EXHIBIT D

Republic of Panama

This description of the Republic of Panama is dated as of September 30, 2011 and appears as Exhibit D to the Republic of Panama’s Annual Report on Form 18-K to the U.S. Securities and Exchange Commission for the fiscal year ended December 31, 2010.

TABLE OF CONTENTS

The fiscal year of the Government of the Republic of Panama (the “Government”) ends on December 31. The twelve-month period ended December 31, 2010 is referred to in this description of the Republic of Panama as “2010” and other years are referred to in a similar manner unless otherwise indicated. All references to “$” or “dollars” are to United States Dollars.

Totals in certain tables in this description of the Republic of Panama may differ from the sum of the respective individual items in such tables due to rounding.

- i -

INDEX OF TABLES

- ii -

D-1

RECENT DEVELOPMENTS

Recent Government Actions

On August 30, 2011, President Ricardo Martinelli dismissed Vice President Juan Carlos Varela as Minister of Foreign Affairs, prompting members of Mr. Varela’s party to resign from senior governmental positions and resulting in the termination of the coalition between the President’s party (Cambio Democrático (CD)) and that of the Vice President (Partido Panameñista (PPA)). In an address to the nation on September 1, 2011, President Martinelli explained his decision, stating that the Minister of Foreign Affairs should be a full-time position, and that Mr. Varela had neglected the duties of his office as a Presidential candidate for the 2014 elections. Mr. Varela, who will remain in his elected position as Vice President of the country, is also the President of PPA. The officials from his party who resigned include, most notably, Alberto Vallarino, Minister of Economy and Finance, and Carlos Duboy, Minister of Housing. President Martinelli and the remainder of his Cabinet belong to CD. President Martinelli and his senior economic advisors, including Vice Minister of Economy Frank De Lima, have indicated that the political changes will not alter in any way the course of economic and fiscal policy that have been under way since the beginning of the Martinelli administration in July 2009. Minister Vallarino has stated his intention to remain in office until his successor has been appointed. Mahesh Khemlani moved from his position as Public Credit Director of the Ministry of Economy and Finance to the position of Vice Minister of Finance on September 1, 2011, replacing former Vice Minister Dulcidio de la Guardia, whose previously planned return to the private sector was unrelated to the political developments mentioned above.

During the first quarter of 2011 the Government created an autonomous public entity, referred to as the Empresa Nacional de Autopistas (“ENA”), in order to provide the financing for, and to acquire ownership of, the Corredor Sur and Corredor Norte toll highways in Panama. The Republic subsequently decided to separate the acquisition of the Corredor Sur and Corredor Norte toll roads into two stand-alone transactions. On August 1, 2011 Ingenieros Civiles Asociados (“ICA”), the Mexican company that owned and operated the Corredor Sur, and ENA, signed a Share Purchase Agreement for ENA to purchase all of ICA’s shares in ICA Panamá for $420.0 million dollars.

On August 12, 2011, ENA acquired the Corredor Sur, and on August 18, 2011, ENA successfully issued and placed $395.0 million dollars in bonds to finance the acquisition of the toll road. The Government contributed $50.0 million to ENA in connection with the purchase. The transaction was finalized on August 24, 2011. The Government intends to conclude the Corredor Norte transaction as soon as practicable.

In July 2011, the Ministry of Economy and Finance Ministerial Resolution No. 99 of 2011 was implemented, creating the Market Makers Program in order to increase liquidity and depth of the market for internal public debt securities. Institutions designated as Market Makers will bid in the domestic market for internal public debt securities in a manner similar to a primary dealer system. Participants, divided into Market Makers (Creadores de Mercado) and Candidates to Market Makers (Aspirantes a Creadores de Mercado), have exclusive access to the primary market and the secondary market, respectively, for Panamanian internal public debt securities. The Market Makers Program was formally launched on June 21, 2011 through a Treasury Notes auction with a 5.0% coupon and 2018 maturity (“Notes due 2018”). The indicative amount of the issuance was set at $50.0 million. The volume of bids received for this auction, however, amounted to US$632.3 million. The Republic issued $258.0 million of the Notes due 2018, with a weighted average yield of 4.560% and a spread of 229 bps over U.S. Treasury Notes of comparable maturity. On July 26, 2011, the Notes due 2018 were reopened for the first time, with an indicative amount of the issuance set at $50.0 million. The volume of bids received for the reopening, however, amounted to $510.4 million, The Republic issued $100.0 million of the reopened Notes due 2018, with a weighted average yield of 3.977% and a spread of 169 bps over U.S. Treasury Notes of comparable maturity.

On July 26, 2011, the Ministry of Economy and Finance launched a global securities administration platform administered by Citibank’s Direct Custody and Settlement division, to provide access to international investors to locally issued Panamanian bonds through sub-custody agreements. The Direct Custody and Clearing (DCC) services provides the clearing and settlement services for broker dealers and global custodians to support trading and investing activities around the world. Citibank’s DCC network includes seven other markets across Latin America and consists of 59 markets worldwide.

D-2

On January 4, 2010, the Cabinet Council of Panama adopted Cabinet Resolution No. 1, published in the Gaceta Oficial Digital No. 26,442 of January 7, 2010, approving a transaction to provide a cap on the cost of bunker fuel for electric generation in 2010, based on fuel prices prevailing during the year. The transaction was aimed at stabilizing the cost of electricity to consumers during 2010. At the time of the transaction, the option was in the money (i.e. the prevailing market price was above the strike price) and the premium cost for the option was $10.17/bbl, resulting in a total cost of $26.9 million. Since the oil prices remained below the strike price for the most part of this period, the Government received only $0.9 million in total gross payouts from this contract. On May 26, 2010 the government took advantage of a market window to buy a second option for 2.5 million barrels, covering the rest of the estimated consumption for 2010 and 25% of the estimated volume for 2011. The premium was $5.30/bbl and the total cost was $13.3 million. From November 2010 to July 2011, market prices moved higher than the strike price and the Government received cumulative gross payouts in the amount of $25.9 million from this contract. The cost of the program is not considered to be material to the 2011 budget of the Republic.

In March 2010, Law No. 5 of 2010 was ratified, approving the Panama implementing legislation of the Corporación Andina de Fomento (“CAF”) agreement. Law 5 was published in Gaceta Oficial No. 26,484 on March 8, 2010. CAF is composed of seventeen sovereigns in the Andean region, seven country members and ten Series C shareholders, and was created to benefit the participating members’ development. Panama had already been a CAF Series C shareholder, and as such, was eligible to receive up to eight times its original investment in CAF. During the general assembly of shareholders in Caracas, on March 3, 2010, the President of CAF announced the shareholders’ decision that the Republic had met all the conditions to qualify as a Series A country member of CAF, including subscribing to at least $36.0 million in guarantee capital stock. As a Series A country member, the Republic now has access to higher financing amounts of up to 15% of CAF’s portfolio, which was $12.0 billion in 2009 (the latest figure available), higher financing possibilities for Panama’s private sector compared to under Panama’s past status as a Series C member, access to a wide variety of technical cooperation programs of CAF, participation as a voting member, and the opportunity to forge better economic and political relationships with the other country members. The Republic finalized its membership as a Series A country member of CAF in July 2010. At July 31, 2011, the Republic had outstanding borrowings of $64.8 million from CAF.

In March 2010, Law No. 8 of 2010 was ratified, modifying the Panamanian Fiscal Code by adopting fiscal measures and creating the Administrative Tax Tribunal. Law 8, published in the Gaceta Oficial Digital No. 26,489-A of March 15, 2010, went into effect on July 1, 2010, with the exception of Articles 9 and 10, relating to personal and corporate income tax rates, which were retroactively effective as of January 1, 2010. This law increased the value-added tax, known as ITBMS, for the first time since it was established in 1976 pursuant to Law No. 75 of December 22, 1976, from 5% to 7%. The modified law also reduced the corporate income tax rate from 30% to 27.5%, effective as of January 1, 2010, with a further reduction, subject to certain exceptions, to 25%, beginning January 1, 2011. Personal income tax rates were modified to reflect the following: (1) taxable income up to $11,000 will have a 0% tax rate; (2) taxable income of more than $11,000 but less than $50,000 will be taxed at 15%; and (3) taxable income of $50,000 or more will be taxed in the amount of $5,850 for the first $50,000 and at 25% for any amount above $50,000. Law 8 of 2010 modified the Fiscal Code to allow the Republic to generate additional revenue to provide for public service such as social expenses, security expenses and infrastructure development. As a result of the modifications to the Fiscal Code, the Republic received approximately $6.8 billion in revenue for 2010, compared to $6.3 billion in 2009, representing an increase of approximately $606.1 million, or 9.7%. The Fiscal Code was again amended on June 30, 2010, pursuant to Law No. 33 of 2010, published in the Gaceta Oficial Digital No. 26,566-A. Among other reforms, Law 33 of 2010 added an additional chapter to the Fiscal Code to cover double taxation treaties so that Panamanian taxpayers can invoke a clause in the treaty itself, as well as refer to the new chapter of the Fiscal Code, in order to avoid paying taxes to two countries on the same transaction or activity.

In April 2010, the Ministerio de Gobierno y Justicia, or Ministry of Government and Justice, was reorganized and split into two separate Ministries. Law No. 15 of 2010, published in the Gaceta Oficial Digital No. 26,511-A of April 14, 2010, created the Ministry of Public Security in order to oversee national security and protect Panamanian citizens and foreigners within the Republic’s jurisdiction. The Ministry of Public Security is responsible for determining the country’s security policies and planning, coordinating, controlling and supporting the efforts of the law enforcement, security and intelligence agencies under its direction.

D-3

Law No. 19 of 2010, published in the Gaceta Oficial Digital No. 26,524-A of May 3, 2010, established the new Ministry of Government, which is in charge of assisting the President in topics related to local government, the penitentiary system, civil aviation and preserving the constitutional rights and guarantees of the Republic.

In June 2010, Law No. 28 of 2010 was ratified, and published in the Gaceta Oficial Digital No. 26,551-B of June 8, 2010, creating a cold chain system in order to provide uninterrupted storage and distribution activities for high-value crops which maintain a given temperature range from the farm to the market. The cold chain system assists local producers in reducing the high percentage of losses related to the post-harvesting and commercialization stages of agricultural production in order to increase national productivity.

On August 25, 2010, Executive Decree No. 85 was issued, and published in Gaceta Oficial Digital No. 26606-A. Executive Decree No. 85 regulates credits recognition from projects developed by the Ministry of Public Security where funding is provided by the contractor.

On April 5, 2011, Law No. 31 of 2011 was ratified, and published in the Gaceta Oficial Digital No. 26,757-A of the same date, modifying the definition of the non-financial public sector to exclude ETESA (Empresa de Transmisión Eléctrica Panameña—Panamanian Electrical Transmission Company), ENA, and Tocumen (Aeropuerto Internacional de Tocumen—Tocumen International Airport).

On May 10, 2011, Law 22 of 2006, which regulates public contracts and related matters, was modified by Law No. 48 of 2011, published in the Gaceta Oficial Digital No. 26,782 of May 11, 2011. The modification grants Dirección General de Contrataciones Públicas, or Public Contracting Authority, the power to impose fines. In addition, it expanded the scope of the law to include regulation of acquisitions by Caja de Seguro Social (Social Security Fund, or “CSS”) of pharmaceutical products as well as contracts with funding supplied by foreign governments. Law 48 modified provisions that regulate, among other things, exemption from the contractor selection process, and sale of assets under exceptional process, advertising and promotion services contracts.

The Economy

The National Assembly of the Republic of Panama (the “Assembly”) approved Panama’s 2011 budget on November 2, 2010. The 2011 budget contemplates total expenditures of $13.0 billion, with budget estimates based on an anticipated 9.5% growth in nominal GDP, and an anticipated consolidated non-financial public sector deficit of approximately $425.9 million (or approximately 1.4% of estimated nominal GDP) for 2011. As of August 2011, the Republic estimates nominal GDP for 2011 will be approximately $30.5 billion.

As of August 2011, the Republic estimates nominal GDP for 2011 to be approximately $30.5 billion. In the first three months of 2011, Panama’s gross domestic product (“GDP”) registered an estimated real increase of 9.7% compared to the same period of 2010. The mining sector grew an estimated 14.0% percent in the first three months of 2011, compared to the same period of 2010 primarily due to a growth in the demand for basic materials used in construction and increased production related to the export of gold. Manufacturing activity increased an estimated 3.2% in the first three months of 2011 compared to the same period of 2010 due in part to an increase in meat products and in chemical products. In the first three months of 2011, the construction sector grew by an estimated 15.6% compared to the same period of 2010 due to public and private investment in civil engineering and non-residential projects, including, among others, expansion of the Panama Canal, international airport expansion and the Government’s expansion and rehabilitation of road infrastructure. The transportation and communications sector grew an estimated 16.0% in the first three months of 2011 compared to the same period of 2010 primarily due to improved port operations, telecommunications systems and air transport operations. The financial intermediation sector grew an estimated 7.0% in the first three months of 2011 compared to the same period of 2010 primarily due to the performance of insurance companies and international banking centers.

The agriculture sector decreased an estimated 0.4% in the first three months of 2011 compared to the same period of 2010 primarily due to a 13.5% decrease in banana exports and others such as a 45.0% decrease in watermelons and a 5.9% decrease in milk production. The fisheries sector decreased an estimated 30.7% in the first three months of 2011 compared to the same period of 2010 due in part to a decrease in the capture and export of marine products. Commerce increased an estimated 9.5% in the first three months of 2011 compared to the same period of 2010 due in part to higher sales of fuel, food, drinks, machinery, equipment and materials. The hotels and restaurant sector increased an estimated 6.8% in the first three months of 2011 compared to the same period of 2010 primarily due to an increase in the number of foreign tourists. The real estate sector increased an estimated 10.7% in

D-4

the first three months of 2011 compared to the same period of 2010 primarily due to an increase in promotion and real estate activities by realtors.

Public Debt

As of July 31, 2011, Panama’s external debt totaled approximately $10.7 billion, representing an increase of $234.2 million since December 31, 2010. Panama’s total public sector debt as of July 31, 2011 was approximately $12.7 billion, representing an increase of $1.1 billion since December 31, 2010. As of July 31, 2011, approximately 79.9% of the total public sector external debt was owed to commercial lenders and bondholders, with 16.5% owed to multilateral institutions and 3.6% owed to bilateral lenders. Since July 31, 2011, there has been no additional external debt issued by the Republic.

In an effort to promote the development of Panama’s capital markets, the Government held twelve auctions as part of its Treasury Bill issuances program from January 19, 2010 to December 14, 2010. During that time, Panama issued $387.1 million of zero-coupon Treasury Bills with short-term maturities of one year or less in Panama’s capital markets. As of December 31, 2010, outstanding Treasury Bills amounted to $230.0 million and outstanding Treasury Notes amounted to $635.1 million. The Government continued the program of Treasury Bill issuances in 2011 with five auctions from January 18, 2011 to May 17, 2011. During that time, Panama issued $178.6 million of zero-coupon Treasury Bills with short-term maturities of one year or less in Panama’s capital markets. The Treasury Notes program had been suspended after the issuance of September 6, 2005; however, the Government reinstated the Treasury Notes issuance program in 2010 pursuant to Cabinet Decree No. 4 dated January 26, 2010 authorizing the issuance of local Treasury Notes in a principal amount up to $600 million. Between February 4, 2010 and December 14, 2010, the Government issued $466.2 million of Treasury Notes in eleven public auctions plus $100.0 million in a direct auction.

The Republic has improved its debt-to-GDP ratio in the past five years. The ratio of total public sector debt to GDP as of December 31, 2010 is estimated to have been 43.4%. Using an estimated year-end nominal GDP figure for 2011, as of July 31, 2011, the ratio of total public sector debt to GDP is estimated to have been 41.5%.

International Trade

Panama concluded its free trade negotiations with the United States in December 2006, and signed a free trade agreement with the United States (the “Trade Promotion Agreement”) on June 28, 2007 that will come into effect upon approval by each country’s legislature. The Panamanian Assembly ratified the Trade Promotion Agreement on July 11, 2007, but the U.S. Congress has yet to ratify the agreement.

In 2010, Panama entered into a number of bilateral trade agreements for the purpose of investment promotion and economic cooperation. Panama entered into investment trade agreements with Costa Rica, Italy, Israel, Finland, Qatar, Canada, and the Belgium-Luxembourg Economic Union. In May 2010, Law No. 23 of 2010 was ratified, and published in the Gaceta Oficial Digital No. 26,548 of May 31, 2010, approving an association agreement between Panama and Costa Rica that was executed on October 29, 2009 in order to strengthen the relationship between the two countries through bilateral agreements. In June 2010, Panama and Italy agreed to expand trade relations through cooperation and the promotion of bilateral investments with an emphasis on defense and security. Panama, through the Ministry of Security and the Ministry of Public Works, was authorized to enter into supply agreements with the Italian company Finmeccanica S.p.A., and its subsidiaries Augusta S.p.A., Selex Sistemta Integrati S.p.A. and Telespazio Argentina S.A. pursuant to Cabinet Resolution Nos. 112, 113, and 114 of August 3, 2010 published in the Gaceta Oficial Digital No. 26594-A of August 6, 2010. On September 29, 2010, Law No. 53 was ratified and published in the Gaceta Oficial Digital No. 26,634-A of October 4, 2010, approving the agreement between Panama and Italy regarding investment promotion and reciprocal protection. The general objective of the agreement is to protect private investors on both sides and their investments in each other’s countries; the agreement includes specific provisions such as a most favored nation clause, investment promotion and protection, indemnification, capital transfer, and dispute resolution, among others. On September 29, 2010, Law No. 56 of 2010 was ratified, and published in the Gaceta Oficial Digital No. 26,634-B of October 4, 2010, approving the agreement between Panama and Israel regarding economic and commercial cooperation. The parties agreed to exchange information related to the legislation and procedures regulating commercial and statistical information, in addition to organizing seminars, conferences and promoting commercial networking contacts to expand activities between the countries.

D-5

On September 29, 2010, Law No. 54 of 2010 was ratified and published in the Gaceta Oficial Digital No. 26,634-B of October 4, 2010 approving the agreement between Panama and Finland regarding investment promotion and reciprocal protection. The agreement protects private investors on both sides and their investments in each other’s countries; the agreement includes specific provisions such as a most favored nation clause, investment promotion and protection, indemnification, capital transfer and dispute resolution, among others. On September 29, 2010, Law No. 55 of 2010 was ratified, and published in the Gaceta Oficial Digital No. 26,634-B of October 4, 2010 approving the agreement between Panama and Qatar regarding investment promotion and reciprocal protection. The agreement protects private investors on both sides and their investments in each other’s countries; the agreement includes specific provisions such as a most favored nation clause, investment promotions and protection, indemnifications, capital transfer, and dispute resolution, among others. On October 26, 2010, Law No. 69 of 2010 was, ratified and published in the Gaceta Oficial Digital No. 26,653-A of October 29, 2010, approving the free trade agreement between Panama and Canada. The general objective of the agreement is to promote investment and expand trade relationships between both countries and their residents; this agreement was executed in recognition of, and to further, the commitments of the countries under the World Trade Organization (WTO). On October 28, 2010, Law No. 73 was ratified, and published in the Gaceta Oficial Digital No. 26,653-D of October 29, approving the agreement between Panama and the Belgium–Luxembourg Economic Union regarding investments promotion and reciprocal protection. The general objective of the agreement is to protect private investors from both countries and their investments in both countries; the agreement includes specific provisions such as a most favored nation clause, investment promotions and protection, indemnifications, capital transfer, and dispute resolution, among others.

In 2010, Panama entered into agreements with Canada concerning environmental protection, and labor rights and cooperation. On October 27, 2010, Law No. 71 was ratified, and published in the Gaceta Oficial Digital No. 26,653-C of October 29, approving the Canada-Panama Environment Agreement of May 14, 2010. The Canada-Panama Environmental Agreement was signed in parallel with the Free Trade Agreement between the parties and reinforces the principle that free trade should not take place at the expense of the environment. Under the environmental agreement, the parties agreed to establish an Environmental Committee with representatives from both parties, which will be responsible for the implementation of the agreement. On October 27, 2010, Law No. 72 was ratified, and published in the Gaceta Oficial Digital No. 26653-D of October 29, 2010, approving the agreement between Panama and Canada on labor cooperation. The labor cooperation agreement was signed in parallel with the Free Trade Agreement between the parties and reinforces principle idea that free trade should not take place at the expense of labor rights. Under the agreement the parties determined to protect, expand and make effective basic rights for laborers, to strengthen cooperation on labor matters, and to advance their respective international commitments related to labor matters, principally the ones agreed as members of the International Labour Organization (ILO).

In 2010, Panama entered into agreements regarding taxation, the development of cultural and educational cooperation, scientific and technical cooperation, and agricultural cooperation, with Mexico, the Sahrawi Arab Democratic Republic, Bolivia, and Israel, respectively. In May 2010, Law No. 24 of 2010 was ratified, and published in the Gaceta Oficial Digital No. 26,548 of June 4, 2010, approving the double taxation treaty between Panama and Mexico in order to avoid double taxation between the countries and to prevent income tax evasion. On September 13, 2010, Law No. 44 was ratified, and published in the Gaceta Oficial Digital No. 26,620 of September 14, 2010, approving the agreement between Panama and the Sahrawi Arab Democratic Republic. The agreement’s objective is the development of cultural and educational cooperation among the two countries; the parties agreed to achieve this objective through scholarship programs, training with respect to technological advances related primarily to educational television, literature and history education, among others. On September 29, 2010, Law No. 52 was ratified, and published in the Gaceta Oficial Digital No.26634-A of October 4, 2010, approving the agreement between Panama and Bolivia for the scientific and technical cooperation between the two countries. The general objective of the agreement is to strengthen the scientific and technical aspects of several areas of common interest in order to improve quality of life, institutional performance, scientific development and industrial and technological modernization; the parties agreed to achieve the general objective by supporting specific areas of common interest including, education, public health, tourism, marine resources, as well as others which may be incorporated in the future through the execution of complementary agreements between the parties. On November 15, 2010, Law No. 81 was ratified and published in the Gaceta Oficial Digital No. 26,663-C of November 18, 2010, approving the agreement between Panama and Israel regarding cooperation within the agriculture field. The agreement aims to promote cooperation between the two countries and private sector organizations and associations

D-6

for the achievement of national and institutional goals related to agricultural development, and scientific and technology advancements for the benefit of agricultural sectors of both countries.

IMF Relationship

Panama is a member of the International Monetary Fund (“IMF”). Under Article IV of the IMF’s Articles of Agreement, the IMF holds bilateral discussions with its member countries usually every year to assess their economic health. The IMF concluded its most recent Article IV consultation with Panama on May 27, 2011.

The Panama Canal

In a national referendum on October 22, 2006, the citizens of Panama voted to approve the canal expansion project proposed by the Panama Canal Authority that includes building a new lane of traffic in conjunction with the construction of a third set of locks which will double the Canal’s capacity allowing increased traffic and larger ships, to cost an estimated $5.2 billion. Construction began in the third quarter of 2009 and is expected to be completed in 2014. On July 15, 2009, the construction of the third set of locks was awarded to the Grupo Unidos por el Canal consortium, or GUPC, composed of Sacyr Vallehermoso, S.A., Impregilo S.p.A., Jan de Nul n.v., and Constructora Urbana, S.A., for a total base price of approximately $3.1 billion. On August 11, 2009, GUPC provided a performance bond of $400 million to the Panama Canal Authority.

As of March 31, 2011, the total value of all the contracts awarded for the expansion project was approximately $4.2 billion. The Panama Canal Authority continuously monitors the quality of GUPC processes and holds coordination meetings with GUPC quality-control personnel in order to ensure that the work is being performed in accordance with the terms of their agreement.

On September 1, 2011, the Assembly approved the Panama Canal Authority’s budget for its fiscal year ending September 30, 2012, allocating $98.2 million to the Canal’s investment program and $396.9 million to the Canal’s modernization program.

On December 9, 2008, the Panama Canal Authority signed a $2.3 billion agreement with five multilateral and development organizations to finance the Canal’s expansion project, which is estimated to cost approximately $5.25 billion. The Japan Bank for International Cooperation (“JBIC”), the European Investment Bank (“EIB”), the IADB, CAF and International Finance Corporation (“IFC”) agreed to provide approximately $800 million, $500 million, $400 million, $300 million and $300 million, respectively, in financing under favorable terms to the Panama Canal Authority. The remaining funds for the expansion project are expected to come from the Canal’s regular business operations and implementation of toll increases. To reduce the risk of lowering demand resulting from toll increases, the Panama Canal Authority implemented a three-year toll increase designed to generate the appropriate cash flows needed to finance a significant portion of the program. In March 2010, the Panama Canal Authority received its first disbursement for $300 million for the expansion project, $200 million of which was provided by JBIC and $100 million of which was provided by EIB. As of September 30, 2010, the Panama Canal Authority had allocated approximately $734.6 million of the expansion project through internal funding.

In 2009, the United States, the main source of customers of the Panama Canal, experienced a marked deceleration of economic activity. Trade via the Panama Canal Authority’s fiscal year ended September 30, 2009 was only slightly affected but toll revenues remained firm despite a decrease in transits. During the Panama Canal Authority’s fiscal year ended September 30, 2010, there was a marginal decline in total transits and tonnage as compared to the fiscal year ended September 30, 2009, from 14,342 transits to 14,230 transits. For the Panama Canal Authority’s fiscal year ended September 30, 2010, toll revenue totaled approximately $1,482.1 million as compared to $1,438.2 million for fiscal year ended September 30, 2009, representing an increase of approximately 3.1%.

From the beginning of the Panama Canal Authority’s 2011 fiscal year (October 1, 2010) through May 31, 2011, approximately 10,343 transits passed through the Canal as compared to 9,861 transits for the same period during fiscal year 2010, resulting in an increase of approximately 4.9%. Approximately 223.6 million PC/UMS (Panama Canal Universal Measurement System) tons of cargo passed through the Canal between October 1, 2010 and May 31, 2011, as compared to 202.7 million PC/UMS tons during the same period of time for fiscal year 2010. From October 1, 2010 through July 31, 2011, toll revenue totaled approximately $1.4 billion, representing an increase of 2.0% as compared to the same period during fiscal year 2010, mainly due to a toll rate increase applied to most

D-7

shipping categories in May 2010 and the remaining shipping categories in October 2010, and also due to the increase in the number of ships in transit.

On May 1, 2010 the Panama Canal Authority terminated a short-term cost reduction program consisting of temporary measures designed to help mitigate the impact of the economic crises on the Panama Canal’s customers and the Panama Canal Authority returned to its regular pricing measures, but it determined to continue to offer flexibility in its reservation system until further notice.

A new toll adjustment went into effect on January 1, 2011 for all segments other than PC/UMS tolls for reefers, which went into effect on April 1, 2011.

D-8

TABLE NO. 1

Selected Panamanian Economic Indicators(1)

The following table sets forth Panama’s principal economic indicators for the years 2006 through 2010:

| | | | | | | | | | | | | | | | | | | | |

| | | 2006(R) | | | 2007(R) | | | 2008(R) | | | 2009(R) | | | 2010(P) | |

Economic Data: | | | | | | | | | | | | | | | | | | | | |

GDP (millions, nominal dollars) | | $ | 17,137 | | | $ | 19,794 | | | $ | 23,001 | | | $ | 24,080 | | | $ | 26,777 | |

GDP (millions, constant dollars)(2) | | $ | 15,239 | | | $ | 17,084 | | | $ | 18,813 | | | $ | 19,414 | | | $ | 20,863 | |

GDP (% change, constant dollars)(2) | | | 8.5 | % | | | 12.1 | % | | | 10.1 | % | | | 3.2 | % | | | 7.5 | % |

Service Sector (% change, constant dollars)(2)(3) | | | 9.4 | % | | | 12.0 | % | | | 10.5 | % | | | 4.2 | % | | | 10.5 | % |

Other (% change, constant dollars)(2)(4) | | | 7.8 | % | | | 8.7 | % | | | 12.4 | % | | | 0.3 | % | | | 0.1 | % |

GDP Per Capita (constant dollars)(2) | | $ | 4,646 | | | $ | 5,115 | | | $ | 5,564 | | | $ | 5,616 | | | $ | 6,125 | |

Population (millions) | | | 3.28 | | | | 3.34 | | | | 3.40 | | | | 3.45 | | | | 3.40 | |

CPI—Period Average (% change) | | | 2.5 | % | | | 4.2 | % | | | 8.7 | % | | | 2.4 | % | | | 3.5 | % |

Unemployment | | | 6.7 | % | | | 4.7 | % | | | 4.2 | % | | | 5.2 | % | | | 4.7 | % |

Public Finance: | | | | | | | | | | | | | | | | | | | | |

Total Consolidated Non-Financial Public Sector Revenues (millions) | | $ | 4,273 | | | $ | 5,499 | | | $ | 6,015 | | | $ | 6,268 | | | $ | 6,874 | |

Total Consolidated Non-Financial Public Sector Expenditures (millions)(5) | | $ | 3,624 | | | $ | 4,218 | | | $ | 5,294 | | | $ | 5,806 | | | $ | 6,670 | |

Overall Surplus (Deficit) (millions) | | $ | 88 | | | $ | 683 | | | $ | 98 | | | $ | (253 | ) | | $ | (512 | ) |

As % of Current GDP | | | 0.5 | % | | | 3.5 | % | | | 0.4 | % | | | (1.0 | )% | | | (1.9 | )% |

Central Government Surplus (Deficit) (millions) | | $ | 36 | | | $ | 240 | | | $ | 63 | | | $ | (357 | ) | | $ | (683 | ) |

As % of Current GDP | | | 0.2 | % | | | 1.2 | % | | | 0.3 | % | | | (1.5 | )% | | | (2.6 | )% |

Public Debt (at December 31): | | | | | | | | | | | | | | | | | | | | |

Internal Debt (millions) | | $ | 2,664 | | | $ | 2,195 | | | $ | 1,960 | | | $ | 822 | | | $ | 1,191 | |

External Debt (millions) | | $ | 7,788 | | | $ | 8,276 | | | $ | 8,477 | | | $ | 10,150 | | | $ | 10,438 | |

Public Debt (as % of Current GDP) | | | | | | | | | | | | | | | | | | | | |

Internal Debt | | | 15.5 | % | | | 11.1 | % | | | 8.5 | % | | | 3.4 | % | | | 4.4 | % |

External Debt | | | 45.4 | % | | | 41.8 | % | | | 36.9 | % | | | 42.2 | % | | | 39.0 | % |

Total Public Debt (millions) | | $ | 10,453 | | | $ | 10,471 | | | $ | 10,438 | | | $ | 10,972 | | | $ | 11,629 | |

Trade Data: | | | | | | | | | | | | | | | | | | | | |

Exports (f.o.b.) Goods(6) (millions) | | $ | 8,478 | | | $ | 9,334 | | | $ | 10,323 | | | $ | 11,133 | | | $ | 11,330 | |

Imports (c.i.f.) Goods(6) (millions) | | $ | (10,190 | ) | | $ | (12,524 | ) | | $ | (14,869 | ) | | $ | (13,256 | ) | | $ | (15,946 | ) |

Merchandise Trade Balance (millions) | | $ | (1,712 | ) | | $ | (3,190 | ) | | $ | (4,546 | ) | | $ | (2,123 | ) | | $ | (4,615 | ) |

Current Account Surplus (Deficit) (millions) | | $ | (527 | ) | | $ | (1,407 | ) | | $ | (2,677 | ) | | $ | (43 | ) | | $ | (2,953 | ) |

Overall Balance of Payments Surplus (Deficit)(7) (millions) | | $ | 172 | | | $ | 622 | | | $ | 585 | | | $ | 616 | | | $ | 348 | |

Total Official Reserves (at December 31) (millions) | | $ | 1,328 | | | $ | 1,927 | | | $ | 2,417 | | | $ | 2,753 | | | $ | 2,245 | |

| (1) | All monetary amounts in millions of U.S. dollars at current prices, unless otherwise noted. |

| (2) | Constant GDP figures are based on 1996 constant dollars. |

| (3) | Including real estate, public administration, commerce, restaurants and hotels, financial services, the Colón Free Trade Zone (or the “CFZ”), The Panama Canal, transportation and communications, public utilities and other services. |

| (4) | Including mining, manufacturing, agriculture and construction. |

| (5) | Excluding interest on external debt. |

| (7) | Figures have been calculated pursuant to Version V of the Balance of Payments Manual prepared by the IMF. |

Sources: Directorate of Analysis and Economic Policies, Office of the Comptroller General, Banco Nacional de Panamá (“BNP”) and Ministry of Economy and Finance.

D-9

THE REPUBLIC OF PANAMA

Area and Population

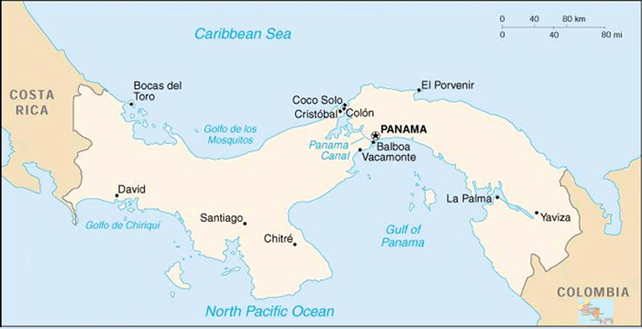

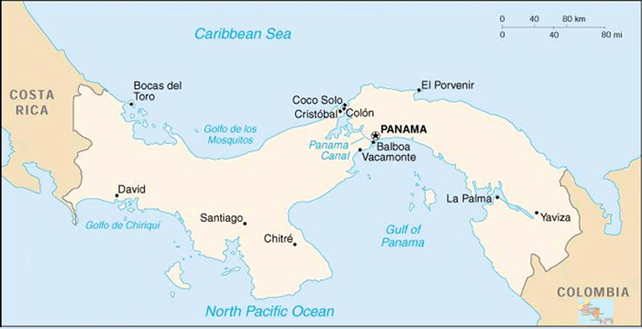

Panama is a republic located on the narrowest point of the Central American isthmus, which connects the continents of North America and South America. It has a coastline of approximately 1,868 miles on the Caribbean Sea and Pacific Ocean and is bordered on the east by Colombia and on the west by Costa Rica. Panama has a national territory of approximately 29,157 square miles situated within its coastline and 345 miles of land borders, and includes numerous coastal islands. The Panama Canal, one of the most important commercial waterways in the world, which connects the Atlantic and Pacific Oceans, bisects the country running northwest to southeast. Panama’s climate is primarily tropical.

As of December 31, 2010, Panama had an estimated population of 3.4 million and a population density of 116.8 people per square mile.

During the period from 2006 to 2010, the population grew by an average of 0.9% per annum. Approximately 64.6% of Panama’s population lives in cities and towns with more than 1,500 inhabitants, and 12.3% of the population is indigenous, some of whom are seeking greater autonomy from the Government. Of the Panamanian population, 29.2% is under 15 years of age, 63.4% is between the ages of 15 and 64, and 7.4% is over the age of 65. Average life expectancy in Panama is 75 years. The infant mortality rate is estimated at 13.4 per 1,000 births. Panama’s official language is Spanish.

In 2010, Panama’s real GDP grew by 7.5% compared to 3.2% in 2009. Inflation, as measured by the end-of-period CPI, was 4.9% in 2010. The Government’s current account for 2010 registered a surplus of $1.15 billion (4.3% of nominal GDP), compared to a surplus of $1.01 billion in 2009 (4.5% of nominal GDP). The Government’s overall deficit increased from $357.2 million in 2009 (1.5% of nominal GDP) to a deficit of $682.6 million in 2010 (2.5% of nominal GDP). In 2010, Panama’s non-financial public sector balance registered a deficit of $511.8 million (or 1.9% of nominal GDP), an increase from a deficit of $252.5 million (or 1.0% of nominal GDP) in 2009.

Panama’s per capita GDP for 2010, expressed in 1996 constant prices, was approximately $5,953. Education indicators from 2010 show that Panama’s adult literacy rate is approximately 94.5%. Estimates show that 36.8% of the population is considered to be living in poverty while 16.6% is considered to be living in extreme poverty.

The Panama Province, the Republic’s largest province, is estimated to comprise 50.2% of Panama’s total population. The Colón Province, located at the northern terminus of the Panama Canal, is estimated to comprise 7.1% of the total population.

Historical Information

Panama gained its independence from Spain in 1821 and subsequently joined the Confederation of Greater Colombia, from which Panama declared its independence on November 3, 1903. Several weeks after gaining independence, Panama signed the Hay/Bunau-Varilla Treaty with the United States, which, among other things, granted the United States the right to occupy a ten-mile wide zone and a concession for the construction, maintenance, operation and protection of the Panama Canal (the “Canal Zone”). See “The Panama Canal—General”.

Panama adopted its first constitution in 1904, and, between 1904 and 1968, Panama generally experienced social and political stability and economic growth under a constitutional democracy. During the period immediately following World War II, the Panamanian military interfered with the civilian government, although this interference largely ended by the mid-1950s. Constitutional government continued until October 1968, when the National Guard mounted a military coup and replaced the civilian government. Although the military made nominal efforts during the late 1970s to return to civilian government, the military generally remained in control of the Government until 1989.

Issues related to control of the Panama Canal and the Canal Zone caused considerable unrest in Panama. In 1977, following 13 years of negotiations, Panama signed treaties with the United States that provided for abolishing

D-10

the Canal Zone in 1979 and the eventual turnover of the Panama Canal to Panama in 1999. See “The Panama Canal—The Canal Treaty of 1977”.

In 1983, General Manuel Antonio Noriega (“Noriega”) became Commander of the National Guard and assumed effective control of the Government. In the spring of 1987, a political crisis galvanized Noriega opponents and resulted in the formation of a major civilian protest and opposition movement widely supported by civilian organizations, political parties and the business community. This political crisis generated an economic crisis as well.

In response to the ensuing political crisis, in March 1988, the United States suspended its Agency for International Development (“AID”) programs to Panama and blocked preferential sugar quotas, causing further economic disruption. The United States imposed additional economic sanctions that year, including a freeze on all United States payments for the Panama Canal (at that time, approximately $6 million per month), an order prohibiting American citizens and companies from making payments to the Government and a freeze on all Government accounts (and certain additional assets) in the United States.

In December 1989, relations between Panama and the United States deteriorated, culminating in a United States military intervention that resulted in the removal of Noriega. Guillermo Endara (“Endara”), who had been elected by a significant majority of the popular vote earlier in the year, was subsequently sworn in as President.

Since the end of 1989, Panama has enjoyed political and economic stability under democratically elected governments. Relations with the United States have been fully restored. Endara finished his presidential term, and in the spring of 1994, orderly national elections were held. Ernesto Pérez Balladares (“Pérez Balladares”), who was elected President with 33% of the vote in May 1994, finished his presidential term in August 1999. Mireya Moscoso (“Moscoso”), who was elected with 44.8% of the vote in May 1999, took office on September 1, 1999 and completed her presidential term on August 31, 2004. On May 2, 2004, Martín Torrijos (“Torrijos”) was elected President with 47.4% of the vote. He took office on September 1, 2004 and completed his presidential term on June 30, 2009. Ricardo Martinelli (“Martinelli”), who was elected President with 60.0% of the vote on May 3, 2009, took office on July 1, 2009.

The Panamanian military was disbanded in 1990, and, in 1994, by constitutional amendment, the military was abolished. Costa Rica, Panama’s western neighbor, also does not have a military. If Panama were attacked by a foreign force and the neutrality of the Panama Canal were jeopardized, the United States would have the right under treaties related to the Panama Canal to take measures to protect the neutrality of the Canal. The national police force of Panama also has certain defensive capabilities.

Form of Government and Political Parties

Panama is a republic with a representative form of government. In 1972, the original version of the current Constitution was adopted (the fourth in Panama’s history), setting forth the structure of the Government, individual and collective rights and duties, and the division of powers among the executive, legislative and judicial branches.

Executive power is vested in the President and the presidentially-appointed Ministers, who constitute the Cabinet. The President and the Vice-President are each elected by direct, universal suffrage for a term of five years. The President and the Vice-President may not be reelected to the same office within ten years after the expiration of their term. In the event the President is unable to finish a term, the Vice President would succeed to the presidency.

National legislative power is vested in the Assembly, Panama’s unicameral legislative body. The number of electoral circuits, each comprising an average of approximately 56,655 persons, determines the number of legislators; as of August 2011, the Assembly had 71 seats. The full Assembly is elected by universal suffrage every five years. Members of the Assembly are not subject to limits on the number of terms in office to which they may be elected. The Assembly has, among other powers, the authority to enact legislation, ratify treaties, approve the budget and ratify the appointment of the Comptroller General, the Attorney General and justices of the Supreme Court of Justice (the “Supreme Court”). To be enacted, legislation must be approved after three separate readings by a majority of all legislators or by a majority of legislators present at the session, depending on the substance of the legislation being enacted. The President may veto bills adopted by the Assembly, but the Assembly may override presidential vetoes by a vote of two-thirds of its members. Pursuant to the Constitution, the Assembly may

D-11

empower the President and the Cabinet to adopt legislation when the Assembly is not in session. The Assembly has the power to amend the Constitution. Amendments to the Constitution may be adopted either by a majority vote of all legislators in two different Assemblies or by a majority vote of all legislators in two sessions of the same Assembly and a public referendum.

On May 3, 2009, Ricardo Martinelli, President of the Cambio Democrático (the “CD”), was elected President of the Republic of Panama for a five-year term with 60.0% of the vote, and took office on July 1, 2009. Martinelli’s coalition, consisting of CD, Partido Panameñista, MOLIRENA and Unión Patriotica, won a majority of the 71 seats available in the Assembly, securing 15, 21, two and four seats, respectively. The Partido Revolucionario Democrático (the “PRD”) secured 26 seats, the Partido Popular secured one seat, and the Vanguardia Moral de la Patria secured none. Two nonpartisan seats were secured.

On August 30, 2011, President Martinelli dismissed Vice President Varela as Minister of Foreign Affairs, prompting members of Mr. Varela’s party to resign from senior governmental positions and resulting in the termination of the coalition between the President’s party (CD) and that of the Vice President (PPA). In an address to the nation on September 1, 2011, President Martinelli explained his decision, stating that the Minister of Foreign Affairs should be a full-time position, and that Mr. Varela had neglected the duties of his office as a Presidential candidate for the 2014 elections. Mr. Varela, who will remain in his elected position as Vice President of the country, is also the President of PPA. The officials from his party who resigned include, most notably, Minister Vallarino, Minister of Economy and Finance, and Minister Duboy, Minister of Housing. President Martinelli and the remainder of his Cabinet belong to CD. President Martinelli and his senior economic advisors, including Vice Minister of Economy Frank De Lima, have indicated that the political changes will not in any way alter the course of economic and fiscal policy which have been under way since the beginning of the Martinelli administration in July 2009. Minister Vallarino has stated his intention to remain in office until his successor has been appointed. Vice Minister Khemlani moved from his position as Public Credit Director of the Ministry of Economy and Finance to the position of Vice Minister of Finance on September 1, 2011, replacing former Vice Minister Dulcidio de la Guardia, whose previously planned return to the private sector was unrelated to the political developments mentioned above.

Judicial power is vested in the Supreme Court and various lower tribunals. The President appoints the nine justices of the Supreme Court for staggered ten-year terms, with two justices being selected every two years, subject to ratification by the Assembly. Lower court judges are appointed by the Supreme Court. The judicial branch prepares its own budget and sends it to the executive branch for inclusion in the general budget presented to the Assembly for approval. The Supreme Court is the final court of appeal and has the power to declare null and void laws, regulations or other acts of the executive or legislative branches that conflict with the Constitution.

Panama is administratively divided into nine provinces and three territories. In each province, executive power is exercised by a governor who is appointed by the President. There are no provincial legislative or judicial bodies. Provincial governments do not have their own independent budgets. Within each province are municipalities that are, in turn, divided into precincts. Each municipality has a municipal council and a mayor who exercises executive power. Mayors and members of municipal councils are elected by direct, universal suffrage for five-year terms. Municipalities levy and collect municipal taxes and adopt their own budgets for financing local projects.

Foreign Affairs and International Organizations

Panama maintains diplomatic relations with 145 countries. Panama is a charter member of the United Nations (“U.N.”) and a member of various other international organizations, including the IMF and the IADB. Panama is a founding member of the Organization of American States and is also a member of the International Bank for Reconstruction and Development (“World Bank”) and the World Bank affiliates, International Finance Corporation (“IFC”) and the Multilateral Investment Guaranty Agency (“MIGA”), as well as a member of the San José Pact, under which Venezuela and Mexico agreed to provide the Central American countries and four Caribbean countries with crude oil and petroleum products under preferential terms. On September 6, 1997, Panama acceded to membership in the World Trade Organization (“WTO”).

D-12

Panama consults with various international agencies, such as the IADB, the World Bank and the IMF, regarding its economic program, objectives, projections and policies. Recently, Panama has utilized the IADB and the World Bank for significant external financing. See “Public Sector Debt—External Debt”.

D-13

THE PANAMANIAN ECONOMY

General

Panama’s unique geographic position, service economy (including the Panama Canal) and monetary regime anchored on the use of the U.S. dollar as legal tender are major factors in Panama’s economic performance.

Panama has used the U.S. dollar as its legal tender since shortly after gaining its independence. The national currency, the Balboa, is used primarily as a unit of account linked to the U.S. dollar at a ratio of one dollar per one Balboa. The Government does not print paper currency, although a limited amount of coinage is minted. Panama’s monetary system is based on its Constitution (beginning with the 1904 Constitution, which established the Balboa) and Panamanian laws expressly recognizing the U.S. dollar as legal tender. There are no Panamanian foreign exchange controls or reporting requirements, and capital moves freely in and out of the country, without local currency risk. Under Panama’s unique monetary system, foreign exchange reserves are not needed to support the currency.

The absence of both a national printed currency and a Balboa exchange market diminishes the significance of the balance of payments as an indicator of the Government’s external debt service capacity. Fiscal policy, therefore, is a more accurate indicator of accumulation and the drawdown of Government reserves available for sovereign debt service. Moreover, this monetary system imposes an element of discipline on Panamanian authorities in the areas of monetary and fiscal policy. Panama is limited in its ability to conduct a stimulative monetary policy and can finance public sector deficits only through borrowing.

In 2006, the non-financial public sector registered a surplus of 0.5% of GDP, and in 2007, the non-financial public sector registered a surplus of 3.5% of GDP. In 2008, the non-financial public sector registered a surplus of 0.4% of GDP, and in 2009, the non-financial public sector registered a deficit of 1.0% of GDP. In 2010, the non-financial public sector registered a deficit of 1.9% of GDP.

From 2006 to 2010, Panama experienced an average annual rate of inflation, as measured by the end-of-period consumer price index, or CPI, of 4.3%. In 2010, the annual rate of inflation, as measured by a revised end-of-period CPI with a base year of 2002, was estimated at 3.5%.

The Panamanian economy is dominated by a large service sector, which, in recent years, has represented an average of over three-quarters of GDP. The manufacturing and agricultural sectors represent far smaller percentages. Historically, the Panamanian economy has been characterized by an imbalance between the open, internationally-oriented service sector and the fairly closed manufacturing and agricultural sectors, where productivity has been considerably lower and government policies have impeded efficient resource allocation. See “Structure of the Panamanian Economy—Principal Sectors of the Economy”.

While much of the service sector economic activity is represented by activities associated with public administration, commerce and real estate, the significant, internationally-oriented activities of this sector distinguish the Panamanian economy. The Panama Canal has played a significant role in the economy, accounting for an average of 4.3% of GDP from 2006 to 2010. The withdrawal of the U.S. military and reversion of facilities in the former Canal Zone, culminating with the reversion of the Canal itself at the end of 1999, had substantial fiscal and macroeconomic impacts on Panama and its economy. These impacts have largely been absorbed by Panama in the years since the withdrawal.

In the Canal’s 2010 fiscal year (which ended September 30, 2010), commercial oceangoing traffic registered 14,230 transits, and the Canal’s toll revenue was $1,482.1 million. See “The Panama Canal—Reversion of the Canal Area to Panama”.

Another significant and distinctive factor in the Panamanian economy is the Colón Free Trade Zone (the “CFZ”), a tax-favored export and import trading zone located near the Atlantic entrance to the Canal, which has accounted for approximately 7.2% of GDP between 2006 and 2010. See “The Colón Free Zone”. As a result of the dollar-based economy, the international trade associated with the Panama Canal and the CFZ, and certain legislative initiatives, Panama has also developed an important banking sector that has represented an average of 8.3% of GDP

D-14

from 2006 to 2010. There is no lender of last resort or deposit insurance in Panama. See “Financial System—The Banking Sector”.

Reforms and Development Programs

In December 2005, the Torrijos administration achieved one of its primary legislative objectives when the Assembly approved Law No. 51, which reformed Panama’s social security system by, among other things, requiring employees to make contributions into the social security system for 20 years (up from the prior 15-year requirement) before becoming eligible to receive benefits and gradually transitioning from the current defined benefits system to personal savings accounts. Law No. 51 also establishes the obligation to support the Régimen de Invalidez, Vejez y Muerte (“IVM”) with annual deposits to an administration and investment trust created for the sustainability of the IVM, of $75 million in 2007, 2008 and 2009, $100 million in 2010, 2011 and 2012, and $140 million in 2013 through 2060.

Trade Liberalization. Trade liberalization received new impetus under the Pérez Balladares administration. Panama’s accession to the WTO became effective September 6, 1997. Panama had begun lowering its duties and quantitative restrictions in anticipation of WTO accession, although significant duties permitted under WTO rules remained in place for certain products. On January 1, 1997, a series of measures became effective that provided for the: (i) conversion of all existing quotas and import permits to ad valorem tariffs; (ii) conversion of all remaining specific or mixed tariffs to ad valorem tariffs; and (iii) setting of a tariff ceiling of 40% for industrial products and 50% for agri-industrial products. A major piece of legislation designed, in part, to remove barriers to Panama’s accession to the WTO, was passed by the Assembly in June 1995 called the Ley de Universalización de Incentivos Tributarios a la Producción. As of September 1, 1997, tariffs were reduced to 10% for components of bread, cooking oils and numerous construction industry inputs, including steel and cement. The Ministry of Planning and Economic Policy, now referred to as the Ministry of Economy and Finance, retained a consultant to study further lowering of duties below those agreed with the WTO, and on October 10, 1997, the Cabinet approved additional reductions of tariffs on certain specific products to 15%. Upon assuming office, the Moscoso administration increased tariffs for certain agricultural products in October 1999. See “Foreign Trade and Balance of Payments—Tariffs and Other Trade Restrictions”.

Panama has concluded the negotiation of comprehensive free trade agreements with Costa Rica, Honduras, Guatemala and Nicaragua. Law No. 17 of February 13, 2008, published in the Gaceta Oficial Digital No. 25,982 of February 20, 2008, serves as the ratification of the free trade agreement between Panama and Costa Rica; the effective date of the agreement was November 23, 2008, and its Tariffs Program entered into effect on January 1, 2009. Law No. 23 of April 25, 2008, published in the Gaceta Oficial Digital No. 26,032 of May 5, 2008, serves as the ratification of the free trade agreement between Panama and Honduras; this agreement became effective on January 9, 2009. The free trade agreement between Panama and Guatemala was ratified by the Assembly of Panama under Law No. 48 of 2008, published in Gaceta Oficial Digital No. 26,084 of July 16, 2008, and became effective on June 20, 2009. The free trade agreement between Panama and Nicaragua was ratified by the Assembly of Panama under Law No. 29 of 2009, published in Gaceta Oficial Digital No. 26,309 of June 23, 2009, and became effective on November 21, 2009 with the tariff reduction program taking effect on January 1, 2010. Under these commercial agreements with Costa Rica, El Salvador, Guatemala, Honduras and Nicaragua, nearly 90% of Panama’s total exports to these countries enter duty-free.

On January 12, 2007, the Assembly approved Law No. 7, which implements the free trade agreement signed with Chile in June 2006. This free trade agreement entered into force on March 7, 2008, eliminating nearly 93% of Chile’s tariffs on goods immediately, with remaining tariffs phased out over 10 years.

On June 20, 2006, then-President Torrijos signed Law No. 19 approving the free trade agreement between Panama and Singapore, which was signed by the parties on March 1, 2006. Upon effectiveness on July 1, 2006, Panama received immediate zero-tariff access for all products exported to Singapore. Panama negotiated varying terms (0-10 years) for tariff reductions on certain agricultural and industrial imports from Singapore and excluded from the agreement more than 200 agricultural products, including rice, pork, dairy products and chicken.

On December 19, 2006, Panama announced the completion of negotiations for the Trade Promotion Agreement with the United States. In 2006, more than 96% of Panama’s merchandise exports to the United States entered duty-free considering the application of various trade preference programs designed to promote economic

D-15

development, such as the Caribbean Basin Initiative and the Generalized System of Preferences. The Trade Promotion Agreement with the United States is expected to expand and secure those benefits for Panama in the long term. Upon effectiveness, this agreement will eliminate nearly 71.2% of Panama’s tariffs on industrial goods immediately, with remaining tariffs phased out over 10 years. In return, the United States will eliminate immediately 99.7% of tariffs applied to industrial goods from Panama. On June 28, 2007, Panama and the United States signed the Trade Promotion Agreement, which will come into force upon approval of each country’s legislature. On July 11, 2007, Panama’s legislature ratified the Trade Promotion Agreement, but as of September 2011, the U.S. Congress has yet to ratify the agreement.

On August 11, 2009, Panama and Canada entered into a free trade agreement. Under the agreement, Panama’s fresh and processed maritime products, representing approximately 30% of its exports to Canada, will have better access to the Canadian market, and Canada will immediately eliminate 100% of its tariffs on imports from Panama. In addition, the agreement will remove tariffs on 90% of goods imported from Canada, with the remaining ones to be phased out over the next decade. The countries’ legislative bodies completed their review of the Free Trade Agreement on March 31, 2010, and on May 14, 2010, the Free Trade Agreement became effective.

In December 2009, Panama and Colombia announced that they will begin negotiations on a free trade agreement to increase trade and economic integration between the two countries. As of September 2011, the two countries have completed four rounds of negotiations, but complete review and ratification of the free trade agreement remains pending.

Other Economic Reforms. Law No. 22 of June 27, 2006 established a new system for government procurement in Panama. Law No. 22 of June 27, 2006, which replaced Law No. 56 of December 27, 1995, created an autonomous government agency known as the Directorate General of Government Contracts that is responsible for the regulation and oversight of the government procurement process. Under Law No. 22 of June 27, 2006, the President now appoints, and the Assembly ratifies the appointment of, a General Director of the Directorate General of Government Contracts. Law No. 22 of June 27, 2006 created an administrative tribunal to resolve appeals by Government contractors and required that the Government’s procurement of goods and services below $300,000 be conducted through an electronic system known as “Panamá Compra.”

On November 6, 2009, Law 69 of 2009, governing public contracts, was ratified. This law was published in the Gaceta Oficial Digital No. 26,402-C of November 6, 2009. The law prohibits modifications or amendments to investment contracts or concession agreements entered into by public sector entities in Panama that would be considered detrimental to the Republic.

On May 10, 2011, Law 22 of 2006, was modified by Law No. 48 of 2011, published in the Gaceta Oficial Digital No. 26,782 of May 11, 2011. The modification grants Dirección General de Contrataciones Públicas, or Public Contracting Authority, the power to impose fines. In addition, it expanded the scope of the law to include regulation of acquisitions by Caja de Seguro Social (Social Security Fund, or “CSS”) of pharmaceutical products as well as contracts with funding supplied by foreign governments. Law 48 modified provisions that regulate, among other things, exemption from the contractor selection process, and sale of assets under exceptional process, advertising and promotion services contracts.

During 2007, two export processing zones, or EPZs, were created in Panama. EPZs are well-defined areas for establishing industrial, commercial and service facilities for operation in a free trade system. In June 2007, Zona Procesadora Chilibre was created, and in August 2007, Zona Procesadora Colon Maritime Investor, S.A. was created, to provide the infrastructure, facilities and support systems necessary to attract new business and foreign investments. As of August 2011, there were 76 official registrations for call centers. A total of 129 investors received assistance between January 2009 and August 2011.

Fiscal Reforms. On June 19, 2006, through Law No. 18, the Assembly modified articles of the Fiscal Code which implements a 10% capital gains tax on the sale of stocks, bonds and other securities. On January 11, 2007, Law No. 5 was passed which facilitated the process by which companies are formed. The law was created with the intention to foster increased investments within the country and to promote new business ideas. This law also protects commercial enterprises from unfair competition.

D-16

On June 5, 2008, Law No. 34 of 2008 was ratified, establishing a Social and Fiscal Responsibility Regime, in order to promote sound fiscal policies and management. This Law was published in the Gaceta Oficial Digital No. 26,056 of June 6, 2008, and came into effect on January 1, 2009. The Social and Fiscal Responsibility Regime requires any new government to present, during the first six months of its administration, a multi-year social strategy, a five-year financial plan and the macroeconomic criteria to manage public expenditures and to incentivize current savings. Under Cabinet Resolution No. 163 issued on December 29, 2009, published in the Gaceta Oficial Digital No. 26,445-A on January 12, 2010, the Government approved the Strategic Government Plan of the Martinelli administration for the next five years. The Strategic Government Plan seeks to boost economic and social development in order to achieve sustained economic growth, reduce poverty and improve income distribution.

On March 9, 2009, the Financial Stimulus Program, referred to as Programa de Estímulo Financiero or PEF, was created under Cabinet Decree No. 9, and published in the Gaceta Oficial Digital No. 26,237 of March 10, 2009. The PEF was established to compensate for the reduction in credit available to Panamanian banks from international sources due to reductions in credit lines from banks abroad and from the international financial markets, in order to promote economic stability and employment growth during the global economic crisis. On June 2, 2009, pursuant to Cabinet Decree No. 19, the Republic modified the fundamentals of the program and reduced the amount of the PEF from $1.1 billion to $610 million, borrowed from Corporación Andina de Fomento (“CAF”), and Banco Nacional de Panamá (“BNP”), leaving open the possibility for BNP to enhance its support to the program in the future. Funds received under the PEF are deposited in a trust administered by BNP (as authorized under Cabinet Resolution No. 28, dated March 16, 2009), and benefit from a guarantee issued by the Republic. The PEF and its trust were duly implemented after the credit facilities were executed, and made publicly available to the Panamanian financial institutions. Panamanian financial institutions seeking access to the PEF are required to provide full collateral for their borrowings. Interest is charged at rates determined with reference to the interest on the loans used to fund the trust and to the term of each loan. Additionally, fees are assessed to cover administrative costs of the program. In connection with the PEF, President Martinelli issued Executive Decree No. 89, dated July 24, 2009, appointing the new Directive Council of the PEF, which is comprised of five individuals, including the General Manager and Risk Manager of BNP, in order to advise the Government on applicable measures to counteract the effects that the global economic crisis may have on Panama and to recommend credit policies applicable to the program.

On September 17, 2009, Law No. 49 of 2009 was ratified, modifying the Panamanian Fiscal Code. This law was published in the Gaceta Oficial Digital No. 26,370-C of September 17, 2009, and came into force on September 17, 2009, with the exceptions of Articles 9, 10 and 29, which came into effect on January 1, 2010. Currently, the Republic has one of the lowest tax rates in Latin America, which accounts for approximately 10% of GDP In March 2010, Law No. 8 of 2010 was ratified, modifying the Panamanian Fiscal Code by adopting fiscal measures and creating the Administrative Tax Tribunal. Law 8, published in the Gaceta Oficial Digital No. 26,489-A of March 15, 2010, went into effect on July 1, 2010, with the exception of Articles 9 and 10, relating to personal and corporate income tax rates, which were retroactively effective as of January 1, 2010. This law increased the value-added tax, known as ITBMS, for the first time since it was established in 1976 pursuant to Law No. 75 of December 22, 1976, from 5% to 7%. The modified law also reduced the corporate income tax rate from 30% to 27.5%, effective as of January 1, 2010, with a further reduction, subject to certain exceptions, to 25%, beginning January 1, 2011. Personal income tax rates were modified to reflect the following: (1) taxable income up to $11,000 will have a 0% tax rate; (2) taxable income of more than $11,000 but less than $50,000 will be taxed at 15%; and (3) taxable income of $50,000 or more will be taxed in the amount of $5,850 for the first $50,000 and at 25% for any amount above $50,000. Law 8 of 2010 modified the Fiscal Code to allow the Republic to generate additional revenue to provide for public service such as social expenses, security expenses and infrastructure development. As a result of the modifications to the Fiscal Code, the Republic received approximately $6.8 billion in revenue for 2010, compared to $6.3 billion in 2009, representing an increase of approximately $606.1 million, or 9.7%. The Fiscal Code was again amended on June 30, 2010, pursuant to Law No. 33 of 2010, published in the Gaceta Oficial Digital No. 26,566-A. Among other reforms, Law 33 of 2010 added an additional chapter to the Fiscal Code to cover double taxation treaties so that Panamanian taxpayers can invoke a clause in the treaty itself, as well as refer to the new chapter of the Fiscal Code, in order to avoid paying taxes to two countries on the same transaction or activity.

Social Developments. Panama’s social spending generally does not involve income subsidies or other welfare benefits but instead focuses on spending in the social sectors of health, education and housing. Together, these areas represented approximately 39.6% of government’s budget for in 2011.

D-17

In May 1995, the Government created the Fondo Fiduciario para el Desarrollo, referred to as the Development Trust Fund, pursuant to Law No. 20, and on June 27, 2000, the Assembly approved Law No. 22, which approved the use of the Development Trust Fund principal for social development programs and infrastructure projects. The laws that currently govern the Development Trust Fund provide that up to $200 million may be drawn down from the Development Trust Fund to support infrastructure projects. The disbursements are to be made against invoices presented to the Ministry of Economy and Finance. See “Structure of the Panamanian Economy—The Role of the Government in the Economy”. In October 2004, the Assembly approved Law No. 52, which further amended the law creating the Development Trust Fund and reallocated certain funds from the Development Trust Fund to new projects, including aid for neighborhoods destroyed by floods in September 2004. For 2006 through 2010, funds were available in the following amounts: $70.0 million to water supply; $30.0 million to irrigation and agricultural projects; and $97.0 million to road rehabilitation. During the same period, $69.8 million had been disbursed to fund water supply projects; $27.3 million to fund irrigation and agricultural projects; and $94.5 million to fund road rehabilitation projects. From inception through December 31, 2010, approximately 194.3 million had been disbursed from the Development Trust Fund under Law 20 of 2002 to support infrastructure projects, $4.9 million of which was disbursed in 2010.

In April 2001, Panama entered into a $47.9 million loan agreement with the World Bank to finance the Programa Nacional de Administración de Tierras, a national land management program. The program was restructured in March 2006, providing equitable access to land and land administration services in selected rural, semi-urban and urban areas, with a total amount financed of $54.0 million. As of August 31, 2011, the loan has a remaining balance of $34.4 million, which must be paid by October 2027.

On February 1, 2006, the Assembly approved Law No. 6, which assigns to the Ministry of Housing the responsibility to develop and oversee the coordination of national and local plans for sustainable development in Panama’s urban areas. Law No. 6 also requires the Ministry of Housing to coordinate with the various municipalities in its efforts to develop and execute local plans for the sustainable development of urban areas.

On August 4, 2009, Law 44 of 2009 was ratified, establishing a Special Program of Economic Assistance under the Ministry of Social Development. This Law was published in the Gaceta Oficial Digital No. 26,338-A of August 4, 2009. The program consists of issuing a monthly payment of $100 to all Panamanians who are 70 years or older and who do not receive retirement or pension benefits. With this program, the Government seeks to improve the quality of life for the elderly currently living in poverty.

On August 25, 2009, President Martinelli issued Executive Decree No. 55, published in the Gaceta Oficial Digital No. 26,369 of September 16, 2009. This decree created the “Fondo Solidario de Vivienda” under the Ministry of Housing. This fund gives low-income families up to $5,000 per family to use on the purchase of a home not to exceed $30,000. This contribution will be given to families that have an income of less than $800 a month.

Environmental Law. During 2008 and 2009, numerous executive decrees were enacted concerning environmental policies, including decrees relating to the protection of whale sharks, establishing a national committee on climate change and changing the general environmental law. In addition, many resolutions were enacted in 2009, such as the protection of specific regions, the approval of the management plan for a national park and the regulation for wildlife preservation.

Infrastructure. Beginning in 2007, Panama has experienced a significant developmental increase in infrastructure. In 2008, the Ministerio de Obras Públicas (Ministry of Public Works, also referred to as MOP), invested $248.2 million in projects relating to the construction, rehabilitation and maintenance of all national highways, consisting of 13,615 kilometers of transportation networks. In April 2009, the first phase of the 42 kilometer trans-isthmus toll road connecting Panama City and Colón, referred to as the Madden-Colón highway, became operational. The first phase of the Madden-Colón highway cost approximately $299.6 million and connects Madden to Quebrada Lopez. As of August 2011, the second phase of the Madden-Colón highway, connecting Quebrada Lopez to Cuatro Altos, was underway, and is expected to be completed by the end of 2012 and cost approximately $203 million.

On July 2, 2009, President Martinelli issued Executive Decree No.150, published in the Gaceta Oficial Digital No. 26,316 of July 3, 2009, which came into effect on July 2, 2009 in order to provide Panamanians with a more efficient mass transportation system. This decree created the Secretary of Metro for Panama, which is part of

D-18

the Ministry of the Presidency and is responsible for the organization and execution of all actions necessary with respect to the design, execution, administration, operation and maintenance of the metro transportation system project, known as “El Metro de Panamá.” “Consorcio Linea Uno”, formed by Odebrecht (a Brazilian company) and FCC (Fomento de Construcciones y Contratas—a Spanish company), is in charge of the construction of the first line. The construction started on March 2011 and is expected to be completed 38 months later, by 2014. The cost of the first phase is estimated to be approximately $1.5 billion, which the government expects to finance through central government borrowings from multilateral and bilateral lending institutions.

Proyecto Mesoamérica. In June 2001, Panama, together with Mexico, Nicaragua, Guatemala, Honduras, El Salvador, Belize and Costa Rica signed the Puebla-Panama Plan, a development plan to be supported by up to $2 billion in loans from the IDB and other multilateral organizations. The development would include joint management of natural resources and infrastructure projects such as highways, roads, electricity, seaports, airports, gas pipelines and communications as well as a plan for environmental protection. In May 2006, the Government signed a loan agreement with CAF for $80 million, of which $17.9 million was disbursed through December 2006, to improve and rehabilitate roads.

In 2006, various initiatives were undertaken in Panama under the Plan Puebla-Panama such as the repair and widening of the Tran-isthmus and Pan-American highways. In addition, the Voluntary Agreement for Sustainable Environmental Behavior was signed by Panama. In 2007, Plan Puebla-Panama continued its initiative to develop infrastructure projects.