WASHINGTON, D.C. 20549

FOR THE FISCAL YEAR ENDED JUNE 30, 2011.

LSI INDUSTRIES INC.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

As of December 31, 2010, the aggregate market value of the registrant’s common stock held by non-affiliates of the registrant was approximately $171,965,000 based upon a closing sale price of $8.46 per share as reported on The NASDAQ Global Select Market.

At August 18, 2011 there were 24,048,248 no par value Common Shares issued and outstanding.

Portions of the Registrant’s Proxy Statement filed with the Commission for its 2011 Annual Meeting of Shareholders are incorporated by reference in Part III, as specified.

“Safe Harbor” Statement under the Private Securities Litigation Reform Act of 1995

This Form 10-K contains certain forward-looking statements that are subject to numerous assumptions, risks or uncertainties. The Private Securities Litigation Reform Act of 1995 provides a safe harbor for forward-looking statements. Forward-looking statements may be identified by words such as “estimates,” “anticipates,” “projects,” “plans,” “expects,” “intends,” “believes,” “seeks,” “may,” “will,” “should” or the negative versions of those words and similar expressions, and by the context in which they are used. Such statements, whether expressed or implied, are based upon current expectations of the Company and speak only as of the date made. Actual results could differ materially from those contained in or implied by such forward-looking statements as a result of a variety of risks and uncertainties over which the Company may have no control. These risks and uncertainties include, but are not limited to, the impact of competitive products and services, product demand and market acceptance risks, potential costs associated with litigation and regulatory compliance, reliance on key customers, financial difficulties experienced by customers, the cyclical and seasonal nature of our business, the adequacy of reserves and allowances for doubtful accounts, fluctuations in operating results or costs whether as a result of uncertainties inherent in tax and accounting matters or otherwise, unexpected difficulties in integrating acquired businesses, the ability to retain key employees of acquired businesses, unfavorable economic and market conditions, the results of asset impairment assessments and the other risk factors that are identified herein. You are cautioned to not place undue reliance on these forward-looking statements. In addition to the factors described in this paragraph, the risk factors identified in our Form 10-K and other filings the Company may make with the SEC constitute risks and uncertainties that may affect the financial performance of the Company and are incorporated herein by reference. The Company does not undertake and hereby disclaims any duty to update any forward-looking statements to reflect subsequent events or circumstances.

We are a leading provider of comprehensive corporate visual image solutions through the combination of extensive screen and digital graphics capabilities, a wide variety of high quality indoor and outdoor lighting products, and related professional services. We also provide graphics and lighting products and professional services on a stand-alone basis. Our company is the leading provider of corporate visual image solutions to the petroleum/convenience store industry. We use this leadership position to penetrate national retailers and multi-site retailers, including quick service and casual restaurants, eyewear chains, retail chain stores and automobile dealerships located primarily in the United States. In addition, we are a leading provider of digital solid-state LED (light emitting diode) video screens and LED specialty lighting to such markets or industries as sports stadiums and arenas, digital billboards, and entertainment. We design and develop all aspects of the solid-state LED video screens and lighting, from the electronic circuit board, to the software to drive and control the LEDs, to the structure of the LED product.

Our focus on product development and innovation creates products that are essential components of our customers’ corporate visual image strategy. We develop and manufacture lighting, graphics and solid-state LED video screen and lighting products and distribute them through an extensive multi-channel distribution network that allows us to effectively service our target markets. Representative customers include BP, Chevron Texaco, 7-Eleven, ExxonMobil, Shell, Burger King, Dairy Queen, Taco Bell, Wendy’s, Best Buy, CVS Caremark, JC Penney, Target Stores, Wal-Mart Stores, Inc., Chrysler, Ford, General Motors, Nissan, and Toyota. We service our customers at the corporate, franchise and local levels.

We believe that national retailers and niche market companies are increasingly seeking single-source suppliers with the project management skills and service expertise necessary to execute a comprehensive visual image program. The integration of our graphics, lighting, technology and professional services capabilities allows our customers to outsource to us the development of an entire visual image program from the planning and design stage through installation. Our approach is to combine standard, high-production lighting products, custom graphics applications and professional services to create complete customer-focused visual image solutions. We also offer products and services on a stand-alone basis to service our existing image solutions customers, to establish a presence in a new market or to create a relationship with a new customer. We believe that our ability to combine graphics and lighting products and professional services into a comprehensive visual image solution differentiates us from our competitors who offer only stand-alone products for lighting or graphics and who lack professional services offerings. During the past several years, we have continued to enhance our ability to provide comprehensive corporate visual image solutions by adding additional graphics capabilities, lighting products, LED video screens, LED lighting products and professional services through acquisitions and internal development.

Our business is organized as follows: the Lighting Segment, which represented 67% of our fiscal 2011 net sales; the Graphics Segment, which represented 23% of our fiscal 2011 net sales; the Electronic Components Segment, which represented 7% of our fiscal 2011 net sales; and an All Other Category, which represented 3% of our fiscal 2011 net sales. Our most significant market, which includes sales of both the Lighting Segment and the Graphics Segment, is the petroleum / convenience store market with approximately 37%, 35%, and 23% of total net sales concentrated in this market in the fiscal years ended June 30, 2011, 2010, and 2009, respectively. See Note 2 of Notes to Consolidated Financial Statements beginning on page F-27 of this Form 10-K for additional information on business segments. Net sales by segment are as follows (in thousands):

Our Lighting Segment manufactures and markets outdoor and indoor lighting for the commercial, industrial and multi-site retail markets, including the petroleum / convenience store market. Our products are designed and manufactured to provide maximum value and meet the high-quality, competitively-priced product requirements of our niche markets. We generally avoid specialty or custom-designed, low-volume products for single order opportunities. We do, however, design proprietary products used by our national account customers in large volume, and occasionally also provide custom products for large, specified projects. Our concentration is on our high-volume, standard product lines that meet our customers’ needs. By focusing our product offerings, we achieve significant manufacturing and cost efficiencies.

Our lighting fixtures, poles and brackets are produced in a variety of designs, styles and finishes. Important functional variations include types of mounting, such as pole, bracket and surface, and the nature of the light requirement, such as down-lighting, wall-wash lighting, canopy lighting, flood-lighting, area lighting and security lighting. Our engineering staff performs photometric analyses, wind load safety studies for all light fixtures and also designs our fixtures and lighting systems. Our lighting products utilize a wide variety of different light sources, including solid-state LED, high-intensity discharge metal-halide, and fluorescent. The major products and services offered within our lighting segment include: exterior area lighting, interior lighting, canopy lighting, landscape lighting, LED lighting, light poles, lighting analysis and photometric layouts. All of our products are designed for performance, reliability, ease of installation and service, as well as attractive appearance. The Company also has a focus on designing lighting system solutions and implementing strategies related to energy savings in substantially all markets served.

We offer our customers expertise in developing and utilizing high-performance LED color and white lightsource solutions for our Lighting, Graphics and Technology applications, which, when combined with the Company’s lighting fixture expertise and technology has the potential to result in a broad spectrum of white light LED fixtures that offer equivalent or improved lighting performance with significant energy and maintenance savings as compared to the present metal halide and fluorescent lighting fixtures.

Lighting Segment fiscal 2011 net sales of $196,550,000 increased $37.4 million or 23.5% over fiscal 2010 net sales. The $37.4 million increase in Lighting Segment net sales was primarily the result of a $19.8 million or 24.7% increase in lighting sales to our niche markets of petroleum / convenience stores, automotive dealerships, and retail national accounts, and a $17.5 million or 22.2% net increase in commissioned net sales to the commercial and industrial lighting market. Fiscal 2011 Lighting Segment net sales to the petroleum / convenience store market of $61,066,000 increased $9.6 million or 19% from fiscal 2010, and represented 31% of total Lighting Segment net sales as compared to 32% in the prior year. White light solid-state LED light fixtures represent a growth area for the Company, with fiscal 2011 Lighting Segment LED net sales of approximately $60,042,000 (approximately 31% of total Lighting Segment net sales), up 59% from the prior year. The Lighting Segment replaced 7-Eleven, Inc.’s traditional lighting with solid-state LED lighting, with fiscal 2011 net sales of $10,243,000 and fiscal 2010 net sales of $21,391,000.

Lighting Segment fiscal 2010 net sales of $159,105,000 decreased $1.4 million or 0.9% from fiscal 2009 net sales. The $1.4 million or 0.9% decrease in Lighting Segment net sales in fiscal 2010 is primarily the net result of an $18.4 million or 18.9% decrease in commissioned net sales to the commercial and industrial lighting market, partially offset by a $17.0 million or 27.0% increase in lighting sales to our niche markets of petroleum / convenience stores, automotive dealerships, and retail national accounts (7-Eleven, Inc. represented an increase of approximately $19.5 million as it replaced traditional lighting with solid-state LED lighting). Fiscal 2010 Lighting Segment net sales to the petroleum / convenience store market were approximately $51,462,000, representing 32% of total Lighting Segment net sales. White light solid-state LED light fixtures represent a growth area for the Company, with fiscal 2010 Lighting Segment LED sales of approximately $37,800,000 (approximately 24% of total Lighting Segment net sales), up 496% from the prior year.

The Graphics Segment manufactures and sells exterior and interior visual image elements related to graphics. These products are used in graphics displays and visual image programs in several markets, including the petroleum/convenience store market and multi-site retail operations. Our extensive lighting and graphics expertise, product offering, visual image solution implementation capabilities and other professional services represent significant competitive advantages. We work with corporations and design firms to establish and implement cost effective corporate visual image programs. Increasingly, we have become the primary supplier of exterior and interior graphics for our customers. We also offer installation or installation management services for those customers who require the installation of interior or exterior products (utilizing pre-qualified independent subcontractors throughout the United States).

Our business can be significantly impacted by participation in a customer’s “image conversion program,” especially if it were to involve a “roll out” of that new image to a significant number of that customer’s and its franchisees’ retail sites. The impact to our business can be very positive with growth in net sales and profitability when we are engaged in an image conversion program. This can be followed in subsequent periods by lesser amounts of business or negative comparisons following completion of an image conversion program, unless we are successful in replacing that completed business with participation in a new image conversion program of similar size with one or more customers. An image conversion program can potentially involve any or all of the following improvements, changes or refurbishments at a customer’s retail site: interior or exterior lighting (see discussion above about our lighting segment), interior or exterior store signage and graphics, and installation of these products in both the prototype and roll out phases of their program. We believe our retail customers are implementing image conversions on a more frequent basis than in the past in order to maintain a safe, fresh look or new image on their site in order to continue to attract customers to their site, and maintain or grow their market share. However, this trend slowed down during the recent recessionary period.

The major products and services offered within our Graphics Segment include the following: signage and canopy graphics, pump dispenser graphics, building fascia graphics, decals, interior signage and marketing graphics, aisle markers, wall mural graphics, fleet graphics, prototype program graphics, installation services for graphics products and solid state LED video screens for the sports and advertising markets.

Graphics Segment fiscal 2011 net sales of $68,155,000 decreased $0.2 million or 0.4% from fiscal 2010 net sales. The $0.2 million decrease in Graphics Segment net sales in fiscal 2011 is primarily the result of image conversion programs and sales to several petroleum / convenience store customers ($8.7 million net increase), and a fast food restaurant chain ($1.1 million increase). These increases were offset by decreases to a national drug store retailer ($3.2 million decrease), two grocery retailers ($2.5 million decrease), the LED video sports screen market ($5.0 million decrease), and changes in volume or completion of several other graphics programs. Fiscal 2011 Graphics Segment net sales to the petroleum / convenience store market of $47,394,000 increased $8.9 million or 23% from fiscal 2010, and represented 70% of total Graphics net sales as compared to 56% in the prior year. The Graphics Segment replaced 7-Eleven, Inc.’s traditional signage lighting with solid-state LED lighting, with fiscal 2011 net sales of $29,709,000 and fiscal 2010 net sales of $20,606,000. Graphics Segment net sales related to LED products totaled approximately $4,938,000 in fiscal 2011 as compared to $20,275,000 in fiscal 2010 (approximately 7% and 30% of total Graphics Segment net sales in fiscal 2011 and 2010, respectively).

Graphics Segment fiscal 2010 net sales of $68,395,000 increased $7.6 million or 12.6% over fiscal 2009 net sales. The $7.6 million or 12.6% increase in Graphics Segment net sales in fiscal 2010 is primarily the result of image conversion programs and sales to several petroleum / convenience store customers ($16.1 million net increase), and the LED video sports screen market ($0.2 million increase). These increases were partially offset by the following decreases: a grocery retailer ($5.1 million decrease); five retail customers ($1.2 million net decrease); a national drug store retailer ($0.7 million decrease); a lawn care company ($0.4 million decrease); and changes in volume or completion of several other graphics programs. Fiscal 2010 Graphics Segment net sales to the petroleum / convenience store market were approximately $38,490,000, representing 56% of total Graphics net sales. Graphics Segment net sales related to LED products and installation totaled approximately $20,275,000 (approximately 30% of total Graphics Segment net sales).

The Electronic Components Segment includes the results of LSI ADL Technology. This subsidiary operates in Columbus, Ohio and designs, engineers and manufactures custom designed electronic circuit boards, assemblies and sub-assemblies used in various applications including the control of solid-state LED lighting. The Company acquired AdL Technology in fiscal 2010 as a vertical integration of circuit boards for LED lighting as well as the Company’s other LED product lines such as digital scoreboards, advertising ribbons and billboards. LSI ADL Technology allows the Company to stay on the leading edge of product development, while at the same time providing opportunities to drive down manufacturing costs and control delivery of key components.

Customer net sales of the Electronic Components Segment were $21,449,000 in fiscal 2011, up $5.3 million or 33% over fiscal 2010 net sales of $16,116,000. In addition to these customer sales, the Electronic Components Segment supplied a significant amount of electronic circuit boards to both the Lighting and Graphics Segments, with growth of approximately 374% in these intersegment net sales in fiscal 2011.

The All Other Category includes the results of all LSI operations that are not able to be aggregated into one of the three reportable business segments. Operating results of LSI Saco Technologies, LSI Images, LSI Adapt and LSI Marcole are included in the All Other Category. The major products and services offered by operations included in the All Other Category include: design, production, and support of high-performance light engines and large format video screens using LED technology; exterior and interior menu board systems primarily for the quick service restaurant market; and surveying, permitting and installation management services related to products of the Graphics Segment; and for fiscal 2010 and 2009, electrical wire harnesses (for LSI’s light fixtures and for the white goods or appliance industry). LSI Saco Technologies offers its customers expertise in developing and utilizing high-performance LED color and white lightsource solutions for both lighting and graphics applications. This technology generated development in the Company’s Lighting Segment of a broad spectrum of white light LED fixtures that offer equivalent or improved lighting performance with significant energy and maintenance savings as compared to the traditional metal halide and fluorescent lighting fixtures. Additionally, this LED technology is used in the Company’s Graphics Segment to light, accent and provide color lighting to graphics display and visual image programs of the Company’s retail, quick service restaurant and sports market customers.

All Other Category fiscal 2011 net sales of $7,347,000 decreased $3.4 million or 31.9% from fiscal 2010 primarily as the net result of increased net sales of menu board systems ($0.2 million), decreased sales of LED video screens to the entertainment and other markets ($3.0 million), no sales of electrical wire harnesses ($2.9 million) and changes in volume or completion of other customer programs. The Company sold its wire harness operation and business at the end of the third quarter of fiscal 2010 and thereafter had no further sales of wire harnesses. Fiscal 2010 net sales of $10,786,000 decreased $1.8 million or 14.1% from fiscal 2009 primarily as the net result of decreased net sales to two quick service restaurant menu board customers ($0.8 million), decreased net sales of LED video screens to the entertainment market ($0.3 million), decreased net sales of specialty LED lighting ($0.1 million), decreased net sales of electrical wire harnesses ($1.0 million) and changes in volume or completion of other customer programs.

There were no impairments of goodwill or intangible assets in fiscal 2011.

In fiscal 2010, we recorded a $153,000 non-cash intangible asset impairment charge. Due to declining use of a trade name and a reduced outlook of future net sales, we determined that a trade name with a $137,000 carrying value in the All Other Category was fully impaired. Additionally, the Lighting Segment no longer sells a certain product that supported a $16,000 patent intangible asset, therefore it was fully impaired. Goodwill was not impaired in fiscal 2010.

In fiscal 2009, we recorded a $14,467,000 non-cash goodwill impairment charge. Charges totaling $11,185,000 were recorded in the Lighting Segment, charges totaling $716,000 were recorded in the Graphics Segment, and charges totaling $2,566,000 were recorded in the All Other Category. Impairment tests conducted in three of the four fiscal quarters indicated there were full or partial impairments of goodwill in one of our reporting units in our Lighting Segment, one reporting unit in the Graphics Segment and one reporting unit in our All Other Category due to the combination of a decline in the market capitalization of the Company at certain quarter-end balance sheet dates and a decline in the estimated forecasted discounted cash flows which management attributes to a weaker economic cycle impacting certain of our customers, notably national retailers.

Our lighting products are sold primarily throughout the United States, but also in Canada, Australia, Latin America, Europe and the Middle East (about 5% of total net sales are outside the United States) using a combination of regional sales managers, independent sales representatives and distributors. Although in some cases we sell directly to national firms, more frequently we are designated as a preferred vendor for product sales to customer-owned as well as franchised, licensed and dealer operations. Our graphics products, which are program-driven, LED video screens, electronic components, and other products and services sold by operations in the All Other Category are sold primarily through our own sales force. Our marketing approach and means of distribution vary by product line and by type of market.

Sales are developed by contacts with national retail marketers, branded product companies, franchise and dealer operations. In addition, sales are also achieved through recommendations from local architects, engineers, petroleum and electrical distributors and contractors. Our sales are partially seasonal as installation of outdoor lighting and graphic systems in the northern states decreases during the winter months.

Our image center and i-Zone center capabilities are important parts of our sales process. The image center, unique within the lighting and graphics industry, is a facility that can produce a computer-generated virtual prototype of a customer’s facility on a large screen through the combination of high technology software and audio/visual presentation. The i-Zone center is a digitally controlled facility containing a large solid-state LED video screen and several displays that showcase our LED technology and LED products. With these capabilities, our customers can instantly explore a wide variety of lighting and graphics alternatives to develop consistent day and nighttime images. These centers give our customers more options, greater control, and more effective time utilization in the development of lighting, graphics and visual image solutions, all with much less expense than traditional prototyping. In addition to being cost and time effective for our customers, we believe that our image center and i-Zone center capabilities result in the best solution for our customers’ needs.

The image and i-Zone centers also contain comprehensive indoor and outdoor product display areas that allow our customers to see many of our products and services in one setting. This aids our customers in making quick and effective lighting and graphic design decisions through hands-on product demonstrations and side-by-side comparisons. More importantly, these capabilities allow us to expand our customer’s interest from just a single product into other products and solutions. We believe that our image center and i-Zone center capabilities have further enhanced our position as a highly qualified outsourcing partner capable of guiding a customer through image alternatives utilizing our lighting and graphics products and services. We believe this capability distinguishes us from our competitors and will become increasingly beneficial in attracting additional customers.

We design, engineer and manufacture substantially all of our lighting and graphics products through a vertically integrated business model. By emphasizing high-volume production of standard product lines, we achieve significant manufacturing efficiencies. When appropriate, we utilize alliances with vendors to outsource certain products and assemblies. LED products and related software are engineered, designed and final-assembled by the Company, while a portion of the manufacturing has been performed by select qualified vendors. We are not dependent on any one supplier for any of our component parts.

The principal raw materials and purchased components used in the manufacturing of our products are steel, aluminum, wire harnesses, sockets, lamps, certain fixture housings, acrylic and glass lenses, lighting ballasts, inks, various graphics substrates such as decal material and vinyls, LEDs and electrical components. We source these materials and components from a variety of suppliers. Although an interruption of these supplies and components could disrupt our operations, we believe generally that alternative sources of supply exist and could be readily arranged. We strive to reduce price volatility in our purchases of raw materials and components through quarterly or annual contracts with certain of our suppliers. Our lighting operations generally carry relatively small amounts of finished goods inventory, except for certain products that are stocked to meet quick delivery requirements. Most often, lighting products are made to order and shipped shortly after they are manufactured. Our graphics operations manufacture custom graphics products for customers who frequently require us to stock certain amounts of finished goods in exchange for their commitment to that inventory. In some Graphics programs, customers also give us a cash advance for the inventory that we stock for them. The Company’s operations dealing with LED products generally carry LED and LED component inventory due to longer lead times, or worldwide shortages of electronic components. LED products are generally made to order and shipped shortly after assembly is complete. Customers purchasing LED video screens routinely give us cash advances for large projects prior to shipment. Our electronic components operation purchases electronic components from multiple suppliers and manufactures custom electronic circuit boards. Due to the worldwide shortage of electronic component parts, the Company has increased its amount of component parts carried in inventory. Most products are made to order and, as a result, this operation does not carry very much finished goods.

We believe we are a low-cost producer for our types of products, and as such, are in a position to promote our product lines with substantial marketing and sales activities.

We currently operate out of eleven manufacturing facilities and two sales facilities in seven U.S. states and Canada. During fiscal 2011, we consolidated our smallest Lighting manufacturing facility into our largest facility.

Our manufacturing operations are subject to various federal, state and local regulatory requirements relating to environmental protection and occupational health and safety. We do not expect to incur material capital expenditures with regard to these matters and believe our facilities are in compliance with such regulations.

We experience strong competition in all segments of our business, and in all markets served by our product lines. Although we have many competitors, some of which have greater financial and other resources, we do not compete with the same companies across our entire product and service offerings. We believe product quality and performance, price, customer service, prompt delivery, and reputation to be important competitive factors. We also have several product and process patents which have been obtained in the normal course of business which provide a competitive advantage in the marketplace.

Our sales are partially seasonal as installation of outdoor lighting and graphic systems in the northern states lessens during the harshest winter months. We had a backlog of orders, which we believe to be firm, of $28.7 million and $60.5 million at June 30, 2011 and 2010, respectively. All orders are believed to be shippable or installed within twelve months. The decrease as of June 30, 2011 relates primarily to the completion of a $38 million program with 7-Eleven, Inc. to install retrofit solid-state LED lighting at over 3,000 of its sites in North America.

We have approximately 1,200 full-time and 282 temporary employees as of June 30, 2011. We offer a comprehensive compensation and benefit program to most employees, including competitive wages, a discretionary bonus plan, a profit-sharing plan and retirement plan, and a 401(k) savings plan (for U.S. employees), a non-qualified deferred compensation plan (for certain employees), an equity compensation plan, and medical and dental insurance.

LSI Industries Inc. is an Ohio corporation, incorporated in 1976.

In addition to the other information set forth in this report, you should carefully consider the following factors which could materially affect our business, financial condition, cash flows or future results. Any one of these factors could cause the Company’s actual results to vary materially from recent results or from anticipated future results. The risks described below are not the only risks facing our Company. Additional risks and uncertainties not currently known to us or that we currently deem to be immaterial also may materially adversely affect our business, financial condition and/or operating results.

The markets in which we operate are subject to competitive pressures that could affect selling prices, and therefore could adversely affect our operating results.

Our businesses operate in markets that are highly competitive, and we compete on the basis of price, quality, service and/or brand name across the industries and markets served. Some of our competitors for certain products, primarily in the Lighting Segment, have greater sales, assets and financial resources than we have. Some of our competitors are based in foreign countries and have cost structures and prices in foreign currencies. Accordingly, currency fluctuations could cause our U.S. dollar-priced products to be less competitive than our competitors’ products which are priced in other currencies. Competitive pressures could affect prices we charge our customers or demand for our products, which could adversely affect our operating results. Additionally, customers for our products are attempting to reduce the number of vendors from which they purchase in order to reduce the size and diversity of their inventories and their transaction costs. To remain competitive, we will need to invest continuously in manufacturing, marketing, customer service and support, and our distribution networks. We may not have sufficient resources to continue to make such investments and we may be unable to maintain our competitive position.

Lower levels of economic activity in our end markets could adversely affect our operating results.

Our businesses operate in several market segments including commercial, industrial, retail, petroleum / convenience store and entertainment. Operating results can be negatively impacted by volatility in these markets. Future downturns in any of the markets we serve could adversely affect our overall sales and profitability.

Our operating results may be adversely affected by unfavorable economic, political and market conditions.

Economic and political conditions worldwide have from time to time contributed to slowdowns in our industry at large, as well as to the specific segments and markets in which we operate. When combined with ongoing customer consolidation activity and periodic manufacturing and inventory initiatives, the current uncertain macro-economic and political climate, including but not limited to the effects of weakness in domestic and foreign financial and credit markets, could lead to reduced demand from our customers and increased price competition for our products, increased risk of excess and obsolete inventories and uncollectible receivables, and higher overhead costs as a percentage of revenue. If the markets in which we participate experience further economic downturns, as well as a slow recovery period, this could negatively impact our sales and revenue generation, margins and operating expenses, and consequently have a material adverse effect on our business, financial condition and results of operations.

Price increases or significant shortages of raw materials and components could adversely affect our operating margin.

The Company purchases large quantities of raw materials and components — mainly steel, aluminum, light bulbs and fluorescent tubes, lighting ballasts, sockets, wire harnesses, plastic, lenses, glass lenses, vinyls, inks, LEDs, electronic components and corrugated cartons. Materials comprise the largest component of costs, representing approximately 62% of the cost of sales in both 2011 and 2010. While we have multiple sources of supply for each of our major requirements, significant shortages could disrupt the supply of raw materials. Further increases in the price of these raw materials and components could further increase the Company’s operating costs and materially adversely affect margins. Although the Company attempts to pass along increased costs in the form of price increases to customers, the Company may be unsuccessful in doing so for competitive reasons. Even when price increases are successful, the timing of such price increases may lag significantly behind the incurrence of higher costs. As of August 2011, there are selected electronic component parts and certain other parts shortages in the market place, some of which have affected the Company’s manufacturing operations and shipment schedules even though multiple suppliers may be available. The lead times from electronic component suppliers have significantly increased for some component parts and prices of some of these electronic component parts have increased during this period of shortages. Fluorescent tubes and other light bulbs contain rare earth minerals, which have become more expensive and in short supply throughout the world, thereby affecting the Company’s supply and cost of these light sources.

We have a concentration of net sales to the petroleum / convenience store market, and any substantial change in this market could have an adverse affect on our business.

Approximately 37% of our net sales in fiscal year 2011 are concentrated in the petroleum / convenience store market. Sales to this market segment are dependent upon the general conditions prevailing in and the profitability of the petroleum and convenience store industries and general market conditions. Our petroleum market business is subject to reactions by the petroleum industry to world political events, particularly those in the Middle East, and to the price and supply of oil. Major disruptions in the petroleum industry generally result in a curtailment of retail marketing efforts, including expansion and refurbishing of retail outlets, by the petroleum industry and adversely affect our business. Any substantial change in purchasing decisions by one or more of our largest customers, whether due to actions by our competitors, customer financial constraints, industry factors or otherwise, could have an adverse effect on our business.

Difficulties with integrating acquisitions could adversely affect operating costs and expected benefits from those acquisitions.

We have pursued and may continue to seek potential acquisitions to complement and expand our existing businesses, increase our revenues and profitability, and expand our markets. We cannot be certain that we will be able to identify, acquire or profitably manage additional companies or successfully integrate such additional companies without substantial costs, delays or other problems. Also, companies acquired recently and in the future may not achieve revenues, profitability or cash flows that justify our investment in them. We expect to spend significant time and effort in expanding our existing businesses and identifying, completing and integrating acquisitions. We expect to face competition for acquisition candidates which may limit the number of acquisition opportunities available to us, possibly leading to a decrease in the rate of growth of our revenues and profitability, and may result in higher acquisition prices. The success of these acquisitions we do make will depend on our ability to integrate these businesses into our operations. We may encounter difficulties in integrating acquisitions into our operations, retaining key employees of acquired companies and in managing strategic investments. Therefore, we may not realize the degree or timing of the benefits anticipated when we first enter into a transaction.

If acquisitions are made in the future and goodwill and intangible assets are recorded on the balance sheet, circumstances could arise in which the goodwill and intangible assets could become impaired and therefore would be written off.

We have pursued and will continue to seek potential acquisitions to complement and expand our existing businesses, increase our revenues and profitability, and expand our markets through acquisitions. As a result of acquisitions, we have significant goodwill and intangible assets recorded on our balance sheet. We will continue to evaluate the recoverability of the carrying amount of our goodwill and intangible assets on an ongoing basis, and we may incur substantial non-cash impairment charges, which would adversely affect our financial results. There can be no assurance that the outcome of such reviews in the future will not result in substantial impairment charges. Impairment assessment inherently involves judgment as to assumptions about expected future cash flows and the impact of market conditions on those assumptions. Future events and changing market conditions may impact our assumptions as to prices, costs, holding periods or other factors that may result in changes in our estimates of future cash flows. Although we believe the assumptions we used in testing for impairment are reasonable, significant changes in any one of our assumptions could produce a significantly different result. If there were to be a decline in our market capitalization and a decline in estimated forecasted discounted cash flows, there could be an impairment of the goodwill and intangible assets. A non-cash impairment charge could be material to the earnings of the reporting period in which it is recorded.

If customers do not accept new products, we could experience a loss of competitive position which could adversely affect future revenues.

The Company is committed to product innovation on a timely basis to meet customer demands. Development of new products for targeted markets requires the Company to develop or otherwise leverage leading technologies in a cost-effective and timely manner. Failure to meet these changing demands could result in a loss of competitive position and seriously impact future revenues. Products or technologies developed by others may render the Company’s products or technologies obsolete or noncompetitive. A fundamental shift in technologies in key product markets could have a material adverse effect on the Company’s operating results and competitive position within the industry. More specifically, the development of new or enhanced products is a complex and uncertain process requiring the anticipation of technological and market trends. We may experience design, manufacturing, marketing or other difficulties, such as an inability to attract a sufficient number of experienced engineers, that could delay or prevent our development, introduction or marketing of new products or enhancements and result in unexpected expenses. Such difficulties could cause us to lose business from our customers and could adversely affect our competitive position. In addition, added expenses could decrease the profitability associated with those products that do not gain market acceptance.

Our business is cyclical and seasonal, and in downward economic cycles our operating profits and cash flows could be adversely affected.

Historically, sales of our products have been subject to cyclical variations caused by changes in general economic conditions. Our revenues in our third quarter ending March 31 are also affected by the impact of weather on construction and installation programs and the annual budget cycles of major customers. The demand for our products reflects the capital investment decisions of our customers, which depend upon the general economic conditions of the markets that our customers serve, including, particularly, the petroleum and convenience store industries. During periods of expansion in construction and industrial activity, we generally have benefited from increased demand for our products. Conversely, downward economic cycles in these industries result in reductions in sales and pricing of our products, which may reduce our profits and cash flow. During economic downturns, customers also tend to delay purchases of new products. The cyclical and seasonal nature of our business could at times adversely affect our liquidity and financial results.

A loss of key personnel or inability to attract qualified personnel could have an adverse affect on our operating results.

The Company’s future success depends on the ability to attract and retain highly skilled technical, managerial, marketing and finance personnel, and, to a significant extent, upon the efforts and abilities of senior management. The Company’s management philosophy of cost-control results in a very lean workforce. Future success of the Company will depend on, among other factors, the ability to attract and retain other qualified personnel, particularly management, research and development engineers and technical sales professionals. The loss of the services of any key employees or the failure to attract or retain other qualified personnel could have a material adverse effect on the Company’s results of operations.

The costs of litigation and compliance with environmental regulations, if significantly increased, could have an adverse affect on our operating profits.

We are, and may in the future be, a party to any number of legal proceedings and claims, including those involving patent litigation, product liability, employment matters, and environmental matters, which could be significant. Given the inherent uncertainty of litigation, we can offer no assurance that existing litigation or a future adverse development will not have a material adverse impact. We are also subject to various laws and regulations relating to environmental protection and the discharge of materials into the environment, and it could potentially be possible we could incur substantial costs as a result of the noncompliance with or liability for clean up or other costs or damages under environmental laws.

None.

The Company considers these facilities (total of 1,358,000 square feet) adequate for its current level of operations.

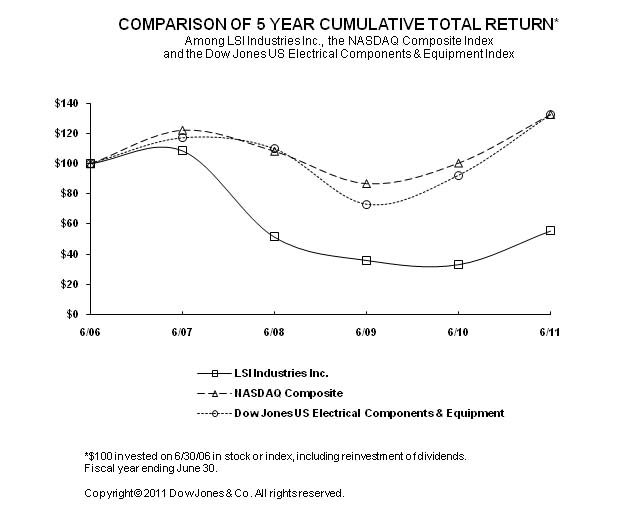

The following graph compares the cumulative total shareholder return on the Company’s common shares during the five fiscal years ended June 30, 2011 with a cumulative total return on the NASDAQ Stock Market Index (U.S. companies) and the Dow Jones Electrical Equipment Index. The comparison assumes $100 was invested June 30, 2006 in the Company’s Common Shares and in each of the indexes presented; it also assumes reinvestment of dividends.

The stock price performance included in this graph is not necessarily indicative of future stock price performance.

“Selected Financial Data” begins on page F-43 of this Form 10-K.

“Management’s Discussion and Analysis of Financial Condition and Results of Operations” appears on pages F-1 through F-14 of this Form 10-K.

The Company is exposed to market risk from changes in variable interest rates, changes in prices of raw materials and component parts, and changes in foreign currency translation rates. Each of these risks is discussed below.

The Company earns interest income on its cash, cash equivalents, and short-term investments (if any) and pays interest expense on its debt. Because of variable interest rates, the Company is exposed to the risk of interest rate fluctuations, which impact interest income, interest expense, and cash flows. With the current balance in the Company’s short-term cash investments and absence of any outstanding variable rate debt, the adverse exposure to interest rate fluctuations has decreased considerably. The Company’s outstanding mortgage debt is at a fixed rate of interest.

All of the Company’s $35,000,000 available lines of credit are subject to interest rate fluctuations, should the Company borrow on these lines of credit. Additionally, the Company expects to generate cash from its operations that will subsequently be used to pay down as much of the debt (if any is outstanding) as possible or invest cash in short-term investments (if no debt is outstanding), while still funding the growth of the Company.

The Company purchases large quantities of raw materials and components, mainly steel, aluminum, light bulbs, fluorescent tubes, lighting ballasts, sockets, wire harnesses, plastic, lenses, glass, vinyls, inks, LEDs, electronic components, and corrugated cartons. The Company’s operating results could be affected by the availability and price fluctuations of these materials. The Company uses multiple suppliers, has alternate suppliers for most materials, and has no significant dependence on any single supplier. Other than industry-wide electronic component supply shortages and the recent shortage in rare earth minerals used in fluorescent lamps, the Company has not experienced any significant supply problems in recent years. Supply shortages of certain electronic components and certain other parts in fiscal 2010 and fiscal 2011 have caused some production and shipment delays, and the Company is dealing with some increased supply chain lead times. Price risk for these materials is related to increases in commodity items that affect all users of the materials, including the Company’s competitors. For the fiscal year ended June 30, 2011, the raw material component of cost of goods sold subject to price risk was approximately $138 million. The Company does not actively hedge or use derivative instruments to manage its risk in this area. The Company does, however, seek new vendors, negotiate with existing vendors, and at times commit to minimum volume levels to mitigate price increases. The Company negotiates supply agreements with certain vendors to lock in prices over a negotiated period of time. In response to rising material prices, the Company’s Lighting Segment announced price increases ranging from 4% to 8%, depending on the product, effective with late April 2011 orders. While competitors of the Company’s lighting business have announced similar price increases, the lighting market remains very price competitive. The Company’s Graphics Segment generally establishes new sales prices, reflective of the then current raw material prices, for each custom graphics program as it begins.

As a result of the operation of a subsidiary in Montreal, Canada, the Company is exposed to fluctuations in foreign currency exchange rates in the operation of its Canadian business. However, a substantial amount of this business is conducted in U.S. dollars, therefore, any potential risk is deemed immaterial. Additionally, the financial transactions and financial statements of this subsidiary are recorded in U.S. dollars.

Schedules other than those listed above are omitted for the reason(s) that they are either not applicable or not required or because the information required is contained in the financial statements or notes thereto. Selected quarterly financial data is found in Note 17 of the accompanying consolidated financial statements.

None.

The Company maintains disclosure controls and procedures (as such term is defined in Rules 13a-15(e) and 15d-15(e) under the Securities Exchange Act of 1934 as amended (the “Exchange Act”)) that are designed to ensure that information required to be disclosed in the Company’s reports under the Exchange Act, is recorded, processed, summarized and reported within the time periods specified in the SEC’s rules and forms, and that such information is accumulated and communicated to management, including the Company’s Chief Executive Officer and Chief Financial Officer, as appropriate, to allow timely decisions regarding required disclosure. The Company periodically reviews the design and effectiveness of its disclosure controls and internal control over financial reporting. The Company makes modifications to improve the design and effectiveness of its disclosure controls and internal control structure, and may take other corrective action, if its reviews identify a need for such modifications or actions. The Company’s disclosure controls and procedures are designed to provide reasonable assurance of achieving their objectives.

As of the end of the period covered by this Form 10-K, an evaluation was completed under the supervision and with the participation of our management, including our principal executive officer and principal financial officer, regarding the design and effectiveness of our disclosure controls and procedures. Based on this evaluation, our management, including our principal executive officer and principal financial officer, has concluded that our disclosure controls and procedures were effective as of June 30, 2011.

There were no changes in the Company’s internal control over financial reporting (as defined in Rules 13a-15(f) and 15d-15(f) under the Exchange Act) during the fiscal quarter ended June 30, 2011, that have materially affected, or are reasonably likely to materially affect, the Company’s internal control over financial reporting. See Management’s Report on Internal Control Over Financial Reporting on page F-15.

None.

LSI will provide shareholders with any exhibit upon the payment of a specified reasonable fee, which fee shall be limited to LSI’s reasonable expenses in furnishing such exhibit. The exhibits identified herein as being filed with the SEC have been so filed with the SEC but may not be included in this version of the Annual Report to Shareholders.

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The Company’s “forward looking statements” and disclosures as presented earlier in this Form 10-K in the “Safe Harbor” Statement, as well as the Company’s consolidated financial statements and accompanying notes presented later in this Form 10-K should be referred to when reading Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Net Sales by Business Segment

| (In thousands) | | 2011 | | | 2010 | | | 2009 | |

| Lighting Segment | | $ | 196,550 | | | | 159,105 | | | $ | 160,475 | |

| Graphics Segment | | | 68,155 | | | | 68,395 | | | | 60,765 | |

| Electronic Components Segment | | | 21,449 | | | | 16,116 | | | | — | |

| All Other Category | | | 7,347 | | | | 10,786 | | | | 12,559 | |

| | | $ | 293,501 | | | | 254,402 | | | $ | 233,799 | |

Operating Income (Loss) by Business Segment

| (In thousands) | | 2011 | | | 2010 | | | 2009 | |

| Lighting Segment | | $ | 11,423 | | | | 9,073 | | | $ | (3,884 | ) |

| Graphics Segment | | | 6,373 | | | | 3,237 | | | | 2,362 | |

| Electronic Components Segment | | | 7,886 | | | | 2,279 | | | | — | |

| All Other Category | | | (543 | ) | | | (1,807 | ) | | | (4,321 | ) |

| Corporate and Eliminations | | | (8,835 | ) | | | (10,873 | ) | | | (8,568 | ) |

| | | $ | 16,304 | | | | 1,909 | | | $ | (14,411 | ) |

Summary Comments

Fiscal 2011 net sales of $293,501,000 increased $39.1 million or 15.4% as compared to fiscal 2010. See Note 2 to the financial statements for discussion of the retroactive reclassification of the Company’s reportable business segments. Net sales were favorably influenced by increased net sales of the Lighting Segment (up $37.4 million or 23.5%), and the Electronic Components Segment (up $5.3 million or 33.1%). Net sales were unfavorably influenced by decreased net sales of the Graphics Segment (down $0.2 million or 0.4%), and the All Other Category (down $3.4 million or 31.9%). Net sales to the petroleum / convenience store market, the Company’s largest niche market, were $108,460,000 or 37% of total net sales and $89,952,000 or 35% of total net sales of fiscal 2011 and 2010, respectively. The $18.5 million or 21% increase is primarily due to an increase of sales of solid-state LED lighting into this market.

The Company recorded intangible asset impairment expenses in fiscal 2010 totaling $153,000 ($16,000 in the Lighting Segment and $137,000 in the All Other Category). There were no such intangible asset impairment expenses in fiscal 2011. The Company recorded significant goodwill impairment expenses in fiscal 2009 totaling $14,467,000 ($11.2 million in the Lighting Segment, $0.7 million in the Graphics Segment and $2.6 million in the All Other Category). There were no goodwill impairment expenses in fiscal 2011 or 2010.

The Company also recorded significant acquisition-related and other professional fees expenses in fiscal 2010, totaling $1,198,000 ($678,000 of inventory adjustments related to acquisition fair value accounting on the opening balance sheet of LSI ADL Technology; and $520,000 of acquisition transaction costs related to the acquisition of LSI ADL Technology). There were no such similar significant expenses in fiscal 2011. See also the section below on Non-GAAP Financial Measures.

The Company’s total net sales of products and services related to solid-state LED technology in light fixtures and video screens for sports, advertising and entertainment markets have been recorded as indicated in the table below. In addition, the Company sells certain elements of graphic identification programs that contain solid-state LED light sources.

| | | LED Net Sales | |

| (In thousands) | | FY 2011 | | | FY 2010 | | | % Change | |

| First Quarter | | $ | 16,673 | | | $ | 17,999 | | | | (7.4)% | |

| Second Quarter | | | 17,585 | | | | 18,533 | | | | (5.1)% | |

| First Half | | | 34,258 | | | | 36,532 | | | | (6.2)% | |

| Third Quarter | | | 12,943 | | | | 11,510 | | | | 12.5% | |

| Nine Months | | | 47,201 | | | | 48,042 | | | | (1.8)% | |

| Fourth Quarter | | | 21,453 | | | | 14,538 | | | | 47.6% | |

| Full Year | | $ | 68,654 | | | $ | 62,580 | | | | 9.7% | |

Fiscal 2011 LED net sales of $68,654,000 were up $6.1 million or 9.7% from fiscal 2010. The $68,654,000 total LED net sales and the $6.1 million increase are primarily the result of Lighting Segment LED net sales of $60,042,000 (up $22.2 million or 59%), Graphics Segment LED net sales of $4,938,000 (down $15.3 million or 76%, primarily due to lower LED sports screen sales and lower LED lighting for signage) and All Other Category LED net sales of $3,674,000 (down $0.8 million or 18% in the entertainment market).

During the recession of 2008 through 2010, virtually all of our markets were adversely impacted and our business suffered as a result. During these difficult and uncertain economic conditions, we took a number of proactive steps to meet our operating challenges, including strict control of expenses, capital expenditure reductions, close management of accounts receivable and inventories, prudent staffing decisions, and maintaining a conservative financial position coupled with positive free cash flow. Economic conditions in many of the markets we serve now have continued to show improvement in fiscal 2011. We continue to adjust our expense levels to production rates we are experiencing and to manage working capital efficiently. We are also strategically positioning the business for future growth and are very positive about the longer term outlook and opportunities for the Company. LSI is still facing a period of challenging business conditions in the near term due to the general economic conditions, but expects to emerge a stronger and more efficient company as business conditions continue to improve.

Non-GAAP Financial Measures

The Company believes it is appropriate to evaluate its performance after making adjustments to the U.S. GAAP net income (loss) for the 2010 and 2009 fiscal years. Adjusted net income and earnings per share, which exclude the impact of the LSI ADL Technology acquisition deal costs, acquisition-related fair value inventory adjustments, the loss on the sale of LSI Marcole, goodwill and intangible asset impairments, and a loss contingency related to a menu board patent litigation, are non-GAAP financial measures. We believe that these adjusted supplemental measures are useful in assessing the operating performance of our business. These supplemental measures are used by our management, including our chief operating decision maker, to evaluate business results. We exclude these items because they are not representative of the ongoing results of operations of our business. Below is a reconciliation of this non-GAAP measure to net income (loss) for the periods indicated.

| | | FY 2011 | | | FY 2010 | | | FY 2009 | |

| | | | | | | Diluted | | | | | | | Diluted | | | | | | | Diluted | |

(In thousands, except per share data; unaudited) | | Amount | | | EPS | | | Amount | | | EPS | | | Amount | | | EPS | |

| Reconciliation of net income (loss) to adjusted net income: | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Net income (loss) as reported | | $ | 10,828 | | | $ | 0.44 | | | $ | 1,424 | | | $ | 0.06 | | | $ | (13,414 | ) | | $ | (0.62 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Adjustment for the loss on sale of LSI Marcole, inclusive of the income tax effect | | | — | | | | — | | | | 422 | (1) | | | 0.02 | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Adjustment for the acquisition deal costs and acquisition-related fair value inventory adjustment, inclusive of the income tax effect | | | — | | | | — | | | | 791 | (2) | | | 0.03 | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Adjustment for the loss contingency related to the menu board patent litigation, inclusive of the income tax effect | | | — | | | | — | | | | — | (3) | | | — | | | | 125 | (3) | | | 0.01 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Adjustment for goodwill and intangible asset impairments, inclusive of the income tax effect | | | — | | | | — | | | | 148 | (4) | | | 0.01 | | | | 13,583 | (5) | | | 0.62 | |

| | | | | | | | | | | | | | | | | | | | | | |

| Adjusted net income and earnings per share | | $ | 10,828 | | | | 0.44 | | | $ | 2,785 | | | $ | 0.12 | | | $ | 294 | | | $ | 0.01 | |

The income tax effects of the adjustments in the tables above were calculated using the estimated U.S. effective income tax rates for the periods indicated, with appropriate consideration given for the permanent non-deductible portion of the goodwill impairments in fiscal 2009. The income tax effects were as follows (in thousands):

| (1) | | $217 |

| | | |

| (2) | | $407 |

| | | |

| (3) | | $75 |

| | | |

| (4) | | $5 |

| | | |

| (5) | | $884 |

Results of Operations

2011 Compared to 2010

| Lighting Segment | | | |

| (In thousands) | | 2011 | | | 2010 | |

| Net Sales | | $ | 196,550 | | | $ | 159,105 | |

| Gross Profit | | $ | 44,499 | | | $ | 37,185 | |

| Operating Income | | $ | 11,423 | | | $ | 9,073 | |

Lighting Segment net sales of $196,550,000 in fiscal 2011 increased 23.5% from fiscal 2010 net sales of $159,105,000. The $37.4 million increase in Lighting Segment net sales is primarily the net result of a $19.8 million or 24.7% net increase in lighting sales to our niche markets (petroleum / convenience store market net sales were up 19%, net sales to the automotive dealership market were up 58%, and net sales to the quick service restaurant market were up 20%) and national retail accounts, and a $17.5 million or 22.2% increase in commissioned net sales to the commercial / industrial lighting market. Sales of lighting to the petroleum / convenience store market represented 31% and 32% of Lighting Segment net sales in fiscal years 2011 and 2010, respectively. Lighting Segment net sales of lighting to this, the Company’s largest niche market, were up 19% from fiscal 2010 to $61,066,000, with approximately $10.2 million related to a program with 7-Eleven, Inc., who replaced traditional canopy, site and sign lighting with solid-state LED lighting. Lighting Segment fiscal 2010 net sales to 7-Eleven, Inc. were approximately $21.4 million for a similar LED replacement lighting program. The petroleum / convenience store market has been, and will continue to be, a very important niche market for the Company. The Lighting Segment’s net sales of light fixtures having solid-state LED technology totaled $60.0 million in fiscal 2011, representing a 59% increase from fiscal 2010 net sales of solid-state LED light fixtures of $37.8 million.

Gross profit of $44,499,000 in fiscal 2011 increased $7.3 million or 20% from fiscal 2010, and decreased from 22.5% to 22.2% as a percentage of Lighting Segment net sales (customer plus inter-segment net sales). The increase in amount of gross profit is due to the net effect of increased net sales at decreased margins, and increased overhead absorption. The following items also influenced the Lighting Segment’s gross profit margin: competitive pricing pressures; $2.2 million increased freight costs; $0.3 million increased benefits and compensation; $0.3 million increased warranty costs; $0.3 million increased utilities; $0.2 million increased repairs and maintenance; $0.4 million increased outside service costs; $0.1 million increased depreciation expense; and $0.6 million increased manufacturing supplies expense.

Selling and administrative expenses of $33,076,000 in fiscal 2011 increased $5.0 million from fiscal 2010. The following items were the primary contributors to the increase: $0.1 million increased compensation and benefits expense; $3.0 million increased sales commission expense reflective of increased net sales; $0.4 million increased research and development expense; $0.8 million increased customer relations expense; $0.2 million increased outside services; $0.1 million increased sales samples expense; $0.1 million decreased communications expense; $0.1 million decreased royalty income; $0.1 million increased advertising; and $0.5 million increased bad debt expense.

The Lighting Segment fiscal 2011 operating income of $11,423,000 increased $2.4 million or 25.9% from operating income of $9,073,000 in fiscal 2010. This increase of $2.4 million was the net result of increased net sales, increased gross profit (at lower margin percentages), and increased selling and administrative expenses.

| | | |

| (In thousands) | | 2011 | | | 2010 | |

| Net Sales | | $ | 68,155 | | | $ | 68,395 | |

| Gross Profit | | $ | 16,903 | | | $ | 13,781 | |

| Operating Income | | $ | 6,373 | | | $ | 3,237 | |

Graphics Segment net sales of $68,155,000 in fiscal 2011 decreased 0.4% from fiscal 2010 net sales of $68,395,000. The $0.2 million decrease in Graphics Segment net sales is primarily the net result of image conversion programs and sales to twelve petroleum / convenience store customers ($8.7 million net increase), grocery market ($2.5 million decrease), the LED video sports screen market ($5.0 million decrease), a national drug store retailer ($3.2 million decrease), a fast food restaurant chain ($1.1 million increase), and changes in volume or completion of several other graphics programs. Sales of graphics products and services to the petroleum / convenience store market represented 70% and 56% of Graphics Segment net sales in fiscal years 2011 and 2010, respectively. Graphics Segment net sales of graphics to this, the Company’s largest niche market, were up 23% from fiscal 2010 to $47,394,000, with approximately $29.7 million related to a program with 7-Eleven, Inc., who replaced traditional sign lighting with solid-state LED lighting. The petroleum / convenience store market has been, and will continue to be, a very important niche market for the Company. The Graphics Segment net sales of solid-state LED video screens and LED lighting for signage totaled $4.9 million in fiscal 2011 as compared to $20.3 million in the prior year.

Image and brand programs, whether full conversions or enhancements, are important to the Company’s strategic direction. Image programs include situations where our customers refurbish their retail sites around the country by replacing some or all of the lighting, graphic elements, menu board systems and possibly other items they may source from other suppliers. These image programs often take several quarters to complete and involve both our customers’ corporate-owned sites as well as their franchisee-owned sites, the latter of which involve separate sales efforts by the Company with each franchisee. The Company may not always be able to replace net sales immediately when a large image conversion program has concluded. Brand programs typically occur as new products are offered or new departments are created within existing retail stores. Relative to net sales to a customer before and after an image or brand program, net sales during the program are typically significantly higher, depending upon how much business is awarded to the Company. Sales related to a customer’s image or brand program are reported in the Lighting Segment, Graphics Segment, or the All Other Category depending upon the product and/or service provided.

Gross profit of $16,903,000 in fiscal 2011 increased $3.1 million or 23% from fiscal 2010, and increased from 19.9% to 24.4% as a percentage of Graphics Segment net sales (customer plus inter-segment net sales). The increase in amount of gross profit is due to the net effect of decreased net sales at increased margins, and decreased overhead absorption. The following items also influenced the Graphics Segment’s gross profit margin: competitive pricing pressures; $0.1 million decreased freight costs; $0.1 million decreased warranty costs; $0.1 million decreased rent/lease expense; and $0.1 million increased property taxes.

Selling and administrative expenses of $10,530,000 in fiscal 2011 were slightly lower than fiscal 2010. The following items of expense changed between years as follows: $0.2 million decreased compensation and benefits; $0.1 million increased rent expense; $0.2 million decreased customer relations expense; $0.1 million increased outside services expense; $0.1 million decreased sales commission expense; and increased expense related to a patent settlement agreement.

The Graphics Segment fiscal 2011 operating income of $6,373,000 increased $3.1 million or 97% from operating income of $3,237,000 in fiscal 2010. The $3.1 million increase in operating income was the result of decreased net sales, increased gross profit, and decreased selling and administrative expenses.

| Electronic Components Segment | | | |

| (In thousands) | | 2011 | | | 2010 | |

| Net Sales | | $ | 21,449 | | | $ | 16,116 | |

| Gross Profit | | $ | 9,601 | | | $ | 3,847 | |

| Operating Income | | $ | 7,886 | | | $ | 2,279 | |

Electronic Components Segment net sales of $21,449,000 in fiscal 2011 increased 33.1% from fiscal 2010 net sales of $16,116,000. The $5.3 million increase in Electronic Components Segment net sales is primarily the net result of a $2.9 million increase to industrial markets, $1.0 million decrease to telecommunications markets, $0.8 million increase to retail markets, $0.5 million increase to medical markets and $0.2 million decrease to transportation related markets. In addition to this segment’s growth in customer sales, its inter-segment net sales grew 374% in support of LED lighting sales.

Gross profit of $9,601,000 in fiscal 2011 increased $5.8 million or 150% from fiscal 2010, and increased from 17.9% to 20.4% as a percentage of Electronic Components Segment net sales (customer plus inter-segment net sales). Approximately $3.8 million of increased gross profit resulted from the significant increase in the amount of inter-segment business as well as from increased Electronic Components customer net sales. Gross profit of the Electronic Components Segment in fiscal 2010 was reduced by $678,000 related to the roll-out of fair value inventory adjustments for LSI ADL Technology’s sales of products that were in finished goods or work-in-process inventory on the acquisition date and therefore were valued at fair value, as opposed to manufactured cost, in the opening balance sheet in accordance with the requirements of purchase accounting. The following items also influenced the Electronic Components Segment’s gross profit margin: competitive pricing pressures; $0.2 million increase shipping costs; $0.4 million increased benefits and compensation; $0.1 million increased outside services; and $0.5 million increased manufacturing supplies.

Selling and administrative expenses of $1,715,000 in fiscal 2011 increased $0.1 million from fiscal 2010. The following items of expense changed between years as follows: $0.1 million increased employee compensation and benefits expense; $0.1 million increased supplies; and $0.1 million increased repairs and maintenance.

The Electronic Components Segment fiscal 2011 operating income of $7,886,000 increased $5.6 million from operating income of $2,279,000 in the same period of fiscal 2010. The $5.6 million increase in operating income was the result of increased net sales and increased gross profit, partially offset by increased selling and administrative expenses.

| | | |

| (In thousands) | | 2011 | | | 2010 | |

| Net Sales | | $ | 7,347 | | | $ | 10,786 | |

| Gross Profit | | $ | 2,089 | | | $ | 1,267 | |

| Operating (Loss) | | $ | (543 | ) | | $ | (1,807 | ) |

All Other Category net sales of $7,347,000 in fiscal 2011 decreased 31.9% from fiscal 2010 net sales of $10,786,000. The $3.4 million decrease in the All Other Category net sales is primarily the net result of net increased sales of menu board systems ($0.2 million), decreased sales of LED video screens to the entertainment and other markets ($3.0 million), no sales of electrical wire harnesses ($2.9 million) and changes in volume or completion of other customer programs. The Company sold its wire harness operation and business at the end of the third quarter of fiscal 2010 and therefore has no further sales or expenses related to wire harnesses.

The gross profit of $2,089,000 in fiscal 2011 increased $0.8 million or 65% from fiscal of 2010, and increased from 7.1% to 16.2% as a percentage of the All Other Category net sales (customer plus inter-segment net sales). The increase in amount of gross profit is due to the net effect of decreased net sales and increased margins. The following items also influenced the All Other Category’s gross profit margin: competitive pricing pressures; $0.6 million decreased indirect wage compensation and benefits; $0.5 million increased installation costs; $0.1 million decreased manufacturing supplies; $0.1 million decreased utilities; $0.2 million decreased warranty expense; and $0.1 million decreased depreciation expense.

Selling and administrative expenses of $2,632,000 in fiscal 2011 decreased $0.4 million or 14% as compared to the prior year. Changes of expense between years include $0.2 million decreased benefits and compensation, $0.2 million decreased royalty expense, $0.1 million decreased depreciation expense, and $0.3 million increased bad debt expense.

The All Other Category fiscal 2011 operating loss of $(543,000) compares to an operating loss of $(1,807,000) in fiscal 2010. This $1.3 million decreased operating loss was the net result of decreased net sales, increased gross profit, and decreased selling and administrative expenses. Sales and resulting gross margins were not high enough to cover selling and administrative expenses.

Corporate and Eliminations | | | |

| (In thousands) | | 2011 | | | 2010 | |

| Gross Profit | | $ | (747 | ) | | $ | (347 | ) |

| Operating (Loss) | | $ | (8,835 | ) | | $ | (10,873 | ) |

The negative gross profit relates to the intercompany profit in inventory elimination.

Selling and administrative expenses of $8,088,000 in fiscal 2011 were down $2.4 million or 23.2% from the same period of the prior year. The reduction in expense is primarily related to the net result of $1.3 million reduced compensation and benefits expense, $0.1 million increased repair and maintenance expense, $0.1 million reduced audit and accounting fees, $0.1 million reduced outside consulting services, $0.4 million reduced research and development expenses, and no acquisition deal costs in fiscal 2011 as compared to $0.5 million in the prior year.

Consolidated Results

The Company reported net interest expense of $137,000 in fiscal 2011 as compared to net interest expense of $125,000 in fiscal 2010. Commitment fees related to the unused portions of the Company’s lines of credit, interest expense on a mortgage, and interest income on invested cash are included in the net interest expense amounts above.

The $5,339,000 income tax expense in fiscal 2011 represents a consolidated effective tax rate of 33.0%. This is the net result of an income tax rate of 31.2% for the Company’s U.S. operations, influenced by certain permanent book-tax differences that were significant relative to the amount of taxable income, by certain U.S. federal and Canadian income tax credits, by a benefit related to uncertain income tax positions, by adjustments to deferred income tax liabilities, and by a full valuation reserve on the Company’s Canadian tax position. The $360,000 income tax expense in fiscal 2010 represents a consolidated effective tax rate of 20.2%. This is the net result of a U.S. federal income tax rate of 34% influenced by certain permanent book-tax differences that were significant relative to the amount of taxable income, by certain U.S. federal and Canadian income tax credits, by a benefit related to uncertain income tax positions, by an increase in state income taxes, and by full valuation reserves on the Company’s Canadian tax position and a certain state deferred income tax asset.

The Company reported net income of $10,828,000 in fiscal 2011 as compared to net income of $1,424,000 in fiscal 2010. The increased net income is primarily the result of increased net sales and increased gross profit, partially offset by increased operating expenses and increased income tax expense. Diluted earnings per share were $0.44 in fiscal 2011 as compared to $0.06 in fiscal 2010. The weighted average common shares outstanding for purposes of computing diluted earnings per share in fiscal 2011 was 24,339,000 shares as compared to 24,134,000 shares in fiscal 2010.

2010 Compared to 2009

| Lighting Segment | | | | | | |

| (In thousands) | | 2010 | | | 2009 | |

| Net Sales | | $ | 159,105 | | | $ | 160,475 | |

| Gross Profit | | $ | 37,185 | | | $ | 36,403 | |

| Operating Income (Loss) | | $ | 9,073 | | | $ | (3,884 | ) |