Barclays Global Financial Services Conference Bruce Van Saun Chief Executive Officer September 12, 2017 Exhibit 99.1

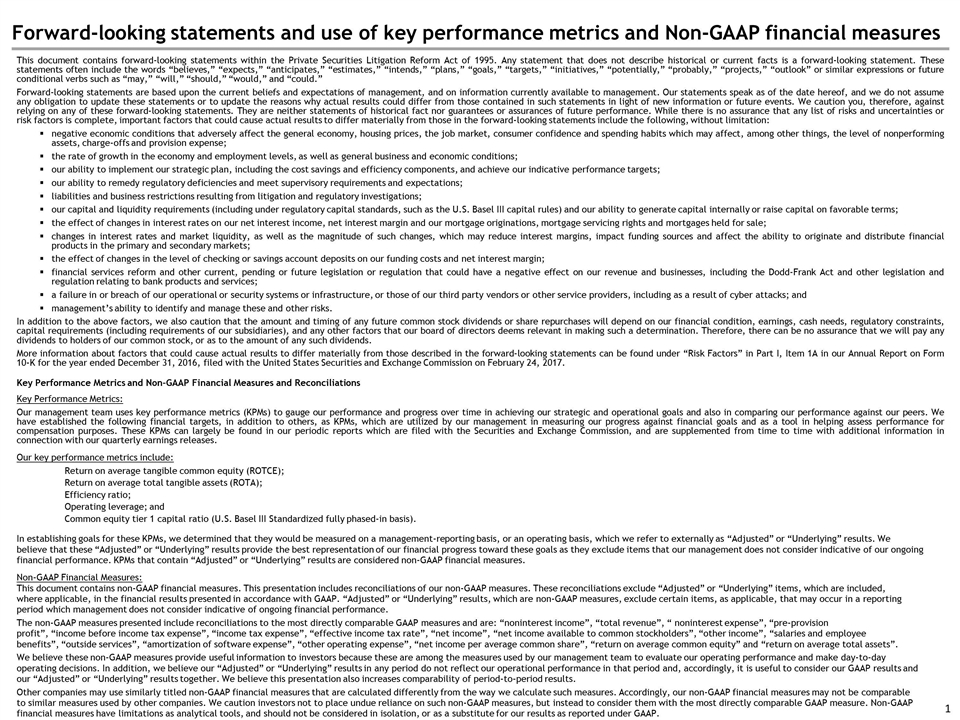

Forward-looking statements and use of key performance metrics and Non-GAAP financial measures This document contains forward-looking statements within the Private Securities Litigation Reform Act of 1995. Any statement that does not describe historical or current facts is a forward-looking statement. These statements often include the words “believes,” “expects,” “anticipates,” “estimates,” “intends,” “plans,” “goals,” “targets,” “initiatives,” “potentially,” “probably,” “projects,” “outlook” or similar expressions or future conditional verbs such as “may,” “will,” “should,” “would,” and “could.” Forward-looking statements are based upon the current beliefs and expectations of management, and on information currently available to management. Our statements speak as of the date hereof, and we do not assume any obligation to update these statements or to update the reasons why actual results could differ from those contained in such statements in light of new information or future events. We caution you, therefore, against relying on any of these forward-looking statements. They are neither statements of historical fact nor guarantees or assurances of future performance. While there is no assurance that any list of risks and uncertainties or risk factors is complete, important factors that could cause actual results to differ materially from those in the forward-looking statements include the following, without limitation: negative economic conditions that adversely affect the general economy, housing prices, the job market, consumer confidence and spending habits which may affect, among other things, the level of nonperforming assets, charge-offs and provision expense; the rate of growth in the economy and employment levels, as well as general business and economic conditions; our ability to implement our strategic plan, including the cost savings and efficiency components, and achieve our indicative performance targets; our ability to remedy regulatory deficiencies and meet supervisory requirements and expectations; liabilities and business restrictions resulting from litigation and regulatory investigations; our capital and liquidity requirements (including under regulatory capital standards, such as the U.S. Basel III capital rules) and our ability to generate capital internally or raise capital on favorable terms; the effect of changes in interest rates on our net interest income, net interest margin and our mortgage originations, mortgage servicing rights and mortgages held for sale; changes in interest rates and market liquidity, as well as the magnitude of such changes, which may reduce interest margins, impact funding sources and affect the ability to originate and distribute financial products in the primary and secondary markets; the effect of changes in the level of checking or savings account deposits on our funding costs and net interest margin; financial services reform and other current, pending or future legislation or regulation that could have a negative effect on our revenue and businesses, including the Dodd-Frank Act and other legislation and regulation relating to bank products and services; a failure in or breach of our operational or security systems or infrastructure, or those of our third party vendors or other service providers, including as a result of cyber attacks; and management’s ability to identify and manage these and other risks. In addition to the above factors, we also caution that the amount and timing of any future common stock dividends or share repurchases will depend on our financial condition, earnings, cash needs, regulatory constraints, capital requirements (including requirements of our subsidiaries), and any other factors that our board of directors deems relevant in making such a determination. Therefore, there can be no assurance that we will pay any dividends to holders of our common stock, or as to the amount of any such dividends. More information about factors that could cause actual results to differ materially from those described in the forward-looking statements can be found under “Risk Factors” in Part I, Item 1A in our Annual Report on Form 10-K for the year ended December 31, 2016, filed with the United States Securities and Exchange Commission on February 24, 2017. Key Performance Metrics and Non-GAAP Financial Measures and Reconciliations Key Performance Metrics: Our management team uses key performance metrics (KPMs) to gauge our performance and progress over time in achieving our strategic and operational goals and also in comparing our performance against our peers. We have established the following financial targets, in addition to others, as KPMs, which are utilized by our management in measuring our progress against financial goals and as a tool in helping assess performance for compensation purposes. These KPMs can largely be found in our periodic reports which are filed with the Securities and Exchange Commission, and are supplemented from time to time with additional information in connection with our quarterly earnings releases. Our key performance metrics include: Return on average tangible common equity (ROTCE); Return on average total tangible assets (ROTA); Efficiency ratio; Operating leverage; and Common equity tier 1 capital ratio (U.S. Basel III Standardized fully phased-in basis). In establishing goals for these KPMs, we determined that they would be measured on a management-reporting basis, or an operating basis, which we refer to externally as “Adjusted” or “Underlying” results. We believe that these “Adjusted” or “Underlying” results provide the best representation of our financial progress toward these goals as they exclude items that our management does not consider indicative of our ongoing financial performance. KPMs that contain “Adjusted” or “Underlying” results are considered non-GAAP financial measures. Non-GAAP Financial Measures: This document contains non-GAAP financial measures. This presentation includes reconciliations of our non-GAAP measures. These reconciliations exclude “Adjusted” or “Underlying” items, which are included, where applicable, in the financial results presented in accordance with GAAP. “Adjusted” or “Underlying” results, which are non-GAAP measures, exclude certain items, as applicable, that may occur in a reporting period which management does not consider indicative of ongoing financial performance. The non-GAAP measures presented include reconciliations to the most directly comparable GAAP measures and are: “noninterest income”, “total revenue”, “ noninterest expense”, “pre-provision profit”, “income before income tax expense”, “income tax expense”, “effective income tax rate”, “net income”, “net income available to common stockholders”, “other income”, “salaries and employee benefits”, “outside services”, “amortization of software expense”, “other operating expense”, “net income per average common share”, “return on average common equity” and “return on average total assets”. We believe these non-GAAP measures provide useful information to investors because these are among the measures used by our management team to evaluate our operating performance and make day-to-day operating decisions. In addition, we believe our “Adjusted” or “Underlying” results in any period do not reflect our operational performance in that period and, accordingly, it is useful to consider our GAAP results and our “Adjusted” or “Underlying” results together. We believe this presentation also increases comparability of period-to-period results. Other companies may use similarly titled non-GAAP financial measures that are calculated differently from the way we calculate such measures. Accordingly, our non-GAAP financial measures may not be comparable to similar measures used by other companies. We caution investors not to place undue reliance on such non-GAAP measures, but instead to consider them with the most directly comparable GAAP measure. Non-GAAP financial measures have limitations as analytical tools, and should not be considered in isolation, or as a substitute for our results as reported under GAAP.

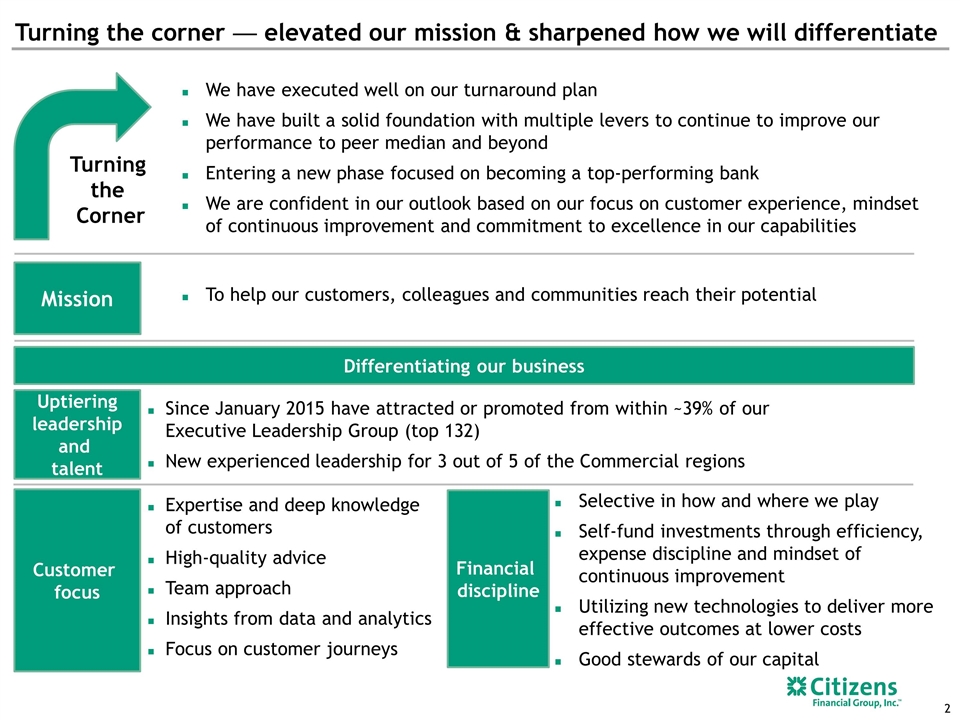

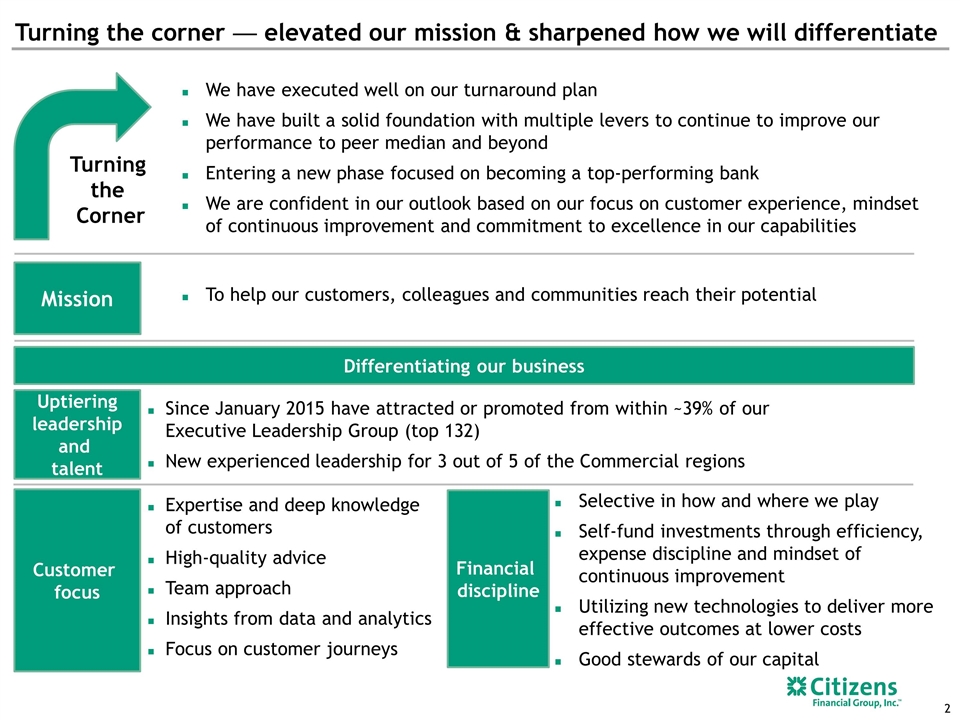

Turning the corner — elevated our mission & sharpened how we will differentiate To help our customers, colleagues and communities reach their potential Expertise and deep knowledge of customers High-quality advice Team approach Insights from data and analytics Focus on customer journeys Selective in how and where we play Self-fund investments through efficiency, expense discipline and mindset of continuous improvement Utilizing new technologies to deliver more effective outcomes at lower costs Good stewards of our capital Mission Differentiating our business Customer focus Turning the Corner We have executed well on our turnaround plan We have built a solid foundation with multiple levers to continue to improve our performance to peer median and beyond Entering a new phase focused on becoming a top-performing bank We are confident in our outlook based on our focus on customer experience, mindset of continuous improvement and commitment to excellence in our capabilities Financial discipline Uptiering leadership and talent Since January 2015 have attracted or promoted from within ~39% of our Executive Leadership Group (top 132) New experienced leadership for 3 out of 5 of the Commercial regions

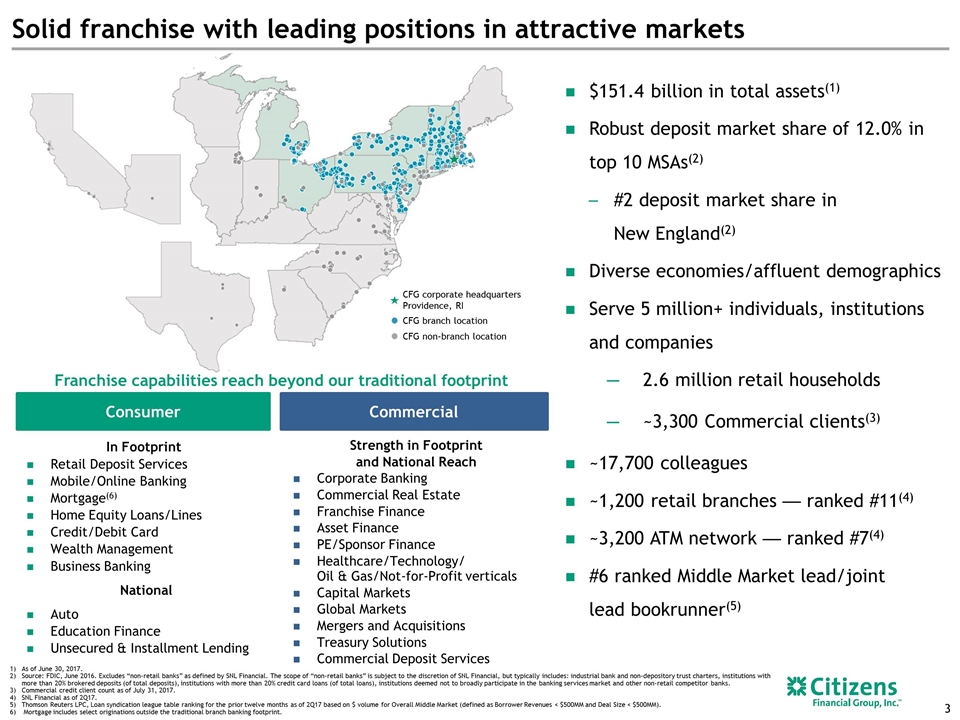

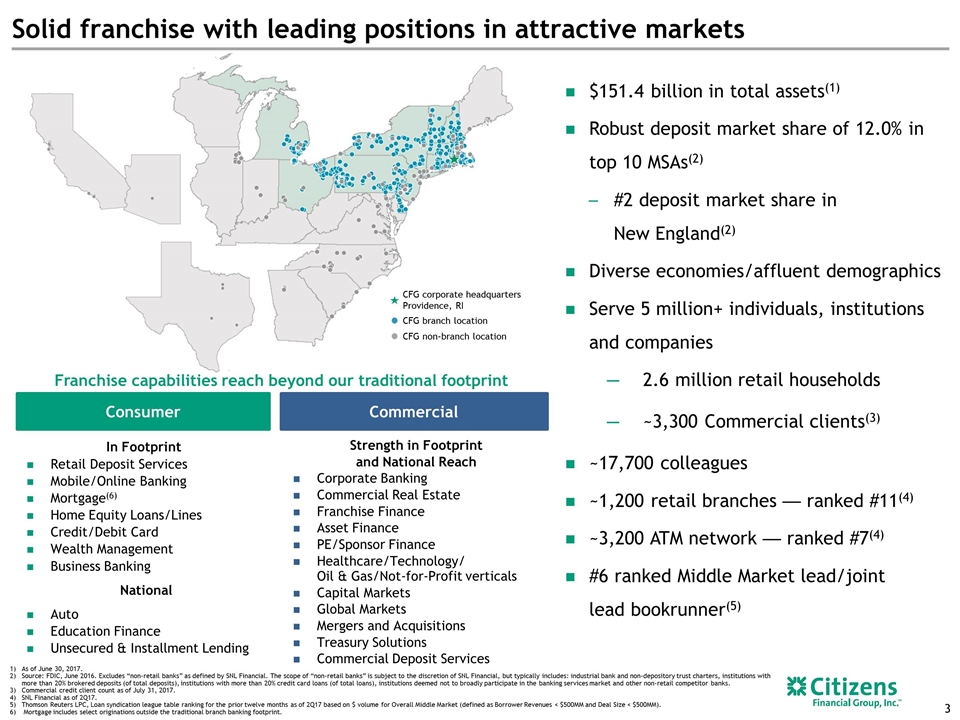

Solid franchise with leading positions in attractive markets $151.4 billion in total assets(1) Robust deposit market share of 12.0% in top 10 MSAs(2) #2 deposit market share in New England(2) Diverse economies/affluent demographics Serve 5 million+ individuals, institutions and companies 2.6 million retail households ~3,300 Commercial clients(3) ~17,700 colleagues ~1,200 retail branches — ranked #11(4) ~3,200 ATM network — ranked #7(4) #6 ranked Middle Market lead/joint lead bookrunner(5) Strength in Footprint and National Reach Corporate Banking Commercial Real Estate Franchise Finance Asset Finance PE/Sponsor Finance Healthcare/Technology/ Oil & Gas/Not-for-Profit verticals Capital Markets Global Markets Mergers and Acquisitions Treasury Solutions Commercial Deposit Services In Footprint Retail Deposit Services Mobile/Online Banking Mortgage(6) Home Equity Loans/Lines Credit/Debit Card Wealth Management Business Banking National Auto Education Finance Unsecured & Installment Lending Franchise capabilities reach beyond our traditional footprint As of June 30, 2017. Source: FDIC, June 2016. Excludes “non-retail banks” as defined by SNL Financial. The scope of “non-retail banks” is subject to the discretion of SNL Financial, but typically includes: industrial bank and non-depository trust charters, institutions with more than 20% brokered deposits (of total deposits), institutions with more than 20% credit card loans (of total loans), institutions deemed not to broadly participate in the banking services market and other non-retail competitor banks. Commercial credit client count as of July 31, 2017. SNL Financial as of 2Q17. Thomson Reuters LPC, Loan syndication league table ranking for the prior twelve months as of 2Q17 based on $ volume for Overall Middle Market (defined as Borrower Revenues < $500MM and Deal Size < $500MM). Mortgage includes select originations outside the traditional branch banking footprint. CFG corporate headquarters Providence, RI CFG branch location CFG non-branch location Consumer Commercial

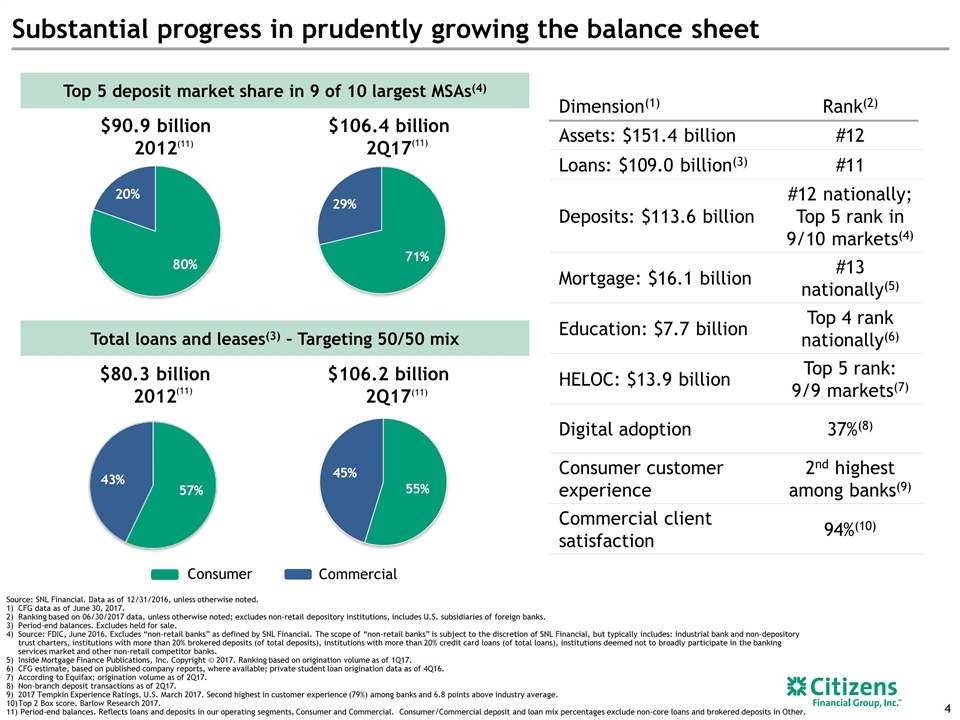

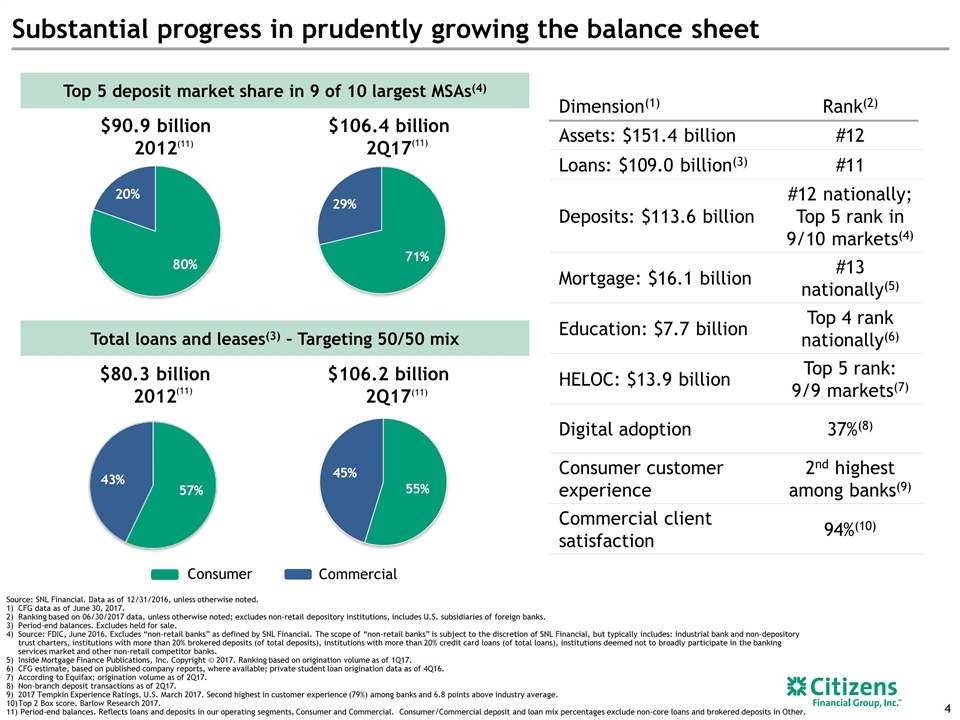

Consumer Substantial progress in prudently growing the balance sheet Dimension(1) Rank(2) Assets: $151.4 billion #12 Loans: $109.0 billion(3) #11 Deposits: $113.6 billion #12 nationally; Top 5 rank in 9/10 markets(4) Mortgage: $16.1 billion #13 nationally(5) Education: $7.7 billion Top 4 rank nationally(6) HELOC: $13.9 billion Top 5 rank: 9/9 markets(7) Digital adoption 37%(8) Consumer customer experience 2nd highest among banks(9) Commercial client satisfaction 94%(10) Source: SNL Financial. Data as of 12/31/2016, unless otherwise noted. CFG data as of June 30, 2017. Ranking based on 06/30/2017 data, unless otherwise noted; excludes non-retail depository institutions, includes U.S. subsidiaries of foreign banks. Period-end balances. Excludes held for sale. Source: FDIC, June 2016. Excludes “non-retail banks” as defined by SNL Financial. The scope of “non-retail banks” is subject to the discretion of SNL Financial, but typically includes: industrial bank and non-depository trust charters, institutions with more than 20% brokered deposits (of total deposits), institutions with more than 20% credit card loans (of total loans), institutions deemed not to broadly participate in the banking services market and other non-retail competitor banks. Inside Mortgage Finance Publications, Inc. Copyright © 2017. Ranking based on origination volume as of 1Q17. CFG estimate, based on published company reports, where available; private student loan origination data as of 4Q16. According to Equifax; origination volume as of 2Q17. Non-branch deposit transactions as of 2Q17. 2017 Tempkin Experience Ratings, U.S. March 2017. Second highest in customer experience (79%) among banks and 6.8 points above industry average. Top 2 Box score. Barlow Research 2017. Period-end balances. Reflects loans and deposits in our operating segments, Consumer and Commercial. Consumer/Commercial deposit and loan mix percentages exclude non-core loans and brokered deposits in Other. Top 5 deposit market share in 9 of 10 largest MSAs(4) Total loans and leases(3) – Targeting 50/50 mix $90.9 billion 2012 $106.4 billion 2Q17 $106.2 billion 2Q17 $80.3 billion 2012 Commercial (11) (11) (11) (11)

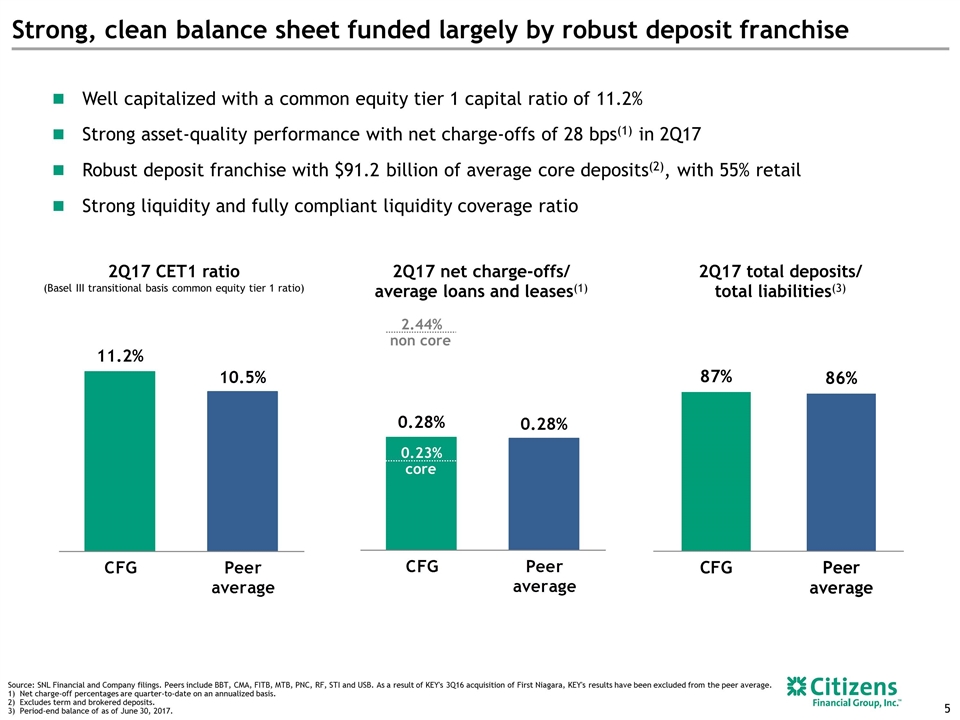

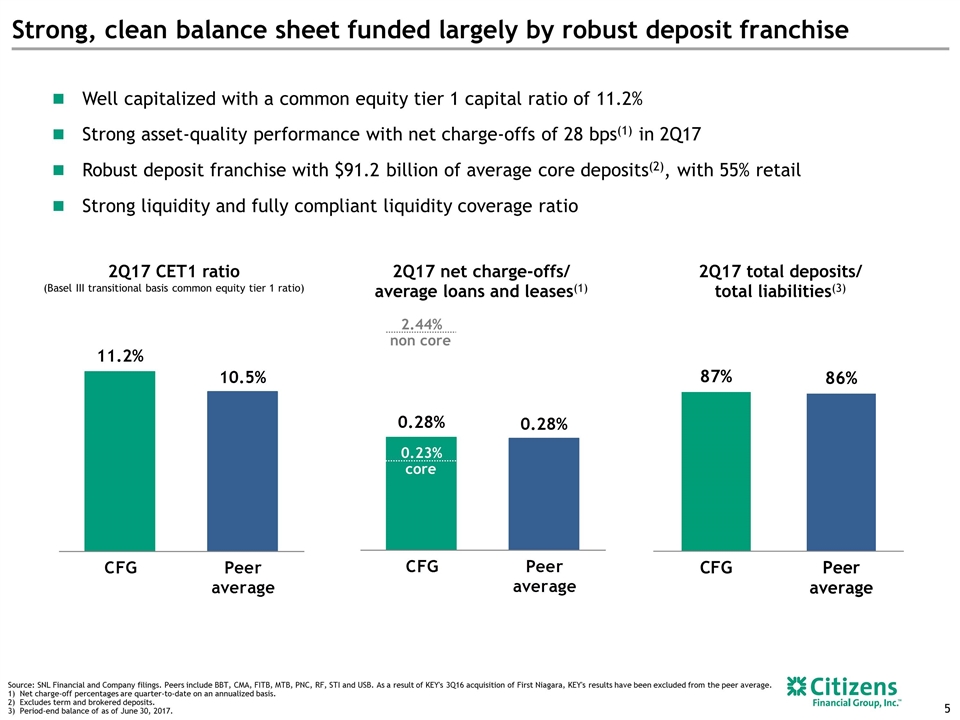

Well capitalized with a common equity tier 1 capital ratio of 11.2% Strong asset-quality performance with net charge-offs of 28 bps(1) in 2Q17 Robust deposit franchise with $91.2 billion of average core deposits(2), with 55% retail Strong liquidity and fully compliant liquidity coverage ratio Strong, clean balance sheet funded largely by robust deposit franchise 2Q17 net charge-offs/ average loans and leases(1) 2Q17 CET1 ratio (Basel III transitional basis common equity tier 1 ratio) Source: SNL Financial and Company filings. Peers include BBT, CMA, FITB, MTB, PNC, RF, STI and USB. As a result of KEY's 3Q16 acquisition of First Niagara, KEY's results have been excluded from the peer average. Net charge-off percentages are quarter-to-date on an annualized basis. Excludes term and brokered deposits. Period-end balance of as of June 30, 2017. 2Q17 total deposits/ total liabilities(3) 2.44% non core 0.23% core

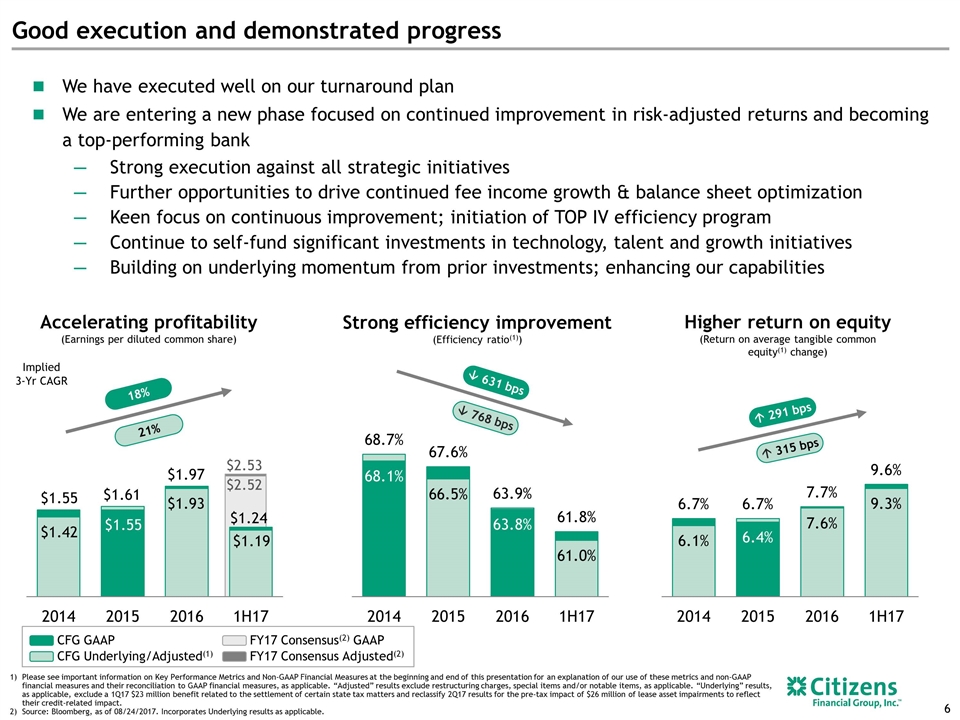

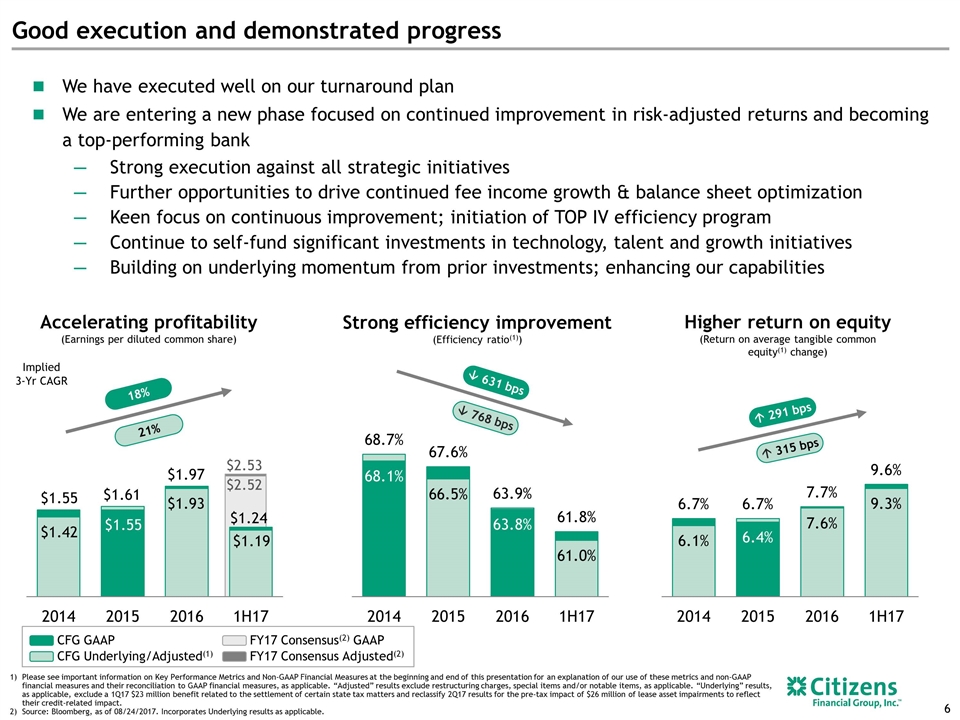

$2.52 $2.53 We have executed well on our turnaround plan We are entering a new phase focused on continued improvement in risk-adjusted returns and becoming a top-performing bank Strong execution against all strategic initiatives Further opportunities to drive continued fee income growth & balance sheet optimization Keen focus on continuous improvement; initiation of TOP IV efficiency program Continue to self-fund significant investments in technology, talent and growth initiatives Building on underlying momentum from prior investments; enhancing our capabilities CFG GAAP CFG Underlying/Adjusted(1) Please see important information on Key Performance Metrics and Non-GAAP Financial Measures at the beginning and end of this presentation for an explanation of our use of these metrics and non-GAAP financial measures and their reconciliation to GAAP financial measures, as applicable. “Adjusted” results exclude restructuring charges, special items and/or notable items, as applicable. “Underlying” results, as applicable, exclude a 1Q17 $23 million benefit related to the settlement of certain state tax matters and reclassify 2Q17 results for the pre-tax impact of $26 million of lease asset impairments to reflect their credit-related impact. Source: Bloomberg, as of 08/24/2017. Incorporates Underlying results as applicable. Higher return on equity (Return on average tangible common equity(1) change) Strong efficiency improvement (Efficiency ratio(1)) Accelerating profitability (Earnings per diluted common share) Good execution and demonstrated progress FY17 Consensus(2) GAAP FY17 Consensus Adjusted(2) â 768 bps Implied 3-Yr CAGR 21% â 631 bps á 291 bps á 315 bps 18%

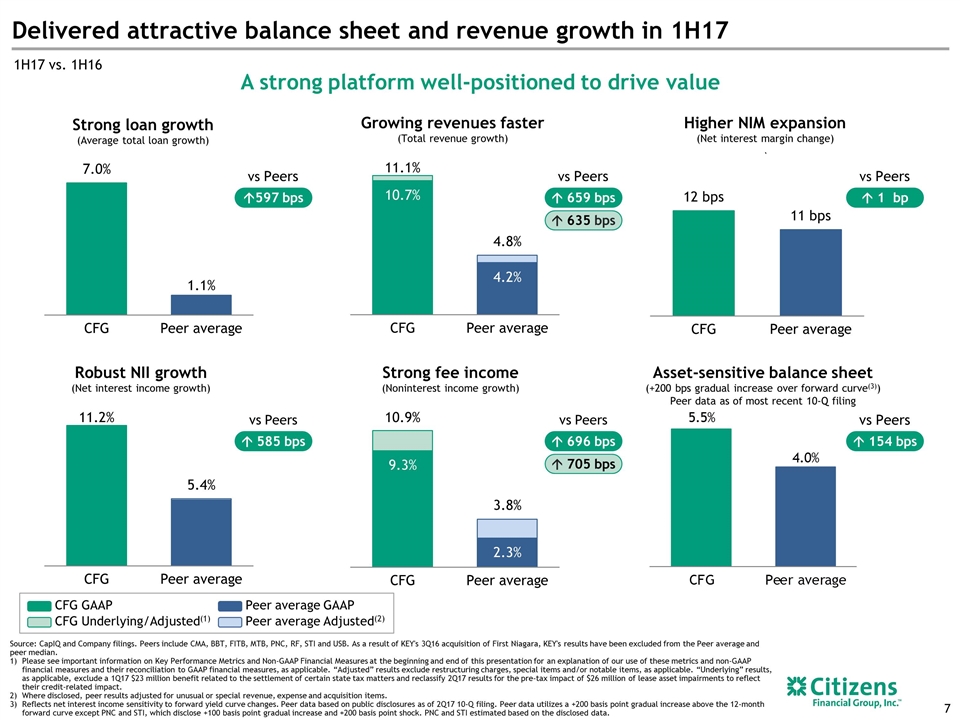

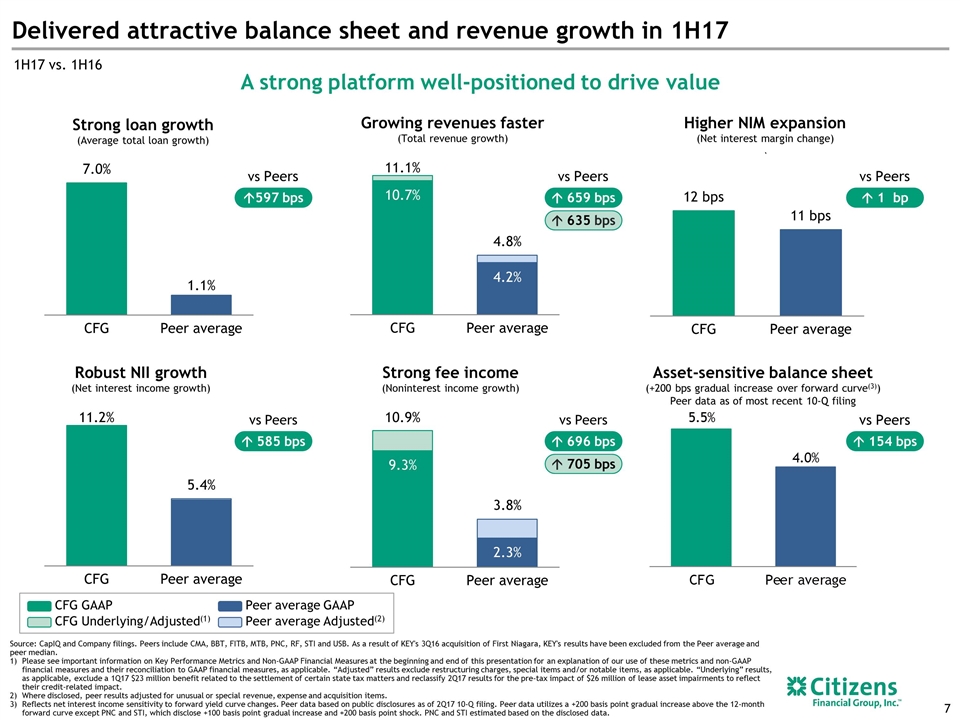

Source: CapIQ and Company filings. Peers include CMA, BBT, FITB, MTB, PNC, RF, STI and USB. As a result of KEY's 3Q16 acquisition of First Niagara, KEY's results have been excluded from the Peer average and peer median. Please see important information on Key Performance Metrics and Non-GAAP Financial Measures at the beginning and end of this presentation for an explanation of our use of these metrics and non-GAAP financial measures and their reconciliation to GAAP financial measures, as applicable. “Adjusted” results exclude restructuring charges, special items and/or notable items, as applicable. “Underlying” results, as applicable, exclude a 1Q17 $23 million benefit related to the settlement of certain state tax matters and reclassify 2Q17 results for the pre-tax impact of $26 million of lease asset impairments to reflect their credit-related impact. Where disclosed, peer results adjusted for unusual or special revenue, expense and acquisition items. Reflects net interest income sensitivity to forward yield curve changes. Peer data based on public disclosures as of 2Q17 10-Q filing. Peer data utilizes a +200 basis point gradual increase above the 12-month forward curve except PNC and STI, which disclose +100 basis point gradual increase and +200 basis point shock. PNC and STI estimated based on the disclosed data. Executive Summary---Positioning Citizens to Investors Strong loan growth (Average total loan growth) A strong platform well-positioned to drive value Growing revenues faster (Total revenue growth) Higher NIM expansion (Net interest margin change) ` Asset-sensitive balance sheet (+200 bps gradual increase over forward curve(3)) Peer data as of most recent 10-Q filing Robust NII growth (Net interest income growth) Strong fee income (Noninterest income growth) á597 bps vs Peers á 1 bp vs Peers Delivered attractive balance sheet and revenue growth in 1H17 1H17 vs. 1H16 á 659 bps vs Peers á 635 bps á 585 bps vs Peers á 696 bps vs Peers á 705 bps vs Peers á 154 bps CFG GAAP CFG Underlying/Adjusted(1) Peer average GAAP Peer average Adjusted(2)

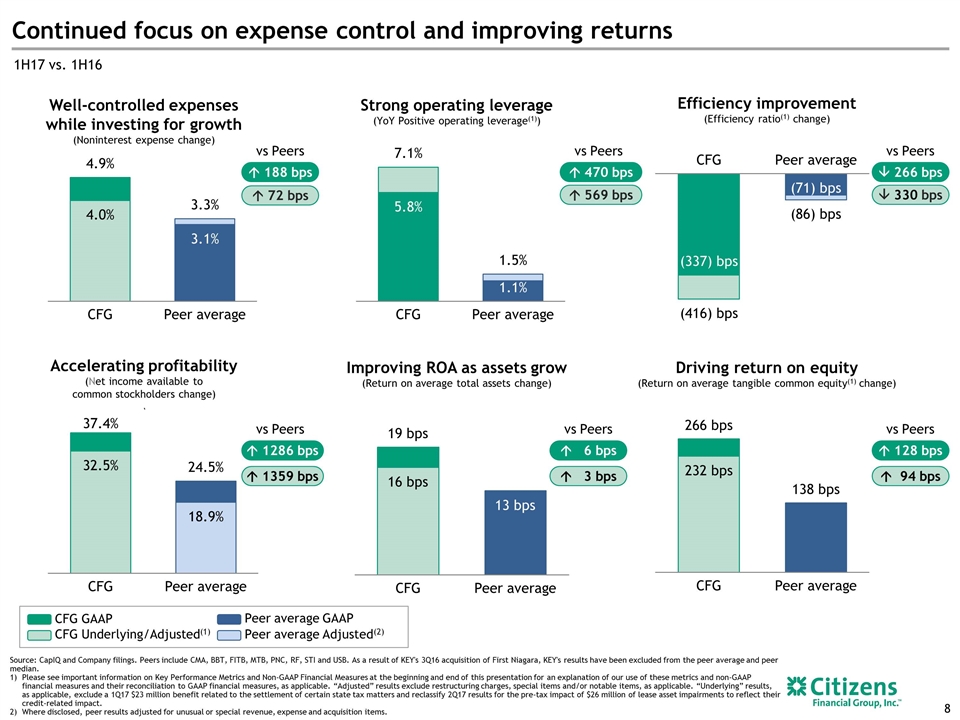

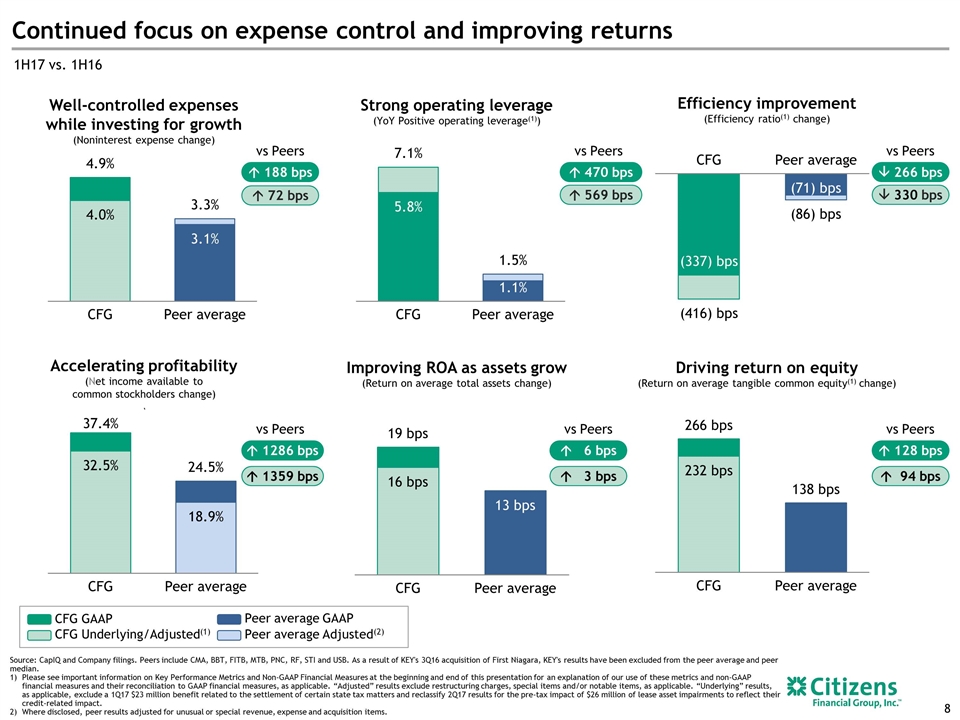

Executive Summary---Positioning Citizens to Investors Well-controlled expenses while investing for growth (Noninterest expense change) Accelerating profitability (Net income available to common stockholders change) ` Driving return on equity (Return on average tangible common equity(1) change) Improving ROA as assets grow (Return on average total assets change) Strong operating leverage (YoY Positive operating leverage(1)) Source: CapIQ and Company filings. Peers include CMA, BBT, FITB, MTB, PNC, RF, STI and USB. As a result of KEY's 3Q16 acquisition of First Niagara, KEY's results have been excluded from the peer average and peer median. Please see important information on Key Performance Metrics and Non-GAAP Financial Measures at the beginning and end of this presentation for an explanation of our use of these metrics and non-GAAP financial measures and their reconciliation to GAAP financial measures, as applicable. “Adjusted” results exclude restructuring charges, special items and/or notable items, as applicable. “Underlying” results, as applicable, exclude a 1Q17 $23 million benefit related to the settlement of certain state tax matters and reclassify 2Q17 results for the pre-tax impact of $26 million of lease asset impairments to reflect their credit-related impact. Where disclosed, peer results adjusted for unusual or special revenue, expense and acquisition items. Continued focus on expense control and improving returns 1H17 vs. 1H16 á 1286 bps vs Peers á 1359 bps á 6 bps vs Peers á 3 bps á 128 bps vs Peers á 94 bps á 188 bps vs Peers á 72 bps á 470 bps vs Peers á 569 bps â 266 bps vs Peers â 330 bps CFG Underlying/Adjusted(1) Peer average GAAP Peer average Adjusted(2) Efficiency improvement (Efficiency ratio(1) change) CFG GAAP

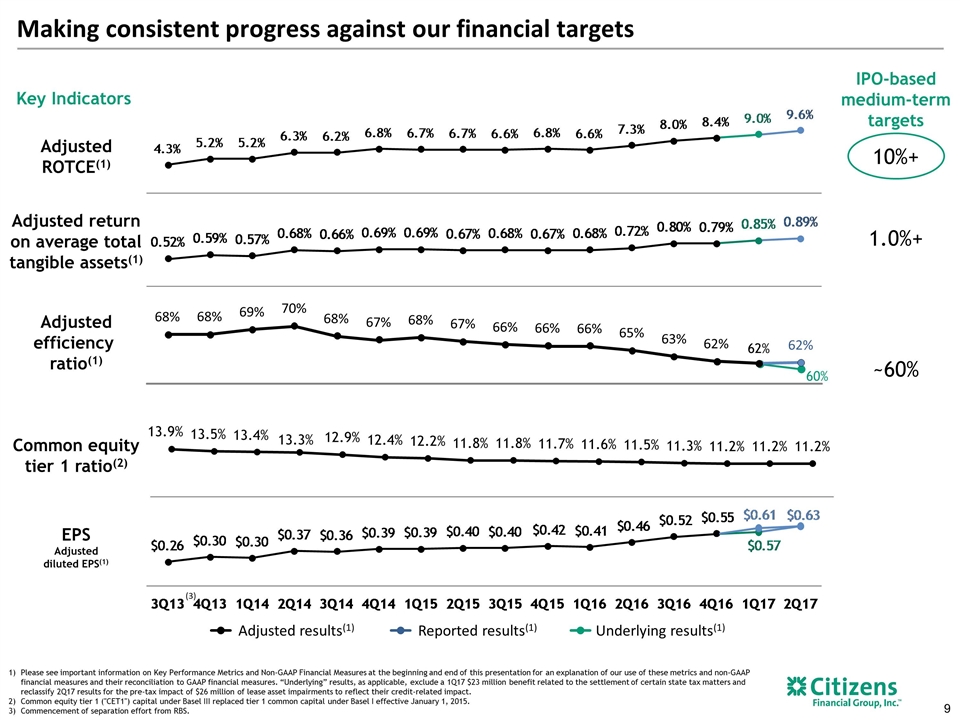

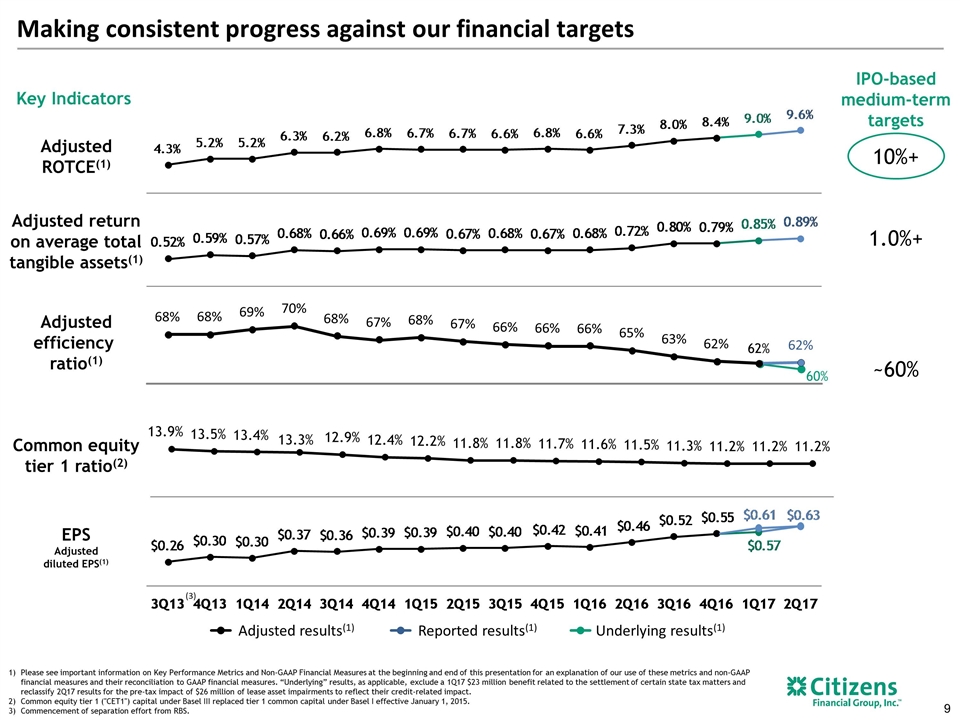

1.0%+ Adjusted efficiency ratio(1) ~60% 10%+ Making consistent progress against our financial targets IPO-based medium-term targets Key Indicators Adjusted ROTCE(1) Adjusted return on average total tangible assets(1) EPS Adjusted diluted EPS(1) Common equity tier 1 ratio(2) (3) Underlying results(1) Reported results(1) Adjusted results(1) Please see important information on Key Performance Metrics and Non-GAAP Financial Measures at the beginning and end of this presentation for an explanation of our use of these metrics and non-GAAP financial measures and their reconciliation to GAAP financial measures. “Underlying” results, as applicable, exclude a 1Q17 $23 million benefit related to the settlement of certain state tax matters and reclassify 2Q17 results for the pre-tax impact of $26 million of lease asset impairments to reflect their credit-related impact. Common equity tier 1 ("CET1") capital under Basel III replaced tier 1 common capital under Basel I effective January 1, 2015. Commencement of separation effort from RBS. 60% 62% 62% 68% 68% 69% 70% 68% 67% 68% 67% 66% 66% 66% 65% 63% 62%

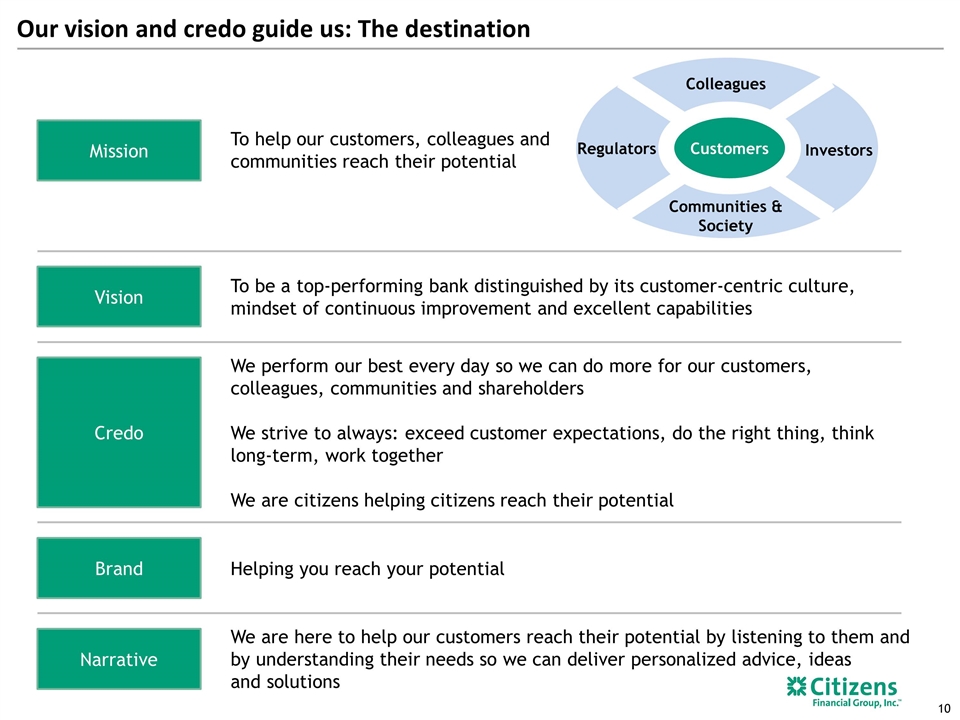

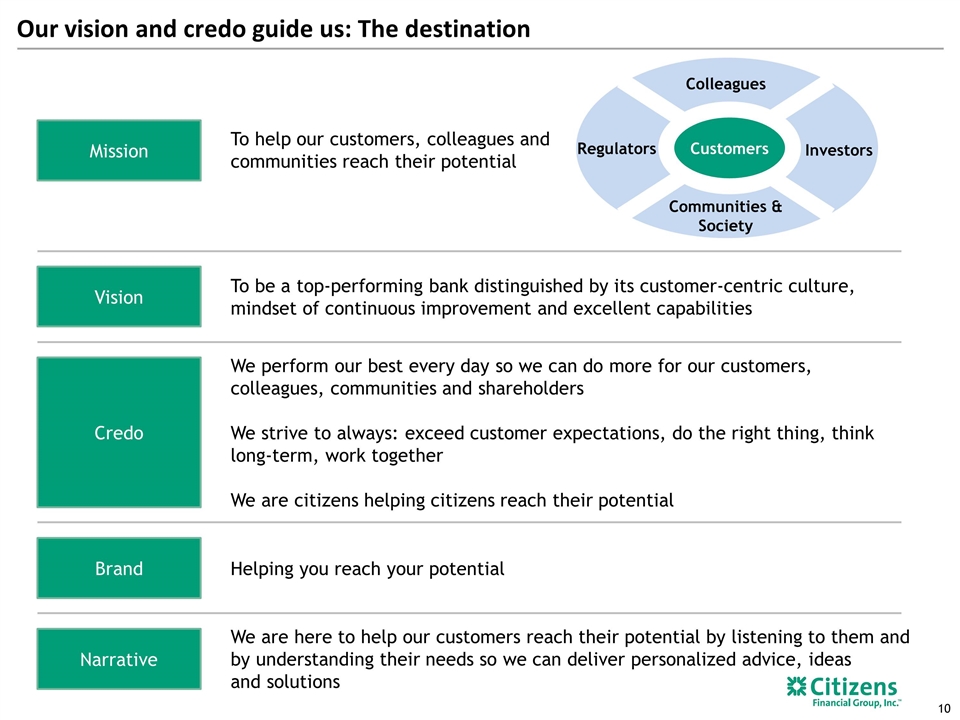

Helping you reach your potential We perform our best every day so we can do more for our customers, colleagues, communities and shareholders We strive to always: exceed customer expectations, do the right thing, think long-term, work together We are citizens helping citizens reach their potential To help our customers, colleagues and communities reach their potential We are here to help our customers reach their potential by listening to them and by understanding their needs so we can deliver personalized advice, ideas and solutions To be a top-performing bank distinguished by its customer-centric culture, mindset of continuous improvement and excellent capabilities Mission Vision Credo Brand Narrative Our vision and credo guide us: The destination Colleagues Regulators Investors Communities & Society Customers

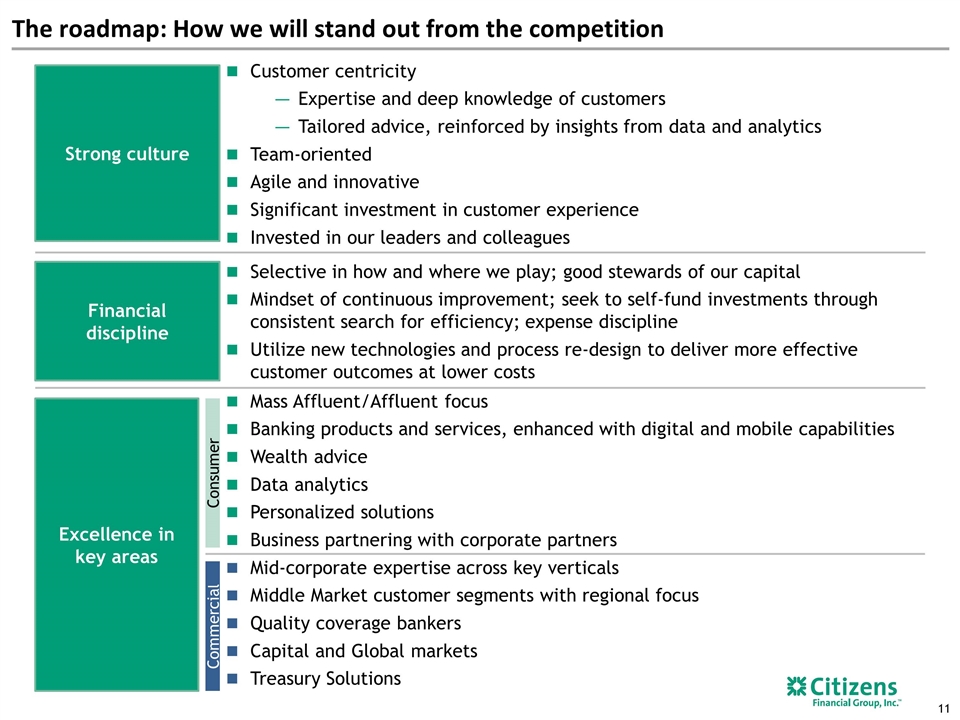

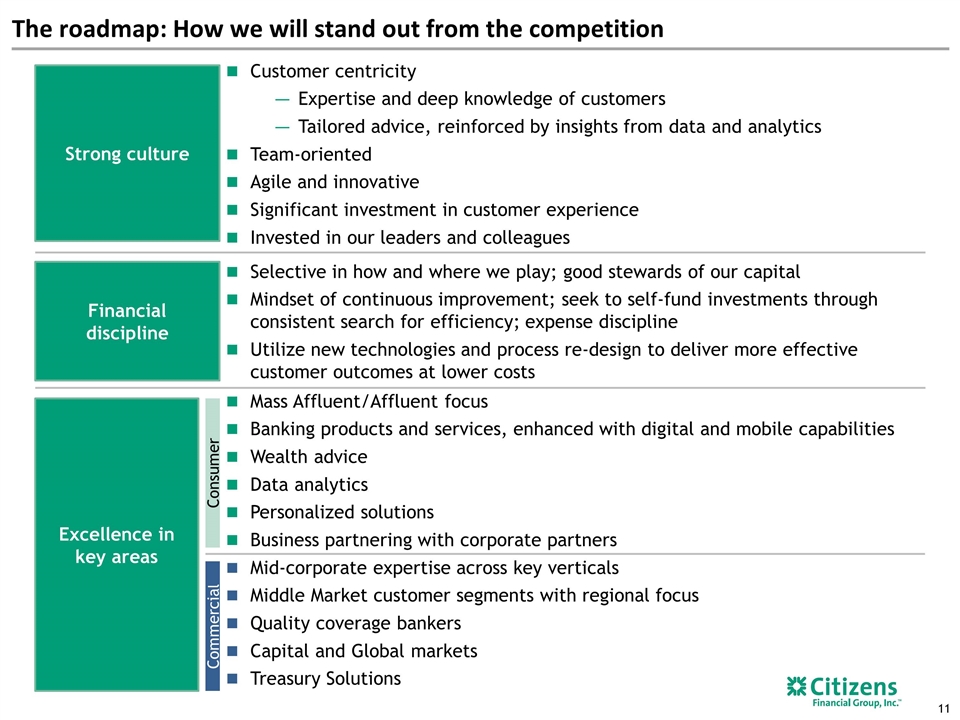

The roadmap: How we will stand out from the competition Strong culture Customer centricity Expertise and deep knowledge of customers Tailored advice, reinforced by insights from data and analytics Team-oriented Agile and innovative Significant investment in customer experience Invested in our leaders and colleagues Financial discipline Selective in how and where we play; good stewards of our capital Mindset of continuous improvement; seek to self-fund investments through consistent search for efficiency; expense discipline Utilize new technologies and process re-design to deliver more effective customer outcomes at lower costs Excellence in key areas Mass Affluent/Affluent focus Banking products and services, enhanced with digital and mobile capabilities Wealth advice Data analytics Personalized solutions Business partnering with corporate partners Mid-corporate expertise across key verticals Middle Market customer segments with regional focus Quality coverage bankers Capital and Global markets Treasury Solutions Consumer Commercial

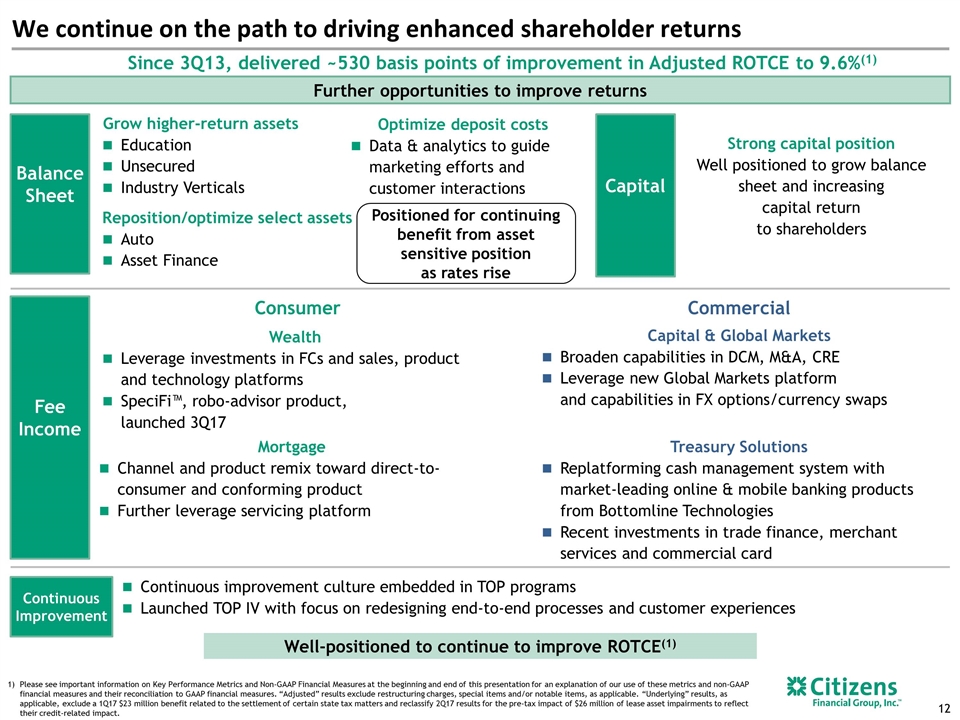

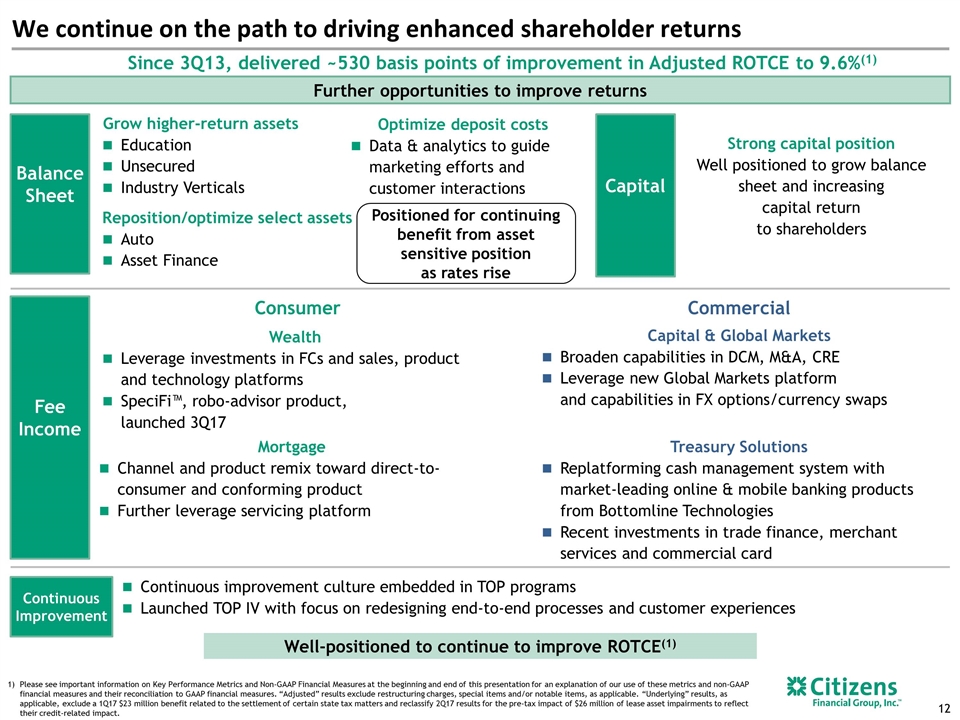

Optimize deposit costs Data & analytics to guide marketing efforts and customer interactions We continue on the path to driving enhanced shareholder returns Further opportunities to improve returns Balance Sheet Continuous Improvement Continuous improvement culture embedded in TOP programs Launched TOP IV with focus on redesigning end-to-end processes and customer experiences Since 3Q13, delivered ~530 basis points of improvement in Adjusted ROTCE to 9.6%(1) Well-positioned to continue to improve ROTCE(1) Grow higher-return assets Education Unsecured Industry Verticals Reposition/optimize select assets Auto Asset Finance Positioned for continuing benefit from asset sensitive position as rates rise Consumer Commercial Wealth Leverage investments in FCs and sales, product and technology platforms SpeciFi™, robo-advisor product, launched 3Q17 Mortgage Channel and product remix toward direct-to-consumer and conforming product Further leverage servicing platform Capital & Global Markets Broaden capabilities in DCM, M&A, CRE Leverage new Global Markets platform and capabilities in FX options/currency swaps Treasury Solutions Replatforming cash management system with market-leading online & mobile banking products from Bottomline Technologies Recent investments in trade finance, merchant services and commercial card Strong capital position Well positioned to grow balance sheet and increasing capital return to shareholders Fee Income Capital Please see important information on Key Performance Metrics and Non-GAAP Financial Measures at the beginning and end of this presentation for an explanation of our use of these metrics and non-GAAP financial measures and their reconciliation to GAAP financial measures. “Adjusted” results exclude restructuring charges, special items and/or notable items, as applicable. “Underlying” results, as applicable, exclude a 1Q17 $23 million benefit related to the settlement of certain state tax matters and reclassify 2Q17 results for the pre-tax impact of $26 million of lease asset impairments to reflect their credit-related impact.

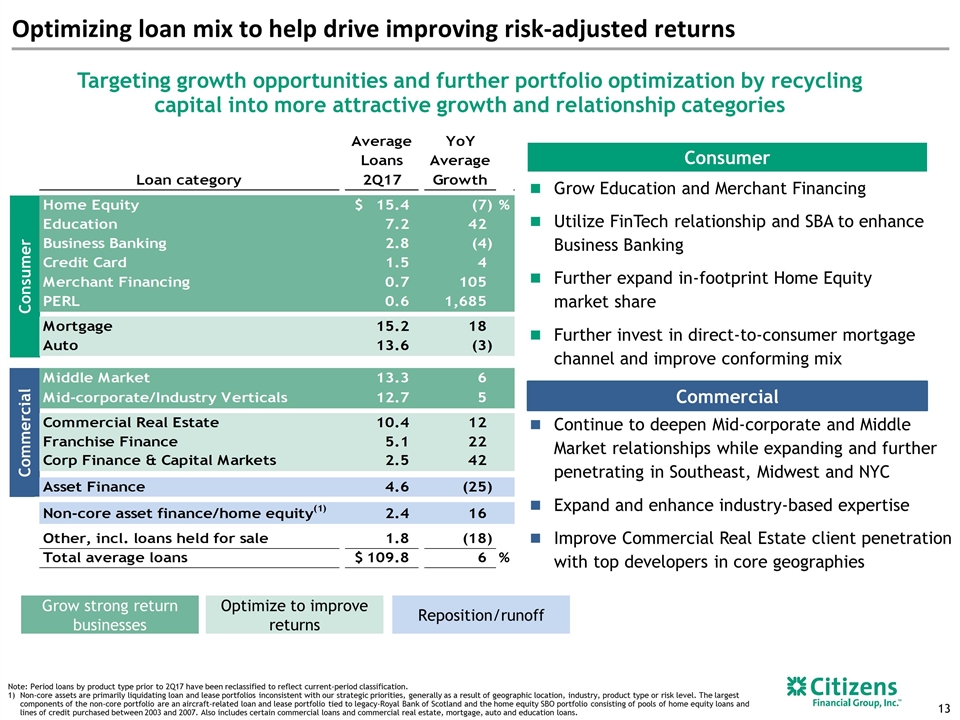

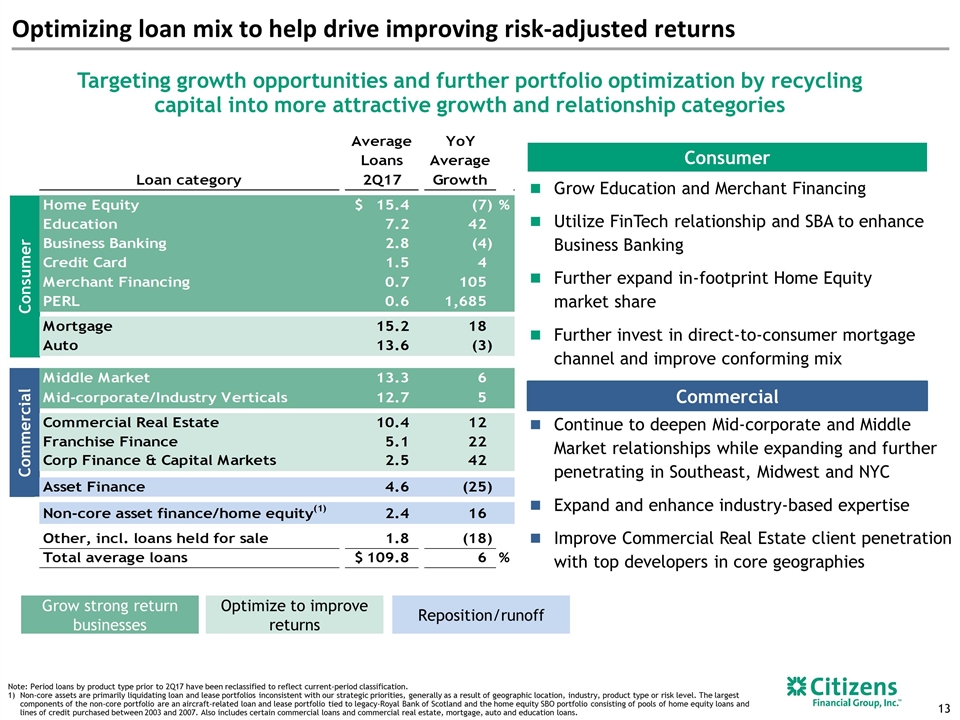

Optimizing loan mix to help drive improving risk-adjusted returns Targeting growth opportunities and further portfolio optimization by recycling capital into more attractive growth and relationship categories Grow strong return businesses Optimize to improve returns Reposition/runoff Consumer Commercial Grow Education and Merchant Financing Utilize FinTech relationship and SBA to enhance Business Banking Further expand in-footprint Home Equity market share Further invest in direct-to-consumer mortgage channel and improve conforming mix Continue to deepen Mid-corporate and Middle Market relationships while expanding and further penetrating in Southeast, Midwest and NYC Expand and enhance industry-based expertise Improve Commercial Real Estate client penetration with top developers in core geographies Note: Period loans by product type prior to 2Q17 have been reclassified to reflect current-period classification. Non-core assets are primarily liquidating loan and lease portfolios inconsistent with our strategic priorities, generally as a result of geographic location, industry, product type or risk level. The largest components of the non-core portfolio are an aircraft-related loan and lease portfolio tied to legacy-Royal Bank of Scotland and the home equity SBO portfolio consisting of pools of home equity loans and lines of credit purchased between 2003 and 2007. Also includes certain commercial loans and commercial real estate, mortgage, auto and education loans. Consumer Commercial

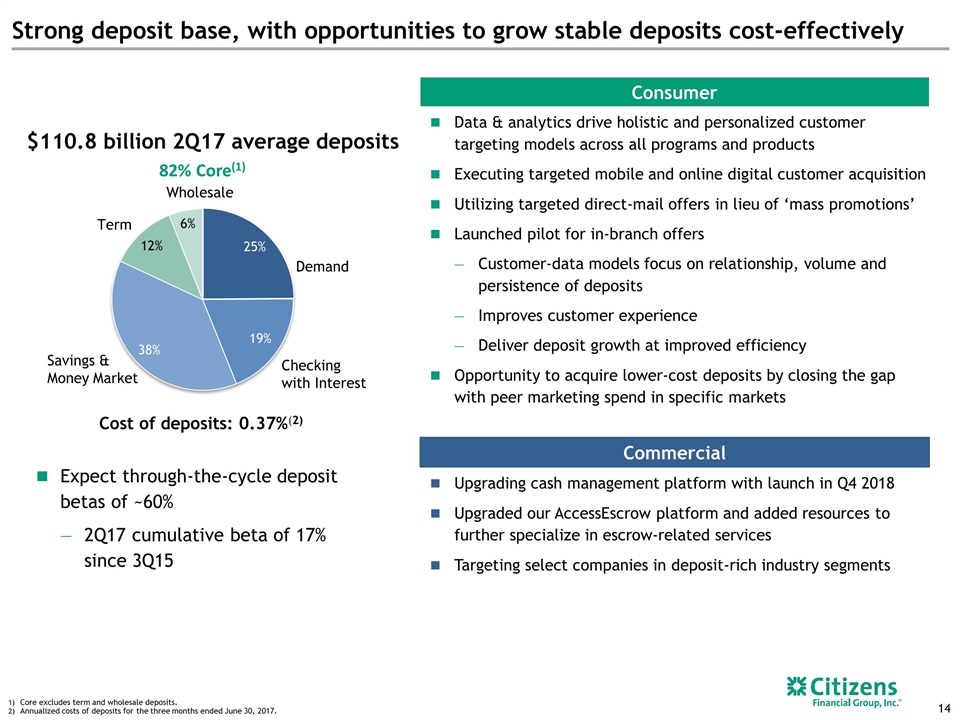

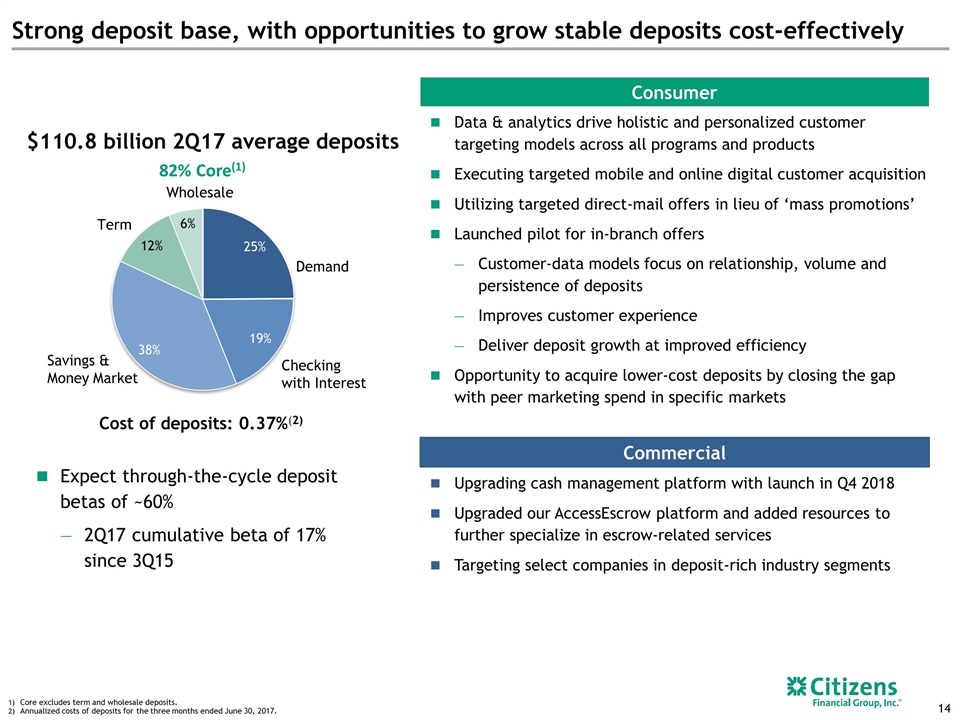

Core excludes term and wholesale deposits. Annualized costs of deposits for the three months ended June 30, 2017. Term Savings & Money Market Checking with Interest Demand Cost of deposits: 0.37%(2) $110.8 billion 2Q17 average deposits Strong deposit base, with opportunities to grow stable deposits cost-effectively Wholesale 82% Core(1) Data & analytics drive holistic and personalized customer targeting models across all programs and products Executing targeted mobile and online digital customer acquisition Utilizing targeted direct-mail offers in lieu of ‘mass promotions’ Launched pilot for in-branch offers Customer-data models focus on relationship, volume and persistence of deposits Improves customer experience Deliver deposit growth at improved efficiency Opportunity to acquire lower-cost deposits by closing the gap with peer marketing spend in specific markets Expect through-the-cycle deposit betas of ~60% 2Q17 cumulative beta of 17% since 3Q15 Consumer Commercial Upgrading cash management platform with launch in Q4 2018 Upgraded our AccessEscrow platform and added resources to further specialize in escrow-related services Targeting select companies in deposit-rich industry segments

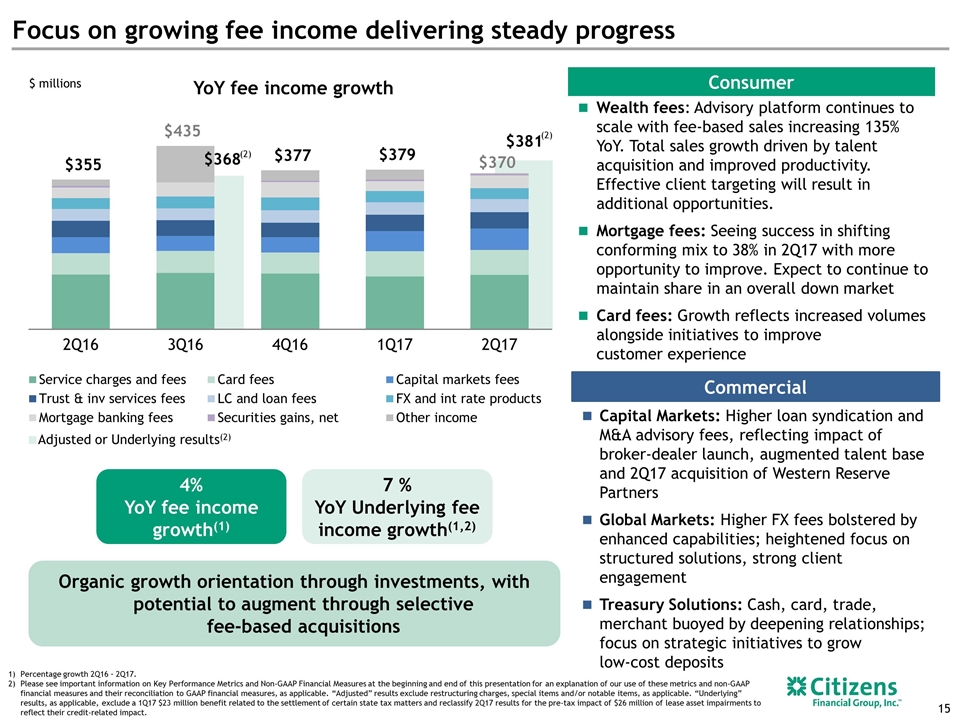

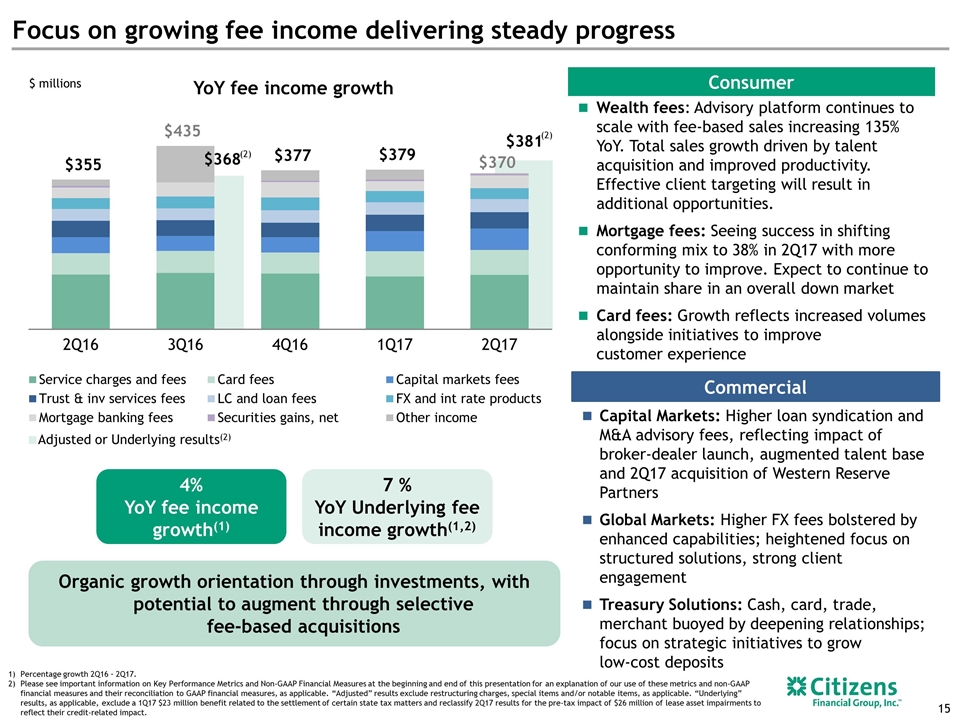

YoY fee income growth Focus on growing fee income delivering steady progress Wealth fees: Advisory platform continues to scale with fee-based sales increasing 135% YoY. Total sales growth driven by talent acquisition and improved productivity. Effective client targeting will result in additional opportunities. Mortgage fees: Seeing success in shifting conforming mix to 38% in 2Q17 with more opportunity to improve. Expect to continue to maintain share in an overall down market Card fees: Growth reflects increased volumes alongside initiatives to improve customer experience Consumer Commercial Capital Markets: Higher loan syndication and M&A advisory fees, reflecting impact of broker-dealer launch, augmented talent base and 2Q17 acquisition of Western Reserve Partners Global Markets: Higher FX fees bolstered by enhanced capabilities; heightened focus on structured solutions, strong client engagement Treasury Solutions: Cash, card, trade, merchant buoyed by deepening relationships; focus on strategic initiatives to grow low-cost deposits Percentage growth 2Q16 – 2Q17. Please see important information on Key Performance Metrics and Non-GAAP Financial Measures at the beginning and end of this presentation for an explanation of our use of these metrics and non-GAAP financial measures and their reconciliation to GAAP financial measures, as applicable. “Adjusted” results exclude restructuring charges, special items and/or notable items, as applicable. “Underlying” results, as applicable, exclude a 1Q17 $23 million benefit related to the settlement of certain state tax matters and reclassify 2Q17 results for the pre-tax impact of $26 million of lease asset impairments to reflect their credit-related impact. 4% YoY fee income growth(1) 7 % YoY Underlying fee income growth(1,2) $368 $381 Adjusted or Underlying results(2) (2) $ millions Organic growth orientation through investments, with potential to augment through selective fee-based acquisitions (2)

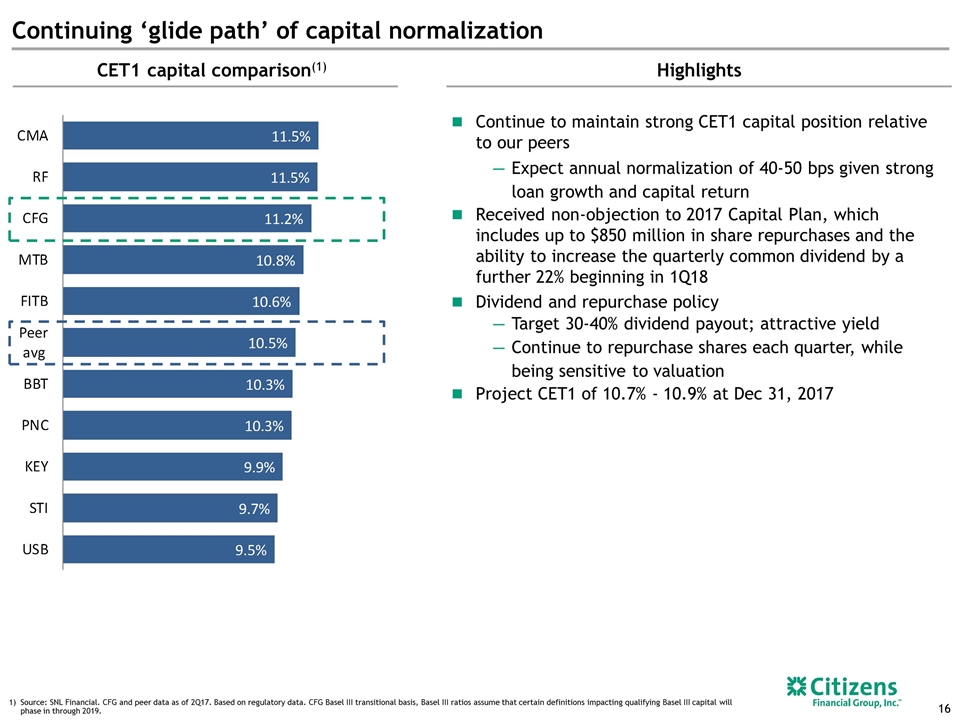

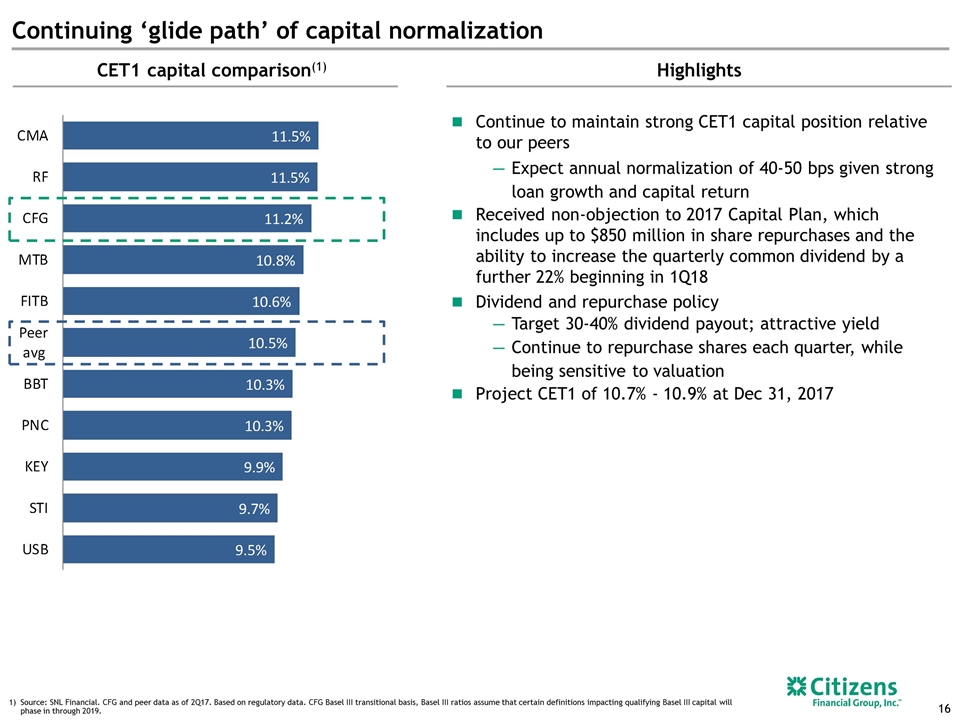

Source: SNL Financial. CFG and peer data as of 2Q17. Based on regulatory data. CFG Basel III transitional basis, Basel III ratios assume that certain definitions impacting qualifying Basel III capital will phase in through 2019. Continuing ‘glide path’ of capital normalization Highlights CET1 capital comparison(1) Continue to maintain strong CET1 capital position relative to our peers Expect annual normalization of 40-50 bps given strong loan growth and capital return Received non-objection to 2017 Capital Plan, which includes up to $850 million in share repurchases and the ability to increase the quarterly common dividend by a further 22% beginning in 1Q18 Dividend and repurchase policy Target 30-40% dividend payout; attractive yield Continue to repurchase shares each quarter, while being sensitive to valuation Project CET1 of 10.7% - 10.9% at Dec 31, 2017

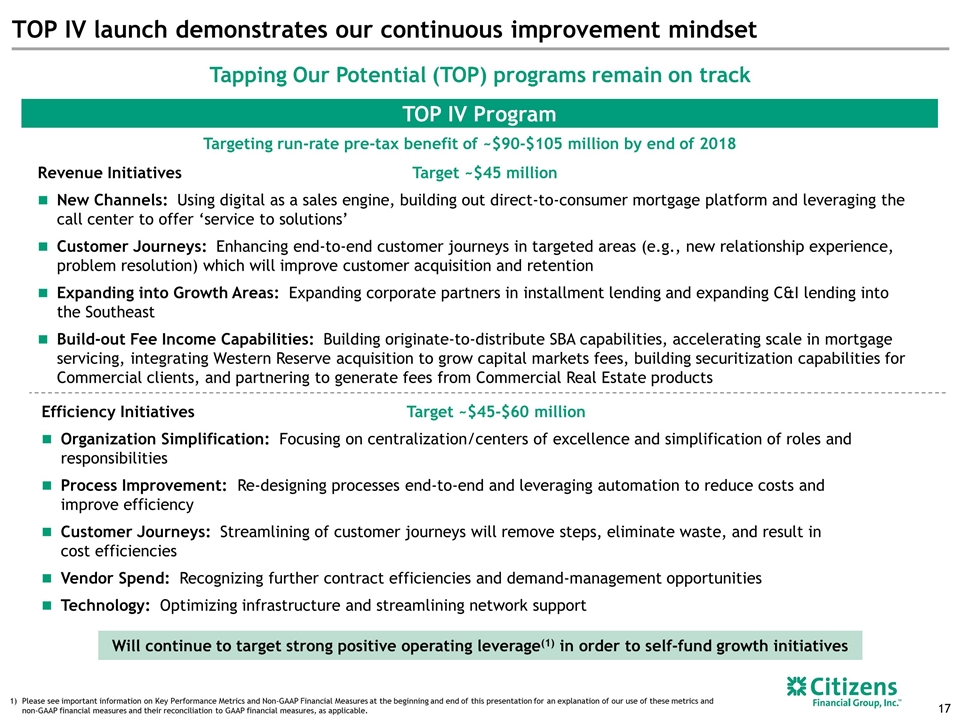

TOP IV Program Efficiency Initiatives Target ~$45-$60 million Organization Simplification: Focusing on centralization/centers of excellence and simplification of roles and responsibilities Process Improvement: Re-designing processes end-to-end and leveraging automation to reduce costs and improve efficiency Customer Journeys: Streamlining of customer journeys will remove steps, eliminate waste, and result in cost efficiencies Vendor Spend: Recognizing further contract efficiencies and demand-management opportunities Technology: Optimizing infrastructure and streamlining network support Revenue Initiatives Target ~$45 million New Channels: Using digital as a sales engine, building out direct-to-consumer mortgage platform and leveraging the call center to offer ‘service to solutions’ Customer Journeys: Enhancing end-to-end customer journeys in targeted areas (e.g., new relationship experience, problem resolution) which will improve customer acquisition and retention Expanding into Growth Areas: Expanding corporate partners in installment lending and expanding C&I lending into the Southeast Build-out Fee Income Capabilities: Building originate-to-distribute SBA capabilities, accelerating scale in mortgage servicing, integrating Western Reserve acquisition to grow capital markets fees, building securitization capabilities for Commercial clients, and partnering to generate fees from Commercial Real Estate products Targeting run-rate pre-tax benefit of ~$90-$105 million by end of 2018 Tapping Our Potential (TOP) programs remain on track TOP IV launch demonstrates our continuous improvement mindset Will continue to target strong positive operating leverage(1) in order to self-fund growth initiatives Please see important information on Key Performance Metrics and Non-GAAP Financial Measures at the beginning and end of this presentation for an explanation of our use of these metrics and non-GAAP financial measures and their reconciliation to GAAP financial measures, as applicable.

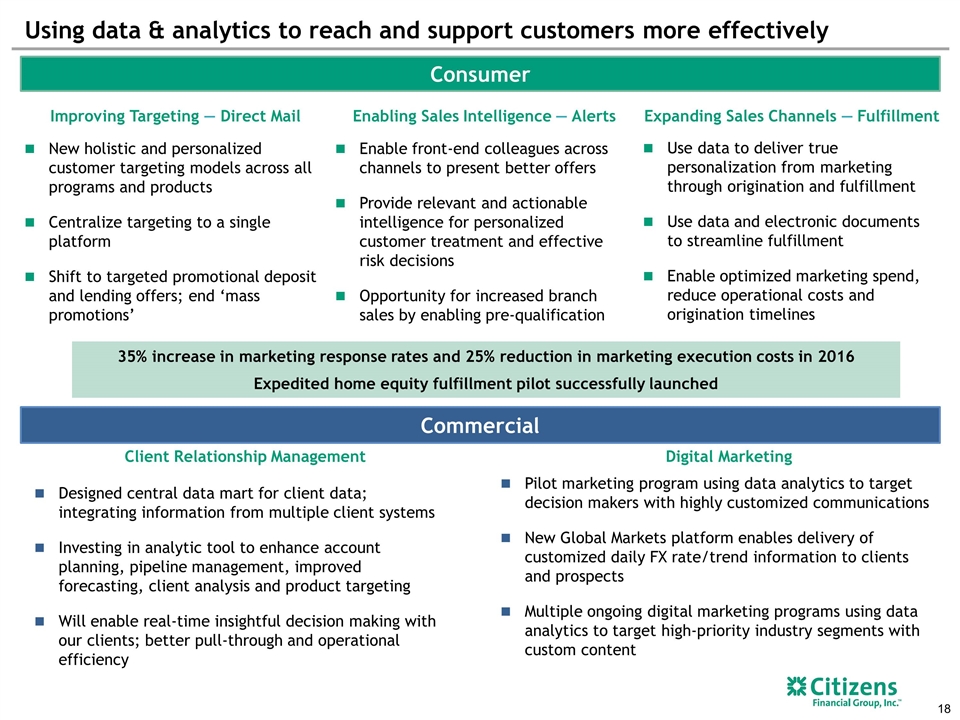

Using data & analytics to reach and support customers more effectively Improving Targeting — Direct Mail Enabling Sales Intelligence — Alerts Expanding Sales Channels — Fulfillment New holistic and personalized customer targeting models across all programs and products Centralize targeting to a single platform Shift to targeted promotional deposit and lending offers; end ‘mass promotions’ Enable front-end colleagues across channels to present better offers Provide relevant and actionable intelligence for personalized customer treatment and effective risk decisions Opportunity for increased branch sales by enabling pre-qualification Use data to deliver true personalization from marketing through origination and fulfillment Use data and electronic documents to streamline fulfillment Enable optimized marketing spend, reduce operational costs and origination timelines 35% increase in marketing response rates and 25% reduction in marketing execution costs in 2016 Expedited home equity fulfillment pilot successfully launched Consumer Commercial Designed central data mart for client data; integrating information from multiple client systems Investing in analytic tool to enhance account planning, pipeline management, improved forecasting, client analysis and product targeting Will enable real-time insightful decision making with our clients; better pull-through and operational efficiency Pilot marketing program using data analytics to target decision makers with highly customized communications New Global Markets platform enables delivery of customized daily FX rate/trend information to clients and prospects Multiple ongoing digital marketing programs using data analytics to target high-priority industry segments with custom content Client Relationship Management Digital Marketing

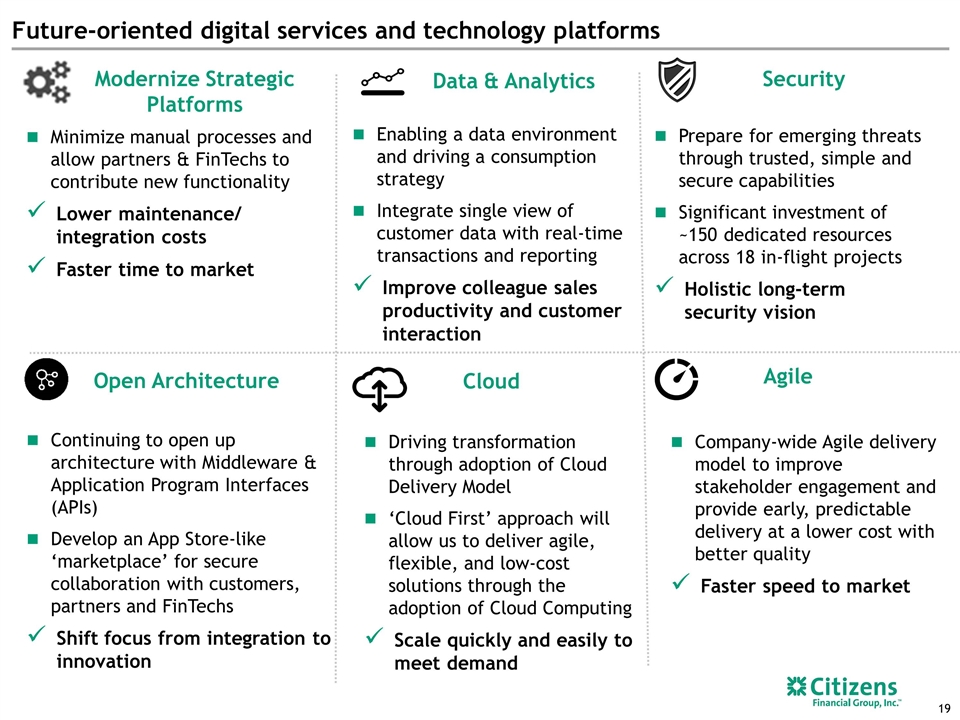

Future-oriented digital services and technology platforms Security Open Architecture Continuing to open up architecture with Middleware & Application Program Interfaces (APIs) Develop an App Store-like ‘marketplace’ for secure collaboration with customers, partners and FinTechs Shift focus from integration to innovation Cloud Agile Modernize Strategic Platforms Data & Analytics Minimize manual processes and allow partners & FinTechs to contribute new functionality Lower maintenance/ integration costs Faster time to market Enabling a data environment and driving a consumption strategy Integrate single view of customer data with real-time transactions and reporting Improve colleague sales productivity and customer interaction Prepare for emerging threats through trusted, simple and secure capabilities Significant investment of ~150 dedicated resources across 18 in-flight projects Holistic long-term security vision Driving transformation through adoption of Cloud Delivery Model ‘Cloud First’ approach will allow us to deliver agile, flexible, and low-cost solutions through the adoption of Cloud Computing Scale quickly and easily to meet demand Company-wide Agile delivery model to improve stakeholder engagement and provide early, predictable delivery at a lower cost with better quality Faster speed to market

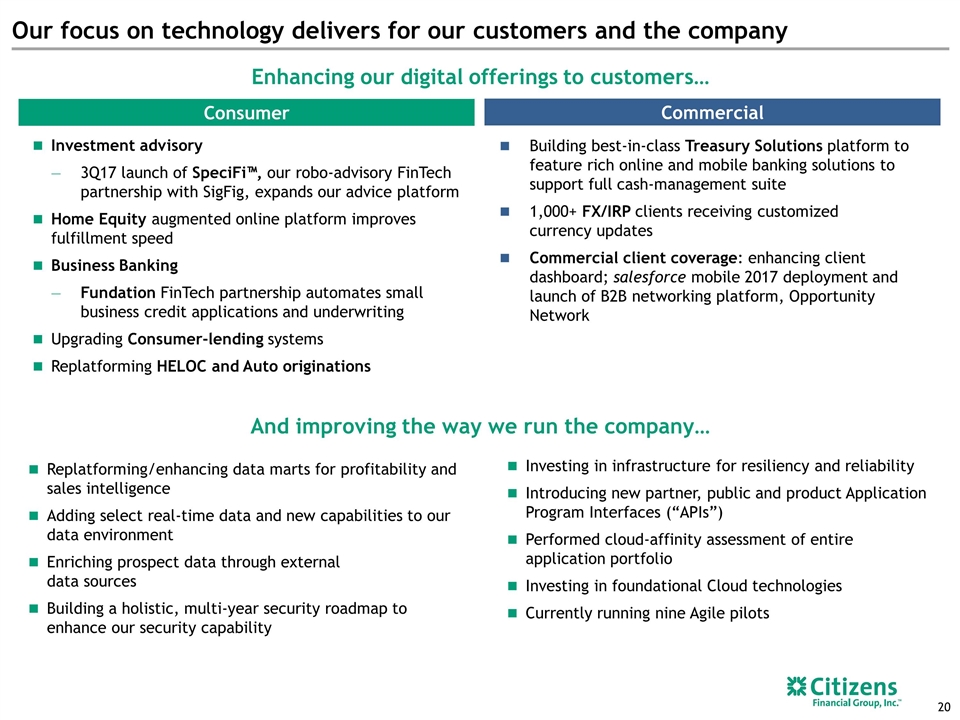

Our focus on technology delivers for our customers and the company Enhancing our digital offerings to customers… Commercial Investment advisory 3Q17 launch of SpeciFi™, our robo-advisory FinTech partnership with SigFig, expands our advice platform Home Equity augmented online platform improves fulfillment speed Business Banking Fundation FinTech partnership automates small business credit applications and underwriting Upgrading Consumer-lending systems Replatforming HELOC and Auto originations Building best-in-class Treasury Solutions platform to feature rich online and mobile banking solutions to support full cash-management suite 1,000+ FX/IRP clients receiving customized currency updates Commercial client coverage: enhancing client dashboard; salesforce mobile 2017 deployment and launch of B2B networking platform, Opportunity Network Consumer And improving the way we run the company… Replatforming/enhancing data marts for profitability and sales intelligence Adding select real-time data and new capabilities to our data environment Enriching prospect data through external data sources Building a holistic, multi-year security roadmap to enhance our security capability Investing in infrastructure for resiliency and reliability Introducing new partner, public and product Application Program Interfaces (“APIs”) Performed cloud-affinity assessment of entire application portfolio Investing in foundational Cloud technologies Currently running nine Agile pilots

Citizens has delivered consistent EPS growth…. Compound annual growth rate. Please see important information on Key Performance Metrics and Non-GAAP Financial Measures at the beginning and end of this presentation for an explanation of our use of these metrics and non-GAAP financial measures and their reconciliation to GAAP financial measures, as applicable. “Adjusted” results exclude restructuring charges, special items and/or notable items, as applicable. . “Underlying” results, as applicable, exclude a 1Q17 $23 million benefit related to the settlement of certain state tax matters and reclassify 2Q17 results for the pre-tax impact of $26 million of lease asset impairments to reflect their credit-related impact. Source: Bloomberg, as of 09/08/2017 2017E Price/Earnings Ratio(3) CFG Peer Peer Average …though valuation has fallen off 26% CAGR(1) CFG Adjusted/Underlying(2) CFG GAAP 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 consensus estimates(3) EPS $0.52 $0.57 2016/2017E EPS Adj growth rate(3) 55%

Investment thesis We have executed well on our turnaround plan As we enter a new phase focused on growth and building a great bank, we are confident in our outlook Strong Board and talented and seasoned management team Focus on continuous improvement will drive continued EPS growth and ROTCE(1) improvement (TOP IV, balance sheet optimization); still positioned for ‘self help’ Starting to reap benefits of investment spend in technology, digital, data, talent and product capabilities Strong capital position offers flexibility to drive organic growth and strong capital returns Track record of strong financial performance Strong revenue, net income, EPS growth Substantial improvement in efficiency ratio, ROTCE(1) Good expense discipline and consistent, sizable operating leverage(1) Prudent risk-taking: below-median credit stress losses Stock upside given current sub-par valuation Track record of exceeding estimates and upward earnings revisions Low P/E relative to growth Below ROTCE(1) ‘regression line’ Please see important information on Key Performance Metrics and Non-GAAP Financial Measures at the beginning and end of this presentation for an explanation of our use of these metrics and non-GAAP financial measures and their reconciliation to GAAP financial measures.

Appendix

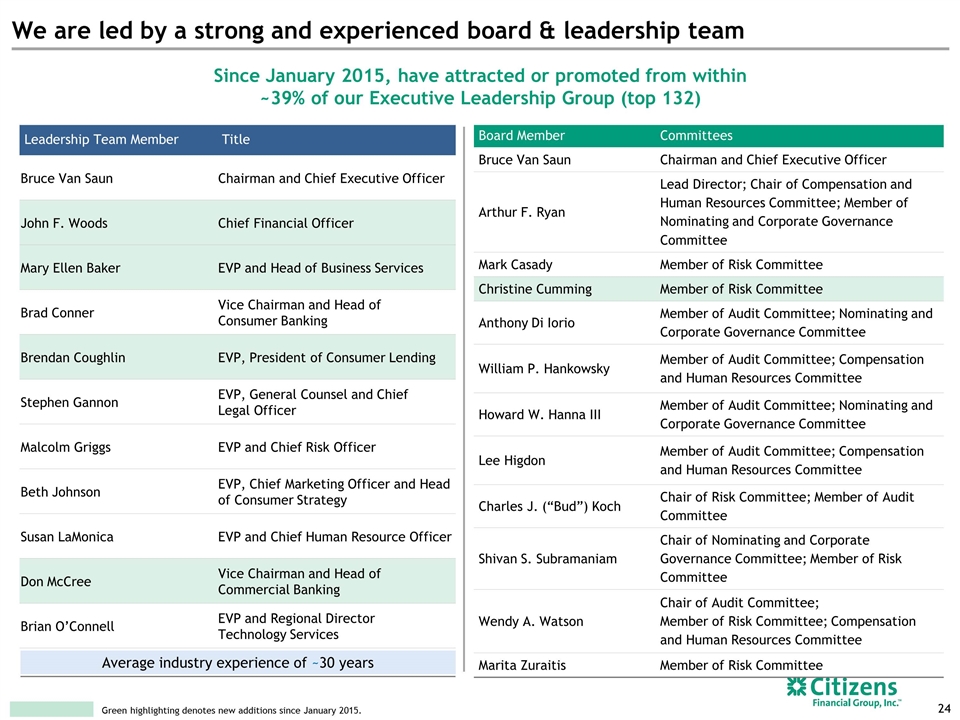

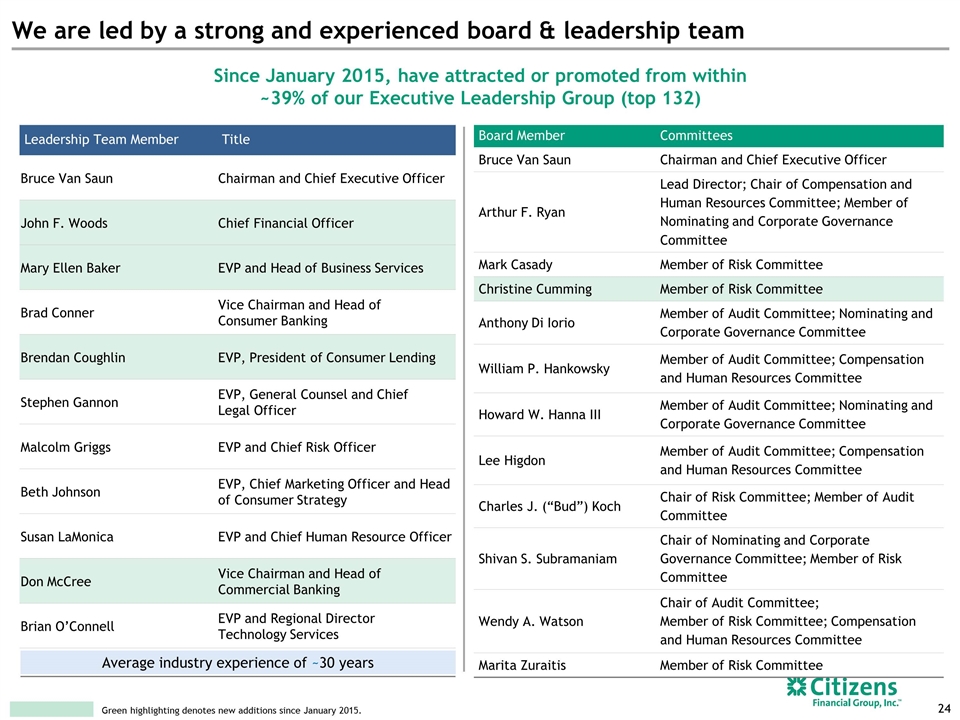

Average industry experience of ~30 years Leadership Team Member Title Bruce Van Saun Chairman and Chief Executive Officer John F. Woods Chief Financial Officer Mary Ellen Baker EVP and Head of Business Services Brad Conner Vice Chairman and Head of Consumer Banking Brendan Coughlin EVP, President of Consumer Lending Stephen Gannon EVP, General Counsel and Chief Legal Officer Malcolm Griggs EVP and Chief Risk Officer Beth Johnson EVP, Chief Marketing Officer and Head of Consumer Strategy Susan LaMonica EVP and Chief Human Resource Officer Don McCree Vice Chairman and Head of Commercial Banking Brian O’Connell EVP and Regional Director Technology Services Board Member Committees Bruce Van Saun Chairman and Chief Executive Officer Arthur F. Ryan Lead Director; Chair of Compensation and Human Resources Committee; Member of Nominating and Corporate Governance Committee Mark Casady Member of Risk Committee Christine Cumming Member of Risk Committee Anthony Di Iorio Member of Audit Committee; Nominating and Corporate Governance Committee William P. Hankowsky Member of Audit Committee; Compensation and Human Resources Committee Howard W. Hanna III Member of Audit Committee; Nominating and Corporate Governance Committee Lee Higdon Member of Audit Committee; Compensation and Human Resources Committee Charles J. (“Bud”) Koch Chair of Risk Committee; Member of Audit Committee Shivan S. Subramaniam Chair of Nominating and Corporate Governance Committee; Member of Risk Committee Wendy A. Watson Chair of Audit Committee; Member of Risk Committee; Compensation and Human Resources Committee Marita Zuraitis Member of Risk Committee We are led by a strong and experienced board & leadership team Since January 2015, have attracted or promoted from within ~39% of our Executive Leadership Group (top 132) Green highlighting denotes new additions since January 2015.

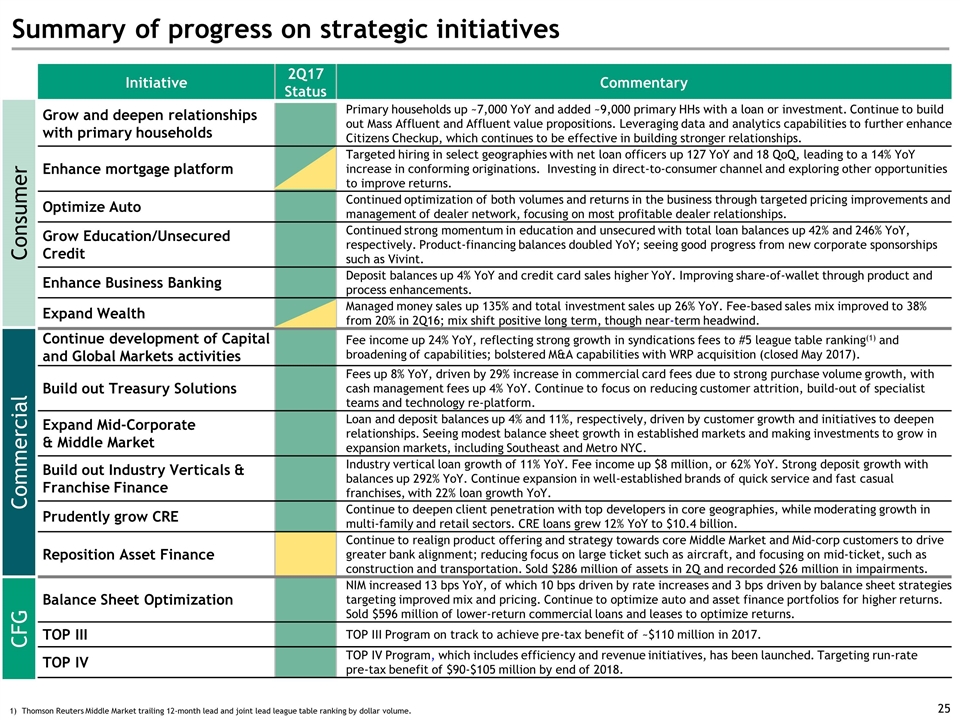

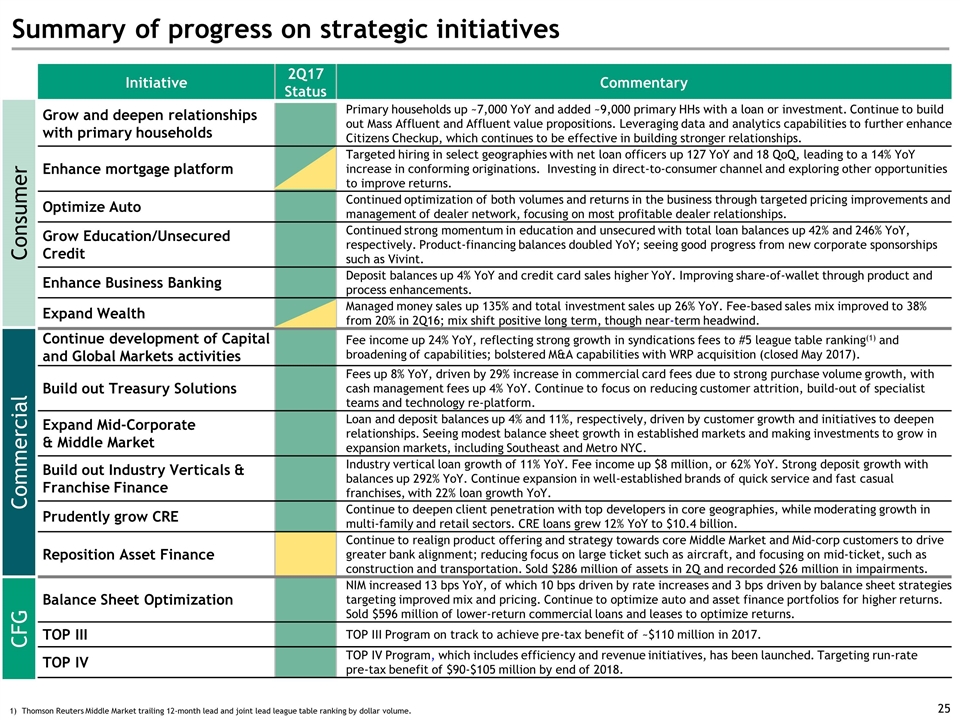

Consumer Commercial CFG Summary of progress on strategic initiatives Initiative 2Q17 Status Commentary Grow and deepen relationships with primary households Primary households up ~7,000 YoY and added ~9,000 primary HHs with a loan or investment. Continue to build out Mass Affluent and Affluent value propositions. Leveraging data and analytics capabilities to further enhance Citizens Checkup, which continues to be effective in building stronger relationships. Enhance mortgage platform Targeted hiring in select geographies with net loan officers up 127 YoY and 18 QoQ, leading to a 14% YoY increase in conforming originations. Investing in direct-to-consumer channel and exploring other opportunities to improve returns. Optimize Auto Continued optimization of both volumes and returns in the business through targeted pricing improvements and management of dealer network, focusing on most profitable dealer relationships. Grow Education/Unsecured Credit Continued strong momentum in education and unsecured with total loan balances up 42% and 246% YoY, respectively. Product-financing balances doubled YoY; seeing good progress from new corporate sponsorships such as Vivint. Enhance Business Banking Deposit balances up 4% YoY and credit card sales higher YoY. Improving share-of-wallet through product and process enhancements. Expand Wealth Managed money sales up 135% and total investment sales up 26% YoY. Fee-based sales mix improved to 38% from 20% in 2Q16; mix shift positive long term, though near-term headwind. Continue development of Capital and Global Markets activities Fee income up 24% YoY, reflecting strong growth in syndications fees to #5 league table ranking(1) and broadening of capabilities; bolstered M&A capabilities with WRP acquisition (closed May 2017). Build out Treasury Solutions Fees up 8% YoY, driven by 29% increase in commercial card fees due to strong purchase volume growth, with cash management fees up 4% YoY. Continue to focus on reducing customer attrition, build-out of specialist teams and technology re-platform. Expand Mid-Corporate & Middle Market Loan and deposit balances up 4% and 11%, respectively, driven by customer growth and initiatives to deepen relationships. Seeing modest balance sheet growth in established markets and making investments to grow in expansion markets, including Southeast and Metro NYC. Build out Industry Verticals & Franchise Finance Industry vertical loan growth of 11% YoY. Fee income up $8 million, or 62% YoY. Strong deposit growth with balances up 292% YoY. Continue expansion in well-established brands of quick service and fast casual franchises, with 22% loan growth YoY. Prudently grow CRE Continue to deepen client penetration with top developers in core geographies, while moderating growth in multi-family and retail sectors. CRE loans grew 12% YoY to $10.4 billion. Reposition Asset Finance Continue to realign product offering and strategy towards core Middle Market and Mid-corp customers to drive greater bank alignment; reducing focus on large ticket such as aircraft, and focusing on mid-ticket, such as construction and transportation. Sold $286 million of assets in 2Q and recorded $26 million in impairments. Balance Sheet Optimization NIM increased 13 bps YoY, of which 10 bps driven by rate increases and 3 bps driven by balance sheet strategies targeting improved mix and pricing. Continue to optimize auto and asset finance portfolios for higher returns. Sold $596 million of lower-return commercial loans and leases to optimize returns. TOP III TOP III Program on track to achieve pre-tax benefit of ~$110 million in 2017. TOP IV TOP IV Program, which includes efficiency and revenue initiatives, has been launched. Targeting run-rate pre-tax benefit of $90-$105 million by end of 2018. Thomson Reuters Middle Market trailing 12-month lead and joint lead league table ranking by dollar volume.

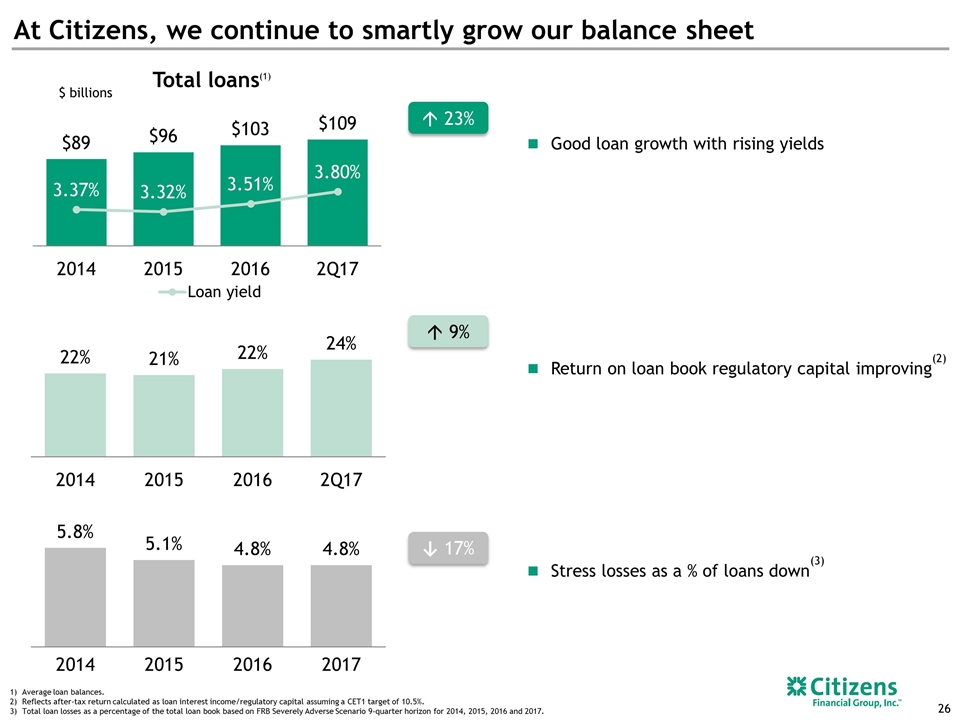

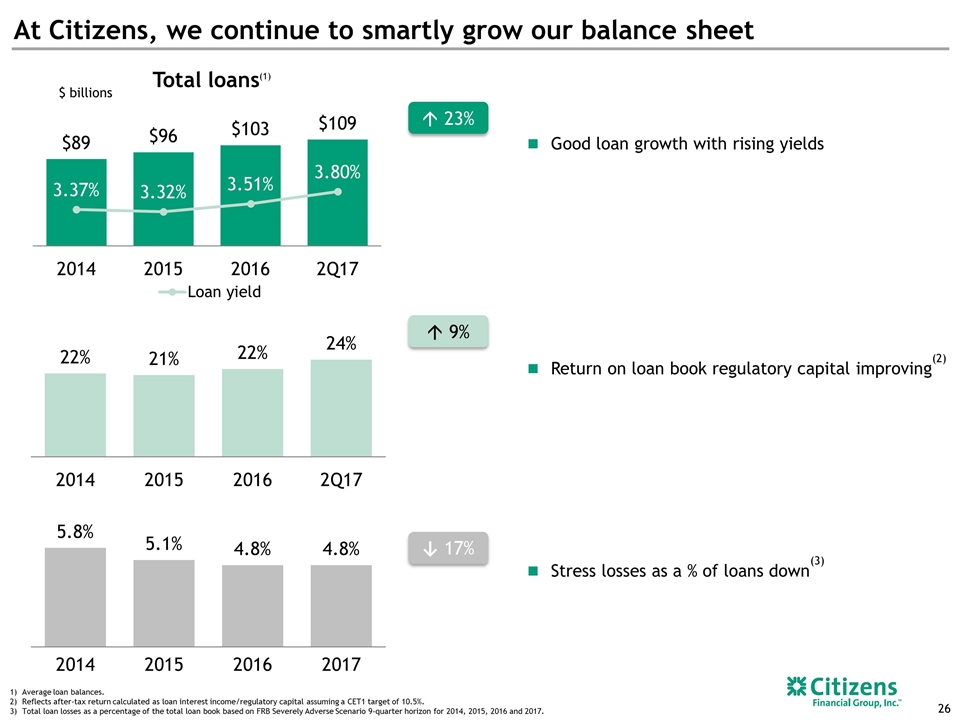

At Citizens, we continue to smartly grow our balance sheet á 23% Good loan growth with rising yields Return on loan book regulatory capital improving(2) Stress losses as a % of loans down(3) Total loans $ billions Average loan balances. Reflects after-tax return calculated as loan interest income/regulatory capital assuming a CET1 target of 10.5%. Total loan losses as a percentage of the total loan book based on FRB Severely Adverse Scenario 9-quarter horizon for 2014, 2015, 2016 and 2017. á 9% (1) ↓ 17% Should this be bps? 274

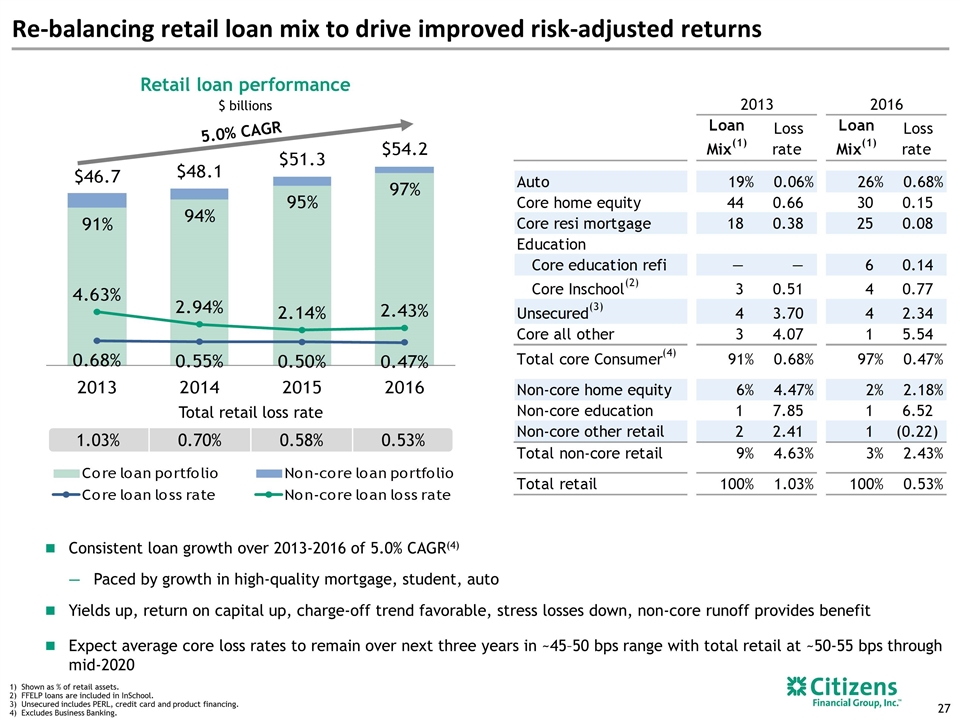

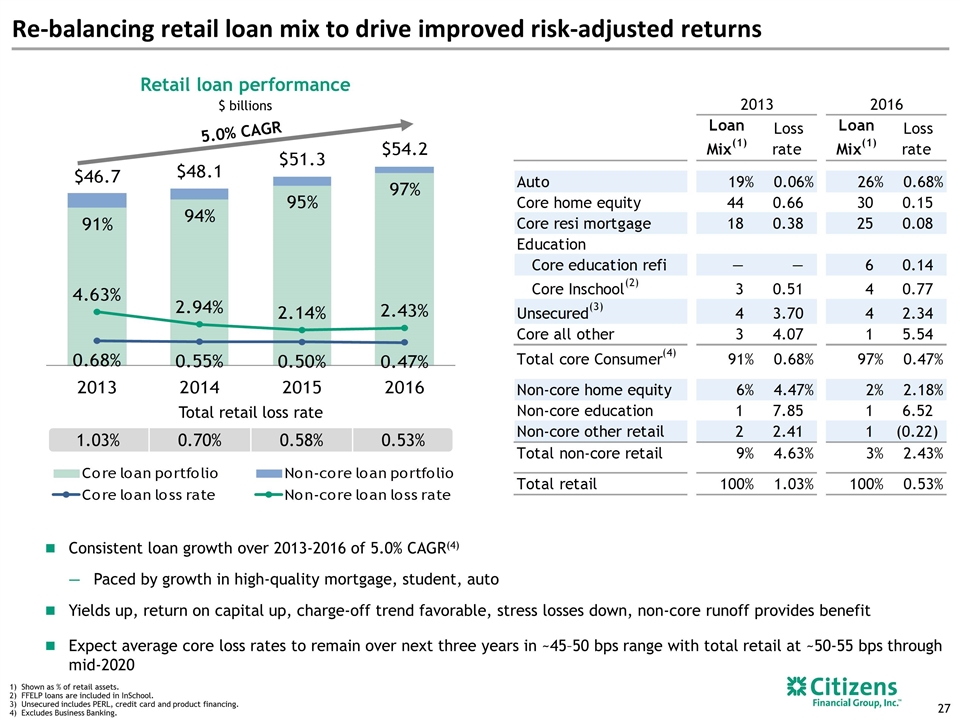

1.03% 0.70% 0.58% 0.53% Retail loan performance Total retail loss rate Consistent loan growth over 2013-2016 of 5.0% CAGR(4) Paced by growth in high-quality mortgage, student, auto Yields up, return on capital up, charge-off trend favorable, stress losses down, non-core runoff provides benefit Expect average core loss rates to remain over next three years in ~45–50 bps range with total retail at ~50-55 bps through mid-2020 Shown as % of retail assets. FFELP loans are included in InSchool. Unsecured includes PERL, credit card and product financing. Excludes Business Banking. Re-balancing retail loan mix to drive improved risk-adjusted returns $ billions 5.0% CAGR

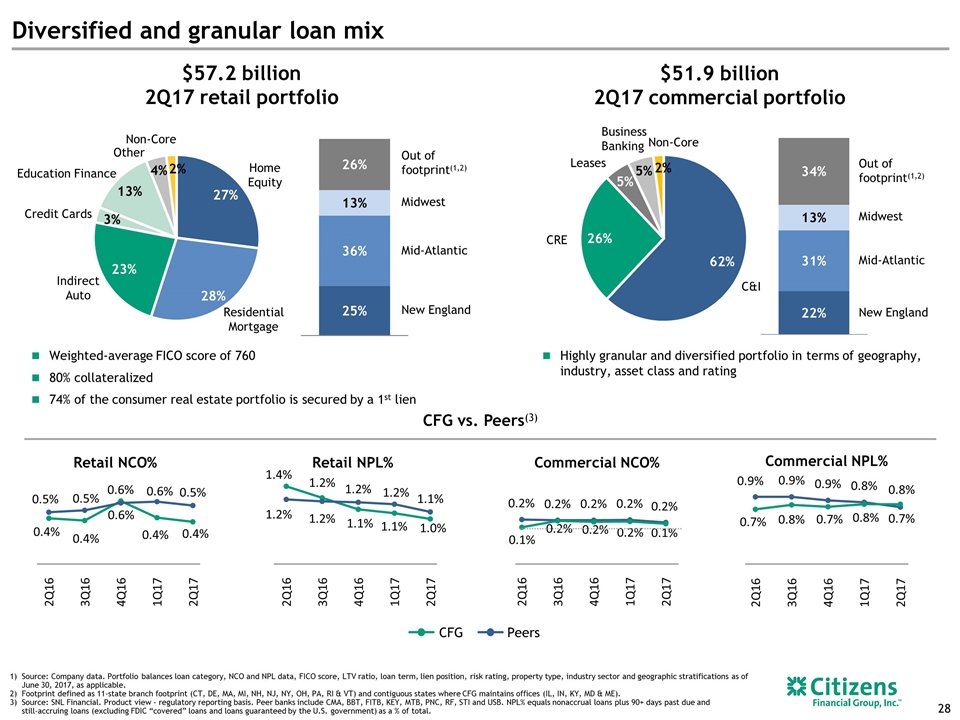

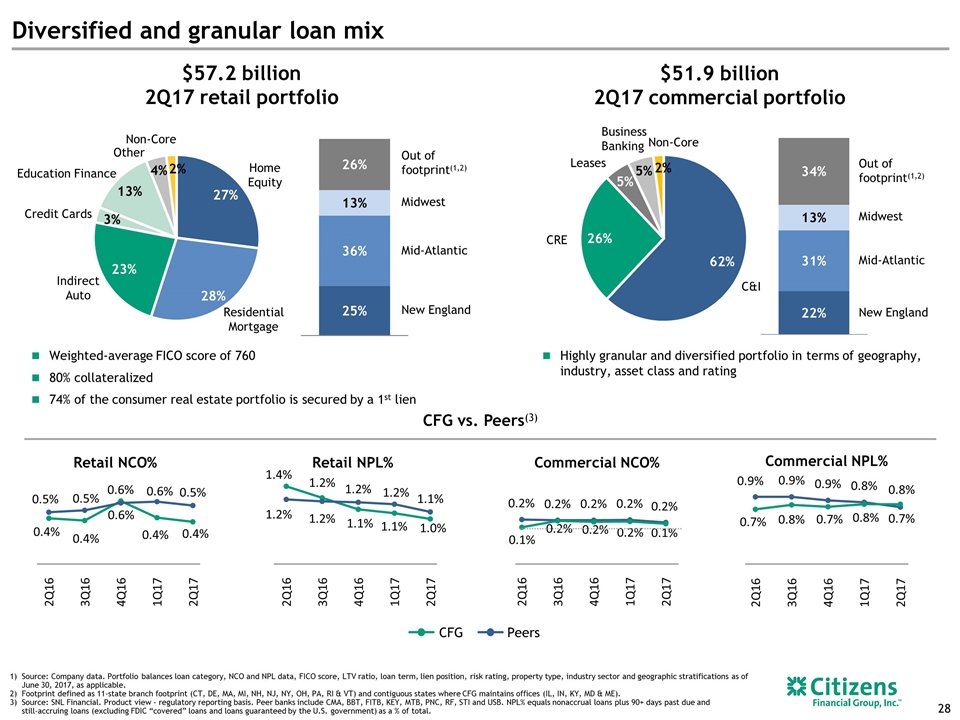

$57.2 billion 2Q17 retail portfolio Source: Company data. Portfolio balances loan category, NCO and NPL data, FICO score, LTV ratio, loan term, lien position, risk rating, property type, industry sector and geographic stratifications as of June 30, 2017, as applicable. Footprint defined as 11-state branch footprint (CT, DE, MA, MI, NH, NJ, NY, OH, PA, RI & VT) and contiguous states where CFG maintains offices (IL, IN, KY, MD & ME). Source: SNL Financial. Product view - regulatory reporting basis. Peer banks include CMA, BBT, FITB, KEY, MTB, PNC, RF, STI and USB. NPL% equals nonaccrual loans plus 90+ days past due and still‐accruing loans (excluding FDIC “covered” loans and loans guaranteed by the U.S. government) as a % of total. $51.9 billion 2Q17 commercial portfolio Mid-Atlantic Midwest New England Leases C&I CRE Mid-Atlantic Midwest New England Diversified and granular loan mix Weighted-average FICO score of 760 80% collateralized 74% of the consumer real estate portfolio is secured by a 1st lien Highly granular and diversified portfolio in terms of geography, industry, asset class and rating Home Equity Indirect Auto Residential Mortgage Education Finance Credit Cards Other Non-Core Business Banking Retail NCO% Retail NPL% Commercial NPL% Commercial NCO% Out of footprint(1,2) CFG Peers CFG vs. Peers(3) Non-Core Out of footprint(1,2)

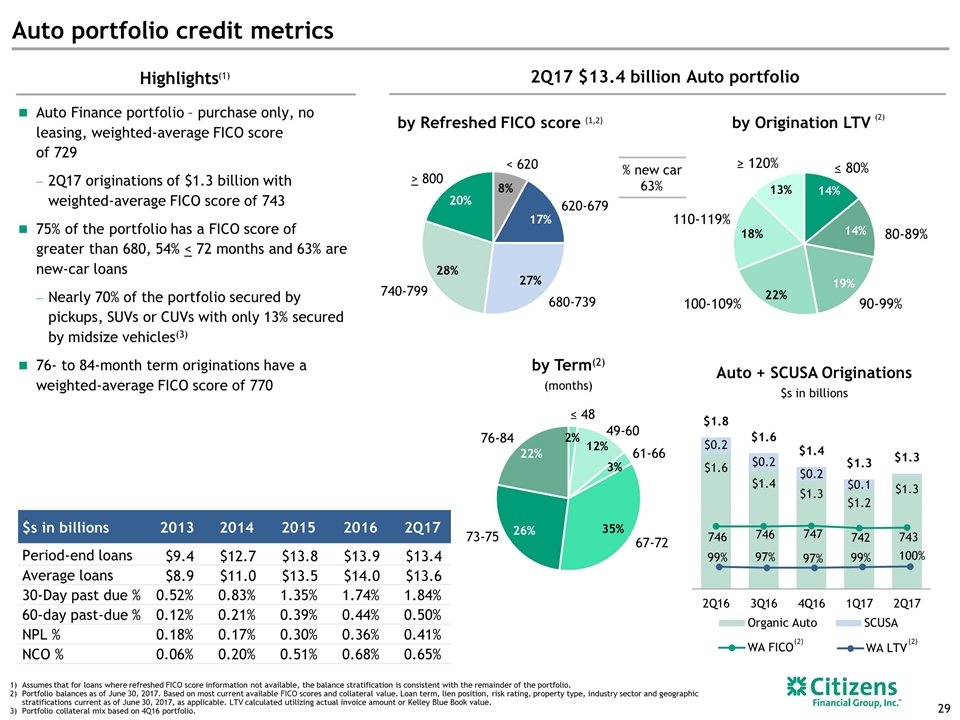

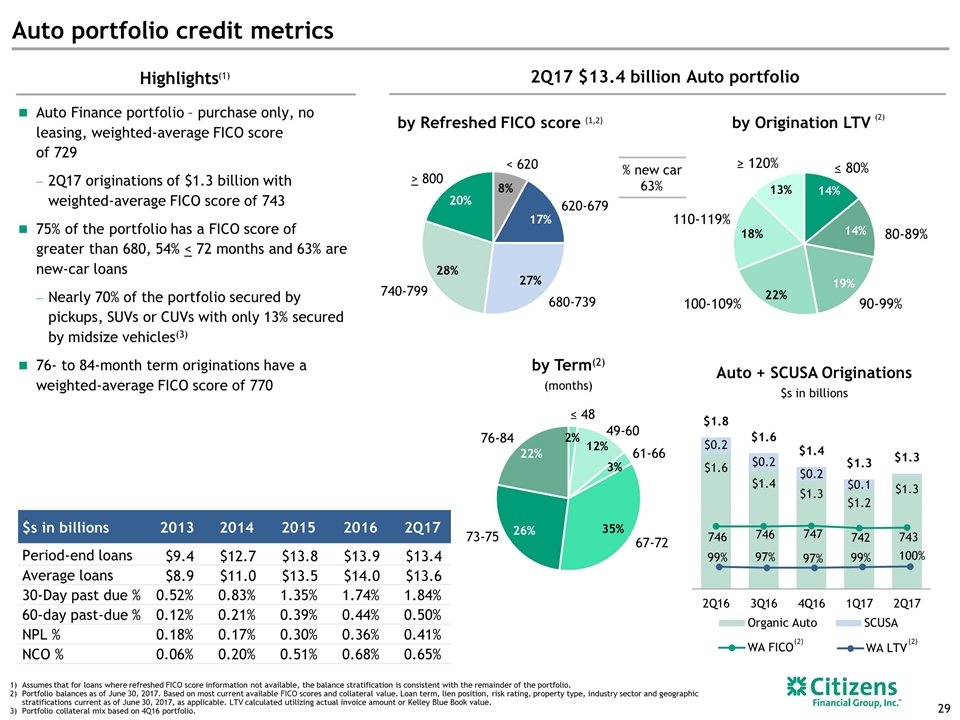

Auto portfolio credit metrics Highlights by Refreshed FICO score ≤ 48 49-60 76-84 61-66 67-72 73-75 by Origination LTV 80-89% 90-99% 100-109% 110-119% ≥ 120% ≤ 80% Assumes that for loans where refreshed FICO score information not available, the balance stratification is consistent with the remainder of the portfolio. Portfolio balances as of June 30, 2017. Based on most current available FICO scores and collateral value. Loan term, lien position, risk rating, property type, industry sector and geographic stratifications current as of June 30, 2017, as applicable. LTV calculated utilizing actual invoice amount or Kelley Blue Book value. Portfolio collateral mix based on 4Q16 portfolio. (1) (1,2) Auto + SCUSA Originations $s in billions (2) 2Q17 $13.4 billion Auto portfolio % new car 63% $s in billions 2013 2014 2015 2016 2Q17 Period-end loans $9.4 $12.7 $13.8 $13.9 $13.4 Average loans $8.9 $11.0 $13.5 $14.0 $13.6 30-Day past due % 0.52% 0.83% 1.35% 1.74% 1.84% 60-day past-due % 0.12% 0.21% 0.39% 0.44% 0.50% NPL % 0.18% 0.17% 0.30% 0.36% 0.41% NCO % 0.06% 0.20% 0.51% 0.68% 0.65% (2) (2) by Term(2) (months) Auto Finance portfolio – purchase only, no leasing, weighted-average FICO score of 729 2Q17 originations of $1.3 billion with weighted-average FICO score of 743 75% of the portfolio has a FICO score of greater than 680, 54% < 72 months and 63% are new-car loans Nearly 70% of the portfolio secured by pickups, SUVs or CUVs with only 13% secured by midsize vehicles(3) 76- to 84-month term originations have a weighted-average FICO score of 770 620-679 680-739 > 800 < 620 740-799

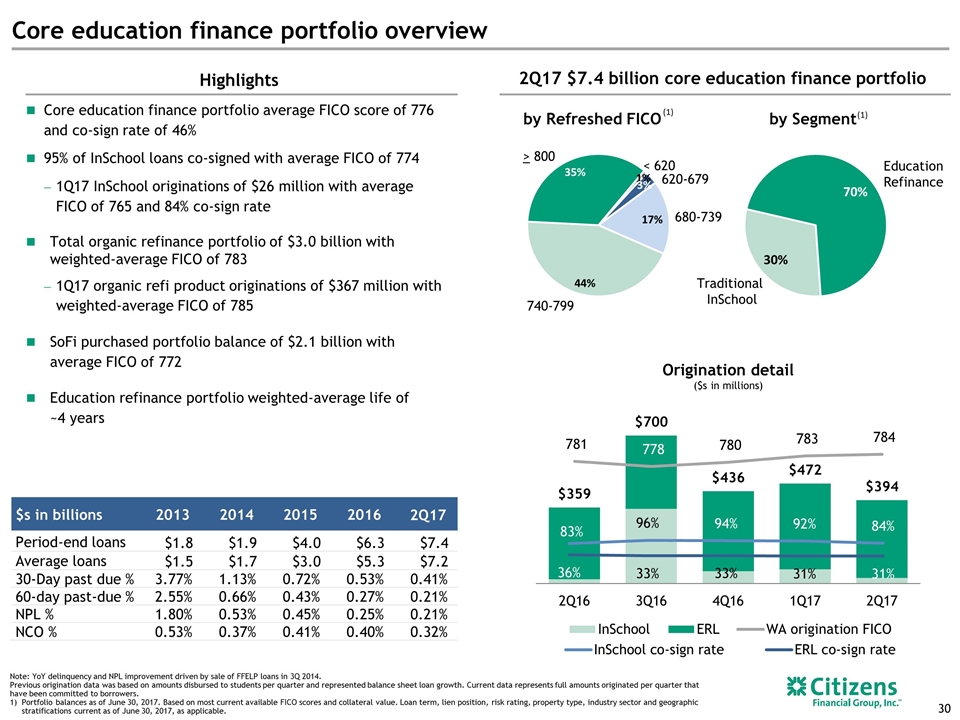

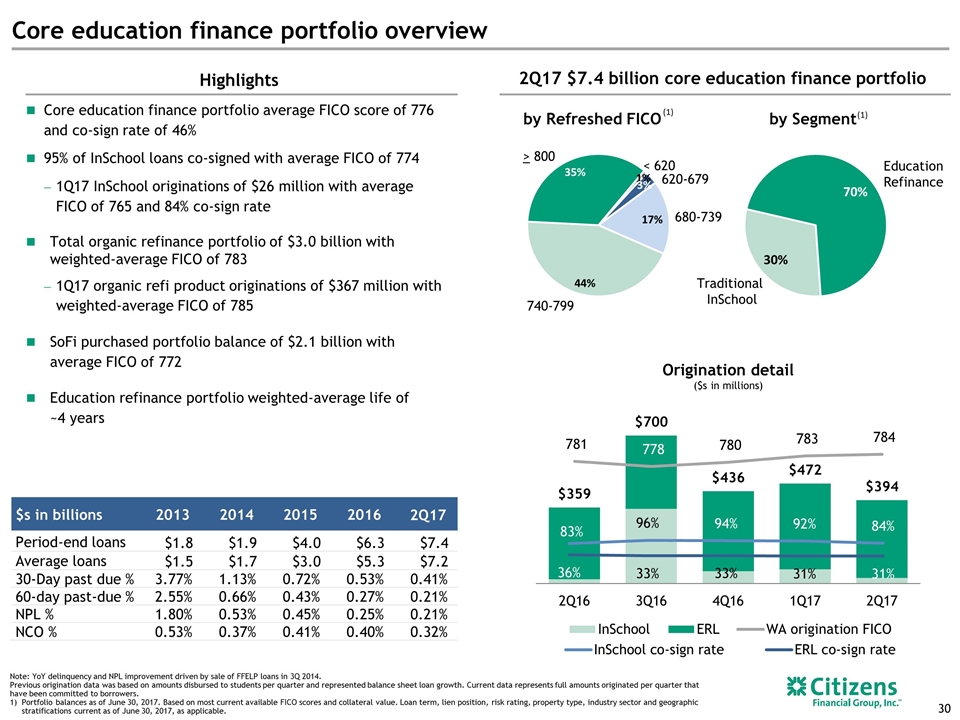

Core education finance portfolio overview Highlights by Refreshed FICO Note: YoY delinquency and NPL improvement driven by sale of FFELP loans in 3Q 2014. Previous origination data was based on amounts disbursed to students per quarter and represented balance sheet loan growth. Current data represents full amounts originated per quarter that have been committed to borrowers. Portfolio balances as of June 30, 2017. Based on most current available FICO scores and collateral value. Loan term, lien position, risk rating, property type, industry sector and geographic stratifications current as of June 30, 2017, as applicable. Core education finance portfolio average FICO score of 776 and co-sign rate of 46% 95% of InSchool loans co-signed with average FICO of 774 1Q17 InSchool originations of $26 million with average FICO of 765 and 84% co-sign rate Total organic refinance portfolio of $3.0 billion with weighted-average FICO of 783 1Q17 organic refi product originations of $367 million with weighted-average FICO of 785 SoFi purchased portfolio balance of $2.1 billion with average FICO of 772 Education refinance portfolio weighted-average life of ~4 years by Segment Traditional InSchool Education Refinance (1) $s in billions 2013 2014 2015 2016 2Q17 Period-end loans $1.8 $1.9 $4.0 $6.3 $7.4 Average loans $1.5 $1.7 $3.0 $5.3 $7.2 30-Day past due % 3.77% 1.13% 0.72% 0.53% 0.41% 60-day past-due % 2.55% 0.66% 0.43% 0.27% 0.21% NPL % 1.80% 0.53% 0.45% 0.25% 0.21% NCO % 0.53% 0.37% 0.41% 0.40% 0.32% 2Q17 $7.4 billion core education finance portfolio (1) Origination detail ($s in millions) 620-679 680-739 > 800 < 620 740-799

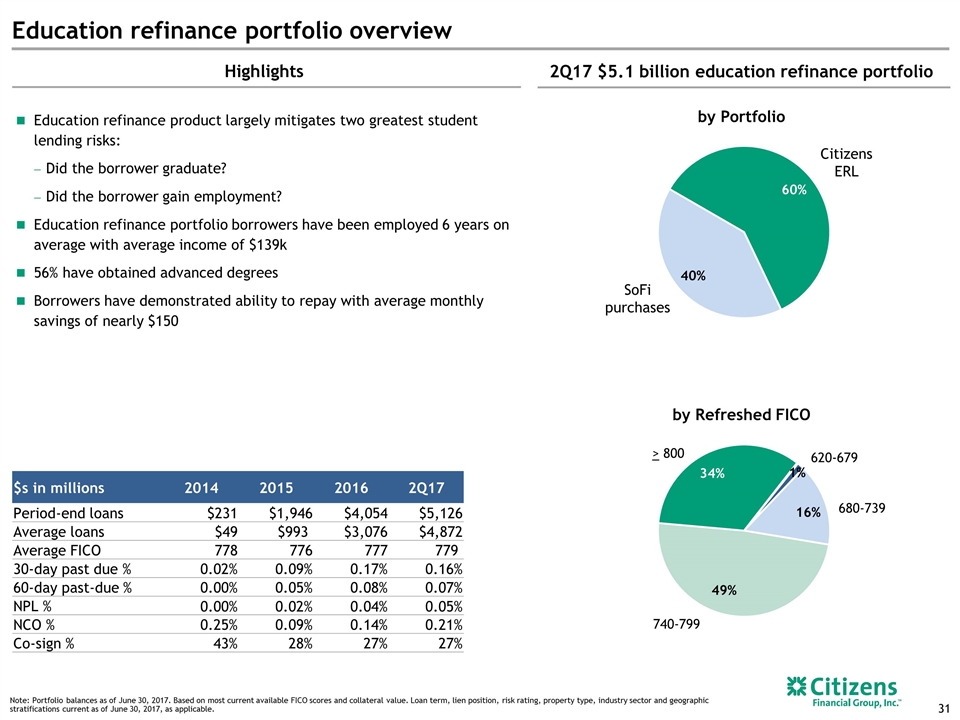

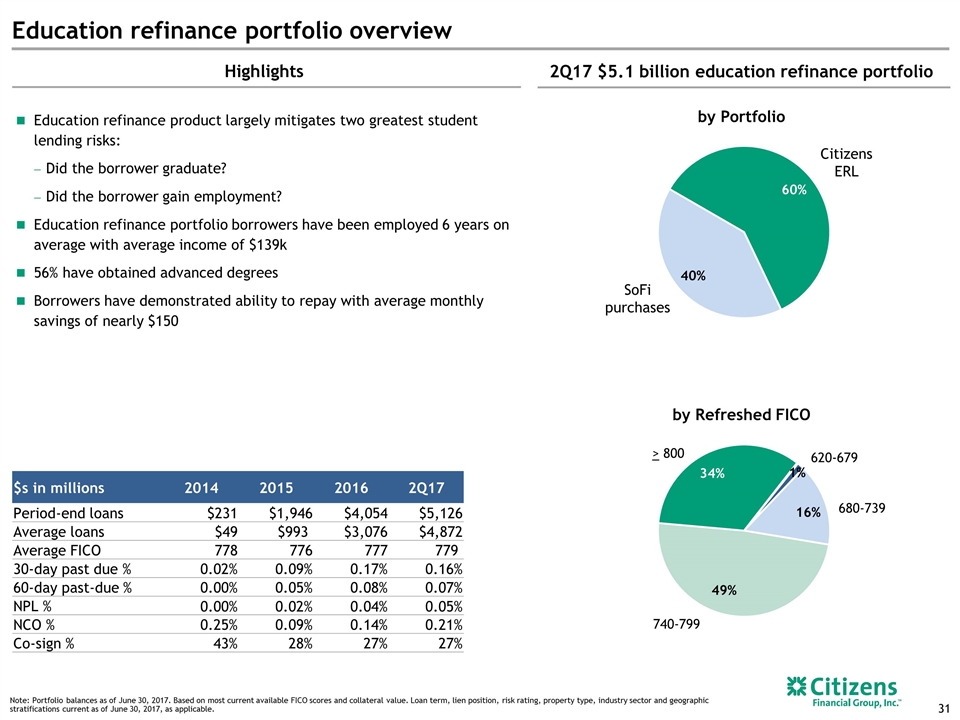

Education refinance portfolio overview Note: Portfolio balances as of June 30, 2017. Based on most current available FICO scores and collateral value. Loan term, lien position, risk rating, property type, industry sector and geographic stratifications current as of June 30, 2017, as applicable. Education refinance product largely mitigates two greatest student lending risks: Did the borrower graduate? Did the borrower gain employment? Education refinance portfolio borrowers have been employed 6 years on average with average income of $139k 56% have obtained advanced degrees Borrowers have demonstrated ability to repay with average monthly savings of nearly $150 Highlights 2Q17 $5.1 billion education refinance portfolio Citizens ERL SoFi purchases 620-679 680-739 > 800 740-799 by Refreshed FICO by Portfolio $s in millions 2014 2015 2016 2Q17 Period-end loans $231 $1,946 $4,054 $5,126 Average loans $49 $993 $3,076 $4,872 Average FICO 778 776 777 779 30-day past due % 0.02% 0.09% 0.17% 0.16% 60-day past-due % 0.00% 0.05% 0.08% 0.07% NPL % 0.00% 0.02% 0.04% 0.05% NCO % 0.25% 0.09% 0.14% 0.21% Co-sign % 43% 28% 27% 27%

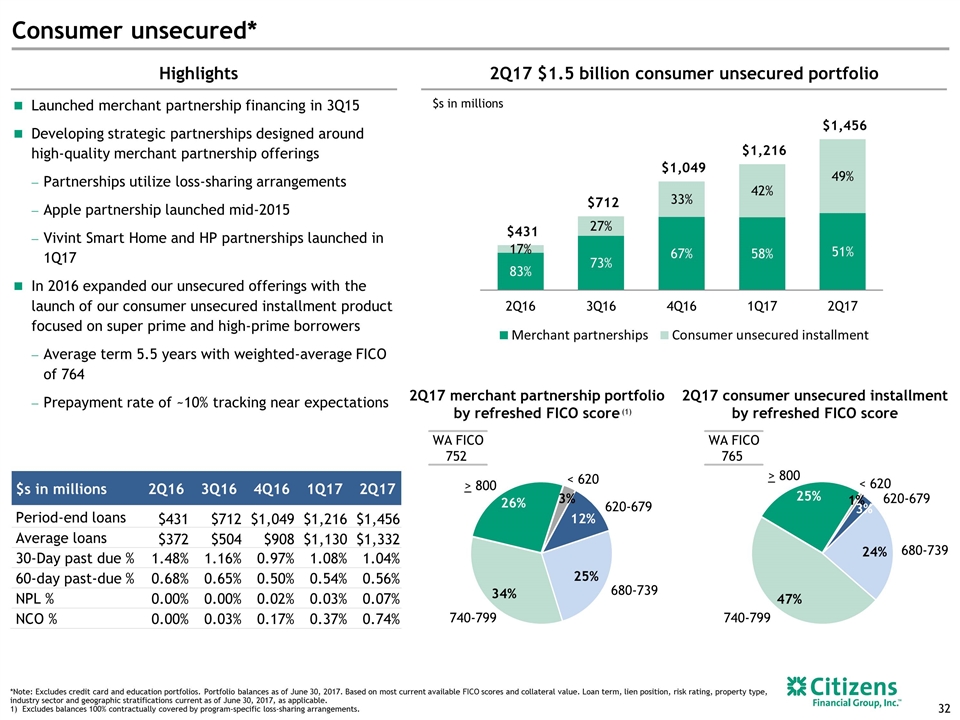

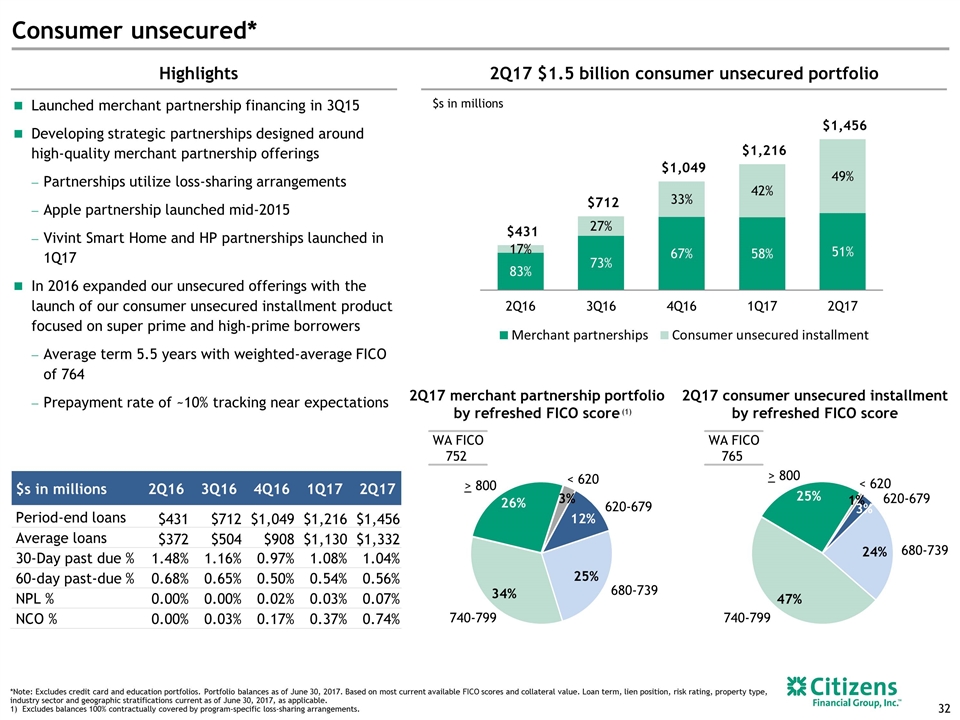

Consumer unsecured* $s in millions 2Q16 3Q16 4Q16 1Q17 2Q17 Period-end loans $431 $712 $1,049 $1,216 $1,456 Average loans $372 $504 $908 $1,130 $1,332 30-Day past due % 1.48% 1.16% 0.97% 1.08% 1.04% 60-day past-due % 0.68% 0.65% 0.50% 0.54% 0.56% NPL % 0.00% 0.00% 0.02% 0.03% 0.07% NCO % 0.00% 0.03% 0.17% 0.37% 0.74% Highlights Launched merchant partnership financing in 3Q15 Developing strategic partnerships designed around high-quality merchant partnership offerings Partnerships utilize loss-sharing arrangements Apple partnership launched mid-2015 Vivint Smart Home and HP partnerships launched in 1Q17 In 2016 expanded our unsecured offerings with the launch of our consumer unsecured installment product focused on super prime and high-prime borrowers Average term 5.5 years with weighted-average FICO of 764 Prepayment rate of ~10% tracking near expectations 2Q17 $1.5 billion consumer unsecured portfolio $s in millions 2Q17 merchant partnership portfolio by refreshed FICO score 2Q17 consumer unsecured installment by refreshed FICO score WA FICO 765 *Note: Excludes credit card and education portfolios. Portfolio balances as of June 30, 2017. Based on most current available FICO scores and collateral value. Loan term, lien position, risk rating, property type, industry sector and geographic stratifications current as of June 30, 2017, as applicable. Excludes balances 100% contractually covered by program-specific loss-sharing arrangements. (1) WA FICO 752 620-679 680-739 > 800 < 620 740-799 620-679 680-739 > 800 < 620 740-799

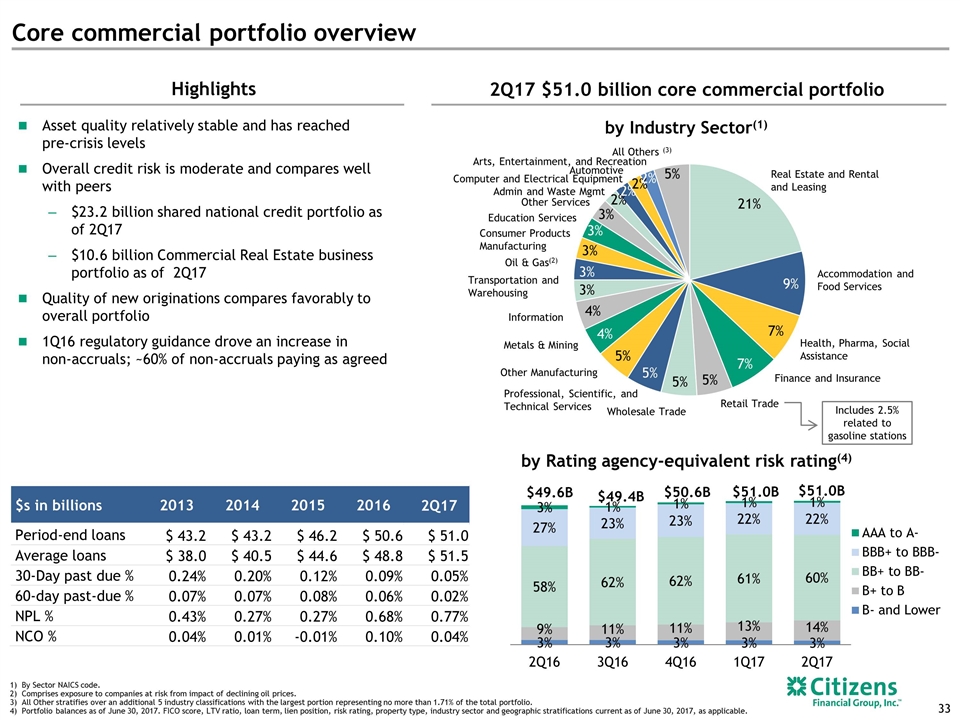

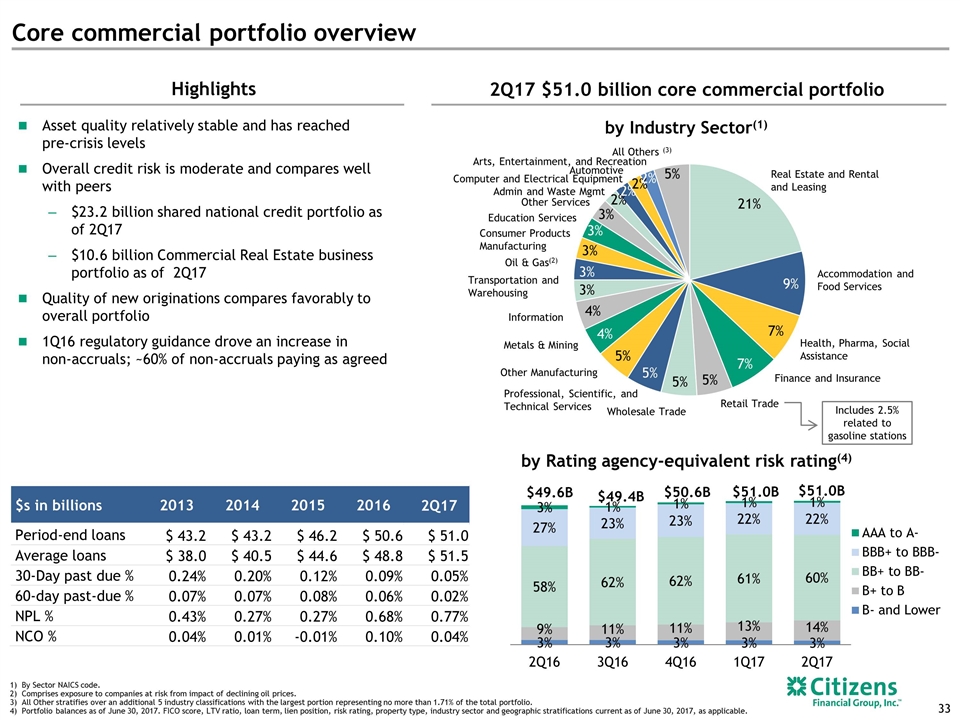

Core commercial portfolio overview Asset quality relatively stable and has reached pre-crisis levels Overall credit risk is moderate and compares well with peers $23.2 billion shared national credit portfolio as of 2Q17 $10.6 billion Commercial Real Estate business portfolio as of 2Q17 Quality of new originations compares favorably to overall portfolio 1Q16 regulatory guidance drove an increase in non-accruals; ~60% of non-accruals paying as agreed Highlights by Industry Sector(1) by Rating agency-equivalent risk rating(4) Includes 2.5% related to gasoline stations By Sector NAICS code. Comprises exposure to companies at risk from impact of declining oil prices. All Other stratifies over an additional 5 industry classifications with the largest portion representing no more than 1.71% of the total portfolio. Portfolio balances as of June 30, 2017. FICO score, LTV ratio, loan term, lien position, risk rating, property type, industry sector and geographic stratifications current as of June 30, 2017, as applicable. 2Q17 $51.0 billion core commercial portfolio $s in billions 2013 2014 2015 2016 2Q17 Period-end loans $ 43.2 $ 43.2 $ 46.2 $ 50.6 $ 51.0 Average loans $ 38.0 $ 40.5 $ 44.6 $ 48.8 $ 51.5 30-Day past due % 0.24% 0.20% 0.12% 0.09% 0.05% 60-day past-due % 0.07% 0.07% 0.08% 0.06% 0.02% NPL % 0.43% 0.27% 0.27% 0.68% 0.77% NCO % 0.04% 0.01% -0.01% 0.10% 0.04%

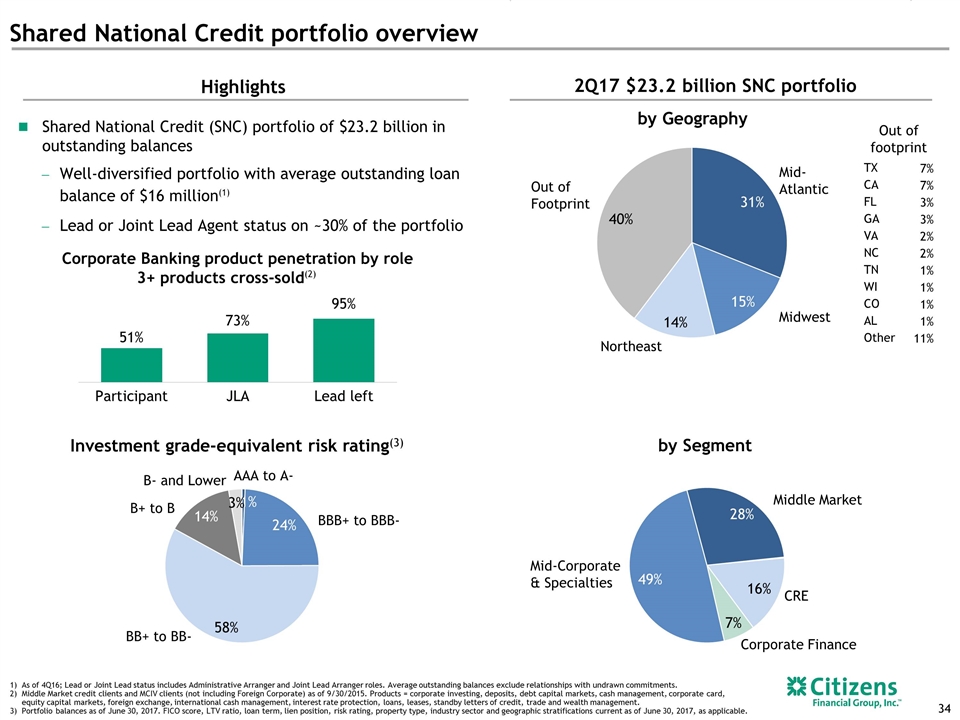

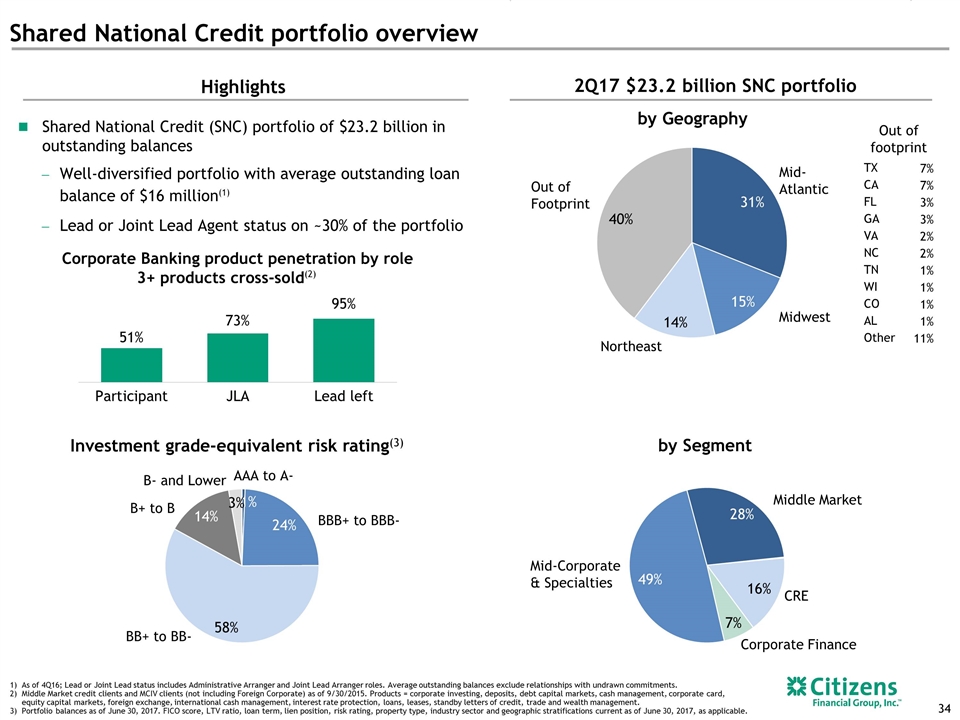

As of 4Q16; Lead or Joint Lead status includes Administrative Arranger and Joint Lead Arranger roles. Average outstanding balances exclude relationships with undrawn commitments. Middle Market credit clients and MCIV clients (not including Foreign Corporate) as of 9/30/2015. Products = corporate investing, deposits, debt capital markets, cash management, corporate card, equity capital markets, foreign exchange, international cash management, interest rate protection, loans, leases, standby letters of credit, trade and wealth management. Portfolio balances as of June 30, 2017. FICO score, LTV ratio, loan term, lien position, risk rating, property type, industry sector and geographic stratifications current as of June 30, 2017, as applicable. Shared National Credit portfolio overview Investment grade-equivalent risk rating(3) Highlights by Segment by Geography Out of footprint Shared National Credit (SNC) portfolio of $23.2 billion in outstanding balances Well-diversified portfolio with average outstanding loan balance of $16 million(1) Lead or Joint Lead Agent status on ~30% of the portfolio 2Q17 $23.2 billion SNC portfolio Corporate Banking product penetration by role 3+ products cross-sold(2) . TX 7% CA 7% FL 3% GA 3% VA 2% NC 2% TN 1% WI 1% CO 1% AL 1% Other 11%

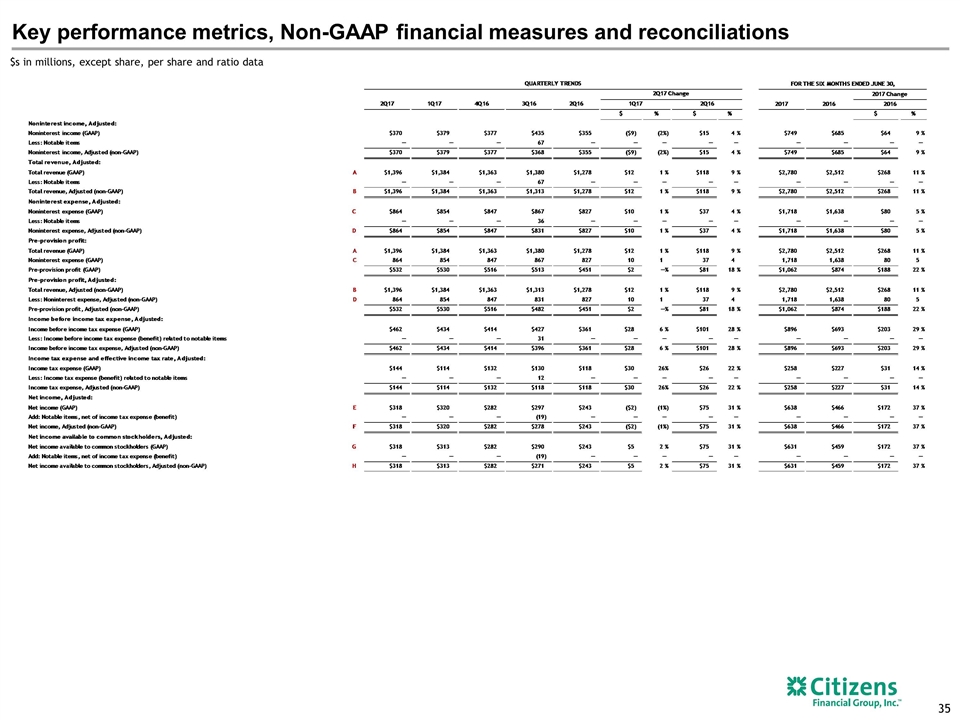

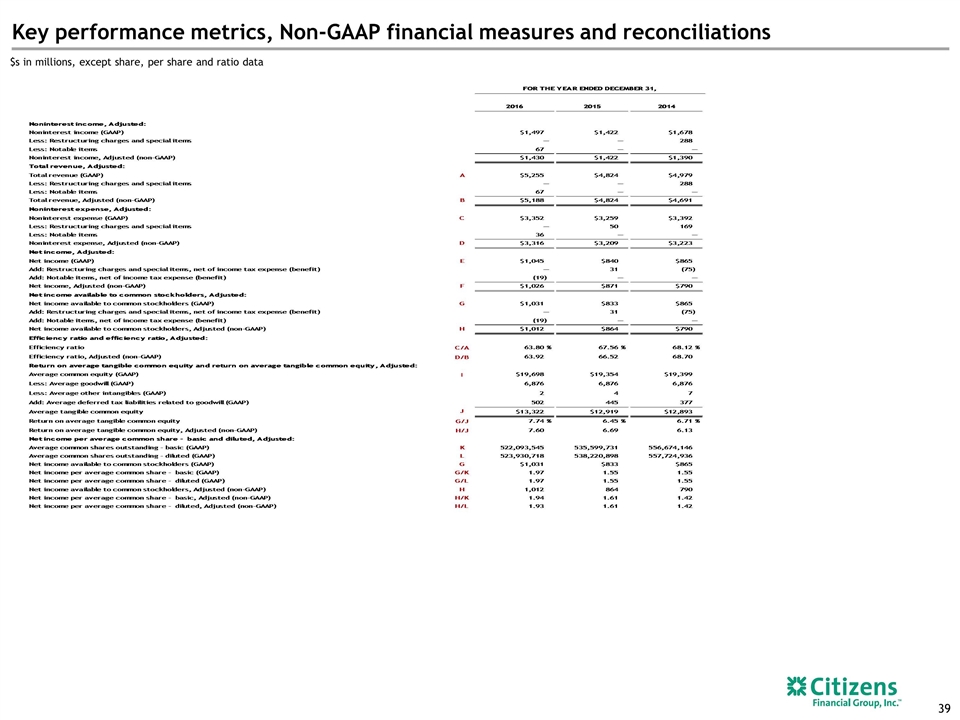

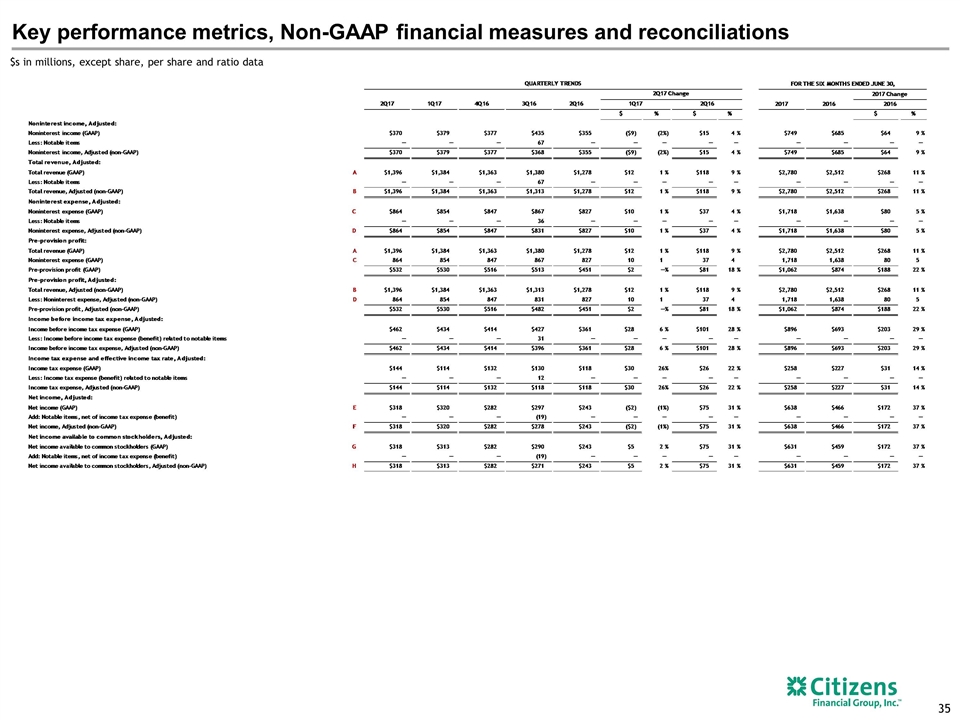

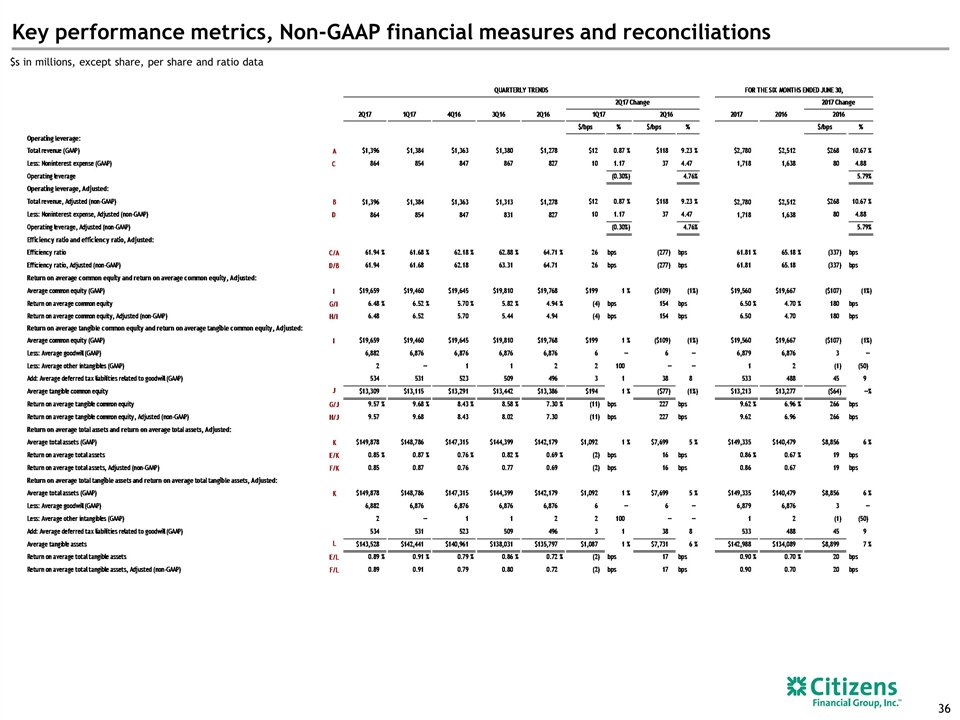

Key performance metrics, Non-GAAP financial measures and reconciliations $s in millions, except share, per share and ratio data

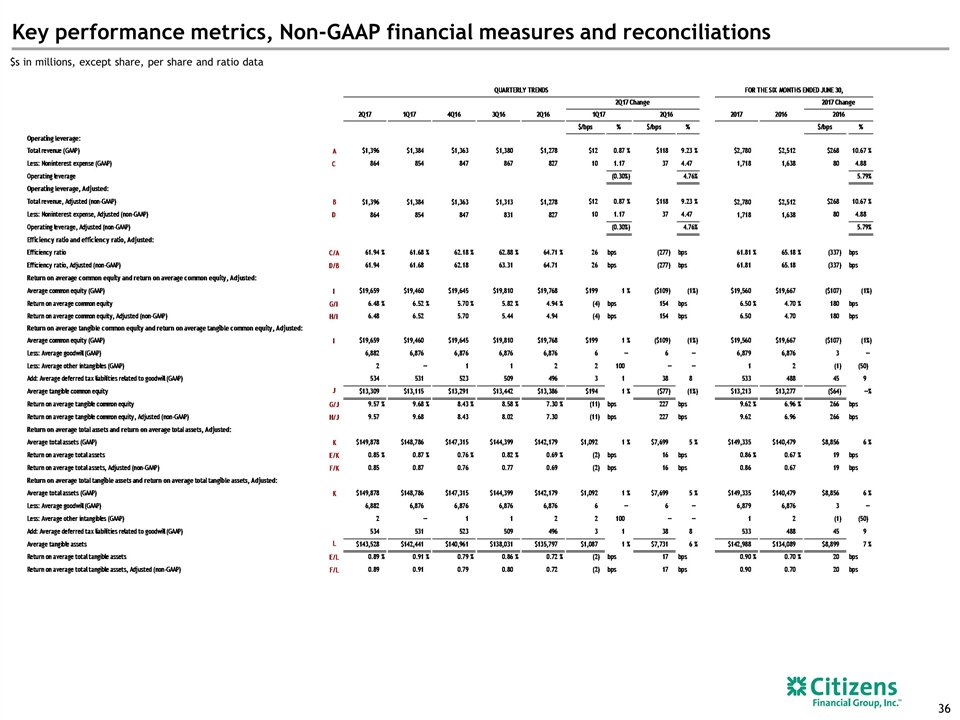

Key performance metrics, Non-GAAP financial measures and reconciliations $s in millions, except share, per share and ratio data

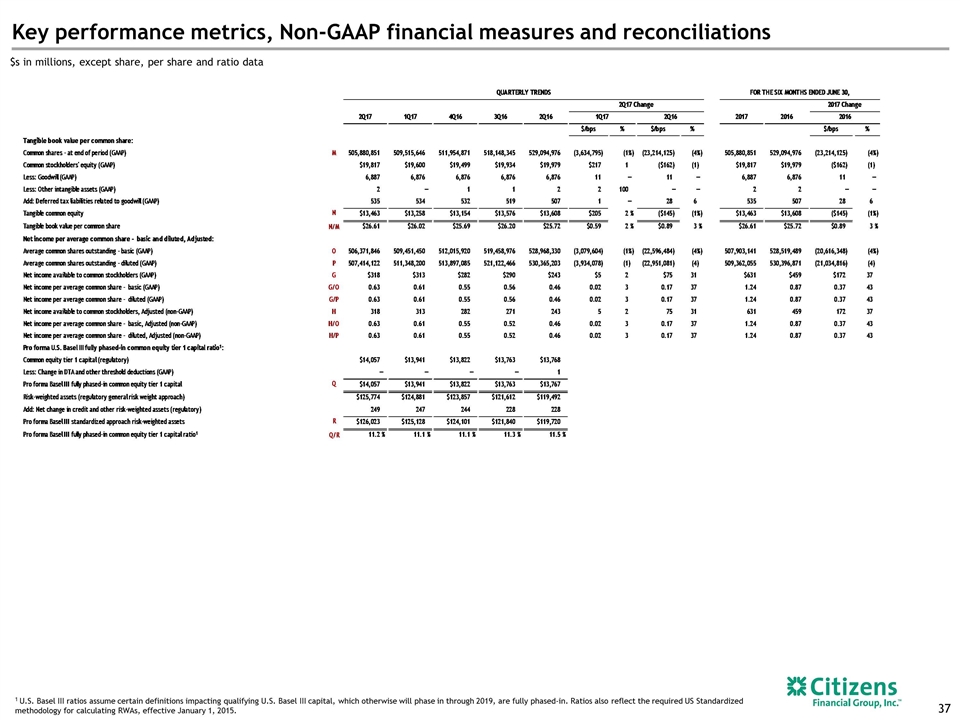

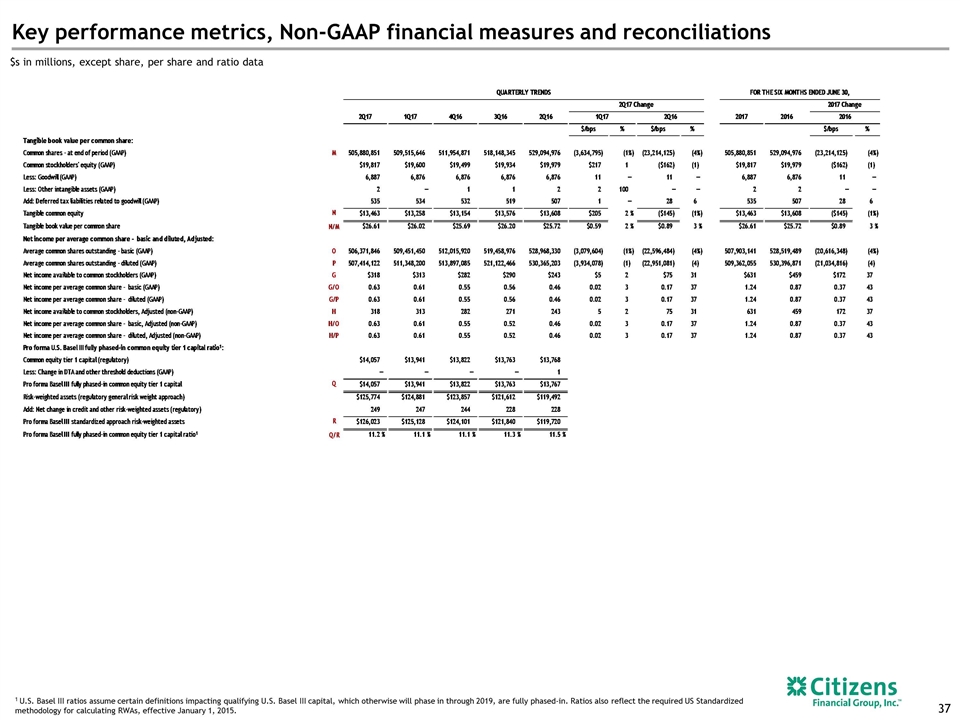

Key performance metrics, Non-GAAP financial measures and reconciliations $s in millions, except share, per share and ratio data 1 U.S. Basel III ratios assume certain definitions impacting qualifying U.S. Basel III capital, which otherwise will phase in through 2019, are fully phased-in. Ratios also reflect the required US Standardized methodology for calculating RWAs, effective January 1, 2015.

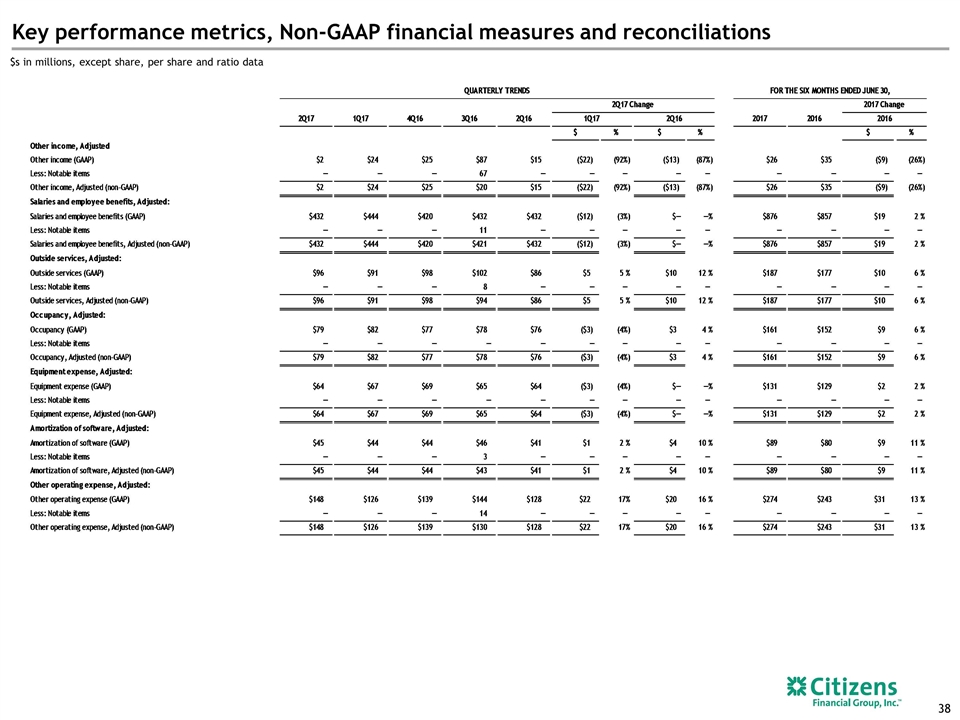

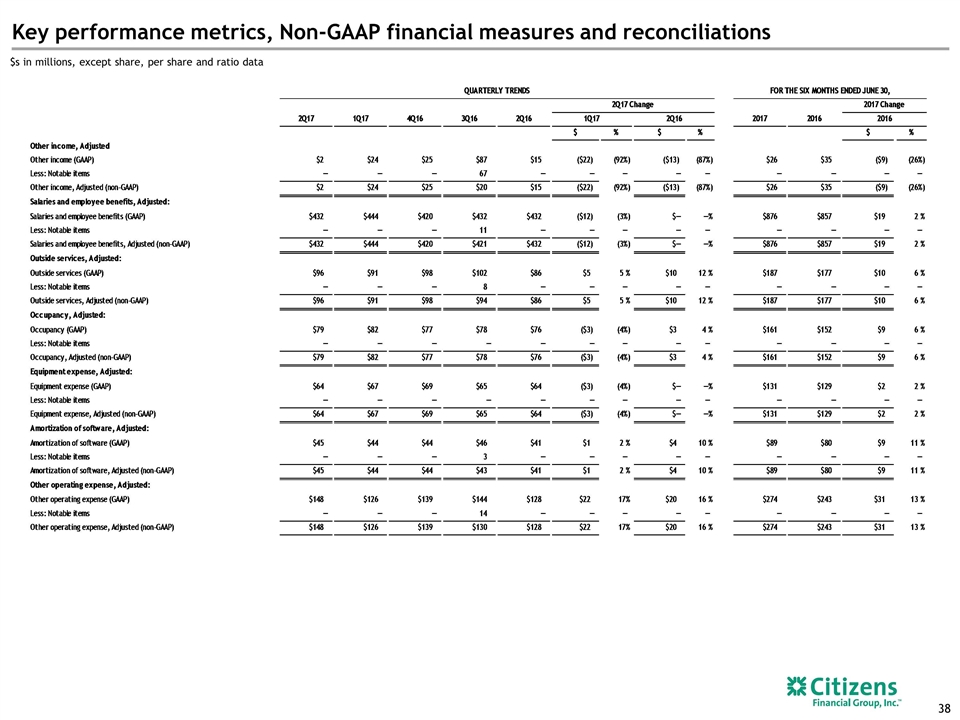

Key performance metrics, Non-GAAP financial measures and reconciliations $s in millions, except share, per share and ratio data

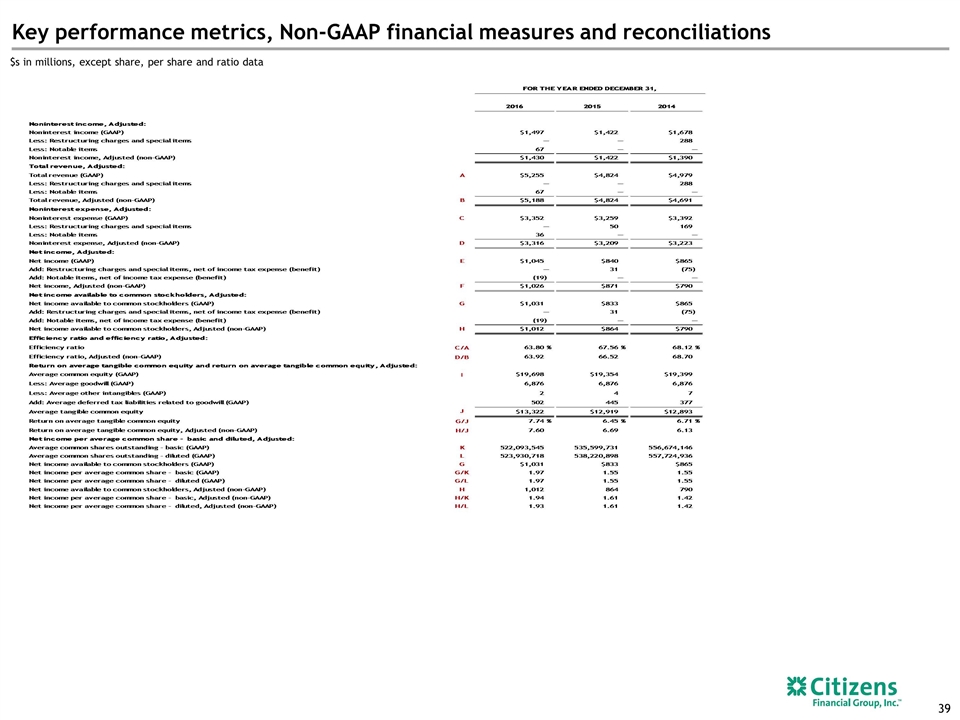

Key performance metrics, Non-GAAP financial measures and reconciliations $s in millions, except share, per share and ratio data

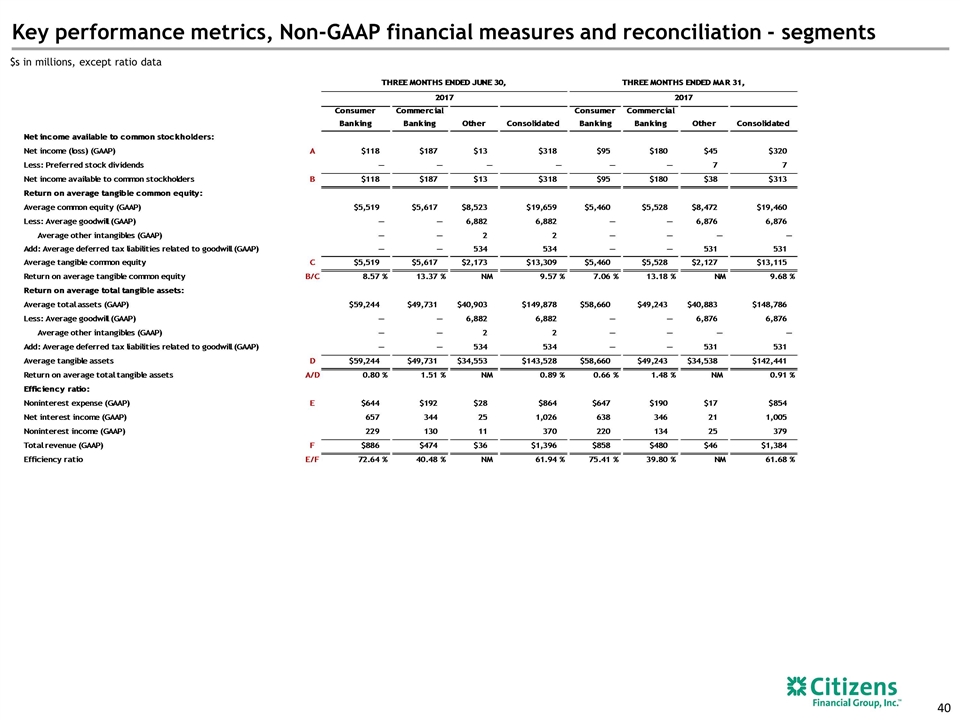

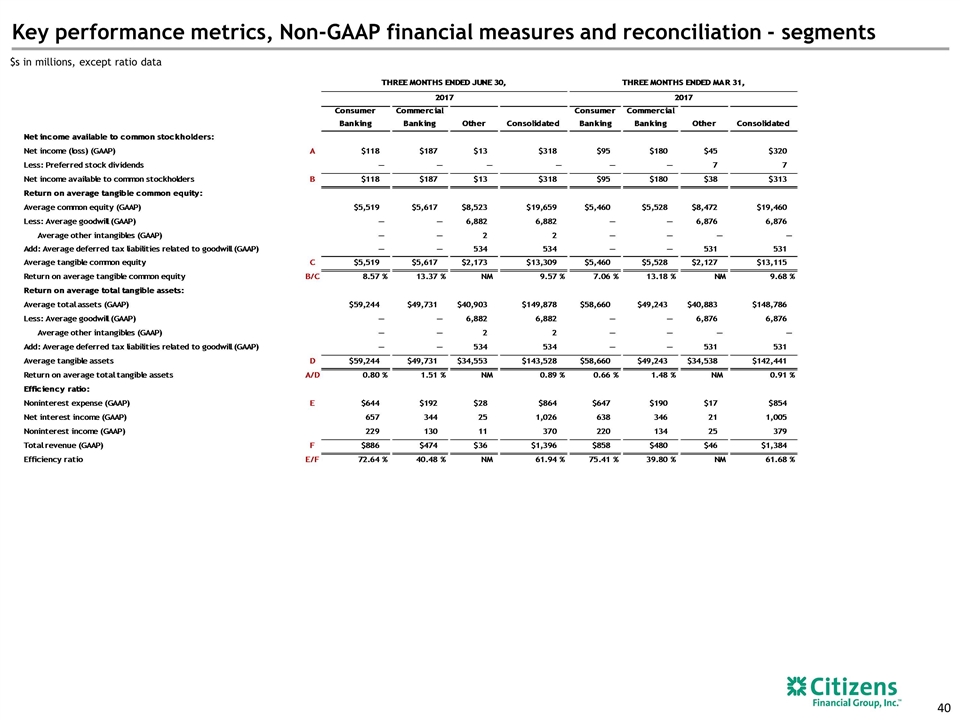

Key performance metrics, Non-GAAP financial measures and reconciliation - segments $s in millions, except ratio data

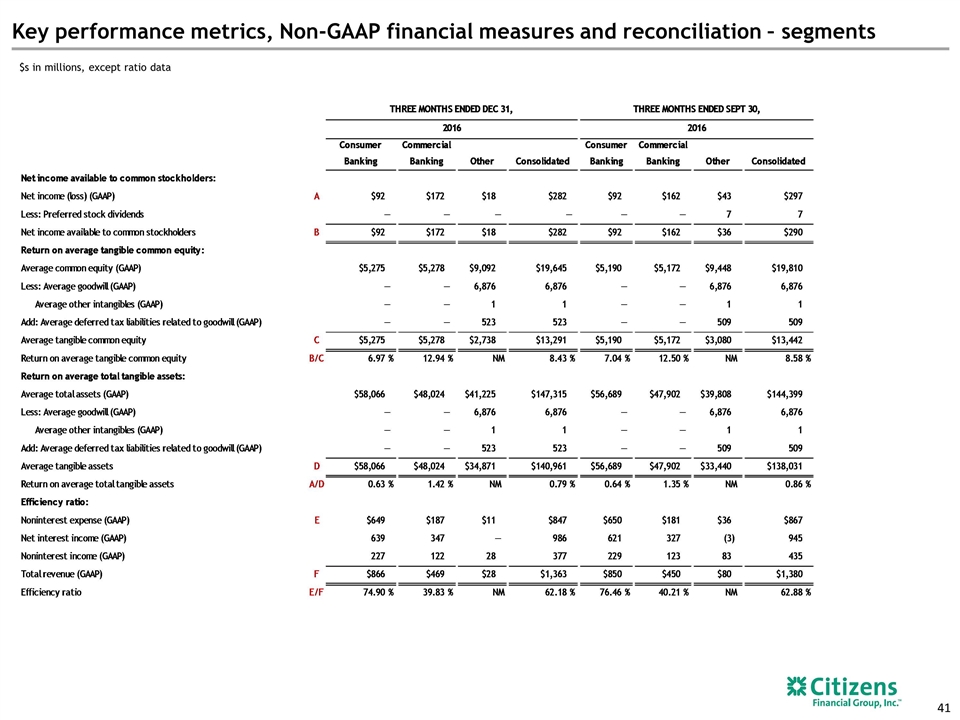

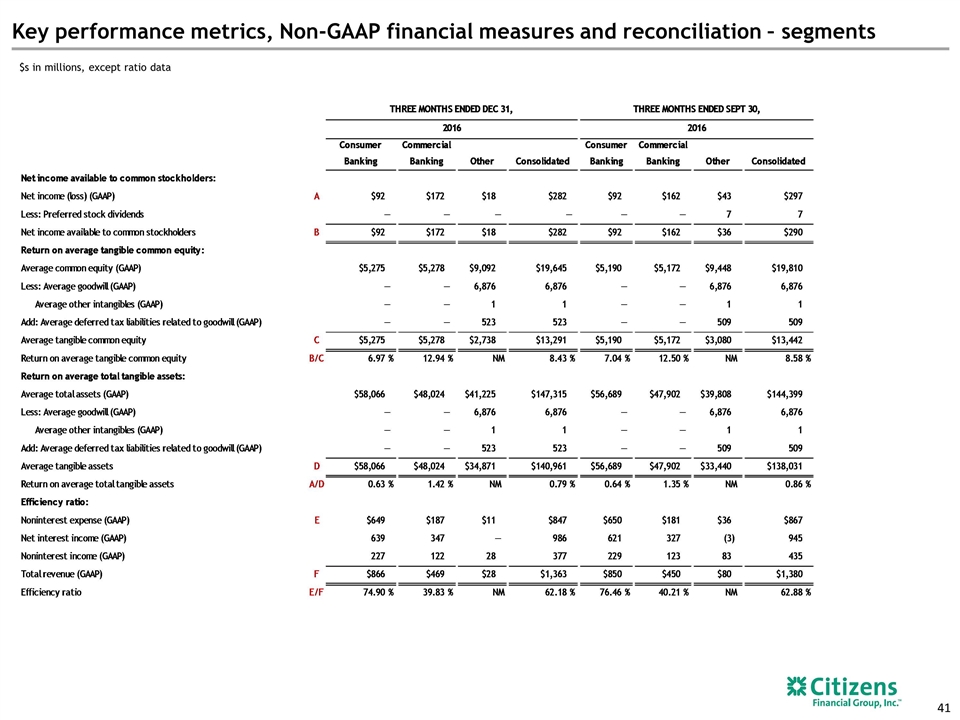

Key performance metrics, Non-GAAP financial measures and reconciliation – segments $s in millions, except ratio data

Key performance metrics, Non-GAAP financial measures and reconciliation – segments $s in millions, except ratio data

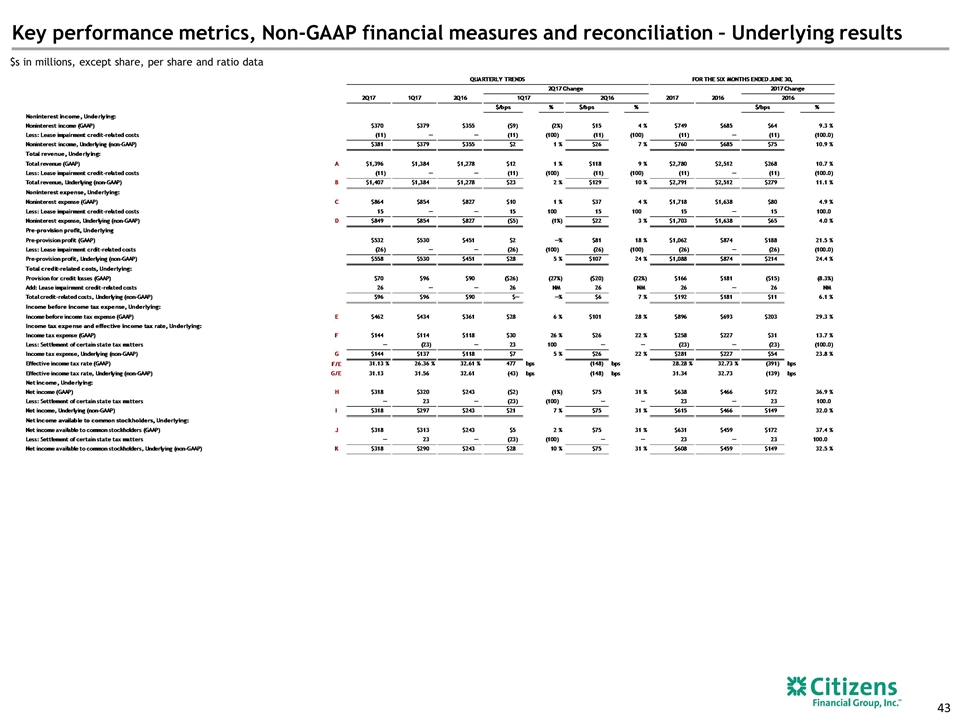

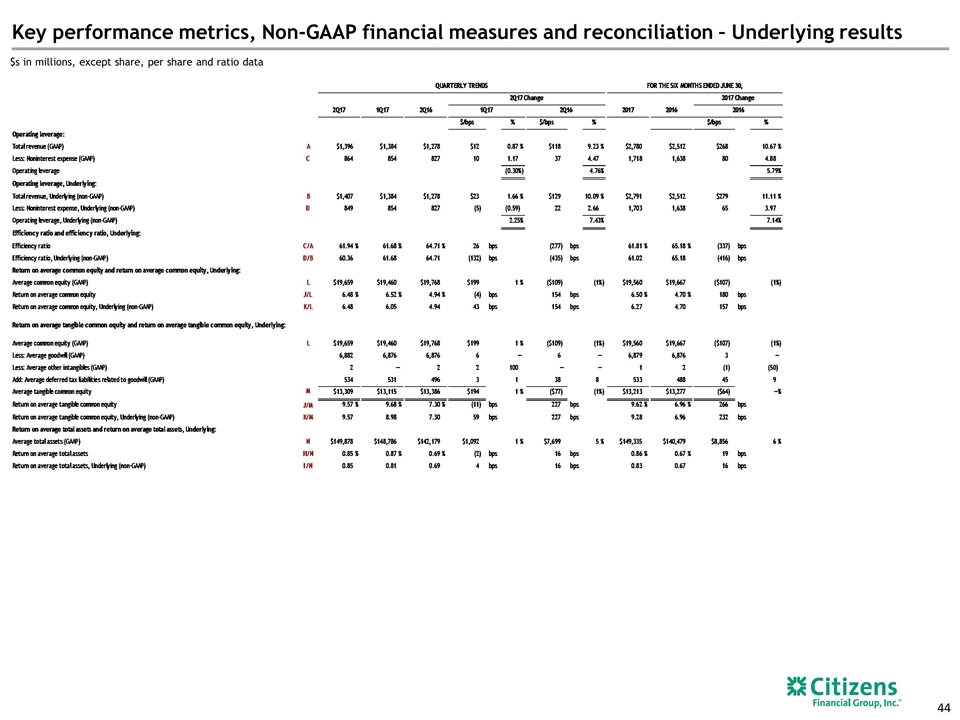

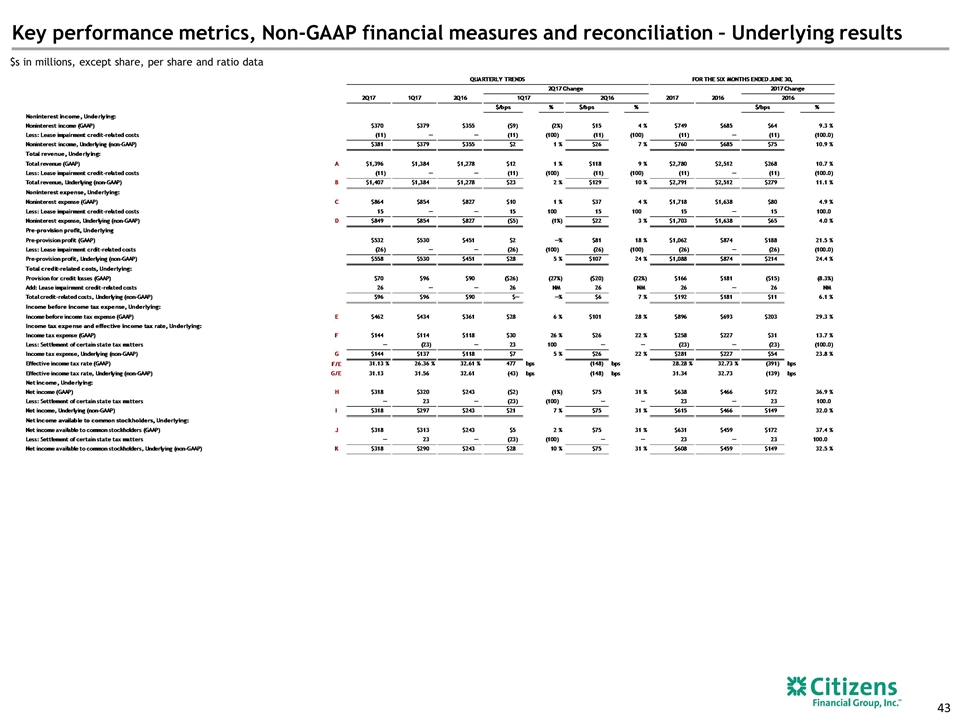

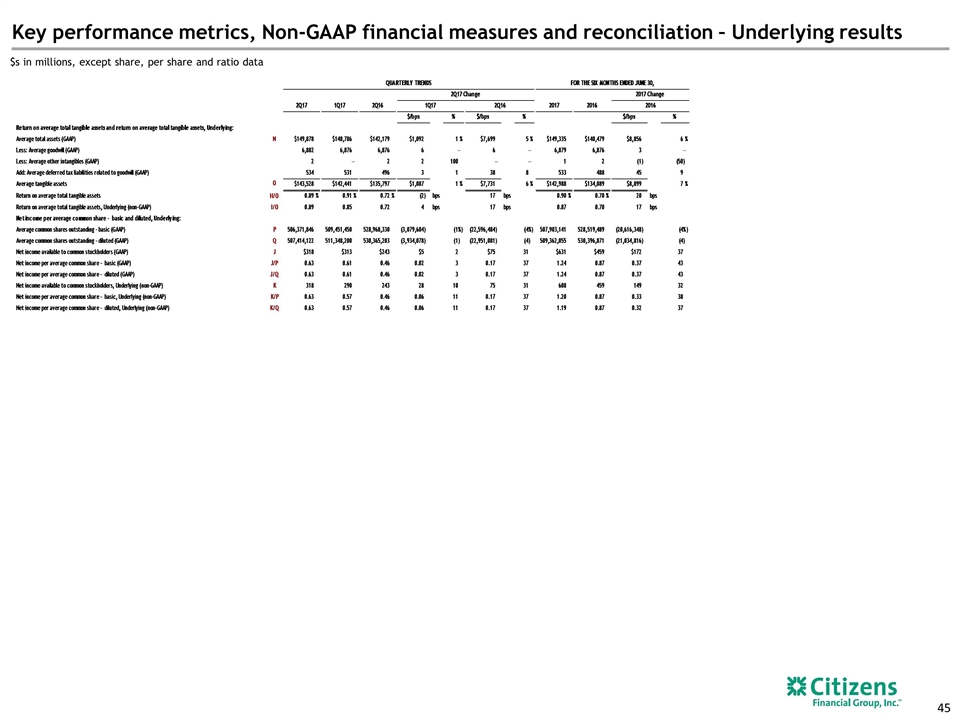

Key performance metrics, Non-GAAP financial measures and reconciliation – Underlying results $s in millions, except share, per share and ratio data

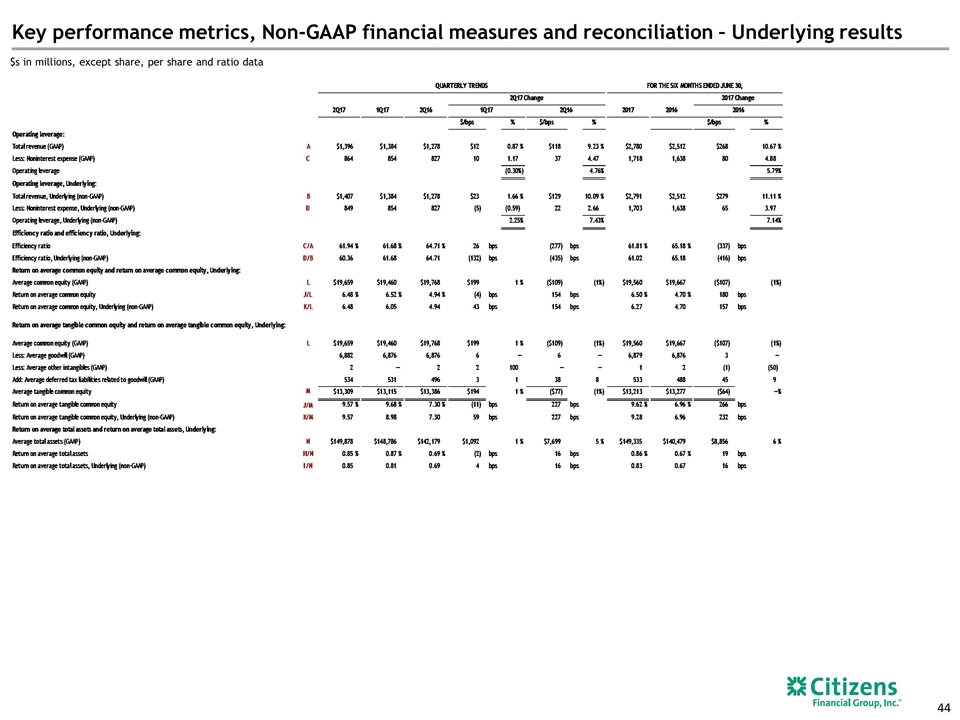

Key performance metrics, Non-GAAP financial measures and reconciliation – Underlying results $s in millions, except share, per share and ratio data

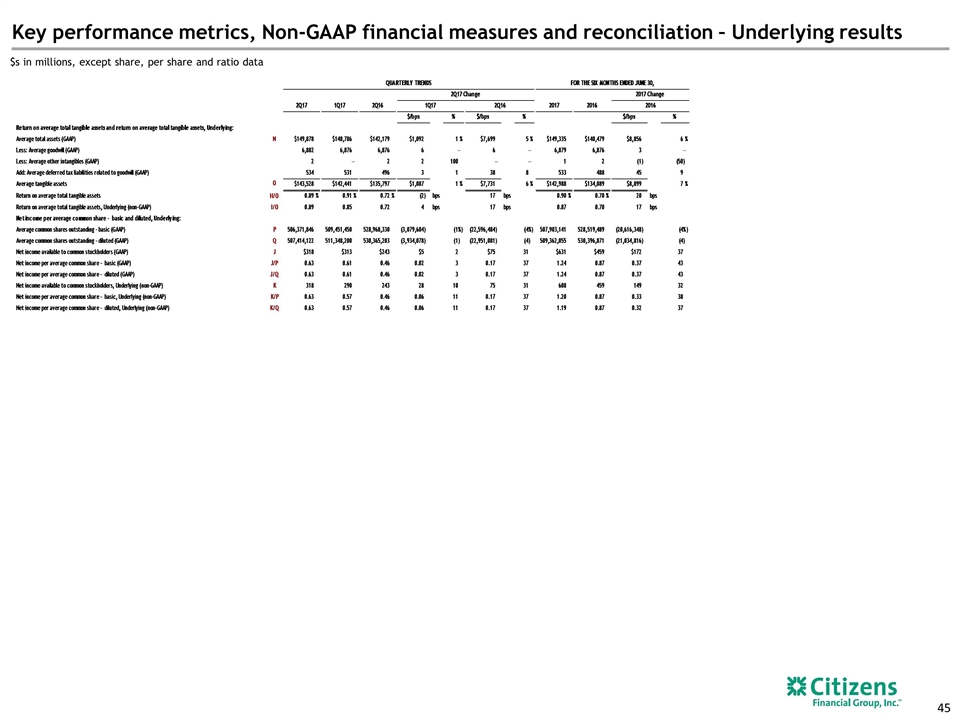

Key performance metrics, Non-GAAP financial measures and reconciliation – Underlying results $s in millions, except share, per share and ratio data

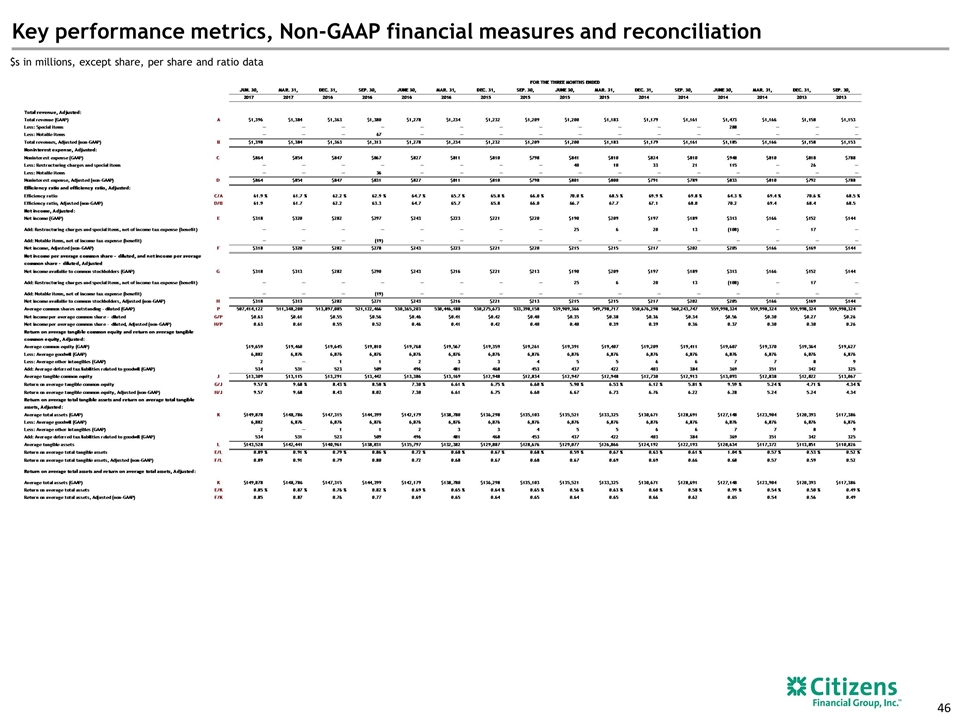

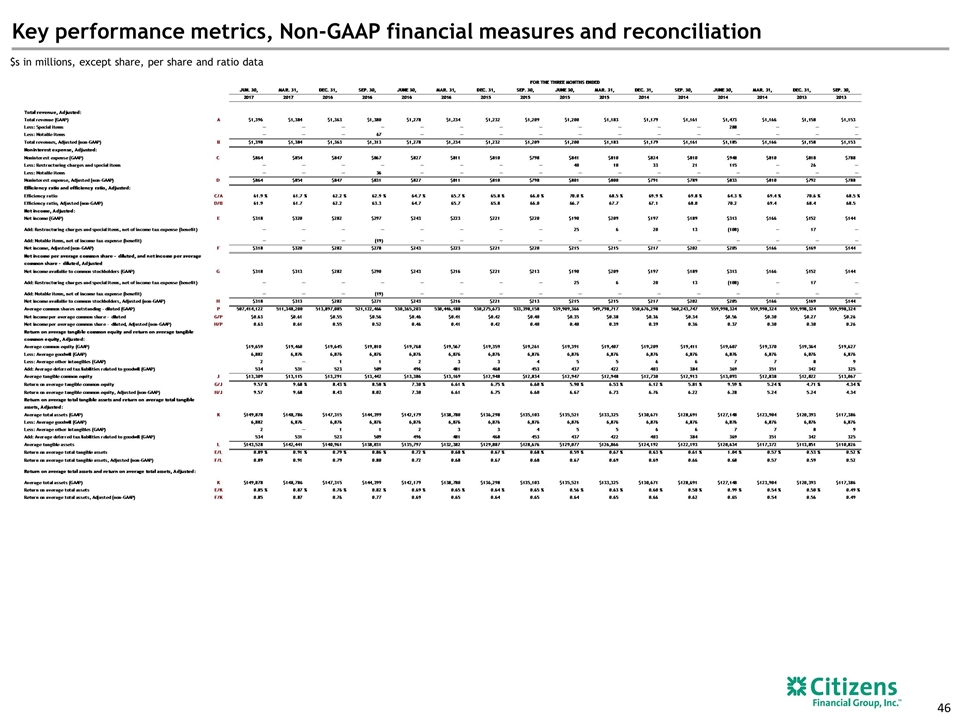

Key performance metrics, Non-GAAP financial measures and reconciliation $s in millions, except share, per share and ratio data