Parker Hannifin Corporation Fiscal 2022 Third Quarter Earnings Presentation May 5, 2022 Exhibit 99.2

Forward-Looking Statements and Non-GAAP Financial Measures 2 Forward-looking statements contained in this and other written and oral reports are made based on known events and circumstances at the time of release, and as such, are subject in the future to unforeseen uncertainties and risks. Often but not always, these statements may be identified from the use of forward-looking terminology such as “anticipates,” “believes,” “may,” “should,” “could,” “expects,” “targets,” “is likely,” “will,” or the negative of these terms and similar expressions, and include all statements regarding future performance, earnings projections, events or developments. Neither Parker nor any of its respective associates or directors, officers or advisers, provides any representation, assurance or guarantee that the occurrence of the events expressed or implied in any forward-looking statements will actually occur. Parker cautions readers not to place undue reliance on these statements. It is possible that the future performance and earnings projections of the company, including its individual segments, may differ materially from past performance or current expectations. The risks and uncertainties in connection with such forward-looking statements related to the proposed acquisition of Meggitt include, but are not limited to, the occurrence of any event, change or other circumstances that could delay or prevent the closing of the proposed acquisition, including the failure to satisfy any of the conditions to the proposed acquisition; the possibility that in order for the parties to obtain regulatory approvals, conditions are imposed that prevent or otherwise adversely affect the anticipated benefits from the proposed acquisition or cause the parties to abandon the proposed acquisition; adverse effects on Parker’s common stock because of the failure to complete the proposed acquisition; Parker’s business experiencing disruptions due to acquisition-related uncertainty or other factors making it more difficult to maintain relationships with employees, business partners or governmental entities; the possibility that the expected synergies and value creation from the proposed acquisition will not be realized or will not be realized within the expected time period, due to unsuccessful implementation strategies or otherwise; and significant transaction costs related to the proposed acquisition. Among other factors which may affect future performance are: the impact of the global outbreak of COVID-19 and governmental and other actions taken in response; changes in business relationships with and purchases by or from major customers, suppliers or distributors, including delays or cancellations in shipments; disputes regarding contract terms or significant changes in financial condition, changes in contract cost and revenue estimates for new development programs and changes in product mix; ability to identify acceptable strategic acquisition targets; uncertainties surrounding timing, successful completion or integration of acquisitions and similar transactions, including the integration of LORD Corporation or Exotic Metals; the ability to successfully divest businesses planned for divestiture and realize the anticipated benefits of such divestitures; the determination to undertake business realignment activities and the expected costs thereof and, if undertaken, the ability to complete such activities and realize the anticipated cost savings from such activities; ability to implement successfully business and operating initiatives, including the timing, price and execution of share repurchases and other capital initiatives; availability, cost increases of or other limitations on our access to raw materials, component products and/or commodities if associated costs cannot be recovered in product pricing; ability to manage costs related to insurance and employee retirement and health care benefits; legal and regulatory developments and changes; compliance costs associated with environmental laws and regulations; potential supply chain and labor disruptions, including as a result of labor shortages; threats associated with international conflicts and efforts to combat terrorism and cyber- security risks; uncertainties surrounding the ultimate resolution of outstanding legal proceedings, including the outcome of any appeals; local and global political and competitive market conditions, including global reactions to U.S. trade policies, and resulting effects on sales and pricing; and global economic factors, including manufacturing activity, air travel trends, currency exchange rates, difficulties entering new markets and general economic conditions such as inflation, deflation, interest rates (including fluctuations associated with any potential credit rating decline) and credit availability; inability to obtain, or meet conditions imposed for, required governmental and regulatory approvals; changes in consumer habits and preferences; government actions, including the impact of changes in the tax laws in the United States and foreign jurisdictions and any judicial or regulatory interpretation thereof; and large scale disasters, such as floods, earthquakes, hurricanes, industrial accidents and pandemics. Readers should consider these forward-looking statements in light of risk factors discussed in Parker’s Annual Report on Form 10-K for the fiscal year ended June 30, 2021 and other periodic filings made with the SEC. This presentation contains references to non-GAAP financial information for Parker, including organic sales for Parker and by segment, adjusted earnings per share, adjusted operating margin for Parker and by segment, adjusted net income, EBITDA, adjusted EBITDA, EBITDA margin, adjusted EBITDA margin, adjusted Net Debt, and free cash flow. EBITDA is defined as earnings before interest, taxes, depreciation and amortization. For Parker, adjusted EBITDA is defined as EBITDA before business realignment, Integration costs to achieve, acquisition related expenses, and other one-time items. Free cash flow is defined as cash flow from operations less capital expenditures. Although organic sales, adjusted earnings per share, adjusted operating margin for Parker and by segment, adjusted net income, EBITDA, adjusted EBITDA, EBITDA margin and free cash flow are not measures of performance calculated in accordance with GAAP, we believe that they are useful to an investor in evaluating the company performance for the period presented. Detailed reconciliations of these non-GAAP financial measures to the comparable GAAP financial measures have been included in the appendix to this presentation. Please visit www.PHstock.com for more information

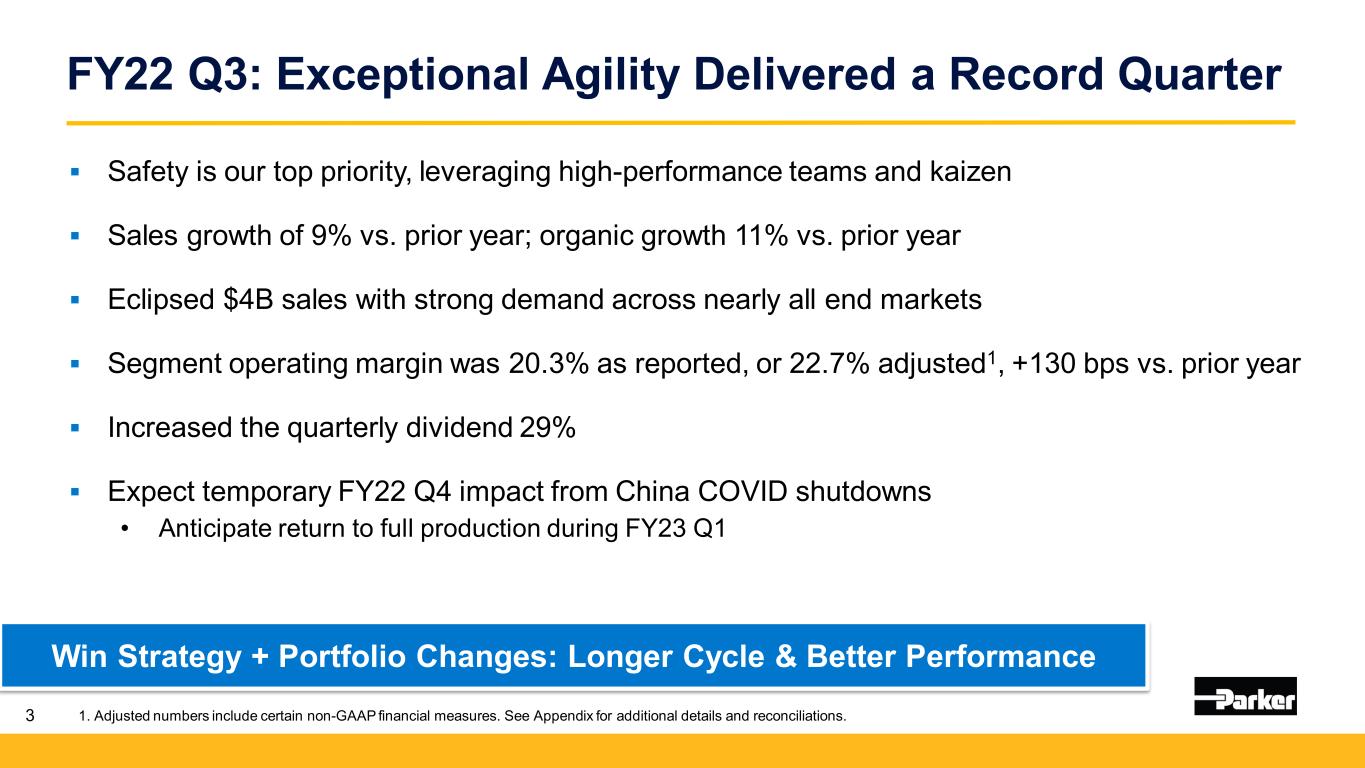

FY22 Q3: Exceptional Agility Delivered a Record Quarter 3 Safety is our top priority, leveraging high-performance teams and kaizen Sales growth of 9% vs. prior year; organic growth 11% vs. prior year Eclipsed $4B sales with strong demand across nearly all end markets Segment operating margin was 20.3% as reported, or 22.7% adjusted1, +130 bps vs. prior year Increased the quarterly dividend 29% Expect temporary FY22 Q4 impact from China COVID shutdowns • Anticipate return to full production during FY23 Q1 1. Adjusted numbers include certain non-GAAP financial measures. See Appendix for additional details and reconciliations. Win Strategy + Portfolio Changes: Longer Cycle & Better Performance

What Drives Parker? Great Generators and Deployers of Cash Living Up to Our Purpose Top Quartile Performance vs. Proxy Peers 4

Power Generation Parker is Essential to the Natural Gas Value Chain Enabling Growth in Natural Gas as a Bridge to Hydrogen 5 Upstream Midstream Gas Conditioning Liquefaction, Storage & Regasification Parker Technologies Utilized: Engineered Materials Filtration Fluid Conveyance Hydraulics Pneumatics Process Control

Hydraulics & Pneumatics • Motors and Pumps • Hydraulic Intensifiers • Valves & Accumulators Fluid Conveyance • Hydrogen Fuel Nozzles • Fittings and Quick Couplings • Cryogenic Solutions Filtration • Gas Filtration and Separation • Humidification & Gas Drying Engineered Materials • Hermetic Sealing • High Temp & Cryogenic Sealing Enabling Growth in Natural Gas as a Bridge to Hydrogen Parker Technologies Expertise in Dual Fuel Power Generation • Fuel Cells • Water Separation & Purification • Humidification and Gas Drying • H2 Power Generation Turbines • Water Injection Systems Applications for both CNG & H2 6

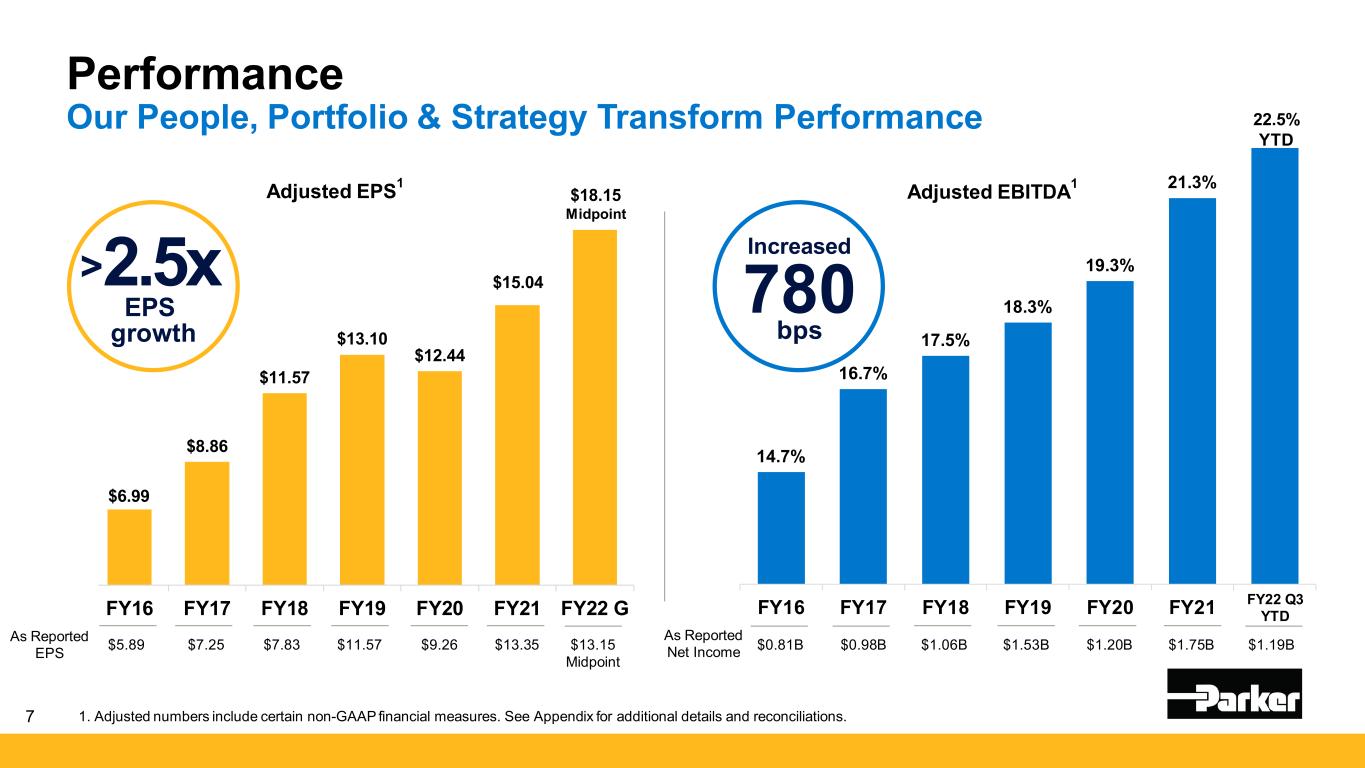

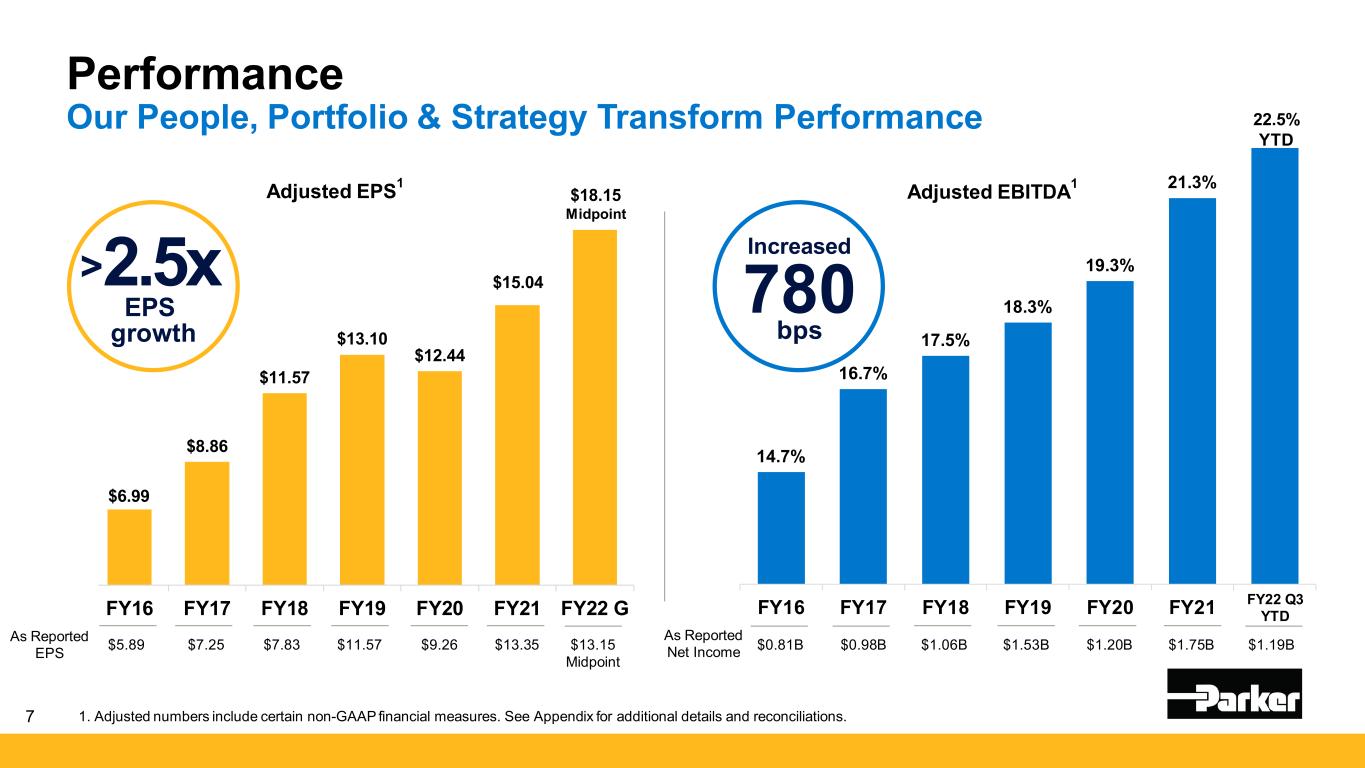

$6.99 $8.86 $11.57 $13.10 $12.44 $15.04 FY16 FY17 FY18 FY19 FY20 FY21 FY22 G Adjusted EPS1 1. Adjusted numbers include certain non-GAAP financial measures. See Appendix for additional details and reconciliations. $5.89 $7.25 $7.83 $11.57 $9.26 $13.35 $13.15As Reported EPS Performance Our People, Portfolio & Strategy Transform Performance 14.7% 16.7% 17.5% 18.3% 19.3% 21.3% FY16 FY17 FY18 FY19 FY20 FY21 Adjusted EBITDA1 Increased 780 bps Midpoint $18.15 Midpoint 2.5x EPS growth > 22.5% YTD $0.81B $0.98B $1.06B $1.53B $1.20B $1.75B $1.19BAs Reported Net Income FY22 Q3 YTD 7

Continued Progress on Meggitt Transaction 8 Compelling Strategic Aerospace Combination

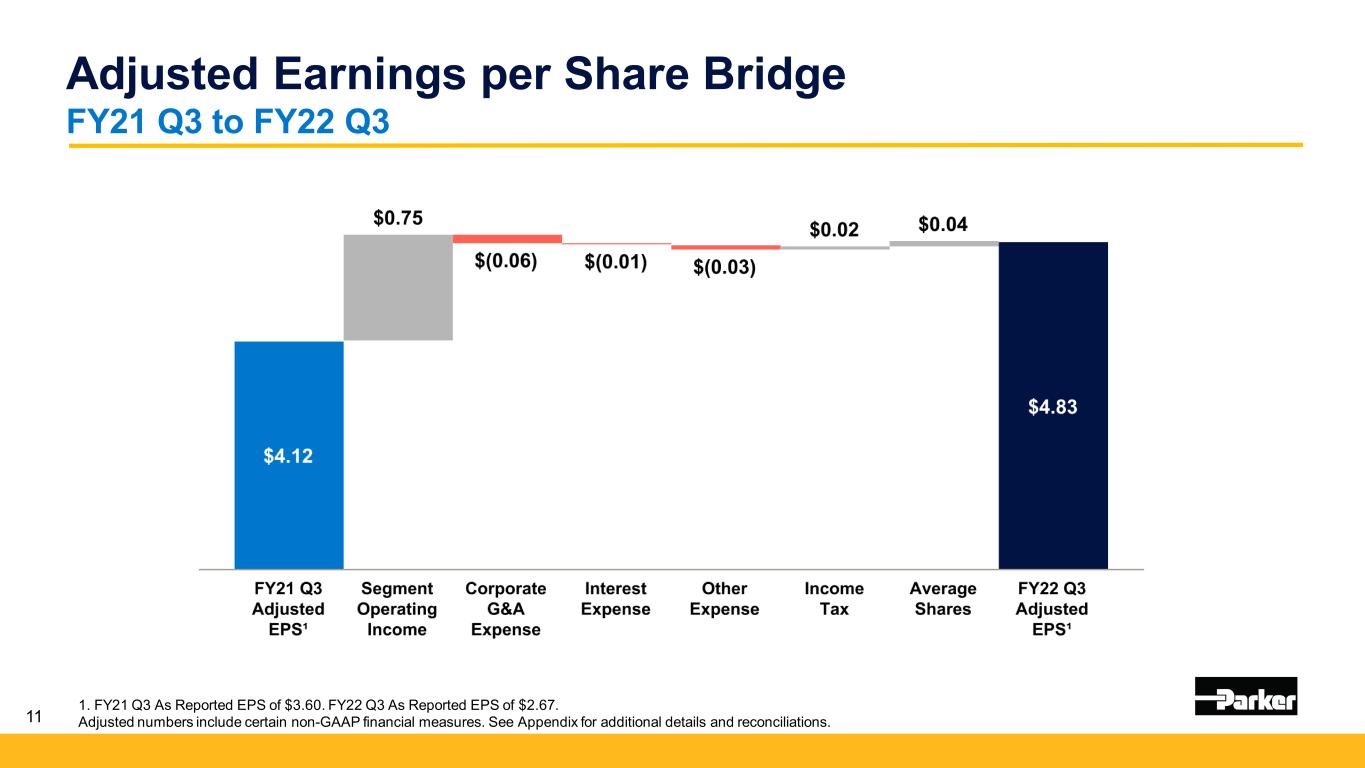

10 Financial Summary FY22 Q3 vs. FY21 Q3 1. Sales figures As Reported. Adjusted numbers include certain non-GAAP financial measures. See Appendix for additional details and reconciliations. Note: FY21 Q3 As Reported: Segment Operating Margin of 19.0%, EBITDA Margin of 21.6%, Net Income of $473M, EPS of $3.60. $ Millions, except per share amounts Q3 FY22 Q3 FY22 Q3 FY21 YoY Change As Reported Adjusted¹ Adjusted¹ Adjusted Sales $4,086 $4,086 $3,746 +9.1% Segment Operating Margin 20.3% 22.7% 21.4% +130 bps EBITDA Margin 15.7% 22.6% 21.9% +70 bps Net Income $348 $630 $542 +16% EPS $2.67 $4.83 $4.12 +17%

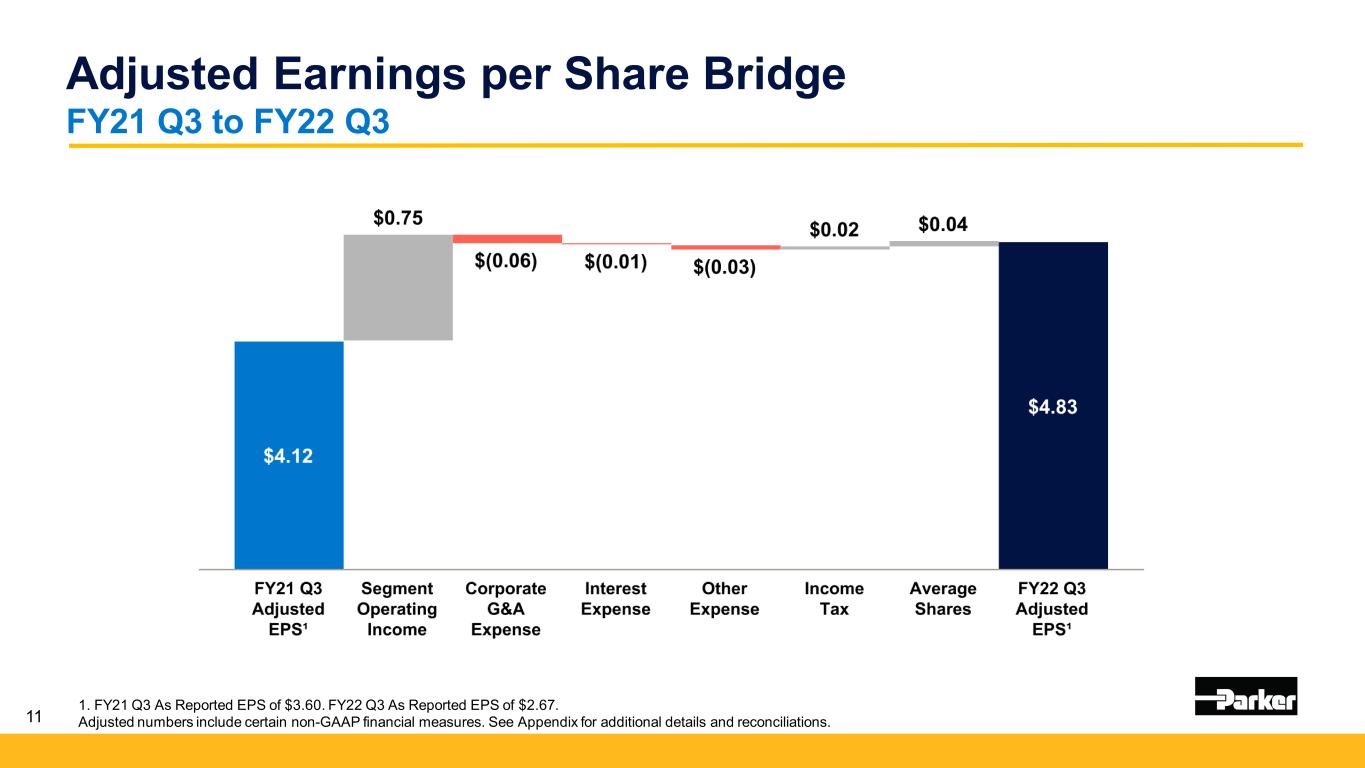

11 Adjusted Earnings per Share Bridge FY21 Q3 to FY22 Q3 1. FY21 Q3 As Reported EPS of $3.60. FY22 Q3 As Reported EPS of $2.67. Adjusted numbers include certain non-GAAP financial measures. See Appendix for additional details and reconciliations.

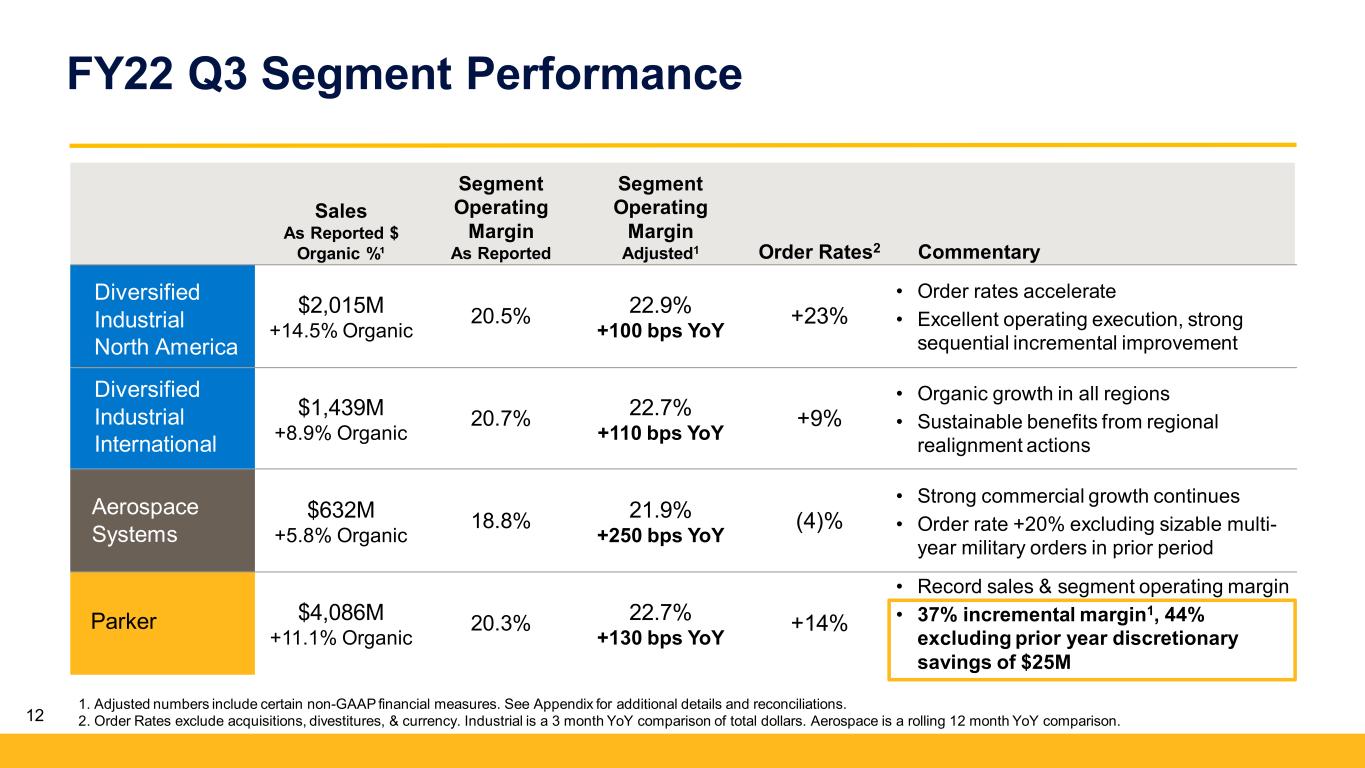

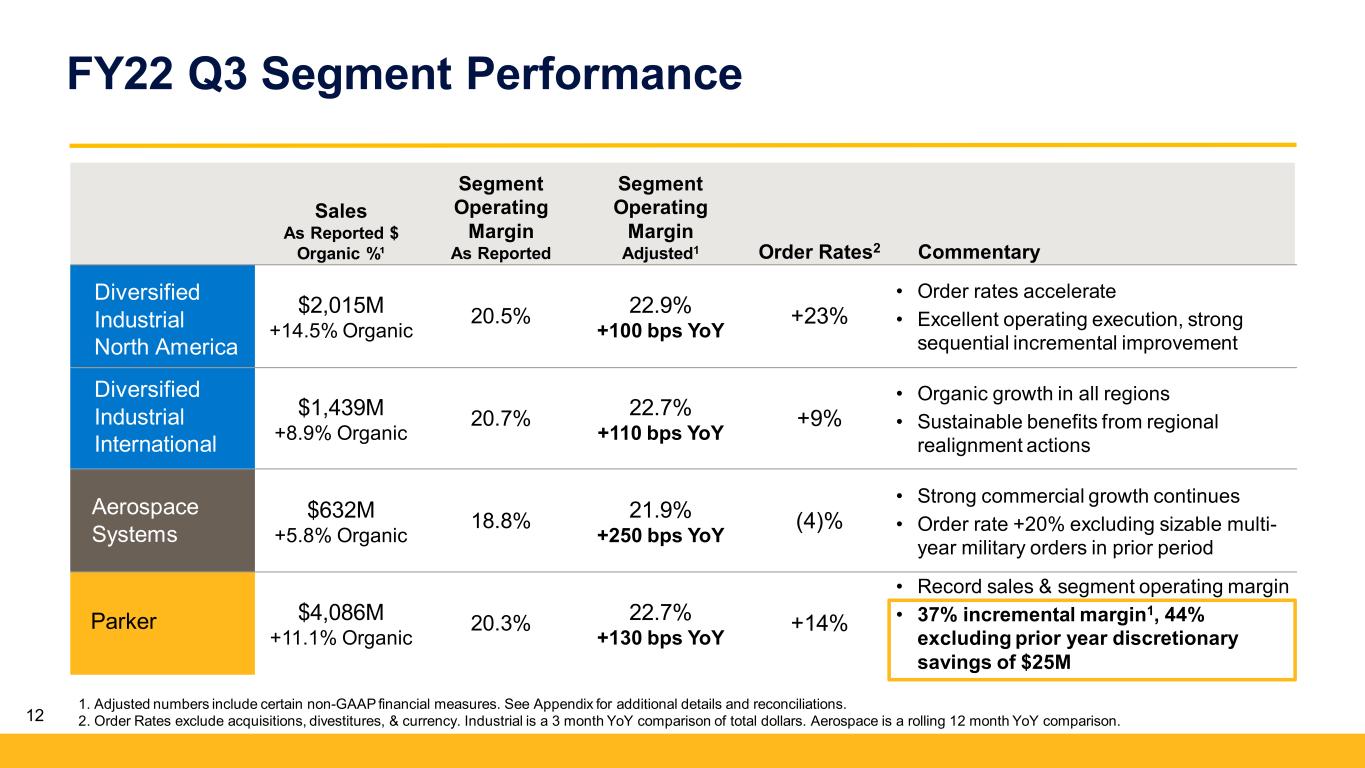

12 FY22 Q3 Segment Performance Sales As Reported $ Organic %¹ Segment Operating Margin As Reported Segment Operating Margin Adjusted1 Order Rates2 Commentary $2,015M +14.5% Organic 20.5% 22.9% +100 bps YoY +23% • Order rates accelerate • Excellent operating execution, strong sequential incremental improvement $1,439M +8.9% Organic 20.7% 22.7% +110 bps YoY +9% • Organic growth in all regions • Sustainable benefits from regional realignment actions $632M +5.8% Organic 18.8% 21.9% +250 bps YoY (4)% • Strong commercial growth continues • Order rate +20% excluding sizable multi- year military orders in prior period $4,086M +11.1% Organic 20.3% 22.7% +130 bps YoY +14% • Record sales & segment operating margin • 37% incremental margin1, 44% excluding prior year discretionary savings of $25M 1. Adjusted numbers include certain non-GAAP financial measures. See Appendix for additional details and reconciliations. 2. Order Rates exclude acquisitions, divestitures, & currency. Industrial is a 3 month YoY comparison of total dollars. Aerospace is a rolling 12 month YoY comparison. Diversified Industrial International Diversified Industrial North America Parker Aerospace Systems

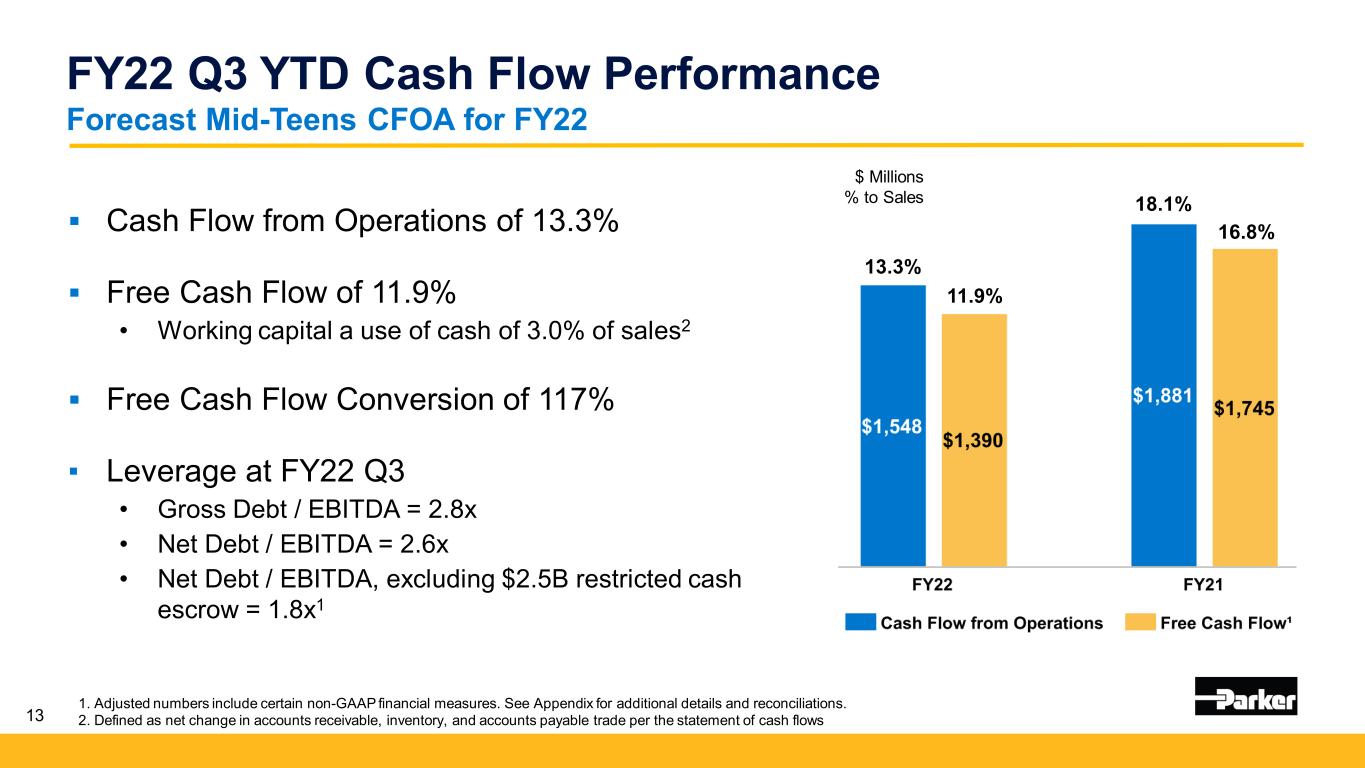

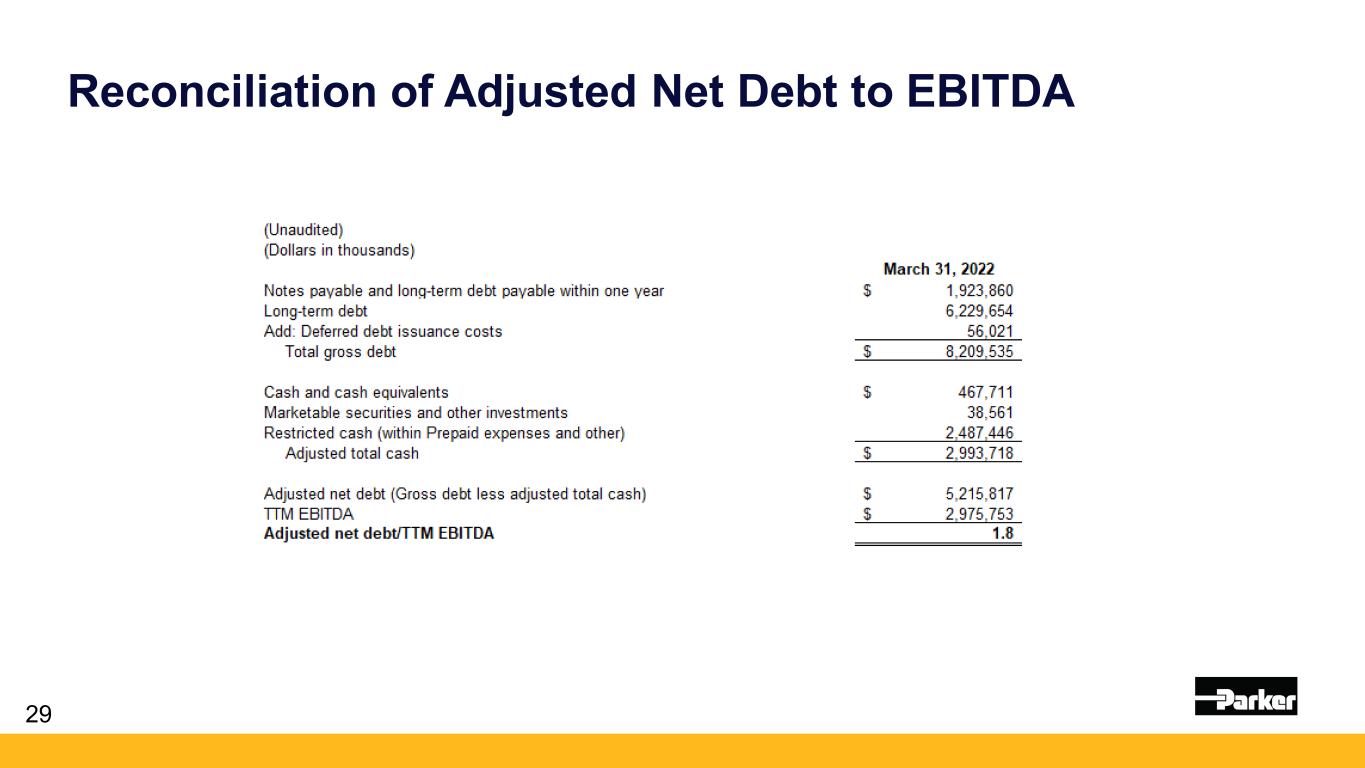

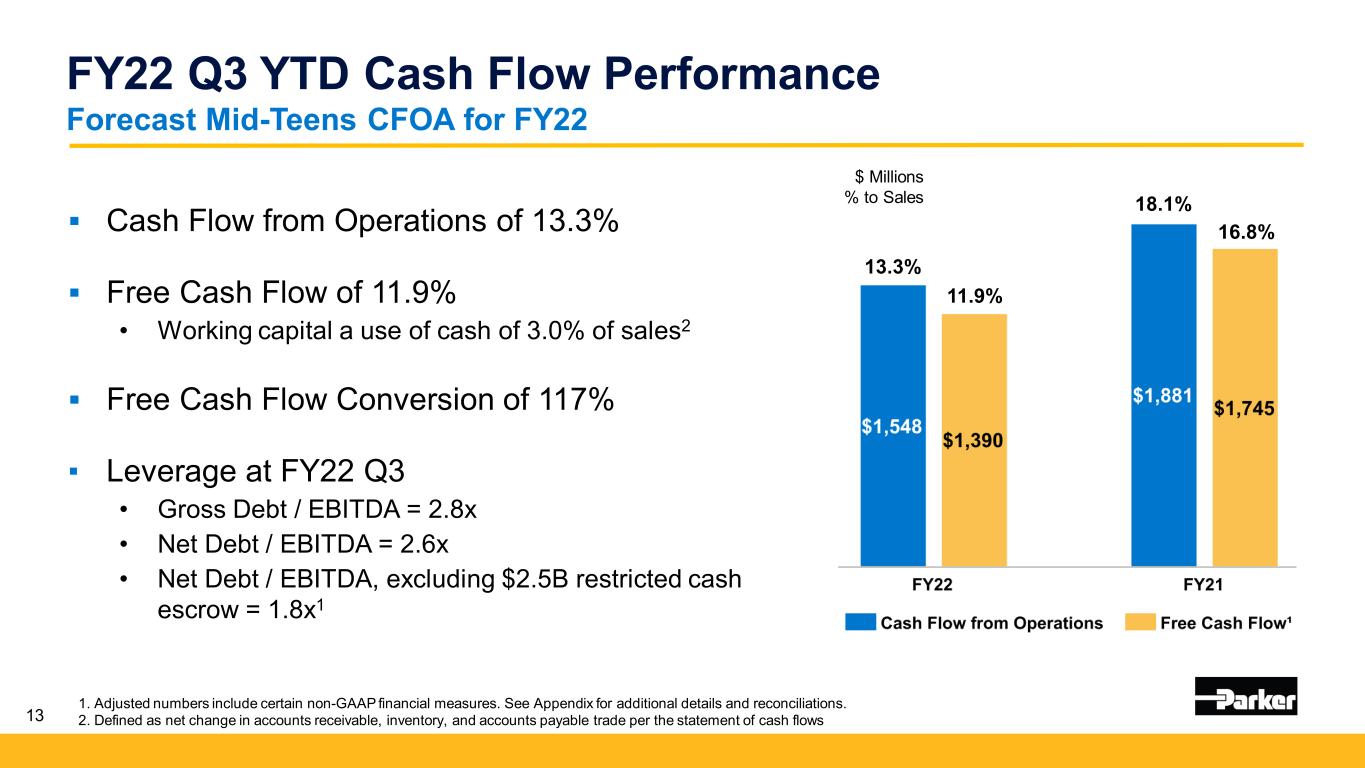

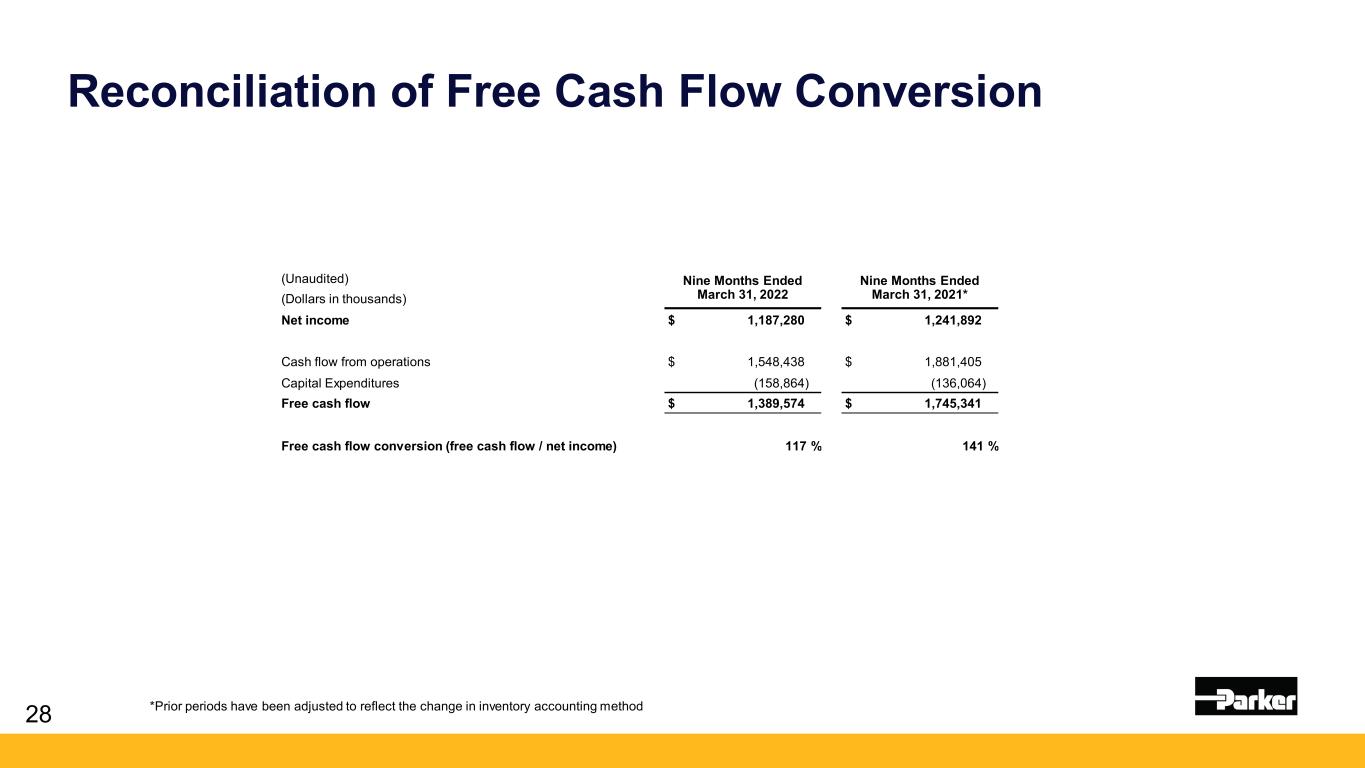

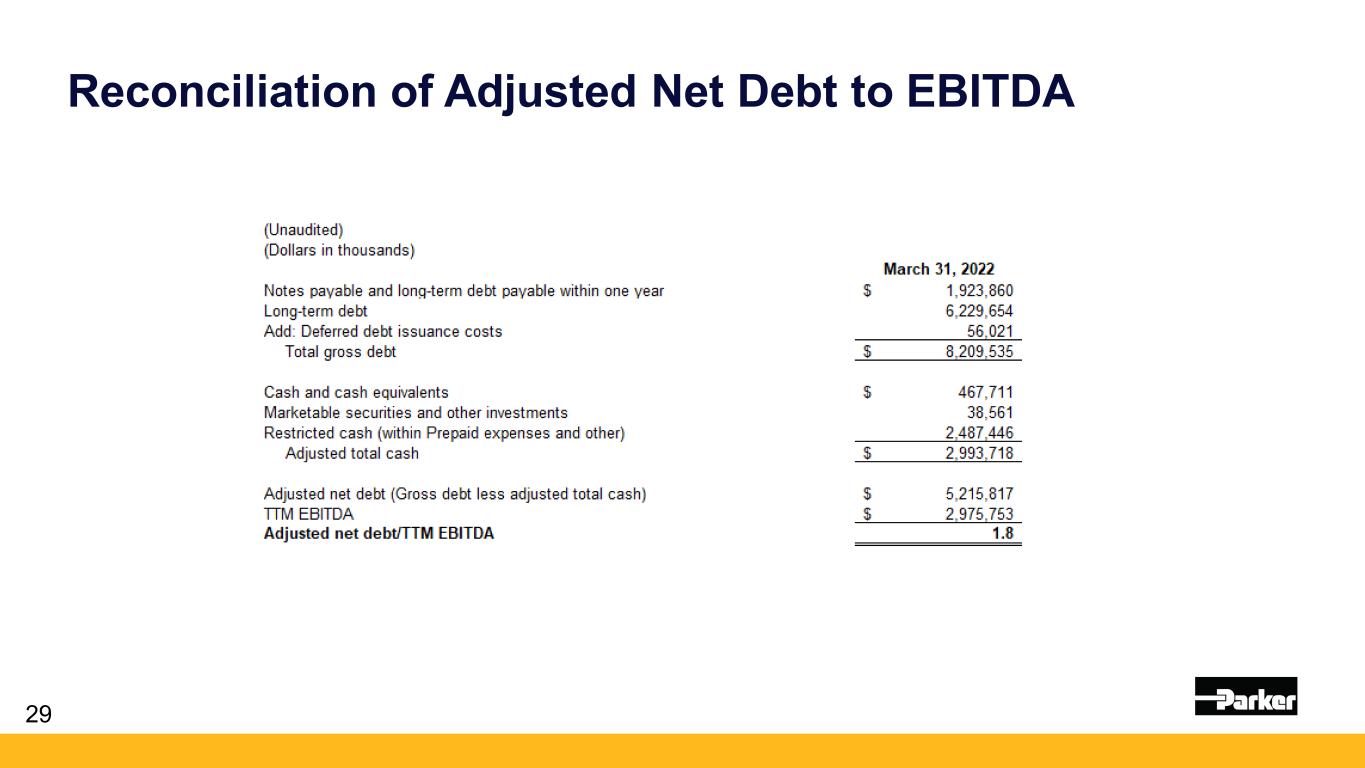

13 FY22 Q3 YTD Cash Flow Performance Forecast Mid-Teens CFOA for FY22 1. Adjusted numbers include certain non-GAAP financial measures. See Appendix for additional details and reconciliations. 2. Defined as net change in accounts receivable, inventory, and accounts payable trade per the statement of cash flows $ Millions % to Sales 13.3% 11.9% 18.1% 16.8% Cash Flow from Operations of 13.3% Free Cash Flow of 11.9% • Working capital a use of cash of 3.0% of sales2 Free Cash Flow Conversion of 117% ▪ Leverage at FY22 Q3 • Gross Debt / EBITDA = 2.8x • Net Debt / EBITDA = 2.6x • Net Debt / EBITDA, excluding $2.5B restricted cash escrow = 1.8x1

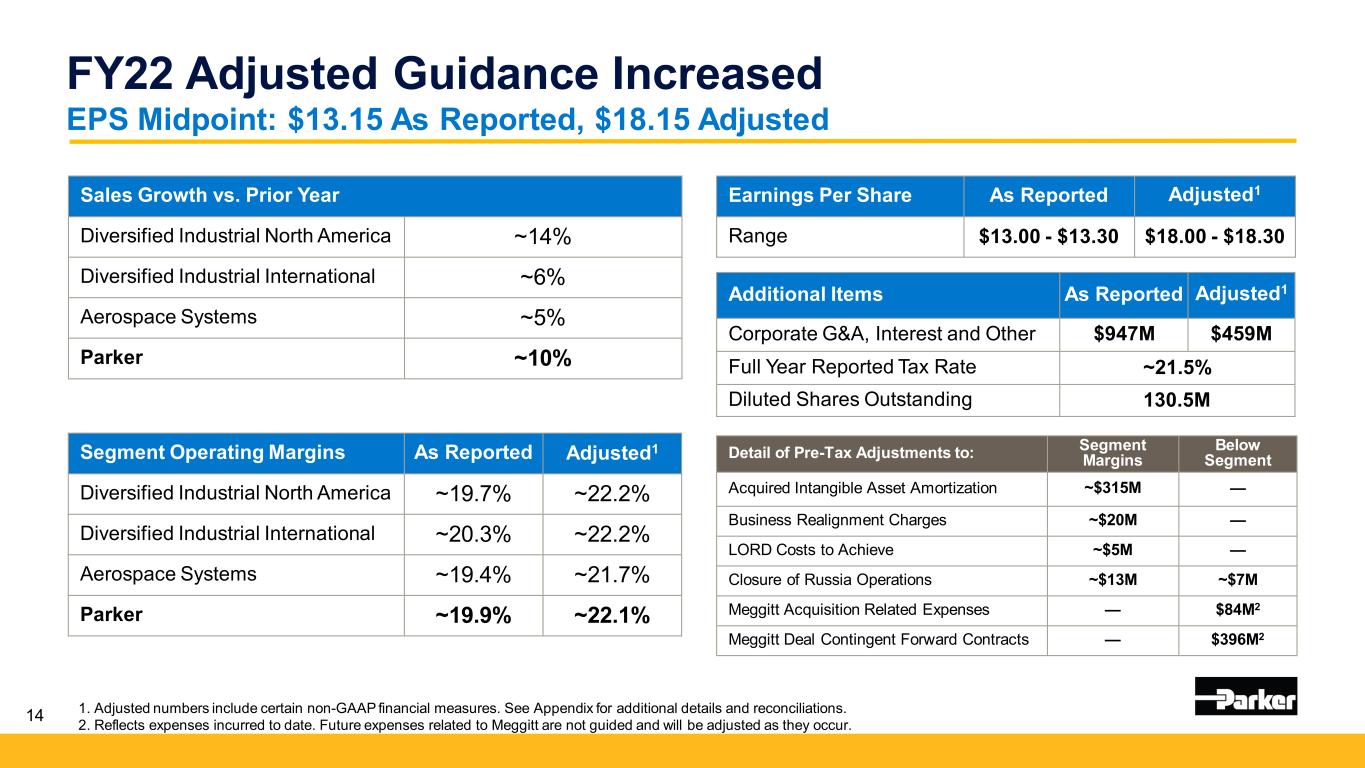

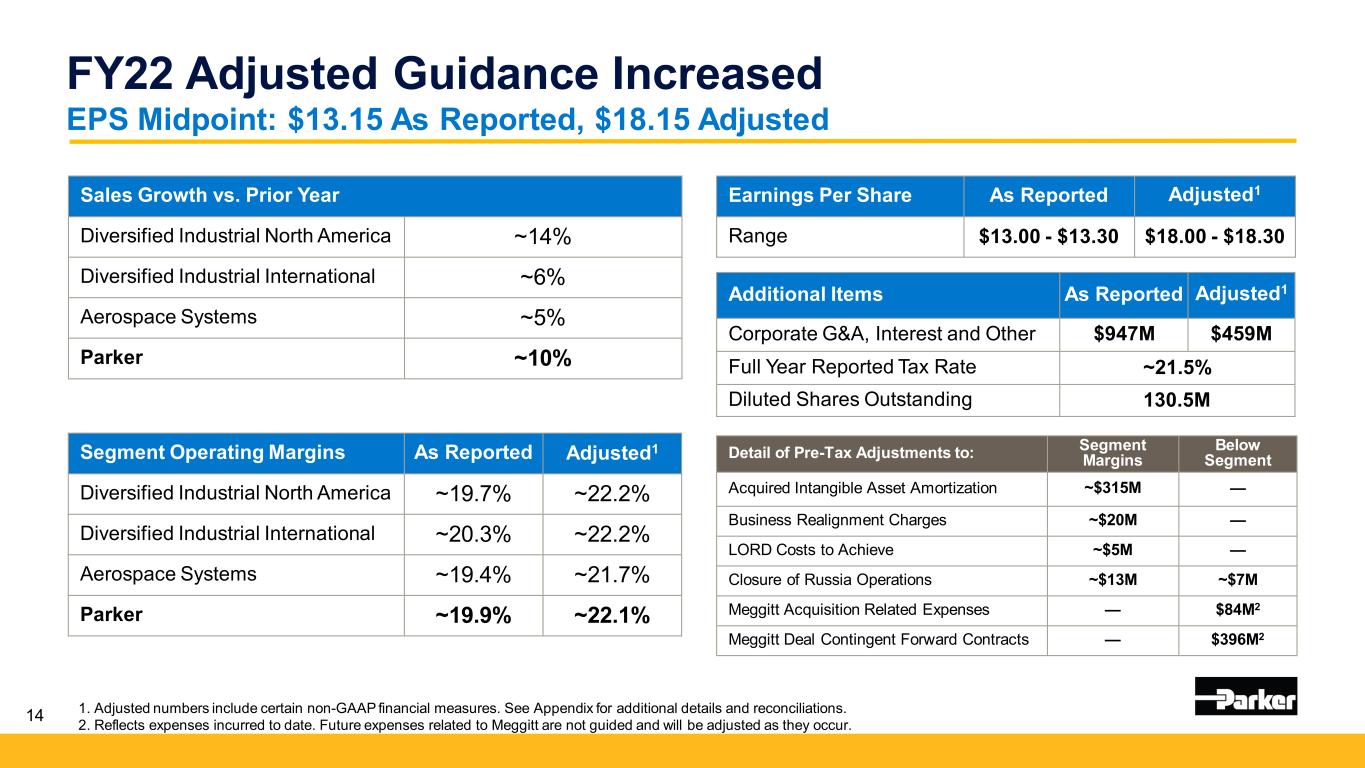

14 FY22 Adjusted Guidance Increased EPS Midpoint: $13.15 As Reported, $18.15 Adjusted Sales Growth vs. Prior Year Diversified Industrial North America ~14% Diversified Industrial International ~6% Aerospace Systems ~5% Parker ~10% Segment Operating Margins As Reported Adjusted1 Diversified Industrial North America ~19.7% ~22.2% Diversified Industrial International ~20.3% ~22.2% Aerospace Systems ~19.4% ~21.7% Parker ~19.9% ~22.1% Additional Items As Reported Adjusted1 Corporate G&A, Interest and Other $947M $459M Full Year Reported Tax Rate ~21.5% Diluted Shares Outstanding 130.5M Earnings Per Share As Reported Adjusted1 Range $13.00 - $13.30 $18.00 - $18.30 Detail of Pre-Tax Adjustments to: Segment Margins Below Segment Acquired Intangible Asset Amortization ~$315M — Business Realignment Charges ~$20M — LORD Costs to Achieve ~$5M — Closure of Russia Operations ~$13M ~$7M Meggitt Acquisition Related Expenses — $84M2 Meggitt Deal Contingent Forward Contracts — $396M2 1. Adjusted numbers include certain non-GAAP financial measures. See Appendix for additional details and reconciliations. 2. Reflects expenses incurred to date. Future expenses related to Meggitt are not guided and will be adjusted as they occur.

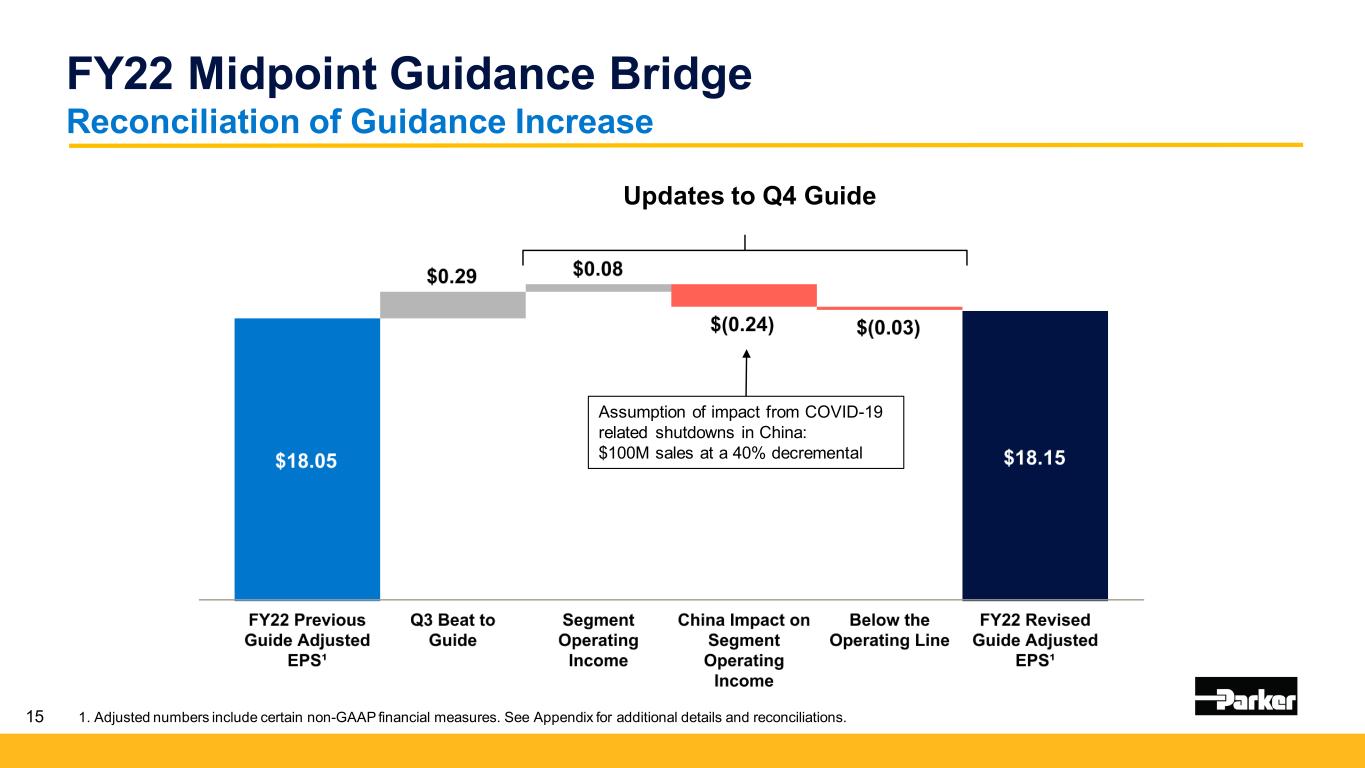

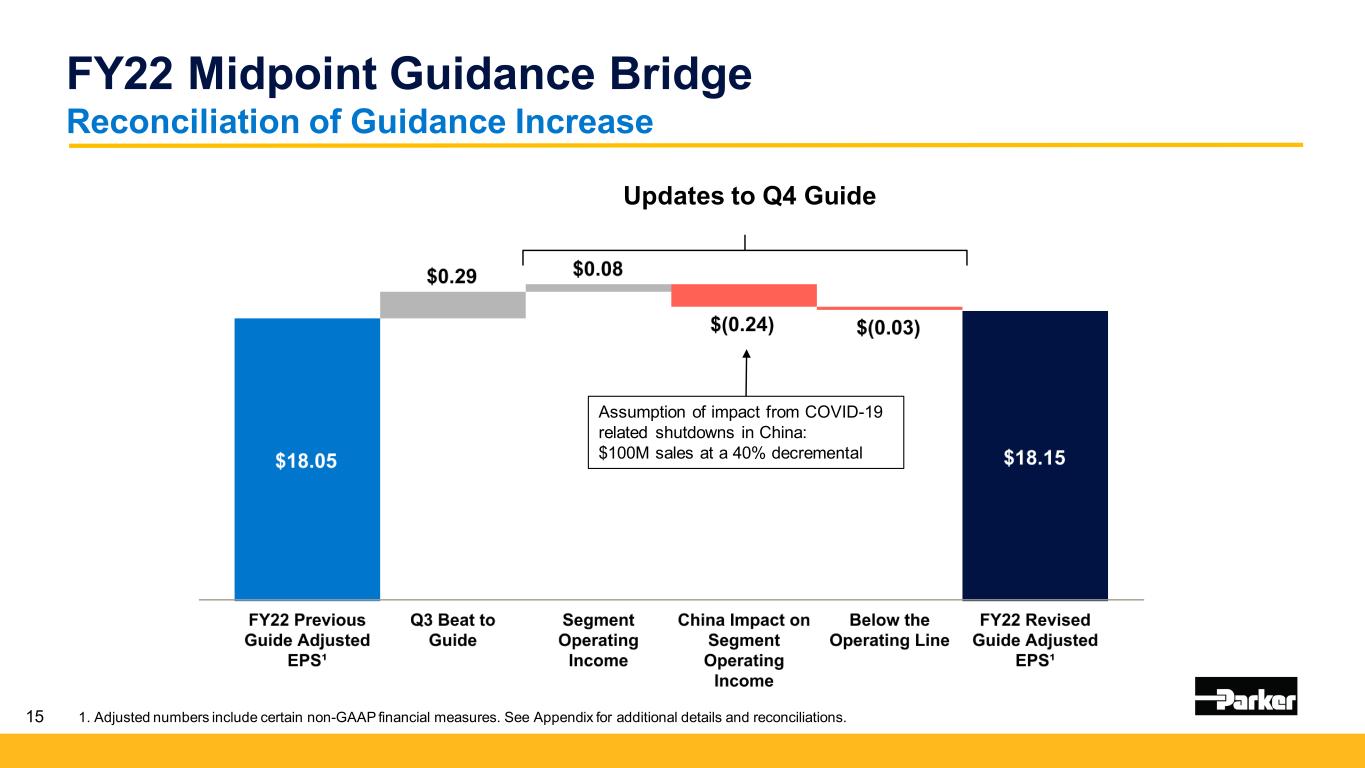

15 FY22 Midpoint Guidance Bridge Reconciliation of Guidance Increase 1. Adjusted numbers include certain non-GAAP financial measures. See Appendix for additional details and reconciliations. Updates to Q4 Guide Assumption of impact from COVID-19 related shutdowns in China: $100M sales at a 40% decremental

Key Messages Highly engaged global team living up to our purpose The Win Strategy™ 3.0 has accelerated our performance Strategic portfolio transformation - longer cycle & more resilient Positioned for growth with secular trends Our clean technologies enable a more sustainable world Announced FY27 targets with continued margin expansion 16 A Transformed Parker with a Promising Future

Upcoming Event Calendar 4Q FY22 Earnings & FY23 Guidance August 4, 2022 Annual Meeting of Shareholders October 26, 2022 1Q FY23 Earnings November 3, 2022 2Q FY23 Earnings February 2, 2023 3Q FY23 Earnings May 4, 2023 4Q FY23 Earnings August 3, 2023

Appendix • Reconciliation of Organic Growth • Adjusted Amounts Reconciliation • Reconciliation of EPS • Reconciliation of Total Segment Operating Margin to Adjusted Total Segment Operating Margin • Reconciliation of EBITDA to Adjusted EBITDA • Reconciliation of Free Cash Flow Conversion • Reconciliation of Adjusted Net Debt to EBITDA • Supplemental Sales Information – Global Technology Platforms • Reconciliation of Forecasted EPS 18

Reconciliation of Organic Growth 19 (Dollars in thousands) (Unaudited) Quarter-to-Date As Reported Currency Organic As Reported Net Sales March 31, 2022 March 31, 2022 March 31, 2021 Diversified Industrial: North America $ 2,014,715 $ (1,207) $ 2,013,508 $ 1,758,383 International 1,439,357 73,598 1,512,955 1,388,999 Total Diversified Industrial 3,454,072 72,391 3,526,463 3,147,382 Aerospace Systems 632,315 1,588 633,903 598,944 Total Parker Hannifin $ 4,086,387 $ 73,979 $ 4,160,366 $ 3,746,326 As reported Currency Organic Diversified Industrial: North America 14.6 % 0.1 % 14.5 % International 3.6 % (5.3)% 8.9 % Total Diversified Industrial 9.7 % (2.3)% 12.0 % Aerospace Systems 5.6 % (0.2)% 5.8 % Total Parker Hannifin 9.1 % (2.0)% 11.1 %

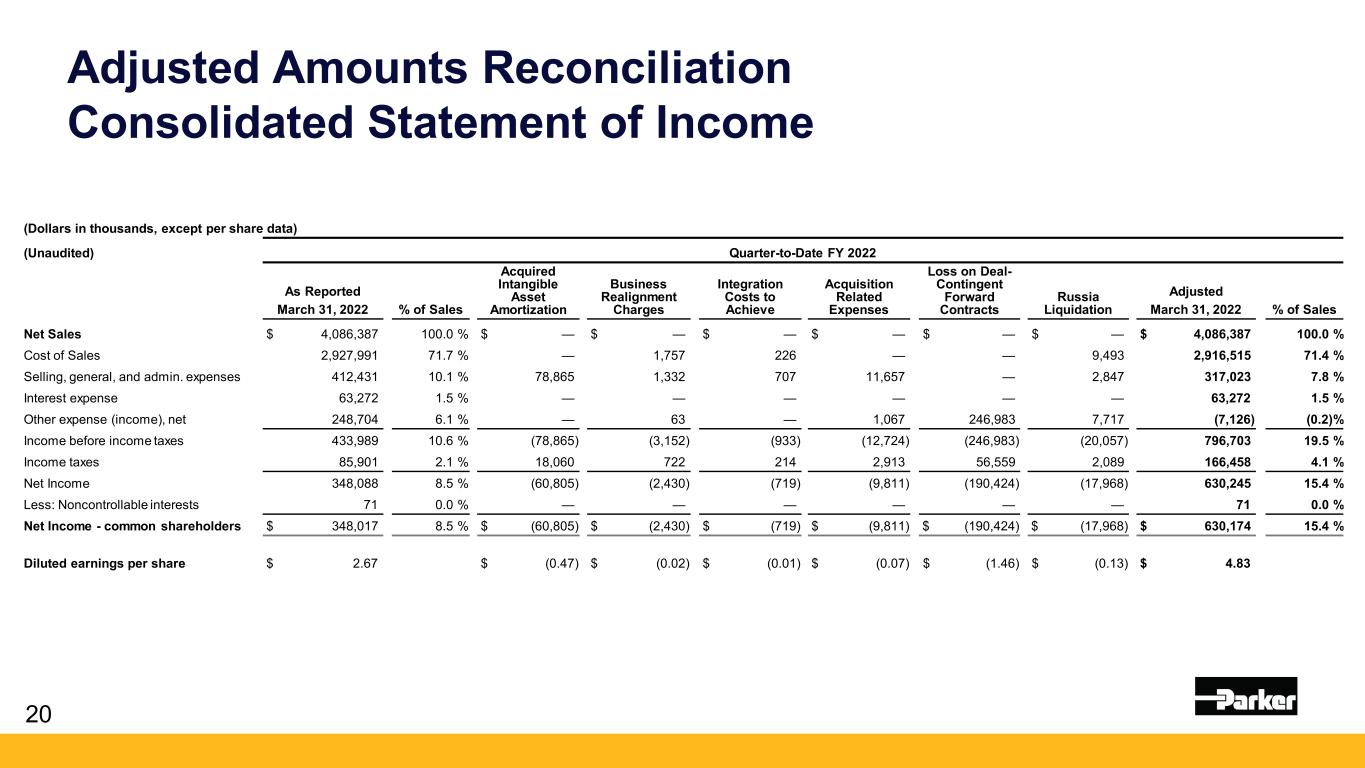

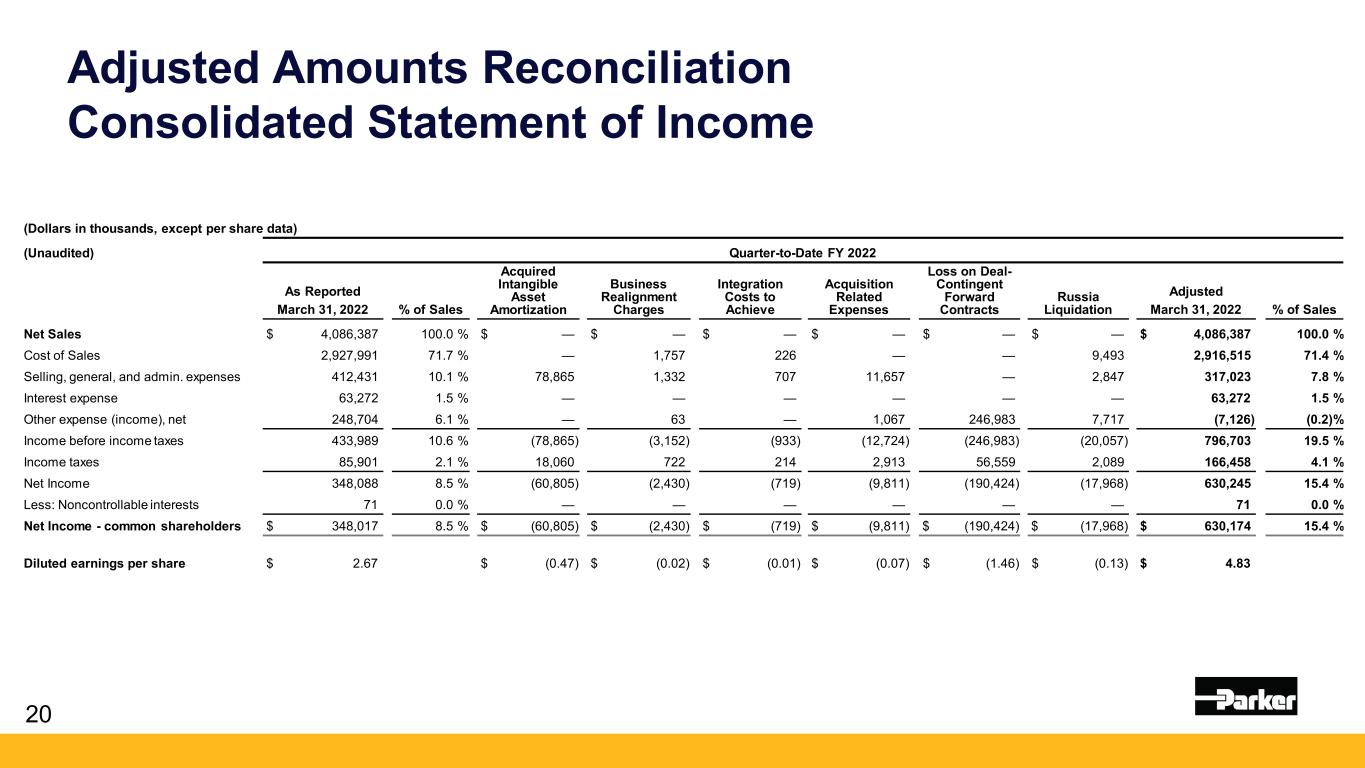

Adjusted Amounts Reconciliation Consolidated Statement of Income 20 (Dollars in thousands, except per share data) (Unaudited) Quarter-to-Date FY 2022 % of Sales Acquired Intangible Asset Amortization Business Realignment Charges Integration Costs to Achieve Acquisition Related Expenses Loss on Deal- Contingent Forward Contracts Russia Liquidation % of Sales As Reported Adjusted March 31, 2022 March 31, 2022 Net Sales $ 4,086,387 100.0 % $ — $ — $ — $ — $ — $ — $ 4,086,387 100.0 % Cost of Sales 2,927,991 71.7 % — 1,757 226 — — 9,493 2,916,515 71.4 % Selling, general, and admin. expenses 412,431 10.1 % 78,865 1,332 707 11,657 — 2,847 317,023 7.8 % Interest expense 63,272 1.5 % — — — — — — 63,272 1.5 % Other expense (income), net 248,704 6.1 % — 63 — 1,067 246,983 7,717 (7,126) (0.2)% Income before income taxes 433,989 10.6 % (78,865) (3,152) (933) (12,724) (246,983) (20,057) 796,703 19.5 % Income taxes 85,901 2.1 % 18,060 722 214 2,913 56,559 2,089 166,458 4.1 % Net Income 348,088 8.5 % (60,805) (2,430) (719) (9,811) (190,424) (17,968) 630,245 15.4 % Less: Noncontrollable interests 71 0.0 % — — — — — — 71 0.0 % Net Income - common shareholders $ 348,017 8.5 % $ (60,805) $ (2,430) $ (719) $ (9,811) $ (190,424) $ (17,968) $ 630,174 15.4 % Diluted earnings per share $ 2.67 $ (0.47) $ (0.02) $ (0.01) $ (0.07) $ (1.46) $ (0.13) $ 4.83

Adjusted Amounts Reconciliation Consolidated Statement of Income 21 (Dollars in thousands, except per share data) (Unaudited) Quarter-to-Date FY 2021 % of Sales Acquired Intangible Asset Amortization Business Realignment Charges Lord Costs to Achieve Exotic Costs to Achieve As Reported Adjusted March 31, 2021* March 31, 2021* % of Sales Net sales $ 3,746,326 100.0 % $ — $ — $ — $ — $ 3,746,326 100.0 % Cost of sales 2,712,785 72.4 % — 3,056 425 — 2,709,304 72.3 % Selling, general and admin. expenses 386,831 10.3 % 81,253 2,545 2,206 24 300,803 8.0 % Interest expense 60,830 1.6 % — — — — 60,830 1.6 % Other (income) expense, net (13,460) (0.4)% — 1 — — (13,461) (0.4)% Income before income taxes 599,340 16.0 % (81,253) (5,602) (2,631) (24) 688,850 18.4 % Income taxes 126,101 3.4 % 18,851 1,300 610 6 146,868 3.9 % Net income 473,239 12.6 % (62,402) (4,302) (2,021) (18) 541,982 14.5 % Less: Noncontrolling interests 86 0.0 % — — — — 86 0.0 % Net income - common shareholders $ 473,153 12.6 % $ (62,402) $ (4,302) $ (2,021) $ (18) $ 541,896 14.5 % Diluted earnings per share $ 3.60 $ (0.47) $ (0.03) $ (0.02) $ — $ 4.12 *Prior periods have been adjusted to reflect the change in inventory accounting method

Adjusted Amounts Reconciliation Business Segment Information 22 (Dollars in thousands) (Unaudited) Quarter-to-Date FY 2022 % of Sales Acquired Intangible Asset Amortization Business Realignment Charges Integration Costs to Achieve Acquisition Related Expenses Loss on Deal- Contingent Forward Contracts Russia Liquidation % of Sales2 As Reported Adjusted March 31, 2022 March 31, 2022 Diversified Industrial North America1 $ 413,998 20.5 % $ 47,408 $ 355 $ 297 $ — $ — $ — $ 462,058 22.9 % International1 298,475 20.7 % 18,704 2,416 636 — — 6,257 326,488 22.7 % Aerospace Systems1 119,016 18.8 % 12,753 318 — — — 6,570 138,657 21.9 % Total segment operating income 831,489 20.3 % (78,865) (3,089) (933) — — (12,827) 927,203 22.7 % Corporate administration 57,405 1.4 % — — — — — — 57,405 1.4 % Income before interest and other 774,084 18.9 % (78,865) (3,089) (933) — — (12,827) 869,798 21.3 % Interest expense 63,272 1.5 % — — — — — — 63,272 1.5 % Other (income) expense 276,823 6.8 % — 63 — 12,724 246,983 7,230 9,823 0.2 % Income before income taxes $ 433,989 10.6 % $ (78,865) $ (3,152) $ (933) $ (12,724) $ (246,983) $ (20,057) $ 796,703 19.5 % 1Segment operating income as a percent of sales is calculated on as reported segment sales. 2Adjusted amounts as a percent of sales are calculated on as reported segment sales.

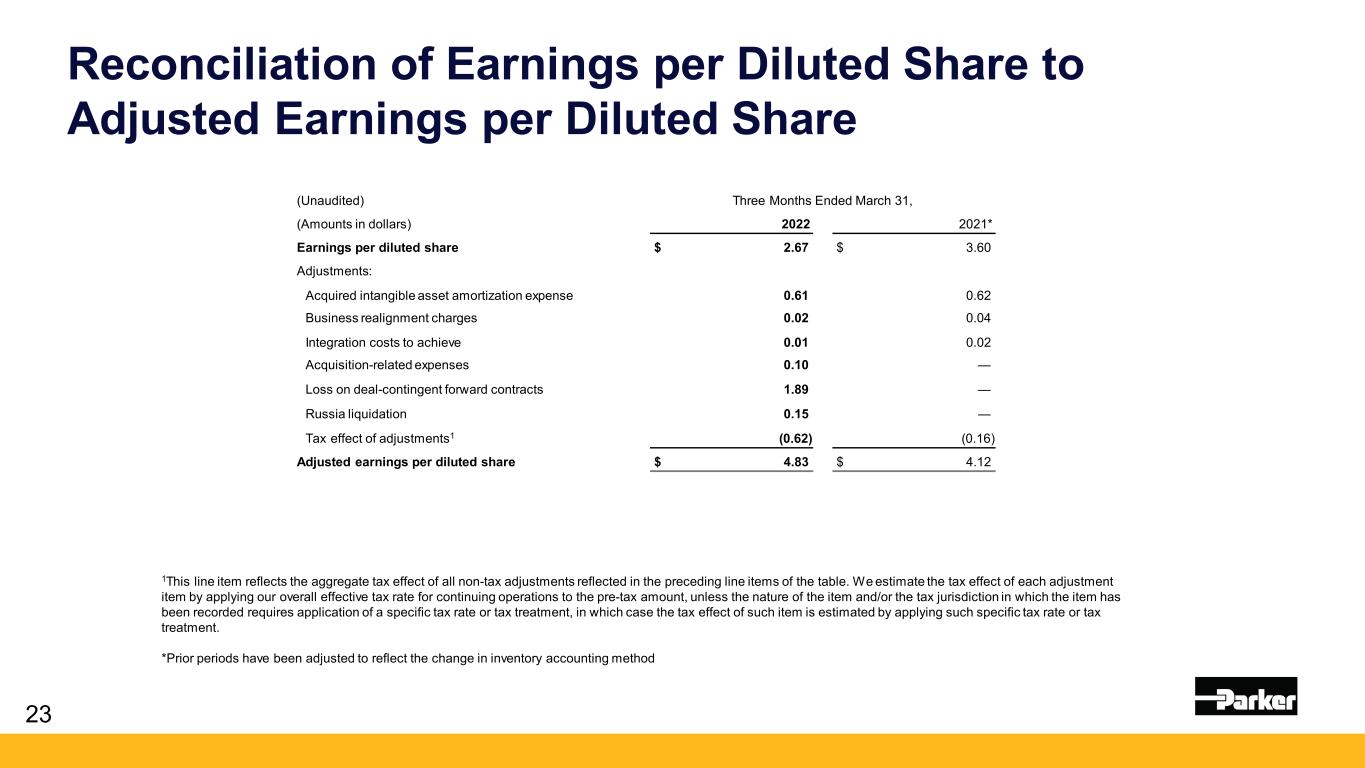

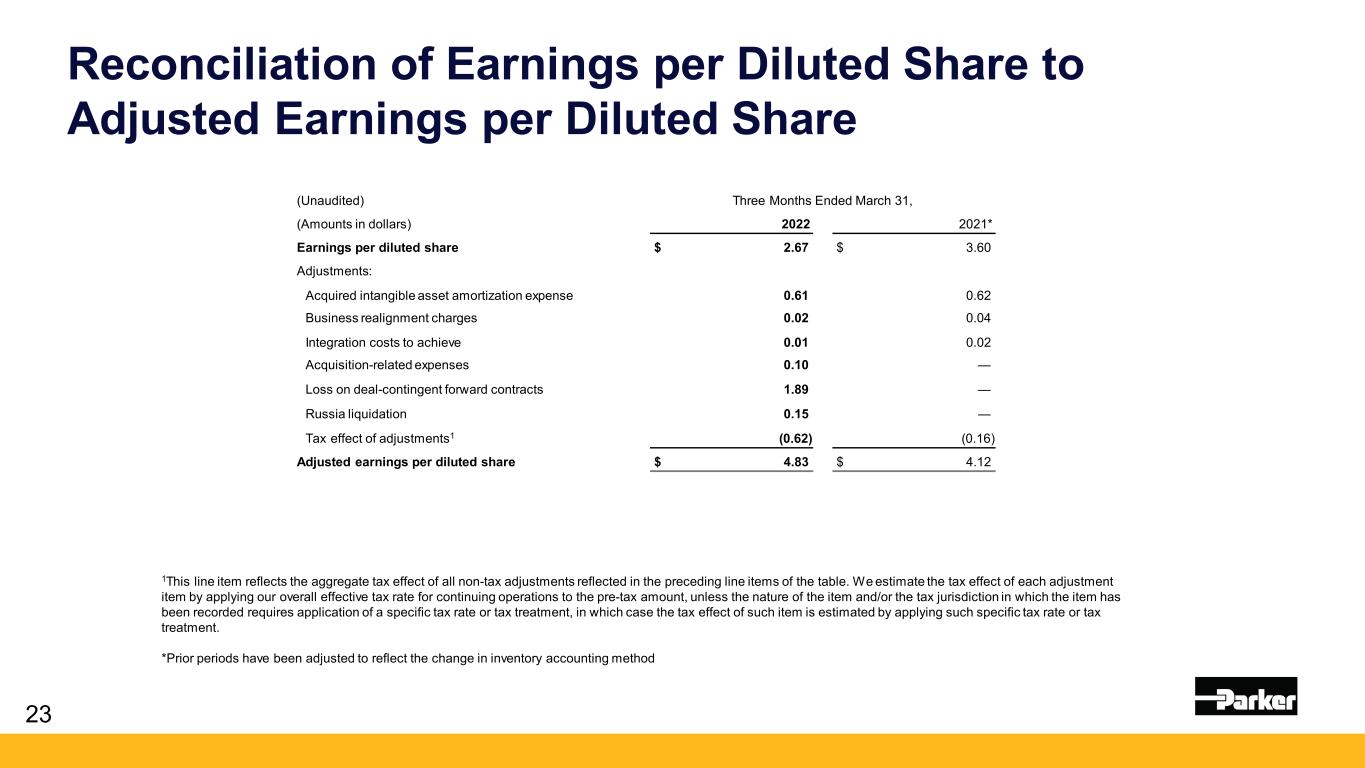

Reconciliation of Earnings per Diluted Share to Adjusted Earnings per Diluted Share 23 (Unaudited) Three Months Ended March 31, (Amounts in dollars) 2022 2021* Earnings per diluted share $ 2.67 $ 3.60 Adjustments: Acquired intangible asset amortization expense 0.61 0.62 Business realignment charges 0.02 0.04 Integration costs to achieve 0.01 0.02 Acquisition-related expenses 0.10 — Loss on deal-contingent forward contracts 1.89 — Russia liquidation 0.15 — Tax effect of adjustments1 (0.62) (0.16) Adjusted earnings per diluted share $ 4.83 $ 4.12 1This line item reflects the aggregate tax effect of all non-tax adjustments reflected in the preceding line items of the table. We estimate the tax effect of each adjustment item by applying our overall effective tax rate for continuing operations to the pre-tax amount, unless the nature of the item and/or the tax jurisdiction in which the item has been recorded requires application of a specific tax rate or tax treatment, in which case the tax effect of such item is estimated by applying such specific tax rate or tax treatment. *Prior periods have been adjusted to reflect the change in inventory accounting method

Reconciliation of Earnings per Diluted Share to Adjusted Earnings per Diluted Share 24 1This line item reflects the aggregate tax effect of all non-tax adjustments reflected in the preceding line items of the table. We estimate the tax effect of each adjustment item by applying our overall effective tax rate for continuing operations to the pre-tax amount, unless the nature of the item and/or the tax jurisdiction in which the item has been recorded requires application of a specific tax rate or tax treatment, in which case the tax effect of such item is estimated by applying such specific tax rate or tax treatment. *FY19 and FY20 have been adjusted to reflect the change in inventory accounting method

25 Reconciliation of Total Segment Operating Margin to Adjusted Total Segment Operating Margin (Unaudited) Three Months Ended Three Months Ended (Dollars in thousands) March 31, 2022 March 31, 2021 Operating income Operating margin Operating income Operating margin Total segment operating income $ 831,489 20.3 % $ 713,319 19.0 % Adjustments: Acquired intangible asset amortization expense 78,865 81,253 Business realignment charges 3,089 5,445 Integration costs to achieve 933 2,655 Russia liquidation 12,827 — Adjusted total segment operating income $ 927,203 22.7 % $ 802,672 21.4 %

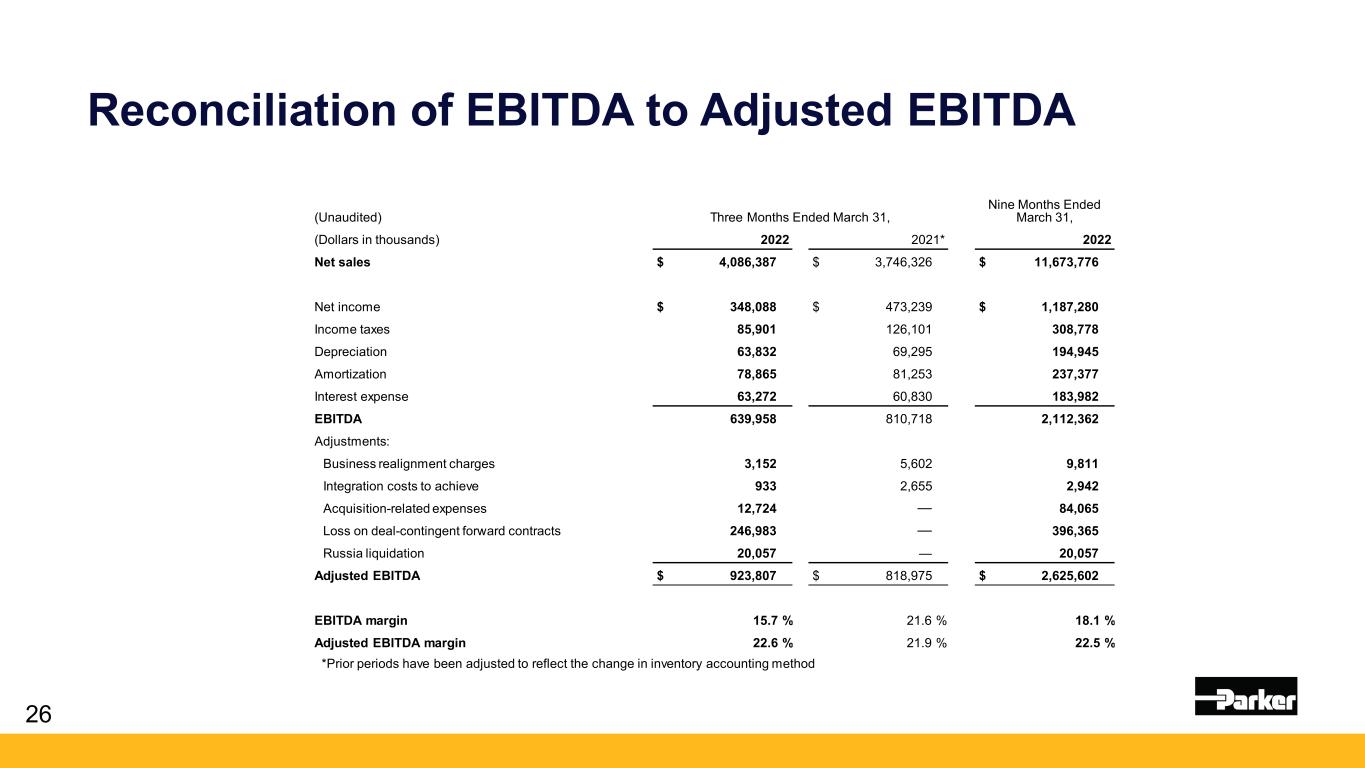

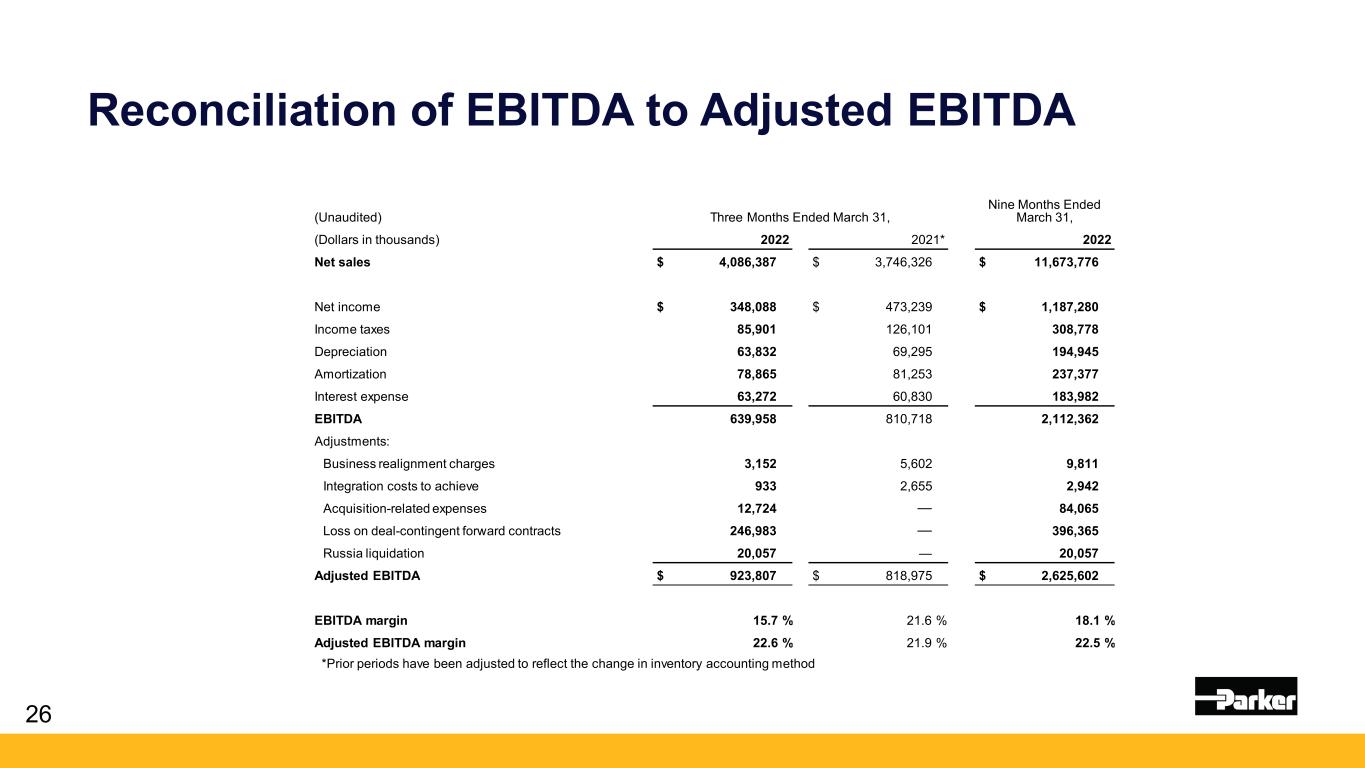

26 Reconciliation of EBITDA to Adjusted EBITDA (Unaudited) Three Months Ended March 31, Nine Months Ended March 31, (Dollars in thousands) 2022 2021* 2022 Net sales $ 4,086,387 $ 3,746,326 $ 11,673,776 Net income $ 348,088 $ 473,239 $ 1,187,280 Income taxes 85,901 126,101 308,778 Depreciation 63,832 69,295 194,945 Amortization 78,865 81,253 237,377 Interest expense 63,272 60,830 183,982 EBITDA 639,958 810,718 2,112,362 Adjustments: Business realignment charges 3,152 5,602 9,811 Integration costs to achieve 933 2,655 2,942 Acquisition-related expenses 12,724 — 84,065 Loss on deal-contingent forward contracts 246,983 — 396,365 Russia liquidation 20,057 — 20,057 Adjusted EBITDA $ 923,807 $ 818,975 $ 2,625,602 EBITDA margin 15.7 % 21.6 % 18.1 % Adjusted EBITDA margin 22.6 % 21.9 % 22.5 % *Prior periods have been adjusted to reflect the change in inventory accounting method

27 1Amounts have been adjusted to reflect the change in inventory accounting method. *Totals may not foot due to rounding Reconciliation of EBITDA to Adjusted EBITDA

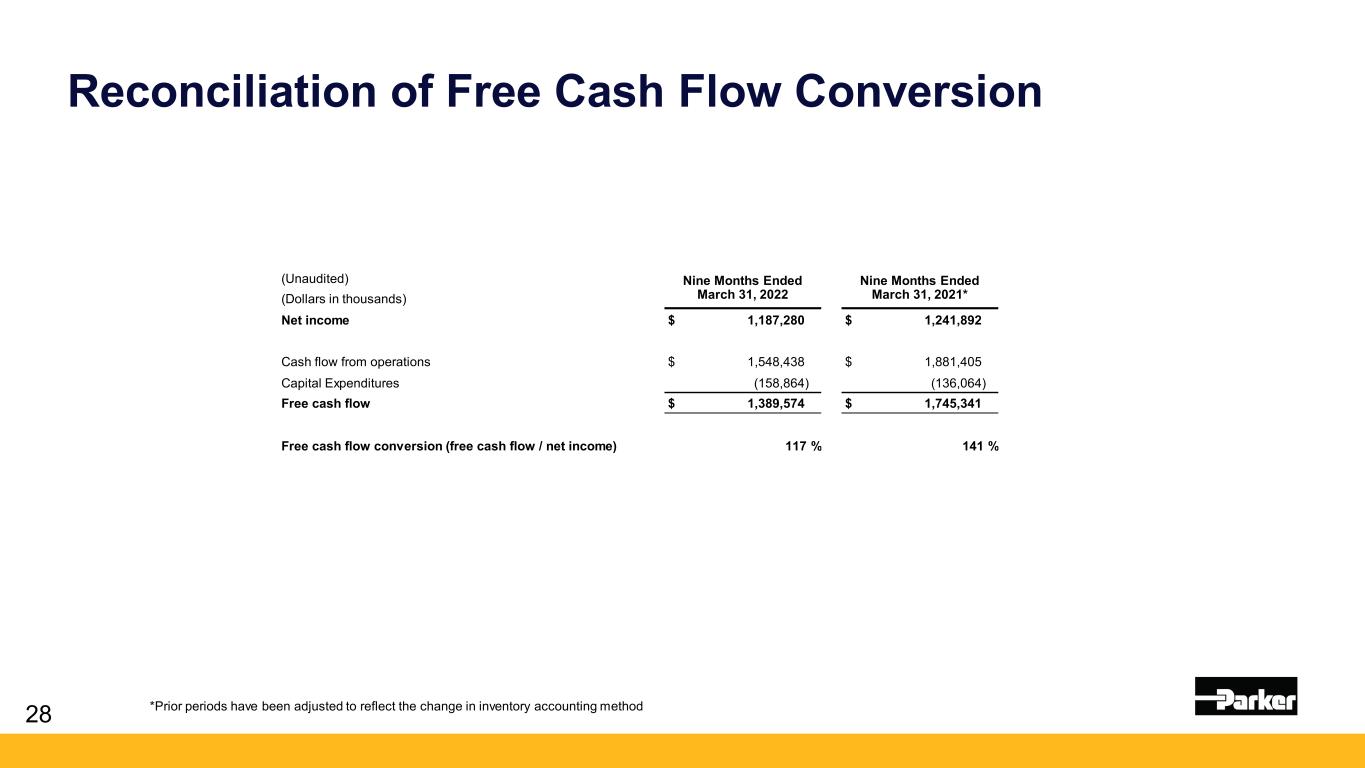

Reconciliation of Free Cash Flow Conversion 28 (Unaudited) Nine Months Ended March 31, 2022 Nine Months Ended March 31, 2021*(Dollars in thousands) Net income $ 1,187,280 $ 1,241,892 Cash flow from operations $ 1,548,438 $ 1,881,405 Capital Expenditures (158,864) (136,064) Free cash flow $ 1,389,574 $ 1,745,341 Free cash flow conversion (free cash flow / net income) 117 % 141 % *Prior periods have been adjusted to reflect the change in inventory accounting method

Reconciliation of Adjusted Net Debt to EBITDA 29

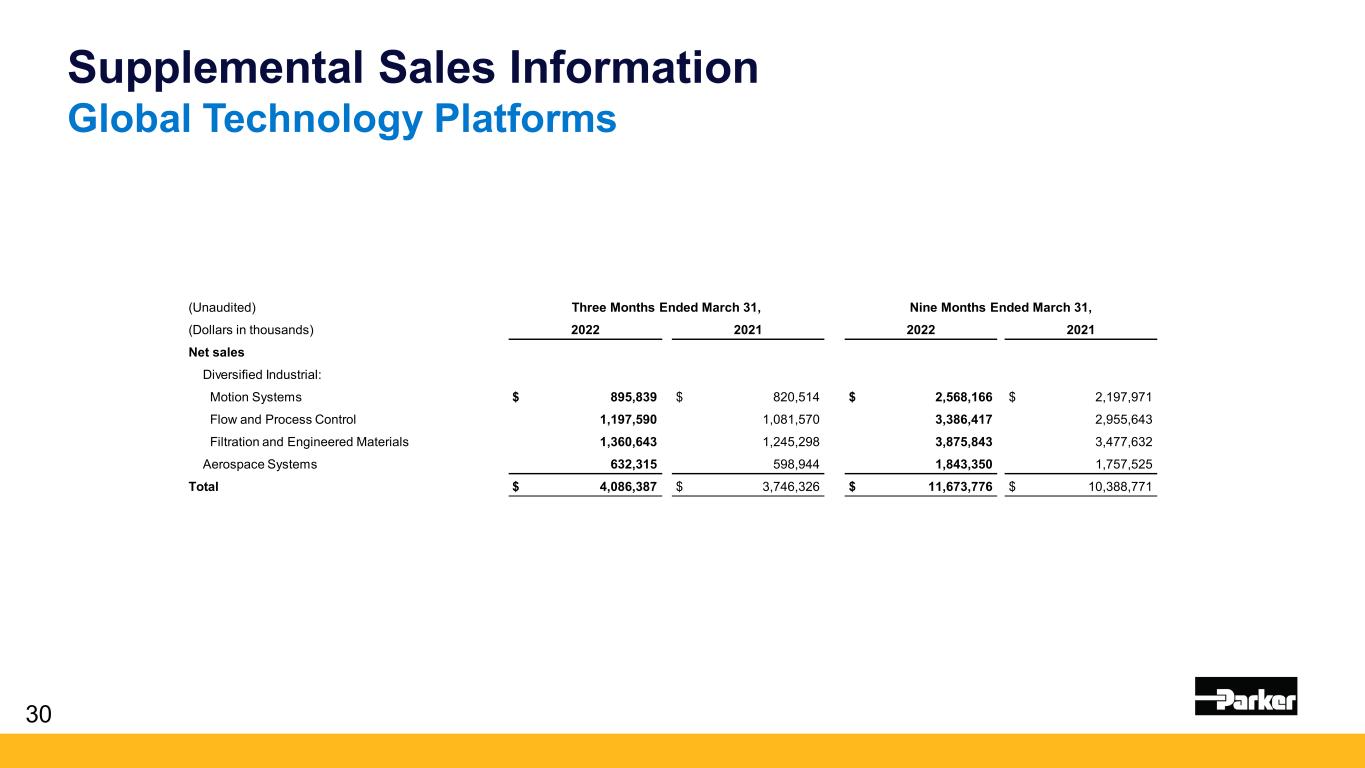

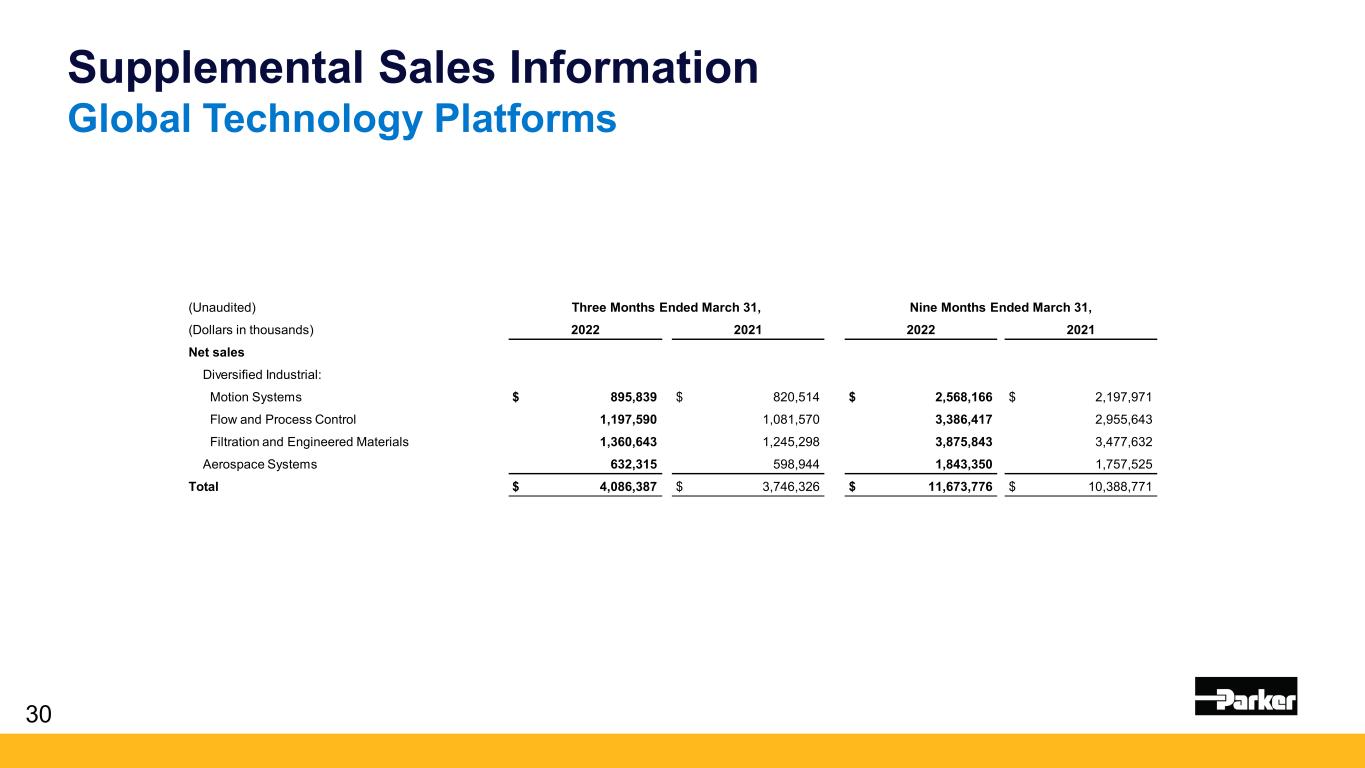

Supplemental Sales Information Global Technology Platforms 30 (Unaudited) Three Months Ended March 31, Nine Months Ended March 31, (Dollars in thousands) 2022 2021 2022 2021 Net sales Diversified Industrial: Motion Systems $ 895,839 $ 820,514 $ 2,568,166 $ 2,197,971 Flow and Process Control 1,197,590 1,081,570 3,386,417 2,955,643 Filtration and Engineered Materials 1,360,643 1,245,298 3,875,843 3,477,632 Aerospace Systems 632,315 598,944 1,843,350 1,757,525 Total $ 4,086,387 $ 3,746,326 $ 11,673,776 $ 10,388,771

Reconciliation of EPS Fiscal Year 2022 Guidance 31 (Unaudited) (Amounts in dollars) Fiscal Year 2022 Forecasted earnings per diluted share $13.00 to $13.30 Adjustments: Business realignment charges 0.15 Costs to achieve 0.04 Acquisition-related intangible asset amortization expense 2.43 Acquisition-related expenses 0.64 Loss on deal-contingent forward contracts 3.04 Russia Liquidation 0.15 Tax effect of adjustments1 (1.45) Adjusted forecasted earnings per diluted share $18.00 to $18.30 1This line item reflects the aggregate tax effect of all non-tax adjustments reflected in the preceding line items of the table. We estimate the tax effect of each adjustment item by applying our overall effective tax rate for continuing operations to the pre-tax amount, unless the nature of the item and/or the tax jurisdiction in which the item has been recorded requires application of a specific tax rate or tax treatment, in which case the tax effect of such item is estimated by applying such specific tax rate or tax treatment.