LCI INDUSTRIES LCI Industries Third Quarter 2019 Earnings Conference Call November 5, 2019 1

LCI INDUSTRIES Forward-Looking Statements and Non-GAAP Financial Measures This presentation contains certain “forward-looking statements” with respect to our financial condition, results of operations, business strategies, operating efficiencies or synergies, competitive position, growth opportunities, acquisitions, plans and objectives of management, markets for the Company’s common stock, the impact of legal proceedings, and other matters. Statements in this presentation that are not historical facts are “forward-looking statements” for the purpose of the safe harbor provided by Section 21E of the Securities Exchange Act of 1934, as amended, and Section 27A of the Securities Act of 1933, as amended, and involve a number of risks and uncertainties. Forward-looking statements, including, without limitation, those relating to the Company's future business prospects, net sales, expenses and income (loss), cash flow, financial condition, and addressable market, whenever they occur in this presentation are necessarily estimates reflecting the best judgment of the Company's senior management at the time such statements were made. There are a number of factors, many of which are beyond the Company’s control, which could cause actual results and events to differ materially from those described in the forward-looking statements. These factors include, in addition to other matters described in this presentation, pricing pressures due to domestic and foreign competition, costs and availability of raw materials (particularly steel and aluminum) and other components, seasonality and cyclicality in the industries to which we sell our products, availability of credit for financing the retail and wholesale purchase of products for which we sell our components, inventory levels of retail dealers and manufacturers, availability of transportation for products for which we sell our components, the financial condition of our customers, the financial condition of retail dealers of products for which we sell our components, retention and concentration of significant customers, the costs, pace of and successful integration of acquisitions and other growth initiatives, availability and costs of production facilities and labor, employee benefits, employee retention, realization and impact of expansion plans, efficiency improvements and cost reductions, the disruption of business resulting from natural disasters or other unforeseen events, the successful entry into new markets, the costs of compliance with environmental laws, laws of foreign jurisdictions in which we operate, other operational and financial risks related to conducting business internationally, increased governmental regulation and oversight, information technology performance and security, the ability to protect intellectual property, warranty and product liability claims or product recalls, interest rates, oil and gasoline prices and availability, the impact of international, national and regional economic conditions and consumer confidence on the retail sale of products for which we sell our components, and other risks and uncertainties discussed more fully under the caption “Risk Factors” in the Company’s Annual Report on Form 10-K for the year ended December 31, 2018, and in the Company’s subsequent filings with the Securities and Exchange Commission. Readers of this presentation are cautioned not to place undue reliance on these forward-looking statements, since there can be no assurance that these forward-looking statements will prove to be accurate. The Company disclaims any obligation or undertaking to update forward-looking statements to reflect circumstances or events that occur after the date the forward-looking statements are made, except as required by law. This presentation includes certain non-GAAP financial measures. These non-GAAP financial measures should not be considered a substitute for the comparable GAAP financial measures. A reconciliation of these non-GAAP financial measures to the most directly comparable GAAP financial measure is included in this presentation. 2

LCI INDUSTRIES Third Quarter 2019 Highlights Year-over-year growth in adjacent, aftermarket and international sales Delivered strong operating margin improvement across the business Generated traction through new product innovations, advancing sales penetration Executed on our diversification strategy with further expansion in the Marine and International markets 3

LCI INDUSTRIES RV OEM • Volume challenges in RV OEM continues to impact performance ◦ RV OEM Q3 revenues down 9% YoY, due to double-digit wholesale shipment declines ◦ Further diversified net sales mix, with RV OEM now accounting for less than 59% of total net sales(1) • Organic growth drove improvement in content per towable RV ◦ LCI has worked to keep content growth relatively stable as some RV OEMs continue to de-content to offset higher input costs due to tariffs ◦ Content per towable RV: $3,531, +2.2% YoY ◦ Content per motorhome: $2,405, (2.9)% YoY • Inventory correction appears to be in the final stages and should be completed by the end of 2019 ◦ RV dealer inventories are seeing significant reductions ◦ Following the RV Open House, ordering patterns exceeded expectations and overall dealer sentiment is positive 4 ◦ Long-term outlook for the RV industry remains positive as the RV lifestyle is increasingly popular among new generations of buyers (1)For trailing twelve months ended September 30, 2019

LCI INDUSTRIES Expanding Markets Executing on our diversification strategy to reach goal of 40% RV OEM by 2022 Aftermarket Adjacent Markets International • Seeing consistent and • Integration of Lewmar further increased • Further expanding European significant growth in aftermarket LCI’s market share in marine footprint through integration of Lewmar Marine, Lavet, and Ciesse from both organic growth • Continuing to explore additional opportunities and expanded opportunities for long-term content • Announced acquisition of relationships with dealers and growth in residential, marine, cargo, SureShade, a sunshade designer other partners equestrian trailers, bus, and commercial and manufacturer with strong • Appointed Jamie Schnur as vehicle markets presence in Europe Group President to support • Anticipating ample runway for 5 rapid growth in the segment growth in OEM and adjacent markets abroad

LCI INDUSTRIES Third Quarter 2019 Innovation Highlights Innovation: a critical part of our strategy • Q3 2019 marked a major milestone for OneControl, which now makes up 25% of the total market for digital RV platforms • Continuing to develop new and innovative products, including electric stabilizers and lift-assisted ramps, to enable content growth and further expand market share in RV • New product and innovation development underway across our 19 R&D centers 6

LCI INDUSTRIES Growth Strategy Accelerating Track Record with M&A • Announced the acquisition of SureShade and further incorporated Lewmar, Lavet and Ciesse into the business, expanding our presence internationally • Targeting acquisitions that are immediately accretive, with great leadership teams that bolt-on to existing product lines or expand LCI into new products with existing customers or markets • Maintaining a robust pipeline of M&A targets split evenly across all market segments Capitalizing on Ability to Win Market Share • Growing market leadership in adjacent markets, international markets, and the aftermarket segment through enhanced engineering and innovation Continued Focus on Stated Capital Allocation Goals • Investment in the business • Reduce leverage • Return capital to shareholders • Execute strategic acquisitions 7

LCI INDUSTRIES Financial Performance Consolidated Net Sales Operating Margin (in thousands) $604,244 $586,221 7.5% 8.4% Third Quarter 2018 Third Quarter 2019 Third Quarter 2018 Third Quarter 2019 Consolidated Net Sales by Market (9%) +3% +16% +32% 8 RV OEM ADJACENT OEM AFTERMARKET INTERNATIONAL SEGMENT MARKETS

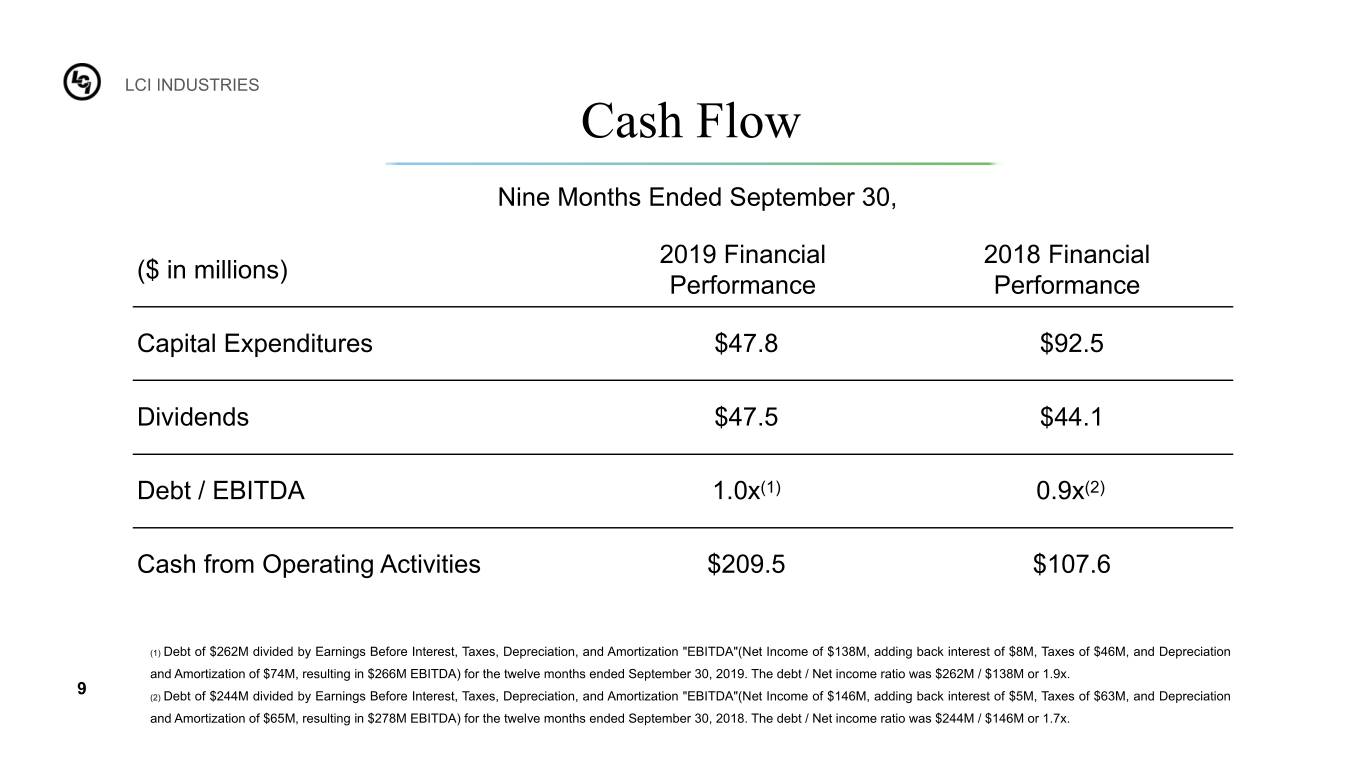

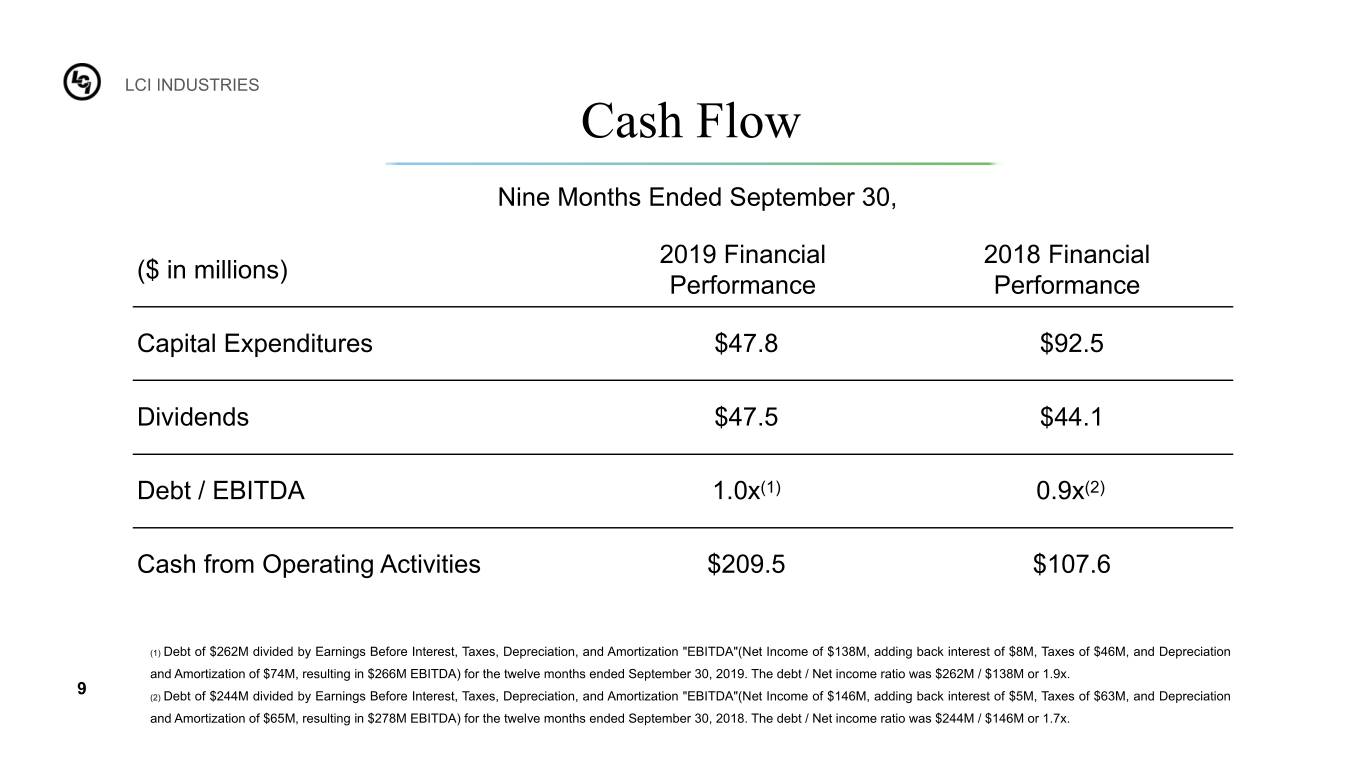

LCI INDUSTRIES Cash Flow Nine Months Ended September 30, 2019 Financial 2018 Financial ($ in millions) Performance Performance Capital Expenditures $47.8 $92.5 Dividends $47.5 $44.1 Debt / EBITDA 1.0x(1) 0.9x(2) Cash from Operating Activities $209.5 $107.6 (1) Debt of $262M divided by Earnings Before Interest, Taxes, Depreciation, and Amortization "EBITDA"(Net Income of $138M, adding back interest of $8M, Taxes of $46M, and Depreciation and Amortization of $74M, resulting in $266M EBITDA) for the twelve months ended September 30, 2019. The debt / Net income ratio was $262M / $138M or 1.9x. 9 (2) Debt of $244M divided by Earnings Before Interest, Taxes, Depreciation, and Amortization "EBITDA"(Net Income of $146M, adding back interest of $5M, Taxes of $63M, and Depreciation and Amortization of $65M, resulting in $278M EBITDA) for the twelve months ended September 30, 2018. The debt / Net income ratio was $244M / $146M or 1.7x.

L C I I N D U S T R I E S Q&A