- BANF Dashboard

- Financials

- Filings

-

Holdings

-

Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

BancFirst (BANF) 8-KRegulation FD Disclosure

Filed: 24 Nov 21, 10:30am

Table of Contents

| Page |

|

|

About the Company................................................................................................... | 1 |

|

|

Awards and Recognition.......................................................................................... | 2 |

|

|

Sound Governance..................................................................................................... | 3 |

|

|

Developing Social and Human Capital...................................................................... | 6 |

|

|

Managing Environmental Risks................................................................................ | 16 |

|

|

About This Report

This report provides a comprehensive review of how BancFirst Corporation is addressing sustainability, including environmental, social and governance (ESG) and other matters important to our business, as well as to our various stakeholders and the communities we serve. Throughout the report we refer to other sources for more information, including our annual report, our proxy statement, and our investor relations website. The information presented is as of or proximate to September 30, 2021, unless otherwise stated.

About the Company

History

The Company was organized in 1984, and has grown from a multibank holding company with $450 million in assets serving seven communities, to a regional financial holding company with over $11 billion in assets serving 60 communities in Oklahoma and Texas. We operate as a “super community bank”, managing our community banking offices on a decentralized basis, which permits them to be responsive to local customer needs. Its two subsidiary banks are BancFirst in Oklahoma and Pegasus Bank in Dallas, Texas. Our strategy focuses on providing a full range of banking services to retail customers and small to medium-sized businesses. More information about the Company’s business and its strategies can be found in its Annual Report.

Core Values

Our core values govern how we do business and also inform our approach to sustainability.

Sustainability

The essence of BancFirst Corporation’s mission statement is creating long-term value. We view “sustainability” as the activities that maintain or enhance the ability of the Company to create enterprise value over the long-term. Sustainability is accomplished through:

How the Company addresses each of these elements of sustainability is presented in the remainder of this report.

1

Awards and Recognition

BancFirst Corporation has received numerous awards and recognition, demonstrating its financial strength, consistent performance, service to its customers and communities, and commitment to building long-term value.

2

Sound Governance

Overview

Sound governance is essential to long-term sustainable growth. The Company complies with all federal and state laws regulating corporate governance and disclosures, as well as various governance best practices. This report is not a comprehensive review of our corporate governance. Disclosures regarding governance matters required by SEC rules and regulations, the Sarbanes-Oxley Act of 2002, and the Nasdaq Stock Market rules are included in the Proxy Statement for our Annual Meeting of Shareholders issued April 7, 2021 and our Annual Report on Form 10-K for the year ended December 31, 2020. Additional information regarding corporate governance is available on the Company’s investor relations page of its website at www.BancFirst.bank/Investor-Relations. This report addresses other aspects of governance not directly required by laws and regulations, but are nonetheless key elements of governance related to sustainability.

Sustainability Committee

The Company has formed a Sustainability Committee comprised of executive risk managers, the CEO and an independent director. Its purpose is to develop a strategy for enhancing sustainability and to incorporate environmental, social and governance factors into the Company’s business processes. The Sustainability Committee reports to the Board of Directors.

Board Composition

The Company’s Proxy Statement provides detailed information regarding its Board of Directors, including:

Business Ethics

Our core value of Integrity encompasses the business ethics under which we operate. The Company’s Code of Conduct addresses various ethical and legal matters, and is available on the Investor Relations page of our website. All directors, officers and employees are required to confirm in writing that they have read, understand, and agree to comply with the Code. In addition, our Corporate Policies address certain ethical and legal matters, such as:

3

Legal Proceedings and Enforcement Actions

The Company is a defendant in legal actions arising from normal business activities. The amount of losses and legal fees that the Company has incurred has been immaterial. Most of the litigation has related to lending, largely arising from collection counterclaims, and other transactional disputes with individual customers. The Company has never been the subject of an enforcement action by a governmental regulatory authority.

Whistleblower Policies and Procedures

The Company’s Code of Conduct provides for a whistleblower program using EthicsPoint, a comprehensive, anonymous Internet and telephone based reporting system that allows management and employees to work together to address financial reporting issues, fraud, inappropriate conduct, harassment, discrimination, or other matters in the workplace. All EthicsPoint reports are reviewed, investigated, and addressed, as applicable, by the Company’s Audit Committee Chairman, Chief Internal

Auditor, Executive Chairman, Chief Executive Officer, or Director of Human Resources. Retaliation or harassment against any reporting person through EthicsPoint, or any whistleblower to a regulatory agency, is explicitly prohibited. Any incidents of potential retaliation are to be reported directly to the Director of Human Resources for investigation and corrective action, in order to protect the confidentiality of the reporting person. This program is intended to comply with the requirements of the Sarbanes-Oxley Act and the Consumer Financial Protection Act. The Company has not been accused of any violations of whistleblower regulations.

4

The telephone number and Internet address to access the EthicsPoint system are provided in the Code of Conduct, the Employee Handbook and on the Company’s intranet. Instructions for how to file a report, and questions and answers are also provided to employees on the intranet.

Shareholder Participation/Voting

To facilitate shareholder participation in meetings, the Company provides for voting on proxy resolutions by mail, internet, and telephone. In addition, shareholders may participate in the meetings in person or by conference call. Proxy statements and voting instructions are provided by mail, on the Company’s investor relations website, or by electronic delivery if requested by the shareholder. Shareholders may submit proposals in advance to be considered for inclusion in the Annual Meeting.

The Company has only common stock outstanding and each share is entitled to one vote. It has Senior Preferred Stock that is authorized that may be issued with voting rights. There are no existing voting right restrictions.

Compliance

As a publicly traded financial holding company, BancFirst Corporation operates in a highly regulated environment. Compliance programs, procedures, and training are necessary for sustaining its legal, regulatory and ethical compliance. Each year, banking regulatory agencies conduct examinations that assess the Company’s governance processes and compliance programs. The more significant elements of its compliance processes are summarized below.

5

Developing Social and Human Capital

Overview

Developing social and human capital enhances sustainability. We develop social and human capital through:

Community Leadership and Investment

Community Leadership is one of our core values. Our success depends on the growth and development of our communities. Employees are encouraged to act as effective and responsible citizens by taking part in community and political activities that enhance the quality of life. Examples of these community development activities include:

The Company supports and funds, on an ongoing long-term basis, the following history, arts and educational programs to enrich the lives of students in our communities:

6

Access to Financial Services

The Company provides a wide range of financial services that are available for access by all persons in its communities. Its extensive branch network and other delivery systems help ensure that its products and services are available to all segments of its communities, including low to moderate income areas. According to a 2017 FDIC survey, within the Company’s primary market area of Oklahoma, 7.3% of the households were unbanked and 21.7% of the households were considered underbanked. Several of the Company’s delivery systems, products and services are available to benefit these households, including:

Deposit Services

The Company has a leading market share of deposit customers in Oklahoma. Below is a summary of deposit accounts for individuals and small businesses.

| Number of Accounts | Balance |

Personal |

|

|

Demand Deposit | 256,650 | $1,914,516,000 |

Savings | 91,069 | $994,916,000 |

Treasury Fund | 20,183 | $1,656,171,000 |

Small Business |

|

|

Demand Deposit | 38,564 | $805,944,000 |

Savings | 2,205 | $51,141,000 |

7

Over 86% of the Company’s personal demand deposit accounts are no cost accounts that provide core banking services without extra fees or minimum balance requirements.

| Number of Accounts | Balance |

No Cost Accounts | 222,140 | $1,258,819,000 |

Credit Services

The Company is committed to meeting the credit needs of all segments of the communities that it serves. We provide a wide range of credit products to individuals and small businesses, as well as corporate customers. Below is a summary of BancFirst’s loans by broad segment (excluding real estate loans).

| Number of Accounts | Balance |

Personal | 29,522 | $382,615,000 |

Small business | 14,563 | $765,918,000 |

Corporate | 674 | $1,071,804,000 |

A significant number of the Company’s loans are made to borrowers in low to moderate income (LMI) areas. For 2020:

In addition to the lending activities described under its Community Reinvestment Act program below, the Company has the following special programs to ensure access to credit services for potentially underserved segments in its markets.

BancFirst pursues outreach programs in its larger communities to better serve majority minority areas, such as:

BancFirst also maintains a unique Flexible Home Loan Program (FHLP) that benefits minority loan applicants who do not otherwise meet the bank’s standards of creditworthiness. The FHLP is authorized by Regulation B, which is enforced by the Consumer Financial Protection Bureau. Applicants who meet the criteria of the program have their applications forwarded to FHLP underwriting for consideration

under the more flexible terms of the program. During 2020, 18% of the loans submitted to the program were subsequently approved under the more accommodative terms of the FHLP. The approval percentage was 22% for the first nine months of 2021. Since inception in 2011, a total of 264 loans have been approved under the program.

8

Pegasus Bank is implementing a program to develop consumer and small business credit products to deliver to minorities and low-to-moderate income borrowers within its market area, by partnering with community service groups targeting those market segments.

Community Reinvestment Act Performance

BancFirst is subject to the Community Reinvestment Act (CRA). The most recent CRA examination was conducted by the FDIC in 2021. The examination and the resulting Performance Evaluation cover three tests: Lending Test, Investment Test, and Service Test. These three tests were evaluated for performance since the previous examination in 2018. The Lending Test was rated High Satisfactory, and overall performance was rated Satisfactory. Also, the examination did not identify any evidence of discriminatory or other illegal credit practices for the bank as a whole. Overall conclusions and significant factors for the three tests were:

The results of CRA examinations are considered in enhancing our strategies to further develop or expand products and services, and to improve access to financial services by all persons in our communities.

Consumer Protection

The Company is committed to fair and ethical conduct in serving its customers. Its core value of Customer Care encompasses issues of customer and product responsibility, sales practices, marketing

and the treatment of customers in financial distress. The Company maintains a Product Development group that oversees new product and service offerings, and evaluates the related customer, marketing, sales, and compliance considerations. This group is also responsible for:

9

As a financial holding company, the Company is subject to various consumer protection laws and regulations, and is examined for compliance by the Federal Reserve and the FDIC. Responsibility for maintaining consumer compliance is assigned to lending and operational compliance officers. Our Corporate Policies cover many aspects of consumer protection and compliance, such as:

The Company is subject to the Truth in Savings Act (Regulation DD), the purpose of which is to enable consumers to make informed decisions about bank deposit services. It requires banks to provide consumers detailed disclosures regarding terms and costs of deposit accounts, and imposes requirements for advertisements. The Company is in full compliance with Regulation DD.

To ensure adherence to the policies, laws and regulations listed above, the Asset Quality and Internal Audit Departments conduct periodic compliance audits. The Company is also examined by banking regulatory agencies for consumer compliance.

The Company is also committed to maintaining responsible sales practices, and has several measures to ensure that unethical or inappropriate behavior is discouraged or prevented, such as:

10

To assist customers who incur significant overdraft fees, we notify them of less costly services that are available and provide financial education resources. Customers who continue to experience a high level of overdrafts may also be offered the assistance of a banker and a plan to keep the account active, while suspending overdrafts and repaying the overdrawn position over time.

Customers who become past due on their home loans are provided with homeowner counseling resources. Furthermore, past due notices provide information to borrowers who have protections under the Servicemembers Civil Relief Act.

Pandemic Response

The COVID-19 pandemic caused financial distress for many of our customers, including families and small business. In response, the Company took several proactive steps to provide relief to our customers, such as:

Privacy and Information Security

Ensuring the privacy and security of both our customers’ and the Company’s information is essential to maintaining confidence in our Company, and our reputation. We have strict policies regarding privacy, and we maintain a robust Information Security Program. The Program follows the guidelines of section 501(b) of the Gramm-Leach-Bliley Act and sections 621 and 628 of the Fair Credit Reporting Act. The Company also maintains an Identity Theft Program that complies with sections 114 and 315 of the Fair and Accurate Credit Transaction Act (FACT Act). In addition, we provide resources on our website for our customers regarding protecting personal information and bank accounts.

Our policy is to comply with all laws and regulations requiring the prompt notification and disclosure of breaches of sensitive private information to affected customers and to regulatory authorities, including the Interagency Guidance Response Programs for Unauthorized Access to Consumer Information and Customer Notice. The Company has not experienced any significant data breaches requiring public disclosure or notification of regulatory authorities.

11

Approach

The Company has an Information Security Committee, comprised of the Chief Information Officer, the Chief Technology Officer, the Information Security Officer, the Chief Risk Officer, the Chief Operations Officer, and the EVP of Financial Services. The Committee oversees the Information Security Program and strategy. The Program includes risk assessments, processes to manage and control risks, training for all employees, and monitoring of systems and controls, to accomplish the following objectives:

The Program relies on well-proven principles of information security by:

The Company also maintains an extensive Vendor Management Program to ensure vendors adequately protect information. This program includes:

12

Human Capital

The Company’s approach to developing human capital resources focuses on objectives that include, but are not limited to, providing fair and equitable compensation, training employees to reach heightened skill sets and standards of motivation, identifying and developing the proficiencies of all employees, and enhancing ongoing diversity, equity and inclusion initiatives. Human capital is developed through a variety of strategies, including:

13

Employee Engagement

We conduct a survey of all employees biennially to measure and promote employee engagement and satisfaction with a variety of other workforce matters including training, development, compensation and work environment. For the most recent survey conducted in 2018, favorable responses to the survey categories ranged from a high of 93% to a low of 68%, and 62% of the questions measured above the industry norm. Survey participants can also provide comments and suggestions for consideration.

Gender Diversity

The Company promotes fair and equitable treatment of women in its workforce. The Company has an inclusive culture, holding an annual event celebrating and promoting the accomplishments of its women. It also strictly prohibits gender bias and discrimination, and sexual harassment. A majority of the Company’s employees are women and there is significant representation of women in management and the executive team.

Percentage of women in the overall workforce | 75.0% |

Percentage of women in management positions | 67.6% |

Percentage of women in the executive team | 15.7% |

14

Government and Community Relations

BancFirst Corporation operates only within the United States, in Oklahoma and Texas. Also, the Company does not engage in offering offshore banking services, or other activities enabling tax base erosion and profit shifting to other jurisdictions. In compliance with the Bank Secrecy Act, the Company reports numerous Suspicious Activity Reports to the Treasury Department regarding possible money laundering or other criminal activities, and it cooperates with law enforcement agencies in their investigations of such activities. It has policies regarding government and community relations, addressing and restricting political activities of the Company and its employees, but encouraging support of community development activities. By policy and law, the Company is prohibited from making contributions or expenditures related to a political campaign or election, or to a political action committee. Also, the Company has not received any grants, tax relief, or other types of financial benefits such as assistance payments or bailouts, from any government. Additionally, the Company did not borrow from the Federal Reserve’s Paycheck Protection Program Liquidity Facility to fund the PPP loans that it made.

15

Managing Environmental Risk

Overview

Managing environmental risk supports long-term value creation. Environmental risks, such as pollution, changing climate and exploitation of natural resources, can adversely affect the Company, our customers, and our communities. The impacts of Government regulation of environmental risks must also be considered. The Company has responded to certain environmental risks to its business for many years, but we are developing processes to assess and respond to new and emerging risks on a more comprehensive basis.

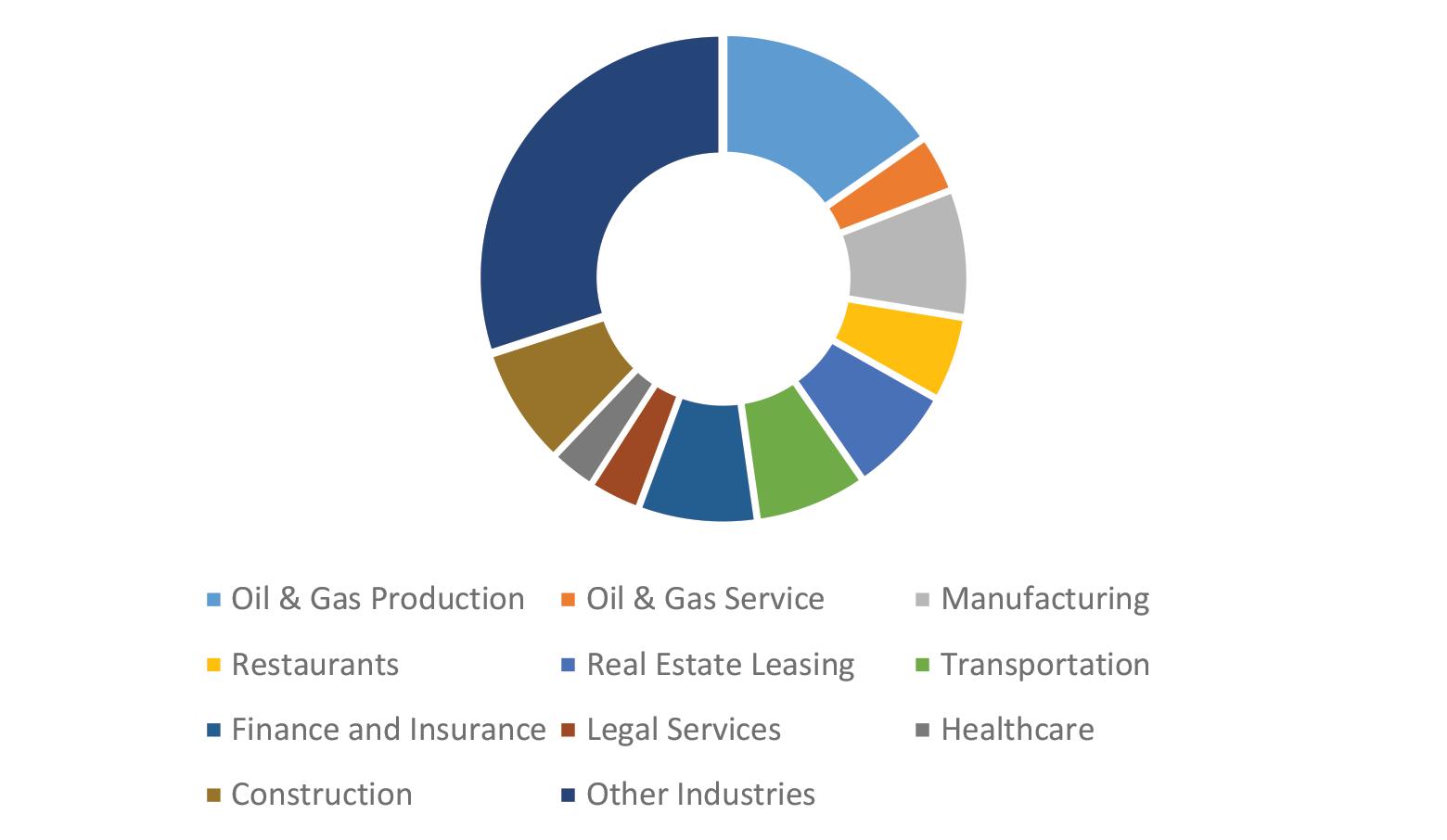

Environmental Impact of Financing Activities

The Company operates in Oklahoma and Texas, which have economies that are significantly influenced by the energy industry and other industries that could be impacted by environmental risks. Below is a schedule listing the top 10 industries represented in the Company’s commercial and industrial loans.

Industry | Number of Loans | Balance |

Oil & Gas Production | 346 | $219,200,000 |

Oil & Gas Service | 258 | $54,390,000 |

Manufacturing | 710 | $121,565,000 |

Construction | 1,449 | $112,992,000 |

Finance & Insurance | 144 | $112,937,000 |

Transportation | 675 | $106,281,000 |

Real Estate Leasing | 393 | $102,921,000 |

Restaurants | 560 | $80,324,000 |

Legal Services | 485 | $49,264,000 |

Health Care | 358 | $43,341,000 |

Other Industries | 4,793 | $430,234,000 |

Total Commercial & Industrial | 10,171 | $1,433,449,000 |

16

The Company’s loan policies limit its exposure to oil & gas industry related collateral by setting the maximum amount of loans secured by oil & gas production and equipment at 55% of its equity capital, and the actual percentage is well below this limit at approximately 22%. The aggregate balance of all the Company’s loans related to the oil & gas industry is approximately $369 million, which is only 6.1% of its total loan portfolio.

The Company does not participate in any significant project financing that would have environmental considerations.

Energy and Paper Efficiency

The Company has several initiatives to improve its energy efficiency and use of paper. These initiatives include:

17