| | |

| PROSPECTUS SUPPLEMENT | | Filed Pursuant to Rule 424(b)(3) File No. 333-163050 |

To prospectus dated December 16, 2009 | |

Republic of Panama

Invites the Owners of its

U.S.$1,471,000,000 7.250% Global Bonds due 2015 (the “Old Bonds”)

(ISIN: US698299AU88; CUSIP: 698299AU8; Common Code: 020635525)

to submit, in a modified Dutch auction, offers

to exchange Old Bonds for

6.700% U.S. Dollar-Denominated Amortizing Global Bonds due 2036 (the “Reopened Bonds”)

(ISIN: US698299AW45; CUSIP: 698299AW4; Common Code: 024213927)

and, if Panama determines to pay an additional amount of cash, a U.S. dollar amount of cash as so determined

This prospectus supplement and the accompanying prospectus are together referred to as the “Invitation”.

|

THE INVITATION AND WITHDRAWAL RIGHTS WILL EXPIRE AT 5:00 P.M., NEW YORK CITY TIME, ON TUESDAY, JANUARY 24, 2012, UNLESS EXTENDED OR EARLIER TERMINATED BY PANAMA IN ITS SOLE DISCRETION (SUCH DATE, AS IT MAY BE EXTENDED, THE “EXPIRATION DATE”). |

The aggregate principal amount of the Old Bonds outstanding is U.S.$1,471,000,000. Panama reserves the right to determine the principal amount of Old Bonds that it will accept pursuant to the Invitation in its sole discretion.

The Reopened Bonds, if and when issued, will be a further issuance of, will be consolidated to form a single series with, and will be fully fungible with, the outstanding 6.700% U.S. Dollar-Denominated Amortizing Global Bonds due 2036 (together with the Reopened Bonds, the “bonds”) issued by the Republic of Panama (the “Republic” or “Panama”), of which U.S.$1,785,297,000 aggregate principal amount is outstanding on the date of this prospectus supplement and which are listed on the Official List of the Luxembourg Stock Exchange and trade on the Euro MTF market. The outstanding bonds are, and Reopened Bonds issued pursuant to the Invitation will be, direct, unconditional and general obligations of Panama and will rank equally with Panama’s existing and future external indebtedness as described in “Debt Securities – Status of the Debt Securities” in the accompanying prospectus. Panama has pledged its full faith and credit for the due and punctual payment of all obligations of Panama in respect of the bonds.

The Reopened Bonds have been designated Collective Action Securities and, as such, will contain provisions regarding acceleration and future modifications to their terms that differ from those applicable to the Republic’s outstanding Public External Indebtedness issued prior to January 28, 2004. Under these provisions, which are described in the sections entitled “Description of the Reopened Bonds— Default; Acceleration of Maturity” and “— Amendments and Waivers” in this prospectus supplement and “Collective Action Securities” in the accompanying prospectus, the Republic may amend the payment provisions of the bonds and certain other terms with the consent of the holders of 75% of the aggregate principal amount of the outstanding bonds.

Application will be made to list the Reopened Bonds issued pursuant to the Invitation on the Official List of the Luxembourg Stock Exchange and to have such Reopened Bonds trade on the Euro MTF market.

See “Risk Factors” on page S-17 for a discussion of factors you should consider before submitting an offer to exchange your Old Bonds for Reopened Bonds.

Panama is conducting a concurrent invitation for holders to submit offers to sell the Old Bonds for cash (the “Concurrent Cash Invitation”), but reserves the right to cancel the Concurrent Cash Invitation at any time. The Invitation and Concurrent Cash Invitation are conditioned upon the settlement of an issue of local Panamanian bonds or another financing, in either case, satisfactory to Panama, which we refer to as the “Financing Condition” and which Panama may in its sole discretion waive. The Invitation is not conditioned on the results of the Concurrent Cash Invitation, and the Concurrent Cash Invitation is not conditioned on the results of the Invitation. Any individual Old Bond may be offered for exchange in the Invitation or offered for sale in the Concurrent Cash Invitation, but may not be offered in both invitations. Panama currently expects it will be willing to accept a larger principal amount of the Old Bonds for exchange through this Invitation than for sale through the Concurrent Cash Invitation.

Neither the United States Securities and Exchange Commission (“SEC”) nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this document or the accompanying prospectus. Any representation to the contrary is a criminal offense.

The Joint Dealer Managers for the Invitation are:

| | |

| GOLDMAN, SACHS & CO. | | CITIGROUP |

The date of this prospectus supplement is January 17, 2012

This Invitation has been prepared on the basis that the transactions contemplated by the Invitation in any Member State of the European Economic Area which has implemented the Prospectus Directive (each a “Relevant Member State”) will be made pursuant to an exemption under the Prospectus Directive from the requirement to publish a prospectus for offers of securities. Accordingly, any person making or intending to make any offer in that Relevant Member State of bonds which are the subject of the transactions contemplated by this Invitation, may only do so in circumstances in which no obligation arises for Panama or either of the Joint Dealer Managers (as defined herein) to produce a prospectus for such offer pursuant to Article 3 of the Prospectus Directive in relation to such offer. Neither Panama nor the Joint Dealer Managers has authorized, or hereby authorizes, the making of any offer or invitation in circumstances in which an obligation arises for Panama or either of the Joint Dealer Managers to publish a prospectus for such offer or invitation.

In relation to each Relevant Member State with effect from and including the date on which the Prospectus Directive is implemented in that Relevant Member State (the “Relevant Implementation Date”), no exchange offer of bonds subject to this Invitation to the public has been or will be made in that Relevant Member State other than:

| | (a) | to any legal entity which is a qualified investor as defined in the Prospectus Directive or, if the Relevant Member State has implemented the relevant provision of the 2010 PD Amending Directive, as defined in the 2010 PD Amending Directive; |

| | (b) | to fewer than 100 or, if the Relevant Member State has implemented the relevant provision of the 2010 PD Amending Directive, 150, natural or legal persons (other than qualified investors as defined in the Prospectus Directive), as permitted under the Prospectus Directive subject to obtaining the prior consent of the representatives of Panama for any such offer; or |

| | (c) | in any other circumstances falling within Article 3(2) of the Prospectus Directive; |

provided that no such offer of bonds shall require Panama or either of the Joint Dealer Managers to publish a prospectus pursuant to Article 3 of the Prospectus Directive.

For the purposes of this Invitation, the expression an “offer of bonds to the public” in relation to any bonds in any Relevant Member State means the communication in any form and by any means of sufficient information on the terms of the offer and the bonds to be offered so as to enable an investor to decide to purchase or subscribe the bonds , as the same may be varied in that Relevant Member State by any measure implementing the Prospectus Directive in that Relevant Member State. The expression Prospectus Directive means Directive 2003/71/EC (and amendments thereto, including the 2010 PD Amending Directive, to the extent implemented in the Relevant Member State), and includes any relevant implementing measure in each Relevant Member State and the expression “2010 PD Amending Directive” means Directive 2010/73/EU.

In the United Kingdom no exchange of bonds subject to this Invitation has been or will be made to persons other than (a) persons with professional experience in matters relating to investments who fall within Article 19(5) of the U.K. Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (as amended, the “Order”); or (b) a person falling within Article 49(2)(a) to (d) of the Order (such a person, a “relevant person”). In the United Kingdom, a person other than a relevant person should not act or rely on this document or any of its contents. In the United Kingdom, any investment or investment activity to which this document relates is available only to relevant persons and will be engaged in only with such persons.

S-2

TABLE OF CONTENTS

PROSPECTUS SUPPLEMENT

Prospectus

| | | | |

Where You Can Find More Information | | | 2 | |

Data Dissemination | | | 3 | |

Use of Proceeds | | | 3 | |

Debt Securities | | | 4 | |

Collective Action Securities | | | 16 | |

Warrants | | | 19 | |

Governing Law | | | 20 | |

Jurisdiction and Enforcement | | | 20 | |

Plan of Distribution | | | 21 | |

Selling Securityholders | | | 23 | |

Validity of the Securities | | | 24 | |

Official Statements | | | 24 | |

Authorized Representative | | | 24 | |

Glossary | | | 24 | |

S-3

INTRODUCTION

This document supplements the accompanying prospectus dated December 16, 2009 relating to Panama’s debt securities and warrants. You should read this document along with the accompanying prospectus. Both documents contain information you should consider when making your investment decision. If the information in this document differs from the information contained in the accompanying prospectus, you should rely on the information in this document.

We have provided you only the information contained or incorporated by reference in this document and the accompanying prospectus. Panama has not authorized anyone else to provide you with different information. Panama is offering the Reopened Bonds and seeking offers to exchange the Old Bonds only in jurisdictions where it is lawful to do so. The information contained in this document and the accompanying prospectus is current only as of their respective dates.

Panama is furnishing this document and the accompanying prospectus solely for use by current holders of Old Bonds in the context of the Invitation and for Luxembourg listing purposes. Panama confirms that:

| | • | | the information contained in this document and the prospectus is true and correct in all material respects and is not misleading, |

| | • | | it has not omitted other facts the omission of which makes this document and the accompanying prospectus as a whole misleading, and |

| | • | | it accepts responsibility for the information it has provided in this document and the accompanying prospectus. |

The Reopened Bonds are debt securities of Panama, which are being offered under Panama’s registration statement no. 333-163050 filed with the SEC under the U.S. Securities Act of 1933, as amended. The accompanying prospectus is part of the registration statement. The accompanying prospectus provides you with a general description of the securities that Panama may offer, and this document contains specific information about the terms of the Invitation and the Reopened Bonds. This document also adds, updates or changes information provided or incorporated by reference in the accompanying prospectus. Consequently, before you offer to exchange your Old Bonds, you should read this document together with the accompanying prospectus as well as the documents incorporated by reference in the prospectus. The documents incorporated by reference in the accompanying prospectus consist of Panama’s Annual Report for 2010 on Form 18-K, and all amendments to the Annual Report. You can inspect those documents at the office of the SEC, and you may obtain copies of them and a further supplement, which will be prepared for the listing of the Reopened Bonds and reviewed by the Luxembourg Stock Exchange, describing the results of the Invitation, when announced, free of charge at the office of the Luxembourg listing agent, paying agent and transfer agent, The Bank of New York Mellon (Luxembourg) S.A., listed on the back cover page of this document.

The information contained in this Invitation and the documents incorporated herein by reference are accurate only as of the date on the front of those documents, regardless of the time of delivery of those documents or of any exchange. Neither the delivery of this Invitation nor any exchange of Old Bonds pursuant to the exchange offer shall, under any circumstances, create any implication that the information contained or incorporated by reference herein is current as of any time subsequent to the date of such information or that there has been no change in the information set out in it or in the affairs of Panama since the date hereof.

Panama will cancel the Old Bonds it acquires pursuant to the Invitation and the Concurrent Cash Invitation, reducing the aggregate principal amount of Old Bonds that otherwise might trade in the market, which could adversely affect the liquidity and market value of the remaining Old Bonds that Panama does not acquire.

None of Panama, Goldman, Sachs & Co. or Citigroup Global Markets Inc., as the “Joint Dealer Managers” for the Invitation, the fiscal agent or Bondholder Communications Group, LLC, as the “Information and Exchange Agent” for the

S-4

Invitation, has expressed any opinion as to whether the terms of the Invitation are fair. None of Panama, the Joint Dealer Managers, the fiscal agent or the Information and Exchange Agent makes any recommendation that you offer to exchange Old Bonds or refrain from doing so pursuant to the Invitation, and no one has been authorized by Panama, the Joint Dealer Managers or the Information and Exchange Agent to make any such recommendation. You must make your own decision as to whether to offer to exchange Old Bonds or refrain from doing so, and, if so, the principal amount of Old Bonds to offer to exchange and the Offer Premium (as described in this document) that you would accept if you were to exchange your Old Bonds for Reopened Bonds.

References to “U.S.$” or “$” in this prospectus supplement are to U.S. dollars.

References to the “Republic” or “Panama” are to the Republic of Panama.

Offers to exchange may only be submitted by a direct participant in The Depository Trust Company (“DTC”), the Euroclear System (“Euroclear”) or Clearstream Banking,société anonyme (“Clearstream, Luxembourg”). Panama reserves the right to reject any offer not received in the appropriate form.

Until 40 days after the Expiration Date, all dealers effecting transactions in the Reopened Bonds in the United States, whether or not participating in this distribution, may be required to deliver a copy of this prospectus supplement and the accompanying prospectus.

FORWARD LOOKING STATEMENTS

Panama has made forward-looking statements in this prospectus supplement and the accompanying prospectus. Statements that are not historical facts are forward-looking statements. These statements are based on Panama’s current plans, estimates, assumptions and projections. Therefore, you should not place undue reliance on them. Forward-looking statements speak only as of the date they are made, and Panama undertakes no obligation to update any of them in light of new information or future events.

Forward-looking statements involve inherent risks. Panama cautions you that many factors could affect the future performance of the Panamanian economy. These factors include, but are not limited to:

| | • | | interest rates in the United States and financial markets outside Panama; |

| | • | | political or governmental developments in Panama; |

| | • | | changes in economic or tax policies; |

| | • | | the imposition of trade barriers; |

| | • | | general economic and business conditions in Panama and the global economy; |

| | • | | the ability of the Panama Canal to remain a competitive route for inter-oceanic transportation; |

| | • | | the ability of Panama to effect key economic reforms; and |

| | • | | the impact of hostilities or political unrest in other countries that may affect international trade, commodity prices and the global economy. |

CERTAIN LEGAL RESTRICTIONS

The distribution of materials relating to the Invitation, and the transactions contemplated by the Invitation, may be restricted by law in certain jurisdictions. If materials relating to the Invitation come into your possession, you are required by Panama to inform yourself of and to observe all of these restrictions. The materials relating to the Invitation do not constitute, and may not be used in connection with, an offer or solicitation in any place where offers or solicitations are not permitted by law. If a jurisdiction requires that the Invitation be made by a licensed broker or dealer and either of the Joint Dealer Managers or any affiliate of either of the Joint Dealer Managers is a licensed broker or dealer in that jurisdiction, the Invitation shall be deemed to be made by the Joint Dealer Managers or such affiliate on behalf of Panama in that jurisdiction. Owners who may lawfully participate in the Invitation in accordance with the terms thereof are referred to as “holders”. For more information, see “Plan of Distribution” and “Jurisdictional Restrictions” in this document.

S-5

SUMMARY

This summary should be read as an introduction to this prospectus supplement and the accompanying prospectus. Any decision to invest in the Reopened Bonds by an investor should be based on consideration of this prospectus supplement and the accompanying prospectus as a whole.

The Issuer

Overview

Panama is located on the narrowest point of the Central American isthmus, which connects the continents of North America and South America. It has a coastline of approximately 1,868 miles on the Caribbean Sea and Pacific Ocean, and is bordered on the east by Colombia and on the west by Costa Rica. Panama has a national territory of approximately 29,157 square miles situated within its coastline and 345 miles of land borders, and includes numerous coastal islands. The Panama Canal, which connects the Atlantic and Pacific Oceans, bisects the country running northwest to southeast.

As of December 31, 2010, Panama had an estimated population of 3.4 million and a population density of 116.8 people per square mile. The Panama Province, the Republic’s largest province, is estimated to comprise 50.2% of Panama’s total population. The Colón Province, located at the northern terminus of the Panama Canal, is estimated to comprise 7.1% of the total population.

Government

Panama is a republic with a representative form of government. In 1972, the original version of the current Constitution was adopted (the fourth in Panama’s history), setting forth the structure of the Government, individual and collective rights and duties, and the division of powers among the executive, legislative and judicial branches.

Executive power is vested in the President and the presidentially appointed Ministers, who constitute the Cabinet. The President and the Vice President are each elected by direct, universal suffrage for a term of five years. The President and the Vice President may not be reelected to the same office within ten years after the expiration of their term. In the event the President is unable to finish a term, the Vice President would succeed to the presidency.

National legislative power is vested in the National Assembly, referred to as the Assembly, Panama’s unicameral legislative body. The number of electoral circuits, each comprising an average of approximately 57,000 persons, determines the number of legislators; the Assembly currently has 71 seats. The full Assembly is elected by universal suffrage every five years. Members of the Assembly are not subject to limits on the number of terms in office to which they may be elected. The Assembly has, among other powers, the authority to enact legislation, ratify treaties, approve the budget and ratify the appointment of the Comptroller General, the Attorney General and justices of the Supreme Court of Justice, referred to as the Supreme Court.

Judicial power is vested in the Supreme Court and various lower tribunals. The President appoints the nine justices of the Supreme Court for staggered ten-year terms, subject to ratification by the Assembly. Lower court judges are appointed by the Supreme Court. The judicial branch prepares its own budget and sends it to the executive branch for inclusion in the general budget presented to the Assembly for approval. The Supreme Court is the final court of appeal and has the power to declare null and void laws, regulations or other acts of the executive or legislative branches that conflict with the Constitution.

Panama is administratively divided into nine provinces and three territories. In each province, executive power is exercised by a governor who is appointed by the President. There are no provincial legislative or judicial bodies. Provincial governments do not have their own independent budgets. Within each province are municipalities that are, in turn, divided into precincts. Each municipality has a municipal council and a mayor who exercises executive power. Mayors and members of municipal councils are elected by direct, universal suffrage for five-year terms. Municipalities levy and collect municipal taxes and adopt their own budgets for financing local projects.

On May 3, 2009 Ricardo Martinelli was elected President of the Republic of Panama for a five-year term, and took office on July 1, 2009. See “Recent Developments—Recent Government Actions”.

S-6

Selected Panamanian Economic Indicators(1)

The following table sets forth Panama’s principal economic indicators for the years 2006 through 2010:

| | | | | | | | | | | | | | | | | | | | |

| | | 2006(R) | | | 2007(R) | | | 2008(R) | | | 2009(R) | | | 2010(P) | |

Economic Data: | | | | | | | | | | | | | | | | | | | | |

GDP (millions, nominal dollars) (2) | | $ | 17,137 | | | $ | 19,794 | | | $ | 23,001 | | | $ | 24,080 | | | $ | 26,777 | |

GDP (millions, constant dollars) (2) (3) | | $ | 15,239 | | | $ | 17,084 | | | $ | 18,813 | | | $ | 19,414 | | | $ | 20,863 | |

GDP (% change, constant dollars)(2) (3) | | | 8.5 | % | | | 12.1 | % | | | 10.1 | % | | | 3.2 | % | | | 7.5 | % |

Service Sector (% change, constant dollars)(2)(3) (4) | | | 9.4 | % | | | 12.0 | % | | | 10.5 | % | | | 4.2 | % | | | 10.5 | % |

Other (% change, constant dollars)(2) (3) (5) | | | 7.8 | % | | | 8.7 | % | | | 12.4 | % | | | 0.3 | % | | | 0.1 | % |

GDP Per Capita (constant dollars)(3) | | $ | 4,646 | | | $ | 5,115 | | | $ | 5,564 | | | $ | 5,616 | | | $ | 6,125 | |

Population (millions) | | | 3.28 | | | | 3.34 | | | | 3.40 | | | | 3.45 | | | | 3.40 | |

CPI - Period Average (% change) | | | 2.5 | % | | | 4.2 | % | | | 8.7 | % | | | 2.4 | % | | | 3.5 | % |

Unemployment | | | 6.7 | % | | | 4.7 | % | | | 4.2 | % | | | 5.2 | % | | | 4.7 | % |

Public Finance: | | | | | | | | | | | | | | | | | | | | |

Total Consolidated Non-Financial Public Sector Revenues (millions) | | $ | 4,273 | | | $ | 5,499 | | | $ | 6,015 | | | $ | 6,268 | | | $ | 6,874 | |

Total Consolidated Non-Financial Public Sector Expenditures (millions) (6) | | $ | 3,624 | | | $ | 4,218 | | | $ | 5,294 | | | $ | 5,806 | | | $ | 6,670 | |

Overall Surplus (Deficit) (millions) | | $ | 88 | | | $ | 683 | | | $ | 98 | | | $ | (253 | ) | | $ | (512 | ) |

As % of Nominal GDP | | | 0.5 | % | | | 3.5 | % | | | 0.4 | % | | | (1.0 | )% | | | (1.9 | )% |

Central Government Surplus (Deficit) (millions) | | $ | 36 | | | $ | 240 | | | $ | 63 | | | $ | (357 | ) | | $ | (683 | ) |

As % of Nominal GDP | | | 0.2 | % | | | 1.2 | % | | | 0.3 | % | | | (1.5 | )% | | | (2.6 | )% |

Public Debt (at December 31): | | | | | | | | | | | | | | | | | | | | |

Internal Debt (millions) | | $ | 2,664 | | | $ | 2,195 | | | $ | 1,960 | | | $ | 822 | | | $ | 1,191 | |

External Debt (millions) | | $ | 7,788 | | | $ | 8,276 | | | $ | 8,477 | | | $ | 10,150 | | | $ | 10,438 | |

Public Debt (as % of Nominal GDP) | | | | | | | | | | | | | | | | | | | | |

Internal Debt | | | 15.5 | % | | | 11.1 | % | | | 8.5 | % | | | 3.4 | % | | | 4.4 | % |

External Debt | | | 45.4 | % | | | 41.8 | % | | | 36.9 | % | | | 42.2 | % | | | 39.0 | % |

Total Public Debt (millions) | | $ | 10,453 | | | $ | 10,471 | | | $ | 10,438 | | | $ | 10,972 | | | $ | 11,629 | |

Trade Data: | | | | | | | | | | | | | | | | | | | | |

Exports (f.o.b.) Goods(7) (millions) | | $ | 8,478 | | | $ | 9,334 | | | $ | 10,323 | | | $ | 11,133 | | | $ | 11,330 | |

Imports (c.i.f.) Goods(7)(millions) | | $ | (10,190 | ) | | $ | (12,524 | ) | | $ | (14,869 | ) | | $ | (13,256 | ) | | $ | (15,946 | ) |

Merchandise Trade Balance (millions) | | $ | (1,712 | ) | | $ | (3,190 | ) | | $ | (4,546 | ) | | $ | (2,123 | ) | | $ | (4,615 | ) |

Current Account Surplus (Deficit) (millions) | | $ | (527 | ) | | $ | (1,407 | ) | | $ | (2,677 | ) | | $ | (43 | ) | | $ | (2,953 | ) |

Overall Balance of Payments Surplus (Deficit)(8)(millions) | | $ | 172 | | | $ | 622 | | | $ | 585 | | | $ | 616 | | | $ | 348 | |

Total Official Reserves (at December 31) (millions) | | $ | 1,328 | | | $ | 1,927 | | | $ | 2,417 | | | $ | 2,753 | | | $ | 2,245 | |

| (1) | All monetary amounts in millions of U.S. dollars at nominal prices, unless otherwise noted. |

| (2) | 2009 GDP figures are preliminary, 2010 GDP figures are estimated. |

| (3) | Constant GDP figures are based on 1996 constant dollars. |

| (4) | Including real estate, public administration, commerce, restaurants and hotels, financial services, the Colón Free Trade Zone (or the “CFZ”), The Panama Canal, transportation and communications, public utilities and other services. |

| (5) | Including mining, manufacturing, agriculture and construction. |

| (6) | Excluding interest on external debt. |

| (8) | Figures have been calculated pursuant to the Version V of the Balance of Payments Manual prepared by the IMF. |

Sources: Directorate of Analysis and Economic Policies, Office of the Comptroller General,Banco Nacional de Panamá (“BNP”) and Ministry of Economy and Finance.

S-7

Summary of the Invitation

This summary highlights information contained elsewhere in this document. It is not complete and may not contain all the information that you should consider before offering Old Bonds in exchange for Reopened Bonds. You should read the entire prospectus supplement, the accompanying prospectus and related letters of transmittal carefully.

| | |

| The Invitation | | Panama is inviting holders of its Old Bonds to submit offers to exchange Old Bonds for newly issued Reopened Bonds and, if Panama determines to pay an additional amount of cash, a U.S. dollar amount of cash as so determined. The Reopened Bonds, if and when issued, will be a further issuance of, will be consolidated to form a single series with, and will be fully fungible with, Panama’s outstanding 6.700% U.S. Dollar-Denominated Amortizing Global Bonds due 2036. |

| |

| Purpose | | The Invitation is part of a broader program of Panama to manage its external liabilities. Panama is conducting a Concurrent Cash Invitation for holders to submit offers to sell Old Bonds for cash but reserves the right to cancel the Concurrent Cash Invitation at any time. The Invitation and Concurrent Cash Invitation are conditioned upon the settlement of an issue of local Panamanian bonds or another financing, in either case, satisfactory to Panama, which we refer to as the “Financing Condition” and which Panama may in its sole discretion waive. The Invitation is not conditioned on the results of the Concurrent Cash Invitation, and the Concurrent Cash Invitation is not conditioned on the results of the Invitation. Any individual Old Bond may be offered for exchange in the Invitation or offered for sale in the Concurrent Cash Invitation, but may not be offered in both invitations. Panama currently expects it will be willing to accept a larger principal amount of Old Bonds for exchange through this Invitation than for sale through the Concurrent Cash Invitation. |

| |

| Consideration to Be Received Pursuant to the Exchange Invitation | | If you offer to exchange Old Bonds pursuant to the Invitation, Panama accepts your offer and the Financing Condition is satisfied or waived, you will receive for each U.S.$1,000 principal amount of Old Bonds you exchange in the Invitation: |

| |

| | • a principal amount of Reopened Bonds equal to the Exchange Ratio; and |

| |

| | • if Panama determines to pay an additional amount of cash, a U.S. dollar amount of cash as so determined, which we refer to as the “Clearing Cash Premium”. |

| |

| | The “Exchange Ratio” will be equal to: |

| |

| | • U.S.$1,000,multiplied by, |

| |

| | • the Old Bond Exchange Value,divided by |

| |

| | • the Reopened Bond Exchange Value. |

S-8

| | |

| | The Exchange Ratio will be rounded to the nearest cent, with U.S.$0.005 to be taken as one cent. |

| |

| | The aggregate principal amount of Reopened Bonds that will be issued to you will be rounded down to the nearest U.S.$1,000 and you will receive a cash payment in respect of the principal amount not issued as a result of that rounding. The cash payment for rounding will be an amount equal to the principal amount not issuedmultiplied by the Reopened Bond Exchange Valuedivided by U.S.$1,000. |

| |

| | You will not receive a payment in respect of any accrued and unpaid interest on your Old Bonds accepted for exchange. You will also not be required to pay an amount equal to the interest accrued since the last interest payment date of the Reopened Bonds issued to you. These amounts have been incorporated into and form part of the calculation of the Exchange Ratio, which will affect the principal amount of Reopened Bonds issued to you. |

| |

| Determination of Old Bond Exchange Value | | The “Old Bond Exchange Value” will be the sum of: |

| |

| | 1. a price per U.S.$1,000 principal amount (rounded to the nearest cent, with U.S.$0.005 to be taken as one cent) intended to result in a yield to maturity on the Expected Settlement Date (as defined below) equal to the sum of: |

| |

| | • the Old Bond UST Benchmark Rate,plus |

| |

| | • the Old Bond Benchmark Spread, |

| |

| | plus |

| |

| | 2. the amount of interest accrued on each U.S.$1,000 principal amount of Old Bonds during the period from and including the most recent interest payment date for the Old Bonds to but excluding the Expected Settlement Date. |

| |

| | The Old Bond Exchange Value will be rounded to the nearest cent, with U.S.$0.005 to be taken as one cent. |

| |

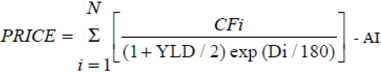

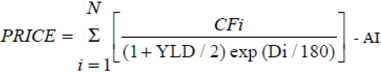

| | The price component of the Old Bond Exchange Value will be calculated in accordance with the methodology specified in Annex A. |

| |

| Determination of Reopened Bond Exchange Value | | The “Reopened Bond Exchange Value” will be the sum of: |

| |

| | 1. a price per U.S.$1,000 principal amount (rounded to the nearest cent, with U.S.$0.005 to be taken as one cent) intended to result in a yield to maturity on the Expected Settlement Date equal to the sum of: |

| |

| | • the Reopened Bond UST Benchmark Rate,plus |

| |

| | • the Reopened Bond Benchmark Spread, |

| | plus |

S-9

| | |

| | 2. the amount of interest accrued on each U.S.$1,000 principal amount of Reopened Bonds during the period from and including the most recent interest payment date for the Reopened Bonds to but excluding the Expected Settlement Date. |

| |

| | The Reopened Bond Exchange Value will be rounded to the nearest cent, with U.S.$0.005 to be taken as one cent. |

| |

| | The price component of the Reopened Bond Exchange Value will be calculated in accordance with the methodology specified in Annex A. |

| |

| Determination of UST Benchmark Rates | | The “Old Bond UST Benchmark Rate” will be the yield to maturity (calculated in accordance with standard market practice) corresponding to the bid-side price, as reported on Bloomberg page PX5 as of approximately 8:30 A.M., New York City time, on the Expiration Date, for the U.S. Treasury 0.250% Note due January 15, 2015. |

| |

| | The “Reopened Bond UST Benchmark Rate” will be the yield to maturity (calculated in accordance with standard market practice) corresponding to the bid-side price, as reported on Bloomberg page PX8 as of approximately 8:30 A.M., New York City time, on the Expiration Date, for the U.S. Treasury 3.125% Bond due November 15, 2041 |

| |

| | We collectively refer to the Old Bond UST Benchmark Rate and the Reopened Bond UST Benchmark rate as the “UST Benchmark Rates”. We will round each UST Benchmark Rate to the nearest 0.001%, with 0.0005% to be taken as 0.001%. |

| |

| Benchmark Spreads | | The “Old Bond Benchmark Spread” will be 1.352%. The “Reopened Bond Benchmark Spread” will be 1.813%. We collectively refer to the Old Bond Benchmark Spread and the Reopened Bond Benchmark Spread as the “Benchmark Spreads”. |

| |

| Announcement of the Exchange Ratio | | At or around 8:30 A.M., New York City time, on the Expiration Date, Panama will determine and announce the UST Benchmark Rates, the Old Bond Exchange Value, the Reopened Bond Exchange Value and the Exchange Ratio. |

| |

| Minimum Clearing Cash Premium | | The Minimum Clearing Cash Premium for each U.S.$1,000 principal amount of Old Bonds accepted for exchange in the Invitation will be zero. |

| |

| Determination and Announcement of Clearing Cash Premium | | The “Clearing Cash Premium” for each U.S.$1,000 principal amount of Old Bonds accepted for exchange in the Invitation will be an amount determined by Panama in its sole discretion pursuant to a modified Dutch auction. Panama will determine and announce the Clearing Cash Premium at or around 3:00 P.M., New York City time, on the business day after the Expiration Date (the “Preliminary Announcement Date”), or as soon as possible thereafter. The Clearing Cash Premium will not be less than the Minimum Clearing Cash Premium of zero. |

S-10

| | |

| Determination and Announcement of Exchange Amount | | Panama, in its sole discretion, will determine and announce the aggregate principal amount of Old Bonds it will accept for exchange in the Invitation, subject to the satisfaction or waiver of the Financing Condition, at or around 3:00 P.M., New York City time, on the Preliminary Announcement Date (or as soon as possible thereafter). We call the aggregate principal amount of Old Bonds that Panama accepts for exchange in the Invitation the “Exchange Amount”. Panama reserves the right in its sole discretion not to accept any exchange offers. |

| |

| Competitive and Noncompetitive Offers | | You may submit: |

| |

| | • one or more competitive offers setting forth the cash payment you would be willing to accept as the Clearing Cash Premium; we call this amount your “Offer Premium”; each Offer Premium must be expressed in increments of U.S.$2.50 per U.S.$1,000 principal amount; or |

| |

| | • one or more noncompetitive offers. You understand that by submitting a non-competitive offer, if your offer is accepted, you have agreed to accept the Clearing Cash Premium established by Panama, which could be zero. If you submit an offer with an Offer Premium equal to the Minimum Clearing Cash Premium of zero, your offer will be deemed to be a noncompetive offer. |

| |

| Acceptance and Proration | | The Invitation will be conducted pursuant to a modified Dutch auction process. Panama may in its discretion reject all offers. Once Panama determines the Clearing Cash Premium and the Exchange Amount, it will accept for exchange all properly submitted: (1) noncompetitive offers; and (2) competitive offers specifying an Offer Premium at or below the Clearing Cash Premium, subject in each case to proration as described under “Terms of the Invitation—Acceptance of Offers; Proration” and subject in all cases to the satisfaction or waiver of the Financing Condition. Noncompetitive offers will not be subject to proration unless Panama accepts, in its sole discretion, less than the total principal amount of noncompetitive offers submitted; in such a case, no competitive offers will be accepted. |

| |

| | You will be entitled to receive the benefit of the Clearing Cash Premium if your offer is accepted by Panama. You will receive this benefit even if you submitted a competitive offer specifying a lower Offer Premium or submitted a noncompetitive offer. |

| |

| Preliminary Announcement Date; Expected Settlement Date | | At or around 3:00 P.M., New York City time, on the Preliminary Announcement Date (or as soon as possible thereafter) Panama will determine, in its sole discretion, and announce the Clearing Cash Premium, the Exchange Amount, information with respect to any proration of offers and the date it then expects to be the settlement date for the Invitation (the “Expected Settlement Date”), which in all cases will be subject to the satisfaction or waiver of the Financing Condition. Panama reserves the right in its sole discretion not to accept any exchange offers. |

S-11

| | |

| | The consideration you receive pursuant to the Invitation will be determined by reference to the Expected Settlement Date. Panama expects the settlement date for the Invitation (the “Settlement Date”) to be the Expected Settlement Date. However, if the actual Settlement Date turns out to be later than the Expected Settlement Date, Panama will not adjust the principal amount of Reopened Bonds or cash (if any) you will receive pursuant to the Invitation. |

| |

| Income Tax Consequences | | Please see the section entitled “Taxation” for important information regarding the possible tax consequences to holders who exchange Old Bonds for Reopened Bonds. |

| |

| Submitting Offers | | If you are a holder and you wish to participate, you or the custodial entity through which you hold your Old Bonds must submit an offer, at or prior to 5:00 P.M., New York City time, on the Expiration Date. Offers may be submitted only by direct participants in DTC, Euroclear or Clearstream, Luxembourg. |

| |

| | If you are a beneficial owner and the custodial entity through which you hold your Old Bonds uses DTC, Euroclear or Clearstream, Luxembourg as a clearing system, then you must follow instructions and deadlines as specified by DTC, Euroclear or Clearstream, Luxembourg, as applicable. |

| |

| Withdrawal | | The right to withdraw an offer will expire upon expiration of the Invitation. |

| |

Extension or Termination of the Invitation | | Panama reserves the right, in its sole discretion, to extend or terminate the Invitation. Any such extension or termination will be announced by Panama by press release issued to PRNewswire (or other appropriate international news service), which we refer to as the “News Service”, by 9:00 A.M., New York City time, on the business day following such termination or extension. The duration of any such extension shall be within Panama’s sole discretion. If Panama extends the Invitation, it will at the time of extension announce the date it then expects to be the Settlement Date. |

| |

| Term of the Invitation; Amendments | | The Invitation will expire at 5:00 P.M., New York City time, on the Expiration Date, unless Panama in its sole discretion extends it or terminates it earlier. |

| |

| | Panama reserves the right, in its sole discretion, to amend the Invitation. Any such amendment will be announced by Panama by press release issued to the News Service by 9:00 A.M., New York City time, on the business day following such amendment. |

| |

| Jurisdictions | | Panama is making the Invitation only in those jurisdictions where it is legal. See “Certain Legal Restrictions”, “Holders’ Representations, Warranties and Undertakings”, “Plan of Distribution” and “Jurisdictional Restrictions”. |

S-12

Securities Offered - The Reopened Bonds

| | |

| Issuer | | Republic of Panama. |

| |

| Securities Offered | | 6.700% U.S. Dollar-Denominated Amortizing Global Bonds due 2036. The Reopened Bonds will be a further issuance of, and will be consolidated to form a single series with, Panama’s existing 6.700% U.S. Dollar-Denominated Amortizing Global Bonds due 2036 (the “bonds”) issued on January 26, 2006 and April 2, 2007, of which U.S.$1,785,297,000 aggregate principal amount is outstanding on the date of this prospectus supplement. The Reopened Bonds will be fully fungible with the previously issued bonds. |

| |

| Maturity date | | January 26, 2036. Panama will pay the principal of the bonds in three equal annual installments on January 26 of each year, commencing on January 26, 2034. |

| |

| Issue date | | The Reopened Bonds will be issued on the Settlement Date, unless the Invitation is terminated in accordance with the terms of the Invitation. |

| |

| Interest rate | | 6.700% per annum, computed on the basis of a 360-day year, consisting of twelve 30-day months. |

| |

| Interest Payment Dates | | Semi-annually on January 26 and July 26 of each year. The first interest payment date for the Reopened Bonds will be July 26, 2012, and such payment will include interest from and including January 26, 2012. |

| |

| Collective Action Clauses | | The outstanding bonds are, and the Reopened Bonds will be, designated Collective Action Securities and, as such, contain provisions regarding acceleration and voting on amendments, modifications, changes and waivers that differ from those applicable to Panama’s outstanding Public External Indebtedness issued prior to January 28, 2004. These provisions are commonly referred to as “collective action clauses”. Under these provisions, Panama may amend certain key terms of the global bonds, including the maturity date, interest rate and other payment terms, with the consent of the holders of not less than 75% of the aggregate principal amount of the outstanding global bonds. See “Description of the Reopened Bonds—Default; Acceleration of Maturity” and “—Amendments and Waivers” in this prospectus supplement and “Collective Action Securities” in the accompanying prospectus. |

| |

| Redemption or Sinking Fund | | The outstanding bonds are not, and the Reopened Bonds will not be, redeemable prior to maturity, except for the regularly scheduled amortization of principal for the bonds. The outstanding bonds do not, and the Reopened Bonds will not, benefit from any sinking fund. |

S-13

| | |

| Status | | The outstanding bonds constitute, and the Reopened Bonds will constitute, direct, unconditional and general obligations of Panama, and the outstanding bonds rank, and the Reopened Bonds will rank, equally in right of payment with all other indebtedness issued in accordance with the fiscal agency agreement and with all other unsecured and unsubordinated Indebtedness of Panama. Panama has pledged its full faith and credit for the due and punctual payment of principal of and interest on the bonds and all other amounts due and payable under the bonds. See “Description of the Reopened Bonds—General Terms of the Reopened Bonds” in this prospectus supplement and “Debt Securities—Status of the Debt Securities” in the accompanying prospectus. |

| |

| Denominations | | The bonds are issuable in minimum denominations of U.S.$1,000 and integral multiples of U.S.$1,000 in excess thereof. |

| |

| Additional Amounts | | Panama will make payments of principal and interest in respect of the bonds without withholding or deduction for or on account of any present or future Panamanian taxes, duties, assessments or governmental charges of whatever nature except as described in “Debt Securities—Tax Withholding; Payment of Additional Amounts” in the accompanying prospectus. |

| |

| Further Issues | | From time to time, without the consent of holders of the bonds, and subject to the required approvals under Panamanian law, Panama may create and issue additional debt securities with the same terms and conditions as those of the bonds (or the same except for the amount of the first interest payment and the issue price), provided that such additional debt securities do not have, for purposes of U.S. federal income taxation (regardless of whether any holders of such debt securities are subject to the U.S. federal tax laws), a greater amount of original issue discount than the bonds have as of the date of issuance of such additional debt securities. See “Description of the Reopened Bonds—Further Issues of the Bonds” in this prospectus supplement and “Collective Action Securities” in the accompanying prospectus. |

| |

| Form | | The bonds are and will be represented by one or more book-entry securities in fully registered form, without coupons, and are and will be registered in the name of, and deposited with a custodian for, The Depository Trust Company (“DTC”). Beneficial interests in the bonds are and will be shown on, and transfer thereof will be effected only through, records maintained by DTC and its participants, unless certain contingencies occur, in which case the bonds will be issued in definitive form. See “Description of the Reopened Bonds—Definitive Bonds” in this prospectus supplement. |

| |

| Fiscal Agent | | The bonds will be issued pursuant to a fiscal agency agreement, dated as of September 26, 1997, as amended as of September 4, 2003, between Panama and The Bank of New York Mellon (as successor to JPMorgan Chase Bank, N.A.), as fiscal agent, paying agent, transfer agent and registrar. |

S-14

| | |

| Taxation | | For a discussion of the Panama and United States tax consequences associated with the bonds, see “Taxation—Panama Taxation” and “—United States Federal Income Taxation” in this prospectus supplement and “Debt Securities—Tax Withholding; Payment of Additional Amounts” in the prospectus. Investors should consult their own tax advisors in determining the non-U.S., U.S. federal, state, local and any other tax consequences to them of the purchase by exchange for Old Bonds and any Clearing Cash Premium, ownership and disposition of the bonds. |

| |

| Payment of Principal and Interest | | Principal of and interest on the bonds and any other amounts due with respect to the bonds will be payable in U.S. dollars or other legal tender of the United States of America. As long as the bonds are in the form of book-entry securities, payment of principal and interest to investors will be made through the facilities of DTC. |

| |

| Negative Pledge | | The bonds will contain certain covenants, including restrictions on the incurrence of certain Liens. See “Debt Securities—Negative Pledge” in the accompanying prospectus. |

| |

| Events of Default | | The bonds will contain events of default the occurrence of which may result in the acceleration of Panama’s obligations under the bonds prior to maturity upon notice by holders of at least 25% of the aggregate principal amount of the outstanding bonds. See “Description of the Reopened Bonds—Default; Acceleration of Maturity” in this prospectus supplement. |

| |

| Governing Law | | The bonds are and will be governed by the laws of the State of New York except with respect to their authorization and execution, which are governed by the laws of the Republic of Panama. |

| |

| Listing | | Application will be made to list the Reopened Bonds on the Luxembourg Stock Exchange and have the Reopened Bonds trade in the Euro MTF market. The outstanding bonds are listed on the Official List of the Luxembourg Stock Exchange and trade in the Euro MTF market. |

| |

| Trading | | The Reopened Bonds will begin trading on a when-and-if-issued basis following the satisfaction or waiver of the Financing Condition and the announcement of the final results of the Invitation. |

| |

| Security Identifiers | | CUSIP: 698299AW4 ISIN: US698299AW45 Common Code: 024213927 |

S-15

Summary Time Schedule for the Invitation

The following summarizes the anticipated time schedule for the Invitation, assuming, among other things, that the Expiration Date is not extended. This summary is qualified in its entirety by, and should be read in conjunction with, the more detailed information appearing elsewhere in this document. All references are to New York City time.

| | |

Date | | Action |

| |

| January 17, 2012 | | Announcement of the terms of the Invitation. |

| |

| January 17, 2012 through January 24, 2012 at 5:00 P.M. | | The Invitation is open during this period. Holders of Old Bonds may submit competitive or noncompetitive offers as described in this document. |

| |

| At or around 8:30 A.M., January 24, 2012 | | Panama determines and announces the UST Benchmark Rates, the Old Bond Exchange Value, the Reopened Bond Exchange Value and the Exchange Ratio. |

| |

| 5:00 P.M., January 24, 2012 | | The Invitation expires, unless Panama extends it or terminates it earlier in its sole discretion. You may no longer submit offers. We refer to this date as the “Expiration Date”. Withdrawal rights expire at 5:00 P.M. on the Expiration Date. |

| |

| At or around 3:00 P.M., January 25, 2012 | | If Panama determines to accept any exchange offers, Panama determines, in its sole discretion, and announces the Clearing Cash Premium (if any), the Exchange Amount, information with respect to any proration of offers and the Expected Settlement Date, which in all cases will be subject to the satisfaction or waiver of the Financing Condition. We refer to this date as the “Preliminary Announcement Date”. |

| |

| January 30, 2012 | | Panama expects to settle a new issue of local Panamanian bonds (or other financing). Panama issues a press release confirming the Financing Condition has been met or if it has not been met, announcing whether it will waive the Financing Condition with respect to the Invitation. We refer to this date as the “Final Announcement Date”. |

| |

| February 1, 2012 | | Settlement of the Invitation. We refer to the date on which the Invitation settles as the “Settlement Date”. |

S-16

RISK FACTORS

This section describes certain risks associated with the Invitation. You should consult your financial and legal advisors about the risk of participating in the Inviation. Panama disclaims any responsibility for advising you on these matters.

Risk Factors Relating to the Invitation

If the invitation is completed, the trading market for the remaining Old Bonds may become illiquid, which may adversely affect the market value of the Old Bonds.

Old Bonds not exchanged or purchased pursuant to the Invitation or Concurrent Cash Invitation will remain outstanding. The exchange or purchase of Old Bonds pursuant to the Invitation and Concurrent Cash Invitation and the cancellation of such Old Bonds will reduce the aggregate principal amount of Old Bonds that otherwise might trade in the market, which could adversely affect the liquidity and market value of any Old Bonds not exchanged or purchased. See “Terms of the Invitation—Market for the Old Bonds and Reopened Bonds”.

If a holder’s exchange offer is accepted, such holder is likely to receive a smaller aggregate principal amount of Reopened Bonds than the aggregate principal amount of Old Bonds accepted for exchange.

In accordance with the prevailing market prices of the Old Bonds and the Reopened Bonds, as illustrated in the hypothetical example in Annex B, a holder whose tendered Old Bonds are accepted by Panama for exchange is expected to receive a smaller aggregate principal amount of Reopened Bonds in exchange for such Old Bonds.

Risk Factors Relating to the Reopened Bonds

The price at which the Reopened Bonds will trade in the secondary market is uncertain.

Application will be made to have the Reopened Bonds listed on the Luxembourg Stock Exchange and admitted to trading on the Euro MTF Market of the Luxembourg Stock Exchange. However, no assurance can be given as to the liquidity of the trading market for the Reopened Bonds and the price at which the Reopened Bonds may trade in the secondary market from time to time. In addition, Government related entities in Panama may, from time to time, purchase a portion of the Reopened Bonds, further reducing the amount of Reopened Bonds outstanding and reducing the liquidity of the secondary markets for the Reopened Bonds.

The Reopened Bonds will contain provisions that permit Panama to amend the payment terms without the consent of all holders.

The Reopened Bonds will contain provisions regarding acceleration and voting on future amendments, modifications and waivers, which are commonly referred to as “collective action clauses”. Under these provisions, certain key terms of the Reopened Bonds may be amended, including the maturity date, interest rate and other payment terms, with the consent of the holders of 75% of the aggregate principal amount of the outstanding Reopened Bonds. See “Description of the Global Bonds—Amendments and Waivers” in this prospectus supplement and “Collective Action Securities” in the accompanying prospectus.

Risk Factors Relating to Panama

Panama is a foreign sovereign state and accordingly it may be difficult to obtain or enforce judgments against it.

Panama is a foreign sovereign state. As a result, it may be difficult or impossible for investors to obtain or enforce judgments against Panama, whether in an investor’s own jurisdiction or elsewhere. See “Jurisdiction and Enforcement” in the accompanying prospectus.

Certain economic risks are inherent in any investment in an emerging market country such as Panama.

S-17

Investing in an emerging market country such as Panama carries economic risks. These risks include many different factors that may affect Panama’s economic results, including the following:

| | • | | interest rates in the United States and financial markets outside Panama; |

| | • | | changes in economic or tax policies; |

| | • | | the imposition of trade barriers; |

| | • | | general economic and business conditions in Panama and the global economy; |

| | • | | the ability of the Panama Canal to remain a competitive route for inter-oceanic transportation; |

| | • | | the ability of Panama to effect key economic reforms; and |

| | • | | the impact of hostilities or political unrest in other countries that may affect international trade, commodity prices and the global economy. |

Any of these factors, as well as volatility in the markets for securities similar to the Reopened Bonds, may adversely affect the price or liquidity of, and trading markets for, the Reopened Bonds. See “Forward-looking Statements” in this prospectus supplement.

Panama’s U.S. dollar monetary arrangements impose constraints on fiscal and monetary policies and on its ability to finance deficits.

Public finance in Panama is heavily influenced by the U.S. dollar-based monetary arrangements in place since 1904. Panama has used the U.S. dollar as its legal tender since shortly after gaining its independence. The national currency, the Balboa, is used primarily as a unit of account linked to the U.S. dollar at a ratio of one dollar per one Balboa. The Government does not print paper currency, although a limited amount of coinage is minted. Although the absence of a printed national currency and the general absence of domestic budgetary financing through the banking system (other than from 1987 to 1989) reduce the risk of runaway inflation, they do impose constraints on fiscal and monetary policy, particularly for responding to external shocks, that are not present in countries that can finance their deficits by printing local currency. Panama’s non-financial public sector balance for 2007 registered a surplus of approximately $683.0 million (or 3.5% of nominal GDP). Panama’s non-financial public sector balance for 2008 registered a surplus of approximately $97.8 million (or 0.4% of nominal GDP). Panama’s non-financial public sector balance for 2009 registered a deficit of approximately $252.6 million (or 1.0% of estimated nominal GDP). In 2010, Panama’s non-financial public sector balance registered a deficit of $511.7 million (or 1.9% of estimated nominal GDP), an increase from the deficit of $252.6 million (or 1.0% of estimated nominal GDP) in 2009. As of September 30, 2011, Panama’s non-financial public sector balance registered a deficit of $1.1 billion (or 3.6% of estimated nominal GDP). See “Recent Developments—The Economy” in this prospectus supplement. Future deficits could result in an increase in Panama’s debt, which could in turn have an adverse effect on Panama’s ability to service its debt.

An adverse change in Panama’s debt-to-GDP ratio could increase the burden of servicing Panama’s debt.

Panama’s ratio of total public sector debt to GDP was 52.9% in 2007. In 2008, Panama’s ratio of total public sector debt to GDP was 45.4%. In 2009, the ratio of total public sector debt to GDP was 45.6%, and in 2010, the ratio of total public sector debt to GDP was estimated to be 43.7%. Any significant increase in Panama’s public sector debt-to-GDP ratio could have an adverse effect on Panama’s ability to service its debt. See “Recent Developments—The Economy” in this prospectus supplement.

Panama’s economy remains vulnerable to external shocks, including the global economic crisis that began in 2008 and those that could be caused by future significant economic difficulties of its major regional trading partners or by more general “contagion” effects, which could have a material adverse effect on Panama’s economic growth and its ability to service its public debt.

Emerging-market investment generally poses a greater degree of risk than investment in more mature market economies because the economies in the developing world are more susceptible to destabilization resulting from domestic and international developments.

S-18

A significant decline in the economic growth of any of Panama’s major trading partners could adversely affect Panama’s economic growth. In addition, because international investors’ reactions to the events occurring in one emerging market country sometimes appear to demonstrate a “contagion” effect, in which an entire region or class of investment is disfavored by international investors, Panama could be adversely affected by negative economic or financial developments in other emerging market countries.

Economic growth slowed for fiscal year 2009, with real GDP growth (based on preliminary figures) of 3.2% for 2009 as compared to real GDP growth of 10.1% for 2008, due in part to the impact of the global economic crisis on the Panama economy. The United States, Panama’s main trading partner and the main source of customers of the Panama Canal, experienced a marked deceleration of economic activity during this time. In 2010, Panama’s economy measured by estimated real GDP grew 7.5% to U.S.$26.8 billion. Preliminary figures for the first nine months of 2011 show estimated real GDP growth of 10.4%.

There can be no assurance that any crises such as those described above or similar events will not negatively affect investor confidence in emerging markets or the economies of the principal countries in Latin America, including Panama. In addition, there can be no assurance that these events will not adversely affect Panama’s economy, its ability to raise funding in the external debt markets in the future or its ability to service its public debt.

S-19

INCORPORATION BY REFERENCE

The SEC allows Panama to incorporate by reference some information that Panama files with the SEC. Panama can disclose important information to you by referring you to those documents. Panama’s Commission filings are available to the public from the SEC’s website at http://www.sec.gov. Exhibit D to Panama’s annual report on Form 18-K for the year ended December 31, 2010, filed with the SEC on October 3, 2011, as amended by Amendment No. 1 thereto, filed on Form 18-K/A with the SEC on November 18, 2011, as such report on Form 18-K may be further amended from time to time, is considered part of and incorporated by reference in this prospectus supplement and the accompanying prospectus. You may also obtain copies of documents incorporated by reference, free of charge, at the office of the Luxembourg paying agent specified on the inside back cover of this prospectus supplement or from the website of the Luxembourg Stock Exchange at http://www.bourse.lu.

For purposes of Commission Regulation (EC) No. 809/2004, any information not listed in the cross reference table but included in the documents incorporated by reference is given for information purposes only:

| | |

| EC No. 809/2004, as amended by EC No. 1289/2008 Item | | Annual Report on Form 18-K for 2010 |

| |

| Issuer’s position within the governmental framework | | “The Republic of Panama —Form of Government and Political Parties” on pages D-11 to D-12 of Exhibit D |

| |

| Geographic location and legal form of the issuer | | “The Republic of Panama” on pages D-10 to D-13 of Exhibit D |

| |

| Recent events relevant to the issuer’s solvency | | “The Panama Economy—Reforms and Development Programs” and “—Economic Performance—2006 Through 2010” on pages D-19 to D-26 of Exhibit D |

| |

| Structure of the issuer’s economy | | “Structure of the Panama Economy” on pages D-27 to D-34, “The Panama Canal” on pages D-35 to D-39, “The Colón Free Zone” on page D-40 and “Financial System” on pages D-52 to D-58 of Exhibit D |

| |

| Gross domestic product | | “The Panama Economy—Gross Domestic Product” on pages D-23 to D-26 of Exhibit D |

| |

| Panama’s political system and government | | “The Republic of Panama —Form of Government and Political Parties” on pages D-11 to D-12 of Exhibit D |

| |

| Tax and budgetary systems of the issuer | | “Public Finance—Central Government Budget” and “—Taxation” on pages D-46 to D-47 and D-47 to D-48 of Exhibit D |

| |

| Gross public debt of the issuer | | “Public Sector Debt” on pages D-66 to D-74 of Exhibit D |

| |

| Foreign trade and balance of payments | | “Foreign Trade and Balance of Payments” on pages D-59 to D-65 of Exhibit D |

| |

| Foreign exchange reserves | | “Public Finance—International Reserves” on pages D-50 to D-51 of Exhibit D |

| |

| Financial position and resources | | “Public Finance” on pages D-46 to D-51 of Exhibit D |

| |

Income and expenditure figures and 2010 Budget and 2011 Budget | | “Public Finance—Central Government Budget” on pages D-46 to D-47 of Exhibit D |

S-20

RECENT DEVELOPMENTS

The information included in this section supplements the information about Panama contained in Panama’s annual report for the year ended December 31, 2010 on Form 18-K filed with the SEC on October 3, 2011, as amended by Amendment No. 1 thereto, filed on Form 18-K/A with the SEC on November 18, 2011. To the extent the information in this section is inconsistent with the information contained in such annual report, as amended, the information in this section replaces such information. No significant changes to the information provided in Panama’s annual report and its amendment for the year ended December 31, 2010 have occurred. Initially capitalized terms used in this section have the respective meaning assigned to those terms in such annual report.

Recent Government Actions

On August 30, 2011, President Ricardo Martinelli dismissed Vice President Juan Carlos Varela as Minister of Foreign Affairs, prompting members of Mr. Varela’s party to resign from senior governmental positions and resulting in the termination of the coalition between the President’s party (Cambio Democrático(CD)) and that of the Vice President (Partido Panameñista (PPA)). In an address to the nation on September 1, 2011, President Martinelli explained his decision, stating that the Minister of Foreign Affairs should be a full-time position, and that Mr. Varela had neglected the duties of his office as a Presidential candidate for the 2014 elections. Mr. Varela, who will remain in his elected position as Vice President of the country, is also the President of PPA. The officials from his party who resigned include, most notably, Alberto Vallarino, Minister of Economy and Finance, and Carlos Duboy, Minister of Housing. President Martinelli and the remainder of his Cabinet belong to CD. President Martinelli and his senior economic advisors, including then Vice Minister of Economy Frank De Lima, indicated that the political changes will not alter in any way the course of economic and fiscal policy that has been under way since the beginning of the Martinelli administration in July 2009. Subsequently, on October 6, 2011, Vice Minister De Lima was named Minister of Economy and Finance. Mahesh Khemlani moved from his position as Public Credit Director of the Ministry of Economy and Finance to the position of Vice Minister of Finance on September 1, 2011, replacing former Vice Minister Dulcidio de la Guardia, whose previously planned return to the private sector was unrelated to the political developments mentioned above. On October 10, 2011, following the appointment of Mr. De Lima as Minister of Economy and Finance, Omar Castillo was named Vice Minister of Economy.

During the first quarter of 2011 the Government created an autonomous public entity, referred to as theEmpresa Nacional de Autopistas (“ENA”), in order to provide the financing for, and to acquire ownership of, theCorredor Sur andCorredor Norte toll highways in Panama. The Republic subsequently decided to separate the acquisition of theCorredor SurandCorredor Norte toll roads into two stand-alone transactions. On August 1, 2011 Ingenieros Civiles Asociados(“ICA”), the Mexican company that owned and operated theCorredor Sur, and ENA, signed a Share Purchase Agreement for ENA to purchase all of ICA’s shares in ICA Panamá for $420.0 million dollars. On August 12, 2011, ENA acquired theCorredor Sur, and on August 18, 2011, ENA successfully issued and placed $395.0 million dollars in bonds to finance the acquisition of the toll road. The Government contributed $50.0 million to ENA in connection with the purchase. The transaction was finalized on August 24, 2011. The Government intends to conclude theCorredor Norte transaction during the first quarter of 2012.

In March 2010, Law No. 8 of 2010 was ratified, modifying the Panamanian Fiscal Code. This law created the Administrative Tax Tribunal, increased the value-added tax, known as ITBMS, for the first time since it was established in 1976, from 5% to 7% and reduced the corporate income tax rate from 30% to 27.5%, effective as of January 1, 2010, with a further reduction, subject to certain exceptions, to 25%, beginning January 1, 2011. As a result of the modifications to the Fiscal Code, the Republic received approximately $6.8 billion in revenue for 2010, compared to $6.3 billion in 2009, representing an increase of approximately $606.1 million, or 9.7%. The Fiscal Code was again amended on June 30, 2010, pursuant to Law No. 33 of 2010, which added an additional chapter to the Fiscal Code to cover double taxation treaties so that Panamanian taxpayers can invoke a clause in the treaty itself, as well as refer to the new chapter of the Fiscal Code, in order to avoid paying taxes to two countries on the same transaction or activity. On September 27, 2011 Law No. 72 of 2011 was ratified, modifying other tax measures. The new law makes mandatory the issuance of invoices for all sales transactions, and establishes what kind of information must be included in such invoices.

S-21

Law No. 72 of 2011 also modifies Law No. 34 of 2008, which established the Social and Fiscal Responsibility Regime, in order to promote sound fiscal policies and management. The Social and Fiscal Responsibility Regime requires any new government to present, during the first six months of its administration, a multi-year social strategy, a five-year financial plan and the macroeconomic criteria to manage public expenditures and to incentivize current savings. By means of adding a definition for “turn key projects” and “deferred payments” Law No. 72 limits the expenditures on these projects, which now cannot exceed 20% of the total investment expenditures of the nonfinancial public sector for any given fiscal year.

The Economy

The National Assembly of the Republic of Panama (the “Assembly”) approved Panama’s 2012 budget on October 11, 2011. The 2012 budget contemplates total expenditures of $14.5 billion, with budget estimates based on an anticipated 10.8% growth in nominal GDP, and an anticipated consolidated non-financial public sector deficit of approximately $647.6 million (or approximately 1.9% of estimated nominal GDP) for 2012.

In the first nine months of 2011, Panama’s gross domestic product (“GDP”) registered an estimated real increase of 10.4% compared to the same period of 2010. The mining sector grew an estimated 19% percent in the first nine months of 2011, compared to the same period of 2010 primarily due to a growth in the demand for basic materials used in construction. Manufacturing activity increased an estimated 2.3% in the first nine months of 2011 compared to the same period of 2010 due in part to the combination of strong growth in sectors such as production of cement, lime and plaster, and the decrease in other sectors such as fish and fish products processing and production of dairy products. In the first nine months of 2011, the construction sector grew by an estimated 23.6% compared to the same period of 2010 due to public and private investment in civil engineering and non-residential projects, including, among others, the expansion of the Panama Canal, the Panama Bay Sanitation Project and the Government’s expansion and rehabilitation of road infrastructure. The transportation and communications sector grew an estimated 10.8% in the first nine months of 2011 compared to the same period of 2010 primarily due to the competitive sector’s activities in telecommunications, port services, and air transportation. The financial intermediation sector grew an estimated 7.0% in the first nine months of 2011 compared to the same period of 2010 primarily due to the performance of the international banking center caused by an increase in internal and external credit. The agriculture sector increased an estimated 3.2% in the first nine months of 2011 compared to the same period of 2010 primarily due to crops such as rice and corn, as well as an increase in cultivated and harvested areas. The fisheries sector decreased an estimated 15.4% in the first nine months of 2011 compared to the same period of 2010 due to a decrease in the capture and export of marine products, which was slightly offset by an increase in shrimp exports. Commerce increased an estimated 21.2% in the first nine months of 2011 compared to the same period of 2010 due in part to higher sales of fuel, agricultural raw materials, food, drinks and tobacco. The hotels and restaurant sector increased an estimated 7.4% in the first nine months of 2011 compared to the same period of 2010 primarily due to an increase in the number of foreign tourists. The real estate sector increased an estimated 6.5% in the first nine months of 2011 compared to the same period of 2010 primarily due to an increase in offers of existing homes and market real estate activities.

Public Debt

As of November 30, 2011, Panama’s public sector external debt totaled approximately $10.8 billion, representing an increase of $336.5 million since December 31, 2010. Panama’s total public sector debt as of November 30, 2011 was approximately $12.9 billion, representing an increase of $1.3 billion since December 31, 2010. As of November 30, 2011, approximately 78.8% of the total public sector external debt was owed to commercial lenders and bondholders, with 17.3% owed to multilateral institutions and 3.6% owed to bilateral lenders. Since November 30, 2011, there has been no additional external debt issued by the Republic.

In an effort to promote the development of Panama’s capital markets, the Government held twelve auctions as part of its Treasury Bill issuances program from January 19, 2010 to December 14, 2010. During that time, Panama issued $387.1 million of zero-coupon Treasury Bills with short-term maturities of one year or less in Panama’s capital markets. As of December 31, 2010, outstanding Treasury Bills amounted to $230.0 million. The Government continued the program of Treasury Bill issuances in 2011 with ten auctions from January 18, 2011 to November 30, 2011. During that time, Panama issued $367.6 million of zero-coupon Treasury Bills with short-term

S-22

maturities of one year or less in Panama’s capital markets, including a direct placement on October 27, 2011 with the National Bank of Panama for $45 million. The Treasury Notes program had been suspended after the issuance of September 6, 2005; however, the Government reinstated the Treasury Notes issuance program in 2010 pursuant to Cabinet Decree No. 4 dated January 26, 2010 authorizing the issuance of local Treasury Notes in a principal amount up to $600 million. Between February 4, 2010 and December 14, 2010, the Government issued $466.2 million of Treasury Notes in eleven public auctions plus $100.0 million in a direct auction. As of December 31, 2010 outstanding Treasury Notes amounted to $1,133.0 million.

The Republic has improved its debt-to-GDP ratio in the past five years from 61.0% as of December 31, 2006 to a preliminary 43.7% as of December 31, 2010.

International Trade

On June 7, 2011, after signing a tax information exchange agreement with France, Panama moved to the OECD’s list of jurisdictions considered to have substantially implemented the OECD’s tax reporting standards. The Panamanian Assembly, through Law 78 of 2011, published on October 19, 2011, ratified the Treaty between the government of the Republic of Panama and the government of the Republic of France to avoid double taxation and prevent tax evasion regarding income tax and its protocol.

The Panama Canal

During the Panama Canal Authority’s fiscal year ended September 30, 2011, cargo that passed through the Canal increased 7.1% to 321.2 million Panama Canal Universal Measurement System (PC/UMS) tons from the 299.8 million PC/UMS tons that passed through the Canal during its fiscal year ended September 30, 2010. This figure sets a historic high, exceeding the previous record of 312.9 million PC/UMS tons achieved during its fiscal year ended September 30, 2007. For the fiscal year ended September 30, 2011 toll revenue totaled approximately $1.7 billion, representing an increase of 16.7% as compared to the fiscal year ended September 30, 2010, mainly due to a toll rate increase and the increase in the number of ships in transit.

S-23

TERMS OF THE INVITATION

Purpose of the Invitation

Panama is inviting holders of Old Bonds to submit, on the terms and subject to the conditions of this document and the prospectus, offers to exchange Old Bonds for Reopened Bonds and, if Panama determines to pay an additional amount of cash, a U.S. dollar amount of cash as so determined. Panama is conducting a Concurrent Cash Invitation for holders to submit offers to sell Old Bonds for cash, but reserves the right to cancel the Concurrent Cash Invitation at any time. The Invitation and the Concurrent Cash Invitation are conditioned upon settlement of an issue of local Panamanian bonds or another financing, in each case, satisfactory to Panama, which we refer to as the “Financing Condition”. Panama may waive the Financing Condition in its sole discretion at or prior to the Final Announcement Date. The Invitation is not conditioned on the results of the Concurrent Cash Invitation, and the Concurrent Cash Invitation is not conditioned on the results of the Invitation. Any individual Old Bond may be offered for exchange in the Invitation or offered for sale in the Concurrent Cash Invitation, but may not be offered in both invitations. Panama currently expects it will be willing to accept a larger principal amount of Old Bonds for exchange through this Invitation than for sale through the Concurrent Cash Invitation.

The Invitation and Concurrent Cash Invitation are both part of a broader program of Panama to manage its external liabilities.

Consideration to Be Received Pursuant to Exchange Invitation

If you offer to exchange Old Bonds pursuant to the Invitation, Panama accepts your offer and the Financing Condition is satisfied or waived, you will receive for each U.S.$1,000 principal amount of Old Bonds you exchange in the Invitation:

| | • | | a principal amount of Reopened Bonds equal to the Exchange Ratio; and |

| | • | | if Panama determines to pay an additional amount of cash, a cash payment in U.S. dollars as so determined, which we refer to as the “Clearing Cash Premium”. |

Calculation of Exchange Ratio, Old Bond Exchange Value and Reopened Bond Exchange Value

The “Exchange Ratio” will be equal to:

| | • | | U.S.$1,000,multiplied by, |

| | • | | the Old Bond Exchange Value,divided by |

| | • | | the Reopened Bond Exchange Value. |

The Exchange Ratio will be rounded to the nearest cent, with U.S.$ 0.005 to be taken as one cent. The aggregate principal amount of Reopened Bonds that will be issued to you will be rounded down to the nearest U.S.$1,000 and you will receive a cash payment in respect of the principal amount not issued as a result of that rounding. The cash payment for rounding will be an amount equal to the principal amount not issuedmultiplied by the Reopened Bond Exchange Valuedivided by U.S.$1,000.