UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. __)

Filed by the Registrant S

Filed by a Party other than the Registrant o

Check the appropriate box:

| o | | Preliminary Proxy Statement |

| o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| S | | Definitive Proxy Statement |

| o | | Definitive Additional Materials |

| o | | Soliciting Material Pursuant to § 240.14A-12 |

Chemung Financial Corporation

(Name of Registrant as Specified in Its Charter)

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | |

| Payment of Filing Fee (Check the appropriate box): |

| | | |

| S | No fee required. |

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | |

| | (1) | Title of each class of securities to which transaction applies: |

| | | |

| | | N/A |

| | | |

| | | |

| | (2) | Aggregate number of securities to which transactions applies: |

| | | |

| | | N/A |

| | | |

| | | |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | |

| | | N/A |

| | | |

| | | |

| | (4) | Proposed maximum aggregate value of transaction: |

| | | |

| | | N/A |

| | | |

| | | |

| | (5) | Total fee paid: |

| | | |

| | | N/A |

| |

One Chemung Canal Plaza

Elmira, New York 14901

April 1, 2014

Dear Fellow Shareholder:

You are invited to attend the Annual Meeting of Shareholders of Chemung Financial Corporation on Thursday, May 8, 2014 at the Holiday Inn Elmira – Riverview, located at 760 East Water Street, Elmira, New York.

The Annual Meeting will begin with a review of the matters to be voted upon by the shareholders, as described in the accompanying Notice of Annual Meeting of Shareholders and related Proxy Statement. In addition to the formal business matters upon which shareholder action is required, we will report to you on the condition of your Company, what we accomplished in 2013, and our plans for the future.

Your vote is important. We want to be sure that your shares are represented and that your vote is properly accounted for and, whether or not you plan to attend the Annual Meeting, we request that you vote your shares. You may vote your shares by telephone, by the Internet or by returning the enclosed proxy card, as further explained in the Proxy Statement. Please see the attached Notice of Annual Meeting of Shareholders and accompanying Proxy Statement for additional information regarding how to vote your shares.

We also encourage you to review the following Proxy Statement for a better understanding of the Company, its compensation practices and corporate governance structure, as well as a summary of the matters that will be voted on this year. We have attempted to present the information contained in the Proxy Statement in a straightforward and easily understood manner. However, much of the information presented is required by law to be included in a certain format. We appreciate your taking the time to read our Proxy Statement and hope that we have addressed the issues that interest you, our shareholders. Thank you for your support and investment in Chemung Financial Corporation.

Sincerely,

Ronald M. Bentley

President & CEO

[This page intentionally left blank]

CHEMUNG FINANCIAL CORPORATION

One Chemung Canal Plaza

Elmira, New York 14901

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To Our Shareholders:

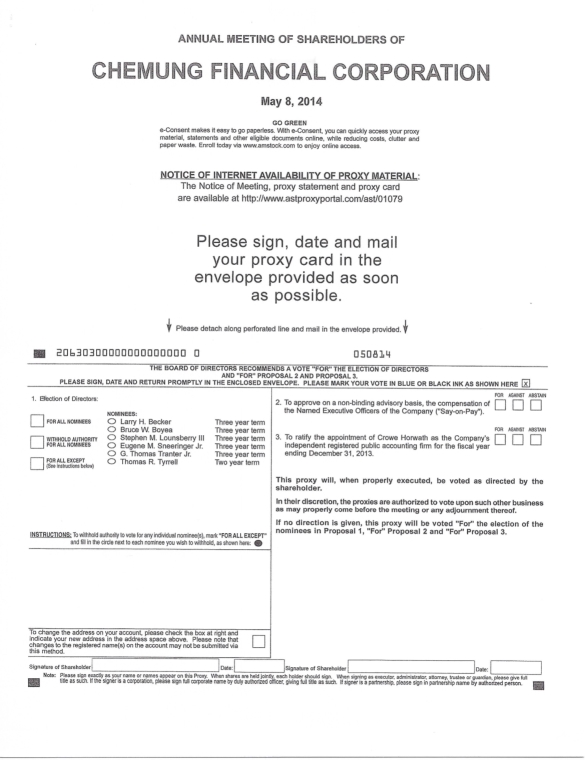

NOTICE IS HEREBY GIVEN that the 2014 Annual Meeting of the Shareholders of Chemung Financial Corporation (“the Annual Meeting”) will be held at the Holiday Inn Elmira – Riverview, 760 East Water Street, Elmira, New York, on Thursday, May 8, 2014 at 2:00 p.m., for the following purposes:

| 1. | Election of Directors [Proposal 1]: |

| a. | The election of five directors for a term of three years expiring in 2017; |

| b. | The election of one director for a term of two years expiring in 2016; |

| 2. | To approve on a non-binding advisory basis, the compensation of the Named Executive Officers of the Company (“Say-On-Pay”) [Proposal 2]; |

| 3. | Ratification of the appointment of Crowe Horwath LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2014 [Proposal 3]; and |

to consider and transact such other business as may properly come before the Annual Meeting or any adjournment thereof. At the present time, the Board of Directors knows of no other business to come before the Annual Meeting.

Whether or not you plan to attend the Annual Meeting, it is important that your shares are represented at the Annual Meeting. Please vote by completing, signing and mailing the enclosed proxy card in the postage-paid envelope provided, or vote by telephone or via the Internet following the instructions on the proxy card. If you do attend the Annual Meeting, you may revoke your proxy and vote your shares in person.

The close of business on March 10, 2014 has been fixed as the record date for the determination of the shareholders entitled to notice of and to vote at the Annual Meeting.

By Order of the Board of Directors

Kathleen S. McKillip

Secretary

April 1, 2014

Elmira, New York

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Shareholders to be held on May 8, 2014: The Company’s 2013 Annual Report to Shareholders on Form 10-K, an abbreviated report for the twelve-month period, and the form of Proxy for the Annual Meeting accompany this Proxy Statement. The 2014 Proxy Statement and Annual Report to Shareholders for the year ended December 31, 2013 are available at http://www.astproxyportal.com/ast/01079.

TABLE OF CONTENTS

Information Regarding The Board Of Directors | 2 5 7 9 13 13 17 17 17 18 19 28 29 30 31 31 31 |

CHEMUNG FINANCIAL CORPORATION

PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS

MAY 8, 2014

Information Regarding The Annual Meeting

Time and Place of the Meeting

This Proxy Statement is provided in connection with the solicitation of proxies by the Board of Directors (the “Board”) for use at the Annual Meeting of Shareholders (the “Annual Meeting”) of Chemung Financial Corporation (“Chemung Financial” or “the Company”) to be held on Thursday, May 8, 2014 at 2:00 p.m., at the Holiday Inn Elmira – Riverview, 760 East Water Street, Elmira, New York.

This Proxy Statement and the accompanying Proxy and Notice of Annual Meeting of Shareholders are being mailed to shareholders on or about April 1, 2014. In the Proxy Statement, the “Bank” refers to Chemung Canal Trust Company, a subsidiary bank of Chemung Financial.

Shareholders Entitled to Vote

The record date for the Annual Meeting is March 10, 2014. Only shareholders of record at the close of business on that date are entitled to notice of and to vote at the Annual Meeting. On the record date there were 4,614,382 shares of common stock of the Company outstanding and entitled to vote. Each share of common stock is entitled to one vote on each matter that properly comes before the meeting.

Quorum

A quorum of shareholders is necessary to hold a valid meeting. A quorum will be present if shareholders holding at least a majority of the outstanding shares are present at the Annual Meeting in person or represented by proxy. In other words, the holders of 2,307,192 shares must be present in person or represented by proxy at the Annual Meeting to have a quorum. Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank or other nominee) or if you vote in person at the meeting. Abstentions and broker non-votes will be counted towards the quorum requirement. If there is no quorum, the holders of the majority of shares present at the Annual Meeting in person or represented by proxy may adjourn the Annual Meeting to another date.

Proxies and Voting Procedures

Shares represented by properly executed proxies will be voted as directed. If a proxy does not specify how it is to be voted, it will be voted as the Board recommends – that is, “FOR” the election of the five director nominees for a three-year term and the election of one director nominee for a two-year term as named in the Proxy Statement, “FOR” the approval of the advisory vote on the compensation of the Named Executive Officers (“NEOs”), which we refer to as the “Say-On-Pay” vote, and “FOR” the ratification of Crowe Horwath as our independent registered public accounting firm. A special rule for shares held in the name of a broker is described below. The Board knows of no other business to be brought before the Annual Meeting, but if any other matters are properly presented at the Annual Meeting for consideration, the persons named as proxies will have discretion to vote on those matters according to their best judgment.

We offer three alternative ways to vote your shares:

To Vote by Internet – If you hold Chemung Financial shares in your own name and not through a broker, bank or other agent, you can vote your shares electronically via the Internet at www.voteproxy.com by following the on-screen instructions. You should have your Proxy card available when you access the web page. If you vote via the Internet, you do not need to return your Proxy card. To Vote by Telephone – If you wish to vote by telephone, call toll-free 1-800-776-9437 and follow the instructions. Have your Proxy card available when you call. To Vote by Mail – To vote by mail, please sign, date and mail your Proxy card in the envelope provided as soon as possible. |

The deadline for the telephone and Internet voting is 11:59 p.m. Eastern Daylight Time on May 7, 2014.

Changing Your Vote

A shareholder may revoke a proxy vote at any time before it is voted by: (1) delivering written notice of revocation bearing a later date than the proxy to the Secretary of the Company; (2) submitting a later-dated proxy by mail, telephone or via the Internet; or (3) by voting in person at the Annual Meeting. Attendance at the Annual Meeting will not by itself constitute a revocation of a proxy. To revoke your proxy, you must complete and submit a ballot at the Annual Meeting or submit a later-dated proxy. |

Required Vote

There are no cumulative voting rights. Nominees for director will be elected by a plurality of votes cast at the Annual Meeting by holders of common stock present in person, or represented by proxy and entitled to vote on such election, meaning that the nominees for each directorship who receive the most votes will be elected. Only shares voted in favor of a nominee will be counted toward the achievement of a plurality. Both the advisory vote on the compensation of the NEOs (Say-On-Pay) (Proposals 2); and, the ratification of the appointment of Crowe Horwath LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2014 (Proposal 3) require the affirmative vote of a majority of the votes cast at the meeting. Abstentions will not count in the determination of the approval of any of the proposals. |

The Say-On-Pay vote (Proposal 2) is non-binding. The Say-On-Pay vote is being provided as required by Rule 14a-21(a) of the Securities Exchange Act (the “Exchange Act”.) The next advisory vote on Say-On-Pay will occur at the 2015 annual meeting of the shareholders. |

Beneficial Owner: Shares Registered in the Name of Broker or Other Agent

If your shares are registered in the name of your broker, bank or other agent, you should receive a proxy card and voting instructions from your holder of record that must be followed in order for the record holder to vote the shares in accordance with your instructions. You should complete and mail the proxy card to ensure that your vote is counted. Alternatively, you may vote by telephone or over the Internet as instructed by your broker, bank or other agent. If you hold shares through a brokerage firm, bank or other agent and wish to vote in person at the Annual Meeting, you must obtain a “legal” proxy from your broker, bank or other agent. |

If you choose not to provide instructions to your broker, bank or other agent, or do not obtain a “legal” proxy to vote at the Annual Meeting, your shares are referred to as “uninstructed shares.” Whether your broker, bank or other agent has the discretion to vote these shares on your behalf depends on the ballot item. The following table summarizes the votes required for passage of each proposal and the effect of abstentions and uninstructed shares held by brokers. Brokers may not vote uninstructed shares on your behalf in director elections. For your vote to be counted, you must submit your voting instruction to your broker. |

Vote Required and Board Recommendations

| Proposal | Item | Votes Required for Approval | Board of Directors Recommendation | Effect of Abstentions | Effect of Uninstructed Shares Held by Broker, Bank or Other Agent |

| Proposal No. 1 | Election of Directors | A plurality of votes cast by holders of shares of Common Stock entitled to vote | “FOR” all Director nominees | Not Voted | Not Voted |

| Proposal No. 2 | Approval, on a non-binding advisory basis, of the compensation of the NEOs, as disclosed in this Proxy Statement (Say-On-Pay) | An affirmative vote of a majority of all votes cast by the holders of Common Stock entitled to vote | “FOR” the non-binding advisory approval of the compensation of the NEOs, as disclosed in this Proxy Statement | Not Voted | Not Voted |

| Proposal No. 3 | Ratification of the appointment of the independent registered public accounting firm, Crowe Horwath LLP, as the Company’s indepen-dent auditor for the fiscal year ending December 31, 2014 | An affirmative vote of a majority of all votes cast by the holders of Common Stock entitled to vote | “FOR” the ratification of the appointment of the independent registered public accounting firm, Crowe Horwath LLP, as the Company’s independent auditor for the fiscal year ending December 31, 2014 | Not Voted | Discretionary Vote |

Solicitation of Proxies

The cost of soliciting proxies will be paid by the Company. In addition to solicitations by mail, some of the directors, officers or employees of the Company may conduct solicitations in person or by telephone or other appropriate means without remuneration. The Company may also request nominees, brokerage houses, custodians and fiduciaries to forward soliciting material to beneficial owners of stock and will reimburse such intermediaries for their reasonable expenses in forwarding proxy materials.

Election of Directors

The Board is divided into three classes of directors, as equal in number as possible, with one class to be elected each year for a term of three years. The Board is not aware that any nominee named in this Proxy Statement will be unable or unwilling to serve as a director.

Shareholders will be entitled to elect five directors for a three-year term expiring at the 2017 Annual Meeting and one director for a two-year term expiring at the 2016 Annual Meeting, or until their respective successors have been duly elected and qualified. Unless authority to vote for the nominees is withheld, the shares represented by the enclosed Proxy card, if properly executed and returned, will be voted FOR the election of the nominees. Should any nominee become unable to serve as a director, the persons named as proxies will vote for any alternative nominee, who may be nominated by the Board.

The biography of each of the nominees and continuing directors listed below contains information regarding the individual’s service as a director, business experience, and other director positions, if any, held currently or at any time during the last five years, and individual experience, qualifications, and skills that contribute to the Board’s effectiveness as a whole.

Nominees for Election, Term Expires 2017

Larry H. Becker, age 74, has served as a director since 2011. He is Chief Operating Officer of Windsor Development Group, Inc., a regional full service real estate development company that specializes in the development, acquisition and management of supermarket-anchored properties. He has held this position since 1983. Prior to founding Windsor Development, Mr. Becker was a founding member of Teal, Becker & Chiaramonte CPAs, an accounting firm in the New York State Capital Region. Qualifications to serve on the Board include forty years of experience owning and managing various business entities in the Capital Region of New York State, experience in corporate finance and accounting, and his experience serving on the Board of Directors of Capital Bank & Trust Company.

Bruce W. Boyea, age 62, has served as a director since 2011. He has served as Chairman, President and CEO of Security Mutual Life Insurance Company of New York, a life insurance company, since 1999. He is also Chairman of Security Administrators, Inc., a subsidiary of Security Mutual that provides pension administration services to small and medium-sized companies. Qualifications to serve on the Board include strategic planning skills, financial management experience, business management, sales and marketing expertise, corporate oversight and leadership skills, and over thirty years experience in the insurance industry.

Stephen M. Lounsberry III, age 60, has served as a director since 1995. He is President of Applied Technology Manufacturing, a manufacturer of machined industrial and railroad component parts, a position he has held since 1981. Qualifications to serve on the Board include experience in management, marketing, sales, operations, and strategic planning. He was also a commercial bank internal auditor and vice president of a community bank, through which he gained experience and knowledge of all aspects of banking.

Eugene M. Sneeringer Jr., age 59, has served as a director since 2011. He has been, since 1979, a Principal in the firm of Sneeringer Monahan Provost Redgrave Title Agency, Inc. He is a practicing attorney specializing in real estate law, commercial lending and title insurance. Qualifications to serve on the Board include over thirty years experience in commercial transactions, real estate and financial workouts, knowledge and expertise in the mortgage industry, especially related to the Capital Region of New York State, and his experience serving on the Board of Directors of Capital Bank & Trust Company.

G. Thomas Tranter Jr., age 59, was appointed as a director in February 2014. He has served as President of Corning Enterprises and Director of Government Affairs for Corning Incorporated, a diversified manufacturing company since 2004. From 2000 to May 2004 he served as Director of Government Affairs for Corning Incorporated. He formerly served twenty-six years in public administration and management, including serving as the elected Chemung County Executive for three 4-year terms. Qualifications to serve on the Board include leadership, business development and managerial skills together with extensive experience in government relations and community development.

Nominee for Election, Term Expires 2016

Thomas R. Tyrrell, age 63, was appointed as a director in February 2014. He has served as the Albany area Chairman of Arthur J. Gallagher & Co., a company specializing in providing contract surety and property and casualty insurance and risk management products and services to the construction industry with particular emphasis on the heavy highway, bridge and general building construction disciplines. Qualifications to serve on the Board include business management skills, sales experience, business ownership experience and service on several Boards in the Albany area in the non-profit arena.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” EACH OF THE ABOVE NOMINEES

Continuing Directors, Term Expires 2016

Ronald M. Bentley, age 61, has served as a director since March 2007. He has served as the President and Chief Executive Officer (“CEO”) of the Company since March 2007 and previously as President and Chief Operating Officer of the Bank from July 2006 to April 2007. He was formerly the President of Retail Banking at NBT Bancorp Inc. from 2005 to 2006 and Executive Vice President of Retail Banking and Regional President at NBT Bancorp Inc. from 2003 to 2005. Qualifications to serve on the Board include thirty-five years of experience in the banking industry, and leadership, management, strategic planning and organizational skills.

Robert H. Dalrymple, age 63, has served as a director since 1995. Since 1994, he has been Secretary and Vice President of Dalrymple Holding Corporation, the parent company for several construction materials and highway construction companies. Mr. Dalrymple is the brother of David J. Dalrymple, also a director of the Company. Qualifications to serve on the Board include experience in all aspects of business ownership, strategic planning skills and financial management experience.

Clover M. Drinkwater, age 67, has served as a director since January 2005. She has been a Partner in the law firm of Sayles & Evans since 1986. Qualifications to serve on the Board include strong leadership skills, expertise in tax and legal matters and thirty years of legal experience in trust and estate administration.

Richard W. Swan, age 65, has served as a director since 1984. He has served as Chairman of the Board of Swan & Sons-Morss Co., Inc., an insurance brokerage agency, since 2007 and was formerly President of Swan & Sons-Morss Co., Inc. from 1983 until 2007. Qualifications to serve on the Board include business management skills, sales experience and all aspects of business ownership.

Continuing Directors, Term Expires 2015

David J. Dalrymple, age 60, has served as a director since 1993, and is currently Chairman of the respective Boards of the Company and the Bank. He has held the position of President of Dalrymple Holding Corporation, the parent company for several construction materials and highway construction companies, since 1993. Mr. Dalrymple is the brother of Robert H. Dalrymple, also a director of the Company. Qualifications to serve on the Board include over three decades of experience in business ownership, financial planning experience, and strong managerial and organizational skills.

William D. Eggers, age 69, has served as a director since 2002. He has been Senior Counsel with the law firm of Nixon Peabody LLP since 2007 and prior thereto served as Senior Vice President and General Counsel of Corning Incorporated, a diversified manufacturing company, from 1997 until 2007. Qualifications to serve on the Board include nine years of experience as legal counsel to a Fortune 500 public company, including experience as counsel to audit and finance committees, and service for five years on the company’s risk management council.

John F. Potter, age 68, has served as a director since 1991. He has been President of Seneca Beverage Corporation, a wholesale distributor of beer and water products since 1968. Qualifications to serve on the Board include experience in all aspects of business ownership, business planning, entrepreneurial experience, management experience, sales and marketing, and customer relations skills.

Robert L. Storch, age 70, has served as a director since 2009. He owned and managed a dairy farm that included breeding and merchandising purebred cattle for both domestic and international markets from 1966 until 2004. He served as a board member and officer of several agricultural organizations that dealt with land management and dairy product marketing. He also served for sixteen years as a board member of the Bank of Canton. Qualifications to serve on the Board include experience in business management, business planning, sales and marketing.

Jan P. Updegraff, age 71, has served as a director since 1996. He retired from the Bank on December 31, 2007. He was President and Chief Executive Officer of the Company and the Bank from 1998 to 2006 and Vice Chairman of the Board from 2006 to 2007. Qualifications to serve on the Board include over three decades of experience in the banking industry, leadership skills, and experience in corporate finance, customer relations and corporate oversight skills.

Stock Ownership of Significant Shareholders, Directors and Executive Officers

The following table provides information regarding the ownership of the outstanding common stock of Chemung Financial as of March 10, 2014, the record date for the Annual Meeting. Information is included for: 1) owners of more than 5% of common stock (other than directors or officers); 2) directors, nominees for directors and NEOs; and 3) executive officers and directors as a group. Unless otherwise indicated, each of the beneficial owners named below has sole voting and investment authority with respect to the shares listed.

Five Percent Shareholders:

Name of Beneficial Owner | Number of Shares Beneficially Owned | 1 | Percentage of Shares Beneficially Owned |

| More than 5% Owner: | | | |

Chemung Canal Trust Company Elmira, NY 14901 | 411,437 | 2 | 8.92% |

| | | | |

| Other Beneficial Owner: | | | |

Chemung Canal Trust Company Profit-Sharing, Savings and Investment Plan | 169,549 | 3 | 3.67% |

Directors, Nominees and Named Executive Officers: |

| Larry Becker | 35,283 | 4 | * |

| Ronald M. Bentley | 34,347 | 15 | * |

| Bruce W. Boyea | 2,091 | 9 | * |

| David J. Dalrymple | 370,240 | 5, 7 | 8.02% |

| Robert H. Dalrymple | 276,942 | 6, 7 | 6.00% |

| Clover M. Drinkwater | 8,916 | | * |

| William D. Eggers | 10,825 | 8 | * |

| Stephen M. Lounsberry III | 13,434 | 9 | * |

| John F. Potter | 47,936 | 9, 10 | 1.04% |

| Eugene M. Sneeringer Jr. | 64,478 | 11 | 1.40% |

| Robert L. Storch | 2,787 | | * |

| Richard W. Swan | 86,186 | 12 | 1.87% |

| G. Thomas Tranter Jr. | 2,500 | 18 | * |

| Thomas R. Tyrrell | 0 | 19 | * |

| Jan P. Updegraff | 6,629 | 13 | * |

| John R. Battersby Jr. | 6,943 | 14, 15, 17 | * |

| Richard G. Carr | 7,274 | 15 | * |

| Karl F. Krebs | 798 | 15, 20 | * |

| Karen R. Makowski | 4,474 | 15 | * |

| Melinda A. Sartori | 7,825 | 15 | * |

| Mark A. Severson | 203 | 21 | * |

| Anders M. Tomson | 10,758 | 15 | * |

Directors and executive officers as a group (21 persons) | 1,000,870 | 16 | 21.69% |

| *Less than 1% based upon 4,614,382 outstanding as of March 10, 2014 |

| 1 | Under Rule 13d-3 of the Exchange Act, a person is considered a beneficial owner of a security if he/she has or shares voting power or investment power over the security or has the right to acquire beneficial ownership of the security within 60 days from the date of this filing. "Voting Power" is the power to vote or direct the voting of shares. "Investment Power" is the power to dispose or direct the disposition of shares. |

| 2 | Held by the Bank in various fiduciary capacities, either alone or with others. Includes 27,711 shares held with sole voting and dispositive powers and 411,437 shares held with shared voting power. There are 257,108 shares held with shared dispositive powers. Shares held in a co-fiduciary capacity by the Bank are voted by the co-fiduciary in the same manner as if the co-fiduciary were the sole fiduciary. Shares held by the Bank as sole trustee will be voted by the Bank only if the trust instrument provides for voting of the shares at the direction of the grantor or a beneficiary and the Bank actually receives voting instructions. |

| | 7 |

| 3 | The Plan participants instruct the Bank, as trustee, how to vote these shares. If a participant fails to instruct the voting of the shares, the Bank votes these shares in the same proportion as it votes all of the shares for which it receives voting instructions. Plan participants have dispositive power over these shares subject to certain restrictions. |

| 4 | Includes 11,651 shares held directly and 50% of the 47,265 shares held by Windsor Glens Falls Partnership LLC of which Mr. Becker is a general partner. |

| 5 | Includes 9,593 shares held directly; 21,350 shares held in trust over which Mr. Dalrymple has voting and dispositive powers; 318,642 shares held by the Dalrymple Family Limited Partnership of which David J. Dalrymple and his spouse are general partners; and 33 1/3% of the 41,058 shares held by Dalrymple Holding Corporation, of which David J. Dalrymple is an officer, director and principal shareholder. |

| 6 | Includes 242,661 shares held directly; 3,204 shares held in trust over which Mr. Dalrymple has voting and dispositive powers; and 33 1/3% of the 41,058 shares held by Dalrymple Holding Corporation of which Robert H. Dalrymple is an officer, director and principal shareholder. Includes 10,422 shares held by Mr. Dalrymple’s spouse as to which he disclaims beneficial ownership. |

| 7 | Includes for both David J. Dalrymple and Robert H. Dalrymple 6,983 shares which represent 46.2% of the 30,230 shares held by Susquehanna Supply Company, a corporation in which each of David J. Dalrymple and Robert H. Dalrymple has a 23.1% ownership interest. |

| 8 | Includes 4,647 shares held by Mr. Eggers’ spouse as Trustee FBO Mr. Eggers’ daughter as to which he disclaims beneficial ownership. |

| 9 | Excludes shares that Messrs. Boyea (847), Lounsberry (12,543) and Potter (27,145) have credited to their accounts in memorandum unit form under the Company’s Deferred Directors’ Fee Plan. The deferred fees held in memorandum unit form will be paid solely in shares of the Company’s common stock pursuant to the terms of the Plan and the election of the Plan participants. Shares held in memorandum unit form under the Plan have no voting rights. |

| 10 | Includes 7,672 shares held by Mr. Potter’s spouse, as to which he disclaims beneficial ownership. |

| 11 | Includes 9,492 shares owned by Mr. Sneeringer’s spouse as to which he disclaims beneficial ownership. |

| 12 | Includes 11,700 shares owned by Swan & Sons-Morss Co., Inc. of which Mr. Swan is a director, and 33,255 shares held in four trusts over which Mr. Swan has voting and dispositive power. Includes 4,316 shares held in trust for the benefit of Mr. Swan, as income beneficiary, and 4,474 shares held by Mr. Swan’s spouse as to which Mr. Swan disclaims beneficial ownership to both. |

| 13 | Includes 4,038 shares owned by Mr. Updegraff’s spouse, as to which he disclaims beneficial ownership. |

| 14 | Includes 2,457 shares owned by Mr. Battersby’s spouse, as to which he disclaims beneficial ownership. |

| 15 | Includes all shares of common stock of the Company held for the benefit of each executive officer by the Bank as trustee of the Bank’s Profit Sharing, Savings and Investment Plan. Messrs. Bentley, Battersby, Carr, Krebs, Tomson, Mrs. Makowski and Mrs. Sartori have an interest in 7,449, 0, 3,440, 48, 1,764, 1,459, and 4,723 shares, respectively. |

| 16 | Includes 43,202 shares owned by spouses of certain officers and directors of which such officers and directors disclaim beneficial ownership. |

| 17 | Mr. Battersby retired on December 31, 2012 and returned as Interim Executive Vice President, Chief Financial Officer and Treasurer from September 18, 2013 to October 15, 2013. |

| 18 | Mr. Tranter was appointed as a director in February 2014. |

| 19 | Mr. Tyrrell was appointed as a director in February 2014. |

| 20 | Mr. Krebs joined the Company on October 16, 2013 as Executive Vice President, CFO & Treasurer. |

| 21 | Mr. Severson left the Company on September 3, 2013. |

Information Regarding the Board

Board Organization and Operation

Chemung Financial is managed under the direction of its Board. All members of the Board also serve on the Board of the Bank. The Board establishes policies and strategies and regularly monitors the effectiveness of management in carrying out these policies and strategies. Members of the Board are kept informed of the Company’s business activities through discussions with key members of the management team, by reviewing materials provided to the Board and by participating in meetings of the Board and its committees. Currently, the Board has fifteen members.

The Company separates the roles of CEO and Chairman of the Board, which provides the appropriate balance between strategy development and independent oversight of management. The CEO is familiar with the Company’s business and industry and is responsible for identifying strategic priorities and leading the discussion and execution of strategy. The Chairman of the Board presides at all executive sessions of the Board, facilitating teamwork and communication between management and the Board, while providing guidance to the CEO. Mr. David J. Dalrymple served as Chairman of the Board in 2013.

The Company’s Governance Guidelines require that the Board consist of a majority of independent directors. Based upon a review of the responses of the directors to questions regarding affiliations, compensation history, employment, and relationships with family members and others, the Board determined that all directors except for Mr. Bentley meet the independence requirements of applicable laws and rules and NASDAQ listing requirements as determined by the Nominating and Governance Committee (the “Nominating Committee”). A copy of the Corporate Governance Guidelines can be viewed on the Bank's website at http://www.snl.com/irweblinkx/govdocs.aspx?iid=100690.

During 2013, the Board of the Company held twelve meetings. The Board of the Bank also held twelve meetings in 2013. Each director attended at least 75% of the total Board meetings and meetings of the Board committees on which he or she served.

Board Committees

The committees of the Company’s Board are the Executive, Audit and Risk Management, Compensation and Personnel, and Nominating Committee.

Executive Committee: This committee serves in a dual capacity as the Executive Committee for the Company and the Bank. The Executive Committee may, during the interval between Board meetings, exercise all of the authority of the Board, except those powers that are expressly reserved to the Board under law or the Company’s bylaws. In 2013, members of the Executive Committee included Messrs. D. Dalrymple (Chair), Bentley, R. Dalrymple, Swan, Updegraff and Ms. Drinkwater. There were three meetings of the Executive Committee in 2013.

Audit and Risk Management Committee: The responsibilities of the Audit and Risk Management Committee (the “Audit Committee”) include the appointment of independent auditors, the pre-approval of all audit and non-audit services performed by the Company’s independent auditors, the review of the adequacy of internal accounting and disclosure controls of the Company, and the oversight of risk management. All Audit Committee members are independent as defined by applicable laws and regulations. In 2013, members of the Committee included Messrs. Becker (Chair), Eggers, Potter, Sneeringer and Storch. Mr. Becker served as the Audit Committee’s “financial expert”, the Audit Committee having determined that Mr. Becker met all required qualifications within the meaning of pertinent regulations. There were five meetings of the Audit Committee in 2013. See the Audit Committee Report on page 29.

A copy of the Audit and Risk Management Committee Charter can be viewed on the Bank’s website at http://www.snl.com/irweblinkx/govdocs.aspx?iid=100690.

Compensation and Personnel Committee: The primary responsibilities of the Compensation and Personnel Committee (the “Compensation Committee”), as described in its Charter (amended July, 2013), are to exercise authority, in its sole discretion, to retain and terminate, or obtain the advice of, any adviser to be used to assist it in the performance of its duties, but only after taking into consideration factors relevant to the adviser’s independence from management as specified in NASDAQ Listing Rule 5605(d)(3), or any successor provision thereto; discharge the Board’s duties relating to the compensation of the executive officers, including recommending to the Board the compensation of the CEO; review the Bank’s compensation policies and programs affecting other employees; review management’s proposals for the election and promotion of officers and make recommendations to the Board; monitor compensation trends; and, select a peer group of companies against which to compare the Company’s compensation for the CEO, executive officers and chief auditor. The Compensation Committee met five times in 2013. The members of the Compensation Committee meet the independence requirements of applicable laws and rules as determined by the Board. In 2013, members of the Compensation Committee included Messrs. Lounsberry (Chair), D. Dalrymple, R. Dalrymple, Eggers, Sneeringer and Swan.

A copy of the Compensation and Personnel Committee Charter can be viewed on the Bank’s website at http://www.snl.com/irweblinkx/govdocs.aspx?iid=100690.

Nominating and Governance Committee: The Nominating Committee consists of Messrs. Eggers (Chair), D. Dalrymple, Lounsberry, Potter, Updegraff and Ms. Drinkwater. The Nominating Committee met five times in 2013. The members of the Nominating Committee meet the independent requirements of applicable laws and rules as determined by the Board. In general, the Committee oversees the Company’s corporate governance matters on behalf of the Board and is responsible for the identification and recommendation of individuals qualified to become members of the Board. The Committee’s functions include: (i) identifying, evaluating and recommending qualified director nominees; (ii) the consideration of shareholder nominees for election to the Board; (iii) reviewing the committee structure and making recommendations to the Board for committee membership; (iv) recommending corporate governance guidelines to the Board; and (v) overseeing a self-evaluation process for the Board and its committees.

The Committee reviews annually with the Board the composition of the Board as a whole and considers whether the Board reflects an appropriate balance of knowledge, experience, skills, expertise and diversity. Among other factors, the Committee looks for director nominees who know the communities and industries that the Company serves. The Committee utilizes the following process when identifying and evaluating the individuals that it recommends to the Board as director nominees.

| · | The Committee reviews the qualifications of each candidates who has been properly recommended or nominated by the shareholders, as well as those candidates who have been identified by management, individual members of the Board or, if the Committee determines, a search firm. |

| · | The Committee evaluates the performance and qualifications of individual members of the Board eligible for re-election at the annual meeting of shareholders. |

| · | The Committee considers the suitability of each candidate, including the current members of the Board, in light of the current needs of the Board. In evaluating the suitability of the candidates, the Committee considers many factors including character, judgment, independence, business expertise, experience, other commitments, and such other factors as the Committee determines are pertinent. Diversity of experience, skills, gender, race, ethnicity and age are factors, among others, considered in this process. |

| · | After such review and consideration, the Committee recommends that the Board select the slate of director nominees. |

| · | Shareholder recommendations for nominees to the Board must be directed in writing to the Corporate Secretary, One Chemung Canal Plaza, Elmira, New York 14901, and must include: (i) the name and address of the shareholder proposing a nominee for consideration; (ii) the number of shares owned by the notifying shareholder and the date the shares were acquired; (iii) any material interest of the notifying shareholder in the nomination and a statement in support of the nominee with references; (iv) the name, age, address and contact information for each proposed nominee; (v) the principal occupation or employment of each proposed nominee; (vi) the number of shares of the Company’s common stock that are owned by the nominee as of a record date; (vii) detailed information about any relationship or understanding between the proposing shareholder and the nominee; (viii) detailed information of any relationship between the nominee and the Company within the last three years; and, (ix) other information regarding the nominee as would be required to be included in the Proxy Statement pursuant to Regulation 14A under the Securities Exchange Act of 1934 (“Exchange Act”). |

Chemung Financial’s bylaws establish an advance notice procedure with regard to certain matters, including shareholder proposals and director nominations, which are properly brought before an annual meeting of shareholders. To be timely, a shareholder’s notice must be delivered to or mailed and received at the Company’s principal executive offices not less than 120 calendar days prior to the date Proxy Statements were mailed to shareholders in connection with the previous year’s annual meeting of shareholders. In the event that no annual meeting was held in the previous year or the date of the annual meeting has been changed by more than thirty (30) days from the date contemplated at the time of the previous year’s Proxy Statement, notice by the shareholder to be timely must be so received a reasonable time before the solicitation is made.

A copy of the Nominating and Governance Committee Charter can be viewed on the Bank’s website at http://www.snl.com/irweblinkx/govdocs.aspx?iid=100690.

Compensation of Directors

The Compensation Committee periodically reviews the compensation of the Board and makes recommendations to the full Board with respect to the type and amounts of compensation payable to the directors for service on the Board and Board committees.

Each non-employee director of the Company receives an annual retainer of $5,500. Each non-employee director receives a fee of $400 for each meeting of the Board and its committees attended and the chair of each committee receives $500 for each committee meeting attended. The Chairman of the Board receives an additional annual retainer of $2,750. One fee is paid for attendance at meetings that serve both the Company and the Bank. Mr. Bentley receives no cash compensation for his services as a director.

A Deferred Directors’ Fee Plan for non-employee directors provides that directors may elect to defer receipt of all or any part of their fees. Deferrals are either credited with interest compounded quarterly at the Applicable Federal Rate for short-term debt instruments or converted to units, which appreciate or depreciate, as would an actual share of the Company’s common stock purchased on the deferral date. Cash deferrals are paid into an interest bearing account and paid in cash. Units are paid in shares of common stock.

Pursuant to the provisions of the Chemung Financial Corporation Directors’ Compensation Plan, additional compensation is paid to each non-employee director in shares of the Company’s common stock in an amount equal to the total amount of cash fees earned by each director during the year, valued as of December 31, and paid in January. For his service as a director on the respective Boards of the Company and the Bank, Mr. Bentley is paid a director’s fee in shares of common stock in an amount equal in value to the average cash compensation awarded to non-employee directors who served as directors for twelve (12) months in the previous year.

Director Compensation Table

Directors | Fees Earned or Paid in Cash | Number of Shares Awarded (1) | Market Value of Shares (2) | Total |

| Larry Becker | $20,400 | 627 | $20,400 | $40,800 | |

| Ronald M. Bentley | - | 645 | $20,979 | $20,979 | |

| Bruce W. Boyea | $17,900 | 550 | $17,900 | $35,800 | |

| David J. Dalrymple | $27,650 | 850 | $27,650 | $55,300 | |

| Robert H. Dalrymple | $20,300 | 624 | $20,300 | $40,600 | |

| Clover M. Drinkwater | $18,300 | 563 | $18,300 | $36,600 | |

| William D. Eggers | $24,000 | 738 | $24,000 | $48,000 | |

| Stephen M. Lounsberry III | $23,200 | 713 | $23,200 | $46,400 | |

| John F. Potter | $22,500 | 692 | $22,500 | $45,000 | |

| Eugene M. Sneeringer Jr. | $20,000 | 615 | $20,000 | $40,000 | |

| Robert L. Storch | $17,500 | 538 | $17,500 | $35,000 | |

| Richard W. Swan | $20,300 | 624 | $20,300 | $40,600 | |

G. Thomas Tranter Jr.(3) | - | - | - | - | |

Thomas R. Tyrrell(3) | - | - | - | - | |

| Jan P. Updegraff | $19,700 | 606 | $19,700 | $39,400 | |

(1) The total number of shares awarded are determined by dividing the total amount of the annual retainer and fees by the grant price of the shares, as described in footnote (2) below. Any fractional shares are rounded up to the next whole share. (2) These amounts are based on the grant price of the share, which is determined as the average of the closing prices of a share of Company common stock as quoted on the NASDAQ Stock Market for each of the prior thirty trading days ending on 12/31/13. Pursuant to this formula, the rounded, per share market value is equal to $32.56. (3) Messrs. Tranter and Tyrrell were appointed as directors in February 2014. |

Communicating with the Board

Shareholders may communicate in writing with the Board or with individual directors by contacting the Company’s Corporate Secretary at Chemung Financial Corporation, One Chemung Canal Plaza, Elmira, New York 14901. The Corporate Secretary will relay the question or message to the specific director identified by the shareholder or, if no specific director is requested, to the CEO.

Directors Attendance at Annual Meetings

The Company does not have a formal policy regarding attendance by a member of the Board at the Company’s annual meeting. The Company will continue to encourage such attendance. In 2013, eleven directors attended the annual meeting of shareholders.

The Board’s Role in Risk Oversight

The Board has charged the Audit Committee with the oversight of risk management. In 2009, the Board created the position of Chief Risk Officer (CRO) reporting to the President and CEO and the Audit Committee. The CRO is responsible for developing and maintaining a comprehensive process for identifying, assessing, monitoring, and reporting key risks to the organization. The CRO ensures that risk limits are appropriate for the nature and complexity of the Bank’s business activities and are consistent with the risk parameters established by the Board. The CRO makes regular reports to the Board and Audit Committee regarding the status of risk management.

As it relates to the risks inherent in the Bank’s incentive compensation plans, Audit Committee meetings are held to determine if the Bank’s incentive compensation plans encourage excessive risk-taking. At the present time, the Audit Committee and the Board do not believe these plans create risks that are reasonably likely to have a material adverse effect on the Company due to the existence of internal controls and the fact that the incentive payments comprise a moderate portion of employees’ total compensation. See the “Compensation Discussion and Analysis” section for more information about the Bank’s incentive compensation plans.

Approval, on a Non-Binding Advisory Basis, of the Compensation

of the Named Executive Officers

The Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (the “Dodd-Frank Act”) added Section 14A to the Exchange Act, which requires the Company to provide our shareholders an opportunity to vote to approve, on a non-binding advisory basis, the compensation of our NEOs (Say-On-Pay), as disclosed in this Proxy Statement in accordance with the compensation disclosure rules of the Securities and Exchange Commission (“SEC”). As described in greater detail under the heading “Compensation Discussion and Analysis”, the Company seeks to align the interests of our NEOs with the interests of the shareholders.

This vote is advisory, which means that the vote on executive compensation is not binding on the Company, our Board or the Compensation Committee of the Board. The vote on the resolution is not intended to address any specific element of compensation, but rather relates to the overall compensation of the Company’s NEOs, as described in this Proxy Statement in accordance with the compensation disclosure rules of the SEC. At the 2013 annual meeting, shareholders voted to approve the compensation program of the Company’s NEOs for the fiscal year ended December 31, 2012. The Company asks that shareholders again vote to approve the Company’s compensation program for its NEOs as described in this Proxy Statement.

The compensation of the Company’s NEOs is disclosed in the Compensation Discussion and Analysis, the summary compensation table and the other related tables and narrative disclosures contained elsewhere in this Proxy Statement. As discussed in those disclosures, the Board believes that our executive compensation philosophy, policies, and procedures provide a strong link between each NEOs’ compensation and our short and long-term performance. The objective of our executive compensation program is to provide compensation which is competitive based on our performance and aligned with the long-term interest of our shareholders.

The Company asks shareholders to indicate their support of our NEOs’ compensation as described in this Proxy Statement. This proposal will be presented at the Annual Meeting as a resolution in substantially the following form:

“RESOLVED, that the Company’s shareholders approve, on a non-binding advisory basis, the compensation of the Company’s NEOs, as disclosed in the Company’s Proxy Statement for the 2014 Annual Meeting of Shareholders pursuant to the compensation disclosure rules of the SEC, including the Compensation Discussion and Analysis, the Summary Compensation Table and narrative discussion, and other related tables and disclosure.”

THE BOARD UNANIMOUSLY RECOMMENDS A VOTE, ON A NON-BINDING ADVISORY BASIS, “FOR” THE APPROVAL OF THE COMPENSATION OF OUR NEOS, AS DISCLOSED IN THIS PROXY STATEMENT

Compensation Discussion and Analysis

Compensation Committee

The Compensation Committee, currently consisting of Directors Lounsberry (Chair), D. Dalrymple, R. Dalrymple, Eggers, Sneeringer and Swan, met five times in 2013. The members of the Committee meet the independence requirements of applicable laws and rules as determined by the Board.

Compensation Philosophy and Objectives

As discussed previously, the Compensation Committee reviews and administers the Company’s compensation policies and practices for the NEOs. The NEOs named in the Summary Compensation Table are: Ronald M. Bentley, President and CEO; Karl F. Krebs, Executive Vice President, Chief Financial Officer and Treasurer, who joined the Company on October 16, 2013; Mark A. Severson, Executive Vice President, Chief Financial Officer and Treasurer for the period May 16, 2012 to September 3, 2013; and, John R. Battersby Jr., Interim Executive Vice President and Chief Financial Officer for the period September 18, 2013 to October 15, 2013. The other NEOs are: Bank executive officers Richard G. Carr, Karen R. Makowski, Melinda A. Sartori and Anders M. Tomson.

The Company’s compensation philosophy is designed to attract, motivate and retain highly qualified financial services professionals capable of maximizing business performance for the benefit of shareholders. The Compensation Committee believes in a simple, straightforward approach to executive compensation and therefore, has limited the number and types of plans used to compensate NEOs, as discussed below in the Elements of Compensation subsection.

The Bank’s compensation plans are designed to reward NEOs for satisfying both Company and individual performance goals. In 2013, compensation components of NEO compensation consisted of: 1) base salary; 2) short and long-term performance-based incentives; and 3) retirement and other benefits. The Compensation Committee reviews quantitative and qualitative/subjective measures before applying its judgment to determine appropriate compensation for its NEOs. As a result, incentive plan pay is not tied directly to any specific set of metrics. As such, the Compensation Committee has not established rigid formulas for the allocation between cash and non-cash components, the allocation of short-term and long-term equity incentive compensation, or the percentage in which other NEOs’ compensation opportunity should be in relation to the CEO’s compensation. In 2013, the relationship between the NEOs’ total compensation (base salary plus cash and stock-based incentive compensation) and the Company’s financial results demonstrates the alignment the Company has established between pay and business performance. At the annual meeting of shareholders in 2013, shareholders approved NEO compensation as in effect in fiscal year ended December 31, 2012. The Compensation Committee considered the shareholders’ positive vote in determining NEO compensation in 2013.

Setting Executive Compensation

The Compensation Committee analyzes and uses compensation data provided by a peer group comprised of Northeast banks with assets between $1.2 - $4.8 billion. The Compensation Committee believes that the total compensation paid to the NEOs in 2013 approximates the average total compensation for similar positions at the peer banks. The following is the peer group used in the 2013: Alliance, Arrow, Byrn Mawr Bank Corp., Canandaigua National, Citizens & Northern, CNB Financial, Enterprise Bancorp Inc., Essa Bancorp. Inc., Financial Institutions, Merchant Bancshares, Orrstown Financial, Tompkins Financial, United Financial Bancorp and Westfield Financial.

The Company does not target any specific element of compensation to compare to amounts paid by the peer group with respect to that element. Rather, the Company uses the peer bank data to inform it of the pay levels and practices of the Company’s peers as they most closely represent the labor market in which the Company competes for key talent. Informed by this data, the Compensation Committee’s goal is to provide a competitive level of total compensation targeted at the average level of comparably-sized financial institutions. In 2013, the total compensation for the NEOs approximates the average of the participating banks.

Elements of Compensation

In 2013, the Company’s mix of base salary and incentive compensation places the variable pay received by NEOs, other than the CEO, at approximately 35% of the NEOs’ base salary. The CEO’s incentive pay, comprised of cash and unrestricted stock, represented approximately 65% of his base pay. Awards under the incentive plans are based on the Compensation Committee’s independent business judgment after evaluating the performance of each executive officer against pre-established Company and individual goals. The Compensation Committee regularly reviews these elements of compensation in order to ensure that, as a whole, they conform to the Company’s philosophy and objectives.

Base Salary: Base salary paid to executives is reviewed against market on an annual basis. Base salary levels reflect the Compensation Committee’s perceived value of the position, both in the context of the market data for similar positions, as well as the individual fulfilling the duties of the position. Mr. Bentley reviews the base salaries of the other NEOs with the Compensation Committee and a recommendation for approval is submitted to the full Board. The recommendations are based upon an evaluation process, which includes professional and leadership performance as well as the attainment of goals set forth in the Company’s annual business plan.

The Compensation Committee reviewed the relevant market data and considered individual performance of each NEO in 2012, and determined that the base salaries should be increased in January 2013 as follows: Mr. Carr $3,000; Mr. Severson $4,000; Mr. Tomson $4,326; Mrs. Makowski $3,500; and, Mrs. Sartori $3,170. The actual base salaries for 2013 are reported in the Summary Compensation Table on page 19. Similarly in December 2013, the Compensation Committee reviewed the NEOs’ base salaries utilizing the same methodology (relevant market data and individual performance) and increased the base salaries as follows: Mr. Carr $15,300; Mrs. Makowski $5,355; Mrs. Sartori $4,845; and, Mr. Tomson $6,619. Since Mr. Krebs joined the Company on October 16, 2013, no adjustment was made to his base pay.

The Compensation Committee conducts an annual performance review of the CEO. The CEO’s performance objectives are defined consistent with, and in support of, the Company’s annual business plan. Performance is also measured against progress towards the attainment of the Company’s long-term strategic plan. These goals include, but are not limited to, metrics related to net income, return on equity, efficiency, asset quality, bank performance against a peer group and progress in achieving long-term strategic objectives. The peer group consists of publicly traded banks in the Northeast, New York and Pennsylvania with total assets between $1 to $3 billion. In 2013 the following banks were included in the peer group: ACNB Corporation, Arrow Financial Corporation, Bar Harbor Bankshares, Bridge Bancorp, Inc., Bryn Mawr Bank Corporation, Cambridge Bancorp, Camden National Corporation, Canandaigua National Corporation, Citizens & Northern Corporation, CNB Financial Corporation, Codorus Valley Bancorp, Inc., Customers Bancorp, Inc., Enterprise Bancorp, Inc., Financial Institutions, Inc., First Bancorp, Inc., First of Long Island Corporation, Franklin Financial Services Corporation, Hudson Valley Holding Corp., Intervest Bancshares Corporation, Merchants Bancshares, Inc., Metro Bancorp, Inc. Orrstown Financial Services, Inc., Sterling Bancorp, Suffolk Bancorp and Univest Corporation of Pennsylvania.

The Compensation Committee conducts an annual performance review of the CEO. The CEO’s performance objectives are defined consistent with, and in support of, the Company’s annual business plan. Performance is also measured against progress towards the attainment of the Company’s long-term strategic plan. These goals include, but are not limited to, metrics related to net income, return on equity, efficiency, asset quality, bank performance against a peer group and progress in achieving long-term strategic objectives.

In January 2014, the Compensation Committee determined that Mr. Bentley achieved his 2013 goals and he received a base salary increase of $11,900. Based on a similar assessment of the CEO’s performance in 2012, the Compensation Committee increased Mr. Bentley’s base salary by $8,100 in 2013. The total base salary earned by Mr. Bentley in 2013 is reported in the Summary Compensation Table on page 19.

Short and Long-Term Performance-Based Incentive Compensation: The Company has created incentive compensation plans to motivate and reward senior officers (including the NEOs) for achieving predefined goals. The Compensation Committee and the Board do not subscribe to formula-driven incentive plans, but believe in maintaining discretion over the payment of incentive compensation. This discretion permits the Compensation Committee to make compensation decisions in the best interests of the Company and shareholders when events beyond the control of management positively or negatively influence financial results. In such circumstances, the Compensation Committee may reduce or increase incentive payments but in no event may the payments be materially greater than the levels described below. Each executive officer’s incentive award opportunity is not limited to a specified percentage of the incentive pool.

The Compensation Committee and the Board do not believe these incentive plans are reasonably likely to have a material adverse effect on the Company. These plans are believed to be of low risk as they provide for payments that comprise a moderate percentage of total compensation and, therefore, do not encourage excessive risk taking. Furthermore, the Company has decided to limit equity incentive awards to restricted stock grants, thereby reducing any motivation to take unnecessary or excessive risk to increase Company stock price, as may be the case with stock options. Additionally, restricted stock awards are not tied to formulas that could focus NEOs on only short-term results. Finally, these programs generally conform to sound incentive compensation policies as prescribed by the Federal Reserve Board.

The Compensation Committee employs cash and restricted stock awards to recognize significant efforts or individual contributions of senior officers, including the NEOs. In determining these awards, many factors are considered including, but not limited to, the Company’s net earnings vs. original plan, the financial results delivered by the senior officer’s division against goal, service quality results vs. goal, individual success in implementing business plan initiatives, and other contributions made by the senior officer to the Company’s success. The senior officers eligible for an award, the criteria used to determine individual awards, and actual awards are reviewed with the Compensation Committee. There is no expectation that these awards will be paid each year. In 2013, the Company established a cash bonus pool representing 20% of the aggregate base salaries of participants and a restricted stock pool representing 15% of the aggregate base salaries of participants. In 2013, the cash awards were $330,000 and the value of the restricted stock awards were $260,000, for a total of $590,000 representing approximately 35% of the aggregate base salaries of plan participants. As previously stated, these two components of incentive compensation for NEOs (other than the CEO) represent approximately 35% of the NEO’s base salary.

The following paragraphs provide a further description of these plans.

Amended and Restated Restricted Stock Plan (the “Restricted Stock Plan”): In 2010, the Board approved a Restricted Stock Plan for officers of the Company, excluding the CEO. The Board may make discretionary grants of restricted shares of the Company’s common stock to officers selected to participate in the Plan. The Board believes that these awards: 1) align the interests of the Company’s executives and senior managers with the interests of the Company and its shareholders; 2) ensure that the Company’s compensation practices are competitive and comparable with its peers; and 3) promote retention of select management level employees. The awards are based on the performance, responsibility and contributions of the NEOs and other senior officers. Mr. Bentley recommends the number of shares to be awarded to senior officers, including the NEOs, which is subject to the approval of the Compensation Committee and the Board. The awards may not exceed 15,000 shares per year in the aggregate. Thirteen senior officers including Madams Makowski and Sartori and Messrs. Carr and Tomson were awarded restricted stock in 2013. These shares vest over a five-year period, lapse with termination of employment, with or without cause, and vest immediately in case of death, disability or a change of control.

Chemung Financial Corporation Incentive Compensation Plan (the “Incentive Compensation Plan”): The Incentive Compensation Plan provides for the grant of unrestricted stock and/or cash awards to select officers and key employees designated annually in the sole discretion of the Board as a reward for attainment of annual and long-term performance goals. The maximum number of shares that can be awarded as unrestricted stock is ten thousand (10,000) per calendar year. The maximum cash bonus is $300,000 per calendar year. In 2014, the Compensation Committee recommended, and the Board approved, granting an Incentive Plan award of $245,572 to the CEO. The award was based on Mr. Bentley’s 2013 performance measured against his pre-determined individual and Company goals and other qualitative information considered by the Compensation Committee and the Board. The award was paid in January 2014: $128,550 in cash and $117,021 in Company stock, which amounted to 3,595 shares. Mr. Bentley was the only executive approved by the Board to participate in the Plan in 2013.

Retirement and Other Benefits: The Company provides retirement benefits through a combination of the Chemung Canal Trust Company Pension Plan (the “Pension Plan”) and the Chemung Canal Trust Company 401(k) Profit Sharing, Savings and Investment Plan (the “401(k) Plan”). The Company instituted a “soft freeze” of the Pension Plan after June 30, 2010. Employees hired after June 30, 2010 are not eligible to participate. All NEOs, except Mrs. Makowski and Messrs. Krebs and Tomson, participate in the Pension Plan. The Pension Plan is funded solely through Company contributions and the benefits are determined based upon years of service and a calculation of final average compensation, which is further described on page 24.

The Company’s 401(k) Plan allows employees to contribute up to 70% of base pay on a pre-tax basis up to the statutory limits. Because Mrs. Makowski and Messrs. Krebs and Tomson do not participate in the Pension Plan, they receive a 4% non-discretionary contribution to the 401(k) Plan subject to limitations imposed by the Internal Revenue Code of 1986, as amended (the “Code”), and applicable regulations. Company contributions to the 401(k) Plan for employees hired prior to July 30, 2010 are discretionary in accordance with the business plan approved by the Board each year.

In June 2012, the Compensation Committee adopted a Defined Contribution Supplemental Executive Retirement Plan (the “Defined Contribution SERP”) to attract and retain high-quality talent. The Defined Contribution SERP is intended to provide a retirement benefit comparable to that received by other executive officers participating in the Bank’s Pension Plan. Because Mrs. Makowski and Messrs. Krebs and Tomson do not participate in the Pension Plan, they are credited with an annual Company contribution in an amount equal to 20% of their base salary until the earlier of: (i) their termination of employment for any reason; or (ii) the discontinuation of their participation in the Defined Contribution SERP. The Company may discontinue future contributions to any participant at any time. Benefits are payable upon retirement, disability, death or a change in control. The annual Company contribution is credited as of the last day of the applicable plan year, provided that the participant is actively employed on that date. Based on a review of CEO compensation and retirement plan data of peer banks, the Board has approved Mr. Bentley’s participation in the Defined Contribution SERP. The Company also maintains the Chemung Canal Trust Company Executive Supplemental Pension Plan (the “Pension Plan SERP”), described more fully on page 24, to provide eligible executives pension benefits that are not payable under the Pension Plan because of limitations imposed by the Code.

The NEOs are eligible for the same benefits available to all other employees of the Company including life and health insurance, vacations, holidays, and personal and sick leave.

The Company maintains the Chemung Canal Trust Company Deferred Compensation Plan (the “Deferred Compensation Plan”) that allows the NEOs, and other senior officers that the Compensation Committee may approve annually, to defer amounts up to all of their compensation to a future date. Although all of the NEOs are eligible to participate, Messrs. Carr and Krebs and Madams Makowski and Sartori are the only NEOs who participate in this plan. The Deferred Compensation Plan is described more fully on page 24.

The NEOs are granted perquisites, which the Compensation Committee believes are modest, reasonable and similar to those provided to executive officers at peer financial institutions, and are designed to assist the executives in carrying out their duties. Club memberships are provided to the NEOs to enable them to interact and foster relationships with clients and local business people. Mr. Bentley has the use of a Company-owned vehicle for business purposes. His personal use of the vehicle is subject to tax. Madams Makowski and Sartori and Messrs. Carr, Krebs and Severson each received a car allowance during 2013 which is taxed as additional compensation in accordance with IRS regulations.

The Company entered into a Severance Agreement and a Change of Control Agreement with Mr. Bentley upon his joining the Company in 2006. Under the Severance Agreement, if Mr. Bentley’s employment is terminated without cause or for good reason by him, he would receive his base salary for one year and would remain covered under the Company’s employee benefit programs for one year. Under the Change of Control Agreement, Mr. Bentley would receive a range of different payments depending on the circumstances, which are further described on page 27.

The Company has entered into Change in Control Agreements with Messrs. Carr, Krebs and Tomson and Madams Sartori and Makowski. The purpose of the agreements is to retain and secure key employees and encourage their continued attention and dedication to their assigned duties. In the event of his/her termination following a change in control, the executive would receive a severance benefit equal to two times his/her highest annual compensation, including salary and bonuses, paid by the Bank to the Executive for any of the two calendar years ending with the year in which Executive’s employment terminated. Under the terms of the Restricted Stock Plan, if there is a change in control, all stock awards would automatically vest and all restrictions would lapse.

Compensation and Personnel Committee Report

The Compensation Committee has reviewed and discussed the foregoing Compensation Discussion and Analysis with management and, based on its review and discussion, recommended to the Board that the Compensation Discussion and Analysis be included in this Proxy Statement.

The Compensation and Personnel Committee:

| Stephen M. Lounsberry III, Chairman | William D. Eggers |

| David J. Dalrymple | Eugene M. Sneeringer Jr. |

| Robert H. Dalrymple | Richard W. Swan |

Tax and Accounting Matters

Section 162(m). Section 162(m) of the Code generally disallows a tax deduction to the Company for compensation in excess of one million dollars paid to the Company’s CEO, and to the next four highest paid officers of the Company, unless the compensation qualifies as “performance-based compensation” or falls under certain other specified exceptions under Section 162(m). Generally, to qualify as performance-based compensation, the plan or arrangement must contain specific performance criteria, specific limits on awards and amounts and must have shareholder approval.

Section 409A. Section 409A of the Code generally provides that unless certain requirements are met, amounts deferred under a nonqualified deferred compensation plan are currently includible in an employee’s gross income to the extent not subject to a substantial risk of forfeiture. Section 409A applies to most forms of deferred compensation, including but not limited to, nonqualified deferred compensation plans or arrangements, certain equity based performance awards, and severance plans or individual severance arrangements contained within employment agreements. Generally, under Section 409A, any severance arrangement not in compliance with Section 409A covering a NEO pursuant to an employment or change in control agreement which is effective upon termination of employment and any deferrals under a nonqualified deferred compensation plan that do not comply with Section 409A may subject the NEO to: (i) current income inclusion of the relevant amounts; (ii) interest at the IRS underpayment rate; and (iii) an additional 20% excise tax. The Company believes it is operating in compliance with the statutory and regulatory provisions currently in effect.

Sections 4999 and 280G. Section 4999 of the Code imposes a 20% excise tax on certain “excess parachute payments” made to “disqualified individuals.” Under Section 280G of the Code, such excess parachute payments are also nondeductible to the Company. If payments that are contingent on a change of control to a disqualified individual (which terms include the NEOs) exceed 2.99 times the individual’s “base amount,” they constitute “excess parachute payments” to the extent they exceed one times the individual’s base amount.

Pursuant to the change in control agreement with Mr. Bentley, the Company will make an indemnification payment to him in the event an excise tax is imposed on “excessive parachute payments” paid to him pursuant to his change in control agreement. Neither the Company nor the Bank is permitted to claim a federal income tax deduction for the portion of the change in control payment that constitutes an “excess parachute payment” or the indemnification payment.

Accounting Considerations. The Audit Committee is informed of the financial statement implications of the components of the compensation program for NEOs.

Compensation Committee Interlocks and Insider Participation

None of the members of the Compensation Committee was an officer or an employee of the Company or any of its subsidiaries during 2013 or any prior period. None of the Company’s executive officers has served as a member of a compensation committee or board of directors of any entity that has an executive officer serving as a member of the Company’s Board or Compensation Committee.

The following sets forth certain information regarding the NEOs and other executive officers of the Company and the Bank.

| Name | Age | Position |

| | | |

| Ronald M. Bentley | 61 | President and Chief Executive Officer of the Company and the Bank (2007); Chief Operating Officer of the Bank (2006); President, Retail Banking at NBT Bancorp, Inc. (2005); Executive Vice President, Retail Banking and Regional President at NBT Bancorp, Inc. (2003). Mr. Bentley has been with the Company since 2006. |

| Karl F. Krebs | 57 | Chief Financial Officer, Treasurer of the Company and Executive Vice President, Chief Financial Officer and Treasurer of the Bank (commencing October 16, 2013); Executive Vice President and Chief Financial Officer of Financial Institutions (2009); Senior Financial Specialist at West Valley Environmental Services, LLC, an environmental remediation services firm, prior to joining Financial Institutions in 2009. President of Robar General Funding Corp., a mortgage and construction loan broker, from 2006 to 2008; Senior Vice President and Line-of-Business Finance Director at Five Star Bank from 2005 to 2006. |

| Mark A. Severson | 60 | Chief Financial Officer and Treasurer of the Company and Executive Vice President, Chief Financial Officer and Treasurer of the Bank (2012); Executive Vice President and Treasurer of FNB United Corp., North Carolina (2007-2011); Chief Financial Officer of Camco Financial Corporation, Ohio (2001-2007); Chief Financial Officer of FCNB Corp., Maryland (1990-2001). Mr. Severson joined the Company in May 2012 and terminated employment on September 3, 2013. |

| John R. Battersby, Jr. | 63 | Chief Financial Officer, Treasurer and Executive Vice President of the Bank (2012); Chief Financial Officer and Treasurer of the Company (2003); Executive Vice President, Chief Financial Officer and Treasurer of the Bank (2004). Mr. Battersby had been with the Company since 1988 and retired as of December 31, 2012. Mr. Battersby returned as Interim Executive Vice President and Chief Financial Officer from September 18, 2013 to October 15, 2013. |

| Richard G. Carr | 60 | Executive Vice President of the Bank (2011) responsible for Business Client Services; Senior Vice President of the Bank (2004). Mr. Carr has been with the Company since 1997. |

| Louis C. DiFabio | 50 | Executive Vice President of the Bank (2011) responsible for Retail Client Services; Senior Vice President of the Bank (2005). Mr. DiFabio has been with the Company since 1987. |

| Karen R. Makowski | 57 | Executive Vice President, Chief Administrative and Risk Officer (2011); Consultant in regulatory compliance and strategic planning (2009); President & CEO, Panther Community Bank Florida (2006). Mrs. Makowski has been with the Company since 2011. |

| Melinda A. Sartori | 56 | Executive Vice President of the Bank (2002) responsible for the Wealth Management Group. Mrs. Sartori has been with the Company since 1994. |

| Anders M. Tomson | 46 | President, Capital Bank Division of Chemung Canal Trust Company (2011); Senior Vice President and Commercial Real Estate Division Executive at Citizens Bank in Albany (2006-2010). Mr. Tomson has been with the Company since 2011. |

Executive Compensation

The following tables summarize compensation information paid or earned by NEOs of the Company and the Bank for the fiscal year ended December 31, 2013, with comparative information for 2012 and 2011 relating to the summary compensation table.

Summary Compensation Table

Name and Principal Position | Year | Salary (1) | Bonus (1) | Stock Awards | Non-Equity Incentive Plan Compensation (4) | Change in Pension Value (5) | All Other Compensation (6) | Total |

Ronald M. Bentley President & Chief Executive Officer | 2013 2012 2011 | $428,988 $404,000 $389,000 | $128,550 $121,750 $100,000 | $117,021(2) $112,154 (2) $96,073 (2) | $21,449 $20,250 $19,450 | $69,252 $127,703 $88,890 | $105,744 $103,121 $22,095 | $871,004 $888,978 $715,508 |

Karl F. Krebs (8) Executive Vice President, Chief Financial Officer and Treasurer | 2013 | $36,923 | - | - | - | - | $8,385 | $45,308 |