UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-04222 | |||||||

| ||||||||

Morgan Stanley New York Tax-Free Income Fund | ||||||||

(Exact name of registrant as specified in charter) | ||||||||

| ||||||||

522 Fifth Avenue, New York, New York |

| 10036 | ||||||

(Address of principal executive offices) |

| (Zip code) | ||||||

| ||||||||

Ronald E. Robison 522 Fifth Avenue, New York, New York 10036 | ||||||||

(Name and address of agent for service) | ||||||||

| ||||||||

Registrant’s telephone number, including area code: | 212-296-6990 |

| ||||||

| ||||||||

Date of fiscal year end: | December 31, 2007 |

| ||||||

| ||||||||

Date of reporting period: | December 31, 2007 |

| ||||||

Item 1 - Report to Shareholders

Welcome, Shareholder:

In this report, you'll learn about how your investment in Morgan Stanley New York Tax-Free Income Fund performed during the annual period. We will provide an overview of the market conditions, and discuss some of the factors that affected performance during the reporting period. In addition, this report includes the Fund's financial statements and a list of Fund investments.

This material must be preceded or accompanied by a prospectus for the fund being offered.

Market forecasts provided in this report may not necessarily come to pass. There is no assurance that the Fund will achieve its investment objective. The Fund is subject to market risk, which is the possibility that market values of securities owned by the Fund will decline and, therefore, the value of the Fund's shares may be less than what you paid for them. Accordingly, you can lose money investing in this Fund. Please see the prospectus for more complete information on investment risks.

Fund Report

For the year ended December 31, 2007

| Total Return for the 12 Months Ended December 31, 2007 | |||||||||||||||||||||||

| Class A | Class B | Class C | Class D | Lehman Brothers New York Exempt Index1 | Lipper New York Municipal Debt Funds Index2 | ||||||||||||||||||

| 2.33 | % | 2.36 | % | 1.80 | % | 2.56 | % | 3.63 | % | 1.76 | % | ||||||||||||

The performance of the Fund's four share classes varies because each has different expenses. The Fund's total returns assume the reinvestment of all distributions but do not reflect the deduction of any applicable sales charges. Such costs would lower performance. See Performance Summary for standardized performance and benchmark information.

Because Class B shares incurred lower expenses under the 12b-1 Plan than did Class A shares for the fiscal period ended December 31, 2007, the total operating expense ratio for Class B shares was lower and, as a result, the performance of Class B shares was higher than that of the Class A shares. There can be no assurance that this will continue to occur in the future as the maximum fees payable by Class B shares under the 12b-1 Plan are higher than those payable by Class A shares.

Currently, the Distributor has agreed to waive the 12b-1 fee on Class B shares to the extent it exceeds 0.24% of the average daily net assets of such shares on an annualized basis. The Distributor may discontinue this waiver in the future.

Market Conditions

Worries surrounding the residential housing downturn persisted throughout the 12-month period. Confronted with increasing delinquency rates on subprime loans, high-profile hedge fund collapses and a series of subprime mortgage related credit downgrades, markets responded severely beginning in the second quarter of the year. The impact was exacerbated by forced sellers looking to liquidate assets to help meet margin calls and capital withdrawals, which resulted in a flight to quality.

As the subprime mortgage crisis worsened, investors grew increasingly concerned about the impact on financial markets, the financial system and the broader economy, and demanded additional compensation for owning riskier investments. As a result, credit spreads widened sharply. The subprime crisis severely impacted many major banks and Wall Street firms, which took write-downs and losses on the subprime mortgage loans and securities in their portfolios. Some sold stakes to sovereign funds in exchange for cash infusions needed to bolster their balance sheets.

The Federal Open Market Committee (the "Fed") took steps to ease the liquidity crisis, reducing the target federal funds rate by at total of one percent in three separate moves between September and the end of the year, bringing the rate to 4.25 percent. These reductions, coupled with the flight to quality, caused yields across the yield curve to decline, but more so on the short end. As a result, the shape of the yield curve (which reflects the difference between yields of short-term and longer-term securities) shifted from relatively flat at the beginning of the year to steep by the

2

end of the year. The municipal yield curve ended the year steeper as well. Overall, U.S. Treasury securities outperformed municipal bonds, as well as all other areas of the fixed income market. In terms of new issue supply in the municipal market, 2007 was a record-breaking year. The State of New York continued to lead the nation in issuance of municipal bonds.

Performance Analysis

All share classes of Morgan Stanley New York Tax-Free Income Fund underperformed the Lehman Brothers New York Exempt Index and outperformed the Lipper New York Municipal Debt Funds Index for the 12 months ended December 31, 2007, assuming no deduction of applicable sales charges.

Throughout the year, we employed a defensive interest rate strategy by keeping the Fund's duration* shorter than that of the benchmark Lehman Brothers New York Exempt Index. This strategy was implemented through the use of a U.S. Treasury futures hedge and was beneficial early in the period when interest rates were rising. However, as yields on the long end of the curve declined later in the year and the spread between short- and long-dated issues narrowed, this positioning detracted from relative performance. An overweight to longer-dated issues also dampened returns as yields on the long end of the curve ended the year higher.

In terms of the Fund's sector positioning, an overweight to the hospital/life care and tobacco sectors hindered performance. Conversely, an overweight to the public utility sector, particularly water and sewer bonds, benefited performance. The flight to quality that took place during the period helped boost the performance of the more solid infrastructure sectors such as utilities. It also led to the outperformance of the higher rated segment of the municipal market. As such, the Fund's emphasis on higher quality securities was additive to performance as well, particularly in the second half of the year.

There is no guarantee that any sectors mentioned will continue to perform as discussed herein or that securities in such sectors will be held by the Fund in the future.

* A measure of the sensitivity of a bond's price to changes in interest rates, expressed in years. Each year of duration represents an expected 1 percent change in the price of a bond for every 1 percent change in interest rates. The longer a bond's duration, the greater the effect of interest-rate movements on its price. Typically, funds with shorter durations perform better in rising-interest-rate environments, while funds with longer durations perform better when rates decline.

3

| TOP FIVE SECTORS | |||||||

| IDR/PCR* | 16.7 | % | |||||

| Other Revenue | 16.1 | ||||||

| Housing | 10.8 | ||||||

| Hospital | 10.7 | ||||||

| Refunded | 9.0 | ||||||

| LONG-TERM CREDIT ANALYSIS | |||||||

| Aaa/AAA | 48.2 | % | |||||

| Aa/AA | 14.8 | ||||||

| A/A | 16.4 | ||||||

| Baa/BB | 16.2 | ||||||

| NR | 4.4 | ||||||

* Industrial Development/Pollution Control Revenue

Data as of December 31, 2007. Subject to change daily. All percentages for top five sectors are as a percentage of net assets and all percentages for long-term credit analysis are as a percentage of total long-term investments. These data are provided for informational purposes only and should not be deemed a recommendation to buy or sell the securities mentioned. Morgan Stanley is a full-service securities firm engaged in securities trading and brokerage activities, investment banking, research and analysis, financing and financial advisory services.

Investment Strategy

The Fund will normally invest at least 80 percent of its assets in securities that pay interest exempt from federal, New York state and New York city income tax or other local income taxes. The Fund's "Investment Adviser," Morgan Stanley Investment Advisors Inc., generally invests the Fund's assets in investment grade, New York municipal obligations. Municipal obligations are bonds, notes or short-term commercial paper issued by state governments, local governments or their respective agencies. These municipal obligations will have the following ratings at the time of purchase:

• municipal bonds — within the four highest grades by Moody's Investors Service Inc. ("Moody's"), Standard & Poor's Ratings Group, a division of The McGraw-Hill Companies, Inc. ("S&P"), or Fitch Ratings ("Fitch");

• municipal notes — within the two highest grades or, if not rated, have outstanding bonds within the four highest grades by Moody's, S&P or Fitch; and

• municipal commercial paper — within the highest grade by Moody's, S&P or Fitch.

For More Information About Portfolio Holdings

Each Morgan Stanley fund provides a complete schedule of portfolio holdings in its semiannual and annual reports within 60 days of the end of the fund's second and fourth fiscal quarters. The semiannual reports and the annual reports are filed electronically with the Securities and Exchange Commission (SEC) on Form N-CSRS and Form N-CSR, respectively. Morgan Stanley also delivers the semiannual and annual reports to fund shareholders and makes these reports available on its public web site, www.morganstanley.com. Each

4

Morgan Stanley fund also files a complete schedule of portfolio holdings with the SEC for the fund's first and third fiscal quarters on Form N-Q. Morgan Stanley does not deliver the reports for the first and third fiscal quarters to shareholders, nor are the reports posted to the Morgan Stanley public web site. You may, however, obtain the Form N-Q filings (as well as the Form N-CSR and N-CSRS filings) by accessing the SEC's web site, http://www.sec.gov. You may also review and copy them at the SEC's public reference room in Washington, DC. Information on the operation of the SEC's public reference room may be obtained by calling the SEC at (800) SEC-0330. You can also request copies of these materials, upon payment of a duplicating fee, by electronic request at the SEC's e-mail address (publicinfo@sec.gov) or by writing the public reference section of the SEC, Washington, DC 20549-0102.

Householding Notice

To reduce printing and mailing costs, the Fund attempts to eliminate duplicate mailings to the same address. The Fund delivers a single copy of certain shareholder documents, including shareholder reports, prospectuses and proxy materials, to investors with the same last name who reside at the same address. Your participation in this program will continue for an unlimited period of time unless you instruct us otherwise. You can request multiple copies of these documents by calling (800) 869-NEWS, 8:00 a.m. to 8:00 p.m., ET. Once our Customer Service Center has received your instructions, we will begin sending individual copies for each account within 30 days.

5

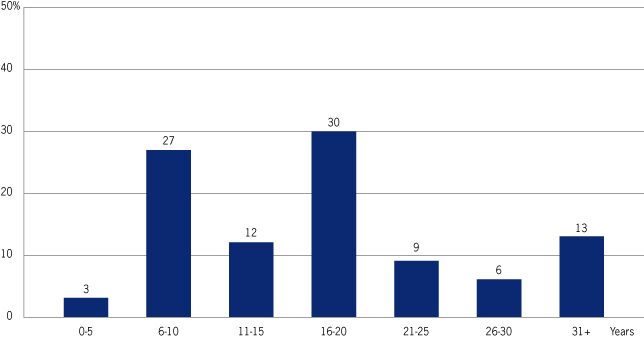

Distribution by Maturity

(% of Long-Term Portfolio) As of December 31, 2007

Weighted Average Maturity: 18 Years(a)

(a) Where applicable, maturities reflect mandatory tenders, puts and call dates.

Portfolio structure is subject to change.

6

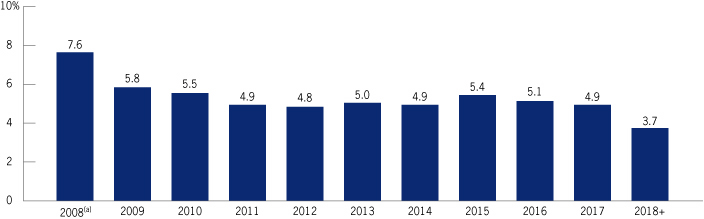

Call and Cost (Book) Yield Structure

(Based on Long-Term Portfolio) As of December 31, 2007

Years Bonds Callable—Weighted Average Call Protection: 5 Years

Cost (Book) Yield(b)—Weighted Average Book Yield: 5.5%

(a) May include issues initially callable in previous years.

(b) Cost or "book" yield is the annual income earned on a portfolio investment based on its original purchase price before the Fund's operating expenses. For example, the Fund is earning a book yield of 7.6% on 20% of the long-term portfolio that is callable in 2008.

Portfolio structure is subject to change.

7

Performance Summary

Performance of $10,000 Investment—Class B

8

| Average Annual Total Returns—Period Ended December 31, 2007 | |||||||||||||||||||||||||||||||||||

| Symbol | Class A Shares* (since 07/28/97) NYFAX | Class B Shares** (since 04/25/85) NYFBX | Class C Shares† (since 07/28/97) NYFCX | Class D Shares†† (since 07/28/97) NYFDX | |||||||||||||||||||||||||||||||

| 1 Year | 2.33% (2.02) | 3 4 | 2.36% (2.52) | 3 4 | 1.80% 0.82 | 3 4 | 2.56% — | 3 | |||||||||||||||||||||||||||

| 5 Years | 3.71 2.81 | 3 4 | 3.39 3.06 | 3 4 | 3.08 3.08 | 3 4 | 3.82 — | 3 | |||||||||||||||||||||||||||

| 10 Years | 4.50 4.05 | 3 4 | 4.04 4.04 | 3 4 | 3.89 3.89 | 3 4 | 4.62 — | 3 | |||||||||||||||||||||||||||

| Since Inception | 4.63 4.20 | 3 4 | 6.24 6.24 | 3 4 | 4.01 4.01 | 3 4 | 4.75 — | 3 | |||||||||||||||||||||||||||

Performance data quoted represents past performance, which is no guarantee of future results and current performance may be lower or higher than the figures shown. For most recent month-end performance figures, please visit www.morganstanley.com/msim or speak with your Financial Advisor. Investment returns and principal value will fluctuate and fund shares, when redeemed, may be worth more or less than their original cost. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Performance for Class A, Class B, Class C, and Class D shares will vary due to differences in sales charges and expenses.

* The maximum front-end sales charge for Class A is 4.25%.

** The maximum contingent deferred sales charge (CDSC) for Class B is 5.0%.

† The maximum contingent deferred sales charge for Class C is 1.0% for shares redeemed within one year of purchase.

†† Class D has no sales charge.

(1) The Lehman Brothers New York Exempt Index tracks the performance of New York issued municipal bonds rated at least Baa or BBB by Moody's Investors Service, Inc. or Standard & Poor's Corporation, respectively and with maturities of 2 years or greater. The Index is unmanaged and its returns do not include any sales charges or fees. Such costs would lower performance. It is not possible to invest directly in an index.

(2) The Lipper New York Municipal Debt Funds Index is an equally weighted performance index of the largest qualifying funds (based on net assets) in the Lipper New York Municipal Debt Funds classification. The Index, which is adjusted for capital gains distributions and income dividends, is unmanaged and should not be considered an investment. There are currently 30 funds represented in this Index. The Fund is in the Lipper New York Municipal Debt Funds classification as of the date of this report.

(3) Figure shown assumes reinvestment of all distributions and does not reflect the deduction of any sales charges.

(4) Figure shown assumes reinvestment of all distributions and the deduction of the maximum applicable sales charge. See the Fund's current prospectus for complete details on fees and sales charges.

‡ Ending value assuming a complete redemption on December 31, 2007.

9

Expense Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemption fees; and (2) ongoing costs, including advisory fees; distribution and service (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period 07/01/07 – 12/31/07.

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical expenses based on the Fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing cost of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) and redemption fees. Therefore, the second line of the table is useful in comparing ongoing costs, and will not help you determine the relative total cost of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| Beginning Account Value | Ending Account Value | Expenses Paid During Period * | |||||||||||||

| 07/01/07 | 12/31/07 | 07/01/07 – 12/31/07 | |||||||||||||

| Class A | |||||||||||||||

| Actual (2.20% return) | $ | 1,000.00 | $ | 1,022.00 | $ | 4.99 | |||||||||

| Hypothetical (5% annual return before expenses) | $ | 1,000.00 | $ | 1,020.27 | $ | 4.99 | |||||||||

| Class B | |||||||||||||||

| Actual (2.15% return) | $ | 1,000.00 | $ | 1,021.50 | $ | 4.59 | |||||||||

| Hypothetical (5% annual return before expenses) | $ | 1,000.00 | $ | 1,020.67 | $ | 4.58 | |||||||||

| Class C | |||||||||||||||

| Actual (1.85% return) | $ | 1,000.00 | $ | 1,018.50 | $ | 7.53 | |||||||||

| Hypothetical (5% annual return before expenses) | $ | 1,000.00 | $ | 1,017.74 | $ | 7.53 | |||||||||

| Class D | |||||||||||||||

| Actual (2.33% return) | $ | 1,000.00 | $ | 1,023.30 | $ | 3.72 | |||||||||

| Hypothetical (5% annual return before expenses) | $ | 1,000.00 | $ | 1,021.53 | $ | 3.72 | |||||||||

* Expenses are equal to the Fund's annualized expense ratios of 0.98%, 0.90%, 1.48% and 0.73% for Class A, Class B, Class C and Class D shares, respectively, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). If the Fund had borne all of its expenses, the annualized expense ratios would have been 1.14%, 1.06%, 1.64% and 0.89% for Class A, Class B, Class C and Class D shares, respectively.

10

Morgan Stanley New York Tax-Free Income Fund

Portfolio of Investments n December 31, 2007

| PRINCIPAL AMOUNT IN THOUSANDS | COUPON RATE | MATURITY DATE | VALUE | ||||||||||||||||

| Tax-Exempt Municipal Bonds (96.2%) | |||||||||||||||||||

| New York (88.2%) | |||||||||||||||||||

| $ | 2,000 | Battery Park City Authority, Ser 2003 A | 5.00 | % | 11/01/24 | $ | 2,097,400 | ||||||||||||

| 500 | Hempstead Industrial Development Agency, Hofstra University Ser 1996 (MBIA Insd) | 5.80 | 07/01/15 | 506,670 | |||||||||||||||

| 4,000 | Hudson Yards Infrastructure Corporation, 2007 Ser A (MBIA Insd) | 4.50 | 02/15/47 | 3,811,920 | |||||||||||||||

| 2,000 | Long Island Power Authority, Ser 2000 A (FSA Insd) | 0.00 | 06/01/18 | 1,310,460 | |||||||||||||||

| 3,000 | Metropolitan Transportation Authority, Dedicated Tax Refg Ser 2002 A (FSA Insd) | 5.25 | 11/15/24 | 3,204,060 | |||||||||||||||

| 1,000 | Nassau County Tobacco Settlement Corporation, Ser 2006 | 0.00 | @ | 06/01/26 | 914,620 | ||||||||||||||

| 2,000 | New York City Health & Hospital Corporation, 2003 Ser A (AMBAC Insd) | 5.25 | 02/15/22 | 2,125,140 | |||||||||||||||

| 1,612 | New York City Housing Development Corporation, East Midtown - FHA Ins Sec 223 | 6.50 | 11/15/18 | 1,614,753 | |||||||||||||||

| 1,667 | New York City Housing Development Corporation, Ruppert - FHA Ins Sec 223 | 6.50 | 11/15/18 | 1,753,776 | |||||||||||||||

| 1,000 | New York City Industrial Development Agency, Airis JFK I LLC Ser 2001 A (AMT) | 5.50 | 07/01/28 | 941,470 | |||||||||||||||

| 2,000 | New York City Industrial Development Agency, Brooklyn Navy Yard Cogeneration Partners LP Ser 1997 (AMT) | 5.75 | 10/01/36 | 1,934,340 | |||||||||||||||

| 1,500 | New York City Industrial Development Agency, IAC/Interactive Corp Ser 2005 | 5.00 | 09/01/35 | 1,358,250 | |||||||||||||||

| 1,000 | New York City Industrial Development Agency, Queens Baseball Stadium Ser 2006 (AMBAC Insd) | 5.00 | 01/01/46 | 1,021,440 | |||||||||||||||

| 1,035 | New York City Industrial Development Agency, Royal Charter Properties - The New York & Presbyterian Hospital Parking Ser 2001 (FSA Insd) | 5.25 | 12/15/32 | 1,092,970 | |||||||||||||||

| 2,000 | New York City Industrial Development Agency, Terminal One Group Association Ser 2005 (AMT) | 5.50 | 01/01/24 | 2,048,060 | |||||||||||||||

| 3,000 | New York City Municipal Water Finance Authority, 2001 Ser B | 5.125 | 06/15/31 | 3,120,210 | |||||||||||||||

| 2,000 | New York City Transitional Finance Authority, 2003 Ser D (MBIA Insd) | 5.25 | 02/01/20 | 2,141,920 | |||||||||||||||

| 2,000 | New York City Transitional Finance Authority, Refg 2003 Ser A | 5.50 | @ | 11/01/26 | 2,156,000 | ||||||||||||||

| 1,000 | New York City, 2005 Ser G | 5.00 | 12/01/26 | 1,025,510 | |||||||||||||||

| 1,000 | New York Counties Tobacco Trust IV, Ser 2005 A ** | 5.00 | 06/01/45 | 926,930 | |||||||||||||||

See Notes to Financial Statements

11

Morgan Stanley New York Tax-Free Income Fund

Portfolio of Investments n December 31, 2007 continued

| PRINCIPAL AMOUNT IN THOUSANDS | COUPON RATE | MATURITY DATE | VALUE | ||||||||||||||||

| $ | 2,000 | New York Local Government Assistance Corporation, Ser 1993 C | 5.50 | % | 04/01/17 | $ | 2,234,840 | ||||||||||||

| 1,000 | New York State Dormitory Authority, Catholic Health Long Island - St Francis Hospital Ser 2004 | 5.00 | 07/01/27 | 978,670 | |||||||||||||||

| 2,000 | New York State Dormitory Authority, City University Ser 1993 A | 5.75 | 07/01/09 | 2,046,160 | |||||||||||||||

| 1,000 | New York State Dormitory Authority, Montefiore Hospital - FHA Insured Mtge Ser 2004 (FGIC Insd) | 5.00 | 08/01/29 | 1,029,700 | |||||||||||||||

| 1,000 | New York State Dormitory Authority, New York University Ser 1998 A (MBIA Insd) | 5.75 | 07/01/15 | 1,146,940 | |||||||||||||||

| 1,000 | New York State Dormitory Authority, School District Ser 2002 C (MBIA Insd) | 5.25 | 04/01/21 | 1,069,370 | |||||||||||||||

| 1,000 | New York State Dormitory Authority, School District Ser 2002 E (MBIA Insd) | 5.50 | 10/01/17 | 1,087,220 | |||||||||||||||

| 2,000 | New York State Dormitory Authority, State University 1993 Ser A | 5.25 | 05/15/15 | 2,174,000 | |||||||||||||||

| 2,205 | New York State Dormitory Authority, Suffolk County Judicial Ser 1986 (ETM) | 7.375 | 07/01/16 | 2,611,359 | |||||||||||||||

| 2,000 | New York State Dormitory Authority, Winthrop South Nassau University Health Ser 2003 B | 5.50 | 07/01/23 | 2,039,380 | |||||||||||||||

| 2,000 | New York State Dorrmitory Authority, North shore Long Island Jewish Group Ser 2007 A | 5.00 | 05/01/32 | 1,961,220 | |||||||||||||||

| 6,000 | New York State Energy & Research Development Authority, Brooklyn Union Gas Co 1991 Ser D (AMT) | 8.043 | ## | 07/01/26 | 6,379,500 | ||||||||||||||

| 3,960 | New York State Housing Finance Agency, 1996 Ser A Refg (FSA Insd) | 6.10 | 11/01/15 | 3,998,254 | |||||||||||||||

| 1,000 | New York State Mortgage Agency Homeowner Ser 143 (AMT) | 4.90 | 10/01/37 | 945,370 | |||||||||||||||

| 2,000 | New York State Power Authority, Ser 2000 A | 5.25 | 11/15/40 | 2,078,060 | |||||||||||||||

| 1,000 | Suffolk County Industrial Development Agency, Jeffersons Ferry Ser 2006 | 5.00 | 11/01/28 | 920,570 | |||||||||||||||

| 1,000 | TSASC Inc, Tobacco Settlement Ser 2006-1 | 5.125 | 06/01/42 | 953,570 | |||||||||||||||

| 1,500 | Westchester Tobacco Asset Securitization Corporation, Ser 2005 | 5.125 | 06/01/45 | 1,423,590 | |||||||||||||||

| 70,183,672 | |||||||||||||||||||

See Notes to Financial Statements

12

Morgan Stanley New York Tax-Free Income Fund

Portfolio of Investments n December 31, 2007 continued

| PRINCIPAL AMOUNT IN THOUSANDS | COUPON RATE | MATURITY DATE | VALUE | ||||||||||||||||

| Puerto Rico (8.0%) | |||||||||||||||||||

| $ | 2,000 | Puerto Rico Highway & Transportation Authority, Refg Ser X | 5.50 | % | 07/01/15 | $ | 2,159,920 | ||||||||||||

| 4,000 | Puerto Rico Infrastructure Financing Authority, 2000 Ser A (ETM) | 5.375 | 10/01/24 | 4,217,640 | |||||||||||||||

| 6,377,560 | |||||||||||||||||||

| Total Tax-Exempt Municipal Bonds (Cost $73,621,548) | 76,561,232 | ||||||||||||||||||

| Short-Term New York Tax-Exempt Municipal Obligations (2.4%) | |||||||||||||||||||

| 500 | Nassau County Industrial Development Agency, Cold Spring Harbor Laboratory Ser 1999 (Demand 01/02/2008) | 3.73 | * | 01/01/34 | 500,000 | ||||||||||||||

| 600 | New York City Municipal Water finance Authority, Ser 2003 F-2 (Demand 01/02/2008) | 3.54 | * | 06/15/35 | 600,000 | ||||||||||||||

| 800 | New York Ser 1993 E2 (Demand 01/02/2008) | 3.54 | * | 08/01/21 | 800,000 | ||||||||||||||

| Total Short-Term New York Tax-Exempt Municipal Obligations (Cost $1,900,000) | 1,900,000 | ||||||||||||||||||

| Total Investments (Cost $75,521,548) (a) (b) | 98.6 | % | 78,461,232 | ||||||||||||||||

| Other Assets in Excess of Liabilities | 1.4 | 1,117,676 | |||||||||||||||||

| Net Assets | 100.0 | % | $ | 79,578,908 | |||||||||||||||

AMT Alternative Minimum Tax.

ETM Escrowed to Maturity.

FHA Federal Housing Administration.

@ Security is a "step-up" bond where the coupon increases on a predetermined future date.

## Current coupon rate for inverse floating rate municipal obligation (See Note 6). This rate resets periodically as the auction rate on the related security changes. Positions in inverse floating rate municipal obligations have a total value of $6,379,500, which represents 8.0% of net assets.

* Current coupon rate of variable demand obligation.

** A portion of this security has been physically segregated in connection with open futures contracts in the amount of $197,700.

(a) Securities have been designated as collateral in the amount equal to $56,825,850 in connection with open futures contracts.

(b) The aggregate cost for federal income tax purposes is $75,364,087. The aggregate gross unrealized appreciation is $3,784,520 and the aggregate gross unrealized depreciation is $687,375, resulting in net unrealized appreciation of $3,097,145.

Bond Insurance:

AMBAC AMBAC Assurance Corporation.

FGIC Financial Guaranty Insurance Company.

FSA Financial Security Assurance Inc.

MBIA Municipal Bond Investors Assurance Corporation.

See Notes to Financial Statements

13

Morgan Stanley New York Tax-Free Income Fund

Portfolio of Investments n December 31, 2007 continued

Futures Contracts Open at December 31, 2007:

| NUMBER OF CONTRACTS | LONG/SHORT | DESCRIPTION, DELIVERY MONTH AND YEAR | UNDERLYING FACE AMOUNT AT VALUE | UNREALIZED APPRECIATION (DEPRECIATION) | |||||||||||||||

| 223 | Long | Swap Future 10 Year March 2008 | $ | 24,634,531 | $ | 160,146 | |||||||||||||

| 38 | Long | U.S. Treasury Notes 2 Year March 2008 | 7,989,500 | 19,587 | |||||||||||||||

| 52 | Long | US Treasury Notes 5 Year March 2008 | 5,734,625 | 33,055 | |||||||||||||||

| 40 | Short | US Treasury Bonds 20 Year March 2008 | (4,655,000 | ) | (36,702 | ) | |||||||||||||

| 127 | Short | US Treasury Notes 10 Year March 2008 | (14,400,610 | ) | (140,954 | ) | |||||||||||||

| Net Unrealized Appreciation | $ | 35,132 | |||||||||||||||||

See Notes to Financial Statements

14

Morgan Stanley New York Tax-Free Income Fund

Financial Statements

Statement of Assets and Liabilities

December 31, 2007

| Assets: | |||||||

| Investments in securities, at value (cost $75,521,548) | $ | 78,461,232 | |||||

| Cash | 95,019 | ||||||

| Receivable for: | |||||||

| Interest | 990,669 | ||||||

| Shares of beneficial interest sold | 189,648 | ||||||

| Variation margin | 103,685 | ||||||

| Prepaid expenses and other assets | 38,543 | ||||||

| Receivable from Distributor | 19,165 | ||||||

| Total Assets | 79,897,961 | ||||||

| Liabilities: | |||||||

| Payable for: | |||||||

| Dividends and distributions to shareholders | 134,289 | ||||||

| Distribution fee | 23,466 | ||||||

| Investment advisory fee | 19,984 | ||||||

| Shares of beneficial interest redeemed | 5,696 | ||||||

| Administration fee | 5,409 | ||||||

| Transfer agent fee | 102 | ||||||

| Accrued expenses and other payables | 130,107 | ||||||

| Total Liabilities | 319,053 | ||||||

| Net Assets | $ | 79,578,908 | |||||

| Composition of Net Assets: | |||||||

| Paid-in-capital | $ | 76,186,745 | |||||

| Net unrealized appreciation | 2,974,816 | ||||||

| Accumulated undistributed net investment income | 179,552 | ||||||

| Accumulated undistributed net realized gain | 237,795 | ||||||

| Net Assets | $ | 79,578,908 | |||||

| Class A Shares: | |||||||

| Net Assets | $ | 49,048,297 | |||||

| Shares Outstanding (unlimited authorized, $.01 par value) | 4,448,151 | ||||||

| Net Asset Value Per Share | $ | 11.03 | |||||

| Maximum Offering Price Per Share, (net asset value plus 4.44% of net asset value) | $ | 11.52 | |||||

| Class B Shares: | |||||||

| Net Assets | $ | 17,423,754 | |||||

| Shares Outstanding (unlimited authorized, $.01 par value) | 1,591,682 | ||||||

| Net Asset Value Per Share | $ | 10.95 | |||||

| Class C Shares: | |||||||

| Net Assets | $ | 2,880,527 | |||||

| Shares Outstanding (unlimited authorized, $.01 par value) | 262,829 | ||||||

| Net Asset Value Per Share | $ | 10.96 | |||||

| Class D Shares: | |||||||

| Net Assets | $ | 10,226,330 | |||||

| Shares Outstanding (unlimited authorized, $.01 par value) | 937,604 | ||||||

| Net Asset Value Per Share | $ | 10.91 | |||||

Statement of Operations

For the year ended December 31, 2007

| Net Investment Income: | |||||||

| Interest Income | $ | 4,727,925 | |||||

| Expenses | |||||||

| Investment advisory fee | 404,465 | ||||||

| Distribution fee (Class A shares) | 127,506 | ||||||

| Distribution fee (Class B shares) | 21,854 | ||||||

| Distribution fee (Class C shares) | 20,912 | ||||||

| Interest and residual trust expenses | 87,856 | ||||||

| Shareholder reports and notices | 74,141 | ||||||

| Professional fees | 73,655 | ||||||

| Administration fee | 68,845 | ||||||

| Transfer agent fees and expenses | 42,147 | ||||||

| Registration fees | 8,810 | ||||||

| Trustees' fees and expenses | 7,686 | ||||||

| Custodian fees | 5,567 | ||||||

| Other | 19,342 | ||||||

| Total Expenses | 962,786 | ||||||

| Less: amounts waived/reimbursed | (140,152 | ) | |||||

| Less: expense offset | (5,132 | ) | |||||

| Net Expenses | 817,502 | ||||||

| Net Investment Income | 3,910,423 | ||||||

| Net Realized and Unrealized Gain (Loss): Net Realized Gain (Loss) on: | |||||||

| Investments | (30,578 | ) | |||||

| Futures contracts | 312,682 | ||||||

| Net Realized Gain | 282,104 | ||||||

| Net Change in Unrealized Appreciation/Depreciation on: | |||||||

| Investments | (2,358,201 | ) | |||||

| Futures contracts | 1,998 | ||||||

| Net Change in Unrealized Appreciation/Depreciation | (2,356,203 | ) | |||||

| Net Loss | (2,074,099 | ) | |||||

| Net Increase | $ | 1,836,324 | |||||

See Notes to Financial Statements

15

Morgan Stanley New York Tax-Free Income Fund

Financial Statements continued

Statements of Changes in Net Assets

| FOR THE YEAR ENDED DECEMBER 31, 2007 | FOR THE YEAR ENDED DECEMBER 31, 2006 | ||||||||||

| Increase (Decrease) in Net Assets: Operations: | |||||||||||

| Net investment income | $ | 3,910,423 | $ | 4,295,332 | |||||||

| Net realized gain | 282,104 | 557,640 | |||||||||

| Net change in unrealized appreciation/depreciation | (2,356,203 | ) | (400,162 | ) | |||||||

| Net Increase | 1,836,324 | 4,452,810 | |||||||||

| Dividends and Distributions to Shareholders from: | |||||||||||

| Net investment income | |||||||||||

| Class A shares | (2,317,544 | ) | (2,614,208 | ) | |||||||

| Class B shares | (942,393 | ) | (1,093,274 | ) | |||||||

| Class C shares | (108,994 | ) | (116,057 | ) | |||||||

| Class D shares | (482,876 | ) | (447,215 | ) | |||||||

| Net realized gain | |||||||||||

| Class A shares | (65,410 | ) | (286,760 | ) | |||||||

| Class B shares | (27,855 | ) | (113,299 | ) | |||||||

| Class C shares | (3,596 | ) | (14,164 | ) | |||||||

| Class D shares | (13,259 | ) | (54,339 | ) | |||||||

| Total Dividends and Distributions | (3,961,927 | ) | (4,739,316 | ) | |||||||

| Net decrease from transactions in shares of beneficial interest | (12,356,194 | ) | (9,676,025 | ) | |||||||

| Net Decrease | (14,481,797 | ) | (9,962,531 | ) | |||||||

| Net Assets: | |||||||||||

| Beginning of period | 94,060,705 | 104,023,236 | |||||||||

| End of Period (Including accumulated undistributed net investment income of $179,552 and $121,258, respectively) | $ | 79,578,908 | $ | 94,060,705 | |||||||

See Notes to Financial Statements

16

Morgan Stanley New York Tax-Free Income Fund

Notes to Financial Statements n December 31, 2007

1. Organization and Accounting Policies

Morgan Stanley New York Tax-Free Income Fund (the "Fund") is registered under the Investment Company Act of 1940, as amended (the "Act"), as a diversified, open-end management investment company. The Fund's investment objective is to provide a high level of current income which is exempt from federal, New York State and New York City income tax, consistent with the preservation of capital. The Fund was organized as a Massachusetts business trust on January 17, 1985 and commenced operations on April 25, 1985. On July 28, 1997, the Fund converted to a multiple class share structure.

The Fund offers Class A shares, Class B shares, Class C shares and Class D shares. The four classes are substantially the same except that most Class A shares are subject to a sales charge imposed at the time of purchase and some Class A shares, and most Class B shares and Class C shares are subject to a contingent deferred sales charge imposed on shares redeemed within eighteen months, six years and one year, respectively. Class D shares are not subject to a sales charge. Additionally, Class A shares, Class B shares and Class C shares incur distribution expenses.

The Fund will assess a 2% redemption fee on Class A shares, Class B shares, Class C shares, and Class D shares, which is paid directly to the Fund, for shares redeemed or exchanged within seven days of purchase, subject to certain exceptions. The redemption fee is designed to protect the Fund and its remaining shareholders from the effects of short-term trading.

The following is a summary of significant accounting policies:

A. Valuation of Investments — (1) portfolio securities are valued by an outside independent pricing service approved by the Trustees. The pricing service uses both a computerized grid matrix of tax-exempt securities and evaluations by its staff, in each case based on information concerning market transactions and quotations from dealers which reflect the mean between the last reported bid and asked price. The portfolio securities are thus valued by reference to a combination of transactions and quotations for the same or other securities believed to be comparable in quality, coupon, maturity, type of issue, call provisions, trading characteristics and other features deemed to be relevant. The Trustees believe that timely and reliable market quotations are generally not readily available for purposes of valuing tax-exempt securities and that the valuations supplied by the pricing service are more likely to approximate the fa ir value of such securities; (2) futures are valued at the latest sale price on the commodities exchange on which they trade unless it is determined that such price does not reflect their market value, in which case they will be valued at their fair value as determined in good faith under procedures established by and under the supervision of the Trustees; and (3) short-term debt securities having a maturity date of more than sixty days at time of purchase are valued on a mark-to-market basis until sixty days prior to maturity and thereafter at amortized cost based on their value on the 61st day. Short-term debt securities having a maturity date of sixty days or less at the time of purchase are valued at amortized cost.

B. Accounting for Investments — Security transactions are accounted for on the trade date (date the order to buy or sell is executed). Realized gains and losses on security transactions are determined by

17

Morgan Stanley New York Tax-Free Income Fund

Notes to Financial Statements n December 31, 2007 continued

the identified cost method. Discounts are accreted and premiums are amortized over the life of the respective securities and are included in interest income. Interest income is accrued daily.

C. Floating Rate Note and Dealer Trusts Obligations Related to Securities Held — The Fund enters into transactions in which it transfers to Dealer Trusts ("Dealer Trusts"), fixed rate bonds in exchange for cash and residual interests in the Dealer Trusts' assets and cash flows, which are in the form of inverse floating rate investments. The Dealer Trusts fund the purchases of the fixed rate bonds by issuing floating rate notes to third parties and allowing the Fund to retain residual interest in the bonds. The Fund enters into shortfall agreements with the Dealer Trusts which commit the Fund to pay the Dealer Trusts, in certain circumstances, the difference between the liquidation value of the fixed rate bonds held by the Dealer Trusts and the liquidation value of the floating rate notes held by third parties, as well as any shortfalls in interest cash flows. The residual interests held by the Fund (inverse floating rate in vestments) include the right of the Fund (1) to cause the holders of the floating rate notes to tender their notes at par at the next interest rate reset date, and (2) to transfer the municipal bond from the Dealer Trusts to the Fund, thereby collapsing the Dealer Trusts. The Fund accounts for the transfer of bonds to the Dealer Trusts as secured borrowings, with the securities transferred remaining in the Fund's investment assets, and the related floating rate notes reflected as Fund liabilities under the caption "floating rate note and dealer trusts obligations" on the Statement of Assets and Liabilities. The Fund records the interest income from the fixed rate bonds under the caption "Interest Income" and records the expenses related to floating rate note obligations and any administrative expenses of the Dealer Trusts under the caption "Interest and residual trust expenses" on the Statement of Operations. The notes issued by the Dealer Trusts have interest rates that reset weekly and the floating rate no te holders have the option to tender their notes to the Dealer Trusts for redemption at par at each reset date. For the year ended December 31, 2007, the Fund did not hold any floating rate note and dealer trusts obligations.

D. Multiple Class Allocations — Investment income, expenses (other than distribution fees), and realized and unrealized gains and losses are allocated to each class of shares based upon the relative net asset value on the date such items are recognized. Distribution fees are charged directly to the respective class.

E. Futures Contracts — A futures contract is an agreement between two parties to buy and sell financial instruments or contracts based on financial indices at a set price on a future date. Upon entering into such a contract, the Fund is required to pledge to the broker cash, U.S. Government securities or other liquid portfolio securities equal to the minimum initial margin requirements of the applicable futures exchange. Pursuant to the contract, the Fund agrees to receive from or pay to the broker an amount of cash equal to the daily fluctuation in the value of the contract. Such receipts or payments known as variation margin are recorded by the Fund as unrealized gains and losses. Upon closing of the contract, the Fund realizes a gain or loss equal to the difference between the value of the contract at the time it was opened and the value at the time it was closed.

F. Federal Income Tax Policy — It is the Fund's policy to comply with the requirements of Subchapter M of the Internal Revenue Code applicable to regulated investment companies and to distribute substantially all of

18

Morgan Stanley New York Tax-Free Income Fund

Notes to Financial Statements n December 31, 2007 continued

its taxable income to its shareholders. Therefore, no provision for federal income taxes is required. The Fund files tax returns with the U.S. Internal Revenue Service and New York. The Fund adopted the provisions of the Financial Accounting Standards Board ("FASB") Interpretation No. 48 ("FIN 48") Accounting for Uncertainty in Income Taxes on June 29, 2007. FIN 48 sets forth a minimum threshold for financial statement recognition of the benefit of a tax position taken or expected to be taken in a tax return. The implementation of FIN 48 did not result in any unrecognized tax benefits in the accompanying financial statements. If app licable, the Fund recognizes interest accrued related to unrecognized tax benefits in interest expense and penalties in other expenses in the Statement of Operations. Each of the tax years in the four year period ended December 31, 2007, remains subject to examination by taxing authorities.

G. Dividends and Distributions to Shareholders — Dividends and distributions to shareholders are recorded on the ex-dividend date.

H. Use of Estimates — The preparation of financial statements in accordance with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts and disclosures. Actual results could differ from those estimates.

2. Investment Advisory/Administration Agreements

Pursuant to an Investment Advisory Agreement with Morgan Stanley Investment Advisers, Inc. (the "Investment Adviser"), the Fund pays the Investment Adviser an advisory fee, accrued daily and payable monthly, by applying the following annual rates to the Fund's net assets determined as of the close of each business day: 0.47% to the portion of the daily net assets not exceeding $500 million and 0.445% to the portion of the daily net assets exceeding $500 million.

Pursuant to an administration Agreement with Morgan Stanley Services Company Inc. (the "Administrator"), an affiliate of the Investment Adviser, the Fund pays an administration fee, accrued daily and payable monthly, by applying the annual rate of 0.08% to the Fund's daily net assets.

Under an agreement between the Administrator and State Street Bank and Trust Company ("State Street"), State Street provides certain administrative services to the Fund. For such services, the Administrator pays State Street a portion of the fee the Administrator receives from the Fund.

The Investment Adviser has agreed to cap the Fund's operating expenses (except for 12b-1 fees) by assuming the Fund's "other expenses" and/or waiving the Fund's advisory fees, and the Administrator has agreed to waive the Fund's administrative fees, to the extent that such operating expenses exceed 0.65% of the average daily net assets of the Fund on an annualized basis. Such voluntary waivers may be terminated at any time without notice.

3. Plan of Distribution

Shares of the Fund are distributed by Morgan Stanley Distributors Inc. (the "Distributor"), an affiliate of the Investment Adviser and Administrator. The Fund has adopted a Plan of Distribution (the "Plan")

19

Morgan Stanley New York Tax-Free Income Fund

Notes to Financial Statements n December 31, 2007 continued

pursuant to Rule 12b-1 under the Act. The Plan provides that the Fund will pay the Distributor a fee which is accrued daily and paid monthly at the following annual rates: (i) Class A — up to 0.25% of the average daily net assets of Class A shares; (ii) Class B — up to 0.75% of the lesser of: (a) the average daily aggregate gross sales of the Class B shares since the inception of the Fund (not including reinvestment of dividend or capital gain distributions) less the average daily aggregate net asset value of the Class B shares redeemed since the Fund's inception upon which a contingent deferred sales charge has been imposed or waived; or (b) the average daily net assets of Class B shares; and (iii) Class C — up to 0.75% of the average daily net assets of Class C shares.

In the case of Class B shares, provided that the Plan continues in effect, any cumulative expenses incurred by the Distributor but not yet recovered may be recovered through the payment of future distribution fees from the Fund pursuant to the Plan and contingent deferred sales charges paid by investors upon redemption of Class B shares. Although there is no legal obligation for the Fund to pay expenses incurred in excess of payments made to the Distributor under the Plan and the proceeds of contingent deferred sales charges paid by investors upon redemption of shares, if for any reason the Plan is terminated, the Trustees will consider at that time the manner in which to treat such expenses. The Distributor has advised the Fund that there were no excess expenses as of December 31, 2007.

At December 31, 2007, included in the Statement of Assets and Liabilities, is a receivable from the Fund's Distributor which represents payments due to be reimbursed to the Fund under the Plan. Because the Plan is what is referred to as a "reimbursement plan", the Distributor reimburses to the Fund any 12b-1 fees collected in excess of the actual distribution expenses incurred. This receivable represents this excess amount as of December 31, 2007.

Effective February 20, 2007, the Distributor has agreed to waive the 12b-1 fee on Class B shares to the extent it exceeds 0.24% of the average daily net assets of such shares on an annualized basis. The Distributor may discontinue this waiver in the future. For the year ended December 31, 2007, the distribution fee for Class B shares was accrued at an annual rate of 0.11%.

In the case of Class A shares and Class C shares, expenses incurred pursuant to the Plan in any calendar year in excess of 0.25% or 0.75% of the average daily net assets of Class A or Class C, respectively, will not be reimbursed by the Fund through payments in any subsequent year, except that expenses representing a gross sales credit to Morgan Stanley Financial Advisors and other authorized financial representatives at the time of sale may be reimbursed in the subsequent calendar year. For the year ended December 31, 2007, the distribution fee was accrued for Class A shares and Class C shares at the annual rate of 0.24% and 0.75%, respectively.

The Distributor has informed the Fund that for the year ended December 31, 2007, it received contingent deferred sales charges from certain redemptions of the Fund's Class B shares and Class C shares of $32,100 and $486, respectively and received $19,559 in front-end sales charges from sales of the Fund's Class A shares. The respective shareholders pay such charges which are not an expense of the Fund.

20

Morgan Stanley New York Tax-Free Income Fund

Notes to Financial Statements n December 31, 2007 continued

4. Security Transactions and Transactions with Affiliates

The cost of purchases and proceeds from sales of portfolio securities, excluding short-term investments, for the year ended December 31, 2007, aggregated $3,071,100 and $18,749,520, respectively.

Morgan Stanley Trust, an affiliate of the Investment Adviser, Administrator and Distributor, is the Fund's transfer agent.

The Fund has an unfunded noncontributory defined benefit pension plan covering certain independent Trustees of the Fund who will have served as independent Trustees for at least five years at the time of retirement. Benefits under this plan are based on factors which include years of service and compensation. The Trustees voted to close the plan to new participants and eliminate the future benefits growth due to increases to compensation after July 31, 2003. Aggregate pension costs for the year ended December 31, 2007, included in Trustees' fees and expenses in the Statement of Operations amounted to $5,928. At December 31, 2007, the Fund had an accrued pension liability of $61,468 which is included in accrued expenses in the Statement of Assets and Liabilities.

The Fund has an unfunded Deferred Compensation Plan (the "Compensation Plan") which allows each independent Trustee to defer payment of all, or a portion, of the fees he or she receives for serving on the Board of Trustees. Each eligible Trustee generally may elect to have the deferred amounts credited with a return equal to the total return on one or more of the Morgan Stanley funds that are offered as investment options under the Compensation Plan. Appreciation/depreciation and distributions received from these investments are recorded with an offsetting increase/decrease in the deferred compensation obligation and do not affect the net asset value of the Fund.

5. Expense Offset

The expense offset represents a reduction of the fees and expenses for interest earned on cash balances maintained by the Fund with the transfer agent and custodian.

6. Purposes of and Risks Relating to Certain Financial Instruments

The Fund may invest a portion of its assets in inverse floating rate instruments, either through outright purchases of inverse floating rate securities or through the transfer of bonds to a Dealer Trust in exchange for cash and residual interests in the Dealer Trust. These investments are typically used by the Fund in seeking to enhance the yield of the portfolio. These instruments typically involve greater risks than a fixed rate municipal bond. In particular, these instruments are acquired through leverage or may have leverage embedded in them and therefore involve many of the risks associated with leverage. Leverage is a speculative technique that may expose the Fund to greater risk and increased costs. Leverage may cause the Fund's net asset value to be more volatile than if it had not been leveraged because leverage tends to magnify the effect of any increases or decreases in the value of the Fund's portfolio securities. Th e use of leverage may also cause the Fund to liquidate portfolio positions when it may not be advantageous to do so in order to satisfy its obligations with respect to inverse floating rate instruments.

21

Morgan Stanley New York Tax-Free Income Fund

Notes to Financial Statements n December 31, 2007 continued

To hedge against adverse interest rate changes, the Fund may invest in financial futures, municipal bond index futures and interest rate swap futures contracts ("futures contracts").

These futures contracts involve elements of market risk in excess of the amount reflected in the Statement of Assets and Liabilities. The Fund bears the risk of an unfavorable change in the value of the underlying securities. Risks may also arise upon entering into these contracts from the potential inability of the counterparties to meet the terms of their contracts.

7. Shares of Beneficial Interest

Transactions in shares of beneficial interest were as follows:

| FOR THE YEAR ENDED DECEMBER 31, 2007 | FOR THE YEAR ENDED DECEMBER 31, 2006 | ||||||||||||||||||

| SHARES | AMOUNT | SHARES | AMOUNT | ||||||||||||||||

| CLASS A SHARES | |||||||||||||||||||

| Sold | 95,853 | $ | 1,084,018 | 115,658 | $ | 1,304,688 | |||||||||||||

| Conversion from Class B | — | — | 122,875 | 1,378,868 | |||||||||||||||

| Conversion to Class B | (127,584 | ) | (1,430,602 | ) | — | — | |||||||||||||

| Reinvestment of dividends and distributions | 131,559 | 1,459,538 | 157,494 | 1,773,426 | |||||||||||||||

| Redeemed | (771,179 | ) | (8,587,642 | ) | (883,569 | ) | (9,943,460 | ) | |||||||||||

| Net decrease — Class A | (671,351 | ) | (7,474,688 | ) | (487,542 | ) | (5,486,478 | ) | |||||||||||

| CLASS B SHARES | |||||||||||||||||||

| Sold | 32,718 | 366,428 | 70,070 | 786,007 | |||||||||||||||

| Conversion from Class A | 128,385 | 1,430,602 | — | — | |||||||||||||||

| Conversion to Class A | — | — | (123,728 | ) | (1,378,868 | ) | |||||||||||||

| Reinvestment of dividends and distributions | 39,729 | 437,797 | 52,188 | 583,778 | |||||||||||||||

| Redeemed | (627,917 | ) | (6,875,510 | ) | (377,777 | ) | (4,222,631 | ) | |||||||||||

| Net decrease — Class B | (427,085 | ) | (4,640,683 | ) | (379,247 | ) | (4,231,714 | ) | |||||||||||

| CLASS C SHARES | |||||||||||||||||||

| Sold | 34,762 | 385,591 | 28,215 | 317,092 | |||||||||||||||

| Reinvestment of dividends and distributions | 6,702 | 73,850 | 7,031 | 78,704 | |||||||||||||||

| Redeemed | (31,164 | ) | (347,112 | ) | (151,923 | ) | (1,704,371 | ) | |||||||||||

| Net increase (decrease) — Class C | 10,300 | 112,329 | (116,677 | ) | (1,308,575 | ) | |||||||||||||

| CLASS D SHARES | |||||||||||||||||||

| Sold | 81,540 | 894,342 | 203,584 | 2,252,743 | |||||||||||||||

| Reinvestment of dividends and distributions | 30,335 | 332,774 | 28,208 | 314,485 | |||||||||||||||

| Redeemed | (143,948 | ) | (1,580,268 | ) | (109,311 | ) | (1,216,486 | ) | |||||||||||

| Net increase (decrease) — Class D | (32,073 | ) | (353,152 | ) | 122,481 | 1,350,742 | |||||||||||||

| Net decrease in Fund | (1,120,209 | ) | $ | (12,356,194 | ) | (860,985 | ) | $ | (9,676,025 | ) | |||||||||

22

Morgan Stanley New York Tax-Free Income Fund

Notes to Financial Statements n December 31, 2007 continued

8. Federal Income Tax Status

The amount of dividends and distributions from net investment income and net realized capital gains are determined in accordance with federal income tax regulations which may differ from generally accepted accounting principles. These "book/tax" differences are either considered temporary or permanent in nature. To the extent these differences are permanent in nature, such amounts are reclassified within the capital accounts based on their federal tax-basis treatment; temporary differences do not require reclassification. Dividends and distributions which exceed net investment income and net realized capital gains for tax purposes are reported as distributions of paid-in-capital.

The tax character of distributions paid was as follows:

| FOR THE YEAR ENDED DECEMBER 31, 2007 | FOR THE YEAR ENDED DECEMBER 31, 2006 | ||||||||||

| Tax-exempt income | $ | 3,851,807 | $ | 4,270,754 | |||||||

| Long-term capital gains | 110,120 | 468,562 | |||||||||

| Total distributions | $ | 3,961,927 | $ | 4,739,316 | |||||||

| As of December 31, 2007, the tax-basis components of accumulated earnings were as follows: | |||||||||||

| Undistributed tax-exempt income | $ | 84,139 | |||||||||

| Undistributed ordinary income | 16 | ||||||||||

| Undistributed long-term gains | 273,003 | ||||||||||

| Net accumulated earnings | 357,158 | ||||||||||

| Temporary differences | (62,140 | ) | |||||||||

| Net unrealized appreciation | 3,097,145 | ||||||||||

| Total accumulated earnings | $ | 3,392,163 | |||||||||

As of December 31, 2007, the Fund had temporary book/tax differences primarily attributable to book amortization of discounts on debt securities and mark-to-market of open futures contracts.

Permanent differences, due to tax adjustments on debt securities sold by the Fund, resulted in the following reclassifications among the Fund's components of net assets at December 31, 2007:

| ACCUMULATED UNDISTRIBUTED NET INVESTMENT INCOME | ACCUMULATED UNDISTRIBUTED NET REALIZED GAIN | PAID-IN-CAPITAL | |||||||||

| $ | (322 | ) | $ | 322 | — | ||||||

9. Accounting Pronouncement

In September 2006, Statement of Financial Accounting Standards No. 157, Fair Value Measurements (SFAS 157), was issued and is effective for fiscal years beginning after November 15, 2007. SFAS 157 defines fair value, establishes a framework for measuring fair value and expands disclosures about fair value measurements. Management is currently evaluating the impact the adoption of SFAS 157 will have on the Fund's financial statement disclosures.

23

Morgan Stanley New York Tax-Free Income Fund

Financial Highlights

Selected ratios and per share data for a share of beneficial interest outstanding throughout each period:

| FOR THE YEAR ENDED DECEMBER 31, | |||||||||||||||||||||||

| 2007 | 2006 | 2005 | 2004 | 2003 | |||||||||||||||||||

| Class A Shares | |||||||||||||||||||||||

| Selected Per Share Data: | |||||||||||||||||||||||

| Net asset value, beginning of period | $ | 11.29 | $ | 11.31 | $ | 11.67 | $ | 11.79 | $ | 11.82 | |||||||||||||

| Income (loss) from investment operations: | |||||||||||||||||||||||

| Net investment income | 0.50 | 0.49 | 0.52 | 0.52 | 0.51 | ||||||||||||||||||

| Net realized and unrealized gain (loss) | (0.26 | ) | 0.03 | (0.17 | ) | (0.11 | ) | 0.06 | |||||||||||||||

| Total income from investment operations | 0.24 | 0.52 | 0.35 | 0.41 | 0.57 | ||||||||||||||||||

| Less dividends and distributions from: | |||||||||||||||||||||||

| Net investment income | (0.49 | ) | (0.48 | ) | (0.51 | ) | (0.51 | ) | (0.51 | ) | |||||||||||||

| Net realized gain | (0.01 | ) | (0.06 | ) | (0.20 | ) | (0.02 | ) | (0.09 | ) | |||||||||||||

| Total dividends and distributions | (0.50 | ) | (0.54 | ) | (0.71 | ) | (0.53 | ) | (0.60 | ) | |||||||||||||

| Net asset value, end of period | $ | 11.03 | $ | 11.29 | $ | 11.31 | $ | 11.67 | $ | 11.79 | |||||||||||||

| Total Return† | 2.33 | % | 4.63 | % | 3.10 | % | 3.61 | % | 4.90 | % | |||||||||||||

| Ratios to Average Net Assets(1)(2): | |||||||||||||||||||||||

| Total expenses (before expense offset) | 1.00 | %(3) | 0.91 | %(3) | 0.90 | %(3) | 0.84 | %(3) | 0.93 | % | |||||||||||||

| Total expenses (before expense offset, exclusive of interest and residual trust expenses) | 0.90 | % | 0.91 | % | 0.90 | % | 0.84 | % | 0.93 | % | |||||||||||||

| Net investment income | 4.49 | %(3) | 4.32 | %(3) | 4.37 | %(3) | 4.42 | %(3) | 4.29 | % | |||||||||||||

| Supplemental Data: | |||||||||||||||||||||||

| Net assets, end of period, in thousands | $ | 49,048 | $ | 57,776 | $ | 63,437 | $ | 2,819 | $ | 4,285 | |||||||||||||

| Portfolio turnover rate | 4 | % | 12 | % | 15 | % | 11 | % | 20 | % | |||||||||||||

† Does not reflect the deduction of sales charge. Calculated based on the net asset value as of the last business day of the period.

(1) Does not reflect the effect of expense offset of 0.01%.

(2) Reflects overall Fund ratios for investment income and non-class specific expenses.

(3) If the Fund had borne all its expenses that were reimbursed or waived by the Investment Adviser and Administrator, the annualized expense and net investment income ratios, before expense offset, would have been as follows:

| PERIOD ENDED | EXPENSE RATIO | NET INVESTMENT INCOME RATIO | |||||||||

| December 31, 2007 | 1.16 | % | 4.33 | % | |||||||

| December 31, 2006 | 1.03 | 4.20 | |||||||||

| December 31, 2005 | 1.00 | 4.27 | |||||||||

| December 31, 2004 | 0.89 | 4.37 | |||||||||

See Notes to Financial Statements

24

Morgan Stanley New York Tax-Free Income Fund

Financial Highlights continued

| FOR THE YEAR ENDED DECEMBER 31, | |||||||||||||||||||||||

| 2007 | 2006 | 2005 | 2004 | 2003 | |||||||||||||||||||

| Class B Shares | |||||||||||||||||||||||

| Selected Per Share Data: | |||||||||||||||||||||||

| Net asset value, beginning of period | $ | 11.21 | $ | 11.24 | $ | 11.59 | $ | 11.71 | $ | 11.80 | |||||||||||||

| Income (loss) from investment operations: | |||||||||||||||||||||||

| Net investment income | 0.51 | 0.51 | 0.48 | 0.45 | 0.44 | ||||||||||||||||||

| Net realized and unrealized gain (loss) | (0.26 | ) | 0.02 | (0.15 | ) | (0.11 | ) | 0.00 | |||||||||||||||

| Total income from investment operations | 0.25 | 0.53 | 0.33 | 0.34 | 0.44 | ||||||||||||||||||

| Less dividends and distributions from: | |||||||||||||||||||||||

| Net investment income | (0.50 | ) | (0.50 | ) | (0.48 | ) | (0.44 | ) | (0.44 | ) | |||||||||||||

| Net realized gain | (0.01 | ) | (0.06 | ) | (0.20 | ) | (0.02 | ) | (0.09 | ) | |||||||||||||

| Total dividends and distributions | (0.51 | ) | (0.56 | ) | (0.68 | ) | (0.46 | ) | (0.53 | ) | |||||||||||||

| Net asset value, end of period | $ | 10.95 | $ | 11.21 | $ | 11.24 | $ | 11.59 | $ | 11.71 | |||||||||||||

| Total Return† | 2.36 | % | 4.84 | % | 2.93 | % | 3.01 | % | 3.81 | % | |||||||||||||

| Ratios to Average Net Assets(1)(2): | |||||||||||||||||||||||

| Total expenses (before expense offset) | 0.87 | %(3) | 0.72 | %(3) | 1.21 | %(3) | 1.43 | %(3) | 1.46 | % | |||||||||||||

| Total expenses (before expense offset, exclusive of interest and residual trust expenses) | 0.77 | % | 0.72 | % | 1.21 | % | 1.43 | % | 1.46 | % | |||||||||||||

| Net investment income | 4.62 | %(3) | 4.51 | %(3) | 4.06 | %(3) | 3.83 | %(3) | 3.76 | % | |||||||||||||

| Supplemental Data: | |||||||||||||||||||||||

| Net assets, end of period, in thousands | $ | 17,424 | $ | 22,629 | $ | 26,952 | $ | 99,530 | $ | 113,223 | |||||||||||||

| Portfolio turnover rate | 4 | % | 12 | % | 15 | % | 11 | % | 20 | % | |||||||||||||

† Does not reflect the deduction of sales charge. Calculated based on the net asset value as of the last business day of the period.

(1) Does not reflect the effect of expense offset of 0.01%.

(2) Reflects overall Fund ratios for investment income and non-class specific expenses.

(3) If the Fund had borne all its expenses that were reimbursed or waived by the Investment Adviser and Administrator, the annualized expense and net investment income ratios, before expense offset, would have been as follows:

| PERIOD ENDED | EXPENSE RATIO | NET INVESTMENT INCOME RATIO | |||||||||

| December 31, 2007 | 1.03 | % | 4.46 | % | |||||||

| December 31, 2006 | 0.84 | 4.39 | |||||||||

| December 31, 2005 | 1.31 | 3.96 | |||||||||

| December 31, 2004 | 1.48 | 3.78 | |||||||||

See Notes to Financial Statements

25

Morgan Stanley New York Tax-Free Income Fund

Financial Highlights continued

| FOR THE YEAR ENDED DECEMBER 31, | |||||||||||||||||||||||

| 2007 | 2006 | 2005 | 2004 | 2003 | |||||||||||||||||||

| Class C Shares | |||||||||||||||||||||||

| Selected Per Share Data: | |||||||||||||||||||||||

| Net asset value, beginning of period | $ | 11.22 | $ | 11.25 | $ | 11.60 | $ | 11.72 | $ | 11.79 | |||||||||||||

| Income (loss) from investment operations: | |||||||||||||||||||||||

| Net investment income | 0.44 | 0.43 | 0.45 | 0.45 | 0.44 | ||||||||||||||||||

| Net realized and unrealized gain (loss) | (0.26 | ) | 0.03 | (0.16 | ) | (0.11 | ) | 0.02 | |||||||||||||||

| Total income from investment operations | 0.18 | 0.46 | 0.29 | 0.34 | 0.46 | ||||||||||||||||||

| Less dividends and distributions from: | |||||||||||||||||||||||

| Net investment income | (0.43 | ) | (0.43 | ) | (0.44 | ) | (0.44 | ) | (0.44 | ) | |||||||||||||

| Net realized gain | (0.01 | ) | (0.06 | ) | (0.20 | ) | (0.02 | ) | (0.09 | ) | |||||||||||||

| Total dividends and distributions | (0.44 | ) | (0.49 | ) | (0.64 | ) | (0.46 | ) | (0.53 | ) | |||||||||||||

| Net asset value, end of period | $ | 10.96 | $ | 11.22 | $ | 11.25 | $ | 11.60 | $ | 11.72 | |||||||||||||

| Total Return† | 1.80 | % | 4.11 | % | 2.51 | % | 3.01 | % | 3.98 | % | |||||||||||||

| Ratios to Average Net Assets(1)(2): | |||||||||||||||||||||||

| Total expenses (before expense offset) | 1.51 | %(3) | 1.41 | %(3) | 1.41 | %(3) | 1.43 | %(3) | 1.46 | % | |||||||||||||

| Total expenses (before expense offset, exclusive of interest and residual trust expenses) | 1.41 | % | 1.41 | % | 1.41 | % | 1.43 | % | 1.46 | % | |||||||||||||

| Net investment income | 3.98 | %(3) | 3.82 | %(3) | 3.86 | %(3) | 3.83 | %(3) | 3.76 | % | |||||||||||||

| Supplemental Data: | |||||||||||||||||||||||

| Net assets, end of period, in thousands | $ | 2,881 | $ | 2,832 | $ | 4,152 | $ | 4,066 | $ | 4,679 | |||||||||||||

| Portfolio turnover rate | 4 | % | 12 | % | 15 | % | 11 | % | 20 | % | |||||||||||||

† Does not reflect the deduction of sales charge. Calculated based on the net asset value as of the last business day of the period.

(1) Does not reflect the effect of expense offset of 0.01%.

(2) Reflects overall Fund ratios for investment income and non-class specific expenses.

(3) If the Fund had borne all its expenses that were reimbursed or waived by the Investment Adviser and Administrator, the annualized expense and net investment income ratios, before expense offset, would have been as follows:

| PERIOD ENDED | EXPENSE RATIO | NET INVESTMENT INCOME RATIO | |||||||||

| December 31, 2007 | 1.67 | % | 3.82 | % | |||||||

| December 31, 2006 | 1.53 | 3.70 | |||||||||

| December 31, 2005 | 1.51 | 3.76 | |||||||||

| December 31, 2004 | 1.48 | 3.78 | |||||||||

See Notes to Financial Statements

26

Morgan Stanley New York Tax-Free Income Fund

Financial Highlights continued

| FOR THE YEAR ENDED DECEMBER 31, | |||||||||||||||||||||||

| 2007 | 2006 | 2005 | 2004 | 2003 | |||||||||||||||||||

| Class D Shares | |||||||||||||||||||||||

| Selected Per Share Data: | |||||||||||||||||||||||

| Net asset value, beginning of period | $ | 11.16 | $ | 11.19 | $ | 11.55 | $ | 11.67 | $ | 11.76 | |||||||||||||

| Income (loss) from investment operations: | |||||||||||||||||||||||

| Net investment income | 0.52 | 0.51 | 0.53 | 0.53 | 0.53 | ||||||||||||||||||

| Net realized and unrealized gain (loss) | (0.25 | ) | 0.03 | (0.16 | ) | (0.10 | ) | 0.00 | |||||||||||||||

| Total income from investment operations | 0.27 | 0.54 | 0.37 | 0.43 | 0.53 | ||||||||||||||||||

| Less dividends and distribution from: | |||||||||||||||||||||||

| Net investment income | (0.51 | ) | (0.51 | ) | (0.53 | ) | (0.53 | ) | (0.53 | ) | |||||||||||||

| Net realized gain | (0.01 | ) | (0.06 | ) | (0.20 | ) | (0.02 | ) | (0.09 | ) | |||||||||||||

| Total dividends and distributions | (0.52 | ) | (0.57 | ) | (0.73 | ) | (0.55 | ) | (0.62 | ) | |||||||||||||

| Net asset value, end of period | $ | 10.91 | $ | 11.16 | $ | 11.19 | $ | 11.55 | $ | 11.67 | |||||||||||||

| Total Return† | 2.56 | % | 4.89 | % | 3.27 | % | 3.78 | % | 4.59 | % | |||||||||||||

| Ratios to Average Net Assets(1)(2): | |||||||||||||||||||||||

| Ttoal expenses (before expense offset) | 0.76 | %(3) | 0.66 | %(3) | 0.66 | %(3) | 0.68 | %(3) | 0.71 | % | |||||||||||||

| Total expenses (before expense offset, exclusive of interest and residual trust expenses) | 0.66 | % | 0.66 | % | 0.66 | % | 0.68 | % | 0.71 | % | |||||||||||||

| Net investment income | 4.73 | %(3) | 4.57 | %(3) | 4.61 | %(3) | 4.58 | %(3) | 4.51 | % | |||||||||||||

| Supplemental Data: | |||||||||||||||||||||||

| Net assets, end of period, in thousands | $ | 10,226 | $ | 10,824 | $ | 9,483 | $ | 10,582 | $ | 11,402 | |||||||||||||

| Portfolio turnover rate | 4 | % | 12 | % | 15 | % | 11 | % | 20 | % | |||||||||||||

† Calculated based on the net asset value as of the last business day of the period.

(1) Does not reflect the effect of expense offset of 0.01%.

(2) Reflects overall Fund ratios for investment income and non-class specific expenses.

(3) If the Fund had borne all its expenses that were reimbursed or waived by the Investment Adviser and Administrator, the annualized expense and net investment income ratios, before expense offset, would have been as follows:

| PERIOD ENDED | EXPENSE RATIO | NET INVESTMENT INCOME RATIO | |||||||||

| December 31, 2007 | 0.92 | % | 4.57 | % | |||||||

| December 31, 2006 | 0.78 | 4.45 | |||||||||

| December 31, 2005 | 0.76 | 4.51 | |||||||||

| December 31, 2004 | 0.73 | 4.53 | |||||||||

See Notes to Financial Statements

27

Morgan Stanley New York Tax-Free Income Fund

Report of Independent Registered Public Accounting Firm

To the Shareholders and Board of Trustees of

Morgan Stanley New York Tax-Free Income Fund:

We have audited the accompanying statement of assets and liabilities of Morgan Stanley New York Tax-Free Income Fund (the "Fund"), including the portfolio of investments, as of December 31, 2007, and the related statements of operations for the year then ended and changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended. These financial statements and financial highlights are the responsibility of the Fund's management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. The Fund is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Fund's internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of December 31, 2007, by correspondence with the custodian. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Morgan Stanley New York Tax-Free Income Fund as of December 31, 2007, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

Deloitte & Touche LLP

New York, New York

February 26, 2008

28

Morgan Stanley New York Tax-Free Income Fund

Trustee and Officer Information (unaudited)

Independent Trustees:

| Name, Age and Address of Independent Trustee | Position(s) Held with Registrant | Term of Office and Length of Time Served* | Principal Occupation(s) During Past 5 Years | Number of Portfolios in Fund Complex Overseen by Independent Trustee** | Other Directorships Held by Independent Trustee | ||||||||||||||||||

| Frank L. Bowman (63) c/o Kramer Levin Naftalis & Frankel LLP Counsel to the Independent Trustees 1177 Avenue of the Americas New York, NY 10036 | Trustee | Since August 2006 | President and Chief Executive Officer, Nuclear Energy Institute (policy organization) (since February 2005); Director or Trustee of various Retail Funds and Institutional Funds (since August 2006); Chairperson of the Insurance Sub-Committee of the Insurance, Valuation and Compliance Committee (since February 2007); formerly, variously, Admiral in the U.S. Navy, Director of Naval Nuclear Propulsion Program and Deputy Administrator – Naval Reactors in the National Nuclear Security Administration at the U.S. Department of Energy (1996-2004). Honorary Knight Commander of the Most Excellent Order of the British Empire. | 180 | Director of the National Energy Foundation, the U.S. Energy Association, the American Council for Capital Formation and the Armed Services YMCA of the USA. | ||||||||||||||||||

| Michael Bozic (67) c/o Kramer Levin Naftalis & Frankel LLP Counsel to the Independent Trustees 1177 Avenue of the Americas New York, NY 10036 | Trustee | Since April 1994 | Private investor; Chairperson of the Insurance, Valuation and Compliance Committee (since October 2006); Director or Trustee of the Retail Funds (since April 1994) and the Institutional Funds (since July 2003); formerly, Chairperson of the Insurance Committee (July 2006-September 2006); Vice Chairman of Kmart Corporation (December 1998-October 2000), Chairman and Chief Executive Officer of Levitz Furniture Corporation (November 1995-November 1998) and President and Chief Executive Officer of Hills Department Stores (May 1991-July 1995); variously Chairman, Chief Executive Officer, President and Chief Operating Officer (1987-1991) of the Sears Merchandise Group of Sears, Roebuck & Co. | 182 | Director of various business organizations. | ||||||||||||||||||

29

Morgan Stanley New York Tax-Free Income Fund

Trustee and Officer Information (unaudited) continued

| Name, Age and Address of Independent Trustee | Position(s) Held with Registrant | Term of Office and Length of Time Served* | Principal Occupation(s) During Past 5 Years | Number of Portfolios in Fund Complex Overseen by Independent Trustee** | Other Directorships Held by Independent Trustee | ||||||||||||||||||

| Kathleen A. Dennis (54) c/o Kramer Levin Naftalis & Frankel LLP Counsel to the Independent Trustees 1177 Avenue of the Americas New York, NY 10036 | Trustee | Since August 2006 | President, Cedarwood Associates (mutual fund and investment management) (since July 2006); Chairperson of the Money Market and Alternatives Sub-Committee of the Investment Committee (since October 2006) and Director or Trustee of various Retail Funds and Institutional Funds (since August 2006); formerly, Senior Managing Director of Victory Capital Management (1993-2006). | 180 | Director of various non-profit organizations. | ||||||||||||||||||

| Dr. Manuel H. Johnson (59) c/o Johnson Smick Group, Inc. 888 16th Street, N.W. Suite 740 Washington, D.C. 20006 | Trustee | Since July 1991 | Senior Partner, Johnson Smick International, Inc. (consulting firm); Chairperson of the Investment Committee (since October 2006) and Director or Trustee of the Retail Funds (since July 1991) and the Institutional Funds (since July 2003); Co-Chairman and a founder of the Group of Seven Council (G7C) (international economic commission); formerly, Chairperson of the Audit Committee (July 1991-September 2006); Vice Chairman of the Board of Governors of the Federal Reserve System and Assistant Secretary of the U.S. Treasury. | 182 | Director of NVR, Inc. (home construction); Director of Evergreen Energy. | ||||||||||||||||||

| Joseph J. Kearns (65) c/o Kearns & Associates LLC PMB754 23852 Pacific Coast Highway Malibu, CA 90265 | Trustee | Since August 1994 | President, Kearns & Associates LLC (investment consulting); Chairperson of the Audit Committee (since October 2006) and Director or Trustee of the Retail Funds (since July 2003) and the Institutional Funds (since August 1994); formerly, Deputy Chairperson of the Audit Committee (July 2003-September 2006) and Chairperson of the Audit Committee of the Institutional Funds (October 2001-July 2003); CFO of the J. Paul Getty Trust. | 183 | Director of Electro Rent Corporation (equipment leasing) and The Ford Family Foundation. | ||||||||||||||||||

30

Morgan Stanley New York Tax-Free Income Fund

Trustee and Officer Information (unaudited) continued

| Name, Age and Address of Independent Trustee | Position(s) Held with Registrant | Term of Office and Length of Time Served* | Principal Occupation(s) During Past 5 Years | Number of Portfolios in Fund Complex Overseen by Independent Trustee** | Other Directorships Held by Independent Trustee | ||||||||||||||||||