- LCII Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

LCI Industries (LCII) 8-KOther Events

Filed: 6 Mar 07, 12:00am

A Leading National Supplier of a Wide Variety of

Components for RV’s and Manufactured Homes

Drew Industries (NYSE:DW)

2003

Forward Looking Statements

This presentation contains certain “forward-looking statements” within the meaning of the Private Securities

Litigation Reform Act of 1995 with respect to financial condition, results of operations, business strategies,

operating efficiencies or synergies, competitive position, growth opportunities for existing products, plans and

objectives of management, markets for the Company’s common stock and other matters. Statements in this

presentation that are not historical facts are “forward-looking statements” for the purpose of the safe harbor

provided by Section 21E of the Exchange Act and Section 27A of the Securities Act. Forward-looking statements,

including, without limitation those relating to our future business prospects, revenues and income, wherever they

occur in this presentation, are necessarily estimates reflecting the best judgment of our senior management, at the

time such statements were made, and involve a number of risks and uncertainties that could cause actual results

to differ materially from those suggested by forward-looking statements. The Company does not undertake to

update forward-looking statements to reflect circumstances or events that occur after the date the forward-looking

statements are made. You should consider forward-looking statements, therefore, in light of various important

factors, including those set forth in this presentation and the Company’s SEC filings.

There are a number of factors, many of which are beyond the Company’s control, which could cause actual results

and events to differ materially from those described in the forward-looking statements. These factors include pricing

pressures due to domestic and foreign competition, costs and availability of raw materials (particularly steel and

related components, vinyl, aluminum, glass and ABS resin), availability of retail and wholesale financing for

manufactured homes, availability and costs of labor, inventory levels of retailers and manufacturers, levels of

repossessed manufactured homes, changes in zoning regulations for manufactured homes, the decline in the

manufactured housing industry, the financial condition of our customers, retention of significant customers, interest

rates, oil and gasoline prices, the outcome of litigation, and adverse weather conditions impacting retail sales. In

addition, national and regional economic conditions and consumer confidence may affect the retail sale of

recreational vehicles and manufactured homes.

Page 2

About Drew Industries

A leading national

manufacturer of

quality components

for Recreational

Vehicles (RV) and

Manufactured

Homes (MH)

Page 3

Headquartered in White

Plains, New York – 10

employees

43 manufacturing facilities in

the U.S. and 1 facility in

Canada

Approximately 4,000

employees nationwide

Organic growth from 2001

through 12/31/06 was well

over $230 million or a 13%

average annual growth,

excluding price increases,

acquisitions, and FEMA

business

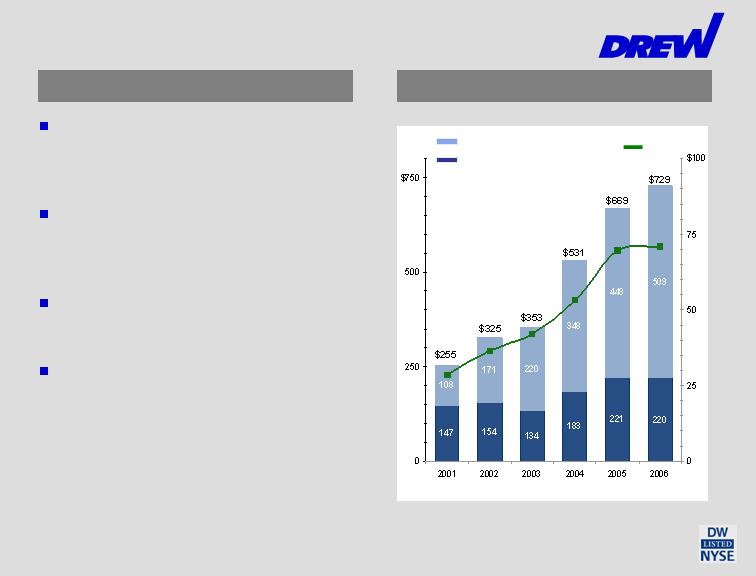

Company Overview

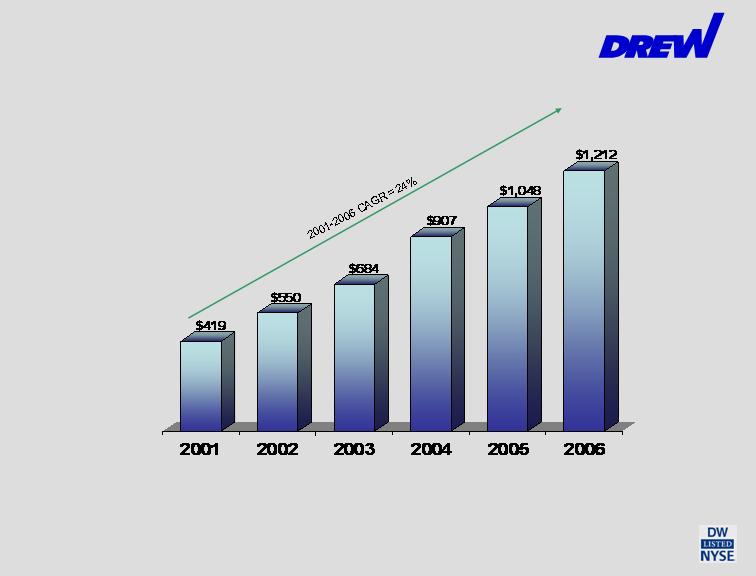

Financial Performance

Sales and EBITDA in millions

MH segment sales

RV segment sales

EBITDA(1)

(1)

2001-2006 EBIDTA CAGR = 20%. EBITDA is

operating profit plus depreciation and amortization

Page 4

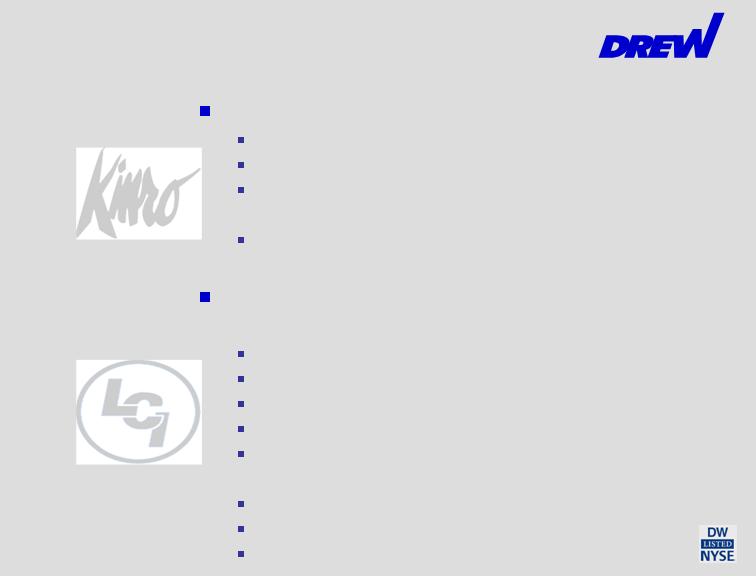

Drew’s Companies

Kinro, Inc. – Acquired 1980

Aluminum windows for RVs

Doors for RVs

Aluminum and vinyl windows and screens

for MHs

Bath and shower units for MHs and RVs

Lippert Components, Inc. – Acquired 1997

Chassis and chassis parts for RVs and MHs

Slide out mechanisms for RVs

Leveling devices for RVs

Axles for towable RVs and for MHs

Specialty trailers for boats, personal

watercraft and equipment hauling

Axles for Specialty Trailers

Bed lifts for “toy-hauler” RVs

Steps for RVs

Page 5

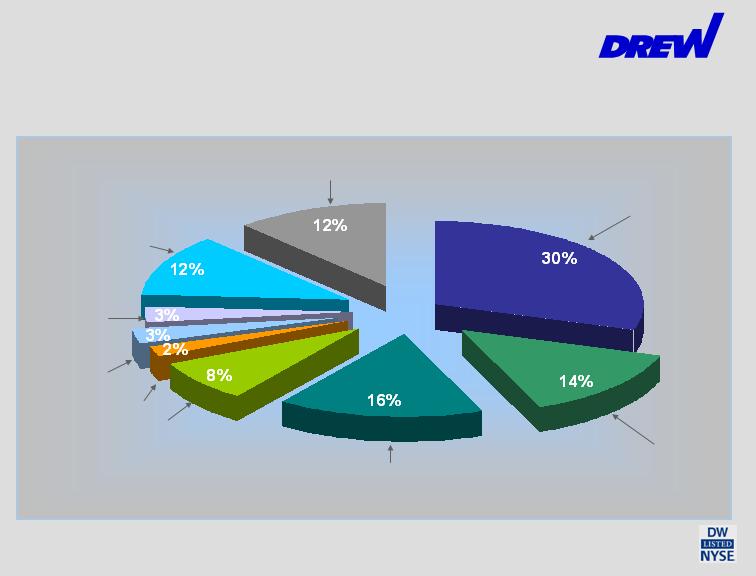

Drew’s Segments – 2006

MH = $21 million

32%

RV = $44 million

68%

Revenues - $729 million

90% of RV revenues are for

towable RVs

Segment Operating Profit - $65 million

MH = $220 million

30%

RV = $509 million

70%

Page 6

Drew’s Products

RV Chassis and Chassis Parts:

$215 million

RV Windows & Doors:

$118 million

12 Months Ended December 31, 2006

Sales - $729 million

Other: $12 million

MH and RV

Bath Products:

$20 million

Specialty

Trailers:

$25 million

RV Slide-out mechanisms:

$105 million

RV and MH Axles & Tires:

$58 million

Page 7

MH Chassis & Chassis

Parts: $87 million

MH Windows, Doors &

Screens: $89 million

Supplier to Industry Leaders

Outstanding customer service and national coverage, with 44

production facilities (approximately 3 million sq. ft.), make us a key

partner with our customers.

Supply most of the Leading Producers of RVs and MHs:

Both RV and MH

Fleetwood (NYSE:FLE)

Skyline (NYSE: SKY)

RV

Coachmen (NYSE: COA)

Forest River (owned by Berkshire Hathaway)

Monaco Coach (NYSE: MNC)

Starcraft (privately owned)

Thor (NYSE:THO)

MH

Champion (NYSE: CHB)

Clayton (owned by Berkshire Hathaway)

Oakwood Homes and Southern Energy Homes

(owned by Clayton)

Palm Harbor (Nasdaq: PHHM)

Page 8

Business Strategy

Increase sales and profitability through:

Market share growth

New product introductions

Strategic acquisitions

This strategy accomplished through:

Outstanding customer service

Motivating management through profit incentives and training

programs

Maintaining highly efficient factories by optimizing production

through state-of-the-art manufacturing technology and methods

Extensive R & D efforts

Disciplined and patient acquirer

Page 9

Content Per Vehicle - RV

Peak potential is $2,400 to $2,700 per RV

(a)

Excludes sales of specialty trailers, as well as Emergency Living Units (“ELU’s”) purchased

by FEMA.

90% of RV segment sales are for Towable RVs

See Page 17 for Industry Information

Page 10

(a)

(a)

Operating

profit margin 8.6% 9.4% 11.3% 9.2%(a) 9.6%(a) 8.6%(a)

Content Per Home - MH

Peak potential is $3,200 to $3,500 per home

Operating

Profit margin 10.8% 11.0% 10.7% 10.1% 10.2% 9.5%

See Page 21 for Industry Information

Page 11

$763

$916

$1,021

$1,457

$1,507

$1,784

2001

2002

2003

2004

2005

2006

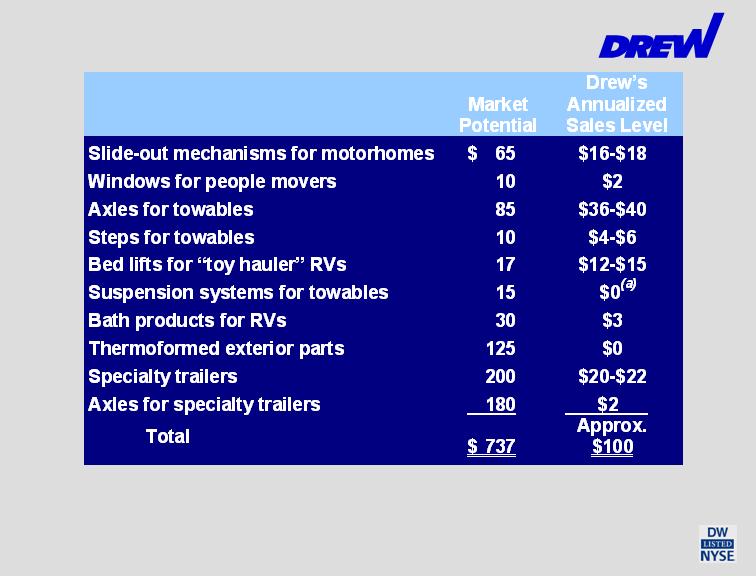

New Product Introductions

Annualized sales of these products increased from about $70 million in the 4th

quarter of 2005.

(in millions)

Page 12

(a)

New product line in connection with the January 2007 acquisition of Trailair and Equa-Flex.

Acquisition Criteria

Drew is a disciplined and patient

acquirer

Target less than 6 times pro forma EBITDA

Immediately accretive

Complementary to our core RV and MH markets

Strategic

Acquisitions

Seek to acquire products or technologies that we can

introduce through our nationwide customer base and

factory network

Become a more extensive supplier to our customers

Page 13

July 2003

LTM Manufacturing

Slide-out

mechanisms,

specialty slide-out

storage trays and

decks, and electric

stabilizer jacks for

RVs. Annual sales of

$4 million

Acquisition History

Strategic

Acquisitions

June 2006

Happijac

Bed lifts for

“toy haulers”.

Annualized sales

of $15 million

May 2004

Zieman

RV, MH and

specialty

trailers. Annual

sales of over

$40 million

Each of our RV and MH acquisitions has

expanded geographic markets or

broadened product lines

2002

Quality Frames

RV chassis.

Annual sales of

$7 million

2001

Better Bath

Bath and shower

products for MH.

Annual sales of

$20 million

11 Acquisitions

1980 – 2001

Including Kinro (1980)

and Lippert

Components (1997)

May 2005

Venture Welding

MH Chassis. Annual

sales of $18 million

March 2006

Steelco

MH & RV

Chassis. Annual

sales of $8

million

Oct 2003

ET&T Frames

Primarily specialty

trailer units.

Annual sales of

$7 million

Page 14

January 2007

Trailair

Equa-Flex

RV Suspension

Systems.

Annual sales of

$3 million

Drew’s Management Team

Highly respected and experienced

management:

Drew

Leigh Abrams, CEO, 35+ years

Fred Zinn, CFO, 25+ years

Kinro

David Webster, CEO, Chairman,

30+ years

Lippert

Jason Lippert, CEO, Chairman

12+ years

Excellent management training

and incentive programs

Innovative &

Experienced

Management

Leigh Abrams

David Webster

Page 15

Jason Lippert

Investments

Kinro and Lippert have

extensive R&D departments

Since January 1997:

Invested over $151 million in

plant and equipment

Invested approximately $170

million for acquisitions

Invested $40 million for stock repurchases at an average

price of $5.37 per share

These investments have been accretive to earnings

Page 16

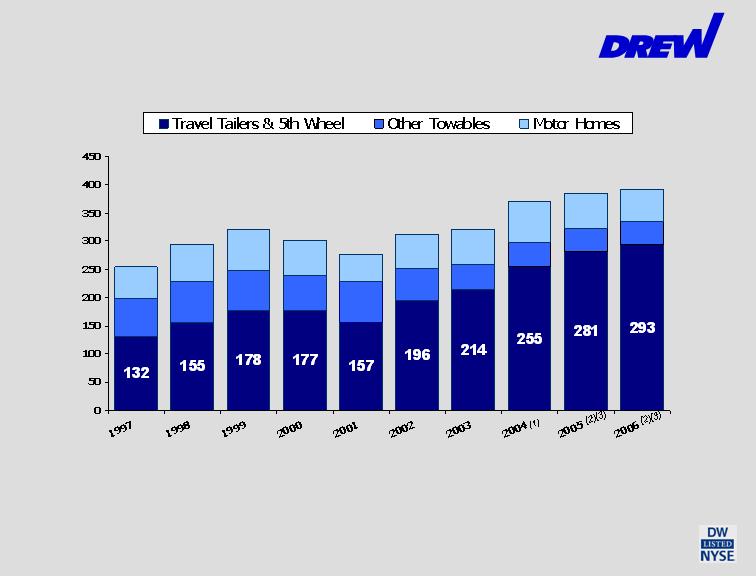

RVs - Industry Wholesale Shipments

(Thousands of Vehicles)

90% of Drew’s current RV product sales are for Travel Trailers and 5th Wheel RVs

(1)

Includes approximately 13,500 RVs purchased by FEMA for emergency housing for 2004 hurricane victims.

(2)

Excludes 38,900 ELU’s in 2005 and 31,400 ELU’s in 2006 purchased by FEMA. A total of 70,300 ELU’s were

purchased by FEMA for the period 9/05 to 4/06. The Company’s sales content per ELU was significantly less than

that of a typical travel trailer.

(3)

Starting in September 2005, about 27,000 towable RVs were purchased by FEMA from dealers which were

replaced by the dealers in 2005 and 2006.

254

293

321

257

311

321

370

391

300

384

Page 17

RV Market

84% of industry 2005 unit sales

46% of wholesale dollar sales

Retail cost $4,000 to $100,000

per unit. Average about $20,000

16% of industry 2005 unit sales

54% of wholesale dollar sales

Retail cost $41,000 to $400,000+

per unit. Average about $100,000

Since 1995 the travel trailer and

5th wheel market has grown at an

annual rate of approximately 8%,

compared to a less than 1% in-

crease in motorhome shipments.

TOWABLE RVS (90% of Drew RV revenues)

MOTORHOMES

Travel trailer with

expandable ends

Type A Motorhomes

Type B Motorhomes

Type C Motorhomes

Folding camping trailer

Travel trailer

Folding camping trailer

Sport utility RV

Fifth wheel travel trailer

Truck camper

Page 18

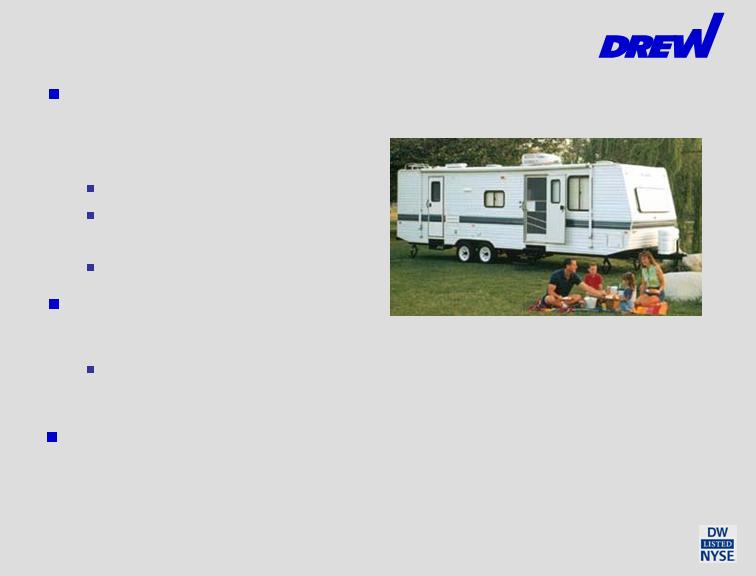

Growth In RV Market

Positive Demographic

Trends

Primary owners of RVs are

50 and over

According to census

projections, there are

expected to be 20 million

more people over 50 by 2014

Strong Growth

Prospects

Industry Advertising Campaign

Target Market 30 and over

Post 9/11 security concerns and high airline ticket

prices increase RV travel vacations

Fifth Wheel RV

Page 19

How RVs Are Used

Shift in U.S. culture

toward more RV-related

activities

NASCAR events

College and NFL football

games

“Toy Haulers”

More economical family

vacations

Typical RV family vacation

up to 74% less expensive

Strong Growth

Prospects

Many RVs are “parked”over the long-term

Travel Trailer

Page 20

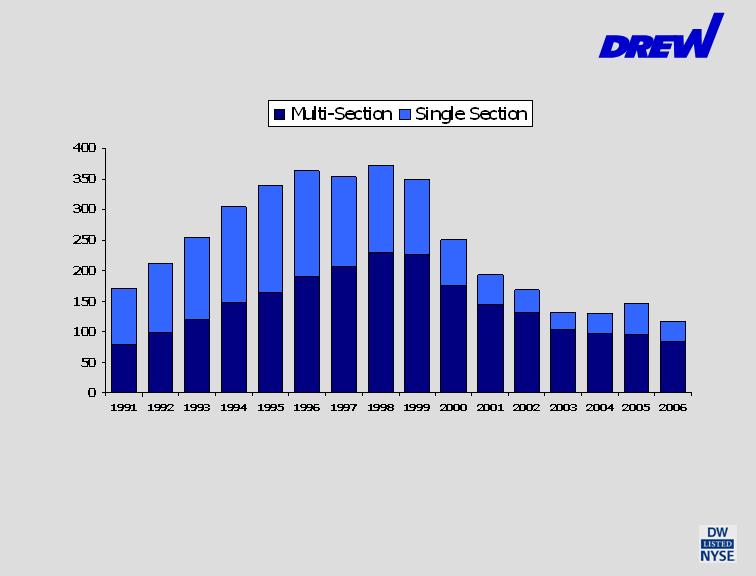

MH - Industry Production

171

211

254

304

340

363

353

373

349

(Thousands of Homes)

131

168

193

251

(1)

131

(1)

Includes approximately 3,500, 15,000 and 3,000 for 2004, 2005 and 2006, respectively,

MHs purchased by FEMA for emergency housing for hurricane victims.

(1)

147

(1)

117

Drew’s MH segment remained profitable every quarter since 1998.

47%

61%

59%

52%

49%

49%

47%

47%

75%

70%

65%

78%

74%

80%

72%

64%

Page 21

Manufactured Housing (MH) Market

Cost per sq. ft. is $39 for MH vs.

$91 for site-built homes

Average retail price of $62,300

for a 1,595 sq. ft. MH

9 million manufactured homes

across the U.S.

Strong Growth

Prospects

Improved quality, appearance and safety

Studies have shown that MH built since 1995 sustain no more

damage in hurricanes than site-built homes

Industry production down 69% from 1998 to 2006, but Drew’s

MH sales are up 13% and segment operating profit is down only

20%

Page 22

MH: Industry Trends

Low inventory levels at retail dealers

Slowing of repossessions

Conventional financing now more common

than chattel financing

Improved industry lending practices should

lead to fewer repossessions

Berkshire Hathaway acquired Clayton,

Oakwood, Southern Energy and 21st

Mortgage; raised more than $8 billion for MH

financing

Strong Growth

Prospects

Page 23

MH: Strong Future

Baby Boomers retire and

relocate to warmer climate

Affordability

Home appreciation due to

greater ownership of land

along with home

Possible rebuilding of

hurricane-damaged areas

during late 2007

Improved industry image

Industry wide Advertising

Campaign needed

Strong

Growth

Prospects

Page 24

Drew’s Ownership and Governance

Ownership by Executives and Directors:

Currently own 16%

Filed Form S-3 on October 3, 2005. All

insider sales are complete except for

one Director. After his sale, insiders

ownership will be 12%.

Drew’s Corporate Governance Program –

ranked in the 96th percentile of all Russell 3000

Companies by Institutional Shareholder

Services.

Added to S&P SmallCap 600 Index in October

2005

Page 25

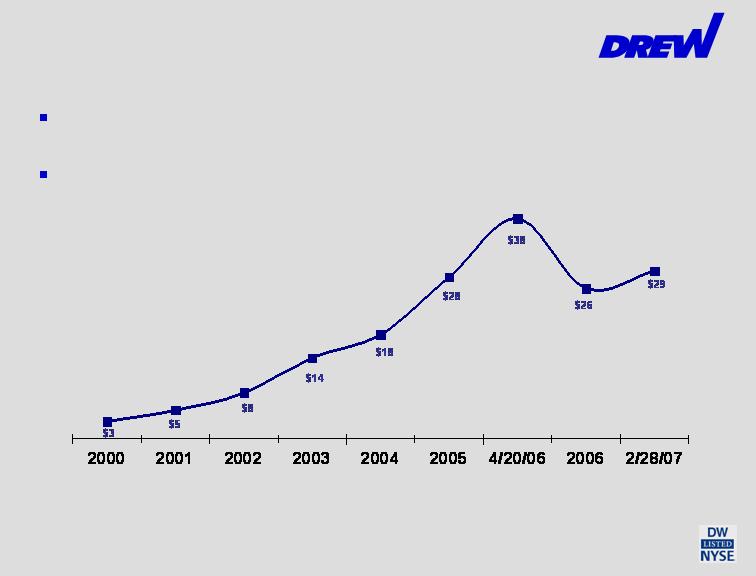

Financial Performance

The price of Drew’s common stock is 10 times the price as of

December 31, 2000

Drew has 21.8 million shares outstanding and a market

capitalization of more than $620 million as of February 28, 2007

(December 31 unless noted)

Stock Price History

Drew effected a 2-for-1 stock split on 9/7/05 to holders of record on 8/19/05

Page 26

Operating Results

Year Ended December 31,

Financial

Performance

(1)

Excluding the estimated impact of hurricane-related sales from both 2006 and 2005, the

Company estimates that diluted EPS would have been approximately $1.33 in 2006, compared

to approximately $1.40 in 2005.

(2)

Sales during the latter part of 2006 were negatively impacted by weakness in both the RV and

MH industries.

(3)

Adjusted for 2 for 1 stock split on 9/7/05.

(4)

EBITDA is operating profit plus depreciation and amortization (see page 30).

($ in millions, except EPS)

Page 27

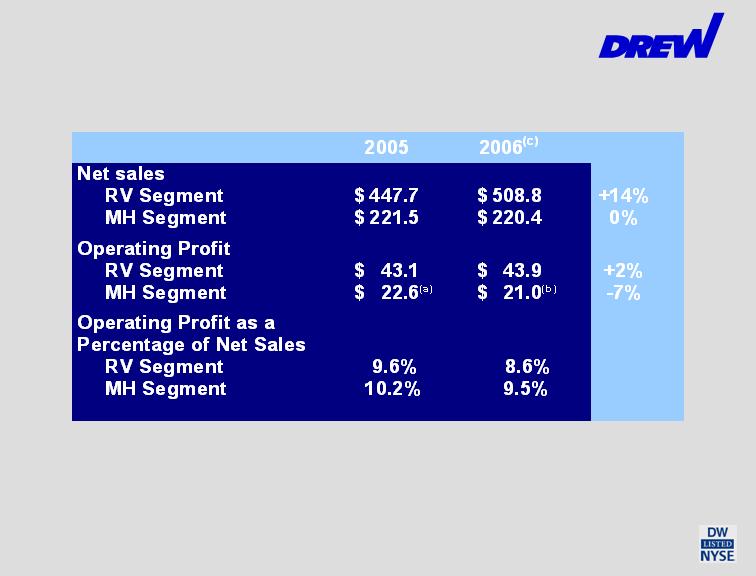

Results By Segment

Year Ended December 31,

Financial

Performance

(a)

After a charge of $0.8 million related to legal proceedings, net of related incentive compensation.

(b)

After a gain of $0.8 million related to the sale of closed facilities, net of related incentive compensation.

(c)

Sales during the latter part of 2006 were negatively impacted by weakness in both the RV and MH

industries.

See Press Release dated February 13, 2007 for a reconciliation to consolidated results.

($ in millions)

Page 28

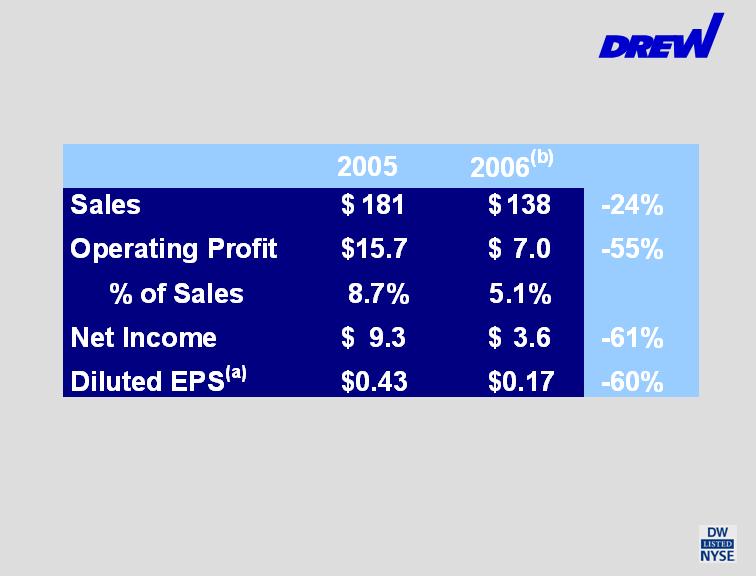

Operating Results

Three Months Ended December 31,

Financial

Performance

(a)

Excluding the estimated impact of hurricane-related sales, the Company estimates that diluted

EPS would have been approximately $0.27 in the fourth quarter of 2005.

(b)

Sales during the latter part of 2006 were negatively impacted by weakness in both the RV and

MH industries.

($ in millions, except EPS)

Page 29

Reconciliation of Operating Profit

to EBITDA

Financial

Performance

Page 30

($ in millions)

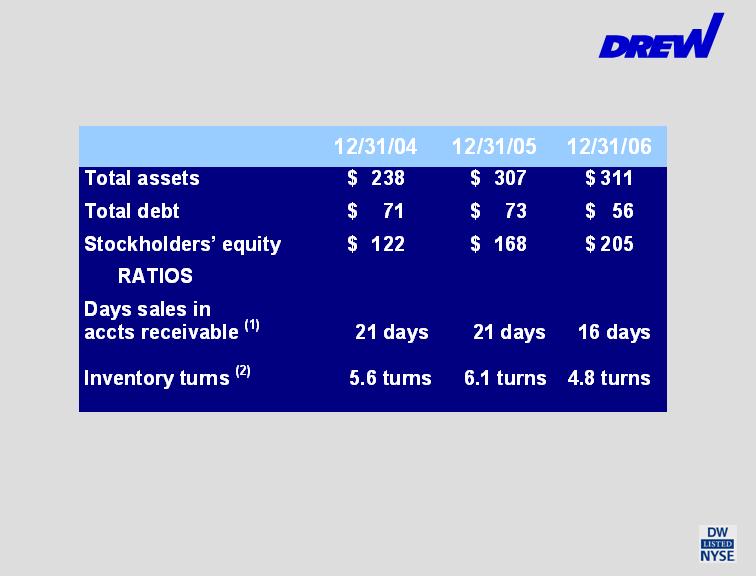

Balance Sheet

Financial

Performance

(1) Days sales in accounts receivable is the most recent month’s net sales divided by accounts

receivable, net, at the end of the period.

(2) Inventory turns is cost of goods sold for the latest quarter divided by average inventory for

the quarter.

Page 31

($ in millions)

Financial Strength

Financial

Performance

Page 32

(1) EBITDA is operating profit plus depreciation and amortization (see page 30).

12/31/04

12/31/05

12/31/06

Return on Equity

23%

24%

16

%

Return on Assets

12%

12%

9

%

Total Debt to Equity

0.6

0.4

0.

3

Total Debt to EBITDA

(1)

1.3

1.1

0

.

8

Peer Comparison

19%

12%

17.0

27.2

Spartan (SPAR)

(9%)

0%

47.8

N/A

Fleetwood (FLE)

17%

11%

14.4

21.7

Drew (DW)

ROE

ROA

Forward

P/E

Trailing

P/E

0%

1%

19.3

511.8

Monaco (MNC)

24%

16%

13.1

15.2

Thor (THO)

18.9

28.8

Winnebago (WGO)

16%

8%

Source: Capital IQ, February 26, 2007, except forward P/E, which is provided by

Thomson Financial and is based on fiscal 2007 analyst projections.

Financial

Performance

Page 33

Thank You

Analyst coverage:

Avondale Partners, LLC:

Kathryn Thompson (615) 467-5637

BB&T Capital Markets:

John Diffendal (615) 340-8284

Sidoti & Company LLC:

Scott Stember (212) 453-7017

Susquehanna Financial Group, LLLP:

Cheryl Cortez (312) 427-5236

For more information contact:

Leigh J. Abrams, President and CEO

914-428-9098

leigh@drewindustries.com

Fredric M. Zinn, Executive VP and CFO

914-428-9098

fred@drewindustries.com

Or visit: www.drewindustries.com

Page 34