-53, Class SP, 23.285s, 2037 | 965,422 | 1,318,334 |

| IFB Ser. 08-24, Class SP, 22.368s, 2038 | 4,693,377 | 6,393,262 |

| Federal National Mortgage Association | | |

| IFB Ser. 05-122, Class SE, 22.227s, 2035 | 1,051,263 | 1,403,845 |

| IFB Ser. 05-75, Class GS, 19.502s, 2035 | 1,034,534 | 1,308,972 |

| IFB Ser. 05-106, Class JC, 19.35s, 2035 | 846,156 | 1,085,187 |

| IFB Ser. 05-83, Class QP, 16.745s, 2034 | 310,027 | 382,679 |

| IFB Ser. 11-4, Class CS, 12.401s, 2040 | 3,551,132 | 3,683,421 |

| FRB Ser. 03-W14, Class 2A, 4.223s, 2043 | 1,775 | 1,745 |

| FRB Ser. 03-W3, Class 1A4, 3.938s, 2042 | 2,741 | 2,704 |

| FRB Ser. 04-W2, Class 4A, 3.918s, 2044 | 1,802 | 1,783 |

| FRB Ser. 04-W7, Class A2, 3.541s, 2034 | 714 | 737 |

| FRB Ser. 03-W11, Class A1, 3.098s, 2033 | 134 | 135 |

| FRB Ser. 07-95, Class A3, 0 1/2s, 2036 | 11,005,000 | 10,117,777 |

| Ser. 01-50, Class B1, IO, 0.418s, 2041 | 14,304,936 | 187,752 |

| Ser. 01-79, Class BI, IO, 0.317s, 2045 | 2,447,199 | 27,531 |

| Ser. 08-53, Class DO, PO, zero %, 2038 | 571,658 | 401,030 |

| Ser. 07-64, Class LO, PO, zero %, 2037 | 274,225 | 239,807 |

| Ser. 07-44, Class CO, PO, zero %, 2037 | 456,150 | 374,481 |

| Ser. 08-36, Class OV, PO, zero %, 2036 | 100,346 | 72,118 |

| Ser. 04-61, Class CO, PO, zero %, 2031 | 323,408 | 321,205 |

| Ser. 1988-12, Class B, zero %, 2018 | 12,200 | 11,269 |

| FRB Ser. 06-115, Class SN, zero %, 2036 | 358,931 | 355,791 |

| FRB Ser. 06-104, Class EK, zero %, 2036 | 49,116 | 44,881 |

| FRB Ser. 05-117, Class GF, zero %, 2036 | 14,794 | 13,631 |

| FRB Ser. 05-45, Class FG, zero %, 2035 | 114,228 | 106,168 |

| FRB Ser. 06-1, Class HF, zero %, 2032 | 36,482 | 33,548 |

| IFB Ser. 06-48, Class FG, zero %, 2036 | 62,671 | 61,999 |

|

| Government National Mortgage Association | | |

| IFB Ser. 10-158, Class SD, 14.24s, 2040 | 1,057,000 | 1,094,069 |

| IFB Ser. 11-25, Class SP, 13.79s, 2040 | 1,809,000 | 1,819,999 |

| IFB Ser. 10-20, Class SC, IO, 5.897s, 2040 | 8,835,135 | 1,412,208 |

| Ser. 11-56, Class SA, 5 1/2s, 2041 Δ | 6,690,000 | 9,165,701 |

| Ser. 10-116, Class QI, IO, 4s, 2034 | 7,748,831 | 1,158,356 |

| Ser. 06-36, Class OD, PO, zero %, 2036 | 21,852 | 20,438 |

| FRB Ser. 07-73, Class KI, IO, zero %, 2037 | 1,346,719 | 23,357 |

| FRB Ser. 07-73, Class KM, zero %, 2037 | 134,796 | 116,694 |

| FRB Ser. 07-35, Class UF, zero %, 2037 | 18,209 | 17,446 |

|

| GSMPS Mortgage Loan Trust 144A | | |

| Ser. 05-RP1, Class 1AS, IO, 5.949s, 2035 | 351,075 | 49,736 |

| IFB Ser. 04-4, Class 1AS, IO, 5.368s, 2034 | 849,991 | 119,354 |

| Ser. 06-RP2, Class 1AS1, IO, 5.267s, 2036 | 9,659,881 | 1,350,381 |

| FRB Ser. 06-RP2, Class 1AF1, 0.65s, 2036 | 9,659,881 | 8,162,600 |

| FRB Ser. 04-4, Class 1AF, 0.65s, 2034 | 849,991 | 713,993 |

| FRB Ser. 05-RP1, Class 1AF, 0.6s, 2035 | 351,075 | 294,903 |

|

| Structured Adjustable Rate Mortgage Loan Trust 144A | | |

| Ser. 04-NP2, Class A, 0.6s, 2034 | 28,620 | 22,968 |

|

| Structured Asset Securities Corp. Ser. 07-4, Class 1A4, IO, 1s, 2045 | 16,583,137 | 458,030 |

|

| Total mortgage-backed securities (cost $74,152,901) | | $78,389,123 |

20

| | | |

| PURCHASED OPTIONS | Expiration date/ | Contract | |

| OUTSTANDING (1.4%)* | strike price | amount | Value |

|

| |

| Option on an interest rate swap with JPMorgan | | | |

| Chase Bank, N.A. for the right to receive a | | | |

| fixed rate of 4.04% versus the three month | | | |

| USD-LIBOR-BBA maturing September 11, 2025. | Sep-15/4.04 | $5,044,100 | $173,890 |

|

| Option on an interest rate swap with JPMorgan | | | |

| Chase Bank, N.A. for the right to pay a fixed | | | |

| rate of 4.04% versus the three month | | | |

| USD-LIBOR-BBA maturing September 11, 2025. | Sep-15/4.04 | 5,044,100 | 531,394 |

|

| Option on an interest rate swap with Barclay’s | | | |

| Bank PLC for the right to receive a fixed rate | | | |

| of 4.47% versus the three month USD-LIBOR-BBA | | | |

| maturing August 25, 2041. | Aug-11/4.47 | 94,065,800 | 4,603,580 |

|

| Option on an interest rate swap with Barclay’s | | | |

| Bank PLC for the right to pay a fixed rate | | | |

| of 4.47% versus the three month USD-LIBOR-BBA | | | |

| maturing August 25, 2041. | Aug-11/4.47 | 94,065,800 | 3,130,510 |

|

| Option on an interest rate swap with JPMorgan | | | |

| Chase Bank, N.A. for the right to receive a | | | |

| fixed rate of 4.555% versus the three month | | | |

| USD-LIBOR-BBA maturing August 5, 2041. | Aug-11/4.555 | 14,979,600 | 839,906 |

|

| Option on an interest rate swap with JPMorgan | | | |

| Chase Bank, N.A. for the right to pay a fixed | | | |

| rate of 4.555% versus the three month | | | |

| USD-LIBOR-BBA maturing August 5, 2041. | Aug-11/4.555 | 14,979,600 | 355,017 |

|

| Option on an interest rate swap with Barclay’s | | | |

| Bank PLC for the right to pay a fixed rate | | | |

| of 3.96% versus the three month USD-LIBOR-BBA | | | |

| maturing June 3, 2021. | Jun-11/3.96 | 50,610,200 | 270,765 |

|

| Option on an interest rate swap with JPMorgan | | | |

| Chase Bank, N.A. for the right to receive a | | | |

| fixed rate of 3.59% versus the three month | | | |

| USD-LIBOR-BBA maturing April 28, 2021. | Apr-11/3.59 | 26,636,946 | 259,710 |

|

| Total purchased options outstanding (cost $12,353,450) | | $10,164,772 |

| |

| |

| SHORT-TERM INVESTMENTS (58.9%)* | Principal amount/shares | Value |

|

| |

| Interest in $374,656,000 joint tri-party repurchase | | | |

| agreement dated March 31, 2011 with Merrill Lynch & Co. | | | |

| due April 1, 2011 — maturity value of $49,608,220 for an | | | |

| effective yield of 0.16% (collateralized by various mortgage- | | |

| backed securities with coupon rates ranging from | | | |

| 1.518% to 6.50% and due dates ranging from December 1, | | | |

| 2015 to March 20, 2061, valued at $382,149,120) | | $49,608,000 | $49,608,000 |

|

| Putnam Money Market Liquidity Fund 0.13% e | | 82,957,404 | 82,957,404 |

|

| U.S. Treasury Bills for effective yields ranging from 0.18% | | |

| to 0.25%, July 28, 2011 # ## | | $70,000,000 | 69,941,620 |

|

| U.S. Treasury Bill for an effective yield of 0.20%, | | | |

| June 2, 2011 # ## | | 1,837,000 | 1,836,148 |

|

| U.S. Treasury Bill for an effective yield of 0.06%, | | | |

| April 21, 2011 | | 40,000,000 | 39,998,667 |

|

| U.S. Treasury Cash Management Bills for effective yields | | | |

| ranging from 0.06% to 0.11%, April 15, 2011 | | 75,000,000 | 74,997,691 |

|

21

| | |

| SHORT-TERM INVESTMENTS (58.9%)* cont. | Principal amount/shares | Value |

|

| U.S. Treasury Bill for an effective yield of 0.06%, | | |

| April 14, 2011 | $50,000,000 | $49,998,935 |

|

| U.S. Treasury Bill for an effective yield of 0.04%, | | |

| April 7, 2011 | 50,000,000 | 49,999,650 |

|

| Total short-term investments (cost $419,351,350) | | $419,338,115 |

|

| |

| TOTAL INVESTMENTS | | |

|

| Total investments (cost $996,345,049) | | $1,005,158,766 |

| |

| Key to holding’s abbreviations |

| |

| FRB | Floating Rate Bonds |

| IFB | Inverse Floating Rate Bonds |

| IO | Interest Only |

| PO | Principal Only |

| TBA | To Be Announced Commitments |

Notes to the fund’s portfolio

Unless noted otherwise, the notes to the fund’s portfolio are for the close of the fund’s reporting period, which ran from October 1, 2010 through March 31, 2011 (the reporting period).

* Percentages indicated are based on net assets of $712,512,236.

# These securities, in part or in entirety, were pledged and segregated with the broker to cover margin requirements for futures contracts at the close of the reporting period.

## These securities, in part or in entirety, were pledged and segregated with the custodian for collateral on certain derivatives contracts at the close of the reporting period.

Δ Forward commitments, in part or in entirety (Note 1).

e See Note 6 to the financial statements regarding investments in Putnam Money Market Liquidity Fund. The rate quoted in the security description is the annualized 7-day yield of the fund at the close of the reporting period.

i Security purchased with cash or security received, that was pledged to the fund for collateral on certain derivatives contracts (Note 1).

At the close of the reporting period, the fund maintained liquid assets totaling $249,304,953 to cover certain derivatives contracts.

Debt obligations are considered secured unless otherwise indicated.

144A after the name of an issuer represents securities exempt from registration under Rule 144A under the Securities Act of 1933, as amended. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers.

See Note 1 to the financial statements regarding TBA’s.

The rates shown on FRB are the current interest rates at the close of the reporting period.

The dates shown on debt obligations are the original maturity dates.

IFB are securities that pay interest rates that vary inversely to changes in the market interest rates. As interest rates rise, inverse floaters produce less current income. The interest rates shown are the current interest rates at the close of the reporting period.

22

| | | | | |

| FUTURES CONTRACTS OUTSTANDING at 3/31/11 (Unaudited) | | | |

| |

| | Number of | | | Expiration | Unrealized |

| | contracts | Value | | date | appreciation |

|

| Euro-Dollar 90 day (Short) | 585 | $144,999,563 | | Mar-12 | $278,445 |

|

| U.S. Treasury Bond 20 yr (Long) | 56 | 6,730,500 | | Jun-11 | 38,394 |

|

| U.S. Treasury Note 10 yr (Short) | 94 | 11,188,938 | | Jun-11 | 144,400 |

|

| Total | | | | | $461,239 |

| | | | |

| WRITTEN OPTIONS OUTSTANDING at 3/31/11 (premiums received $57,819,329) (Unaudited) | |

| |

| | Contract | | Expiration date/ | |

| | amount | | strike price | Value |

|

| Option on an interest rate swap with Citibank, N.A. for | | | | |

| the obligation to pay a fixed rate of 4.49% versus the three | | | | |

| month USD-LIBOR-BBA maturing August 17, 2021. | $29,998,000 | | Aug-11/4.49 | $2,047,062 |

|

| Option on an interest rate swap with JPMorgan Chase | | | | |

| Bank, N.A. for the obligation to pay a fixed rate of | | | | |

| 4.525% versus the three month USD-LIBOR-BBA | | | | |

| maturing July 26, 2021. | 43,781,000 | | Jul-11/4.525 | 3,176,312 |

|

| Option on an interest rate swap with Bank of America, | | | | |

| N.A. for the obligation to receive a fixed rate of 4.475% | | | | |

| versus the three month USD-LIBOR-BBA maturing | | | | |

| August 19, 2021. | 12,932,000 | | Aug-11/4.475 | 64,919 |

|

| Option on an interest rate swap with Bank of America, | | | | |

| N.A. for the obligation to pay a fixed rate of 4.475% | | | | |

| versus the three month USD-LIBOR-BBA maturing | | | | |

| August 19, 2021. | 12,932,000 | | Aug-11/4.475 | 866,703 |

|

| Option on an interest rate swap with Bank of America, | | | | |

| N.A. for the obligation to receive a fixed rate of 4.55% | | | | |

| versus the three month USD-LIBOR-BBA maturing | | | | |

| August 17, 2021. | 14,999,000 | | Aug-11/4.55 | 61,196 |

|

| Option on an interest rate swap with Citibank, N.A. for the | | | | |

| obligation to receive a fixed rate of 4.49% versus the three | | | | |

| month USD-LIBOR-BBA maturing August 17, 2021. | 29,998,000 | | Aug-11/4.49 | 141,291 |

|

| Option on an interest rate swap with Bank of America, | | | | |

| N.A. for the obligation to pay a fixed rate of 4.55% | | | | |

| versus the three month USD-LIBOR-BBA maturing | | | | |

| August 17, 2021. | 14,999,000 | | Aug-11/4.55 | 1,090,877 |

|

| Option on an interest rate swap with Bank of America, | | | | |

| N.A. for the obligation to receive a fixed rate of 4.765% | | | | |

| versus the three month USD-LIBOR-BBA maturing | | | | |

| August 16, 2021. | 5,677,000 | | Aug-11/4.765 | 12,944 |

|

| Option on an interest rate swap with Bank of America, | | | | |

| N.A. for the obligation to pay a fixed rate of 4.765% | | | | |

| versus the three month USD-LIBOR-BBA maturing | | | | |

| August 16, 2021. | 5,677,000 | | Aug-11/4.765 | 507,581 |

|

| Option on an interest rate swap with Bank of America, | | | | |

| N.A. for the obligation to receive a fixed rate of 4.70% | | | | |

| versus the three month USD-LIBOR-BBA maturing | | | | |

| August 8, 2021. | 90,809,000 | | Aug-11/4.70 | 209,769 |

|

| Option on an interest rate swap with Bank of America, | | | | |

| N.A. for the obligation to pay a fixed rate of 4.70% | | | | |

| versus the three month USD-LIBOR-BBA maturing | | | | |

| August 8, 2021. | 90,809,000 | | Aug-11/4.70 | 7,710,592 |

|

23

| | | | |

| WRITTEN OPTIONS OUTSTANDING at 3/31/11 (premiums received $57,819,329) (Unaudited) cont. | |

| |

| | Contract | | Expiration date/ | |

| | amount | | strike price | Value |

|

| Option on an interest rate swap with JPMorgan Chase | | | | |

| Bank, N.A. for the obligation to receive a fixed rate | | | | |

| of 4.745% versus the three month USD-LIBOR-BBA | | | | |

| maturing July 27, 2021. | $65,671,500 | | Jul-11/4.745 | $105,731 |

|

| Option on an interest rate swap with JPMorgan Chase | | | | |

| Bank, N.A. for the obligation to pay a fixed rate of | | | | |

| 4.745% versus the three month USD-LIBOR-BBA | | | | |

| maturing July 27, 2021. | 65,671,500 | | Jul-11/4.745 | 5,885,480 |

|

| Option on an interest rate swap with Citibank, N.A. for the | | | | |

| obligation to receive a fixed rate of 4.5475% versus the | | | | |

| three month USD-LIBOR-BBA maturing July 26, 2021. | 20,529,000 | | Jul-11/4.5475 | 52,349 |

|

| Option on an interest rate swap with Citibank, N.A. for | | | | |

| the obligation to receive a fixed rate of 4.52% versus the | | | | |

| three month USD-LIBOR-BBA maturing July 26, 2021. | 41,058,000 | | Jul-11/4.52 | 113,320 |

|

| Option on an interest rate swap with JPMorgan Chase | | | | |

| Bank, N.A. for the obligation to receive a fixed rate | | | | |

| of 4.525% versus the three month USD-LIBOR-BBA | | | | |

| maturing July 26, 2021. | 43,781,000 | | Jul-11/4.525 | 119,084 |

|

| Option on an interest rate swap with JPMorgan Chase | | | | |

| Bank, N.A. for the obligation to receive a fixed rate | | | | |

| of 4.46% versus the three month USD-LIBOR-BBA | | | | |

| maturing July 26, 2021. | 43,781,000 | | Jul-11/4.46 | 143,164 |

|

| Option on an interest rate swap with Citibank, N.A. for | | | | |

| the obligation to pay a fixed rate of 4.5475% versus the | | | | |

| three month USD-LIBOR-BBA maturing July 26, 2021. | 20,529,000 | | Jul-11/4.5475 | 1,525,305 |

|

| Option on an interest rate swap with JPMorgan Chase | | | | |

| Bank, N.A. for the obligation to pay a fixed rate of 4.46% | | | | |

| versus the three month USD-LIBOR-BBA maturing | | | | |

| July 26, 2021. | 43,781,000 | | Jul-11/4.46 | 2,956,969 |

|

| Option on an interest rate swap with Citibank, N.A. for | | | | |

| the obligation to pay a fixed rate of 4.52% versus the | | | | |

| three month USD-LIBOR-BBA maturing July 26, 2021. | 41,058,000 | | Jul-11/4.52 | 2,962,745 |

|

| Option on an interest rate swap with JPMorgan Chase | | | | |

| Bank, N.A. for the obligation to receive a fixed rate | | | | |

| of 4.375% versus the three month USD-LIBOR-BBA | | | | |

| maturing August 10, 2045. | 8,242,500 | | Aug-15/4.375 | 1,269,840 |

|

| Option on an interest rate swap with JPMorgan Chase | | | | |

| Bank, N.A. for the obligation to pay a fixed rate of | | | | |

| 4.375% versus the three month USD-LIBOR-BBA | | | | |

| maturing August 10, 2045. | 8,242,500 | | Aug-15/4.375 | 623,628 |

|

| Option on an interest rate swap with JPMorgan Chase | | | | |

| Bank, N.A. for the obligation to pay a fixed rate of 4.46% | | | | |

| versus the three month USD-LIBOR-BBA maturing | | | | |

| August 7, 2045. | 8,242,500 | | Aug-15/4.46 | 661,213 |

|

| Option on an interest rate swap with JPMorgan Chase | | | | |

| Bank, N.A. for the obligation to receive a fixed rate | | | | |

| of 4.46% versus the three month USD-LIBOR-BBA | | | | |

| maturing August 7, 2045. | 8,242,500 | | Aug-15/4.46 | 1,208,515 |

|

| Option on an interest rate swap with JPMorgan Chase | | | | |

| Bank, N.A. for the obligation to receive a fixed rate | | | | |

| of 3.89% versus the three month USD-LIBOR-BBA | | | | |

| maturing April 28, 2021. | 10,654,778 | | Apr-11/3.89 | 20,883 |

|

24

| | | | |

| WRITTEN OPTIONS OUTSTANDING at 3/31/11 (premiums received $57,819,329) (Unaudited) cont. | |

| |

| | Contract | | Expiration date/ |

| | amount | | strike price | Value |

|

| Option on an interest rate swap with Barclays Bank PLC for | | | | |

| the obligation to receive a fixed rate of 5.36% versus the three | | | | |

| month USD-LIBOR-BBA maturing February 13, 2025. | $7,846,920 | | Feb-15/5.36 | $396,269 |

|

| Option on an interest rate swap with Barclays Bank PLC for the | | | | |

| obligation to pay a fixed rate of 5.36% versus the three month | | | | |

| USD-LIBOR-BBA maturing February 13, 2025. | 7,846,920 | | Feb-15/5.36 | 629,323 |

|

| Option on an interest rate swap with JPMorgan Chase | | | | |

| Bank, N.A. for the obligation to receive a fixed rate | | | | |

| of 5.27% versus the three month USD-LIBOR-BBA | | | | |

| maturing February 12, 2025. | 17,656,640 | | Feb-15/5.27 | 941,877 |

|

| Option on an interest rate swap with JPMorgan Chase | | | | |

| Bank, N.A. for the obligation to pay a fixed rate of 5.27% | | | | |

| versus the three month USD-LIBOR-BBA maturing | | | | |

| February 12, 2025. | 17,656,640 | | Feb-15/5.27 | 1,346,319 |

|

| Option on an interest rate swap with JPMorgan Chase | | | | |

| Bank, N.A. for the obligation to pay a fixed rate of 5.51% | | | | |

| versus the three month USD-LIBOR-BBA maturing | | | | |

| May 14, 2022. | 44,468,500 | | May-12/5.51 | 5,497,851 |

|

| Option on an interest rate swap with JPMorgan Chase | | | | |

| Bank, N.A. for the obligation to receive a fixed rate | | | | |

| of 5.51% versus the three month USD-LIBOR-BBA | | | | |

| maturing May 14, 2022. | 44,468,500 | | May-12/5.51 | 371,655 |

|

| Total | | | | $42,720,766 |

| |

| |

| TBA SALE COMMITMENTS OUTSTANDING at 3/31/11 (proceeds receivable $7,831,875) (Unaudited) | |

| |

| | Principal | | Settlement | |

| Agency | amount | | date | Value |

|

| GNMA,3 1/2s, April 1, 2041 | $1,000,000 | | 4-20-11 | $952,656 |

|

| FNMA, 4s, April 1, 2041 | 7,000,000 | | 4-13-11 | 6,886,250 |

|

| Total | | | | $7,838,906 |

| | | | | | |

| INTEREST RATE SWAP CONTRACTS OUTSTANDING at 3/31/11 (Unaudited) | | |

| |

| | Upfront | | | Payments | Payments | Unrealized |

| Swap counterparty / | premium | Termination | | made by | received by | appreciation/ |

| Notional amount | received (paid) | date | | fund per annum | fund per annum | (depreciation) |

|

| Bank of America, N.A. | | | | | | |

| $227,025,000 | $(207,930) | 7/23/20 | | 3 month USD- | | |

| | | | | LIBOR-BBA | 2.96% | $(8,275,324) |

|

| 213,238,600 | (319,243) | 2/7/15 | | 1.891% | 3 month USD- | |

| | | | | | LIBOR-BBA | (447,053) |

|

| Barclays Bank PLC | | | | | | |

| 85,005,200 | (27,272) | 2/17/16 | | 3 month USD- | | |

| | | | | LIBOR-BBA | 2.56% | 943,864 |

|

| 35,774,400 | (6,677) | 2/17/19 | | 3.4% | 3 month USD- | |

| | | | | | LIBOR-BBA | (602,002) |

|

| 4,151,000 | — | 3/10/41 | | 3 month USD- | | |

| | | | | LIBOR-BBA | 4.38% | 79,724 |

|

| 91,947,000 | 108,909 | 3/30/16 | | 3 month USD- | | |

| | | | | LIBOR-BBA | 2.39% | 10,464 |

|

25

| | | | | | |

| INTEREST RATE SWAP CONTRACTS OUTSTANDING at 3/31/11 (Unaudited) cont. | | |

| |

| | Upfront | | | Payments | Payments | Unrealized |

| Swap counterparty / | premium | Termination | | made by | received by | appreciation/ |

| Notional amount | received (paid) | date | | fund per annum | fund per annum | (depreciation) |

|

| Barclays Bank PLC cont. | | | | | |

| $31,655,700 | $(64,154) | 3/30/21 | | 3.55% | 3 month USD- | |

| | | | | | LIBOR-BBA | $(68,952) |

|

| 9,160,800 | 11,810 | 3/30/31 | | 3 month USD- | | |

| | | | | LIBOR-BBA | 4.17% | 17,754 |

|

| 129,176,300 | 29,886 | 4/1/13 | | 1% | 3 month USD- | |

| | | | | | LIBOR-BBA | (100,582) |

|

| 5,065,000 | — | 4/1/21 | | 3.562% | 3 month USD- | |

| | | | | | LIBOR-BBA | (4,457) |

|

| 121,717,500 | (11,661) | 1/28/16 | | 3 month USD- | | |

| | | | | LIBOR-BBA | 2.17% | (634,267) |

|

| Citibank, N.A. | | | | | | |

| 205,736,400 | 39,413 | 7/9/20 | | 3 month USD- | | |

| | | | | LIBOR-BBA | 3.01% | (6,074,978) |

|

| 10,804,800 | (2,926) | 6/28/14 | | 1.81% | 3 month USD- | |

| | | | | | LIBOR-BBA | (111,852) |

|

| Credit Suisse International | | | | | |

| 28,700,000 | — | 12/17/40 | | 4.334% | 3 month USD- | |

| | | | | | LIBOR-BBA | (614,229) |

|

| 48,292,300 | — | 2/3/13 | | 0.83125% | 3 month USD- | |

| | | | | | LIBOR-BBA | (14,372) |

|

| 87,308,800 | (116,364) | 3/14/16 | | 3 month USD- | | |

| | | | | LIBOR-BBA | 2.35% | (236,416) |

|

| 32,642,300 | 74,829 | 3/14/41 | | 4.36% | 3 month USD- | |

| | | | | | LIBOR-BBA | (424,407) |

|

| 35,100,000 E | — | 3/21/13 | | 1.15625% | 3 month USD- | |

| | | | | | LIBOR-BBA | 87,399 |

|

| 9,900,000 | — | 3/23/21 | | 3.452% | 3 month USD- | |

| | | | | | LIBOR-BBA | 75,340 |

|

| 34,666,200 | (9,530) | 11/3/12 | | 0.50% | 3 month USD- | |

| | | | | | LIBOR-BBA | 54,813 |

|

| 8,333,100 | — | 11/17/40 | | 3.95% | 3 month USD- | |

| | | | | | LIBOR-BBA | 354,754 |

|

| 306,623,200 | (32,666) | 2/24/13 | | 0.96% | 3 month USD- | |

| | | | | | LIBOR-BBA | (616,527) |

|

| 146,722,700 | (30,018) | 2/24/15 | | 2.04% | 3 month USD- | |

| | | | | | LIBOR-BBA | (749,570) |

|

| 58,338,900 | (9,341) | 2/24/21 | | 3.69% | 3 month USD- | |

| | | | | | LIBOR-BBA | (962,016) |

|

| 96,059,400 | 28,107 | 2/24/26 | | 4.16% | 3 month USD- | |

| | | | | | LIBOR-BBA | (2,159,459) |

|

| Deutsche Bank AG | | | | | | |

| 84,065,300 | (2,384) | 11/3/12 | | 0.50% | 3 month USD- | |

| | | | | | LIBOR-BBA | 153,647 |

|

| 178,199,300 | 417,449 | 7/27/20 | | 3 month USD- | | |

| | | | | LIBOR-BBA | 2.94% | (6,281,856) |

|

| 176,092,900 | — | 1/14/13 | | 0.85625% | 3 month USD- | |

| | | | | | LIBOR-BBA | (301,658) |

|

26

| | | | | | |

| INTEREST RATE SWAP CONTRACTS OUTSTANDING at 3/31/11 (Unaudited) cont. | | |

| |

| | Upfront | | | Payments | Payments | Unrealized |

| Swap counterparty / | premium | Termination | | made by | received by | appreciation/ |

| Notional amount | received (paid) | date | | fund per annum | fund per annum | (depreciation) |

|

| Goldman Sachs International | | | | | |

| $99,094,900 | $33,980 | 2/15/13 | | 1.03% | 3 month USD- | |

| | | | | | LIBOR-BBA | $(335,134) |

|

| 13,322,600 | — | 2/28/41 | | 3 month USD- | | |

| | | | | LIBOR-BBA | 4.31% | 110,383 |

|

| 32,668,100 E | — | 3/19/13 | | 1.09375% | 3 month USD- | |

| | | | | | LIBOR-BBA | 98,984 |

|

| 33,474,500 | — | 4/4/16 | | 3 month USD- | | |

| | | | | LIBOR-BBA | 2.415% | — |

|

| JPMorgan Chase Bank, N.A. | | | | | |

| 92,297,100 | (40,436) | 2/16/16 | | 3 month USD- | | |

| | | | | LIBOR-BBA | 2.58% | 1,111,545 |

|

| 12,609,100 | (21,632) | 3/11/21 | | 3 month USD- | | |

| | | | | LIBOR-BBA | 3.64% | 105,994 |

|

| 40,202,800 | 127,363 | 3/11/26 | | 4.12% | 3 month USD- | |

| | | | | | LIBOR-BBA | (524,258) |

|

| 70,200,000 E | — | 3/21/13 | | 1.1685% | 3 month USD- | |

| | | | | | LIBOR-BBA | 166,374 |

|

| 24,700,000 E | — | 3/22/13 | | 1.185% | 3 month USD- | |

| | | | | | LIBOR-BBA | 55,328 |

|

| 125,597,000 | 22,421 | 3/31/16 | | 3 month USD- | | |

| | | | | LIBOR-BBA | 2.42% | 54,912 |

|

| 6,985,100 | 13,125 | 3/31/41 | | 3 month USD- | | |

| | | | | LIBOR-BBA | 4.28% | 12,203 |

|

| 104,077,500 | — | 11/5/15 | | 3 month USD- | | |

| | | | | LIBOR-BBA | 1.42% | (3,308,440) |

|

| 9,251,400 | 2,183 | 1/27/13 | | 0.84% | 3 month USD- | |

| | | | | | LIBOR-BBA | (5,238) |

|

| 111,382,800 | 19,185 | 1/31/15 | | 1.79% | 3 month USD- | |

| | | | | | LIBOR-BBA | 283,634 |

|

| 69,674,900 | — | 2/4/13 | | 0.879% | 3 month USD- | |

| | | | | | LIBOR-BBA | (84,064) |

|

| 36,591,100 | — | 12/3/12 | | 0.8025% | 3 month USD- | |

| | | | | | LIBOR-BBA | (113,838) |

|

| 43,715,800 | — | 12/6/12 | | 0.805% | 3 month USD- | |

| | | | | | LIBOR-BBA | (133,622) |

|

| UBS, AG | | | | | | |

| 19,568,200 | — | 12/9/40 | | 4.1075% | 3 month USD- | |

| | | | | | LIBOR-BBA | 339,486 |

|

| Total | | | | | | $(29,067,969) |

E See Note 1 to the financial statements regarding extended effective dates.

27

| | | | | | |

| TOTAL RETURN SWAP CONTRACTS OUTSTANDING at 3/31/11 (Unaudited) | | |

| |

| | Upfront | | | Fixed payments | Total return | Unrealized |

| Swap counterparty / | premium | Termination | | received (paid) by | received by | appreciation/ |

| Notional amount | received (paid) | date | | fund per annum | or paid by fund | (depreciation) |

|

| Barclays Bank PLC | | | | | | |

| $437,651 | $— | 1/12/40 | | 5.00% (1 month | Synthetic TRS | $5,517 |

| | | | | USD-LIBOR) | Index 5.00% | |

| | | | | | 30 year Fannie Mae | |

| | | | | | pools | |

|

| 167,382 | — | 1/12/40 | | 4.50% (1 month | Synthetic TRS | 967 |

| | | | | USD-LIBOR) | Index 4.50% | |

| | | | | | 30 year Fannie Mae | |

| | | | | | pools | |

|

| 1,322,181 | — | 1/12/40 | | 5.00% (1 month | Synthetic TRS | 16,668 |

| | | | | USD-LIBOR) | Index 5.00% | |

| | | | | | 30 year Fannie Mae | |

| | | | | | pools | |

|

| 752,236 | — | 1/12/40 | | 5.00% (1 month | Synthetic TRS | 9,483 |

| | | | | USD-LIBOR) | Index 5.00% | |

| | | | | | 30 year Fannie Mae | |

| | | | | | pools | |

|

| 22,192,755 | — | 1/12/38 | | (6.50%) 1 month | Synthetic TRS | (248,880) |

| | | | | USD-LIBOR | Index 6.50% | |

| | | | | | 30 year Fannie Mae | |

| | | | | | pools | |

|

| 14,698,791 | — | 1/12/38 | | (6.50%) 1 month | Synthetic TRS | (164,839) |

| | | | | USD-LIBOR | Index 6.50% | |

| | | | | | 30 year Fannie Mae | |

| | | | | | pools | |

|

| 10,795,712 | (43,858) | 1/12/40 | | 4.50% (1 month | Synthetic TRS | (5,434) |

| | | | | USD-LIBOR) | Index 4.50% | |

| | | | | | 30 year Fannie Mae | |

| | | | | | pools | |

|

| 6,169,245 | (79,043) | 1/12/41 | | 5.00% (1 month | Synthetic TRS | (3,984) |

| | | | | USD-LIBOR) | Index 5.00% | |

| | | | | | 30 year Fannie Mae | |

| | | | | | pools | |

|

| 3,821,432 | — | 1/12/38 | | (6.50%) 1 month | Synthetic TRS | (42,855) |

| | | | | USD-LIBOR | Index 6.50% | |

| | | | | | 30 year Fannie Mae | |

| | | | | | pools | |

|

| 2,093,260 | — | 1/12/38 | | 6.50% (1 month | Synthetic TRS | 23,475 |

| | | | | USD-LIBOR) | Index 6.50% | |

| | | | | | 30 year Fannie Mae | |

| | | | | | pools | |

|

| 1,979,337 | — | 1/12/38 | | (6.50%) 1 month | Synthetic TRS | (22,197) |

| | | | | USD-LIBOR | Index 6.50% | |

| | | | | | 30 year Fannie Mae | |

| | | | | | pools | |

|

| 2,573,271 | — | 1/12/38 | | (6.50%) 1 month | Synthetic TRS | (28,858) |

| | | | | USD-LIBOR | Index 6.50% | |

| | | | | | 30 year Fannie Mae | |

| | | | | | pools | |

|

28

| | | | | | |

| TOTAL RETURN SWAP CONTRACTS OUTSTANDING at 3/31/11 (Unaudited) cont. | | |

| |

| | Upfront | | | Fixed payments | Total return | Unrealized |

| Swap counterparty / | premium | Termination | | received (paid) by | received by | appreciation/ |

| Notional amount | received (paid) | date | | fund per annum | or paid by fund | (depreciation) |

|

| Barclays Bank PLC cont. | | | | | |

| $18,755,132 | $— | 1/12/40 | | 5.00% (1 month | Synthetic TRS | $236,441 |

| | | | | USD-LIBOR) | Index 5.00% | |

| | | | | | 30 year Fannie Mae | |

| | | | | | pools | |

|

| 7,574,661 | — | 1/12/40 | | 5.00% (1 month | Synthetic TRS | 95,492 |

| | | | | USD-LIBOR) | Index 5.00% | |

| | | | | | 30 year Fannie Mae | |

| | | | | | pools | |

|

| 886,838 | — | 1/12/40 | | 5.00% (1 month | Synthetic TRS | 11,180 |

| | | | | USD-LIBOR) | Index 5.00% | |

| | | | | | 30 year Fannie Mae | |

| | | | | | pools | |

|

| 1,161,778 | — | 1/12/40 | | 4.50% (1 month | Synthetic TRS | 6,714 |

| | | | | USD-LIBOR) | Index 4.50% | |

| | | | | | 30 year Fannie Mae | |

| | | | | | pools | |

|

| 16,114,173 | — | 1/12/38 | | (6.50%) 1 month | Synthetic TRS | (180,712) |

| | | | | USD-LIBOR | Index 6.50% | |

| | | | | | 30 year Fannie Mae | |

| | | | | | pools | |

|

| 14,687,533 | — | 1/12/39 | | 5.50% (1 month | Synthetic TRS | 124,842 |

| | | | | USD-LIBOR) | Index 5.50% | |

| | | | | | 30 year Fannie Mae | |

| | | | | | pools | |

|

| 7,185,074 | — | 1/12/39 | | 5.50% (1 month | Synthetic TRS | 61,072 |

| | | | | USD-LIBOR) | Index 5.50% 30 | |

| | | | | | 30 year Fannie Mae | |

| | | | | | pools | |

|

| 16,114,173 | — | 1/12/38 | | (6.50%) 1 month | Synthetic TRS | (180,712) |

| | | | | USD-LIBOR | Index 6.50% | |

| | | | | | 30 year Fannie Mae | |

| | | | | | pools | |

|

| Goldman Sachs International | | | | | |

| 62,797,939 | (107,934) | 1/12/39 | | (5.50%) 1 month | Synthetic TRS | (537,136) |

| | | | | USD-LIBOR | Index 5.50% | |

| | | | | | 30 year Fannie Mae | |

| | | | | | pools | |

|

| 62,838,615 | 127,641 | 1/12/40 | | 5.00% (1 month | Synthetic TRS | 824,929 |

| | | | | USD-LIBOR) | Index 5.00% | |

| | | | | | 30 year Fannie Mae | |

| | | | | | pools | |

|

| 11,118,548 | — | 1/12/39 | | 5.50% (1 month | Synthetic TRS | 94,506 |

| | | | | USD-LIBOR) | Index 5.50% | |

| | | | | | 30 year Fannie Mae | |

| | | | | | pools | |

|

| 6,391,153 | — | 1/12/39 | | 5.50% (1 month | Synthetic TRS | 54,324 |

| | | | | USD-LIBOR) | Index 5.50% | |

| | | | | | 30 year Fannie Mae | |

| | | | | | pools | |

|

29

| | | | | | |

| TOTAL RETURN SWAP CONTRACTS OUTSTANDING at 3/31/11 (Unaudited) cont. | | |

| |

| | Upfront | | | Fixed payments | Total return | Unrealized |

| Swap counterparty / | premium | Termination | | received (paid) by | received by | appreciation/ |