- LCII Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

PRE 14A Filing

LCI Industries (LCII) PRE 14APreliminary proxy

Filed: 25 Mar 24, 4:47pm

| ☑ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material under §240.14a-12 |

| (Name of Registrant as Specified in its Charter) |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| ☑ | No fee required. |

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

April 4, 2024

| Tracy D. Graham Chairman, Lippert Board of Directors |

Dear Fellow Stockholders:

You are cordially invited to join us for our 2024 Annual Meeting of Stockholders, which will be held in a virtual format only on May 16, 2024, at 9:00 A.M. ET.

The Notice of Annual Meeting of Stockholders and the Proxy Statement that follow describe the business to be conducted at the annual meeting. Members of our Board of Directors and executive officer team plan to be present at the meeting and available to answer questions regarding the Company.

Your vote is very important. Whether or not you expect to attend the meeting, we encourage you to submit your proxy through the Internet or by mail. This will ensure that your shares are represented at the meeting. Even if you submit a proxy, you may revoke it at any time before it is voted. If you attend the meeting and wish to vote via the online platform, you will be able to do so even if you have previously submitted a proxy through the Internet or by mail.

We appreciate your continued support of our Company.

| Sincerely, |

| TRACY D. GRAHAM |

| Chairman of the Board |

| NOTICE OF 2024 ANNUAL MEETING OF STOCKHOLDERS AND PROXY STATEMENT | LCI INDUSTRIES | 3 |

LCI INDUSTRIES

3501 County Road 6 East

Elkhart, Indiana 46514

Notice of Annual Meeting of Stockholders to be held May 16, 2024

NOTICE IS HEREBY GIVEN to the holders of common stock of LCI Industries that the Annual Meeting of Stockholders of LCI Industries (the “Company”) will be held in a virtual format only on May 16, 2024, at 9:00 A.M. ET, for the following purposes:

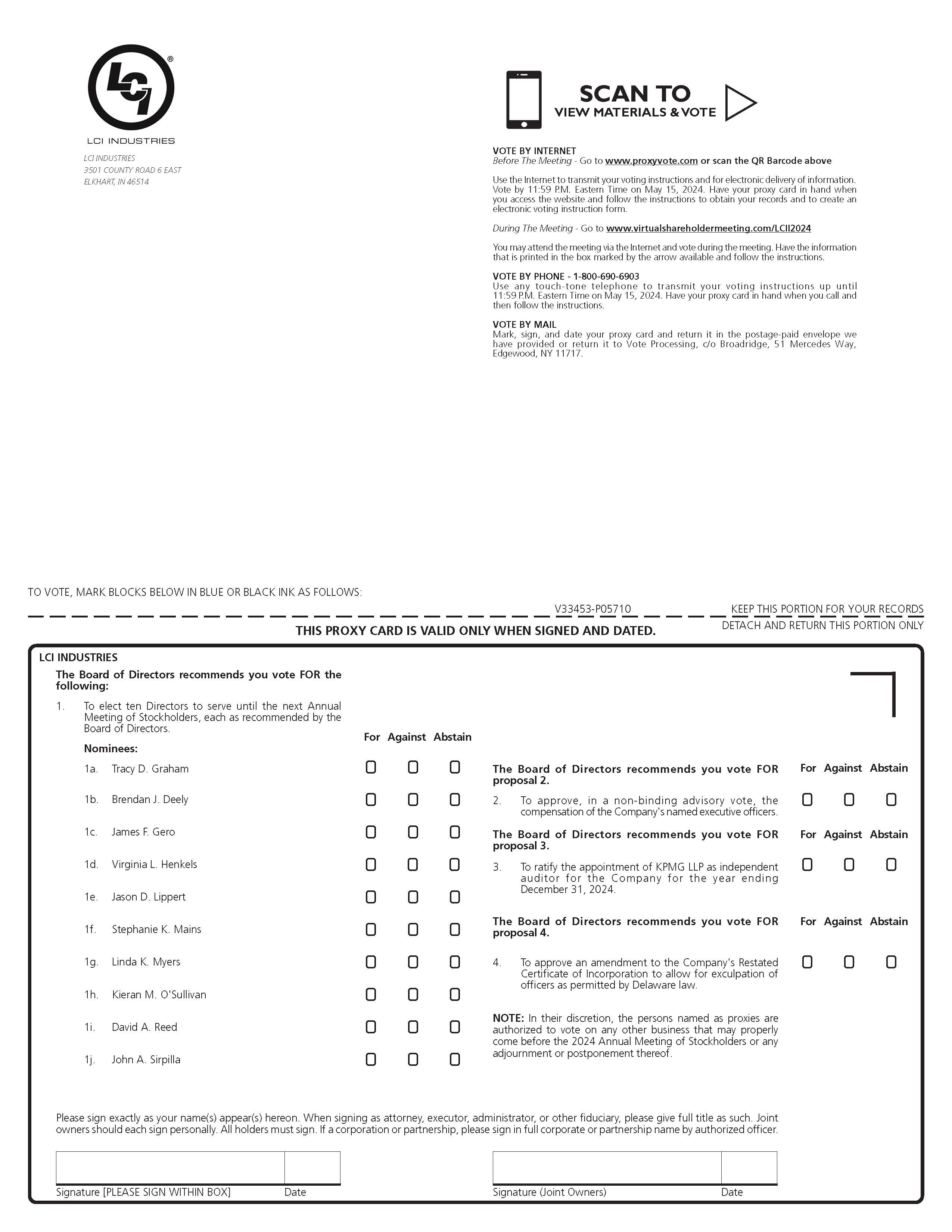

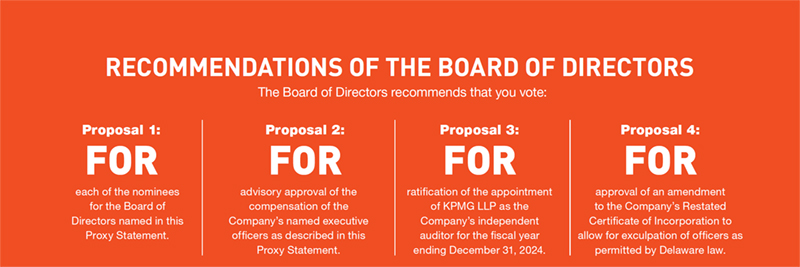

| (1) | To elect ten Directors to serve until the next Annual Meeting of Stockholders, each as recommended by the Board of Directors; | |

| (2) | To approve, in a non-binding advisory vote, the compensation of the Company’s named executive officers as described in the accompanying Proxy Statement; | |

| (3) | To ratify the appointment of KPMG LLP as independent auditor for the Company for the year ending December 31, 2024; | |

| (4) | To approve an amendment to the Company’s Restated Certificate of Incorporation to allow for exculpation of officers as permitted by Delaware law; and | |

| (5) | To transact such other business as may properly come before the meeting or any adjournment or postponement thereof. |

The Board of Directors has fixed March 22, 2024, as the record date for the meeting, and only holders of record of the Company’s common stock at the close of business on that date will be entitled to vote on all matters to be considered at the meeting or any adjournment or postponement thereof.

A list of all stockholders entitled to vote at the meeting will be available for inspection at the Company’s office for ten days prior to the meeting.

| By Order of the Board of Directors, | |

| ANDREW J. NAMENYE | |

| Executive Vice President, Chief Legal Officer, and Corporate Secretary |

Dated: April 4, 2024

Elkhart, IN

NOTICE TO HOLDERS OF COMMON STOCK

| YOUR PROXY IS IMPORTANT TO ENSURE A QUORUM AT THE MEETING. WHETHER OR NOT YOU EXPECT TO ATTEND THE MEETING, PLEASE VOTE YOUR SHARES THROUGH THE INTERNET OR, IF YOU RECEIVED A PRINTED COPY OF THE PROXY CARD BY MAIL, BY SIGNING, DATING, AND MAILING THE PROXY CARD IN THE ENVELOPE PROVIDED. | ||

| IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL STOCKHOLDER MEETING TO BE HELD ON MAY 16, 2024. | ||

| THIS NOTICE OF ANNUAL MEETING, PROXY STATEMENT, AND OUR 2023 ANNUAL REPORT TO STOCKHOLDERS, INCLUDING OUR 2023 ANNUAL REPORT ON FORM 10-K, ARE AVAILABLE AT HTTP://WWW.PROXYVOTE.COM. |

| 4 | NOTICE OF 2024 ANNUAL MEETING OF STOCKHOLDERS AND PROXY STATEMENT | LCI INDUSTRIES |

TABLE OF CONTENTS

| 6 | PROXY STATEMENT SUMMARY |

| 9 | ENVIRONMENTAL AND SOCIAL |

| 12 | PROXY STATEMENT |

| 12 | General Information |

| 13 | VOTING SECURITIES |

| 13 | Vote Required on Proposals |

| 14 | Recommendations of the Board of Directors |

| 14 | Principal Holders of Voting Securities |

| 15 | Security Ownership of Certain Beneficial Owners and Management |

| 16 | Delinquent Section 16(a) Reports |

| 17 | PROPOSAL 1. ELECTION OF DIRECTORS |

| 17 | Director Qualifications and Selection Process |

| 19 | Director Skills and Experiences |

| 20 | Our Director Nominees |

| 24 | CORPORATE GOVERNANCE AND RELATED MATTERS |

| 24 | Statement Regarding Corporate Governance |

| 24 | Board of Directors and Director Independence |

| 24 | Leadership Structure |

| 25 | Executive Sessions |

| 25 | Board Committees |

| 28 | Compensation-Related Risk |

| 28 | Compensation Recovery Policy |

| 29 | Director Stock Ownership Requirements |

| 29 | Team Members and Directors Guidelines for Business Conduct |

| 29 | Management and Board Succession |

| 29 | Contacting the Board of Directors |

| 29 | Prohibition on Hedging by Directors and Team Members |

| 30 | DIRECTOR COMPENSATION |

| 31 | Discussion of Director Compensation |

| 32 | EXECUTIVE COMPENSATION |

| 32 | A Message from our Compensation and Human Capital Committee |

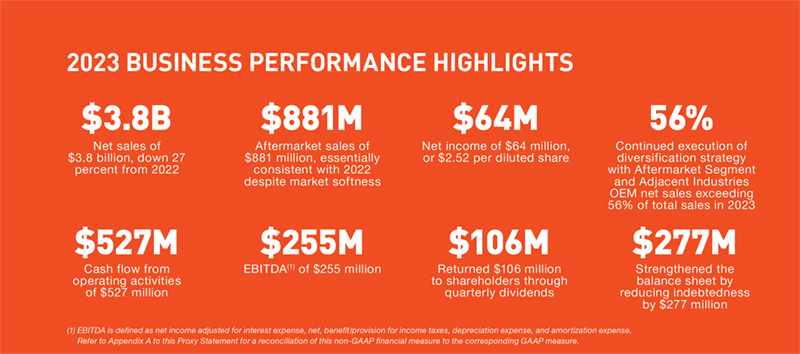

| 33 | Business Performance Highlights |

| 33 | Compensation Discussion and Analysis |

| 48 | Report of the Compensation and Human Capital Committee |

| 49 | Summary Compensation Table |

| 52 | Grants of Plan-Based Awards Table |

| 54 | Outstanding Equity Awards at Fiscal Year-End |

| 55 | Option Exercises and Stock Vested |

| 55 | Non-Qualified Deferred Compensation |

| 56 | Potential Payments on Termination or Change-In-Control |

| 60 | EQUITY COMPENSATION PLAN INFORMATION |

| 61 | CEO PAY RATIO |

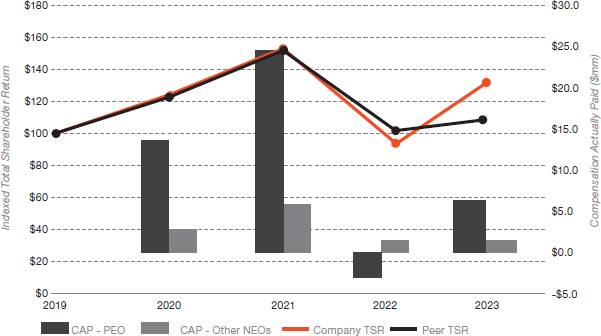

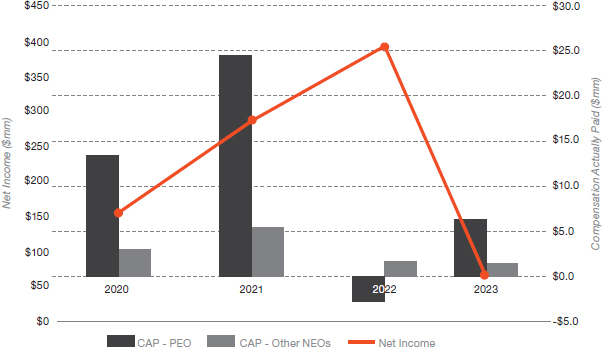

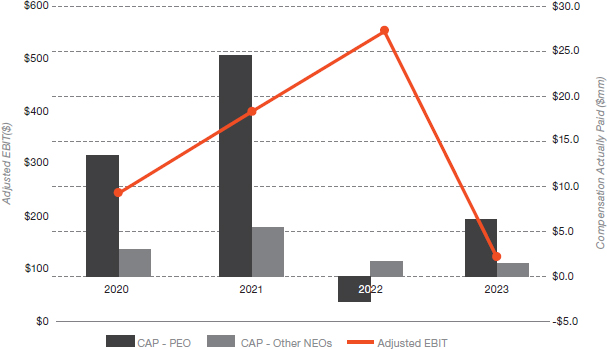

| 62 | PAY VERSUS PERFORMANCE |

| 65 | TRANSACTIONS WITH RELATED PERSONS |

| 65 | Approval of Certain Related Person Transactions |

| 65 | Compensation and Human Capital Committee Interlocks and Insider Participation |

| 66 | PROPOSAL 2. ADVISORY VOTE ON EXECUTIVE COMPENSATION |

| 67 | PROPOSAL 3. RATIFICATION OF APPOINTMENT OF AUDITORS |

| 67 | Fees for Independent Auditors |

| 68 | REPORT OF THE AUDIT COMMITTEE |

| 70 | PROPOSAL 4. AMENDMENT TO THE COMPANY’S RESTATED CERTIFICATE OF INCORPORATION |

| 72 | TRANSACTION OF OTHER BUSINESS |

| 72 | STOCKHOLDER PROPOSALS FOR THE 2025 ANNUAL MEETING |

| 73 | APPENDIX A |

| 74 | APPENDIX B |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

The statements included in this Proxy Statement regarding future performance and results, expectations, plans, strategies, priorities, commitments, and other statements that are not historical facts are forward-looking statements within the meaning of the federal securities laws. Forward-looking statements are based upon current beliefs, expectations, and assumptions and are subject to significant risks, uncertainties, and changes in circumstances that could cause actual results to differ materially from the forward-looking statements. A detailed discussion of risks and uncertainties that could cause actual results and events to differ materially from such forward-looking statements is included in the section titled “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2023. Readers of this Proxy Statement are cautioned not to place undue reliance on these forward-looking statements, since there can be no assurance that these forward-looking statements will prove to be accurate. We expressly disclaim any obligation to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise. | ||

| NOTICE OF 2024 ANNUAL MEETING OF STOCKHOLDERS AND PROXY STATEMENT | LCI INDUSTRIES | 5 |

PROXY STATEMENT SUMMARY

This summary highlights information contained elsewhere in this Proxy Statement. This summary does not contain all the information you should consider, and you should read the entire Proxy Statement and our 2023 Annual Report carefully before voting.

2024 ANNUAL MEETING OF STOCKHOLDERS

| Date and Time: | May 16, 2024, at 9:00 A.M. ET |

| Place: | www.virtualshareholdermeeting.com/LCII2024 |

| Record Date: | March 22, 2024 |

VOTING MATTERS AND BOARD RECOMMENDATIONS

| Voting Matter | Board Recommendation | Page Number with More Information | |

| Proposal 1: | Election of ten Directors | FOR each nominee | 17 |

| Proposal 2: | Advisory vote to approve the compensation of the Company’s named executive officers | FOR | 66 |

| Proposal 3: | To ratify the appointment of KPMG LLP as independent auditor for the Company for the year ending December 31, 2024 | FOR | 67 |

| Proposal 4: | Approval of an amendment to the Company’s Restated Certificate of Incorporation to allow for exculpation of officers as permitted by Delaware law | FOR | 70 |

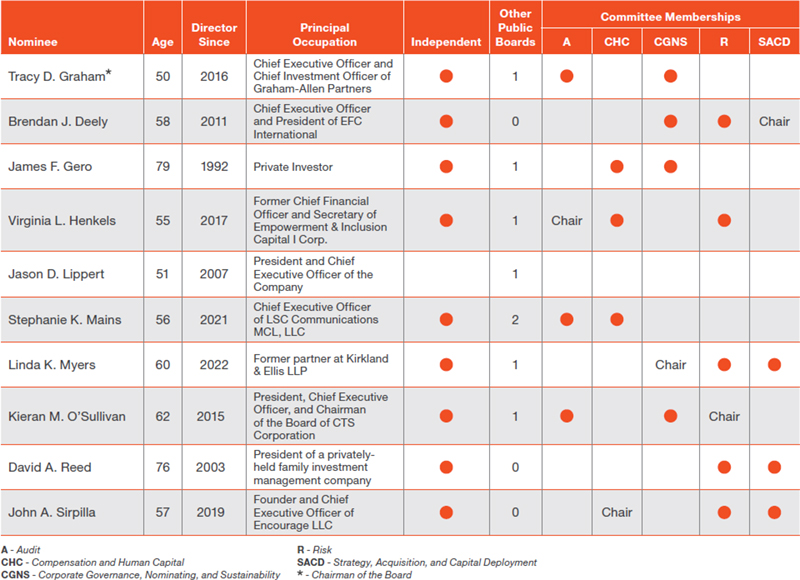

DIRECTOR NOMINEES

For more information, visit page 20

| 6 | NOTICE OF 2024 ANNUAL MEETING OF STOCKHOLDERS AND PROXY STATEMENT | LCI INDUSTRIES |

BUSINESS OVERVIEW

MARKETS SERVED

| NOTICE OF 2024 ANNUAL MEETING OF STOCKHOLDERS AND PROXY STATEMENT | LCI INDUSTRIES | 7 |

CORPORATE GOVERNANCE HIGHLIGHTS

| ✓ | 9 of 10 Director Nominees are Independent |

| ✓ | Independent Chairman of the Board |

| ✓ | Annual Election of All Directors |

| ✓ | Directors Elected by Majority Vote in Uncontested Director Elections |

| ✓ | Annual Board and Committee Evaluations |

| ✓ | Extensive Board Oversight of Risk Management, Including Separate Risk Committee |

| ✓ | Non-Employee Directors Regularly Meet Without Management Present |

| ✓ | Single Class Voting Structure (One Share, One Vote) |

| ✓ | Guidelines for Business Conduct Applicable to All Team Members and Directors |

| ✓ | Code of Ethics for Senior Financial Officers |

| ✓ | No Supermajority Voting Requirements |

| ✓ | No Shareholder Rights Plan (Poison Pill) |

| ✓ | Board Oversight of Environmental, Sustainability, and Social Matters |

2023 COMPENSATION

SUMMARY COMPENSATION TABLE

| Name Principal Position | Year | Salary | Stock Awards | Non-Equity Incentive Plan Compensation | All Other Compensation | Total | |||||

| Jason D. Lippert President and Chief Executive Officer | 2023 2022 2021 | $ $ $ | 1,155,000 1,100,000 1,085,620 | $ $ $ | 7,169,980 6,522,567 5,245,239 | $ $ $ | – 2,640,000 4,500,000 | $ $ $ | 317,863 271,108 162,891 | $ $ $ | 8,642,843 10,533,675 10,993,750 |

| Lillian D. Etzkorn Executive Vice President and Chief Financial Officer | 2023 | $ | 364,580 | $ | 771,725 | $ | – | $ | 259,261 | $ | 1,395,566 |

| Ryan R. Smith Group President - North America | 2023 2022 2021 | $ $ $ | 925,000 800,000 750,000 | $ $ $ | 3,583,161 2,451,043 1,225,688 | $ $ $ | – 2,800,000 4,375,000 | $ $ $ | 163,884 125,288 78,504 | $ $ $ | 4,672,045 6,176,331 6,429,192 |

| Jamie M. Schnur Group President - Aftermarket | 2023 2022 2021 | $ $ $ | 730,000 620,000 600,000 | $ $ $ | 2,392,737 1,838,252 1,333,487 | $ $ $ | – 1,193,500 2,100,000 | $ $ $ | 123,448 105,074 67,737 | $ $ $ | 3,246,185 3,756,826 4,101,224 |

| Andrew J. Namenye Executive Vice President, Chief Legal Officer, and Corporate Secretary | 2023 2022 2021 | $ $ $ | 500,000 500,000 445,578 | $ $ $ | 1,191,910 1,186,032 710,954 | $ $ $ | – 708,750 743,750 | $ $ $ | 82,165 81,027 51,525 | $ $ $ | 1,774,075 2,475,809 1,951,807 |

| Brian M. Hall Former Executive Vice President and Chief Financial Officer | 2023 2022 2021 | $ $ $ | 303,883 525,000 500,000 | $ $ $ | – 1,245,358 1,078,559 | $ $ $ | – 826,875 1,050,000 | $ $ $ | 26,210 76,302 60,588 | $ $ $ | 330,093 2,673,535 2,689,147 |

For more information, visit page 49.

EXECUTIVE COMPENSATION HIGHLIGHTS

| ✓ | Pay for performance |

| ✓ | Establish challenging performance goals in incentive plans |

| ✓ | Maintain robust stock ownership guidelines for named executive officers and Directors |

| ✓ | Require termination of employment in addition to a change in control for accelerated equity vesting (double trigger) |

| ✓ | Require non-competition agreement for receipt of equity awards |

| ✓ | Subject executives’ incentive-based compensation to clawback |

| ✓ | Limit executive perquisites |

| ✓ | Do not provide excise tax gross-ups |

| 8 | NOTICE OF 2024 ANNUAL MEETING OF STOCKHOLDERS AND PROXY STATEMENT | LCI INDUSTRIES |

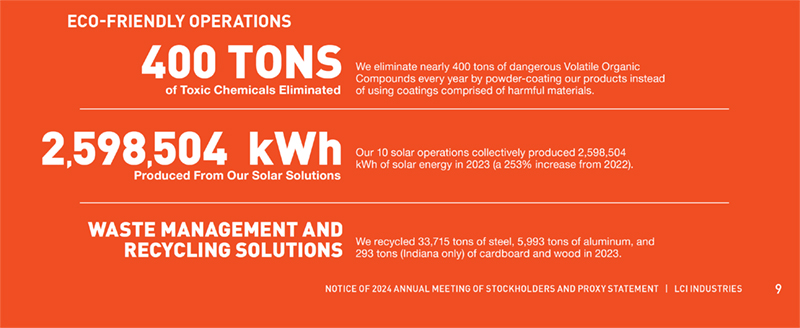

ENVIRONMENTAL & SOCIAL

The Company released its latest Corporate Social Responsibility (CSR) Report in May 2023. We plan to publish our next CSR Report in the second quarter of 2024, which will, for the first time, align with the Task Force on Climate-related Financial Disclosures (TCFD) framework. The Company continues to report in line with the Sustainability Accounting Standards Board (SASB) and Global Reporting Initiative (GRI) frameworks for sustainability disclosures. Our CSR Reports elaborate on the Company’s commitments, such as reducing its environmental footprint, updating policies, and enhancing procedures and standards relating to team members’ health and safety. The CSR Reports are available on the Company’s website at www.lci1.com/sustainability.

ENVIRONMENTAL

The Company’s approach to sustainability is guided by our passion to protect and invest in the communities that we call home. We integrate sustainability into our everyday actions by conscious resource selection and process improvements that aim to lessen our environmental footprint and promote efficiency. Our teams embrace lean initiatives, and we consistently invest in comprehensive training, advanced machinery, and eco-friendly energy alternatives to provide safer processes, cost savings, and a healthier environment.

OUR CORE VALUES

Our core values define us. Our Company’s culture and shared values drive our attitudes, behaviors, and actions, every day, at every facility. The Company’s Leadership Development Team brings the Company’s core values to life through transformative company culture initiatives and numerous learning opportunities for our team members.

SOCIAL RESPONSIBILITY

| People are our priority, and community is our core. We strive to make lives better through meaningful relationships with our co-workers, our customers, and our communities. The Company’s team members feel a deeper sense of purpose at work, and we continue to build a better work environment by aligning our cultural and business strategies with the needs of our many team members. One way we measure success is by how we touch the lives of people inside and outside of our walls. Our team members drive our social impact | philosophy with their passionate hearts and minds. Since 2017, our team members have collectively spent more than 868,000 hours volunteering at over 2,000 non-profit organizations, supporting charitable fundraising events, and caring for our fellow team members in need. Through monetary donations, product donations, and company-wide fundraising events, the Company gave back over $1,115,000 in 2023 to support the needs of our communities. |

2023 SOCIAL IMPACT

| 10 | NOTICE OF 2024 ANNUAL MEETING OF STOCKHOLDERS AND PROXY STATEMENT | LCI INDUSTRIES |

LCI INDUSTRIES

3501 County Road 6 East

Elkhart, Indiana 46514

PROXY STATEMENT - 2024 ANNUAL MEETING OF STOCKHOLDERS

GENERAL INFORMATION

The Board of Directors of LCI Industries, a Delaware corporation (the “Company,” “we,” “us,” or “our”), is soliciting proxies for use at the Annual Meeting of Stockholders to be held in a virtual format on May 16, 2024, at 9:00 A.M. ET, or any adjournment or postponement thereof, at which holders of record of the Company’s Common Stock, par value $0.01 per share (the “Common Stock”), at the close of business on March 22, 2024 (the “Record Date”), shall be entitled to vote on all matters considered at the meeting. You may access the Annual Meeting of Stockholders via the Internet through www.virtualshareholdermeeting.com/LCII2024.

The Company’s stockholders will receive a Notice of Internet Availability of Proxy Materials (the “Notice”), which was or will be sent to stockholders on or about April 4, 2024, containing information on the availability of the proxy materials on the Internet. Stockholders will not receive a printed copy of the proxy materials unless previously requested or requested in the manner described in the Notice. The Notice explains how to access and review this Proxy Statement and our 2023 Annual Report to Stockholders, and how you may vote by proxy.

All valid proxies received by the Company (whether by mail or via the Internet) in time for the Annual Meeting will be voted in the manner indicated on the proxies and, if no voting instructions are indicated, “FOR” the Directors named in Proposal 1 and “FOR” Proposals 2, 3, and 4. If specific instructions are indicated, the proxies will be voted in accordance with such instructions. Each proxy may be revoked at any time after it is submitted, except as to matters upon which, prior to such revocation, a vote shall have been cast pursuant to the authority conferred by such proxy. A proxy may be revoked by giving written notice of revocation to the Secretary of the Company, by giving a proxy with a later date, or by attending the Annual Meeting and voting virtually. Attendance at the Annual Meeting alone will not revoke a proxy.

If you are the record holder of your shares (that is, you hold shares of the Company’s Common Stock in your own name and not through your broker or another nominee), you may choose to submit your proxy via the Internet. The website to submit your proxy via the Internet is www.proxyvote.com. You may submit your proxy via the Internet 24 hours a day until 11:59 P.M. ET on May 15, 2024. You will be able to confirm that your instructions have been properly recorded. If your shares are held in “street name” (that is, in the name of a bank, broker, or other holder of record), you will receive instructions from the holder of record that you must follow in order for your shares to be voted. Submitting your proxy via the Internet will also be available to stockholders owning shares held in “street name.” If you submit your proxy via the Internet, you do not need to return a proxy card.

The cost of solicitation by the Company, including postage, printing, and handling, and the expenses incurred by brokerage firms, custodians, nominees, and fiduciaries in forwarding proxy materials to beneficial owners, will be borne by the Company. The solicitation is to be made primarily by mail, but may be supplemented by telephone calls, emails, and personal solicitation. Management may also use the services of Directors and team members of the Company to solicit proxies, without additional compensation.

THE COMPANY’S ANNUAL REPORT ON FORM 10-K FOR THE YEAR ENDED DECEMBER 31, 2023, AS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION (INCLUDING THE CONSOLIDATED FINANCIAL STATEMENTS), IS PART OF THE ANNUAL REPORT TO STOCKHOLDERS THAT ACCOMPANIES THIS PROXY STATEMENT. ADDITIONAL COPIES WILL BE FURNISHED TO ANY STOCKHOLDER WITHOUT CHARGE UPON REQUEST TO THE COMPANY AT 3501 COUNTY ROAD 6 EAST, ELKHART, INDIANA 46514, TELEPHONE (574) 535-1125, E-MAIL LCII@LCI1.COM. THE ANNUAL REPORT ON FORM 10-K IS ALSO AVAILABLE THROUGH LINKS ON THE COMPANY’S WEBSITE AT HTTPS://INVESTORS.LCI1.COM AND AT WWW.PROXYVOTE.COM.

| 12 | NOTICE OF 2024 ANNUAL MEETING OF STOCKHOLDERS AND PROXY STATEMENT | LCI INDUSTRIES |

VOTING SECURITIES

The Company’s Common Stock trades on the New York Stock Exchange (“NYSE”) under the symbol “LCII.”

Stockholders of record will be entitled to one vote on each matter for each share of Common Stock held on the Record Date. At the close of business on the Record Date, there were 25,448,136 shares of our Common Stock outstanding and eligible to vote at the Annual Meeting. A majority in voting power of the outstanding shares of Common Stock entitled to vote at the meeting must be present or represented by proxy at the meeting in order to have a quorum for the transaction of business. Abstentions and broker non-votes will be treated as shares present for the purpose of determining the presence of a quorum.

“Broker non-votes” means shares held of record by a broker for which the broker has not received voting instructions from the beneficial owner of the shares and lacks the authority to vote the shares in its discretion. Proposals 1, 2, and 4 fall within this category. Accordingly, if you hold your shares in “street name” and wish your shares to be voted on Proposals 1, 2, and 4, you must give your broker voting instructions. Proposal 3 is considered to be a discretionary item, and your broker will be able to vote on this proposal even if it does not receive instructions from you.

If the persons present or represented by proxy at the meeting constitute the holders of less than a majority in voting power of the outstanding shares of Common Stock as of the Record Date, the Annual Meeting may be adjourned to a subsequent date for the purpose of obtaining a quorum. Votes will be tabulated by the inspector of election appointed for the meeting, who will separately tabulate affirmative and negative votes, abstentions, and, if applicable, broker non-votes.

VOTE REQUIRED ON PROPOSALS

The votes required to approve each of the proposals, and the impact of abstentions and broker non-votes, if any, on each of the proposals, are as follows:

| Proposal Number | Subject | Vote Required | Impact of Abstentions and Broker Non-Votes, if any |

| Proposal 1: | Election of Directors | A nominee must receive a majority of the votes cast with respect to his or her election, which means that the number of votes cast “for” a nominee must exceed the number of votes cast “against” that nominee. | Abstentions and broker non-votes will not affect the outcome of this proposal. |

| Proposal 2: | Advisory vote on executive compensation | Approval by the affirmative vote of the holders of a majority in voting power of the outstanding shares of Common Stock that are present virtually or by proxy at the meeting and entitled to vote thereon. | Abstentions will have the same effect as votes cast against this proposal. Broker non-votes will not affect the outcome of this proposal. |

| Proposal 3: | Ratification of appointment of independent auditor | Approval by the affirmative vote of the holders of a majority in voting power of the outstanding shares of Common Stock that are present virtually or by proxy at the meeting and entitled to vote thereon. | Abstentions will have the same effect as votes cast against this proposal. Broker non-votes will not affect the outcome of this proposal. |

| Proposal 4: | Approval of an amendment to the Company’s Restated Certificate of Incorporation to allow for exculpation of officers as permitted by Delaware law | Approval by the affirmative vote of the holders of a majority of the outstanding shares of Common Stock entitled to vote thereon. | Abstentions and broker non-votes will have the same effect as votes cast against this proposal. |

We are not currently aware of any other business to be acted upon at the Annual Meeting. If, however, other matters are properly brought before the meeting, or any adjournment or postponement of the meeting, your proxy includes a grant of discretionary authority to the individuals appointed to vote your Common Stock or act on those matters according to their best judgment, including to adjourn the Annual Meeting.

| NOTICE OF 2024 ANNUAL MEETING OF STOCKHOLDERS AND PROXY STATEMENT | LCI INDUSTRIES | 13 |

PRINCIPAL HOLDERS OF VOTING SECURITIES

Set forth below is information with respect to each person known to the Company on March 15, 2024, to be the beneficial owner of more than five percent of any class of the Company’s voting securities. Unless otherwise noted, the stockholders listed in the table have sole voting and investment power with respect to the shares of Common Stock owned by them.

| Name Address of Beneficial Owner | Amount and Nature of Beneficial Ownership(1) | Approximate Percent of Class(1) |

| BlackRock, Inc.(2) 50 Hudson Yards New York, NY 10001 | 4,096,659 | 16.1% |

| The Vanguard Group(3) 100 Vanguard Boulevard Malvern, PA 19355 | 2,785,212 | 10.9% |

| Kayne Anderson Rudnick Investment Management, LLC(4) 2000 Avenue of the Stars, Suite 1110 Los Angeles, CA 90067 | 2,324,010 | 9.1% |

| FMR, LLC(5) 245 Summer Street Boston, MA 02210 | 2,110,284 | 8.3% |

| (1) | Beneficial ownership is determined in accordance with rules of the Securities and Exchange Commission (the “SEC”) and includes general voting power and/or investment power with respect to securities. The approximate percent of class is determined based on the number of outstanding shares of the Company’s Common Stock on March 15, 2024. |

| (2) | Based on information reported to the SEC in an amended Schedule 13G filed by BlackRock, Inc. (“BlackRock”) on January 22, 2024, reflecting beneficial ownership as of December 31, 2023. BlackRock had sole voting power over 4,041,248 shares and sole dispositive power over 4,096,659 shares. |

| (3) | Based on information reported to the SEC in an amended Schedule 13G filed by The Vanguard Group (“Vanguard”) on February 13, 2024, reflecting beneficial ownership as of December 29, 2023. Vanguard had sole dispositive power over 2,730,290 shares, shared voting power over 27,694 shares, and shared dispositive power over 54,922 shares. |

| (4) | Based on information reported to the SEC in an amended Schedule 13G filed by Kayne Anderson Rudnick Investment Management, LLC (“Kayne”) on February 13, 2024, reflecting beneficial ownership as of December 31, 2023. Kayne had sole voting power over 1,744,799 shares, shared voting and dispositive power over 369,320 shares, and sole dispositive power over 1,954,690 shares. |

| (5) | Based on information reported to the SEC in a Schedule 13G filed by FMR LLC (“FMR”) and Abigail P. Johnson on February 9, 2024, reflecting beneficial ownership as of December 29, 2023. FMR had sole voting power over 2,108,788 shares and sole dispositive power over 2,110,284 shares, and Ms. Johnson had sole dispositive power over 2,110,284 shares. |

| 14 | NOTICE OF 2024 ANNUAL MEETING OF STOCKHOLDERS AND PROXY STATEMENT | LCI INDUSTRIES |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

Set forth below is information with respect to beneficial ownership on March 15, 2024, of the Company’s voting securities by each Director, each of whom is a nominee for election, by each of our executive officers named in the Summary Compensation Table herein, and by all current Directors and executive officers of the Company as a group. Unless otherwise noted, the stockholders listed in the table have sole voting and investment power with respect to the shares of Common Stock owned by them, and their address is c/o LCI Industries, 3501 County Road 6 East, Elkhart, Indiana 46514.

| Name of Beneficial Owner | Amount and Nature of Beneficial Ownership(1) | Approximate Percent of Class(1) |

| Brendan J. Deely | 12,973(2) | * |

| James F. Gero | 318,060(3) | 1.2% |

| Tracy D. Graham | 14,240(2) | * |

| Virginia L. Henkels | 12,899(4) | * |

| Jason D. Lippert | 383,145(5) | 1.5% |

| Stephanie K. Mains | 4,067(6) | * |

| Linda K. Myers | 2,080(7) | * |

| Kieran M. O’Sullivan | 21,535(2) | * |

| David A. Reed | 18,944(8) | * |

| John A. Sirpilla | 7,107(2) | * |

| Lillian D. Etzkorn | 1,028(5) | * |

| Andrew J. Namenye | 23,355(5) | * |

| Jamie M. Schnur | 35,711(5) | * |

| Ryan R. Smith | 24,011(5) | * |

| Brian M. Hall | 34,894(5) | * |

| All current Directors and executive officers as a group (14 persons) | 879,155 | 3.5% |

| * | Represents less than 1% of the outstanding shares of Common Stock. |

| (1) | Beneficial ownership is determined in accordance with rules of the SEC and includes general voting power and/or investment power with respect to securities. Shares of Common Stock subject to deferred stock units (“DSUs”), restricted stock units (“RSUs”), and performance stock units (“PSUs”) that vest within 60 days of March 15, 2024, are deemed to be outstanding for the purpose of computing the amount of beneficial ownership and percentage ownership of the person holding such equity units but are not deemed outstanding for computing the percentage ownership of any other person. |

| (2) | Includes 1,344 RSUs, which represents RSUs granted in May 2023, plus dividend equivalents thereon, that are scheduled to vest within 60 days of March 15, 2024. |

| (3) | Includes 1,344 RSUs, which represents RSUs granted in May 2023, plus dividend equivalents thereon, that are scheduled to vest within 60 days of March 15, 2024. Excludes 8,470 DSUs, plus dividend equivalents thereon, not issuable within 60 days. |

| (4) | Includes 1,344 RSUs, which represents RSUs granted in May 2023, plus dividend equivalents thereon, that are scheduled to vest within 60 days of March 15, 2024. Excludes 5,409 DSUs, plus dividend equivalents thereon, not issuable within 60 days. |

| (5) | Excludes the following respective equity units that are not issuable within 60 days: |

| NOTICE OF 2024 ANNUAL MEETING OF STOCKHOLDERS AND PROXY STATEMENT | LCI INDUSTRIES | 15 |

| RSUs | PSUs | |

| Jason D. Lippert | 41,375 | 114,251 |

| Lillian D. Etzkorn | 5,782 | 9,506 |

| Ryan R. Smith | 20,971 | 48,216 |

| Jamie M. Schnur | 13,196 | 36,452 |

| Andrew J. Namenye | 7,736 | 18,885 |

| Brian M. Hall | — | 6,696 |

| (6) | Includes 1,344 RSUs, which represents RSUs granted in May 2023, plus dividend equivalents thereon, that are scheduled to vest within 60 days of March 15, 2024. Excludes 979 DSUs, plus dividend equivalents thereon, not issuable within 60 days. |

| (7) | Includes 1,344 RSUs, which represents RSUs granted in May 2023, plus dividend equivalents thereon, that are scheduled to vest within 60 days of March 15, 2024. Excludes 1,065 DSUs, plus dividend equivalents thereon, not issuable within 60 days. |

| (8) | Includes 1,344 RSUs, which represents RSUs granted in May 2023, plus dividend equivalents thereon, that are scheduled to vest within 60 days of March 15, 2024. Excludes 266 DSUs, plus dividend equivalents thereon, not issuable within 60 days. |

DELINQUENT SECTION 16(A) REPORTS

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires the Company’s executive officers and Directors, and persons who beneficially own more than ten percent of the Company’s equity securities, to file reports of ownership and changes in ownership with the SEC.

Based on its review of the copies of such forms and representations from its Directors and executive officers, the Company believes that during 2023, all such filing requirements were satisfied.

Locations as of 12/31/23

| 16 | NOTICE OF 2024 ANNUAL MEETING OF STOCKHOLDERS AND PROXY STATEMENT | LCI INDUSTRIES |

Proposal 1. ELECTION OF DIRECTORS

The business and affairs of the Company are managed under the direction of our Board of Directors. The Company’s Restated Certificate of Incorporation currently provides that the number of directors shall consist of not less than three nor more than twelve persons. Our bylaws provide that the number of directors, not less than three nor more than twelve persons, shall be determined from time to time by resolution of the Board. The Board of Directors currently consists of ten Directors. As discussed further below, it is proposed that, at the 2024 Annual Meeting, the stockholders elect a Board of ten Directors to serve for a term of one year or until their successors are elected and qualify. Proxies cannot be voted for a greater number of persons than ten, which is the number of nominees named in this Proxy Statement.

The Company’s bylaws require directors to be elected under a majority voting standard in uncontested elections. In any contested election, directors will be elected by a plurality vote. In an uncontested election, which the election of Directors at the 2024 Annual Meeting will be, each of the nominees, as an incumbent Director, was required to submit an irrevocable resignation, contingent on (i) that person not receiving a majority of the votes cast in his or her election, and (ii) acceptance of that resignation by the Board of Directors in accordance with the policies and procedures adopted by the Board of Directors for such purpose. In the event a nominee in an uncontested election fails to receive a majority of the votes cast, the Corporate Governance, Nominating, and Sustainability Committee will make a recommendation to the Board of Directors as to whether to accept or reject the resignation of such incumbent Director, or whether other action should be taken. The Board of Directors will act on the resignation, taking into account the Committee’s recommendation, and publicly disclose (by a press release and filing an appropriate disclosure with the SEC) its decision regarding the resignation and, if such resignation is rejected, the rationale behind the decision, within 90 days following certification of the election results. The Corporate Governance, Nominating, and Sustainability Committee, in making its recommendation, and the Board of Directors, in making its decision, each may consider any factors and other information that they consider appropriate and relevant. If the Board of Directors accepts a Director’s

resignation pursuant to this process, the Board of Directors may fill the resulting vacancy.

DIRECTOR QUALIFICATIONS AND SELECTION PROCESS

The Corporate Governance, Nominating, and Sustainability Committee of the Board leads the search for individuals qualified to become Directors and selects nominees to be presented for stockholder approval at each Annual Meeting. The Committee considers candidates for Board membership suggested by members of the Committee and Directors, as well as by Management and stockholders. In this regard, the Corporate Governance, Nominating, and Sustainability Committee considers the composition of the Board with respect to experience, balance of professional interests, required expertise, and other factors. In addition, the Committee will endeavor to include candidates who reflect diverse backgrounds, including diversity of race, ethnicity, and gender, when assembling an initial pool of qualified candidates from which to fill Board vacancies. The objective of the Committee will be to identify and recommend the most capable candidates who have experience in the areas of expertise needed at that time and meet the criteria for nomination.

The Corporate Governance, Nominating, and Sustainability Committee uses the same criteria for evaluating candidates suggested by stockholders as it does for those proposed by Directors or Management. To be considered for membership on the Board, a candidate must meet the following criteria, which are also set forth in the Company’s Governance Principles: (a) should possess the highest personal and professional ethics, integrity, and values, and be committed to representing the long-term interests of the stockholders; (b) should have an inquisitive and objective perspective, practical wisdom, and mature judgment; (c) must be willing to devote sufficient time to carry out his or her duties and responsibilities effectively; (d) should be committed to serving on the Board for an extended period of time; (e) should be prepared to resign in the event of any significant change in his or her personal circumstances which may impair his or her ability to effectively serve on the Board; (f) Directors who also serve as CEOs or in equivalent positions should not serve on more than two boards of public companies in addition to the Company’s Board; and (g) Directors who are not CEOs or equivalent should not serve on more than four boards of public companies in addition to the Company’s Board.

| NOTICE OF 2024 ANNUAL MEETING OF STOCKHOLDERS AND PROXY STATEMENT | LCI INDUSTRIES | 17 |

The Corporate Governance, Nominating, and Sustainability Committee seeks candidates who have demonstrated exceptional ability and judgment and who can, in conjunction with other Directors, most effectively serve the long-term interests of our stockholders. The particular experience, qualifications, and skills of each nominee described on pages 19 through 23 of this Proxy Statement reflect that our Board, taken as a whole, provides a broad diversity of knowledge of our Company and industry, expertise in finance and investment, experience with technology-based and growth-oriented companies and global markets, competence in accounting and financial reporting, and leadership in business and with socially responsible organizations.

The Corporate Governance, Nominating, and Sustainability Committee recommended to the Board each of the nominees for election as Directors as set forth herein. No candidates for Director nominees were submitted to the Committee by any stockholder in connection with the 2024 Annual Meeting.

Stockholders may propose candidates for director for consideration by the Corporate Governance, Nominating, and Sustainability Committee by submitting the names of such candidates and supporting information to:

Corporate Secretary

LCI Industries

52567 Independence Ct.

Elkhart, Indiana 46514

The candidate must meet the qualifications for Directors described above and in the Company’s Governance Principles.

In addition, any stockholder who wishes to nominate a director candidate at an annual meeting may do so by following the procedures and providing the information set forth under “Stockholder Proposals for the 2025 Annual Meeting” and in Section 1.13 of the Company’s bylaws.

| 18 | NOTICE OF 2024 ANNUAL MEETING OF STOCKHOLDERS AND PROXY STATEMENT | LCI INDUSTRIES |

DIRECTOR SKILLS AND EXPERIENCES

The following matrix highlights our Director nominees’ primary skills and experiences. This matrix is intended as a high-level summary and not an exhaustive list of each Director’s skills or contributions to the Board.

| NOTICE OF 2024 ANNUAL MEETING OF STOCKHOLDERS AND PROXY STATEMENT | LCI INDUSTRIES | 19 |

OUR DIRECTOR NOMINEES

Following the recommendation of the Corporate Governance, Nominating, and Sustainability Committee, the Board of Directors has nominated the ten persons named below for election to the Board of Directors at the Annual Meeting. Each of the nominees was elected to his or her present term of office at the Annual Meeting of Stockholders held on May 18, 2023.

| Tracy D. Graham

Mr. Graham, 50, Chairman of the Board of Directors, has been a member of our Board of Directors since 2016. Mr. Graham is Chief Executive Officer and Chief Investment Officer of Graham-Allen Partners, a private equity firm focused on acquiring and growing technology and technology-enabled companies. Prior to forming Graham-Allen Partners in 2009, he served as Vice President of SMB Technology Services for Cincinnati Bell, one of the nation’s leading regionally focused local exchange, wireless, and data center providers. Mr. Graham also successfully built and sold three technology companies over a 12-year period, including GramTel USA, Inc., a provider of managed data center and related services to mid-sized businesses, which was sold to Cincinnati Bell. Mr. Graham is a director of 1st Source Corporation, a publicly owned bank holding company headquartered in South Bend, Indiana. He also serves on the board of directors of The Horton Group, a national insurance, employee benefits, and risk advisory firm. He is also a member of the Board of Trustees at the University of Notre Dame, his alma mater.

Mr. Graham has over 26 years of executive and leadership experience with technology-based and growth-oriented companies, as well as a multifaceted understanding of the data technology and cybersecurity issues facing businesses today. |

| Committees: Audit; Corporate Governance, Nominating, and Sustainability | |

| Brendan J. Deely

Mr. Deely, 58, has been a member of our Board of Directors since 2011. Mr. Deely is Chief Executive Officer and President of EFC International, a premier global solutions provider of specialty engineered fasteners and components. From 2018 until 2023, Mr. Deely was the President and Chief Executive Officer of Banner Solutions, a leading wholesaler of commercial, residential, and electronic access control door hardware and security products. From 2016 to March 2018, he was an independent director and then President and Chief Executive Officer of A.H. Harris Construction Supplies, a leading distributor of construction supplies and equipment. From 2004 until December 2014, Mr. Deely was President and Chief Executive Officer of L&W Supply Corporation, a subsidiary of USG Corporation, and from 2008 until November 2014, he was Senior Vice President of USG Corporation, a publicly owned manufacturer and distributor of high-performance building systems. For more than five years prior thereto, Mr. Deely held various executive positions with USG Corporation and its subsidiaries. He is a current Board member of Dayton Superior Corporation, a leading single-source provider of concrete accessories, chemicals, and forming products for the non-residential construction industry.

Mr. Deely has extensive experience with respect to corporate management, operations, supply chain, and compensation matters, and extensive experience with socially responsible organizations. |

| Committees: Corporate Governance, Nominating, and Sustainability; Risk; Strategy, Acquisition, and Capital Deployment (chair) |

| 20 | NOTICE OF 2024 ANNUAL MEETING OF STOCKHOLDERS AND PROXY STATEMENT | LCI INDUSTRIES |

| James F. Gero

Mr. Gero, 79, has been a member of our Board of Directors since 1992. Mr. Gero is a private investor and served as Chairman of the Board of Orthofix International, N.V., a publicly owned international supplier of orthopedic devices for bone fixation and stimulation, from 2004 to December 2013. Mr. Gero also serves as a director of Intrusion, Inc., a publicly owned supplier of security software.

Mr. Gero has extensive experience with respect to corporate management and leadership, strategic planning, and compensation matters, and has public company board experience. |

| Committees: Compensation and Human Capital; Corporate Governance, Nominating, and Sustainability | |

| Virginia L. Henkels

Ms. Henkels, 55, has been a member of our Board of Directors since 2017. Ms. Henkels most recently was Chief Financial Officer and Secretary of Empowerment & Inclusion Capital I Corp., a mission-based special purpose acquisition company (SPAC) focused on promoting equity and inclusion until February 2023. From 2008 to 2017, Ms. Henkels served as Executive Vice President, Chief Financial Officer, and Treasurer of Swift Transportation Company, a then publicly traded transportation services company, where she led numerous capital market transactions, including its 2010 initial public offering. She also held various finance and accounting leadership positions with increasing responsibilities since 2004 at Swift Transportation and from 1990 to 2002 at Honeywell International, Inc., a global diversified technology and manufacturing company. Ms. Henkels is currently a member of the National Association of Corporate Directors and the Women’s Corporate Director organizations. Ms. Henkels also serves on the board of directors of Viad Corp., a publicly traded full-service live events and travel experience company, and Isaac Instruments, a privately-held solutions provider of transportation technology to simplify trucking. Previously, Ms. Henkels served on the board of directors of Echo Global Logistics, Inc., a provider of technology-enabled transportation and supply chain management solutions from 2018 until it was acquired by The Jordan Companies in November 2021.

Formerly a CPA, Ms. Henkels has extensive experience with finance, accounting, capital markets, and investor relations, as well as experience in strategy development, risk management, mergers and acquisitions, audit, corporate culture, and corporate governance. |

| Committees: Audit (chair); Compensation and Human Capital; Risk | |

| Jason D. Lippert

Mr. Lippert, 51, has been a member of our Board of Directors since 2007. Mr. Lippert became Chief Executive Officer of the Company in May 2013, was also appointed President of the Company in May 2019, and has been Chief Executive Officer of Lippert Components since February 2003. Mr. Lippert has over 29 years of experience with the Company and its subsidiaries, and he has served in a wide range of leadership positions. Since November 1, 2021, Mr. Lippert also serves on the board of directors of Quanex Building Products Corporation, a publicly traded manufacturer of components sold to Original Equipment Manufacturers (OEMs) in the building products industry.

Mr. Lippert has particular knowledge of the industries and customers to which we sell our products, as well as extensive experience with strategic planning, acquisitions, marketing, manufacturing, and the sale of our products. |

| Stephanie K. Mains

Ms. Mains, 56, has been a member of our Board of Directors since 2021. Ms. Mains has served as Chief Executive Officer of LSC Communications MCL, LLC, a portfolio company of Atlas Holdings, since April 2021. Ms. Mains has over 30 years of experience across diverse industry segments, including aviation, energy, and transportation, and in the last 15 years, building and expanding global service businesses serving industrial, oil and gas, utility, distributed power, and electrification spaces. Prior to her current role, she held the interim Chief Executive Officer role for GE Power Conversion, a $1B advanced electrification and digital solutions business, leading the business to a profitable turnaround through COVID-19 in 2020. From 2015-2019, she served as the President and Chief Executive Officer of Industrial Solutions, a GE and later ABB company. She led Industrial Solutions, a $2.7B GE business delivering technologies that distribute, protect, and control electricity, through a transformation and divestiture to ABB. From 2013-2015, Ms. Mains served as President and Chief Executive Officer of GE Distributed Power Global Services, where she integrated and grew a $2.2B global business platform, servicing technologies that provide at the point of use power to the oil and gas, utilities, mining, and industrial segments. From 2006 until 2013, she held positions of increasing responsibility in GE Energy from General Manager to Vice President. During this time, she led the global build-out and transformation of a $4B service operation providing power equipment and services to utility and oil and gas customers. Prior to joining GE Energy, she spent 16 years across multiple GE businesses in financial and leadership positions, including Chief Financial Officer of GE Aviation Services-Contractual Services and Material Solutions, a $4B aviation material services business. Ms. Mains also serves on the board of directors of Diamondback Energy, Inc., an independent oil and natural gas company; Gates Industrial Corporation plc, a global manufacturer of innovative, highly engineered power transmission and fluid power solutions; and Stryten Manufacturing, a manufacturer of premium battery solutions, which is a private portfolio company of Atlas Holdings.

Ms. Mains has extensive experience building and leading global businesses across multiple industrial and services segments. She has expertise in strategy and portfolio development, financial management, acquisitions and integrations, digital transformation, global expansion, manufacturing and service capability development, customer engagement models, organization talent development, and global cultural evolution. |

| Committees: Audit; Compensation and Human Capital | |

| Linda K. Myers

Ms. Myers, 60, has been a member of our Board of Directors since November 2022. Most recently, Ms. Myers served as a partner and seasoned member of the senior leadership team at Kirkland & Ellis LLP (“Kirkland”), a large multi-national law firm, from 1996 through February 2022. During her time at Kirkland, Ms. Myers served on the Global Management Executive Committee and established Kirkland’s Diversity Integration Task Force, which determines policy and structural enhancements to execute the firm’s commitment to diversity at all levels. Ms. Myers is also a founding member of Kirkland’s Women’s Leadership Initiative. Ms. Myers currently serves on the board of directors of Gibraltar Industries, a leading manufacturer and provider of products and services for the renewable energy, residential, agtech, and infrastructure markets. At Gibraltar, she serves as Chair of the Gibraltar Nominating, Governance & Corporate Social Responsibility Committee and a member of its Audit & Risk Committee, Capital Structure & Asset Management Committee, and Compensation & Human Capital Committee. In January of 2024, Ms. Myers joined the board of Marex Group plc, a UK based financial services company. She is a member of its Renumeration Committee and Audit & Compliance Committee. Ms. Myers also holds board leadership roles at Kinzie Capital Partners, National Philanthropic Trust, Chicago Shakespeare Theater, and Lyric Opera of Chicago.

Ms. Myers has extensive financial and legal acumen, as well as leadership abilities which are of significant value to LCI Industries, our Board of Directors, and our stockholders. |

| Committees: Corporate Governance, Nominating, and Sustainability (chair); Risk; Strategy, Acquisition, and Capital Deployment | |

| Kieran M. O’Sullivan

Mr. O’Sullivan, 62, has been a member of our Board of Directors since 2015. Mr. O’Sullivan is President, Chief Executive Officer, and Chairman of the Board of CTS Corporation, a publicly owned designer and manufacturer of electronic components and sensors to original equipment manufacturers in the automotive, communications, medical, defense and aerospace, industrial, and computer markets. Prior to joining CTS in 2013, he served as Executive Vice President of Continental AG’s Global Infotainment and Connectivity Business and led the NAFTA Interior Division, having joined Continental AG, a global automotive supplier, in 2006.

Mr. O’Sullivan has over 27 years of leadership experience in operations, strategy, mergers and acquisitions, and finance roles in the manufacturing services, electronics, and automotive business segments, experience in global markets, as well as experience as a sitting President and Chief Executive Officer of a publicly owned corporation. |

| Committees: Audit; Corporate Governance, Nominating, and Sustainability; Risk (chair) |

| 22 | NOTICE OF 2024 ANNUAL MEETING OF STOCKHOLDERS AND PROXY STATEMENT | LCI INDUSTRIES |

| David A. Reed

Mr. Reed, 76, has been a member of our Board of Directors since 2003. Mr. Reed is President of a privately held family investment management company. Mr. Reed retired as Senior Vice Chair for Ernst & Young LLP in 2000 where he held several senior U.S. and global operating, administrative, and marketing roles in his 26-year tenure with the firm. He served on Ernst & Young LLP’s Management Committee and Global Executive Council from 1991 to 2000. His experience includes service as a director for several publicly owned, venture capital, and private equity-based companies since 2000.

Mr. Reed has accounting and financial acumen, with particular knowledge of financial reporting and taxation, and has public company board experience. |

| Committees: Risk; Strategy, Acquisition, and Capital Deployment | |

| John A. Sirpilla

Mr. Sirpilla, 57, has been a member of our Board of Directors since 2019. Mr. Sirpilla is Chief Executive Officer and the founder of Encourage LLC, a small family office focused on investing in retail, medical development, and health management. From 2003 to 2012, Mr. Sirpilla served as President of Camping World Accessory Stores, a 140-store nationwide retail chain serving the RV industry. In 2012, Mr. Sirpilla was promoted to Chief Business Development Officer for the parent company of Camping World and Good Sam, where he led store operations, logistics, and new business development until his retirement in 2017. Mr. Sirpilla formerly served as Chairman of the Board for the Stark County Catholic Schools and the United Way of Greater Stark County. Mr. Sirpilla is a current Board member of the Pro Football Hall of Fame, Aultman Health Foundation, TecTraum Inc., Wellspring Financial Services, and Society Brands.

Mr. Sirpilla has over 30 years of executive and leadership experience in the RV industry, as well as extensive knowledge and expertise in investments and strategic planning. |

| Committees: Compensation and Human Capital (chair); Risk; Strategy, Acquisition, and Capital Deployment |

Unless contrary instructions are indicated, the persons named as proxies in the form of proxy solicited from holders of our Common Stock will vote for the election of the nominees indicated above. If any such nominees should be unable or unwilling to serve, the persons named as proxies will vote for such other person or persons as may be proposed by the Board of Directors. The Board of Directors has no reason to believe that any of the named nominees will be unable or unwilling to serve.

CORPORATE GOVERNANCE AND RELATED MATTERS

STATEMENT REGARDING

CORPORATE GOVERNANCE

The Company regularly monitors developments in the area of corporate governance, including rules promulgated by the SEC and the NYSE. The Company’s corporate governance policies and procedures are designed to comply with all laws and rules applicable to corporate governance, and the Company has continually implemented “best practices” as it deems appropriate to protect and enhance stockholders’ interests.

The Company’s Governance Principles, as well as the Charters of the Audit Committee, the Compensation and Human Capital Committee, the Corporate Governance, Nominating, and Sustainability Committee, the Risk Committee, and the Strategy, Acquisition, and Capital Deployment Committee, and the Key Practices of the Audit Committee, the Compensation and Human Capital Committee, and the Corporate Governance, Nominating, and Sustainability Committee, in addition to the Company’s Guidelines for Business Conduct, Code of Ethics for Senior Financial Officers, and Whistleblower Policy, can be accessed on the Company’s website at http://investors.lci1.com under “Governance - Governance Documents.” A copy of any corporate governance document will be furnished, without charge, upon written request to Corporate Secretary, LCI Industries, 52567 Independence Ct., Elkhart, Indiana 46514. Information on our website is not incorporated by reference into this Proxy Statement.

BOARD OF DIRECTORS AND

DIRECTOR INDEPENDENCE

Directors are elected annually by the Company’s stockholders for one-year terms. The Board currently consists of nine independent Directors, and one Director, Jason D. Lippert, who is employed by the Company as its President and Chief Executive Officer.

The Board of Directors reviews, at least annually, the independence of each Director. During these reviews, the Board considers transactions and relationships between each Director (and his or her immediate family and affiliates) and the Company

and Management to determine whether any such transactions or relationships are inconsistent with a determination that the Director is independent. The review is based primarily on responses of the Directors to questions in a directors’ and officers’ questionnaire regarding employment, business, familial, compensation, and other relationships. In reviewing the independence of the Directors, the Board applies the standards that it has adopted to assist it in making determinations of independence and that are contained in the Company’s Governance Principles, which are available on the Company’s website at http://investors.lci1.com under “Governance - Governance Documents.” In March 2024, the Board determined that none of Messrs. Graham, Deely, Gero, O’Sullivan, Reed, or Sirpilla, nor Mses. Henkels, Mains, or Myers, has any material relationship with the Company or its subsidiaries. Accordingly, the Board has determined that each of these nine Directors meets the “independence” standards of the NYSE.

The independent Directors have complete access to, and are encouraged to communicate with, the Company’s Chief Executive Officer and any other executives of the Company. During the year ended December 31, 2023, the Board of Directors held 4 meetings. All Directors attended at least 75% of the regularly scheduled and special meetings of the Board and the Board committees on which they served.

Directors are expected to attend the Company’s annual meetings. At the Company’s 2023 Annual Meeting, all Directors standing for election attended virtually.

LEADERSHIP STRUCTURE

The Company has continuously maintained separate positions for Chairman of the Board and for Chief Executive Officer in order to provide an independent and unbiased level of review and oversight of senior Management. Tracy D. Graham currently serves as Chairman of the Board, and Jason D. Lippert serves as President and Chief Executive Officer. The Chairman of the Board coordinates the activities of the independent Directors, serves as a liaison on Board-related issues between the independent Directors and the CEO, and performs any other duties and responsibilities that the Board of Directors may determine. While the Board elects a Chairman of the Board annually, it is generally expected that he or she will serve for more than one year.

| 24 | NOTICE OF 2024 ANNUAL MEETING OF STOCKHOLDERS AND PROXY STATEMENT | LCI INDUSTRIES |

The role of the Chairman of the Board also includes:

| ● | presiding at executive sessions, with the authority to call meetings of the non-employee Directors; |

| ● | advising on the selection of committee chairs; |

| ● | approving the agenda, schedule, and information sent to the Directors for Board meetings and assuring that there is sufficient time for discussion of all items on Board meeting agendas; |

| ● | working with the CEO to prepare a schedule of strategic discussion items; and |

| ● | guiding the Board’s governance processes, including the annual Board self-evaluation and succession planning. |

The Board periodically reviews its leadership structure to evaluate whether it remains appropriate for the Company.

EXECUTIVE SESSIONS

The non-employee Directors meet regularly in executive sessions without Management. An executive session is held in conjunction with each regularly scheduled Board meeting and is led by the Chairman of the Board. At least once a year, a meeting of only the independent Directors is held. Additional executive sessions may be called by the Chairman of the Board in his discretion or at the request of the Board.

BOARD COMMITTEES

The Company has five standing Committees of the Board of Directors: the Audit Committee, the Compensation and Human Capital Committee, the Corporate Governance, Nominating, and Sustainability Committee, the Risk Committee, and the Strategy, Acquisition, and Capital Deployment Committee. All members of the Audit Committee, the Compensation and Human Capital Committee, and the Corporate Governance, Nominating, and Sustainability Committee are independent Directors who meet the independence and experience standards of the NYSE and the SEC. The Board annually selects the Directors who serve

on the committees. Each committee functions pursuant to a written Charter and, other than the Risk Committee and Strategy, Acquisition, and Capital Deployment Committee, written Key Practices adopted by the Board of Directors and reviewed annually by each committee.

| NOTICE OF 2024 ANNUAL MEETING OF STOCKHOLDERS AND PROXY STATEMENT | LCI INDUSTRIES | 25 |

The following table reflects the current membership of each Board Committee:

| Name | Audit Committee | Compensation and Human Capital Committee | Corporate Governance, Nominating, and Sustainability Committee | Risk Committee | Strategy, Acquisition, and Capital Deployment Committee |

| Tracy D. Graham |  |  | |||

| Brendan J. Deely |  |  | Chair | ||

| James F. Gero |  |  | |||

| Virginia L. Henkels | Chair |  |  | ||

| Stephanie K. Mains |  |  | |||

| Linda K. Myers | Chair |  |  | ||

| Kieran M. O’Sullivan |  |  | Chair | ||

| David A. Reed |  |  | |||

| John A. Sirpilla | Chair |  |  |

Audit Committee

The purpose of the Audit Committee of the Board of Directors is to assist the Board in its oversight of (i) the conduct of the Company’s financial reporting processes and the integrity of the Company’s financial statements; (ii) the Company’s compliance with legal and regulatory requirements; (iii) the independence, qualifications, and performance of the Company’s independent auditor; (iv) the adequacy and effectiveness of the Company’s systems of internal control over financial reporting and disclosure controls and procedures, and the performance of the Company’s internal audit function; and (v) the Company’s compliance with ethical standards adopted by the Company. The Committee also prepares an annual report for inclusion in the Company’s Proxy Statement. The Audit Committee selects the Company’s independent auditor, which selection is submitted to the stockholders for ratification in this Proxy Statement. See “Proposal 3. Ratification of Appointment of Auditors.”

In coordination with the Risk Committee, the Audit Committee oversees the Company’s cyber security risk management strategies, programs, policies, procedures, and functions.

All of the Audit Committee members meet the independence and experience requirements of the NYSE and the SEC. Ms. Henkels serves as Chair of the Audit Committee, and each member of the Committee has been determined by the Board of Directors to be an “audit committee financial expert” as defined by the SEC. This Committee held 7 meetings during the year ended December 31, 2023.

Compensation and Human Capital Committee

The purpose of the Compensation and Human Capital Committee of the Board of Directors is (i) to assist the Board in discharging its responsibilities in respect of compensation of the Company’s executive officers; (ii) to prepare an annual report on executive compensation for inclusion in the Company’s Proxy Statement; and (iii) to oversee the Company’s strategies, initiatives, and policies related to human resources.

The Compensation and Human Capital Committee is responsible for reviewing the performance and development of the Company’s Management in achieving corporate goals, and ensuring that the Company’s senior executives are compensated consistent with the long-term objectives of the Company as well as competitive practices. This Committee provides oversight and guidance in the development of compensation and benefit programs for senior executives of the Company, determines the compensation terms for the Company’s Chief Executive Officer and other executive officers, administers the LCI Industries 2018 Omnibus Incentive Plan (the “2018 Plan”), approves equity awards, and coordinates with the Corporate Governance, Nominating, and Sustainability Committee with respect to compensation of Directors. The Compensation and Human Capital Committee approved the compensation, consisting of salary, incentive bonus, equity awards, and benefits paid for 2023 to the “Named Executive Officers.” See “Executive Compensation – Compensation Discussion and Analysis.”

In addition, the Compensation and Human Capital Committee oversees and administers the Company’s clawback policy. It also oversees the development, implementation, and effectiveness of the Company’s strategies, initiatives, and policies related to human resources, including, but not limited to: talent acquisition, retention, development, and succession (excluding succession related to the Company’s Chief Executive Officer, which succession is overseen by the Corporate Governance, Nominating, and Sustainability Committee); company culture; employee engagement; workforce demographics; enterprise health care programs; diversity, equity, and inclusion matters; and other key human resources policies and practices.

| 26 | NOTICE OF 2024 ANNUAL MEETING OF STOCKHOLDERS AND PROXY STATEMENT | LCI INDUSTRIES |

Mr. Sirpilla serves as Chairman of the Compensation and Human Capital Committee. All members of the Compensation and Human Capital Committee meet the independence requirements of the NYSE and the SEC. This Committee held 4 meetings during the year ended December 31, 2023.

Corporate Governance, Nominating, and Sustainability Committee

The purpose of the Corporate Governance, Nominating, and Sustainability Committee of the Board of Directors is to assist the Board in (i) identifying qualified individuals to become Directors; (ii) determining the composition of the Board of Directors and its Committees; (iii) monitoring a process to assess Board effectiveness; (iv) developing and implementing the Company’s corporate governance principles and business guidelines; (v) evaluating potential candidates for executive positions; and (vi) oversight of sustainability and social responsibility matters.

The Corporate Governance, Nominating, and Sustainability Committee oversees the development of executive succession plans, coordinates with the Compensation and Human Capital Committee with respect to compensation of Directors, reviews and approves related person transactions, and resolves any conflicts of interest involving a Director. The Committee reviews and, if necessary, recommends revisions to the Company’s Guidelines for Business Conduct, Code of Ethics for Senior Financial Officers, and other governance policies adopted from time to time. The Committee also oversees, reviews, and reports to the Board on a periodic basis

with regard to sustainability and social responsibility matters, including impacts to the Company’s business and strategy, the Company’s public reporting on these topics, and any recommendations with respect to oversight and related policies.

The Corporate Governance, Nominating, and Sustainability Committee leads the search for individuals qualified to become Directors and selects nominees to be presented for stockholder approval at each Annual Meeting of Stockholders and to fill vacancies on the Board of Directors. See “Proposal 1. Election of Directors – Director Qualifications and Selection Process.”

Ms. Myers serves as Chair of the Corporate Governance, Nominating, and Sustainability Committee. This Committee held 4 meetings during the year ended December 31, 2023.

Risk Committee

The purpose of the Risk Committee of the Board of Directors is to provide oversight of Company-wide risk management practices to assist the Board in (i) overseeing that the executive team has identified and assessed all the risks that the organization faces and has established a risk management infrastructure capable of addressing those risks; (ii) overseeing in conjunction with other Board-level committees or the full Board, if applicable, risk, such as strategic, financial, credit, market, liquidity, cyber and physical security, property, information technology, legal, regulatory, reputational, and other risks; (iii) overseeing the division of risk-related responsibilities to each Board committee as clearly as possible and performing a gap analysis to determine that the oversight of any risks are not missed; and (iv) in conjunction with the full Board, approving the Company’s enterprise-wide risk management framework. The Company faces a number of material risks, including financial and operational risks. Accordingly, the Company conducts regular enterprise risk management reviews to identify and assess these risks, and to implement effective plans to manage them.

Mr. O’Sullivan serves as Chairman of the Risk Committee. This Committee held 4 meetings during the year ended December 31, 2023.

| NOTICE OF 2024 ANNUAL MEETING OF STOCKHOLDERS AND PROXY STATEMENT | LCI INDUSTRIES | 27 |

Strategy, Acquisition, and Capital Deployment Committee

The purpose of the Strategy, Acquisition, and Capital Deployment Committee of the Board of Directors is to assist the Board in fulfilling its oversight responsibilities relating to the formulation and execution of strategy for the Company, risks and opportunities relating to such strategy, and strategic decisions regarding investments, acquisitions, and divestitures by the Company. The Strategy, Acquisition, and Capital Deployment Committee (i) works with Management in the development of the Company’s strategy; (ii) monitors execution of the Company’s strategic plan, both domestically and internationally, against stated goals and objectives, and provides guidance and feedback as necessary; (iii) in conjunction with Management, develops an acquisition strategy that aligns with the Company’s long-term strategic plan; (iv) reviews each proposed acquisition by the Company above an established threshold in the context of various factors, including whether to recommend approval of the acquisition; (v) from time to time, reviews and recommends to the Board of Directors whether to exit an existing business or dispose of assets; and (vi) reviews and analyzes actions and results against stated goals and objectives.

Mr. Deely serves as Chairman of the Strategy, Acquisition, and Capital Deployment Committee. This Committee held 6 meetings during the year ended December 31, 2023.

COMPENSATION-RELATED RISK

To identify risks that could be created by our compensation policies and practices, the Compensation and Human Capital Committee reviews enterprise risk management assessments and evaluates our controls to determine if they adequately mitigate compensation-related risks. If appropriate, controls are modified or supplemented. The Compensation and Human Capital Committee assessed our executive compensation programs and concluded that our compensation policies and

practices do not create risks that are reasonably likely to have a material adverse effect on the Company. The Compensation and Human Capital Committee believes our executive compensation programs, including the design of long-term incentive plans, oversight by the Compensation and Human Capital Committee, and sufficiency of control features, prevent unintentional material risk. In addition, stock ownership guidelines, the long-term nature of equity awards, share retention, and incentive compensation forfeiture, taken together, motivate Management to carefully consider risk in making business decisions and evaluating growth opportunities, and mitigate excessive risk-taking to achieve short-term results.

COMPENSATION RECOVERY POLICY

Effective September 7, 2023, our Board of Directors adopted a Compensation Recovery Policy (the “Clawback Policy”) in accordance with the listing standards of the NYSE. The Clawback Policy applies to all incentive-based compensation, which is any compensation that is granted, earned, or vested based wholly or in part upon the attainment of a financial reporting measure, received by our executive officers, including our named executive officers.

The Clawback Policy applies in the case of an accounting restatement due to the material noncompliance of the Company with any financial reporting requirement under the securities laws, including any required accounting restatement to correct an error in previously issued financial statements that is material to the previously issued financial statements, or that would result in a material misstatement if the error were corrected in the current period or left uncorrected in the current period. The Clawback Policy provides that promptly following such an accounting restatement, the Compensation and Human Capital Committee will determine the amount of the erroneously awarded compensation, which is the excess of the amount of incentive-based compensation received by current and former executive officers during the three completed fiscal years immediately preceding the required restatement date over the amount of incentive-based compensation that otherwise would have been received had it been determined based on the restated amounts. The Company will provide each such executive officer with a written notice of such amount and a demand for repayment or return. If such repayment or return is not made within a reasonable time, the Clawback Policy provides that the Company will recover the erroneously awarded compensation in a reasonable and prompt manner using any lawful method, subject to limited exceptions as permitted by the NYSE.

| 28 | NOTICE OF 2024 ANNUAL MEETING OF STOCKHOLDERS AND PROXY STATEMENT | LCI INDUSTRIES |

DIRECTOR STOCK OWNERSHIP REQUIREMENTS

To help align the personal interests of non-employee Directors with the interests of stockholders, all non-employee Directors are required to hold Company Common Stock, RSUs, or DSUs equivalent to 5x each non-employee Director’s annual cash retainer (exclusive of any cash retainer for serving as a Board or Committee chair). Equity interests that count toward satisfaction of the guidelines include shares owned outright by, or held in trust for the benefit of, the individual and his or her immediate family members residing in the same household, plus RSUs, DSUs, and stock awards (whether vested or unvested). Stock options (whether vested or unvested) do not count toward satisfaction of the guidelines. Non-employee Directors are required to achieve ownership in accordance with the guidelines within five years of the date they assume their position. As of the date of this Proxy Statement, all non-employee Directors satisfy the stock ownership requirements or are within that five-year period.

TEAM MEMBERS AND DIRECTORS GUIDELINES FOR BUSINESS CONDUCT

The Company has Guidelines for Business Conduct that all Management team members and Directors are required to annually sign and follow in conducting the Company’s business, and a Code of Ethics for Senior Financial Officers governing the conduct of its President and Chief Executive Officer, Chief Financial Officer, and the financial officers of the Company and its subsidiaries.

MANAGEMENT AND BOARD SUCCESSION

The Board periodically reviews with the Chief Executive Officer and maintains a succession plan for executive officers, after considering recommendations from the Corporate Governance, Nominating, and Sustainability Committee. The plan is designed to ensure an effective transition of Management of our operations to qualified executives upon the retirement of senior executives. The Board is also responsible for maintaining an emergency succession plan that is reviewed periodically with Management.

CONTACTING THE BOARD OF DIRECTORS

Any stockholder, or other interested party, who wishes to communicate with the Board of Directors, or our non-employee Directors as a group, or any member of the Board, may do so electronically by sending an e-mail to LCII@lci1.com or by writing to any Director c/o LCI Industries, 3501 County Road 6 East, Elkhart, Indiana 46514. Communications received electronically or in writing will be distributed to the Chairman or the other members of the Board, as appropriate, depending on the facts and circumstances described in communications received. For example, communications regarding accounting, internal accounting, internal accounting controls, and auditing matters generally will be forwarded to the Chair of the Audit Committee.

PROHIBITION ON HEDGING BY DIRECTORS AND TEAM MEMBERS

The Board of Directors has adopted a Hedging Policy that prohibits the Company’s Directors, executive officers, team members, and their designees from purchasing any financial instruments (including prepaid variable forward contracts, equity swaps, collars, and exchange funds), or otherwise engaging in transactions that hedge or offset, or are designed to hedge or offset, any decrease in the market value of the Company’s Common Stock. This prohibition applies to all shares of the Company’s Common Stock owned directly or indirectly by such persons. The Hedging Policy does not preclude the Company’s Directors, officers, team members, and their designees from engaging in general portfolio diversification.

| NOTICE OF 2024 ANNUAL MEETING OF STOCKHOLDERS AND PROXY STATEMENT | LCI INDUSTRIES | 29 |

DIRECTOR COMPENSATION

The following table summarizes compensation paid to non-employee Directors during fiscal 2023:

Name | Fees Earned or Paid in Cash(1) | Stock Awards(2) | All Other Compensation(3) | Total | ||||||||||||

| Tracy D. Graham | $ | 250,000 | $ | 150,034 | $ | 5,700 | $ | 405,734 | ||||||||

| Frank J. Crespo(4) | $ | 45,824 | $ | 0 | $ | 6,741 | $ | 52,565 | ||||||||

| Brendan J. Deely | $ | 118,091 | $ | 150,034 | $ | 5,700 | $ | 273,825 | ||||||||

| James F. Gero | $ | 115,000 | $ | 150,034 | $ | 38,066 | $ | 303,100 | ||||||||

| Virginia L. Henkels | $ | 125,000 | $ | 150,034 | $ | 27,931 | $ | 302,965 | ||||||||

| Stephanie K. Mains | $ | 115,000 | $ | 150,034 | $ | 7,293 | $ | 272,327 | ||||||||

| Linda K. Myers | $ | 125,663 | $ | 150,034 | $ | 8,083 | $ | 283,780 | ||||||||

| Kieran M. O’Sullivan | $ | 115,000 | $ | 150,034 | $ | 5,700 | $ | 270,734 | ||||||||