2Q23 Financial Results July 19, 2023

2 Forward-looking statements and use of non-GAAP financial measures This document contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Any statement that does not describe historical or current facts is a forward-looking statement. These statements often include the words “believes,” “expects,” “anticipates,” “estimates,” “intends,” “plans,” “goals,” “targets,” “initiatives,” “potentially,” “probably,” “projects,” “outlook,” “hopeful,” “guidance” or similar expressions or future conditional verbs such as “may,” “will,” “should,” “would,” and “could.” Forward-looking statements are based upon the current beliefs and expectations of management, and on information currently available to management. Our statements speak as of the date hereof, and we do not assume any obligation to update these statements or to update the reasons why actual results could differ from those contained in such statements in light of new information or future events. We caution you, therefore, against relying on any of these forward-looking statements. They are neither statements of historical fact nor guarantees or assurances of future performance. While there is no assurance that any list of risks and uncertainties or risk factors is complete, important factors that could cause actual results to differ materially from those in the forward-looking statements include the following, without limitation: • Negative economic, business and political conditions, including as a result of the interest rate environment, supply chain disruptions, inflationary pressures and labor shortages, that adversely affect the general economy, housing prices, the job market, consumer confidence and spending habits; • The rate of growth in the economy and employment levels, as well as general business and economic conditions, and changes in the competitive environment; • Our ability to implement our business strategy, including the cost savings and efficiency components, and achieve our financial performance goals, including the anticipated benefits of the HSBC and Investors transactions; • The effects of geopolitical instability, including as a result of Russia’s invasion of Ukraine and the imposition of sanctions on Russia and other actions in response, on economic and market conditions, inflationary pressures and the interest rate environment, commodity price and foreign exchange rate volatility, and heightened cybersecurity risks; • Our ability to meet heightened supervisory requirements and expectations; • Liabilities and business restrictions resulting from litigation and regulatory investigations; • Our capital and liquidity requirements under regulatory capital standards and our ability to generate capital internally or raise capital on favorable terms; • The effect of changes in interest rates on our net interest income, net interest margin and our mortgage originations, mortgage servicing rights and mortgages held for sale; • Changes in interest rates and market liquidity, as well as the magnitude of such changes, which may reduce interest margins, impact funding sources and affect the ability to originate and distribute financial products in the primary and secondary markets; • The effect of changes in the level of checking or savings account deposits on our funding costs and net interest margin; • Financial services reform and other current, pending or future legislation or regulation that could have a negative effect on our revenue and businesses; • Environmental risks, such as physical or transitional risks associated with climate change and social and governance risks, that could adversely affect our reputation, operations, business, and customers. • A failure in or breach of our operational or security systems or infrastructure, or those of our third party vendors or other service providers, including as a result of cyber-attacks; and • Management’s ability to identify and manage these and other risks. In addition to the above factors, we also caution that the actual amounts and timing of any future common stock dividends or share repurchases will be subject to various factors, including our capital position, financial performance, capital impacts of strategic initiatives, market conditions, receipt of required regulatory approvals and other regulatory considerations, as well as any other factors that our Board of Directors deems relevant in making such a determination. Therefore, there can be no assurance that we will repurchase shares from or pay any dividends to holders of our common stock, or as to the amount of any such repurchases or dividends. More information about factors that could cause actual results to differ materially from those described in the forward-looking statements can be found in the “Risk Factors” section in Part I, Item 1A of our Annual Report on Form 10-K for the fiscal year ended December 31, 2022 as filed with the Securities and Exchange Commission. Non-GAAP Financial Measures: This document contains non-GAAP financial measures denoted as Underlying. Underlying results for any given reporting period exclude certain items that may occur in that period which Management does not consider indicative of the Company’s on-going financial performance. We believe these non-GAAP financial measures provide useful information to investors because they are used by our Management to evaluate our operating performance and make day-to-day operating decisions. In addition, we believe our Underlying results in any given reporting period reflect our on-going financial performance in that period and, accordingly, are useful to consider in addition to our GAAP financial results. We further believe the presentation of Underlying results increases comparability of period-to-period results. The Appendix presents reconciliations of our non- GAAP measures to the most directly comparable GAAP financial measures. Other companies may use similarly titled non-GAAP financial measures that are calculated differently from the way we calculate such measures. Accordingly, our non-GAAP financial measures may not be comparable to similar measures used by such companies. We caution investors not to place undue reliance on such non-GAAP financial measures, but to consider them with the most directly comparable GAAP measures. Non-GAAP financial measures have limitations as analytical tools and should not be considered in isolation or as a substitute for our results reported under GAAP.

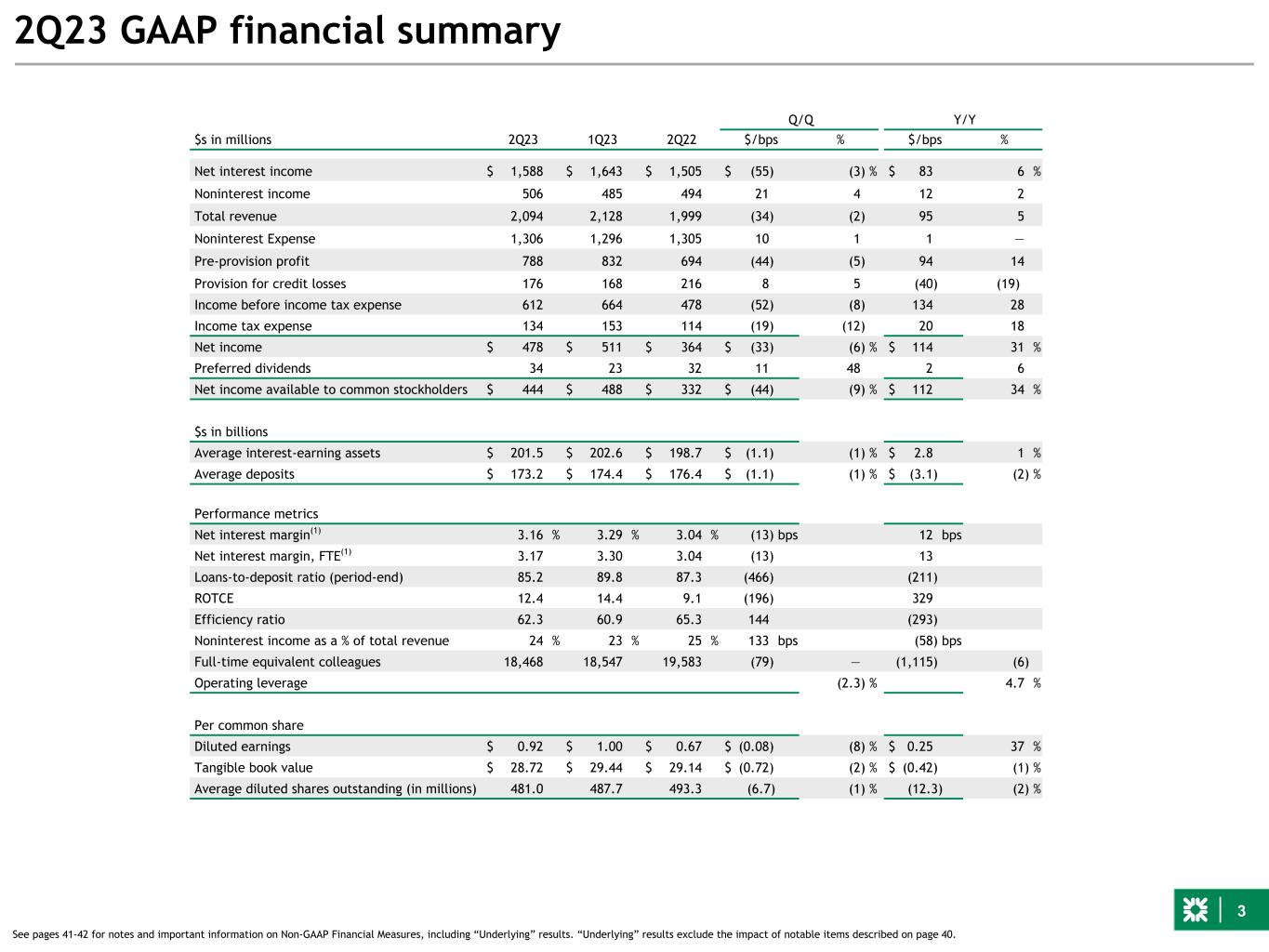

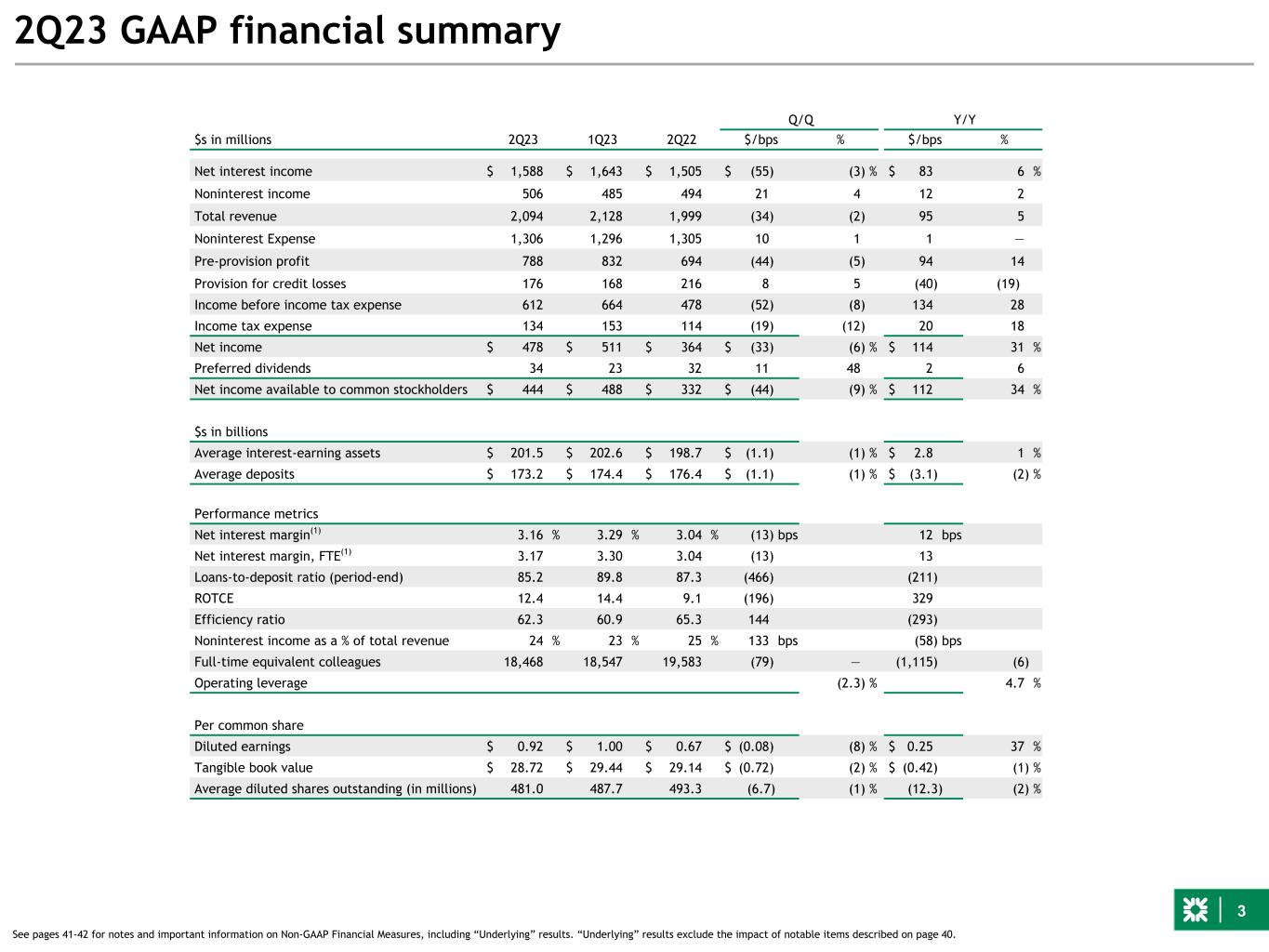

3 2Q23 GAAP financial summary 2Q23 1Q23 2Q22 Q/Q Y/Y $s in millions $/bps % $/bps % Net interest income $ 1,588 $ 1,643 $ 1,505 $ (55) (3) % $ 83 6 % Noninterest income 506 485 494 21 4 12 2 Total revenue 2,094 2,128 1,999 (34) (2) 95 5 Noninterest Expense 1,306 1,296 1,305 10 1 1 — Pre-provision profit 788 832 694 (44) (5) 94 14 Provision for credit losses 176 168 216 8 5 (40) (19) Income before income tax expense 612 664 478 (52) (8) 134 28 Income tax expense 134 153 114 (19) (12) 20 18 Net income $ 478 $ 511 $ 364 $ (33) (6) % $ 114 31 % Preferred dividends 34 23 32 11 48 2 6 Net income available to common stockholders $ 444 $ 488 $ 332 $ (44) (9) % $ 112 34 % $s in billions Average interest-earning assets $ 201.5 $ 202.6 $ 198.7 $ (1.1) (1) % $ 2.8 1 % Average deposits $ 173.2 $ 174.4 $ 176.4 $ (1.1) (1) % $ (3.1) (2) % Performance metrics Net interest margin(1) 3.16 % 3.29 % 3.04 % (13) bps 12 bps Net interest margin, FTE(1) 3.17 3.30 3.04 (13) 13 Loans-to-deposit ratio (period-end) 85.2 89.8 87.3 (466) (211) ROTCE 12.4 14.4 9.1 (196) 329 Efficiency ratio 62.3 60.9 65.3 144 (293) Noninterest income as a % of total revenue 24 % 23 % 25 % 133 bps (58) bps Full-time equivalent colleagues 18,468 18,547 19,583 (79) — (1,115) (6) Operating leverage (2.3) % 4.7 % Per common share Diluted earnings $ 0.92 $ 1.00 $ 0.67 $ (0.08) (8) % $ 0.25 37 % Tangible book value $ 28.72 $ 29.44 $ 29.14 $ (0.72) (2) % $ (0.42) (1) % Average diluted shares outstanding (in millions) 481.0 487.7 493.3 (6.7) (1) % (12.3) (2) % See pages 41-42 for notes and important information on Non-GAAP Financial Measures, including “Underlying” results. “Underlying” results exclude the impact of notable items described on page 40.

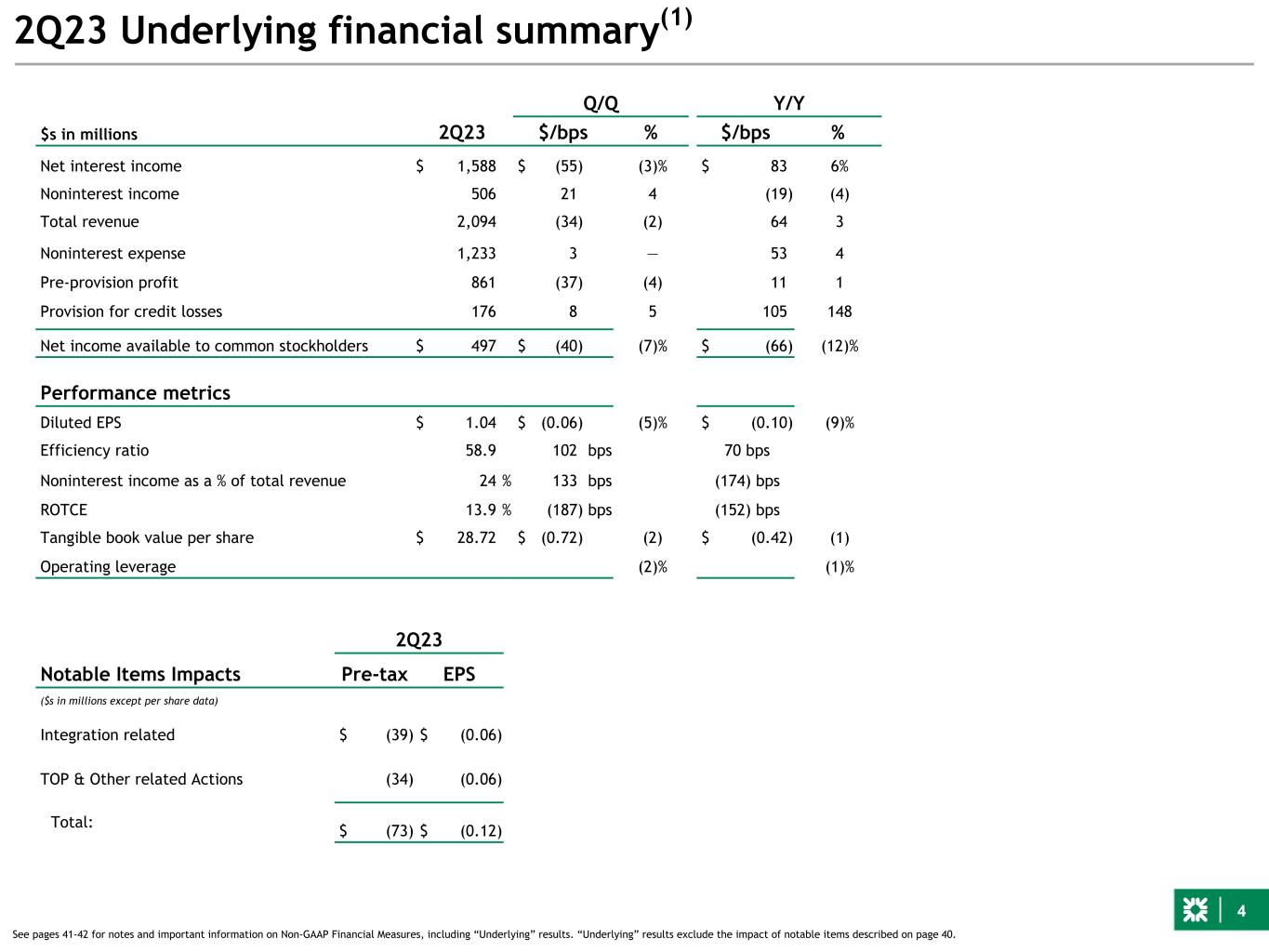

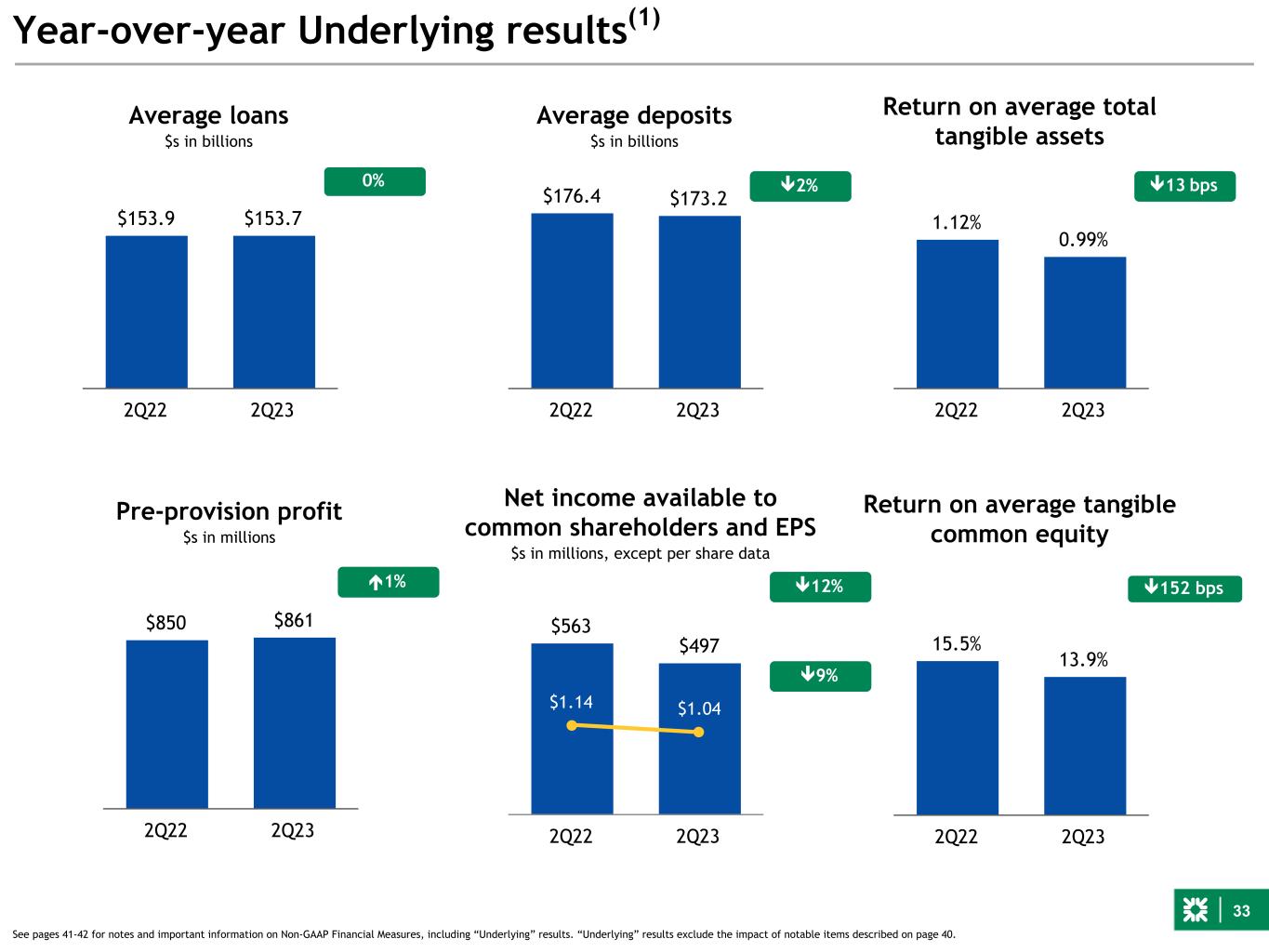

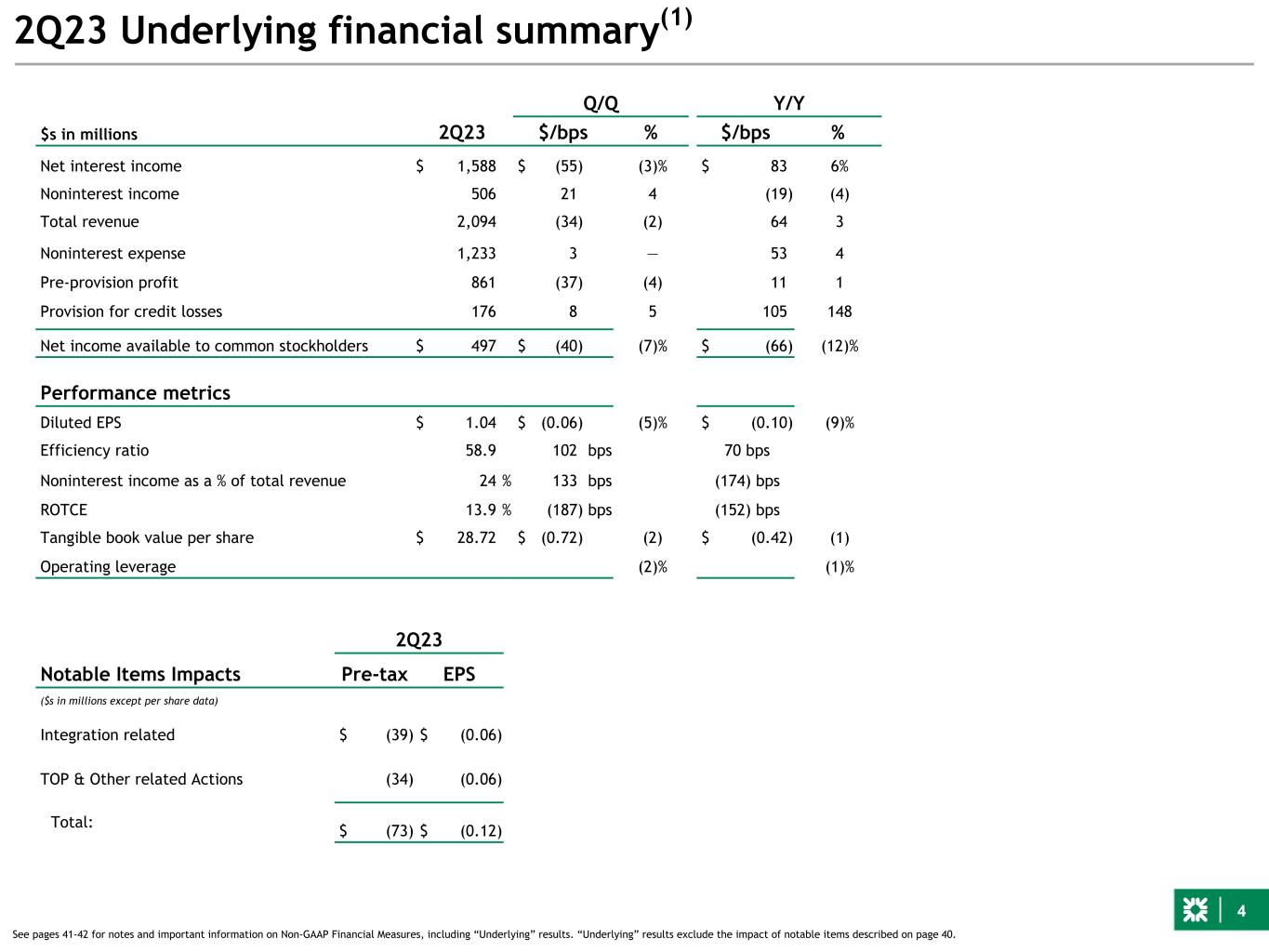

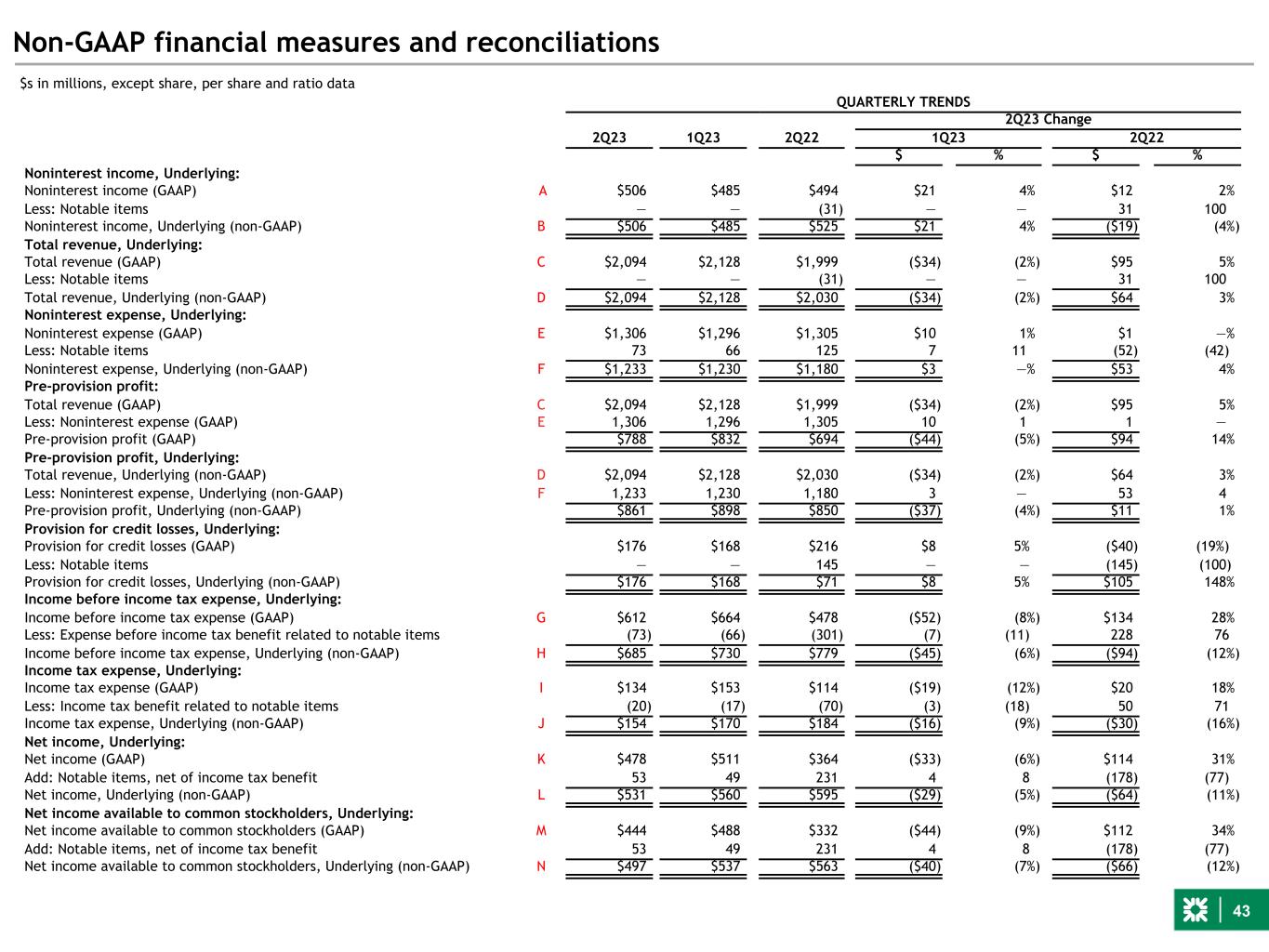

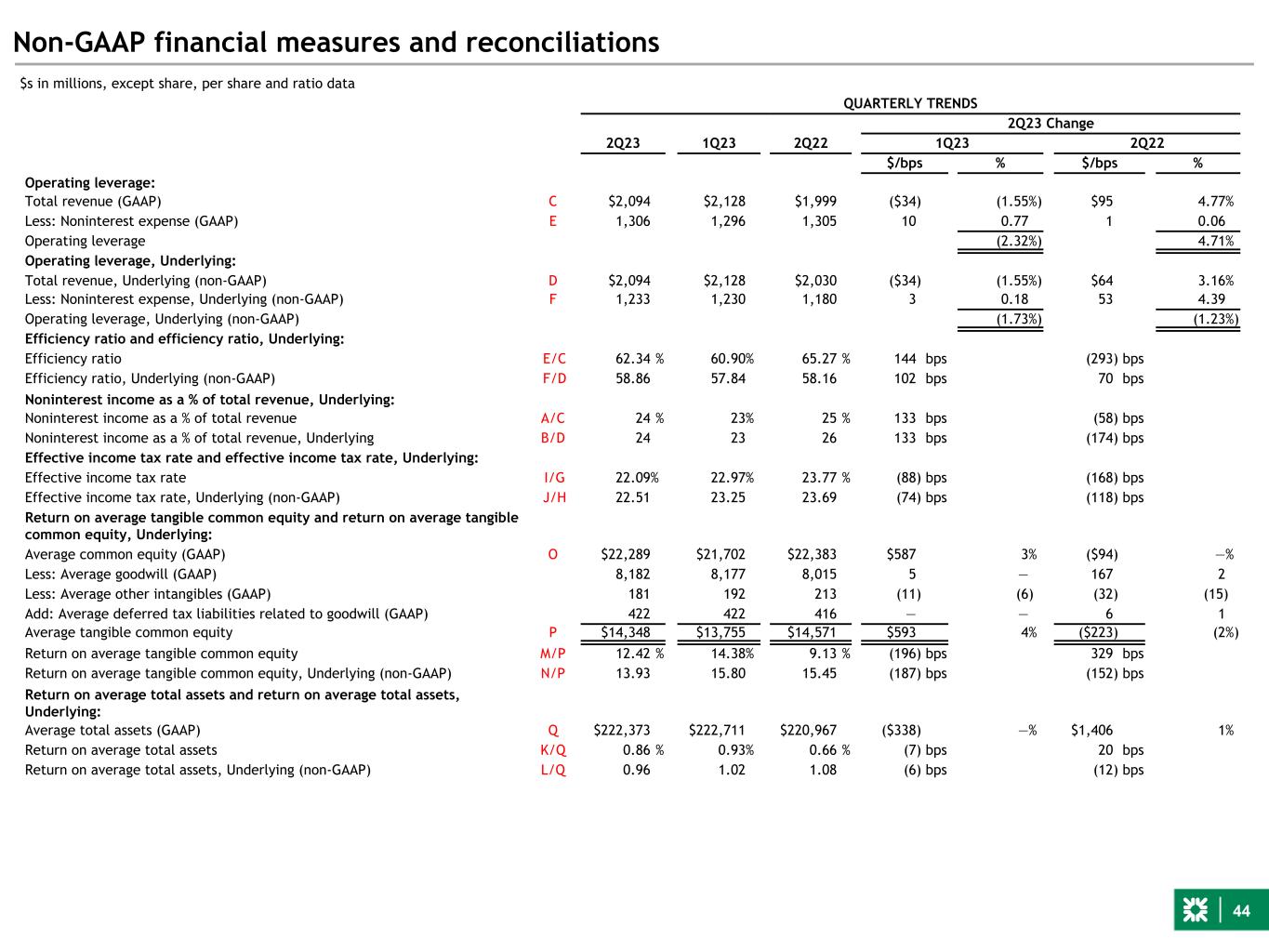

4 2Q23 Underlying financial summary(1) Q/Q Y/Y $s in millions 2Q23 $/bps % $/bps % Net interest income $ 1,588 $ (55) (3)% $ 83 6% Noninterest income 506 21 4 (19) (4) Total revenue 2,094 (34) (2) 64 3 Noninterest expense 1,233 3 — 53 4 Pre-provision profit 861 (37) (4) 11 1 Provision for credit losses 176 8 5 105 148 Net income available to common stockholders $ 497 $ (40) (7)% $ (66) (12)% Performance metrics Diluted EPS $ 1.04 $ (0.06) (5)% $ (0.10) (9)% Efficiency ratio 58.9 102 bps 70 bps Noninterest income as a % of total revenue 24 % 133 bps (174) bps ROTCE 13.9 % (187) bps (152) bps Tangible book value per share $ 28.72 $ (0.72) (2) $ (0.42) (1) Operating leverage (2)% (1)% See pages 41-42 for notes and important information on Non-GAAP Financial Measures, including “Underlying” results. “Underlying” results exclude the impact of notable items described on page 40. 2Q23 Notable Items Impacts Pre-tax EPS ($s in millions except per share data) Integration related $ (39) $ (0.06) TOP & Other related Actions (34) (0.06) Total: $ (73) $ (0.12)

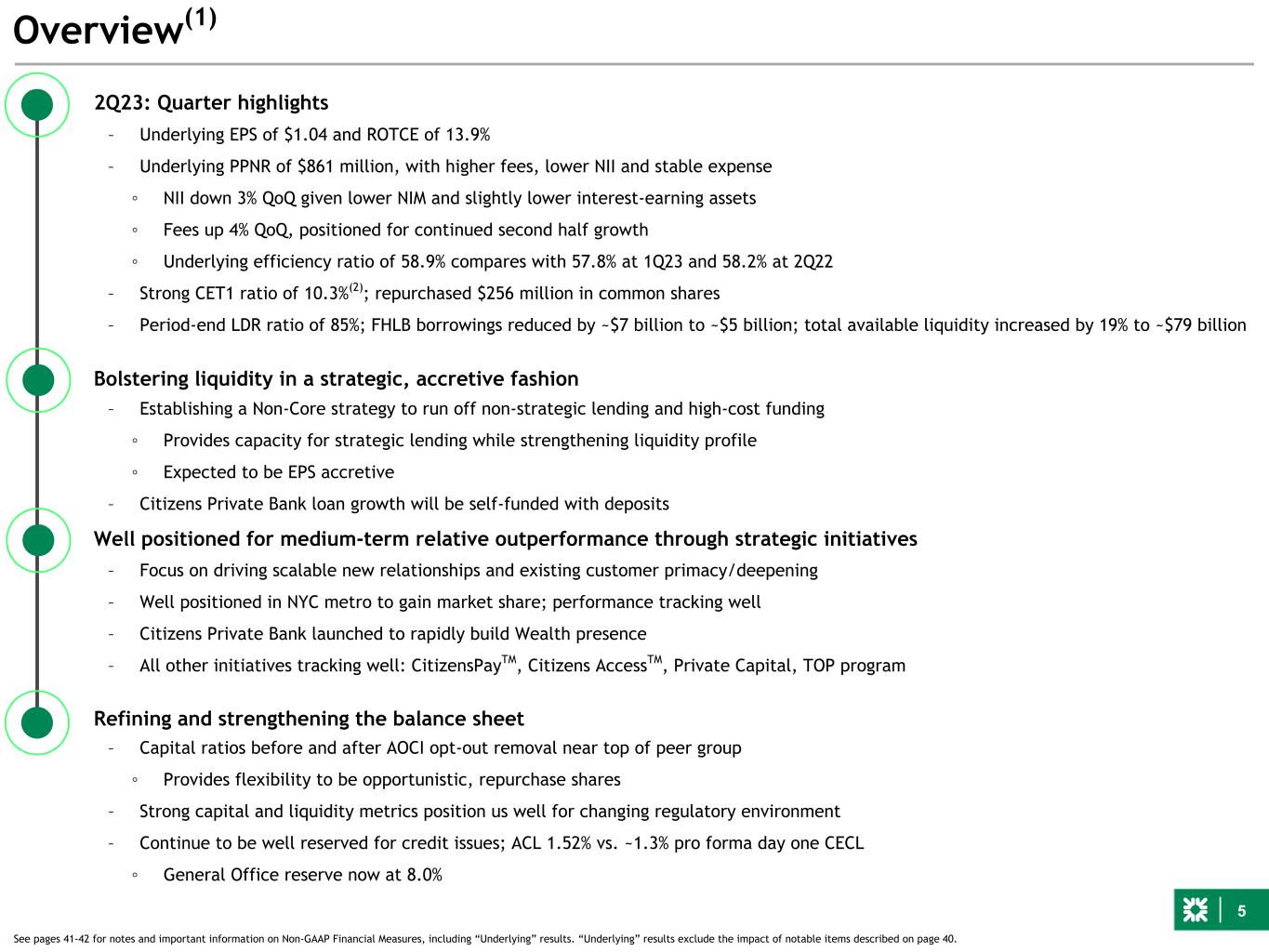

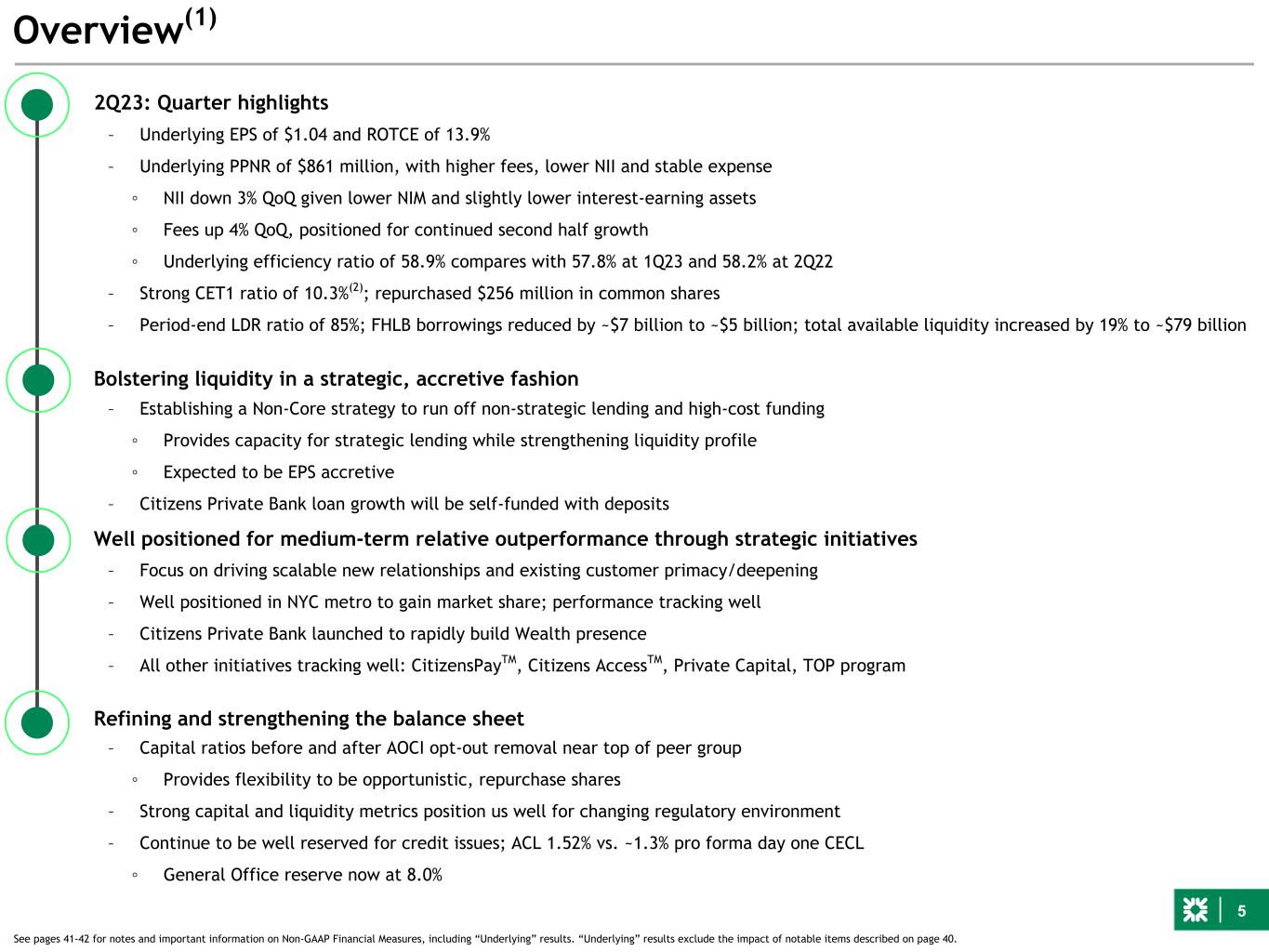

5 – Focus on driving scalable new relationships and existing customer primacy/deepening – Well positioned in NYC metro to gain market share; performance tracking well – Citizens Private Bank launched to rapidly build Wealth presence – All other initiatives tracking well: CitizensPayTM, Citizens AccessTM, Private Capital, TOP program Overview(1) See pages 41-42 for notes and important information on Non-GAAP Financial Measures, including “Underlying” results. “Underlying” results exclude the impact of notable items described on page 40. 2Q23: Quarter highlights – Underlying EPS of $1.04 and ROTCE of 13.9% – Underlying PPNR of $861 million, with higher fees, lower NII and stable expense ◦ NII down 3% QoQ given lower NIM and slightly lower interest-earning assets ◦ Fees up 4% QoQ, positioned for continued second half growth ◦ Underlying efficiency ratio of 58.9% compares with 57.8% at 1Q23 and 58.2% at 2Q22 – Strong CET1 ratio of 10.3%(2); repurchased $256 million in common shares – Period-end LDR ratio of 85%; FHLB borrowings reduced by ~$7 billion to ~$5 billion; total available liquidity increased by 19% to ~$79 billion Well positioned for medium-term relative outperformance through strategic initiatives Bolstering liquidity in a strategic, accretive fashion Refining and strengthening the balance sheet – Capital ratios before and after AOCI opt-out removal near top of peer group ◦ Provides flexibility to be opportunistic, repurchase shares – Strong capital and liquidity metrics position us well for changing regulatory environment – Continue to be well reserved for credit issues; ACL 1.52% vs. ~1.3% pro forma day one CECL ◦ General Office reserve now at 8.0% – Establishing a Non-Core strategy to run off non-strategic lending and high-cost funding ◦ Provides capacity for strategic lending while strengthening liquidity profile ◦ Expected to be EPS accretive – Citizens Private Bank loan growth will be self-funded with deposits

6 3.30% 0.21% (0.34)% 3.17% 1Q23 Asset Yields Funding Costs 2Q23 $198.7B $203.6B $204.5B $202.6B $201.5B $1,505 $1,665 $1,695 $1,643 $1,588 3.04% 3.25% 3.30% 3.30% 3.17% 2Q22 3Q22 4Q22 1Q23 2Q23 ■ NII down 3%, as expected, given lower NIM and slightly lower interest-earning assets, partly offset by higher day count – NIM of 3.17% decreased 13 bps, as higher funding costs were partly offset by higher earning-asset yields – Interest-earning asset yields increased 24 bps to 5.00% – Interest-bearing deposit costs up 47 bps to 221 bps; well-controlled cumulative beta of 42% Net interest income $s in millions, except earning assets NII and NIM Average interest-earning assets Net interest income NIM, FTE Net interest income decline reflects higher funding costs ■ NII up 6%, reflecting higher NIM and 1% growth in average interest-earning assets – NIM of 3.17%, up 13 bps, reflects higher earning- asset yields given higher market interest rates and interest-earning asset growth, partly offset by increased funding costs – Interest-earning asset yields up 174 bps – Interest-bearing deposit costs up 203 bps NIM 1Q23 to 2Q23 Year-Over-Year Linked Quarter

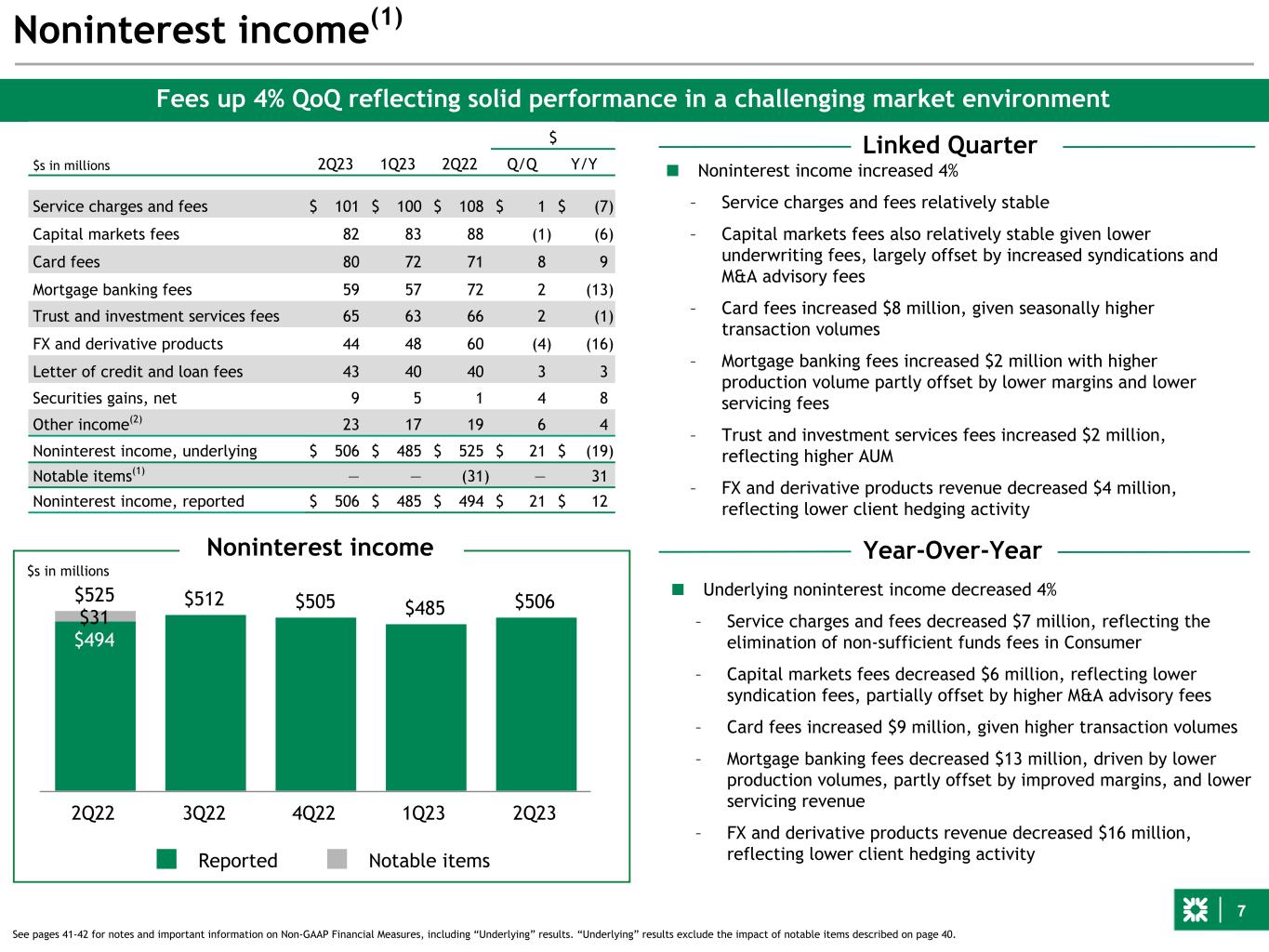

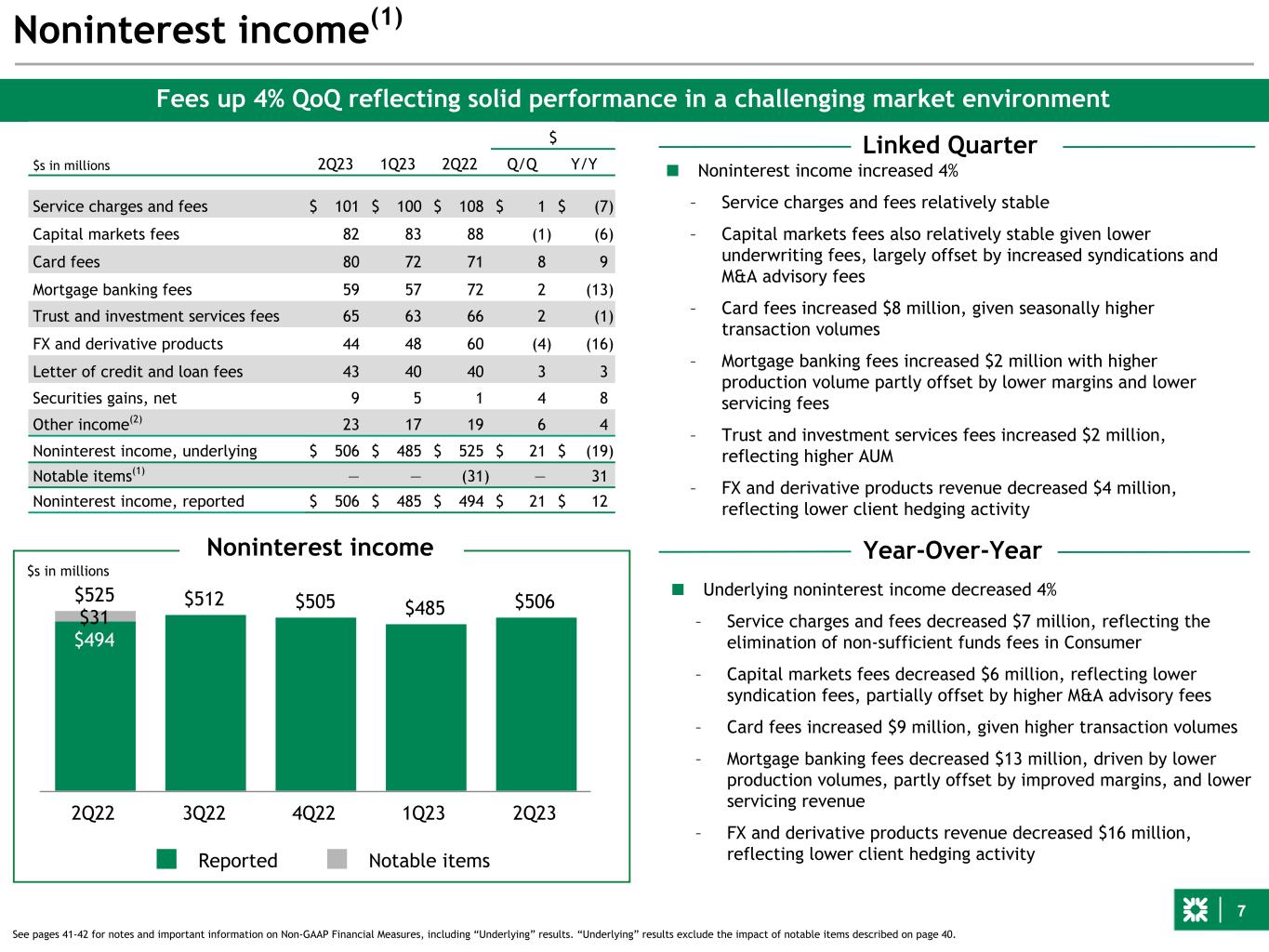

7 $512 $505 $485 $506$525 $494 $31 Reported Notable items 2Q22 3Q22 4Q22 1Q23 2Q23 Noninterest income(1) $s in millions Fees up 4% QoQ reflecting solid performance in a challenging market environment See pages 41-42 for notes and important information on Non-GAAP Financial Measures, including “Underlying” results. “Underlying” results exclude the impact of notable items described on page 40. Linked Quarter Year-Over-YearNoninterest income ■ Underlying noninterest income decreased 4% – Service charges and fees decreased $7 million, reflecting the elimination of non-sufficient funds fees in Consumer – Capital markets fees decreased $6 million, reflecting lower syndication fees, partially offset by higher M&A advisory fees – Card fees increased $9 million, given higher transaction volumes – Mortgage banking fees decreased $13 million, driven by lower production volumes, partly offset by improved margins, and lower servicing revenue – FX and derivative products revenue decreased $16 million, reflecting lower client hedging activity ■ Noninterest income increased 4% – Service charges and fees relatively stable – Capital markets fees also relatively stable given lower underwriting fees, largely offset by increased syndications and M&A advisory fees – Card fees increased $8 million, given seasonally higher transaction volumes – Mortgage banking fees increased $2 million with higher production volume partly offset by lower margins and lower servicing fees – Trust and investment services fees increased $2 million, reflecting higher AUM – FX and derivative products revenue decreased $4 million, reflecting lower client hedging activity $s in millions 2Q23 1Q23 2Q22 $ Q/Q Y/Y Service charges and fees $ 101 $ 100 $ 108 $ 1 $ (7) Capital markets fees 82 83 88 (1) (6) Card fees 80 72 71 8 9 Mortgage banking fees 59 57 72 2 (13) Trust and investment services fees 65 63 66 2 (1) FX and derivative products 44 48 60 (4) (16) Letter of credit and loan fees 43 40 40 3 3 Securities gains, net 9 5 1 4 8 Other income(2) 23 17 19 6 4 Noninterest income, underlying $ 506 $ 485 $ 525 $ 21 $ (19) Notable items(1) — — (31) — 31 Noninterest income, reported $ 506 $ 485 $ 494 $ 21 $ 12

8 Noninterest expense(1) ■ Underlying noninterest expense broadly stable – Reflects lower salaries and employee benefits, given seasonal declines in payroll taxes and 401k costs – Equipment and software increased given equipment purchases and increased software maintenance – Other operating expense increased primarily reflecting higher advertising and FDIC insurance ■ Underlying noninterest expense of $1.2 billion increased 4% – Reflects lower salaries and employee benefits, given lower variable compensation – Higher equipment and software expense driven by increased software maintenance and amortization costs – Higher other operating expense given increased advertising and an industry-wide increased FDIC insurance surcharge See pages 41-42 for notes and important information on Non-GAAP Financial Measures, including “Underlying” results. “Underlying” results exclude the impact of notable items described on page 40. Efficiency ratio Disciplined on expenses while prioritizing key strategic investments Linked Quarter Year-Over-Year 65.3% 57.0% 56.4% 60.9% 62.3% 58.2% 54.9% 54.4% 57.8% 58.9% Underlying Notable items 2Q22 3Q22 4Q22 1Q23 2Q23 2Q23 1Q23 2Q22 $ $s in millions Q/Q Y/Y Salaries & employee benefits $ 601 $ 642 $ 611 $ (41) $ (10) Outside services 156 149 148 7 8 Equipment & software 177 165 163 12 14 Occupancy 106 106 110 — (4) Other operating expense 193 168 148 25 45 Noninterest expense, underlying $ 1,233 $ 1,230 $ 1,180 $ 3 $ 53 Notable items (1) 73 66 125 7 (52) Noninterest expense, reported $ 1,306 $ 1,296 $ 1,305 $ 10 $ 1 Full-time equivalents (FTEs) 18,468 18,547 19,583 (79) (1,115)

9 ■ Average loans down $2.8 billion, or 2% – Commercial down $2.1 billion, or 3%, driven by C&I balance sheet optimization actions – Retail down $0.7 billion, or 1%, given planned run off in auto and lower education largely offset by growth in mortgage and home equity ■ Period-end loans down $3.4 billion, or 2% – Commercial down $2.6 billion, or 3%, due to C&I balance sheet optimization actions – Retail down $0.8 billion, or 1% ■ Average loan yield of 5.52%, up 27 bps QoQ $153.8 $156.9 $157.1 $156.5 $153.7 2Q22 3Q22 4Q22 1Q23 2Q23 Loans and leases $s in billions Loans down slightly reflecting balance sheet optimization ■ Average loans broadly stable – Commercial up slightly and retail down slightly ■ Period-end loans down $4.9 billion, or 3% – Commercial down $3.2 billion, or 4%, driven by C&I balance sheet optimization actions – Retail down $1.7 billion, or 2%, driven by planned run off in auto and lower education, largely offset by growth in mortgage and home equity Average loans and leases $156.2 $156.1 $156.7 $154.7 $151.3 2Q22 3Q22 4Q22 1Q23 2Q23 $s in billions Period-end loans and leases 3.55% 4.17% 4.75% 5.25% 5.52% Linked Quarter Year-Over-Year

10 $176.4 $177.6 $179.0 $174.4 $173.2 2Q22 3Q22 4Q22 1Q23 2Q23 Deposit performance and cost of funds Spot deposit increase of $5.5 billion QoQ across Consumer and Commercial $s in billions 2Q23 Average deposits 0.12% 0.39% 0.88% 1.28% 1.68% 0.18% 0.56% 1.23% 1.74% 2.21% Total deposit costs Interest-bearing deposit costs Commercial Consumer Other Year-Over-Year 2Q23 Period-end deposits Term Linked Quarter ■ Period-end deposits up $5.5 billion, or 3%, as the Company replenished balances following seasonal and rate-related outflows in the first two months of first quarter 2023 – Deposit growth led by Consumer, up $3.0 billion – Commercial up $2.0 billion ■ Average deposits down $1.1 billion, or 1% ■ Citizens Access™ 2Q23 average balance of $9.7 billion; period- end balance of $10.6 billion ■ Total deposit costs increased 40 bps ■ Interest bearing deposit costs increased 47 bps; sequential beta 101%; cumulative beta 42% ■ Total cost of funds of 197 bps, up 38 bps, reflects mix shift toward deposits and away from higher cost wholesale funding ■ Period-end FHLB advances of $5.0 billion, down $6.8 billion ■ Period-end deposits down $1.3 billion, or 1%, primarily due to rate-related outflows; Average deposits down $3.1 billion, or 2% ■ Total deposit costs up 156 bps and interest-bearing deposit costs up 203 bps ■ Total cost of funds up 172 bps $178.9 $178.6 $180.7 $172.2 $177.7 Commercial Consumer Other 2Q22 3Q22 4Q22 1Q23 2Q23 $s in billions

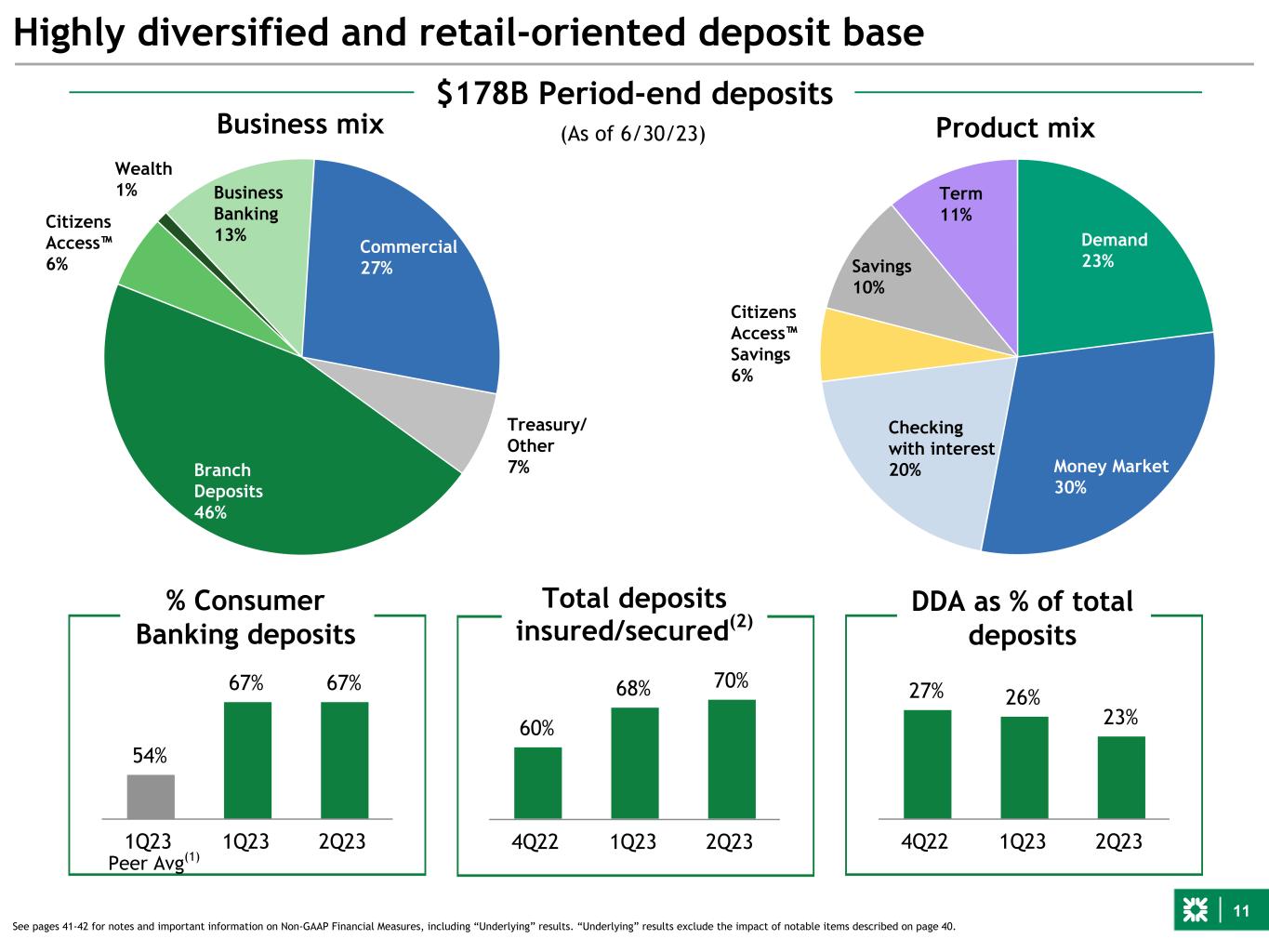

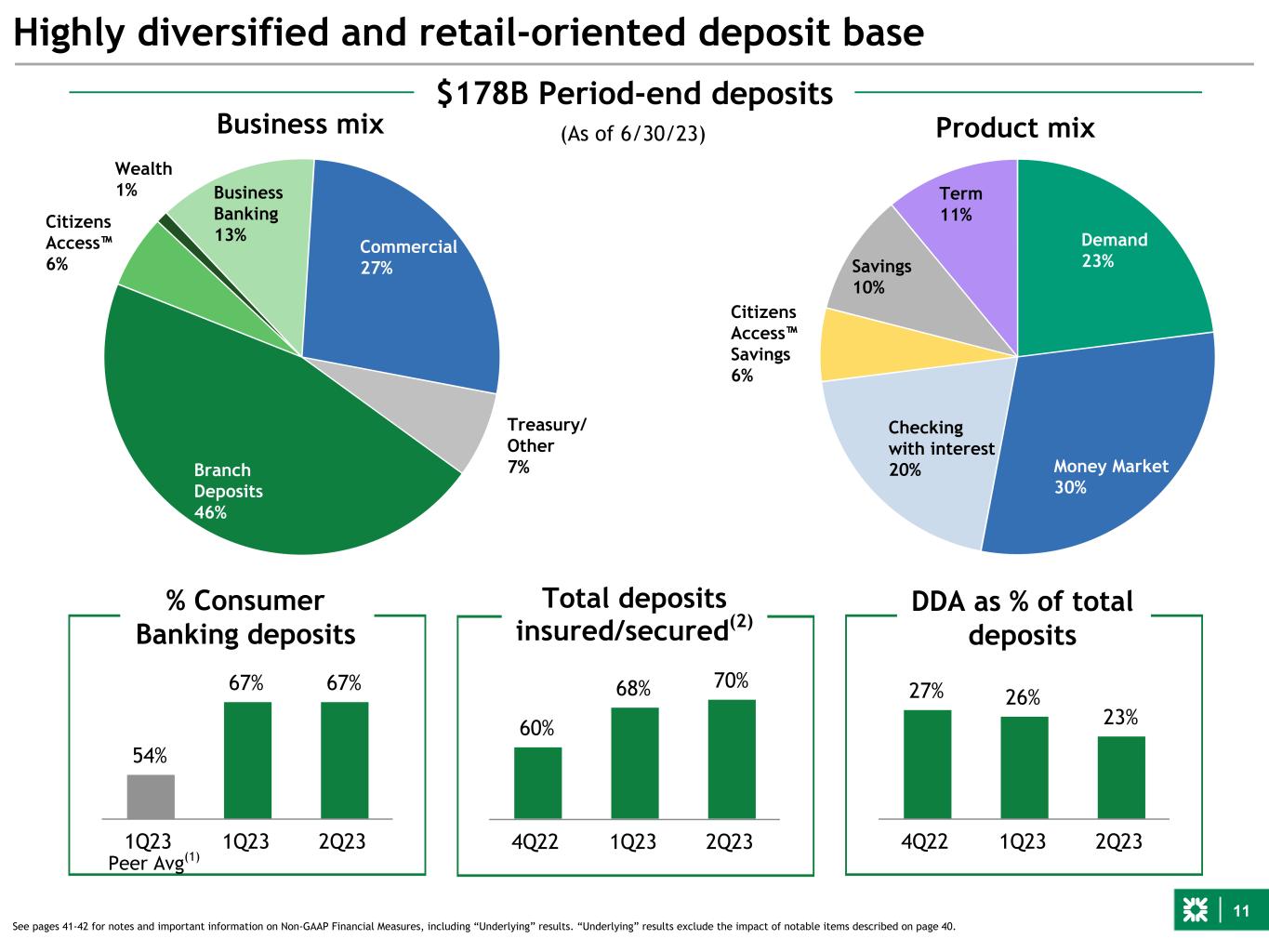

11 Demand 23% Money Market 30% Checking with interest 20% Citizens Access™ Savings 6% Savings 10% Term 11% 60% 68% 70% 4Q22 1Q23 2Q23 54% 67% 67% 1Q23 1Q23 2Q23 Branch Deposits 46% Citizens Access™ 6% Wealth 1% Business Banking 13% Commercial 27% Treasury/ Other 7% (As of 6/30/23) Highly diversified and retail-oriented deposit base $178B Period-end deposits Peer Avg(1) 27% 26% 23% 4Q22 1Q23 2Q23 Business mix Product mix See pages 41-42 for notes and important information on Non-GAAP Financial Measures, including “Underlying” results. “Underlying” results exclude the impact of notable items described on page 40. Total deposits insured/secured(2) % Consumer Banking deposits DDA as % of total deposits

12 $839 $852 $944 $996 $1,191 0.54% 0.55% 0.60% 0.64% 0.79% Nonaccrual loans Nonaccrual loans to total loans 2Q22 3Q22 4Q22 1Q23 2Q23 $2,147 $2,196 $2,240 $2,275 $2,299 1.37% 1.41% 1.43% 1.47% 1.52% Allowance for credit losses Allowance to loan coverage ratio 2Q22 3Q22 4Q22 1Q23 2Q23 ■ NCOs of $152 million, or 40 bps of average loans and leases, up 6 bps QoQ ■ Nonaccrual loans increased 15 bps QoQ to 79 bps of total loans driven by an increase in commercial, primarily reflecting lumpiness in the General Office segment of commercial real estate ■ Provision for credit losses of $176 million, with a reserve build of $24 million; ACL coverage ratio of 1.52%, up 5 bps QoQ ■ ACL to nonaccrual loans and leases ratio of 193% compares with 229% as of 1Q23 and 256% as of 2Q22 $71 $123 $132 $168 $176 $49 $74 $88 $133 $152 0.13% 0.19% 0.22% 0.34% 0.40% 2Q22 3Q22 4Q22 1Q23 2Q23 Credit quality overview $s in millions $s in millions See pages 41-42 for notes and important information on Non-GAAP Financial Measures, including “Underlying” results. “Underlying” results exclude the impact of notable items described on page 40. Nonaccrual loans $s in millions Allowance for credit losses Underlying provision for credit losses Net charge-offs Net charge-off ratio (1) HighlightsCredit provision expense; net charge-offs (2) *2Q22 provision for credit losses excludes the Day-1 CECL (double count) of $145 million related to the ISBC acquisition. *

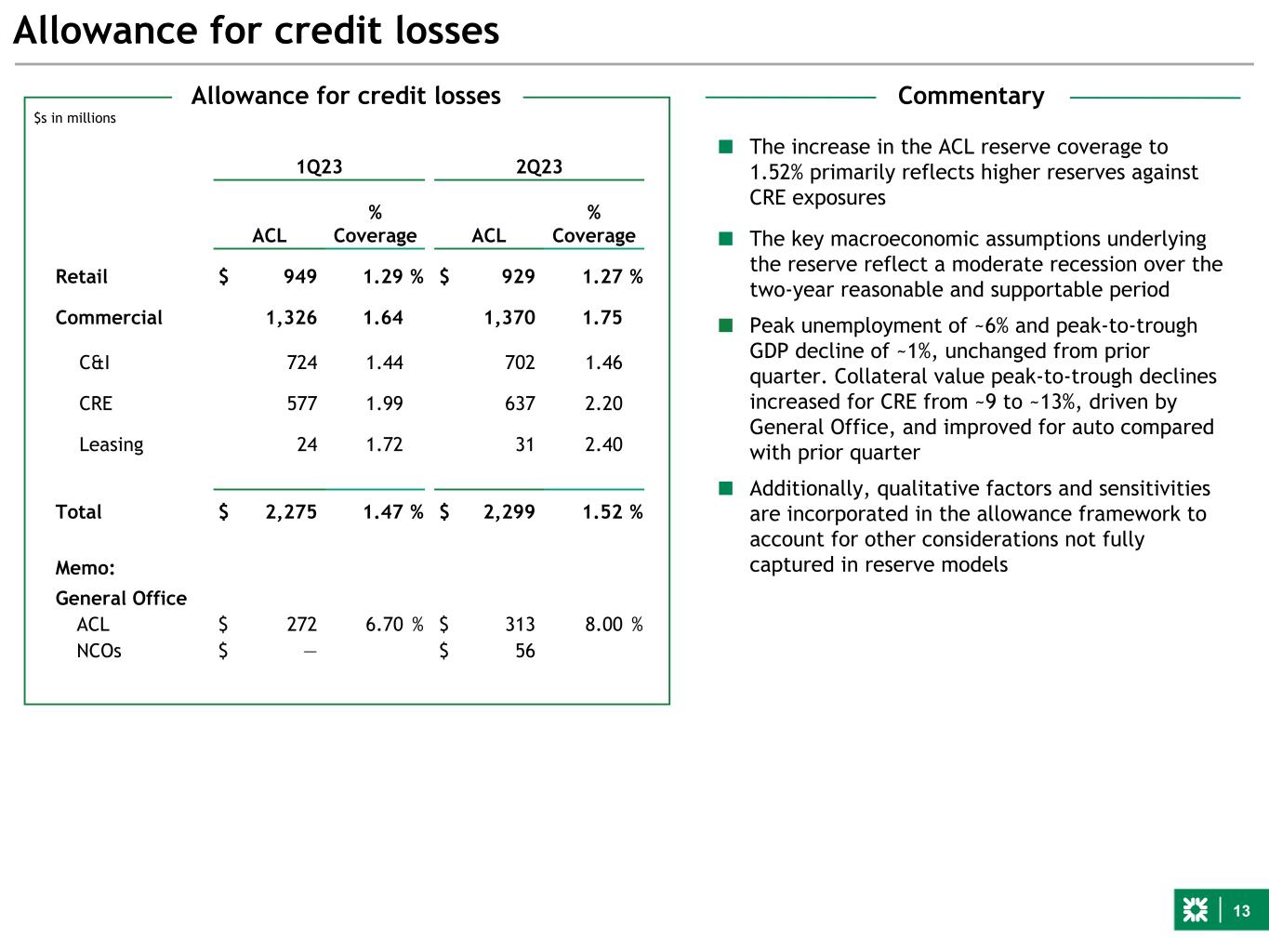

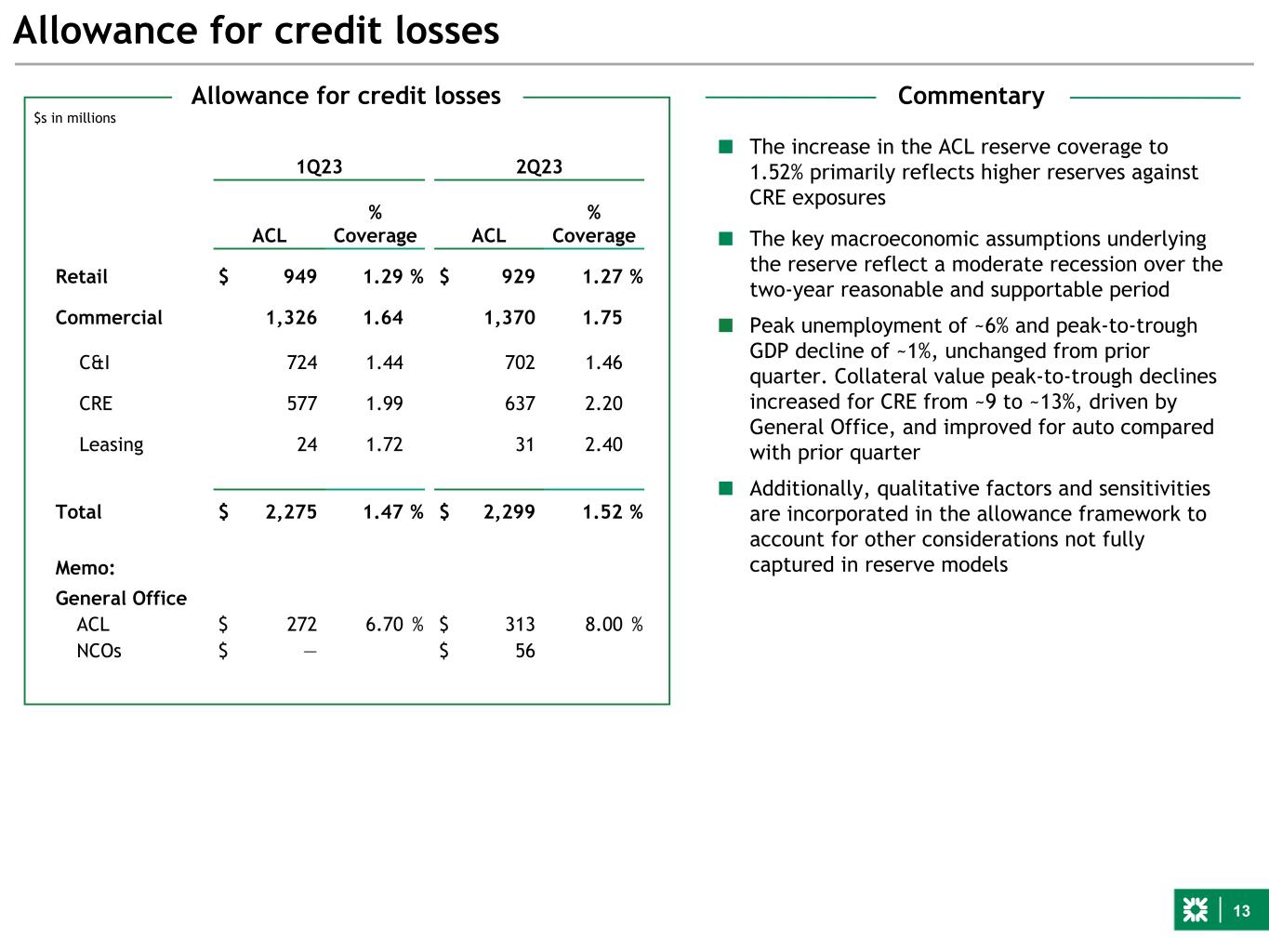

13 1Q23 2Q23 ACL % Coverage ACL % Coverage Retail $ 949 1.29 % $ 929 1.27 % Commercial 1,326 1.64 1,370 1.75 C&I 724 1.44 702 1.46 CRE 577 1.99 637 2.20 Leasing 24 1.72 31 2.40 Total $ 2,275 1.47 % $ 2,299 1.52 % Memo: General Office ACL $ 272 6.70 % $ 313 8.00 % NCOs $ — $ 56 Allowance for credit losses ■ The increase in the ACL reserve coverage to 1.52% primarily reflects higher reserves against CRE exposures ■ The key macroeconomic assumptions underlying the reserve reflect a moderate recession over the two-year reasonable and supportable period ■ Peak unemployment of ~6% and peak-to-trough GDP decline of ~1%, unchanged from prior quarter. Collateral value peak-to-trough declines increased for CRE from ~9 to ~13%, driven by General Office, and improved for auto compared with prior quarter ■ Additionally, qualitative factors and sensitivities are incorporated in the allowance framework to account for other considerations not fully captured in reserve models $s in millions CommentaryAllowance for credit losses

14 Laser-focused and well-equipped to manage portfolio to mitigate losses Current assumptions Property valuations (peak-to-trough % decline) down ~67% Avg. Loss Severity (%) ~45-50% Default rate (%) ~16-18% Scenario losses implied ~$315 million General Office ACL Coverage 8.0% Strong reserve coverage of CRE General Office CRE General Office key reserve assumptions CommentaryGeneral Office portfolio - ACL coverage $4.0 $4.1 $3.9 4.9% 6.7% 8.0% Portfolio Balance ACL Coverage Ratio 4Q22 1Q23 2Q23 $ in billions ■ Strong ACL coverage of General Office; continually reassessing potential loss content based on detailed loan by loan portfolio review as market conditions evolve – Increased ACL coverage for CRE General Office to 8.0% from 6.7% while absorbing ~$56 million in 2Q NCOs – ~98.5% of CRE General Office is current pay ■ Under more severe stress scenarios, expect CRE General Office credit losses to be manageable with modest impacts to capital – Current stress assumptions already 2x as severe as 1990-1993 or 2008/2009 downturns – Believe current reserve adequately covers projected risks – Capital impacts of higher stress scenarios very modest ■ Have limited CRE originations to existing clients; restricted new originations for CRE Office in mid-2020 ■ Proactively engaging borrowers on mutually beneficial work-out solutions well before maturity ■ Portfolio management prioritized based on multiple dimensions including: – Property location (MSA), building quality, operating performance, LTV, rent roll, and loan maturity ■ ACL informed by a specific CRE downside macro scenario combined with a loan-by-loan analysis – Assumed a deep stress, materially worse than historical market experience for factors such as NOI, property values, default rate, and loss severity

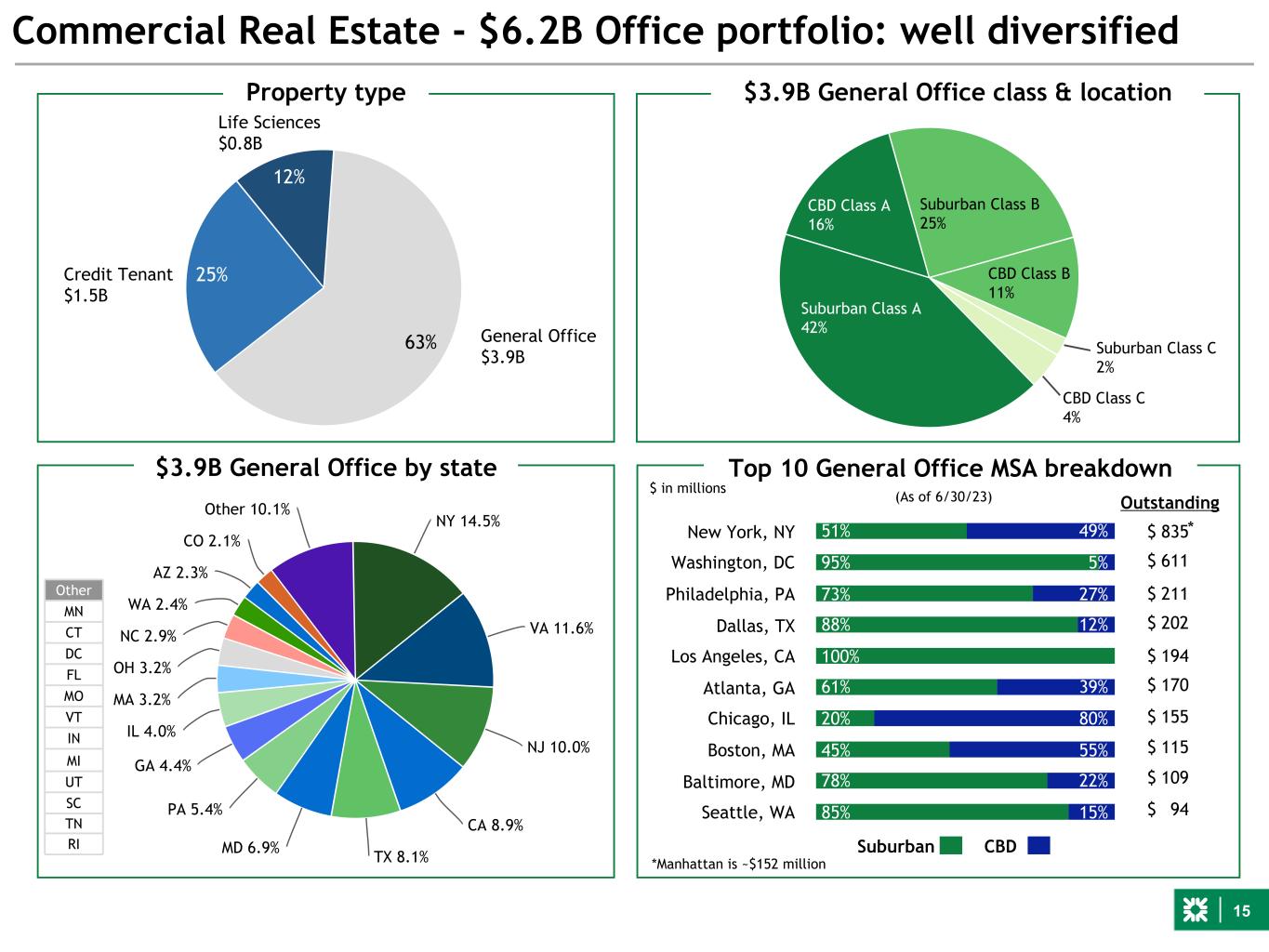

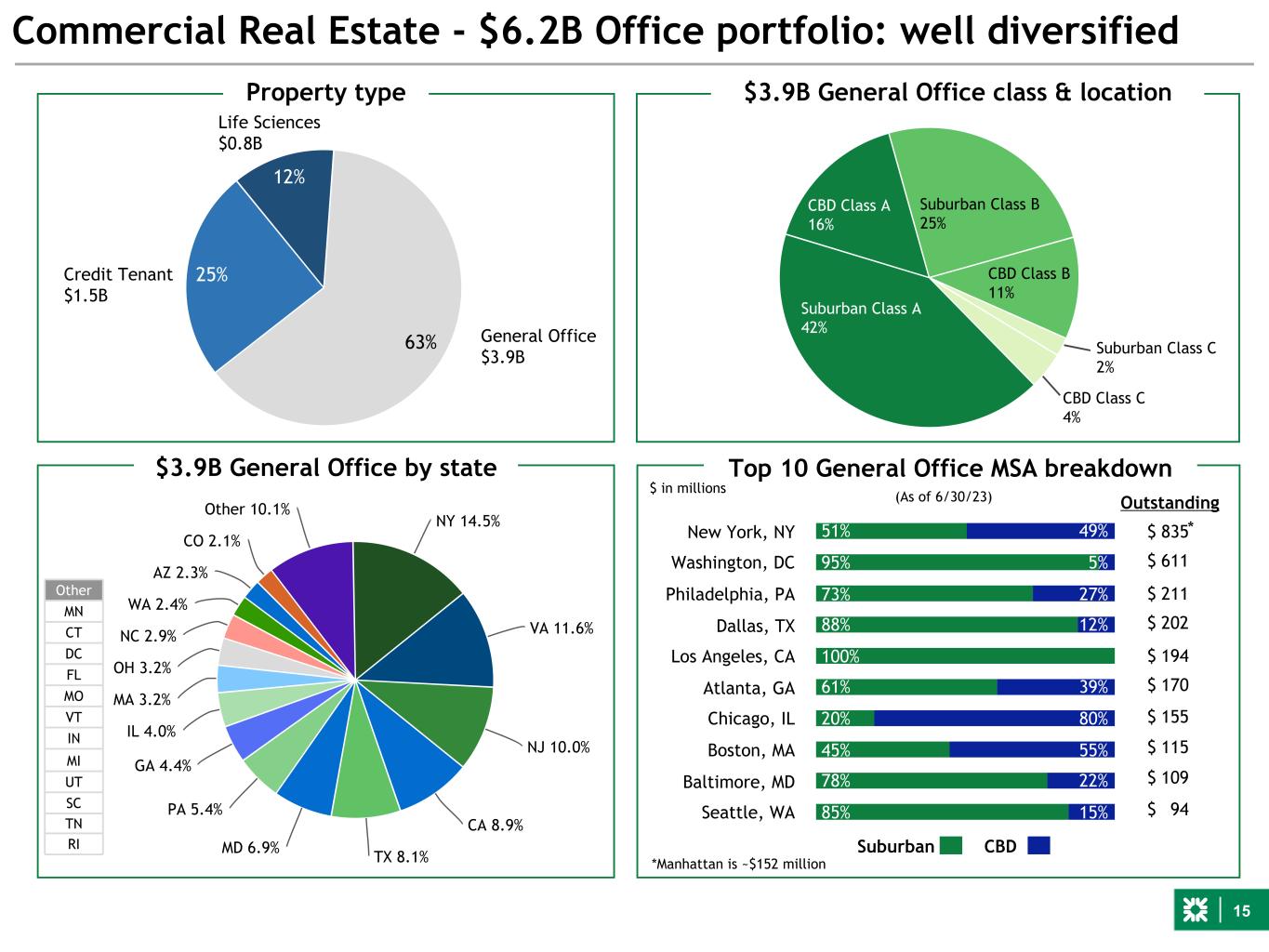

15 Suburban Class C 2% CBD Class C 4% Suburban Class A 42% CBD Class A 16% Suburban Class B 25% CBD Class B 11% 51% 95% 73% 88% 100% 61% 20% 45% 78% 85% 49% 5% 27% 12% 39% 80% 55% 22% 15% New York, NY Washington, DC Philadelphia, PA Dallas, TX Los Angeles, CA Atlanta, GA Chicago, IL Boston, MA Baltimore, MD Seattle, WA Suburban CBD NY 14.5% VA 11.6% NJ 10.0% CA 8.9% TX 8.1%MD 6.9% PA 5.4% GA 4.4% IL 4.0% MA 3.2% OH 3.2% NC 2.9% WA 2.4% AZ 2.3% CO 2.1% Other 10.1% Commercial Real Estate - $6.2B Office portfolio: well diversified $3.9B General Office by state Other MN CT DC FL MO VT IN MI UT SC TN RI 25% 12% 63% General Office $3.9B Credit Tenant $1.5B Life Sciences $0.8B Property type $3.9B General Office class & location Top 10 General Office MSA breakdown Outstanding *Manhattan is ~$152 million $ 835 $ 611 $ 211 $ 202 $ 194 $ 170 $ 155 $ 115 $ 109 $ 94 $ in millions (As of 6/30/23) *

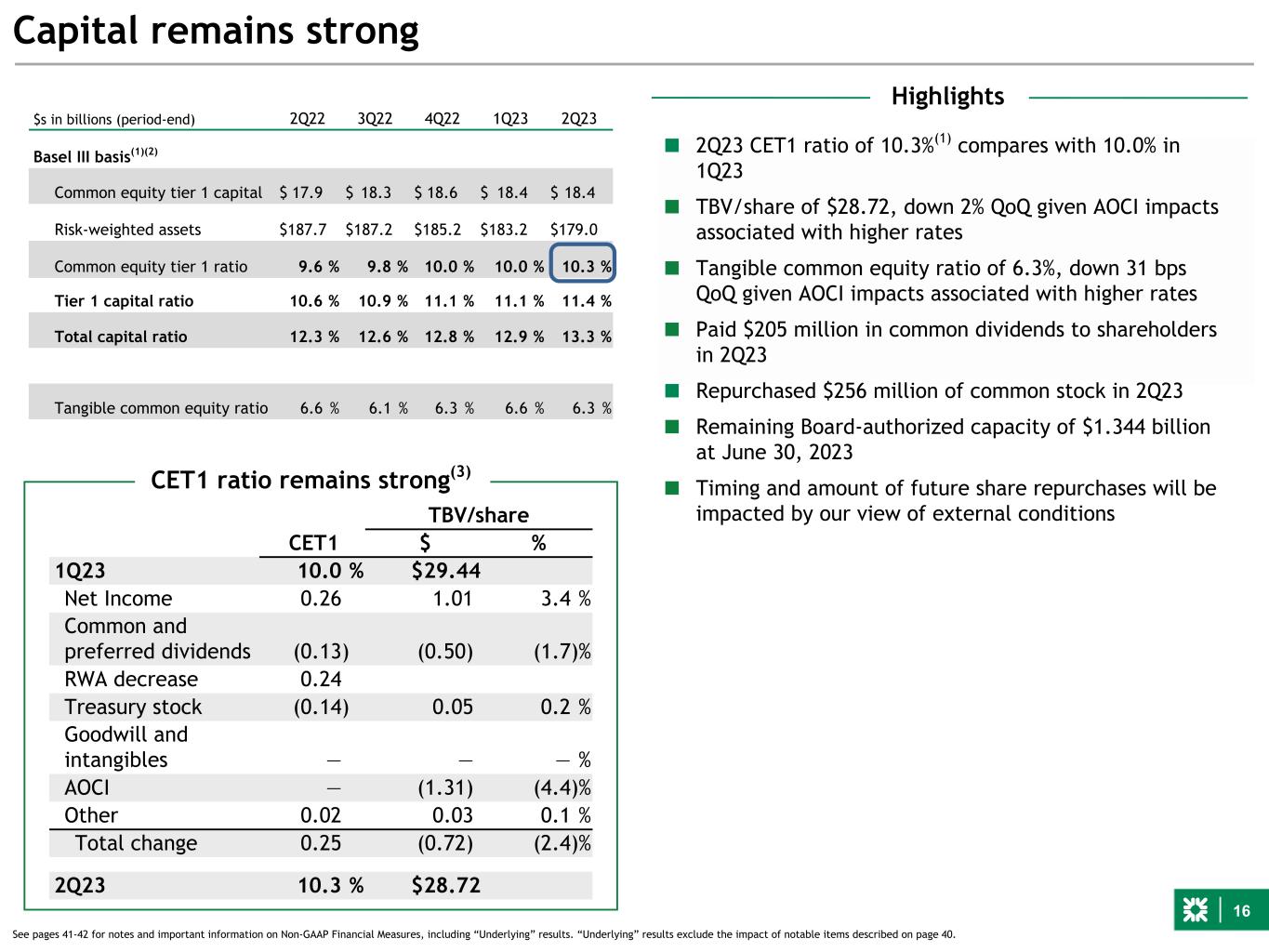

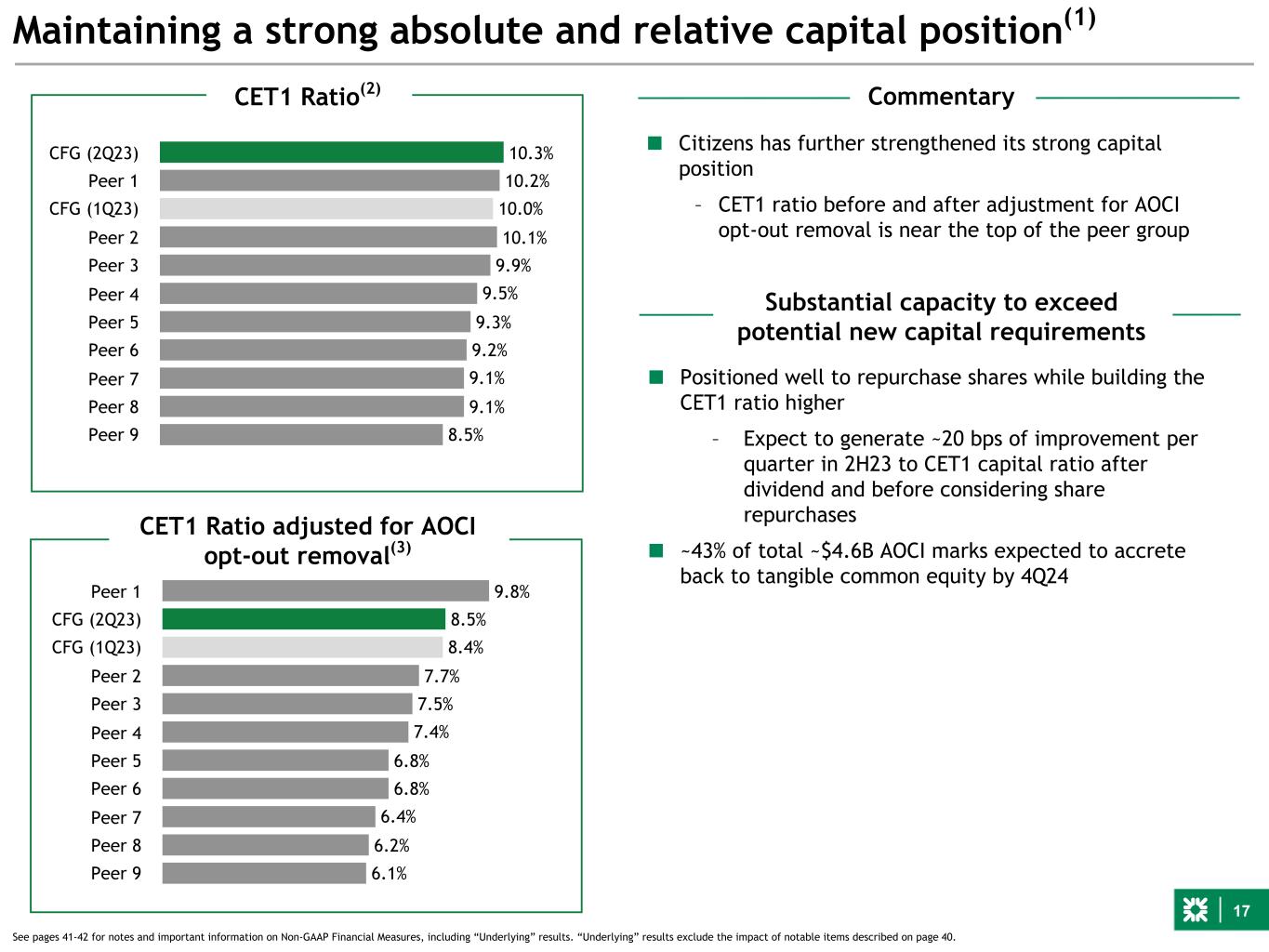

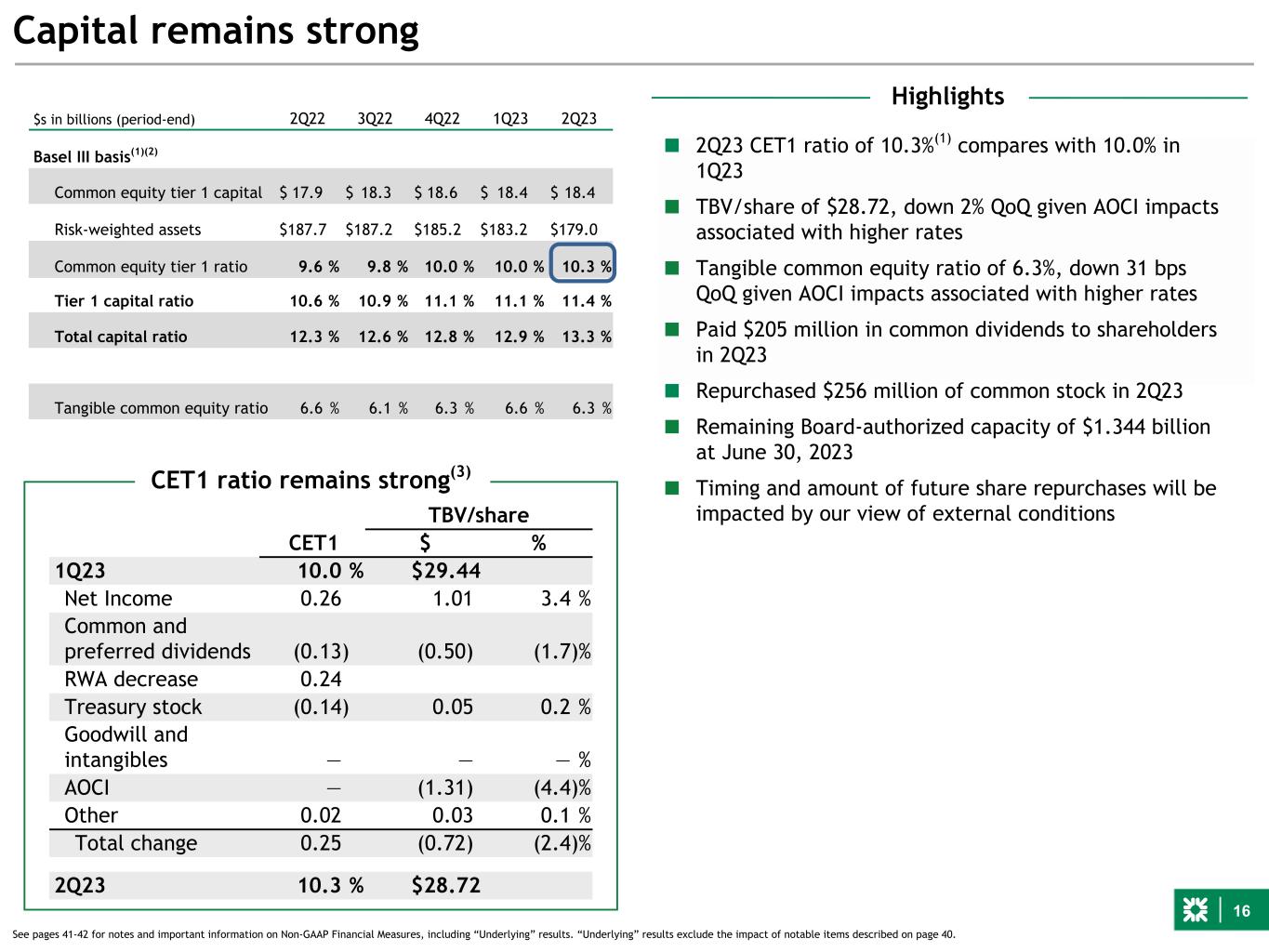

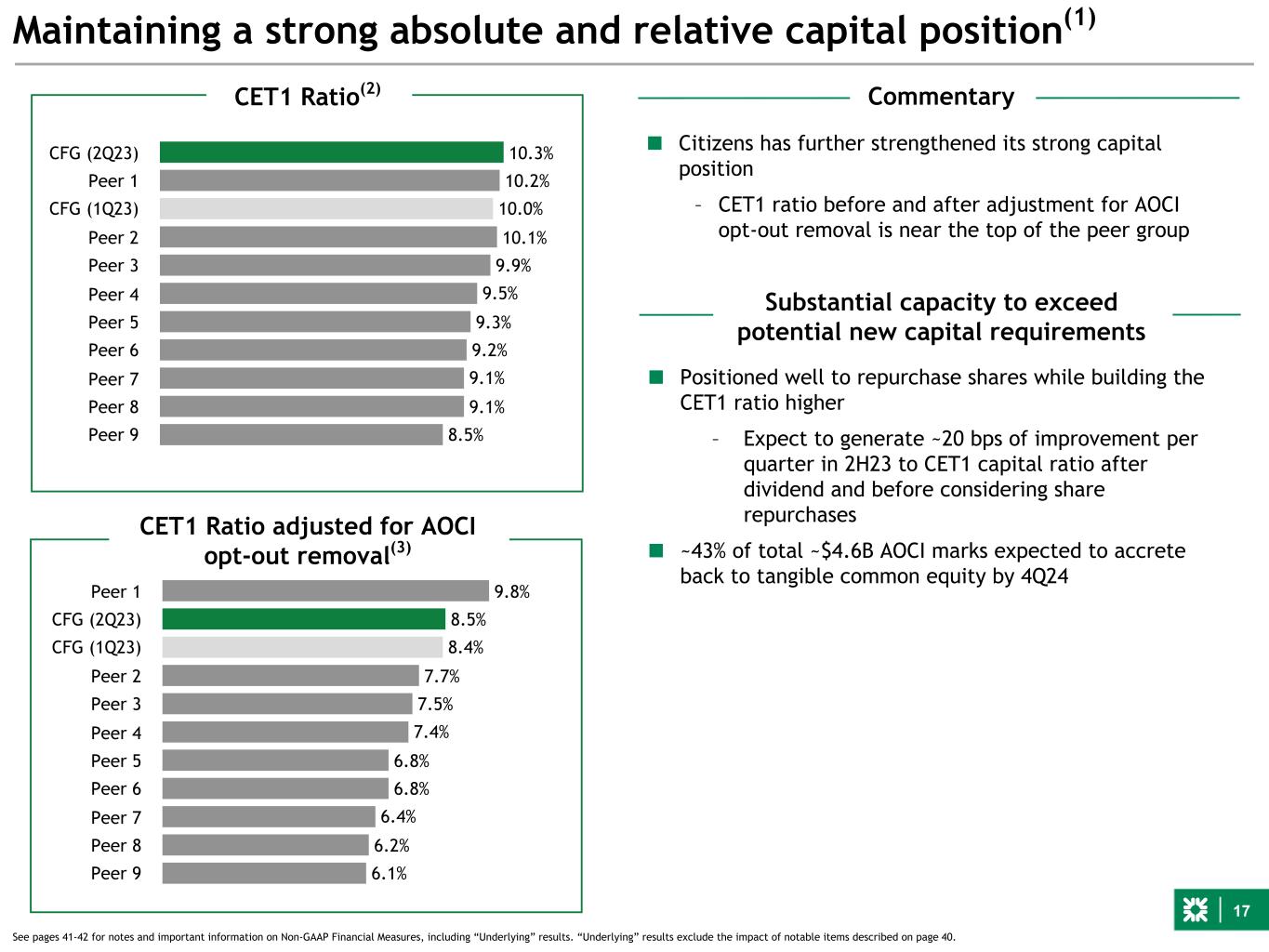

16 ■ 2Q23 CET1 ratio of 10.3%(1) compares with 10.0% in 1Q23 ■ TBV/share of $28.72, down 2% QoQ given AOCI impacts associated with higher rates ■ Tangible common equity ratio of 6.3%, down 31 bps QoQ given AOCI impacts associated with higher rates ■ Paid $205 million in common dividends to shareholders in 2Q23 ■ Repurchased $256 million of common stock in 2Q23 ■ Remaining Board-authorized capacity of $1.344 billion at June 30, 2023 ■ Timing and amount of future share repurchases will be impacted by our view of external conditions Capital remains strong $s in billions (period-end) 2Q22 3Q22 4Q22 1Q23 2Q23 Basel III basis(1)(2) Common equity tier 1 capital $ 17.9 $ 18.3 $ 18.6 $ 18.4 $ 18.4 Risk-weighted assets $ 187.7 $ 187.2 $ 185.2 $ 183.2 $ 179.0 Common equity tier 1 ratio 9.6 % 9.8 % 10.0 % 10.0 % 10.3 % Tier 1 capital ratio 10.6 % 10.9 % 11.1 % 11.1 % 11.4 % Total capital ratio 12.3 % 12.6 % 12.8 % 12.9 % 13.3 % Tangible common equity ratio 6.6 % 6.1 % 6.3 % 6.6 % 6.3 % See pages 41-42 for notes and important information on Non-GAAP Financial Measures, including “Underlying” results. “Underlying” results exclude the impact of notable items described on page 40. TBV/share CET1 $ % 1Q23 10.0 % $29.44 Net Income 0.26 1.01 3.4 % Common and preferred dividends (0.13) (0.50) (1.7) % RWA decrease 0.24 Treasury stock (0.14) 0.05 0.2 % Goodwill and intangibles — — — % AOCI — (1.31) (4.4) % Other 0.02 0.03 0.1 % Total change 0.25 (0.72) (2.4) % 2Q23 10.3 % $28.72 CET1 ratio remains strong(3) Highlights

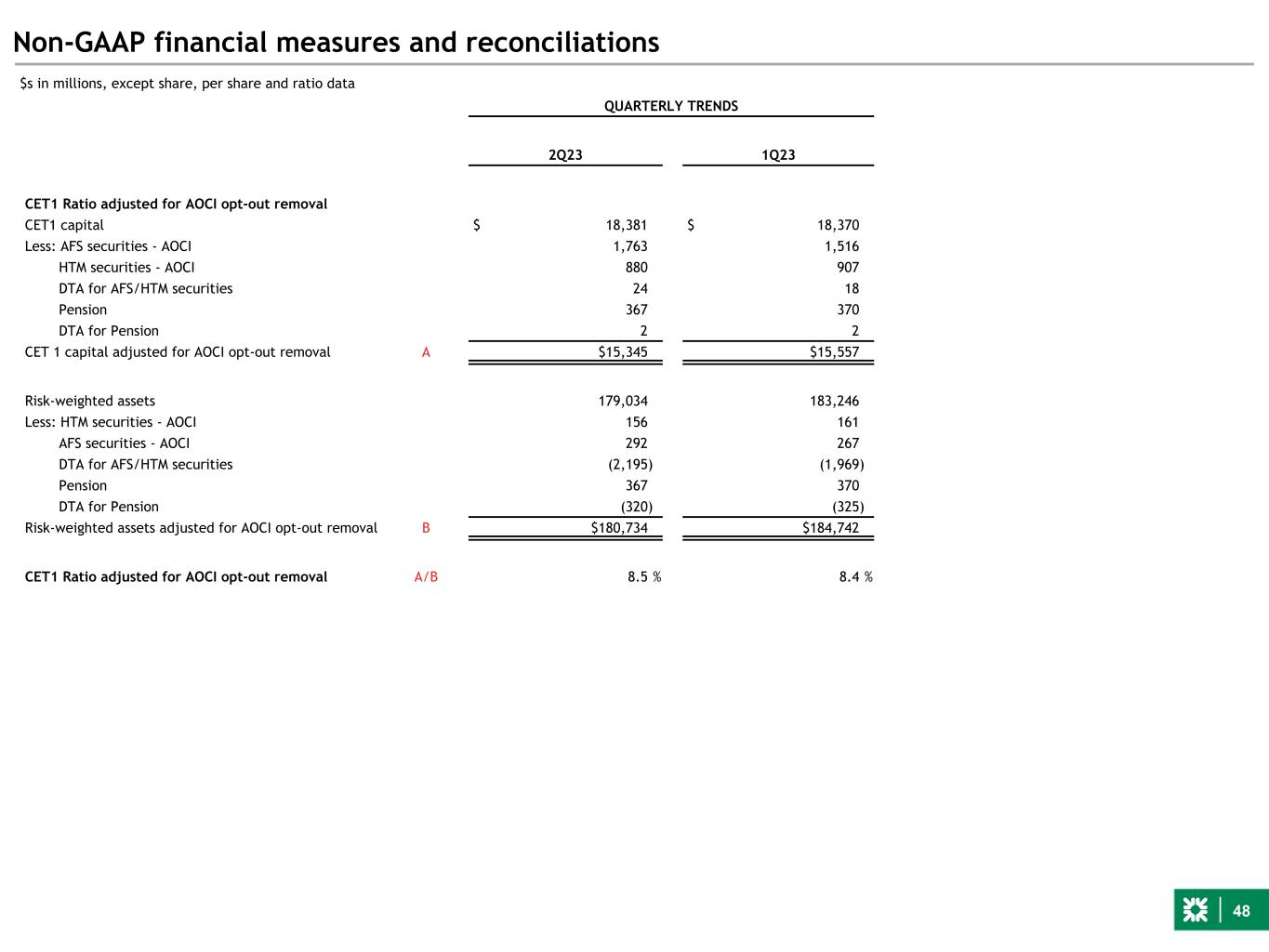

17 Maintaining a strong absolute and relative capital position(1) CET1 Ratio(2) 10.3% 10.2% 10.0% 10.1% 9.9% 9.5% 9.3% 9.2% 9.1% 9.1% 8.5% CFG (2Q23) Peer 1 CFG (1Q23) Peer 2 Peer 3 Peer 4 Peer 5 Peer 6 Peer 7 Peer 8 Peer 9 9.8% 8.5% 8.4% 7.7% 7.5% 7.4% 6.8% 6.8% 6.4% 6.2% 6.1% Peer 1 CFG (2Q23) CFG (1Q23) Peer 2 Peer 3 Peer 4 Peer 5 Peer 6 Peer 7 Peer 8 Peer 9 CET1 Ratio adjusted for AOCI opt-out removal(3) See pages 41-42 for notes and important information on Non-GAAP Financial Measures, including “Underlying” results. “Underlying” results exclude the impact of notable items described on page 40. Commentary Substantial capacity to exceed potential new capital requirements ■ Citizens has further strengthened its strong capital position – CET1 ratio before and after adjustment for AOCI opt-out removal is near the top of the peer group ■ Positioned well to repurchase shares while building the CET1 ratio higher – Expect to generate ~20 bps of improvement per quarter in 2H23 to CET1 capital ratio after dividend and before considering share repurchases ■ ~43% of total ~$4.6B AOCI marks expected to accrete back to tangible common equity by 4Q24

18 Spotlight on key strategic initiatives Balance Sheet Optimization (BSO) New York City Metro Citizens AccessTM/Citizens PayTM Capturing the Private Capital opportunity TOP 8/9 We continue to invest in a series of unique initiatives that position Citizens for medium-term outperformance vs. peers I II III IV V VI Citizens Private Bank

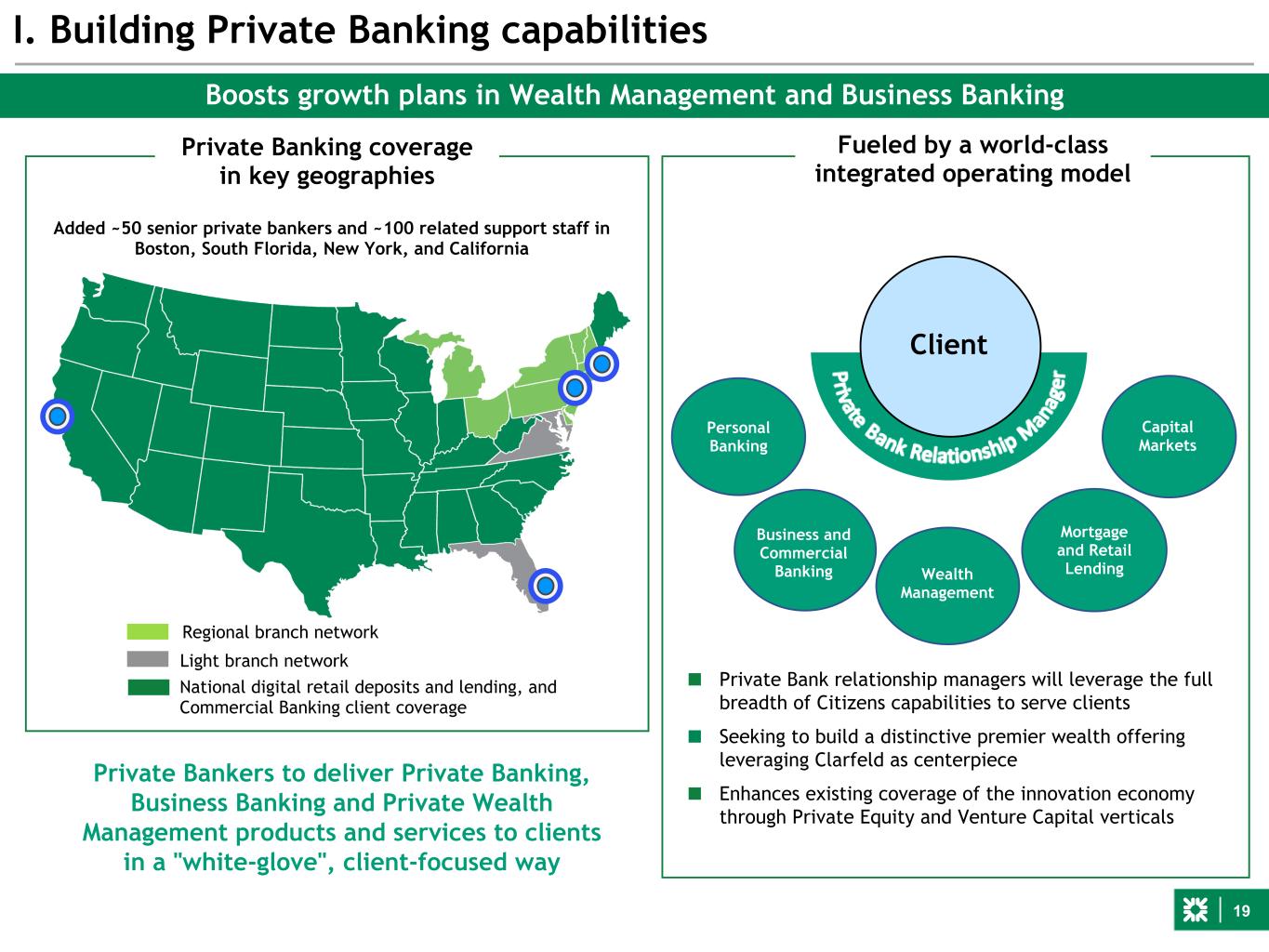

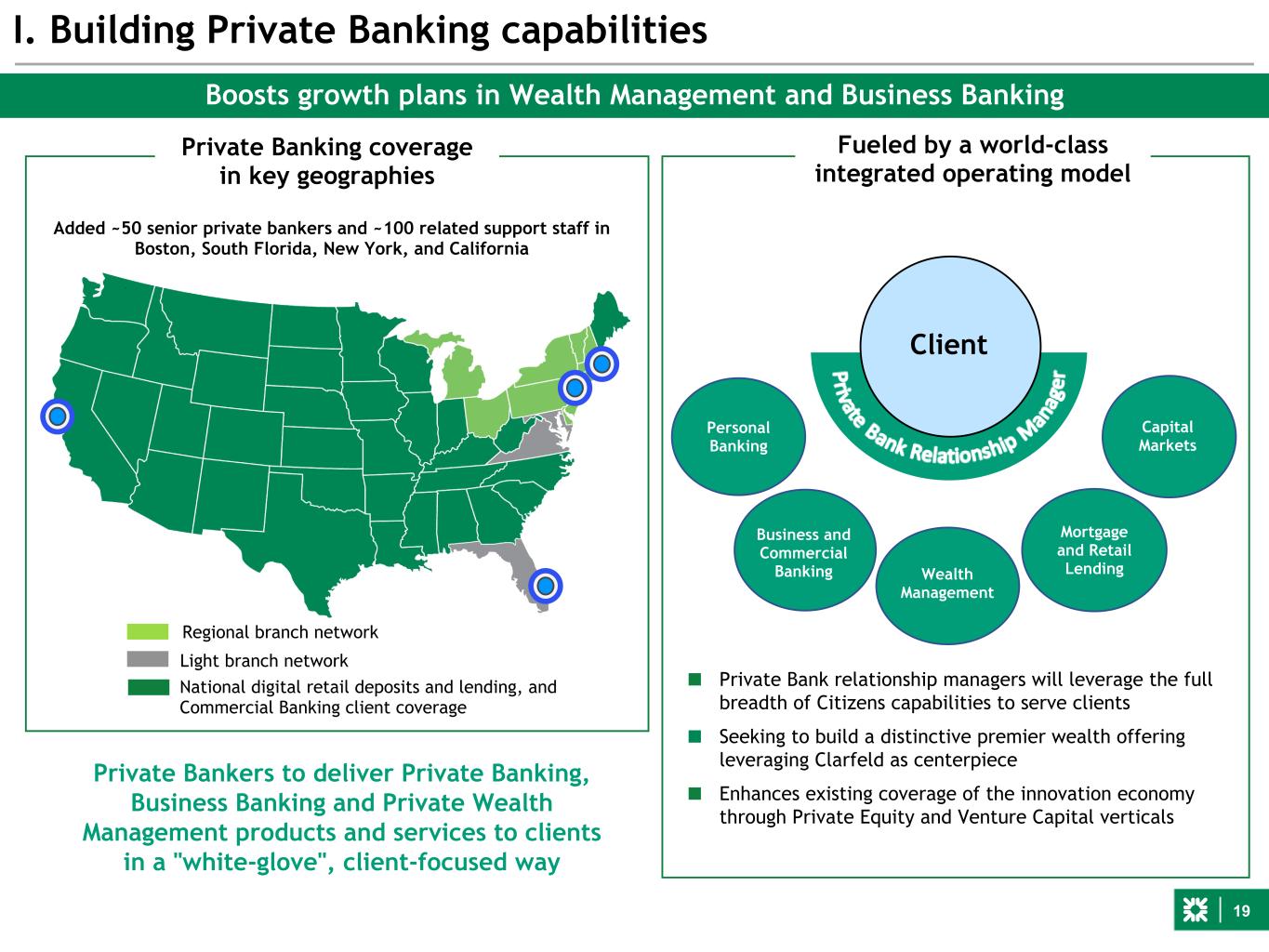

19 Client I. Building Private Banking capabilities Added ~50 senior private bankers and ~100 related support staff in Boston, South Florida, New York, and California Boosts growth plans in Wealth Management and Business Banking Regional branch network Light branch network National digital retail deposits and lending, and Commercial Banking client coverage Fueled by a world-class integrated operating model Private Banking coverage in key geographies ■ Private Bank relationship managers will leverage the full breadth of Citizens capabilities to serve clients ■ Seeking to build a distinctive premier wealth offering leveraging Clarfeld as centerpiece ■ Enhances existing coverage of the innovation economy through Private Equity and Venture Capital verticals Mortgage and Retail Lending Personal Banking Private Bankers to deliver Private Banking, Business Banking and Private Wealth Management products and services to clients in a "white-glove", client-focused way Capital Markets Business and Commercial Banking Wealth Management

20 ■ Open Private Banking centers in San Francisco, South Florida, New York and Boston ■ Scale premier Wealth offering leveraging the Clarfeld platform; hire Wealth and Financial Advisers in key markets ■ Upgrade key retail processes to deliver best in class Private Bank experience ■ Launch distinct brand positioning I. Building Private Banking capabilities Next steps to deliver a world class Private Bank Core operating principles for the business ■ Deliver high-touch client service model ■ Effective risk management, including solid credit discipline ■ Market competitive loan pricing ■ Loans funded with stable deposits ■ Compensation aligned to achievement of core objectives Medium-term aspirations 2023 is a year of investment, ~($0.08-$0.10) EPS impact on performance, plus ~($0.03) notables Break-even reached mid-2024, FY 2024 expected to be accretive Strong growth projections: ~$9 billion loans, ~$11 billion deposits, ~$10 billion AUM by YE2025; significant EPS accretion of ~5%* ■ Hired ~50 senior bankers and ~100 support staff; adding additional talent to round out the effort – Financials will be disclosed separately over 2H23 and FY 2024 to provide transparency on expense impact ■ Accelerates growth plans in key markets: Metro New York, Boston, South Florida, and California ■ Adds new presence and capabilities on the West Coast which complements JMP and our commercial activities Launch of Citizens Private Bank * Based on Bloomberg consensus estimate for FY2025 as of 7/18/23

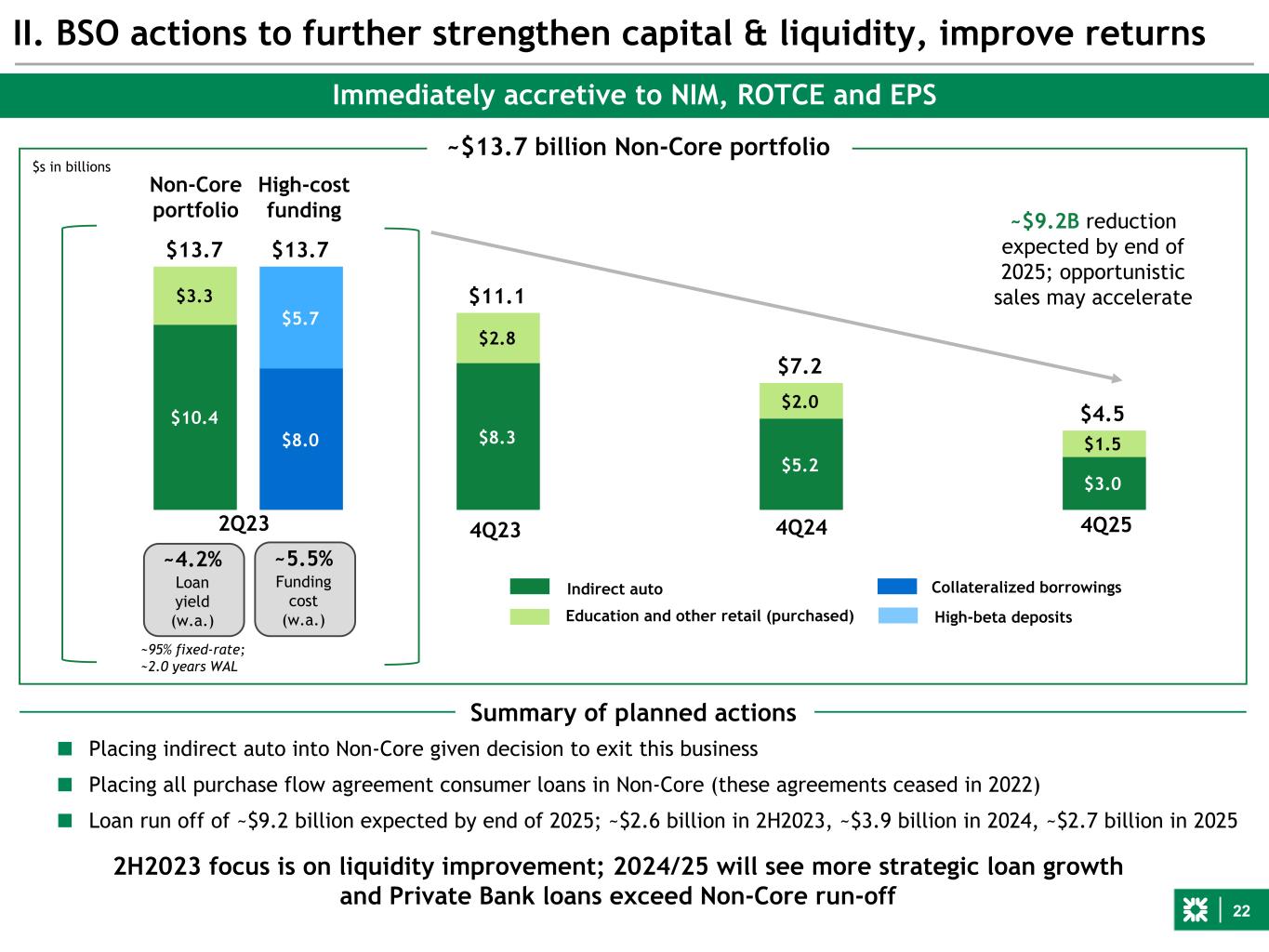

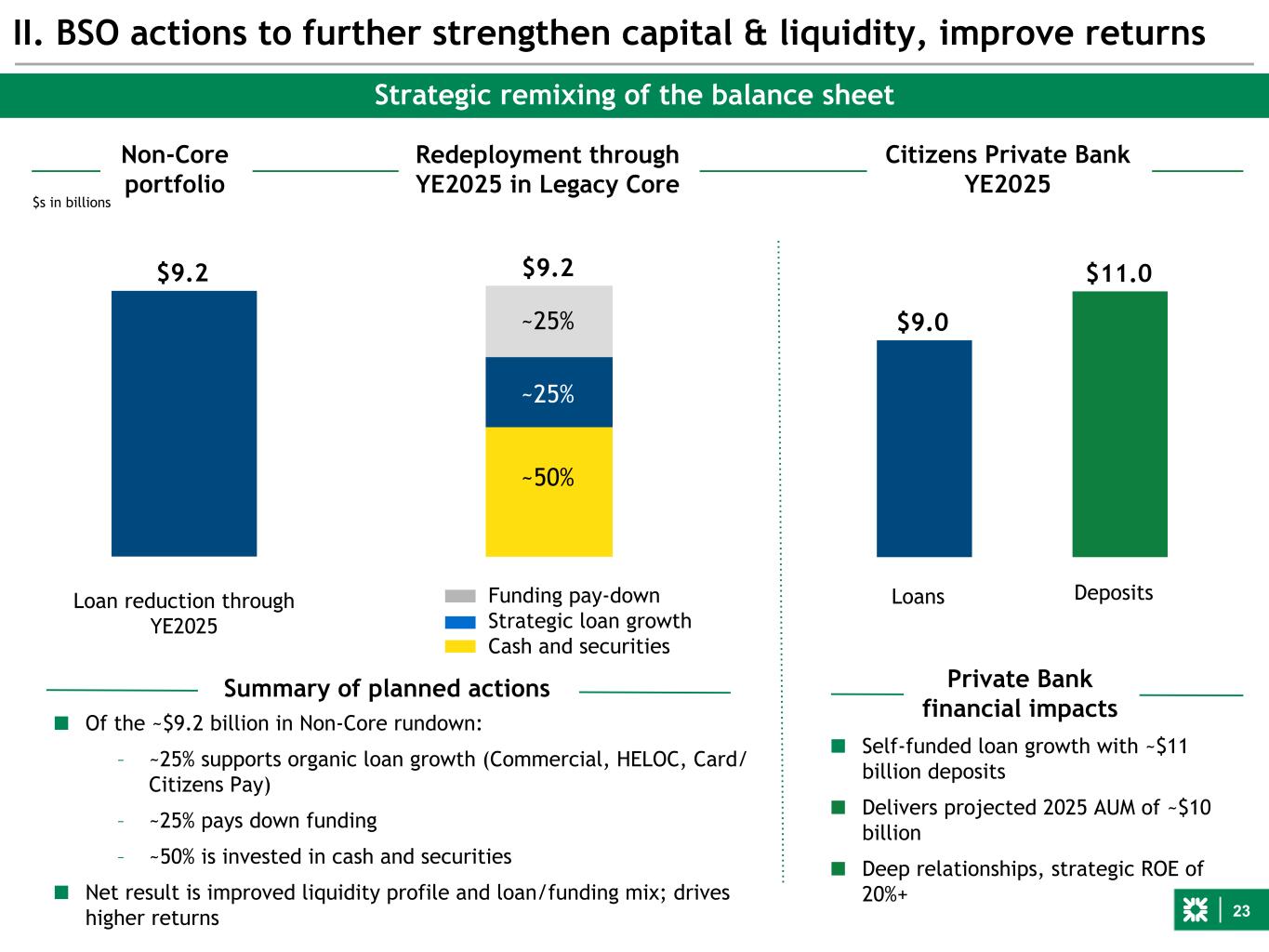

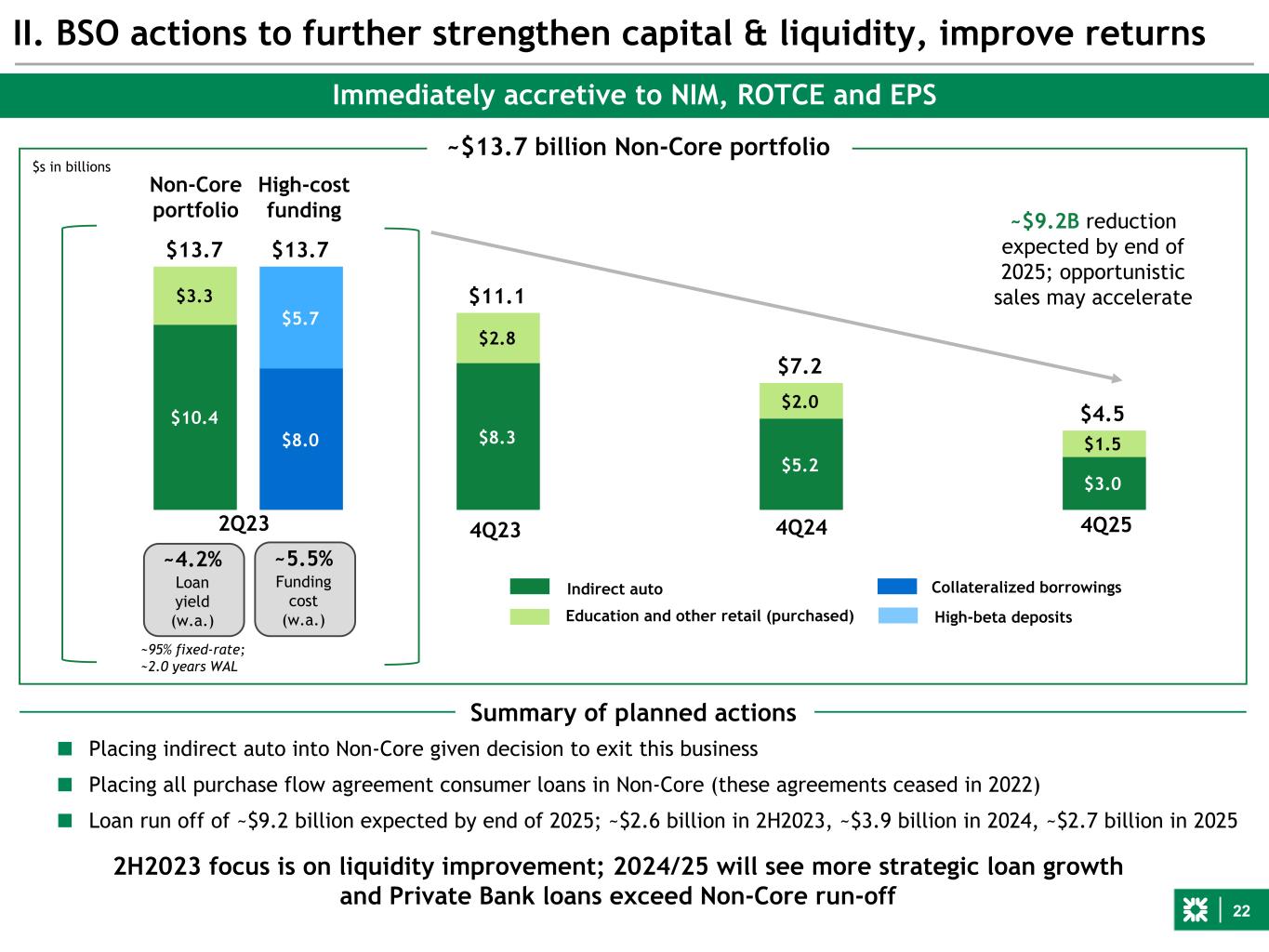

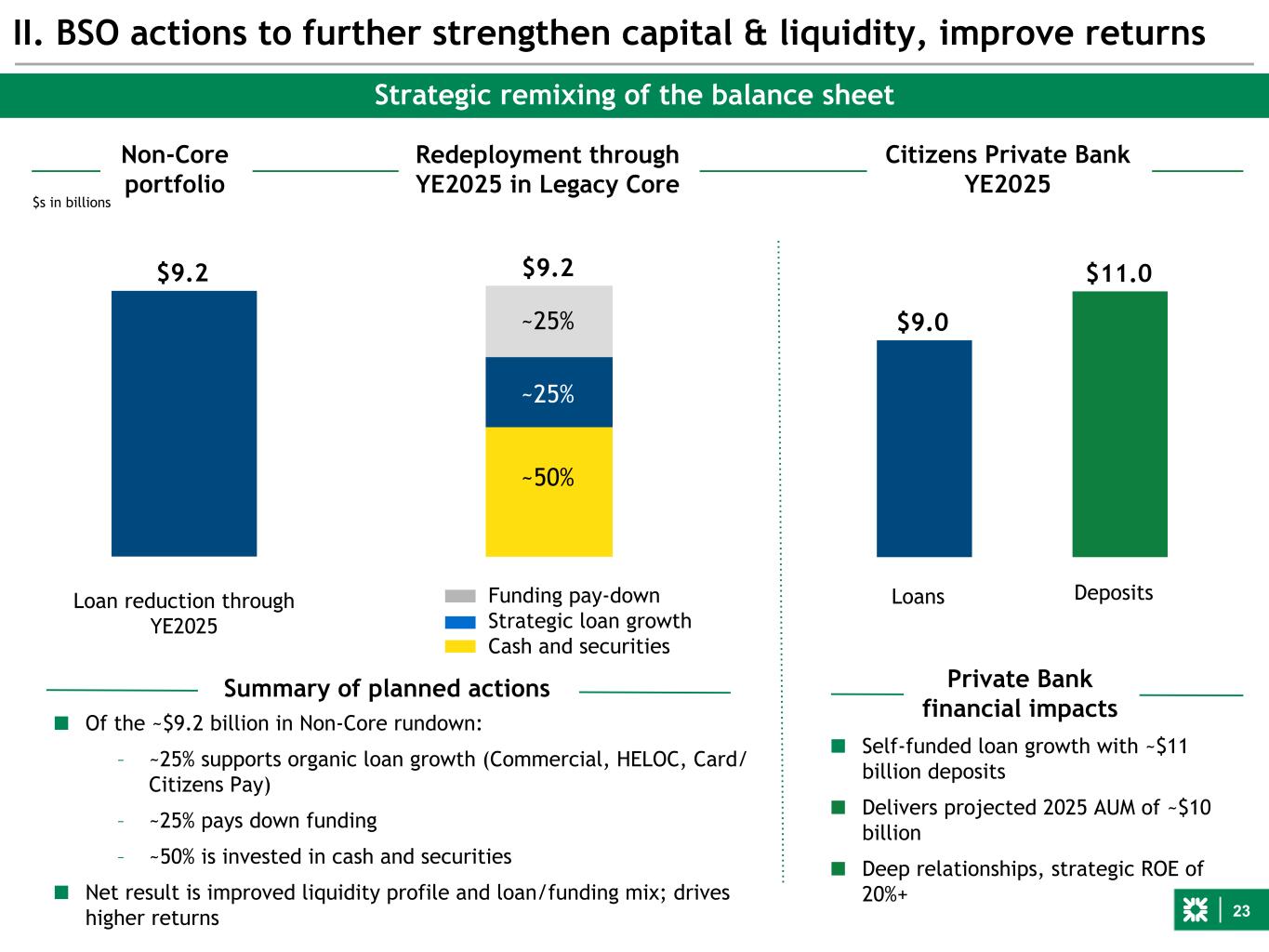

21 II. BSO actions to further strengthen capital & liquidity, improve returns We have been increasingly active in balance sheet optimization (BSO) strategies – Ongoing rotation of loan capital to deepen relationships – Sale of student loans (3Q20) – Sold non-strategic loans from ISBC acquisition (2022) – Exited indirect auto origination business; executed auto funding securitizations (2023) Given the increase in rates, plus the advent of quantitative tightening and heightened competition for deposits, we have crafted a BSO plan designed to: Key elements of BSO plan include: – Establishing a ~$14 billion Non-Core run-off portfolio (indirect auto, purchased consumer loans) and associated high-cost funding – Achieving a ~$9 billion run off by YE2025 – Non-Core assets are generating negative spread given funding from higher cost wholesale and deposits – Expenses and credit costs associated with the Non-Core portfolio will also decline over time – Run off will fund strategic loan growth (~25%), cash/securities investment (~50%), and funding reduction (~25%) – Driving deposit-funded loan growth in Citizens Private Bank of ~$9 billion by YE2025 (~$11 billion deposits, ~$10 billion AUM) Overall impacts expected to be meaningfully accretive to NIM, EPS, ROTCE – Lower our LDR towards 80%, bolster already strong LCR – Reduce wholesale funding and increase further our available liquidity – Focus on low cost Consumer deposit growth – Continue to remix loan portfolio to focus on deep relationship lending – Enhance ROTCE

22 $13.7 $11.1 $7.2 $4.5 $13.7 $10.4 $8.3 $5.2 $3.0 $3.3 $2.8 $2.0 $1.5$8.0 $5.7 II. BSO actions to further strengthen capital & liquidity, improve returns ~$9.2B reduction expected by end of 2025; opportunistic sales may accelerate Education and other retail (purchased) Non-Core portfolio High-cost funding ~4.2% Loan yield (w.a.) ~5.5% Funding cost (w.a.) ~$13.7 billion Non-Core portfolio Indirect auto High-beta deposits Collateralized borrowings ■ Placing indirect auto into Non-Core given decision to exit this business ■ Placing all purchase flow agreement consumer loans in Non-Core (these agreements ceased in 2022) ■ Loan run off of ~$9.2 billion expected by end of 2025; ~$2.6 billion in 2H2023, ~$3.9 billion in 2024, ~$2.7 billion in 2025 ~95% fixed-rate; ~2.0 years WAL Summary of planned actions Immediately accretive to NIM, ROTCE and EPS 2Q23 4Q23 4Q24 4Q25 2H2023 focus is on liquidity improvement; 2024/25 will see more strategic loan growth and Private Bank loans exceed Non-Core run-off $s in billions

23 II. BSO actions to further strengthen capital & liquidity, improve returns $9.0 $11.0$9.2 Private Bank financial impacts■ Of the ~$9.2 billion in Non-Core rundown: – ~25% supports organic loan growth (Commercial, HELOC, Card/ Citizens Pay) – ~25% pays down funding – ~50% is invested in cash and securities ■ Net result is improved liquidity profile and loan/funding mix; drives higher returns Summary of planned actions Non-Core portfolio Redeployment through YE2025 in Legacy Core Citizens Private Bank YE2025 ■ Self-funded loan growth with ~$11 billion deposits ■ Delivers projected 2025 AUM of ~$10 billion ■ Deep relationships, strategic ROE of 20%+ $s in billions Strategic remixing of the balance sheet Funding pay-down Strategic loan growth Cash and securities Loan reduction through YE2025 Loans Deposits $9.2 ~25% ~25% ~50%

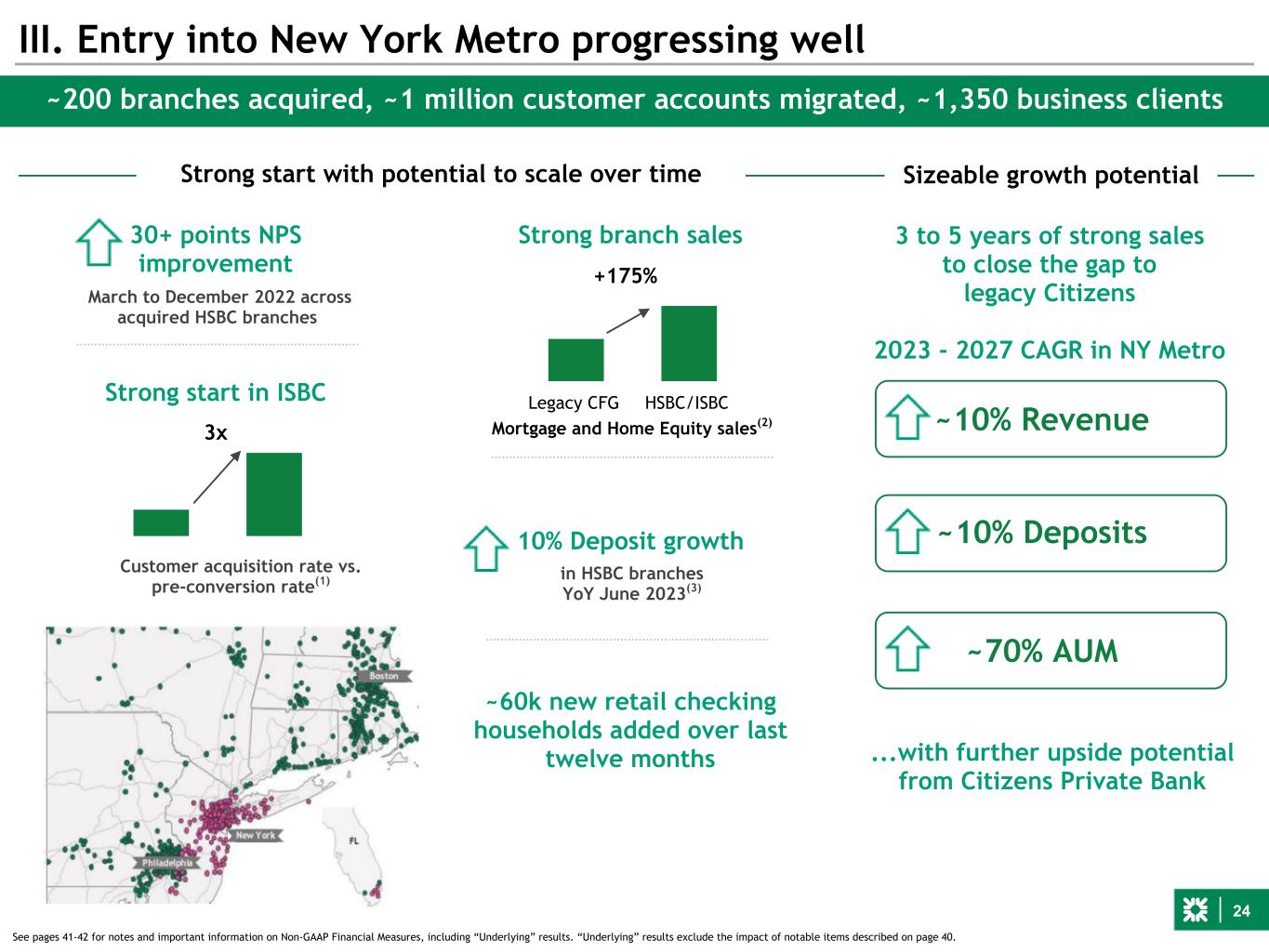

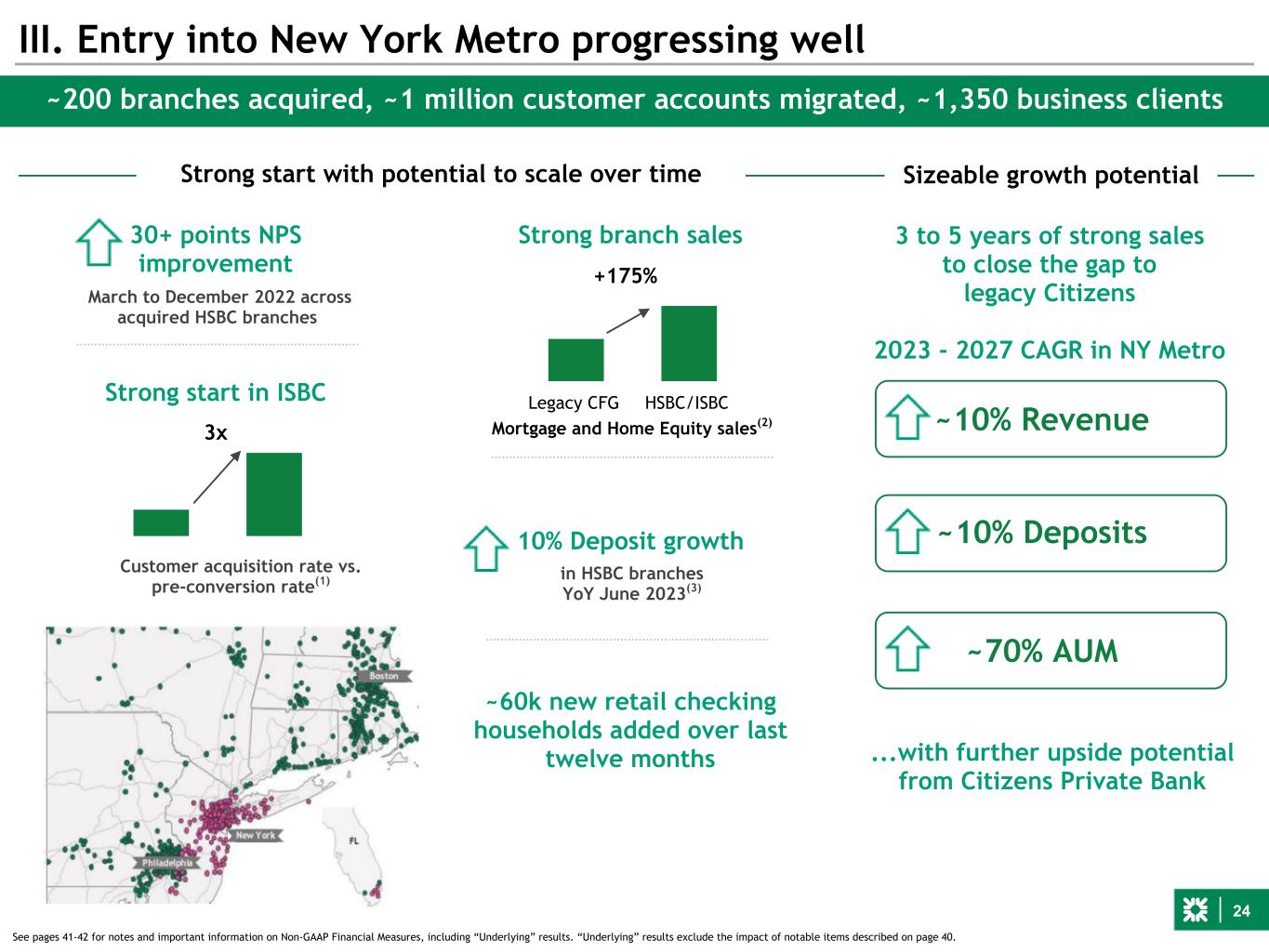

24 30+ points NPS improvement III. Entry into New York Metro progressing well 24 ~200 branches acquired, ~1 million customer accounts migrated, ~1,350 business clients Strong start with potential to scale over time in HSBC branches YoY June 2023(3) Customer acquisition rate vs. pre-conversion rate(1) March to December 2022 across acquired HSBC branches ~60k new retail checking households added over last twelve months Sizeable growth potential 10% Deposit growth Strong start in ISBC 3x ~10% Revenue ~10% Deposits ~70% AUM 3 to 5 years of strong sales to close the gap to legacy Citizens 2023 - 2027 CAGR in NY Metro ...with further upside potential from Citizens Private Bank Strong branch sales Legacy CFG HSBC/ISBC +175% Mortgage and Home Equity sales(2) See pages 41-42 for notes and important information on Non-GAAP Financial Measures, including “Underlying” results. “Underlying” results exclude the impact of notable items described on page 40.

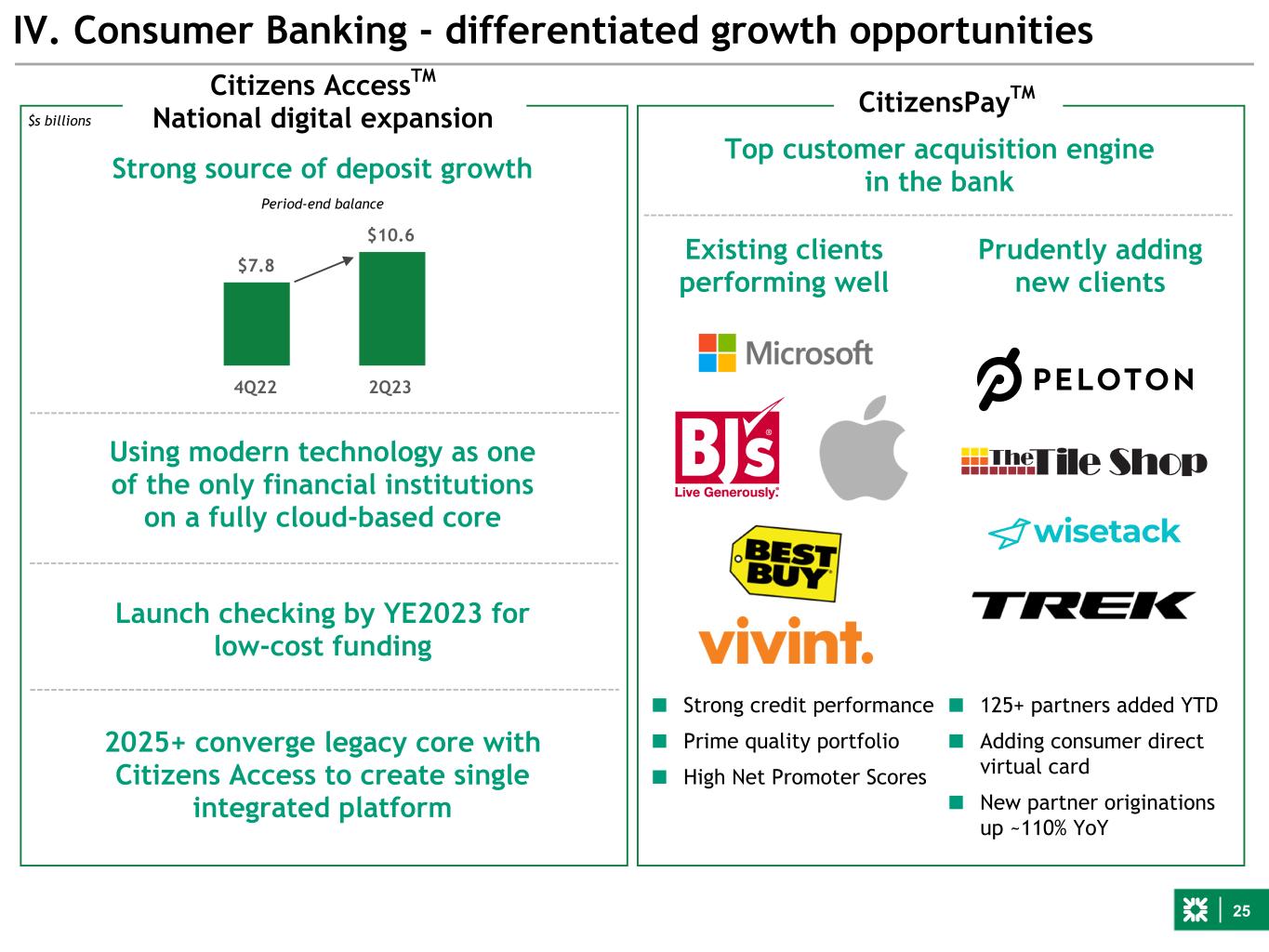

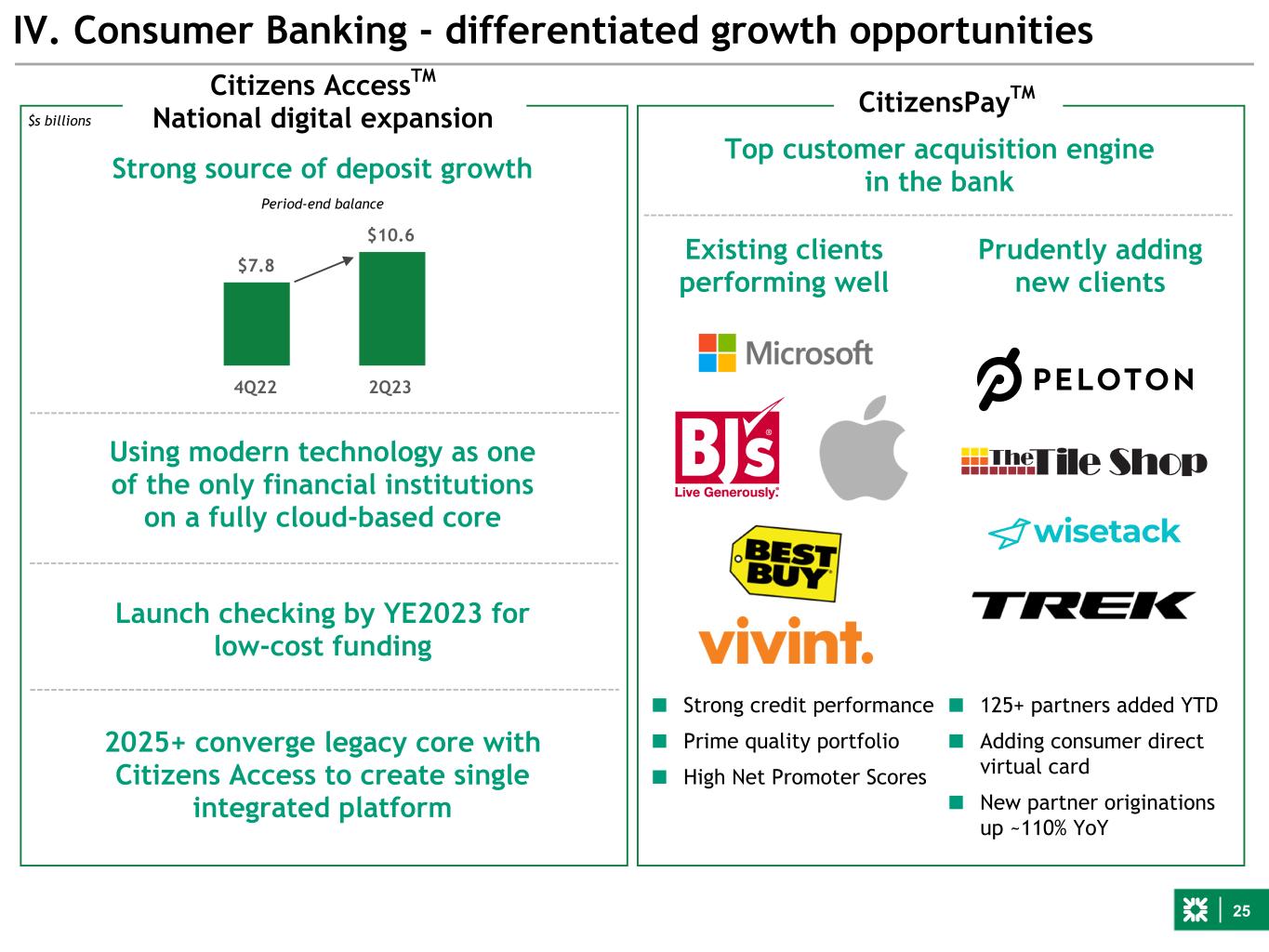

25 Using modern technology as one of the only financial institutions on a fully cloud-based core Launch checking by YE2023 for low-cost funding 2025+ converge legacy core with Citizens Access to create single integrated platform $7.8 $10.6 4Q22 2Q23 IV. Consumer Banking - differentiated growth opportunities CitizensPayTMCitizens AccessTM National digital expansion Existing clients performing well Prudently adding new clients Strong source of deposit growth $s billions Period-end balance ■ Strong credit performance ■ Prime quality portfolio ■ High Net Promoter Scores ■ 125+ partners added YTD ■ Adding consumer direct virtual card ■ New partner originations up ~110% YoY Top customer acquisition engine in the bank

26 Citizens serving Private Capital for 10 years Citizens has been cultivating distinctive capabilities to serve the Private Capital ecosystem ■ Consistent, dedicated strategy to serve the sponsor community ■ Significant investments in talent and capabilities, including five advisory acquisitions since 2017 ■ Steady multi-year gains in middle market & overall market ■ Effectively utilizing the balance sheet to maximize sponsor returns with capital call lines and fund leverage ■ New Private Bankers significantly expand sponsor relationships and capabilities V. Capturing the Private Capital opportunity Top 3 U.S. sponsor middle market bookrunner(1) 2017-2022 eclipsed prior six years by 79% $3.6 trillion Private Capital fundraising versus ~15% increase for U.S. corporates - 2018 to 2022 (versus prior 5-year period) ~33% increase in sponsor-driven Investment Banking fees ■ Strong financial sponsor relationships ■ Deep expertise in attractive verticals ■ Full debt and equity underwriting capabilities ■ High-touch M&A execution ■ Full-scope hedging capabilities ■ Capital call lines, cash management ■ Originate for distribution with low hold levels Poised to capitalize on coming wave of Private Capital activity Full life-cycle Private Capital capabilities A substantial and growing market ■ Deal activity muted for last year due to higher financing costs, disparate views on valuation and macro uncertainty ■ Many sponsors have not deployed meaningful amounts of capital for 12 months and counting ■ Increasing pent-up demand for M&A and capital markets activity pending more clarity on economic outlook Over the last six years, Private Capital fundraising has led to record deal formation, M&A activity and fees See pages 41-42 for notes and important information on Non-GAAP Financial Measures, including “Underlying” results. “Underlying” results exclude the impact of notable items described on page 40.

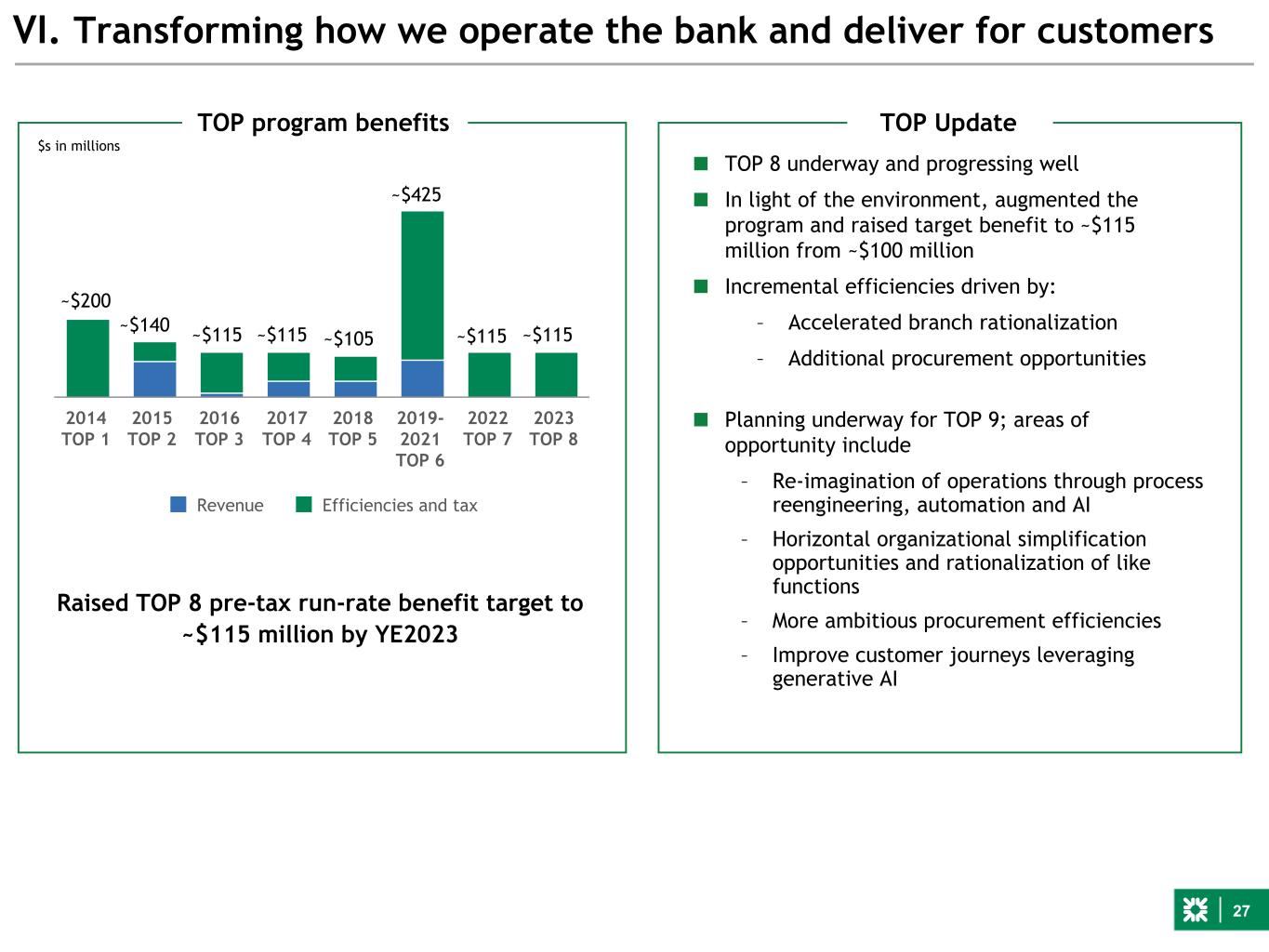

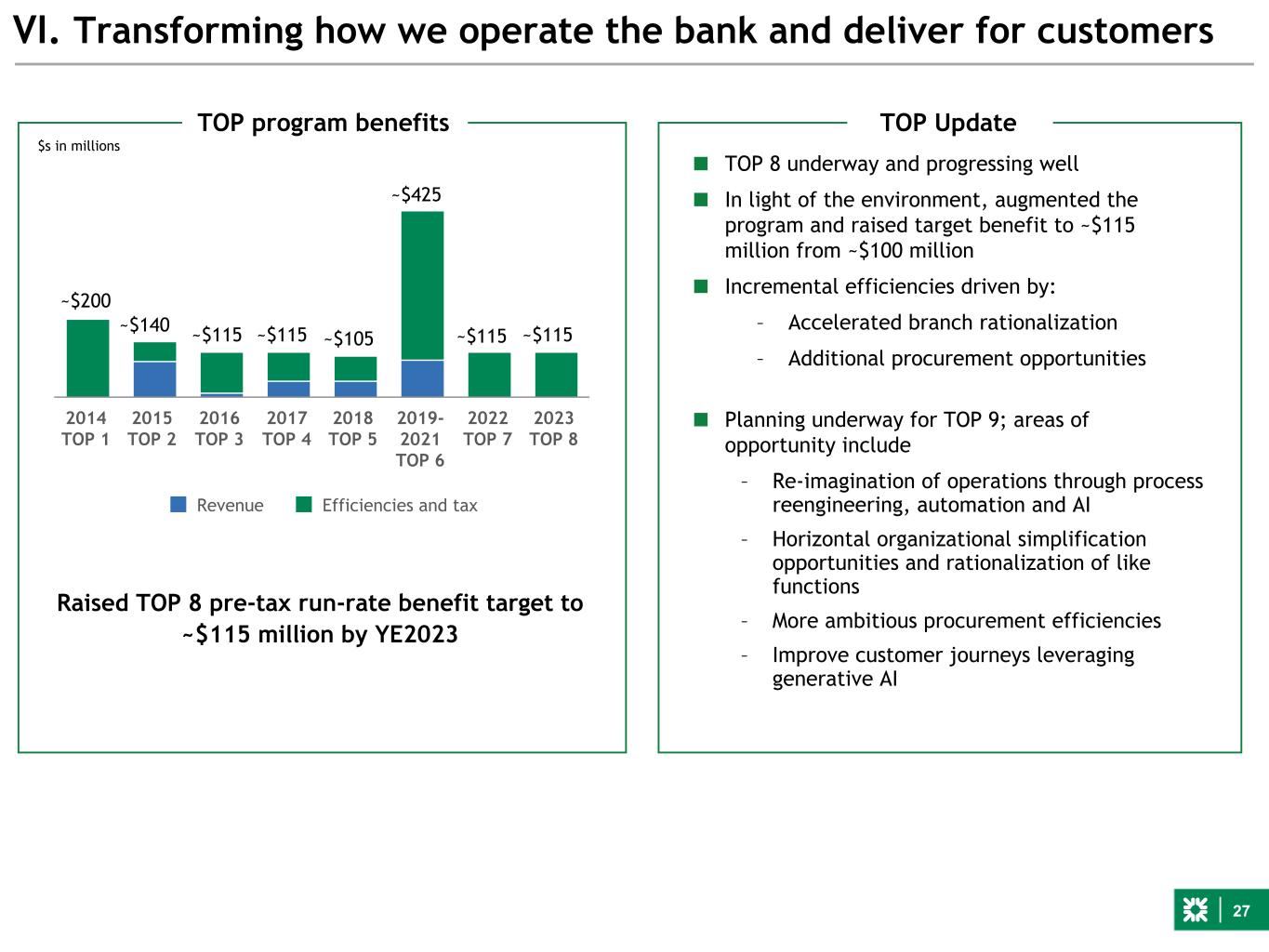

27 Revenue Efficiencies and tax 2014 TOP 1 2015 TOP 2 2016 TOP 3 2017 TOP 4 2018 TOP 5 2019- 2021 TOP 6 2022 TOP 7 2023 TOP 8 ~$200 VI. Transforming how we operate the bank and deliver for customers TOP program benefits TOP Update $s in millions ~$140 ~$115 ~$115 ~$105 ~$425 ~$115 ~$115 Raised TOP 8 pre-tax run-rate benefit target to ~$115 million by YE2023 ■ TOP 8 underway and progressing well ■ In light of the environment, augmented the program and raised target benefit to ~$115 million from ~$100 million ■ Incremental efficiencies driven by: – Accelerated branch rationalization – Additional procurement opportunities ■ Planning underway for TOP 9; areas of opportunity include – Re-imagination of operations through process reengineering, automation and AI – Horizontal organizational simplification opportunities and rationalization of like functions – More ambitious procurement efficiencies – Improve customer journeys leveraging generative AI

28 3Q23 outlook vs. 2Q23 See pages 41-42 for notes and important information on Non-GAAP Financial Measures, including “Underlying” results. “Underlying” results exclude the impact of notable items described on page 40. ■ Targeting low-to-mid-80s LDR by YE2023 ■ Expect terminal IBD beta of 49-50% – Expect NIM to begin to stabilize in Q4 assuming current market view of Fed rates ■ Citizens Private Bank build out impact to Underlying EPS of ~($0.06) in Q3 and ~($0.02-$0.04) in Q4 2Q23 Underlying(1) 3Q23 Underlying outlook excluding impact of Private Bank Net interest income $1,588MM Down ~4% Noninterest income $506MM Up ~3% Noninterest expense $1,233MM Broadly stable Net charge-offs 40 bps Broadly stable to up slightly CET1 ratio(2) 10.3% Up modestly including share repurchases Tax rate 22.5% ~22%

29 Investment thesis Citizens has a robust capital, liquidity and funding position – Committed to strengthening even further with BSO, including Non-Core strategy – Relative strength allows Citizens to take advantage of opportunities – Focused on deploying capital to best relationship/highest risk adjusted return areas – Flexibility to return capital to shareholders Citizens continues to have a series of unique initiatives that will lead to relative medium-term outperformance Citizens has performed well since the IPO given its sound strategy, capable & experienced leadership and a strong customer-focused culture – Track record of strong execution – Commitment to operating and financial discipline – Excellence in our capabilities, highly competitive with mega-banks and peers Citizens is poised to deliver mid-teens ROTCE through a challenging environment. Represents attractive opportunity for investors at current valuation – Well positioned in NYC metro to gain market share; performance tracking well – Citizens Private Bank launched to rapidly build Wealth presence – All other initiatives tracking well: Citizens PayTM, Citizens AccessTM, Private Capital, TOP 8

Appendix

31 Overall Satisfaction Top 2 Box score of 95%, remains at all time high for Commercial clients Forbes America's Best Banks Newsweek America's Best Loyalty Programs First half 2023 awards and recognition Euromoney’s Awards for Excellence 2023 Best Super-Regional Bank

32 Net income available to common shareholders and EPS $s in millions, except per share data ê4% $898 $861 1Q23 2Q23 Linked-quarter Underlying results(1) Return on average total tangible assets Return on average tangible common equity Average loans $s in billions Average deposits $s in billions ê2% $3.5 2 $3.5 6 ê5% $156.5 $153.7 1Q23 2Q23 $174.4 $173.2 1Q23 2Q23 1.06% 0.99% 1Q23 2Q23 15.8% 13.9% 1Q23 2Q23 $537 $497 $1.10 $1.04 1Q23 2Q23 ê7% Pre-provision profit $s in millions See pages 41-42 for notes and important information on Non-GAAP Financial Measures, including “Underlying” results. “Underlying” results exclude the impact of notable items described on page 40. ê187 bps ê7 bps ê1%

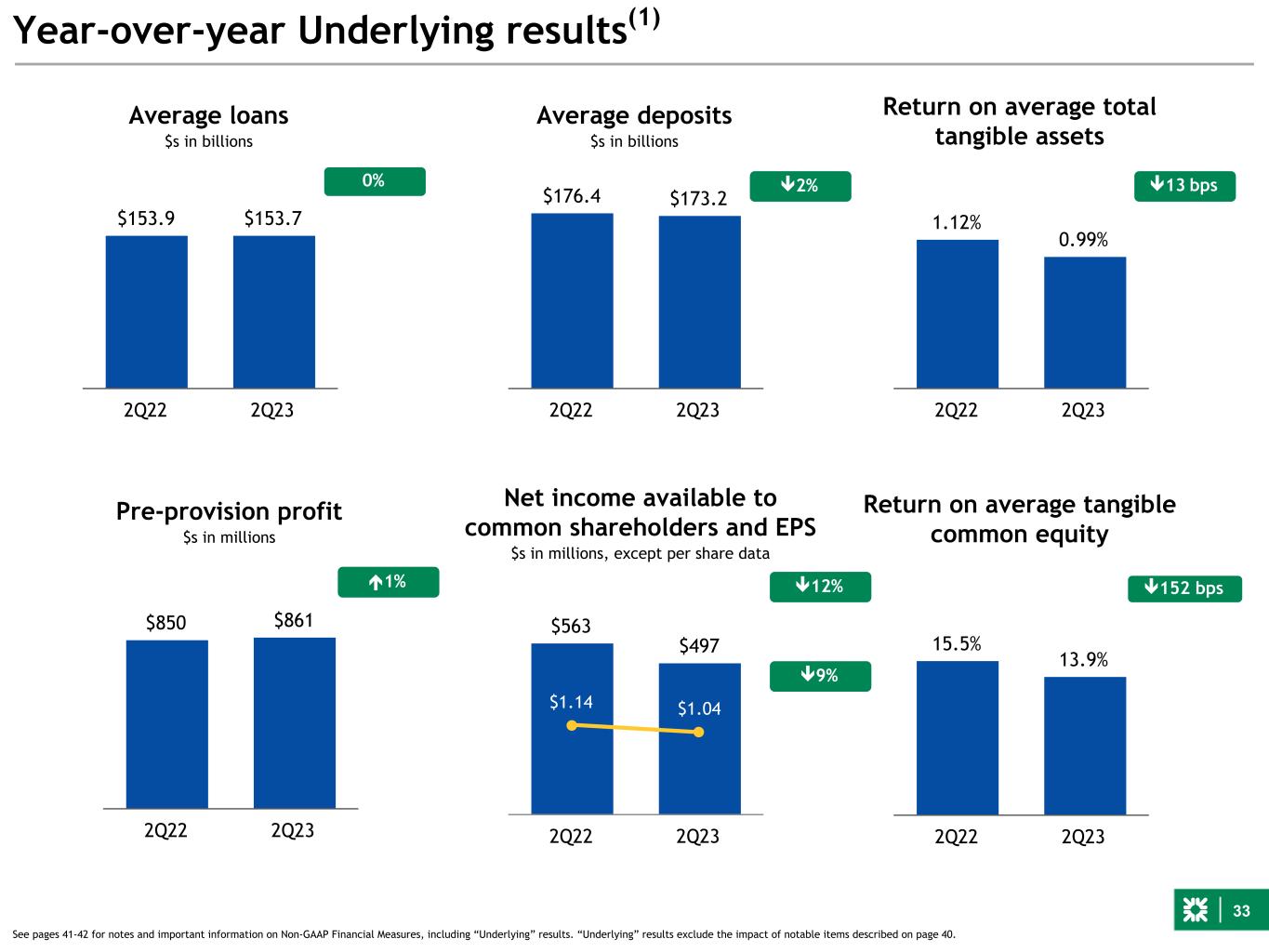

33 $850 $861 2Q22 2Q23 Year-over-year Underlying results(1) Return on average total tangible assets é1% Average loans $s in billions 0% Net income available to common shareholders and EPS $s in millions, except per share data Return on average tangible common equity Average deposits $s in billions $3.5 2 ê13 bps $3.5 6 $153.9 $153.7 2Q22 2Q23 $176.4 $173.2 2Q22 2Q23 1.12% 0.99% 2Q22 2Q23 15.5% 13.9% 2Q22 2Q23 ê2% Pre-provision profit $s in millions ê152 bps $563 $497 $1.14 $1.04 2Q22 2Q23 See pages 41-42 for notes and important information on Non-GAAP Financial Measures, including “Underlying” results. “Underlying” results exclude the impact of notable items described on page 40. ê9% ê12%

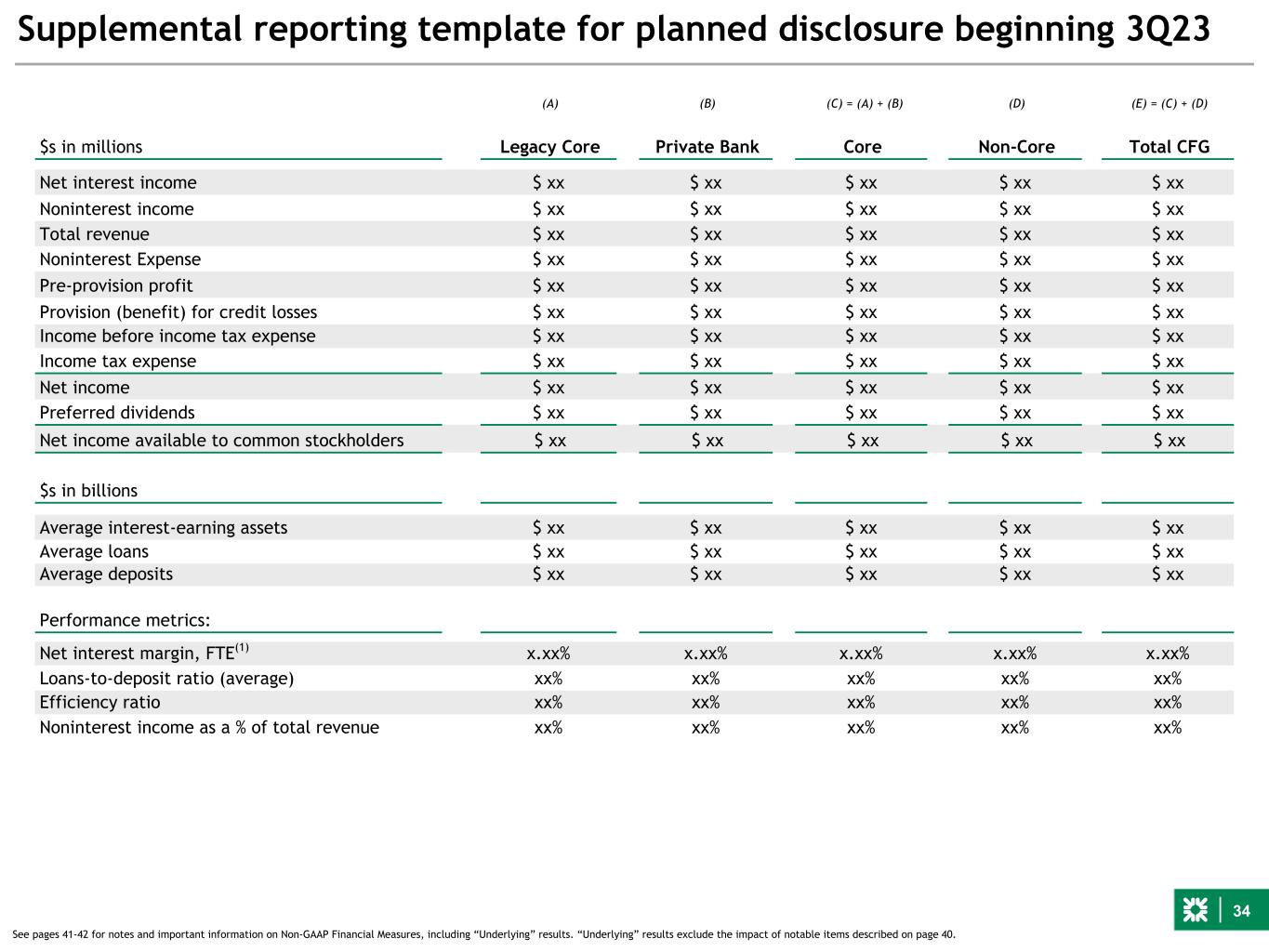

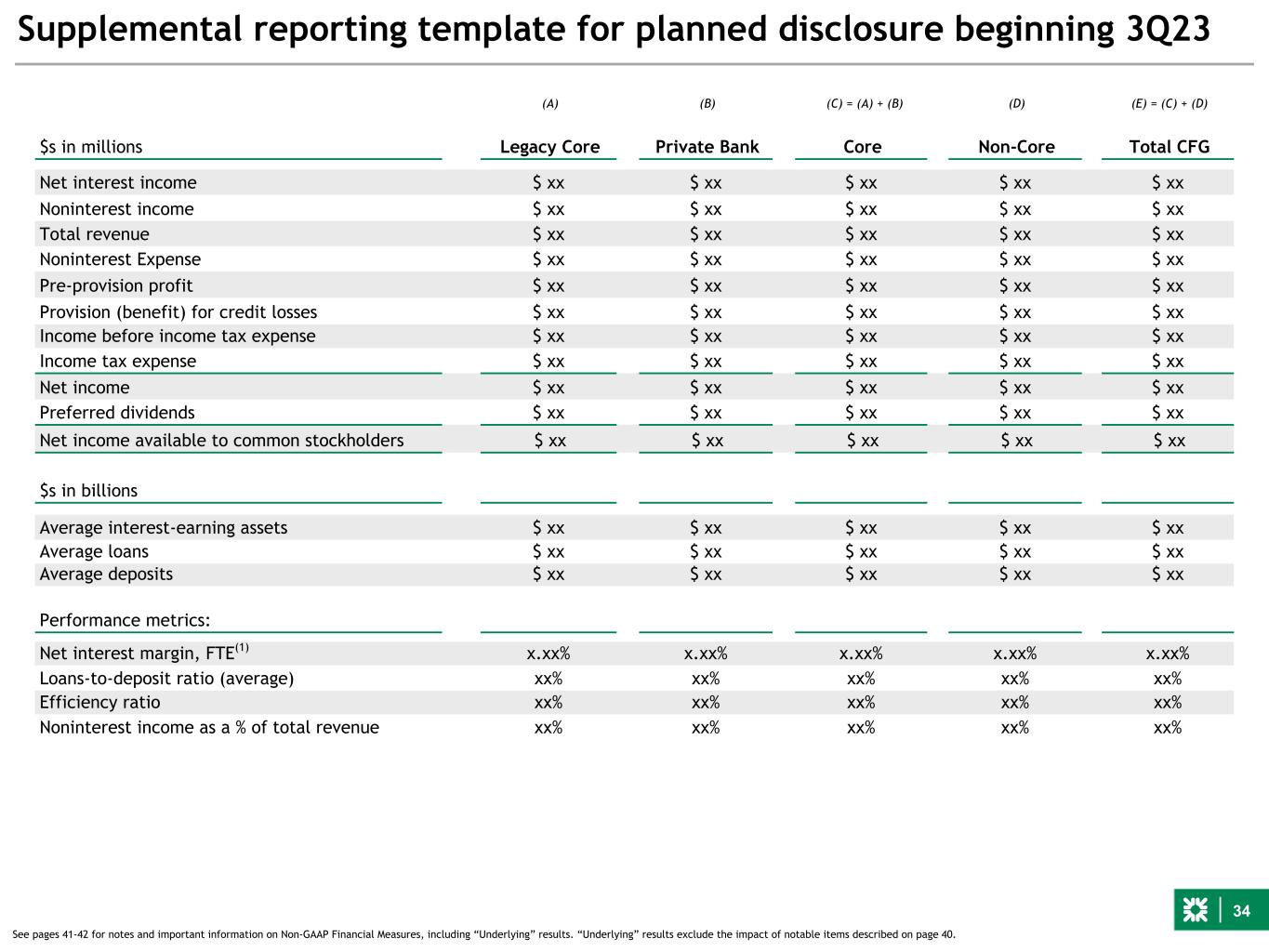

34 Supplemental reporting template for planned disclosure beginning 3Q23 (A) (B) (C) = (A) + (B) (D) (E) = (C) + (D) $s in millions Legacy Core Private Bank Core Non-Core Total CFG Net interest income $ xx $ xx $ xx $ xx $ xx Noninterest income $ xx $ xx $ xx $ xx $ xx Total revenue $ xx $ xx $ xx $ xx $ xx Noninterest Expense $ xx $ xx $ xx $ xx $ xx Pre-provision profit $ xx $ xx $ xx $ xx $ xx Provision (benefit) for credit losses $ xx $ xx $ xx $ xx $ xx Income before income tax expense $ xx $ xx $ xx $ xx $ xx Income tax expense $ xx $ xx $ xx $ xx $ xx Net income $ xx $ xx $ xx $ xx $ xx Preferred dividends $ xx $ xx $ xx $ xx $ xx Net income available to common stockholders $ xx $ xx $ xx $ xx $ xx $s in billions Average interest-earning assets $ xx $ xx $ xx $ xx $ xx Average loans $ xx $ xx $ xx $ xx $ xx Average deposits $ xx $ xx $ xx $ xx $ xx Performance metrics: Net interest margin, FTE(1) x.xx% x.xx% x.xx% x.xx% x.xx% Loans-to-deposit ratio (average) xx% xx% xx% xx% xx% Efficiency ratio xx% xx% xx% xx% xx% Noninterest income as a % of total revenue xx% xx% xx% xx% xx% See pages 41-42 for notes and important information on Non-GAAP Financial Measures, including “Underlying” results. “Underlying” results exclude the impact of notable items described on page 40.

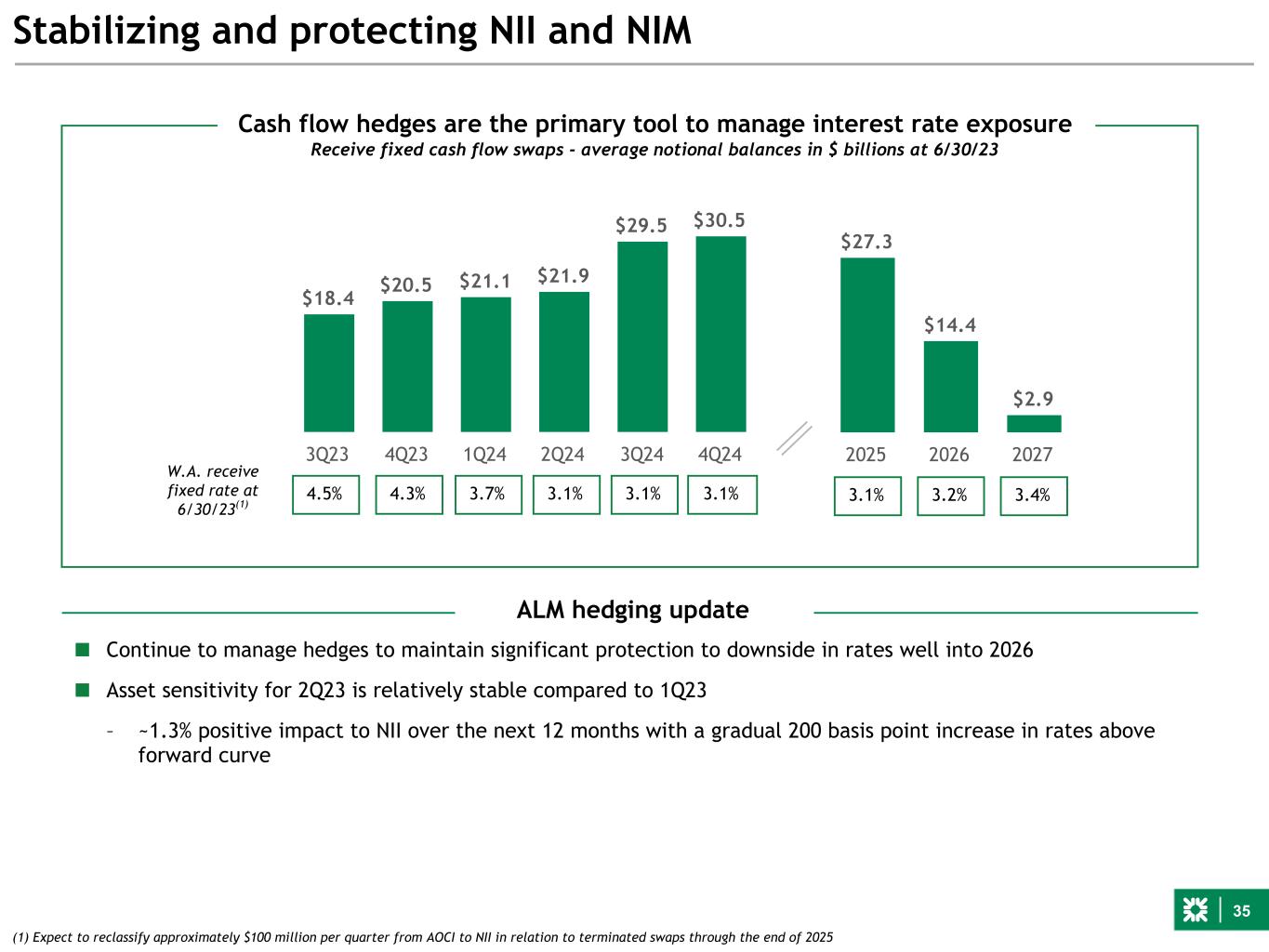

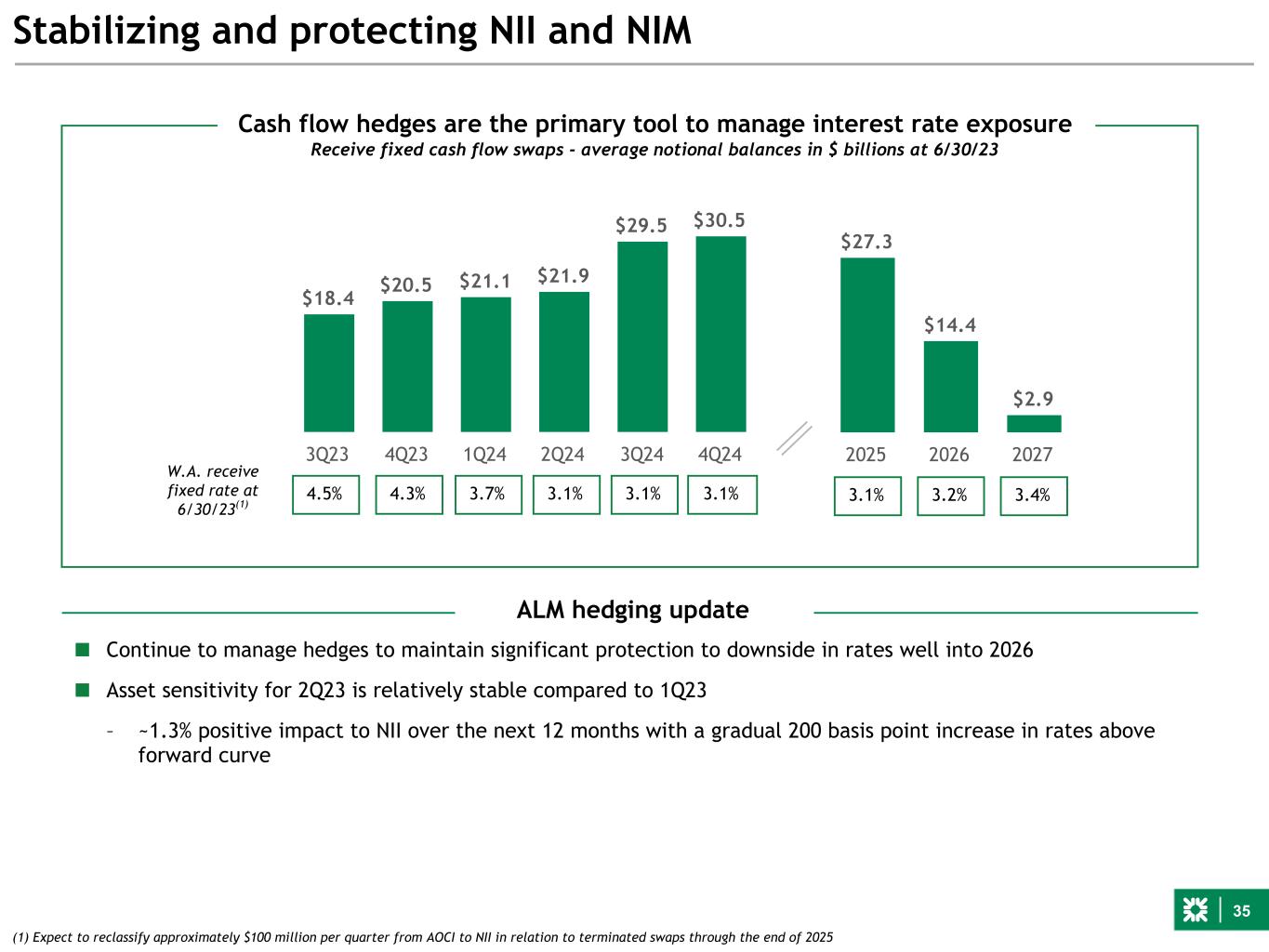

35 (1) Expect to reclassify approximately $100 million per quarter from AOCI to NII in relation to terminated swaps through the end of 2025 Stabilizing and protecting NII and NIM $27.3 $14.4 $2.9 2025 2026 2027 Cash flow hedges are the primary tool to manage interest rate exposure Receive fixed cash flow swaps - average notional balances in $ billions at 6/30/23 W.A. receive fixed rate at 6/30/23(1) 3.1% 3.2% $18.4 $20.5 $21.1 $21.9 $29.5 $30.5 3Q23 4Q23 1Q24 2Q24 3Q24 4Q24 3.1%3.1%3.1%3.7%4.3%4.5% 3.4% ALM hedging update ■ Continue to manage hedges to maintain significant protection to downside in rates well into 2026 ■ Asset sensitivity for 2Q23 is relatively stable compared to 1Q23 – ~1.3% positive impact to NII over the next 12 months with a gradual 200 basis point increase in rates above forward curve

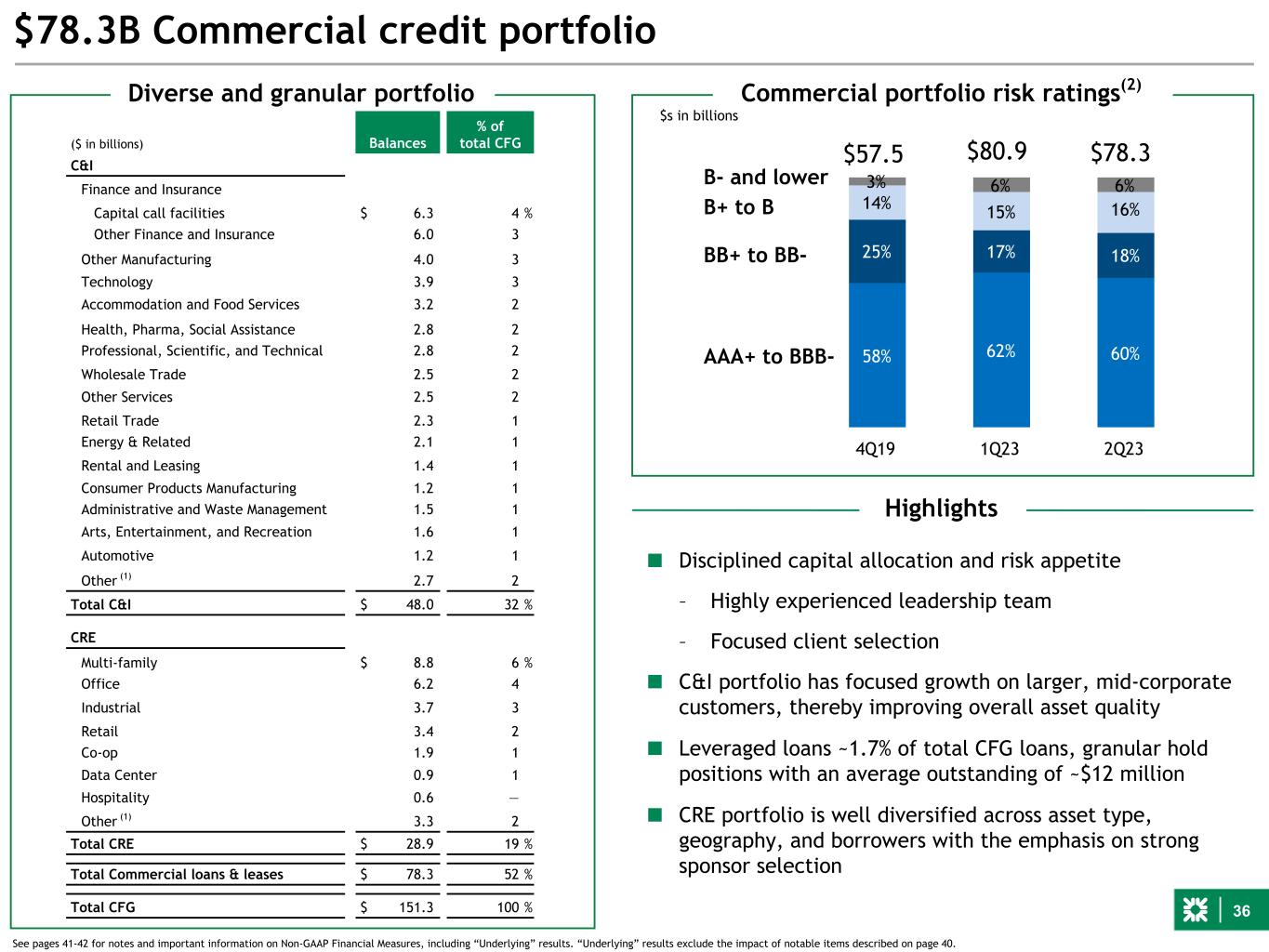

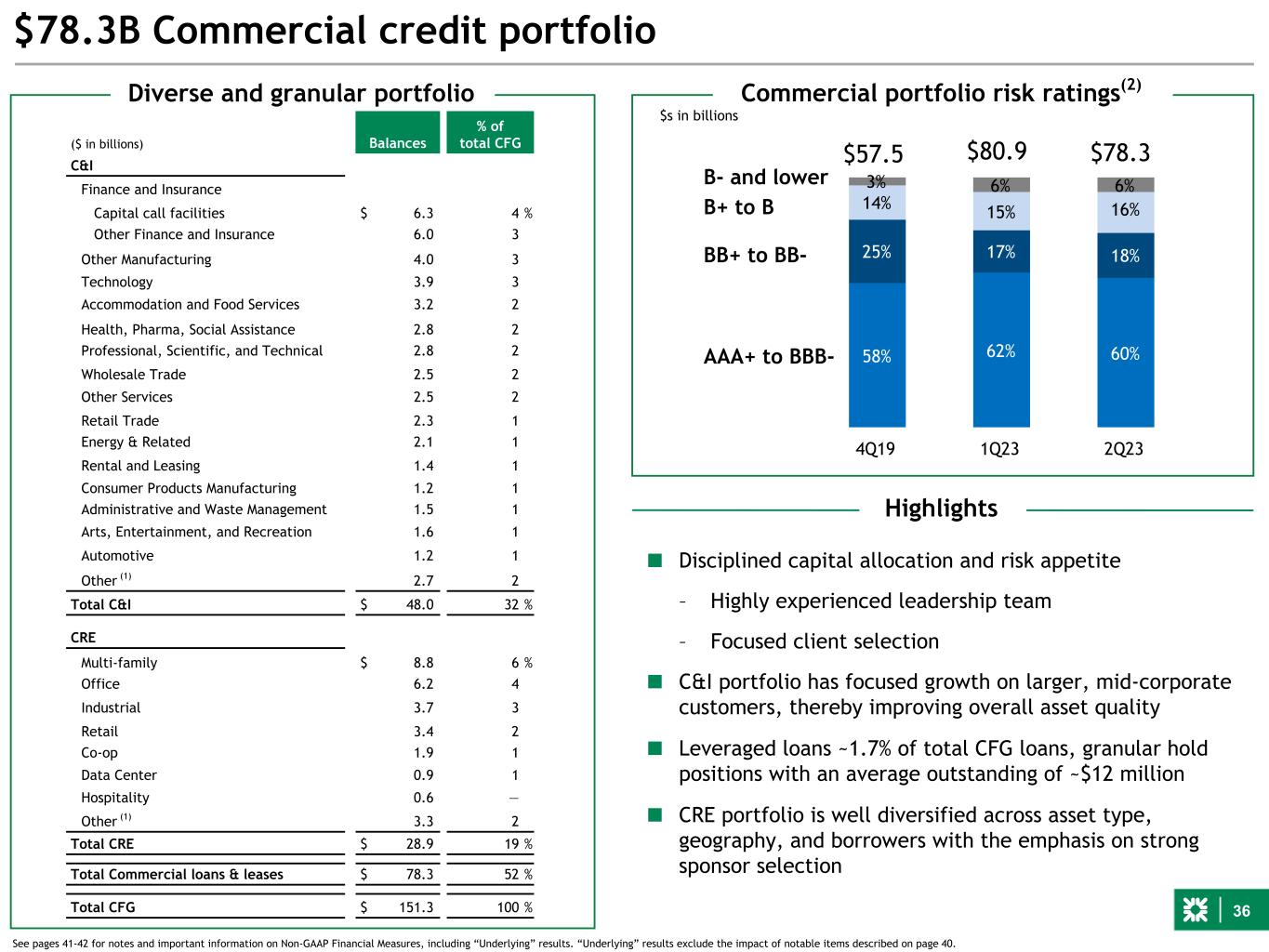

36 $78.3B Commercial credit portfolio See pages 41-42 for notes and important information on Non-GAAP Financial Measures, including “Underlying” results. “Underlying” results exclude the impact of notable items described on page 40. Commercial portfolio risk ratings(2) $s in billions 58% 62% 60% 25% 17% 18% 14% 15% 16% 3% 6% 6% 4Q19 1Q23 2Q23 B- and lower B+ to B BB+ to BB- AAA+ to BBB- $57.5 $78.3 Highlights $80.9($ in billions) Balances % of total CFG C&I Finance and Insurance Capital call facilities $ 6.3 4 % Other Finance and Insurance 6.0 3 Other Manufacturing 4.0 3 Technology 3.9 3 Accommodation and Food Services 3.2 2 Health, Pharma, Social Assistance 2.8 2 Professional, Scientific, and Technical 2.8 2 Wholesale Trade 2.5 2 Other Services 2.5 2 Retail Trade 2.3 1 Energy & Related 2.1 1 Rental and Leasing 1.4 1 Consumer Products Manufacturing 1.2 1 Administrative and Waste Management 1.5 1 Arts, Entertainment, and Recreation 1.6 1 Automotive 1.2 1 Other (1) 2.7 2 Total C&I $ 48.0 32 % CRE Multi-family $ 8.8 6 % Office 6.2 4 Industrial 3.7 3 Retail 3.4 2 Co-op 1.9 1 Data Center 0.9 1 Hospitality 0.6 — Other (1) 3.3 2 Total CRE $ 28.9 19 % Total Commercial loans & leases $ 78.3 52 % Total CFG $ 151.3 100 % Diverse and granular portfolio ■ Disciplined capital allocation and risk appetite – Highly experienced leadership team – Focused client selection ■ C&I portfolio has focused growth on larger, mid-corporate customers, thereby improving overall asset quality ■ Leveraged loans ~1.7% of total CFG loans, granular hold positions with an average outstanding of ~$12 million ■ CRE portfolio is well diversified across asset type, geography, and borrowers with the emphasis on strong sponsor selection

37 38% 42% 43% 33% 32% 32% 18% 16% 16% 5% 5% 4%6% 5% 5% 4Q19 1Q23 2Q23 42% 19% 15% 4% 13% 7% $73.0B Retail credit portfolio See pages 41-42 for notes and important information on Non-GAAP Financial Measures, including “Underlying” results. “Underlying” results exclude the impact of notable items described on page 40. 800+ 740-799 680-739 640-679 <640 $61.6 $73.0 $s in billions Retail portfolio FICOs(2) $73.8 Home equity Retail loans(1) Residential mortgages Auto Education - in school Education - refinance Other retail ~94% of retail portfolio > 680 Super-prime/prime* ~76% of retail portfolio Secured ■ Mortgage – FICO ~785 – Weighted-average LTV of ~55% ■ Home equity – FICO ~765 – ~40% secured by 1st lien – ~96% CLTV less than 80% – ~85% CLTV less than 70% ■ Auto – FICO ~740 – Weighted-average LTV of ~78% ■ Education – FICO ~785 ■ Other retail: – Credit card – FICO ~735 – Citizens PayTM – FICO ~725; incorporates loss sharing High quality, diverse portfolio '* Super-prime/prime defined as FICO of 680 or above at origination

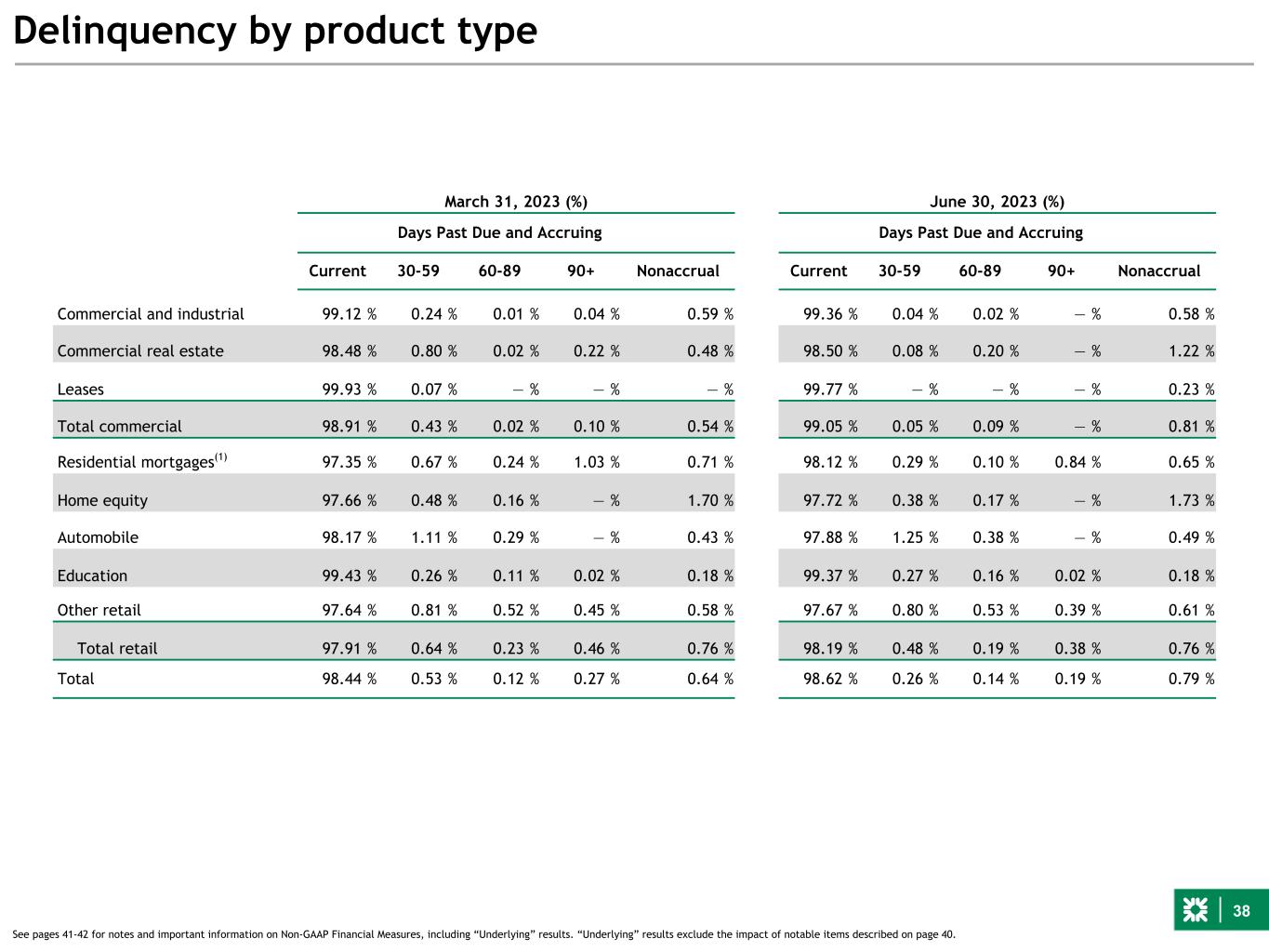

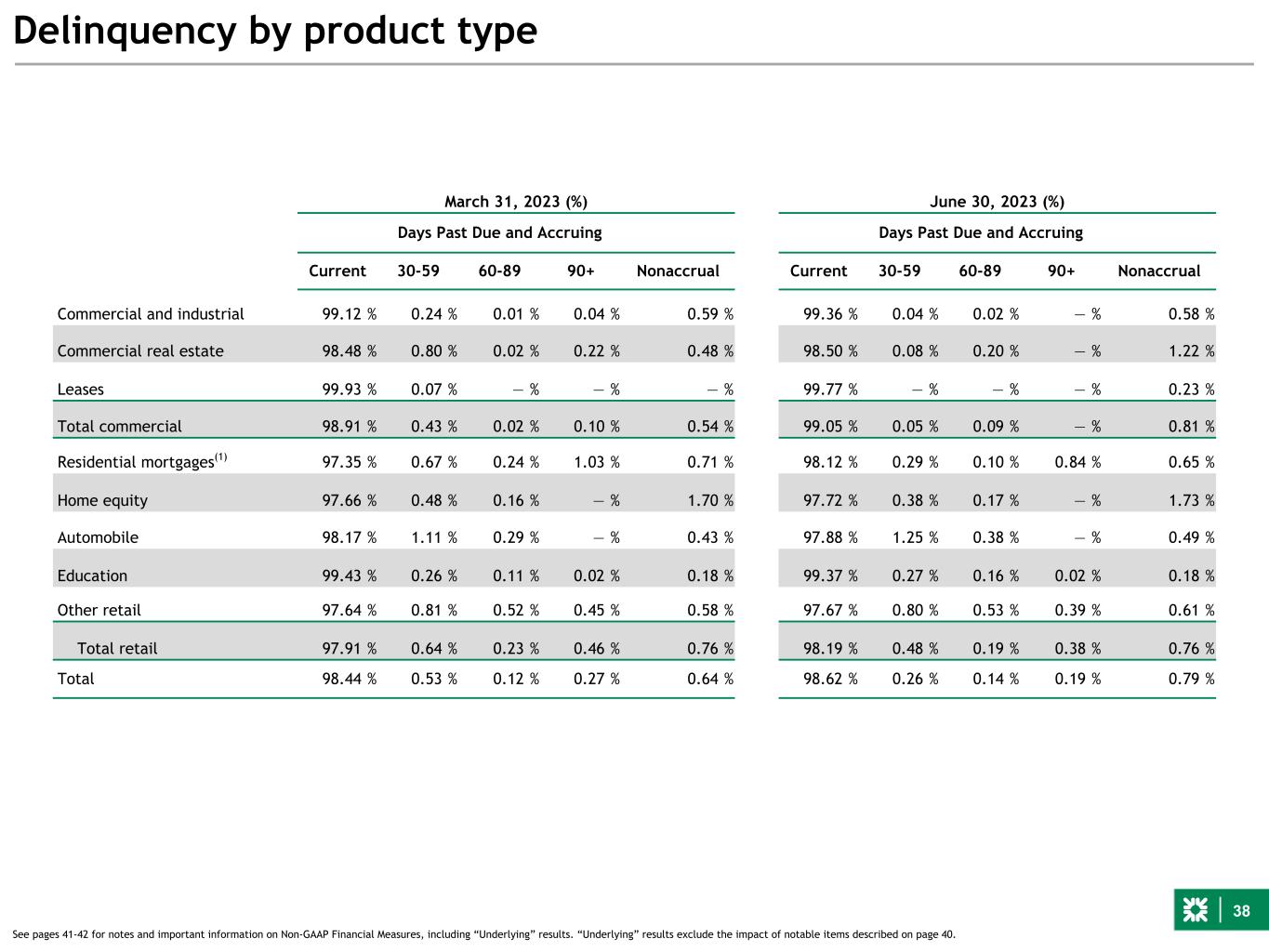

38 Delinquency by product type See pages 41-42 for notes and important information on Non-GAAP Financial Measures, including “Underlying” results. “Underlying” results exclude the impact of notable items described on page 40. March 31, 2023 (%) June 30, 2023 (%) Days Past Due and Accruing Days Past Due and Accruing Current 30-59 60-89 90+ Nonaccrual Current 30-59 60-89 90+ Nonaccrual Commercial and industrial 99.12 % 0.24 % 0.01 % 0.04 % 0.59 % 99.36 % 0.04 % 0.02 % — % 0.58 % Commercial real estate 98.48 % 0.80 % 0.02 % 0.22 % 0.48 % 98.50 % 0.08 % 0.20 % — % 1.22 % Leases 99.93 % 0.07 % — % — % — % 99.77 % — % — % — % 0.23 % Total commercial 98.91 % 0.43 % 0.02 % 0.10 % 0.54 % 99.05 % 0.05 % 0.09 % — % 0.81 % Residential mortgages(1) 97.35 % 0.67 % 0.24 % 1.03 % 0.71 % 98.12 % 0.29 % 0.10 % 0.84 % 0.65 % Home equity 97.66 % 0.48 % 0.16 % — % 1.70 % 97.72 % 0.38 % 0.17 % — % 1.73 % Automobile 98.17 % 1.11 % 0.29 % — % 0.43 % 97.88 % 1.25 % 0.38 % — % 0.49 % Education 99.43 % 0.26 % 0.11 % 0.02 % 0.18 % 99.37 % 0.27 % 0.16 % 0.02 % 0.18 % Other retail 97.64 % 0.81 % 0.52 % 0.45 % 0.58 % 97.67 % 0.80 % 0.53 % 0.39 % 0.61 % Total retail 97.91 % 0.64 % 0.23 % 0.46 % 0.76 % 98.19 % 0.48 % 0.19 % 0.38 % 0.76 % Total 98.44 % 0.53 % 0.12 % 0.27 % 0.64 % 98.62 % 0.26 % 0.14 % 0.19 % 0.79 %

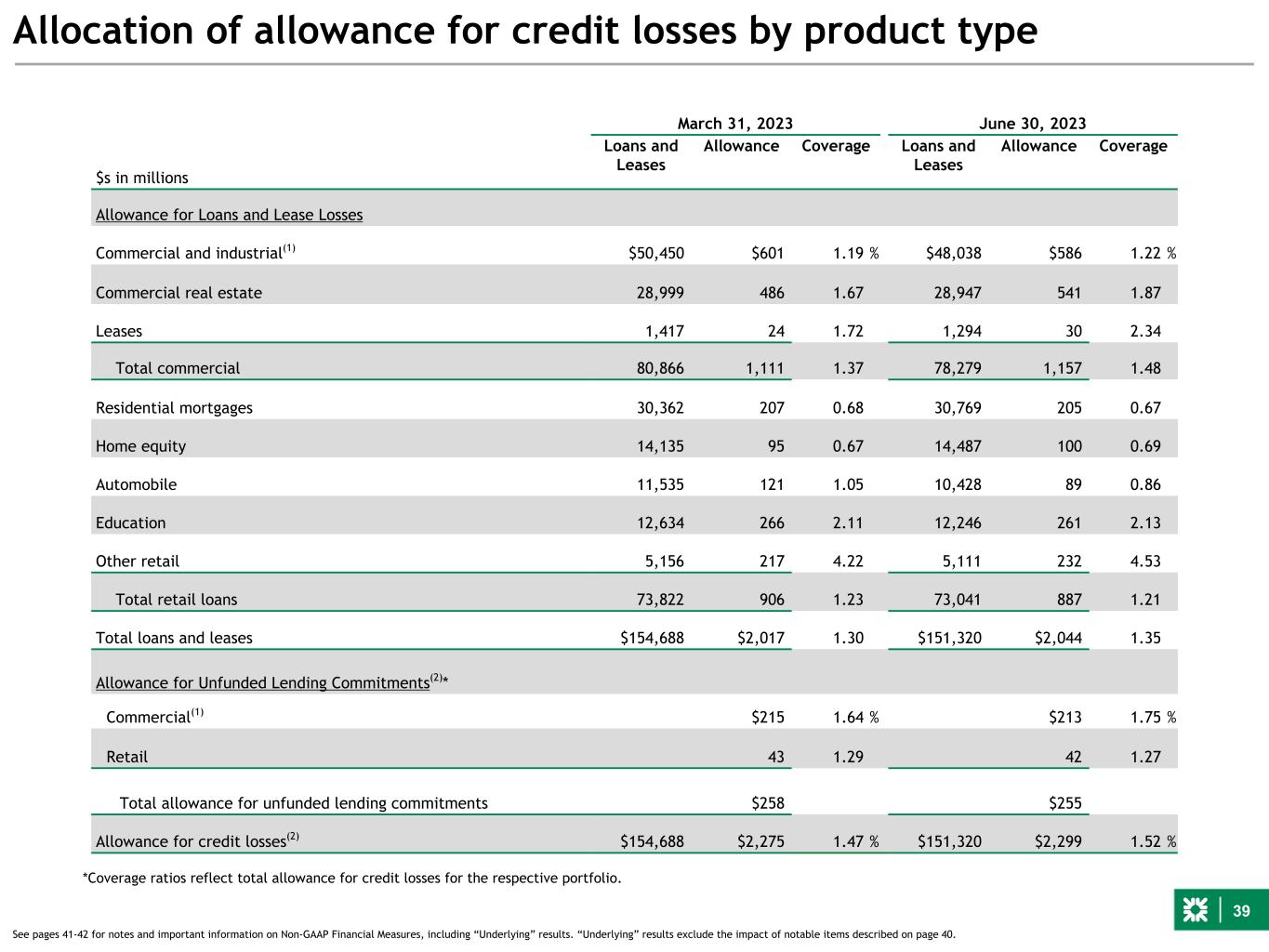

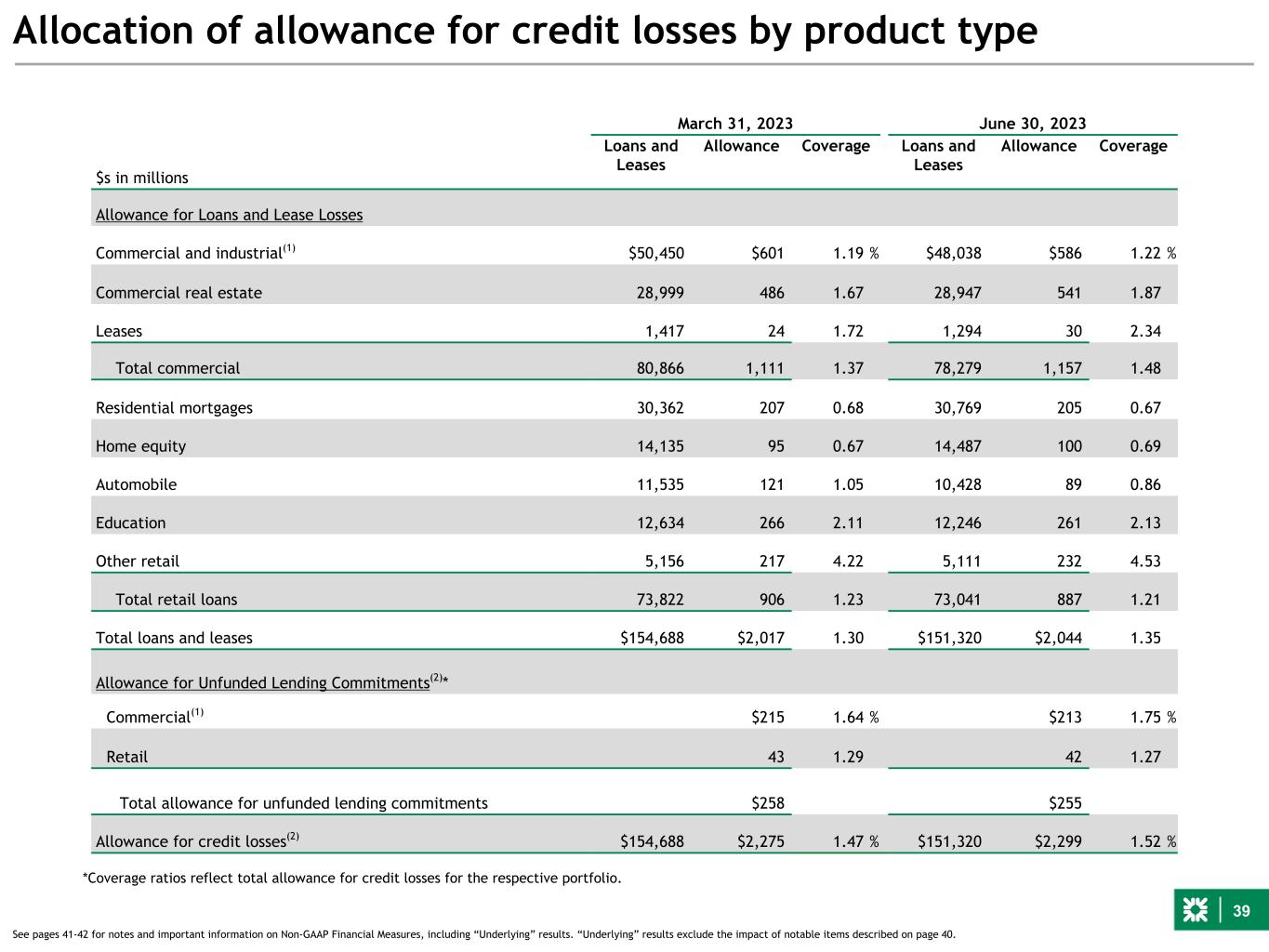

39 Allocation of allowance for credit losses by product type March 31, 2023 June 30, 2023 $s in millions Loans and Leases Allowance Coverage Loans and Leases Allowance Coverage Allowance for Loans and Lease Losses Commercial and industrial(1) $50,450 $601 1.19 % $48,038 $586 1.22 % Commercial real estate 28,999 486 1.67 28,947 541 1.87 Leases 1,417 24 1.72 1,294 30 2.34 Total commercial 80,866 1,111 1.37 78,279 1,157 1.48 Residential mortgages 30,362 207 0.68 30,769 205 0.67 Home equity 14,135 95 0.67 14,487 100 0.69 Automobile 11,535 121 1.05 10,428 89 0.86 Education 12,634 266 2.11 12,246 261 2.13 Other retail 5,156 217 4.22 5,111 232 4.53 Total retail loans 73,822 906 1.23 73,041 887 1.21 Total loans and leases $154,688 $2,017 1.30 $151,320 $2,044 1.35 Allowance for Unfunded Lending Commitments(2)* Commercial(1) $215 1.64 % $213 1.75 % Retail 43 1.29 42 1.27 Total allowance for unfunded lending commitments $258 $255 Allowance for credit losses(2) $154,688 $2,275 1.47 % $151,320 $2,299 1.52 % *Coverage ratios reflect total allowance for credit losses for the respective portfolio. See pages 41-42 for notes and important information on Non-GAAP Financial Measures, including “Underlying” results. “Underlying” results exclude the impact of notable items described on page 40.

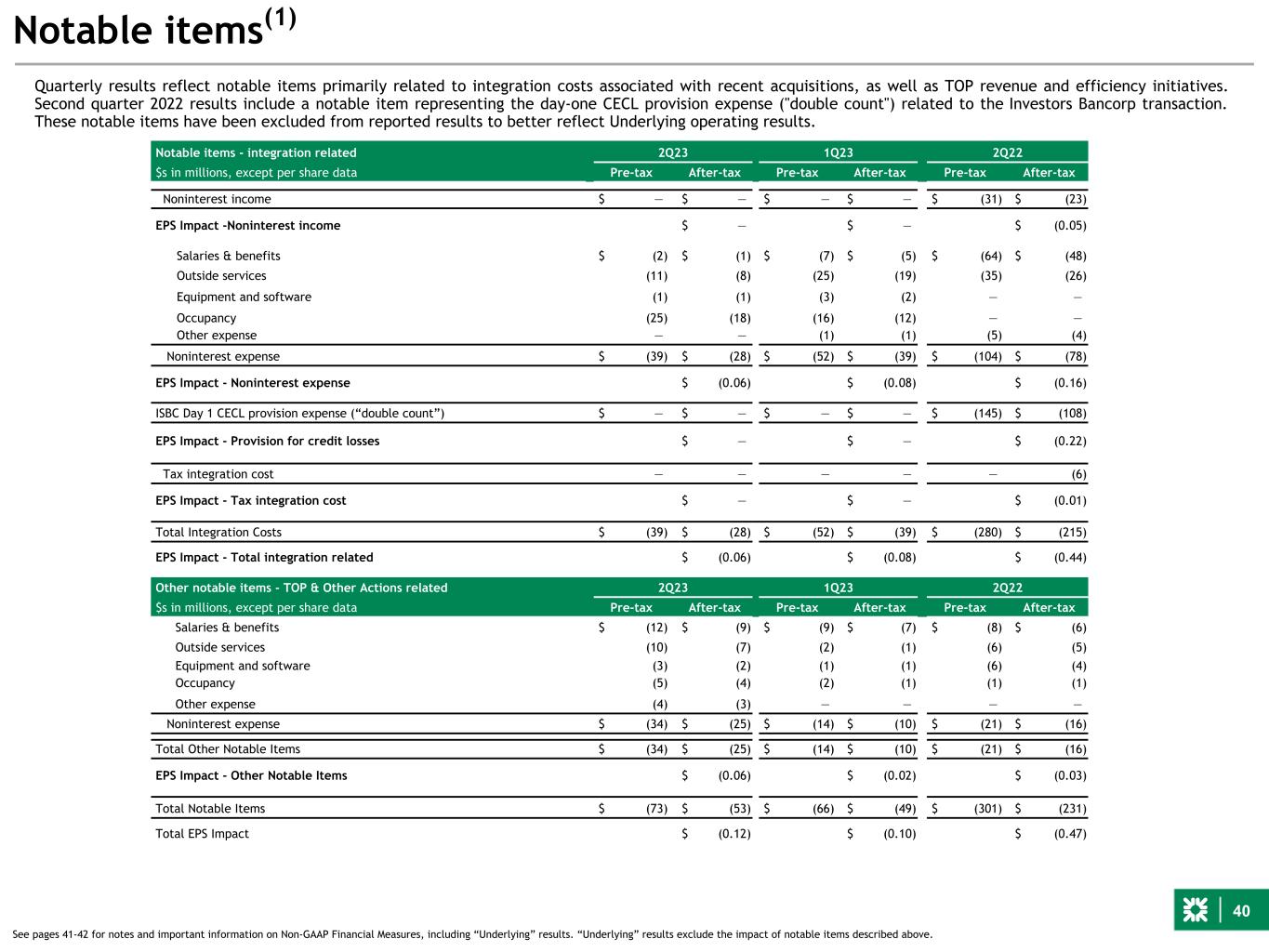

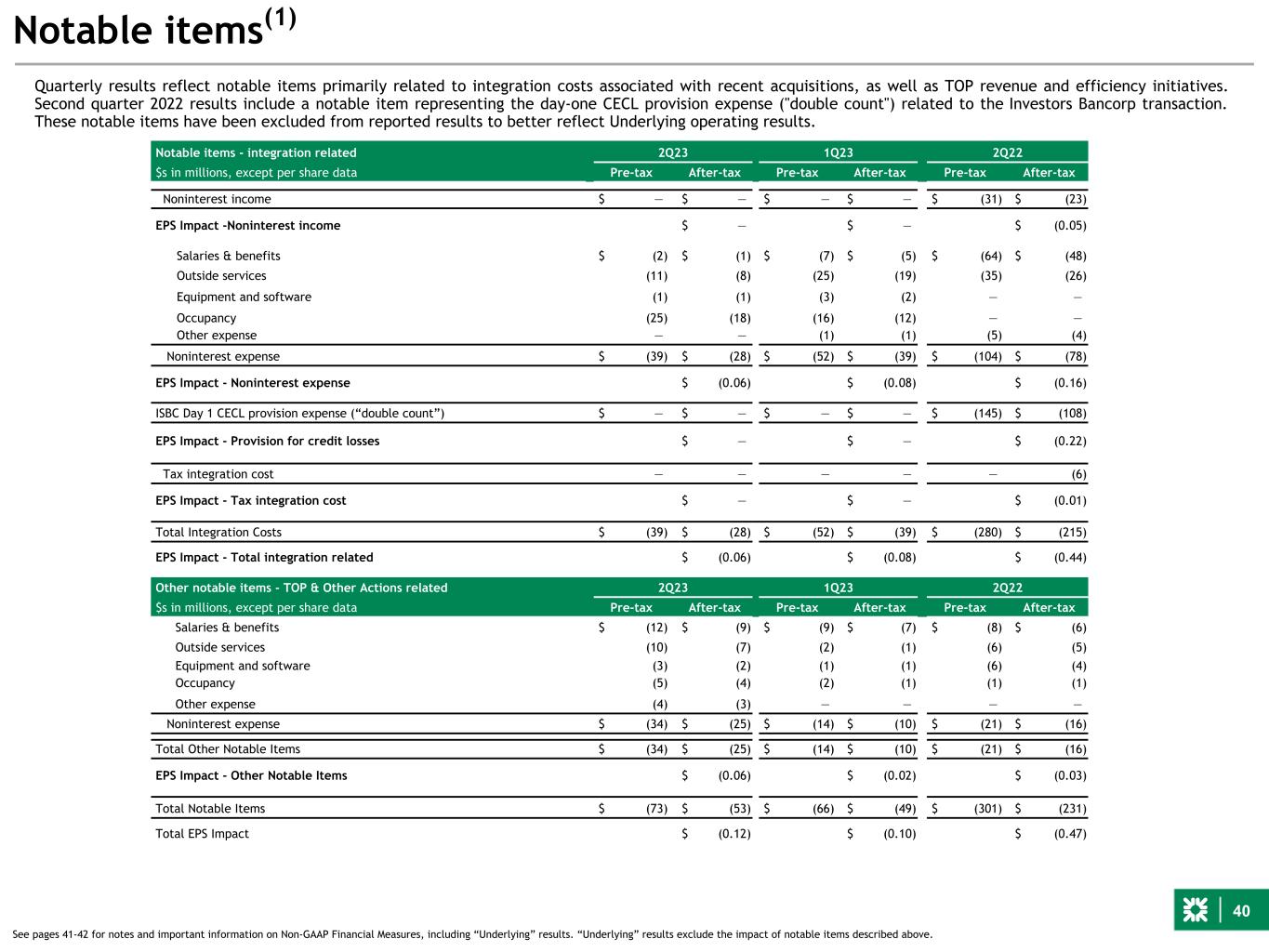

40 Notable items(1) Quarterly results reflect notable items primarily related to integration costs associated with recent acquisitions, as well as TOP revenue and efficiency initiatives. Second quarter 2022 results include a notable item representing the day-one CECL provision expense ("double count") related to the Investors Bancorp transaction. These notable items have been excluded from reported results to better reflect Underlying operating results. See pages 41-42 for notes and important information on Non-GAAP Financial Measures, including “Underlying” results. “Underlying” results exclude the impact of notable items described above. Notable items - integration related 2Q23 1Q23 2Q22 $s in millions, except per share data Pre-tax After-tax Pre-tax After-tax Pre-tax After-tax Noninterest income $ — $ — $ — $ — $ (31) $ (23) EPS Impact -Noninterest income $ — $ — $ (0.05) Salaries & benefits $ (2) $ (1) $ (7) $ (5) $ (64) $ (48) Outside services (11) (8) (25) (19) (35) (26) Equipment and software (1) (1) (3) (2) — — Occupancy (25) (18) (16) (12) — — Other expense — — (1) (1) (5) (4) Noninterest expense $ (39) $ (28) $ (52) $ (39) $ (104) $ (78) EPS Impact - Noninterest expense $ (0.06) $ (0.08) $ (0.16) ISBC Day 1 CECL provision expense (“double count”) $ — $ — $ — $ — $ (145) $ (108) EPS Impact - Provision for credit losses $ — $ — $ (0.22) Tax integration cost — — — — — (6) EPS Impact - Tax integration cost $ — $ — $ (0.01) Total Integration Costs $ (39) $ (28) $ (52) $ (39) $ (280) $ (215) EPS Impact - Total integration related $ (0.06) $ (0.08) $ (0.44) Other notable items - TOP & Other Actions related 2Q23 1Q23 2Q22 $s in millions, except per share data Pre-tax After-tax Pre-tax After-tax Pre-tax After-tax Salaries & benefits $ (12) $ (9) $ (9) $ (7) $ (8) $ (6) Outside services (10) (7) (2) (1) (6) (5) Equipment and software (3) (2) (1) (1) (6) (4) Occupancy (5) (4) (2) (1) (1) (1) Other expense (4) (3) — — — — Noninterest expense $ (34) $ (25) $ (14) $ (10) $ (21) $ (16) Total Other Notable Items $ (34) $ (25) $ (14) $ (10) $ (21) $ (16) EPS Impact - Other Notable Items $ (0.06) $ (0.02) $ (0.03) Total Notable Items $ (73) $ (53) $ (66) $ (49) $ (301) $ (231) Total EPS Impact $ (0.12) $ (0.10) $ (0.47)

41 Notes on Non-GAAP Financial Measures See important information on our use of Non-GAAP Financial Measures at the beginning this presentation and reconciliations to GAAP financial measures at the end of this presentation. Non-GAAP measures are herein defined as Underlying results. Where there is a reference to Underlying results in a paragraph or table, all measures that follow these references are on the same basis, when applicable. Allowance coverage ratios for loans and leases includes the allowance for funded loans and leases in the numerator and funded loans and leases in the denominator. Allowance coverage ratios for credit losses includes the allowance for funded loans and leases and allowance for unfunded lending commitments in the numerator and funded loans and leases in the denominator. General Notes a. References to net interest margin are on a fully taxable equivalent ("FTE") basis. b. Throughout this presentation, references to consolidated and/or commercial loans and loan growth include leases. Loans held for sale are also referred to as LHFS. c. Select totals may not sum due to rounding. d. Based on Basel III standardized approach. Capital Ratios are preliminary. e. Throughout this presentation, reference to balance sheet items are on an average basis and loans exclude held for sale unless otherwise noted. Notes Notes on slide 3 - 2Q23 GAAP financial summary 1) See general note a). Notes on slide 4 - 2Q23 Underlying financial summary 1) See note on non-GAAP financial measures. Notes on slide 5 - Overview 1) See note on non-GAAP financial measures. 2) See general note d). Notes on slide 7 - Noninterest income 1) See above note on non-GAAP financial measures. See Notable Items slide 40 for more detail. 2) Includes bank-owned life insurance income and other miscellaneous income for all periods presented. Notes on slide 8 - Noninterest expense 1) See above note on non-GAAP financial measures. See Notable Items slide 40 for more detail. Notes on slide 11 - Highly diversified and retail-oriented deposit base 1) Estimated based on available company disclosures. 2) Includes collateralized state and municipal balances and excludes bank and nonbank subsidiaries. Notes on slide 12 - Credit quality overview 1) See note on non-GAAP financial measures. 2) Allowance for credit losses to nonperforming loans and leases. Notes on slide 16 - Capital remains strong 1) See general note d). 2) For regulatory capital purposes, we have elected to delay the estimated impact of CECL on regulatory capital for a two-year period ended December 31,2021, followed by a three-year transition period ending December 31, 2024. As of December 31, 2021, the modified CECL transition amount was $384 million and is being transitioned out of regulatory capital over a three-year period. 3) See general note c). Notes on slide 17 - Maintaining a strong absolute and relative capital position 1) Peer data sourced from 1Q company disclosures. 2) See general note d). 3) Pension and DTA risk-weighted assets impact has been included. Notes on slide 24 - Entry into New York Metro progressing well 1) Branch originated sales only; Investors pre CD1 checking sales sourced from internal Investors reporting. 2) Represents sales rate to new-to-bank customers within 4 months of initial onboarding. 3) Deposit Balances reflect average monthly balance as of Jun23 vs Jun22 for HSBC portfolio only (acquired and new) vs Legacy.

42 Notes continued Notes on slide 26 - Capturing Private Capital opportunity 1) 2Q23 LTM by volume and deals. Notes on slide 28 - 3Q23 outlook vs. 2Q23 1) See note on non-GAAP financial measures. 2) See general note d). Notes on slide 32 - Linked-quarter Underlying results 1) See note on non-GAAP financial measures. Notes on slide 33 - Year-over-year Underlying results 1) See note on non-GAAP financial measures. Notes on slide 34 - Supplemental reporting template for planned disclosure beginning 3Q23 1) See general note a). Notes on slide 36 - Commercial credit portfolio 1) Includes deferred fees and costs. 2) Reflects period end balances. Notes on slide 37 - Retail credit porftolio 1) See general note c). 2) Reflects period end balances. Notes on slide 38 - Delinquency by product type 1) 90+ days past due and accruing includes $256 million and $309 million of loans fully or partially guaranteed by the FHA, VA, and USDA at June 30, 2023 and March 31, 2023, respectively. Notes on slide 39 - Allocation of allowance for credit losses by product type 1) Coverage ratio includes total commercial allowance for unfunded lending commitments and total commercial allowance for loan and lease losses in the numerator and total commercial loans and leases in the denominator. 2) Coverage ratio includes total retail allowance for unfunded lending commitments and total retail allowance for loan losses in the numerator and total retail loans in the denominator. Notes on slide 40 - Notable items 1) See note on non-GAAP financial measures.

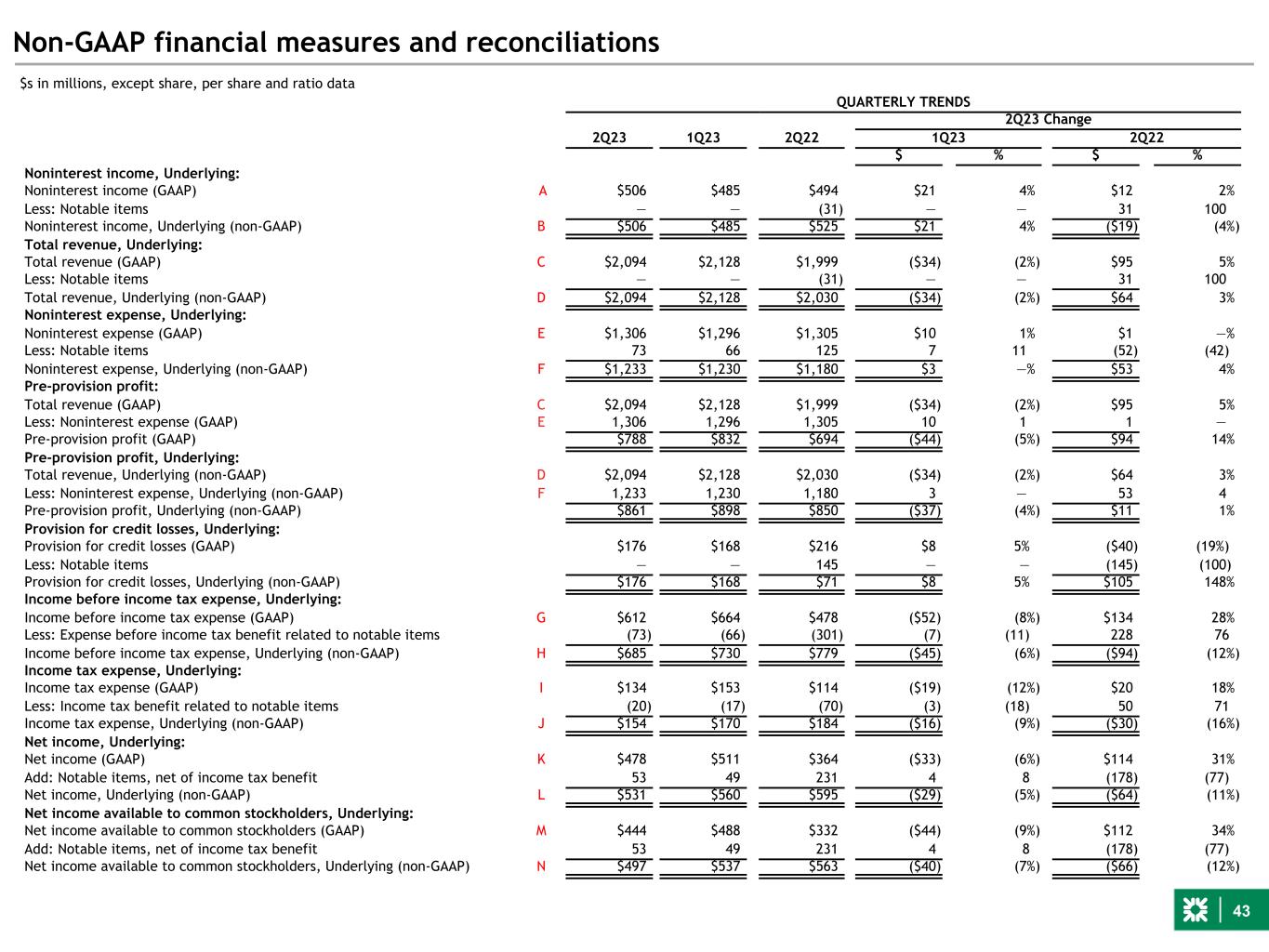

43 Non-GAAP financial measures and reconciliations $s in millions, except share, per share and ratio data QUARTERLY TRENDS 2Q23 Change 2Q23 1Q23 2Q22 1Q23 2Q22 $ % $ % Noninterest income, Underlying: Noninterest income (GAAP) A $506 $485 $494 $21 4% $12 2% Less: Notable items — — (31) — — 31 100 Noninterest income, Underlying (non-GAAP) B $506 $485 $525 $21 4% ($19) (4%) Total revenue, Underlying: Total revenue (GAAP) C $2,094 $2,128 $1,999 ($34) (2%) $95 5% Less: Notable items — — (31) — — 31 100 Total revenue, Underlying (non-GAAP) D $2,094 $2,128 $2,030 ($34) (2%) $64 3% Noninterest expense, Underlying: Noninterest expense (GAAP) E $1,306 $1,296 $1,305 $10 1% $1 —% Less: Notable items 73 66 125 7 11 (52) (42) Noninterest expense, Underlying (non-GAAP) F $1,233 $1,230 $1,180 $3 —% $53 4% Pre-provision profit: Total revenue (GAAP) C $2,094 $2,128 $1,999 ($34) (2%) $95 5% Less: Noninterest expense (GAAP) E 1,306 1,296 1,305 10 1 1 — Pre-provision profit (GAAP) $788 $832 $694 ($44) (5%) $94 14% Pre-provision profit, Underlying: Total revenue, Underlying (non-GAAP) D $2,094 $2,128 $2,030 ($34) (2%) $64 3% Less: Noninterest expense, Underlying (non-GAAP) F 1,233 1,230 1,180 3 — 53 4 Pre-provision profit, Underlying (non-GAAP) $861 $898 $850 ($37) (4%) $11 1% Provision for credit losses, Underlying: Provision for credit losses (GAAP) $176 $168 $216 $8 5% ($40) (19%) Less: Notable items — — 145 — — (145) (100) Provision for credit losses, Underlying (non-GAAP) $176 $168 $71 $8 5% $105 148% Income before income tax expense, Underlying: Income before income tax expense (GAAP) G $612 $664 $478 ($52) (8%) $134 28% Less: Expense before income tax benefit related to notable items (73) (66) (301) (7) (11) 228 76 Income before income tax expense, Underlying (non-GAAP) H $685 $730 $779 ($45) (6%) ($94) (12%) Income tax expense, Underlying: Income tax expense (GAAP) I $134 $153 $114 ($19) (12%) $20 18% Less: Income tax benefit related to notable items (20) (17) (70) (3) (18) 50 71 Income tax expense, Underlying (non-GAAP) J $154 $170 $184 ($16) (9%) ($30) (16%) Net income, Underlying: Net income (GAAP) K $478 $511 $364 ($33) (6%) $114 31% Add: Notable items, net of income tax benefit 53 49 231 4 8 (178) (77) Net income, Underlying (non-GAAP) L $531 $560 $595 ($29) (5%) ($64) (11%) Net income available to common stockholders, Underlying: Net income available to common stockholders (GAAP) M $444 $488 $332 ($44) (9%) $112 34% Add: Notable items, net of income tax benefit 53 49 231 4 8 (178) (77) Net income available to common stockholders, Underlying (non-GAAP) N $497 $537 $563 ($40) (7%) ($66) (12%)

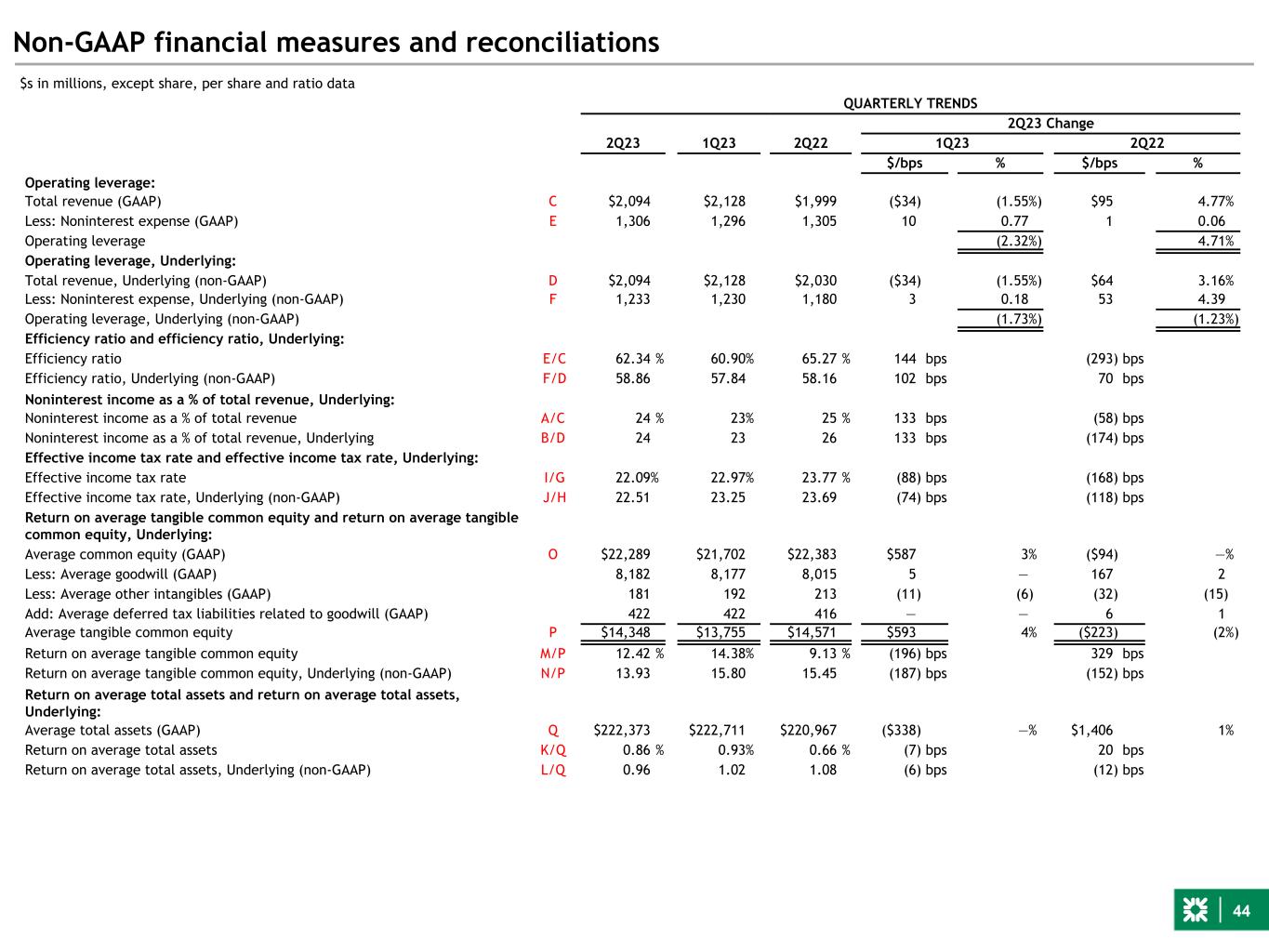

44 Non-GAAP financial measures and reconciliations QUARTERLY TRENDS 2Q23 Change 2Q23 1Q23 2Q22 1Q23 2Q22 $/bps % $/bps % Operating leverage: Total revenue (GAAP) C $2,094 $2,128 $1,999 ($34) (1.55%) $95 4.77% Less: Noninterest expense (GAAP) E 1,306 1,296 1,305 10 0.77 1 0.06 Operating leverage (2.32%) 4.71% Operating leverage, Underlying: Total revenue, Underlying (non-GAAP) D $2,094 $2,128 $2,030 ($34) (1.55%) $64 3.16% Less: Noninterest expense, Underlying (non-GAAP) F 1,233 1,230 1,180 3 0.18 53 4.39 Operating leverage, Underlying (non-GAAP) (1.73%) (1.23%) Efficiency ratio and efficiency ratio, Underlying: Efficiency ratio E/C 62.34 % 60.90% 65.27 % 144 bps (293) bps Efficiency ratio, Underlying (non-GAAP) F/D 58.86 57.84 58.16 102 bps 70 bps Noninterest income as a % of total revenue, Underlying: Noninterest income as a % of total revenue A/C 24 % 23% 25 % 133 bps (58) bps Noninterest income as a % of total revenue, Underlying B/D 24 23 26 133 bps (174) bps Effective income tax rate and effective income tax rate, Underlying: Effective income tax rate I/G 22.09% 22.97% 23.77 % (88) bps (168) bps Effective income tax rate, Underlying (non-GAAP) J/H 22.51 23.25 23.69 (74) bps (118) bps Return on average tangible common equity and return on average tangible common equity, Underlying: Average common equity (GAAP) O $22,289 $21,702 $22,383 $587 3% ($94) —% Less: Average goodwill (GAAP) 8,182 8,177 8,015 5 — 167 2 Less: Average other intangibles (GAAP) 181 192 213 (11) (6) (32) (15) Add: Average deferred tax liabilities related to goodwill (GAAP) 422 422 416 — — 6 1 Average tangible common equity P $14,348 $13,755 $14,571 $593 4% ($223) (2%) Return on average tangible common equity M/P 12.42 % 14.38% 9.13 % (196) bps 329 bps Return on average tangible common equity, Underlying (non-GAAP) N/P 13.93 15.80 15.45 (187) bps (152) bps Return on average total assets and return on average total assets, Underlying: Average total assets (GAAP) Q $222,373 $222,711 $220,967 ($338) —% $1,406 1% Return on average total assets K/Q 0.86 % 0.93% 0.66 % (7) bps 20 bps Return on average total assets, Underlying (non-GAAP) L/Q 0.96 1.02 1.08 (6) bps (12) bps $s in millions, except share, per share and ratio data

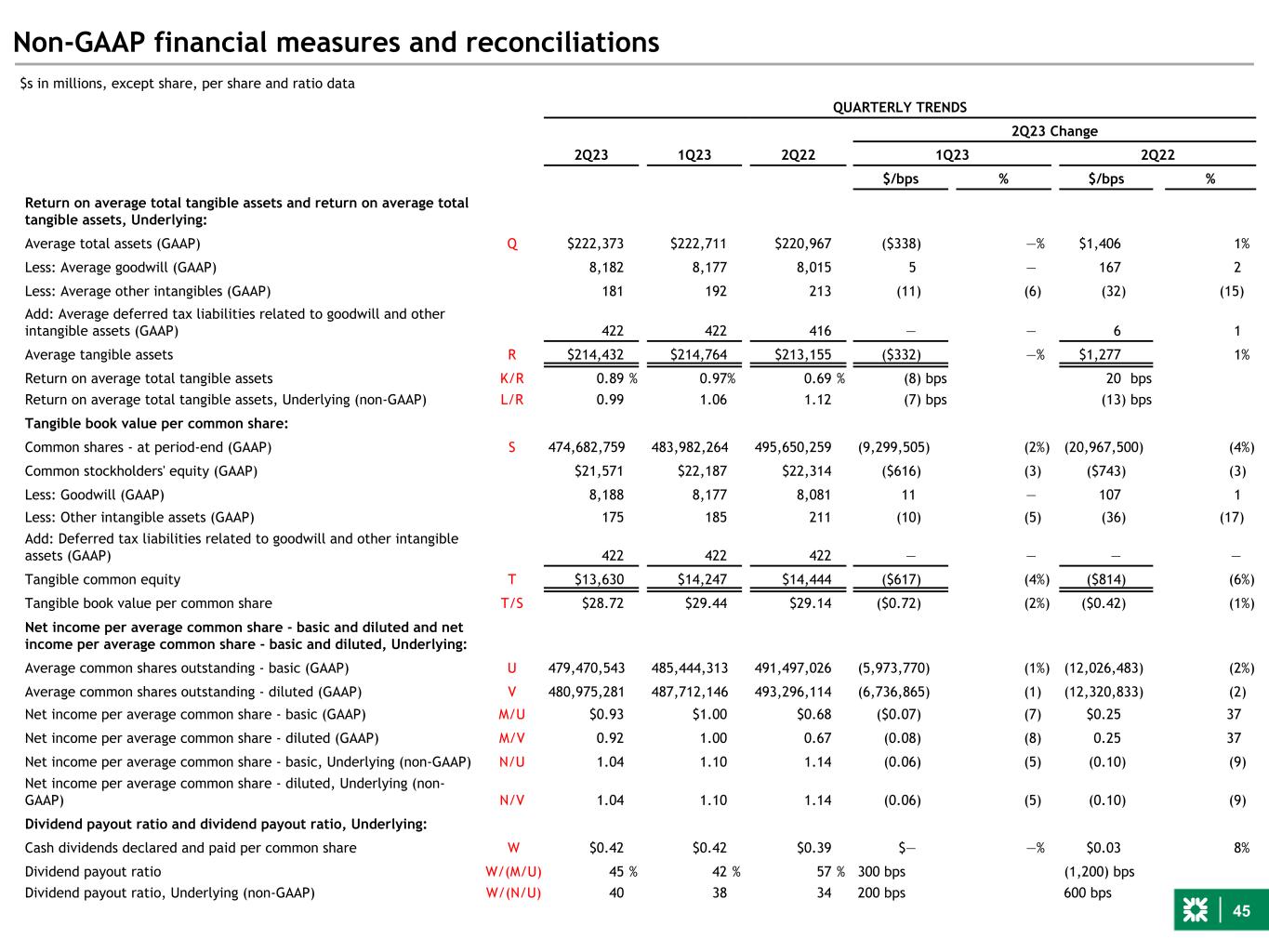

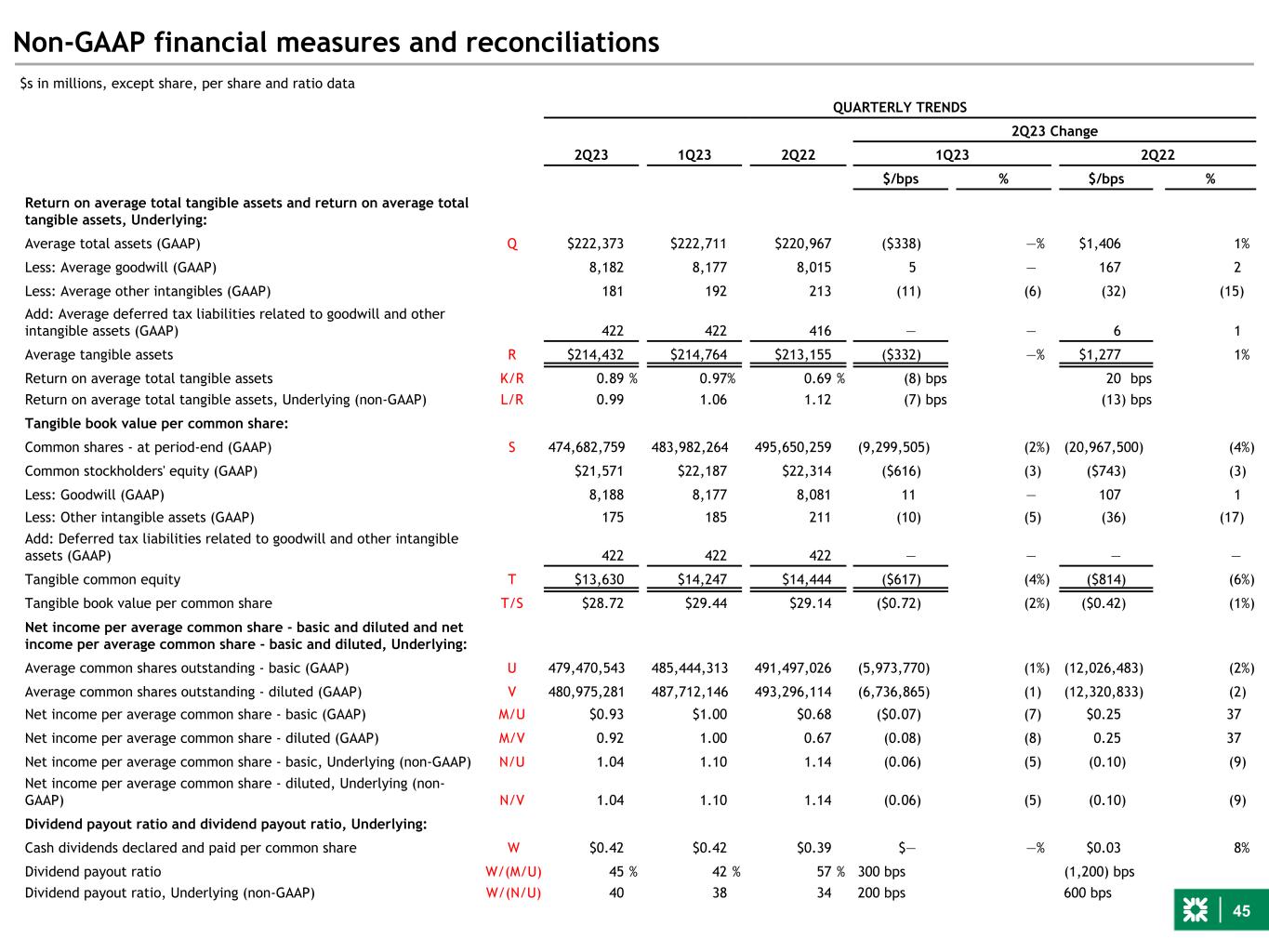

45 Non-GAAP financial measures and reconciliations QUARTERLY TRENDS 2Q23 Change 2Q23 1Q23 2Q22 1Q23 2Q22 $/bps % $/bps % Return on average total tangible assets and return on average total tangible assets, Underlying: Average total assets (GAAP) Q $222,373 $222,711 $220,967 ($338) —% $1,406 1% Less: Average goodwill (GAAP) 8,182 8,177 8,015 5 — 167 2 Less: Average other intangibles (GAAP) 181 192 213 (11) (6) (32) (15) Add: Average deferred tax liabilities related to goodwill and other intangible assets (GAAP) 422 422 416 — — 6 1 Average tangible assets R $214,432 $214,764 $213,155 ($332) —% $1,277 1% Return on average total tangible assets K/R 0.89 % 0.97% 0.69 % (8) bps 20 bps Return on average total tangible assets, Underlying (non-GAAP) L/R 0.99 1.06 1.12 (7) bps (13) bps Tangible book value per common share: Common shares - at period-end (GAAP) S 474,682,759 483,982,264 495,650,259 (9,299,505) (2%) (20,967,500) (4%) Common stockholders' equity (GAAP) $21,571 $22,187 $22,314 ($616) (3) ($743) (3) Less: Goodwill (GAAP) 8,188 8,177 8,081 11 — 107 1 Less: Other intangible assets (GAAP) 175 185 211 (10) (5) (36) (17) Add: Deferred tax liabilities related to goodwill and other intangible assets (GAAP) 422 422 422 — — — — Tangible common equity T $13,630 $14,247 $14,444 ($617) (4%) ($814) (6%) Tangible book value per common share T/S $28.72 $29.44 $29.14 ($0.72) (2%) ($0.42) (1%) Net income per average common share - basic and diluted and net income per average common share - basic and diluted, Underlying: Average common shares outstanding - basic (GAAP) U 479,470,543 485,444,313 491,497,026 (5,973,770) (1%) (12,026,483) (2%) Average common shares outstanding - diluted (GAAP) V 480,975,281 487,712,146 493,296,114 (6,736,865) (1) (12,320,833) (2) Net income per average common share - basic (GAAP) M/U $0.93 $1.00 $0.68 ($0.07) (7) $0.25 37 Net income per average common share - diluted (GAAP) M/V 0.92 1.00 0.67 (0.08) (8) 0.25 37 Net income per average common share - basic, Underlying (non-GAAP) N/U 1.04 1.10 1.14 (0.06) (5) (0.10) (9) Net income per average common share - diluted, Underlying (non- GAAP) N/V 1.04 1.10 1.14 (0.06) (5) (0.10) (9) Dividend payout ratio and dividend payout ratio, Underlying: Cash dividends declared and paid per common share W $0.42 $0.42 $0.39 $— —% $0.03 8% Dividend payout ratio W/(M/U) 45 % 42 % 57 % 300 bps (1,200) bps Dividend payout ratio, Underlying (non-GAAP) W/(N/U) 40 38 34 200 bps 600 bps $s in millions, except share, per share and ratio data

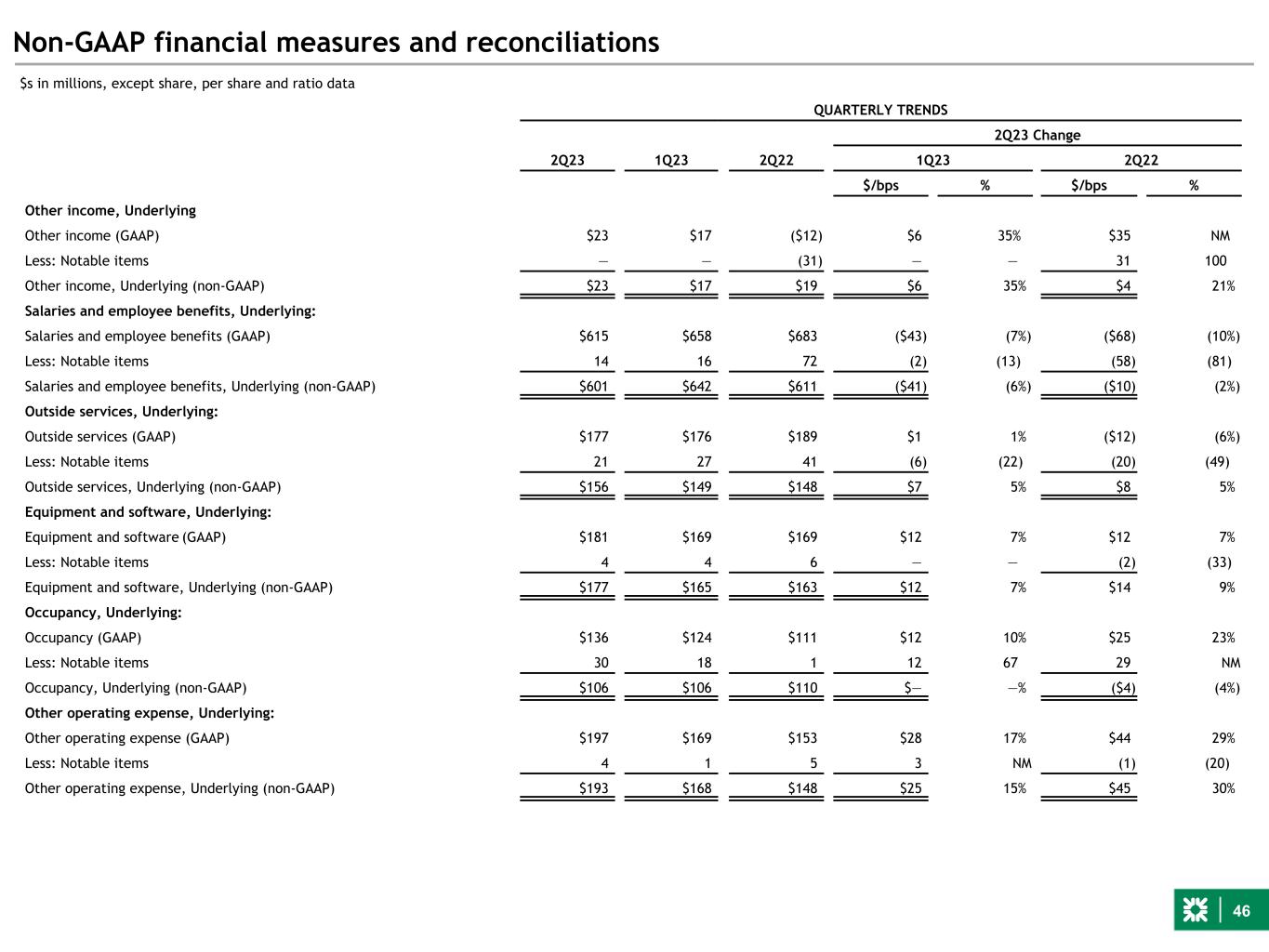

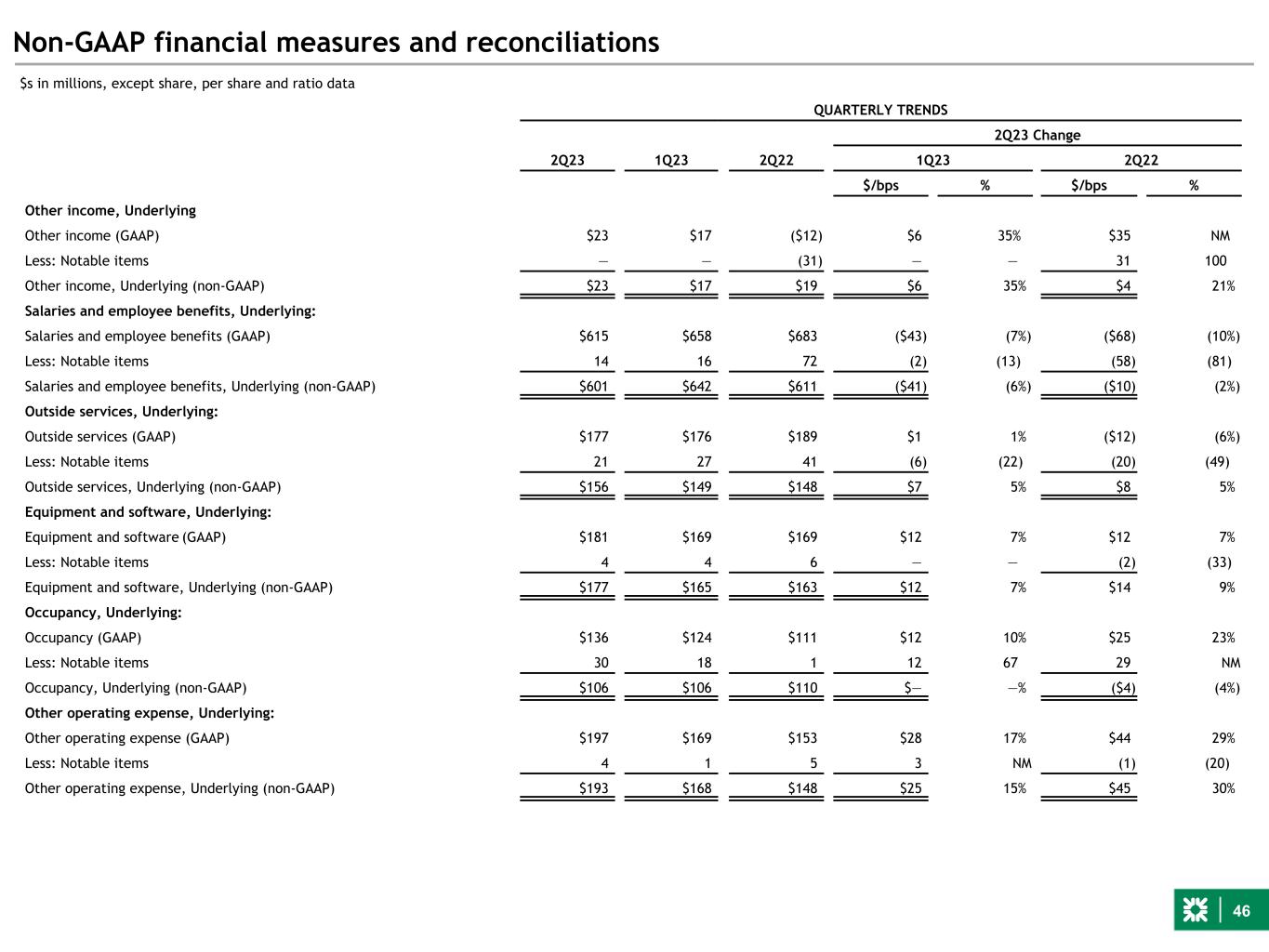

46 Non-GAAP financial measures and reconciliations QUARTERLY TRENDS 2Q23 Change 2Q23 1Q23 2Q22 1Q23 2Q22 $/bps % $/bps % Other income, Underlying Other income (GAAP) $23 $17 ($12) $6 35% $35 NM Less: Notable items — — (31) — — 31 100 Other income, Underlying (non-GAAP) $23 $17 $19 $6 35% $4 21% Salaries and employee benefits, Underlying: Salaries and employee benefits (GAAP) $615 $658 $683 ($43) (7%) ($68) (10%) Less: Notable items 14 16 72 (2) (13) (58) (81) Salaries and employee benefits, Underlying (non-GAAP) $601 $642 $611 ($41) (6%) ($10) (2%) Outside services, Underlying: Outside services (GAAP) $177 $176 $189 $1 1% ($12) (6%) Less: Notable items 21 27 41 (6) (22) (20) (49) Outside services, Underlying (non-GAAP) $156 $149 $148 $7 5% $8 5% Equipment and software, Underlying: Equipment and software (GAAP) $181 $169 $169 $12 7% $12 7% Less: Notable items 4 4 6 — — (2) (33) Equipment and software, Underlying (non-GAAP) $177 $165 $163 $12 7% $14 9% Occupancy, Underlying: Occupancy (GAAP) $136 $124 $111 $12 10% $25 23% Less: Notable items 30 18 1 12 67 29 NM Occupancy, Underlying (non-GAAP) $106 $106 $110 $— —% ($4) (4%) Other operating expense, Underlying: Other operating expense (GAAP) $197 $169 $153 $28 17% $44 29% Less: Notable items 4 1 5 3 NM (1) (20) Other operating expense, Underlying (non-GAAP) $193 $168 $148 $25 15% $45 30% $s in millions, except share, per share and ratio data

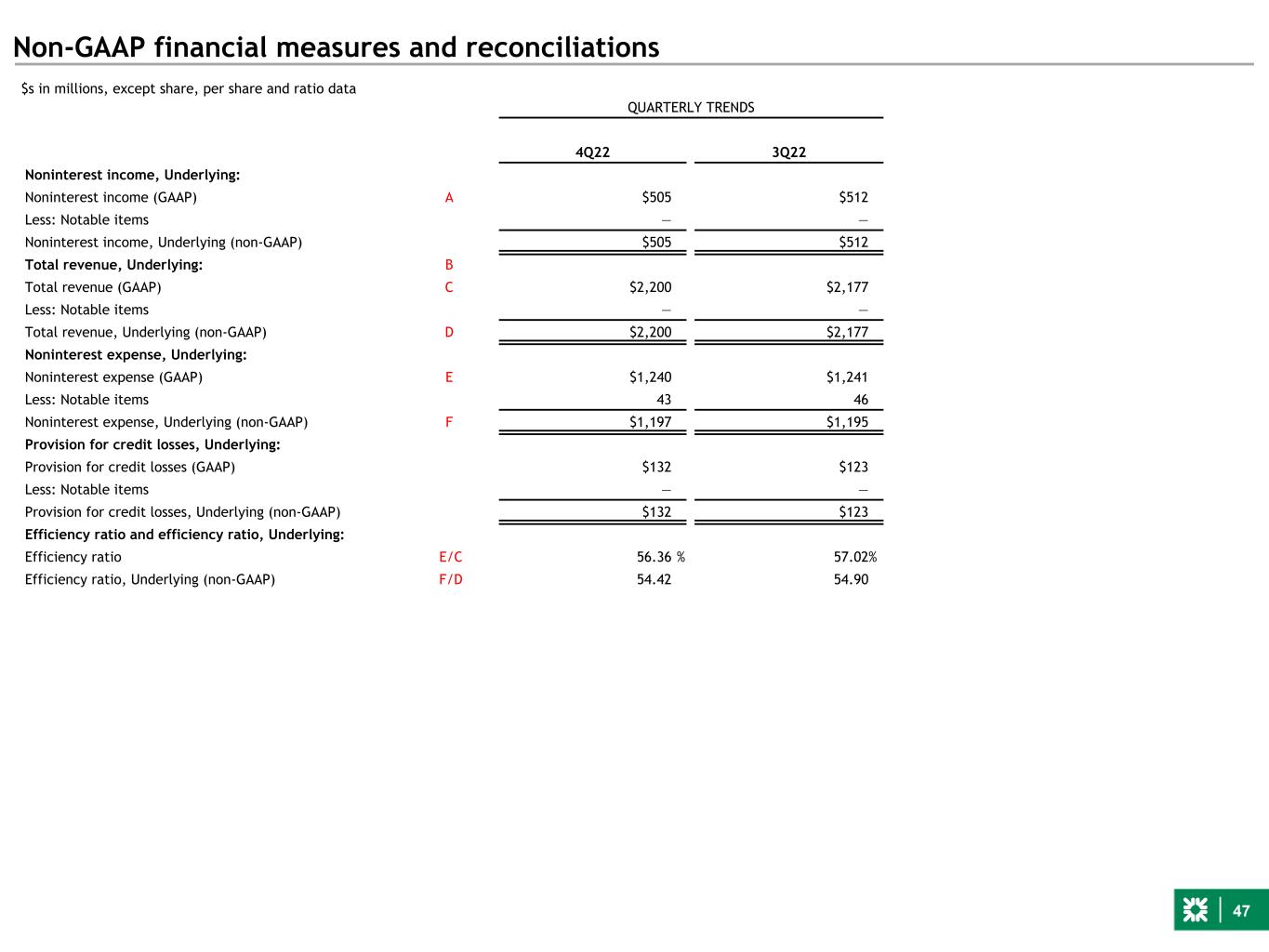

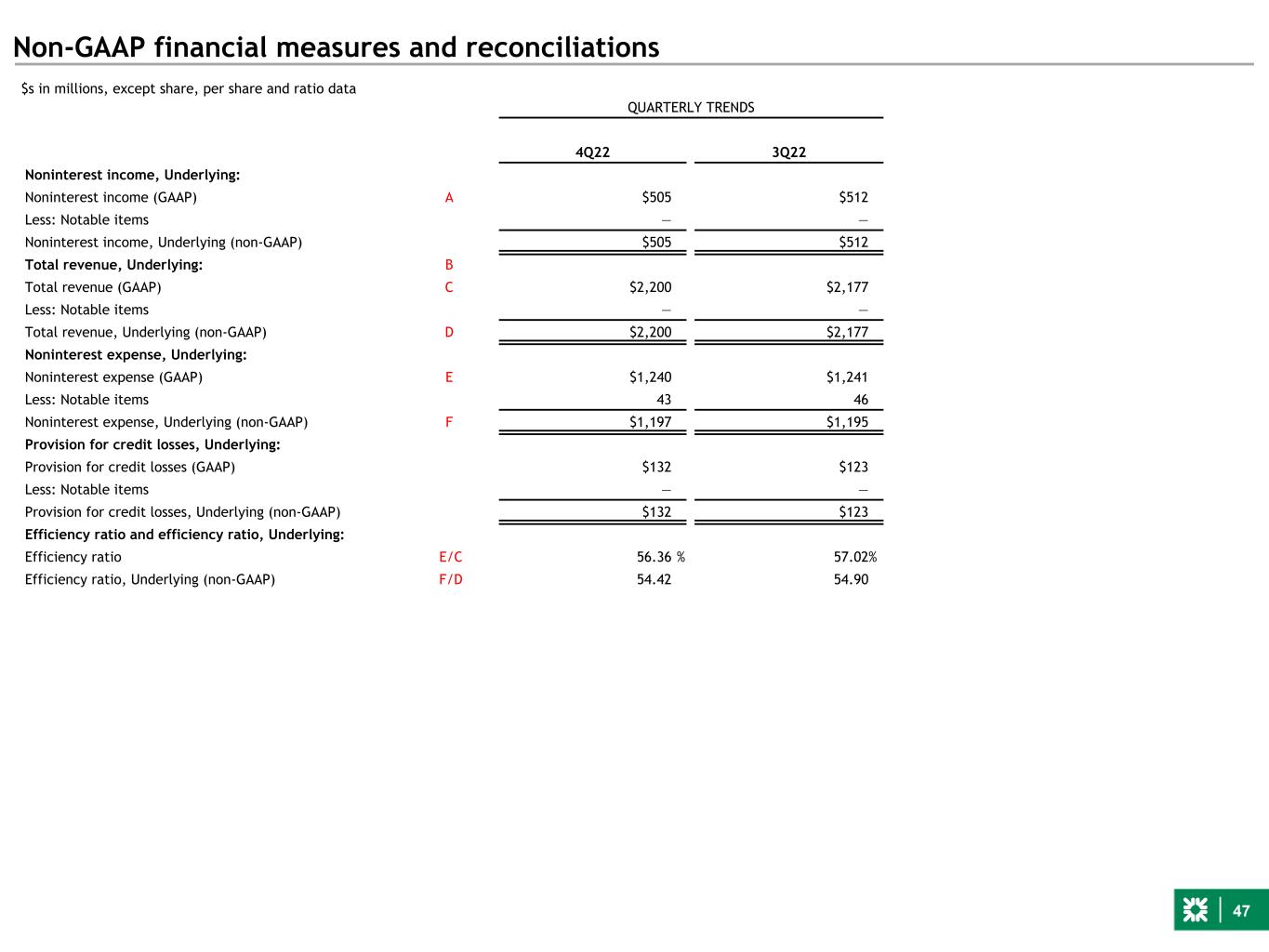

47 Non-GAAP financial measures and reconciliations $s in millions, except share, per share and ratio data QUARTERLY TRENDS 4Q22 3Q22 Noninterest income, Underlying: Noninterest income (GAAP) A $505 $512 Less: Notable items — — Noninterest income, Underlying (non-GAAP) $505 $512 Total revenue, Underlying: B Total revenue (GAAP) C $2,200 $2,177 Less: Notable items — — Total revenue, Underlying (non-GAAP) D $2,200 $2,177 Noninterest expense, Underlying: Noninterest expense (GAAP) E $1,240 $1,241 Less: Notable items 43 46 Noninterest expense, Underlying (non-GAAP) F $1,197 $1,195 Provision for credit losses, Underlying: Provision for credit losses (GAAP) $132 $123 Less: Notable items — — Provision for credit losses, Underlying (non-GAAP) $132 $123 Efficiency ratio and efficiency ratio, Underlying: Efficiency ratio E/C 56.36 % 57.02% Efficiency ratio, Underlying (non-GAAP) F/D 54.42 54.90

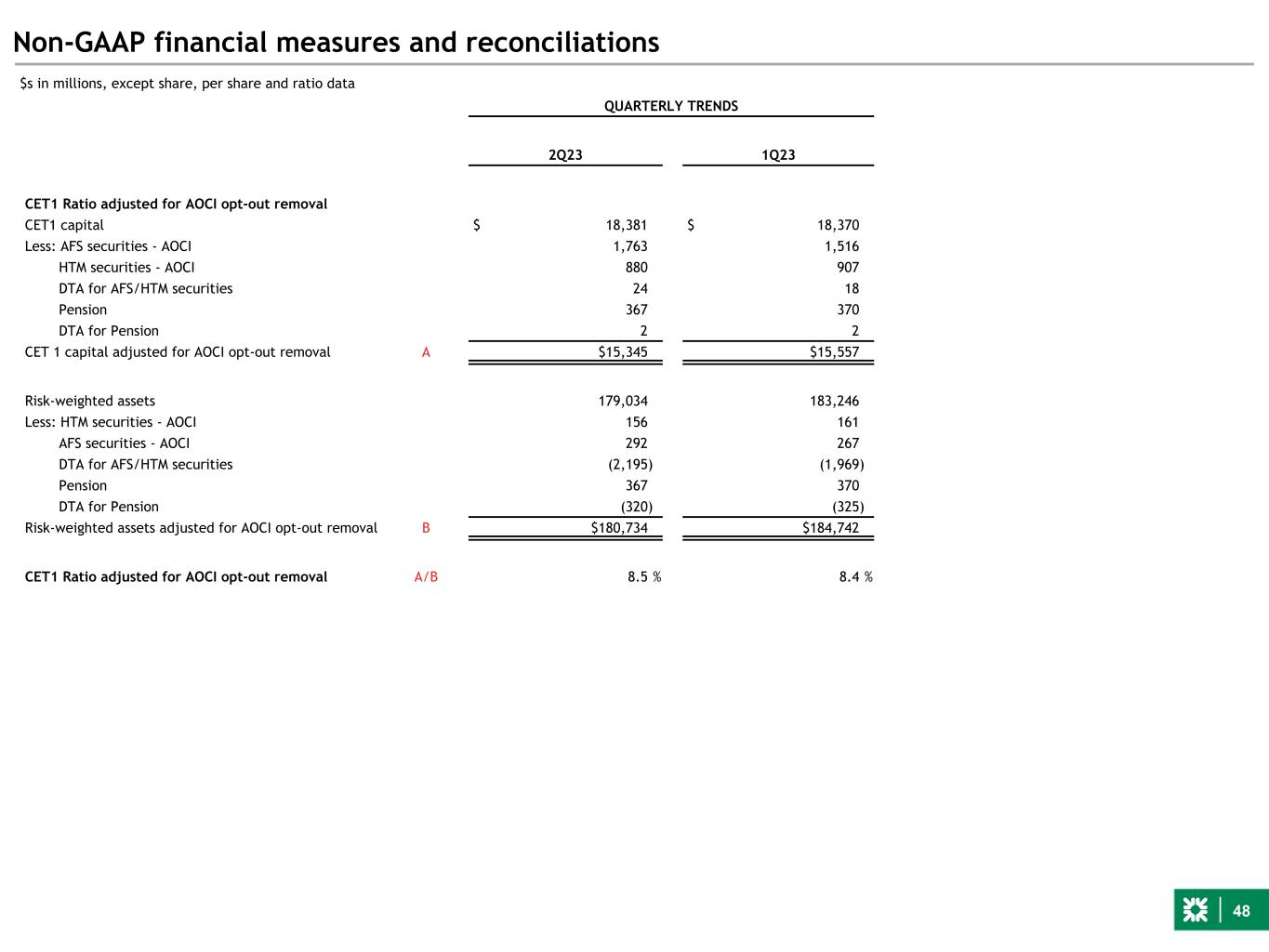

48 Non-GAAP financial measures and reconciliations QUARTERLY TRENDS 2Q23 1Q23 CET1 Ratio adjusted for AOCI opt-out removal CET1 capital $ 18,381 $ 18,370 Less: AFS securities - AOCI 1,763 1,516 HTM securities - AOCI 880 907 DTA for AFS/HTM securities 24 18 Pension 367 370 DTA for Pension 2 2 CET 1 capital adjusted for AOCI opt-out removal A $15,345 $15,557 Risk-weighted assets 179,034 183,246 Less: HTM securities - AOCI 156 161 AFS securities - AOCI 292 267 DTA for AFS/HTM securities (2,195) (1,969) Pension 367 370 DTA for Pension (320) (325) Risk-weighted assets adjusted for AOCI opt-out removal B $180,734 $184,742 CET1 Ratio adjusted for AOCI opt-out removal A/B 8.5 % 8.4 % $s in millions, except share, per share and ratio data