Free signup for more

- Track your favorite companies

- Receive email alerts for new filings

- Personalized dashboard of news and more

- Access all data and search results

Filing tables

LCII similar filings

- 21 Mar 06 Drew Industries to Acquire Supplier of

- 14 Mar 06 Drew Industries Acquires RV and MH Chassis Supplier Steelco

- 7 Mar 06 Entry into a Material Definitive Agreement

- 24 Feb 06 Other Events

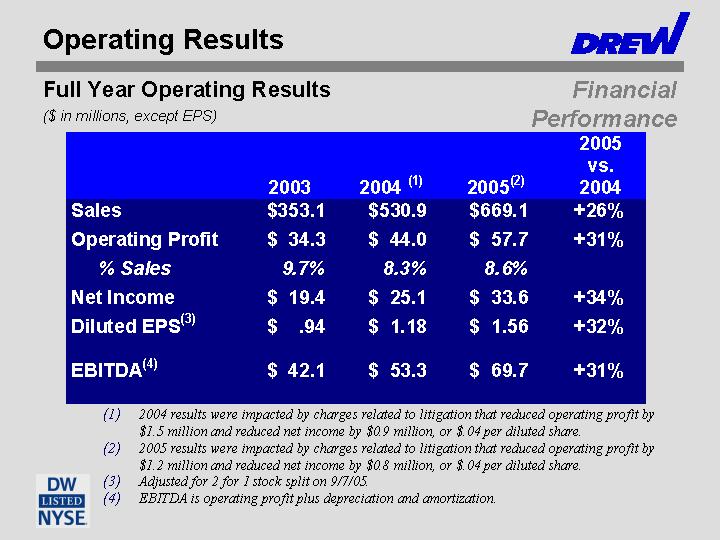

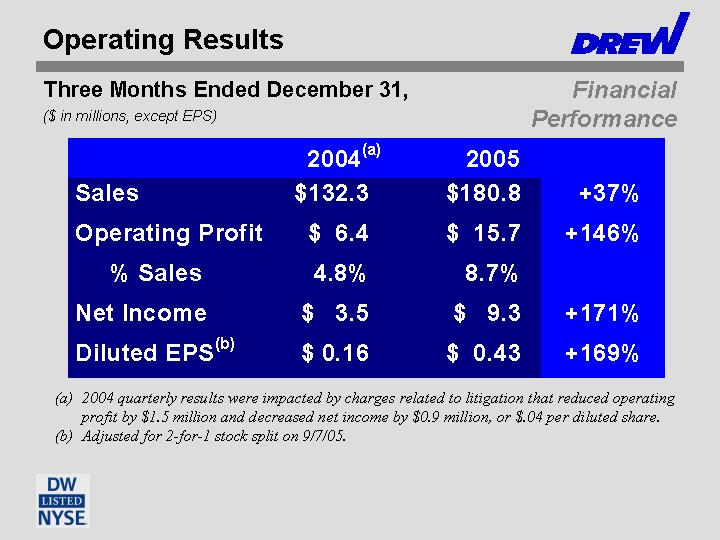

- 16 Feb 06 Drew Industries Reports Fourth Straight Year of Record

- 31 Jan 06 Other Events

- 12 Dec 05 Other Events

Filing view

External links