UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

o |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material Pursuant to §240.14a-12

|

IMCOR Pharmaceutical Co. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required. |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

|

|

|

|

Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

IMCOR Pharmaceutical Co.

6175 Lusk Boulevard

San Diego, CA 92121

Notice of 2004 Annual Meeting

of Stockholders and Proxy Statement | | December 27, 2004 |

The 2004 annual meeting of stockholders of IMCOR Pharmaceutical Co. (formerly Photogen Technologies, Inc.) (the "Company") will be held on January 20, 2005, at 10:00 a.m., Chicago time, at the Union League Club of Chicago, 65 West Jackson Boulevard, Chicago, Illinois. The purposes of the meeting are to:

- 1.

- Ratify the issuance of more than 20% of the Company's voting stock in connection with a financing transaction with certain institutional and accredited investors and the conversion of the aggregate principal amount of $8,559,500, plus accrued interest, under the Company's secured promissory notes into the Company's common stock;

- 2.

- Amend our 2000 Long Term Incentive Compensation Plan to (a) increase the number of shares of common stock reserved for issuance from 4,568,750 to 30,000,000 shares, (b) provide for the cashless exercise of options, and (c) provide that acceleration of vesting of options on a change of control is discretionary not mandatory;

- 3.

- Amend our Restated Articles of Incorporation to increase the number of shares of common stock authorized for issuance from 150,000,000 to 200,000,000 shares;

- 4.

- Amend our Restated Articles of Incorporation to effect, as determined by our Board of Directors in its sole discretion, one or more reverse stock splits in a range of a total of one-for-two up to one-for-twenty;

- 5.

- Elect seven directors; and

- 6.

- Transact such other business as may properly come before the meeting or any adjournment.

Stockholders are cordially invited to attend the meeting.If you plan to attend, please notify the Company by January 13, 2005. Space is limited. Only stockholders holding common stock of record at the close of business on November 26, 2004 will be entitled to notice of the annual meeting and to vote at the meeting or any adjournment. A list of stockholders of the Company entitled to vote at the meeting will be available for inspection by stockholders at the Company's office, for ten days before the annual meeting during normal business hours.

Please complete, date, sign and return the enclosed proxy card in the envelope provided, which requires no postage if mailed in the United States. If you decide to attend the meeting, you may, if desired, revoke the proxy and vote the shares in person. Attendance at this meeting does not itself serve to revoke your proxy.

| | | By Order of the Board of Directors, |

|

|

Taffy J. Williams, President and Chief Executive Officer |

TABLE OF CONTENTS

| INTRODUCTION | | 1 |

| | General Information | | 1 |

| | Shareholders Entitled to Vote | | 1 |

| | How to Vote | | 1 |

| | Changing Your Vote | | 1 |

| | Votes Required to Approve Proposals | | 2 |

| | Board Recommendation; Interest of Certain Persons in Matters to Be Acted Upon | | 2 |

| | Agreements to Vote in Favor of Proposals | | 2 |

| | Proxy Solicitation | | 3 |

| | Dissenters' Rights of Appraisal | | 3 |

| | Stockholder Proposals | | 3 |

| | Licensing Transaction | | 3 |

| PRO FORMA INFORMATION | | 3 |

| FORWARD LOOKING STATEMENTS | | 4 |

| PROPOSAL 1 Ratify Issuance of More Than 20% of Our Outstanding Stock in a Financing Transaction and Conversion of Notes | | 4 |

| | Background of Financing Transaction | | 6 |

| | Summary of Financing Transaction | | 6 |

| | Use of Proceeds | | 7 |

| | Dilution | | 7 |

| | Exhibits Relating to Proposal 1 | | 7 |

| PROPOSAL 2 Amend the 2000 Long Term Incentive Compensation Plan | | 8 |

| | Introduction | | 8 |

| | Summary of the 2000 Long Term Incentive Compensation Plan | | 9 |

| | | Introduction | | 9 |

| | | Nature Of Awards To Be Granted Pursuant to the 2000 Long Term Incentive Compensation Plan | | 9 |

| | | Common Stock Subject to the 2000 Long Term Incentive Compensation Plan | | 9 |

| | | Administration of the 2000 Long Term Incentive Compensation Plan | | 10 |

| | | Purchase of Common Stock Under the 2000 Long Term Incentive Compensation Plan | | 10 |

| | | Termination of Employment, Death or Disability of Option holder | | 11 |

| | | Expiration, Termination and Amendment of the 2000 Long Term Incentive Compensation Plan | | 11 |

| | | Federal Tax Consequences | | 11 |

| | | New Plan Benefits | | 12 |

| | | Equity Compensation Plan Information | | 12 |

| PROPOSAL 3 Amend Articles of Incorporation to Increase Authorized Shares of Common Stock | | 13 |

| PROPOSAL 4 Amend Articles of Incorporation to Effect a Reverse Stock Split | | 14 |

| | | Introduction | | 14 |

| | | Reasons for the Reverse Split | | 15 |

| | | Effecting the Reverse Split | | 15 |

| | | No Fractional Shares | | 16 |

| | | Exchange of Stock Certificates | | 16 |

| | | Effect on Outstanding Shares | | 16 |

| | | Accounting Consequences | | 17 |

| | | Federal Income Tax Consequences | | 17 |

| PROPOSAL 5 Election of Seven Directors to the Company's Board of Directors | | 17 |

| | Directors, Executive Officers, Promoters and Control Persons | | 18 |

| | | |

i

| | | Director Nominees | | 18 |

| | Executive Officers and Significant Employees | | 19 |

| | | Directors' Meetings and Committees | | 20 |

| | | Corporate Governance | | 22 |

| | | Security Ownership of Certain Beneficial Owners and Management | | 22 |

| | | Compensation Committee Interlocks and Insider Participation | | 25 |

| | | Certain Relationships and Related Transactions | | 25 |

| | | Executive Compensation | | 26 |

| | | Stock Options | | 27 |

| | Compliance with Section 16(a) of the Exchange Act | | 29 |

| | | Change in Control Agreements | | 30 |

| | Securities Authorized for Issuance Under Equity Compensation Plans. | | 30 |

| | Director Compensation. | | 31 |

| | Compensation Committee Report | | 31 |

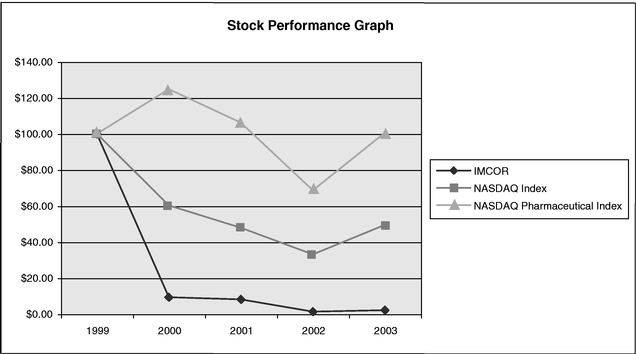

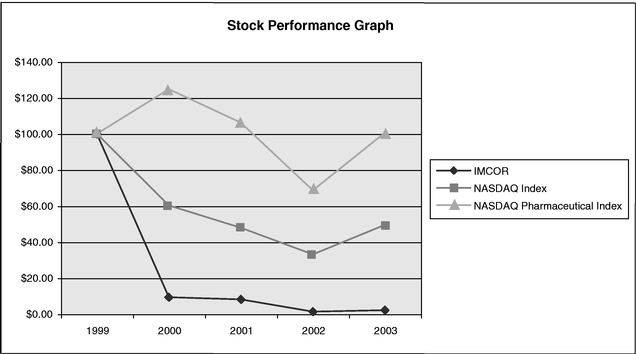

| | Stock Performance Chart | | 32 |

| Financial and Other Information | | 33 |

| | | Financial Statements and Supplementary Financial Information | | 33 |

| | | Management's Discussion and Analysis of Financial Condition and Result of Operations | | 33 |

| | | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | | 33 |

| | | Quantitative and Qualitative Disclosures About Market Risk | | 33 |

| | | Other Information | | 33 |

| | Audit Committee Report | | 33 |

| | Independent Auditors' Fees | | 35 |

| | | Audit Fees | | 35 |

| | | Audit-Related Fees. | | 35 |

| | | Tax Fees. | | 35 |

| | | All Other Fees. | | 35 |

| | | Audit Committee Pre-Approval Policy. | | 36 |

| Other Matters | | 36 |

| Information Incorporated By Reference | | 36 |

ii

EXHIBIT LIST

| A | | Form of Securities Purchase Agreement |

| B | | Form of Warrant Agreement |

| C | | Form of Registration Rights Agreement |

| D | | April Voting Agreement |

| E | | Amended 2000 Long-Term Incentive Compensation Plan |

| F | | Form 10-KSB/A for fiscal year ended December 31, 2003, as amended |

| G | | Audit Committee Charter |

| H | | Form 10-QSB/A for the quarterly period ended September 30, 2004 |

iii

IMCOR PHARMACEUTICAL CO.

6175 LUSK BOULEVARD

SAN DIEGO, CA 92121

PROXY STATEMENT

FOR

2004 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JANUARY 20, 2005

INTRODUCTION

General Information. IMCOR Pharmaceutical Co. (formerly known as Photogen Technologies, Inc.) ("we," "us," "our," or the "Company") is furnishing this Proxy Statement to holders of our common stock, par value $.001 per share ("Common Stock"), in connection with the solicitation of Proxies on behalf of the Board of Directors for the Annual Meeting of Stockholders to be held at 10:00 a.m., Chicago time, on January 20, 2005 (the "Annual Meeting"). This Annual Meeting is for 2004. The Annual Meeting will be held at the Union League Club of Chicago, 65 West Jackson Boulevard, Chicago, Illinois. We mailed this Proxy Statement to stockholders on approximately December 27, 2004.

Shareholders Entitled to Vote. Only stockholders of record at the close of business on November 26, 2004 are entitled to notice of and to vote at the Annual Meeting. Stockholders will be solicited by mail on or about December 27, 2004. On all matters that may come before the Annual Meeting, each holder of Common Stock will be entitled to one vote for each share of Common Stock he or she holds at the close of business on November 26, 2004.

Holders of a majority of the outstanding Common Stock entitled to vote and present in person or represented by proxy will constitute a quorum at the Annual Meeting. We will count abstentions and broker non-votes for purposes of determining the presence of a quorum, but we will not count them to determine whether the stockholders have approved any given proposal. A broker "non-vote" occurs when a nominee holding shares for a beneficial owner does not vote on a particular proposal because the nominee does not have discretionary voting power with respect to that item and has not received instructions from the beneficial owner.

At November 26, 2004 there were approximately 80,065,300 shares of Common Stock issued and outstanding and entitled to one vote per share. The holders of Common Stock vote as a group on all matters to be considered at the Annual Meeting, except on Proposal 1 for which certain shares are excluded as described under "Vote Required to Approve Proposals" below. We also have 4,500 shares of newly issued Series A Convertible Preferred Stock outstanding but those shares are not entitled to vote on the matters being considered at the Annual Meeting.

We are the record holder of 5,033 shares of Common Stock (less than 0.007% of the outstanding Common Stock) as exchange agent for stockholders who have not turned in their shares of our predecessor (Bemax Corporation) in exchange for Company shares in connection with previous reverse splits of the Common Stock. Proxy materials will be delivered to the last known addresses of those stockholders. If any of those stockholders vote at the Annual Meeting (by Proxy or attending the Annual Meeting), we will record their vote in accordance with their direction. We will treat shares held by such stockholders who do not vote as broker non-votes.

How to Vote. Please sign, date and return the enclosed Proxy promptly. If your shares are held in the name of a bank, broker or other holder of record (that is, in "street name") you will receive instructions from the holder of record that you must follow for your shares to be voted.

Changing Your Vote. Returning your completed Proxy will not prevent you from voting in person at the Annual Meeting if you are present and wish to vote. You may attend the Annual Meeting, revoke your Proxy and vote in person if you desire to do so, but attending the Annual Meeting will not

1

by itself revoke your Proxy. If your shares are held in the name of a bank, broker or other holder of record, you must obtain a Proxy, executed in your favor, from the holder of record to be able to vote at the Annual Meeting. You may revoke your Proxy at any time before it is exercised by either giving written notice of revocation to the Company's Secretary or by submitting a new Proxy dated after the revoked Proxy to us before the Annual Meeting.

Votes Required to Approve Proposals. Shares represented by executed Proxies that are not revoked will be voted in accordance with the instructions in the Proxy or, in the absence of instructions, in accordance with the recommendations of the Board of Directors. Assuming a quorum is present at the Annual Meeting, the following table sets forth the votes required to approve each Proposal:

Proposal

| | Vote Required to Approve

|

|---|

| Proposal 1 (Ratify issuance of more than 20% of stock in connection with a financing transaction and conversion of Secured Promissory Notes) | | Holders of a majority of Common Stock present in person or represented by proxy (excluding shares issued in the initial and second closings of the financing and upon the conversion of the Secured Notes) |

Proposal 2 (Amend the 2000 Long Term Incentive Compensation Plan) |

|

Holders of a majority of Common Stock present in person or represented by proxy |

Proposal 3 (Amend Articles of Incorporation to Increase Authorized Shares) |

|

Holders of a majority of Common Stock present in person or represented by proxy |

Proposal 4 (Reverse Stock Split) |

|

Holders of a majority of Common Stock present in person or represented by proxy |

Proposal 5 (Elect 7 directors) |

|

A plurality of the votes cast by the holders of Common Stock (a "plurality" means that the individuals who receive the largest number of affirmative votes cast are elected as directors up to the maximum number of directors to be chosen) |

Other Business |

|

Holders of a majority of Common Stock present in person or represented by proxy |

Board Recommendation; Interest of Certain Persons in Matters to Be Acted Upon. The Board of Directors unanimously approved each of the Proposals to be considered at the Annual Meeting and recommends that stockholders also vote FOR approval of each Proposal. Because they may be deemed to have an indirect financial interest in certain aspects of the financing transaction, Messrs. Fleming and McPhee abstained from the Board's vote on the financing transaction. Mr. Fleming is associated with Oxford Bioscience Partners IV L.P. ("Oxford") and MRNA Fund II L.P. ("MRNA") and Mr. McPhee is associated with Mi3, L.P. ("Mi3"). Those entities are participating in the financing transaction.

Agreements to Vote in Favor of Proposals. Pursuant to a Voting, Drag-Along and Right of First Refusal Agreement dated as of November 12, 2002 (the "Voting Agreement") and a separate Voting Agreement dated as of April 7, 2004, as amended by Amendment No. 1 to this separate Voting Agreement dated as of April 19, 2004 (the "April Voting Agreement"), Dr. Robert Weinstein, Stuart

2

Levine, Tannebaum, LLC, Mi3, Oxford and MRNA (collectively, the "Stockholders"), who collectively own approximately 51,384,623 shares of Common Stock (approximately 66.2%, as of November 26, 2004, of the Common Stock eligible to vote on Proposal 1 and approximately 64.2%, as of November 26, 2004, of the shares of Common Stock eligible to vote for Proposal 2 and for directors), agreed to vote in favor of Proposal 1 (ratify issuance of more than 20% of stock and conversion of notes in connection with a financing transaction), Proposal 2 (amend 2000 Long Term Incentive Compensation Plan) and Proposal 5 (election of seven director nominees). A copy of the April Voting Agreement is attached as Exhibit D. Because the record date of November 26, 2004 follows the initial and second closings of the financing transaction, the shares issued in the initial and second closings, upon the conversion of the Secured Notes and to reflect the adjusted conversion price of the conversion of the Convertible Notes will not vote at the Annual Meeting on Proposal 1.

As a result of the Voting Agreement and the April Voting Agreement, there are sufficient votes to approve Proposals 1 and 2 and approve the director nominees.

Proxy Solicitation. We will pay all expenses of the solicitation, including the cost of preparing, assembling and mailing the proxy solicitation materials. We expect to reimburse brokerage houses, custodians, nominees and fiduciaries on request for reasonable out-of-pocket expenses they incur in connection with forwarding solicitation materials to the beneficial owners of our Common Stock.

Dissenters' Rights of Appraisal. There are no dissenters' rights of appraisal in connection with any of the matters to be voted on at the Annual Meeting.

Stockholder Proposals. Stockholders interested in presenting a proposal for consideration at our annual meeting of stockholders in 2005 may do so by following the procedures prescribed in Rule 14a-8 under the Securities Exchange Act of 1934 and our Bylaws. To be eligible for inclusion, the Company's Corporate Secretary must receive stockholder proposals no later than March 31, 2005.

Licensing Transaction. On October 29, 2004, we entered into a non-exclusive, cross-licensing agreement with Bristol-Myers Squibb Medical Imaging, Inc. (“BMSMI”) covering ultrasound contrast agent patents. Under the terms of the agreement, BMSMI and the Company will have the right to further develop and commercialize their respective ultrasound contrast imaging agents without risk of infringing upon the other company’s patent rights. We received a payment of $4,000,000 under the terms of the license agreement, and will have the right of first negotiation to license select compounds from Bristol-Myers Squibb Medical Imaging, Inc.

In connection with the license agreement, we entered into a securities purchase agreement with BMSMI and Bristol-Myers Squibb Company pursuant to which we sold an aggregate of 4,500 shares of its recently authorized Series A Convertible Preferred Stock for a total purchase price of $4,500,000. Each such share is entitled to a liquidation preference if not otherwise converted to common stock of $1,000, and may also be redeemed at the same price beginning no earlier than the year 2034. These Series A shares may be convertible under certain conditions into 16,666,667 shares of the our common stock at a conversion rate of $0.27 per share.

An investment banking institution was paid $680,000 in cash and has been issued a 5-year warrant to purchase up to 1,333,333 shares of our common stock at a purchase price of $0.27 per underlying share as compensation for assistance it provided to us in this transaction with BMSMI.

Utilizing a portion of the proceeds received under the BMSMI agreements, on November 2, 2004, we repaid the remaining balance outstanding under the Secured Notes held by Xmark Fund Ltd. and Xmark Fund L.P., amounting to $1,183,835. These notes were secured by a lien on substantially all of our assets. The security interest has now been terminated and at this time there are no blanket liens on any of our owned assets.

We estimate the amount of additional financing required to fund operations and meet continuing obligations through December 31, 2005 could be an additional $12,000,000, in addition to the $8,500,000 resulting from transactions with BMSMI. At our current rate of expenditures (which can be reduced), we may not be able to continue our current level of operations beyond the first quarter of 2005. Therefore, substantial additional capital resources will be required to fund our planned ongoing operations related to clinical development, marketing and manufacturing of Imagent, research and business development activities, debt repayment and other working capital needs.

PRO FORMA INFORMATION

The table below shows the beneficial ownership of certain stockholders: (i) before the transactions in Proposals 1 and 2; (ii) after the consummation of the issuances of Common Stock, warrants and Agent Warrants (defined below) in connection with the financing transaction (Proposal 1); and (iii) after the increase in the shares reserved under the 2000 Long Term Incentive Compensation Plan (the "2000 Plan") (Proposal 2).

Pro Forma Ownership

As of November 26, 2004

| | Pre-Financing—

April 18, 2004(1)(5)

| | Actual as of November 26, 2004 reflecting $10.15 MM Financing Debt Conversion(5)

| | Pro-Forma Increase in Options 2000 Plan

| |

|---|

| | Shares

| | Percent

Ownership

| | Shares

| | Percent

Ownership

| | Shares

| | Percent

Ownership

| |

|---|

| Parties to voting agreements(2) | | 11,918,951 | | 49.2 | % | 54,325,874 | | 54.6 | % | 54,325,874 | | 42.3 | % |

| All Other Officers, Directors, 5% Holders(2) | | 3,268,581 | | 13.5 | % | 1,865,292 | | 1.9 | % | 1,865,292 | | 1.5 | % |

| Other Options, Warrants(2) | | 1,027,355 | | 4.2 | % | 14,586,884 | (3) | 14.7 | % | 14,586,884 | | 11.4 | % |

| $10.15 Million Financing, Debt Conversion | | — | | 0.0 | % | 19,612,499 | | 19.7 | % | 19,612,499 | | 15.3 | % |

| Other Investors | | 8,002,085 | | 33.1 | % | 9,038,928 | | 9.1 | % | 9,038,928 | | 7.0 | % |

| Reserve for issued warrants and options not exercisable in 60 days and reserve for ungranted stock options | | 0 | | 0 | % | 0 | | 0 | % | 28,877,501 | (4) | 22.5 | % |

| | |

| |

| |

| |

| |

| |

| |

| Total | | 24,216,972 | | 100.0 | % | 99,429,477 | | 100.0 | % | 128,306,978 | | 100.0 | % |

- (1)

- Does not include the originally issued Series A Preferred Stock (which was converted into common stock as of June 10, 2004).

3

- (2)

- Includes options and warrants exercisable within 60 days.

- (3)

- Includes warrants representing 11,836,251 shares issued as part of the $10.15 million financing, not otherwise included under the voting agreement.

- (4)

- Includes stock options not exercisable within 60 days representing 7,618,790 shares (including 6,311,852 attributable to Taffy Williams, 502,500 attributable to other officers and directors, and 804,438 attributable to other parties); warrants not exercisable in 60 days representing 152,000 shares and reserve for ungranted options representing 21,106,711 shares.

- (5)

- Excludes reserve for issued warrants and options not exercisable in 60 days and reserve for ungranted stock options because this column reflects beneficially held voting shares.

FORWARD LOOKING STATEMENTS

This Proxy Statement contains (and press releases and other public statements we may issue from time to time may contain) forward-looking statements regarding our business and operations. Statements that are not historical facts are forward-looking statements. Forward-looking statements include those relating to:

- •

- our current business and product development plans,

- •

- our future business, product development and acquisition plans,

- •

- the timing and results of regulatory approval for proposed products, and

- •

- projected capital needs, working capital, liquidity, revenues, interest costs and income.

Examples of forward-looking statements include predictive statements, statements that depend on or refer to future events or conditions, and statements that may include words such as "expects," "anticipates," "intends," "plans," "believes," "estimates," "should," "may," or similar expressions, or statements that imply uncertainty or involve hypothetical events.

Forward-looking statements involve known and unknown risks and uncertainties that may cause our actual results in future periods to differ materially from what is currently anticipated. We made cautionary statements in certain sections of our Form 10-KSB/A for the year ended December 31, 2003, as filed with the Securities and Exchange Commission ("SEC"), including under "Risk Factors." A copy of the Form 10-KSB/A will accompany this Proxy Statement and is included in this Proxy Statement. You should read these cautionary statements as being applicable to all related forward-looking statements wherever they appear in this Proxy Statement. In light of these risks, uncertainties and assumptions, the forward-looking events discussed in this Proxy Statement or other documents incorporated by reference might not occur. No forward-looking statement is a guarantee of future performance and you should not place undue reliance on any forward-looking statement. We do not undertake any obligation to release publicly any revisions to these forward looking statements, to reflect events or circumstances after the date of this Proxy Statement, or to reflect the occurrence of unanticipated events, except as may be required under applicable securities laws.

PROPOSAL 1

Ratify Issuance of More Than 20% of Our Outstanding Stock in a Financing Transaction and Conversion of Notes

At this Annual Meeting we are asking stockholders to consider and vote upon a proposal to ratify the $10.15 million financing we recently completed. We had planned to obtain stockholder approval of this financing prior to issuing more than 20% of our shares, but Nasdaq's decision to delist our shares from the SmallCap Market gave us an opportunity to close prior to obtaining stockholder approval. We nonetheless want to give stockholders an opportunity to consider the financing at this Annual Meeting.

Until June 28, 2004, our Common Stock was listed on the Nasdaq SmallCap Market ("Nasdaq"). Because we did not hold an annual meeting in 2003 we were operating under a temporary exemption from the annual meeting listing requirement granted by Nasdaq that was to expire in June, 2004. In order to finalize our proxy statement and the accompanying Form 10-KSB/A we had to delay the

4

Annual Meeting until mid-July. We requested that Nasdaq extend the exemption until July 19, 2004 in order to complete our response to the SEC's comments. We received notice on June 24, 2004 that Nasdaq would not agree to an extension of the time in which to hold the Annual Meeting.

Accordingly, Nasdaq delisted our shares effective June 28, 2004. Nasdaq denied our appeal of their decision to delist our shares. We cannot provide assurances as to whether our shares can be listed on another exchange or Nasdaq at a later date.

NASD Marketplace Rule 4350(i)(1)(D)(ii) requires companies to seek stockholder approval prior to the sale, issuance or potential issuance by the company of common stock (or securities convertible or exercisable into common stock) equal to 20% or more of the common stock or voting power outstanding before the issuance for less than the greater of book or market value of the stock. For that reason, we divided the financing into two tranches, the first involving the issuance of 19.5% of our Common Stock and the balance of the securities to be issued in a second tranche which would close after we obtained stockholder approval.

Because the necessity of having a shareholder vote prior to issuing more than 20% of our common stock is a Nasdaq rule, the delisting enabled us to close the second tranche of our financing before obtaining a shareholder vote. We consulted with the investors in this financing prior to closing the second tranche and, based on the feedback we received and to reflect changes since the original pricing of the transaction, we decided to reduce the purchase price for the Common Stock to $0.40 per share (from $0.75) and to lower the exercise price of the warrants to $0.50 per share (from $1.00). The warrants continue to be exercisable for 50% of the shares each investor purchased, but covers a greater number of shares given the reduction in the purchase price and corresponding increase in the number of shares issued to each investor.

We closed the second tranche of the financing on June 30, 2004. Holders of over 87% of the Common Stock to be purchased in the financing waived any condition to closing that would not have been met due to Nasdaq delisting our shares and the Company not holding a shareholder vote to approve issuing more than 20% of its stock in the second closing (and any representations, warranties and covenants that may have been breached by these events).

In essence, the financing transaction involved the following:

- •

- We issued 25,374,999 shares of Common Stock for a total purchase price of $10,150,000 and warrants to acquire a total of 12,687,502 shares of Common Stock at an exercise price of $0.50 per share of our Common Stock in a private placement to accredited investors.

- •

- We converted an aggregate principal amount of $8,559,500 plus accrued interest we owed to three existing investors pursuant to our Secured Promissory Notes (the "Secured Notes"), each bearing interest at a rate of 7.25% per annum, into 22,670,952 shares of Common Stock. No warrants were issued in connection with this conversion.

- •

- We converted $4,160,000 principal amount, plus accrued interest, of the Revolving Convertible Senior Secured Promissory Notes (the "Convertible Notes") into 11,069,720 shares of Common Stock pursuant to stockholder approval we received on February 5, 2004 (5,903,851 shares issued at the initial closing and 5,165,869 shares issued to reflect the adjusted conversion price at the second closing). No warrants were issued in connection with this conversion.

5

| • | | We issued to our co-placement agents for the financing, Roth Capital Partners, LLC and Rodman & Renshaw, LLC, as part of their fees for services rendered in the financing transaction, warrants to purchase 2,030,000 shares of our Common Stock (8% of the shares sold in the financing). The warrants issued to our placement agents in connection with the financing are referred to as the "Agent Warrants." |

Background of Financing Transaction. We have been seeking additional financing since 2003. We were not successful in raising additional capital on acceptable terms during that time. During this period, our three principal institutional investors, Oxford, Mi3 and MRNA, provided us with capital through secured loans. As we believed that the capital markets were becoming more receptive to companies such as ours, we reinitiated our efforts to seek additional equity financing. We retained Roth Capital Partners, LLC and Rodman & Renshaw, LLC, as co-placement agents, to assist us in this financing.

Summary of Financing Transaction. We sold in a private transaction $10.15 million of our Common Stock to accredited investors in accordance with the Securities Purchase Agreement entered into between the Company and each of the purchasers signatory thereto (including Oxford and MRNA, affiliates of Mr. Fleming, a Company director, and Mi3, an affiliate of Mr. McPhee, a Company director) (collectively, the "Purchasers"). A copy of the Securities Purchase Agreement is attached as Exhibit A. The transaction is intended to qualify as a private placement under Section 4(2) of the Securities Act of 1933 and/or Rule 506 of Regulation D under the Securities Act. The purchase price was $0.40 per share (the "Offering Price").

We also issued warrants with an exercise price of $0.50 per share to the investors for an aggregate number of shares of our Common Stock equal to the product of 50% multiplied by the issue amount divided by the Offering Price (resulting in warrants carrying one half of the Common Stock purchased at the closing for cash). The warrants may be exercised for a period of five years and are immediately exercisable. We have the right to demand that the holders of the warrants exercise the warrants at any time if the price of our Common Stock exceeds $3.50 per share for at least twenty consecutive trading days. The exercise price and the number of shares issuable upon exercise of the warrant are subject to anti-dilution adjustments. A copy of the Warrant Agreement is attached as Exhibit B.

We filed a registration statement on August 3, 2004 covering the resale of the shares sold to the investors. A copy of the Registration Rights Agreement is attached as Exhibit C. We paid all expenses associated with the registration statement. If the registration statement is not declared effective by the SEC within the first to occur of (i) the 60th day following the second closing (or 90th day after the second closing if the filed registration statement is reviewed and commented upon by the SEC), (ii) the 60th day following termination of the obligations to complete the second closing in accordance with the Securities Purchase Agreement (or the 90th day after such event if the filed registration statement is reviewed and commented upon by the SEC), or (iii) the fifth business day following the date on which we are is notified by the SEC that the registration statement will not be reviewed or is no longer subject to further review and comments, we must make pro rata payments to each investor of 2% of the aggregate amount that investor invested as partial compensation for the delay. We may pay these amounts by delivering additional shares of Common Stock valued at the monthly closing price.

Three institutional investors (Oxford, Mi3 and MRNA) loaned us (i) an aggregate principal amount of $4,160,000 as evidenced by Convertible Notes, bearing interest at 7.25% per annum and (ii) an aggregate principal amount of $8,559,500 as evidenced by Secured Notes, bearing interest at 7.25% per annum.

The Convertible Notes (including accrued interest) were convertible by their terms into shares of our Common Stock on the same terms that shares were issued in a qualified financing. The conversion of the Convertible Notes into our Common Stock was previously approved by the stockholders at the Special Meeting of our Stockholders held on February 5, 2004. The Convertible Notes plus accrued interest were converted into 11,069,720 shares of our Common Stock at the conversion price of $0.40 per share (5,903,851 shares issued at the initial closing and 5,165,869 shares issued to reflect the adjusted conversion price at the second closing).

6

The three institutional investors agreed to also convert the Secured Notes (including accrued interest) into 22,670,952 shares of our Common Stock at the conversion price of $0.40 per share (with no warrants). The Stockholders have or will receive registration rights with respect to all of the shares issued in connection with the conversion of the Convertible Notes and the Secured Notes.

The Common Stock issued in the financing transaction will be entitled to one vote per share on all matters the holders of Common Stock may vote on; provided, however that because the record date of November 26, 2004 follows the initial and second closings of the financing transaction, the shares issued in the initial and second closings, upon the conversion of the Secured Notes and to reflect the adjusted conversion price of the conversion of the Convertible Notes will not vote at the Annual Meeting on Proposal 1. This is a requirement under Nasdaq rules which we are following in connection with this ratification.

Use of Proceeds. Proceeds from the sale of our Common Stock to the Purchasers must be used for the following purposes unless otherwise authorized by a majority of our Board:

- •

- manufacturing, marketing and continued development of Imagent®;

- •

- research and development of PH-50;

- •

- research and development of N1177;

- •

- payment of commissions and other fees associated with the financing transaction;

- •

- payment of certain obligations to vendors of goods or services and other creditors; and

- •

- working capital and general corporate purposes.

Pending use of the proceeds for these purposes, we will invest the funds in securities issued or guaranteed by the United States, national bank repurchase agreements secured by those securities or other investments approved by a majority of the Board, but not in any way that would result in the Company being subject to the Investment Company Act of 1940.

Dilution. As a consequence of the shares to be issued in the financing transaction, current holders of Common Stock will incur dilution of their shares. The table under the heading "Pro Forma Information" on page 3 above illustrates the dilution.

Exhibits Relating to Proposal 1. The following exhibits to this Proxy Statement are pertinent to Proposal 1:

Exhibit

| | Description

|

|---|

| Exhibit A | | Form of Securities Purchase Agreement |

| Exhibit B | | Form of Warrant Agreement |

| Exhibit C | | Form of Registration Rights Agreement |

| Exhibit D | | April Voting Agreement |

7

PROPOSAL 2

Amend the 2000 Long Term Incentive Compensation Plan

Introduction

We adopted the 2000 Plan at the Annual Meeting held in May, 2000. As of November 26, 2004, there were 4,568,750 shares reserved for issuance under the 2000 Plan and options covering 3,899,137 shares of Common Stock have been granted and remain outstanding.

We have two other stock option plans, the 1998 Long Term Incentive Compensation Plan (the "1998 Plan") and the Senior Executive Long Term Incentive Compensation Plan (the "Senior Executive Plan"). As of November 26, 2004, there were 500,000 shares reserved for issuance under the 1998 Plan and options covering 414,625 shares of Common Stock have been granted and remain outstanding. As of November 26, 2004, there were 1,000,000 shares reserved for issuance under the Senior Executive Plan and options covering 1,000,000 shares of Common Stock have been granted and remain outstanding. We have no current intentions to increase the number of shares available for grant under either of these two plans.

Our Board of Directors believes the availability of additional options to purchase Common Stock is necessary to enable us to continue to provide our key employees with equity ownership as an incentive to contribute to our success. Thus, our Compensation Committee voted to amend the 2000 Plan, subject to stockholder approval, to increase the shares covered by the 2000 Plan by 25,431,250 shares, from 4,568,750 to 30,000,000 shares. This increase includes the award of a non-qualified option to purchase 1,050,000 shares of Common Stock granted to Dr. Williams, our President and Chief Executive Officer, pursuant to his current employment agreement. The option granted to Dr. Williams has an exercise price of $1.08 per share and a term of 10 years. It vests upon the earlier of a Change of Control, as defined therein, and Dr. Williams' ceasing to be a salaried employee of the Company. Stockholders holding approximately 64.2% of our Common Stock outstanding as of November 26, 2004 have agreed in writing to approve the issuance of the option to Dr. Williams. Pursuant to the terms of Dr. Williams' employment agreement because the Company closed a financing transaction by July 23, 2004 he was also awarded a non-qualified option to purchase 4,028,402 shares (i.e., the number of shares, which taken together with all other options Dr. Williams has been awarded (other than his options to purchase 750,000 shares with an exercise price or $60 per share and 300,000 shares at $11 per share), equaled 6% of our outstanding Common Stock on a fully diluted basis). The additional option has a 10-year term, exercisable at $.40 per share (i.e., the same price as the shares issued in the financing).

We are now asking the stockholders to approve the amendment of the 2000 Plan to increase the aggregate number of shares of Common Stock issuable under the 2000 Plan from 4,568,750 to 30,000,000. We are also planning to amend the vesting and payment provisions of the Plan. Currently, vesting of option awards accelerates if there is a Change of Control of the Company. Because we will be seeking new capital there is a possibility that such a transaction would result in a Change of Control as defined in the 2000 Plan but under circumstances where it would not be appropriate to accelerate vesting. Therefore, we would like to amend the 2000 Plan so that, upon a Change of Control, vesting of awards would be accelerated in the Compensation Committee's discretion rather than automatically. This change would only affect awards granted after the effective date of the amendment. Each option receipient's award agreement shall specify whether or not such options vest upon a Change of Control.

The exercise price for options granted under the 2000 Plan currently may be paid in cash. We would like to amend the 2000 Plan to provide for the cashless exercise of options, allowing the option recipient to exercise options by transferring to the Company shares he or she has held for a period of at least six months. Each option recipient’s award agreement will specify whether or not such option holder has a cashless exercise right, and will apply only to option awards granted after the effective date of the 2000 Plan amendment.

8

The Board of Directors believes that it is in the Company's best interests to continue the practice of making stock options available to those key employees responsible for significant contributions to our business. The Board believes that the equity stake in our development and success afforded by stock options provides key employees with an incentive to continue to energetically apply their talents to our business.

Summary of the 2000 Long Term Incentive Compensation Plan

The following is a brief and non-comprehensive summary of the 2000 Plan. The complete text of the 2000 Plan, as amended, is attached as Exhibit E to this Proxy Statement and you should refer to that Exhibit for a complete statement of the Plan's provisions.

Introduction. The 2000 Plan is intended to advance our interests by providing key employees with additional incentives to promote the success of our business, to increase their proprietary interest in our success and to encourage them to remain in our employ. The Board and its Compensation Committee believe that the 2000 Plan is a necessary tool to help us compete effectively with other enterprises for the services of new employees and to retain key employees and directors, all as may be required for the future development of our business. Currently, options covering 3,899,137 shares which remain outstanding have been granted to employees under the 2000 Plan. We have granted options covering 414,625 shares which remain outstanding under the 1998 Plan, and options covering 1,000,000 shares which remain outstanding under the Senior Executive Plan to employees, outside directors and others. We cannot determine at this time how many other persons will be eligible for receipt of awards under the 2000 Plan.

Each senior executive officer of the Company, by reason of being eligible to receive awards under the 2000 Plan, has an interest in seeing that the stockholders increase the shares covered by the 2000 Plan.

Nature Of Awards To Be Granted Pursuant to the 2000 Long Term Incentive Compensation Plan. The 2000 Plan provides for the grant of options intended to qualify as "incentive stock options" ("ISOs") under Section 422(b) of the Internal Revenue Code of 1986 (the "Code") and non-qualified stock options ("NQSOs"). The 2000 Plan also permits awards of restricted stock. Any award may be subject to various performance goals established by the Compensation Committee.

Common Stock Subject to the 2000 Long Term Incentive Compensation Plan. Currently, the aggregate number of shares of Common Stock covered by the 2000 Plan is 4,568,750 shares. If Proposal 2 is approved, 30,000,000 shares will be covered by the 2000 Plan.

Shares issued upon exercise of options or awards of Restricted Stock under the 2000 Plan may be either authorized but unissued shares or shares re-acquired by the Company. If, on or prior to the termination of the 2000 Plan, an award expires or is terminated for any reason without having been exercised or vested in full, the unpurchased or unvested shares will again become available for the grant of awards under the 2000 Plan.

The Compensation Committee will determine the purchase price of the shares of Common Stock covered by each NQSO and will be at least the par value of the shares. ISOs will have an exercise price of at least 100% of the fair market value of the Common Stock at the time the option is granted, determined by reference to the closing sale price at which the Common Stock trades on the principal securities exchange on which the shares are traded.

No option granted to any person who, at the time of the grant, owns (taking into account the attribution rules of Section 424(d) of the Code) stock possessing more than 10% of the total combined voting power of all classes of our stock or of the stock of any of our corporate subsidiaries, may be designated as an ISO unless at the time of such grant the purchase price of the shares of Common Stock covered by such option is at least 110% of the fair market value, but in no event less than the

9

par value, of such shares. The aggregate fair market value (determined at the time each ISO is granted) of the shares of Common Stock with respect to which ISOs issued to any one person are exercisable for the first time during any calendar year may not exceed $100,000.

Awards of restricted stock under the 2000 Plan will be made at the discretion of the Compensation Committee and will consist of shares of Common Stock granted to a participant and covered by a restricted stock award agreement. At the time of an award, a participant will have the benefits of ownership in respect of such shares, including the right to vote such shares and receive dividends thereon and other distributions, subject to the restrictions in the 2000 Plan and in the restricted stock award agreement. The shares will be legended and, at our option, may be held in escrow and may not be sold, transferred or disposed of until such restrictions have lapsed. Each award may be subject to a lapsing formula pursuant to which the restrictions on transferability lapse over a particular time period. The Compensation Committee has broad discretion as to the specific terms and conditions of each award, including applicable rights upon certain terminations of employment.

Administration of the 2000 Long Term Incentive Compensation Plan. The Compensation Committee will administer the 2000 Plan. The Compensation Committee has full and exclusive authority to, among other things, determine the grant of awards under the 2000 Plan. Drs. Dean and Watson served as the members of the Compensation Committee during the 2003 fiscal year. Prior to their resignation from the Board, Lester McKeever and Robert J. Weinstein, M.D. were on the Compensation Committee and, until he resigned from the Compensation Committee, William McPhee was also a member. Mr. McPhee rejoined the Compensation Committee in 2004.

Purchase of Common Stock Under the 2000 Long Term Incentive Compensation Plan. Each award granted under the 2000 Plan will be granted pursuant to and subject to the terms and conditions of an award agreement (an "Award Agreement") to be entered into between us and the award holder at the time of the grant. Any Award Agreement will incorporate by reference all of the terms and provisions of the 2000 Plan as in effect at the time of grant and may contain other terms and provisions approved by the Compensation Committee.

The Compensation Committee will determine the expiration date of an award granted under the 2000 Plan at the time of grant. Each award will become exercisable or vested in whole, in part or in installments, at the time or times as the Compensation Committee may prescribe and specify in the Award Agreement.

In the event of a "Change in Control" (defined in the 2000 Plan) of the Company, awards granted under the 2000 Plan, which, by their terms, vest or are exercisable in installments, currently will become immediately exercisable or vested in full. These provisions of the 2000 Plan may have some deterrent effect on certain mergers, tender offers or other takeover attempts, thereby having some potential adverse effect on the market price of our Common Stock. We propose to amend this so that accelerated vesting is left to the Compensation Committee's discretion.

The exercise price for options granted under the 2000 Plan currently may be paid in cash. At the discretion of the Compensation Committee, subject to applicable requirements of the Securities Exchange Act of 1934, the option holder may currently deliver with his or her exercise notice irrevocable instructions to a broker to promptly deliver to us an amount of sale or loan proceeds sufficient to pay the exercise price. We would like to amend the 2000 Plan to provide that the exercise price may be paid in cash or by using the shares underlying the options as consideration for the exercise price by reducing the number of shares underlying the options under a formula. Option holders would instruct the Company to withhold that number of shares of common stock otherwise issuable pursuant to an exercise of the option determined by dividing (A) the product determined by multiplying (1) the aggregate number of shares of common stock specified in the exercise notice, times (2) the exercise price, by (B) the fair market value of one share of common stock as of the date of the exercise notice.

10

Awards granted under the 2000 Plan are assignable or transferable by will or pursuant to the laws of descent and distribution or as otherwise specifically permitted by the Award Agreement or by the Compensation Committee, and options will be exercisable during the award holder's lifetime by the award holder himself or herself or any permitted transferee. No holder of any option will have any rights to dividends or other rights of a stockholder with respect to shares subject to an option before exercising the option.

Termination of Employment, Death or Disability of Option holder. Each option, to the extent it has not been previously exercised, will terminate upon the earliest to occur of: (i) the expiration of the option period set forth in the Award Agreement; (ii) for ISOs, the expiration of three months following the Participant's retirement (following the Participant's retirement, NQSOs will terminate upon the expiration of the option period set forth in the Award Agreement); (iii) the expiration of 12 months following the Participant's death or disability; (iv) immediately upon termination for cause; (v) the expiration of 90 days following the Participant's termination of employment for any reason other than cause, Change in Control, death, disability, or retirement; or (vi) at such other time and on such conditions provided for in the Award Agreement. Upon a termination of employment related to a Change in Control, options will be treated in the manner set forth in the Change of Control provisions.

Upon a Participant's death, disability, or retirement, all restricted stock will vest immediately. Each Award Agreement will set forth the extent to which the Participant will have the right to retain unvested restricted shares following termination of the Participant's employment with the Company in all other circumstances. Such provisions will be determined in the sole discretion of the Compensation Committee, will be included in the Award Agreement entered into with each Participant, need not be uniform among all shares of restricted stock issued pursuant to the 2000 Plan, and may reflect distinctions based on the reasons for termination of employment.

Expiration, Termination and Amendment of the 2000 Long Term Incentive Compensation Plan. The 2000 Plan may at any time be terminated, modified, altered, suspended or amended by the Board of Directors or the Compensation Committee. The Board of Directors or the Compensation Committee may, insofar as permitted by law, from time to time with respect to any shares of Common Stock at the time not subject to options or other awards, suspend or discontinue the 2000 Plan or revise or amend it in any respect whatsoever, except that, without approval of the stockholders, no such revision or amendment may increase the number of shares available for grants of ISOs under the 2000 Plan or alter the class of participants in the 2000 Plan. Subject to the provisions described above, the Board of Directors or the Compensation Committee will have the power to amend the 2000 Plan and any outstanding awards granted thereunder in such respects as the Board of Directors or the Compensation Committee may, in its sole discretion, deem advisable in order to incorporate in the 2000 Plan or any such award any new provision or change designed to comply with or take advantage of requirements or provisions of the Code or other statute, or rules or regulations of the Internal Revenue Service or other federal or state governmental agency enacted or promulgated after the adoption of the 2000 Plan.

Federal Tax Consequences. We believe that the following generally summarizes the federal income tax consequences of awards under the Plan for participants and us. A participant will not be deemed to have received any income subject to tax at the time a stock option (including an ISO) or Restricted Stock award that is subject to conditions, restrictions or contingencies is awarded, nor will we be entitled to a tax deduction at that time. When a stock option (other than an ISO) is exercised, the participant will be deemed to have received an amount of ordinary income equal to the excess of the fair market value of the shares purchased over the exercise price. The income tax consequences of Restricted Stock Awards will depend on how the awards are structured, but generally, a participant will be deemed to have ordinary income at the time a Restricted Stock Award is distributed to him free of all conditions, restrictions and contingencies. In each case, we will be allowed a tax deduction in the

11

year and in an amount equal to the amount of ordinary income that the participant is deemed to have received. The amount of the deduction for certain highly compensated employees may be limited to $1 million annually for performance-based awards under Section 162(m) of the Internal Revenue Code.

If an ISO is exercised by a participant who satisfies certain employment requirements at the time of exercise, the participant will not be deemed to have received any income subject to tax at such time, although the excess of the fair market value of the Common Stock so acquired on the date of exercise over the exercise price will be an item of tax preference for purposes of the alternative minimum tax. Section 422 of the Code provides that if the Common Stock is held at least one year after the exercise date and two years after the date of grant, the participant will realize a long-term capital gain or loss upon a subsequent sale, measured as the difference between the exercise price and the sales price. If that portion of Common Stock acquired upon the exercise of an ISO which is not held for one year, a "disqualifying disposition" results, at which time, the participant is deemed to have received an amount of ordinary income equal to the lesser of (a) the excess of the fair market value of the Common Stock on the date of exercise over the exercise price or (b) the excess of the amount realized on the disposition of the shares over the exercise price. If the amount realized on the "disqualifying disposition" of the Common Stock exceeds the fair market value on the date of exercise, the gain on the excess of the ordinary income portion will be treated as a capital gain. Any loss on the disposition of Common Stock acquired through the exercise of an ISO is a capital loss. No income tax deduction will be allowed to us with respect to shares of Common Stock purchased by a participant through the exercise of an ISO, provided there is no "disqualifying disposition" as described above. In the event of a "disqualifying disposition", we are entitled to a tax deduction equal to the amount of ordinary income recognized by the participant.

New Plan Benefits. To date, options to acquire 3,899,137 shares of Common Stock have been granted and remain outstanding under the 2000 Plan. During the 2004 and future fiscal years, we may consider granting Awards to existing employees or hiring additional personnel and others who may become eligible for receipt of Awards under the 2000 Plan. At this point, however, we cannot provide information as to the amount of the Awards, if any, that would be granted under the 2000 Plan.

Equity Compensation Plan Information. The following table gives information about our Common Stock that may be issued upon the exercise of options under all of our existing equity compensation plans as of December 31, 2003.

Plan Category

| | (a) Number of securities to be issued upon exercise of outstanding options, warrants and rights

| | (b) Weighted-average exercise price of outstanding options, warrants and rights

| | (c) Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a))

|

|---|

| Equity compensation plans approved by security holders | | 5,889,470 | | $ | 10.90 | | 178,155 |

| Equity compensation plans not approved by security holders | | 1,252,431 | (1) | $ | 1.75 | | 0 |

| Total | | 7,141,901 | | $ | 9.30 | | 178,155 |

- (1)

- In addition to shares we may issue under the plans approved by the stockholders, we have granted options and warrants to consultants, the placement agent for our Series B Preferred Stock and to Dr. Williams (which is subject to stockholder approval in Proposal 2) pursuant to arrangements that were not submitted to stockholders for approval. Each of these grants is on different terms under specific agreements negotiated with each recipient. Exercise prices range from $1.08 to $47.78 per share, with terms expiring between 2004 and 2013. Each agreement contains anti-dilution features.

12

We have options outstanding under three plans, the 1998 Plan, the Senior Executive Plan and the 2000 Plan. Each of these Plans was approved by the stockholders. If Proposal 2 is approved, we will increase the number of shares authorized for issuance under the 2000 Plan to 30,000,000 shares.

PROPOSAL 3

Amend Articles of Incorporation to Increase Authorized Shares of Common Stock

We believe that it may be in the best interests of the Company to amend our Restated Articles of Incorporation to increase the number of authorized shares of Common Stock to 200,000,000 from 150,000,000. The Board of Directors does not believe that the current number of shares available is adequate to serve the Company's need for potential future equity financing.

Our current Restated Articles of Incorporation provide for the authorization of 150,000,000 shares of Common Stock. The proposed amendment provides for the authorization of 200,000,000 shares of Common Stock. As of November 26, 2004, based on the number of shares of Common Stock currently outstanding and the number of shares eligible for issuance under all of our stock options plans, warrant agreements and upon the conversion of our newly issued Series A Convertible Preferred Stock, there were 119,542,395 shares of Common Stock either outstanding or reserved, leaving 30,457,605 authorized, but unissued, and unreserved shares of Common Stock available for other corporate purposes or opportunities. The Board of Directors believes that such number may not be adequate to provide for our financing needs.

This amendment increases by 50,000,000 the number of authorized and unissued shares of Common Stock which may be used for any proper corporate purpose by the Company, including issuance of shares in public or private offerings, issuance of securities convertible into shares of Common Stock for cash as a means of obtaining additional capital for use in our business and operations, or issuance of shares of Common Stock as part or all of the consideration required to be paid by the Company in the acquisition of other businesses or properties.

With this increase, we believe that we will have sufficient shares of Common Stock available for corporate purposes or opportunities as are likely to arise in the reasonably foreseeable future particularly if stockholders grant authority to effect up to a 1 for 20 reverse split as contemplated by Proposal 4. Although we have no current plan or proposal to issue any of the currently authorized and unissued shares of Common Stock not already reserved or the additional shares of the Common Stock proposed to be authorized, additional shares could be issued in connection with one or more equity financings.

If the amendment is approved, the newly authorized shares of Common Stock would have all of the rights and privileges as the shares of Common Stock presently authorized. Once shares of Common Stock are authorized, the Board of Directors can issue shares of Common Stock without stockholder approval, except as may be required by law or regulations or by the rules of any stock exchange on which our securities may then be listed.

The issuance of the additional shares of Common Stock, may, under certain circumstances, make attempts to acquire control of the Company more difficult. For example, an issuance of additional shares of Common Stock may make it more difficult to obtain stockholder approval of actions such as removal of directors or amendments to the Bylaws. In addition, shares of Common Stock could be issued in other transactions that could make a change of control of the Company more difficult. We are not aware of any effort to obtain control of the Company by a tender offer, proxy contest, or otherwise, and we have no present intention to use the additional shares of authorized Common Stock for anti-takeover purposes.

Although the Board of Directors would issue additional shares based on its judgment as to the best interests of the Company and its stockholders, the issuance of additional shares of Common Stock

13

would have the effect of diluting the voting power per share and could have the effect of diluting the book value per share of the outstanding shares of Common Stock.

The text of the first sentence of the FOURTH Article of the Restated Articles of Incorporation, as it is proposed to be amended pursuant to this proposal, is as follows:

"The total number of shares of all classes of stock which the Corporation shall have the authority to issue is two hundred million (200,000,000) shares of Common Stock, par value $.001 per share."

If approved by the stockholders, the proposed amendment will become effective upon its filing with the Secretary of State of Nevada, which is expected to take place as soon as practicable after the Annual Meeting.

PROPOSAL 4

Amend Articles of Incorporation to Effect a Reverse Stock Split

Introduction. We believe that it may be in the best interests of the Company to amend our Restated Articles of Incorporation to effect one or more reverse stock splits of our outstanding Common Stock (the "Reverse Split") which could range from an aggregate of a one-for-two up to one-for-twenty reverse stock split, if and as determined by our Board of Directors in its sole discretion within the 12 months after the Annual Meeting, on the terms described in this Proxy Statement. The principal effect of the Reverse Split would be to decrease the number of issued and outstanding shares of our Common Stock (but not the total shares authorized for issuance). Except for adjustments that may result from the treatment of fractional shares as described below, each stockholder would hold the same percentage of Common Stock outstanding immediately following the Reverse Split as such stockholder held immediately prior to the Reverse Split. The relative voting and other rights that accompany the shares of Common Stock would not be affected by the Reverse Split. In the event that our Board of Directors determines that it is in the best interests of the Company to effect a Reverse Split, we will file a Form 8-K with the SEC detailing the specific terms of such split.

This Reverse Split includes the one-for-five reverse split previously approved by stockholders at the February 5, 2004 special meeting. The Board has not implemented the one-for-five reverse split and we seek authority to increase the size of the split to up to one-for-twenty.

The Reverse Split would be accomplished by amending our Restated Articles of Incorporation on one or more occasions so long as, during the 12 months after the Annual Meeting, the total Reverse Split does not exceed one-for-twenty shares. Each amendment would be set forth in a paragraph in the following form (assuming Proposal 3 is approved):

"Effective as of the close of business on the date of filing this Amendment to the Restated Articles of Incorporation with the Nevada Secretary of State (the "Effective Time"), the filing of this Amendment shall effect a reverse split (the "Reverse Split") pursuant to which [ ] shares of Common Stock, par value $0.001 per share, issued and outstanding and held by a single holder, shall be combined into one validly issued, fully paid and nonassessable share of Common Stock, par value $0.001 per share. Each stock certificate that prior to the Effective Time represented shares of Common Stock shall, following the Effective Time represent the number of shares into which the shares of Common Stock represented by such certificate shall be combined as a result of the Reverse Split. The Corporation shall not issue fractional shares or scrip as a result of the Reverse Split, but shall round up to the nearest whole share any fractional share that would otherwise result from the Reverse Split; the number of authorized shares of Common Stock shall continue to be 200,000,000; and the par value of the Common Stock shall be $0.001 per share."

14

The Reverse Split will become effective on a date or dates determined by our Board of Directors (the "Effective Date").

Stockholders do not have the statutory right to dissent and obtain an appraisal of their shares under Nevada law in connection with the amendment to our Restated Articles of Incorporation to complete the Reverse Split.

We may use the authorized and unissued shares of Common Stock to raise capital in a public or private offering, to enter into a strategic transaction or to grant options or warrants to employees or others. We have no current agreements to enter into any stock offerings or strategic transactions although we plan to explore various strategic options concerning our businesses, including securing additional financing, joint ventures, licensing or selling all or a portion of our technology and other possible strategic transactions. In addition, 39,477,095 shares of the Company's authorized and unissued shares are reserved for future grants and the issuance upon exercise of outstanding warrants and options previously granted under our various stock option plans and agreements and the conversion of our newly issued Series A Convertible Preferred Stock.

Reasons for the Reverse Split. If effected, the Reverse Split should enable us to reduce the number of shares outstanding to a more appropriate number for a company at our stage of development as well as attempt to increase the market price of our Common Stock in an effort to ensure meeting the listing requirements of Nasdaq (if we are relisted) or another exchange. A Reverse Split may also increase the attractiveness of our Common Stock to prospective investors and the financial community.

If effected, the Reverse Split and resulting anticipated increase in the price of our Common Stock should also enhance the acceptability and marketability of our Common Stock to the financial community and investing public. Many institutional investors have policies prohibiting them from holding lower-priced stocks in their portfolios, which reduces the number of potential buyers of our Common Stock. Additionally, analysts at many brokerage firms are reluctant to recommend lower-priced stocks to their clients or monitor the activity of lower-priced stocks. Brokerage houses also frequently have internal policies that discourage individual brokers from dealing in lower-priced stocks. Further, because brokers' commissions on lower-priced stock generally represent a higher percentage of the stock price than commissions on higher priced stock, investors in lower-priced stocks pay transaction costs which are a higher percentage of their total share value, which may limit the willingness of individual investors and institutions to purchase our Common Stock.

If implemented, the Reverse Split may result in some stockholders owning "odd-lots" of less than 100 shares. Brokerage commissions and other costs of transactions in odd-lots may be higher, particularly on a per-share basis, than the cost of transactions in even multiples of 100 shares. In addition, if effected, the Reverse Split may make it more difficult for us to meet other requirements for listing on Nasdaq or another exchange relating to the minimum number of shares that must be in the public float and the minimum number of round lot holders.

We cannot assure stockholders that the Reverse Split will have any of the desired consequences described above. Specifically, we cannot assure stockholders that, if effected, the post- Reverse Split market price of our Common Stock will increase proportionately to the ratio for the Reverse Split, that the market price of our Common Stock will not decrease to its pre-split level, that our market capitalization will be equal to the market capitalization before the Reverse Split or that the Reverse Split will enable us to become relisted with Nasdaq or listed with another exchange.

Effecting the Reverse Split. If approved by the stockholders at the Annual Meeting and our Board of Directors determines that it is in the best interests of the Company to effect the Reverse Split on one or more occasions in the twelve months following this Annual Meeting, we will file Amendments to our Restated Articles of Incorporation with the Nevada Secretary of State to become effective at a time determined by our Board of Directors. Upon effectiveness of the Amendment to our

15

Restated Articles of Incorporation, without further action by us or our stockholders, the outstanding shares of Common Stock held by stockholders of record as of the Effective Date would be converted into the right to receive a number of shares of Common Stock (the "New Common Stock") calculated based on a reverse split ratio. For example, if a stockholder presently holds 10,000 shares of Common Stock, that stockholder would hold 5,000 shares of Common Stock following a one-for two Reverse Split or 500 shares following a one-for-twenty Reverse Split.

No Fractional Shares. We will not issue any fractional shares in connection with the Reverse Split, if effected. Instead, any fractional share resulting from the Reverse Split will be rounded up to the nearest whole share.

Exchange of Stock Certificates. If approved by the Board of Directors, the conversion of the shares of our Common Stock under the Reverse Split would occur automatically on the Effective Date. This would occur regardless of when stockholders physically surrender their stock certificates for new stock certificates.

If effected, our transfer agent, Computershare Investor Services LLC, will act as exchange agent ("Exchange Agent") to implement the exchange of stock certificates. As soon as practicable after the Effective Date, the Company or the Exchange Agent would send a letter to each stockholder of record at the Effective Date for use in transmitting certificates representing shares of our Common Stock ("Old Certificates") to the Exchange Agent. The letter of transmittal would contain instructions for the surrender of Old Certificates to the Exchange Agent in exchange for certificates representing the appropriate number of whole shares of New Common Stock. No new stock certificates would be issued to a stockholder until such stockholder has surrendered all Old Certificates, together with a properly completed and executed letter of transmittal, to the Exchange Agent.

Stockholders would then receive a new certificate in exchange for certificates representing the number of whole shares of New Common Stock into which their shares of Common Stock have been converted as a result of the Reverse Split. Until surrendered, we would deem outstanding Old Certificates held by stockholders to be canceled and only to represent the number of whole shares of New Common Stock to which these stockholders are entitled. All expenses of the exchange of certificates would be borne by us.

YOU SHOULD NOT SEND YOUR OLD CERTIFICATES TO THE EXCHANGE AGENT UNTIL YOU HAVE RECEIVED THE LETTER OF TRANSMITTAL.

Effect on Outstanding Shares. If the Reverse Split is completed, the number of shares of our Common Stock owned by each stockholder will be reduced in the same proportion as the reduction in the total number of shares outstanding, such that the percentage of our Common Stock owned by each stockholder will remain unchanged. The number of shares of Common Stock that may be purchased upon exercise of outstanding options, warrants, and other securities convertible into, or exercisable or exchangeable for, shares of our Common Stock, and the exercise or conversion prices for these securities, will be adjusted in accordance with their terms as of the Effective Date.

If Proposal 3 is approved and a Reserve Split is consummated the number of authorized shares of Common Stock will continue to be 200,000,000 shares. The following chart indicates the number of authorized, but unissued shares of Common Stock that would be outstanding if a one-for-five, one-for-ten, one-for-fifteen or one-for-twenty Reserve Split were effected (based upon 80,065,300 issued and outstanding shares of Common Stock as of November 26, 2004). We may effect Reverse Splits in

16

any amount (not necessarily in multiples of five) so long as the total Reverse Split during the 12 months following the Annual Meeting does not exceed one-for-twenty.

| | Pre-Split

| | 1-for-5

| | 1-for-10

| | 1-for-15

| | 1-for-20

|

|---|

| Authorized but unissued Shares of Common Stock | | 69,934,700 | | 13,986,940 | | 6,993,470 | | 4,662,314 | | 3,496,735 |

Accounting Consequences. The par value of our Common Stock will remain unchanged at $.001 per share after the Reverse Split. However, the Common Stock as designated on our Balance Sheet would be adjusted downward in respect of the shares of the New Common Stock to be issued in the Reverse Split such that the Common Stock would become an amount equal to the aggregate par value of the shares of New Common Stock being issued in the Reverse Split, and that the Additional Paid-in Capital as designated on our Balance Sheet would be increased by an amount equal to the amount by which the Common Stock was decreased. Additionally, net loss per share would increase proportionately as a result of the Reverse Split. We do not anticipate that any other accounting consequence would arise as a result of the Reverse Split, if effected.

Federal Income Tax Consequences. The following is a summary of the material anticipated United States federal income tax consequences of the Reverse Split to our stockholders. This summary is based on the United States federal income tax laws now in effect and as currently interpreted, and does not take into account possible changes in such laws or interpretations. This summary is provided for general information only and does not address all aspects of the possible federal income tax consequences of the Reverse Split and is not intended as tax advice to any person. In particular, this summary does not consider the federal income tax consequences to our stockholders in light of their individual investment circumstances or to holders subject to special treatment under the federal income tax laws, and does not address any consequences of the Reverse Split under any state, local, or foreign tax laws.

We believe that our stockholders who exchange their Common Stock solely for New Common Stock should generally recognize no gain or loss for federal income tax purposes. A stockholder's aggregate tax basis in its shares of New Common Stock received should be the same as the stockholder's aggregate tax basis in the Common Stock exchanged therefor. The holding period of the New Common Stock received by that stockholder should include the period during which the surrendered Common Stock was held, provided all such Common Stock was held as a capital asset at the Effective Date.

We will not recognize any gain or loss as a result of the Reverse Split, if effected.