Parker Hannifin Corporation Fiscal 2022 First Quarter Earnings Presentation November 4, 2021 Exhibit 99.2

Forward-Looking Statements and Non-GAAP Financial Measures 2 Forward-looking statements contained in this and other written and oral reports are made based on known events and circumstances at the time of release, and as such, are subject in the future to unforeseen uncertainties and risks. These statements may be identified from the use of forward-looking terminology such as “anticipates,” “believes,” “may,” “should,” “could,” “potential,” “continues,” “plans,” “forecasts,” “estimates,” “projects,” “predicts,” “would,” “intends,” “expects,” “targets,” “is likely,” “will,” or the negative of these terms and similar expressions, and include all statements regarding future performance, earnings projections, events or developments. Parker cautions readers not to place undue reliance on these statements. It is possible that the future performance and earnings projections of the company, including its individual segments, may differ materially from current expectations, depending on economic conditions within its mobile, industrial and aerospace markets, and the company's ability to maintain and achieve anticipated benefits associated with announced realignment activities, strategic initiatives to improve operating margins, actions taken to combat the effects of the current economic environment, and growth, innovation and global diversification initiatives. Additionally, the actual impact of changes in tax laws in the United States and foreign jurisdictions and any judicial or regulatory interpretation thereof on future performance and earnings projections may impact the company’s tax calculations. A change in the economic conditions in individual markets may have a particularly volatile effect on segment performance. The risks and uncertainties in connection with such forward-looking statements related to the proposed acquisition of Meggitt include, but are not limited to, the occurrence of any event, change or other circumstances that could delay the closing of the acquisition; the possibility of nonconsummation of the acquisition; the failure to satisfy any of the conditions to the acquisition (including the satisfaction of the conditions detailed in the Rule 2.7 announcement); the possibility that a governmental entity may prohibit the consummation of the acquisition or may delay or refuse to grant a necessary regulatory approval in connection with the acquisition, or that in order for the parties to obtain any such regulatory approvals, conditions are imposed that adversely affect the anticipated benefits from the acquisition or cause the parties to abandon the acquisition; adverse effects on Parker’s common stock because of the failure to complete the acquisition; Parker’s business experiencing disruptions due to acquisition-related uncertainty or other factors making it more difficult to maintain relationships with employees, business partners or governmental entities; the possibility that the expected synergies and value creation from the acquisition will not be realized or will not be realized within the expected time period; the parties being unable to successfully implement integration strategies; and significant transaction costs related to the acquisition. Readers should consider these forward-looking statements in light of risk factors discussed in Parker’s Annual Report on Form 10-K for the fiscal year ended June 30, 2021 and other periodic filings made with the Securities and Exchange Commission. Among other factors which may affect future performance are: the impact of the global outbreak of COVID-19 and governmental and other actions taken in response; changes in business relationships with and purchases by or from major customers, suppliers or distributors, including delays or cancellations in shipments; disputes regarding contract terms or significant changes in financial condition, changes in contract cost and revenue estimates for new development programs and changes in product mix; ability to identify acceptable strategic acquisition targets; uncertainties surrounding timing, successful completion or integration of acquisitions and similar transactions, including the integration of LORD Corporation or Exotic Metals; the ability to successfully divest businesses planned for divestiture and realize the anticipated benefits of such divestitures; the determination to undertake business realignment activities and the expected costs thereof and, if undertaken, the ability to complete such activities and realize the anticipated cost savings from such activities; ability to implement successfully capital allocation initiatives, including timing, price and execution of share repurchases; availability, limitations or cost increases of raw materials, component products and/or commodities that cannot be recovered in product pricing; ability to manage costs related to insurance and employee retirement and health care benefits; compliance costs associated with environmental laws and regulations; potential supply chain and labor disruptions, including as a result of labor shortages; threats associated with and efforts to combat terrorism and cyber-security risks; uncertainties surrounding the ultimate resolution of outstanding legal proceedings, including the outcome of any appeals; global competitive market conditions, including global reactions to U.S. trade policies, and resulting effects on sales and pricing; and global economic factors, including manufacturing activity, air travel trends, currency exchange rates, difficulties entering new markets and general economic conditions such as inflation, deflation, interest rates and credit availability. The company makes these statements as of the date of this disclosure and undertakes no obligation to update them unless otherwise required by law. This presentation contains references to non-GAAP financial information, including adjusted earnings per share, adjusted operating margin for Parker and by segment, EBITDA, adjusted EBITDA, EBITDA margin, organic sales growth, and free cash flow. EBITDA is defined as earnings before interest, taxes, depreciation and amortization. Adjusted EBITDA is defined as EBITDA before business realignment, Integration costs to achieve, acquisition related expenses, and other one-time items. Free cash flow is defined as cash flow from operations less capital expenditures. Although organic sales growth, adjusted earnings per share, adjusted operating margin for Parker and by segment, EBITDA, adjusted EBITDA, EBITDA margin and free cash flow are not measures of performance calculated in accordance with GAAP, we believe that they are useful to an investor in evaluating the company performance for the period presented. Detailed reconciliations of these non-GAAP financial measures to the comparable GAAP financial measures have been included in the appendix to this presentation. Please visit www.PHstock.com for more information

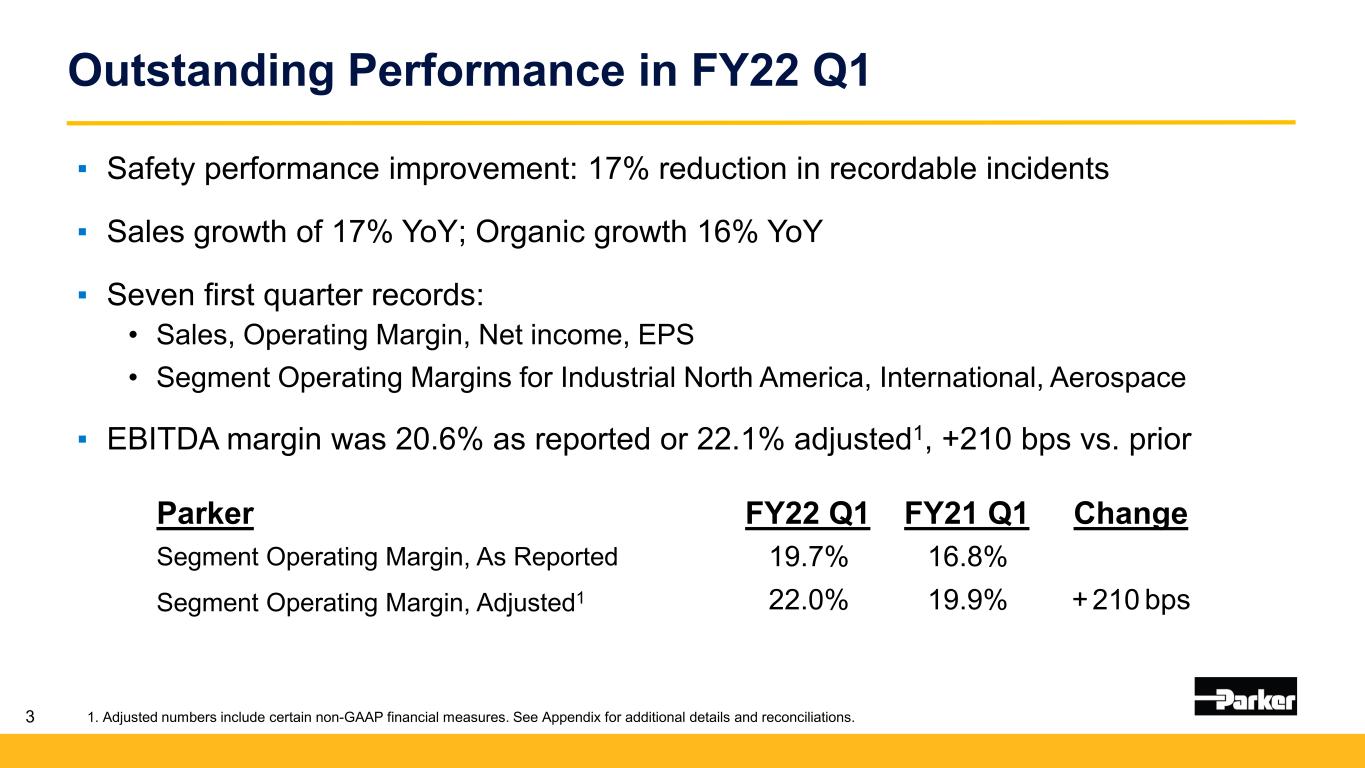

Outstanding Performance in FY22 Q1 3 ▪ Safety performance improvement: 17% reduction in recordable incidents ▪ Sales growth of 17% YoY; Organic growth 16% YoY ▪ Seven first quarter records: • Sales, Operating Margin, Net income, EPS • Segment Operating Margins for Industrial North America, International, Aerospace ▪ EBITDA margin was 20.6% as reported or 22.1% adjusted1, +210 bps vs. prior Parker FY22 Q1 FY21 Q1 Change Segment Operating Margin, As Reported 19.7% 16.8% Segment Operating Margin, Adjusted1 22.0% 19.9% 210+ bps 1. Adjusted numbers include certain non-GAAP financial measures. See Appendix for additional details and reconciliations.

What Drives Parker? Great Generators and Deployers of Cash Living Up to Our Purpose Top Quartile Performance vs. Proxy Peers 4

5

Parker’s Purpose in Action Expertise in Semiconductor Manufacturing 6 Process Control • Ultra high purity (UHP) valves • UHP pressure regulators • Flouropolymer valve manifolds Fluid & Gas Handling • Cooling hoses • Quick couplings Electromechanical • Solenoid actuation valves • Servo systems for wafer spinning Engineered Materials • Electromagnetic shielding • Load lock & chamber seals Parker Technologies Essential to the Digital Supply Chain Applications • Liquid & gas mobile transport • Bulk gas distribution at facility • Specialty chemical delivery • Valve manifold boxes • Semiconductor tool hookup • Fabrication tools Parker Technologies

Unmatched Breadth of Core Technologies HYDRAULICS PNEUMATICS ELECTRO- MECHANICAL FILTRATION FLUID & GAS HANDLING PROCESS CONTROL ENGINEERED MATERIALS CLIMATE CONTROL Partnering with our customers to increase their productivity and profitability From customers who buy 4 or more Parker technologies of Our Revenue: Enables clean technologies of Our Portfolio: 7 2/3’s2/3’s~ ~

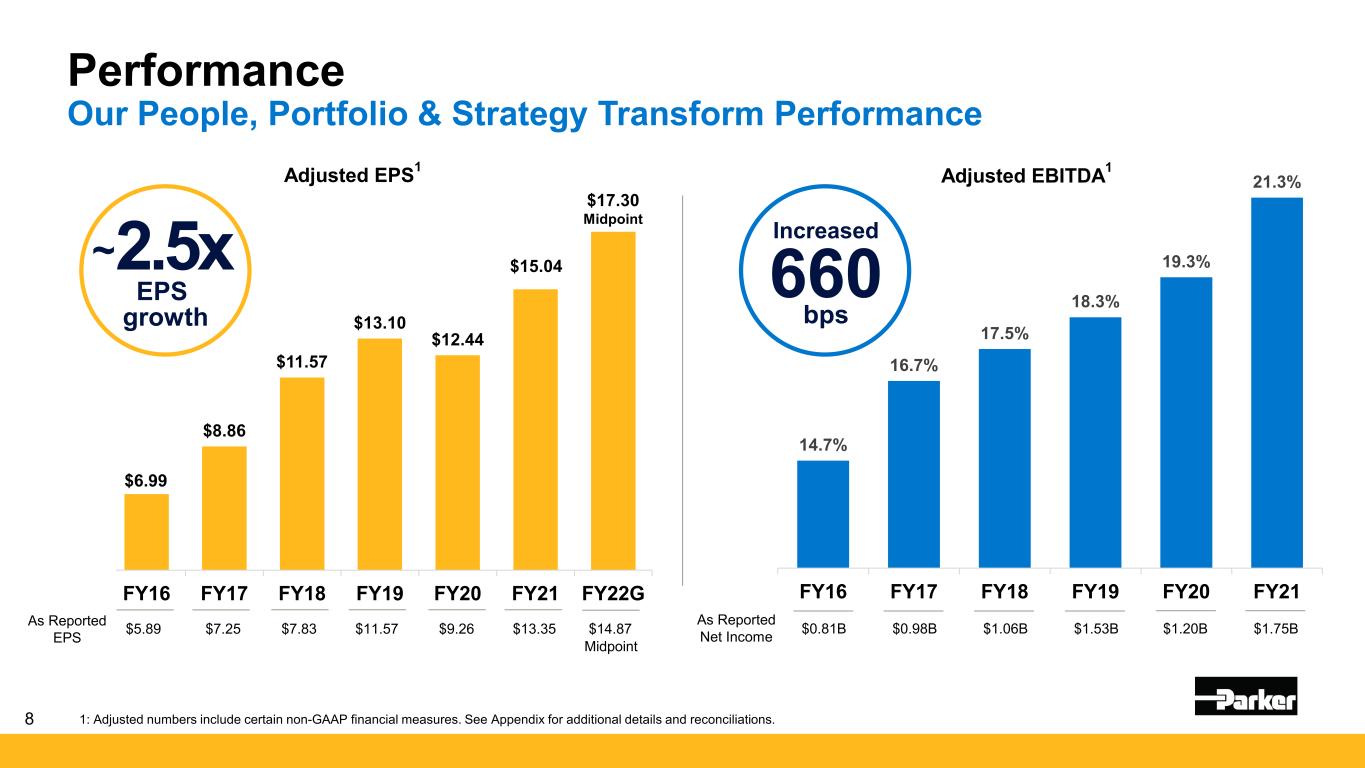

$6.99 $8.86 $11.57 $13.10 $12.44 $15.04 FY16 FY17 FY18 FY19 FY20 FY21 FY22G Adjusted EPS1 1: Adjusted numbers include certain non-GAAP financial measures. See Appendix for additional details and reconciliations. $5.89 $7.25 $7.83 $11.57 $9.26 $13.35 $14.87As Reported EPS Performance Our People, Portfolio & Strategy Transform Performance 14.7% 16.7% 17.5% 18.3% 19.3% 21.3% FY16 FY17 FY18 FY19 FY20 FY21 Adjusted EBITDA1 8 $0.81B $0.98B $1.06B $1.53B $1.20B $1.75BAs Reported Net Income Increased 660 bps Midpoint $17.30 Midpoint2.5x EPS growth ~

Continued Progress on Meggitt Transaction 9 Compelling Strategic Aerospace Combination

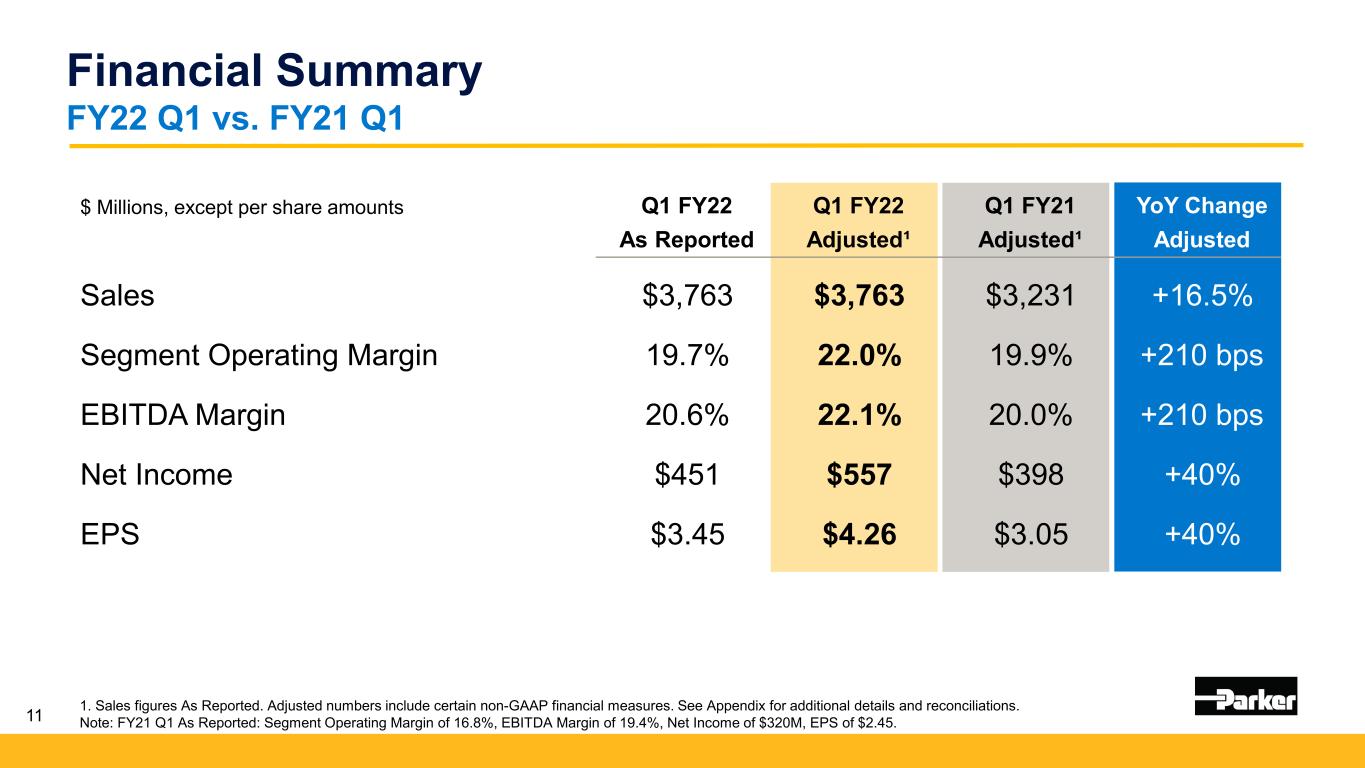

11 Financial Summary FY22 Q1 vs. FY21 Q1 1. Sales figures As Reported. Adjusted numbers include certain non-GAAP financial measures. See Appendix for additional details and reconciliations. Note: FY21 Q1 As Reported: Segment Operating Margin of 16.8%, EBITDA Margin of 19.4%, Net Income of $320M, EPS of $2.45. $ Millions, except per share amounts Q1 FY22 Q1 FY22 Q1 FY21 YoY Change As Reported Adjusted¹ Adjusted¹ Adjusted Sales $3,763 $3,763 $3,231 +16.5% Segment Operating Margin 19.7% 22.0% 19.9% +210 bps EBITDA Margin 20.6% 22.1% 20.0% +210 bps Net Income $451 $557 $398 +40% EPS $3.45 $4.26 $3.05 +40%

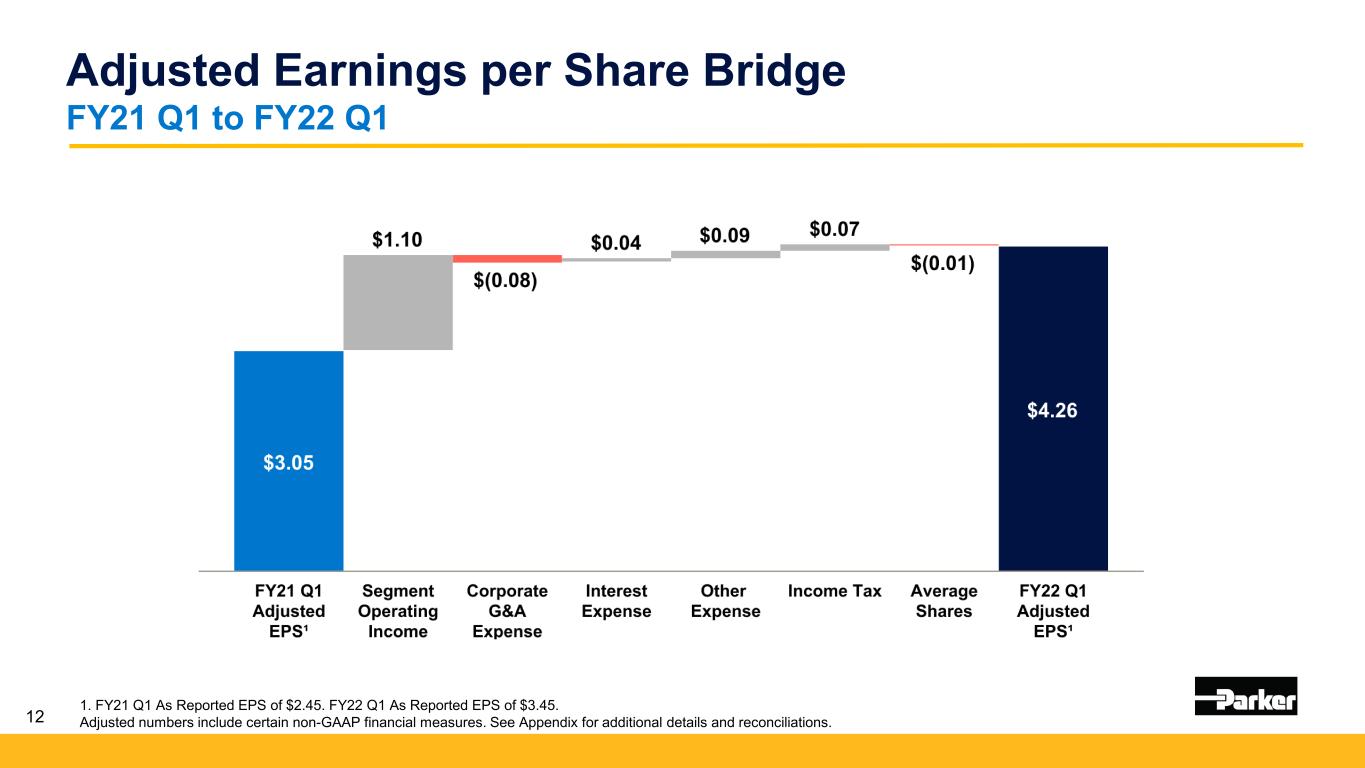

12 Adjusted Earnings per Share Bridge FY21 Q1 to FY22 Q1 1. FY21 Q1 As Reported EPS of $2.45. FY22 Q1 As Reported EPS of $3.45. Adjusted numbers include certain non-GAAP financial measures. See Appendix for additional details and reconciliations.

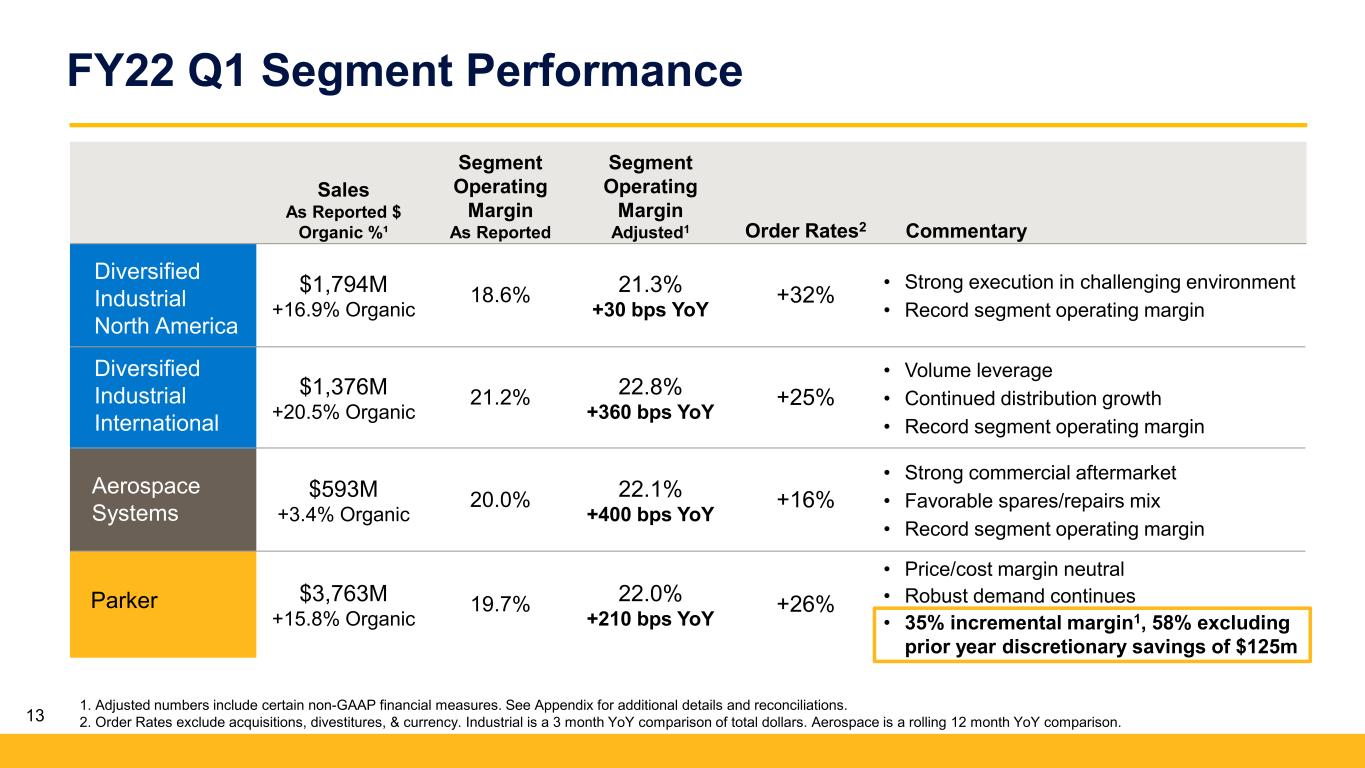

13 FY22 Q1 Segment Performance Sales As Reported $ Organic %¹ Segment Operating Margin As Reported Segment Operating Margin Adjusted1 Order Rates2 Commentary $1,794M +16.9% Organic 18.6% 21.3% +30 bps YoY +32% • Strong execution in challenging environment • Record segment operating margin $1,376M +20.5% Organic 21.2% 22.8% +360 bps YoY +25% • Volume leverage • Continued distribution growth • Record segment operating margin $593M +3.4% Organic 20.0% 22.1% +400 bps YoY +16% • Strong commercial aftermarket • Favorable spares/repairs mix • Record segment operating margin $3,763M +15.8% Organic 19.7% 22.0% +210 bps YoY +26% • Price/cost margin neutral • Robust demand continues • 35% incremental margin1, 58% excluding prior year discretionary savings of $125m 1. Adjusted numbers include certain non-GAAP financial measures. See Appendix for additional details and reconciliations. 2. Order Rates exclude acquisitions, divestitures, & currency. Industrial is a 3 month YoY comparison of total dollars. Aerospace is a rolling 12 month YoY comparison. Diversified Industrial International Diversified Industrial North America Parker Aerospace Systems

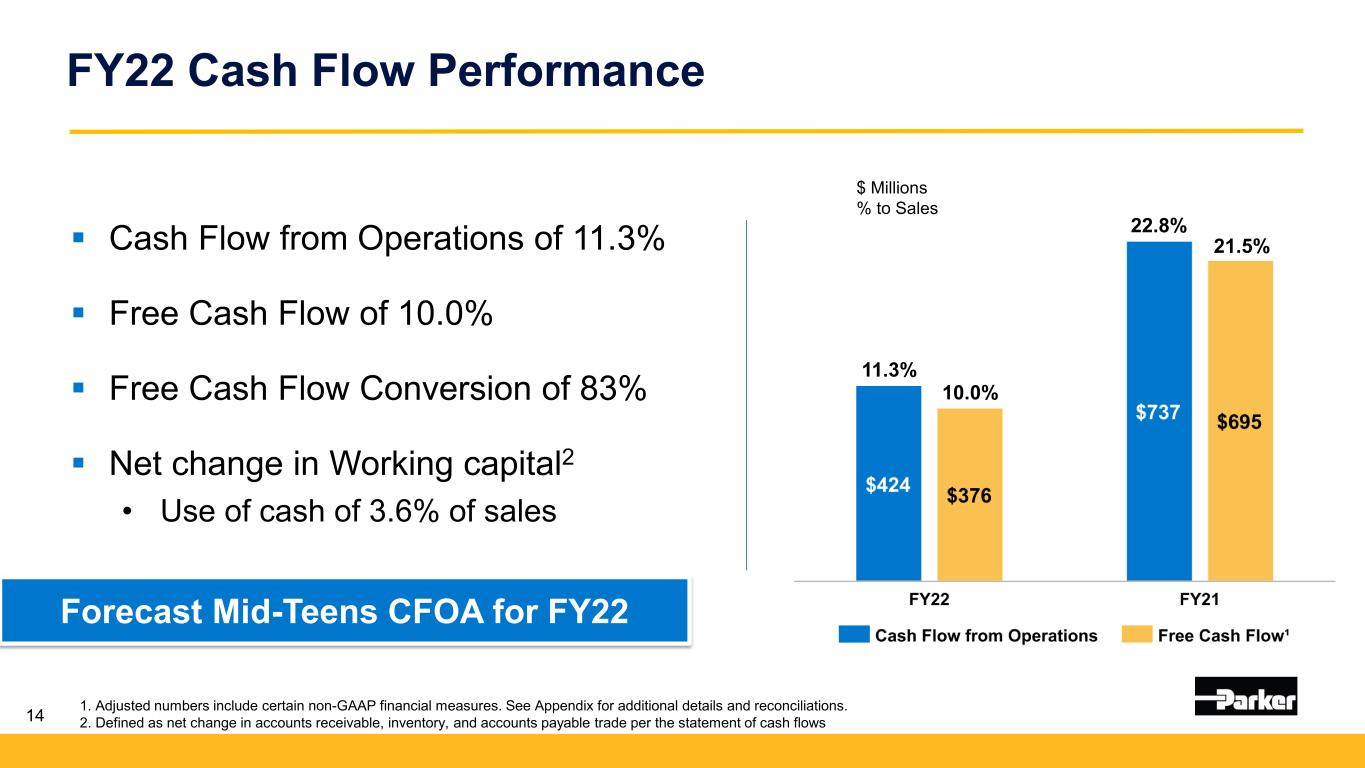

14 FY22 Cash Flow Performance Cash Flow from Operations of 11.3% Free Cash Flow of 10.0% Free Cash Flow Conversion of 83% Net change in Working capital2 • Use of cash of 3.6% of sales 1. Adjusted numbers include certain non-GAAP financial measures. See Appendix for additional details and reconciliations. 2. Defined as net change in accounts receivable, inventory, and accounts payable trade per the statement of cash flows $ Millions % to Sales 11.3% 10.0% 22.8% 21.5% Forecast Mid-Teens CFOA for FY22

Capital Deployment Strategies Dividends: Maintain annual increase record • Target 5-year average payout 30-35% of net income Fund organic growth and productivity • Target capital expenditures 2% of sales Offset share dilution through 10b5-1 share repurchase program • Additional discretionary repurchase of $180M Meggitt financing update 15

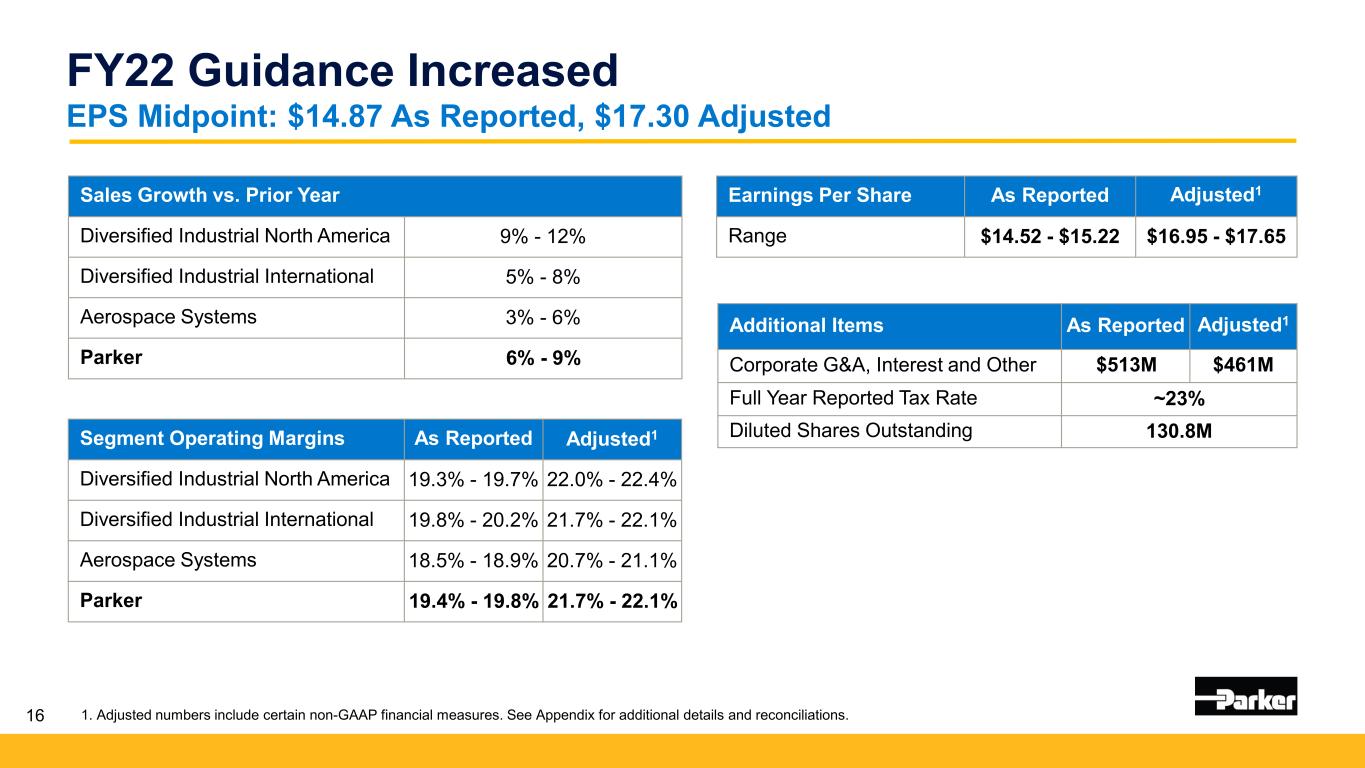

16 FY22 Guidance Increased EPS Midpoint: $14.87 As Reported, $17.30 Adjusted Sales Growth vs. Prior Year Diversified Industrial North America 9% - 12% Diversified Industrial International 5% - 8% Aerospace Systems 3% - 6% Parker 6% - 9% Segment Operating Margins As Reported Adjusted1 Diversified Industrial North America 19.3% - 19.7% 22.0% - 22.4% Diversified Industrial International 19.8% - 20.2% 21.7% - 22.1% Aerospace Systems 18.5% - 18.9% 20.7% - 21.1% Parker 19.4% - 19.8% 21.7% - 22.1% Additional Items As Reported Adjusted1 Corporate G&A, Interest and Other $513M $461M Full Year Reported Tax Rate ~23% Diluted Shares Outstanding 130.8M Earnings Per Share As Reported Adjusted1 Range $14.52 - $15.22 $16.95 - $17.65 1. Adjusted numbers include certain non-GAAP financial measures. See Appendix for additional details and reconciliations.

Key Messages Highly engaged global team delivering outstanding performance Living up to our purpose Top quartile performance Strategic portfolio transformation 17 The Win Strategy™ 3.0 & Capital Deployment Accelerate Performance

Appendix • Reconciliation of Organic Growth • Adjusted Amounts Reconciliation • Reconciliation of EPS • Reconciliation of Total Segment Operating Margin to Adjusted Total Segment Operating Margin • Reconciliation of EBITDA to Adjusted EBITDA • Reconciliation of Free Cash Flow Conversion • Supplemental Sales Information – Global Technology Platforms • Reconciliation of Forecasted EPS 19

Reconciliation of Organic Growth (Dollars in thousands) (Unaudited) Quarter-to-Date As Reported Currency Organic As Reported Net Sales September 30, 2021 September 30, 2021 September 30, 2020 Diversified Industrial: North America $ 1,793,715 $ (7,927) $ 1,785,788 $ 1,528,111 International 1,376,436 (15,200) 1,361,236 1,129,251 Total Diversified Industrial 3,170,151 (23,127) 3,147,024 2,657,362 Aerospace Systems 592,658 107 592,765 573,178 Total Parker Hannifin $ 3,762,809 $ (23,020) $ 3,739,789 $ 3,230,540 As reported Currency Organic Diversified Industrial: North America 17.4 % 0.5 % 16.9 % International 21.9 % 1.4 % 20.5 % Total Diversified Industrial 19.3 % 0.9 % 18.4 % Aerospace Systems 3.4 % — % 3.4 % Total Parker Hannifin 16.5 % 0.7 % 15.8 % 20

Adjusted Amounts Reconciliation Consolidated Statement of Income (Dollars in thousands, except per share data) (Unaudited) Quarter-to-Date FY 2022 % of Sales Acquired Intangible Asset Amortization Business Realignment Charges Integration Costs to Achieve Acquisition Related Expenses % of Sales As Reported Adjusted September 30, 2021 September 30, 2021 Net Sales $ 3,762,809 100.0 % $ — $ — $ — $ — $ 3,762,809 100.0 % Cost of Sales 2,713,897 72.1 % — 1,001 651 — 2,712,245 72.1 % Selling, general, and admin. expenses 407,765 10.8 % 79,771 2,013 551 12,998 312,432 8.3 % Interest expense 59,350 1.6 % — — — — 59,350 1.6 % Other (income), net 10,052 0.3 % — — — 39,201 (29,149) (0.8)% Income before income taxes 571,745 15.2 % (79,771) (3,014) (1,202) (52,199) 707,931 18.8 % Income taxes 120,282 3.2 % 17,948 678 270 11,745 150,923 4.0 % Net Income 451,463 12.0 % (61,823) (2,336) (932) (40,454) 557,008 14.8 % Less: Noncontrollable interests 306 0.0 % — — — — 306 0.0 % Net Income - common shareholders $ 451,157 12.0 % $ (61,823) $ (2,336) $ (932) $ (40,454) $ 556,702 14.8 % Diluted earnings per share $ 3.45 $ (0.47) $ (0.02) $ (0.01) $ (0.31) $ 4.26 21

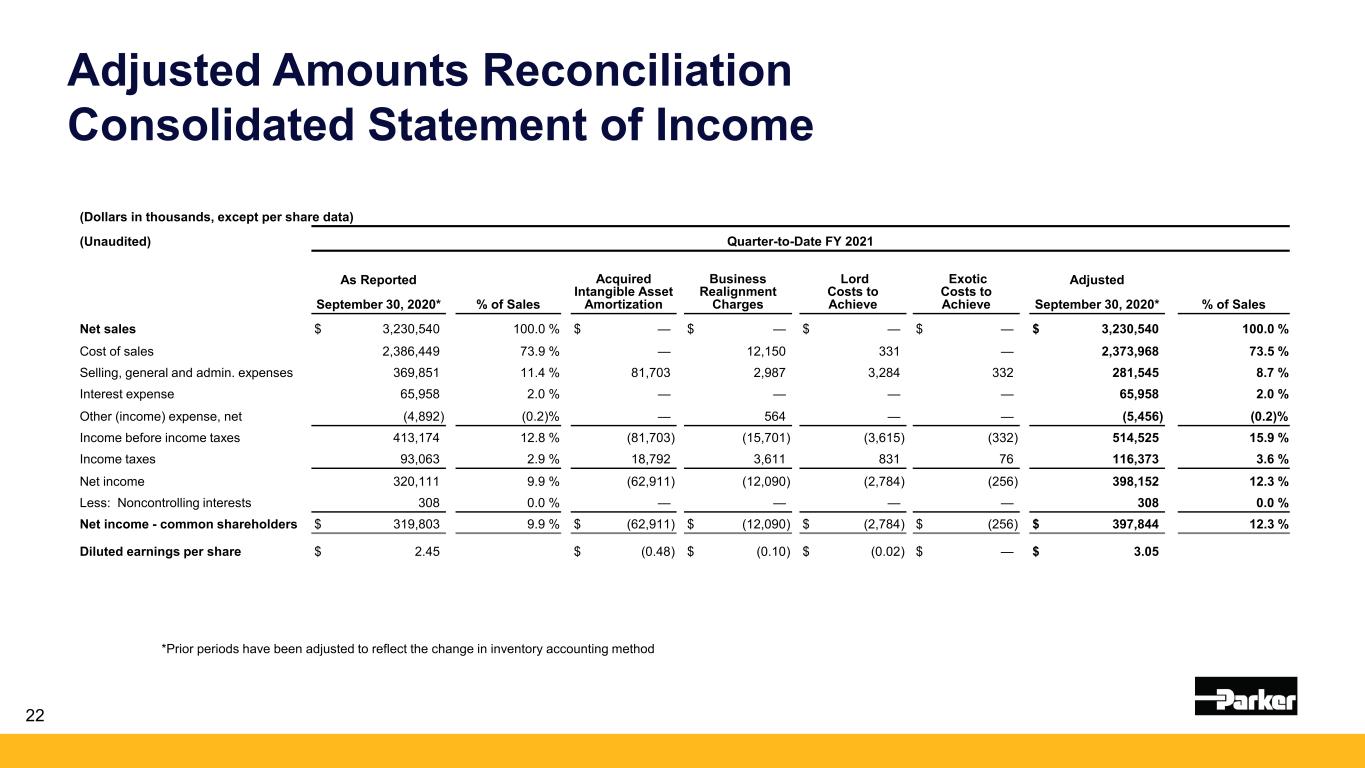

Adjusted Amounts Reconciliation Consolidated Statement of Income (Dollars in thousands, except per share data) (Unaudited) Quarter-to-Date FY 2021 % of Sales Acquired Intangible Asset Amortization Business Realignment Charges Lord Costs to Achieve Exotic Costs to Achieve As Reported Adjusted September 30, 2020* September 30, 2020* % of Sales Net sales $ 3,230,540 100.0 % $ — $ — $ — $ — $ 3,230,540 100.0 % Cost of sales 2,386,449 73.9 % — 12,150 331 — 2,373,968 73.5 % Selling, general and admin. expenses 369,851 11.4 % 81,703 2,987 3,284 332 281,545 8.7 % Interest expense 65,958 2.0 % — — — — 65,958 2.0 % Other (income) expense, net (4,892) (0.2)% — 564 — — (5,456) (0.2)% Income before income taxes 413,174 12.8 % (81,703) (15,701) (3,615) (332) 514,525 15.9 % Income taxes 93,063 2.9 % 18,792 3,611 831 76 116,373 3.6 % Net income 320,111 9.9 % (62,911) (12,090) (2,784) (256) 398,152 12.3 % Less: Noncontrolling interests 308 0.0 % — — — — 308 0.0 % Net income - common shareholders $ 319,803 9.9 % $ (62,911) $ (12,090) $ (2,784) $ (256) $ 397,844 12.3 % Diluted earnings per share $ 2.45 $ (0.48) $ (0.10) $ (0.02) $ — $ 3.05 *Prior periods have been adjusted to reflect the change in inventory accounting method 22

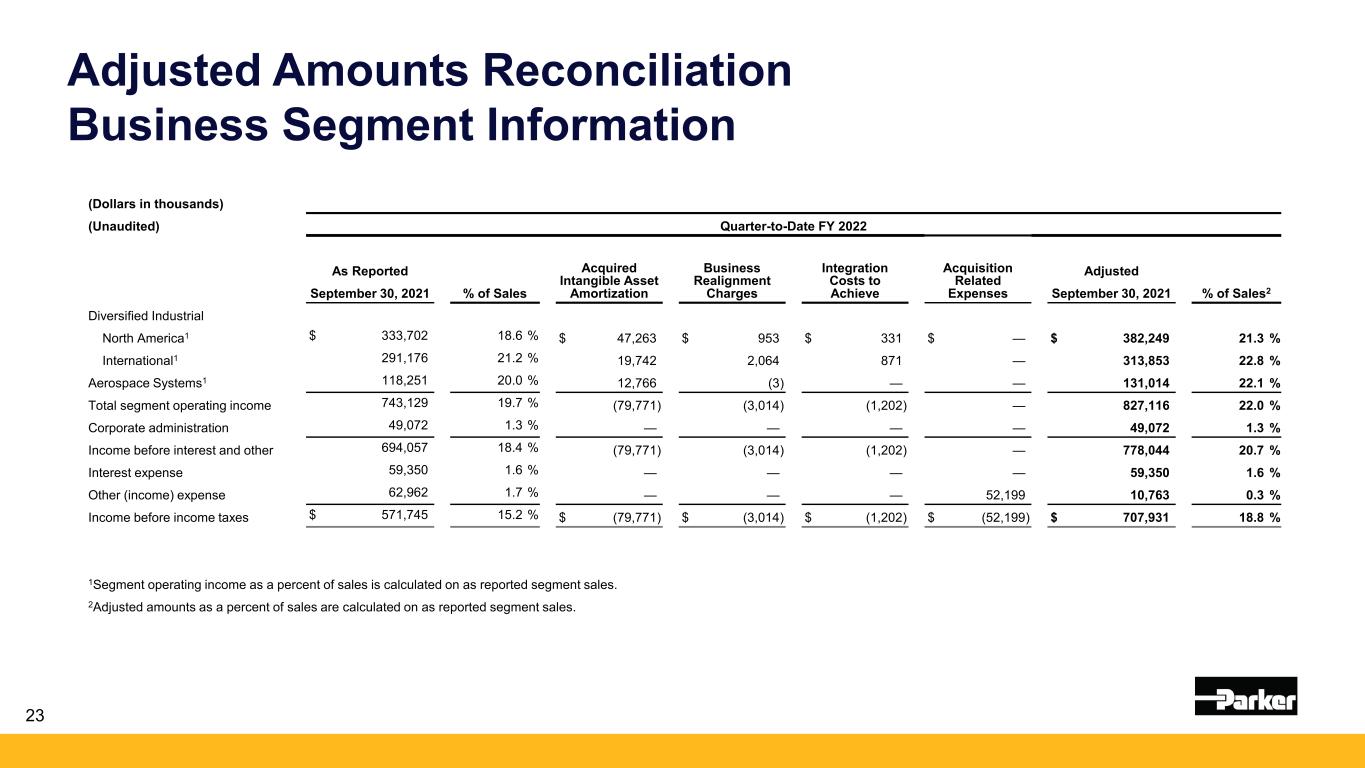

Adjusted Amounts Reconciliation Business Segment Information (Dollars in thousands) (Unaudited) Quarter-to-Date FY 2022 % of Sales Acquired Intangible Asset Amortization Business Realignment Charges Integration Costs to Achieve Acquisition Related Expenses % of Sales2 As Reported Adjusted September 30, 2021 September 30, 2021 Diversified Industrial North America1 $ 333,702 18.6 % $ 47,263 $ 953 $ 331 $ — $ 382,249 21.3 % International1 291,176 21.2 % 19,742 2,064 871 — 313,853 22.8 % Aerospace Systems1 118,251 20.0 % 12,766 (3) — — 131,014 22.1 % Total segment operating income 743,129 19.7 % (79,771) (3,014) (1,202) — 827,116 22.0 % Corporate administration 49,072 1.3 % — — — — 49,072 1.3 % Income before interest and other 694,057 18.4 % (79,771) (3,014) (1,202) — 778,044 20.7 % Interest expense 59,350 1.6 % — — — — 59,350 1.6 % Other (income) expense 62,962 1.7 % — — — 52,199 10,763 0.3 % Income before income taxes $ 571,745 15.2 % $ (79,771) $ (3,014) $ (1,202) $ (52,199) $ 707,931 18.8 % 1Segment operating income as a percent of sales is calculated on as reported segment sales. 2Adjusted amounts as a percent of sales are calculated on as reported segment sales. 23

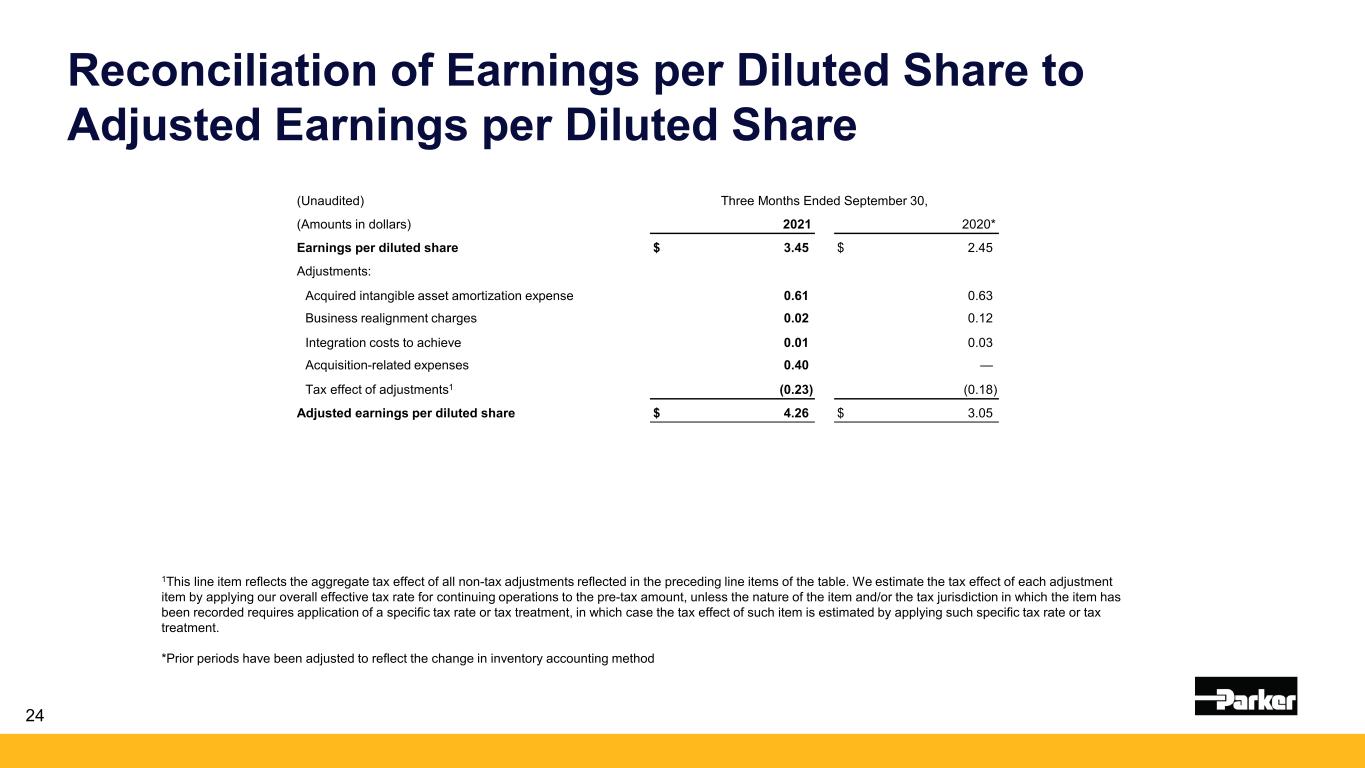

Reconciliation of Earnings per Diluted Share to Adjusted Earnings per Diluted Share (Unaudited) Three Months Ended September 30, (Amounts in dollars) 2021 2020* Earnings per diluted share $ 3.45 $ 2.45 Adjustments: Acquired intangible asset amortization expense 0.61 0.63 Business realignment charges 0.02 0.12 Integration costs to achieve 0.01 0.03 Acquisition-related expenses 0.40 — Tax effect of adjustments1 (0.23) (0.18) Adjusted earnings per diluted share $ 4.26 $ 3.05 1This line item reflects the aggregate tax effect of all non-tax adjustments reflected in the preceding line items of the table. We estimate the tax effect of each adjustment item by applying our overall effective tax rate for continuing operations to the pre-tax amount, unless the nature of the item and/or the tax jurisdiction in which the item has been recorded requires application of a specific tax rate or tax treatment, in which case the tax effect of such item is estimated by applying such specific tax rate or tax treatment. *Prior periods have been adjusted to reflect the change in inventory accounting method 24

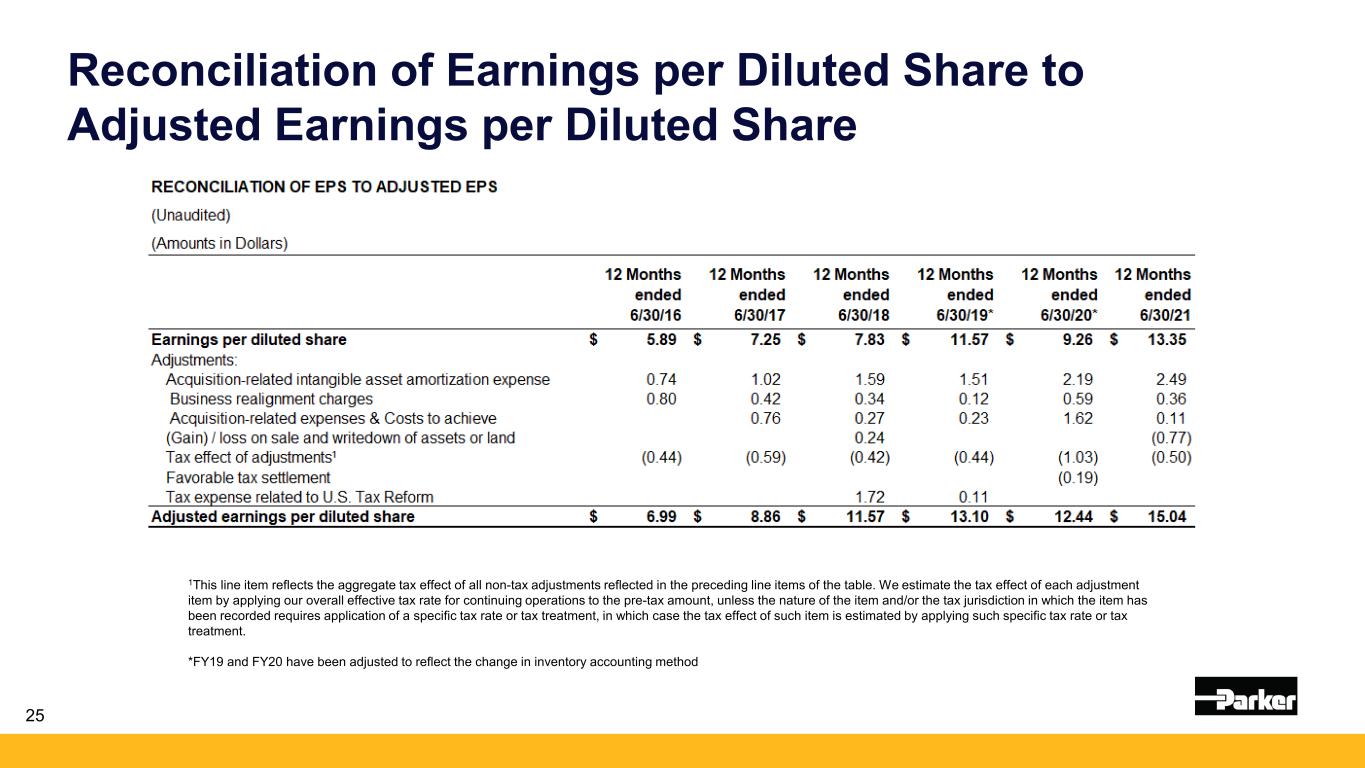

Reconciliation of Earnings per Diluted Share to Adjusted Earnings per Diluted Share 1This line item reflects the aggregate tax effect of all non-tax adjustments reflected in the preceding line items of the table. We estimate the tax effect of each adjustment item by applying our overall effective tax rate for continuing operations to the pre-tax amount, unless the nature of the item and/or the tax jurisdiction in which the item has been recorded requires application of a specific tax rate or tax treatment, in which case the tax effect of such item is estimated by applying such specific tax rate or tax treatment. *FY19 and FY20 have been adjusted to reflect the change in inventory accounting method 25

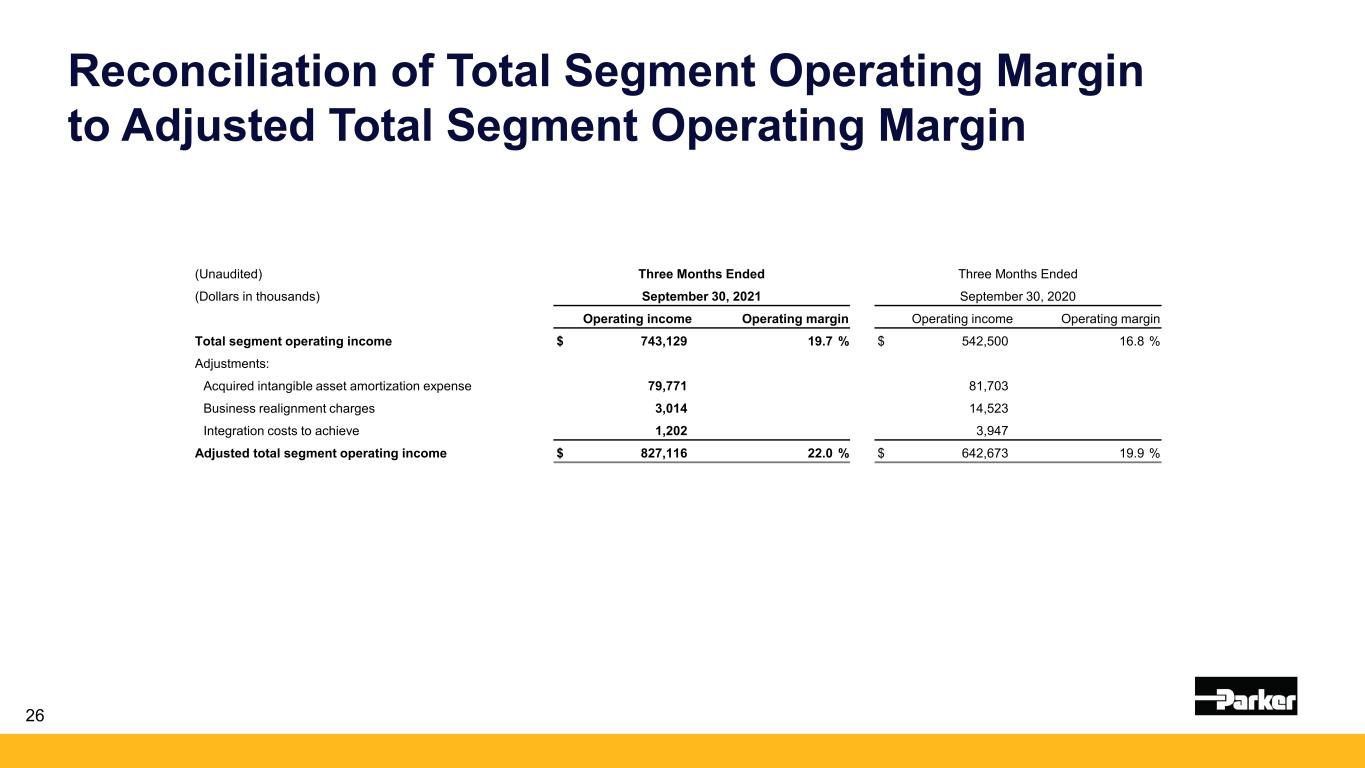

Reconciliation of Total Segment Operating Margin to Adjusted Total Segment Operating Margin (Unaudited) Three Months Ended Three Months Ended (Dollars in thousands) September 30, 2021 September 30, 2020 Operating income Operating margin Operating income Operating margin Total segment operating income $ 743,129 19.7 % $ 542,500 16.8 % Adjustments: Acquired intangible asset amortization expense 79,771 81,703 Business realignment charges 3,014 14,523 Integration costs to achieve 1,202 3,947 Adjusted total segment operating income $ 827,116 22.0 % $ 642,673 19.9 % 26

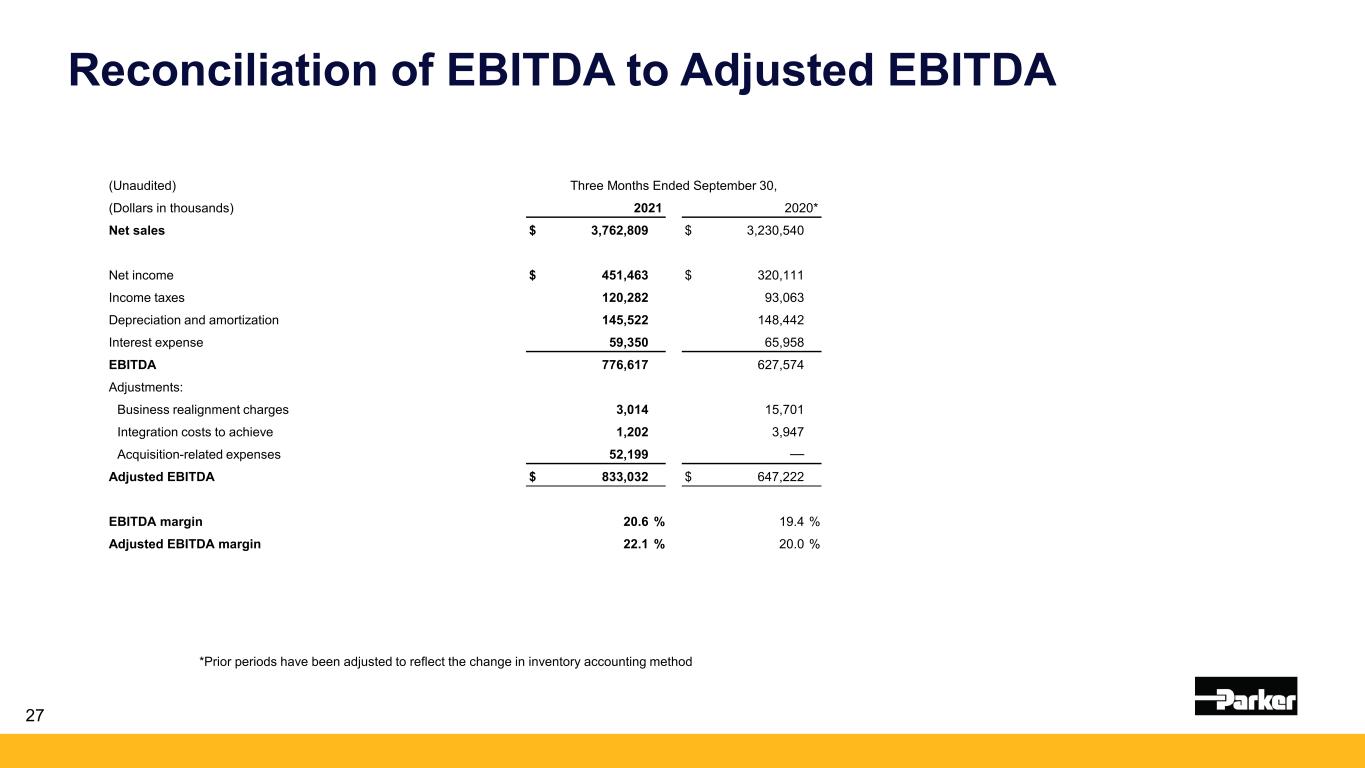

Reconciliation of EBITDA to Adjusted EBITDA (Unaudited) Three Months Ended September 30, (Dollars in thousands) 2021 2020* Net sales $ 3,762,809 $ 3,230,540 Net income $ 451,463 $ 320,111 Income taxes 120,282 93,063 Depreciation and amortization 145,522 148,442 Interest expense 59,350 65,958 EBITDA 776,617 627,574 Adjustments: Business realignment charges 3,014 15,701 Integration costs to achieve 1,202 3,947 Acquisition-related expenses 52,199 — Adjusted EBITDA $ 833,032 $ 647,222 EBITDA margin 20.6 % 19.4 % Adjusted EBITDA margin 22.1 % 20.0 % *Prior periods have been adjusted to reflect the change in inventory accounting method 27

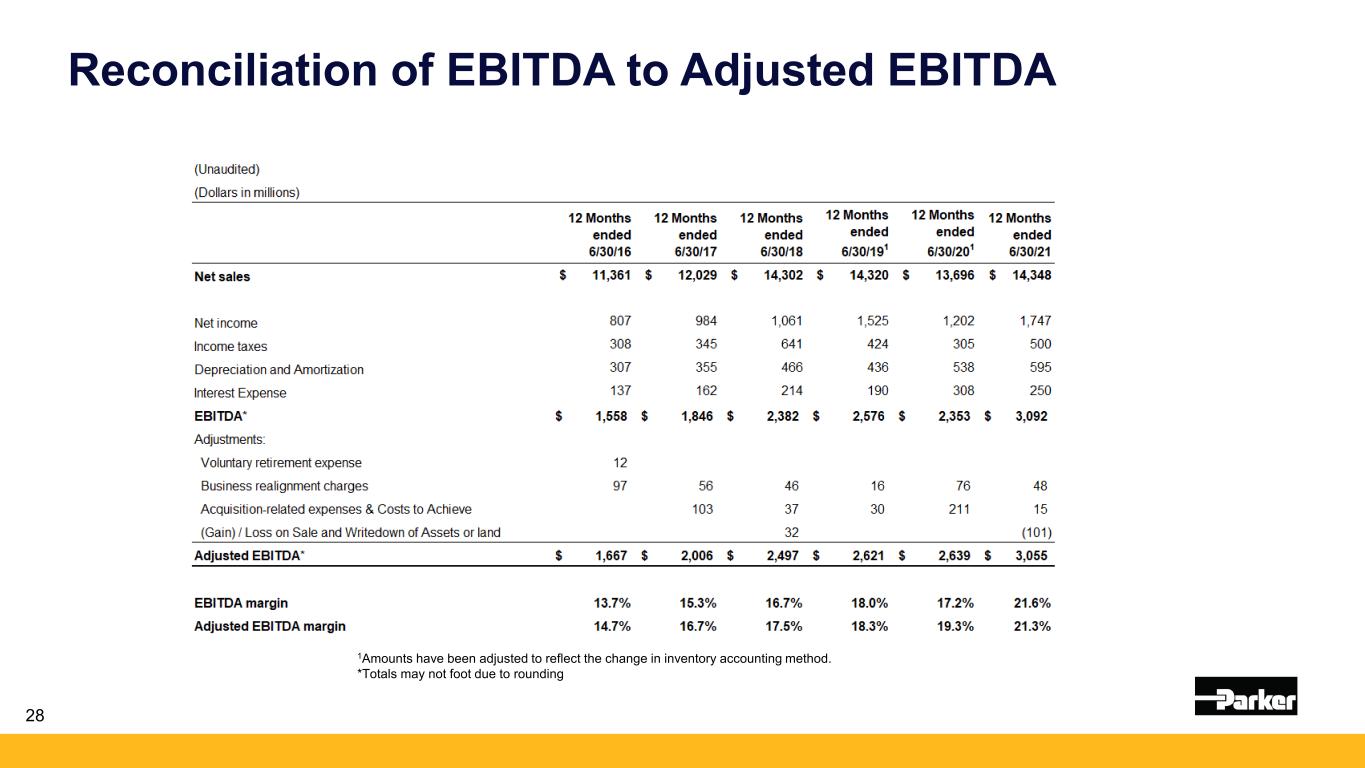

1Amounts have been adjusted to reflect the change in inventory accounting method. *Totals may not foot due to rounding Reconciliation of EBITDA to Adjusted EBITDA 28

Reconciliation of Free Cash Flow Conversion (Unaudited) Three Months Ended September 30, 2021 Three Months Ended September 30, 2020*(Dollars in thousands) Net income $ 451,463 $ 320,111 Cash flow from operations $ 424,359 $ 737,374 Capital Expenditures (48,203) (42,117) Free cash flow $ 376,156 $ 695,257 Free cash flow conversion (free cash flow / net income) 83 % 217 % *Prior periods have been adjusted to reflect the change in inventory accounting method29

Supplemental Sales Information Global Technology Platforms (Unaudited) Three Months Ended September 30, (Dollars in thousands) 2021 2021 Net sales Diversified Industrial: Motion Systems $ 828,672 $ 657,141 Flow and Process Control 1,085,423 924,125 Filtration and Engineered Materials 1,256,056 1,076,096 Aerospace Systems 592,658 573,178 Total $ 3,762,809 $ 3,230,540 30

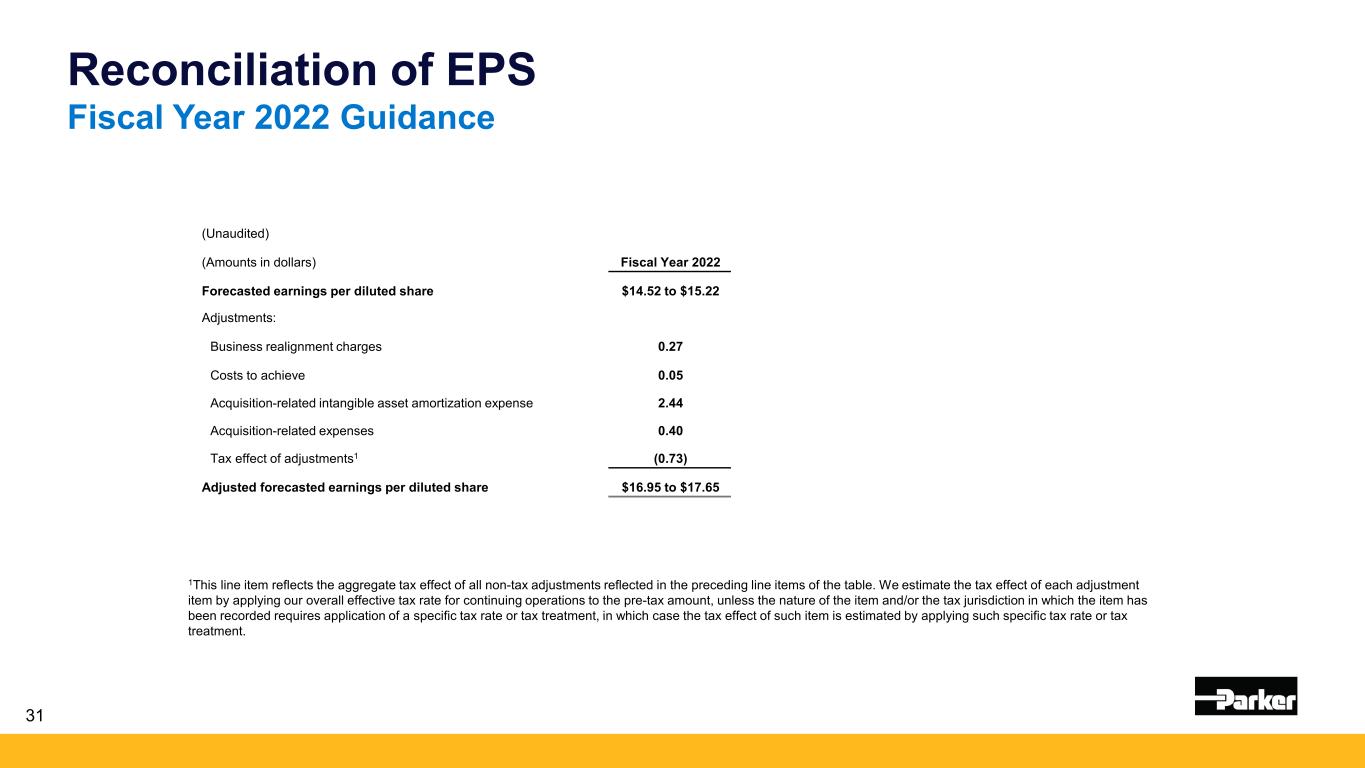

Reconciliation of EPS Fiscal Year 2022 Guidance (Unaudited) (Amounts in dollars) Fiscal Year 2022 Forecasted earnings per diluted share $14.52 to $15.22 Adjustments: Business realignment charges 0.27 Costs to achieve 0.05 Acquisition-related intangible asset amortization expense 2.44 Acquisition-related expenses 0.40 Tax effect of adjustments1 (0.73) Adjusted forecasted earnings per diluted share $16.95 to $17.65 1This line item reflects the aggregate tax effect of all non-tax adjustments reflected in the preceding line items of the table. We estimate the tax effect of each adjustment item by applying our overall effective tax rate for continuing operations to the pre-tax amount, unless the nature of the item and/or the tax jurisdiction in which the item has been recorded requires application of a specific tax rate or tax treatment, in which case the tax effect of such item is estimated by applying such specific tax rate or tax treatment. 31