As filed with the U.S. Securities and Exchange Commission on March 11, 2009

File No. 333-

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-14

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 x

Pre-Effective Amendment No.

Post-Effective Amendment No.

JPMorgan Trust II

(Exact Name of Registrant as Specified in Charter)

245 Park Avenue

New York, New York 10167

(Address of Principal Executive Offices)

(800) 480-4111

(Registrant’s Area Code and Telephone Number)

Frank J. Nasta, Esq.

J.P. Morgan Investment Management Inc.

245 Park Avenue

New York, NY 10167

(Name and Address of Agent for Service)

With copies to: | With copies to: |

AS SOON AS PRACTICABLE AFTER THE EFFECTIVE DATE OF THIS REGISTRATION STATEMENT

(Approximate Date of Proposed Public Offering)

TITLE OF SECURITIES BEING REGISTERED:

Shares of beneficial interest of Registrant

Calculation of Registration Fee under the Securities Act of 1933: No filing fee is due because of reliance on Section 24(f) of the Investment Company Act of 1940, which permits registration of an indefinite number of securities.

It is proposed that this filing will become effective on April 9, 2009 pursuant to Rule 488 under the Securities Act of 1933.

JPMorgan Intermediate Tax Free Bond Fund

JPMorgan Core Plus Bond Fund

JPMorgan Short Duration Bond Fund

JPMorgan Core Bond Fund

JPMorgan Short-Intermediate Municipal Bond Fund

(known as the “JPMorgan Short Term Municipal Bond Fund”

prior to April 30, 2009)

JPMorgan Bond Fund

JPMorgan Short Term Bond Fund

JPMorgan Tax Aware Enhanced Income Fund

JPMorgan Tax Aware Short-Intermediate Income Fund

JPMorgan Intermediate Bond Fund

JPMorgan Kentucky Municipal Bond Fund

JPMorgan Louisiana Municipal Bond Fund

JPMorgan West Virginia Municipal Bond Fund

New York, New York 10167

Combined Special Meeting of Shareholders to be held June 15, 2009

proposed Reorganizations. On February 18, 2009, the Boards of Trustees of JPMorgan Trust I and JPMorgan Trust II approved the proposed Reorganizations and concurred that the proposed Reorganizations are in the best interest of each Acquired Fund and Acquiring Fund (as defined below).

| Acquired Fund | Acquiring Fund | |||||

|---|---|---|---|---|---|---|

Trust I Acquired Funds | ||||||

| JPMorgan Bond Fund | JPMorgan Core Plus Bond Fund | |||||

| JPMorgan Short Term Bond Fund | JPMorgan Short Duration Bond Fund | |||||

| JPMorgan Tax Aware Enhanced Income Fund JPMorgan Tax Aware Short-Intermediate Income Fund | JPMorgan Short-Intermediate Municipal Bond Fund (known as the “JPMorgan Short Term Municipal Bond Fund” prior to April 30, 2009)* | |||||

Trust II Acquired Funds | ||||||

| JPMorgan Intermediate Bond Fund | JPMorgan Core Bond Fund | |||||

| JPMorgan Kentucky Municipal Bond Fund | ||||||

| JPMorgan Louisiana Municipal Bond Fund | JPMorgan Intermediate Tax Free Bond Fund | |||||

| JPMorgan West Virginia Municipal Bond Fund | ||||||

| * | Please note that the JPMorgan Short Term Municipal Bond Fund will change its name to the JPMorgan Short-Intermediate Municipal Bond Fund and will also change its main investment strategies prior to the time of the Reorganization. Because these changes will occur prior to the Reorganization and the Proxy Statement/Prospectus enclosed with this letter describes the Acquiring Funds whose shares you will receive through the Reorganization, the Proxy Statement/Prospectus reflects those changes. Therefore, the Proxy Statement/Prospectus refers to the “JPMorgan Short-Intermediate Municipal Bond Fund,” describes the new main investment strategies, and does not describe the main investment strategies of the JPMorgan Short Term Municipal Bond Fund in effect as of the date of the Proxy Statement/Prospectus. |

| To vote by Telephone: | To vote by Internet: | |||||

|---|---|---|---|---|---|---|

| (1) Read the Proxy Statement/Prospectus and have your proxy card at hand. | (1) Read the Proxy Statement/Prospectus and have your proxy card at hand. | |||||

| (2) Call the 1-800 number that appears on your proxy card. | (2) Go to the website that appears on your proxy card. | |||||

| (3) Enter the control number set forth on the proxy card and follow the simple instructions. | (3) Enter the control number set forth on the proxy card and follow the simple instructions. | |||||

President

JPMorgan Trust I

JPMorgan Trust II

JPMorgan Core Plus Bond Fund

JPMorgan Short Duration Bond Fund

JPMorgan Core Bond Fund

JPMorgan Short-Intermediate Municipal Bond Fund

(known as the “JPMorgan Short Term Municipal Bond Fund”

prior to April 30, 2009)

JPMorgan Bond Fund

JPMorgan Short Term Bond Fund

JPMorgan Tax Aware Enhanced Income Fund

JPMorgan Tax Aware Short-Intermediate Income Fund

JPMorgan Intermediate Bond Fund

JPMorgan Kentucky Municipal Bond Fund

JPMorgan Louisiana Municipal Bond Fund

JPMorgan West Virginia Municipal Bond Fund

New York, New York 10167

To Be Held on June 15, 2009

the corresponding Acquiring Fund to which each such shareholder is entitled in the liquidation of the Acquired Fund.

| Acquired Fund | Acquiring Fund | |||||

|---|---|---|---|---|---|---|

| JPMorgan Bond Fund | JPMorgan Core Plus Bond Fund | |||||

| JPMorgan Short Term Bond Fund | JPMorgan Short Duration Bond Fund | |||||

| JPMorgan Tax Aware Enhanced Income Fund JPMorgan Tax Aware Short-Intermediate Income Fund | JPMorgan Short-Intermediate Municipal Bond Fund (known as the “JPMorgan Short Term Municipal Bond Fund” prior to April 30, 2009)* | |||||

| JPMorgan Intermediate Bond Fund | JPMorgan Core Bond Fund | |||||

| JPMorgan Kentucky Municipal Bond Fund JPMorgan Louisiana Municipal Bond Fund JPMorgan West Virginia Municipal Bond Fund | JPMorgan Intermediate Tax Free Bond Fund | |||||

| * | Please note that the JPMorgan Short Term Municipal Bond Fund will change its name to the JPMorgan Short-Intermediate Municipal Bond Fund and will also change its main investment strategies prior to the time of the Reorganization. Because these changes will occur prior to the Reorganization and the Proxy Statement/Prospectus enclosed with this letter describes the Acquiring Funds whose shares you will receive through the Reorganization, the Proxy Statement/Prospectus reflects those changes. Therefore, the Proxy Statement/Prospectus refers to the “JPMorgan Short-Intermediate Municipal Bond Fund,” describes the new main investment strategies, and does not describe the main investment strategies of the JPMorgan Short Term Municipal Bond Fund in effect as of the date of the Proxy Statement/Prospectus. |

| To vote by Telephone: | To vote by Internet: | |||||

|---|---|---|---|---|---|---|

| (1) Read the Proxy Statement/Prospectus and have your proxy card at hand. | (1) Read the Proxy Statement/Prospectus and have your proxy card at hand. | |||||

| (2) Call the 1-800 number that appears on your proxy card. | (2) Go to the website that appears on your proxy card. | |||||

| (3) Enter the control number set forth on the proxy card and follow the simple instructions. | (3) Enter the control number set forth on the proxy card and follow the simple instructions. | |||||

| Frank J. Nasta | ||||||

| Secretary | ||||||

| JPMorgan Trust I | ||||||

| JPMorgan Trust II | ||||||

JPMorgan Bond Fund

JPMorgan Short Term Bond Fund

JPMorgan Tax Aware Enhanced Income Fund

JPMorgan Tax Aware Short-Intermediate Income Fund

JPMorgan Intermediate Bond Fund

JPMorgan Kentucky Municipal Bond Fund

JPMorgan Louisiana Municipal Bond Fund

JPMorgan West Virginia Municipal Bond Fund

JPMorgan Intermediate Tax Free Bond Fund

JPMorgan Core Plus Bond Fund

JPMorgan Short Duration Bond Fund

JPMorgan Core Bond Fund

JPMorgan Short-Intermediate Municipal Bond Fund

(known as the “JPMorgan Short Term Municipal Bond Fund”

prior to April 30, 2009)

New York, New York 10167

| Acquired Fund | Acquiring Fund | |||||

|---|---|---|---|---|---|---|

| JPMorgan Bond Fund | JPMorgan Core Plus Bond Fund | |||||

| JPMorgan Short Term Bond Fund | JPMorgan Short Duration Bond Fund | |||||

| JPMorgan Tax Aware Enhanced Income Fund JPMorgan Tax Aware Short-Intermediate Income Fund | JPMorgan Short-Intermediate Municipal Bond Fund (known as the “JPMorgan Short Term Municipal Bond Fund” prior to April 30, 2009)* | |||||

| JPMorgan Intermediate Bond Fund | JPMorgan Core Bond Fund | |||||

| JPMorgan Kentucky Municipal Bond Fund JPMorgan Louisiana Municipal Bond Fund JPMorgan West Virginia Municipal Bond Fund | JPMorgan Intermediate Tax Free Bond Fund | |||||

| * | Please note that the JPMorgan Short Term Municipal Bond Fund will change its name to the JPMorgan Short-Intermediate Municipal Bond Fund and will also change its main investment strategies prior to the time of the Reorganization. Because these changes will occur prior to the Reorganization and the Proxy Statement/Prospectus enclosed with this letter describes the Acquiring Funds whose shares you will receive through the Reorganization, the Proxy Statement/Prospectus reflects those changes. Therefore, the Proxy Statement/Prospectus refers to the “JPMorgan Short-Intermediate Municipal Bond Fund,” describes the new main investment strategies, and does not describe the main investment strategies of the JPMorgan Short Term Municipal Bond Fund in effect as of the date of the Proxy Statement/Prospectus. |

Acquiring Fund to which each such shareholder is entitled in the liquidation of the Acquired Fund.

| Acquired Fund | Class A | Class B | Class C | Select Class | Institutional Class | Ultra | ||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| JPMorgan Bond Fund | X | X | X | X | X | X | ||||||||||||||||||||

| JPMorgan Short Term Bond Fund | X | X | X | |||||||||||||||||||||||

| JPMorgan Tax Aware Enhanced Income Fund | X | X | X | |||||||||||||||||||||||

| JPMorgan Tax Aware Short-Intermediate Income Fund | X | X | ||||||||||||||||||||||||

| JPMorgan Intermediate Bond Fund | X | X | X | X | X | |||||||||||||||||||||

| JPMorgan Kentucky Municipal Bond Fund | X | X | X | |||||||||||||||||||||||

| JPMorgan Louisiana Municipal Bond Fund | X | X | X | |||||||||||||||||||||||

| JPMorgan West Virginia Municipal Bond Fund | X | X | X | |||||||||||||||||||||||

| Acquired Fund | Acquiring Fund | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| JPMorgan Bond Fund | JPMorgan Core Plus Bond Fund | |||||||||||||||||||||||||

| Class A | → | Class A | ||||||||||||||||||||||||

| Class B | → | Class B | ||||||||||||||||||||||||

| Class C | → | Class C | ||||||||||||||||||||||||

| Select Class | → | Select Class | ||||||||||||||||||||||||

| Institutional Class | → | Institutional Class* | ||||||||||||||||||||||||

| Ultra | → | Ultra | ||||||||||||||||||||||||

| JPMorgan Short Term Bond Fund | JPMorgan Short Duration Bond Fund | |||||||||||||||||||||||||

| Class A | → | Class A | ||||||||||||||||||||||||

| Select Class | → | Select Class | ||||||||||||||||||||||||

| Institutional Class | → | Ultra | ||||||||||||||||||||||||

| JPMorgan Tax Aware Enhanced Income Fund | JPMorgan Short-Intermediate Municipal Bond Fund | |||||||||||||||||||||||||

| Class A | → | Class A | ||||||||||||||||||||||||

| Select Class | → | Select Class | ||||||||||||||||||||||||

| Institutional Class | → | Institutional Class* | ||||||||||||||||||||||||

| JPMorgan Tax Aware Short-Intermediate Income Fund | JPMorgan Short-Intermediate Municipal Bond Fund | |||||||||||||||||||||||||

| Select Class | → | Select Class | ||||||||||||||||||||||||

| Institutional Class | → | Institutional Class* | ||||||||||||||||||||||||

| JPMorgan Intermediate Bond Fund | JPMorgan Core Bond Fund | |||||||||||||||||||||||||

| Class A | �� | Class A | ||||||||||||||||||||||||

| Class B | → | Class B | ||||||||||||||||||||||||

| Class C | → | Class C | ||||||||||||||||||||||||

| Select Class | → | Select Class | ||||||||||||||||||||||||

| Ultra | → | Ultra | ||||||||||||||||||||||||

| JPMorgan Kentucky Municipal Bond Fund | JPMorgan Intermediate Tax Free Bond Fund | |||||||||||||||||||||||||

| Class A | → | Class A | ||||||||||||||||||||||||

| Class B | → | Class B | ||||||||||||||||||||||||

| Select Class | → | Select Class | ||||||||||||||||||||||||

| Acquired Fund | Acquiring Fund | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| JPMorgan Louisiana Municipal Bond Fund | JPMorgan Intermediate Tax Free Bond Fund | |||||||||||||||||||||||||

| Class A | → | Class A | ||||||||||||||||||||||||

| Class B | → | Class B | ||||||||||||||||||||||||

| Select Class | → | Select Class | ||||||||||||||||||||||||

| JPMorgan West Virginia Municipal Bond Fund | JPMorgan Intermediate Tax Free Bond Fund | |||||||||||||||||||||||||

| Class A | → | Class A | ||||||||||||||||||||||||

| Class B | → | Class B | ||||||||||||||||||||||||

| Select Class | → | Select Class | ||||||||||||||||||||||||

| * | An Institutional Class will be added to the JPMorgan Core Plus Bond Fund and the JPMorgan Short-Intermediate Municipal Bond Fund to accommodate the Reorganizations, if approved. |

(“SAI”) for the JPMorgan Core Bond Fund, JPMorgan Core Plus Bond Fund, and JPMorgan Short Duration Bond Fund, dated July 1, 2008, as supplemented; the SAI for the JPMorgan Intermediate Tax Free Bond Fund and the JPMorgan Short-Intermediate Municipal Bond Fund, dated July 1, 2008; and the SAI dated [•], 2009 relating to this Proxy Statement/Prospectus and the Reorganizations are incorporated by reference into this Proxy Statement/Prospectus, which means they are considered legally a part of the Proxy Statement/Prospectus. You may receive a copy of the SAIs without charge by contacting the JPMorgan Funds at (800) 480-4111, or by writing to the JPMorgan Funds at JPMorgan Funds Services, PO Box 8528, Boston, MA 02266-8528. Except for the SAI relating to this Proxy Statement/Prospectus and the Reorganizations, incorporated into this Proxy Statement/Prospectus, the SAIs may also be obtained by visiting the JPMorgan Funds website at www.jpmorganfunds.com.

| Page | ||||||

|---|---|---|---|---|---|---|

| PROPOSAL | 1 | |||||

| SUMMARY | 3 | |||||

| Proposed Reorganizations | 3 | |||||

| Effect of Proposed Reorganizations of the Acquired Funds | 5 | |||||

| Comparison of Investment Objectives and Main Investment Strategies | 5 | |||||

| Comparison of Fees and Expenses | 13 | |||||

| Comparison of Sales Load, Distribution and Shareholder Servicing Arrangements | 35 | |||||

| Comparison of Purchase, Redemption and Exchange Policies and Procedures | 35 | |||||

| COMPARISON OF INVESTMENT OBJECTIVES, STRATEGIES AND PRINCIPAL RISKS OF INVESTING IN THE FUNDS | 37 | |||||

| Principal Risks of Investing in the Funds | 53 | |||||

| Investment Restrictions | 63 | |||||

| INFORMATION ABOUT THE REORGANIZATIONS | 64 | |||||

| The Reorganization Agreement | 64 | |||||

| Description of the Acquiring Funds’ Shares | 65 | |||||

| Reasons for the Reorganizations and Board Considerations | 66 | |||||

| Federal Income Tax Consequences | 67 | |||||

| INFORMATION ABOUT MANAGEMENT OF THE ACQUIRING FUNDS | 72 | |||||

| Additional Compensation to Financial Intermediaries | 73 | |||||

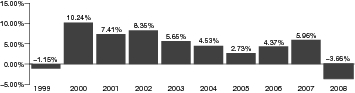

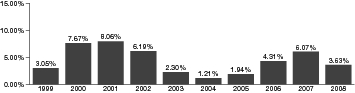

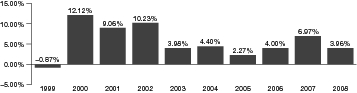

| Performance of the Acquiring Funds | 74 | |||||

| ADDITIONAL INFORMATION ABOUT THE ACQUIRING FUNDS AND ACQUIRED FUNDS | 86 | |||||

| Financial Highlights | 87 | |||||

| Distributor | 87 | |||||

| Administrator | 87 | |||||

| FORM OF ORGANIZATION | 87 | |||||

| CAPITALIZATION | 88 | |||||

| DIVIDENDS AND DISTRIBUTIONS | 99 | |||||

| OTHER BUSINESS | 99 | |||||

| SHAREHOLDER COMMUNICATIONS WITH THE BOARD | 99 | |||||

| Page | ||||||

|---|---|---|---|---|---|---|

| VOTING INFORMATION | 99 | |||||

| Proxy Solicitation | 100 | |||||

| Quorum | 101 | |||||

| Vote Required | 101 | |||||

| Effect of Abstentions and Broker “Non-Votes” | �� | 101 | ||||

| Adjournments | 102 | |||||

| Shareholder Proposals | 102 | |||||

| Record Date, Outstanding Shares and Interests of Certain Persons | 102 | |||||

| LEGAL MATTERS | 103 | |||||

| APPENDIX A — Legal Proceedings and Additional Fee and Expense Information Affecting the JPMorgan Trust II Funds and Former One Group Mutual Funds | A-1 | |||||

| APPENDIX B — Form of Reorganization Agreement Among JPMorgan Trust I Funds and JPMorgan Trust II Funds | B-1 | |||||

| APPENDIX C — How to Do Business with the Acquiring Funds | C-1 | |||||

| APPENDIX D — Comparison of Investment Objectives, Main Investment Strategies and Investment Restrictions, and Information Regarding Fund Managers and Acquiring Funds’ Investment Processes | D-1 | |||||

| APPENDIX E — Financial Highlights of the Acquiring Funds | E-1 | |||||

| APPENDIX F — Record Date, Outstanding Shares and Interests of Certain Persons | F-1 | |||||

will be continued after June 30, 2010.

| Acquired Fund | Acquiring Fund | |||||

|---|---|---|---|---|---|---|

| JPMorgan Bond Fund | JPMorgan Core Plus Bond Fund | |||||

| JPMorgan Short Term Bond Fund | JPMorgan Short Duration Bond Fund | |||||

| JPMorgan Tax Aware Enhanced Income Fund JPMorgan Tax Aware Short Intermediate Income Fund | JPMorgan Short-Intermediate Municipal Bond Fund (known as the “JPMorgan Short Term Municipal Bond Fund” prior to April 30, 2009)* | |||||

| JPMorgan Intermediate Bond Fund | JPMorgan Core Bond Fund | |||||

| JPMorgan Kentucky Municipal Bond Fund JPMorgan Louisiana Municipal Bond Fund JPMorgan West Virginia Municipal Bond Fund | JPMorgan Intermediate Tax Free Bond Fund | |||||

| * | Please note that the JPMorgan Short Term Municipal Bond Fund will change its name to the JPMorgan Short-Intermediate Municipal Bond Fund and will also change its main investment strategies prior to the time of the Reorganization. Because these changes will occur prior to the Reorganization and the Proxy Statement/Prospectus enclosed with this letter describes the Acquiring Funds whose shares you will receive through the Reorganization, the Proxy Statement/Prospectus reflects |

| those changes. Therefore, the Proxy Statement/Prospectus refers to the “JPMorgan Short-Intermediate Municipal Bond Fund,” describes the new main investment strategies, and does not describe the main investment strategies of the JPMorgan Short Term Municipal Bond Fund in effect as of the date of the Proxy Statement/Prospectus. |

JPMorgan Trust I and the Board of JPMorgan Trust II recommend that shareholders of the Trust I Acquired Funds and Trust II Acquired Funds vote “FOR” the proposed Reorganization Agreement effecting the Reorganization.

more thorough comparison of the Funds and their investment objectives and main investment strategies can be found in Appendix D. Additional information regarding the Acquired Funds can be found in their respective prospectuses.

JPMorgan Core Plus Bond Fund

JPMorgan Short Duration Bond Fund

JPMorgan Short-Intermediate Municipal Bond Fund1

| 1 | Please note that the investment strategies of the JPMorgan Short-Intermediate Municipal Bond Fund reflect the strategies of the Fund as they will be at the time of the Reorganization and not necessarily the strategies of the Fund prior to that time. |

JPMorgan Short-Intermediate Municipal Bond Fund1

| 1 | Please note that the investment strategies of the JPMorgan Short-Intermediate Municipal Bond Fund reflect the strategies of the Fund as they will be at the time of the Reorganization and not necessarily the strategies of the Fund prior to that time. |

JPMorgan Core Bond Fund

of its Assets will consist of obligations issued by the U.S. government or its agencies and instrumentalities, some of which may be subject to repurchase agreements, whereas the JPMorgan Core Bond Fund does not have any such requirement. For purposes of these policies, “Assets” mean net assets plus the amount of borrowings for investment purposes. The JPMorgan Intermediate Bond Fund seeks to maintain an average weighted maturity between three and ten years, while the JPMorgan Core Bond Fund seeks to maintain an average weighted maturity between four and twelve years. The JPMorgan Core Bond Fund also may purchase taxable or tax-exempt municipal securities, unlike the JPMorgan Intermediate Bond Fund. Each Fund also may invest in preferred stock.

JPMorgan Intermediate Tax Free Bond Fund

JPMorgan Kentucky Municipal Bond Fund maintains an average weighted maturity between three and fifteen years. However, the Funds currently have similar durations of approximately five years.

JPMorgan Intermediate Tax Free Bond Fund

JPMorgan Intermediate Tax Free Bond Fund

Reorganizations are equal to or less than the net expense levels (excluding any fees and expenses associated with investment in other funds, dividend expenses related to short sales, interest (including interest related to investments in inverse floaters), taxes, and extraordinary expenses and expenses related to the Board of Trustees’ deferred compensation plan) in effect prior to the Reorganization for the corresponding share classes of the Acquired Funds. These contractual fee waivers and/or reimbursements will stay in effect until June 30, 2010. There is no guarantee such waivers and/or reimbursements will be continued after June 30, 2010.

| ANNUAL FUND OPERATING EXPENSES (%) (expenses that are deducted from Fund assets) | JPMorgan Bond Fund | JPMorgan Core Plus Bond Fund | JPMorgan Core Plus Bond Fund (Pro Forma Combined) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Class A Shares | Class B Shares | Class C Shares | Select Class Shares | Institutional Class Shares | Ultra Shares | Class A Shares | Class B Shares | Class C Shares | Select Class Shares | Ultra Shares | Class A Shares | Class B Shares | Class C Shares | Select Class Shares | Institutional Class Shares | Ultra Shares | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Management Fee | 0.30 | % | 0.30 | % | 0.30 | % | 0.30 | % | 0.30 | % | 0.30 | % | 0.30 | % | 0.30 | % | 0.30 | % | 0.30 | % | 0.30 | % | 0.30 | % | 0.30 | % | 0.30 | % | 0.30 | % | 0.30 | % | 0.30 | % | |||||||||||||||||||||||||||||||||||||

| Distribution (Rule 12b-1) Fees | 0.25 | % | 0.75 | % | 0.75 | % | 0.00 | % | 0.00 | % | 0.00 | % | 0.25 | % | 0.75 | % | 0.75 | % | 0.00 | % | 0.00 | % | 0.25 | % | 0.75 | % | 0.75 | % | 0.00 | % | 0.00 | % | 0.00 | % | |||||||||||||||||||||||||||||||||||||

| Shareholder Service Fees | 0.25 | % | 0.25 | % | 0.25 | % | 0.25 | % | 0.10 | % | 0.00 | % | 0.25 | % | 0.25 | % | 0.25 | % | 0.25 | % | 0.00 | % | 0.25 | % | 0.25 | % | 0.25 | % | 0.25 | % | 0.10 | % | 0.00 | % | |||||||||||||||||||||||||||||||||||||

| Other Expenses | 0.18 | %1 | 0.18 | %1 | 0.18 | %1 | 0.18 | %1 | 0.18 | %1 | 0.18 | %1 | 0.17 | %1 | 0.17 | %1 | 0.17 | %1 | 0.17 | %1 | 0.17 | %1 | 0.16 | % | 0.16 | % | 0.16 | % | 0.16 | % | 0.16 | % | 0.16 | % | |||||||||||||||||||||||||||||||||||||

| Acquired Fund Fees and Expenses | 0.01 | % | 0.01 | % | 0.01 | % | 0.01 | % | 0.01 | % | 0.01 | % | 0.00 | % | 0.00 | % | 0.00 | % | 0.00 | % | 0.00 | % | 0.01 | % | 0.01 | % | 0.01 | % | 0.01 | % | 0.01 | % | 0.01 | % | |||||||||||||||||||||||||||||||||||||

| Total Annual Fund Operating Expenses | 0.99 | %2 | 1.49 | %2 | 1.49 | %2 | 0.74 | %2 | 0.59 | %2 | 0.49 | %2 | 0.97 | %2 | 1.47 | %2 | 1.47 | %2 | 0.72 | %2 | 0.47 | %2 | 0.97 | % | 1.47 | % | 1.47 | % | 0.72 | % | 0.57 | % | 0.47 | % | |||||||||||||||||||||||||||||||||||||

| Fee Waiver and/or Expense Reimbursement | –0.23 | %3 | –0.08 | %3 | –0.08 | %3 | –0.08 | %3 | –0.09 | %3 | –0.08 | %3 | –0.05 | %4 | –0.02 | %4 | –0.02 | %4 | –0.05 | %4 | –0.02 | %4 | –0.21 | %5 | –0.06 | %5 | –0.06 | %5 | –0.06 | %5 | –0.07 | %5 | –0.06 | %5 | |||||||||||||||||||||||||||||||||||||

| Net Expenses | 0.76 | % | 1.41 | % | 1.41 | % | 0.66 | % | 0.50 | % | 0.41 | % | 0.92 | % | 1.45 | % | 1.45 | % | 0.67 | % | 0.45 | % | 0.76 | % | 1.41 | % | 1.41 | % | 0.66 | % | 0.50 | % | 0.41 | % | |||||||||||||||||||||||||||||||||||||

1 | “Other Expenses” are based on the actual amounts incurred during the 12 months ended 8/31/08. |

2 | The Total Annual Operating Expenses included in the fee table are different from the ratio of expenses to average net assets that appear in the Financial Highlights. The Financial Highlights are based on the fiscal year ended 2/29/08, and do not include Acquired Fund Fees and Expenses. |

3 | JPMIM, JPMFM and JPMDS have contractually agreed to waive fees and/or reimburse expenses to the extent that total annual operating expenses (excluding Acquired Fund Fees and Expenses, dividend expenses related to short sales, interest, taxes and extraordinary expenses and expense related to the Board of Trustees’ deferred compensation plan) exceed 0.75%, 1.50%, 1.50%, 0.69%, 0.49% and 0.40% of the average daily net assets of Class A, Class B, Class C, Select Class, Institutional Class and Ultra Shares, respectively, through 6/30/09. Without the Acquired Fund Fees and Expenses, the Total Annual Operating Expenses would have been 0.98%, 1.48%, 1.48%, 0.73%, 0.58% and 0.48% and Net Expenses would have been 0.75%, 1.40%, 1.40%, 0.65%, 0.49% and 0.40% of the average daily net assets of Class A, Class B, Class C, Select Class, Institutional Class and Ultra Shares, respectively. In addition, the Fund’s service providers may voluntarily waive or reimburse certain of their fees, as they may determine, from time to time. |

4 | JPMIA, JPMFM and JPMDS have contractually agreed to waive fees and/or reimburse expenses to the extent that total annual operating expenses (excluding Acquired Fund Fees and Expenses, dividend expenses related to short sales, interest, taxes and extraordinary expenses and expenses related to the Board of Trustees’ deferred compensation plan) exceed 0.92%, 1.57%, 1.57%, 0.67% and 0.45% of the average daily net assets of Class A, Class B, Class C, Select Class and Ultra Shares, respectively, through 6/30/09. In addition, the Fund’s service providers may voluntarily waive or reimburse certain of their fees, as they may determine, from time to time. |

5 | JPMIM, JPMFM and JPMDS have contractually agreed to waive fees and/or reimburse expenses to the extent that total annual operating expenses (excluding Acquired Fund Fees and Expenses, dividend expenses related to short sales, interest, taxes and extraordinary expenses and expenses related to the Board of Trustees’ deferred compensation plan) exceed 0.75%, 1.40%, 1.40%, 0.65%, 0.49%and 0.40% of the average daily net assets of Class A, Class B, Class C, Select Class, Institutional Class and Ultra Shares, respectively, through 6/30/10. Without the Acquired Fund Fees and Expenses, the Total Annual Operating Expenses would have been 0.96%, 1.46%, 1.46%, 0.71%, 0.56% and 0.46% and Net Expenses would have been 0.75%, 1.40%, 1.40%, 0.65%, 0.49% and 0.40% of the average daily net assets of Class A, Class B, Class C, Select Class, Institutional Class and Ultra Shares, respectively. In addition, the Fund’s service providers may voluntarily waive or reimburse certain of their fees, as they may determine, from time to time. |

| • | 5% return each year, |

| • | net expenses through the expiration of each Fund’s and the combined Fund’s contractual expense caps, respectively, and total annual operating expenses thereafter, and |

| • | all dividends and distributions are reinvested. |

| If You Sell Your Shares Your Cost Would Be: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| JPMorgan Bond Fund | JPMorgan Core Plus Bond Fund | JPMorgan Core Plus Bond Fund (Pro Forma Combined) | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 1 Year | 3 Years | 5 Years | 10 Years | 1 Year | 3 Years | 5 Years | 10 Years | 1 Year | 3 Years | 5 Years | 10 Years | |||||||||||||||||||||||||||||||||||||||||

| Class A* | $ | 450 | $ | 656 | $ | 880 | $ | 1,522 | $ | 465 | $ | 668 | $ | 886 | $ | 1,516 | $ | 450 | $ | 652 | $ | 871 | $ | 1,502 | ||||||||||||||||||||||||||||

| Class B** | 644 | 763 | 1,006 | 1,637 | *** | 648 | 763 | 1,001 | 1,620 | *** | 644 | 759 | 997 | 1,617 | *** | |||||||||||||||||||||||||||||||||||||

| Class C** | 244 | 463 | 806 | 1,773 | 248 | 463 | 801 | 1,756 | 244 | 459 | 797 | 1,752 | ||||||||||||||||||||||||||||||||||||||||

| Select Class | 67 | 229 | 404 | 911 | 68 | 225 | 396 | 890 | 67 | 224 | 395 | 889 | ||||||||||||||||||||||||||||||||||||||||

| Institutional Class | 51 | 180 | 320 | 729 | n/a | n/a | n/a | n/a | 51 | 176 | 311 | 707 | ||||||||||||||||||||||||||||||||||||||||

| Ultra | 42 | 149 | 266 | 608 | 46 | 149 | 261 | 590 | 42 | 145 | 257 | 586 | ||||||||||||||||||||||||||||||||||||||||

| If You Do Not Sell Your Shares, Your Cost for Class B and Class C Shares Would Be: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| JPMorgan Bond Fund | JPMorgan Core Plus Bond Fund | JPMorgan Core Plus Bond Fund (Pro Forma Combined) | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 1 Year | 3 Years | 5 Years | 10 Years | 1 Year | 3 Years | 5 Years | 10 Years | 1 Year | 3 Years | 5 Years | 10 Years | |||||||||||||||||||||||||||||||||||||||||

| Class B | 144 | 463 | 806 | 1,637 | *** | 148 | 463 | 801 | 1,620 | *** | 144 | 459 | 797 | 1,617 | *** | |||||||||||||||||||||||||||||||||||||

| Class C | 144 | 463 | 806 | 1,773 | 148 | 463 | 801 | 1,756 | 144 | 459 | 797 | 1,752 | ||||||||||||||||||||||||||||||||||||||||

| * | Assumes sales charge is deducted when shares are purchased. |

| ** | Assumes applicable deferred sales charge is deducted when shares are sold. |

| *** | Reflects conversion of Class B shares to Class A shares after they have been owned for eight years. |

JPMorgan Short Duration Bond Fund

| ANNUAL FUND OPERATING EXPENSES (%) (expenses that are deducted from Fund assets) | JPMorgan Short Term Bond Fund | JPMorgan Short Duration Bond Fund | JPMorgan Short Duration Bond Fund (Pro Forma Combined) | |||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Class A Shares | Select Class Shares | Institutional Class Shares | Class A Shares | Select Class Shares | Ultra Shares | Class A Shares | Select Class Shares | Ultra Shares | ||||||||||||||||||||||||||||||

| Management Fee | 0.25 | % | 0.25 | % | 0.25 | % | 0.25 | % | 0.25 | % | 0.25 | % | 0.25 | % | 0.25 | % | 0.25% | |||||||||||||||||||||

| Distribution (Rule 12b-1) Fees | 0.25 | % | 0.00 | % | 0.00 | % | 0.25 | % | 0.00 | % | 0.00 | % | 0.25 | % | 0.00 | % | 0.00% | |||||||||||||||||||||

| Shareholder Service Fees | 0.25 | % | 0.25 | % | 0.10 | % | 0.25 | % | 0.25 | % | 0.00 | % | 0.25 | % | 0.25 | % | 0.00% | |||||||||||||||||||||

| Other Expenses | 0.16%1 | 0.16%1 | 0.16%1 | 0.13%1 | 0.13%1 | 0.13%1 | 0.13 | % | 0.13 | % | 0.13% | |||||||||||||||||||||||||||

| Acquired Fund Fees and Expenses | 0.01 | % | 0.01 | % | 0.01 | % | 0.01 | % | 0.01 | % | 0.01 | % | 0.01 | % | 0.01 | % | 0.01% | |||||||||||||||||||||

| Total Annual Fund Operating Expenses | 0.92%2 | 0.67%2 | 0.52%2 | 0.89%2 | 0.64%2 | 0.39%2 | 0.89 | % | 0.64 | % | 0.39% | |||||||||||||||||||||||||||

| Fee Waiver and/or Expense Reimbursement | –0.16%3 | –0.11%3 | –0.21%3 | –0.08%4 | –0.08%4 | –0.08%4 | –0.13%5 | –0.08%5 | –0.08%5 | |||||||||||||||||||||||||||||

| Net Expenses | 0.76 | % | 0.56 | % | 0.31 | % | 0.81 | % | 0.56 | % | 0.31 | % | 0.76 | % | 0.56 | % | 0.31% | |||||||||||||||||||||

1 | “Other Expenses” are based on the actual amounts incurred during the 12 months ended 8/31/08. |

2 | The Total Annual Operating Expenses included in the fee table are different from the ratio of expenses to average net assets that appear in the Financial Highlights. The Financial Highlights are based on a fiscal year ended 2/29/08, and do not include Acquired Fund Fees and Expenses. |

3 | JPMIM, JPMFM and JPMDS have contractually agreed to waive fees and/or reimburse expenses to the extent that total annual operating expenses (excluding Acquired Fund Fees and Expenses, dividend expenses related to short sales, interest, taxes and extraordinary expenses and expenses related to the Board of Trustees’ deferred compensation plan) exceed 0.75%, 0.60% and 0.30% of the average daily net assets of Class A, Select Class and Institutional Class Shares, respectively, through 6/30/09. Without the Acquired Fund Fees and Expenses, the Total Annual Operating Expenses of the Fund would have been 0.91%, 0.66% and 0.51%, and Net Expenses would have been 0.75%, 0.55%, and 0.30%, of the average daily net assets of the Class A, Select Class and Institutional Class Shares, respectively. In addition, the Fund’s service providers may voluntarily waive or reimburse certain of their fees, as they may determine, from time to time. |

4 | JPMIA, JPMFM and JPMDS have contractually agreed to waive fees and/or reimburse expenses to the extent that total annual operating expenses (excluding Acquired Fund Fees and Expenses, dividend expenses related to short sales, interest, taxes and extraordinary expenses and expenses related to the Board of Trustees’ deferred compensation plan) exceed 0.80%, 0.55% and 0.44% of the average daily net assets of Class A, Select Class and Ultra Shares, respectively, through 6/30/09. Without the Acquired Fund Fees and Expenses, the Total Annual Operating Expenses of the Fund would have been 0.88%,0.63% and 0.38%, and Net Expenses would have been 0.80%, 0.55% and 0.30%, of the average daily net assets of the Class A, Select Class and Ultra Shares, respectively. In addition, the Fund’s service providers may voluntarily waive or reimburse certain of their fees, as they may determine, from time to time. |

5 | JPMIA, JPMFM and JPMDS have contractually agreed to waive fees and/or reimburse expenses to the extent that total annual operating expenses (excluding Acquired Fund Fees and Expenses, dividend expenses related to short sales, interest, taxes and extraordinary expenses and expenses related to the Board of Trustees’ deferred compensation plan) exceed 0.75%, 0.55% and 0.30% of the average daily net assets of Class A, Select Class and Ultra Shares, respectively, through 6/30/10. Without the Acquired Fund Fees and Expenses, the Total Annual Operating Expenses of the Fund would have been 0.88%, 0.63% and 0.38%, and Net Expenses would have been 0.75%, 0.55% and 0.30%, of the average daily net assets of the Class A, Select Class and Ultra Shares, respectively. In addition, the Fund’s service providers may voluntarily waive or reimburse certain of their fees, as they may determine, from time to time. |

| • | 5% return each year, |

| • | net expenses through the expiration of each Fund’s and the combined Fund’s contractual expense caps, respectively, and total annual operating expenses thereafter, and |

| • | all dividends and distributions are reinvested. |

| Whether or Not You Sell Your Shares, Your Cost Would Be: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| JPMorgan Short Term Bond Fund | JPMorgan Short Duration Bond Fund | JPMorgan Short Duration Bond Fund (Pro Forma Combined) | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 1 Year | 3 Years | 5 Years | 10 Years | 1 Year | 3 Years | 5 Years | 10 Years | 1 Year | 3 Years | 5 Years | 10 Years | |||||||||||||||||||||||||||||||||||||||||

| Class A* | $ | 301 | $ | 496 | $ | 708 | $ | 1,316 | $ | 306 | $ | 495 | $ | 699 | $ | 1,289 | $ | 301 | $ | 490 | $ | 695 | $ | 1,285 | ||||||||||||||||||||||||||||

| Select Class | 57 | 203 | 362 | 824 | 57 | 197 | 349 | 791 | 57 | 197 | 349 | 791 | ||||||||||||||||||||||||||||||||||||||||

| Ultra | n/a | n/a | n/a | n/a | 32 | 117 | 211 | 485 | 32 | 117 | 211 | 485 | ||||||||||||||||||||||||||||||||||||||||

| Institutional Class | 32 | 146 | 270 | 632 | n/a | n/a | n/a | n/a | n/a | n/a | n/a | n/a | ||||||||||||||||||||||||||||||||||||||||

| * | Assumes sales charge is deducted when shares are purchased. |

JPMorgan Tax Aware Short-Intermediate Income Fund and

JPMorgan Short-Intermediate Municipal Bond Fund

| ANNUAL FUND OPERATING EXPENSES (%) (expenses that are deducted from Fund assets) | JPMorgan Tax Aware Enhanced Income Fund | JPMorgan Tax Aware Short- Intermediate Income Fund | JPMorgan Short-Intermediate Municipal Bond Fund | |||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Class A Shares | Select Class Shares | Institutional Class Shares | Select Class Shares | Institutional Class Shares | Class A Shares | Select Class Shares | ||||||||||||||||||||||||||||||||||||||||||||

| Management Fee | 0.25 | % | 0.25 | % | 0.25 | % | 0.25 | % | 0.25 | % | 0.25 | % | 0.25 | % | ||||||||||||||||||||||||||||||||||||

| Distribution (Rule 12b-1) Fees | 0.25 | % | 0.00 | % | 0.00 | % | 0.00 | % | 0.00 | % | 0.25 | % | 0.00 | % | ||||||||||||||||||||||||||||||||||||

| Shareholder Service Fees | 0.25 | % | 0.25 | % | 0.10 | % | 0.25 | % | 0.10 | % | 0.25 | % | 0.25 | % | ||||||||||||||||||||||||||||||||||||

| Other Expenses | 0.22 | %1 | 0.22 | %1 | 0.22 | %1 | 0.17 | %1 | 0.17 | %1 | 0.19 | %1 | 0.19 | %1 | ||||||||||||||||||||||||||||||||||||

| Acquired Fund Fees and Expenses | 0.03 | % | 0.03 | % | 0.03 | % | 0.01 | % | 0.01 | % | 0.01 | % | 0.01 | % | ||||||||||||||||||||||||||||||||||||

| Total Annual Fund Operating Expenses | 1.00 | %2 | 0.75 | %2 | 0.60 | %2 | 0.68 | %2 | 0.53 | %2 | 0.95 | %3 | 0.70 | %3 | ||||||||||||||||||||||||||||||||||||

| Fee Waiver and/or Expense Reimbursement | –0.22 | %4 | –0.22 | %4 | –0.32 | %4 | –0.11 | %5 | –0.11 | %5 | –0.14 | %6 | –0.14 | %6 | ||||||||||||||||||||||||||||||||||||

| Net Expenses | 0.78 | % | 0.53 | % | 0.28 | % | 0.57 | % | 0.42 | % | 0.81 | % | 0.56 | % | ||||||||||||||||||||||||||||||||||||

| ANNUAL FUND OPERATING EXPENSES (%) (expenses that are deducted from Fund assets) | JPMorgan Short-Intermediate Municipal Bond Fund (Pro Forma Combined, Assuming Reorganization of only the JPMorgan Tax Aware Enhanced Income Fund)* | JPMorgan Short-Intermediate Municipal Bond Fund (Pro Forma Combined, Assuming Reorganization of only the JPMorgan Tax Aware Short-Intermediate Income Fund)* | JPMorgan Short-Intermediate Municipal Bond Fund (Pro Forma Combined)* | |||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Class A Shares | Select Class Shares | Institutional Class Shares | Class A Shares | Select Class Shares | Institutional Class Shares | Class A Shares | Select Class Shares | Institutional Class Shares | ||||||||||||||||||||||||||||||

| Management Fee | 0.25 | % | 0.25 | % | 0.25 | % | 0.25 | % | 0.25 | % | 0.25 | % | 0.25 | % | 0.25 | % | 0.25% | |||||||||||||||||||||

| Distribution (Rule 12b-1) Fees | 0.25 | % | 0.00 | % | 0.00 | % | 0.25 | % | 0.00 | % | 0.00 | % | 0.25 | % | 0.00 | % | 0.00% | |||||||||||||||||||||

| Shareholder Service Fees | 0.25 | % | 0.25 | % | 0.10 | % | 0.25 | % | 0.25 | % | 0.10 | % | 0.25 | % | 0.25 | % | 0.10% | |||||||||||||||||||||

| Other Expenses | 0.17 | % | 0.17 | % | 0.17 | % | 0.16 | % | 0.16 | % | 0.16 | % | 0.16 | % | 0.16 | % | 0.16% | |||||||||||||||||||||

| Acquired Fund Fees and Expenses | 0.01 | % | 0.01 | % | 0.01 | % | 0.01 | % | 0.01 | % | 0.01 | % | 0.01 | % | 0.01 | % | 0.01% | |||||||||||||||||||||

| Total Annual Fund Operating Expenses | 0.93 | % | 0.68 | % | 0.53 | % | 0.92 | % | 0.67 | % | 0.52 | % | 0.92 | % | 0.67 | % | 0.52% | |||||||||||||||||||||

| Fee Waiver and/or Expense Reimbursement | –0.17 | %7 | –0.17 | %7 | –0.27 | %7 | –0.15 | %8 | –0.15 | %8 | –0.25 | %8 | –0.15 | %9 | –0.15 | %9 | –0.25%9 | |||||||||||||||||||||

| Net Expenses | 0.76 | % | 0.51 | % | 0.26 | % | 0.77 | % | 0.52 | % | 0.27 | % | 0.77 | % | 0.52 | % | 0.27% | |||||||||||||||||||||

| * | Because both the JPMorgan Tax Aware Enhanced Income Fund and JPMorgan Tax Aware Short-Intermediate Income Fund may merge with the JPMorgan Short-Intermediate Municipal Bond Fund, the pro forma columns represent the three possibilities that may result from the vote of the shareholders: (1) shareholders approve the JPMorgan Tax Aware Enhanced Income Fund merger but do not approve the JPMorgan Tax Aware Short-Intermediate Income Fund merger; (2) shareholders approve the JPMorgan Tax Aware Short-Intermediate Income Fund merger but do not approve the JPMorgan Tax Aware Enhanced Income Fund merger; or (3) shareholders approve both the JPMorgan Tax Aware Enhanced Income Fund merger and the JPMorgan Tax Aware Short-Intermediate Income Fund merger. |

1 | “Other Expenses” are based on the actual amounts incurred during the 12 months ended 8/31/08. “Other Expenses” for the Tax Aware Short-Intermediate Income Fund and the Pro Forma Combined Funds including the assets of the Tax Aware Short-Intermediate Income Fund include expenses related to the Fund’s liability with respect to floating rate notes issued by trusts whose inverse floater certificates are held by the Fund. The Fund also records offsetting interest income relating to the municipal obligation underlying such transactions (“Imputed Interest on Floating Rate Notes”). Therefore, the Fund’s net asset value per share and total returns have not been affected by these additional expenses. |

2 | The Total Annual Operating Expenses included in the fee table are different from the ratio of expenses to average net assets that appear in the Financial Highlights. The Financial Highlights are based on a fiscal year ended 10/31/08, and do not include Acquired Fund Fees and Expenses. |

3 | The Total Annual Operating Expenses included in the fee table are different from the ratio of expenses to average net assets that appear in the Financial Highlights. The Financial Highlights are based on a fiscal year ended 2/29/08, and do not include Acquired Fund Fees and Expenses. |

4 | JPMIM, JPMFM and JPMDS have contractually agreed to waive fees and/or reimburse expenses to the extent that total annual operating expenses (excluding Acquired Fund Fees and Expenses, dividend expenses related to short sales, interest, taxes and extraordinary expenses and expenses related to the Board of Trustees’ deferred compensation plan) exceed 0.75%, 0.50% and 0.25% of the average daily net assets of Class A, Select Class and Institutional Class Shares, respectively, through 2/28/10. Without the Acquired Fund Fees and Expenses, the Total Annual Operating Expenses of the Fund would have been 0.97%, 0.72% and 0.57%, and Net Expenses would have been 0.75%, 0.50%, and 0.25%, of the average daily net assets of the Class A, Select Class and Institutional Class Shares, respectively. In addition, the Fund’s service providers may voluntarily waive or reimburse certain of their fees, as they may determine, from time to time. |

5 | JPMIM, JPMFM and JPMDS have contractually agreed to waive fees and/or reimburse expenses to the extent that total annual operating expenses (excluding Acquired Fund Fees and Expenses, dividend expenses related to short sales, interest (which includes imputed interest), taxes and extraordinary expenses and expenses related to the Board of Trustees’ deferred compensation plan) exceed 0.55% and 0.40% of the average daily net assets of Select Class and Institutional Class Shares, respectively, through 2/28/10. Without the Imputed Interest on Floating Rate Notes and the Acquired Fund Fees and Expenses, the Total Annual Operating Expenses of the Fund would have been 0.66% and 0.51%, and Net Expenses would have been 0.55% and 0.40%, of the average daily net assets of the Select Class and Institutional Class shares, respectively. In addition, the Fund’s service providers may voluntarily waive or reimburse certain of their fees, as they may determine, from time to time. |

6 | JPMIA, JPMFM and JPMDS have contractually agreed to waive fees and/or reimburse expenses to the extent that total annual operating expenses (excluding Acquired Fund Fees and Expenses, dividend expenses related to short sales, interest, taxes and extraordinary expenses and expenses related to the Board of Trustees’ deferred compensation plan) exceed 0.80% and 0.55% of the average daily net assets of Class A and Select Class shares, respectively, through 6/30/09. Without the Acquired Fund Fees and Expenses, the Total Annual Operating Expenses of the Fund would have been 0.94% and 0.69%, and Net Expenses would have been 0.80% and 0.55%, of the average daily net assets for Class A and Select Class Shares, respectively. In addition, the Fund’s service providers may voluntarily waive or reimburse certain of their fees, as they may determine, from time to time. |

7 | JPMIA, JPMFM and JPMDS have contractually agreed to waive fees and/or reimburse expenses to the extent that total annual operating expenses (excluding Acquired Fund Fees and Expenses, dividend expenses related to short sales, interest, taxes and extraordinary expenses and expenses related to the Board of Trustees’ deferred compensation plan) exceed 0.75%, 0.50% and 0.25% of the average daily net assets of Class A, Select Class and Institutional Class Shares, respectively, through 6/30/10. Without the Acquired Fund Fees and Expenses, the Total Annual Operating Expenses of the Fund would have been 0.92%, 0.67%, and 0.52%, and Net Expenses would have been 0.75%, 0.50% and 0.25% of the average daily net assets for Class A, Select Class and Institutional Class Shares, respectively. In addition, the Fund’s service providers may voluntarily waive or reimburse certain of their fees, as they may determine, from time to time. |

8 | JPMIA, JPMFM and JPMDS have contractually agreed to waive fees and/or reimburse expenses to the extent that total annual operating expenses (excluding Acquired Fund Fees and Expenses, dividend expenses related to short sales, interest (which includes imputed interest), taxes and extraordinary expenses and expenses related to the Board of Trustees’ deferred compensation plan) exceed 0.75%, 0.50% and 0.25% of the average daily net assets of Class A, Select Class and Institutional Class Shares, respectively, through 6/30/10. Without the Imputed Interest on Floating Rate Notes and the Acquired Fund Fees and Expenses, the Total Annual Operating Expenses of the Fund would have been 0.90%, 0.65%, and 0.50%, and Net Expenses would have been 0.75%, 0.50% and 0.25% of the average daily net assets for Class A, Select Class and Institutional Class Shares, respectively. In addition, the Fund’s service providers may voluntarily waive or reimburse certain of their fees, as they may determine, from time to time. |

9 | JPMIA, JPMFM and JPMDS have contractually agreed to waive fees and/or reimburse expenses to the extent that total annual operating expenses (excluding Acquired Fund Fees and Expenses, dividend expenses related to short sales, interest (which includes imputed interest), taxes and extraordinary expenses and expenses related to the Board of Trustees’ deferred compensation plan) exceed 0.75%, 0.50% and 0.25% of the average daily net assets of Class A, Select Class and Institutional Class Shares, respectively, through 6/30/10. Without the Imputed Interest on Floating Rate Notes and the Acquired Fund Fees and Expenses, the Total Annual Operating Expenses of the Fund would have been 0.90%, 0.65%, and 0.50%, and Net Expenses would have been 0.75%, 0.50%,and 0.25% of the average daily net assets for Class A, Select Class and Institutional Class Shares, respectively. In addition, the Fund’s service providers may voluntarily waive or reimburse certain of their fees, as they may determine, from time to time. |

| • | 5% return each year, |

| • | net expenses through the expiration of each Fund’s and the combined Fund’s contractual expense caps, respectively, and total annual operating expenses thereafter, and |

| • | all dividends and distributions are reinvested |

| Whether or Not You Sell Your Shares, Your Cost Would Be: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| JPMorgan Tax Aware Enhanced Income Fund | JPMorgan Tax Aware Short-Intermediate Income Fund | JPMorgan Short-Intermediate Municipal Bond Fund | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 1 Year | 3 Years | 5 Years | 10 Years | 1 Year | 3 Years | 5 Years | 10 Years | 1 Year | 3 Years | 5 Years | 10 Years | |||||||||||||||||||||||||||||||||||||||||

| Class A* | $ | 303 | $ | 515 | $ | 744 | $ | 1,403 | n/a | n/a | n/a | n/a | $ | 306 | $ | 507 | $ | 725 | $ | 1,353 | ||||||||||||||||||||||||||||||||

| Select Class | $ | 54 | $ | 218 | $ | 395 | $ | 910 | $ | 58 | $ | 206 | $ | 368 | $ | 836 | 57 | 210 | 376 | 857 | ||||||||||||||||||||||||||||||||

| Institutional Class | 29 | 160 | 303 | 719 | 43 | 159 | 285 | 654 | n/a | n/a | n/a | n/a | ||||||||||||||||||||||||||||||||||||||||

| JPMorgan Short-Intermediate Municipal Bond Fund (Pro Forma Combined, Assuming Reorganization of only the JPMorgan Tax Aware Enhanced Income Fund) | JPMorgan Short-Intermediate Municipal Bond Fund (Pro Forma Combined, Assuming Reorganization of only the JPMorgan Tax Aware Short-Intermediate Income Fund) | JPMorgan Short-Intermediate Municipal Bond Fund (Pro Forma Combined) | |||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 Year | 3 Years | 5 Years | 10 Years | 1 Year | 3 Years | 5 Years | 10 Years | 1 Year | 3 Years | 5 Years | 10 Years | ||||||||||||||||||||||||||||||||||||||||

| Class A* | $ | 301 | $ | 498 | $ | 712 | $ | 1,327 | $ | 302 | $ | 497 | $ | 709 | $ | 1,317 | $ | 302 | $ | 497 | $ | 709 | $ | 1,317 | |||||||||||||||||||||||||||

| Select Class | 52 | 200 | 362 | 830 | 53 | 199 | 358 | 820 | 53 | 199 | 358 | 820 | |||||||||||||||||||||||||||||||||||||||

| Institutional Class | 27 | 143 | 269 | 639 | 28 | 141 | 266 | 629 | 28 | 141 | 266 | 629 | |||||||||||||||||||||||||||||||||||||||

| * | Assumes sales charge is deducted when shares are purchased. |

JPMorgan Core Bond Fund

| ANNUAL FUND OPERATING EXPENSES (%) (expenses that are deducted from Fund assets) | JPMorgan Intermediate Bond Fund | JPMorgan Core Bond Fund | JPMorgan Core Bond (Pro Forma Combined) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Class A Shares | Class B Shares | Class C Shares | Select Class Shares | Ultra Shares | Class A Shares | Class B Shares | Class C Shares | Select Class Shares | Ultra Shares | Class A Shares | Class B Shares | Class C Shares | Select Class Shares | Ultra Shares | |||||||||||||||||||||||||||||||||||||||||||||||||

| Management Fee | 0.30 | % | 0.30 | % | 0.30 | % | 0.30 | % | 0.30 | % | 0.30 | % | 0.30 | % | 0.30 | % | 0.30 | % | 0.30 | % | 0.30 | % | 0.30 | % | 0.30 | % | 0.30 | % | 0.30 | % | |||||||||||||||||||||||||||||||||

| Distribution (Rule 12b-1) Fees | 0.25 | % | 0.75 | % | 0.75 | % | 0.00 | % | 0.00 | % | 0.25 | % | 0.75 | % | 0.75 | % | 0.00 | % | 0.00 | % | 0.25 | % | 0.75 | % | 0.75 | % | 0.00 | % | 0.00 | % | |||||||||||||||||||||||||||||||||

| Shareholder Service Fees | 0.25 | % | 0.25 | % | 0.25 | % | 0.25 | % | 0.00 | % | 0.25 | % | 0.25 | % | 0.25 | % | 0.25 | % | 0.00 | % | 0.25 | % | 0.25 | % | 0.25 | % | 0.25 | % | 0.00 | % | |||||||||||||||||||||||||||||||||

| Other Expenses | 0.18 | %1 | 0.18 | %1 | 0.18 | %1 | 0.18 | %1 | 0.18 | %1 | 0.18 | %1 | 0.18 | %1 | 0.18 | %1 | 0.18 | %1 | 0.18 | %1 | 0.18 | % | 0.18 | % | 0.18 | % | 0.18 | % | 0.18 | % | |||||||||||||||||||||||||||||||||

| Acquired Fund Fees and Expenses | 0.00 | % | 0.00 | % | 0.00 | % | 0.00 | % | 0.00 | % | 0.01 | % | 0.01 | % | 0.01 | % | 0.01 | % | 0.01 | % | 0.01 | % | 0.01 | % | 0.01 | % | 0.01 | % | 0.01 | % | |||||||||||||||||||||||||||||||||

| Total Annual Fund Operating Expenses | 0.98 | %2 | 1.48 | %2 | 1.48 | %2 | 0.73 | %2 | 0.48 | %2 | 0.99 | %2 | 1.49 | %2 | 1.49 | %2 | 0.74 | %2 | 0.49 | %2 | 0.99 | % | 1.49 | % | 1.49 | % | 0.74 | % | 0.49 | % | |||||||||||||||||||||||||||||||||

| Fee Waiver and/or Expense Reimbursement | –0.15 | %3 | 0.00 | %3 | 0.00 | %3 | –0.15 | %3 | 0.00 | %3 | –0.23 | %4 | –0.02 | %4 | –0.02 | %4 | –0.13 | %4 | 0.00 | %4 | –0.23 | %5 | –0.08 | %5 | –0.08 | %5 | –0.15 | %5 | –0.08 | %5 | |||||||||||||||||||||||||||||||||

| Net Expenses | 0.83 | % | 1.48 | % | 1.48 | % | 0.58 | % | 0.48 | % | 0.76 | % | 1.47 | % | 1.47 | % | 0.61 | % | 0.49 | % | 0.76 | % | 1.41 | % | 1.41 | % | 0.59 | % | 0.41 | % | |||||||||||||||||||||||||||||||||

1 | “Other Expenses” are based on the actual amounts incurred during the 12 months ended 8/31/08. |

2 | The Total Annual Operating Expenses included in the fee table are different from the ratio of expenses to average net assets that appear in the Financial Highlights. The Financial Highlights are based on a fiscal year ended 2/29/08, and do not include Acquired Fund Fees and Expenses. |

1 | “Other Expenses” are based on the actual amounts incurred during the 12 months ended 8/31/08. |

2 | The Total Annual Operating Expenses included in the fee table are different from the ratio of expenses to average net assets that appear in the Financial Highlights. The Financial Highlights are based on a fiscal year ended 2/29/08, and do not include Acquired Fund Fees and Expenses. |

3 | JPMIA, JPMFM and JPMDS have contractually agreed to waive fees and/or reimburse expenses to the extent that total annual operating expenses (excluding Acquired Fund Fees and Expenses, dividend expenses related to short sales, interest, taxes and extraordinary expenses and expenses related to the Board of Trustees’ deferred compensation plan) exceed 0.83%, 1.48%, 1.48%, 0.58% and 0.48% of the average daily net assets of Class A, Class B, Class C, Select Class and Ultra Shares, respectively, through 6/30/09. In addition, the Fund’s service providers may voluntarily waive or reimburse certain of their fees, as they may determine, from time to time. |

4 | JPMIA, JPMFM and JPMDS have contractually agreed to waive fees and/or reimburse expenses to the extent that total annual operating expenses (excluding Acquired Fund Fees and Expenses, dividend expenses related to short sales, interest, taxes and extraordinary expenses and expenses related to the Board of Trustees’ deferred compensation plan) exceed 0.75%, 1.46%, 1.46%, 0.60% and 0.48%, of the average daily net assets of |

| the Class A, Class B, Class C, Select Class and Ultra Shares, respectively, through 6/30/09. Without the Acquired Fund Fees and Expenses, the Total Annual Operating Expenses of the Fund would have been 0.98%, 1.48%, 1.48%, 0.73% and 0.48%, and Net Expenses would have been 0.75%, 1.46%, 1.46%, 0.60% and 0.48%, of the average daily net assets of the Class A, Class B, Class C, Select Class and Ultra Shares, respectively. In addition, the Fund’s service providers may voluntarily waive or reimburse certain of their fees, as they may determine, from time to time. |

5 | JPMIA, JPMFM and JPMDS have contractually agreed to waive fees and/or reimburse expenses to the extent that total annual operating expenses (excluding Acquired Fund Fees and Expenses, dividend expenses related to short sales, interest, taxes and extraordinary expenses and expenses related to the Board of Trustees’ deferred compensation plan) exceed 0.75%, 1.40%, 1.40%, 0.58% and 0.40%, of the average daily net assets of the Class A, Class B, Class C, Select Class and Ultra Shares, respectively, through 6/30/10. Without the Acquired Fund Fees and Expenses, the Total Annual Operating Expenses of the Fund would have been 0.98%, 1.48%, 1.48%, 0.73% and 0.48%, and Net Expenses would have been 0.75%, 1.40%, 1.40%, 0.58% and 0.40%, of the average daily net assets of the Class A, Class B, Class C, Select Class and Ultra Shares, respectively. In addition, the Fund’s service providers may voluntarily waive or reimburse certain of their fees, as they may determine, from time to time. |

| • | 5% return each year, |

| • | net expenses through the expiration of each Fund’s and the combined Fund’s contractual expense caps, respectively, and total annual operating expenses thereafter, and |

| • | all dividends and distributions are reinvested. |

| If You Sell Your Shares, Your Cost Would Be: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| JPMorgan Intermediate Bond Fund | JPMorgan Core Bond Fund | JPMorgan Core Bond Fund (Pro Forma Combined) | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 1 Year | 3 Years | 5 Years | 10 Years | 1 Year | 3 Years | 5 Years | 10 Years | 1 Year | 3 Years | 5 Years | 10 Years | |||||||||||||||||||||||||||||||||||||||||

| Class A* | $ | 457 | $ | 661 | $ | 882 | $ | 1,518 | $ | 450 | $ | 656 | $ | 880 | $ | 1,522 | $ | 450 | $ | 656 | $ | 880 | $ | 1,522 | ||||||||||||||||||||||||||||

| Class B** | 651 | 768 | 1,008 | 1,633 | *** | 650 | 769 | 1,011 | 1,643 | *** | 644 | 763 | 1,006 | 1,637 | *** | |||||||||||||||||||||||||||||||||||||

| Class C** | 251 | 468 | 808 | 1,768 | 250 | 469 | 811 | 1,778 | 244 | 463 | 806 | 1,773 | ||||||||||||||||||||||||||||||||||||||||

| Select Class | 59 | 218 | 391 | 892 | 62 | 223 | 399 | 906 | 60 | 221 | 397 | 904 | ||||||||||||||||||||||||||||||||||||||||

| Ultra | 49 | 154 | 269 | 604 | 50 | 157 | 274 | 616 | 42 | 149 | 266 | 608 | ||||||||||||||||||||||||||||||||||||||||

| If You Do Not Sell Your Shares, Your Cost for Class B and Class C Shares Would Be: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| JPMorgan Intermediate Bond Fund | JPMorgan Core Bond Fund | JPMorgan Core Bond Fund (Pro Forma Combined) | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 1 Year | 3 Years | 5 Years | 10 Years | 1 Year | 3 Years | 5 Years | 10 Years | 1 Year | 3 Years | 5 Years | 10 Years | |||||||||||||||||||||||||||||||||||||||||

| Class B | 151 | 468 | 808 | 1,633 | *** | 150 | 469 | 811 | 1,643 | *** | 144 | 463 | 806 | 1,637 | *** | |||||||||||||||||||||||||||||||||||||

| Class C | 151 | 468 | 808 | 1,768 | 150 | 469 | 811 | 1,778 | 144 | 463 | 806 | 1,773 | ||||||||||||||||||||||||||||||||||||||||

| * | Assumes sales charge is deducted when shares are purchased. |

| ** | Assumes applicable deferred sales charge is deducted when shares are sold. |

| *** | Reflects conversion of Class B shares to Class A shares after they have been owned for eight years. |

JPMorgan West Virginia Municipal Bond Fund and JPMorgan Intermediate Tax Free Bond Fund*

| ANNUAL FUND OPERATING EXPENSES (%) (expenses that are deducted from Fund assets) | JPMorgan Kentucky Municipal Bond Fund | JPMorgan Louisiana Municipal Bond Fund | JPMorgan West Virginia Municipal Bond Fund | JPMorgan Intermediate Tax Free Bond Fund | |||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Class A Shares | Class B Shares | Select Class Shares | Class A Shares | Class B Shares | Select Class Shares | Class A Shares | Class B Shares | Select Class Shares | Class A Shares | Class B Shares | Select Class Shares | ||||||||||||||||||||||||||||||||||||||||

| Management Fee | 0.30 | % | 0.30 | % | 0.30 | % | 0.30 | % | 0.30 | % | 0.30 | % | 0.30 | % | 0.30 | % | 0.30 | % | 0.30 | % | 0.30 | % | 0.30 | % | |||||||||||||||||||||||||||

| Distribution (Rule 12b-1) Fees | 0.25 | % | 0.75 | % | 0.00 | % | 0.25 | % | 0.75 | % | 0.00 | % | 0.25 | % | 0.75 | % | 0.00 | % | 0.25 | % | 0.75 | % | 0.00 | % | |||||||||||||||||||||||||||

| Shareholder Service Fees | 0.25 | % | 0.25 | % | 0.25 | % | 0.25 | % | 0.25 | % | 0.25 | % | 0.25 | % | 0.25 | % | 0.25 | % | 0.25 | % | 0.25 | % | 0.25 | % | |||||||||||||||||||||||||||

| Other Expenses | 0.28 | %1 | 0.28 | %1 | 0.28 | %1 | 0.31 | %1 | 0.31 | %1 | 0.31 | %1 | 0.26 | %1 | 0.26 | %1 | 0.26 | %1 | 0.13 | %1 | 0.13 | %1 | 0.13 | %1 | |||||||||||||||||||||||||||

| Acquired Fund Fees & Expenses | 0.00 | % | 0.00 | % | 0.00 | % | 0.01 | % | 0.01 | % | 0.01 | % | 0.00 | % | 0.00 | % | 0.00 | % | 0.01 | % | 0.01 | % | 0.01 | % | |||||||||||||||||||||||||||

| Total Annual Fund Operating Expenses | 1.08 | %2 | 1.58 | %2 | 0.83 | %2 | 1.12 | %2 | 1.62 | %2 | 0.87 | %2 | 1.06 | %2 | 1.56 | %2 | 0.81 | %2 | 0.94 | %2 | 1.44 | %2 | 0.69 | %2 | |||||||||||||||||||||||||||

| Fee Waiver and/or Expense Reimbursement | –0.20 | %3 | –0.05 | %3 | –0.20 | %3 | –0.23 | %4 | –0.08 | %4 | –0.23 | %4 | –0.18 | %5 | –0.03 | %5 | –0.18 | %5 | –0.18 | %6 | 0.00 | %6 | –0.09 | %6 | |||||||||||||||||||||||||||

| Net Expenses | 0.88 | % | 1.53 | % | 0.63 | % | 0.89 | % | 1.54 | % | 0.64 | % | 0.88 | % | 1.53 | % | 0.63 | % | 0.76 | % | 1.44 | % | 0.60 | % | |||||||||||||||||||||||||||

| ANNUAL FUND OPERATING EXPENSES (%) (expenses that are deducted from Fund assets) | JPMorgan Intermediate Tax Free Bond Fund (Pro Forma Combined, assuming Reorganization of only the Kentucky Municipal Bond Fund)* | JPMorgan Intermediate Tax Free Bond Fund (Pro Forma Combined, assuming Reorganization of only the Louisiana Municipal Bond Fund)* | JPMorgan Intermediate Tax Free Bond Fund (Pro Forma Combined, assuming Reorganization of only the West Virginia Municipal Bond Fund)* | JPMorgan Intermediate Tax Free Bond Fund (Pro Forma Combined, assuming Reorganization of all of the Kentucky Municipal Bond Fund, Louisiana Municipal Bond Fund and West Virginia Municipal Bond Fund)* | |||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Class A Shares | Class B Shares | Select Class Shares | Class A Shares | Class B Shares | Select Class Shares | Class A Shares | Class B Shares | Select Class Shares | Class A Shares | Class B Shares | Select Class Shares | ||||||||||||||||||||||||||||||||||||||||

| Management Fee | 0.30 | % | 0.30 | % | 0.30 | % | 0.30 | % | 0.30 | % | 0.30 | % | 0.30 | % | 0.30 | % | 0.30 | % | 0.30 | % | 0.30 | % | 0.30 | % | |||||||||||||||||||||||||||

| Distribution (Rule 12b-1) Fees | 0.25 | % | 0.75 | % | 0.00 | % | 0.25 | % | 0.75 | % | 0.00 | % | 0.25 | % | 0.75 | % | 0.00 | % | 0.25 | % | 0.75 | % | 0.00 | % | |||||||||||||||||||||||||||

| Shareholder Service Fees | 0.25 | % | 0.25 | % | 0.25 | % | 0.25 | % | 0.25 | % | 0.25 | % | 0.25 | % | 0.25 | % | 0.25 | % | 0.25 | % | 0.25 | % | 0.25 | % | |||||||||||||||||||||||||||

| Other Expenses | 0.13 | % | 0.13 | % | 0.13 | % | 0.13 | % | 0.13 | % | 0.13 | % | 0.13 | % | 0.13 | % | 0.13 | % | 0.13 | % | 0.13 | % | 0.13 | % | |||||||||||||||||||||||||||

| Acquired Fund Fees and Expenses | 0.01 | % | 0.01 | % | 0.01 | % | 0.01 | % | 0.01 | % | 0.01 | % | 0.01 | % | 0.01 | % | 0.01 | % | 0.01 | % | 0.01 | % | 0.01 | % | |||||||||||||||||||||||||||

| Total Annual Fund Operating Expenses | 0.94 | % | 1.44 | % | 0.69 | % | 0.94 | % | 1.44 | % | 0.69 | % | 0.94 | % | 1.44 | % | 0.69 | % | 0.94 | % | 1.44 | % | 0.69 | % | |||||||||||||||||||||||||||

| Fee Waiver and/or Expense Reimbursement | –0.18 | %7 | 0.00 | %7 | –0.09 | %7 | –0.18 | %8 | 0.00 | %8 | –0.09 | %8 | –0.18 | %9 | 0.00 | %9 | –0.09 | %9 | –0.18 | %10 | 0.00 | %10 | –0.09 | %10 | |||||||||||||||||||||||||||

| Net Expenses | 0.76 | % | 1.44 | % | 0.60 | % | 0.76 | % | 1.44 | % | 0.60 | % | 0.76 | % | 1.44 | % | 0.60 | % | 0.76 | % | 1.44 | % | 0.60 | % | |||||||||||||||||||||||||||

| * | Because the JPMorgan Kentucky Municipal Bond Fund, JPMorgan Louisiana Municipal Bond Fund and JPMorgan West Virginia Municipal Bond Fund may merge with the JPMorgan Intermediate Tax Free Bond Fund, the pro forma columns represent four of the possibilities that may result from the vote of the shareholders: (1) shareholders approve the JPMorgan Kentucky Municipal Bond Fund reorganization but do not approve the JPMorgan Louisiana Municipal Bond Fund and JPMorgan West Virginia Municipal Bond Fund reorganizations; (2) shareholders approve the JPMorgan Louisiana Municipal Bond Fund reorganization but do not approve the JPMorgan Kentucky Municipal Bond Fund and JPMorgan West Virginia Municipal Bond Fund reorganizations; (3) shareholders approve both the JPMorgan West Virginia Municipal Bond Fund reorganization but do not approve the JPMorgan Kentucky Municipal Bond Fund and JPMorgan Louisiana Municipal Bond Fund reorganizations; and (4) shareholders approve all of the JPMorgan Kentucky Municipal Bond Fund, JPMorgan Louisiana Municipal Bond Fund and JPMorgan West Virginia Municipal Bond Fund reorganizations. |

1 | “Other Expenses” are based on the actual amounts incurred during the 12 months ended 8/31/08. |

2 | The Total Annual Operating Expenses included in the fee table are different from the ratio of expenses to average net assets that appear in the Financial Highlights. The Financial Highlights are based on a fiscal year ended 2/29/08, and do not include Acquired Fund Fees and Expenses. |

3 | JPMIA, JPMFM and JPMDS have contractually agreed to waive fees and/or reimburse expenses to the extent that total annual operating expenses (excluding Acquired Fund Fees and Expenses, dividend expenses related to short sales, interest, taxes and extraordinary expenses and expenses related to the Board of Trustees’ deferred compensation plan) exceed 0.88%, 1.53% and 0.63% of the average daily net assets of Class A, Class B and Select Class Shares, respectively, through 6/30/09. In addition, the Fund’s service providers may voluntarily waive or reimburse certain of their fees, as they may determine, from time to time. |

4 | JPMIA, JPMFM and JPMDS have contractually agreed to waive fees and/or reimburse expenses to the extent that total annual operating expenses (excluding Acquired Fund Fees and Expenses, dividend expenses related to short sales, interest, taxes and extraordinary expenses and expenses related to the Board of Trustees’ deferred compensation plan) exceed 0.88%, 1.53% and 0.63%, of the average daily net assets of the Class A, Class B and Select Class Shares, respectively, through 6/30/09. Without the Acquired Fund Fees and Expenses, the Total Annual Operating Expenses of the Fund would have been 1.11%, 1.61% and 0.86%, and Net Expenses would have been 0.88%, 1.53% and 0.63%, of the average daily net assets of the Class A, Class B and Select Class Shares, respectively. In addition, the Fund’s service providers may voluntarily waive or reimburse certain of their fees, as they may determine, from time to time. |

5 | JPMIA, JPMFM and JPMDS have contractually agreed to waive fees and/or reimburse expenses to the extent that total annual operating expenses (excluding Acquired Fund Fees and Expenses, dividend expenses related to short sales, interest, taxes and extraordinary expenses and expenses related to the Board of Trustees’ deferred compensation plan) exceed 0.88%, 1.53% and 0.63%, of the average daily net assets of the Class A, Class B and Select Class Shares, respectively, through 6/30/09. In addition, the Fund’s service providers may voluntarily waive or reimburse certain of their fees, as they may determine, from time to time. |

6 | JPMIM, JPMFM and JPMDS have contractually agreed to waive fees and/or reimburse expenses to the extent that total annual operating expenses (excluding Acquired Fund Fees and Expenses, dividend expenses related to short sales, interest, taxes and extraordinary expenses and expenses related to the Board of Trustees’ deferred compensation plan) exceed 0.75%, 1.43% and 0.59%, of the average daily net assets of the Class A, Class B and Select Class Shares, respectively, through 6/30/09. Without the Acquired Fund Fees and Expenses, the Total Annual Operating Expenses of the Fund would have been 0.93%, 1.43% and 0.68%, and Net Expenses would have been 0.75%, 1.43% and 0.59%, of the average daily net assets of the Class A, Class B and Select Class Shares, respectively. In addition, the Fund’s service providers may voluntarily waive or reimburse certain of their fees, as they may determine, from time to time. |

7 | JPMIM, JPMFM and JPMDS have contractually agreed to waive fees and/or reimburse expenses to the extent that total annual operating expenses (excluding Acquired Fund Fees and Expenses, dividend expenses related to short sales, interest, taxes and extraordinary expenses and expenses related to the Board of Trustees’ deferred compensation plan) exceed 0.75%, 1.43% and 0.59%, of the average daily net assets of the Class A, Class B and Select Class Shares, respectively, through 6/30/10. Without the Acquired Fund Fees and Expenses, the Total Annual Operating Expenses of the Fund would have been 0.93%, 1.43% and 0.68%, and Net Expenses would have been 0.75%, 1.43% and 0.59%, of the average daily net assets of the Class A, Class B and Select Class Shares, respectively. In addition, the Fund’s service providers may voluntarily waive or reimburse certain of their fees, as they may determine, from time to time. |

8 | JPMIM, JPMFM and JPMDS have contractually agreed to waive fees and/or reimburse expenses to the extent that total annual operating expenses (excluding Acquired Fund Fees and Expenses, dividend expenses related to short sales, interest, taxes and extraordinary expenses and expenses related to the Board of Trustees’ deferred compensation plan) exceed 0.75%, 1.43% and 0.59%, of the average daily net assets of the Class A, Class B and Select Class Shares, respectively, through 6/30/10. Without the Acquired Fund Fees and Expenses, the Total Annual Operating Expenses of the Fund would have been 0.93%, 1.43% and 0.68%, and Net Expenses would have been 0.75%, 1.43% and 0.59%, of the average daily net assets of the Class A, Class B and Select Class Shares, respectively. In addition, the Fund’s service providers may voluntarily waive or reimburse certain of their fees, as they may determine, from time to time. |

9 | JPMIM, JPMFM and JPMDS have contractually agreed to waive fees and/or reimburse expenses to the extent that total annual operating expenses (excluding Acquired Fund Fees and Expenses, dividend expenses related to short sales, interest, taxes and extraordinary expenses and expenses related to the Board of Trustees’ deferred compensation plan) exceed 0.75%, 1.43% and 0.59%, of the average daily net assets of the Class A, Class B and Select Class Shares, respectively, through 6/30/10. Without the Acquired Fund Fees and Expenses, the Total Annual Operating Expenses of the Fund would have been 0.93%, 1.43% and 0.68%, and Net Expenses would have been 0.75%, 1.43% and 0.59%, of the average daily net assets of the Class A, Class B and Select Class Shares, respectively. In addition, the Fund’s service providers may voluntarily waive or reimburse certain of their fees, as they may determine, from time to time. |

10 | JPMIM, JPMFM and JPMDS have contractually agreed to waive fees and/or reimburse expenses to the extent that total annual operating expenses (excluding Acquired Fund Fees and Expenses, dividend expenses related to short sales, interest, taxes and extraordinary expenses and expenses related to the Board of Trustees’ deferred compensation plan) exceed 0.75%, 1.43% and 0.59%, of the average daily net assets of the Class A, Class B and Select Class Shares, respectively, through 6/30/10. Without the Acquired Fund Fees and Expenses, the Total Annual Operating Expenses of the Fund would have been 0.93%, 1.43% and 0.68%, and Net Expenses would have been 0.75%, 1.43% and 0.59%, of the average daily net assets of the Class A, Class B and Select Class Shares, respectively. In addition, the Fund’s service providers may voluntarily waive or reimburse certain of their fees, as they may determine, from time to time. |

| • | 5% return each year, |

| • | net expenses through the expiration of each Fund’s and the combined Fund’s contractual expense caps, respectively, and total annual operating expenses thereafter, and |

| • | all dividends and distributions are reinvested. |

| If You Sell Your Shares, Your Cost Would Be: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| JPMorgan Kentucky Municipal Bond Fund | JPMorgan Louisiana Municipal Bond Fund | JPMorgan West Virginia Municipal Bond Fund | JPMorgan Intermediate Tax Free Bond Fund | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1 Year | 3 Years | 5 Years | 10 Years | 1 Year | 3 Years | 5 Years | 10 Years | 1 Year | 3 Years | 5 Years | 10 Years | 1 Year | 3 Years | 5 Years | 10 Years | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Class A* | $ | 461 | $ | 686 | $ | 930 | $ | 1,625 | $ | 462 | $ | 696 | $ | 947 | $ | 1,667 | $ | 461 | $ | 682 | $ | 921 | $ | 1,605 | $ 450 | $ 646 | $ 859 | $1,471 | |||||||||||||||||||||||||||||||||||||||

| Class B** | 656 | 794 | 1,056 | 1,740 | *** | 657 | 803 | 1,074 | 1,782 | *** | 656 | 790 | 1,047 | 1,720 | *** | 647 | 756 | 987 | 1,588*** | ||||||||||||||||||||||||||||||||||||||||||||||||

| Select Class | 64 | 245 | 441 | 1,007 | 65 | 255 | 460 | 1,051 | 64 | 241 | 432 | 985 | 61 | 212 | 375 | 850 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| JPMorgan Intermediate Tax Free Bond Fund (Pro Forma Combined, assuming Reorganization of only the Kentucky Municipal Bond Fund) | JPMorgan Intermediate Tax Free Bond Fund (Pro Forma Combined, assuming Reorganization of only the Louisiana Municipal Bond Fund) | JPMorgan Intermediate Tax Free Bond Fund (Pro Forma Combined, assuming Reorganization of only the West Virginia Municipal Bond Fund) | JPMorgan Intermediate Tax Free Bond Fund (Pro Forma Combined) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 Year | 3 Years | 5 Years | 10 Years | 1 Year | 3 Years | 5 Years | 10 Years | 1 Year | 3 Years | 5 Years | 10 Years | 1 Year | 3 Years | 5 Years | 10 Years | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Class A* | $ | 450 | $ | 646 | $ | 859 | $ | 1,471 | $ | 450 | $ | 646 | $ | 859 | $ | 1,471 | $ | 450 | $ | 646 | $ | 859 | $ | 1,471 | $ | 450 | $ | 646 | $ | 859 | $ | 1,471 | ||||||||||||||||||||||||||||||||||||||

| Class B** | 647 | 756 | 987 | 1,588 | *** | 647 | 756 | 987 | 1,588 | *** | 647 | 756 | 987 | 1,588 | *** | 647 | 756 | 987 | 1,588 | *** | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Select Class | 61 | 212 | 375 | 850 | 61 | 212 | 375 | 850 | 61 | 212 | 375 | 850 | 61 | 212 | 375 | 850 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| If You Do Not Sell Your Shares, Your Cost for Class B Shares Would Be: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||