Goldman Sachs Financial Services Conference 2024 Investor Presentation December 10, 2024 Bruce Van Saun Chairman, Chief Executive Officer

2 Forward-looking statements and use of non-GAAP financial measures This document contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Any statement that does not describe historical or current facts is a forward- looking statement. These statements often include the words “believes,” “expects,” “anticipates,” “estimates,” “intends,” “plans,” “goals,” “targets,” “initiatives,” “potentially,” “probably,” “projects,” “outlook,” “guidance” or similar expressions or future conditional verbs such as “may,” “will,” “should,” “would,” and “could.” Forward-looking statements are based upon the current beliefs and expectations of management, and on information currently available to management. Our statements speak as of the date hereof, and we do not assume any obligation to update these statements or to update the reasons why actual results could differ from those contained in such statements in light of new information or future events. We caution you, therefore, against relying on any of these forward-looking statements. They are neither statements of historical fact nor guarantees or assurances of future performance. While there is no assurance that any list of risks and uncertainties or risk factors is complete, important factors that could cause actual results to differ materially from those in the forward-looking statements include the following, without limitation: • Negative economic, business and political conditions, including as a result of the interest rate environment, supply chain disruptions, inflationary pressures and labor shortages, that adversely affect the general economy, housing prices, the job market, consumer confidence and spending habits; • The general state of the economy and employment, as well as general business and economic conditions, and changes in the competitive environment; • Our capital and liquidity requirements under regulatory standards and our ability to generate capital and liquidity on favorable terms; • The effect of changes in our credit ratings on our cost of funding, access to capital markets, ability to market our securities, and overall liquidity position; • The effect of changes in the level of commercial and consumer deposits on our funding costs and net interest margin; • Our ability to execute on our strategic business initiatives and achieve our financial performance goals across our Consumer and Commercial businesses, including our Private Bank; • The effects of geopolitical instability, including the wars in Ukraine and the Middle East, on economic and market conditions, inflationary pressures and the interest rate environment, commodity price and foreign exchange rate volatility, and heightened cybersecurity risks; • Our ability to comply with heightened supervisory requirements and expectations as well as new or amended regulations; • Liabilities and business restrictions resulting from litigation and regulatory investigations; • The effect of changes in interest rates on our net interest income, net interest margin and our mortgage originations, mortgage servicing rights and mortgages held for sale; • Changes in interest rates and market liquidity, as well as the magnitude of such changes, which may reduce interest margins, impact funding sources and affect the ability to originate and distribute financial products in the primary and secondary markets; • Financial services reform and other current, pending or future legislation or regulation that could have a negative effect on our revenue and businesses; • Environmental risks, such as physical or transition risks associated with climate change, and social and governance risks, that could adversely affect our reputation, operations, business, and customers; • A failure in or breach of our compliance with laws, as well as operational or security systems or infrastructure, or those of our third-party vendors or other service providers, including as a result of cyber-attacks; and • Management’s ability to identify and manage these and other risks. In addition to the above factors, we also caution that the actual amounts and timing of any future common stock dividends or share repurchases will be subject to various factors, including our capital position, financial performance, capital impacts of strategic initiatives, market conditions, and regulatory considerations, as well as any other factors that our Board of Directors deems relevant in making such a determination. Therefore, there can be no assurance that we will repurchase shares from or pay any dividends to holders of our common stock, or as to the amount of any such repurchases or dividends. More information about factors that could cause actual results to differ materially from those described in the forward-looking statements can be found in the “Risk Factors” section in Part I, Item 1A of our Annual Report on Form 10-K for the fiscal year ended December 31, 2023 as filed with the Securities and Exchange Commission. Non-GAAP Financial Measures: This document contains non-GAAP financial measures denoted as Underlying. Underlying results for any given reporting period exclude certain items that may occur in that period which Management does not consider indicative of the Company’s on-going financial performance. We believe these non-GAAP financial measures provide useful information to investors because they are used by our Management to evaluate our operating performance and make day-to-day operating decisions. In addition, we believe our Underlying results in any given reporting period reflect our on-going financial performance in that period and, accordingly, are useful to consider in addition to our GAAP financial results. We further believe the presentation of Underlying results increases comparability of period- to-period results. The Appendix presents reconciliations of our non-GAAP measures to the most directly comparable GAAP financial measures. Other companies may use similarly titled non-GAAP financial measures that may be calculated differently from the way we calculate such measures. Accordingly, our non-GAAP financial measures may not be comparable to similar measures used by such companies. We caution investors not to place undue reliance on such non-GAAP financial measures, but to consider them with the most directly comparable GAAP measures. Non-GAAP financial measures have limitations as analytical tools and should not be considered in isolation or as a substitute for our results reported under GAAP.

3 FORTUNE World’s Most Admired Companies™ - 2nd consecutive year FORTUNE World’s Most Innovative Companies American Banker The Most Powerful Women in Banking™ Kiplinger A Best Bank for High- Net-Worth Clients Global Finance Best Bank for Long- Term Liquidity and Treasury Management Human Rights Campaign Foundation Top score on 2023-2024 Corporate Equality Index Datos Insights CFE Gold Winner, Commercial Banking Impact Award for Customer Experience Strong franchise with leading positions in attractive markets 2024 Recognition Attractive footprint with large mass-affluent and affluent segments Deposits from all 50 states Assets Deposits Loans $220B $175B $142B As of September 30, 2024 Regional branch network Light branch network Commercial Banking client coverage and National retail deposits and lending Private Bank locations DisabilityIN Best Place to Work for Disability Inclusion - 4th consecutive year PayTech Awards Top Innovation in Payments in 2024

4 ■ Strong deposit franchise grounded in primary relationships and high-quality customer growth ■ Differentiated lending platform with focus on building relationships ■ Significant potential to scale NY Metro and capture more affluent households Consumer Commercial Private Bank ■ Building premier Private Bank with exceptional service model ■ High-quality growth in deposits, lending and wealth management ■ Geographically-aligned teams to leverage and deepen relationships ■ Full suite of Capital Markets & Advisory capabilities and Treasury Solutions ■ Integrated coverage model with focus on attractive high-growth markets, private capital and industry verticals ■ Digitization and operational transformation Well-positioned businesses Transformed Best-positioned Premier Grow high- quality deposits and deepen customer relationships Drive scale in growth markets, key industries, high-opportunity businesses Deliver high- quality solutions and advice Continue to optimize balance sheet and business mix Invest in our people and communities Strategic objectives Next Gen Tech Mobile/Digital Talent Risk Management Brand/Marketing Enablers

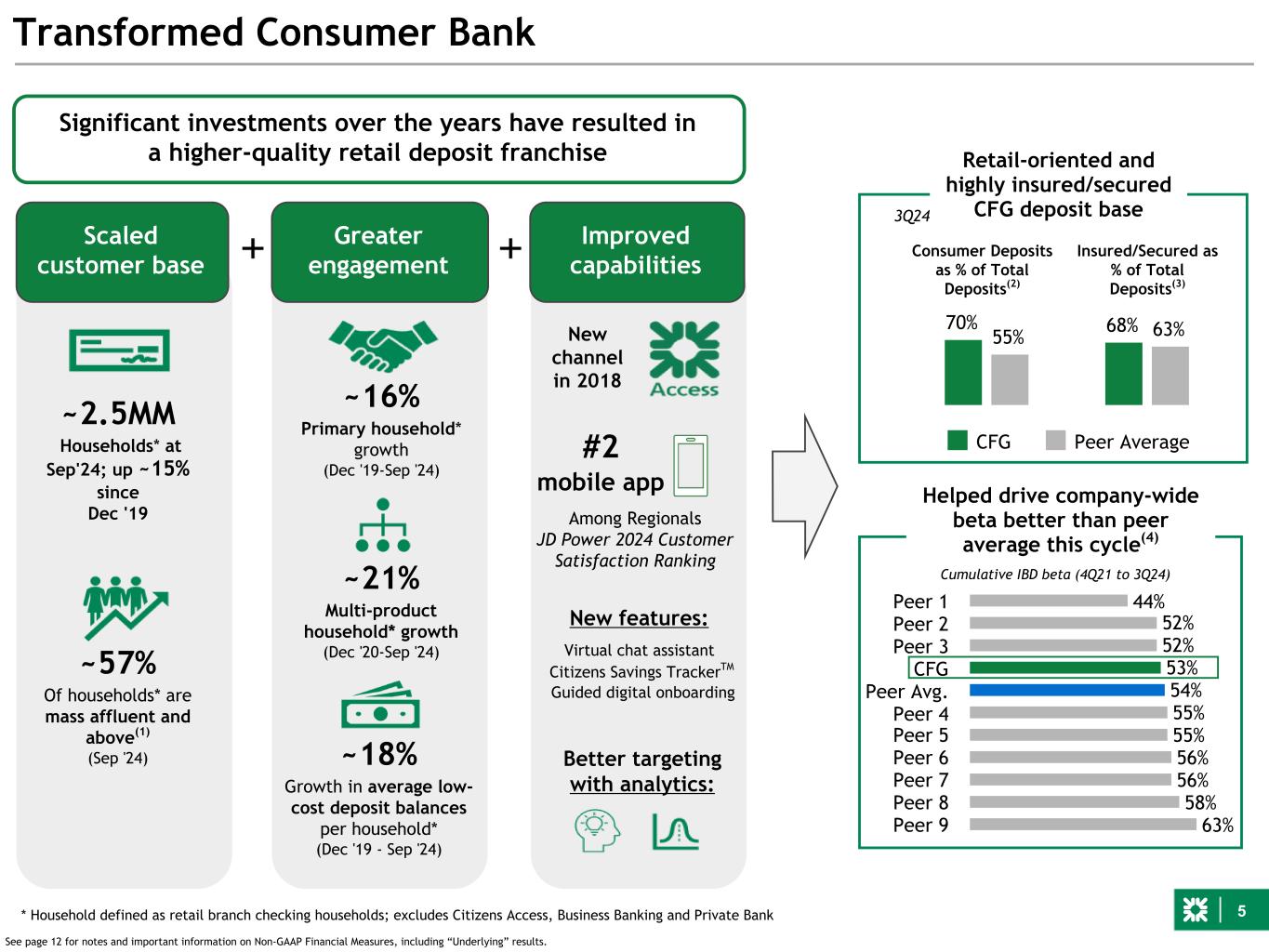

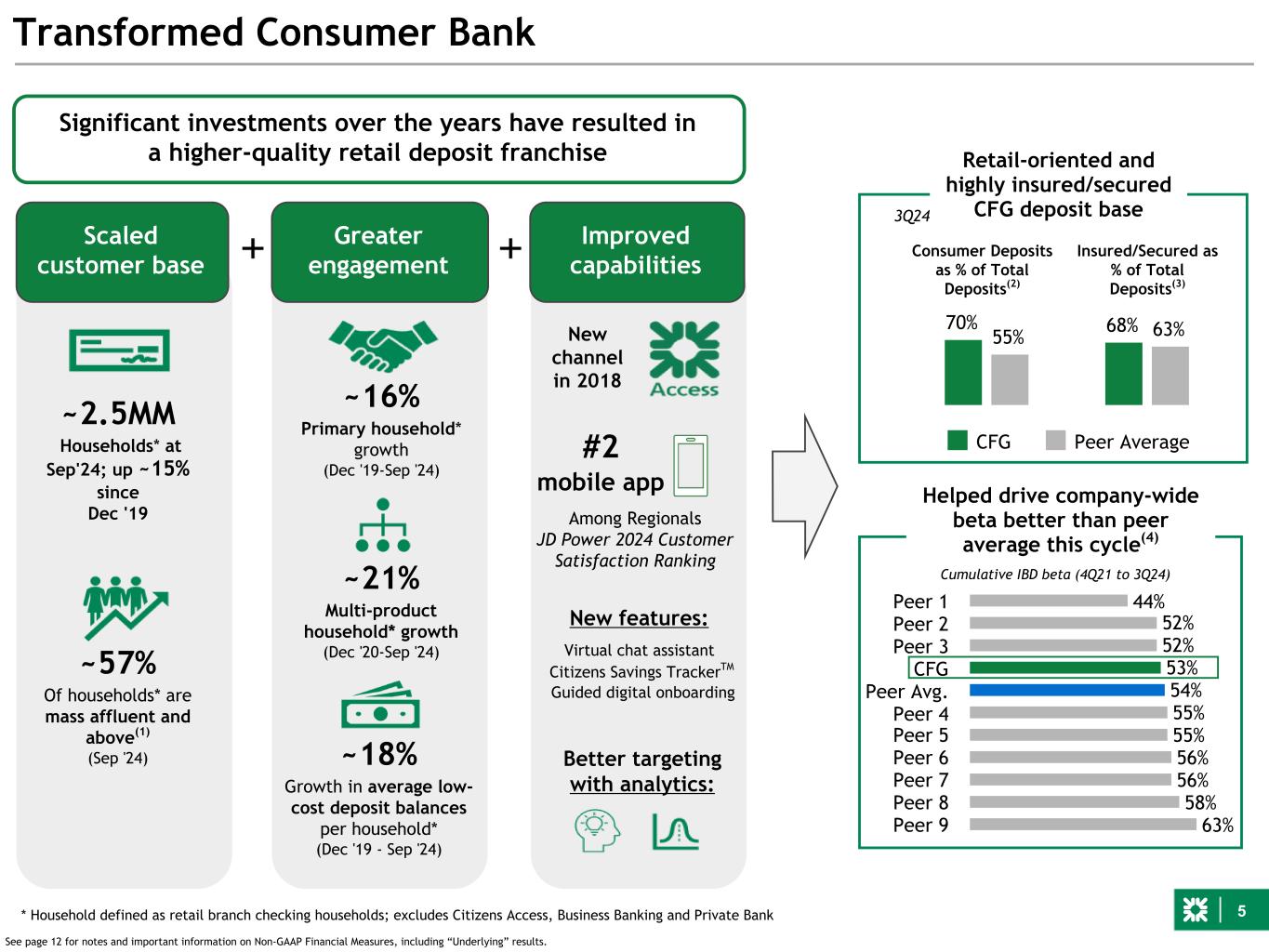

5 44% 52% 52% 53% 54% 55% 55% 56% 56% 58% 63% Peer 1 Peer 2 Peer 3 CFG Peer Avg. Peer 4 Peer 5 Peer 6 Peer 7 Peer 8 Peer 9 Transformed Consumer Bank Helped drive company-wide beta better than peer average this cycle(4) Cumulative IBD beta (4Q21 to 3Q24) Consumer Deposits as % of Total Deposits(2) Insured/Secured as % of Total Deposits(3) 70% 68% 55% 63% CFG Peer Average Retail-oriented and highly insured/secured CFG deposit base Significant investments over the years have resulted in a higher-quality retail deposit franchise See page 12 for notes and important information on Non-GAAP Financial Measures, including “Underlying” results. Scaled customer base Greater engagement ~57% Of households* are mass affluent and above(1) (Sep '24) ~2.5MM Households* at Sep'24; up ~15% since Dec '19 ~18% Growth in average low- cost deposit balances per household* (Dec '19 - Sep '24) ~16% Primary household* growth (Dec '19-Sep '24) Guided digital onboarding Virtual chat assistant Citizens Savings TrackerTM Improved capabilities New channel in 2018 Better targeting with analytics: #2 mobile app New features: ~21% Multi-product household* growth (Dec '20-Sep '24) Among Regionals JD Power 2024 Customer Satisfaction Ranking * Household defined as retail branch checking households; excludes Citizens Access, Business Banking and Private Bank 3Q24

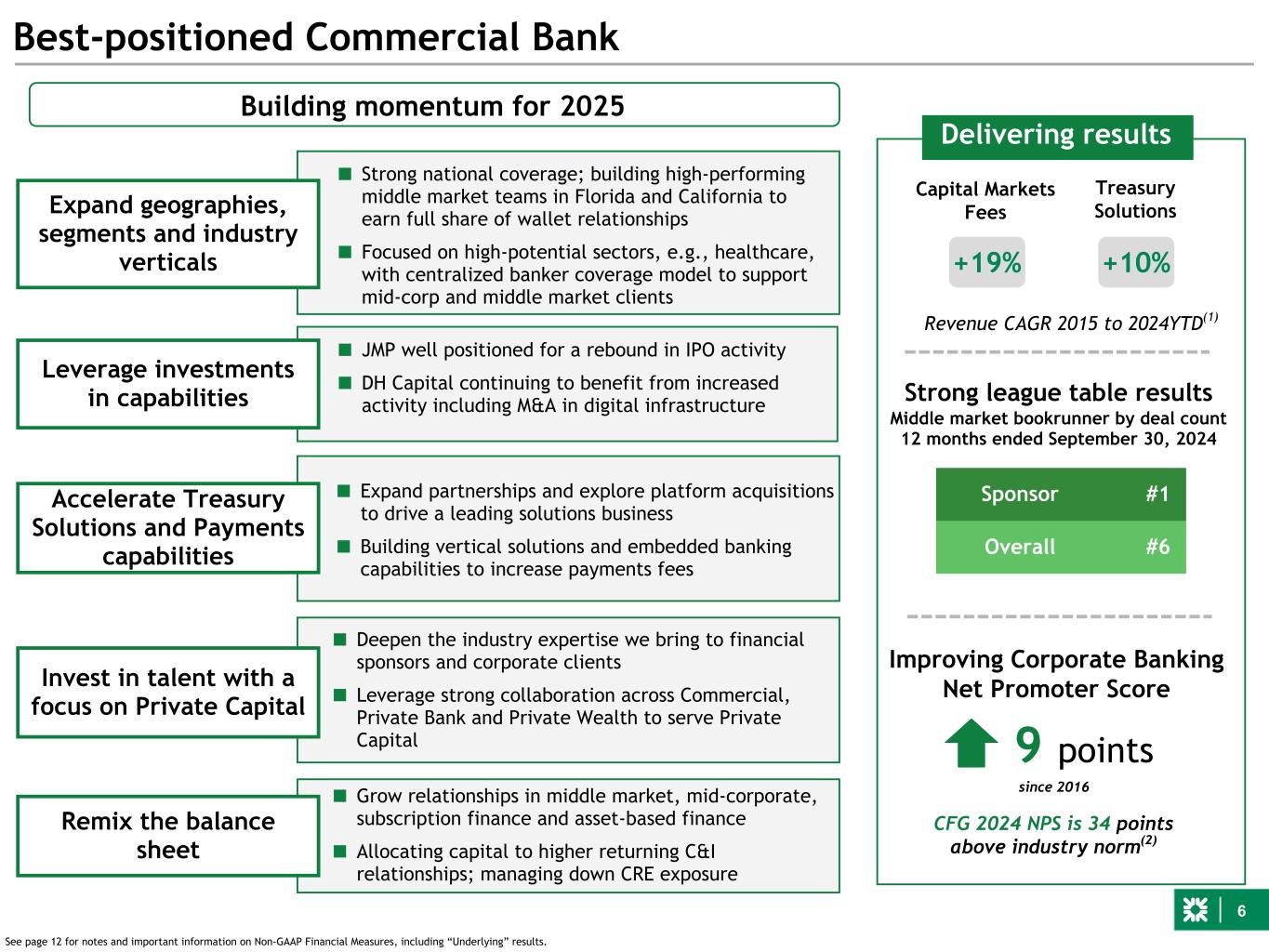

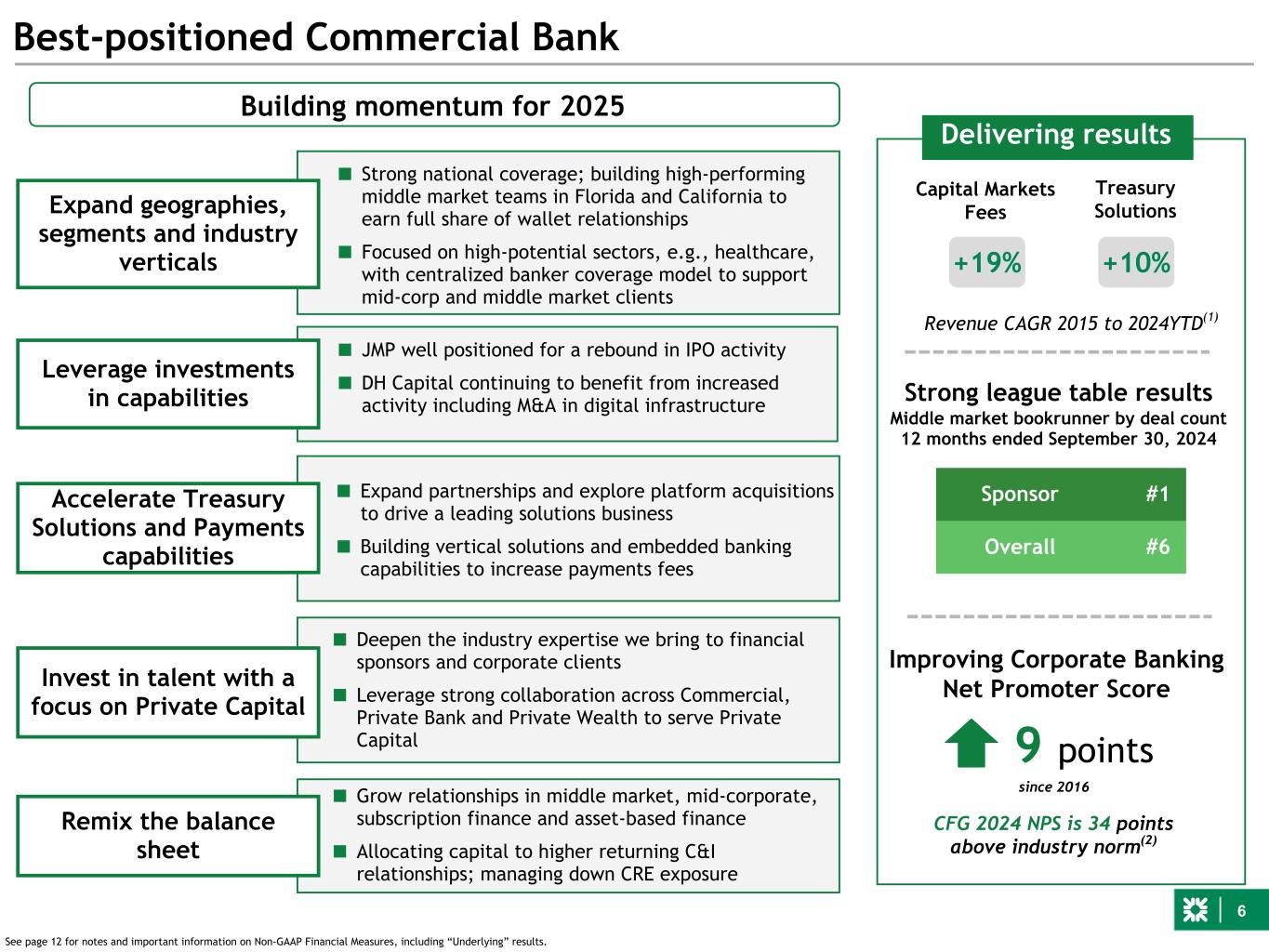

6 Best-positioned Commercial Bank Delivering results Building momentum for 2025 See page 12 for notes and important information on Non-GAAP Financial Measures, including “Underlying” results. Strong league table results Middle market bookrunner by deal count 12 months ended September 30, 2024 Sponsor #1 Overall #6 Capital Markets Fees Treasury Solutions Revenue CAGR 2015 to 2024YTD(1) +10%+19% ■ Grow relationships in middle market, mid-corporate, subscription finance and asset-based finance ■ Allocating capital to higher returning C&I relationships; managing down CRE exposure ■ Strong national coverage; building high-performing middle market teams in Florida and California to earn full share of wallet relationships ■ Focused on high-potential sectors, e.g., healthcare, with centralized banker coverage model to support mid-corp and middle market clients Expand geographies, segments and industry verticals ■ Expand partnerships and explore platform acquisitions to drive a leading solutions business ■ Building vertical solutions and embedded banking capabilities to increase payments fees Accelerate Treasury Solutions and Payments capabilities Invest in talent with a focus on Private Capital Remix the balance sheet ■ Deepen the industry expertise we bring to financial sponsors and corporate clients ■ Leverage strong collaboration across Commercial, Private Bank and Private Wealth to serve Private Capital Leverage investments in capabilities ■ JMP well positioned for a rebound in IPO activity ■ DH Capital continuing to benefit from increased activity including M&A in digital infrastructure Improving Corporate Banking Net Promoter Score 9 points since 2016 CFG 2024 NPS is 34 points above industry norm(2)

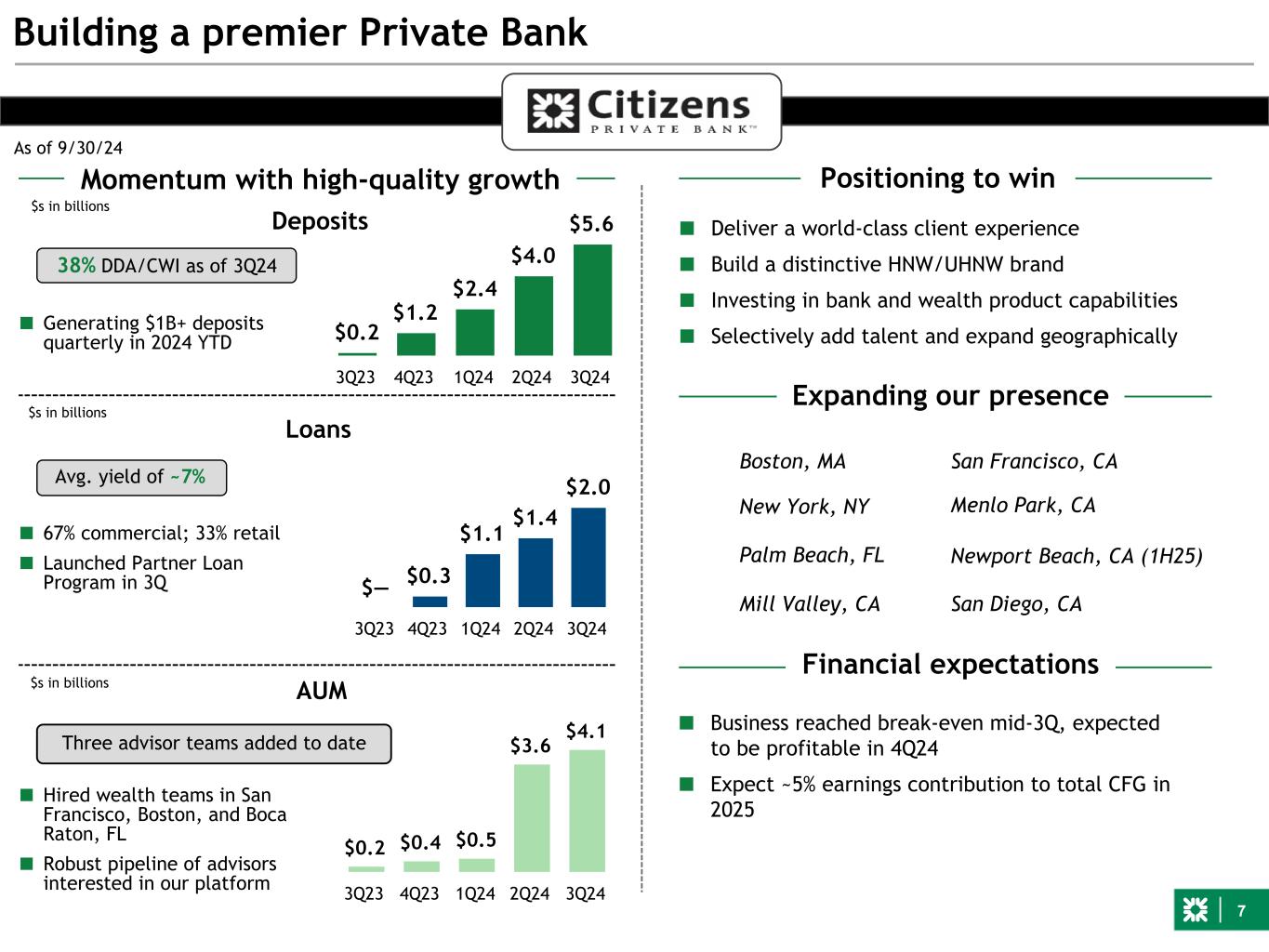

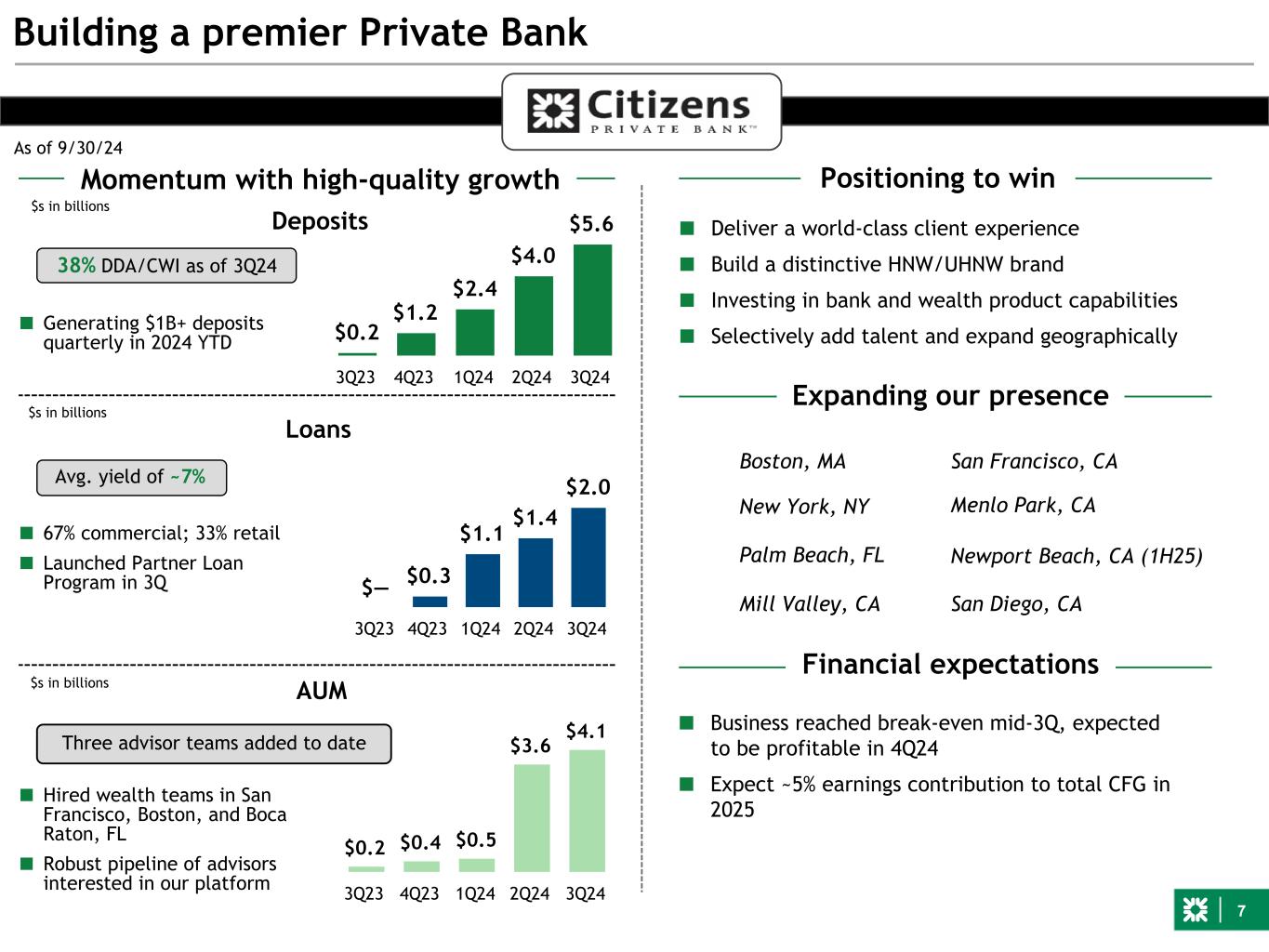

7 Building a premier Private Bank Three advisor teams added to date ■ Business reached break-even mid-3Q, expected to be profitable in 4Q24 ■ Expect ~5% earnings contribution to total CFG in 2025 $0.2 $1.2 $2.4 $4.0 $5.6 3Q23 4Q23 1Q24 2Q24 3Q24 $0.2 $0.4 $0.5 $3.6 $4.1 3Q23 4Q23 1Q24 2Q24 3Q24 Avg. yield of ~7% ■ Hired wealth teams in San Francisco, Boston, and Boca Raton, FL ■ Robust pipeline of advisors interested in our platform 38% DDA/CWI as of 3Q24 Loans ■ Deliver a world-class client experience ■ Build a distinctive HNW/UHNW brand ■ Investing in bank and wealth product capabilities ■ Selectively add talent and expand geographically $s in billions $— $0.3 $1.1 $1.4 $2.0 3Q23 4Q23 1Q24 2Q24 3Q24 Deposits As of 9/30/24 ■ 67% commercial; 33% retail ■ Launched Partner Loan Program in 3Q Positioning to win Financial expectations Expanding our presence AUM Momentum with high-quality growth $s in billions $s in billions ■ Generating $1B+ deposits quarterly in 2024 YTD Boston, MA Mill Valley, CA San Francisco, CA Palm Beach, FL New York, NY Menlo Park, CA Newport Beach, CA (1H25) San Diego, CA

8 Sept-23 Sept-24 Building a leading NYC Metro/NJ franchise NY Metro NPS +37 pts since mid-2022 $9.9 $10.5 Sept-23 Sept-24 Retail deposit growth ($ billions) Retail HH growth +7% YoY +5% YoY Early momentum taking retail deposit share Driving brand awareness Building a strong brand in the highly competitive NY/NJ market Generating awareness of strong brand Taking a local/neighborhood-based approach Emphasis on attracting affluent+ households Prioritizing relationships with broad product suite Upgrading and Investing in talent ■ ~4K middle market companies with full relationship potential ■ Aligned coverage model to emphasize greater local market knowledge and accountability ■ Delivering sector-focused M&A advisory and capital markets solutions in partnership with the Investment Bank and Sponsor Coverage ■ Utilizing "One Citizens" approach with emerging middle-market companies ■ Adding talent from large in-market competitors to help grow market share Significant Commercial opportunity 4Q21 3Q24 Target growth Corporate Banking relationships in NYC metro ~160 ~300 ~10% p.a.

9 4 3 3 3 3 4 2 3 2 1 1 1 Sponsor (# rank) 2015 2016 2017 2018 2019 2020 2021 2022 2023 1Q24 LTM 2Q24 LTM 3Q24 LTMEquity Capital Markets Capturing the Private Capital opportunity • Controls 11K+ U.S. companies today (vs. ~2K in 2000) • ~$1 trillion dry powder to deploy in U.S. • ~50% of middle market M&A deals backed by PE sponsors • Grown to over $1.4 trillion market • Rivals size of bank syndicated loan and HY markets Venture Capital Private Equity Private Credit • A focus of the Private Bank • Market share opportunity as VC activity rebounds ■ Covering 225+ PE sponsors focused on 9 industries ■ #1 in sponsor middle market deals and Top-6 middle market M&A franchise ■ Leading industry team developed over 10 years to support private credit firms ■ Coordinated approach to cover and advise Private Capital firms, with growing fee potential Citizens Private Wealth Citizens Private Bank Debt Capital Markets Capital Call Lines Private Credit Finance M&A Advisory Private capital opportunity Covers small/mid-sized PE, VC firms; GPs, LPs Private Bank Commercial Bank Covers larger PE firms, Private Credit Treasury Solutions Rates, FX, commodities hedging Our distinctive capabilities Uniquely positioned and well-coordinated to serve Private Capital Taking share in sponsor middle market deals; ranked #1 through 2024 YTD Private Equity Private Credit Venture Capital

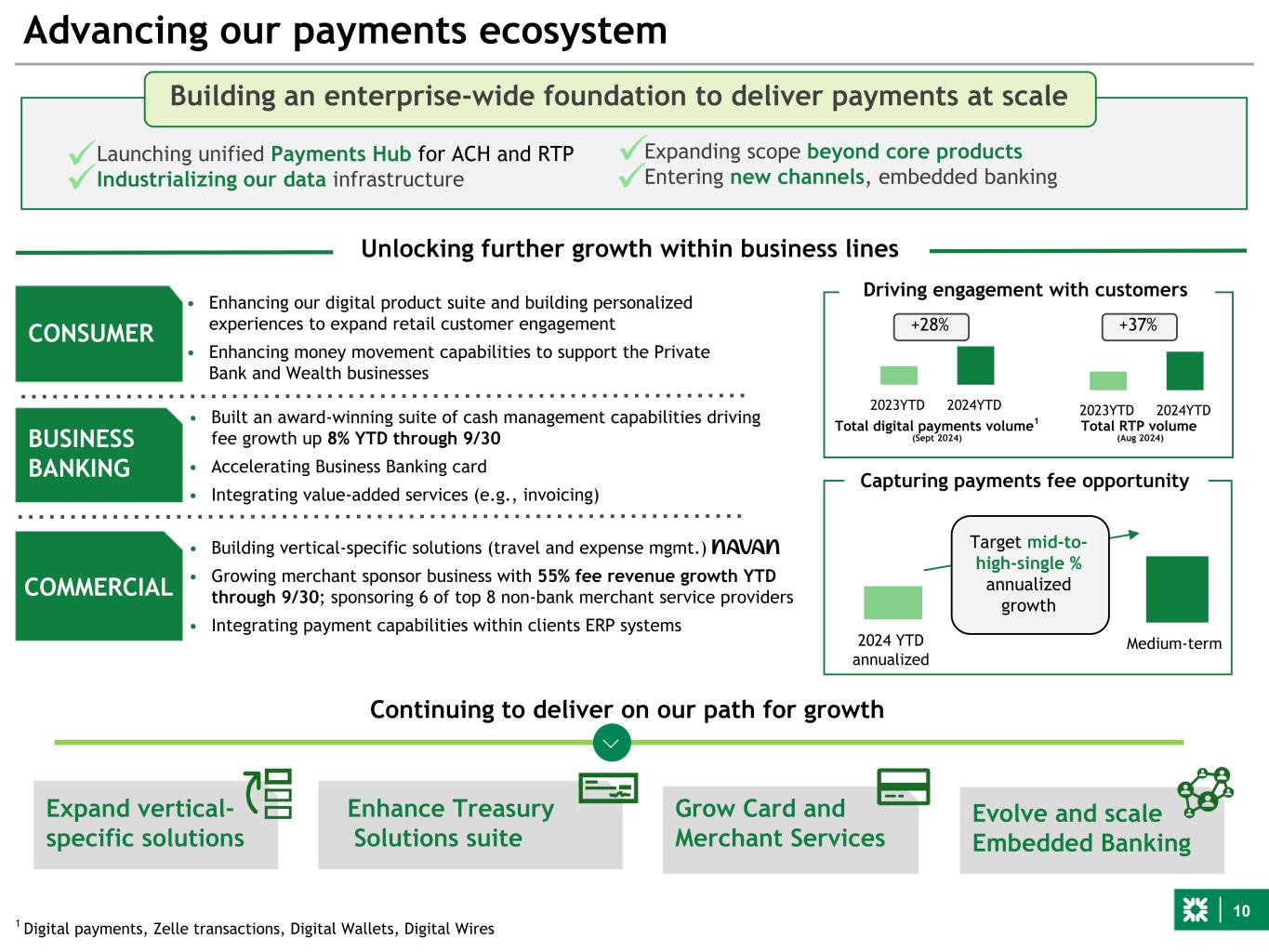

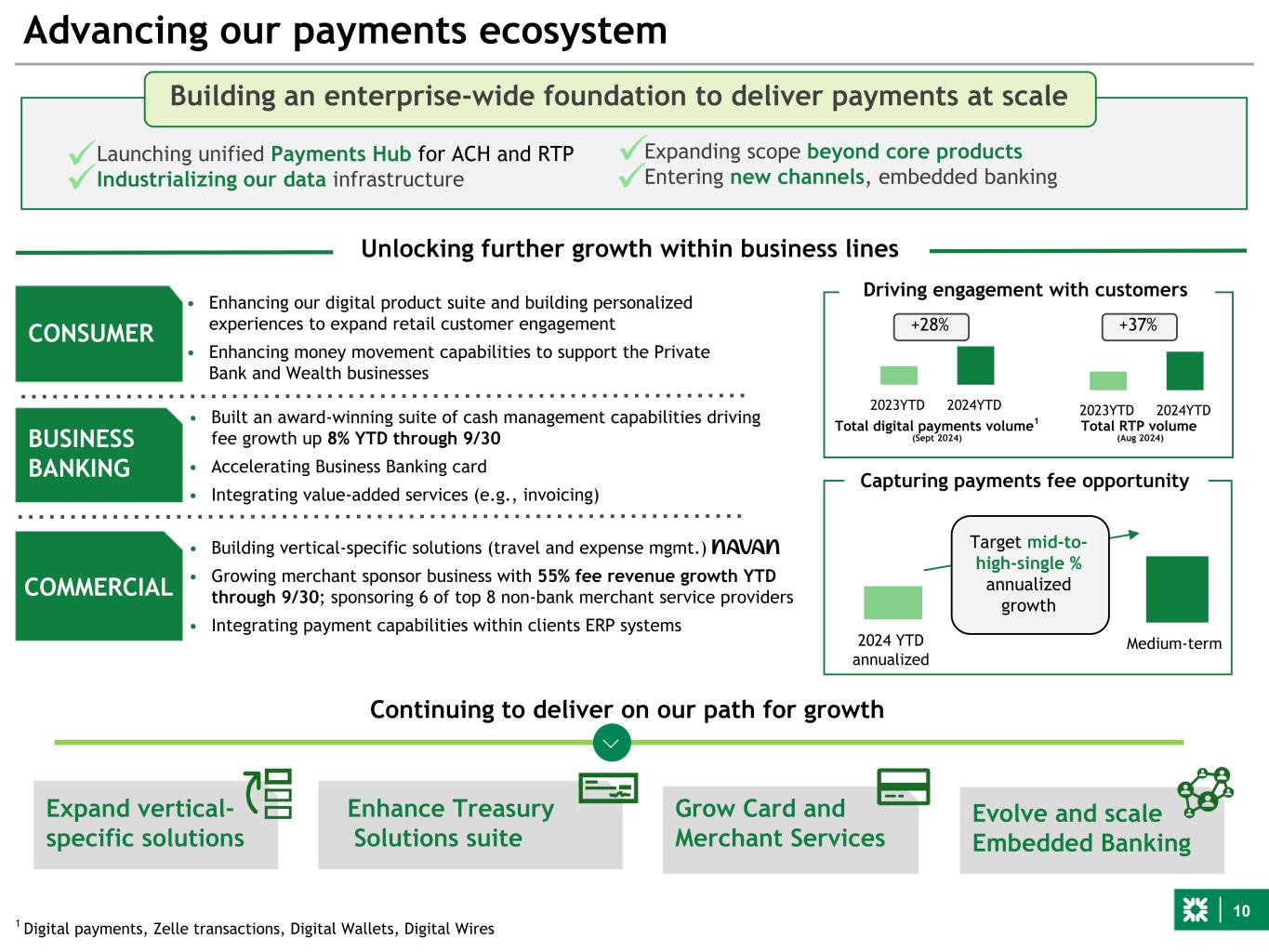

10 • Enhancing our digital product suite and building personalized experiences to expand retail customer engagement • Enhancing money movement capabilities to support the Private Bank and Wealth businesses 2023YTD 2024YTD Total digital payments volume1 (Sept 2024) Advancing our payments ecosystem Building an enterprise-wide foundation to deliver payments at scale Launching unified Payments Hub for ACH and RTP Industrializing our data infrastructure CONSUMER BUSINESS BANKING COMMERCIAL Expanding scope beyond core products Entering new channels, embedded banking Continuing to deliver on our path for growth Enhance Treasury Solutions suite Expand vertical- specific solutions Evolve and scale Embedded Banking Grow Card and Merchant Services • Built an award-winning suite of cash management capabilities driving fee growth up 8% YTD through 9/30 • Accelerating Business Banking card • Integrating value-added services (e.g., invoicing) Unlocking further growth within business lines • Building vertical-specific solutions (travel and expense mgmt.) • Growing merchant sponsor business with 55% fee revenue growth YTD through 9/30; sponsoring 6 of top 8 non-bank merchant service providers • Integrating payment capabilities within clients ERP systems Driving engagement with customers Capturing payments fee opportunity +28% 2024 YTD annualized Target [mid/high single digit+] annualized growth over medium-term 2024 YTD annualized Medium-term Target mid-to- high-single % annualized growth [Medium-term] pending +38% RTP Y/Y volume (Aug 2024) +7% ACH origination Y/Y volume (Aug 2024) 2023YTD 2024YTD Total RTP volume (Aug 2024) +37% 1 Digital payments, Zelle transactions, Digital Wallets, Digital Wires

11 Citizens is an attractive investment opportunity Citizens continues to have a series of unique initiatives that will lead to relative medium-term outperformance – Transformed Consumer Bank with further deposit growth and Wealth revenue potential; well positioned in NYC metro to gain market share; performance tracking well – Best-positioned Commercial Bank ready to serve private capital and high-growth sectors of the U.S. economy – Building premier Wealth/Private Bank franchise - strong momentum entering 2025; added leading Private Wealth teams in San Francisco, South Florida and Boston accelerating AUM growth; opened two offices in the San Francisco Bay area and hired a top private banking team in Southern California in 2H24 Citizens has robust capital, liquidity and funding position Citizens has performed well since the IPO given its sound strategy, capable and experienced leadership and a strong customer-focused culture – Track record of strong execution – Commitment to operating and financial discipline; TOP 9 progressing well, planning to launch TOP 10 – Excellence in our capabilities, highly competitive with mega-banks and peers Citizens is well positioned to deliver ~16 to 18% ROTCE over the medium-term given strategic initiatives and 2025 to 2027 NII tailwinds – Committed to maintaining our strong capital and liquidity position, while further strengthening funding and performance with balance sheet optimization, including Non-Core strategy – Focused on deploying capital to best relationship/highest risk-adjusted return areas – Flexibility to support customers and invest while continuing to return capital to shareholders; repurchased $325 million of common shares in 3Q24 – Significant NII tailwind from Non-Core and swaps over the medium term; target NIM range 3.25 to 3.40% – Private Bank results go from net investment position towards 20%+ ROTCE – Current significant drag from Non-Core dissipates with time

12 Notes on Non-GAAP Financial Measures See important information on our use of Non-GAAP Financial Measures at the beginning this presentation and reconciliations to GAAP financial measures at the end of this presentation. Non-GAAP measures are herein defined as Underlying results. Where there is a reference to Underlying results in a paragraph or table, all measures that follow these references are on the same basis, when applicable. Allowance coverage ratios for loans and leases includes the allowance for funded loans and leases in the numerator and funded loans and leases in the denominator. Allowance coverage ratios for credit losses includes the allowance for funded loans and leases and allowance for unfunded lending commitments in the numerator and funded loans and leases in the denominator. General Notes a. References to net interest margin are on a fully taxable equivalent ("FTE") basis. b. Throughout this presentation, references to consolidated and/or commercial loans and loan growth include leases. Loans held for sale are also referred to as LHFS. c. Select totals may not sum due to rounding. d. Throughout this presentation, reference to balance sheet items are on an average basis and loans exclude held for sale unless otherwise noted. Notes Notes on slide 5 - Transformed Consumer Bank 1) Mass affluent and above are retail households with the higher value of IXI or current month deposit/investment balances greater than or equal to $100K. 2) Estimated based on available company disclosures. 3) Includes collateralized state and municipal balances and excludes bank and nonbank subsidiaries. 4) Peer data as of September 30, 2024. Peers include CMA, FITB, HBAN, KEY, MTB, PNC, RF, TFC and USB. Notes on slide 6 - Best-positioned Commercial Bank 1) Compounded annual growth rate is calculated using 2024 YTD annualized results (through 9/30). 2) Normative data: Barlow Research’s Middle Market National Business Banking Study rolling 4-quarter data (3Q2023-2Q2024) Large bank lead clients (assets >$50B) with $25MM-<$500MM in annual sales revenue.