Parker Hannifin Corporation Exhibit 99.2 2nd Quarter Fiscal Year 2020 Earnings Release January 30, 2020

Forward-Looking Statements and Non-GAAP Financial Measures Forward-looking statements contained in this and other written and oral reports are made based on known events and circumstances at the time of release, and as such, are subject in the future to unforeseen uncertainties and risks. These statements may be identified from the use of forward-looking terminology such as “anticipates,” “believes,” “may,” “should,” “could,” “potential,” “continues,” “plans,” “forecasts,” “estimates,” “projects,” “predicts,” “would,” “intends,” “anticipates,” “expects,” “targets,” “is likely,” “will,” or the negative of these terms and similar expressions, and include all statements regarding future performance, earnings projections, events or developments. Parker cautions readers not to place undue reliance on these statements. It is possible that the future performance and earnings projections of the company, including its individual segments, may differ materially from current expectations, depending on economic conditions within its mobile, industrial and aerospace markets, and the company's ability to maintain and achieve anticipated benefits associated with announced realignment activities, strategic initiatives to improve operating margins, actions taken to combat the effects of the current economic environment, and growth, innovation and global diversification initiatives. Additionally, the actual impact of changes in tax laws in the United States and foreign jurisdictions and any judicial or regulatory interpretation thereof on future performance and earnings projections may impact the company’s tax calculations. A change in the economic conditions in individual markets may have a particularly volatile effect on segment performance. Among other factors which may affect future performance are: changes in business relationships with and purchases by or from major customers, suppliers or distributors, including delays or cancellations in shipments; disputes regarding contract terms or significant changes in financial condition, changes in contract cost and revenue estimates for new development programs and changes in product mix; ability to identify acceptable strategic acquisition targets; uncertainties surrounding timing, successful completion or integration of acquisitions and similar transactions, including the integration of CLARCOR, LORD Corporation or Exotic Metals; the ability to successfully divest businesses planned for divestiture and realize the anticipated benefits of such divestitures; the determination to undertake business realignment activities and the expected costs thereof and, if undertaken, the ability to complete such activities and realize the anticipated cost savings from such activities; ability to implement successfully capital allocation initiatives, including timing, price and execution of share repurchases; availability, limitations or cost increases of raw materials, component products and/or commodities that cannot be recovered in product pricing; ability to manage costs related to insurance and employee retirement and health care benefits; compliance costs associated with environmental laws and regulations; potential labor disruptions; threats associated with and efforts to combat terrorism and cyber-security risks; uncertainties surrounding the ultimate resolution of outstanding legal proceedings, including the outcome of any appeals; global competitive market conditions, including global reactions to U.S. trade policies, and resulting effects on sales and pricing; and global economic factors, including manufacturing activity, air travel trends, currency exchange rates, difficulties entering new markets and general economic conditions such as inflation, deflation, interest rates and credit availability. The company makes these statements as of the date of this disclosure and undertakes no obligation to update them unless otherwise required by law. This presentation contains references to non-GAAP financial information for Parker, including organic sales for Parker and by segment, adjusted cash flow from operating activities, adjusted earnings per share, adjusted operating margin for Parker and by segment, EBITDA, adjusted EBITDA, EBITDA margin, and free cash flow. EBITDA is defined as earnings before interest, taxes, depreciation and amortization. For Parker, adjusted EBITDA is defined as EBITDA before business realignment, Integration costs to achieve, and acquisition related expenses. Free cash flow is defined as cash flow from operations less capital expenditures . Although organic sales, adjusted cash flow from operating activities, adjusted earnings per share, adjusted operating margin for Parker and by segment, EBITDA, adjusted EBITDA, EBITDA margin and free cash flow are not measures of performance calculated in accordance with GAAP, we believe that they are useful to an investor in evaluating the company performance for the period presented. Detailed reconciliations of these non-GAAP financial measures to the comparable GAAP financial measures have been included in the appendix to this presentation. Please visit www.PHstock.com for more information 2

Agenda • CEO Comments and Highlights of Quarter Results • Results & Outlook • Questions & Answers 3

Highlights Strategic Highlights . Margin and cash flow at all-time high relative to previous downturns . Q2 FY20 adjusted operating margin w/o acquisitions at 16.1% versus 13.5% in Q2 FY16 (last recession) . Cash flow from operations Q2 YTD record . Driven by Win Strategy and stronger portfolio through acquisitions Summary of fiscal 2020 second quarter . Safety: 25% reduction in recordable incidents . Organic sales softness offset by acquisition revenue . Adjusted EBITDA margin 18.5% . Record first half cash flow from operations, free cash flow margin >10%, free cash flow conversion 130% Outlook . Well positioned for growth with excellent margins and cash flow as economic conditions improve . Confidence from: Win Strategy™ 3.0, transformative acquisitions, Purpose Statement 4

Parker’s Competitive Differentiators . The Win Strategy™ . Decentralized business model . Technology breadth & interconnectivity . Engineered products with intellectual property . Long product life cycles . Global distribution, service & support . Low capital investment requirements . Great generators and deployers of cash over the cycle 5

Diluted Earnings per Share 2nd Quarter FY2020 vs. FY2019 As Reported Adjusted $2.54 $2.51 $2.36 $1.57 FY20 Q2 FY19 Q2 FY20 Q2¹ FY19 Q2² 1 Adjusted for Business Realignment Charges, LORD and Exotic Costs to Achieve, Acquisition Related Expenses and the tax effect of such adjustments 6 2 Adjusted for Business Realignment Charges, CLARCOR Costs to Achieve, the tax effect of such adjustments, and tax expense related to U.S. Tax Reform

Influences on Adjusted Earnings per Share 2nd Quarter FY2020 vs. FY2019 ($0.13) $0.16 ($0.20) $0.10 $0.03 $0.07 $2.51 $2.54 FY19 Q2 Segment Corporate Interest Other Income Average FY20 Q2 Adjusted Operating G&A Expense Expense Expense Tax Shares Adjusted EPS¹ Income EPS² 1 Adjusted for Business Realignment Charges, CLARCOR Costs to Achieve, and the tax effect of such adjustments, tax expense related to U.S. Tax Reform 7 2 Adjusted for Business Realignment Charges, LORD and Exotic Costs to Achieve, Acquisition Related Expenses, and the tax effect of such adjustments

Sales & Segment Operating Margin Total Parker $ in millions 2nd Quarter % FY2020 Change FY2019 Sales As Reported $ 3,498 0.7 % $ 3,472 Acquisitions1 286 8.2 % Currency (15) (0.4)% Organic Sales $ 3,227 (7.1)% % of % of FY2020 Sales FY2019 Sales Segment Operating Margin As Reported $ 486 13.9 % $ 568 16.4 % Business Realignment 10 3 Integration Costs to Achieve2 7 5 Acquisition Related Expenses3 49 - Adjusted $ 552 15.8 % $ 576 16.6 % 1: Acquisitions reflect Exotic (closed 9/16/19) and LORD (closed 10/29/19) 2: Integration Costs to Achieve for LORD and Exotic (FY20), CLARCOR (FY19) 8 3: Acquisition Related Expenses for Exotic and LORD (FY20).

FY2020 Q2 Acquisitions Impact on Segment Margins As Reported FY19 Q2 FY20 Q2 Total Total LORD + Legacy $M Parker Parker Exotic Parker Sales $3,472 $3,498 $286 $3,212 Operating Income $568 $486 ($20) $506 Operating Margin 16.4% 13.9% (7.0%) 15.8% Adjusted* FY19 Q2 FY20 Q2 Total Total LORD + Legacy $M Parker Parker Exotic Parker Sales $3,472 $3,498 $286 $3,212 Operating Income $576 $552 $36 $516 Operating Margin 16.6% 15.8% 12.6% 16.1% 9 *Adjusted for Business Realignment Charges, Integration Costs to Achieve, and one-time Acquisition Related Inventory Step-up Expense

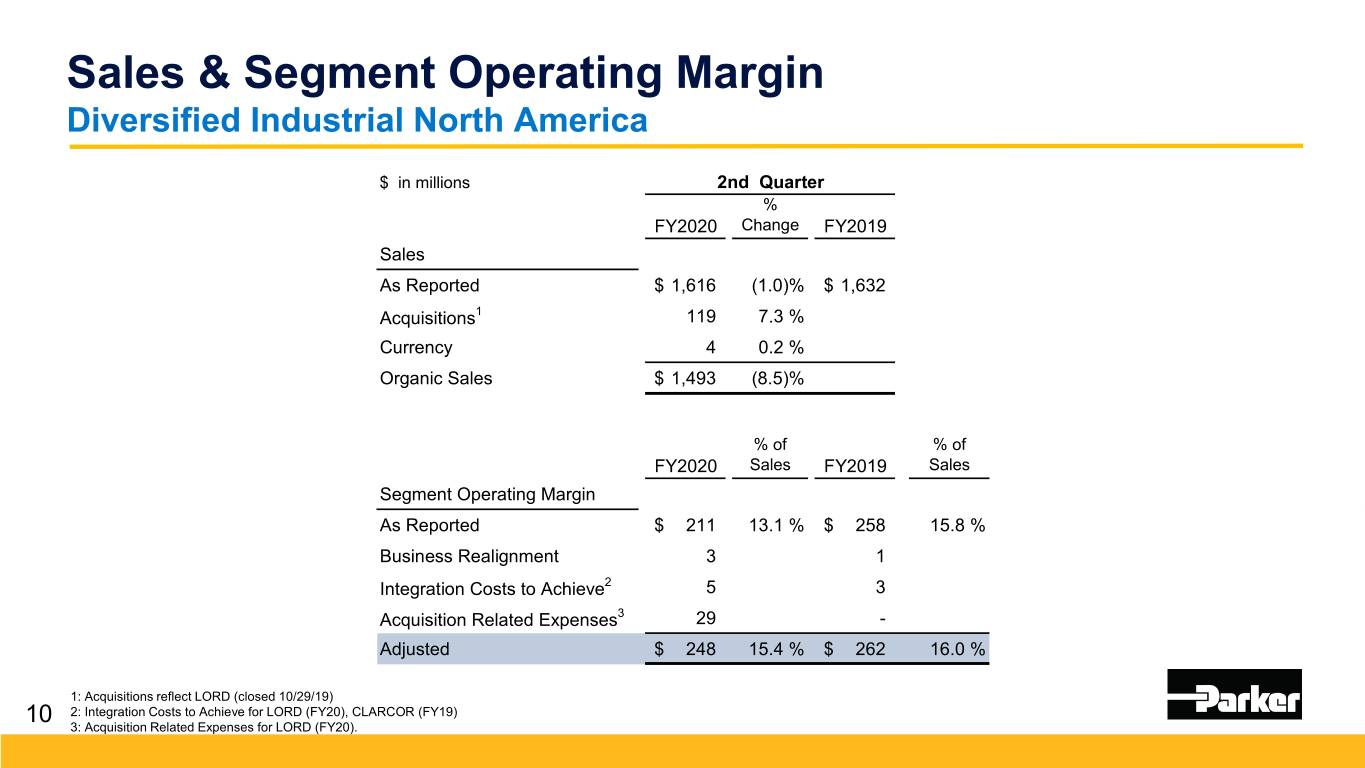

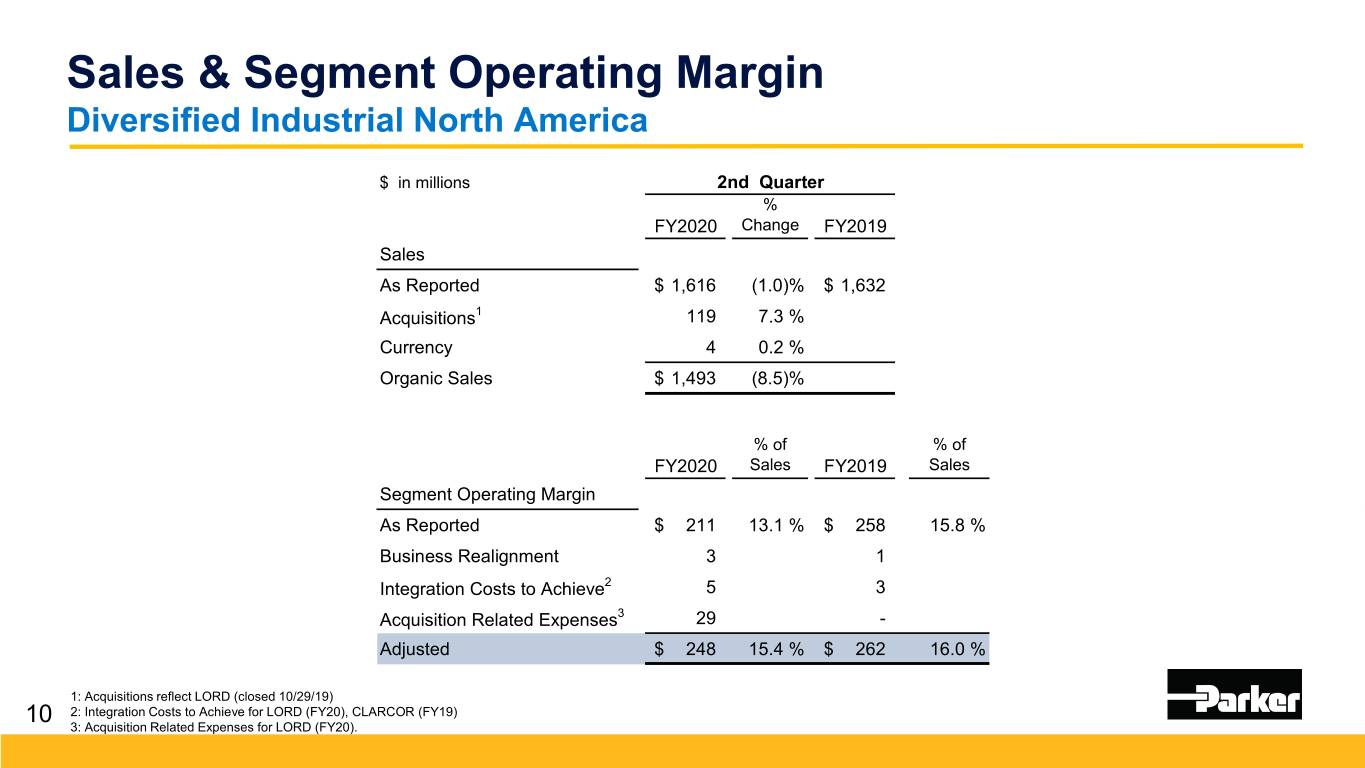

Sales & Segment Operating Margin Diversified Industrial North America $ in millions 2nd Quarter % FY2020 Change FY2019 Sales As Reported $ 1,616 (1.0)% $ 1,632 Acquisitions1 119 7.3 % Currency 4 0.2 % Organic Sales $ 1,493 (8.5)% % of % of FY2020 Sales FY2019 Sales Segment Operating Margin As Reported $ 211 13.1 % $ 258 15.8 % Business Realignment 3 1 Integration Costs to Achieve2 5 3 Acquisition Related Expenses3 29 - Adjusted $ 248 15.4 % $ 262 16.0 % 1: Acquisitions reflect LORD (closed 10/29/19) 2: Integration Costs to Achieve for LORD (FY20), CLARCOR (FY19) 10 3: Acquisition Related Expenses for LORD (FY20).

Sales & Segment Operating Margin Diversified Industrial International $ in millions 2nd Quarter % FY2020 Change FY2019 Sales As Reported $ 1,147 (6.3)% $ 1,224 Acquisitions1 56 4.5 % Currency (18) (1.4)% Organic Sales $ 1,109 (9.4)% % of % of FY2020 Sales FY2019 Sales Segment Operating Margin As Reported $ 154 13.4 % $ 189 15.5 % Business Realignment 7 2 Integration Costs to Achieve2 2 2 Acquisition Related Expenses3 5 - Adjusted $ 168 14.6 % $ 193 15.7 % 1: Acquisitions reflect LORD (closed 10/29/19) 2: Integration Costs to Achieve for LORD (FY20), CLARCOR (FY19) 11 3: Acquisition Related Expenses for LORD (FY20).

Sales & Segment Operating Margin Aerospace Systems $ in millions 2nd Quarter % FY2020 Change FY2019 Sales As Reported $ 735 19.3 % $ 616 Acquisitions1 111 18.0 % Currency (0) 0.0 % Organic Sales $ 624 1.3 % % of % of FY2020 Sales FY2019 Sales Segment Operating Margin As Reported $ 121 16.5 % $ 121 19.7 % Business Realignment 0 - Integration Costs to Achieve2 1 - Acquisition Related Expenses3 14 - Adjusted $ 136 18.5 % $ 121 19.7 % 1: Acquisitions reflect Exotic (closed 9/16/19) and LORD (closed 10/29/19) 2: Integration Costs to Achieve for Exotic (FY20) 12 3: Acquisition Related Expenses for Exotic and LORD (FY20).

Consecutive years with 10%+ Cash Flow from Operating Activities 18 CFOA margins1 YTD FY2020 vs. FY2019 11% Increase $826 $826 $741 $541 $ Millions FY20 As Reported FY19 FY20 FY19¹ Adjusted YTD FY 2020 % of Sales FY 2019 % of Sales As Reported Cash Flow From Operating Activities $ 826 12.1% $ 541 7.8% Discretionary Pension Plan Contribution - 200 Adjusted Cash Flow From Operating Activities $ 826 12.1% $ 741 10.7% 13 1: Adjusted for Discretionary Pension Plan Contributions

Order Rates Dec 2019 Sep 2019 Dec 2018 Sep 2018 Total Parker (3)% (2)% 1 % 5 % Diversified Industrial North America (7)% (6)% 0 % 8 % Diversified Industrial International (6)% (10)% (2)% 3 % Aerospace Systems 12 % 22 % 10 % 3 % Excludes Acquisitions, Divestitures & Currency 3-month year-over-year comparisons of total dollars, except Aerospace Systems Aerospace Systems is calculated using a 12-month rolling average 14

FY2020 Guidance Including Acquisitions EPS Midpoint: $9.08 As Reported, $10.55 Adjusted Sales Growth vs. Prior Year Diversified Industrial North America (1.1)% - 1.5% Diversified Industrial International (8.8)% - (6.2)% Aerospace Systems 13.3% - 15.9% Total Parker (1.2)% - 1.3% Segment Operating Margins As Reported Adjusted¹ Diversified Industrial North America 15.1% - 15.4% 16.2% - 16.6% Diversified Industrial International 13.4% - 13.8% 14.1% - 14.5% Aerospace Systems 17.8% - 18.2% 18.5% - 18.9% Total Parker 15.1% - 15.5% 16.0% - 16.4% Below the Line Items As Reported Adjusted¹ Corporate General & Administrative Expense, Interest and Other $ 664 M $ 548 M Tax Rate As Reported Full Year 22.5% Shares Diluted Shares Outstanding 130.4 M Earnings Per Share As Reported Adjusted¹ Range $8.78 - $9.38 $10.25 - $10.85 1: Expected FY20 Adjusted Segment Operating Margins exclude Business Realignment Charges of $40M, Costs to Achieve of $27M, and one-time Acquisition Related 15 Inventory Step-up Expense of $69M. Additionally, expected FY20 Adjusted Earnings Per Share also exclude one-time Acquisition Related Transaction Costs of $116M.

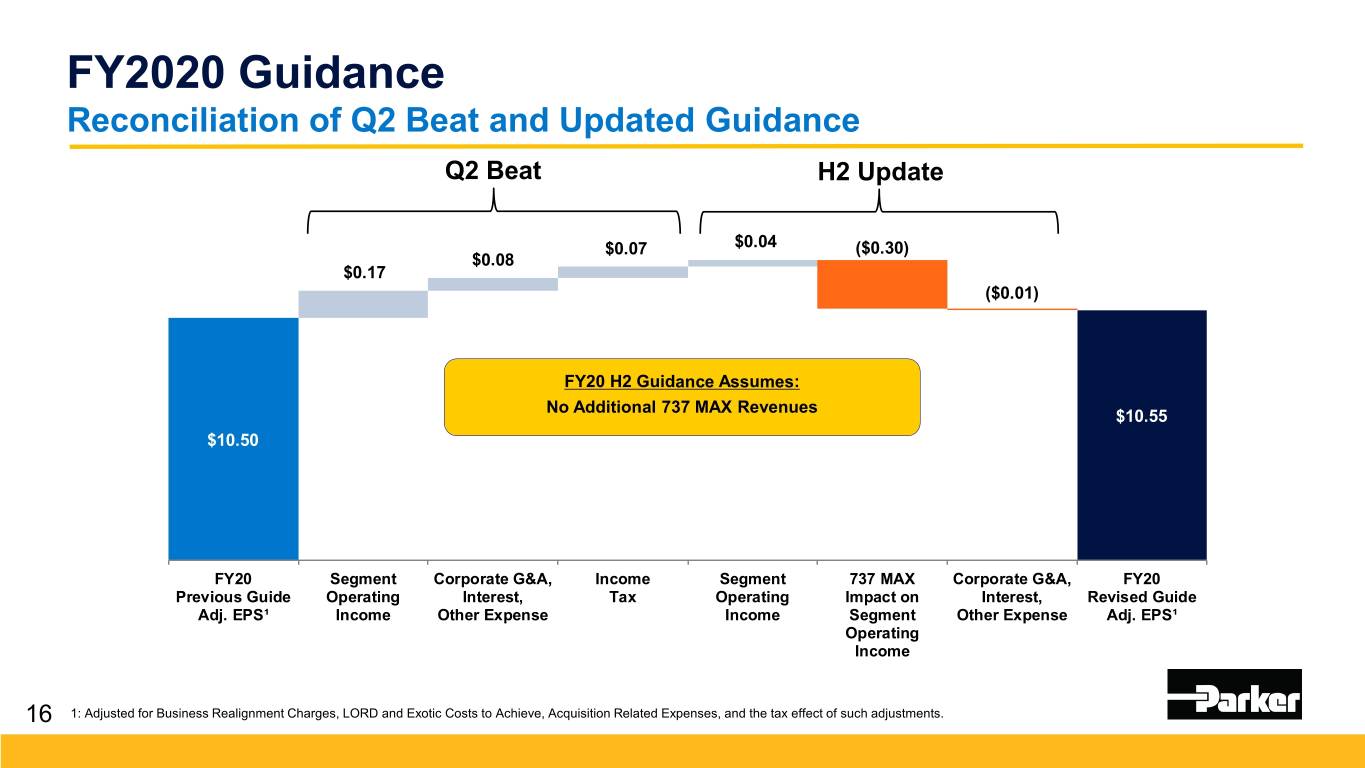

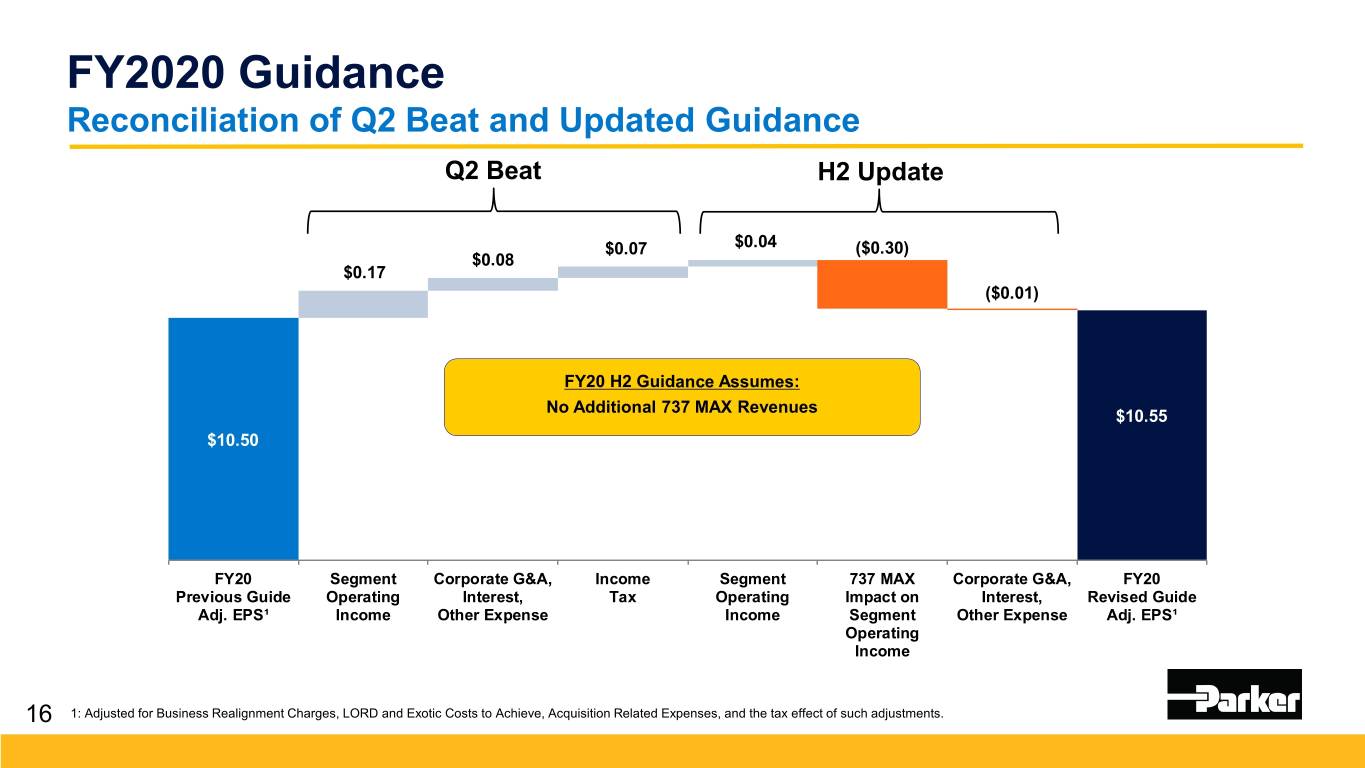

FY2020 Guidance Reconciliation of Q2 Beat and Updated Guidance Q2 Beat H2 Update $0.07 $0.04 ($0.30) $0.08 $0.17 ($0.01) FY20 H2 Guidance Assumes: No Additional 737 MAX Revenues $10.55 $10.50 FY20 Segment Corporate G&A, Income Segment 737 MAX Corporate G&A, FY20 Previous Guide Operating Interest, Tax Operating Impact on Interest, Revised Guide Adj. EPS¹ Income Other Expense Income Segment Other Expense Adj. EPS¹ Operating Income 16 1: Adjusted for Business Realignment Charges, LORD and Exotic Costs to Achieve, Acquisition Related Expenses, and the tax effect of such adjustments.

Impact of Acquisitions As Reported FY19 FY20 LORD + $M Total Parker Total Parker Exotic Legacy Parker Sales $14,320 $14,324 $993 $13,331 Operating Income $2,431 $2,187 $13 $2,174 Operating Margin 17.0% 15.3% 1.3% 16.3% EBITDA Margin 17.9% 16.8% 3.9% 17.8% Adjusted* FY19 FY20 LORD + $M Total Parker Total Parker Exotic Legacy Parker Sales $14,320 $14,324 $993 $13,331 Operating Income $2,460 $2,321 $104 $2,217 Operating Margin 17.2% 16.2% 10.5% 16.6% EBITDA Margin 18.2% 18.6% 24.8% 18.1% *Adjusted for Business Realignment Charges, Integration Costs to Achieve, and Acquisition Related Expenses Note: Segment Operating Income includes FY20 Amortization expense estimated at $37M for Exotic and $64M for LORD. LORD Sales split approximately 62% Diversified Industrial 17 North America, 34% Diversified Industrial International, and 4% Aerospace Systems. Exotic Sales 100% in Aerospace Systems

Key Messages . Excellent cash flow from operations . Raising the floor on operating margins . Parker’s transformation continues . Well on our way to top quartile performance . Confidence in reaching our FY23 5-year targets Thanks again to our Global Team Members 18

Appendix . Consolidated Statement of Income . Adjusted Amounts Reconciliation . Reconciliation of EPS . Business Segment Information . Reconciliation of Total Segment Operating Margin to Adjusted Total Segment Operating Margin . Reconciliation of EBITDA to Adjusted EBITDA . Consolidated Balance Sheet . Consolidated Statement of Cash Flows . Reconciliation of Cash Flow from Operations to Adjusted Cash Flow from Operations . Reconciliation of Free Cash Flow Conversion . Reconciliation of Forecasted EPS . Supplemental Sales Information – Global Technology Platforms

Consolidated Statement of Income (Unaudited) Three Months Ended December 31, (Dollars in thousands, except per share amounts) 2019 2018 Net sales $ 3,497,974 $ 3,472,045 Cost of sales 2,682,765 2,602,339 Selling, general and administrative expenses 491,121 397,259 Interest expense 82,891 47,518 Other (income), net (13,549) (6,225) Income before income taxes 254,746 431,154 Income taxes 50,148 119,241 Net income 204,598 311,913 Less: Noncontrolling interests 124 176 Net income attributable to common shareholders $ 204,474 $ 311,737 Earnings per share attributable to common shareholders: Basic earnings per share $ 1.59 $ 2.39 Diluted earnings per share $ 1.57 $ 2.36 Average shares outstanding during period - Basic 128,396,933 130,361,273 Average shares outstanding during period - Diluted 130,495,381 132,311,210 CASH DIVIDENDS PER COMMON SHARE (Unaudited) Three Months Ended December 31, (Amounts in dollars) 2019 2018 Cash dividends per common share $ 0.88 $ 0.76 21

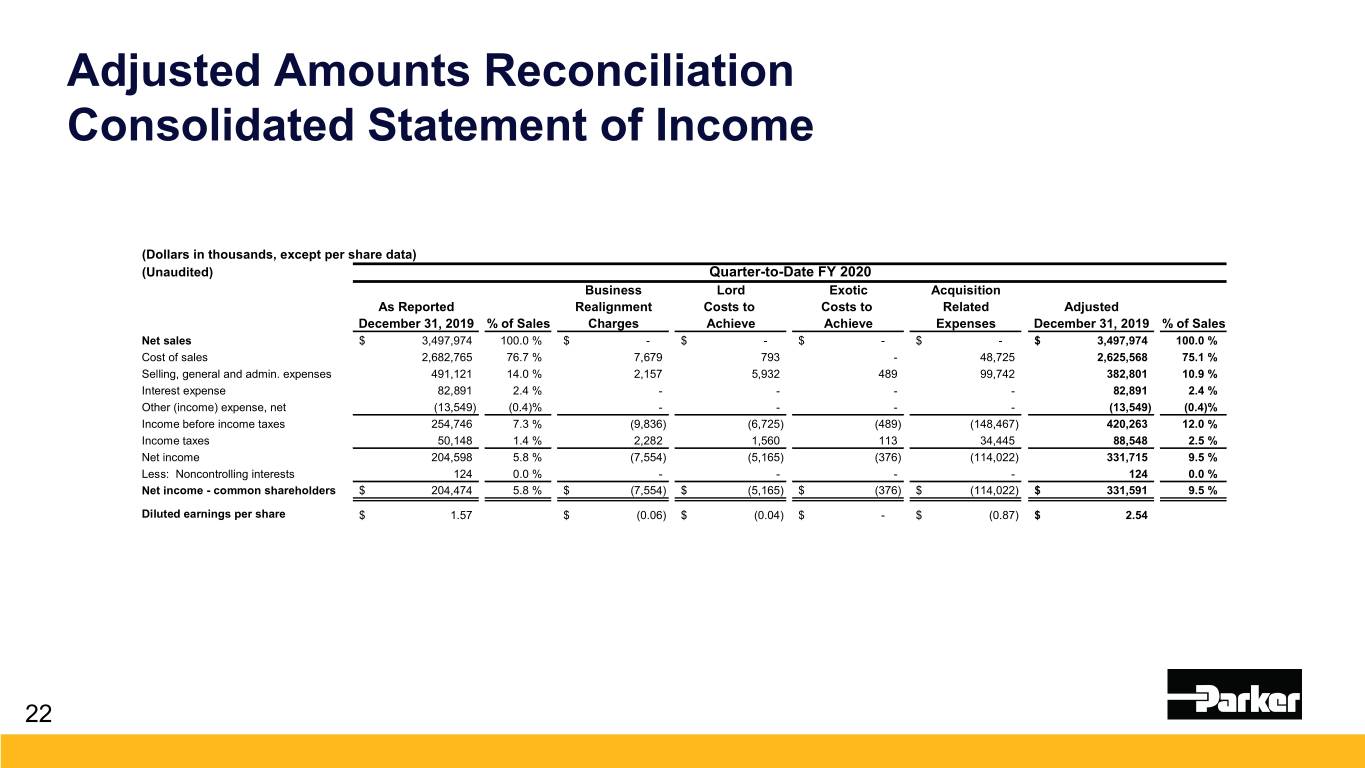

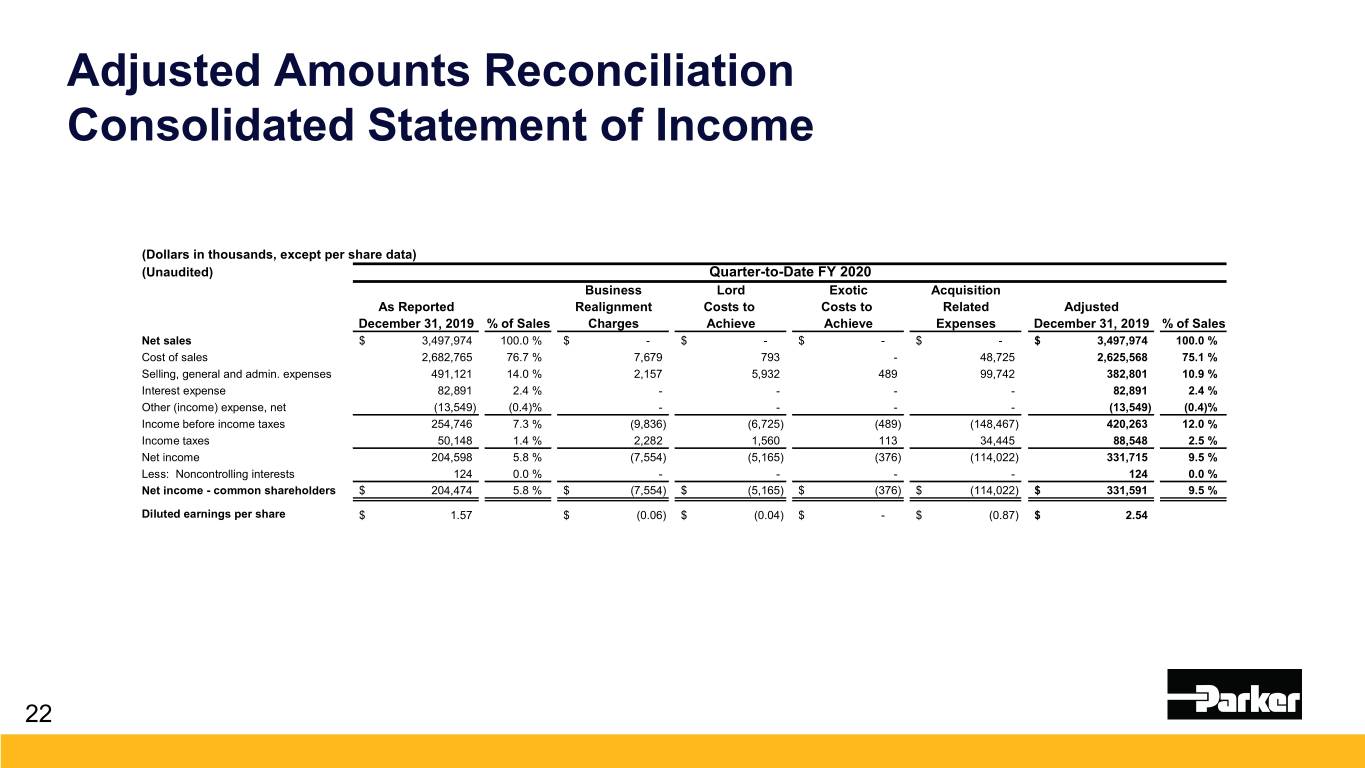

Adjusted Amounts Reconciliation Consolidated Statement of Income (Dollars in thousands, except per share data) (Unaudited) Quarter-to-Date FY 2020 Business Lord Exotic Acquisition As Reported Realignment Costs to Costs to Related Adjusted December 31, 2019 % of Sales Charges Achieve Achieve Expenses December 31, 2019 % of Sales Net sales $ 3,497,974 100.0 % $ - $ - $ - $ - $ 3,497,974 100.0 % Cost of sales 2,682,765 76.7 % 7,679 793 - 48,725 2,625,568 75.1 % Selling, general and admin. expenses 491,121 14.0 % 2,157 5,932 489 99,742 382,801 10.9 % Interest expense 82,891 2.4 % - - - - 82,891 2.4 % Other (income) expense, net (13,549) (0.4)% - - - - (13,549) (0.4)% Income before income taxes 254,746 7.3 % (9,836) (6,725) (489) (148,467) 420,263 12.0 % Income taxes 50,148 1.4 % 2,282 1,560 113 34,445 88,548 2.5 % Net income 204,598 5.8 % (7,554) (5,165) (376) (114,022) 331,715 9.5 % Less: Noncontrolling interests 124 0.0 % - - - - 124 0.0 % Net income - common shareholders $ 204,474 5.8 % $ (7,554) $ (5,165) $ (376) $ (114,022) $ 331,591 9.5 % Diluted earnings per share $ 1.57 $ (0.06) $ (0.04) $ - $ (0.87) $ 2.54 22

Adjusted Amounts Reconciliation Business Segment Information (Dollars in thousands) (Unaudited) Quarter-to-Date FY 2020 Business Lord Exotic Acquisition As Reported Realignment Costs to Costs to Related Adjusted December 31, 2019 % of Sales Charges Achieve Achieve Expenses December 31, 2019 % of Sales2 Diversified Industrial: North America1 $ 211,339 13.1% $ 3,285 $ 4,685 $ - $ 29,126 $ 248,435 15.4% International1 153,816 13.4% 6,382 2,040 - 5,375 167,613 14.6% Aerospace Systems1 121,039 16.5% 52 - 489 14,224 135,804 18.5% Total segment operating income 486,194 13.9% (9,719) (6,725) (489) (48,725) 551,852 15.8% Corporate administration 35,660 1.0% 117 - - - 35,543 1.0% Income before interest and other 450,534 12.9% (9,836) (6,725) (489) (48,725) 516,309 14.8% Interest expense 82,891 2.4% - - - - 82,891 2.4% Other (income) expense 112,897 3.2% - - - 99,742 13,155 0.4% Income before income taxes $ 254,746 7.3% $ (9,836) $ (6,725) $ (489) $ (148,467) $ 420,263 12.0% 1Segment operating income as a percent of sales is calculated on segment sales. 2Adjusted amounts as a percent of sales are calculated on as reported sales. 23

Reconciliation of Earnings per Diluted Share to Adjusted Earnings per Diluted Share (Unaudited) Three Months Ended December 31, (Amounts in dollars) 2019 2018 Earnings per diluted share $ 1.57 $ 2.36 Adjustments: Business realignment charges 0.08 0.02 Clarcor costs to achieve - 0.04 Lord costs to achieve 0.05 - Acquisition-related expenses 1.14 - 1 Tax effect of adjustments (0.30) (0.02) Tax expense related to U.S. Tax Reform - 0.11 Adjusted earnings per diluted share $ 2.54 $ 2.51 1This line item reflects the aggregate tax effect of all non-tax adjustments reflected in the preceding line items of the table. We estimate the tax effect of each adjustment item by applying our overall effective tax rate for continuing operations to the pre-tax amount, unless the nature of the item and/or the tax jurisdiction in which the item has been recorded requires application of a specific tax rate or tax treatment, in which case the tax effect of such item is estimated by applying such specific tax rate or tax treatment. 24

Business Segment Information (Unaudited) Three Months Ended December 31, (Dollars in thousands) 2019 2018 Net sales Diversified Industrial: North America $ 1,615,852 $ 1,632,059 International 1,147,084 1,223,679 Aerospace Systems 735,038 616,307 Total net sales $ 3,497,974 $ 3,472,045 Segment operating income Diversified Industrial: North America $ 211,339 $ 257,774 International 153,816 189,085 Aerospace Systems 121,039 121,463 Total segment operating income 486,194 568,322 Corporate general and administrative expenses 35,660 63,890 Income before interest expense and other expense 450,534 504,432 Interest expense 82,891 47,518 Other expense 112,897 25,760 Income before income taxes $ 254,746 $ 431,154 25

Reconciliation of Total Segment Operating Margin to Adjusted Total Segment Operating Margin (Unaudited) Three Months Ended Three Months Ended (Dollars in thousands) December 31, 2019 December 31, 2018 Operating income Operating margin Operating income Operating margin Total segment operating income $ 486,194 13.9 % $ 568,322 16.4 % Adjustments: Business realignment charges 9,719 2,515 Clarcor costs to achieve - 4,867 Lord costs to achieve 6,725 - Exotic costs to achieve 489 - Acquisition-related expenses 48,725 - Adjusted total segment operating income $ 551,852 15.8 % $ 575,704 16.6 % 26

Reconciliation of Total Segment Operating Margin to Adjusted Total Segment Operating Margin Three Months Ended Three Months Ended Three Months Ended (Unaudited) December 31, 2019 December 31, 2019 December 31, 2019 (Dollars in millions) Total Parker LORD & Exotic Legacy Parker Operating income Operating margin Operating income Operating margin Operating income Operating margin Total segment operating income $ 486 13.9 % $ (20) (7.0)% $ 506 15.8 % Adjustments: Business realignment charges 10 - 10 Costs to achieve 7 7 - One-time acquisition expenses 49 49 - Adjusted total segment operating income $ 552 15.8 % $ 36 12.6 % $ 516 16.1 % 27

Reconciliation of Total Segment Operating Margin to Adjusted Total Segment Operating Margin (Unaudited) Three Months Ended (Dollars in thousands) December 31, 2015 Operating income Operating margin Total segment operating income $ 330,712 12.2 % Adjustments: Business realignment charges 34,800 Adjusted total segment operating income $ 365,512 13.5 % 28

Reconciliation of EBITDA to Adjusted EBITDA (Unaudited) Three Months Ended December 31, (Dollars in thousands) 2019 2018 Net sales $ 3,497,974 $ 3,472,045 Net income $ 204,598 $ 311,913 Income taxes 50,148 119,241 Depreciation and amortization 144,229 110,052 Interest expense 82,891 47,518 EBITDA 481,866 588,724 Adjustments: Business realignment charges 9,836 2,515 Clarcor costs to achieve - 5,087 Lord costs to achieve 6,725 - Exotic costs to achieve 489 - Acquisition-related expenses 148,467 - Adjusted EBITDA $ 647,383 $ 596,326 EBITDA margin 13.8 % 17.0 % Adjusted EBITDA margin 18.5 % 17.2 % 29

Reconciliation of Total Segment Operating Margin to Adjusted Total Segment Operating Margin and EBITDA to Adjusted EBITDA RECONCILIATION OF TOTAL SEGMENT OPERATING MARGIN TO ADJUSTED TOTAL SEGMENT OPERATING MARGIN (Unaudited) Twelve Months Ended (Dollars in thousands) June 30, 2019 Operating income Operating margin Total segment operating income $ 2,431,233 17.0 % Adjustments: Business realignment charges 15,503 Clarcor costs to achieve 12,327 LORD acquisition and integration costs 912 Adjusted total segment operating income $ 2,459,975 17.2 % RECONCILIATION OF EBITDA TO ADJUSTED EBITDA (Unaudited) Twelve Months Ended (Dollars in thousands) June 30, 2019 Net sales $ 14,320,324 Net income 1,512,931 Income taxes 420,494 Depreciation and amortization 436,189 Interest expense 190,138 EBITDA 2,559,752 Adjustments: Business realignment charges 15,677 Clarcor costs to achieve 12,458 Lord acquisition and integration costs 17,146 Adjusted EBITDA $ 2,605,033 EBITDA margin 17.9 % Adjusted EBITDA margin 18.2 % 30

Reconciliation of Forecasted FY2020 Total Segment Operating Margin to Adjusted Total Segment Operating Margin and EBITDA to Adjusted EBITDA RECONCILIATION OF FORECASTED FISCAL 2020 TOTAL SEGMENT OPERATING MARGIN TO FORECASTED FISCAL 2020 ADJUSTED TOTAL SEGMENT OPERATING MARGIN (Unaudited) (Dollars in millions) Total Parker LORD & Exotic Legacy Parker Operating income Operating margin Operating income Operating margin Operating income Operating margin Total segment operating income $ 2,187 15.3 % $ 13 1.3 % $ 2,174 16.3 % Adjustments: Business realignment charges 40 40 Costs to achieve 27 23 3 One-time acquisition expenses 69 69 - Adjusted total segment operating income $ 2,321 16.2 % $ 104 10.5 % $ 2,217 16.6 % RECONCILIATION OF FORECASTED FISCAL 2020 EBITDA TO FORECASTED FISCAL 2020 ADJUSTED EBITDA (Unaudited) (Dollars in millions) Total Parker LORD & Exotic Legacy Parker Net sales $ 14,324 $ 993 $ 13,331 Net income 1,185 (169) 1,354 Income taxes 339 (51) 390 Depreciation and amortization 564 142 427 Interest expense 319 117 202 EBITDA 2,407 39 2,373 Adjustments: Business realignment charges 40 - 40 Costs to achieve 27 23 3 One-time acquisition expenses 185 185 - Adjusted EBITDA $ 2,658 $ 247 $ 2,416 EBITDA margin 16.8 % 3.9 % 17.8 % Adjusted EBITDA margin 18.6 % 24.8 % 18.1 % 31 Note: Data has been intentionally rounded to the nearest million and therefore may not sum

Consolidated Balance Sheet (Unaudited) December 31, June 30, December 31, (Dollars in thousands) 2019 2019 2018 Assets Current assets: Cash and cash equivalents $ 948,355 $ 3,219,767 $ 1,047,385 Marketable securities and other investments 145,120 150,931 30,956 Trade accounts receivable, net 1,973,187 2,131,054 1,938,709 Non-trade and notes receivable 319,126 310,708 324,254 Inventories 2,014,260 1,678,132 1,804,564 Prepaid expenses and other 261,103 182,494 188,868 Total current assets 5,661,151 7,673,086 5,334,736 Plant and equipment, net 2,335,940 1,768,287 1,793,805 Deferred income taxes 114,032 150,462 98,779 Goodwill 7,955,170 5,453,805 5,462,555 Intangible assets, net 4,036,108 1,783,277 1,883,825 Investments and other assets 941,588 747,773 733,987 Total assets $ 21,043,989 $ 17,576,690 $ 15,307,687 Liabilities and equity Current liabilities: Notes payable and long-term debt payable within one year $ 1,604,318 $ 587,014 $ 1,144,347 Accounts payable, trade 1,311,733 1,413,155 1,307,178 Accrued payrolls and other compensation 372,549 426,285 319,787 Accrued domestic and foreign taxes 165,265 167,312 182,617 Other accrued liabilities 637,257 558,007 555,005 Total current liabilities 4,091,122 3,151,773 3,508,934 Long-term debt 8,141,220 6,520,831 4,303,331 Pensions and other postretirement benefits 1,366,814 1,304,379 937,938 Deferred income taxes 569,582 193,066 286,622 Other liabilities 532,750 438,489 449,696 Shareholders' equity 6,330,175 5,961,969 5,815,209 Noncontrolling interests 12,326 6,183 5,957 32 Total liabilities and equity $ 21,043,989 $ 17,576,690 $ 15,307,687

Consolidated Statement of Cash Flows (Unaudited) Six Months Ended December 31, (Dollars in thousands) 2019 2018 Cash flows from operating activities: Net income $ 543,639 $ 687,812 Depreciation and amortization 253,300 222,543 Stock incentive plan compensation 73,069 64,615 Loss on sale of businesses - 623 (Gain) loss on plant and equipment and intangible assets (4,478) 3,428 (Gain) loss on marketable securities (1,969) 5,701 Gain on investments (1,849) (3,213) Net change in receivables, inventories and trade payables 227,247 (110,709) Net change in other assets and liabilities (278,168) (379,687) Other, net 15,177 49,927 Net cash provided by operating activities 825,968 541,040 Cash flows from investing activities: Acquisitions (net of cash of $82,192 in 2019 and $690 in 2018) (5,075,605) (2,042) Capital expenditures (118,593) (94,426) Proceeds from sale of plant and equipment 20,993 34,121 Proceeds from sale of businesses - 19,540 Purchases of marketable securities and other investments (190,129) (2,845) Maturities and sales of marketable securities and other investments 198,872 14,432 Other 9,374 (90) Net cash used in investing activities (5,155,088) (31,310) Cash flows from financing activities: Net payments for common stock activity (134,892) (565,335) Net proceeds from debt 2,416,222 505,811 Dividends paid (227,025) (200,459) Net cash provided by (used in) financing activities 2,054,305 (259,983) Effect of exchange rate changes on cash 3,403 (24,499) Net (decrease) increase in cash and cash equivalents (2,271,412) 225,248 Cash and cash equivalents at beginning of period 3,219,767 822,137 33 Cash and cash equivalents at end of period $ 948,355 $ 1,047,385

Reconciliation of Cash Flow from Operations to Adjusted Cash Flow from Operations (Unaudited) Six Months Ended Six Months Ended (Dollars in thousands) December 31, 2019 Percent of sales December 31, 2018 Percent of sales As reported cash flow from operations $ 825,968 12.1 % $ 541,040 7.8 % Discretionary pension contribution - 200,000 Adjusted cash flow from operations $ 825,968 12.1 % $ 741,040 10.7 % 34

Reconciliation of Free Cash Flow Conversion (Unaudited) Six Months Ended (Dollars in thousands) December 31, 2019 Net income $ 543,639 Cash flow from operations $ 825,968 Capital Expenditures (118,593) Free cash flow $ 707,375 Free cash flow conversion (free cash flow / net income) 130 % 35

Reconciliation of EPS Fiscal Year 2020 Guidance (Unaudited) (Amounts in dollars) Fiscal Year 2020 Forecasted earnings per diluted share $8.78 - $9.38 Adjustments: Business realignment charges 0.30 Costs to achieve 0.20 One-time acquisition expenses 1.43 1 Tax effect of adjustments (0.46) Adjusted forecasted earnings per diluted share $10.25 - $10.85 1This line item reflects the aggregate tax effect of all non-tax adjustments reflected in the preceding line items of the table. We estimate the tax effect of each adjustment item by applying our overall effective tax rate for continuing operations to the pre-tax amount, unless the nature of the item and/or the tax jurisdiction in which the item has been recorded requires application of a specific tax rate or tax treatment, in which case the tax effect of such item is estimated by applying such specific tax rate or tax treatment. 36

Supplemental Sales Information Global Technology Platforms Three Months Ended (Unaudited) December 31, (Dollars in thousands) 2019 2018 Net sales Diversified Industrial: Motion Systems $ 752,306 $ 856,357 Flow and Process Control 942,249 1,015,200 Filtration and Engineered Material 1,068,381 984,181 Aerospace Systems 735,038 616,307 Total $ 3,497,974 $ 3,472,045 37