LCI Industries Q3 2024 Earnings Conference Call November 7, 2024 1

Forward-Looking Statements This presentation contains certain “forward-looking statements” with respect to our financial condition, results of operations, profitability, margin growth, business strategies, operating efficiencies or synergies, competitive position, growth opportunities, acquisitions, plans and objectives of management, markets for the Company’s common stock, the impact of legal proceedings, and other matters. Statements in this presentation that are not historical facts are “forward-looking statements” for the purpose of the safe harbor provided by Section 21E of the Securities Exchange Act of 1934, as amended, and Section 27A of the Securities Act of 1933, as amended, and involve a number of risks and uncertainties. Forward-looking statements, including, without limitation, those relating to the Company's future business prospects, net sales, expenses and income (loss), capital expenditures, tax rate, cash flow, financial condition, liquidity, covenant compliance, retail and wholesale demand, integration of acquisitions, R&D investments, commodity prices and industry trends, whenever they occur in this presentation are necessarily estimates reflecting the best judgment of the Company's senior management at the time such statements were made. There are a number of factors, many of which are beyond the Company’s control, which could cause actual results and events to differ materially from those described in the forward-looking statements. These factors include, in addition to other matters described in this presentation, the impacts of future pandemics, geopolitical tensions, armed conflicts, or natural disaster on the global economy and on the Company's customers, suppliers, employees, business and cash flows, pricing pressures due to domestic and foreign competition, costs and availability of, and tariffs on, raw materials (particularly steel and aluminum) and other components, seasonality and cyclicality in the industries to which we sell our products, availability of credit for financing the retail and wholesale purchase of products for which we sell our components, inventory levels of retail dealers and manufacturers, availability of transportation for products for which we sell our components, the financial condition of our customers, the financial condition of retail dealers of products for which we sell our components, retention and concentration of significant customers, the costs, pace and successful integration of acquisitions and other growth initiatives, availability and costs of production facilities and labor, team member benefits, team member retention, realization and impact of expansion plans, efficiency improvements and cost reductions, the disruption of business resulting from natural disasters or other unforeseen events, the successful entry into new markets, the costs of compliance with environmental laws, laws of foreign jurisdictions in which we operate, other operational and financial risks related to conducting business internationally, and increased governmental regulation and oversight, information technology performance and security, the ability to protect intellectual property, warranty and product liability claims or product recalls, interest rates, oil and gasoline prices and availability, the impact of international, national and regional economic conditions and consumer confidence on the retail sale of products for which we sell our components, and other risks and uncertainties discussed more fully under the caption “Risk Factors” in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023, and in the Company’s subsequent filings with the Securities and Exchange Commission, including the Company's Quarterly Reports on Form 10-Q. Readers of this presentation are cautioned not to place undue reliance on these forward- looking statements, since there can be no assurance that these forward-looking statements will prove to be accurate. The Company disclaims any obligation or undertaking to update forward-looking statements to reflect circumstances or events that occur after the date the forward-looking statements are made, except as required by law. This presentation includes certain non-GAAP financial measures, such as EBITDA, EBITDA as a percentage of net sales, net debt to EBITDA leverage, and free cash flow. These non-GAAP financial measures should not be considered a substitute for the comparable GAAP financial measures. Reconciliations of these non-GAAP financial measures to the most directly comparable GAAP financial measure are included in the presentation. 2

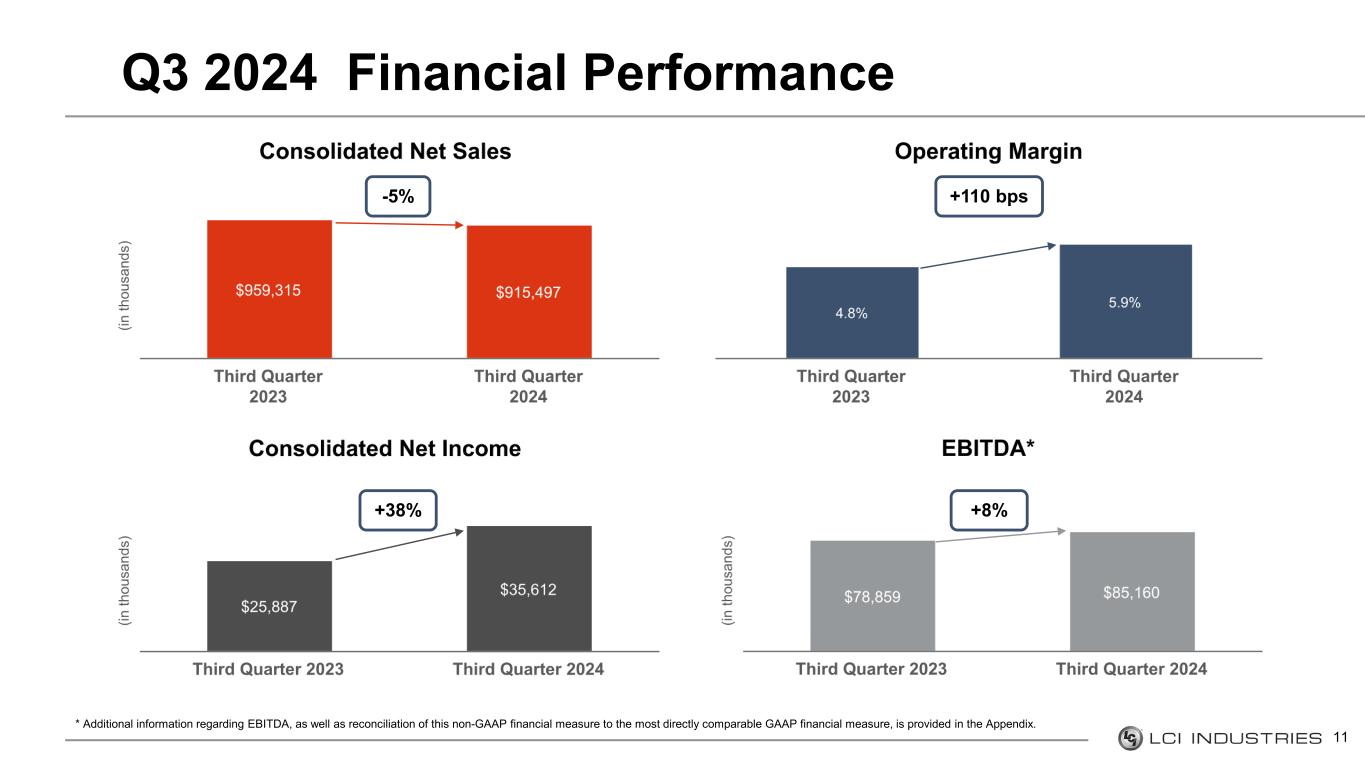

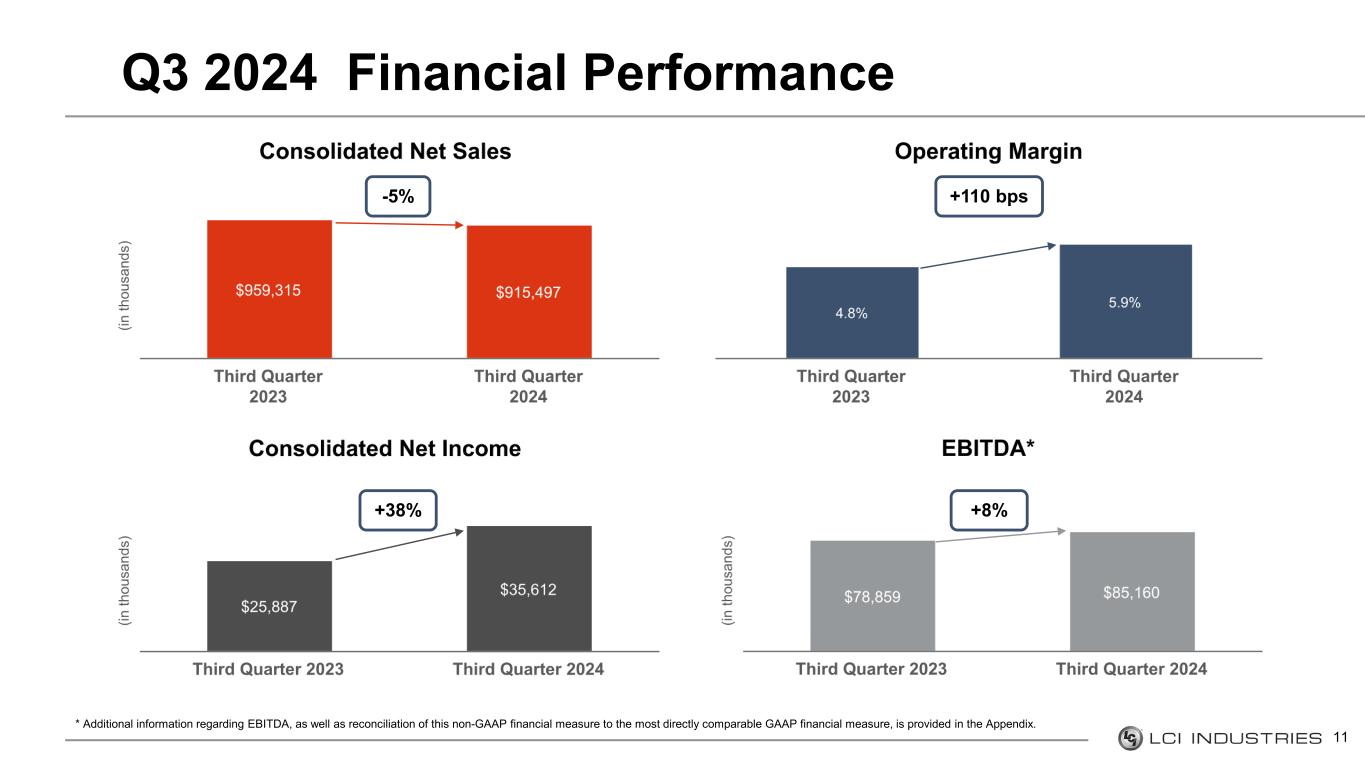

Strong operating performance and cash flow generation in challenging environment Third Quarter 2024 Highlights Financial Performance ■ Net sales of $915 million in the third quarter, down 5% year- over-year ■ Net income of $36 million, or 3.9% of net sales, in the third quarter, up 38% year-over-year ■ EBITDA1 of $85 million, or 9.3% of net sales, in the third quarter, up 8% year-over-year ■ Cash flows provided by operations of $402 million for the LTM period ended September 30, 2024 Executing Cost Management and Continuous Improvement initiatives ■ Operating profit margin of 5.9%, up 110 bps year-over year ■ Lowered material costs through supply chain improvements ■ Product quality initiatives helped reduce warranty costs by $10 million year-over-year ■ Consolidating facilities while maintaining scalable capacity to optimize manufacturing footprint - gross reductions of approximately two million sq. feet since 2023 Gaining Share through Innovation ■ Grew sales to RV OEMs in our top 5 product categories despite negative mix shift ■ Delivered towable organic content growth both sequentially and year-over-year2 ■ Highly successful new product launch with 2025 RV model year - including ABS, A/C innovation, coil spring suspension, new window designs, and new patented Sun Deck 3 1 Additional information regarding EBITDA and EBITDA as a percentage of net sales, and reconciliations of these non-GAAP financial measures to the most directly comparable GAAP financial measures, are provided in the Appendix 2 For twelve months ended September 30, 2024 Capital Allocation ■ Strong liquidity position with $161 million of cash and cash equivalents and $383 million of availability on revolving credit facility at September 30, 2024 ■ Returned $80 million of capital to shareholders with quarterly dividends YTD through September 30, 2024 ■ Continuing to evaluate strategic acquisitions opportunities

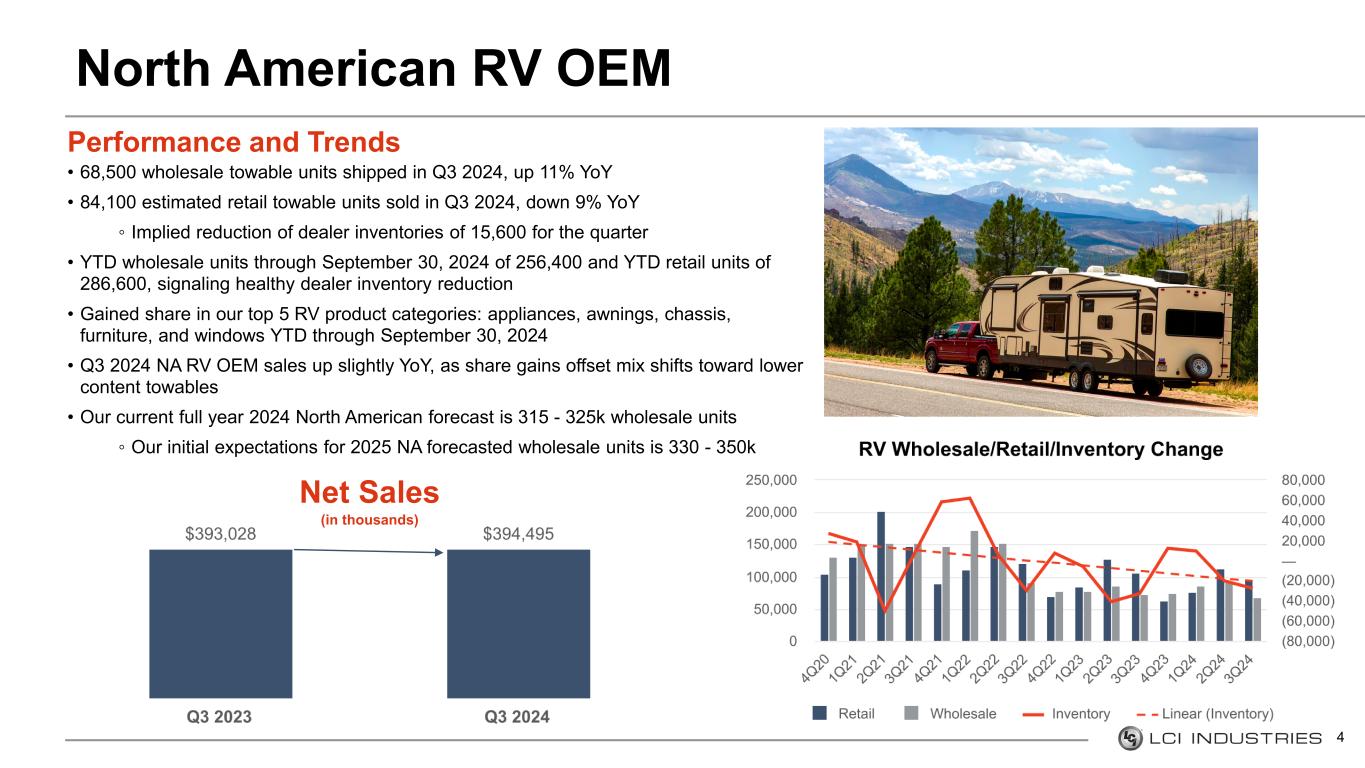

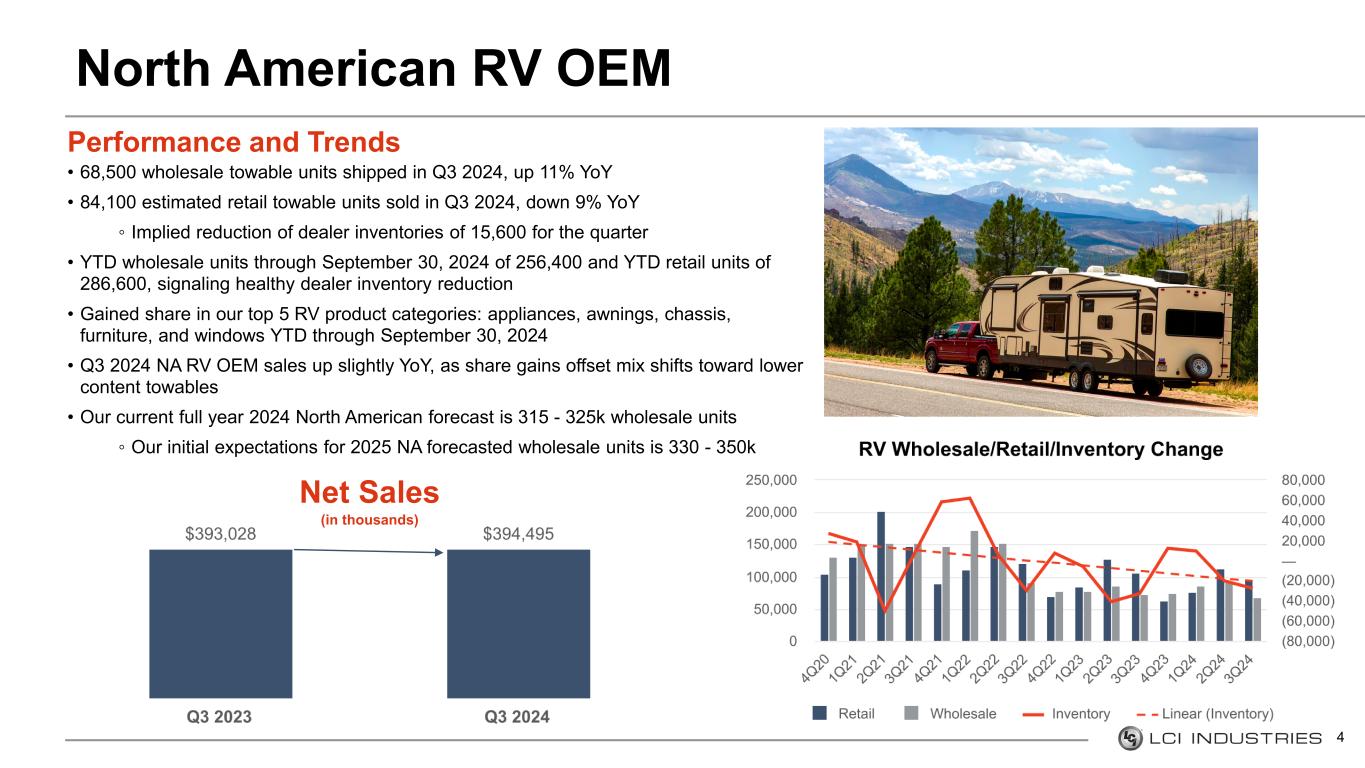

Performance and Trends • 68,500 wholesale towable units shipped in Q3 2024, up 11% YoY • 84,100 estimated retail towable units sold in Q3 2024, down 9% YoY ◦ Implied reduction of dealer inventories of 15,600 for the quarter • YTD wholesale units through September 30, 2024 of 256,400 and YTD retail units of 286,600, signaling healthy dealer inventory reduction • Gained share in our top 5 RV product categories: appliances, awnings, chassis, furniture, and windows YTD through September 30, 2024 • Q3 2024 NA RV OEM sales up slightly YoY, as share gains offset mix shifts toward lower content towables • Our current full year 2024 North American forecast is 315 - 325k wholesale units ◦ Our initial expectations for 2025 NA forecasted wholesale units is 330 - 350k North American RV OEM 4 Net Sales (in thousands)

Innovation Driving RV Content Growth, Share Gains 5 YoY Towable Content Growth (LTM) Key 2025 Model Year Product Wins Sequential Towable Content Growth (LTM) Touring Coil Suspension Furrion® 18K Chill Cube Air Conditioner * "Other" includes impact of RV unit shipments versus industry production, index sales price adjustments, and the impact of acquisitions and divestitures New Window Designs and Integrated Shades

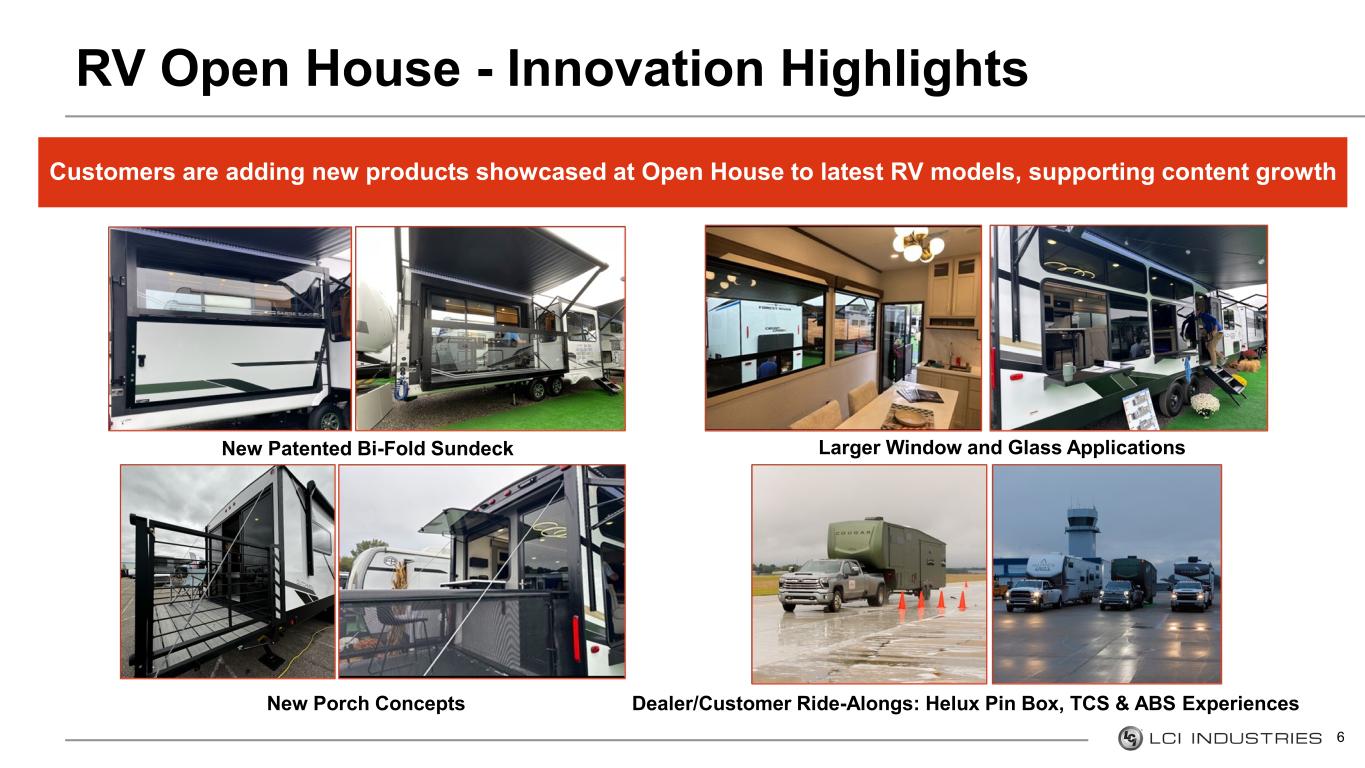

Customers are adding new products showcased at Open House to latest RV models, supporting content growth RV Open House - Innovation Highlights 6 New Porch Concepts Dealer/Customer Ride-Alongs: Helux Pin Box, TCS & ABS Experiences Larger Window and Glass ApplicationsNew Patented Bi-Fold Sundeck

Performance and Trends • Q3 2024 Adjacent Industries sales down 12% YoY • Decrease primarily due to lower sales to North American marine and utility trailer OEMs ◦ Pressured by current dealer inventory levels, inflation, and elevated interest rates impacting retail consumers • Expanding presence in transportation and building markets: ◦ Supplying axles to top trailer brands, which produce 500k+ utility and cargo trailers annually ◦ Adding windows in off-road vehicles, school buses, and manufactured housing, driving growth Adjacent Industries OEM 7 Net Sales (in thousands)

Performance and Trends • Q3 2024 sales in line with the prior year; resiliency driven by market share gains in the automotive aftermarket, offset by softness in RV and Marine aftermarkets • 100 bps YoY margin contraction primarily driven by increased labor costs due to product mix and increased production facility costs from investments to expand capacity in the automotive aftermarket • Driving portfolio expansion in diversified markets with towing and truck accessories, boating accessories, appliances, and electronics • Meeting heightened repair and replacement demand as RV ownership has reached record levels in recent years ◦ 2021 and 2022 model year units are exiting warranty period and shifting into aftermarket sales opportunity Aftermarket Segment 8 Net Sales (in thousands)

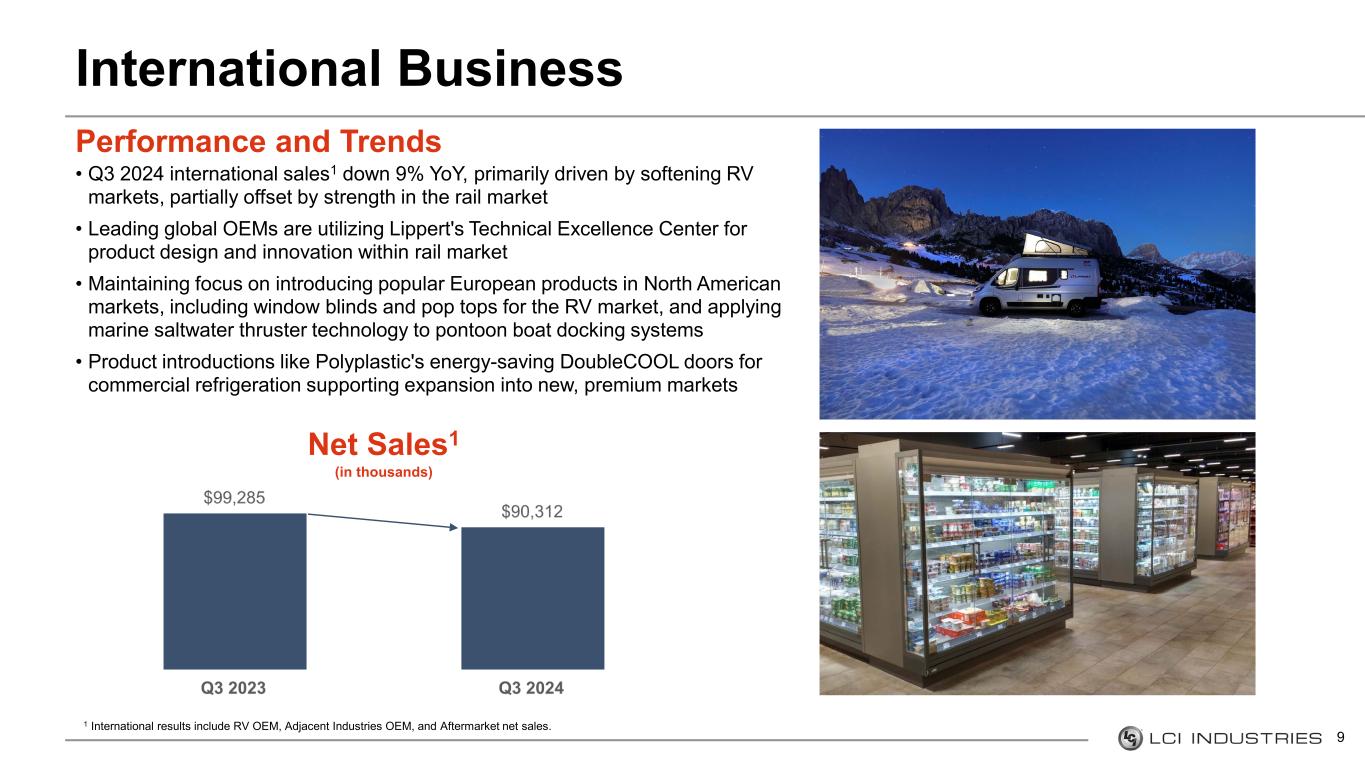

International Business 9 Net Sales1 (in thousands) 1 International results include RV OEM, Adjacent Industries OEM, and Aftermarket net sales. Performance and Trends • Q3 2024 international sales1 down 9% YoY, primarily driven by softening RV markets, partially offset by strength in the rail market • Leading global OEMs are utilizing Lippert's Technical Excellence Center for product design and innovation within rail market • Maintaining focus on introducing popular European products in North American markets, including window blinds and pop tops for the RV market, and applying marine saltwater thruster technology to pontoon boat docking systems • Product introductions like Polyplastic's energy-saving DoubleCOOL doors for commercial refrigeration supporting expansion into new, premium markets

Leveraging Strengths to Win Market Share • Delivering innovative products through leading, nimble manufacturing capabilities • Building upon long-term customer relationships to expand product offerings and bundle multiple product categories • Focusing on content and market share growth across our business Growth Strategy Winning through our diversified portfolio, cutting-edge innovation, and best-in-class service Capital Allocation Strategy • Focusing on strategic acquisitions to expand presence in existing markets • Investing in R&D and innovation to drive profitable growth • Returning capital to shareholders Continue Execution of our Diversification Strategy • Expanding market share beyond our RV OEM channel to increase stability and deliver shareholder value • Enhancing our offerings in the outdoor recreation, transportation, and building products industries • Working to capture market share in approximately $12 billion of combined addressable opportunities across our business 10

Q3 2024 Financial Performance * Additional information regarding EBITDA, as well as reconciliation of this non-GAAP financial measure to the most directly comparable GAAP financial measure, is provided in the Appendix. 11 -5% +38% +110 bps +8%

As of and for the nine months ended September 30 Liquidity and Cash Flow 2024 2023 Cash and Cash Equivalents $161M $31M Remaining Availability under Revolving Credit Facility(1) $383M $179M Capital Expenditures $31M $50M Dividends $80M $80M Debt / Net Income (TTM) 6.3x 18.4x Net Debt/EBITDA (TTM)(2) 2.0x 3.8x Cash from Operating Activities $264M $389M Free Cash Flow(2) $232M $339M 1 Remaining availability under the revolving credit facility is subject to covenant restrictions. 2 Additional information regarding net debt to EBITDA and free cash flow, as well as a reconciliation of these non-GAAP financial measures to the most directly comparable GAAP financial measures, is provided in the Appendix. 12

Reconciliation of Non-GAAP Measures Appendix EBITDA Three Months Ended September 30, Nine months ended September 30, Twelve months ended September 30, ($ in thousands) 2024 2023 2024 2023 2024 2023 Net income $ 35,612 $ 25,887 $ 133,320 $ 66,572 $ 130,943 $ 49,443 Interest expense, net 6,516 10,325 23,799 30,968 33,255 39,188 Provision for income taxes 11,760 9,378 44,984 23,267 40,526 9,139 Depreciation and amortization 31,272 33,269 96,000 98,818 128,950 132,064 EBITDA $ 85,160 $ 78,859 $ 298,103 $ 219,625 $ 333,674 $ 229,834 Net sales $ 915,497 $ 959,315 $ 2,938,070 $ 2,947,264 $ 3,775,614 $ 3,841,610 Net income as a % of Net Sales 3.9 % 2.7 % 4.5 % 2.3 % 3.5 % 1.3 % EBITDA as % of Net Sales 9.3 % 8.2 % 10.1 % 7.5 % 8.8 % 6.0 % FREE CASH FLOW Nine Months Ended September 30, NET DEBT/EBITDA (TTM) September 30, 2024 September 30, 2023 ($ in thousands) 2024 2023 Total debt $ 822,544 $ 908,811 Net cash flows provided by Less cash and cash equivalents 161,184 31,242 operating activities $ 263,688 $ 389,263 Net debt $ 661,360 $ 877,569 Capital expenditures (31,390) (50,060) Free cash flow $ 232,298 $ 339,203 Total Debt/Net Income (TTM) 6.3x 18.4x Net Debt/EBITDA (TTM) 2.0x 3.8x 13 EBITDA, EBITDA as a percentage of net sales, and free cash flow are non-GAAP performance measures included to illustrate and improve comparability of the Company's results from period to period. EBITDA is defined as net income (loss) before interest expense, provision (benefit) for income taxes, and depreciation and amortization expense. Free cash flow is defined as net cash flows provided by operating activities minus capital expenditures. The Company considers these non-GAAP measures in evaluating and managing the Company's operations and believes that discussion of results adjusted for these items is meaningful to investors because they provide a useful analysis of ongoing underlying trends. The adjusted measures are not in accordance with, nor are they a substitute for, GAAP measures, and they may not be comparable to similarly titled measures used by other companies. The net debt to EBITDA ratio on a trailing twelve month basis is a non-GAAP performance measure included because the Company believes it is useful to investors in evaluating the Company's leverage. The net debt to EBITDA ratio is defined as total debt, less cash and cash equivalents, divided by EBITDA. The net debt to EBITDA ratio is a non-GAAP measure and should not be considered a substitute for the ratio of total debt to net income determined in accordance with GAAP. The Company's calculation of its net debt to EBITDA ratio might not be calculated in the same manner as, and thus might not be comparable to, similarly titled measures used by other companies.

14