- CFG Dashboard

- Financials

- Filings

- Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEFA14A Filing

Citizens Financial (CFG) DEFA14AAdditional proxy soliciting materials

Filed: 11 Mar 22, 11:25am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☐ | Definitive Proxy Statement | |

| ☒ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to §240.14a-12 | |

CITIZENS FINANCIAL GROUP, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

SHIFTING TO OFFENSE, READYFOR THE FUTURE Annual Review 2021

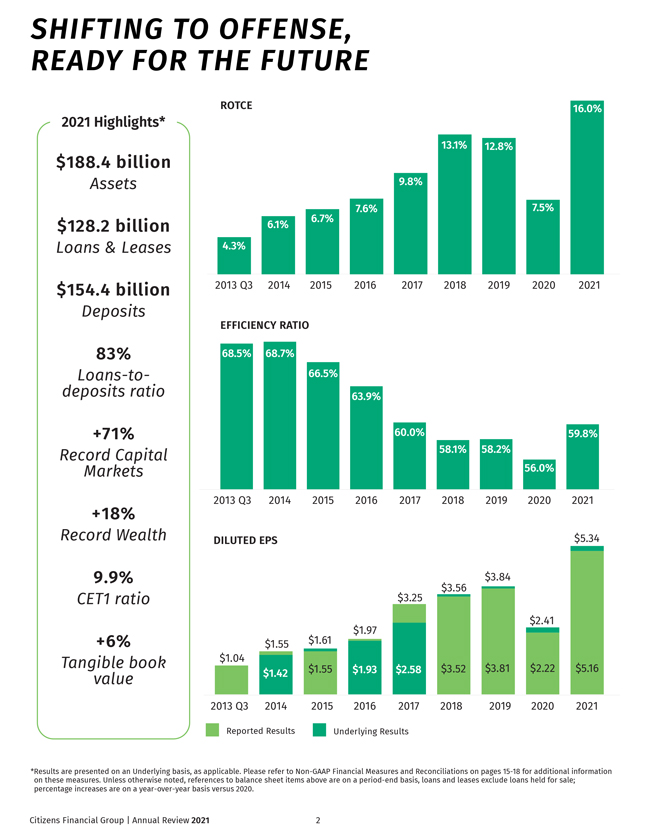

SHIFTING TO OFFENSE, READY FORTHE FUTURE ROTCE 2021 Highlights* $188.4billion Assets $128.2 billion Loans &Leases $154.4 billion Deposits 83% deposits Loans-to- ratio +71% Record Markets Capital +18% Record Wealth 9.9% CET1 ratio +6% Tangiblebook value *Results arepresented on an Underlying basis, as applicable. Please refertoNon-GAAP Financial Measures and Reconciliations on pages 15-18 foradditional information on these measures. Unless otherwise noted, references to balancesheet items above areona period-end basis, loans and leases exclude loans heldfor sale; percentageincreases areonayear-over-year basis versus 2020. Citizens Financial Group |Annual Review 2021 2 DILUTED EPS

TO MY FELLOW SHAREHOLDERS Sinceour IPO in 2014, we have focused relentlessly on transforming every aspect of Citizens. From our talent and technology to our product offerings and our engagement on environmental, social and governance(ESG) issues, Citizens has achieved dramatic changethat enables us to better serve customerstodaywhilepositioning ourselves well forarapidly transforming future. Our efforts to buildastronger,morediversified business paid dividends throughout the course of the coronavirus pandemic. We have leveragedour financial strength in the serviceofour customers during this challenging time, whilealso executing our digital-first, data-driven strategy.Whilewestill have moretodobeforewecan realize our vision of being atop-performing bank, we have laid the essential foundation to deliver success over the long-term. BruceVan Saun Chairman and Chief ExecutiveOfficer Citizens Financial Group,Inc. The capabilities, strategy,leadership and culturewehave assembled have enabled us to consistently deliver strong operational and financial results. We noware in aposition to playoffense and further accelerate the execution of our strategic growth plans. As we do this, we will benefitfromour distinctiveand diversified revenue growth initiatives, along with additional opportunities to increase feeincome and maintain positive operating leverage.Meanwhile, our innovativeefficiency programs have enabled us to self-fund important growth initiatives. Our acquisition of HSBC’s East Coast branches and online deposits, which closed in February, and InvestorsBancorp,which we aretargeting to close in early second quarter of 2022, areamong the numerous ways we arenow playing offense to the benefitof our stakeholders. These acquisitions will giveusaTop 10 deposit position in the New York City Metromarket and provide aspringboardfor futuregrowth as we work to bring both existing and new customersthe full rangeofCitizens capabilities, coupled with an excellent experience. Whilethe agenda ahead of us is highly ambitious, we will be guided by our Credo,with afocus on performing our best and helping our customers, communities, shareholders and all of those we serve reach their potential —todayand over the longer-term. This strong commitment to apurpose-driven culturehas enabled our success and allowed us to overcome amyriad of obstacles and challenges. We perform our best every daysowecan do morefor our: → Customers → Colleagues → Communities → Shareholders Citizens Financial Group |Annual Review 2021 3

STRONG EXECUTION IN 2021 Despiteaneconomic and public health environment that remained fluid throughout 2021, we continued to raise our game forall stakeholders. Our financial results were strong. On an Underlying basis,*wereportednet income of $2.4 billion, earnings per shareof$5.34, and ROTCEof16.0%. Our feeresults were particularly noteworthy, with record Capital Markets fees up 71% and record Wealth fees up 18%. Our credit results were excellent, with anet charge-off ratio of 26 basis points and anonperforming loans to loans ratio of 0.55%, down from 0.83% in 2020. Expense discipline and the ability to self-fund growth investments continue to be hallmarks forCitizens. Our TOP6program achievedits total target pre-taxrun-rate benefitofapproximately $425 million by year end, helping drivepositiveoperating leverage over the back half of 2021, whilesupporting ongoing efforts to transform how we operateand deliver forcustomersand colleagues. We have also launched aTOP 7 program that targets approximately $100 million in pre-taxrun-rate benefitbyyear-end 2022. This program will include key transformational programs aimed at honing our deliverymodel, simplifying our organizational structure, optimizing our branch network and helping drivethe multi-year digitization of the bank. It will also fund critical technology programs in areas such as robotics, machine learning, artificial intelligenceand cloud applications. 1. The graph compares the cumulativetotal stockholder returns forour performancesince September24, 2014, relativetothe performanceofStandard& Poor’s 500® Index, the KBWNasdaq Bank Index(BKX),and the market-capitalization weighted average of our peer regional banks (CMA, FITB, HBAN, KEY,MTB, PNC,RF, TFC and USB). The graph assumes all dividends were reinvested on the datepaid forCFG common stock, the S&P500 index, the BKX and our peer regional banks. Citizens FinancialGroup |Annual Re i 4

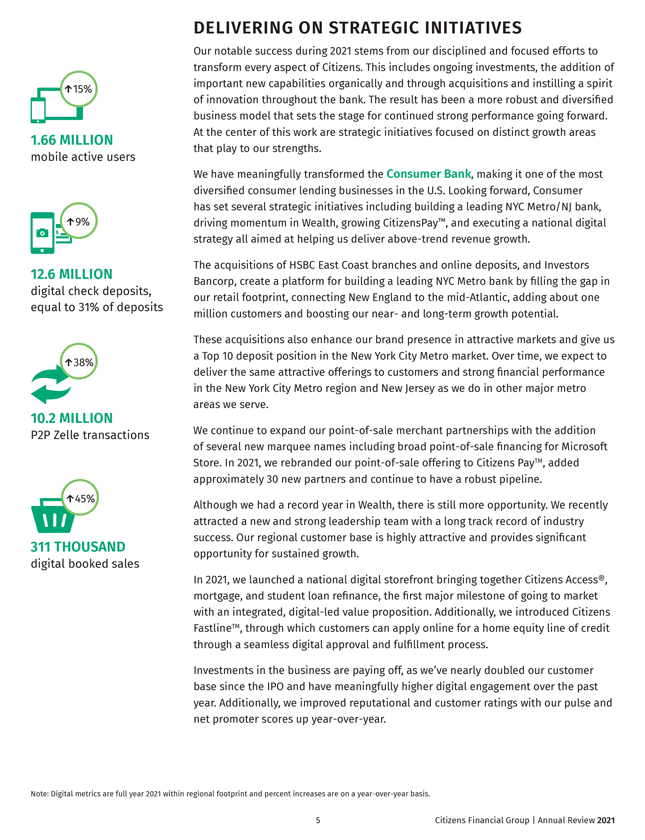

DELIVERING ON STRATEGICINITIATIVES Our notablesuccess during 2021 stems from our disciplined and focused efforts to transform every aspect of Citizens. This includes ongoing investments, the addition of important new capabilities organically and through acquisitions and instilling aspirit of innovation throughout the bank. The result has been amorerobust and diversified business model that sets the stagefor continued strong performancegoing forward. At the center of this work arestrategic initiatives focused on distinct growth areas that playtoour strengths. We have meaningfully transformed the ConsumerBank,making it one of the most diversified consumer lending businesses in the U.S. Looking forward, Consumer has set severalstrategic initiatives including building aleading NYCMetro/NJ bank, driving momentum in Wealth, growing CitizensPay™,and executing anational digital strategy all aimed at helping us deliver above-trend revenue growth. The acquisitions of HSBC East Coast branches and online deposits, and Investors Bancorp,createaplatform forbuilding aleading NYCMetrobank by filling the gap in our retail footprint, connecting New England to the mid-Atlantic, adding about one million customersand boosting our near-and long-term growth potential. These acquisitions also enhanceour brand presenceinattractivemarkets and giveus aTop 10 deposit position in the New York City Metromarket. Over time, we expect to deliver the same attractiveofferings to customersand strong financial performance in the New York City Metroregion and New Jerseyaswedoinother major metro areas we serve. We continue to expand our point-of-salemerchant partnerships with the addition of severalnew marquee names including broad point-of-sale financing forMicrosoft Store. In 2021, we rebranded our point-of-saleoffering to Citizens PayTM,added approximately 30 new partnersand continue to have arobust pipeline. Although we had arecordyear in Wealth, thereisstill moreopportunity.Werecently attracted anew and strong leadership team with along track record of industry success. Our regional customer base is highly attractiveand provides significant opportunity forsustained growth. In 2021, we launched anational digital storefront bringing together Citizens Access®, mortgage, and student loan refinance, the firstmajor milestone of going to market with an integrated, digital-led value proposition. Additionally,weintroduced Citizens FastlineTM,through which customerscan apply online forahome equity line of credit through aseamless digital approval and fulfillment process. Investments in the business arepaying off,aswe’venearly doubled our customer base sincethe IPO and have meaningfully higher digital engagement over the past year.Additionally,weimproved reputational and customer ratings with our pulse and net promoter scores up year-over-year. ↑15% 1.66 MILLION mobileactiveusers ↑9% 12.6 MILLION digital check deposits, equal to 31%ofdeposits ↑38% 10.2 MILLION P2P Zelletransactions ↑45% 311 THOUSAND digital booked sales Note: Digital metrics arefull year 2021 within regional footprintand percent increases areona year-over-year basis. 5 Citizens FinancialGroup |Annual Review 2021

We continued to dramatically reposition our Commercial Banking business, further broadening capabilities and strengthening our execution. Throughout 2021 we invested significantly in talent and capabilities to help clients throughout their full lifecycle. In 2021, we closed on the acquisitions of WillametteManagement Associates and JMP Group as well as announced the acquisition of DH Capital. These acquisitions bring additional solutions and capital markets expertise, including new equity underwriting and research capabilities. We also further built out capabilities in severalareas, including foreign exchangeand commodity hedging as well as asset-based lending. Further,Commercial delivered new and enhanced treasurysolutions capabilities, including an upgraded accessESCROW®portal, anew integrated payables solution and aReceivables Automation platform. By adding capabilities in astrategic, deliberate manner,Commercial nowoffersclients acompleteset of investment banking solutions. Our Commercial clients continue to recognize the value we bring throughout the life cycleoftheir business with our 93%overall satisfaction scoreinBarlow’s 2021 survey. Enhancing our coverage model is another key aspect of our commercial strategy and heretoo we made significant progress. The JMP Group acquisition deepened our expertise in key growing sections of the U.S. economysuch as health care, technology and fintech, whileexpanding leveraged financeopportunities across JMP’s middle market and financial sponsor client base. Wearewell-positioned tosupportthe growth of privateequity sponsor ownership in the U.S., with an ability toprovide M&A opportunities, leveraged financeand subscription line financing. Our execution in the serviceofall of our stakeholderscontinues toberecognized externally.During 2021, wewerenamed Best U.S. Bank byEuromoneymagazine and werenamed toGlobal Finance’s World’s Best Banks list. These accolades area testament tothe transformation wehave driven at Citizens sincethe IPO. COMMITMENTTORESPONSIBLECITIZENSHIP At Citizens we believe we have aresponsibility to all of our stakeholderstobuilda diverse, sustainable, and inclusivefuturethat unites value with purpose. We understand that this commitment makes us stronger in every aspect, enabling us to do evenmore to address critical economic needs and buildstronger communities. This means that we embracethe development of our peopleand the engagement of our communities whilefactoring social responsibility intoour business decisions. Our commitment to this journeyisatthe heartofthe Citizens Credo,inspiring us to createapositiveand lasting impact across ESG issues through our reach, innovation, and insights. In the area of environmental sustainability,weadopted targets to reduceour Scope 1and 2greenhouse gas emissions 30% by 2025 and 50% by 2035, based on our 2016 baseline. These reductions align with the recommendations of the Paris Agreement, which aims to limit increases in average global temperature. We also introduced an innovativeGreen Deposits offering that enables corporateclients to direct their cash reservestowardcompanies and projects that areexpected to createapositive environmental impact. This offering attracted over $100 million in deposits by year-end 2021. We also continued progress on our 2020 $10million social equity commitment and our incremental $500 million commitment to providing access to capital forsmall 6 Citizens FinancialGroup |Annual Review 2021

businesses, housing and other developments in predominantly minority communities. We also continued to deliver on our commitment to provide $300 million in enhanced Low-Income Housing TaxCredit developments located in predominantly minority census tracts. The capital created by our enhanced pricing approach helps address the digital divide at no cost to residents by providing features such as technology centerswith computer workstations and internet connectivity.Further,our colleagues demonstrated their commitment to strengthening the communities we serve by volunteering arecord 154,000 hoursofserviceduring 2021. Forbes List of America’s Best Employers for Diversity for the 3rd Year in aRow We understand that we can only win as an organization if our people, leadership and cultureremain at our core,and that social responsibility must be embedded in our corporatestrategy.Our ongoing efforts to attract and retain great talent and create adiverse and inclusivecultureremain an important partofour ESG approach and we continue to buildonour progress in this area. In 2021 we launched the Citizens Learning Hub colleague training and development platform and revamped our external and internal career sitebased on candidatefeedback. We also launched our DE&I Learning Journeyfor colleagues. Citizens has received aperfect scoreonthe Human Rights Campaign CorporateEquality Indexand has been included on the Forbes Best Employersfor Diversity list forthe thirdyear in arow. CLOSING COMMENTS As always, Iwouldliketoclose by thanking my fellow shareholders, our customers and our nearly 17,500 colleagues foryour supportoverthe past year.Iwouldalso like to express my appreciation to our boardofdirectorsfor their guidanceand many contributions. Iwouldespecially liketothank Lee Higdon and Bud Koch, who will retire from our Boardafter their current terms expireatthe 2022 Annual Meeting. Kevin Cummings, Investors’ Chairman and Chief ExecutiveOfficer, and MicheleSiekerka, who currently serve on the InvestorsBoard, areexpected to join Citizens’ Boardupon closing of the acquisition. Citizens delivered excellent performancein2021 and we enter 2022 with strong momentum. The investments that we’vemade to transform and reposition Citizens sinceour IPO areyielding results and we aredelivering forall of our stakeholders. We’ve navigated the pandemic environment well, shifting to offense over the course of 2021 and have positioned Citizens forsustainablefuturegrowth. Kind regards, BruceVan Saun Chairman andChief ExecutiveOfficer Citizens Financial Group,Inc. 7 Citizens FinancialGroup |Annual Review 2021 2nd Year in aRow Citizens named abest placefor work forLGBTQ equity by the Human Rights Campaign The 2021 Best U.S. Bank EuroMoneyAwards forExcellence 2021 Best Places to Work forPeoplewith Disabilities Disability Equity Index scoreof90 Named MilitaryFriendly Employer status as acompanythat is “Better forVeterans”

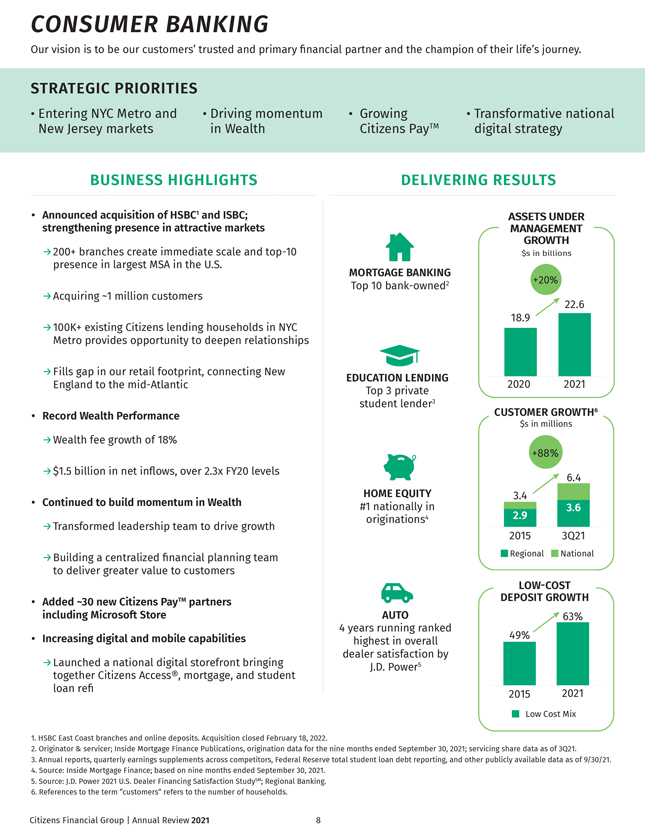

CONSUMER BANKING Our vision is to be our customers’ trusted and primary financial partner and the champion of their life’s journey. STRATEGIC PRIORITIES •Entering NYCMetroand •Driving momentum •Growing •Transformativenational New Jerseymarkets in Wealth Citizens PayTM digital strategy BUSINESSHIGHLIGHTS DELIVERING RESULTS •Announced acquisition of HSBC1 and ISBC; ASSETSUNDER strengthening presenceinattractivemarkets MANAGEMENT →200+ branches createimmediatescaleand top-10 GROWTH $s in billions presenceinlargest MSAinthe U.S. MORTGAGE BANKING 2 +20% →Acquiring ~1 million customers Top10bank-owned 22.6 18.9 →100K+ existing Citizens lending households in NYC Metroprovides opportunity to deepen relationships →Fills gap in our retail footprint, connecting New EDUCATION LENDING England to the mid-Atlantic 2020 2021 Top3private student lender3 •RecordWealth Performance CUSTOMER GROWTH6 $s in millions →Wealth feegrowth of 18% +88% →$1.5 billion in net inflows, over 2.3x FY20 levels 6.4 HOME EQUITY 3.4 •Continued to buildmomentum in Wealth #1 nationally in 3.6 →Transformed leadership team to drivegrowth originations4 2.9 2015 3Q21 →Building acentralized financial planning team Regional National to deliver greater value to customers LOW-COST •Added ~30new Citizens PayTM partners DEPOSIT GROWTH including Microsoft Store AUTO 63% 4yearsrunning ranked •Increasing digital and mobilecapabilities 49% highest in overall dealer satisfaction by →Launched anational digital storefront bringing J.D.Power5 together Citizens Access®, mortgage, and student loan refi 2021 2015 LowCost Mix 1. HSBC East Coast branches and online deposits. Acquisition closed February18, 2022. 2. Originator &servicer; Inside MortgageFinancePublications, origination data forthe nine months ended September 30, 2021; servicing sharedata as of 3Q21. 3. Annual reports, quarterly earnings supplements across competitors, Federal Reserve total student loan debt reporting, and other publicly availabledata as of 9/30/21. 4. Source:Inside MortgageFinance; based on nine months ended September 30, 2021. 5. Source:J.D.Power2021 U.S. Dealer Financing SatisfactionStudySM;Regional Banking. 6. References to the term “customers” refers to the number of households. Citizens FinancialGroup |Annual Review 2021 8

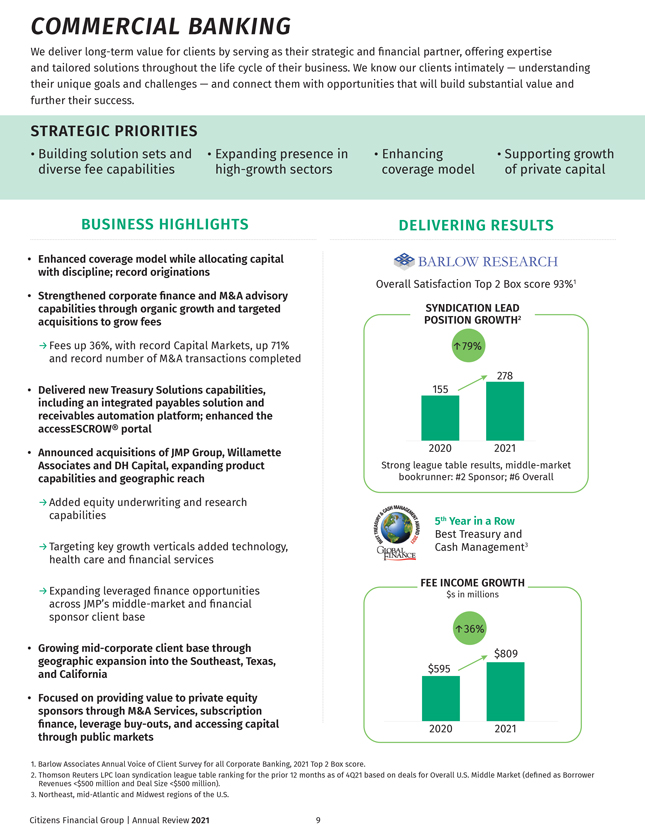

COMMERCIALBANKING We deliver long-term value forclients by serving as their strategic and financial partner,offering expertise and tailored solutions throughout the lifecycle of their business. We knowour clients intimately —understanding their unique goals and challenges —and connect them with opportunities that will buildsubstantial value and further their success. STRATEGIC PRIORITIES •Building solution sets and •Expanding presencein •Enhancing •Supporting growth diverse feecapabilities high-growth sectors coverage model of privatecapital BUSINESSHIGHLIGHTS DELIVERING RESULTS •Enhanced coverage model whileallocating capital with discipline; record originations Overall Satisfaction Top2 Boxscore 93%1 •Strengthened corporate financeand M&A advisory capabilities through organic growth and targeted SYNDICATION LEAD acquisitions to grow fees POSITION GROWTH2 →Fees up 36%, with record Capital Markets, up 71% ↑79% and record number of M&A transactions completed 278 •Delivered new TreasurySolutions capabilities, 155 including an integrated payables solution and receivables automation platform; enhanced the accessESCROW®portal •Announced acquisitions of JMP Group,Willamette 2020 2021 Associates and DH Capital, expanding product Strong leaguetableresults, middle-market capabilities and geographic reach bookrunner: #2 Sponsor; #6 Overall →Added equity underwriting and research capabilities th 5 Year in aRow Best Treasuryand →Targeting key growth verticals added technology, Cash Management3 health careand financial services FEE INCOMEGROWTH →Expanding leveraged financeopportunities $s in millions across JMP’s middle-market and financial sponsor client base ↑36% •Growing mid-corporateclient base through $809 geographic expansion intothe Southeast, Texas, $595 and California •Focused on providing value to privateequity sponsorsthrough M&A Services, subscription finance, leverage buy-outs, and accessing capital 2020 2021 through public markets 1. Barlow Associates Annual VoiceofClient Survey forall CorporateBanking,2021 Top2Box score. 2. Thomson ReutersLPC loan syndicationleague tableranking forthe prior 12 months as of 4Q21 based on deals forOverall U.S. Middle Market (defined as Borrower Revenues <$500 million and Deal Size <$500 million). 3. Northeast, mid-Atlantic and Midwest regions of the U.S. Citizens FinancialGroup |Annual Review 2021 9

COMMITMENT TO COLLEAGUES We arededicated to creating an environment that enables our colleagues to grow and thrive — championing their ongoing well-being across all dimensions of their lives — ensuring thereisequal access and opportunities. Retained Last Year’s Highest Overall Boosted Employee Benefits OHI1 Scoreof74 with additional mental health resourcesaswell with an all-time high participation rate;strong as five days of back-up childand adult care leadership,cultureand career opportunities were noted Starteda“Return to Work” Program forWomen who have been out of the full-time workforce Continue to Attract Top-Tier Talent for18plus months due to childcare, etc. in areas integral to our growth strategy (wealth, digital, data and analytics, agile, technology,etc.) Delivered aNew Development &Career Planning program resulting in 4,600+ colleagues participating in career building sessions Launched the Citizens Learning Hub anew HR Learning Platform forour colleagues’ SupportedContinuation training and development. More than 13,300 colleagues engaged in self-directed digital learning of Transformation Efforts across the enterprise with morethan 2,200 colleagues working in agileways Expanded AcademyStrategy, ensuring our workforce has the skills and capabilities Expanded Impact of Jamie, to be ready forthe future — Agile, Innovation, Next our award-winning AI chat assistant, to support Generation Tech, Data and Leadership Academies internal colleagues through the recruitment process, answering over 1,500 colleague inquiries SUPPORTING OUR COMMUNITIES Citizenship is at the heartofwho we are, rooted in the belief that when peopleand communities reach their potential, we all thrive. Through our Citizens Helping Citizens initiative, we invest our time, resourcesand talent to supportthe communities in which we liveand work. Economic Volunteer Hours CRA Development Over $1.17billion loans and Increased volunteer hours “Outstanding”Community investments committed from 122,000 in 2020 to more Reinvestment Actrating from to supporthousing and than 154,000 in 2021 the OCC economic development Community Partners BoardService Giving Expanded community partners 67%growth in Colleague Board Nearly $1 million in matching to include Education Design Lab, Serviceoverthe past 4years gifts from Citizens Charitable EVERFI, Feeding America, Girls Who Foundation Code, LISC and Year Up 1. OrganizationHealth Index(OHI) is aMcKinseyTM survey. 10 Citizens FinancialGroup |Annual Review 2021

DIVERSITY, EQUITY & INCLUSION Over the past year, we’ve been intentional in developing an environment where everyone is seen, heard and respected. Our commitment to diversity, equity and inclusion (DE&I) directly aligns with our Credo and our hopes for a brighter journey for our colleagues, customers and communities. While there’s still much work to be done, we’re proud of the meaningful progress we’ve made, and we’re made ready to further strengthen our efforts in 2022 and beyond. CREATING EXCEPTIONAL EXPERIENCE THROUGH DE&I Launched Internal Diversity Scorecards Initiated Diverse Hiring Commitment to increase transparency and accountability for senior leader roles Implemented Compulsory Inclusion Training 3,100 Business Resource Group Members for all colleagues engaged in 34 community events; colleague membership continues to grow 5% year-over-year EQUIPPING LEADERS, BUILDING RELATIONSHIPS AND BROADENING THE TALENT POOL Attended Over 10 Diversity-Focused Career Fairs Historically Black Colleges and to build a diverse talent pool Universities Alumni Task Force launched to enhance Citizens’ representation and recruiting strategies within the HBCU community Expanded our “Autism at Work” program and partnership to grow diverse pipelines Launched workshops as part of our DE&I Learning Journey, educating more than 2,100 managers 300 Managers Completed on key DE&I competencies focused on Inclusive Hiring Training, valuing uniqueness, building belonging, other training and manager calls and mitigating bias in the hiring and performance review processes 11 Citizens Financial Group | Annual Review 2021

COMMITTEDTOADVANCING ESG PRIORITIES ENVIRONMENTAL →Adopted targets to reduceour Scope 1and 2GHG emissions 30% by 2025 and 50% by 2035, based on our 2016 baseline. These reductions align with the recommendations of the Paris Agreement, which aims to limit average global temperatureincrease to well-below 2° Celsius compared to pre-industrial levels →Launched the Green Deposits program allowing corporateclients to direct their cash reservestowardcompanies and projects that areexpected to createapositiveenvironmental impact; over $100MM deposits as of December 31, 2021 →Approximately $429MM invested in renewableenergy projects as of December 31, 2021 SOCIAL →We continued progress on our $10MM social equity commitment and our incremental $500MM commitment to providing access to capital in minority communities →Provided approximately $1.5B in financing to help residents and small businesses in majority minority communities gain access to much needed capital. That volume reflects over $400MM in incremental funding to majority minority communities, as compared to our 2019 base-line, during the firstfull year of our three-year $500MM commitment →Partnered with Goalsetter as one of its first10corporatepartnerskicking off their One Stock, One Futurecampaign. The campaign’s goal is to help bridgethe wealth gap affecting communities of colorbyintroducing investments and financial education as critical components to building generational wealth GOVERNANCE →Aligned annual corporateresponsibility reporting to GRI and SASB frameworks →Refreshed Boardand increased ethnic diversity with February2021 appointments →Announced that twonew directors, Kevin Cummings and Michele Siekerka, areexpected to join the Boardupon closing of the Investors Bancorp,Inc. acquisition 12 Citizens FinancialGroup |Annual Review 2021

EXECUTIVE COMMITTEE BOARD OF DIRECTORS BruceVan Saun DonaldH.McCree BruceVan Saun RobertG.Leary Chairman and Chief ViceChairman and Head of Chairman and CEO, Former CEO, ExecutiveOfficer Commercial Banking Citizens Financial Group, The Olayan Group Inc. MaryEllen Baker Michael Ruttledge TerranceJ.Lillis Head of Business Services Chief Information Officer Lee Alexander Retired Chief Financial ExecutiveVicePresident Officer, Principal Financial Brendan Coughlin Eric Schuppenhauer and Chief Information Group,Inc. Head of Consumer Banking Head of Consumer Lending Officer, The Clearing House and National Banking Shivan S. Subramaniam Malcolm Griggs Christine M. Cumming Retired Chairman and CEO, Chief Risk Officerand TedSwimmer Retired FirstVicePresident FM Global General Counsel Head of CorporateFinance and COO, Federal Reserve and Capital Markets Bank of New York Christopher J. Swift Beth Johnson Chairman and CEO, Chief ExperienceOfficer John F. Woods William P. Hankowsky The HartfordFinancial Susan LaMonica ViceChairman Former Chairman, Services Group,Inc. Chief Financial Officer President and CEO, Chief Human Resources Wendy A. Watson Liberty Property Trust Officer Retired ExecutiveVice Leo I. Higdon1 President, Global Services, Past President, StateStreet Bank &Trust Connecticut College Company EdwardJ.Kelly III Marita Zuraitis Former Chairman, Director,President Institutional Clients Group, and CEO,HoraceMann Citigroup,Inc. EducatorsCorporation Charles J. Koch1 Retired Chairman, President and CEO,Charter One Financial NATIONAL REACH Deposits in all 50 states with Citizens Access® 5million retail lending customersacross all 50 states Regional Branch Network Light Branch Network National retail lending and deposits, and Commercial Banking client coverage 1. Leo I. Higdon and Charles J. Koch will retirefromthe Boardafter their current terms expire, effectiveasofthe conclusionofthe April 2022 Annual Meeting. Citizens FinancialGroup |Annual Re i 13

ABOUT CITIZENS FINANCIALGROUP,INC. Citizens Financial Group,Inc. is one of the nation’s oldest and largest financial institutions, with $188.4 billion in assets as of December 31, 2021. HeadquarteredinProvidence, Rhode Island, Citizens offersabroad rangeofretail and commercial banking products and services to individuals, small businesses, middle-market companies, largecorporations and institutions. Citizens helps its customers reach their potential by listening to them and by understanding their needs in order to offer tailored advice, ideas and solutions. In Consumer Banking, Citizens provides an integrated experiencethat includes mobile and online banking, a24/7customer contact center and the convenienceofnearly 3,000 ATMs and morethan 1,000 branches in 14 states and the District of Columbia. Consumer Banking products and services include afull rangeofbanking, lending, savings, wealth management and small business offerings. In Commercial Banking, Citizens offersabroad complement of financial products and solutions, including lending and leasing, deposit and treasurymanagement services, foreign exchange, interest rate and commodity risk management solutions, as well as loan syndications, corporate finance, merger and acquisition, and debt and equity capital markets capabilities. More information is availableatcitizensbank.comorvisit us on Twitter, LinkedIn or Facebook. Form 10-K Contact Citizens forYour Independent Registered We will send Citizens Banking Needs Public Accounting Firm Financial Group,Inc.’s Call 800.922.9999 or visit us Deloitte&Touche LLP 2021 Annual Reporton online at citizensbank.com Boston, MA Form 10-K (including the 617.437.2000 financial statements filed Investor Relations with the Securities and Additional information Transfer Agent ExchangeCommission) about the company, Forquestions regarding free of chargetoany including annual and changeofaddress, lost stockholder who asks quarterly financial or stolen certificates, foracopyinwriting. information, is availableat transferring ownership or Stockholdersalso can ask investor.citizensbank.com dividend checks, please forcopies of anyexhibit to contact the transfer agent. Inquiries mayalso the Form 10-K. be directed to: ComputershareTrust Please send requests to: CFGInvestorRelations@ Company, N.A. CorporateSecretary citizensbank.com. P.O. Box505000 Citizens Financial Group, Louisville, KY 40233 Common Stock Inc. 877.373.6374(U.S., Canada, Citizens Financial Group, 600 WashingtonBlvd. Inc. is listed on the New Puerto Rico) Stamford, CT 06901 781.575.2879 (non-U.S.) York Stock Exchangeunder Headquarters the symbol “CFG.” Citizens Financial computershare.com/ Group,Inc. investor One Citizens Plaza Providence, RI 02903 Citizens FinancialGroup |Annual Re i 14

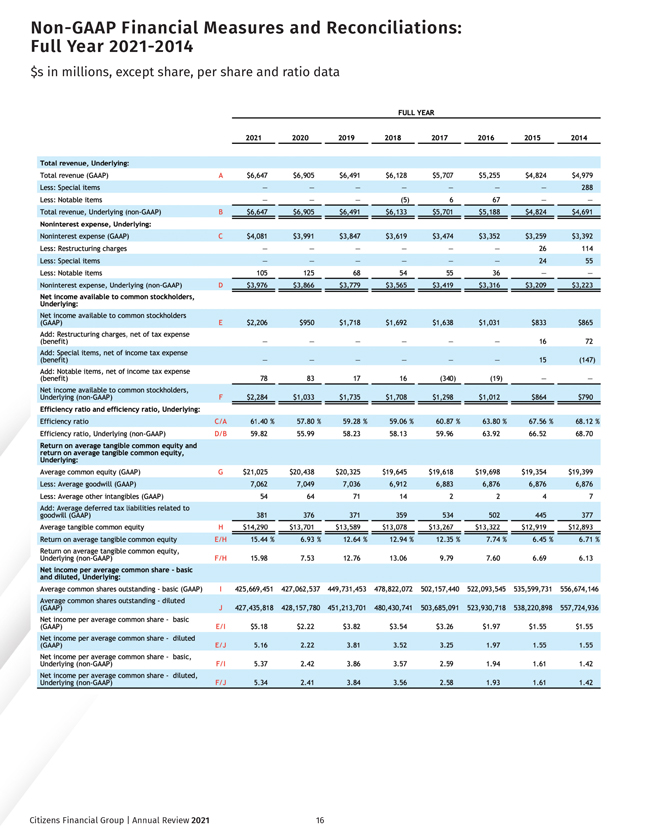

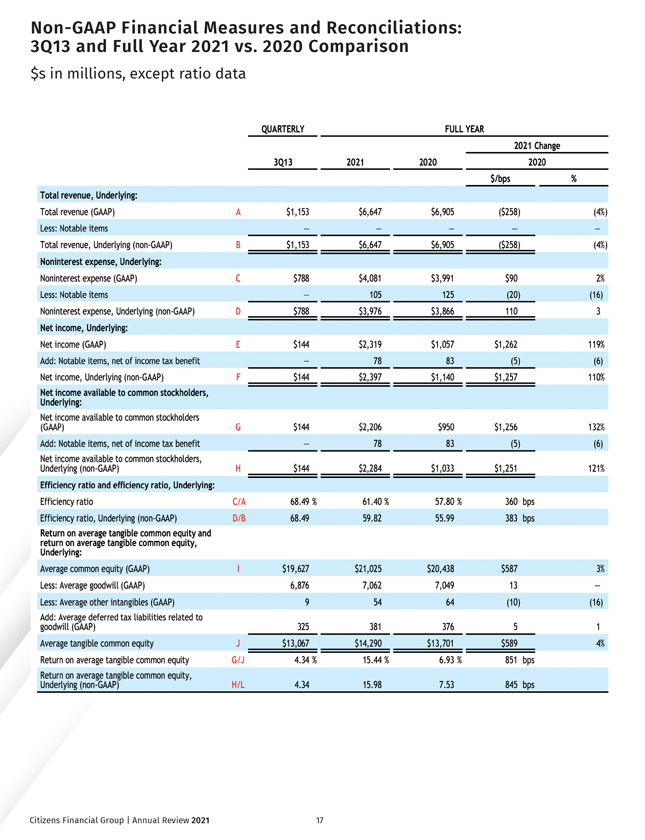

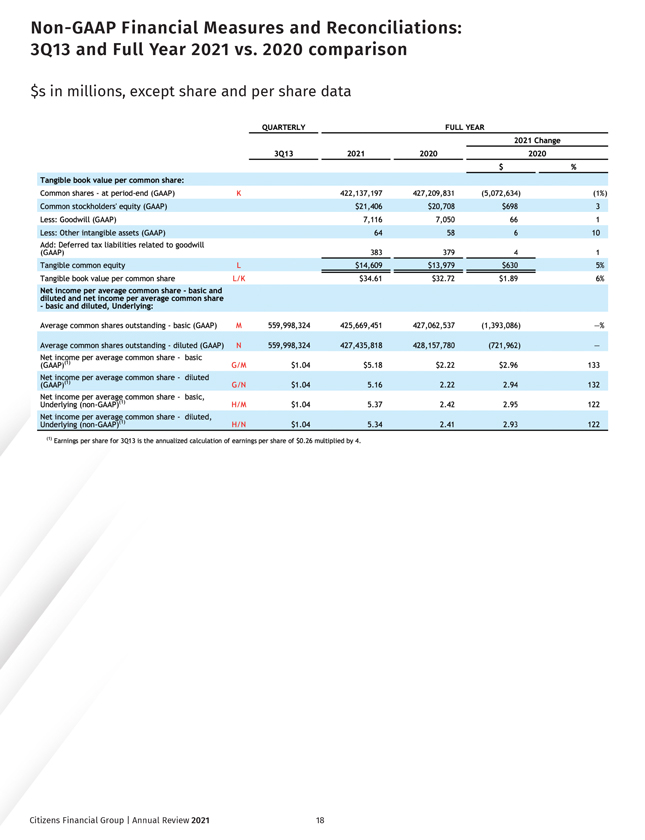

NON-GAAP FINANCIALMEASURES ANDRECONCILIATIONS This document contains non-GAAP financial measures denoted as “Underlying”results. Underlying results forany given reporting period exclude certain items that mayoccur in that period which Management does not consider indicativeofthe Company’s ongoing financial performance. We believe these non-GAAP financial measures provide useful information to investorsbecause theyare used by management to evaluateour operating performanceand makeday-to-dayoperating decisions. In addition, we believe our Underlying results or results excluding the impact of certain items in anygiven reporting period reflect our ongoing financial performanceand increase comparability of period-to-period results, accordingly,are useful to consider in addition to our GAAP financial results. Non-GAAP financial measures aredenoted throughout this document by the use of the term “Underlying”oridentified as excluding the impact of certain items. Wherethereisareferencetothese metrics in that paragraph, all measures that follow areonthe same basis, when applicable. The following reconciliation tables provide computations and moreinformation on the computation of our non-GAAP financial measures and reconciliations to the most directly comparableGAAP financial measures. Other companies mayuse similarly titled non-GAAP financial measures that arecalculated differently from the waywe calculatesuch measures. Accordingly,our non-GAAP financial measures maynot be comparabletosimilar measures used by such companies. We caution investorsnot to placeundue relianceonsuch non-GAAP financial measures, but to consider them with the most directly comparableGAAP measures. Non-GAAP financial measures have limitations as analytical tools and shouldnot be considered in isolation or as asubstitutefor our results reportedunder GAAP. CAUTIONARYSTATEMENTABOUTFORWARD-LOOKING STATEMENTS “SafeHarbor”Statement under the PrivateSecurities Litigation Reform Actof1995: This communication contains “forwardlooking statements” —that is, statements related to future, not past, events. In this context, forward-looking statements often address our expected futurebusiness and financial performanceand financial condition, and often contain wordssuch as “expect,”“anticipate,”“intend,”“plan,”“pending,”“believe,” “seek,”“see,”“will,”“would,” or “target.”Forward-looking statements by their natureaddress mattersthat are, to different degrees, uncertain. Uncertainties that couldcause our actual results to be materially different than those expressed in our forward-looking statements include the failuretoconsummatethe InvestorsBancorp transaction or to makeortakeany filing or other action required to consummateany such transaction on atimely matter or at all. These or other uncertainties maycause our actual futureresults to be materially different from those expressed in our forward-looking statements. We caution you, therefore, against relying on anyofthese forward-looking statements. Theyare neither statements of historical fact nor guarantees or assurances of futureperformance. More information about factorsthat could cause actual results to differ materially from those described in the forward-looking statements can be found under “Risk Factors” in our Annual ReportonForm 10-K forthe year ended December 31, 2021 as filedwith the United States Securities and ExchangeCommission. Citizens FinancialGroup |Annual Re i 15

Non-GAAP FinancialMeasures and Reconciliations: Full Year 2021-2014 $s in millions,exceptshare, per shareand ratio data Citizens FinancialGroup |Annual Re i 16

Non-GAAP FinancialMeasures and Reconciliations: 3Q13 and Full Year 2021vs. 2020 Comparison $s in millions, except ratio data Citizens FinancialGroup |Annual Re i 17

Non-GAAP FinancialMeasures and Reconciliations: 3Q13 and Full Year 2021vs. 2020 comparison $s in millions, except shareand per sharedata Citizens FinancialGroup |Annual Re i 18

[THIS PAGE INTENTIALLYLEFT BLANK]

One Citizens Plaza Providence, Rhode Island 02903