UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☒ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to Rule 14a-12 |

JPMorgan Trust II

J.P. Morgan Mutual Fund Investment Trust

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | 1) | Title of each class of securities to which transaction applies: |

| | 2) | Aggregate number of securities to which transaction applies: |

| | 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4) | Proposed maximum aggregate value of transaction: |

| ☐ | Fee paid with preliminary materials. |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | 1) | Amount Previously Paid: |

| | 2) | Form, Schedule or Registration Statement No.: |

From: votemyproxy@equiniti.com.

Subject: JPMorgan Special Meeting of Shareholders

Dear (First Name on Registration),

The Special Meeting of Shareholders of JPMorgan Growth Advantage Fund (“Growth Advantage”) and JPMorgan Large Cap Growth Fund (“Large Cap”) is scheduled to take place on December 18, 2024 at 11:00 AM Eastern Time and our records indicate your vote has not been recorded.

The proxy materials for this meeting are linked below for your review.

Proxy Statement - https://vote.proxyonline.com/JPM/docs/2024mtg.pdf

Growth Advantage Sample Proxy Card - https://vote.proxyonline.com/JPM/docs/JPMorgan_Growth_Ballot.pdf

Large Cap Sample Proxy Card - https://vote.proxyonline.com/JPM/docs/JPMorgan_Large_Cap_Ballot.pdf

Please respond directly to this email with your last name and voting instructions (FOR, AGAINST or ABSTAIN) for the proposal to change the investment policy.

If you have additional questions, please call us at 888-628-1041 for more information between the hours of 9am and 10pm ET, Monday through Friday or 10am and 6:00 pm ET on Saturday. At the time of the call, please reference the Investor ID listed below.

Thank you for your attention to this matter. Your time is greatly appreciated.

Investor ID: XXXXXXXX

Street Address:

Shares:

JPMorgan Funds

Client Answering Machine Script

Hello.

This is Brian Shlissel, President of JPMorgan Funds. I am calling today because we still need your help.

The Special Meeting of Shareholders has been adjourned for a third time to December 18th due to a lack of shareholder participation.

As of today, your vote has not been registered. Each Fund is required to meet a 50% threshold to hold the meeting. Many of your fellow shareholders have voted, but we lack the participation necessary to hold the meeting. Your registered vote today will immediately end any further contact by phone or mail for this proxy.

Please help the fund reach the 50% threshold by voting with our Proxy Solicitor as soon as possible at 1-888-628-1041 Monday through Friday between the hours of 9:00am and 11:00pm Eastern Time.

Your vote is very important. Thank you for your time and for being a JP Morgan Funds Shareholder.

| | |

JP Morgan Funds Alternative Outreach Communication Messaging (Adjournment Campaign Script) | |

|

Hello, this is Brian Shlissel, President of JPMorgan Funds. You own an investment in either JP Morgan Growth Advantage Fund or JP Morgan Large Cap Growth Fund. Unfortunately, due to lack of shareholder participation the Special Meeting of Shareholders originally scheduled for October 2nd, 2024 has adjourned yet again to December 18th, 2024. An overwhelming amount of your fellow shareholders have voted but unfortunately at this time we just do not have enough shares voted to conduct the business of the meeting.

The Board recommends a vote “FOR” the proposal as outlined in the proxy statement recently mailed to your address. Proxy representatives are available now to cast your vote. This process is simple, does not require any confidential information, will only take a moment of your time and will stop any further outreach for this proxy event. To vote with a proxy representative, please press 1 now. 1 forwards to Vote Rep

(Pause and listen 2 seconds)

If you have any questions about the Special Meeting or would like to review the meeting agenda, please press 2 now. For more information about your investment in either of the JP Morgan Funds, please press 3 now. 2 forwards to Information Rep – 3 forwards to below message

(Pause and listen 2 second)

3 plays message below and forwards to information line

“You currently have an un-voted investment in either of the JP Morgan Funds indicated prior. Please hold for a representative who can provide additional information.” Forwards to information Rep

(Pause and listen 2 second)

To repeat this message press 9 or for further assistance press 2 now to speak to a representative. To end this call press 5. 5 forwards to the following message – 2 forwards to Information Rep

(Pause and listen 2 seconds)

5 Plays the following message.

Thank you for your consideration. Have a nice day.

(Pause and listen 2 seconds)

If you received this message on your answering machine you may contact us toll free at 1-888-628-1041 from 9am to 11pm Eastern Time, Monday through Friday or 10:00am and 6:00pm on Saturday.

ANSWERING MACHINE SCRIPT FOR AOC

Hello, this is Brian Shlissel, President of JPMorgan Funds. We are contacting you regarding the JP Morgan Fund’s adjourned meeting of Shareholders and an important initiative concerning your investment in the Fund.

Please contact us before December 17th at 1-888-628-1041 between the hours of 9am and 11pm Eastern Time, Monday through Friday or 10:00am and 6:00pm on Saturday.

Your time is greatly appreciated. Thank you and have a good day.

Internal

277 Park Avenue

New York, NY 10172

IMPORTANT MESSAGE FROM THE PRESIDENT, J.P. MORGAN ASSET MANAGEMENT

November 26, 2024

Dear Valued Shareholder:

I still need your help. You are among one of the largest investors in the JPMorgan Growth Advantage Fund who has not yet responded to our outreach. We have been trying to contact you about an important matter related to the business of the Fund and we very much need your assistance.

| | | | | | |

| | | | We cannot proceed with this important change for the Fund without the required shareholder response, and this is the reason for following up with you again. | | |

Shareholders are being asked to vote on a proposal to change the Fund from a “diversified company” to a “non-diversified company” by eliminating the restrictive fundamental investment policy (the “Proposal”). The Fund’s Board of Trustees of the Trust has reviewed and approved the Proposal and determined that the Proposal is in the best interests of your Fund’s shareholders.

Please help your fellow fund shareholders by calling us today at 1-888-628-1041. We need to hear from you before December 18th. This call will not take long. Thank you in advance for your assistance with this matter.

Sincerely,

Brian S. Shlissel

President

J.P. Morgan Mutual Fund Investment Trust

This communication relates to an investment you own in JPMorgan Growth Advantage Fund. More information on the Fund can be found at J.P. Morgan Asset Management’s Investment Strategy’s website: https://am.jpmorgan.com/us/en/asset-management/adv/funds/

GR-JPM-NOBO

277 Park Avenue

New York, NY 10172

IMPORTANT MESSAGE FROM THE PRESIDENT,

J.P. MORGAN ASSET MANAGEMENT

November 26, 2024

Dear Valued Shareholder:

I still need your help. You are among one of the largest investors in the JPMorgan Growth Advantage Fund who has not yet responded to our outreach. We have been trying to contact you about an important matter related to the business of the Fund and we very much need your assistance.

| | | | | | |

| | | | We cannot proceed with this important change for the Fund without the required shareholder response, and this is the reason for following up with you again. | | |

Shareholders are being asked to vote on a proposal to change the Fund from a “diversified company” to a “non-diversified company” by eliminating the restrictive fundamental investment policy (the “Proposal”). The Fund’s Board of Trustees of the Trust has reviewed and approved the Proposal and determined that the Proposal is in the best interests of your Fund’s shareholders.

Please help your fellow fund shareholders by calling us today at 1-866-342-2676. We need to hear from you before December 18th. This call will not take long. Thank you in advance for your assistance with this matter.

Sincerely,

Brian S. Shlissel

President

J.P. Morgan Mutual Fund Investment Trust

This communication relates to an investment you own in JPMorgan Growth Advantage Fund. More information on the Fund can be found at J.P. Morgan Asset Management’s Investment Strategy’s website: https://am.jpmorgan.com/us/en/asset-management/adv/funds/

GR-JPM-OBO

277 Park Avenue

New York, NY 10172

IMPORTANT MESSAGE FROM THE PRESIDENT,

J.P. MORGAN ASSET MANAGEMENT

November 26, 2024

Dear Valued Shareholder:

I still need your help. You are among one of the largest investors in the JPMorgan Large Cap Growth Fund who has not yet responded to our outreach. We have been trying to contact you about an important matter related to the business of the Fund and we very much need your assistance.

| | | | | | |

| | | | We cannot proceed with this important change for the Fund without the required shareholder response, and this is the reason for following up with you again. | | |

Shareholders are being asked to vote on a proposal to change the Fund from a “diversified company” to a “non-diversified company” by eliminating the restrictive fundamental investment policy (the “Proposal”). The Fund’s Board of Trustees of the Trust has reviewed and approved the Proposal and determined that the Proposal is in the best interests of your Fund’s shareholders.

Please help your fellow fund shareholders by calling us today at 1-888-628-1041. We need to hear from you before December 18th. This call will not take long. Thank you in advance for your assistance with this matter.

Sincerely,

Brian S. Shlissel

President

JPMorgan Trust II

This communication relates to an investment you own in JPMorgan Large Cap Growth Fund. More information on the Fund can be found at J.P. Morgan Asset Management’s Investment Strategy’s website: https://am.jpmorgan.com/us/en/asset-management/adv/funds/

LC-JPM-NOBO

277 Park Avenue

New York, NY 10172

IMPORTANT MESSAGE FROM THE PRESIDENT,

J.P. MORGAN ASSET MANAGEMENT

November 26, 2024

Dear Valued Shareholder:

I still need your help. You are among one of the largest investors in the JPMorgan Large Cap Growth Fund who has not yet responded to our outreach. We have been trying to contact you about an important matter related to the business of the Fund and we very much need your assistance.

| | | | | | |

| | | | We cannot proceed with this important change for the Fund without the required shareholder response, and this is the reason for following up with you again. | | |

Shareholders are being asked to vote on a proposal to change the Fund from a “diversified company” to a “non-diversified company” by eliminating the restrictive fundamental investment policy (the “Proposal”). The Fund’s Board of Trustees of the Trust has reviewed and approved the Proposal and determined that the Proposal is in the best interests of your Fund’s shareholders.

Please help your fellow fund shareholders by calling us today at 1-866-342-2676. We need to hear from you before December 18th. This call will not take long. Thank you in advance for your assistance with this matter.

Sincerely,

Brian S. Shlissel

President

JPMorgan Trust II

This communication relates to an investment you own in JPMorgan Large Cap Growth Fund. More information on the Fund can be found at J.P. Morgan Asset Management’s Investment Strategy’s website: https://am.jpmorgan.com/us/en/asset-management/adv/funds/

LC-JPM-OBO

FUND NAME MERGED HERE

A SERIES OF TRUST NAME MERGED HERE

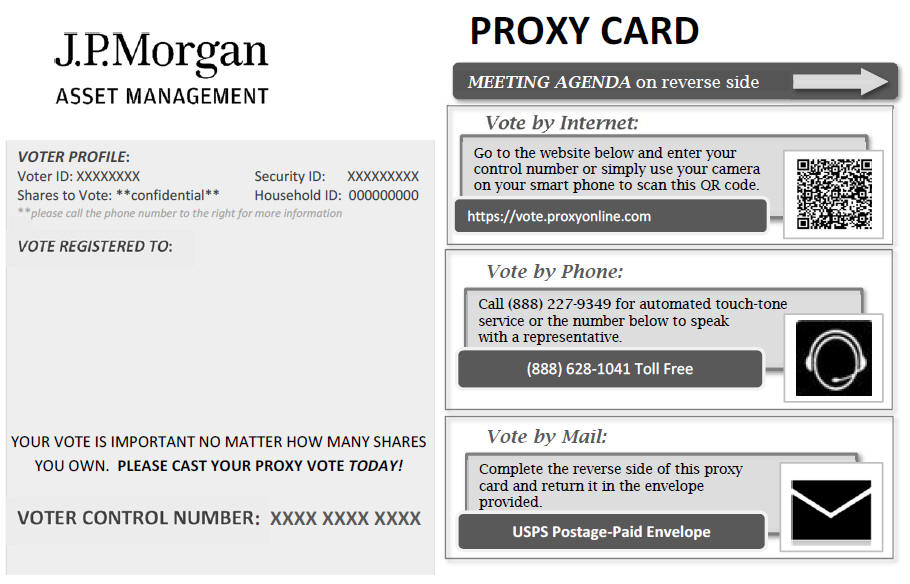

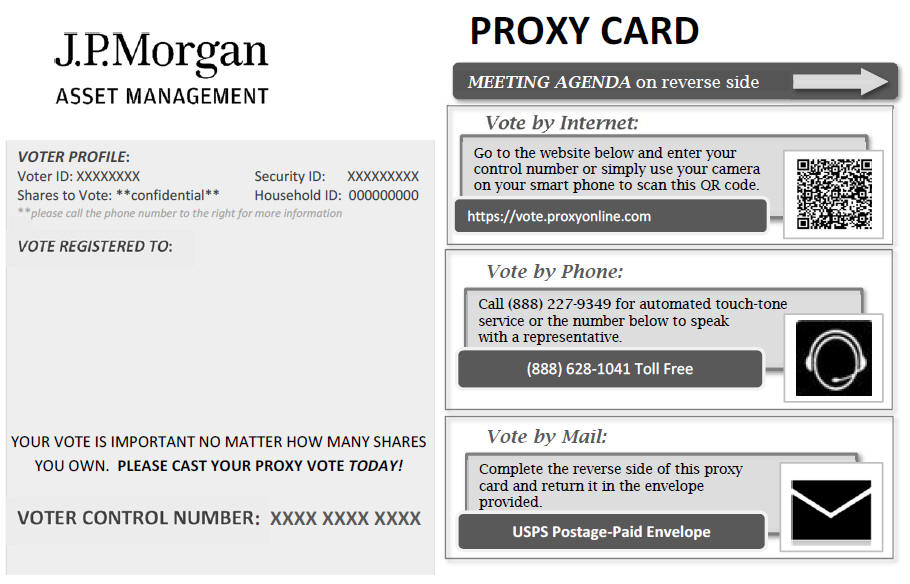

PROXY FOR A SPECIAL JOINT MEETING OF SHAREHOLDERS TO BE HELD ON DECEMBER 18, 2024

The undersigned, revoking prior proxies, hereby appoints Timothy Clemens, Joseph Parascondola and Kiesha Astwood-Smith, and each of them, as attorneys-in-fact and proxies of the undersigned, granted in connection with the voting of the shares subject hereto with full power of substitution, to vote shares held in the name of the undersigned on the record date at the Special Joint Meeting of Shareholders (“Meeting”) of the above named Fund (the “Fund”) to be held at 277 Park Avenue, New York, NY 10172, 17th Floor, on December 18, 2024, at 11:00 a.m. Eastern Time, or at any adjournment thereof, upon the Proposal described in the Notice of Meeting and accompanying Proxy Statement, which have been received by the undersigned.

Do you have questions?

If you have any questions about how to vote your proxy or about the Meeting in general, please call toll-free (888) 628-1041. Representatives are available to assist you Monday through Friday, from 9 a.m. to 10 p.m., Eastern time.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SPECIAL MEETING OF SHAREHOLDERS TO BE HELD ON DECEMBER 18, 2024. The Proxy Statement and the accompanying Notice of Special Joint Meeting of Shareholders are available at:

https://vote.proxyonline.com/JPM/docs/2024mtg.pdf

SHAREHOLDER PRIVACY: To ensure your privacy there is no personal information required to view or request proxy materials and/or vote. The control number listed above is a unique identifier created for this proxy and this proxy only. It is not linked to your account number nor can it be used in any other manner other than this proxy.

FUND NAME MERGED HERE

| | | | |

NOTE: PLEASE SIGN EXACTLY AS YOUR NAME(S) APPEAR(S) ON THIS PROXY CARD. If joint owners, EITHER may sign this Proxy Card. When signing as attorney, executor, administrator, trustee, guardian, or custodian for a minor, please give your full title. When signing on behalf of a corporation or as a partner for a partnership, please give the full corporate or partnership name and your title, if any. | | | | SIGNATURE (AND TITLE IF APPLICABLE) DATE SIGNATURE (IF HELD JOINTLY) DATE |

This proxy is solicited on behalf of the Board of Trustees. The proxy will be voted as specified by the undersigned. If no specification is made for the proposal, this proxy shall be voted FOR such proposal. If any other matters properly come before the Meeting to be voted on, the proxy holders will vote, act and consent on those matters in accordance with the views of management.

THE BOARD OF TRUSTEES UNANIMOUSLY RECOMMENDS A VOTE FOR THE FOLLOWING:

TO VOTE, MARK CIRCLE IN BLUE OR BLACK INK. Example: 🌑

You can vote on the internet, by telephone or by mail. Please see the reverse side for instructions.

PLEASE VOTE ALL YOUR BALLOTS IF YOU RECEIVED MORE THAN ONE BALLOT DUE TO MULTIPLE INVESTMENTS IN THE FUND. REMEMBER TO SIGN AND DATE ABOVE BEFORE MAILING IN YOUR VOTE. THIS PROXY CARD IS VALID ONLY WHEN IT IS SIGNED AND DATED.

THANK YOU FOR CASTING YOUR VOTE