2003

2003

A Leading National Supplier of a Wide Variety of

Components for RV’s and Manufactured Homes

This presentation contains certain “forward-looking statements” within the meaning of the Private Securities Litigation

Reform Act of 1995 with respect to financial condition, results of operations, business strategies, operating efficiencies or

synergies, competitive position, growth opportunities for existing products, plans and objectives of management, markets

for the Company’s common stock and other matters. Statements in this presentation that are not historical facts are

“forward-looking statements” for the purpose of the safe harbor provided by Section 21E of the Exchange Act and Section

27A of the Securities Act. Forward-looking statements, including, without limitation those relating to our future business

prospects, revenues, expenses and income, wherever they occur in this presentation, are necessarily estimates reflecting

the best judgment of our senior management, at the time such statements were made, and involve a number of risks and

uncertainties that could cause actual results to differ materially from those suggested by forward-looking statements. The

Company does not undertake to update forward-looking statements to reflect circumstances or events that occur after

the date the forward-looking statements are made. You should consider forward-looking statements, therefore, in light of

various important factors, including those set forth in this presentation and the Company’s SEC filings.

There are a number of factors, many of which are beyond the Company’s control, which could cause actual results and

events to differ materially from those described in the forward-looking statements. These factors include pricing pressures

due to domestic and foreign competition, costs and availability of raw materials (particularly steel and related

components, vinyl, aluminum, glass and ABS resin), availability of retail and wholesale financing for manufactured homes,

availability and costs of labor, inventory levels of retailers and manufacturers, levels of repossessed manufactured homes,

the disposition into the market by FEMA by sale or otherwise of RVs or manufactured homes purchased by FEMA in

connection with natural disasters, changes in zoning regulations for manufactured homes, the decline in the manufactured

housing industry, the financial condition of our customers, retention of significant customers, interest rates, oil and gasoline

prices, the outcome of litigation, and adverse weather conditions impacting retail sales. In addition, national and regional

economic conditions and consumer confidence may affect the retail sale of recreational vehicles and manufacture

d homes.

Forward Looking Statement

- 2 -

About Drew Industries

A leading national manufacturer of quality

components for Recreational Vehicles (RV) and

Manufactured Homes (MH)

- 3 -

Headquartered in White

Plains, New York – 10

employees

36 manufacturing facilities in

the U.S.

Approximately 4,000

employees nationwide

Organic growth from 2001

through 9/30/07 was over

$168 million or a 9% average

annual growth, excluding

price increases, acquisitions,

and FEMA business

Company Overview

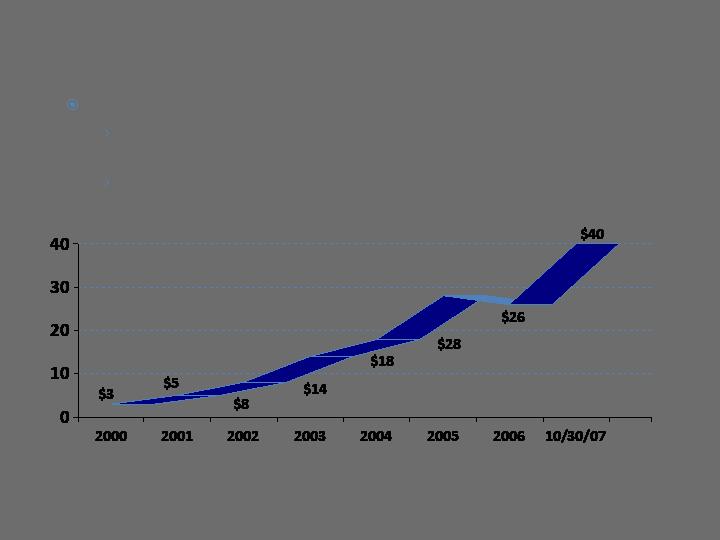

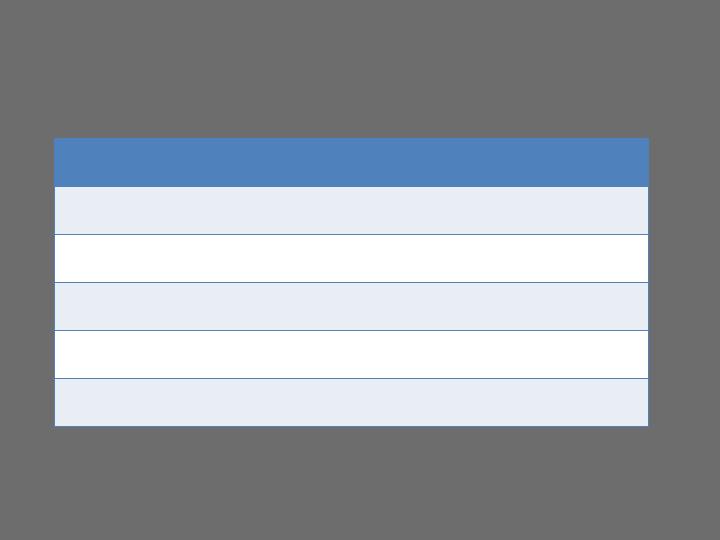

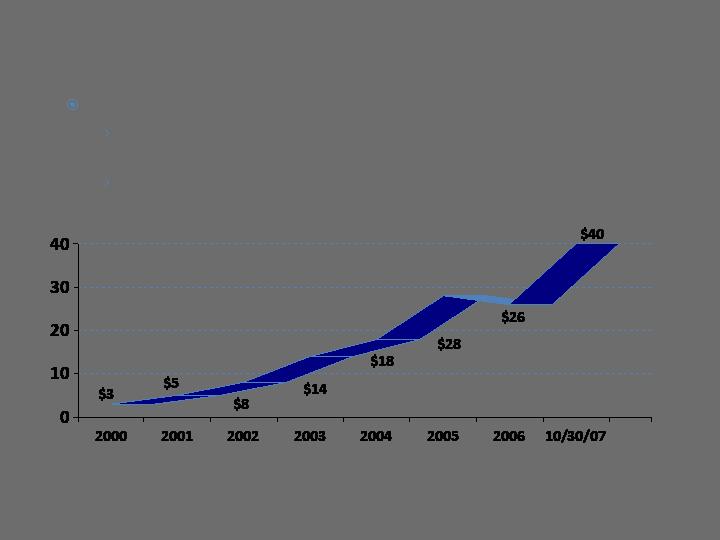

Financial Performance

(1)

2001- LTM September 2007 EBIDTA CAGR = 20%. EBITDA

is operating profit plus depreciation and amortization

Sales and EBITDA (in millions)

MH Segment sales

RV Segment sales

EBITDA(1)

- 4 -

Kinro, Inc. - Acquired 1980

Aluminun windows for RVs

Doors for RVs and MHs

Aluminum and vinyl windows and screens for MHs

Bath and shower units, and sinks for MHs and RVs

Exterior panels for RVs

Lippert Components, Inc. - Acquired 1997

Chassis and chassis parts for RVs and MHs

Slide-out mechanisms and leveling devices for RVs

Axles for towable RVs, MHs and specialty trailers

Bed lifts and ramp doors for “toy-hauler” RVs

Steps for RVs

Suspension systems

Specialty trailers for boats, personal watercraft and

hauling equipment

Drew’s Companies

- 5 -

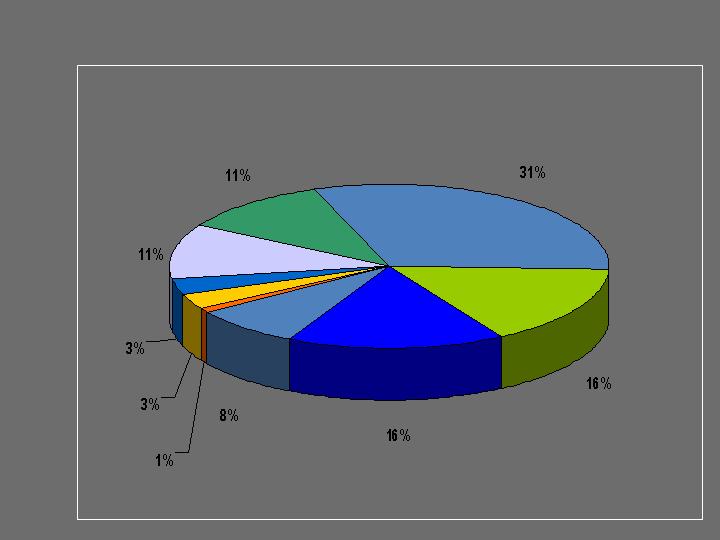

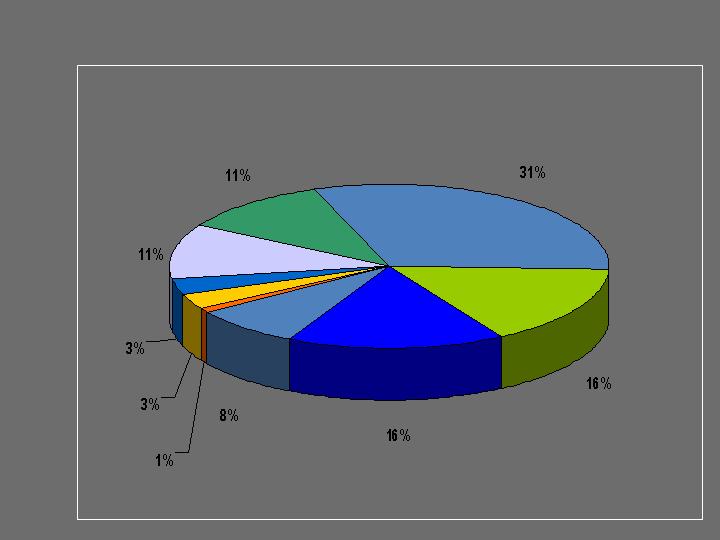

Drew’s Segments – LTM 9/30/07

MH = $186 million

28%

RV = $483 million

72%

- 6 -

Segment Operating Profit - $73 million

Revenues - $669 million

MH = $14 million

19%

RV = $59 million

81%

Drew’s Products

Sales - $669 million

12 Months Ended September 30, 2007

RV Chassis and Chassis

Parts: $201 million

RV Windows and Doors:

$107 million

Other: $6 million

MH and RV Bath

Products: $23 million

Specialty Trailers:

$20 million

RV Slide-out

mechanisms:

$109 million

RV and MH Axles

and Tires:

$56 million

MH Chassis and Chassis

Parts: $73 million

MH Windows, Doors and

Screens: $74 million

- 7 -

Supplier to Industry Leaders

Outstanding customer service and national coverage, with 36

production facilities (nearly 3 million sq. ft.), make us a key partner

with our customers.

Supply most of the Leading Producers of RVs and MHs:

Fleetwood (NYSE: FLE)

Skyline (NYSE: SKY)

Coachmen (NYSE: COA)

Forest River (owned by Berkshire Hathaway)

Heartland Recreational Vehicles, LLC (privately owned)

Monaco Coach (NYSE: MNC)

Starcraft (privately owned)

Thor (NYSE: THO)

Champion (NYSE: CHB)

Clayton (owned by Berkshire Hathaway)

Oakwood Homes and Southern Energy Homes

(owned by Clayton)

Palm Harbor (Nasdaq: PHHM)

- 8 -

Increase sales and profitability through:

Market share growth

New product introductions

Strategic acquisitions

This strategy accomplished through:

Outstanding customer service

Motivating management through profit incentives and

training programs

Maintaining highly efficient factories by optimizing

production efficiencies through state-of-the-art

manufacturing technology, and stringent cost controls

Extensive R & D efforts

Disciplined and patient acquirer

Business Strategy

- 9 -

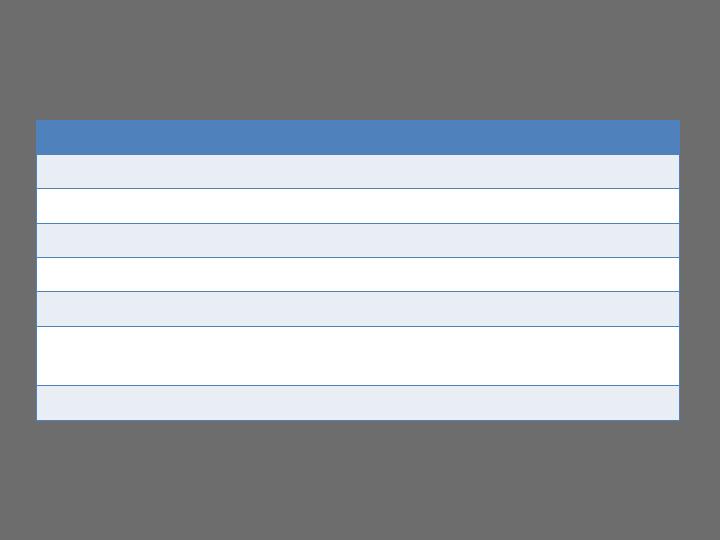

Content Per Vehicle - RV

Peak potential is $2,500 to $2,800 per RV

90% of RV segment sales are for Towable RVs

(1)

Excludes sales of specialty trailers.

(2)

Excludes sales of Emergency Living Units (“ELU’s”) purchased by FEMA.

Operating

profit margin 8.6% 9.4% 11.3% 9.2% 9.6% 8.6% 12.2%

(1)

(1)(2)

(1)

(1)(2)

- 10 -

See Page 17 for Industry Information

Content Per Home - MH

Peak potential is $3,300 to $3,600 per home

Operating

Profit margin 10.8% 11.0% 10.7% 10.1% 10.2% 9.5% 7.7%

See Page 21 for Industry Information

- 11 -

Est.

New Product Introductions

Annualized sales of these products increased from about $105 million in the 3rd quarter of 2006.

(a)

Including recent acquisitions.

(in millions)

Market

Potential

Drew

Annualized

Sales Level

Slide-out mechanisms for motorhomes

$ 65

$10-$12

Windows for people movers

10

$3

Axles for towables

75

$35-$40

Steps for RVs

25

$6-$8(a)

Bed lifts for “toy hauler” RVs

20

$15-$18

Ramp doors for “toy hauler” RVs

15

$2-$3

Suspension systems for towables

15

$5-$7(a)

Bath products for RVs

30

$4

Thermoformed exterior parts

120

$1

Specialty trailers

200

$30(a)

Axles for specialty trailers

180

$6-$8

Total

$ 755

Approx. $120

- 12 -

Drew is a disciplined and patient acquirer

Target price less than 6 times pro forma EBITDA

Immediately accretive

Complementary to our core RV and MH markets

Seek to acquire products or technologies that

we can introduce through our nationwide

customer base and factory network

Become a more extensive supplier to our

customers

Acquisition Criteria

Strategic

Acquisitions

- 13 -

Acquisition History

Strategic

Acquisitions

Each of our RV and MH acquisitions has expanded

geographic markets or broadened product lines

May 2004

Zieman

RV and MH

chassis, and

specialty trailers.

Annual sales of

over $40 million

July 2007

Extreme

Engineering

Custom boat

trailers. Annual

Sales of $12

million

2001

Better Bath

Bath and shower

products for MH.

Annual sales of

$20 million

14 Acquisitions

1980 – 2003

Including Kinro

(1980) and Lippert

Components (1997)

March 2006

Steelco

MH & RV Chassis.

Annual sales

of $8 million

May 2007

Coach Step

Electric steps for

motorhomes. Annual

sales of $2 million

May 2005

Venture Welding

MH Chassis.

Annual sales of

$18 million

June 2006

Happijac

Bed lifts for

“toy haulers”.

Annualized sales

of $15 million

January 2007

Trailair/Equa-

Flex

RV Suspension

Systems.

Annual sales

of $3 million

- 14 -

Drew’s Management Team

Leigh J. Abrams, CEO 35+ years

Fredric M. Zinn, CFO 25+ years

Leigh Abrams

Innovative &

Experienced

Management

David L. Webster, CEO, Chairman 30+ years

Jason D. Lippert, CEO, Chairman 12+years

Jason Lippert

David Webster

Highly respected and experienced

management:

Excellent management training and

incentive programs

- 15 -

Investments

Kinro and Lippert

have extensive R&D

departments

Since January 1997:

Invested over $159 million

in plant and equipment

Invested over $189 million for acquisitions

Invested $40 million for stock repurchases at an

average price of $5.37 per share

These investments have been

accretive to earnings

- 16 -

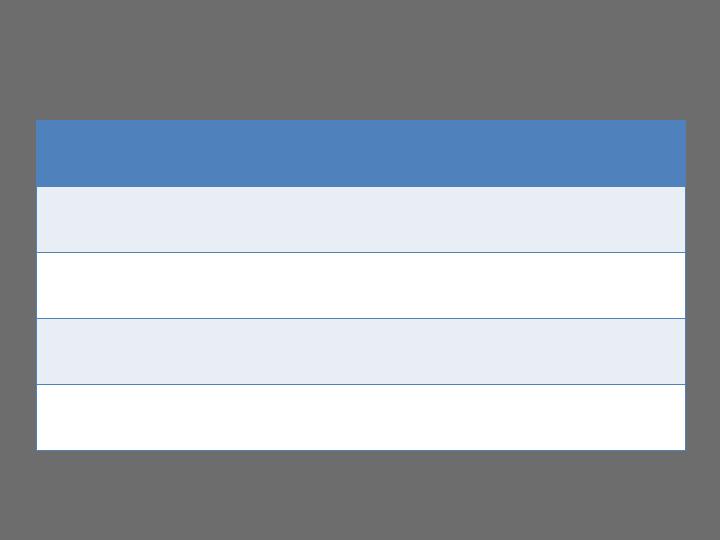

RVs - Industry Wholesale Shipments

90% of Drew’s current RV product sales are for Travel Trailers and 5th Wheel RVs

(1)

Includes approximately 13,500 RVs purchased by FEMA for emergency housing for 2004 hurricane victims.

(2)

Excludes 38,900 ELU’s in 2005 and 31,400 ELU’s in 2006 purchased by FEMA. A total of 70,300 ELU’s were purchased by

FEMA for the period 9/05 to 4/06. The Company’s sales content per ELU was significantly less than that of a typical travel

trailer.

(3)

Starting in September 2005, about 27,000 towable RVs were purchased by FEMA from dealers which were replaced by

the dealers in 2005 and 2006.

(4)

Projection by RVIA. A portion of decline is attributable to FEMA units produced in 2006.

(Thousands of Vehicles)

(1)

(2)(3)

293

361

370

321

311

257

300

321

391

384

(4)

(2)(3)

- 17 -

373

(4)

86% of industry 2006 unit sales

50% of 2006 wholesale dollar sales

or $5.9 billion

Retail cost $4,000 to $100,000 per

unit. Average about $20,000

From 1998 to 2006 the travel trailer

and 5th wheel market grew at an

annual rate of approximately 8%,

compared to a 2% annual decrease

in motorhome shipments

RV Market

14% of industry 2006 unit sales

50% of 2006 wholesale dollar sales

or $5.9 billion

Retail cost $41,000 to $400,000+

per unit. Average about $100,000

Travel trailer

Fifth wheel travel trailer

Travel trailer with

expandable ends

Folding camping trailer

Sport utility RV

Type C Motorhomes

Truck camper

TOWABLE RVS (90% of Drew’s RV revenues)

MOTORHOMES

Type B Motorhomes

Type A Motorhomes

- 18 -

Retail sales of Travel Trailers up this year

Positive Demographic Trends:

Primary owners of RVs are 50 and over

According to census projections in March 2004,

there are expected to be

20 million more people

over 50 by 2014

Industry Advertising

Campaign:

Target Market 30 and over

Post 9/11 security concerns and high airline

ticket prices increase RV travel use

Growth In RV Market

Strong Growth

Prospects

- 19 -

How RVs Are Used

Shift in U.S. culture toward more RV-related

activities:

College and NFL football games

NASCAR events

“Toy Haulers”

More economical

family vacations:

Typical RV family vacation

up to 74% less expensive

Many RVs are “parked” over the long-term as

second homes

Strong Growth

Prospects

- 20 -

MH – Industry Production

(Thousands of Homes)

(1) Includes approximately 3,500, 15,000 and 3,000, for 2004, 2005 and 2006, respectively, MHs

purchased by FEMA for emergency housing for hurricane victims.

(2) Estimate by Company management.

Drew’s MH segment remained profitable every quarter since 1998.

(1)

(1)

(1)

(2)

- 21 -

Manufactured Housing

(MH)Market

Cost per sq. ft. is $39 for MH vs.

$91 for site-built homes

Average retail price of

$62,300 for a 1,595 sq. ft. MH

9 million manufactured

homes across the U.S.

Improved quality,

appearance and safety

Studies have shown that MH built since 1995 sustain no

more damage in hurricanes than site-built homes

Industry production was down 69% from 1998 to 2006, but

Drew’s MH sales were up 13% and segment operating

profit was down only 20%

Strong Growth

Prospects

- 22 -

Improved lending practices

Conventional financing more common

than chattel; improves collateral

Subprime market woes could help MH

Pressure on Fannie Mae/Freddie Mac

to support MH loans

MH: Industry Financing Trends

Strong Growth

Prospects

- 23 -

MH: Other Favorable Factors

Baby Boomers retiring in increasing numbers

Appropriate dealer and manufacturer inventory

levels

Potential for rebuilding the Gulf Coast

Affordability and quality

New HUD code

Improved industry image

Advertising campaign

being developed

Berkshire investments

Strong Growth

Prospects

- 24 -

Executives and Directors currently own

10%

Drew’s Corporate Governance Program

Ranked in the 86th percentile of all Russell

3000 Companies by Institutional Shareholder

Services.

Added to S&P SmallCap 600 Index in

October 2005

Drew’s Ownership and

Governance

- 25 -

Financial Performance

Stock Price History

The price of Drew’s Common stock is more than 13 times the

price as of December 31, 2000

Drew has 21.9 million shares outstanding and a market

capitalization of approximately $875 million as of October 30,

2007

Drew effected a 2-for-1 stock split on 9/7/05 to holders of record on 8/19/05

(December 31 unless noted)

- 26 -

($ in millions, except EPS)

2004

2005

2006(1)(2)

LTM

9/07(2)

LTM

9/07 vs

2006

Sales

$ 531

$ 669

$ 729

$ 669

-8%

Operating Profit

$ 44.0

$ 57.7

$ 55.3

$ 62.8

+14%

% of Sales

8.3%

8.6%

7.6%

9.4%

Net Income

$ 25.1

$ 33.6

$ 31.0

$ 36.9

+19%

Diluted EPS(1)

$ 1.18

$ 1.56

$ 1.42

$ 1.68

+18%

EBITDA(3)

$ 53.3

$ 69.7

$ 71.0

$ 80.3

+13%

Operating Results

Year Ended December 31, (except as noted)

Financial

Performance

(1) Excluding the estimated impact of hurricane-related sales from both 2006 and 2005, the Company

estimates that diluted EPS would have been approximately $1.33 in 2006, compared to approximately

$1.40 in 2005.

(2)

Sales during the latter part of 2006 and the first nine months of 2007 were negatively impacted by

weakness in both the RV and MH industries.

(3)

EBITDA is operating profit plus depreciation and amortization (see page 37).

- 27 -

Results By Segment

($ in millions)

2004

2005

2006(3)

LTM 9/07(3)

Net sales

RV Segment

$ 346.2

$ 447.7

$ 508.8

$ 483.3

MH Segment

$ 184.7

$ 221.5

$ 220.4

$ 185.6

Operating Profit

RV Segment

$ 32.6

$ 43.1

$ 43.9

$ 59.0

MH Segment

$ 17.7(1)

$ 22.6(1)

$ 21.0(2)

$ 14.3

Operating Profit as a Percentage of Net sales

RV Segment

9.4%

9.6%

8.6%

12.2%

MH Segment

9.6%

10.2%

9.5%

7.7%

Year Ended December 31, (except as noted)

(1) After a charge of $1.4 million and $0.8 million for 2004 and 2005, respectively, related to legal

proceedings, net of related incentive compensation.

(2)

After a gain of $0.8 million related to the sale of closed facilities, net of related incentive compensation.

(3)

Sales during the latter part of 2006 and first nine months of 2007 were negatively impacted by weakness

in both the RV and MH industries.

See Form 10-K filed March 13, 2007 for a reconciliation to 2004 through 2006 consolidated results.

See page 38 for reconciliation to LTM 9/07 consolidated results.

Financial

Performance

- 28 -

Operating Results

($ in millions, except EPS)

2006

2007(1)

Sales

$ 181

$ 173

-4%

Operating Profit

$ 12.9

$ 18.3

+42%

% of Sales

7.1%

10.5%

Net Income

$ 6.9

$ 11.1

+60%

Diluted EPS

$ 0.32

$ 0.50

+56%

Three Months Ended September 30,

Financial

Performance

(1) Sales during third quarter of 2007 were negatively impacted by weakness in both the RV and

MH industries.

- 29 -

Results By Segment

($ in millions)

2006

2007

Net sales

RV Segment

$ 126.4

$ 127.2

-1%

MH Segment

$ 54.3

$ 46.2

-15%

Operating Profit

RV Segment

$ 10.7

$ 17.6

+65%

MH Segment

$ 5.2(1)

$ 3.6(1)

-30%

Operating Profit as a Percentage of Net Sales

RV Segment

8.4%

13.8%

MH Segment

9.5%(1)

7.9%(1)

Financial

Performance

Three Months Ended September 30,

See Press Release dated October 31, 2007 for a reconciliation to consolidated results.

(1) Operating profit of this segment for the third quarter of 2006 includes a net gain of $0.5 million related to facility

sales and consolidation costs, as compared to a net charge less than $0.1 million in the same period of 2007. Also,

the third quarter of 2007 includes expenses related to ongoing litigation aggregating $0.6 million. Excluding the

impact of these items, the operating profit margin of this segment would have been 9.1 percent and 8.6 percent

for the third quarter of 2007 and 2006, respectively.

- 30 -

Operating Results

Financial

Performance

Nine Months Ended September 30,

($ in millions, except EPS)

2006(1)

2007(1)

Sales

$ 591

$ 531

-10%

Operating Profit

$ 48.3

$ 55.8

+16%

% of Sales

8.2%

10.5%

Net Income

$ 27.4

$ 33.3

+22%

Diluted EPS(1)

$ 1.25

$ 1.51

+20%

(1) Sales during the latter half of 2006 and first nine months of 2007 were negatively impacted by

weakness in both the RV and MH industries, whiles sales in the first nine months of 2006 included

approximately $20 million of hurricane-related sales, and net income of approximately $.09 per

diluted share.

- 31 -

Results By Segment

($ in millions)

2006(1)

2007(1)

Net sales

RV Segment

$ 415.7

$ 390.2

-6%

MH Segment

$ 175.4

$ 140.6

-20%

Operating Profit

RV Segment

$ 38.0

$ 53.2

+40%

MH Segment

$ 17.5

$ 10.7

-39%

Operating Profit as a Percentage of Net Sales

RV Segment

9.1%

13.6%

MH Segment

10.0%

7.6%

Financial

Performance

Nine Months Ended September 30,

(1) Sales during the latter half of 2006 and first nine months of 2007 were negatively impacted by weakness

in both the RV and MH industries, whiles sales in the first nine months of 2006 included approximately $20

million of hurricane-related sales.

See Press Release dated October 31, 2007 for a reconciliation to consolidated results.

- 32 -

Balance Sheet

($ in millions)

12/31/05

12/31/06

9/30/06

9/30/07

Total assets

$ 307

$ 311

$ 345

$ 365

Total debt

$ 73

$ 56

$ 79

$ 43

Invested cash

$ -

$ 3

$ -

$ 41

Stockholders’ equity

$ 168

$ 205

$ 199

$ 244

RATIOS

Days sales in accounts

receivable(1)

21 days

16 days

20 days

22 days

Inventory turns(2)

6.5 turns

5.6 turns

5.9 turns

6.1 turns

Financial

Performance

(1) Days sales in accounts receivable is the most recent month’s net sales divided by accounts

receivable, net, at the end of the period

(2) Inventory turns is cost of goods sold for the last twelve months divided by average inventory for

the last twelve months.

- 33 -

Financial Strength

12/31/04

12/31/05

12/31/06

LTM 9/07

Return on Equity

23%

24%

16%

17%

Return on Assets

12%

12%

9%

11%

Total Debt to Equity

0.6

0.4

0.3

0.2

Total Debt to EBITDA

1.3

1.1

0.8

0.5

Financial

Performance

(1) EBITDA is operating profit plus depreciation and amortization (see page 37)

- 34 -

Peer comparison

Trailing

P/E

Forward

P/E

ROA

ROE

Drew (DW)

26.9

18.6

10%

16%

Fleetwood (FLE)

N/A

67.3

(4%)

(71%)

Monaco (MNC)

N/A

17.7

1%

(1%)

Spartan (SPAR)

22.6

13.1

13%

20%

Thor (THO)

20.4

14.7

11%

18%

Winnebago (WGO)

19.6

12.6

9%

19%

Financial

Performance

Source: Capital IQ, October 30, 2007, except forward P/E, which is provided by Thomson

Financial and is based on fiscal 2008 analyst projections.

- 35 -

Thank you!

- 36 -

($ in millions)

2001

2002

2003

2004

2005

2006

LTM

9/07

Operating Profit

$ 20.3

$29.2

$ 34.3

$ 44.0

$ 57.7

$ 55.3

$ 62.8

Depreciation &

Amorti

zation

$ 8.4

$ 7.3

$ 7.8

$ 9.3

$ 12.0

$ 15.7

$ 17.5

EBITDA

$ 28.7

$ 36.5

$ 42.1

$ 53.3

$ 69.7

$ 71.0

$ 80.3

Capital

Expenditures

$8.2

$ 10.5

$ 5.1

$ 27.1

$26.1

$ 22.3

$ 9.7

Reconciliation of Operating Profit

to EBITDA

Financial

Performance

- 37 -